UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended January 3, 2009 |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934 |

| | |

For the transition period from ____________ to ______________

Commission File No. 0-11201

MERRIMAC INDUSTRIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 22-1642321 |

| (State or Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| 41 Fairfield Place, West Caldwell, New Jersey | 07006 |

| (Address of Principal Executive Offices) | (Zip Code) |

(973) 575-1300

(Registrant’s telephone number, including area code)

WEBSITE: www.merrimacind.com

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of Exchange on Which Registered |

| Common Stock | | The American Stock Exchange |

| Common Stock Purchase Rights | | The American Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer and large accelerated filer and smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell Company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of common stock held by non-affiliates of the registrant as of June 28, 2008, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $10,121,690.

As of March 25, 2009, 2,952,324 shares of common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant’s Proxy Statement for its 2009 Annual Meeting of stockholders is hereby incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

| 4 |

| | ITEM 1. | BUSINESS | 4 |

| | ITEM 1A. | RISK FACTORS | 11 |

| | ITEM 1B. | UNRESOLVED STAFF COMMENTS. | 16 |

| | ITEM 2. | PROPERTIES. | 16 |

| | ITEM 3. | LEGAL PROCEEDINGS. | 16 |

| | ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. | 17 |

| | |

| PART II | 18 |

| | ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. | 18 |

| | ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. | 19 |

| | ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 33 |

| | ITEM 9 . | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. | 68 |

| | ITEM 9A(T). | CONTROLS AND PROCEDURES. | 68 |

| | ITEM 9A . | OTHER INFORMATION. | 69 |

| | ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. | 70 |

| | ITEM 11. | EXECUTIVE COMPENSATION. | 71 |

| | ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. | 71 |

| | | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE. | 71 |

| | ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. | 71 |

| | ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES. | 71 |

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 29, 2007

EXPLANATORY NOTE

In this Form 10-K, we are restating our consolidated balance sheet as of December 29, 2007, and the related consolidated statements of operations and comprehensive income (loss), stockholders’ equity and cash flows for the year ended December 29, 2007, including the applicable notes. We have also included in this report, restated unaudited condensed consolidated financial information for each of the four quarters of 2007 and each of the first three quarters of 2008.

We do not plan to file an amendment to our Annual Report on Form 10-K for the year ended December 29, 2007, nor do we plan to file amendments to our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, June 30 and September 29, 2007 and March 29, June 28 and September 27, 2008. Thus, you should not rely on any of the previously filed annual or quarterly reports relating to the foregoing periods. They are superseded by this report.

For more detailed information about the restatement, please see Notes 2 and 16, “Restatement of Consolidated Financial Statements” and “Restatement of Unaudited Quarterly Financial Statements”, respectively, in the accompanying consolidated financial statements.

In addition, management has determined that we had material weaknesses in our internal control over financial reporting as of January 3, 2009 and December 29, 2007. As described in more detail in Item 9A(T) of this Annual Report, we have identified the causes of these material weaknesses and are implementing measures designed to remedy them.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains statements relating to future results of the Company (including certain projections and business trends) that are "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected as a result of certain risks and uncertainties. These risks and uncertainties include, but are not limited to: risks associated with demand for and market acceptance of existing and newly developed products as to which the Company has made significant investments, particularly its Multi-Mix® products; risks associated with adequate capacity to obtain raw materials and reduced control over delivery schedules and costs due to reliance on sole source or limited suppliers; slower than anticipated penetration into the satellite communications, defense and wireless markets; failure of our Original Equipment Manufacturer or OEM customers to successfully incorporate our products into their systems; changes in product mix resulting in unexpected engineering and research and development costs; delays and increased costs in product development, engineering and production; reliance on a small number of significant customers; the emergence of new or stronger competitors as a result of consolidation movements in the market; the timing and market acceptance of our or our OEM customers' new or enhanced products; general economic and industry conditions; the ability to protect proprietary information and technology; competitive products and pricing pressures; our ability and the ability of our OEM customers to keep pace with the rapid technological changes and short product life cycles in our industry and gain market acceptance for new products and technologies; risks relating to governmental regulatory actions in communications and defense programs; and inventory risks due to technological innovation and product obsolescence, as well as other risks and uncertainties as are detailed from time to time in the Company's Securities and Exchange Commission filings. The words “believe,” “expect,” “plan,” “anticipate,” and “intend” and similar expressions identify forward-looking statements. These forward looking statements are made only as of the date of the filing of this Annual Report on Form 10-K, readers are cautioned not to place undue reliance on these forward-looking statements and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

GENERAL

Merrimac is a leader in the design and manufacture of active and passive Radio Frequency (RF) and microwave components and integrated multifunction assemblies for military, high-reliability and commercial markets. Our components and integrated assemblies are found in applications as diverse as satellites, military and commercial aircraft, radar, radio systems, medical diagnostic instruments, communications systems and wireless connectivity.

We are a versatile technologically oriented company specializing in radio frequency Multi-Mix®, stripline, microstrip and discreet element technologies. Of special significance has been the combination of two or more of these technologies into single components and integrated multifunction subassemblies to achieve superior performance and reliability while minimizing package size and weight. We maintain ISO 9001:2000 and AS 9100 registered quality assurance programs.

We were originally incorporated as Merrimac Research and Development, a New York corporation, in 1954. In 1994 we were reincorporated as a New Jersey corporation and subsequently reincorporated as a Delaware corporation in 2001.

ELECTRONIC COMPONENTS AND SUBSYSTEMS PRODUCTS

We manufacture and sell approximately 1,500 components and subsystems used in signal processing systems in the frequency spectrum of DC to 65 GHz. Our products are designed to process RF and Microwave signals and are of relatively small size and light weight. When integrated into subsystems, advantages of lower cost and smaller size are realized due to the reduced number of connectors, cases and headers. Our components range in price from $0.50 to more than $10,000 and its subsystems range from $500 to more than $1,500,000.

We have traditionally developed and offered for sale products built to specific customer needs, as well as standard catalog items. The following table provides a breakdown of electronic components sales as derived from initial design orders for products custom designed for specific customer applications, repeat design orders for such products and from catalog sales:

| | | 2008 | | | 2007 | |

| Initial design orders | | | 36 | % | | | 24 | % |

| Repeat design orders | | | 52 | % | | | 62 | % |

| Catalog sale orders | | | 12 | % | | | 14 | % |

We maintain a current product catalog on our internet website at www.merrimacind.com. Our catalog includes over 1,500 standard, passive, signal processing components. These components often form the platform-basis for customization of designs in which the size, package, finish, electrical parameters, environmental performance, reliability and other features are tailored for a specific customer application.

Our strategy is to be a reliable supplier of high quality, technically innovative signal processing products. We coordinate our marketing, research and development, and manufacturing operations to develop new products and expand our existing markets. Our marketing and development activities focus on identifying and producing prototypes for new military and commercial programs and applications in aerospace, navigational systems, telecommunications and cellular analog and digital wireless telecommunications electronics. Our research and development efforts are targeted towards providing customers with more complex, reliable, and compact products at lower costs.

Our product development is focused on the military and space market segments. While we will opportunistically monitor and be alert to commercial opportunities for Multi-Mix®, where the customer is willing to partner with us for our design work, we will limit the speculative funding of this commercial segment. The self-funded investment that we have previously made has created a library of pre-engineered designs, especially in RF Module Amplifiers, which provide platform families for both commercial and military final customization.

The major aerospace companies purchase components and subsystems from us. Our design engineers work to develop solutions to customer requirements that are unique or require special performance. We are committed to continuously enhancing our leading position in high-performance electronic signal processing components and integrated assemblies for communications, defense/aerospace, and Homeland Security/ Global Security and Public Safety applications.

In 1998, we introduced Multi-Mix® Microtechnology capabilities, an innovative process for microwave, multilayer integrated circuits and micro-multifunction module (MMFM®) technology and subsystems. This process is based on fluoropolymer composite substrates, which are bonded together into a multilayer structure using a fusion bonding process. The fusion bonding process provides a homogeneous dielectric medium for superior electrical performance at microwave frequencies. This 3-dimensional Multi-Mix® design consisting of stacked circuit layers permits the manufacture of components and subsystems that are a fraction of the size and weight of conventional microstrip and stripline products.

We have developed a strong library of intellectual property in the form of patents, design elements and expertise centered around our proprietary Multi-Mix® technology. With 16 active US Patents as well as several international patents, we can offer unique RF integration solutions to customers that cannot be easily realized in other technologies. Our ten years of experience and development has created a set of design rules and techniques that enable complex circuits to be reliably and quickly realized in small, rugged, and light weight assemblies. This unique technology allows our customer’s designers to reduce the size, weight and number of components in their end product or system.

In 2001, we introduced our Multi-Mix PICO® Microtechnology. Through Multi-Mix PICO® technology, we offer a group of products at a greatly reduced size, weight and cost that includes hybrid junctions, directional couplers, quadrature hybrids, power dividers and inline couplers, filters and vector modulators along with 802.11a, 802.l1b, and 802.11g Wireless Local Area Network (WLAN) modules. When compared to conventional multilayer quadrature hybrids and directional coupler products, Multi-Mix PICO® is more than 84% smaller in size, without the loss of power or performance.

In 2004, we introduced our Multi-Mix Zapper® product line. The Multi-Mix Zapper® products address the demands of the wireless and other cost-sensitive markets for high quality products manufactured in volume with continued improvements in performance, with dramatic reductions in size and weight at extremely competitive cost. In addition to wireless base station communications, Multi-Mix Zapper® are being used in or evaluated for airborne electronic countermeasures, radar systems, smart antennas, satellite communications receiver modules, missiles, as well as other commercial, military and space applications.

We believe that customers prefer our value-added Multi-Mix® approach over traditional solutions because it enables them to minimize considerable costs of design, test and measurement, packaging, and manufacturing, as well as the unpredictable follow-on costs typically associated with factory tuning and optimization. Multi-Mix® products provide our customers with integrated solutions that simplify their internal design and manufacturing processes while reducing the time and costs it takes to implement manufacturable and repeatable products.

Our Multi-Mix® technology also enables our customers to outsource certain design and manufacturing functions, which in turn allows them to maintain focus on their own core business competencies.

We support many commercial and military customers, projects, and programs with our array of traditional high-frequency technologies, including lumped-element and stripline approaches. Our continuing evolution of Multi-Mix® Microtechnology makes it possible to actively participate in next-generation commercial and military designs. At least one leading military satellite communications customer has indicated that Multi-Mix® Microtechnology is now their technology of choice for higher levels of RF integration. This customer was able to realize a 30-to-50-percent reduction in the size of their satellite receivers compared to their existing conventional technology.

Our major electronic components and subsystems product categories are:

| · | power dividers/combiners that equally divide input signals or combine coherent signals for nearly lossless power combinations; |

| · | I&Q networks (a subassembly of circuits which allows two information signals (incident and quadrature) to be carried on a single radio signal for use in digital communication and navigational positioning); |

| · | directional couplers that allow for signal sampling along transmission lines; |

| · | phase shifters that accurately and repeatedly alter a signal's phase transmission to achieve desired signal processing or demodulation; |

| · | hybrid junctions that serve to split input signals into two output signals with 0 degree phase difference or 180 degrees out of phase with respect to each other; |

| · | balanced mixers that convert input frequencies to another frequency; variable attenuators that serve to control or reduce power flow without distortion; |

| · | beamformers that permit an antenna to electronically track signals when receiving and electronically adjust radiation patterns when transmitting; |

| · | quadrature couplers that serve to split input signals into two output signals 90 degrees out of phase with respect to each other or combine equal amplitude quadrature signals; and |

| · | integration of active circuitry |

These components and integrated assemblies can be utilized in a variety of applications including satellite communications, radar, digital communication systems, global positioning and navigation systems, electronic warfare, electronic countermeasures, commercial communications and radars.

Our other product categories include single-side-band (SSB) modulators, image reject mixers, vector modulators, high power RF Module Amplifiers and a wide variety of specialized integrated Micro-Multifunction Modules (MMFM®) assemblies. In the last fiscal year, no one product accounted for more than ten percent of total net sales.

In 2008, we focused our design efforts on Multi-Mix® multilayer subsystem products for several satcom and military customers. We achieved record bookings of $32.2 million, which represents a 13% increase over the previous year. As a result, our year-end backlog also was a record of $21.0 million. In 2008 and 2007, there were two main areas of growth. We received an increased number of orders for components used in satellite systems, both commercial and military, adding to our market share and recognition in the industry as being a leading supplier of space qualified passive microwave components. Our other area for growth was in custom Multi-Mix® integrated assemblies in support of military radar systems. Multi-Mix® is an enabling technology for next generation radars and EW systems, allowing such systems to be more integrated and lighter than their predecessors. We are participating in several new development projects for key OEMs.

Over 50% of our sales in 2008 were derived from the sales of products for use in high reliability aerospace, satellite, and missile applications. These products are designed to withstand severe environments without failure or maintenance over prolonged periods of time (from 5 to 20 years). We provide facilities dedicated to the design, development, manufacture, and testing of these products along with dedicated program management and documentation personnel.

Our products are used in a broad range of other defense and commercial applications, including radar, navigation, missiles, satellites, electronic warfare and countermeasures, cellular analog and digital wireless telecommunications electronics and communications equipment. Our products are also utilized in systems to receive and distribute television signals from satellites and through other microwave networks including cellular radio.

DISCONTINUED OPERATIONS -FILTRAN MICROCIRCUITS INC.

GENERAL

Filtran Microcircuits Inc. (“FMI”) was established in 1983, and was acquired by us in February 1999. FMI is a manufacturer of microwave micro-circuitry for the high frequency communications industry. FMI has been engaged in the production of microstrip, bonded stripline, and thick metal-backed Teflon® (PTFE) microcircuits for RF applications including satellite, aerospace, PCS, fiber optic telecommunications, automotive, navigational and defense applications worldwide. FMI has supplied mixed dielectric multilayer and high speed interconnect circuitry to meet customer demand for high performance and cost-effective packaging.

In 2007 our management determined, and the Board of Directors approved on August 9, 2007, that the Company should divest its FMI operations with the view to enable us to concentrate our resources on RF Microwave and Multi-Mix® Microtechnology product lines to generate sustainable, profitable growth. Beginning with the third quarter of 2007, we reflected FMI as a discontinued operation and we reclassified prior financial statements to reflect the results of operations, financial position and cash flows of FMI as discontinued operations.

On December 28, 2007, we sold substantially all of the assets of FMI to Firan Technology Group Corporation ("FTG"), a manufacturer of high technology/high reliability printed circuit boards that has operations in Toronto, Ontario, Canada and Chatsworth, California. The transaction was effected pursuant to an asset purchase agreement entered into between Merrimac, FMI and FTG. The total consideration payable by FTG was $1,482,000 (Canadian $1,450,000) plus the assumption of certain liabilities of approximately $368,000 (Canadian $360,000). FTG paid $818,000 (Canadian $800,000) of the purchase price at the closing on December 28, 2007 and the balance was paid on February 21, 2008 following the conclusion of a transitional period.

STRATEGIC OVERVIEW

We seek to leverage our core competencies in High Reliability Design and Services, development of High Power, High Frequency and High Performance products across our main platforms for growth: Our strategy focuses on:

| · | Providing unique and cutting-edge customized technology solutions; |

| · | Expanding existing customer relationships and attracting new customers with our smaller, more complex, more reliable, lower cost product offerings; |

| · | Meeting the advanced needs of our defense, satellite and commercial customers with innovative specialty applications and products; and |

| · | Improving and integrating our internal development, engineering and production capacities to reduce costs and improve service. |

To do this, we coordinate our marketing, research and development, and manufacturing operations to develop new products and expand our markets.

Our marketing and development activities focus on identifying new design opportunities for new long term military and commercial production programs and applications in aerospace, navigational systems, telecommunications and telecommunications electronics. Our research and development efforts are targeted towards providing customers with more complex, reliable, and compact products at lower costs.

We intend to continue to focus on customer service, technology innovation and process excellence to further expand our penetration into the defense, satellite communications and wireless markets. Essential components of our strategy include the following:

Products.

Our platforms for growth are RF Microwave, Multi-Mix® and High Volume Operations in Costa Rica focus on providing unique solutions and delivering profitable value to our key customers. High Power, High Frequency and High Performance are embedded competencies that drive customer value and enable us to consistently meet and exceed the demanding needs and expectations of our customers.

| · | High Power: Our thermal management design and processes enable our products to achieve power levels greater than 500 watts. Our process enables the use of low loss dielectrics and metals, so that power dissipation is minimized (i.e. less heat is generated). In addition, thick metal layers and thermal vias are utilized to draw out, spread, and sink away heat generated in the circuits and modules. Further, since thick metal layers are directly bonded to dielectric layers using a high temperature process, the resulting module is robust, and able to withstand subsequent environmental processing temperatures without being adversely affected. |

| · | High Frequency: Our products operate efficiently across high frequency bands up to 65 GHz, an ever-growing marketplace requirement. The efficient performance of circuits and modules at millimeter wave frequencies is enabled by our ability to miniaturize the printed circuit elements and integrate them with semiconductor microcircuits (MMICs). Our process allows the fabrication of a homogeneous circuit medium with accurate circuit feature producibility. |

| · | High Performance: Our focus on technology innovation and process excellence delivers solutions that perform without failure in all mission-critical environments and under extremely demanding conditions. |

Pursue Technology Innovations.

We intend to use our technological expertise and leadership in the defense, satellite and commercial markets to extend our competitive advantage. We intend to continue to invest in research and development in the Multi Mix® process and with customer funded investment, will focus our efforts on new product development for specific customer applications. We will continue to build upon our relationships with key original equipment manufacturers in order to develop and provide state-of-the-art products and services.

Our research and development activities include the development of new additional designs for the Multi Mix® process capabilities in both our West Caldwell and Costa Rica manufacturing facilities. Through process development we intend to enhance our competitive position by being able to provide sophisticated, customer specific integrated designs that facilitate customers to take advantage of the benefits of our Multi Mix ® technology. We intend to continue to expand our use of computer-aided design and manufacturing (CAD/CAM) in order to reduce design and manufacturing costs as well as development time. We believe that sharing interactive data bases with our customers facilitates real time review and discussion of design concepts.

Customer Intimacy Creates Increased Customer Share.

Our largest customers include BAE Systems, The Boeing Company, EADS Astrium, General Dynamics Corporation, ITT, Lockheed Martin Corporation, L-3 Communications Corporation, Northrop Grumman Corporation, Raytheon Company, Mitsubishi Electronics and Space Systems Loral. All are major industrial corporations that integrate our products into a wide variety of defense and commercial systems.

Our customers desire smaller, lighter, more cost-effective, and highly integrated components, systems, and subsystems for future applications. Our design engineers work to develop solutions to customer requirements that are unique or require special performance. We are committed to continuously enhancing our leading position in high-performance electronic signal processing components for communications, defense and satellite applications, thereby attracting new customers and increasing the reliance of current customers on our expertise.

For most customers, we must be a "qualified" supplier, continually demonstrating our ability to meet their demanding design and manufacturing standards. For defense contractors, we are a mission-critical supplier. For Aerospace companies, our products meet the high reliability standards of space. In these markets, to be a qualified supplier, we must have the technology, and, process excellence to support custom applications in design, manufacturing, testing and custom services.

Process Excellence.

Improved production efficiencies coupled with the expanding capabilities of our low-cost manufacturing facility in Costa Rica and more extensive investment in automated test equipment and modeling software have resulted in a considerable increase in production capacity. Additionally, our investment in a new ERP system has enhanced our competitive position. We are continuing to invest in manufacturing capital equipment in both facilities to provide greater capacity and flexibility and to reduce operating costs.

Defense and Satellite Communications.

In the defense and satellite communications markets, our components are found in a diverse array of applications ranging from national missile defense systems to fighter jets, electronic warfare, shipboard radar communications and other mission-critical applications. Almost all satellites in orbit today utilize our technology.

For our prime contractor customers in defense and satellite communications, we deliver highly customized solutions that are designed for specific applications under very specific design criteria and rigid requirements. Today defense and satellite communications customers seek components and subsystems that meet higher integration and performance standards in smaller, lighter and less costly to produce integrated modules. These products must have exceptional shielding properties and must be able to function without failure in severe environments with wide temperature changes and high levels of shock and vibration.

The cost rates utilized for cost-reimbursement contracts are subject to review by third parties and can be revised, which can result in additions to or reductions from revenue. Revisions which result in reductions to revenue are recognized in the period that the rates are reviewed and finalized; additions to revenue are recognized in the period that the rates are reviewed, finalized, accepted by the customer, and collectability from the customer is assured. We submit financial information regarding the cost rates on cost-reimbursement contracts for each fiscal year in which we performed work on cost-reimbursement contracts. We do not record any estimates on a regular basis for potential revenue adjustments, as there currently is no reasonable basis on which to estimate such adjustments given our very limited experience with these contracts. Currently we do not have any cost-reimbursement contracts on the books. All contracts are firm, fixed price contractual agreements.

MARKETING

We market our products in the United States directly to customers through a sales and marketing staff comprised of eleven employees and four independent domestic sales organizations. We also rely on eighteen independent sales organizations to market our products elsewhere in the world. Our marketing program focuses on identifying new programs and applications for which we can develop prototypes leading to volume production orders.

Key Customers.

The following table presents our key customers and the percentage of net sales made to such customers:

| | | 2008 | | | 2007 | |

| Raytheon Company | | | 16.7 | % | | | 16.6 | % |

| Northrop Grumman Corporation | | | 14.6 | % | | | 7.0 | % |

| The Boeing Company | | | 14.2 | % | | | 6.7 | % |

| Lockheed Martin Corporation | | | 13.2 | % | | | 11.3 | % |

| ITT Corporation | | | 3.6 | % | | | 6.5 | % |

Merrimac has internet addresses (www.merrimacind.com or www.multi-mix.com). Merrimac's product catalog is available on its websites.

EXPORT CONTROLS

Our foreign sales are predominately subject to the Export Administration Regulations ("EAR") administered by the U.S. Department of Commerce and may, in certain instances, be subject to the International Traffic in Arms Regulations ("ITAR'') administered by the U.S. Department of State. EAR restricts the export of dual-use products and technical data to certain countries, while ITAR restricts the export of defense products, technical data and defense services. We believe that we have implemented internal export procedures and controls in order to achieve compliance with the applicable U.S. export control regulations.

RESEARCH AND DEVELOPMENT

During 2008, and 2007 research and development expenditures amounted to approximately $1,019,000 and $1,579,000, respectively. Substantially all of the research and development funds in fiscal 2008 were expended for new Multi-Mix® Microtechnology products. We expect to reduce our research and development fund in fiscal 2009, and will focus our efforts on Multi-Mix® process enhancements for specific customer applications requiring integration of circuitry and further miniaturization, precision and volume applications. We continue to invest in our use of computer aided design and manufacturing (CAD/CAM) in order to reduce design and manufacturing costs as well as development time.

ENVIRONMENTAL REGULATION

We have established internal environmental controls and procedures in both our Costa Rica and New Jersey facilities. We hire independent, environmental experts to perform scheduled audits to evaluate the procedures against regulations and good business practices. When opportunities for improvement are identified, corrective action plans are implemented.

Federal, state and local requirements relating to the discharge of substances into the environment, the disposal of hazardous waste and other activities affecting the environment have had and will continue to have an impact on our manufacturing operations. Thus far, compliance with current environmental requirements has been accomplished without material effect on our liquidity and capital resources, competitive position or financial statements, and we believe that such compliance will not have a material adverse effect on Merrimac's liquidity and capital resources, competitive position or financial statements in the future. We cannot assess the possible effect of compliance with future requirements.

BACKLOG

We manufacture specialized components and subsystems pursuant to firm orders from customers and standard components for inventory. As of January 3, 2009, we had a backlog of orders of approximately $21.0 million. We estimate that approximately 90% of the orders in our backlog as of January 3, 2009 will be shipped within one year. We do not consider our business to be seasonal.

The backlog of unfilled orders includes amounts based on signed contracts as well as agreed letters of intent, which we have determined are legally binding and likely to proceed. Although backlog represents only business that is considered likely to be performed, cancellations or scope adjustments may and do occur. The elapsed time from the award of a contract to completion of performance may be up to approximately four years. The dollar amount of backlog is not necessarily indicative of our future earnings related to the performance of such work due to factors outside our control, such as changes in project schedules, scope adjustment or project cancellations. We cannot predict with certainty the portion of backlog to be performed in a given year. Backlog is adjusted quarterly to reflect project cancellations, deferrals, revised project scope and cost, and sales of subsidiaries, if any.

COMPETITION

We encounter competition in all aspects of its business. We compete both domestically and internationally in the military and commercial markets. Our competitors consist of entities of all sizes. Occasionally, smaller companies offer lower prices due to lower overhead expenses, and generally, larger companies have greater financial and operating resources than us, in addition to well-recognized brand names. We compete on the basis of technological performance, quality, reliability and dependability in meeting shipping schedules as well as on the basis of price. We believe that our performance with respect to the above factors have served it well in earning the respect and loyalty of many customers in the industry. These factors have enabled us over the years to successfully maintain a sound customer base and have directly contributed to our ability to attract new customers and a larger share of existing customers.

MANUFACTURING, ASSEMBLY AND SOURCE OF SUPPLY

Our manufacturing operations consist principally of design, assembly and testing of components and subsystems built from purchased electronic materials and components, fabricated parts, and printed circuits. Manual and semiautomatic methods are utilized depending principally upon production volumes. We have our own machine shop employing CAD/CAM techniques and etching facilities to handle soft and hard substrate materials. In addition, we maintain testing and inspection procedures intended to monitor production controls and enhance product reliability.

We began manufacturing in Costa Rica in the second half of 1996. In February 2001, we entered into a five-year lease in Costa Rica for a 36,200 square-foot facility for manufacturing Multi-Mix® Microtechnology products. The lease was renewed for an additional five years in 2006. The leasehold improvements and capital equipment for this manufacturing facility were completed at a cost of approximately $5,600,000 and this facility was opened for production in August 2002.

We have developed and implemented a quality system to satisfy the needs of our customers and provide adequate assurance that our products will meet or exceed specified requirements. We continue to establish and refine procedures and supporting documentation to enable the fast transition from prototype engineering to operational manufacturing of products.

In October 2002, our Multi-Mix® operations in West Caldwell, New Jersey achieved certification to ISO 9001:2000. In December 2002, our Multi-Mix® facility in Costa Rica achieved certification to ISO 9001:2000. In August 2003, our quality system was revised to incorporate the Costa Rica facility with the West Caldwell facility. During 2003, FM Approvals performed required audits and issued certificates of Registration to ISO 9001:2000 covering both facilities. In June 2004, the West Caldwell facility was surveyed for compliance to the Aerospace standard AS9100. In December 2004, RW TUV (now TUV USA) issued a certificate of registration to the West Caldwell facility for ISO 9001:2000 and AS9100. FM Approvals in Costa Rica and TUV USA in West Caldwell have maintained these registrations via periodic audits through March 2006. In October 2006, the Costa Rica facility successfully completed RW USA's audit for AS9100 and ISO 9001:2000. In January 2007 the West Caldwell facility successfully completed RW USA's audit for AS9100 and ISO 9001:2000. In October/November 2007, both of our West Caldwell and Costa Rica facilities were audited for re-certification to ISO 9001:2000 and AS9100. The recertification was completed in December 2007 and will remain in effect until December 2010, pending successful completion of the required periodic third party audits.

Electronic components and raw materials used in our products are generally available from a sufficient number of qualified suppliers. Some materials are standard items. Subcontractors manufacture certain materials to our specifications. We are dependent on single suppliers for certain of its components or materials.

EMPLOYEE RELATIONS

As of January 3, 2009, we employed approximately 207 full time employees, including 90 employees at our Costa Rica facility. None of our employees are represented by a labor organization. We believe that relations with our employees are satisfactory.

PATENTS

As of April 2, 2009, we own 16 active patents with respect to certain inventions we developed and have received a Notice of Allowance from the U.S. Patent and Trademark Office for a new patent that is expected to be issued shortly. No assurance can be given that the protection that we have acquired through patents is sufficient to deter others, legally or otherwise, from developing or marketing competitive products. There can be no assurance that any of the patents will be found valid, if validity is challenged. Although we have from time to time filed patent applications in connection with the inventions which it believes are patentable, there can be no assurance that these applications will receive patents.

You should carefully consider the matters described below before making an investment decision.

Our business, results of operations or cashflows maybe adversely affected if any of the following risks actually occur. In such case, the trading price of our common stock could decline, and you may lose part or all of your investment.

The market for our products, in particular our Multi-Mix® products, is rapidly evolving. If we are not able to continually enhance our Multi-Mix® process capabilities so that we will be able to handle the specific, unique requirements our customers’ need for their systems our net sales may suffer.

Our future success depends in a large part on our ability to develop and market our Multi-Mix® products and to have the ability to continually refine our process to meet our customers’ specifications. We will also need to continually enhance our existing core products (passive RF and microwave component assemblies, power dividers and other products), lower product cost and develop new products that maintain technological competitiveness. Our core products must meet dynamic customer, regulatory and particular technological requirements and standards, and our Multi-Mix® products must respond to the changing needs of our customers, particularly our OEM customers. These customer requirements might or might not be compatible with our current or future product offerings. We might not be successful in modifying our products and services to address these requirements and standards and our business could suffer.

Although we generated a net profit for fiscal year 2008, we recorded net losses in the previous two fiscal years and we may not be able to sustain our profitability.

Although we generated a net profit of $98,000 for the year ended January 3, 2009, which included a loss of $142,000 related to our discontinued operations, we recorded a net loss of $5,821,000 for the year ended December 29, 2007, of which $4,387,000 was related to our discontinued operations. We experienced approximately a 34% increase in sales for 2008, from continuing operations, primarily resulting from material increased bookings in 2007 and 2008, and resulting from increased backlog of our traditional and Multi-Mix® products. We may not be able to sustain or increase our profitability in the short-term or long-term, on a quarterly or an annual basis, in subsequent periods. If our financial results fall below the expectations of investors, the price of our common stock may suffer.

We rely on a small number of customers for a substantial portion of our net sales, and declines in sales to these customers could adversely affect our operating results.

Sales to our five largest customers accounted for 62% of our net sales in the fiscal year ended January 3, 2009 and our two largest customers, Raytheon Company and Northrop Grumman Corporation, accounted for 16.7% and 14.6% of our 2008 net sales, respectively. We depend on the continued growth, viability and financial stability of our customers, substantially all of which operate in an environment characterized by rapid technological change, short product life cycle, consolidation, and pricing and margin pressures. We expect to continue to depend upon a relatively small number of customers for a significant percentage of our revenue. Consolidation among our customers may further concentrate our business in a limited number of customers and expose us to increased risks relating to dependence on a small number of customers. In addition, a significant reduction in sales to any of our large customers or significant pricing and margin pressures exerted by a key customer would adversely affect our operating results. In the past, some of our large customers have significantly reduced or delayed the volume of products ordered from us as a result of changes in their business, consolidation or divestitures or for other reasons. We cannot be certain that present or future large customers will not terminate their arrangements with us or significantly change, reduce or delay the amount of products ordered from us, any of which would adversely affect our operating results.

A substantial portion of our sales are related to the defense and military communications sectors. However, in times of armed conflict or war, military spending is concentrated on armaments build up, maintenance and troop support, and not on the research and development and specialty applications that are our core strengths and revenue generators. Accordingly, our defense and military product sales may decrease, and should not be expected to increase, at times of armed conflicts or war.

Our products are intended for use in various sectors of the satellite and defense industries, which produces technologically advanced products with short life cycles.

Factors affecting the satellite, defense and telecommunications industries, in particular the short life cycle of certain products, could seriously harm our customers and reduce the volume of products they purchase from us. These factors include:

| · | the inability of our customers to adapt to rapidly changing technology and evolving industry standards that result in short product life cycles; |

| · | the inability of our customers to develop and market their products, some of which are new and untested; |

| · | the potential that our customers' products may become obsolete or the failure of our customers' products to gain widespread commercial acceptance; |

| · | U.S. Government funding being diverted from defense spending to other programs or economic recovery, and |

| · | tight credit which could make it difficult for commercial satellite providers to fund their programs. |

A significant proportion of our revenue is related to U.S Defense spending and commercial satellite programs.

Our business plan anticipates significant future sales from our Multi-Mix® products used in defense applications and commercial satellites. Due to overall economic and market conditions, and a new administration, funding may be diverted from defense spending to the efforts of economic recovery. Additionally, there may be limited financing available for commercial satellite programs. These two factors could have an adverse effect on bookings and revenue.

The expenses relating to our products might increase, which could reduce our gross margins.

In the past, developing engineering solutions, meeting research and development challenges and overcoming production and manufacturing issues have resulted in additional expenses. These expenses create pressure on our average selling prices and may result in decreased margins of our products. We expect that this will continue. In the future, competition could increase, and we anticipate this may result in additional pressure on our pricing. We also may not be able to increase the price of our products in the event that the cost of components or overhead increase. Changes in exchange rates between the United States and Canadian dollars, and other currencies, might result in further disparity between our costs and selling price and hurt our ability to maintain gross margins.

We carry inventory and there is a risk we may be unable to dispose of certain items.

We procure inventory based on specific customer orders and forecasts. Customers have certain rights of modification with respect to these orders and forecasts. As a result, customer modifications to orders and forecasts affecting inventory previously procured by us and our purchases of inventory beyond customer needs may result in excess and obsolete inventory for the related customers. Although we may be able to use some of these excess components and raw materials in other products we manufacture, a portion of the cost of this excess inventory may not be recoverable from customers, nor may any excess quantities be returned to the vendors. We also may not be able to recover the cost of obsolete inventory from vendors or customers.

Write offs or write downs of inventory generally arise from:

| · | declines in the market value of inventory; |

| · | changes in customer demand for inventory, such as cancellation of orders; and |

| · | our purchases of inventory beyond customer needs that result in excess quantities on hand and that we are not able to return to the vendor or charge back to the customer. |

Our products and therefore our inventories are subject to technological risk. At any time either new products may enter the market or prices of competitive products may be introduced with more attractive features or at lower prices than ours. There is a risk we may be unable to sell our inventory in a timely manner and avoid it becoming obsolete. As of January 3, 2009, our inventories including raw materials, work-in-process and finished goods, were valued at $4.9 million reflecting reductions due to valuation allowances for cost overruns of approximately $52,000 against these inventories. In the event we are required to substantially discount our inventory or are unable to sell our inventory in a timely manner, we would be required to increase our valuation allowances and our operating results could be substantially adversely affected.

We depend on a limited number of suppliers.

Electronic devices, components and made-to-order assemblies used in our traditional (i.e., non-Multi-Mix) products are generally obtained from a number of suppliers, although certain components are obtained from a limited number of suppliers. Some devices or components are standard items while others are manufactured to our specifications by our suppliers.

Except as described below, we believe that most raw materials used in manufacturing our products are available from alternative suppliers. We do not have binding agreements or commitments with our suppliers for the quantity and prices of our raw materials. Our reliance on suppliers, especially sole source or limited suppliers, involves the risks of adequate capacity and reduced control over delivery schedules and costs. While there may be alternative qualified suppliers for some of these components, substitutes for certain materials are not readily available. Any significant interruption in delivery of such items could have an adverse effect on our operations.

Manufacturing of our Multi-Mix® products requires certain components and raw materials that currently are only available from a sole supplier or limited number of suppliers, particularly for products intended for specific applications. Our Multi-Mix products utilize certain substrate materials in the fusion bonding process, currently obtained from a single vendor. Although there may be alternative types of substrates that are under evaluation, we have designed its current Multi-Mix® products utilizing the current source of supply, and use of alternative substrates could result in design, engineering, manufacturing, performance and cost challenges and delays.

Any difficulty in obtaining sufficient quantities of such raw materials on a timely basis, and at economic prices, could result in design and engineering changes and expenses, shipment delays and/or an inability to manufacture certain Multi-Mix products. Significant increases in the costs of such materials could also have a material adverse effect on our value proposition and marketing efforts with potential customers and our results of operations and profitability.

We generally do not obtain firm long-term volume purchase commitments from customers, and, therefore, cancellations, reductions in production quantities and delays in production by our customers could adversely affect our operating results.

We generally do not obtain firm long-term purchase commitments from our customers. Customers may cancel their orders, choose not to exercise options for further product purchases, reduce production quantities or delay production for a number of reasons. In the event our customers experience significant decreases in demand for their products and services, our customers may cancel orders, delay the delivery of some of the products that we manufactured or place purchase orders for fewer products than we previously anticipated. Even when our customers are contractually obligated to purchase products from us, we may be unable or, for other business reasons, choose not to enforce our contractual rights. Cancellations, reductions or delays of orders by customers would:

| · | adversely affect our operating results by reducing the volumes of products that we manufacture for our customers; |

| · | delay or eliminate recoupment of our expenditures for inventory purchased in preparation for customer orders; and |

| · | lower our asset utilization, which would result in lower gross margins. |

Products we manufacture may contain design or manufacturing defects that could result in reduced demand for our services and liability claims against us.

We manufacture products to our customers' specifications that are highly complex and may at times contain design or manufacturing defects. Defects have been discovered in products we manufactured in the past and despite our quality control and quality assurance efforts, defects may occur in the future. Defects in the products we manufacture, whether caused by design, manufacturing or component defects, may result in delayed shipments to customers, reduced margins or cancelled customer orders. Should these defects occur in large quantities or frequently, our business reputation may also be tarnished. In addition, these defects may result in liability claims against us. Even if customers are responsible for the defects, we may assume responsibility for any costs or payments.

Variations in our quarterly operating results could occur due to factors including changes in demand for our products, the timing of shipments and changes in our mix of net sales.

Our quarterly net sales, expenses and operating results have varied in the past and might vary significantly from quarter to quarter in the future. Quarter-to-quarter comparisons of our operating results are not a good indication of our future performance, and should not be relied on to predict our future performance. Our short-term expense levels and manufacturing and production facilities infrastructure overhead are relatively fixed and are based on our expectations of future net sales. If we were to experience a reduction in net sales in a quarter, we could have difficulty adjusting our short-term expenditures and absorbing our excess capacity expenses. If this were to occur, our operating results for that quarter would be negatively impacted. Other factors that might cause our operating results to fluctuate on a quarterly basis include:

| · | customer decisions to defer, accelerate or cancel orders; |

| · | timing of shipments of orders for our products; |

| · | changes in the mix of net sales attributable to higher-margin and lower-margin products; |

| · | changes in product mix which could cause unexpected engineering or research and development costs; |

| · | announcements or introductions of new products by our competitors; |

| · | engineering or production delays due to product defects or quality problems and production yield issues; |

| · | dynamic defense budgets which could cause military program delays or cancellations; |

| · | limited capital resources making it difficult to fund commercial programs; and |

| · | economic recovery programs that may divert government funding from defense budgets. |

Due to the availability limits, fluctuations in our borrowing base and other terms of our financing agreement, we may experience capital constraints from time to time.

On September 29, 2008, we entered into an agreement with Wells Fargo Business Credit (“Wells Fargo”) which replaced our credit facility with Capital One, N.A. The new credit facility with Wells Fargo consists of a three-year $5,000,000 collateralized revolving credit facility, a three-year $500,000 equipment term loan and a three-year $2,500,000 real estate term loan. While the credit facility is expected to adequately provide for our capital needs, the revolving line of credit is subject to availability limits under a borrowing base calculation of 85% of eligible domestic accounts receivable, 75% of eligible foreign accounts receivable, and 30% of eligible inventory with an inventory sublimit of $400,000. Due to these terms from time to time we may experience capital constraints. Additionally the Wells Fargo credit facility contains several financial covenants and while we expect to be in compliance with all of our financial covenants during the next year, were we not to be in compliance with one or more of our financial covenants and be unable to obtain a waiver from Wells Fargo, Wells Fargo would be entitled to accelerate the maturity of amounts outstanding under the revolving credit facility. This could materially and adversely impact our financial condition, results of operations and cash flows.

We have significant competition in our industry.

The microwave component and subsystems industry continues to be highly competitive. We compete against many companies, both foreign and domestic, many of which are larger and have greater financial and other resources. Our major competitors are Anaren, Cobham, L-3 Communications (Narda), TRM and K&L Microwave. As a direct supplier to OEMs, we also face significant competition from the in-house capabilities of our customers.

The principal competitive factors are technical performance, reliability, ability to produce in volume, on-time delivery and price. Based on these factors, we believe that we compete favorably in its markets.

The RF Microwave components industry is highly competitive and has become more so as defense spending has changed program-spending profiles. Furthermore, current DoD efforts continue to support troops engaged in existing hostilities around the world. We compete against numerous U.S. and foreign providers with global operations, as well as those who operate on a local or regional basis. In addition, current and prospective customers continually evaluate the merits of manufacturing products internally. Changes in the industries and sectors we service could significantly harm our ability to compete, and consolidation trends could result in larger competitors that may have significantly greater resources with which to compete against us.

We may be operating at a cost disadvantage compared to manufacturers who have greater direct buying power from component suppliers, distributors and raw material suppliers or who have lower cost structures. Our manufacturing processes are generally not subject to significant proprietary protection, and companies with greater resources or a greater market presence may enter our market or increase their competition with us. Increased competition could result in price reductions, reduced sales and margins or loss of market share.

Intellectual property rights in our industry are commonly subject to challenge.

Substantial litigation regarding intellectual property rights exists in our industry. We do not believe our intellectual properties infringe those of others, and are not aware that any third party is infringing our intellectual property rights. A risk always exists that third parties, including current and potential competitors, could claim that our products, or our customers' products, infringe on their intellectual property rights or that we have misappropriated their intellectual property. We may discover that a third party is infringing upon our intellectual property rights, or has been issued an infringing patent.

Infringement suits are time consuming, complex, and expensive to litigate. Such litigation could cause a delay in the introduction of new products, require us to develop non-infringing technology, require us to enter into royalty or license agreements, if available, or require us to pay substantial damages. We have agreed to indemnify certain customers for infringement of third-party intellectual property rights. We could incur substantial expenses and costs in case of a successful indemnification claim. A significant negative impact would result if a successful claim of infringement were made against us and we could not develop non-infringing technology or license the infringed or similar technology on a timely and cost-effective basis.

Our success depends to a significant degree upon the preservation and protection of our product and manufacturing process designs and other proprietary technology. To protect our proprietary technology, we generally limit access to our technology, treat portions of such technology as trade secrets, and obtain confidentiality or non-disclosure agreements from persons with access to the technology. Our agreements with our employees prohibit employees from disclosing any confidential information, technology developments and business practices, and from disclosing any confidential information entrusted to us by other parties. Consultants engaged by us who have access to confidential information generally sign an agreement requiring them to keep confidential and not disclose any non-public confidential information.

We currently have 16 active patents. We plan to pursue intellectual property protection in foreign countries, primarily in the form of international patents, in instances where the technology covered is considered important enough to justify the added expense. By agreement, our employees who initiate or contribute to a patentable design or process are obligated to assign their interest in any potential patent to us.

Our executive officers, engineers, research and development and technical personnel are critical to our business, and without them we might not be able to execute our business strategy.

Our financial performance depends substantially on the performance of our executive officers and key employees. We are dependent in particular on Mason N. Carter, who serves as our Chief Executive Officer, Reynold K. Green, our Chief Operating Officer, J. Robert Patterson, who serves as our Chief Financial Officer and James J. Logothetis, our Chief Technology Officer. We are also dependent upon our other highly skilled engineering, research and development and technical personnel, due to the specialized technical nature of our business. If we lose the services of any of our key personnel and are not able to find replacements in a timely manner, our business could be disrupted, other key personnel might decide to leave, and we might incur increased operating expenses associated with finding and compensating replacements.

Our industry is subject to numerous government regulations.

Our products are incorporated into telecom and wireless communications systems that are subject to regulation domestically by various government agencies, including the Federal Communications Commission and internationally by other government agencies. In addition, because of our participation in the satellite and defense industry, we are subject to audit from time to time for compliance with government regulations by various governmental agencies. We are also subject to a variety of local, state and federal government regulations relating to environmental laws, as they relate to toxic or other hazardous substances used to manufacture our products. We believe that we operate our business in material compliance with applicable laws and regulations. However, any failure to comply with existing or future laws or regulations could have a material adverse affect on our business, financial condition and results of operations.

Export controls could impact our ability to sell our products to non-U.S. customers.

Our products are subject to the Export Administration Regulations ("EAR") administered by the U.S. Department of Commerce and may, in certain instances, be subject to the International Traffic in Arms Regulations ("ITAR") administered by the U.S. Department of State. EAR restricts the export of dual-use products and technical data to certain countries, while ITAR restricts the export of defense products, technical data and defense services. We believe we have implemented internal export procedures and controls in order to achieve compliance with the applicable U.S. export control regulations. The U.S. government agencies responsible for administering EAR and ITAR have significant discretion in the interpretation and enforcement of these regulations, and it is possible that these regulations could adversely affect our ability to sell its products to non-U.S. customers.

Some of our operations are outside the United States, which poses risks to our business operations.

A significant percentage of our sales is derived from the operations of our wholly-owned subsidiary in Costa Rica. These sales are subject to the risks normally associated with international operations which include, without limitation, fluctuating currency exchange rates, changing political and economic conditions, difficulties in staffing and managing foreign operations, greater difficulty and expense in administering business abroad, complications in complying with foreign laws and changes in regulatory requirements, and cultural differences in the conduct of business.

While we believe that current political and economic conditions in Costa Rica are relatively stable, such conditions may adversely change so as to affect underlying business assumptions about the current opportunities which exist for doing business in this country. In particular, the government in Costa Rica could change or the cost of labor and/or goods and services necessary to our operations may increase. We are also dependent on the availability of adequate air transportation to and from Costa Rica to send and to receive product from our factory.

We found material weaknesses in our internal control over financial reporting and concluded that our disclosure controls and procedures and our internal control over financial reporting were not effective as of December 29, 2007 and January 3, 2009.

As disclosed in Part II, Item 9A(T), “Controls and Procedures,” of this Annual Report on Form 10-K, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures and our internal control over financial reporting were not effective as of January 3, 2009. It was also concluded that our disclosure controls and procedures and our internal control over financial reporting for the year ended December 29, 2007, previously reported and believed to be effective, were not effective. Our failure to successfully implement our plans to remediate the material weaknesses discovered could cause us to fail to meet our reporting obligations, to fail to produce timely and reliable financial information, and to effectively prevent and detect fraud. Additionally, such failures could cause investors to lose confidence in our reported financial information, which could have a negative impact on our financial condition and stock price.

If we receive other than an unqualified opinion on the adequacy of our internal control over financial reporting as of January 2, 2010 and future year-ends as required by Section 404 of the Sarbanes-Oxley Act, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in the value of our common stock.

As required by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring public companies to include a report of management on our internal control over financial reporting in their annual reports that contains an assessment by management of the effectiveness of our internal control over financial reporting. In addition, the public accounting firm auditing a company's financial statements must audit and report on the effectiveness of the company's internal control over financial reporting.

If, at the end of fiscal year 2009, our independent auditors issue other than an unqualified opinion on the effectiveness of our internal control over financial reporting for fiscal year 2009, this could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of our financial statements, which could cause the market price of our shares to decline.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None.

United States

Our administrative offices and research and principal production facilities are located in West Caldwell, New Jersey, on a five-acre parcel owned by Merrimac. The West Caldwell plant comprises 71,200 square feet.

We own all of the land, buildings, laboratories, production and office equipment, as well as the furniture and fixtures in West Caldwell, New Jersey. We believe that our plant and facilities are well suited for our business and are properly utilized, suitably located and in good condition.

Costa Rica

We currently leases a 36,200 square-foot facility in San Jose, Costa Rica under a five-year lease which expired in February 2006 (with a five-year renewal option). The renewal option was exercised in February 2006 and the lease will continue through February 2011. This facility, which opened for production in August 2002, is used for manufacturing our products.

| ITEM 3. | LEGAL PROCEEDINGS. |

We are party to lawsuits arising in the normal course of business. It is the opinion of our management that the disposition of these various lawsuits will not individually or in the aggregate have a material adverse effect on our consolidated financial position or the results of operations.

On February 22, 2008, a statement of claim in Ontario Superior Court of Justice was filed by a former FMI employee against FMI seeking damages for approximately $77,000 ($75,000 Canadian) for wrongful dismissal following the sale of FMI’s assets to FTG. We settled this claim in May 2008 for a minimal amount.

On March 10, 2008, a statement of claim in Ontario Superior Court of Justice was filed by nineteen (19) former FMI employees against Merrimac, FMI and FTG seeking damages for wrongful dismissal for approximately $1,000,000 (Canadian $977,000) following the sale of FMI’s assets to FTG. The former FMI employees are alleging that an employment contract existed between FMI and the plaintiffs and are seeking additional damages for termination of the alleged contract. We have an Employment Practices Liability insurance policy that extends coverage to our subsidiaries. The insurance carrier agreed to provide a defense in this matter on April 24, 2008 and they retained Canadian counsel to defend this claim. Thus far we have paid fees and legal costs of $25,000 related to the matter which is the deductible amount of the insurance policy. In accordance with the requirements of SFAS No. 5, after discussions with counsel, we believe an unfavorable outcome is probable and we estimate the amount of the probable loss to be $50,000 for which we made a provision for as of the end of our fiscal year 2008. We and our insurance carrier intend to defend these claims vigorously.

On July 23, 2008, a Statement of Claim was filed in Ontario Superior Court of Justice by the lessor of the premises formerly occupied by FMI in Ontario, Canada, against FMI, Merrimac, and FTG. The Statement of Claim seeks damages of $150,612 in respect of the period from and after which FTG, which purchased the assets of FMI, removed operations from the premises through the term of the lease. In addition, the Statement of Claim seeks damages for $110,319 for repairs to the premises, and seeks to set aside the transfer of assets from FMI to FTG for the failure to comply with the Bulk Sales Act Ontario. On December 19, 2008 we settled all matters with the lessor for $88,000 ($104,000 Canadian) and a release was entered into by the parties.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

No matters were submitted to a vote of our stockholders during the fourth quarter of fiscal 2008.

PART II

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock has been listed and traded on The American Stock Exchange since July 11, 1988, under the symbol MRM. As of March 25, 2009 we had approximately 150 holders of record. We believe there are approximately 800 additional holders in "street name" through broker nominees.

The following table sets forth the range of the high and low trading prices as reported by the AMEX for the period from December 31, 2006 to January 3, 2009.

| Fiscal Year Ended January 3, 2009 | | | | | | |

| | | High | | | Low | |

| First Quarter | | | 10.04 | | | | 6.50 | |

| Second Quarter | | | 7.29 | | | | 4.46 | |

| Third Quarter | | | 5.80 | | | | 3.50 | |

| Fourth Quarter | | | 5.45 | | | | 2.00 | |

| | | | | | | | | |

| Fiscal Year Ended December 29, 2007 | | | | | | | | |

| | | High | | | Low | |

| First Quarter | | | 10.10 | | | | 8.65 | |

| Second Quarter | | | 10.50 | | | | 8.86 | |

| Third Quarter | | | 10.45 | | | | 9.50 | |

| Fourth Quarter | | | 10.15 | | | | 8.64 | |

| We have not paid any cash dividends to our stockholders since the third quarter of 1997. | |

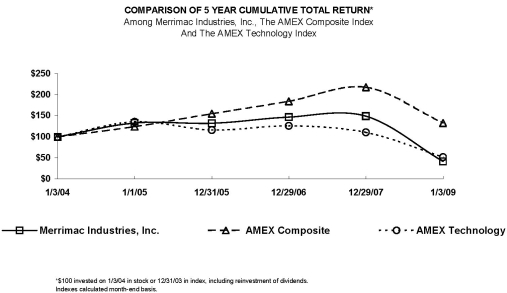

Stock Performance Chart: The following performance graph is a line graph comparing the yearly change in the cumulative total stockholder return on the common stock against the cumulative return of the AMEX Stock Market (U.S. Companies), and a line of business index comprised of the AMEX Technologies Index for the five fiscal years ended January 3, 2009.

| | | 1/3/04 | | | 1/1/05 | | | 12/31/05 | | | 12/30/06 | | | 12/29/07 | | | 01/03/09 | |

| Merrimac Industries, Inc. | | | 100.00 | | | | 132.94 | | | | 132.35 | | | | 147.06 | | | | 149.26 | | | | 41.62 | |

| AMEX Composite | | | 100.00 | | | | 124.13 | | | | 155.00 | | | | 184.30 | | | | 217.52 | | | | 132.72 | |

| AMEX Technology | | | 100.00 | | | | 135.78 | | | | 116.33 | | | | 125.97 | | | | 110.60 | | | | 51.75 | |

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

Equity Compensation Plan Information

The following table gives information as of January 3, 2009, about our common stock that may be issued upon the exercise of options, warrants and rights under our existing equity compensation plans:

| | | (a) | | | (b) | | | (c) | |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| Plan Category | | | | | | | | | |

Equity compensation plans approved by security holders | | | 435,400 | | | $ | 9.12 | | | | 255,533 | |

Equity compensation plans not approved by security holders | | | – | | | | – | | | | – | |

| Total | | | 435,400 | | | $ | 9.12 | | | | 255,533 | |

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

OVERVIEW

CONTINUING OPERATIONS

We are involved in the design, manufacture and sale of electronic component devices offering extremely broad frequency coverage and high performance characteristics, and microstrip, bonded stripline and thick metal-backed Teflon® (PIPE) and mixed dielectric multilayer circuits for communications, defense and aerospace applications. Our operations are conducted primarily through one business segment, electronic components and subsystems.

We are a versatile technologically oriented company specializing in radio frequency Multi-Mix®, stripline, microstrip and discreet element technologies. Of special significance has been the combination of two or more of these technologies into single components and integrated multifunction subassemblies to achieve superior performance and reliability while minimizing package size and weight. Our components and integrated assemblies are found in applications as diverse as satellites, military and commercial aircraft, radar, radio systems, medical diagnostic instruments communications systems and wireless connectivity. We maintain ISO 9001:2000 and AS 9100 registered quality assurance programs. Our components range in price from $0.50 to more than $10,000 and our subsystems range from $500 to more than $1,500,000.

In accordance with the provisions of Statement of Financial Accounting Standards No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets" (SFAS No. 144), the results of operations of FMI for the current and prior periods are reported as discontinued operations and not included in the continuing operations figures.

The following table presents our key customers and the percentage of net sales made to such customers:

| | | 2008 | | | 2007 | |

| Raytheon Company | | | 16.7 | % | | | 16.6 | % |

| Northrop Grumman Corporation | | | 14.6 | % | | | 7.0 | % |

| The Boeing Company | | | 14.2 | % | | | 6.7 | % |