UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3618

Metropolitan Series Fund, Inc.

(Exact name of registrant as specified in charter)

501 Boylston Street

Boston, Massachusetts 02116

(Address of Principal Executive Office)

JAMES L. LIPSCOMB, ESQ.

Executive Vice President & General Counsel

MetLife Group, Inc.

200 Park Avenue

New York, New York 10166-0188

(Name and address of agent for service)

Copy to:

THOMAS M. LENZ, ESQ.

MetLife Advisers, LLC

501 Boylston Street

Boston, Massachusetts 02116

Registrant’s telephone number, including area code: 617-578-3104

Date of fiscal year end: December 31

Date of reporting period: July 1, 2005 to December 31, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”):

Metropolitan Series Fund, Inc.

Table of Contents

Not all Portfolios are available under every product.

Please refer to your prospectus for information on the Portfolios that are available.

Morgan Stanley sponsors the MSCI EAFE® Index, Lehman Brothers sponsors the Lehman Brothers® Aggregate Bond Index, Standard & Poor’s sponsors the S&P 500® Index and the S&P 400 MidCap Index, and Frank Russell Company sponsors the Russell 2000® Index (together referred to as the “index sponsors”). Direct investment in the indexes is not possible. The index sponsors do not sponsor, endorse, sell or promote any of the Metropolitan Series Fund, Inc.’s (the “Fund’s”) Portfolios (the “Portfolios”) or make any representation regarding the advisability of investing in the Portfolios. The index sponsors have no responsibility for and do not participate in the management of the Portfolio assets, or sale of the Portfolio shares. Each index and its associated service marks are the exclusive property of the respective index sponsor, and references thereto have been made with permission. The Fund’s Statement of Additional Information contains a more detailed description of the limited relationship the index sponsors have with Metropolitan Life Insurance Company and the Fund.

Letter from the President

February 2006

To Our Policyholders/Contract Owners:

We are pleased to provide you with the December 31, 2005 Annual Report for the Metropolitan Series Fund, Inc. The Report is designed to help you make informed decisions on how to allocate your money within your variable product.

Like world events and the economy, the capital markets are subject to volatility and the possibility of rapid change. We encourage you to work with your registered representative to develop an investment program to meet your long-term retirement, investment, and insurance needs.

You have the opportunity to join other policyholders and contract owners who are already taking advantage of our eDelivery service. When you register for eDelivery, fund reports, prospectuses and other informational documents are sent to you electronically. You can view and save your documents on-line, rather than receiving them in the mail. eDelivery is free, convenient, paperless and easy. See the inside front cover for information on how to sign up for eDelivery.

We look forward to serving your future investment needs.

Sincerely,

Hugh McHaffie

President, Metropolitan Series Fund, Inc.

Metropolitan Series Fund, Inc.

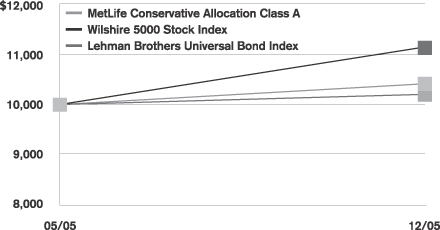

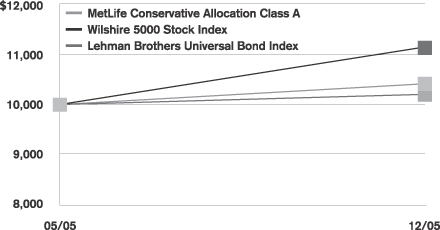

MetLife Conservative Allocation Portfolio

Managed by MetLife Advisers, LLC

Portfolio Manager Commentary*

PORTFOLIO PERFORMANCE

The MetLife Conservative Allocation Portfolio commenced operations on May 1, 2005. For the eight months ended December 31, 2005, the Class A shares of the Portfolio returned 4.1% compared to the 11.4% return of the Wilshire 5000 Stock Index1 and the 2.1% return of the Lehman Brothers Universal Bond Index.2 Considering that no single index or benchmark can accurately capture the multiple asset class design of the Portfolio, we have created a blended benchmark comprised of several indices for portfolio design and evaluation purposes. Specifically, the blended benchmark for the MetLife Conservative Allocation Portfolio consists of a 16% allocation to the Lehman Brothers 1 to 3 Year Government Bond Index,3 a 64% allocation to the Lehman Brothers Universal Bond Index, a 16% allocation to the Wilshire 5000 Stock Index, and a 4% allocation to the Morgan Stanley Capital International EAFE Index.4 During the eight-month period ending December 31, 2005, the blended benchmark returned 4.0%.

PORTFOLIO REVIEW

Since the inception date of the Portfolio on May 1, 2005, common stocks outperformed bonds by a wide margin. Within domestic stocks, small and mid cap stocks performed better than larger stocks. By investment style, growth style stocks did better than value style stocks during this eight-month period. Foreign stocks outperformed domestic stocks. The total return of bonds was only modestly positive due to a general rise in interest rates, which caused bond prices to fall. Below investment grade bonds did better than higher quality bonds as credit concerns eased.

The MetLife Conservative Allocation Portfolio is a “fund of funds” that invests in other portfolios of Metropolitan Series Fund, Inc. (the “Fund”) and Met Investors Series Trust. The Portfolio’s initial target allocations were 20% in equity investments and 80% in fixed income investments. The MetLife Conservative Allocation Portfolio is considered the most conservative of the Fund’s five Asset Allocation Portfolios as measured by its potential risk.

* The views expressed above are those of the investment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Wilshire 5000 Equity Index measures the performance of all U.S. headquartered equity securities with readily available price data. The Index is market capitalized weighted. Approximately 82% of the equity securities that the Index is comprised of are listed on the New York Stock Exchange, approximately 2% are listed on the American Stock Exchange and approximately 16% are over-the-counter securities (1995). The Index was created in 1974 and backdated to 1971, with a base index of December 1980 (base index equals 1,044.596). Dividends are reinvested on the “ex” dividend date and the rebalancing of share weights is done on a monthly basis. No attempt has been made to adjust the market capitalization of the Index to take into account cross holding between corporations. The Index does not include fees or expenses and is not available for direct investment.

2 The Lehman Brothers U.S. Universal Bond Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index, the non-EIRSA portion of the Commercial Mortgage Backed Securities Index and the Commercial Mortgage Backed Securities High Yield Index. Municipal debt, private placements, and non-dollar denominated issues are excluded from the Universal Index. The only constituent of the Index that includes floating-rate debt is the Emerging Markets Index. Bonds and securities must (i) be fixed rate, although they can carry a coupon that steps up or changes according to a predetermined schedule; (ii) be dollar-denominated and (iii) include bonds with maturities up to ten years and long-term indices composed of bonds with maturities longer than ten years. All returns are market value weighted inclusive of accrued interest. Yield is defined as the yield to worst, the lesser of the yield to maturity and yield to call. Market values are expressed in millions of dollars. The Index does not include fees or expenses and is not available for direct investment.

3 The Lehman Brothers 1 to 3 Year Government Bond Index includes most obligations of the U.S Treasury, agencies and quasi-federal corporations having maturities between one to three years. The Index has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

4 The Morgan Stanley Capital International Europe, Australasia and Far East Index (“MSCI EAFE Index”) is an unmanaged free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. The Index does not include fees or expenses and is not available for direct investment.

MSF-2

Metropolitan Series Fund, Inc.

MetLife Conservative Allocation Portfolio

A $10,000 INVESTMENT COMPARED TO

THE WILSHIRE 5000 STOCK INDEX AND THE LEHMAN BROTHERS

UNIVERSAL BOND INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | | | | |

| | | MetLife Conservative Allocation Portfolio | | | Wilshire 5000

Stock Index | | | Lehman Brothers

Universal Bond Index | |

| | | Class A | | | Class B | | | |

| Since Inception | | 4.1 | % | | 4.0 | % | | 11.4 | % | | 2.1 | % |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception date of the Class A and Class B shares is 5/1/05. Index since inception returns are based on the Class A inception date.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION as of December 31, 2005

Top Holdings

| | |

| | | % of Total Net Assets

|

Met Investors Series Trust—PIMCO Total Return Portfolio, (Class A) | | 26.8% |

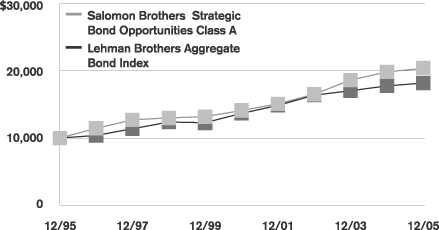

Metropolitan Series Fund, Inc.—Salomon Brothers Strategic Bond Opportunities Portfolio, (Class A) | | 17.9% |

Metropolitan Series Fund, Inc.—BlackRock Bond Income Portfolio, (Class A) | | 15.9% |

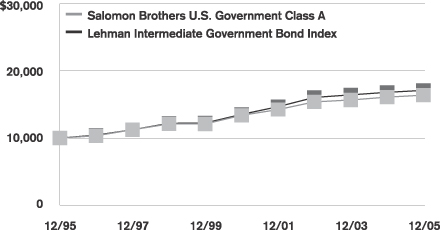

Metropolitan Series Fund, Inc.—Salomon Brothers U.S. Government Portfolio, (Class A) | | 11.9% |

Met Investors Series Trust—Lord Abbett Bond Debenture Portfolio, (Class A) | | 6.0% |

Metropolitan Series Fund, Inc.—T. Rowe Price Large Cap Growth Portfolio, (Class A) | | 4.1% |

Metropolitan Series Fund, Inc.—MetLife Stock Index Portfolio, (Class A) | | 3.0% |

Metropolitan Series Fund, Inc.—FI International Stock Portfolio, (Class A) | | 2.1% |

Met Investors Series Trust—Harris Oakmark International Portfolio, (Class A) | | 2.0% |

Metropolitan Series Fund, Inc.—Davis Venure Value Portfolio, (Class A) | | 2.0% |

MSF-3

Metropolitan Series Fund, Inc.

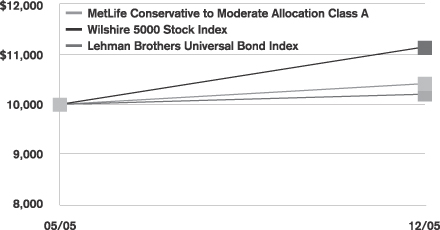

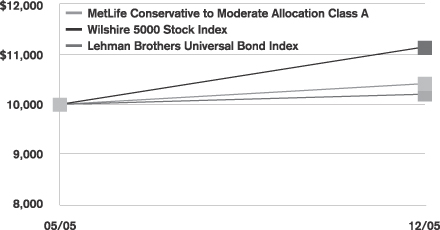

MetLife Conservative to Moderate Allocation Portfolio

Managed by MetLife Advisers, LLC

Portfolio Manager Commentary*

PORTFOLIO PERFORMANCE

The MetLife Conservative to Moderate Allocation Portfolio commenced operations on May 1, 2005. For the eight months ended December 31, 2005, the Class A shares of the Portfolio returned 6.4% compared to the 11.4% return of the Wilshire 5000 Stock Index1 and the 2.1% return of the Lehman Brothers Universal Bond Index.2 Considering that no single index or benchmark can accurately capture the multiple asset class design of the Portfolio, we have created a blended benchmark comprised of several indices for portfolio design and evaluation purposes. Specifically, the blended benchmark for the MetLife Conservative to Moderate Allocation Portfolio consists of a 12% allocation to the Lehman Brothers 1 to 3 Year Government Bond Index3, a 48% allocation to the Lehman Brothers Universal Bond Index, a 32% allocation to the Wilshire 5000 Stock Index, and an 8% allocation to the Morgan Stanley Capital International EAFE Index4. During the eight-month period ending December 31, 2005, the blended benchmark returned 6.1%.

PORTFOLIO REVIEW

Since the inception date of the Portfolio on May 1, 2005, common stocks outperformed bonds by a wide margin. Within domestic stocks, small and mid cap stocks performed better than larger stocks. By investment style, growth style stocks did better than value style stocks during this eight-month period. Foreign stocks outperformed domestic stocks. The total return of bonds was only modestly positive due to a general rise in interest rates, which caused bond prices to fall. Below investment grade bonds did better than higher quality bonds as credit concerns eased.

The MetLife Conservative to Moderate Allocation Portfolio is a “fund of funds” that invests in other portfolios of the Metropolitan Series Fund, Inc. (the “Fund”) and the Met Investors Series Trust. The Portfolio’s initial target allocations were 40% in equity investments and 60% in fixed income investments. The MetLife Conservative to Moderate Allocation Portfolio is considered the second most conservative of the Fund’s five Asset Allocation Portfolios as measured by potential risk.

* The views expressed above are those of the investment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Wilshire 5000 Equity Index measures the performance of all U.S. headquartered equity securities with readily available price data. The Index is market capitalized weighted. Approximately 82% of the equity securities that the Index is comprised of are listed on the New York Stock Exchange, approximately 2% are listed on the American Stock Exchange and approximately 16% are over-the-counter securities (1995). The Index was created in 1974 and backdated to 1971, with a base index of December 1980 (base index equals 1,044.596). Dividends are reinvested on the “ex” dividend date and the rebalancing of share weights is done on a monthly basis. No attempt has been made to adjust the market capitalization of the index to take into account cross holding between corporations. The Index does not include fees or expenses and is not available for direct investment.

2 The Lehman Brothers U.S. Universal Bond Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index, the non-EIRSA portion of the Commercial Mortgage Backed Securities Index and the Commercial Mortgage Backed Securities High Yield Index. Municipal debt, private placements, and non-dollar denominated issues are excluded from the Universal Index. The only constituent of the index that includes floating-rate debt is the Emerging Markets Index. Bonds and securities must be fixed rate, although they can carry a coupon that steps up or changes according to a predetermined schedule; must be dollar-denominated and including bonds with maturities up to ten years and long-term indices composed of bonds with maturities longer than ten years. All returns are market value weighted inclusive of accrued interest. Yield is defined as the yield to worst, the lesser of the yield to maturity and yield to call. Market values are expressed in millions of dollars. The Index does not include fees or expenses and is not available for direct investment.

3 The Lehman Brothers 1 to 3 Year Government Bond Index includes most obligations of the U.S Treasury, agencies and quasi-federal corporations having maturities between one to three years. The Index has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

4 The Morgan Stanley Capital International Europe, Australasia and Far East Index (“MSCI EAFE Index”) is an unmanaged free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. The Index does not include fees or expenses and is not available for direct investment.

MSF-4

Metropolitan Series Fund, Inc.

MetLife Conservative to Moderate Allocation Portfolio

A $10,000 INVESTMENT COMPARED TO

THE WILSHIRE 5000 STOCK INDEX AND THE LEHMAN BROTHERS

UNIVERSAL BOND INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | | | | |

| | | MetLife Conservative to Moderate

Allocation Portfolio | | | Wilshire 5000

Stock Index | | | Lehman Brothers

Universal Bond Index | |

| | | Class A | | | Class B | | | |

| Since Inception | | 6.4 | % | | 6.2 | % | | 11.4 | % | | 2.1 | % |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception date of the Class A and Class B shares is 5/1/05. Index since inception returns are based on the Class A inception date.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION

as of December 31, 2005

Top Holdings

| | |

| | | % of Total Net Assets

|

Met Investors Series Trust—PIMCO Total Return Portfolio, (Class A) | | 21.8% |

Metropolitan Series Fund, Inc.—Salomon Brothers Strategic Bond Opportunities Portfolio, (Class A) | | 14.9% |

Metropolitan Series Fund, Inc.—BlackRock Bond Income Portfolio, (Class A) | | 7.9% |

Metropolitan Series Fund, Inc.—T. Rowe Price Large Cap Growth Portfolio, (Class A) | | 7.1% |

Metropolitan Series Fund, Inc.—MetLife Stock Index Portfolio, (Class A) | | 7.0% |

Metropolitan Series Fund, Inc.—Salomon Brothers U.S. Government Portfolio, (Class A) | | 6.9% |

Met Investors Series Trust—Lord Abbett Bond Debenture Portfolio, (Class A) | | 5.9% |

Metropolitan Series Fund, Inc.—FI International Stock Portfolio, (Class A) | | 4.2% |

Met Investors Series Trust—Harris Oakmark International Portfolio, (Class A) | | 4.0% |

Metropolitan Series Fund, Inc.—Davis Venure Value Portfolio, (Class A) | | 4.0% |

MSF-5

Metropolitan Series Fund, Inc.

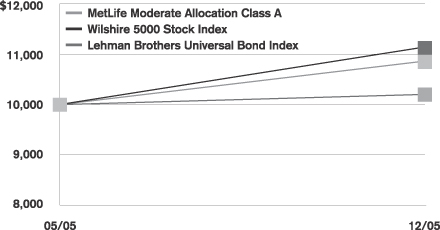

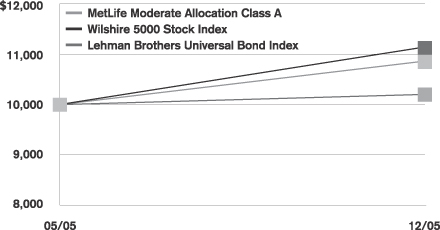

MetLife Moderate Allocation Portfolio

Managed by MetLife Advisers, LLC

Portfolio Manager Commentary*

PORTFOLIO PERFORMANCE

The MetLife Moderate Allocation Portfolio commenced operations on May 1, 2005. For the eight months ended December 31, 2005, the Class A shares of the Portfolio returned 8.7% compared to the 11.4% return of the Wilshire 5000 Stock Index1 and the 2.1% return of the Lehman Brothers Universal Bond Index.2 Considering that no single index or benchmark can accurately capture the multiple asset class design of the Portfolio, we have created a blended benchmark comprised of several indices for portfolio design and evaluation purposes. Specifically, the blended benchmark for the MetLife Moderate Allocation Portfolio consists of an 8% allocation to the Lehman Brothers 1 to 3 Year Government Bond Index3, a 32% allocation to the Lehman Brothers Universal Bond Index, a 48% allocation to the Wilshire 5000 Stock Index, and a 12% allocation to the Morgan Stanley Capital International EAFE Index4. During the eight-month period ending December 31, 2005, the blended benchmark returned 8.2%.

PORTFOLIO REVIEW

Since the inception date of the Portfolio on May 1, 2005, common stocks outperformed bonds by a wide margin. Within domestic stocks, small and mid cap stocks performed better than larger stocks. By investment style, growth style stocks did better than value style stocks during this eight-month period. Foreign stocks outperformed domestic stocks. The total return of bonds was only modestly positive due to a general rise in interest rates, which caused bond prices to fall. Below investment grade bonds did better than higher quality bonds as credit concerns eased.

The MetLife Moderate Allocation Portfolio is a “fund of funds” that invests in other portfolios of the Metropolitan Series Fund, Inc. (the “Fund”) and the Met Investors Series Trust. The Portfolio’s initial target allocations were 60% in equity investments and 40% in fixed income investments. The MetLife Moderate Allocation Portfolio is considered the “middle” of the Fund’s five Asset Allocation Portfolios as measured by its potential risk.

* The views expressed above are those of the investment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Wilshire 5000 Equity Index measures the performance of all U.S. headquartered equity securities with readily available price data. The Index is market capitalized weighted. Approximately 82% of the equity securities that the Index is comprised of are listed on the New York Stock Exchange, approximately 2% are listed on the American Stock Exchange and approximately 16% are over-the-counter securities (1995). The Index was created in 1974 and backdated to 1971, with a base index of December 1980 (base index equals 1,044.596). Dividends are reinvested on the “ex” dividend date and the rebalancing of share weights is done on a monthly basis. No attempt has been made to adjust the market capitalization of the index to take into account cross holding between corporations. The Index does not include fees or expenses and is not available for direct investment.

2 The Lehman Brothers U.S. Universal Bond Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index, the non-EIRSA portion of the Commercial Mortgage Backed Securities Index and the Commercial Mortgage Backed Securities High Yield Index. Municipal debt, private placements, and non-dollar denominated issues are excluded from the Universal Index. The only constituent of the index that includes floating-rate debt is the Emerging Markets Index. Bonds and securities must be fixed rate, although they can carry a coupon that steps up or changes according to a predetermined schedule, must be dollar-denominated and including bonds with maturities up to ten years and long-term indices composed of bonds with maturities longer than ten years. All returns are market value weighted inclusive of accrued interest. Yield is defined as the yield to worst, the lesser of the yield to maturity and yield to call. Market values are expressed in millions of dollars. The Index does not include fees or expenses and is not available for direct investment.

3 The Lehman Brothers 1 to 3 Year Government Bond Index includes most obligations of the U.S Treasury, agencies and quasi-federal corporations having maturities between one to three years. The Index has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

4 The Morgan Stanley Capital International Europe, Australasia and Far East Index (“MSCI EAFE Index”) is an unmanaged free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. The Index does not include fees or expenses and is not available for direct investment.

MSF-6

Metropolitan Series Fund, Inc.

MetLife Moderate Allocation Portfolio

A $10,000 INVESTMENT COMPARED TO

THE WILSHIRE 5000 STOCK INDEX AND THE LEHMAN BROTHERS

UNIVERSAL BOND INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | | | | |

| | | MetLife Moderate Allocation Portfolio | | | Wilshire 5000

Stock Index | | | Lehman Brothers

Universal Bond Index | |

| | | Class A | | | Class B | | | |

| Since Inception | | 8.7 | % | | 8.5 | % | | 11.4 | % | | 2.1 | % |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception date of the Class A and Class B shares is 5/1/05. Index since inception returns are based on the Class A inception date.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION as of December 31, 2005

Top Holdings

| | |

| | | % of Total Net Assets

|

Met Investors Series Trust—PIMCO Total Return Portfolio, (Class A) | | 17.8% |

Metropolitan Series Fund, Inc.—Salomon Brothers Strategic Bond Opportunities Portfolio, (Class A) | | 11.9% |

Metropolitan Series Fund, Inc.—T. Rowe Price Large Cap Growth Portfolio, (Class A) | | 11.0% |

Metropolitan Series Fund, Inc.—MetLife Stock Index Portfolio, (Class A) | | 11.0% |

Met Investors Series Trust—Harris Oakmark International Portfolio, (Class A) | | 7.0% |

Metropolitan Series Fund, Inc.—FI International Stock Portfolio, (Class A) | | 6.3% |

Metropolitan Series Fund, Inc.—Davis Venure Value Portfolio, (Class A) | | 5.0% |

Metropolitan Series Fund, Inc.—Harris Oakmark Large Cap Value Portfolio, (Class A) | | 5.0% |

Metropolitan Series Fund, Inc.—Neuberger Berman Mid Cap Value Portfolio, (Class A) | | 4.1% |

Met Investors Series Trust—Lazard Mid Cap Portfolio, (Class A) | | 4.0% |

MSF-7

Metropolitan Series Fund, Inc.

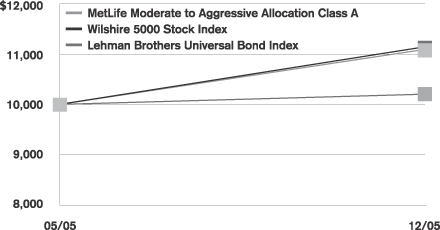

MetLife Moderate to Aggressive Allocation Portfolio

Managed by MetLife Advisers, LLC

Portfolio Manager Commentary*

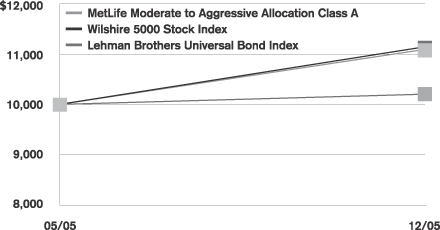

PORTFOLIO PERFORMANCE

The MetLife Moderate to Aggressive Allocation Portfolio commenced operations on May 1, 2005. For the eight months ended December 31, 2005, the Class A shares of the Portfolio returned 10.9% compared to the 11.4% return of the Wilshire 5000 Stock Index1 and the 2.1% return of the Lehman Brothers Universal Bond Index.2 Considering that no single index or benchmark can accurately capture the multiple asset class design of the Portfolio, we have created a blended benchmark comprised of several indices for portfolio design and evaluation purposes. Specifically, the blended benchmark for the MetLife Moderate to Aggressive Allocation Portfolio consists of a 4% allocation to the Lehman Brothers 1 to 3 Year Government Bond Index3, a 16% allocation to the Lehman Brothers Universal Bond Index, a 64% allocation to the Wilshire 5000 Stock Index, and a 16% allocation to the Morgan Stanley Capital International EAFE Index4. During the eight-month period ending December 31, 2005, the blended benchmark returned 10.3%.

PORTFOLIO REVIEW

Since the inception date of the Portfolio on May 1, 2005, common stocks outperformed bonds by a wide margin. Within domestic stocks, small and mid cap stocks performed better than larger stocks. By investment style, growth style stocks did better than value style stocks during this eight-month period. Foreign stocks outperformed domestic stocks. The total return of bonds was only modestly positive due to a general rise in interest rates, which caused bond prices to fall. Below investment grade bonds did better than higher quality bonds as credit concerns eased.

The MetLife Moderate to Aggressive Allocation Portfolio is a “fund of funds” that invests in other portfolios of the Metropolitan Series Fund, Inc. (the “Fund”) and the Met Investors Series Trust. The Portfolio’s initial target allocations were 80% in equity investments and 20% in fixed income investments. The MetLife Moderate to Aggressive Allocation Portfolio is considered the second most aggressive of the Fund’s five Asset Allocation Portfolios as measured by potential risk.

* The views expressed above are those of the investment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Wilshire 5000 Equity Index measures the performance of all U.S. headquartered equity securities with readily available price data. The Index is market capitalized weighted. Approximately 82% of the equity securities that the Index is comprised of are listed on the New York Stock Exchange, approximately 2% are listed on the American Stock Exchange and approximately 16% are over-the-counter securities (1995). The Index was created in 1974 and backdated to 1971, with a base index of December 1980 (base index equals 1,044.596). Dividends are reinvested on the “ex” dividend date and the rebalancing of share weights is done on a monthly basis. No attempt has been made to adjust the market capitalization of the index to take into account cross holding between corporations. The Index does not include fees or expenses and is not available for direct investment.

2 The Lehman Brothers U.S. Universal Bond Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index, the non-EIRSA portion of the Commercial Mortgage Backed Securities Index and the Commercial Mortgage Backed Securities High Yield Index. Municipal debt, private placements, and non-dollar denominated issues are excluded from the Universal Index. The only constituent of the index that includes floating-rate debt is the Emerging Markets Index. Bonds and securities must be fixed rate, although they can carry a coupon that steps up or changes according to a predetermined schedule, must be dollar-denominated and including bonds with maturities up to ten years and long-term indices composed of bonds with maturities longer than ten years. All returns are market value weighted inclusive of accrued interest. Yield is defined as the yield to worst, the lesser of the yield to maturity and yield to call. Market values are expressed in millions of dollars. The Index does not include fees or expenses and is not available for direct investment.

3 The Lehman Brothers 1 to 3 Year Government Bond Index includes most obligations of the U.S. Treasury, agencies and quasi-federal corporations having maturities between one to three years. The Index has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

4 The Morgan Stanley Capital International Europe, Australasia and Far East Index (“MSCI EAFE Index”) is an unmanaged free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. The Index does not include fees or expenses and is not available for direct investment.

MSF-8

Metropolitan Series Fund, Inc.

MetLife Moderate to Aggressive Allocation Portfolio

A $10,000 INVESTMENT COMPARED TO

THE WILSHIRE 5000 STOCK INDEX AND THE LEHMAN BROTHERS

UNIVERSAL BOND INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | | | | |

| | | MetLife Moderate to

Aggressive Allocation Portfolio | | | Wilshire 5000

Stock Index | | | Lehman Brothers

Universal Bond Index | |

| | | Class A | | | Class B | | | |

| Since Inception | | 10.9 | % | | 10.8 | % | | 11.4 | % | | 2.1 | % |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception date of the Class A and Class B shares is 5/1/05. Index since inception returns are based on the Class A inception date.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION

as of December 31, 2005

Top Holdings

| | |

| | | % of Total Net Assets

|

Metropolitan Series Fund, Inc.—MetLife Stock Index Portfolio, (Class A) | | 14.9% |

Metropolitan Series Fund, Inc.—T. Rowe Price Large Cap Growth Portfolio, (Class A) | | 14.0% |

Met Investors Series Trust—Harris Oakmark International Portfolio, (Class A) | | 9.0% |

Met Investors Series Trust—PIMCO Total Return Portfolio, (Class A) | | 8.8% |

Metropolitan Series Fund, Inc.—FI International Stock Portfolio, (Class A) | | 8.3% |

Metropolitan Series Fund, Inc.—Harris Oakmark Large Cap Value Portfolio, (Class A) | | 6.9% |

Metropolitan Series Fund, Inc.—Neuberger Berman Mid Cap Value Portfolio, (Class A) | | 6.1% |

Metropolitan Series Fund, Inc.—Davis Venure Value Portfolio, (Class A) | | 6.0% |

Met Investors Series Trust—Lazard Mid Cap Portfolio, (Class A) | | 5.0% |

Metropolitan Series Fund, Inc.—Salomon Brothers Strategic Bond Opportunities Portfolio, (Class A) | | 4.9% |

MSF-9

Metropolitan Series Fund, Inc.

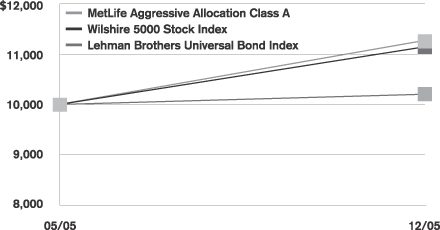

MetLife Aggressive Allocation Portfolio

Managed by MetLife Advisers, LLC

Portfolio Manager Commentary*

��

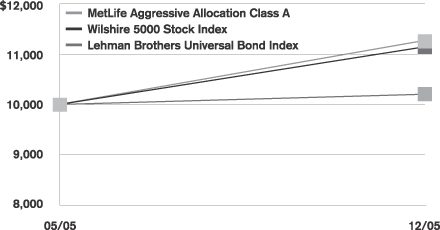

PORTFOLIO PERFORMANCE

The MetLife Aggressive Allocation Portfolio commenced operations on May 1, 2005. For the eight months ended December 31, 2005, the Class A shares of the Portfolio returned 12.7% compared to the 11.4% return of the Wilshire 5000 Stock Index1 and the 2.1% return of the Lehman Brothers Universal Bond Index.2 Considering that no single index or benchmark can accurately capture the multiple asset class design of the Portfolio, we have created a blended benchmark comprised of several indices for portfolio design and evaluation purposes. Specifically, the blended benchmark for the MetLife Aggressive Allocation Portfolio consists of an 80% allocation to the Wilshire 5000 Stock Index and a 20% allocation to the Morgan Stanley Capital International EAFE Index3. During the eight-month period ending December 31, 2005, the blended benchmark returned 12.5%.

PORTFOLIO REVIEW

Since the inception date of the Portfolio on May 1, 2005, common stocks outperformed bonds by a wide margin. Within domestic stocks, small and mid cap stocks performed better than larger stocks. By investment style, growth style stocks did better than value style stocks during this eight-month period. Foreign stocks outperformed domestic stocks. The total return of bonds was only modestly positive due to a general rise in interest rates, which caused bond prices to fall. Below investment grade bonds did better than higher quality bonds as credit concerns eased.

The MetLife Aggressive Allocation Portfolio is a “fund of funds” that invests in other portfolios of the Metropolitan Series Fund, Inc. (the “Fund”) and the Met Investors Series Trust. The Portfolio’s initial target allocations were 100% in equity investments and 0% in fixed income investments, although the other Portfolios in which the Aggressive Allocation Portfolio invests may have held cash during the period. The MetLife Aggressive Allocation Portfolio is considered the most aggressive of the Fund’s five Asset Allocation Portfolios as measured by its potential risk.

* The views expressed above are those of the investment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Wilshire 5000 Equity Index measures the performance of all U.S. headquartered equity securities with readily available price data. The Index is market capitalized weighted. Approximately 82% of the equity securities that the Index is comprised of are listed on the New York Stock Exchange, approximately 2% are listed on the American Stock Exchange and approximately 16% are over-the-counter securities (1995). The Index was created in 1974 and backdated to 1971, with a base index of December 1980 (base index equals 1,044.596). Dividends are reinvested on the “ex” dividend date and the rebalancing of share weights is done on a monthly basis. No attempt has been made to adjust the market capitalization of the index to take into account cross holding between corporations. The Index does not include fees or expenses and is not available for direct investment.

2 The Lehman Brothers U.S. Universal Bond Index represents the union of the U.S. Aggregate Index, the U.S. High-Yield Corporate Index, the 144A Index, the Eurodollar Index, the Emerging Markets Index, the non-EIRSA portion of the Commercial Mortgage Backed Securities Index and the Commercial Mortgage Backed Securities High Yield Index. Municipal debt, private placements, and non-dollar denominated issues are excluded from the Universal Index. The only constituent of the index that includes floating-rate debt is the Emerging Markets Index. Bonds and securities must be fixed rate, although they can carry a coupon that steps up or changes according to a predetermined schedule, must be dollar-denominated and including bonds with maturities up to ten years and long-term indices composed of bonds with maturities longer than ten years. All returns are market value weighted inclusive of accrued interest. Yield is defined as the yield to worst, the lesser of the yield to maturity and yield to call. Market values are expressed in millions of dollars. The Index does not include fees or expenses and is not available for direct investment.

3 The Morgan Stanley Capital International Europe, Australasia and Far East Index (“MSCI EAFE Index”) is an unmanaged free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. & Canada. The Index does not include fees or expenses and is not available for direct investment.

MSF-10

Metropolitan Series Fund, Inc.

MetLife Aggressive Allocation Portfolio

A $10,000 INVESTMENT COMPARED TO

THE WILSHIRE 5000 STOCK INDEX AND THE LEHMAN BROTHERS

UNIVERSAL BOND INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | | | | |

| | | MetLife Aggressive Allocation Portfolio | | | Wilshire 5000

Stock Index | | | Lehman Brothers

Universal Bond Index | |

| | | Class A | | | Class B | | | |

| Since Inception | | 12.7 | % | | 12.6 | % | | 11.4 | % | | 2.1 | % |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception date of the Class A and Class B shares is 5/1/05. Index since inception returns are based on the Class A inception date.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION as of December 31, 2005

Top Holdings

| | |

| | | % of Total Net Assets

|

Metropolitan Series Fund, Inc.—T. Rowe Price Large Cap Growth Portfolio, (Class A) | | 16.9% |

Metropolitan Series Fund, Inc.—MetLife Stock Index Portfolio, (Class A) | | 16.8% |

Metropolitan Series Fund, Inc.—FI International Stock Portfolio, (Class A) | | 10.3% |

Met Investors Series Trust—Harris Oakmark International Portfolio, (Class A) | | 10.0% |

Metropolitan Series Fund, Inc.—Neuberger Berman Mid Cap Value Portfolio, (Class A) | | 8.0% |

Metropolitan Series Fund, Inc.—Davis Venure Value Portfolio, (Class A) | | 7.9% |

Metropolitan Series Fund, Inc.—Harris Oakmark Large Cap Value Portfolio, (Class A) | | 7.9% |

Met Investors Series Trust—Lazard Mid Cap Portfolio, (Class A) | | 6.0% |

Metropolitan Series Fund, Inc.—Russell 2000 Index Portfolio, (Class A) | | 5.0% |

Met Investors Series Trust—T. Rowe Price Mid Cap Growth Portfolio, (Class A) | | 3.0% |

MSF-11

Metropolitan Series Fund, Inc.

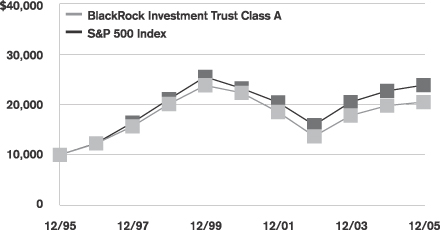

BlackRock Investment Trust Portfolio

Managed by BlackRock Advisors, Inc.

Portfolio Manager Commentary*

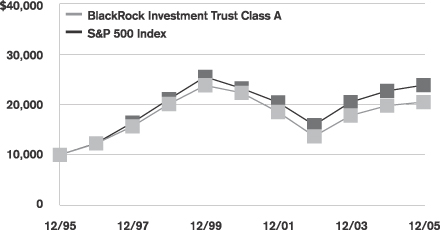

PORTFOLIO PERFORMANCE

For the year ended December 31, 2005, the Class A shares of the BlackRock Investment Trust Portfolio returned 3.6%, compared to its benchmark, the Standard & Poor’s 500 Index1, which returned 4.9%. The average return of its peer group, the Lipper Variable Insurance Products Large-Cap Core Funds Universe2, was 5.8% over the same period.

PORTFOLIO REVIEW

With investor focus on the level of energy prices, the direction of interest rates, a flattening yield curve, a possible economic “soft patch” during the first half of the year, and the ultimate impact of the devastating weather disaster in the Gulf region during the second half of the year, the U.S. equity market gyrated throughout 2005. Ultimately, on the strength of an almost 4% rally in November, the S&P 500 finished the year up 4.9%.

Not all segments of the equity market were positive however. Two sectors actually produced negative returns. The Telecommunication and Consumer Cyclical sectors were down about 9% and 7% respectively. Leading the market up were the Energy and Utilities sectors up over 29% and 13% respectively.

The dominance of value stocks over growth stocks had reached the five-year mark at the end of the first quarter of 2005. Although growth stocks showed some strength during the remainder of the year, the Russell 1000 Value Index3 still edged out the Russell 1000 Growth Index4 by 1.8% for the entire year. Large cap stocks (Russell 1000 Index)5 outpaced small cap stocks (Russell 2000 Index)6 by 1.7% over this same period, reversing a multi-year trend of small cap leadership. However, within the size categories, mid cap stocks (Russell Midcap Index)7 were the strongest, advancing over 12.7% for 2005.

With the completion of the BlackRock/State Street Research merger at the end of January, the Investment Trust Portfolio was transitioned to the quantitative investment process at BlackRock. The management team uses quantitative techniques to analyze a universe of approximately 800 companies, including those in the S&P 500 Index and about 300 other large and medium capitalization companies. Using a multifactor model, the management team identifies stocks with rising earnings expectations that sell at low relative valuations when compared to their sector peers. Based on this information, and using sophisticated risk measurement tools, the management team selects stocks, together with their appropriate weightings, that it believes will maximize the Portfolio’s return per unit of risk. The Portfolio seeks to maintain the market capitalization, sector allocations, and style characteristics of the S&P 500 Index.

The performance of the BlackRock core quantitative model can be clearly divided into two periods. During the first half of 2005 the model was solidly predictive and the Portfolio outperformed the index. During the second half of the year, with investors seemingly preoccupied by macro issues, the model faltered and the Portfolio under performed. Evaluated across the entire year, the model was flat to modestly positive. Both the valuation and earnings expectation components of the model were consistent with the overall model. Estimate Momentum and Earnings Revisions Up on the Earnings Expectation side and Forecast Earnings to Price on the Valuation side were the only positive individual factors. Earnings Revisions Down, Return on Equity and Book to Price were the least predictive factors.

Analyzing the sectors where stock selection had the greatest impact on relative performance, Consumer Cyclicals, Energy, and Basic Materials were the strongest performing sectors. Within these sectors, specific names that helped relative performance include Nordstrom, ConocoPhillips, Valero, Newfield Exploration, Consol Energy, and Georgia Pacific. All of these names were highly ranked by the model and were held in the Portfolio during the period. The strength of these sectors was overwhelmed by the weak relative performance in Technology, Consumer Non-Cyclicals and Commercial Services sectors. The Portfolio was hurt by an overweight in several poor performing stocks, such as IBM, Qlogic, Archer Daniels Midland, Energizer, and Cendant; and an underweight in the strong performing Apple Computer and Boeing.

* On January 31, 2005, BlackRock Advisors, Inc. (“BlackRock”) succeeded State Street Research & Management Company (“State Street Research”) as subadviser to the Portfolio, and the Portfolio’s name was changed from State Street Research Investment Trust Portfolio to BlackRock Investment Trust Portfolio. This commentary was prepared by BlackRock. The views expressed above are those of the subinvestment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Standard & Poor’s (S&P) 500® Composite Stock Price Index is an unmanaged index representing the performance of 500 major companies, most of which are listed on the New York Stock Exchange. The S&P 500 performance has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

2 Lipper Variable Products Fund Averages. Each of these is an average of the total return performance (calculated on the basis of net asset value) of funds with similar investment objectives to those of the subject Portfolio as calculated by Lipper Analytical Services, an independent mutual fund ranking service.

3 The Russell 1000® Value Index is an unmanaged measure of the largest capitalized U.S. domiciled companies with a less than average growth orientation. Companies in this Index generally have a low price-to-book and price-to-earnings ratio, higher divided yields and lower forecasted growth values. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

4 The Russell 1000® Growth Index is an unmanaged measure of performance of the largest capitalized U.S. companies, within the Russell 1000 companies, that have higher price-to-book ratios and forecasted growth values. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

5 The Russell 1000® Index is an unmanaged measure of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 90% of the investable U.S.equity market. The Index had a total market capitalization range of $1.8 billion to $387 billion with an average market capitalization of approximately $13 billion. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

6 The Russell 2000® Index is an unmanaged measure of performance of the 2,000 smallest companies in the Russell 3000 Index. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

7 The Russell Midcap Index is an unmanaged measure of performance of those Russell Midcap companies (the 800 smallest companies in the Russell 1000 Index) with higher price-to-book ratios and higher forecasted growth values. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

MSF-12

Metropolitan Series Fund, Inc.

BlackRock Investment Trust Portfolio

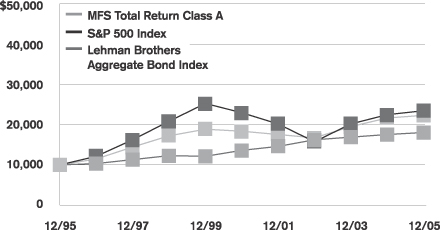

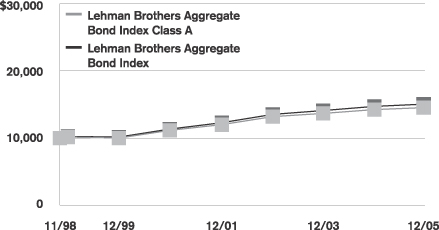

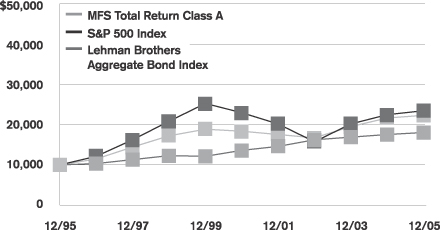

A $10,000 INVESTMENT COMPARED TO THE

S&P 500 INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | | | | |

| | | BlackRock Investment Trust Portfolio | | | S&P 500

Index | |

| | | Class A | | | Class B | | | Class E | | |

| 1 Year | | 3.6 | % | | 3.3 | % | | 3.5 | % | | 4.9 | % |

| 5 Years | | -1.7 | | | N/A | | | N/A | | | 0.5 | |

| 10 Years | | 7.4 | | | N/A | | | N/A | | | 9.1 | |

| Since Inception | | — | | | -0.7 | | | -0.6 | | | — | |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception dates of the Class A, Class B and Class E shares are: 5/16/83, 5/01/01 and 5/01/01, respectively.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION

as of December 31, 2005

Top Holdings

| | |

| | | % of Total

Net Assets

|

General Electric Co. | | 4.4% |

Microsoft Corp. | | 3.0% |

Bank of America Corp. | | 2.6% |

Intel Corp. | | 2.5% |

Exxon Mobil Corp. | | 2.5% |

Pfizer, Inc. | | 2.3% |

International Business Machines Corp. | | 1.9% |

Wachovia Corp. | | 1.7% |

ConocoPhillips | | 1.7% |

Altria Group, Inc. | | 1.6% |

Top Sectors

| | |

| | | % of Equity

Market Value

|

Financials | | 21.3% |

Technology | | 17.2% |

Health Care | | 12.8% |

Energy | | 9.1% |

Consumer (non-cyclical) | | 7.7% |

Consumer (cyclicals) | | 7.1% |

Industrials | | 6.4% |

Consumer Services | | 5.0% |

Utility | | 3.5% |

Telecommunications | | 3.1% |

MSF-13

Metropolitan Series Fund, Inc.

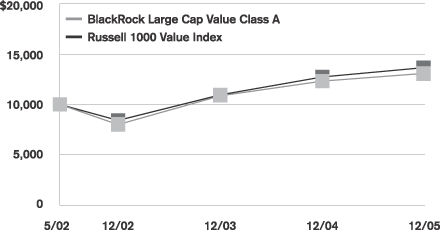

BlackRock Large Cap Value Portfolio

Managed by BlackRock Advisors, Inc.

Portfolio Manager Commentary*

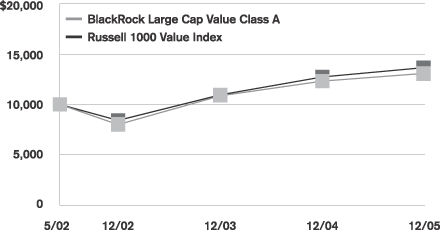

PORTFOLIO PERFORMANCE

For the year ended December 31, 2005, the Class A shares of the BlackRock Large Cap Value Portfolio returned 6.0%, compared to its benchmark, the Russell 1000 Value Index1, which returned 7.1%. The average return of its peer group, the Lipper Variable Insurance Products Large-Cap Value Funds Universe2, was 4.8% over the same period.

PORTFOLIO REVIEW

With investor focus on the level of energy prices, the direction of interest rates, a flattening yield curve, a possible economic “soft patch” during the first half of the year, and the ultimate impact of the devastating weather disaster in the Gulf region during the second half of the year, the U.S. equity market gyrated throughout 2005. Ultimately, on the strength of an almost 4% rally in November, the S&P 500 finished the year up 4.9%.

Not all segments of the equity market were positive however. Two sectors actually produced negative returns. The Telecommunication and Consumer Cyclical sectors were down about 9% and 7% respectively. Leading the market up were the Energy and Utilities sectors up over 29% and 13% respectively.

The dominance of value stocks over growth stocks had reached the five-year mark at the end of the first quarter of 2005. Although growth stocks showed some strength during remainder of the year, the Russell 1000 Value Index still edged out the Russell 1000 Growth Index3 by 1.8% for the full year. Large cap stocks (Russell 1000 Index4) outpaced small cap stocks (Russell 2000 Index5) by 1.7% over this same period reversing a multi-year trend of small cap leadership. However, within the size categories, mid cap stocks (Russell Midcap Index6) were the strongest, advancing over 12.7% for 2005.

With the completion of the BlackRock/State Street Research merger at the end of January, the Portfolio was transitioned to the quantitative investment process at BlackRock. The management team uses quantitative techniques to analyze a universe of approximately 800 value companies. The management team uses a multi-factor model, which identifies the key factors that drive the performance of value stocks. Using this multi-factor model, the management team identifies stocks with low relative valuations and improving earnings expectations when compared to their sector peers. Based on this information, and using sophisticated risk measurement tools, the management team selects stocks, together with their appropriate weightings, that it believes will maximize the Portfolio’s return per unit of risk. The Portfolio seeks to maintain the market capitalization, sector allocations, and style characteristics similar to those of the Russell 1000 Value Index.

The performance of the BlackRock value quantitative model was flat to modestly predictive during 2005. Both the valuation and earnings expectation components of the model were consistent with the overall model. Estimate Momentum and Earnings Revisions Up on the Earnings Expectation side and Forecast Earnings to Price on the Valuation side along with Price Momentum were the most predictive individual factors. Earnings Revisions Down, Return on Equity and Earnings Surprise were the least predictive factors.

Analyzing the sectors where stock selection had the greatest impact on relative performance, Basic Materials, Energy, and Consumer Cyclicals were the strongest performing sectors. Within these sectors, specific names that helped relative performance include Consol Energy, Phelps Dodge, Amerada Hess, Valero, Cummins, and Barnes & Noble. All of these names were highly ranked by the model and held in the Portfolio during the period. The strength of these sectors was offset by the weak relative performance in the Technology, Consumer Non-Cyclicals and Healthcare sectors. The Portfolio was hurt by overweight positions in several poor performing stocks, Kroger, Energizer, Pfizer; and an underweight position in the strong performing Hewlett Packard.

* On January 31, 2005, BlackRock Advisors, Inc. (“BlackRock”) succeeded State Street Research & Management Company (“State Street Research”) as subadviser to the Portfolio, and the Portfolio’s name was changed from State Street Research Large Cap Value Portfolio to BlackRock Large Cap Value Portfolio. This commentary was prepared by BlackRock. The views expressed above are those of the subinvestment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Russell 1000® Value Index is an unmanaged measure of the largest capitalized U.S. domiciled companies with a less than average growth orientation. Companies in this Index generally have a low price-to-book and price-to-earnings ratio, higher divided yields and lower forecasted growth values. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

2 Lipper Variable Products Fund Averages. Each of these is an average of the total return performance (calculated on the basis of net asset value) of funds with similar investment objectives to those of the subject Portfolio as calculated by Lipper Analytical Services, an independent mutual fund ranking service.

3 The Russell 1000® Growth Index is an unmanaged measure of performance of the largest capitalized U.S. companies, within the Russell 1000 companies, that have higher price-to-book ratios and forecasted growth values. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

4 The Russell 1000® Index is an unmanaged measure of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 90% of the investable U.S. equity market. The Index had a total market capitalization range of $1.8 billion to $387 billion with an average market capitalization of approximately $13 billion. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

5 The Russell 2000® Index is an unmanaged measure of performance of the 2,000 smallest companies in the Russell 3000 Index. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

6 The Russell Midcap Index is an unmanaged measure of performance of those Russell Midcap companies (the 800 smallest companies in the Russell 1000 Index) with higher price-to-book ratios and higher forecasted growth values. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

MSF-14

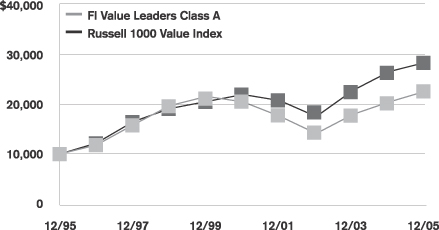

Metropolitan Series Fund, Inc.

BlackRock Large Cap Value Portfolio

A $10,000 INVESTMENT COMPARED TO THE

RUSSELL 1000 VALUE INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | | | | |

| | | BlackRock Large Cap Value Portfolio | | | Russell 1000

Value Index | |

| | | Class A | | | Class B | | | Class E | | |

| 1 Year | | 6.0 | % | | 5.6 | % | | 5.7 | % | | 7.1 | % |

| Since Inception | | 7.5 | | | 13.8 | | | 7.4 | | | 8.8 | |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception dates of the Class A, Class B and Class E shares are: 5/01/02, 7/30/02 and 5/01/02, respectively. Index since inception returns are based on the Class A inception date.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION

as of December 31, 2005

Top Holdings

| | |

| | | % of Total

Net Assets

|

Exxon Mobil Corp. | | 4.6% |

Bank of America Corp. | | 4.4% |

Pfizer, Inc. | | 3.3% |

Citigroup, Inc. | | 2.9% |

ConocoPhillips | | 2.4% |

Wachovia Corp. | | 2.4% |

General Electric Co. | | 2.3% |

AT&T, Inc. | | 2.2% |

JPMorgan Chase & Co. | | 1.8% |

PPL Corp. | | 1.7% |

Top Sectors

| | |

| | | % of Equity

Market Value

|

Financials | | 36.7% |

Energy | | 13.2% |

Utility | | 6.8% |

Health Care | | 6.7% |

Technology | | 6.2% |

Consumer Services | | 5.8% |

Telecommunications | | 5.3% |

Consumer (non-cyclicals) | | 5.2% |

Basic Materials | | 4.3% |

Consumer (cyclicals) | | 3.5% |

MSF-15

Metropolitan Series Fund, Inc.

BlackRock Legacy Large Cap Growth Portfolio

Managed by BlackRock Advisors, Inc.

Portfolio Manager Commentary*

PORTFOLIO PERFORMANCE

For the year ended December 31, 2005, the Class A shares of the BlackRock Legacy Large Cap Growth Portfolio returned 7.0%, compared to its benchmark, the Russell 1000 Growth Index1, which returned 5.3%. The average return of its peer group, the Lipper Variable Insurance Products Large-Cap Growth Funds Universe2, was 7.3% over the same period.

PORTFOLIO REVIEW

Equity markets delivered modest returns during the fourth quarter on the heels of subdued energy prices and economic strength. The S&P 500 Index3 ended the quarter with a gain of 2.1%, leaving the Index up 4.9% for 2005, and marking the third consecutive year of gains. However, strong earnings growth among companies did little to propel market returns during the year, as investors focused on elevated oil prices, interest rates, and a susceptible housing market.

In this environment, the Portfolio outperformed its benchmark, the Russell 1000 Growth Index. The Portfolio benefited from strong stock selection across a number of sectors including, information technology, health care, financials and materials. Stock selection decisions in consumer staples, consumer discretionary, and industrials created a modest drag on return comparisons. Additionally, our overweight to the energy sector helped to drive both absolute and relative gains higher over the course of the year.

Stock selection decisions within the information technology sector led to favorable return comparisons during the year, as the Portfolio’s positions tended to significantly outperform benchmark holdings. Among information technology holdings, Internet service provider Google was the top individual contributor to relative gains during the year. Google continues to benefit from robust trends in their paid search business, as an increasing number of companies are shifting their marketing spending from traditional media such as print and radio towards the Internet. Software proved to be another area of strength within the technology segment of the Portfolio. Customer relationship management software provider Salesforce.com posted impressive gains, rising over 70% in the portfolio. Expanded distribution of the firm’s on demand CRM software has helped to accelerate earnings, and deliver strong investment returns. Additionally, our avoidance of troubled blue chips such as International Business Machines and Dell Inc. added value relative to the benchmark.

Broad-based strength among our positions in the financials sector bolstered both absolute and relative returns during 2005. Good stock selection propelled gains, with holdings such as diversified asset manager Franklin Resources and futures exchange operator Chicago Mercantile Exchange making the largest contributions to performance.

Despite modest fourth quarter losses, energy finished 2005 as the top performing area of the market due to the fundamental backdrop of rising energy prices boosting profitability across the sector. Our overweight to the sector was instrumental in delivering above benchmark returns over the course of the year, with key contributions coming from a variety of companies including oil services firm Schlumberger, exploration and production companies, EOG Resources and Newfield Exploration, and Consol Energy in the coal industry.

Select positions in both consumer segments, as well as the industrials sector, had a negative impact on returns. Within consumer staples, cosmetics manufacturer Avon Products was the largest detractor, while the major source of underperformance in the consumer discretionary sector was audio equipment maker Harman International. Weakness in industrials can be largely attributed to a position in conglomerate Tyco International. After a strong 2003 and 2004, Tyco struggled throughout 2005, and we sold our position on concerns that the company cannot sustain growth.

* On January 31, 2005, BlackRock Advisors, Inc. (“BlackRock”) succeeded State Street Research & Management Company (“State Street Research”) as subadviser to the Portfolio, and the Portfolio’s name was changed from State Street Research Large Cap Growth Portfolio to BlackRock Legacy Large Cap Growth Portfolio. This commentary was prepared by BlackRock. The views expressed above are those of the subinvestment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Russell 1000® Growth Index is an unmanaged measure of performance of the largest capitalized U.S. companies, within the Russell 1000 companies, that have higher price-to-book ratios and forecasted growth values. The Index performance has not been adjusted for ongoing management, distribution and operating expenses and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

2 Lipper Variable Products Fund Averages. Each of these is an average of the total return performance (calculated on the basis of net asset value) of funds with similar investment objectives to those of the subject Portfolio as calculated by Lipper Analytical Services, an independent mutual fund ranking service.

3 The Standard & Poor’s (S&P) 500® Index is an unmanaged index representing the performance of 500 major companies, most of which are listed on the New York Stock Exchange. The S&P 500 performance has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

MSF-16

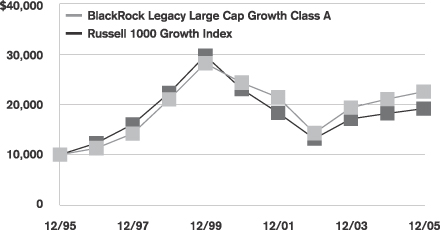

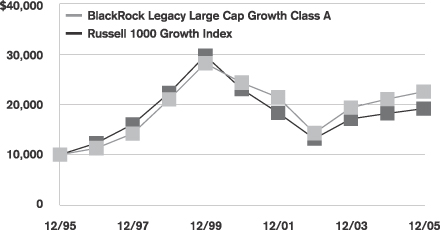

Metropolitan Series Fund, Inc.

BlackRock Legacy Large Cap Growth Portfolio

A $10,000 INVESTMENT COMPARED TO

THE RUSSELL 1000 GROWTH INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | | | | | |

| | | BlackRock Legacy Large Cap Growth Portfolio | | | Russell 1000

Growth Index | |

| | | Class A | | | Class B | | | Class E | | |

| 1 Year | | 7.0 | % | | 6.8 | % | | 6.9 | % | | | 5.3 | % |

| 5 Years | | -1.5 | | | N/A | | | N/A | | | - | 3.6 | |

| 10 Years | | 8.5 | | | N/A | | | N/A | | | | 6.7 | |

| Since Inception | | — | | | 11.7 | | | -1.8 | | | | — | |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception dates of the Class A, Class B and Class E shares are: 10/31/94, 7/30/02, 5/01/01, respectively.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION

as of December 31, 2005

Top Holdings

| | |

| | | % of Total

Net Assets

|

Microsoft Corp. | | 4.9% |

General Electric Co. | | 4.9% |

Google, Inc. (Class A) | | 3.9% |

The Procter & Gamble Co. | | 3.4% |

UnitedHealth Group, Inc. | | 3.1% |

Yahoo!, Inc. | | 3.0% |

St. Jude Medical, Inc. | | 2.7% |

American Express Co. | | 2.7% |

CONSOL Energy, Inc. | | 2.6% |

Johnson & Johnson | | 2.6% |

Top Sectors

| | |

| | | % of Total

Net Assets

|

Information Technology | | 27.6% |

Health Care | | 23.3% |

Consumer Discretionary | | 10.2% |

Energy | | 10.2% |

Financials | | 8.6% |

Industrials | | 8.4% |

Consumer Staples | | 7.9% |

Materials | | 1.6% |

Telecommunications | | 0.7% |

Cash/Other | | 1.8% |

MSF-17

Metropolitan Series Fund, Inc.

Capital Guardian U.S. Equity Portfolio

Managed by Capital Guardian Trust Company

Portfolio Manager Commentary*

PORTFOLIO PERFORMANCE

For the year ended December 31, 2005, the Class A shares of the Capital Guardian U.S. Equity Portfolio returned 5.8%, compared to its benchmark, the Standard & Poor’s 500 Index1, which returned 4.9%. The average return of its peer group, the Lipper Variable Insurance Products Multi-Cap Core Funds Universe2, was 6.7% over the same period.

PORTFOLIO REVIEW

A rally late in the year brought equity results for the full year into respectable territory. Equity markets were supported all year by solid corporate results and strong economic growth. Profits grew at a double-digit pace for the third consecutive year, while economic growth exceeded expectations despite being tested by higher energy prices, devastating hurricanes, and rising short-term interest rates.

Many economically sensitive companies, especially those in the materials and industrial sectors, rose sharply after having languished for most of the year. Conversely, defensive areas such as utilities and consumer staples lagged after posting better-than-average returns in previous quarters. Growth stocks outperformed value stocks for the year’s final three quarters, though they underperformed for the full calendar year.

Similarly, stocks in the financial sector ended the year on a high note after trailing the market for most of the year. Profits among financial stocks were strong all year especially in the area of investment banking, thanks to the high volume of mergers and acquisitions.

Information technology stocks, which were flat over the first nine months of the year, rose during the fourth quarter to end the year up slightly. Technology stocks were helped by improved earnings guidance and growing consumer demand, and, in the area of semiconductors, by tighter capacity and the emerging view that flash memory would play a larger role in the next generation of consumer products.

The energy sector was the best-performing sector by far for the full year. Integrated oil stocks slid as oil prices fell and Congress considered levying a windfall profits tax on the industry. Oil services companies, however, posted strong returns.

The Portfolio outperformed its benchmark in 2005 due mainly to strong stock selection in the health care sector. The top contributors within the health care sector represented two of the top ten holdings in the portfolio (AstraZeneca and Allergan) as well as Israel-based Teva Pharmaceutical, Wellpoint, Inc., and Amgen. During the later stages of the year, we reduced our exposure to health care somewhat on strength, though we were still overweight relative to the index at the end of year.

The Portfolio also benefited from strong stock selection in the information technology sector, where it was also overweight relative to the index. We felt that certain industry leaders represented in the Portfolio such as Google, KLA-Tencor, and Intel were gaining market share and this is not yet reflected in their valuations. In the semi-conductor equipment area, we owned a number of companies for their highly proprietary products and inexpensive valuations.

Results were also helped by an overweight position in the energy sector, where we emphasized oil services rather than integrated oil companies. Top contributors within the energy sector included Unocal Corp., Schlumberger, Ltd., and Transocean, Inc.

The top overall detractor for the year was stock selection in the financial sector. Our positions in government-sponsored mortgage providers hurt results, as continued uncertainty over their future regulatory oversight caused these stocks to decline. Other areas that detracted from returns during the year were stock selection in the material and utility sectors.

* The views expressed above are those of the subinvestment advisor firm as of December 31, 2005 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation or country diversification is historical and is not an indication of future Portfolio composition, which will vary.

1 The Standard & Poor’s (S&P) 500® Composite Stock Price Index is an unmanaged index representing the performance of 500 major companies, most of which are listed on the New York Stock Exchange. The S&P 500 performance has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

2 Lipper Variable Products Fund Averages. Each of these is an average of the total return performance (calculated on the basis of net asset value) of funds with similar investment objectives to those of the subject Portfolio as calculated by Lipper Analytical Services, an independent mutual fund ranking service.

MSF-18

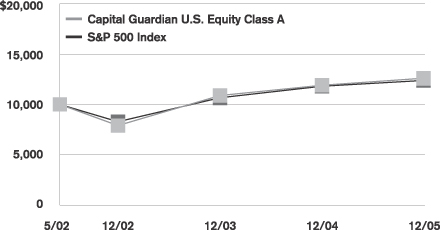

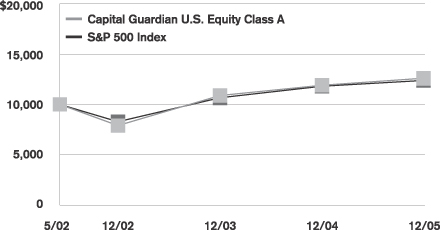

Metropolitan Series Fund, Inc.

Capital Guardian U.S. Equity Portfolio

A $10,000 INVESTMENT COMPARED TO THE

S&P 500 INDEX

Average Annual Returns as of December 31, 2005

| | | | | | | | | |

| | | Capital Guardian U.S. Equity Portfolio | | | S&P 500

Index | |

| | | Class A | | | Class B | | |

| 1 Year | | 5.8 | % | | 5.5 | % | | 4.9 | % |

| Since Inception | | 6.5 | | | 6.2 | | | 6.0 | |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception date of the Class A and Class B shares is 5/01/02. Index since inception returns are based on the Class A inception date.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION

as of December 31, 2005

Top Holdings

| | |

| | | % of Total

Net Assets

|

General Electric Co. | | 2.9% |

SLM Corp. | | 2.7% |

AstraZeneca, Plc. (ADR) | | 2.6% |

Washington Mutual, Inc. | | 2.4% |

Forest Laboratories, Inc. | | 2.4% |

JPMorgan Chase & Co. | | 2.3% |

Allergan, Inc. | | 2.1% |

Lowe’s Cos., Inc. | | 2.1% |

Microsoft Corp. | | 2.1% |

Wells Fargo & Co. | | 1.9% |

Top Sectors

| | |

| | | % of Total

Net Assets

|

Information Technology | | 21.4% |

Health Care | | 16.7% |

Financials | | 16.5% |

Industrials | | 11.3% |

Consumer Staples | | 9.0% |

Consumer Discretionary | | 8.9% |

Energy | | 7.4% |

Matrials | | 3.1% |

Telecommunication Services | | 2.9% |

Utilities | | 0.9% |

MSF-19

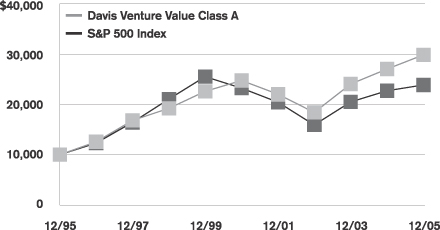

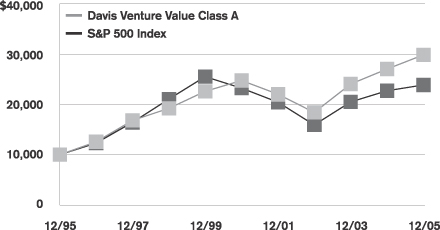

Metropolitan Series Fund, Inc.

Davis Venture Value Portfolio

Managed by Davis Selected Advisers, L.P.

Portfolio Manager Commentary*

PORTFOLIO PERFORMANCE

For the year ended December 31, 2005, the Class A shares of the Davis Venture Value Portfolio returned 10.3%, compared to its benchmark, the Standard & Poor’s 500 Index1, which returned 4.9%. The average return of its peer group, the Lipper Variable Insurance Products Large-Cap Value Funds Universe2, was 4.8% over the same period.

PORTFOLIO REVIEW

During the year ended December 31, 2005, the stock market, as measured by the S&P 500 Index, increased by 4.9%. U.S. economic activity, as measured by the inflation-adjusted gross domestic product (“GDP”), increased between 3.3% and 4.1% over each of the first three calendar quarters of the year. Interest rates, as measured by the 10-year Treasury bond, began 2005 at about 4.2%, ranged as low as 4.0% and ended 2005 at about 4.4%.

Energy companies were the most important contributors to the Portfolio’s performance over the year. Energy companies were also the strongest performing sector of the S&P 500 Index. The Portfolio benefited both by investing a larger percentage of its assets in energy companies than did the S&P 500 Index. As a group, the individual energy companies that the Portfolio owned out-performed the average energy company included in the S&P 500 Index. All of the Portfolio’s energy companies performed well, with EOG Resources, Devon Energy, ConocoPhillips, and Occidental Petroleum, all among the Portfolio’s top ten contributors to performance.

The Portfolio’s largest industry group holdings were in diversified financial companies, insurance companies, and consumer staple companies. All three sectors were important contributors to performance. Moody’s (a diversified financial company), Progressive, Loews, and American International Group (three insurance companies), and Altria (a consumer staples company) were among the Portfolio’s top ten contributors to performance.