UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust – June Funds

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: June 30

Date of reporting period: June 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

June 30, 2013

Annual Report

Touchstone Strategic Trust

Touchstone Capital Growth Fund

Touchstone International Small Cap Fund

Touchstone Mid Cap Value Opportunities Fund

Touchstone Small Cap Value Opportunities Fund

Touchstone Value Fund

Table of Contents

| | Page |

| Letter from the President | 3 |

| Management's Discussion of Fund Performance (Unaudited) | 4 - 19 |

| Tabular Presentation of Portfolios of Investments (Unaudited) | 20 - 21 |

| Portfolio of Investments: | |

| Touchstone Capital Growth Fund | 22 |

| Touchstone International Small Cap Fund | 24 |

| Touchstone Mid Cap Value Opportunities Fund | 26 |

| Touchstone Small Cap Value Opportunities Fund | 28 |

| Touchstone Value Fund | 30 |

| Statements of Assets and Liabilities | 32 - 35 |

| Statements of Operations | 36 - 37 |

| Statements of Changes in Net Assets | 38 - 41 |

| Statements of Changes in Net Assets - Capital Stock Activity | 42 - 46 |

| Financial Highlights | 47 - 58 |

| Notes to Financial Statements | 59 - 72 |

| Report of Independent Registered Public Accounting Firm | 73 |

| Other Items (Unaudited) | 74 - 79 |

| Management of the Trust (Unaudited) | 80 - 82 |

| Privacy Protection Policy | 83 |

Letter from the President

Dear Fellow Shareholder,

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the 12 months ended June 30, 2013.

Uneven economic conditions and volatility reigned throughout most of the fiscal year. Despite a U.S. Presidential election that left many apprehensive about the potential direction of spending and taxation, and a Congressional “fiscal cliff” that brought the return of the payroll tax, the U.S. economy, although uneven, continued to grow at a moderate pace. Stock market gains and rising home prices helped to bolster consumer confidence, which sparked consumer spending. Employment was also a bright spot as new jobs were added to the economy and the unemployment rate declined. Federal Reserve (the Fed) policy remained accommodative throughout the period as the Fed kept short-term rates in the 0.00% - 0.25% range where they have been since 2008. Domestic equities rallied for most of the period until the Fed indicated it might start scaling back its massive bond-buying program, negatively affecting both equity and bond markets. The resulting pullback in equities shook the confidence of many investors; however, stocks proved much more resilient than many expected.

For the fiscal year, U.S. equity markets posted positive, double-digit returns and outperformed both developed and emerging markets. Value stocks’ performance exceeded their growth counterparts and mid-cap stock returns surpassed those of small- and large-cap stocks, although all capitalizations performed well and also posted double-digit returns.

We believe it remains more important than ever to focus on the long-term composition of your investment portfolio as diversification is essential to balancing risk and return. We recommend that you continue to work with your financial professional on a sound asset allocation strategy to help keep your financial goals on course.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Capital Growth Fund

Sub-Advised by Ashfield Capital Partners, LLC

Investment Philosophy

The Fund seeks long-term capital growth by primarily investing in equity securities of large capitalization companies believed to possess above-average growth potential by utilizing an integrated systematic investment process that combines bottom-up fundamental analysis with a top-down, thematic overlay to construct the Fund’s portfolio.

Fund Performance

The Touchstone Capital Growth Fund (Class A Shares) underperformed its benchmark, the Russell 1000® Growth Index, for the 12-month period ended June 30, 2013. The Fund’s total return was 15.30 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 17.07 percent for the same period.

Market Environment

The one-year period ended June 30, 2013, brought strong returns for the overall equity markets. At the same time, the fixed income markets—which saw an unprecedented 30-year slide in interest rates—finally experienced a bottoming out and an increase in interest rates. Commodities continued the trend of moderation that had begun in mid-2011 and investors’ view of gold being a safe haven finally saw a topping process unfold, leading to a significant retracement during the one-year period. As liquidity continued to flow forth from central banks, equities reacted positively. Mid- and small-capstocks’ performance exceeded that of their large-cap counterparts and value stocks outperformed growth stocks. Throughout the period, defensive stocks outperformed cyclical stocks. From a factor perspective, performance favored stocks with lower beta1, lower price-to-earnings (P/E), lower market caps, and either a zero-to-low yield or very high yield within the Russell 1000® Growth Index.

Portfolio Review

The major overriding factor that detracted from the Fund’s performance during the period was the lack of demand for cyclically oriented stocks and sectors. Over the past several summers, the markets have experienced a sell-off of cyclically inclined sectors, as the economic data weakened and investor sentiment was driven lower by the self-fulfilling “sell in May” experience. (Often declared as “sell in May and go away,” this adage encourages investors to sell their stock holdings in May to avoid a seasonal decline in equity markets.) During 2013, this phenomenon occurred earlier for the cyclically inclined sectors, thus detracting from Fund performance. And, with the Consumer Discretionary, Energy, Industrials and Information Technology sectors comprising more than two-thirds of the portfolio weight, we believe this trend was very difficult to avoid. Interestingly, in 2013 the economic data did not turn lower as it had in the previous years, possibly allowing for a better rebound once the market normalizes.

The Fund’s worst performing sector during the period was the Information Technology sector, where higher-growth-leaning names underperformed. Higher-growth-leaning is a term that refers to those companies in the technology space that are not considered “mature tech.” (“Mature tech” would be considered companies like Microsoft Corp., Intel Corp. and Hewlett-Packard Co.) Growth technology names are companies experiencing high revenue growth while also reinvesting in their businesses at high levels. The Fund tended to own more of the latter, which were not rewarded during the period.

Among the top contributors to Fund performance were Google Inc. (Information Technology sector), Celgene Corp. (Health Care sector), and Pioneer Natural Resources Co. (Energy sector). Google, a global technology company, continued to lead online and in mobile search businesses from an innovation standpoint, which sent

Management's Discussion of Fund Performance (Unaudited) (Continued)

the company’s shares higher. Company earnings estimates also continued to climb as Google made forays into new businesses and better monetized its existing businesses. Celgene, a global biopharmaceutical company, announced several milestones for their portfolio of drugs, including the approval of REVLIMID in China. The company also achieved FDA approval for its cancer drug POMALYST in February. Overall, Celgene continued to meet or exceed expectations during the period. Pioneer Natural Resources, an independent oil and gas exploration and production company, continued to perform well within its portfolio of drilling properties and issued strong production guidance. The company also entered into an agreement with Sinochem Group, one of China’s largest suppliers of chemical products and sold a 40 percent stake of its interest in its Texas oil-shale acreage, which pushed Pioneer Natural Resources’ stock higher.

Among the largest detractors from Fund performance for the period were Apple Inc., NetEase Inc. and VMware Inc. (all from the Information Technology sector). Shares of Apple, a designer and manufacturer of computers and mobile devices, issued guidance below analysts’ lofty expectations, which hurt the stock. Apple also faced scrutiny over tax-avoidance tactics and experienced slipping margins as higher priced phone sales slowed and competitive pressures weighed on shares. NetEase, an Internet-technology company, missed its third quarter of 2012 earnings and revenue expectations, in addition to experiencing margin erosion. As such, the Fund’s position in the company was sold in November of 2012. Shares of VMware, a provider of virtualization infrastructure solutions, were negatively impacted when the company’s chief executive officer departed in July of 2012. There were also market fears over high penetration of server virtualization software, which led to lower growth projections. As a result, the position was sold in March 2013.

Outlook

We believe that with reasonably low earnings expectations in the U.S. and the prospect for earnings surprises improving, the equity market may advance further in the second half of 2013, despite the likelihood that bond yields will continue to rise over the next 18 months. Going forward, with increased confidence in the U.S. economy and an improvement in Europe’s economy, based on current and leading indicators, we remain committed to holding quality, economically sensitive issues in the Information Technology, Industrials and Consumer Discretionary sectors. And, while our focus remains balanced between established large-cap growth companies and emerging large-cap growth companies, we continue to believe that in a growth-challenged world, companies that can deliver higher-than-average top- and bottom-line growth could be rewarded with higher valuations. As the inter-market forces of defensive versus cyclical securities stabilize over time, we believe the Fund is positioned to benefit from the rebound in cyclical names.

1Beta is a measure of the volatility of a portfolio relative to its benchmark.

Management's Discussion of Fund Performance (Unaudited) (Continued)

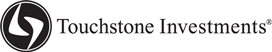

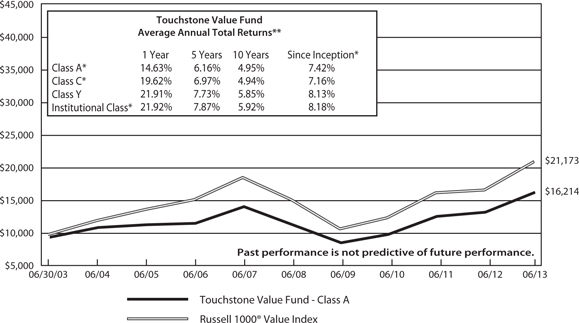

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Capital Growth Fund - Class A* and the Russell 1000® Growth Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on September 30, 2003, April 12, 2012, November 29, 1996 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional shares performance was calculated using the historical performance of Class Y shares for the periods prior to September 30, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Note to Chart

The Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management's Discussion of Fund Performance (Unaudited)

Touchstone International Small Cap Fund

Sub-Advised by Copper Rock Capital Partners LLC

Investment Philosophy

The Touchstone International Small Cap Fund seeks capital appreciation by primarily investing in equity securities of non-U.S. small-cap companies diversified across sectors and industries. The Fund’s investment process seeks to add value through bottom-up stock selection and in-depth fundamental research and searches for companies believed to have strong management, superior earnings growth prospects and attractive relative valuations.

Fund Performance

The Touchstone International Small Cap Fund (Class A Shares) outperformed its benchmark the S&P Developed Ex-U.S. Small Cap Index for the 12-month period ended June 30, 2013. The Fund’s total return was 24.99 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 18.54 percent.

Market Environment

Investors were generally risk averse in response to the political and economic uncertainties throughout the world. Yet, following economic turmoil early in the period, investors grew more confident due to definitive statements from central banks to stabilize the global financial system. At the onset of 2013, this led to record-breaking rallies in the U.S. and significant positive returns in the international markets. By period end, the tone for the equity markets emphasized the economic recovery, albeit a slow global economic recovery.

The most pronounced impact to the markets during the period was Japan’s policy directives to stimulate its economy and resume consumer confidence by indirect spending to weaken the yen. As a result, Japan’s stock market reacted positively in early 2013, as the Nikkei 225 Index rallied and Japanese stocks outperformed amongst developed-economy stock markets. However, investors later weathered wide swings and extreme volatility in the Japanese market—much of which was attributed to the combination of investors’ uncertainty over whether these policy moves and parliamentary decisions would be lasting, and the natural correction following the dramatic market rally. Regardless, with generally improving consumer and business sentiment, niche businesses in Japan and Europe also benefited, along with niche market leaders in the emerging markets, due to their developing middle classes. In general, the period was representative of a typical market where stock selection mattered and earnings were rewarded, as the economy moved forward and investors saw signs of a global economic recovery.

Portfolio Review

For the period, there was contribution to the Fund’s relative return from stock selection within the Consumer Discretionary, Financials, Materials, Consumer Staples, Energy, and Information Technology sectors. Also as a result of the Fund’s bottom-up stock selection, there was positive contribution to relative return across all regions, along with modest underperformance from stock selection within Japan.

Among the stocks that contributed to Fund performance during the period were Compagnie Plastic Omnium SA (Consumer Discretionary sector), ams AG (Information Technology sector), Avex Group Holdings Inc., (Consumer Discretionary sector), and Ashtead Group PLC (Industrials sector). Compagnie Plastic Omnium, a France-based global auto-parts company, maintained its leading market share in niche products and its unique long-term growth trajectory, as the company benefited from the rising number of vehicle purchases in the emerging markets. The company also posted consistently strong results, which were driven primarily by the increasing penetration of plastic fuel tanks for automobiles. Ams AG, the Austria-based semiconductor manufacturer formerly known as austriamicrosystems AG, had been a long-term holding in the Fund over the period. However,

Management's Discussion of Fund Performance (Unaudited) (Continued)

we sensed pressure in global demand for semiconductors while the market simultaneously became increasingly sensitive to the fact that the supply chain for Apple Inc.2 was beginning to build inventory at an uncomfortable rate. In light of this change in the landscape, coupled with the fact the stock approached our fair-value target, we exited the position in favor of other opportunities. Avex Group Holdings, a Japan-based producer and distributor of entertainment media, benefited from strong momentum during the year. The company’s platform extension into broader goods and distribution significantly boosted earnings contribution per artist or group. Additionally, a long string of popular album releases and high demand for online music offerings led to expanded royalty revenues and expanded returns on invested capital. Ashtead Group is a U.K.-based construction-equipment rental company with assets primarily in the U.S. under the Sunbelt brand name. The company’s prudent capital-expenditures program has resulted in high incremental margins through significantly increased utilization rates and rental yields. Furthermore, we believe Ashtead Group’s young fleet is among the best service proposition for small and medium-sized contractors, and is an efficient branch network operation. We also believe the company is primed to further capitalize on the secular shift as U.S. construction companies move from owned to rented fleets of machinery, as well as the nascent U.S. construction market recovery.

The Fund maintained an underweight position relative to the Index in the Industrials sector during the period, which detracted from relative returns. This, coupled with some modest underperformance in a handful of individual positions, contributed to the sector’s overall underperformance. Among the individual stocks that detracted from performance were Ausdrill Ltd. (Industrials sector), NRW Holdings Ltd. (Industrials sector), Weathernews Inc. (Industrials sector), and ITOCHUTechno-Solutions Corp. (Technology sector). Both Ausdrill, an Australia-based mining service provider, and NRW Holdings, an Australia-based mine services and civil contracting company, were impacted by falling bulk commodity prices against the background of a slowing economy in China. Also, fears of systemic risk in the Chinese banking system halted many areas of new exploration and construction, and left mine service providers with significant overcapacities. As a result, Ausdrill and NRW Holdings were sold during the period, as there was a change in visibility for each stock. Weathernews is a Japan-based provider of weather forecasting and routing services for shipping and railway companies as well as for consumer online applications. Shares of Weathernews declined during the period as network-carrier pricing of the company’s mobile phone application came in significantly lower than expected. This altered expectations of the company’s sustainable profits and capital returns, and, as such, we exited the position in favor of higher and more visible upside opportunities. ITOCHUTechno-Solutions is a Japan-based designer and constructer of computer network systems and software in Japan. The stock’s fundamental results had been sound and the stock outperformed until the fourth quarter of 2012 when the sharp rotation occurred in favor of Japanese stocks that benefited from a sharply weaker yen. This rotation fell on the back of the aggressive stimulus monetary policies from the country’s newly elected government. As a result, ITOCHU Techno-Solutions stock underperformed and its model score deteriorated as its earnings momentum declined. In turn, we exited the position.

Outlook

We remain positive on our outlook for global markets, as steady, improving U.S. economic growth is acknowledged by both U.S.-based investors and non-U.S. based investors. Additionally, we believe valuations remain generally reasonable outside of the U.S. and earnings growth is accelerating within small corporations that can finance their own growth and offer innovative products and services despite the moderate global economy.

Going forward, we anticipate the economic recovery should produce an environment of commitment from investors. We believe the markets are indeed differentiating between successful and unsuccessful business models, thus offering stock pickers opportunities to add alpha1 in the foreseeable future.

1Alpha is the portion of a portfolio's total return that is unique to that portfolio and is independent of movements in its benchmark.

2Apple Inc. was not a fund holding on June 30, 2013.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International Small Cap Fund - Class A* and the S&P Developed Ex-U.S. Small Cap Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on July 31, 2003, April 12, 2012, December 31, 1996 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional shares performance was calculated using the historical performance of Class Y shares for the periods prior to July 31, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Note to Chart

The S&P Developed Ex-U.S. Small Cap Index is an unmanaged index of small-cap stocks from developed countries, excluding the United States.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Mid Cap Value Opportunities Fund

Sub-Advised by Thompson Siegel & Walmsley LLC

Investment Philosophy

The Fund seeks long-term capital growth by primarily investing in equity securities of mid-cap companies that are believed to present value that is not reflected by prevailing market prices or that have experienced fundamental changes and are intrinsically undervalued by the investment community. Using a combination of quantitative and qualitative methods, a company’s attractiveness is assessed in an effort to understand why the market may be mispricing the stocks, what factors are changing that can return the stock to fair value and whether those changes are sustainable over a medium term investment horizon based on both absolute and sector-relative valuation of cash flows, the relative earnings prospects of the company and the stock’s recent price action.

Fund Performance

The Touchstone Mid Cap Value Opportunities Fund (Class A Shares) outperformed its benchmark, the Russell Midcap® Value Index, for the 12-month period ended June 30, 2013. The Fund’s total return was 31.36 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 27.65 percent for the same period.

Market Environment

During the one-year period, the European Central Bank managed to eliminate the worst fears from the minds of investors around mid-year 2012, and equities rallied into year-end and through most of the first half of 2013. Investors’ risk appetite was not the driver of returns however, unlike in previous rallies since the beginning of the financial crisis. Though the market favored value, performance was mixed between defensive and cyclical sectors, and the market dynamic was ultimately stock specific.

Portfolio Review

The Fund outperformed its benchmark for the one-year period based predominantly on stock selection, though sector allocation was also positive during the period. The Consumer Discretionary and Health Care sectors were the leading sectors that contributed to the Fund’s positive returns. The Fund was overweight in both of these top-performing sectors and value was also added through stock selection. A wide variety of consumer stocks added to performance, especially retailers and media companies. Investors moved through industries as they searched for pockets of inexpensive stocks—first running up valuations for service companies and health maintenance organizations (HMOs), and only later rotating into pharmaceuticals. Holdings within the Industrials sector detracted from performance primarily because the Fund was underweight this top-performing sector.

Among the individual stocks that contributed to Fund performance during the period were GameStop Corp. (Consumer Discretionary sector), T-Mobile US Inc. (Telecommunication Services sector), H&R Block Inc. (Consumer Discretionary sector), Symantec Corp. (Information Technology sector), and Western Digital Corp. (Information Technology sector). Shares of GameStop, a multichannel video game retailer, rallied sharply with anticipation of an upswing in the gaming console cycle. Upcoming console launches by Sony Corp. and Microsoft Corp. helped drive positive sentiment around this video gaming retailer. T-Mobile US, a wireless carrier, rallied for a number of reasons, including the completion of its merger with Metro PCS, its first official iPhone launch, and continued build out of the higher-speed LTE network. H&R Block, a tax-preparation services company, experienced a number of positive events during the period, including a strong outlook for tax filings industry-wide, increased gain in market share, and analyst upgrades. Symantec, a network security provider, announced that the company’s chairman of the board would take over as chief executive officer, which the market viewed as a potential catalyst for unlocking value. Western Digital, a hard disk drive maker, significantly beat earnings

Management's Discussion of Fund Performance (Unaudited) (Continued)

expectations. Additionally, the company expects positive results going forward due to cost savings from its acquisition of Hitachi, and its upcoming rollout of Windows 8.

Among the individual stocks that detracted from performance were Energy XXI (Bermuda) Ltd. (Energy sector), DeVry, Inc. (Consumer Discretionary sector), Annaly Capital Management, Inc. (Financials sector), CF Industries Holdings Inc. (Materials sector), and Windstream Corp. (Telecommunication Services sector). Energy XXI (Bermuda), an oil exploration and production company, experienced weather-related delays that resulted in reduced production output during the first quarter of 2013. Commodity price declines during the second quarter of 2013 further weighed on the stock. DeVry, a for-profit education provider, was hindered by an industry-wide phenomenon of higher costs to attract new students, including increased advertising and scholarships. The Fund eliminated the position in late 2012. Shares of Annaly Capital Management, a U.S. mortgage Real Estate Investment Trust (REIT), declined over the period, despite announcing a new chief executive officer and an acquisition intended to diversify its portfolio of mortgage-backed securities. The company also suffered during the period as rising concerns over interest rates weighed on dividend-yielding stocks, especially REITs. The company, which had offered a double-digit dividend yield, was particularly affected by concerns over interest rates. CF Industries Holdings, a fertilizer producer, reported record profits and surpassed analyst expectations during the second quarter of 2013; however, a lack of outlook comments for the second half of 2013 caused the stock to sell-off. Windstream, a voice and data services provider, came under pressure after a competitor announced a significant dividend cut, which sent shares lower.

Outlook

Looking ahead, we believe growth in the U.S. economy is stable but slow, with much of the strength coming from the recovering auto and housing markets. Corporate balance sheets are sound, even cash-heavy; but, with profit margins near historic levels, we expect earnings will be under pressure over the next few years. Growth must come mainly from rising revenues, which should remain elusive until the U.S. manages a return to trend Gross Domestic Product (GDP) growth. The government is playing a major role in how the economic cycle plays out. In our opinion, the U.S. Federal Reserve Board (the Fed) must manage an artful exit from its position supporting this fragile recovery as it becomes self-sustaining. The timing and circumstances of the next fiscal policy debate could complicate or simplify that maneuver.

Even after the market’s correction in the second quarter of 2013, the strong equity rally of the last year has left few, if any, broad swathes of undervalued stocks in the market. Increasingly, investors have to be selective to find those companies where opportunity and risk are not adequately reflected by price. The Fund’s disciplined investment process favors this type of market environment.

Management's Discussion of Fund Performance (Unaudited) (Continued)

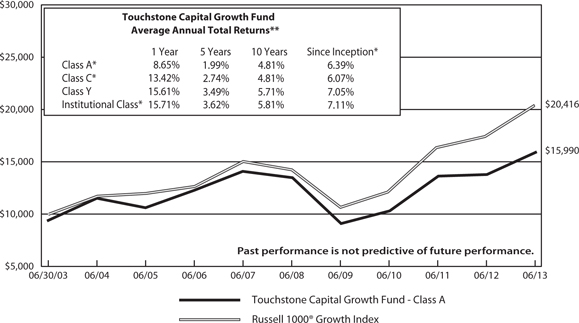

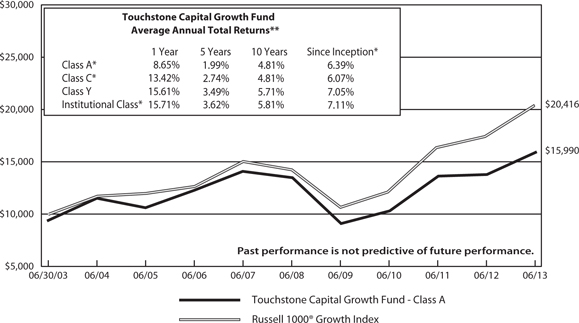

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Mid Cap Value Opportunities Fund - Class A* and the Russell Midcap® Value Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on June 4, 2007, April 12, 2012, December 9, 2008 and June 4, 2007, respectively. Class C shares and Class Y shares performance was calculated using the historical performance of Class A shares for the periods prior to April 12, 2012 and December 9, 2008, respectively. The returns have been restated for sales charges and for fees applicable to Class C and Class Y shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Note to Chart

The Russell Midcap® Value Index measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Small Cap Value Opportunities Fund

Sub-Advised by Thompson, Siegel & Walmsley LLC

Investment Philosophy

The Fund seeks long-term capital growth by primarily investing in equity securities of small-cap companies that are believed to present value that is not reflected by prevailing market prices or that have experienced fundamental changes and are intrinsically undervalued by the investment community. Using a combination of quantitative and qualitative methods, a company’s attractiveness is assessed in an effort to understand why the market may be mispricing the stocks, what factors are changing that can return the stock to fair value and whether those changes are sustainable over a medium term investment horizon based on both absolute and sector-relative valuation of cash flows, the relative earnings prospects of the company and the stock’s recent price action.

Fund Performance

The Touchstone Small Cap Value Opportunities Fund (Class A Shares) slightly underperformed its benchmark, the Russell 2000® Value Index, for the 12-month period ended June 30, 2013. The Fund’s total return was 24.31% (calculated excluding the maximum sales charge) while the total return of the benchmark was 24.76 % for the same period.

Market Environment

During the one-year period, the European Central Bank managed to eliminate the worst fears from the minds of investors around mid-year 2012, and equities rallied into year-end and through most of the first half of 2013. Investors’ risk appetite was not the driver of returns, however, unlike in previous rallies since the beginning of the financial crisis. Though the market favored value, performance was mixed between defensive and cyclical sectors, and the market dynamic was ultimately stock-specific.

Portfolio Review

As the market shifted away from macroeconomic and political themes, and instead focused on stock-specific drivers, the Fund posted a strong absolute return yet slightly underperformed its benchmark during the period.

The leading economic sectors, in terms of contribution to the Fund’s relative returns, were the Consumer Discretionary and Health Care sectors. Within the Consumer Discretionary sector, positions from multiple industry groups posted strong gains, many of which were the result of turnaround stories. Within the Health Care sector, the Fund’s services positions benefited from anticipated reimbursement rate increases.

Stock selection within the Financials sector was a top detractor during the period. Industry-wide regulatory changes (such as reduced fees paid to ATM providers by third-party networks) and increased competition weighed on the Fund’s selection of electronic payment processors and consumer finance companies. However, despite recent performance, we believe significant opportunities remain for these companies to benefit from growth among under-banked consumers, especially in areas such as prepaid debit cards and payday loans. The Fund also owned a number of stocks that benefited from Mergers & Acquisitions (M&A) activity during the period. The stocks were from multiple sectors that included Consumer Discretionary, Financials, Health Care, and Information Technology.

Among the individual stocks that contributed to Fund performance were Krispy Kreme Doughnuts, Inc. (Consumer Discretionary sector), Santarus, Inc. (Health Care sector), and Cooper Tire & Rubber Co., Multimedia Games Holdings Co. Inc. and Shutterfly, Inc. (all three from the Consumer Discretionary sector). Doughnut maker Krispy Kreme was a prime example of a turnaround story that was discussed earlier. During the period, the company appointed a new management team, closed underperforming stores, and implemented a strategy to grow its

Management's Discussion of Fund Performance (Unaudited) (Continued)

store base through franchise opportunities. The market took notice and the stock more than doubled during the last twelve months. After experiencing a sizable gain, the stock was sold during the period upon reaching a justified valuation. Santarus Inc., a specialty biopharmaceutical company, was a standout holding during the period. Santarus received official FDA approval of one of its major pipeline drugs, Uceris, and raised its full-year guidance estimates, which sent shares higher. Cooper Tire & Rubber, a global tire manufacturer, was an attractive stock during the period, as we believed the company would benefit from a favorable spread between raw materials costs and tire prices because it was the only tire company using a last-in-first-out accounting system. However, in June 2013, the company was acquired by a competitor at an attractive premium, which sent shares higher, and the stock was sold after benefiting from the increase in share price. Multimedia Games Holdings, a gaming machine company, received approval to sell gaming devices in Nevada, New Jersey, and Pennsylvania, which drove demand for the company. Internet-based photo-customizing company Shutterfly continued to take market share. The company, which allows users to turn digital photos into products such as calendars and greeting cards, forecasted higher-than-expected 2013 sales based on new mobile applications and recent acquisitions.

Among the individual stocks that detracted from performance during the period were ACCO Brands Corp. and Acacia Research Corp. (both in the Industrials sector), Energy XXI (Bermuda) Ltd. (Energy sector), magicJack VocalTec Ltd. (Telecommunication Services sector), and Noranda Aluminum Holding Corp. (Materials sector). Shares of ACCO Brands, an office-products manufacturer, declined after reporting lackluster forward guidance due to the uncertainty regarding the global unemployment picture, especially in Europe. Acacia Research, a patent- and licensing-services company, secured licensing deals with major technology companies during the quarter; however, investors were hoping for but did not see increased revenue from one of its largest clients Apple Inc., which sent shares lower. Shares of Energy XXI (Bermuda), an oil exploration and production company, experienced weather-related delays that resulted in reduced production output for the company. The company’s stock fell further in sympathy with the sell-off in crude oil and other commodities during the second quarter of 2013. Shares of magicJack VocalTec, an Internet phone-service provider, suffered as a result of a delayed rollout of the company’s new WiFi-enabled product. Noranda Aluminum, an integrated producer of aluminum products and rolled aluminum coils, suffered from weak aluminum prices industry-wide, which weighed on the company’s stock.

Outlook

Auto sales, unemployment, and commercial and residential construction all exhibited stable, positive trends, and consumer confidence improved during the one-year period. Going forward, as the U.S. economy continues to strengthen, we expect smaller companies, which tend to be more cyclical, will likely benefit from a pickup in both consumer and corporate spending. It is also at this point in the equity market cycle - with higher multiples and growth more stable and abundant - that investors seem to go searching for bargains, which tends to favor less expensive stocks. We continue to believe the Fund will be at an advantage in this environment due to its significant cash- flow-valuation discount and attractive growth characteristics relative to its benchmark. The market continues to display encouraging signs that investors are differentiating between stocks based on fundamentals rather than macro developments, which we believe is a favorable environment for the Fund’s stock-picking abilities.

Management's Discussion of Fund Performance (Unaudited) (Continued)

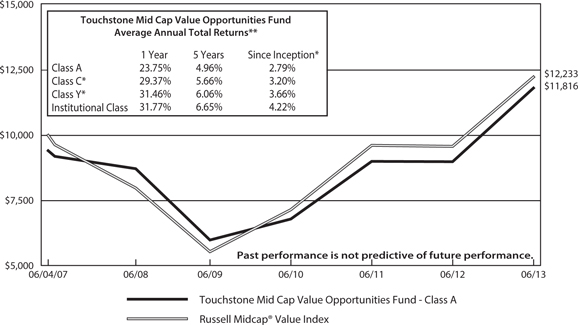

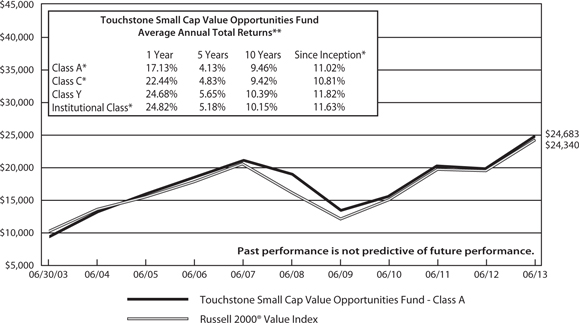

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Small Cap Value Opportunities Fund - Class A* and the Russell 2000® Value Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on July 31, 2003 April 12, 2012, July 25, 2003 and December 9, 2008, respectively. Performance information presented prior to July 25, 2003 for Class Y shares includes performance of a predecessor fund whose inception date was July 31, 2000. Class A shares, Class C shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for periods prior to July 31, 2003, April 12, 2012 and December 9, 2008, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Note to Chart

The Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Value Fund

Sub-Advised by Barrow, Hanley, Mewhinney & Strauss, LLC

Investment Philosophy

The Touchstone Value Fund seeks long-term growth by primarily investing in equity securities of large-and mid-cap companies believed to be undervalued. The Fund uses traditional methods of stock selection - research and analysis - to identify companies that have price-to-earnings and price-to-book ratios below the market, above-average dividend yields, and are out of favor due to internal or external challenges judged to be short-term in nature. Stock selection is driven by fundamental analysis on individual companies rather than by broad market themes.

Fund Performance

The Touchstone Value Fund (Class A Shares) underperformed its benchmark, the Russell 1000® Value Index, for the 12-month period ended June 30, 2013. The Fund’s total return was 21.56% (calculated excluding the maximum sales charge) while the total return of the benchmark was 25.32% for the same period.

Market Environment

Domestic equities rallied during the fiscal year period, until the U.S. Federal Reserve Board (the Fed) indicated it might start scaling back its massive bond-buying program. The announcement sparked a difficult period for the bond market and a pullback in most equity markets. The rapidity and magnitude of the rise in interest rates shocked investors in both bond and equity markets, challenging investors’ perceptions of safety and risk. Extrapolating further interest rate increases had some bond investors pouring out of retail bond funds after years of massive inflows, in spite of an economy that was still weak and measured inflation readings that were still low. The pain in the bond market has dwarfed that in the equity markets, but the pullback in equities has been enough to shake the confidence of many investors, particularly those who were seeking safety in stocks perceived to be bond proxies with high-dividend yields.

Despite the recent pullback in U.S. equities, stocks have proven much more resilient than many expected. While there was a more severe pullback in some of the highest-yielding sectors, such as Telecommunication Services and Utilities, it was unusual for the broader equity market to hold up as well as it did. During the period, domestic equities outperformed international equities and value outperformed growth. Within the S&P 500 Index, the Financials sector was the best performing sector while Utilities, typically one of the highest-yielding sectors, was the worst performing sector.

Portfolio Review

Within the Russell 1000® Value Index, there were some notable performance trends related to market capitalization and valuation. The largest companies, as defined by market capitalization, lagged the performance of companies further down the market-cap spectrum. Additionally, stocks with higher price-to-earnings (P/E) outperformed during the period. The Fund’s focus on companies trading at a significant P/E discount to the market was at odds with that performance attribute of the Russell 1000® Value Index over the period. The dividend premium and valuation discount the Fund seeks are often masked in a rapidly rising market. However, we believe a market in such rapid ascension inevitably moderates and the Fund’s relative performance advantage tends to be gained in more modestly rising or down markets.

Stock selection contributed to Fund performance during the period, and the Fund’s Energy and Heath Care sector stocks meaningfully outperformed those in the Index. However, the relative returns from those sectors were not enough to offset the negative impact from the Fund’s Consumer Staples stocks - especially tobacco companies - and holdings in the Information Technology sector.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Energy sector stocks were mixed during the one-year period, as oil price volatility continued to impact share prices. However, the largest positive contributor to Fund performance was Phillips 66 Co., a producer of natural gas liquids and petrochemicals. The company’s earnings were ahead of expectations, as its refining operations were able to access price-advantaged crudes in the U.S. and Canada and its chemical operations benefited from growing demand in the U.S. The company’s share price also benefited from an increase in its dividend during the period.

The Health Care sector proved to be fertile ground for finding companies that are trading at discounted valuations, have high free-cash-flow yields and have significant potential for capital return. The portfolio’s overweight to the sector added to the Fund’s relative performance during the period. Among the companies that supported Fund performance most were Baxter International Inc. and Medtronic Inc. Diversified health care company Baxter International has a profitable product line that has improved over time as the industry consolidates and vertically integrates. In addition, Baxter International’s relatively stable medical supply and pharmaceutical businesses performed well and the company’s pipeline of new products has improved rapidly. Though Baxter International did suffer from a disappointing delay to one of its new pipeline drugs, the delay was not material to earnings in the near term. Medtronic, a medical device manufacturer, has a broad array of new products in the pipeline, a new CEO with a strong track record and advantages over its competitors in product-bundling deals, which we believe should prove important as hospital systems consolidate and reduce costs. Though there were concerns about the company’s weaker ICD (Implantable Cardioverter Defibrillator) and spine markets, which weighed on the stock, the concerns started to ease during the period. The other portion of Medtronic’s business, however, performed well and we believe the outlook remains positive.

Within the Financials sector, stocks performed well during the period, particularly as the sell-off in the bond market drove interest rates higher. Fund performance was led by consumer credit companies American Express Co. and SLM Corp., and banks, JPMorgan Chase & Co. and Citigroup Inc. Many Financials sector stocks benefited from higher interest rates through higher net interest margins (the spread they charge between the cost of funds and the rate at which they loan the funds; net interest margins have been under pressure in the prolonged low-interest-rate environment). While these financial companies benefit the most from a rise in short-term rates, the market is also anticipating a steepening in the yield curve, which could further boost margins. The outlook for higher dividends and buybacks in the Financials space also continued to be robust. We believe incremental capital will continue to be built through retained earnings, much of which can be returned to shareholders.

The Fund’s underperformance in the Consumer Staples sector was driven almost entirely by tobacco holdings. The largest detractor in this sector was Imperial Tobacco Group PLC, whose underperformance suffered chiefly from a geography problem, given that more than 60 percent of its earnings come from Europe and the United Kingdom and many of the consumers in these regions have endured severe economic pressure. The beleaguered consumer is switching in droves either to illicit cigarettes or trading down to low-priced value cigarettes, and some are turning to RYO (roll your own) and MYO (make your own) cigarettes. The existence of illicit cigarettes has cut into Imperial Tobacco Group’s organic growth, and its price-to-earnings ratio has contracted as a result. Partial offsets to the adverse impact of illicit trade is the company’s strong positioning in fine-cut tobacco used in RYO cigarettes, its good growth in a handful of emerging markets and its strong cigar business.

Outlook

We believe interest rates and decisions made by the Fed will remain central issues for equity investors going forward and predicting the magnitude of further rate increases, or the Fed’s action or inaction is highly speculative. We can say that, for some time, we have kept our focus on higher interest rates when analyzing companies and we continue to believe that the stocks in the Fund’s portfolio should generate and return capital to shareholders in a variety of interest rate scenarios.

Management's Discussion of Fund Performance (Unaudited) (Continued)

We believe the effect of further interest rate increases on equities may be more muted than expected if accompanied by better economic growth (improving earnings), or if the economy proves less sensitive than in past cycles because rates (negative real rates) have been so low for so long. We believe it is also important to remember that the change in Fed language - which intended to taper purchases - does not include a signal to begin selling the massive portfolio of bonds on the Fed’s balance sheet, and should mean that Fed-driven interest rate hikes will not happen for some time. If rates do increase, we believe that equity markets can still post gains despite growing competition from higher bond rates. As always, we believe active stock selection remains key. While stocks don’t appear overvalued, we believe a significant amount of upside has likely been captured for now.

Management's Discussion of Fund Performance (Unaudited) (Continued)

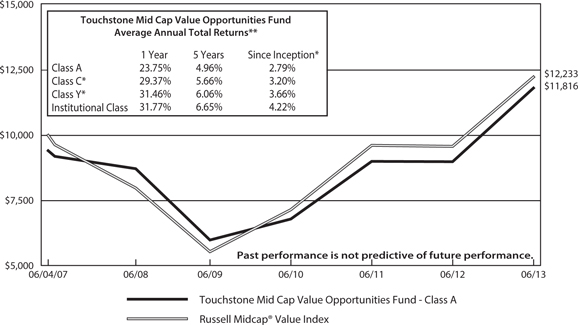

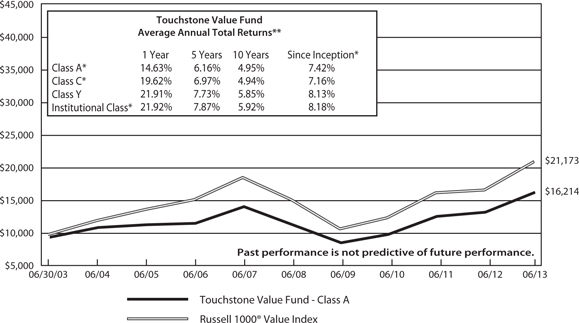

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Value Fund - Class A* and the Russell 1000® Value Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on July 31, 2003, April 12, 2012, September 10, 1998 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for the periods prior to July 31, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Note to Chart

The Russell 1000® Value Index measures those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Tabular Presentation of Portfolios of Investments (Unaudited)

June 30, 2013

The tables below provide each Fund’s sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Capital Growth Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 27.8 | % |

| Consumer Discretionary | | | 19.9 | |

| Industrials | | | 14.1 | |

| Health Care | | | 12.5 | |

| Energy | | | 8.6 | |

| Consumer Staples | | | 8.1 | |

| Financials | | | 6.2 | |

| Materials | | | 2.0 | |

| Investment Funds | | | 1.6 | |

| Other Assets/Liabilities (Net) | | | (0.8 | ) |

| Total | | | 100.0 | % |

| Touchstone International Small Cap Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Consumer Discretionary | | | 20.6 | % |

| Financials | | | 18.9 | |

| Industrials | | | 17.0 | |

| Materials | | | 9.3 | |

| Consumer Staples | | | 8.8 | |

| Information Technology | | | 8.7 | |

| Health Care | | | 6.0 | |

| Energy | | | 3.7 | |

| Utilities | | | 3.3 | |

| Telecommunication Services | | | 1.9 | |

| Exchange Traded Funds | | | 2.0 | |

| Investment Funds | | | 5.5 | |

| Other Assets/Liabilities (Net) | | | (5.7 | ) |

| Total | | | 100.0 | % |

| Touchstone Mid Cap Value Opportunities Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 18.8 | % |

| Information Technology | | | 17.7 | |

| Utilities | | | 13.3 | |

| Health Care | | | 11.8 | |

| Consumer Discretionary | | | 11.3 | |

| Industrials | | | 6.8 | |

| Energy | | | 5.2 | |

| Materials | | | 3.6 | |

| Telecommunications Services | | | 3.6 | |

| Consumer Staples | | | 2.0 | |

| Investment Funds | | | 15.4 | |

| Other Assets/Liabilities (Net) | | | (9.5 | ) |

| Total | | | 100.0 | % |

| Touchstone Small Cap Value Opportunities Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 26.3 | % |

| Industrials | | | 18.4 | |

| Consumer Discretionary | | | 13.0 | |

| Information Technology | | | 11.9 | |

| Health Care | | | 8.8 | |

| Materials | | | 5.1 | |

| Energy | | | 4.2 | |

| Utilities | | | 3.8 | |

| Consumer Staples | | | 3.5 | |

| Telecommunication Services | | | 1.4 | |

| Exchange Traded Fund | | | 1.3 | |

| Investment Funds | | | 11.7 | |

| Other Assets/Liabilities (Net) | | | (9.4 | ) |

| Total | | | 100.0 | % |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone Value Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 25.0 | % |

| Health Care | | | 20.7 | |

| Industrials | | | 12.9 | |

| Energy | | | 11.9 | |

| Consumer Staples | | | 7.4 | |

| Information Technology | | | 6.7 | |

| Consumer Discretionary | | | 5.5 | |

| Telecommunication Services | | | 4.6 | |

| Utilities | | | 1.1 | |

| Materials | | | 1.1 | |

| Investment Funds | | | 2.7 | |

| Other Assets/Liabilities (Net) | | | 0.4 | |

| Total | | | 100.0 | % |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Portfolio of Investments

Touchstone Capital Growth Fund – June 30, 2013

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks— 99.2% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 27.8% | | | | | | | | |

| Accenture PLC (Ireland) - Class A† | | | 33,680 | | | $ | 2,423,613 | |

| Analog Devices, Inc. | | | 59,480 | | | | 2,680,169 | |

| Apple, Inc. | | | 20,380 | | | | 8,072,110 | |

| ARM Holdings PLC (United Kingdom), ADR | | | 58,325 | | | | 2,110,198 | |

| ASML Holding NV | | | 23,323 | | | | 1,844,849 | |

| Broadcom Corp. - Class A | | | 71,185 | | | | 2,403,206 | |

| eBay, Inc.* | | | 68,400 | | | | 3,537,648 | |

| EMC Corp. | | | 140,396 | | | | 3,316,154 | |

| Equinix, Inc.* | | | 20,920 | | | | 3,864,342 | |

| Google, Inc. - Class A* | | | 8,154 | | | | 7,178,537 | |

| International Business Machines Corp. | | | 13,068 | | | | 2,497,425 | |

| Qualcomm, Inc. | | | 77,890 | | | | 4,757,521 | |

| Trimble Navigation Ltd.* | | | 126,430 | | | | 3,288,444 | |

| | | | | | | | 47,974,216 | |

| | | | | | | | | |

| Consumer Discretionary — 19.9% | | | | | | | | |

| Amazon.com, Inc.* | | | 8,375 | | | | 2,325,654 | |

| Autoliv, Inc.† | | | 22,665 | | | | 1,754,044 | |

| BorgWarner, Inc.* | | | 43,695 | | | | 3,764,324 | |

| Dollar General Corp.* | | | 48,025 | | | | 2,421,901 | |

| Lululemon Athletica, Inc. (Canada)* | | | 23,255 | | | | 1,523,668 | |

| Michael Kors Holdings Ltd. (Hong Kong)* | | | 62,870 | | | | 3,899,197 | |

| priceline.com, Inc.* | | | 3,435 | | | | 2,841,192 | |

| Ralph Lauren Corp. | | | 13,670 | | | | 2,375,026 | |

| Starbucks Corp. | | | 30,245 | | | | 1,980,745 | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 26,695 | | | | 1,686,857 | |

| Urban Outfitters, Inc.* | | | 79,820 | | | | 3,210,360 | |

| VF Corp. | | | 10,420 | | | | 2,011,685 | |

| Walt Disney Co. (The) | | | 34,410 | | | | 2,172,992 | |

| Williams-Sonoma, Inc. | | | 40,705 | | | | 2,275,002 | |

| | | | | | | | 34,242,647 | |

| | | | | | | | | |

| Industrials — 14.1% | | | | | | | | |

| Danaher Corp. | | | 48,875 | | | | 3,093,788 | |

| Deere & Co. | | | 36,540 | | | | 2,968,875 | |

| Flowserve Corp. | | | 47,595 | | | | 2,570,606 | |

| Fluor Corp. | | | 39,100 | | | | 2,319,021 | |

| Precision Castparts Corp. | | | 9,895 | | | | 2,236,369 | |

| Rockwell Automation, Inc. | | | 39,735 | | | | 3,303,568 | |

| Union Pacific Corp. | | | 26,155 | | | | 4,035,193 | |

| United Technologies Corp. | | | 40,485 | | | | 3,762,676 | |

| | | | | | | | 24,290,096 | |

| | | | | | | | | |

| Health Care — 12.5% | | | | | | | | |

| Allergan, Inc. | | | 16,669 | | | | 1,404,197 | |

| Celgene Corp.* | | | 29,721 | | | | 3,474,682 | |

| Cerner Corp.* | | | 23,834 | | | | 2,290,209 | |

| Express Scripts Holding Co.* | | | 38,371 | | | | 2,367,107 | |

| Henry Schein, Inc.* | | | 46,781 | | | | 4,479,281 | |

| Thermo Fisher Scientific, Inc. | | | 36,500 | | | | 3,088,995 | |

| Valeant Pharmaceuticals International, Inc. (Canada)* | | | 26,520 | | | | 2,282,842 | |

| Varian Medical Systems, Inc.* | | | 32,696 | | | | 2,205,345 | |

| | | | | | | | 21,592,658 | |

| | | | | | | | | |

| Energy — 8.6% | | | | | | | | |

| Anadarko Petroleum Corp. | | | 30,300 | | | | 2,603,679 | |

| Cameron International Corp.* | | | 54,785 | | | | 3,350,651 | |

| Chevron Corp. | | | 18,340 | | | | 2,170,356 | |

| Pioneer Natural Resources Co. | | | 23,458 | | | | 3,395,546 | |

| Schlumberger Ltd. | | | 45,626 | | | | 3,269,559 | |

| | | | | | | | 14,789,791 | |

| | | | | | | | | |

| Consumer Staples — 8.1% | | | | | | | | |

| Anheuser-Busch InBev N.V. (Belgium), ADR | | | 37,990 | | | | 3,428,977 | |

| Diageo PLC (United Kingdom), ADR | | | 29,275 | | | | 3,365,161 | |

| Estee Lauder Cos., Inc. (The) - Class A | | | 33,655 | | | | 2,213,489 | |

| Hain Celestial Group, Inc. (The)* | | | 30,720 | | | | 1,995,878 | |

| Walgreen Co. | | | 67,760 | | | | 2,994,992 | |

| | | | | | | | 13,998,497 | |

| | | | | | | | | |

| Financials — 6.2% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 36,042 | | | | 2,915,077 | |

| BlackRock, Inc. | | | 9,565 | | | | 2,456,770 | |

| Goldman Sachs Group, Inc. (The) | | | 17,070 | | | | 2,581,838 | |

| Ocwen Financial Corp.* | | | 65,850 | | | | 2,714,337 | |

| | | | | | | | 10,668,022 | |

| | | | | | | | | |

| Materials — 2.0% | | | | | | | | |

| Monsanto Co. | | | 35,210 | | | | 3,478,748 | |

| Total Common Stocks | | | | | | $ | 171,034,675 | |

| | | | | | | | | |

| Investment Funds— 1.6% | | | | | | | | |

| Invesco Government & Agency Portfolio, Institutional Class** | | | 1,219,083 | | | | 1,219,083 | |

| Touchstone Institutional Money Market Fund^ | | | 1,639,168 | | | | 1,639,168 | |

| Total Investment Funds | | | | | | $ | 2,858,251 | |

| | | | | | | | | |

| Total Investment Securities —100.8% | | | | | | | | |

| (Cost $119,682,020) | | | | | | $ | 173,892,926 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.8%) | | | | | | | (1,407,275 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 172,485,651 | |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

| ^ | Affiliated Fund. See Note 4 in Notes to Financial Statements. |

| † | All or a portion of the security is on loan. The total market value of the securities on loan as of June 30, 2013 was $1,157,702. |

Touchstone Capital Growth Fund (Continued)

Portfolio Abbreviations:

ADR - American Depositary Receipt

PLC - Public Limited Company

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

Valuation inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 171,034,675 | | | $ | — | | | $ | — | | | $ | 171,034,675 | |

| Investment Funds | | | 2,858,251 | | | | — | | | | — | | | | 2,858,251 | |

| | | | | | | | | | | | | | | $ | 173,892,926 | |

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone International Small Cap Fund – June 30, 2013

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks— 98.2% | | | | | | | | |

| | | | | | | | | |

| United Kingdom — 20.6% | | | | | | | | |

| Ashtead Group PLC | | | 163,138 | | | $ | 1,601,655 | |

| Babcock International Group PLC | | | 47,859 | | | | 802,891 | |

| Berendsen PLC | | | 63,596 | | | | 720,132 | |

| Blinkx PLC* | | | 476,100 | | | | 791,110 | |

| Cineworld Group PLC | | | 192,000 | | | | 990,692 | |

| Dialight PLC | | | 39,764 | | | | 679,184 | |

| Elementis PLC | | | 235,539 | | | | 785,990 | |

| esure Group PLC* | | | 202,435 | | | | 1,000,352 | |

| Hargreaves Lansdown PLC | | | 100,648 | | | | 1,359,364 | |

| Majestic Wine PLC | | | 111,861 | | | | 808,146 | |

| Micro Focus International PLC | | | 133,580 | | | | 1,442,505 | |

| Moneysupermarket.com Group PLC | | | 398,665 | | | | 1,161,773 | |

| Paragon Group of Cos. PLC | | | 229,037 | | | | 1,067,362 | |

| Rightmove PLC | | | 33,100 | | | | 1,049,164 | |

| Rotork PLC | | | 19,366 | | | | 786,446 | |

| Savills PLC | | | 197,124 | | | | 1,711,958 | |

| Spectris PLC | | | 31,400 | | | | 912,180 | |

| TalkTalk Telecom Group PLC | | | 216,700 | | | | 739,604 | |

| Taylor Wimpey PLC | | | 714,000 | | | | 1,039,811 | |

| TUI Travel PLC | | | 286,000 | | | | 1,552,495 | |

| WS Atkins PLC | | | 63,800 | | | | 978,135 | |

| | | | | | | | 21,980,949 | |

| | | | | | | | | |

| Japan — 18.2% | | | | | | | | |

| Avex Group Holdings, Inc. | | | 46,500 | | | | 1,465,139 | |

| Chiyoda Co. Ltd. | | | 31,600 | | | | 808,957 | |

| COMSYS Holdings Corp. | | | 69,000 | | | | 881,458 | |

| Credit Saison Co. Ltd. | | | 38,900 | | | | 976,226 | |

| Daiichikosho Co. Ltd. | | | 24,300 | | | | 665,690 | |

| FP Corp. | | | 13,700 | | | | 948,972 | |

| Fuji Media Holdings, Inc. | | | 600 | | | | 1,208,711 | |

| HIS Co. Ltd. | | | 25,800 | | | | 1,099,062 | |

| Hoshizaki Electric Co. Ltd. | | | 48,000 | | | | 1,539,020 | |

| Japan Petroleum Exploration Co. | | | 27,400 | | | | 1,111,968 | |

| Jin Co. Ltd.† | | | 22,500 | | | | 1,077,586 | |

| Pola Orbis Holdings, Inc. | | | 29,600 | | | | 1,001,291 | |

| Sawai Pharmaceutical Co. Ltd. | | | 7,800 | | | | 931,942 | |

| Seria Co. Ltd.† | | | 32,158 | | | | 969,150 | |

| Ship Healthcare Holdings, Inc. | | | 28,700 | | | | 1,056,211 | |

| Sumitomo Rubber Industries Ltd. | | | 59,200 | | | | 968,163 | |

| Suzuken Co. Ltd. | | | 23,900 | | | | 804,860 | |

| Tokyo Ohka Kogyo Co. Ltd. | | | 40,100 | | | | 921,839 | |

| Toshiba Machine Co. Ltd. | | | 210,400 | | | | 1,028,877 | |

| | | | | | | | 19,465,122 | |

| | | | | | | | | |

| Canada — 6.7% | | | | | | | | |

| Dollarama, Inc. | | | 12,034 | | | | 842,277 | |

| Element Financial Corp.* | | | 122,979 | | | | 1,399,694 | |

| Horizon North Logistics, Inc. | | | 191,666 | | | | 1,157,249 | |

| Intertape Polymer Group, Inc. | | | 85,900 | | | | 1,061,805 | |

| Onex Corp. | | | 26,579 | | | | 1,206,000 | |

| Westjet Airlines Ltd. | | | 67,500 | | | | 1,476,181 | |

| | | | | | | | 7,143,206 | |

| | | | | | | | | |

| Ireland — 6.3% | | | | | | | | |

| C&C Group PLC | | | 220,000 | | | | 1,186,109 | |

| Glanbia PLC | | | 71,209 | | | | 959,327 | |

| Greencore Group PLC | | | 605,000 | | | | 1,233,041 | |

| Kingspan Group PLC | | | 83,500 | | | | 1,111,870 | |

| Paddy Power PLC | | | 14,365 | | | | 1,239,684 | |

| Smurfit Kappa Group PLC | | | 62,205 | | | | 1,038,828 | |

| | | | | | | | 6,768,859 | |

| | | | | | | | | |

| Australia — 5.1% | | | | | | | | |

| DuluxGroup Ltd. | | | 298,703 | | | | 1,150,087 | |

| FlexiGroup Ltd. | | | 284,617 | | | | 1,134,896 | |

| Iluka Resources Ltd. | | | 98,000 | | | | 895,366 | |

| REA Group Ltd. | | | 35,000 | | | | 881,218 | |

| Spark Infrastructure Group | | | 868,576 | | | | 1,378,212 | |

| | | | | | | | 5,439,779 | |

| | | | | | | | | |

| Denmark — 5.1% | | | | | | | | |

| GN Store Nord A/S | | | 79,672 | | | | 1,505,816 | |

| Matas A/S* | | | 45,126 | | | | 937,155 | |

| Royal UNIBREW A/S | | | 12,689 | | | | 1,116,081 | |

| Topdanmark A/S* | | | 73,280 | | | | 1,867,137 | |

| | | | | | | | 5,426,189 | |

| | | | | | | | | |

| Germany — 4.6% | | | | | | | | |

| Aurelius AG | | | 44,421 | | | | 1,067,362 | |

| Draegerwerk AG & Co. KGaA (Preference)† | | | 8,700 | | | | 1,192,448 | |

| Freenet AG | | | 58,775 | | | | 1,283,738 | |

| NORMA Group AG | | | 37,700 | | | | 1,366,163 | |

| | | | | | | | 4,909,711 | |

| | | | | | | | | |

| France — 4.2% | | | | | | | | |

| Plastic Omnium SA | | | 34,000 | | | | 1,843,699 | |

| Teleperformance | | | 22,500 | | | | 1,083,032 | |

| UBISOFT Entertainment* | | | 116,620 | | | | 1,527,084 | |

| | | | | | | | 4,453,815 | |

| | | | | | | | | |

| Cayman Islands — 3.3% | | | | | | | | |

| NagaCorp Ltd. | | | 1,296,000 | | | | 1,010,927 | |

| Prince Frog International Holdings Ltd.† | | | 1,816,000 | | | | 1,254,989 | |

| Towngas China Co. Ltd. | | | 1,258,000 | | | | 1,252,153 | |

| | | | | | | | 3,518,069 | |

| | | | | | | | | |

| Norway — 2.7% | | | | | | | | |

| Borregaard ASA | | | 182,709 | | | | 797,088 | |

| Det Norske Oljeselskap ASA* | | | 55,861 | | | | 766,044 | |

| TGS Nopec Geophysical Co. ASA | | | 46,000 | | | | 1,336,604 | |

| | | | | | | | 2,899,736 | |

| | | | | | | | | |

| Belgium — 2.6% | | | | | | | | |

| Barco NV | | | 23,882 | | | | 1,932,607 | |

| EVS Broadcast Equipment SA | | | 11,798 | | | | 819,131 | |

| | | | | | | | 2,751,738 | |

| | | | | | | | | |

| Austria — 2.6% | | | | | | | | |

| Oesterreichische Post AG | | | 43,400 | | | | 1,694,739 | |

| RHI AG | | | 30,000 | | | | 1,044,568 | |

| | | | | | | | 2,739,307 | |

Touchstone International Small Cap Fund (Continued)

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 98.2% (Continued) | | | | | | | | |

| | | | | | | | | |

| Singapore — 2.3% | | | | | | | | |

| Asian Pay Television Trust* | | | 1,250,000 | | | $ | 838,264 | |

| China Minzhong Food Corp. Ltd.*† | | | 930,000 | | | | 766,746 | |

| SATS Ltd. | | | 334,000 | | | | 866,951 | |

| | | | | | | | 2,471,961 | |

| | | | | | | | | |

| Thailand — 2.1% | | | | | | | | |

| Sansiri PCL | | | 6,845,082 | | | | 688,591 | |

| Thai Tap Water Supply PCL | | | 2,691,902 | | | | 876,615 | |

| Tisco Financial Group PCL | | | 502,493 | | | | 664,266 | |

| | | | | | | | 2,229,472 | |

| | | | | | | | | |

| Italy — 2.1% | | | | | | | | |

| Banca Generali SpA | | | 57,592 | | | | 1,241,408 | |

| Recordati SpA | | | 85,531 | | | | 949,095 | |

| | | | | | | | 2,190,503 | |

| | | | | | | | | |

| Switzerland — 2.0% | | | | | | | | |

| Aryzta AG | | | 19,540 | | | | 1,098,485 | |

| Bucher Industries AG | | | 4,500 | | | | 1,078,132 | |

| | | | | | | | 2,176,617 | |

| | | | | | | | | |

| Finland — 2.0% | | | | | | | | |

| Huhtamaki OYJ | | | 68,105 | | | | 1,265,013 | |

| Pohjola Bank PLC, Class A† | | | 58,628 | | | | 861,571 | |

| | | | | | | | 2,126,584 | |

| | | | | | | | | |

| Bermuda — 1.7% | | | | | | | | |

| Catlin Group Ltd. | | | 128,902 | | | | 978,705 | |

| Lancashire Holdings Ltd. | | | 73,284 | | | | 882,779 | |

| | | | | | | | 1,861,484 | |

| | | | | | | | | |

| Luxembourg — 1.3% | | | | | | | | |

| Samsonite International SA | | | 591,000 | | | | 1,423,389 | |

| | | | | | | | | |

| Sweden — 1.2% | | | | | | | | |

| Fastighets AB Balder, Class B* | | | 174,811 | | | | 1,264,272 | |

| | | | | | | | | |

| Turkey — 0.8% | | | | | | | | |

| Dogus Otomotiv Servis ve Ticaret AS | | | 173,977 | | | | 882,198 | |

| | | | | | | | | |

| Cyprus — 0.7% | | | | | | | | |

| Prosafe SE | | | 87,100 | | | | 764,985 | |

| Total Common Stocks | | | | | | $ | 104,887,945 | |

| | | | | | | | | |

| Exchange Traded Fund — 2.0% | | | | | | | | |

| iShares MSCI EAFE Small Cap Index Fund† | | | 50,209 | | | | 2,105,765 | |

| | | | | | | | | |

| Investment Funds— 5.5% | | | | | | | | |

| Invesco Government & Agency Portfolio, Institutional Class** | | | 5,205,070 | | | | 5,205,070 | |

| Touchstone Institutional Money Market Fund^ | | | 699,197 | | | | 699,197 | |

| Total Investment Funds | | | | | | $ | 5,904,267 | |

| | | | | | | | | |

| Total Investment Securities —105.7% | | | | | | | | |

| (Cost $96,127,704) | | | | | | $ | 112,897,977 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (5.7%) | | | | | | | (6,039,080 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 106,858,897 | |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

| ^ | Affiliated Fund. See Note 4 in Notes to Financial Statements. |

| † | All or a portion of the security is on loan. The total market value of the securities on loan as of June 30, 2013 was $5,054,576. |

Portfolio Abbreviations:

PCL - Public Company Limited

PLC - Public Limited Company

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

Valuation inputs at Reporting Date:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 104,887,945 | | | $ | — | | | $ | — | | | $ | 104,887,945 | |

| Exchange Traded Fund | | | 2,105,765 | | | | — | | | | — | | | | 2,105,765 | |

| Investment Funds | | | 5,904,267 | | | | — | | | | — | | | | 5,904,267 | |

| | | | | | | | | | | | | | | $ | 112,897,977 | |

At June 30, 2013, equity securities valued at $49,843,113 were transferred from Level 2 to Level 1. Transfers from Level 2 to Level 1 are due to significant movement of a designated U.S. market index, triggering a systematic valuation model provided by an independent third party to fair value the international equity securities at the end of the prior reporting period.

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone Mid Cap Value Opportunities Fund – June 30, 2013

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks— 94.1% | | | | | | | | |

| | | | | | | | | |

| Financials — 18.8% | | | | | | | | |

| Allstate Corp. (The) | | | 54,700 | | | $ | 2,632,164 | |

| Annaly Capital Management, Inc. REIT | | | 303,000 | | | | 3,808,710 | |

| Assured Guaranty Ltd. (Bermuda) | | | 55,100 | | | | 1,215,506 | |

| Everest Re Group Ltd. (Bermuda) | | | 18,200 | | | | 2,334,332 | |

| Fairfax Financial Holdings Ltd. (Canada) | | | 6,200 | | | | 2,418,620 | |

| First Republic Bank | | | 61,000 | | | | 2,347,280 | |

| HCC Insurance Holdings, Inc. | | | 48,100 | | | | 2,073,591 | |

| Loews Corp. | | | 51,300 | | | | 2,277,720 | |

| Progressive Corp. (The) | | | 81,000 | | | | 2,059,020 | |

| Willis Group Holdings PLC (Ireland) | | | 27,420 | | | | 1,118,188 | |

| | | | | | | | 22,285,131 | |

| | | | | | | | | |

| Information Technology — 17.7% | | | | | | | | |

| Amdocs Ltd. (Guernsey) | | | 64,300 | | | | 2,384,887 | |

| CA, Inc. | | | 67,200 | | | | 1,923,936 | |

| Dolby Laboratories, Inc. - Class A† | | | 61,900 | | | | 2,070,555 | |

| EchoStar Corp.* | | | 26,400 | | | | 1,032,504 | |

| Global Payments, Inc.† | | | 48,800 | | | | 2,260,416 | |

| KLA-Tencor Corp. | | | 35,700 | | | | 1,989,561 | |

| Lam Research Corp.* | | | 40,600 | | | | 1,800,204 | |

| Micron Technology, Inc.* | | | 42,300 | | | | 606,159 | |

| Teradyne, Inc.*† | | | 95,300 | | | | 1,674,421 | |

| Total System Services, Inc. | | | 100,300 | | | | 2,455,344 | |

| Western Digital Corp. | | | 14,500 | | | | 900,305 | |

| Western Union Co. (The) | | | 103,900 | | | | 1,777,729 | |

| | | | | | | | 20,876,021 | |

| | | | | | | | | |

| Utilities — 13.3% | | | | | | | | |

| Alliant Energy Corp. | | | 54,200 | | | | 2,732,764 | |

| American Water Works Co., Inc. | | | 64,300 | | | | 2,651,089 | |

| CMS Energy Corp. | | | 98,800 | | | | 2,684,396 | |

| Westar Energy, Inc. | | | 81,700 | | | | 2,611,132 | |

| Wisconsin Energy Corp. | | | 65,900 | | | | 2,701,241 | |

| Xcel Energy, Inc. | | | 82,300 | | | | 2,332,382 | |

| | | | | | | | 15,713,004 | |

| | | | | | | | | |

| Health Care — 11.8% | | | | | | | | |

| AmerisourceBergen Corp. | | | 26,800 | | | | 1,496,244 | |

| Cardinal Health, Inc. | | | 36,800 | | | | 1,736,960 | |

| CIGNA Corp. | | | 8,000 | | | | 579,920 | |