UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03462

Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant's telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2022

Date of reporting period: June 30, 2022

Item 1. Report to Stockholders.

TABLE OF CONTENTS

Letter to Shareholders | 1 |

Portfolio Composition | 4 |

Schedules of Investments | 11 |

Statements of Assets and Liabilities | 54 |

Statements of Operations | 56 |

Statements of Changes in Net Assets | 58 |

Financial Highlights | 62 |

Notes to Financial Statements | 72 |

Shareholder Expense Analysis | 90 |

This Semi-Annual Report is prepared and distributed for the general information of the shareholders of the Funds. This material is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. Investors are advised to consider carefully the investment objectives, risks, charges and expenses of the Fund before investing. The prospectus contains this and other information about the Funds.

Meeder Funds are distributed by Meeder Distribution Services, Inc. (Member FINRA), an affiliate of Meeder Investment Management. An affiliated registered investment adviser, Meeder Asset Management, Inc., serves as the investment adviser to Meeder Funds and is paid a fee for its services.

Letter to Shareholders June 30, 2022

A Bear Market is Here

MARKET UPDATE

The S&P 500 Index officially reached bear market territory after finishing the second quarter down more than -20% from its all-time high set on January 3rd. It was the worst first-half performance for the S&P 500 since 1970. Bonds, represented by the Bloomberg Aggregate Index could not escape the carnage either as they also finished June down more than -10% YTD. This was just the third time since 1981 that stocks and bonds experienced two consecutive quarters of negative performance. Prior to that, the most recent occurrence was during the Financial Crisis of 2008.

The second quarter was a continuation of many of the same themes as the first quarter this year, as illustrated in Figure 1. Value stocks outperformed their Growth peers and Large- caps generally outperformed Small-caps. When looking at the 9 style boxes, the performance of each of Russell’s 9 equity style indexes were negative. S&P sectors only had Energy produce positive performance year-to-date, up more than 30%. Utilities, Consumer Staples, and Health Care sectors each had single-digit losses year-to-date. The remaining sectors have experienced negative performance year-to-date, down anywhere from 16-32%. International markets suffered too, just as the global supply chain issues continue to struggle to meet demand.

FIGURE 1

YTD PERFORMANCE THROUGH JUNE 30, 2022

| | VALUE | BLEND | GROWTH |

Large-Cap | -12.9% | -19.9% | -28.1% |

Mid-Cap | -10.0% | -21.6% | -31.0% |

Small-Cap | -17.3% | -23.4% | -29.5% |

INVESTMENT | RETURN |

Developed International ex-USA Index | -21.6% |

Emerging Markets Index | -14.4% |

Bloomberg U.S Aggregate Bond Index | -10.4% |

SOURCE: Morningstar Direct; Bloomberg; Large Value: Russell 1000 Value TR Index, Large Blend: S&P 500 Index TR, Large Growth: Russell 1000 Growth Index TR, Mid Value: Russell Midcap Value Index TR, Mid Blend: Russell Midcap Index TR, Mid Growth: Russell Midcap Growth Index TR, Small Value: Russell 2000 Value Index TR, Small Blend: Russell 2000 Index TR, Small Growth: Russell 2000 Growth Index TR. Developed International: STOXX Global 1800 ex-USA Index TR, Emerging Markets: STOXX Emerging Markets 1500 Index TR

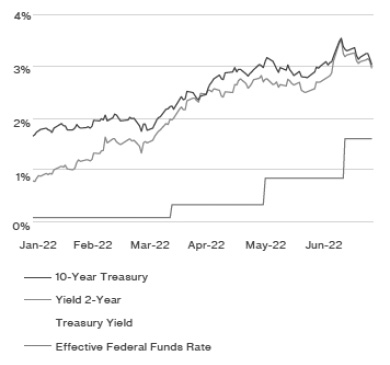

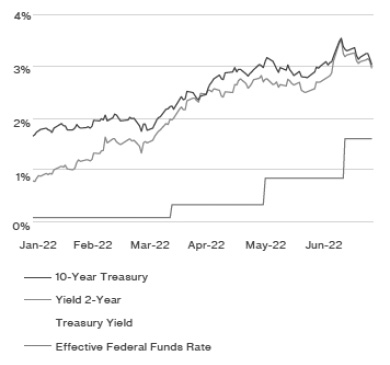

FEDERAL RESERVE

The Fed is trying to restore credibility with the marketplace after dismissing inflationary trends as just being transitory for nearly a year. The Fed took bold action after seeing inflation reach a 40-year high and increased the federal funds rate by 0.75% on June 15, making it the largest single rate increase since 1994. This brought the overnight lending rate between banks to a range of 1.50%-1.75%. The committee is currently telegraphing that they will likely increase rates by an additional 0.75% at their July meeting. The Fed is predicting that the federal funds target rate at the end of 2022 will be between 3.25% and 3.50%, which remains much higher than where rates currently sit. In June, the 10-Year Treasury yield closed above 3.49% for the first time since July 2011. It has also caused the spread between the 2 and 10-year Treasury maturities to invert. This occurs when the economic forecast looks unsteady and investors favor purchasing longer-term debt over short-term debt. They do this to try and lock in long-term bond yields to reduce risk. Historically, this has been a precursor to an economic recession.

FIGURE 2

TREASURY YIELDS AND FEDERAL FUNDS RATE

SOURCE: FRED

2022 Semi-Annual Report | June 30, 2022 | Page 1 |

RECESSION AROUND THE CORNER?

Now that the Fed has committed to “do-whatever-it-takes to control inflation” and will be aggressively raising rates for the foreseeable future, investors are questioning if the economy has what it takes to rebound this time. As the Fed continues to tighten, the question remains, will the economy be able to continue to grow despite the dampening demand caused by an increase in interest rates? The first quarter of 2022 saw the U.S. economy unexpectedly contract by -1.6%. While the National Bureau of Economic Research is responsible for determining the official declaration of a recession, many investors follow the old methodology of two consecutive quarters of negative GDP growth as the definition of a recession. As interest rate increases continue to work their way into the economy, there are signs that some of the demand is already declining rapidly. For example, according to the U.S. Census Bureau, new housing starts declined by -14.4% from April to May.

SENTIMENT AT HISTORIC LOW

Consumers are feeling different about this bear market from others that have occurred in recent years. The University of Michigan Index of Consumer Sentiment survey for June reported a level of 50.0, making it an all-time low in the survey’s history since 1978. It was a substantial drop of more than -14% from May. Previously, investors knew that the Federal Reserve was ultimately backing up the stock market which is why some analysts believe that we had the V-shaped recoveries after the significant drawdowns we experienced in 2019 and 2020.

RUSSIA AND UKRAINE WAR

As the war between Russia and Ukraine continues to drag on, Ukraine is defending itself on several fronts better than many expected. This unprovoked Russian attack led many countries, including the European Union, to ban the purchase of Russian oil exports. This sent the price of crude oil higher as demand already outweighed supply. Russia is the world’s second- largest oil producer behind the U.S. and produces more than 9.4 million barrels per day. This shortage and continued supply chain issues were primary drivers in pushing inflation to reach 40-year highs.

HOW IS THIS IMPACTING PORTFOLIOS?

At Meeder, we manage investment solutions across different risk profiles and time horizons. Meeder manages strategies using a systematic approach that guides us in the allocation of our portfolios. Many of these solutions employ one or more of our core investment strategies: Growth, Defensive Equity, and Fixed Income.

GROWTH

Investment portfolios comprised of the Growth Strategy maintain a more aggressive objective and typically remain invested in the stock market. In the second quarter, equity markets experienced significant volatility as the Russia and Ukraine War continued. This led many countries to ban the purchase of Russian oil exports, sending the price of crude oil higher and exacerbating supply chain disruptions. The Fed took bold action after seeing inflation reach a 40-year high and increased the federal funds rate by 0.75% on June 15 making it the largest single rate increase since 1994. This volatility caused the performance of nearly all equity markets to struggle. Investors that remained in the Growth Strategy experienced more volatility than our Defensive Equity strategies but achieved performance similar to the equity market as represented by the S&P 500 Index.

DEFENSIVE EQUITY

Portfolios that utilize the Defensive Equity Strategy follow a rules-based and data-driven approach using the Meeder Investment Positioning System (IPS) model. This investment model is used to determine the risk relative to the reward available in the marketplace and identify when we should be increasing or decreasing the portfolio’s equity exposure. At the beginning of the quarter, the strategy had a 70% allocation to equities. By the end of April, credit risk continued to rise, and inflation, interest rates, and geopolitical uncertainty weighed on the model score. The IPS model guided us to reduce our allocation to equities to 51%. In the middle of May, the long-term trends and momentum were very weak. Valuations remained elevated, causing us to reduce our equity allocation to as low as 32%. In early June our intermediate and short-term models became a little more positive due to the extreme number of flows into inverse bearish ETFs. We view this from a contrarian perspective and increased our equity exposure to 41%. For the remainder of the quarter, any improvement in the IPS model scores were essentially negated by the heightened volatility present in the marketplace. The defensive equity positioning throughout the quarter substantially reduced the market volatility experienced by investors relative to the equity market as measured by the S&P 500 Index.

FIXED INCOME

The Meeder Fixed Income Strategy tactically shifts portfolio exposure utilizing our proprietary investment models. These models are designed to actively monitor factors to guide us in determining the credit quality, emerging market debt exposure, and the portfolio’s U.S. Treasury duration.

Meeder Fixed Income portfolios started the second quarter with exposure to high yield bonds, investment-grade bonds, short-term U.S. Treasuries, and cash. As market volatility increased early in the quarter, momentum and volatility factors in our credit model signaled risk-off sentiment and we reduced high yield positions in our portfolios, moving the proceeds to cash. We also extended portfolio duration from mid-May through mid-June, as momentum factors in our duration model indicated relative strength in longer duration Treasuries. As volatility subsided towards the end of May, macroeconomic, momentum and volatility factors in our credit and emerging markets led us to increase high yield and emerging market exposure briefly.

However, rate volatility in the fixed income markets continued to rise during the quarter and the Federal Reserve surprised the markets with a higher-than- expected, 0.75% rate hike on the federal funds rate in June. Our models ultimately guided us to exit high yield and

Page 2 | 2022 Semi-Annual Report | June 30, 2022 |

emerging market positions in mid- June, increasing the cash position in our portfolios. Higher cash exposure helped our portfolios’ relative performance against market benchmarks on the downside during the quarter.

One-third of the portfolio remained invested in U.S. Investment grade securities throughout the quarter. At the end of the second quarter, we reduced High Yield and Emerging Market exposure and shortened the duration by raising cash.

LOOKING AHEAD

Inflation will remain a very important issue for the global economy in the foreseeable future. This presents a unique and challenging environment that we have not seen for more than 40 years. The good news is that we have seen inflationary times worse than this and have built our models with everything we learned since that time. While no two economic periods are the same, we will continue to make our investment decisions based on economic data and factors that remove emotion from the decision- making process. We will continue to follow our disciplined process and rules-based approach to managing money and, as always, we thank you for trusting us to help you reach your financial goals.

Sincerely,

Robert S. Meeder

President and CEO

2022 Semi-Annual Report | June 30, 2022 | Page 3 |

Portfolio Composition

June 30, 2022

Muirfield Fund

Common Stock Sector

Concentration

as of June 30, 2022 | % of total

common

stocks |

Information Technology | 29.4% |

Healthcare | 19.9% |

Financials | 11.3% |

Industrials | 9.4% |

Consumer Discretionary | 9.1% |

Communication Services | 6.4% |

Energy | 6.2% |

Consumer Staples | 4.5% |

Materials | 2.3% |

Utilities | 1.3% |

Real Estate Investment Trust | 0.2% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

Microsoft Corp. | 4.6% |

Apple, Inc. | 3.8% |

Berkshire Hathaway, Inc. - Class B | 2.6% |

Johnson & Johnson | 1.8% |

Alphabet, Inc. - Class C | 1.8% |

Costco Wholesale Corp. | 1.1% |

Amazon.com, Inc. | 1.1% |

Lockheed Martin Corp. | 1.0% |

UnitedHealth Group, Inc. | 0.9% |

Northrop Grumman Systems Corp. | 0.9% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Asset Allocation

as of June 30, 2022 |

% of total

net assets

|

Common Stocks (United States) | 52.3% |

Money Market Registered Investment Companies | 42.6% |

Bank Obligations | 0.1% |

Other Assets/Liabilities (Net) | 5.0% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Spectrum Fund

Common Stock Sector

Concentration

as of June 30, 2022 | % of total

common

stocks |

Information Technology | 28.4% |

Healthcare | 20.7% |

Financials | 11.9% |

Consumer Discretionary | 9.2% |

Industrials | 7.8% |

Energy | 7.4% |

Communication Services | 6.6% |

Consumer Staples | 4.9% |

Materials | 1.9% |

Utilities | 1.1% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

Microsoft Corp. | 5.7% |

Apple, Inc. | 4.8% |

Berkshire Hathaway, Inc. - Class B | 3.0% |

Alphabet, Inc. - Class C | 2.4% |

UnitedHealth Group, Inc. | 2.1% |

Amazon.com, Inc. | 1.6% |

Amgen USA, Inc. | 1.4% |

Costco Wholesale Corp. | 1.4% |

Johnson & Johnson | 1.3% |

Chevron Corp. | 1.2% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Asset Allocation

as of June 30, 2022 |

% of total

net assets

|

Common Stocks (United States) | 66.5% |

Money Market Registered Investment Companies | 25.4% |

Other Assets/Liabilities (Net) | 8.1% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

2022 Semi-Annual Report | June 30, 2022 | Page 5 |

Global Allocation Fund

Common Stock Sector

Concentration

as of June 30, 2022 | % of total

common

stocks |

Information Technology | 28.7% |

Healthcare | 19.4% |

Financials | 14.0% |

Consumer Discretionary | 8.7% |

Industrials | 8.3% |

Energy | 6.7% |

Communication Services | 6.5% |

Consumer Staples | 5.2% |

Materials | 1.4% |

Utilities | 1.0% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company

Geographic Concentration

as of June 30, 2022 | % of total

common

stocks |

U.S. Fixed Income | 24.7% |

International Equity | 75.3% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

iShares Core MSCI EAFE ETF | 6.7% |

Microsoft Corp. | 1.7% |

iShares Core MSCI Emerging Markets ETF | 1.6% |

Apple, Inc. | 1.6% |

Berkshire Hathaway, Inc. - Class B | 1.3% |

Alphabet, Inc. - Class C | 0.8% |

Johnson & Johnson | 0.6% |

Marsh & McLennan Cos., Inc. | 0.5% |

Amazon.com, Inc. | 0.5% |

UnitedHealth Group, Inc. | 0.5% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Asset Allocation

as of June 30, 2022 |

% of total

net assets

|

Common Stocks (United States) | 21.7% |

Equity Registered Investment Companies | 8.4% |

Fixed Income Registered Investment Companies | 2.7% |

Money Market Registered Investment Companies | 62.7% |

Bank Obligations | 1.3% |

Other Assets/Liabilities (Net) | 3.2% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Balanced Fund

Common Stock Sector

Concentration

as of June 30, 2022 | % of total

common

stocks |

Information Technology | 28.7% |

Healthcare | 19.9% |

Financials | 12.8% |

Consumer Discretionary | 8.6% |

Industrials | 8.4% |

Energy | 7.2% |

Communication Services | 6.4% |

Consumer Staples | 4.7% |

Materials | 1.9% |

Utilities | 1.3% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company

Geographic Concentration

as of June 30, 2022 | % of total

common

stocks |

U.S. Fixed Income | 100.0% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

Microsoft Corp. | 3.0% |

Apple, Inc. | 2.6% |

Berkshire Hathaway, Inc. - Class B | 2.0% |

PGIM Short-Term Corporate Bond Fund - Class R6 | 1.5% |

Diamond Hill Short Duration Securitized Bond Fund - Class Y | 1.5% |

Alphabet, Inc. - Class C | 1.3% |

Segall Bryant & Hamill Plus Bond Fund Institutional | 1.1% |

DoubleLine Total Return Bond Fund - Class I | 1.1% |

UnitedHealth Group Inc. | 1.0% |

Baird Core Plus Bond Fund Class Institutional | 0.9% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Asset Allocation

as of June 30, 2022 |

% of total

net assets

|

Common Stocks (United States) | 36.2% |

Fixed Income Registered Investment Companies | 8.5% |

Money Market Registered Investment Companies | 50.7% |

Bank Obligations | 0.1% |

Other Assets/Liabilities (Net) | 4.5% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 6 | 2022 Semi-Annual Report | June 30, 2022 |

Moderate Allocation Fund

Common Stock Sector

Concentration

as of June 30, 2022 | % of total

common

stocks |

Information Technology | 28.4% |

Healthcare | 19.5% |

Financials | 14.6% |

Consumer Discretionary | 8.6% |

Industrials | 8.4% |

Communication Services | 6.7% |

Energy | 6.6% |

Consumer Staples | 4.7% |

Materials | 1.4% |

Utilities | 1.0% |

Real Estate Investment Trust | 0.1% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company

Geographic Concentration

as of June 30, 2022 | % of total

common

stocks |

U.S. Fixed Income | 100.0% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

PGIM Short-Term Corporate Bond Fund - Class R6 | 2.4% |

Diamond Hill Short Duration Securitized Bond Fund - Class Y | 2.4% |

Segall Bryant & Hamill Plus Bond Fund Institutional | 1.8% |

DoubleLine Total Return Bond Fund - Class I | 1.8% |

Baird Core Plus Bond Fund Class Institutional | 1.5% |

Microsoft Corp. | 1.4% |

Apple, Inc. | 1.3% |

Pioneer Bond Fund - Class K | 1.0% |

Frost Total Return Bond Fund Class Institutional | 1.0% |

Berkshire Hathaway, Inc. - Class B | 1.0% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Asset Allocation

as of June 30, 2022 |

% of total

net assets

|

Common Stocks (United States) | 17.2% |

Fixed Income Registered Investment Companies | 14.2% |

Money Market Registered Investment Companies | 66.0% |

Bank Obligations | 0.2% |

Other Assets/Liabilities (Net) | 2.4% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Conservative Allocation Fund

Common Stock Sector

Concentration

as of June 30, 2022 | % of total

common

stocks |

Information Technology | 27.6% |

Healthcare | 18.6% |

Financials | 12.0% |

Consumer Discretionary | 7.9% |

Communication Services | 7.1% |

Energy | 6.6% |

Utilities | 6.6% |

Industrials | 6.3% |

Consumer Staples | 4.1% |

Materials | 3.2% |

Real Estate Investment Trust | 0.0% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company

Geographic Concentration

as of June 30, 2022 | % of total

common

stocks |

U.S. Fixed Income | 100.0% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

PGIM Short-Term Corporate Bond Fund - Class R6 | 3.4% |

Diamond Hill Short Duration Securitized Bond Fund - Class Y | 3.4% |

Segall Bryant & Hamill Plus Bond Fund Institutional | 2.5% |

DoubleLine Total Return Bond Fund - Class I | 2.5% |

Baird Core Plus Bond Fund Class Institutional | 2.1% |

Pioneer Bond Fund - Class K | 1.4% |

Frost Total Return Bond Fund Class Institutional | 1.4% |

Guggenheim Total Return Bond Fund Institutional Class | 1.1% |

iShares Core US Aggregate Bond ETF | 1.0% |

BBH Limited Duration Fund Class Institutional | 0.9% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Asset Allocation

as of June 30, 2022 |

% of total

net assets

|

Common Stocks (United States) | 1.2% |

Fixed Income Registered Investment Companies | 19.8% |

Money Market Registered Investment Companies | 77.7% |

Other Assets/Liabilities (Net) | 1.3% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

2022 Semi-Annual Report | June 30, 2022 | Page 7 |

Dynamic Allocation Fund

Common Stock Sector

Concentration

as of June 30, 2022 | % of total

common

stocks |

Information Technology | 28.6% |

Healthcare | 19.9% |

Financials | 12.4% |

Consumer Discretionary | 9.2% |

Industrials | 8.2% |

Energy | 7.0% |

Communication Services | 6.4% |

Consumer Staples | 5.2% |

Materials | 1.8% |

Utilities | 1.3% |

Real Estate Investment Trust | 0.0% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Registered Investment Company

Geographic Concentration

as of June 30, 2022 | % of total

common

stocks |

U.S. Fixed Income | 91.1% |

International Equity | 8.9% |

Total | 100.0% |

As a percentage of total registered investment companies. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

Microsoft Corp. | 5.4% |

Apple, Inc. | 4.5% |

Berkshire Hathaway, Inc. - Class B | 3.1% |

Alphabet, Inc. - Class C | 2.2% |

UnitedHealth Group, Inc. | 1.8% |

Amazon.com, Inc. | 1.5% |

Johnson & Johnson | 1.5% |

Costco Wholesale Corp. | 1.4% |

ExxonMobil Oil Corp. | 1.1% |

Chevron Corp. | 1.1% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Asset Allocation

as of June 30, 2022 |

% of total

net assets

|

Common Stocks (United States) | 62.1% |

Fixed Income Registered Investment Companies | 4.6% |

Equity Registered Investment Companies | 0.5% |

Money Market Registered Investment Companies | 29.6% |

Bank Obligations | 0.2% |

Other Assets/Liabilities (Net) | 3.0% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Quantex Fund

Common Stock Sector

Concentration

as of June 30, 2022 | % of total

common

stocks |

Industrials | 18.7% |

Consumer Discretionary | 12.7% |

Financials | 12.0% |

Information Technology | 9.8% |

Healthcare | 9.5% |

Utilities | 8.7% |

Materials | 8.5% |

Real Estate Investment Trust | 6.3% |

Communication Services | 5.5% |

Consumer Staples | 4.8% |

Energy | 3.5% |

Total | 100.0% |

As a percentage of total common stocks. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

Mosaic Co. Foundation/The | 0.9% |

Leidos Holdings, Inc. | 0.9% |

Nielsen Holdings PLC | 0.8% |

Quanta Services, Inc. | 0.8% |

Huntington Ingalls Industries, Inc. | 0.8% |

Atmos Energy Corp. | 0.8% |

Rollins, Inc. | 0.8% |

CF Industries Holdings, Inc. | 0.8% |

SolarEdge Technologies, Inc. | 0.8% |

Alliant Energy Corp. | 0.7% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Asset Allocation

as of June 30, 2022 |

% of total

net assets

|

Common Stocks (United States) | 58.6% |

Money Market Registered Investment Companies | 37.4% |

Other Assets/Liabilities (Net) | 4.0% |

Total | 100.0% |

As a percentage of total net assets. The Fund has invested in stock index futures contracts in order to equitize cash balances it holds in a proprietary money market fund.

Page 8 | 2022 Semi-Annual Report | June 30, 2022 |

Tactical Income Fund

Fixed Income Sector Concentration

as of June 30, 2022 | % of total

fixed

income

securities |

Investment Grade | 29.0% |

Cash & Equivalents | 71.0% |

Total | 100.0% |

As a percentage of total fixed income securities. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

iShares Core 1-5 Year USD Bond ETF | 14.2% |

BBH Limited Duration Fund Class Institutional | 7.5% |

Diamond Hill Short Duration Securitized Bond Fund - Class Y | 3.1% |

Frost Total Return Bond Fund Class Institutional | 2.5% |

PGIM Short-Term Corporate Bond Fund - Class R6 | 1.4% |

Government National Mortgage Association, 6.50%, 7/20/2038 | 0.1% |

As a percentage of total net assets. Holdings exclude short-term investments and derivatives.

Institutional Prime Money Market Fund

Sector Concentration

as of June 30, 2022 |

% of total

net assets

|

Commercial Paper | 40.7% |

Certificates of Deposit | 27.4% |

Repurchase Agreements | 23.5% |

Money Market Registered Investment Companies | 4.6% |

Variable Rate Demand Notes | 3.2% |

Corporate Obligations | 2.1% |

Other Assets/Liabilities (Net) | -1.5% |

Total | 100.0% |

As a percentage of total net assets. Concentrations are subject to change.

Top 10 Holdings

as of June 30, 2022 |

% of total

net assets

|

South Street Repo, 1.50%, due 7/1/2022 | 8.6% |

South Street Repo, 1.55%, due 7/1/2022 | 7.8% |

StoneX Repo, 1.70%, due 7/1/2022 | 7.1% |

Federated Hermes Government Obligations Fund, 1.41% | 4.6% |

Great Bear Funding, 1.60%, 7/1/2022 | 2.1% |

Great Bear Funding, 1.58%, 7/5/2022 | 2.1% |

Halkin Finance, LLC, 1.11%, 7/1/2022 | 1.9% |

Natixis SA/New York, NY, 1.88%, 12/2/2022 | 1.4% |

Standard Chartered Bank NY, 0.66%, 11/1/2022 | 1.4% |

Bank of Montreal Chicago, 2.03%, 1/3/2023 | 1.4% |

As a percentage of total net assets.

2022 Semi-Annual Report | June 30, 2022 | Page 9 |

2022 Semi-Annual Report

Fund Holdings & Financial Statements

Schedules of Investments

June 30, 2022 (unaudited)

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — 52.3% |

Communication Services — 3.4% | | | | | | | | |

Alphabet, Inc. (1) | | | 5,193 | | | | 11,359,428 | |

AT&T, Inc. | | | 29,147 | | | | 610,921 | |

Cogent Communications Holdings, Inc. | | | 2,264 | | | | 137,561 | |

Comcast Corp. | | | 81,067 | | | | 3,181,069 | |

Emerald Holding, Inc. (1) | | | 8 | | | | 33 | |

Entravision Communications Corp. | | | 1,883 | | | | 8,586 | |

IDT Corp. (1) | | | 15,505 | | | | 389,951 | |

Interpublic Group of Cos., Inc./The | | | 49,688 | | | | 1,367,911 | |

Liberty TripAdvisor Holdings, Inc. (1) | | | 8,364 | | | | 6,328 | |

Lions Gate Entertainment Corp. (1) | | | 688 | | | | 6,075 | |

Lumen Technologies, Inc. | | | 7,466 | | | | 81,454 | |

Meta Platforms, Inc. (1) | | | 16,153 | | | | 2,604,671 | |

News Corp. | | | 1,172 | | | | 18,260 | |

Nexstar Media Group, Inc. | | | 3,686 | | | | 600,376 | |

Omnicom Group, Inc. | | | 19,418 | | | | 1,235,179 | |

Telephone and Data Systems, Inc. | | | 410 | | | | 6,474 | |

Verizon Communications, Inc. | | | 802 | | | | 40,702 | |

| | | | | | | | 21,654,979 | |

| | | | | | | | | |

Consumer Discretionary — 4.7% | | | | | | | | |

Abercrombie & Fitch Co. (1) | | | 192 | | | | 3,249 | |

Academy Sports & Outdoors, Inc. | | | 53,605 | | | | 1,905,122 | |

Amazon.com, Inc. (1) | | | 64,824 | | | | 6,884,957 | |

AutoZone, Inc. (1) | | | 547 | | | | 1,175,569 | |

Booking Holdings, Inc. (1) | | | 921 | | | | 1,610,820 | |

Cavco Industries, Inc. (1) | | | 694 | | | | 136,017 | |

Dana, Inc. | | | 3,684 | | | | 51,834 | |

Dillard’s, Inc. | | | 68 | | | | 14,999 | |

Everi Holdings, Inc. (1) | | | 1,466 | | | | 23,910 | |

Fisker, Inc. (1) | | | 3 | | | | 26 | |

Ford Motor Co. | | | 45,012 | | | | 500,984 | |

Frontdoor, Inc. (1) | | | 2,948 | | | | 70,988 | |

Garmin, Ltd. | | | 72 | | | | 7,074 | |

Genesco, Inc. (1) | | | 1,423 | | | | 71,022 | |

Gentex Corp. | | | 476 | | | | 13,314 | |

Gentherm, Inc. (1) | | | 1,770 | | | | 110,466 | |

Genuine Parts Co. | | | 94 | | | | 12,502 | |

Grand Canyon Education, Inc. (1) | | | 17,367 | | | | 1,635,798 | |

H&R Block, Inc. | | | 11,137 | | | | 393,359 | |

Hibbett, Inc. | | | 2,837 | | | | 124,005 | |

Home Depot, Inc./The | | | 2,383 | | | | 653,585 | |

Hovnanian Enterprises, Inc. (1) | | | 10 | | | | 428 | |

Kohl’s Corp. | | | 14,402 | | | | 514,007 | |

La-Z-Boy, Inc. | | | 315 | | | | 7,469 | |

Lear Corp. | | | 55 | | | | 6,924 | |

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — continued |

LKQ Corp. | | | 69 | | | | 3,387 | |

Lowe’s Cos., Inc. | | | 20 | | | | 3,493 | |

Lululemon Athletica, Inc. (1) | | | 9,068 | | | | 2,472,027 | |

M/I Homes, Inc. (1) | | | 7,987 | | | | 316,764 | |

Macy’s, Inc. | | | 86,196 | | | | 1,579,111 | |

Mohawk Industries, Inc. (1) | | | 6,873 | | | | 852,871 | |

Monarch Casino & Resort, Inc. (1) | | | 582 | | | | 34,146 | |

Murphy USA, Inc. | | | 280 | | | | 65,204 | |

Nordstrom, Inc. | | | 3,925 | | | | 82,935 | |

ONE Group Hospitality, Inc./The (1) | | | 3,356 | | | | 24,734 | |

O’Reilly Automotive, Inc. (1) | | | 2,508 | | | | 1,584,454 | |

PVH Corp. | | | 12,348 | | | | 702,601 | |

Qurate Retail, Inc. | | | 7,934 | | | | 22,771 | |

Rent-A-Center, Inc./TX | | | 281 | | | | 5,465 | |

Ross Stores, Inc. | | | 3,156 | | | | 221,646 | |

Skyline Champion Corp. (1) | | | 20,917 | | | | 991,884 | |

Smith & Wesson Brands, Inc. | | | 10,263 | | | | 134,753 | |

Sonos, Inc. (1) | | | 37,511 | | | | 676,698 | |

Sturm Ruger & Co., Inc. | | | 283 | | | | 18,013 | |

Tapestry, Inc. | | | 6,717 | | | | 205,003 | |

Target Corp. | | | 2,938 | | | | 414,934 | |

Terminix Global Holdings, Inc. (1) | | | 2 | | | | 81 | |

Tesla, Inc. (1) | | | 575 | | | | 387,217 | |

Thor Industries, Inc. | | | 3,534 | | | | 264,096 | |

TJX Cos., Inc./The | | | 10,052 | | | | 561,404 | |

Town Sports International Holdings, Inc. (1) | | | 4,613 | | | | 1 | |

Tractor Supply Co. | | | 2,516 | | | | 487,727 | |

Tupperware Brands Corp. (1) | | | 645 | | | | 4,089 | |

Ulta Beauty, Inc. (1) | | | 5,150 | | | | 1,985,222 | |

Yum! Brands, Inc. | | | 4,033 | | | | 457,786 | |

| | | | | | | | 30,488,945 | |

| | | | | | | | | |

Consumer Staples — 2.4% | | | | | | | | |

Albertsons Cos., Inc. | | | 22,234 | | | | 594,092 | |

Archer-Daniels-Midland Co. | | | 26,248 | | | | 2,036,845 | |

Bunge, Ltd. | | | 11,487 | | | | 1,041,756 | |

Coca-Cola Co./The | | | 3,709 | | | | 233,333 | |

Costco Wholesale Corp. | | | 15,244 | | | | 7,306,144 | |

Darling Ingredients, Inc. (1) | | | 2,457 | | | | 146,929 | |

Flowers Foods, Inc. | | | 750 | | | | 19,740 | |

General Mills, Inc. | | | 19,764 | | | | 1,491,194 | |

Hostess Brands, Inc. (1) | | | 8,446 | | | | 179,140 | |

Ingredion, Inc. | | | 3,551 | | | | 313,056 | |

Kroger Co./The | | | 166 | | | | 7,857 | |

Mondelez International, Inc. | | | 4,967 | | | | 308,401 | |

NewAge, Inc. (1) | | | 14 | | | | 3 | |

The accompanying notes are an integral part of these financial statements.

2022 Semi-Annual Report | June 30, 2022 | Page 11 |

Schedules of Investments

June 30, 2022 (unaudited)

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — continued |

PepsiCo, Inc. | | | 868 | | | | 144,661 | |

Simply Good Foods Co./The (1) | | | 11,593 | | | | 437,868 | |

Sysco Corp. | | | 40 | | | | 3,388 | |

Tyson Foods, Inc. | | | 10,693 | | | | 920,240 | |

| | | | | | | | 15,184,647 | |

| | | | | | | | | |

Energy — 3.2% | | | | | | | | |

Alto Ingredients, Inc. (1) | | | 1,605 | | | | 5,955 | |

APA Corp. | | | 7,673 | | | | 267,788 | |

Arch Resources, Inc. | | | 67 | | | | 9,587 | |

Baker Hughes Co. | | | 204 | | | | 5,889 | |

Berry Corp. | | | 2,368 | | | | 18,044 | |

Brigham Minerals, Inc. | | | 266 | | | | 6,552 | |

Bristow Group, Inc. (1) | | | 2,574 | | | | 60,232 | |

California Resources Corp. | | | 1,723 | | | | 66,336 | |

Centennial Resource Development, Inc./DE (1) | | | 580 | | | | 3,468 | |

Centrus Energy Corp. (1) | | | 2,426 | | | | 60,044 | |

ChampionX Corp. | | | 337 | | | | 6,689 | |

Cheniere Energy, Inc. | | | 4,803 | | | | 638,943 | |

Chevron Corp. | | | 35,561 | | | | 5,148,522 | |

Chord Energy Corp. | | | 47 | | | | 5,718 | |

Civitas Resources, Inc. | | | 327 | | | | 17,099 | |

ConocoPhillips | | | 6,796 | | | | 610,349 | |

Continental Resources, Inc./OK | | | 113 | | | | 7,385 | |

Coterra Energy, Inc. | | | 244 | | | | 6,293 | |

CVR Energy, Inc. | | | 438 | | | | 14,673 | |

Delek US Holdings, Inc. | | | 376 | | | | 9,716 | |

Devon Energy Corp. | | | 3,257 | | | | 179,493 | |

Diamondback Energy, Inc. | | | 2,487 | | | | 301,300 | |

DT Midstream, Inc. | | | 5,259 | | | | 257,796 | |

EOG Resources, Inc. | | | 5,707 | | | | 630,281 | |

EQT Corp. | | | 6,023 | | | | 207,191 | |

Exxon Mobil Corp. | | | 44,061 | | | | 3,773,384 | |

Halliburton Co. | | | 183 | | | | 5,739 | |

Hess Corp. | | | 1,994 | | | | 211,244 | |

HF Sinclair Corp. | | | 720 | | | | 32,515 | |

Laredo Petroleum, Inc. (1) | | | 218 | | | | 15,029 | |

Magnolia Oil & Gas Corp. | | | 275 | | | | 5,772 | |

Marathon Petroleum Corp. | | | 36,385 | | | | 2,991,211 | |

Matador Resources Co. | | | 1,875 | | | | 87,356 | |

Murphy Oil Corp. | | | 184 | | | | 5,555 | |

Nine Energy Service, Inc. (1) | | | 7,505 | | | | 19,888 | |

Occidental Petroleum Corp. | | | 498 | | | | 29,322 | |

ONEOK, Inc. | | | 19,525 | | | | 1,083,638 | |

Ovintiv, Inc. | | | 5,060 | | | | 223,601 | |

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — continued |

PBF Energy, Inc. (1) | | | 216 | | | | 6,268 | |

PDC Energy, Inc. | | | 953 | | | | 58,714 | |

Phillips 66 | | | 9,887 | | | | 810,635 | |

Pioneer Natural Resources Co. | | | 1,755 | | | | 391,505 | |

ProPetro Holding Corp. (1) | | | 369 | | | | 3,690 | |

REX American Resources Corp. (1) | | | 51 | | | | 4,325 | |

Schlumberger NV | | | 23,752 | | | | 849,372 | |

SM Energy Co. | | | 1,208 | | | | 41,302 | |

Targa Resources Corp. | | | 6,362 | | | | 379,621 | |

Teekay Corp. (1) | | | 3,592 | | | | 10,345 | |

Valero Energy Corp. | | | 10,631 | | | | 1,129,863 | |

Whiting Petroleum Corp. | | | 122 | | | | 8,300 | |

Williams Cos., Inc./The | | | 502 | | | | 15,667 | |

World Fuel Services Corp. | | | 2,314 | | | | 47,344 | |

| | | | | | | | 20,786,548 | |

| | | | | | | | | |

Financials — 5.9% | | | | | | | | |

American Equity Investment Life Holding Co. | | | 10,002 | | | | 365,773 | |

American Financial Group, Inc./OH | | | 2,518 | | | | 349,524 | |

American International Group, Inc. | | | 63,115 | | | | 3,227,070 | |

Aon PLC | | | 14 | | | | 3,776 | |

Atlanticus Holdings Corp. (1) | | | 129 | | | | 4,537 | |

Axis Capital Holdings, Ltd. | | | 385 | | | | 21,980 | |

Bank of New York Mellon Corp./The | | | 24,075 | | | | 1,004,168 | |

Berkshire Hathaway, Inc. (1) | | | 61,253 | | | | 16,723,294 | |

Capital Bancorp, Inc. | | | 246 | | | | 5,338 | |

Carlyle Group, Inc./The | | | 23 | | | | 728 | |

Charles Schwab Corp./The | | | 15,661 | | | | 989,462 | |

Chubb, Ltd. | | | 3,118 | | | | 612,936 | |

Enact Holdings, Inc. | | | 309 | | | | 6,637 | |

Erie Indemnity Co. | | | 45 | | | | 8,649 | |

Essent Group, Ltd. | | | 10,298 | | | | 400,592 | |

Fidelity National Financial, Inc. | | | 16,823 | | | | 621,778 | |

Hartford Financial Services Group, Inc./The | | | 5,375 | | | | 351,686 | |

Markel Corp. (1) | | | 210 | | | | 271,583 | |

Marsh & McLennan Cos., Inc. | | | 25,477 | | | | 3,955,304 | |

Medley Management, Inc. (1)(5) | | | 235 | | | | 0 | |

Moelis & Co. | | | 4,017 | | | | 158,069 | |

Mr Cooper Group, Inc. (1) | | | 1,667 | | | | 61,246 | |

New Residential Investment Corp. | | | 1,068 | | | | 9,954 | |

NMI Holdings, Inc. (1) | | | 424 | | | | 7,060 | |

Northrim BanCorp, Inc. | | | 2,779 | | | | 111,883 | |

OFG Bancorp | | | 257 | | | | 6,528 | |

Old Republic International Corp. | | | 978 | | | | 21,868 | |

OneMain Holdings, Inc. | | | 30,367 | | | | 1,135,118 | |

The accompanying notes are an integral part of these financial statements.

Page 12 | 2022 Semi-Annual Report | June 30, 2022 |

Schedules of Investments

June 30, 2022 (unaudited)

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — continued |

Pathward Financial, Inc. | | | 3,673 | | | | 142,035 | |

Popular, Inc. | | | 90 | | | | 6,924 | |

Prudential Financial, Inc. | | | 11,769 | | | | 1,126,058 | |

Pzena Investment Management, Inc. | | | 7,429 | | | | 48,957 | |

Regions Financial Corp. | | | 33,360 | | | | 625,500 | |

Rocket Cos., Inc. | | | 3 | | | | 22 | |

State Street Corp. | | | 6,373 | | | | 392,895 | |

Stewart Information Services Corp. | | | 14,949 | | | | 743,713 | |

Synchrony Financial | | | 9,858 | | | | 272,278 | |

Unum Group | | | 201 | | | | 6,838 | |

W R Berkley Corp. | | | 8,168 | | | | 557,548 | |

Walker & Dunlop, Inc. | | | 4,498 | | | | 433,337 | |

Westamerica BanCorp | | | 318 | | | | 17,700 | |

Willis Towers Watson PLC | | | 16,007 | | | | 3,159,622 | |

Zions Bancorp NA | | | 3,255 | | | | 165,680 | |

| | | | | | | | 38,135,648 | |

| | | | | | | | | |

Healthcare — 10.4% | | | | | | | | |

Abbott Laboratories | | | 11,797 | | | | 1,281,744 | |

AbbVie, Inc. | | | 36,570 | | | | 5,601,061 | |

Agilent Technologies, Inc. | | | 89 | | | | 10,571 | |

Align Technology, Inc. (1) | | | 14 | | | | 3,313 | |

Amgen, Inc. | | | 21,249 | | | | 5,169,882 | |

Amneal Pharmaceuticals, Inc. (1) | | | 7,487 | | | | 23,809 | |

Assertio Holdings, Inc. (1) | | | 3,562 | | | | 10,508 | |

Avalo Therapeutics, Inc. (1) | | | 17,337 | | | | 8,669 | |

Avid Bioservices, Inc. (1) | | | 246 | | | | 3,754 | |

Bio-Techne Corp. | | | 21 | | | | 7,279 | |

Bristol-Myers Squibb Co. | | | 51,154 | | | | 3,938,858 | |

Brooklyn ImmunoTherapeutics, Inc. (1) | | | 5 | | | | 3 | |

Cardinal Health, Inc. | | | 36,005 | | | | 1,881,981 | |

Catalent, Inc. (1) | | | 13,756 | | | | 1,475,881 | |

Celldex Therapeutics, Inc. (1) | | | 32 | | | | 863 | |

Centene Corp. (1) | | | 5,425 | | | | 459,009 | |

Centogene NV (1) | | | 2,360 | | | | 5,593 | |

Cigna Corp. | | | 5,727 | | | | 1,509,179 | |

Cyteir Therapeutics, Inc. (1) | | | 3 | | | | 9 | |

Danaher Corp. | | | 2,716 | | | | 688,560 | |

Dyne Therapeutics, Inc. (1) | | | 4 | | | | 27 | |

Eli Lilly & Co. | | | 12,720 | | | | 4,124,206 | |

Eloxx Pharmaceuticals, Inc. (1) | | | 14,948 | | | | 4,036 | |

Endo International PLC (1) | | | 21,615 | | | | 10,066 | |

Fulgent Genetics, Inc. (1) | | | 6,797 | | | | 370,640 | |

Galectin Therapeutics, Inc. (1) | | | 3,817 | | | | 5,000 | |

Genprex, Inc. (1) | | | 4,483 | | | | 6,231 | |

Gilead Sciences, Inc. | | | 42,865 | | | | 2,649,486 | |

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — continued |

Humana, Inc. | | | 1,140 | | | | 533,600 | |

IDEXX Laboratories, Inc. (1) | | | 1,790 | | | | 627,807 | |

Illumina, Inc. (1) | | | 3,660 | | | | 674,758 | |

ImmunityBio, Inc. (1) | | | 14,061 | | | | 52,307 | |

Incyte Corp. (1) | | | 3,850 | | | | 292,485 | |

Intra-Cellular Therapies, Inc. (1) | | | 356 | | | | 20,320 | |

Johnson & Johnson | | | 64,271 | | | | 11,408,745 | |

Kronos Bio, Inc. (1) | | | 3 | | | | 11 | |

La Jolla Pharmaceutical Co. (1) | | | 1,666 | | | | 5,315 | |

Laboratory Corp. of America Holdings | | | 278 | | | | 65,152 | |

McKesson Corp. | | | 8,991 | | | | 2,932,954 | |

Merck & Co., Inc. | | | 49,542 | | | | 4,516,744 | |

Moderna, Inc. (1) | | | 11,479 | | | | 1,639,775 | |

Molina Healthcare, Inc. (1) | | | 26 | | | | 7,270 | |

Oak Street Health, Inc. (1) | | | 1 | | | | 16 | |

Palatin Technologies, Inc. (1) | | | 15,677 | | | | 4,399 | |

Pfizer, Inc. | | | 62,691 | | | | 3,286,889 | |

Premier, Inc. | | | 2,907 | | | | 103,722 | |

QuidelOrtho Corp. (1) | | | 4,151 | | | | 403,394 | |

Regeneron Pharmaceuticals, Inc. (1) | | | 2,877 | | | | 1,700,681 | |

UnitedHealth Group, Inc. | | | 11,212 | | | | 5,758,820 | |

Universal Health Services, Inc. | | | 1,326 | | | | 133,541 | |

Veeva Systems, Inc. (1) | | | 867 | | | | 171,701 | |

Veracyte, Inc. (1) | | | 4,212 | | | | 83,819 | |

Vertex Pharmaceuticals, Inc. (1) | | | 3,044 | | | | 857,769 | |

Viatris, Inc. | | | 29,587 | | | | 309,776 | |

West Pharmaceutical Services, Inc. | | | 4,491 | | | | 1,357,944 | |

Zoetis, Inc. | | | 3,233 | | | | 555,720 | |

| | | | | | | | 66,755,652 | |

| | | | | | | | | |

Industrials — 4.9% | | | | | | | | |

AECOM | | | 208 | | | | 13,566 | |

Allison Transmission Holdings, Inc. | | | 187 | | | | 7,190 | |

Atkore, Inc. (1) | | | 9,025 | | | | 749,165 | |

Axon Enterprise, Inc. (1) | | | 7,443 | | | | 693,464 | |

Babcock & Wilcox Enterprises, Inc. (1) | | | 14 | | | | 84 | |

BlueLinx Holdings, Inc. (1) | | | 131 | | | | 8,752 | |

Boise Cascade Co. | | | 10,341 | | | | 615,186 | |

Builders FirstSource, Inc. (1) | | | 56,707 | | | | 3,045,166 | |

Cintas Corp. | | | 10 | | | | 3,735 | |

Copart, Inc. (1) | | | 14,086 | | | | 1,530,585 | |

Costamare, Inc. | | | 524 | | | | 6,340 | |

CoStar Group, Inc. (1) | | | 5,624 | | | | 339,746 | |

Eagle Bulk Shipping, Inc. | | | 144 | | | | 7,471 | |

EMCOR Group, Inc. | | | 8,293 | | | | 853,847 | |

Emerson Electric Co. | | | 1,156 | | | | 91,948 | |

The accompanying notes are an integral part of these financial statements.

2022 Semi-Annual Report | June 30, 2022 | Page 13 |

Schedules of Investments

June 30, 2022 (unaudited)

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — continued |

Encore Wire Corp. | | | 3,243 | | | | 337,013 | |

FedEx Corp. | | | 15 | | | | 3,401 | |

Genco Shipping & Trading, Ltd. | | | 2,685 | | | | 51,874 | |

General Dynamics Corp. | | | 18,049 | | | | 3,993,341 | |

Graco, Inc. | | | 3,462 | | | | 205,677 | |

Heidrick & Struggles International, Inc. | | | 1,132 | | | | 36,632 | |

Heritage-Crystal Clean, Inc. (1) | | | 140 | | | | 3,774 | |

Hillenbrand, Inc. | | | 5,410 | | | | 221,594 | |

Hubbell, Inc. | | | 1,440 | | | | 257,155 | |

Infrastructure and Energy Alternatives, Inc. (1) | | | 3,588 | | | | 28,812 | |

Karat Packaging, Inc. (1) | | | 307 | | | | 5,237 | |

Kforce, Inc. | | | 117 | | | | 7,177 | |

Lockheed Martin Corp. | | | 15,199 | | | | 6,534,962 | |

ManpowerGroup, Inc. | | | 3,617 | | | | 276,375 | |

Matson, Inc. | | | 4,056 | | | | 295,601 | |

Montrose Environmental Group, Inc. (1) | | | 1 | | | | 34 | |

Mueller Industries, Inc. | | | 4,931 | | | | 262,773 | |

MYR Group, Inc. (1) | | | 755 | | | | 66,538 | |

Northrop Grumman Corp. | | | 11,911 | | | | 5,700,247 | |

nVent Electric PLC | | | 2,601 | | | | 81,489 | |

Raytheon Technologies Corp. | | | 28,380 | | | | 2,727,602 | |

Regal Rexnord Corp. | | | 2,651 | | | | 300,942 | |

Republic Services, Inc. | | | 282 | | | | 36,905 | |

Sterling Infrastructure, Inc. (1) | | | 316 | | | | 6,927 | |

Textron, Inc. | | | 6,577 | | | | 401,657 | |

Titan Machinery, Inc. (1) | | | 156 | | | | 3,496 | |

TrueBlue, Inc. (1) | | | 323 | | | | 5,782 | |

United Parcel Service, Inc. | | | 20 | | | | 3,651 | |

Univar Solutions, Inc. (1) | | | 258 | | | | 6,416 | |

V2X, Inc. (1) | | | 1,245 | | | | 41,658 | |

Waste Management, Inc. | | | 8,623 | | | | 1,319,147 | |

WillScot Mobile Mini Holdings Corp. (1) | | | 3 | | | | 97 | |

WW Grainger, Inc. | | | 677 | | | | 307,649 | |

| | | | | | | | 31,497,880 | |

| | | | | | | | | |

Information Technology — 15.4% | | | | | | | | |

ACI Worldwide, Inc. (1) | | | 3,129 | | | | 81,010 | |

Advanced Micro Devices, Inc. (1) | | | 4,045 | | | | 309,321 | |

Affirm Holdings, Inc. (1) | | | 2,649 | | | | 47,841 | |

Alpha & Omega Semiconductor, Ltd. (1) | | | 32,281 | | | | 1,076,249 | |

Amdocs, Ltd. | | | 44 | | | | 3,666 | |

American Software, Inc./GA | | | 713 | | | | 11,522 | |

Amkor Technology, Inc. | | | 35,568 | | | | 602,878 | |

Apple, Inc. | | | 176,678 | | | | 24,155,416 | |

Arrow Electronics, Inc. (1) | | | 9,145 | | | | 1,025,063 | |

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — continued |

Avid Technology, Inc. (1) | | | 5,155 | | | | 133,772 | |

Avnet, Inc. | | | 8,301 | | | | 355,947 | |

Axcelis Technologies, Inc. (1) | | | 11,450 | | | | 627,918 | |

Belden, Inc. | | | 1,085 | | | | 57,798 | |

Broadcom, Inc. | | | 756 | | | | 367,272 | |

Cadence Design Systems, Inc. (1) | | | 11,915 | | | | 1,787,607 | |

Cass Information Systems, Inc. | | | 112 | | | | 3,786 | |

Cisco Systems, Inc. | | | 22,031 | | | | 939,402 | |

Cognizant Technology Solutions Corp. | | | 4,563 | | | | 307,957 | |

CommVault Systems, Inc. (1) | | | 1,060 | | | | 66,674 | |

Concentrix Corp. | | | 2,744 | | | | 372,196 | |

Corning, Inc. | | | 2,534 | | | | 79,846 | |

Dell Technologies, Inc. | | | 429 | | | | 19,824 | |

Diodes, Inc. (1) | | | 7,041 | | | | 454,637 | |

Dolby Laboratories, Inc. | | | 6,270 | | | | 448,681 | |

Duck Creek Technologies, Inc. (1) | | | 1 | | | | 15 | |

DXC Technology Co. (1) | | | 6,664 | | | | 201,986 | |

DZS, Inc. (1) | | | 3 | | | | 49 | |

EPAM Systems, Inc. (1) | | | 2,193 | | | | 646,453 | |

Euronet Worldwide, Inc. (1) | | | 2,449 | | | | 246,345 | |

Extreme Networks, Inc. (1) | | | 1,770 | | | | 15,788 | |

Fabrinet (1) | | | 305 | | | | 24,736 | |

Intel Corp. | | | 80,484 | | | | 3,010,906 | |

International Money Express, Inc. (1) | | | 562 | | | | 11,504 | |

Intuit, Inc. | | | 8,519 | | | | 3,283,563 | |

Jabil, Inc. | | | 57,095 | | | | 2,923,835 | |

Juniper Networks, Inc. | | | 367 | | | | 10,460 | |

Manhattan Associates, Inc. (1) | | | 43,576 | | | | 4,993,810 | |

Mastercard, Inc. | | | 6,986 | | | | 2,203,943 | |

Microchip Technology, Inc. | | | 14,690 | | | | 853,195 | |

Micron Technology, Inc. | | | 78,374 | | | | 4,332,515 | |

Microsoft Corp. | | | 114,877 | | | | 29,503,860 | |

Monolithic Power Systems, Inc. | | | 411 | | | | 157,840 | |

New Relic, Inc. (1) | | | 4,260 | | | | 213,213 | |

NortonLifeLock, Inc. | | | 13,979 | | | | 306,979 | |

Oracle Corp. | | | 34,448 | | | | 2,406,882 | |

Photronics, Inc. (1) | | | 4,920 | | | | 95,842 | |

Power Integrations, Inc. | | | 6,692 | | | | 501,967 | |

Pure Storage, Inc. (1) | | | 14,303 | | | | 367,730 | |

QUALCOMM, Inc. | | | 44,230 | | | | 5,649,940 | |

Qualys, Inc. (1) | | | 1,823 | | | | 229,953 | |

StarTek, Inc. (1) | | | 2,934 | | | | 8,479 | |

Synopsys, Inc. (1) | | | 1,034 | | | | 314,026 | |

Tenable Holdings, Inc. (1) | | | 10,008 | | | | 454,463 | |

WEX, Inc. (1) | | | 898 | | | | 139,693 | |

Xperi Holding Corp. | | | 4,260 | | | | 61,472 | |

The accompanying notes are an integral part of these financial statements.

Page 14 | 2022 Semi-Annual Report | June 30, 2022 |

Schedules of Investments

June 30, 2022 (unaudited)

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States)— continued |

Zebra Technologies Corp. (1) | | | 1,479 | | | | 434,752 | |

Zoom Video Communications, Inc. (1) | | | 15,849 | | | | 1,711,217 | |

| | | | | | | | 98,653,694 | |

| | | | | | | | | |

Materials — 1.2% | | | | | | | | |

AdvanSix, Inc. | | | 1,277 | | | | 42,703 | |

Air Products and Chemicals, Inc. | | | 31 | | | | 7,455 | |

Alcoa Corp. | | | 3,649 | | | | 166,321 | |

CF Industries Holdings, Inc. | | | 545 | | | | 46,723 | |

Clearwater Paper Corp. (1) | | | 113 | | | | 3,800 | |

Cleveland-Cliffs, Inc. (1) | | | 1,040 | | | | 15,985 | |

Dow, Inc. | | | 17,824 | | | | 919,897 | |

Eagle Materials, Inc. | | | 3,389 | | | | 372,587 | |

Freeport-McMoRan, Inc. | | | 32,031 | | | | 937,227 | |

Huntsman Corp. | | | 354 | | | | 10,036 | |

International Paper Co. | | | 11,412 | | | | 477,364 | |

Louisiana-Pacific Corp. | | | 25,240 | | | | 1,322,828 | |

LyondellBasell Industries NV | | | 14,522 | | | | 1,270,094 | |

Newmont Corp. | | | 268 | | | | 15,992 | |

Nucor Corp. | | | 7,026 | | | | 733,585 | |

Olin Corp. | | | 1,864 | | | | 86,266 | |

Packaging Corp. of America | | | 2,937 | | | | 403,838 | |

PPG Industries, Inc. | | | 29 | | | | 3,316 | |

Reliance Steel & Aluminum Co. | | | 40 | | | | 6,794 | |

Royal Gold, Inc. | | | 5,076 | | | | 542,015 | |

Ryerson Holding Corp. | | | 760 | | | | 16,180 | |

Schnitzer Steel Industries, Inc. | | | 830 | | | | 27,257 | |

Southern Copper Corp. | | | 3,414 | | | | 170,051 | |

Steel Dynamics, Inc. | | | 1,109 | | | | 73,360 | |

Sylvamo Corp. | | | 1,618 | | | | 52,876 | |

Trinseo PLC | | | 475 | | | | 18,269 | |

Tronox Holdings PLC | | | 453 | | | | 7,610 | |

United States Steel Corp. | | | 4,660 | | | | 83,461 | |

Westrock Co. | | | 155 | | | | 6,175 | |

| | | | | | | | 7,840,065 | |

| | | | | | | | | |

Real Estate Investment Trust — 0.1% | | | | | | | | |

Altisource Portfolio Solutions SA (1) | | | 3,399 | | | | 36,505 | |

Brixmor Property Group, Inc. | | | 901 | | | | 18,209 | |

Broadstone Net Lease, Inc. | | | 5 | | | | 103 | |

CareTrust REIT, Inc. | | | 11,988 | | | | 221,059 | |

CatchMark Timber Trust, Inc. | | | 1,594 | | | | 16,036 | |

CorEnergy Infrastructure Trust, Inc. | | | 13,458 | | | | 33,914 | |

Corporate Office Properties Trust | | | 11,293 | | | | 295,764 | |

Essex Property Trust, Inc. | | | 26 | | | | 6,799 | |

Kilroy Realty Corp. | | | 280 | | | | 14,652 | |

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) — continued |

Lamar Advertising Co. | | | 40 | | | | 3,519 | |

PotlatchDeltic Corp. | | | 2,682 | | | | 118,518 | |

SITE Centers Corp. | | | 605 | | | | 8,149 | |

Spirit MTA REIT Liquidating Trust (1)(5) | | | 9,151 | | | | 0 | |

| | | | | | | | 773,227 | |

| | | | | | | | | |

Utilities — 0.7% | | | | | | | | |

AES Corp./The | | | 333 | | | | 6,996 | |

CenterPoint Energy, Inc. | | | 6,493 | | | | 192,063 | |

Constellation Energy Corp. | | | 22,699 | | | | 1,299,736 | |

Evergy, Inc. | | | 321 | | | | 20,945 | |

National Fuel Gas Co. | | | 1,234 | | | | 81,506 | |

NRG Energy, Inc. | | | 23,835 | | | | 909,782 | |

SJW Group | | | 481 | | | | 30,019 | |

UGI Corp. | | | 36,952 | | | | 1,426,717 | |

Vistra Corp. | | | 12,555 | | | | 286,882 | |

| | | | | | | | 4,254,646 | |

| | | | | | | | | |

Total Common Stocks (United States) (Cost $293,356,560) | | | | | | | 336,025,931 | |

| | | | | | | | | |

Preferred Stock (United States) — 0.0% |

WESCO International, Inc. Series A Variable Preferred (6) | | | 2,612 | | | | 71,621 | |

Total Preferred Stock (United States) (Cost $65,288) | | | | | | | 71,621 | |

| | | | | | | | | |

Warrants (United States) — 0.0% |

Chaparral Energy, Inc. A Warrants, Expiration Date 10/14/2024 (1)(5) | | | 7 | | | | 0 | |

Chaparral Energy, Inc. B Warrants, Expiration Date 10/14/2025 (1)(5) | | | 7 | | | | 0 | |

Civitas Solutions, Inc. A Warrants, Expiration Date 1/20/2025 (1)(5) | | | 57 | | | | 0 | |

Civitas Solutions, Inc. B Warrants, Expiration Date 1/20/2026 (1)(5) | | | 28 | | | | 0 | |

Hertz Global Holdings, Inc. Warrants, Expiration Date 6/30/2051 (1) | | | 349 | | | | 3,417 | |

Nabors Industries, Ltd. Warrants, Expiration Date 6/11/2026 (1) | | | 122 | | | | 3,902 | |

Oasis Petroleum, Inc. Warrants, Expiration Date 11/19/2024 (1)(5) | | | 23 | | | | 0 | |

Whiting Petroleum Corp. A Warrants, Expiration Date 9/1/2024 (1) | | | 128 | | | | 1,715 | |

The accompanying notes are an integral part of these financial statements.

2022 Semi-Annual Report | June 30, 2022 | Page 15 |

Schedules of Investments

June 30, 2022 (unaudited)

Muirfield Fund |

Security Description | | Shares,

Contracts

or Principal

Amount ($) | | | Fair

Value ($) | |

Warrants (United States) — continued |

Whiting Petroleum Corp. B Warrants, Expiration Date 9/1/2025 (1) | | | 63 | | | | 662 | |

Total Warrants (United States) (Cost $8,512) | | | | | | | 9,696 | |

| | | | | | | | | |

Money Market Registered Investment Companies — 42.6% |

Meeder Institutional Prime Money Market Fund, 1.42% (2) | | | 273,689,073 | | | | 273,579,597 | |

Total Money Market Registered Investment Companies (Cost $273,624,584) | | | | | | | 273,579,597 | |

| | | | | | | | | |

Bank Obligations — 0.1% |

First Merchants Bank Deposit Account, 0.55%, 7/1/2022 (3) | | | 249,644 | | | | 249,644 | |

Metro City Bank Deposit Account, 0.05%, 7/1/2022 (3) | | | 248,529 | | | | 248,529 | |

Total Bank Obligations (Cost $498,173) | | | | | | | 498,173 | |

Total Investments — 95.0% (Cost $567,553,117) | | | | | | | 610,185,018 | |

Other Assets less Liabilities — 5.0% | | | | | | | 32,434,083 | |

Total Net Assets — 100.0% | | | | | | | 642,619,101 | |

| | | | | | | | | |

Trustee Deferred Compensation (4) |

Meeder Balanced Fund - Retail Class | | | 5,216 | | | | 61,392 | |

Meeder Dynamic Allocation Fund - Retail Class | | | 13,845 | | | | 155,618 | |

Meeder Muirfield Fund - Retail Class | | | 9,385 | | | | 77,708 | |

Meeder Conservative Allocation Fund - Retail Class | | | 1,544 | | | | 32,748 | |

Total Trustee Deferred Compensation (Cost $321,238) | | | | | | | 327,466 | |

| | | | | | | | | |

| | | Long

(Short)

Contracts | | | Expiration

Date | | | Notional

Value of

Contracts

($) | | | Value and

Unrealized

Appreciation

(Depreciation)

($) | |

Futures Contracts |

Index Futures | | | | | | | | | | | | | | | | |

E-mini Standard & Poors MidCap 400 Futures | | | (182 | ) | | | 9/16/2022 | | | | (41,277,600 | ) | | | 302,148 | |

Mini MSCI EAFE Index Futures | | | 405 | | | | 9/16/2022 | | | | 37,596,150 | | | | 39,960 | |

Mini MSCI Emerging Markets Index Futures | | | 141 | | | | 9/16/2022 | | | | 7,069,035 | | | | (15,982 | ) |

Russell 2000 Mini Index Futures | | | 196 | | | | 9/16/2022 | | | | 16,738,400 | | | | (167,143 | ) |

Standard & Poors 500 Mini Futures | | | (491 | ) | | | 9/16/2022 | | | | (93,032,225 | ) | | | (1,526,652 | ) |

Total Futures Contracts | | | 69 | | | | | | | | (72,906,240 | ) | | | (1,367,669 | ) |

(1) | Represents non-income producing securities. |

(2) | Investment in affiliate. The yield shown represents the 7-day yield in effect at June 30, 2022. |

(3) | Variable rate security. Securities payable at par including accrued interest (usually within seven days notice) and unconditionally secured as to principal and interest by letters of credit or other credit support agreements from major banks. The interest rates are adjustable and are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. The rate shown represents the rate in effect at June 30, 2022. The maturity date shown, if applicable, reflects the earlier of the next demand date or stated maturity date. |

(4) | Assets of affiliates to the Muirfield Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

(5) | Fair valued security deemed a Level 3 security. Security is not part of the investment strategy of the Fund. |

The accompanying notes are an integral part of these financial statements.

Page 16 | 2022 Semi-Annual Report | June 30, 2022 |

Schedules of Investments

June 30, 2022 (unaudited)

Spectrum Fund |

Security Description | | Shares or

Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) - Long — 66.5% |

Communication Services — 4.4% | | | | | | | | |

Alphabet, Inc. (1) | | | 2,048 | | | | 4,479,898 | |

AT&T, Inc. | | | 7,528 | | | | 157,787 | |

Cogent Communications Holdings, Inc. | | | 2,317 | | | | 140,781 | |

Comcast Corp. | | | 28,990 | | | | 1,137,568 | |

Entravision Communications Corp. | | | 1,225 | | | | 5,586 | |

IDT Corp. (1) | | | 5,190 | | | | 130,529 | |

Interpublic Group of Cos., Inc./The | | | 16,266 | | | | 447,803 | |

Liberty TripAdvisor Holdings, Inc. (1) | | | 2,709 | | | | 2,050 | |

Meta Platforms, Inc. (1) | | | 5,332 | | | | 859,785 | |

Nexstar Media Group, Inc. | | | 1,175 | | | | 191,384 | |

Omnicom Group, Inc. | | | 7,569 | | | | 481,464 | |

| | | | | | | | 8,034,635 | |

| | | | | | | | | |

Consumer Discretionary — 6.1% | | | | | | | | |

Academy Sports & Outdoors, Inc. | | | 13,700 | | | | 486,898 | |

Amazon.com, Inc. (1) | | | 27,747 | | | | 2,947,009 | |

AutoZone, Inc. (1) | | | 159 | | | | 341,710 | |

Booking Holdings, Inc. (1) | | | 288 | | | | 503,709 | |

Caleres, Inc. | | | 285 | | | | 7,478 | |

Chico’s FAS, Inc. (1) | | | 382 | | | | 1,899 | |

Ethan Allen Interiors, Inc. | | | 206 | | | | 4,163 | |

Everi Holdings, Inc. (1) | | | 1,238 | | | | 20,192 | |

Ford Motor Co. | | | 15,097 | | | | 168,030 | |

Frontdoor, Inc. (1) | | | 1,128 | | | | 27,162 | |

Gentex Corp. | | | 265 | | | | 7,412 | |

Gentherm, Inc. (1) | | | 1,237 | | | | 77,201 | |

Grand Canyon Education, Inc. (1) | | | 6,858 | | | | 645,955 | |

H&R Block, Inc. | | | 4,966 | | | | 175,399 | |

Hibbett, Inc. | | | 2,700 | | | | 118,017 | |

Home Depot, Inc./The | | | 248 | | | | 68,019 | |

Kohl’s Corp. | | | 4,212 | | | | 150,326 | |

Lowe’s Cos., Inc. | | | 1,895 | | | | 331,000 | |

Lululemon Athletica, Inc. (1) | | | 2,701 | | | | 736,320 | |

M/I Homes, Inc. (1) | | | 5,276 | | | | 209,246 | |

Macy’s, Inc. | | | 24,116 | | | | 441,805 | |

Mohawk Industries, Inc. (1) | | | 3,870 | | | | 480,228 | |

Nordstrom, Inc. | | | 1,973 | | | | 41,689 | |

O’Reilly Automotive, Inc. (1) | | | 639 | | | | 403,695 | |

PVH Corp. | | | 6,450 | | | | 367,005 | |

Qurate Retail, Inc. | | | 2,482 | | | | 7,123 | |

Skyline Champion Corp. (1) | | | 6,640 | | | | 314,869 | |

Smith & Wesson Brands, Inc. | | | 5,227 | | | | 68,631 | |

Sonos, Inc. (1) | | | 17,098 | | | | 308,448 | |

Tapestry, Inc. | | | 2,247 | | | | 68,578 | |

Target Corp. | | | 690 | | | | 97,449 | |

Thor Industries, Inc. | | | 2,491 | | | | 186,152 | |

Spectrum Fund |

Security Description | | Shares or

Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) - Long — continued |

TJX Cos., Inc./The | | | 6,585 | | | | 367,772 | |

Tractor Supply Co. | | | 297 | | | | 57,573 | |

Ulta Beauty, Inc. (1) | | | 1,993 | | | | 768,262 | |

Yum! Brands, Inc. | | | 2,153 | | | | 244,387 | |

| | | | | | | | 11,250,811 | |

| | | | | | | | | |

Consumer Staples — 3.3% | | | | | | | | |

Albertsons Cos., Inc. | | | 4,897 | | | | 130,848 | |

Archer-Daniels-Midland Co. | | | 7,038 | | | | 546,149 | |

Bunge, Ltd. | | | 3,331 | | | | 302,088 | |

Costco Wholesale Corp. | | | 5,228 | | | | 2,505,676 | |

Darling Ingredients, Inc. (1) | | | 1,050 | | | | 62,790 | |

General Mills, Inc. | | | 11,179 | | | | 843,456 | |

Kroger Co./The | | | 1,605 | | | | 75,965 | |

Mondelez International, Inc. | | | 9,418 | | | | 584,764 | |

PepsiCo, Inc. | | | 787 | | | | 131,161 | |

Simply Good Foods Co./The (1) | | | 6,380 | | | | 240,973 | |

Tyson Foods, Inc. | | | 7,280 | | | | 626,517 | |

| | | | | | | | 6,050,387 | |

| | | | | | | | | |

Energy — 4.9% | | | | | | | | |

APA Corp. | | | 3,444 | | | | 120,196 | |

Berry Corp. | | | 842 | | | | 6,416 | |

Bristow Group, Inc. (1) | | | 676 | | | | 15,818 | |

Centrus Energy Corp. (1) | | | 679 | | | | 16,805 | |

Cheniere Energy, Inc. | | | 537 | | | | 71,437 | |

Chevron Corp. | | | 14,979 | | | | 2,168,660 | |

Civitas Resources, Inc. | | | 117 | | | | 6,118 | |

ConocoPhillips | | | 5,174 | | | | 464,677 | |

Devon Energy Corp. | | | 1,435 | | | | 79,083 | |

Diamondback Energy, Inc. | | | 666 | | | | 80,686 | |

DT Midstream, Inc. | | | 2,203 | | | | 107,991 | |

EOG Resources, Inc. | | | 2,444 | | | | 269,915 | |

Exxon Mobil Corp. | | | 23,862 | | | | 2,043,542 | |

Hess Corp. | | | 561 | | | | 59,432 | |

Laredo Petroleum, Inc. (1) | | | 54 | | | | 3,723 | |

Marathon Oil Corp. | | | 3,999 | | | | 89,898 | |

Marathon Petroleum Corp. | | | 24,088 | | | | 1,980,274 | |

Nine Energy Service, Inc. (1) | | | 1,635 | | | | 4,333 | |

ONEOK, Inc. | | | 6,383 | | | | 354,257 | |

Overseas Shipholding Group, Inc. (1) | | | 808 | | | | 1,656 | |

Ovintiv, Inc. | | | 1,774 | | | | 78,393 | |

Phillips 66 | | | 2,135 | | | | 175,049 | |

Pioneer Natural Resources Co. | | | 980 | | | | 218,618 | |

Schlumberger NV | | | 6,838 | | | | 244,527 | |

SM Energy Co. | | | 274 | | | | 9,368 | |

Targa Resources Corp. | | | 1,808 | | | | 107,883 | |

The accompanying notes are an integral part of these financial statements.

2022 Semi-Annual Report | June 30, 2022 | Page 17 |

Schedules of Investments

June 30, 2022 (unaudited)

Spectrum Fund |

Security Description | | Shares or

Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) - Long — continued |

Teekay Corp. (1) | | | 1,555 | | | | 4,478 | |

Valero Energy Corp. | | | 2,660 | | | | 282,705 | |

World Fuel Services Corp. | | | 312 | | | | 6,384 | |

| | | | | | | | 9,072,322 | |

| | | | | | | | | |

Financials — 7.9% | | | | | | | | |

American Equity Investment Life Holding Co. | | | 3,778 | | | | 138,161 | |

American International Group, Inc. | | | 29,095 | | | | 1,487,627 | |

Argo Group International Holdings, Ltd. | | | 392 | | | | 14,449 | |

Bank of New York Mellon Corp./The | | | 8,561 | | | | 357,079 | |

Berkshire Hathaway, Inc. (1) | | | 20,363 | | | | 5,559,506 | |

Capital BanCorp., Inc. | | | 1,243 | | | | 26,973 | |

Charles Schwab Corp./The | | | 7,614 | | | | 481,053 | |

Chubb, Ltd. | | | 4,139 | | | | 813,645 | |

Erie Indemnity Co. | | | 120 | | | | 23,063 | |

Essent Group, Ltd. | | | 4,593 | | | | 178,668 | |

Fidelity National Financial, Inc. | | | 13,530 | | | | 500,069 | |

Hartford Financial Services Group, Inc./The | | | 1,798 | | | | 117,643 | |

Investors Title Co. | | | 43 | | | | 6,746 | |

Markel Corp. (1) | | | 159 | | | | 205,627 | |

Marsh & McLennan Cos., Inc. | | | 10,768 | | | | 1,671,732 | |

Moelis & Co. | | | 445 | | | | 17,511 | |

Mr Cooper Group, Inc. (1) | | | 629 | | | | 23,109 | |

Northrim BanCorp., Inc. | | | 1,218 | | | | 49,037 | |

OneMain Holdings, Inc. | | | 12,199 | | | | 455,999 | |

Pathward Financial, Inc. | | | 1,123 | | | | 43,426 | |

Prudential Financial, Inc. | | | 2,389 | | | | 228,580 | |

Pzena Investment Management, Inc. | | | 2,467 | | | | 16,258 | |

Regions Financial Corp. | | | 10,374 | | | | 194,513 | |

State Street Corp. | | | 3,490 | | | | 215,159 | |

Stewart Information Services Corp. | | | 2,427 | | | | 120,743 | |

Synchrony Financial | | | 3,449 | | | | 95,261 | |

W R Berkley Corp. | | | 2,045 | | | | 139,592 | |

Walker & Dunlop, Inc. | | | 1,022 | | | | 98,459 | |

Willis Towers Watson PLC | | | 6,501 | | | | 1,283,232 | |

| | | | | | | | 14,562,920 | |

| | | | | | | | | |

Healthcare — 13.8% | | | | | | | | |

AbbVie, Inc. | | | 13,362 | | | | 2,046,524 | |

Alaunos Therapeutics, Inc. (1) | | | 3,984 | | | | 4,940 | |

Amgen, Inc. | | | 10,473 | | | | 2,548,081 | |

Amneal Pharmaceuticals, Inc. (1) | | | 1,938 | | | | 6,163 | |

Avid Bioservices, Inc. (1) | | | 1,826 | | | | 27,865 | |

Bristol-Myers Squibb Co. | | | 16,628 | | | | 1,280,356 | |

Cardinal Health, Inc. | | | 22,075 | | | | 1,153,860 | |

Catalent, Inc. (1) | | | 5,348 | | | | 573,787 | |

Spectrum Fund |

Security Description | | Shares or

Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) - Long — continued |

Centene Corp. (1) | | | 1,840 | | | | 155,682 | |

Centogene NV (1) | | | 664 | | | | 1,574 | |

Cigna Corp. | | | 3,246 | | | | 855,386 | |

Corvus Pharmaceuticals, Inc. (1) | | | 1,984 | | | | 1,964 | |

CVS Health Corp. | | | 8,589 | | | | 795,857 | |

Danaher Corp. | | | 2,638 | | | | 668,786 | |

Eli Lilly & Co. | | | 5,823 | | | | 1,887,991 | |

Eloxx Pharmaceuticals, Inc. (1) | | | 7,574 | | | | 2,045 | |

Endo International PLC (1) | | | 7,100 | | | | 3,306 | |

Fulgent Genetics, Inc. (1) | | | 6,036 | | | | 329,143 | |

Genprex, Inc. (1) | | | 1,467 | | | | 2,039 | |

Gilead Sciences, Inc. | | | 9,026 | | | | 557,897 | |

Humana, Inc. | | | 944 | | | | 441,858 | |

IDEXX Laboratories, Inc. (1) | | | 864 | | | | 303,031 | |

Illumina, Inc. (1) | | | 1,345 | | | | 247,964 | |

ImmunityBio, Inc. (1) | | | 9,360 | | | | 34,819 | |

Incyte Corp. (1) | | | 1,929 | | | | 146,546 | |

Johnson & Johnson | | | 13,348 | | | | 2,369,403 | |

La Jolla Pharmaceutical Co. (1) | | | 873 | | | | 2,785 | |

McKesson Corp. | | | 2,596 | | | | 846,841 | |

Merck & Co., Inc. | | | 10,689 | | | | 974,516 | |

Moderna, Inc. (1) | | | 4,090 | | | | 584,257 | |

Molina Healthcare, Inc. (1) | | | 101 | | | | 28,241 | |

Otonomy, Inc. (1) | | | 2,774 | | | | 5,770 | |

Pfizer, Inc. | | | 16,502 | | | | 865,200 | |

QuidelOrtho Corp. (1) | | | 3,217 | | | | 312,628 | |

Regeneron Pharmaceuticals, Inc. (1) | | | 736 | | | | 435,072 | |

UnitedHealth Group, Inc. | | | 7,365 | | | | 3,782,885 | |

Universal Health Services, Inc. | | | 2,015 | | | | 202,931 | |

Veracyte, Inc. (1) | | | 151 | | | | 3,005 | |

Viatris, Inc. | | | 9,003 | | | | 94,261 | |

West Pharmaceutical Services, Inc. | | | 2,147 | | | | 649,188 | |

Zoetis, Inc. | | | 682 | | | | 117,229 | |

| | | | | | | | 25,351,676 | |

| | | | | | | | | |

Industrials — 5.2% | | | | | | | | |

Atkore, Inc. (1) | | | 2,840 | | | | 235,748 | |

Axon Enterprise, Inc. (1) | | | 4,171 | | | | 388,612 | |

Boise Cascade Co. | | | 1,218 | | | | 72,459 | |

Builders FirstSource, Inc. (1) | | | 20,331 | | | | 1,091,775 | |

BWX Technologies, Inc. | | | 3,995 | | | | 220,085 | |

Copart, Inc. (1) | | | 9,256 | | | | 1,005,757 | |

CoStar Group, Inc. (1) | | | 9,234 | | | | 557,826 | |

EMCOR Group, Inc. | | | 1,800 | | | | 185,328 | |

Encore Wire Corp. | | | 1,086 | | | | 112,857 | |

General Dynamics Corp. | | | 6,525 | | | | 1,443,656 | |

Graco, Inc. | | | 2,304 | | | | 136,881 | |

The accompanying notes are an integral part of these financial statements.

Page 18 | 2022 Semi-Annual Report | June 30, 2022 |

Schedules of Investments

June 30, 2022 (unaudited)

Spectrum Fund |

Security Description | | Shares or

Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) - Long — continued |

Hillenbrand, Inc. | | | 789 | | | | 32,317 | |

Hubbell, Inc. | | | 250 | | | | 44,645 | |

Karat Packaging, Inc. (1) | | | 140 | | | | 2,388 | |

Lockheed Martin Corp. | | | 2,747 | | | | 1,181,100 | |

ManpowerGroup, Inc. | | | 1,584 | | | | 121,033 | |

Matson, Inc. | | | 1,704 | | | | 124,188 | |

Mueller Industries, Inc. | | | 3,073 | | | | 163,760 | |

MYR Group, Inc. (1) | | | 138 | | | | 12,162 | |

Northrop Grumman Corp. | | | 3,404 | | | | 1,629,052 | |

Raytheon Technologies Corp. | | | 1,073 | | | | 103,126 | |

United Parcel Service, Inc. | | | 365 | | | | 66,627 | |

V2X, Inc. (1) | | | 888 | | | | 29,712 | |

Waste Management, Inc. | | | 3,326 | | | | 508,811 | |

WW Grainger, Inc. | | | 200 | | | | 90,886 | |

| | | | | | | | 9,560,791 | |

| | | | | | | | | |

Information Technology — 18.9% | | | | | | | | |

A10 Networks, Inc. | | | 6,963 | | | | 100,128 | |

ACI Worldwide, Inc. (1) | | | 2,755 | | | | 71,327 | |

Advanced Micro Devices, Inc. (1) | | | 2,137 | | | | 163,416 | |

Affirm Holdings, Inc. (1) | | | 670 | | | | 12,100 | |

Alpha & Omega Semiconductor, Ltd. (1) | | | 14,207 | | | | 473,661 | |

American Software, Inc./GA | | | 713 | | | | 11,522 | |

Amkor Technology, Inc. | | | 15,193 | | | | 257,521 | |

Apple, Inc. | | | 64,610 | | | | 8,833,479 | |

Arrow Electronics, Inc. (1) | | | 1,361 | | | | 152,554 | |

Avid Technology, Inc. (1) | | | 1,479 | | | | 38,380 | |

Avnet, Inc. | | | 4,145 | | | | 177,738 | |

Axcelis Technologies, Inc. (1) | | | 3,558 | | | | 195,121 | |

Broadcom, Inc. | | | 142 | | | | 68,985 | |

Cadence Design Systems, Inc. (1) | | | 3,831 | | | | 574,765 | |

Cisco Systems, Inc. | | | 8,900 | | | | 379,496 | |

Cognizant Technology Solutions Corp. | | | 2,014 | | | | 135,925 | |

Concentrix Corp. | | | 570 | | | | 77,315 | |

Dell Technologies, Inc. | | | 644 | | | | 29,759 | |

Diodes, Inc. (1) | | | 2,792 | | | | 180,279 | |

Dolby Laboratories, Inc. | | | 1,730 | | | | 123,799 | |

DXC Technology Co. (1) | | | 965 | | | | 29,249 | |

EPAM Systems, Inc. (1) | | | 852 | | | | 251,153 | |

Intel Corp. | | | 33,422 | | | | 1,250,317 | |

Intuit, Inc. | | | 2,339 | | | | 901,544 | |

Jabil, Inc. | | | 18,556 | | | | 950,253 | |

Manhattan Associates, Inc. (1) | | | 17,562 | | | | 2,012,605 | |

Mastercard, Inc. | | | 2,431 | | | | 766,932 | |

Microchip Technology, Inc. | | | 4,382 | | | | 254,507 | |

Micron Technology, Inc. | | | 28,928 | | | | 1,599,140 | |

Microsoft Corp. | | | 41,108 | | | | 10,557,766 | |

Spectrum Fund |

Security Description | | Shares or

Principal

Amount ($) | | | Fair

Value ($) | |

Common Stocks (United States) - Long — continued |

NortonLifeLock, Inc. | | | 985 | | | | 21,631 | |

Oracle Corp. | | | 11,866 | | | | 829,077 | |

Photronics, Inc. (1) | | | 377 | | | | 7,344 | |

Power Integrations, Inc. | | | 3,351 | | | | 251,359 | |

Pure Storage, Inc. (1) | | | 7,504 | | | | 192,928 | |

QUALCOMM, Inc. | | | 15,298 | | | | 1,954,167 | |

Qualys, Inc. (1) | | | 1,400 | | | | 176,596 | |

StarTek, Inc. (1) | | | 2,176 | | | | 6,289 | |

Tenable Holdings, Inc. (1) | | | 2,524 | | | | 114,615 | |

Wolfspeed, Inc. (1) | | | 104 | | | | 6,599 | |

Zebra Technologies Corp. (1) | | | 13 | | | | 3,821 | |

Zoom Video Communications, Inc. (1) | | | 5,220 | | | | 563,603 | |

| | | | | | | | 34,758,765 | |

| | | | | | | | | |

Materials — 1.3% | | | | | | | | |