United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number811-03541

Asset Management Fund

(Exact name of registrant as specified in charter)

690 Taylor Road, Suite 210 Gahanna, OH 43230

(Address of principal executive offices) (Zip code)

Foreside Management Services, LLC, 690 Taylor Road, Suite 210 Gahanna, OH 43230

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | (800) 247-9780 – Austin Atlantic Funds

(800) 701-9502 – AAMA Funds |

| | |

Date of fiscal year end:6/30

Date of reporting period:6/30/19

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

AAMA Equity Fund

Ticker: AMFEX

AAMA Income Fund

Ticker: AMFIX

Annual Report

June 30, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at 1-800-701-9502 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-800-701-9502. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

| |

| AAMA Funds | |

| Letter To Shareholders | June 30, 2019 |

Dear Shareholder,

Thank you for investing in the AAMA Funds. In this report you will find the audited financial statements and management reviews for the AAMA Equity Fund and the AAMA Income Fund for the year ended June 30, 2019.

For the twelve months ended June 30, 2019, the U.S. Equity market was mixed with large cap stocks as measured by the S&P 500 Index providing a 10.42% return while small company stocks as measured by the S&P Small Cap 600 Index returned negative 4.88%. Increased stock market volatility over the last twelve months has been influenced by tariff concerns, political maneuvering, federal reserve commentary and geopolitical concerns. Looking past the daily headlines, and focusing on earnings and economic data, we find the markets boxed in between deteriorating economic and corporate profit trends and the potential positive effect of lower interest rates.

Fixed income returns over the last twelve months were bolstered by falling interest rates with the Barclays Aggregate Bond Index gaining 7.87% while shorter term bonds as measured by the 1-3 Year Treasury Index returned 4.01%. Interest rates fell across the curve as economic reports have indicated slowing global growth and central bankers have projected renewed monetary accommodation.

We appreciate your continued use of the AAMA Funds as part of your investment allocations and look forward to assisting you in meeting your long-term investment goals and objectives. As always, we encourage you to continue to work with your investment professional to implement your financial plan based upon your individual goals and objectives.

Sincerely,

| | |

| |  |

| | | |

| Robert D. Baker | | Philip A. Voelker |

| Co-Portfolio Managers | | |

Past performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results. Investing involves risk, including the potential loss of principal. Allocations are subject to change.

AAMA Funds are distributed by Foreside Financial Services, LLC. Advanced Asset Management Advisors, Inc. is the investment adviser to the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. For additional information about the Funds, including fees, expenses, and risks, view our prospectus online at www.aamafunds.com or call 800-701-9502. Read the prospectus carefully before you invest or send money.

AAMA Funds

Management Discussion of Fund Performance

June 30, 2019 (Unaudited)

The AAMA Equity Fund returned 6.85% for the year ended June 30, 2019 which can be compared to the S&P 500 index return of 10.42%. Equity market gains were concentrated in large companies as evidenced by the 1.36% return in the S&P Midcap 400 Index and a loss of -4.88% in the S&P Small Cap 600 Index. It is also interesting to note that the equal weighted S&P 500 Index return for the year ended June 30, 2019 was 8.1%. The Fund’s relative underperformance when compared to the capitalization weighted S&P 500 Index was primarily due to four factors. First, the Fund had no direct exposure to the Utility and Real Estate sectors. These sectors were market leaders over the year. Second, the Fund had some exposure to small and mid-cap stocks. As noted, these indices underperformed the S&P 500 Index significantly for the year. (These exposures were eliminated from the portfolio during the first calendar quarter of 2019). Third, the Fund did have an average cash position of 8% for the year. Our allocation to cash contributed a neutral to positive affect on returns for the first nine months of the year but detracted from performance during the three months ended June 30 as the stock market rallied to new highs. Fourth, the S&P 500 Index is a capitalization-weighted index. The largest 25 companies represent an approximately 38% weight in the index and on average out-performed the average stock in the index. The Fund had exposure to 20 of these 25 companies but not to the same degree they are represented in the index.

On the positive side, the Fund’s stock selection added value relative to both capitalization weighted sector returns and equal weighted sector returns in 5 of the 9 sectors represented within the common stock holdings. These five sectors were Consumer Discretionary, Consumer Staples, Financials, Information Technology and Materials.

Over the last 12 months, the U.S. equity market was characterized by modestly rising prices with increased volatility. Volatility increased markedly in November/ December 2018 and equity indices lost between 13 and 20 percent in the quarter ended December, 31 2018. The AAMA Equity Fund performed well during the equity market decline with a return better than the S&P 500, S&P Midcap and S&P Small Cap indices.

The fourth quarter 2018 decline pushed many stocks to attractive valuations and we viewed this as an opportunity to deploy a significant portion of our cash position into equity holdings. The ensuing recovery in equity markets provided an opportunity to eliminate our exposure to under-performing small and mid-cap equities in the first quarter of 2019. Further market strength in the spring of 2019 pushed some of our holdings to over-valued levels. These positions were sold and the portfolio ended the period with approximately 18% in cash equivalents.

AAMA Funds

Management Discussion of Fund Performance

(Continued)

Corporate earnings growth has slowed recently and stock prices have become more sensitive to prospective changes in revenue and earnings growth. Stock prices have also been reacting to perceived trends in Federal Reserve policy, trade tensions and geopolitical issues. These factors have contributed to increased market volatility even though macro U.S. economic trends remain positive with low unemployment, low inflation and strong consumer sentiment. A more stable outlook for renewed earnings growth or lower stock prices will likely present additional opportunities for deployment of our cash position.

The small and mid-capitalization companies the Fund invest in may be more vulnerable to adverse business or economic events than larger, more established companies. Small and mid-capitalization companies may have limited product lines, markets and management groups.

The S&P 500 Index is an unmanaged index, generally representative of the U.S. Stock Market as a whole. The S&P MidCap 400 Index is an unmanaged index, generally representative of the mid-cap segment of the U.S. equity market. The S&P SmallCap 600 Index is an unmanaged index, generally representative of the small-cap segment of the U.S. equity market. Indexes that are unmanaged, do not reflect fees or expenses and an investor cannot invest directly in an index.

Sectors and allocations are subject to change. Past performance does not guarantee future results.

AAMA Funds

Management Discussion of Fund Performance

(Continued)

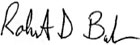

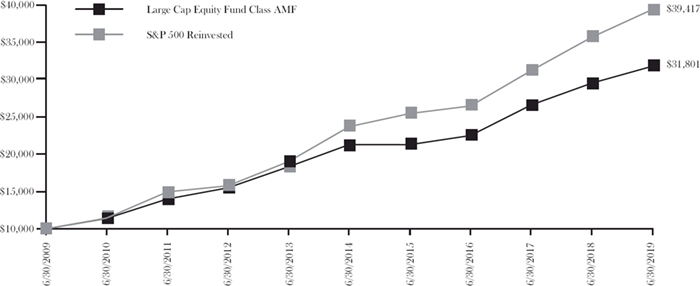

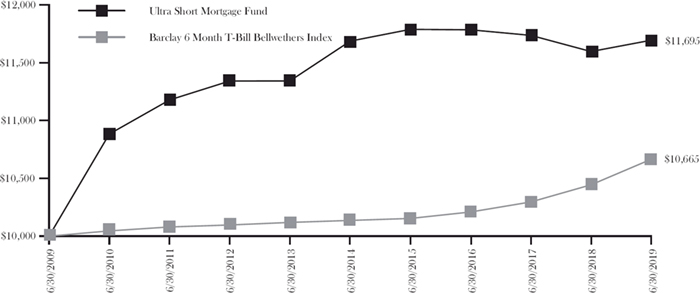

Comparison of the Change in Value of a $10,000 Investment in

AAMA Equity Fund versus the S&P 500® Index*

| | | | | | | |

Average Annual Total Returns (for the periods ended June 30, 2019) |

| | | | 1 Year | | Since Inception(c) | |

| | AAMA Equity Fund(a)(b) | | 6.85 | % | | 9.81% | | |

| | S&P 500® Index* | | 10.42 | % | | 12.38% | | |

| (a) | The Fund’s total returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | The total expense ratio as disclosed in the October 28, 2018 prospectus was 1.21%. |

| (c) | Inception date of the Fund is June 30, 2017. The Fund commenced operations on July 3, 2017. |

| * | The S&P 500 Index is an unmanaged index generally representative of the U.S. Stock Market as a whole. Indexes that are unmanaged do not reflect fees or expenses and an investor cannot invest directly in an index. |

The Fund and S&P 500 Index returns presented include the reinvestment of dividends and interest.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance, please call 1-800-701-9502.

AAMA Equity Fund

Schedule of Portfolio Investments

June 30, 2019

| COMMON STOCKS — 45.3% | | Shares | | | Value | |

| AEROSPACE & DEFENSE — 1.9% | | | | | | | | |

| Boeing Company (The) | | | 11,000 | | | $ | 4,004,110 | |

| Spirit AeroSystems Holdings, Inc. - Class A | | | 8,900 | | | | 724,193 | |

| United Technologies Corporation | | | 13,438 | | | | 1,749,627 | |

| | | | | | | | 6,477,930 | |

| AIRLINES — 0.2% | | | | | | | | |

| Southwest Airlines Company | | | 15,200 | | | | 771,856 | |

| | | | | | | | | |

| BANKS — 4.6% | | | | | | | | |

| Bank of America Corporation | | | 123,800 | | | | 3,590,200 | |

| BB&T Corporation | | | 36,800 | | | | 1,807,984 | |

| Commerce Bancshares, Inc. | | | 9,765 | | | | 582,580 | |

| JPMorgan Chase & Company | | | 37,400 | | | | 4,181,320 | |

| SunTrust Banks, Inc. | | | 11,000 | | | | 691,350 | |

| U.S. Bancorp | | | 42,900 | | | | 2,247,960 | |

| Zions Bancorporation | | | 47,400 | | | | 2,179,452 | |

| | | | | | | | 15,280,846 | |

| BEVERAGES — 0.6% | | | | | | | | |

| PepsiCo, Inc. | | | 16,400 | | | | 2,150,532 | |

| | | | | | | | | |

| BIOTECHNOLOGY — 0.5% | | | | | | | | |

| Amgen, Inc. | | | 8,400 | | | | 1,547,952 | |

| | | | | | �� | | | |

| BUILDING PRODUCTS — 0.7% | | | | | | | | |

| Johnson Controls International plc | | | 47,600 | | | | 1,966,356 | |

| Masco Corporation | | | 13,200 | | | | 517,968 | |

| | | | | | | | 2,484,324 | |

| COMMUNICATIONS EQUIPMENT — 1.2% | | | | | | | | |

| Cisco Systems, Inc. | | | 71,600 | | | | 3,918,668 | |

| | | | | | | | | |

| CONSTRUCTION & ENGINEERING — 0.4% | | | | | | | | |

| Fluor Corporation | | | 18,000 | | | | 606,420 | |

| Quanta Services, Inc. | | | 16,100 | | | | 614,859 | |

| | | | | | | | 1,221,279 | |

| CONSUMER FINANCE — 1.0% | | | | | | | | |

| Capital One Financial Corporation | | | 36,500 | | | | 3,312,010 | |

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued)

| COMMON STOCKS — 45.3% (Continued) | | Shares | | | Value | |

| CONTAINERS & PACKAGING — 0.8% | | | | | | | | |

| Ball Corporation | | | 37,000 | | | $ | 2,589,630 | |

| | | | | | | | | |

| DIVERSIFIED TELECOMMUNICATION | | | | | | | | |

| SERVICES — 1.2% | | | | | | | | |

| Verizon Communications, Inc. | | | 73,100 | | | | 4,176,203 | |

| | | | | | | | | |

| ELECTRICAL EQUIPMENT — 0.5% | | | | | | | | |

| Emerson Electric Company | | | 24,400 | | | | 1,627,968 | |

| | | | | | | | | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & | | | | | | | | |

| COMPONENTS — 1.2% | | | | | | | | |

| Corning, Inc. | | | 117,800 | | | | 3,914,494 | |

| | | | | | | | | |

| ENERGY EQUIPMENT & SERVICES — 0.8% | | | | | | | | |

| Schlumberger Ltd. | | | 65,000 | | | | 2,583,100 | |

| | | | | | | | | |

| FOOD & STAPLES RETAILING — 1.5% | | | | | | | | |

| Kroger Company (The) | | | 77,500 | | | | 1,682,525 | |

| Walmart, Inc. | | | 29,100 | | | | 3,215,259 | |

| | | | | | | | 4,897,784 | |

| FOOD PRODUCTS — 0.8% | | | | | | | | |

| Archer-Daniels-Midland Company | | | 41,200 | | | | 1,680,960 | |

| McCormick & Company, Inc. | | | 7,300 | | | | 1,131,573 | |

| | | | | | | | 2,812,533 | |

| HEALTH CARE EQUIPMENT & SUPPLIES — 1.0% | | | | | | | | |

| Edwards Lifesciences Corporation(a) | | | 9,700 | | | | 1,791,978 | |

| Medtronic plc | | | 15,100 | | | | 1,470,589 | |

| | | | | | | | 3,262,567 | |

| HEALTH CARE PROVIDERS & SERVICES — 1.9% | | | | | | | | |

| Humana, Inc. | | | 8,700 | | | | 2,308,110 | |

| UnitedHealth Group, Inc. | | | 10,400 | | | | 2,537,704 | |

| Universal Health Services, Inc. - Class B | | | 12,100 | | | | 1,577,719 | |

| | | | | | | | 6,423,533 | |

| HOTELS, RESTAURANTS & LEISURE — 0.5% | | | | | | | | |

| Carnival Corporation | | | 35,000 | | | | 1,629,250 | |

| | | | | | | | | |

| HOUSEHOLD DURABLES — 0.2% | | | | | | | | |

| Newell Brands, Inc. | | | 50,000 | | | | 771,000 | |

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued)

| COMMON STOCKS — 45.3% (Continued) | | Shares | | | Value | |

| HOUSEHOLD PRODUCTS — 0.7% | | | | | | | | |

| Procter & Gamble Company (The) | | | 21,900 | | | $ | 2,401,335 | |

| | | | | | | | | |

| INTERACTIVE MEDIA & SERVICES — 1.1% | | | | | | | | |

| Alphabet, Inc. - Class A(a) | | | 3,400 | | | | 3,681,520 | |

| | | | | | | | | |

| INTERNET & DIRECT MARKETING RETAIL — 1.4% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 2,400 | | | | 4,544,712 | |

| | | | | | | | | |

| IT SERVICES — 1.8% | | | | | | | | |

| Mastercard, Inc. - Class A | | | 11,100 | | | | 2,936,283 | |

| Visa, Inc. - Class A | | | 17,400 | | | | 3,019,770 | |

| | | | | | | | 5,956,053 | |

| MACHINERY — 0.8% | | | | | | | | |

| Cummins, Inc. | | | 10,000 | | | | 1,713,400 | |

| ITT, Inc. | | | 12,900 | | | | 844,692 | |

| | | | | | | | 2,558,092 | |

| OIL, GAS & CONSUMABLE FUELS — 2.4% | | | | | | | | |

| Chevron Corporation | | | 9,000 | | | | 1,119,960 | |

| Diamondback Energy, Inc. | | | 11,000 | | | | 1,198,670 | |

| Exxon Mobil Corporation | | | 41,600 | | | | 3,187,808 | |

| ONEOK, Inc. | | | 17,000 | | | | 1,169,770 | |

| Pioneer Natural Resources Company | | | 9,000 | | | | 1,384,740 | |

| | | | | | | | 8,060,948 | |

| PHARMACEUTICALS — 2.1% | | | | | | | | |

| Bristol-Myers Squibb Company | | | 50,000 | | | | 2,267,500 | |

| Johnson & Johnson | | | 16,000 | | | | 2,228,480 | |

| Pfizer, Inc. | | | 61,500 | | | | 2,664,180 | |

| | | | | | | | 7,160,160 | |

| ROAD & RAIL — 1.8% | | | | | | | | |

| Norfolk Southern Corporation | | | 14,200 | | | | 2,830,486 | |

| Union Pacific Corporation | | | 19,800 | | | | 3,348,378 | |

| | | | | | | | 6,178,864 | |

| SEMICONDUCTORS & SEMICONDUCTOR | | | | | | | | |

| EQUIPMENT — 4.4% | | | | | | | | |

| Applied Materials, Inc. | | | 93,800 | | | | 4,212,558 | |

| Intel Corporation | | | 64,300 | | | | 3,078,041 | |

| QUALCOMM, Inc. | | | 50,900 | | | | 3,871,963 | |

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued)

| COMMON STOCKS — 45.3% (Continued) | | Shares | | | Value | |

| SEMICONDUCTORS & SEMICONDUCTOR | | | | | | | | |

| EQUIPMENT — 4.4% (Continued) | | | | | | | | |

| Texas Instruments, Inc. | | | 31,700 | | | $ | 3,637,892 | |

| | | | | | | | 14,800,454 | |

| SOFTWARE — 3.4% | | | | | | | | |

| Adobe, Inc.(a) | | | 13,200 | | | | 3,889,380 | |

| Microsoft Corporation | | | 32,500 | | | | 4,353,700 | |

| Oracle Corporation | | | 35,000 | | | | 1,993,950 | |

| Red Hat, Inc.(a) | | | 7,000 | | | | 1,314,320 | |

| | | | | | | | 11,551,350 | |

| SPECIALTY RETAIL — 1.3% | | | | | | | | |

| Home Depot, Inc. (The) | | | 17,000 | | | | 3,535,490 | |

| Lowe’s Companies, Inc. | | | 9,000 | | | | 908,190 | |

| | | | | | | | 4,443,680 | |

| TECHNOLOGY HARDWARE, STORAGE & | | | | | | | | |

| PERIPHERALS — 1.4% | | | | | | | | |

| Apple, Inc. | | | 22,800 | | | | 4,512,576 | |

| | | | | | | | | |

| TRADING COMPANIES & DISTRIBUTORS — 0.7% | | | | | | | | |

| Fastenal Company | | | 30,000 | | | | 977,700 | |

| W.W. Grainger, Inc. | | | 5,100 | | | | 1,367,973 | |

| | | | | | | | 2,345,673 | |

| WIRELESS TELECOMMUNICATION SERVICES — 0.5% | | | | | | | | |

| T-Mobile US, Inc.(a) | | | 24,300 | | | | 1,801,602 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS(Cost $123,837,248) | | | | | | $ | 151,850,478 | |

| EXCHANGE-TRADED FUNDS — 36.5% | | Shares | | | Value | |

| iShares Core S&P 500 ETF | | | 101,200 | | | $ | 29,828,700 | |

| iShares Core S&P U.S. Growth ETF | | | 239,600 | | | | 15,018,128 | |

| Schwab U.S. Large-Cap ETF | | | 401,700 | | | | 28,195,323 | |

| Vanguard Growth ETF | | | 112,500 | | | | 18,381,375 | |

| Vanguard S&P 500 ETF | | | 115,600 | | | | 31,113,740 | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | | |

| (Cost $99,374,357) | | | | | | $ | 122,537,266 | |

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued)

U.S. TREASURY

OBLIGATIONS — 10.4% | | Rate | | | Maturity | | | Principal

Amount | | | Fair Value | |

| U.S. Treasury Bills — 10.4% | | | | | | | | | | | | | | | | |

| US Treasury Bill | | | | | | | | | | | | | | | | |

| (Cost $34,969,341) | | | 2.106 | %(b) | | | 07/16/19 | | | $ | 35,000,000 | | | $ | 34,969,871 | |

| MONEY MARKET FUND — 7.7% | | Shares | | | Value | |

| Morgan Stanley Institutional Liquidity Funds - Treasury | | | | | | | | |

| Securities Portfolio - Advisory Class, 1.86%(c) | | | | | | | | |

| (Cost $25,870,750) | | | 25,870,750 | | | $ | 25,870,750 | |

| | | | | | | | | |

| TOTAL INVESTMENTS(Cost $284,051,696)— 99.9% | | | | | | $ | 335,228,365 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 0.1% | | | | | | | 382,291 | |

| | | | | | | | | |

| NET ASSETS — 100.0% | | | | | | $ | 335,610,656 | |

(a) Non-income producing security.

(b) Rate shown is the annualized yield at time of purchase, not a coupon rate.

(c) The rate shown is the 7-day effective yield as of June 30, 2019.

plc - Public Liability Company

| Security Allocation (Percentage of Net Assets) |

| Common Stocks | | | 45.3 | % |

| Exchange-Traded Funds | | | 36.5 | % |

| U.S. Treasury Obligations | | | 10.4 | % |

| Cash Equivalents* | | | 7.8 | % |

| Total | | | 100.0 | % |

* Includes Other Assets in Excess of Liabilities

See accompanying notes to financial statements.

AAMA Funds

Management Discussion of Fund Performance

June 30, 2019 (Unaudited)

The AAMA Income Fund returned 2.97% for the year ended June 30, 2019 which can be compared to the Bloomberg Barclays 1-5 Year U.S. Government/ Credit Index return of 5.34%. The Fund’s relative underperformance when compared to the benchmark was primarily due to two factors. First, the Fund had no exposure to credit risk for the year and credit instruments outperformed government bonds. Second, the Fund’s average maturity was less than the index and longer maturity bonds outperformed those with a shorter maturity.

Over the last 12 months, credit markets were driven first by rising short term interest rates in the United States for six months, then by the prospect for falling short term rates over the last six months. In January, the Federal Reserve executed an abrupt about face from tightening monetary policy to telegraphing future plans to ease. Bond yields declined across the maturity curve and across all segments of credit quality.

For the entire year, the Fund maintained a conservative position with a laddered portfolio of U.S. Government and Agency debt with an average maturity ranging between 1.5 and 2.0 years. Credit spreads ranged near historical lows over the year and except for a brief spike in late December offered little justification for exposure to credit risk on a risk-adjusted basis. Credit exposure had been eliminated from the Fund portfolio in the spring of 2018 and none was added during the last 12 months. The yield curve has not provided much incentive to extend maturities into more volatile, longer-term bonds given the relative health of the U.S. economy.

When the Fund invests in fixed income securities including corporate bonds, the value of the Fund will fluctuate with changes in interest rates. When interest rates rise, fixed income securities (i.e. debt obligations) generally will decline in value.

Sectors and allocations are subject to change. Past performance does not guarantee future results.

AAMA Funds

Management Discussion of Fund Performance

(Continued)

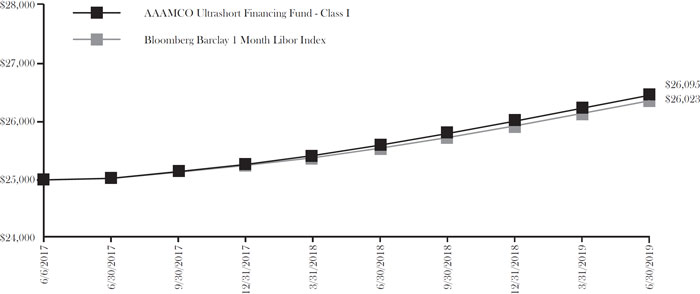

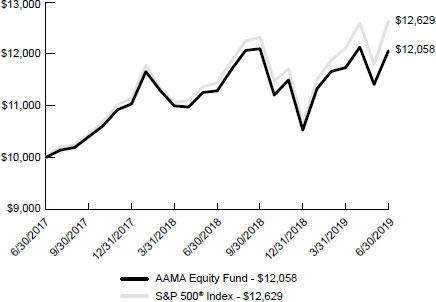

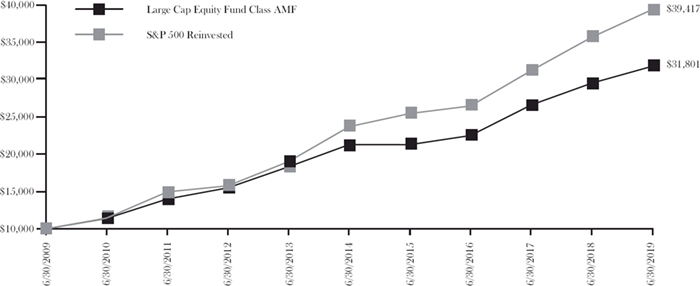

Comparison of the Change in Value of a $10,000 Investment in AAMA Income Fund versus the Bloomberg Barclays 1-5 Year U.S. Government/Credit Index*

| Average Annual Total Returns |

| (for the periods ended June 30, 2019) |

| | 1 Year | Since

Inception(c) |

| AAMA Income Fund(a)(b) | 2.97% | 1.30% |

| Bloomberg Barclays 1-5 Year U.S. Government/Credit Index* | 5.34% | 2.53% |

| (a) | The Fund’s total returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | The total expense ratio as disclosed in the October 28, 2018 prospectus was 0.94%. |

| (c) | Inception date of the Fund is June 30, 2017. The Fund commenced operations on July 3, 2017. |

| * | The Bloomberg Barclays 1-5 Year U.S. Government/Credit Index is a broad-based benchmark that measures the non-securitized component of the Barclays U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities that have a remaining maturity of greater than or equal to one year and less than five years. Indexes that are unmanaged, do not reflect fees or expenses and an investor cannot invest directly in an index. |

The Fund and Barclays 1-5 Year U.S. Government/Credit Index returns presented include the reinvestment of dividends and interest.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance, please call 1-800-701-9502.

AAMA Income Fund

Schedule of Portfolio Investments

June 30, 2019

U.S. GOVERNMENT

AGENCIES — 5.6% | | Coupon | | Maturity | | | Principal

Amount | | | Fair Value | |

| FEDERAL HOME LOAN BANK — 3.5% | | | | | | | | | | | | | | | | |

| Federal Home Loan Bank | | | 2.125 | % | | | 02/11/20 | | | $ | 5,000,000 | | | $ | 5,002,629 | |

| | | | | | | | | | | | | | | | | |

| FEDERAL HOME LOAN MORTGAGE CORPORATION — 2.1% | | | | | | | | | | | | | | | | |

| Federal Home Loan Mortgage Corporation | | | 2.500 | % | | | 04/23/20 | | | | 3,000,000 | | | | 3,013,130 | |

| | | | | | | | | | | | | | | | | |

| TOTAL U.S. GOVERNMENT AGENCIES | | | | | | | | | | | | | | | | |

| (Cost $7,979,493) | | | | | | | | | | | | | | $ | 8,015,759 | |

U.S. TREASURY

OBLIGATIONS — 86.7% | |

Coupon | | Maturity | | | Principal

Amount | | | Fair Value | |

| U.S. Treasury Bills — 7.6%(a) | | | | | | | | | | | | | | | | |

| U.S. Treasury Bills | | | 2.405 | % | | | 07/11/19 | | | $ | 11,000,000 | | | $ | 10,994,067 | |

| | | | | | | | | | | | | | | | | |

| U.S. Treasury Notes — 79.1% | | | | | | | | | | | | | | | | |

| U.S. Treasury Notes | | | 1.625 | % | | | 08/31/19 | | | | 10,000,000 | | | | 9,988,979 | |

| U.S. Treasury Notes | | | 3.375 | % | | | 11/15/19 | | | | 7,000,000 | | | | 7,031,445 | |

| U.S. Treasury Notes | | | 1.375 | % | | | 01/15/20 | | | | 12,000,000 | | | | 11,954,063 | |

| U.S. Treasury Notes | | | 1.500 | % | | | 05/15/20 | | | | 2,000,000 | | | | 1,991,094 | |

| U.S. Treasury Notes | | | 3.500 | % | | | 05/15/20 | | | | 6,000,000 | | | | 6,076,641 | |

| U.S. Treasury Notes | | | 1.625 | % | | | 07/31/20 | | | | 10,000,000 | | | | 9,965,625 | |

| U.S. Treasury Notes | | | 1.375 | % | | | 09/15/20 | | | | 3,000,000 | | | | 2,981,484 | |

| U.S. Treasury Notes | | | 2.625 | % | | | 11/15/20 | | | | 5,000,000 | | | | 5,050,781 | |

| U.S. Treasury Notes | | | 3.625 | % | | | 02/15/21 | | | | 7,000,000 | | | | 7,200,156 | |

| U.S. Treasury Notes | | | 2.250 | % | | | 04/30/21 | | | | 10,000,000 | | | | 10,082,031 | |

| U.S. Treasury Notes | | | 2.000 | % | | | 08/31/21 | | | | 10,000,000 | | | | 10,050,391 | |

| U.S. Treasury Notes | | | 2.000 | % | | | 11/15/21 | | | | 3,000,000 | | | | 3,018,750 | |

| U.S. Treasury Notes | | | 1.875 | % | | | 01/31/22 | | | | 5,000,000 | | | | 5,016,016 | |

| U.S. Treasury Notes | | | 1.875 | % | | | 05/31/22 | | | | 5,000,000 | | | | 5,020,898 | |

AAMA Income Fund

Schedule of Portfolio Investments

(Continued)

U.S. TREASURY

OBLIGATIONS — 86.7%

(Continued) | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

| U.S. Treasury Notes — 79.1% (Continued) | | | | | | | | | | | | | | | | |

| U.S. Treasury Notes | | | 1.875% | | | | 07/31/22 | | | $ | 2,000,000 | | | $ | 2,008,281 | |

| U.S. Treasury Notes | | | 2.000% | | | | 11/30/22 | | | | 10,000,000 | | | | 10,087,109 | |

| U.S. Treasury Notes | | | 2.500% | | | | 05/15/24 | | | | 6,000,000 | | | | 6,202,969 | |

| | | | | | | | | | | | | | | | 113,726,713 | |

| Total U.S. Treasury Obligations | | | | | | | | | | | | | | | | |

| (Cost $124,075,214) | | | | | | | | | | | | | | $ | 124,720,780 | |

| MONEY MARKET FUND — 7.3% | | Shares | | | Value | |

| Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio - Advisory Class, 1.86%(b) | | | | | | | | |

| (Cost $10,464,715) | | | 10,464,715 | | | $ | 10,464,715 | |

| | | | | | | | | |

| TOTAL INVESTMENTS(Cost $142,519,422)— 99.6% | | | | | | $ | 143,201,254 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 0.4% | | | | | | | 626,274 | |

| | | | | | | | | |

| NET ASSETS — 100.0% | | | | | | $ | 143,827,528 | |

(a) Rate shown is the annualized yield at time of purchase, not a coupon rate.

(b) The rate shown is the 7-day effective yield as of June 30, 2019.

| Security Allocation (Percentage of Net Assets) | |

| U.S. Government Agencies | | | 5.6 | % |

| U.S. Treasury Obligations | | | 86.7 | % |

| Cash Equivalents* | | | 7.7 | % |

| Total | | | 100.0 | % |

| * | Includes Other Assets in Excess of Liabilities |

See accompanying notes to financial statements.

AAMA Funds

Statements of Assets and Liabilities

June 30, 2019

| | | AAMA

Equity Fund | | | AAMA

Income Fund | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | | | |

| At cost | | $ | 284,051,696 | | | $ | 142,519,422 | |

| At value | | $ | 335,228,365 | | | $ | 143,201,254 | |

| Receivable for capital shares sold | | | 358,650 | | | | 122,935 | |

| Dividends and interest receivable | | | 425,617 | | | | 665,496 | |

| TOTAL ASSETS | | | 336,012,632 | | | | 143,989,685 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payable for capital shares redeemed | | | 84,683 | | | | 64,581 | |

| Payable to Adviser | | | 270,055 | | | | 76,970 | |

| Unitary fees payable | | | 47,238 | | | | 20,606 | |

| TOTAL LIABILITIES | | | 401,976 | | | | 162,157 | |

| | | | | | | | | |

| NET ASSETS | | $ | 335,610,656 | | | $ | 143,827,528 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Paid-in capital | | $ | 283,361,225 | | | $ | 143,403,145 | |

| Accumulated earnings | | | 52,249,431 | | | | 424,383 | |

| Net assets | | $ | 335,610,656 | | | $ | 143,827,528 | |

| | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized) | | | 28,181,468 | | | | 5,740,157 | |

| | | | | | | | | |

| Net asset value, offering price and redemption price per share | | $ | 11.91 | | | $ | 25.06 | |

See accompanying notes to financial statements.

AAMA Funds

Statements of Operations

Year Ended June 30, 2019

| | | AAMA

Equity Fund | | | AAMA

Income Fund | |

| INVESTMENT INCOME | | | | | | | | |

| Dividends | | $ | 5,629,139 | | | $ | 39,151 | |

| Interest | | | 472,979 | | | | 2,836,428 | |

| TOTAL INVESTMENT INCOME | | | 6,102,118 | | | | 2,875,579 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Investment advisory fees | | | 3,216,354 | | | | 1,067,256 | |

| Unitary fees | | | 569,850 | | | | 252,157 | |

| TOTAL EXPENSES | | | 3,786,204 | | | | 1,319,413 | |

| Less fee reductions by the Adviser | | | (587,024 | ) | | | (315,542 | ) |

| NET EXPENSES | | | 3,199,180 | | | | 1,003,871 | |

| | | | | | | | | |

| NET INVESTMENT INCOME | | | 2,902,938 | | | | 1,871,708 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | |

| Net realized losses on investment transactions | | | (247,014 | ) | | | (212 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 19,032,235 | | | | 2,250,313 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 18,785,221 | | | | 2,250,101 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 21,688,159 | | | $ | 4,121,809 | |

See accompanying notes to financial statements.

AAMA Equity Fund

Statements of Changes in Net Assets

| | | Year Ended

June 30,

2019 | | | Year Ended June 30, 2018(a)(b) | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 2,902,938 | | | $ | 2,164,511 | |

| Net realized losses on investment transactions | | | (247,014 | ) | | | (164,527 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 19,032,235 | | | | 32,144,434 | |

| Net increase in net assets from operations | | | 21,688,159 | | | | 34,144,418 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | (2,435,351 | ) | | | (1,143,931 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 80,885,356 | | | | 337,121,845 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 2,434,971 | | | | 1,143,931 | |

| Payments for shares redeemed | | | (74,990,274 | ) | | | (63,238,468 | ) |

| Net increase in net assets from capital share transactions | | | 8,330,053 | | | | 275,027,308 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 27,582,861 | | | | 308,027,795 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 308,027,795 | | | | — | |

| End of year | | $ | 335,610,656 | | | $ | 308,027,795 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 7,082,329 | | | | 33,090,449 | |

| Shares reinvested | | | 236,405 | | | | 103,523 | |

| Shares redeemed | | | (6,536,847 | ) | | | (5,794,391 | ) |

| Net increase in shares outstanding | | | 781,887 | | | | 27,399,581 | |

| Shares outstanding, beginning of year | | | 27,399,581 | | | | — | |

| Shares outstanding, end of year | | | 28,181,468 | | | | 27,399,581 | |

| (a) | Inception date of the Fund was June 30, 2017. The Fund commenced operations on July 3, 2017. |

| (b) | The presentation of Distributions to Shareholders has been updated to reflect the changes prescribed in amendments to Regulation S-X, effective November 5, 2018 (Note 2). For the year ended June 30, 2018, distributions to shareholders consisted of $1,143,931 from net investment income. As of June 30, 2018, accumulated net investment income was $1,020,580. |

See accompanying notes to financial statements.

AAMA Income Fund

Statements of Changes in Net Assets

| | | Year Ended

June 30,

2019 | | | Year Ended

June 30,

2018(a)(b) | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 1,871,708 | | | $ | 1,402,874 | |

| Net realized losses on investment transactions | | | (212 | ) | | | (257,237 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 2,250,313 | | | | (1,568,481 | ) |

| Net increase (decrease) in net assets from operations | | | 4,121,809 | | | | (422,844 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | (1,876,305 | ) | | | (1,398,561 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 33,909,969 | | | | 174,182,651 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 1,876,253 | | | | 1,398,303 | |

| Payments for shares redeemed | | | (37,254,496 | ) | | | (30,709,251 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (1,468,274 | ) | | | 144,871,703 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 777,230 | | | | 143,050,298 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 143,050,298 | | | | — | |

| End of year | | $ | 143,827,528 | | | $ | 143,050,298 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 1,369,663 | | | | 6,979,639 | |

| Shares reinvested | | | 75,762 | | | | 56,376 | |

| Shares redeemed | | | (1,505,211 | ) | | | (1,236,072 | ) |

| Net increase (decrease) in shares outstanding | | | (59,786 | ) | | | 5,799,943 | |

| Shares outstanding, beginning of year | | | 5,799,943 | | | | — | |

| Shares outstanding, end of year | | | 5,740,157 | | | | 5,799,943 | |

| (a) | Inception date of the Fund was June 30, 2017. The Fund commenced operations on July 3, 2017. |

| (b) | The presentation of Distributions to Shareholders has been updated to reflect the changes prescribed in amendments to Regulation S-X, effective November 5, 2018 (Note 2). For the year ended June 30, 2018, distributions to shareholders consisted of $1,398,561 from net investment income. As of June 30, 2018, accumulated net investment income was $4,313. |

See accompanying notes to financial statements.

AAMA Equity Fund

Financial Highlights

Per Share Data for a Share Outstanding Throughout Each Year

| | | Year Ended

June 30, 2019 | | | Year Ended

June 30, 2018 | (a) |

| Net asset value at beginning of year | | $ | 11.24 | | | $ | 10.00 | |

| Income from investment operations: | | | | | | | | |

| Net investment income | | | 0.10 | | | | 0.08 | |

| Net realized and unrealized gains on investments | | | 0.66 | | | | 1.20 | |

| Total from investment operations | | | 0.76 | | | | 1.28 | |

| Less distributions from: | | | | | | | | |

| Net investment income | | | (0.09 | ) | | | (0.04 | ) |

| Net asset value at end of year | | $ | 11.91 | | | $ | 11.24 | |

| Total return(b) | | | 6.85 | % | | | 12.85 | %(c) |

| Net assets at end of year (000’s) | | $ | 335,611 | | | $ | 308,028 | |

| Ratio of total expenses to average net assets(d) | | | 1.18 | % | | | 1.19 | %(e) |

| Ratio of net expenses to average net assets(d)(f) | | | 0.99 | % | | | 0.90 | %(e) |

| Ratio of net investment income to average net assets(f)(g) | | | 0.90 | % | | | 0.78 | %(e) |

| Portfolio turnover rate | | | 20 | % | | | 5 | %(c) |

| (a) | Inception date of the Fund was June 30, 2017. The Fund commenced operations on July 3, 2017. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or realized capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would be lower if the Adviser and administrator had not reduced fees. |

| (d) | The ratios of expenses to average net assets do not reflect the Fund’s proportionate share of expenses of the underlying investment companies in which the Fund invests. |

| (f) | Ratio was determined after fee reductions. |

| (g) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends and distributions by the underlying investment companies in which the Fund invests. |

See accompanying notes to financial statements.

AAMA Income Fund

Financial Highlights

Per Share Data for a Share Outstanding Throughout Each Year

| | | Year Ended

June 30, 2019 | | | | Year Ended

June 30, 2018 | (a) |

| Net asset value at beginning of year | | $ | 24.66 | | | | $ | 25.00 | |

| Income (loss) from investment operations: | | | 0.33 | | | | | 0.26 | |

| Net investment income | | | | | | | | | |

| Net realized and unrealized gains (losses) on investments | | | 0.40 | | | | | (0.35 | ) |

| Total from investment operations | | | 0.73 | | | | | (0.09 | ) |

| Less distributions from: | | | (0.33 | ) | | | | (0.25 | ) |

| Net investment income | | | | | | | | | |

| Net asset value at end of year | | $ | 25.06 | | | | $ | 24.66 | |

| Total return(b) | | | 2.97% | | | | | (0.34% | )(c) |

| Net assets at end of year (000’s) | | $ | 143,828 | | | | $ | 143,050 | |

| Ratio of total expenses to average net assets | | | 0.93% | | | | | 0.94% | (d) |

| Ratio of net expenses to average net assets(e) | | | 0.71% | (f) | | | | 0.63% | (d) |

| Ratio of net investment income toaverage net assets(e) | | | 1.32% | | | | | 1.05% | (d) |

| Portfolio turnover rate | | | 20% | | | | | 6% | (c) |

| (a) | Inception date of the Fund was June 30, 2017. The Fund commenced operations on July 3, 2017. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or realized capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would be lower if the Adviser and administrator had not reduced fees. |

| (e) | Ratio was determined after fee reductions. |

| (f) | The impact of the voluntary fee waiver by the Adviser for the year ended June 30, 2019 was 0.02%. |

See accompanying notes to financial statements.

AAMA Funds

Notes to Financial Statements

June 30, 2019

1. Organization

AAMA Equity Fund and AAMA Income Fund (individually, a “Fund,” and, collectively, the “Funds” or “AAMA Funds”) are each a separate series of Asset Management Fund (the “Trust”), a professionally managed, diversified, open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is organized as a Delaware statutory trust operating under a Second Amended and Restated Declaration of Trust dated November 27, 2018. Other series of the Trust are not included in this report. The inception date of the Funds was June 30, 2017. The Funds commenced operations on July 3, 2017, when they began to execute their investment objectives, which included purchasing investments.

AAMA Equity Fund’s investment objective is long-term capital appreciation.

AAMA Income Fund’s investment objective is current income with a secondary objective of preservation of capital.

2. Significant Accounting Policies

Each Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic (“ASC”) 946, “Financial Services – Investment Companies.” The following is a summary of the Funds’ significant accounting policies used in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

New Accounting Pronouncements — In March 2017, FASB issued Accounting Standards Update No. 2017-08 (“ASU 2017-08”), “Receivables – Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities.” ASU 2017-08 shortens the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. ASU 2017-08 does not require an accounting change for securities held at a discount, which continue to accrete to maturity. ASU 2017-08 is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018. Management is currently evaluating the impact, if any, of applying ASU 2017-08.

In August 2018, FASB issued Accounting Standards Update 2018-13 (“ASU 2018-13”), “Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement,” which amends the fair value measurement disclosure requirements of ASC Topic 820 (“ASC 820”), “Fair Value Measurement.” ASU 2018-13 includes new, eliminated, and modified disclosure requirements for ASC 820. In addition, ASU 2018-13 clarifies that materiality is an appropriate consideration when evaluating disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods therein. Early adoption is permitted and the Funds have adopted ASU 2018-13 with these financial statements.

AAMA Funds

Notes to Financial Statements (Continued)

Securities valuation — The Funds record their investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used by the Funds maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 — quoted prices in active markets for identical securities |

| ● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 — significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments) |

Portfolio securities are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally, 4:00 p.m., Eastern time) on each day the NYSE is open. Listed securities, including common stocks and exchange-traded funds (“ETFs”), for which market quotations are readily available are valued at the closing prices on the primary exchange where the securities are normally traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Investments in other investment companies, except ETFs, are valued at their reported net asset value (“NAV”). In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Debt securities are typically valued on the basis of valuations provided by dealers or by an independent pricing service approved by the Board of Trustees (the “Board”) that determines valuations based upon market transactions for normal, institutional-size trading units of similar securities. Short-term debt investments of sufficient credit quality maturing in less than 61 days may be valued at amortized cost if it is determined that amortized cost approximates fair value. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

Securities for which market quotations are not readily available (e.g., an approved pricing service does not provide a price, a price has become stale, or an event occurs that materially affects the furnished price) are valued by the Pricing Committee. In these cases, the Pricing Committee determines in good faith, subject to procedures adopted by the Board, the fair value of such securities (“good faith fair valuation”). When a good faith fair valuation of a security is required, consideration is generally given to a number of factors, including, but not limited to the following: type of security, nature and duration of any restrictions on disposition of the security, forces that influence the market in which the security is purchased or sold, existence of merger proposals or tender offers, expectation of additional news about the company and volume and depth of public trading in similar securities of the issuer or similar companies. Depending on the source and relative significance of the valuation inputs in these instances, the valuations for these securities will be classified as Level 2 or Level 3 in the fair value hierarchy.

AAMA Funds

Notes to Financial Statements (Continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure the fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value each Fund’s investments as of June 30, 2019, by security type:

| AAMA Equity Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 151,850,478 | | | $ | — | | | $ | — | | | $ | 151,850,478 | |

| Exchange-Traded Funds | | | 122,537,266 | | | | — | | | | — | | | | 122,537,266 | |

| U.S. Treasury Obligations | | | — | | | | 34,969,871 | | | | — | | | | 34,969,871 | |

| Money Market Fund | | | 25,870,750 | | | | — | | | | — | | | | 25,870,750 | |

| Total | | $ | 300,258,494 | | | $ | 34,969,871 | | | $ | — | | | $ | 335,228,365 | |

| AAMA Income Fund | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

| U.S. Government Agencies | | $ | — | | | $ | 8,015,759 | | | $ | — | | | $ | 8,015,759 | |

| U.S. Treasury Obligations | | | — | | | | 124,720,780 | | | | — | | | | 124,720,780 | |

| Money Market Fund | | | 10,464,715 | | | | — | | | | — | | | | 10,464,715 | |

| Total | | $ | 10,464,715 | | | $ | 132,736,539 | | | $ | — | | | $ | 143,201,254 | |

Refer to each Fund’s Schedule of Portfolio Investments for a listing of the securities by security type and industry type. The Funds did not hold derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the year ended June 30, 2019.

AAMA Funds

Notes to Financial Statements (Continued)

Share valuation — The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to the NAV per share.

Investment income — Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Discounts and premiums on fixed income securities are amortized using the interest method. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Trust’s understanding of the applicable country’s rules and tax rates.

Distributions to shareholders — Dividends arising from net investment income, if any, are declared and paid annually to shareholders of the AAMA Equity Fund. Dividends arising from net investment income are declared and paid monthly to shareholders of the AAMA Income Fund. Net realized capital gains, if any, are distributed at least once each year. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are permanent in nature and are primarily due to differing treatments of net short-term capital gains. Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid by each Fund during the year ended June 30, 2019 was ordinary income in the amounts of $2,435,351 paid to the shareholders of AAMA Equity Fund and $1,876,305 paid to the shareholders of AAMA Income Fund. The tax character of distributions paid by each Fund during the year ended June 30, 2018 was ordinary income in the amounts of $1,143,931 paid to shareholders of AAMA Equity Fund and $1,398,561 paid to the shareholders of AAMA Income Fund.

Investment transactions — Investment transactions are accounted for on trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Expenses— Expenses incurred by the Trust that do not relate to a specific Fund of the Trust are allocated to the individual Funds based on each Fund’s relative net assets or another appropriate basis as determined by the Board.

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

AAMA Funds

Notes to Financial Statements (Continued)

Federal income tax— Each Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Funds of liability for federal income taxes to the extent 100% of their net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The tax character of accumulated earnings as of June 30, 2019 was as follows:

| | | AAMA

Equity Fund | | | AAMA

Income Fund | |

| Tax cost of portfolio investments | | $ | 284,051,731 | | | $ | 142,519,422 | |

| Gross unrealized appreciation | | $ | 52,777,231 | | | $ | 780,706 | |

| Gross unrealized depreciation | | | (1,600,597 | ) | | | (98,874 | ) |

| Net unrealized appreciation | | | 51,176,634 | | | | 681,832 | |

| Undistributed ordinary income | | | 1,484,302 | | | | — | |

| Captial loss carryforwards | | | (411,505 | ) | | | (257,449 | ) |

| Accumulated earnings | | $ | 52,249,431 | | | $ | 424,383 | |

As of June 30, 2019, AAMA Equity Fund and AAMA Income Fund had short-term capital loss carryforwards of $411,505 and $257,449, respectively, for income tax purposes. These capital loss carryforwards, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

For the year ended June 30, 2019, AAMA Equity Fund reclassified $3,864, increasing paid-in capital, and AAMA Income Fund reclassified $284, decreasing paid-in capital, with respect to distributable earnings on the Statements of Assets and Liabilities. These reclassifications are due to permanent differences in the recognition of capital gains or losses under income tax regulations and GAAP.

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions for all open tax years and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Funds identify their major tax jurisdiction as U.S. Federal.

AAMA Funds

Notes to Financial Statements (Continued)

3. Investment Transactions

Investment transactions, other than short-term investments and U.S. Government securities, were as follows for the year ended June 30, 2019:

| | | AAMA

Equity Fund | | | AAMA

Income Fund | |

| Purchase of investment securities | | $ | 58,239,923 | | | $ | — | |

| Proceeds from sales and maturities of investment securities | | $ | 92,793,608 | | | $ | — | |

Investment transactions in long-term U.S. Government securities were as follows for the year ended June 30, 2019:

| | | AAMA

Equity Fund | | | AAMA

Income Fund | |

| Purchase of U.S. Government securities | | $ | — | | | $ | 24,989,815 | |

Proceeds from sales and maturities of U.S. Government securities | | $ | — | | | $ | 34,000,000 | |

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENTS

Each Fund’s investments are managed by Advanced Asset Management Advisors, Inc. (the “Adviser”) under the terms of an Investment Advisory Agreement. AAMA Equity Fund pays the Adviser a fee, which is computed and accrued daily and paid monthly, at an annual rate of 1.00% of its average daily net assets. AAMA Income Fund pays the Adviser a fee, which is computed and accrued daily and paid monthly, at an annual rate of 0.75% of its average daily net assets.

The Adviser had entered into an Expense Limitation Agreement (“ELA”) under which it had contractually agreed, until February 28, 2019, to reduce its investment advisory fees and to reimburse other expenses to the extent necessary so that total annual operating expenses (excluding brokerage costs, interest, taxes, dividend expense on short positions, litigation and indemnification expenses, acquired fund fees and expenses, and extraordinary expenses (as determined under GAAP)) did not exceed 0.90% for AAMA Equity Fund and 0.63% for AAMA Income Fund. Accordingly, during the year ended June 30, 2019, the Adviser contractually reduced its advisory fees in the amount of $587,024 and $281,188 for AAMA Equity Fund and AAMA Income Fund, respectively.

AAMA Funds

Notes to Financial Statements (Continued)

Additionally, during the year ended June 30, 2019, the Adviser voluntarily waived its advisory fees in the amount of $34,354 for AAMA Income Fund. These voluntary waivers are not eligible for recovery by the Adviser.

Under the terms of the ELA, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by each Fund for a period of three years after the fiscal year that such fees and expenses were incurred, provided the repayments do not cause total annual operating expenses to exceed the lesser of (i) the expense limitation then in effect, if any, or (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of June 30, 2019, the Adviser may seek repayment of investment advisory fee reductions totaling $1,391,721 and $692,959 from AAMA Equity Fund and AAMA Income Fund, respectively, no later than the dates as stated below:

| | | | AAMA

Equity Fund | | | AAMA

Income Fund | |

| June 30, 2021 | | | $ | 804,697 | | | $ | 411,771 | |

| June 30, 2022 | | | | 587,024 | | | | 281,188 | |

| | | | $ | 1,391,721 | | | $ | 692,959 | |

BUSINESS MANAGER AND ADMINISTRATOR

Foreside Management Services, LLC (“Foreside”) serves as the Trust’s business manager and administrator. Pursuant to the terms of a Management and Administration Agreement (the “Agreement”) between the Trust, on behalf of the Funds, and Foreside, Foreside performs and coordinates all management and administration services for the Trust either directly or through working with the Trust’s service providers. Services provided under the Agreement by Foreside include, but are not limited to, coordinating and monitoring activities of the third party service providers to the Funds; serving as officers of the Trust, including but not limited to, President, Secretary, Chief Compliance Officer, Anti-Money Laundering Officer, Treasurer and others as are deemed necessary and appropriate; performing compliance services for the Trust, including maintaining the Trust’s compliance program as required under the 1940 Act; managing the process of filing amendments to the Trust’s registration statement and other reports to shareholders; coordinating the Board meeting preparation process; reviewing financial reports and filing them with the SEC; and maintaining books and records in accordance with applicable laws and regulations.

AAMA Funds

Notes to Financial Statements (Continued)

Pursuant to the Agreement, Foreside pays all operating expenses of the Trust and the Funds not specifically assumed by the Trust, unless the Trust or the Adviser otherwise agree to pay, including without limitation the compensation and expenses of any employees and officers of the Trust and of any other persons rendering any services to the Trust; clerical and shareholder service staff salaries; office space and other office expenses; fees and expenses incurred by the Trust in connection with membership in investment company organizations; legal, auditing and accounting expenses; expenses of registering shares under federal and state securities laws; insurance expenses; fees and expenses of the transfer agent, dividend disbursing agent, shareholder service agent, custodian, fund accounting agent and financial administrator (excluding fees and expenses payable to Foreside) and accounting and pricing services agent; expenses, including clerical expenses, of issue, sale, redemption or repurchase of shares of the Funds; the cost of preparing and distributing reports and notices to shareholders; the cost of printing or preparing prospectuses and statements of additional information for delivery to each Fund’s current shareholders; the cost of printing or preparing any documents, statements or reports to shareholders; fees and expenses of Trustees of the Trust who are not interested persons of the Trust, as defined by the 1940 Act (“Independent Trustees”); and all other operating expenses not specifically assumed by the Trust. In paying expenses that would otherwise be obligations of the Trust, Foreside is expressly acting as an agent on behalf of the Trust. Foreside Financial Services, LLC serves as the Funds’ principal underwriter and is an affiliate of Foreside. For the services under the Agreement and expenses assumed by Foreside, the Trust, on behalf of the Funds, pays Foreside an annual fee equal to 0.20% of the average daily net assets of the Funds up to $250,000,000 and 0.15% of the average daily net assets of the Funds greater than $250,000,000; subject, however, to an minimum fee of $777,000, effective November 1, 2018. Prior to November 1, 2018, the minimum fee was $795,000. Such expenses are disclosed on the Statements of Operations as “Unitary fees.”

OTHER SERVICE PROVIDER

Ultimus Fund Solutions, LLC (“Ultimus”) serves as the transfer agent, fund accountant and financial administrator for the Funds. The transfer agent services provided by Ultimus to the Funds include, but are not limited to (i) processing shareholder purchase and redemption requests; (ii) processing dividend payments; and (iii) maintaining shareholder account records. The administrative and fund accounting services provided by Ultimus to the Funds include (i) computing each Fund’s NAV for purposes of the sale and redemption of its shares; (ii) computing the dividends payable by each Fund; (iii) preparing certain periodic reports and statements; and (iv) maintaining the general ledger and other accounting records for the Funds.

AAMA Funds

Notes to Financial Statements (Continued)

PRINCIPAL HOLDER OF FUND SHARES

As of June 30, 2019, the following account holder owned of record 25% or more of the outstanding shares of each Fund:

| NAME OF RECORD OWNER | | % Ownership | |

| AAMA Equity Fund | | | |

| TD Ameritrade, Inc. (for the benefit of its clients) | | | 74% | |

| AAMA Income Fund | | | | |

| TD Ameritrade, Inc. (for the benefit of its clients) | | | 78% | |

A beneficial owner of 25% or more of each Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. Investment in Other Investment Companies

The Funds may invest a significant portion of their assets in shares of one or more investment companies, including ETFs. ETFs issue their shares to authorized participants in return for a specific basket of securities. The authorized participants then sell the ETF’s shares on the secondary market. In other words, ETF shares are traded on a securities exchange based on their fair value. There are certain risks associated with investments in ETFs. Investments in ETFs are subject to the risk that the ETF’s shares may trade at a premium (creating the risk that the Fund pays more than NAV for an ETF when making a purchase) or discount (creating the risk that a Fund receives less than NAV when selling an ETF) to the ETF’s NAV. Investments in ETFs are also subject to index-tracking risk because the total return generated by the securities will be reduced by transaction costs and expenses not incurred by the indices. Certain securities comprising the index tracked by an ETF may temporarily be unavailable, which may further impede the ETF’s ability to track its applicable index or match the index’s performance. Finally, ETF shares are also subject to the risks applicable to the underlying basket of securities. As of June 30, 2019, AAMA Equity Fund had 36.5% of the value of its net assets invested in ETFs.

6. Contingencies and Commitments

The Funds indemnify the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Funds. Additionally, in the normal course of business the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

AAMA Funds

Notes to Financial Statements (Continued)

7. Trustee Compensation

The Independent Trustees are compensated for their services to the Trust by Foreside as part of the Management and Administration Agreement. Each Independent Trustee receives an annual retainer of $14,000, and an in person meeting fee of $4,000 for Board meetings and $1,500 for committee meetings. For each telephonic meeting, the attendance fee is $1,000. Collectively, the Independent Trustees were paid $130,500 in fees during the year ended June 30, 2019 for the entire Trust. Foreside paid Trustee compensation in the amount of $65,250 on behalf of the Funds. In addition, Foreside reimburses Trustees for out-of-pocket expenses incurred in conjunction with attendance of meetings.

8. Subsequent Events

The Funds are required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statements of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Funds are required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

AAMA Funds

Report of Independent Registered

Public Accounting Firm

To the Shareholders of AAMA Funds and

Board of Trustees of Asset Management Fund

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of portfolio investments, of AAMA Equity Fund and AAMA Income Fund (the “AAMA Funds” or “Funds”), each a series of the Asset Management Fund, as of June 30, 2019, and the related statements of operations for the year then ended, the statements of changes in net assets and the financial highlights for each of the two years in the period then ended, including the related notes, (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of June 30, 2019, the results of their operations for the year then ended, the changes in their net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

AAMA Funds

Report of Independent Registered

Public Accounting Firm (Continued)

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2019, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significantestimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Funds’ auditor since 2017.

COHEN & COMPANY, LTD.

Cleveland, Ohio

August 27, 2019

AAMA Funds

About Your Fund’s Expenses (Unaudited)

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Funds, you incur ongoing costs, including management fees and other expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (January 1, 2019 through June 30, 2019).

The table below illustrates each Fund’s costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from each Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Funds. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Funds under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare each Fund’s ongoing costs with those of other mutual funds. It assumes that each Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the returns used are not the Funds’ actual returns, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess each Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Funds do not charge sales loads or redemption fees.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

AAMA Funds

About Your Fund’s Expenses (Unaudited)

More information about the Funds’ expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Funds’ prospectus.

| | Beginning

Account Value

January 1, 2019 | | Ending

Account Value

June 30, 2019 | | Net

Expense

Ratio(a) | | Expenses

Paid During

Period(b) | |

| AAMA Equity Fund | | | | | | | | |

| Based on Actual Fund Return | | $1,000.00 | | | $1,145.20 | | | 1.09% | | | $5.79 | |

| Based on Hypothetical 5% Return (before expenses) | | $1,000.00 | | | $1,019.40 | | | 1.09% | | | $5.45 | |

| | | | | | | | | | | | | |

| AAMA Income Fund | | | | | | | | | | | | |

| Based on Actual Fund Return | | $1,000.00 | | | $1,018.30 | | | 0.78% | | | $3.91 | |

| Based on Hypothetical 5% Return (before expenses) | | $1,000.00 | | | $1,020.92 | | | 0.78% | | | $3.91 | |

| (a) | Annualized, based on the Fund’s most recent one-half year expenses. |

| (b) | Expenses are equal to each Fund’s annualized net expense ratio multiplied by the average account value over the period, muliplied by 181/365 (to reflect the one-half year period). |

AAMA Funds

Other Information (Unaudited)

A description of the policies and procedures that the Funds use to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-800-701-9502, or on the SEC’s website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-800-701-9502, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings of the Funds with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. The filings are available upon request, by calling 1-800-701-9502. Furthermore, you may obtain a copy of these filings on the SEC’s website at www.sec.gov.

Federal Tax Information (Unaudited)

Qualified Dividend Income – For the fiscal year ended June 30, 2019, AAMA Equity Fund and AAMA Income Fund have designated 100.00% and 0.01%, respectively, of ordinary income distributions, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction – Corporate shareholders are generally entitled to take the dividends received deduction on the portion of a Fund’s dividends that qualify under tax law. For the fiscal year ended June 30, 2019, 100.00% and 0.01%, of ordinary income dividends paid by AAMA Equity Fund and AAMA Income Fund, respectively, qualify for the corporate dividends received deduction.

AAMA Funds

Board of Trustees and Executive Officers

(Unaudited)

Listed below is basic information regarding the Trustee and executive officers of the Trust. The Trust’s Statement of Additional Information includes additional information about Trustees and is available, without charge, upon request by calling 1-800-701-9502.

Name, Year of Birth

and Address1 | Position(s) Held

With Trust, Length

of Time Served and

Term of Office | Principal Occupation(s) During Past

Five Years, Prior Relevant Experience

and Other Directorships During the

Past Five Years | No. of

Portfolios

in Trust

Overseen |

| Independent Trustees | | |

David J. Gruber

Year of Birth: 1963 | Chairman of the Board since 2018. Trustee since 2015. Indefinite Term of Office | Director of Risk Advisory Services for Holbrook and Manter, CPAs from January 2016 to present; President of DJG Financial Consulting, LLC (financial consulting firm), 2007 to 2015; Independent Trustee for Monteagle Funds (6 Funds), Audit Committee Chair, Valuation Committee member from 2015 to present; Board member of Cross Shore Discovery Fund, 2014 to present; Board member of Fifth Third Funds, 2003 to 2012. | 5 |

Carla S. Carstens

Year of Birth: 1951 | Trustee since 2015. Indefinite Term of Office | Advisory Board of Directors of AIT Worldwide Logistics, 2013 to 2015; Board member and Treasurer of Athena International, 2010 to 2016; Board member and Chairman of Strategic Planning and Women and Inclusion Initiatives of Financial Executives International Chicago, 2009 to present; Board of Directors and Audit Committee Chair of Chicago Yacht Club Foundation, 2015 to 2017. | 5 |

James A. Simpson

Year of Birth: 1970 | Trustee since 2018. Indefinite Term of Office | President, ETP Resources, LLC, a financial services consulting company, 2009 to present. Trustee of Virtus ETF Trust II, 2015 to present and Trustee of ETFis Series Trust I, 2014 to present. | 5 |

| 1 | The mailing address of each Independent Trustee is 690 Taylor Road, Suite 210, Gahanna, Ohio 43230. |

AAMA Funds

Board of Trustees and Executive Officers

(Unaudited) (Continued)