UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-3618 |

Metropolitan Series Fund, Inc.

|

| (Exact name of registrant as specified in charter) |

| | |

501 Boylston Street Boston, Massachusetts 02116 |

| (Address of Principal Executive Office) |

MICHAEL P. LAWLOR, ESQ.

MetLife Advisers, LLC

501 Boylston Street

Boston, Massachusetts 02116

|

| (Name and address of agent for service) |

Copy to:

JOHN M. LODER, ESQ.

Ropes & Gray, LLP

One International Place

Boston, Massachusetts 02110

Registrant’s telephone number, including area code: 617-578-3104

Date of fiscal year end: December 31

Date of reporting period: January 1, 2008 through December 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection

burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”):

Simplify your life…

with MetLife eDelivery® while helping MetLife preserve the planet’s natural resources.

(see details on inside cover)

| | |

Metropolitan Series Fund, Inc. BlackRock Aggressive Growth Portfolio Annual Report | | December 31, 2008 |

NOT PART OF THE ANNUAL REPORT

Letter from the President

February 1, 2009

Letter to Policy Holders:

2008 was an extraordinary year in the capital markets around the world and for the global economy. Energy prices rose to record levels early in the year before falling by two-thirds by year-end. A credit crisis that began with concerns about sub-prime mortgages led to massive changes in the financial landscape with government takeovers, forced sales, and outright failures of a number of large, once venerable firms.

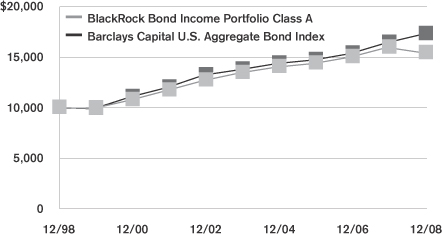

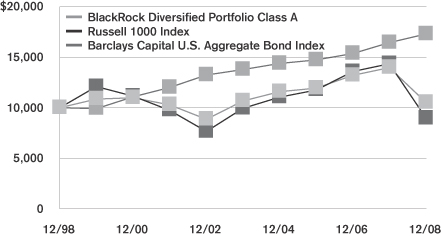

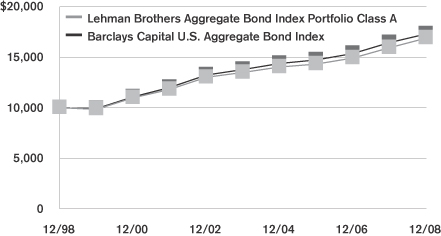

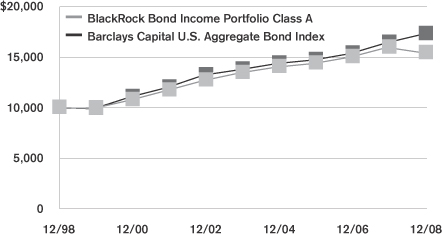

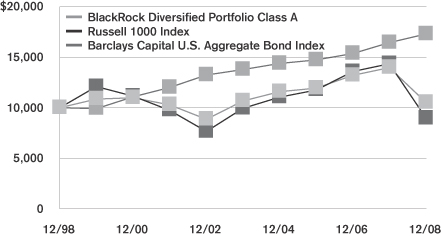

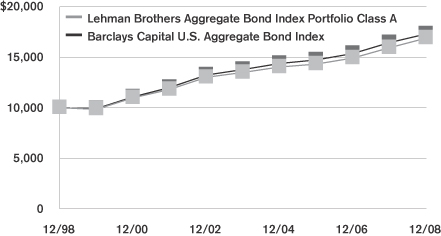

While bonds as measured by the Barclays Capital U.S. Aggregate Bond Index (formerly known as, Lehman Brothers U.S. Aggregate Bond Index) were up 5.2% for the year in response to declining interest rates, there were large differences in the total returns of the various sectors of the bond market. U.S. treasury securities were up over 13% as frightened investors sought refuge in what they perceived to be the safest and most liquid investments. In contrast, investment grade corporate securities lost nearly 5% as credit spreads widened and below investment grade or high yield bonds fell over 26%.

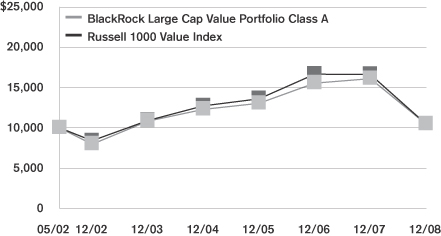

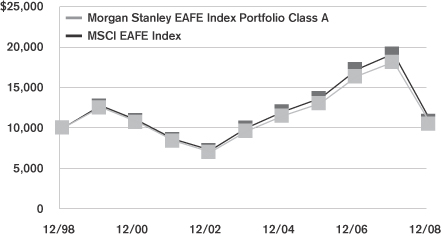

In response to the growing credit crisis and the weakening economy, common stocks fell sharply across all regions, styles, and capitalizations. As measured by the Standard and Poor’s 500, U.S. common stocks fell 37% for the year, the worst calendar year decline since the 1930s. Foreign stocks were down even more with the MSCI EAFE Index down 43% for the year.

On the following pages, you will find a complete review of your Portfolio and its investment performance.

MetLife is committed to building your financial freedom. We appreciate your trust and will continue to focus our efforts on meeting your investment needs.

Sincerely,

Elizabeth M. Forget

President, Metropolitan Series Fund, Inc.

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Managed by BlackRock Advisors, LLC

Portfolio Manager Commentary*

PORTFOLIO PERFORMANCE

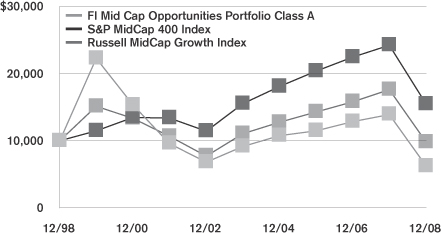

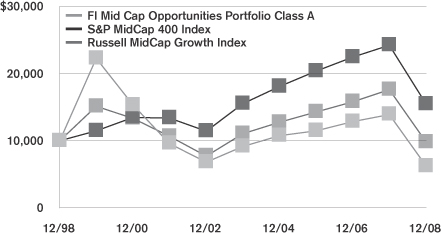

For the twelve-month period ended December 31, 2008, the Class A shares of the BlackRock Aggressive Growth Portfolio returned -45.7%, compared to its benchmark, the Russell Midcap Growth Index1, which returned -44.3%. The average return of its peer group, the Lipper Variable Insurance Products2 Mid-Cap Growth Funds Universe, was -45.2% over the same period.

PORTFOLIO REVIEW

The U.S. equity market trended lower through the first half of 2008, as weakness in the housing and mortgage market, fear of recession, and sharply rising energy and commodity costs dominated investor attention. The credit market troubles which had begun in 2007 with subprime mortgages rapidly spread in September 2008 with a number of large and previously distinguished financial institutions either failing, being rescued by the federal government or selling themselves as a last resort. Volatility rose to extreme levels as continued government intervention and economic stimuli grappled with massive deleveraging and a flight to safety. The uncertainty of the credit crisis, combined with the lack of lending activity, resulted in a sharp downturn in economic activity during the fall, guaranteeing a second consecutive decline in quarterly GDP. Investors in stocks found no safe haven, as sharp declines impacted all sectors, market capitalizations and styles.

The BlackRock Aggressive Growth Portfolio underperformed the -44.3% return of the Russell Midcap Growth Index. Stock selection in the consumer staples sector was the most significant detractor for the Portfolio during the year. Strong stock selection in the information technology sector was a positive contributor to Portfolio returns during the period.

Weaker stock selection in the consumer staples sector, which was the best relative performer in the benchmark, was the most significant detractor from relative returns for the Portfolio. The Portfolio’s slight underweight in the sector also hindered performance comparisons. Minerals-based cosmetic company Bare Escentuals dropped more than 75% on investor worries about increased domestic competition and slower growth. Weakening fundamentals, along with management’s lack of execution has confirmed the prudence of our exit from the position. Elsewhere in the Portfolio, video game retailer GameStop fell 65% on concerns about slowing revenue growth. The company operates retail centers for selling video game hardware and software, as well as used video gaming equipment. The Portfolio continues to hold a position in the name, as we believe its fundamentals and valuations are currently attractive. Finally, an overweight in the energy sector had a slightly negative effect on the Portfolio, as the sector dropped more than 55% for the year.

Stronger stock selection in the information technology sector was the biggest contributor to relative returns for the period. Although not spared the volatility, semiconductor names Broadcom and PMC-Sierra held up relatively well on strong execution. Elsewhere in technology, software provider Intuit relatively outperformed on continued demand for its tax filing software.

The most notable changes in sector positioning during the year came in the consumer discretionary, energy and industrials sectors. Within the consumer discretionary sector, an increase in both relative and absolute weights was the result of selectively adding names to the Portfolio. During the second half of the year, we added some very small positions in early cyclical names. These included Darden Restaurants, Bed Bath & Beyond and Burger King. We also eliminated a few consumer discretionary holdings during the year, as the individual company fundamentals warranted. Notable names include International Game Technology and Pinnacle Entertainment, as fundamentals in casino & gaming operators indicated early signs of weakness. The reductions in our relative positions in energy and materials were mostly related to the unwinding of these sectors in the broad market. We did add some small additional positions in the energy sector, as the valuations looked attractive. Within industrials, we decreased Portfolio exposure by selling Quanex and Precision Castparts.

At year-end, the Portfolio’s largest overweights were in the healthcare and information technology sectors, and the most significant underweight was in the financials sector. We continue to look for names with good growth opportunities, regardless of sector or market conditions.

* The views expressed above are those of the subadvisory firm as of December 31, 2008 and are subject to change based on market and other conditions. Information about the Portfolio’s holdings, asset allocation, industry allocation, or country diversification is historical and is not an indication of future Portfolio composition, which will vary. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. Direct investment in any index is not possible.

1 The Russell Midcap® Growth Index is an unmanaged measure of performance of those Russell Midcap companies (the 800 smallest companies in the Russell 1000 Index) with higher price-to-book ratios and higher forecasted growth values.

2 The Lipper Variable Products Fund Average is an average of the total return performance (calculated on the basis of net asset value) of variable product funds with similar investment objectives to those of the subject Portfolio as calculated by Lipper Analytical Services, an independent mutual fund ranking service.

MSF-2

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

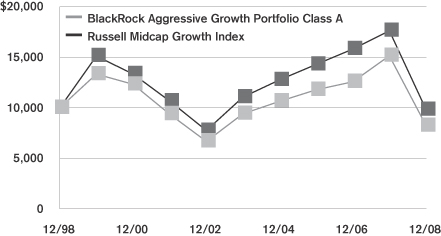

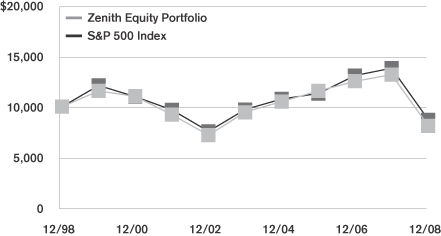

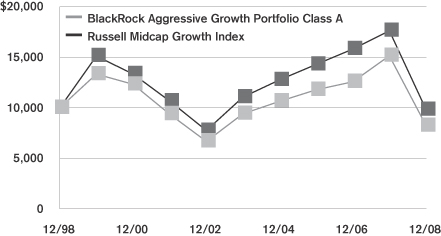

A $10,000 INVESTMENT COMPARED TO THE RUSSELL MIDCAP GROWTH INDEX

Average Annual Returns as of December 31, 2008

| | | | | | | | | | | | | | | |

| | | BlackRock Aggressive Growth Portfolio | | | Russell

Midcap

Growth Index | |

| | | Class A | | | Class B | | | Class D | | | Class E | | |

| 1 Year | | -45.7 | % | | -45.8 | % | | -45.7 | % | | -45.8 | % | | -44.3 | % |

| 5 Year | | -2.7 | | | — | | | — | | | -2.8 | | | -2.3 | |

| 10 Year | | -1.9 | | | — | | | — | | | — | | | -0.2 | |

| Since Inception | | — | | | -4.1 | | | -15.2 | | | -3.7 | | | — | |

Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts or any additional expenses that participants in certain eligible qualified plans may bear relating to the operations of their plans. If these charges were included, the returns would be lower.

Inception dates of the Class A, Class B, Class D and Class E shares are: 4/29/88, 4/26/04, 5/2/06 and 5/1/01, respectively.

This information represents past performance and is not indicative of future results. Investment return and principal value may fluctuate so that shares, upon redemption, may be worth more or less than the original cost.

PORTFOLIO COMPOSITION

as of December 31, 2008

Top Holdings

| | |

| | | % of Total

Net Assets |

Ametek, Inc. | | 3.2% |

Scientific Games Corp. | | 2.9% |

Harris Corp. | | 2.6% |

IDEX Corp. | | 2.5% |

Shire, Plc. (ADR) | | 2.4% |

Mednax, Inc. | | 2.4% |

Medco Health Solutions, Inc. | | 2.3% |

Apollo Group, Inc. (Class A) | | 2.3% |

Amdocs, Ltd. | | 2.2% |

Iron Mountain, Inc. | | 2.2% |

Top Sectors

| | |

| | | % of Total

Market Value |

Information Technology | | 22.4% |

Health Care | | 19.0% |

Consumer Discretionary | | 16.9% |

Industrials | | 13.9% |

Energy | | 10.4% |

Materials | | 5.1% |

Financials | | 4.9% |

Cash | | 3.7% |

Consumer Staples | | 2.7% |

Telecommunication Services | | 1.0% |

MSF-3

Metropolitan Series Fund, Inc.

Shareholder Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees; distribution and service (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) (referred to as “expenses”) of investing in the Portfolio and compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2008 through December 31, 2008.

Actual Expenses

The first line for each share class of the Portfolio in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested in the particular share class of the Portfolio, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class of the Portfolio in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees or charges of your variable insurance product or any additional expenses that participants in certain eligible qualified plans may bear relating to the operations of their plan. Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these other costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Portfolio | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

July 1,

2008 | | Ending

Account Value

December 31,

2008 | | Expenses Paid

During Period*

July 1, 2008

to

December 31,

2008 |

BlackRock Aggressive Growth—Class A | | Actual | | 0.77 | % | | $ | 1,000.00 | | $ | 569.35 | | $ | 3.04 |

| | Hypothetical | | 0.77 | % | | $ | 1,000.00 | | $ | 1,021.22 | | $ | 3.91 |

| | | | | |

BlackRock Aggressive Growth—Class B | | Actual | | 1.02 | % | | $ | 1,000.00 | | $ | 568.70 | | $ | 4.02 |

| | Hypothetical | | 1.02 | % | | $ | 1,000.00 | | $ | 1,019.95 | | $ | 5.18 |

| | | | | |

BlackRock Aggressive Growth—Class D | | Actual | | 0.87 | % | | $ | 1,000.00 | | $ | 569.39 | | $ | 3.43 |

| | Hypothetical | | 0.87 | % | | $ | 1,000.00 | | $ | 1,020.71 | | $ | 4.42 |

| | | | | |

BlackRock Aggressive Growth—Class E | | Actual | | 0.92 | % | | $ | 1,000.00 | | $ | 569.07 | | $ | 3.63 |

| | Hypothetical | | 0.92 | % | | $ | 1,000.00 | | $ | 1,020.46 | | $ | 4.67 |

* Expenses paid are equal to the Portfolio’s annualized expense ratio for the most recent six month period, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the the one-half year period).

MSF-4

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Schedule of Investments as of December 31, 2008

Common Stock—95.3% of Total Net Assets

| | | | | |

Security Description | | Shares | | Value* |

| | | | | |

| | |

Aerospace & Defense—2.2% | | | | | |

BE Aerospace, Inc. (a) | | 663,300 | | $ | 5,100,777 |

Goodrich Corp. | | 225,600 | | | 8,351,712 |

| | | | | |

| | | | | 13,452,489 |

| | | | | |

| | |

Biotechnology—1.4% | | | | | |

Martek Biosciences Corp. (a) (b) | | 283,200 | | | 8,583,792 |

| | | | | |

| | |

Capital Markets—1.1% | | | | | |

Invesco, Ltd. | | 457,521 | | | 6,606,603 |

| | | | | |

| | |

Chemicals—3.0% | | | | | |

Agrium, Inc. | | 180,600 | | | 6,163,878 |

Airgas, Inc. | | 138,000 | | | 5,380,620 |

Celanese Corp. (Series A) (b) | | 538,100 | | | 6,688,583 |

| | | | | |

| | | | | 18,233,081 |

| | | | | |

| | |

Commercial & Professional Services—2.2% | | | | | |

Employee Solutions, Inc. (c) (d) | | 484 | | | 0 |

Iron Mountain, Inc. (a) (b) | | 541,100 | | | 13,381,403 |

| | | | | |

| | | | | 13,381,403 |

| | | | | |

| | |

Communications Equipment—2.6% | | | | | |

Harris Corp. | | 425,264 | | | 16,181,296 |

| | | | | |

| | |

Construction & Engineering—1.9% | | | | | |

Quanta Services, Inc. (a) | | 581,100 | | | 11,505,780 |

| | | | | |

| | |

Containers & Packaging—1.3% | | | | | |

Rock-Tenn Co. | | 243,619 | | | 8,326,898 |

| | | | | |

| | |

Diversified Consumer Services—2.3% | | | | | |

Apollo Group, Inc. (Class A) (a) | | 186,200 | | | 14,266,644 |

| | | | | |

| | |

Diversified Financial Services—2.8% | | | | | |

CME Group, Inc. | | 21,930 | | | 4,563,852 |

MSCI, Inc. (a) | | 730,900 | | | 12,980,784 |

| | | | | |

| | | | | 17,544,636 |

| | | | | |

| | |

Electrical Equipment—3.2% | | | | | |

Ametek, Inc. | | 649,100 | | | 19,609,311 |

| | | | | |

|

Electronic Equipment, Instruments & Components—1.5% |

Amphenol Corp. (Class A) | | 380,700 | | | 9,129,186 |

| | | | | |

| | |

Energy Equipment & Services—5.7% | | | | | |

Acergy S.A. (ADR) (b) | | 503,500 | | | 2,910,230 |

IHS, Inc. (a) | | 242,900 | | | 9,089,318 |

National Oilwell Varco, Inc. (a) | | 196,400 | | | 4,800,016 |

Noble Corp. | | 343,800 | | | 7,594,542 |

Superior Energy Services, Inc. (a) | | 369,800 | | | 5,890,914 |

Weatherford International, Ltd. (a) | | 450,000 | | | 4,869,000 |

| | | | | |

| | | | | 35,154,020 |

| | | | | |

| | | | | |

Security Description | | Shares | | Value* |

| | | | | |

| | |

Health Care Equipment & Supplies—2.8% | | | | | |

Hologic, Inc. (a) (b) | | 649,600 | | $ | 8,490,272 |

ResMed, Inc. (a) | | 242,500 | | | 9,088,900 |

| | | | | |

| | | | | 17,579,172 |

| | | | | |

| | |

Health Care Providers & Services—10.1% | | | | | |

AmerisourceBergen Corp. | | 223,100 | | | 7,955,746 |

Laboratory Corp. of America Holdings (a) (b) | | 69,700 | | | 4,489,377 |

Lincare Holdings, Inc. (a) (b) | | 291,700 | | | 7,855,481 |

Magellan Health Services, Inc. (a) | | 328,400 | | | 12,860,144 |

Medco Health Solutions, Inc. (a) | | 345,000 | | | 14,458,950 |

Mednax, Inc. (a) | | 460,700 | | | 14,604,190 |

| | | | | |

| | | | | 62,223,888 |

| | | | | |

| | |

Hotels, Restaurants & Leisure—7.1% | | | | | |

Burger King Holdings, Inc. | | 289,200 | | | 6,906,096 |

Darden Restaurants, Inc. (b) | | 343,200 | | | 9,671,376 |

Orient-Express Hotels, Ltd. (Class A) (a) (b) | | 263,500 | | | 2,018,410 |

Panera Bread Co. (a) (b) | | 142,500 | | | 7,444,200 |

Scientific Games Corp. (a) (b) | | 1,009,900 | | | 17,713,646 |

| | | | | |

| | | | | 43,753,728 |

| | | | | |

| | |

Household Products—1.2% | | | | | |

Church & Dwight Co., Inc. | | 135,600 | | | 7,609,872 |

| | | | | |

| | |

IT Services—6.2% | | | | | |

Genpact, Ltd. (a) | | 1,039,200 | | | 8,542,224 |

Lender Processing Services, Inc. | | 395,250 | | | 11,640,113 |

SAIC, Inc. (a) | | 644,900 | | | 12,562,652 |

TeleTech Holdings, Inc. (a) | | 707,000 | | | 5,903,450 |

| | | | | |

| | | | | 38,648,439 |

| | | | | |

| | |

Life Sciences Tools & Services—1.2% | | | | | |

Thermo Fisher Scientific, Inc. (a) (b) | | 214,100 | | | 7,294,387 |

| | | | | |

| | |

Machinery—4.5% | | | | | |

IDEX Corp. | | 634,704 | | | 15,328,102 |

Joy Global, Inc. | | 317,200 | | | 7,260,708 |

Oshkosh Corp. (b) | | 597,100 | | | 5,308,219 |

| | | | | |

| | | | | 27,897,029 |

| | | | | |

| | |

Media—2.3% | | | | | |

CKX, Inc. (a) (b) | | 1,069,400 | | | 3,924,698 |

DreamWorks Animation SKG, Inc. (a) | | 415,300 | | | 10,490,478 |

| | | | | |

| | | | | 14,415,176 |

| | | | | |

| | |

Metals & Mining—0.8% | | | | | |

Century Aluminum Co. (a) (b) | | 510,698 | | | 5,106,980 |

| | | | | |

| | |

Oil, Gas & Consumable Fuels—4.7% | | | | | |

Chesapeake Energy Corp. | | 361,200 | | | 5,840,604 |

Consol Energy, Inc. | | 281,500 | | | 8,045,270 |

Massey Energy Co. | | 307,300 | | | 4,237,667 |

Plains Exploration & Production Co. (a) | | 276,200 | | | 6,418,888 |

*See accompanying notes to financial statements.

MSF-5

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Schedule of Investments as of December 31, 2008

Common Stock—(Continued)

| | | | | |

Security Description | | Shares | | Value* |

| | | | | |

| | |

Oil, Gas & Consumable Fuels—(Continued) | | | | | |

Ultra Petroleum Corp. (a) | | 130,700 | | $ | 4,510,457 |

| | | | | |

| | | | | 29,052,886 |

| | | | | |

| | |

Personal Products—1.4% | | | | | |

Avon Products, Inc. | | 214,500 | | | 5,154,435 |

Bare Escentuals, Inc. (a) (b) | | 711,900 | | | 3,723,237 |

| | | | | |

| | | | | 8,877,672 |

| | | | | |

| | |

Pharmaceuticals—3.5% | | | | | |

Medicis Pharmaceutical Corp. (b) | | 507,300 | | | 7,051,470 |

Shire, Plc. (ADR) (b) | | 331,100 | | | 14,826,658 |

| | | | | |

| | | | | 21,878,128 |

| | | | | |

| |

Real Estate Management & Development—0.0% | | | |

FX Real Estate & Entertainment, Inc. (a) (b) | | 209,779 | | | 31,467 |

| | | | | |

| |

Semiconductors & Semiconductor Equipment—4.5% | | | |

Broadcom Corp. (a) | | 690,500 | | | 11,717,785 |

Lam Research Corp. (a) (b) | | 289,800 | | | 6,166,944 |

PMC-Sierra, Inc. (a) (b) | | 1,991,490 | | | 9,678,641 |

| | | | | |

| | | | | 27,563,370 |

| | | | | |

| | |

Software—7.6% | | | | | |

Adobe Systems, Inc. (a) | | 490,440 | | | 10,441,468 |

Amdocs, Ltd. (a) | | 759,950 | | | 13,899,485 |

Ansys, Inc. (a) | | 154,600 | | | 4,311,794 |

Intuit, Inc. (a) (b) | | 496,500 | | | 11,811,735 |

Salesforce.com, Inc. (a) (b) | | 211,700 | | | 6,776,517 |

| | | | | |

| | | | | 47,240,999 |

| | | | | |

| | |

Specialty Retail—4.7% | | | | | |

Bed Bath & Beyond, Inc. (a) (b) | | 251,600 | | | 6,395,672 |

GameStop Corp. (Class A) (a) (b) | | 507,500 | | | 10,992,450 |

The TJX Cos., Inc. | | 345,600 | | | 7,108,992 |

Urban Outfitters, Inc. (a) | | 321,600 | | | 4,817,568 |

| | | | | |

| | | | | 29,314,682 |

| | | | | |

| |

Textiles, Apparel & Luxury Goods—0.5% | | | |

Lululemon Athletica, Inc. (a) (b) | | 370,600 | | | 2,938,858 |

| | | | | |

| |

Wireless Telecommunication Services—1.0% | | | |

American Tower Corp. (Class A) (a) | | 217,327 | | | 6,372,028 |

| | | | | |

Total Common Stock

(Identified Cost $873,672,563) | | | | | 589,773,900 |

| | | | | |

| | |

| Mutual Funds—1.0% | | | | | |

| | |

Exchange Traded Funds—1.0% | | | | | |

iShares Russell Midcap Growth Index Fund | | 201,400 | | | 6,307,848 |

| | | | | |

Total Mutual Funds

(Identified Cost $10,276,636) | | | | | 6,307,848 |

| | | | | |

| | | | | | | |

| |

| Short Term Investments—20.9% | | | | |

| Security Description | | Shares/Face

Amount | | Value* | |

| | | | | | | |

| | |

Mutual Funds—17.0% | | | | | | | |

State Street Navigator Securities Lending Prime Portfolio (e) | | | 105,303,762 | | $ | 105,303,762 | |

| | | | | | | |

| | |

Repurchase Agreement—3.9% | | | | | | | |

State Street Repurchase Agreement dated 12/31/08 at 0.010% to be repurchased at $23,804,013 on 01/02/09, collateralized by $24,010,000 Federal Home Loan Bank 2.730% due 06/10/09 with a value of $24,281,313. | | $ | 23,804,000 | | | 23,804,000 | |

| | | | | | | |

Total Short Term Investments

(Identified Cost $129,107,762) | | | | | | 129,107,762 | |

| | | | | | | |

Total Investments—117.2%

(Identified Cost $1,013,056,961) (f) | | | | | | 725,189,510 | |

Liabilities in excess of other assets | | | | | | (106,374,286 | ) |

| | | | | | | |

| Total Net Assets—100% | | | | | $ | 618,815,224 | |

| | | | | | | |

| (b) | A portion or all of the security was on loan. As of December 31, 2008, the market value of securities loaned was $105,655,960 and the collateral received consisted of cash in the amount of $105,303,762. The cash collateral is invested in a money market fund managed by an affiliate of the custodian. |

| (d) | Non-Income Producing; issuer filed under Chapter 11 of the Federal Bankruptcy Code. |

| (e) | Represents investment of cash collateral received from securities lending transactions. |

| (f) | The aggregate cost of investments for federal income tax purposes as of December 31, 2008 was $1,022,435,919 and the composition of unrealized appreciation and depreciation of investment securities was $21,009,966 and $(318,256,375), respectively. |

| (ADR)— | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. Trading on exchanges not located in the United States or Canada significantly influences the value of ADRs. |

*See accompanying notes to financial statements.

MSF-6

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

The Portfolio adopted the provisions of Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (FAS 157), effective with the beginning of the Portfolio’s fiscal year. FAS 157 establishes a framework for measuring fair value and expands disclosures about fair value measurements in financial statements. The three levels of the hierarchy under FAS 157 are described below:

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Portfolio’s net assets as of December 31, 2008:

| | | | | | |

| Valuation Inputs | | Investments In

Securities | | Other Financial

Instruments* |

Level 1 - Quoted Prices | | $ | 701,385,510 | | $ | 0 |

Level 2 - Other Significant Observable Inputs | | | 23,804,000 | | | 0 |

Level 3 - Significant Unobservable Inputs | | | 0 | | | 0 |

Total | | $ | 725,189,510 | | $ | 0 |

* Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards, swap contracts and written options, which are valued based on the unrealized appreciation/depreciation on the instrument.

MSF-7

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Statement of Assets & Liabilities

December 31, 2008

| | | | | | | |

Assets | | | | | | | |

Investments at value (a) (b) | | | | | $ | 725,189,510 | |

Cash | | | | | | 335 | |

Receivable for: | | | | | | | |

Fund shares sold | | | | | | 194,427 | |

Accrued interest and dividends | | | | | | 146,188 | |

Foreign taxes | | | | | | 18 | |

| | | | | | | |

Total Assets | | | | | | 725,530,478 | |

Liabilities | | | | | | | |

Payable for: | | | | | | | |

Securities purchased | | $ | 312,747 | | | | |

Fund shares redeemed | | | 670,448 | | | | |

Withholding taxes | | | 1,490 | | | | |

Collateral for securities loaned | | | 105,303,762 | | | | |

Due to custodian bank | | | 2,898 | | | | |

Accrued expenses: | | | | | | | |

Management fees | | | 366,674 | | | | |

Service and distribution fees | | | 16,974 | | | | |

Other expenses | | | 40,261 | | | | |

| | | | | | | |

Total Liabilities | | | | | | 106,715,254 | |

| | | | | | | |

Net Assets | | | | | $ | 618,815,224 | |

| | | | | | | |

Net assets consists of: | | | | | | | |

Capital paid in | | | | | $ | 1,206,648,645 | |

Undistributed net investment income | | | | | | 1,045,714 | |

Accumulated net realized losses | | | | | | (301,011,684 | ) |

Unrealized depreciation on investments | | | | | | (287,867,451 | ) |

| | | | | | | |

Net Assets | | | | | $ | 618,815,224 | |

| | | | | | | |

| Computation of offering price: | | | | | | | |

Class A | | | | | | | |

Net asset value and redemption price per share ($457,840,230 divided by 29,193,478 shares outstanding) | | | | | $ | 15.68 | |

| | | | | | | |

Class B | | | | | | | |

Net asset value and redemption price per share ($32,045,568 divided by 2,150,663 shares outstanding) | | | | | $ | 14.90 | |

| | | | | | | |

Class D | | | | | | | |

Net asset value and redemption price per share ($117,943,945 divided by 7,587,364 shares outstanding) | | | | | $ | 15.54 | |

| | | | | | | |

Class E | | | | | | | |

Net asset value and redemption price per share ($10,985,481 divided by 707,494 shares outstanding) | | | | | $ | 15.53 | |

| | | | | | | |

(a) Identified cost of investments | | | | | $ | 1,013,056,961 | |

| | | | | | | |

(b) Includes cash collateral for securities loaned of | | | | | $ | 105,303,762 | |

| | | | | | | |

Statement of Operations

For the Year Ended December 31, 2008

| | | | | | | | |

Investment Income | | | | | | | | |

Dividends | | | | | | $ | 6,288,795 | (a) |

Interest | | | | | | | 2,745,777 | (b) |

| | | | | | | | |

| | | | | | | 9,034,572 | |

Expenses | | | | | | | | |

Management fees | | $ | 7,197,439 | | | | | |

Service and distribution fees—Class B | | | 108,738 | | | | | |

Service and distribution fees—Class D | | | 201,694 | | | | | |

Service and distribution fees—Class E | | | 24,194 | | | | | |

Directors’ fees and expenses | | | 31,905 | | | | | |

Custodian | | | 88,600 | | | | | |

Audit and tax services | | | 31,946 | | | | | |

Legal | | | 16,516 | | | | | |

Printing | | | 248,204 | | | | | |

Insurance | | | 19,936 | | | | | |

Miscellaneous | | | 19,686 | | | | | |

| | | | | | | | |

Total expenses | | | 7,988,858 | | | | | |

Expense reductions | | | (188,815 | ) | | | 7,800,043 | |

| | | | | | | | |

Net Investment Income | | | | | | | 1,234,529 | |

| | | | | | | | |

Realized and Unrealized Loss | | | | | | | | |

| Realized loss on: | | | | | | | | |

Investments—net | | | | | | | (13,997,593 | ) |

| Change in unrealized depreciation on: | | | | | | | | |

Investments—net | | | | | | | (530,783,936 | ) |

| | | | | | | | |

Net loss | | | | | | | (544,781,529 | ) |

| | | | | | | | |

Net Decrease in Net Assets From Operations | | | | | | $ | (543,547,000 | ) |

| | | | | | | | |

| (a) | Net of foreign taxes of $26,351. |

| (b) | Includes income on securities loaned of $2,120,507. |

See accompanying notes to financial statements.

MSF-8

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year ended

December 31,

2008 | | | Year ended

December 31,

2007 | |

From Operations | | | | | | | | |

Net investment income (loss) | | $ | 1,234,529 | | | $ | (3,366,482 | ) |

Net realized gain (loss) | | | (13,997,593 | ) | | | 137,208,639 | |

Change in unrealized appreciation (depreciation) | | | (530,783,936 | ) | | | 94,696,186 | |

| | | | | | | | |

Increase (decrease) in net assets from operations | | | (543,547,000 | ) | | | 228,538,343 | |

| | | | | | | | |

Decrease in net assets from capital share transactions | | | (109,634,253 | ) | | | (145,603,986 | ) |

| | | | | | | | |

Net increase (decrease) in net assets | | | (653,181,253 | ) | | | 82,934,357 | |

| | |

Net Assets | | | | | | | | |

Beginning of the period | | | 1,271,996,477 | | | | 1,189,062,120 | |

| | | | | | | | |

End of the period | | $ | 618,815,224 | | | $ | 1,271,996,477 | |

| | | | | | | | |

Undistributed Net Investment Income | | | | | | | | |

End of the period | | $ | 1,045,714 | | | $ | 0 | |

| | | | | | | | |

Other Information:

Capital Shares

Transactions in capital shares were as follows:

| | | | | | | | | | | | | | |

| | | Year ended

December 31, 2008 | | | Year ended

December 31, 2007 | |

| | | Shares | | | $ | | | Shares | | | $ | |

Class A | | | | | | | | | | | | | | |

Sales | | 1,083,815 | | | $ | 23,861,568 | | | 2,125,807 | | | $ | 56,726,170 | |

Redemptions | | (4,349,912 | ) | | | (102,062,908 | ) | | (6,434,262 | ) | | | (170,180,611 | ) |

| | | | | | | | | | | | | | |

Net decrease | | (3,266,097 | ) | | $ | (78,201,340 | ) | | (4,308,455 | ) | | $ | (113,454,441 | ) |

| | | | | | | | | | | | | | |

Class B | | | | | | | | | | | | | | |

Sales | | 1,231,192 | | | $ | 26,842,935 | | | 1,107,249 | | | $ | 28,952,558 | |

Redemptions | | (724,956 | ) | | | (15,061,146 | ) | | (408,530 | ) | | | (10,419,375 | ) |

| | | | | | | | | | | | | | |

Net increase | | 506,236 | | | $ | 11,781,789 | | | 698,719 | | | $ | 18,533,183 | |

| | | | | | | | | | | | | | |

Class D | | | | | | | | | | | | | | |

Sales | | 772,219 | | | $ | 18,133,231 | | | 468,353 | | | $ | 12,656,593 | |

Redemptions | | (2,567,742 | ) | | | (61,103,088 | ) | | (2,438,024 | ) | | | (64,215,232 | ) |

| | | | | | | | | | | | | | |

Net decrease | | (1,795,523 | ) | | $ | (42,969,857 | ) | | (1,969,671 | ) | | $ | (51,558,639 | ) |

| | | | | | | | | | | | | | |

Class E | | | | | | | | | | | | | | |

Sales | | 256,311 | | | $ | 5,557,784 | | | 205,002 | | | $ | 5,675,736 | |

Redemptions | | (253,021 | ) | | | (5,802,629 | ) | | (186,065 | ) | | | (4,799,825 | ) |

| | | | | | | | | | | | | | |

Net increase (decrease) | | 3,290 | | | $ | (244,845 | ) | | 18,937 | | | $ | 875,911 | |

| | | | | | | | | | | | | | |

Decrease derived from capital share transactions | | | | | $ | (109,634,253 | ) | | | | | $ | (145,603,986 | ) |

| | | | | | | | | | | | | | |

See accompanying notes to financial statements.

MSF-9

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class A | |

| | | Year ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Net Asset Value, Beginning of Period | | $ | 28.89 | | | $ | 23.96 | | | $ | 22.45 | | | $ | 20.28 | | | $ | 17.95 | |

| | | | | | | | | | | | | | | | | | | | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.04 | (a) | | | (0.06 | )(a) | | | (0.07 | ) | | | (0.07 | ) | | | (0.07 | ) |

Net realized and unrealized gain (loss) of investments | | | (13.25 | ) | | | 4.99 | | | | 1.58 | | | | 2.24 | | | | 2.40 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (13.21 | ) | | | 4.93 | | | | 1.51 | | | | 2.17 | | | | 2.33 | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 15.68 | | | $ | 28.89 | | | $ | 23.96 | | | $ | 22.45 | | | $ | 20.28 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return (%) | | | (45.7 | ) | | | 20.6 | | | | 6.7 | | | | 10.7 | | | | 13.0 | |

Ratio of operating expenses to average net assets before expense reductions (%) | | | 0.77 | | | | 0.76 | | | | 0.79 | | | | 0.79 | | | | 0.79 | |

Ratio of operating expenses to average net assets after expense reductions (%) (b) | | | 0.75 | | | | 0.74 | | | | 0.77 | | | | 0.77 | | | | 0.78 | |

Ratio of net investment income (loss) to average net assets (%) | | | 0.16 | | | | (0.24 | ) | | | (0.29 | ) | | | (0.33 | ) | | | (0.38 | ) |

Portfolio turnover rate (%) | | | 48 | | | | 49 | | | | 91 | | | | 71 | | | | 95 | |

Net assets, end of period (000) | | $ | 457,840 | | | $ | 937,655 | | | $ | 880,965 | | | $ | 938,550 | | | $ | 954,736 | |

| | | | | | | | | | | | | | | | | | | | |

| | | Class B | |

| | | Year ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004(c) | |

Net Asset Value, Beginning of Period | | $ | 27.51 | | | $ | 22.88 | | | $ | 21.49 | | | $ | 19.46 | | | $ | 18.12 | |

| | | | | | | | | | | | | | | | | | | | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.02 | )(a) | | | (0.12 | )(a) | | | (0.09 | ) | | | (0.08 | ) | | | (0.03 | ) |

Net realized and unrealized gain (loss) of investments | | | (12.59 | ) | | | 4.75 | | | | 1.48 | | | | 2.11 | | | | 1.37 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (12.61 | ) | | | 4.63 | | | | 1.39 | | | | 2.03 | | | | 1.34 | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 14.90 | | | $ | 27.51 | | | $ | 22.88 | | | $ | 21.49 | | | $ | 19.46 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return (%) | | | (45.8 | ) | | | 20.2 | | | | 6.5 | | | | 10.4 | | | | 7.4 | (d) |

Ratio of operating expenses to average net assets before expense reductions (%) | | | 1.02 | | | | 1.01 | | | | 1.04 | | | | 1.04 | | | | 1.04 | (e) |

Ratio of operating expenses to average net assets after expense reductions (%) (b) | | | 1.00 | | | | 0.99 | | | | 1.02 | | | | 1.01 | | | | 1.03 | (e) |

Ratio of net investment loss to average net assets (%) | | | (0.11 | ) | | | (0.48 | ) | | | (0.53 | ) | | | (0.56 | ) | | | (0.56 | )(e) |

Portfolio turnover rate (%) | | | 48 | | | | 49 | | | | 91 | | | | 71 | | | | 95 | |

Net assets, end of period (000) | | $ | 32,046 | | | $ | 45,243 | | | $ | 21,634 | | | $ | 11,761 | | | $ | 4,165 | |

| Please | see following page for Financial Highlights footnote legend. |

See accompanying notes to financial statements.

MSF-10

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Financial Highlights

| | | | | | | | | | | | |

| | | Class D | |

| | | Year ended December 31, | |

| | | 2008 | | | 2007 | | | 2006(c) | |

Net Asset Value, Beginning of Period | | $ | 28.66 | | | $ | 23.80 | | | $ | 24.12 | |

| | | | | | | | | | | | |

Income From Investment Operations | | | | | | | | | | | | |

Net investment income (loss) | | | 0.01 | (a) | | | (0.09 | )(a) | | | (0.06 | ) |

Net realized and unrealized gain (loss) of investments | | | (13.13 | ) | | | 4.95 | | | | (0.26 | ) |

| | | | | | | | | | | | |

Total from investment operations | | | (13.12 | ) | | | 4.86 | | | | (0.32 | ) |

| | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 15.54 | | | $ | 28.66 | | | $ | 23.80 | |

| | | | | | | | | | | | |

Total Return (%) | | | (45.7 | ) | | | 20.4 | | | | (1.3 | )(d) |

Ratio of operating expenses to average net assets before expense reductions (%) | | | 0.87 | | | | 0.86 | | | | 0.89 | (e) |

Ratio of operating expenses to average net assets after expense reductions (%) (b) | | | 0.85 | | | | 0.84 | | | | 0.87 | (e) |

Ratio of net investment income (loss) to average net assets (%) | | | 0.06 | | | | (0.34 | ) | | | (0.36 | )(e) |

Portfolio turnover rate (%) | | | 48 | | | | 49 | | | | 91 | |

Net assets, end of period (000) | | $ | 117,944 | | | $ | 268,928 | | | $ | 270,158 | |

| | | | | | | | | | | | | | | | | | | | |

| | | Class E | |

| | | Year ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Net Asset Value, Beginning of Period | | $ | 28.64 | | | $ | 23.79 | | | $ | 22.33 | | | $ | 20.20 | | | $ | 17.90 | |

| | | | | | | | | | | | | | | | | | | | |

Income from Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.00 | (a)(f) | | | (0.10 | )(a) | | | (0.12 | ) | | | (0.11 | ) | | | (0.09 | ) |

Net realized and unrealized gain (loss) of investments | | | (13.11 | ) | | | 4.95 | | | | 1.58 | | | | 2.24 | | | | 2.39 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (13.11 | ) | | | 4.85 | | | | 1.46 | | | | 2.13 | | | | 2.30 | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 15.53 | | | $ | 28.64 | | | $ | 23.79 | | | $ | 22.33 | | | $ | 20.20 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return (%) | | | (45.8 | ) | | | 20.4 | | | | 6.5 | | | | 10.5 | | | | 12.8 | |

Ratio of operating expenses to average net assets before expense reductions (%) | | | 0.92 | | | | 0.91 | | | | 0.94 | | | | 0.94 | | | | 0.94 | |

Ratio of operating expenses to average net assets after expense reductions (%) (b) | | | 0.90 | | | | 0.89 | | | | 0.92 | | | | 0.92 | | | | 0.93 | |

Ratio of net investment income (loss) to average net assets (%) | | | 0.00 | (g) | | | (0.39 | ) | | | (0.44 | ) | | | (0.48 | ) | | | (0.52 | ) |

Portfolio turnover rate (%) | | | 48 | | | | 49 | | | | 91 | | | | 71 | | | | 95 | |

Net assets, end of period (000) | | $ | 10,985 | | | $ | 20,171 | | | $ | 16,305 | | | $ | 17,653 | | | $ | 17,893 | |

| (a) | Per share amount is based on average shares outstanding during the period. |

| (b) | The Portfolio has entered into arrangements with certain brokers who paid a portion of the Portfolio’s expenses. |

| (c) | Commencement of operations was April 26, 2004 and May 2, 2006 for Classes B and D, respectively. |

| (d) | Periods less than one year are not computed on an annualized basis. |

| (e) | Computed on an annualized basis. |

| (f) | Net investment income was less than $0.01 per share. |

| (g) | Ratio of net investment income to average net assets was less than 0.01%. |

See accompanying notes to financial statements.

MSF-11

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2008

Metropolitan Series Fund, Inc. (the “Fund”) is organized as a corporation under the laws of Maryland pursuant to Articles of Incorporation filed on November 23, 1982, as amended, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end investment company. The Fund is a “series” type of mutual fund, which issues separate series of stock. Each series represents an interest in a separate portfolio of Fund investments. The BlackRock Aggressive Growth Portfolio (the “Portfolio”) is a diversified series of the Fund. Shares in the Fund are not offered directly to the general public and are currently available only to separate accounts established by Metropolitan Life Insurance Company (“MetLife”), New England Life Insurance Company, General American Life Insurance Company (“General American”), The MetLife Investors Group of Insurance Companies, MetLife Insurance Company of Connecticut and other affiliated insurance companies (collectively, the “Insurance Companies”) and to certain eligible qualified retirement plans (“Qualified Plans”), as an investment vehicle for variable life insurance, group annuity or variable annuity products of these insurance companies or Qualified Plans, although the Portfolio is not available to all such separate accounts and Qualified Plans. The Portfolio’s shares may be divided into different classes. Currently, the classes being offered by the Portfolio are named Class A, Class B, Class D and Class E. The classes of the Portfolio’s shares are identical, except that certain additional charges (Rule 12b-1 fees) are made against Class B, Class D and Class E shares. Investment income, realized and unrealized capital gains and losses, the common expenses of the Portfolio and certain Portfolio-level expense reductions, if any, are allocated daily, on a pro rata basis, to each class based on the relative net assets of each class to the total net assets of the Portfolio.

| 2. | SIGNIFICANT ACCOUNTING POLICIES: |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies consistently followed by the Portfolio in the preparation of its financial statements. The policies are in conformity with GAAP.

Investment Valuation:

Debt securities (other than short term obligations with a remaining maturity of sixty days or less) are generally valued on the basis of evaluated or composite bid quotations obtained by independent pricing services and/or brokers and dealers selected by the relevant subadviser pursuant to authorization of the Board of Directors of the Fund (the “Board” or “Directors”). Such quotations take into account appropriate factors such as institutional-sized trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data. Short term obligations with a remaining maturity of sixty days or less are valued at amortized cost which approximates fair market value.

Equity securities traded on a national securities exchange or other exchanges are valued at their last sale price on the principal trading market. Equity securities traded on the NASDAQ National Market System are valued at the NASDAQ Official Closing Price (the “NOCP”). The NOCP is the last reported sale price if the last reported sale price falls between the spread of the last reported bid and asked prices. If the last reported bid and asked prices are above the last reported sale price, the NOCP will be the last reported bid price. If the last reported bid and asked prices are below the last reported sale price, the NOCP will be the last reported asked price. Equity securities traded on a national securities exchange or other exchanges or on the NASDAQ National Market System for which there is no reported sale during the day are valued at the last reported bid price. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for that security by the Board or its delegates. If no closing price is available, then such securities are valued by using the last reported bid price. Equity securities traded over-the-counter are valued at the last reported sales price.

If no current market value quotation is readily available or reliable for a portfolio security, fair value will be determined in accordance with procedures established by and under the general supervision of the Board. When the Portfolio uses fair value pricing, it may take into account any factors it deems appropriate. The value of securities used by the Portfolio to calculate its net asset value may differ from quoted or published prices for the same securities. Fair value pricing involves subjective judgments and the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

The Portfolio expects to use fair value pricing for securities primarily traded on U.S. exchanges only under very limited circumstances. For example, the Portfolio may use fair value pricing if the exchange on which a security is traded closes early or trading in the security is suspended.

MSF-12

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2008—(Continued)

Securities traded primarily on an exchange outside of the United States which closes before the close of the New York Stock Exchange will be valued at the last sales price on that non-U.S. exchange. Securities traded primarily on an exchange outside of the United States for which there is no reported sale during the day are valued at the mean between the last reported bid and asked prices. However, because most foreign markets close well before the Portfolio values its securities (typically at 4 p.m. Eastern Time), the earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred after these foreign markets close but before the Portfolio values its securities. To account for this, the Portfolio may frequently value many of its foreign equity securities using fair value prices based on third party vendor modeling tools.

Forward foreign currency exchange contracts are valued based on the mean between closing bid and asked prices of the forward currency contract rates in the London foreign exchange markets on a daily basis as provided by a reliable bank or dealer.

Options, whether on securities, indices, futures contracts, or otherwise, are valued at the last sales price available as of the close of business on the day of valuation or, if there is no such sale price available, at the mean between the bid and asked prices. Options on currencies are valued at the spot price each day.

The value of futures contracts will be the sum of the margin deposit plus or minus the difference between the value of the futures contract on each day the net asset value is calculated and the value on the date the futures contract originated, value being that established on a recognized commodity exchange, or by reference to other customary sources, with gain or loss being realized when the futures contract closes or expires.

Subject to the Board’s oversight, the Board has delegated the day-to-day oversight of pricing matters, including determinations in good faith under the Fund’s procedures the fair value of securities for which current market quotations are not readily available to the subadviser of the Portfolio.

Investment Transactions and Related Investment Income:

Portfolio security transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date or, for certain foreign securities, when notified. Interest income, which includes amortization of premium and accretion of discount on debt securities, is recorded on the accrual basis. Realized gains and losses on investments and unrealized appreciation and depreciation are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Repurchase Agreements:

The Portfolio, through the custodian or a subcustodian, receives delivery of the underlying securities collateralizing repurchase agreements. The Portfolio requires the custodian to take possession, to have legally segregated in the Federal Reserve Book Entry System, or to have segregated within the custodian’s vault, all securities held as collateral for repurchase agreements. It is the Portfolio’s policy that the market value of the collateral be at least equal to 100% of the repurchase price in the case of a repurchase agreement of one-day duration and 102% on all other repurchase agreements. The Portfolio’s subadviser is responsible for determining that the value of the collateral is at all times at least equal to the repurchase price. In connection with transactions in repurchase agreements, if the seller defaults and the value of the collateral declines or if the seller enters an insolvency proceeding, realization of the collateral by the Portfolio may be delayed, limited or wholly denied.

Foreign Currency Translation:

The books and records of the Portfolio are maintained in U.S. dollars. The values of securities, currencies and other assets and liabilities denominated in currencies other than U.S. dollars are translated into U.S. dollars based upon foreign exchange rates prevailing at the end of the period. Purchases and sales of investment securities, income and expenses are translated on the respective dates of such transactions. Since the values of investment securities are presented at the foreign exchange rates prevailing at the end of the period, it is not practical to isolate that portion of the results of operations arising from changes in exchange rates from that portion of the results of operations reflecting fluctuations arising from changes in market prices of the investment securities. Such fluctuations are included in the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded by the Portfolio and the U.S. dollar equivalent of the amounts actually received or paid by the Portfolio. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investment securities, resulting from changes in the exchange rate.

MSF-13

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2008—(Continued)

Forward Foreign Currency Exchange Contracts:

The Portfolio may enter into forward foreign currency exchange contracts primarily to hedge against foreign currency exchange rate risks on its non-U.S. dollar denominated investment securities. When entering into a forward currency contract, the Portfolio agrees to receive or deliver a fixed quantity of foreign currency for an agreed-upon price on an agreed future date. These contracts are valued daily and the Portfolio’s net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the foreign exchange rates at the dates of entry into the contracts and the forward rates at the settlement date, is included in the Statement of Assets and Liabilities. Realized and unrealized gains and losses are included in the Statement of Operations. These instruments involve market and/or credit risk in excess of the amount recognized in the Statement of Assets and Liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates.

Futures Contracts:

The Portfolio may buy and sell futures contracts (on recognized exchanges) as a hedge, to maintain exposure to the broad equity markets or to enhance return. Futures contracts are agreements to buy or sell a security, or deliver a final cash settlement price in connection with an index, interest rate, currency, or other contracts not calling for physical delivery, for a set price in the future. The Portfolio must post an amount equal to a portion of the total market value of the futures contract as futures variation margin, which is returned when the Portfolio’s obligations under the contract have been satisfied. From time to time thereafter, the Portfolio may have to post variation margin to maintain this amount as the market value of the contract fluctuates. Risks of entering into futures contracts (and related options) include the possibility that there may be an illiquid market and that a change in the value of the contract or option may not correlate with changes in the value of the underlying securities.

Options:

The Portfolio may use options to hedge against changes in values of securities the Portfolio owns or expects to purchase, to maintain exposure to the broad equity markets or to enhance return. Writing puts or buying calls tends to increase the Portfolio’s exposure to the underlying instrument and writing calls or buying puts tends to decrease the Portfolio’s exposure to the underlying instrument, and can be used to hedge other Portfolio investments. For options purchased to hedge the Portfolio’s investments, the potential risk to the Portfolio is that the change in value of options contracts may not correspond to the change in value of the hedged instruments. In addition, losses may arise from changes in the value of the underlying instruments, if there is an illiquid secondary market, or if the counterparty is unable to perform. The maximum loss for purchased options is limited to the premium initially paid for the option. For options written by the Portfolio, the maximum loss is not limited to the premium initially received for the option.

The main risk associated with purchasing an option is that the option expires without being exercised. In this case, the option expires worthless and the premium paid for the option is considered the loss. The risk associated with writing a call option is that the Portfolio may forgo the opportunity for a profit if the market value of the underlying position increases and the option is exercised. The risk in writing a put option is that the Portfolio may incur a loss if the market value of the underlying position decreases and the option is exercised. In addition, the Portfolio risks not being able to enter into a closing transaction for the written option as the result of an illiquid market.

“When-Issued” Securities:

Purchasing securities “when-issued” is a forward commitment by the Portfolio to buy a security. The estimated amount of the Portfolio’s payment obligation and the security’s interest rate are determined when the commitment is made, even though no interest accrues until the security is issued, which is generally 15 to 120 days later. The Portfolio will segregate liquid assets with its custodian sufficient at all times to satisfy these commitments. If the value of the security is less when delivered than when the commitment was made, the Portfolio will suffer a loss.

Federal Income Taxes:

It is the Portfolio’s policy to comply with the requirements of the Internal Revenue Code of 1986, as amended (the “Code”), and regulations thereunder, applicable to regulated investment companies and to distribute, with respect to each taxable year, all of its taxable income to shareholders. Therefore, no federal income tax provision is required. The Portfolio is subject to the provisions of the Financial Accounting Standards Board Interpretation (“FASB”) No. 48, Accounting for Uncertainties in Income

MSF-14

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2008—(Continued)

Taxes (FIN 48). FIN 48 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The implementation of FIN 48 did not result in any unrecognized tax benefits in the accompanying financial statements. Each of the Portfolio’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

As of December 31, 2008, the Portfolio had capital loss carryforwards as follows:

| | | | | | | |

Expiring

12/31/09 | | Expiring

12/31/10 | | Total |

| $ | 227,327,608 | | $ | 20,631,133 | | $ | 247,958,741 |

The utilization of the capital loss carryforward acquired as part of a merger may be limited under section 382 of the Code.

As of December 31, 2008, the components of distributable earnings (accumulated losses) on a federal income tax basis were as follows:

| | | | | | | | | | | | | | | | |

Undistributed

Ordinary

Income | | Undistributed

Long Term

Gain | | Unrealized

Depreciation | | | Loss

Carryforwards | | | Total | |

| $ | 1,045,714 | | $ | — | | $ | (297,246,409 | ) | | $ | (247,958,741 | ) | | $ | (544,159,436 | ) |

Pursuant to Federal income tax regulations applicable to investment companies, the Portfolio has elected to treat net capital losses realized between November 1 and December 31 of each year as occurring on the first day of the following tax year. For the year ended December 31, 2008, the following amounts of realized capital and currency losses reflected in the accompanying financial statements will not be recognized for Federal income tax purposes until January 1, 2009:

| | | | |

Currency | | Capital | |

$— | | $ | (43,673,987 | ) |

Dividends and Distributions to Shareholders:

The Portfolio records dividends and distributions on the ex-dividend date. Net realized gains from security transactions (if any) are generally distributed annually to shareholders. The timing and characterization of certain income and capital gains distributions are determined in accordance with federal tax regulations that may differ from GAAP. Permanent book and tax basis differences relating to shareholder distributions will result in reclassification between under/over distributed net investment income, accumulated net realized gains/losses and paid in capital.

Expense Reductions:

Certain Portfolio trades are directed to brokers who paid a portion of the Portfolio’s expenses. Amounts paid for the Portfolio are shown as expense reductions in the Statement of Operations.

| 3. | INVESTMENT TRANSACTIONS: |

For the year ended December 31, 2008, purchases and sales of securities (excluding short term investments) for the Portfolio were as follows:

| | | | | | | | | | |

| Purchases | | Sales |

| U.S. Government | | Other | | U.S. Government | | Other |

| $ | 0 | | $ | 469,175,067 | | $ | 0 | | $ | 571,997,195 |

MSF-15

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2008—(Continued)

| 4. | INVESTMENT MANAGEMENT FEES AND OTHER TRANSACTIONS WITH AFFILIATES: |

Investment Management Agreement:

MetLife Advisers, LLC (“MetLife Advisers”) is the investment adviser to the Portfolio. The Fund has entered into an investment management agreement with MetLife Advisers with respect to the Portfolio. For providing investment management services to the Portfolio, MetLife Advisers receives monthly compensation at the following annual rates:

| | | | |

Management

Fees earned by

MetLife Advisers

for the year ended

December 31, 2008 | | Annual

percentage

rates paid to

MetLife Advisers | | Based on Portfolios

average daily net asset

levels |

| $7,197,439 | | 0.750% | | Of the first $500 million |

| | 0.700% | | Of the next $500 million |

| | 0.650% | | On amounts in excess of $1 billion |

Certain officers and directors of the Fund may also be officers of MetLife Advisers; however, such officers and directors receive no compensation from the Fund.

MetLife Advisers has entered into an investment subadvisory agreement with respect to the Portfolio. BlackRock Advisors, LLC is compensated by MetLife Advisers to provide subadvisory services for the Portfolio.

Service and Distribution Fees:

The Fund has adopted a Distribution and Service Plan under Rule 12b-1 of the 1940 Act for the Portfolio’s Class B, D and E shares. Under the Distribution and Service Plan, the Class B, D and E shares of the Portfolio pay a fee to compensate the Insurance Companies (or their affiliates) and other broker-dealers and financial intermediaries involved in the offer and sale of Portfolio shares for promoting or selling and servicing the Class B, D and E shares. The fees under the Distribution and Service Plan for each applicable class of the Portfolio’s shares are calculated as a percentage of the Portfolio’s average daily net assets that are attributable to that Class. Currently, the fee is 0.25% per year for Class B shares, 0.10% per year for Class D shares and 0.15% per year for Class E shares. Amounts paid by the Portfolio for the year ended December 31, 2008 are shown as Service and Distribution fees in the Statement of Operations.

The Fund has entered into a securities lending arrangement with the Fund’s custodian, State Street Bank and Trust Company (the “custodian”). Under the agreement, the custodian is authorized to loan securities on the Portfolios’ behalf. In exchange, the Portfolio receives either cash or securities as collateral against the loaned securities. The Portfolio receives collateral at least equal to 102% of the market value of the loaned securities (105% for foreign securities), at each loan’s inception. Collateral must be maintained at least at 100% of the market value of the loaned securities for the duration of the loan. The cash collateral is invested in the Navigator Securities Lending Prime Portfolio, an affiliate of the custodian, which invests in a variety of high quality U.S. dollar-denominated instruments. If the market value of the collateral at the close of trading on a business day is less than 100% of the market value of the loaned securities at the close of trading on that day, the borrower shall be required to deliver, by the close of business on the following business day, an additional amount of collateral, equal to at least 100% of the market value of all the loaned securities as of such preceding day. The Portfolio receives 80% of the annual net income from securities lending transactions, which is included in interest income of the Portfolio. The remaining 20% is paid to the custodian as compensation for its securities lending services. Interest income received by the Portfolio via lending transactions during the year ended December 31, 2008 is footnoted in the Statement of Operations. The Portfolio bears the risk of any deficiency in the amount of collateral available for return to a borrower due to a loss in an approved investment purchased with such collateral. Any outstanding loans by the Portfolio at December 31, 2008 are footnoted in the Schedule of Investments.

| 6. | MARKET AND CREDIT RISK: |

In the normal course of business, the Portfolio invests in securities and enters into transactions where risks exist due to fluctuations in the market (market risk) or failure of the other party to a transaction to perform (credit risk). The value of securities held by the Portfolio may decline in response to certain events, including those directly involving the companies whose securities are owned by the Portfolio; conditions affecting the general economy; overall market changes; local, regional or global

MSF-16

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Notes to Financial Statements—December 31, 2008—(Continued)

political, social or economic instability; and currency and interest rate and price fluctuations. Similar to credit risk, the Portfolio may be exposed to counterparty risk, or the risk that an entity with which the Portfolio has unsettled or open transactions may default. Financial assets, which potentially expose the Portfolio to credit and counterparty risks, consist principally of investments and cash due from counterparties. The extent of the Portfolio’s exposure to credit and counterparty risks in respect to these financial assets approximates their value as recorded in the Portfolio’s Statements of Assets and Liabilities.

| 7. | RECENT ACCOUNTING PRONOUNCEMENTS: |

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“FAS 161”), an amendment of FASB Statement No. 133. FAS 161 requires enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and hedging activities are accounted for, and (c) how derivative instruments and related hedging activities affect a fund’s financial position, financial performance, and cash flows. Management does not believe the adoption of FAS 161 will materially impact the financial statement amounts, but will require additional disclosures. This will include qualitative and quantitative disclosures on derivative positions existing at period end and the effect of using derivatives during the reporting period. FAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. Management is currently evaluating the impact the adoption of FAS 161 will have on the Portfolio’s financial statement disclosures.

MSF-17

Metropolitan Series Fund, Inc.

BlackRock Aggressive Growth Portfolio

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Metropolitan Series Fund, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the BlackRock Aggressive Growth Portfolio (one of the portfolios constituting the Metropolitan Series Fund, Inc.) (the “Fund”) as of December 31, 2008, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2008, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the BlackRock Aggressive Growth Portfolio of the Metropolitan Series Fund, Inc. as of December 31, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Boston, Massachusetts

February 24, 2009

MSF-18

Metropolitan Series Fund, Inc.

Directors and Officers

The Fund’s Directors review actions of the Fund’s investment adviser and subadvisers, and decide upon matters of general policy. The Fund’s officers supervise the daily business operations of the Fund. The Board of Directors and the Fund’s officers are listed below. Each Director is responsible for overseeing all 38 Portfolios of the Fund. There is no limit to the term a Director may serve. Directors serve until their resignation, retirement or removal in accordance with the Fund’s organizational documents and policies adopted by the Board from time to time. Officers hold office at the pleasure of the Board or until the election or appointment and the qualification of a successor. The address of the Directors and officers is c/o Metropolitan Series Fund, Inc., 501 Boylston Street, Boston, MA 02116.

Interested Directors(1)

Each Director below is an “interested person” (as defined by the 1940 Act) with respect to the Fund in that Ms. Forget is an employee of MetLife and Mr. Typermass is a former employee of MetLife and owns securities issued by MetLife, Inc., the ultimate parent company of MetLife Advisers.

| | | | | | | | |

Name, Address and Age | | Current

position(s)

with Fund | | Position(s)

held since | | Principal occupations

over past five years, including other directorships(2) | | Number of

Portfolios in

Fund Complex

Overseen by

Director(3) |

Elizabeth M. Forget Age: 42 | | Director, Chairman of the Board, President and Chief Executive Officer | | 2006 | | Senior Vice President (since 2007), MetLife, Inc.; President, Met Investors Advisory, LLC; Trustee and President, Met Investors Series Trust; Executive Vice President, MetLife Investors Group, Inc.; President, Chief Executive Officer and Chair of the Board of Managers (since 2006), MetLife Advisers; President, Met Investors Advisory, LLC. | | 87 |

| | | | |

Arthur G. Typermass Age: 71 | | Director | | 1998 | | Formerly, Senior Vice President and Treasurer, MetLife. | | 38 |

Non-Interested Directors(1)

Each Director below is not an “interested person” (as defined by the 1940 Act) with respect to the Fund (collectively, the “Independent Directors”).

| | | | | | | | |

Name, Address and Age | | Current

position(s)

with Fund | | Position(s)

held since | | Principal occupations

over past five years, including other directorships(2) | | Number of

Portfolios in

Fund Complex

Overseen by

Director(3) |

Steve A. Garban† Age: 71 | | Director | | 1985 | | Formerly, Chief Financial Officer, Senior Vice President Finance and Operations and Treasurer (Emeritus), The Pennsylvania State University. | | 38 |

| | | | |

Linda B. Strumpf Age: 61 | | Director | | 2000 | | Vice President and Chief Investment Officer, Ford Foundation. | | 38 |

| | | | |

Michael S. Scott Morton† Age: 71 | | Director | | 1993 | | Jay W. Forrester Professor of Management (Emeritus) at Sloan School of Management, MIT. | | 38 |

| | | | |

H. Jesse Arnelle Age: 75 | | Director | | 2001 | | Formerly, Counsel, Womble Carlyle Sandrie & Rice; Director, Textron Inc. (global multi- industry company)*; formerly, Director, Gannet Co. Inc. (diversified news and information company)*; formerly, Director, Eastman Chemical Company (global chemical company)*; formerly, Director, Waste Management, Inc.*; formerly, Director, Armstrong Holdings Inc. (parent company of floor and ceiling products business)*; formerly, Director, FPL Group Inc. (public utility holding company)*; Director, URS Corporation (engineering design services firm)*. | | 38 |

MSF-19

Metropolitan Series Fund, Inc.

Directors and Officers—(Continued)

| | | | | | | | |

Name, Address and Age | | Current

position(s)

with Fund | | Position(s)

held since | | Principal occupations

over past five years, including other directorships(2) | | Number of

Portfolios in

Fund Complex

Overseen by

Director(3) |