United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03541

Asset Management Fund

(Exact name of registrant as specified in charter)

690 Taylor Road, Suite 210 Gahanna, OH 43230

(Address of principal executive offices) (Zip code)

Foreside Management Services, LLC, 690 Taylor Road, Suite 210 Gahanna, OH 43230

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (800) 247-9780 – Austin Atlantic Funds |

| | (800) 701-9502 – AAMA Funds |

Date of fiscal year end: 6/30

Date of reporting period: 6/30/21

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

AAMA Equity Fund

Ticker: AMFEX

AAMA Income Fund

Ticker: AMFIX

Annual Report

June 30, 2021

AAMA Funds |

Letter To Shareholders | June 30, 2021 |

Dear Fellow Shareholder,

Over the last fifteen months and since the beginning of the Covid-19 pandemic, the U.S. Government has initiated programs which include $7.7 trillion of monetary and fiscal stimulus with another $4 trillion in programs proposed. One might call this the grandest financial experiment of all time. The sheer size of government programs relative to GDP (36% to 55%) is unprecedented. Will the experiment work? While forecasting anything today carries a high margin of error—the numbers are just too large, and there are numerous variables—inflation might be the best indicator of where this grand experiment will lead us.

The Consumer Price Index is currently the highest in 13 years and the tamer core Personal Consumption Index is the highest in 30 years. So now we are looking for indications for how long this may last and signs it may reverse to a deflationary trend. While the inflation story has not concluded, uncertainty abounds and predictions remain precarious when so much hinges on government policy.

The vast sum of money sloshing around in the system has not found a suitable home. Personal savings have doubled to $2.3 trillion. The money supply has grown 30% and bank reserves by 24%. Any way you measure it, the monetary system is awash with liquidity. So much so that the Federal Reserve (the “Fed”) has been draining reserves from the system by nearly $1 trillion. Contrary to the Fed adding $120 billion per month through security purchases, reverse repurchase transactions have now offset 8 months of that effort. The less-publicized reverse repurchase transactions may be intended to keep short term rates above zero or to avoid a more public end to quantitative easing which risks a sizeable negative reaction in the securities markets.

Corporate profits have rebounded with the economy and are expected to reach new highs over the remainder of this year and into next. Profit growth started to stall in early 2018 and the wavering has contributed to increased equity market volatility over the last three years.

Many companies and small businesses have been complaining about the lack of qualified workers which translates to higher operating costs. The degree of acceptance (or rejection) of higher prices for finished goods and services will affect volumes and profits. Even with the optimistic earnings projections, stock prices have more than discounted estimates with forward price-to-earnings ratios reaching 22.5, a new high for the last 20 years.

We continue to evaluate the markets and diligently position the assets of the AAMA Equity and Income Funds to provide sound investment returns for our shareholders. Again, we would like to extend our condolences to any of our fellow shareholders, family, and friends who have lost dear ones to the virus.

1

AAMA Funds |

Letter To Shareholders (Continued) |

We encourage you to continue to work with your financial advisor to plan and implement strategies to grow and protect your long-term asset values and we appreciate the confidence demonstrated by your investment within the AAMA Family of mutual funds.

Sincerely,

|

|

Robert D. Baker | Philip A. Voelker |

AAMA Funds are distributed by Foreside Financial Services, LLC. Advanced Asset Management Advisors, Inc. is the investment adviser to the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. For additional information about the Funds, including fees, expenses, and risks, view our prospectus online at www.aamafunds.com or call 800-701-9502. Read the prospectus carefully before you invest or send money.

The Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The Personal Consumption Index is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services.

The price-to-earnings ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

2

AAMA Equity Fund

Management Discussion of Fund Performance

June 30, 2021 (Unaudited)

The AAMA Equity Fund returned 33.64% for the twelve months ended June 30, 2021. This can be compared to the S&P 500 Index return of 40.79%. All major equity indices experienced strong returns following the pandemic-related decline in the spring of 2020. Some of the market barometers that posted stronger returns were those that had suffered worse returns during the prior two years of market volatility. Without regard for the specific path, all major indices have reached new price highs during this market recovery. The five largest market cap companies in the S&P 500 Index have represented between 20 and 25% of the market index over the last year. These five stocks combined contributed 9.6 percentage points to the S&P 500 Index capitalization weighted return for the year. While the AAMA Equity Fund has routinely held positions in many of the largest companies, our diversification guidelines have not allowed market weighted exposure to these issuers. Our exposure to these companies contributed 6.5 percentage points to the return of the AAMA Equity Fund. The cash holdings within the AAMA Equity Fund averaged 13% over the last year which also detracted from the Fund’s relative performance.

Trailing twelve-month operating profits for the S&P 500 Index are expected to fully recover their late 2019 highs in the 3rd quarter of 2021. Even so, the full recovery in stock prices has once again raised most traditional stock market valuation measures to elevated levels. The stock market has spent much of the last three years with elevated valuations and not coincidentally stock price volatility has been elevated as well.

The last twelve months has evidenced significant swings in relative price performance between growth stocks and value stocks as well as between different capitalization ranges. This is not surprising given the dramatic swings in the economy and economic indicators. It may be most important for investors to focus on trends in broad measures of inflation. Low inflation and modest economic growth since 2008 have prompted central banks around the world to aggressively foster accommodating financial conditions. Persistent and elevated inflation would at some point change the trend away from accommodation and likely damage current elevated market valuations.

The portfolio of the AAMA Equity Fund continues to focus on large companies with a balance between growth and value. Sector weightings over the last twelve months have favored technology, communications, healthcare, and consumer staples.

3

AAMA Equity Fund

Management Discussion of Fund Performance

June 30, 2021 (Unaudited) (Continued)

The small and mid-capitalization companies the Fund invests in may be more vulnerable to adverse business or economic events than larger, more established companies. Small and mid-capitalization companies may have limited product lines, markets and management groups.

The S&P 500 Index is an unmanaged index, generally representative of the U.S. Stock Market as a whole.

Indexes that are unmanaged, do not reflect fees or expenses and an investor cannot invest directly in an index.

Sectors and allocations are subject to change. Past performance does not guarantee future results.

4

AAMA Equity Fund

Management Discussion of Fund Performance

(Unaudited) (Continued)

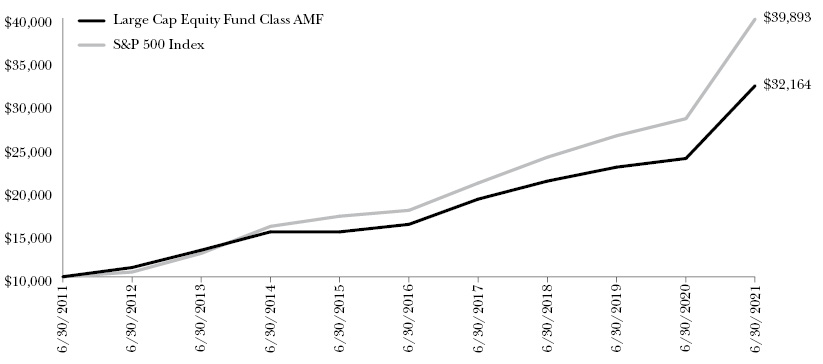

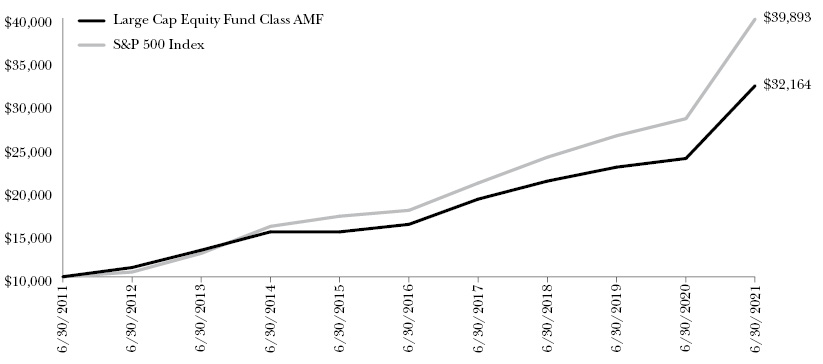

Comparison of the Change in Value of a $10,000 Investment in

AAMA Equity Fund versus the S&P 500® Index*

Average Annual Total Returns

(for the periods ended June 30, 2021) | |

| | 1 Year | 3 Years | Since

Inception(c) | |

AAMA Equity Fund(a)(b) | 33.64% | 13.87% | 13.62% | |

S&P 500® Index* | 40.79% | 18.67% | 17.58% | |

(a) | The Fund’s total returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | The total expense ratio as disclosed in the October 28, 2020 prospectus was 1.21%. |

(c) | Inception date of the Fund is June 30, 2017. The Fund commenced operations on July 3, 2017. |

* | The S&P 500® Index is an unmanaged index generally representative of the U.S. Stock Market as a whole. Indexes are unmanaged, do not reflect fees or expenses and an investor cannot invest directly in an index. |

The Fund and S&P 500® Index returns presented include the reinvestment of dividends and interest.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance, please call 1-800-701-9502.

5

AAMA Equity Fund

Schedule of Portfolio Investments

June 30, 2021 |

COMMON STOCKS — 58.0% | | Shares | | | Fair Value | |

AEROSPACE & DEFENSE — 0.9% | | | | | | | | |

Raytheon Technologies Corporation | | | 46,696 | | | $ | 3,983,636 | |

| | | | | | | | | |

BANKING — 1.4% | | | | | | | | |

JPMorgan Chase & Company | | | 37,400 | | | | 5,817,196 | |

| | | | | | | | | |

BEVERAGES — 0.9% | | | | | | | | |

PepsiCo, Inc. | | | 26,400 | | | | 3,911,688 | |

| | | | | | | | | |

BIOTECH & PHARMA — 5.4% | | | | | | | | |

Amgen, Inc. | | | 15,000 | | | | 3,656,250 | |

Bristol-Myers Squibb Company | | | 94,000 | | | | 6,281,080 | |

Johnson & Johnson | | | 48,000 | | | | 7,907,520 | |

Pfizer, Inc. | | | 141,500 | | | | 5,541,140 | |

| | | | | | | | 23,385,990 | |

CONTAINERS & PACKAGING — 0.7% | | | | | | | | |

Ball Corporation | | | 37,000 | | | | 2,997,740 | |

| | | | | | | | | |

DIVERSIFIED INDUSTRIALS — 1.7% | | | | | | | | |

Emerson Electric Company | | | 78,400 | | | | 7,545,216 | |

| | | | | | | | | |

E-COMMERCE DISCRETIONARY — 1.0% | | | | | | | | |

Amazon.com, Inc. (a) | | | 1,200 | | | | 4,128,192 | |

| | | | | | | | | |

ELECTRIC UTILITIES — 0.7% | | | | | | | | |

Exelon Corporation | | | 30,000 | | | | 1,329,300 | |

Public Service Enterprise Group, Inc. | | | 25,000 | | | | 1,493,500 | |

| | | | | | | | 2,822,800 | |

ENGINEERING & CONSTRUCTION — 0.3% | | | | | | | | |

Quanta Services, Inc. | | | 16,100 | | | | 1,458,177 | |

| | | | | | | | | |

FOOD — 0.9% | | | | | | | | |

Conagra Brands, Inc. | | | 106,000 | | | | 3,856,280 | |

| | | | | | | | | |

HEALTH CARE FACILITIES & SERVICES — 2.2% | | | | | | | | |

UnitedHealth Group, Inc. | | | 19,400 | | | | 7,768,536 | |

Universal Health Services, Inc. - Class B | | | 12,100 | | | | 1,771,803 | |

| | | | | | | | 9,540,339 | |

See accompanying notes to financial statements. |

6

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued) |

COMMON STOCKS — 58.0% (Continued) | | Shares | | | Fair Value | |

HOME & OFFICE PRODUCTS — 0.6% | | | | | | | | |

Newell Brands, Inc. | | | 100,000 | | | $ | 2,747,000 | |

| | | | | | | | | |

HOME CONSTRUCTION — 0.6% | | | | | | | | |

Masco Corporation | | | 43,200 | | | | 2,544,912 | |

| | | | | | | | | |

HOUSEHOLD PRODUCTS — 0.9% | | | | | | | | |

Procter & Gamble Company (The) | | | 29,400 | | | | 3,966,942 | |

| | | | | | | | | |

INDUSTRIAL SUPPORT SERVICES — 1.4% | | | | | | | | |

Fastenal Company | | | 30,000 | | | | 1,560,000 | |

Grainger (W.W.), Inc. | | | 10,100 | | | | 4,423,800 | |

| | | | | | | | 5,983,800 | |

INTERNET MEDIA & SERVICES — 1.9% | | | | | | | | |

Alphabet, Inc. - Class A (a) | | | 3,400 | | | | 8,302,086 | |

| | | | | | | | | |

LEISURE FACILITIES & SERVICES — 1.8% | | | | | | | | |

Starbucks Corporation | | | 70,000 | | | | 7,826,700 | |

| | | | | | | | | |

MEDICAL EQUIPMENT & DEVICES — 2.4% | | | | | | | | |

Edwards Lifesciences Corporation (a) | | | 29,100 | | | | 3,013,887 | |

Medtronic plc | | | 59,100 | | | | 7,336,083 | |

| | | | | | | | 10,349,970 | |

METALS & MINING — 2.1% | | | | | | | | |

Freeport-McMoRan, Inc. | | | 250,000 | | | | 9,277,500 | |

| | | | | | | | | |

OIL & GAS PRODUCERS — 2.5% | | | | | | | | |

Chevron Corporation | | | 46,500 | | | | 4,870,410 | |

Exxon Mobil Corporation | | | 92,000 | | | | 5,803,360 | |

| | | | | | | | 10,673,770 | |

RETAIL - CONSUMER STAPLES — 2.1% | | | | | | | | |

Kroger Company (The) | | | 102,500 | | | | 3,926,775 | |

Walmart, Inc. | | | 36,600 | | | | 5,161,332 | |

| | | | | | | | 9,088,107 | |

RETAIL - DISCRETIONARY — 1.3% | | | | | | | | |

Home Depot, Inc. (The) | | | 17,000 | | | | 5,421,130 | |

See accompanying notes to financial statements. |

7

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued) |

COMMON STOCKS — 58.0% (Continued) | | Shares | | | Fair Value | |

SEMICONDUCTORS — 7.3% | | | | | | | | |

Applied Materials, Inc. | | | 93,800 | | | $ | 13,357,120 | |

Intel Corporation | | | 88,300 | | | | 4,957,162 | |

QUALCOMM, Inc. | | | 50,900 | | | | 7,275,137 | |

Texas Instruments, Inc. | | | 31,700 | | | | 6,095,910 | |

| | | | | | | | 31,685,329 | |

SOFTWARE — 4.8% | | | | | | | | |

Adobe, Inc. (a) | | | 13,200 | | | | 7,730,448 | |

Microsoft Corporation | | | 32,500 | | | | 8,804,250 | |

Oracle Corporation | | | 57,000 | | | | 4,436,880 | |

| | | | | | | | 20,971,578 | |

TECHNOLOGY HARDWARE — 3.6% | | | | | | | | |

Apple, Inc. | | | 47,200 | | | | 6,464,512 | |

Cisco Systems, Inc. | | | 71,600 | | | | 3,794,800 | |

Corning, Inc. | | | 134,800 | | | | 5,513,320 | |

| | | | | | | | 15,772,632 | |

TECHNOLOGY SERVICES — 1.9% | | | | | | | | |

Mastercard, Inc. - Class A | | | 11,100 | | | | 4,052,499 | |

Visa, Inc. - Class A | | | 17,400 | | | | 4,068,468 | |

| | | | | | | | 8,120,967 | |

TELECOMMUNICATIONS — 3.9% | | | | | | | | |

T-Mobile US, Inc. (a) | | | 73,815 | | | | 10,690,626 | |

Verizon Communications, Inc. | | | 108,100 | | | | 6,056,843 | |

| | | | | | | | 16,747,469 | |

TRANSPORTATION & LOGISTICS — 2.8% | | | | | | | | |

Norfolk Southern Corporation | | | 14,200 | | | | 3,768,822 | |

Union Pacific Corporation | | | 19,800 | | | | 4,354,614 | |

United Parcel Service, Inc. - Class B | | | 20,000 | | | | 4,159,400 | |

| | | | | | | | 12,282,836 | |

| | | | | | | | | |

TOTAL COMMON STOCKS (Cost $145,208,828) | | | | | | $ | 251,209,982 | |

See accompanying notes to financial statements. |

8

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued) |

EXCHANGE-TRADED FUNDS — 34.4% | | Shares | | | Fair Value | |

iShares Core S&P 500 ETF | | | 69,200 | | | $ | 29,750,464 | |

iShares Core S&P U.S. Growth ETF | | | 239,600 | | | | 24,194,808 | |

Schwab U.S. Large-Cap ETF | | | 281,700 | | | | 29,288,349 | |

Vanguard Growth ETF | | | 112,500 | | | | 32,266,125 | |

Vanguard S&P 500 ETF | | | 85,600 | | | | 33,685,312 | |

Total Exchange-Traded Funds (Cost $77,931,172) | | | | | | $ | 149,185,058 | |

|

U.S. TREASURY

OBLIGATIONS — 6.9% | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

U.S. TREASURY BILLS — 6.9% | | | | | | | | | | | | | | | | |

US Treasury Bill (Cost $29,998,258) | | | 0.023%(b) | | | | 09/30/21 | | | $ | 30,000,000 | | | $ | 29,996,019 | |

See accompanying notes to financial statements. |

9

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued) |

MONEY MARKET FUNDS — 0.8% | | Shares | | | Fair Value | |

First American U.S. Treasury Money Market Fund - Class Z, 0.01% (c) (Cost $3,522,232) | | | 3,522,232 | | | $ | 3,522,232 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $256,660,490) — 100.1% | | | | | | $ | 433,913,291 | |

| | | | | | | | | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.1%) | | | | | | | (476,136 | ) |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 433,437,155 | |

(a) | Non-income producing security. |

(b) | Rate shown is the annualized yield at time of purchase. |

(c) | The rate shown is the 7-day effective yield as of June 30, 2021. |

plc - Public Liability Company |

Security Allocation (Percentage of Net Assets) |

Common Stocks | 58.0% |

Exchange-Traded Funds | 34.4% |

U.S. Treasury Obligations | 6.9% |

Cash Equivalents* | 0.7% |

Total | 100.0% |

* | Includes Liabilities in Excess of Other Assets. |

See accompanying notes to financial statements. |

10

AAMA Income Fund

Management Discussion of Fund Performance

June 30, 2021 (Unaudited)

The AAMA Income Fund returned -0.80% for the twelve months ended June 30, 2021. This can be compared to the Bloomberg Barclays 1-5 year U.S. Government/Credit Index return of 0.40% over the same period. Other indices compiled by Bloomberg/Barclays are notable. The U.S. Long Treasury Index return was -10.42%. The Bloomberg Barclays U.S. Aggregate Index return was -0.33% and the Bloomberg Barclays 1-5 year Government Bond Index return was -0.32%. It was a volatile year for income markets as the safe haven of long-term Treasuries was abandoned in favor of corporate credits and other income sectors.

Twelve months ago, the headlines were dominated by the largest post-war quarterly decline in U.S. GDP. Since then we immediately experienced the largest quarterly increase in GDP, labor and product shortages, and economic indicators suggesting the economy has continued its robust recovery. The shortages and continued fiscal and monetary stimulus have contributed to elevated inflation. Regardless of one’s preferred measure, inflation has accelerated to multi-decade highs. It is not surprising that the bond markets have been volatile over the last twelve months.

Yet, the ten-year U.S. Treasury yield is still solidly below inflation offering a negative real current yield to investors. We have maintained a relatively short maturity and high-quality structure in the portfolio. This strategy has generated lower current income yet avoided the volatility of longer-dated securities.

When the Fund invests in fixed income securities including corporate bonds, the value of the Fund will fluctuate with changes in interest rates. When interest rates rise, fixed income securities (i.e. debt obligations) generally will decline in value.

The Bloomberg Barclays 1-5 Year U.S. Government/Credit Index is a broad-based benchmark that measures the non-securitized component of the Bloomberg Barclays U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities that have a remaining maturity of greater than or equal to one year and less than five years.

The Bloomberg Barclays 1-5 Year Government Bond Index measures U.S. dollar-denominated, fixed- rate, nominal debt issued by the U.S. Treasury with a maturity of less than 5 years.

The Bloomberg Barclays U.S. Long Treasury Index consists of U.S. dollar-denominated, fixed rate nominal debt issued by the U.S. Treasury with maturities of 10 years or more.

The Bloomberg Barclays U.S. Aggregate Index covers taxable corporate bonds, Treasury bonds, asset-backed securities and municipal bonds.

Indexes that are unmanaged, do not reflect fees or expenses and an investor cannot invest directly in an index.

Sectors and allocations are subject to change. Past performance does not guarantee future results.

11

AAMA Income Fund

Management Discussion of Fund Performance

(Unaudited) (Continued)

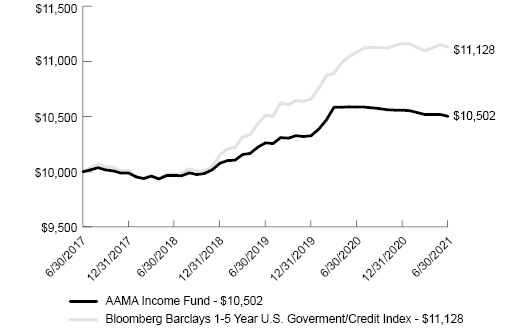

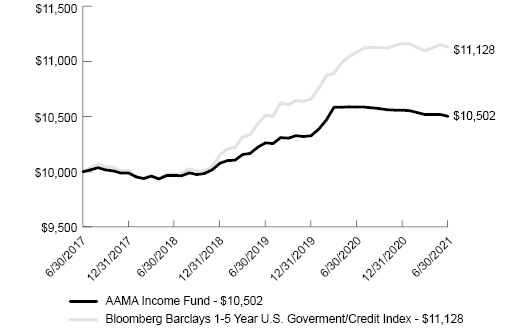

Comparison of the Change in Value of a $10,000 Investment in AAMA Income Fund versus the Bloomberg Barclays 1-5 Year U.S. Government/Credit Index*

Average Annual Total Returns

(for the periods ended June 30, 2021) | |

| | 1 Year | 3 Years | Since

Inception(c) | |

AAMA Income Fund(a)(b) | (0.80%) | 1.76% | 1.23% | |

Bloomberg Barclays 1-5 Year U.S. Government/Credit Index* | 0.40% | 3.70% | 2.71% | |

(a) | The Fund’s total returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | The total expense ratio as disclosed in the October 28, 2020 prospectus was 0.93%. |

(c) | Inception date of the Fund is June 30, 2017. The Fund commenced operations on July 3, 2017. |

* | The Bloomberg Barclays 1-5 Year U.S. Government/Credit Index is a broad-based benchmark that measures the non-securitized component of the Bloomberg Barclays U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities that have a remaining maturity of greater than or equal to one year and less than five years. Indexes are unmanaged, do not reflect fees or expenses and an investor cannot invest directly in an index. |

The Fund and Bloomberg Barclays 1-5 Year U.S. Government/Credit Index returns presented include the reinvestment of dividends and interest.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance, please call 1-800-701-9502.

12

AAMA Income Fund

Schedule of Portfolio Investments

June 30, 2021 |

EXCHANGE-TRADED FUNDS — 29.5% | | Shares | | | Fair Value | |

iShares 1-3 Year Treasury Bond ETF | | | 155,000 | | | $ | 13,354,800 | |

Vanguard Mortgage-Backed Securities ETF | | | 283,000 | | | | 15,103,710 | |

Vanguard Short-Term Treasury ETF | | | 249,000 | | | | 15,296,070 | |

Total Exchange-Traded Funds (Cost $44,188,547) | | | | | | $ | 43,754,580 | |

|

MUNICIPAL BONDS — 0.9% | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

City of Powell, Ohio, Various Purpose Ltd., GO Bond, Series 2021, (Cost $1,389,370) | | | 2.000% | | | | 12/01/26 | | | $ | 1,320,000 | | | $ | 1,391,794 | |

|

U.S. GOVERNMENT

AGENCIES — 8.5% | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

FEDERAL HOME LOAN BANK — 8.5% | | | | | | | | | | | | | | | | |

Federal Home Loan Bank | | | 2.360% | | | | 05/23/22 | | | $ | 7,000,000 | | | $ | 7,138,283 | |

Federal Home Loan Bank | | | 2.750% | | | | 12/13/24 | | | | 5,000,000 | | | | 5,368,468 | |

TOTAL U.S. GOVERNMENT AGENCIES (Cost $12,228,719) | | | | | | | | | | | | | | $ | 12,506,751 | |

|

U.S. TREASURY

OBLIGATIONS — 59.1% | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

U.S. TREASURY NOTES — 59.1% | | | | | | | | | | | | | | | | |

U.S. Treasury Notes | | | 2.000% | | | | 08/31/21 | | | $ | 10,000,000 | | | $ | 10,032,399 | |

U.S. Treasury Notes | | | 2.000% | | | | 11/15/21 | | | | 3,000,000 | | | | 3,021,562 | |

U.S. Treasury Notes | | | 1.875% | | | | 01/31/22 | | | | 5,000,000 | | | | 5,052,930 | |

U.S. Treasury Notes | | | 1.875% | | | | 05/31/22 | | | | 5,000,000 | | | | 5,081,641 | |

U.S. Treasury Notes | | | 1.875% | | | | 07/31/22 | | | | 2,000,000 | | | | 2,038,125 | |

U.S. Treasury Notes | | | 2.000% | | | | 11/30/22 | | | | 10,000,000 | | | | 10,258,594 | |

See accompanying notes to financial statements. |

13

AAMA Income Fund

Schedule of Portfolio Investments

(Continued) |

U.S. TREASURY

OBLIGATIONS — 59.1%

(Continued) | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

U.S. TREASURY NOTES — 59.1% (Continued) | | | | | | | | | | | | | | | | |

U.S. Treasury Notes | | | 1.750% | | | | 01/31/23 | | | $ | 5,000,000 | | | $ | 5,122,461 | |

U.S. Treasury Notes | | | 1.750% | | | | 05/15/23 | | | | 10,000,000 | | | | 10,281,250 | |

U.S. Treasury Notes | | | 2.750% | | | | 11/15/23 | | | | 10,000,000 | | | | 10,573,828 | |

U.S. Treasury Notes | | | 2.500% | | | | 05/15/24 | | | | 6,000,000 | | | | 6,355,547 | |

U.S. Treasury Notes | | | 0.500% | | | | 04/30/27 | | | | 10,000,000 | | | | 9,698,828 | |

U.S. Treasury Notes | | | 1.125% | | | | 02/29/28 | | | | 10,000,000 | | | | 9,970,312 | |

TOTAL U.S. TREASURY OBLIGATIONS (Cost $85,867,432) | | | | | | | | | | | | | | $ | 87,487,477 | |

|

MONEY MARKET FUNDS — 2.0% | | Shares | | | Fair Value | |

First American U.S. Treasury Money Market Fund - Class Z, 0.01% (a) (Cost $3,014,897) | | | 3,014,897 | | | $ | 3,014,897 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $146,688,965) — 100.0% | | | | | | $ | 148,155,499 | |

| | | | | | | | | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.0%) (b) | | | | | | | (35,237 | ) |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 148,120,262 | |

(a) | The rate shown is the 7-day effective yield as of June 30, 2021. |

(b) | Percentage rounds to less than 0.1%. |

GO - General Obligation |

Security Allocation (Percentage of Net Assets) |

U.S. Treasury Obligations | 59.1% |

Exchange-Traded Funds | 29.5% |

U.S. Government Agencies | 8.5% |

Municipal Bonds | 0.9% |

Cash Equivalents* | 2.0% |

Total | 100.0% |

* | Includes Liabilities in Excess of Other Assets. |

See accompanying notes to financial statements. |

14

AAMA Funds

Statements of Assets and Liabilities

June 30, 2021 |

| | AAMA

Equity Fund | | | AAMA

Income Fund | |

ASSETS | | | | | | | | |

Investments in securities: | | | | | | | | |

At cost | | $ | 256,660,490 | | | $ | 146,688,965 | |

At value | | $ | 433,913,291 | | | $ | 148,155,499 | |

Receivable for capital shares sold | | | 212,439 | | | | 28,968 | |

Dividends and interest receivable | | | 152,313 | | | | 344,894 | |

TOTAL ASSETS | | | 434,278,043 | | | | 148,529,361 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable for capital shares redeemed | | | 434,358 | | | | 308,051 | |

Payable to Adviser | | | 353,245 | | | | 82,808 | |

Unitary fees payable | | | 53,285 | | | | 18,240 | |

TOTAL LIABILITIES | | | 840,888 | | | | 409,099 | |

| | | | | | | | | |

NET ASSETS | | $ | 433,437,155 | | | $ | 148,120,262 | |

| | | | | | | | | |

Net assets consist of: | | | | | | | | |

Paid-in capital | | $ | 259,655,351 | | | $ | 146,806,146 | |

Distributable earnings | | | 173,781,804 | | | | 1,314,116 | |

Net assets | | $ | 433,437,155 | | | $ | 148,120,262 | |

| | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized) | | | 26,659,863 | | | | 5,872,694 | |

| | | | | | | | | |

Net asset value, offering price and redemption price per share | | $ | 16.26 | | | $ | 25.22 | |

See accompanying notes to financial statements. |

15

AAMA Funds

Statements of Operations

Year Ended June 30, 2021 |

| | AAMA

Equity Fund | | | AAMA

Income Fund | |

INVESTMENT INCOME | | | | | | | | |

Dividends | | $ | 5,918,861 | | | $ | 268,682 | |

Interest | | | 25,752 | | | | 2,030,434 | |

TOTAL INVESTMENT INCOME | | | 5,944,613 | | | | 2,299,116 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Investment advisory fees | | | 3,996,153 | | | | 1,146,835 | |

Unitary fees | | | 637,671 | | | | 244,683 | |

TOTAL EXPENSES | | | 4,633,824 | | | | 1,391,518 | |

Less fees voluntarily waived by the Adviser | | | — | | | | (123,417 | ) |

NET EXPENSES | | | 4,633,824 | | | | 1,268,101 | |

| | | | | | | | | |

NET INVESTMENT INCOME | | | 1,310,789 | | | | 1,031,015 | |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | |

Net realized gains (losses) on investment transactions | | | 4,646,299 | | | | (28,529 | ) |

Long-term capital gain distributions from regulated investment companies | | | — | | | | 34,474 | |

Net change in unrealized appreciation (depreciation) on investments | | | 108,628,917 | | | | (2,226,554 | ) |

NET REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | 113,275,216 | | | | (2,220,609 | ) |

| | | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | | $ | 114,586,005 | | | $ | (1,189,594 | ) |

See accompanying notes to financial statements. |

16

AAMA Equity Fund

Statements of Changes in Net Assets |

| | Year Ended

June 30,

2021 | | | Year Ended

June 30,

2020 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 1,310,789 | | | $ | 2,311,959 | |

Net realized gains (losses) on investment transactions | | | 4,646,299 | | | | (8,207,172 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 108,628,917 | | | | 17,447,215 | |

Net increase in net assets resulting from operations | | | 114,586,005 | | | | 11,552,002 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | (1,729,607 | ) | | | (2,876,027 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 93,968,609 | | | | 97,798,339 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 1,728,044 | | | | 2,876,027 | |

Payments for shares redeemed | | | (134,108,435 | ) | | | (85,968,458 | ) |

Net increase (decrease) in net assets from capital share transactions | | | (38,411,782 | ) | | | 14,705,908 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 74,444,616 | | | | 23,381,883 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 358,992,539 | | | | 335,610,656 | |

End of year | | $ | 433,437,155 | | | $ | 358,992,539 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 6,590,423 | | | | 8,242,033 | |

Shares reinvested | | | 120,337 | | | | 224,164 | |

Shares redeemed | | | (9,433,573 | ) | | | (7,264,989 | ) |

Net increase (decrease) in shares outstanding | | | (2,722,813 | ) | | | 1,201,208 | |

Shares outstanding, beginning of year | | | 29,382,676 | | | | 28,181,468 | |

Shares outstanding, end of year | | | 26,659,863 | | | | 29,382,676 | |

See accompanying notes to financial statements. |

17

AAMA Income Fund

Statements of Changes in Net Assets |

| | Year Ended

June 30,

2021 | | | Year Ended

June 30,

2020 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 1,031,015 | | | $ | 1,560,451 | |

Net realized gains (losses) on investment transactions | | | (28,529 | ) | | | 13,677 | |

Long-term capital gain distributions from regulated investment companies | | | 34,474 | | | | — | |

Net change in unrealized appreciation (depreciation) on investments | | | (2,226,554 | ) | | | 3,011,256 | |

Net increase (decrease) in net assets resulting from operations | | | (1,189,594 | ) | | | 4,585,384 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | (945,606 | ) | | | (1,560,605 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 38,513,800 | | | | 54,572,296 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 944,523 | | | | 1,560,605 | |

Payments for shares redeemed | | | (42,771,162 | ) | | | (49,416,907 | ) |

Net increase (decrease) in net assets from capital share transactions | | | (3,312,839 | ) | | | 6,715,994 | |

| | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (5,448,039 | ) | | | 9,740,773 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 153,568,301 | | | | 143,827,528 | |

End of year | | $ | 148,120,262 | | | $ | 153,568,301 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 1,514,102 | | | | 2,150,786 | |

Shares reinvested | | | 37,177 | | | | 61,794 | |

Shares redeemed | | | (1,683,003 | ) | | | (1,948,319 | ) |

Net increase (decrease) in shares outstanding | | | (131,724 | ) | | | 264,261 | |

Shares outstanding, beginning of year | | | 6,004,418 | | | | 5,740,157 | |

Shares outstanding, end of year | | | 5,872,694 | | | | 6,004,418 | |

See accompanying notes to financial statements. |

18

AAMA Equity Fund

Financial Highlights |

Per Share Data for a Share Outstanding Throughout Each Year |

| | Year Ended

June 30,

2021 | | | Year Ended

June 30,

2020 | | | Year Ended

June 30,

2019 | | | Year Ended

June 30,

2018 (a) | |

Net asset value at beginning of year | | $ | 12.22 | | | $ | 11.91 | | | $ | 11.24 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (b) | | | 0.05 | | | | 0.08 | | | | 0.10 | | | | 0.08 | |

Net realized and unrealized gains on investments | | | 4.05 | | | | 0.33 | | | | 0.66 | | | | 1.20 | |

Total from investment operations | | | 4.10 | | | | 0.41 | | | | 0.76 | | | | 1.28 | |

| | | | | | | | | | | | | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.06 | ) | | | (0.10 | ) | | | (0.09 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 16.26 | | | $ | 12.22 | | | $ | 11.91 | | | $ | 11.24 | |

| | | | | | | | | | | | | | | | | |

Total return (c) | | | 33.64 | % | | | 3.41 | % | | | 6.85 | % | | | 12.85 | %(d) |

| | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 433,437 | | | $ | 358,993 | | | $ | 335,611 | | | $ | 308,028 | |

| | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets (e) | | | 1.16 | % | | | 1.18 | % | | | 1.18 | % | | | 1.19 | %(f) |

| | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets (e) | | | 1.16 | % | | | 1.18 | % | | | 0.99 | %(g) | | | 0.90 | %(f)(g) |

| | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets (b)(e) | | | 0.33 | % | | | 0.67 | % | | | 0.90 | %(g) | | | 0.78 | %(f)(g) |

| | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 0 | %(h) | | | 22 | % | | | 20 | % | | | 5 | %(d) |

(a) | Inception date of the Fund is June 30, 2017. The Fund commenced operations on July 3, 2017. |

(b) | Recognition of net investment income by the Fund is affected by the timing of the declaration of the dividends and distributions by the underlying investment companies in which the Fund invests. |

(c) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if the Adviser and administrator had not reduced fees for the years ended June 30, 2019 and 2018. |

(d) | Not annualized. |

(e) | The ratios of income and expenses to average net assets do not reflect the Fund’s proportionate share of income and expenses of the underlying investment companies in which the Fund invests. |

(f) | Annualized. |

(g) | Ratio was determined after fee reductions. |

(h) | Percentage rounds to less than 1%. |

See accompanying notes to financial statements. |

19

AAMA Income Fund

Financial Highlights |

Per Share Data for a Share Outstanding Throughout Each Year |

| | Year Ended

June 30,

2021 | | | Year Ended

June 30,

2020 | | | Year Ended

June 30,

2019 | | | Year Ended

June 30,

2018 (a) | |

Net asset value at beginning of year | | $ | 25.58 | | | $ | 25.06 | | | $ | 24.66 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.17 | (b) | | | 0.27 | (b) | | | 0.33 | | | | 0.26 | |

Net realized and unrealized gains (losses) on investments | | | (0.37 | ) | | | 0.52 | | | | 0.40 | | | | (0.35 | ) |

Total from investment operations | | | (0.20 | ) | | | 0.79 | | | | 0.73 | | | | (0.09 | ) |

| | | | | | | | | | | | | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.16 | ) | | | (0.27 | ) | | | (0.33 | ) | | | (0.25 | ) |

| | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 25.22 | | | $ | 25.58 | | | $ | 25.06 | | | $ | 24.66 | |

| | | | | | | | | | | | | | | | | |

Total return (c) | | | (0.80 | %) | | | 3.17 | % | | | 2.97 | % | | | (0.34 | %)(d) |

| | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 148,120 | | | $ | 153,568 | | | $ | 143,828 | | | $ | 143,050 | |

| | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 0.91 | %(e) | | | 0.93 | %(e) | | | 0.93 | % | | | 0.94 | %(f) |

| | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets (g) | | | 0.83 | %(e)(h) | | | 0.83 | %(e)(h) | | | 0.71 | %(h) | | | 0.63 | %(f) |

| | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets (g) | | | 0.67 | %(b)(e) | | | 1.06 | %(b)(e) | | | 1.32 | % | | | 1.05 | %(f) |

| | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 37 | % | | | 33 | % | | | 20 | % | | | 6 | %(d) |

(a) | Inception date of the Fund is June 30, 2017. The Fund commenced operations on July 3, 2017. |

(b) | Recognition of net investment income by the Fund is affected by the timing of the declaration of the dividends and distributions by the underlying investment companies in which the Fund invests. |

(c) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if the Adviser and administrator had not reduced fees. |

(d) | Not annualized. |

(e) | The ratios of income and expenses to average net assets do not reflect the Fund’s proportionate share of income and expenses of the underlying investment companies in which the Fund invests. |

(f) | Annualized. |

(g) | Ratio was determined after fee reductions. |

(h) | The impact of the voluntary fee waiver by the Adviser for the years ended June 30, 2021, 2020 and 2019 was 0.08%, 0.10% and 0.02%, respectively. |

See accompanying notes to financial statements. |

20

AAMA Funds

Notes to Financial Statements

June 30, 2021

1. Organization

AAMA Equity Fund and AAMA Income Fund (individually, a “Fund,” and, collectively, the “Funds” or “AAMA Funds”) are each a separate series of Asset Management Fund (the “Trust”), a professionally managed, diversified, open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is organized as a Delaware statutory trust operating under a Second Amended and Restated Declaration of Trust dated November 27, 2018. Other series of the Trust are not included in this report. The inception date of the Funds was June 30, 2017. The Funds commenced operations on July 3, 2017, when they began to execute their investment objectives, which included purchasing investments.

AAMA Equity Fund’s investment objective is long-term capital appreciation.

AAMA Income Fund’s investment objective is current income with a secondary objective of preservation of capital.

2. Significant Accounting Policies

Each Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Funds’ significant accounting policies used in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Securities valuation — The Funds record their investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used by the Funds maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These inputs are summarized in the three broad levels listed below:

● | Level 1 — quoted prices in active markets for identical securities |

● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

● | Level 3 — significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments) |

21

AAMA Funds

Notes to Financial Statements (Continued)

Portfolio securities are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally, 4:00 p.m., Eastern time) on each day the NYSE is open. Listed securities, including common stocks and exchange-traded funds (“ETFs”), for which market quotations are readily available are valued at the closing prices on the primary exchange where the securities are normally traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Investments in other investment companies, except ETFs, are valued at their reported net asset value (“NAV”). In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Debt securities are typically valued on the basis of valuations provided by dealers or by an independent pricing service approved by the Board of Trustees (the “Board”) that determines valuations based upon market transactions for normal, institutional-size trading units of similar securities. Short-term debt investments of sufficient credit quality maturing in less than 61 days may be valued at amortized cost if it is determined that amortized cost approximates fair value. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

Securities for which market quotations are not readily available (e.g., an approved pricing service does not provide a price, a price has become stale, or an event occurs that materially affects the furnished price) are valued by the Pricing Committee. In these cases, the Pricing Committee determines in good faith, subject to procedures adopted by the Board, the fair value of such securities (“good faith fair valuation”). When a good faith fair valuation of a security is required, consideration is generally given to a number of factors, including, but not limited to the following: type of security, nature and duration of any restrictions on disposition of the security, forces that influence the market in which the security is purchased or sold, existence of merger proposals or tender offers, expectation of additional news about the company and volume and depth of public trading in similar securities of the issuer or similar companies. Depending on the source and relative significance of the valuation inputs in these instances, the valuations for these securities will be classified as Level 2 or Level 3 in the fair value hierarchy.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure the fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

22

AAMA Funds

Notes to Financial Statements (Continued)

The following is a summary of each Fund’s investments and the inputs used to value the investments as of June 30, 2021, by security type:

AAMA Equity Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 251,209,982 | | | $ | — | | | $ | — | | | $ | 251,209,982 | |

Exchange-Traded Funds | | | 149,185,058 | | | | — | | | | — | | | | 149,185,058 | |

U.S. Treasury Obligations | | | — | | | | 29,996,019 | | | | — | | | | 29,996,019 | |

Money Market Funds | | | 3,522,232 | | | | — | | | | — | | | | 3,522,232 | |

Total | | $ | 403,917,272 | | | $ | 29,996,019 | | | $ | — | | | $ | 433,913,291 | |

AAMA Income Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Exchange-Traded Funds | | $ | 43,754,580 | | | $ | — | | | $ | — | | | $ | 43,754,580 | |

Municipal Bonds | | | — | | | | 1,391,794 | | | | — | | | | 1,391,794 | |

U.S. Government Agencies | | | — | | | | 12,506,751 | | | | — | | | | 12,506,751 | |

U.S. Treasury Obligations | | | — | | | | 87,487,477 | | | | — | | | | 87,487,477 | |

Money Market Funds | | | 3,014,897 | | | | — | | | | — | | | | 3,014,897 | |

Total | | $ | 46,769,477 | | | $ | 101,386,022 | | | $ | — | | | $ | 148,155,499 | |

Refer to each Fund’s Schedule of Portfolio Investments for a listing of the securities by security type and industry type. The Funds did not hold derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the year ended June 30, 2021.

Share valuation — The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to the NAV per share.

Investment income — Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the securities received. Discounts and premiums on fixed income securities are amortized using the interest method. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Trust’s understanding of the applicable country’s rules and tax rates.

Distributions to shareholders — Dividends arising from net investment income, if any, are declared and paid annually to shareholders of the AAMA Equity Fund. Dividends arising from net investment income are declared and paid monthly to shareholders of the AAMA Income Fund. Net realized capital gains, if any, are distributed at least once each year. The amount of distributions

23

AAMA Funds

Notes to Financial Statements (Continued)

from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are permanent in nature and are primarily due to differing treatments of net short-term capital gains.

Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid by each Fund during the year ended June 30, 2021 was ordinary income in the amounts of $1,729,607 paid to the shareholders of AAMA Equity Fund and $945,606 paid to the shareholders of AAMA Income Fund. The tax character of distributions paid by each Fund during the year ended June 30, 2020 was ordinary income in the amounts of $2,876,027 paid to shareholders of AAMA Equity Fund and $1,560,605 paid to the shareholders of AAMA Income Fund.

Investment transactions — Investment transactions are accounted for on trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Expenses — Expenses incurred by the Trust that do not relate to a specific Fund of the Trust are allocated to the individual Funds based on each Fund’s relative net assets or another appropriate basis as determined by the Board.

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increase (decrease) in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal income tax — Each Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Funds of liability for federal income taxes to the extent 100% of their net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

24

AAMA Funds

Notes to Financial Statements (Continued)

The tax character of accumulated earnings as of June 30, 2021 was as follows:

| | AAMA

Equity Fund | | | AAMA

Income Fund | |

Tax cost of portfolio investments | | $ | 256,660,490 | | | $ | 146,688,965 | |

Gross unrealized appreciation | | $ | 177,885,946 | | | $ | 1,900,501 | |

Gross unrealized depreciation | | | (633,145 | ) | | | (433,967 | ) |

Net unrealized appreciation | | | 177,252,801 | | | | 1,466,534 | |

Accumulated ordinary income | | | 501,417 | | | | 85,409 | |

Accumulated capital and other losses | | | (3,972,414 | ) | | | (237,827 | ) |

Accumulated earnings | | $ | 173,781,804 | | | $ | 1,314,116 | |

During the year ended June 30, 2021, AAMA Equity Fund utilized short-term capital loss carryforwards of $2,032,109 and long-term capital loss carryforwards of $2,614,190 to offset current year gains and AAMA Income Fund utilized short-term capital loss carryforwards of $5,945 to offset current year gains.

As of June 30, 2021, AAMA Equity Fund had short-term capital loss carryforwards of $3,972,414 and AAMA Income Fund had short-term capital loss carryforwards of $237,827 for income tax purposes. These capital loss carryforwards, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions for all open tax years and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Funds identify their major tax jurisdiction as U.S. Federal. The Funds recognize interest and penalties if any, related to unrecognized tax benefits as income tax expense on the Statements of Operations. During the year ended June 30, 2021, the Funds did not incur any interest or penalties.

3. Investment Transactions

Investment transactions, other than short-term investments, were as follows for the year ended June 30, 2021:

Non-U.S. Government | | AAMA

Equity Fund | | | AAMA

Income Fund | |

Purchase of investment securities | | $ | 362,156 | | | $ | 33,665,650 | |

Proceeds from sales of investment securities | | $ | 8,328,432 | | | $ | 9,033,713 | |

25

AAMA Funds

Notes to Financial Statements (Continued)

U.S. Government (long-term) | | AAMA

Equity Fund | | | AAMA

Income Fund | |

Purchase of U.S. government securities | | $ | — | | | $ | 19,590,358 | |

Proceeds from sales and maturities of U.S. government securities | | $ | — | | | $ | 45,000,000 | |

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

Each Fund’s investments are managed by Advanced Asset Management Advisors, Inc. (the “Adviser”) under the terms of an Investment Advisory Agreement. AAMA Equity Fund pays the Adviser a fee, which is computed and accrued daily and paid monthly, at an annual rate of 1.00% of its average daily net assets. AAMA Income Fund pays the Adviser a fee, which is computed and accrued daily and paid monthly, at an annual rate of 0.75% of its average daily net assets.

During the year ended June 30, 2021, the Adviser voluntarily waived its advisory fees in the amount of $123,417 for AAMA Income Fund. These voluntary waivers are not eligible for recovery by the Adviser in future periods.

During the year ended June 30, 2021, there were no expense cap limitations in place for the Funds. Under the terms of a previous Expense Limitation Agreement, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by each Fund for a period of three years after the fiscal year that such fees and expenses were incurred, provided the repayments do not cause total annual operating expenses to exceed the lesser of (i) the expense limitation then in effect, if any, or (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of June 30, 2021, the Adviser may seek repayment of investment advisory fee reductions totaling $587,024 and $281,188 from AAMA Equity Fund and AAMA Income Fund, respectively, no later than the dates as stated below:

| | AAMA

Equity Fund | | | AAMA

Income Fund | |

June 30, 2022 | | $ | 587,024 | | | $ | 281,188 | |

BUSINESS MANAGER AND ADMINISTRATOR

Foreside Management Services, LLC (“Foreside”) serves as the Trust’s business manager and administrator. Pursuant to the terms of a Management and Administration Agreement (the “Agreement”) between the Trust, on behalf

26

AAMA Funds

Notes to Financial Statements (Continued)

of the Funds, and Foreside, Foreside performs and coordinates all management and administration services for the Trust either directly or through working with the Trust’s service providers. Services provided under the Agreement by Foreside include, but are not limited to, coordinating and monitoring activities of the third party service providers to the Funds; serving as officers of the Trust, including but not limited to, President, Secretary, Chief Compliance Officer, Anti-Money Laundering Officer, Treasurer and others as are deemed necessary and appropriate; performing compliance services for the Trust, including maintaining the Trust’s compliance program as required under the 1940 Act; managing the process of filing amendments to the Trust’s registration statement and other reports to shareholders; coordinating the Board meeting preparation process; reviewing financial reports and filing them with the U.S. Securities and Exchange Commission (the “SEC”); and maintaining books and records in accordance with applicable laws and regulations.

Pursuant to the Agreement, Foreside pays all operating expenses of the Trust and the Funds not specifically assumed by the Trust, unless the Trust or the Adviser otherwise agree to pay, including without limitation the compensation and expenses of any employees and officers of the Trust and of any other persons rendering any services to the Trust; clerical and shareholder service staff salaries; office space and other office expenses; fees and expenses incurred by the Trust in connection with membership in investment company organizations; legal, auditing and accounting expenses; expenses of registering shares under federal and state securities laws; insurance expenses; fees and expenses of the transfer agent, dividend disbursing agent, shareholder service agent, custodian, fund accounting agent and financial administrator (excluding fees and expenses payable to Foreside) and accounting and pricing services agent; expenses, including clerical expenses, of issue, sale, redemption or repurchase of shares of the Funds; the cost of preparing and distributing reports and notices to shareholders; the cost of printing or preparing prospectuses and statements of additional information for delivery to each Fund’s current shareholders; the cost of printing or preparing any documents, statements or reports to shareholders; fees and expenses of Trustees of the Trust who are not interested persons of the Trust, as defined by the 1940 Act (“Independent Trustees”); and all other operating expenses not specifically assumed by the Trust. In paying expenses that would otherwise be obligations of the Trust, Foreside is expressly acting as an agent on behalf of the Trust. Foreside Financial Services, LLC serves as the Funds’ principal underwriter and is an affiliate of Foreside. For the services under the Agreement and expenses assumed by Foreside, the Trust, on behalf of the Funds, paid Foreside an annual fee equal to 0.20% of the average daily net assets of the Funds up to $250,000,000 and 0.15% of the average daily net assets of the Funds greater than $250,000,000; subject, however, to an minimum fee of $777,000, through October 31, 2020. Effective, November 1,

27

AAMA Funds

Notes to Financial Statements (Continued)

2020, the Funds pay Foreside an annual fee equal to 0.20% of the average daily net assets of the Funds up to $250,000,000, 0.135% of the average daily net assets of the Funds between $250,000,000 and $500,000,000 and 0.05% of the average daily net assets of the Funds greater than $500,000,000; subject, however, to an minimum fee of $777,000. Such expenses are disclosed on the Statements of Operations as “Unitary fees.”

OTHER SERVICE PROVIDER

Ultimus Fund Solutions, LLC (“Ultimus”) serves as the transfer agent, fund accountant and financial administrator for the Funds. The transfer agent services provided by Ultimus to the Funds include, but are not limited to (i) processing shareholder purchase and redemption requests; (ii) processing dividend payments; and (iii) maintaining shareholder account records. The administrative and fund accounting services provided by Ultimus to the Funds include (i) computing each Fund’s NAV for purposes of the sale and redemption of its shares; (ii) computing the dividends payable by each Fund; (iii) preparing certain periodic reports and statements; and (iv) maintaining the general ledger and other accounting records for the Funds.

PRINCIPAL HOLDERS OF FUND SHARES

As of June 30, 2021, the following account holders owned of record 25% or more of the outstanding shares of each Fund:

NAME OF RECORD OWNER | % Ownership |

AAMA Equity Fund | |

TD Ameritrade, Inc. (for the benefit of its clients) | 75% |

AAMA Income Fund | |

TD Ameritrade, Inc. (for the benefit of its clients) | 78% |

A beneficial owner of 25% or more of each Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. Investments in Other Investment Companies

The Funds may invest a significant portion of their assets in shares of one or more investment companies, including ETFs. ETFs issue their shares to authorized participants in return for a specific basket of securities and/or cash. The authorized participants then sell the ETF’s shares on the secondary market. In other words, ETF shares are traded on a securities exchange based on their fair value. There are certain risks associated with investments in ETFs. Disruptions to the creations and redemptions process through which authorized

28

AAMA Funds

Notes to Financial Statements (Continued)

participants directly purchase and sell ETF shares, the existence of extreme market volatility or potential lack of an active trading market, or changes in the liquidity of the market for an ETF’s underlying portfolio holdings, may result in the ETF’s shares trading at significantly above (at a premium to) or below (at a discount to) NAV, which may result in the Funds paying significantly more or receiving significantly less for ETF shares than the value of the relevant ETF’s underlying holdings. An ETF’s shares could also trade at a premium or discount to NAV when an ETF’s underlying securities trade on a foreign exchange that is closed when the securities exchange on which the ETF trades is open. The current price of the ETF’s underlying securities and the last quoted price for the underlying security are likely to deviate in such circumstances. There can be no assurance that an active trading market for an ETF’s shares will develop or be maintained. Trading may be halted, for example, due to market conditions. Because the value of ETF shares depends on the demand in the market, a Fund’s holdings may not be able to be liquidated at the most optimal time, adversely affecting performance. There can be no assurance that an ETF’s investment objectives will be achieved. Each ETF is subject to specific risks, depending on the nature of the ETF. These risks could include liquidity risk, sector risk, foreign and emerging market risk, as well as risks associated with real estate investments and natural resources. ETFs in which a Fund invests will not be able to replicate exactly the performance of the indices they track, if any, because the total return generated by the securities will be reduced by transaction costs incurred in adjusting the actual balance of the securities. In addition, ETFs in which a Fund invests will incur expenses not incurred by their applicable indices. Certain securities the indices tracked by the ETFs may, from time to time, temporarily be unavailable, which may further impede the ETFs’ ability to track their applicable indices. An investment in an ETF presents the risk that the ETF may no longer meet the listing requirements of any applicable exchanges on which the ETF is listed. As of June 30, 2021, AAMA Equity Fund and AAMA Income Fund had 34.4% and 29.5%, respectively, of the fair value of their net assets invested in ETFs.

6. Contingencies and Commitments

The Funds indemnify the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Funds. Additionally, in the normal course of business the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

29

AAMA Funds

Notes to Financial Statements (Continued)

7. Trustee Compensation

The Independent Trustees are compensated for their services to the Trust by Foreside as part of the Management and Administration Agreement. Each Independent Trustee receives an annual retainer plus meeting fees (which vary depending on meeting type). Collectively, the Independent Trustees were paid $111,750 in fees during the year ended June 30, 2021, for the entire Trust, which include other funds not managed by Advanced Asset Management Advisors, Inc. Foreside paid Trustee compensation in the amount of $55,875 on behalf of the Funds. In addition, Foreside reimburses Trustees for out-of-pocket expenses incurred in conjunction with attendance of meetings.

8. Subsequent Events

The Funds are required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statements of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Funds are required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

30

AAMA Funds

Report of Independent Registered Public Accounting Firm

To the Shareholders of AAMA Funds and

Board of Trustees of Asset Management Fund

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of portfolio investments, of AAMA Equity Fund and AAMA Income Fund (the “AAMA Funds” or the “Funds”), each a series of the Asset Management Fund, as of June 30, 2021, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the four years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of June 30, 2021, the results of their operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the four years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant

31

AAMA Funds

Report of Independent Registered Public Accounting Firm (Continued)

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Funds’ auditor since 2017.

COHEN & COMPANY, LTD.

Cleveland, Ohio

August 27, 2021

32

AAMA Funds

About Your Funds’ Expenses (Unaudited)

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Funds, you incur ongoing costs, including management fees and other expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (January 1, 2021 through June 30, 2021).

The table below illustrates each Fund’s costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from each Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Funds. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Funds under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare each Fund’s ongoing costs with those of other mutual funds. It assumes that each Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the returns used are not the Funds’ actual returns, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess each Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Funds do not charge sales loads or redemption fees.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

33

AAMA Funds

About Your Funds’ Expenses (Unaudited)

More information about the Funds’ expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Funds’ prospectus.

| Beginning

Account Value

January 1, 2021 | Ending

Account Value

June 30, 2021 | Net

Expense

Ratio(a) | Expenses

Paid During

Period(b) |

AAMA Equity Fund | | | | |

Based on Actual Fund Return | $ 1,000.00 | $ 1,126.80 | 1.15% | $ 6.06 |

Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,019.09 | 1.15% | $ 5.76 |

| | | | | |

AAMA Income Fund | | | | |

Based on Actual Fund Return | $ 1,000.00 | $ 994.80 | 0.83% | $ 4.11 |

Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,020.68 | 0.83% | $ 4.16 |

(a) | Annualized, based on the Fund’s most recent one-half year expenses. |

(b) | Expenses are equal to each Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

34

AAMA Funds

Other Information (Unaudited)

A description of the policies and procedures that the Funds use to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-800-701-9502, or on the SEC’s website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-800-701-9502, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings of the Funds with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The filings are available upon request, by calling 1-800-701-9502. Furthermore, you may obtain a copy of these filings on the SEC’s website at www.sec.gov.

Federal Tax Information (Unaudited)

Qualified Dividend Income – For the fiscal year ended June 30, 2021, AAMA Equity Fund and AAMA Income Fund have designated 100.00% and 0.00%, respectively, of ordinary income distributions, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction – Corporate shareholders are generally entitled to take the dividends received deduction on the portion of a Fund’s dividends that qualify under tax law. For the fiscal year ended June 30, 2021, 100.00% and 0.00%, of ordinary income dividends paid by AAMA Equity Fund and AAMA Income Fund, respectively, qualify for the corporate dividends received deduction.

35

AAMA Funds

Board of Trustees and Executive Officers

(Unaudited)

Listed below is basic information regarding the Trustee and executive officers of the Trust. The Trust’s Statement of Additional Information includes additional information about Trustees and is available, without charge, upon request by calling 1-800-701-9502.

Name, Year of Birth

and Address1 | Position(s) Held

With Trust, Length

of Time Served and

Term of Office | Principal Occupation(s) During Past

Five Years, Prior Relevant Experience

and Other Directorships During the

Past Five Years | No. of

Portfolios

in Trust

Overseen |

Independent Trustees | |

David J. Gruber

Year of Birth: 1963 | Chairman of the Board since 2018. Trustee since 2015. Indefinite Term of Office | Director of Risk Advisory Services for Holbrook and Manter, CPAs from January 2016 to present; President of DJG Financial Consulting, LLC (financial consulting firm), 2007 to 2015; Independent Trustee for Oak Associates Funds (7 Funds), Audit Committee Chair, 2019 to present; Independent Trustee for Monteagle Funds (6 Funds), Audit Committee Chair, Valuation Committee member from 2015 to present; Board member of Cross Shore Discovery Fund, Audit Committee Chair, 2014 to present; Board member of Fifth Third Funds, 2003 to 2012. | 4 |

Carla S. Carstens

Year of Birth: 1951 | Trustee since 2015. Indefinite Term of Office | Trustee, Vice Chair and Chair of the Governance Committee of Resurrection University, 2019 to present; Board member and past Chair of Strategic Planning, and Diversity Initiatives Committees of Financial Executives International Chicago, 2009 to 2020; Board of Directors and Audit Committee Chair of Chicago Yacht Club Foundation, 2015 to 2017; Board member and Treasurer of Athena International, 2010 to 2016; and Advisory Board of Directors of AIT Worldwide Logistics, 2013 to 2015; a National Association of Corporate Directors Governance Fellow. | 4 |

James A. Simpson

Year of Birth: 1970 | Trustee since 2018. Indefinite Term of Office | President, ETP Resources, LLC, a financial services consulting company, 2009 to present. Trustee of Virtus ETF Trust II, 2015 to present and Trustee of ETFis Series Trust I, 2014 to present. | 4 |

1 | The mailing address of each Independent Trustee is 690 Taylor Road, Suite 210, Gahanna, Ohio 43230. |

36

AAMA Funds

Board of Trustees and Executive Officers

(Unaudited) (Continued)

The following table provides information regarding each officer of the Trust.