UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust – March 5/3

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: March 31

Date of reporting period: March 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

March 31, 2013

Annual Report

Touchstone Strategic Trust

Touchstone International Value Fund

Touchstone Small Cap Growth Fund

(formerly known as Touchstone Micro Cap Value Fund)

Touchstone Small Company Value Fund

Touchstone Strategic Income Fund

Table of Contents

| | Page |

| Letter from the President | 3 |

| Management's Discussion of Fund Performance (Unaudited) | 4 - 18 |

| Tabular Presentation of Portfolios of Investments | 19 - 20 |

| Portfolios of Investments: | |

| Touchstone International Value Fund | 21 |

| Touchstone Small Cap Growth Fund (formerly known as Touchstone Micro Cap Value Fund) | 23 |

| Touchstone Small Company Value Fund | 28 |

| Touchstone Strategic Income Fund | 30 |

| Statements of Assets and Liabilities | 36 - 37 |

| Statements of Operations | 38 - 39 |

| Statements of Changes in Net Assets | 40 - 43 |

| Statements of Changes in Net Assets - Capital Stock Activity | 44 - 47 |

| Financial Highlights | 48 - 55 |

| Notes to Financial Statements | 56 - 74 |

| Report of Independent Registered Public Accounting Firm | 75 |

| Other Items (Unaudited) | 76 - 80 |

| Management of the Trust (Unaudited) | 81 - 83 |

| Privacy Protection Policy | 87 |

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. The fiscal year end of the Fifth Third Fund Trust was changed from July 31 to March 31 when Touchstone completed its acquisition of Fifth Third Funds in September 2012. Therefore, you are receiving this annual report for an abbreviated eight-month period. Inside you will find key financial information and manager commentaries for the period ended March 31, 2013.

At the outset of the period, U.S. equity markets were preoccupied with politics, including the U.S. Presidential campaign and election, and the uncertainty surrounding the fiscal cliff debate that lasted through year-end. Equity markets finished 2012 with positive returns and 2013 ushered in a resurgent bull market as investors brushed off political uncertainties resulting from U.S. debt and sequester negotiations.

Outside the U.S., the period was marked by improving confidence as European fiscal concerns lessened and Chinese economic data showed modest improvement. The European Central Bank enacted stimulus measures early in the period to offset Europe’s widespread debt crisis, contributing to improving investor confidence and a global equity rally through period end.

International stocks outperformed U.S. stocks and value stocks outpaced growth stocks for the period. From a market capitalization perspective, mid-cap stocks led small- and large-cap stocks, though each generated double-digit returns.

In the U.S., the Federal Reserve’s third round of quantitative easing was in place as the period commenced and the low interest rate environment persisted throughout. The non-U.S. Treasury sectors of the bond market outperformed the investment grade sectors.

We continue to believe that diversification is essential to balancing risk and return. We recommend that you consult with your financial professional to build an asset allocation strategy that meets your long-term goals.

Touchstone is committed to helping investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific areas of expertise.

We thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone International Value Fund

Sub-Advised by Barrow, Hanley, Mewhinney & Strauss, LLC

Investment Philosophy

The Touchstone International Value Fund seeks long-term capital growth by primarily investing in equity securities of non-U.S. companies believed to be undervalued and searches for companies that have price-to-earnings and price-to-book ratios below the market, free cash flow ratios at or below the market and dividend yields above the market.

Fund Performance

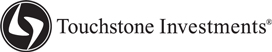

The Touchstone International Value Fund (Class A Shares) underperformed its benchmark, the MSCI EAFE Index, for the eight-month period ended March 31, 2013. The Fund’s total return was 11.15 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 18.45 percent. Prior to September 10, 2012, the performance, rating and ranking history for this Fund was that of the Fifth Third International Equity Fund, managed by Fifth Third Asset Management.

Market Environment

Since the financial crises of 2008, global equity market returns have been increasingly driven by coordinated stimulus and government intervention. Stock correlations within individual sectors have also risen dramatically, particularly in the historically defensive sectors such as Health Care, Consumer Staples, Utilities, and Telecommunication Services. The resulting dispersion of returns has been at all-time lows, which has made it difficult for individual companies to distinguish themselves. Consequently, the markets have been challenging for active equity managers to generate excess returns.

The fourth quarter of 2012 was strong for international equities, whether developed or emerging. The eurozone was mostly stable during the period, following the European Central Bank’s (ECB) reassuring promise to buy bonds in a euro-style version of Quantitative Easing (“QE”). In Asia, previous fears of a Chinese hard landing abated as the country’s new administration took office and evidence of increased economic activity emerged. In Japan, the election of the country’s new prime minister generated much excitement, as did the Liberal Democratic Party’s new commitment to aggressive monetary easing to weaken the yen, which should be a boost for Japanese exporters. Across asset classes, risk aversion was a priority for some investors, whose concerns over macro-economic events led them to the perceived safety of government bonds and other strategies to hedge risk. However, in a continued environment of massive global liquidity and a lower interest rate environment in many parts of the world, investors were rewarded for moving out of the risk spectrum into stocks and other higher beta1 assets. Sector performance was driven by improved expectations for a stable and improving global economy as stocks in the Financials and Consumer Discretionary sectors led the market. Energy stocks lagged on lower commodity prices, while investors moved away from the Utilities and Telecommunication Services sectors, which were last year’s safe havens.

Throughout the first quarter of 2013, equity market performance around the globe was generally strong but experienced a significant reversal in leadership over the prior quarter. The best performance occurred in some of the most mature, developed markets—led by the U.S. and Japan—where expansionary monetary policies drove demand for risk assets. Emerging markets lagged, as Chinese growth prospects cooled. Meanwhile, sectors that are more exposed to developed markets—such as Financials, Health Care, and Consumer stocks—performed well. Japanese equities continued to rally on expectations of further actions by the Bank of Japan and central government to stimulate growth. Prospects for economic growth in Europe remain muted as the continent continues to work through the mire of its sovereign debt crisis. Cyprus’ banking crisis late in the first quarter put pressure on many European banks, effectively creating headwinds for the remainder of the quarter. U.S.

Management's Discussion of Fund Performance (Unaudited)

(Continued)

asset markets were propelled during the period and continued to generate upward momentum. The United States’ easy monetary policy positively impacted the private sector, as household debt service declined materially from its peak in 2007.

Portfolio Review

Throughout the eight-month period, stock selection and weighting within the Materials sector was the largest contributor to the Fund’s relative performance. Stock selection in the Utilities sector also contributed during the period. Stock selection and weighting in the Financials, Information Technology, and Consumer Discretionary sectors were the primary detractors during the period. From a regional standpoint, the Fund’s underweight position and stock selection in Europe, primarily in the Financials sector, also detracted for the period. Weak stock selection in Japan was the largest detractor for the Fund over the period.

Stocks that detracted from performance throughout the period were Vodafone Group PLC (Telecommunication Services sector), Philip Morris International Inc. and Imperial Tobacco Group PLC (Consumer Staples sector), Teva Pharmaceutical Industries Ltd. (Health Care sector) and ING Groep N.V. and Banco Santander S.A. (Financials sector). Vodafone Group, a U.K.-based communications company, suffered due to weak operating results in Southern Europe and from a general reduction of dividends throughout the industry in Continental Europe. Vodafone’s management reduced cash flow guidance for fiscal 2013, which also contributed to the stock’s poor performance. Philip Morris International, a manufacturer of tobacco products, underperformed significantly during the fourth quarter, after having produced solid performance during the first nine months of 2012. All tobacco stocks sold off during the quarter, regardless of where they did business, as investors were rattled about possible U.S. price wars that might be instigated by Altria Group Inc. That said, Altria Group announced cigarette price increases in November and Philip Morris International stock suffered as a result. Imperial Tobacco Group, a British multinational tobacco company, suffered chiefly from a geography problem, given that more than 60 percent of its earnings come from Europe and the United Kingdom and many of the consumers in these regions are enduring severe economic pressure. Teva Pharmaceutical Industries, an Israel-based global pharmaceutical company, saw its stock decline as the company suffered through a CEO transition, weak earnings from its European business, and concern over the contribution to earnings from its largest branded drug, Copaxone. ING Groep, a European-based financial company, performed poorly after the financial crisis in Cyprus put pressure on all banking institutions in the eurozone and generated concerns over deposit outflows in southern Europe. Banco Santander, a Spain-based financial company, was weak in the quarter largely as a result of the Cypriot proposal to penalize depositors.

Contributors to performance for the period were Amada Company Ltd., Mabuchi Motor Co. Ltd., Embraer S.A. and MTU Aero Engines Holdings AG (Industrials sector), Canon Inc. (Information Technology sector), Itochu Corp. (Consumer Discretionary sector) and Novartis AG (Health Care sector). Amada Company, a Japan-based manufacturing company, performed positively due to a substantial weakening of the yen as well as increased optimism that the global economy will avoid a near-term recession. Mabuchi Motor Co., a Japan-based auto motor company, announced plans to reduce its capital expenditures in 2013 and increase the company’s dividend, which benefited the stock. Embraer, a Brazil-based aircraft manufacturer, saw its shares move higher primarily due to increased orders for the company’s aircraft. After a mid-January order for 20 aircraft, the company announced another airline company’s order of 47 E-Jets, with options for an additional 47. MTU Aero Engines Holdings is a German-based company that manufactures aircraft engine components and provides engine maintenance. The company’s positive performance during the period was the result of continued strong trends in the commercial aerospace industry and company management’s guidance of volume growth of new engines throughout 2016. Canon is a Japan-based manufacturing company, which operates in the office, consumer and industrial market segments. Canon’s shares ended the quarter on a high note as the yen weakened and the company’s DSLR (digital single-lens reflex) camera business continued to show solid order trends. The DSLR segment continues to benefit from duopoly status, strong pricing on lenses, and increasing penetration

Management's Discussion of Fund Performance (Unaudited)

(Continued)

in developing countries. Itochu, a Japan-based trading company, posted solid operational results during the period, as shares were driven by improved investor sentiment on Japan as well as some movement in commodities in which the company is invested. Novartis, a multinational pharmaceutical company based in Switzerland, remained a solid performer primarily because of its strong new drug pipeline and its implementation of cost reductions. Though some of its drugs suffered from the “patent cliff,” whereby the patents on their drugs had expired, Novartis still maintained a diverse product lineup with many products not impacted by patent expiration issues.

Outlook

Globally, margins and profits remain at high levels and companies are generating significant amounts of free cash flow. As a result, we expect “return of capital” will continue to be an important theme in 2013, as companies deploy cash to increase dividends, share repurchases, and global mergers and acquisitions activity. Furthermore, we believe that despite several years of robust equity returns, most markets around the world are still reasonably valued and we continue to find attractive individual stock opportunities in every major region of the world for the Fund’s relatively concentrated portfolio. While the last year was particularly challenging, we believe the Fund’s fundamental, concentrated process is well positioned for the market environment going forward. As such, we anticipate stocks will continue to become less correlated and individual company fundamentals will matter more. In our opinion, the Fund, comprised of a collection of companies with discounted valuations and above-average earnings and yield prospects, is strategically positioned to capitalize on these opportunities.

1Beta is a measure of the volatility of a portfolio relative to its benchmark.

Management's Discussion of Fund Performance (Unaudited)

(Continued)

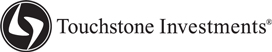

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International Value Fund - Class A* and the MSCI EAFE Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares commenced operations on August 18, 1994, Class C shares commenced operations on April 25, 1996, Class Y shares commenced operations on October 9, 1998 and Institutional Class shares commenced operations on September 10, 2012. The Class C shares performance information was calculated using the historical performance of Class A shares for periods prior to April 25,1996, Class Y shares performance information was calculated using the historical performance of Class A shares for periods prior to October 9, 1998 and Institutional Class shares performance information was calculated using the historical performance of Class A shares for periods prior to September 10, 2012. The returns have been restated for sales charges and for fees applicable to Class C, Class Y, and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

MSCI EAFE is a free float-adjusted market capitalization index that is designed to measure developed market equity performance excluding the U.S. and Canada.

Management's Discussion of Fund Performance (Unaudited)

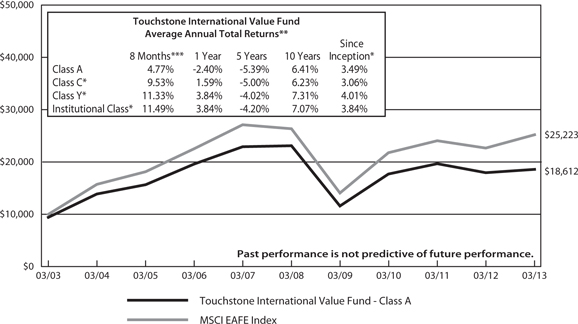

Touchstone Small Cap Growth Fund

Sub-Advised by Russell Implementation Services, Inc.

As discussed here and in the Subsequent Events section of the Notes to Financial Statements, the Touchstone Micro Cap Value Fund became the Touchstone Small Cap Growth Fund on April 26, 2013. This Annual Report presents the financial information and manager commentaries relating to the Fund as it existed during the relevant period, August 1, 2012 through March 31, 2013. In other words, this discussion and the remainder of the Annual Report are applicable to the previous micro-cap strategies and investments employed by the Fund through March 31, 2013 and are not financial information and commentaries related to the Fund’s small-cap growth strategies and investments that came into effect on April 26, 2013. Following this commentary and throughout this Annual Report the Touchstone Micro Cap Value Fund is referred to by its current name,Touchstone Small Cap Growth Fund.

Investment Philosophy

For the period of August 1, 2012 through January 15, 2013, the Touchstone Micro Cap Value Fund was sub-advised by Fifth Third Asset Management, Inc. For the period of January 16, 2013 through March 31, 2013, the Fund was managed by Russell Implementation Services, Inc. The Fund seeks capital appreciation by investing primarily in equity securities of micro-cap companies.

Fund Performance

The Touchstone Micro Cap Value Fund (Class A Shares) underperformed its benchmark, the Russell Microcap® Value Index, for the 8-month period ended March 31, 2013. The Fund’s total return was 20.93 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 22.15 percent.

Market Environment

Merger and Acquisition activity can be an important driver for the micro-cap sector and buy-out activity accelerated in 2012 in part due to anticipated changes to the tax code. Avoidance of the “Fiscal Cliff” and signs of improving employment conditions helped spur the market higher into the first quarter of 2013.

The Consumer Discretionary and Industrials sectors were the strongest performing sectors as signs of continued, albeit modest, economic growth in the U.S. has been an important driver of investor interest in these more cyclical sectors. The Energy sector was the only sector to experience negative returns during this period. A decline in the price of oil was the main performance driver.

Portfolio Review

For the period August 1, 2012 through March 31, 2013, there was wide performance dispersions across the sectors. The top returning sectors were Consumer Discretionary, Industrials, and Health Care. The weakest sectors were Energy and Utilities.

Stocks that contributed to performance for the period included OfficeMax Inc. (Consumer Discretionary sector), a retail office products company which provided strong performance following a buyout offer from competitor Office Depot, Inc. (Consumer Discretionary sector). Power Secure International (Industrials sector), which provides products and services to electric utilities, saw strong performance due to better than expected earnings and contract wins. BioScrip, Inc. (Health Care sector), which provides home infusion services, rallied on improving business conditions and acquisitions. Ducommun Inc. (Industrials sector), an aerospace and defense product and service provider, outperformed following stronger than expected earnings.

Management's Discussion of Fund Performance (Unaudited)

(Continued)

Stocks that detracted from performance for the period included Inteliquent (name changed to Neutral Tandem, Inc.) (Information Technology sector), a telecommunications equipment provider that reported a large earnings miss, guided down estimates and announced executive departures. The Dolan Co. (Consumer Discretionary sector), a professional services company, reported an earnings miss and a write down of assets, which put downward pressure on the stock. Great Panther Silver Ltd. (Materials sector), a silver mining and production company, has seen earnings weakness due to cost overruns. Endeavor International Corp. (Energy sector), an oil and gas exploration and production company, has seen significant share price weakness partly due to production shortfalls and halted operations at one well due to storm damage. A cash position that averaged approximately 6.5% of the Fund’s portfolio also detracted from performance.

Outlook

On February 21, 2013, the Board of Trustees approved changes to the Fund’s name, sub-advisor, and investment goals and strategy. Effective April 26, 2013, the Fund was renamed the Touchstone Small Cap Growth Fund and will seek long-term capital growth by primarily investing in small-cap companies.

Management's Discussion of Fund Performance (Unaudited)

(Continued)

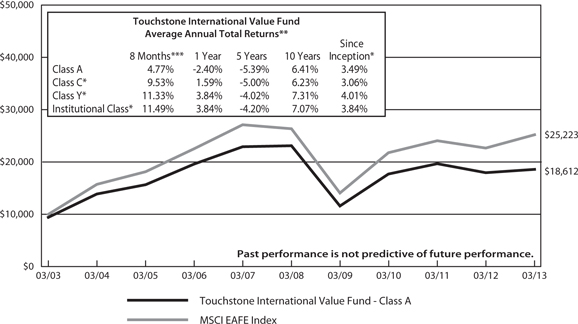

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Small Cap Growth Fund - Class A*, Russell 2000® Value Index and the Russell Microcap® Value Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares and Class C shares commenced operations on August 13, 2001, Class Y shares commenced operations on February 1, 1998 and Institutional Class shares commenced operations on September 10, 2012. The Class A and Class C shares performance information was calculated using the historical performance of Class Y shares for periods prior to August 13, 2001 and Institutional Class shares performance information was calculated using the historical performance of Class Y shares for periods prior to September 10, 2012. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

The Russell 2000®Value Index measures the performance for those Russell 2000®companies with lower price-to book ratios and lower forecasted growth values.

The Russell Microcap®Value Index measures the performance of those Russell Microcap companies with lower price-to-book ratios and lower forecasted growth values.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Small Company Value Fund

Sub-Advised by DePrince, Race & Zollo, Inc.

Investment Philosophy

The Touchstone Small Company Value Fund seeks long-term capital appreciation by investing primarily in common stocks of small-cap companies that appear to be trading below their perceived value. The Fund utilizes a bottom-up security selection process that consists of three factors: dividend yield, low valuation, and a fundamental catalyst. For the period of August 1, 2012 to September 9, 2012, the Fund was sub-advised by Fifth Third Asset Management, Inc. Following an acquisition by Touchstone Advisors, Inc. of certain Fifth Third Funds, DePrince, Race & Zollo Inc. was appointed the Fund’s sub-advisor effective September 10, 2012 and repositioned the portfolio to realign with its new strategy resulting in elevated turnover in the portfolio.

Fund Performance

The Touchstone Small Company Value Fund (Class A Shares) underperformed its benchmark, the Russell 2000® Value Index, for the eight-month period ended March 31, 2013. The Fund’s total return was 20.74 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 23.01 percent.

Market Environment

In the past eight months, the markets experienced a significant change in sentiment. Despite slower global activity and mixed economic data as the third quarter of 2012 closed, markets were supported by companies reporting in-line earnings on reduced expectations and the announcement of another round of quantitative easing by the Federal Reserve (the “Fed”). Even with a slower economic backdrop, U.S. companies continued to execute operationally, and equity market valuations remained attractive relative to alternative investments and historical averages. The fourth quarter of 2012 was marked by economic and political uncertainty both domestically and overseas. Investors grew concerned over the pace of the economic recovery, the impending fiscal cliff decision, and the presidential election. However, gains in employment boosted consumer confidence, which continues to drive the recovery in the auto and housing markets. Improvements in manufacturing and service sectors also supported global markets in the quarter. Amid the dramatic macro-economic swings that dominated markets in 2012, the stock market was able to remain forward-looking as economic conditions improved. This resulted in the U.S. major stock indexes reaching record highs during the first quarter of 2013 as investors continued to move money into U.S. equities.

Portfolio Review

Stock selection in the Energy sector and an underweight to the Consumer Discretionary sector were the largest detractors from Fund performance during the period. Additional detracting sectors for the period were the Materials and Telecommunication Services sectors. Throughout the eight-month period, overall stock selection and an overweight of the Health Care sector were the largest overall contributors to the Fund’s performance. The Information Technology, Utilities, and Consumer Staples sectors were additional contributors to performance during the period.

Among the individual stocks that contributed to Fund performance were Brooks Automation Inc. and Methode Electronics Inc. (both from the Information Technology sector), ALLETE Inc. and Black Hills Corp. (both from the Utilities sector). United Stationers Inc., Ryder System Inc., Harsco Corp. (all from the Industrials sector), Kronos Worldwide, Inc., and Titanium Metals Corp. (both from the Materials sector), and Steris Corporation and Meridian Bioscience, Inc. (both from the Health Care sector) were also contributors. Brooks Automation, a provider of automation, vacuums and instrumentation solutions, saw its shares rise during the period. The company reduced costs, achieved several new design wins in its core semiconductor business, and remained

Management's Discussion of Fund Performance (Unaudited)

(Continued)

committed to its emerging growth opportunity in the life sciences segment. Methode Electronics, a manufacturer of component and subsystem devices, saw its shares benefit due to positive results from its recently launched program for center consoles and trailer brake switches in General Motors’ GMT900 replacement platform. This is the largest program in company history and should continue to boost revenues. Methode Electronics also produces the TouchSensor program for Whirlpool appliances, which is beneficial as well. The Fund’s two Utilities sector holdings, ALLETE and Black Hills, also contributed to relative performance. Ryder System, a truck leasing company, exhibited better-than-expected earnings results on improved margins. Demand for this cost efficient alternative to purchasing trucks remains strong, and we believe Ryder’s margins will continue to improve as they integrate their new fleet of more energy efficient and technologically advanced trucks. United Stationers, a wholesale distributor of business products, had solid earnings and an accretive acquisition. Kronos Worldwide produces titanium dioxide, a key chemical component in making paint, and is directly tied to the housing and plastic markets. The stock’s performance was due to tighter inventory levels, better pricing, and improving construction outlooks in the U.S. and Asia. Titanium Metals accepted a takeover bid by Precision Castparts Corp. and was sold in December. Steris is a maker of antibacterial gel used in hospitals and doctor’s offices. The company got a positive FDA announcement, as expected, late in the third quarter of 2012 and released earnings that showed significant improvement in net income and free cash flow as a result of increased sales and better expense management. Meridian Bioscience is the maker of diagnostic test kits sold to clinics and hospitals for use in detecting strep A & B, along with numerous other infectious diseases. The company benefitted from the FDA approval of new tests.

Among the individual stocks that detracted from Fund performance were Noranda Aluminum Holding Corp. and Schnitzer Steel Industries Inc. (both from the Materials sector) and W&T Offshore Inc. (Energy sector). Noranda Aluminum, a producer of aluminum products and rolled aluminum coils, suffered as a result of international growth concerns. However, Noranda Aluminum is vertically integrated and should see incremental profitability improvement from increases in its bauxite capacity—a key input to alumina and aluminum production—through dredging and rail expansion in Jamaica. Aluminum supply should also tighten as high-cost producers are under severe cost pressures. Schnitzer Steel Industries, a recycler of ferrous and nonferrous scrap material, was also negatively impacted by international growth factors. We remain constructive on Schnitzer Steel, as the company is seeing positive results from its internal cost reduction program. Company management has reduced its selling, general and administrative (SG&A) expenses by 10 percent in the past year and plans to continue the program through year-end. The company is also growing its auto parts segment, which should benefit from strengthening domestic auto sales. Better auto sales and construction activity provided incremental sources of scrap supply, which should boost processing spreads. W&T Offshore is an exploration and production company with concentrations in the Gulf of Mexico, and onshore operations in the Permian Basin and East Texas. W&T Offshore traded lower on growth and production concerns despite beating its earnings expectations for the fourth quarter of 2012. The company remains committed to diversifying its onshore assets through acquisitions and we expect it should benefit from seven additional horizontal drilling sites planned this year at the Yellow Rose Wolfberry project. EXCO Resources, Inc. is tied to natural gas prices, which were rising in the second half of the year until December when they were negatively impacted by the milder winter weather. EXCO is divesting non-strategic assets and expects to generate close to $1 billion in proceeds to fund significant oil acquisitions going forward.

Outlook

With regard to the Fund, we believe low relative valuations combined with improving earnings outlooks and supportive central bank policies should provide a supportive backdrop for the portfolio as we enter the second quarter of 2013. We also expect the Fund to remain positioned in companies that can benefit from the ongoing economic recovery, albeit to a lesser degree than it was at the beginning of the year. For example, at the end of the first quarter, the Fund’s bottom-up process led the Fund’s portfolio to an overweight in economically sensitive sectors such as Information Technology, Industrials, and Materials.

Management's Discussion of Fund Performance (Unaudited)

(Continued)

We believe the fundamental backdrop for financial companies continues to show improvement. These stocks have screened well on a valuation basis for several quarters, but we are now gaining conviction in fundamental catalysts to increase the Fund’s exposure to the space. As the yield curve steepens, the housing and commercial real estate markets recover, and credit quality and loan growth improve, we remain constructive on bank stocks. Furthermore, we believe increased mergers and acquisitions activity should also continue to fuel the positive sentiment toward the sector. Going forward, we remain concerned that the weakness in Europe and Asia could impact the domestic economic recovery, even though it continues to show incremental signs of strength. We are also concerned the strong momentum may not be sustainable given the tepid rate of recovery we’ve seen in the underlying economy.

Management's Discussion of Fund Performance (Unaudited)

(Continued)

Comparison of the Change in Value of a $10,000 Investment in the Small Company Value Fund - Class A* and the Russell 2000® Value Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares, Class C shares and Class Y shares commenced operations on April 1, 2003, and Institutional Class shares commenced operations on September 10, 2012. Institutional Class shares performance information was calculated using the historical performance of Class A shares for periods prior to September 10, 2012. The returns have been restated for sales charges and for fees applicable to Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

The Russell 2000® Value Index measures the performance for those Russell 2000® companies with lower price-to book ratios and lower forecasted growth values.

Management's Discussion of Fund Performance (Unaudited)

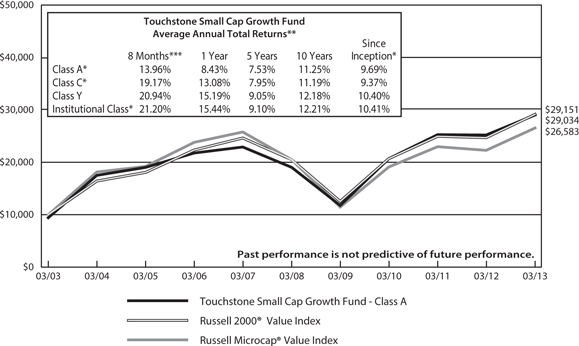

Touchstone Strategic Income Fund

Sub-Advised by Fifth Third Asset Management, Inc.

Investment Philosophy

The Fund seeks a high level of income consistent with reasonable risk by investing in a variety of income-producing asset classes including debt securities, common stock, and preferred stock. A top-down macro-economic perspective, along with bottom-up security selection analysis, with an emphasis on quality, relative value, and high current income is employed. The approach seeks to maximize risk-adjusted returns through fundamental research, quantitative modeling, and capital structure analysis by evaluating companies on such factors as sales, assets, earnings, markets, and management. Correlation analysis, the statistical measure of how two securities move in relation to each other, is conducted between asset classes in an effort to build a portfolio with low correlation to both stocks and bonds.

Fund Performance

The Touchstone Strategic Income Fund (Class A Shares) outperformed its benchmark the Barclays U.S. Aggregate Bond Index for the eight-month period ended March 31, 2013. The Fund’s total return was 4.77 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 0.29 percent.

Market Environment

The macro-economic backdrop was characterized by spread tightening, yield compression, and an increasingly sharp investor focus on yield as fixed-income assets delivered solid performance during the eight-month period. Upward yield pressure was kept in check by a combination of coordinated quantitative easing among the world’s central banks and a continued slow-growth environment still burdened by high debt amounts.

While the beginning of the period did not provide much reason to celebrate, the markets still indicated that they generally felt reassured by continued policy support for liquidity, especially in Europe. Accordingly, the U. S. Treasury market began the period flat to slightly negative, restrained by the tilt toward an environment that favored “risk-on” strategies. U.S. economic data remained relatively weak, albeit steady, as Europe continued to wallow in recession. Stocks finished with strength at the outset of the period. As corporate spreads continued to narrow, bonds also improved. Gold began the period reinvigorated by the strong talk of more monetary stimulus and climbed sharply. Real Estate Investment Trusts (REITs), in contrast, underperformed the general stock market.

Toward year-end 2012, the markets generally avoided downward volatility aside from a brief selloff after the U.S. election. The Federal Reserve (Fed) gave a hint of an exit strategy in its last meeting of the year stating it would target 6.5% unemployment as the best time to withdraw stimulus. For the most part, this environment created a “grind it out” ending to 2012. U.S. stocks were flat to slightly down as they consolidated large gains made earlier in the period. Long-term U.S. Treasury bonds rose from historic lows on hopes of better growth ahead and, at year-end, a deal to avoid the front page crisis known as the “fiscal cliff.”

The equity markets started off 2013 with continued reports of solid earnings in the U.S. Overall, economic data in the U. S. proved steady as the Fed reiterated its accommodative stance, despite continued speculation that its quantitative easing policies would start unwinding sometime in 2013. Meanwhile, the ongoing relative calm in the Eurozone was read by investors as a net positive as well. In early 2013, a sovereign debt scare arose in Cyprus as bank customer savings were “bailed in” to rescue banks there with fresh liquidity. However, the rest of early 2013 passed relatively quietly in Europe with very limited cross-border, sovereign-debt contagion. Simultaneously, Japan’s economy showed signs of life as that country’s new regime reiterated their intent to weaken the yen until deflation was defeated.

Management's Discussion of Fund Performance (Unaudited)

(Continued)

Portfolio Review

Core bond holdings contributed to Fund performance during the period, led by new purchases and credit rating upgrades. Sovereign bond holdings outperformed, led by Polish government bonds. The Fund’s Investment Grade and High Yield Corporate Bond holdings also outperformed, led by positions in the Industrials and Consumer Discretionary sectors.

The Fund’s Preferred allocation performed well, and benefited from the lower systemic risk in Europe and new issue selection. Even though call risk weighed on appreciation potential, Preferred holdings outperformed, led by American Financial Group, Inc. and First Horizon National Corp. (Financials sector). Selections of new issues and Convertible holdings also helped relative performance. The Fund’s Non-Convertible Preferred allocation kept up with the strong market, with contributions from some of the larger holdings in General Electric Company (Industrials sector), Endurance Specialty Holdings Ltd., Arch Capital Group Ltd., and JPMorgan Chase & Co. (all in the Financials sector). Call activity in Preferreds picked up during the period and the Fund sold issues that Fund management anticipated would be called and were trading at negative yields to their call dates.

Investments in natural resources underperformed in both the Core bond and Preferred portion of the Fund’s portfolio due to weaker oil prices. Additionally, gold continued to have an adverse effect on the Fund’s portfolio. This resulted in selling the Fund’s direct exposure to gold at the end of the period, while continuing to hold some exposure to gold mining on the belief they were oversold. A single gold holding detracted the most from Fund performance, when the Convertible Preferred holding declined during the period on a mix of bad sentiment, labor issues, and a worrisome change of senior management.

The Fund’s equity exposure was additive to performance. The environment shifted from “risk-off” to “risk on” during the period. In this same timeframe, both DDR Corp. and MeadWestvaco Corp. (Consumer Goods sector) were primary contributors to equity performance. Other contributors were Telstra Corp. Ltd. (Technology sector) and Valero Energy Corp. (Utilities sector) which provided strong performance as refinery stocks were in favor. Telstra, which contributed strongly over the period, hit its target and was sold. The Fund added Marathon Petroleum Corp. (Materials sector) while exiting Rockwell Automation, Inc. (Industrial Goods sector) after it rallied on earnings.

The Fund’s Real Estate Investment Trust (REIT) holdings contributed mixed performance. While the Fund’s REIT allocation benefitted particularly from positions in Two Harbors Investment Corp., Starwood Property Trust, Inc., and Hospitality Properties Trust (all in the Financials sector), several of the Fund’s mortgage REITs detracted amid worries that a pickup in mortgage refinancing activity would cause massive cuts to dividends and declines in book value.

Significant changes to the Fund’s portfolio over the period included adding exposure to Equities, Convertibles, and High Yield Corporate Bonds. Stocks that had performed well were sold as they climbed to what we believed were fair value and therefore offered limited potential for further price appreciation.

Outlook

We are doubtful that Fed policies alone will stimulate growth. Nonetheless, we expect to maintain a healthy yield premium to Core bond mandates even as we remain disciplined and wary of market imbalances that may be developing and creating risk. Although interest rates continue to defy expectations, we believe the seeds are being sown for a sustained rise in yields.

While we thought the period would end more eventfully, not much changed. Equities in the U.S. look poised to advance, in our belief, as there appears to be few other options for investors to pursue as credit spreads approach pre-crisis levels and U.S. Treasury yields remain very low. Despite speculation on the part of analysts, the Fed has not moved from its current position. While investors will look to the earnings season for clues on

Management's Discussion of Fund Performance (Unaudited)

(Continued)

the market’s direction, nervousness abounds. In keeping with our view that we will continue to experience a relatively slow growth environment, especially in light of the ongoing pullback in government spending referred to as “sequestration,” we remain neutral on the direction of interest rates at this time. Additionally, our belief is that the stock market will continue to work forward (perhaps after a correction), but at a slower and more defensive pace. From a relative value standpoint the common wisdom seems to indicate that there simply aren’t many alternatives to equities worth considering. Common wisdom, however, can be quickly undone. We see at least two wild cards on the horizon that could do just that: Europe’s ongoing Sovereign debt saga, and the tense geopolitical situation in Asia, which seems to be growing hotter by the moment. Even as we revisit our short position on the yen, we are looking for cooler heads to prevail in that region, too.

Management's Discussion of Fund Performance (Unaudited)

(Continued)

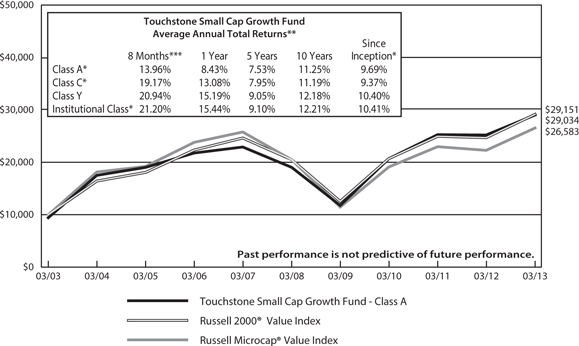

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Strategic Income Fund - Class A* and the Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares commenced operations on April 1, 2004, Class C shares commenced operations on October 29, 2001, Class Y shares commenced operations on September 1, 1998 and Institutional Class shares commenced operations on September 10, 2012. The Class A shares, Class C shares and Class Y shares performance information was calculated using the historical performance of the Fifth Third/ Maxus Income Fund Investor shares, with an inception date of March 10, 1985, for periods prior to April 1, 2004, October 29, 2001 and September 1, 1998, respectively. Institutional Class shares performance information was calculated using the historical performance of Class Y shares for the periods prior to September 10, 2012. The returns have been restated for sales charges and for fees applicable to Class A, Class C, Class Y and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Tabular Presentation of Portfolios of Investments (Unaudited)

March 31, 2013

The tables below provide each Fund’s sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone International Value Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 24.4 | % |

| Industrials | | | 17.7 | |

| Consumer Staples | | | 11.2 | |

| Energy | | | 10.5 | |

| Consumer Discretionary | | | 8.2 | |

| Health Care | | | 8.0 | |

| Utilities | | | 5.2 | |

| Information Technology | | | 4.9 | |

| Materials | | | 4.4 | |

| Telecommunication Services | | | 3.1 | |

| Investment Funds | | | 18.7 | |

| Other Assets/Liabilities (Net) | | | (16.3 | ) |

| Total | | | 100.0 | % |

| | | | | |

| Touchstone Small Company Value Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 25.6 | % |

| Industrials | | | 17.8 | |

| Information Technology | | | 16.4 | |

| Consumer Discretionary | | | 12.5 | |

| Materials | | | 10.9 | |

| Energy | | | 5.1 | |

| Health Care | | | 4.3 | |

| Consumer Staples | | | 3.5 | |

| Utilities | | | 1.3 | |

| Investment Funds | | | 16.3 | |

| Other Assets/Liabilities (Net) | | | (13.7 | ) |

| Total | | | 100.0 | % |

| | | | | |

| Touchstone Small Cap Growth Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 38.3 | % |

| Industrials | | | 15.1 | |

| Information Technology | | | 10.9 | |

| Consumer Discretionary | | | 10.8 | |

| Health Care | | | 6.6 | |

| Consumer Staples | | | 4.8 | |

| Materials | | | 3.7 | |

| Energy | | | 3.2 | |

| Utilities | | | 3.1 | |

| Telecommunication Services | | | 1.5 | |

| Rights | | | 0.0 | |

| Investment Fund | | | 1.9 | |

| Other Assets/Liabilities (Net) | | | 0.1 | |

| Total | | | 100.0 | % |

| | | | | |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Tabular Presentation of Portfolios of Investments (Unaudited)

March 31, 2013 (Continued)

| Touchstone Strategic Income Fund | | | |

| Credit Quality* | | (% of Fixed Income Securities) | |

| AAA/Aaa | | | 25.2 | % |

| AA/Aa | | | 7.0 | |

| A/A | | | 4.8 | |

| BBB/Baa | | | 38.1 | |

| BB/Ba | | | 13.3 | |

| B/B | | | 6.7 | |

| NR | | | 4.9 | |

| | | | 100.0 | % |

| Credit Quality* | | (% of Preferred Stocks) | |

| A/A | | | 13.4 | |

| BBB/Baa | | | 52.6 | |

| BB/Ba | | | 8.6 | |

| NR | | | 25.4 | |

| | | | 100.0 | % |

| Sector Allocation** | | (% of Net Assets) | |

| Fixed Income Securities | | | 51.4 | |

| Preferred Stocks | | | 31.0 | |

| Common Stocks | | | | |

| Financials | | | 4.3 | |

| Health Care | | | 2.4 | |

| Energy | | | 2.3 | |

| Utilities | | | 2.1 | |

| Industrials | | | 1.4 | |

| Information Technology | | | 0.8 | |

| Telecommunication Services | | | 0.6 | |

| Consumer Staples | | | 0.5 | |

| Consumer Discretionary | | | 0.3 | |

| Investment Funds | | | 1.8 | |

| Other Assets/Liabilities (Net) | | | 1.1 | |

| Total | | | 100.0 | % |

| * | Composite of Standard and Poors, Moody's and Fitch ratings. |

| ** | Sector classifications are based upon the Global Industry Classification Standard (GICS®). |

Portfolio of Investments

Touchstone International Value Fund – March 31, 2013

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks— 97.6% | | | | | | | | |

| | | | | | | | | |

| United Kingdom — 23.9% | | | | | | | | |

| Anglo American PLC | | | 68,198 | | | $ | 1,753,317 | |

| Barclays PLC | | | 580,231 | | | | 2,566,883 | |

| BP PLC | | | 555,946 | | | | 3,884,941 | |

| Dairy Crest Group PLC | | | 274,747 | | | | 1,789,260 | |

| DS Smith PLC | | | 697,428 | | | | 2,318,650 | |

| Imperial Tobacco Group PLC | | | 113,839 | | | | 3,976,661 | |

| Invensys PLC | | | 295,972 | | | | 1,577,606 | |

| National Grid PLC | | | 299,805 | | | | 3,484,887 | |

| Royal Dutch Shell PLC - Class A | | | 106,622 | | | | 3,442,814 | |

| Sage Group PLC (The) | | | 304,886 | | | | 1,587,596 | |

| Vodafone Group PLC | | | 1,385,480 | | | | 3,928,261 | |

| | | | | | | | 30,310,876 | |

| | | | | | | | | |

| Japan — 13.4% | | | | | | | | |

| Amada Co. Ltd. | | | 443,000 | | | | 2,922,431 | |

| Canon, Inc. | | | 76,500 | | | | 2,803,686 | |

| ITOCHU Corp. | | | 334,500 | | | | 4,082,865 | |

| Mabuchi Motor Co. Ltd. | | | 55,000 | | | | 2,956,392 | |

| Sumitomo Corp. | | | 199,700 | | | | 2,509,641 | |

| Yokogawa Electric Corp. | | | 182,100 | | | | 1,818,388 | |

| | | | | | | | 17,093,403 | |

| | | | | | | | | |

| Switzerland — 8.0% | | | | | | | | |

| ABB Ltd. | | | 79,572 | | | | 1,794,625 | |

| ABB Ltd. ADR† | | | 38,100 | | | | 867,156 | |

| Helvetia Holding AG | | | 2,277 | | | | 917,468 | |

| Novartis AG | | | 61,149 | | | | 4,344,780 | |

| Zurich Insurance Group AG | | | 8,062 | | | | 2,243,738 | |

| | | | | | | | 10,167,767 | |

| | | | | | | | | |

| Norway — 6.9% | | | | | | | | |

| DNB ASA | | | 181,501 | | | | 2,661,569 | |

| Marine Harvest ASA* | | | 2,651,070 | | | | 2,457,825 | |

| Orkla ASA | | | 216,867 | | | | 1,733,971 | |

| Seadrill Ltd.† | | | 48,000 | | | | 1,786,080 | |

| Seadrill Ltd. | | | 3,248 | | | | 117,725 | |

| | | | | | | | 8,757,170 | |

| | | | | | | | | |

| France — 6.6% | | | | | | | | |

| Casino Guichard Perrachon SA | | | 29,231 | | | | 3,071,780 | |

| GDF Suez | | | 48,736 | | | | 938,337 | |

| Sanofi | | | 42,925 | | | | 4,361,719 | |

| | | | | | | | 8,371,836 | |

| | | | | | | | | |

| Singapore — 6.6% | | | | | | | | |

| Jardine Cycle & Carriage Ltd. | | | 131,000 | | | | 5,400,113 | |

| United Overseas Bank Ltd. | | | 180,000 | | | | 2,957,552 | |

| | | | | | | | 8,357,665 | |

| | | | | | | | | |

| Germany — 6.3% | | | | | | | | |

| Daimler AG | | | 51,000 | | | | 2,774,823 | |

| Deutsche Boerse AG | | | 39,406 | | | | 2,386,474 | |

| MTU Aero Engines Holding AG | | | 30,443 | | | | 2,885,786 | |

| | | | | | | | 8,047,083 | |

| | | | | | | | | |

| Netherlands — 5.7% | | | | | | | | |

| Aegon N.V. | | | 412,600 | | | | 2,481,037 | |

| Delta Lloyd N.V. | | | 154,900 | | | | 2,656,722 | |

| ING Groep NV* | | | 298,643 | | | | 2,119,656 | |

| | | | | | | | 7,257,415 | |

| | | | | | | | | |

| Italy — 3.2% | | | | | | | | |

| Eni SpA | | | 85,291 | | | | 1,916,566 | |

| Snam SpA | | | 470,708 | | | | 2,145,615 | |

| | | | | | | | 4,062,181 | |

| | | | | | | | | |

| Brazil — 2.9% | | | | | | | | |

| Brookfield Incorporacoes SA | | | 617,600 | | | | 761,016 | |

| Embraer SA ADR | | | 80,800 | | | | 2,882,136 | |

| | | | | | | | 3,643,152 | |

| | | | | | | | | |

| Spain — 2.2% | | | | | | | | |

| Banco Santander SA | | | 416,288 | | | | 2,797,238 | |

| | | | | | | | | |

| Austria — 2.1% | | | | | | | | |

| Erste Group Bank AG* | | | 97,700 | | | | 2,721,403 | |

| | | | | | | | | |

| Denmark — 1.8% | | | | | | | | |

| Danske Bank AS* | | | 131,225 | | | | 2,346,365 | |

| | | | | | | | | |

| Russia — 1.7% | | | | | | | | |

| Rosneft OAO GDR | | | 286,300 | | | | 2,184,241 | |

| | | | | | | | | |

| Korea — 1.7% | | | | | | | | |

| Shinhan Financial Group Co. Ltd. | | | 60,550 | | | | 2,168,720 | |

| | | | | | | | | |

| Israel — 1.2% | | | | | | | | |

| Teva Pharmaceutical Industries Ltd. ADR | | | 38,500 | | | | 1,527,680 | |

| | | | | | | | | |

| Hong Kong — 1.2% | | | | | | | | |

| Yue Yuen Industrial Holdings Ltd. | | | 455,700 | | | | 1,485,235 | |

| | | | | | | | | |

| United States — 1.0% | | | | | | | | |

| Philip Morris International, Inc. | | | 13,100 | | | | 1,214,501 | |

| | | | | | | | | |

| Cayman Islands — 0.7% | | | | | | | | |

| Dongyue Group† | | | 1,581,600 | | | | 916,864 | |

| | | | | | | | | |

| Luxembourg — 0.5% | | | | | | | | |

| Arcelormittal | | | 47,888 | | | | 616,924 | |

| Total Common Stocks | | | | | | $ | 124,047,719 | |

| | | | | | | | | |

| Investment Funds— 18.7% | | | | | | | | |

| Invesco Government & Agency | | | | | | | | |

| Portfolio, Institutional Class** | | | 2,451,274 | | | | 2,451,274 | |

| Touchstone Institutional Money Market | | | | | | | | |

| Fund^ | | | 21,291,834 | | | | 21,291,834 | |

| Total Investment Funds | | | | | | $ | 23,743,108 | |

Touchstone International Value Fund

March 31, 2013 (Continued)

| | | Market | |

| | | Value | |

| | | | |

| Total Investment Securities —116.3% | | | | |

| (Cost $147,078,306) | | $ | 147,790,827 | |

| | | | | |

| Liabilities in Excess of Other Assets — (16.3%) | | | (20,722,798 | ) |

| | | | | |

| Net Assets — 100.0% | | $ | 127,068,029 | |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

| ^ | Affiliated Fund. See Note 4 in Notes to Financial Statements. |

| † | All or a portion of the security is on loan. The total market value of the securities on loan as of March 31, 2013 was $2,379,203. |

Portfolio Abbreviations:

ADR - American Depositary Receipt

GDR - Global Depositary Receipt

PLC - Public Limited Company

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

Valuation inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 124,047,719 | | | $ | — | | | $ | — | | | $ | 124,047,719 | |

| Investment Funds | | | 23,743,108 | | | | — | | | | — | | | | 23,743,108 | |

| | | | | | | | | | | | | | | $ | 147,790,827 | |

See accompanying Notes to Financial Statements.

Portfolio of Investments

Touchstone Small Cap Growth Fund – March 31, 2013

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks— 98.0% | | | | | | | | |

| | | | | | | | | |

| Financials — 38.3% | | | | | | | | |

| 1st United Bancorp, Inc. | | | 3,153 | | | $ | 20,368 | |

| Access National Corp. | | | 1,674 | | | | 27,454 | |

| ACNB Corp. | | | 1,097 | | | | 18,276 | |

| AG Mortgage Investment Trust, Inc. REIT | | | 659 | | | | 16,785 | |

| American Equity Investment Life Holding Co. | | | 33,239 | | | | 494,929 | |

| American River Bankshares* | | | 2,032 | | | | 15,260 | |

| Ameris Bancorp* | | | 1,481 | | | | 21,252 | |

| Ameriserv Financial, Inc.* | | | 4,390 | | | | 13,741 | |

| Ames National Corp. | | | 1,000 | | | | 20,860 | |

| Apollo Residential Mortgage, Inc. REIT | | | 2,403 | | | | 53,563 | |

| Artio Global Investors, Inc. | | | 4,975 | | | | 13,531 | |

| AV Homes, Inc.* | | | 2,240 | | | | 29,859 | |

| Bancorp, Inc.* | | | 4,907 | | | | 67,962 | |

| Banner Corp. | | | 1,444 | | | | 45,963 | |

| Berkshire Hills Bancorp, Inc. | | | 18,955 | | | | 484,111 | |

| BNC Bancorp | | | 2,726 | | | | 27,315 | |

| Bofi Holding, Inc.* | | | 11,120 | | | | 398,986 | |

| Bridge Capital Holdings* | | | 1,493 | | | | 22,753 | |

| C&F Financial Corp. | | | 478 | | | | 19,574 | |

| Camden National Corp. | | | 1,022 | | | | 33,808 | |

| Capital City Bank Group, Inc.* | | | 1,753 | | | | 21,650 | |

| Capital Southwest Corp. | | | 228 | | | | 26,220 | |

| CapLease, Inc. REIT | | | 47,072 | | | | 299,849 | |

| Cardinal Financial Corp. | | | 4,311 | | | | 78,374 | |

| Cedar Realty Trust, Inc. REIT | | | 7,098 | | | | 43,369 | |

| Center Bancorp, Inc. | | | 28,343 | | | | 352,303 | |

| Centerstate Banks, Inc. | | | 4,691 | | | | 40,249 | |

| Central Valley Community Bancorp | | | 1,529 | | | | 12,951 | |

| CIFC Corp.* | | | 1,378 | | | | 11,341 | |

| Citizens, Inc.* | | | 3,312 | | | | 27,788 | |

| Codorus Valley Bancorp, Inc. | | | 996 | | | | 16,354 | |

| Community Bankers Trust Corp.* | | | 4,221 | | | | 13,803 | |

| Consolidated-Tomoka Land Co. | | | 288 | | | | 11,303 | |

| Consumer Portfolio Services, Inc.* | | | 3,611 | | | | 42,285 | |

| Crawford & Co. - Class B | | | 3,979 | | | | 30,201 | |

| Dime Community Bancshares, Inc. | | | 33,470 | | | | 480,629 | |

| Doral Financial Corp.* | | | 20,145 | | | | 14,196 | |

| Eagle Bancorp, Inc.* | | | 2,716 | | | | 59,453 | |

| EMC Insurance Group, Inc. | | | 9,971 | | | | 262,536 | |

| Farmers Capital Bank Corp.* | | | 1,637 | | | | 30,776 | |

| Farmers National Banc Corp. | | | 4,114 | | | | 25,959 | |

| FBR & Co.* | | | 874 | | | | 16,535 | |

| Fidelity Southern Corp.* | | | 2,021 | | | | 23,242 | |

| First Bancorp Troy | | | 2,218 | | | | 29,921 | |

| First Bancorp, Inc. | | | 587 | | | | 10,572 | |

| First Busey Corp. | | | 2,193 | | | | 10,022 | |

| First California Financial Group, Inc.* | | | 2,404 | | | | 20,482 | |

| First Financial Holdings, Inc. | | | 16,180 | | | | 339,133 | |

| First M&F Corp. | | | 1,742 | | | | 24,649 | |

| First Marblehead Corp. (The)* | | | 11,686 | | | | 11,803 | |

| First Merchants Corp. | | | 2,717 | | | | 42,032 | |

| First Pactrust Bancorp, Inc. | | | 25,400 | | | | 289,560 | |

| Firstbank Corp. | | | 1,788 | | | | 24,782 | |

| German American Bancorp, Inc. | | | 1,739 | | | | 40,014 | |

| GFI Group, Inc. | | | 12,035 | | | | 40,197 | |

| Gladstone Capital Corp. | | | 31,383 | | | | 288,724 | |

| Gladstone Commercial Corp. REIT | | | 18,800 | | | | 366,036 | |

| Gramercy Capital Corp. REIT* | | | 3,226 | | | | 16,807 | |

| Great Southern Bancorp, Inc. | | | 384 | | | | 9,366 | |

| Guaranty Bancorp* | | | 17,243 | | | | 36,210 | |

| Hanmi Financial Corp.* | | | 25,048 | | | | 400,768 | |

| Heartland Financial USA, Inc. | | | 3,161 | | | | 79,878 | |

| Heritage Commerce Corp.* | | | 1,580 | | | | 10,633 | |

| Heritage Oaks Bancorp* | | | 1,727 | | | | 9,844 | |

| Home Federal Bancorp, Inc. | | | 881 | | | | 11,277 | |

| Home Loan Servicing Solutions Ltd. | | | 2,731 | | | | 63,714 | |

| Homeowners Choice, Inc. | | | 968 | | | | 26,378 | |

| HomeStreet, Inc.* | | | 405 | | | | 9,048 | |

| Horizon Bancorp | | | 821 | | | | 16,592 | |

| ICG Group, Inc.* | | | 2,411 | | | | 30,089 | |

| Imperial Holdings, Inc.* | | | 4,797 | | | | 19,428 | |

| Independent Bank Corp. | | | 12,987 | | | | 423,246 | |

| JMP Group, Inc. | | | 33,050 | | | | 228,376 | |

| KCAP Financial, Inc. | | | 2,320 | | | | 24,986 | |

| Lakeland Bancorp, Inc. | | | 5,594 | | | | 55,101 | |

| Lakeland Financial Corp. | | | 745 | | | | 19,884 | |

| LNB Bancorp, Inc. | | | 1,788 | | | | 14,858 | |

| MainSource Financial Group, Inc. | | | 35,058 | | | | 492,214 | |

| Marlin Business Services Corp. | | | 1,399 | | | | 32,443 | |

| MBT Financial Corp.* | | | 3,705 | | | | 14,450 | |

| Meadowbrook Insurance Group, Inc. | | | 18,474 | | | | 130,242 | |

| Mercantile Bank Corp. | | | 582 | | | | 9,725 | |

| MetroCorp Bancshares, Inc.* | | | 3,485 | | | | 35,164 | |

| Middleburg Financial Corp. | | | 772 | | | | 14,985 | |

| MidSouth Bancorp, Inc. | | | 1,851 | | | | 30,097 | |

| MidWestOne Financial Group, Inc. | | | 978 | | | | 23,286 | |

| Monmouth Real Estate Investment Corp. - Class A REIT | | | 45,146 | | | | 503,378 | |

| MPG Office Trust, Inc. REIT* | | | 11,530 | | | | 31,708 | |

| MVC Capital, Inc. | | | 24,422 | | | | 313,334 | |

| National Bankshares, Inc. | | | 1,185 | | | | 41,392 | |

| NewBridge Bancorp* | | | 3,201 | | | | 18,854 | |

| NewStar Financial, Inc.* | | | 1,590 | | | | 21,036 | |

| NGP Capital Resources Co. | | | 46,452 | | | | 330,274 | |

| NorthRim Bancorp, Inc. | | | 10,336 | | | | 232,250 | |

| Oriental Financial Group, Inc. | | | 6,531 | | | | 101,296 | |

| Orrstown Financial Services, Inc.* | | | 1,563 | | | | 23,117 | |

| Pacific Mercantile Bancorp* | | | 2,271 | | | | 13,285 | |

| Peapack Gladstone Financial Corp. | | | 1,285 | | | | 19,159 | |

| Peoples Bancorp, Inc. | | | 2,068 | | | | 46,303 | |

| Phoenix Cos., Inc. (The)* | | | 478 | | | | 14,708 | |

| Preferred Bank* | | | 2,597 | | | | 40,981 | |

| Premier Financial Bancorp, Inc. | | | 1,479 | | | | 17,142 | |

| QCR Holdings, Inc. | | | 905 | | | | 14,932 | |

| Radian Group, Inc. | | | 27,880 | | | | 298,595 | |

| RAIT Financial Trust REIT | | | 4,777 | | | | 38,073 | |

| Renasant Corp. | | | 25,652 | | | | 574,092 | |

| Republic First Bancorp, Inc.* | | | 4,842 | | | | 13,412 | |

| Safeguard Scientifics, Inc.* | | | 20,170 | | | | 318,686 | |

| Seacoast Banking Corp. of Florida* | | | 12,030 | | | | 25,143 | |

| Security National Financial Corp. - Class A* | | | 1,453 | | | | 10,433 | |

Touchstone Small Cap Growth Fund

March 31, 2013 (Continued)

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 98.0% (Continued) | | | | | | | | |

| | | | | | | | | |

| Financials — (Continued) | | | | | | | | |

| Shore Bancshares, Inc.* | | | 1,852 | | | $ | 12,631 | |

| Sierra Bancorp | | | 1,822 | | | | 23,959 | |

| Simmons First National Corp. - Class A | | | 14,188 | | | | 359,240 | |

| Southwest Bancorp, Inc.* | | | 2,498 | | | | 31,375 | |

| STAG Industrial, Inc. REIT | | | 2,528 | | | | 53,771 | |

| State Bank Financial Corp. | | | 3,457 | | | | 56,591 | |

| Sterling Bancorp. | | | 42,819 | | | | 435,041 | |

| Stewart Information Services Corp. | | | 2,969 | | | | 75,620 | |

| Stratus Properties, Inc.* | | | 1,065 | | | | 17,072 | |

| Suffolk Bancorp* | | | 1,013 | | | | 14,425 | |

| Sun Bancorp, Inc.* | | | 7,444 | | | | 25,384 | |

| SWS Group, Inc.* | | | 3,867 | | | | 23,395 | |

| Taylor Capital Group, Inc.* | | | 1,848 | | | | 29,550 | |

| Triangle Capital Corp. | | | 2,980 | | | | 83,410 | |

| Trico Bancshares | | | 971 | | | | 16,604 | |

| Trustmark Corp. | | | 484 | | | | 12,108 | |

| United Community Banks, Inc.* | | | 3,472 | | | | 39,372 | |

| United Community Financial Corp.* | | | 7,445 | | | | 28,887 | |

| United Insurance Holdings Corp. | | | 29,154 | | | | 167,052 | |

| Univest Corp. of Pennsylvania | | | 1,612 | | | | 28,081 | |

| ViewPoint Financial Group, Inc. | | | 20,791 | | | | 418,107 | |

| Virginia Commerce Bancorp, Inc.* | | | 4,486 | | | | 63,028 | |

| Washington Trust Bancorp, Inc. | | | 17,913 | | | | 490,458 | |

| Waterstone Financial, Inc.* | | | 1,414 | | | | 11,694 | |

| West Bancorporation, Inc. | | | 3,298 | | | | 36,608 | |

| Western Asset Mortgage Capital Corp. | | | | | | | | |

| REIT | | | 1,576 | | | | 36,626 | |

| Wilshire Bancorp, Inc.* | | | 3,690 | | | | 25,018 | |

| WSFS Financial Corp. | | | 8,642 | | | | 420,347 | |

| Yadkin Valley Financial Corp.* | | | 4,242 | | | | 17,010 | |

| | | | | | | | 13,728,779 | |

| | | | | | | | | |

| Industrials — 15.1% | | | | | | | | |

| AAR Corp. | | | 10,116 | | | | 186,033 | |

| Accuride Corp.* | | | 6,976 | | | | 37,601 | |

| Aceto Corp. | | | 26,718 | | | | 295,768 | |

| American Railcar Industries, Inc. | | | 1,378 | | | | 64,408 | |

| American Superconductor Corp.* | | | 3,676 | | | | 9,778 | |

| American Woodmark Corp.* | | | 1,760 | | | | 59,893 | |

| Apogee Enterprises, Inc. | | | 5,916 | | | | 171,268 | |

| Arkansas Best Corp. | | | 999 | | | | 11,668 | |

| Asset Acceptance Capital Corp.* | | | 3,445 | | | | 23,219 | |

| CAI International, Inc.* | | | 431 | | | | 12,421 | |

| CBIZ, Inc.* | | | 60,611 | | | | 386,698 | |

| Ceco Environmental Corp. | | | 19,257 | | | | 248,993 | |

| Celadon Group, Inc. | | | 11,391 | | | | 237,616 | |

| Cenveo, Inc.* | | | 6,325 | | | | 13,599 | |

| Consolidated Graphics, Inc.* | | | 4,343 | | | | 169,811 | |

| Dolan Co. (The)* | | | 22,992 | | | | 54,951 | |

| Douglas Dynamics, Inc. | | | 762 | | | | 10,531 | |

| Ducommun, Inc.* | | | 15,820 | | | | 313,078 | |

| Energy Recovery, Inc.* | | | 8,573 | | | | 31,720 | |

| EnergySolutions, Inc.* | | | 9,890 | | | | 37,088 | |

| EnerNOC, Inc.* | | | 1,570 | | | | 27,271 | |

| Federal Signal Corp.* | | | 6,514 | | | | 53,024 | |

| FuelCell Energy, Inc.* | | | 15,725 | | | | 14,841 | |

| Furmanite Corp.* | | | 3,141 | | | | 21,013 | |

| Genco Shipping & Trading Ltd. | | | 4,056 | | | | 11,681 | |

| General Finance Corp.* | | | 2,160 | | | | 9,719 | |

| Gibraltar Industries, Inc.* | | | 4,284 | | | | 78,183 | |

| Global Power Equipment Group, Inc. | | | 1,105 | | | | 19,470 | |

| GP Strategies Corp.* | | | 15,321 | | | | 365,559 | |

| Great Lakes Dredge & Dock Corp. | | | 32,120 | | | | 216,168 | |

| Greenbrier Cos., Inc.* | | | 4,469 | | | | 101,491 | |

| H&E Equipment Services, Inc. | | | 1,080 | | | | 22,032 | |

| Insteel Industries, Inc. | | | 2,379 | | | | 38,825 | |

| Kimball International, Inc. - Class B | | | 4,744 | | | | 42,981 | |

| LB Foster Co. | | | 228 | | | | 10,098 | |

| Lydall, Inc.* | | | 1,596 | | | | 24,499 | |

| Marten Transport Ltd. | | | 17,620 | | | | 354,691 | |

| Michael Baker Corp. | | | 402 | | | | 9,849 | |

| Navigant Consulting, Inc.* | | | 30,670 | | | | 403,004 | |

| NCI Building Systems, Inc.* | | | 2,849 | | | | 49,487 | |

| Orion Marine Group, Inc.* | | | 26,031 | | | | 258,748 | |

| Pacer International, Inc.* | | | 2,494 | | | | 12,545 | |

| Patriot Transportation Holding, Inc.* | | | 519 | | | | 14,439 | |

| PGT, Inc.* | | | 2,130 | | | | 14,633 | |

| Pike Electric Corp. | | | 19,464 | | | | 276,973 | |

| PMFG, Inc.* | | | 2,444 | | | | 15,079 | |

| Powersecure International, Inc.* | | | 17,663 | | | | 224,497 | |

| Rand Logistics, Inc.* | | | 1,813 | | | | 11,105 | |

| Republic Airways Holdings, Inc.* | | | 3,284 | | | | 37,897 | |

| Schawk, Inc. | | | 13,929 | | | | 153,080 | |

| Standex International Corp. | | | 766 | | | | 42,299 | |

| Vitran Corp., Inc.* | | | 15,516 | | | | 94,958 | |

| | | | | | | | 5,406,281 | |

| | | | | | | | | |

| Information Technology — 10.9% | | | | | | | | |

| Alpha & Omega Semiconductor Ltd.* | | | 27,158 | | | | 241,163 | |

| ANADIGICS, Inc.* | | | 10,345 | | | | 20,689 | |

| Audience, Inc.* | | | 820 | | | | 12,505 | |

| Aviat Networks, Inc.* | | | 7,260 | | | | 24,466 | |

| Avid Technology, Inc.* | | | 2,058 | | | | 12,904 | |

| Axcelis Technologies, Inc.* | | | 7,353 | | | | 9,191 | |

| Blucora, Inc.* | | | 4,229 | | | | 65,465 | |

| Checkpoint Systems, Inc.* | | | 1,947 | | | | 25,428 | |

| CIBER, Inc.* | | | 76,971 | | | | 361,764 | |

| Computer Task Group, Inc. | | | 14,036 | | | | 300,230 | |

| Comtech Telecommunications Corp. | | | 5,100 | | | | 123,828 | |

| CTS Corp. | | | 33,493 | | | | 349,667 | |

| Daktronics, Inc. | | | 1,921 | | | | 20,170 | |

| EXFO, Inc. (Canada)* | | | 16,496 | | | | 83,965 | |

| Global Cash Access Holdings, Inc.* | | | 29,169 | | | | 205,641 | |

| Intevac, Inc.* | | | 2,347 | | | | 11,078 | |

| Intralinks Holdings, Inc.* | | | 4,924 | | | | 31,317 | |

| IXYS Corp. | | | 19,892 | | | | 190,764 | |

| Kemet Corp.* | | | 1,965 | | | | 12,281 | |

| Kopin Corp.* | | | 3,475 | | | | 12,858 | |

| Limelight Networks, Inc.* | | | 5,007 | | | | 10,314 | |

| Mattson Technology, Inc.* | | | 8,130 | | | | 11,219 | |

| MeetMe, Inc.* | | | 2,941 | | | | 6,705 | |

| Mercury Systems, Inc.* | | | 1,523 | | | | 11,225 | |

| ModusLink Global Solutions, Inc.* | | | 3,300 | | | | 10,889 | |

Touchstone Small Cap Growth Fund

March 31, 2013 (Continued)

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 98.0% (Continued) | | | | | | | | |

| | | | | | | | | |

| Information Technology — (Continued) | | | | | | | | |

| Oclaro, Inc.* | | | 12,287 | | | $ | 15,482 | |

| OCZ Technology Group, Inc.* | | | 11,835 | | | | 21,303 | |

| Perficient, Inc.* | | | 27,780 | | | | 323,915 | |

| Pericom Semiconductor Corp.* | | | 26,644 | | | | 181,446 | |

| Photronics, Inc.* | | | 44,110 | | | | 294,655 | |

| Radisys Corp.* | | | 3,030 | | | | 14,908 | |

| Rudolph Technologies, Inc.* | | | 18,218 | | | | 214,608 | |

| Seachange International, Inc.* | | | 3,249 | | | | 38,631 | |

| Silicon Graphics International Corp.* | | | 5,111 | | | | 70,276 | |

| STEC, Inc.* | | | 2,986 | | | | 13,198 | |

| Supertex, Inc. | | | 13,859 | | | | 307,808 | |

| support.com, Inc.* | | | 2,222 | | | | 9,288 | |

| TechTarget, Inc.* | | | 2,458 | | | | 12,020 | |

| Viasystems Group, Inc.* | | | 766 | | | | 9,989 | |

| Westell Technologies, Inc. - Class A* | | | 112,122 | | | | 225,365 | |

| Zygo Corp.* | | | 620 | | | | 9,182 | |

| | | | | | | | 3,927,800 | |

| | | | | | | | | |

| Consumer Discretionary — 10.8% | | | | | | | | |

| 1-800-Flowers.Com, Inc. - Class A* | | | 2,717 | | | | 13,503 | |

| Bassett Furniture Industries, Inc. | | | 1,625 | | | | 25,935 | |

| Beazer Homes USA, Inc.* | | | 4,128 | | | | 65,388 | |

| Big 5 Sporting Goods Corp. | | | 928 | | | | 14,486 | |

| Bluegreen Corp.* | | | 1,033 | | | | 10,165 | |

| Cache, Inc.* | | | 11,814 | | | | 49,855 | |

| Carriage Services, Inc. | | | 16,664 | | | | 354,110 | |

| Christopher & Banks Corp.* | | | 4,708 | | | | 30,272 | |

| Citi Trends, Inc.* | | | 16,000 | | | | 163,680 | |

| Core-Mark Holding Co., Inc. | | | 195 | | | | 10,005 | |

| Corinthian Colleges, Inc.* | | | 3,817 | | | | 8,016 | |

| Daily Journal Corp.* | | | 101 | | | | 11,211 | |

| Destination Xl Group, Inc.* | | | 43,782 | | | | 222,850 | |

| Digital Generation, Inc.* | | | 2,420 | | | | 15,561 | |

| Entravision Communications Corp. - Class A | | | 6,827 | | | | 21,778 | |

| Exide Technologies* | | | 10,885 | | | | 29,390 | |

| Fisher Communications, Inc. | | | 1,093 | | | | 42,889 | |

| Flexsteel Industries, Inc. | | | 442 | | | | 10,935 | |

| Fred's, Inc. - Class A | | | 19,870 | | | | 271,822 | |

| Furniture Brands International, Inc.* | | | 8,696 | | | | 8,695 | |

| Global Sources Ltd. | | | 1,942 | | | | 14,682 | |

| Gray Television, Inc.* | | | 4,834 | | | | 22,671 | |

| hhgregg, Inc.* | | | 5,309 | | | | 58,664 | |

| Hooker Furniture Corp. | | | 22,990 | | | | 366,461 | |

| Hovnanian Enterprises, Inc. - Class A* | | | 23,597 | | | | 136,155 | |

| Isle of Capri Casinos, Inc.* | | | 2,278 | | | | 14,329 | |

| Krispy Kreme Doughnuts, Inc.* | | | 10,445 | | | | 150,826 | |

| LIN TV Corp. - Class A* | | | 6,154 | | | | 67,632 | |

| M/I Homes, Inc.* | | | 4,218 | | | | 103,130 | |

| Mcclatchy Co. (The) - Class A* | | | 5,708 | | | | 16,553 | |

| Motorcar Parts of America, Inc.* | | | 20,190 | | | | 123,765 | |

| Perry Ellis International, Inc. | | | 13,322 | | | | 242,327 | |

| Spartan Motors, Inc. | | | 39,920 | | | | 211,975 | |

| Standard Motor Products, Inc. | | | 15,316 | | | | 424,560 | |

| Stein Mart, Inc. | | | 25,120 | | | | 210,506 | |

| Tuesday Morning Corp.* | | | 4,661 | | | | 36,169 | |

| Universal Electronics, Inc.* | | | 1,946 | | | | 45,244 | |

| Valuevision Media, Inc.* | | | 6,242 | | | | 21,597 | |

| VOXX International Corp.* | | | 13,657 | | | | 146,266 | |

| Winnebago Industries, Inc.* | | | 3,740 | | | | 77,194 | |

| Zale Corp.* | | | 2,262 | | | | 8,890 | |

| | | | | | | | 3,880,142 | |

| | | | | | | | | |

| Health Care — 6.6% | | | | | | | | |

| Albany Molecular Research, Inc.* | | | 1,726 | | | | 18,140 | |

| Alphatec Holdings, Inc.* | | | 5,814 | | | | 12,268 | |

| AMAG Pharmaceuticals, Inc.* | | | 630 | | | | 15,026 | |

| Amedisys, Inc.* | | | 2,956 | | | | 32,871 | |

| AMN Healthcare Services, Inc.* | | | 2,173 | | | | 34,399 | |

| Astex Pharmaceuticals* | | | 20,907 | | | | 93,245 | |

| Bioscrip, Inc.* | | | 21,724 | | | | 276,112 | |

| Cambrex Corp.* | | | 17,934 | | | | 229,376 | |

| Codexis, Inc.* | | | 5,539 | | | | 13,238 | |

| Cross Country Healthcare, Inc.* | | | 39,495 | | | | 209,718 | |

| Curis, Inc.* | | | 4,035 | | | | 13,235 | |

| Cynosure, Inc. - Class A* | | | 625 | | | | 16,356 | |

| Enzo Biochem, Inc.* | | | 3,333 | | | | 8,399 | |

| Enzon Pharmaceuticals, Inc. | | | 3,439 | | | | 13,068 | |

| Gentiva Health Services, Inc.* | | | 4,110 | | | | 44,470 | |

| Geron Corp.* | | | 29,892 | | | | 31,984 | |

| Healthways, Inc.* | | | 25,603 | | | | 313,637 | |

| Hi-Tech Pharmacal Co., Inc. | | | 473 | | | | 15,661 | |

| Insmed, Inc.* | | | 5,797 | | | | 43,420 | |

| Medical Action Industries, Inc.* | | | 2,096 | | | | 12,575 | |

| Pacific Biosciences of California, Inc.* | | | 5,928 | | | | 14,761 | |

| Palomar Medical Technologies, Inc.* | | | 1,578 | | | | 21,287 | |

| PDI, Inc.* | | | 1,272 | | | | 7,505 | |

| Providence Service Corp. (The)* | | | 7,009 | | | | 129,596 | |

| Rigel Pharmaceuticals, Inc.* | | | 1,769 | | | | 12,012 | |

| RTI Biologics, Inc.* | | | 2,694 | | | | 10,614 | |

| Solta Medical, Inc.* | | | 6,476 | | | | 14,247 | |

| SurModics, Inc.* | | | 415 | | | | 11,309 | |

| Symmetry Medical, Inc.* | | | 31,801 | | | | 364,121 | |

| Synergetics USA, Inc.* | | | 34,400 | | | | 119,368 | |

| Targacept, Inc.* | | | 3,908 | | | | 16,726 | |

| Transcept Pharmaceuticals, Inc.* | | | 1,626 | | | | 7,789 | |

| US Physical Therapy, Inc. | | | 6,430 | | | | 172,646 | |

| Zeltiq AESthetics, Inc.* | | | 2,161 | | | | 8,255 | |

| | | | | | | | 2,357,434 | |

| | | | | | | | | |

| Consumer Staples — 4.8% | | | | | | | | |

| Alliance One International, Inc.* | | | 4,232 | | | | 16,462 | |

| Boulder Brands, Inc.* | | | 11,344 | | | | 101,869 | |

| Central European Distribution Corp.* | | | 12,255 | | | | 4,105 | |

| Chiquita Brands International, Inc.* | | | 25,483 | | | | 197,748 | |

| John B Sanfilippo & Son, Inc. | | | 513 | | | | 10,250 | |

| Nash Finch Co. | | | 15,413 | | | | 301,787 | |