UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03462

Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2024

Date of reporting period: June 30, 2024

Item 1. Report to Stockholders.

0000702435mf:SPMidCap4001AdditionalIndexMember2015-09-300000702435mf:MorningstarModeratelyConservativeTargetRiskIndex27AdditionalIndexMember2024-01-012024-06-300000702435mf:Russell3000Index6BroadBasedIndexMember2024-04-300000702435mf:Russell3000Index10BroadBasedIndexMember2021-08-310000702435mf:MorningstarAggressiveTargetRiskIndex11AdditionalIndexMember2022-10-310000702435mf:Russell3000Index12BroadBasedIndexMember2024-06-30

Semi-Annual Shareholder Report

June 30, 2024

This semi-annual shareholder report contains important information about the Muirfield Fund for the period of December 31, 2023, to 6/30/2024, as well as certain changes to the Fund. You can find additional information about the Fund at meederinvestment.com/mutual-funds . You can also request this information by contacting us at 866.633.3371 .

What were the Fund's costs for the period?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| Retail Class | $59.90 | 1.13% |

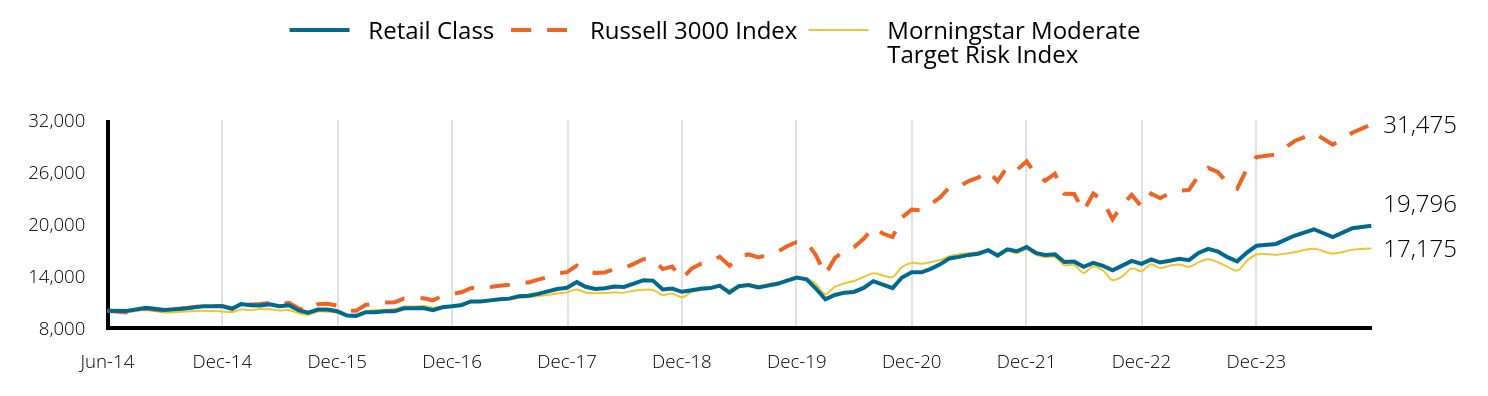

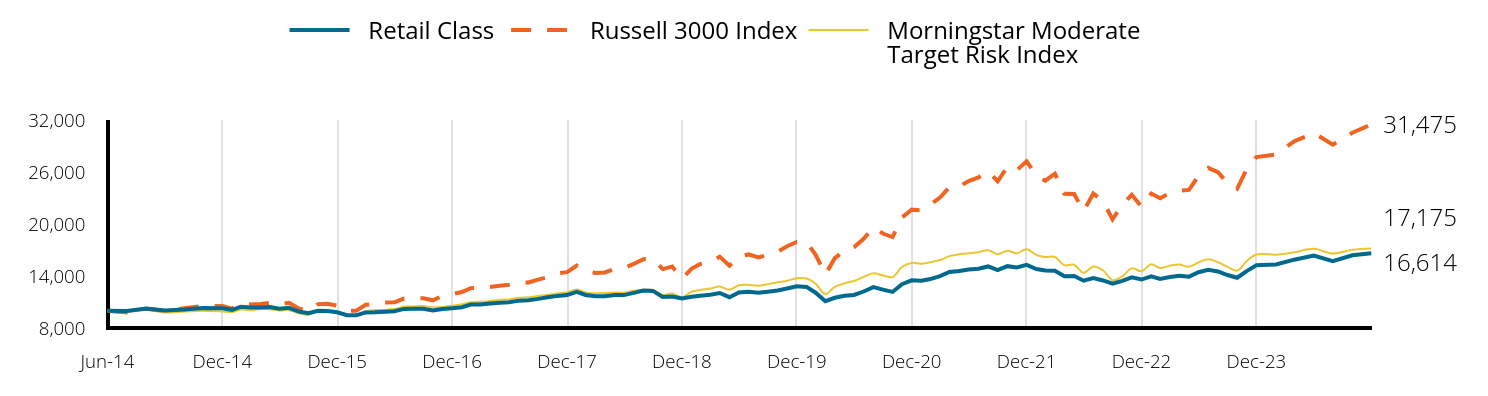

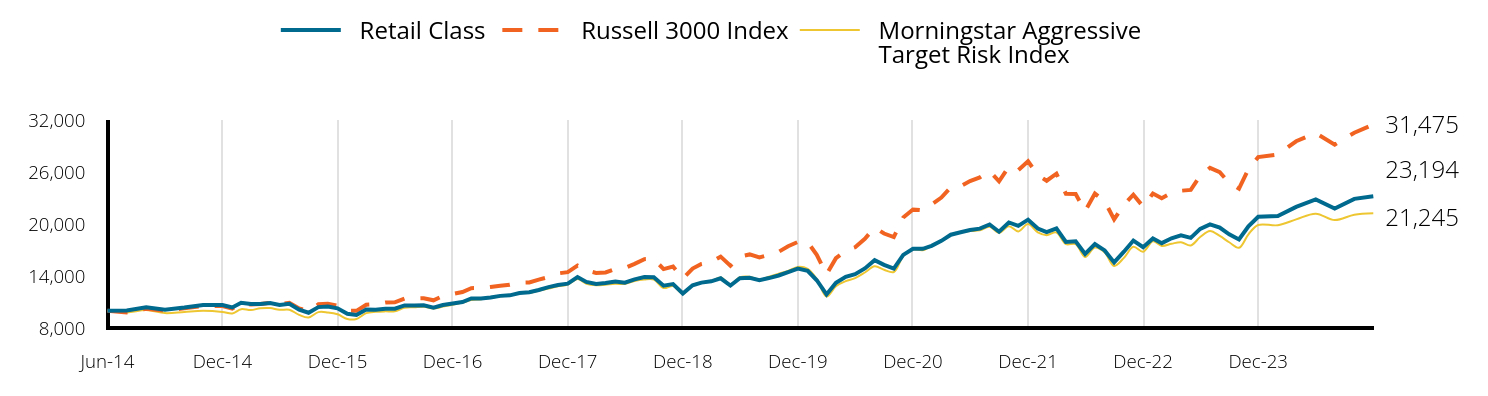

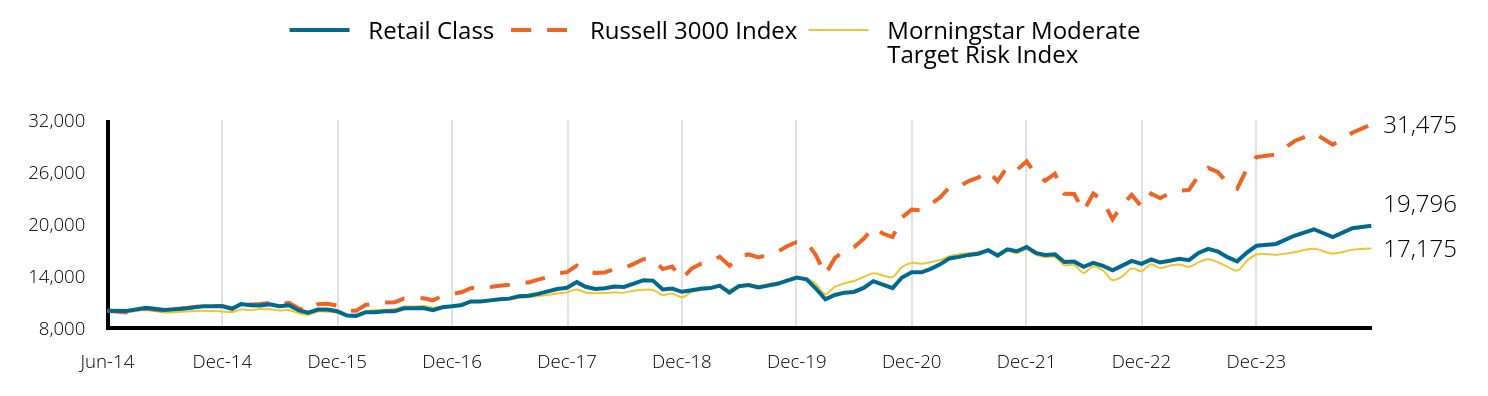

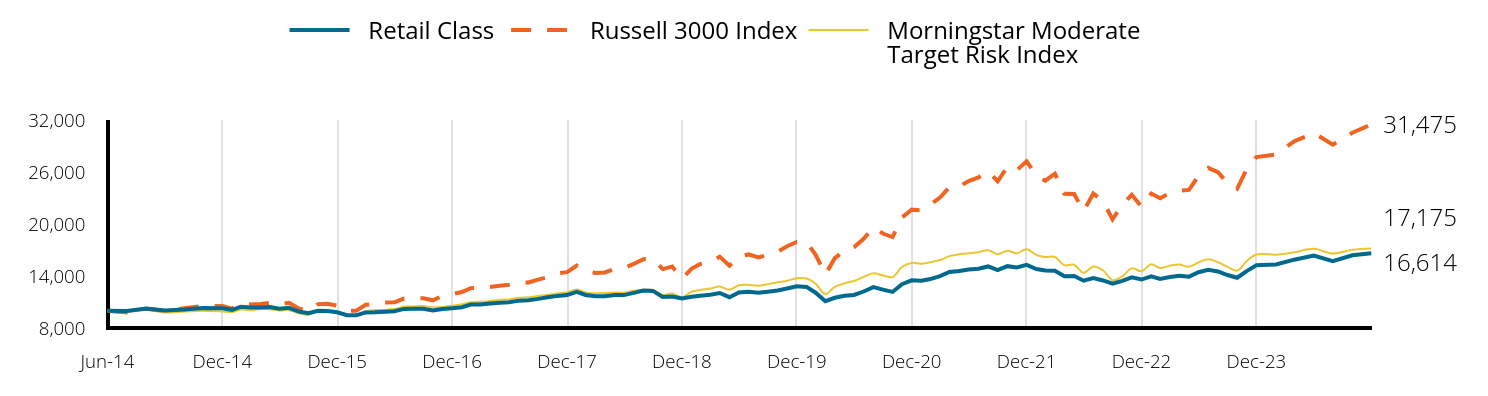

Total Return Based on a $10,000 Investment

| Retail Class | Russell 3000 Index | Morningstar Moderate Target Risk Index |

|---|

| Jun-14 | 10,000 | 10,000 | 10,000 |

| Jul-14 | 9,960 | 9,803 | 9,861 |

| Aug-14 | 10,337 | 10,214 | 10,063 |

| Sep-14 | 10,070 | 10,001 | 9,801 |

| Oct-14 | 10,236 | 10,276 | 9,909 |

| Nov-14 | 10,512 | 10,525 | 10,002 |

| Dec-14 | 10,516 | 10,525 | 9,915 |

| Jan-15 | 10,217 | 10,232 | 9,841 |

| Feb-15 | 10,756 | 10,825 | 10,129 |

| Mar-15 | 10,621 | 10,715 | 10,051 |

| Apr-15 | 10,606 | 10,763 | 10,184 |

| May-15 | 10,726 | 10,912 | 10,176 |

| Jun-15 | 10,516 | 10,729 | 10,030 |

| Jul-15 | 10,621 | 10,909 | 10,054 |

| Aug-15 | 10,022 | 10,250 | 9,694 |

| Sep-15 | 9,767 | 9,952 | 9,515 |

| Oct-15 | 10,127 | 10,738 | 9,916 |

| Nov-15 | 10,127 | 10,797 | 9,874 |

| Dec-15 | 9,938 | 10,576 | 9,738 |

| Jan-16 | 9,446 | 9,979 | 9,429 |

| Feb-16 | 9,400 | 9,976 | 9,474 |

| Mar-16 | 9,830 | 10,678 | 9,947 |

| Apr-16 | 9,815 | 10,744 | 10,072 |

| May-16 | 9,938 | 10,936 | 10,101 |

| Jun-16 | 9,922 | 10,959 | 10,186 |

| Jul-16 | 10,276 | 11,394 | 10,470 |

| Aug-16 | 10,291 | 11,423 | 10,492 |

| Sep-16 | 10,307 | 11,441 | 10,532 |

| Oct-16 | 10,050 | 11,193 | 10,378 |

| Nov-16 | 10,389 | 11,694 | 10,435 |

| Dec-16 | 10,507 | 11,922 | 10,572 |

| Jan-17 | 10,661 | 12,147 | 10,743 |

| Feb-17 | 11,064 | 12,599 | 10,960 |

| Mar-17 | 11,048 | 12,607 | 11,015 |

| Apr-17 | 11,188 | 12,741 | 11,130 |

| May-17 | 11,312 | 12,871 | 11,258 |

| Jun-17 | 11,389 | 12,987 | 11,301 |

| Jul-17 | 11,652 | 13,232 | 11,494 |

| Aug-17 | 11,714 | 13,258 | 11,551 |

| Sep-17 | 11,931 | 13,581 | 11,685 |

| Oct-17 | 12,226 | 13,877 | 11,831 |

| Nov-17 | 12,505 | 14,299 | 11,991 |

| Dec-17 | 12,638 | 14,442 | 12,122 |

| Jan-18 | 13,292 | 15,203 | 12,451 |

| Feb-18 | 12,756 | 14,642 | 12,094 |

| Mar-18 | 12,504 | 14,349 | 12,016 |

| Apr-18 | 12,588 | 14,403 | 12,029 |

| May-18 | 12,789 | 14,810 | 12,102 |

| Jun-18 | 12,739 | 14,907 | 12,084 |

| Jul-18 | 13,108 | 15,401 | 12,294 |

| Aug-18 | 13,510 | 15,942 | 12,402 |

| Sep-18 | 13,468 | 15,968 | 12,389 |

| Oct-18 | 12,444 | 14,793 | 11,805 |

| Nov-18 | 12,544 | 15,089 | 11,970 |

| Dec-18 | 12,176 | 13,685 | 11,545 |

| Jan-19 | 12,346 | 14,859 | 12,179 |

| Feb-19 | 12,516 | 15,382 | 12,390 |

| Mar-19 | 12,601 | 15,606 | 12,547 |

| Apr-19 | 12,890 | 16,230 | 12,789 |

| May-19 | 12,091 | 15,179 | 12,407 |

| Jun-19 | 12,822 | 16,246 | 12,940 |

| Jul-19 | 12,959 | 16,487 | 12,981 |

| Aug-19 | 12,669 | 16,151 | 12,870 |

| Sep-19 | 12,891 | 16,434 | 13,059 |

| Oct-19 | 13,095 | 16,788 | 13,275 |

| Nov-19 | 13,454 | 17,426 | 13,459 |

| Dec-19 | 13,824 | 17,929 | 13,742 |

| Jan-20 | 13,614 | 17,910 | 13,706 |

| Feb-20 | 12,583 | 16,444 | 13,098 |

| Mar-20 | 11,307 | 14,182 | 11,903 |

| Apr-20 | 11,814 | 16,061 | 12,751 |

| May-20 | 12,076 | 16,919 | 13,159 |

| Jun-20 | 12,163 | 17,306 | 13,419 |

| Jul-20 | 12,619 | 18,289 | 13,896 |

| Aug-20 | 13,408 | 19,614 | 14,312 |

| Sep-20 | 12,999 | 18,900 | 14,063 |

| Oct-20 | 12,595 | 18,492 | 13,875 |

| Nov-20 | 13,826 | 20,741 | 15,043 |

| Dec-20 | 14,426 | 21,675 | 15,504 |

| Jan-21 | 14,426 | 21,578 | 15,409 |

| Feb-21 | 14,795 | 22,253 | 15,596 |

| Mar-21 | 15,341 | 23,050 | 15,840 |

| Apr-21 | 16,027 | 24,238 | 16,296 |

| May-21 | 16,203 | 24,349 | 16,521 |

| Jun-21 | 16,431 | 24,950 | 16,629 |

| Jul-21 | 16,572 | 25,371 | 16,748 |

| Aug-21 | 16,977 | 26,095 | 16,967 |

| Sep-21 | 16,359 | 24,924 | 16,517 |

| Oct-21 | 17,084 | 26,610 | 16,924 |

| Nov-21 | 16,855 | 26,205 | 16,617 |

| Dec-21 | 17,340 | 27,236 | 17,084 |

| Jan-22 | 16,630 | 25,634 | 16,439 |

| Feb-22 | 16,430 | 24,988 | 16,187 |

| Mar-22 | 16,503 | 25,799 | 16,197 |

| Apr-22 | 15,612 | 23,484 | 15,250 |

| May-22 | 15,666 | 23,452 | 15,294 |

| Jun-22 | 15,066 | 21,490 | 14,361 |

| Jul-22 | 15,521 | 23,506 | 15,096 |

| Aug-22 | 15,157 | 22,629 | 14,636 |

| Sep-22 | 14,647 | 20,531 | 13,511 |

| Oct-22 | 15,194 | 22,214 | 13,963 |

| Nov-22 | 15,744 | 23,374 | 14,876 |

| Dec-22 | 15,401 | 22,005 | 14,559 |

| Jan-23 | 15,924 | 23,521 | 15,358 |

| Feb-23 | 15,550 | 22,971 | 14,924 |

| Mar-23 | 15,756 | 23,585 | 15,189 |

| Apr-23 | 15,980 | 23,837 | 15,328 |

| May-23 | 15,831 | 23,929 | 15,059 |

| Jun-23 | 16,655 | 25,563 | 15,566 |

| Jul-23 | 17,125 | 26,480 | 15,938 |

| Aug-23 | 16,824 | 25,968 | 15,584 |

| Sep-23 | 16,166 | 24,731 | 15,055 |

| Oct-23 | 15,695 | 24,076 | 14,625 |

| Nov-23 | 16,675 | 26,321 | 15,703 |

| Dec-23 | 17,486 | 27,717 | 16,485 |

| Jan-24 | 17,698 | 28,024 | 16,464 |

| Feb-24 | 18,641 | 29,541 | 16,731 |

| Mar-24 | 19,391 | 30,494 | 17,130 |

| Apr-24 | 18,485 | 29,152 | 16,592 |

| May-24 | 19,507 | 30,530 | 17,030 |

| Jun-24 | 19,796 | 31,475 | 17,175 |

The Growth of $10,000 chart compares the performance of the Fund over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

| Total Net Assets | $868,805,924 |

| # of Portfolio Holdings | 161 |

| Portfolio Turnover Rate | 150% |

| Advisory Fees and Waivers | 2,543,674 |

Average Annual Total Returns

| . | 1 Year | 5 Year | 10 Year |

|---|

| Retail Class | 18.86% | 9.07% | 7.07% |

| Russell 3000 Index | 23.13% | 14.14% | 12.15% |

| Morningstar Moderate Target Risk Index | 10.34% | 5.83% | 5.56% |

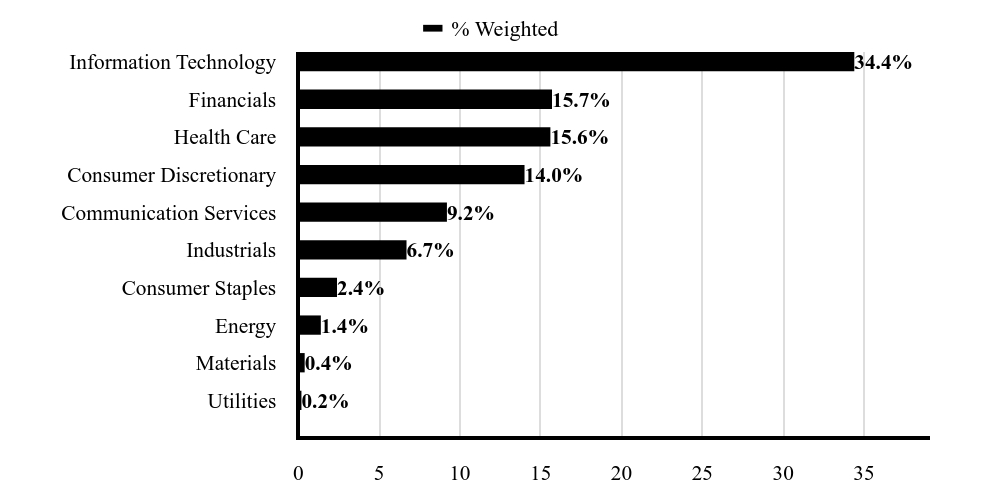

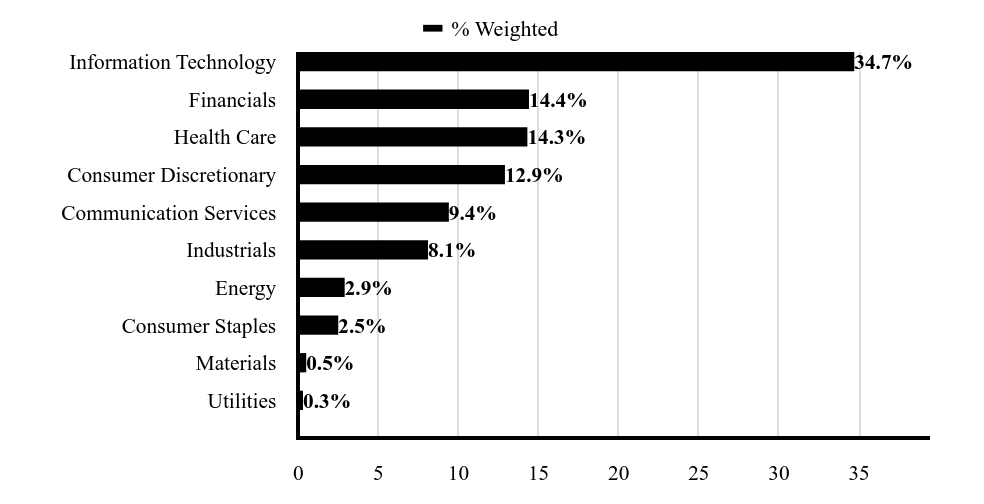

What did the Fund invest in?

| Berkshire Hathaway Inc | 7.2% |

| Microsoft Corp | 5.9% |

| NVIDIA Corp | 4.6% |

| Amazon.com Inc | 4.0% |

| Alphabet Inc | 3.6% |

| Apple Inc | 2.6% |

| Texas Instruments Inc | 2.6% |

| Meta Platforms Inc | 2.4% |

| Johnson & Johnson | 1.9% |

| Merck & Co Inc | 1.9% |

| As a percentage of total net assets. Holdings exclude short-term investments and derivatives. |

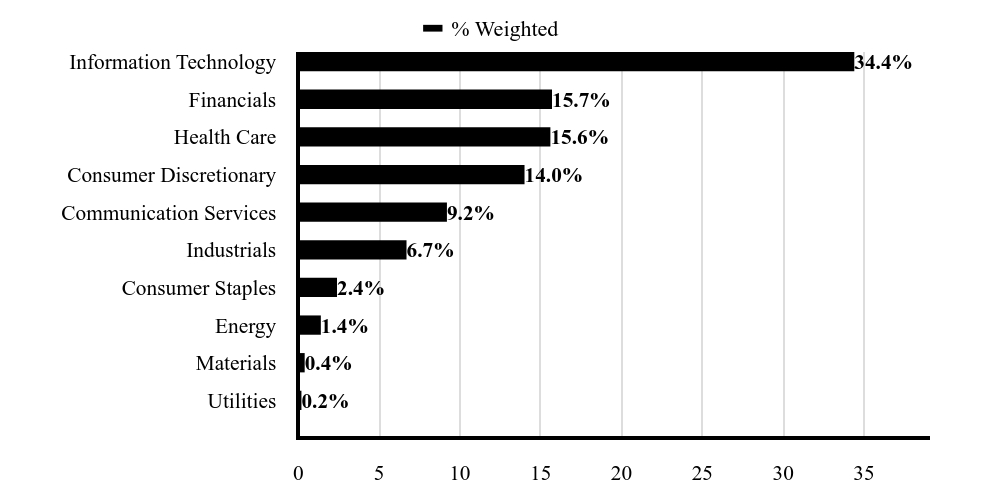

| Value | Value |

|---|

| Utilities | 0.2%Footnote Reference |

| Materials | 0.4%Footnote Reference |

| Energy | 1.4%Footnote Reference |

| Consumer Staples | 2.4%Footnote Reference |

| Industrials | 6.7%Footnote Reference |

| Communication Services | 9.2%Footnote Reference |

| Consumer Discretionary | 14.0%Footnote Reference |

| Health Care | 15.6%Footnote Reference |

| Financials | 15.7%Footnote Reference |

| Information Technology | 34.4%Footnote Reference |

| Footnote | Description |

Footnote | As a percentage of total common stocks. Concentrations are subject to change. |

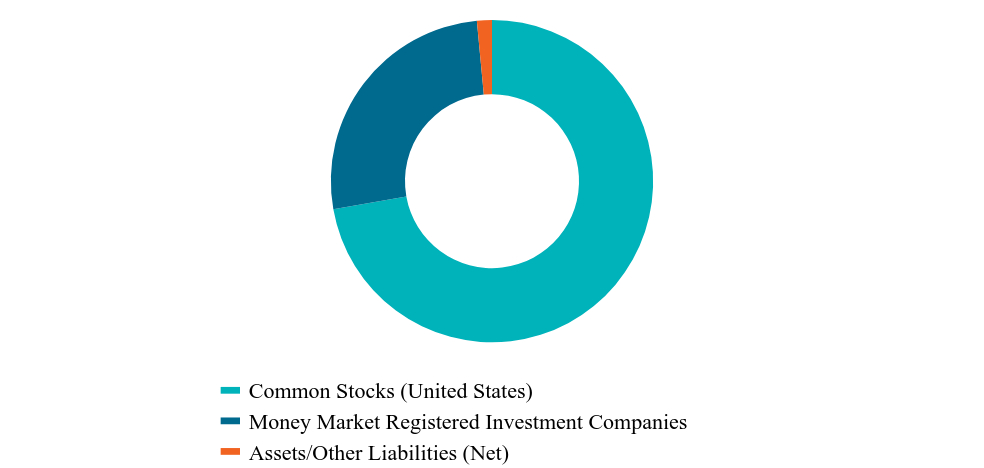

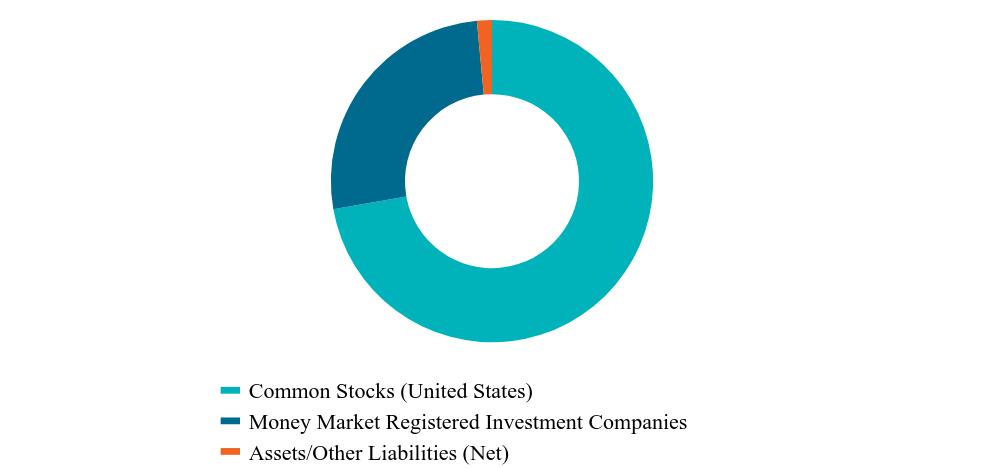

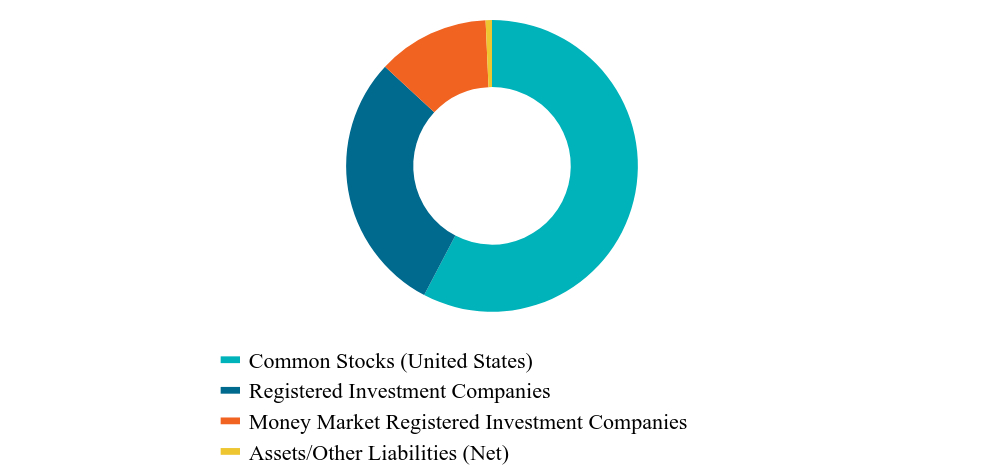

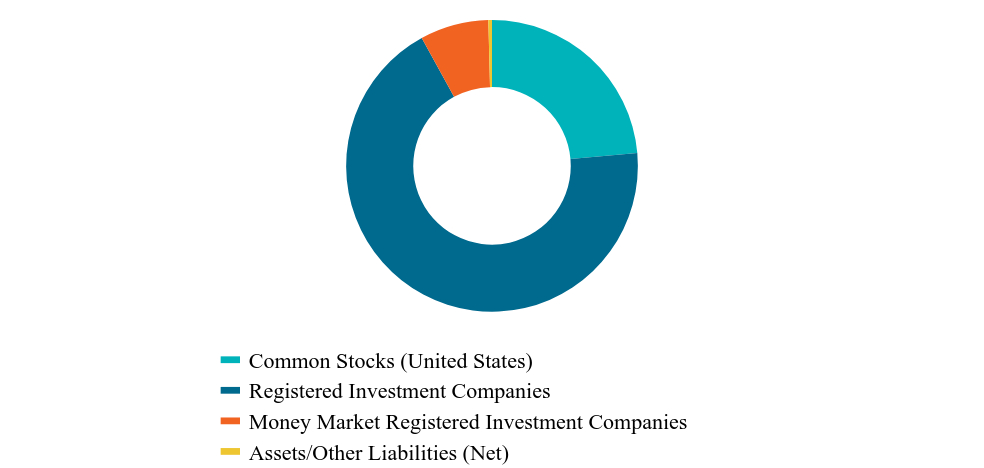

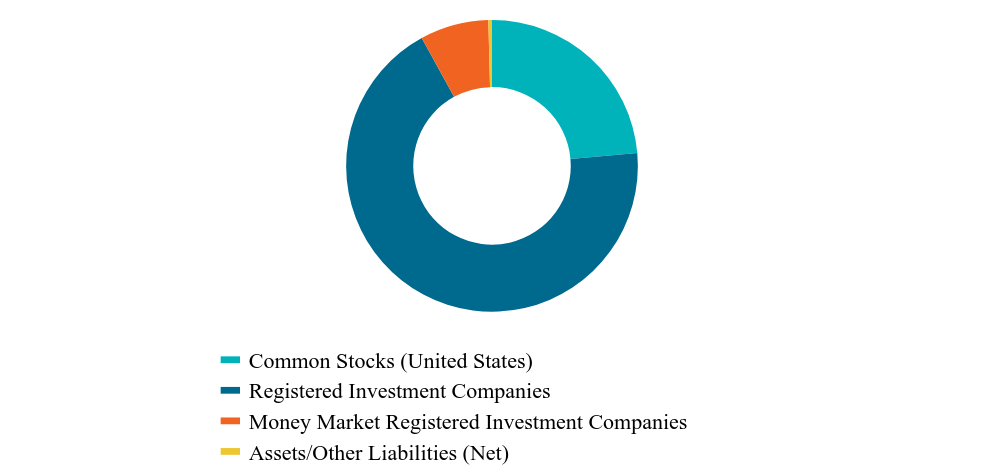

| Value | Value |

|---|

| Common Stocks (United States) | 72.2%Footnote Reference |

| Money Market Registered Investment Companies | 26.3%Footnote Reference |

| Assets/Other Liabilities (Net) | 1.5% |

| Footnote | Description |

Footnote | As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, proxy voting information and other important materials, scan the QR code or visit www.meederinvestment.com/meeder-funds-resources.

To reduce fund expenses, only one copy of most shareholder documents are delivered to shareholders with multiple accounts at the same address. If you wish to receive copies of this document for each account, please contact the Meeder Funds at 866.633.3371 or contact your financial intermediary.

Semi-Annual Shareholder Report

June 30, 2024

Semi-Annual Shareholder Report

June 30, 2024

This semi-annual shareholder report contains important information about the Global Allocation Fund for the period of December 31, 2023, to 6/30/2024, as well as certain changes to the Fund. You can find additional information about the Fund at meederinvestment.com/mutual-funds . You can also request this information by contacting us at 866.633.3371 .

What were the Fund's costs for the period?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| Adviser Class | $72.94 | 1.41% |

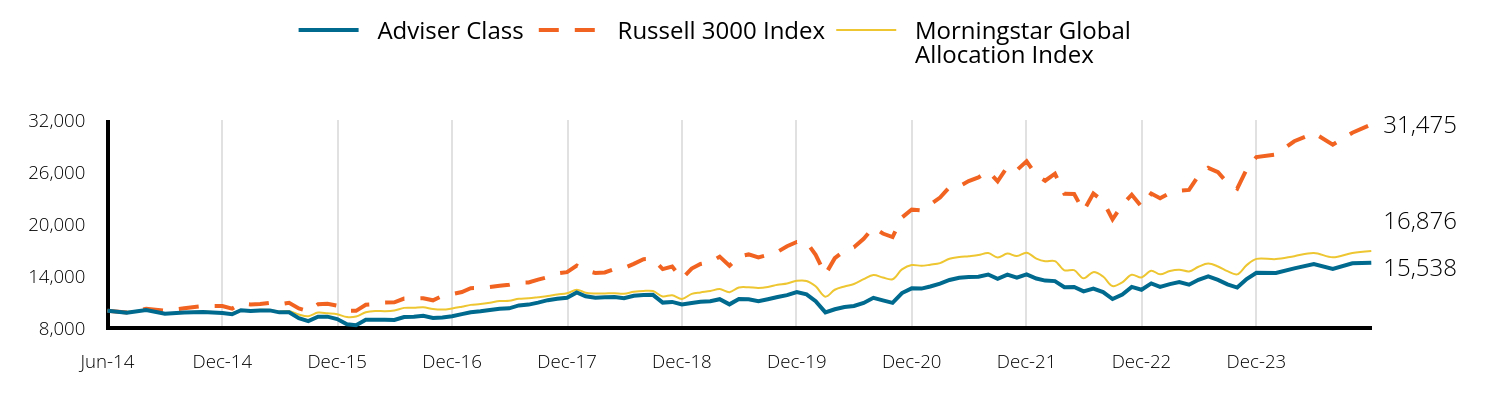

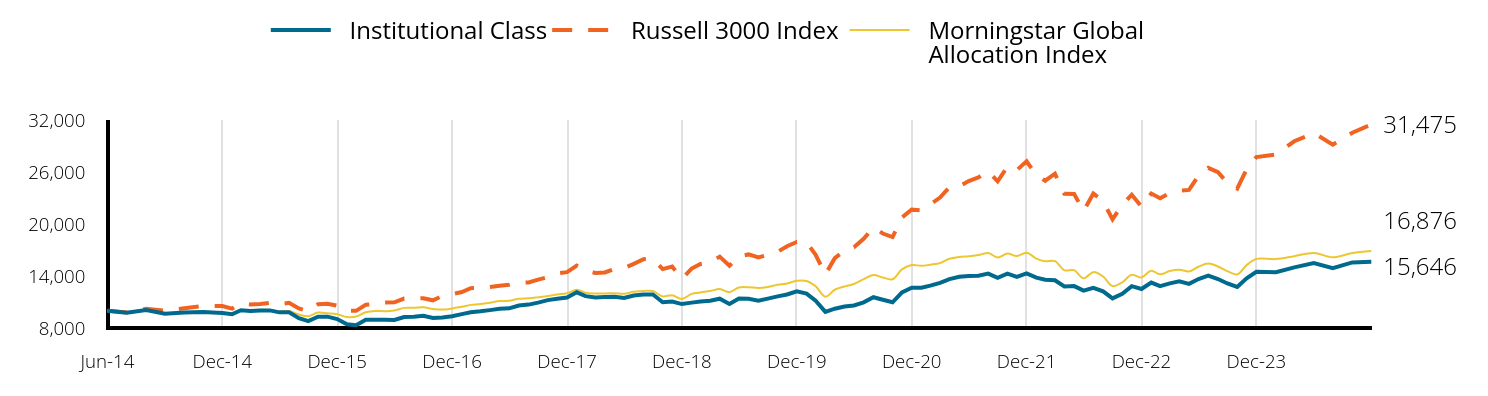

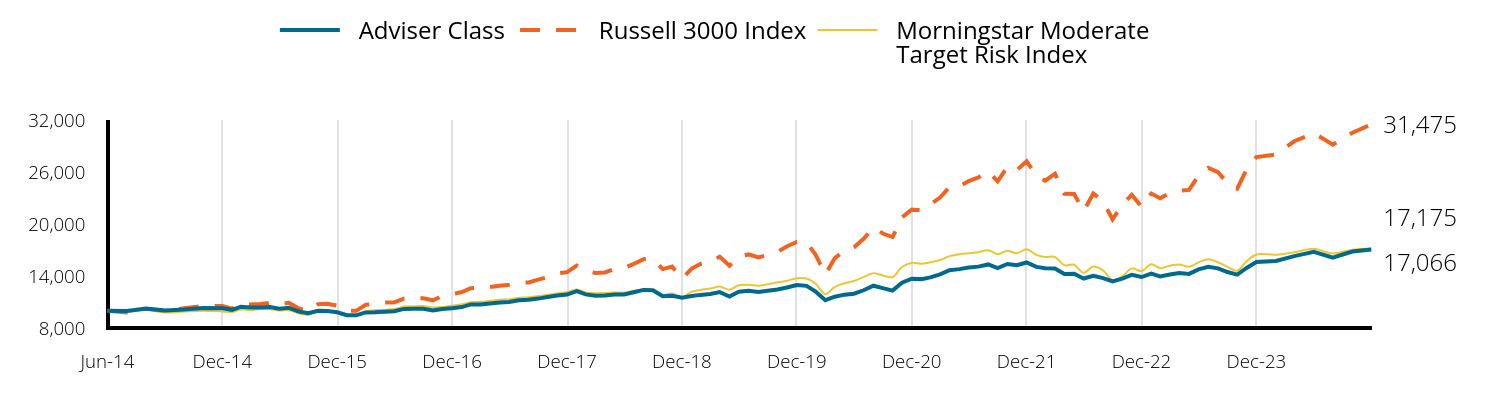

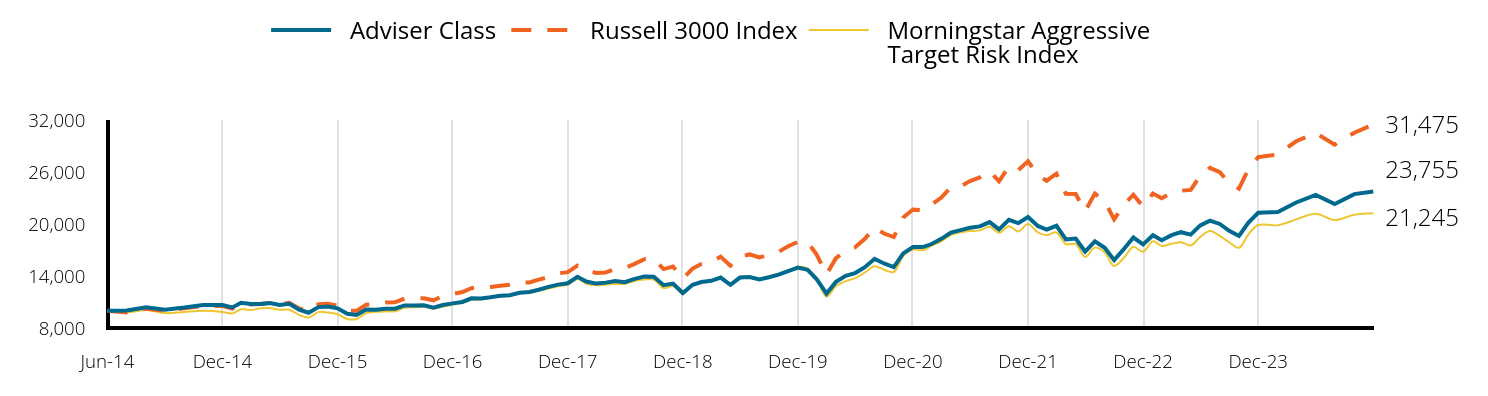

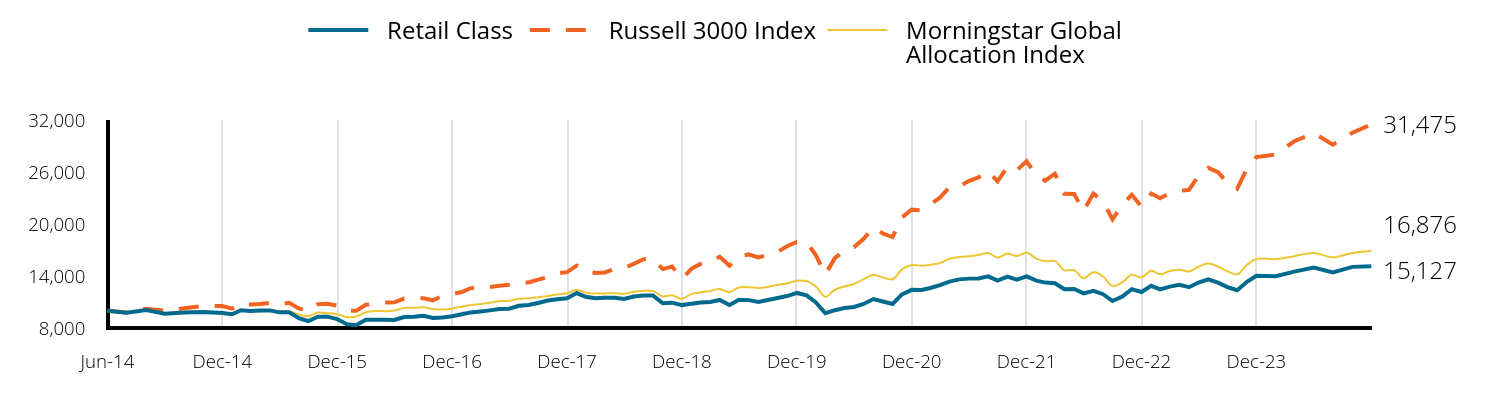

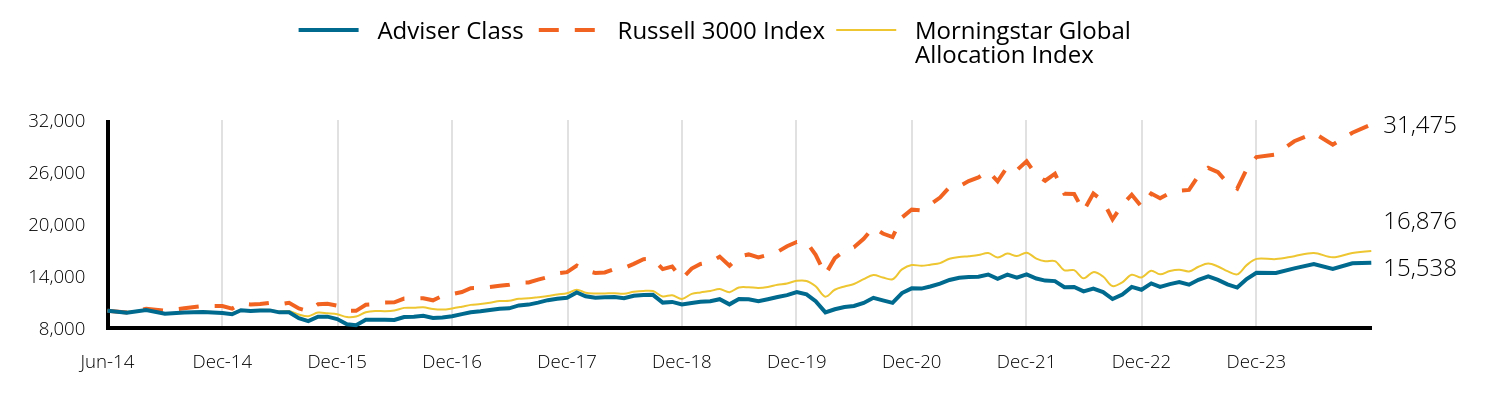

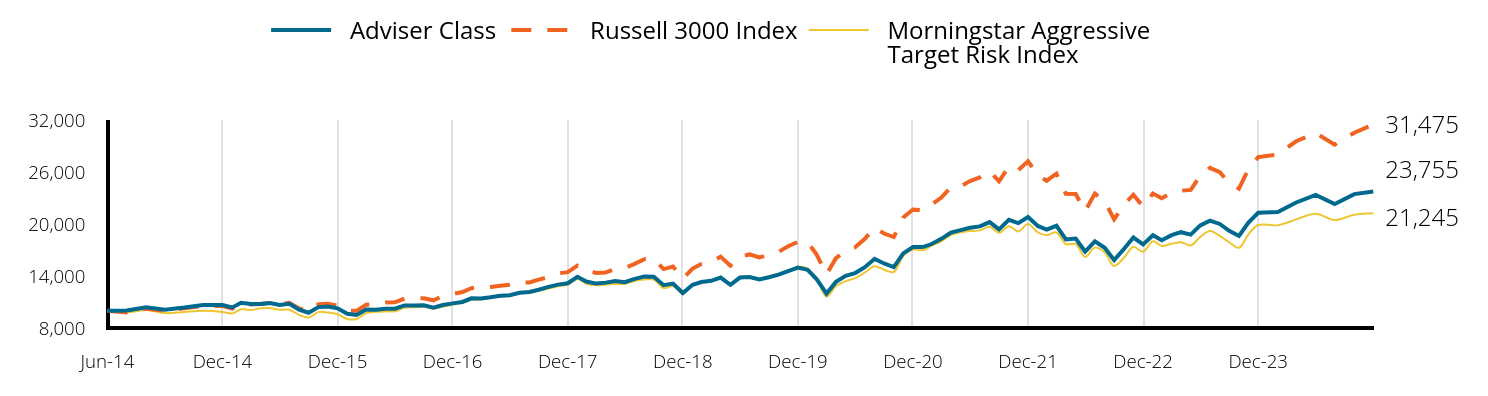

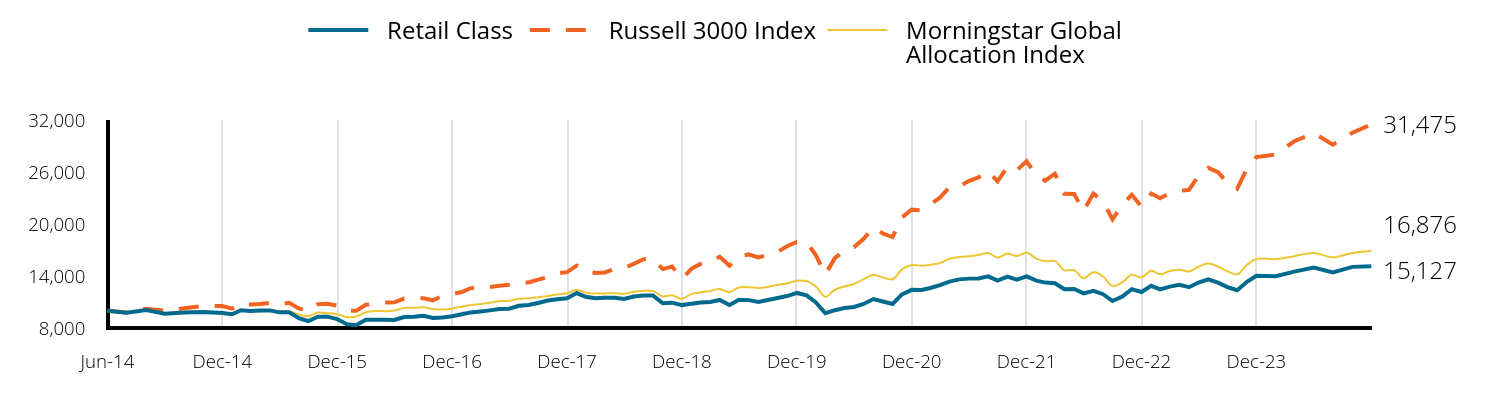

Total Return Based on a $10,000 Investment

| Adviser Class | Russell 3000 Index | Morningstar Global Allocation Index |

|---|

| Jun-14 | 10,000 | 10,000 | 10,000 |

| Jul-14 | 9,757 | 9,803 | 9,872 |

| Aug-14 | 10,073 | 10,214 | 10,046 |

| Sep-14 | 9,655 | 10,001 | 9,734 |

| Oct-14 | 9,793 | 10,276 | 9,803 |

| Nov-14 | 9,834 | 10,525 | 9,890 |

| Dec-14 | 9,731 | 10,525 | 9,778 |

| Jan-15 | 9,590 | 10,232 | 9,722 |

| Feb-15 | 10,049 | 10,825 | 10,021 |

| Mar-15 | 9,956 | 10,715 | 9,947 |

| Apr-15 | 10,012 | 10,763 | 10,113 |

| May-15 | 10,031 | 10,912 | 10,073 |

| Jun-15 | 9,806 | 10,729 | 9,918 |

| Jul-15 | 9,806 | 10,909 | 9,951 |

| Aug-15 | 9,131 | 10,250 | 9,561 |

| Sep-15 | 8,793 | 9,952 | 9,369 |

| Oct-15 | 9,309 | 10,738 | 9,775 |

| Nov-15 | 9,309 | 10,797 | 9,688 |

| Dec-15 | 9,029 | 10,576 | 9,584 |

| Jan-16 | 8,439 | 9,979 | 9,263 |

| Feb-16 | 8,323 | 9,976 | 9,324 |

| Mar-16 | 8,951 | 10,678 | 9,819 |

| Apr-16 | 8,951 | 10,744 | 9,968 |

| May-16 | 8,942 | 10,936 | 9,939 |

| Jun-16 | 8,922 | 10,959 | 10,020 |

| Jul-16 | 9,272 | 11,394 | 10,321 |

| Aug-16 | 9,301 | 11,423 | 10,337 |

| Sep-16 | 9,398 | 11,441 | 10,398 |

| Oct-16 | 9,145 | 11,193 | 10,193 |

| Nov-16 | 9,213 | 11,694 | 10,123 |

| Dec-16 | 9,359 | 11,922 | 10,255 |

| Jan-17 | 9,604 | 12,147 | 10,462 |

| Feb-17 | 9,819 | 12,599 | 10,668 |

| Mar-17 | 9,927 | 12,607 | 10,759 |

| Apr-17 | 10,064 | 12,741 | 10,912 |

| May-17 | 10,210 | 12,871 | 11,106 |

| Jun-17 | 10,269 | 12,987 | 11,139 |

| Jul-17 | 10,602 | 13,232 | 11,369 |

| Aug-17 | 10,700 | 13,258 | 11,434 |

| Sep-17 | 10,925 | 13,581 | 11,555 |

| Oct-17 | 11,210 | 13,877 | 11,690 |

| Nov-17 | 11,366 | 14,299 | 11,872 |

| Dec-17 | 11,497 | 14,442 | 12,005 |

| Jan-18 | 12,095 | 15,203 | 12,424 |

| Feb-18 | 11,657 | 14,642 | 12,072 |

| Mar-18 | 11,487 | 14,349 | 11,984 |

| Apr-18 | 11,557 | 14,403 | 11,991 |

| May-18 | 11,567 | 14,810 | 12,009 |

| Jun-18 | 11,428 | 14,907 | 11,965 |

| Jul-18 | 11,718 | 15,401 | 12,171 |

| Aug-18 | 11,818 | 15,942 | 12,274 |

| Sep-18 | 11,828 | 15,968 | 12,259 |

| Oct-18 | 10,928 | 14,793 | 11,646 |

| Nov-18 | 11,008 | 15,089 | 11,781 |

| Dec-18 | 10,723 | 13,685 | 11,343 |

| Jan-19 | 10,881 | 14,859 | 11,936 |

| Feb-19 | 11,017 | 15,382 | 12,108 |

| Mar-19 | 11,095 | 15,606 | 12,258 |

| Apr-19 | 11,326 | 16,230 | 12,491 |

| May-19 | 10,728 | 15,179 | 12,132 |

| Jun-19 | 11,352 | 16,246 | 12,678 |

| Jul-19 | 11,310 | 16,487 | 12,699 |

| Aug-19 | 11,100 | 16,151 | 12,622 |

| Sep-19 | 11,321 | 16,434 | 12,738 |

| Oct-19 | 11,573 | 16,788 | 12,980 |

| Nov-19 | 11,794 | 17,426 | 13,144 |

| Dec-19 | 12,154 | 17,929 | 13,445 |

| Jan-20 | 11,887 | 17,910 | 13,427 |

| Feb-20 | 11,084 | 16,444 | 12,806 |

| Mar-20 | 9,799 | 14,182 | 11,616 |

| Apr-20 | 10,163 | 16,061 | 12,412 |

| May-20 | 10,420 | 16,919 | 12,797 |

| Jun-20 | 10,537 | 17,306 | 13,078 |

| Jul-20 | 10,891 | 18,289 | 13,629 |

| Aug-20 | 11,480 | 19,614 | 14,116 |

| Sep-20 | 11,191 | 18,900 | 13,831 |

| Oct-20 | 10,900 | 18,492 | 13,628 |

| Nov-20 | 12,030 | 20,741 | 14,763 |

| Dec-20 | 12,571 | 21,675 | 15,266 |

| Jan-21 | 12,548 | 21,578 | 15,169 |

| Feb-21 | 12,791 | 22,253 | 15,303 |

| Mar-21 | 13,110 | 23,050 | 15,482 |

| Apr-21 | 13,539 | 24,238 | 15,991 |

| May-21 | 13,803 | 24,349 | 16,188 |

| Jun-21 | 13,891 | 24,950 | 16,286 |

| Jul-21 | 13,924 | 25,371 | 16,410 |

| Aug-21 | 14,167 | 26,095 | 16,645 |

| Sep-21 | 13,682 | 24,924 | 16,134 |

| Oct-21 | 14,156 | 26,610 | 16,585 |

| Nov-21 | 13,814 | 26,205 | 16,303 |

| Dec-21 | 14,192 | 27,236 | 16,687 |

| Jan-22 | 13,703 | 25,634 | 16,008 |

| Feb-22 | 13,471 | 24,988 | 15,700 |

| Mar-22 | 13,410 | 25,799 | 15,716 |

| Apr-22 | 12,701 | 23,484 | 14,653 |

| May-22 | 12,738 | 23,452 | 14,672 |

| Jun-22 | 12,224 | 21,490 | 13,730 |

| Jul-22 | 12,542 | 23,506 | 14,445 |

| Aug-22 | 12,139 | 22,629 | 13,937 |

| Sep-22 | 11,344 | 20,531 | 12,839 |

| Oct-22 | 11,870 | 22,214 | 13,268 |

| Nov-22 | 12,739 | 23,374 | 14,148 |

| Dec-22 | 12,415 | 22,005 | 13,833 |

| Jan-23 | 13,142 | 23,521 | 14,603 |

| Feb-23 | 12,735 | 22,971 | 14,194 |

| Mar-23 | 13,068 | 23,585 | 14,577 |

| Apr-23 | 13,290 | 23,837 | 14,726 |

| May-23 | 12,994 | 23,929 | 14,530 |

| Jun-23 | 13,561 | 25,563 | 15,062 |

| Jul-23 | 13,946 | 26,480 | 15,429 |

| Aug-23 | 13,548 | 25,968 | 15,096 |

| Sep-23 | 13,039 | 24,731 | 14,553 |

| Oct-23 | 12,665 | 24,076 | 14,187 |

| Nov-23 | 13,651 | 26,321 | 15,251 |

| Dec-23 | 14,379 | 27,717 | 15,971 |

| Jan-24 | 14,341 | 28,024 | 15,949 |

| Feb-24 | 14,883 | 29,541 | 16,288 |

| Mar-24 | 15,386 | 30,494 | 16,653 |

| Apr-24 | 14,805 | 29,152 | 16,152 |

| May-24 | 15,462 | 30,530 | 16,652 |

| Jun-24 | 15,538 | 31,475 | 16,876 |

The Growth of $10,000 chart compares the performance of the Fund over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

| Total Net Assets | $36,167,888 |

| # of Portfolio Holdings | 146 |

| Portfolio Turnover Rate | 100% |

| Advisory Fees and Waivers | 128,889 |

Average Annual Total Returns

| . | 1 Year | 5 Year | 10 Year |

|---|

| Adviser Class | 14.58% | 6.48% | 4.51% |

| Russell 3000 Index | 23.13% | 14.14% | 12.15% |

| Morningstar Global Allocation Index | 12.04% | 5.89% | 5.37% |

What did the Fund invest in?

| iShares Core MSCI EAFE ETF | 8.5% |

| Berkshire Hathaway Inc | 3.0% |

| Microsoft Corp | 2.9% |

| Fidelity Total Bond Fund - Class Z | 2.5% |

| Baird Core Plus Bond Fund - Class I | 2.2% |

| NVIDIA Corp | 2.1% |

| iShares Core MSCI Emerging Markets ETF | 1.8% |

| Alphabet Inc | 1.7% |

| Amazon.com Inc | 1.6% |

| Frost Total Return Bond Fund - Class I | 1.3% |

| As a percentage of total net assets. Holdings exclude short-term investments and derivatives. |

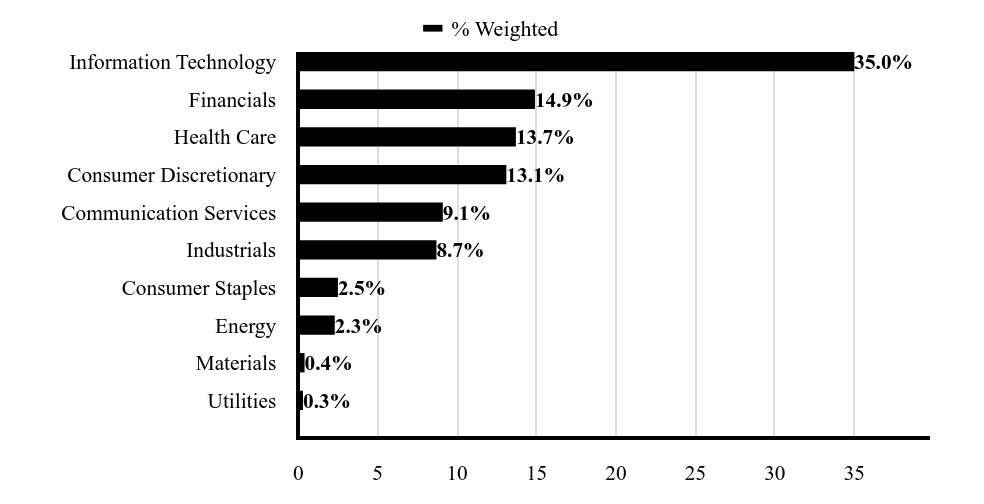

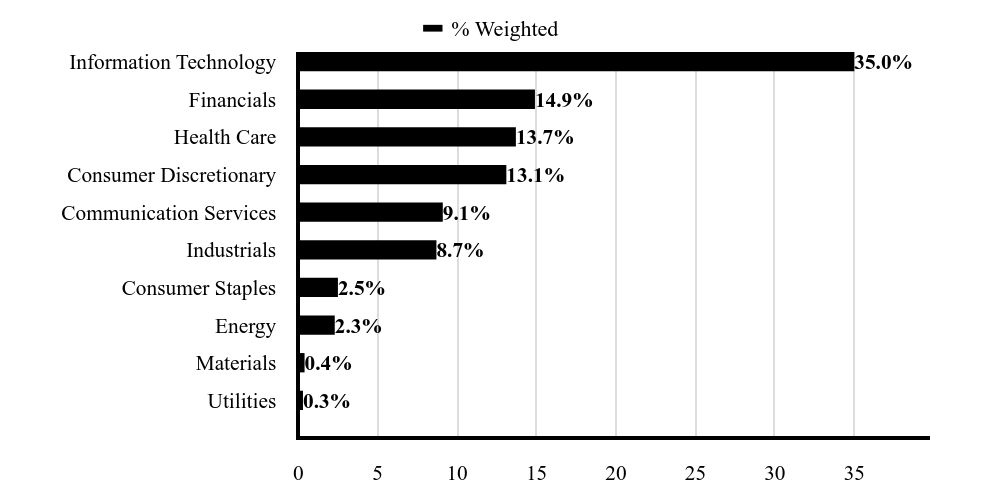

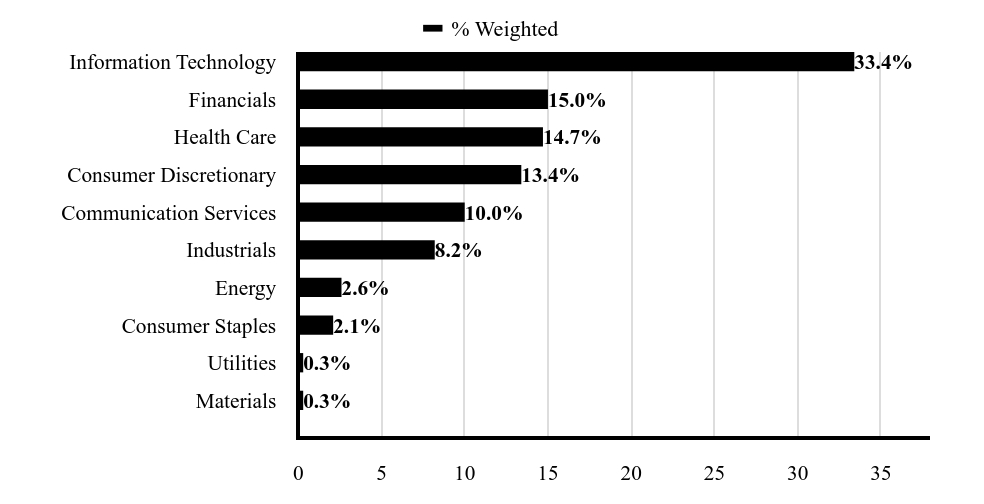

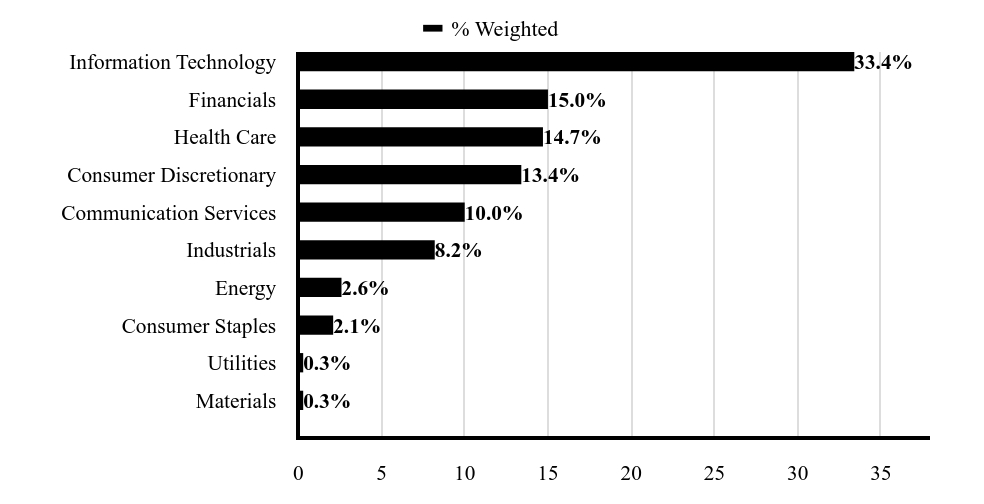

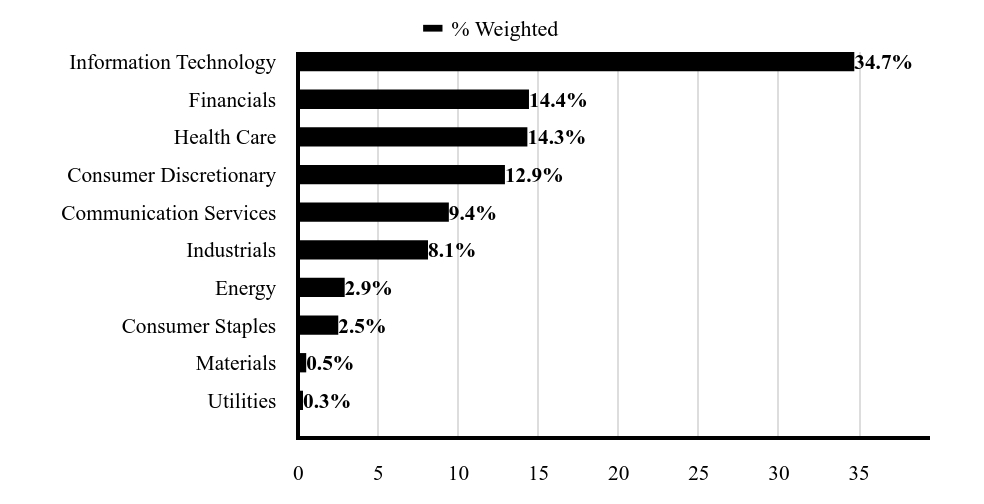

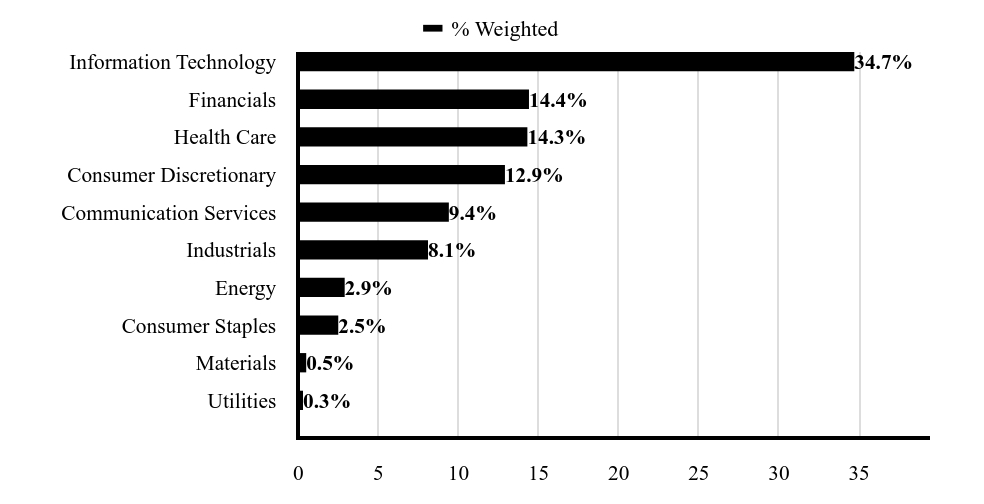

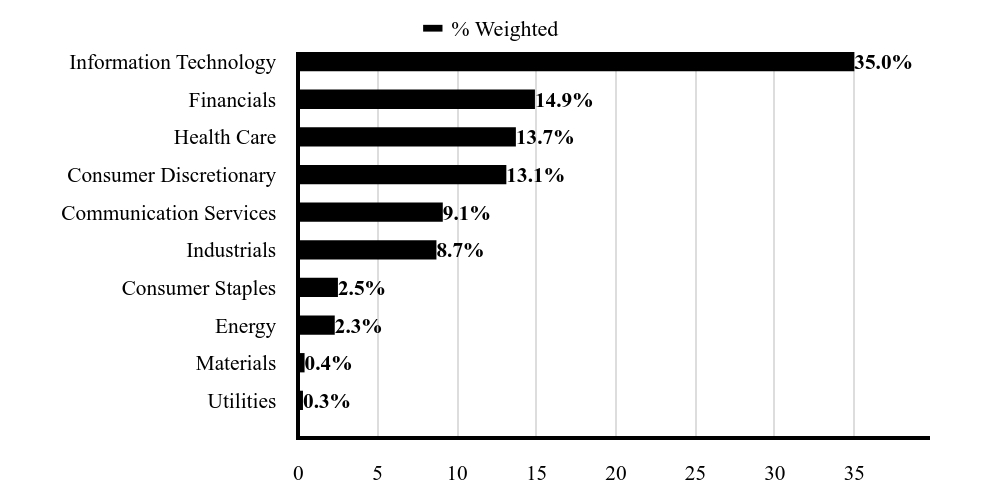

| Value | Value |

|---|

| Utilities | 0.3%Footnote Reference |

| Materials | 0.4%Footnote Reference |

| Energy | 2.3%Footnote Reference |

| Consumer Staples | 2.5%Footnote Reference |

| Industrials | 8.7%Footnote Reference |

| Communication Services | 9.1%Footnote Reference |

| Consumer Discretionary | 13.1%Footnote Reference |

| Health Care | 13.7%Footnote Reference |

| Financials | 14.9%Footnote Reference |

| Information Technology | 35.0%Footnote Reference |

| Footnote | Description |

Footnote | As a percentage of total common stocks. Concentrations are subject to change. |

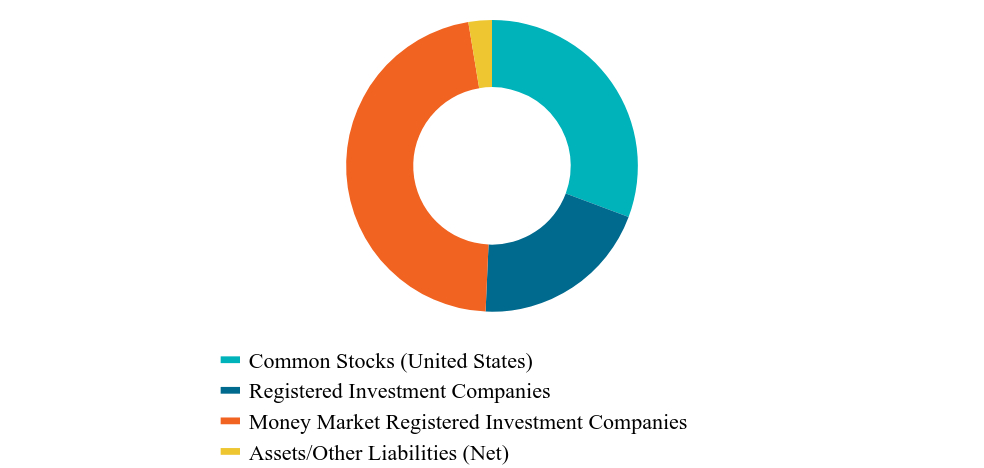

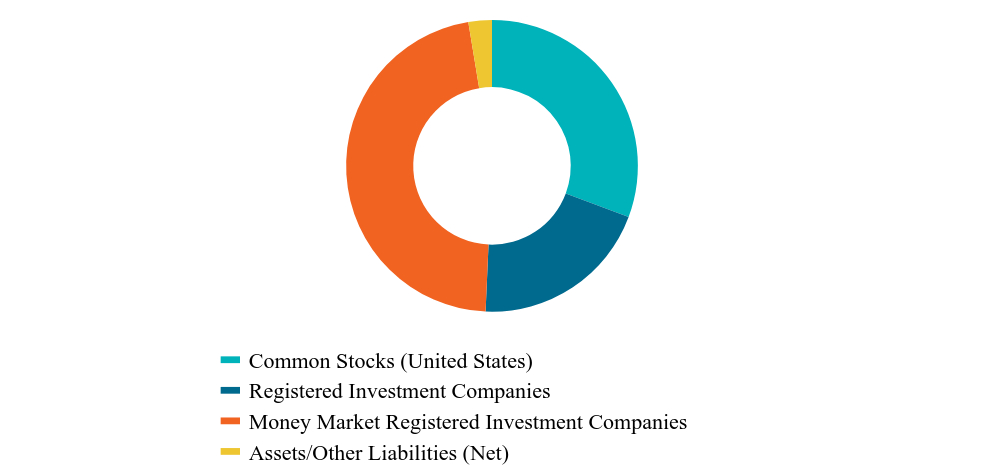

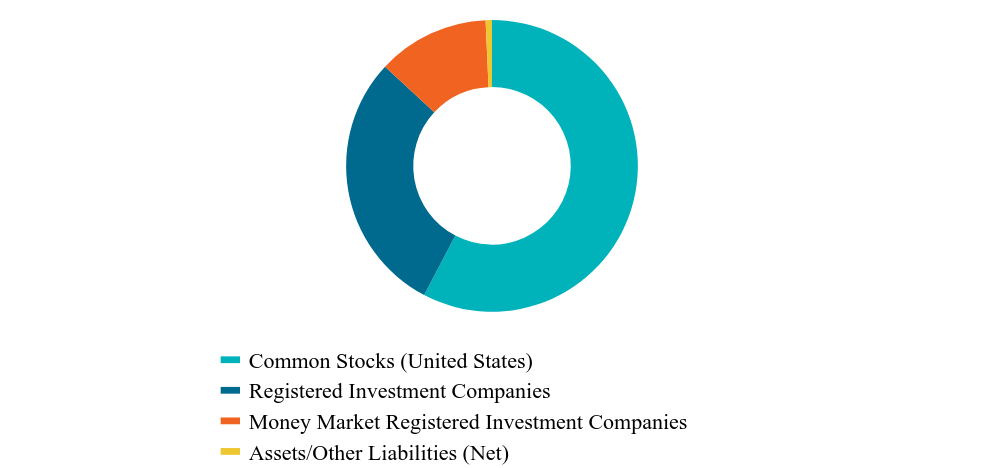

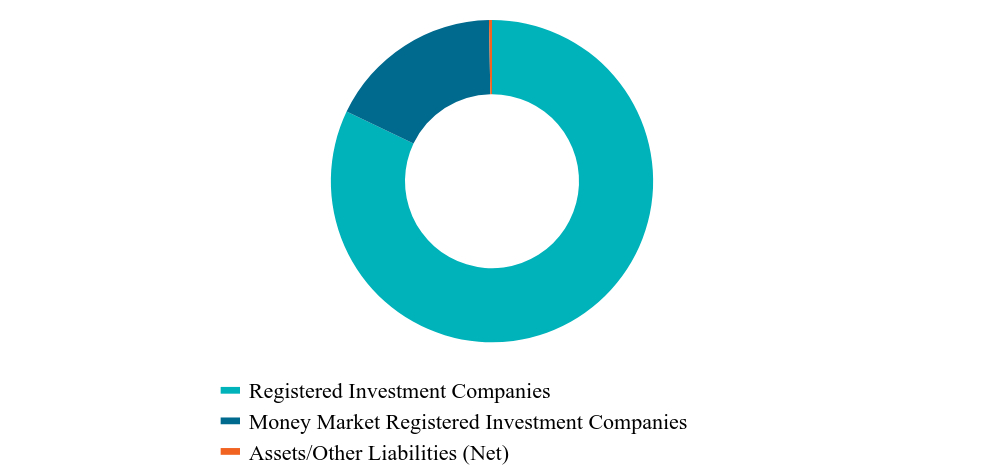

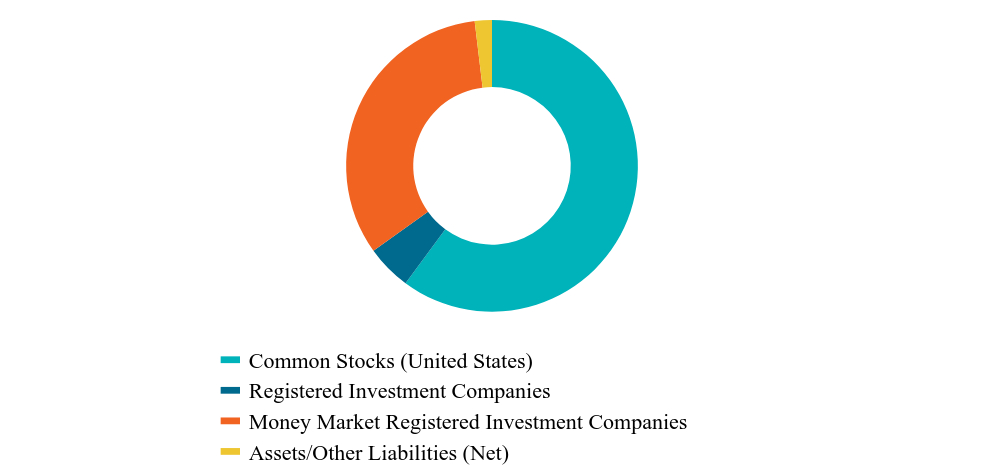

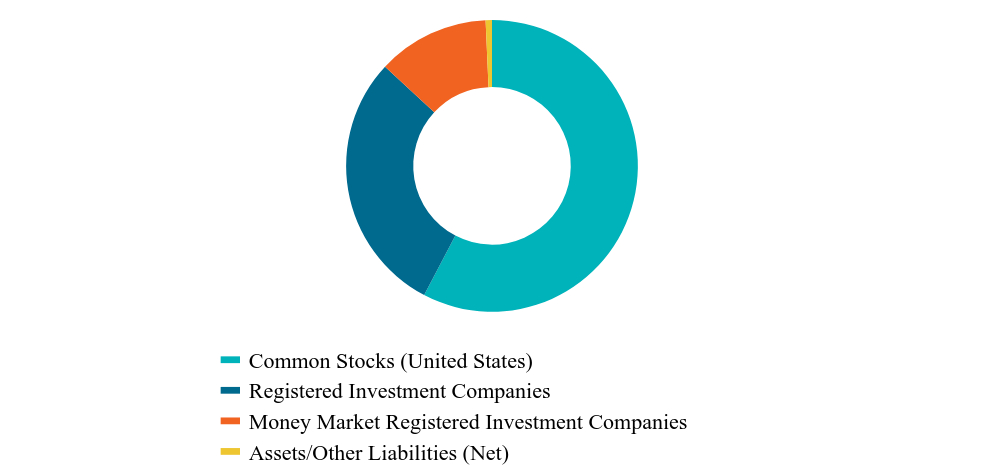

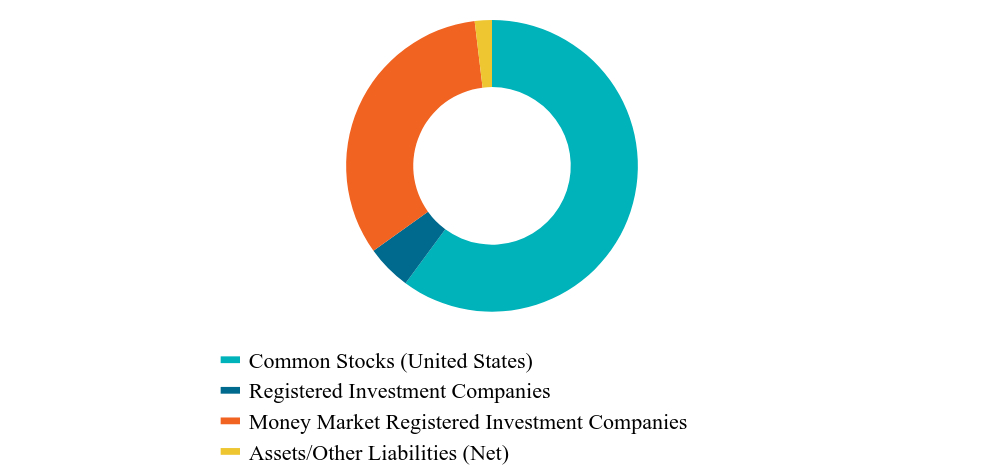

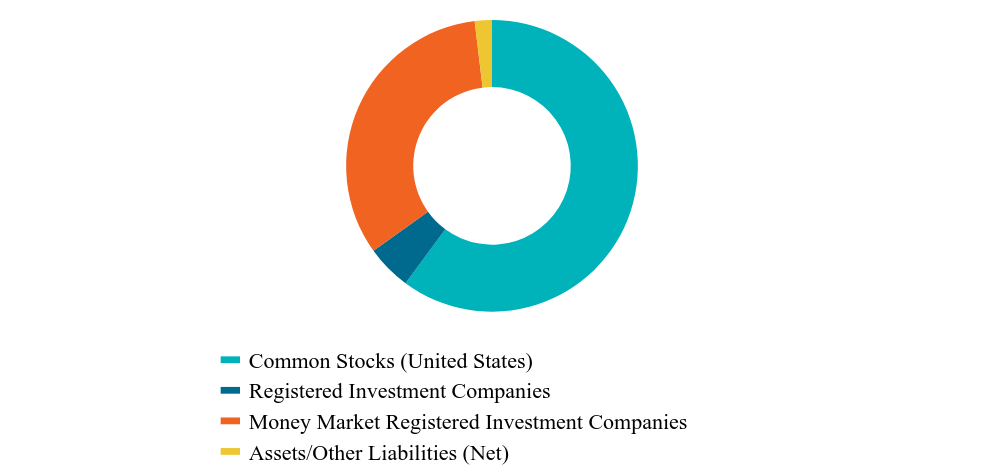

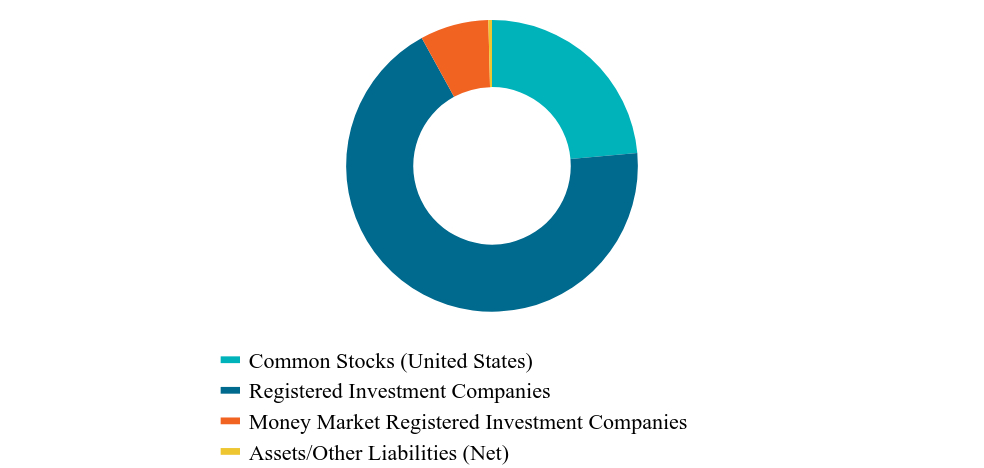

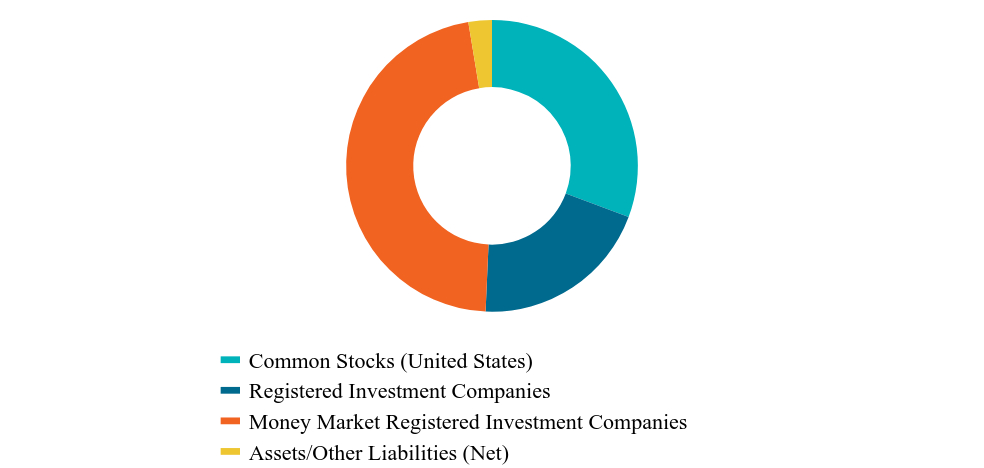

| Value | Value |

|---|

| Common Stocks (United States) | 30.7%Footnote Reference |

| Registered Investment Companies | 20.0%Footnote Reference |

| Money Market Registered Investment Companies | 46.7%Footnote Reference |

| Assets/Other Liabilities (Net) | 2.6% |

| Footnote | Description |

Footnote | As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, proxy voting information and other important materials, scan the QR code or visit www.meederinvestment.com/meeder-funds-resources.

To reduce fund expenses, only one copy of most shareholder documents are delivered to shareholders with multiple accounts at the same address. If you wish to receive copies of this document for each account, please contact the Meeder Funds at 866.633.3371 or contact your financial intermediary.

Semi-Annual Shareholder Report

June 30, 2024

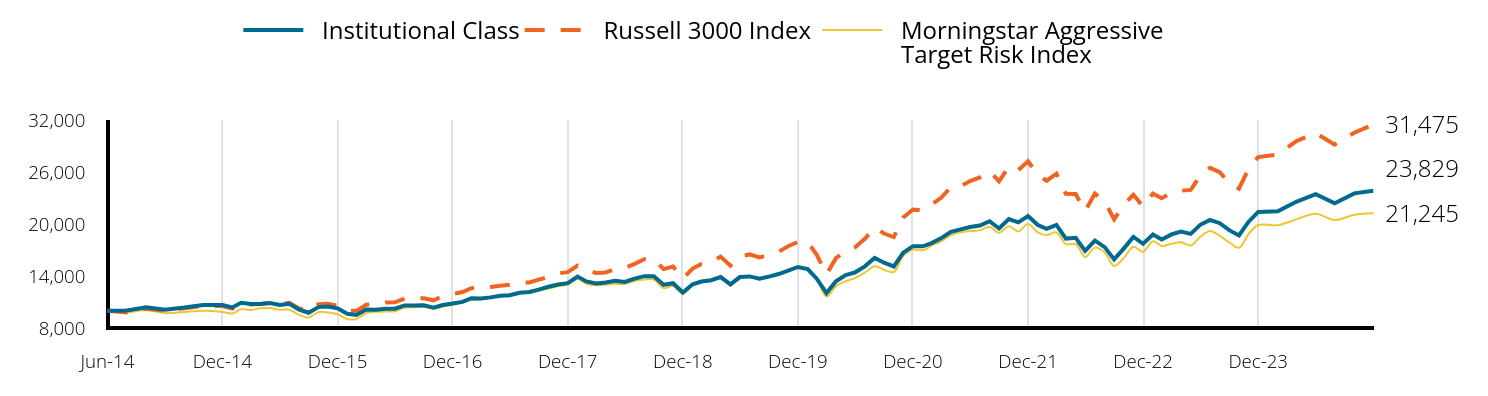

Institutional Class SRUIX

Semi-Annual Shareholder Report

June 30, 2024

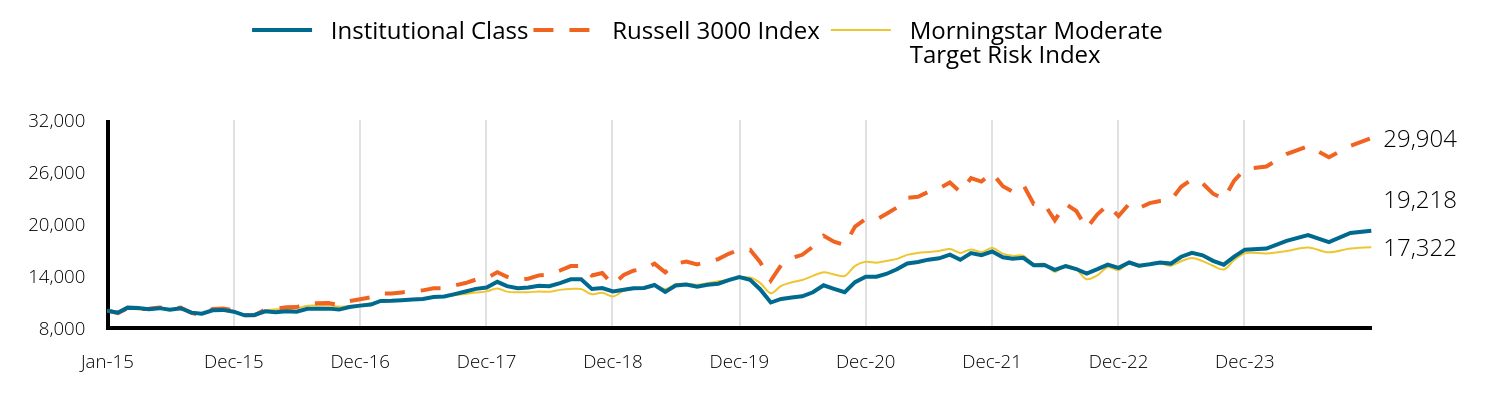

This semi-annual shareholder report contains important information about the Spectrum Fund for the period of December 31, 2023, to 6/30/2024, as well as certain changes to the Fund. You can find additional information about the Fund at meederinvestment.com/mutual-funds . You can also request this information by contacting us at 866.633.3371 .

What were the Fund's costs for the period?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| Institutional Class | $47.08 | 0.89% |

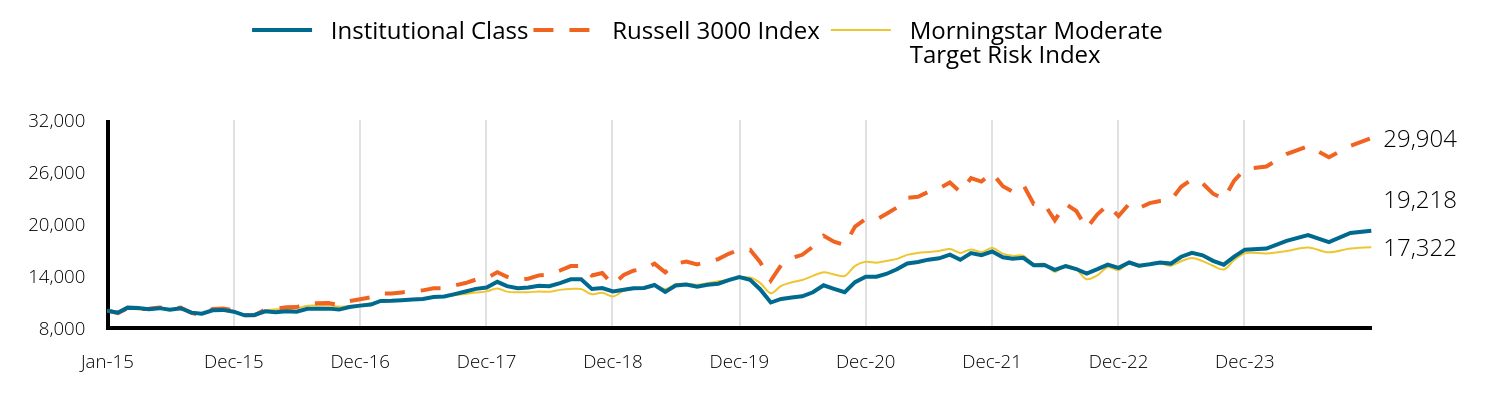

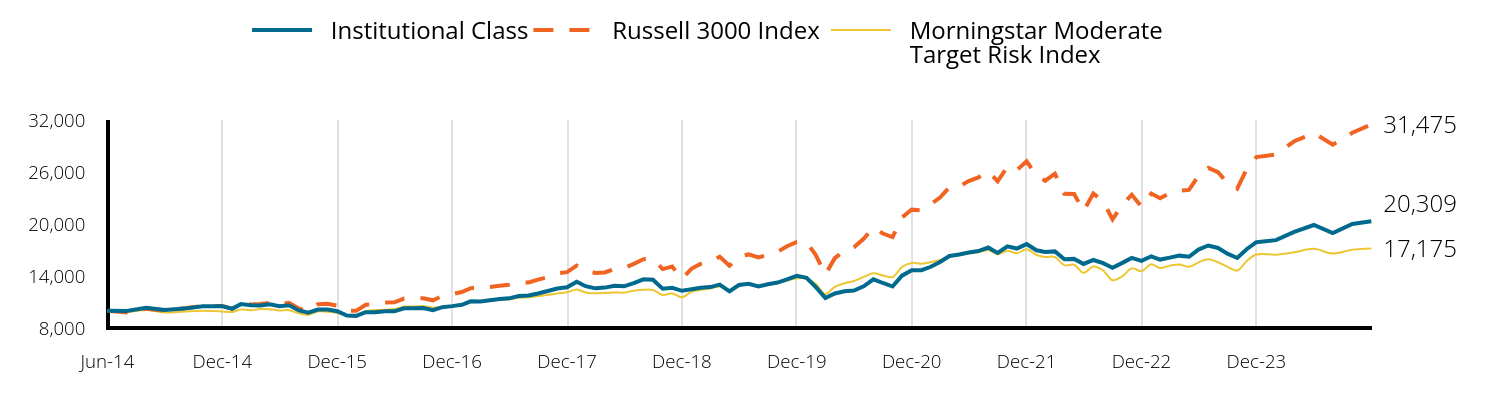

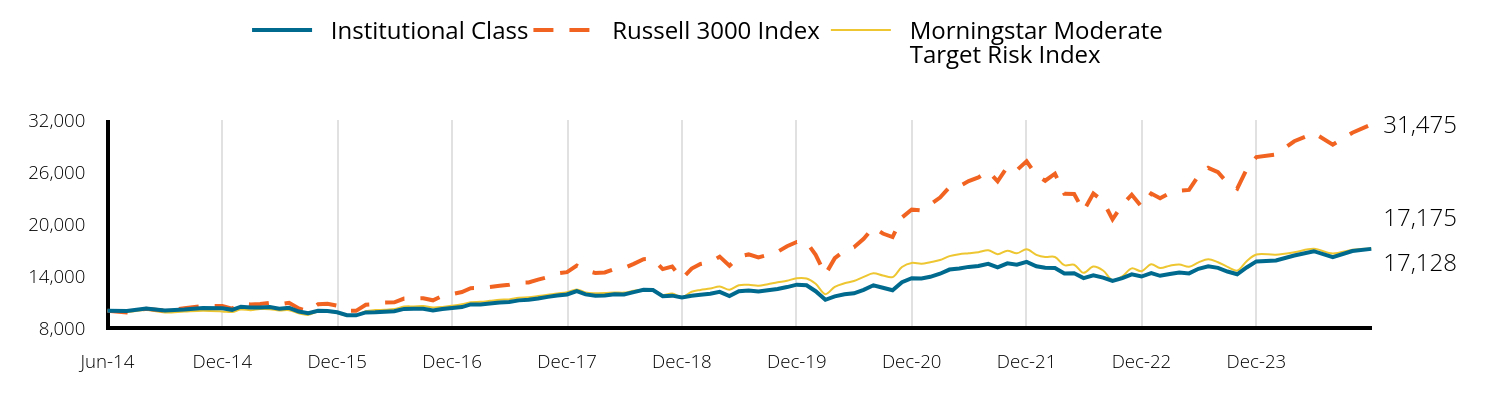

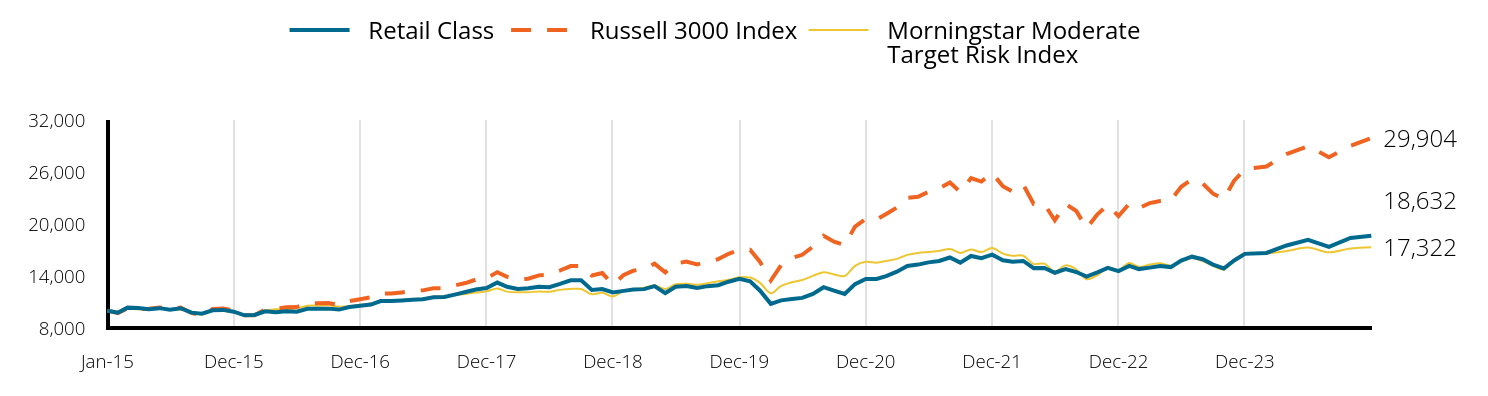

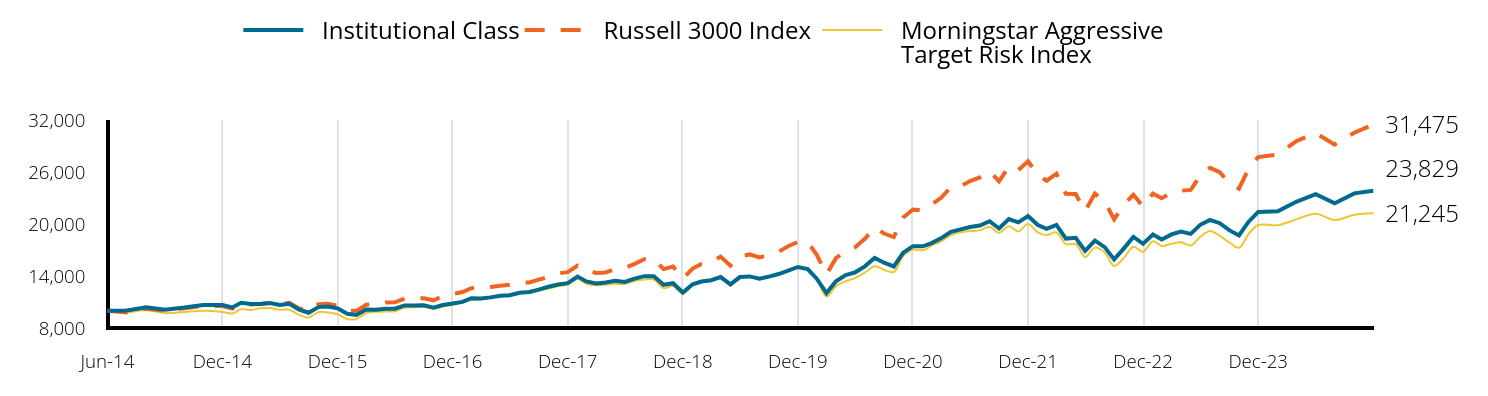

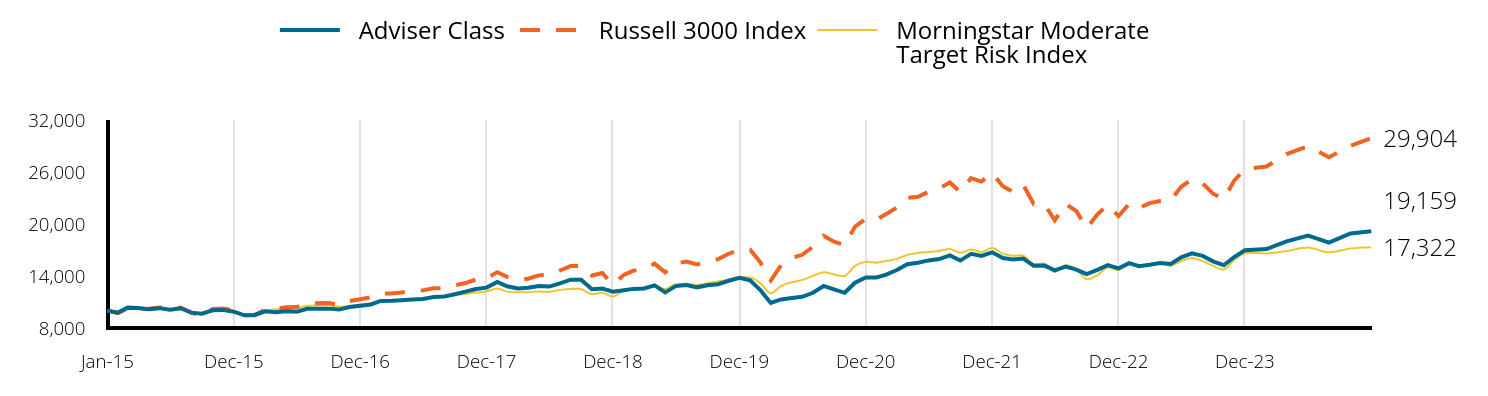

Total Return Based on a $10,000 Investment

| Institutional Class | Russell 3000 Index | Morningstar Moderate Target Risk Index |

|---|

| Jan-15 | 10,000 | 10,000 | 10,000 |

| Jan-15 | 9,770 | 9,722 | 9,925 |

| Feb-15 | 10,350 | 10,285 | 10,216 |

| Mar-15 | 10,310 | 10,180 | 10,137 |

| Apr-15 | 10,170 | 10,226 | 10,271 |

| May-15 | 10,290 | 10,368 | 10,263 |

| Jun-15 | 10,100 | 10,194 | 10,115 |

| Jul-15 | 10,280 | 10,365 | 10,140 |

| Aug-15 | 9,770 | 9,739 | 9,777 |

| Sep-15 | 9,650 | 9,455 | 9,596 |

| Oct-15 | 10,050 | 10,202 | 10,000 |

| Nov-15 | 10,090 | 10,258 | 9,959 |

| Dec-15 | 9,879 | 10,048 | 9,821 |

| Jan-16 | 9,463 | 9,481 | 9,509 |

| Feb-16 | 9,504 | 9,478 | 9,555 |

| Mar-16 | 9,920 | 10,145 | 10,032 |

| Apr-16 | 9,808 | 10,208 | 10,158 |

| May-16 | 9,940 | 10,391 | 10,187 |

| Jun-16 | 9,869 | 10,412 | 10,273 |

| Jul-16 | 10,214 | 10,825 | 10,560 |

| Aug-16 | 10,224 | 10,853 | 10,582 |

| Sep-16 | 10,235 | 10,870 | 10,622 |

| Oct-16 | 10,123 | 10,635 | 10,467 |

| Nov-16 | 10,417 | 11,111 | 10,524 |

| Dec-16 | 10,581 | 11,327 | 10,663 |

| Jan-17 | 10,704 | 11,541 | 10,835 |

| Feb-17 | 11,126 | 11,970 | 11,054 |

| Mar-17 | 11,136 | 11,978 | 11,109 |

| Apr-17 | 11,208 | 12,105 | 11,225 |

| May-17 | 11,290 | 12,229 | 11,355 |

| Jun-17 | 11,342 | 12,339 | 11,398 |

| Jul-17 | 11,578 | 12,572 | 11,592 |

| Aug-17 | 11,630 | 12,596 | 11,650 |

| Sep-17 | 11,907 | 12,903 | 11,785 |

| Oct-17 | 12,206 | 13,185 | 11,932 |

| Nov-17 | 12,514 | 13,585 | 12,094 |

| Dec-17 | 12,670 | 13,721 | 12,225 |

| Jan-18 | 13,329 | 14,444 | 12,558 |

| Feb-18 | 12,835 | 13,912 | 12,197 |

| Mar-18 | 12,583 | 13,633 | 12,119 |

| Apr-18 | 12,681 | 13,684 | 12,132 |

| May-18 | 12,868 | 14,071 | 12,206 |

| Jun-18 | 12,813 | 14,163 | 12,187 |

| Jul-18 | 13,186 | 14,633 | 12,399 |

| Aug-18 | 13,615 | 15,147 | 12,508 |

| Sep-18 | 13,615 | 15,172 | 12,494 |

| Oct-18 | 12,506 | 14,055 | 11,906 |

| Nov-18 | 12,605 | 14,336 | 12,072 |

| Dec-18 | 12,226 | 13,002 | 11,644 |

| Jan-19 | 12,405 | 14,118 | 12,283 |

| Feb-19 | 12,572 | 14,614 | 12,496 |

| Mar-19 | 12,617 | 14,828 | 12,654 |

| Apr-19 | 12,962 | 15,420 | 12,898 |

| May-19 | 12,170 | 14,422 | 12,513 |

| Jun-19 | 12,896 | 15,435 | 13,050 |

| Jul-19 | 13,007 | 15,664 | 13,092 |

| Aug-19 | 12,762 | 15,345 | 12,980 |

| Sep-19 | 12,996 | 15,614 | 13,170 |

| Oct-19 | 13,108 | 15,950 | 13,389 |

| Nov-19 | 13,520 | 16,557 | 13,574 |

| Dec-19 | 13,870 | 17,035 | 13,859 |

| Jan-20 | 13,565 | 17,016 | 13,823 |

| Feb-20 | 12,473 | 15,623 | 13,210 |

| Mar-20 | 10,940 | 13,475 | 12,005 |

| Apr-20 | 11,357 | 15,259 | 12,860 |

| May-20 | 11,526 | 16,075 | 13,272 |

| Jun-20 | 11,650 | 16,443 | 13,534 |

| Jul-20 | 12,123 | 17,376 | 14,014 |

| Aug-20 | 12,923 | 18,635 | 14,435 |

| Sep-20 | 12,519 | 17,957 | 14,184 |

| Oct-20 | 12,121 | 17,569 | 13,993 |

| Nov-20 | 13,293 | 19,707 | 15,172 |

| Dec-20 | 13,904 | 20,593 | 15,636 |

| Jan-21 | 13,916 | 20,501 | 15,541 |

| Feb-21 | 14,234 | 21,142 | 15,729 |

| Mar-21 | 14,769 | 21,900 | 15,975 |

| Apr-21 | 15,440 | 23,029 | 16,435 |

| May-21 | 15,611 | 23,134 | 16,662 |

| Jun-21 | 15,884 | 23,705 | 16,771 |

| Jul-21 | 16,043 | 24,105 | 16,891 |

| Aug-21 | 16,464 | 24,793 | 17,112 |

| Sep-21 | 15,866 | 23,681 | 16,658 |

| Oct-21 | 16,652 | 25,282 | 17,069 |

| Nov-21 | 16,402 | 24,897 | 16,759 |

| Dec-21 | 16,821 | 25,877 | 17,230 |

| Jan-22 | 16,161 | 24,355 | 16,579 |

| Feb-22 | 15,993 | 23,741 | 16,325 |

| Mar-22 | 16,101 | 24,512 | 16,336 |

| Apr-22 | 15,248 | 22,312 | 15,381 |

| May-22 | 15,272 | 22,282 | 15,425 |

| Jun-22 | 14,708 | 20,418 | 14,484 |

| Jul-22 | 15,152 | 22,333 | 15,225 |

| Aug-22 | 14,804 | 21,500 | 14,761 |

| Sep-22 | 14,278 | 19,506 | 13,626 |

| Oct-22 | 14,784 | 21,106 | 14,082 |

| Nov-22 | 15,316 | 22,208 | 15,004 |

| Dec-22 | 14,940 | 20,907 | 14,684 |

| Jan-23 | 15,557 | 22,347 | 15,489 |

| Feb-23 | 15,187 | 21,825 | 15,052 |

| Mar-23 | 15,359 | 22,408 | 15,319 |

| Apr-23 | 15,557 | 22,647 | 15,459 |

| May-23 | 15,433 | 22,735 | 15,187 |

| Jun-23 | 16,224 | 24,288 | 15,699 |

| Jul-23 | 16,671 | 25,158 | 16,074 |

| Aug-23 | 16,386 | 24,673 | 15,717 |

| Sep-23 | 15,752 | 23,497 | 15,183 |

| Oct-23 | 15,303 | 22,875 | 14,750 |

| Nov-23 | 16,239 | 25,008 | 15,837 |

| Dec-23 | 17,041 | 26,334 | 16,626 |

| Jan-24 | 17,162 | 26,626 | 16,604 |

| Feb-24 | 18,048 | 28,067 | 16,874 |

| Mar-24 | 18,707 | 28,973 | 17,276 |

| Apr-24 | 17,901 | 27,698 | 16,734 |

| May-24 | 18,962 | 29,006 | 17,175 |

| Jun-24 | 19,218 | 29,904 | 17,322 |

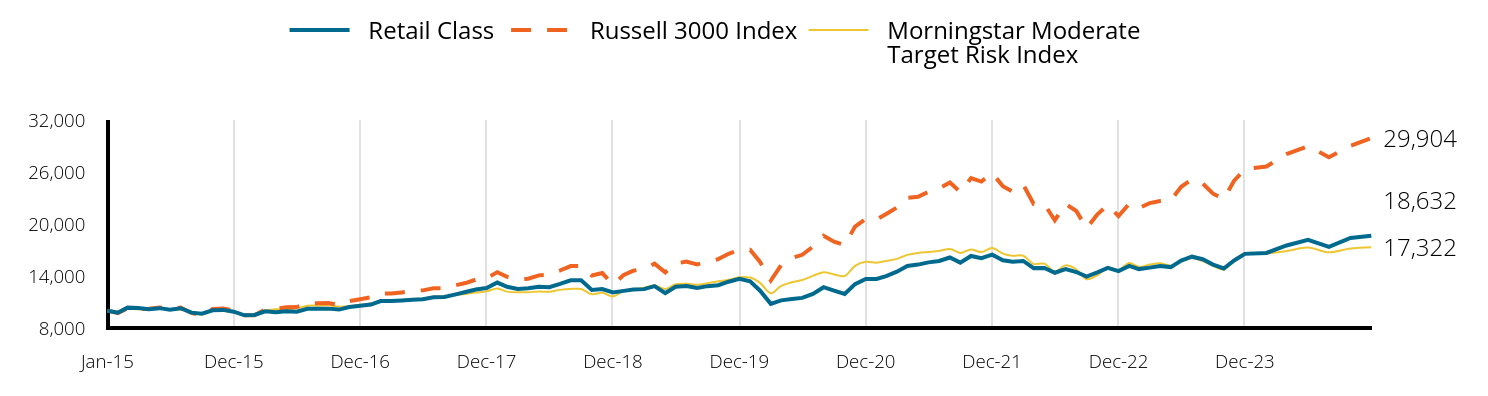

The Growth of $10,000 chart compares the performance of the Fund over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

| Total Net Assets | $211,678,626 |

| # of Portfolio Holdings | 496 |

| Portfolio Turnover Rate | 139% |

| Advisory Fees and Waivers | 747,751 |

Average Annual Total Returns

| . | 1 Year | 5 Year | Since Inception |

|---|

| Institutional Class (Inception Date: 1/1/15) | 18.45% | 8.31% | 7.12% |

| Russell 3000 Index | 23.13% | 14.14% | 12.23% |

| Morningstar Moderate Target Risk Index | 10.34% | 5.83% | 5.96% |

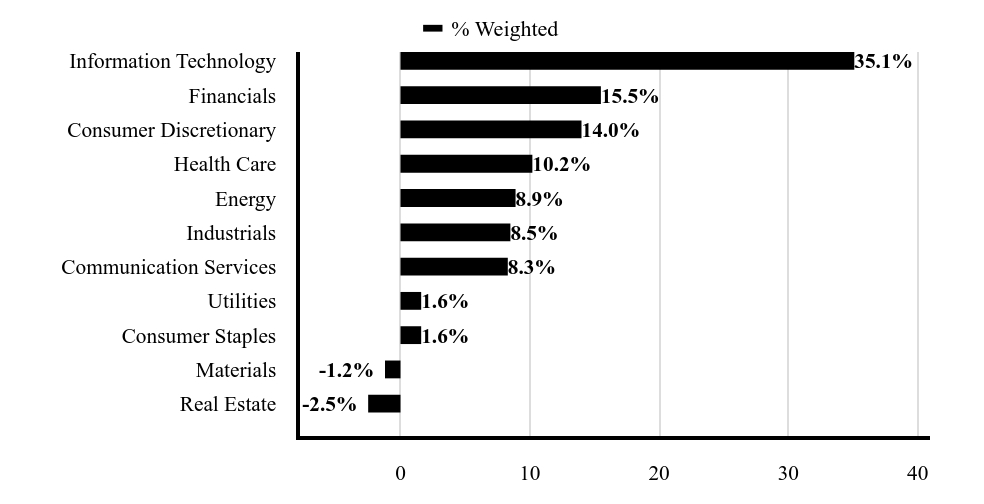

What did the Fund invest in?

| Microsoft Corp | 5.1% |

| iShares Short Treasury Bond ETF | 4.4% |

| Berkshire Hathaway Inc | 4.3% |

| NVIDIA Corp | 3.9% |

| Apple Inc | 3.4% |

| Mastercard Inc | 2.7% |

| Alphabet Inc | 2.6% |

| Amazon.com Inc | 2.4% |

| Texas Instruments Inc | 2.3% |

| Exxon Mobil Corp | 2.2% |

| As a percentage of total net assets. Holdings exclude short-term investments and derivatives. |

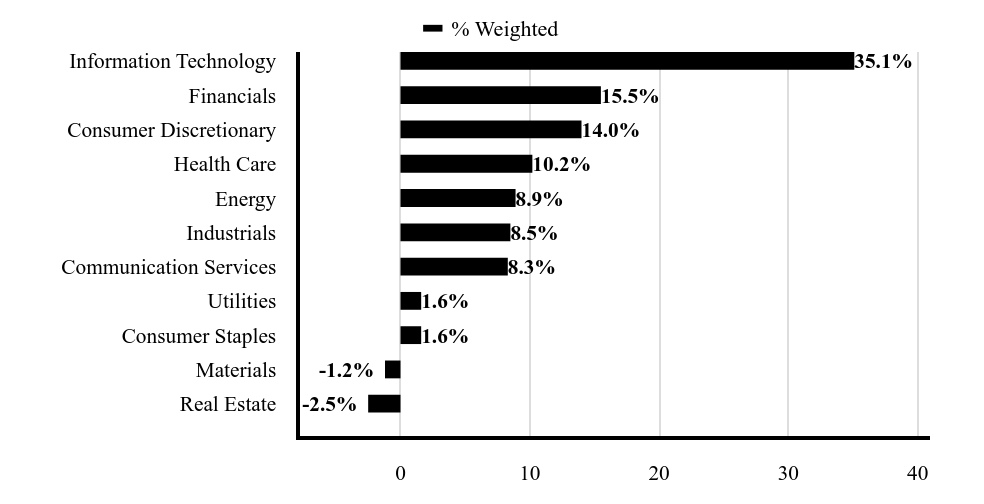

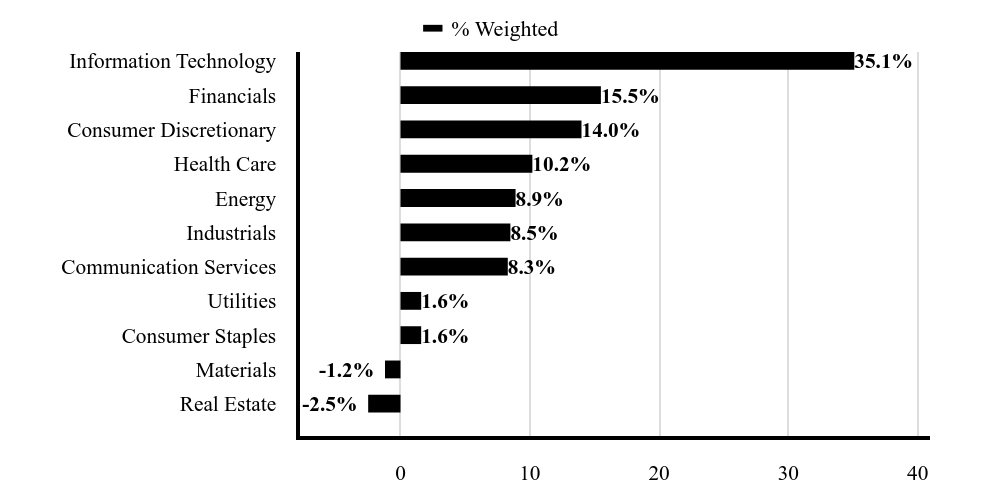

| Value | Value |

|---|

| Real Estate | |

| Materials | |

| Consumer Staples | 1.6%Footnote Reference |

| Utilities | 1.6%Footnote Reference |

| Communication Services | 8.3%Footnote Reference |

| Industrials | 8.5%Footnote Reference |

| Energy | 8.9%Footnote Reference |

| Health Care | 10.2%Footnote Reference |

| Consumer Discretionary | 14.0%Footnote Reference |

| Financials | 15.5%Footnote Reference |

| Information Technology | 35.1%Footnote Reference |

| Footnote | Description |

Footnote | As a percentage of total common stocks. Concentrations are subject to change. |

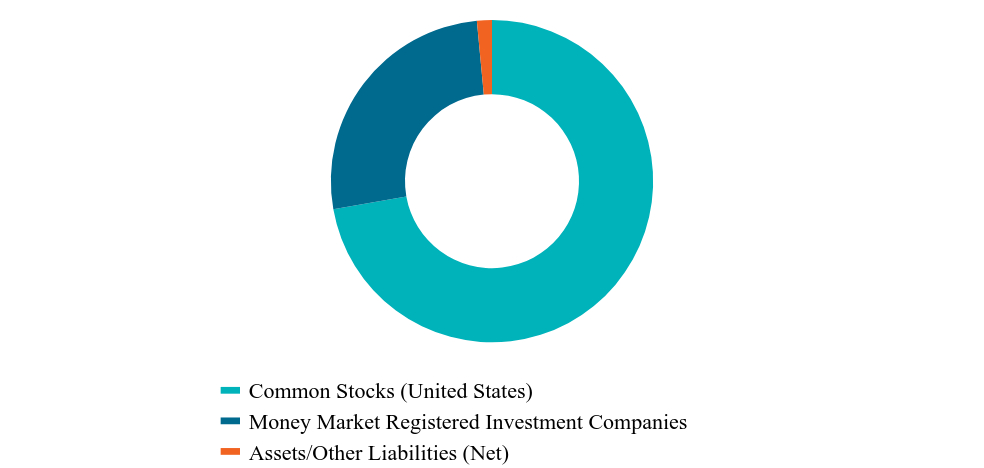

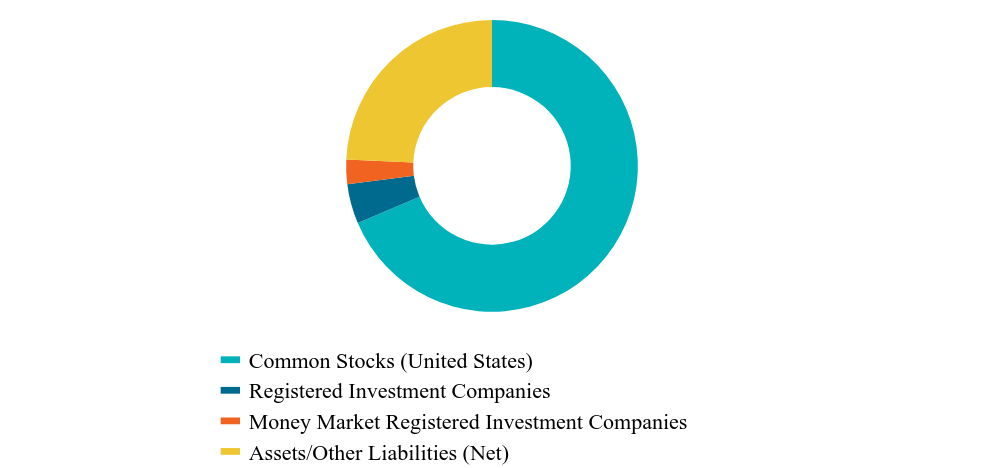

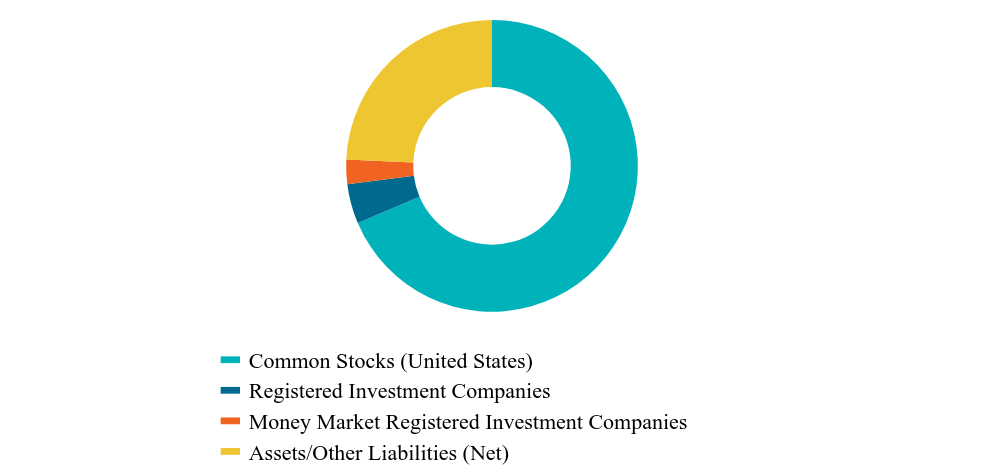

| Value | Value |

|---|

| Common Stocks (United States) | 68.6%Footnote Reference |

| Registered Investment Companies | 4.4%Footnote Reference |

| Money Market Registered Investment Companies | 2.7%Footnote Reference |

| Assets/Other Liabilities (Net) | 24.3% |

| Footnote | Description |

Footnote | As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, proxy voting information and other important materials, scan the QR code or visit www.meederinvestment.com/meeder-funds-resources.

To reduce fund expenses, only one copy of most shareholder documents are delivered to shareholders with multiple accounts at the same address. If you wish to receive copies of this document for each account, please contact the Meeder Funds at 866.633.3371 or contact your financial intermediary.

Institutional Class SRUIX

Semi-Annual Shareholder Report

June 30, 2024

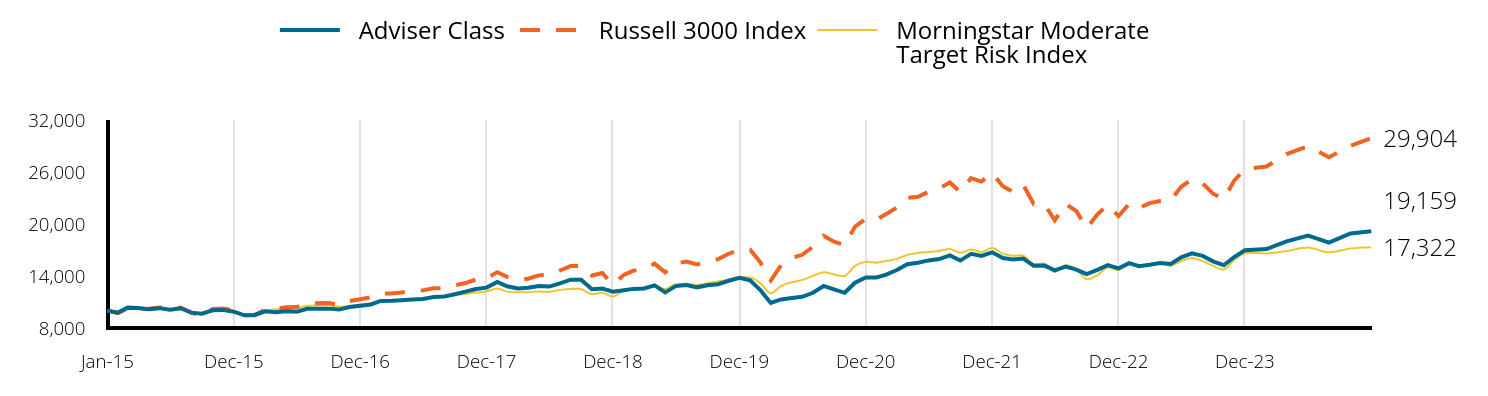

Semi-Annual Shareholder Report

June 30, 2024

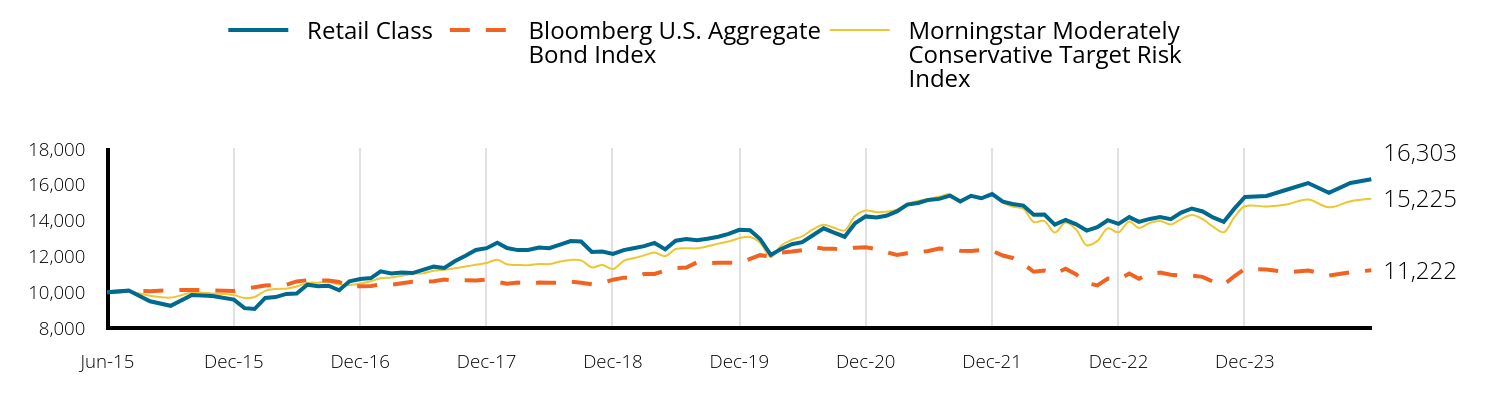

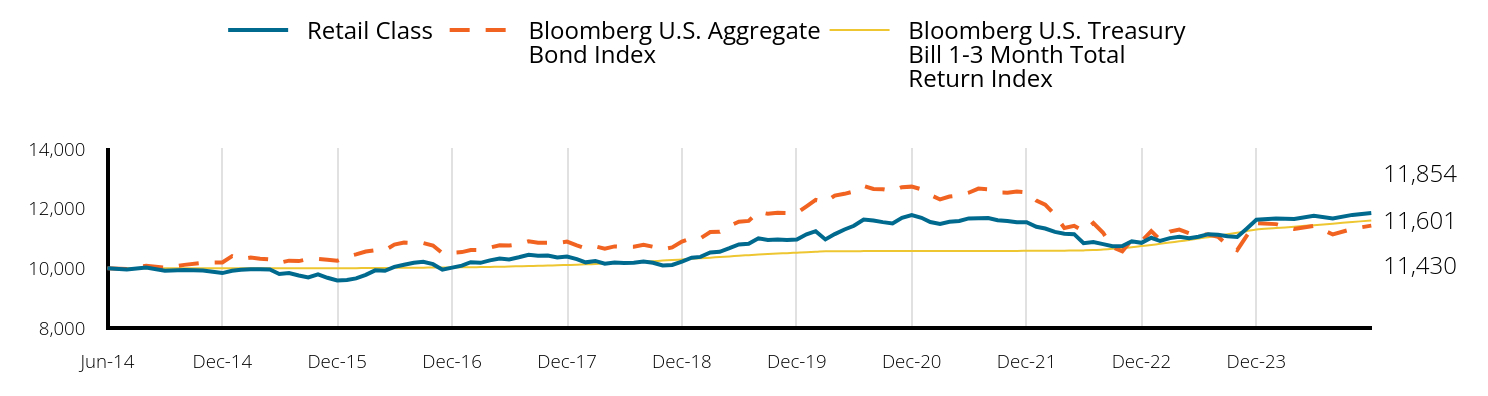

This semi-annual shareholder report contains important information about the Moderate Allocation Fund for the period of December 31, 2023, to 6/30/2024, as well as certain changes to the Fund. You can find additional information about the Fund at meederinvestment.com/mutual-funds . You can also request this information by contacting us at 866.633.3371 .

What were the Fund's costs for the period?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| Retail Class | $69.28 | 1.35% |

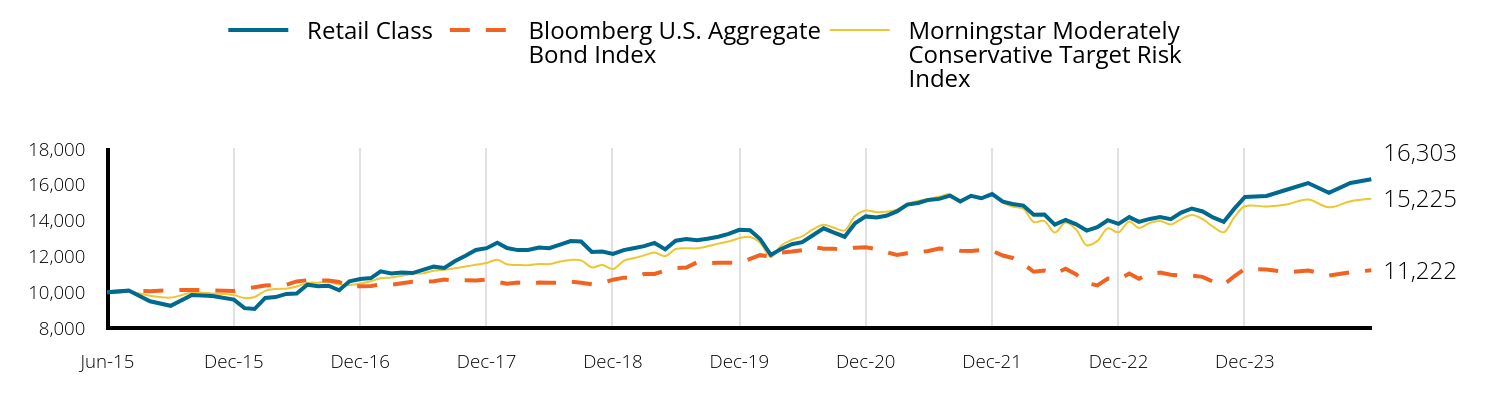

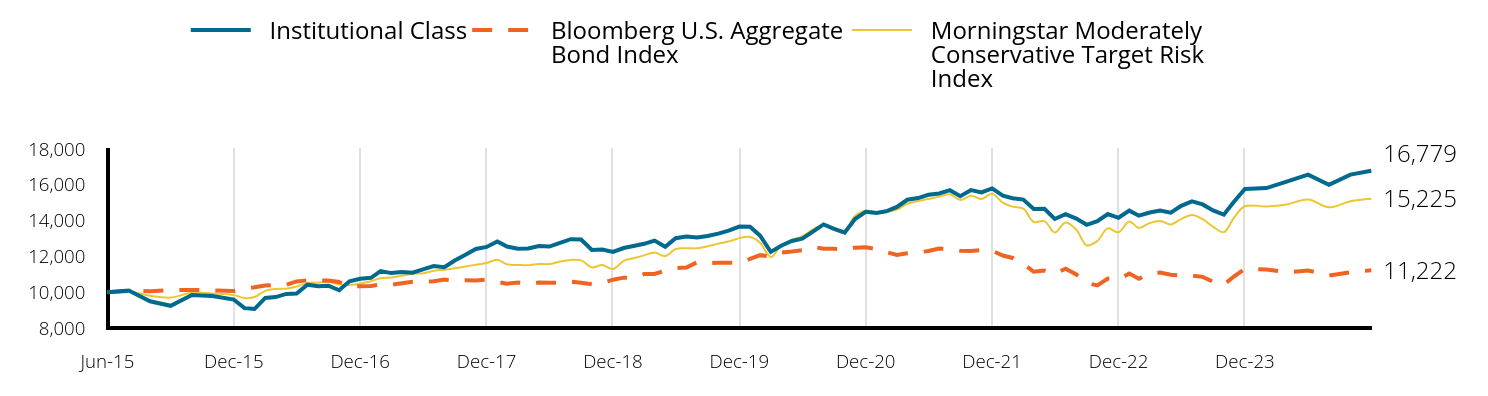

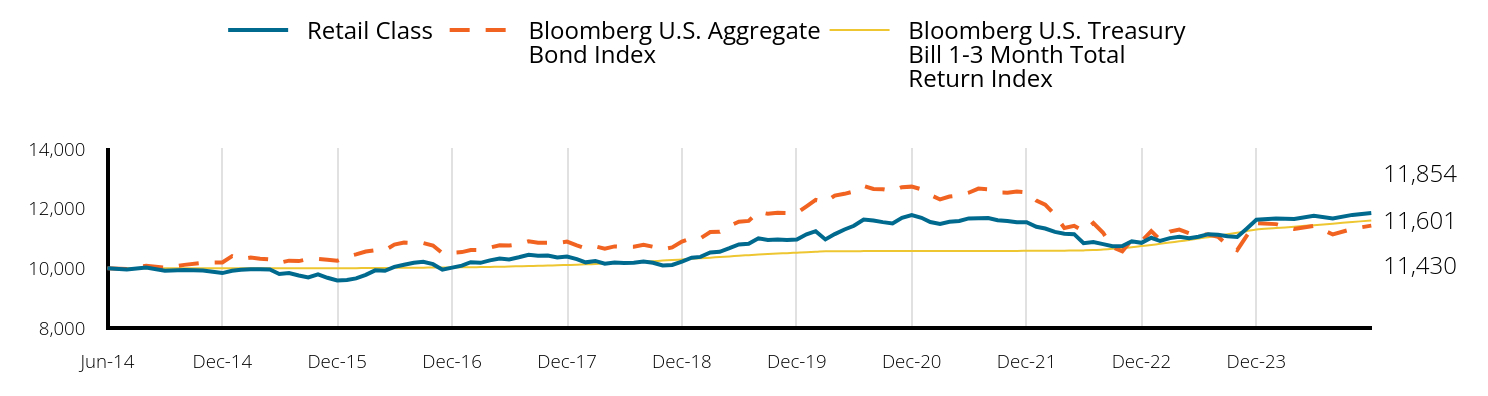

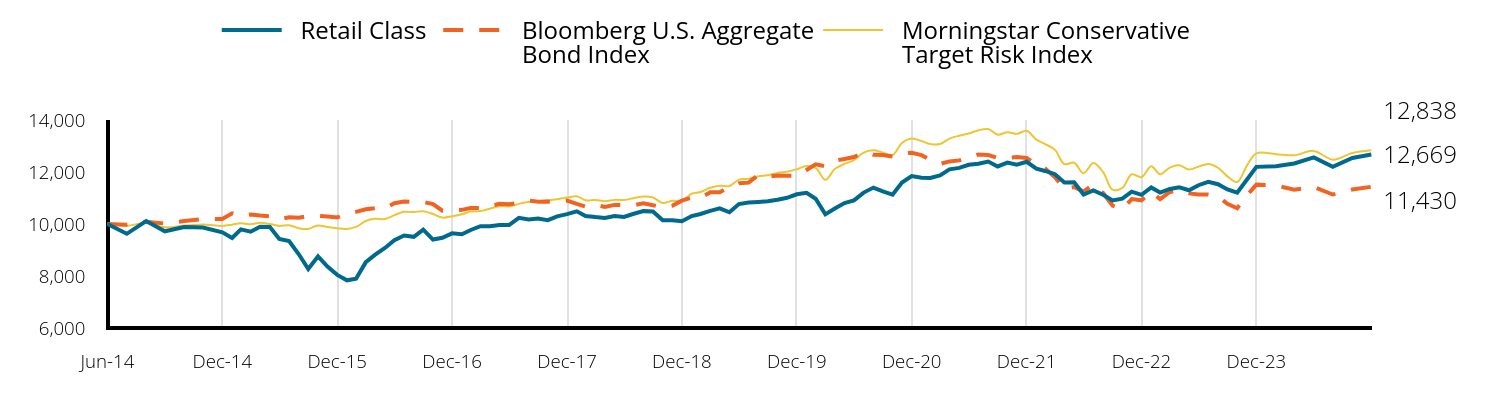

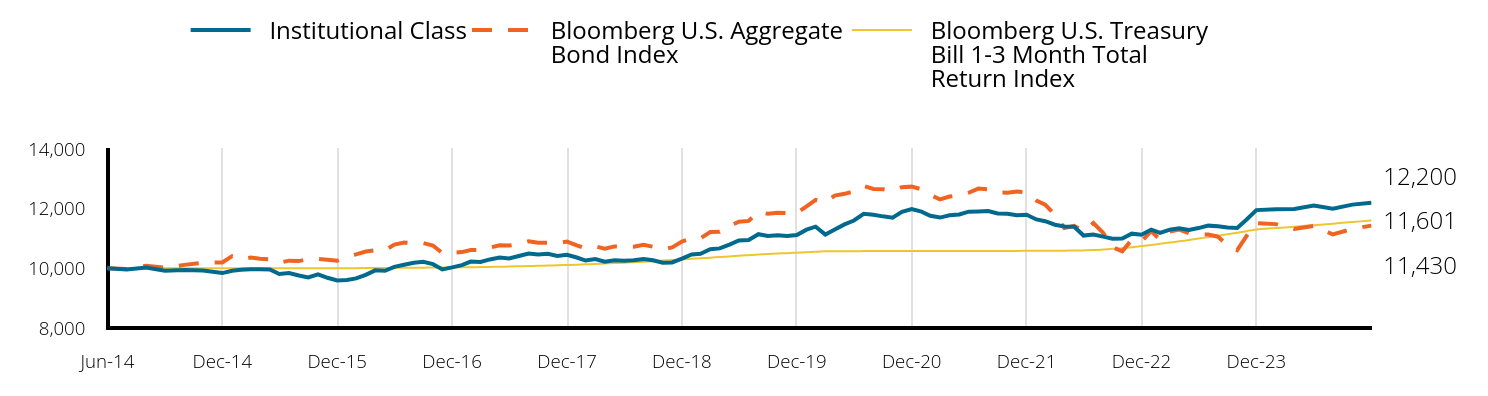

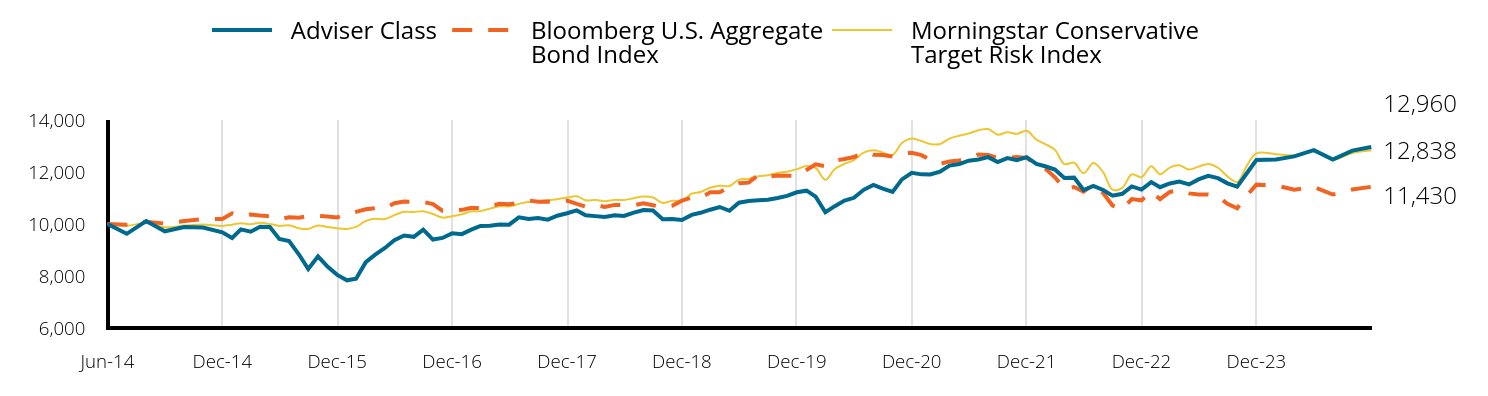

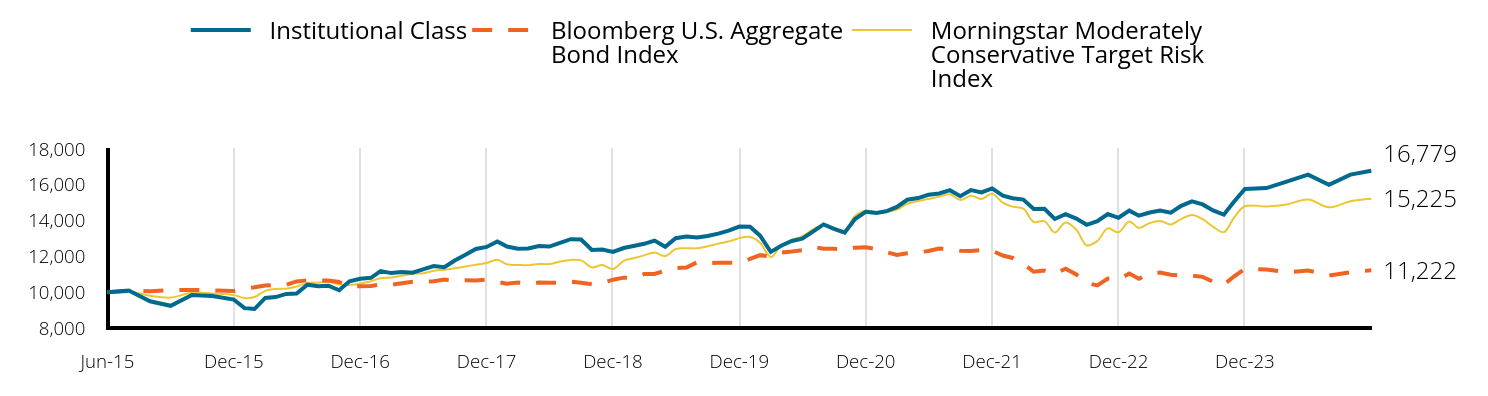

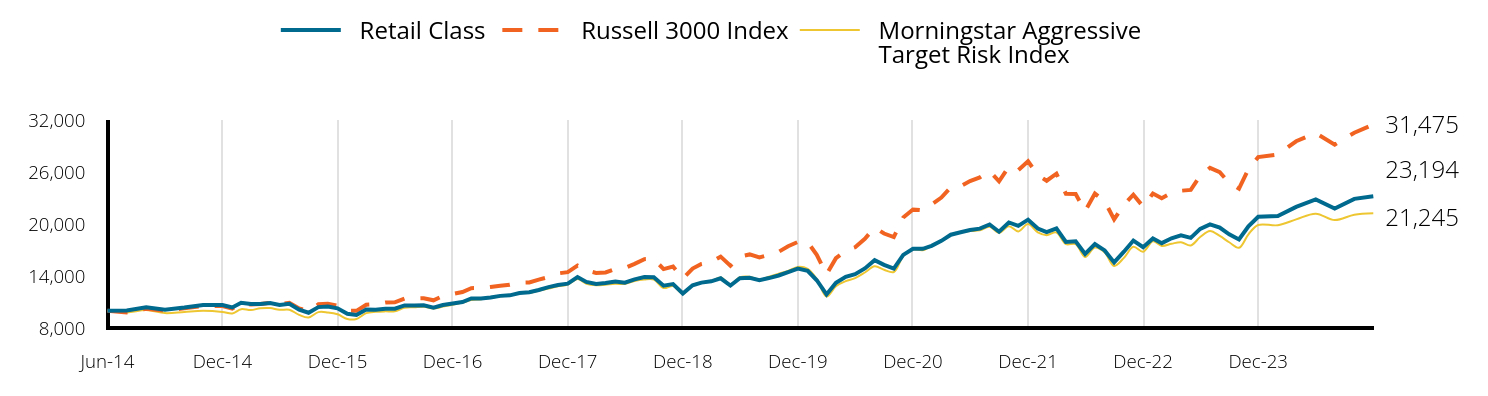

Total Return Based on a $10,000 Investment

| Retail Class | Bloomberg U.S. Aggregate Bond Index | Morningstar Moderately Conservative Target Risk Index |

|---|

| Jun-15 | 10,000 | 10,000 | 10,000 |

| Jul-15 | 10,090 | 10,070 | 10,037 |

| Aug-15 | 9,490 | 10,055 | 9,801 |

| Sep-15 | 9,240 | 10,123 | 9,700 |

| Oct-15 | 9,847 | 10,125 | 9,973 |

| Nov-15 | 9,787 | 10,098 | 9,925 |

| Dec-15 | 9,585 | 10,065 | 9,836 |

| Jan-16 | 9,111 | 10,204 | 9,669 |

| Feb-16 | 9,060 | 10,276 | 9,729 |

| Mar-16 | 9,677 | 10,371 | 10,076 |

| Apr-16 | 9,728 | 10,410 | 10,178 |

| May-16 | 9,905 | 10,413 | 10,195 |

| Jun-16 | 9,930 | 10,600 | 10,313 |

| Jul-16 | 10,420 | 10,667 | 10,520 |

| Aug-16 | 10,333 | 10,655 | 10,530 |

| Sep-16 | 10,364 | 10,649 | 10,566 |

| Oct-16 | 10,110 | 10,567 | 10,436 |

| Nov-16 | 10,607 | 10,317 | 10,396 |

| Dec-16 | 10,740 | 10,332 | 10,491 |

| Jan-17 | 10,787 | 10,352 | 10,615 |

| Feb-17 | 11,162 | 10,422 | 10,778 |

| Mar-17 | 11,043 | 10,416 | 10,816 |

| Apr-17 | 11,105 | 10,497 | 10,918 |

| May-17 | 11,069 | 10,577 | 11,032 |

| Jun-17 | 11,249 | 10,567 | 11,051 |

| Jul-17 | 11,426 | 10,612 | 11,192 |

| Aug-17 | 11,354 | 10,707 | 11,259 |

| Sep-17 | 11,725 | 10,656 | 11,336 |

| Oct-17 | 12,034 | 10,663 | 11,434 |

| Nov-17 | 12,354 | 10,649 | 11,533 |

| Dec-17 | 12,458 | 10,698 | 11,630 |

| Jan-18 | 12,757 | 10,575 | 11,812 |

| Feb-18 | 12,468 | 10,474 | 11,557 |

| Mar-18 | 12,351 | 10,542 | 11,523 |

| Apr-18 | 12,361 | 10,463 | 11,506 |

| May-18 | 12,490 | 10,538 | 11,576 |

| Jun-18 | 12,458 | 10,525 | 11,569 |

| Jul-18 | 12,651 | 10,527 | 11,710 |

| Aug-18 | 12,855 | 10,595 | 11,801 |

| Sep-18 | 12,828 | 10,527 | 11,779 |

| Oct-18 | 12,247 | 10,444 | 11,385 |

| Nov-18 | 12,268 | 10,506 | 11,512 |

| Dec-18 | 12,134 | 10,699 | 11,297 |

| Jan-19 | 12,347 | 10,813 | 11,751 |

| Feb-19 | 12,458 | 10,806 | 11,891 |

| Mar-19 | 12,570 | 11,014 | 12,056 |

| Apr-19 | 12,750 | 11,017 | 12,217 |

| May-19 | 12,391 | 11,212 | 12,022 |

| Jun-19 | 12,873 | 11,353 | 12,410 |

| Jul-19 | 12,964 | 11,378 | 12,451 |

| Aug-19 | 12,896 | 11,673 | 12,451 |

| Sep-19 | 12,986 | 11,611 | 12,561 |

| Oct-19 | 13,099 | 11,646 | 12,713 |

| Nov-19 | 13,257 | 11,640 | 12,831 |

| Dec-19 | 13,484 | 11,632 | 13,020 |

| Jan-20 | 13,461 | 11,855 | 13,081 |

| Feb-20 | 12,972 | 12,069 | 12,760 |

| Mar-20 | 12,084 | 11,998 | 11,958 |

| Apr-20 | 12,415 | 12,211 | 12,606 |

| May-20 | 12,677 | 12,268 | 12,916 |

| Jun-20 | 12,791 | 12,345 | 13,122 |

| Jul-20 | 13,180 | 12,530 | 13,507 |

| Aug-20 | 13,569 | 12,428 | 13,767 |

| Sep-20 | 13,326 | 12,422 | 13,595 |

| Oct-20 | 13,097 | 12,366 | 13,451 |

| Nov-20 | 13,853 | 12,488 | 14,255 |

| Dec-20 | 14,233 | 12,505 | 14,564 |

| Jan-21 | 14,176 | 12,415 | 14,469 |

| Feb-21 | 14,268 | 12,236 | 14,492 |

| Mar-21 | 14,509 | 12,083 | 14,610 |

| Apr-21 | 14,889 | 12,178 | 14,938 |

| May-21 | 14,981 | 12,218 | 15,096 |

| Jun-21 | 15,154 | 12,304 | 15,206 |

| Jul-21 | 15,211 | 12,442 | 15,336 |

| Aug-21 | 15,395 | 12,418 | 15,465 |

| Sep-21 | 15,061 | 12,310 | 15,142 |

| Oct-21 | 15,385 | 12,307 | 15,385 |

| Nov-21 | 15,246 | 12,344 | 15,210 |

| Dec-21 | 15,477 | 12,312 | 15,491 |

| Jan-22 | 15,060 | 12,047 | 14,996 |

| Feb-22 | 14,926 | 11,912 | 14,777 |

| Mar-22 | 14,840 | 11,581 | 14,662 |

| Apr-22 | 14,326 | 11,142 | 13,921 |

| May-22 | 14,338 | 11,214 | 13,970 |

| Jun-22 | 13,775 | 11,038 | 13,328 |

| Jul-22 | 14,032 | 11,307 | 13,895 |

| Aug-22 | 13,787 | 10,988 | 13,494 |

| Sep-22 | 13,443 | 10,513 | 12,619 |

| Oct-22 | 13,629 | 10,377 | 12,866 |

| Nov-22 | 14,019 | 10,759 | 13,564 |

| Dec-22 | 13,814 | 10,710 | 13,345 |

| Jan-23 | 14,191 | 11,040 | 13,950 |

| Feb-23 | 13,927 | 10,754 | 13,588 |

| Mar-23 | 14,091 | 11,027 | 13,865 |

| Apr-23 | 14,192 | 11,094 | 13,978 |

| May-23 | 14,078 | 10,973 | 13,783 |

| Jun-23 | 14,445 | 10,934 | 14,084 |

| Jul-23 | 14,674 | 10,927 | 14,310 |

| Aug-23 | 14,508 | 10,857 | 14,078 |

| Sep-23 | 14,178 | 10,581 | 13,657 |

| Oct-23 | 13,934 | 10,414 | 13,345 |

| Nov-23 | 14,651 | 10,886 | 14,173 |

| Dec-23 | 15,321 | 11,302 | 14,799 |

| Jan-24 | 15,373 | 11,271 | 14,790 |

| Feb-24 | 15,722 | 11,112 | 14,899 |

| Mar-24 | 16,096 | 11,215 | 15,171 |

| Apr-24 | 15,552 | 10,931 | 14,738 |

| May-24 | 16,096 | 11,117 | 15,084 |

| Jun-24 | 16,303 | 11,222 | 15,225 |

The Growth of $10,000 chart compares the performance of the Fund over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

| Total Net Assets | $174,590,060 |

| # of Portfolio Holdings | 150 |

| Portfolio Turnover Rate | 87% |

| Advisory Fees and Waivers | 503,423 |

Average Annual Total Returns

| . | 1 Year | 5 Year | Since Inception |

|---|

| Retail Class (Inception Date: 6/30/15) | 12.86% | 4.84% | 5.58% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.29% |

| Morningstar Moderately Conservative Target Risk Index | 8.10% | 4.17% | 4.78% |

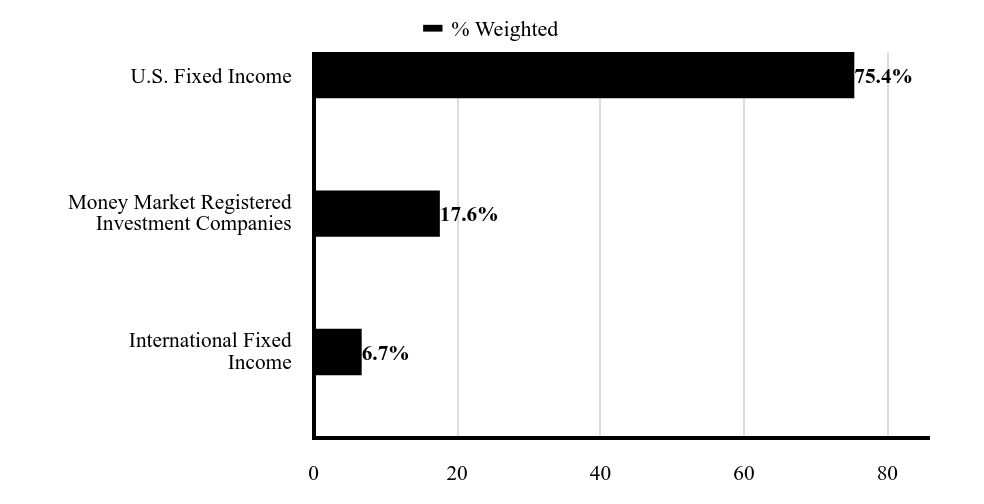

What did the Fund invest in?

| Fidelity Total Bond Fund - Class Z | 12.3% |

| Baird Core Plus Bond Fund - Class I | 11.8% |

| Frost Total Return Bond Fund - Class I | 6.6% |

| Dodge & Cox Income Fund - Class I | 3.9% |

| Berkshire Hathaway Inc | 3.8% |

| Microsoft Corp | 3.6% |

| Fidelity Advisor High Income Advantage Fund - Class Z | 3.6% |

| iShares 20+ Year Treasury Bond ETF | 3.6% |

| BrandywineGLOBAL High Yield Fund - Class I | 3.6% |

| NVIDIA Corp | 2.6% |

| As a percentage of total net assets. Holdings exclude short-term investments and derivatives. |

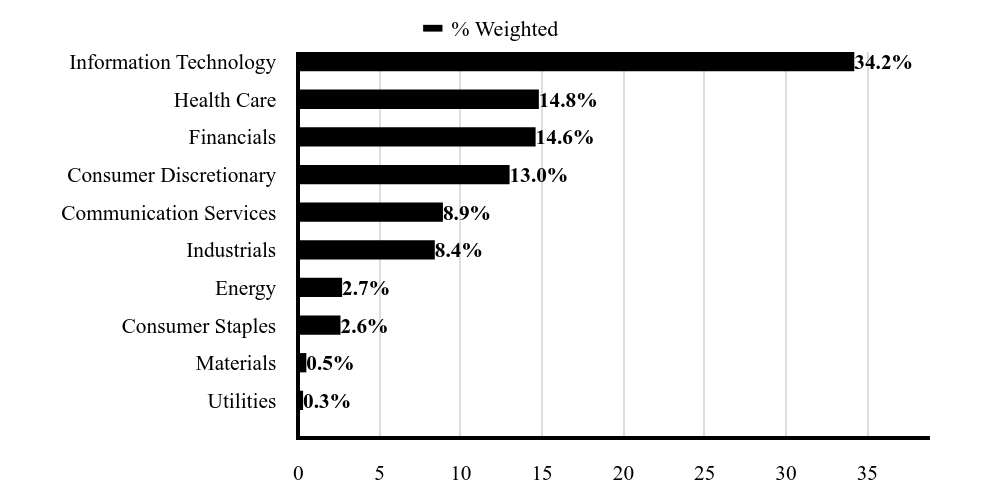

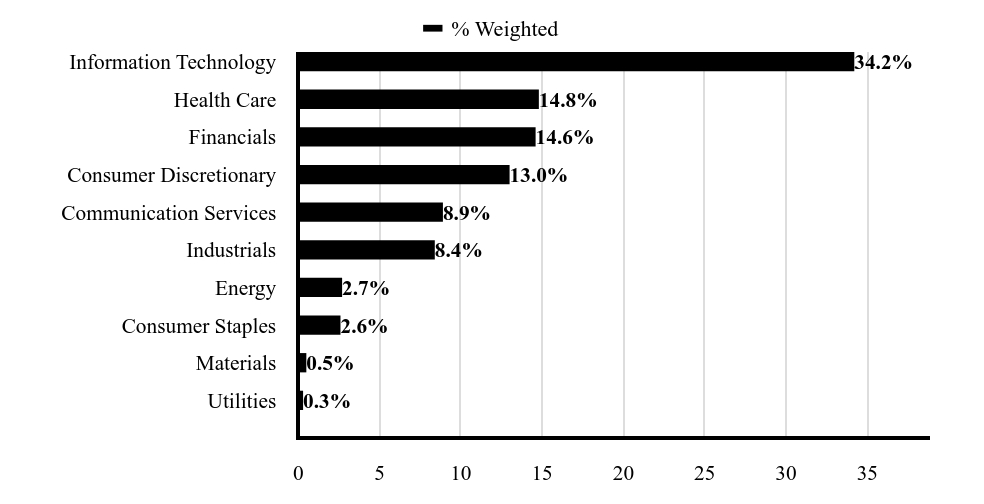

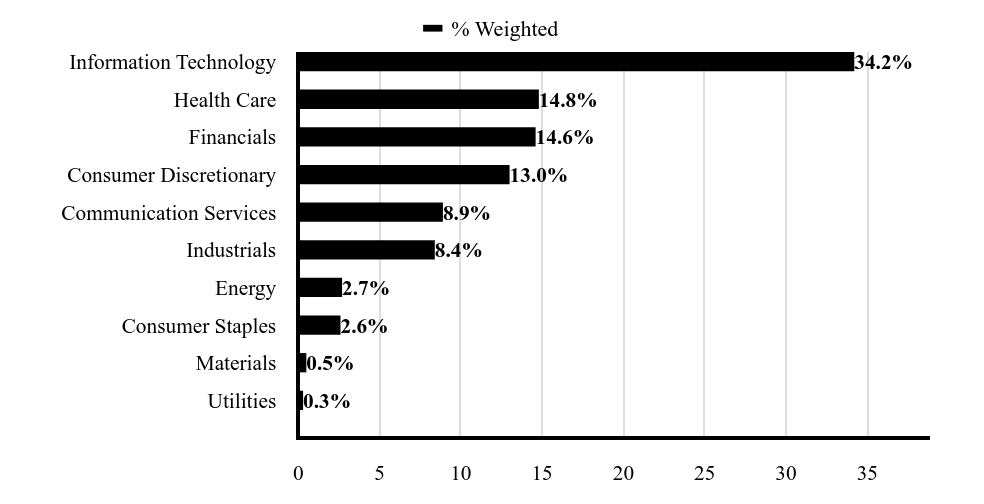

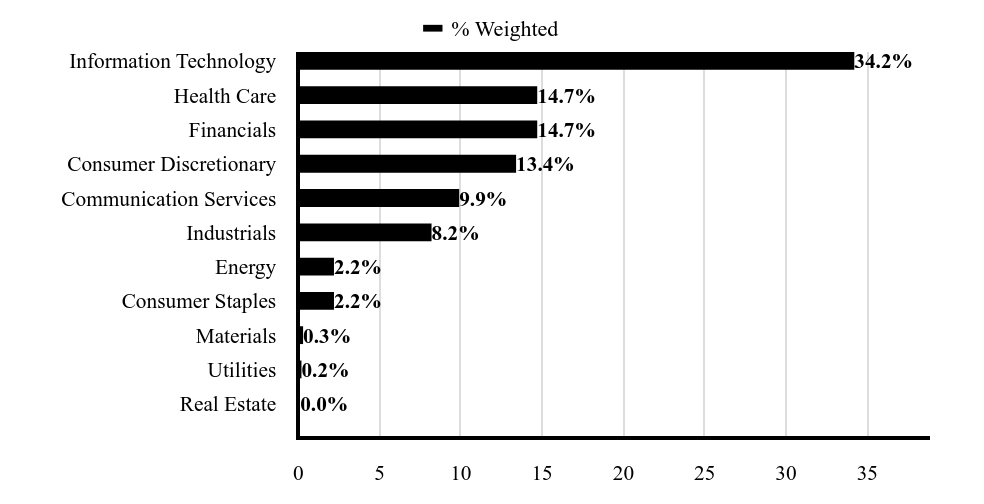

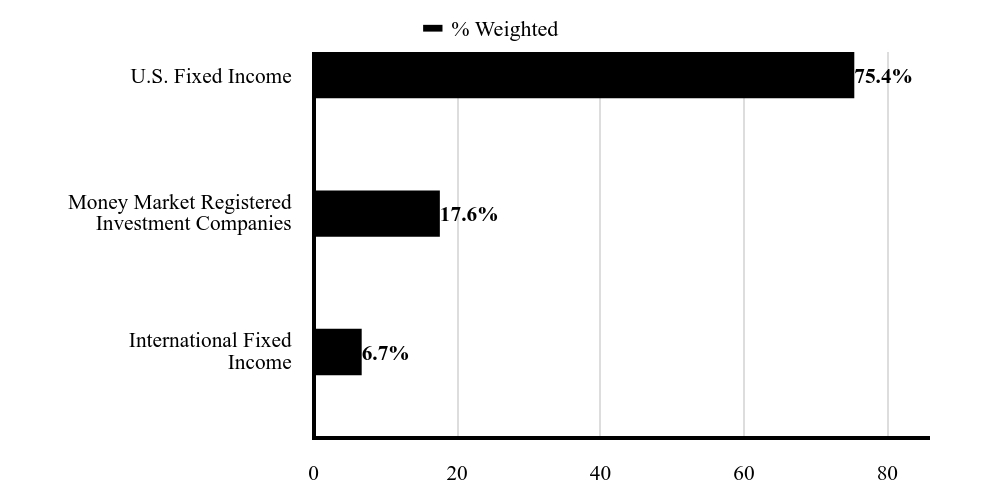

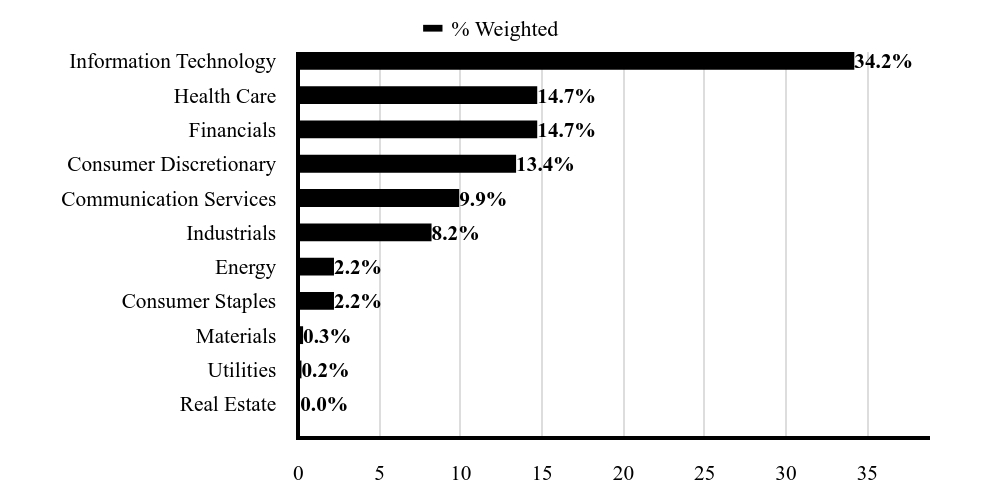

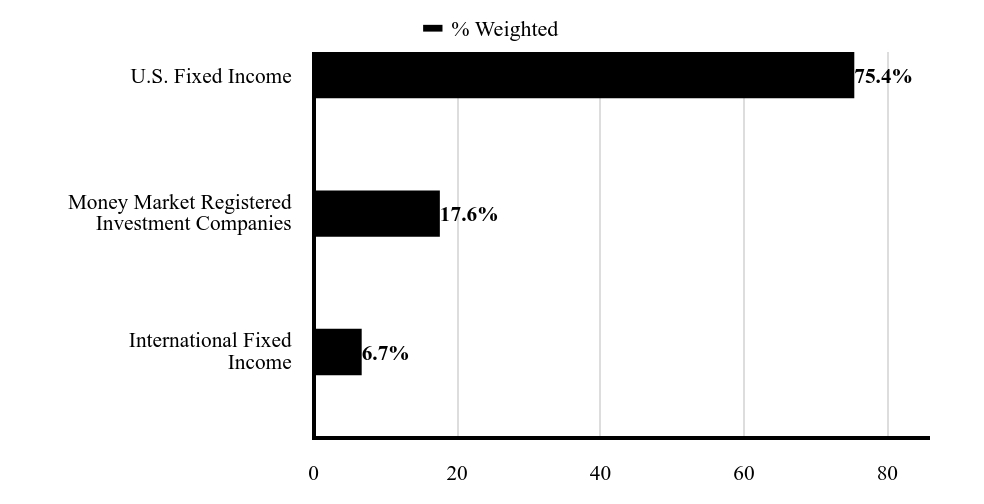

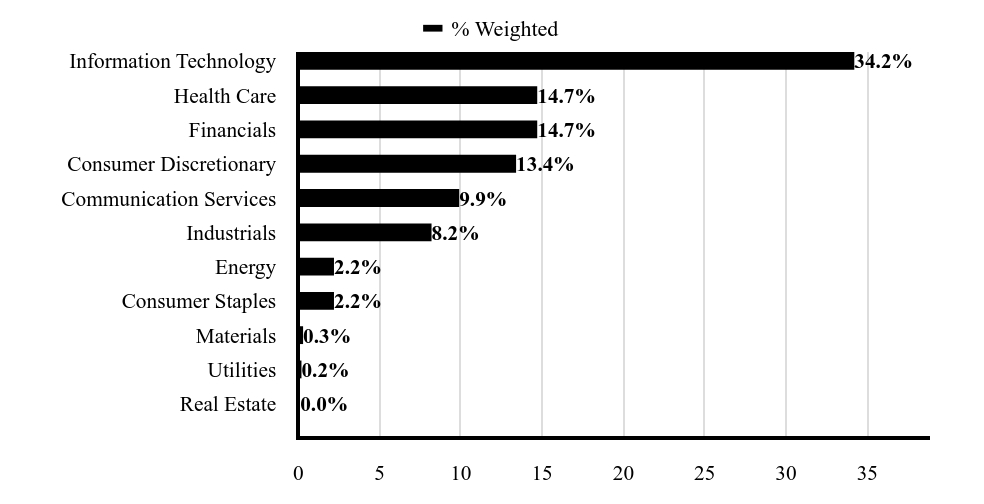

| Value | Value |

|---|

| Utilities | 0.3%Footnote Reference |

| Materials | 0.5%Footnote Reference |

| Consumer Staples | 2.6%Footnote Reference |

| Energy | 2.7%Footnote Reference |

| Industrials | 8.4%Footnote Reference |

| Communication Services | 8.9%Footnote Reference |

| Consumer Discretionary | 13.0%Footnote Reference |

| Financials | 14.6%Footnote Reference |

| Health Care | 14.8%Footnote Reference |

| Information Technology | 34.2%Footnote Reference |

| Footnote | Description |

Footnote | As a percentage of total common stocks. Concentrations are subject to change. |

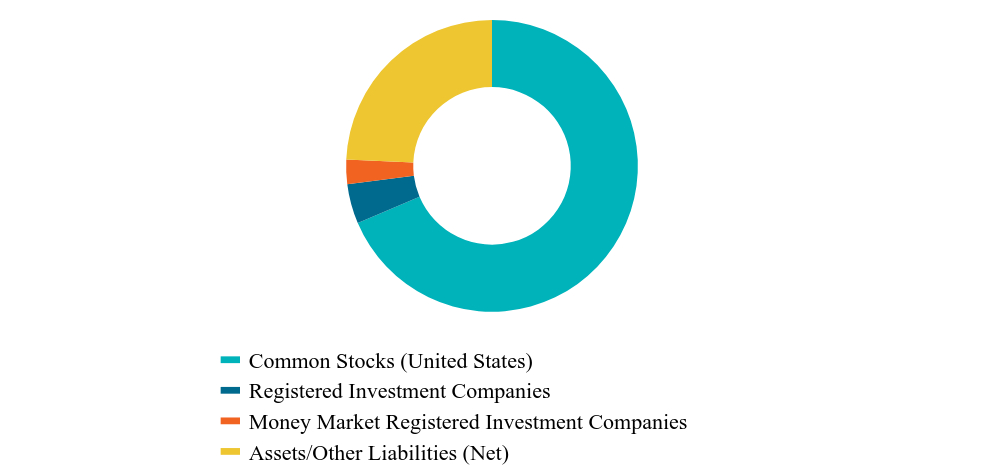

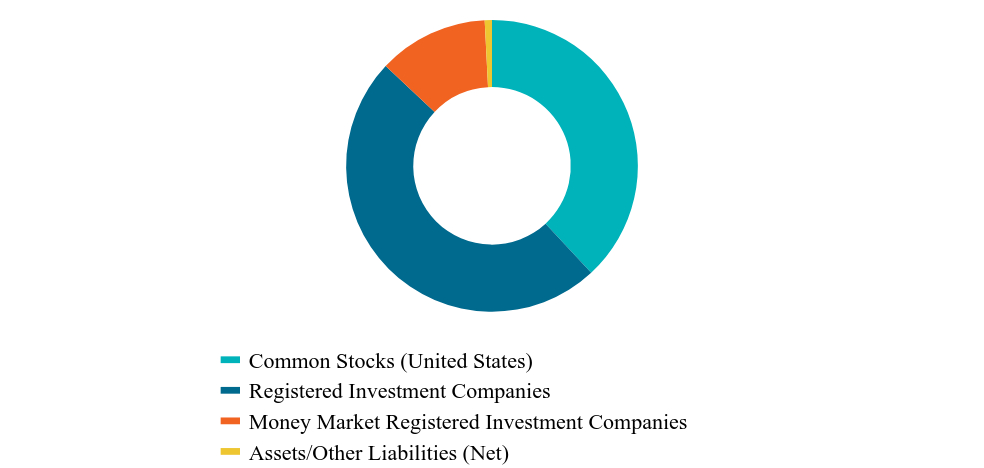

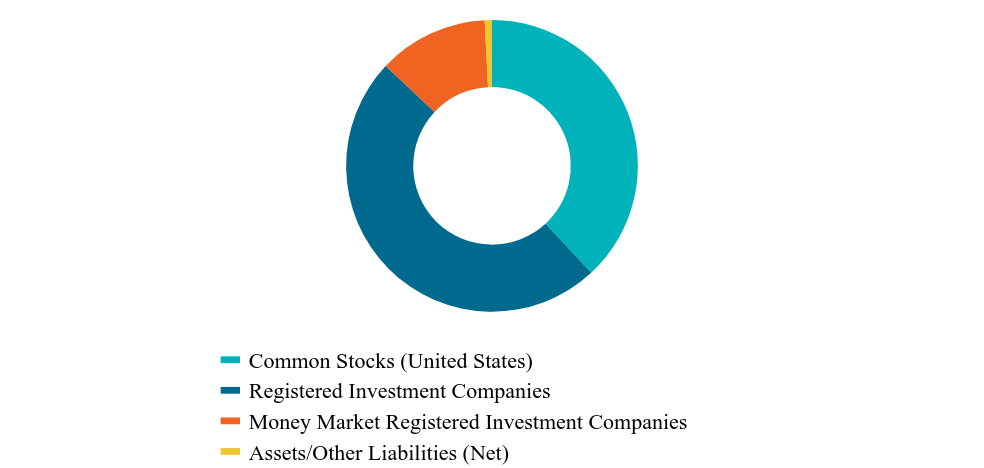

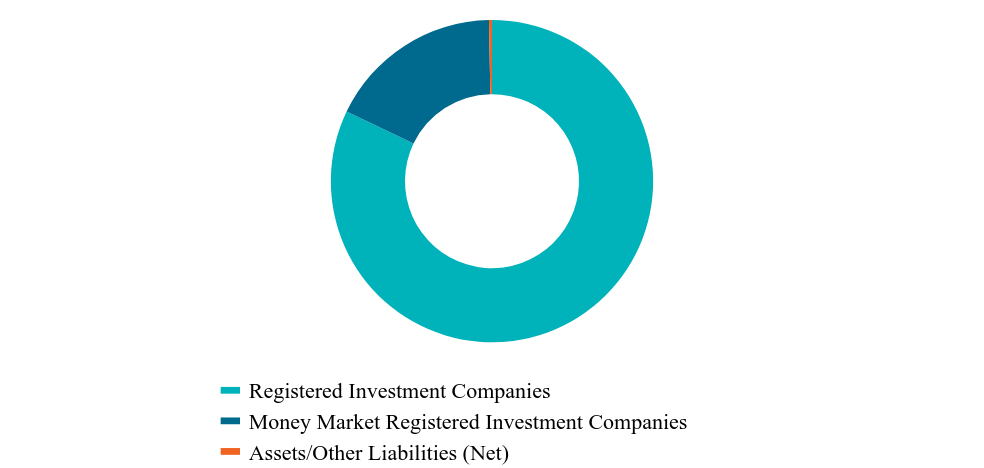

| Value | Value |

|---|

| Common Stocks (United States) | 38.1%Footnote Reference |

| Registered Investment Companies | 48.9%Footnote Reference |

| Money Market Registered Investment Companies | 12.2%Footnote Reference |

| Assets/Other Liabilities (Net) | 0.8% |

| Footnote | Description |

Footnote | As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, proxy voting information and other important materials, scan the QR code or visit www.meederinvestment.com/meeder-funds-resources.

To reduce fund expenses, only one copy of most shareholder documents are delivered to shareholders with multiple accounts at the same address. If you wish to receive copies of this document for each account, please contact the Meeder Funds at 866.633.3371 or contact your financial intermediary.

Semi-Annual Shareholder Report

June 30, 2024

Semi-Annual Shareholder Report

June 30, 2024

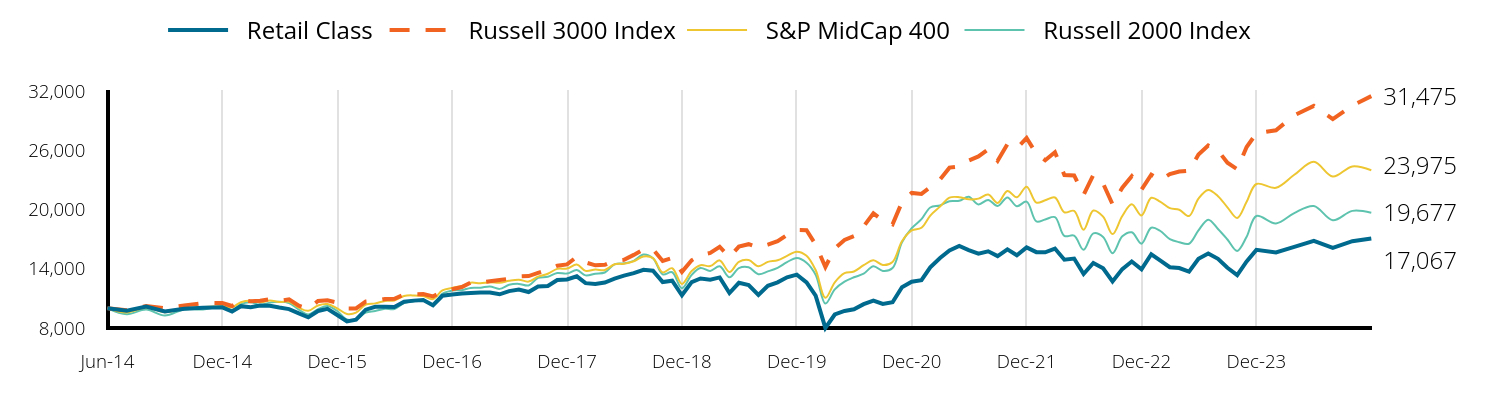

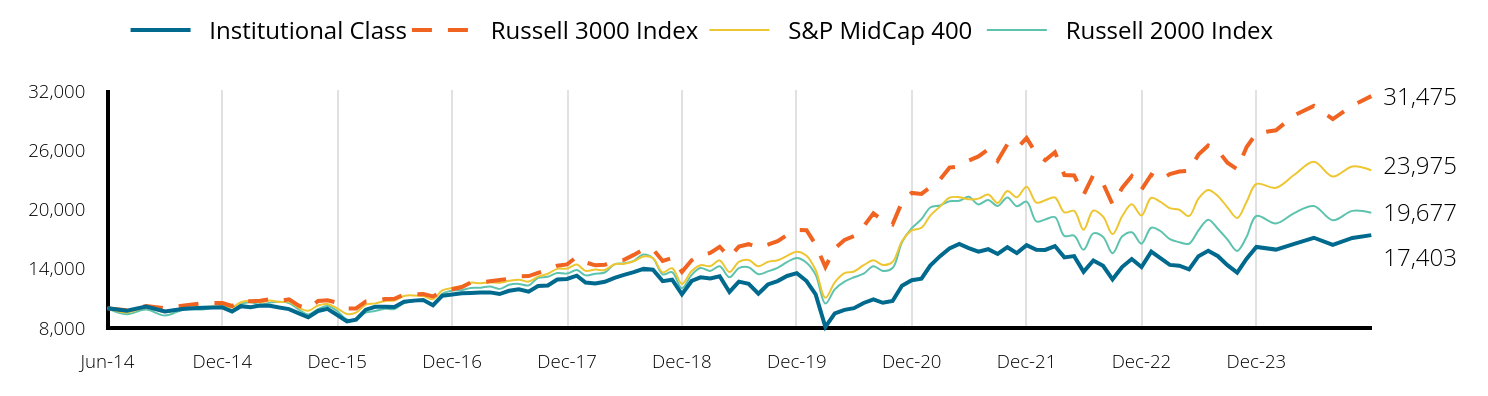

This semi-annual shareholder report contains important information about the Sector Rotation Fund for the period of December 31, 2023, to 6/30/2024, as well as certain changes to the Fund. You can find additional information about the Fund at meederinvestment.com/mutual-funds . You can also request this information by contacting us at 866.633.3371 .

What were the Fund's costs for the period?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| Retail Class | $85.03 | 1.65% |

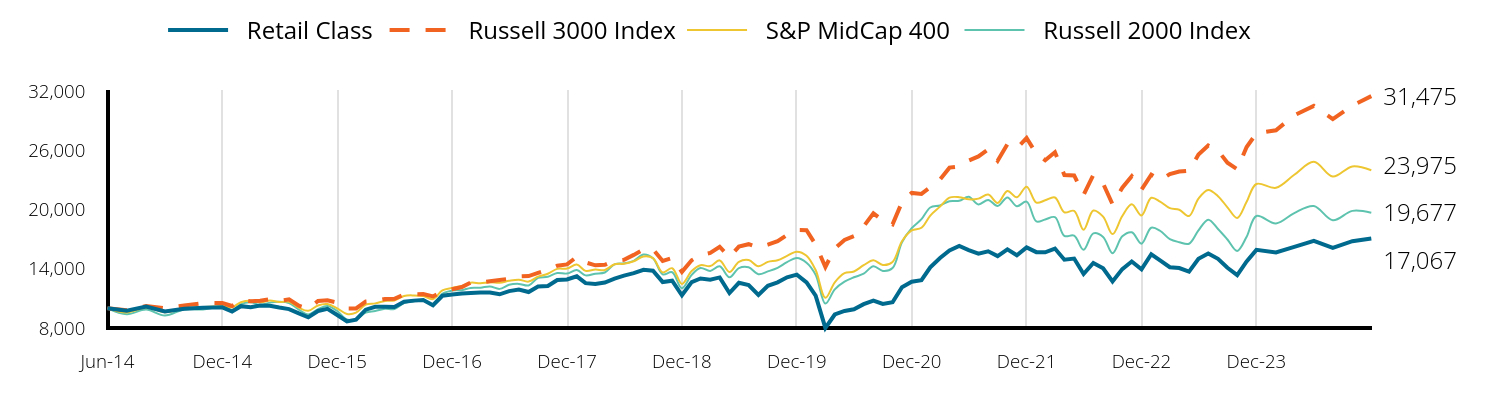

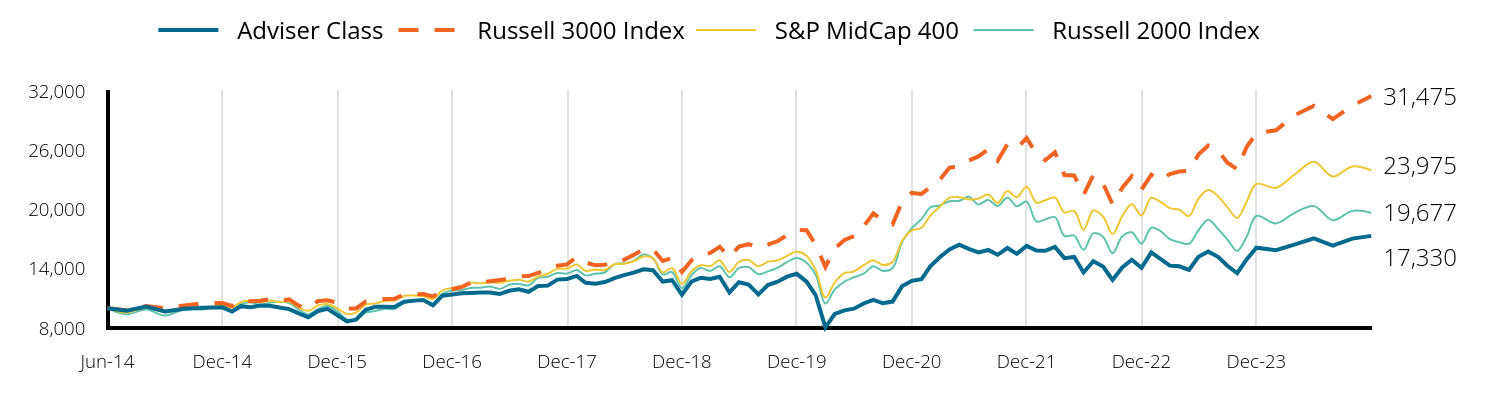

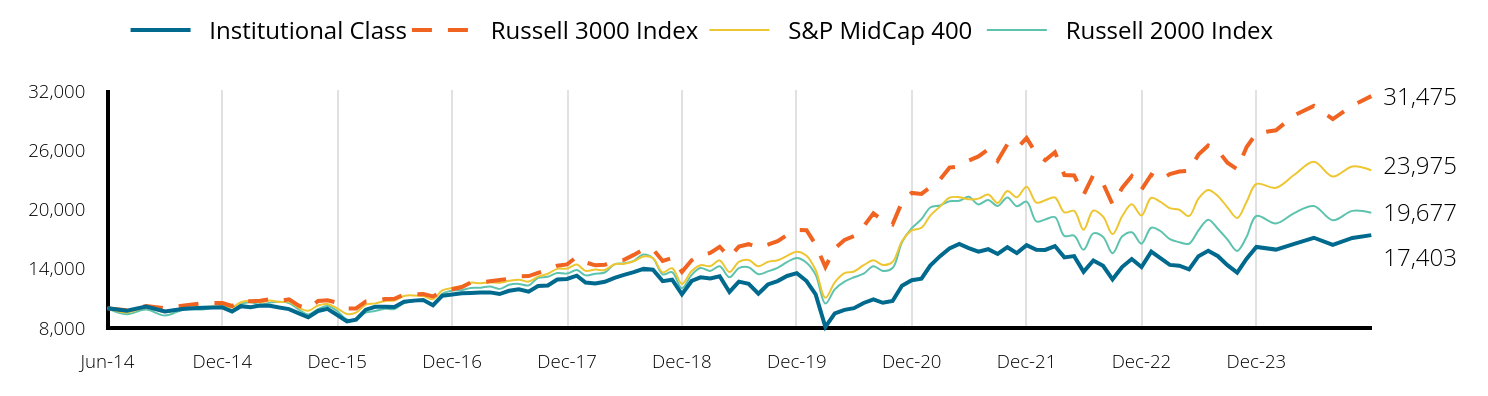

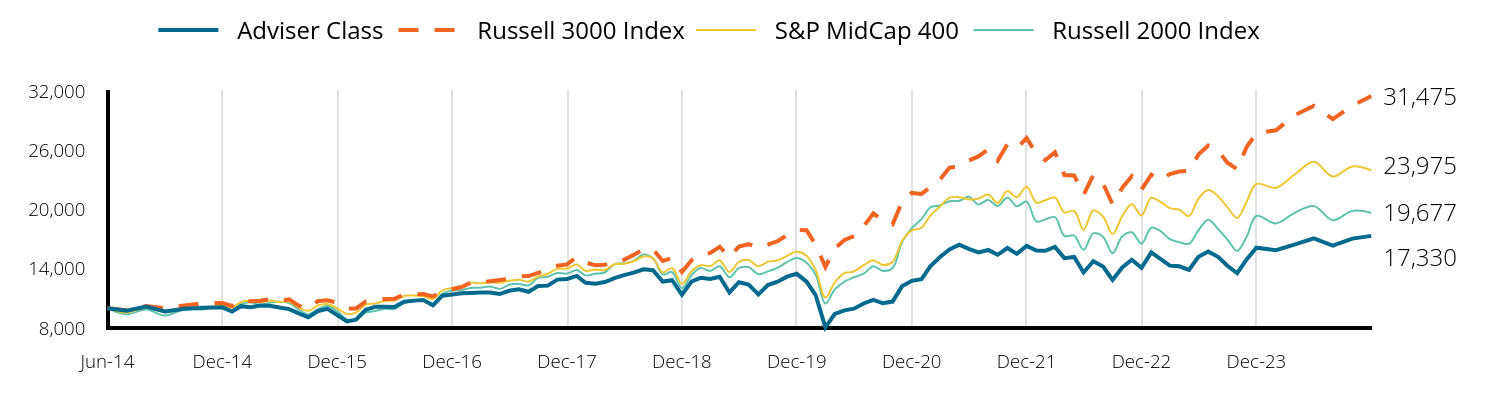

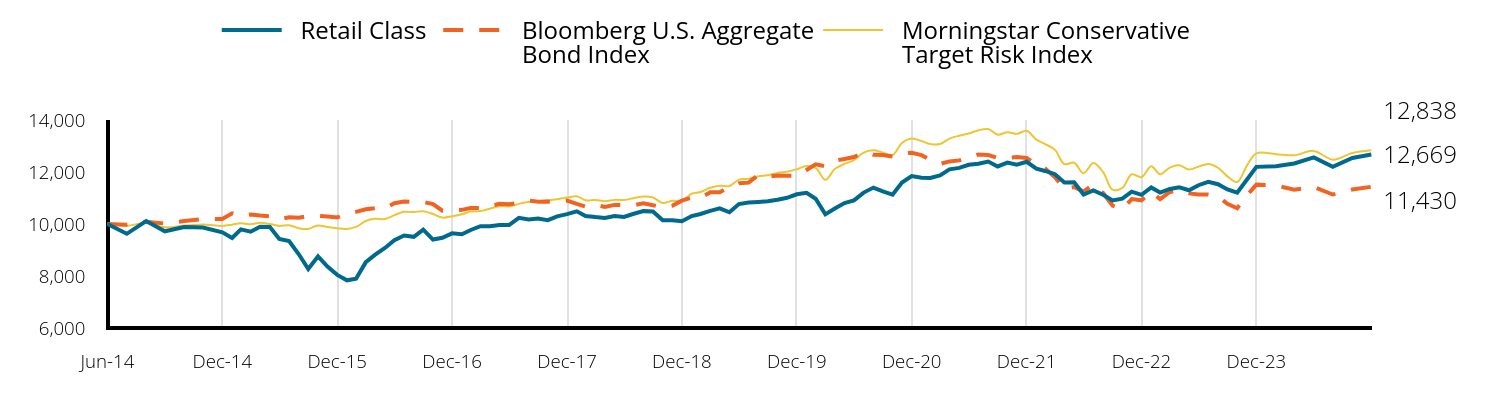

Total Return Based on a $10,000 Investment

| Retail Class | Russell 3000 Index | S&P MidCap 400 | Russell 2000 Index |

|---|

| Jun-14 | 10,000 | 10,000 | 10,000 | 10,000 |

| Jul-14 | 9,750 | 9,803 | 9,573 | 9,395 |

| Aug-14 | 10,182 | 10,214 | 10,059 | 9,861 |

| Sep-14 | 9,675 | 10,001 | 9,602 | 9,264 |

| Oct-14 | 9,945 | 10,276 | 9,944 | 9,875 |

| Nov-14 | 10,054 | 10,525 | 10,128 | 9,884 |

| Dec-14 | 10,095 | 10,525 | 10,211 | 10,165 |

| Jan-15 | 9,673 | 10,232 | 10,097 | 9,838 |

| Feb-15 | 10,210 | 10,825 | 10,614 | 10,422 |

| Mar-15 | 10,109 | 10,715 | 10,754 | 10,604 |

| Apr-15 | 10,267 | 10,763 | 10,594 | 10,333 |

| May-15 | 10,244 | 10,912 | 10,782 | 10,569 |

| Jun-15 | 10,069 | 10,729 | 10,640 | 10,649 |

| Jul-15 | 9,911 | 10,909 | 10,654 | 10,525 |

| Aug-15 | 9,474 | 10,250 | 10,060 | 9,863 |

| Sep-15 | 9,083 | 9,952 | 9,736 | 9,379 |

| Oct-15 | 9,722 | 10,738 | 10,284 | 9,908 |

| Nov-15 | 9,938 | 10,797 | 10,423 | 10,230 |

| Dec-15 | 9,320 | 10,576 | 9,989 | 9,717 |

| Jan-16 | 8,667 | 9,979 | 9,421 | 8,862 |

| Feb-16 | 8,835 | 9,976 | 9,554 | 8,862 |

| Mar-16 | 9,856 | 10,678 | 10,367 | 9,569 |

| Apr-16 | 10,150 | 10,744 | 10,494 | 9,719 |

| May-16 | 10,144 | 10,936 | 10,737 | 9,938 |

| Jun-16 | 10,124 | 10,959 | 10,781 | 9,932 |

| Jul-16 | 10,658 | 11,394 | 11,244 | 10,525 |

| Aug-16 | 10,772 | 11,423 | 11,300 | 10,711 |

| Sep-16 | 10,832 | 11,441 | 11,228 | 10,830 |

| Oct-16 | 10,311 | 11,193 | 10,928 | 10,315 |

| Nov-16 | 11,269 | 11,694 | 11,802 | 11,466 |

| Dec-16 | 11,384 | 11,922 | 12,061 | 11,787 |

| Jan-17 | 11,503 | 12,147 | 12,263 | 11,833 |

| Feb-17 | 11,534 | 12,599 | 12,585 | 12,062 |

| Mar-17 | 11,582 | 12,607 | 12,536 | 12,078 |

| Apr-17 | 11,585 | 12,741 | 12,641 | 12,210 |

| May-17 | 11,414 | 12,871 | 12,579 | 11,962 |

| Jun-17 | 11,739 | 12,987 | 12,783 | 12,375 |

| Jul-17 | 11,896 | 13,232 | 12,896 | 12,467 |

| Aug-17 | 11,640 | 13,258 | 12,698 | 12,308 |

| Sep-17 | 12,209 | 13,581 | 13,195 | 13,077 |

| Oct-17 | 12,257 | 13,877 | 13,493 | 13,188 |

| Nov-17 | 12,865 | 14,299 | 13,989 | 13,568 |

| Dec-17 | 12,911 | 14,442 | 14,020 | 13,513 |

| Jan-18 | 13,234 | 15,203 | 14,423 | 13,867 |

| Feb-18 | 12,542 | 14,642 | 13,784 | 13,330 |

| Mar-18 | 12,448 | 14,349 | 13,912 | 13,502 |

| Apr-18 | 12,609 | 14,403 | 13,876 | 13,619 |

| May-18 | 13,006 | 14,810 | 14,448 | 14,445 |

| Jun-18 | 13,301 | 14,907 | 14,509 | 14,549 |

| Jul-18 | 13,557 | 15,401 | 14,765 | 14,803 |

| Aug-18 | 13,891 | 15,942 | 15,237 | 15,441 |

| Sep-18 | 13,800 | 15,968 | 15,070 | 15,069 |

| Oct-18 | 12,648 | 14,793 | 13,631 | 13,433 |

| Nov-18 | 12,788 | 15,089 | 14,057 | 13,646 |

| Dec-18 | 11,317 | 13,685 | 12,466 | 12,025 |

| Jan-19 | 12,655 | 14,859 | 13,770 | 13,378 |

| Feb-19 | 13,017 | 15,382 | 14,354 | 14,073 |

| Mar-19 | 12,894 | 15,606 | 14,272 | 13,779 |

| Apr-19 | 13,122 | 16,230 | 14,846 | 14,247 |

| May-19 | 11,541 | 15,179 | 13,663 | 13,139 |

| Jun-19 | 12,574 | 16,246 | 14,707 | 14,067 |

| Jul-19 | 12,338 | 16,487 | 14,882 | 14,148 |

| Aug-19 | 11,347 | 16,151 | 14,257 | 13,450 |

| Sep-19 | 12,279 | 16,434 | 14,694 | 13,730 |

| Oct-19 | 12,621 | 16,788 | 14,860 | 14,091 |

| Nov-19 | 13,128 | 17,426 | 15,302 | 14,671 |

| Dec-19 | 13,408 | 17,929 | 15,732 | 15,094 |

| Jan-20 | 12,616 | 17,910 | 15,321 | 14,610 |

| Feb-20 | 11,272 | 16,444 | 13,867 | 13,380 |

| Mar-20 | 8,011 | 14,182 | 11,059 | 10,473 |

| Apr-20 | 9,369 | 16,061 | 12,628 | 11,912 |

| May-20 | 9,726 | 16,919 | 13,552 | 12,687 |

| Jun-20 | 9,892 | 17,306 | 13,722 | 13,135 |

| Jul-20 | 10,414 | 18,289 | 14,355 | 13,499 |

| Aug-20 | 10,783 | 19,614 | 14,859 | 14,260 |

| Sep-20 | 10,432 | 18,900 | 14,377 | 13,783 |

| Oct-20 | 10,603 | 18,492 | 14,689 | 14,072 |

| Nov-20 | 12,137 | 20,741 | 16,786 | 16,666 |

| Dec-20 | 12,689 | 21,675 | 17,881 | 18,107 |

| Jan-21 | 12,842 | 21,578 | 18,150 | 19,019 |

| Feb-21 | 14,138 | 22,253 | 19,384 | 20,204 |

| Mar-21 | 15,085 | 23,050 | 20,289 | 20,407 |

| Apr-21 | 15,847 | 24,238 | 21,203 | 20,835 |

| May-21 | 16,307 | 24,349 | 21,245 | 20,878 |

| Jun-21 | 15,887 | 24,950 | 21,027 | 21,283 |

| Jul-21 | 15,531 | 25,371 | 21,100 | 20,514 |

| Aug-21 | 15,765 | 26,095 | 21,511 | 20,973 |

| Sep-21 | 15,281 | 24,924 | 20,657 | 20,355 |

| Oct-21 | 15,958 | 26,610 | 21,872 | 21,221 |

| Nov-21 | 15,363 | 26,205 | 21,230 | 20,336 |

| Dec-21 | 16,159 | 27,236 | 22,308 | 20,791 |

| Jan-22 | 15,681 | 25,634 | 20,700 | 18,789 |

| Feb-22 | 15,660 | 24,988 | 20,930 | 18,990 |

| Mar-22 | 16,043 | 25,799 | 21,220 | 19,226 |

| Apr-22 | 14,912 | 23,484 | 19,712 | 17,321 |

| May-22 | 15,033 | 23,452 | 19,860 | 17,347 |

| Jun-22 | 13,471 | 21,490 | 17,949 | 15,920 |

| Jul-22 | 14,592 | 23,506 | 19,897 | 17,582 |

| Aug-22 | 14,052 | 22,629 | 19,279 | 17,222 |

| Sep-22 | 12,717 | 20,531 | 17,507 | 15,572 |

| Oct-22 | 13,963 | 22,214 | 19,348 | 17,286 |

| Nov-22 | 14,735 | 23,374 | 20,532 | 17,690 |

| Dec-22 | 13,938 | 22,005 | 19,395 | 16,542 |

| Jan-23 | 15,465 | 23,521 | 21,184 | 18,154 |

| Feb-23 | 14,849 | 22,971 | 20,800 | 17,847 |

| Mar-23 | 14,152 | 23,585 | 20,133 | 16,995 |

| Apr-23 | 14,075 | 23,837 | 19,975 | 16,689 |

| May-23 | 13,702 | 23,929 | 19,338 | 16,535 |

| Jun-23 | 15,009 | 25,563 | 21,110 | 17,879 |

| Jul-23 | 15,546 | 26,480 | 21,980 | 18,973 |

| Aug-23 | 15,000 | 25,968 | 21,345 | 18,024 |

| Sep-23 | 14,102 | 24,731 | 20,223 | 16,962 |

| Oct-23 | 13,360 | 24,076 | 19,143 | 15,806 |

| Nov-23 | 14,745 | 26,321 | 20,772 | 17,236 |

| Dec-23 | 15,910 | 27,717 | 22,583 | 19,342 |

| Jan-24 | 15,646 | 28,024 | 22,196 | 18,590 |

| Feb-24 | 16,209 | 29,541 | 23,514 | 19,641 |

| Mar-24 | 16,820 | 30,494 | 24,830 | 20,344 |

| Apr-24 | 16,108 | 29,152 | 23,336 | 18,912 |

| May-24 | 16,794 | 30,530 | 24,360 | 19,861 |

| Jun-24 | 17,067 | 31,475 | 23,975 | 19,677 |

The Growth of $10,000 chart compares the performance of the Fund over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

| Total Net Assets | $36,570,948 |

| # of Portfolio Holdings | 583 |

| Portfolio Turnover Rate | 164% |

| Advisory Fees and Waivers | 132,883 |

Average Annual Total Returns

| . | 1 Year | 5 Year | 10 Year |

|---|

| Retail Class | 13.72% | 6.30% | 5.49% |

| Russell 3000 Index | 23.13% | 14.14% | 12.15% |

| S&P MidCap 400 | 13.57% | 10.27% | 9.14% |

| Russell 2000 Index | 10.06% | 6.94% | 7.00% |

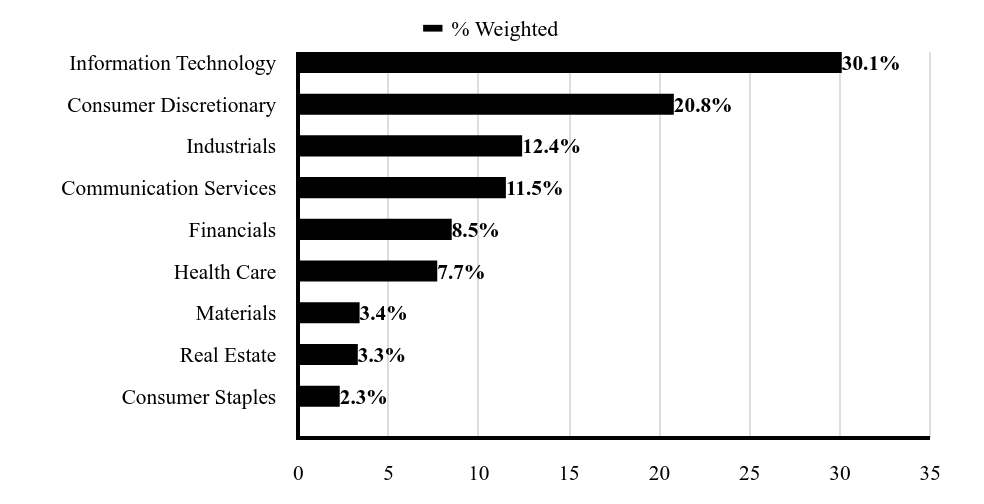

What did the Fund invest in?

| Amazon.com Inc | 3.9% |

| Microsoft Corp | 3.6% |

| Apple Inc | 3.3% |

| NVIDIA Corp | 3.2% |

| Alphabet Inc | 2.9% |

| Meta Platforms Inc | 1.6% |

| Fidelity Total Bond Fund - Class Z | 1.4% |

| Baird Core Plus Bond Fund - Class I | 1.4% |

| Tesla Inc | 1.2% |

| Home Depot Inc/The | 0.8% |

| As a percentage of total net assets. Holdings exclude short-term investments and derivatives. |

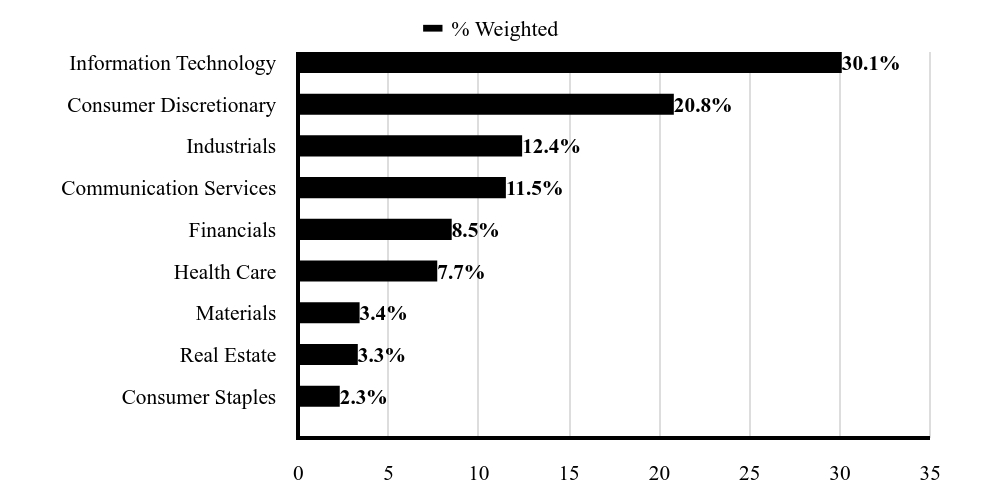

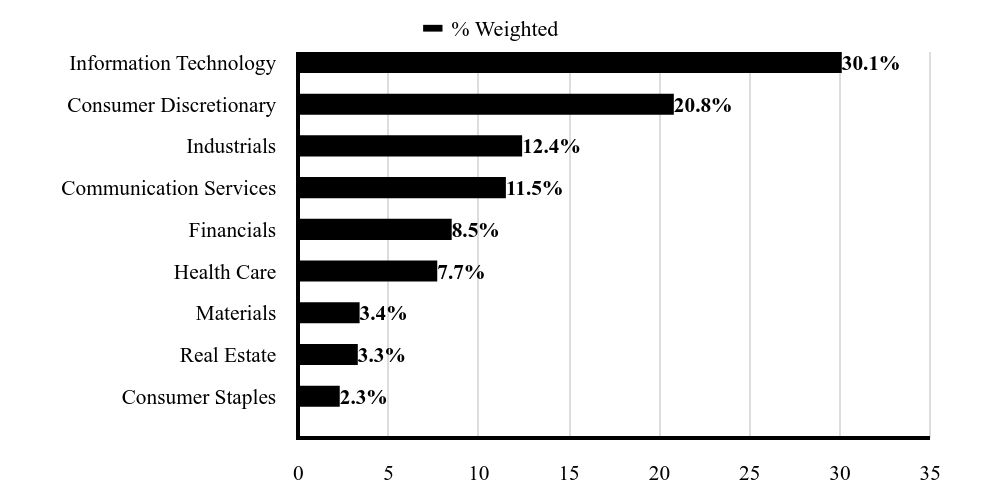

| Value | Value |

|---|

| Consumer Staples | 2.3%Footnote Reference |

| Real Estate | 3.3%Footnote Reference |

| Materials | 3.4%Footnote Reference |

| Health Care | 7.7%Footnote Reference |

| Financials | 8.5%Footnote Reference |

| Communication Services | 11.5%Footnote Reference |

| Industrials | 12.4%Footnote Reference |

| Consumer Discretionary | 20.8%Footnote Reference |

| Information Technology | 30.1%Footnote Reference |

| Footnote | Description |

Footnote | As a percentage of total common stocks. Concentrations are subject to change. |

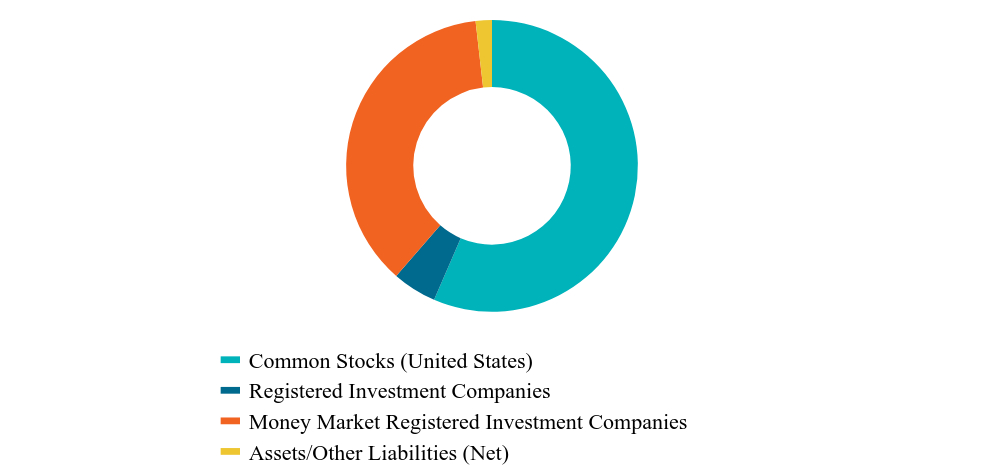

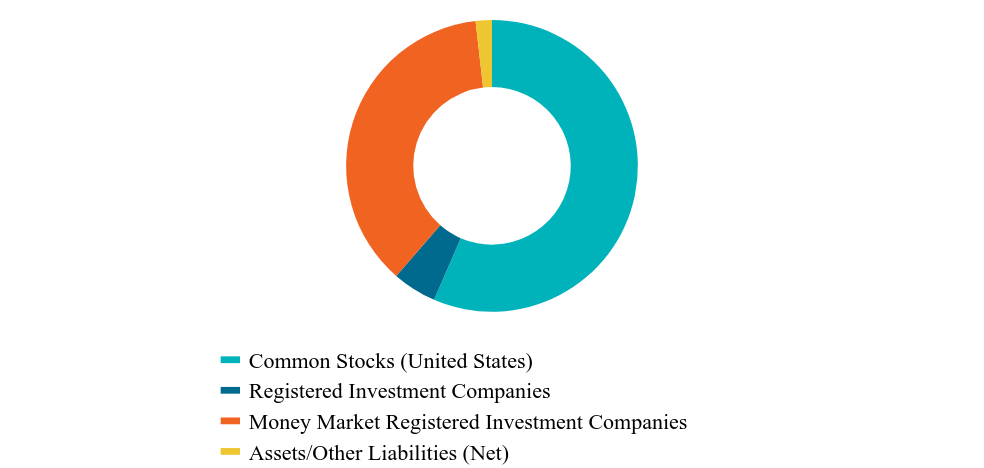

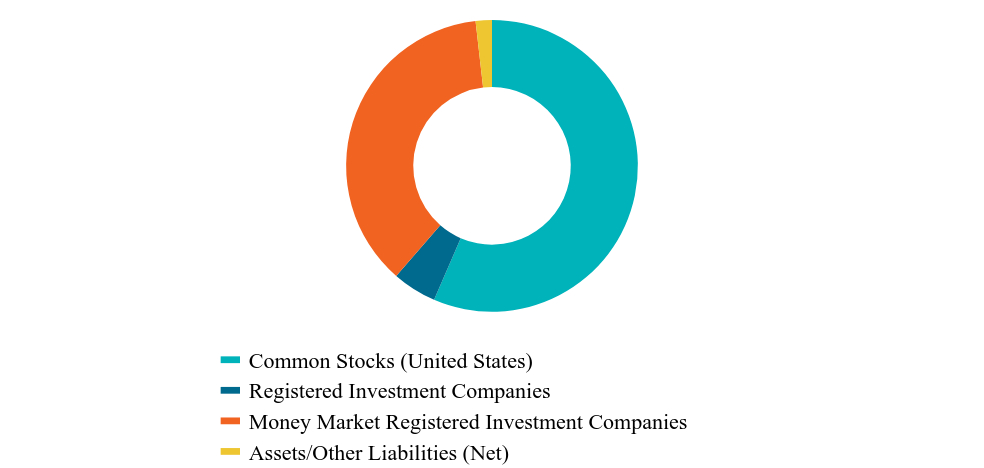

| Value | Value |

|---|

| Common Stocks (United States) | 56.5%Footnote Reference |

| Registered Investment Companies | 4.9%Footnote Reference |

| Money Market Registered Investment Companies | 36.8%Footnote Reference |

| Assets/Other Liabilities (Net) | 1.8% |

| Footnote | Description |

Footnote | As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, proxy voting information and other important materials, scan the QR code or visit www.meederinvestment.com/meeder-funds-resources.

To reduce fund expenses, only one copy of most shareholder documents are delivered to shareholders with multiple accounts at the same address. If you wish to receive copies of this document for each account, please contact the Meeder Funds at 866.633.3371 or contact your financial intermediary.

Semi-Annual Shareholder Report

June 30, 2024

Semi-Annual Shareholder Report

June 30, 2024

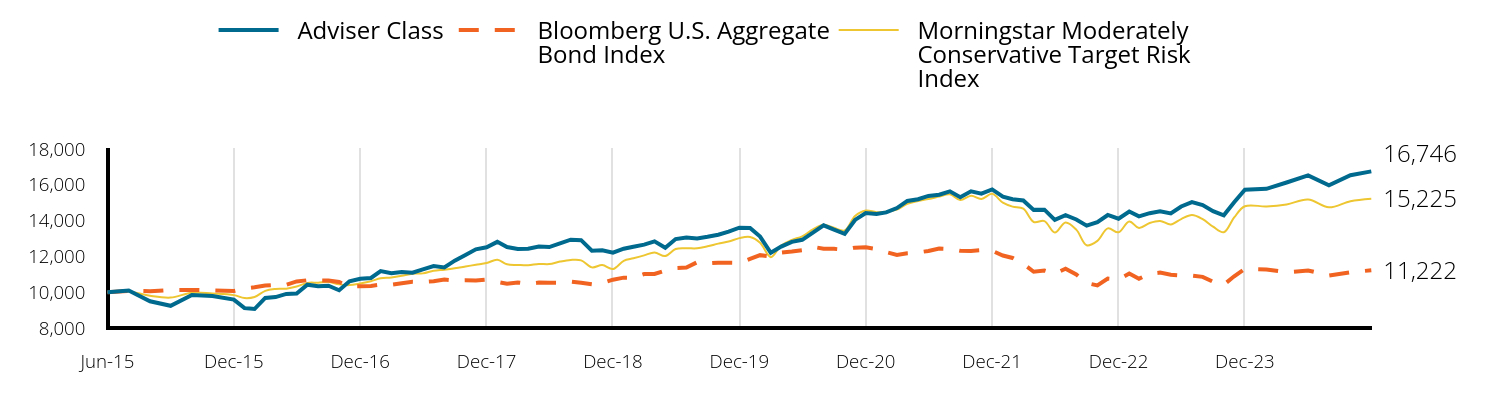

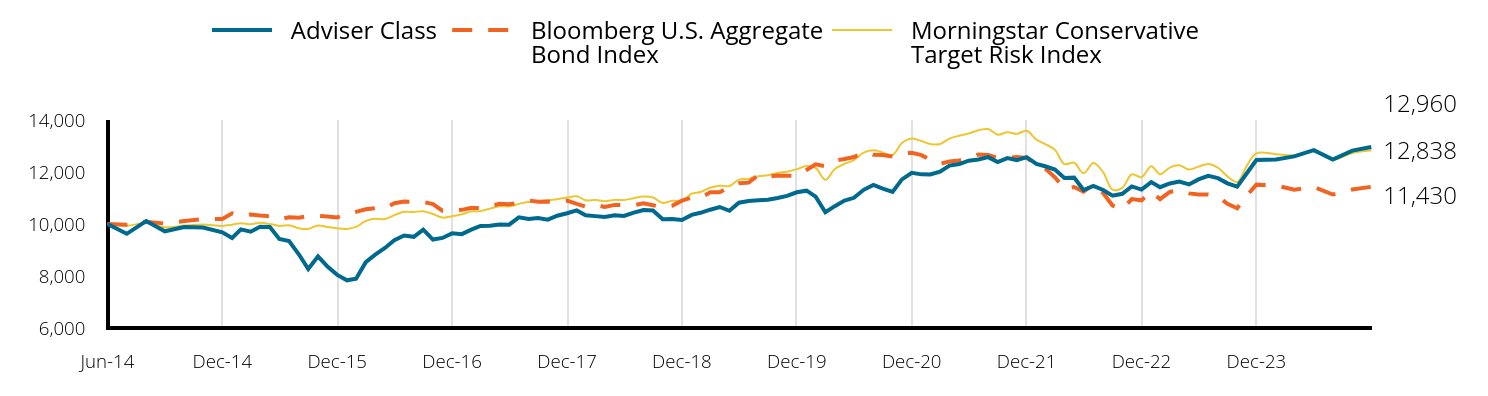

This semi-annual shareholder report contains important information about the Moderate Allocation Fund for the period of December 31, 2023, to 6/30/2024, as well as certain changes to the Fund. You can find additional information about the Fund at meederinvestment.com/mutual-funds . You can also request this information by contacting us at 866.633.3371 .

What were the Fund's costs for the period?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| Adviser Class | $48.27 | 0.94% |

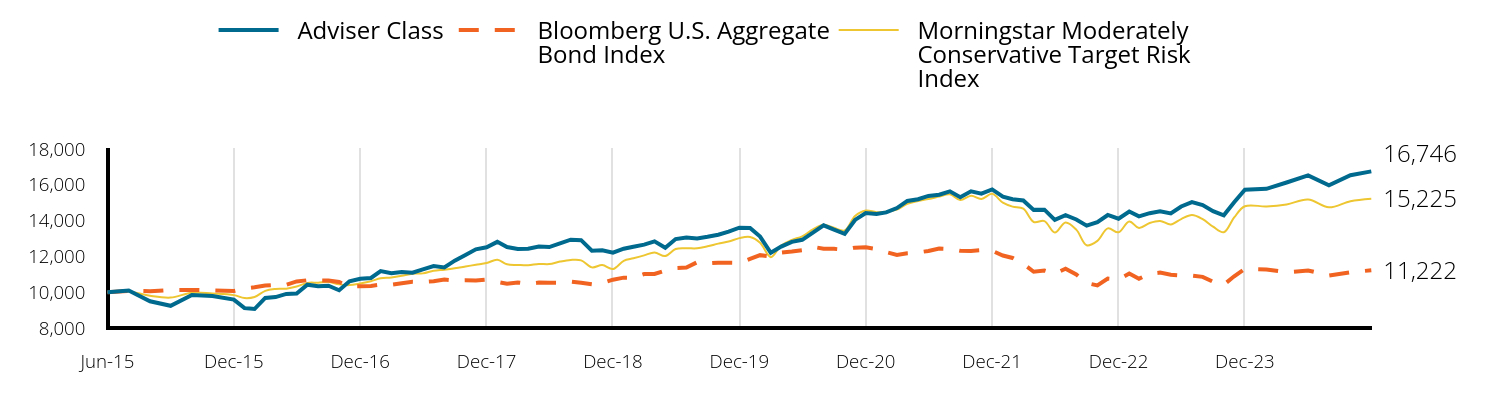

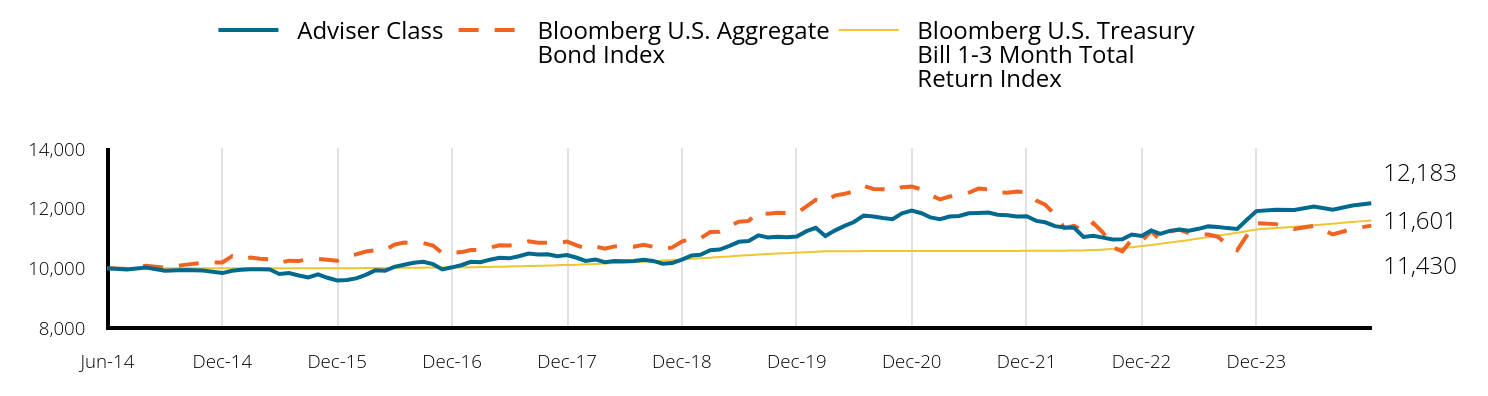

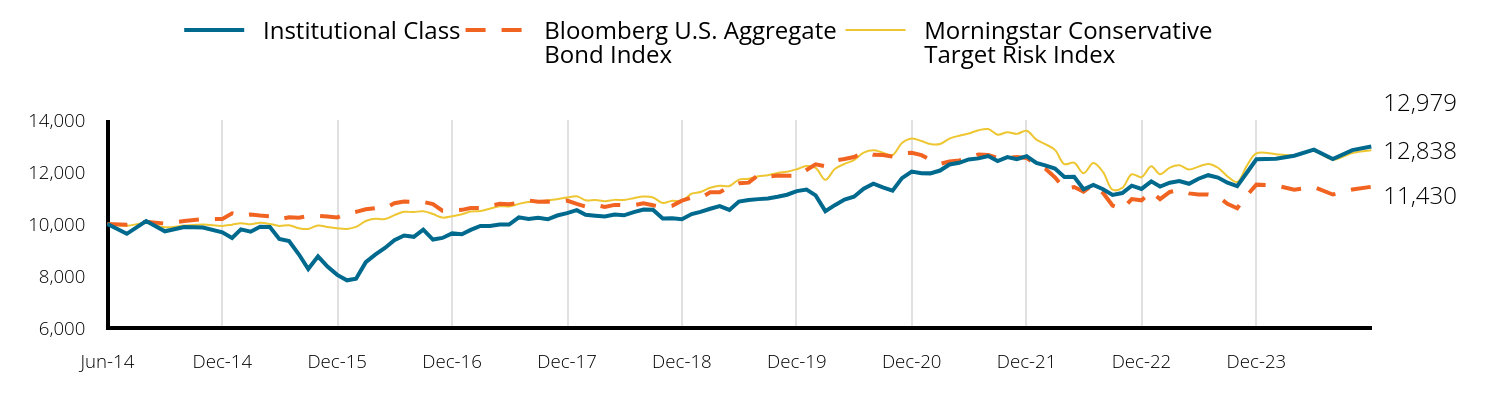

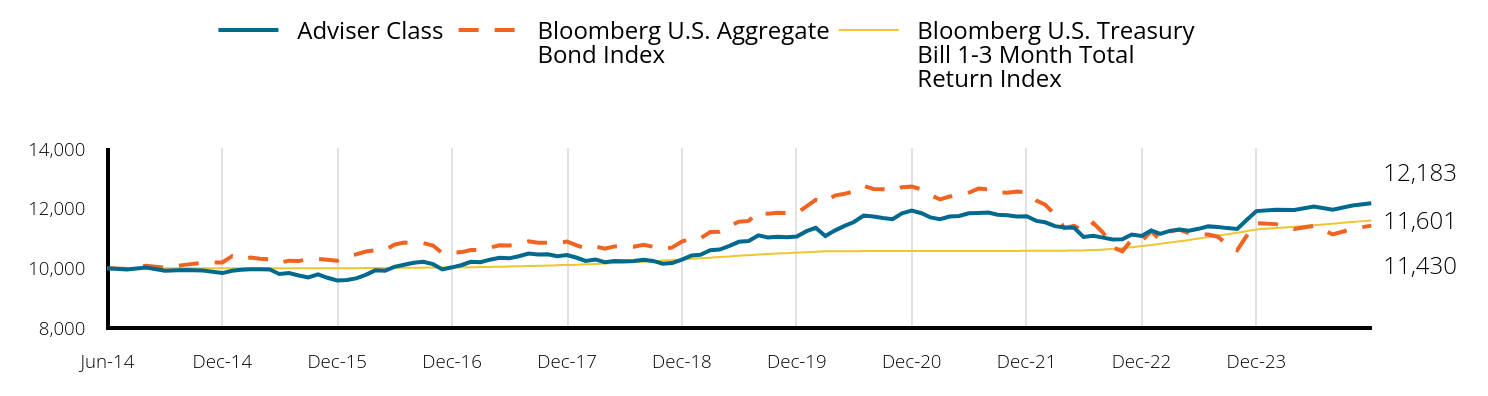

Total Return Based on a $10,000 Investment

| Adviser Class | Bloomberg U.S. Aggregate Bond Index | Morningstar Moderately Conservative Target Risk Index |

|---|

| Jun-15 | 10,000 | 10,000 | 10,000 |

| Jul-15 | 10,090 | 10,070 | 10,037 |

| Aug-15 | 9,490 | 10,055 | 9,801 |

| Sep-15 | 9,240 | 10,123 | 9,700 |

| Oct-15 | 9,847 | 10,125 | 9,973 |

| Nov-15 | 9,787 | 10,098 | 9,925 |

| Dec-15 | 9,585 | 10,065 | 9,836 |

| Jan-16 | 9,111 | 10,204 | 9,669 |

| Feb-16 | 9,060 | 10,276 | 9,729 |

| Mar-16 | 9,677 | 10,371 | 10,076 |

| Apr-16 | 9,728 | 10,410 | 10,178 |

| May-16 | 9,905 | 10,413 | 10,195 |

| Jun-16 | 9,930 | 10,600 | 10,313 |

| Jul-16 | 10,420 | 10,667 | 10,520 |

| Aug-16 | 10,333 | 10,655 | 10,530 |

| Sep-16 | 10,364 | 10,649 | 10,566 |

| Oct-16 | 10,110 | 10,567 | 10,436 |

| Nov-16 | 10,607 | 10,317 | 10,396 |

| Dec-16 | 10,748 | 10,332 | 10,491 |

| Jan-17 | 10,795 | 10,352 | 10,615 |

| Feb-17 | 11,180 | 10,422 | 10,778 |

| Mar-17 | 11,057 | 10,416 | 10,816 |

| Apr-17 | 11,129 | 10,497 | 10,918 |

| May-17 | 11,088 | 10,577 | 11,032 |

| Jun-17 | 11,275 | 10,567 | 11,051 |

| Jul-17 | 11,463 | 10,612 | 11,192 |

| Aug-17 | 11,381 | 10,707 | 11,259 |

| Sep-17 | 11,763 | 10,656 | 11,336 |

| Oct-17 | 12,083 | 10,663 | 11,434 |

| Nov-17 | 12,393 | 10,649 | 11,533 |

| Dec-17 | 12,511 | 10,698 | 11,630 |

| Jan-18 | 12,811 | 10,575 | 11,812 |

| Feb-18 | 12,522 | 10,474 | 11,557 |

| Mar-18 | 12,414 | 10,542 | 11,523 |

| Apr-18 | 12,425 | 10,463 | 11,506 |

| May-18 | 12,554 | 10,538 | 11,576 |

| Jun-18 | 12,522 | 10,525 | 11,569 |

| Jul-18 | 12,727 | 10,527 | 11,710 |

| Aug-18 | 12,932 | 10,595 | 11,801 |

| Sep-18 | 12,905 | 10,527 | 11,779 |

| Oct-18 | 12,321 | 10,444 | 11,385 |

| Nov-18 | 12,342 | 10,506 | 11,512 |

| Dec-18 | 12,203 | 10,699 | 11,297 |

| Jan-19 | 12,428 | 10,813 | 11,751 |

| Feb-19 | 12,540 | 10,806 | 11,891 |

| Mar-19 | 12,658 | 11,014 | 12,056 |

| Apr-19 | 12,839 | 11,017 | 12,217 |

| May-19 | 12,478 | 11,212 | 12,022 |

| Jun-19 | 12,968 | 11,353 | 12,410 |

| Jul-19 | 13,059 | 11,378 | 12,451 |

| Aug-19 | 13,002 | 11,673 | 12,451 |

| Sep-19 | 13,093 | 11,611 | 12,561 |

| Oct-19 | 13,207 | 11,646 | 12,713 |

| Nov-19 | 13,377 | 11,640 | 12,831 |

| Dec-19 | 13,600 | 11,632 | 13,020 |

| Jan-20 | 13,588 | 11,855 | 13,081 |

| Feb-20 | 13,106 | 12,069 | 12,760 |

| Mar-20 | 12,201 | 11,998 | 11,958 |

| Apr-20 | 12,546 | 12,211 | 12,606 |

| May-20 | 12,810 | 12,268 | 12,916 |

| Jun-20 | 12,925 | 12,345 | 13,122 |

| Jul-20 | 13,329 | 12,530 | 13,507 |

| Aug-20 | 13,733 | 12,428 | 13,767 |

| Sep-20 | 13,491 | 12,422 | 13,595 |

| Oct-20 | 13,259 | 12,366 | 13,451 |

| Nov-20 | 14,035 | 12,488 | 14,255 |

| Dec-20 | 14,421 | 12,505 | 14,564 |

| Jan-21 | 14,363 | 12,415 | 14,469 |

| Feb-21 | 14,456 | 12,236 | 14,492 |

| Mar-21 | 14,700 | 12,083 | 14,610 |

| Apr-21 | 15,096 | 12,178 | 14,938 |

| May-21 | 15,189 | 12,218 | 15,096 |

| Jun-21 | 15,376 | 12,304 | 15,206 |

| Jul-21 | 15,445 | 12,442 | 15,336 |

| Aug-21 | 15,632 | 12,418 | 15,465 |

| Sep-21 | 15,306 | 12,310 | 15,142 |

| Oct-21 | 15,634 | 12,307 | 15,385 |

| Nov-21 | 15,505 | 12,344 | 15,210 |

| Dec-21 | 15,741 | 12,312 | 15,491 |

| Jan-22 | 15,330 | 12,047 | 14,996 |

| Feb-22 | 15,194 | 11,912 | 14,777 |

| Mar-22 | 15,119 | 11,581 | 14,662 |

| Apr-22 | 14,597 | 11,142 | 13,921 |

| May-22 | 14,609 | 11,214 | 13,970 |

| Jun-22 | 14,037 | 11,038 | 13,328 |

| Jul-22 | 14,299 | 11,307 | 13,895 |

| Aug-22 | 14,062 | 10,988 | 13,494 |

| Sep-22 | 13,714 | 10,513 | 12,619 |

| Oct-22 | 13,915 | 10,377 | 12,866 |

| Nov-22 | 14,312 | 10,759 | 13,564 |

| Dec-22 | 14,105 | 10,710 | 13,345 |

| Jan-23 | 14,502 | 11,040 | 13,950 |

| Feb-23 | 14,233 | 10,754 | 13,588 |

| Mar-23 | 14,412 | 11,027 | 13,865 |

| Apr-23 | 14,515 | 11,094 | 13,978 |

| May-23 | 14,400 | 10,973 | 13,783 |

| Jun-23 | 14,786 | 10,934 | 14,084 |

| Jul-23 | 15,032 | 10,927 | 14,310 |

| Aug-23 | 14,863 | 10,857 | 14,078 |

| Sep-23 | 14,526 | 10,581 | 13,657 |

| Oct-23 | 14,292 | 10,414 | 13,345 |

| Nov-23 | 15,022 | 10,886 | 14,173 |

| Dec-23 | 15,718 | 11,302 | 14,799 |

| Jan-24 | 15,770 | 11,271 | 14,790 |

| Feb-24 | 16,126 | 11,112 | 14,899 |

| Mar-24 | 16,521 | 11,215 | 15,171 |

| Apr-24 | 15,965 | 10,931 | 14,738 |

| May-24 | 16,535 | 11,117 | 15,084 |

| Jun-24 | 16,746 | 11,222 | 15,225 |

The Growth of $10,000 chart compares the performance of the Fund over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

| Total Net Assets | $174,590,060 |

| # of Portfolio Holdings | 150 |

| Portfolio Turnover Rate | 87% |

| Advisory Fees and Waivers | 503,423 |

Average Annual Total Returns

| . | 1 Year | 5 Year | Since Inception |

|---|

| Adviser Class (Inception Date: 6/30/15) | 13.26% | 5.25% | 5.90% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.29% |

| Morningstar Moderately Conservative Target Risk Index | 8.10% | 4.17% | 4.78% |

What did the Fund invest in?

| Fidelity Total Bond Fund - Class Z | 12.3% |

| Baird Core Plus Bond Fund - Class I | 11.8% |

| Frost Total Return Bond Fund - Class I | 6.6% |

| Dodge & Cox Income Fund - Class I | 3.9% |

| Berkshire Hathaway Inc | 3.8% |

| Microsoft Corp | 3.6% |

| Fidelity Advisor High Income Advantage Fund - Class Z | 3.6% |

| iShares 20+ Year Treasury Bond ETF | 3.6% |

| BrandywineGLOBAL High Yield Fund - Class I | 3.6% |

| NVIDIA Corp | 2.6% |

| As a percentage of total net assets. Holdings exclude short-term investments and derivatives. |

| Value | Value |

|---|

| Utilities | 0.3%Footnote Reference |

| Materials | 0.5%Footnote Reference |

| Consumer Staples | 2.6%Footnote Reference |

| Energy | 2.7%Footnote Reference |

| Industrials | 8.4%Footnote Reference |

| Communication Services | 8.9%Footnote Reference |

| Consumer Discretionary | 13.0%Footnote Reference |

| Financials | 14.6%Footnote Reference |

| Health Care | 14.8%Footnote Reference |

| Information Technology | 34.2%Footnote Reference |

| Footnote | Description |

Footnote | As a percentage of total common stocks. Concentrations are subject to change. |

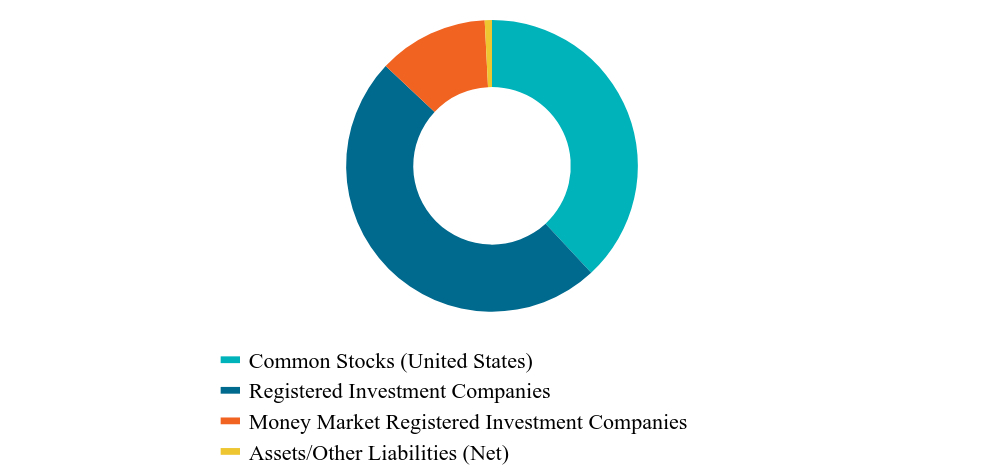

| Value | Value |

|---|

| Common Stocks (United States) | 38.1%Footnote Reference |

| Registered Investment Companies | 48.9%Footnote Reference |

| Money Market Registered Investment Companies | 12.2%Footnote Reference |

| Assets/Other Liabilities (Net) | 0.8% |

| Footnote | Description |

Footnote | As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, proxy voting information and other important materials, scan the QR code or visit www.meederinvestment.com/meeder-funds-resources.

To reduce fund expenses, only one copy of most shareholder documents are delivered to shareholders with multiple accounts at the same address. If you wish to receive copies of this document for each account, please contact the Meeder Funds at 866.633.3371 or contact your financial intermediary.

Semi-Annual Shareholder Report

June 30, 2024

Semi-Annual Shareholder Report

June 30, 2024

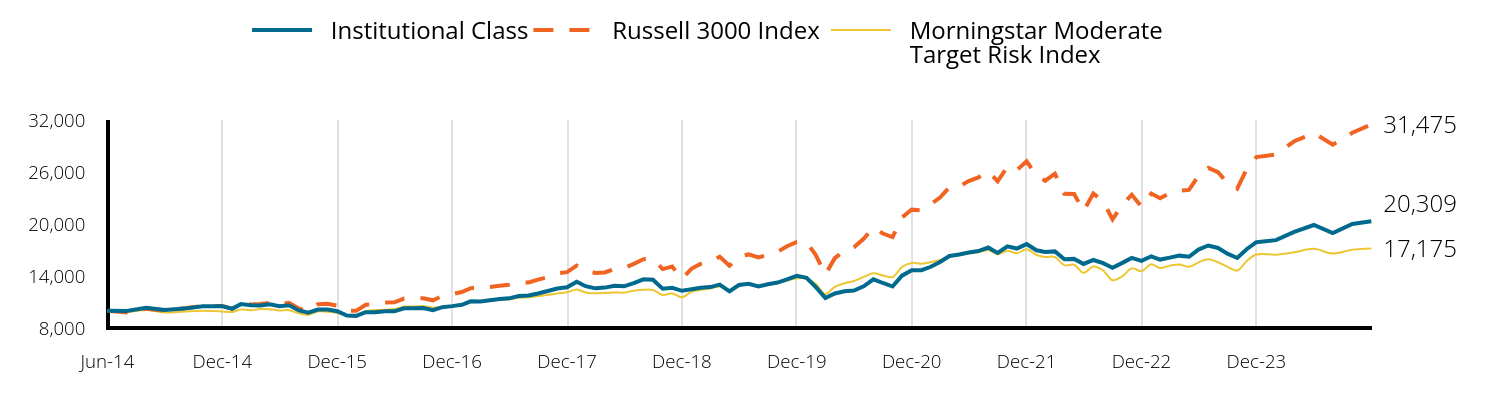

This semi-annual shareholder report contains important information about the Muirfield Fund for the period of December 31, 2023, to 6/30/2024, as well as certain changes to the Fund. You can find additional information about the Fund at meederinvestment.com/mutual-funds . You can also request this information by contacting us at 866.633.3371 .

What were the Fund's costs for the period?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| Adviser Class | $44.58 | 0.84% |

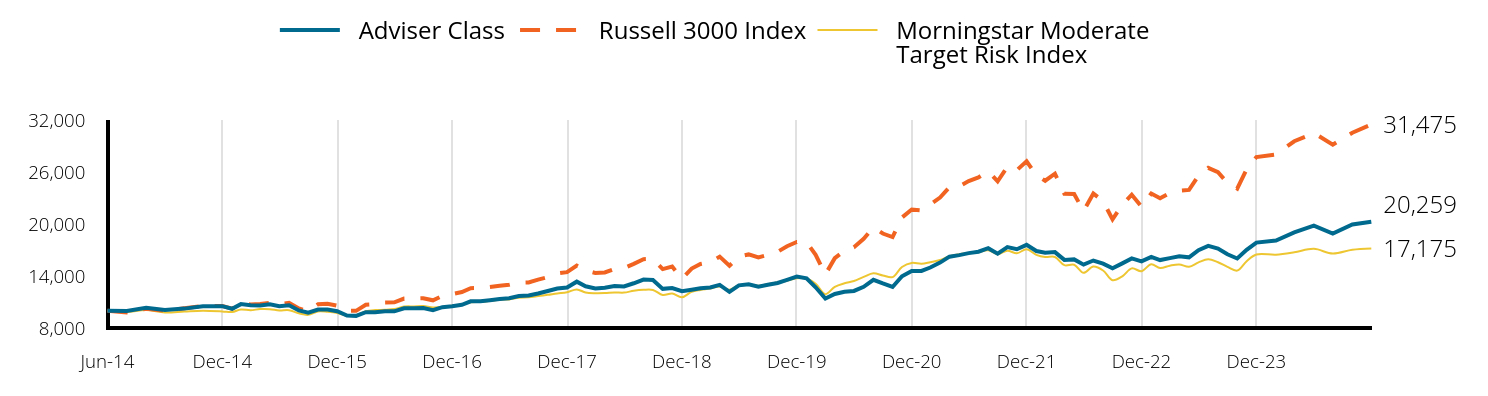

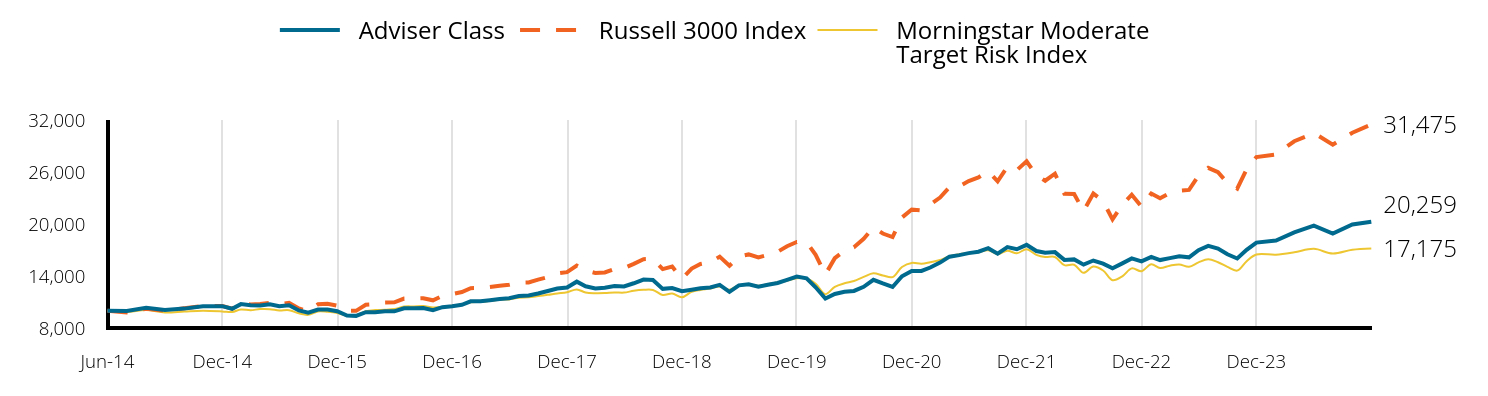

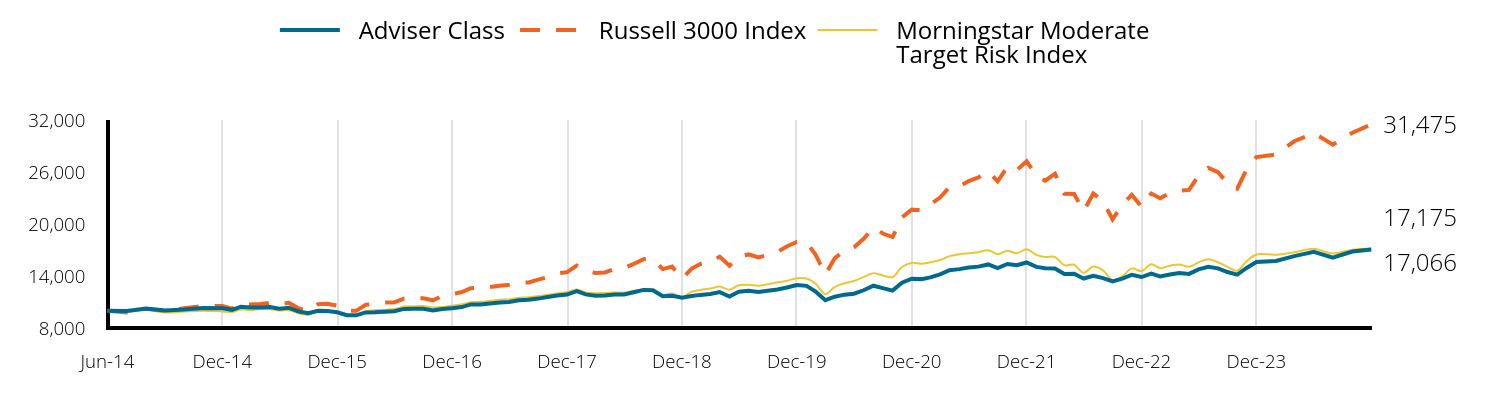

Total Return Based on a $10,000 Investment

| Adviser Class | Russell 3000 Index | Morningstar Moderate Target Risk Index |

|---|

| Jun-14 | 10,000 | 10,000 | 10,000 |

| Jul-14 | 9,960 | 9,803 | 9,861 |

| Aug-14 | 10,337 | 10,214 | 10,063 |

| Sep-14 | 10,070 | 10,001 | 9,801 |

| Oct-14 | 10,236 | 10,276 | 9,909 |

| Nov-14 | 10,512 | 10,525 | 10,002 |

| Dec-14 | 10,516 | 10,525 | 9,915 |

| Jan-15 | 10,217 | 10,232 | 9,841 |

| Feb-15 | 10,756 | 10,825 | 10,129 |

| Mar-15 | 10,621 | 10,715 | 10,051 |

| Apr-15 | 10,606 | 10,763 | 10,184 |

| May-15 | 10,726 | 10,912 | 10,176 |

| Jun-15 | 10,516 | 10,729 | 10,030 |

| Jul-15 | 10,621 | 10,909 | 10,054 |

| Aug-15 | 10,022 | 10,250 | 9,694 |

| Sep-15 | 9,767 | 9,952 | 9,515 |

| Oct-15 | 10,127 | 10,738 | 9,916 |

| Nov-15 | 10,127 | 10,797 | 9,874 |

| Dec-15 | 9,938 | 10,576 | 9,738 |

| Jan-16 | 9,446 | 9,979 | 9,429 |

| Feb-16 | 9,400 | 9,976 | 9,474 |

| Mar-16 | 9,830 | 10,678 | 9,947 |

| Apr-16 | 9,815 | 10,744 | 10,072 |

| May-16 | 9,938 | 10,936 | 10,101 |

| Jun-16 | 9,922 | 10,959 | 10,186 |

| Jul-16 | 10,276 | 11,394 | 10,470 |

| Aug-16 | 10,291 | 11,423 | 10,492 |

| Sep-16 | 10,307 | 11,441 | 10,532 |

| Oct-16 | 10,050 | 11,193 | 10,378 |

| Nov-16 | 10,405 | 11,694 | 10,435 |

| Dec-16 | 10,520 | 11,922 | 10,572 |

| Jan-17 | 10,675 | 12,147 | 10,743 |

| Feb-17 | 11,077 | 12,599 | 10,960 |

| Mar-17 | 11,077 | 12,607 | 11,015 |

| Apr-17 | 11,201 | 12,741 | 11,130 |

| May-17 | 11,340 | 12,871 | 11,258 |

| Jun-17 | 11,433 | 12,987 | 11,301 |

| Jul-17 | 11,681 | 13,232 | 11,494 |

| Aug-17 | 11,743 | 13,258 | 11,551 |

| Sep-17 | 11,976 | 13,581 | 11,685 |

| Oct-17 | 12,270 | 13,877 | 11,831 |

| Nov-17 | 12,549 | 14,299 | 11,991 |

| Dec-17 | 12,676 | 14,442 | 12,122 |

| Jan-18 | 13,346 | 15,203 | 12,451 |

| Feb-18 | 12,810 | 14,642 | 12,094 |

| Mar-18 | 12,559 | 14,349 | 12,016 |

| Apr-18 | 12,643 | 14,403 | 12,029 |

| May-18 | 12,844 | 14,810 | 12,102 |

| Jun-18 | 12,793 | 14,907 | 12,084 |

| Jul-18 | 13,162 | 15,401 | 12,294 |

| Aug-18 | 13,581 | 15,942 | 12,402 |

| Sep-18 | 13,539 | 15,968 | 12,389 |

| Oct-18 | 12,515 | 14,793 | 11,805 |

| Nov-18 | 12,616 | 15,089 | 11,970 |

| Dec-18 | 12,246 | 13,685 | 11,545 |

| Jan-19 | 12,416 | 14,859 | 12,179 |

| Feb-19 | 12,586 | 15,382 | 12,390 |

| Mar-19 | 12,671 | 15,606 | 12,547 |

| Apr-19 | 12,977 | 16,230 | 12,789 |

| May-19 | 12,178 | 15,179 | 12,407 |

| Jun-19 | 12,918 | 16,246 | 12,940 |

| Jul-19 | 13,054 | 16,487 | 12,981 |

| Aug-19 | 12,764 | 16,151 | 12,870 |

| Sep-19 | 12,986 | 16,434 | 13,059 |

| Oct-19 | 13,191 | 16,788 | 13,275 |

| Nov-19 | 13,550 | 17,426 | 13,459 |

| Dec-19 | 13,937 | 17,929 | 13,742 |

| Jan-20 | 13,727 | 17,910 | 13,706 |

| Feb-20 | 12,695 | 16,444 | 13,098 |

| Mar-20 | 11,401 | 14,182 | 11,903 |

| Apr-20 | 11,926 | 16,061 | 12,751 |

| May-20 | 12,188 | 16,919 | 13,159 |

| Jun-20 | 12,276 | 17,306 | 13,419 |

| Jul-20 | 12,750 | 18,289 | 13,896 |

| Aug-20 | 13,558 | 19,614 | 14,312 |

| Sep-20 | 13,137 | 18,900 | 14,063 |

| Oct-20 | 12,731 | 18,492 | 13,875 |

| Nov-20 | 13,967 | 20,741 | 15,043 |

| Dec-20 | 14,588 | 21,675 | 15,504 |

| Jan-21 | 14,588 | 21,578 | 15,409 |

| Feb-21 | 14,977 | 22,253 | 15,596 |

| Mar-21 | 15,542 | 23,050 | 15,840 |

| Apr-21 | 16,231 | 24,238 | 16,296 |

| May-21 | 16,407 | 24,349 | 16,521 |

| Jun-21 | 16,637 | 24,950 | 16,629 |

| Jul-21 | 16,796 | 25,371 | 16,748 |

| Aug-21 | 17,202 | 26,095 | 16,967 |

| Sep-21 | 16,571 | 24,924 | 16,517 |

| Oct-21 | 17,335 | 26,610 | 16,924 |

| Nov-21 | 17,086 | 26,205 | 16,617 |

| Dec-21 | 17,595 | 27,236 | 17,084 |

| Jan-22 | 16,883 | 25,634 | 16,439 |

| Feb-22 | 16,682 | 24,988 | 16,187 |

| Mar-22 | 16,755 | 25,799 | 16,197 |

| Apr-22 | 15,859 | 23,484 | 15,250 |

| May-22 | 15,914 | 23,452 | 15,294 |

| Jun-22 | 15,311 | 21,490 | 14,361 |

| Jul-22 | 15,786 | 23,506 | 15,096 |

| Aug-22 | 15,421 | 22,629 | 14,636 |

| Sep-22 | 14,891 | 20,531 | 13,511 |

| Oct-22 | 15,458 | 22,214 | 13,963 |

| Nov-22 | 16,029 | 23,374 | 14,876 |

| Dec-22 | 15,685 | 22,005 | 14,559 |

| Jan-23 | 16,211 | 23,521 | 15,358 |

| Feb-23 | 15,836 | 22,971 | 14,924 |

| Mar-23 | 16,061 | 23,585 | 15,189 |

| Apr-23 | 16,286 | 23,837 | 15,328 |

| May-23 | 16,155 | 23,929 | 15,059 |

| Jun-23 | 16,982 | 25,563 | 15,566 |

| Jul-23 | 17,473 | 26,480 | 15,938 |

| Aug-23 | 17,171 | 25,968 | 15,584 |

| Sep-23 | 16,510 | 24,731 | 15,055 |

| Oct-23 | 16,017 | 24,076 | 14,625 |

| Nov-23 | 17,022 | 26,321 | 15,703 |

| Dec-23 | 17,856 | 27,717 | 16,485 |

| Jan-24 | 18,089 | 28,024 | 16,464 |

| Feb-24 | 19,038 | 29,541 | 16,731 |

| Mar-24 | 19,812 | 30,494 | 17,130 |

| Apr-24 | 18,900 | 29,152 | 16,592 |

| May-24 | 19,948 | 30,530 | 17,030 |

| Jun-24 | 20,259 | 31,475 | 17,175 |

The Growth of $10,000 chart compares the performance of the Fund over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

| Total Net Assets | $868,805,924 |

| # of Portfolio Holdings | 161 |

| Portfolio Turnover Rate | 150% |

| Advisory Fees and Waivers | 2,543,674 |

Average Annual Total Returns

| . | 1 Year | 5 Year | 10 Year |

|---|

| Adviser Class | 19.30% | 9.42% | 7.32% |

| Russell 3000 Index | 23.13% | 14.14% | 12.15% |

| Morningstar Moderate Target Risk Index | 10.34% | 5.83% | 5.56% |

What did the Fund invest in?

| Berkshire Hathaway Inc | 7.2% |

| Microsoft Corp | 5.9% |

| NVIDIA Corp | 4.6% |

| Amazon.com Inc | 4.0% |

| Alphabet Inc | 3.6% |

| Apple Inc | 2.6% |

| Texas Instruments Inc | 2.6% |

| Meta Platforms Inc | 2.4% |

| Johnson & Johnson | 1.9% |

| Merck & Co Inc | 1.9% |

| As a percentage of total net assets. Holdings exclude short-term investments and derivatives. |

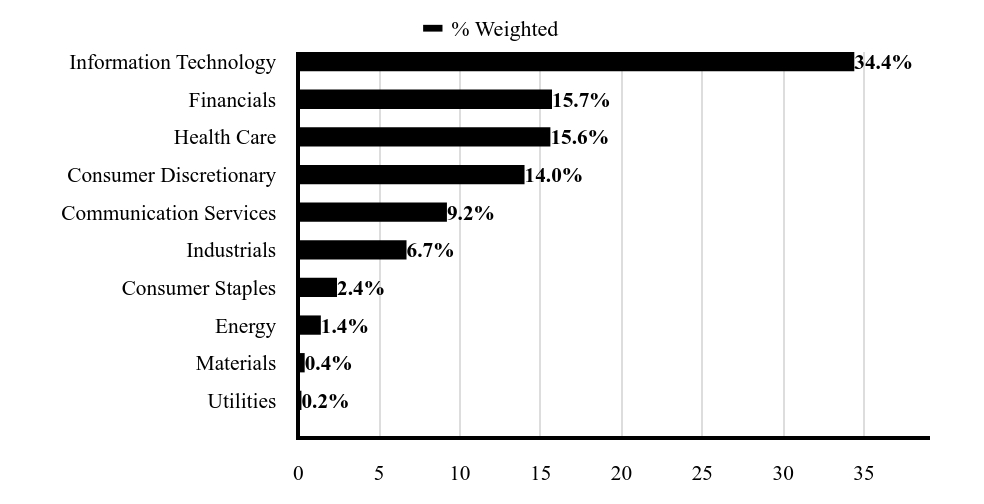

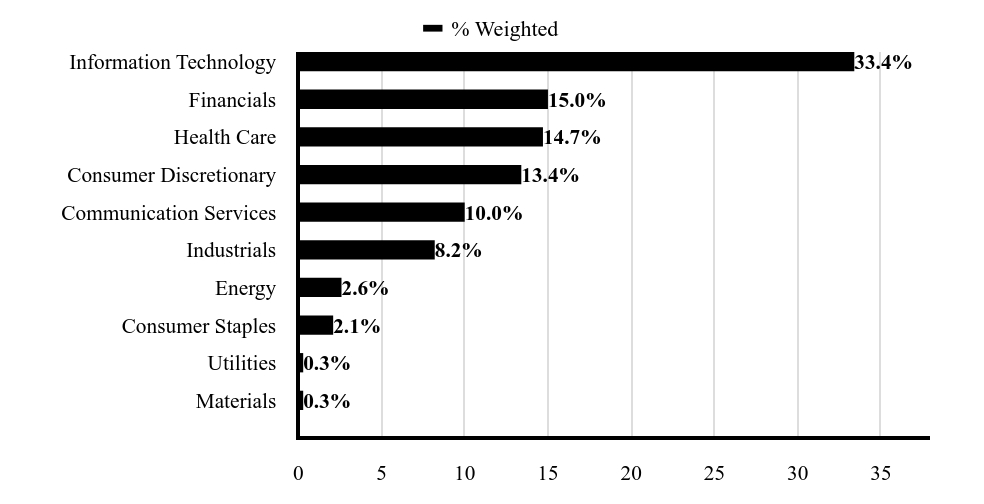

| Value | Value |

|---|

| Utilities | 0.2%Footnote Reference |

| Materials | 0.4%Footnote Reference |

| Energy | 1.4%Footnote Reference |

| Consumer Staples | 2.4%Footnote Reference |

| Industrials | 6.7%Footnote Reference |

| Communication Services | 9.2%Footnote Reference |

| Consumer Discretionary | 14.0%Footnote Reference |

| Health Care | 15.6%Footnote Reference |

| Financials | 15.7%Footnote Reference |

| Information Technology | 34.4%Footnote Reference |

| Footnote | Description |

Footnote | As a percentage of total common stocks. Concentrations are subject to change. |

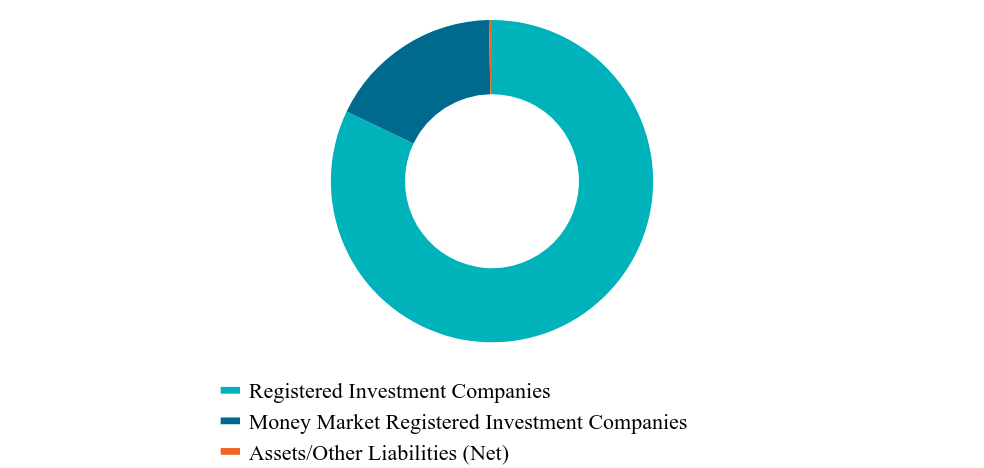

| Value | Value |

|---|

| Common Stocks (United States) | 72.2%Footnote Reference |

| Money Market Registered Investment Companies | 26.3%Footnote Reference |

| Assets/Other Liabilities (Net) | 1.5% |

| Footnote | Description |

Footnote | As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, proxy voting information and other important materials, scan the QR code or visit www.meederinvestment.com/meeder-funds-resources.

To reduce fund expenses, only one copy of most shareholder documents are delivered to shareholders with multiple accounts at the same address. If you wish to receive copies of this document for each account, please contact the Meeder Funds at 866.633.3371 or contact your financial intermediary.

Semi-Annual Shareholder Report

June 30, 2024

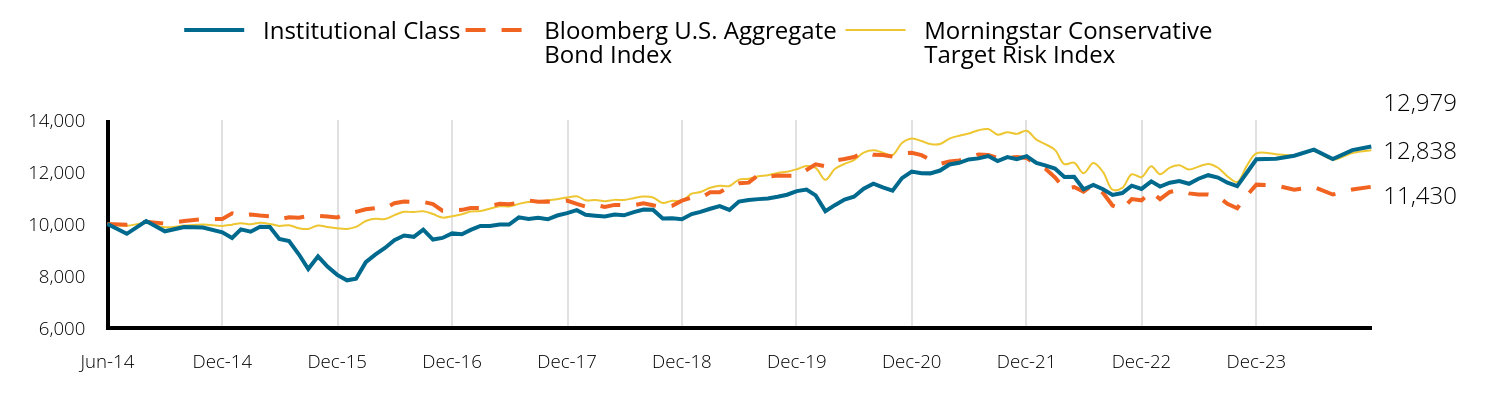

Institutional Class GBPIX

Semi-Annual Shareholder Report

June 30, 2024

This semi-annual shareholder report contains important information about the Global Allocation Fund for the period of December 31, 2023, to 6/30/2024, as well as certain changes to the Fund. You can find additional information about the Fund at meederinvestment.com/mutual-funds . You can also request this information by contacting us at 866.633.3371 .

What were the Fund's costs for the period?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of $10K Investment | Cost Paid as % of $10K Investment |

|---|

| Institutional Class | $74.98 | 1.45% |

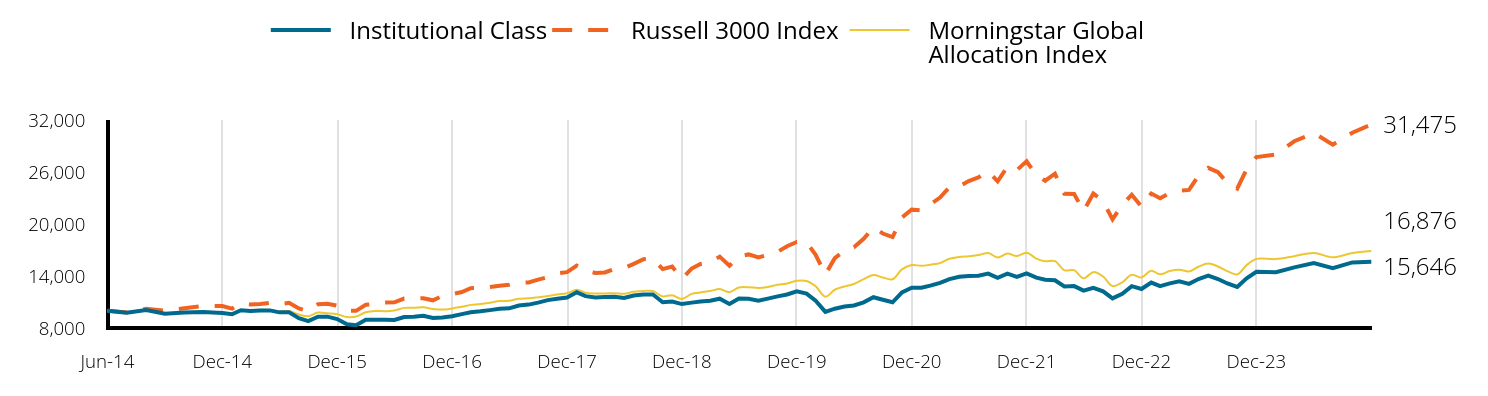

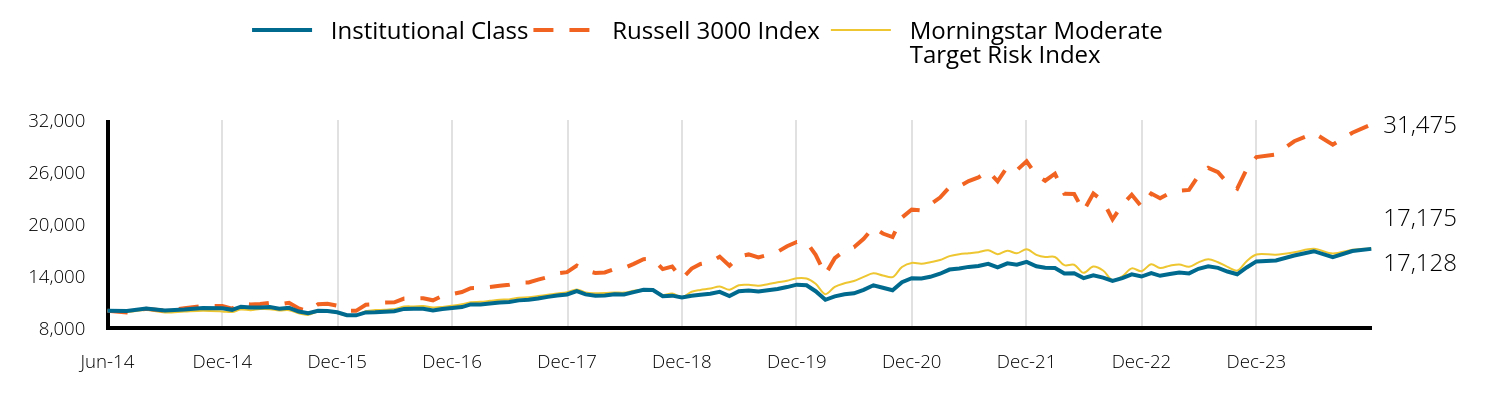

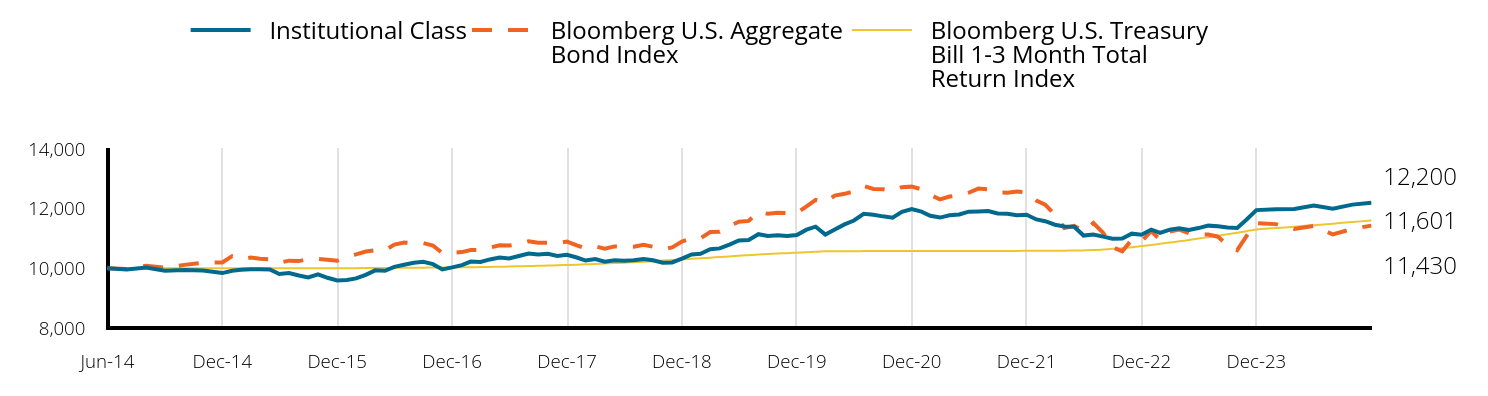

Total Return Based on a $10,000 Investment

| Institutional Class | Russell 3000 Index | Morningstar Global Allocation Index |

|---|

| Jun-14 | 10,000 | 10,000 | 10,000 |

| Jul-14 | 9,757 | 9,803 | 9,872 |

| Aug-14 | 10,073 | 10,214 | 10,046 |

| Sep-14 | 9,655 | 10,001 | 9,734 |

| Oct-14 | 9,793 | 10,276 | 9,803 |

| Nov-14 | 9,834 | 10,525 | 9,890 |

| Dec-14 | 9,731 | 10,525 | 9,778 |

| Jan-15 | 9,590 | 10,232 | 9,722 |

| Feb-15 | 10,049 | 10,825 | 10,021 |

| Mar-15 | 9,956 | 10,715 | 9,947 |

| Apr-15 | 10,012 | 10,763 | 10,113 |

| May-15 | 10,031 | 10,912 | 10,073 |

| Jun-15 | 9,806 | 10,729 | 9,918 |

| Jul-15 | 9,806 | 10,909 | 9,951 |

| Aug-15 | 9,131 | 10,250 | 9,561 |

| Sep-15 | 8,793 | 9,952 | 9,369 |

| Oct-15 | 9,309 | 10,738 | 9,775 |

| Nov-15 | 9,309 | 10,797 | 9,688 |

| Dec-15 | 9,029 | 10,576 | 9,584 |

| Jan-16 | 8,439 | 9,979 | 9,263 |

| Feb-16 | 8,323 | 9,976 | 9,324 |

| Mar-16 | 8,951 | 10,678 | 9,819 |

| Apr-16 | 8,951 | 10,744 | 9,968 |

| May-16 | 8,942 | 10,936 | 9,939 |

| Jun-16 | 8,922 | 10,959 | 10,020 |

| Jul-16 | 9,272 | 11,394 | 10,321 |

| Aug-16 | 9,301 | 11,423 | 10,337 |

| Sep-16 | 9,398 | 11,441 | 10,398 |

| Oct-16 | 9,145 | 11,193 | 10,193 |

| Nov-16 | 9,213 | 11,694 | 10,123 |

| Dec-16 | 9,359 | 11,922 | 10,255 |

| Jan-17 | 9,603 | 12,147 | 10,462 |

| Feb-17 | 9,818 | 12,599 | 10,668 |

| Mar-17 | 9,926 | 12,607 | 10,759 |

| Apr-17 | 10,062 | 12,741 | 10,912 |

| May-17 | 10,209 | 12,871 | 11,106 |

| Jun-17 | 10,268 | 12,987 | 11,139 |

| Jul-17 | 10,600 | 13,232 | 11,369 |

| Aug-17 | 10,698 | 13,258 | 11,434 |

| Sep-17 | 10,923 | 13,581 | 11,555 |

| Oct-17 | 11,217 | 13,877 | 11,690 |

| Nov-17 | 11,374 | 14,299 | 11,872 |

| Dec-17 | 11,518 | 14,442 | 12,005 |

| Jan-18 | 12,116 | 15,203 | 12,424 |

| Feb-18 | 11,677 | 14,642 | 12,072 |

| Mar-18 | 11,518 | 14,349 | 11,984 |

| Apr-18 | 11,578 | 14,403 | 11,991 |

| May-18 | 11,598 | 14,810 | 12,009 |

| Jun-18 | 11,458 | 14,907 | 11,965 |

| Jul-18 | 11,749 | 15,401 | 12,171 |

| Aug-18 | 11,859 | 15,942 | 12,274 |

| Sep-18 | 11,869 | 15,968 | 12,259 |

| Oct-18 | 10,967 | 14,793 | 11,646 |

| Nov-18 | 11,048 | 15,089 | 11,781 |

| Dec-18 | 10,761 | 13,685 | 11,343 |

| Jan-19 | 10,929 | 14,859 | 11,936 |

| Feb-19 | 11,066 | 15,382 | 12,108 |

| Mar-19 | 11,150 | 15,606 | 12,258 |

| Apr-19 | 11,382 | 16,230 | 12,491 |

| May-19 | 10,781 | 15,179 | 12,132 |

| Jun-19 | 11,413 | 16,246 | 12,678 |

| Jul-19 | 11,381 | 16,487 | 12,699 |

| Aug-19 | 11,160 | 16,151 | 12,622 |

| Sep-19 | 11,392 | 16,434 | 12,738 |

| Oct-19 | 11,646 | 16,788 | 12,980 |

| Nov-19 | 11,868 | 17,426 | 13,144 |

| Dec-19 | 12,231 | 17,929 | 13,445 |

| Jan-20 | 11,961 | 17,910 | 13,427 |

| Feb-20 | 11,143 | 16,444 | 12,806 |

| Mar-20 | 9,862 | 14,182 | 11,616 |

| Apr-20 | 10,228 | 16,061 | 12,412 |

| May-20 | 10,486 | 16,919 | 12,797 |

| Jun-20 | 10,605 | 17,306 | 13,078 |

| Jul-20 | 10,960 | 18,289 | 13,629 |

| Aug-20 | 11,552 | 19,614 | 14,116 |

| Sep-20 | 11,263 | 18,900 | 13,831 |

| Oct-20 | 10,970 | 18,492 | 13,628 |

| Nov-20 | 12,110 | 20,741 | 14,763 |

| Dec-20 | 12,650 | 21,675 | 15,266 |

| Jan-21 | 12,639 | 21,578 | 15,169 |

| Feb-21 | 12,883 | 22,253 | 15,303 |

| Mar-21 | 13,206 | 23,050 | 15,482 |

| Apr-21 | 13,639 | 24,238 | 15,991 |

| May-21 | 13,906 | 24,349 | 16,188 |

| Jun-21 | 13,995 | 24,950 | 16,286 |

| Jul-21 | 14,028 | 25,371 | 16,410 |

| Aug-21 | 14,273 | 26,095 | 16,645 |

| Sep-21 | 13,784 | 24,924 | 16,134 |

| Oct-21 | 14,262 | 26,610 | 16,585 |

| Nov-21 | 13,906 | 26,205 | 16,303 |

| Dec-21 | 14,300 | 27,236 | 16,687 |

| Jan-22 | 13,806 | 25,634 | 16,008 |

| Feb-22 | 13,559 | 24,988 | 15,700 |

| Mar-22 | 13,510 | 25,799 | 15,716 |

| Apr-22 | 12,794 | 23,484 | 14,653 |

| May-22 | 12,831 | 23,452 | 14,672 |

| Jun-22 | 12,312 | 21,490 | 13,730 |

| Jul-22 | 12,633 | 23,506 | 14,445 |

| Aug-22 | 12,226 | 22,629 | 13,937 |

| Sep-22 | 11,423 | 20,531 | 12,839 |

| Oct-22 | 11,954 | 22,214 | 13,268 |

| Nov-22 | 12,832 | 23,374 | 14,148 |

| Dec-22 | 12,504 | 22,005 | 13,833 |

| Jan-23 | 13,238 | 23,521 | 14,603 |

| Feb-23 | 12,827 | 22,971 | 14,194 |

| Mar-23 | 13,151 | 23,585 | 14,577 |

| Apr-23 | 13,387 | 23,837 | 14,726 |

| May-23 | 13,089 | 23,929 | 14,530 |

| Jun-23 | 13,649 | 25,563 | 15,062 |

| Jul-23 | 14,038 | 26,480 | 15,429 |

| Aug-23 | 13,649 | 25,968 | 15,096 |

| Sep-23 | 13,135 | 24,731 | 14,553 |

| Oct-23 | 12,745 | 24,076 | 14,187 |

| Nov-23 | 13,740 | 26,321 | 15,251 |

| Dec-23 | 14,489 | 27,717 | 15,971 |

| Jan-24 | 14,438 | 28,024 | 15,949 |

| Feb-24 | 14,997 | 29,541 | 16,288 |

| Mar-24 | 15,480 | 30,494 | 16,653 |

| Apr-24 | 14,906 | 29,152 | 16,152 |

| May-24 | 15,569 | 30,530 | 16,652 |

| Jun-24 | 15,646 | 31,475 | 16,876 |

The Growth of $10,000 chart compares the performance of the Fund over the period shown with dividends and capital gains reinvested to the Fund’s benchmark. Benchmark indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and accounting fees.

Investment performance assumes reinvestment of all dividend and capital gain distributions. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Historical performance attributed to the Institutional and Adviser Share Classes prior to their inception dates is based on the performance of the Retail Share Class. No adjustment has been made to reflect class-specific distribution or servicing fees. Returns may reflect the effect of voluntary fee waivers or expense reimbursements over the period shown. Without these waivers, performance would have been lower.

The performance data shown represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For current month-end performance data, please visit our website at www.meederfunds.com.

| Total Net Assets | $36,167,888 |

| # of Portfolio Holdings | 146 |

| Portfolio Turnover Rate | 100% |

| Advisory Fees and Waivers | 128,889 |

Average Annual Total Returns

| . | 1 Year | 5 Year | 10 Year |

|---|

| Institutional Class | 14.63% | 6.51% | 4.58% |

| Russell 3000 Index | 23.13% | 14.14% | 12.15% |

| Morningstar Global Allocation Index | 12.04% | 5.89% | 5.37% |

What did the Fund invest in?

| iShares Core MSCI EAFE ETF | 8.5% |

| Berkshire Hathaway Inc | 3.0% |

| Microsoft Corp | 2.9% |

| Fidelity Total Bond Fund - Class Z | 2.5% |

| Baird Core Plus Bond Fund - Class I | 2.2% |

| NVIDIA Corp | 2.1% |

| iShares Core MSCI Emerging Markets ETF | 1.8% |

| Alphabet Inc | 1.7% |

| Amazon.com Inc | 1.6% |

| Frost Total Return Bond Fund - Class I | 1.3% |

| As a percentage of total net assets. Holdings exclude short-term investments and derivatives. |

| Value | Value |