| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM N-CSR |

| |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| |

| |

| |

| Investment Company Act File Number: 811-3566 |

|

| |

| T. Rowe Price Growth & Income Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

| |

| |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| |

| |

| Date of fiscal year end: December 31 |

| |

| |

| Date of reporting period: June 30, 2009 |

Item 1: Report to Shareholders| Growth & Income Fund | June 30, 2009 |

The views and opinions in this report were current as of June 30, 2009. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

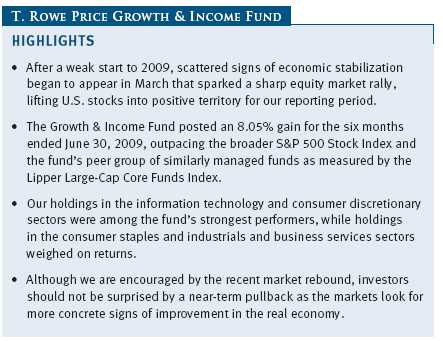

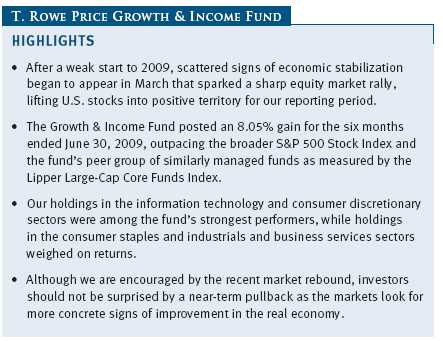

Although the U.S. and global economies remain mired in an economic downturn of historic proportions, scattered signs of stabilization began to appear over the last six months. For U.S. stocks, weakness at the end of 2008 stretched into the first two months of 2009 as the S&P 500 Index lost approximately 25% from the start of the year through early March. Early signs that the economy may have reached a bottom spurred a sharp rally beginning in March, although investor optimism receded and markets gave back some gains in the closing weeks of June as tepid economic data indicated a more subdued, long-term recovery. However, the rally was enough to lift most major indices into positive territory for the reporting period.

The Growth & Income Fund posted an 8.05% gain for the six months ended June 30, 2009, outpacing the broader S&P 500 Stock Index and the fund’s peer group of similarly managed funds as measured by the Lipper Large-Cap Core Funds Index. Fund holdings in the information technology sector provided the largest boost to returns, and our consumer discretionary stocks and energy shares also helped, benefiting from strong overall stock selection relative to the benchmark S&P 500. Our positions in the consumer staples and industrials and business services sectors weighed on returns, despite performing better than stocks in their corresponding S&P 500 sectors.

While the results of the past six months have been encouraging, we understand that they do not completely make up for the losses suffered during the worst of the market downturn in 2008 and early 2009. Rest assured, we will continue to rely on our exhaustive analysis and disciplined approach to identify those companies that are best positioned to provide long-term capital appreciation and sustainable current income for our shareholders.

MARKET ENVIRONMENT

The U.S. economy is currently in one of the deepest and longest downturns since the Great Depression. Gross domestic product has contracted markedly and unemployment exceeded 9% by the end of our reporting period, with further increases likely over the coming months.

Scattered signs of economic stabilization began to emerge in March as credit markets improved, housing price declines began to moderate, and consumer confidence increased. However, economic news throughout June was mixed. On the positive side, the Conference Board’s index of leading economic indicators surged in June for the second straight month, unemployment claims continued to drop, and consumer confidence was stronger than expected early in the month. However, weakness in manufacturing and industrial production began to appear later in the month, and a cautious retail outlook coupled with an unexpected increase in jobless claims took some of the wind out of the recovery argument.

U.S. stocks began our reporting period on a sour note as the weakness of 2008’s historic equity market downturn extended into 2009. However, equities rallied sharply from their March lows, sparked by oversold valuations and early signs that the economy is in the process of bottoming and that government measures to stabilize the financial markets may be starting to bear fruit. With an improving backdrop for the economy and markets, investors regained some measure of confidence and appetite for risk before tepid economic news dampened their optimism in June. Nevertheless, growth stocks significantly outperformed value stocks across all market capitalizations for the period. Additionally, the best-performing S&P 500 sectors were information technology, materials, and consumer discretionary—traditionally seen as the market’s “riskier,” more economically sensitive sectors. At the same time, the traditional market safe havens turned in weaker performance as health care, utilities, and consumer staples were either flat or negative for the period. Viewed as the impetus and epicenter of the recent downturn, financials sector shares lost ground despite an extraordinary rebound over the last three months of the reporting period.

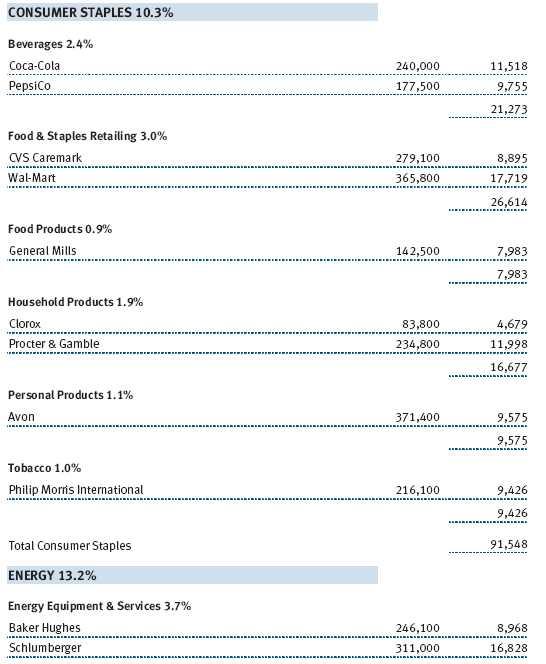

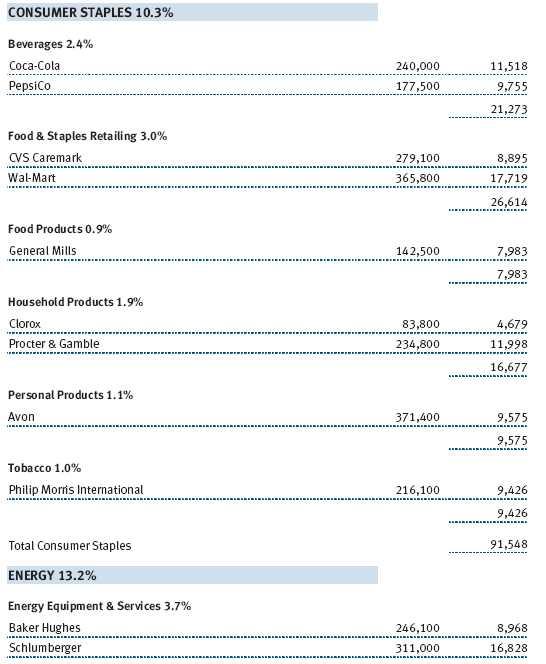

PERFORMANCE REVIEW

Often at the leading edge of market recoveries, the information technology sector posted strong returns for the period in anticipation of increased consumer spending and business capital expenditures. Microsoft shares rallied strongly in April after the company reported earnings that were in line with analyst estimates and affirmed plans to cut costs. With its vast resources, software market dominance, and exceptional business model, we believe Microsoft compares very favorably to the broader market. Our semiconductor holdings also aided results as demand expectations grew. Shares in Texas Instruments, Analog Devices, and Intel boosted returns, and a position in Marvell Technology Group was one of our strongest performers. Selling chips in diverse end markets including hard disk drives, communications infrastructure, and smartphones, Marvell management has cut costs aggressively and maintained attractive gross margins and profitability despite revenue pressures. Shares in electronic equipment supplier Tyco Electronics weighed on returns and we eliminated the position during the period. (Please see the portfolio of investments for a complete listing of holdings and the amount each represents in the portfolio.)

Our exposure to the consumer discretionary sector boosted returns as the pace of the economic downturn slowed and investors focused on expectations for increased consumer spending going forward. Specialty retailer TJX was the largest single contributor to fund performance for the period. Parent company of TJ Maxx and Marshalls, TJX is a good example of the type of company we currently own in the consumer sector: one that provides customers a good product at a good value, preserving its relevance even in tough economic times. Internet retailer Amazon.com was the second-biggest contributor to the fund’s returns. Amazon continues to benefit from one of the best management teams in the business, investing in innovative products and services and taking market share. Amazon’s business model continues to drive significant free cash flow and high returns on invested capital. Gaming equipment manufacturer International Game Technology and casino operator Wynn Resorts weighed on returns as leisure spending collapsed.

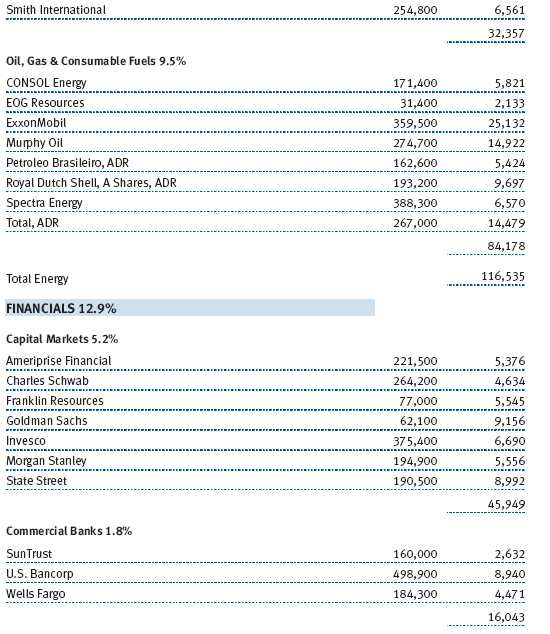

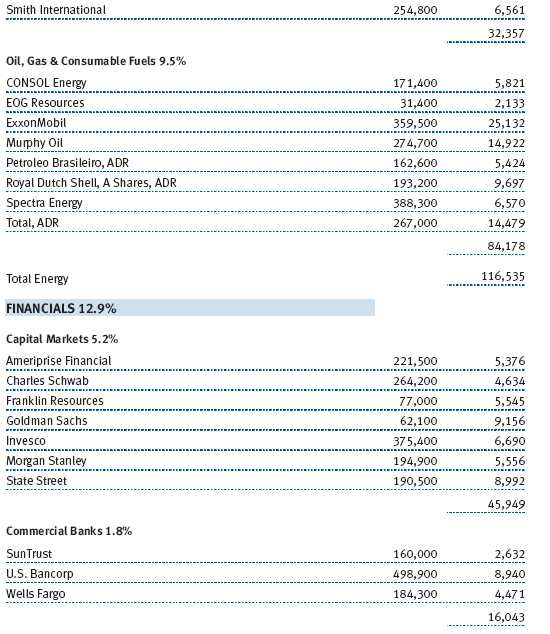

Our energy sector holdings also helped to boost fund returns as early indications of economic stabilization increased future demand expectations and energy prices surged over the second half of the period. Despite the potential for short-term energy price fluctuations, we believe prices should trend significantly higher over time due to increased demand from an improving global economy and as developing markets become increasingly hungry for energy to feed their growing industrial and consumer base. Our position in oil services leader Schlumberger helped returns because the company maintains strong international operations and a solid long-term growth profile. Murphy Oil and Brazilian giant Petroleo Brasileiro (Petrobras) also aided performance. A position in ExxonMobil was one of the largest detractors from fund returns as the company struggled with weak energy prices in the first half of the period and higher costs. However, we still believe it is a solid long-term investment due to its superior global oil field assets and disciplined management.

Fund holdings in the traditionally defensive consumer staples sector weighed on returns as investors focused on more growth-oriented companies. Shares in the world’s biggest retailer, Wal-Mart, fell as investors had concerns about the company’s ability to sustain sales and profit growth once the recession ends and consumers return to buying from higher-price point competitors. Procter & Gamble, the world’s largest consumer staples company, also struggled as revenues, earnings, and profitability weakened in response to slower consumer spending. With its diversified product mix containing some of the world’s most recognizable brands and with a truly global footprint, we believe Procter & Gamble is well positioned for the long term despite near-term challenges.

The fund’s exposure to the industrials and business services sector also weighed on returns, although strong stock selection helped our comparison to the benchmark S&P 500 Index. Industrial conglomerate GE was the single largest detractor from fund returns. The firm suffered early in the period as the economic downturn accelerated and corporate capital expenditures ground to a virtual halt. Its large financial services exposure further exacerbated the share price weakness as the financials sector plummeted, although its diversified income stream should benefit the company going forward. A position in Danaher helped to offset some of the damage from GE in the sector. Danaher is a highly diversified industrial manufacturer whose end markets benefit from strong growth and low cyclicality. The company’s management has also successfully executed acquisitions that have benefited earnings.

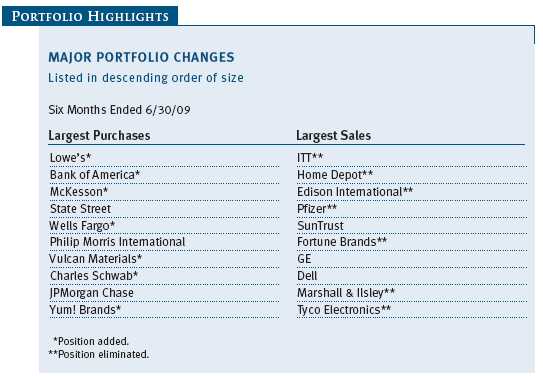

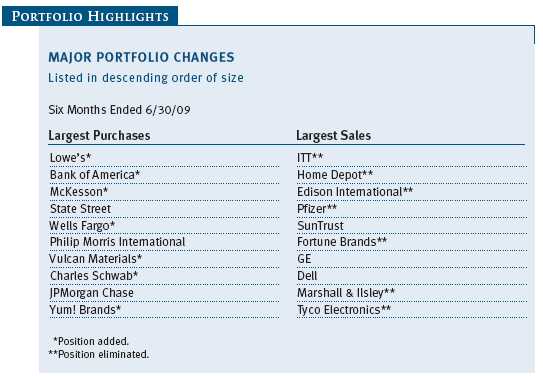

The fund established several new positions over the first half of the year. We purchased shares in Bank of America as a deteriorating credit outlook and concerns regarding its capital sufficiency pushed the valuation to attractive levels. With most purchases, but especially those in the financials sector, we are buying based upon “normalized” earnings (post-recession). In this light, Bank of America looks attractively priced as it is trading at just 4.5 times our 2012 estimate.

We believe the company will be a good performer over the next 12 to 18 months as the market begins to recognize the company’s earnings power. Declines in construction activity and expenses associated with a recent acquisition pressured shares of Vulcan Materials, providing an attractive entry point. As the leading U.S. producer of aggregates used in concrete and asphalt, the company has a solid business model, operates in an industry with very high barriers to entry, and should benefit substantially from increased infrastructure spending. We initiated a position in home improvement retailer Lowe’s. Despite the recent housing troubles, we expect Lowe’s to benefit substantially as the housing market rebounds. Management is aggressively monitoring costs and inventory levels, setting the stage for significant earnings leverage when the environment improves.

ITT is among the positions that we eliminated during the past six months. ITT designs and manufactures industrial and defense products, deriving well over half of the company’s revenues and profits from the defense sector. Despite a leading position in many of its business segments, we believe the company will suffer over the short term as the U.S. gradually reduces its military commitment in Iraq, and we took the opportunity to eliminate our position while prices were still relatively attractive. We also eliminated our position in pharmaceutical maker Pfizer as its pending purchase of Wyeth, another fund holding, increased the combined position size to uncomfortable levels. Beaten down by the broader collapse in the housing sector, we eliminated our position in Home Depot and see better opportunities in its major competitor, Lowe’s (see above), as the economy and housing sector improve.

OUTLOOK

Companies in our portfolio have largely done an admirable job negotiating the current economic downturn. Most have aggressively attacked their cost structure in an effort to offset declining revenue and protect profitability. The good news is that many companies will have significant earnings leverage when the revenue environment improves. However, a smooth ride is anything but certain. Despite the much-hyped “green shoots” of recovery, our economy still faces significant headwinds. Weakness in housing, unemployment, automobiles, and other areas gives cause for concern, as do the long-term implications of the massive government stimulus programs. The question of how we are to pay for the huge deficits looms large, and tax increases are already being proposed. Amid all the questions, one thing is certain: Our nation’s indebtedness will continue to increase, raising the likelihood of a weaker dollar and higher inflation down the road.

We currently favor stocks that stand to benefit the most from a gradual market rebound, and we are selectively adding companies with solid fundamentals and strong competitive positions. In addition, we believe it is prudent to favor companies that have global exposure and are not too reliant on the U.S. for growth. We have become more constructive on financials stocks because we believe the sector is beginning to show signs of stabilization and good value. Already one of our largest exposures, the information technology sector has above-average growth prospects. It seems likely that there is pent-up demand for products as most companies pared their IT budgets substantially over the past year. Despite the difficult short-term outlook for energy prices, we believe prices should trend significantly higher over time based on increased demand from a gradually improving global economy.

Although we are cautiously optimistic that the worst of the global economic and market downturn is behind us, our optimism is tempered with concerns about the depth and sustainability of the current rebound and a belief that markets may have gotten ahead of the recovery. Investors should not be surprised by a near-term pullback as the markets look for more concrete signs of improvement in the real economy. In this uncertain economic environment, we continue to rely on our exhaustive analysis and disciplined approach to identify the best long-term opportunities for our shareholders.

Respectfully submitted,

Thomas J. Huber

President of the fund and chairman of its Investment Advisory Committee

July 21, 2009

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF STOCK INVESTING

As with all stock and bond mutual funds, a fund’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets. Funds investing in stocks with a dividend orientation may have somewhat lower potential for price appreciation than those concentrating on rapidly growing firms. Also, a company may reduce or eliminate its dividend.

GLOSSARY

Beta: A measure of the market risk of a stock showing how responsive it is to a given market index, such as the S&P 500 Stock Index. By definition, the beta of the benchmark index is 1.00. A fund with a 1.10 beta is expected to perform 10% better than the index in up markets and 10% worse in down markets. Usually, higher betas represent riskier investments.

Free cash flow: The excess cash a company generates from its operations that can be taken out of the business for the benefit of shareholders, such as dividends, share repurchases, investments, and acquisitions.

Lipper indexes: Fund benchmarks that consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

Price/book ratio: A valuation measure that compares a stock’s market price with its book value, i.e., the company’s net worth divided by the number of outstanding shares.

Price/earnings (P/E) ratio: A valuation measure calculated by dividing the price of a stock by its current or projected earnings per share. This ratio gives investors an idea of how much they are paying for current or future earnings power.

Risk/reward: The relationship between the degree of risk associated with an investment and its return potential. Typically, the higher the potential return of an investment, the greater the risk.

S&P 500 Stock Index: An unmanaged index that tracks the stocks of 500 primarily large-capitalization U.S. companies.

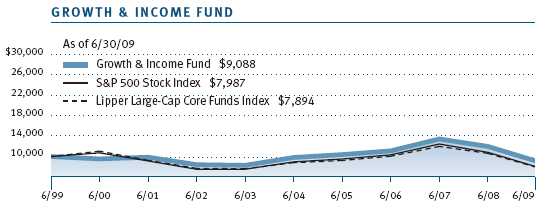

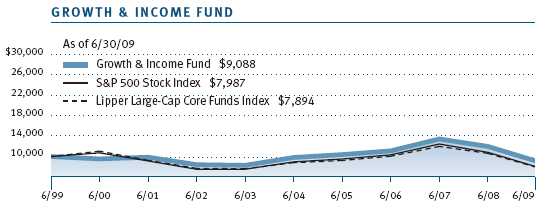

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns had been earned at a constant rate.

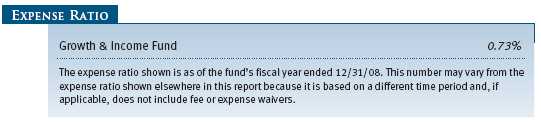

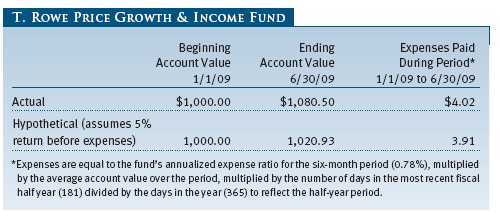

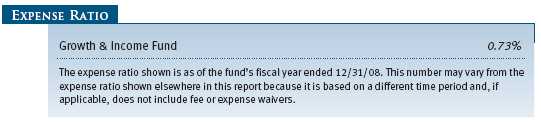

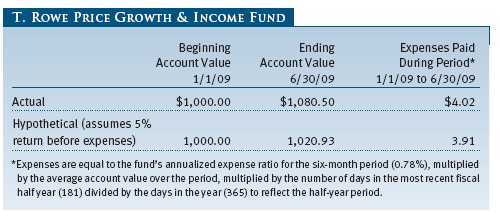

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

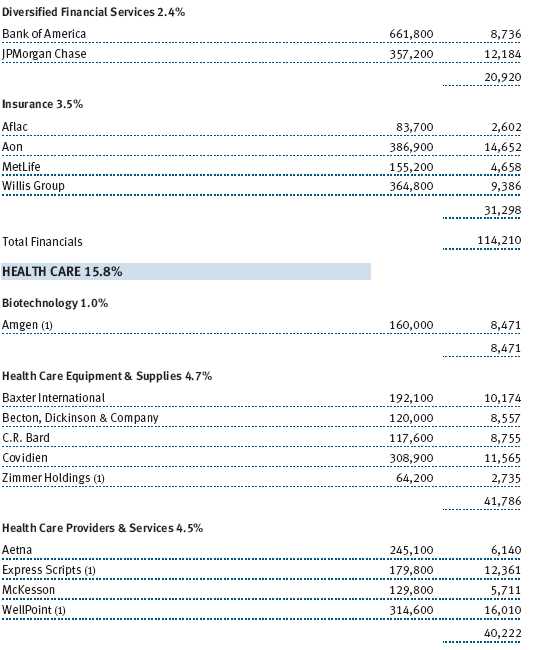

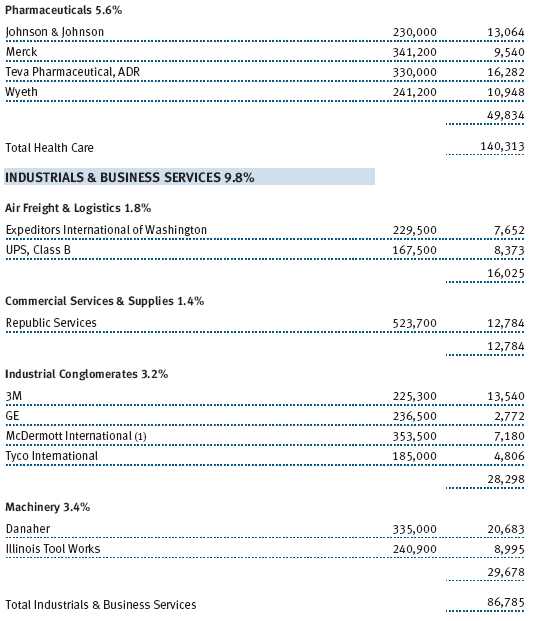

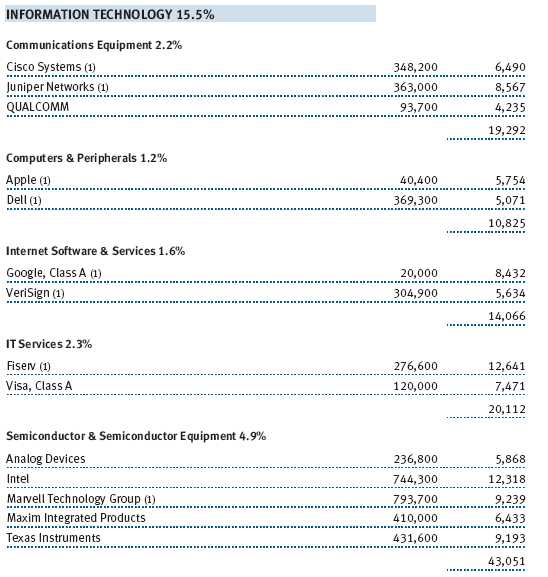

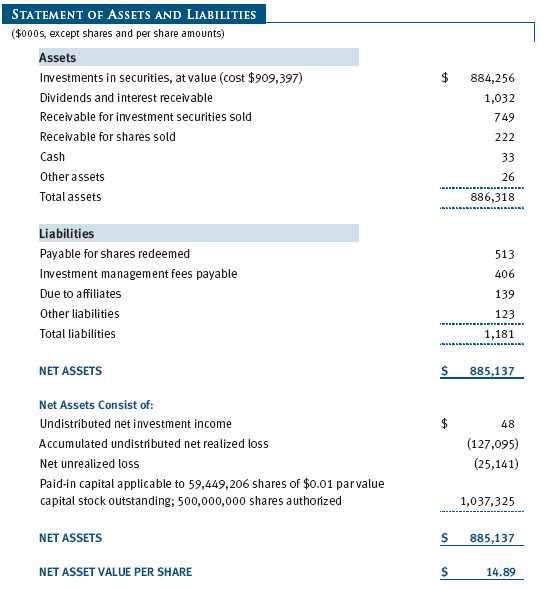

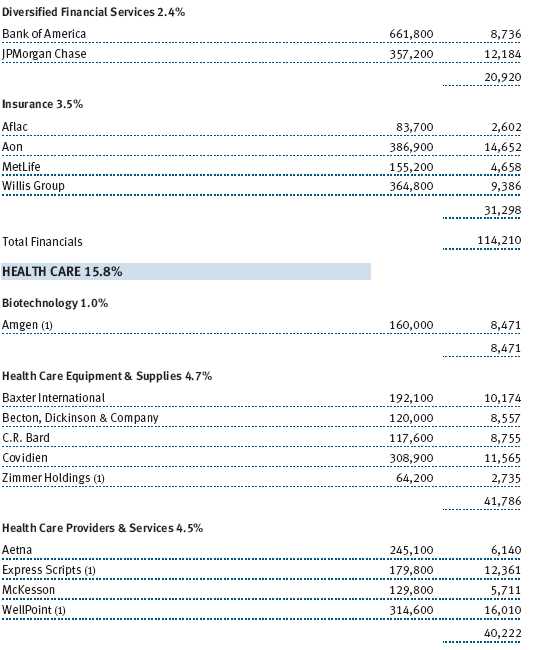

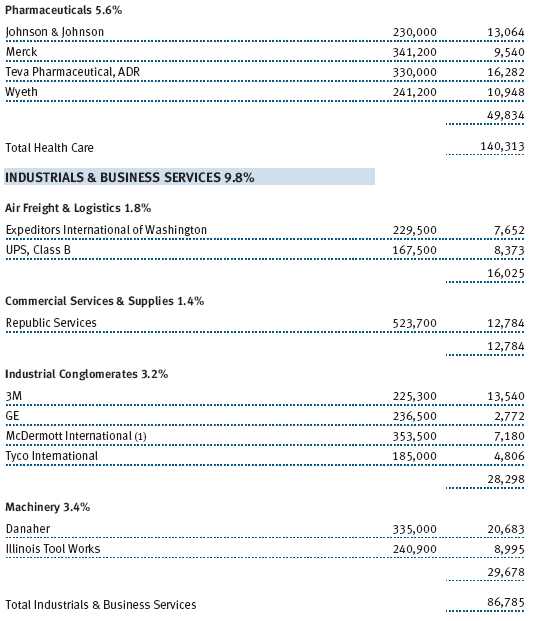

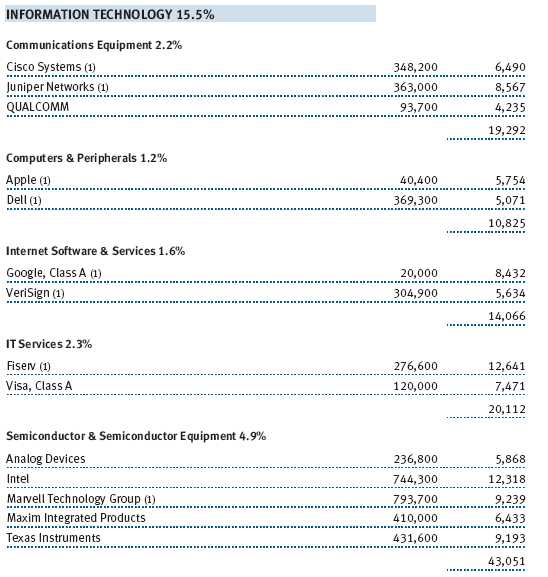

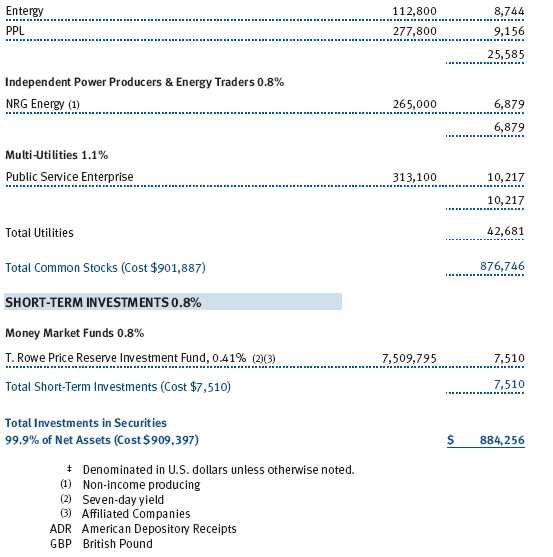

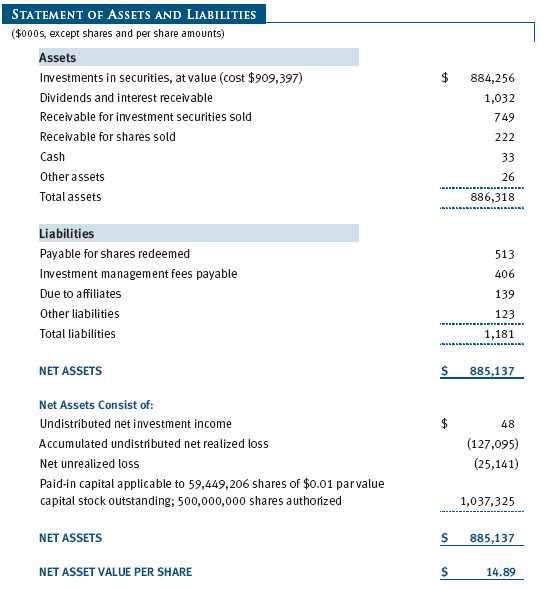

Unaudited

The accompanying notes are an integral part of these financial statements.

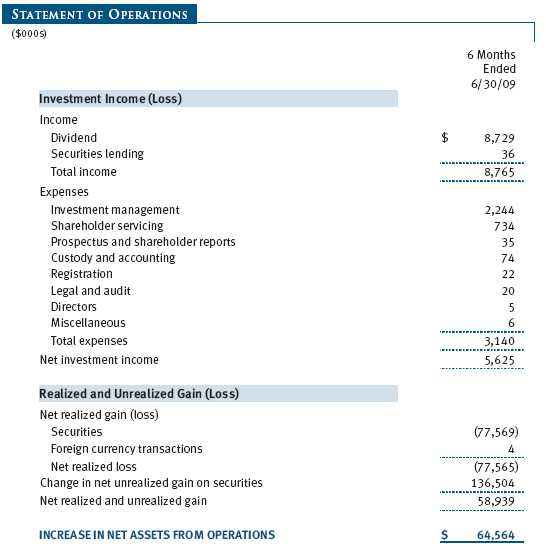

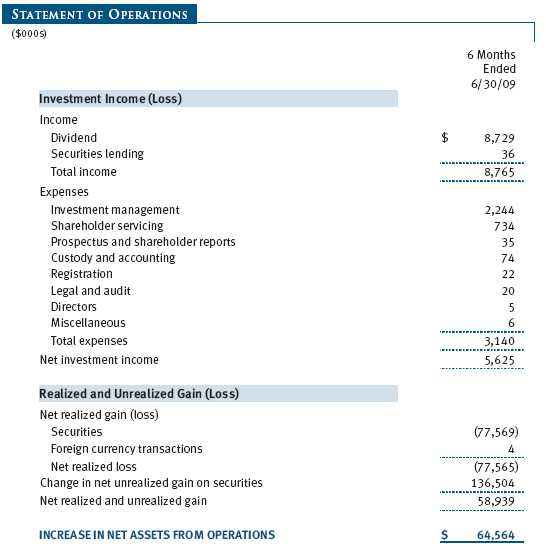

Unaudited

The accompanying notes are an integral part of these financial statements.

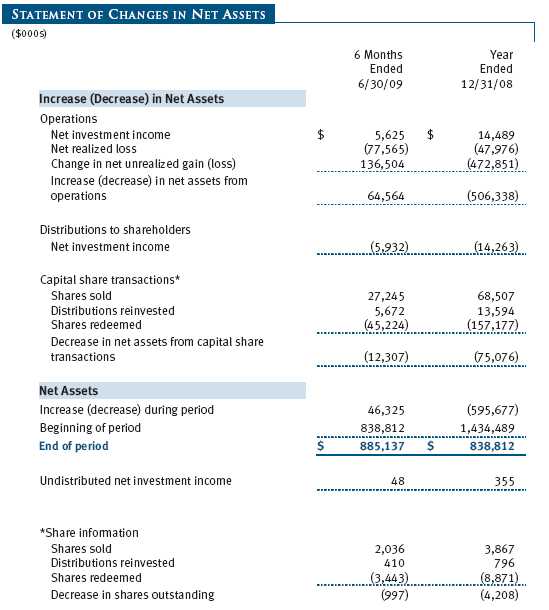

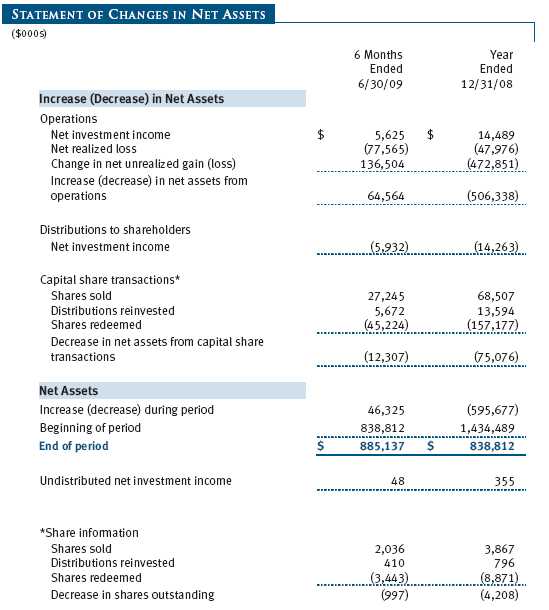

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price Growth & Income Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund commenced operations on December 21, 1982. The fund seeks to provide long-term capital growth, a reasonable level of current income, and increasing future income through investments primarily in dividend-paying common stocks.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund ultimately realizes upon sale of the securities. Further, fund management believes no events have occurred between June 30, 2009 and August 20, 2009, the date of issuance of the financial statements, that require adjustment of, or disclosure in, the accompanying financial statements.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid on a quarterly basis. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Rebates Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $4,000 for the six months ended June 30, 2009.

New Accounting Pronouncement On January 1, 2009, the fund adopted Statement of Financial Accounting Standards No. 161 (FAS 161), Disclosures about Derivative Instruments and Hedging Activities. FAS 161 requires enhanced disclosures about derivative and hedging activities, including how such activities are accounted for and their effect on financial position, performance and cash flows. Adoption of FAS 161 had no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined under Statement of Financial Accounting Standards No. 157 (FAS 157), Fair Value Measurements. The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares closing prices, the next day’s opening prices in the same markets, and adjusted prices.

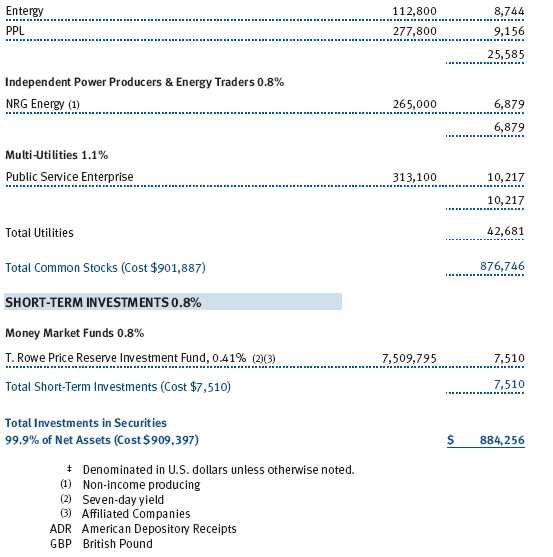

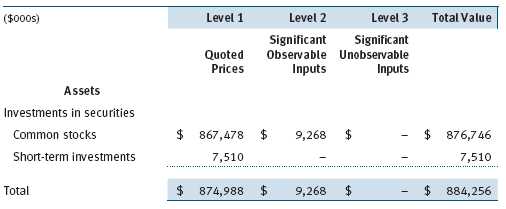

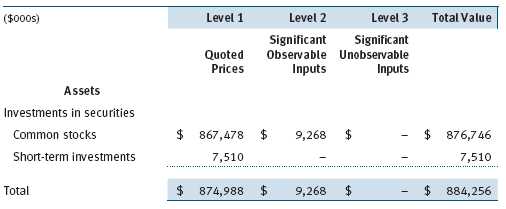

Valuation Inputs Various inputs are used to determine the value of the fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, non-U.S. equity securities actively traded in foreign markets generally are reflected in Level 2 despite the availability of closing prices because the fund evaluates and determines whether those closing prices reflect fair value at the close of the NYSE or require adjustment, as described above. The following table summarizes the fund’s investments, based on the inputs used to determine their values on June 30, 2009:

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Securities Lending The fund lends its securities to approved brokers to earn additional income. It receives as collateral cash and U.S. government securities valued at 102% to 105% of the value of the securities on loan. Cash collateral is invested by the fund’s lending agent(s) in accordance with investment guidelines approved by fund management. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. Securities lending revenue recognized by the fund consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower and compensation to the lending agent. At June 30, 2009, there were no securities on loan.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $86,129,000 and $94,644,000, respectively, for the six months ended June 30, 2009.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions are determined in accordance with Federal income tax regulations, which differ from generally accepted accounting principles, and, therefore, may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of June 30, 2009.

In accordance with federal tax regulations, the fund deferred recognition of certain capital loss amounts previously recognized in the prior fiscal year for financial reporting purposes until the current fiscal period for tax purposes. Such deferrals amounted to $15,588,000 and related to net capital losses realized between November 1 and the fund’s fiscal year-end date. Further, the fund intends to retain realized gains to the extent of available capital loss carryforwards. As of December 31, 2008, the fund had $31,693,000 of unused capital loss carryforwards, all of which expire in fiscal 2016.

At June 30, 2009, the cost of investments for federal income tax purposes was $909,397,000. Net unrealized loss aggregated $25,141,000 at period-end, of which $96,961,000 related to appreciated investments and $122,102,000 related to depreciated investments.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.25% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At June 30, 2009, the effective annual group fee rate was 0.31%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the fund. For the six months ended June 30, 2009, expenses incurred pursuant to these service agreements were $48,000 for Price Associates, $428,000 for T. Rowe Price Services, Inc., and $134,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT |

On March 10, 2009, the fund’s Board of Directors (Board) unanimously approved the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price Associates, Inc. (Manager). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Manager during the course of the year, as discussed below:

Services Provided by the Manager

The Board considered the nature, quality, and extent of the services provided to the fund by the Manager. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Manager’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Manager.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the 1-, 3-, 5-, and 10-year periods as well as the fund’s year-by-year returns and compared these returns with previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the severity of the market turmoil in 2008, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Manager under the Contract and other benefits that the Manager (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements. The Board noted that soft dollars were not used to pay for third-party, non-broker research during 2008. The Board also received information on the estimated costs incurred and profits realized by the Manager and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Manager’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Manager. Under the Contract, the fund pays a fee to the Manager composed of two components—a group fee rate based on the aggregate assets of certain T. Rowe Price mutual funds (including the fund) that declines at certain asset levels and an individual fund fee rate that is assessed on the assets of the fund. The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees

The Board reviewed the fund’s management fee rate, operating expenses, and total expense ratio and compared them with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate was above the median for certain groups of comparable funds, but at or below the median for other groups of comparable funds. The information also indicated that the fund’s expense ratio was generally below the median for comparable funds. The Board also reviewed the fee schedules for comparable privately managed accounts of the Manager and its affiliates. Management informed the Board that the Manager’s responsibilities for privately managed accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Growth & Income Fund, Inc. |

| |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | August 20, 2009 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | August 20, 2009 |

| |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date | August 20, 2009 |