0000709364 ck0000709364:C000026028Member ck0000709364:InformationTechnologyMember 2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03599

Name of Registrant: The Royce Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

Name and address of agent for service: John E. Denneen, Esq.

745 Fifth Avenue

New York, NY 10151

Registrant’s telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31, 2023

Date of reporting period: January 1, 2024 – June 30, 2024

Item 1. Reports to Shareholders.

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Fund

Consultant Class—RYPCX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Fund—Consultant Class | $98 | 1.94% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,901 |

| Number of Holdings | 285 |

| Turnover Rate | 20% |

What Did The Fund Invest In?

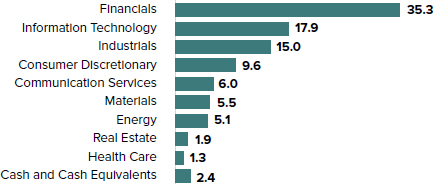

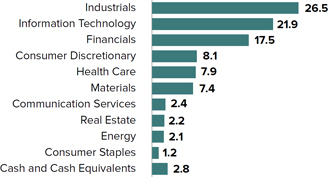

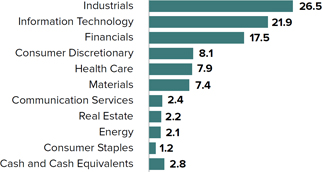

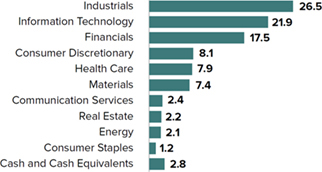

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| Arcosa | 1.8 | |  |

| First Citizens BancShares Cl. A | 1.6 | |

| Air Lease Cl. A | 1.6 | |

| Element Solutions | 1.5 | |

| Haemonetics Corporation | 1.4 | |

| Onto Innovation | 1.4 | |

| Enovis Corporation | 1.2 | |

| Computer Modelling Group | 1.2 | |

| Cirrus Logic | 1.2 | |

| Alamos Gold Cl. A | 1.2 | |

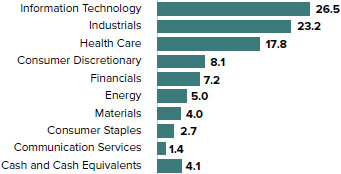

| Portfolio Sector Breakdown | |

| Industrials | 26.5 |

| Information Technology | 21.9 |

| Financials | 17.5 |

| Consumer Discretionary | 8.1 |

| Health Care | 7.9 |

| Materials | 7.4 |

| Communication Services | 2.4 |

| Real Estate | 2.2 |

| Energy | 2.1 |

| Consumer Staples | 1.2 |

| Cash and Cash Equivalents | 2.8 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | PMF-CC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Fund

Investment Class—PENNX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Fund—Investment Class | $47 | 0.93% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,901 |

| Number of Holdings | 285 |

| Turnover Rate | 20% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| Arcosa | 1.8 | |  |

| First Citizens BancShares Cl. A | 1.6 | |

| Air Lease Cl. A | 1.6 | |

| Element Solutions | 1.5 | |

| Haemonetics Corporation | 1.4 | |

| Onto Innovation | 1.4 | |

| Enovis Corporation | 1.2 | |

| Computer Modelling Group | 1.2 | |

| Cirrus Logic | 1.2 | |

| Alamos Gold Cl. A | 1.2 | |

| Portfolio Sector Breakdown | |

| Industrials | 26.5 |

| Information Technology | 21.9 |

| Financials | 17.5 |

| Consumer Discretionary | 8.1 |

| Health Care | 7.9 |

| Materials | 7.4 |

| Communication Services | 2.4 |

| Real Estate | 2.2 |

| Energy | 2.1 |

| Consumer Staples | 1.2 |

| Cash and Cash Equivalents | 2.8 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | PMF-IC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Fund

Institutional Class—RPMIX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Fund—Institutional Class | $45 | 0.88% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,901 |

| Number of Holdings | 285 |

| Turnover Rate | 20% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| Arcosa | 1.8 | |  |

| First Citizens BancShares Cl. A | 1.6 | |

| Air Lease Cl. A | 1.6 | |

| Element Solutions | 1.5 | |

| Haemonetics Corporation | 1.4 | |

| Onto Innovation | 1.4 | |

| Enovis Corporation | 1.2 | |

| Computer Modelling Group | 1.2 | |

| Cirrus Logic | 1.2 | |

| Alamos Gold Cl. A | 1.2 | |

| Portfolio Sector Breakdown | |

| Industrials | 26.5 |

| Information Technology | 21.9 |

| Financials | 17.5 |

| Consumer Discretionary | 8.1 |

| Health Care | 7.9 |

| Materials | 7.4 |

| Communication Services | 2.4 |

| Real Estate | 2.2 |

| Energy | 2.1 |

| Consumer Staples | 1.2 |

| Cash and Cash Equivalents | 2.8 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | PMF-INC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Fund

Service Class—RYPFX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Fund—Service Class | $64 | 1.26% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,901 |

| Number of Holdings | 285 |

| Turnover Rate | 20% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| Arcosa | 1.8 | |  |

| First Citizens BancShares Cl. A | 1.6 | |

| Air Lease Cl. A | 1.6 | |

| Element Solutions | 1.5 | |

| Haemonetics Corporation | 1.4 | |

| Onto Innovation | 1.4 | |

| Enovis Corporation | 1.2 | |

| Computer Modelling Group | 1.2 | |

| Cirrus Logic | 1.2 | |

| Alamos Gold Cl. A | 1.2 | |

| Portfolio Sector Breakdown | |

| Industrials | 26.5 |

| Information Technology | 21.9 |

| Financials | 17.5 |

| Consumer Discretionary | 8.1 |

| Health Care | 7.9 |

| Materials | 7.4 |

| Communication Services | 2.4 |

| Real Estate | 2.2 |

| Energy | 2.1 |

| Consumer Staples | 1.2 |

| Cash and Cash Equivalents | 2.8 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | PMF-SC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Dividend Value Fund Investment Class—RDVIX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Dividend Value Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Dividend Value Fund—Investment Class | $56 | 1.09% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $66 |

| Number of Holdings | 47 |

| Turnover Rate | 2% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| HEICO Corporation Cl. A | 5.1 | |  |

| Carlyle Group | 4.6 | |

| Evercore Cl. A | 4.3 | |

| Applied Industrial Technologies | 4.0 | |

| SEI Investments | 3.7 | |

| First Citizens BancShares Cl. A | 3.4 | |

| Royal Gold | 3.3 | |

| KKR & Co. | 3.1 | |

| Franco-Nevada | 3.0 | |

| Hubbell Incorporated | 2.9 | |

| | | |

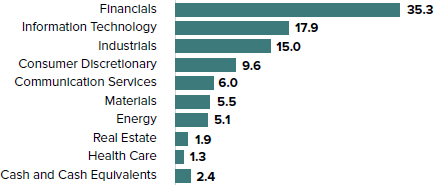

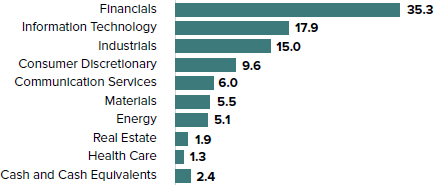

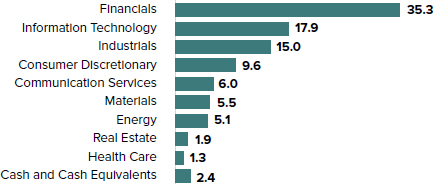

| Portfolio Sector Breakdown | |

| Financials | 34.7 |

| Industrials | 30.0 |

| Materials | 14.6 |

| Consumer Discretionary | 5.5 |

| Health care | 4.0 |

| Energy | 1.6 |

| Real Estate | 1.5 |

| Cash and Cash Equivalents | 8.1 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus ● Financial Information | ● Fund Holdings ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RDV-IC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Dividend Value Fund Service Class—RYDVX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Dividend Value Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Dividend Value Fund—Service Class | $69 | 1.34% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $66 |

| Number of Holdings | 47 |

| Turnover Rate | 2% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| HEICO Corporation Cl. A | 5.1 | |  |

| Carlyle Group | 4.6 | |

| Evercore Cl. A | 4.3 | |

| Applied Industrial Technologies | 4.0 | |

| SEI Investments | 3.7 | |

| First Citizens BancShares Cl. A | 3.4 | |

| Royal Gold | 3.3 | |

| KKR & Co. | 3.1 | |

| Franco-Nevada | 3.0 | |

| Hubbell Incorporated | 2.9 | |

| Portfolio Sector Breakdown | |

| Financials | 34.7 |

| Industrials | 30.0 |

| Materials | 14.6 |

| Consumer Discretionary | 5.5 |

| Health Care | 4.0 |

| Energy | 1.6 |

| Real Estate | 1.5 |

| Cash and Cash Equivalents | 8.1 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus ● Financial Information | ● Fund Holdings ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RDV-SC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Global Financial Services Fund Institutional Class—RGFIX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Global Financial Services Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

This report provides information about the adoption of a plan of liquidation with respect to the Fund.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Global Financial Services Fund—Institutional Class | $77 | 1.49% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $29 |

| Number of Holdings | 48 |

| Turnover Rate | 3% |

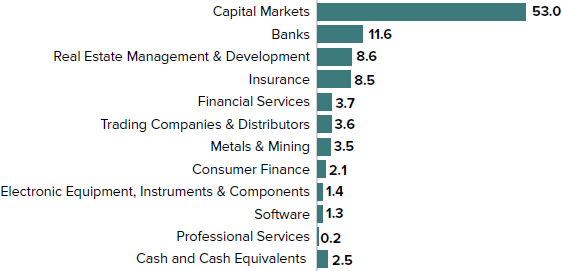

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Country Breakdown1,2 | | |

| Tel Aviv Stock Exchange | 5.7 | | United States | 43.8 | |

| Sprott | 5.2 | | Canada | 28.4 | |

| KKR & Co. | 4.7 | | Israel | 5.7 | |

| First Citizens BancShares Cl. A | 4.7 | | Bermuda | 5.5 | |

| FirstService Corporation | 4.0 | | United Kingdom | 3.7 | |

| E-L Financial | 3.7 | | ¹Represents countries that are 3% or more of net assets. |

| Intermediate Capital Group | 3.7 | | ²Securities are categorized by the country of their headquarters. |

| FTAI Aviation | 3.6 | | | | |

| Franco-Nevada | 3.5 | | | | |

| Altus Group | 3.0 | | | | |

| | | | | |

| Portfolio Industry Breakdown |

| |

|

| Portfolio Industry Breakdown | |

| Capital Market | 53.0 |

| Banks | 11.6 |

| Real Estate Management & Development | 8.6 |

| Insurance | 8.5 |

| Financial Services | 3.7 |

| Trading Companies & Distributors | 3.6 |

| Metals & Mining | 3.5 |

| Consumer Finance | 2.1 |

| Electronic Equipment, Instruments & Components | 1.4 |

| Software | 1.3 |

| Professional Services | 0.2 |

| Cash and Cash Equivalents | 2.5 |

| ROYCE GLOBAL FINANCIAL SERVICES FUND—INSTITUTIONAL CLASS (RGFIX) | Semiannual Shareholder Report—June 30, 2024 |

How Has the Fund Changed?

The Board of Trustees of The Royce Fund has approved a plan of liquidation for Royce Global Financial Services Fund (“RFS”). RFS is being liquidated primarily because it has not maintained assets at a sufficient level for it to be viable. A final distribution was paid on August 1, 2024, to shareholders of record on July 31, 2024. The liquidation of RFS will be completed on September 9, 2024.

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus ● Financial Information | ● Fund Holdings ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Industry weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RFS-INC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Global Financial Services Fund Service Class—RYFSX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Global Financial Services Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

This report provides information about the adoption of a plan of liquidation with respect to the Fund.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT¹ |

| Royce Global Financial Services Fund—Service Class | $77 | 1.49% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $29 |

| Number of Holdings | 48 |

| Turnover Rate | 3% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | Country Breakdown1,2 | |

| Tel Aviv Stock Exchange | 5.7 | | United States | 43.8 | |

| Sprott | 5.2 | | Canada | 28.4 | |

| KKR & Co. | 4.7 | | Israel | 5.7 | |

| First Citizens BancShares Cl. A | 4.7 | | Bermuda | 5.5 | |

| FirstService Corporation | 4.0 | | United Kingdom | 3.7 | |

| E-L Financial | 3.7 | | ¹Represents countries that are 3% or more of net assets. |

| Intermediate Capital Group | 3.7 | | ²Securities are categorized by the country of their headquarters. |

| FTAI Aviation | 3.6 | | |

| Franco-Nevada | 3.5 | | |

| Altus Group | 3.0 | | |

| | | | | |

Portfolio Industry Breakdown

| Portfolio Industry Breakdown | |

| Capital Market | 53.0 |

| Banks | 11.6 |

| Real Estate Management & Development | 8.6 |

| Insurance | 8.5 |

| Financial Services | 3.7 |

| Trading Companies & Distributors | 3.6 |

| Metals & Mining | 3.5 |

| Consumer Finance | 2.1 |

| Electronic Equipment, Instruments & Components | 1.4 |

| Software | 1.3 |

| Professional Services | 0.2 |

| Cash and Cash Equivalents | 2.5 |

| ROYCE GLOBAL FINANCIAL SERVICES FUND—SERVICE CLASS (RYFSX) | Semiannual Shareholder Report—June 30, 2024 |

How Has the Fund Changed?

The Board of Trustees of The Royce Fund has approved a plan of liquidation for Royce Global Financial Services Fund (“RFS”). RFS is being liquidated primarily because it has not maintained assets at a sufficient level for it to be viable. A final distribution was paid on August 1, 2024, to shareholders of record on July 31, 2024. The liquidation of RFS will be completed on September 9, 2024.

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements.Industry weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RFS-SC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce International Premier Fund Investment Class—RIPNX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce International Premier Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE OF A $10,000 INVESTMENT¹ |

| Royce International Premier Fund—Investment Class | $58 | 1.19% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $317 |

| Number of Holdings | 60 |

| Turnover Rate | 20% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | Country Breakdown1,2 | |

| Hansen Technologies | 2.5 | | United Kingdom | 23.5 | |

| TKC Corporation | 2.2 | | Japan | 22.7 | |

| IPH | 2.1 | | Sweden | 8.0 | |

| Riken Keiki | 2.1 | | Australia | 6.3 | |

| Intertek Group | 2.1 | | Italy | 4.9 | |

| Zuken | 2.0 | | Switzerland | 4.0 | |

| NICE Information Service | 2.0 | | Canada | 3.7 | |

| JCU | 2.0 | | France | 3.6 | |

| As One | 2.0 | | Brazil | 3.4 | |

| Diploma | 1.9 | | ¹Represents countries that are 3% or more of net assets. |

| | | | ²Securities are categorized by the country of their headquarters. |

| | | | | |

Portfolio Sector Breakdown

| Portfolio Sector Breakdown | |

| Industrials | 40.2 |

| Information Technology | 27.6 |

| Health Care | 9.0 |

| Financials | 7.0 |

| Materials | 4.5 |

| Communication Services | 3.6 |

| Consumer Discretionary | 3.3 |

| Preferred Stock | 1.5 |

| Cash and Cash Equivalents | 3.3 |

| ROYCE INTERNATIONAL PREMIER FUND—INVESTMENT CLASS (RIPNX) | Semiannual Shareholder Report—June 30, 2024 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RIP-IC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce International Premier Fund

Institutional Class—RIPIX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce International Premier Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce International Premier Fund—Institutional Class | $51 | 1.04% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $317 |

| Number of Holdings | 60 |

| Turnover Rate | 20% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Country Breakdown1,2 | | |

| Hansen Technologies | 2.5 | | United Kingdom | 23.5 | |

| TKC Corporation | 2.2 | | Japan | 22.7 | |

| IPH | 2.1 | | Sweden | 8.0 | |

| Riken Keiki | 2.1 | | Australia | 6.3 | |

| Intertek Group | 2.1 | | Italy | 4.9 | |

| Zuken | 2.0 | | Switzerland | 4.0 | |

| NICE Information Service | 2.0 | | Canada | 3.7 | |

| JCU | 2.0 | | France | 3.6 | |

| As One | 2.0 | | Brazil | 3.4 | |

| Diploma | 1.9 | | ¹Represents countries that are 3% or more of net assets. | |

| | | | ²Securities are categorized by the country of their headquarters. | |

| Portfolio Sector Breakdown |

|

| Portfolio Sector Breakdown | |

| Industrials | 40.2 |

| Information Technology | 27.6 |

| Health Care | 9.0 |

| Financials | 7.0 |

| Materials | 4.5 |

| Communication Services | 3.6 |

| Consumer Discretionary | 3.3 |

| Preferred Stock | 1.5 |

| Cash and Cash Equivalents | 3.3 |

| ROYCE INTERNATIONAL PREMIER FUND—INSTITUTIONAL CLASS (RIPIX) | Semiannual Shareholder Report—June 30, 2024 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RIP-INC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce International Premier Fund

Service Class—RYIPX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce International Premier Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce International Premier Fund—Service Class | $70 | 1.44% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $317 |

| Number of Holdings | 60 |

| Turnover Rate | 20% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Country Breakdown1,2 | | |

| Hansen Technologies | 2.5 | | United Kingdom | 23.5 | |

| TKC Corporation | 2.2 | | Japan | 22.7 | |

| IPH | 2.1 | | Sweden | 8.0 | |

| Riken Keiki | 2.1 | | Australia | 6.3 | |

| Intertek Group | 2.1 | | Italy | 4.9 | |

| Zuken | 2.0 | | Switzerland | 4.0 | |

| NICE Information Service | 2.0 | | Canada | 3.7 | |

| JCU | 2.0 | | France | 3.6 | |

| As One | 2.0 | | Brazil | 3.4 | |

| Diploma | 1.9 | | ¹Represents countries that are 3% or more of net assets. | |

| | | | ²Securities are categorized by the country of their headquarters. | |

| Portfolio Sector Breakdown |

|

| Portfolio Sector Breakdown | |

| Industrials | 40.2 |

| Information Technology | 27.6 |

| Health Care | 9.0 |

| Financials | 7.0 |

| Materials | 4.5 |

| Communication Services | 3.6 |

| Consumer Discretionary | 3.3 |

| Preferred Stock | 1.5 |

| Cash and Cash Equivalents | 3.3 |

| ROYCE INTERNATIONAL PREMIER FUND—SERVICE CLASS (RYIPX) | Semiannual Shareholder Report—June 30, 2024 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RIP-SC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Micro-Cap Fund

Consultant Class—RYMCX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Micro-Cap Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Micro-Cap Fund—Consultant Class | $113 | 2.24% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $300 |

| Number of Holdings | 123 |

| Turnover Rate | 10% |

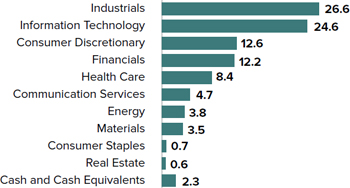

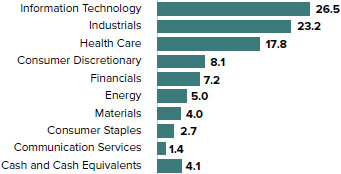

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 1.6 | |  |

| Artivion | 1.4 | |

| Newpark Resources | 1.4 | |

| Graham Corporation | 1.3 | |

| American Superconductor | 1.3 | |

| VSE Corporation | 1.3 | |

| QuinStreet | 1.3 | |

| Shoe Carnival | 1.3 | |

| CRA International | 1.3 | |

| Arlo Technologies | 1.3 | |

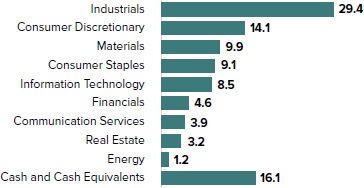

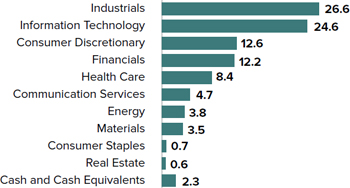

| Portfolio Sector Breakdown | |

| Industrials | 26.6 |

| Information Technology | 24.6 |

| Consumer Discretionary | 12.6 |

| Financials | 12.2 |

| Health Care | 8.4 |

| Communication Services | 4.7 |

| Energy | 3.8 |

| Materials | 3.5 |

| Consumer Staples | 0.7 |

| Real Estate | 0.6 |

| Cash and Cash Equivalents | 2.3 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RMC-CC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Micro-Cap Fund

Investment Class—RYOTX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Micro-Cap Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Micro-Cap Fund—Investment Class | $62 | 1.23% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $300 |

| Number of Holdings | 123 |

| Turnover Rate | 10% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 1.6 | |  |

| Artivion | 1.4 | |

| Newpark Resources | 1.4 | |

| Graham Corporation | 1.3 | |

| American Superconductor | 1.3 | |

| VSE Corporation | 1.3 | |

| QuinStreet | 1.3 | |

| Shoe Carnival | 1.3 | |

| CRA International | 1.3 | |

| Arlo Technologies | 1.3 | |

| Portfolio Sector Breakdown | |

| Industrials | 26.6 |

| Information Technology | 24.6 |

| Consumer Discretionary | 12.6 |

| Financials | 12.2 |

| Health Care | 8.4 |

| Communication Services | 4.7 |

| Energy | 3.8 |

| Materials | 3.5 |

| Consumer Staples | 0.7 |

| Real Estate | 0.6 |

| Cash and Cash Equivalents | 2.3 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RMC-IC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Micro-Cap Fund

Service Class—RMCFX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Micro-Cap Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Micro-Cap Fund—Service Class | $75 | 1.49% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $300 |

| Number of Holdings | 123 |

| Turnover Rate | 10% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 1.6 | |  |

| Artivion | 1.4 | |

| Newpark Resources | 1.4 | |

| Graham Corporation | 1.3 | |

| American Superconductor | 1.3 | |

| VSE Corporation | 1.3 | |

| QuinStreet | 1.3 | |

| Shoe Carnival | 1.3 | |

| CRA International | 1.3 | |

| Arlo Technologies | 1.3 | |

| Portfolio Sector Breakdown | |

| Industrials | 26.6 |

| Information Technology | 24.6 |

| Consumer Discretionary | 12.6 |

| Financials | 12.2 |

| Health Care | 8.4 |

| Communication Services | 4.7 |

| Energy | 3.8 |

| Materials | 3.5 |

| Consumer Staples | 0.7 |

| Real Estate | 0.6 |

| Cash and Cash Equivalents | 2.3 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RMC-SC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Opportunity Fund

Consultant Class—ROFCX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Opportunity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Opportunity Fund—Consultant Class | $113 | 2.24% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,238 |

| Number of Holdings | 225 |

| Turnover Rate | 15% |

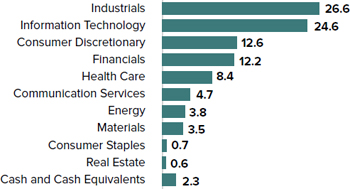

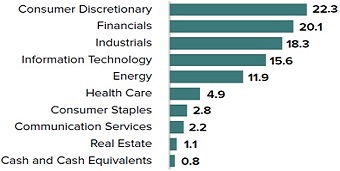

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 0.9 | |  |

| Artivion | 0.9 | |

| Ultra Clean Holdings | 0.8 | |

| VSE Corporation | 0.8 | |

| Veeco Instruments | 0.8 | |

| Kyndryl Holdings | 0.8 | |

| Lakeland Industries | 0.8 | |

| AAR Corp. | 0.8 | |

| Select Water Solutions Cl. A | 0.8 | |

| Carpenter Technology | 0.8 | |

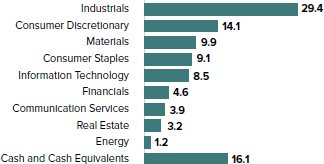

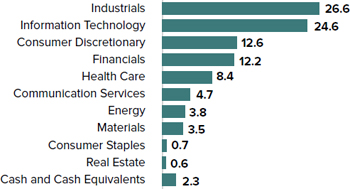

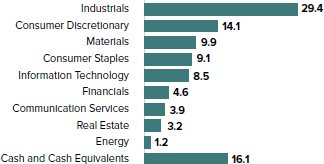

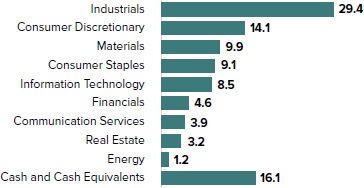

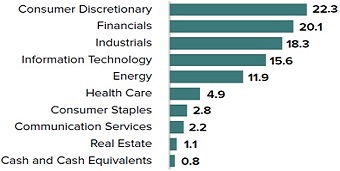

| Portfolio Sector Breakdown | |

| Industrials | 28.2 |

| Information Technology | 21.0 |

| Consumer Discretionary | 13.3 |

| Financials | 7.6 |

| Energy | 7.6 |

| Materials | 6.8 |

| Health Care | 6.8 |

| Communication Services | 5.2 |

| Consumer Staples | 1.2 |

| Real Estate | 0.3 |

| Cash and Cash Equivalents | 2.0 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | ROF-CC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Opportunity Fund

Investment Class—RYPNX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Opportunity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Opportunity Fund—Investment Class | $62 | 1.22% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,238 |

| Number of Holdings | 225 |

| Turnover Rate | 15% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 0.9 | |  |

| Artivion | 0.9 | |

| Ultra Clean Holdings | 0.8 | |

| VSE Corporation | 0.8 | |

| Veeco Instruments | 0.8 | |

| Kyndryl Holdings | 0.8 | |

| Lakeland Industries | 0.8 | |

| AAR Corp. | 0.8 | |

| Select Water Solutions Cl. A | 0.8 | |

| Carpenter Technology | 0.8 | |

| Portfolio Sector Breakdown | |

| Industrials | 28.2 |

| Information Technology | 21.0 |

| Consumer Discretionary | 13.3 |

| Financials | 7.6 |

| Energy | 7.6 |

| Materials | 6.8 |

| Health Care | 6.8 |

| Communication Services | 5.2 |

| Consumer Staples | 1.2 |

| Real Estate | 0.3 |

| Cash and Cash Equivalents | 2.0 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | ROF-IC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Opportunity Fund

Institutional Class—ROFIX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Opportunity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Opportunity Fund—Institutional Class | $57 | 1.12% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,238 |

| Number of Holdings | 225 |

| Turnover Rate | 15% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 0.9 | |  |

| Artivion | 0.9 | |

| Ultra Clean Holdings | 0.8 | |

| VSE Corporation | 0.8 | |

| Veeco Instruments | 0.8 | |

| Kyndryl Holdings | 0.8 | |

| Lakeland Industries | 0.8 | |

| AAR Corp. | 0.8 | |

| Select Water Solutions Cl. A | 0.8 | |

| Carpenter Technology | 0.8 | |

| Portfolio Sector Breakdown | |

| Industrials | 28.2 |

| Information Technology | 21.0 |

| Consumer Discretionary | 13.3 |

| Financials | 7.6 |

| Energy | 7.6 |

| Materials | 6.8 |

| Health Care | 6.8 |

| Communication Services | 5.2 |

| Consumer Staples | 1.2 |

| Real Estate | 0.3 |

| Cash and Cash Equivalents | 2.0 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | ROF-INC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Opportunity Fund

R Class—ROFRX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Opportunity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Opportunity Fund—R Class | $93 | 1.85% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,238 |

| Number of Holdings | 225 |

| Turnover Rate | 15% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 0.9 | |  |

| Artivion | 0.9 | |

| Ultra Clean Holdings | 0.8 | |

| VSE Corporation | 0.8 | |

| Veeco Instruments | 0.8 | |

| Kyndryl Holdings | 0.8 | |

| Lakeland Industries | 0.8 | |

| AAR Corp. | 0.8 | |

| Select Water Solutions Cl. A | 0.8 | |

| Carpenter Technology | 0.8 | |

| Portfolio Sector Breakdown | |

| Industrials | 28.2 |

| Information Technology | 21.0 |

| Consumer Discretionary | 13.3 |

| Financials | 7.6 |

| Energy | 7.6 |

| Materials | 6.8 |

| Health Care | 6.8 |

| Communication Services | 5.2 |

| Consumer Staples | 1.2 |

| Real Estate | 0.3 |

| Cash and Cash Equivalents | 2.0 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | ROF-RC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Small-Cap Opportunity Fund

Service Class—RYOFX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Small-Cap Opportunity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Small-Cap Opportunity Fund—Service Class | $75 | 1.49% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,238 |

| Number of Holdings | 225 |

| Turnover Rate | 15% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| CECO Environmental | 0.9 | |  |

| Artivion | 0.9 | |

| Ultra Clean Holdings | 0.8 | |

| VSE Corporation | 0.8 | |

| Veeco Instruments | 0.8 | |

| Kyndryl Holdings | 0.8 | |

| Lakeland Industries | 0.8 | |

| AAR Corp. | 0.8 | |

| Select Water Solutions Cl. A | 0.8 | |

| Carpenter Technology | 0.8 | |

| Portfolio Sector Breakdown | |

| Industrials | 28.2 |

| Information Technology | 21.0 |

| Consumer Discretionary | 13.3 |

| Financials | 7.6 |

| Energy | 7.6 |

| Materials | 6.8 |

| Health Care | 6.8 |

| Communication Services | 5.2 |

| Consumer Staples | 1.2 |

| Real Estate | 0.3 |

| Cash and Cash Equivalents | 2.0 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | ROF-SC-STSR-0624 |

| The Royce Funds | June 30, 2024 |

| | |

Royce Premier Fund

Consultant Class—RPRCX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Premier Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| FUND/CLASS | COSTS OF A

$10,000 INVESTMENT | COSTS PAID AS A PERCENTAGE

OF A $10,000 INVESTMENT¹ |

| Royce Premier Fund—Consultant Class | $112 | 2.24% |

¹Annualized

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,396 |

| Number of Holdings | 50 |

| Turnover Rate | 7% |

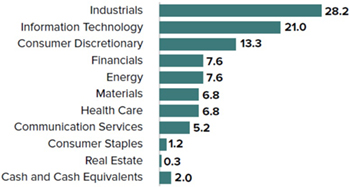

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| MKS Instruments | 3.2 | |  |

| Innospec | 3.0 | |

| Stella-Jones | 3.0 | |

| Arcosa | 3.0 | |

| SEI Investments | 2.9 | |

| Kadant | 2.8 | |

| FirstService Corporation | 2.8 | |

| Reliance | 2.7 | |

| Cirrus Logic | 2.7 | |

| Haemonetics Corporation | 2.6 | |

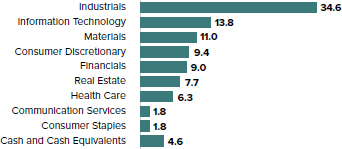

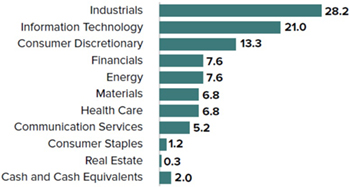

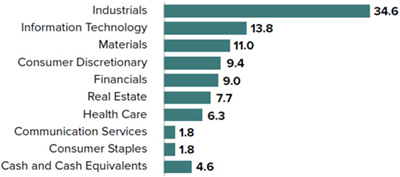

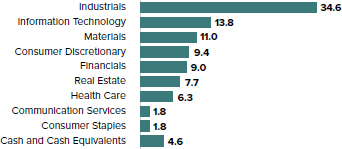

| Portfolio Sector Breakdown | |

| Industrials | 34.6 |

| Information Technology | 13.8 |

| Materials | 11.0 |

| Consumer Discretionary | 9.4 |

| Financials | 9.0 |

| Real Estate | 7.7 |

| Health Care | 6.3 |

| Communication Services | 1.8 |

| Consumer Staples | 1.8 |

| Cash and Cash Equivalents | 4.6 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus | ● Fund Holdings |

| ● Financial Information | ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

“Costs paid” reflect contractual fee waivers and/or expense reimbursements. Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RPR-CC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Premier Fund Investment Class—RYPRX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Premier Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Premier Fund—Investment Class | $59 | 1.18% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,396 |

| Number of Holdings | 50 |

| Turnover Rate | 7% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| MKS Instruments | 3.2 | |  |

| Innospec | 3.0 | |

| Stella-Jones | 3.0 | |

| Arcosa | 3.0 | |

| SEI Investments | 2.9 | |

| Kadant | 2.8 | |

| FirstService Corporation | 2.8 | |

| Reliance | 2.7 | |

| Cirrus Logic | 2.7 | |

| Haemonetics Corporation | 2.6 | |

| | | |

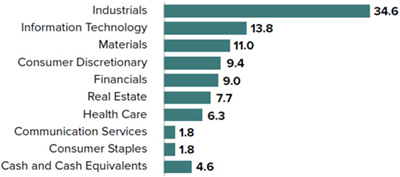

| Portfolio Sector Breakdown | |

| Industrials | 34.6 |

| Information Technology | 13.8 |

| Materials | 11.0 |

| Consumer Discretionary | 9.4 |

| Financials | 9.0 |

| Real Estate | 7.7 |

| Health Care | 6.3 |

| Communication Services | 1.8 |

| Consumer Staples | 1.8 |

| Cash and Cash Equivalents | 4.6 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus ● Financial Information | ● Fund Holdings ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RPR-IC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Premier Fund Institutional Class—RPFIX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Premier Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Premier Fund—Institutional Class | $55 | 1.11% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,396 |

| Number of Holdings | 50 |

| Turnover Rate | 7% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| MKS Instruments | 3.2 | |  |

| Innospec | 3.0 | |

| Stella-Jones | 3.0 | |

| Arcosa | 3.0 | |

| SEI Investments | 2.9 | |

| Kadant | 2.8 | |

| FirstService Corporation | 2.8 | |

| Reliance | 2.7 | |

| Cirrus Logic | 2.7 | |

| Haemonetics Corporation | 2.6 | |

| | | |

| Portfolio Sector Breakdown | |

| Industrials | 34.6 |

| Information Technology | 13.8 |

| Materials | 11.0 |

| Consumer Discretionary | 9.4 |

| Financials | 9.0 |

| Real Estate | 7.7 |

| Health Care | 6.3 |

| Communication Services | 1.8 |

| Consumer Staples | 1.8 |

| Cash and Cash Equivalents | 4.6 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus ● Financial Information | ● Fund Holdings ● Proxy Voting Information |

Householding

We will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send you only one copy of these materials for as long as you remain a shareholder of the Fund. If you would like to receive individual mailings, please call 1-800-221-4268. Please allow 30 days for your request to be processed. Shareholders may also elect to receive these reports electronically. Please go to www.royceinvest.com for more details.

Important Information

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI. Distributor: Royce Fund Services, LLC.

| NOT FDIC INSURED ● MAY LOSE VALUE ● NOT BANK GUARANTEED | RPR-INC-STSR-0624 |

| | |

| The Royce Funds | June 30, 2024 |

| | |

Royce Premier Fund Service Class—RPFFX |  |

Semiannual Shareholder Report

This semiannual shareholder report contains important information about Royce Premier Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at www.royceinvest.com/literature. You can also request this information by contacting us at 1-800-221-4268.

What Were the Fund Costs for the Last Six-Months?

Based on a hypothetical $10,000 investment

| | COSTS OF A | COSTS PAID AS A PERCENTAGE |

| FUND/CLASS | $10,000 INVESTMENT | OF A $10,000 INVESTMENT¹ |

| Royce Premier Fund—Service Class | $74 | 1.49% |

| ¹Annualized | | |

Key Fund Statistics

As of 6/30/24

| Fund Size (Millions) | $1,396 |

| Number of Holdings | 50 |

| Turnover Rate | 7% |

What Did The Fund Invest In?

Representing percentage of total net assets of the Fund as of 6/30/24 (%)

| Top 10 Positions | | | Portfolio Sector Breakdown |

| MKS Instruments | 3.2 | |  |

| Innospec | 3.0 | |

| Stella-Jones | 3.0 | |

| Arcosa | 3.0 | |

| SEI Investments | 2.9 | |

| Kadant | 2.8 | |

| FirstService Corporation | 2.8 | |

| Reliance | 2.7 | |

| Cirrus Logic | 2.7 | |

| Haemonetics Corporation | 2.6 | |

| | | |

| Portfolio Sector Breakdown | |

| Industrials | 34.6 |

| Information Technology | 13.8 |

| Materials | 11.0 |

| Consumer Discretionary | 9.4 |

| Financials | 9.0 |

| Real Estate | 7.7 |

| Health Care | 6.3 |

| Communication Services | 1.8 |

| Consumer Staples | 1.8 |

| Cash and Cash Equivalents | 4.6 |

Where Can I Find Additional Information About The Fund?

Additional information is available at www.royceinvest.com/literature, including its:

| ● Prospectus ● Financial Information | ● Fund Holdings ● Proxy Voting Information |

Householding