UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3445

The Merger Fund

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Frederick W. Green

The Merger Fund

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2010

Item 1. Reports to Stockholders.

ANNUAL REPORT

SEPTEMBER 30, 2010

November 16, 2010

Dear Fellow Shareholder:

As previously reported, The Merger Fund® posted a gain of 4.4% for its fiscal year ended September 30, 2010. Over the same period, the S&P 500, our official benchmark, was up 10.2%. Although we’re disappointed that the Fund’s performance in fiscal 2010 fell a little short of our rate-of-return objectives, the fact that we lagged the market as stocks continued to recover from their financial-crisis lows is of much less importance to us. An investment vehicle that routinely hedges against market risk in order to protect capital amid severe downturns can’t also be expected to outperform the averages when stocks are rallying. The key to the Fund’s long-term success has been its consiste ncy under a wide range of market conditions. That shouldn’t change going forward.

Deal selection is normally the key driver of the Fund’s results, and last year was no exception. Of the 155 mergers, takeovers and other corporate reorganizations in which we held positions during fiscal 2010—a record number—144 proceeded more or less as expected. Three proposed acquisitions that had reached the definitive-agreement stage were terminated, as was an additional takeover that had gotten only as far as an agreement in principle. Seven “pre-deal” arbitrage situations fell into the failed-transaction category. All in all, our batting average was pretty good. If we can keep it up and M&A activity continues to strengthen, fiscal 2011 should be a good year.

Against the Odds

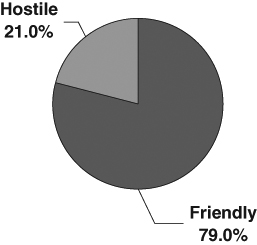

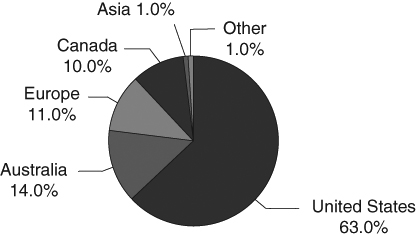

Once again, we have included a series of charts which reflect the nature of the arbitrage opportunities in which the Fund has recently invested. Chart 1 shows that as of September 30, friendly transactions comprised 79% of the dollar value of our long positions, while unsolicited, or hostile, takeover attempts accounted for 21%. The latter figure, which is up from just 8% a year earlier, represents one of the highest proportions of hostile deals in our portfolio since the Fund’s inception in 1989.

Deal-making is hard enough when both buyers and sellers are motivated to pursue a transaction. But hostile acquisitions take things to a completely different level, and the odds of success are stacked against companies that won’t take no for an answer. Nonetheless, a larger-than-normal number of would-be acquirers have recently concluded that certain transactions are sufficiently compelling to warrant the risks of going hostile. This more aggressive behavior is due in part to improving confidence levels in corporate boardrooms, something that has contributed to a rebound in M&A activity generally. With fears of another global financial crisis or severe economic contraction receding, many CEOs are comfortable growing their businesses through acquisitions, whether by friendly or hosti le means. Other companies are under increasing pressure to make bold moves on the M&A front because of competitive threats to their core businesses. Big Pharma, for example, faces the imminent loss of patent protection on some of its best-selling drugs, a prospect that helps explain why several of the major pharmaceutical companies have launched unsolicited bids for smaller biotech and specialty players whose products aren’t vulnerable to generic competition.

The upturn in hostile takeovers has also been influenced by the disconnect between many buyers and sellers over how to price transactions. Although the S&P 500 is up more than 75% since its March 2009 lows, some acquisition targets still think their shares are substantially undervalued and are refusing to enter into formal merger talks until potential buyers signal their willingness to pay a big takeover premium. Would-be acquirers, of course, can be frustrated by such demands, and a few have chosen to bypass the board and take their offers directly to the target’s shareholders.

From an arbitrage standpoint, we generally don’t care whether the target of an unsolicited offer ends up in a deal with the original bidder or with a white knight that agrees to pay more, as long as the ultimate deal price is above our cost. It’s also worth noting that whether a proposed takeover is friendly or hostile, we apply the same qualitative and quantitative analysis to evaluate the potential investment.

Private Equity Gets Its Mojo Back

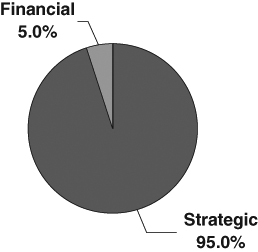

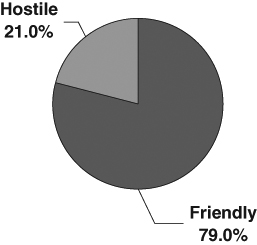

Chart 2 shows that as of September 30, 95% of the pending takeovers in the Fund’s portfolio were strategic in nature, while 5% represented financial transactions, up from less than 1% a year earlier. By “strategic,” we mean combinations that involve a corporate buyer—usually operating in the same industry as the target—whose objective in doing the transaction is to enhance shareholder value over the long term. In a typical financial, or going-private, deal, an investor group that includes the target’s management uses mostly debt to buy out the public shareholders, with the goal of selling the company or taking it public again a few years later.

Our sense is that the volume of going-private transactions has reached an inflection point and that several factors will support an expansion of this type of deal activity going forward. To begin with, private-equity firms have lots of money to spend. On a global basis, the industry is estimated to have more than $500 billion in uncommitted equity capital, which, when leveraged with debt financing, could fund well over $1 trillion worth of transactions. And these companies can’t just sit on their large war chests, earning lucrative management fees along the way; if the money isn’t spent, it must be returned to investors.

Another positive for going-private deals is that the debt markets have become much more accommodating. In the immediate aftermath of the financial meltdown, few banks were interested in funding highly leveraged transactions, and the high-yield bond market was essentially closed down. Now, however, banks are willing to get back in the game. Loan covenants may be less borrower-friendly than was the case during the height of the LBO boom, and lenders are demanding more conservative deal structures—more equity, less debt—but the money’s there. And historically low interest rates are especially beneficial to financial buyers.

Finally, private-equity firms could put more of their capital to work by simply reducing their rate-of-return requirements on new investments. With stocks up sharply over the past 18 months and fewer bargains for PE firms to exploit, lower hurdle rates would significantly expand the pool of companies that are good LBO candidates. Based on recent deal activity, private-equity buyers already appear to be lowering their sights. In fact, the head of a leading PE shop recently complained that his peers have been overpaying in competitive-bidding situations. On balance, the environment for going-private deals is positive enough that we could easily see these transactions become a larger part of the M&A universe.

Cash is King

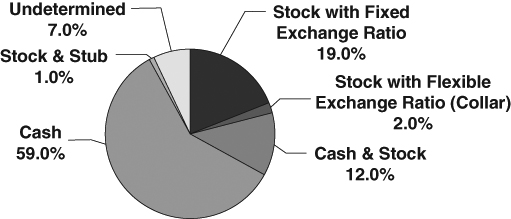

Chart 3 shows the type of merger consideration to be received by the selling company’s shareholders in transactions in which the Fund held positions at the end of September. Based on the chart, cash has regained its status as the preferred acquisition currency. All-cash deals represented 59% of our investments at the end of the September quarter, up from 31% a year earlier. Cash-and-stock transactions now account for 12% of the portfolio, down from 43% last year, while all-stock mergers make up 21% of our positions, compared to 14% a year earlier.

With Corporate America holding nearly $1 trillion in cash on its collective balance sheet, it probably isn’t surprising that many companies in M&A mode want to spend some of it on acquisitions. And for would-be acquirers that are less flush, the combination of willing lenders and low interest rates makes cash-based deals eminently doable. Moreover, even with the recovery in stock prices, many CEOs are reluctant to use what they still regard as undervalued shares as an acquisition currency. Another plus for cash takeovers is that with borrowing costs so low, they are almost always accretive to the buyer’s earnings per share.

As arbitrageurs, we generally have no preference when it comes to the type of merger consideration we are to receive. Whether it’s cash or stock or some combination of the two, we routinely attempt to hedge away the market risk associated with the investment.

Where the Deals Are

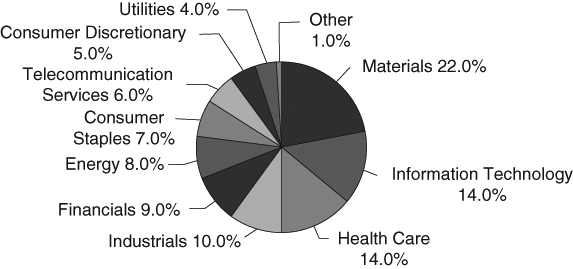

Chart 4 shows the Fund’s investments grouped by economic sector. Reflecting two multi-billion-dollar unsolicited takeover attempts, one targeting an industrial gas company and the other a major fertilizer producer, the materials sector accounted for 22% of the Fund’s investments at the end of September, up from 10% a year earlier.

Information technology continues to be a fertile area for M&A activity, and the sector recently represented 14% of the portfolio, although this figure is down from about 21% a year earlier. One of the principal drivers of consolidation in this space is the desire of the bigger players to expand their product lines so that they can offer one-stop shopping to corporate IT managers. The industry leaders also see acquisitions as a way to ensure that they stay ahead of the curve with respect to new technologies. Other tech deals have resulted from evolving business models that place a higher value on recurring revenue from IT services and support than on one-time hardware sales.

The health care sector represented 14% of the Fund’s arbitrage positions at the end of September. As discussed earlier, Big Pharma is under the gun because many of its best-selling drugs face generic competition that will undermine sales and profitability. Since their own R & D programs to produce new blockbuster drugs mostly have come up short, it makes sense that the industry leaders would be looking to offset the lost revenue with acquisitions that give them access to promising drugs that are either already on the market or in the development pipeline.

Going Global

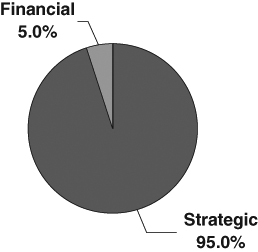

Chart 5 shows the Fund’s investments grouped by the geographic region in which the target company is domiciled. The Merger Fund® has been investing outside the U.S. since its inception, but in recent years our portfolio has become increasingly global in nature. As of the end of September, 37% of the Fund’s arbitrage investments involved non-U.S. targets. Australian deals accounted for 14% of our holdings, while European and Canadian takeovers represented 11% and 10%, respectively.

As we’ve noted before, successful overseas investing requires more than the basic arb toolkit. Although there is considerable overlap in the way we evaluate domestic deals and those involving non-U.S. targets, it’s important to recognize that foreign transactions unfold in the context of political, regulatory and corporate-governance systems that may be very different from the U.S. model. And the process of settling foreign trades, hedging currencies and dealing with the other mechanics of cross-border investing adds another layer of complexity. After all these years, however, we know the drill. Not only do we have the infrastructure in place to handle the technical side of foreign investing, but our portfolio-management team also has access to an international network of research analysts, advisers

and trading partners, most of whom we’ve worked with for a long time. All in all, The Merger Fund® appears particularly well-positioned to exploit what is likely to be an expanding universe of global investment opportunities.

Onward and Upward

Chart 6 shows the total dollar value of U.S. mergers and acquisitions, by quarter, since 2000. While M&A activity has recently begun to trend higher, the pace of deal-making is still well below the levels seen just a few years ago. For the first nine months of 2010, merger volume was up about 25% from the year-earlier period. But compared to the first nine months of 2007—before the recession and financial meltdown—this year’s total was nearly 60% lower.

We’ve been predicting an upturn in the pace of corporate consolidation for a while now, and it finally seems to be happening. Moreover, if Chart 6 is any indication, the recovery in M&A activity has a long way to go. We believe that the financial crisis caused many potential acquirers to put their takeover plans on hold and that there is considerable pent-up demand for both strategic and financial transactions. Cash-heavy balance sheets, the ready availability of debt financing at low interest rates and improving boardroom confidence—helped by the prospect of a more business-friendly political climate—should all make it easier to put deals together. And it’s also true that many companies, especially those whose organic growth prospects are less than stellar, don� 217;t have the luxury of sitting on the M&A sidelines; doing deals may represent one of the few opportunities to enhance shareholder value. The bottom line is that we’re optimistic that The Merger Fund® will be presented with a full plate of attractive investment opportunities in the months and years ahead.

| | Sincerely, |

| | |

| |  |

| | |

| | Frederick W. Green |

| | President |

| Chart 1 | Chart 2 |

| | |

| PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

| By Type of Deal* | By Type of Buyer* |

| | |

|  |

| | |

| | |

Chart 3

PORTFOLIO COMPOSITION

By Deal Terms*

* Data expressed as a percentage of long equity positions as of September 30, 2010

Chart 4

PORTFOLIO COMPOSITION

By Sector*

Chart 5

PORTFOLIO COMPOSITION

By Region*

* Data expressed as a percentage of long equity positions as of September 30, 2010

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Chart 6

MERGER ACTIVITY

2000 – 2010

Source: Securities Data Corp.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND AND S&P 500

| | | Average |

| | | Annual Total Return |

| | 1 Yr. | 3 Yr. | 5 Yr. | 10 Yr. |

| The Merger Fund | 4.39% | 1.85% | 4.12% | 3.48% |

| The Standard & Poor’s 500 Index | 10.16% | (7.16)% | 0.64% | (0.43)% |

The Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on September 30, 2000. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund

EXPENSE EXAMPLE

September 30, 2010

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) redemption fees and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 for the period 4/01/10 – 9/30/10.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop-payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, a $15.00 fee will be charged by the Fund’s transfer agent. You will be charged a redemption fee equal to 2.00% of the net amount of the redemption if you redeem your shares less than 30 calendar days after you purchase them. IRAs will be charged a $12.00 annual maintenance fee. To the extent the Fund invests in shares of other investment companies as part of its investment strat egy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the se cond line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account | Ending Account | Expenses Paid During |

| | Value 4/01/10 | Value 9/30/10 | Period 4/01/10-9/30/10* |

Actual + (1) | $1,000.00 | $1,007.60 | $14.19 |

Hypothetical ++ (2) | $1,000.00 | $1,010.93 | $14.22 |

| + | Excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, your actual cost of investment in the Fund would be $7.20 |

| ++ | Excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, your hypothetical cost of investment in the Fund would be $7.23. |

| (1) | Ending account values and expenses paid during period based on a 0.76% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| * | Expenses are equal to the Fund’s annualized expense ratio of 2.82%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

The Merger Fund

SCHEDULE OF INVESTMENTS

September 30, 2010

| Shares | | | | Value | |

| COMMON STOCKS — 65.07% | | | |

| | | | | | |

| | | ACQUISITION CORPORATIONS — 0.61% | | | |

| | 1,298,800 | | Liberty Acquisition Holdings Corp. (a) | | $ | 13,364,652 | |

| | 767,601 | | Phoenix Group Holdings (b) (c) | | | 8,259,868 | |

| | | | | | | 21,624,520 | |

| | | | AIRLINES — 0.95% | | | | |

| | 4,633,400 | | AirTran Holdings, Inc. (a) | | | 34,055,490 | |

| | | | | | | | |

| | | | ASSET MANAGEMENT & CUSTODY BANKS — 1.32% | | | | |

| | 7,710,000 | | GLG Partners Inc. (a) | | | 34,695,000 | |

| | 1,161,594 | | KKR Co. (a) | | | 12,312,897 | |

| | | | | | | 47,007,897 | |

| | | | BIOTECHNOLOGY — 3.53% | | | | |

| | 290,777 | | Crucell NV (a) (b) | | | 9,711,863 | |

| | 1,319,702 | | Genzyme Corporation (a) (e) | | | 93,421,705 | |

| | 415,591 | | Talecris Biotherapeutics Holdings Corp. (a) | | | 9,508,722 | |

| | 1,380,632 | | ZymoGenetics, Inc. (a) | | | 13,461,162 | |

| | | | | | | 126,103,452 | |

| | | | BROADCASTING & CABLE TV — 0.12% | | | | |

| | 308,400 | | Liberty Media Corp. — Interactive (a) | | | 4,228,164 | |

| | | | | | | | |

| | | | CABLE & SATELLITE TV — 0.99% | | | | |

| | 2,089,400 | | Comcast Corporation Special Class A | | | 35,540,694 | |

| | | | | | | | |

| | | | COMMERCIAL PRINTING — 0.76% | | | | |

| | 2,403,250 | | Bowne & Co. Inc. | | | 27,228,821 | |

| | | | | | | | |

| | | | COMMUNICATIONS EQUIPMENT — 2.98% | | | | |

| | 6,612,757 | | ADC Telecommunications, Inc (a) (f) | | | 83,783,631 | |

| | 2,649,100 | | Motorola, Inc. (a) (e) | | | 22,596,823 | |

| | | | | | | 106,380,454 | |

| | | | COMPUTER STORAGE & PERIPHERALS — 0.73% | | | | |

| | 292,100 | | EMC Corp. (a) | | | 5,932,551 | |

| | 751,100 | | Netezza Corporation (a) (e) | | | 20,242,145 | |

| | | | | | | 26,174,696 | |

| | | | CONSUMER FINANCE — 2.86% | | | | |

| | 2,791,582 | | AmeriCredit Corp. (a) | | | 68,282,096 | |

| | 2,939,300 | | SLM Corporation (a) | | | 33,948,915 | |

| | | | | | | 102,231,011 | |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS (continued)

September 30, 2010

| Shares | | | | Value | |

| | | | | | |

| | | DATA PROCESSING & OUTSOURCED SERVICES — 1.86% | | | |

| | 1,316,700 | | Hewitt Associates, Inc. (a) (g) | | $ | 66,401,181 | |

| | | | | | | | |

| | | | DIVERSIFIED CHEMICALS — 0.98% | | | | |

| | 3,027,058 | | Huntsman Corporation (e) | | | 34,992,790 | |

| | | | | | | | |

| | | | DIVERSIFIED METALS & MINING — 0.54% | | | | |

| | 104,552 | | Indophil Resources NL (a) (b) | | | 93,981 | |

| | 326,471 | | Rio Tinto plc — ADR | | | 19,173,642 | |

| | | | | | | 19,267,623 | |

| | | | ELECTRICAL UTILITIES — 2.78% | | | | |

| | 4,052,500 | | Allegheny Energy Inc. (f) | | | 99,367,300 | |

| | | | | | | | |

| | | | ELECTRICAL COMPONENTS & EQUIPMENT — 0.50% | | | | |

| | 1,286,122 | | SunPower Corp. Class B (a) (d) | | | 17,825,651 | |

| | | | | | | | |

| | | | ELECTRICAL EQUIPMENT & INSTRUMENTS — 0.04% | | | | |

| | 134,148 | | L-1 Identity Solutions, Inc. (a) (d) | | | 1,573,556 | |

| | | | | | | | |

| | | | ELECTRICAL EQUIPMENT MANUFACTURERS — 0.16% | | | | |

| | 544,700 | | Cogent, Inc. (a) | | | 5,795,608 | |

| | | | | | | | |

| | | | FERTILIZERS & AGRICULTURAL CHEMICALS — 6.50% | | | | |

| | 1,613,300 | | Potash Corporation of Saskatchewan (b) (e) | | | 232,379,732 | |

| | | | | | | | |

| | | | FOOD RETAIL — 0.18% | | | | |

| | 153,369 | | Casey’s General Stores, Inc. (e) | | | 6,403,156 | |

| | | | | | | | |

| | | | GOLD — 3.32% | | | | |

| | 4,725,746 | | Kinross Gold Corporation (b) (g) | | | 88,645,055 | |

| | 774,110 | | Newcrest Mining Ltd. — ADR | | | 29,803,235 | |

| | | | | | | 118,448,290 | |

| | | | HEALTH CARE FACILITIES — 2.76% | | | | |

| | 2,936,252 | | Psychiatric Solutions, Inc. (a) (e) | | | 98,511,255 | |

| | | | | | | | |

| | | | HEALTH CARE SUPPLIES — 3.29% | | | | |

| | 705,000 | | Alcon Inc. — ADR (g) | | | 117,586,950 | |

| | | | | | | | |

| | | | INDEPENDENT POWER PRODUCERS | | | | |

| | | | & ENERGY TRADERS — 0.10% | | | | |

| | 360,250 | | Mirant Corporation (a) (g) | | | 3,588,090 | |

| | | | | | | | |

| | | | INDUSTRIAL GASES — 2.70% | | | | |

| | 1,419,311 | | Airgas, Inc. (e) | | | 96,442,183 | |

| | | | | | | | |

| | | | INTEGRATED TELECOMMUNICATION SERVICES — 4.73% | | | | |

| | 26,921,700 | | Qwest Communications International Inc. (g) | | | 168,799,059 | |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS (continued)

September 30, 2010

| Shares | | | | Value | |

| | | | | | |

| | | LIFE SCIENCES TOOLS & SERVICES — 0.04% | | | |

| | 77,862 | | WuXi Pharmatech (Cayman) Inc. — ADR (a) | | $ | 1,336,112 | |

| | | | | | | | |

| | | | METAL & GLASS CONTAINERS — 4.35% | | | | |

| | 4,716,080 | | Pactiv Corporation (a) (g) | | | 155,536,318 | |

| | | | | | | | |

| | | | MOVIES & ENTERTAINMENT — 0.33% | | | | |

| | 914,300 | | News Corporation Class A (g) | | | 11,940,758 | |

| | | | | | | | |

| | | | OIL & GAS EQUIPMENT & SERVICES — 0.15% | | | | |

| | 160,219 | | Halliburton Company | | | 5,298,428 | |

| | | | | | | | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 0.70% | | | | |

| | 1,037,442 | | Mariner Energy, Inc. (a) | | | 25,137,219 | |

| | 1 | | SandRidge Energy, Inc. (a) | | | 6 | |

| | | | | | | 25,137,225 | |

| | | | PERSONAL PRODUCTS — 3.36% | | | | |

| | 1,155,119 | | Alberto-Culver Company | | | 43,490,230 | |

| | 1,393,500 | | NBTY Inc. (a) | | | 76,614,630 | |

| | | | | | | 120,104,860 | |

| | | | PHARMACEUTICALS — 0.68% | | | | |

| | 975,906 | | Valeant Pharmaceuticals International (b) | | | 24,446,445 | |

| | | | | | | | |

| | | | RESTAURANTS — 0.16% | | | | |

| | 35,000 | | Burger King Holdings, Inc. (f) | | | 835,800 | |

| | 284,337 | | California Pizza Kitchen, Inc. (a) | | | 4,850,789 | |

| | | | | | | 5,686,589 | |

| | | | SOFT DRINKS — 0.61% | | | | |

| | 477,900 | | Coca-Cola Enterprises Inc. (e) | | | 14,814,900 | |

| | 136,365 | | Fomento Economico Mexicano SAB de CV — ADR | | | 6,917,797 | |

| | | | | | | 21,732,697 | |

| | | | SYSTEMS SOFTWARE — 6.45% | | | | |

| | 755,379 | | ArcSight, Inc. (a) (g) | | | 32,904,309 | |

| | 4,181,836 | | McAfee Inc. (a) (f) | | | 197,633,570 | |

| | | | | | | 230,537,879 | |

| | | | TRUCKING — 2.95% | | | | |

| | 1,939,580 | | Dollar Thrifty Automotive Group, Inc. (a) (e) | | | 97,250,541 | |

| | 777,300 | | Hertz Global Holdings, Inc. (a) (d) | | | 8,231,607 | |

| | | | | | | 105,482,148 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $2,230,325,682) | | | 2,325,197,082 | |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS (continued)

September 30, 2010

| Shares | | | | Value | |

| | | | |

| EXCHANGE TRADED FUNDS — 0.01% | | | |

| | 150 | | iShares MSCI Mexico Investable Market Index Fund | | $ | 7,948 | |

| | 22,900 | | Market Vectors Global Alternative Energy ETF | | | 472,198 | |

| | | | TOTAL EXCHANGE TRADED FUNDS | | | | |

| | | | (Cost $464,190) | | | 480,146 | |

| | | | | |

| PREFERRED STOCKS — 0.00% | | | | |

| | 300 | | KeyCorp Capital Series F | | | 7,650 | |

| | | | TOTAL PREFERRED STOCKS | | | | |

| | | | (Cost $6,249) | | | 7,650 | |

| | | | | |

| WARRANTS — 0.02% | | | | |

| | | | Kinross Gold Corporation (b) | | | | |

| | 147,472 | | Expiration: September, 2014, Exercise Price: $21.300 (a) | | | 630,651 | |

| | | | TOTAL WARRANTS (Cost $558,581) | | | 630,651 | |

| | | | | | | | |

| Principal Amount | | | | | | |

| | | | | |

| CONVERTIBLE BONDS — 1.43% | | | | |

| | | | General Growth Properties LP | | | | |

| $ | 47,860,000 | | 3.980%, 04/15/2027 (Acquired 02/26/2010 | | | | |

| | | | through 05/18/2010) (c) | | | 51,210,200 | |

| | | | TOTAL CONVERTIBLE BONDS | | | | |

| | | | (Cost $49,708,150) | | | 51,210,200 | |

| | | | | |

| CORPORATE BONDS — 1.95% | | | | |

| | | | Mariner Energy, Inc. | | | | |

| | 40,316,000 | | 11.750%, 06/30/2016 | | | 50,898,950 | |

| | | | Mirant Corporation | | | | |

| | 18,074,000 | | 7.375%, 12/31/2013 | | | 18,706,590 | |

| | | | TOTAL CORPORATE BONDS | | | | |

| | | | (Cost $69,229,264) | | | 69,605,540 | |

| | | | | | | | |

| Contracts (100 shares per contract) | | | | |

| | | | | |

| PURCHASED PUT OPTIONS — 0.17% | | | | |

| | | | The Blackstone Group, LP | | | | |

| | 7,221 | | Expiration: December, 2010, Exercise Price: $12.00 | | | 512,691 | |

| | | | Global Alternative Energy ETF | | | | |

| | 3,424 | | Expiration: October, 2010, Exercise Price: $23.00 | | | 883,392 | |

| | | | iShares MSCI Mexico Investable Market Index Fund | | | | |

| | 780 | | Expiration: December, 2010, Exercise Price: $55.00 | | | 276,900 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

September 30, 2010

| Contracts (100 shares per contract) | | Value | |

| | | | |

| PURCHASED PUT OPTIONS — 0.17% (continued) | | | |

| | | iShares MSCI Spain Index | | | |

| | 150 | | Expiration: October, 2010, Exercise Price: $42.00 | | $ | 27,000 | |

| | | | iShares Nasdaq Biotech | | | | |

| | 664 | | Expiration: October, 2010, Exercise Price: $85.00 | | | 66,400 | |

| | | | Market Vectors Coal ETF | | | | |

| | 1,450 | | Expiration: October, 2010, Exercise Price: $35.00 | | | 39,875 | |

| | | | Materials SPDR | | | | |

| | 2,215 | | Expiration: December, 2010, Exercise Price: $35.00 | | | 653,425 | |

| | | | SPDR Trust Series 1 | | | | |

| | 9,700 | | Expiration: November, 2010, Exercise Price: $114.00 | | | 3,525,950 | |

| | | | TOTAL PURCHASED PUT OPTIONS | | | | |

| | | | (Cost $9,071,830) | | | 5,985,633 | |

| | | | | | | | |

| Shares | | | | | | |

| | | | | |

| SHORT TERM INVESTMENTS — 24.46% | | | | |

| | 124,252,707 | | Dreyfus Cash Management 0.210% (f) (h) | | | 124,252,707 | |

| | 150,000,000 | | Fidelity Institutional Government Portfolio 0.051% (d) (h) | | | 150,000,000 | |

| | 150,000,000 | | Fidelity Institutional Prime Money Market Portfolio 0.242% (d) (h) | | | 150,000,000 | |

| | 150,000,000 | | First American Government Obligations Fund 0.036% (d) (h) | | | 150,000,000 | |

| | 150,000,000 | | First American Prime Obligations Fund 0.128% (d) (h) | | | 150,000,000 | |

| | 150,000,000 | | First American Treasury Obligations Fund 0.015% (f) (h) | | | 150,000,000 | |

| | | | TOTAL SHORT TERM INVESTMENTS | | | | |

| | | | (Cost $874,252,707) | | | 874,252,707 | |

| | | | TOTAL INVESTMENTS | | | | |

| | | | (Cost $3,233,616,653) — 93.11% | | $ | 3,327,369,609 | |

Percentages are stated as a percent of net assets.

ADR — American Depository Receipt

| (a) | Non-income producing security. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of September 30, 2010 these securities represented 1.43% of total net assets. |

| (d) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (e) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (f) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (g) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

| (h) | The rate quoted is the annualized seven-day yield as of September 30, 2010. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF SECURITIES SOLD SHORT

September 30, 2010

| Shares | | | | Value | |

| | 239,300 | | AMP Ltd. (a) | | $ | 1,181,917 | |

| | 837,529 | | Aon Corporation | | | 32,755,759 | |

| | 176,886 | | Apache Corporation | | | 17,292,375 | |

| | 199,100 | | Avis Budget Group, Inc. | | | 2,319,515 | |

| | 4,451,750 | | CenturyLink, Inc. | | | 175,666,055 | |

| | 2,089,800 | | Comcast Corporation Class A | | | 37,783,584 | |

| | 2,698,061 | | FirstEnergy Corp. | | | 103,983,271 | |

| | 34,130 | | Goldcorp Inc. (a) | | | 1,482,759 | |

| | 158,400 | | Halliburton Company | | | 5,238,288 | |

| | 4,733,175 | | Kinross Gold Corporation (a) | | | 88,784,408 | |

| | 4 | | Market Vectors Global Alternative Energy ETF | | | 82 | |

| | 196,817 | | National Australia Bank Ltd. (a) | | | 4,820,506 | |

| | 72,930 | | Newcrest Mining Ltd. (a) | | | 2,796,352 | |

| | 914,300 | | News Corporation Class B | | | 13,769,358 | |

| | 1,125,534 | | Novartis AG — ADR | | | 64,909,546 | |

| | 327,293 | | Rio Tinto Ltd. (a) (b) | | | 24,267,659 | |

| | 233,900 | | Southwest Airlines Co. | | | 3,057,073 | |

| | 1,286,122 | | SunPower Corp. Class A | | | 18,520,157 | |

| | 976,177 | | Valeant Pharmaceuticals International | | | 24,453,234 | |

| | 46,995 | | VMware Inc. | | | 3,991,755 | |

| | | | TOTAL SECURITIES SOLD SHORT (Proceeds $593,940,199) | | $ | 627,073,653 | |

ADR — American Depository Receipt

| (a) | Foreign Issued Security. |

| (b) | Level 2 Investment (See Note 2) |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN

September 30, 2010

| Contracts (100 shares per contract) | | Value | |

| CALL OPTIONS | | | | | |

| | | Airgas, Inc. | | | |

| | 11,118 | | Expiration: October, 2010, Exercise Price: $65.00 | | $ | 4,002,480 | |

| | | | Alcon Inc. ADR | | | | |

| | 1,316 | | Expiration: October, 2010, Exercise Price: $165.00 | | | 473,760 | |

| | | | AXA Asia Pacific Holdings Ltd. | | | | |

| | 970 | | Expiration: November, 2010, Exercise Price: AUD 5.00 | | | 28,596 | |

| | 16,171 | | Expiration: December, 2010, Exercise Price: AUD 6.00 | | | 46,896 | |

| | | | Casey’s General Stores, Inc. | | | | |

| | 463 | | Expiration: October, 2010, Exercise Price: $40.00 | | | 96,072 | |

| | | | Coca-Cola Enterprises Inc. | | | | |

| | 4,779 | | Expiration: October, 2010, Exercise Price: $30.00 | | | 573,480 | |

| | | | Dollar Thrifty Automotive Group, Inc. | | | | |

| | 6,459 | | Expiration: October, 2010, Exercise Price: $49.00 | | | 936,555 | |

| | 9,747 | | Expiration: October, 2010, Exercise Price: $50.00 | | | 682,290 | |

| | 718 | | Expiration: November, 2010, Exercise Price: $55.00 | | | 14,360 | |

| | | | Foster’s Group | | | | |

| | 24,464 | | Expiration: December, 2010, Exercise Price: AUD 6.00 | | | 661,996 | |

| | | | Genzyme Corporation | | | | |

| | 4,661 | | Expiration: October, 2010, Exercise Price: $67.50 | | | 1,817,790 | |

| | 5,119 | | Expiration: October, 2010, Exercise Price: $70.00 | | | 885,587 | |

| | | | Hertz Global Holdings, Inc. | | | | |

| | 4,096 | | Expiration: October, 2010, Exercise Price: $11.00 | | | 143,360 | |

| | 3,677 | | Expiration: November, 2010, Exercise Price: $10.00 | | | 404,470 | |

| | | | Huntsman Corporation | | | | |

| | 1,642 | | Expiration: October, 2010, Exercise Price: $9.00 | | | 420,352 | |

| | 11,812 | | Expiration: October, 2010, Exercise Price: $10.00 | | | 1,889,920 | |

| | 13,292 | | Expiration: November, 2010, Exercise Price: $11.00 | | | 1,462,120 | |

| | | | L-1 Identity Solutions, Inc. | | | | |

| | 816 | | Expiration: October, 2010, Exercise Price: $10.00 | | | 141,168 | |

| | | | Liberty Media Corp. — Interactive | | | | |

| | 3,084 | | Expiration: October, 2010, Exercise Price: $11.00 | | | 840,390 | |

| | | | Motorola, Inc. | | | | |

| | 26,491 | | Expiration: October, 2010, Exercise Price: $8.00 | | | 1,509,987 | |

| | | | Netezza Corporation | | | | |

| | 3,200 | | Expiration: October, 2010, Exercise Price: $27.50 | | | 32,000 | |

| | 977 | | Expiration: November, 2010, Exercise Price: $27.50 | | | 14,655 | |

| | 556 | | Expiration: November, 2010, Exercise Price: $30.00 | | | 2,780 | |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF OPTIONS WRITTEN (continued)

September 30, 2010

| Contracts (100 shares per contract) | | Value | |

| | | Potash Corporation of Saskatchewan | | | |

| | 7,993 | | Expiration: October, 2010, Exercise Price: $140.00 | | $ | 4,396,150 | |

| | 3,406 | | Expiration: October, 2010, Exercise Price: $145.00 | | | 776,568 | |

| | 2,110 | | Expiration: October, 2010, Exercise Price: $150.00 | | | 213,110 | |

| | 1,756 | | Expiration: November, 2010, Exercise Price: $135.00 | | | 2,045,740 | |

| | | | Psychiatric Solutions, Inc. | | | | |

| | 977 | | Expiration: December, 2010, Exercise Price: $35.00 | | | 4,885 | |

| | | | SLM Corporation | | | | |

| | 4,376 | | Expiration: October, 2010, Exercise Price: $11.00 | | | 328,200 | |

| | 13,909 | | Expiration: November, 2010, Exercise Price: $10.00 | | | 2,538,393 | |

| | 11,110 | | Expiration: November, 2010, Exercise Price: $11.00 | | | 1,205,435 | |

| | | | | | | 28,589,545 | |

| PUT OPTIONS | | | | | | |

| | | | SPDR Trust Series 1 | | | | |

| | 6,305 | | Expiration: November, 2010, Exercise Price: $104.00 | | | 693,550 | |

| | | | TOTAL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $36,582,592) | | $ | 29,283,095 | |

AUD — Australian Dollars

The accompanying notes are an integral part of these financial statements.

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2010

| ASSETS: | | | | | | |

| Investments, at value | | | | | | |

| Investments in non affiliates (Cost 2,937,551,357) | | $ | 3,020,595,361 | | | | |

| Investments in affiliates (Cost 296,065,296) | | | 306,774,248 | | | | |

| Total investments | | | | | | $ | 3,327,369,609 | |

| Cash | | | | | | | 997,640 | |

| Deposits at brokers | | | | | | | 418,967,662 | |

| Receivable from brokers | | | | | | | 593,940,199 | |

| Receivable for investments sold | | | | | | | 34,109,340 | |

| Receivable for foreign currency translation | | | | | | | 9,863 | |

| Receivable for swap contracts | | | | | | | 7,373,004 | |

| Receivable for closed swap contracts | | | | | | | 1,228,227 | |

| Receivable for fund shares issued | | | | | | | 19,412,024 | |

| Dividends and interest receivable | | | | | | | 4,345,621 | |

| Prepaid expenses and other receivables | | | | | | | 320,114 | |

| Total Assets | | | | | | | 4,408,073,303 | |

| LIABILITIES: | | | | | | | | |

| Securities sold short, at value (proceeds of $593,940,199) | | | 627,073,653 | | | | | |

| Written option contracts, at value (premiums received $36,582,592) | | | 29,283,095 | | | | | |

| Payable for forward currency exchange contracts | | | 44,337,446 | | | | | |

| Payable for foreign currency translation | | | 2,780 | | | | | |

| Payable for swap contracts | | | 401,893 | | | | | |

| Payable for swap interest | | | 327,247 | | | | | |

| Payable for investments purchased | | | 124,273,839 | | | | | |

| Payable for fund shares redeemed | | | 1,502,278 | | | | | |

| Investment advisory fee payable | | | 1,946,177 | | | | | |

| Distribution fees payable | | | 2,016,324 | | | | | |

| Dividends payable | | | 1,448,055 | | | | | |

| Accrued expenses and other liabilities | | | 1,878,224 | | | | | |

| Total Liabilities | | | | | | | 834,491,011 | |

| NET ASSETS | | | | | | $ | 3,573,582,292 | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Accumulated undistributed net investment income | | | | | | $ | 7,037,435 | |

| Accumulated undistributed net realized gain on investments, securities | | | | | | | | |

| sold short, written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translation and forward currency exchange contracts | | | | | | | 23,302,093 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 93,752,956 | | | | | |

| Securities sold short | | | (33,133,454 | ) | | | | |

| Written option contracts | | | 7,299,497 | | | | | |

| Swap contracts | | | 6,971,111 | | | | | |

| Foreign currency translation | | | 7,083 | | | | | |

| Forward currency exchange contracts | | | (44,337,446 | ) | | | | |

| Net unrealized appreciation | | | | | | | 30,559,747 | |

| Paid-in capital | | | | | | | 3,512,683,017 | |

| Total Net Assets | | | | | | $ | 3,573,582,292 | |

| NET ASSET VALUE and offering price per share*, ($3,573,582,292 / 224,338,920 | | | | | | | | |

| shares of beneficial interest outstanding) | | | | | | $ | 15.93 | |

| | | | | | | | | |

| * | The redemption price per share may vary based on the length of time a shareholder holds Fund shares. |

The accompanying notes are an integral part of these financial statements.

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2010

| INVESTMENT INCOME: | | | | | | |

| Interest | | | | | $ | 2,920,183 | |

| Dividend income on long positions (net of foreign withholding taxes of $1,237,869) | | | | | | | |

| Non affiliates | | | | | | 32,252,049 | |

| Affiliates | | | | | | 286,242 | |

| Total investment income | | | | | | 35,458,474 | |

| EXPENSES: | | | | | | | |

| Investment advisory fees | | $ | 27,503,555 | | | | | |

| Distribution fees | | | 6,575,889 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 3,546,201 | | | | | |

| Administration fees | | | 1,031,911 | | | | | |

| Federal and state registration fees | | | 466,702 | | | | | |

| Reports to shareholders | | | 456,254 | | | | | |

| Professional fees | | | 365,879 | | | | | |

| Fund accounting expense | | | 311,228 | | | | | |

| Miscellaneous expenses | | | 213,433 | | | | | |

| Custody fees | | | 200,170 | | | | | |

| Trustees’ fees and expenses | | | 170,896 | | | | | |

| Borrowing expense on securities sold short | | | 4,655,625 | | | | | |

| Dividends on securities sold short | | | 27,238,175 | | | | | |

| Total expenses before expense waiver by adviser | | | | | | | 72,735,918 | |

| Less: Expense reimbursed by Adviser | | | | | | | (2,016,250 | ) |

| Net expenses | | | | | | | 70,719,668 | |

| NET INVESTMENT LOSS | | | | | | | (35,261,194 | ) |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain (loss) on: | | | | | | | | |

| Investments | | | | | | | | |

| Non affiliates | | | 119,892,558 | | | | | |

| Affiliates | | | 3,051,936 | | | | | |

| Securities sold short | | | 4,773,548 | | | | | |

| Written option contracts expired or closed | | | 17,568,384 | | | | | |

| Swap contracts | | | 3,351,425 | | | | | |

| Foreign currency translation | | | (169,070 | ) | | | | |

| Forward currency exchange contracts | | | 4,534,097 | | | | | |

| Net realized gain | | | | | | | 153,002,878 | |

| Change in unrealized appreciation / (depreciation) on: | | | | | | | | |

| Investments | | | (36,100,018 | ) | | | | |

| Securities sold short | | | 49,062,170 | | | | | |

| Written option contracts | | | 6,382,996 | | | | | |

| Swap contracts | | | 6,540,613 | | | | | |

| Foreign currency translation | | | (227,495 | ) | | | | |

| Forward currency exchange contracts | | | (36,327,516 | ) | | | | |

| Net unrealized depreciation | | | | | | | (10,669,250 | ) |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | | 142,333,628 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | 107,072,434 | |

The accompanying notes are an integral part of these financial statements.

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | September 30, 2010 | | | September 30, 2009 | |

| Net investment loss | | $ | (35,261,194 | ) | | $ | (36,230,340 | ) |

| Net realized gain on investments, securities sold short, | | | | | | | | |

| written option contracts expired or closed, | | | | | | | | |

| swap contracts, foreign currency translation | | | | | | | | |

| and forward currency exchange contracts | | | 153,002,878 | | | | 58,562,542 | |

| Change in unrealized appreciation (depreciation) | | | | | | | | |

| on investments, securities sold short, written option | | | | | | | | |

| contracts, swap contracts, foreign currency translation | | | | | | | | |

| and forward currency exchange contracts | | | (10,669,250 | ) | | | 58,598,655 | |

| Net increase in net assets resulting from operations | | | 107,072,434 | | | | 80,930,857 | |

| Distributions to shareholders from: (Note 2) | | | | | | | | |

| Net investment income | | | (42,329 | ) | | | (5,185,512 | ) |

| Net realized gains | | | — | | | | (4,823,592 | ) |

| Return of capital | | | — | | | | (21,325,423 | ) |

| Total dividends and distributions | | | (42,329 | ) | | | (31,334,527 | ) |

| Net increase in net assets from | | | | | | | | |

| capital share transactions (Note 4) | | | 1,655,172,030 | | | | 347,618,561 | |

| Net increase in net assets | | | 1,762,202,135 | | | | 397,214,891 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 1,811,380,157 | | | | 1,414,165,266 | |

| End of year (including accumulated undistributed | | | | | | | | |

| net investment income of $7,037,435 | | | | | | | | |

| and $6,282,325, respectively) | | $ | 3,573,582,292 | | | $ | 1,811,380,157 | |

The accompanying notes are an integral part of these financial statements.

FINANCIAL HIGHLIGHTS

Selected per share data is based on a share of beneficial interest outstanding throughout each year.

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | | | Sept. 30, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of year | | $ | 15.26 | | | $ | 14.79 | | | $ | 16.55 | | | $ | 15.95 | | | $ | 15.78 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.02 | )(2) | | | 0.24 | (2) | | | 0.00 | (3)(4) | | | 0.13 | (3) | | | 0.06 | (3) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.69 | | | | 0.58 | | | | (0.70 | ) | | | 1.13 | | | | 0.99 | |

| Total from investment operations | | | 0.67 | | | | 0.82 | | | | (0.70 | ) | | | 1.26 | | | | 1.05 | |

| Redemption fees | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | (4) | | | (0.06 | ) | | | (0.37 | ) | | | (0.11 | ) | | | (0.01 | ) |

| Distributions from net realized gains | | | — | | | | (0.05 | ) | | | (0.69 | ) | | | (0.55 | ) | | | (0.87 | ) |

| Distributions from return to capital | | | — | | | | (0.24 | ) | | | — | | | | — | | | | — | |

| Total distributions | | | — | | | | (0.35 | ) | | | (1.06 | ) | | | (0.66 | ) | | | (0.88 | ) |

| Net Asset Value, end of year | | $ | 15.93 | | | $ | 15.26 | | | $ | 14.79 | | | $ | 16.55 | | | $ | 15.95 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | 4.39 | % | | | 5.78 | % | | | (4.32 | )% | | | 8.15 | % | | | 7.10 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 3,573,582 | | | $ | 1,811,380 | | | $ | 1,414,165 | | | $ | 1,821,714 | | | $ | 1,563,045 | |

| Ratio of operating expenses | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 2.57 | % | | | 4.22 | % | | | 1.66 | % | | | 2.16 | % | | | 2.08 | % |

| Ratio of dividends on short positions | | | | | | | | | | | | | | | | | | | | |

| and borrowing expense on securities | | | | | | | | | | | | | | | | | | | | |

| sold short to average net assets | | | 1.16 | % | | | 2.68 | % | | | 0.19 | % | | | 0.76 | % | | | 0.71 | % |

| Ratio of operating expense to average net | | | | | | | | | | | | | | | | | | | | |

| assets excluding dividends on short positions | | | | | | | | | | | | | | | | | | | | |

| and borrowing expense on securities sold short | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.48 | % | | | 1.54 | % | | | 1.48 | % | | | 1.41 | % | | | 1.37 | % |

| After expense waiver | | | 1.41 | % | | | 1.54 | % | | | 1.47 | % | | | 1.40 | %(5) | | | 1.37 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | (1.35 | )% | | | (2.49 | )% | | | (0.10 | )% | | | 0.82 | % | | | 0.43 | % |

| After expense waiver | | | (1.28 | )% | | | (2.49 | )% | | | (0.09 | )% | | | 0.83 | % | | | 0.43 | % |

Portfolio turnover rate(6) | | | 192.21 | % | | | 318.45 | % | | | 300.24 | % | | | 334.87 | % | | | 369.47 | % |

Footnotes To Financial Highlights On Following Page

The accompanying notes are an integral part of these financial statements.

FINANCIAL HIGHLIGHTS (continued)

| (1) | Net investment income (loss) before interest expense, borrowing expense on securities sold short and dividends on securities sold short for the years ended September 30, 2010, 2009, 2008, 2007 and 2006 was $0.12, $0.55, $0.02, $0.26, and $0.18, respectively. |

| (2) | Net investment income per share is calculated using ending balance after consideration of adjustments for permanent book and tax differences. |

| (3) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (4) | Amount less than $0.005 per share. |

| (5) | The Fund incurred proxy expenses of approximately $525,000 in 2007 related to shareholder approval of changes in the Fund’s fundamental investment policies and the election of trustees. |

| (6) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short positions). The denominator includes the average long positions throughout the year. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2010

Note 1 — ORGANIZATION

The Merger Fund (the “Fund”) is a no-load, open-end, non-diversified investment company organized as a trust under the laws of the Commonwealth of Massachusetts on April 12, 1982, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund was formerly known as the Risk Portfolio of The Ayco Fund. In January of 1989, the Fund’s fundamental investment policies were amended to permit the Fund to engage in merger arbitrage. At the same time, Westchester Capital Management, Inc. (the “Adviser”) became the Fund’s investment adviser, and the Fund began to do business as The Merger Fund. See Note 11 for a discussion of a transaction that will cause the Fund’s investment adviser to change. Merger arbitrage i s a highly specialized investment approach generally designed to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles.

A.Investment Valuation

Securities listed on the NASDAQ Global Market and the NASDAQ Global Select Market are valued at the NASDAQ Official Closing Price (“NOCP”). Investments in registered investment companies that are money market funds are valued at the end of day net asset value. Other listed securities are valued at the last sale price on the exchange on which such securities are primarily traded or, in the case of options, at the last sale price. Securities not listed on an exchange and securities for which there are no transactions are valued at the average of the closing bid and asked prices. When pricing options, if no sales are reported or if the last sale is outside the bid and asked parameters, the higher of the intrinsic value of the option or the mean b etween the last reported bid and asked prices will be used. Securities for which there are no such valuations are valued at fair value as determined in good faith by the Adviser under the supervision of the Board of Trustees. The Adviser reserves the right to value securities, including options, at prices other than last-sale prices, intrinsic value prices, or the average of closing bid and asked prices, when such prices are believed unrepresentative of fair market value as determined in good faith by the Adviser. When fair-value pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. In addition, due to the subjective and variable nature of fair-value pricing, it is possible that the value determined for a particular asset may be materially different from the value realized upon such asset’s sale. At September 30, 2010, the Fund did not have any fair valued securities. Inves tments in United States government securities (other than short-term securities) are valued at the average of the quoted bid and asked prices in the over-the-counter market. Short-term investments are carried at amortized cost, which approximates market value.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | Level 1 — | Quoted prices in active markets for identical securities. |

| | Level 2 — | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | Level 3 — | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following tables provide the fair value measurements of applicable Fund assets and liabilities by level within the fair value hierarchy for the Fund as of September 30, 2010. These assets and liabilities are measured on a recurring basis.

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | Assets | | | | | | | | | | | | |

| | Common Stocks* | | $ | 2,325,197,082 | | | $ | — | | | $ | — | | | $ | 2,325,197,082 | |

| | Exchange Traded Funds | | | 480,146 | | | | — | | | | — | | | | 480,146 | |

| | Preferred Stocks | | | 7,650 | | | | — | | | | — | | | | 7,650 | |

| | Warrants | | | 630,651 | | | | — | | | | — | | | | 630,651 | |

| | Convertible Bonds | | | — | | | | 51,210,200 | | | | — | | | | 51,210,200 | |

| | Corporate Bonds | | | — | | | | 69,605,540 | | | | — | | | | 69,605,540 | |

| | Purchased Put Options | | | 5,985,633 | | | | — | | | | — | | | | 5,985,633 | |

| | Short Term Investments | | | 874,252,707 | | | | — | | | | — | | | | 874,252,707 | |

| | Swap Contracts ** | | | — | | | | 6,971,111 | | | | — | | | | 6,971,111 | |

| | Liabilities | | | | | | | | | | | | | | | | |

| | Securities Sold Short | | $ | 602,805,994 | | | $ | 24,267,659 | | | $ | — | | | $ | 627,073,653 | |

| | Options Written | | | 29,283,095 | | | | — | | | | — | | | | 29,283,095 | |

| | Forward Currency | | | | | | | | | | | | | | | | |

| | Exchange Contracts ** | | | — | | | | 44,337,446 | | | | — | | | | 44,337,446 | |

| * | Please refer to the Schedule of Investments to view common stocks segregated by industry type. |

| ** | Swap contracts and forward currency exchange contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Level 3 Reconciliation Disclosure

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | Description | | Investments in Securities | |

| | Balance as of September 30, 2009 | | $ | 1,923,260 | |

| | Accrued discounts/premiums | | | — | |

| | Realized gain (loss) | | | 77,378 | |

| | Change in unrealized appreciation (depreciation) | | | — | |

| | Net purchases (sales) | | | (2,000,638 | ) |

| | Transfers in and/or out of Level 3 | | | — | |

| | Balance as of September 30, 2010 | | $ | — | |

In January, 2010 FASB issued Accounting Standards Update No. 2010-06, Improving Disclosures about Fair Value Measurements (“ASU 2010-06”). ASU 2010-06 will require new disclosures regarding transfers into and out of Levels 1 and 2 (effective for interim and annual periods beginning after December 15, 2009) as well as additional details regarding Level 3 transaction activity (effective for the interim and annual periods beginning after December 15, 2010). Management is currently evaluating the effect that this additional requirement will have on the Fund’s financial statements.

B.Securities Sold Short

The Fund may sell securities or currencies short for hedging purposes. For financial statement purposes, an amount equal to the settlement amount is initially included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities or currencies sold, but not yet purchased, may require purchasing the securities or currencies at prices which may differ from the market value reflected on the Statement of Assets and Liabilities. Short sale transactions result in off balance sheet risk because the ultimate obligation may exceed the related amounts shown in the Statement of Assets and Liabilities. The Fund will incur a loss if the price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund’s loss on a short sale is potentially unlimited because there is no upward limit on the price a borrowed security could attain.

The Fund is liable for any dividends payable on securities while those securities are sold short. As collateral for its securities sold short, the Fund is required under the 1940 Act to maintain assets consisting of cash, cash equivalents or liquid securities. These collateral assets are required to be adjusted daily to reflect changes in the value of the securities or currencies sold short.

C.Transactions with Brokers for Securities Sold Short

The Fund’s receivable from brokers for proceeds on securities sold short and deposit at brokers for securities sold short are with two securities dealers. The Fund does not require the brokers to maintain collateral in support of the receivable from brokers for proceeds on securities sold short. The Fund

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

maintains cash deposits at brokers beyond the receivable for short sales. These cash deposits are presented as deposits at brokers on the Statement of Assets and Liabilities.

D.Federal Income Taxes

No provision for federal income taxes has been made since the Fund has complied to date with the provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in future years and to distribute investment company net taxable income and net capital gains to shareholders. Additionally, the Fund intends to make all required distributions to avoid federal excise tax.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to income tax positions taken or expected to be taken on a tax return. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. As of September 30, 2010, open Federal and New York tax years include the tax years ended September 30, 2007 through 2010. The Fund has no examination in progress.

E. Written Option Contracts

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund writes (sells) covered call options to hedge portfolio investments. Uncovered put options can also be written by the Fund as part of a merger arbitrage strategy involving a pending corporate reorganization. When the Fund writes (sells) an option, an amount equal to the premium received by the Fund is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market daily to reflect the current value of the option written. By writing an option, the Fund may become obligated during the term of the option to deliver or purchase the securities underlying the option at the exercise price if the option is exercised. Option contracts are valued at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract written is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When an option expires on its stipulated expiration date or the Fund enters into a closing purchase transaction, the Fund realizes a gain or loss if the cost of the closing purchase transaction differs from the premium received when the option was sold without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is eliminated. When an option is exercised, the premium originally received decreases the cost basis of the security (or increases the proceeds on a sale of the security), and the Fund realizes a gain or loss from the sale of the underlying security. With written option contracts, there is minimal counterparty credit risk to the Fund since written option contracts are exchange traded.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

F. Purchased Options

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund purchases put or call options to hedge portfolio investments. Premiums paid for option contracts purchased are included in the Statement of Assets and Liabilities as an asset. Option contracts are valued daily at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract purchased is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When option contracts expire or are closed, realized gains or losses are rec ognized without regard to any unrealized gains or losses on the underlying securities. With purchased options, there is minimal counterparty credit risk to the Fund since purchased options are exchange traded.

G. Forward Currency Exchange Contracts

The Fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The Fund may use forward currency exchange contracts to hedge against changes in the value of foreign currencies. The Fund may enter into forward currency exchange contracts obligating the Fund to deliver and receive a currency at a specified future date. Forward contracts are valued daily, and unrealized appreciation or depreciation is recorded daily as the difference between the contract exchange rate and the closing forward rate applied to the face amount of the contract. A realized gain or loss is recorded at the time the forward contract expires. With forward contracts, there is minimal counterparty credit risk to the Fund since forw ard contracts are exchange traded.

The use of forward currency exchange contracts does not eliminate fluctuations in the underlying prices of the Fund’s investment securities; however, it does establish a rate of exchange that can be achieved in the future. The use of forward currency exchange contracts involves the risk that anticipated currency movements will not be accurately predicted. A forward currency exchange contract would limit the risk of loss due to a decline in the value of a particular currency; however it would also limit any potential gain that might result should the value of the currency increase instead of decrease. These contracts may involve market risk in excess of the amount of receivable or payable reflected on the Statement of Assets and Liabilities.

H. Equity Swap Contracts

The Fund is subject to equity price risk and interest rate risk in the normal course of pursuing its investment objectives. The Fund has entered into both long and short equity swap contracts with multiple broker-dealers. A long equity swap contract entitles the Fund to receive from the counterparty any appreciation and dividends paid on an individual security, while obligating the Fund to pay the counterparty any depreciation on the security as well as interest on the notional amount of the contract at a rate equal to LIBOR plus 25 to 100 basis points. A short equity swap contract obligates the Fund to pay the counterparty any appreciation and dividends paid on an individual security, while entitling the Fund to receive from the counterparty any depreciation on the security a s well as interest on the notional value of the contract at a rate equal to LIBOR less 25 to 100 basis points.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund may also enter into equity swap contracts whose value is determined by the spread between a long equity position and a short equity position. This type of swap contract obligates the Fund to pay the counterparty an amount tied to any increase in the spread between the two securities over the term of the contract. The Fund is also obligated to pay the counterparty any dividends paid on the short equity holding as well as any net financing costs. This type of swap contract entitles the Fund to receive from the counterparty any gains based on a decrease in the spread as well as any dividends paid on the long equity holding and any net interest income.

Fluctuations in the value of an open contract are recorded daily as a net unrealized gain or loss. The Fund will realize a gain or loss upon termination or reset of the contract. Either party, under certain conditions, may terminate the contract prior to the contract’s expiration date.

Credit risk may arise as a result of the failure of the counterparty to comply with the terms of the contract. The Fund considers the creditworthiness of each counterparty to a contract in evaluating potential credit risk quarterly. The counterparty risk to the Fund is limited to the net unrealized gain, if any, on the contract, along with dividends receivable on long equity contracts and interest receivable on short equity contracts. Additionally, risk may arise from unanticipated movements in interest rates or in the value of the underlying securities.

I.Distributions to Shareholders

Dividends from net investment income and net realized capital gains, if any, are declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences are due primarily to wash sale-loss deferrals, constructive sales, straddle-loss deferrals, adjustments on swap contracts, and unrealized gains or losses on Section 1256 contracts, which were realized, for tax purposes, at September 30, 2010. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes. At September 30, 2 010, the Fund increased accumulated undistributed net investment income by $36,058,633, reduced accumulated undistributed net gain by $53,947,813, and increased paid-in capital by $17,889,180.

J.Foreign Securities

Investing in securities of foreign companies involves special risks and considerations not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and adverse political and economic developments. Moreover, securities of many foreign companies and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government.

K.Foreign Currency Translation

The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities. However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gain or loss from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences.

L.When-Issued Securities

The Fund may engage in securities transactions on a when-issued or delayed-delivery basis. Although the payment and interest terms of these securities are established at the time the Fund enters into the agreement, these securities may be delivered for cash proceeds at a future date. During this period, the securities are subject to market fluctuations. The Fund records sales of when-issued securities and reflects the values of such securities in determining net asset value in the same manner as other open short-sale positions. When delayed-delivery purchases are outstanding, the Fund segregates and maintains at all times cash, cash equivalents or other liquid securities in an amount at least equal to the market value.

M.Cash Equivalents

The Fund considers highly liquid temporary cash investments purchased with an original maturity of less than three months to be cash equivalents. Cash equivalents are included in short-term investments on the Schedule of Investments as well as in investments on the Statement of Assets and Liabilities.

N.Guarantees and Indemnifications

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

O.Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires the Adviser to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

P.Other

Investment and shareholder transactions are recorded on the trade date. Realized gains and losses from security transactions are recorded on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest is accounted for on the accrual basis and includes amortization of premiums and discounts on the interest method. Expenses include $4,655,625 of borrowing expense on securities sold short. The Fund may utilize derivative instruments such as

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

September 30, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

options, forward currency exchange contracts and other instruments with similar characteristics to the extent that they are consistent with the Fund’s investment objectives and limitations. The use of these instruments may involve additional investment risks, including the possibility of illiquid markets or imperfect correlation between the value of the instruments and the underlying securities.

Q.Counterparty Risk

The Fund helps manage counterparty credit risk by entering into agreements only with counterparties the Adviser believes have the financial resources to honor their obligations and by having the Adviser monitor the financial stability of the counterparties. Collateral pledges are monitored and subsequently adjusted if and when the valuations fluctuate, either up or down, by at least the predetermined threshold amount.

R.The Right to Offset

Financial assets and liabilities as well as cash collateral received and posted are offset by counterparty, and the net amount is reported in the consolidated statement of financial condition when the Fund believes there exists a legally enforceable right to set off the recognized amounts.

S.Derivatives

The Fund has adopted authoritative standards regarding disclosure about derivatives and hedging activities and how they affect the Fund’s Statement of Assets and Liabilities and Statement of Operations. For the year ended September 30, 2010: long option contracts (261,998 contracts) were purchased and $84,735,536 premiums were paid, written option contracts (1,616,434 contracts) were opened and $278,506,601 premiums were received, equity swap contracts were opened for a notional value of $1,620,889,914 and closed for a notional value of $1,116,548,684 and an average of 17 forward currency exchange contract positions were open during the year.

Statement of Assets and Liabilities

Fair values of derivative instruments as of September 30, 2010:

| | | | Asset Derivatives | | | Liability Derivatives | |

| | | | Statement of Assets | | | | | | Statement of Assets | | | | |

| | | | and Liabilities | | | | | | and Liabilities | | | | |

| | Derivatives | | Location | | | Fair Value | | | Location | | | Fair Value | |

| | Equity Price Risk: | | | | | | | | | | | | |

| | Purchased Options | | Investments | | | $ | 5,985,633 | | | N/A | | | $ | — | |