UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3445

The Merger Fund

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Frederick W. Green

The Merger Fund

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2008

Item 1. Reports to Stockholders.

THE

MERGER

FUND®

ANNUAL REPORT

SEPTEMBER 30, 2008

November 24, 2008

Dear Fellow Shareholder:

As previously reported, The Merger Fund® showed a loss of 4.3% in its fiscal year ended September 30, 2008. Over the same 12 months, both the S&P 500 and the average equity mutual fund were down about 22%. We did a pretty good job of deal selection in fiscal 2008, but investor jitters caused arbitrage spreads on a number of pending transactions to widen significantly in the September quarter, which weighed on the Fund’s performance. (The pressure on takeover stocks came even before the meltdown in the financial markets in October and November, a period during which the Fund’s NAV has held up exceptionally well.)

With respect to deal selection, of the 133 mergers, takeovers and other corporate reorganizations in which the Fund held positions during fiscal 2008, 123 unfolded more or less as expected. Of the remaining six deals that were subject to definitive merger agreements, five were terminated and one was left in legal limbo after the buyer balked at completing the transaction on its original terms. Two hostile takeover attempts were called off, and two other “pre-deal” situations also fell into the failed-transaction category.

Looking ahead, we are optimistic both about the Fund’s current arbitrage holdings and the long-term success of our specialized investment approach, which has been refined and strengthened over nearly three decades. The Fund’s risk-management strategies have proven themselves in a treacherous market environment, and we believe that our unique investment vehicle can continue to distinguish itself in the months and years ahead.

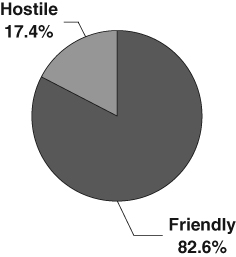

Going Hostile

Once again, we have included a series of charts which reflect the nature of the arbitrage situations in which the Fund has recently invested. Chart 1 shows that as of September 30, friendly transactions comprised about 83% of the dollar value of our long positions, while unsolicited, or hostile, takeover attempts accounted for approximately 17%. The latter figure, which is up sharply from just 1% a year earlier, represents one of the highest levels of hostile deals in the Fund’s portfolio since inception.

We have often written about how difficult it is to complete an unwelcome takeover, but 2008 has seen an increasing number of companies willing to take the plunge. With the standard defenses against unsolicited offers—poison pills, staggered boards and target-friendly state laws—not having become any less formidable over the past year or so, this new-found aggressiveness can be explained in part by corporate opportunism. The bear market—sometimes in combination with company-specific developments that have further rattled investors—has caused many potential acquisition targets to trade at levels that fail to reflect their long-term earning power or their value to a corporate buyer. When this happens, a strategic acquirer can afford to offer a big takeover premium in hopes of forcing the target to the bargaining table.

For other would-be acquirers, hostile deals may appear to be worth the risk when organic efforts to achieve some key strategic objective have come up short. For example, despite Microsoft’s protestations to the contrary, the software giant clearly had come to the conclusion that it needed to do something dramatic to improve its competitive position against Google, and its hostile pursuit of Yahoo—although subsequently abandoned—should be viewed accordingly. It is worth noting that this year’s batch of unsolicited takeover attempts have followed a familiar pattern: most have failed, although the jury is still out on a few in which the Fund continues to hold positions.

Private Equity Runs Dry

Chart 2 shows that 92% of the takeovers in the Fund’s portfolio as of September 30 were strategic in nature, meaning combinations that involve a corporate buyer—typically operating in the same industry as the target—whose objective in doing the transaction is to enhance shareholder value on a longer-term basis. The rest, 8%, were financial, or going-private, deals, in which an investor group uses large amounts of borrowed money to buy out the public shareholders. In most cases, the goal in such highly leveraged takeovers is to pay down debt over a few years’ time and then either sell or IPO the company at a price that yields a sizable profit for the buyout group.

What a difference a year makes! As of September 30, 2007, 48% of the Fund’s assets were invested in highly leveraged transactions. Back then private-equity firms were at the end of a multi-year run during which banks and other lenders showered them with huge quantities of financing on extremely favorable terms. In more than a few instances financial buyers were able to outbid strategic players, and transaction prices rose to levels that left little room for error. The environment is completely different now. Banks, which have already taken billions in write-offs on leveraged buyouts financed at the top of the market, have turned off the spigot, while the high-yield bond market is essentially closed. To get any deals done at all, financial buyers will have to pursue smaller transactions, put more equity into the capital structure and accept loan terms that are less borrower-friendly. From an arbitrage standpoint, an investment universe heavily skewed toward strategic deals is not a bad thing; such transactions have historically been a little less accident-prone.

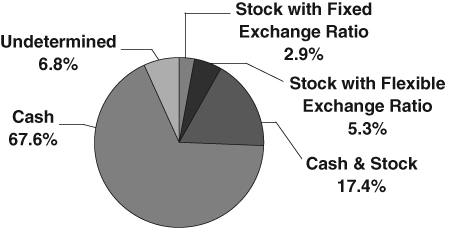

Show Me the Money

Chart 3 shows the type of merger consideration to be received by the selling company’s shareholders in transactions in which the Fund held positions at the end of September. This year’s chart shows that when it comes to deal-making, cash is still king, although the percentage of stock-based deals has shown a significant increase from year-ago levels. More specifically, all-cash takeovers accounted for about 68% of our investments this September, down from a record-high of 85% 12 months earlier. All-stock transactions represented about 8% of the total, up from only 1% last year, while cash-and-stock deals comprised 17% of the Fund’s portfolio, compared with 10% at the end of fiscal 2007.

Cash is often the preferred acquisition currency in a volatile environment because it gives both buyer and seller a fixed transaction price that is not subject to the vagaries of the market. Also, cash deals tend to be more accretive to the buyer’s bottom line than stock deals, and despite the economic downturn, many potential acquirers continue to hold large amounts of cash on their books. Finally, with stock prices down sharply over the past year, most CEOs probably regard their own shares as seriously undervalued and may be reluctant to use them for acquisitions. At the same time, however, not all would-be acquirers enjoy Fort Knox-like balance sheets. Those that don’t may be leery of becoming too leveraged, especially in a market that puts a premium on corporate liquidity. And with banks extremely cautious about making new loans, some companies may have no choice but to issue stock when doing deals.

Where the Deals Are

Chart 4 shows the Fund’s investments grouped by economic sector. Reflecting several compelling arbitrage opportunities in the food and beverage and tobacco industries, the consumer staples sector took the top spot this year, representing about 21% of our portfolio at the end of September. A year earlier this group accounted for less than 3% of the Fund’s investments, placing it ninth among the 10 sectors. M&A activity in the materials group, which includes chemical companies and miners, accounted for 17% of our holdings this year, up from 13% 12 months earlier. With the major pharmaceutical companies looking to further expand their biotech exposure, the health-care sector has recently seen a significant amount of deal-making, and this category ranked third among the Fund’s investments at the end of September. Another round of consolidation in financial services is probably in the cards, but many potential acquirers have their own problems to deal with and, at least temporarily, are less focused on M&A. This sector represented about 10% of the Fund’s holdings in September, down from 13% at the end of fiscal 2007. As we explain every year in these reports, the Fund’s portfolio-management team doesn’t target particular sectors for investment; we go where the transactions are, provided, of course, that our deal-selection criteria are met and that we don’t end up putting all of our eggs in one industry basket.

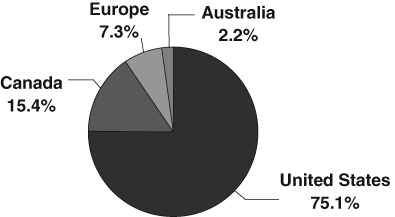

Spanning the Globe

Chart 5 shows the Fund’s arbitrage investments grouped by the geographic region in which the target company is domiciled. At the end of fiscal 2008, 75% of the deals in our portfolio involved U.S.-based targets. Companies located in Canada, Europe and Australia accounted for 15%, 7% and 2% of the Fund’s holdings, respectively. A year earlier, non-U.S. targets represented 16% of the portfolio, indicating that the Fund’s investment activity has become somewhat more global in nature over the past 12 months. In addition to having considerable experience investing outside the U.S., our portfolio-management team enjoys access to an international network of research analysts, attorneys and other advisers who can help us evaluate proposed M&A transactions in the context of political, regulatory and corporate-governance systems that may be very different from the U.S. model. Also, because we routinely hedge against currency risk, fluctuations in exchange rates have little or no impact on the Fund’s performance.

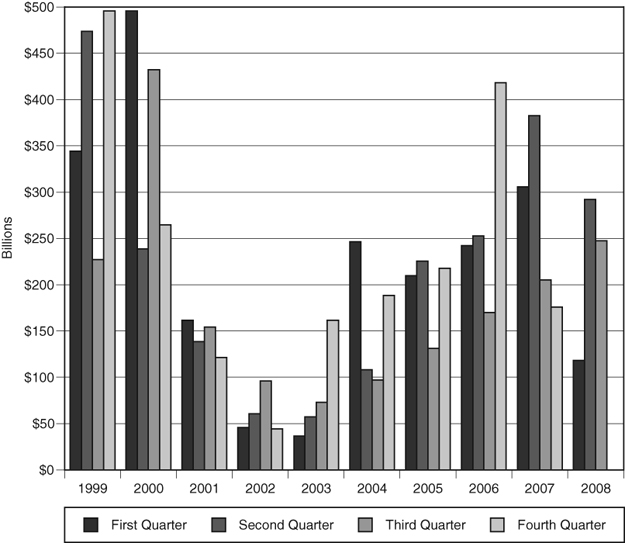

M&A in Flux

Chart 6 shows the total dollar value of mergers and acquisitions in the U.S., by quarter, since 1999. M&A volume fell about 35% from year-earlier levels in the 12 months ended September 2008. Although takeover activity in the September quarter was actually up year over year, recent turmoil in the financial markets is likely to put a near-term damper on deal-making. For one thing, market volatility makes it more difficult for buyers and sellers to agree on how to price transactions. Buyers, naturally, want to pay only modest premiums for companies whose stocks are trading at depressed levels, while sellers view such offers as opportunistic and not reflective of fundamental value. The reality, however, is that for many companies, a strategic merger or takeover may represent one of the best opportunities to enhance shareholder value. And, as noted earlier, an increasing number of would-be acquirers appear willing to go hostile when presented with the right opportunity. Takeover activity, in other words, is not expected to fall off a cliff, and The Merger Fund® should continue to benefit from an adequate flow of attractive investment opportunities.

Sincerely,

Frederick W. Green

President

| Chart 1 | Chart 2 |

| | |

| PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

| By Type of Deal* | By Type of Buyer* |

| |

Chart 3

PORTFOLIO COMPOSITION

By Deal Terms*

* Data expressed as a percentage of long equity positions as of September 30, 2008

Chart 4

PORTFOLIO COMPOSITION

By Sector*

Chart 5

PORTFOLIO COMPOSITION

By Region*

* Data expressed as a percentage of long equity positions as of September 30, 2008

Chart 6

MERGER ACTIVITY

1999 – 2008

Source: Securities Data Corp.

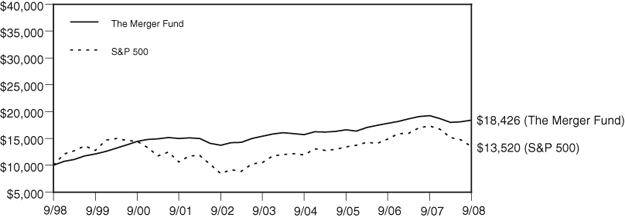

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND AND THE S&P 500

| | | | | | Average | |

| | | | | | Annual Total Return | |

| | | 1 Yr. | | | 3 Yr. | | | 5 Yr. | | | 10 Yr. | |

| The Merger Fund | | | (4.32 | )% | | | 3.49 | % | | | 3.66 | % | | | 6.30 | % |

| The Standard & Poor’s 500 Index | | | (21.98 | )% | | | 0.22 | % | | | 5.17 | % | | | 3.06 | % |

The Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on September 30, 1998. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund

EXPENSE EXAMPLE

September 30, 2008

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) redemption fees and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 for the period 4/01/08 – 9/30/08.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop-payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, a $15.00 fee will be charged by the Fund’s transfer agent. You will be charged a redemption fee equal to 2.00% of the net amount of the redemption if you redeem your shares less than 30 calendar days after you purchase them. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning Account | | | Ending Account | | | Expenses Paid During | |

| | | Value 4/01/08 | | | Value 9/30/08 | | | Period 4/01/08-9/30/08* | |

Actual + (1) | | $ | 1,000.00 | | | $ | 1,023.50 | | | $ | 8.65 | |

Hypothetical ++ (2) | | $ | 1,000.00 | | | $ | 1,016.45 | | | $ | 8.62 | |

| + | Excluding interest expense and dividends on short positions, your actual cost of investment in the Fund would be $7.69. |

| ++ | Excluding interest expense and dividends on short positions, your hypothetical cost of investment in the Fund would be $7.67. |

| (1) | Ending account values and expenses paid during period based on a 2.35% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.71%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

The Merger Fund

SCHEDULE OF INVESTMENTS

September 30, 2008

| Shares | | | | Value | |

| COMMON STOCKS — 75.02% | | | |

| | | AEROSPACE & DEFENSE — 4.63% | | | |

| | 853,709 | | DRS Technologies, Inc. (d) | | $ | 65,522,166 | |

| | | | AGRICULTURAL PRODUCTS — 2.38% | | | | |

| | 1,041,100 | | Corn Products International, Inc. | | | 33,606,708 | |

| | | | BIOTECHNOLOGY — 7.78% | | | | |

| | 651,000 | | Genentech, Inc. (a)(e) | | | 57,730,680 | |

| | 837,100 | | ImClone Systems Incorporated (a)(e) | | | 52,268,524 | |

| | | | | | | 109,999,204 | |

| | | | BREWERS — 7.01% | | | | |

| | 1,529,000 | | Anheuser-Busch Companies, Inc. (b) | | | 99,201,520 | |

| | | | COAL & CONSUMABLE FUELS — 0.41% | | | | |

| | 766,700 | | PBS Coals Limited (a) | | | 5,763,308 | |

| | | | COMMUNICATIONS EQUIPMENT — 1.32% | | | | |

| | 3,266,074 | | 3Com Corporation (a)(e) | | | 7,609,952 | |

| | 565,400 | | Foundry Networks, Inc. (a) | | | 10,295,934 | |

| | 1,324,935 | | Nextwave Wireless Inc. (a)(b) | | | 794,961 | |

| | | | | | | 18,700,847 | |

| | | | COMPUTER HARDWARE — 1.55% | | | | |

| | 663,200 | | Diebold, Incorporated | | | 21,958,552 | |

| | | | COMPUTER STORAGE & PERIPHERALS — 0.73% | | | | |

| | 526,600 | | SanDisk Corporation (a)(d) | | | 10,295,030 | |

| | | | DIVERSIFIED CHEMICALS — 4.81% | | | | |

| | 2,190,800 | | Hercules Incorporated (e) | | | 43,355,932 | |

| | 1,960,934 | | Huntsman Corporation | | | 24,707,768 | |

| | | | | | | 68,063,700 | |

| | | | DIVERSIFIED METALS & MINING — 2.40% | | | | |

| | 409,500 | | Fording Canadian Coal Trust (a) | | | 33,988,481 | |

| | | | DRUG RETAIL — 0.11% | | | | |

| | 20,800 | | Longs Drug Stores Corporation | | | 1,573,312 | |

| | | | ENVIRONMENTAL & FACILITIES SERVICES — 0.76% | | | | |

| | 967,200 | | Allied Waste Industries, Inc. (a) | | | 10,745,592 | |

| | | | HOME ENTERTAINMENT SOFTWARE — 1.37% | | | | |

| | 1,182,903 | | Take-Two Interactive Software, Inc. (a) | | | 19,399,609 | |

| | | | INSURANCE BROKERS — 2.30% | | | | |

| | 697,300 | | Hilb Rogal and Hobbs Company | | | 32,591,802 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2008

| Shares | | | | Value | |

| | | INTEGRATED OIL & GAS — 1.96% | | | |

| | 2,179,949 | | Origin Energy Limited | | $ | 27,752,824 | |

| | | | INTEGRATED TELECOMMUNICATION SERVICES — 2.63% | | | | |

| | 1,079,800 | | BCE Inc. | | | 37,236,232 | |

| | | | INVESTMENT BANKING & BROKERAGE — 0.17% | | | | |

| | 93,300 | | Merrill Lynch & Co., Inc. (c) | | | 2,360,490 | |

| | | | LIFE & HEALTH INSURANCE — 3.69% | | | | |

| | 1,056,659 | | Nationwide Financial Services, Inc. (e) | | | 52,124,988 | |

| | | | MULTI-UTILITIES — 2.69% | | | | |

| | 1,424,473 | | Puget Energy, Inc. (b) | | | 38,033,429 | |

| | | | OIL & GAS DRILLING — 1.98% | | | | |

| | 3,593,550 | | Grey Wolf, Inc. (a) | | | 27,957,819 | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 1.57% | | | | |

| | 337,000 | | EnCana Corporation | | | 22,151,010 | |

| | | | PACKAGED FOODS & MEATS — 6.00% | | | | |

| | 1,068,500 | | Wm. Wrigley Jr. Company (d) | | | 84,838,900 | |

| | | | PHARMACEUTICALS — 6.14% | | | | |

| | 108,200 | | Alpharma Inc. (a)(c) | | | 3,991,498 | |

| | 1,267,800 | | Barr Pharmaceuticals Inc. (a)(d) | | | 82,787,340 | |

| | | | | | | 86,778,838 | |

| | | | PROPERTY-CASUALTY INSURANCE — 2.34% | | | | |

| | 565,005 | | Philadelphia Consolidated Holding Corp. (a) | | | 33,092,343 | |

| | | | SPECIALTY CHEMICALS — 5.48% | | | | |

| | 1,106,798 | | Rohm and Haas Company (c) | | | 77,475,860 | |

| | | | TOBACCO — 2.81% | | | | |

| | 597,000 | | UST Inc. | | | 39,724,380 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $1,111,388,814) | | | 1,060,936,944 | |

| CONVERTIBLE PREFERRED STOCKS — 0.84% | | | | |

| | 18,230 | | SLM Corporation Series C | | | 11,818,874 | |

| | | | TOTAL CONVERTIBLE PREFERRED STOCKS | | | | |

| | | | (Cost $20,805,957) | | | 11,818,874 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2008

| Shares | | | | Value | |

| EXCHANGE TRADED FUNDS — 0.55% | | | |

| | 32,499 | | Energy Select Sector SPDR Fund | | $ | 2,057,187 | |

| | 50,000 | | SPDR Trust Series 1 | | | 5,799,500 | |

| | | | TOTAL EXCHANGE TRADED FUNDS | | | | |

| | | | (Cost $8,325,822) | | | 7,856,687 | |

| | | | | | | | |

| Contracts (100 shares per contract) | | | | |

| PUT OPTIONS PURCHASED — 1.36% | | | | |

| | | | Energy Select Sector SPDR Fund | | | | |

| | 1,814 | | Expiration: October, 2008, Exercise Price: $70.00 | | | 1,255,288 | |

| | 3,227 | | Expiration: October, 2008, Exercise Price: $75.00 | | | 3,670,712 | |

| | | | Foundry Networks, Inc. | | | | |

| | 1,300 | | Expiration: October, 2008, Exercise Price: $15.00 | | | 13,000 | |

| | 4,354 | | Expiration: December, 2008, Exercise Price: $15.00 | | | 283,010 | |

| | | | iShares Nasdaq Biotech | | | | |

| | 633 | | Expiration: December, 2008, Exercise Price: $90.00 | | | 623,505 | |

| | | | KBW Insurance | | | | |

| | 1,210 | | Expiration: December, 2008, Exercise Price: $45.00 | | | 1,137,400 | |

| | | | Materials Select Sector SPDR Trust | | | | |

| | 3,597 | | Expiration: December, 2008, Exercise Price: $42.00 | | | 3,291,255 | |

| | | | PowerShares Aerospace & Defense | | | | |

| | 1,549 | | Expiration: October, 2008, Exercise Price: $23.00 (f) | | | 192,076 | |

| | | | SPDR Trust Series 1 | | | | |

| | 2,176 | | Expiration: October, 2008, Exercise Price: $136.00 | | | 4,286,720 | |

| | | | Telecom HOLDRs Trust | | | | |

| | 3,098 | | Expiration: November, 2008, Exercise Price: $35.00 | | | 2,850,160 | |

| | | | US Natural Gas Fund | | | | |

| | 926 | | Expiration: October, 2008, Exercise Price: $45.00 | | | 1,101,940 | |

| | | | Utilities Select Sector SPDR | | | | |

| | 1,357 | | Expiration: October, 2008, Exercise Price: $37.00 | | | 569,940 | |

| | | | TOTAL PUT OPTIONS PURCHASED | | | | |

| | | | (Cost $13,169,957) | | | 19,275,006 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2008

| Principal Amount | | | | Value | |

| ESCROW NOTES — 0.14% | | | |

| $ | 468,600 | | Telecorp PCS, Inc. Escrow Shares (a)(f) | | $ | 4,686 | |

| | 4,472,698 | | Price Communications Liquidating Trust (a)(f) | | | 1,923,260 | |

| | | | TOTAL ESCROW NOTES | | | | |

| | | | (Cost $1,923,260) | | | 1,927,946 | |

| SHORT-TERM INVESTMENTS — 13.89% | | | | |

| | | | COMMERCIAL PAPER — 6.86% | | | | |

| | | | U.S. Bank Commercial Paper | | | | |

| | 43,000,000 | | 1.617%, 10/02/2008 (g) | | | 42,998,101 | |

| | 27,000,000 | | 2.003%, 10/03/2008 (g) | | | 26,997,045 | |

| | 27,000,000 | | 2.085%, 10/06/2008 (g) | | | 26,992,312 | |

| | | | | | | 96,987,458 | |

| | | | DISCOUNT NOTES — 3.25% | | | | |

| | | | Federal Home Loan Bank | | | | |

| | 46,000,000 | | 1.678%, 10/01/2008 (g) | | | 46,000,000 | |

| | | | VARIABLE-RATE DEMAND NOTES — 3.78% | | | | |

| | 22,757,113 | | American Family Financial Services, Inc., 2.235% (h) | | | 22,757,113 | |

| | 27,117,764 | | U.S. Bank, 2.450% (h) | | | 27,117,764 | |

| | 3,584,236 | | Wisconsin Corporate Central Credit Union, 2.418% (h) | | | 3,584,236 | |

| | | | | | | 53,459,113 | |

| | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | (Cost $196,446,571) | | | 196,446,571 | |

| | | | TOTAL INVESTMENTS | | | | |

| | | | (Cost $1,352,060,381) — 91.80% | | $ | 1,298,262,028 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (c) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (d) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (e) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

| (g) | Rate shown is the calculated yield to maturity. |

| (h) | The coupon rate shown on variable rate securities represents the rate at September 30, 2008. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF SECURITIES SOLD SHORT

September 30, 2008

| Shares | | | | Value | |

| | 203,710 | | Ashland Inc. | | $ | 5,956,480 | |

| | 80,238 | | Bank of America Corporation | | | 2,808,330 | |

| | 51,144 | | Brocade Communications Systems, Inc. | | | 297,658 | |

| | 407,087 | | Bunge Limited | | | 25,719,757 | |

| | 478,487 | | Precision Drilling Trust | | | 7,928,530 | |

| | 87,039 | | Republic Services, Inc. | | | 2,609,429 | |

| | 652,290 | | SLM Corporation | | | 8,049,259 | |

| | 132,172 | | Teck Cominco Limited | | | 3,848,854 | |

| | 795,322 | | Teva Pharmaceutical Industries Ltd. - ADR | | | 36,417,794 | |

| | 1,103,232 | | Thomson Reuters Corporation | | | 29,958,596 | |

| | 429,574 | | Willis Group Holdings Limited | | | 13,858,057 | |

| | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | (Proceeds $176,909,346) | | $ | 137,452,744 | |

ADR – American Depository Receipt

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN

September 30, 2008

| Contracts (100 shares per contract) | | Value | |

| CALL OPTIONS | | | | | |

| | | Alpharma Inc. | | | |

| | 1,082 | | Expiration: October, 2008, Exercise Price: $35.00 | | $ | 259,680 | |

| | | | Diebold, Incorporated | | | | |

| | 921 | | Expiration: October, 2008, Exercise Price: $35.00 | | | 55,260 | |

| | 250 | | Expiration: November, 2008, Exercise Price: $35.00 | | | 21,250 | |

| | | | Genentech, Inc. | | | | |

| | 460 | | Expiration: October, 2008, Exercise Price: $95.00 | | | 78,200 | |

| | | | ImClone Systems Incorporated | | | | |

| | 1,361 | | Expiration: October, 2008, Exercise Price: $60.00 | | | 544,400 | |

| | 6,892 | | Expiration: October, 2008, Exercise Price: $65.00 | | | 1,033,800 | |

| | | | Longs Drug Stores Corporation | | | | |

| | 208 | | Expiration: October, 2008, Exercise Price: $75.00 | | | 28,600 | |

| | | | SanDisk Corporation | | | | |

| | 4,095 | | Expiration: October, 2008, Exercise Price: $20.00 | | | 819,000 | |

| | | | SPDR Trust Series 1 | | | | |

| | 500 | | Expiration: October, 2008, Exercise Price: $110.00 | | | 435,000 | |

| | | | Take-Two Interactive Software, Inc. | | | | |

| | 1,477 | | Expiration: October, 2008, Exercise Price: $17.50 | | | 96,005 | |

| | | | TOTAL CALL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $5,507,516) | | $ | 3,371,195 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2008

| ASSETS: | | | | | | |

| Investments, at value (Cost $1,352,060,381) | | | | | $ | 1,298,262,028 | |

| Cash | | | | | | 84,373,274 | |

| Deposits at brokers for securities sold short | | | | | | 32,801,775 | |

| Receivable from brokers for proceeds on securities sold short | | | | | | 178,500,319 | |

| Receivable for forward currency exchange contracts | | | | | | 10,726,254 | |

| Receivable for investments sold | | | | | | 46,038,598 | |

| Receivable for written option contracts | | | | | | 1,424,963 | |

| Receivable for swap contracts | | | | | | 16,699,378 | |

| Receivable for fund shares issued | | | | | | 6,296,631 | |

| Dividends and interest receivable | | | | | | 4,240,946 | |

| Prepaid expenses | | | | | | 72,499 | |

| Total Assets | | | | | | 1,679,436,665 | |

| LIABILITIES: | | | | | | | |

| Securities sold short, at value (proceeds of $176,909,346) | | $ | 137,452,744 | | | | | |

| Options written, at value (premiums received $5,507,516) | | | 3,371,195 | | | | | |

| Payable for swap contracts | | | 34,827,709 | | | | | |

| Payable for securities purchased | | | 82,497,347 | | | | | |

| Payable for fund shares redeemed | | | 4,150,850 | | | | | |

| Investment advisory fee payable | | | 1,162,204 | | | | | |

| Distribution fees payable | | | 817,812 | | | | | |

| Accrued expenses and other liabilities | | | 991,538 | | | | | |

| Total Liabilities | | | | | | | 265,271,399 | |

| NET ASSETS | | | | | | $ | 1,414,165,266 | |

| NET ASSETS Consist Of: | | | | | | | | |

| Accumulated undistributed net investment income | | | | | | $ | 10,388,687 | |

| Accumulated undistributed net realized loss on investments, securities | | | | | | | | |

| sold short, written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translations and forward currency exchange contracts | | | | | | | (101,154,564 | ) |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | $ | (53,798,353 | ) | | | | |

| Securities sold short | | | 39,456,602 | | | | | |

| Written option contracts | | | 2,136,321 | | | | | |

| Swap contracts | | | (15,881,826 | ) | | | | |

| Foreign currency translations | | | (8,656 | ) | | | | |

| Forward currency exchange contracts | | | 10,726,254 | | | | | |

| Net unrealized depreciation | | | | | | | (17,369,658 | ) |

| Paid-in capital | | | | | | | 1,522,300,801 | |

| Total Net Assets | | | | | | $ | 1,414,165,266 | |

| NET ASSET VALUE and offering price per share* | | | | | | | | |

| ($1,414,165,266 / 95,615,412 shares of beneficial interest outstanding) | | | | | | $ | 14.79 | |

| * | The redemption price per share may vary based on the length of time a shareholder holds Fund shares. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2008

| INVESTMENT INCOME: | | | | | | |

| Interest | | | | | $ | 11,688,136 | |

| Dividend income on long positions from unaffiliated issuers | | | | | | | |

| (net of foreign withholding taxes of $159,508) | | | | | | 11,719,400 | |

| Total investment income | | | | | | 23,407,536 | |

| EXPENSES: | | | | | | | |

| Investment advisory fee | | $ | 14,839,511 | | | | | |

| Distribution fees | | | 3,663,221 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 1,182,059 | | | | | |

| Federal and state registration fees | | | 90,951 | | | | | |

| Professional fees | | | 332,211 | | | | | |

| Trustees' fees and expenses | | | 136,575 | | | | | |

| Custody fees | | | 323,978 | | | | | |

| Administration fee | | | 642,277 | | | | | |

| Fund accounting expense | | | 205,065 | | | | | |

| Reports to shareholders | | | 309,191 | | | | | |

| Dividends on short positions | | | 2,759,720 | | | | | |

| Interest | | | 128,767 | | | | | |

| Other | | | 191,091 | | | | | |

| Total expenses before expense reimbursement by adviser | | | | | | | 24,804,617 | |

| Expense waived by adviser (Note 3) | | | | | | | (54,865 | ) |

| Net Expenses | | | | | | | 24,749,752 | |

| NET INVESTMENT LOSS | | | | | | | (1,342,216 | ) |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain (loss) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | (215,062,594 | ) | | | | |

| Investments in affiliated issuers | | | 1,729,452 | | | | | |

| Securities sold short | | | 10,699,748 | | | | | |

| Written option contracts expired or closed | | | 38,169,809 | | | | | |

| Swap contracts | | | 112,256,507 | | | | | |

| Foreign currency translations | | | (13,706,740 | ) | | | | |

| Forward currency exchange contracts | | | (6,085 | ) | | | | |

| Net realized loss | | | | | | | (65,919,903 | ) |

| Change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | (49,327,128 | ) | | | | |

| Securities sold short | | | 40,348,410 | | | | | |

| Written option contracts | | | 1,586,630 | | | | | |

| Swap contracts | | | (33,239,501 | ) | | | | |

| Foreign currency translations | | | (25,621 | ) | | | | |

| Forward currency exchange contracts | | | 28,131,947 | | | | | |

| Net unrealized loss | | | | | | | (12,525,263 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | | | | | (78,445,166 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | (79,787,382 | ) |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF CASH FLOWS

For the Year Ended September 30, 2008

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net decrease in net assets resulting from operations | | $ | (79,787,382 | ) |

| Adjustments to reconcile net decrease in net assets resulting from | | | | |

| operations to net cash provided (used) by operating activities: | | | | |

| Net realized (gain) loss on: | | | | |

| Investments | | | 213,333,142 | |

| Securities sold short | | | (10,699,748 | ) |

| Written option contracts expired or closed | | | (38,169,809 | ) |

| Change in unrealized depreciation on investments, | | | | |

| securities sold short, and written option contracts | | | 7,392,088 | |

| Amortization and accretion of premium and discount | | | (5,283,680 | ) |

| Changes in assets and liabilities: | | | | |

| Deposits at brokers for securities sold short | | | 67,854,194 | |

| Receivable from brokers for proceeds on securities sold short | | | (186,749,917 | ) |

| Receivable for forward currency exchange contracts | | | (28,131,946 | ) |

| Receivable for investments sold | | | (8,571,428 | ) |

| Receivable for written option contracts | | | (461,669 | ) |

| Receivable for swap contracts | | | 11,533,913 | |

| Dividends and interest receivable | | | 752,635 | |

| Prepaid expenses | | | 3,150 | |

| Payable for swap contracts | | | 31,266,436 | |

| Payable for securities purchased | | | 38,287,699 | |

| Investment advisory fees payable | | | (317,990 | ) |

| Distribution fees payable | | | 71,167 | |

| Accrued expenses and other liabilities | | | (2,298,091 | ) |

| Purchases of investments | | | (13,741,781,944 | ) |

| Proceeds from sale of investments | | | 14,105,387,025 | |

| Proceeds from securities sold short | | | 599,076,828 | |

| Cover of securities sold short | | | (511,905,114 | ) |

| Premiums received on written option contracts | | | 77,117,784 | |

| Written option contracts closed or exercised | | | (37,585,752 | ) |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | | | 500,331,591 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from shares issued | | | 549,303,182 | |

| Receivable for fund shares issued | | | (1,232,344 | ) |

| Payment on shares redeemed less redemption fees | | | (873,568,120 | ) |

| Payable for fund shares redeemed | | | (2,754,337 | ) |

| Cash distributions paid | | | (3,496,811 | ) |

| Cash repayment of loan | | | (93,676,000 | ) |

| NET CASH USED BY FINANCING ACTIVITIES | | | (425,424,430 | ) |

| NET CHANGE IN CASH FOR THE YEAR | | | 74,907,161 | |

| CASH, BEGINNING OF YEAR | | | 9,466,113 | |

| CASH, END OF YEAR | | $ | 84,373,274 | |

| SUPPLEMENTAL INFORMATION: | | | | |

| Cash paid for interest on loan outstanding | | $ | 128,767 | |

| Noncash financing activities consisting of reinvestments of distributions | | | 102,723,394 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | September 30, 2008 | | | September 30, 2007 | |

| | | | | | | |

| Net investment income (loss) | | $ | (1,342,216 | ) | | $ | 14,261,942 | |

| Net realized gain (loss) on investments, securities | | | | | | | | |

| sold short, written option contracts expired or closed, | | | | | | | | |

| swap contracts, foreign currency translations | | | | | | | | |

| and forward currency exchange contracts | | | (65,919,903 | ) | | | 128,489,970 | |

| Change in unrealized depreciation on investments, | | | | | | | | |

| securities sold short, written option contracts, | | | | | | | | |

| swap contracts, foreign currency translations and | | | | | | | | |

| forward currency exchange contracts | | | (12,525,263 | ) | | | (14,411,633 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (79,787,382 | ) | | | 128,340,279 | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | (37,192,512 | ) | | | (10,472,365 | ) |

| Net realized gains | | | (69,027,693 | ) | | | (51,659,654 | ) |

| Total dividends and distributions | | | (106,220,205 | ) | | | (62,132,019 | ) |

| Net increase (decrease) in net assets from | | | | | | | | |

| capital share transactions (Note 4) | | | (221,541,544 | ) | | | 192,461,069 | |

| Net increase (decrease) in net assets | | | (407,549,131 | ) | | | 258,669,329 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 1,821,714,397 | | | | 1,563,045,068 | |

| End of period (including accumulated undistributed net | | | | | | | | |

| investment income of $10,388,687 | | | | | | | | |

| and $22,368,243, respectively) | | $ | 1,414,165,266 | | | $ | 1,821,714,397 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS

Selected per share data is based on a share of beneficial interest outstanding throughout each period.

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of period | | $ | 16.55 | | | $ | 15.95 | | | $ | 15.78 | | | $ | 15.10 | | | $ | 14.84 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | 0.00 | (2)(5) | | | 0.13 | (2) | | | 0.06 | (2) | | | (0.06 | )(2) | | | (0.08 | )(3) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (0.70 | ) | | | 1.13 | | | | 0.99 | | | | 0.94 | | | | 0.38 | |

| Total from investment operations | | | (0.70 | ) | | | 1.26 | | | | 1.05 | | | | 0.88 | | | | 0.30 | |

| Redemption fees | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) | | | 0.00 | (5) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.37 | ) | | | (0.11 | ) | | | (0.01 | ) | | | 0.00 | (5) | | | (0.04 | ) |

| Distributions from net realized gains | | | (0.69 | ) | | | (0.55 | ) | | | (0.87 | ) | | | (0.20 | ) | | | — | |

| Total distributions | | | (1.06 | ) | | | (0.66 | ) | | | (0.88 | ) | | | (0.20 | ) | | | (0.04 | ) |

| Net Asset Value, end of period | | $ | 14.79 | | | $ | 16.55 | | | $ | 15.95 | | | $ | 15.78 | | | $ | 15.10 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (4.32 | )% | | | 8.15 | % | | | 7.10 | % | | | 5.88 | % | | | 1.99 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 1,414,165 | | | $ | 1,821,714 | | | $ | 1,563,045 | | | $ | 1,484,675 | | | $ | 1,681,281 | |

| Ratio of operating expenses | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.66 | % | | | 2.16 | % | | | 2.08 | % | | | 1.77 | % | | | 1.87 | % |

| Ratio of interest expense and | | | | | | | | | | | | | | | | | | | | |

| dividends on short positions to | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | 0.19 | % | | | 0.76 | % | | | 0.71 | % | | | 0.41 | % | | | 0.50 | % |

| Ratio of operating expense to | | | | | | | | | | | | | | | | | | | | |

| average net assets excluding | | | | | | | | | | | | | | | | | | | | |

| interest expense and dividends | | | | | | | | | | | | | | | | | | | | |

| on short positions | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.48 | % | | | 1.41 | % | | | 1.37 | % | | | 1.36 | % | | | 1.37 | % |

| After expense waiver | | | 1.47 | % | | | 1.40 | %(6) | | | 1.37 | % | | | 1.36 | % | | | 1.37 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | (0.09 | )% | | | 0.83 | % | | | 0.43 | % | | | (0.35 | )% | | | (0.68 | )% |

Portfolio turnover rate(4) | | | 300.24 | % | | | 334.87 | % | | | 369.47 | % | | | 312.04 | % | | | 256.88 | % |

_______________

Footnotes To Financial Highlights On Following Page

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS (continued)

| (1) | Net investment income before interest expense and dividends on short positions for the years ended September 30, 2008, 2007, 2006, 2005 and 2004 was $0.02, $0.26, $0.18, $0.01 and $0.00, respectively. |

| (2) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (3) | Net investment (loss) per share represents net investment (loss) for the respective period divided by the monthly average shares of beneficial interest outstanding throughout the period. |

| (4) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short positions). The denominator includes the average long positions throughout the period. |

| (5) | Amount less than $0.005 per share. |

| (6) | The Fund incurred proxy expenses of approximately $525,000 in 2007 related to shareholder approval of changes in the Fund’s fundamental investment policies and the election of trustees. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2008

Note 1 — ORGANIZATION

The Merger Fund (the “Fund”) is a no-load, open-end, non-diversified investment company organized as a trust under the laws of the Commonwealth of Massachusetts on April 12, 1982, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund was formerly known as the Risk Portfolio of The Ayco Fund. In January of 1989, the Fund’s fundamental policies were amended to permit the Fund to engage exclusively in merger arbitrage. At the same time, Westchester Capital Management, Inc. became the Fund’s investment adviser, and the Fund began to do business as The Merger Fund. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles.

Securities listed on the NASDAQ Global Market and the NASDAQ Global Select Market are valued at the NASDAQ Official Closing Price (“NOCP”). Other listed securities are valued at the last reported sales price on the exchange on which such securities are primarily traded or, in the case of options, at the last sale price. Securities not listed on an exchange and securities for which there are no transactions are valued at the average of the closing bid and asked prices. When pricing options, if no sales are reported or if the last sale is outside the bid and asked parameters, the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices will be used. Securities for which there are no such valuations are valued at fair value as determined in good faith by management under the supervision of the Board of Trustees. The Adviser (as defined herein) reserves the right to value securities, including options, at prices other than last-sale prices, intrinsic value prices, or the average of closing bid and asked prices when such prices are believed unrepresentative of fair market value as determined in good faith by the Adviser. When fair-valued pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. In addition, due to the subjective and variable nature of fair value pricing, it is possible that the value determined for a particular asset may be materially different from the value realized upon such asset’s sale. At September 30, 2008, fair-valued long securities represented 0.14% of investments, at value. Investments in United States government securities (other than short-term securities) are valued at the average of the quoted bid and asked prices in the over-the-counter market. Short-term investments are carried at amortized cost, which approximates market value.

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement on Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. Management does not believe the adoption of SFAS No. 157 will impact the financial statement amounts; however, additional disclosures will be required about the inputs used to develop the measurements and the effect of certain measurements on changes in net assets for the period.

The Fund may sell securities or currencies short for hedging purposes. For financial statement purposes, an amount equal to the settlement amount is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities or currencies sold, but not yet purchased, may require purchasing the securities or currencies at prices which may differ from the market value reflected on the Statement of Assets and Liabilities.

The Fund is liable for any dividends payable on securities while those securities are in a short position. As collateral for its short positions, the Fund is required under the 1940 Act to maintain assets consisting of cash, cash equivalents or liquid securities. These assets are required to be adjusted daily to reflect changes in the value of the securities or currencies sold short.

| C. | Transactions with Brokers for Short Sales |

The Fund’s receivable from brokers for proceeds on securities sold short and deposit at brokers for securities sold short are with three major securities dealers. The Fund does not require the brokers to maintain collateral in support of the receivable from the broker for proceeds on securities sold short.

No provision for federal income taxes has been made since the Fund has complied to date with the provisions of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in future years and to distribute investment company net taxable income and net capital gains to shareholders. Additionally, the Fund intends to make all required distributions to avoid federal excise tax.

Effective October 1, 2007, the Fund adopted FASB Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 requires the evaluation of tax positions taken on previously filed tax returns or expected to be taken on future returns. These positions must meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained upon examination. In evaluating whether a tax position has met the recognition threshold, the Fund must presume that the position will be examined by the appropriate taxing authority that has full knowledge of all relevant information. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax expense in the current year.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

FIN 48 requires the Fund to analyze all open tax years, as defined by the statute of limitations, for all major jurisdictions. Open tax years are those that are open for examination by taxing authorities. Major jurisdictions for the Fund include Federal and New York State. As of September 30, 2008, open Federal and New York tax years include the tax years ended September 30, 2005 through 2008. The Fund has no examination in progress.

The Fund has reviewed all open tax years and major jurisdictions and concluded that the adoption of FIN 48 resulted in no effect to the Fund’s financial position or results of operations. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken for the year ended September 30, 2008. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

| E. | Written Option Accounting |

The Fund writes (sells) covered call options to hedge portfolio investments. Uncovered put options can also be written by the Fund as part of a merger arbitrage strategy involving a pending corporate reorganization. When the Fund writes (sells) an option, an amount equal to the premium received by the Fund is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the option written. By writing an option, the Fund may become obligated during the term of the option to deliver or purchase the securities underlying the option at the exercise price if the option is exercised. Option contracts are valued at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract written is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When an option expires on its stipulated expiration date or the Fund enters into a closing purchase transaction, the Fund realizes a gain or loss if the cost of the closing purchase transaction differs from the premium received when the option was sold without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is eliminated. When an option is exercised, the premium originally received decreases the cost basis of the security (or increases the proceeds on a sale of the security), and the Fund realizes a gain or loss from the sale of the underlying security.

| F. | Purchased Option Accounting |

The Fund purchases put options to hedge portfolio investments. Call options may be purchased only for the purpose of closing out previously written covered call options. Premiums paid for option contracts purchased are included in the Statement of Assets and Liabilities as an asset. Option contracts are valued at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract purchased is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When option contracts expire or are closed, realized gains or losses are recognized without regard to any unrealized gains or losses on the underlying securities.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

| G. | Forward Currency Exchange Contracts |

The Fund may enter into forward currency exchange contracts obligating the Fund to deliver and receive a currency at a specified future date. Forward contracts are valued daily, and unrealized appreciation or depreciation is recorded daily as the difference between the contract exchange rate and the closing forward rate applied to the face amount of the contract. A realized gain or loss is recorded at the time the forward contract is closed.

| H. | Distributions to Shareholders |

Dividends from net investment income and net realized capital gains, if any, are declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences are due primarily to wash sale-loss deferrals, constructive sales, straddle-loss deferrals, adjustments on swap contracts, and unrealized gains or losses on Section 1256 contracts, which were realized, for tax purposes, at September 30, 2008. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes. At September 30, 2008, the Fund increased accumulated undistributed net investment income by $26,555,172, reduced accumulated undistributed net realized loss by $26,555,173, and increased paid-in capital by $1. The Fund may utilize earnings and profits deemed distributed to shareholders on redemptions of shares as part of the dividends-paid deduction.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Investing in securities of foreign companies involves special risks and considerations not typically associated with investing in U.S. companies. These risks include revaluation of currencies and adverse political and economic developments. Moreover, securities of many foreign companies and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies.

| K. | Foreign Currency Translations |

The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gain or loss from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences.

The Fund may sell securities on a when-issued or delayed-delivery basis. Although the payment and interest terms of these securities are established at the time the Fund enters into the agreement, these securities may be delivered for cash proceeds at a future date. The Fund records sales of when-issued securities and reflects the values of such securities in determining net asset value in the same manner as other open short-sale positions. The Fund segregates and maintains at all times cash, cash equivalents or other liquid securities in an amount at least equal to the market value for when-issued securities.

The Fund considers highly liquid temporary cash investments purchased with an original maturity of less than three months to be cash equivalents. Cash equivalents are included in short-term investments on the Schedule of Investments as well as in the investments on the Statement of Assets and Liabilities.

| N. | Guarantees and Indemnifications |

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Investment and shareholder transactions are recorded on the trade date. Realized gains and losses from security transactions are recorded on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest is accounted for on the accrual basis. Investment income includes $4,545,000 of interest earned on receivables from brokers for proceeds on securities sold short and deposits. The Fund may utilize derivative instruments such as options, forward currency exchange contracts and other instruments with similar characteristics to the extent that they are consistent with the Fund’s investment objectives and limitations. The use of these instruments may involve additional investment risks, including the possibility of illiquid markets or imperfect correlation between the value of the instruments and the underlying securities.

Note 3 — AGREEMENTS

The Fund’s investment adviser is Westchester Capital Management, Inc. (the “Adviser”) pursuant to an investment advisory agreement dated January 31, 1989. Under the terms of this agreement, the Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 1.00% of the Fund’s average daily net assets. Effective August 1, 2004, the Adviser agreed to voluntarily waive

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 3 — AGREEMENTS (continued)

0.10% of its fee at net asset levels between $1.5 billion through $2 billion. When net assets of the Fund exceed $2 billion, the Adviser has agreed to voluntarily waive 0.20% of its fee. Investment advisory fees voluntarily waived by the Adviser for the year ended September 30, 2008 were $54,865. Certain officers of the Fund are also officers of the Adviser.

U.S. Bancorp Fund Services, LLC, a subsidiary of U.S. Bancorp, a publicly held bank holding company, serves as transfer agent, administrator and accounting services agent for the Fund. U.S. Bank, N.A. serves as custodian for the Fund.

Distribution services are performed pursuant to distribution contracts with broker-dealers and other qualified institutions.

Note 4 — SHARES OF BENEFICIAL INTEREST

The Trustees have the authority to issue an unlimited amount of shares of beneficial interest without par value.

Changes in shares of beneficial interest were as follows:

| | | Year Ended | | | Year Ended | |

| | | September 30, 2008 | | | September 30, 2007 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Issued | | | 36,375,889 | | | $ | 549,303,182 | | | | 46,881,581 | | | $ | 754,043,652 | |

| Issued as reinvestment | | | | | | | | | | | | | | | | |

| of dividends | | | 6,857,369 | | | | 102,723,394 | | | | 3,795,005 | | | | 59,240,023 | |

| Redemption fee | | | — | | | | 294,852 | | | | — | | | | 90,752 | |

| Redeemed | | | (57,699,720 | ) | | | (873,862,972 | ) | | | (38,594,484 | ) | | | (620,913,358 | ) |

| Net increase (decrease) | | | (14,466,462 | ) | | $ | (221,541,544 | ) | | | 12,082,102 | | | $ | 192,461,069 | |

Note 5 — INVESTMENT TRANSACTIONS

Purchases and sales of securities for the year ended September 30, 2008 (excluding short-term investments, options and short positions) aggregated $3,528,731,760 and $4,063,588,021, respectively. There were no purchases or sales of U.S. Government securities.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 5 — INVESTMENT TRANSACTIONS (continued)

At September 30, 2008, the components of accumulated earnings (losses) on a tax basis were as follows:

| Cost of investments | | $ | 1,384,428,801 | |

| Gross unrealized appreciation | | | 21,989,306 | |

| Gross unrealized depreciation | | | (108,156,079 | ) |

| Net unrealized appreciation/(depreciation) | | $ | (86,116,773 | ) |

| Undistributed ordinary income | | $ | 10,054,185 | |

| Undistributed long-term capital gain | | | — | |

| Total distributable earnings | | $ | 10,054,185 | |

| Other accumulated gains/(losses) | | | (32,022,947 | ) |

| Total accumulated earnings/(losses) | | $ | (108,135,535 | ) |

The tax components of dividends paid during the fiscal year ended September 30, 2008 and the fiscal year ended September 30, 2007 were as follows:

| | | 2008 | | | 2007 | |

| Ordinary Income | | $ | 106,220,205 | | | $ | 62,132,019 | |

| Long-Term Capital Gains | | | — | | | | — | |

| Total Distributions Paid | | $ | 106,220,205 | | | $ | 62,132,019 | |

The Fund incurred a post-October capital loss of $63,905,997, which is deferred for tax purposes until the next fiscal year.

For the fiscal year ended September 30, 2008, certain dividends paid by the Fund may be subject to a maximum tax rate of 15% as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from net investment income designated as qualified dividend income for the fiscal year ended September 30, 2008 was 40.56% for the Fund (unaudited).

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends-received deduction for the fiscal year ended September 30, 2008 was 34.50% for the Fund (unaudited).

Note 6 — OPTION CONTRACTS WRITTEN

The premium amount and the number of option contracts written during the year ended September 30, 2008 were as follows:

| | | Premium Amount | | | Number of Contracts | |

| Options outstanding at September 30, 2007 | | $ | 4,145,293 | | | | 18,590 | |

| Options written | | | 77,117,784 | | | | 350,937 | |

| Options closed | | | (20,571,467 | ) | | | (130,787 | ) |

| Options exercised | | | (28,141,007 | ) | | | (107,487 | ) |

| Options expired | | | (27,043,087 | ) | | | (114,007 | ) |

| Options outstanding at September 30, 2008 | | $ | 5,507,516 | | | | 17,246 | |

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 7 — DISTRIBUTION PLAN

The Fund has adopted an Amended and Restated Plan of Distribution (the “Plan”) dated July 19, 2005, pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Fund will compensate broker-dealers or qualified institutions with whom the Fund has entered into a contract to distribute Fund shares (“Dealers”). Under the Plan, the amount of such compensation paid in any one year shall not exceed 0.25% annually of the average daily net assets of the Fund, which may be payable as a service fee for providing recordkeeping, subaccounting, subtransfer agency and/or shareholder liaison services. For the year ended September 30, 2008, the Fund incurred $3,663,221 pursuant to the Plan.

The Plan will remain in effect from year to year provided such continuance is approved at least annually by a vote either of a majority of the Trustees, including a majority of the non-interested Trustees, or a majority of the Fund’s outstanding shares.

Note 8 – CREDIT FACILITY

Custodial Trust Company has made available to the Fund a $400 million credit facility (subject to increase under certain conditions) pursuant to a Loan and Security Agreement (“Agreement”) dated March 18, 1992 (subsequently amended) for the purpose of purchasing portfolio securities. The Agreement can be terminated by either the Fund or Custodial Trust Company with three months’ prior notice. For the year ended September 30, 2008, the interest rate on the outstanding principal amount was the Federal Funds Rate plus 0.75% (weighted average rate of 5.643% was paid on the loan during the year ended September 30, 2008). Advances are collateralized by securities owned by the Fund and held separately in a special custody account pursuant to a Special Custody Agreement dated March 31, 1994. During the year ended September 30, 2008, the Fund had an outstanding average daily balance of $2,663,287. The maximum amount outstanding during the year ended September 30, 2008, was $95,000,000. At September 30, 2008, the Fund did not have a loan payable balance. As collateral for the loan, the Fund is required under the 1940 Act to maintain assets consisting of cash, cash equivalents or liquid securities. The assets are required to be adjusted daily to reflect changes in the amount of the loan outstanding.

Note 9 — FORWARD CURRENCY EXCHANGE CONTRACTS

At September 30, 2008, the Fund had entered into “position hedge” forward currency exchange contracts that obligated the Fund to deliver or receive currencies at a specified future date. The net unrealized appreciation of $10,726,254 is included in the unrealized appreciation section of the Statement of Assets and Liabilities. The terms of the open contracts are as follows:

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 9 — FORWARD CURRENCY EXCHANGE CONTRACTS (continued)

| Settlement | Currency to | | U.S. $ Value at | Currency to | | U.S. $ Value at |

| Date | be Delivered | | September 30, 2008 | be Received | | September 30, 2008 |

| 11/7/08 | 34,879,184 | | Australian Dollars | $ | 27,511,871 | 29,207,655 | | U.S. Dollars | $ | 29,207,655 |

| 10/3/08 | 2,875,237 | | British Pounds | | 5,112,082 | 5,625,218 | | U.S. Dollars | | 5,625,218 |

| 11/10/08 | 18,188,256 | | British Pounds | | 32,399,650 | 35,773,200 | | U.S. Dollars | | 35,773,200 |

| 10/17/08 | 6,363,610 | | Canadian Dollars | | 5,986,883 | 6,129,464 | | U.S. Dollars | | 6,129,464 |

| 12/12/08 | 115,749,900 | | Canadian Dollars | | 109,065,987 | 111,657,518 | | U.S. Dollars | | 111,657,518 |

| 10/24/08 | 13,656,894 | | Euros | | 19,271,774 | 21,184,046 | | U.S. Dollars | | 21,184,046 |

| 12/5/08 | 9,104,053 | | Euros | | 12,852,333 | 13,349,733 | | U.S. Dollars | | 13,349,733 |

| | | | | $ | 212,200,580 | | | | $ | 222,926,834 |

Equity Swaps

The Fund has entered into both long and short equity swap contracts with multiple broker-dealers. A long equity swap contract entitles the Fund to receive from the counterparty any appreciation and dividends paid on an individual security, while obligating the Fund to pay the counterparty any depreciation on the security as well as interest on the notional amount of the contract at a rate equal to LIBOR plus 25 to 100 basis points. A short equity swap contract obligates the Fund to pay the counterparty any appreciation and dividends paid on an individual security, while entitling the Fund to receive from the counterparty any depreciation on the security as well as interest on the notional value of the contract at a rate equal to LIBOR less 25 to 100 basis points.

The Fund may also enter into equity swap contracts whose value is determined by the spread between a long equity position and a short equity position. This type of swap contract obligates the Fund to pay the counterparty an amount tied to any increase in the spread between the two securities over the term of the contract. The Fund is also obligated to pay the counterparty any dividends paid on the short equity holding as well as any net financing costs. This type of swap contract entitles the Fund to receive from the counterparty any gains based on a decrease in the spread as well as any dividends paid on the long equity holding and any net interest income.

Fluctuations in the value of an open contract are recorded daily as a net unrealized gain or loss. The Fund will realize a gain or loss upon termination or reset of the contract. Either party, under certain conditions, may terminate the contract prior to the contract’s expiration date.

Credit risk may arise as a result of the failure of the counterparty to comply with the terms of the contract. The Fund considers the creditworthiness of each counterparty to a contract in evaluating potential credit risk quarterly. The counterparty risk to the Fund is limited to the net unrealized gain, if any, on the contract, along with dividends receivable on long equity contracts and interest receivable on short equity contracts. Additionally, risk may arise from unanticipated movements in interest rates or in the value of the underlying securities. At September 30, 2008, the Fund had the following open equity swap contracts:

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 10 — SWAP CONTRACTS (continued)

| Termination | | | | | | | Unrealized Appreciation | | |

Date | | Security | | Shares | | (Depreciation) | | Counterparty |

| 12/12/2008 | | BCE Inc. | | | 1,627,800 | | | | (2,710,624 | ) | Merrill Lynch & Co. Inc. |

| 3/31/2009 | | BHP Billiton plc | | | (1,410,500 | ) | | | 15,959,666 | | J.P. Morgan Chase & Co. Inc. |

| 10/22/2008 | | Enodis plc | | | 5,545,200 | | | | (1,870,247 | ) | J.P. Morgan Chase & Co. Inc. |

| 11/5/2008 | | Fording Canadian Coal Trust | | | 165,000 | | | | 294,916 | | Merrill Lynch & Co. Inc. |

| 3/31/2009 | | Rio Tinto plc | | | 369,483 | | | | (17,211,892 | ) | J.P. Morgan Chase & Co. Inc. |

| 6/30/2009 | | Societes des Auto | | | 223,769 | | | | (228,310 | ) | J.P. Morgan Chase & Co. Inc. |

| 11/12/2008 | | Taylor Nelson Sofres plc | | | 1,693,674 | | | | (1,291,060 | ) | J.P. Morgan Chase & Co. Inc. |

| 11/5/2008 | | Teck Cominco Limited | | | (8,575 | ) | | | 98,027 | | Merrill Lynch & Co. Inc. |

| 3/31/2009 | | Thomson Reuters plc | | | 1,110,232 | | | | (8,801,482 | ) | J.P. Morgan Chase & Co. Inc. |

| 4/30/2009 | | Union Fenosa, S.A. | | | 496,675 | | | | (467,589 | ) | J.P. Morgan Chase & Co. Inc. |

| 11/12/2009 | | WPP Group plc | | | (217,860 | ) | | | 346,769 | | J.P. Morgan Chase & Co. Inc. |

| | | | | | | | | $ | (15,881,826 | ) | |

Credit Default Swaps

The Fund may enter into credit default swaps. In a credit default swap, one party makes a stream of payments to another party in exchange for the right to receive a specified return in the event of a default by a referenced entity, typically corporate issues, on its obligation. The Fund may use the swaps as part of a merger arbitrage strategy involving pending corporate reorganizations. The Fund may purchase credit protection on the referenced entity of the credit default swap (‘‘Buy Contract’’) or provide credit protection on the referenced entity of the credit default swap (‘‘Sale Contract’’).

Swap contracts involve, to varying degrees, elements of market risk and exposure to loss in excess of the amount reflected in the Statement of Assets and Liabilities. The notional amounts reflect the extent of the total investment exposure that the Fund has under the swap contract. The primary risks associated with the use of swap agreements are imperfect correlation between movements in the notional amount and the price of the underlying securities and the inability of counterparties to perform. The Fund bears the risk of loss of the amount expected to be received under a swap contract in the event of default or bankruptcy of the swap contract counterparty. At September 30, 2008, the Fund did not have any open credit default swap contracts.

Note 11 — NEW ACCOUNTING STANDARDS

In March 2008, FASB issued its Statement on Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities” (“SFAS 161”). This standard is intended to enhance financial statement disclosures for derivative instruments and hedging activities and enable investors to understand: (i) how and why a fund uses derivative instruments, (ii) how derivative instruments and related hedge items are accounted for, and (iii) how derivative instruments and related hedge items affect a fund’s financial position, results of operations and cash flows. SFAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. As of September 30, 2008 management does not believe the adoption of SFAS 161 will impact the financial statement amounts; however, additional disclosures in the notes to the financial statements may be required about the use of derivative instruments and hedge items.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2008

Note 12 — TRANSACTIONS WITH AFFILIATES

Pursuant to Section (2)(a)(3) of the 1940 Act, if the Fund owns 5% or more of the outstanding voting securities of an issuer, the issuer is deemed to be an affiliate of the Fund. During the year ended September 30, 2008, the Fund owned the following positions in such companies for investment purposes only:

| | Share | | | Share | | | |

| | Balance at | | | Balance at | Unrealized | | |

| Issuer | October 1, | | | September 30, | Appreciation | Dividend | Realized |

| Name | 2007 | Purchases | Sales | 2008 | (Depreciation) | Income | Appreciation |

| Rural Cellular* | | | | | | | |

| Corporation | 527,090 | 352,636 | 879,726 | — | — | — | $1,729,452 |

| * | Issuer was not an affiliate as of September 30, 2008. |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

The Merger Fund: