United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03541

Asset Management Fund

(Exact name of registrant as specified in charter)

1000 Brickell Avenue, Suite 500, Miami, FL 33131

(Address of principal executive offices) (Zip code)

Beacon Hill Fund Services, Inc., 4041 North High Street, Suite 402, Columbus, Ohio 43214

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 247-9780

Date of fiscal year end: 10/31

Date of reporting period: 10/31/13

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Managed By:

Shay Assets Management, Inc.

ANNUAL REPORT

October 31, 2013

CHAIRMAN’S LETTER

The Asset Management Fund (“AMF” and each series, a “Fund”) family of no load institutional mutual funds is pleased to present to shareholders the 2013 Annual Report.

The global economy is now finishing up a fifth year of difficult adjustment and restructuring. Central banks remain on center stage and are the dominant drivers of financial market trends as politicians continue to stumble towards policies to contain the fiscal imbalances which are the greatest source of systematic risk in the western economic system. Our fellow citizens understand these risks; rarely have Washington politicians been held in lower regard by voters and this pessimism is likely holding back our recovery. After all, how can Washington expect consumers and investors to regain their “animal spirits” while observing Congress flail through the Fiscal Cliff, sequestration, the government shutdown and the rollout of ObamaCare? Unfortunately, we do not expect our leaders to fix this toxic environment in the near future.

Meanwhile, the Federal Reserve continues to do the heavy lifting for the U.S. economy. Quantitative Easing (“QE”) has undoubtedly been a success, if success is measured as negative real government yields and private and corporate sectors that have the lowest debt service costs in decades. But another key objective of QE is to encourage private sector risk-taking and generate healthy nominal economic growth to pay back the accumulated government debt. While the buoyant equity markets would suggest that QE is working, achieving acceptable GDP and inflation targets has been more difficult. The temptation, therefore, is to keep QE and “financial repression” in place longer than what might seem reasonable. And while the new Fed Chairperson-to-be, Janet Yellen, is clearly a dove in regards to these issues, she will be faced with a much more hawkish and vocal Open Market Committee lineup in 2014. Plan on more Fed-generated volatility over the next few years.

The evil twin of financial repression that doesn’t get nearly as much play as it’s sibling but is equally important is “regulatory repression”. Most financial market participants think of Dodd-Frank as a financial market overhaul; however, it also keeps the risk-taking activities encouraged by financial repression out of the depository system. In a fractional banking system, this is exactly where those risks, properly capitalized and managed, need to reside; they encourage investment and economic growth. Unfortunately, these opportunities are migrating back into the unregulated shadow banking and securitization systems. We don’t believe that these non-depository markets have been properly restructured, and therefore remain a future source of unsupervised risk. Depositories, meanwhile, are still de-leveraging, de-risking and being forced to improve liquidity, which is just another way of saying to bulk up on government securities. We fear that if the Washington politicians can’t control spending, the next stage of regulatory repression is far worse: capital and foreign exchange controls, caps on deposit rates, and mandated investment in government securities for non-depositories, such as pension funds. Sound impossible in the U.S.? Perhaps, but examples of this happening in Europe over the past few years are too numerous for this letter.

Given these themes, we continue to focus on staying long liquidity and transparency and under weighting our duration benchmarks. The restructuring of our fixed income funds has proven beneficial for shareholders, and the recent performance of our short duration fixed income funds has been particularly strong. As always, we are grateful for your continuing support and continue to seek the best investment strategies for achieving our shareholder’s investment objectives.

Rodger D. Shay, Sr.

Chairman

Asset Management Fund

This report has been prepared to provide information to the shareholders of the Funds and must be preceded or accompanied by the Prospectus. It should not be construed as an offering to sell or buy any shares of the Funds. Such an offering is made only by the Prospectus. You may obtain a current copy of the Prospectus by calling 1-800-247-9780 or at AMF’s website (www.amffunds.com). Investors should consider the investment objectives, risks and expenses of the Funds before investing. Read the Prospectus carefully before you invest. Like all Mutual Funds, the AMF Funds are not FDIC insured, may lose value and have no bank guarantee.

MARKET OVERVIEW

October 31, 2013

Last year, we expressed some concern that investor complacency could lead to some surprises in the bond markets due to what we called the “Interest Rate Gap”, or the difference between the price the Fed will pay for fixed income securities and price that brings in real economic buyers. We also forecasted a steeper yield curve in 2013. In fact, the sharp increase in interest rates which we experienced in 2013 was the direct result of the Federal Reserve opening the discussion to a “Tapering” of their Quantitative Easing (“QE”) program. While Treasury Bill rates fell 5-10 bps during the funds’ fiscal year, short Treasury Note rates rose 5-20 bps and intermediate and long Treasury Notes and Bonds rose 60-90 bps.

Of course, the catalyst to the Fed opening the discussion of higher rates was the continued firming in economic conditions. While GDP growth remains below potential, it is encouraging that GDP has been accelerating all year given the headwinds caused by the Fiscal Cliff, sequestration, higher taxes, and weak growth in government employment. The housing market has begun what many to believe to be a long, steady improvement, and the rise in home and equity prices mean that household net worth has never been higher. Private employment continues to improve, and indicators hint at an acceleration in job growth into 2014.

And even though employment and industrial activity aren’t back to 2008 levels, the Fed’s QE policy has allowed consumer and corporation balance sheets to heal dramatically. While nominal debt levels remain historically high, most consumer debt has been termed out at very low interest rates. Households are currently spending just over 15% of disposable income to service fixed debt and other payments (such as property taxes), which is the lowest level in over thirty years. The federal government’s HARP (“Home Affordable Refinance Program”) program for underwater mortgagors certainly helped to lower mortgage payments, and the Fed’s QE policy allowed healthy homeowners to lock in the lowest mortgage rates since the 1960’s. While that made owning higher coupon mortgage-backed securities somewhat uncomfortable for a good part of 2013, we believe the mortgage-backed securities market is entering a period of tremendous prepayment stability now that the generational lows in mortgage rates have been achieved. Since Q 2 2009, over 18 million GSE loans (about 75% of the total) have been refinanced, with 2.9 million coming through HARP alone. As such, the pool of eligible loans that are refinanceable has declined sharply. With mortgage rates up 100 bps since late last year, principal prepayment rates have fallen by 60%.

By our estimates, U.S. economic growth looks primed for a surprise on the upside. We say that with some real trepidation; actual GDP has come in below both the Fed’s forecast and private economist survey’s since 2008. For the record, the Fed’s September 2013 forecast is for 2014 GDP of 2.9% - 3.1%, down slightly from their June 2013 forecast. The private sector is forecasting 2.6%. We’re leaning towards the Fed, and as the unemployment rate prepares to drop below 7% early next year - a level not breached since the end of 2008 – we expect that QE will be dialed down throughout 2014. Janet Yellen will be faced with an Open Market Committee with almost as many hawks as doves. She will face some contentious new members, and we expect Fed risk will add to volatility in 2014. As such, we’ve focused our investments on shorter duration, floating rate securities.

As we stated last year, the rebound in home prices caught some by surprise. In 2013, the continued rebound impacted economic and political events on a number of fronts. First, after several tweaks to the HARP program, the Obama administration got the desired results in mortgage modifications. At the same time, the political imperative to do something dramatic to cure the underwater homeowner problem has declined significantly. At one point, nearly 25% of all homes with mortgages were underwater. Currently, that number is less than 15%, and only 6% are significantly underwater. With home prices forecast to continue to rise modestly, the underwater homeowner is being cured naturally. The one caveat: the improvement in the housing market has also returned the GSEs to reasonable health, and FHLMC and FNMA have nearly completely repaid the government’s initial investment from 2008 when they were placed into receivership. For the foreseeable future, the GSEs will be net cash generators for the federal government. The Obama Administration could use some of these profits for more aggressive loan modifications. All said, what this certainly means is that housing reform is likely to take a back seat once again, as Congress faces more pressing problems with debt and entitlement reforms.

| |

| Portfolio composition is subject to change. |

| |

Past performance does not guarantee future results. Investments returns and net asset values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. |

MARKET OVERVIEW

October 31, 2013

As for 2014, we expect a year of increased volatility. After several years of growth hovering around 2% in the U.S., a number of headwinds have been removed. QE is nearing its end; investors should start to think hard about what they believe to be market based levels on nominal, long term interest rates because, in our view, the Fed will wind down its QE program throughout 2014 and U.S. Treasury and mortgage rates will, for the first time in several years, be solely dominated by the forces of inflation and real GDP. We thank all of our shareholders for allowing us to assist them with their investment needs, and look forward to serving you in the future.

This report has been prepared to provide information to the shareholders of the Funds and must be preceded or accompanied by the Prospectus. It should not be construed as an offering to sell or buy any shares of the Funds. Such an offering is made only by the Prospectus. You may obtain a current copy of the Prospectus by calling 1-800-247-9780 or at AMF’s website (www.amffunds.com). Investors should consider the investment objectives, risks and expenses of the Funds before investing. Read the Prospectus carefully before you invest. Like all Mutual Funds, the AMF Funds are not FDIC insured, may lose value and have no bank guarantee.

| |

| Portfolio composition is subject to change. |

| |

Past performance does not guarantee future results. Investments returns and net asset values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. |

ASSET MANAGEMENT FUND REVIEW

October 31, 2013

Ultra Short Mortgage Fund

With nearly zero interest rate volatility on the front part of the yield curve, the Fund focused on securities that we believed would provide stable, prepayment protected yields. The Fund’s holdings are mainly seasoned government agency hybrid ARMs. Many of the loans backing these pools provide the borrower with a monthly mortgage payment below that available from fixed mortgage rates, which helps to keep their refinancing risk relatively low. However, the federal government’s enhancements to the HARP Program (“Home Affordable Refinance Program”) in late 2012 did raise prepayments rates on most government mortgage securities, negatively impacting the returns of the Fund. Once interest rates rose in the second half of the fiscal year, prepayment rates declined markedly, allowing the Fund to retain more of its coupon income and positively impacted performance. The Fund’s focus continues to be on seasoned loans which have a variety of impediments to refinancing. This strategy allows the Fund to maintain a relatively attractive yield compared to newly issued securities. The Fund benefitted substantially from a number of litigation recoveries associated with private label mortgage-backed securities. The Fund was ranked in the 55th percentile and the 5th percentile of the Morningstar Ultrashort Bond category* for the one-year periods ended October 31, 2012 and October 31, 2013, respectively.

Portfolio composition is subject to change.

Past performance does not guarantee future results. Investments returns and net asset values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost.

| | * | The Morningstar category is assigned based on the underlying securities in each portfolio. Morningstar places funds in a given category based on their portfolio statistics and compositions over the past three years. When necessary, Morningstar may change a category assignment based on recent changes to the portfolio. Morningstar has classified the Ultra Short Mortgage Fund in the Ultrashort Bond category. The Morningstar percentile rankings were based on 111 funds and 130 funds on 10/31/12 and 10/31/13, respectively. The one, three, five and ten year percentile rankings for the Ultra Short Fund in the Morningstar Ultrashort Bond category as of 10/31/12 and 10/31/13 were as follows: |

| | 1yr | 3yr | 5yr | 10yr |

| 10/31/12 | 55th | 16th | 98th | 96th |

| 10/31/13 | 5th | 18th | 91st | 92nd |

| | | The percentile rankings shown reflect any expenses that were voluntarily reduced during the periods presented and litigation recoveries received in the current fiscal year associated with private label mortgage-backed securities. In such instances, and without this activity, the percentile rankings would have been less favorable. |

ASSET MANAGEMENT FUND REVIEW

October 31, 2013

Ultra Short Fund

With nearly zero interest rate volatility on the front part of the yield curve, the Fund focused on securities that we believed would provide stable, prepayment protected yields. The Fund’s holdings are mainly seasoned government agency hybrid ARMs. Many of the loans backing these pools provide the borrower with a monthly mortgage payment below that available from fixed mortgage rates, which helps to keep their refinancing risk relatively low. However, the federal government’s enhancements to the HARP Program (“Home Affordable Refinance Program”) in late 2012 did raise prepayments rates on most government mortgage securities, negatively impacting the returns of the Fund. Once interest rates rose in the second half of the fiscal year, prepayment rates declined markedly, allowing the Fund to retain more of its coupon income and positively impacted performance. The Fund’s focus continues to be on seasoned loans which have a variety of impediments to refinancing. This strategy allows the Fund to maintain a relatively attractive yield compared to newly issued securities. The Fund benefitted substantially from a number of litigation recoveries associated with private label mortgage-backed securities. The Fund was ranked in the 46th percentile and the 2nd percentile of the Morningstar Ultrashort Bond category* for the one-year periods ended October 31, 2012 and October 31, 2013, respectively.

Portfolio composition is subject to change.

Past performance does not guarantee future results. Investments returns and net asset values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost.

| | * | The Morningstar category is assigned based on the underlying securities in each portfolio. Morningstar places funds in a given category based on their portfolio statistics and compositions over the past three years. When necessary, Morningstar may change a category assignment based on recent changes to the portfolio. Morningstar has classified the Ultra Short Fund in the Ultrashort Bond category. The Morningstar percentile rankings were based on 111 funds and 130 funds on 10/31/12 and 10/31/13, respectively. The one, three, five and ten year percentile rankings for the Ultra Short Fund in the Morningstar Ultrashort Bond category as of 10/31/12 and 10/31/13 were as follows: |

| | 1yr | 3yr | 5yr | 10yr |

| 10/31/12 | 46th | 97th | 100th | 100th |

| 10/31/13 | 2nd | 21st | 100th | 100th |

| | | The percentile rankings shown reflect any expenses that were voluntarily reduced during the periods presented and litigation recoveries received in the current fiscal year associated with private label mortgage-backed securities. In such instances, and without this activity, the percentile rankings would have been less favorable. |

ASSET MANAGEMENT FUND REVIEW

October 31, 2013

Short U.S. Government Fund

With nearly zero interest rate volatility on the front part of the yield curve, the Fund focused on securities that we believed would provide stable, prepayment protected yields. The Fund increased its exposure to seasoned government agency hybrid ARMs throughout the year as a defensive strategy against rising interest rates. From the beginning of 2013 until October, the percentage of floating rate and adjustable rate securities increased from 40% to 63%. Mortgage spreads also widened during the initial increase in interest rates, and since the Fund maintained its spread duration during this period the net asset value has improved as spreads tightened in the last few months of the fiscal year. Also, prepayment rates have declined markedly since interest rates rose this summer, allowing the Fund to retain more of its coupon income and positively impacted performance. The Fund’s focus continues to be on seasoned loans which have a variety of impediments to refinancing. The Fund benefitted slightly from a number of litigation recoveries associated with private label mortgage-backed securities. The Fund was ranked in the 33rd percentile and the 24th percentile of the Morningstar Short Government Bond category* for the one year periods ended October 31, 2012 and October 31, 2013, respectively.

Portfolio composition is subject to change.

Past performance does not guarantee future results. Investments returns and net asset values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost.

| | * | The Morningstar category is assigned based on the underlying securities in each portfolio. Morningstar places funds in a given category based on their portfolio statistics and compositions over the past three years. When necessary, Morningstar may change a category assignment based on recent changes to the portfolio. Morningstar has classified the Short U. S. Government Fund in the Short Government Bond category. The Morningstar percentile rankings were based on 145 funds and 151 funds on 10/31/12 and 10/31/13, respectively. The one, three, five and ten year percentile rankings for the Short U.S. Government Fund in the Morningstar Short Government Bond category as of 10/31/12 and 10/31/13 were as follows: |

| | 1yr | 3yr | 5yr | 10yr |

| 10/31/12 | 33rd | 63rd | 97th | 91st |

| 10/31/13 | 24th | 44th | 50th | 92nd |

| | | The percentile rankings shown reflect any expenses that were voluntarily or contractually reduced during the periods presented and litigation recoveries received in the current fiscal year associated with private label mortgage-backed securities. In such instances, and without this activity, the percentile rankings would have been less favorable. |

ASSET MANAGEMENT FUND REVIEW

October 31, 2013

Intermediate Mortgage Fund

With nearly zero interest rate volatility on the front part of the yield curve, the Fund focused on securities that we believed would provide stable, prepayment protected yields. The Fund increased its exposure to seasoned government agency hybrid ARMs throughout the year as a defensive strategy against rising interest rates. Mortgage spreads also widened during the initial increase in interest rates, and since the Fund maintained its spread duration during this period the net asset value has improved as spreads tightened in the last few months of the fiscal year. Also, prepayment rates have declined markedly since interest rates rose this summer, allowing the Fund to retain more of its coupon income and positively impacted performance. The Fund’s focus continues to be on seasoned or refinancing-impaired loans which have a variety of impediments to refinancing. For example, the Fund purchased GNMA securities backed by home loans from residences in Puerto Rico. Even though these securities were refinanceable for much of 2013, they have experienced no prepayments. The Fund benefitted substantially from a number of litigation recoveries associated with private label mortgage-backed securities. The Fund was ranked in the 42nd percentile and the 97th percentile of the Morningstar Short-Term Bond category* for the one year periods ended October 31, 2012 and October 31, 2013, respectively.

| |

| Portfolio composition is subject to change. |

Past performance does not guarantee future results. Investments returns and net asset values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost.

| | | |

| | * | The Morningstar category is assigned based on the underlying securities in each portfolio. Morningstar places funds in a given category based on their portfolio statistics and compositions over the past three years. When necessary, Morningstar may change a category assignment based on recent changes to the portfolio. Morningstar has classified the Intermediate Mortgage Fund in the Short Term Bond category. The Morningstar percentile rankings were based on 436 funds and 465 funds on 10/31/12 and 10/31/13, respectively. The one, three, five and ten year percentile rankings for the Intermediate Mortgage Fund in the Morningstar Short-Term Bond category as of 10/31/12 and 10/31/13 were as follows: |

| | | | | | |

| | | 1yr | 3yr | 5yr | 10yr |

| 10/31/12 | | 42nd | 98th | 100th | 100th |

| 10/31/13 | | 97th | 74th | 100th | 100th |

| | | |

| | | The percentile rankings shown reflect any expenses that were voluntarily or contractually reduced during the periods presented and litigation recoveries received in the current fiscal year associated with private label mortgage-backed securities. In such instances, and without this activity, the percentile rankings would have been less favorable. |

ASSET MANAGEMENT FUND REVIEW

October 31, 2013

U.S. Government Mortgage Fund

The fund sought to maintain a lower than normal interest rate exposure throughout the year due to our expectation that interest rate would rise. While this strategy was beneficial to the Fund as rates rose in the summer, the defensive nature of funds’ holdings also reduced net interest income. The Fund’s holdings are mainly higher coupon, fixed rate securities and refinancing-impaired securities. This strategy has allowed the Fund to maintain a relatively attractive yield compared to newly issued securities. For example, the Fund purchased GNMA securities backed by home loans from residences in Puerto Rico. Even though these securities were refinanceable for much of 2013, they have experienced no prepayments. The Fund also used fixed rate MBS to manage interest rate exposure, and the Fund was generally positioned toward the lower end of its targeted duration range. The Fund was ranked in the 44th percentile and the 76th percentile of the Morningstar Intermediate Government Bond category* for the one year periods ended October 31, 2012 and October 31, 2013, respectively.

On December 11, 2013, the Board of Trustees determined that it is in the best interest of the Shareholders of the U.S. Government Mortgage Fund to liquidate the Fund. The liquidation will commence on January 10, 2014.

| |

| Portfolio composition is subject to change. |

Past performance does not guarantee future results. Investments returns and net asset values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost.

| | | |

| | * | The Morningstar category is assigned based on the underlying securities in each portfolio. Morningstar places funds in a given category based on their portfolio statistics and compositions over the past three years. When necessary, Morningstar may change a category assignment based on recent changes to the portfolio. Morningstar has classified the U.S. Government Mortgage Fund in the Intermediate Government Bond category. The Morningstar percentile rankings were based on 351 funds and 307 funds on 10/31/12 and 10/31/13, respectively. The one, three, five and ten year percentile rankings for the U.S. Government Mortgage Fund in the Morningstar Intermediate Government Bond category as of 10/31/12 and 10/31/13 were as follows: |

| | | | | | |

| | | 1yr | 3yr | 5yr | 10yr |

| 10/31/12 | | 44th | 97th | 100th | 100th |

| 10/31/13 | | 76th | 88th | 99th | 100th |

| | | |

| | | The percentile rankings shown reflect any expenses that were voluntarily or contractually reduced during the periods presented. In such instances, and without this activity, the percentile rankings would have been less favorable. |

AMF LARGE CAP EQUITY FUND REVIEW

October 31, 2013

During the one-year period ending October 31, 2013, the AMF Large Cap Equity Fund (Class AMF) produced a total return of 23.55%. Total return figures for the Fund’s peer group and benchmark index were 27.16% for the Morningstar Large Blend Category and 27.18% for the Standard & Poor’s 500 Index for the same period. Total return assumes the reinvestment of all dividends and capital gains and the deduction of all applicable fees and expenses. Individual security performance, relative market sector weightings, cash balances and fund expense ratio are the primary drivers of the Fund’s investment return relative to its peer group and index benchmarks.

The Fund contains 28 high quality, large capitalization common stock investments. With its focus on companies that have demonstrated an ability to achieve long-term sustainable earnings and dividend growth, the Fund is more heavily weighted toward sectors of the market that are less cyclical in nature. As such, the Fund tends to be less volatile than the broad market, rising less in a bull market but declining less in a bear market.

We are happy to report that the Fund just celebrated its sixtieth anniversary, making it one of the oldest mutual funds in the country. The Fund’s 23.55% total return this year is the best October 31st 1-year return since 1998, 15 years ago. As of October 31, 2013, the Fund’s annualized total return since inception on June 30, 1953 is 10.51%, more than 700 basis points above inflation. A $10,000 investment at inception would be worth $4,164,563 as of October 31, 2013 assuming the reinvestment of all dividends and capital gains. To put these figures into some perspective, in 1953 $10,000 was equivalent to about half of the cost of a typical new home. Today $4.1 million is equivalent to approximately 16 new homes. The power of long-term compounding is an amazing investment tool.

The domestic economy produced positive growth during this past year, however the overall pace remains sluggish. Gross Domestic Product (GDP) growth made progress throughout the past four quarters rising from 0.1% to 2.8%, although the year-over-year figure amounted to a relatively modest 1.6%. The employment landscape continues to show signs of improvement with the unemployment rate dipping to 7.3% recently. The underemployment rate however, which includes people marginally attached to the labor force and those working part-time but who would prefer full-time employment, remains elevated at 13.8%. The labor participation rate of 62.8% is the lowest it’s been since the 1970’s.

Due to the slow economic progress and the challenging labor market, the Federal Reserve continued its accommodative monetary policy throughout the past year. However, there have been signs that the Fed may begin to reduce its Quantitative Easing policy in the near future. This strategy of purchasing bonds in the open market has kept both short and long-term interest rates at historically low levels. As the market has anticipated the Fed “tapering” its Quantitative Easing program, long-term interest rates have begun to move up from their extremely low levels. This has produced a slight headwind for the recovering housing market as mortgage rates have risen.

From a corporate performance perspective, during the past year S&P 500 revenues grew 4% while profit margins expanded from 8.9% to 9.6%, resulting in operating earnings growth of 5%. This is an improvement over the prior year’s 3% operating earnings growth rate. The stock market’s strong return during the past year was largely attributable to an expansion in the price-to-earnings ratio. Investors were more willing to pay a higher price for each dollar of earnings as recent economic data supported the outlook for further economic improvement. The Fed added to this economic optimism flashing signs of “tapering” its Quantitative Easing program.

The Fund’s investment philosophy focuses on investing in high quality, large capitalization common stocks. We specifically seek to acquire equity stakes in established companies that we believe have the ability to produce long-term sustainable earnings and dividend growth at favorable valuations for long-term ownership. We believe that this is a prudent way for investors to accumulate wealth over the long-term and benefit from the mathematical merits of compounding. As of October 31, 2013, the portfolio’s 28 holdings had a weighted average earnings yield of 6.08% (12-month trailing earnings divided by the closing stock price on 10/31/13). The weighted average 5-year historical earnings growth rate for these holdings was 7.10%. The weighted average dividend yield of our current portfolio holdings was 2.34%. Over the previous 5-year period, the growth rate of these dividends has been 8.07% on a weighted average basis. The return on equity for our portfolio holdings on a weighted average basis was 25.16% as of October 31, 2013. The current earnings and dividend yields available in the equity market are attractive relative to the “risk-free” alternatives available in the U.S. Treasury market. While price-to-earnings ratios have expanded during the past few years, they remain in line with the 60-year historical average.

Our portfolio turnover of 5% during the past year is evidence of our long-term investment horizon. There are three primary reasons why we will choose to make changes in portfolio composition: valuations, fundamentals and relative opportunities. In late

| |

| Portfolio composition is subject to change. |

Past performance does not guarantee future results. Investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

AMF LARGE CAP EQUITY FUND REVIEW

October 31, 2013

2012, we eliminated Cisco Systems and Home Depot from the portfolio. Cisco was eliminated primarily for fundamental reasons and secondarily for valuation. Its revenue and earnings growth were continuing to decelerate as its core server and switch markets have matured. New competitors have been entering the market with alternative software solutions that risk diminishing the value of Cisco’s core hardware product lines. Management has attempted to diversify the company’s business although success has been limited. For these reasons, along with the fact that its stock price reflected our estimate of fair market value, we chose to eliminate the position. Home Depot’s valuation exceeded our estimated fair value as its stock price had risen significantly over the prior 18 months. In our opinion, this lofty valuation discounted a significant portion of its future return potential.

During the past year, long-term holding Abbott Labs spun off its research-based pharmaceutical business into a new company called AbbVie. The “new” Abbott Labs consists of the remaining business units, including Nutritionals, Diabetes Care, Vascular and other medical devices and products. AbbVie is highly reliant on its blockbuster drug Humira for a majority of its revenues and profits. With so much riding on the success of one product, we felt it was best for the Fund to eliminate AbbVie from the portfolio after the spinoff and realize the capital appreciation accumulated over the Fund’s 15+ year holding period. Shares of the remaining Abbott Labs company were retained in the portfolio as this business is more reflective of the type of high quality, stable investment the Fund seeks.

In the relative opportunities category, early in 2013 we eliminated General Dynamics in exchange for Emerson Electric, both in the Industrial sector of the portfolio. General Dynamics is a major defense contractor as well as the manufacturer of Gulf-stream business jets. With so much of its revenue dependent on the Department of Defense and subject to cuts by the U.S. government, its projected revenue growth has been on the decline. It will be difficult for the Gulfstream business to offset these large potential headwinds. Given its weakening business environment and fair valuation, the position was used as a source of funds to purchase Emerson Electric. Emerson is a high quality company that has demonstrated an ability to deliver long-term sustainable earnings and dividend growth. It is a well diversified industrial company with multiple business units including Process Management, Industrial Automation, Network Power, Climate Technologies and Commercial and Residential Solutions. At the time of purchase, the shares were favorably valued and offered an attractive dividend yield.

A second opportunistic transaction occurred toward the end the period when we eliminated Sysco (the food distribution company) in the Consumer Staples sector and purchased Schlumberger in the Energy sector. Sysco had been in the Fund for over 17 years. It was a model of consistent earnings and dividend growth over a majority of that period, up until the past few years. The recession injured their client base, many of which are restaurants. Moreover, it has also been conducting a business transformation project for an extensive period of time that has not met objectives. Management recently announced that next year’s earnings would fall below expectations. We chose to realize our large capital gains in this long-term holding, which had the added effect of reducing our large market overweighting in the Consumer Staples sector. Schlumberger is an oilfield services company that has a worldwide footprint and dominates its industry. It is involved in all aspects of exploration and production for the oil and natural gas industry including reservoir characterization, drilling and servicing, along with reservoir production. This company compliments our other energy sector holdings which include Chevron and Exxon Mobil. As new oil and gas reserves become harder to locate and extract, demand for Schlumberger’s technology and service capabilities continues to increase.

In addition to the companies mentioned above, a number of other holdings were reduced during the year due to rising valuations after strong performance and/or due to their large weighting in the portfolio. Some of the larger reductions included Berkshire Hathaway, American Express, Microsoft, Procter & Gamble, Johnson & Johnson and United Technologies. All of these companies, however, continue to be core holdings in the portfolio.

As always, the Fund’s portfolio management team continues its focus on common stock investments that offer the opportunity for long-term sustainable earnings and dividend growth, making additions to the portfolio when valuations are attractive, in pursuit of long-term wealth creation with subdued volatility.

| |

| Portfolio composition is subject to change. |

Past performance does not guarantee future results. Investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

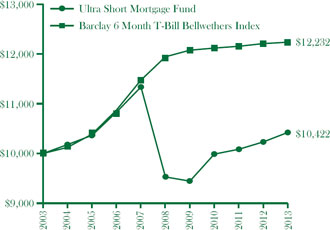

Investment Comparison (Unaudited)

Comparison of change in value of a hypothetical $10,000 investment for the years ended October 31

| | | | | | | |

| | | | | | |

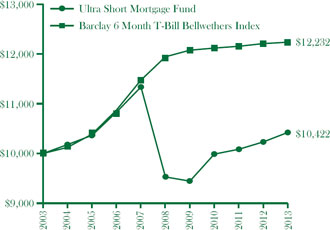

| Ultra Short Mortgage Fund | | | |

| | | | |

| | Gross Expense Ratio | Net Expense Ratio |

| | 1.03% | 0.73% |

| | | | | |

| | The above expense ratios are from the Fund’s prospectus dated March 1, 2013. As indicated in the difference between the gross and net expense ratio, voluntary fee waivers were in effect from November 1, 2012 through October 31, 2013. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the Financial Highlights. |

| | | | | |

| | Average Annual Total Return |

| | Periods Ending October 31, 2013 |

| | | | | |

| | | One | Five | Ten |

| | | Year | Year | Year |

| | Ultra Short Mortgage Fund(1) | 1.86% | 1.81% | 0.41% |

| | Barclay 6 Month T-Bill | | | |

| | Bellwethers Index | 0.20% | 0.42% | 2.06% |

| | | | | |

| | | | | | |

| | (1) During the fiscal year ended October, 31, 2013, the Ultra Short Mortgage Fund received monies related to certain nonrecurring litigation settlements. If these monies were not received, the One Year return would have been –0.20%. The Five Year and Ten Year returns would also have been lower. See Notes to the Financial Statements for more information. |

| | | | | | |

| | | | | | |

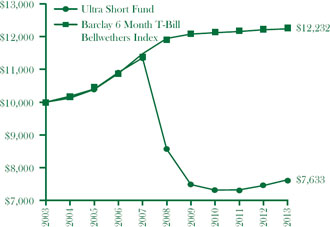

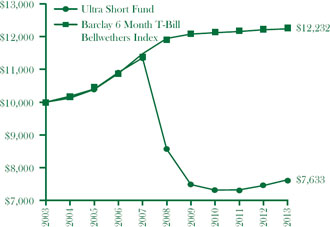

| Ultra Short Fund | | | | | |

| | | | |

| | Gross Expense Ratio | Net Expense Ratio |

| | 1.19% | 0.89% |

| | | | | |

| | The above expense ratios are from the Fund’s prospectus dated March 1, 2013. As indicated in the difference between the gross and net expense ratio, voluntary fee waivers were in effect from November 1, 2012 through October 31, 2013. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the Financial Highlights. |

| | | | | |

| | Average Annual Total Return |

| | Periods Ending October 31, 2013 |

| | | | | |

| | | One | Five | Ten |

| | | Year | Year | Year |

| | Ultra Short Fund(2) | 2.37% | –2.28% | –2.67% |

| | Barclay 6 Month T-Bill | | | |

| | Bellwethers Index | 0.20% | 0.42% | 2.06% |

| | | | | | |

| | (2) During the fiscal year ended October, 31, 2013, the Ultra Short Fund received monies related to certain nonrecurring litigation settlements. If these monies were not received, the One Year, Five Year returns would have been –0.98% and –2.92%, respectively. The Ten Year return would also have been lower. See Notes to the Financial Statements for more information. |

| | | | | | | |

| | | | | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Performance figures in the table and graph do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of Fund shares. The Barclay 6 Month T-Bill Bellwethers Index is an unmanaged index comprised of U.S. Government Treasury Bonds with an average maturity of six months. The index represents unmanaged groups of bonds that differ from the composition of each AMF Fund. The index does not include a reduction in return for expenses. Investors cannot invest directly in an index, although they can invest in its underlying securities. To obtain current month-end performance information for any of the AMF Funds, please call 1-800-247-9780. |

Investment Comparison (Unaudited)

Comparison of change in value of a hypothetical $10,000 investment for the years ended October 31

| | | | | | | |

| | | | | | | |

| Short U.S. Government Fund | | | | | |

| | | | |

| | Gross Expense Ratio | Net Expense Ratio |

| | 0.78% | 0.75% |

| | | | | |

| | The above expense ratios are from the Fund’s prospectus dated March 1, 2013. As indicated in the difference between the gross and net expense ratio, voluntary and contractual fee waivers are in effect from March 1, 2013 through February 28th, 2014. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the Financial Highlights. |

| | | | | |

| | Average Annual Total Return |

| | Periods Ending October 31, 2013 |

| | | | | |

| | | One | Five | Ten |

| | | Year | Year | Year |

| | Short U.S. Government Fund(1) | –0.14% | 2.08% | 1.66% |

| | Barclay 1-3 Year U.S. Government | | | |

| | Bond Index | 0.53% | 1.48% | 2.63% |

| | | | | | |

| | (1) During the fiscal year ended October, 31, 2013, the Short U.S. Government Fund received monies related to certain nonrecurring litigation settlements. If these monies were not received, the returns presented would have been lower. See Notes to the Financial Statements for more information. |

| | | | | | |

| | | | | | |

| Intermediate Mortgage Fund | | | | | |

| | | | |

| | Gross Expense Ratio | Net Expense Ratio |

| | 0.89% | 0.75% |

| | | | | |

| | The above expense ratios are from the Fund’s prospectus dated March 1, 2013. As indicated in the difference between the gross and net expense ratio, voluntary and contractual fee waivers are in effect from March 1, 2013 through February 28th, 2014. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the Financial Highlights. |

| | | | | |

| | Average Annual Total Return |

| | Periods Ending October 31, 2013 |

| | | | | |

| | | One | Five | Ten |

| | | Year | Year | Year |

| | Intermediate Mortgage Fund(2) | –1.31% | –3.33% | –3.45% |

| | Barclay Fixed Rate Mortgage | | | |

| | Backed Securities Index | –0.38% | 5.15% | 4.89% |

| | Barclay 1-5 Year Government Index | 0.35% | 2.28% | 3.20% |

| | | | | | |

| | (2) During the fiscal year ended October, 31, 2013, the Intermediate Mortgage Fund received monies related to certain nonrecurring litigation settlements. If these monies were not received, the One Year, Five Year returns would have been –2.65% and –3.59%, respectively. The Ten Year return would also have been lower. See Notes to the Financial Statements for more information. |

| | | |

| | | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Performance figures in the table and graph do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of Fund shares. The Barclay 1-3 Year U.S. Government Bond Index is an unmanaged index generally representative of government securities with maturities of one to three years. The Barclay Fixed Rate Mortgage Backed Securities Index is a broad-based unmanaged index that represents the general performance of fixed rate mortgage bonds. The Barclay 1-5 Year Government Index is an unmanaged index generally representative of government securities with maturities of one to five years. The indices represent unmanaged groups of bonds that differ from the composition of each AMF Fund. The indices do not include a reduction in return for expenses. Investors cannot invest directly in an index, although they can invest in its underlying securities. To obtain current month-end performance information for any of the AMF Funds, please call 1-800-247-9780. |

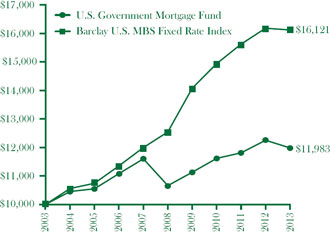

Investment Comparison (Unaudited)

Comparison of change in value of a hypothetical $10,000 investment for the years ended October 31

| | | | | | | |

| | | | | | | |

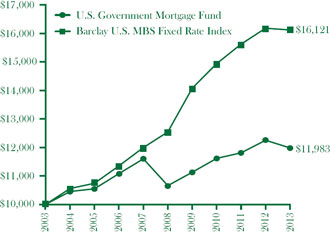

| U.S. Government Mortgage Fund | | | | | |

| | | | | | |

| | Gross Expense Ratio | Net Expense Ratio |

| | 0.78% | 0.75% |

| | | | | |

| | The above expense ratios are from the Fund’s prospectus dated March 1, 2013. As indicated in the difference between the gross and net expense ratio, voluntary and contractual fee waivers are in effect from March 1, 2013 through February 28th, 2014. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the Financial Highlights. |

| | | | | |

| | Average Annual Total Return |

| | Periods Ending October 31, 2013 |

| | | | | |

| | | One | Five | Ten |

| | | Year | Year | Year |

| | U.S. Government Mortgage Fund | –2.19% | 2.37% | 1.82% |

| | Barclay Fixed Rate Mortgage | | | |

| | Backed Securities Index | –0.38% | 5.15% | 4.89% |

| | | | | | | |

| | | | | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Performance figures in the table and graph do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of Fund shares. The Barclay Fixed Rate Mortgage Backed Securities Index is a broad-based unmanaged index that represents the general performance of fixed rate mortgage bonds. The index represents unmanaged groups of bonds that differ from the composition of each AMF Fund. The index does not include a reduction in return for expenses. Investors cannot invest directly in an index, although they can invest in its underlying securities. To obtain current month-end performance information for any of the AMF Funds, please call 1-800-247-9780. |

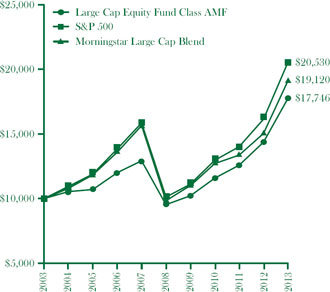

Investment Comparison (Unaudited)

Comparison of change in value of a hypothetical $10,000 investment for the years ended October 31

| | | | | | | |

| | | | | | |

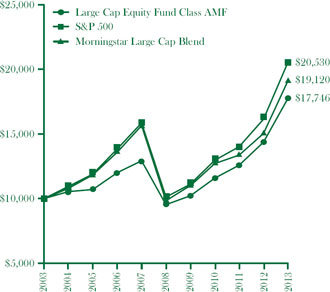

| Large Cap Equity Fund | | | | | |

| | | | | | |

| The following graph shows that an investment of $10,000 in the Class AMF of the Fund on October 31, 2003 would have been worth $17,746 on October 31, 2013, assuming all dividends and distributions had been reinvested. A similar investment in the S&P 500, over the same period, would have been to $20,530. A similar investment in the Morningstar Large Cap Blend, over the same period, would have worth to $19,120. | | Gross Expense Ratio Class AMF 1.30% Class H 1.05% | Net Expense Ratio Class AMF 1.20% Class H 1.05% |

| | | | |

| | The above expense ratios are from the Fund’s prospectus dated March 1, 2013. As indicated in the difference between the gross and net expense ratio for Class AMF, voluntary fee waivers were in effect from November 1, 2012 through October 31, 2013. Additional information pertaining to the Fund’s expense ratios as of October 31, 2013 can be found in the Financial Highlights. |

| | | | | | |

| | Average Annual Total Return |

| | Periods Ending October 31, 2013* |

| | | | | | |

| | | One | Five | Ten | Since |

| | | Year | Year | Year | Inception |

| | Class AMF(1) | 23.55% | 13.23% | 5.90% | 10.51% |

| | Class H(2) | 23.74% | N/A | N/A | 19.17% |

| | Morningstar Large Cap Blend | 27.16% | 14.24% | 6.69% | |

| | S&P 500 | 27.18% | 15.17% | 7.46% | 21.75%(3) |

| | | | | | | |

| | * Assumes reinvestment of all dividends and distributions and the deduction of all applicable fees and expenses. Average annual returns are stated for periods greater than one year. The S&P 500 does not include a reduction in total return for expenses. |

| | (1) Class AMF of the Fund commenced operations on June 30, 1953. |

| | (2) Class H of the Fund commenced operations on February 20, 2009. |

| | (3) Return presented is for the period from February 20, 2009 to October 31, 2013. |

| | | | | | | |

| | | | | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Performance figures in the table and graph do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of Fund shares. The Morningstar Large Cap Blend Average consists of funds that, by portfolio practice, invest at least 70% of assets in domestic stocks in the top 70% of the capitalization of the U.S. equity market. These portfolios tend to invest across the spectrum of U.S. industries, and owing to their broad exposure, the portfolios’ returns are often similar to those of the S&P 500 Index. The Standard & Poors 500 Index is an unmanaged index, generally representative of the U.S. stock market as a whole. Each of these indices represents an unmanaged group of securities that differ from the composition of each AMF Fund. Investors cannot invest directly in an index, although they can invest in its underlying securities. To obtain current month-end performance information for any of the AMF Funds, please call 1-800-247-9780. |

ASSET MANAGEMENT FUND

ULTRA SHORT MORTGAGE FUND

SCHEDULE OF INVESTMENTS

October 31, 2013

| | |

Percentage | | | | | | | | |

| | | of Net | | Maturity | | Principal | | | | |

| | | Assets | | Date | | Amount | | | Value | |

| ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES* | | | 88.3 | % | | | | | | | | |

| 1 Yr. Constant Maturity Treasury Based ARMS | | | 45.6 | % | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | |

| 2.49% | | | | | | 7/1/28 | | $ | 1,586,373 | | | $ | 1,659,069 | |

| 2.07% | | | | | | 8/1/29 | | | 1,130,101 | | | | 1,166,157 | |

| 2.30% | | | | | | 3/1/30 | | | 190,853 | | | | 199,301 | |

| 2.37% | | | | | | 5/1/33 | | | 609,207 | | | | 641,001 | |

| 2.47% | | | | | | 9/1/33 | | | 2,107,241 | | | | 2,205,702 | |

| 2.30% | | | | | | 1/1/35 | | | 5,179,078 | | | | 5,464,046 | |

| 2.37% | | | | | | 1/1/35 | | | 4,079,019 | | | | 4,315,847 | |

| 2.50% | | | | | | 9/1/36 | | | 10,618,502 | | | | 11,286,077 | |

| 2.60% | | | | | | 6/1/37 | | | 16,341,064 | | | | 17,402,220 | |

| 2.29% | | | | | | 9/1/38 | | | 7,122,328 | | | | 7,559,226 | |

| 2.36% | | | | | | 9/1/38 | | | 20,754,003 | | | | 22,066,257 | |

| Fannie Mae Grantor Trust | | | | | | | | | | | | | | |

| 3.54% | | | | | | 5/25/42 | | | 6,839,431 | | | | 7,318,192 | |

| 2.86% | | | | | | 8/25/43 | | | 8,292,179 | | | | 8,684,730 | |

| Fannie Mae Whole Loan | | | | | | | | | | | | | | |

| 3.06% | | | | | | 8/25/42 | | | 7,575,811 | | | | 7,992,345 | |

| 3.63% | | | | | | 8/25/42 | | | 3,051,806 | | | | 3,259,176 | |

| 2.69% | | | | | | 4/25/45 | | | 13,186,765 | | | | 13,996,830 | |

| Freddie Mac | | | | | | | | | | | | | | |

| 2.24% | | | | | | 10/1/22 | | | 394,242 | | | | 404,194 | |

| 2.28% | | | | | | 9/1/27 | | | 758,851 | | | | 782,723 | |

| 2.24% | | | | | | 9/1/28 | | | 5,585,496 | | | | 5,792,534 | |

| 2.26% | | | | | | 9/1/30 | | | 411,246 | | | | 421,478 | |

| 2.39% | | | | | | 7/1/31 | | | 2,714,710 | | | | 2,801,500 | |

| | | | | | | | | | | | | | 125,418,605 | |

| 12 Mo. London Interbank Offering Rate (LIBOR) | | | 25.9 | % | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | |

| 2.59% | | | | | | 8/1/37 | | | 25,199,559 | | | | 26,905,519 | |

| 2.27% | | | | | | 9/1/37 | | | 6,559,308 | | | | 6,970,229 | |

| 2.71% | | | | | | 10/1/37 | | | 3,654,038 | | | | 3,907,536 | |

| 2.44% | | | | | | 7/1/38 | | | 7,867,713 | | | | 8,413,536 | |

| 4.35% | | | | | | 5/1/39 | | | 10,910,008 | | | | 11,625,715 | |

| Freddie Mac | | | | | | | | | | | | | | |

| 2.54% | | | | | | 5/1/39 | | | 12,503,580 | | | | 13,371,015 | |

| | | | | | | | | | | | | | 71,193,550 | |

| 6 Mo. Certificate of Deposit Based ARMS | | | 0.8 | % | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | |

| 1.25% | | | | | | 6/1/21 | | | 538,979 | | | | 542,099 | |

| 1.72% | | | | | | 12/1/24 | | | 1,138,622 | | | | 1,164,247 | |

| Freddie Mac | | | | | | | | | | | | | | |

| 1.94% | | | | | | 1/1/26 | | | 510,926 | | | | 525,807 | |

| | | | | | | | | | | | | | 2,232,153 | |

| 6 Mo. London Interbank Offering Rate (LIBOR) | | | 3.9 | % | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | |

| 1.66% | | | | | | 9/1/27 | | | 2,239,154 | | | | 2,292,956 | |

| 1.71% | | | | | | 3/1/28 | | | 1,938,557 | | | | 1,974,954 | |

| 2.25% | | | | | | 6/1/28 | | | 284,805 | | | | 295,032 | |

| 1.57% | | | | | | 9/1/33 | | | 1,180,522 | | | | 1,206,208 | |

| 1.73% | | | | | | 11/1/33 | | | 948,135 | | | | 972,271 | |

| 1.75% | | | | | | 11/1/33 | | | 1,898,847 | | | | 1,947,885 | |

| | | | | | | | | | | | | | | |

See notes to financial statements.

ASSET MANAGEMENT FUND

ULTRA SHORT MORTGAGE FUND

SCHEDULE OF INVESTMENTS

October 31, 2013

| | |

Percentage | | | | | | | |

| | | of Net | | Maturity | | Principal | | | |

| | | Assets | | Date | | Amount | | Value | |

| Freddie Mac | | | | | | | | | | | |

| 2.55% | | | | | | 9/1/30 | | $ | 1,936,207 | | $ | 2,069,420 | |

| | | | | | | | | | | | | 10,758,726 | |

| Cost of Funds Index Based ARMS | | | 10.0 | % | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | |

| 3.16% | | | | | | 2/1/28 | | | 9,094,559 | | | 9,581,764 | |

| 2.20% | | | | | | 8/1/33 | | | 5,586,830 | | | 5,798,794 | |

| 2.94% | | | | | | 11/1/36 | | | 6,192,219 | | | 6,604,199 | |

| 2.20% | | | | | | 6/1/38 | | | 5,207,521 | | | 5,405,475 | |

| | | | | | | | | | | | | 27,390,232 | |

| SBA Pool Floaters | | | 2.1 | % | | | | | | | | | |

| Small Business Administration Pool | | | | | | | | | | | | | |

| 3.36% | | | | | | 10/25/38 | | | 4,989,341 | | | 5,709,647 | |

TOTAL ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | 242,702,913 | |

| FIXED RATE MORTGAGE-RELATED SECURITIES | | | 5.6 | % | | | | | | | | | |

| 15 Yr. Securities | | | 0.9 | % | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | |

| 2.50% | | | | | | 10/1/27 | | | 2,548,774 | | | 2,539,784 | |

| Collateralized Mortgage Obligations | | | 4.7 | % | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | |

| 5.00% | | | | | | 2/25/18 | | | 2,024,477 | | | 2,138,985 | |

| 4.00% | | | | | | 10/25/23 | | | 989,549 | | | 1,016,907 | |

| 5.00% | | | | | | 3/25/24 | | | 2,861,929 | | | 3,047,016 | |

| Freddie Mac | | | | | | | | | | | | | |

| 4.00% | | | | | | 6/15/36 | | | 6,473,388 | | | 6,758,463 | |

| | | | | | | | | | | | | 12,961,371 | |

| TOTAL FIXED RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | 15,501,155 | |

| | | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | |

| | | of Net | | | | | | | | | |

| | | Assets | | | | Shares | | Value | |

| INVESTMENT COMPANIES | | | 0.0 | % | | | | | | | | | |

| Northern Institutional Treasury Portfolio, 0.01% | | | | | | | | | 823 | | $ | 823 | |

| TOTAL INVESTMENT COMPANIES | | | | | | | | | | | | 823 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | | | | |

ASSET MANAGEMENT FUND

ULTRA SHORT MORTGAGE FUND (concluded)

SCHEDULE OF INVESTMENTS

October 31, 2013

| | | | | | | | | |

| | |

Percentage | | | | | | |

| | | of Net | | Principal | | | | |

| | | Assets | | Amount | | | Value | |

| REPURCHASE AGREEMENTS | | | 5.9 | % | | | | | | |

Bank of America, 0.08%, (Agreement dated 10/31/13 to be repurchased at $16,167, 036 on 11/1/13 | | | | | | $ | 16,167,000 | | | $ | 16,167,000 | |

| TOTAL REPURCHASE AGREEMENTS | | | | | | | | | | | 16,167,000 | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $268,948,008) | | | 99.8 | % | | | | | | | 274,371,891 | |

| NET OTHER ASSETS (LIABILITIES) | | | 0.2 | % | | | | | | | 490,083 | |

| NET ASSETS | | | 100.0 | % | | | | | | $ | 274,861,974 | |

| | | | | | | | | | | | | |

* The rates presented are the rates in effect at October 31, 2013.

See notes to financial statements.

ASSET MANAGEMENT FUND

ULTRA SHORT FUND

SCHEDULE OF INVESTMENTS

October 31, 2013

| | |

Percentage | | | | | | | | |

| | | of Net | | Maturity | | Principal | | | | |

| | | Assets | | Date | | Amount | | | Value | |

| ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES* | | | 88.0 | % | | | | | | | | |

| 1 Yr. Constant Maturity Treasury Based ARMS | | | 47.0 | % | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | |

| 2.28% | | | | | | 10/1/28 | | $ | 100,268 | | | $ | 104,639 | |

| 2.66% | | | | | | 12/1/30 | | | 328,540 | | | | 347,049 | |

| 2.27% | | | | | | 7/1/33 | | | 409,671 | | | | 423,245 | |

| 2.36% | | | | | | 9/1/38 | | | 830,248 | | | | 882,744 | |

| Freddie Mac | | | | | | | | | | | | | | |

| 2.37% | | | | | | 11/1/28 | | | 103,139 | | | | 108,386 | |

| 2.89% | | | | | | 1/1/29 | | | 441,167 | | | | 468,076 | |

| 2.28% | | | | | | 7/1/30 | | | 283,754 | | | | 294,326 | |

| 2.38% | | | | | | 9/1/30 | | | 55,091 | | | | 57,917 | |

| 2.53% | | | | | | 8/1/31 | | | 654,888 | | | | 683,781 | |

| | | | | | | | | | | | | | 3,370,163 | |

| 12 Mo. London Interbank Offering Rate (LIBOR) | | | 41.0 | % | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | |

| 2.59% | | | | | | 8/1/37 | | | 1,296,690 | | | | 1,384,474 | |

| 2.27% | | | | | | 9/1/37 | | | 470,290 | | | | 499,752 | |

| 2.71% | | | | | | 10/1/37 | | | 935,587 | | | | 1,000,493 | |

| 4.35% | | | | | | 5/1/39 | | | 52,180 | | �� | | 55,603 | |

| | | | | | | | | | | | | | 2,940,322 | |

| TOTAL ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | | 6,310,485 | |

| | | | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | | | | | | | | |

| | | Assets | | | | Shares | | | Value | |

| INVESTMENT COMPANIES | | | 11.6 | % | | | | | | | | | | |

| Northern Institutional Treasury Portfolio, 0.01% | | | | | | | | | 830,641 | | | $ | 830,641 | |

| TOTAL INVESTMENT COMPANIES | | | | | | | | | | | | | 830,641 | |

| TOTAL INVESTMENTS | | | | | | | | | | | | | | |

| (Cost $7,053,906) | | | 99.6 | % | | | | | | | | | 7,141,126 | |

| OTHER NET ASSETS (LIABILITIES) | | | 0.4 | % | | | | | | | | | 27,522 | |

| NET ASSETS | | | 100.0 | % | | | | | | | | $ | 7,168,648 | |

| | | | | | | | | | | | | | | |

* The rates presented are the rates in effect at October 31, 2013.

See notes to financial statements.

ASSET MANAGEMENT FUND

SHORT U.S. GOVERNMENT FUND

SCHEDULE OF INVESTMENTS

October 31, 2013

| | |

Percentage | | | | | | | | |

| | | of Net | | Maturity | | Principal | | | | |

| | | Assets | | Date | | Amount | | | Value | |

| ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES* | | | 62.8 | % | | | | | | | | |

| 1 Yr. Constant Maturity Treasury Based ARMS | | | 25.7 | % | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | |

| 2.56% | | | | | | 5/1/31 | | $ | 476,535 | | | $ | 502,741 | |

| 2.37% | | | | | | 1/1/35 | | | 348,870 | | | | 369,126 | |

| 2.50% | | | | | | 9/1/36 | | | 493,884 | | | | 524,934 | |

| Fannie Mae Grantor Trust | | | | | | | | | | | | | | |

| 3.54% | | | | | | 5/25/42 | | | 774,206 | | | | 828,400 | |

| 2.86% | | | | | | 8/25/43 | | | 1,619,314 | | | | 1,695,972 | |

| Freddie Mac | | | | | | | | | | | | | | |

| 2.36% | | | | | | 3/1/27 | | | 234,528 | | | | 243,776 | |

| 2.53% | | | | | | 8/1/31 | | | 955,157 | | | | 997,297 | |

| | | | | | | | | | | | | | 5,162,246 | |

| 12 Mo. London Interbank Offering Rate (LIBOR) | | | 37.1 | % | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | |

| 2.27% | | | | | | 9/1/37 | | | 940,580 | | | | 999,504 | |

| 2.71% | | | | | | 10/1/37 | | | 1,590,498 | | | | 1,700,839 | |

| 2.36% | | | | | | 9/1/38 | | | 1,487,528 | | | | 1,581,583 | |

| 4.35% | | | | | | 5/1/39 | | | 391,346 | | | | 417,019 | |

| Freddie Mac | | | | | | | | | | | | | | |

| 2.54% | | | | | | 5/1/39 | | | 2,568,596 | | | | 2,746,793 | |

| | | | | | | | | | | | | | 7,445,738 | |

TOTAL ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | | 12,607,984 | |

| FIXED RATE MORTGAGE-RELATED SECURITIES | | | 27.5 | % | | | | | | | | | | |

| 10 Yr. Securities | | | 6.8 | % | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | |

| 3.50% | | | | | | 7/1/21 | | | 1,286,372 | | | | 1,362,312 | |

| 15 Yr. Securities | | | 14.1 | % | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | |

| 3.00% | | | | | | 1/1/27 | | | 2,711,357 | | | | 2,818,944 | |

| Freddie Mac | | | | | | | | | | | | | | |

| 8.00% | | | | | | 12/17/15 | | | 7,412 | | | | 7,872 | |

| | | | | | | | | | | | | | 2,826,816 | |

| 30 Yr. Securities | | | 6.6 | % | | | | | | | | | | |

| Government National Mortgage Association | | | | | | | | | | | | | | |

| 3.50% | | | | | | 9/15/42 | | | 1,273,740 | | | | 1,324,640 | |

| Collateralized Mortgage Obligations | | | 0.0 | % | | | | | | | | | | |

| Government National Mortgage Association | | | | | | | | | | | | | | |

| 3.96% | | | | | | 6/16/31 | | | 9,954 | | | | 9,960 | |

| TOTAL FIXED RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | | 5,523,728 | |

| | | | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | | | | | | | | |

| | | Assets | | | | Shares | | | Value | |

| INVESTMENT COMPANIES | | | 0.0 | % | | | | | | | | | | |

| Northern Institutional Treasury Portfolio, 0.01% | | | | | | | | | 521 | | | $ | 521 | |

| TOTAL INVESTMENT COMPANIES | | | | | | | | | | | | | 521 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| See notes to financial statements. | | |

ASSET MANAGEMENT FUND

SHORT U.S. GOVERNMENT FUND (concluded)

SCHEDULE OF INVESTMENTS

October 31, 2013

| | | | | | | | | |

| | |

Percentage | | | | | | |

| | | of Net | | Principal | | | | |

| | | Assets | | Amount | | | Value | |

| REPURCHASE AGREEMENTS | | | 9.4 | % | | | | | | |

| Bank of America, 0.08%, (Agreement dated 10/31/13 | | | | | | | | | | |

| to be repurchased at $1,879,004 on 11/1/13 | | | | | | | | | | |

| Collateralized by Fixed Rate U.S. Government | | | | | | | | | | |

| Mortgage-Backed Security. 2.50%, with a value of | | | | | | | | | | |

| $1,916,581, due at 10/16/43) | | | | | | $ | 1,879,000 | | | $ | 1,879,000 | |

| TOTAL REPURCHASE AGREEMENTS | | | | | | | | | | | 1,879,000 | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $19,861,719) | | | 99.7 | % | | | | | | | 20,011,233 | |

| NET OTHER ASSETS (LIABILITIES) | | | 0.3 | % | | | | | | | 57,912 | |

| NET ASSETS | | | 100.0 | % | | | | | | $ | 20,069,145 | |

| | | | | | | | | | | | | |

* The rates presented are the rates in effect at October 31, 2013.

See notes to financial statements.

ASSET MANAGEMENT FUND

INTERMEDIATE MORTGAGE FUND

SCHEDULE OF INVESTMENTS

October 31, 2013

| | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | Maturity | | | Principal | | | | |

| | | Assets | | | Date | | | Amount | | | Value | |

| ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES* | | | 33.5% | | | | | | | | | | |

| 1 Yr. Constant Maturity Treasury Based ARMS | | | 6.2% | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | |

| 2.54% | | | | | | 7/1/37 | | | $ | 1,414,446 | | | $ | 1,511,346 | |

| 12 Mo. London Interbank Offering Rate (LIBOR) | | | 27.3% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 2.27% | | | | | | 9/1/37 | | | | 4,702,900 | | | | 4,997,523 | |

| 2.36% | | | | | | 9/1/38 | | | | 1,141,592 | | | | 1,213,773 | |

| 4.35% | | | | | | 5/1/39 | | | | 391,346 | | | | 417,019 | |

| | | | | | | | | | | | | | | 6,628,315 | |

| TOTAL ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | | | 8,139,661 | |

| FIXED RATE MORTGAGE-RELATED SECURITIES. | | | 55.0% | | | | | | | | | | | | |

| 10 Yr. Securities | | | 4.5% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 3.50% | | | | | | 7/1/21 | | | | 1,029,098 | | | | 1,089,850 | |

| 15 Yr. Securities | | | 3.6% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 7.00% | | | | | | 3/1/15 | | | | 7,349 | | | | 7,549 | |

| 7.00% | | | | | | 3/1/15 | | | | 8,111 | | | | 8,348 | |

| 7.00% | | | | | | 3/1/15 | | | | 14,033 | | | | 14,383 | |

| 7.50% | | | | | | 11/1/15 | | | | 19,746 | | | | 20,582 | |

| 6.50% | | | | | | 1/1/16 | | | | 11,434 | | | | 11,855 | |

| 6.00% | | | | | | 6/1/16 | | | | 69,668 | | | | 72,954 | |

| 6.00% | | | | | | 7/1/17 | | | | 59,475 | | | | 63,121 | |

| 6.00% | | | | | | 7/1/17 | | | | 87,093 | | | | 92,333 | |

| 2.50% | | | | | | 2/1/26 | | | | 466,339 | | | | 471,660 | |

| Freddie Mac | | | | | | | | | | | | | | | |

| 6.00% | | | | | | 6/1/17 | | | | 109,472 | | | | 116,467 | |

| | | | | | | | | | | | | | | 879,252 | |

| 30 Yr. Securities | | | 19.7% | | | | | | | | | | | | |

| Freddie Mac | | | | | | | | | | | | | | | |

| 3.50% | | | | | | 11/1/41 | | | | 2,109,752 | | | | 2,158,242 | |

| 3.00% | | | | | | 8/1/42 | | | | 86,820 | | | | 85,367 | |

| Government National Mortgage Association | | | | | | | | | | | | | | | |

| 3.50% | | | | | | 8/15/42 | | | | 2,448,912 | | | | 2,546,773 | |

| | | | | | | | | | | | | | | 4,790,382 | |

| Collateralized Mortgage Obligations | | | 27.2% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 4.00% | | | | | | 10/25/32 | | | | 211,783 | | | | 216,528 | |

| Freddie Mac | | | | | | | | | | | | | | | |

| 5.50% | | | | | | 9/15/33 | | | | 5,852,041 | | | | 6,405,837 | |

| | | | | | | | | | | | | | | 6,622,365 | |

| TOTAL FIXED RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | | | 13,381,849 | |

| | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | | | | | | | | |

| | | Assets | | | | | | Shares | | | Value | |

| INVESTMENT COMPANIES | | | 0.0% | | | | | | | | | | |

| Northern Institutional Treasury Portfolio, 0.01% | | | | | | | | | | 665 | | | $ | 665 | |

| TOTAL INVESTMENT COMPANIES | | | | | | | | | | | | | | 665 | |

| | | | | | | | | | | | | | | | |

See notes to financial statements.

ASSET MANAGEMENT FUND

INTERMEDIATE MORTGAGE FUND (concluded)

SCHEDULE OF INVESTMENTS

October 31, 2013

| | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | | | | Principal | | | | |

| | | Assets | | | | | | Amount | | | Value | |

| REPURCHASE AGREEMENTS | | | 11.7% | | | | | | | | | | |

| Bank of America, 0.08%, (Agreement dated 10/31/13 | | | | | | | | | | | | | |

| to be repurchased at $2,854,006 on 11/1/13. | | | | | | | | | | | | | |

| Collateralized by Fixed Rate U.S. Government | | | | | | | | | | | | | |

| Mortgage-Backed Security, 2.50%, with a value of | | | | | | | | | | | | | |

| $2,911,080, due at 10/16/43) | | | | | | | | | $ | 2,854,000 | | | $ | 2,854,000 | |

| TOTAL REPURCHASE AGREEMENTS | | | | | | | | | | | | | | 2,854,000 | |

| TOTAL INVESTMENTS | | | | | | | | | | | | | | | |

| (Cost $24,383,414) | | | 100.2% | | | | | | | | | | | 24,376,175 | |

| NET OTHER ASSETS (LIABILITIES) | | | (0.2)% | | | | | | | | | | | (46,380 | ) |

| NET ASSETS | | | 100.0% | | | | | | | | | | $ | 24,329,795 | |

| | | | | | | | | | | | | | | | |

| * | The rates presented are the rates in effect at October 31, 2013. |

See notes to financial statements.

ASSET MANAGEMENT FUND

U.S. GOVERNMENT MORTGAGE FUND

SCHEDULE OF INVESTMENTS

October 31, 2013

| | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | Maturity | | | Principal | | | | |

| | | Assets | | | Date | | | Amount | | | Value | |

| ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES* | | | 73.9% | | | | | | | | | | |

| 1 Yr. Constant Maturity Treasury Based ARMS | | | 22.1% | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | |

| 2.54% | | | | | | 7/1/37 | | | $ | 2,208,649 | | | $ | 2,359,956 | |

| 12 Mo. London Interbank Offering Rate (LIBOR) | | | 46.9% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 2.27% | | | | | | 9/1/37 | | | | 1,673,723 | | | | 1,778,577 | |

| Freddie Mac | | | | | | | | | | | | | | | |

| 2.54% | | | | | | 5/1/39 | | | | 3,015,309 | | | | 3,224,495 | |

| | | | | | | | | | | | | | | 5,003,072 | |

| HYBRID ARMS | | | 4.9% | | | | | | | | | | | | |

| Freddie Mac | | | | | | | | | | | | | | | |

| 2.64% | | | | | | 11/1/36 | | | | 504,004 | | | | 524,014 | |

| TOTAL ADJUSTABLE RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | | | 7,887,042 | |

| FIXED RATE MORTGAGE-RELATED SECURITIES | | | 23.1% | | | | | | | | | | | | |

| 10 Yr. Securities | | | 2.6% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 3.50% | | | | | | 7/1/21 | | | | 257,274 | | | | 272,462 | |

| 15 Yr. Securities | | | 4.5% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 7.00% | | | | | | 3/1/15 | | | | 10,109 | | | | 10,383 | |

| 2.50% | | | | | | 2/1/26 | | | | 466,339 | | | | 471,661 | |

| | | | | | | | | | | | | | | 482,044 | |

| 30 Yr. Securities | | | 15.3% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 5.00% | | | | | | 3/1/38 | | | | 142,672 | | | | 155,055 | |

| Government National Mortgage Association | | | | | | | | | | | | | | | |

| 7.50% | | | | | | 2/15/24 | | | | 58,520 | | | | 68,731 | |

| 7.00% | | | | | | 4/15/27 | | | | 81,801 | | | | 96,363 | |

| 6.00% | | | | | | 1/15/29 | | | | 75,322 | | | | 84,713 | |

| 3.50% | | | | | | 8/15/42 | | | | 490,718 | | | | 510,328 | |

| 3.50% | | | | | | 9/15/42 | | | | 685,751 | | | | 713,155 | |

| | | | | | | | | | | | | | | 1,628,345 | |

| Collateralized Mortgage Obligations | | | 0.7% | | | | | | | | | | | | |

| Fannie Mae | | | | | | | | | | | | | | | |

| 4.00% | | | | | | 1/25/33 | | | | 12,283 | | | | 12,369 | |

| Freddie Mac | | | | | | | | | | | | | | | |

| 4.00% | | | | | | 3/15/33 | | | | 61,169 | | | | 65,305 | |

| | | | | | | | | | | | | | | 77,674 | |

| TOTAL FIXED RATE MORTGAGE-RELATED SECURITIES | | | | | | | | | | | | | | 2,460,525 | |

| | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | | | | | | | | |

| | | Assets | | | | | | Shares | | | Value | |

| INVESTMENT COMPANIES | | | 2.9% | | | | | | | | | | |

| Northern Institutional Treasury Portfolio, 0.01% | | | | | | | | | | 309,608 | | | $ | 309,608 | |

| TOTAL INVESTMENT COMPANIES | | | | | | | | | | | | | | 309,608 | |

| TOTAL INVESTMENTS | | | | | | | | | | | | | | | |

| (Cost $10,596,748) | | | 99.9% | | | | | | | | | | | 10,657,175 | |

| NET OTHER ASSETS (LIABILITIES) | | | 0.1% | | | | | | | | | | | 9,692 | |

| NET ASSETS | | | 100.0% | | | | | | | | | | $ | 10,666,867 | |

| | | | | | | | | | | | | | | | |

| * | The rates presented are the rates in effect at October 31, 2013. |

See notes to financial statements.

ASSET MANAGEMENT FUND

LARGE CAP EQUITY FUND

SCHEDULE OF INVESTMENTS

October 31, 2013

| | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | | | | | | | | |

| | | Assets | | | | | | Shares | | | Value | |

| COMMON STOCKS | | | 94.9% | | | | | | | | | | |

| Aerospace & Defense | | | 4.1% | | | | | | | | | | |

United Technologies Corp. | | | | | | | | | | 36,800 | | | $ | 3,910,000 | |

| Air Freight & Logistics | | | 4.1% | | | | | | | | | | | | |

| United Parcel Service, Inc. | | | | | | | | | | 40,000 | | | | 3,929,600 | |

| Beverages | | | 8.6% | | | | | | | | | | | | |

| Coca-Cola Co. | | | | | | | | | | 100,000 | | | | 3,957,000 | |

| PepsiCo, Inc. | | | | | | | | | | 50,000 | | | | 4,204,500 | |

| | | | | | | | | | | | | | | 8,161,500 | |

| Chemicals | | | 4.1% | | | | | | | | | | | | |

| Du Pont (E.I.) De Nemours | | | | | | | | | | 40,000 | | | | 2,448,000 | |

| Praxair, Inc. | | | | | | | | | | 12,000 | | | | 1,496,520 | |

| | | | | | | | | | | | | | | 3,944,520 | |

| Commercial Banks | | | 4.5% | | | | | | | | | | | | |

| Wells Fargo & Co. | | | | | | | | | | 100,000 | | | | 4,269,000 | |

| Diversified Financial Services | | | 3.4% | | | | | | | | | | | | |

| American Express Co. | | | | | | | | | | 40,000 | | | | 3,272,000 | |

| Electrical Equipment | | | 2.8% | | | | | | | | | | | | |

| Emerson Electric Co. | | | | | | | | | | 40,000 | | | | 2,678,800 | |

| Energy Equipment & Services | | | 1.0% | | | | | | | | | | | | |

| Schlumberger Ltd | | | | | | | | | | 10,000 | | | | 937,200 | |

| Food & Staples Retailing | | | 4.0% | | | | | | | | | | | | |

| Wal-Mart Stores, Inc. | | | | | | | | | | 50,000 | | | | 3,837,500 | |

| Food Products | | | 2.7% | | | | | | | | | | | | |

| General Mills, Inc. | | | | | | | | | | 50,000 | | | | 2,521,000 | |

| Health Care Equipment & Supplies | | | 5.5% | | | | | | | | | | | | |

| Becton, Dickinson & Co. | | | | | | | | | | 25,000 | | | | 2,628,250 | |

| Medtronic, Inc. | | | | | | | | | | 45,000 | | | | 2,583,000 | |

| | | | | | | | | | | | | | | 5,211,250 | |

| Hotels, Restaurants & Leisure | | | 4.1% | | | | | | | | | | | | |

| McDonald’s Corp. | | | | | | | | | | 40,000 | | | | 3,860,800 | |

| Household Products | | | 3.4% | | | | | | | | | | | | |

| Procter & Gamble | | | | | | | | | | 40,000 | | | | 3,230,000 | |

| Industrial Conglomerates | | | 8.3% | | | | | | | | | | | | |

| 3M Company | | | | | | | | | | 32,000 | | | | 4,027,200 | |

| General Electric Co. | | | | | | | | | | 150,000 | | | | 3,921,000 | |

| | | | | | | | | | | | | | | 7,948,200 | |

| Insurance | | | 4.5% | | | | | | | | | | | | |

Berkshire Hathaway, Inc. (Class A)(a) | | | | | | | | | | 25 | | | | 4,324,870 | |

| IT Services | | | 5.7% | | | | | | | | | | | | |

| Automatic Data Processing | | | | | | | | | | 25,000 | | | | 1,874,250 | |

| International Business Machines Corp. | | | | | | | | | | 20,000 | | | | 3,584,200 | |

| | | | | | | | | | | | | | | 5,458,450 | |

| Media | | | 4.0% | | | | | | | | | | | | |

| The Walt Disney Company | | | | | | | | | | 55,000 | | | | 3,772,450 | |

| Oil & Gas Consumable Fuels | | | 7.5% | | | | | | | | | | | | |

| Chevron Corp. | | | | | | | | | | 30,000 | | | | 3,598,800 | |

| Exxon Mobil Corp. | | | | | | | | | | 40,000 | | | | 3,584,800 | |

| | | | | | | | | | | | | | | 7,183,600 | |

| |

| See notes to financial statements. |

LARGE CAP EQUITY FUND (concluded)

SCHEDULE OF INVESTMENTS

October 31, 2013

| | | | | | | | | | | | | |

| | | Percentage | | | | | | | | | | |

| | | of Net | | | | | | | | | | |

| | | Assets | | | | | | Shares | | | Value | |

| Pharmaceuticals | | | 6.3% | | | | | | | | | | |

| Abbott Laboratories | | | | | | | | | | 50,000 | | | $ | 1,827,500 | |

| Johnson & Johnson | | | | | | | | | | 45,000 | | | | 4,167,450 | |