Touchstone Sands Capital International Growth Fund

Sub-Advised by Sands Capital Management, LLC

Investment Philosophy

The Touchstone Sands Capital International Growth Fund (the “Fund”) seeks long-term capital appreciation. The Fund invests in equity and equity-related securities issued by companies located in foreign countries. The Fund’s sub-adviser, Sands Capital Management, LLC, uses a “bottom-up” approach to investment selection that focuses on a company’s long-term business fundamentals, as opposed to sector or regional allocations. Sands Capital seeks companies that have: sustainable above-average earnings growth; a leadership position in a promising business space; significant competitive advantages such as profitability, superior quality or distribution relative to competitors or strong brand and consumer loyalty; a clear mission in an understandable business model; financial strength; and a rational valuation in relation to competitors, the market and business prospects.

Fund Performance

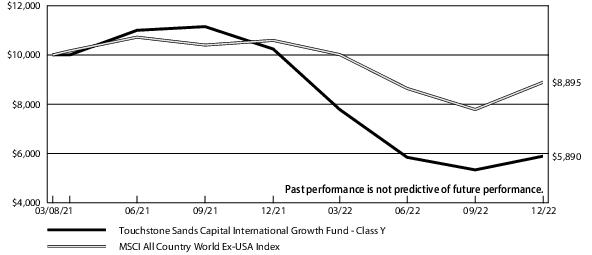

The Touchstone Sands Capital International Growth Fund (Class Y Shares) underperformed its benchmark, the MSCI ACWI Ex-USA Index, for the 12-month period ended December 31, 2022. The Fund’s total return was -42.48 percent while the benchmark’s total return was -16.00 percent.

Market Environment

The 12 months ending 2022 was the worst year for international equities (as measured by the MSCI ACWI Index ex-USA) since 2008. While the market selloff was broad-based, it was deeper for growth-oriented stocks. In 2022, the MSCI ACWI ex-USA Growth Index underperformed the MSCI ACWI ex-U.S. Value Index by the widest margin since 2000.

Within the broader MSCI ACWI ex-USA Index, outperforming sectors included Energy, Financials, and Materials. Only Energy produced a positive return during the period. Information Technology, Consumer Discretionary, and Communication Services were the laggards.

Portfolio Review

The Fund underperformed in 2022 amid the most challenging market for international growth equities in over two decades. Security selection drove the bulk of the underperformance, and sector allocation was also a headwind.

All regions and all but one sector detracted from relative results in 2022. Western Europe was the top regional detractor, while Eastern Europe detracted the least. From a sector perspective, Information Technology and Communication Services accounted for the bulk of the underperformance, while Real Estate—a zero percent weight—was the sole contributor to relative results.

The top absolute contributors were HDFC Bank Limited ("HDFC Bank"), Genmab A/S ("Genmab"), CTS Eventim AG ("CTS Eventim"), AIA, and WEG Industries ("WEG"). HDFC Bank remains what we view as the best emerging market banking franchise. Looking ahead, we believe the merger of HDFC Bank and Housing Development Finance Corporation (HDFC) will remove cross-selling barriers that previously existed for lending and mortgage products, enabling greater synergies and ultimately higher and more durable earnings growth.

CTS Eventim was added to the portfolio late in the period. The business is the largest event ticketing business in Europe, by market share. We see the business as a monopolistic marketplace connecting fragmented buyers and sellers within a secularly growing consumer category (live entertainment), seeded with some first-party inventory (internal concert promotion).

WEG—one of the world’s largest manufacturers of electric equipment—was also purchased late in the period. The Brazil-based business’ vision is to provide complete and efficient solutions for the entire electrification value chain, from power generation to consumption. The business is highly diversified, with over half of its revenue derived outside of Brazil, and a product base that spans industrial equipment, green energy, commercial motors, and paints/varnishes.

The top absolute detractors were Atlassian Corporation ("Atlassian"), Sea Limited ADR ("SEA"), Shopify Inc. ("Shopify"), Taiwan Semiconductor Manufacturing Company Limited (" Taiwan Semiconductor"), and Adyen NV ("Adyen").

Atlassian, Sea, and Shopify are all high-growth, high-valuation companies that sold off considerably among the market’s purge of long-duration assets. In Atlassian’s case, management’s about-face relating to cloud revenue guidance caused a drop in shares, and anxiety about enterprise cloud demand amid a potential U.S. recessionary environment continues to weigh on sentiment. Investors’ focus on near-term profitability weighed on shares of Sea, which is unprofitable and previously focused on aggressive international expansion. It has since refocused its efforts and has demonstrated progress in ecommerce profitability. Shopify shares came under pressure given its low current margin profile, concerns about the durability of ecommerce demand and growth, and competition.