UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust – June Funds

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: June 30

Date of reporting period: June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

June 30, 2020

Annual Report

| Touchstone Strategic Trust |

| Touchstone Balanced Fund |

| Touchstone International Equity Fund |

| Touchstone International Growth Opportunities Fund |

| Touchstone International Small Cap Fund |

| Touchstone Large Cap Focused Fund |

| Touchstone Large Cap Fund |

| Touchstone Large Company Growth Fund |

| Touchstone Ohio Tax-Free Bond Fund |

| Touchstone Small Company Fund |

| Touchstone Value Fund |

IMPORTANT NOTE: Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Touchstone Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the shareholder reports from Touchstone Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, annual and semi-annual shareholder reports will be available on the Touchstone Funds’ website (TouchstoneInvestments.com/Resources), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future annual and semi-annual shareholder reports in paper, free of charge. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive paper copies of shareholder reports through the mail or otherwise change your delivery method, contact your financial intermediary or, if you hold your shares directly through Touchstone Funds, visit TouchstoneInvestments.com/Resources/Edelivery or call Touchstone Funds toll-free at 1.800.543.0407. Your election to receive shareholder reports in paper will apply to all Touchstone Funds that you hold through the financial intermediary, or directly with Touchstone.

This report identifies the Funds’ investments on June 30, 2020. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information and manager commentaries for the Funds for the 12 months ended June 30, 2020.

Trade-related rhetoric between the U.S. and China drove market volatility throughout 2019. Trade discussions between the two nations took a more constructive tone by year end, culminating in an announcement of a “phase one” agreement in early 2020 to reduce some tariff levels. Aside from this conflict, the U.S. economy continued its steady pace, driven by strong employment data and solid consumer spending. Outside the U.S., economic growth in developed markets such as the U.K., European Union and Japan continued its slow pace, all while each of their respective central banks continued to maintain low-to-zero overnight rates. Outside of the U.S. and developed markets, emerging markets continued to show overall weakness, inhibited by the U.S.-China trade slowdown and lower-than-expected Indian economic growth. This already fragile, low-growth environment was upended in the first half of 2020 as COVID-19 swept the globe, bringing with it containment measures resulting in massive shutdowns of economic activity. Following an economic lockdown during most of March and April 2020, U.S. state governors began to slowly reopen their economies across the country. Although employment numbers and retail sales figures through the latter portion of the 12-month period rebounded strongly from their March 2020 lows, investor sentiment remains cautious, given concerns that the capital markets may be pricing in an overly optimistic economic rebound scenario.

Following strong gains in the second half of 2019, the S&P 500® Index experienced a significant whipsaw during the first half of 2020. A severe pullback during the first quarter was followed by a strong rebound late in the quarter which carried into the second quarter. However, U.S. equity performance varied widely primarily by style with growth equities far outperforming value equities during the 12-month period. U.S. growth stocks were predominately driven by Communication Services, Consumer Discretionary, Information Technology and Health Care stocks as companies comprising these sectors were least impacted or even benefited from the COVID-19 lockdowns. Conversely, U.S. value equities faced significant headwinds as the sudden drop in economic activity in the first half of 2020 adversely impacted cyclical sectors, including value equity-tilted ones such as Financials, Energy, Materials and Industrials. Compared to their mid cap and small cap peers, large cap stocks held up better largely due to their ability to weather challenging economic conditions. Technology behemoths such as Amazon, Microsoft, Facebook and Netflix drove the strong aforementioned growth equity returns as their businesses benefited from the COVID-19-induced lockdown impacting everyday life and working conditions.

Non-U.S. developed equity markets generally trailed the U.S. over the past 12 months. Japan performed relatively well with slow growth in COVID-19 cases and aggressive stimulus measures while Europe was hit harder by the pandemic. Similar to the U.S., Internet and Health Care stocks were among the top contributors in developed markets while Energy and Financials lagged. In emerging markets, equities exhibited the same pattern as the U.S. and developed markets with Internet stocks and Asia Pacific countries who experienced COVID-19 lockdowns earlier in the year, such as China, Taiwan and South Korea, leading the way. These Asia-Pacific countries experienced an abating COVID-19 virus by the second quarter and were able to reopen their economies earlier than were the U.S. and Europe.

Within fixed income, Treasury prices benefited and yields compressed to cycle lows from U.S. Federal Reserve Board (Fed) actions and a flight to safety during the rapid sell-off of risk assets in the first half of 2020. Meanwhile, credit-sensitive sectors saw the strong results of 2019 nearly or completely erased as concerns over the potential for rising defaults and technical selling pressures mounted. During the first quarter of 2020, spreads across investment grade credit, high yield credit, bank loans and collateralized loan obligations (CLOs) all reached levels unseen since the 2008 Credit Crisis. The Fed stepped in during the volatility to provide liquidity by slashing overnight rates to zero and providing support for the fixed income markets through new asset purchase programs. Those actions helped ease the volatility and negative sentiment that appeared in March, as credit spreads narrowed over the last three months of the period.

Times like these reaffirm our belief in the importance of the steady hands of financial professionals, the trust you must have in your investment strategy and understanding the risks of trying to time the market. Additionally, we believe that environments that are more volatile create more opportunity for active managers to add value, especially those that are Distinctively Active with high active share. We greatly value your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Balanced Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Fund seeks to achieve its investment goal of providing investors with capital appreciation and current income by generally investing in a diversified portfolio comprising 60 percent equity securities and 40 percent fixed-income securities.

With respect to equities, the Fund invests primarily in issuers having a market capitalization, at the time of purchase, above $5 billion. Equity securities include common stock and preferred stock. With respect to fixed-income, the Fund will invest primarily in bonds, including mortgage-related securities, asset-backed securities, government securities (both U.S. government securities and foreign sovereign debt), and corporate debt securities.

Fund Performance

The Touchstone Balanced Fund (Class A Shares) outperformed both of its benchmarks, the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond Index, for the 12-month period ended June 30, 2020. The Fund’s total return was 10.09 percent (calculated excluding the maximum sales charge), while the total return of the S&P 500® Index was 7.51 percent and the total return of the Bloomberg Barclays U.S. Aggregate Bond Index was 8.74 percent.

Market Environment

Equity and credit markets ended 2019 producing some of the largest calendar year returns in recent memory. In a banner year for risk assets, U.S. Treasuries still managed to produce solid gains as well. This was due to falling interest rates as uncertainty around trade negotiations with China rattled the U.S. Treasury market causing the curve to invert for most of the year before twisting back to a steeper shape as tensions eventually cooled and both sides appeared to be headed toward resolving the dispute. Tariffs, concern over global growth, low inflation consistently below the U.S. Federal Reserve Board’s (Fed) target, and modest but resilient U.S. growth at roughly 1.5-2.0 percent, kept a cap on rates, providing an accommodative environment regarding financial conditions.

Given this backdrop, our outlook coming into 2020 was optimistic – fundamentals were strong, the consumer was in good shape, business earnings were healthy, and trade negotiations between China and the U.S. were turning a corner. Then risk assets hit an unexpected wall in March as fears surrounding the COVID-19 pandemic turned into a state of panic, bringing the risk-on bull market to a screeching halt. Economies around the world implemented quarantine measures and issued shelter in place orders to curb the spread of the virus. This brought activity to a grinding halt. Only recently have indicators started to provide a clear picture of how glib this slowdown is going to reverberate through the global economy. While it is uncertain what the time line is going to look like to get things back to normal and people back to work, markets have offered up some pain in terms of historic losses. Equities declined significantly and credit was hit hard with lack of liquidity in the markets intensifying the selloff. Spreads on High Yield and Investment Grade Credit hit levels that markets have not experienced since 2008.

Both the Fed and Congress have moved swiftly to help support the economy and credit markets, hopefully bridging the gap between now and when the economy and society can return to a sense of normalcy. The Fed has provided multiple credit facilities to different areas of the market to provide financing and liquidity in order to keep markets functioning and capital accessible. Congress has done its part fiscally, with the passage of the CARES Act, aimed at establishing support for both the consumer and businesses with extensions of unemployment insurance and the creation of the Paycheck Protection Program (PPP) that targets small business through SBA loans in order to continue to make payroll for existing employees and continue paying rent and utilities. However, both monetary and fiscal policy continue to be fluid and change rather quickly depending on what areas of the market and society are most in need of support. Both monetary and fiscal policies when fully implemented may total more than $5 trillion.

The support offered through these programs to limit the fallout has been well received by investors as the stock market reversed course on March 23. An added boost was received as businesses began to reopen in late April and the unemployment rate fell unexpectedly in May. The jobs report for May shocked economists and investors, when it showed that 2.5 million jobs had been created and the unemployment rate fell to 13.4 percent from 14.7 percent in April. It was followed by another encouraging report in June, which showed U.S. jobs gains accelerated to 4.8 million while the unemployment rate fell to 11.1 percent. The two-month cumulative increase in nonfarm payrolls recouped one third of the 22.2 million jobs lost in March and April. These data releases and hopes for a quick restart acted as a tailwind for risk assets to end the trailing twelve months.

Portfolio Review

Over the twelve-month period, the equity allocation of the Balanced Fund outperformed the S&P 500 Index, as sector allocation and security selection both contributed. Among the largest contributors to equity allocation was strong security selection within the Consumer Discretionary and Information Technology sectors.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

The fixed income allocation of the Balanced Fund outperformed the Bloomberg Barclays U.S. Aggregate Bond Index in this period. The fixed income allocation was slightly overweight risk for most of the period with an overweight risk to Securitized Assets and a modest overweight to Investment Grade Credit. During the volatile market conditions experienced in March, we took advantage of spread widening in the extreme risk off environment. Credit spreads across sectors reached valuations well beyond levels seen in previous recessions. As a result, allocations were increased to Investment Grade Credit and re-allocated back into High Yield for the first time since October of 2017. In the second quarter of 2020, the Fund was able to recover some losses generated in the first quarter of 2020 as spreads tightened back in as markets responded to the sweeping policy efforts implemented by Congress and the Fed.

Outlook

We believe that the worst is likely behind us in terms of economic impact. The economy is beginning to reopen and activity has rebounded sharply with many indicators increasing at a faster rate than originally anticipated. Consensus expectations are for gross domestic product (GDP) to rebound to pre-virus levels around the end of 2021. In our judgement, a slightly more optimistic scenario is priced in given the recent strong data. Credit spreads and equity markets largely reflect this expectation. While significantly better than the worst levels of March, we do not view markets as overvalued.

As we started to see in June, reopening will bring an increase in virus cases. We believe some resurgence was expected by markets, but the ultimate market impact will be determined by the measures taken to contain the virus. Markets are not expecting broad-based shutdowns such as we saw in March/April. If re-opening the economy is impacted in a material way, similar to the measures taken previously, we believe markets will adjust their expectations for a rebound and valuations would suffer in another risk off move.

Asset valuations generally reflect the ongoing progress in reopening the economy. Risk remains elevated during this process and there will likely be volatility, but we think valuations are generally fair. As such, we are comfortable with the Fund’s portfolio position given valuations, policy support, and resumption of economic growth. We are targeting a slight overweight allocation to equities and overweight risk within fixed income with allocations to High Yield and Emerging Markets Debt.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Balanced Fund - Class A*, the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares and Class Y shares based on the differences in sales loads and fees paid by shareholders in the different classes. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone International Equity Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Fund seeks growth of capital by investing primarily in common stocks of established companies, located in or that conduct their business mainly in one or more foreign countries, which may include emerging markets. The investment philosophy focuses on quality at a reasonable price, where quality is defined based on the following five fundamental factors: business quality, valuation, growth, management and balance sheet strength.

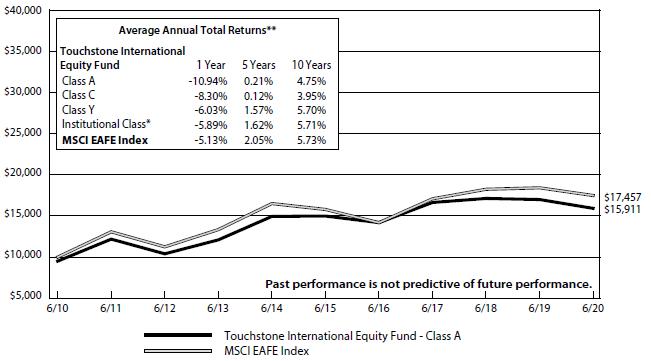

Fund Performance

The Touchstone International Equity Fund (Class A Shares) underperformed its benchmark, the MSCI EAFE Index, for the 12-month period ended June 30, 2020. The Fund’s total return was -6.28 percent (calculated excluding maximum sales charge) while the benchmark’s total return was -5.13 percent.

Market Environment

The 12- month period ending June 30, 2020 was a rollercoaster ride for global equities, culminating in one of the quickest bear markets followed by one of the most dramatic recoveries in living memory. During the last six-months of 2019, many global equities climbed to new highs in response to progress in U.S. trade talks with China and better-than-expected economic news. The first half of 2020 brought much more angst and volatility as COVID-19 spread, sending shockwaves around the globe. In an effort to stem the spread of the virus, numerous countries went into lockdown and instituted social distancing rules, devastating global economies. From mid-February to late-March, the MSCI EAFE benchmark index plummeted, followed by one of the swiftest rebounds on record as investors increasingly turned optimistic on the back of the extraordinary fiscal and monetary support from governments around the world. However, over the entire 12-month period, the MSCI EAFE Index declined.

With this backdrop, Emerging Markets slightly outperformed Developed Markets and growth stocks trounced their value counterparts over the 12-month period. Classic defensive sectors such as Healthcare and Utilities outperformed cyclical sectors, such as Financial and Energy, within the benchmark. The Information Technology sector also performed well, as growth became increasingly harder to find and the work from home trend drove demand for software and hardware. Precious metals performed well for the second consecutive year while the U.S. dollar was more or less flat over the period.

Portfolio Review

The Fund’s underperformance was mainly due to poor stock selection in the Energy, Industrials, and Information Technology sectors. Positive contributing factors included being the Fund’s underweight to the lagging Financials sector, the Fund’s gold mining exposure, and solid stock selection in the Consumer Staples sector. By geography, holdings in Denmark and the Netherlands were the largest detractors to relative performance. A Fund underweight to the outperforming Japanese market was also a headwind. On the other hand, the Fund benefited from solid stock selection in the U.K. and Greater China and a slightly elevated cash position over much of the period. The main detractors from relative performance were the Fund’s oil services investments as well as individual holdings, ISS A/S (Denmark, Industrials sector), and JCDecaux SA (France, Communication Services sector).

We witnessed one of the most abrupt downward moves in oil markets in memory during the period. This was driven by the inability of the Organization of the Petroleum Exporting Countries (OPEC) and Russia to agree on supply constraints at the same time that the global pandemic was causing demand to implode. The sector’s downward revisions to capital expenditures are anticipated to put significant pressure on all oil services providers. Other Fund oil services holdings over the period included the Dutch domiciled Core Laboratories N.V. (Amsterdam, Energy sector), which focuses on helping oil producers maximize hydrocarbon recovery, as well as leading seismic providers, France-based CGG (France, Energy sector), and Norway-based TGS-Nopec Geophysical Company ASA (Norway, Energy sector). Core Laboratories has been particularly impacted by its exposure to the highly volatile U.S. shale market. While we believe oil services will face near term challenges in an environment of lower industry spending, we continue to prefer asset-light businesses that offer niche services with a proven history of performing through cycles.

ISS A/S is a leading global provider of facilities services, with strong market positions in Western Europe and Emerging Markets. The Danish-based company offers a full range of facilities services including cleaning, catering, security and property, and facility management. ISS entered the pandemic already in a relatively delicate position, having faced a handful of operational disappointments and sporting what looks like higher than optimal financial leverage. As a cleaning and integrated facilities service provider, ISS has been negatively impacted by government lockdowns as customer premises are vacated. Nonetheless, we believe the longer-term investment thesis remains unchanged as the company is well-positioned for the structural growth opportunities from increasing outsourcing penetration of cleaning services. The company’s low capital intensity, along with a management focus on enhancing margins and pursuing accretive growth opportunities continue to support our investment case.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

JCDecaux SA is the global leader in the highly fragmented outdoor advertising market, with a total of more than 1.1 million advertising panels in over 75 countries. The outdoor signs of the French advertising group can be seen across big cities and at transport hubs around the world. Given the unprecedented nature of the COVID-19 crisis, the company’s advertising business finds itself on the front lines of the consumer and travel downturn. Outdoor advertisers also suffer from high operational leverage due to their fixed cost nature. Despite the current challenges, we believe JCDecaux has the strongest financial position among its peers and is well positioned to benefit from further consolidation opportunities in its industry. The increasing digitization of the company’s advertising panels has the potential to drive top-line growth over time.

The biggest positive contributors to relative performance over the period came from Barrick Gold Corp. (Canada, Materials sector), ConvaTec Group plc (U.K., Health Care sector), and Tencent Holdings Ltd. (China, Communication Services sector).

Barrick Gold Corp. is one of the world’s largest and most diversified gold producers, operating mines in North America, South America, Africa, and Australia/Pacific. It is a product of the strategic merger with Randgold Resources in 2018 that added world-class mines with costs at or below Barrick’s legacy portfolio. Led by its well-regarded CEO Mark Bristow, the company has among the strongest track records of value creation in the industry. We believe the fundamentals for gold mining stock remain supportive on the back of low/negative yields and as a hedge against potential inflationary pressures emanating from continuing easy monetary and fiscal policies around the world.

ConvaTec Group plc is a U.K.-based medical technology company focused on therapies for the management of chronic conditions, with leading market positions in advanced wound care, ostomy care, continence and critical care, and infusion devices. Originally spun out of Bristol-Myers Squibb, ConvaTec operates in a structurally growing area, but has lagged its key competitor due to a long period of underinvestment. However, the company is starting to demonstrate a turnaround with more consistent results and we see potential if the company’s new CEO can deliver on its transformation plans.

Tencent Holdings Ltd. operates the largest social networking site in China. Its core communication platforms WeChat and QQ have ensured user stickiness due to its strong network effects. Tencent’s expanding portfolio of platforms that provide services such as communication, gaming, cloud service, video content, and payments provides untapped monetization opportunities. The company has been a beneficiary of increased usage of internet services by consumers and businesses during the pandemic. Tencent’s core gaming business is also entering a strong product launch cycle, which we believe should support the acceleration of revenue growth.

The Fund had an active 12 months, adding 19 new names and exiting 20. Many of the additions were made in attempt to raise the overall quality and liquidity of the Fund’s holdings, taking advantage of COVID-related market volatility. A number of the eliminations were due to elevated stock valuations while a few names were sold due to deteriorating company fundamentals. Despite these changes, sector and country allocations did not change materially.

Outlook

Now several months into the greatest health and economic crises of our lifetimes, the future remains as uncertain as we can ever remember it being. Financial markets have largely shrugged off this uncertainty, however, thanks in large part to unprecedented degrees of fiscal and monetary policy response globally. While much of Asia and Europe appear to have the pandemic under control for now, a number of hot spots remain, including in regions of the U.S., and it remains to be seen how infection rates will respond to broader re-opening efforts or the return of cold weather in the northern hemisphere’s winter.

Travel and leisure continue to be disproportionately impacted, as any activities that require people to gather in numbers are likely to be limited or on hold altogether for the foreseeable future. Conventional wisdom clings to the hope for a vaccine in the coming year, though based on the track record in developing vaccines for a variety of other viruses in recent decades, this hope may disappoint. Therefore, we are left with a wide range of possible economic, financial, and even political outcomes, driven by the interaction of developments on the health front, ongoing policy responses and human psychology.

China, having gone through the crisis first, is ahead of the rest of the world in seeing life return to something approaching normal. A number of economic indicators, notably corporate profits, industrial production, car sales, and property transactions, are back to pre-Covid levels. Yet even in China, travel and leisure spending continues to lag. A more “vigorous” response to further outbreaks than is politically possible in the West should allow Chinese activity to continue its recovery in the coming months. China’s concerns are probably more on the trade and geopolitical fronts, with a combination of weak global demand and tensions with the U.S., among other countries, constraining growth.

Overall, Europe is now benefiting from a relatively prompt and comprehensive response to the pandemic. Anecdotal evidence and high frequency data have been encouraging so far, though even more than in the U.S. and China, travel and leisure spending remains almost unbelievably weak, due to the region’s dependence on international travelers. In an effort to not let the crisis go to waste, European leaders are pushing ahead with further integration of the Eurozone, planning to issue $750 billion euros of jointly backed bonds to fund a Europe Recovery Program which will primarily benefit Italy and Greece. Although not a done deal, European Union (EU) leaders are scheduled to meet later this summer to finalize plans and expectations are high.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

The crisis has accentuated the lack of growth in developed international markets. As growth has become even more scarce and with interest rates close to zero or even negative, markets we believe are increasingly willing to put premium valuations on higher quality businesses exhibiting reliable revenue growth as well as on more speculative ideas with attractive if unquantifiable blue sky potential. Though this has been a trend for the last several years, it has created an even more dangerous dynamic for investors currently, since the range of potential economic outcomes is seemingly wider than ever. As investors, we are being forced to choose between buying expensive growth stocks or sticking with more mundane cyclicals that look reasonably valued with relatively optimistic expectations for economic recovery over the near term. In some ways, it is similar to what we witnessed over the second half of 2019, only now we are even less confident about the path of recovery. In addition, there are parts of the market which we might have once considered to be secular growth but are now dependent on a resumption of travel and mass gatherings. Some examples include outdoor advertising, catering and hotel brand franchising. Investing in a post-Covid world feels increasingly like playing three-dimensional chess.

Finally, we find ourselves in recent months pondering if the crisis and subsequent massive policy response around the world will not finally be the trigger that leads to a transition from disinflation, which has been the dominant economic force around the world for the past four decades, to a period characterized by reflation. Realistically, the near-term amount of slack in the global economy and the still healthy demand for risk-free assets, such as U.S. Treasuries, with low or even negative yields, suggest that it is too early to call for the end of deflation. We think it bears watching whether the unprecedented level of money supply growth and government spending can finally start to put upward pressure on prices other than just for financial assets.

Despite the distractions we hold steadfast to our philosophy that the way to build wealth over the long term is to identify attractively valued, well capitalized, high quality businesses, those that operate with high barriers to entry and can thus generate consistently above average returns on invested capital, run by sensible people who prioritize their responsibilities. Entering the second half of the year with a still relatively healthy cash position, we believe the Fund is well positioned to take advantage of the inevitable hiccups in the ongoing global recovery.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

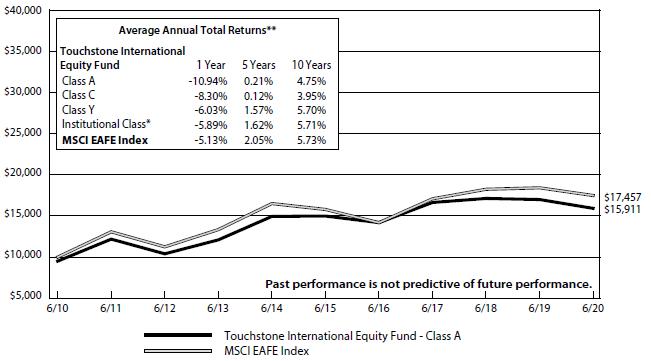

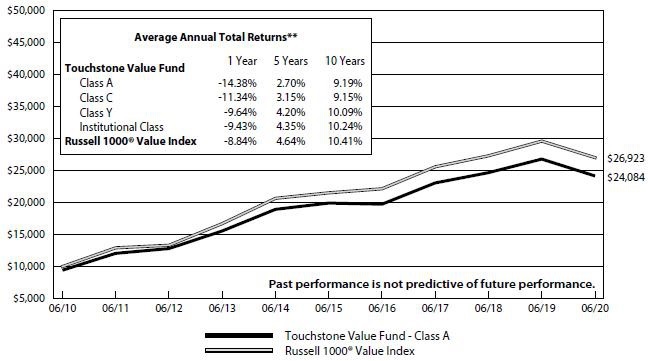

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International Equity Fund - Class A* and the MSCI EAFE Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Institutional Class shares was October 30, 2017. Institutional Class shares performance information was calculated using the historical performance of Class A shares for the period prior to October 30, 2017. The returns have been restated for sales loads and fees applicable to Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance excluding the U.S. and Canada.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone International Growth Opportunities Fund

Sub-Advised by DSM Capital Partners LLC

Investment Philosophy

The Touchstone International Growth Opportunities Fund seeks long-term capital appreciation by primarily investing in international equity securities of companies believed to offer the best opportunity for reliable growth at attractive stock valuations. The Fund utilizes a bottom-up idea-driven growth style with a distinct valuation discipline. It seeks to identify companies which are believed to exhibit certain quality characteristics, including: predictable growth, solid fundamentals, attractive profitability and successful management.

Fund Performance

The Touchstone International Growth Opportunities Fund (Class A Shares) outperformed its benchmark, the MSCI All Country World Ex-USA Index, for the 12-month period ended June 30, 2020. The Fund’s total return was 5.07 percent (calculated excluding maximum sales charge) while the total return of the benchmark was -4.80 percent.

Market Environment

Prior to the COVID-19 pandemic, a period characterized by slow growth, low inflation, and low interest rates, translated into an earnings tailwind for the market through the second half of 2019. However, due to the speed and severity of the global economic downturn caused by COVID-19, this tailwind appeared to be disrupted in 2020. The virus observed no borders and caused the entire global economy to transition from a slow expansion to, quite likely, a deep recession in record time, which drove a market meltdown in the first quarter. Then, in anticipation of an improved outlook for the control and treatment of the virus, equity markets rallied through June 2020.

Portfolio Review

During the 12-month period, both stock selection and sector allocation contributed to the relative outperformance. The relative overweights to the Consumer Discretionary and Information Technology sectors and resulting underweights to Financials and Utilities also contributed. In terms of stock selection, the Consumer Staples and Communication Services sectors led contribution while Consumer Discretionary and Health Care were more challenged. Stock selection within Emerging Markets drove relative results on a regional basis though this was slightly offset by an overweight allocation, as Developed outperformed.

The holdings which contributed most to the Fund’s performance during the period were instant messaging and electronic game platform company, Tencent Holdings Ltd. (China, Communications sector); e-commerce company, JD.com (China, Consumer Discretionary sector); e-commerce and internet infrastructure services company, Alibaba Group Holding Ltd. (China, Consumer Discretionary sector); development company, NICE Ltd. (Israel, Information Technology sector); and educational services company, New Oriental Education & Technology Inc. (China, Consumer Discretionary sector).

The weakest contributors to the Fund’s performance during the period were airplane and military equipment company, Airbus SE (Germany, Industrials sector); aerospace and defense electrical systems company, Thales SA (France, Industrials sector), Coca-Cola bottler Coca-Cola HBC (Switzerland, Consumer Staples sector); internet payment software solutions company, Wirecard (Germany, Financial sector) and corporate banking services company, HDFC Bank (India, Financial sector).

The Fund’s positioning during the 12-month period has been consistent with DSM’s investment philosophy. The notable change was the decreased weight to Emerging Markets over the second half of 2019. The majority of the Fund’s portfolio was invested in the Communication Services, Consumer Discretionary, Consumer Staples, Financials, Health Care, Industrials and Information Technology sectors.

Outlook

There is little doubt that 2020 will be a recession year. However, we continue to believe that economic growth will restart in the U.S. in the second half of 2020, and globally in 2021. We believe that the economic outlook today is quite similar to the economic outlook after the 2008-2009 Great Financial Crisis. Prior to the COVID-19 pandemic, DSM Capital Partners had projected for many years that the global economic expansion, characterized by slow growth, low inflation, and low interest rates, would last longer than the majority of previous economic growth periods. As the world slowly recovers from this pandemic, we believe a similar outlook is warranted.

Despite some COVID-19 second-wave outbreaks, China is well into the process of restarting its economy. Absent a large occurrence, we believe the Chinese consumer will continue a slow return to pre-coronavirus spending patterns. In our view, the same is true of China’s industrial economy. Chinese manufacturing activity surprised recently with new orders expanding for the first time since

Management’s Discussion of Fund Performance (Unaudited) (Continued)

January. Unfortunately, the Japanese economy remains weak, as employment and exports continue to decline. On the other hand, industrial production has moved slightly higher perhaps providing the first glimmers of an economic recovery. If the coronavirus remains under control in Japan, we believe COVID-19 restrictions should continue to be lifted creating the potential for the economy to grow once again. That said, we believe Japan’s longer-term growth prospects remain limited.

Like Japan and China, Europe appears to have turned the corner in its battle against coronavirus. Recent Eurozone manufacturing statistics have improved and the European Central Bank (ECB) remains committed to providing large amounts of liquidity in order to prevent the economy from retreating. In recent weeks, European stocks have outperformed U.S. equities, however we do not believe this marks a lasting shift in market leadership from the U.S. to the European Union (EU) Intermediate-term growth prospects remain limited in Europe.

In our view, economic growth in the developed world has the potential to re-start over the second half of this year. However, given the ongoing growth of COVID-19 cases in many emerging markets including India and Latin America, strong and broad-based global growth may not be immediately forthcoming.

We continue to believe in our Growth philosophy. In our view, Value stocks will continue to face revenue and profit pressures from the ongoing evolution of digital/internet technologies, which weigh heavily on the traditional businesses that comprise much of these benchmark. We believe Value stocks are generally more cyclical, operate in industries that are more competitive, have greater capital requirements, and are more at risk of losing their way in an ever more digitally driven world. In addition, we think a pickup in inflation is needed to alleviate the pricing pressure found across the product lines of many companies in the Value benchmark, which we doubt will be forthcoming in the foreseeable future.

The Fund is more than half allocated to digital companies that utilize the internet to provide their services. We believe these businesses have strong balance sheets, cash flows, and management teams. In our view, they are unique, face few competitors, and are self-financing. These companies use technology to serve both business and consumer customers in a very broad range of industries, often globally. We believe this mix of businesses provides diversified economic and end market/customer exposure.

Our investment approach is built on the simple concept that “Earnings Win”. Over time, we believe that businesses appreciate in value as their earnings grow.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

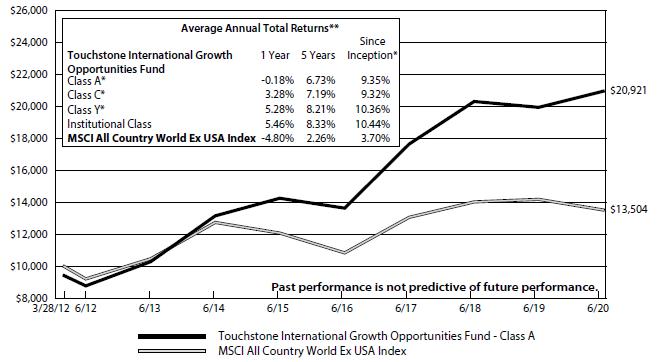

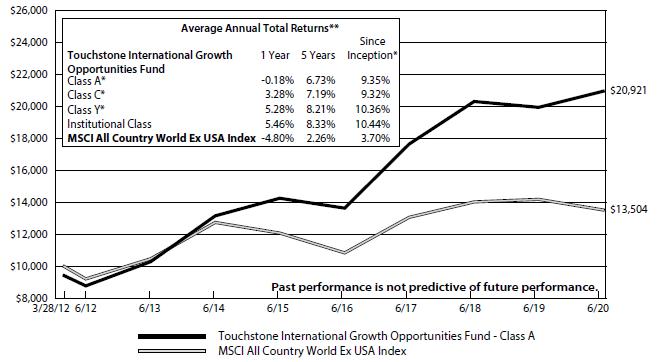

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International Growth Opportunities Fund - Class A* and MSCI All Country World Ex USA Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was August 15, 2016, August 15, 2016, August 15, 2016 and March 28, 2012, respectively. Class A shares, Class C shares and Class Y shares performance information was calculated using the historical performance of Institutional Class shares for periods prior to August 15, 2016. The returns have been restated for sales loads and fees applicable to Class A, Class C and Class Y shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

MSCI All Country World Ex-USA Index is an unmanaged, capitalization-weighted index composed of companies representative of both developed and emerging markets excluding the United States.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone International Small Cap Fund

Sub-Advised by Russell Investments Implementation Services, LLC

Investment Philosophy

The Touchstone International Small Cap Fund seeks capital appreciation by primarily investing in equity securities of non-U.S. small-cap companies diversified across sectors and industries.

Fund Performance

The Touchstone International Small Cap Fund (Class A Shares) underperformed its benchmark, the S&P Developed Ex-U.S. Small Cap Index for the 12-month period ended June 30, 2020. The Fund’s total return was -17.86 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was -3.75 percent.

Market Environment

Trade-related rhetoric between the U.S. and China drove market volatility throughout 2019. By the end of year, the U.S.-China trade discussions took a more constructive tone, culminating in an announcement of a “phase one” agreement in early 2020 to reduce some tariff levels. The U.S. economy continued its steady pace, driven by strong employment data and solid consumer spending. Outside the U.S., economic growth in developed markets such as the U.K., European Union and Japan continued their slow pace, all while each of their central banks continued to maintain low-to-zero overnight rates. Emerging markets continued to show overall weakness, driven by the U.S.-China trade slowdown and lower-than-expected Indian economic growth. This already fragile, low-growth environment was upended in the first half of 2020 as COVID-19 swept the globe, bringing with it containment measures resulting in massive shutdowns of economic activity.

In non-U.S. developed equity markets, Japan performed relatively well with slow growth in COVID-19 cases and aggressive stimulus measures while Europe was hit harder by the pandemic. Similar to the U.S., Information Technology and Health Care stocks were among the top contributors in developed markets while Energy and Financials lagged. In emerging markets, internet stocks and Asia Pacific countries who experienced COVID-19 lockdowns earlier in the year, such as China,Taiwan and South Korea, outperformed. These Asia Pacific countries experienced an abating COVID-19 virus and were able to re-open their economies earlier than the U.S. and Europe.

Overall, global stock markets declined during the period. U.S. large-cap stocks posted high single digit gains while their counterparts in developed and emerging markets declined. Small-cap stocks across the globe generally declined. From a style perspective, there was notable dispersion with growth stocks producing positive results while their value counterparts turned in double-digit percentage losses.

Portfolio Review

The following review reflects management by Copper Rock Capital Partners LLC, the Fund’s former sub-advisor, from the beginning of the 12-month period through May 21, 2020. Russell Investments Implementation Services, LLC (“Russell”) was appointed to serve as interim sub-advisor from May 22, 2020 through September 11, 2020.

The Fund’s underperformance was a result of poor stock selection across most sectors. The majority of underperformance came from stock selection in the Consumer Discretionary, Industrials and Financials sectors, while selection in the Materials, Health Care and Consumer Staples sectors also detracted. Stock selection in the Energy and Real Estate sectors benefited Fund performance. An overweight to the Information Technology and Health Care sectors and underweight to the Energy sector were positive contributors partially offsetting stock selection headwinds.

Among the individual stocks that contributed the most to performance during the period were Azbil Corp. and Dialog Semiconductor plc (both Information Technology sector) and Nichirei, Inc. (Consumer Staples sector). Azbil is the market leader in building automation systems. This company tends to have a very predictable and repeatable revenue and earnings stream as it offers maintenance contracts on many of the buildings it had a hand in constructing. Azbil is often referred to as the “Honeywell” of Japan, a reflection of Honeywell’s domination of building automation in the U.S. This stock performed well in a relative sense because of its high quality and predictable earnings stream as well as its debt-free balance sheet. Dialog Semiconductor manufactures power management integrated circuits for smartphones, tablets and other portable devices. It has benefited from a recovery in smart phone volumes, internal cost cutting measures and recent bolt on acquisitions. During the period, the stock performed well as estimates moved higher and valuations expanded closer to sector comparables. Nichirei produces and distributes frozen food and meat products. The company also provides cold storage logistic services for food distribution. Nichirei is a clear beneficiary of growth in the frozen food area, which is growing based upon demography and preference for easy to prepare meals. Sales are being positively impacted from people staying at home during the coronavirus outbreak. Capex for its cold storage business is peaking this year, which should lead to improved margins from efficiency and accelerating cash flows.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Among the individual stocks that detracted from Fund performance were Challenger Limited (Financials Sector), SSP Group plc and William Hill plc (both Consumer Discretionary sector). Challenger is an investment management firm that provides annuities and retirement income products for clients. We believe Challenger is uniquely positioned to provide solutions for guaranteed income to retirees post retirement through converting savings to annuities, which is a $67 billion annual market annually. Aging demography and favorable regulation should support a longer term growth opportunity. Challenger performed well during the period as the company outperformed its guidance; however, performance shifted as investors questioned the size of potential asset write-downs from declining equity and debt markets coupled with the likely interruption in writing new annuities in the depressed environment. SSP is a catering and concession services provider, primarily in airports and train stations in U.S. and Europe. The company had been gaining share within airports globally due to solid operating execution and strong local offerings. The unprecedented disruption to travel across the world due to COVID-19 is likely to have a dramatic impact on sales and profitability. William Hill specializes in betting parlors and online gaming. William Hill assets include a U.K. cash cow betting parlor business which funded the company’s nascent, yet fast growing U.S. online sports betting business. The company was executing well going into the coronavirus debacle. Once investors realized that the effect of the virus was going to likely be an extended shutdown of both U.K. betting parlors and U.S. casinos, the outlook for William Hill changed dramatically to the downside.

Outlook

The COVID-19 pandemic represents the greatest public health and economic crises of our lifetimes. Despite several months of the best efforts to contain the pandemic, the future remains uncertain. Although many countries appear to have the pandemic under control, including much of Asia and Europe, several hot spots remain. Given this backdrop, we expect a continuation of higher risks for companies whose business models rely on the resumption of travel and mass gatherings such as airlines, hotels, outdoor advertising and catering.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

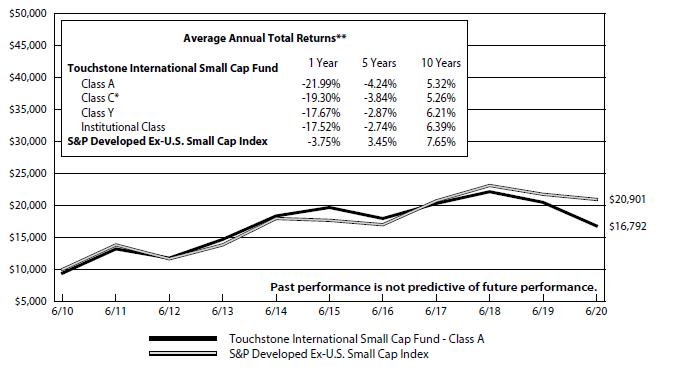

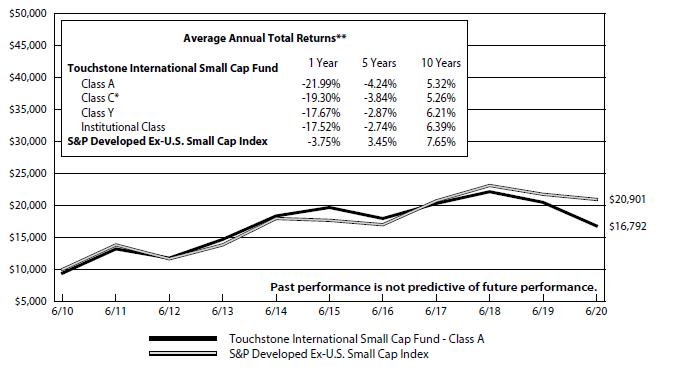

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International Small Cap Fund - Class A* and the S&P Developed Ex-U.S. Small Cap Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class C shares was April 12, 2012. Class C shares performance was calculated using the historical performance of Class Y shares for the period prior to April 12, 2012. The returns have been restated for sales loads and fees applicable to Class C shares. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

S&P Developed Ex-U.S. Small Cap Index is an unmanaged index of small-cap stocks from developed countries, excluding the United States.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Large Cap Focused Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Fund seeks capital appreciation by investing in companies of all capitalizations that are trading below what is believed to be the estimate of their intrinsic value and have a sustainable competitive advantage or a high barrier to entry in place. The barrier(s) to entry can be created through a cost advantage, economies of scale, high customer loyalty or a government barrier (e.g. license or subsidy). Fort Washington believes that the strongest barrier to entry is the combination of economies of scale and high customer loyalty.

Fund Performance

The Touchstone Large Cap Focused Fund (Class A Shares) outperformed the S&P 500® Index for the 12-month period ended June 30, 2020. The Fund’s total return was 9.54 percent (excluding the maximum sales charge) while the return of its benchmark was 7.51 percent.

Market Environment

Over the last twelve month period, U.S. equities recorded positive returns despite a historically rapid bear market in the first quarter of 2020. In the third quarter of 2019, U.S. equity markets moved mildly higher primarily due the strength of the U.S. consumer. Stocks again moved higher in the fourth quarter primarily due to optimism around the phase one trade agreement between the U.S. and China. During the first quarter of 2020, U.S. equity markets pulled back significantly primarily due to concerns over the global spread of the coronavirus and the oil price war between Russia and Saudi Arabia. In the second quarter, investors responded favorably to massive economic support by global governments and started to price in a recovery from the pandemic.

Over the one year period ending June 30, 2020, benchmark performance was driven by the Information Technology sector. The Consumer Discretionary, Communication Services, and Health Care sectors also performed well. Sectors that underperformed the broader index the most included Energy, Financials, and Industrials.

Portfolio Review

The first half of 2020 (and the last six months of the fiscal year) has been a volatile time in U.S. equity markets as investors have contemplated the unique dynamics of the novel coronavirus pandemic. After one of the shortest bear markets in history, the second quarter saw a sharp rally as the market priced in an eventual recovery. In our view, the massive action by the U.S. government late in the first quarter took the tail risk of a collapsing financial system off the table which was the foundational element to the rebound in risk assets.

With this framework in mind, we have kept top down portfolio positioning relatively consistent while taking the opportunity to upgrade the Fund’s portfolio from a bottom up level amidst volatility. We have deployed or re-deployed capital at a measured pace consistently since the latter half of the first quarter. We have not implemented a defensive posture for overall portfolio construction as we believe the impact on most of the Fund’s portfolio has been and will be temporary rather than structural. The Fund consistently reduced position sizes in businesses that we view as more expensive, could have balance sheet issues, or are less compelling to free up capital for more attractive business models that have become buyable. We believe this episode has demonstrated the importance of owning a portfolio of businesses that are supported by barriers to entry with strong balance sheets and good valuations.

Within the Fund’s holdings, sectors that outperformed the benchmark included Consumer Discretionary, Financials, Health Care, Utilities, and Communication Services. Energy and Consumer Staples performed roughly in line with the benchmark. Real Estate, Materials, Information Technology, and Industrials underperformed. Sector allocation was positive due to the underweights in Energy and Consumer Staples.

The three stocks that contributed the most to performance were JD.com Inc. (Consumer Discretionary sector), Apple Inc. (Information Technology sector), and Microsoft Corp. (Information Technology sector). The three stocks that detracted the most from performance were Berkshire Hathaway Inc. Class B Shares (Financials sector), Jones Lang LaSalle Inc. (Real Estate sector), and Carnival Corp. (Consumer Discretionary sector).

Outlook

Looking forward, we recognize the potential for more pull backs as the reopening continues to unfold. While the trajectory of the virus is difficult to handicap, we view progress on testing, tracing, and isolation procedures into the Fall as a bridge to a vaccine that helps avoid the level of economic impact we saw in the Spring. Assuming a recessionary hit to earnings in 2020 and a subsequent U-shaped recovery over the next several years, we see the U.S. equity market as currently attractive.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Our process seeks to realize the longer-term benefits of consistently owning high excess return on capital businesses that are mispriced. The process seeks to weather the unavoidable and unpredictable near-term shocks on the path to achieving its objective.

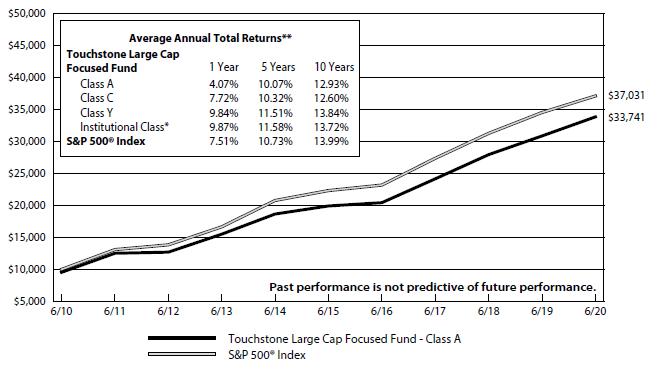

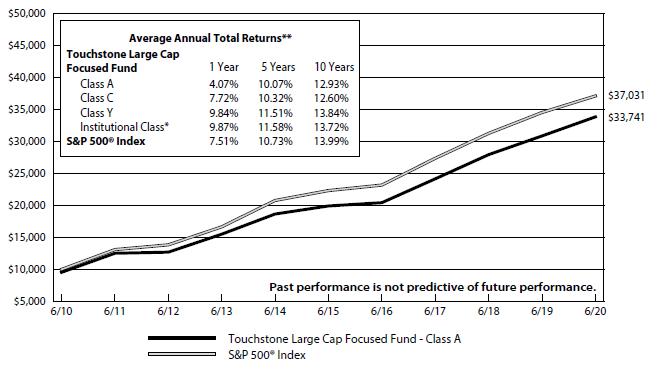

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Large Cap Focused Fund - Class A* and the S&P 500® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Institutional Class shares was December 23, 2014. Institutional Class shares performance was calculated using the historical performance of Class A shares for the period prior to December 23, 2014. The returns have been restated for sales loads and fees applicable to Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Large Cap Fund

Sub-Advised by The London Company

Investment Philosophy

The Touchstone Large Cap Fund seeks long-term capital growth by investing primarily in common stocks of large-cap U.S. listed companies. The Fund seeks to purchase financially stable large-cap companies that it believes are consistently generating high returns on unleveraged operating capital, run by shareholder-oriented management, and trading at a discount to the company’s respective private market values.

Fund Performance

The Touchstone Large Cap Fund (Class A Shares) underperformed its benchmark, the Russell 1000® Index, for the 12-month period ended June 30, 2020. The Fund’s total return was -1.18 percent (excluding the maximum sales charge) while the benchmark’s total return was 7.48 percent.

Market Environment

The major U.S. stock indices were led by large-cap growth stocks for the one-year period ending June 30, 2020. Returns of the broader market were more subdued, which belied the return of volatility, which contained two quarters of significant moves.

The prevailing event was the emergence of the coronavirus and fears over its impact on the economy. After reporting positive returns in the second half of 2019, the market declined in the first quarter of 2020 driven by fear of the coronavirus. This was followed by a rally as the U.S. economy started to reopen and investors looked past the valley of declining earnings.

The U.S. Federal Reserve Board (the Fed) was very active during the period. The Fed announced numerous plans to aid the economy, continued to add stimulus, and communicated a willingness to do more if needed. Chairman Powell made it clear that rates will likely remain low for quite some time. This was well received by the market.

Economic news improved later in the period following the low points reached in March and April. While overall spending was still down year over year, investors focused on the sequential progress off the lows. The biggest positive was improvement in the employment data in May and June. The unemployment rate fell to 11.1 percent in June. Job gains were widespread across industries as workers returned to their jobs following the reopening of many businesses. Retail sales bounced back in June reflecting some pent up demand as one-time checks and expanded unemployment insurance more than offset losses in income. In terms of the survey data, both the ISM manufacturing and non-manufacturing surveys rose over 50, suggesting economic expansion.

In terms of factor performance, as mentioned, Growth was the dominant factor in the period. Other positive factors included Momentum, Size, and Volatility. Quality factors had a mixed impact and Value and Yield factors underperformed.

Portfolio Review

Within the Fund, both sector allocation and stock selection detracted from relative performance. In terms of sector allocation, an overweight position to the Financials sector and underweight position to the Information Technology sector detracted from relative performance. This was partially offset by underweight positions to the Energy and Utilities sectors.

Among the individual stocks that contributed to Fund performance during the period were Apple Inc. (Information Technology sector), Alphabet Inc. (Communication Services sector), and Citrix Systems Inc. (Information Technology sector).Technology ecosystem creator, Apple, held up well in the first quarter and then rallied in the second quarter reflecting strength in services sales and solid iPhone results. Operating cash flow grew while the balance sheet was strong with over $80 billion in net cash and investments. The company increased its dividend and added to its share repurchase authorization late in the period. Despite Alphabet’s quarterly report being weaker than expected in the December quarter, the advertising and consumer technology solutions provider outperformed the broader market. Alphabet reported a deceleration in U.S. growth with some of the weaker sales attributed to the hardware business. Alphabet provided more financial information about operations such as YouTube and Google Cloud. Though advertising spending will likely come down, Google is more diversified with YouTube & Cloud. Those businesses account for more than 40 percent of incremental growth. The company continued to invest in its strong ecosystems (search, cloud, and hardware) with a larger focus on privacy and security. Alphabet has a solid balance sheet and significant market share. Citrix Systems, a provider of network security solutions, has been a major beneficiary of the work-from-home situation required by the COVID outbreak as its software products allowed workers to securely access applications from almost anywhere. As such, in the early stages of the COVID outbreak in 2020, the stock outperformed. However, as the economy moved toward reopening and workers returning to the office, the stock generated positive absolute performance, but lagged on a relative basis during the second quarter. We believe the company’s products will continue to become more and more relevant in the workplace in the coming years.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Among the stocks that detracted from Fund performance were Carnival Corp. (Consumer Discretionary sector), Berkshire Hathaway Inc. (Financials sector), and Southwest Airlines Co. (Industrials sector). Cruise operator, Carnival Corporation, was down significantly as the spread of coronavirus became a problem in early 2020. As the stock negatively reacted to the virus, it fell enough to hit our soft stop loss in late February. Initially, we maintained the position believing that the stock price more than accounted for the risks. As time passed, we realized that operating profits were likely to fall over the next year while capital spending would continue to be funded by additional debt. We grew more concerned that greater debt could limit Carnival’s financial flexibility and weaken the downside protection story. Therefore, we sold the stock in mid/late March. Berkshire Hathaway has historically been less volatile due to the nature of its diversified business and its large cash position; this helped the stock outperform in the first quarter of 2020 and drove underperformance in the second quarter. In addition, we believe that investors were frustrated that the company did not capitalize on the spike in volatility to make any acquisitions or opportunistically repurchase its own shares. We continue to have strong confidence in the capital allocation abilities of Buffett and his disciples. Southwest Airlines sold off in 2020 as the travel industry came to a standstill. While we still view Southwest as a best-in-class airline that will survive, we exited the Fund’s position during the second quarter as our thesis was no longer intact. We thought that with the company now burdened with debt and demand potentially severely impaired for the foreseeable future, it no longer fit the Fund’s approach.

During the 12-month period, we were more active during this time of volatility and traded around names to adhere to the Fund’s investment discipline. New positions included Pfizer Inc. (Health Care sector), Citrix Systems Inc. and Texas Instruments Inc. (Information Technology sector), Air Products & Chemicals Inc. (Materials sector), and Store Capital Corp. (Real Estate sector). Fund positions that were sold included Carnival Corp. (Consumer Discretionary sector), Alleghany Corp. (Financials sector), General Dynamics Corp. and Southwest Airlines Co. (Industrials sector), and Albemarle Corp. (Materials sector).

Outlook

U.S. stocks rebounded strongly in the second quarter of 2020, following the weak first quarter caused by business disruption from the pandemic. Investors turned more optimistic during the last quarter of the period, driven by improving economic data, falling unemployment, corporate commentary suggesting stabilization in end demand, and hope around potential vaccines and treatments to fight COVID-19. We are encouraged by the improvement in the economic data, but we are not sure how the pandemic will unfold or what long-term impacts will emerge from the crisis. The state of public health is most important and it may be a while before we have adequate testing and a vaccine that can significantly reduce the health risk to the average person. With the heightened uncertainty on the health side, we recognize economic data could change quickly in the near term. In that environment, we think we will see significant price volatility.

While business closures and social distancing seemed to get the virus under control by the middle of the second quarter, sadly the virus began to pick up steam again late in the period. A significant resurgence in the virus could lead to reopening plans being either paused or rolled back. Another risk is the reduction in expanded unemployment benefits, which are set to expire at the end of July. We think the U.S. government will pass another round of stimulus, but the level of benefits to the end consumer is uncertain. Longer term, we remain optimistic about the prospects for the U.S. economy.

With regard to monetary policy, we think the Fed will remain accommodative and Fed Chair Powell made it clear that the federal funds rate will likely remain low for quite some time. The Fed’s Open Market Committee members suggest rates will remain close to zero until the end of 2022. We believe quantitative easing will likely continue while the various facilities to help maintain liquidity throughout the economy will remain in place. The Fed significantly expanded its balance sheet during the quarter ending June with roughly $7 trillion in assets. Its balance sheet will likely expand more over the next few quarters.

In terms of the equity market, we continue to believe in quality attributes and strong company fundamentals. Valuation for the broader market is roughly back above its long-term average. Low interest rates argue for higher multiples, but multiple expansion from here may be limited. While we believe the risks and rewards are somewhat balanced as they relate to stocks overall, we always remain cautious and focus on limiting downside in each holding.

We believe the Fund provides the opportunity to own a group of competitively advantaged businesses (judged by return on capital), with strong balance sheets (lower net debt/ebidta), at a valuation slightly less than the broader market. Typically, a higher quality portfolio of companies will trade at a premium to the market.

Finally, we believe in the quality of the Fund’s holdings for the next few years, even if the market trades modestly higher. In an environment of possibly lower expected returns and greater volatility, we believe the Fund is positioned well.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Large Cap Fund - Class A* and the Russell 1000® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of the Fund was July 9, 2014. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Large Company Growth Fund

Sub-Advised by DSM Capital Partners LLC

Investment Philosophy

The Touchstone Large Company Growth Fund seeks long-term capital appreciation by primarily investing in U.S. equity securities of large capitalization companies believed to offer the best opportunity for reliable growth at attractive stock valuations. The Fund utilizes a bottom-up idea-driven growth style with a distinct valuation discipline. It seeks to identify companies which are believed to exhibit certain quality characteristics, including: solid fundamentals, attractive profitability and successful management.

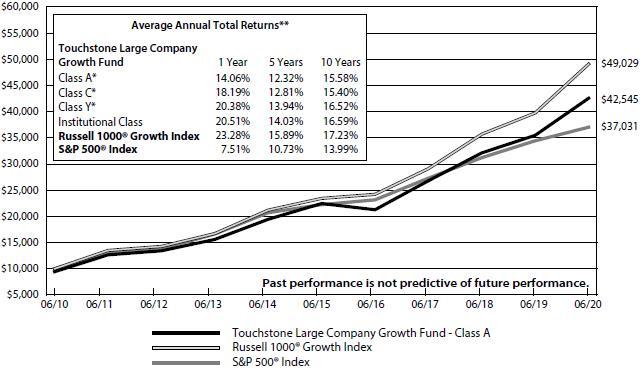

Fund Performance

The Touchstone Large Company Growth Fund (A Class shares) underperformed its benchmark, the Russell 1000® Growth Index, for the 12-month period ended June 30, 2020. The Fund’s total return was 20.07 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was 23.28 percent.

Market Environment

Prior to the COVID-19 pandemic, a period characterized by slow growth, low inflation, and low interest rates, translated into an earnings tailwind for the market through the second half of 2019. However, due to the speed and severity of the global economic downturn caused by COVID-19, this tailwind appeared to be disrupted in 2020. The virus observed no borders and caused the entire global economy to transition from a slow expansion to, quite likely, a deep recession in record time, which drove a market meltdown in the first quarter. Then, in anticipation of an improved outlook for the control and treatment of the virus, equity markets rallied through June 2020. Equity markets tend to discount future earnings and cash flows over the next decade or more. Accordingly, the markets recovered before the U.S. economy.

Portfolio Review

During the 12-month period the Fund’s underperformance versus the benchmark was primarily due to weak stock selection in the Information Technology and Health Care sectors. This was partially offset by the Fund’s stock selection in the Communication Services sector and underweight allocation to the Industrials sector.

The holdings which contributed most to the Fund’s performance during the period were application software/cloud storage company, Microsoft Corp. (Information Technology sector); application software development company, Adobe Inc.(Information Technology sector); digital and mobile payments company, PayPal Holdings Inc. (Information Technology sector); instant messaging and electronic game platform company Tencent Holdings Ltd. (Communication Services sector); and e-commerce and cloud services company, Amazon.com Inc. (Consumer Discretionary sector).

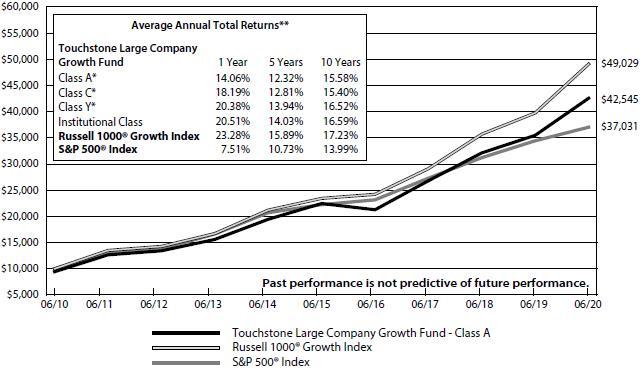

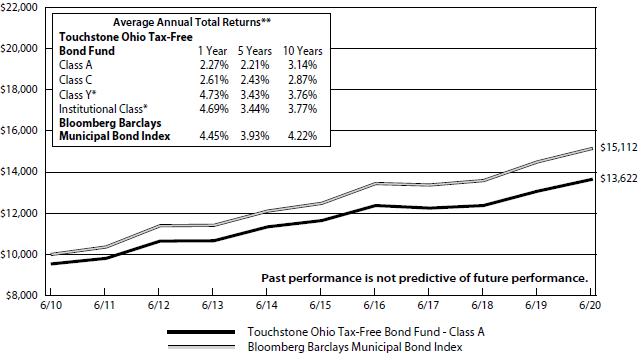

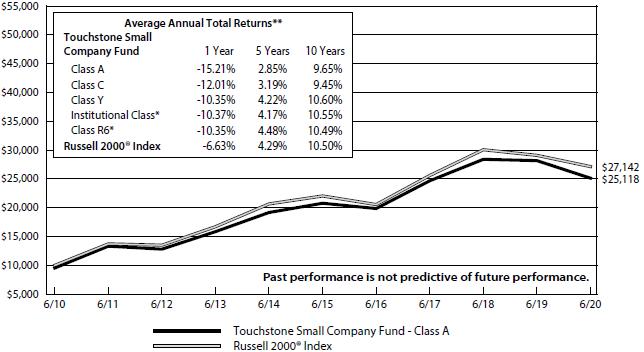

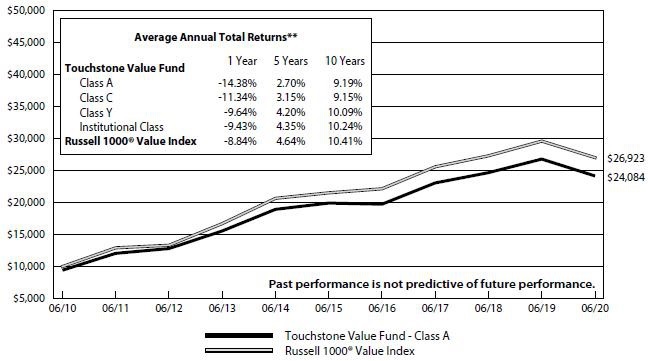

The weakest contributors to the Fund’s performance during the period were animal health medicines and vaccines company, Elanco Animal Health Inc. (Health Care sector); global cruise operator, Royal Caribbean Cruises Ltd. (Consumer Discretionary sector); business outsourcing solutions company, Automatic Data Processing Inc. (Information Technology sector), online travel agent, Booking Holdings (Consumer Discretionary sector); and medical devices company, Boston Scientific Corp. (Health Care sector).