UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3445

The Merger Fund

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Roy Behren and Michael T. Shannon

The Merger Fund

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Item 1. Reports to Stockholders.

THE

MERGER

FUND®

ANNUAL REPORT

DECEMBER 31, 2011

February 1, 2012

Dear Fellow Shareholders:

The Merger Fund® bounced back nicely in the fourth quarter, posting a 2.9% gain which brought the Fund to a 1.7% gain for the calendar year, our 73rd gain in the 92 quarters since inception.1 Although the strong quarter coincided with strength in the overall equity markets, our performance was actually due to multiple deal completions and successful deal selection as well as a snap-back in overextended arbitrage spreads resulting from the third-quarter market turbulence.

Although we are not satisfied with a 1.7% rate of return, we did achieve our goal of providing non-correlated, positive returns in a difficult market environment. U.S. equity markets gained traction, finishing modestly in the black, thanks to the S&P 500’s stratospheric 11.8% fourth-quarter gain, while most of Europe remained stuck in the mud, ending the year with negative returns. Our take is that the macro environment remains challenging worldwide, despite apparent stability in various sectors of corporate earnings. Neither the European sovereign debt problems nor the U.S. fiscal and budgetary issues have been resolved, and therefore economic visibility is limited. Nobody knows whether the U.S. issues will progress before the November election amid Congressional gridlock, yet for reasons we will discuss below, we remain optimistic about future deal activity. Our 22nd gain in the past 24 years compares as follows with some relevant benchmarks and peer groups:

| | 2011 Return | Std. Deviation | Beta vs. S&P 500 |

| MERFX | 1.7% | 3.7 | 0.18 |

| HFRX Event Driven Index | -4.9% | 5.8 | 0.32 |

| HFRX Merger Arbitrage Index | -2.1% | 3.7 | 0.21 |

| S&P 500 | 2.1% | 15.9 | 1.00 |

| MSCI World Index | -5.0% | 17.5 | 1.08 |

We again accomplished this performance objective with less than one quarter of the volatility (standard deviation) and a beta (correlation) of less than one fifth of that of the S&P 500, reflecting our emphasis on risk-adjusted metrics and the uncorrelated nature of the Fund. Conservative deal selection and the prudent use of derivatives positively impacted performance.2 The Fund purchased put options, sold call options, and utilized forward contracts and total-return swap contracts for risk-management (as opposed to speculative) purposes as well as return-enhancement purposes.

We were invested in a total of 104 positions during the quarter and experienced one terminated transaction, consistent with our historic deal-selection success rate of 98% plus. We ended the quarter with 62 investments in the portfolio. However, due to the typical year-end dynamics of deal completions and seasonally low deal announcements, we also ended the year with approximately 16% in cash. This exceeds our target range of 5-10% but is not atypical for the end of the year. Rest assured that we will not invest in unattractive transactions or stray from our mandate merely to show a low cash position.

Nonetheless, our quarterly performance of +2.9% was obtained by opportunistically deploying our liquidity during the third-quarter European debt crisis as well as being invested in 26 successfully

| 1 | On December 29th, The Merger Fund® paid a distribution to shareholders of record as of December 28th of $0.4519 per share, consisting of $0.3689 in short-term capital gains and $0.0830 in net investment income. |

| 2 | TheFund typically uses derivative instruments for hedging purposes or as a more tax-efficient way to invest in foreign transactions. Use of these instruments may involve certain costs and risks. A complete description of the Fund’s principal and other risk factors are contained in the Fund’s prospectus and statement of additional information. |

completed deals prior to the end of the year. Reflecting this dynamic, our ratio of winning to losing investments for the quarter was three to one. Our largest loser during the period was our macro portfolio hedge, which cost 20 basis points while the S&P 500 Index was up almost 12%. The second largest detractor from performance was Pharmasset, Inc., an $11 billion biotech company with a Hepatitis C treatment pipeline. Pharmasset was the subject of a tender offer from Gilead Sciences Inc. The deal was announced in November and the transaction was completed in mid-January, entirely recouping the Fund’s fourth quarter negative mark-to-market.

Remarkably, the Fund made 0.13% in its only terminated transaction of the period, AT&T’s attempted $39 billion purchase of T-Mobile from Deutsche Telekom AG (“DT”). As we typically do, we structured our investment conservatively, in the form of an in-the-money buy-write strategy on AT&T, the buyer. Win, lose or draw, we thought that although the transaction was positive and highly accretive for AT&T, the stock price would be protected during the pendency of the transaction by its earnings power and high dividend yield. The U.S. Department of Justice sued to block the acquisition in August, which AT&T indicated it would fight, but the death knell then tolled in November when the FCC scheduled an administrative hearing on AT&T’s application. Within a month, AT&T, in agreement with DT, folded its tent and walked away from the deal, despite its contractual right to litigate, the strong strategic rationale for the deal and a $4 billion termination fee owed to DT. We were surprised by the timing as well as the decision, but although AT&T traded down modestly on the news, we were protected by the structure of an in-the-money call and the premium received for the call, combined with the insurance of a long put option, and thus escaped with a modest profit.

Our biggest winner for the quarter involved the interminable rental car saga of Dollar Thrifty Automotive Group (“DTG”). After being our second biggest loser in the third quarter, DTG bounced back to contribute 0.64% to our performance. It looks like we are nearing the end game, as there is persistent press speculation and non-denial from the parties regarding progress with the FTC approval process. In the meantime, Hertz continues to reiterate its commitment to the acquisition and DTG has continued to report solid earnings, so the price of poker appears to have gone up. Recall that DTG has not yet agreed to be acquired, so DTG’s asking price has probably gone up, and so has our potential downside price if no deal comes together. Hertz’s most recent offer, which has officially expired, valued DTG at $69.52 on February 1, compared to its closing price that day of $74.20. We would add that it is not a given that Avis has been gone too long from the process to consider returning to the fray.

Other significant contributors in the quarter were British Sky Broadcasting, from which we are completing an orderly exit after News Corp. withdrew its bid in light of a phone-hacking scandal (25 bps); Synthes Inc., the Swiss firm being bought by Johnson & Johnson (22 bps); and Motorola Mobility Holdings, Inc., the handset maker that Google is in the process of purchasing (13 bps).

Probably the most atypical holding at year end was NYSE Euronext (“NYX”), which although formally “engaged” but not yet married to Deutsche Boerse AG (“DB”), ran into significant regulatory problems. Although the U.S. Department of Justice cleared the transaction, the European Commission expressed concern with the combined company’s share of worldwide derivatives trading. Many investors thought that this was such a good deal for DB that its price would fall if the deal were to be blocked, and many investors also thought that the deal terms for NYX were below the price at which it would trade in the absence of a deal. Consequently, this was not a normal merger arbitrage situation, as NYX was bid up and DB sold down under the theory that NYX was worth more as a standalone company than the value of the deal consideration. These market forces caused the arbitrage spread to tighten and then trade at

a negative spread, i.e., NYX was trading above the deal price, so an investor would definitely lose money if the deal were successfully completed; however, there was the possibility that the investor would make money on a termination as the spread moved further into negative territory as NYX traded up and DB traded down. As our investors know, we are not in the business of conducting relative value trades, and when we are handed the opportunity to lock in a profit— particularly a profit which is greater than we would have received if the deal were successfully completed— we take it. Therefore, we unwound our NYX position in December at between $1 and $1.50 in excess of the deal price. Because of significant speculative activity in NYX, option volatility levels increased and option prices became inflated. We took advantage of this by selling calls against our long stock, thereby converting some of our position into a short term, deep in-the-money buy-write. As of the date of this letter, DB’s arguments ended up as wasted words and thus it was a stormy Monday on January 30th as the EU denied approval of the transaction on anti-trust grounds. Two days later, the parties decided not to waste any more time and immediately terminated the transaction. Time will tell if we left any money on the table but we are comfortable with our decision to avoid this directional bet. The NYX position contributed 20 bps during the quarter.

GLOBAL REVIEW

Unlike the prior quarter, new positions predominantly involved U.S. companies. Of the Fund’s 26 new investments, only five were international, with two Canadian targets, and one each from Japan, the United Kingdom and Australia. Sector distribution was diverse, with the most popular industries being information technology, healthcare and energy.

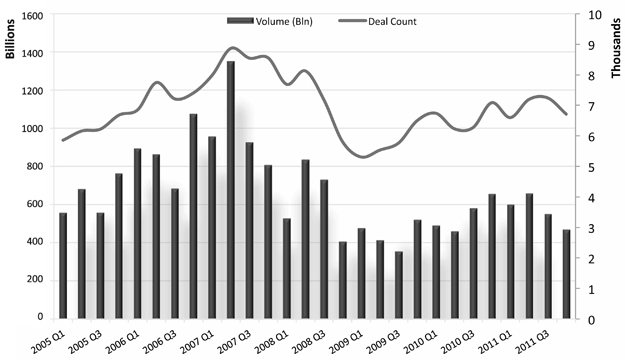

From a higher level perspective, here is how full-year worldwide activity stacked up:3

| | • | Globally, announced deal volume was essentially unchanged from 2010, with $2.27 trillion on 27,720 deals. However, the year was front-end loaded, as Q4 activity of $465 billion made it the slowest quarter of the year and represented a decrease of 29% year-over-year compared to Q4 of 2010. |

| | • | M&A activity in the Americas accounted for over 48% of global deal volume in 2011, followed by EMEA with 30% and APAC with 22%. The U.S. alone accounted for 38% of the Americas’ total volume. |

| | • | Private-equity transactions have exceeded $155 billion in North America this year, accounting for 23% of all deal activity. |

| | • | A significant majority of transactions, 56%, provided for cash consideration, while all-stock consideration represented only 17% of deal volume. |

There are multiple takeaways from these data. We have seen geographic as well as sector rotation in the past, and although last year’s activity trended strongly towards North America, trends often change course in short periods of time. M&A activity tends to be non-linear and there will be ebbs and flows even within up-cycles. The foundation has been laid for an extended period of corporate reorganization activity. As we have discussed before, strengthened corporate balance sheets coupled with record low funding rates incentivize companies to undertake transactions. The latest figure we have seen is that nonfinancial companies held a record $2.1 trillion in cash and other liquid assets at the end of September, according

| 3 | Bloomberg Global Financial Advisory Mergers & Acquisitions Rankings Q4 2011. |

to the Federal Reserve’s September flow of funds report.4 Earlier this month, Eastman Chemical reported that its after-tax funding cost for the $3.5 billion debt it needed to purchase Solutia, the specialty materials company, was expected to average 3% for a mix of five to 30-year obligations.

As we have seen, however, economic and political uncertainty can dampen activity, causing acquirers to stand back. “In my 30 years in the business, I can’t recall a time when political factors have had more of an impact than they do now,” Gene Sykes, co-head of global M&A at Goldman Sachs, was quoted as saying, and continued, “…we’ve had many discussions with boards and CEOs about deal opportunities, and while the desire to execute is there, until the picture becomes clearer, most of them are on hold.”5 In fact, the first month of 2012 has seen the lowest levels of dealmaking since 2003, with only $103 billion worth of transactions announced globally, nearly half the level of January 2011.

WHERE IT ALL BEGINS

Although there may be a lull in activity while companies wait for the smoke to clear, many bankers are observing a growing backlog. Larry Slaughter, co-head of North American investment banking at JPMorgan, noted in a recent FT article “…our pipeline of activity is up so we expect M&A to increase. Shareholders still prefer companies to grow, either via M&A or organically, rather than return cash to shareholders by dividends or stock buy-backs.”6 Aryeh Bourkoff, head of UBS AG’s investment banking for the Americas, also noted, “We’ve been spending time with companies and private-equity firms on planning so that when the obstacles to doing deals are alleviated, they are prepared to move. When there is more confidence and stability, you’ll see the deal gates open relatively quickly.”7 Echoing this sentiment was Henrik Aslaksen, global head of M&A at Deutsche Bank AG, who is quoted in the same article as saying, “If the macro environment cooperates, there will be big deals in 2012, even in Europe.”

Additionally, hostile approaches are often viewed as a leading indicator of an M&A rebound. Current unsolicited offers include Martin Marietta’s $5 billion bid for Vulcan Materials, Roche’s recent $5.7 billion bid for Illumina, and Westlake Chemical’s hostile $1.2 billion offer to buy Georgia Gulf Corporation. Companies that are having difficulty growing organically and can no longer cut costs often feel there is only one way out—to take immediate action to avoid the wrath of activist shareholders or even avoid becoming targets themselves.

The New York Times Dealbook recently cited a study by Ernst & Young in which 36% of companies surveyed plan to pursue an acquisition this year,8 so it is clearly not the end of the line for mergers.

And so, The Merger Fund® will be watching, cash in hand if necessary, for a revival of dealmaking. We will continue to be disciplined in our investment activities throughout the cycle rather than trying to force risky positions into the portfolio.

In any event, even if there are indeed blue skies ahead for merger activity, we find it necessary to recalibrate our expected returns in the near future. Given the extraordinary low cost of capital and risk-free interest rates,9 it is unrealistic to expect double-digit returns in this environment. High quality deals

| 4 | Wall Street Journal, 12/17/11, “Number of the Week: The Upside of Companies Sitting on Cash”. |

| 5 | Wall Street Journal, 1/3/12, “Europe’s Woes Even Dampened M&A”. |

| 6 | Financial Times, 1/29/12, “Sluggish start to year for M&A volumes”. |

| 8 | NYT Dealbook, 1/2/12, “On Wall Street, Renewed Optimism for Deal-Making”. |

| 9 | Six months Treasury Bills, slightly longer than the typical merger transaction takes to close, currently yield only .09% per annum. |

are currently trading at mid-to-high single digit annual returns in best-case scenarios. This would be the high end of our short-term return target since we vigorously manage portfolio risk. A merger arbitrage portfolio structured to provide double-digit returns in this environment would need to incur such high levels of risk and leverage that its capital account would head southbound very quickly.

OUR COMPANY

As we have mentioned, the Adviser, the Fund and the industry in general are at a crossroads. Regulatory authorities and sophisticated investors require institutional-quality infrastructure, compliance, reporting and risk-management processes. Our growth has enabled us to develop these programs and we have separated these functions from the portfolio management team. We have devoted significant resources to disaster recovery and business continuity. To that end we have implemented full real-time data backups to our co-location facility beyond the outskirts of town. Our COO has spearheaded this effort and we now have separate compliance, IT, accounting, middle and back office groups and have also implemented additional computer-driven compliance modules through a Bloomberg product called AIM (Bloomberg Asset and Investment Manager). We also remain vigilant to counterparty exposure. We recently had the pleasure of a routine eight week on-site examination by the Northeast Regional Office of the SEC, and we are awaiting the final results.

As we have mentioned, Westchester Capital Management is also managing (sub-advising) a ’40-Act registered mutual fund called the Dunham Monthly Distribution Fund, which provides a somewhat more conservative profile than The Merger Fund®. There is a significant strategy overlap and Merger Fund shareholders should feel comfortable that our attention is firmly focused on merger arbitrage.

Accordingly, although at some point we will develop additional product offerings as an adjunct to our flagship merger arbitrage products, we will do so only when we are comfortable that we have the appropriate infrastructure in place, including any additional personnel needed to ensure that the existing portfolio management team is not distracted from the task at hand. We will provide details as soon as legally permissible.

While we are on the subject of personnel, we are happy to announce that we have hired an additional senior analyst with experience in merger arbitrage, special situations and fixed-income analysis. Steve Tan has been in the investment business for 12 years, most recently as Vice President and Senior Analyst in the High Yield and Distressed Group at Avenue Capital Group in New York. He will be particularly helpful to the team as we analyze non-equity investments.

Finally, to reiterate our thoughts on the timing of our quarterly letters, we like being able to discuss the beginning of and outlook for the next quarter in addition to a discussion of the prior quarter. However, in an effort to provide more timely communications and necessary comparative statistics, we are making the statistical summary that is attached to each letter available no later than two weeks from the end of the quarter. It will be available electronically over the Internet or available upon request from the Fund. We will also endeavor to provide the letter and post it on the Internet within four weeks after the end of each quarter.

For convenience, investors can arrange for e-alerts of important Fund communications. Through our website at www.mergerfund.com, you can check account balances, make purchases and sales, and sign up for notification of trade confirmations, statements and shareholder communications via e-mail.

We appreciate your support and welcome your feedback. All of us at Westchester Capital Management and The Merger Fund® wish you a happy 2012.

Sincerely,

|  |

| Roy Behren | Mike Shannon |

Before investing in The Merger Fund®, consider its investment objectives, risks, charges, and expenses. For a prospectus or summary prospectus containing this and other information, including current performance data that may be lower or higher than the data included herein, contact your investment professional or view it online at mergerfund.com. Please read it carefully. The performance data included herein represents past performance and does not guarantee future results. The Merger Fund’s share price and return will vary, and investors may have a gain or loss when they redeem their shares. Current month-end performance is available at www.mergerfund.com.

Past performance is not indicative of future results.

The S&P 500 TR is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. It is shown with dividends reinvested. You cannot invest directly in the index.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

The HFRX Indices (“HFRX”) are a series of benchmarks of hedge fund industry performance which are engineered to achieve representative performance of a larger universe of hedge fund strategies. Hedge Fund Research, Inc. (“HFR, Inc.”) employs the HFRX Methodology (UCITSIII compliant), a proprietary and highly quantitative process by which hedge funds are selected as constituents for the HFRX Indices. This methodology includes robust classification, cluster analysis, correlation analysis, advanced optimization and Monte Carlo simulations. More specifically, the HFRX Methodology defines certain qualitative characteristics, such as whether the fund is open to transparent fund investment and the satisfaction of the index manager’s due diligence requirements. Production of the HFRX Methodology results in a model output which selects funds that, when aggregated and weighted, have the highest statistical likelihood of producing a return series that is most representative of the reference universe of strategies.

HFRX Merger Arbitrage Index includes investment managers who employ an investment process primarily focused on opportunities in equity and equity related instruments of companies which are currently engaged in a corporate transaction. Merger Arbitrage involves primarily announced transactions, typically with limited or no exposure to situations which pre- or post-date a formal announcement or situations in which no formal announcement is expected to occur. Opportunities are frequently presented in cross border, collared and international transactions which incorporate multiple geographic regulatory institutions, with typically involve minimal exposure to corporate credits. Merger Arbitrage strategies typically have over 75% of positions in announced transactions over a given market cycle.

HFRX Event Driven Index includes investment managers who maintain positions in companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated, and frequently involve additional derivative securities. Event Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company specific developments. Investment theses are typically predicated on fundamental characteristics (as opposed to quantitative), with the realization of the thesis predicated on a specific development exogenous to the existing capital structure.

Source: www.hedgefundresearch.com

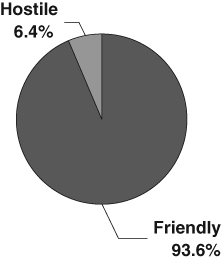

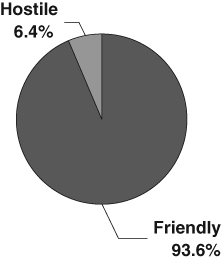

| Chart 1 | Chart 2 |

| | |

| PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

| By Type of Deal* | By Type of Buyer* |

| | |

|  |

| | |

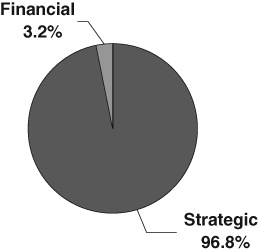

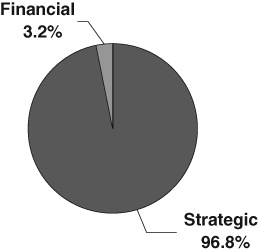

| Chart 3 |

| |

| PORTFOLIO COMPOSITION |

| By Deal Terms* |

| |

|

| |

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2011. |

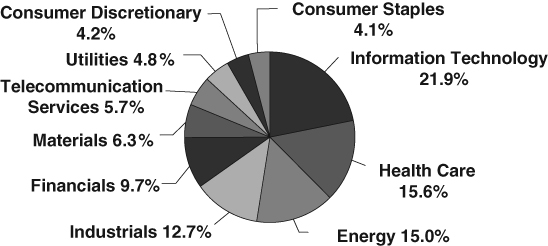

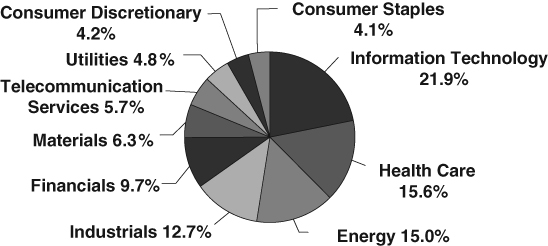

| Chart 4 |

| |

| PORTFOLIO COMPOSITION |

| By Sector* |

| |

|

| |

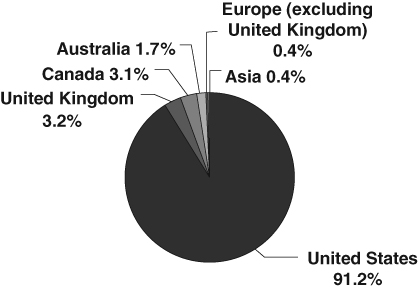

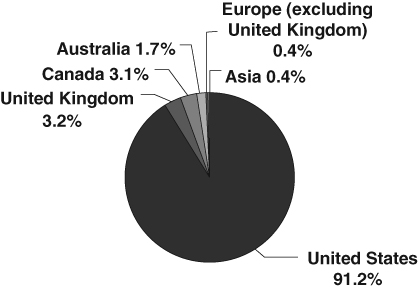

| Chart 5 |

| |

| PORTFOLIO COMPOSITION |

| By Region* |

| |

|

| |

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2011. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Chart 6

GLOBAL MERGER ACTIVITY

Source: Bloomberg M&A Advisory League Tables

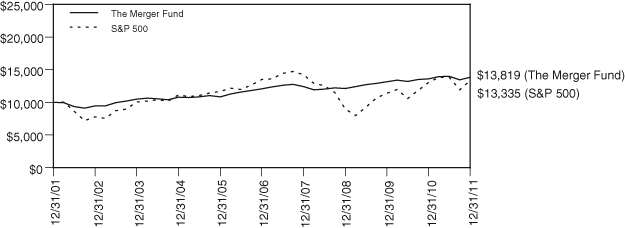

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND AND S&P 500

| | | | Average |

| | Quarter Ended | | Annual Total Return |

| | December 31, 2011 | 1 Yr. | 3 Yr. | 5 Yr. | 10 Yr. |

| The Merger Fund | 2.90% | 1.66% | 4.49% | 2.80% | 3.29% |

| The Standard & Poor’s 500 Index | 11.82% | 2.11% | 14.11% | -0.25% | 2.92% |

The Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on December 31, 2001. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund

EXPENSE EXAMPLE

December 31, 2011

(Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. As of January 27, 2012, the Fund no longer charges redemption fees. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 for the six month period 7/01/11 – 12/31/11.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop-payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, a $15.00 fee will be charged by the Fund’s transfer agent. IRAs will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under U.S. generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account | Ending Account | Expenses Paid During |

| | Value 7/01/11 | Value 12/31/11 | Period 7/01/11-12/31/11* |

Actual + (1) | $1,000.00 | $ 987.80 | $8.07 |

Hypothetical ++ (2) | $1,000.00 | $1,017.09 | $8.19 |

| + | Excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, your actual cost of investment in the Fund would be $6.61. |

| ++ | Excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, your hypothetical cost of investment in the Fund would be $6.72. |

| (1) | Ending account values and expenses paid during period based on a (1.22)% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.61%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

The Merger Fund

SCHEDULE OF INVESTMENTS

December 31, 2011

| Shares | | | | Value | |

| | | | | | |

| COMMON STOCKS — 68.41% | | | |

| | | | |

| | | AEROSPACE & DEFENSE — 6.19% | | | |

| | 2,515,929 | | Goodrich Corporation (g) | | $ | 311,220,417 | |

| | | | | | | | |

| | | | APPLICATION SOFTWARE — 3.90% | | | | |

| | 3,169,947 | | Magma Design Automation, Inc. (a) | | | 22,760,220 | |

| | 4,344,497 | | SuccessFactors, Inc. (a)(f)(j) | | | 173,215,095 | |

| | | | | | | 195,975,315 | |

| | | | | | | | |

| | | | BIOTECHNOLOGY — 1.48% | | | | |

| | 581,500 | | Pharmasset, Inc. (a) | | | 74,548,300 | |

| | | | | | | | |

| | | | COMMUNICATION EQUIPMENT — 7.18% | | | | |

| | 2,480,900 | | Blue Coat Systems, Inc. (a)(j) | | | 63,138,905 | |

| | 7,664,921 | | Motorola Mobility Holdings, Inc. (a)(f) | | | 297,398,935 | |

| | | | | | | 360,537,840 | |

| | | | | | | | |

| | | | COMPUTER STORAGE & PERIPHERALS — 0.10% | | | | |

| | 223,900 | | EMC Corp. (a) | | | 4,822,806 | |

| | | | | | | | |

| | | | CONSTRUCTION MATERIALS — 0.49% | | | | |

| | 620,400 | | Vulcan Materials Company | | | 24,412,740 | |

| | | | | | | | |

| | | | DIVERSIFIED CHEMICALS — 0.18% | | | | |

| | 910,400 | | Huntsman Corporation | | | 9,104,000 | |

| | | | | | | | |

| | | | DIVERSIFIED METALS & MINING — 0.46% | | | | |

| | 684,500 | | Grande Cache Coal Corporation (a)(b) | | | 6,658,547 | |

| | 565,885 | | Pilot Gold Inc. (a)(b) | | | 716,556 | |

| | 326,471 | | Rio Tinto plc — ADR | | | 15,970,961 | |

| | | | | | | 23,346,064 | |

| | | | | | | | |

| | | | DRUG RETAIL — 1.12% | | | | |

| | 1,705,300 | | Walgreen Company | | | 56,377,218 | |

| | | | | | | | |

| | | | ELECTRIC UTILITIES — 1.29% | | | | |

| | 1,152,910 | | Progress Energy Inc. | | | 64,586,018 | |

| | | | | | | | |

| | | | FOOD RETAIL — 0.20% | | | | |

| | 1,074,914 | | Winn Dixie Stores, Inc. (a) | | | 10,082,693 | |

| | | | | | | | |

| | | | GENERAL MERCHANDISE STORES — 1.14% | | | | |

| | 2,596,000 | | 99 Cents Only Stores (a) | | | 56,982,200 | |

| | | | | | | | |

| | | | HEALTH CARE EQUIPMENT — 0.16% | | | | |

| | 148,786 | | SonoSite, Inc. (a) | | | 8,013,614 | |

| | | | | | | | |

| | | | HEALTH CARE SERVICES — 1.16% | | | | |

| | 1,044,616 | | Medco Health Solutions, Inc. (a) | | | 58,394,035 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2011

| Shares | | | | Value | |

| | | | | | |

| | | HOTELS, RESORTS & CRUISE LINES — 0.33% | | | |

| | 575,100 | | Marriott International Inc. | | $ | 16,775,667 | |

| | | | | | | | |

| | | | HOUSEHOLD PRODUCTS — 1.12% | | | | |

| | 610,900 | | Colgate-Palmolive Company | | | 56,441,051 | |

| | | | | | | | |

| | | | INDEPENDENT POWER PRODUCERS | | | | |

| | | | & ENERGY TRADERS — 2.64% | | | | |

| | 3,344,530 | | Constellation Energy Group Inc. | | | 132,677,505 | |

| | | | | | | | |

| | | | INTEGRATED OIL & GAS — 1.27% | | | | |

| | 877,300 | | ConocoPhillips | | | 63,928,851 | |

| | | | | | | | |

| | | | INTEGRATED TELECOMMUNICATION SERVICES — 4.13% | | | | |

| | 4,216,400 | | AT&T Inc. (f) | | | 127,503,936 | |

| | 1,767,182 | | CenturyLink, Inc. | | | 65,739,170 | |

| | 355,100 | | Verizon Communications Inc. | | | 14,246,612 | |

| | | | | | | 207,489,718 | |

| | | | | | | | |

| | | | INTERNET SOFTWARE & SERVICES — 1.59% | | | | |

| | 167,500 | | LoopNet, Inc. (a) | | | 3,061,900 | |

| | 32,100 | | RightNow Technologies, Inc. (a) | | | 1,371,633 | |

| | 4,675,200 | | Yahoo! Inc. (a)(f) | | | 75,410,976 | |

| | | | | | | 79,844,509 | |

| | | | | | | | |

| | | | LIFE & HEALTH INSURANCE — 0.50% | | | | |

| | 563,100 | | Delphi Financial Group, Inc. | | | 24,945,330 | |

| | | | | | | | |

| | | | MANAGED HEALTH CARE — 2.45% | | | | |

| | 2,260,783 | | Healthspring, Inc. (a) | | | 123,303,105 | |

| | | | | | | | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 2.69% | | | | |

| | 1,400,900 | | Chesapeake Energy Corp. | | | 31,226,061 | |

| | 6,602,800 | | Daylight Energy Ltd. (a)(b) | | | 65,266,450 | |

| | 3,723,675 | | EXCO Resources Inc. | | | 38,912,404 | |

| | | | | | | 135,404,915 | |

| | | | | | | | |

| | | | OIL & GAS STORAGE & TRANSPORTATION — 7.47% | | | | |

| | 7,274,128 | | El Paso Corporation (f) | | | 193,273,581 | |

| | 2,928,922 | | Southern Union Company | | | 123,336,905 | |

| | 1,792,400 | | Williams Companies, Inc. | | | 59,185,048 | |

| | | | | | | 375,795,534 | |

| | | | | | | | |

| | | | PACKAGED FOODS & MEATS — 0.86% | | | | |

| | 2,270,600 | | Sara Lee Corp. | | | 42,959,752 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2011

| Shares | | | | Value | |

| | | | | | |

| | | PAPER PACKAGING — 3.56% | | | |

| | 5,648,872 | | Temple-Inland Inc. (j) | | $ | 179,125,731 | |

| | | | | | | | |

| | | | PHARMACEUTICALS — 1.13% | | | | |

| | 849,200 | | Abbott Laboratories | | | 47,750,516 | |

| | 429,300 | | Pfizer Inc. | | | 9,290,052 | |

| | | | | | | 57,040,568 | |

| | | | | | | | |

| | | | REINSURANCE — 1.58% | | | | |

| | 1,450,420 | | Transatlantic Holdings, Inc. (f) | | | 79,381,487 | |

| | | | | | | | |

| | | | SEMICONDUCTOR EQUIPMENT — 1.16% | | | | |

| | 1,407,700 | | Novellus Systems, Inc. (a) | | | 58,123,933 | |

| | | | | | | | |

| | | | SEMICONDUCTORS — 3.62% | | | | |

| | 3,670,572 | | NetLogic Microsystems Inc. (a)(j) | | | 181,950,254 | |

| | | | | | | | |

| | | | SPECIALIZED FINANCE — 3.11% | | | | |

| | 3,546,832 | | NYSE Euronext (f) | | | 92,572,315 | |

| | 2,574 | | Osaka Securities Exchange Co. (b) | | | 14,781,188 | |

| | 1,206,481 | | TMX Group Inc. (b) | | | 49,372,459 | |

| | | | | | | 156,725,962 | |

| | | | | | | | |

| | | | STEEL — 0.35% | | | | |

| | 1,266,800 | | Commercial Metals Company | | | 17,519,844 | |

| | | | | | | | |

| | | | SYSTEMS SOFTWARE — 0.15% | | | | |

| | 555,700 | | DemandTec, Inc. (a) | | | 7,318,569 | |

| | | | | | | | |

| | | | TRADING COMPANIES & DISTRIBUTORS — 0.32% | | | | |

| | 873,900 | | RSC Holdings, Inc. (a) | | | 16,167,150 | |

| | | | | | | | |

| | | | TRUCKING — 3.27% | | | | |

| | 2,338,825 | | Dollar Thrifty Automotive Group, Inc. (a)(f)(j) | | | 164,325,845 | |

| | | | | | | | |

| | | | WIRELESS TELECOMMUNICATION SERVICES — 0.06% | | | | |

| | 129,347 | | Telephone and Data Systems, Inc. — Class S | | | 3,079,752 | |

| | | | | | | | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $3,469,101,353) | | | 3,438,728,292 | |

| | | | | | | | |

| WARRANTS — 0.01% | | | | |

| | 142,642 | | Kinross Gold Corporation (a)(b) | | | 203,024 | |

| | | | | | | | |

| | | | TOTAL WARRANTS | | | | |

| | | | (Cost $540,029) | | | 203,024 | |

The accompanying notes are an integral part of these financial statements

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2011

| Principal Amount | | | Value | |

| | | | | | |

| CORPORATE BONDS — 2.33% | | | |

| | | Level 3 Financing, Inc. | | | |

| $ | 20,026,000 | | 9.250%, 11/1/2014 | | $ | 20,576,715 | |

| | | | Terrestar Networks, Inc. | | | | |

| | 43,660,000 | | 15.000%, 2/15/2014 | | | | |

| | | | (Acquired 7/27/11 — 8/11/11, Cost $0) (d)(i)(k) | | | — | |

| | | | Washington Mutual, Inc. | | | | |

| | 11,636,000 | | 4.000%, 1/15/2009 (d) | | | 12,799,600 | |

| | 5,747,000 | | 4.200%, 1/15/2010 (d) | | | 6,436,640 | |

| | 9,377,000 | | 5.500%, 8/24/2011(d) | | | 10,924,205 | |

| | 20,154,000 | | 5.000%, 3/22/2012 (d) | | | 22,975,560 | |

| | 37,798,000 | | 5.250%, 9/15/2017 (d) | | | 43,373,205 | |

| | | | TOTAL CORPORATE BONDS | | | | |

| | | | (Cost $115,314,649) | | | 117,085,925 | |

| Contracts (100 shares per contract) | | | |

| | | | | | |

| PURCHASED PUT OPTIONS — 0.43% | | | |

| | | Abbott Laboratories | | | |

| | 6,243 | | Expiration: January 2012, Exercise Price: $47.50 | | | 34,337 | |

| | 2,249 | | Expiration: January 2012, Exercise Price: $50.00 | | | 20,241 | |

| | | | AT&T Inc. | | | | |

| | 11,029 | | Expiration: January 2012, Exercise Price: $25.00 | | | 16,543 | |

| | 30,178 | | Expiration: February 2012, Exercise Price: $25.00 | | | 181,068 | |

| | | | CenturyLink, Inc. | | | | |

| | 15,632 | | Expiration: January 2012, Exercise Price: $30.00 | | | 39,080 | |

| | | | Chesapeake Energy Corp. | | | | |

| | 9,152 | | Expiration: January 2012, Exercise Price: $20.00 | | | 210,496 | |

| | 4,882 | | Expiration: January 2012, Exercise Price: $21.00 | | | 202,603 | |

| | | | Colgate-Palmolive Company | | | | |

| | 6,109 | | Expiration: February 2012, Exercise Price: $75.00 | | | 152,725 | |

| | | | Commercial Metals Company | | | | |

| | 12,668 | | Expiration: January 2012, Exercise Price: $12.00 | | | 126,680 | |

| | | | ConocoPhillips | | | | |

| | 8,773 | | Expiration: January 2012, Exercise Price: $62.50 | | | 65,798 | |

| | | | Energy Select Sector SPDR Fund | | | | |

| | 4,880 | | Expiration: January 2012, Exercise Price: $70.00 | | | 1,032,120 | |

| | | | FTSE 100 | | | | |

| | 1,681 | | Expiration: February 2012, Exercise Price: $5,600.00 | | | 482,956 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2011

Contracts (100 shares per contract) | | Value | |

| | | | |

| PURCHASED PUT OPTIONS — 0.43% (continued) | | | |

| | | Kinder Morgan, Inc. | | | |

| | 12,869 | | Expiration: June 2012, Exercise Price: $40.00 | | $ | 13,898,520 | |

| | | | Materials Select Sector SPDR Trust | | | | |

| | 636 | | Expiration: March 2012, Exercise Price: $36.00 | | | 211,470 | |

| | | | Pfizer Inc. | | | | |

| | 4,293 | | Expiration: March 2012, Exercise Price: $17.00 | | | 49,369 | |

| | | | Sara Lee Corp. | | | | |

| | 22,706 | | Expiration: January 2012, Exercise Price: $15.00 | | | 56,765 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 11,447 | | Expiration: January 2012, Exercise Price: $128.00 | | | 4,080,856 | |

| | | | SPDR S&P Retail ETF | | | | |

| | 390 | | Expiration: January 2012, Exercise Price: $53.00 | | | 56,745 | |

| | | | Technology Select Sector SPDR Fund | | | | |

| | 2,240 | | Expiration: March 2012, Exercise Price: $27.00 | | | 434,560 | |

| | | | Verizon Communications Inc. | | | | |

| | 3,551 | | Expiration: January 2012, Exercise Price: $31.00 | | | 7,102 | |

| | | | Vulcan Materials Company | | | | |

| | 3,102 | | Expiration: January 2012, Exercise Price: $29.00 | | | 23,265 | |

| | | | Walgreen Company | | | | |

| | 17,053 | | Expiration: January 2012, Exercise Price: $28.00 | | | 102,318 | |

| | | | Williams Companies, Inc. | | | | |

| | 14,870 | | Expiration: January 2012, Exercise Price: $22.50 | | | 74,350 | |

| | 3,054 | | Expiration: January 2012, Exercise Price: $25.00 | | | 24,432 | |

| | | | Yahoo! Inc. | | | | |

| | 38,725 | | Expiration: January 2012, Exercise Price: $12.50 | | | 116,175 | |

| | | | TOTAL PURCHASED PUT OPTIONS | | | | |

| | | | (Cost $37,915,905) | | | 21,700,574 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2011

| Shares | | | | Value | |

| | | | | | |

| SHORT-TERM INVESTMENTS — 27.98% | | | |

| | 285,000,000 | | BlackRock Liquidity Funds TempFund Portfolio 0.11% (c)(g) | | $ | 285,000,000 | |

| | 285,000,000 | | Fidelity Institutional Government Portfolio 0.01% (c)(h) | | | 285,000,000 | |

| | 285,000,000 | | Goldman Sachs Financial Square | | | | |

| | | | Money Market Fund 0.17% (c)(h) | | | 285,000,000 | |

| | 266,389,252 | | Invesco Prime Portfolio Money Market 0.09% (c)(e)(j) | | | 266,389,252 | |

| | 285,000,000 | | The Liquid Asset Portfolio 0.02% (c)(e) | | | 285,000,000 | |

| | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | (Cost $1,406,389,252) | | | 1,406,389,252 | |

| | | | TOTAL INVESTMENTS | | | | |

| | | | (Cost $5,029,261,188) — 99.16% | | $ | 4,984,107,067 | |

ADR — American Depository Receipt

ETF — Exchange Traded Fund

| (a) | Non-income producing security. |

| (c) | The rate quoted is the annualized seven-day yield as of December 31, 2011. |

| (d) | Default or other conditions exist and security is not presently accruing income. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (f) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (g) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (h) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

| (i) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of December 31, 2011, these securities represented 0.00% of total net assets. |

| (k) | Security fair valued in good faith. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF SECURITIES SOLD SHORT

December 31, 2011

| Shares | | | | Value | |

| | 66,021 | | Alleghany Corporation | | $ | 18,835,131 | |

| | 218,411 | | Colfax Corporation (b) | | | 6,229,081 | |

| | 6,203 | | CoStar Group Inc. | | | 413,926 | |

| | 394,037 | | Duke Energy Corporation | | | 8,668,814 | |

| | 885,281 | | Energy Transfer Equity, L.P. | | | 35,924,703 | |

| | 2,048,559 | | Exelon Corporation | | | 88,846,004 | |

| | 844,165 | | Express Scripts, Inc. | | | 37,725,734 | |

| | 370,805 | | Hertz Global Holdings, Inc. | | | 4,345,835 | |

| | 2,323,101 | | Johnson & Johnson (b) | | | 152,790,353 | |

| | 1,122,283 | | Kinder Morgan, Inc. | | | 36,103,844 | |

| | 7,429 | | Kinross Gold Corporation (a) | | | 84,809 | |

| | 327,535 | | Rio Tinto Ltd. (a)(b) | | | 20,389,282 | |

| | 119,000 | | Telephone and Data Systems, Inc. | | | 3,080,910 | |

| | 243,110 | | United Rentals, Inc. | | | 7,183,900 | |

| | 188,933 | | Validus Holdings Ltd (a). | | | 5,951,390 | |

| | 17,915 | | VMware Inc. | | | 1,490,349 | |

| | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | (Proceeds $414,526,221) | | $ | 428,064,065 | |

| (b) | Security fair valued in good faith. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN

December 31, 2011

Contracts (100 shares per contract) | | Value | |

| | | | |

| CALL OPTIONS WRITTEN | | | |

| | | Abbott Laboratories | | | |

| | 6,243 | | Expiration: January 2012, Exercise Price: $52.50 | | $ | 2,341,125 | |

| | 2,249 | | Expiration: January 2012, Exercise Price: $55.00 | | | 326,105 | |

| | | | ASX Ltd. | | | | |

| | 3,703 | | Expiration: January 2012, Exercise Price: AUD 30.00 | | | 338,421 | |

| | 2,377 | | Expiration: January 2012, Exercise Price: AUD 30.50 | | | 136,854 | |

| | | | AT&T Inc. | | | | |

| | 5,867 | | Expiration: January 2012, Exercise Price: $29.00 | | | 727,508 | |

| | 36,297 | | Expiration: February 2012, Exercise Price: $28.00 | | | 8,130,528 | |

| | | | Blue Coat Systems, Inc. | | | | |

| | 1,049 | | Expiration: January 2012, Exercise Price: $26.00 | | | 2,623 | |

| | | | CenturyLink, Inc. | | | | |

| | 9,268 | | Expiration: January 2012, Exercise Price: $36.00 | | | 1,390,200 | |

| | 6,350 | | Expiration: January 2012, Exercise Price: $37.00 | | | 476,250 | |

| | | | Chesapeake Energy Corp. | | | | |

| | 9,127 | | Expiration: January 2012, Exercise Price: $22.50 | | | 675,398 | |

| | 4,882 | | Expiration: January 2012, Exercise Price: $24.00 | | | 141,578 | |

| | | | Colgate-Palmolive Company | | | | |

| | 6,109 | | Expiration: February 2012, Exercise Price: $85.00 | | | 4,780,292 | |

| | | | Commercial Metals Company | | | | |

| | 12,668 | | Expiration: January 2012, Exercise Price: $14.00 | | | 443,380 | |

| | | | ConocoPhillips | | | | |

| | 8,773 | | Expiration: January 2012, Exercise Price: $70.00 | | | 3,053,004 | |

| | | | Dollar Thrifty Automotive Group, Inc. | | | | |

| | 6,421 | | Expiration: January 2012, Exercise Price: $65.00 | | | 3,756,285 | |

| | | | Duke Energy Corporation | | | | |

| | 26,169 | | Expiration: January 2012, Exercise Price: $19.00 | | | 7,850,700 | |

| | | | El Paso Corporation | | | | |

| | 11,094 | | Expiration: January 2012, Exercise Price: $24.00 | | | 2,851,158 | |

| | 2,500 | | Expiration: January 2012, Exercise Price: $25.00 | | | 392,500 | |

| | 1,687 | | Expiration: April 2012, Exercise Price: $24.00 | | | 463,925 | |

| | | | EXCO Resources Inc. | | | | |

| | 2,356 | | Expiration: January 2012, Exercise Price: $11.00 | | | 141,360 | |

| | | | Exelon Corporation | | | | |

| | 4,658 | | Expiration: January 2012, Exercise Price: $42.50 | | | 582,250 | |

| | 4,657 | | Expiration: January 2012, Exercise Price: $44.00 | | | 181,623 | |

| | 862 | | Expiration: February 2012, Exercise Price: $40.00 | | | 310,320 | |

| | 465 | | Expiration: February 2012, Exercise Price: $41.00 | | | 126,712 | |

| | | | Kinder Morgan, Inc. | | | | |

| | 12,869 | | Expiration: June 2012, Exercise Price: $40.00 | | | 160,863 | |

| | | | Lam Research Corporation | | | | |

| | 15,838 | | Expiration: June 2012, Exercise Price: $31.00 | | | 12,353,640 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2011

Contracts (100 shares per contract) | | Value | |

| | | | | | |

| | | Marriott International Inc. | | | |

| | 5,751 | | Expiration: January 2012, Exercise Price: $28.00 | | $ | 905,783 | |

| | | | Motorola Mobility Holdings, Inc. | | | | |

| | 2,441 | | Expiration: January 2012, Exercise Price: $40.00 | | | 6,102 | |

| | | | NYSE Euronext | | | | |

| | 4,308 | | Expiration: January 2012, Exercise Price: $24.00 | | | 980,070 | |

| | 16,332 | | Expiration: January 2012, Exercise Price: $25.00 | | | 2,376,306 | |

| | 1,910 | | Expiration: January 2012, Exercise Price: $27.00 | | | 79,265 | |

| | 6,177 | | Expiration: March 2012, Exercise Price: $26.00 | | | 926,550 | |

| | | | Pfizer Inc. | | | | |

| | 4,293 | | Expiration: March 2012, Exercise Price: $19.00 | | | 1,197,747 | |

| | | | Sara Lee Corp. | | | | |

| | 22,706 | | Expiration: January 2012, Exercise Price: $17.50 | | | 3,292,370 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 953 | | Expiration: January 2012, Exercise Price: $132.00 | | | 24,778 | |

| | | | SuccessFactors, Inc. | | | | |

| | 4,875 | | Expiration: January 2012, Exercise Price: $40.00 | | | 24,375 | |

| | 1,804 | | Expiration: February 2012, Exercise Price: $40.00 | | | 4,510 | |

| | | | Transatlantic Holdings, Inc. | | | | |

| | 990 | | Expiration: January 2012, Exercise Price: $52.50 | | | 252,450 | |

| | 7,465 | | Expiration: January 2012, Exercise Price: $55.00 | | | 298,600 | |

| | | | Verizon Communications Inc. | | | | |

| | 3,551 | | Expiration: March 2012, Exercise Price: $36.00 | | | 1,463,012 | |

| | | | Vulcan Materials Company | | | | |

| | 6,204 | | Expiration: January 2012, Exercise Price: $34.00 | | | 3,412,200 | |

| | | | Walgreen Company | | | | |

| | 2,739 | | Expiration: January 2012, Exercise Price: $30.00 | | | 897,022 | |

| | 14,314 | | Expiration: January 2012, Exercise Price: $31.00 | | | 3,456,831 | |

| | | | Williams Companies, Inc. | | | | |

| | 14,870 | | Expiration: January 2012, Exercise Price: $28.00 | | | 7,583,700 | |

| | 3,054 | | Expiration: January 2012, Exercise Price: $30.00 | | | 977,280 | |

| | | | Yahoo! Inc. | | | | |

| | 39,971 | | Expiration: January 2012, Exercise Price: $14.00 | | | 8,813,606 | |

| | 6,781 | | Expiration: February 2012, Exercise Price: $14.00 | | | 1,674,907 | |

| | | | | | | 90,782,066 | |

| PUT OPTIONS WRITTEN | | | | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 5,723 | | Expiration: January 2012, Exercise Price: $119.00 | | | 400,610 | |

| | | | TOTAL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $83,679,758) | | $ | 91,182,676 | |

AUD — Australian Dollars

ETF — Exchange Traded Fund

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF FORWARD CURRENCY EXCHANGE CONTRACTS*

December 31, 2011

| | | | | | | U.S. $ | | | | | | | U.S. $ | | | Unrealized | |

| Settlement | | Currency to | | Value at | | | Currency to | | Value at | | | Appreciation | |

| Date | | be Delivered | | Dec. 31, 2011 | | | be Received | | Dec. 31, 2011 | | | (Depreciation) | |

| 1/12/12 | | | 6,063,803 | | Australian Dollars | | $ | 6,192,395 | | | | 6,172,951 | | U.S. Dollars | | $ | 6,172,951 | | | $ | (19,444 | ) |

| 1/12/12 | | | 823,522 | | U.S. Dollars | | | 823,522 | | | | 807,938 | | Australian Dollars | | | 825,072 | | | | 1,550 | |

| 1/19/12 | | | 2,536,030 | | Australian Dollars | | | 2,587,486 | | | | 2,591,823 | | U.S. Dollars | | | 2,591,823 | | | | 4,337 | |

| 1/19/12 | | | 2,613,171 | | U.S. Dollars | | | 2,613,171 | | | | 2,536,030 | | Australian Dollars | | | 2,587,486 | | | | (25,685 | ) |

| 1/31/12 | | | 37,583,620 | | Australian Dollars | | | 38,289,019 | | | | 37,658,787 | | U.S. Dollars | | | 37,658,787 | | | | (630,232 | ) |

| 1/31/12 | | | 6,033,337 | | U.S. Dollars | | | 6,033,337 | | | | 6,001,350 | | Australian Dollars | | | 6,113,988 | | | | 80,651 | |

| 4/27/12 | | | 34,355,724 | | Australian Dollars | | | 34,696,945 | | | | 33,922,242 | | U.S. Dollars | | | 33,922,242 | | | | (774,703 | ) |

| 2/16/12 | | | 12,821,268 | | British Pounds | | | 19,902,342 | | | | 20,207,384 | | U.S. Dollars | | | 20,207,384 | | | | 305,042 | |

| 2/22/12 | | | 5,752,229 | | British Pounds | | | 8,928,608 | | | | 8,892,946 | | U.S. Dollars | | | 8,892,946 | | | | (35,662 | ) |

| 3/22/12 | | | 63,579,770 | | British Pounds | | | 98,659,200 | | | | 99,185,077 | | U.S. Dollars | | | 99,185,077 | | | | 525,877 | |

| 1/5/12 | | | 4,544,610 | | Canadian Dollars | | | 4,460,329 | | | | 4,410,530 | | U.S. Dollars | | | 4,410,530 | | | | (49,799 | ) |

| 1/5/12 | | | 283,938 | | U.S. Dollars | | | 283,938 | | | | 288,948 | | Canadian Dollars | | | 283,602 | | | | (336 | ) |

| 2/15/12 | | | 66,758,611 | | Canadian Dollars | | | 65,459,320 | | | | 64,743,727 | | U.S. Dollars | | | 64,743,727 | | | | (715,593 | ) |

| 2/23/12 | | | 6,845,000 | | Canadian Dollars | | | 6,710,560 | | | | 6,653,901 | | U.S. Dollars | | | 6,653,901 | | | | (56,659 | ) |

| 3/14/12 | | | 59,016,999 | | Canadian Dollars | | | 57,833,579 | | | | 60,005,913 | | U.S. Dollars | | | 60,005,913 | | | | 2,172,334 | |

| 3/14/12 | | | 3,218,062 | | U.S. Dollars | | | 3,218,062 | | | | 3,264,698 | | Canadian Dollars | | | 3,199,234 | | | | (18,828 | ) |

| 3/29/12 | | | 1,697,655 | | Canadian Dollars | | | 1,663,104 | | | | 1,649,971 | | U.S. Dollars | | | 1,649,971 | | | | (13,133 | ) |

| 1/18/12 | | | 1,153,854,000 | | Japanese Yen | | | 14,994,974 | | | | 15,039,866 | | U.S. Dollars | | | 15,039,866 | | | | 44,892 | |

| 1/18/12 | | | 14,859,678 | | U.S. Dollars | | | 14,859,678 | | | | 1,153,854,000 | | Japanese Yen | | | 14,994,974 | | | | 135,296 | |

| 3/30/12 | | | 1,158,300,000 | | Japanese Yen | | | 15,075,031 | | | | 14,879,636 | | U.S. Dollars | | | 14,879,636 | | | | (195,395 | ) |

| 4/26/12 | | | 151,115,888 | | Swiss Francs (a) | | | 162,071,604 | | | | 161,820,301 | | U.S. Dollars | | | 161,820,301 | | | | (251,303 | ) |

| | | | | | | | $ | 565,356,204 | | | | | | | | $ | 565,839,411 | | | $ | 483,207 | |

| * | JPMorgan Chase & Co. Inc. is the counterparty for all open forward currency exchange contracts held by the Fund as of December 31, 2011. |

| (a) | Security fair valued in good faith. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF SWAP CONTRACTS

December 31, 2011

| | | | | | | | | | Unrealized | | |

| Termination | | | | | | | | | Appreciation | | |

| Date | Security | | Shares | | | Notional | | | (Depreciation)* | | Counterparty |

| LONG SWAP CONTRACTS | | | | | | | | | | |

| 2/23/12 | ASX Ltd. | | | 1,053,314 | | | $ | 32,637,292 | | | $ | 719,698 | | JPMorgan Chase & Co. Inc. |

| 4/20/12 | British Sky Broadcasting Group | | | 3,413,600 | | | | 38,662,297 | | | | (7,204,744 | ) | Merrill Lynch & Co. Inc. |

| 4/20/12 | British Sky Broadcasting Group | | | 5,078,964 | | | | 57,524,143 | | | | (8,231,100 | ) | JPMorgan Chase & Co. Inc. |

| 1/26/12 | Charter International PLC | | | 1,756,338 | | | | 25,511,881 | | | | 896,974 | | JPMorgan Chase & Co. Inc. |

| 3/15/12 | Extract Resources Limited | | | 1,135,810 | | | | 9,768,920 | | | | 122,333 | | Merrill Lynch & Co. Inc. |

| 3/15/12 | Extract Resources Limited | | | 2,835,950 | | | | 24,391,552 | | | | 522,171 | | JPMorgan Chase & Co. Inc. |

| 12/31/12 | Hillgrove Resources Ltd. | | | 13,139,699 | | | | 2,465,533 | | | | (467,116 | ) | JPMorgan Chase & Co. Inc. |

| 6/30/12 | Smith & Nephew PLC | | | 858,249 | | | | 8,205,187 | | | | (1,110,791 | ) | Merrill Lynch & Co. Inc. |

| 4/30/12 | Synthes, Inc. (a) | | | 1,818,964 | | | | 304,188,769 | | | | (5,570,458 | ) | JPMorgan Chase & Co. Inc. |

| 6/30/12 | TMX Group, Inc. | | | 98,200 | | | | 3,985,527 | | | | (358,499 | ) | Deutsche Bank AG |

| SHORT SWAP CONTRACTS | | | | | | | | | | | | | |

| 6/15/12 | Express Scripts, Inc. | | | (1,984 | ) | | | (87,971 | ) | | | 21,883 | | Merrill Lynch & Co. Inc. |

| 4/30/12 | Johnson & Johnson (a) | | | (100 | ) | | | (231 | ) | | | (231 | ) | Merrill Lynch & Co. Inc. |

| | | | | | | | | | | | $ | (20,659,880 | ) | |

| * | Net unrealized depreciation is a payable on the Statement of Assets and Liabilities. |

| (a) | Security fair valued in good faith. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2011

| ASSETS: | | | | | | |

| Investments, at value | | | | | | |

| Investments in non affiliates (Cost $4,039,428,758) | | | | | $ | 3,955,961,985 | |

| Investments in affiliates (Cost $989,832,430) | | | | | | 1,028,145,082 | |

| Cash | | | | | | 6,104,391 | |

| Cash held in foreign currency (Cost $4,130,107) | | | | | | 4,177,337 | |

| Deposits at brokers | | | | | | 203,139,778 | |

| Receivable from brokers | | | | | | 414,526,221 | |

| Receivable for investments sold | | | | | | 61,307,744 | |

| Receivable for forward currency exchange contracts | | | | | | 3,269,979 | |

| Receivable for fund shares issued | | | | | | 28,898,901 | |

| Dividends and interest receivable | | | | | | 7,094,882 | |

| Prepaid expenses and other receivables | | | | | | 132,617 | |

| Total Assets | | | | | | 5,712,758,917 | |

| | | | | | | | |

| LIABILITIES: | | | | | | | |

| Securities sold short, at value (Proceeds of $414,526,221) | | $ | 428,064,065 | | | | | |

| Written option contracts, at value (Premiums received $83,679,758) | | | 91,182,676 | | | | | |

| Payable for forward currency exchange contracts | | | 2,786,772 | | | | | |

| Payable for swap contracts | | | 20,659,880 | | | | | |

| Payable for swap contracts closed | | | 64,795 | | | | | |

| Payable for swap interest | | | 216,130 | | | | | |

| Payable for investments purchased | | | 122,741,584 | | | | | |

| Payable for fund shares redeemed | | | 8,565,307 | | | | | |

| Investment advisory fee payable | | | 3,719,423 | | | | | |

| Distribution fees payable | | | 5,062,575 | | | | | |

| Dividends payable | | | 87,092 | | | | | |

| Accrued expenses and other liabilities | | | 3,048,358 | | | | | |

| Total Liabilities | | | | | | | 686,198,657 | |

| NET ASSETS | | | | | | $ | 5,026,560,260 | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Accumulated undistributed net investment income | | | | | | $ | 70,048,008 | |

| Accumulated undistributed net realized loss on investments, securities | | | | | | | | |

| sold short, written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translation and forward currency exchange contracts | | | | | | | (67,281,793 | ) |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | (45,154,121 | ) | | | | |

| Securities sold short | | | (13,537,844 | ) | | | | |

| Written option contracts | | | (7,502,918 | ) | | | | |

| Swap contracts | | | (20,659,880 | ) | | | | |

| Foreign currency translation | | | 47,230 | | | | | |

| Forward currency exchange contracts | | | 483,207 | | | | | |

| Net unrealized depreciation | | | | | | | (86,324,326 | ) |

| Paid-in capital | | | | | | | 5,110,118,371 | |

| Total Net Assets | | | | | | $ | 5,026,560,260 | |

| NET ASSET VALUE and offering price per share*, | | | | | | | | |

| ($5,026,560,260 / 322,459,516 shares of beneficial interest outstanding) | | | | | | $ | 15.59 | |

| * | The redemption price per share may vary based on the length of time a shareholder holds the Fund’s shares. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF OPERATIONS

For the Three Months Ended December 31, 2011*

| INVESTMENT INCOME: | | | | | | |

| Interest | | | | | | |

| Non Affiliates | | | | | $ | 999,673 | |

| Affiliates | | | | | | 41,868 | |

| Dividend income on long positions | | | | | | | |

| Non Affiliates (net of foreign withholding taxes of $69,759) | | | | | | 11,449,312 | |

| Affiliates | | | | | | 734,353 | |

| Total investment income | | | | | | 13,225,206 | |

| | | | | | | | |

| EXPENSES: | | | | | | | |

| Investment advisory fee | | $ | 12,593,719 | | | | | |

| Distribution fees | | | 3,144,918 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 1,511,430 | | | | | |

| Administration fees | | | 381,172 | | | | | |

| Professional fees | | | 228,668 | | | | | |

| Reports to shareholders | | | 137,820 | | | | | |

| Fund accounting expense | | | 103,698 | | | | | |

| Custody fees | | | 103,366 | | | | | |

| Federal and state registration fees | | | 91,535 | | | | | |

| Trustees’ fees and expenses | | | 46,541 | | | | | |

| Miscellaneous expenses | | | 37,018 | | | | | |

| Borrowing expense on securities sold short | | | 1,350,700 | | | | | |

| Dividends on securities sold short | | | 2,507,739 | | | | | |

| Total expenses before expense waiver by Adviser | | | | | | | 22,238,324 | |

| Less: Expense waived by Adviser | | | | | | | (1,639,710 | ) |

| Net expenses | | | | | | | 20,598,614 | |

| NET INVESTMENT LOSS | | | | | | | (7,373,408 | ) |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain (loss) on: | | | | | | | | |

| Investments | | | (44,040,304 | ) | | | | |

| Securities sold short | | | 5,556,378 | | | | | |

| Written option contracts expired or closed | | | 27,444,127 | | | | | |

| Swap contracts | | | (22,684,511 | ) | | | | |

| Foreign currency translation | | | (2,211 | ) | | | | |

| Forward currency exchange contracts | | | 24,050,434 | | | | | |

| Net realized loss | | | | | | | (9,676,087 | ) |

| Change in unrealized appreciation / (depreciation) on: | | | | | | | | |

| Investments | | | 178,584,559 | | | | | |

| Securities sold short | | | (37,551,018 | ) | | | | |

| Written option contracts | | | (19,621,215 | ) | | | | |

| Swap contracts | | | 73,238,431 | | | | | |

| Foreign currency translation | | | 47,230 | | | | | |

| Forward currency exchange contracts | | | (37,949,764 | ) | | | | |

| Net unrealized appreciation | | | | | | | 156,748,223 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | | 147,072,136 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | 139,698,728 | |

| | | | | | | | | |

| * | The Fund changed its fiscal year end from September 30 to December 31. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2011

| INVESTMENT INCOME: | | | | | | |

| Interest | | | | | $ | 6,004,227 | |

| Dividend income on long positions | | | | | | | |

| Non Affiliates | | | | | | 30,377,891 | |

| Affiliates | | | | | | 382,650 | |

| Total investment income | | | | | | 36,764,768 | |

| | | | | | | | |

| EXPENSES: | | | | | | | |

| Investment advisory fee | | $ | 43,967,215 | | | | | |

| Distribution fees | | | 10,771,317 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 5,345,165 | | | | | |

| Administration fees | | | 1,466,205 | | | | | |

| Federal and state registration fees | | | 594,519 | | | | | |

| Reports to shareholders | | | 510,024 | | | | | |

| Professional fees | | | 442,284 | | | | | |

| Fund accounting expense | | | 383,835 | | | | | |

| Custody fees | | | 289,098 | | | | | |

| Miscellaneous expenses | | | 220,112 | | | | | |

| Trustees’ fees and expenses | | | 153,048 | | | | | |

| Borrowing expense on securities sold short | | | 4,297,394 | | | | | |

| Dividends on securities sold short | | | 23,192,563 | | | | | |

| Total expenses before expense waiver by Adviser | | | | | | | 91,632,779 | |

| Less: Expense waived by Adviser | | | | | | | (5,296,618 | ) |

| Net expenses | | | | | | | 86,336,161 | |

| NET INVESTMENT LOSS | | | | | | | (49,571,393 | ) |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain (loss) on: | | | | | | | | |

| Investments | | | | | | | | |

| Non Affiliates | | | 140,880,080 | | | | | |

| Affiliates | | | 54,028,443 | | | | | |

| Securities sold short | | | 1,339,501 | | | | | |

| Written option contracts expired or closed | | | 66,124,635 | | | | | |

| Swap contracts | | | 83,205,915 | | | | | |

| Foreign currency translation | | | 54,709 | | | | | |

| Forward currency exchange contracts | | | (73,002,999 | ) | | | | |

| Net realized gain | | | | | | | 272,630,284 | |

| Change in unrealized appreciation / (depreciation) on: | | | | | | | | |

| Investments | | | (317,491,636 | ) | | | | |

| Securities sold short | | | 57,146,628 | | | | | |

| Written option contracts | | | 4,818,800 | | | | | |

| Swap contracts | | | (100,869,422 | ) | | | | |

| Foreign currency translation | | | (7,083 | ) | | | | |

| Forward currency exchange contracts | | | 82,770,417 | | | | | |

| Net unrealized depreciation | | | | | | | (273,632,296 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | | | | | (1,002,012 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | (50,573,405 | ) |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF CHANGES IN NET ASSETS

| | | Three Months Ended | | | Year Ended | | | Year Ended | |

| | | December 31, 2011* | | | September 30, 2011 | | | September 30, 2010 | |

| | | | | | | | | | |

| Net investment loss | | $ | (7,373,408 | ) | | $ | (49,571,393 | ) | | $ | (35,261,194 | ) |

| Net realized gain (loss) on investments, securities | | | | | | | | | | | | |

| sold short, written option contracts expired or closed, | | | | | | | | | | | | |

| swap contracts, foreign currency translation and | | | | | | | | | | | | |

| forward currency exchange contracts | | | (9,676,087 | ) | | | 272,630,284 | | | | 153,002,878 | |

| Change in unrealized appreciation (depreciation) | | | | | | | | | | | | |

| on investments, securities sold short, written option | | | | | | | | | | | | |

| contracts, swap contracts, foreign currency translation | | | | | | | | | | | | |

| and forward currency exchange contracts | | | 156,748,223 | | | | (273,632,296 | ) | | | (10,669,250 | ) |

| Net increase (decrease) in net assets | | | | | | | | | | | | |

| resulting from operations | | | 139,698,728 | | | | (50,573,405 | ) | | | 107,072,434 | |

| Distributions to shareholders from: (Note 2) | | | | | | | | | | | | |

| Net investment income | | | (26,112,274 | ) | | | — | | | | (42,329 | ) |

| Net realized gains | | | (116,043,398 | ) | | | (70,276,496 | ) | | | — | |

| Total dividends and distributions | | | (142,155,672 | ) | | | (70,276,496 | ) | | | (42,329 | ) |

| Net increase in net assets from | | | | | | | | | | | | |

| capital share transactions (Note 4) | | | 115,163,137 | | | | 1,461,121,676 | | | | 1,655,172,030 | |

| Net increase in net assets | | | 112,706,193 | | | | 1,340,271,775 | | | | 1,762,202,135 | |

| | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | |

| Beginning of period | | | 4,913,854,067 | | | | 3,573,582,292 | | | | 1,811,380,157 | |

| End of period (including accumulated undistributed | | | | | | | | | | | | |

| net investment income of $70,048,008, | | | | | | | | | | | | |

| 78,326,065 and $7,037,435, respectively) | | $ | 5,026,560,260 | | | $ | 4,913,854,067 | | | $ | 3,573,582,292 | |

| * | For the period October 1, 2011 through December 31, 2011. The Fund changed its fiscal year end from September 30 to December 31. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS

Selected per share data is based on a share of beneficial interest outstanding throughout each period.

| | | Three | | | | | | | | | | | | | | | | |

| | | Months | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | Dec. 31, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | |

| | | | 2011* | | | | 2011 | | | | 2010 | | | | 2009 | | | | 2008 | | | | 2007 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of period | | $ | 15.59 | | | $ | 15.93 | | | $ | 15.26 | | | $ | 14.79 | | | $ | 16.55 | | | $ | 15.95 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.02 | )(4) | | | (0.18 | )(4) | | | (0.02 | )(2) | | | 0.24 | (2) | | | 0.00 | (3)(5) | | | 0.13 | (3) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| on investments | | | 0.47 | | | | 0.13 | | | | 0.69 | | | | 0.58 | | | | (0.70 | ) | | | 1.13 | |

| Total from investment operations | | | 0.45 | | | | (0.05 | ) | | | 0.67 | | | | 0.82 | | | | (0.70 | ) | | | 1.26 | |

| Redemption fees | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | (0.08 | ) | | | — | | | | 0.00 | (5) | | | (0.06 | ) | | | (0.37 | ) | | | (0.11 | ) |

| Distributions from net realized gains | | | (0.37 | ) | | | (0.29 | ) | | | — | | | | (0.05 | ) | | | (0.69 | ) | | | (0.55 | ) |

| Distributions from return to capital | | | — | | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| Total distributions | | | (0.45 | ) | | | (0.29 | ) | | | — | | | | (0.35 | ) | | | (1.06 | ) | | | (0.66 | ) |

| Net Asset Value, end of period | | $ | 15.59 | | | $ | 15.59 | | | $ | 15.93 | | | $ | 15.26 | | | $ | 14.79 | | | $ | 16.55 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 2.90 | %(9) | | | (0.34 | )% | | | 4.39 | % | | | 5.78 | % | | | (4.32 | )% | | | 8.15 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 5,026,560 | | | $ | 4,913,854 | | | $ | 3,573,582 | | | $ | 1,811,380 | | | $ | 1,414,165 | | | $ | 1,821,714 | |

| Ratio of operating expenses to | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | 1.64 | %(8) | | | 1.96 | % | | | 2.57 | % | | | 4.22 | % | | | 1.66 | % | | | 2.16 | % |

| Ratio of interest expense, dividends on | | | | | | | | | | | | | | | | | | | | | | | | |

| securities sold short and borrowing | | | | | | | | | | | | | | | | | | | | | | | | |

| expense on securities sold short to | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | 0.31 | %(8) | | | 0.62 | % | | | 1.16 | % | | | 2.68 | % | | | 0.19 | % | | | 0.76 | % |

| Ratio of operating expenses to average | | | | | | | | | | | | | | | | | | | | | | | | |

| net assets excluding interest expense, | | | | | | | | | | | | | | | | | | | | | | | | |

| borrowing expense on securities sold short | | | | | | | | | | | | | | | | | | | | | | | | |

| and dividends on securities sold short | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.46 | %(8) | | | 1.46 | % | | | 1.48 | % | | | 1.54 | % | | | 1.48 | % | | | 1.41 | % |

| After expense waiver | | | 1.33 | %(8) | | | 1.34 | % | | | 1.41 | % | | | 1.54 | % | | | 1.47 | % | | | 1.40 | %(6) |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | (0.72 | )%(8) | | | (1.25 | )% | | | (1.35 | )% | | | (2.49 | )% | | | (0.10 | )% | | | 0.82 | % |

| After expense waiver | | | (0.59 | )%(8) | | | (1.13 | )% | | | (1.28 | )% | | | (2.49 | )% | | | (0.09 | )% | | | 0.83 | % |

Portfolio turnover rate(7) | | | 48.13 | %(9) | | | 292.79 | % | | | 192.21 | % | | | 318.45 | % | | | 300.24 | % | | | 334.87 | % |

Footnotes To Financial Highlights On Following Page

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS (continued)

| (1) | Net investment income (loss) before interest expense, borrowing expense on securities sold short and dividends on securities sold short for the three months ended December 31, 2011 and the years ended September 30, 2011, 2010, 2009, 2008 and 2007 was $(0.01), $(0.08), $0.12, $0.55, $0.02 and $0.26, respectively. |

| (2) | Net investment income (loss) per share is calculated using ending balance after consideration of adjustments for permanent book and tax differences. |

| (3) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (4) | Net investment income (loss) per share represents net investment income (loss) divided by the average shares outstanding throughout the period. |

| (5) | Amount less than $0.005 per share. |

| (6) | The Fund incurred proxy expenses of approximately $525,000 in 2007 related to shareholder approval of changes in the Fund’s fundamental investment policies and the election of trustees. |

| (7) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short positions). The denominator includes the average long positions throughout the period. |

| * | For the period October 1, 2011 through December 31, 2011. The Fund changed its fiscal year end from September 30 to December 31. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2011

Note 1 — ORGANIZATION

The Merger Fund (the “Fund”) is a no-load, open-end, non-diversified investment company organized as a trust under the laws of the Commonwealth of Massachusetts on April 12, 1982, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund was formerly known as the Risk Portfolio of The Ayco Fund. In January of 1989, the Fund’s fundamental investment policies were amended to permit the Fund to engage in merger arbitrage. At the same time, Westchester Capital Management, Inc. became the Fund’s investment adviser, and the Fund began to do business as The Merger Fund. In a transaction that closed on December 31, 2010, Westchester Capital Management, Inc. transferred substantially all of its business and assets to Westchester Capital Management, LLC (the “Adviser”), which became the Fund’s investment adviser. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations. During the prior fiscal period, the Fund’s Board of Trustees approved a change in the Fund’s fiscal year end from September 30 to December 31.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES