UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES |

Investment Company Act file number 811-03595

Name of Fund: BlackRock Healthcare Fund, Inc.

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Donald C. Burke, Chief Executive Officer, BlackRock

Healthcare Fund, Inc., 800 Scudders Mill Road, Plainsboro, NJ, 08536. Mailing address:

P.O. Box 9011, Princeton, NJ, 08543-9011

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 04/30/2008

Date of reporting period: 05/01/2007 – 04/30/2008

Item 1 – Report to Stockholders |

| EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS |

| | BlackRock

Healthcare Fund, Inc.

ANNUAL REPORT | APRIL 30, 2008 |

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE |

| Table of Contents | | |

| |

|

| |

| | | Page |

| |

|

| |

| A Letter to Shareholders | | 3 |

| Annual Report: | | |

| Fund Summary | | 4 |

| About Fund Performance | | 6 |

| Disclosure of Expenses | | 6 |

| Financial Statements: | | |

| Schedule of Investments | | 7 |

| Statement of Assets and Liabilities | | 9 |

| Statement of Operations | | 10 |

| Statements of Changes in Net Assets | | 11 |

| Financial Highlights | | 12 |

| Notes to Financial Statements | | 15 |

| Report of Independent Registered Public Accounting Firm | | 20 |

| Important Tax Information (Unaudited) | | 20 |

| Officers and Directors | | 21 |

| Additional Information | | 24 |

| Mutual Fund Family | | 26 |

2 BLACKROCK HEALTHCARE FUND, INC.

Dear Shareholder

Over the past several months, financial markets have been buffeted by the housing recession, the credit market unraveling

and related liquidity freeze and steadily rising commodity prices. Counterbalancing these difficulties were booming export

activity, a robust non-financial corporate sector and, notably, aggressive and timely monetary and fiscal policy actions.

Amid the market tumult, the Federal Reserve Board (the “Fed”) intervened with a series of moves to bolster liquidity and

ensure financial market stability. Since September 2007, the central bank slashed the target federal funds rate 325 basis

points (3.25%), bringing the rate to 2.0% as of period-end. Of greater magnitude, however, were the Fed’s other policy

decisions, which included opening the discount window directly to broker dealers and investment banks and backstopping

the unprecedented rescue of Bear Stearns.

The Fed’s response to the financial crisis helped to improve credit conditions and investor mood. After hitting a low point

on March 17 (coinciding with the collapse of Bear Stearns), equity markets found a welcome respite in April, when the

S&P 500 Index of U.S. stocks posted positive monthly performance for the first time since October 2007. International

markets, which outpaced those of the U.S. for much of 2007, saw a reversal in that trend, as effects of the credit crisis and

downward pressures on growth were far-reaching.

In contrast to equity markets, Treasury securities rallied (yields fell as prices correspondingly rose), as a broad “flight-

to–quality” theme persisted. The yield on 10-year Treasury issues, which touched 5.30% in June 2007 (its highest level

in five years), fell to 4.04% by year-end and to 3.77% by April 30. Treasury issues relinquished some of their gains in April,

however, as investor appetite for risk returned and other high-quality fixed income sectors outperformed.

Problems within the monoline insurance industry and the failure of auctions for auction rate securities plagued the

municipal bond market, driving yields higher and prices lower across the curve. However, in conjunction with the more

recent shift in sentiment, the sector delivered strong performance in the final month of the reporting period.

Overall, the major benchmark indexes generated results that generally reflected heightened investor risk aversion:

Total Returns as of April 30, 2008 6-month 12-month |

| U.S. equities (S&P 500 Index) | | – 9.64% | | | – 4.68% |

|

|

| |

|

|

| Small cap U.S. equities (Russell 2000 Index) | –12.92 | | –10.96 |

|

| |

|

| International equities (MSCI Europe, Australasia, Far East Index) | | –9.21 | | | – 1.78 |

|

|

| |

|

|

| Fixed income (Lehman Brothers U.S. Aggregate Index) | | + 4.08 | | | + 6.87 |

|

|

| |

|

|

| Tax-exempt fixed income (Lehman Brothers Municipal Bond Index) | | + 1.47 | | | + 2.79 |

|

|

| |

|

|

| High yield bonds (Lehman Brothers U.S. Corporate High Yield 2% Issuer Capped Index) | | –0.73 | | | – 0.80 |

|

|

| |

|

|

| | Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

As you navigate today’s volatile markets, we encourage you to review your investment goals with your financial professional

and to make portfolio changes, as needed. For more up-to-date commentary on the economy and financial markets, we

invite you to visit www.blackrock.com/funds. As always, we thank you for entrusting BlackRock with your investment assets,

and we look forward to continuing to serve you in the months and years ahead. |

THIS PAGE NOT PART OF YOUR FUND REPORT

Portfolio Management Commentary

How did the Fund perform?

•The Fund outperformed the broad-market benchmark, the S&P 500

Index, and the Russell 3000 Health Care Index for the annual period.

What factors influenced performance?

•Fund outperformance during the fiscal year was the result of positive

stock selection and sub-sector allocation decisions.

•The Fund’s overweight relative to the Russell 3000 Health Care Index

in both the health care equipment & supplies and life science tools &

services sub-sectors, and underweight in pharmaceuticals and health

care providers & services contributed significantly to performance.

Additionally, effective security selection within each of these sub-

sectors benefited comparative results.

•Standout performers during the period included Thermo Fisher

Scientific, Inc. and Covance, Inc. in the life sciences area and Cytyc

Corp. (acquired by Hologic Inc., another Fund holding), Intuitive Surgical,

Inc. and SonoSite, Inc. in the health care equipment & supplies sub-

sector. German pharmaceuticals/chemical company Bayer AG and Sun

Pharmaceuticals Industries Ltd., a generic pharmaceutical company

based in India, also enhanced relative returns. Each of these com-

panies experienced substantial earnings acceleration due to strong

new product performance.

•In contrast, Fund holdings that were exposed to clinical study failures,

FDA new product approval delays and HMO revenue and earnings

shortfalls had the greatest negative impact on comparative perform-

ance. Notably, a negative clinical trial outcome for one of Progenics

Pharmaceuticals, Inc.’s highly anticipated new products hampered the

Fund’s comparative results, as did an earnings shortfall at OMRIX

Biopharmaceuticals, Inc.

Describe recent portfolio activity.

•During the period, we increased Fund exposure to the biotechnology

sub-sector. Among our largest purchases were well-known biotech

leaders Celgene Corp. and Genentech, Inc., in addition to Onyx

Pharmaceuticals, which has developed a new product for the treat-

ment of liver cancer. We also added Teva Pharmaceuticals Industries

Ltd., a leading generic and specialty pharmaceutical product company.

•We reduced exposure to health care equipment and supplies, trimming

or selling several holdings that had been excellent performers, but had

become richly valued, in our view. Major sales included Intuitive Surgical,

Inc. and Baxter International, Inc.

Describe Fund positioning at period-end.

•At the end of the reporting period, the Fund’s largest sub-sector weight-

ings were in pharmaceuticals, biotechnology and health care equipment

and supplies.

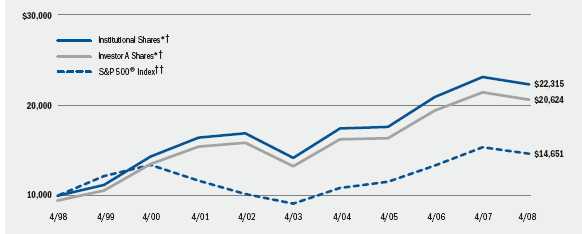

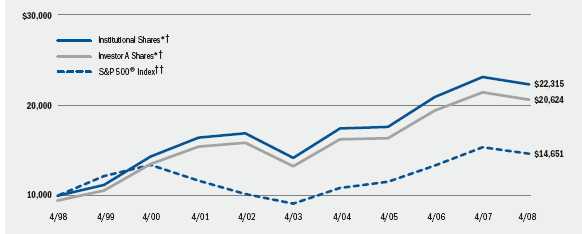

| Total Return Based on a $10,000 Investment |

* Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees.

† The Fund invests worldwide primarily in equity securities of companies that, in the opinion of management, derive or are expected to derive a

substantial portion of their sales from products or services in health care.

† † This unmanaged Index covers 500 industrial, utility, transportation and financial companies of the U.S. markets (mostly NYSE issues)

representing about 75% of NYSE market capitalization and 30% of NYSE issues. S&P 500 is a trademark of the McGraw-Hill Companies.

4 BLACKROCK HEALTHCARE FUND, INC. APRIL 30, 2008

| Performance Summary for the Period Ended April 30, 2008 | | | | | | | | | | | | | |

| |

| |

| |

|

| |

| |

| |

|

| |

| | | | | | | | | Average Annual Total Returns* | | | | |

| | | | |

| |

| |

| |

| |

|

| | | | | 1 Year | | | | 5 Years | | | | 10 Years |

| | | | |

| |

| |

|

| |

| |

|

| | | 6-Month | | w/o sales | | w/sales | | w/o sales | | w/sales | | w/o sales | | w/sales |

| | | Total Returns | | charge | | charge | | charge | | charge | | charge | | charge |

| |

| |

| |

| |

| |

| |

| |

|

| Institutional | | –14.00% | | –3.54% | | — | | +9.47% | | — | | +8.36% | | — |

| Investor A | | –14.03 | | –3.80 | | –8.85% | | + 9.22 | | +8.05% | | +8.09 | | +7.51% |

| Investor B | | –14.37 | | –4.49 | | –7.99 | | + 8.35 | | +8.10 | | +7.43 | | +7.43 |

| Investor C | | –14.57 | | –4.62 | | –5.39 | | + 8.36 | | +8.36 | | +7.22 | | +7.22 |

| Class R | | –14.39 | | –4.29 | | — | | + 8.96 | | — | | +7.85 | | — |

| S&P 500 Index | | – 9.64 | | –4.68 | | — | | +10.62 | | — | | +3.89 | | — |

| Russell 3000 Health Care Index** | | –11.45 | | –9.26 | | — | | + 5.56 | | — | | +2.69 | | — |

| |

| |

| |

| |

|

| |

| |

| |

|

| | * Assuming maximum sales charges. See “About Fund Performance” on page 6 for a detailed description of share classes, including any related sales charges and fees.

** The Russell 3000 Health Care Index is an unmanaged index containing companies involved in medical services or healthcare in the Russell 3000 Index.

Past performance is not indicative of future results. |

| Expense Example | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

|

| |

| | | | | Actual | | | | | | Hypothetical** | | |

| | |

| |

| |

| |

| |

| |

|

| | | Beginning | | Ending | | | | Beginning | | Ending | | |

| | | Account Value | | Account Value | | Expenses Paid | | Account Value | | Account Value | | Expenses Paid |

| | | November 1, 2007 | | April 30, 2008 | | During the Period* | | November 1, 2007 | | April 30, 2008 | | During the Period* |

| |

| |

| |

| |

| |

| |

|

| Institutional | | $1,000 | | $860.00 | | $ 6.01 | | $1,000 | | $1,017.84 | | $ 6.52 |

| Investor A | | $1,000 | | $859.70 | | $ 7.12 | | $1,000 | | $1,017.24 | | $ 7.72 |

| Investor B | | $1,000 | | $856.30 | | $10.85 | | $1,000 | | $1,013.21 | | $11.76 |

| Investor C | | $1,000 | | $854.30 | | $10.83 | | $1,000 | | $1,013.21 | | $11.76 |

| Class R | | $1,000 | | $856.10 | | $ 9.74 | | $1,000 | | $1,014.41 | | $10.57 |

| |

| |

| |

| |

| |

| |

|

* For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.30% for Institutional, 1.54% for Investor A, 2.35% for Investor B, 2.35% for

Investor C and 2.11% for Class R), multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period shown).

** Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 366.

See “Disclosure of Expenses” on page 6 for further information on how expenses were calculated. |

| Fund Profile as of April 30, 2008 |

| | | Percent of |

| Ten Largest Holdings | | Net Assets |

| |

|

| Thermo Fisher Scientific, Inc. | | 7% |

| Hologic, Inc. | | 6 |

| Bayer AG | | 6 |

| Celgene Corp. | | 5 |

| SonoSite, Inc. | | 4 |

| Sun Pharmaceuticals Industries Ltd. | | 4 |

| Abbott Laboratories | | 4 |

| Cerner Corp. | | 4 |

| Roche Holding AG | | 3 |

| Teva Pharmaceutical Industries Ltd. | | 3 |

| |

|

| | | Percent of |

| Five Largest Industries | | Net Assets |

| |

|

| Biotechnology | | 24% |

| Pharmaceuticals | | 23 |

| Health Care Equipment & Supplies | | 15 |

| Life Sciences Tools & Services | | 9 |

| Health Care Providers & Services | | 8 |

| |

|

| | | Percent of |

| | | Long-Term |

| Sector Representation | | Investments |

| |

|

| Health Care | | 91% |

| Materials | | 6 |

| Consumer Staples | | 2 |

| Information Technology | | 1 |

| |

|

| For Fund compliance purposes, the Fund's industry and sector classifications refer to |

| any one or more of the industry and sector sub-classifications used by one or more |

| widely recognized market indexes or ratings group indexes, and/or as defined by Fund |

| management. This definition may not apply for purposes of this report, which may |

| combine such industry and sector sub-classifications for reporting ease. | | |

| BLACKROCK HEALTHCARE FUND, INC. |

About Fund Performance

•Institutional Sharesare not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available

only to eligible investors.

•Investor A Sharesincur a maximum initial sales charge (front-end load)

of 5.25% and a service fee of 0.25% per year (but no distribution fee).

•Investor B Sharesare subject to a maximum contingent deferred sale

charge of 4.50% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.75% per year and a service

fee of 0.25% per year. These shares automatically convert to Investor A

Shares after approximately eight years. (There is no initial sales charge

for automatic share conversions.) All returns for periods greater than

eight years reflect this conversion.

•Investor C Sharesare subject to a distribution fee of 0.75%per year

and a service fee of 0.25% per year. In addition, Investor C Shares are

subject to a 1% contingent deferred sales charge if redeemed within

one year of purchase.

•Class R Sharesdo not incur a maximum initial sales charge (front-end

load) or deferred sales charge. These shares are subject to a distribution

fee of 0.25% per year and a service fee of 0.25% per year. Class R

Shares are available only to certain retirement plans. Prior to inception,

Class R Share performance results are those of the Institutional Shares

(which have no distribution or service fees) restated to reflect Class R

Share fees.

Performance information reflects past performance and does not guar-

antee future results. Current performance may be lower or higher than

the performance data quoted. Refer to www.blackrock.com/funds

to obtain performance data current to the most recent month-end.

Performance results do not reflect the deduction of taxes that a share-

holder would pay on fund distributions or the redemption of fund shares.

Figures shown in the performance table on pages 4 and 5 assume rein-

vestment of all dividends and capital gain distributions, if any, at net

asset value on the ex-dividend date. Investment return and principal

value of shares will fluctuate so that shares, when redeemed, may be

worth more or less than their original cost. Dividends paid to each class

of shares will vary because of the different levels of service, distribution

and transfer agency fees applicable to each class, which are deducted

from the income available to be paid to shareholders. |

Disclosure of Expenses

Shareholders of this Fund may incur the following charges: (a) expenses

related to transactions, including sales charges, redemption fees and

exchange fees; and (b) operating expenses including advisory fees,

distribution fees including 12b-1 fees, and other Fund expenses. The

expense example on page 5 (which is based on a hypothetical invest-

ment of $1,000 invested on November 1, 2007 and held through April

30, 2008) is intended to assist shareholders both in calculating expens-

es based on an investment in the Fund and in comparing these expens-

es with similar costs of investing in other mutual funds.

The table provides information about actual account values and actual

expenses. In order to estimate the expenses a shareholder paid during

the period covered by this report, shareholders can divide their account

value by $1,000 and then multiply the result by the number correspon-

ding to their share class under the heading entitled “Expenses Paid

During the Period.”

The table also provides information about hypothetical account values

and hypothetical expenses based on the Fund’s actual expense ratio

and an assumed rate of return of 5% per year before expenses. In

order to assist shareholders in comparing the ongoing expenses of

investing in this Fund and other funds, compare the 5% hypothetical

example with the 5% hypothetical examples that appear in other funds’

shareholder reports.

The expenses shown in the table are intended to highlight shareholders’

ongoing costs only and do not reflect any transactional expenses, such

as sales charges, redemption fees or exchange fees. Therefore, the hypo-

thetical table is useful in comparing ongoing expenses only, and will

not help shareholders determine the relative total expenses of owning

different funds. If these transactional expenses were included, shareholder

expenses would have been higher.

6 BLACKROCK HEALTHCARE FUND, INC.

Schedule of Investments April 30, 2008 (Percentages shown are based on Net Assets) |

| Common Stocks | | Shares | | Value |

| |

| |

|

| |

| Biotechnology — 24.2% | | | | |

| Celgene Corp. (a) | | 325,500 | | $ 20,226,570 |

| Cleveland Biolabs, Inc. (a) | | 250,000 | | 1,287,500 |

| Cougar Biotechnology, Inc. (a)(b) | | 80,000 | | 1,614,400 |

| Cytori Therapeutics, Inc. (a)(b) | | 180,000 | | 907,200 |

| Genentech, Inc. (a) | | 86,000 | | 5,865,200 |

| Genmab A/S (a) | | 50,000 | | 2,697,709 |

| Genzyme Corp. (a) | | 115,056 | | 8,094,190 |

| Gilead Sciences, Inc. (a) | | 199,000 | | 10,300,240 |

| Intercell AG (a) | | 220,000 | | 9,285,623 |

| Lexicon Genetics, Inc. (a) | | 1,360,069 | | 2,801,742 |

| Medigene AG (a) | | 71,100 | | 661,347 |

| Nanosphere, Inc. (a) | | 70,000 | | 466,200 |

| OMRIX Biopharmaceuticals, Inc. (a)(b) | | 545,000 | | 8,093,250 |

| Onyx Pharmaceuticals, Inc. (a) | | 285,000 | | 10,020,600 |

| Progenics Pharmaceuticals, Inc. (a)(b) | | 728,700 | | 9,815,589 |

| Sangamo Biosciences, Inc. (a)(b) | | 345,000 | | 4,398,750 |

| Savient Pharmaceuticals, Inc. (a)(b) | | 150,000 | | 3,276,000 |

| Seattle Genetics, Inc. (a) | | 200,000 | | 2,032,000 |

| Synta Pharmaceuticals Corp. (a)(b) | | 300,000 | | 2,013,000 |

| Tercica, Inc. (a)(b) | | 64,401 | | 320,073 |

| Vical, Inc. (a) | | 120,000 | | 422,400 |

| | | | |

|

| | | | | 104,599,583 |

| |

| |

|

| Chemicals — 5.9% | | | | |

| Bayer AG | | 300,000 | | 25,402,481 |

| |

| |

|

| Food & Staples Retailing — 1.9% | | | | |

| CVS Caremark Corp. | | 200,000 | | 8,074,000 |

| |

| |

|

| Health Care Equipment & Supplies — 15.0% | | | | |

| Alsius Corp. (a) | | 183,302 | | 159,473 |

| Gen-Probe, Inc. (a) | | 123,000 | | 6,932,280 |

| Hansen Medical, Inc. (a)(b) | | 120,000 | | 2,094,000 |

| Hologic, Inc. (a)(b) | | 878,000 | | 25,628,820 |

| Masimo Corp. (a) | | 130,000 | | 3,789,500 |

| Mindray Medical International Ltd. (c) | | 200,000 | | 6,800,000 |

| SonoSite, Inc. (a)(b) | | 606,000 | | 19,325,340 |

| | | | |

|

| | | | | 64,729,413 |

| |

| |

|

| Health Care Providers & Services — 7.8% | | | | |

| Aetna, Inc. | | 162,000 | | 7,063,200 |

| AmerisourceBergen Corp. | | 20,000 | | 811,000 |

| Cardinal Health, Inc. | | 20,000 | | 1,041,400 |

| Cigna Corp. | | 40,000 | | 1,708,400 |

| Express Scripts, Inc. (a) | | 100,000 | | 7,002,000 |

| Genoptix, Inc. (a)(b) | | 231,639 | | 6,353,858 |

| Medco Health Solutions, Inc. (a) | | 199,000 | | 9,858,460 |

| | | | |

|

| | | | | 33,838,318 |

| |

| |

|

| Common Stocks | | Shares | | Value |

| |

| |

|

| |

| Health Care Technology — 6.8% | | | | |

| Cerner Corp. (a)(b) | | 339,000 | | $ 15,685,530 |

| HLTH Corp. (a) | | 1,250,000 | | 13,900,000 |

| | | | |

|

| | | | | 29,585,530 |

| |

| |

|

| Internet Software & Services — 1.2% | | | | |

| WebMD Health Corp. Class A (a)(b) | | 166,000 | | 5,204,100 |

| |

| |

|

| Life Sciences Tools & Services — 9.2% | | | | |

| Covance, Inc. (a) | | 39,000 | | 3,267,810 |

| Exelixis, Inc. (a) | | 140,000 | | 1,065,400 |

| Thermo Fisher Scientific, Inc. (a) | | 491,000 | | 28,414,170 |

| Waters Corp. (a) | | 51,000 | | 3,134,460 |

| WuXi PharmaTech Cayman, Inc. (a)(c) | | 220,000 | | 4,056,800 |

| | | | |

|

| | | | | 39,938,640 |

| |

| |

|

| Pharmaceuticals — 23.1% | | | | |

| Abbott Laboratories | | 300,000 | | 15,825,000 |

| BioForm Medical, Inc. (a)(b) | | 150,000 | | 762,000 |

| Bristol-Myers Squibb Co. | | 400,000 | | 8,788,000 |

| Elan Corp. Plc (a)(c) | | 300,000 | | 7,887,000 |

| Eurand NV (a) | | 100,000 | | 1,595,000 |

| Glenmark Pharmaceuticals Ltd. | | 200,000 | | 3,319,019 |

| Johnson & Johnson | | 100,000 | | 6,709,000 |

| Merck & Co., Inc. | | 150,000 | | 5,706,000 |

| Pfizer, Inc. | | 50,000 | | 1,005,500 |

| Roche Holding AG | | 85,000 | | 14,065,476 |

| Simcere Pharmacautical-ADR (a)(c) | | 40,800 | | 513,672 |

| Sirtris Pharmaceuticals, Inc. (a)(b) | | 50,000 | | 1,117,500 |

| Sun Pharmaceuticals Industries Ltd. (a) | | 440,000 | | 15,796,914 |

| Takeda Pharmaceutical Co., Ltd. | | 50,000 | | 2,643,550 |

| Teva Pharmaceutical Industries Ltd. (c) | | 300,000 | | 14,034,000 |

| | | | |

|

| | | | | 99,767,631 |

| |

| |

|

| Total Common Stocks (Cost — $353,283,738) — 95.1% | | 411,139,696 |

| |

|

| |

| |

| |

| | | Beneficial | | |

| | | Interest | | |

| Short-Term Securities | | (000) | | |

| |

| |

|

| Merrill Lynch Premier Institutional Fund, | | | | |

| 3.03% (d)(e)(f) | | $ 87,398 | | 87,398,300 |

| |

| |

|

| Total Short-Term Securities | | | | |

| (Cost — $87,398,300) — 20.2% | | | | 87,398,300 |

| |

| |

|

| Total Investments (Cost — $440,682,038*) — 115.3% | | 498,537,996 |

| Liabilities in Excess of Other Assets — (15.3%) | | | | (66,326,816) |

| | | | |

|

| Net Assets — 100.0% | | | | $432,211,180 |

| | | | |

|

See Notes to Financial Statements.

BLACKROCK HEALTHCARE FUND, INC. APRIL 30, 2008 7

Schedule of Investments (concluded)

* The cost and unrealized appreciation (depreciation) of investments as of April 30,

2008, as computed for federal income tax purposes, were as follows:

| Aggregate cost | | $ 446,958,786 |

| | |

|

| Gross unrealized appreciation | | $ 77,804,896 |

| Gross unrealized depreciation | | (26,225,686) |

| | |

|

| Net unrealized appreciation | | $ 51,579,210 |

| | |

|

(a) Non-income producing security.

(b) Security, or a portion of security, is on loan.

(c) Depositary receipts.

(d) Investments in companies considered to be an affiliate of the Fund, for purposes of

Section 2(a)(3) of the Investment Company Act of 1940, were as follows: |

| | | Net | | |

| | | Activity | | Interest |

| Affiliate | | (000) | | Income |

| |

| |

|

| |

| BlackRock Liquidity Series, LLC | | | | |

| Cash Sweep Series | | $ (10,090) | | $629,600 |

| BlackRock Liquidity Series, LLC | | | | |

| Money Market Series | | $ (167,472) | | $542,309 |

| Merrill Lynch Premier Institutional Fund | | $ 87,398 | | $ 900 |

| |

| |

|

(e) Represents the current yield as of report date.

(f) Security was purchased with the cash proceeds from securities loans.

•For Fund compliance purposes,the Fund's industry classifications refer to any one

or more of the industry sub-classifications used by one or more widely recognized

market indexes or ratings group indexes, and/or as defined by Fund management.

This definition may not apply for purposes of this report, which may combine such

industry sub-classifications for reporting ease. These industry classifications

are unaudited.

See Notes to Financial Statements.

| | 8 BLACKROCK HEALTHCARE FUND, INC. APRIL 30, 2008 |

| Statement of Assets and Liabilities | | |

| |

| April 30, 2008 | | |

| |

|

| |

| Assets | | |

| |

|

| |

| Investments at value — unaffiliated (including securities loaned of $83,603,578)(cost — $353,283,738) | | $ 411,139,696 |

| Investments at value — affiliated (cost — $87,398,300) | | 87,398,300 |

| Cash | | 16,686,028 |

| Foreign currency at value (cost — $27,008) | | 26,784 |

| Investments sold receivable | | 7,683,741 |

| Capital shares sold receivable | | 719,824 |

| Dividends receivable | | 648,179 |

| Securities lending income receivable | | 57,867 |

| Interest receivable | | 49,309 |

| Prepaid expenses | | 25,803 |

| | |

|

| Total assets | | 524,435,531 |

| |

|

| |

| |

| Liabilities | | |

| |

|

| |

| Collateral at value — securities loaned | | 87,398,300 |

| Investments purchased payable | | 2,456,641 |

| Capital shares redeemed payable | | 1,486,220 |

| Investment advisory fees payable | | 345,839 |

| Distribution fees payable | | 130,969 |

| Deferred foreign capital gains tax payable | | 127,380 |

| Other affiliates payable | | 120,521 |

| Other accrued expenses payable | | 158,481 |

| | |

|

| Total liabilities | | 92,224,351 |

| |

|

| |

| |

| Net Assets | | |

| |

|

| |

| Net Assets | | $ 432,211,180 |

| |

|

| |

| |

| Net Assets Consist of | | |

| |

|

| |

| Institutional Shares of Common Stock, $0.10 par value, 200,000,000 shares authorized | | $ 2,230,149 |

| Investor A Shares of Common Stock, $0.10 par value, 100,000,000 shares authorized | | 3,298,027 |

| Investor B Shares of Common Stock, $0.10 par value, 250,000,000 shares authorized | | 1,297,051 |

| Investor C Shares of Common Stock, $0.10 par value, 100,000,000 shares authorized | | 2,057,307 |

| Class R Shares of Common Stock, $0.10 par value, 250,000,000 shares authorized | | 259,693 |

| Paid-in capital in excess of par | | 378,264,903 |

| Accumulated net investment loss | | (82,870) |

| Accumulated net realized loss | | (12,896,279) |

| Net unrealized appreciation/depreciation | | 57,783,199 |

| | |

|

| Net Assets | | $ 432,211,180 |

| |

|

| |

| |

| Net Asset Value | | |

| |

|

| |

| Institutional — Based on net assets of $132,783,724 and 22,301,488 shares outstanding | | $ 5.95 |

| | |

|

| Investor A — Based on net assets of $175,093,596 and 32,980,271 shares outstanding | | $ 5.31 |

| | |

|

| Investor B — Based on net assets of $44,711,437 and 12,970,510 shares outstanding | | $ 3.45 |

| | |

|

| Investor C — Based on net assets of $70,451,955 and 20,573,066 shares outstanding | | $ 3.42 |

| | |

|

| Class R — Based on net assets of $9,170,468 and 2,596,930 shares outstanding | | $ 3.53 |

| | |

|

| See Notes to Financial Statements. |

| BLACKROCK HEALTHCARE FUND, INC. |

| Statement of Operations | | |

| |

| Year Ended April 30, 2008 | | |

| |

|

| |

| Investment Income | | |

| |

|

| |

| Dividends (net of $180,594 foreign withholding tax) | | $ 2,786,028 |

| Interest from affiliates | | 629,600 |

| Securities lending | | 543,209 |

| | |

|

| Total income | | 3,958,837 |

| |

|

| |

| |

| Expenses | | |

| |

|

| |

| Investment advisory | | 4,519,263 |

| Service — Investor A | | 425,737 |

| Service and distribution — Investor B | | 571,195 |

| Service and distribution — Investor C | | 713,356 |

| Service and distribution — Class R | | 40,068 |

| Transfer agent — Institutional | | 246,366 |

| Transfer agent — Investor A | | 260,934 |

| Transfer agent — Investor B | | 144,792 |

| Transfer agent — Investor C | | 166,330 |

| Transfer agent — Class R | | 35,320 |

| Accounting services | | 167,876 |

| Custodian | | 99,273 |

| Professional | | 75,388 |

| Registration | | 74,952 |

| Printing | | 73,889 |

| Officer and Directors | | 31,824 |

| Miscellaneous | | 37,289 |

| | |

|

| Total expenses | | 7,683,852 |

| | |

|

| Net investment loss | | (3,725,015) |

| |

|

| |

| |

| Realized and Unrealized Gain (Loss) | | |

| |

|

| |

| Net realized gain (loss) from: | | |

| Investments (including $3,372 foreign capital gain credit) | | 24,103,866 |

| Foreign currency transactions | | (158,558) |

| | |

|

| | | 23,945,308 |

| | |

|

| Net change in unrealized appreciation/depreciation on: | | |

| Investments (including $63,731 deferred foreign capital gain credit) | | (39,684,189) |

| Foreign currency transactions | | 45,502 |

| | |

|

| | | (39,638,687) |

| | |

|

| Total realized and unrealized loss | | (15,693,379) |

| | |

|

| Net Decrease in Net Assets Resulting from Operations | | $ (19,418,394) |

| | |

|

| See Notes to Financial Statements. |

10 BLACKROCK HEALTHCARE FUND, INC.

| Statements of Changes in Net Assets | | | | |

| |

| | | Year Ended |

| | | April 30, |

| | |

|

| Increase (Decrease) in Net Assets: | | 2008 | | 2007 |

| |

| |

|

| |

| Operations | | | | |

| |

| |

|

| |

| Net investment loss | | $ (3,725,015) | | $ (5,028,576) |

| Net realized gain | | 23,945,308 | | 47,928,471 |

| Net change in unrealized appreciation/depreciation | | (39,638,687) | | (1,892,152) |

| | |

| |

|

| Net increase (decrease) in net assets resulting from operations | | (19,418,394) | | 41,007,743 |

| |

| |

|

| |

| Distributions to Shareholders from | | | | |

| |

| |

|

| |

| Net realized gain: | | | | |

| Institutional | | (19,190,519) | | (18,041,102) |

| Investor A | | (23,511,776) | | (21,510,564) |

| Investor B | | (11,380,057) | | (16,162,029) |

| Investor C | | (13,862,386) | | (13,564,480) |

| Class R | | (1,455,949) | | (871,195) |

| Tax return of capital: | | | | |

| Institutional | | (821,866) | | — |

| Investor A | | (1,066,468) | | — |

| Investor B | | (519,689) | | — |

| Investor C | | (681,171) | | — |

| Class R | | (74,088) | | — |

| | |

| |

|

| Decrease in net assets resulting from distributions to shareholders | | (72,563,969) | | (70,149,370) |

| |

| |

|

| |

| Capital Share Transactions | | | | |

| |

| |

|

| |

| Net increase (decrease) in net assets derived from capital share transactions | | 72,072,219 | | (46,379,248) |

| |

| |

|

| |

| Net Assets | | | | |

| |

| |

|

| |

| Total decrease in net assets | | (19,910,144) | | (75,520,875) |

| Beginning of year | | 452,121,324 | | 527,642,199 |

| | |

| |

|

| End of year | | $ 432,211,180 | | $ 452,121,324 |

| | |

| |

|

| End of year accumulated net investment loss | | $ (82,870) | | $ (19,870) |

| | |

| |

|

| See Notes to Financial Statements. |

| BLACKROCK HEALTHCARE FUND, INC. |

| Financial Highlights | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | Institutional | | | | | | | | | | | | Investor A | | | | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | | | | Year Ended April 30, | | | | | | | | Year Ended April 30, | | |

| | |

| |

| |

| |

| |

| |

| |

|

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | | 2008 | | 2007 | | 2006 | | | | 2005 | | 2004 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net asset value, beginning of year | | $ 7.08 | | $ 7.29 | | $ 6.55 | | $ 6.87 | | $ 5.59 | | $ 6.41 | | $ 6.69 | | $ 6.04 | | $ 6.38 | | $ 5.21 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net investment loss1 | | (0.03) | | (0.04) | | (0.05) | | | | (0.06) | | (0.05) | | (0.04) | | (0.05) | | (0.07) | | | | (0.07) | | (0.06) |

| Net realized and unrealized gain (loss) | | (0.14) | | 0.67 | | 1.27 | | | | 0.11 | | 1.33 | | (0.12) | | 0.61 | | 1.19 | | | | 0.10 | | 1.23 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net increase (decrease) from investment | | | | | | | | | | | | | | | | | | | | | | | | |

| operations | | (0.17) | | 0.63 | | 1.22 | | | | 0.05 | | 1.28 | | (0.16) | | 0.56 | | 1.12 | | | | 0.03 | | 1.17 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net realized gain | | (0.92) | | (0.84) | | (0.48) | | | | (0.37) | | — | | (0.90) | | (0.84) | | (0.47) | | | | (0.37) | | — |

| Tax return of capital | | (0.04) | | — | | — | | | | — | | — | | (0.04) | | — | | — | | | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total distributions | | (0.96) | | (0.84) | | (0.48) | | | | (0.37) | | — | | (0.94) | | (0.84) | | (0.47) | | | | (0.37) | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net asset value, end of year | | $ 5.95 | | $ 7.08 | | $ 7.29 | | $ 6.55 | | $ 6.87 | | $ 5.31 | | $ 6.41 | | $ 6.69 | | $ 6.04 | | $ 6.38 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Total Investment Return2 | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Based on net asset value | | (3.54%) | | 10.62% | | 18.70%3 | | | | 0.99% | | 22.90% | | (3.80%) | | 10.43% | | 18.61%3 | | | | 0.74% | | 22.46% |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total expenses | | 1.29% | | 1.33% | | 1.30% | | | | 1.33% | | 1.29% | | 1.52% | | 1.57% | | 1.55% | | | | 1.58% | | 1.55% |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net investment loss | | (0.42%) | | (0.64%) | | (0.75%) | | (0.88%) | | (0.75%) | | (0.64%) | | (0.89%) | | (0.99%) | | | | (1.13%) | | (1.00%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net assets, end of year (000) | | $132,784 | | $147,755 | | $159,116 | | $146,922 | | $275,570 | | $175,094 | | $160,652 | | $172,585 | | $142,774 | | $160,443 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Portfolio turnover | | 163% | | 152% | | 120% | | | | 127% | | 141% | | 163% | | 152% | | 120% | | | | 127% | | 141% |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| 1 | Based on average shares outstanding. |

| |

| 2 | Total investment returns exclude the effects of any sales charges. |

| |

| 3 | In 2006, there was no impact to the Fund’s total investment return as a result of a payment by Merrill Lynch Investment Managers, L.P. |

| |

| See Notes to Financial Statements. |

12 BLACKROCK HEALTHCARE FUND, INC.

| Financial Highlights (continued) | | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | | | | Investor B | | | | | | | | | | Investor C | | | | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| | | | | | | Year Ended April 30, | | | | | | Year Ended April 30, | | |

| | |

| |

| |

| |

| |

| |

| |

|

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | | 2008 | | 2007 | | 2006 | | | | 2005 | | 2004 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net asset value, beginning of year | | $ 4.44 | | $ 4.93 | | $ 4.57 | | $ 4.96 | | $ 4.08 | | $ 4.43 | | $ 4.92 | | $ 4.57 | | $ 4.96 | | $ 4.07 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net investment loss1 | | (0.06) | | | | (0.07) | | (0.09) | | (0.09) | | (0.08) | | (0.06) | | (0.07) | | (0.09) | | | | (0.09) | | (0.08) |

| Net realized and unrealized gain (loss) | | (0.06) | | | | 0.41 | | 0.89 | | 0.07 | | 0.96 | | (0.06) | | 0.41 | | 0.88 | | | | 0.07 | | 0.97 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net increase (decrease) from investment | | | | | | | | | | | | | | | | | | | | | | | | |

| operations | | (0.12) | | | | 0.34 | | 0.80 | | (0.02) | | 0.88 | | (0.12) | | 0.34 | | 0.79 | | | | (0.02) | | 0.89 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net realized gain | | (0.83) | | | | (0.83) | | (0.44) | | (0.37) | | — | | (0.85) | | (0.83) | | (0.44) | | | | (0.37) | | — |

| Tax return of capital | | (0.04) | | | | — | | — | | — | | — | | (0.04) | | — | | — | | | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total distributions | | (0.87) | | | | (0.83) | | (0.44) | | (0.37) | | — | | (0.89) | | (0.83) | | (0.44) | | | | (0.37) | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net asset value, end of year | | $ 3.45 | | $ 4.44 | | $ 4.93 | | $ 4.57 | | $ 4.96 | | $ 3.42 | | $ 4.43 | | $ 4.92 | | $ 4.57 | | $ 4.96 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Total Investment Return2 | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Based on net asset value | | (4.49%) | | 9.41% | | 17.64%3 | | (0.09%) | | 21.57% | | (4.62%) | | 9.47% | | 17.50%3 | | | | (0.09%) | | 21.87% |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Ratios to Average Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total expenses | | 2.37% | | 2.36% | | 2.33% | | 2.36% | | 2.32% | | 2.35% | | 2.36% | | 2.33% | | | | 2.37% | | 2.33% |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net investment loss | | (1.52%) | | (1.67%) | | (1.79%) | | (1.91%) | | (1.78%) | | (1.47%) | | (1.67%) | | (1.77%) | | | | (1.92%) | | (1.79%) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Net assets, end of year (000) | | $ 44,711 | | $ 68,034 $ 105,503 $ 117,482 $ 177,952 | | $ 70,452 | | $ 69,535 | | $ 85,553 | | $ 68,743 | | $ 85,753 |

| | |

| |

| |

| |

| |

| |

| |

|

| Portfolio turnover | | 163% | | | | 152% | | 120% | | 127% | | 141% | | 163% | | 152% | | 120% | | | | 127% | | 141% |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| 1 | Based on average shares outstanding. |

| |

| 2 | Total investment returns exclude the effects of sales charges. |

| |

| 3 | In 2006, there was no impact to the Fund’s total investment return as a result of a payment by Merrill Lynch Investment Managers, L.P. |

| |

| See Notes to Financial Statements. |

| BLACKROCK HEALTHCARE FUND, INC. |

| Financial Highlights (concluded) | | | | | | | | | | | | |

| |

| | | | | | | Class R | | | | | | |

| | |

| |

| |

| |

| |

| |

|

| | | | | Year Ended April 30, | | | | |

| | |

| |

| |

| |

|

| | | 2008 | | 2007 | | 2006 | | | | 2005 | | 2004 |

| |

| |

| |

| |

| |

| |

|

| |

| Per Share Operating Performance | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

|

| |

| Net asset value, beginning of year | | $ 4.57 | | $ 5.04 | | $ 4.66 | | $ 5.02 | | $ 4.09 |

| | |

| |

| |

| |

| |

|

| Net investment loss1 | | (0.05) | | (0.05) | | (0.06) | | | | (0.06) | | (0.02) |

| Net realized and unrealized gain (loss) | | (0.06) | | 0.42 | | 0.90 | | | | 0.07 | | 0.95 |

| | |

| |

| |

| |

| |

| |

|

| Net increase (decrease) from investment operations | | (0.11) | | 0.37 | | 0.84 | | | | 0.01 | | 0.93 |

| | |

| |

| |

| |

| |

| |

|

| Distributions from: | | | | | | | | | | | | |

| Net realized gain | | (0.89) | | (0.84) | | (0.46) | | | | (0.37) | | — |

| Tax return of capital | | (0.04) | | — | | — | | | | — | | — |

| | |

| |

| |

| |

| |

| |

|

| Total distributions | | (0.93) | | (0.84) | | (0.46) | | | | (0.37) | | — |

| | |

| |

| |

| |

| |

| |

|

| Net asset value, end of year | | $ 3.53 | | $ 4.57 | | $ 5.04 | | $ 4.66 | | $ 5.02 |

| |

| |

| |

| |

| |

|

| |

| Total Investment Return | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

|

| |

| Based on net asset value | | (4.29%) | | 9.98% | | 18.25%2 | | | | 0.54% | | 22.74% |

| |

| |

| |

| |

| |

| |

|

| |

| Ratios to Average Net Assets | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

|

| |

| Total expenses | | 2.06% | | 1.88% | | 1.80% | | | | 1.83% | | 1.73% |

| | |

| |

| |

| |

| |

| |

|

| Net investment loss | | (1.16%) | | (1.20%) | | (1.20%) | | | | (1.37%) | | (1.15%) |

| |

| |

| |

| |

| |

| |

|

| |

| Supplemental Data | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

|

| |

| Net assets, end of year (000) | | $ 9,170 | | $ 6,145 | | $ 4,885 | | $ 1,853 | | $ 473 |

| | |

| |

| |

| |

| |

|

| Portfolio turnover | | 163% | | 152% | | 120% | | | | 127% | | 141% |

| | |

| |

| |

| |

| |

| |

|

| 1 | Based on average shares outstanding. |

| |

| 2 | In 2006, there was no impact to the Fund’s total investment return as a result of a payment by Merrill Lynch Investment Managers, L.P. |

| |

| See Notes to Financial Statements. |

14 BLACKROCK HEALTHCARE FUND, INC.

Notes to Financial Statements

1. Significant Accounting Policies:

BlackRock Healthcare Fund, Inc. (the “Fund”) is registered under the

Investment Company Act of 1940, as amended (the “1940 Act”), as a

non-diversified, open-end management investment company. The Fund’s

financial statements are prepared in conformity with accounting princi-

ples generally accepted in the United States of America, which may

require the use of management accruals and estimates. Actual results

may differ from these estimates. The Fund offers multiple classes of

shares. Institutional Shares are sold without a sales charge and only to

certain eligible investors. Investor A Shares are generally sold with a

front-end sales charge. Investor B and Investor C Shares may be subject

to a contingent deferred sales charge. Class R Shares are sold only to

certain retirement plans. All classes of shares have identical voting, divi-

dend, liquidation and other rights and the same terms and conditions,

except that Investor A, Investor B, Investor C and Class R Shares bear

certain expenses related to the shareholder servicing of such shares,

and Investor B, Investor C and Class R Shares also bear certain expens-

es related to the distribution of such shares. Each class has exclusive

voting rights with respect to matters relating to its shareholder servicing

and distribution expenditures (except that Investor B shareholders may

vote on material changes to the Investor A distribution plan).

The following is a summary of significant accounting policies followed by

the Fund:

Valuation of Investments: Equity investments traded on a recognized

securities exchange or the NASDAQ Global Market System are valued at

the last reported sale price that day or the NASDAQ official closing price,

if applicable. Equity investments traded on a recognized exchange for

which there were no sales on that day are valued at the last available

bid price. Investments in open-end investment companies are valued at

net asset value each business day. Short-term securities are valued at

amortized cost.

In the event that application of these methods of valuation results in a

price for an investment which is deemed not to be representative of the

market value of such investment, the investment will be valued by a

method approved by the Board of Directors (the “Board”) as reflecting

fair value (“Fair Value Assets”). When determining the price for Fair Value

Assets, the investment advisor and/or sub-advisor seeks to determine

the price that the Fund might reasonably expect to receive from the cur-

rent sale of that asset in an arm’s-length transaction. Fair value determi-

nations shall be based upon all available factors that the investment

advisor and/or sub-advisor deems relevant. The pricing of all Fair Value

Assets is subsequently reported to the Board or a committee thereof.

Generally, trading in foreign securities is substantially completed each

day at various times prior to the close of business on the New York Stock

Exchange (“NYSE”). The values of such securities used in computing the |

net assets of the Fund are determined as of such times. Foreign cur-

rency exchange rates will generally be determined as of the close of

business on the NYSE. Occasionally, events affecting the values of such

securities and such exchange rates may occur between the times at

which they are determined and the close of business on the NYSE

that may not be reflected in the computation of the Fund’s net assets.

If events (for example, a company announcement, market volatility or

a natural disaster) occur during such periods that are expected to

materially affect the value of such securities, those securities will be

valued at their fair value as determined in good faith by the Board or

by the investment advisor using a pricing service and/or procedures

approved by the Board.

Foreign Currency Transactions: Foreign currency amounts are translated

into United States dollars on the following basis: (i) market value of

investment securities, assets and liabilities at the current rate of

exchange; and (ii) purchases and sales of investment securities, income

and expenses at the rates of exchange prevailing on the respective dates

of such transactions.

The Fund reports foreign currency related transactions as components of

realized gains for financial reporting purposes, whereas such compo-

nents are treated as ordinary income for federal income tax purposes.

Investment Transactions and Investment Income: Investment transac-

tions are recorded on the dates the transactions are entered into (the

trade dates). Realized gains and losses on security transactions are

determined on the identified cost basis. Dividend income is recorded

on the ex-dividend dates. Dividends from foreign securities where the

ex-dividend date may have passed are subsequently recorded when the

Fund has determined the ex-dividend date. Interest income is recognized

on the accrual basis. Income and realized and unrealized gains and

losses are allocated daily to each class based on its relative net assets.

Dividends and Distributions: Dividends and distributions paid by the

Fund are recorded on the ex-dividend dates. Portions of the distributions

paid by the Fund during the year ended April 30, 2008 were character-

ized as a tax return of capital.

Securities Lending: The Fund may lend securities to financial institutions

that provide cash or securities issued or guaranteed by the U.S. govern-

ment as collateral, which will be maintained at all times in an amount

equal to at least 100% of the current market value of the loaned securi-

ties. The market value of the loaned securities is determined at the close

of business of the Fund and any additional required collateral is deliv-

ered to the Fund on the next business day. The Fund typically receives

the income on the loaned securities but does not receive the income on

the collateral. Where the Fund receives cash collateral, it may invest such

collateral and retain the amount earned on such investment, net of any

amount rebated to the borrower. The Fund may receive a flat fee for its |

| BLACKROCK HEALTHCARE FUND, INC. |

Notes to Financial Statements (continued)

loans. Loans of securities are terminable at any time and the borrower,

after notice, is required to return borrowed securities within the standard

time period for settlement of securities transactions. The Fund may pay

reasonable lending agent, administrative and custodial fees in connec-

tion with its loans. In the event that the borrower defaults on its obliga-

tion to return borrowed securities because of insolvency or for any other

reason, the Fund could experience delays and costs in gaining access to

the collateral. The Fund also could suffer a loss where the value of the

collateral falls below the market value of the borrowed securities, in the

event of borrower default or in the event of losses on investments made

with cash collateral.

Income Taxes: It is the Fund’s policy to comply with the requirements of

the Internal Revenue Code applicable to regulated investment compa-

nies and to distribute substantially all of its taxable income to its share-

holders. Therefore, no federal income tax provision is required. Under the

applicable foreign tax laws, a withholding tax may be imposed on inter-

est, dividends and capital gains at various rates.

Effective October 31, 2007, the Fund implemented Financial Accounting

Standards Board (“FASB”) Interpretation No. 48, “Accounting for Uncer-

tainty in Income Taxes — an interpretation of FASB Statement No. 109”

(“FIN 48”). FIN 48 prescribes the minimum recognition threshold a tax

position must meet in connection with accounting for uncertainties in

income tax positions taken or expected to be taken by an entity, includ-

ing investment companies, before being measured and recognized in the

financial statements. The investment advisor has evaluated the applica-

tion of FIN 48 to the Fund, and has determined that the adoption of FIN

48 does not have a material impact on the Fund’s financial statements.

The Fund files U.S. federal and various state and local tax returns. No

income tax returns are currently under examination. The statute of limita-

tions on the Fund’s U.S. federal tax returns remain open for the years

ended April 30, 2005 through April 30, 2007. The statute of limitations

on the Fund’s state and local tax returns may remain open for an addi-

tional year depending upon the jurisdiction.

Recent Accounting Pronouncements: In September 2006, Statement of

Financial Accounting Standards No. 157, “Fair Value Measurements”

(“FAS 157”), was issued and is effective for fiscal years beginning after

November 15, 2007. FAS 157 defines fair value, establishes a frame-

work for measuring fair value and expands disclosures about fair value

measurements. The impact on the Fund’s financial statement disclo-

sures, if any, is currently being assessed.

In addition, in February 2007, Statement of Financial Accounting

Standards No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities” (“FAS 159”), was issued and is effective for fiscal

years beginning after November 15, 2007. FAS 159 permits entities to |

choose to measure many financial instruments and certain other items

at fair value that are not currently required to be measured at fair value.

FAS 159 also establishes presentation and disclosure requirements

designed to facilitate comparisons between entities that choose different

measurement attributes for similar types of assets and liabilities. The

impact on the Fund’s financial statement disclosures, if any, is currently

being assessed.

In March 2008, Statement of Financial Accounting Standards No. 161,

“Disclosures about Derivative Instruments and Hedging Activities — an

amendment of FASB Statement No. 133” (“FAS 161”) was issued and

is effective for fiscal years beginning after November 15, 2008. FAS 161

is intended to improve financial reporting for derivative instruments by

requiring enhanced disclosure that enables investors to understand how

and why an entity uses derivatives, how derivatives are accounted for,

and how derivative instruments affect an entity’s results of operations

and financial position. The investment advisor is currently evaluating the

implications of FAS 161 and the impact on the Fund’s financial state-

ment disclosures, if any, is currently being assessed.

Other: Expenses directly related to the Fund or its classes are charged to

that Fund or class. Other operating expenses shared by several funds

are pro-rated among those funds on the basis of relative net assets or

other appropriate methods. Other expenses of the Fund are allocated

daily to each class based on its relative net assets.

2. Investment Advisory Agreement and Other Transactions

with Affiliates:

The Fund entered into an Investment Advisory Agreement with BlackRock

Advisors, LLC (the “Advisor”), an indirect, wholly owned subsidiary of

BlackRock, Inc. to provide investment advisory and administration ser-

vices. Merrill Lynch & Co., Inc. (“Merrill Lynch”) and The PNC Financial

Services Group, Inc. (“PNC”) are principal owners of BlackRock, Inc.

The Advisor is responsible for the management of the Fund’s portfolio

and provides the necessary personnel, facilities, equipment and certain

other services necessary to the operation of the Fund. For such services,

the Fund pays a monthly fee at an annual rate of 1.0% of the average

daily net assets of the Fund. For the year ended April 30, 2008, the

Fund reimbursed the Advisor $7,744, for certain accounting services,

which is included in accounting services expenses in the Statement

of Operations.

In addition, the Advisor has entered into a sub-advisory agreement

with BlackRock Investment Management, LLC (“BIM”), an affiliate of the

Advisor, under which the Advisor pays BIM, for services it provides, a

monthly fee that is an annual percentage of the investment advisory

fee paid by the Fund to the Advisor. |

16 BLACKROCK HEALTHCARE FUND, INC.

Notes to Financial Statements (continued)

The Fund has also entered into separate Distribution Agreements and

Distribution Plans with FAM Distributors, Inc. (“FAMD”) and BlackRock

Distributors, Inc. and its affiliates (“BDI”) (collectively, the “Distributor”).

FAMD is a wholly owned subsidiary of Merrill Lynch Group, Inc., and BDI

is an affiliate of BlackRock, Inc.

Pursuant to the Distribution Plans adopted by the Fund in accordance

with Rule 12b-1 under the 1940 Act, the Fund pays the Distributor

ongoing service and distribution fees. The fees are accrued daily and

paid monthly at annual rates based upon the average daily net assets of

the shares as follows: |

| | | Service | | Distribution |

| | | Fee | | Fee |

| |

| |

|

| Investor A | | 0.25% | | — |

| Investor B | | 0.25% | | 0.75% |

| Investor C | | 0.25% | | 0.75% |

| Class R | | 0.25% | | 0.25% |

| |

| |

|

Pursuant to sub-agreements with each Distributor, broker-dealers, includ-

ing Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”), a

wholly owned subsidiary of Merrill Lynch, and each Distributor provide

shareholder servicing and distribution services to the Fund. The ongoing

service fee and/or distribution fee compensates the Distributor and

each broker-dealer for providing shareholder servicing and/or distri-

bution-related services to Investor A, Investor B, Investor C and Class R

shareholders.

For the year ended April 30, 2008, the affiliates earned underwriting

discounts, direct commissions and dealer concessions on sales of the

Fund’s Investor A Shares which totaled $132,381.

For the year ended April 30, 2008, affiliates received contingent deferred

sales charges of $38,355 and $10,631 relating to transactions in

Investor B and Investor C Shares, respectively. Furthermore, affiliates

received contingent deferred sales charges of $340 relating to transac-

tions subject to front-end sales charge waivers on Investor A Shares.

The Advisor maintains a call center, which is responsible for providing

certain shareholder services to the Fund, such as responding to share-

holder inquiries and processing transactions based upon instructions

from shareholders with respect to the subscription and redemption of

Fund shares. For the year ended April 30, 2008, the Fund reimbursed

the Advisor the following amounts for costs incurred running the call

center, which are a component of the transfer agent fees in the accom-

panying Statement of Operations. |

| | | Call Center |

| | | Fees |

| |

|

| Institutional | | $8,970 |

| Investor A | | $6,225 |

| Investor B | | $2,330 |

| Investor C | | $2,818 |

| Class R | | $ 277 |

| |

|

The Fund has received an exemptive order from the Securities and

Exchange Commission permitting it to lend portfolio securities to

MLPF&S or its affiliates. As of April 30, 2008, the Fund loaned securities

with a value of $2,194,500 to MLPF&S or its affiliates. Pursuant to that

order, the Fund has retained BIM as the securities lending agent for a

fee based on a share of the returns on investment of cash collateral.

BIM may, on behalf of the Fund, invest cash collateral received by the

Fund for such loans, among other things, in a private investment comp-

any managed by the Advisor or in registered money market funds

advised by the Advisor or its affiliates. For the year ended April 30,

2008, BIM received $141,982 in securities lending agent fees.

In addition, MLPF&S received $549,842 in commissions on the execu-

tion of portfolio security transactions for the Fund for the year ended

April 30, 2008.

PFPC Inc., an indirect, wholly owned subsidiary of PNC and an affiliate

of the Advisor, serves as transfer agent. Each class of the Fund bears

the costs of transfer agent fees associated with such respective classes.

Transfer agency fees borne by each class of the Fund are comprised of

those fees charged for all shareholder communications including share-

holder reports, dividend and distribution notices, and proxy materials

for shareholders meetings, as well as per account and per transaction

fees related to servicing and maintenance of shareholder accounts,

including the issuing, redeeming and transferring of shares of each class

of the Fund, 12b-1 fee calculation, check writing, anti-money laundering

services, and customer identification services.

Certain officers and/or directors of the Fund are officers and/or directors

of BlackRock, Inc. or its affiliates.

3. Investments:

Purchases and sales of investments, excluding short-term securities,

for the year ended April 30, 2008, were $717,827,520, and

$728,937,242, respectively. |

| BLACKROCK HEALTHCARE FUND, INC. |

| Notes to Financial Statements (continued) | | | | | | | | | |

| |

| 4. Capital Share Transactions: | | | | | | | | | | | |

| Transactions in common stock for each class were as follows: | | | | | | | | | |

| |

| | | Year Ended | | | | Year Ended | | |

| | | April 30, 2008 | | | | April 30, 2007 | | |

| | |

| |

| |

| |

|

| | | Shares | | | Amount | | Shares | | | | Amount |

| |

|

| |

| |

| |

| |

|

| Institutional Shares | | | | | | | | | | | |

| |

|

| |

| |

| |

| |

|

| Shares sold | | 3,636,933 | $ 24,157,299 | | 1,680,191 | | $ 11,164,078 |

| Shares issued to shareholders in reinvestment | | | | | | | | | | | |

| of distributions | | 1,666,185 | | | 11,110,554 | | 2,574,159 | | | | 15,775,291 |

| | |

|

| |

| |

| |

| |

|

| Total issued | | 5,303,118 | | | 35,267,853 | | 4,254,350 | | | | 26,939,369 |

| Shares redeemed | | (3,859,722) | | | (25,369,674) | | (5,218,571) | | | | (34,370,859) |

| | |

|

| |

| |

| |

| |

|

| Net increase (decrease) | | 1,443,396 | $ 9,898,179 | | (964,221) | | $ (7,431,490) |

| |

|

| |

| |

|

| |

| Investor A Shares | | | | | | | | | | | |

| |

|

| |

| |

| |

| |

|

| Shares sold and automatic conversion of shares | | 13,900,855 | $ 81,903,347 | | 5,529,150 | | $ 33,428,253* |

| Shares issued to shareholders in reinvestment | | | | | | | | | | | |

| of distributions | | 2,230,527 | | | 13,359,839 | | 3,406,307 | | | | 18,923,333 |

| | |

|

| |

| |

| |

| |

|

| Total issued | | 16,131,382 | | | 95,263,186 | | 8,935,457 | | | | 52,351,586 |

| Shares redeemed | | (8,232,045) | | | (48,139,484) | | (9,662,117) | | | | (57,886,509) |

| | |

|

| |

| |

| |

| |

|

| Net increase (decrease) | | 7,899,337 | $ 47,123,702 | | (726,660) | | $ (5,534,923) |

| | |

|

| |

| |

|

| | * In September 2006, certain brokerages, including a wholly owned subsidiary of Merrill Lynch, entered into a remediation agreement with a regulatory organization, which

among other things, permitted certain shareholders of Investor B Shares to convert their shares into the Fund’s Investor A Shares. As a result, a wholly owned subsidiary of

Merrill Lynch supplemented the Investor A Share purchase by approximately $61,000. |

| Investor B Shares | | | | | | | | |

| |

| |

| |

| |

|

| Shares sold | | 2,536,472 | | $ 10,043,911 | | 1,243,186 | | $ 5,325,187 |

| Shares issued to shareholders in reinvestment | | | | | | | | |

| of distributions | | 1,603,409 | | 6,436,538 | | 3,689,599 | | 14,366,476 |

| | |

| |

| |

| |

|

| Total issued | | 4,139,881 | | 16,480,449 | | 4,932,785 | | 19,691,663 |

| Shares redeemed and automatic conversion of shares | | (6,493,212) | | (25,984,096) | | (11,030,047) | | (46,535,654) |

| | |

| |

| |

| |

|

| Net decrease | | (2,353,331) | | $ (9,503,647) | | (6,097,262) | | $ (26,843,991) |

| |

| |

| |

| |

|

| |

| Investor C Shares | | | | | | | | |

| |

| |

| |

| |

|

| Shares sold | | 7,623,364 | | $ 29,864,565 | | 2,129,339 | | $ 9,034,668 |

| Shares issued to shareholders in reinvestment | | | | | | | | |

| of distributions | | 1,872,373 | | 7,474,447 | | 3,078,519 | | 11,960,130 |

| | |

| |

| |

| |

|

| Total issued | | 9,495,737 | | 37,339,012 | | 5,207,858 | | 20,994,798 |

| Shares redeemed | | (4,610,643) | | (17,870,414) | | (6,907,028) | | (29,145,267) |

| | |

| |

| |

| |

|

| Net increase (decrease) | | 4,885,094 | | $ 19,468,598 | | (1,699,170) | | $ (8,150,469) |

| |

| |

| |

| |

|

| |

| Class R Shares | | | | | | | | |

| |

| |

| |

| |

|

| Shares sold | | 2,286,947 | | $ 9,216,749 | | 870,793 | | $ 3,790,289 |

| Shares issued to shareholders in reinvestment | | | | | | | | |

| of distributions | | 186,789 | | 767,099 | | 210,784 | | 840,798 |

| | |

| |

| |

| |

|

| Total issued | | 2,473,736 | | 9,983,848 | | 1,081,577 | | 4,631,087 |

| Shares redeemed | | (1,221,218) | | (4,898,461) | | (707,165) | | (3,049,462) |

| | |

| |

| |

| |

|

| Net increase | | 1,252,518 | | $ 5,085,387 | | 374,412 | | $ 1,581,625 |

| | |

| |

| |

| |

|

18 BLACKROCK HEALTHCARE FUND, INC.

| Notes to Financial Statements (concluded) |

5. Short-Term Borrowings:

The Fund, along with certain other funds managed by the Advisor and its

affiliates, is a party to a $500,000,000 credit agreement with a group

of lenders. The Fund may borrow under the credit agreement to fund

shareholder redemptions and for other lawful purposes other than for

leverage. The Fund may borrow up to the maximum amount allowable

under the Fund’s current Prospectus and Statement of Additional

Information, subject to various other legal, regulatory or contractual

limits. On November 21, 2007, the credit agreement was renewed for

one year under substantially the same terms. The Fund pays a commit-

ment fee of 0.06% per annum based on the Fund’s pro rata share of

the unused portion of the credit agreement, which is included in miscel-

laneous expenses in the Statement of Operations. Amounts borrowed

under the credit agreement bear interest at a rate equal to, at the fund’s

election, the federal funds rate plus 0.35% or a base rate as defined in

the credit agreement. The Fund did not borrow under the credit agree-

ment during the year ended April 30, 2008.

6. Commitments:

At April 30, 2008, the Fund had entered into foreign exchange contracts

under which it had agreed to purchase various foreign currencies with

approximate values of $272,000. |

7. Income Tax Information:

Reclassification: U.S. generally accepted accounting principles require that

certain components of net assets be adjusted to reflect permanent differ-

ences between financial and tax reporting. Accordingly, during the current

year, $3,662,015 has been reclassified between accumulated net realized

loss and accumulated net investment loss as a result of permanent differ-

ences attributable to net operating losses, foreign currency transactions

and foreign taxes paid. These reclassifications have no effect on net assets

or net asset values per share.

The tax character of distributions paid during the fiscal years ended

April 30, 2008 and April 30, 2007 was as follows: |

| | | 4/30/2008 | | 4/30/2007 |

| | |

| |

|

| Distributions paid from: | | | | |

| Ordinary income | | $ 21,440,851 | | $ 2,650,052 |

| Net long-term capital gains | | 47,959,836 | | 67,499,318 |

| Tax return of capital | | 3,163,282 | | — |

| | |

| |

|

| Total distributions | | $72,563,969 | | $70,149,370 |

| | |

| |

|

| |

| As of April 30, 2008, the components of accumulated earnings on a tax |

| basis were as follows: | | | | |

| |

| |

|

| Net unrealized gains | | | | $ 44,804,050* |

| | | | |

|

| Total net accumulated earnings | | | | $ 44,804,050 |

| | | | |

|

* The difference between book-basis and tax-basis net unrealized gains is attributable

primarily to the tax deferral of losses on wash sales, the realization for tax purposes

of unrealized gains (losses) on certain foreign currency contracts and the deferral

of post-October currency and capital losses for tax purposes. |

| BLACKROCK HEALTHCARE FUND, INC. |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of BlackRock

Healthcare Fund, Inc.:

We have audited the accompanying statement of assets and liabilities,

including the schedule of investments, of BlackRock Healthcare Fund,

Inc. (the “Fund”) as of April 30, 2008, and the related statement of

operations for the year then ended, the statements of changes in net

assets for each of the two years in the period then ended, and the finan-

cial highlights for each of the five years in the period then ended. These

financial statements and financial highlights are the responsibility of the

Fund’s management. Our responsibility is to express an opinion on these

financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public

Company Accounting Oversight Board (United States). Those standards

require that we plan and perform the audit to obtain reasonable assur-

ance about whether the financial statements and financial highlights

are free of material misstatement. The Fund is not required to have, nor

were we engaged to perform, an audit of its internal control over finan-

cial reporting. Our audits included consideration of internal control over

financial reporting as a basis for designing audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of the Fund’s internal control over financial

reporting. Accordingly, we express no such opinion. An audit also

includes examining, on a test basis, evidence supporting the amounts

and disclosures in the financial statements, assessing the accounting

principles used and significant estimates made by management, as well

as evaluating the overall financial statement presentation. Our proce-

dures included confirmation of securities owned as of April 30, 2008,

by correspondence with the custodian and brokers; where replies were

not received from brokers, we performed other auditing procedures.

We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred

to above present fairly, in all material respects, the financial position

of BlackRock Healthcare Fund, Inc. as of April 30, 2008, the results

of its operations for the year then ended, the changes in its net assets

for each of the two years in the period then ended, and the financial

highlights for each of the five years in the period then ended, in con-

formity with accounting principles generally accepted in the United

States of America.

Deloitte & Touche LLP

Princeton, New Jersey

June 25, 2008 |

Important Tax Information (Unaudited)

The following information is provided with respect to the ordinary income distributions paid by BlackRock Healthcare Fund, Inc. during the fiscal year

ended April 30, 2008: |

| | | Record Date | | July 18, 2007 | | December 11, 2007 |

| | | Payable Date | | July 20, 2007 | | December 13, 2007 |

| |

| |

| |

|

| Qualified Dividend Income for Individuals | | | | 80.17%* | | 5.49%* |