UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3445

The Merger Fund

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Frederick W. Green

The Merger Fund

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2009

Item 1. Reports to Stockholders.

THE

MERGER

FUND®

ANNUAL REPORT

SEPTEMBER 30, 2009

November 18, 2009

Dear Fellow Shareholder:

As previously reported, The Merger Fund® posted a gain of 5.8% for its fiscal year ended September 30, 2009. Over the same period, the S&P 500, our official benchmark, lost 6.9%. We’re proud of the Fund’s performance in an extraordinarily challenging investment environment. Not only did we come close to meeting our rate-of-return objectives, but our shareholders were also spared the stomach-turning volatility exhibited by most other equity funds.

Deal selection is normally the key driver of the Fund’s results, and last year was no exception. Of the 113 mergers, takeovers and other corporate reorganizations in which we held positions during fiscal 2009, 103 proceeded more or less as expected. Of the remaining five deals that were subject to definitive agreements, three were terminated—although one of the targets ended up in a transaction with another buyer—one was completed at a lower price and one was completed at a higher price after an interloper came in with a topping bid. Five “pre-deal” situations fell into the failed-transaction category. All in all, our batting average was pretty good.

The events since the onset of the financial crisis have made us even more confident in the merits of the Fund’s highly specialized investment approach. Instead of making directional, open-ended bets whose success is largely dependent on where the stock market is headed, virtually all of our investments are tied to announced corporate reorganizations that have a “date with destiny.” If we do our job well, The Merger Fund® should continue to deliver attractive risk-adjusted returns to its shareholders.

A Little Less Hostile

Once again, we have included a series of charts which reflect the nature of the arbitrage opportunities in which the Fund has recently invested. Chart 1 shows that as of September 30, friendly transactions comprised about 92% of the dollar value of our long positions, while unsolicited, or hostile, takeover attempts accounted for approximately 8%. A year earlier, hostile deals represented 17% of our portfolio, one of the highest levels since the Fund’s inception in 1989.

Whereas the S&P 500’s 22% decline in the 12 months ended September 30, 2008 caused many potential takeover candidates to trade at prices that were perceived to be well below intrinsic value—thereby encouraging hostile approaches by opportunistic corporate acquirers—the stock market’s strong recovery since its March 2009 lows has made it harder for prospective buyers to offer the big takeover premiums required to force their reluctant targets to the negotiating table. Nonetheless, with hostile deals accounting for 8% of our recent investments, a relatively high percentage by historical standards, it’s clear that a number of companies are still identifying acquisition opportunities sufficiently compelling to warrant an aggressive approach to deal-making.

That’s not to say that these would-be acquirers will be any more successful in their efforts than the other companies which have gone down this path in the past. We have frequently written

about how difficult it is to complete an unwelcome takeover, and little has changed in this regard over the past year or so. For most targets, the standard defenses against unsolicited offers—poison pills, staggered boards and target-friendly state laws—remain in place. What is different, however, is that hostile buyers, like corporate acquirers in general, now possess more financial firepower with which to pursue deals, thanks to stronger balance sheets, improved access to the debt markets and higher-valued shares to use as an acquisition currency. Unsolicited takeover attempts, in other words, aren’t going away and could accelerate should more companies conclude that opportunities for organic growth are limited and that going hostile is worth the risk.

From an arbitrage standpoint, we generally don’t care whether the target of an unsolicited offer ends up in a deal with the original bidder or with a white knight that agrees to pay more, as long as the ultimate deal price is above our cost. It’s also worth noting that whether a proposed takeover is friendly or hostile, we apply the same qualitative and quantitative analysis to evaluate the potential investment.

Private Equity Regroups

Chart 2 shows that essentially all of the pending takeovers in the Fund’s portfolio as of September 30 were strategic in nature. By “strategic,” we mean combinations that involve a corporate buyer—typically operating in the same industry as the target—whose objective in doing the transaction is to enhance shareholder value over the long term. Financial, or going-private, deals, in which an investor group with a shorter time horizon uses mostly debt to buy out the target’s public shareholders, have been few and far between over the past 12 months. In contrast to two or three years ago, a time when private equity gobbled up big chunks of Corporate America, financial buyers no longer have access to vast amounts of debt carrying low interest rates and few protections for the lenders. The big banks, having lost billions on these borrower-friendly loans, are determined not to make the same mistake again. Tighter lending standards mean that financial buyers must fund their deals with less debt and more equity. And with less leverage, it’s harder to make the numbers work, especially when a private-equity firm is in competition with a strategic buyer able to realize greater deal-related synergies.

Faced with a less favorable environment for takeovers of public companies, some private-equity firms are diversifying into money management and investment banking. And instead of doing the mega deals that were common just a few years ago, financial players will probably use a good portion of their estimated $400 billion in uncommitted capital to do smaller transactions, including buying divisions or product lines from companies that no longer view them as strategically important. The bottom line is that leveraged buyouts are likely to remain a relatively small percentage of the Fund’s investments unless private-equity firms decide to accept lower rates of return on public deals.

A Change in the Mix

Chart 3 shows the type of merger consideration to be received by the selling company’s shareholders in transactions in which the Fund held positions at the end of September. Cash appears to be losing some of its luster when it comes to deal-making. A year ago, all-cash

takeovers accounted for 62% of our investments, but by this September the number had fallen to 31%. Cash-and-stock deals now represent 43% of the portfolio, up from only 17% at the end of fiscal 2008. Over the same period, all-stock transactions rose from 8% to 14% of the Fund’s investments.

These significant changes in merger consideration shouldn’t come as a surprise. When stocks are unusually volatile and valuations depressed, as was the case last fall and winter, both buyers and sellers tend to show a preference for cash deals. Buyers don’t want to issue shares at what they view as bargain-basement levels, while sellers who are spooked by the market’s volatility and worried that stock prices could go even lower want the certainty of a cash transaction.

The environment is different now. With equity valuations having improved, buyers can feel more comfortable using their shares as an acquisition currency. And many sellers, after being reminded this year that stocks can go up almost as fast as they go down, seem willing to take at least some equity. It’s probably no accident that cash-and-stock transactions comprise the largest portion of the Fund’s recent investments; such deals allow both buyers and sellers to take a middle road. From an arbitrage standpoint, we generally have no preference when it comes to the type of merger consideration we are to receive. Whether it’s cash or stock or some combination of the two, we routinely attempt to hedge away the market risk associated with the investment.

Where the Deals Are

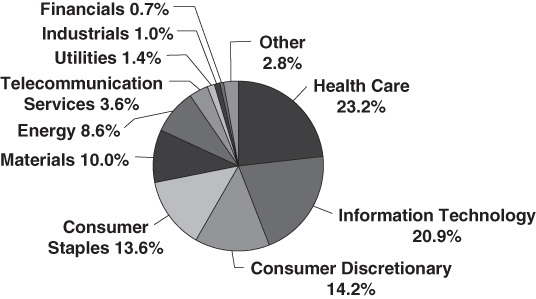

Chart 4 shows the Fund’s investments grouped by economic sector. Spurred by forthcoming patent expirations on many of their blockbuster drugs and the ever-increasing cost of developing new ones, Big Pharma has been in deal-making mode. At the end of September, mergers and acquisitions in the healthcare sector accounted for about 23% of the Fund’s investments, up from 16% at the end of fiscal 2008.

Information technology has been another fertile area for M&A activity, and this sector represented 21% of the portfolio as of September 30, up from just 6% 12 months earlier. IT managers’ preference for dealing with fewer vendors, each offering a broader suite of compatible products, has fostered combinations in this sector, as have evolving business models that place a higher value on recurring revenue from IT services and support than on one-time hardware sales.

Transactions involving consumer companies comprised nearly 28% of our arbitrage positions at the end of September, split almost evenly between the consumer discretionary and consumer staples sectors. Recent high-profile deals in the food and beverage industry highlight another strategic motivation for many corporate acquirers, namely the desire to increase exposure to faster-growing emerging markets at a time when domestic revenue gains are harder to come by.

Making Sure It’s Safe to Drink the Water

Chart 5 shows the Fund’s investments grouped by the geographic region in which the target company is domiciled. As was the case a year earlier, roughly three-quarters of the Fund’s arbitrage investments, by dollar value, involved U.S.-based targets at the end of fiscal 2009. What’s different this year is that our non-U.S. positions are more spread out geographically. In addition to identifying attractive investment opportunities in Canada, Australia and Europe, areas where the Fund has been active for a long time, we’ve also recently established positions in takeover targets based in Asia and South America.

Successful overseas investing requires more than the basic arb toolkit. Although there is considerable overlap in the way we evaluate domestic deals and those involving non-U.S. targets, it’s important to recognize that foreign transactions unfold in the context of political, regulatory and corporate-governance systems that may be very different from the U.S. model. And the process of settling foreign trades, hedging currencies and dealing with the other technical aspects of cross-border investing adds another layer of complexity. Fortunately, with nearly three decades of experience in overseas M&A and access to an international network of research analysts, advisers and trading partners, our portfolio-management team should be up to the task.

Looking Across the Valley

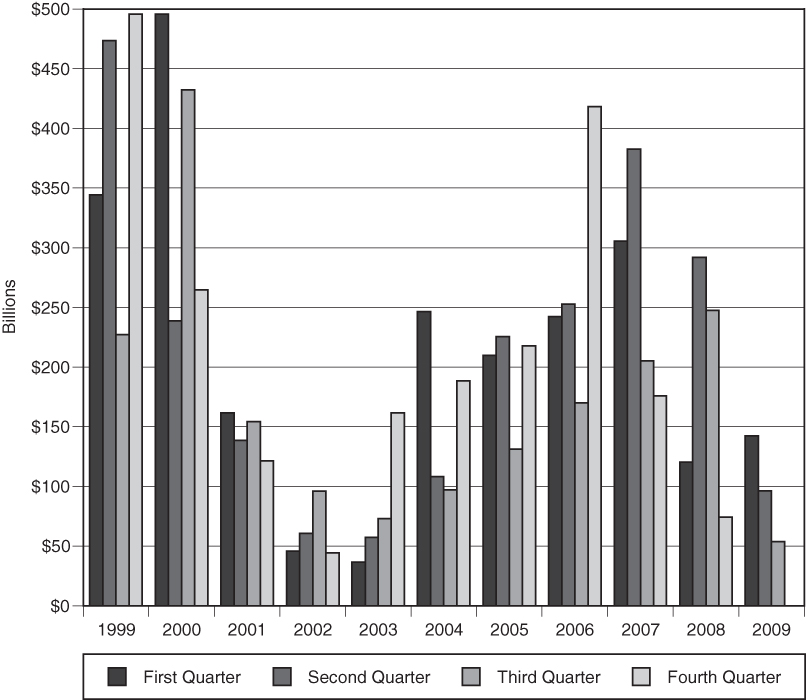

Chart 6 shows the total dollar value of U.S. mergers and acquisitions, by quarter, since 1999. Last fall’s financial meltdown and the ensuing Great Recession took their toll on deal-making. M&A volume fell over 50% from year-earlier levels in the 12 months ended September 2009, making it the slowest period for business combinations since 2003.

The outlook for the next year or so is considerably more encouraging. Confidence is returning to corporate boardrooms, the credit markets have unthawed and balance sheets are bulging with cash. More stability in equity valuations should also make it easier for buyers and sellers to come to terms on price.

Regardless of economic conditions, there are always management teams who believe that organic growth can only take their companies so far. But at a time when many firms are struggling to increase revenues and unable to do much more to cut costs, an increasing number of executives seem likely to conclude that a strategic business combination or other type of corporate reorganization offers one of the best opportunities to enhance shareholder value.

| | Sincerely, |

| | |

| |  |

| | |

| | Frederick W. Green |

| | President |

| Chart 1 | Chart 2 |

| | |

| PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

| By Type of Deal* | By Type of Buyer* |

| | |

|  |

Chart 3

PORTFOLIO COMPOSITION

By Deal Terms*

* Data expressed as a percentage of long equity positions as of September 30, 2009

Chart 4

PORTFOLIO COMPOSITION

By Sector*

Chart 5

PORTFOLIO COMPOSITION

By Region*

* Data expressed as a percentage of long equity positions as of September 30, 2009

Chart 6

MERGER ACTIVITY

1999 – 2009

Source: Securities Data Corp.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND AND S&P 500

| | | | Average |

| | | | Annual Total Return |

| | 1 Yr. | | 3 Yr. | | 5 Yr. | | 10 Yr. |

| The Merger Fund | 5.78% | | 3.06% | | 4.42% | | 4.86% |

| The Standard & Poor’s 500 Index | (6.91)% | | (5.43)% | | 1.02% | | (0.15)% |

The Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on September 30, 1999. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund

EXPENSE EXAMPLE

September 30, 2009

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) redemption fees and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 for the period 4/01/09 – 9/30/09.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop-payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, a $15.00 fee will be charged by the Fund’s transfer agent. You will be charged a redemption fee equal to 2.00% of the net amount of the redemption if you redeem your shares less than 30 calendar days after you purchase them. IRAs will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account | Ending Account | Expenses Paid During |

| | Value 4/01/09 | Value 9/30/09 | Period 4/01/09-9/30/09* |

Actual + (1) | $1,000.00 | $1,039.50 | $26.74 |

Hypothetical ++ (2) | $1,000.00 | $ 998.85 | $26.21 |

| + | Excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, your actual cost of investment in the Fund would be $7.92. |

| ++ | Excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, your hypothetical cost of investment in the Fund would be $7.84. |

| (1) | Ending account values and expenses paid during period based on a 3.95% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| * | Expenses are equal to the Fund’s annualized expense ratio of 5.23%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

The Merger Fund

SCHEDULE OF INVESTMENTS

September 30, 2009

| Shares | | | | Value | |

| | | | |

| COMMON STOCKS — 92.51% | | | |

| | | | | | |

| | | ACQUISITION CORPORATIONS — 2.75% | | | |

| | 300,000 | | BPW Acquisition Corp. (a) | | $ | 2,937,000 | |

| | 1,074,900 | | Liberty Acquisition Holdings Corp. (a) | | | 10,211,550 | |

| | 462,203 | | Pearl Group Ltd. (a)(g) | | | 6,324,043 | |

| | 2,394,600 | | Sapphire Industrials Corp. (a) | | | 23,802,324 | |

| | 676,100 | | Triplecrown Acquisition Corp. (a) | | | 6,558,170 | |

| | | | | | | 49,833,087 | |

| | | | AGRICULTURAL PRODUCTS — 1.42% | | | | |

| | 2,579,585 | | Viterra Inc. (g) | | | 25,732,001 | |

| | | | | | | | |

| | | | APPLICATION SOFTWARE — 1.03% | | | | |

| | 371,546 | | SPSS Inc. (a) | | | 18,558,723 | |

| | | | | | | | |

| | | | ASSET MANAGEMENT & CUSTODY BANKS — 0.65% | | | | |

| | 1,256,832 | | KKR Private Equity Investors LP (a)(e)(g) | | | 11,751,379 | |

| | | | | | | | |

| | | | BREWERS — 2.33% | | | | |

| | 4,177,400 | | Lion Nathan Ltd. (g) | | | 42,196,704 | |

| | | | | | | | |

| | | | CABLE & SATELLITE TV — 6.39% | | | | |

| | 936,500 | | Comcast Corporation Special Class A (b) | | | 15,058,920 | |

| | 3,234,750 | | Liberty Media Corporation Series A (a)(b) | | | 100,633,073 | |

| | | | | | | 115,691,993 | |

| | | | COMPUTER HARDWARE — 5.33% | | | | |

| | 10,614,000 | | Sun Microsystems, Inc. (a)(c) | | | 96,481,260 | |

| | | | | | | | |

| | | | COMPUTER STORAGE & PERIPHERALS — 1.59% | | | | |

| | 1,485,600 | | Hitachi Maxell Ltd. (g) | | | 28,714,042 | |

| | | | | | | | |

| | | | DATA PROCESSING & OUTSOURCED SERVICES — 6.67% | | | | |

| | 923,600 | | Affiliated Computer Services, Inc. (a)(c) | | | 50,031,412 | |

| | 2,050,800 | | Metavante Technologies Inc. (a) | | | 70,711,584 | |

| | | | | | | 120,742,996 | |

| | | | DIVERSIFIED BANKS — 0.03% | | | | |

| | 395,000 | | Aozora Bank Ltd. (a)(g) | | | 572,049 | |

| | | | | | | | |

| | | | DIVERSIFIED CHEMICALS — 0.46% | | | | |

| | 921,058 | | Huntsman Corporation (c) | | | 8,390,838 | |

| | | | | | | | |

| | | | DIVERSIFIED METALS & MINING — 0.68% | | | | |

| | 224,676 | | BHP Billiton plc — ADR (b)(g) | | | 12,379,648 | |

| | | | | | | | |

| | | | FERTILIZERS & AGRICULTURAL CHEMICALS — 7.49% | | | | |

| | 586,600 | | CF Industries Holdings Inc. (c) | | | 50,582,518 | |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS (continued)

September 30, 2009

| Shares | | | | Value | |

| | | | | | |

| | | FERTILIZERS & AGRICULTURAL CHEMICALS — 7.49% (continued) | | | |

| | 776,000 | | The Mosaic Company | | $ | 37,302,320 | |

| | 2,007,400 | | Nufarm Limited (g) | | | 20,100,034 | |

| | 797,300 | | Terra Industries Inc. | | | 27,642,391 | |

| | | | | | | 135,627,263 | |

| | | | GOLD — 1.17% | | | | |

| | 3,548,702 | | Sino Gold Mining Limited (a)(e)(g) | | | 21,100,678 | |

| | | | | | | | |

| | | | INDEPENDENT POWER PRODUCERS | | | | |

| | | | & ENERGY TRADERS — 1.40% | | | | |

| | 3,752,500 | | Canadian Hydro Developers, Inc. (a)(b)(g) | | | 18,050,133 | |

| | 5,538,921 | | Infigen Energy (g) | | | 7,378,517 | |

| | | | | | | 25,428,650 | |

| | | | IT CONSULTING & OTHER SERVICES — 4.68% | | | | |

| | 332,800 | | Hitachi Information Systems, Ltd. (g) | | | 10,733,092 | |

| | 2,495,100 | | Perot Systems Corp. (a) | | | 74,104,470 | |

| | | | | | | 84,837,562 | |

| | | | LIFE SCIENCES TOOLS & SERVICES — 2.30% | | | | |

| | 814,933 | | Varian, Inc. (a)(d) | | | 41,610,479 | |

| | | | | | | | |

| | | | MOVIES & ENTERTAINMENT — 4.70% | | | | |

| | 1,716,092 | | Marvel Entertainment, Inc. (a)(b) | | | 85,152,485 | |

| | | | | | | | |

| | | | OIL & GAS EQUIPMENT & SERVICES — 6.53% | | | | |

| | 3,915,150 | | BJ Services Company (e) | | | 76,071,364 | |

| | 951,725 | | NATCO Group Inc. (a)(d) | | | 42,142,383 | |

| | | | | | | 118,213,747 | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 1.67% | | | | |

| | 525,789 | | EnCana Corporation (g) | | | 30,290,704 | |

| | | | | | | | |

| | | | PACKAGED FOODS & MEATS — 1.67% | | | | |

| | 591,944 | | Cadbury plc — ADR (c)(g) | | | 30,313,452 | |

| | | | | | | | |

| | | | PHARMACEUTICALS — 20.44% | | | | |

| | 5,108,726 | | Schering Plough Corp. (b) | | | 144,321,510 | |

| | 1,920,300 | | Sepracor Inc. (a) | | | 43,974,870 | |

| | 837,400 | | Warner Chilcott plc — ADR (a)(g) | | | 18,104,588 | |

| | 3,374,333 | | Wyeth (b) | | | 163,925,097 | |

| | | | | | | 370,326,065 | |

| | | | PUBLISHING — 0.00% | | | | |

| | 2,150 | | Thomson Reuters Corporation (g) | | | 72,176 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2009

| Shares | | | | Value | |

| | | | | | |

| | | RESTAURANTS — 2.78% | | | |

| | 606,085 | | Chipotle Mexican Grill, Inc. Class B (a)(b) | | $ | 50,438,394 | |

| | | | | | | | |

| | | | SOFT DRINKS — 5.94% | | | | |

| | 2,809,100 | | Pepsi Bottling Group Inc. (b) | | | 102,363,604 | |

| | 184,100 | | PepsiAmericas Inc. | | | 5,257,896 | |

| | | | | | | 107,621,500 | |

| | | | SYSTEMS SOFTWARE — 1.10% | | | | |

| | 678,400 | | Hitachi Software Engineering Co., Ltd. (g) | | | 19,989,617 | |

| | | | | | | | |

| | | | WIRELESS TELECOMMUNICATION SERVICES — 1.31% | | | | |

| | 2,980,591 | | Centennial Communications Corp. (a) | | | 23,785,116 | |

| | | | | | | | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $1,543,456,378) | | | 1,675,852,608 | |

| | | | | |

| PREFERRED STOCKS — 0.00% | | | | |

| | 300 | | KeyCorp Capital Preferred Series F | | | 6,726 | |

| | | | TOTAL PREFERRED STOCKS (Cost $6,249) | | | 6,726 | |

| | | | | | | | |

| Contracts (100 shares per contract) | | | | |

| | | | | |

| PURCHASED PUT OPTIONS — 0.22% | | | | |

| | | | The Blackstone Group, LP | | | | |

| | 5,417 | | Expiration: October, 2009, Exercise Price: $15.00 | | | 568,785 | |

| | | | DirecTV Group, Inc. | | | | |

| | 638 | | Expiration: December, 2009, Exercise Price: $30.00 | | | 204,160 | |

| | | | Global Alternative Energy ETF | | | | |

| | 2,440 | | Expiration: October, 2009, Exercise Price: $27.50 | | | 524,600 | |

| | | | Health Care Select Sector SPDR Fund | | | | |

| | 1,662 | | Expiration: October, 2009, Exercise Price: $30.00 | | | 232,680 | |

| | | | iShares MSCI Brazil Index Fund | | | | |

| | 503 | | Expiration: December, 2009, Exercise Price: $72.00 | | | 342,040 | |

| | | | Materials Select Sector SPDR Trust | | | | |

| | 985 | | Expiration: December, 2009, Exercise Price: $35.00 | | | 453,100 | |

| | | | SPDR Trust Series 1 | | | | |

| | 3,230 | | Expiration: October, 2009, Exercise Price: $107.00 | | | 834,955 | |

| | | | Technology Select Sector SPDR Fund | | | | |

| | 1,462 | | Expiration: December, 2009, Exercise Price: $22.00 | | | 241,230 | |

| | | | Time Warner Inc. | | | | |

| | 3,947 | | Expiration: October, 2009, Exercise Price: $29.00 | | | 365,098 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2009

| Contracts (100 shares per contract) | | Value | |

| | | | |

| PURCHASED PUT OPTIONS — 0.22% (continued) | | | |

| | | The Walt Disney Company | | | |

| | 2,010 | | Expiration: January, 2010, Exercise Price: $15.00 | | $ | 15,075 | |

| | 1,797 | | Expiration: January, 2010, Exercise Price: $17.50 | | | 22,462 | |

| | 522 | | Expiration: January, 2010, Exercise Price: $20.00 | | | 13,572 | |

| | 1,264 | | Expiration: January, 2010, Exercise Price: $21.00 | | | 44,240 | |

| | 341 | | Expiration: January, 2010, Exercise Price: $24.00 | | | 27,280 | |

| | 691 | | Expiration: January, 2010, Exercise Price: $25.00 | | | 79,465 | |

| | | | TOTAL PURCHASED PUT OPTIONS | | | | |

| | | | (Cost $6,512,475) | | | 3,968,742 | |

| | | | | | | | |

| Principal Amount | | | | |

| | | | | |

| ESCROW NOTES — 0.11% | | | | |

| $ | 4,472,698 | | Price Communications Liquidating Trust (a)(f) | | | 1,923,260 | |

| | | | TOTAL ESCROW NOTES | | | | |

| | | | (Cost $1,923,260) | | | 1,923,260 | |

| | | | | | | | |

| Shares | | | | | | |

| | | | | |

| SHORT-TERM INVESTMENTS — 8.48% | | | | |

| | | | | | | | |

| | | | MONEY MARKET FUNDS — 8.48% | | | | |

| | 75,000,000 | | First American Government Obligations Fund, 0.39% (e) | | | 75,000,000 | |

| | 75,000,000 | | First American Prime Obligations Fund, 0.18% (e) | | | 75,000,000 | |

| | 3,638,377 | | First American Treasury Obligations Fund, 0.38% | | | 3,638,377 | |

| | | | | | | 153,638,377 | |

| | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | (Cost $153,638,377) | | | 153,638,377 | |

| | | | TOTAL INVESTMENTS | | | | |

| | | | (Cost $1,705,536,739) — 101.32% | | $ | 1,835,389,713 | |

Percentages are stated as a percent of net assets.

ADR – American Depository Receipt

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (c) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (d) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (e) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF SECURITIES SOLD SHORT

September 30, 2009

| Shares | | | | Value | |

| | 173,300 | | Agrium Inc. (a) | | $ | 8,628,607 | |

| | 1,566,769 | | Baker Hughes Incorporated | | | 66,838,366 | |

| | 224,751 | | BHP Billiton plc — ADR (a) | | | 14,835,813 | |

| | 195,400 | | The Blackstone Group, LP | | | 2,774,680 | |

| | 1,126,991 | | Cameron International Corp. | | | 42,622,800 | |

| | 606,085 | | Chipotle Mexican Grill, Inc. | | | 58,820,549 | |

| | 936,500 | | Comcast Corporation Class A | | | 15,817,485 | |

| | 2,747,750 | | DirecTV Group Inc. | | | 75,782,945 | |

| | 1,951,805 | | Eldorado Gold Corporation (a) | | | 22,250,577 | |

| | 339,489 | | Energy Select Sector SPDR Fund | | | 18,305,247 | |

| | 2,768,840 | | Fidelity National Information Services Inc. | | | 70,633,108 | |

| | 65,000 | | Kraft Foods, Inc. | | | 1,707,550 | |

| | 2,944,569 | | Merck & Co. Inc. | | | 93,136,717 | |

| | 950,448 | | Pepsico Inc. | | | 55,753,280 | |

| | 3,322,832 | | Pfizer Inc. | | | 54,992,870 | |

| | 395,000 | | Shinsei Bank Ltd. (a) | | | 607,252 | |

| | 2,579,475 | | Viterra Inc. (a) | | | 25,730,905 | |

| | 1,278,730 | | The Walt Disney Company | | | 35,113,926 | |

| | 3,300,034 | | Xerox Corporation | | | 25,542,263 | |

| | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | (Proceeds $607,699,316) | | $ | 689,894,940 | |

ADR – American Depository Receipt

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN

September 30, 2009

| Contracts (100 shares per contract) | | Value | |

| | | | | | |

| CALL OPTIONS | | | |

| | | Affiliated Computer Services, Inc. | | | |

| | 2,549 | | Expiration: November, 2009, Exercise Price: $50.00 | | $ | 1,328,029 | |

| | | | Cadbury plc — ADR | | | | |

| | 3,411 | | Expiration: October, 2009, Exercise Price: $50.00 | | | 596,925 | |

| | 450 | | Expiration: November, 2009, Exercise Price: $50.00 | | | 130,500 | |

| | | | CF Industries Holdings Inc. | | | | |

| | 2,723 | | Expiration: October, 2009, Exercise Price: $80.00 | | | 1,906,100 | |

| | 1,410 | | Expiration: October, 2009, Exercise Price: $85.00 | | | 493,500 | |

| | | | DirecTV Group, Inc. | | | | |

| | 1,844 | | Expiration: October, 2009, Exercise Price: $25.00 | | | 493,270 | |

| | 2,385 | | Expiration: November, 2009, Exercise Price: $25.00 | | | 739,350 | |

| | 638 | | Expiration: December, 2009, Exercise Price: $30.00 | | | 51,040 | |

| | | | EnCana Corporation | | | | |

| | 1,863 | | Expiration: October, 2009, Exercise Price: $55.00 | | | 633,420 | |

| | | | Huntsman Corporation | | | | |

| | 1,867 | | Expiration: October, 2009, Exercise Price: $7.50 | | | 317,390 | |

| | 1,000 | | Expiration: November, 2009, Exercise Price: $7.50 | | | 197,000 | |

| | | | Kraft Foods, Inc. | | | | |

| | 40 | | Expiration: October, 2009, Exercise Price: $25.00 | | | 5,200 | |

| | 1,568 | | Expiration: October, 2009, Exercise Price: $26.00 | | | 78,400 | |

| | | | The Mosaic Company | | | | |

| | 7,760 | | Expiration: October, 2009, Exercise Price: $45.00 | | | 3,259,200 | |

| | | | SPDR Trust Series 1 | | | | |

| | 1,615 | | Expiration: October, 2009, Exercise Price: $108.00 | | | 163,115 | |

| | | | Sun Microsystems, Inc. | | | | |

| | 8,767 | | Expiration: October, 2009, Exercise Price: $10.00 | | | 4,383 | |

| | 4,661 | | Expiration: January, 2010, Exercise Price: $10.00 | | | 11,652 | |

| | | | Terra Industries Inc. | | | | |

| | 2,858 | | Expiration: October, 2009, Exercise Price: $28.00 | | | 1,906,286 | |

| | 5,115 | | Expiration: October, 2009, Exercise Price: $34.00 | | | 741,675 | |

| | | | Varian, Inc. | | | | |

| | 1,389 | | Expiration: November, 2009, Exercise Price: $55.00 | | | 10,418 | |

| | | | Warner Chilcott plc — ADR | | | | |

| | 461 | | Expiration: October, 2009, Exercise Price: $17.50 | | | 191,315 | |

| | 7,913 | | Expiration: October, 2009, Exercise Price: $20.00 | | | 1,325,428 | |

| | | | | | | 14,583,596 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

September 30, 2009

| Contracts (100 shares per contract) | | Value | |

| | | | | | |

| PUT OPTIONS | | | |

| | | SPDR Trust Series 1 | | | |

| | 1,615 | | Expiration: October, 2009, Exercise Price: $102.00 | | $ | 138,890 | |

| | | | TOTAL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $15,638,987) | | $ | 14,722,486 | |

ADR – American Depository Receipt

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2009

| ASSETS: | | | | | | |

| Investments, at value (Cost $1,705,536,739) | | | | | $ | 1,835,389,713 | |

| Cash | | | | | | 730,488 | |

| Cash held in foreign currency (Cost $16,750,277) | | | | | | 16,939,439 | |

| Deposits at brokers for securities sold short | | | | | | 135,522,269 | |

| Receivable from brokers for proceeds on securities sold short | | | | | | 581,970,773 | |

| Receivable for investments sold | | | | | | 51,528,069 | |

| Receivable for foreign currency translation | | | | | | 45,416 | |

| Receivable for swap contracts | | | | | | 1,075,691 | |

| Receivable for fund shares issued | | | | | | 8,559,766 | |

| Dividends and interest receivable | | | | | | 2,629,101 | |

| Prepaid expenses and other receivables | | | | | | 718,362 | |

| Total Assets | | | | | | 2,635,109,087 | |

| LIABILITIES: | | | | | | | |

| Securities sold short, at value (proceeds of $607,699,316) | | $ | 689,894,940 | | | | | |

| Options written, at value (premiums received $15,638,987) | | | 14,722,486 | | | | | |

| Payable for forward currency exchange contracts | | | 8,009,930 | | | | | |

| Payable for swap contracts | | | 645,193 | | | | | |

| Payable for swap interest | | | 23,952 | | | | | |

| Payable for investments purchased | | | 104,539,960 | | | | | |

| Payable for fund shares redeemed | | | 1,485,014 | | | | | |

| Investment advisory fee payable | | | 1,428,713 | | | | | |

| Distribution fees payable | | | 957,280 | | | | | |

| Dividends and interest payable | | | 1,109,724 | | | | | |

| Accrued expenses and other liabilities | | | 911,738 | | | | | |

| Total Liabilities | | | | | | | 823,728,930 | |

| NET ASSETS | | | | | | $ | 1,811,380,157 | |

| NET ASSETS Consist Of: | | | | | | | | |

| Accumulated undistributed net investment income | | | | | | $ | 6,282,325 | |

| Accumulated undistributed net realized loss on investments, securities | | | | | | | | |

| sold short, written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translation and forward currency exchange contracts | | | | | | | (75,752,972 | ) |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 129,852,974 | | | | | |

| Securities sold short | | | (82,195,624 | ) | | | | |

| Written option contracts | | | 916,501 | | | | | |

| Swap contracts | | | 430,498 | | | | | |

| Foreign currency translations | | | 234,578 | | | | | |

| Forward currency exchange contracts | | | (8,009,930 | ) | | | | |

| Net unrealized appreciation | | | | | | | 41,228,997 | |

| Paid-in capital | | | | | | | 1,839,621,807 | |

| Total Net Assets | | | | | | $ | 1,811,380,157 | |

| NET ASSET VALUE and offering price per share*, ($1,811,380,157 / 118,701,683 | | | | | | | | |

| shares of beneficial interest outstanding) | | | | | | $ | 15.26 | |

| * | The redemption price per share may vary based on the length of time a shareholder holds Fund shares. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2009

INVESTMENT INCOME: | | | | | | |

| Interest | | | | | $ | 2,124,807 | |

| Dividend income on long positions | | | | | | | |

| (net of foreign withholding taxes of $227,321) | | | | | | 23,163,269 | |

| Total investment income | | | | | | 25,288,076 | |

| EXPENSES: | | | | | | | |

| Investment advisory fee | | $ | 14,576,347 | | | | | |

| Distribution fees | | | 3,644,059 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 2,044,815 | | | | | |

| Federal and state registration fees | | | 128,882 | | | | | |

| Professional fees | | | 470,883 | | | | | |

| Trustees’ fees and expenses | | | 132,160 | | | | | |

| Custody fees | | | 136,399 | | | | | |

| Administration fee | | | 620,074 | | | | | |

| Fund accounting expense | | | 199,582 | | | | | |

| Reports to shareholders | | | 352,404 | | | | | |

| Miscellaneous expenses | | | 190,511 | | | | | |

| Borrowing expense on securities sold short | | | 27,520,799 | | | | | |

| Dividends on securities sold short | | | | | | | | |

| (net of foreign withholding taxes of $42,106) | | | 11,561,110 | | | | | |

| Total expenses before expense waiver by adviser | | | | | | | 61,578,025 | |

| Less: Expense reimbursed by Adviser, (Note 3) | | | | | | | (59,609 | ) |

| Net expenses | | | | | | | 61,518,416 | |

| | | | | | | | | |

| NET INVESTMENT LOSS | | | | | | | (36,230,340 | ) |

| REALIZED AND UNREALIZED GAIN / (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain / (loss) on: | | | | | | | | |

| Investments | | | (16,267,417 | ) | | | | |

| Securities sold short | | | 43,172,851 | | | | | |

| Written option contracts expired or closed | | | 30,938,979 | | | | | |

| Swap contracts | | | (29,575,052 | ) | | | | |

| Foreign currency translations | | | (115,902 | ) | | | | |

| Forward currency exchange contracts | | | 30,409,083 | | | | | |

| Net realized gain | | | | | | | 58,562,542 | |

| Change in unrealized appreciation / (depreciation) on: | | | | | | | | |

| Investments | | | 183,651,327 | | | | | |

| Securities sold short | | | (121,652,226 | ) | | | | |

| Written option contracts | | | (1,219,820 | ) | | | | |

| Swap contracts | | | 16,312,324 | | | | | |

| Foreign currency translations | | | 243,234 | | | | | |

| Forward currency exchange contracts | | | (18,736,184 | ) | | | | |

| Net unrealized gain | | | | | | | 58,598,655 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | | 117,161,197 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | 80,930,587 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | September 30, 2009 | | | September 30, 2008 | |

| Net investment loss | | $ | (36,230,340 | ) | | $ | (1,342,216 | ) |

| Net realized gain / (loss) on investments, | | | | | | | | |

| securities sold short, written option contracts expired or | | | | | | | | |

| closed, swap contracts, foreign currency translations | | | | | | | | |

| and forward currency exchange contracts | | | 58,562,542 | | | | (65,919,903 | ) |

| Change in unrealized appreciation / (depreciation) on | | | | | | | | |

| investments, securities sold short, written option | | | | | | | | |

| contracts, swap contracts, foreign currency translations | | | | | | | | |

| and forward currency exchange contracts | | | 58,598,655 | | | | (12,525,263 | ) |

| Net increase / (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 80,930,857 | | | | (79,787,382 | ) |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | (5,185,512 | ) | | | (37,192,512 | ) |

| Net realized gains | | | (4,823,592 | ) | | | (69,027,693 | ) |

| Return of capital | | | (21,325,423 | ) | | | — | |

| Total dividends and distributions | | | (31,334,527 | ) | | | (106,220,205 | ) |

| Net increase / (decrease) in net assets from | | | | | | | | |

| capital share transactions (Note 4) | | | 347,618,561 | | | | (221,541,544 | ) |

| Net increase / (decrease) in net assets | | | 397,214,891 | | | | (407,549,131 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 1,414,165,266 | | | | 1,821,714,397 | |

| End of year (including accumulated undistributed | | | | | | | | |

| net investment income of $6,282,325 | | | | | | | | |

| and $10,388,687 respectively) | | $ | 1,811,380,157 | | | $ | 1,414,165,266 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS

Selected per share data is based on a share of beneficial interest outstanding throughout each year.

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of year | | $ | 14.79 | | | $ | 16.55 | | | $ | 15.95 | | | $ | 15.78 | | | $ | 15.10 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | 0.24 | (2) | | | 0.00 | (3)(4) | | | 0.13 | (3) | | | 0.06 | (3) | | | (0.06 | )(3) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.58 | | | | (0.70 | ) | | | 1.13 | | | | 0.99 | | | | 0.94 | |

| Total from investment operations | | | 0.82 | | | | (0.70 | ) | | | 1.26 | | | | 1.05 | | | | 0.88 | |

| Redemption fees | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.06 | ) | | | (0.37 | ) | | | (0.11 | ) | | | (0.01 | ) | | | 0.00 | (4) |

| Distributions from net realized gains | | | (0.05 | ) | | | (0.69 | ) | | | (0.55 | ) | | | (0.87 | ) | | | (0.20 | ) |

| Distributions from return to capital | | | (0.24 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.35 | ) | | | (1.06 | ) | | | (0.66 | ) | | | (0.88 | ) | | | (0.20 | ) |

| Net Asset Value, end of year | | $ | 15.26 | | | $ | 14.79 | | | $ | 16.55 | | | $ | 15.95 | | | $ | 15.78 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 5.78 | % | | | (4.32 | )% | | | 8.15 | % | | | 7.10 | % | | | 5.88 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 1,811,380 | | | $ | 1,414,165 | | | $ | 1,821,714 | | | $ | 1,563,045 | | | $ | 1,484,675 | |

| Ratio of operating expenses | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 4.22 | % | | | 1.66 | % | | | 2.16 | % | | | 2.08 | % | | | 1.77 | % |

| Ratio of interest expense, borrowing | | | | | | | | | | | | | | | | | | | | |

| expense on securities sold short and | | | | | | | | | | | | | | | | | | | | |

| dividends on securities sold short to | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | 2.68 | % | | | 0.19 | % | | | 0.76 | % | | | 0.71 | % | | | 0.41 | % |

| Ratio of operating expense to | | | | | | | | | | | | | | | | | | | | |

| average net assets excluding interest | | | | | | | | | | | | | | | | | | | | |

| expense, borrowing expense on | | | | | | | | | | | | | | | | | | | | |

| securities sold short and dividends | | | | | | | | | | | | | | | | | | | | |

| on securities sold short | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.54 | % | | | 1.48 | % | | | 1.41 | % | | | 1.37 | % | | | 1.36 | % |

| After expense waiver | | | 1.54 | % | | | 1.47 | % | | | 1.40 | %(5) | | | 1.37 | % | | | 1.36 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (2.49 | )% | | | (0.09 | )% | | | 0.83 | % | | | 0.43 | % | | | (0.35 | )% |

Portfolio turnover rate(6) | | | 318.45 | % | | | 300.24 | % | | | 334.87 | % | | | 369.47 | % | | | 312.04 | % |

Footnotes To Financial Highlights On Following Page

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS (continued)

| (1) | Net investment income (loss) before interest expense, borrowing expense on securities sold short and dividends on securities sold short for the years ended September 30, 2009, 2008, 2007, 2006 and 2005 was $0.55, $0.02, $0.26, $0.18 and $0.01, respectively. |

| (2) | Net investment income per share is calculated using ending balance after consideration of adjustments for permanent book and tax differences. |

| (3) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (4) | Amount less than $0.005 per share. |

| (5) | The Fund incurred proxy expenses of approximately $525,000 in 2007 related to shareholder approval of changes in the Fund’s fundamental investment policies and the election of trustees. |

| (6) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short positions). The denominator includes the average long positions throughout the year. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2009

Note 1 — ORGANIZATION

The Merger Fund (the “Fund”) is a no-load, open-end, non-diversified investment company organized as a trust under the laws of the Commonwealth of Massachusetts on April 12, 1982, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund was formerly known as the Risk Portfolio of The Ayco Fund. In January of 1989, the Fund’s fundamental policies were amended to permit the Fund to engage exclusively in merger arbitrage. At the same time, Westchester Capital Management, Inc. became the Fund’s investment adviser, and the Fund began to do business as The Merger Fund. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles. In preparing these financial statements, the Fund has evaluated subsequent events and transactions for potential recognition or disclosure through November 25, 2009, the date the financial statements were issued.

A.Investment Valuation

Securities listed on the NASDAQ Global Market and the NASDAQ Global Select Market are valued at the NASDAQ Official Closing Price (“NOCP”). Other listed securities are valued at the last sale price on the exchange on which such securities are primarily traded or, in the case of options, at the last sale price. Securities not listed on an exchange and securities for which there are no transactions are valued at the average of the closing bid and asked prices. When pricing options, if no sales are reported or if the last sale is outside the bid and asked parameters, the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices will be used. Securities for which there are no such valuations are valued at fair value as determined in good faith by management under the supervision of the Board of Trustees. The Adviser (as defined herein), reserves the right to value securities, including options, at prices other than last-sale prices, intrinsic value prices, or the average of closing bid and asked prices, when such prices are believed unrepresentative of fair market value as determined in good faith by the Adviser. When fair-value pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. In addition, due to the subjective and variable nature of fair-value pricing, it is possible that the value determined for a particular asset may be materially different from the value realized upon such asset’s sale. At September 30, 2009, fair-valued long securities represented 0.11% of investments, at value. Investments in United States government securities (other than short-term securities) are valued at the average of the quoted bid and asked prices in the over-the-counter market. Short-term investments are carried at amortized cost, which approximates market value.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| Level 1 — | Quoted prices in active markets for identical securities. |

| Level 2 — | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| Level 3 — | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following tables provide the fair value measurements of applicable Fund assets and liabilities by level within the fair value hierarchy for the Fund as of September 30, 2009. These assets and liabilities are measured on a recurring basis.

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Common Stocks | | $ | 1,675,852,608 | | | $ | — | | | $ | — | | | $ | 1,675,852,608 | |

| Preferred Stocks | | | 6,726 | | | | — | | | | — | | | | 6,726 | |

| Purchased Put Options | | | 3,968,742 | | | | — | | | | — | | | | 3,968,742 | |

| Escrow Notes | | | — | | | | — | | | | 1,923,260 | | | | 1,923,260 | |

| Short-Term Investments | | | 153,638,377 | | | | — | | | | — | | | | 153,638,377 | |

| Swap Contracts * | | | — | | | | 1,075,691 | | | | — | | | | 1,075,691 | |

| Total Investments | | $ | 1,833,466,453 | | | $ | 1,075,691 | | | $ | 1,923,260 | | | $ | 1,836,465,404 | |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | $ | 689,894,940 | | | $ | — | | | $ | — | | | $ | 689,894,940 | |

| Written Option Contracts | | | 14,722,486 | | | | — | | | | — | | | | 14,722,486 | |

| Swap Contracts * | | | — | | | | 645,193 | | | | — | | | | 645,193 | |

| Forward Currency | | | | | | | | | | | | | | | | |

| Exchange Contracts * | | | — | | | | 8,009,930 | | | | — | | | | 8,009,930 | |

| * | Swap contracts and forward currency exchange contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Level 3 Reconciliation Disclosure

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| Balance as of September 30, 2008 | | $ | 13,746,820 | |

| Accrued discounts/premiums | | | — | |

| Realized gain (loss) | | | (15,282,474 | ) |

| Change in unrealized appreciation (depreciation) | | | 8,987,083 | |

| Net purchases (sales) | | | (5,528,169 | ) |

| Transfers in and/or out of Level 3 | | | — | |

| Balance as of September 30, 2009 | | $ | 1,923,260 | |

B.Securities Sold Short

The Fund may sell securities or currencies short for hedging purposes. For financial statement purposes, an amount equal to the settlement amount is initially included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities or currencies sold, but not yet purchased, may require purchasing the securities or currencies at prices which may differ from the market value reflected on the Statement of Assets and Liabilities. Short sale transactions result in off balance sheet risk because the ultimate obligation may exceed the related amounts shown in the Statement of Assets and Liabilities. The Fund will incur a loss if the price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund’s loss on a short sale is potentially unlimited because there is no upward limit on the price a borrowed security could attain.

The Fund is liable for any dividends payable on securities while those securities are sold short. As collateral for its securities sold short, the Fund is required under the 1940 Act to maintain assets consisting of cash, cash equivalents or liquid securities. These assets are required to be adjusted daily to reflect changes in the value of the securities or currencies sold short.

C.Transactions with Brokers for Securities Sold Short

The Fund’s receivable from brokers for proceeds on securities sold short and deposit at brokers for securities sold short are with three major securities dealers. The Fund does not require the brokers to maintain collateral in support of the receivable from brokers for proceeds on securities sold short.

D.Federal Income Taxes

No provision for federal income taxes has been made since the Fund has complied to date with the provisions of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in future years and to distribute investment company net taxable income and net capital gains to shareholders. Additionally, the Fund intends to make all required distributions to avoid federal excise tax.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to income tax positions taken or expected to be taken on a tax return. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. As of September 30, 2009, open Federal and New York tax years include the tax years ended September 30, 2006 through 2009. The Fund has no examination in progress.

E.Written Option Contracts

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund writes (sells) covered call options to hedge portfolio investments. Uncovered put options can also be written by the Fund as part of a merger arbitrage strategy involving a pending corporate reorganization. When the Fund writes (sells) an option, an amount equal to the premium received by the Fund is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market daily to reflect the current value of the option written. By writing an option, the Fund may become obligated during the term of the option to deliver or purchase the securities underlying the option at the exercise price if the option is exercised. Option contracts are valued at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract written is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When an option expires on its stipulated expiration date or the Fund enters into a closing purchase transaction, the Fund realizes a gain or loss if the cost of the closing purchase transaction differs from the premium received when the option was sold without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is eliminated. When an option is exercised, the premium originally received decreases the cost basis of the security (or increases the proceeds on a sale of the security), and the Fund realizes a gain or loss from the sale of the underlying security. With written option contracts, there is minimal counterparty credit risk to the Fund since written option contracts are exchange traded.

F.Purchased Options

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund purchases put options to hedge portfolio investments. Call options may be purchased only for the purpose of closing out previously written covered call options. Premiums paid for option contracts purchased are included in the Statement of Assets and Liabilities as an asset. Option contracts are valued daily at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract purchased is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When option contracts expire or are closed, realized gains or losses are recognized without regard to any unrealized gains or losses on the underlying securities. With purchased options, there is minimal counterparty credit risk to the Fund since purchased options are exchange traded.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

G.Forward Currency Exchange Contracts

The Fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The Fund may use forward currency exchange contracts to hedge against changes in the value of foreign currencies. The Fund may enter into forward currency exchange contracts obligating the Fund to deliver and receive a currency at a specified future date. Forward contracts are valued daily, and unrealized appreciation or depreciation is recorded daily as the difference between the contract exchange rate and the closing forward rate applied to the face amount of the contract. A realized gain or loss is recorded at the time the forward contract expires. With forward contracts, there is minimal counterparty credit risk to the Fund since forward contracts are exchange traded.

The use of forward currency exchange contracts does not eliminate fluctuations in the underlying prices of the Fund’s investment securities; however, it does establish a rate of exchange that can be achieved in the future. The use of forward currency exchange contracts involves the risk that anticipated currency movements will not be accurately predicted. A forward currency exchange contract would limit the risk of loss due to a decline in the value of a particular currency; however it would also limit any potential gain that might result should the value of the currency increase instead of decrease. These contracts may involve market risk in excess of the amount of receivable or payable reflected on the Statement of Assets and Liabilities.

H.Distributions to Shareholders

Dividends from net investment income and net realized capital gains, if any, are declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences are due primarily to wash sale-loss deferrals, constructive sales, straddle-loss deferrals, adjustments on swap contracts, and unrealized gains or losses on Section 1256 contracts, which were realized, for tax purposes, at September 30, 2009. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes. At September 30, 2009, the Fund increased accumulated undistributed net investment income by $58,634,437, reduced accumulated undistributed net realized loss by $(28,336,882), and reduced paid-in capital by $(30,297,555). The Fund may utilize earnings and profits deemed distributed to shareholders on redemptions of shares as part of the dividends-paid deduction.

I.Foreign Securities

Investing in securities of foreign companies involves special risks and considerations not typically associated with investing in U.S. companies. These risks include revaluation of currencies and adverse political and economic developments. Moreover, securities of many foreign companies and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

J.Foreign Currency Translations

The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities. However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gain or loss from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences.

K.When-Issued Securities

The Fund may engage in securities transactions on a when-issued or delayed-delivery basis. Although the payment and interest terms of these securities are established at the time the Fund enters into the agreement, these securities may be delivered for cash proceeds at a future date. During this period, the securities are subject to market fluctuations. The Fund records sales of when-issued securities and reflects the values of such securities in determining net asset value in the same manner as other open short-sale positions. When delayed-delivery purchases are outstanding, the Fund segregates and maintains at all times cash, cash equivalents or other liquid securities in an amount at least equal to the market value.

L.Cash Equivalents

The Fund considers highly liquid temporary cash investments purchased with an original maturity of less than three months to be cash equivalents. Cash equivalents are included in short-term investments on the Schedule of Investments as well as in investments on the Statement of Assets and Liabilities.

M.Guarantees and Indemnifications

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

N.Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

O.Other

Investment and shareholder transactions are recorded on the trade date. Realized gains and losses from security transactions are recorded on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest is accounted for on the accrual basis and includes amortization of premiums and discounts on the interest method. Expenses include $27,520,799 of borrowing expense on securities sold short. The Fund may utilize derivative instruments such as options, forward currency exchange contracts and other instruments with similar characteristics to the extent that they are consistent with the Fund’s investment objectives and limitations. The use of these instruments may involve additional investment risks, including the possibility of illiquid markets or imperfect correlation between the value of the instruments and the underlying securities.

P.Counterparty Risk

The Fund helps manage counterparty credit risk by entering into agreements only with counterparties the Adviser believes have the financial resources to honor their obligations and by having the Adviser monitor the financial stability of the counterparties. Collateral pledges are monitored and subsequently adjusted if and when the valuations fluctuate, either up or down, by at least the predetermined threshold amount.

Q.The Right to Offset

Financial assets and liabilities as well as cash collateral received and posted are offset by counterparty, and the net amount is reported in the consolidated statement of financial condition when the Fund believes there exists a legally enforceable right to set off the recognized amounts.

R.Derivatives

The Fund has adopted authoritative standards regarding disclosure about derivatives and hedging activities and how they affect the Fund’s Statement of Assets and Liabilities and Statement of Operations. For the year ended September 30, 2009: long option contracts (503,501 contracts) were purchased and $189,324,494 premiums were paid, written option contracts (921,466 contracts) were opened and $185,761,079 premiums were received, equity swap contracts were opened for a notional value of $424,853,148 and closed for a notional value of $548,970,202 and an average of 10 forward currency exchange contract positions were open during the year.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Statement of Assets and Liabilities:

Fair values of derivative instruments as of September 30, 2009:

| | | Asset Derivatives | | | Liability Derivatives | |

| | | Statement of Assets | | | | | | Statement of Assets | | | | |

| | | and Liabilities | | | | | | and Liabilities | | | | |

| Derivatives | | Location | | | Fair Value | | | Location | | | Fair Value | |

| Equity contracts: | | | | | | | | | | | | |

| Purchased Options | | Investments | | | $ | 3,968,742 | | | N/A | | | $ | — | |

| Written Option Contracts | | N/A | | | | — | | | Options Written | | | | 14,722,486 | |

| Swap Contracts | | Receivables | | | | 1,075,691 | | | Payables | | | | 645,193 | |

| Foreign exchange contracts: | | | | | | | | | | | | | | | | |

| Forward Currency | | | | | | | | | | | | | | | | |

| Exchange Contracts | | Receivables | | | | — | | | Payables | | | | 8,009,930 | |

| Total | | | | | | $ | 5,044,433 | | | | | | | $ | 23,377,609 | |

Statement of Operations

The effect of derivative instruments on the Statement of Operations for the year ended September 30, 2009:

| | | Amount of Realized Gain (Loss) on Derivatives | |

| | | | | | | | | Forward | | | | | | | |

| | | | | | Option | | | Currency | | | | | | | |

| | | Purchased | | | Contracts | | | Exchange | | | Swap | | | | |

| Derivatives | | Options | | | Written | | | Contracts | | | Contracts | | | Total | |

| Equity contracts | | $ | (6,797,713 | ) | | $ | 30,938,979 | | | $ | — | | | $ | (29,575,052 | ) | | $ | (5,433,786 | ) |

| Foreign | | | | | | | | | | | | | | | | | | | | |

| exchange contracts | | | — | | | | — | | | | 30,409,083 | | | | — | | | | 30,409,083 | |

| Total | | $ | (6,797,713 | ) | | $ | 30,938,979 | | | $ | 30,409,083 | | | $ | (29,575,052 | ) | | $ | 24,975,297 | |

| | | Change in Unrealized Appreciation (Depreciation) on Derivatives | |

| | | | | | | | | Forward | | | | | | | |

| | | | | | Option | | | Currency | | | | | | | |

| | | Purchased | | | Contracts | | | Exchange | | | Swap | | | | |

| Derivatives | | Options | | | Written | | | Contracts | | | Contracts | | | Total | |

| Equity contracts | | $ | (8,648,782 | ) | | $ | (1,219,820 | ) | | $ | — | | | $ | 16,312,324 | | | $ | 6,443,722 | |

| Foreign | | | | | | | | | | | | | | | | | | | | |

| exchange contracts | | | — | | | | — | | | | (18,736,184 | ) | | | — | | | | (18,736,184 | ) |

| Total | | $ | (8,648,782 | ) | | $ | (1,219,820 | ) | | $ | (18,736,184 | ) | | $ | 16,312,324 | | | $ | (12,292,462 | ) |

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 3 — AGREEMENTS

The Fund’s investment adviser is Westchester Capital Management, Inc. (the “Adviser”) pursuant to an investment advisory agreement dated January 31, 1989. Under the terms of this agreement, the Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 1.00% of the Fund’s average daily net assets. Effective August 1, 2004, the Adviser agreed to voluntarily waive 0.10% of its fee at net asset levels between $1.5 billion through $2 billion. When net assets of the Fund exceed $2 billion, the Adviser has agreed to voluntarily waive 0.20% of its fee. Investment advisory fees voluntarily waived by the Adviser for the year ended September 30, 2009 were $59,609. Certain officers of the Fund are also officers of the Adviser.

U.S. Bancorp Fund Services, LLC, a subsidiary of U.S. Bancorp, a publicly held bank holding company, serves as transfer agent, administrator, dividend paying agent and shareholder servicing agent for the Fund. U.S. Bank, N.A. serves as custodian for the Fund.

Distribution services are performed pursuant to distribution contracts with broker-dealers and other qualified institutions.

Note 4 — SHARES OF BENEFICIAL INTEREST

The Board of Trustees has the authority to issue an unlimited amount of shares of beneficial interest without par value.

Changes in shares of beneficial interest were as follows:

| | | Year Ended | | | Year Ended | |

| | | September 30, 2009 | | | September 30, 2008 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Issued | | | 75,468,090 | | | $ | 1,112,051,548 | | | | 36,375,889 | | | $ | 549,303,182 | |

| Issued as reinvestment | | | | | | | | | | | | | | | | |

| of dividends | | | 2,123,238 | | | | 30,107,517 | | | | 6,857,369 | | | | 102,723,394 | |

| Redemption fee | | | — | | | | 455,942 | | | | — | | | | 294,852 | |

| Redeemed | | | (54,505,057 | ) | | | (794,996,446 | ) | | | (57,699,720 | ) | | | (873,862,972 | ) |

| Net increase (decrease) | | | 23,086,271 | | | $ | 347,618,561 | | | | (14,466,462 | ) | | $ | (221,541,544 | ) |

Note 5 — INVESTMENT TRANSACTIONS

Purchases and sales of securities for the year ended September 30, 2009 (excluding short-term investments, options and short positions) aggregated $3,707,335,935 and $3,098,580,975, respectively. There were no purchases or sales of U.S. Government securities.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 5 — INVESTMENT TRANSACTIONS (continued)

At September 30, 2009, the components of accumulated earnings (losses) on a tax basis were as follows:

| Cost of investments | | $ | 1,716,197,081 | |

| Gross unrealized appreciation | | | 233,990,624 | |

| Gross unrealized depreciation | | | (114,797,992 | ) |

| Net unrealized appreciation | | $ | 119,192,632 | |

| Undistributed ordinary income | | $ | — | |

| Undistributed long-term capital gain | | | — | |

| Total distributable earnings | | $ | — | |

| Other accumulated losses | | | (147,357,950 | ) |

| Total accumulated losses | | $ | (28,165,318 | ) |

The tax components of dividends paid during the fiscal year ended September 30, 2009 and September 30, 2008 were as follows:

| | | 2009 | | | 2008 | |

| Ordinary Income | | $ | 10,009,104 | | | $ | 106,220,205 | |

| Return of Capital | | | 21,325,423 | | | | — | |

| Total Distributions Paid | | $ | 31,334,527 | | | $ | 106,220,205 | |

The Fund incurred a post-October capital loss of $10,885,570 for securities and $787,127 for currency, which is deferred for tax purposes until the next fiscal year. The Fund sustained a capital loss carryover of $47,821,041, which expires on September 30, 2017.

For the fiscal year ended September 30, 2009, certain dividends paid by the Fund may be subject to a maximum tax rate of 15% as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from net investment income designated as qualified dividend income for the fiscal year ended September 30, 2009 was 33.45% for the Fund (unaudited).

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends-received deduction for the fiscal year ended September 30, 2009 was 31.00% for the Fund (unaudited). The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(c) for the fiscal year ended September 30, 2009 was 15.40% for the Fund (unaudited).

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2009

Note 6 — WRITTEN OPTION CONTRACTS

The premium amount and the number of option contracts written during the year ended September 30, 2009 were as follows:

| | | Premium Amount | | | Number of Contracts |

| Options outstanding at September 30, 2008 | | $ | 5,507,516 | | | | 17,246 | |

| Options written | | | 185,761,079 | | | | 921,466 | |

| Options closed | | | (81,298,009 | ) | | | (451,374 | ) |

| Options exercised | | | (69,981,271 | ) | | | (222,506 | ) |

| Options expired | | | (24,350,328 | ) | | | (200,930 | ) |

| Options outstanding at September 30, 2009 | | $ | 15,638,987 | | | | 63,902 | |

Note 7 — DISTRIBUTION PLAN

The Fund has adopted an Amended and Restated Plan of Distribution (the “Plan”) dated July 19, 2005, pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Fund will compensate broker-dealers or qualified institutions with whom the Fund has entered into a contract to distribute Fund shares (“Dealers”). Under the Plan, the amount of such compensation paid in any one year shall not exceed 0.25% annually of the average daily net assets of the Fund, which may be payable as a service fee for providing recordkeeping, subaccounting, subtransfer agency and/or shareholder liaison services. For the year ended September 30, 2009, the Fund incurred $3,644,059 pursuant to the Plan.