UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3618

Metropolitan Series Fund, Inc.

(Exact name of registrant as specified in charter)

501 Boylston Street

Boston, Massachusetts 02116

(Address of Principal Executive Office)

THOMAS M. LENZ, ESQ.

MetLife Advisers, LLC

501 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Copy to:

JOHN M. LODER

One Financial Center

Boston, Massachusetts 02111

Registrant’s telephone number, including area code: 617-578-3104

Date of fiscal year end: December 31

Date of reporting period: December 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”):

| | |

Metropolitan Series Fund, Inc. BlackRock Aggressive Growth Portfolio Annual Report | | December 31, 2007 |

Letter from the President

February 1, 2008

Letter to Policy Holders:

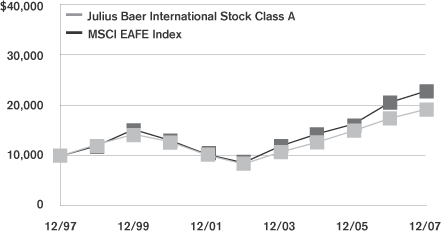

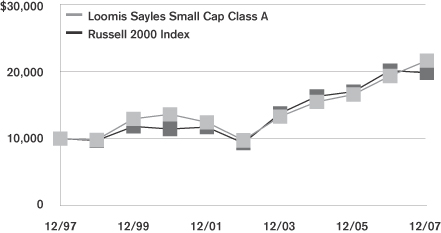

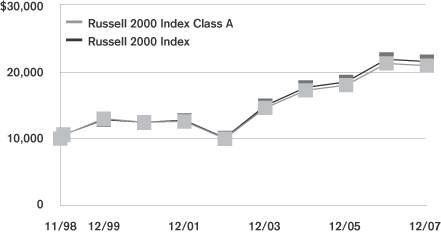

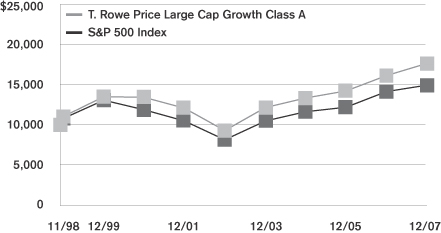

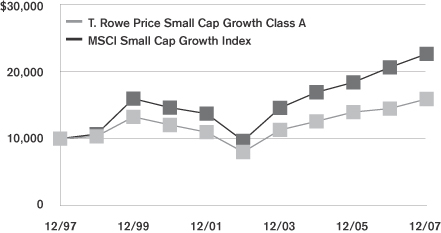

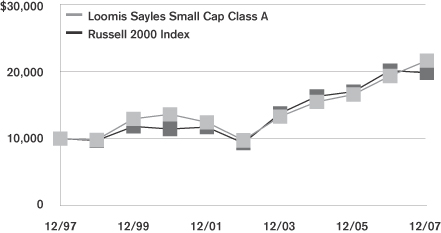

2007 was a tumultuous year in the financial markets driven by concerns in the credit markets surrounding sub-prime mortgages and fears of recession in the U.S. Economy. The broad markets were mixed, with the Dow Jones Industrial Average up 8.9% and the MSCI EAFE Index, which measures the performance of international equities, up 11.2% for the year, while the Russell 2000 Index, which measures the performance of small capitalization stocks, was down 1.6%.

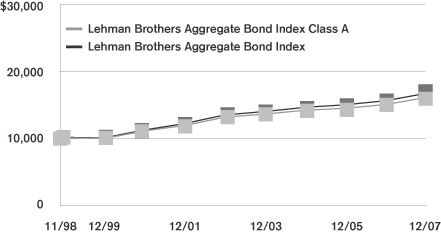

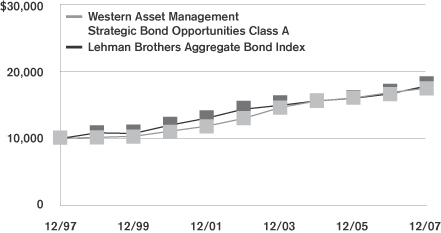

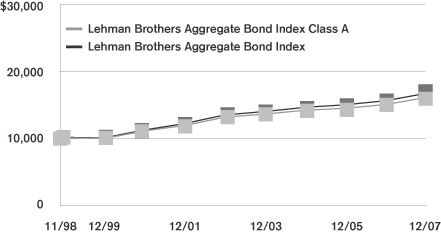

In the fixed income markets, credit spreads increased as a result of the pressure from sub-prime mortgage crisis and the Federal Reserve lowered interest rates by a total of 1% during the year. The Lehman Brothers Aggregate Bond Index posted a 7.0% return for the year.

On the following pages, you will find a complete review of your Portfolio and its investment performance.

MetLife is committed to building your financial freedom. We appreciate your trust and will continue to focus our efforts on meeting your investment needs.

Sincerely,

Elizabeth Forget

President, Metropolitan Series Fund, Inc.

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Managed by BlackRock Advisors, LLC

Portfolio Manager Commentary*

PORTFOLIO PERFORMANCE

For the year ended December 31, 2007, the Class A shares of the BlackRock Aggressive Growth Portfolio returned 20.6%, compared to its benchmark, the Russell Midcap Growth Index1, which returned 11.4%. The average return of its peer group, the Lipper Variable Insurance Products Mid-Cap Growth Funds Universe2 , was 16.5% over the same period.

PORTFOLIO REVIEW

2007 began largely where 2006 left off. A slowdown in U.S. growth occurred following Fed tightening, rising oil prices, and the beginning of concerns around credit and slower spending by the U.S. consumer. Earnings growth remained strong on the back of solid export growth, a declining dollar and share buybacks. A transition in leadership from small, value and domestic to large, growth and multinational became evident as the year began. During the second half of 2007, the benign fundamentals of 2003-2006, namely strong global growth, rising profitability levels, and falling risk premiums, were replaced by credit stress; pressures on the capital position of the financial system; questions about the sustainability of the business cycle; and rising energy and food prices. Reflecting these woes, market prices moved considerably. Government bond yields plummeted, the dollar fell faster than in earlier years, credit spreads widened and equities became trendless and volatile. The financial and consumer discretionary sectors experienced drops of one-quarter to one-third. Commodity and industrial-related multinational companies performed the best. Emerging market economies and equity markets performed well yet again. The Federal Reserve moved from an attitude of vigilance about inflation to one of providing liquidity and lowering rates to shore up the functioning of credit markets and fight economic weakness.

BlackRock Aggressive Growth Portfolio had positive returns for the fifth consecutive year and significantly outperformed the Russell Midcap Growth Index. Strong stock selection in consumer discretionary, financials and healthcare, along with sector positioning in consumer discretionary and energy, helped returns.

The largest change in sector positioning during the year came in information technology (IT), where we notably reduced our overweight versus the benchmark Russell Midcap Growth Index. This shift resulted from a combination of our eliminating some IT holdings from the Portfolio while the benchmark’s sector weighting increased. We eliminated a number of names within the sector, including CACI International and Ingram Micro, in order to pursue more attractive opportunities. Sizeable holding Alliance Data Systems, a private label credit card processing service provider, was sold after the company announced it was being taken private by Blackstone. Additionally, video conference provider Polycom was sold due to high valuation. Cash generated from the selling of these names allowed us to increase our exposure in healthcare from a slight underweight to an overweight position. Notable additions included Medicis Pharmaceutical, Hologic Inc. and Magellan Health Services. At year-end, our largest overweights were concentrated in the healthcare and information technology sectors, while our most significant underweight was in the utilities sector. We continue to look for names with good growth opportunities, regardless of sector or market conditions.

A combination of strong stock selection and a relative underweight in the consumer discretionary sector proved to be the greatest contributors to both absolute and relative returns for the period. Stock selection in the specialty retail industry, in particular, accounted for the largest part of the success. Sizeable Portfolio holding GameStop more than doubled in price as the video game retailer continued to report strong financial results. Dick’s Sporting Goods was also a positive contributor within specialty retail, as the company consistently executed in a tough retail environment. Elsewhere in consumer discretionary, hotel chain Orient-Express Hotels appreciated more than 20% on strong international results and takeover speculation.

Although the financials sector generated limited returns for the period, strong stock selection within the Portfolio helped both relative and absolute returns. CME Group was the top contributor in the sector, benefiting from increased trading activity in addition to its successful merger with the Chicago Board of Trade. Our underweight in utilities had a slightly negative effect on the Portfolio, as the sector accounts for only a small part of the Russell Midcap Growth Index.

Consistent with the Portfolio’s investment process and discipline, its structure at any given time reflects our bottom-up analysis of what we believe are the most promising investment opportunities in the mid cap growth universe. We do not make macroeconomic, sector, or thematic predictions.

* The views expressed above are those of the subadvisory firm as of December 31, 2007 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation, or country diversification is historical and is not an indication of future Portfolio composition, which will vary. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in the Index is not possible.

1 The Russell Midcap® Growth Index is an unmanaged measure of performance of those Russell Midcap companies (the 800 smallest companies in the Russell 1000 Index) with higher price-to-book ratios and higher forecasted growth values.

2 The Lipper Variable Insurance Products Fund Average is an average of the total return performance (calculated on the basis of net asset value) of variable product funds with similar investment objectives to those of the subject Portfolio as calculated by Lipper Analytical Services, an independent mutual fund ranking service.

MSF-2

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

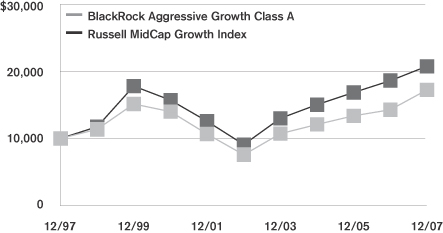

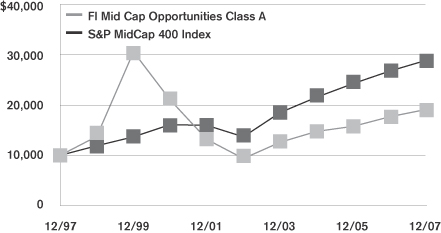

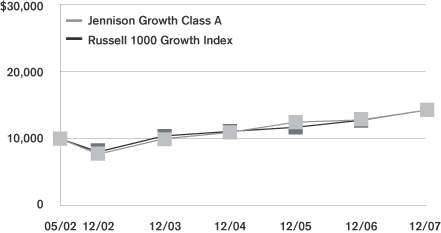

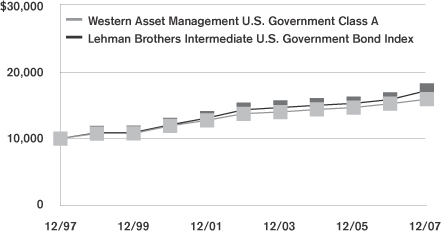

A $10,000 INVESTMENT COMPARED TO

THE RUSSELL MIDCAP GROWTH INDEX

Average Annual Returns as of December 31, 2007

| | | | | | | | | | | | | | | |

| | | BlackRock Aggressive

Growth Portfolio | | | Russell

MidCap

Growth Index | |

| | | Class A | | | Class B | | | Class D | | | Class E | | |

| 1 Year | | 20.6 | % | | 20.2 | % | | 20.4 | % | | 20.4 | % | | 11.4 | % |

| 5 Year | | 17.8 | | | — | | | — | | | 17.6 | | | 17.9 | |

| 10 Year | | 5.6 | | | — | | | — | | | — | | | 7.6 | |

| Since Inception | | — | | | 12.0 | | | 10.9 | | | 5.0 | | | — | |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower.

Inception dates of the Class A, Class B, Class D and Class E shares are: 4/29/88, 4/26/04, 5/2/06 and 5/1/01, respectively.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION as of December 31, 2007

Top Holdings

| | |

| | | % of Total

Net Assets |

GameStop Corp. (Class A) | | 2.9% |

Thermo Fisher Scientific, Inc. | | 2.6% |

Ametek, Inc. | | 2.5% |

CME Group, Inc. | | 2.5% |

Harris Corp. | | 2.4% |

Oshkosh Truck Corp. | | 2.3% |

Pediatrix Medical Group, Inc. | | 2.2% |

Medco Health Solutions, Inc. | | 2.2% |

Agrium, Inc. | | 2.2% |

Amphenol Corp. (Class A) | | 2.2% |

Top Sectors

| | |

| | | % of Total

Market Value |

Information Technology | | 21.7% |

Industrials | | 16.7% |

Health Care | | 15.6% |

Consumer Discretionary | | 14.8% |

Energy | | 13.4% |

Materials | | 6.7% |

Financials | | 5.9% |

Cash | | 2.2% |

Consumer Staples | | 1.6% |

Telecommunication Services | | 1.4% |

MSF-3

Metropolitan Series Fund, Inc.

Shareholder Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees; distribution and service (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) (referred to as “expenses”) of investing in the Portfolio and compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2007 through December 31, 2007.

Actual Expenses

The first line for each share class of the Portfolio in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested in the particular share class of the Portfolio, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class of the Portfolio in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees or charges of your variable insurance product or any additional expenses that participants in certain eligible qualified plans may bear relating to the operations of their plan. Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these other costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Portfolio | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

July 1,

2007 | | Ending

Account Value

December 31,

2007 | | Expenses Paid

During Period*

July 1, 2007

to

December 31,

2007 |

BlackRock Aggressive Growth—Class A | | Actual | | 0.76 | % | | $ | 1,000.00 | | $ | 1,071.20 | | $ | 3.97 |

| | Hypothetical | | 0.76 | % | | $ | 1,000.00 | | $ | 1,021.33 | | $ | 3.87 |

| | | | | |

BlackRock Aggressive Growth—Class B | | Actual | | 1.01 | % | | $ | 1,000.00 | | $ | 1,069.60 | | $ | 5.27 |

| | Hypothetical | | 1.01 | % | | $ | 1,000.00 | | $ | 1,020.05 | | $ | 5.14 |

| | | | | |

BlackRock Aggressive Growth—Class D | | Actual | | 0.86 | % | | $ | 1,000.00 | | $ | 1,070.20 | | $ | 4.49 |

| | Hypothetical | | 0.86 | % | | $ | 1,000.00 | | $ | 1,020.82 | | $ | 4.38 |

| | | | | |

BlackRock Aggressive Growth—Class E | | Actual | | 0.91 | % | | $ | 1,000.00 | | $ | 1,070.30 | | $ | 4.75 |

| | Hypothetical | | 0.91 | % | | $ | 1,000.00 | | $ | 1,020.56 | | $ | 4.63 |

* Expenses paid are equal to the Portfolio’s annualized expense ratio for the most recent six month period, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the one-half year period).

MSF-4

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Schedule of Investments as of December 31, 2007

Common Stock—96.9% of Total Net Assets

| | | | | |

| Security Description | | Shares | | Value* |

| | | | | |

|

Aerospace & Defense—4.4% |

BE Aerospace, Inc. (a) | | 420,500 | | $ | 22,244,450 |

Goodrich Corp. | | 307,300 | | | 21,698,453 |

Precision Castparts Corp. | | 85,480 | | | 11,856,076 |

| | | | | |

| | | | | 55,798,979 |

| | | | | |

|

Air Freight & Logistics—0.5% |

UTi Worldwide, Inc. | | 313,800 | | | 6,150,480 |

| | | | | |

|

Biotechnology—1.0% |

Martek Biosciences Corp. (a) (b) | | 445,000 | | | 13,163,100 |

| | | | | |

|

Capital Markets—2.3% |

Affiliated Managers Group, Inc. (a) (b) | | 79,000 | | | 9,279,340 |

Invesco, Ltd. (b) | | 268,400 | | | 8,422,392 |

T. Rowe Price Group, Inc. | | 181,800 | | | 11,067,984 |

| | | | | |

| | | | | 28,769,716 |

| | | | | |

|

Chemicals—4.0% |

Agrium, Inc. | | 386,100 | | | 27,880,281 |

Celanese Corp. | | 548,700 | | | 23,220,984 |

| | | | | |

| | | | | 51,101,265 |

| | | | | |

|

Commercial Services & Supplies—3.8% |

Employee Solutions, Inc. (a) (b) (c) | | 484 | | | 0 |

Genpact, Ltd. (b) | | 397,700 | | | 6,056,971 |

IHS, Inc. (a) (b) | | 383,200 | | | 23,206,593 |

TeleTech Holdings, Inc. (a) (b) | | 912,000 | | | 19,398,240 |

| | | | | |

| | | | | 48,661,804 |

| | | | | |

|

Communications Equipment—4.6% |

Foundry Networks, Inc. (a) | | 853,600 | | | 14,955,072 |

Harris Corp. | | 483,320 | | | 30,294,498 |

Juniper Networks, Inc. (a) | | 393,300 | | | 13,057,560 |

| | | | | |

| | | | | 58,307,130 |

| | | | | |

|

Construction & Engineering—0.5% |

Quanta Services, Inc. (a) | | 255,000 | �� | | 6,691,200 |

| | | | | |

|

Diversified Consumer Services—0.9% |

DeVry, Inc. | | 213,302 | | | 11,083,172 |

| | | | | |

|

Diversified Financial Services—2.8% |

CME Group, Inc. | | 47,030 | | | 32,262,580 |

MSCI, Inc. (a) | | 78,900 | | | 3,029,760 |

| | | | | |

| | | | | 35,292,340 |

| | | | | |

|

Electrical Equipment—2.5% |

Ametek, Inc. (a) | | 691,800 | | | 32,403,912 |

| | | | | |

| | |

Electronic Equipment & Instruments—2.2% | | | | | |

Amphenol Corp. (Class A) | | 592,300 | | | 27,464,951 |

| | | | | |

| | |

Energy Equipment & Services—4.3% | | | | | |

Acergy S.A. (ADR) (a) | | 678,700 | | | 14,911,039 |

| | | | | |

| Security Description | | Shares | | Value* |

| | | | | |

|

Energy Equipment & Services—(Continued) |

BJ Services Co. | | 273,800 | | $ | 6,642,388 |

Noble Corp. | | 317,100 | | | 17,919,321 |

Transocean, Inc. | | 104,996 | | | 15,030,177 |

| | | | | |

| | | | | 54,502,925 |

| | | | | |

| | |

Health Care Equipment & Supplies—1.6% | | | | | |

Hologic, Inc. (a) | | 300,800 | | | 20,646,912 |

| | | | | |

| | |

Health Care Providers & Services—6.5% | | | | | |

Coventry Health Care, Inc. (a) | | 233,100 | | | 13,811,175 |

Magellan Health Services, Inc. (a) | | 275,000 | | | 12,823,250 |

Medco Health Solutions, Inc. (a) | | 276,200 | | | 28,006,680 |

Pediatrix Medical Group, Inc. (a) | | 411,000 | | | 28,009,650 |

| | | | | |

| | | | | 82,650,755 |

| | | | | |

| | |

Hotels, Restaurants & Leisure—6.6% | | | | | |

International Game Technology | | 390,240 | | | 17,143,243 |

Life Time Fitness, Inc. (a) (b) | | 205,800 | | | 10,224,144 |

Orient-Express Hotels, Ltd. (Class A) (b) | | 258,500 | | | 14,868,920 |

Panera Bread Co. (a) (b) | | 271,700 | | | 9,732,294 |

Pinnacle Entertainment, Inc. (a) (b) | | 321,900 | | | 7,583,964 |

Scientific Games Corp. (a) (b) | | 716,500 | | | 23,823,625 |

| | | | | |

| | | | | 83,376,190 |

| | | | | |

| | |

IT Services—3.4% | | | | | |

Fidelity National Information Services, Inc. | | 497,600 | | | 20,695,184 |

Iron Mountain, Inc. (a) (b) | | 624,300 | | | 23,111,586 |

| | | | | |

| | | | | 43,806,770 |

| | | | | |

| | |

Life Sciences Tools & Services—2.6% | | | | | |

Thermo Fisher Scientific, Inc. (a) (b) | | 583,800 | | | 33,673,584 |

| | | | | |

| | |

Machinery—5.4% | | | | | |

IDEX Corp. | | 527,700 | | | 19,065,801 |

Joy Global, Inc. | | 323,500 | | | 21,292,770 |

Oshkosh Truck Corp. (b) | | 608,900 | | | 28,776,614 |

| | | | | |

| | | | | 69,135,185 |

| | | | | |

|

Media—2.4% |

CKX, Inc. (a) (b) | | 1,069,400 | | | 12,832,800 |

DreamWorks Animation SKG, Inc. (a) | | 675,800 | | | 17,259,932 |

| | | | | |

| | | | | 30,092,732 |

| | | | | |

|

Metals & Mining—2.7% |

Century Aluminum Co. (a) (b) | | 298,100 | | | 16,079,514 |

Quanex Corp. (b) | | 355,500 | | | 18,450,450 |

| | | | | |

| | | | | 34,529,964 |

| | | | | |

|

Oil, Gas & Consumable Fuels—9.1% |

Chesapeake Energy Corp. (b) | | 368,300 | | | 14,437,360 |

Consol Energy, Inc. | | 363,200 | | | 25,976,064 |

EOG Resources, Inc. | | 225,300 | | | 20,108,025 |

Massey Energy Co. (b) | | 600,900 | | | 21,482,175 |

Newfield Exploration Co. (a) | | 444,139 | | | 23,406,125 |

*See accompanying notes to financial statements.

MSF-5

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Schedule of Investments as of December 31, 2007

Common Stock—(Continued)

| | | | | |

| Security Description | |

Shares | | Value* |

| | | | | |

|

Oil, Gas & Consumable Fuels—(Continued) |

Plains Exploration & Production Co. (a) (b) | | 185,000 | | $ | 9,990,000 |

| | | | | |

| | | | | 115,399,749 |

| | | | | |

|

Personal Products—1.6% |

Bare Escentuals, Inc. (a) (b) | | 846,200 | | | 20,520,350 |

| | | | | |

|

Pharmaceuticals—3.8% |

Endo Pharmaceuticals Holdings, Inc. (a) | | 411,200 | | | 10,966,704 |

Forest Laboratories, Inc. (a) | | 166,100 | | | 6,054,345 |

Medicis Pharmaceutical Corp. (a) (b) | | 484,900 | | | 12,592,853 |

Shire, Plc. (ADR) (b) | | 279,300 | | | 19,257,735 |

| | | | | |

| | | | | 48,871,637 |

| | | | | |

|

Semiconductors & Semiconductor Equipment—3.2% |

Broadcom Corp. (a) | | 396,800 | | | 10,372,352 |

Intersil Corp. | | 451,300 | | | 11,047,824 |

Lam Research Corp. (a) | | 143,317 | | | 6,195,594 |

PMC-Sierra, Inc. (a) (b) | | 2,030,790 | | | 13,281,366 |

| | | | | |

| | | | | 40,897,136 |

| | | | | |

|

Software—7.8% |

ACI Worldwide, Inc. (a) (b) | | 474,400 | | | 9,032,576 |

Activision, Inc. (a) | | 263,400 | | | 7,822,980 |

Adobe Systems, Inc. (a) | | 626,640 | | | 26,776,327 |

Amdocs, Ltd. (a) | | 470,250 | | | 16,209,518 |

Intuit, Inc. (a) | | 204,600 | | | 6,467,406 |

Jack Henry & Associates, Inc. (b) | | 495,400 | | | 12,058,036 |

MICROS Systems, Inc. (a) | | 296,100 | | | 20,774,376 |

| | | | | |

| | | | | 99,141,219 |

| | | | | |

|

Specialty Retail—4.4% |

GameStop Corp. (Class A) (a) | | 592,700 | | | 36,812,597 |

TJX Cos., Inc. | | 655,400 | | | 18,829,642 |

| | | | | |

| | | | | 55,642,239 |

| | | | | |

|

Textiles, Apparel & Luxury Goods—0.6% |

Phillips-Van Heusen Corp. | | 210,900 | | | 7,773,774 |

| | | | | |

|

Wireless Telecommunication Services—1.4% |

American Tower Corp. (Class A) (a) | | 413,227 | | | 17,603,470 |

| | | | | |

Total Common Stock

(Identified Cost $988,221,356) | | | | | 1,233,152,640 |

| | | | | |

| | |

| Units—0.9% | | | | | |

|

Capital Markets—0.9% |

AllianceBernstein Holding, L.P. (b) | | 144,200 | | | 10,851,050 |

| | | | | |

Total Units

(Identified Cost $12,865,849) | | | | | 10,851,050 |

| | | | | |

| | | | | | | |

|

| Short Term Investments—17.5% | |

| Security Description | | Face Amount/

Shares | | Value* | |

| | | | | | | |

|

Discount Notes—2.3% | |

Federal Home Loan Bank

4.150%, 01/11/08 | | $ | 19,333,000 | | $ | 19,318,232 | |

4.150%, 01/14/08 | | | 9,700,000 | | | 9,688,616 | |

| | | | | | | |

| | | | | | 29,006,848 | |

| | | | | | | |

|

Mutual Funds—15.2% | |

State Street Navigator Securities Lending Prime Portfolio (d) | | | 193,153,898 | | | 193,153,898 | |

| | | | | | | |

Total Short Term Investments

(Identified Cost $222,160,746) | | | | | | 222,160,746 | |

| | | | | | | |

Total Investments—115.3%

(Identified Cost $1,223,247,951) (e) | | | | | | 1,466,164,436 | |

Liabilities in excess of other assets | | | | | | (194,167,959 | ) |

| | | | | | | |

| Total Net Assets—100% | | | | | $ | 1,271,996,477 | |

| | | | | | | |

| (b) | A portion or all of the security was held on loan. As of December 31, 2007, the market value of securities loaned was $191,842,361 and the collateral received consisted of cash in the amount of $193,153,898 and non cash collateral with a value of $4,693,182. The cash collateral is invested in a money market fund managed by an affiliate of the custodian. The non cash collateral received consists primarily of government securities and bank letters of credit, and are held for the benefit of the Portfolio at the Portfolio’s custodian. |

| (d) | Represents investment of cash collateral received from securities lending transactions. |

| (e) | The aggregate cost of investments for federal income tax purposes as of December 31, 2007 was $1,223,277,407 and the composition of unrealized appreciation and depreciation of investment securities was $307,147,934 and $(64,260,905), respectively. |

| (ADR)— | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. Trading on exchanges not located in the United States or Canada significantly influences the value of ADRs. |

*See accompanying notes to financial statements.

MSF-6

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Statement of Assets & Liabilities

December 31, 2007

| | | | | | | |

Assets | | | | | | | |

Investments at value (a) (b) | | | | | $ | 1,466,164,436 | |

Receivable for: | | | | | | | |

Fund shares sold | | | | | | 206,986 | |

Accrued interest and dividends | | | | | | 293,468 | |

Foreign taxes | | | | | | 18 | |

| | | | | | | |

Total Assets | | | | | | 1,466,664,908 | |

Liabilities | | | | | | | |

Payable for: | | | | | | | |

Fund shares redeemed | | $ | 550,352 | | | | |

Withholding taxes | | | 3,185 | | | | |

Collateral for securities loaned | | | 193,153,898 | | | | |

Due to custodian bank | | | 111,701 | | | | |

Accrued expenses: | | | | | | | |

Management fees | | | 764,665 | | | | |

Service and distribution fees | | | 34,543 | | | | |

Other expenses | | | 50,087 | | | | |

| | | | | | | |

Total Liabilities | | | | | | 194,668,431 | |

| | | | | | | |

Net Assets | | | | | $ | 1,271,996,477 | |

| | | | | | | |

Net assets consists of: | | | | | | | |

Capital paid in | | | | | $ | 1,383,716,923 | |

Accumulated net realized losses | | | | | | (354,636,931 | ) |

Unrealized appreciation on investments | | | | | | 242,916,485 | |

| | | | | | | |

Net Assets | | | | | $ | 1,271,996,477 | |

| | | | | | | |

| Computation of offering price: | | | | | | | |

Class A | | | | | | | |

Net asset value and redemption price per share ($937,655,136 divided by 32,459,575 shares outstanding) | | | | | $ | 28.89 | |

| | | | | | | |

Class B | | | | | | | |

Net asset value and redemption price per share ($45,242,801 divided by 1,644,427 shares outstanding) | | | | | $ | 27.51 | |

| | | | | | | |

Class D | | | | | | | |

Net asset value and redemption price per share ($268,927,920 divided by 9,382,887 shares outstanding) | | | | | $ | 28.66 | |

| | | | | | | |

Class E | | | | | | | |

Net asset value and redemption price per share ($20,170,620 divided by 704,204 shares outstanding) | | | | | $ | 28.64 | |

| | | | | | | |

(a) Identified cost of investments | | | | | $ | 1,223,247,951 | |

| | | | | | | |

| (b) | Includes cash collateral for securities loaned of $193,153,898. |

Statement of Operations

For the Year Ended December 31, 2007

| | | | | | | | |

Investment Income | | | | | | | | |

Dividends | | | | | | $ | 4,661,657 | (a) |

Interest | | | | | | | 1,514,399 | (b) |

| | | | | | | | |

| | | | | | | 6,176,056 | |

Expenses | | | | | | | | |

Management fees | | $ | 8,765,974 | | | | | |

Service and distribution fees—Class B | | | 75,946 | | | | | |

Service and distribution fees—Class D | | | 270,773 | | | | | |

Service and distribution fees—Class E | | | 25,313 | | | | | |

Directors’ fees and expenses | | | 23,669 | | | | | |

Custodian | | | 102,094 | | | | | |

Audit and tax services | | | 31,739 | | | | | |

Legal | | | 13,679 | | | | | |

Printing | | | 365,749 | | | | | |

Insurance | | | 13,682 | | | | | |

Miscellaneous | | | 5,322 | | | | | |

| | | | | | | | |

Total expenses | | | 9,693,940 | | | | | |

Expense reductions | | | (151,402 | ) | | | 9,542,538 | |

| | | | | | | | |

Net Investment Loss | | | | | | | (3,366,482 | ) |

| | | | | | | | |

Realized and Unrealized Gain | | | | | | | | |

| Realized gain on: | | | | | | | | |

Investments—net | | | | | | | 137,208,639 | |

| Change in unrealized appreciation on: | | | | | | | | |

Investments—net | | | | | | | 94,696,186 | |

| | | | | | | | |

Net gain | | | | | | | 231,904,825 | |

| | | | | | | | |

Net Increase in Net Assets From Operations | | | | | | $ | 228,538,343 | |

| | | | | | | | |

| (a) | Net of foreign taxes of $23,458. |

| (b) | Includes net income on securities loaned of $392,874. |

See accompanying notes to financial statements.

MSF-7

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year ended

December 31,

2007 | | | Year ended

December 31,

2006 | |

From Operations | | | | | | | | |

Net investment loss | | $ | (3,366,482 | ) | | $ | (3,482,278 | ) |

Net realized gain | | | 137,208,639 | | | | 149,589,198 | |

Unrealized appreciation (depreciation) | | | 94,696,186 | | | | (90,804,620 | ) |

| | | | | | | | |

Increase in net assets from operations | | | 228,538,343 | | | | 55,302,300 | |

| | | | | | | | |

Increase (decrease) in net assets from capital share transactions | | | (145,603,986 | ) | | | 165,794,896 | |

| | | | | | | | |

Total increase in net assets | | | 82,934,357 | | | | 221,097,196 | |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of the period | | | 1,189,062,120 | | | | 967,964,924 | |

| | | | | | | | |

End of the period | | $ | 1,271,996,477 | | | $ | 1,189,062,120 | |

| | | | | | | | |

Other Information:

Capital Shares

Transactions in capital shares were as follows:

| | | | | | | | | | | | | | |

| | | Year ended

December 31, 2007 | | | Year ended

December 31, 2006 | |

| | | Shares | | | $ | | | Shares | | | $ | |

Class A | | | | | | | | | | | | | | |

Sales | | 2,125,807 | | | $ | 56,726,170 | | | 2,769,960 | | | $ | 64,053,615 | |

Redemptions | | (6,434,262 | ) | | | (170,180,611 | ) | | (7,807,106 | ) | | | (180,666,319 | ) |

| | | | | | | | | | | | | | |

Net decrease | | (4,308,455 | ) | | $ | (113,454,441 | ) | | (5,037,146 | ) | | $ | (116,612,704 | ) |

| | | | | | | | | | | | | | |

Class B | | | | | | | | | | | | | | |

Sales | | 1,107,249 | | | $ | 28,952,558 | | | 736,878 | | | $ | 16,153,676 | |

Redemptions | | (408,530 | ) | | | (10,419,375 | ) | | (338,527 | ) | | | (7,544,279 | ) |

| | | | | | | | | | | | | | |

Net increase | | 698,719 | | | $ | 18,533,183 | | | 398,351 | | | $ | 8,609,397 | |

| | | | | | | | | | | | | | |

Class D | | | | | | | | | | | | | | |

Sales | | 468,353 | | | $ | 12,656,593 | | | 480,560 | | | $ | 11,117,841 | |

Shares issued through acquisition | | 0 | | | | 0 | | | 13,830,963 | | | | 333,602,824 | |

Redemptions | | (2,438,024 | ) | | | (64,215,232 | ) | | (2,958,965 | ) | | | (68,527,661 | ) |

| | | | | | | | | | | | | | |

Net increase (decrease) | | (1,969,671 | ) | | $ | (51,558,639 | ) | | 11,352,558 | | | $ | 276,193,004 | |

| | | | | | | | | | | | | | |

Class E | | | | | | | | | | | | | | |

Sales | | 205,002 | | | $ | 5,675,736 | | | 153,720 | | | $ | 3,523,213 | |

Redemptions | | (186,065 | ) | | | (4,799,825 | ) | | (259,103 | ) | | | (5,918,014 | ) |

| | | | | | | | | | | | | | |

Net increase (decrease) | | 18,937 | | | $ | 875,911 | | | (105,383 | ) | | $ | (2,394,801 | ) |

| | | | | | | | | | | | | | |

Increase (decrease) derived from capital share transactions | | | | | $ | (145,603,986 | ) | | | | | $ | 165,794,896 | |

| | | | | | | | | | | | | | |

See accompanying notes to financial statements.

MSF-8

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class A | |

| | | Year ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Net Asset Value, Beginning of Period | | $ | 23.96 | | | $ | 22.45 | | | $ | 20.28 | | | $ | 17.95 | | | $ | 12.75 | |

| | | | | | | | | | | | | | | | | | | | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.06 | )(a) | | | (0.07 | ) | | | (0.07 | ) | | | (0.07 | ) | | | (0.06 | ) |

Net realized and unrealized gain on investments | | | 4.99 | | | | 1.58 | | | | 2.24 | | | | 2.40 | | | | 5.26 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 4.93 | | | | 1.51 | | | | 2.17 | | | | 2.33 | | | | 5.20 | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 28.89 | | | $ | 23.96 | | | $ | 22.45 | | | $ | 20.28 | | | $ | 17.95 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return (%) | | | 20.6 | | | | 6.7 | | | | 10.7 | | | | 13.0 | | | | 40.8 | |

Ratio of operating expenses to average net assets before expense reductions (%) | | | 0.76 | | | | 0.79 | | | | 0.79 | | | | 0.79 | | | | 0.81 | |

Ratio of operating expenses to average net assets after expense reductions (%) (b) | | | 0.74 | | | | 0.77 | | | | 0.77 | | | | 0.78 | | | | 0.79 | |

Ratio of net investment loss to average net assets (%) | | | (0.24 | ) | | | (0.29 | ) | | | (0.33 | ) | | | (0.38 | ) | | | (0.38 | ) |

Portfolio turnover rate (%) | | | 49 | | | | 91 | | | | 71 | | | | 95 | | | | 98 | |

Net assets, end of period (000) | | $ | 937,655 | | | $ | 880,965 | | | $ | 938,550 | | | $ | 954,736 | | | $ | 926,897 | |

| | | | | | | | | | | | | | | | |

| | | Class B | |

| | | Year ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004(c) | |

Net Asset Value, Beginning of Period | | $ | 22.88 | | | $ | 21.49 | | | $ | 19.46 | | | $ | 18.12 | |

| | | | | | | | | | | | | | | | |

Income From Investment Operations | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.12 | )(a) | | | (0.09 | ) | | | (0.08 | ) | | | (0.03 | ) |

Net realized and unrealized gain on investments | | | 4.75 | | | | 1.48 | | | | 2.11 | | | | 1.37 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 4.63 | | | | 1.39 | | | | 2.03 | | | | 1.34 | |

| | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 27.51 | | | $ | 22.88 | | | $ | 21.49 | | | $ | 19.46 | |

| | | | | | | | | | | | | | | | |

Total Return (%) | | | 20.2 | | | | 6.5 | | | | 10.4 | | | | 7.4 | (d) |

Ratio of operating expenses to average net assets before expense reductions (%) | | | 1.01 | | | | 1.04 | | | | 1.04 | | | | 1.04 | (e) |

Ratio of operating expenses to average net assets after expense reductions (%) (b) | | | 0.99 | | | | 1.02 | | | | 1.01 | | | | 1.03 | (e) |

Ratio of net investment loss to average net assets (%) | | | (0.48 | ) | | | (0.53 | ) | | | (0.56 | ) | | | (0.56 | )(e) |

Portfolio turnover rate (%) | | | 49 | | | | 91 | | | | 71 | | | | 95 | |

Net assets, end of period (000) | | $ | 45,243 | | | $ | 21,634 | | | $ | 11,761 | | | $ | 4,165 | |

| (a) | Per share amount is based on average shares outstanding during the period. |

| (b) | The Portfolio has entered into arrangements with certain brokers who paid a portion of the Portfolio’s expenses. |

| (c) | Commencement of operations was April 26, 2004 and May 2, 2006 for Classes B and D, respectively. |

| (d) | Periods less than one year are not computed on an annualized basis. |

| (e) | Computed on an annualized basis. |

See accompanying notes to financial statements.

MSF-9

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Financial Highlights

| | | | | | | | |

| | | Class D | |

| | | Year ended December 31, | |

| | | 2007 | | | 2006(c) | |

Net Asset Value, Beginning of Period | | $ | 23.80 | | | $ | 24.12 | |

| | | | | | | | |

Income From Investment Operations | | | | | | | | |

Net investment loss | | | (0.09 | )(a) | | | (0.06 | ) |

Net realized and unrealized gain (loss) of investments | | | 4.95 | | | | (0.26 | ) |

| | | | | | | | |

Total from investment operations | | | 4.86 | | | | (0.32 | ) |

| | | | | | | | |

Net Asset Value, End of Period | | $ | 28.66 | | | $ | 23.80 | |

| | | | | | | | |

Total Return (%) | | | 20.4 | | | | (1.3 | )(d) |

Ratio of operating expenses to average net assets before expense reductions (%) | | | 0.86 | | | | 0.89 | (e) |

Ratio of operating expenses to average net assets after expense reductions (%) (b) | | | 0.84 | | | | 0.87 | (e) |

Ratio of net investment loss to average net assets (%) | | | (0.34 | ) | | | (0.36 | )(e) |

Portfolio turnover rate (%) | | | 49 | | | | 91 | |

Net assets, end of period (000) | | $ | 268,928 | | | $ | 270,158 | |

| | | | | | | | | | | | | | | | | | | | |

| | | Class E | |

| | | Year ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Net Asset Value, Beginning of Period | | $ | 23.79 | | | $ | 22.33 | | | $ | 20.20 | | | $ | 17.90 | | | $ | 12.74 | |

| | | | | | | | | | | | | | | | | | | | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.10 | )(a) | | | (0.12 | ) | | | (0.11 | ) | | | (0.09 | ) | | | (0.04 | ) |

Net realized and unrealized gain on investments | | | 4.95 | | | | 1.58 | | | | 2.24 | | | | 2.39 | | | | 5.20 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 4.85 | | | | 1.46 | | | | 2.13 | | | | 2.30 | | | | 5.16 | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 28.64 | | | $ | 23.79 | | | $ | 22.33 | | | $ | 20.20 | | | $ | 17.90 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return (%) | | | 20.4 | | | | 6.5 | | | | 10.5 | | | | 12.8 | | | | 40.6 | |

Ratio of operating expenses to average net assets before expense reductions (%) | | | 0.91 | | | | 0.94 | | | | 0.94 | | | | 0.94 | | | | 0.96 | |

Ratio of operating expenses to average net assets after expense reductions (%) (b) | | | 0.89 | | | | 0.92 | | | | 0.92 | | | | 0.93 | | | | 0.94 | |

Ratio of net investment loss to average net assets (%) | | | (0.39 | ) | | | (0.44 | ) | | | (0.48 | ) | | | (0.52 | ) | | | (0.52 | ) |

Portfolio turnover rate (%) | | | 49 | | | | 91 | | | | 71 | | | | 95 | | | | 98 | |

Net assets, end of period (000) | | $ | 20,171 | | | $ | 16,305 | | | $ | 17,653 | | | $ | 17,893 | | | $ | 11,286 | |

| (a) | Per share amount is based on average shares outstanding during the period. |

| (b) | The Portfolio has entered into arrangements with certain brokers who paid a portion of the Portfolio’s expenses. |

| (c) | Commencement of operations was April 26, 2004 and May 2, 2006 for Classes B and D, respectively. |

| (d) | Periods less than one year are not computed on an annualized basis. |

| (e) | Computed on an annualized basis. |

See accompanying notes to financial statements.

MSF-10

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2007

Metropolitan Series Fund, Inc. (the “Fund”) is organized as a corporation under the laws of Maryland pursuant to Articles of Incorporation filed on November 23, 1982, as amended, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end investment company. The Fund is a “series” type of mutual fund, which issues separate series of stock. Each series represents an interest in a separate portfolio of Fund investments. The BlackRock Aggressive Growth Portfolio (the “Portfolio”) is a diversified series of the Fund. Shares in the Fund are not offered directly to the general public and are currently available only to separate accounts established by Metropolitan Life Insurance Company (“MetLife”), New England Life Insurance Company, General American Life Insurance Company (“General American”), The MetLife Investors Group of Insurance Companies, MetLife Insurance Company of Connecticut and other affiliated insurance companies (collectively, the “Insurance Companies”), as an investment vehicle for variable life insurance, group annuity or variable annuity products, although the Portfolio is not available to all such separate accounts. The Portfolio’s shares may be divided into different classes. Currently, the classes being offered by the Portfolio are named Class A, Class B, Class D and Class E. The classes of the Portfolio’s shares are identical, except that certain additional charges (Rule 12b-1 fees) are made against Class B, Class D and Class E shares. Investment income, realized and unrealized capital gains and losses, the common expenses of the Portfolio and certain Portfolio-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Portfolio.

| 2. | SIGNIFICANT ACCOUNTING POLICIES: |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies consistently followed by the Portfolio in the preparation of its financial statements. The policies are in conformity with GAAP.

Investment Valuation:

Debt securities (other than short term obligations with a remaining maturity of sixty days or less) are valued by independent pricing services selected by the relevant subadviser pursuant to authorization of the Board of Directors of the Fund (the “Board” or “Directors”). Short term obligations with a remaining maturity of sixty days or less are valued at amortized cost which approximates fair market value.

Equity securities traded on a national securities exchange or exchanges are valued at their last sale price on the principal trading market. Equity securities traded on the NASDAQ National Market System are valued at the NASDAQ Official Closing Price (the “NOCP”). The NOCP is the last sale price if it falls between the spread of the last reported bid and asked prices. If the last reported bid and asked prices are above the last reported sale price, the NOCP will be the last reported bid price. If the last reported bid and asked prices are below the last reported sale price, the NOCP will be the last reported asked price. Equity securities traded on a national securities exchange or exchanges or on the NASDAQ National Market System for which there is no reported sale during the day are valued at the last reported bid price. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for that security by the Board or its delegates. If no closing price is available, then such securities are valued by using the last reported bid price. Equity securities traded over-the-counter are valued at the last reported sales price.

If no current market value quotation is readily available or reliable for a portfolio security, fair value will be determined in accordance with procedures established by and under the general supervision of the Board. When the Portfolio uses fair value pricing, it may take into account any factors it deems appropriate. The value of securities used by the Portfolio to calculate its net asset value may differ from quoted or published prices for the same securities. Fair value pricing involves subjective judgments and the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

The Portfolio expects to use fair value pricing for securities primarily traded on U.S. exchanges only under very limited circumstances. For example, the Portfolio may use fair value pricing if the exchange on which a security is traded closes early or trading in the security is suspended.

MSF-11

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2007—(Continued)

Securities traded primarily on an exchange outside of the United States which closes before the close of the New York Stock Exchange will be valued at the last sales price on that non-U.S. exchange. Securities traded primarily on an exchange outside of the United States for which there is no reported sale during the day are valued at the mean between the last reported bid and asked prices. However, because most foreign markets close well before the Portfolio values its securities (typically at 4 p.m. Eastern Time), the earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred after these foreign markets close but before the Portfolio values its securities. To account for this, the Portfolio may frequently value many of its foreign equity securities using fair value prices based on third party vendor modeling tools.

Forward foreign currency exchange contracts are valued based on the mean between closing bid and asked prices of the forward currency contract rates in the London foreign exchange markets on a daily basis as provided by a reliable bank or dealer.

Options, whether on securities, indices, futures contracts, or otherwise, are valued at the last sales price available as of the close of business on the day of valuation or, if there is no such sale price available, at the mean between the bid and asked prices. Options on currencies are valued at the spot price each day.

The value of futures contracts will be the sum of the margin deposit plus or minus the difference between the value of the futures contract on each day the net asset value is calculated and the value on the date the futures contract originated, value being that established on a recognized commodity exchange, or by reference to other customary sources, with gain or loss being realized when the futures contract closes or expires.

Subject to the Board’s oversight, the Board has delegated day-to-day responsibility for valuing Portfolio assets to the subadviser of the Portfolio, who values such assets as described above and operates under procedures approved by the Board.

Investment Transactions and Related Investment Income:

Portfolio security transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date or, for certain foreign securities, when notified. Interest income, which includes amortization of premium and accretion of discount on debt securities, is recorded on the accrual basis. Realized gains and losses on investments and unrealized appreciation and depreciation are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Repurchase Agreements:

The Portfolio, through the custodian or a subcustodian, receives delivery of the underlying securities collateralizing repurchase agreements. The Portfolio requires the custodian to take possession, to have legally segregated in the Federal Reserve Book Entry System, or to have segregated within the custodian’s vault, all securities held as collateral for repurchase agreements. It is the Portfolio’s policy that the market value of the collateral be at least equal to 100% of the repurchase price in the case of a repurchase agreement of one-day duration and 102% on all other repurchase agreements. The Portfolio’s subadviser is responsible for determining that the value of the collateral is at all times at least equal to the repurchase price. In connection with transactions in repurchase agreements, if the seller defaults and the value of the collateral declines or if the seller enters an insolvency proceeding, realization of the collateral by the Portfolio may be delayed, limited or wholly denied.

Foreign Currency Translation:

The books and records of the Portfolio are maintained in U.S. dollars. The values of securities, currencies and other assets and liabilities denominated in currencies other than U.S. dollars are translated into U.S. dollars based upon foreign exchange rates prevailing at the end of the period. Purchases and sales of investment securities, income and expenses are translated on the respective dates of such transactions. Since the values of investment securities are presented at the foreign exchange rates prevailing at the end of the period, it is not practical to isolate that portion of the results of operations arising from changes in exchange rates from that portion of the results of operations reflecting fluctuations arising from changes in market prices of the investment securities. Such fluctuations are included in the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded by the Portfolio and the U.S. dollar equivalent of the amounts actually received or paid by the Portfolio. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investment securities, resulting from changes in the exchange rate.

MSF-12

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2007—(Continued)

Forward Foreign Currency Exchange Contracts:

The Portfolio may enter into forward foreign currency exchange contracts primarily to hedge against foreign currency exchange rate risks on its non-U.S. dollar denominated investment securities. When entering into a forward currency contract, the Portfolio agrees to receive or deliver a fixed quantity of foreign currency for an agreed-upon price on an agreed future date. These contracts are valued daily and the Portfolio’s net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the foreign exchange rates at the dates of entry into the contracts and the forward rates at the settlement date, is included in the Statement of Assets and Liabilities. Realized and unrealized gains and losses are included in the Statement of Operations. These instruments involve market and/or credit risk in excess of the amount recognized in the Statement of Assets and Liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates.

Futures Contracts:

The Portfolio may buy and sell futures contracts (on recognized exchanges) as a hedge or to enhance return. Futures contracts are agreements to buy or sell a security, or deliver a final cash settlement price in connection with an index, interest rate, currency, or other contracts not calling for physical delivery, for a set price in the future. The Portfolio must post an amount equal to a portion of the total market value of the futures contract as futures variation margin, which is returned when the Portfolio’s obligations under the contract have been satisfied. From time to time thereafter, the Portfolio may have to post variation margin to maintain this amount as the market value of the contract fluctuates. Risks of entering into futures contracts (and related options) include the possibility that there may be an illiquid market and that a change in the value of the contract or option may not correlate with changes in the value of the underlying securities.

Options:

The Portfolio may use options to hedge against changes in values of securities the Portfolio owns or expects to purchase. Writing puts or buying calls tends to increase the Portfolio’s exposure to the underlying instrument and writing calls or buying puts tends to decrease the Portfolio’s exposure to the underlying instrument, and can be used to hedge other Portfolio investments. For options purchased to hedge the Portfolio’s investments, the potential risk to the Portfolio is that the change in value of options contracts may not correspond to the change in value of the hedged instruments. In addition, losses may arise from changes in the value of the underlying instruments, if there is an illiquid secondary market, or if the counterparty is unable to perform. The maximum loss for purchased options is limited to the premium initially paid for the option. For options written by the Portfolio, the maximum loss is not limited to the premium initially received for the option.

The main risk associated with purchasing an option is that the option expires without being exercised. In this case, the option expires worthless and the premium paid for the option is considered the loss. The risk associated with writing a call option is that the Portfolio may forgo the opportunity for a profit if the market value of the underlying position increases and the option is exercised. The risk in writing a put option is that the Portfolio may incur a loss if the market value of the underlying position decreases and the option is exercised. In addition, the Portfolio risks not being able to enter into a closing transaction for the written option as the result of an illiquid market.

“When-Issued” Securities:

Purchasing securities “when-issued” is a forward commitment by the Portfolio to buy a security. The estimated amount of the Portfolio’s payment obligation and the security’s interest rate are determined when the commitment is made, even though no interest accrues until the security is issued, which is generally 15 to 120 days later. The Portfolio will segregate liquid assets with its custodian sufficient at all times to satisfy these commitments. If the value of the security is less when delivered than when the commitment was made, the Portfolio will suffer a loss.

Federal Income Taxes:

It is the Portfolio’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended, and regulations thereunder, applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required.

MSF-13

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2007—(Continued)

As of December 31, 2007, the Portfolio had capital loss carryovers as follows:

| | | | | | | | | | |

Expiring

12/31/08 | | Expiring

12/31/09 | | Expiring

12/31/10 | | Total |

| $ | 82,277,708 | | $ | 227,553,754 | | $ | 44,776,015 | | $ | 354,607,477 |

The utilization of the capital loss carryforward acquired as part of a merger may be limited under section 382 of the Internal Revenue Code.

As of December 31, 2007, the components of distributable earnings (accumulated losses) on a federal income tax basis were as follows:

| | | | | | | | | | | | | |

Undistributed

Ordinary

Income | | Undistributed

Long Term

Gain | | Unrealized

Appreciation | | Loss

Carryforwards | | | Total | |

| $— | | $— | | $ | 242,887,029 | | $ | (354,607,477 | ) | | $ | (111,720,448 | ) |

Dividends and Distributions to Shareholders:

The Portfolio records dividends and distributions on the ex-dividend date. Net realized gains from security transactions (if any) are generally distributed annually to shareholders. The timing and characterization of certain income and capital gains distributions are determined in accordance with federal tax regulations that may differ from GAAP. Permanent book and tax basis differences relating to shareholder distributions will result in reclassification between under/over distributed net investment income, accumulated net realized gains/losses and paid in capital.

Expense Reductions:

Certain Portfolio trades are directed to brokers who paid a portion of the Portfolio’s expenses. Amounts paid for the Portfolio are shown as expense reductions in the Statement of Operations.

| 3. | INVESTMENT TRANSACTIONS: |

For the year ended December 31, 2007, purchases and sales of securities (excluding short term investments) for the Portfolio were as follows:

| | | | | | | | | | |

| Purchases | | Sales |

| U.S. Government | | Other | | U.S. Government | | Other |

| $ | 0 | | $ | 591,672,850 | | $ | 0 | | $ | 756,284,950 |

| 4. | INVESTMENT MANAGEMENT FEES AND OTHER TRANSACTIONS WITH AFFILIATES: |

Investment Management Agreement:

MetLife Advisers, LLC (“MetLife Advisers”) is the investment adviser to the Portfolio. The Fund has entered into an investment management agreement with MetLife Advisers with respect to the Portfolio. For providing investment management services to the Portfolio, MetLife Advisers receives monthly compensation at the following annual rates:

| | | | | | | |

| | | Management

Fees earned by

MetLife Advisers

for the year ended

December 31, 2007 | | Annual

percentage

rates paid to

MetLife Advisers | | Based on Portfolios average daily net asset levels |

| | $ | 8,765,974 | | 0.750% | | Of the first $500 million |

| | | | | 0.700% | | Of the next $500 million |

| | | | | 0.650% | | On amounts in excess of $1 billion |

Certain officers and directors of the Fund may also be officers of MetLife Advisers; however, such officers and directors receive no compensation from the Fund.

MetLife Advisers has entered into an investment subadvisory agreement with respect to the Portfolio. BlackRock Advisors, LLC is compensated by MetLife Advisers to provide subadvisory services for the Portfolio.

MSF-14

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2007—(Continued)

Service and Distribution Fees:

The Fund has adopted a Distribution and Service Plan under Rule 12b-1 of the 1940 Act for the Portfolio’s Class B, D and E shares. Under the Distribution and Service Plan, the Class B, D and E shares of the Portfolio pay a fee to compensate the Insurance Companies (or their affiliates) and other broker-dealers and financial intermediaries involved in the offer and sale of Portfolio shares for promoting or selling and servicing, the Class B, D and E shares. The fees under the Distribution and Service Plan for each class of the Portfolio’s shares are calculated as a percentage of the Portfolio’s average daily net assets that are attributable to that Class. Currently, the fee is 0.25% per year for Class B shares, 0.10% per year for Class D shares and 0.15% per year for Class E shares. Amounts paid by the Portfolio for the year ended December 31, 2007 are shown as Service and Distribution fees in the Statement of Operations.

The Fund has entered into a securities lending arrangement with the Fund’s custodian, State Street Bank and Trust Company (the “custodian”). Under the agreement, the custodian is authorized to loan securities on the Portfolios’ behalf. In exchange, the Portfolio receives either cash or securities as collateral against the loaned securities. The Portfolio receives collateral at least equal to 102% of the market value of the loaned securities (105% for foreign securities), at each loan’s inception. Collateral must be maintained at least at 100% of the market value of the loaned securities for the duration of the loan. The cash collateral is invested in the Navigator Securities Lending Prime Portfolio, an affiliate of the custodian, which invests in a variety of high quality U.S. dollar-denominated instruments. If the market value of the collateral at the close of trading on a business day is less than 100% of the market value of the loaned securities at the close of trading on that day, the borrower shall be required to deliver, by the close of business on the following business day, an additional amount of collateral, equal to at least 100% of the market value of all the loaned securities as of such preceding day. The Portfolio receives 80% of the annual net income from securities lending transactions, which is included in interest income of the Portfolio. The remaining 20% is paid to the custodian as compensation for its securities lending services. The Portfolio bears the risk of any deficiency in the amount of collateral available for return to a borrower due to a loss in an approved investment. Any outstanding loans by the Portfolio at December 31, 2007 are footnoted in the Schedule of Investments.

As previously reported, in May 2004, General American received a Wells Notice stating that the SEC staff was considering recommending that the SEC bring a civil action alleging violations of the U.S. securities laws against General American with respect to market timing and late trading in a limited number of privately-placed variable insurance contracts that were sold through General American. General American responded to the SEC staff and cooperated with the investigation. On August 9, 2007, the SEC announced that it had settled an enforcement action regarding late trading against General American with, among other things, General American agreeing to pay a civil penalty and to comply with certain undertakings. General American consented to the SEC’s order without admitting or denying the findings. MetLife Advisers has also advised the Fund’s Board of Directors that, while certain exceptions to the Fund’s policies have been noted, no situations have been identified that would have a material impact on the financial position of the Fund.

| 7. | RECENT ACCOUNTING PRONOUNCEMENTS: |

Effective June 29, 2007, the Fund implemented Financial Accounting Standards Board (“FASB”) Interpretation No. 48, “Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity, including investment companies, before being measured and recognized in the financial statements. Management has evaluated the application of FIN 48 to the Fund, and has determined that the adoption of FIN 48 does not have a material impact on the Fund’s financial statements. The Fund files U.S. tax returns. No income tax returns are currently under examination. The statute of limitations on the Fund’s tax returns remains open for the years ended December 31, 2004 through December 31, 2006.

In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157) was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Portfolio’s financial statement disclosures.

MSF-15

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of the Metropolitan Series Fund, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the BlackRock Aggressive Growth Portfolio, one of the portfolios constituting the Metropolitan Series Fund, Inc. (the “Fund”) as of December 31, 2007, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five year in the period ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2007, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the BlackRock Aggressive Growth Portfolio of the Metropolitan Series Fund, Inc. as of December 31, 2007, the results of its operations for the year then ended, and the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five year in the period ended, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Boston, Massachusetts

February 21, 2008

MSF-16

Metropolitan Series Fund, Inc.

Directors and Officers

The Fund’s Directors review actions of the Fund’s investment adviser and subadvisers, and decide upon matters of general policy. The Fund’s officers supervise the daily business operations of the Fund. The Board of Directors and the Fund’s officers are listed below. Each Director is responsible for overseeing all 36 Portfolios of the Fund. There is no limit to the term a Director may serve. Directors serve until their resignation, retirement or removal in accordance with the Fund’s organizational documents and policies adopted by the Board from time to time. Officers hold office at the pleasure of the Board or until the election or appointment and the qualification of a successor. The address of the directors and officers is c/o Metropolitan Series Fund, Inc., 501 Boylston Street, Boston, MA 02116.

Interested Directors(1)

Each Director below is an “interested person” (as defined by the 1940 Act) with respect to the Fund in that Ms. Forget is an employee of MetLife and Mr. Typermass is a former employee of MetLife and owns securities issued by MetLife, Inc., the ultimate parent company of MetLife Advisers.

| | | | | | | | |

Name, Address and Age | | Current

position(s)

with Fund | | Position(s)

held since | | Principal occupations

over past five years, including other directorships(2) | | Number of

Portfolios in

Fund Complex

Overseen by

Director(3) |

Elizabeth M. Forget Age: 41 | | Director, Chairman of the Board, President and Chief Executive Officer | | 2006 | | Senior Vice President (since 2007), MetLife, Inc.; President, Met Investors Advisory, LLC (“MIA”); Trustee and President, Met Investors Series Trust (“MIST”); Executive Vice President, MetLife Investors Group, Inc.; President (since 2006), MetLife Advisers. | | 81 |

| | | | |

Arthur G. Typermass Age: 70 | | Director | | 1998 | | Formerly, Senior Vice President and Treasurer, MetLife. | | 37 |

Non-Interested Directors(1)

Each Director below is not an “interested person” (as defined by the 1940 Act) with respect to the Fund (collectively, the “Independent Directors”).

| | | | | | | | |

Name, Address and Age | | Current

position(s)

with Fund | | Position(s)

held since | | Principal occupations

over past five years, including other directorships(2) | | Number of

Portfolios in

Fund Complex

Overseen by

Director(3) |

Steve A. Garban† Age: 70 | | Director | | 1985 | | Formerly, Chief Financial Officer, Senior Vice President Finance and Operations and Treasurer (Emeritus), The Pennsylvania State University. | | 37 |

| | | | |

Linda B. Strumpf Age: 60 | | Director | | 2000 | | Vice President and Chief Investment Officer, Ford Foundation. | | 37 |

| | | | |

Michael S. Scott Morton† Age: 70 | | Director | | 1993 | | Jay W. Forrester Professor of Management (Emeritus) at Sloan School of Management, MIT. | | 37 |

| | | | |

H. Jesse Arnelle Age: 74 | | Director | | 2001 | | Formerly, Counsel, Womble Carlyle Sandrie & Rice; Director, Textron Inc. (global multi-industry company)*; formerly, Director, Gannet Co. Inc. (diversified news and information company)*; formerly, Director, Eastman Chemical Company (global chemical company)*; formerly, Director, Waste Management, Inc.*; formerly, Director, Armstrong Holdings Inc. (parent company of floor and ceiling products business)*; formerly, Director, FPL Group Inc. (public utility holding company)*; Director, URS Corporation (engineering design services firm)*. | | 37 |

| | | | |

Nancy Hawthorne Age: 56 | | Director | | 2003 | | Director, Avid Technologies (computer software company)*; formerly, Chairman of the Board of Avid Technologies; formerly, Board of Advisors, L. Knife & Sons, Inc. (beverage distributor); Chief Executive Officer, Clerestory LLC (corporate financial advisor); formerly, Trustee, New England Zenith Fund (“Zenith Fund”)**; formerly, Chief Executive Officer and Managing Partner, Hawthorne, Krauss and Associates (corporate financial advisor); formerly, Chief Financial Officer and Executive Vice President, Continental Cablevision, subsequently renamed MediaOne (cable television company); formerly, Director, Life F/X, Inc.; formerly, Chairman of the Board, WorldClinic (distance medicine company); formerly, Director, Perini Corporation (construction company)*; formerly, Director, CGU (property and casualty insurance company); formerly, Director, Beacon Power Corporation (energy company )*. | | 37 |

MSF-17

Metropolitan Series Fund, Inc.

Directors and Officers—(Continued)

| | | | | | | | |

Name, Address and Age | | Current

position(s)

with Fund | | Position(s)

held since | | Principal occupations

over past five years, including other directorships(2) | | Number of

Portfolios in

Fund Complex

Overseen by

Director(3) |

John T. Ludes Age: 71 | | Director | | 2003 | | President, LFP Properties (consulting firm); Formerly, Trustee, Zenith Fund**; formerly, Vice Chairman, President and Chief Operating Officer, Fortune Brands/American Brands (global conglomerate); formerly, President and CEO, Acushnet Company (athletic equipment company). | | 37 |

Officers(1)

| | | | | | | | |

Name and address | | Age | | Current

position(s)

with Fund | | Position(s)

held since | | Principal occupations over past five years(2) |

| Jeffrey P. Halperin | | 40 | | Chief Compliance Officer | | 2006 | | Vice President (since 2006), Corporate Ethics and Compliance Department, MetLife, Inc.; Chief Compliance Officer (since 2006), MetLife Advisers, MIA and MIST. |

| | | | |

| John F. Guthrie, Jr. | | 64 | | Senior Vice President | | 2002 | | Manager and Senior Vice President, MetLife Advisers; Vice President, MetLife; Vice President (since 2003), MetLife Group, Inc.; Vice President, NELICO; Vice President (since 2005), MIA; formerly, Senior Vice President, Zenith Fund**. |

| | | | |

| Alan C. Leland | | 55 | | Senior Vice President | | 2005 | | Treasurer and Chief Financial Officer, MetLife Advisers, LLC; Treasurer (since 2005), Met Investors Advisory, LLC; Vice President (since 2004), MIA; Vice President (since 2003), MetLife Group, Inc.; Vice President, MetLife; Senior Vice President, NELICO |

| | | | |

| Peter Duffy | | 52 | | Vice President and Treasurer | | 2000 | | Senior Vice President, MetLife Advisers (since 1998); Second Vice President (since 2003), NELICO; Vice President, MetLife (since 2004); Vice President (since 2004), MetLife Group, Inc.; formerly, Vice President and Treasurer, Zenith Fund**. |

| | | | |

| Thomas M. Lenz | | 49 | | Vice President and Secretary | | 2002 | | General Counsel and Secretary, MetLife Advisers; Assistant General Counsel, MetLife; formerly, Vice President and Secretary, Zenith Fund**. |

| * | Indicates a directorship with a registered investment company or a company subject to the reporting requirements of the Securities Exchange Act of 1934, as amended. |

| ** | The Zenith Fund deregistered with the Securities and Exchange Commission (“SEC”) in 2004. |

| (†) | Served as a trustee, director and/or officer of one or more of the following companies, each of which had a direct or indirect advisory relationship with MetLife Advisers or its affiliates prior to January 31, 2005: State Street Research Financial Trust, State Street Research Income Trust, State Street Research Money Market Trust, State Street Research Institutional Funds, State Street Research Capital Trust, State Street Research Master Investment Trust, State Street Research Equity Trust, State Street Research Securities Trust and State Street Research Exchange Trust (collectively, the “State Street Research Funds”). |

| (1) | Each Director of the Fund also serves as trustee of Metropolitan Series Fund II (“Met Series Fund II”), a registered investment company advised by MetLife Advisers. Each officer of the Fund serves in the same position with Met Series Fund II, which consists of one portfolio. |

| (2) | Previous positions during the past five years with the Fund, MIST, MetLife, MetLife Advisers, MIA, Zenith Fund, NELICO or New England Securities Corporation are omitted if not materially different. |

| (3) | The Fund Complex includes the Fund (36 portfolios), Met Series Fund II (1 portfolio) and MIST (44 portfolios) |

MSF-18

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Board Approval of Advisory and Subadvisory Agreements

The Fund’s Contract Review Committees of the Board of Directors (the “Board”) typically meet in early fall to review the Portfolios’ advisory agreements (the “Advisory Agreements”) and subadvisory agreements (collectively, the “Subadvisory Agreements,” and, together with the Advisory Agreements, the “Agreements”) and determine whether to recommend that the full Board approve the continuation of the Agreements for an additional one-year period. (Following the initial approval of an Agreement for a new Portfolio or with a new adviser or subadviser, such annual reviews are not required until 2 years following the execution of such Agreement.) After each Committee has made its recommendations, the full Board, including the Independent Directors, determines whether to approve the continuation of each of the Agreements. In addition, the Board, including the Independent Directors, considers matters bearing on the Agreements at most of its other meetings throughout the year and regularly interviews various individuals at MetLife Advisers responsible for the management of the Portfolios. The Directors also interview selected investment managers and other professionals at the subadvisers at various times throughout the year.