UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-03651 |

| Touchstone Strategic Trust – December Funds |

| (Exact name of registrant as specified in charter) |

| 303 Broadway, Suite 1100 |

| Cincinnati, Ohio 45202-4203 |

| (Address of principal executive offices) (Zip code) |

| E. Blake Moore, Jr. |

| 303 Broadway, Suite 1100 |

| Cincinnati, Ohio 45202-4203 |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

December 31, 2020

Annual Report

| Touchstone Strategic Trust |

| Touchstone Anti-Benchmark® US Core Equity Fund (formerly known as Touchstone Dynamic Equity Fund) |

| Touchstone Dynamic Diversified Income Fund |

| Touchstone Dynamic Global Allocation Fund |

This report identifies the Funds' investments on December 31, 2020. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the 12 months ended December 31, 2020.

A tumultuous calendar year 2020 ended on a high. Third quarter U.S. GDP data released in October reported the largest quarterly growth rate ever recorded while U.S. unemployment continued to decline. This represented a significant rebound in GDP growth from the second quarter; however, the year was expected to end in negative territory. Despite a hotly contested presidential election and a spike in COVID-19 cases leading to a re-imposition of economic restrictions, U.S. capital markets continued to climb following massive stimulus that was enacted in March to combat the widening pandemic. Capital markets received a boost late in the year as vaccine trial results provided reason for optimism. Outside the U.S., economic growth was relatively benign as GDP growth rates in the European Union (EU), Japan and the U.K. rebounded in the third quarter, but not as strongly as in the U.S. Garnering less attention was the official British exit from the EU, also known as Brexit, which occurred at midnight on December 31, 2020, concluding a long saga of negotiation breakdowns and changes in U.K. political leadership.

U.S. equity markets posted strong returns for 2020. The S&P 500® Index was driven by growth equities, which far outpaced value equities due to growth equities’ lower exposure to pandemic-sensitive cyclicals, financials and energy segments of the U.S. economy. Non-U.S. equities posted solid-to-strong returns relative to those in the U.S. International Developed Markets (MSCI EAFE Index) were led by “safe haven” countries such as Japan, Switzerland and France, and Emerging Markets (MSCI EM Index) were led by South Korea, China, Taiwan and India for the year.

The U.S. Federal Reserve Board (Fed) continued near zero overnight rates and substantial direct purchases of an unprecedented breadth of various fixed income securities leading to overall low yields. Higher quality fixed income, which outperformed below investment grade corporate credit, benefited from a “flight to quality” early in the year followed by the aforementioned aggressive Fed monetary policy actions in response to the growing pandemic in March. Cutting overnight rates to zero and reinstituting Global Financial Crisis era policies, such as direct bond issue purchases, precipitated a significant downward shift across the yield curve. Conversely, below investment grade credit illustrated the strong, risk-on sentiment in response to Fed actions and fiscal stimulus efforts beginning in March throughout the remainder of 2020. However, both investment grade and below investment grade corporate credit spreads tightened following the November presidential election, providing a performance tailwind for corporate bonds.

Markets such as these reaffirm our belief in the importance of the steady hands of financial professionals, trust in one’s investment strategy and understanding of the risks of trying to time the market. We believe that environments that are more volatile create opportunity for active managers to add value, especially those that are Distinctively Active.

We greatly value your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely, | | |

| | | |

| | |

| E. Blake Moore Jr. | | |

| President | | |

| Touchstone Strategic Trust | | |

| | | |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Anti-Benchmark® US Core Equity Fund

Sub-Advised by TOBAM S.A.S

Investment Philosophy

The Touchstone Anti-Benchmark® US Core Equity Fund seeks capital appreciation. TOBAM’s methodology seeks to enhance the diversification of portfolio holdings to reduce market bias and potentially improve risk-adjusted returns. TOBAM’s process selects individual stocks and their weights in an effort to reduce the correlations between individual holdings. This enables the creation of portfolios that seek to mitigate the inherent concentration risks associated with capitalization-weighted benchmarks. The lower correlations have the potential to provide a differentiated source of value than other methods of diversification. This quantitative approach creates fully invested, long-only portfolios that do not use leverage, and are designed to help guard against structural biases.

Fund Performance

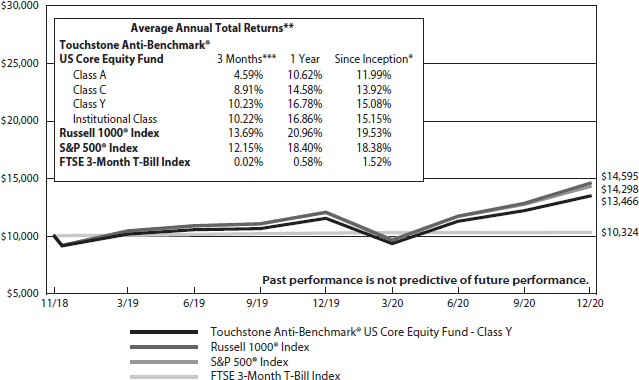

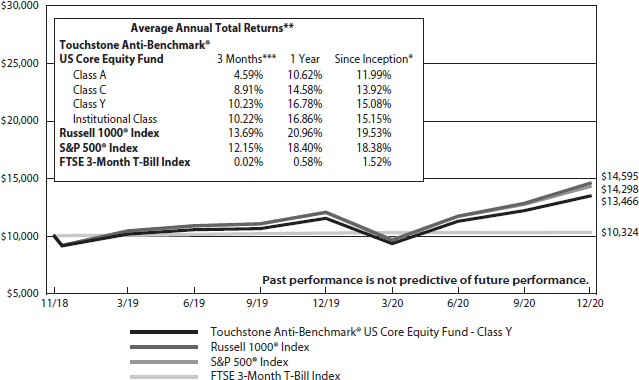

The Touchstone Anti-Benchmark® US Core Equity Fund (Class Y Share) underperformed its benchmark, the Russell 1000® Index, for the 3-month period ended December 31, 2020. The Fund’s total return was 10.23 percent while the total return of the benchmark was 13.69 percent.

Market Environment

The fourth quarter of 2020 ended a tumultuous year on a high note. Third quarter U.S. gross domestic product (GDP) data released in October indicated the largest growth rate (33.4 percent annualized) ever recorded while U.S. unemployment continued its decline from 7.9 percent in September to 6.7 percent in November. Despite a hotly contested presidential election and a spike in COVID-19 cases leading to a re-implementation of economic lockdowns, U.S. capital markets continued to climb during the quarter as vaccine trial results gave investors reason for optimism. Outside the U.S., economic growth was relatively benign as GDP growth rates in the European Union (EU), Japan and the U.K. rebounded in the third quarter, but not as strongly as in the U.S. Garnering less investor attention was the official British exit from the EU, also known as Brexit, which occurred at midnight on December 31, ending a long saga of negotiation breakdowns and changes in U.K. political leadership.

U.S. equity markets generated strong returns during the fourth quarter and for calendar year 2020. Strong leadership among small cap equities, regardless of style, outperforming their mid cap and large cap brethren was reported. From a style standpoint, value equities outperformed growth and core, across the market capitalization spectrum. A notable shift occurred in equity style where value equities outperformed growth following multiple quarters of strong growth equity performance compared to value equities. However, growth equities, and their lower exposure to pandemic-sensitive cyclicals, financials, and energy segments of the U.S. economy, was a net beneficiary in 2020 as they far outpaced value equities over the full calendar year.

Portfolio Review

Despite the COVID-19 virus spread not being contained in the U.S., investors regained confidence. This translated into a steep rebound for the remainder of the year in broad market returns, culminating in strong broad market performance in the fourth quarter. Cyclical and growth-oriented sectors led the market during the quarter. Energy, Financials, Materials, Industrials and Communication Services sectors all posted strong returns. This contributed to even higher levels of market concentration in the U.S. equity market at year-end. The Financials and Energy sectors specifically rebounded over the last two months of the year after vaccine excitement started to be priced into the market and a slow cool down of the oil price war helped to stabilize oil prices. While Energy, Financials and Industrials sectors led the market, the Fund underperformed these sectors due to stock selection in the Energy sector and an underweight and stock selection within Financials and Industrials. An overweight position and poor stock selection within the Consumer Staples sector was the largest detractor to fund performance during the quarter. This was offset slightly by strong stock selection within Communication Services sector.

Outlook and Conclusion

TOBAM’s Anti-Benchmark® strategy does not forecast but simply seeks to maximize diversification. Thus, it does not include fundamental analysis of individual stocks, countries, sectors, economic environments or factors. No discretionary tactical or strategic asset allocation decisions are made with respect to specific regions, sectors or industries. TOBAM’s investment process consists of maximizing diversification from a bottom-up perspective. Securities are bought or sold solely in relation to their potential relative

Management's Discussion of Fund Performance (Unaudited) (Continued)

diversification benefits within the portfolio. A security will be completely sold when it no longer provides the most marginal diversification among all available stocks in the universe, and others purchased when they begin to provide more marginal diversification. TOBAM’s patented Anti-Benchmark® approach is designed to avoid explicit and implicit biases in terms of sector, style, market cap and other statistical measures. For this reason, we apply as few constraints as possible and do not rely on any given view or forecast, in order to avoid unwanted systematic exposures. The Fund’s portfolio reflects even risk contributions from all independent effective risk factors in the investment universe, which may include sector and country factors.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Anti-Benchmark® US Core Equity Fund - Class Y*, the Russell 1000® Index, the S&P 500® Index and the FTSE 3-Month T-Bill Index

| * | The chart above represents performance of Class Y shares only, which will vary from the performance of Class A shares, Class C shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was October 2, 2020, October 2, 2020, November 19, 2018, and November 19, 2018, respectively. Class A shares' and Class C shares' performance was calculated using the historical performance of Class Y shares for the periods prior to October 2, 2020. The returns have been restated for sales loads and fees applicable to Class A and Class C. The returns of the indexes listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index.

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

FTSE 3-Month T-Bill Index tracks the performance of U.S. Treasury Bills with a remaining maturity of three months.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Dynamic Diversified Income Fund

Sub-Advised by Wilshire Associates Incorporated

Investment Philosophy

The Touchstone Dynamic Diversified Income Fund is a “fund-of-funds,” which seeks to achieve its investment goal of providing investors with current income by investing primarily in a diversified portfolio of fixed-income and equity-income oriented underlying funds (although a portion of its assets may be invested in cash, cash equivalents, or in money market funds). The majority of the underlying funds in which the Fund invests will be affiliated funds; however, the Fund has the ability to invest in unaffiliated underlying funds, including exchange-traded funds (ETFs) and exchange-traded notes (ETNs), to the extent that the desired asset class exposure is not available through Touchstone Funds.

Fund Performance

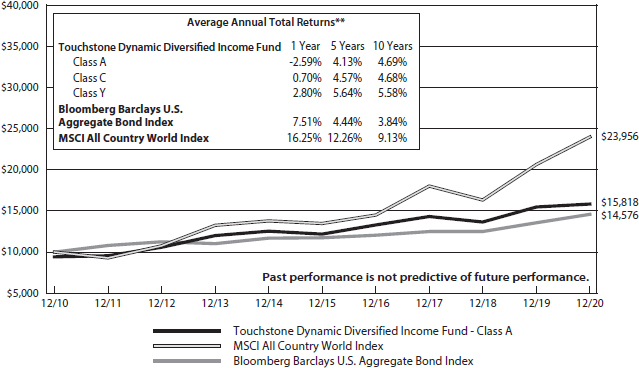

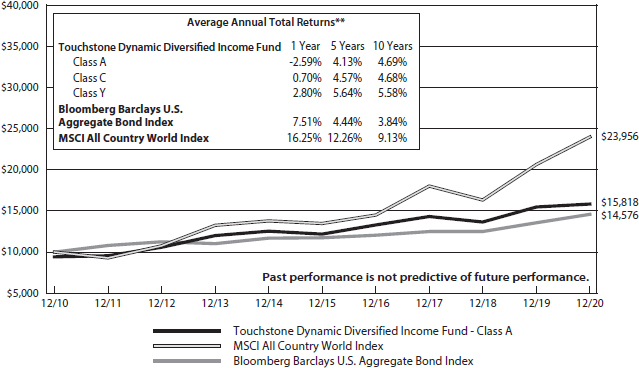

The Touchstone Dynamic Diversified Income Fund (Class A shares) underperformed both its first benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, and its second benchmark, the MSCI All Country World Index (ACWI), for the 12-month period ended December 31, 2020. The Fund’s total return was 2.52 percent (calculated excluding the maximum sales charge) while the total return of the Bloomberg Barclays U.S. Aggregate Bond Index was 7.51 percent and the total return of the MSCI ACWI Index was 16.25 percent.

Market Environment

From both societal and investment perspectives, 2020 will be defined by COVID-19 and the impact of severe economic restrictions and unprecedented government responses. As the virus spread to the U.S., the equity market sold-off quickly from February 19 to March 23. In turn, the U.S. Federal Reserve Board (Fed) slashed its overnight rate from 1.5 percent to zero and the U.S. federal government passed a $2.2 trillion stimulus bill. In April alone, the economy shed more than 20 million jobs while Q1 real gross domestic product (GDP) declined by five percent. The 2020 bear market was historically brief, however, bouncing off the lows on March 23 and rallied to a new high by August 12. Despite the social and economic challenges, the U.S. stock market, represented by the Russell 3000® Index increased during 2020. Seven of the eleven major sectors gained during the year, with Consumer Discretionary, Information Technology and Communication Services ending the year with the highest returns. Sectors that declined were Energy and interest rate-sensitive Real Estate, Financials and Utilities. Large capitalization stocks outperformed small caps and growth stocks continued to outperform value equities during the twelve-month period.

Equity markets outside of the U.S. produced positive gains, though less than U.S. markets. The U.K. was on a path to recovery, with Q3 GDP up a record 16 percent, but concerns about a new variant of the COVID-19 virus led to renewed restrictions and the withdrawal of social accommodations granted for holiday gatherings. A second wave of infections hindered other European countries, as well, and the European Central Bank (ECB) responded by expanding its money-printing program by hundreds of billions of euros. U.S. investors in developed markets equities benefited from a weakening U.S. dollar, but still underperformed Emerging Markets equities.

The U.S. Treasury yield curve finished down meaningfully for the year. The 10-year Treasury yield ended the fourth quarter at 0.93 percent. The U.S. Federal Reserve Board (Fed) decreased rates two times in 2020. In December, the Fed reiterated its pledge to support the economic recovery, including an increase in its bond-buying activities. The domestic fixed income market displayed positive returns for the year across all major indexes led by long-term U.S. Treasuries and corporate bonds.

U.S. and global real estate securities declined for the year. Commodities also declined for the one-year period as the price of crude oil fell. Master Limited Partnerships (MLPs) returns were positive during the fourth quarter but produced negative results for 2020. Finally, gold prices were up for 2020.

Portfolio Review

The Fund’s permanent bias towards equity income and MLPs was a significant detractor. These decisions within the equity bucket detracted from relative performance as the defensive nature of the Fund’s equity income allocations failed to keep pace with the MSCI ACWI Index and exposure to MLPs served as a material headwind. However, the Fund’s selection of underlying funds contributed positively to the Fund’s relative returns.

Management's Discussion of Fund Performance (Unaudited) (Continued)

The Fund’s fixed income holdings posted strong positive results, but lagged the Bloomberg Barclays U.S. Aggregate Bond Index. An overweight to below investment grade credit and foreign fixed income weighed on relative returns. The Touchstone Flexible Income Fund and Touchstone Impact Bond Fund were the strongest performers within the fixed income bucket and within the Fund overall.

During 2020, the Fund made a handful of notable allocation changes. In early February, the decision was made to materially reduce credit risk due to concerns that U.S. credit spreads had narrowed too much and could widen materially at the first sign of any negative market or economic stress. We reduced the allocation to each Touchstone Credit Opportunities Fund and Touchstone High Yield Fund and reallocated to the relatively higher quality Touchstone Impact Bond Fund and Touchstone Flexible Income Fund. We did not foresee the impending negative impact of the spread of COVID-19, but we were concerned that risks were growing in the credit market and wanted to position the Fund more conservatively. These changes ultimately benefited the Fund.

In late April, the decision was made to redeploy some credit risk due to liquidity returning to the credit markets and attractive credit spread levels. The Fund trimmed its exposure to the Touchstone Impact Bond Fund and reallocated the capital to the Touchstone High Yield Fund in order to increase credit risk and take advantage of wide domestic credit spreads. In addition, the allocation to the VanEck Vectors JP Morgan Emerging Markets Local Currency Bond ETF was reduced and reallocated evenly to the Touchstone High Yield Fund and Touchstone Credit Opportunities Fund in order to favor U.S. credit over Emerging Markets Debt.

During the second quarter of 2020, within equities, the Fund eliminated its allocation to the WisdomTree Emerging Markets High Dividend ETF and reallocated evenly to the Touchstone Value Fund and iShares MSCI EAFE Value ETF in order to remove the overweight to emerging markets equity and reduce the overall allocation to foreign equities. The decision to reduce emerging markets exposure was related to the risk that COVID-19 presented to Emerging Markets, particularly with respect to the more limited ability of many emerging economies to deal with the humanitarian crisis of this pandemic. The other notable change was the decision made to trim from JPMorgan Alerian MLP ETN and reallocate to Vanguard High Dividend Yield ETF due to falling conviction in the MLP structure, tempered with an expectation that oil prices have troughed and would likely rise in the coming months.

In late July, the decision was made to further reduce long-term MLP exposure by trimming from the JPMorgan Alerian MLP ETN and reallocating evenly to the Vanguard High Dividend Yield ETF and iShares International Select Dividend ETF due to falling conviction in the MLP structure, tempered by the potential for MLPs to rally in coming months and still provide attractive levels of yield.

In late October, the decision was made to eliminate the remaining allocation to the JPMorgan Alerian MLP ETN and reallocate evenly to the Touchstone Value Fund, Vanguard High Dividend Yield ETF and iShares International Select Dividend ETF due to falling conviction in the MLP structure. This change modestly increased exposure to foreign equity income and reduced expected income in the short-term. It is expected that the MLPs will continue to cut their income payouts, but in the short-term the MLP yield will likely remain much higher than other portfolio investments. The high income potential, however, does not offset the falling conviction in the MLP structure.

Outlook

Although much remains uncertain at the start of 2021, we remain optimistic about risk assets and believe the Fund is well-positioned for the year ahead. Although we believe that volatility may be elevated over the year. Global economic fundamentals have potential for improvement in 2021, particularly if central banks remain accommodative and progress in fighting the pandemic continues on pace.

The Fund continues to be positioned in a mildly conservative manner relative to its long-term strategic target. Overall, we continue to believe that the Fund is best served by remaining invested in risk assets, but we will continue to seek to mitigate risk where appropriate. In fixed income, the Fund remains overweight credit, relative to government. In domestic equities, it remains overweight value, relative to growth equities.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Dynamic

Diversified Income Fund - Class A*, the Bloomberg Barclays U.S. Aggregate Bond Index and the MSCI All Country

World Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares and Class Y shares based on the differences in sales loads and fees paid by shareholders in the different classes. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

MSCI All Country World Index is an unmanaged index that measures the equity market performance of developed and emerging markets.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Dynamic Global Allocation Fund

Sub-Advised by Wilshire Associates Incorporated

Investment Philosophy

The Touchstone Dynamic Global Allocation Fund is a “fund-of-funds,” which seeks to achieve its investment goal of providing investors with capital appreciation by primarily investing in a diversified portfolio of underlying equity and fixed-income funds. These underlying funds, in turn, invest in a variety of U.S. and foreign equity and fixed-income securities (although a portion of its assets may be invested in cash, cash equivalents, or in money market funds). The majority of the underlying funds in which the Fund invests will be affiliated funds; however, the Fund has the ability to invest in unaffiliated underlying funds, including exchange-traded funds (ETFs) and exchange-traded notes (ETNs), to the extent that the desired asset class exposure is not available through Touchstone Funds.

Fund Performance

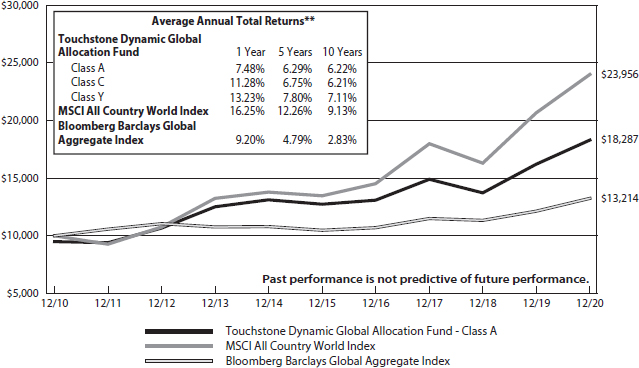

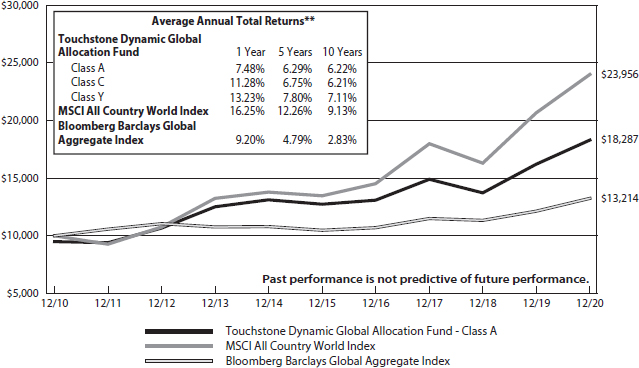

The Touchstone Dynamic Global Allocation Fund (Class A shares) underperformed its primary benchmark the MSCI All Country World Index (ACWI), but outperformed its secondary benchmark the Bloomberg Barclays Global Aggregate Index for the 12-month period ended December 31, 2020. The Fund’s total return was 13.09 percent (calculated excluding the maximum sales charge) while the total return of the MSCI ACWI was 16.25 percent and the total return of the Bloomberg Barclays Global Aggregate Index was 9.20 percent.

Market Environment

From both societal and investment perspectives, 2020 will be defined by COVID-19 and the impact of severe economic restrictions and unprecedented government responses. As the virus spread to the U.S., the equity market sold-off quickly from February 19 to March 23. In turn, the U.S. Federal Reserve Board (Fed) slashed its overnight rate from 1.5 percent to zero and the U.S. federal government passed a $2.2 trillion stimulus bill. In April alone, the economy shed more than 20 million jobs while Q1 real gross domestic product (GDP) declined by five percent. The 2020 bear market was historically brief, however, bouncing off the lows on March 23 and rallied to a new high by August 12. Despite the social and economic challenges, the U.S. stock market, represented by the Russell 3000® Index increased during 2020. Seven of the eleven major sectors gained during the year, with Consumer Discretionary, Information Technology and Communication Services ending the year with the highest returns. Sectors that declined were Energy and interest rate-sensitive Real Estate, Financials and Utilities. Large capitalization stocks outperformed small caps and growth stocks continued to outperform value equities during the twelve-month period.

Equity markets outside of the U.S. produced positive gains, though less than U.S. markets. The U.K. was on a path to recovery, with Q3 GDP up a record 16 percent, but concerns about a new variant of the COVID-19 virus led to renewed restrictions and the withdrawal of social accommodations granted for holiday gatherings. A second wave of infections hindered other European countries, as well, and the European Central Bank responded by expanding its money-printing program by hundreds of billions of euros. U.S. investors in developed markets equities benefitted from a weakening U.S. dollar, but still underperformed Emerging Markets equities.

The U.S. Treasury yield curve finished down meaningfully for the year. The 10-year Treasury yield ended the fourth quarter at 0.93 percent. The Fed decreased rates two times in 2020. In December, the Fed reiterated its pledge to support the economic recovery, including an increase in its bond-buying activities. The domestic fixed income market displayed positive returns for the year across all major indexes led by long-term U.S. Treasuries and corporate bonds.

U.S. and global real estate securities declined for the year. Commodities also declined for the one-year period as the price of crude oil fell. Master Limited Partnerships (MLPs) returns were positive during the fourth quarter but produced negative results for 2020. Finally, gold prices were up for 2020.

Portfolio Review

A generally strong global equity market environment helped lead the Fund to strong absolute returns for the year. Returns were largely dominated by domestic large cap equities. Individual manager performance within the equity bucket was a positive contributor to returns during the year, while allocation decisions within the equity bucket detracted, with the overweight to U.S. value equities and structural overweight to small cap equities weighing on returns.

Management's Discussion of Fund Performance (Unaudited) (Continued)

On a stand-alone basis, the Fund’s “fixed income bucket” underperformed the Bloomberg Barclays Global Aggregate Index as allocations that materially underweight unhedged foreign developed fixed income detracted from performance. An overweight to domestic credit that was implemented early in the 2nd quarter of 2020 benefited Fund returns throughout the remainder of 2020.

For the year, the Fund’s allocation to Touchstone Sands Capital Institutional Growth Fund which was merged into the Touchstone Sands Capital Select Growth Fund – INST Class in mid-December 2020 and Touchstone Sands Capital Emerging Markets Growth Fund were the two strongest performing allocations on the stand-alone basis. In terms of contribution to returns, the most notable contributions were from the Touchstone Sands Capital Select Growth Fund and Touchstone Growth Opportunities Fund. Allocations to the Touchstone International Small Cap (partial year holding) and iShares MSCI EAFE Value ETF were modest detractors to Fund returns during the year.

During 2020, the Fund made several notable allocation changes. In early February, the decision was made to modestly reduce credit risk due to concerns that U.S. credit spreads had narrowed too much and could widen materially at the first sign of any negative market or economic stress. The allocation to the Touchstone Credit Opportunities was reallocated to the relatively higher quality Touchstone Impact Bond Fund. While we did not foresee the impending negative impact of the spread of COVID-19, we were concerned that risks were growing in the credit market and wanted the relatively conservative positioning of the Fund’s credit exposure to be even more conservative. In addition, we modestly trimmed exposure to the Touchstone Small Cap Value Fund and Touchstone Mid Cap Fund and rotated into the Touchstone Value Fund.

In late April, the decision was made to redeploy some credit risk due to liquidity returning to the credit markets and attractive credit spread levels. The Fund initiated an allocation to the Touchstone High Yield, sourced from the Touchstone Impact Bond and from Touchstone Ultra Short Duration Fixed Income Fund and increased the Fund’s credit risk to take advantage of wide domestic credit spreads. In addition, the allocation to the VanEck Vectors JP Morgan Emerging Markets Local Currency Bond ETF was eliminated and reallocated to the iShares International Treasury Bond ETF and Vanguard Total International Bond ETF in order to eliminate the Fund’s overweight to emerging markets debt, relative to foreign developed fixed income.

In the second quarter of 2020, the Fund’s positions in Touchstone Anti-Benchmark® International Core Equity Fund, iShares MSCI EAFE Value ETF and Touchstone International Growth Opportunities Fund were reduced and those proceeds were reallocated to Touchstone Value Fund and Touchstone Growth Opportunities Fund in order to remove the Fund’s overweight to foreign equities due to our reduced conviction in foreign equities relative to U.S. equities. The U.S. had provided substantially more fiscal and monetary stimulus relative to foreign developed nations and demonstrated effective collaboration across political party lines. The structural headwinds that Europe faced with a unified monetary policy applied to differentiated economies had been more challenging in recovering from the downturn. The Fund also trimmed from Touchstone Small Cap Value Fund and reallocated to Touchstone Sands Capital Institutional Growth Fund (which was merged into the Touchstone Sands Capital Select Growth Fund – INST Class) in order to remove the Fund’s overweight to domestic small cap equities. Given the rapid deterioration of the economy and uncertainty regarding when the economic recovery would begin, the decision was made to reduce exposure to more economically sensitive small capitalization equities.

Outlook

Although much remains uncertain at the start of 2021, we remain optimistic about risk assets and believe the Fund is well-positioned for the year ahead, although we believe that volatility may be elevated over the year. Global economic fundamentals have potential for improvement in 2021, particularly if central banks remain accommodative and progress in fighting the pandemic continues on pace.

The Fund is positioned roughly in line with its long-term strategic target. Overall, we continue to believe that the Fund is best served by remaining invested in risk assets, but we will continue to seek to mitigate risk where appropriate. Within fixed income, the Fund remains overweight credit, relative to government. In domestic equities, the Fund remains overweight value relative to growth equities, and within foreign equities, we favor emerging markets over developed markets.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Dynamic

Global Allocation Fund - Class A*, the MSCI All Country World Index and the Bloomberg Barclays Global Aggregate Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares and Class Y shares based on the differences in sales loads and fees paid by shareholders in the different classes. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

MSCI All Country World Index is an unmanaged index that measures the equity market performance of developed and emerging markets.

Bloomberg Barclays Global Aggregate Index is an unmanaged index that measures global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

Tabular Presentation of Portfolios of Investments (Unaudited)

December 31, 2020

The tables below provide each Fund’s sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Anti-Benchmark® US Core Equity Fund | | | | |

| Sector Allocation* | | | (% of Net Assets) | |

| Consumer Staples | | | 22.1 | % |

| Consumer Discretionary | | | 17.3 | |

| Health Care | | | 17.0 | |

| Information Technology | | | 9.8 | |

| Communication Services | | | 7.9 | |

| Real Estate | | | 6.1 | |

| Financials | | | 5.9 | |

| Materials | | | 5.7 | |

| Utilities | | | 3.3 | |

| Energy | | | 2.4 | |

| Industrials | | | 2.1 | |

| Short-Term Investment Fund | | | 0.6 | |

| Other Assets/Liabilities (Net) | | | (0.2 | ) |

| Total | | | 100.0 | % |

| Touchstone Dynamic Diversified Income Fund | | | | |

| Sector Allocation | | | (% of Net Assets) | |

| Affiliated Mutual Funds | | | | |

| Fixed Income Funds | | | 60.0 | % |

| Equity Funds | | | 10.6 | |

| Exchange-Traded Funds | | | 28.4 | |

| Short-Term Investment Funds | | | 5.0 | |

| Other Assets/Liabilities (Net) | | | (4.0 | ) |

| Total | | | 100.0 | % |

| Touchstone Dynamic Global Allocation Fund | | | | |

| Sector Allocation | | | (% of Net Assets) | |

| Affiliated Mutual Funds | | | | |

| Equity Funds | | | 52.8 | % |

| Fixed Income Funds | | | 23.7 | |

| Exchange-Traded Funds | | | 22.7 | |

| Short-Term Investment Funds | | | 5.9 | |

| Other Assets/Liabilities (Net) | | | (5.1 | ) |

| Total | | | 100.0 | % |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Portfolio of Investments

Touchstone Anti-Benchmark® US Core Equity Fund – December 31, 2020

| | | Shares | | | Market

Value | |

| Common Stocks — 99.6% | | | | | | | | |

| Consumer Staples — 22.1% | | | | | | | | |

| Boston Beer Co., Inc.(The) - Class A* | | | 428 | | | $ | 425,556 | |

| Campbell Soup Co. | | | 28,386 | | | | 1,372,463 | |

| Church & Dwight Co., Inc. | | | 1,638 | | | | 142,883 | |

| Clorox Co. (The) | | | 6,461 | | | | 1,304,605 | |

| Conagra Brands, Inc. | | | 32,091 | | | | 1,163,620 | |

| General Mills, Inc. | | | 16,624 | | | | 977,491 | |

| Hormel Foods Corp. | | | 3,937 | | | | 183,504 | |

| JM Smucker Co. (The) | | | 12,057 | | | | 1,393,789 | |

| Kellogg Co. | | | 9,218 | | | | 573,636 | |

| Keurig Dr Pepper, Inc. | | | 19,655 | | | | 628,960 | |

| Kraft Heinz Co. (The) | | | 14,101 | | | | 488,741 | |

| Kroger Co. (The) | | | 45,640 | | | | 1,449,526 | |

| Lamb Weston Holdings, Inc. | | | 7,984 | | | | 628,660 | |

| | | | | | | | 10,733,434 | |

| | | | | | | | | |

| Consumer Discretionary — 17.3% | | | | | | | | |

| Aramark | | | 7,747 | | | | 298,105 | |

| Bright Horizons Family Solutions, Inc.* | | | 586 | | | | 101,372 | |

| Carnival Corp. | | | 10,077 | | | | 218,268 | |

| Chegg, Inc.* | | | 13,176 | | | | 1,190,188 | |

| Chipotle Mexican Grill, Inc.* | | | 371 | | | | 514,469 | |

| Dollar Tree, Inc.* | | | 8,182 | | | | 883,983 | |

| Domino's Pizza, Inc. | | | 3,731 | | | | 1,430,689 | |

| Expedia Group, Inc. | | | 608 | | | | 80,499 | |

| Las Vegas Sands Corp. | | | 4,240 | | | | 252,704 | |

| Marriott International, Inc. - Class A | | | 5,740 | | | | 757,221 | |

| Peloton Interactive, Inc. - Class A* | | | 4,222 | | | | 640,562 | |

| Royal Caribbean Cruises Ltd. | | | 3,233 | | | | 241,473 | |

| Target Corp. | | | 1,041 | | | | 183,768 | |

| Ulta Beauty, Inc.* | | | 231 | | | | 66,334 | |

| Vail Resorts, Inc. | | | 584 | | | | 162,913 | |

| Wynn Resorts Ltd. | | | 964 | | | | 108,768 | |

| Yum China Holdings, Inc. (China) | | | 22,532 | | | | 1,286,352 | |

| | | | | | | | 8,417,668 | |

| | | | | | | | | |

| Health Care — 17.0% | | | | | | | | |

| 10X Genomics, Inc. - Class A* | | | 815 | | | | 115,404 | |

| ABIOMED, Inc.* | | | 4,665 | | | | 1,512,393 | |

| Alnylam Pharmaceuticals, Inc.* | | | 1,945 | | | | 252,792 | |

| Biogen, Inc.* | | | 3,655 | | | | 894,963 | |

| DENTSPLY SIRONA, Inc. | | | 3,267 | | | | 171,060 | |

| DexCom, Inc.* | | | 677 | | | | 250,300 | |

| Exact Sciences Corp.* | | | 998 | | | | 132,225 | |

| Gilead Sciences, Inc. | | | 16,515 | | | | 962,164 | |

| Guardant Health, Inc.* | | | 453 | | | | 58,383 | |

| Insulet Corp.* | | | 1,509 | | | | 385,746 | |

| Jazz Pharmaceuticals PLC* | | | 4,523 | | | | 746,521 | |

| Moderna, Inc.* | | | 4,354 | | | | 454,862 | |

| Neurocrine Biosciences, Inc.* | | | 2,466 | | | | 236,366 | |

| Regeneron Pharmaceuticals, Inc.* | | | 349 | | | | 168,605 | |

| Sarepta Therapeutics, Inc.* | | | 2,278 | | | | 388,376 | |

| Seagen, Inc.* | | | 642 | | | | 112,440 | |

| Teladoc Health, Inc.* | | | 4,757 | | | | 951,210 | |

| Viatris, Inc.* | | | 23,773 | | | | 445,506 | |

| | | | | | | | 8,239,316 | |

| | | | | | | | | |

| Information Technology — 9.8% | | | | | | | | |

| Atlassian Corp. PLC - Class A* | | | 311 | | | | 72,734 | |

| Citrix Systems, Inc. | | | 2,014 | | | | 262,021 | |

| Cloudflare, Inc. - Class A* | | | 2,039 | | | | 154,944 | |

| DocuSign, Inc.* | | | 4,665 | | | | 1,037,029 | |

| Fastly, Inc. - Class A* | | | 5,194 | | | | 453,800 | |

| NortonLifeLock, Inc. | | | 46,723 | | | | 970,904 | |

| RingCentral, Inc. - Class A* | | | 436 | | | | 165,231 | |

| Zoom Video Communications, Inc. - Class A* | | | 1,919 | | | | 647,317 | |

| Zscaler, Inc.* | | | 5,072 | | | | 1,012,929 | |

| | | | | | | | 4,776,909 | |

| | | | | | | | | |

| Communication Services — 7.9% | | | | | | | | |

| Discovery, Inc. - Class C* | | | 12,984 | | | | 340,051 | |

| Fox Corp. - Class A | | | 3,991 | | | | 116,218 | |

| Match Group, Inc.* | | | 2,565 | | | | 387,802 | |

| Roku, Inc.* | | | 2,438 | | | | 809,465 | |

| Snap, Inc. - Class A* | | | 16,223 | | | | 812,286 | |

| Spotify Technology SA* | | | 3,460 | | | | 1,088,724 | |

| Verizon Communications, Inc. | | | 5,192 | | | | 305,030 | |

| | | | | | | | 3,859,576 | |

| | | | | | | | | |

| Real Estate — 6.1% | | | | | | | | |

| Extra Space Storage, Inc. REIT | | | 10,929 | | | | 1,266,234 | |

| Federal Realty Investment Trust REIT | | | 2,079 | | | | 176,964 | |

| Host Hotels & Resorts, Inc. REIT | | | 15,067 | | | | 220,430 | |

| Public Storage REIT | | | 3,078 | | | | 710,803 | |

| Regency Centers Corp. REIT | | | 2,063 | | | | 94,052 | |

| Simon Property Group, Inc. REIT | | | 5,511 | | | | 469,978 | |

| | | | | | | | 2,938,461 | |

| | | | | | | | | |

| Financials — 5.9% | | | | | | | | |

| AGNC Investment Corp. | | | 35,362 | | | | 551,647 | |

| Annaly Capital Management, Inc. | | | 98,057 | | | | 828,582 | |

| Cboe Global Markets, Inc. | | | 5,094 | | | | 474,353 | |

| Credicorp Ltd. (Peru) | | | 1,184 | | | | 194,200 | |

| Huntington Bancshares, Inc. | | | 10,404 | | | | 131,403 | |

| M&T Bank Corp. | | | 1,805 | | | | 229,777 | |

| MarketAxess Holdings, Inc. | | | 809 | | | | 461,583 | |

| | | | | | | | 2,871,545 | |

| | | | | | | | | |

| Materials — 5.7% | | | | | | | | |

| Newmont Corp. | | | 22,738 | | | | 1,361,779 | |

| Royal Gold, Inc. | | | 11,476 | | | | 1,220,587 | |

| Vulcan Materials Co. | | | 1,388 | | | | 205,854 | |

| | | | | | | | 2,788,220 | |

| | | | | | | | | |

| Utilities — 3.3% | | | | | | | | |

| Consolidated Edison, Inc. | | | 12,436 | | | | 898,750 | |

| Eversource Energy | | | 620 | | | | 53,636 | |

| PG&E Corp.* | | | 54,001 | | | | 672,852 | |

| | | | | | | | 1,625,238 | |

| | | | | | | | | |

| Energy — 2.4% | | | | | | | | |

| Cabot Oil & Gas Corp. | | | 28,986 | | | | 471,892 | |

| Diamondback Energy, Inc. | | | 13,833 | | | | 669,517 | |

| | | | | | | | 1,141,409 | |

| | | | | | | | | |

| Industrials — 2.1% | | | | | | | | |

| CH Robinson Worldwide, Inc. | | | 3,298 | | | | 309,583 | |

| IAA, Inc.* | | | 5,458 | | | | 354,661 | |

| Lyft, Inc. - Class A* | | | 2,960 | | | | 145,425 | |

| Plug Power, Inc.* | | | 2,239 | | | | 75,924 | |

| Watsco, Inc. | | | 681 | | | | 154,281 | |

| | | | | | | | 1,039,874 | |

| Total Common Stocks | | | | | | $ | 48,431,650 | |

Touchstone Anti-Benchmark® US Core Equity Fund (Continued)

| | | Shares | | | Market

Value | |

| Short-Term Investment Fund — 0.6% | | | | | | | | |

| Dreyfus Government Cash Management, Institutional Shares, 0.03%∞Ω | | | 286,491 | | | $ | 286,491 | |

| | | | | | | | | |

| Total Investment Securities —100.2% | | | | | | | | |

| (Cost $41,847,112) | | | | | | $ | 48,718,141 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.2%) | | | | | | | (94,045 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 48,624,096 | |

| * | Non-income producing security. |

| ∞ | Open-End Fund. |

| Ω | Represents the 7-day SEC yield as of December 31, 2020. |

Portfolio Abbreviations:

PLC - Public Limited Company

REIT - Real Estate Investment Trust

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation inputs at Reporting Date: | |

| Description | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

| Common Stocks | | $ | 48,431,650 | | | $ | — | | | $ | — | | | $ | 48,431,650 | |

| Short-Term Investment Fund | | | 286,491 | | | | — | | | | — | | | | 286,491 | |

| Total | | $ | 48,718,141 | | | $ | — | | | $ | — | | | $ | 48,718,141 | |

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone Dynamic Diversified Income Fund – December 31, 2020

| | | Shares | | | Market

Value | |

| Affiliated Mutual Funds~^∞ — 70.6% | | | | | | | | |

| Fixed Income Funds — 60.0% | | | | | | | | |

| Touchstone Credit Opportunities Fund | | | 856,662 | | | $ | 8,592,320 | |

| Touchstone Flexible Income Fund | | | 602,231 | | | | 6,775,101 | |

| Touchstone High Yield Fund | | | 671,847 | | | | 5,703,977 | |

| Touchstone Impact Bond Fund | | | 1,196,070 | | | | 12,929,520 | |

| | | | | | | | 34,000,918 | |

| | | | | | | | | |

| Equity Funds — 10.6% | | | | | | | | |

| Touchstone Value Fund | | | 622,593 | | | | 6,045,381 | |

| Total Affiliated Mutual Funds | | | | | | $ | 40,046,299 | |

| | | | | | | | | |

| Exchange-Traded Funds~ — 28.4% | | | | | | | | |

| iShares International Select Dividend ETF | | | 98,286 | | | | 2,896,488 | |

| iShares MSCI EAFE Value ETF† | | | 48,169 | | | | 2,273,577 | |

| VanEck Vectors J.P. Morgan EM Local Currency Bond ETF | | | 35,295 | | | | 1,174,265 | |

| Vanguard Emerging Markets Government Bond ETF† | | | 14,025 | | | | 1,154,258 | |

| Vanguard Global ex-U.S. Real Estate ETF | | | 31,936 | | | | 1,734,444 | |

| Vanguard High Dividend Yield ETF | | | 56,148 | | | | 5,138,103 | |

| Vanguard REIT ETF | | | 20,033 | | | | 1,701,403 | |

| Total Exchange-Traded Funds | | | | | | $ | 16,072,538 | |

| | | | | | | | | |

| Short-Term Investment Funds — 5.0% | | | | | | | | |

| Dreyfus Government Cash Management, Institutional Shares, 0.03%∞Ω | | | 535,591 | | | | 535,591 | |

| Invesco Government & Agency Portfolio, Institutional Class, 0.03%**∞Ω | | | 2,288,940 | | | | 2,288,940 | |

| Total Short-Term Investment Funds | | | | | | $ | 2,824,531 | |

| | | | | | | | | |

| Total Investment Securities —104.0% | | | | | | | | |

| (Cost $58,046,933) | | | | | | $ | 58,943,368 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (4.0%) | | | | | | | (2,254,689 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 56,688,679 | |

| ** | Represents collateral for securities loaned. |

| ^ | All affiliated funds are invested in the Institutional Class, unless otherwise indicated. |

| ~ | The financial statements of the underlying funds can be found on the SEC website. |

| † | All or a portion of the security is on loan. The total market value of the securities on loan as of December 31, 2020 was $2,217,190. |

| ∞ | Open-End Fund. |

| Ω | Represents the 7-day SEC yield as of December 31, 2020. |

Portfolio Abbreviations:

ETF - Exchange-Traded Fund REIT - Real Estate Investment Trust

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation inputs at Reporting Date: | |

| Description | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

| Affiliated Mutual Funds | | $ | 40,046,299 | | | $ | — | | | $ | — | | | $ | 40,046,299 | |

| Exchange-Traded Funds | | | 16,072,538 | | | | — | | | | — | | | | 16,072,538 | |

| Short-Term Investment Funds | | | 2,824,531 | | | | — | | | | — | | | | 2,824,531 | |

| Total | | $ | 58,943,368 | | | $ | — | | | $ | — | | | $ | 58,943,368 | |

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone Dynamic Global Allocation Fund – December 31, 2020

| | | Shares | | | Market

Value | |

| Affiliated Mutual Funds~^∞ — 76.5% | | | | | | | | |

| Equity Funds — 52.8% | | | | | | | | |

| Touchstone Anti-Benchmark® International Core Equity Fund | | | 767,712 | | | $ | 9,082,029 | |

| Touchstone Growth Opportunities Fund | | | 169,926 | | | | 7,255,842 | |

| Touchstone International Growth Fund | | | 295,537 | | | | 4,495,125 | |

| Touchstone Mid Cap Fund | | | 40,263 | | | | 1,787,292 | |

| Touchstone Sands Capital Emerging Markets Growth Fund | | | 128,026 | | | | 2,806,340 | |

| Touchstone Sands Capital Select Growth Fund | | | 278,904 | | | | 5,681,280 | |

| Touchstone Small Cap Value Fund | | | 66,453 | | | | 1,781,595 | |

| Touchstone Value Fund | | | 1,468,720 | | | | 14,261,275 | |

| | | | | | | | 47,150,778 | |

| | | | | | | | | |

| Fixed Income Funds — 23.7% | | | | | | | | |

| Touchstone Credit Opportunities Fund | | | 271,017 | | | | 2,718,304 | |

| Touchstone High Yield Fund | | | 316,158 | | | | 2,684,179 | |

| Touchstone Impact Bond Fund | | | 1,139,506 | | | | 12,318,055 | |

| Touchstone Ultra Short Duration Fixed Income Fund | | | 379,350 | | | | 3,501,404 | |

| | | | | | | | 21,221,942 | |

| Total Affiliated Mutual Funds | | | | | | $ | 68,372,720 | |

| | | | | | | | | |

| Exchange-Traded Funds~ — 22.7% | | | | | | | | |

| iShares Core MSCI Emerging Markets ETF | | | 58,238 | | | | 3,613,086 | |

| iShares International Treasury Bond ETF† | | | 96,093 | | | | 5,338,927 | |

| iShares MSCI EAFE Value ETF† | | | 73,561 | | | | 3,472,079 | |

| Vanguard Emerging Markets Government Bond ETF | | | 32,161 | | | | 2,646,850 | |

| Vanguard Total International Bond ETF | | | 89,130 | | | | 5,218,562 | |

| Total Exchange-Traded Funds | | | | | | $ | 20,289,504 | |

| | | | | | | | | |

| Short-Term Investment Funds — 5.9% | | | | | | | | |

| Dreyfus Government Cash Management, Institutional Shares, 0.03%∞Ω | | | 804,278 | | | | 804,278 | |

| Invesco Government & Agency Portfolio, Institutional Class, 0.03%**∞Ω | | | 4,432,320 | | | | 4,432,320 | |

| Total Short-Term Investment Funds | | | | | | $ | 5,236,598 | |

| | | | | | | | | |

| Total Investment Securities —105.1% | | | | | | | | |

| (Cost $84,813,272) | | | | | | $ | 93,898,822 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (5.1%) | | | | | | | (4,524,778 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 89,374,044 | |

| ** | Represents collateral for securities loaned. |

| ^ | All affiliated funds are invested in the Institutional Class, unless otherwise indicated. |

| ~ | The financial statements of the underlying funds can be found on the SEC website. |

| † | All or a portion of the security is on loan. The total market value of the securities on loan as of December 31, 2020 was $4,297,340. |

| ∞ | Open-End Fund. |

| Ω | Represents the 7-day SEC yield as of December 31, 2020. |

Portfolio Abbreviations:

ETF - Exchange-Traded Fund

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation inputs at Reporting Date: | |

| Description | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

| Affiliated Mutual Funds | | $ | 68,372,720 | | | $ | — | | | $ | — | | | $ | 68,372,720 | |

| Exchange-Traded Funds | | | 20,289,504 | | | | | | | | | | | | 20,289,504 | |

| Short-Term Investment Funds | | | 5,236,598 | | | | — | | | | — | | | | 5,236,598 | |

| Total | | $ | 93,898,822 | | | $ | — | | | $ | — | | | $ | 93,898,822 | |

See accompanying Notes to Financial Statements.

Statements of Assets and Liabilities

December 31, 2020

| | | Touchstone Anti-Benchmark® US Core Equity Fund | | | Touchstone Dynamic Diversified Income Fund | | | Touchstone Dynamic Global Allocation Fund | |

| Assets | | | | | | | | | | | | |

| Affiliated securities, at cost | | $ | — | | | $ | 39,705,323 | | | $ | 60,742,977 | |

| Non-affiliated securities, at cost | | | 41,847,112 | | | | 18,341,610 | | | | 24,070,295 | |

| Affiliated securities, at market value | | $ | — | | | $ | 40,046,299 | | | $ | 68,372,720 | |

| Non-affiliated securities, at market value(A) | | | 48,718,141 | | | | 18,897,069 | | | | 25,526,102 | |

| Dividends and interest receivable | | | 42,606 | | | | 4,560 | | | | — | |

| Receivable for capital shares sold | | | 161 | | | | 45,931 | | | | 2,872 | |

| Receivable for investments sold | | | — | | | | 104,554 | | | | 72,224 | |

| Receivable for securities lending income | | | 1,279 | | | | 1,852 | | | | 2,201 | |

| Other assets | | | 1,810 | | | | 15,227 | | | | 14,774 | |

| Total Assets | | | 48,763,997 | | | | 59,115,492 | | | | 93,990,893 | |

| Liabilities | | | | | | | | | | | | |

| Bank overdrafts | | | 160 | | | | — | | | | — | |

| Payable for return of collateral for securities on loan | | | — | | | | 2,288,940 | | | | 4,432,320 | |

| Payable for capital shares redeemed | | | 46,295 | | | | 5,830 | | | | 38,807 | |

| Payable to Investment Advisor | | | 14,949 | | | | 41,810 | | | | 10,541 | |

| Payable to other affiliates | | | 11,090 | | | | 9,122 | | | | 13,109 | |

| Payable to Trustees | | | 9,746 | | | | 9,746 | | | | 9,746 | |

| Payable for professional services | | | 24,555 | | | | 23,562 | | | | 24,135 | |

| Payable for transfer agent services | | | 8,600 | | | | 35,018 | | | | 74,423 | |

| Payable for reports to shareholders | | | 9,054 | | | | 6,936 | | | | 8,021 | |

| Other accrued expenses and liabilities | | | 15,452 | | | | 5,849 | | | | 5,747 | |

| Total Liabilities | | | 139,901 | | | | 2,426,813 | | | | 4,616,849 | |

| Net Assets | | $ | 48,624,096 | | | $ | 56,688,679 | | | $ | 89,374,044 | |

| Net assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 42,440,473 | | | $ | 60,030,321 | | | $ | 80,382,180 | |

| Distributable earnings (deficit) | | | 6,183,623 | | | | (3,341,642 | ) | | | 8,991,864 | |

| Net Assets | | $ | 48,624,096 | | | $ | 56,688,679 | | | $ | 89,374,044 | |

| (A) Includes market value of securities on loan of: | | $ | — | | | $ | 2,217,190 | | | $ | 4,297,340 | |

See accompanying Notes to Financial Statements.

Statements of Assets and Liabilities (Continued)

| | | Touchstone Anti-Benchmark® US Core Equity Fund | | | Touchstone Dynamic Diversified Income Fund | | | Touchstone Dynamic Global Allocation Fund | |

| Pricing of Class A Shares | | | | | | | | | | | | |

| Net assets applicable to Class A shares | | $ | 6,183,558 | | | $ | 46,997,478 | | | $ | 81,623,777 | |

Shares of beneficial interest outstanding

(unlimited number of shares authorized, no par value) | | | 440,367 | | | | 3,613,403 | | | | 6,166,549 | |

| Net asset value per share* | | $ | 14.04 | | | $ | 13.01 | | | $ | 13.24 | |

| Maximum sale charge - Class A Shares | | | 5.00 | % | | | 5.00 | % | | | 5.00 | % |

Maximum offering price per share

(100%/(100%-maximum sales charge) of net asset value

adjusted to the nearest cent) - Class A shares | | $ | 14.78 | | | $ | 13.69 | | | $ | 13.94 | |

| Pricing of Class C Shares | | | | | | | | | | | | |

| Net assets applicable to Class C shares | | $ | 1,968,508 | | | $ | 2,335,427 | | | $ | 3,014,782 | |

Shares of beneficial interest outstanding

(unlimited number of shares authorized, no par value) | | | 155,793 | | | | 178,246 | | | | 232,781 | |

| Net asset value and offering price per share** | | $ | 12.64 | | | $ | 13.10 | | | $ | 12.95 | |

| Pricing of Class Y Shares | | | | | | | | | | | | |

| Net assets applicable to Class Y shares | | $ | 17,411,330 | | | $ | 7,355,774 | | | $ | 4,735,485 | |

Shares of beneficial interest outstanding

(unlimited number of shares authorized, no par value) | | | 1,226,323 | | | | 564,296 | | | | 354,118 | |

| Net asset value, offering price and redemption price per share | | $ | 14.20 | | | $ | 13.04 | | | $ | 13.37 | |

| Pricing of Institutional Class Shares | | | | | | | | | | | | |

| Net assets applicable to Institutional Class Shares | | $ | 23,060,700 | | | $ | — | | | $ | — | |

Shares of beneficial interest outstanding

(unlimited number of shares authorized, no par value) | | | 1,583,218 | | | | — | | | | — | |

| Net asset value, offering price and redemption price per share | | $ | 14.57 | | | $ | — | | | $ | — | |

* There is no sales load on subscriptions of $1 million or more. Redemptions that were part of a $1 million or more subscription may be subject to a contingent deferred sales load if redeemed within a one-year period from the date of purchase.

** Redemption price per share varies by length of time shares are held due to the terms of the contingent deferred sales charge.

See accompanying Notes to Financial Statements.

Statements of Operations

For the Year and Three Months Ended December 31, 2020

| | | | Touchstone Anti-Benchmark® US Core Equity Fund | | | | Touchstone Dynamic Diversified Income Fund | | | | Touchstone Dynamic Global Allocation Fund | |

| | | | For the Three Months Ended December 31, 2020(A) | | | | For the Year Ended September 30, 2020(B) | | | | For the Year Ended December 31, 2020 | | | | For the Year Ended December 31, 2020 | |

| Investment Income | | | | | | | | | | | | | | | | |

| Dividends from affiliated securities | | $ | — | | | $ | — | | | $ | 1,682,699 | | | $ | 1,021,193 | |

| Dividends from non-affiliated securities(C) | | | 171,647 | | | | 688,713 | | | | 493,350 | | | | 313,092 | |

| Income from securities loaned | | | 2,360 | | | | 411 | | | | 42,730 | | | | 93,537 | |

| Total Investment Income | | | 174,007 | | | | 689,124 | | | | 2,218,779 | | | | 1,427,822 | |

| Expenses | | | | | | | | | | | | | | | | |

| Investment advisory fees | | | 41,671 | | | | 98,351 | | | | 116,036 | | | | 203,607 | |

| Administration fees | | | 16,894 | | | | 40,746 | | | | 83,694 | | | | 117,422 | |

| Compliance fees and expenses | | | 717 | | | | 2,497 | | | | 2,631 | | | | 2,631 | |

| Custody fees | | | 2,754 | | | | 3,635 | | | | 4,262 | | | | 3,834 | |

| Professional fees | | | 20,352 | | | | 25,793 | | | | 22,926 | | | | 23,441 | |

| Transfer Agent fees, Class A | | | 2,338 | | | | — | | | | 33,432 | | | | 72,910 | |

| Transfer Agent fees, Class C | | | 670 | | | | — | | | | 2,080 | | | | 4,820 | |

| Transfer Agent fees, Class Y | | | 4,502 | | | | 273 | | | | 10,762 | | | | 3,917 | |

| Transfer Agent fees, Institutional Class | | | 41 | | | | 116 | | | | — | | | | — | |

| Pricing Expense | | | 171 | | | | 822 | | | | — | | | | — | |

| Transfer Agent out-of-pocket expenses | | | — | | | | — | | | | 23,977 | | | | 41,996 | |

| Registration Fees, Class A | | | — | | | | — | | | | 15,052 | | | | 14,188 | |

| Registration Fees, Class C | | | — | | | | — | | | | 11,794 | | | | 11,305 | |

| Registration Fees, Class Y | | | 4,702 | | | | 4,887 | | | | 14,174 | | | | 6,385 | |

| Registration Fees, Institutional Class | | | 1,617 | | | | 3,064 | | | | — | | | | — | |

| Reports to Shareholders, Class A | | | 1,945 | | | | — | | | | 8,197 | | | | 11,313 | |

| Reports to Shareholders, Class C | | | 1,656 | | | | — | | | | 3,855 | | | | 3,954 | |

| Reports to Shareholders, Class Y | | | 2,301 | | | | 5,117 | | | | 4,379 | | | | 3,768 | |

| Reports to Shareholders, Institutional Class | | | 1,609 | | | | 5,106 | | | | — | | | | — | |

| Distribution expenses, Class A | | | 3,647 | | | | — | | | | 114,002 | | | | 183,586 | |

| Distribution and shareholder servicing expenses, Class C | | | 4,932 | | | | — | | | | 32,495 | | | | 40,281 | |

| Trustee fees | | | 4,921 | | | | 21,452 | | | | 20,818 | | | | 20,818 | |

| Other expenses | | | 3,884 | | | | 14,267 | | | | 16,238 | | | | 16,764 | |

| Total Expenses | | | 121,324 | | | | 226,126 | | | | 540,804 | | | | 786,940 | |

| Fees waived and/or reimbursed by the Advisor and/or Affiliates(D) | | | (54,070 | ) | | | (102,369 | ) | | | (255,063 | ) | | | (367,610 | ) |

| Net Expenses | | | 67,254 | | | | 123,757 | | | | 285,741 | | | | 419,330 | |

| Net Investment Income | | | 106,753 | | | | 565,367 | | | | 1,933,038 | | | | 1,008,492 | |

| Realized and Unrealized Gains (Losses) on Investments | | | | | | | | | | | | | | | | |

| Net realized gains (losses) on investments in non-affiliated securities | | | 5,181,759 | | | | 1,127,307 | | | | (3,235,513 | ) | | | (364,571 | ) |

| Net realized gains (losses) on investments in affiliated securities | | | — | | | | — | | | | 119,343 | | | | (37,697 | ) |

| Capital gain distributions received from affiliated funds | | | — | | | | — | | | | 158,455 | | | | 1,433,030 | |

| Net change in unrealized appreciation (depreciation) on investments in non-affiliated securities(E) | | | (644,549 | ) | | | 2,259,173 | | | | 668,601 | | | | 942,144 | |

| Net change in unrealized appreciation (depreciation) on investments in affiliated securities | | | — | | | | — | | | | 789,172 | | | | 7,173,789 | |

| Net Realized and Unrealized Gains (Losses) on Investments | | $ | 4,537,210 | | | $ | 3,386,480 | | | $ | (1,499,942 | ) | | $ | 9,146,695 | |

| Change in Net Assets Resulting from Operations | | $ | 4,643,963 | | | $ | 3,951,847 | | | $ | 433,096 | | | $ | 10,155,187 | |

| (A) The fund changed its fiscal year end from September 30 to December 31. | | | | | | | | | | | | | | | | |

| (B) See Note 9 in Notes to Financial Statements. | | | | | | | | | | | | | | | | |

| (C) Net of foreign tax withholding of: | | $ | 86 | | | $ | — | | | $ | — | | | $ | — | |

| (D) See Note 4 in Notes to Financial Statements. | | | | | | | | | | | | | | | | |

| (E) Change in unrealized appreciation (depreciation) does not include net appreciation of $3,297,182, for the Touchstone Anti-Benchmark® US Core Equity Fund in connection with the Fund's reorganization. See Note 9 in the Notes to Financial Statements. | |

| | | | | | | | | | | | | | | | | |

| See accompanying Notes to Financial Statements. | | | | | | | | | | | | | | | | |

This page intentionally left blank.

Statements of Changes in Net Assets

| | | Touchstone

Anti-Benchmark® US Core

Equity Fund | | Touchstone

Dynamic Diversified

Income

Fund | |

| | | For the Three

Months Ended

December 31,

2020(A) | | For the

Year

Ended

September 30,

2020 | | For the

Period Ended

September 30,

2019(B) | | For the

Year

Ended

December 31,

2020 | | For the

Year

Ended

December 31,

2019 | |

| From Operations | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 106,753 | | $ | 565,367 | | $ | 484,961 | | $ | 1,933,038 | | $ | 2,578,177 | |

| Net realized gains (losses) on investments and capital gain distributions received | | | 5,181,759 | | | 1,127,307 | | | (798,930 | ) | | (2,957,715 | ) | | (886,803 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | (644,549 | ) | | 2,259,173 | | | 1,959,223 | | | 1,457,773 | | | 5,380,330 | |

| Change in Net Assets from Operations | | | 4,643,963 | | | 3,951,847 | | | 1,645,254 | | | 433,096 | | | 7,071,704 | |

| Distributions to Shareholders: | | | | | | | | | | | | | | | | |

| Distributed earnings, Class A | | | (65,466) | | | — | | | — | | | (1,669,389 | ) | | (1,983,829 | ) |

| Distributed earnings, Class C | | | — | | | — | | | — | | | (84,415 | ) | | (144,648 | ) |

| Distributed earnings, Class Y | | | (224,585 | ) | | (4,992 | ) | | (14 | ) | | (328,104 | ) | | (549,570 | ) |

| Distributed earnings, Institutional Class | | | (3,121 | ) | | (1,274,135 | ) | | (145,890 | ) | | — | | | — | |

| Return of capital, Class Y | | | — | | | (98 | ) | | — | | | — | | | — | |

| Return of capital, Institutional Class | | | — | | | (28,806 | ) | | — | | | — | | | — | |

| Total Distributions | | | (293,172 | ) | | (1,308,031 | ) | | (145,904 | ) | | (2,081,908 | ) | | (2,678,047 | ) |

| Change in Net Assets from Share Transactions(C) | | | 13,528,761 | | | 1,401,151 | | | 25,200,227 | | | (10,940,475 | ) | | 20,549,282 | |

| | | | | | | | | | | | | | | | | |

| Total Increase (Decrease) in Net Assets | | | 17,879,552 | | | 4,044,967 | | | 26,699,577 | | | (12,589,287 | ) | | 24,942,939 | |

| | | | | | | | | | | | | | | | | |

| Net Assets | | | | | | | | | | | | | | | | |

| Beginning of period | | | 30,744,544 | | | 26,699,577 | | | — | | | 69,277,966 | | | 44,335,027 | |

| End of period | | $ | 48,624,096 | | $ | 30,744,544 | | $ | 26,699,577 | | $ | 56,688,679 | | $ | 69,277,966 | |

| (A) | The Fund changed its year end from September 30 to December 31. |

| (B) | Represents the period from commencement of operations (November 19, 2018) through September 30, 2019. |

| (C) | For details on share transactions by class, see Statements of Changes in Net Assets - Capital Stock Activity on page 24 to 25. |

See accompanying Notes to Financial Statements.

Statements of Changes in Net Assets (Continued)

| | Touchstone

Dynamic Global

Allocation

Fund | |

| | For the

Year

Ended

December 31,

2020 | | For the

Year

Ended

December 31,

2019 | |

| | | | | | | |

| | $ | 1,008,492 | | $ | 1,493,295 | |

| | | | | | | |

| | | 1,030,762 | | | 487,110 | |

| | | 8,115,933 | | | 12,374,268 | |

| | | 10,155,187 | | | 14,354,673 | |

| | | | | | | |

| | | (2,320,966 | ) | | (2,967,349 | ) |

| | | (69,303 | ) | | (150,046 | ) |

| | | (139,672 | ) | | (169,554 | ) |

| | | — | | | — | |

| | | — | | | — | |

| | | — | | | — | |

| | | (2,529,941 | ) | | (3,286,949 | ) |

| | | (4,562,939 | ) | | (10,049,192 | ) |

| | | | | | | |

| | | 3,062,307 | | | 1,018,532 | |

| | | | | | | |

| | | | | | | |

| | | 86,311,737 | | | 85,293,205 | |

| | $ | 89,374,044 | | $ | 86,311,737 | |

Statements of Changes in Net Assets - Capital Stock Activity

| | | Touchstone Anti-Benchmark® US Core Equity Fund | |

| | | For the Three

Months Ended

December 31,

2020(A) | | For the Year

Ended

September 30, 2020 | | For the Period

Ended

September 30,

2019(B) | |

| | | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars | |

| Class A | | | | | | | | | | | | | | | | |

| Proceeds from Shares sold | | 7,778 | | $ | 109,618 | | — | | $ | — | | — | | $ | — | |

| Proceeds from Shares issued in connection with merger(C) | | 452,453 | | | 5,867,004 | | — | | | — | | — | | | — | |

| Reinvestment of distributions | | 3,187 | | | 44,558 | | — | | | — | | — | | | — | |

| Cost of Shares redeemed | | (23,051 | ) | | (310,179 | ) | — | | | — | | — | | | — | |

| Change from Class A Share Transactions | | 440,367 | | | 5,711,001 | | | | | | | | | | | |

| Class C | | | | | | | | | | | | — | | | | |

| Proceeds from Shares sold | | 216 | | | 2,621 | | — | | | — | | — | | | — | |

| Proceeds from Shares issued in connection with merger(C) | | 171,625 | | | 1,985,084 | | — | | | — | | — | | | — | |

| Reinvestment of distributions | | — | | | — | | — | | | — | | — | | | — | |

| Cost of Shares redeemed | | (16,048 | ) | | (196,557 | ) | — | | | — | | — | | | — | |

| Change from Class C Share Transactions | | 155,793 | | | 1,791,148 | | — | | | — | | — | | | — | |

| Class Y | | | | | | | | | | | | | | | | |

| Proceeds from Shares sold | | 5,349 | | | 72,146 | | 8,687 | | | 96,718 | | 4,904 | | | 51,823 | |

| Proceeds from Shares issued in connection with merger(C) | | 1,297,709 | | | 17,043,427 | | — | | | — | | — | | | — | |

| Net shares reduction due to reverse stock split(C) | | (1,492 | ) | | — | | — | | | — | | — | | | — | |

| Reinvestment of distributions | | 13,739 | | | 194,269 | | 440 | | | 5,090 | | 1 | | | 14 | |

| Cost of Shares redeemed | | (102,684 | ) | | (1,408,744 | ) | (330 | ) | | (3,598 | ) | — | | | — | |

| Change from Class Y Share Transactions | | 1,212,621 | | | 15,901,098 | | 8,797 | | | 98,210 | | 4,905 | | | 51,837 | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Proceeds from Shares sold | | 235 | | | 3,121 | | — | | | — | | 2,500,250 | | | 25,002,500 | |

| Proceeds from Shares issued in connection with merger(C) | | 9,204 | | | 122,393 | | — | | | — | | — | | | — | |

| Net shares reduction due to reverse stock split(C) | | (315,728 | ) | | — | | — | | | — | | — | | | — | |

| Reinvestment of distributions | | — | | | — | | 113,294 | | | 1,302,941 | | 16,156 | | | 145,890 | |

| Cost of Shares redeemed | | (740,193 | ) | | (10,000,000 | ) | — | | | — | | — | | | — | |

| Change from Institutional Class Share Transactions | | (1,046,482 | ) | | (9,874,486 | ) | 113,294 | | | 1,302,941 | | 2,516,406 | | | 25,148,390 | |

| Change from Share Transactions | | 762,299 | | $ | 13,528,761 | | 122,091 | | $ | 1,401,151 | | 2,521,311 | | $ | 25,200,227 | |

| (A) | The Fund changed its year end from September 30 to December 31. |

| (B) | Represents the period from commencement of operations (November 19, 2018) through September 30, 2019. |

| (C) | See Note 9 in Notes to Financial Statements. |

See accompanying Notes to Financial Statements.

Statements of Changes in Net Assets - Capital Stock Activity (Continued)

| | Touchstone Dynamic Diversified Income Fund | | Touchstone Dynamic Global Allocation Fund | |

| | For the Year

Ended

December 31, 2020 | | For the Year

Ended

December 31, 2019 | | For the Year

Ended

December 31, 2020 | | For the Year

Ended

December 31, 2019 | |

| | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars | | Shares | | Dollars | |

| | | | | | | | | | | | | | | | | | | | | |

| | 280,713 | | $ | 3,432,703 | | 960,372 | | $ | 12,295,904 | | 400,834 | | $ | 4,843,914 | | 1,896,533 | | $ | 21,505,108 | |

| | — | | | — | | 1,130,078 | | | 14,590,667 | | — | | | — | | — | | | — | |

| | 117,354 | | | 1,417,927 | | 130,247 | | | 1,694,254 | | 160,456 | | | 2,050,596 | | 218,338 | | | 2,603,372 | |

| | (639,326 | ) | | (7,835,654 | ) | (583,906 | ) | | (7,583,144 | ) | (777,518 | ) | | (9,250,675 | ) | (894,153 | ) | | (10,453,158 | ) |

| | (241,259 | ) | | (2,985,024 | ) | 1,636,791 | | | 20,997,681 | | (216,228 | ) | | (2,356,165 | ) | 1,220,718 | | | 13,655,322 | |

| | | | | | | | | | | | | | | | | | | | | |

| | 13,863 | | | 170,519 | | 18,487 | | | 243,914 | | 64,738 | | | 682,216 | | 13,313 | | | 163,460 | |

| | — | | | — | | 177,151 | | | 2,299,562 | | — | | | — | | — | | | — | |

| | 6,693 | | | 80,683 | | 10,130 | | | 132,764 | | 5,481 | | | 69,832 | | 12,023 | | | 141,221 | |

| | (196,152 | ) | | (2,382,694 | ) | (927,151 | ) | | (11,889,603 | ) | (282,171 | ) | | (3,264,988 | ) | (1,979,350 | ) | | (21,892,864 | ) |

| | (175,596 | ) | | (2,131,492 | ) | (721,383 | ) | | (9,213,363 | ) | (211,952 | ) | | (2,512,940 | ) | (1,954,014 | ) | | (21,588,183 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | 97,334 | | | 1,219,600 | | 469,453 | | | 6,056,807 | | 73,255 | | | 890,900 | | 53,199 | | | 628,091 | |

| | — | | | — | | 1,753,649 | | | 22,695,377 | | — | | | — | | — | | | — | |

| | — | | | — | | — | | | — | | — | | | — | | — | | | — | |

| | 26,539 | | | 317,677 | | 39,929 | | | 521,382 | | 10,235 | | | 131,691 | | 13,259 | | | 159,451 | |

| | (601,097 | ) | | (7,361,236 | ) | (1,581,018 | ) | | (20,508,602 | ) | (62,593 | ) | | (716,425 | ) | (247,933 | ) | | (2,903,873 | ) |

| | (477,224 | ) | | (5,823,959 | ) | 682,013 | | | 8,764,964 | | 20,897 | | | 306,166 | | (181,475 | ) | | (2,116,331 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | — | | | — | | — | | | — | | — | | | — | | — | | | — | |

| | — | | | — | | — | | | — | | — | | | — | | — | | | — | |

| | — | | | — | | — | | | — | | — | | | — | | — | | | — | |

| | — | | | — | | — | | | — | | — | | | — | | — | | | — | |

| | — | | | — | | — | | | — | | — | | | — | | — | | | — | |

| | — | | | — | | — | | | — | | — | | | — | | — | | | — | |

| | (894,079 | ) | $ | (10,940,475 | ) | 1,597,421 | | $ | 20,549,282 | | (407,283 | ) | $ | (4,562,939 | ) | (914,771 | ) | $ | (10,049,192 | ) |

Financial Highlights

Touchstone Anti-Benchmark® US Core Equity Fund—Class A

Selected Data for a Share Outstanding Throughout The Period

| | | Period Ended

December 31,

2020(A) | |

| Net asset value at beginning of period | | $ | 12.97 | |

| Income (loss) from investment operations: | | | | |

| Net investment income | | | 0.02 | |

| Net realized and unrealized gains on investments | | | 1.20 | |

| Total from investment operations | | | 1.22 | |

| Distributions from: | | | | |

| Net investment income | | | (0.15 | ) |

| Net asset value at end of period | | $ | 14.04 | |

| Total return(B) | | | 9.41 | %(C) |

| Ratios and supplemental data: | | | | |

| Net assets at end of period (000's) | | $ | 6,184 | |

| Ratio to average net assets: | | | | |

| Net expenses | | | 0.79 | %(D) |

| Gross expenses | | | 1.31 | %(D) |

| Net investment income | | | 0.70 | %(D) |

| Portfolio turnover rate | | | 54 | %(C)(E) |

Touchstone Anti-Benchmark® US Core Equity Fund—Class C

Selected Data for a Share Outstanding Throughout The Period

| | | Period Ended

December 31,

2020(A) | |

| Net asset value at beginning of period | | $ | 11.57 | |

| Income (loss) from investment operations: | | | | |

| Net investment loss | | | (— | )(F) |

| Net realized and unrealized gains on investments | | | 1.07 | |

| Total from investment operations | | | 1.07 | |

| Net asset value at end of period | | $ | 12.64 | |

| Total return(B) | | | 9.25 | %(C) |

| Ratios and supplemental data: | | | | |