UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3445

The Merger Fund

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Roy Behren and Michael T. Shannon

The Merger Fund

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2011

Item 1. Reports to Stockholders.

THE

MERGER

FUND®

ANNUAL REPORT

SEPTEMBER 30, 2011

November 15, 2011

Dear Fellow Shareholders,

For the fiscal year ended September 30, 2011, the net asset value (“NAV”) per share of The Merger Fund® declined 0.34%. Given that the Fund utilizes a hedge-fund like strategy, it is worth noting that the past year has been difficult not only for the broad markets but for hedge funds in general with the following indices showing negative marks: HFRX Merger Arbitrage Index (down -0.52%) and the HFRX Event Driven Index (down -5.46%) for the one-year period ended September 30.

The Fund’s performance was lower than our targeted returns due to several factors unrelated to terminated deals. Notably, the Fund’s fiscal year ended right after the two worst months in the market since 2008. In fact, volatility in the market as measured by the VIX which was roughly 16% at the end of July ended September at approximately 43% - a 170% increase! As we have stated previously, merger arbitrage spreads tend to widen during such periods and this was no exception. However, as long as the deals in which we invest are completed, the unrealized losses will be reversed and the Fund will capture the difference between its entry point and the value of the deal consideration. This process has begun, and the Fund is climbing back from its third-quarter performance. As of the date of this letter it is up 1.2% for the calendar year.

Conservative deal selection and the prudent use of derivatives positively impacted performance.1 The Fund purchased put options, sold call options, and utilized forward contracts and total-return swap contracts for risk-management (as opposed to speculative) purposes as well as return-enhancement purposes. As is typical, the volatility of our returns was a fraction of the overall market’s, with The Merger Fund® registering an annualized standard deviation of 3.13% for the period compared to the S&P’s 13.70%.

Deal activity continues to be robust globally, despite periodic geographic rotation, bolstering our view that the next multi-year cycle of increasing M&A activity is imminent. Corporate balance sheets continue to be cash-heavy and many companies that had fueled temporary growth by cutting costs now have limited ways of growing their businesses other than through acquisitions. Additionally, interest rates remain low, enabling the cheapest borrowing costs in decades. Lastly, even in the current volatile environment, many acquirers’ stock prices have increased after announcing deals, providing confidence to other buyers who are considering substantial transactions. As a result, we remain optimistic about an upturn in deal activity in the months ahead. As of the end of September, we were approximately 88% invested and the Fund currently holds positions in 70 arbitrage situations around the globe. Please see the attached letter for the quarter ended September 30, 2011 for more detailed commentary on the market environment and portfolio positioning during the reporting period.

Finally, as previously mentioned, this will be the last period for which the Fund will follow a September 30 fiscal year. The Fund expects to save money on routine audit expenses, and it will also minimize confusion when tracking performance. We expect to have a “stub period” for the quarter ending December 31, 2011, and then our fiscal year will track the calendar year beginning on January 1, 2012. The change will be transparent to investors and should be beneficial for all of our shareholders.

__________

1 The Fund typically uses derivative instruments for hedging purposes or as a more tax-efficient way to invest in foreign transactions. Use of these instruments may involve certain costs and risks. A complete description of the Fund’s principal and other risk factors are contained in the Fund’s prospectus and statement of additional information.

As of September 30, The Merger Fund® was down 1.2% year-to-date, the result of a disappointing and volatile three-month period for all asset classes. Having begun the quarter in the black by 2.9%, it was unfortunate to go back, but the Fund retreated by 400 basis points during the period. We invested in a total of 109 deals during the quarter and experienced two terminated takeovers, consistent with our historic deal-selection success rate of 98% plus. Relatively robust deal activity allowed the Fund to remain fully invested, with 90-95% of its assets deployed throughout the period, despite continued market turmoil. The Fund’s performance was lower than our targeted returns due to several factors unrelated to terminated deals. Weak worldwide economic data alternated with a frenzied flow of governmental and sovereign debt crises, which contributed to disarray in the capital markets. U.S. Treasury obligations soared in value, as did gold prices, reflecting flights to quality (to the extent that one can call T-Bonds “quality”) and to stores of value in an uncertain environment. An additional fallout of this climate of fear was an historic correlation between unrelated, and therefore theoretically uncorrelated, stocks. In fact, equity correlations of S&P 500 members as of September were the highest recorded since the stock market crash of 1987, almost 25 years ago. The result of this correlation is that not just the baby but everything in the tub was thrown out with the bathwater. One would think that European debt problems and protests in Greece and the Middle East should not affect the risk of completion of safe, stable “plain vanilla” U.S. merger transactions, but risk premiums embedded in all investments increased indiscriminately. Reflecting this reflexive “risk-off” mentality, the S&P 500 Index declined 13.9% during the quarter, leaving the broad index down 8.7% for the year. World markets as a whole performed even worse, with the MSCI EAFE World Index losing 18.9% during the quarter, pushing it down to -14.6% through September 2011. For comparison purposes, the HFR Event Driven Index (HFRXED) was down 6.8% for the quarter, leaving it 5.5% in negative territory for the year; and the HFR Merger Arbitrage Index (HFRXMA) lost 4.2% for the quarter, resulting in a 3.2% year-to-date deficit. As the saying goes, “you can’t eat relative performance,” but we take some satisfaction from having out-performed the S&P by 7.5%, the HFRXED by 4.3% and the HFRXMA by 2% since the beginning of the year. We are also pleased that we accomplished this with less than one quarter of the volatility of the S&P,2 a reflection of our emphasis on risk-adjusted metrics.

WHO THE? WHAT THE?

Of the 109 merger-arbitrage investments the Fund was involved in this quarter, 41 produced negative marks-to-market, i.e., showed unrealized losses. This was highly unusual and due to the market forces discussed above. We ended the quarter with 70 investments on the sheets, in line with our diversification target of 35 to 70 positions. We invested in 31 new transactions during the quarter in a broad spectrum of industries and with varying deal structures. In fact, some of these new investments proceeded to trade down after our initial investment, creating additional attractive opportunities for us to deploy capital. It is worth noting that as long as the deals in which we invest proceed to completion, the unrealized losses will be reversed and the Fund will capture the difference between the entry point and the value of the deal consideration, known as the “arbitrage spread.” In fact, that process has begun, and the Fund is climbing back from its third quarter performance. As of the date of this letter it is up 1.2% for the calendar year.

__________

2 YTD standard deviation for The Merger Fund® was 5.42% vs. 22.04% for the S&P 500 Index.

Among our biggest losers for the quarter was British Sky Broadcasting (BSkyB), which we continue to exit in an orderly manner after News Corp. withdrew its bid in light of a phone-hacking scandal. As is our practice, we overlaid the position with a targeted hedge while we are attempting to efficiently liquidate the holding. We also sustained paper losses in DTG, as the saga continues to play out like a Days of Our Lives episode while Hertz and Dollar Thrifty continue their game of cat-and-mouse and Avis potentially hides around the corner in the event the mouse escapes from Hertz’s clutches. We are still optimistic that DTG will ultimately be acquired by one of its rivals, and its value continues to increase as it reports quarter-over-quarter improved results. NYSE Euronext, in the process of being acquired by Deutsche Boerse AG, cost the Fund 0.5% in negative marks during the quarter, and Synthes, Inc., a cross-border acquisition by Johnson & Johnson and one of our largest positions was a loser (we hope temporarily) during the period as well. Even Temple-Inland, which ultimately capitulated to a hostile approach from International Paper Corp., traded down intra-quarter despite the absence of negative developments in the deal.

On the positive side of the ledger, the portfolio reflected assorted small profits in our macro hedge, Petrohawk Energy Corp., a $15 billion acquisition by BHP Billiton Ltd.; Autonomy Corp PLC, a $10 billion acquisition by Hewlett-Packard Co; Man SE, the subject of a plodding share tender by Volkswagen; and finally, three completed transactions: Cephalon Inc. by Teva Pharmaceuticals, Lubrizol by Berkshire Hathaway and National Semiconductor Corp. by Texas Instruments.

New positions were interspersed throughout the globe this quarter as SAB Miller finally quenched its thirst with a $10 billion deal to buy Fosters, Macarthur Coal was mined by a group led by the U.S.-based Peabody Coal for $4 billion, Autonomy Corp plc will no longer be autonomous after agreeing to be purchased by Hewlett-Packard Corp. for in excess of $10 billion; and Northumbrian Water Group plc was purchased after being flooded by a $7.5 billion bid from a consortium called UK Water 2011 Ltd.

Not to be outdone, U.S. deal activity created some interesting opportunities, as Express Scripts found the prescription for growth via a $34 billion merger with Medco Health Solutions Inc.; Google Inc. computed the right price with its $10 billion acquisition of Motorola Mobility Holdings, Inc., and United Technologies blasted off by paying $18 billion for Goodrich Corp. in an all-cash deal. Three leveraged buyouts made their way into our portfolio also: Kinetic Concepts Inc. was purchased by a group led by Apax partners; Emdeon Inc., agreed to be bought by a consortium including the Blackstone Group; and Pharmaceutical Product Development Inc, entered into an agreement to be bought by Carlyle Group and Hellman & Friedman for $4 billion. As our investors may be aware, we tend not to be enamored of financially-driven transactions such as LBOs, but these three deals share some characteristics that make them attractive and make us optimistic about the odds for successful completion. First, the transactions have financing commitments in place; additionally, obtaining financing is not a condition to the buyers’ obligations to complete the deals. Second, the “break fees,” or termination fees, are larger than the typical 3% of deal value that were historically present, so an attempt to walk away from the transaction by the buyer becomes more expensive than it would otherwise be. Third, the equity contribution by the LBO sponsors is between 30%-50%, far greater than that of prior generations of LBOs, reflecting a greater commitment by the sponsors and resulting in an entity with a lower debt to equity ratio than deals of years past. Additionally, the multiple of EBITDA or cash flow paid in the range of 6-9x is lower than the 12-15x multiple that we saw in some of the problematic transactions circa 2007 and before. And finally, the merger agreements extracted by these target companies are more favorably written than earlier iterations with regard to the ability to compel “specific performance” of the buyer’s obligations.

For the stat-o-philes among us, here are some higher-level statistics:3

| | • | Although global deal volume by currency decreased 12% year-over-year compared to the 3rd quarter of 2010, global deal count increased by 11%. |

| | • | Total M&A deal volume for the year through the 3rd quarter was $1.78 trillion compared to $1.54 trillion for the first 3 quarters of last year, representing a 15% increase. U.S. based buyers accounted for 40% of this total volume. |

| | • | Private equity transactions have exceeded $144 billion in total this year, which is the 4th largest on record. Reflecting the aforementioned economic uncertainty, European activity declined by 26% compared to the 3rd quarter of 2010. |

| | • | A significant majority of transactions, 69%, provided for cash consideration, while all-stock consideration represented only 11% of deal volume. |

Deal activity continues to be robust when viewed from a global vantage point, despite periodic geographic rotation. This bolsters our optimism that the next multi-year cycle of increasing M&A activity is imminent. As discussed in previous letters, strengthened corporate balance sheets together with low funding rates incentivize companies to undertake transactions. Significantly, even in the current volatile environment, many acquirers’ stock prices have risen after announcing deals, and this has historically provided confidence to other would-be buyers who are considering significant transactions. The New York Times Dealbook discussed the subject with Jim Woolery, co-head of North America mergers and acquisitions at JPMorgan Chase, who commented “…What is different now versus 2009 is that many companies are well-capitalized with access to attractive financing. Investors want that capital deployed to achieve growth, including through synergistic, scale, core acquisitions. The market has rewarded buyers who move in that direction. We have many clients who want to play offense in these markets in order to drive shareholder value….”4

TAKE ME OUT TO THE BALLGAME

Speaking of offense and statistics, we had the opportunity to see the movie “Moneyball,” based on the book by Michael Lewis and starring Brad Pitt as Billy Beane, the trailblazing General Manager of the Oakland A’s professional baseball team during the year 2002. The premise of the movie was that a team’s payroll should be deployed in the most efficient manner, determined objectively, rather than used to sign superstars or other players based upon the coaches’ and management’s experience, judgments and subjective impressions. Beane pioneered the use of “Sabermetrics,” a term coined by baseball statistician Bill James to analyze team and player success based upon statistics and empirical evidence. Beane took this methodology a step further and applied it to allocation of his team’s payroll. He concluded that the way to extract the greatest value from his payroll was to identify in an objective, quantitative manner those players who, for example, produced the greatest on-base percentage and slugging percentage per expected salary dollar.

It occurred to us that this was an excellent analogy for part of our merger arbitrage process. In the same manner that Billy Beane wanted the best “bang for the buck” when drafting baseball players and that mutual fund investors seek to maximize their expected return while minimizing the risk of significant

__________

3 See Bloomberg Global Financial Advisory Mergers & Acquisitions Rankings Q3 2011.

4 New York Times Dealbook, 10/11/11, “James Woolery of JPMorgan Surveys the M.&A. Scene”.

losses, we attempt to quantitatively analyze individual investments to select those which offer the greatest expected rate-of-return per unit of risk incurred. We measure risk by the level of volatility, or standard deviation of all potential outcomes. The core of our philosophy is to provide attractive risk-adjusted returns rather than merely selecting those investments which offer the highest potential rates of return yet also risk the largest losses. However, our portfolio construction is not merely formula-driven. All of our assumptions, from the expected closing date to the likelihood of receiving shareholder votes, or SEC and other regulatory approvals, or even obtaining financing are all judgment-based and provide the inputs for optimizing our portfolio in the same way that Billy Beane used statistics to optimize the “portfolio” of ballplayers on his team. As his team could trade a player that was underperforming, so too can our Fund, to stretch the metaphor a little further. As soon as an investment in our portfolio no longer provides an attractive risk/reward profile, we will trade out of the position and seek to replace it. We hope that the Mets will adopt the same philosophy.

As mentioned previously, we are currently managing (sub-advising) a ’40 Act registered mutual fund called the Dunham Monthly Distribution Fund, which provides a somewhat more conservative profile than The Merger Fund®.

For those who have inquired about other products we are hoping to develop as an adjunct to our flagship merger arbitrage products, we expect to roll out a complementary investment option which reflects our absolute-return philosophy but will be positioned somewhat less conservatively than The Merger Fund®. We will provide details as soon as legally permissible.

Finally, we have received some inquiries regarding the timing of our quarterly letters. In an effort to provide more timely communications, we will make the statistical summary that is attached to each letter available within 2 weeks of the end of the quarter. It will be available electronically over the internet. Additionally, we still anticipate providing the letter and posting it on the Internet approximately 4-6 weeks after the end of each quarter.

For convenience, investors can arrange for e-alerts of important Fund communications. Through our website at www.mergerfund.com, you can check account balances, make purchases and sales, and sign up for notification of trade confirmations, statements and shareholder communications via e-mail.

We appreciate your support and feedback. All of us at Westchester Capital Management and The Merger Fund® wish you a warm and happy holiday season.

Sincerely,

| | |

|  |

| Roy Behren | Mike Shannon |

Before investing in The Merger Fund, consider its investment objectives, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, including current performance data that may be lower or higher than the data included herein, contact your investment professional or view it online at mergerfund.com. Please read it carefully. The performance data included herein represents past performance and does not guarantee future results. The Merger Fund’s share price and return will vary, and investors may have a gain or loss when they redeem their shares. Current month-end performance is available at www.mergerfund.com.

Past performance is not indicative of future results.

The S&P 500 TR is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. It is shown with dividends reinvested. You cannot invest directly in the index.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. As of November 2011, the MSCI EAFE Index consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. (For an updated country list see www.msci.com.)

The HFRX Indices (“HFRX”) are a series of benchmarks of hedge fund industry performance which are engineered to achieve representative performance of a larger universe of hedge fund strategies. Hedge Fund Research, Inc. (“HFR, Inc.”) employs the HFRX Methodology (UCITSIII compliant), a proprietary and highly quantitative process by which hedge funds are selected as constituents for the HFRX Indices. This methodology includes robust classification, cluster analysis, correlation analysis, advanced optimization and Monte Carlo simulations. More specifically, the HFRX Methodology defines certain qualitative characteristics, such as whether the fund is open to transparent fund investment and the satisfaction of the index manager’s due diligence requirements. Production of the HFRX Methodology results in a model output which selects funds that, when aggregated and weighted, have the highest statistical likelihood of producing a return series that is most representative of the reference universe of strategies.

HFRX Merger Arbitrage Index includes investment managers who employ an investment process primarily focused on opportunities in equity and equity related instruments of companies which are currently engaged in a corporate transaction. Merger Arbitrage involves primarily announced transactions, typically with limited or no exposure to situations which pre- or post-date a formal announcement or situations in which no formal announcement is expected to occur. Opportunities are frequently presented in cross border, collared and international transactions which incorporate multiple geographic regulatory institutions, with typically involve minimal exposure to corporate credits. Merger Arbitrage strategies typically have over 75% of positions in announced transactions over a given market cycle.

HFRX Event Driven Index includes investment managers who maintain positions in companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated, and frequently involve additional derivative securities. Event Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company specific developments. Investment theses are typically predicated on fundamental characteristics (as opposed to quantitative), with the realization of the thesis predicated on a specific development exogenous to the existing capital structure.

Source: www.hedgefundresearch.com

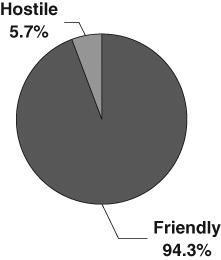

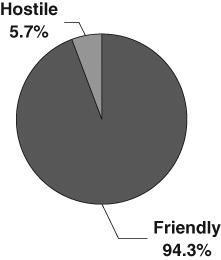

| Chart 1 | Chart 2 |

| | |

| PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

| By Type of Deal* | By Type of Buyer* |

| | |

|  |

| | |

| | |

| | |

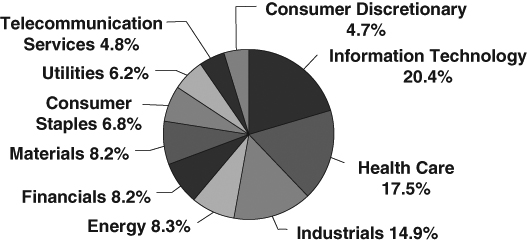

Chart 3

PORTFOLIO COMPOSITION

By Deal Terms*

* Data expressed as a percentage of long common stock and swap contract positions as of September 30, 2011.

Chart 4

PORTFOLIO COMPOSITION

By Sector*

Chart 5

PORTFOLIO COMPOSITION

By Region*

* Data expressed as a percentage of long common stock and swap contract positions as of September 30, 2011.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Chart 6

GLOBAL MERGER ACTIVITY

Source: Bloomberg M&A Advisory League Tables

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND AND S&P 500

| | | Average |

| | | Annual Total Return |

| | 1 Yr. | 3 Yr. | 5 Yr. | 10 Yr. |

| The Merger Fund | -0.34% | 3.24% | 2.63% | 3.05% |

| The Standard & Poor’s 500 Index | 1.14% | 1.23% | -1.18% | 2.82% |

The Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on September 30, 2001. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund

EXPENSE EXAMPLE

September 30, 2011

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) redemption fees and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in U.S. dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 for the period 4/01/11 – 9/30/11.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop-payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, a $15.00 fee will be charged by the Fund’s transfer agent. You will be charged a redemption fee equal to 2.00% of the net amount of the redemption if you redeem your shares less than 30 calendar days after you purchase them. IRAs will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under U.S. generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account | Ending Account | Expenses Paid During |

| | Value 4/01/11 | Value 9/30/11 | Period 4/01/11-9/30/11* |

Actual + (1) | $1,000.00 | $ 964.70 | $10.15 |

Hypothetical ++ (2) | $1,000.00 | $1,014.74 | $10.40 |

| + | Excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, your actual cost of investment in the Fund would be $6.50. |

| ++ | Excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, your hypothetical cost of investment in the Fund would be $6.68. |

| (1) | Ending account values and expenses paid during period based on a (3.53)% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| * | Expenses are equal to the Fund’s annualized expense ratio of 2.06%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

The Merger Fund

SCHEDULE OF INVESTMENTS

September 30, 2011

| Shares | | | | Value | |

| COMMON STOCKS — 63.37% | | | |

| | | AEROSPACE & DEFENSE — 6.12% | | | |

| | 1,726,172 | | Goodrich Corporation (h) | | $ | 208,314,437 | |

| | 2,196,700 | | ITT Corporation (f) | | | 92,261,400 | |

| | | | | | | 300,575,837 | |

| | | | APPLICATION SOFTWARE — 1.33% | | | | |

| | 1,465,374 | | Blackboard Inc. (a) | | | 65,443,603 | |

| | | | BIOTECHNOLOGY — 5.84% | | | | |

| | 3,533,838 | | Cephalon Inc. (a)(g) | | | 285,180,727 | |

| | 489,623 | | Savient Pharmaceuticals Inc. (a) | | | 2,007,454 | |

| | | | | | | 287,188,181 | |

| | | | CABLE & SATELLITE TV — 0.34% | | | | |

| | 797,678 | | Comcast Corporation Special Class A | | | 16,503,958 | |

| | | | COMMUNICATIONS EQUIPMENT — 5.00% | | | | |

| | 6,498,021 | | Motorola Mobility Holdings, Inc. (a)(h) | | | 245,495,233 | |

| | | | COMPUTER HARDWARE — 0.49% | | | | |

| | 1,082,900 | | Hewlett-Packard Company | | | 24,311,105 | |

| | | | COMPUTER STORAGE & PERIPHERALS — 0.10% | | | | |

| | 223,900 | | EMC Corp. (a) | | | 4,699,661 | |

| | | | DIVERSIFIED CHEMICALS — 0.18% | | | | |

| | 910,400 | | Huntsman Corporation (g) | | | 8,803,568 | |

| | | | DIVERSIFIED METALS & MINING — 0.31% | | | | |

| | 565,885 | | Pilot Gold Inc. (a)(b) | | | 648,022 | |

| | 326,471 | | Rio Tinto plc — ADR | | | 14,390,842 | |

| | | | | | | 15,038,864 | |

| | | | ELECTRIC UTILITIES — 3.25% | | | | |

| | 577,800 | | American Electric Power Co. Inc. | | | 21,967,956 | |

| | 3,198,264 | | DPL Inc. | | | 96,395,677 | |

| | 803,000 | | Progress Energy Inc. | | | 41,531,160 | |

| | | | | | | 159,894,793 | |

| | | | ELECTRICAL COMPONENTS & EQUIPMENT — 0.02% | | | | |

| | 105,716 | | SunPower Corp. Class B (a) | | | 777,013 | |

| | | | GAS UTILITIES — 0.07% | | | | |

| | 61,400 | | Nicor Inc. | | | 3,377,614 | |

| | | | HEALTH CARE EQUIPMENT — 2.48% | | | | |

| | 1,848,925 | | Kinetic Concepts, Inc. (a)(h) | | | 121,825,668 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2011

| Shares | | | | Value | |

| | | HEALTH CARE SERVICES — 0.76% | | | |

| | 792,325 | | Medco Health Solutions, Inc. (a) | | $ | 37,152,119 | |

| | | | HEALTH CARE TECHNOLOGY — 0.15% | | | | |

| | 395,534 | | Emdeon, Inc. (a) | | | 7,432,084 | |

| | | | HOTELS, RESORTS & CRUISE LINES — 0.32% | | | | |

| | 575,100 | | Marriott International Inc. | | | 15,665,724 | |

| | | | HOUSEHOLD PRODUCTS — 2.10% | | | | |

| | 736,800 | | Clorox Company (f) | | | 48,871,944 | |

| | 610,900 | | Colgate-Palmolive Company (f) | | | 54,174,612 | |

| | | | | | | 103,046,556 | |

| | | | INDEPENDENT POWER PRODUCERS | | | | |

| | | | & ENERGY TRADERS — 1.79% | | | | |

| | 2,312,910 | | Constellation Energy Group Inc. (f) | | | 88,029,355 | |

| | | | INTEGRATED OIL & GAS — 1.01% | | | | |

| | 782,000 | | ConocoPhillips (f) | | | 49,516,240 | |

| | | | INTEGRATED TELECOMMUNICATION SERVICES — 3.51% | | | | |

| | 3,874,000 | | AT&T Inc. (f) | | | 110,486,480 | |

| | 1,475,382 | | CenturyLink, Inc. (f) | | | 48,864,652 | |

| | 355,100 | | Verizon Communications Inc. | | | 13,067,680 | |

| | | | | | | 172,418,812 | |

| | | | OIL & GAS EQUIPMENT & SERVICES — 0.84% | | | | |

| | 5,201,900 | | Global Industries, Ltd. (a) | | | 41,199,048 | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 1.51% | | | | |

| | 4,797,829 | | EXCO Resources, Inc. (f) | | | 51,432,727 | |

| | 391,600 | | Range Resources Corporation | | | 22,892,936 | |

| | | | | | | 74,325,663 | |

| | | | OIL & GAS STORAGE & TRANSPORTATION — 3.00% | | | | |

| | 1,589,400 | | El Paso Corporation (h) | | | 27,782,712 | |

| | 2,055,671 | | Southern Union Company (h) | | | 83,398,572 | |

| | 1,487,000 | | Williams Companies, Inc. (h) | | | 36,193,580 | |

| | | | | | | 147,374,864 | |

| | | | PACKAGED FOODS & MEATS — 1.05% | | | | |

| | 434,400 | | Kraft Foods, Inc. | | | 14,587,152 | |

| | 2,270,600 | | Sara Lee Corp. | | | 37,124,310 | |

| | | | | | | 51,711,462 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2011

| Shares | | | | Value | |

| | | PAPER PACKAGING — 3.29% | | | |

| | 5,161,371 | | Temple-Inland Inc. (e) | | $ | 161,912,208 | |

| | | | PERSONAL PRODUCTS — 0.88% | | | | |

| | 628,600 | | Mead Johnson Nutrition Co. | | | 43,266,538 | |

| | | | PHARMACEUTICALS — 0.15% | | | | |

| | 429,300 | | Pfizer Inc. | | | 7,590,024 | |

| | | | PUBLISHING — 0.25% | | | | |

| | 299,100 | | McGraw-Hill Companies, Inc. (f) | | | 12,263,100 | |

| | | | REINSURANCE — 1.29% | | | | |

| | 1,305,310 | | Transatlantic Holdings, Inc. (f) | | | 63,333,641 | |

| | | | SEMICONDUCTOR EQUIPMENT — 3.61% | | | | |

| | 2,903,112 | | Varian Semiconductor Equipment Association Inc. (a)(e) | | | 177,525,299 | |

| | | | SEMICONDUCTORS — 3.58% | | | | |

| | 3,660,422 | | NetLogic Microsystems Inc. (a)(e)(j) | | | 176,102,902 | |

| | | | SPECIALIZED FINANCE — 2.95% | | | | |

| | 4,084,807 | | NYSE Euronext (f) | | | 94,930,915 | |

| | 1,282,670 | | TMX Group Inc. (b)(h) | | | 50,112,138 | |

| | | | | | | 145,043,053 | |

| | | | SPECIALIZED REITS — 0.00% | | | | |

| | 4,528 | | Ventas, Inc. | | | 223,683 | |

| | | | SPECIALTY CHEMICALS — 2.97% | | | | |

| | 63,245 | | Arch Chemicals, Inc. | | | 2,967,455 | |

| | 4,085,346 | | Nalco Holding Co. | | | 142,905,403 | |

| | | | | | | 145,872,858 | |

| | | | SPECIALTY STORES — 0.09% | | | | |

| | 358,800 | | Barnes & Noble, Inc. | | | 4,244,604 | |

| | | | TRUCKING — 2.68% | | | | |

| | 2,338,825 | | Dollar Thrifty Automotive Group, Inc. (a)(f)(j) | | | 131,675,848 | |

| | | | WIRELESS TELECOMMUNICATION SERVICES — 0.06% | | | | |

| | 158,100 | | Telephone and Data Systems, Inc. — Class S | | | 3,125,637 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $3,360,596,244) | | | 3,113,986,420 | |

| WARRANTS — 0.01% | | | | |

| | 142,642 | | Kinross Gold Corporation (a)(b) | | | 332,137 | |

| | | | TOTAL WARRANTS | | | | |

| | | | (Cost $540,028) | | | 332,137 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2011

| Principal Amount | | Value | |

| CORPORATE BONDS — 2.69% | | | |

| | | CVS Caremark Corporation | | | |

| $ | 9,931,000 | | 6.302%, 6/1/2037 (k) | | $ | 9,609,732 | |

| | | | Level 3 Financing, Inc. | | | | |

| | 20,026,000 | | 9.250%, 11/1/2014 | | | 19,875,805 | |

| | | | Terrestar Networks, Inc. | | | | |

| | 43,660,000 | | 15.000%, 2/15/2014 | | | | |

| | | | (Acquired 7/27/11 – 8/11/11, Cost $12,323,908) (d)(i)(l) | | | 12,420,462 | |

| | | | Washington Mutual, Inc. | | | | |

| | 11,636,000 | | 4.000%, 1/15/2009 (d) | | | 12,421,430 | |

| | 5,747,000 | | 4.200%, 1/15/2010 (d) | | | 6,163,658 | |

| | 9,377,000 | | 5.500%, 8/24/2011 (d) | | | 10,361,585 | |

| | 20,154,000 | | 5.000%, 3/22/2012 (d) | | | 21,867,090 | |

| | 36,099,000 | | 5.250%, 9/15/2017 (d) | | | 39,618,652 | |

| | | | TOTAL CORPORATE BONDS | | | | |

| | | | (Cost $135,530,169) | | | 132,338,414 | |

| Contracts (100 shares per contract) | | | |

| PURCHASED PUT OPTIONS — 1.25% | | | |

| | | American Electric Power Co. Inc. | | | |

| | 5,778 | | Expiration: November 2011, Exercise Price: $33.00 | | | 202,230 | |

| | | | AT&T Inc. | | | | |

| | 30,178 | | Expiration: October 2011, Exercise Price: $25.00 | | | 422,492 | |

| | 7,603 | | Expiration: November 2011, Exercise Price: $25.00 | | | 300,319 | |

| | | | CenturyLink, Inc. | | | | |

| | 3,387 | | Expiration: October 2011, Exercise Price: $30.00 | | | 101,610 | |

| | 9,313 | | Expiration: October 2011, Exercise Price: $35.00 | | | 2,025,577 | |

| | | | Clorox Company | | | | |

| | 7,368 | | Expiration: October 2011, Exercise Price: $62.50 | | | 442,080 | |

| | | | Colgate-Palmolive Company | | | | |

| | 6,109 | | Expiration: November 2011, Exercise Price: $77.50 | | | 876,642 | |

| | | | ConocoPhillips | | | | |

| | 7,820 | | Expiration: November 2011, Exercise Price: $62.50 | | | 2,854,300 | |

| | | | Constellation Energy Group Inc. | | | | |

| | 6,576 | | Expiration: October 2011, Exercise Price: $30.00 | | | 674,040 | |

| | | | El Paso Corporation | | | | |

| | 15,894 | | Expiration: October 2011, Exercise Price: $17.00 | | | 1,128,474 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2011

| Contracts (100 shares per contract) | | Value | |

| PURCHASED PUT OPTIONS — 1.25% (continued) | | | |

| | | Energy Select Sector SPDR Fund | | | |

| | 1,409 | | Expiration: October 2011, Exercise Price: $66.00 | | $ | 1,116,633 | |

| | 846 | | Expiration: December 2011, Exercise Price: $68.00 | | | 917,910 | |

| | | | FTSE 100 | | | | |

| | 1,036 | | Expiration: November 2011, Exercise Price: $5,300.00 | | | 5,694,793 | |

| | | | Hewlett-Packard Company | | | | |

| | 5,348 | | Expiration: November 2011, Exercise Price: $15.00 | | | 85,568 | |

| | 5,481 | | Expiration: November 2011, Exercise Price: $18.00 | | | 298,714 | |

| | | | iShares iBoxx $ High Yield Corporate Bond Fund | | | | |

| | 954 | | Expiration: December 2011, Exercise Price: $80.00 | | | 248,040 | |

| | 957 | | Expiration: December 2011, Exercise Price: $85.00 | | | 464,145 | |

| | | | ITT Corporation | | | | |

| | 2,114 | | Expiration: October 2011, Exercise Price: $45.00 | | | 750,470 | |

| | 4,926 | | Expiration: October 2011, Exercise Price: $47.50 | | | 2,783,190 | |

| | 14,927 | | Expiration: October 2011, Exercise Price: $55.00 | | | 19,405,100 | |

| | | | Kraft Foods, Inc. | | | | |

| | 4,344 | | Expiration: October 2011, Exercise Price: $30.00 | | | 69,504 | |

| | | | Marriott International Inc. | | | | |

| | 5,751 | | Expiration: October 2011, Exercise Price: $30.00 | | | 1,782,810 | |

| | | | Materials Select Sector SPDR | | | | |

| | 636 | | Expiration: December 2011, Exercise Price: $36.00 | | | 461,100 | |

| | | | McGraw-Hill Companies, Inc. | | | | |

| | 51 | | Expiration: November 2011, Exercise Price: $37.00 | | | 7,395 | |

| | 2,940 | | Expiration: November 2011, Exercise Price: $38.00 | | | 507,150 | |

| | | | Mead Johnson Nutrition Co. | | | | |

| | 6,286 | | Expiration: November 2011, Exercise Price: $55.00 | | | 345,730 | |

| | | | Pfizer Inc. | | | | |

| | 4,293 | | Expiration: October 2011, Exercise Price: $17.00 | | | 141,669 | |

| | | | Progress Energy Inc. | | | | |

| | 8,027 | | Expiration: October 2011, Exercise Price: $42.00 | | | 200,675 | |

| | | | Range Resources Corporation | | | | |

| | 3,916 | | Expiration: November 2011, Exercise Price: $52.50 | | | 1,488,080 | |

| | | | Sara Lee Corp. | | | | |

| | 22,706 | | Expiration: October 2011, Exercise Price: $16.00 | | | 1,021,770 | |

| | | | Semiconductor HOLDRs Trust | | | | |

| | 904 | | Expiration: November 2011, Exercise Price: $37.00 | | | 773,824 | |

| | | | SPDR S&P Retail ETF | | | | |

| | 901 | | Expiration: October 2011, Exercise Price: $51.00 | | | 475,278 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2011

| Contracts (100 shares per contract) | | Value | |

| PURCHASED PUT OPTIONS — 1.25% (continued) | | | |

| | | SPDR S&P 500 ETF Trust | | | |

| | 19,095 | | Expiration: October 2011, Exercise Price: $115.00 | | $ | 10,215,825 | |

| | | | Technology Select Sector SPDR Fund | | | | |

| | 2,240 | | Expiration: December 2011, Exercise Price: $25.00 | | | 530,880 | |

| | | | Verizon Communications Inc. | | | | |

| | 3,551 | | Expiration: December 2011, Exercise Price: $31.00 | | | 186,427 | |

| | | | Williams Companies, Inc. | | | | |

| | 14,870 | | Expiration: November 2011, Exercise Price: $23.00 | | | 2,490,725 | |

| | | | TOTAL PURCHASED PUT OPTIONS | | | | |

| | | | (Cost $35,220,379) | | | 61,491,169 | |

| Shares | | | | | |

| SHORT-TERM INVESTMENTS — 21.60% | | | |

| | 245,138,609 | | BlackRock Liquidity Funds TempFund Portfolio 0.09% (c)(h) | | | 245,138,609 | |

| | 272,000,000 | | Fidelity Institutional Government Portfolio 0.01% (c)(g) | | | 272,000,000 | |

| | 272,000,000 | | Goldman Sachs Financial Square | | | | |

| | | | Money Market Fund 0.17% (c)(g) | | | 272,000,000 | |

| | 272,000,000 | | The Liquid Assets Portfolio 0.10% (c)(g) | | | 272,000,000 | |

| | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | (Cost $1,061,138,609) | | | 1,061,138,609 | |

| | | | TOTAL INVESTMENTS | | | | |

| | | | (Cost $4,593,025,429) — 88.92% | | $ | 4,369,286,749 | |

ADR — American Depository Receipt

ETF — Exchange Traded Fund

| (a) | Non-income producing security. |

| (c) | The rate quoted is the annualized seven-day yield as of September 30, 2011. |

| (d) | Default or other conditions exist and security is not presently accruing income. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (f) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (g) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (h) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

| (i) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of September 30, 2011, these securities represented 0.25% of total net assets. |

| (k) | The coupon rate shown on variable rate securities represents the rate at September 30, 2011. |

| (l) | Security fair valued in good faith. |

The Global Industry Classifications Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF SECURITIES SOLD SHORT

September 30, 2011

| Shares | | | | Value | |

| COMMON STOCKS | | | |

| | 51,449 | | AGL Resources Inc. | | $ | 2,096,032 | |

| | 798,178 | | Comcast Corporation Class A | | | 16,681,920 | |

| | 1,003,031 | | Deutsche Borse AG (a)(b) | | | 49,760,368 | |

| | 1,904,702 | | Ecolab Inc. | | | 93,120,881 | |

| | 23,961 | | Energy Transfer Equity, L. P. | | | 833,363 | |

| | 72,095 | | Exelon Corporation | | | 3,071,968 | |

| | 165,942 | | Express Scripts, Inc. | | | 6,151,470 | |

| | 13,130 | | Hertz Global Holdings, Inc. | | | 116,857 | |

| | 2,322,333 | | Johnson & Johnson (b) | | | 149,140,225 | |

| | 7,429 | | Kinross Gold Corporation (a) | | | 110,382 | |

| | 205,100 | | Nissan Motor Co., Ltd. (a) | | | 1,842,789 | |

| | 327,535 | | Rio Tinto Ltd. (a) | | | 18,696,877 | |

| | 158,100 | | Telephone and Data Systems, Inc. | | | 3,359,625 | |

| | 17,915 | | VMware Inc. | | | 1,440,008 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Proceeds $368,910,314) | | | 346,422,765 | |

| INVESTMENT COMPANIES | | | | |

| | 71,500 | | SPDR S&P 500 ETF Trust | | | 8,091,655 | |

| | | | TOTAL INVESTMENT COMPANIES | | | | |

| | | | (Proceeds $9,617,280) | | | 8,091,655 | |

| | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | (Proceeds $378,527,594) | | $ | 354,514,420 | |

| ETF — Exchange Traded Fund |

| (a) | Foreign security. |

| (b) | Security fair valued in good faith. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN

September 30, 2011

| Contracts (100 shares per contract) | | Value | |

| CALL OPTIONS WRITTEN | | | |

| | | American Electric Power Co. Inc. | | | |

| | 5,778 | | Expiration: November 2011, Exercise Price $37.00 | | $ | 1,112,265 | |

| | | | AT&T Inc. | | | | |

| | 30,178 | | Expiration: October 2011, Exercise Price $30.00 | | | 271,602 | |

| | 7,603 | | Expiration: November 2011, Exercise Price $29.00 | | | 524,607 | |

| | | | BJ’s Wholesale Club, Inc. | | | | |

| | 119 | | Expiration: December 2011, Exercise Price $50.00 | | | 14,875 | |

| | | | CenturyLink, Inc. | | | | |

| | 3,387 | | Expiration: October 2011, Exercise Price $36.00 | | | 50,805 | |

| | 9,313 | | Expiration: October 2011, Exercise Price $39.00 | | | 23,282 | |

| | | | Clorox Company | | | | |

| | 7,368 | | Expiration: October 2011, Exercise Price $67.50 | | | 1,013,100 | |

| | | | Colgate-Palmolive Company | | | | |

| | 6,109 | | Expiration: November 2011, Exercise Price $85.00 | | | 3,894,488 | |

| | | | ConocoPhillips | | | | |

| | 7,820 | | Expiration: November 2011, Exercise Price $67.50 | | | 1,243,380 | |

| | | | Constellation Energy Group Inc. | | | | |

| | 6,575 | | Expiration: October 2011, Exercise Price $35.00 | | | 2,301,250 | |

| | 2,424 | | Expiration: October 2011, Exercise Price $38.00 | | | 393,900 | |

| | | | Dollar Thrifty Automotive Group, Inc. | | | | |

| | 957 | | Expiration: October 2011, Exercise Price $65.00 | | | 117,232 | |

| | 957 | | Expiration: October 2011, Exercise Price $67.50 | | | 71,775 | |

| | 3,348 | | Expiration: October 2011, Exercise Price $70.00 | | | 234,360 | |

| | | | El Paso Corporation | | | | |

| | 15,894 | | Expiration: October 2011, Exercise Price $20.00 | | | 158,940 | |

| | | | EXCO Resources, Inc. | | | | |

| | 2,015 | | Expiration: December 2011, Exercise Price $14.00 | | | 65,488 | |

| | | | Exelon Corporation | | | | |

| | 6,545 | | Expiration: October 2011, Exercise Price $38.00 | | | 3,272,500 | |

| | 2,383 | | Expiration: October 2011, Exercise Price $41.00 | | | 518,303 | |

| | 3,516 | | Expiration: October 2011, Exercise Price $42.00 | | | 492,240 | |

| | | | Hewlett-Packard Company | | | | |

| | 5,348 | | Expiration: November 2011, Exercise Price $19.00 | | | 2,246,160 | |

| | 5,481 | | Expiration: November 2011, Exercise Price $21.00 | | | 1,529,199 | |

| | | | ITT Corporation | | | | |

| | 14,358 | | Expiration: October 2011, Exercise Price $60.00 | | | 71,790 | |

| | | | Kraft Foods, Inc. | | | | |

| | 4,344 | | Expiration: October 2011, Exercise Price $33.00 | | | 532,140 | |

| | | | The Lubrizol Corporation | | | | |

| | 455 | | Expiration: December 2011, Exercise Price $135.00 | | | — | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

September 30, 2011

| Contracts (100 shares per contract) | | Value | |

| | | Macarthur Coal Ltd. | | | |

| | 2,390 | | Expiration: October 2011, Exercise Price AUD 16.00 | | $ | — | |

| | | | Marriott International Inc. | | | | |

| | 5,751 | | Expiration: October 2011, Exercise Price $35.00 | | | 14,377 | |

| | | | McGraw-Hill Companies, Inc. | | | | |

| | 51 | | Expiration: November 2011, Exercise Price $41.00 | | | 15,427 | |

| | 2,940 | | Expiration: November 2011, Exercise Price $42.00 | | | 712,950 | |

| | | | Mead Johnson Nutrition Co. | | | | |

| | 6,286 | | Expiration: November 2011, Exercise Price $65.00 | | | 4,557,350 | |

| | | | NYSE Euronext | | | | |

| | 5,215 | | Expiration: December 2011, Exercise Price $27.00 | | | 466,743 | |

| | 2,869 | | Expiration: December 2011, Exercise Price $28.00 | | | 192,223 | |

| | 1,574 | | Expiration: December 2011, Exercise Price $29.00 | | | 72,404 | |

| | | | Pfizer Inc. | | | | |

| | 4,293 | | Expiration: October 2011, Exercise Price $19.00 | | | 42,930 | |

| | | | Progress Energy Inc. | | | | |

| | 5,081 | | Expiration: October 2011, Exercise Price $47.00 | | | 2,642,120 | |

| | 2,946 | | Expiration: October 2011, Exercise Price $48.00 | | | 1,325,700 | |

| | | | Range Resources Corporation | | | | |

| | 3,916 | | Expiration: November 2011, Exercise Price $57.50 | | | 2,760,780 | |

| | | | Sara Lee Corp. | | | | |

| | 22,706 | | Expiration: October 2011, Exercise Price $19.00 | | | 56,765 | |

| | | | Transatlantic Holdings, Inc. | | | | |

| | 1,988 | | Expiration: October 2011, Exercise Price $50.00 | | | 178,920 | |

| | | | Verizon Communications Inc. | | | | |

| | 3,551 | | Expiration: December 2011, Exercise Price $35.00 | | | 919,709 | |

| | | | Williams Companies, Inc. | | | | |

| | 14,870 | | Expiration: November 2011, Exercise Price $27.00 | | | 1,650,570 | |

| | | | | | | 35,762,649 | |

| PUT OPTIONS WRITTEN | | | | |

| | | | Global Industries, Ltd. | | | | |

| | 2,534 | | Expiration: March 2012, Exercise Price $7.50 | | | 57,015 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 2,863 | | Expiration: October 2011, Exercise Price $105.00 | | | 555,422 | |

| | 12,403 | | Expiration: October 2011, Exercise Price $107.00 | | | 2,976,720 | |

| | | | | | | 3,589,157 | |

| | | | TOTAL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $51,470,103) | | $ | 39,351,806 | |

AUD — Australian Dollars

ETF — Exchange Traded Fund

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF FORWARD CURRENCY EXCHANGE CONTRACTS*

September 30, 2011

| | | | | | | U.S. $ | | | | | | | U.S. $ | | | Unrealized | |

| Settlement | | Currency to | | Value at | | | Currency to | | Value at | | | Appreciation | |

| Date | | be Delivered | | Sept. 30, 2011 | | | be Received | | Sept. 30, 2011 | | | (Depreciation) | |

| 10/5/11 | | | 1,224,771 | | Australian Dollars | | $ | 1,184,451 | | | | 1,292,133 | | U.S. Dollars | | $ | 1,292,133 | | | $ | 107,682 | |

| 10/5/11 | | | 1,295,420 | | U.S. Dollars | | | 1,295,420 | | | | 1,224,771 | | Australian Dollars | | | 1,184,451 | | | | (110,969 | ) |

| 10/19/11 | | | 92,196,397 | | Australian Dollars | | | 88,987,900 | | | | 92,198,011 | | U.S. Dollars | | | 92,198,011 | | | | 3,210,111 | |

| 10/19/11 | | | 1,307,977 | | U.S. Dollars | | | 1,307,977 | | | | 1,264,234 | | Australian Dollars | | | 1,220,238 | | | | (87,739 | ) |

| 10/26/11 | | | 6,281,628 | | Australian Dollars | | | 6,057,054 | | | | 6,454,373 | | U.S. Dollars | | | 6,454,373 | | | | 397,319 | |

| 10/26/11 | | | 3,882,257 | | U.S. Dollars | | | 3,882,257 | | | | 3,735,774 | | Australian Dollars | | | 3,602,216 | | | | (280,041 | ) |

| 12/14/11 | | | 52,007,620 | | Australian Dollars | | | 49,866,239 | | | | 50,789,602 | | U.S. Dollars | | | 50,789,602 | | | | 923,363 | |

| 12/22/11 | | | 31,738,128 | | Australian Dollars | | | 30,403,539 | | | | 32,754,859 | | U.S. Dollars | | | 32,754,859 | | | | 2,351,320 | |

| 12/22/11 | | | 16,222,818 | | U.S. Dollars | | | 16,222,818 | | | | 15,313,600 | | Australian Dollars | | | 14,669,663 | | | | (1,553,155 | ) |

| 1/12/12 | | | 6,063,803 | | Australian Dollars | | | 5,796,109 | | | | 6,172,951 | | U.S. Dollars | | | 6,172,951 | | | | 376,842 | |

| 1/12/12 | | | 823,522 | | U.S. Dollars | | | 823,522 | | | | 807,938 | | Australian Dollars | | | 772,271 | | | | (51,251 | ) |

| 10/4/11 | | | 10,783,915 | | British Pounds | | | 16,815,673 | | | | 17,557,292 | | U.S. Dollars | | | 17,557,292 | | | | 741,619 | |

| 10/4/11 | | | 17,085,668 | | U.S. Dollars | | | 17,085,668 | | | | 10,783,915 | | British Pounds | | | 16,815,673 | | | | (269,995 | ) |

| 12/15/11 | | | 115,249,297 | | British Pounds | | | 179,584,944 | | | | 189,750,342 | | U.S. Dollars | | | 189,750,342 | | | | 10,165,398 | |

| 12/15/11 | | | 7,230,510 | | U.S. Dollars | | | 7,230,510 | | | | 4,554,226 | | British Pounds | | | 7,096,533 | | | | (133,977 | ) |

| 12/16/11 | | | 6,449,632 | | British Pounds | | | 10,043,077 | | | | 10,045,302 | | U.S. Dollars | | | 10,045,302 | | | | 2,225 | |

| 12/21/11 | | | 10,876,422 | | British Pounds | | | 16,946,993 | | | | 17,709,213 | | U.S. Dollars | | | 17,709,213 | | | | 762,220 | |

| 12/21/11 | | | 365,334 | | U.S. Dollars | | | 365,334 | | | | 228,978 | | British Pounds | | | 356,780 | | | | (8,554 | ) |

| 12/28/11 | | | 120,686,527 | | British Pounds | | | 188,033,914 | | | | 196,033,078 | | U.S. Dollars | | | 196,033,078 | | | | 7,999,164 | |

| 12/14/11 | | | 1,697,655 | | Canadian Dollars | | | 1,617,369 | | | | 1,770,419 | | U.S. Dollars | | | 1,770,419 | | | | 153,050 | |

| 3/14/12 | | | 59,016,999 | | Canadian Dollars | | | 56,158,987 | | | | 60,005,913 | | U.S. Dollars | | | 60,005,913 | | | | 3,846,926 | |

| 10/3/11 | | | 6,773,025 | | Euros | | | 9,073,874 | | | | 9,717,936 | | U.S. Dollars | | | 9,717,936 | | | | 644,062 | |

| 10/3/11 | | | 9,098,882 | | U.S. Dollars | | | 9,098,882 | | | | 6,773,025 | | Euros | | | 9,073,874 | | | | (25,008 | ) |

| 10/12/11 | | | 12,013,350 | | Euros | | | 16,093,200 | | | | 17,054,152 | | U.S. Dollars | | | 17,054,152 | | | | 960,952 | |

| 10/12/11 | | | 16,739,402 | | U.S. Dollars | | | 16,739,402 | | | | 12,013,350 | | Euros | | | 16,093,200 | | | | (646,202 | ) |

| 10/26/11 | | | 40,646,408 | | Euros | | | 54,444,995 | | | | 58,474,236 | | U.S. Dollars | | | 58,474,236 | | | | 4,029,241 | |

| 10/26/11 | | | 58,473,667 | | U.S. Dollars | | | 58,473,667 | | | | 40,646,408 | | Euros | | | 54,444,995 | | | | (4,028,672 | ) |

| 12/14/11 | | | 160,866,240 | | Euros | | | 215,450,666 | | | | 216,834,018 | | U.S. Dollars | | | 216,834,018 | | | | 1,383,352 | |

| 10/26/11 | | | 160,961,000 | | Norwegian Kroner | | | 27,384,557 | | | | 29,438,250 | | U.S. Dollars | | | 29,438,250 | | | | 2,053,693 | |

| 10/25/11 | | | 174,716,885 | | Swiss Francs (a) | | | 193,230,705 | | | | 203,541,983 | | U.S. Dollars | | | 203,541,983 | | | | 10,311,278 | |

| 10/25/11 | | | 30,893,152 | | U.S. Dollars | | | 30,893,152 | | | | 23,600,997 | | Swiss Francs | | | 26,101,869 | | | | (4,791,283 | ) |

| | | | | | | | $ | 1,330,592,855 | | | | | | | | $ | 1,369,025,826 | | | $ | 38,432,971 | |

| * | JPMorgan Chase & Co. Inc. is the counterparty for all open forward currency exchange contracts held by the Fund as of September 30, 2011. |

| (a) | Security fair valued in good faith. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF EQUITY SWAP CONTRACTS

September 30, 2011

| | | | | | | | | | Unrealized | | |

| Termination | | | | | | | | | Appreciation | | |

| Date | Security | | Shares | | | Notional | | | (Depreciation)* | | Counterparty |

| LONG SWAP CONTRACTS | | | | | | | | | | | |

| 10/4/11 | Aker Drilling ASA | | | 6,074,000 | | | $ | 27,671,504 | | | $ | (1,995,337 | ) | JPMorgan Chase & Co. Inc. |

| 12/31/11 | ASX Ltd. | | | 1,734,159 | | | | 50,765,146 | | | | (11,650,161 | ) | JPMorgan Chase & Co. Inc. |

| 10/11/11 | Autonomy Corporation PLC | | | 4,732,805 | | | | 188,014,418 | | | | 1,625,435 | | Deutsche Bank AG |

| 12/31/11 | British Sky Broadcasting Group | | | 3,413,600 | | | | 36,380,681 | | | | (10,690,678 | ) | Merrill Lynch & Co. Inc. |

| 12/31/11 | British Sky Broadcasting Group | | | 11,913,904 | | | | 121,050,388 | | | | (30,352,151 | ) | JPMorgan Chase & Co. Inc. |

| 11/15/11 | Eastern Star Gas Limited | | | 28,926,000 | | | | 21,508,795 | | | | (2,587,205 | ) | JPMorgan Chase & Co. Inc. |

| 12/5/11 | Foster’s Group Limited | | | 17,031,821 | | | | 88,151,937 | | | | (1,403,595 | ) | JPMorgan Chase & Co. Inc. |

| 12/31/11 | Hillgrove Resources Ltd. | | | 13,139,699 | | | | 2,892,573 | | | | (1,987,294 | ) | JPMorgan Chase & Co. Inc. |

| 12/31/11 | Indophil Resources NL | | | 5,978,357 | | | | 1,722,890 | | | | (2,480,843 | ) | JPMorgan Chase & Co. Inc. |

| 11/10/11 | MAN SE | | | 1,694,590 | | | | 217,045,494 | | | | (16,079,585 | ) | JPMorgan Chase & Co. Inc. |

| 11/30/11 | Macarthur Coal Ltd. | | | 1,026,533 | | | | 15,939,142 | | | | (329,890 | ) | JPMorgan Chase & Co. Inc. |

| 12/15/11 | Nalco Holding Co. | | | 35,000 | | | | 1,223,600 | | | | 43,453 | | Merrill Lynch & Co. Inc. |

| 10/27/11 | Northumbrian Water Group PLC | | | 2,289,773 | | | | 16,572,873 | | | | (932,033 | ) | JPMorgan Chase & Co. Inc. |

| 12/31/11 | Renault SA | | | 63,300 | | | | 2,237,857 | | | | (1,805,896 | ) | JPMorgan Chase & Co. Inc. |

| 12/31/11 | Smith & Nephew PLC | | | 962,339 | | | | 8,866,164 | | | | (1,846,055 | ) | Merrill Lynch & Co. Inc. |

| 3/31/12 | Synthes, Inc. (a) | | | 1,764,964 | | | | 290,409,630 | | | | (16,430,170 | ) | JPMorgan Chase & Co. Inc. |

| 12/31/11 | TMX Group, Inc. | | | 98,200 | | | | 3,840,838 | | | | (540,570 | ) | Deutsche Bank AG |

| | | | | | | | | | | | | (99,442,575 | ) | |

| | | | | | | | | | | | | | | |

| SHORT SWAP CONTRACTS | | | | | | | | | | | | | | |

| 12/31/11 | Daimler AG | | | (7,029 | ) | | | (332,652 | ) | | | 197,841 | | JPMorgan Chase & Co. Inc. |

| 12/31/11 | Deutsche Borse AG | | | (67,042 | ) | | | (3,512,178 | ) | | | 1,760,323 | | Merrill Lynch & Co. Inc. |

| 12/15/11 | Ecolab Inc. | | | (30,020 | ) | | | (1,480,887 | ) | | | 40,621 | | Merrill Lynch & Co. Inc. |

| 6/30/12 | Express Scripts, Inc. | | | (1,984 | ) | | | (75,967 | ) | | | 37,002 | | Merrill Lynch & Co. Inc. |

| 3/31/12 | Johnson & Johnson (a) | | | (100 | ) | | | (6,381 | ) | | | (76 | ) | Merrill Lynch & Co. Inc. |

| 11/15/11 | Santos Limited | | | (1,963,482 | ) | | | (21,650,393 | ) | | | 3,297,701 | | JPMorgan Chase & Co. Inc. |

| 12/31/11 | Volvo AB | | | (29,677 | ) | | | (310,561 | ) | | | 210,852 | | JPMorgan Chase & Co. Inc. |

| | | | | | | | | | | | | 5,544,264 | | |

| | | | | | | | | | | | $ | (93,898,311 | ) | |

| * | Unrealized appreciation is a receivable and unrealized depreciation is a payable on the Statement of Assets and Liabilities. |

| (a) | Security fair valued in good faith. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2011

| ASSETS: | | | | | | |

| Investments, at value | | | | | | |

| Investments in non affiliates (Cost $4,279,665,060) | | $ | 4,061,507,999 | | | | |

| Investments in affiliates (Cost $313,360,369) | | | 307,778,750 | | | | |

| Total investments | | | | | | $ | 4,369,286,749 | |

| Cash | | | | | | | 3,670,515 | |

| Deposits at brokers | | | | | | | 553,111,619 | |

| Receivable from brokers | | | | | | | 378,527,594 | |

| Receivable for investments sold | | | | | | | 101,857,260 | |

| Receivable for forward currency exchange contracts | | | | | | | 50,419,817 | |

| Receivable for swap contracts | | | | | | | 1,084,864 | |

| Receivable for fund shares issued | | | | | | | 19,299,495 | |

| Dividends and interest receivable | | | | | | | 6,956,088 | |

| Prepaid expenses and other receivables | | | | | | | 208,894 | |

| Total Assets | | | | | | | 5,484,422,895 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Securities sold short, at value (proceeds of $378,527,594) | | | 354,514,420 | | | | | |

| Written option contracts, at value (premiums received $51,470,103) | | | 39,351,806 | | | | | |

| Payable for forward currency exchange contracts | | | 11,986,846 | | | | | |

| Payable for swap contracts | | | 94,983,175 | | | | | |

| Payable for swap contracts closed | | | 406,346 | | | | | |

| Payable for swap interest | | | 325,027 | | | | | |

| Payable for investments purchased | | | 33,463,919 | | | | | |

| Payable for fund shares redeemed | | | 24,653,610 | | | | | |

| Investment advisory fee payable | | | 3,534,883 | | | | | |

| Distribution fees payable | | | 4,408,424 | | | | | |

| Dividends payable | | | 653,050 | | | | | |

| Accrued expenses and other liabilities | | | 2,287,322 | | | | | |

| Total Liabilities | | | | | | | 570,568,828 | |

| NET ASSETS | | | | | | $ | 4,913,854,067 | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Accumulated undistributed net investment income | | | | | | $ | 78,326,065 | |

| Accumulated undistributed net realized gain on investments, securities | | | | | | | | |

| sold short, written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translation and forward currency exchange contracts | | | | | | | 83,645,317 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | (223,738,680 | ) | | | | |

| Securities sold short | | | 24,013,174 | | | | | |

| Written option contracts | | | 12,118,297 | | | | | |

| Swap contracts | | | (93,898,311 | ) | | | | |

| Forward currency exchange contracts | | | 38,432,971 | | | | | |

| Net unrealized depreciation | | | | | | | (243,072,549 | ) |

| Paid-in capital | | | | | | | 4,994,955,234 | |

| Total Net Assets | | | | | | $ | 4,913,854,067 | |

| NET ASSET VALUE and offering price per share*, | | | | | | | | |

| ($4,913,854,067 / 315,131,296 shares of beneficial interest outstanding) | | | | | | $ | 15.59 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2011

| INVESTMENT INCOME: | | | | | | |

| Interest | | | | | $ | 6,004,227 | |

| Dividend income on long positions | | | | | | | |

| Non Affiliates | | | | | | 30,377,891 | |

| Affiliates | | | | | | 382,650 | |

| Total investment income | | | | | | 36,764,768 | |

| EXPENSES: | | | | | | | |

| Investment advisory fee | | $ | 43,967,215 | | | | | |

| Distribution fees | | | 10,771,317 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 5,345,165 | | | | | |

| Administration fees | | | 1,466,205 | | | | | |

| Federal and state registration fees | | | 594,519 | | | | | |

| Reports to shareholders | | | 510,024 | | | | | |

| Professional fees | | | 442,284 | | | | | |

| Fund accounting expense | | | 383,835 | | | | | |

| Custody fees | | | 289,098 | | | | | |

| Miscellaneous expenses | | | 220,112 | | | | | |

| Trustees’ fees and expenses | | | 153,048 | | | | | |

| Borrowing expense on securities sold short | | | 4,297,394 | | | | | |

| Dividends on securities sold short | | | 23,192,563 | | | | | |

| Total expenses before expense waiver by Adviser | | | | | | | 91,632,779 | |

| Less: Expense waived by Adviser | | | | | | | (5,296,618 | ) |

| Net expenses | | | | | | | 86,336,161 | |

| NET INVESTMENT LOSS | | | | | | | (49,571,393 | ) |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain (loss) on: | | | | | | | | |

| Investments | | | | | | | | |

| Non Affiliates | | | 140,880,080 | | | | | |

| Affiliates | | | 54,028,443 | | | | | |

| Securities sold short | | | 1,339,501 | | | | | |

| Written option contracts expired or closed | | | 66,124,635 | | | | | |

| Swap contracts | | | 83,205,915 | | | | | |

| Foreign currency translation | | | 54,709 | | | | | |

| Forward currency exchange contracts | | | (73,002,999 | ) | | | | |

| Net realized gain | | | | | | | 272,630,284 | |

| Change in unrealized appreciation / (depreciation) on: | | | | | | | | |

| Investments | | | (317,491,636 | ) | | | | |

| Securities sold short | | | 57,146,628 | | | | | |

| Written option contracts | | | 4,818,800 | | | | | |

| Swap contracts | | | (100,869,422 | ) | | | | |

| Foreign currency translation | | | (7,083 | ) | | | | |

| Forward currency exchange contracts | | | 82,770,417 | | | | | |

| Net unrealized depreciation | | | | | | | (273,632,296 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | | | | | (1,002,012 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | (50,573,405 | ) |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | September 30, 2011 | | | September 30, 2010 | |

| | | | | | | |

| Net investment loss | | $ | (49,571,393 | ) | | $ | (35,261,194 | ) |

| Net realized gain on investments, securities sold short, | | | | | | | | |

| written option contracts expired or closed, | | | | | | | | |

| swap contracts, foreign currency translation | | | | | | | | |

| and forward currency exchange contracts | | | 272,630,284 | | | | 153,002,878 | |

| Change in unrealized depreciation on investments, | | | | | | | | |

| securities sold short, written option contracts, | | | | | | | | |

| swap contracts, foreign currency translation | | | | | | | | |

| and forward currency exchange contracts | | | (273,632,296 | ) | | | (10,669,250 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (50,573,405 | ) | | | 107,072,434 | |

| Distributions to shareholders from: (Note 2) | | | | | | | | |

| Net investment income | | | — | | | | (42,329 | ) |

| Net realized gains | | | (70,276,496 | ) | | | — | |

| Total dividends and distributions | | | (70,276,496 | ) | | | (42,329 | ) |

| Net increase in net assets from | | | | | | | | |

| capital share transactions (Note 4) | | | 1,461,121,676 | | | | 1,655,172,030 | |

| Net increase in net assets | | | 1,340,271,775 | | | | 1,762,202,135 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 3,573,582,292 | | | | 1,811,380,157 | |

| End of year (including accumulated undistributed | | | | | | | | |

| net investment income of $78,326,065 | | | | | | | | |

| and $7,037,435, respectively) | | $ | 4,913,854,067 | | | $ | 3,573,582,292 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS

Selected per share data is based on a share of beneficial interest outstanding throughout each year.

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of year | | $ | 15.93 | | | $ | 15.26 | | | $ | 14.79 | | | $ | 16.55 | | | $ | 15.95 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.18 | )(4) | | | (0.02 | )(2) | | | 0.24 | (2) | | | 0.00 | (3)(5) | | | 0.13 | (3) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.13 | | | | 0.69 | | | | 0.58 | | | | (0.70 | ) | | | 1.13 | |

| Total from investment operations | | | (0.05 | ) | | | 0.67 | | | | 0.82 | | | | (0.70 | ) | | | 1.26 | |

| Redemption fees | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | | | | — | (5) | | | (0.06 | ) | | | (0.37 | ) | | | (0.11 | ) |

| Distributions from net realized gains | | | (0.29 | ) | | | — | | | | (0.05 | ) | | | (0.69 | ) | | | (0.55 | ) |

| Distributions from return of capital | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| Total distributions | | | (0.29 | ) | | | — | | | | (0.35 | ) | | | (1.06 | ) | | | (0.66 | ) |

| Net Asset Value, end of year | | $ | 15.59 | | | $ | 15.93 | | | $ | 15.26 | | | $ | 14.79 | | | $ | 16.55 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (0.34 | )% | | | 4.39 | % | | | 5.78 | % | | | (4.32 | )% | | | 8.15 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 4,913,854 | | | $ | 3,573,582 | | | $ | 1,811,380 | | | $ | 1,414,165 | | | $ | 1,821,714 | |

| Ratio of operating expenses | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.96 | % | | | 2.57 | % | | | 4.22 | % | | | 1.66 | % | | | 2.16 | % |

| Ratio of dividends on short positions | | | | | | | | | | | | | | | | | | | | |

| and borrowing expense on securities | | | | | | | | | | | | | | | | | | | | |

| sold short to average net assets | | | 0.62 | % | | | 1.16 | % | | | 2.68 | % | | | 0.19 | % | | | 0.76 | % |

| Ratio of operating expense to average net | | | | | | | | | | | | | | | | | | | | |

| assets excluding dividends on short positions | | | | | | | | | | | | | | | | | | | | |

| and borrowing expense on securities sold short | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.46 | % | | | 1.48 | % | | | 1.54 | % | | | 1.48 | % | | | 1.41 | % |

| After expense waiver | | | 1.34 | % | | | 1.41 | % | | | 1.54 | % | | | 1.47 | % | | | 1.40 | %(6) |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | (1.25 | )% | | | (1.35 | )% | | | (2.49 | )% | | | (0.10 | )% | | | 0.82 | % |

| After expense waiver | | | (1.13 | )% | | | (1.28 | )% | | | (2.49 | )% | | | (0.09 | )% | | | 0.83 | % |

Portfolio turnover rate(7) | | | 292.79 | % | | | 192.21 | % | | | 318.45 | % | | | 300.24 | % | | | 334.87 | % |

_______________

Footnotes To Financial Highlights On Following Page

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS (continued)

| (1) | Net investment income (loss) before interest expense, borrowing expense on securities sold short and dividends on securities sold short for the years ended September 30, 2011, 2010, 2009, 2008 and 2007 was $(0.08), $0.12, $0.55, $0.02 and $0.26, respectively. |

| (2) | Net investment income (loss) per share is calculated using ending balance after consideration of adjustments for permanent book and tax differences. |

| (3) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (4) | Net investment income (loss) per share represents net investment income (loss) divided by the average shares outstanding throughout the period. |

| (5) | Amount less than $0.005 per share. |

| (6) | The Fund incurred proxy expenses of approximately $525,000 in 2007 related to shareholder approval of changes in the Fund’s fundamental investment policies and the election of trustees. |

| (7) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short positions). The denominator includes the average long positions throughout the year. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2011

Note 1 — ORGANIZATION

The Merger Fund (the “Fund”) is a no-load, open-end, non-diversified investment company organized as a trust under the laws of the Commonwealth of Massachusetts on April 12, 1982, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund was formerly known as the Risk Portfolio of The Ayco Fund. In January of 1989, the Fund’s fundamental investment policies were amended to permit the Fund to engage in merger arbitrage. At the same time, Westchester Capital Management, Inc. became the Fund’s investment adviser, and the Fund began to do business as The Merger Fund. In a transaction that closed on December 31, 2010, Westchester Capital Management, Inc. transferred substantially all of its business and assets to Westchester Capital Management, LLC (the “Adviser”), which became the Fund’s investment adviser. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were available to be issued. The presentation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and assumptions.

A.Investment Valuation