UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust – July Funds

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: July 31

Date of reporting period: July 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

July 31, 2012

Annual Report

Touchstone Strategic Trust

Touchstone Dynamic Equity Fund

Touchstone Emerging Growth Fund

Touchstone International Equity Fund

Touchstone Balanced Allocation Fund

Touchstone Conservative Allocation Fund

Touchstone Growth Allocation Fund

Touchstone Moderate Growth Allocation Fund

Table of Contents

| | Page |

| Letter from the President | 3 |

| Management's Discussion of Fund Performance (Unaudited) | 4 - 25 |

| Tabular Presentation of Portfolios of Investments (Unaudited) | 26 - 28 |

| Portfolios of Investments: | |

| Touchstone Dynamic Equity Fund | 29 |

| Touchstone Emerging Growth Fund | 32 |

| Touchstone International Equity Fund | 34 |

| Touchstone Balanced Allocation Fund | 38 |

| Touchstone Conservative Allocation Fund | 39 |

| Touchstone Growth Allocation Fund | 40 |

| Touchstone Moderate Growth Allocation Fund | 41 |

| Statements of Assets and Liabilities | 42 - 45 |

| Statements of Operations | 46 - 47 |

| Statements of Changes in Net Assets | 48 - 51 |

| Statements of Changes in Net Assets - Capital Stock Activity | 52 - 57 |

| Statement of Cash Flows | 58 |

| Financial Highlights | 60 - 73 |

| Notes to Financial Statements | 74 - 95 |

| Report of Independent Registered Public Accounting Firm | 96 |

| Other Items (Unaudited) | 97 - 105 |

| Management of the Trust (Unaudited) | 106 - 109 |

| Privacy Protection Policy | 111 |

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information and manager commentaries for the twelve months ended July 31, 2012.

While the U.S. economy continues to recover from the depths of the 2008-2009 recession, the pace of growth has been uneven as reflected by the past 12 months. Major events — including the European debt crisis, a slowdown in emerging-market economies, U.S. deficit concerns, a slow recovery in the housing market, and stagnant unemployment and consumer confidence — have challenged the recovery. Interest rates remained at historic lows while the U.S. Federal Reserve Board (the “Fed”) remained undecided about a third round of quantitative easing (QE3).

After enduring last year’s debt-ceiling debate and Standard & Poor’s downgrade of U.S. debt, stocks enjoyed a healthy start in 2012, but then retracted by mid-year as corporate earnings were mixed, unemployment figures remained elevated, and consumers and businesses alike lowered spending in a cautious move. Dividends and low price-to earnings ratios made equities relatively cheaper versus other fixed income securities such as U.S. Treasuries — as yields on the 10-year note fell to record lows. Against this backdrop of market volatility, political uncertainty, and challenging growth, the U.S. economy continued to prove its resiliency.

Overall, U.S. equities outperformed fixed income securities in this timeframe. Investment grade bonds lagged non-investment grade bonds and both of those lagged U.S. Treasuries. Large-capitalization stocks outperformed small-capitalization stocks, and from a style perspective, growth outperformed value. Developed international equities outperformed emerging market equities, and both were negative.

Remember to pursue a long-term investment strategy to help you navigate future market conditions. Consult with your financial professional to build a diversified asset allocation portfolio of stock, bond, alternative investments and money market mutual funds. We greatly appreciate your continued support.

As always, thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Dynamic Equity Fund

Sub-Advised by Analytic Investors, LLC

Investment Philosophy and Process

The Fund seeks long-term capital appreciation from hedged equity investments with less risk than a fully invested, unhedged equity portfolio. A proprietary system that ranks stocks according to a mathematical model is utilized in an attempt to create a diversified and hedged portfolio, which invests in a combination of stocks and options including covered calls. A security’s intrinsic value is determined by evaluating variables such as relative valuation, price momentum, company fundamentals, liquidity and risk. Portfolio optimization is utilized to select securities that are expected to maximize return, minimize volatility and diversify assets.

Fund Performance and Market Overview

The total return which has been adjusted for sales charges of the Touchstone Dynamic Equity Fund, Class A Shares, was 10.00% for the fiscal year ended July 31, 2012. The S&P 500 Index returned 9.13% for the same period.

The period started down sharply as fear and uncertainty sent markets lower. A major concern among investors was that the European debt crisis was spreading and could lead to recession. Compounding the concern was the political paralysis seen in both Europe and the U.S., which sent investor confidence spiraling further downward.

However, markets rose after a plan was announced to support many struggling European banks and create a stronger fiscal union. In addition, economic reports coming from the U.S. were fairly positive, which was much better than the growth seen at the start of the calendar year. For example, in the U.S., employment and housing markets began to show signs of life, consumer spending was robust, and corporations continued to grow. These factors moved markets higher, but stocks still struggled during the second calendar quarter of 2012 as European headwinds resurfaced and China reported slower growth.

Overall, the uncertainty surrounding Europe continued to dominate the headlines and influence investors, although encouraging news from the U.S. helped domestic equities post positive results for the fiscal year end. In addition, the announcement of the plan to create a stronger fiscal union in Europe also helped push overall returns higher during the 12-month period.

Portfolio Review

The Fund is a hedged equity fund, comprised of equities and options. During the fiscal year, the equity component slightly outperformed the S&P 500 Index and the options component posted positive returns. A positive performing market is often a difficult environment to sell call options, yet during the period the equity market had three large negative returning months where the calls contributed to performance and allowed the Fund to outperform its benchmark.

During the period, the Fund’s emphasis on companies with quality characteristics — such as companies with above-average return on assets and strong profit margins — helped returns, as investors sought relative safety in high-quality companies. As a result, stocks with the highest profit margins outperformed those companies with the weakest profits. In addition, the Fund’s overweight position to stocks of companies with certain growth characteristics positively impacted performance during the period. Specifically, an emphasis on companies with strong recent earnings-per-share growth helped performance, as investors emphasized growth over value during the 12-month period.

Management's Discussion of Fund Performance (Unaudited) (Continued)

On the other hand, since the Fund’s process is style neutral (meaning the portfolio is constructed to have a balance of growth and value characteristics), particular tilts toward certain valuation characteristics negatively impacted results. For example, an emphasis on companies with strong cash flow-to-price ratios negatively impacted results.

Among the individual stocks that contributed to the Fund’s performance were Apple, Inc., Amgen, Inc., Expedia, Inc., Alpha Natural Resources, Inc., and Arch Coal, Inc. An overweight position in Apple, a designer and manufacturer of computers and mobile communication devices, helped Fund performance, as the company reported record sales that far exceeded analyst and investor expectations. An overweight position in Amgen, a biotechnology medicines company, also helped performance as the company’s stock moved higher after Amgen launched an aggressive buyback program. Expedia, an online travel company, posted strong profit and revenue results that exceeded analyst expectations. The company was also an overweight position in the Fund. A short position in Alpha Natural Resources, a supplier and exporter of metallurgical coal, was positive to the Fund after the company’s stock was negatively impacted by the collapse in U.S. coal prices. A short position in Arch Coal, the second-largest U.S. coal producer, also helped relative returns after Arch Coal saw its shares fall after the company announced lower earnings as a result of the weaker demand for fuel.

Among the top detractors from Fund performance were Freeport-McMoRan Copper & Gold, Inc., Tyson Foods, Inc., Ford Motor Co., and Smithfield Foods, Inc. Shares of Freeport-McMoRan Copper & Gold, an international mining company, moved lower as the company is expected to lose production at its Indonesian mine due to labor problems. The dispute would likely entail a loss in production of approximately three million to five million pounds of copper and approximately 5,000 ounces of gold per day. Shares of Tyson Foods, a meat protein and food production company, suffered after the company cut its annual sales forecast and reported that earnings would be lower than projected, as costs of animal feed rose during the period. Ford Motor, a producer of cars and trucks, also suffered after the company reported substantially lower operating profits in the second quarter, primarily due to operations outside the of the U.S. Shares of Smithfield Foods, a producer and marketer of fresh and packaged meats, declined after the company missed analyst earnings expectations and reported a 14% drop in profits during the fourth quarter of 2011.

Outlook and Conclusion

Our process is based on the fundamental belief that there is persistency in the types of characteristics investors prefer. If this holds going forward, we expect the Fund to benefit from being properly positioned toward stocks with characteristics favored by investors.

With regard to market factors, we continue to favor certain valuation characteristics, such as companies with attractive sales-to-price and cash flow-to-price ratios, and deemphasize stocks with above-average dividend yields. In addition, we expect to continue to position the Fund toward stocks with certain quality metrics, such as companies with strong return on assets and above-average profit margins. Within growth, we expect to favor an emphasis on stocks with above-average recent earnings-per-share growth and growth in profitability. Finally, we expect to continue to avoid certain risk factors such as stocks with above-average trading volume and stocks with wide-ranging earnings estimates from analysts.

We intend for the equity portion of the Fund to be fully invested with similar risk exposures as the S&P 500, such as similar sector weights, style tilts, and market capitalization. This equity exposure will be hedged with options. As a result, if the market experiences a strong rally going forward, it may be difficult for the Fund to keep pace with the unhedged index (S&P 500). On the other hand, if the market is flat or moves lower, the options component of the Fund should provide some protection.

Management's Discussion of Fund Performance (Unaudited) (Continued)

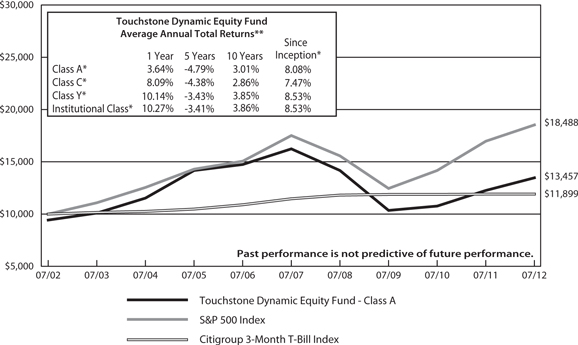

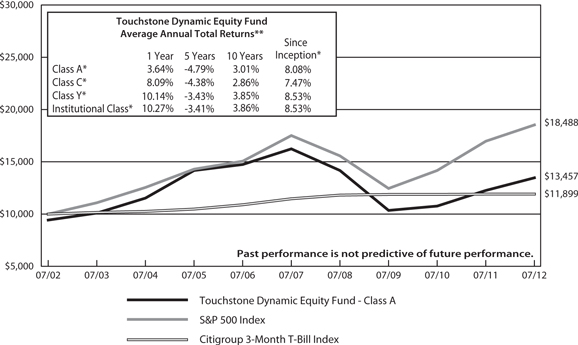

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Dynamic

Equity Fund - Class A*, the S&P 500 Index and the Citigroup 3-Month T-Bill Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class Y shares commenced operations on July 1, 1978, Class A shares and Class C shares commenced operations on March 31, 2005 and Institutional Class shares commenced operations on December 9, 2005. The Class A and Class C shares performance information is calculated using the historical performance of Class Y shares for periods prior to March 31, 2005 and Institutional Class shares performance information is calculated using the historical performance of Class Y shares for periods prior to December 9, 2005. The returns have been restated for sales charges and for fees applicable to Class A, Class C, and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Emerging Growth Fund

Sub-Advised by Copper Rock Capital Partners, LLC

Investment Philosophy and Process

The Fund seeks capital appreciation by investing primarily in equity securities of emerging growth companies of any size, emphasizing small- to mid-cap companies diversified across sectors and industries. A fundamental, bottom-up approach is employed. The approach focuses on companies that exhibit strong management teams, the potential for strong and sustainable revenue and earnings growth, and strong financial and competitive positions.

Fund Performance and Market Overview

The total return which has been adjusted for sales charges of the Touchstone Emerging Growth Fund, Class A Shares, was -6.58% for the fiscal year ended July 31, 2012. The total return of the Russell 2500 Growth Index was -0.28% for the same period.

During the 12-month period ending July 2012, investors saw wide swings in the financial markets, even as optimism over the U.S. employment picture grew and efforts by central banks in Europe and Asia to support economic growth appeared to stave off further debt crises.

Investors continued to take on risk at the start of 2012 as stocks finally started to separate from other asset classes. However, by the end of the second quarter of 2012, world markets declined again with most of the dip registering in May when fears of bond defaults in Europe intensified. Efforts by the European Central Bank and the European Union to recapitalize the Spanish banks eased those fears in early June, which helped markets rally worldwide in the final month of the quarter. In response to the uncertainty across the Atlantic, investors in the U.S. followed suit with a strong sell-off of stocks. This growth scare was compounded by signals that the employment recovery would remain slow throughout the remainder of 2012 and led companies to reign in outlooks and present more cautious guidance for the rest of the year. In response, lower-quality stocks — generally defined as non-earning stocks, stocks with lower long-term earnings, and the lowest return on equity — continued to outperform through the end of June, thereby creating an overall difficult backdrop for the Fund’s holdings to outperform.

Portfolio Review

The Fund’s underperformance during the 12-month period stemmed from a combination of some stock disappointments coupled with headwinds resulting from a low-quality stock rally. Segments like biotechnology, where the Fund had limited exposure, helped boost returns for the Index. The Fund benefited from stock selection in individual positions within sectors that underperformed on the whole, including Information Technology, Health Care and Industrials.

Overall, the Fund’s strategy continued to have a modest overweight in the Industrials sector, preferring to own more secular ideas. Some of these holdings have declined amid concerns over the economic outlook, but we anticipate these prices will come back as short-term fear subsides. We continued to maintain the Fund’s relative underweight position in the Health Care sector, again preferring not to own non-earning biotechnology stocks with very low visibility. Finally, the Fund had a modest overweight relative to the benchmark Index in the Financials sector, and tended to own specialty financial services stocks in lieu of banks.

Among the individual stocks that contributed most to the Fund’s performance were SuccessFactors, Inc., Catamaran Corp., and Air Methods Corp. During the period, SuccessFactors, a provider of cloud-based software solutions, was acquired by SAP AG and the Fund benefited. Catamaran Corp. (formerly SXC Health Solutions Corp.), a provider of pharmacy benefit management services, saw its shares continue to move higher in response to

Management's Discussion of Fund Performance (Unaudited) (Continued)

the disruption caused by the recently completed merger between Medco Health Solutions, Inc. and Express Scripts Holding Co. In addition, Catamaran acquired its closest competitor during the second quarter of 2012, which is expected to be accretive going forward. The Fund also benefited from its position in Air Methods Corp., a provider of air medical emergency transport systems. During the period, Air Methods announced the acquisition of a large competitor, OmniFlight, which was highly accretive.

Among the stocks that detracted from Fund performance were Green Mountain Coffee Roasters, Inc., Cooper Companies, Inc., and Acme Packet, Inc. During the period, Green Mountain Coffee Roasters, a specialty coffee and coffee maker business, was in the news again when a hedge fund questioned accounting practices that had already been resolved. More importantly, however, the company missed its fourth-quarter sales expectations, and the stock moved significantly lower. We eventually exited the position. Cooper Companies, a global medical products company, was a significant detractor in the Fund during the fourth quarter of 2011 and a leading underperformer over the 12-month period. The Fund owned the stock because of the company’s generally recession-resistant business model and strong growth opportunities from its silicone hydrogel lens products, which had previously led to consistent margin expansion and strong earnings. However, we believe that shares of Cooper Companies were overly punished when a recall of one of the company’s contact lens products, which accounted for less than 1% of sales, spread to a limited recall on a product line that totaled close to 20% of sales. As a result of concern that sales could be significantly impacted while Cooper Companies worked to resolve manufacturing issues surrounding the recall, we took an overly cautious stance and reduced the position. Upon confirmation from Cooper Companies that the manufacturing concerns were resolved, and good visibility that the underlying growth prospects remained strong, we added to the position. Finally, the Fund’s position in Acme Packet, a provider of session delivery network solutions, negatively impacted performance. Acme Packet was affected by a slowing wireline buildout of IP networks by carriers, along with the emerging 4G wireless buildout that will require even more session border controls.

Outlook and Conclusion

Recent economic data is consistent with the belief that we will see a slow but gradual recovery in the global economy. While Europe is contracting, and uncertainty regarding sovereign debt and even the future of the euro persist, there have been nascent signs of an uptick in China. The U.S. recovery is being led by corporate productivity investments along with a slow and steady housing recovery. Additionally, we expect the recent decline in oil prices to serve as a stimulus for retail consumption in the upcoming fall and holiday buying seasons, which should help to lift the gross domestic product. The upcoming U.S. presidential election and expiration of the Bush-era tax cuts are expected to create continued volatility in the stock market; however, we do not believe that such rhetoric will have enough of an impact on personal consumption or corporate productivity investments in which to derail the U.S. recovery.

In spite of these near-term and generally short-lived growth scares, we will continue to manage the Fund with a bottom-up, fundamentals-first approach. Through diligent analysis, we continue to expect good earnings growth from company managements that embrace improving incremental operating margins and sustained revenue growth through focused execution.

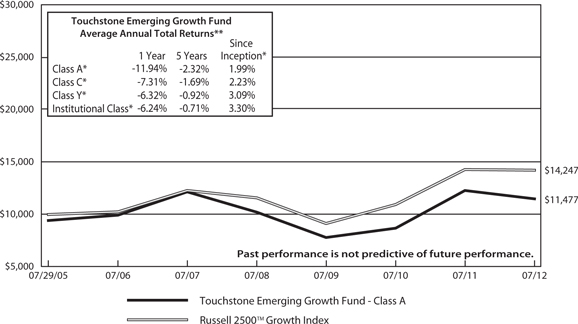

Management's Discussion of Fund Performance (Unaudited) (Continued)

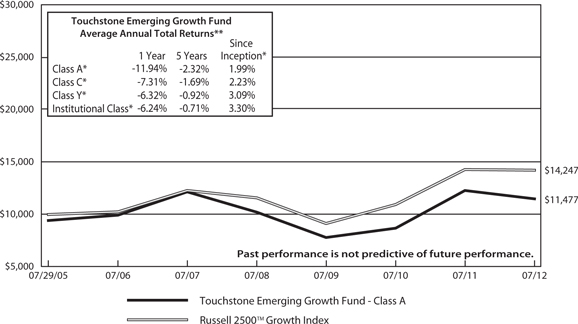

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Emerging Growth Fund - Class A* and the Russell 2500™ Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares and Institutional Class shares commenced operations on July 29, 2005, Class Y shares commenced operations on December 9, 2005, and Class C shares commenced operations on April 12, 2012. Class Y shares performance information is calculated using the historical performance of Class A shares for periods prior to December 9, 2005 and Class C shares performance information is calculated using the historical performance of Class A shares for periods prior to April 12, 2012 . The returns have been restated for sales charges and for fees applicable to Class C and Class Y shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited)

Touchstone International Equity Fund

Sub-Advised by Acadian Asset Management LLC

Investment Philosophy and Process

The Fund seeks long-term capital appreciation by primarily investing in equity securities of non-U.S. issuers. Stock factors are utilized in an effort to predict how well each security will perform relative to its region and industry peer groups, and forecasts are combined to determine a world-relative return forecast for each stock in the allowable universe. A sophisticated portfolio optimization system is employed to trade off the expected return of the stocks with such considerations as the benchmark Index, desired level of risk, transaction cost estimates, available liquidity, and other requirements. A disciplined process is utilized, which is based on the belief that it is crucial to avoid emotional decision-making, and focus on potential returns and risk control.

Fund Performance and Market Review

The total return which has been adjusted for sales charges of the Touchstone International Equity Fund, Class A Shares, was -11.40% for the fiscal year ended July 31, 2012. The total return of the MSCI EAFE Index was -10.99% for the same period.

The second half of 2011 began with sharp losses in the global equity market amid apprehensions about a potential Greek default, mounting fears about weakness in Europe’s banking system, and generally deteriorating economic conditions worldwide. The U.S. in particular grappled with a number of disappointing indicators, including a persistently bleak employment picture and a still-struggling housing market. Toward the end of the calendar year there was some moderation of this downward trajectory, and many markets regained ground. Investors perceived some hopeful economic signals in the U.S., and responded positively to Europe’s progress on liquidity injections, greater economic integration and tighter budget oversight. Overall however, it was a volatile period with frequent large market swings. And, while there were signs of improving economic conditions and generally higher equity returns, deep concerns persisted about the sustainability of a recovery — especially considering the complexity of the European debt crisis and uncertainty about China.

The early part of 2012 saw a strong upward trajectory for global equities, as investors were encouraged by a number of positive developments in the U.S., including improving unemployment figures, stronger consumer data, and signs of stabilization in the housing market. European markets were less strong but still made significant gains, which were buoyed by better-than-expected economic news and indications that a resolution to the Greek debt crisis was moving forward. The Asia-Pacific region was the strongest developed market region in the first calendar quarter of 2012. Japan was the leading country in that region, as its industrial production continued to recover and successful yen intervention credited for delivering a necessary boost to corporate profitability.

As 2012 progressed, market momentum in Europe dampened as intensifying concerns about Greece, Spain and Italy reignited worries about the euro. While a successful European Union summit in June and the election of a pro-reform government in Greece helped to somewhat temper fears, economic indicators in Europe were gloomy as employment and manufacturing growth were threatened by the region’s financial turmoil. The Asia-Pacific region was also weak, with Japan experiencing contraction in its industrial production and China’s economy showing signs of continued slowing. U.S. indicators told a mixed story however. While mounting unease about the strength and sustainability of a recovery in the labor market appeared to weigh on consumer confidence and spending, a number of positive signs emerged from the long-beleaguered housing market. Furthermore, the U.S. Federal Reserve Board toned down its assessment of the economy’s performance and reaffirmed its plans to keep interest rates near zero through late 2014.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Portfolio Review

During the fiscal period, solid gains from stock selection contributed to Fund performance, which helped to offset losses from country allocations. Stock selection in Japan performed strongly and contributed to the majority of Fund performance. Within Japan, key contributors featured holdings in the Industrials and Financials sectors, such as J. Trust Co. Ltd., Daiwa House Industry Co. Ltd., Mitsubishi UFJ Financial Group Inc., Nippo Electric Co. Ltd., and Nippon Road Co. Ltd. A number of financial stocks, including Mitsubishi UFJ Financial Group, rose in mid-February after the Bank of Japan unexpectedly increased asset purchases to stimulate growth. Outside of Japan, the Fund also realized positive active return from its selections in Austria, Germany and Hong Kong. Stock selection in Australia, Sweden and the U.K. detracted from performance during the period.

From a country perspective, detractors from Fund performance resulted from its overweight positions to Japan and Greece, underweight positions to Australia and the U.K., and an overweight to France. This positioning negatively offset the successful underweight to Spain and overweights to Denmark and Singapore.

Among the individual stocks that contributed to the Fund’s performance were J. Trust Co. Ltd. (Financials), Totetsu Kogyo Co. Ltd. and Daiwa House Industry Co. (Industrials), ImperialTobacco Group PLC (Consumer Staples) and Otsuka Holdings Co. Ltd. (Health Care). Shares of the Japan-based Financial Services sector company J. Trust Co. rallied in the first quarter of 2012 after the company purchased assets from bankrupt consumer lender Takefuji Corp. (Financials) without having to assume Takefuji’s liabilities. The purchase also included data on more than eight million borrowers. Totetsu Kogyo Co., a Japan-based company engaged in the operation of construction-related businesses, saw its shares tick upward after the company announced in November 2011, that it raised its consolidated mid-year outlook for revenue, profit, and earnings-per-share for its fiscal year ending March 2012, due to decreased administrative expenses and increased construction. Shares of Imperial Tobacco Group, a U.K.-based tobacco company, received a boost in December 2011, as investors rewarded such companies whose earnings had fewer ties to economic growth. Shares of Daiwa House Industry Co., a Japan-based construction company, rose in the second quarter of 2012 after Deutsche Bank AG (Financials) reaffirmed its “buy” rating and raised its price target for the company’s stock.

Among the largest detractors from Fund performance were Enel S.p.A. (Utilities), Eurasian Natural Resources Corp. PLC and Rio Tinto plc (Materials), BNP Paribas SA (Financials), and OPAP S.A. (Consumer Discretionary). The Italy-based electric utility company, Enel, saw its shares slide after Standard & Poor’s downgraded the company’s credit early in 2012. Eurasian Natural Resources Corp., a Kazakhstan-based diversified natural resources company, saw its shares fall sharply late in the reporting period based on speculation that the company was close to an agreement to buy out Dan Gertler, who is owner of a 49.5% stake in a copper mine in the Democratic Republic of Congo. In August 2011, shares of BNP Paribas, a France-based banking group, declined alongside other European banks amid concerns that lenders will likely face challenges funding themselves and increasing profit as the region’s debt crisis continues to stifle economic growth. The stock saw further losses in September 2011, based on reports that the company’s rating would possibly be cut by Moody’s Investor Services amid concerns over its holdings of Greek sovereign debt. Rio Tinto, an Australia-based company engaged in minerals exploration, development, production and processing, saw its shares move in tandem with copper prices, which dropped to a one-year low late in the third quarter of 2011. This was based on concerns that a weaker global economy will likely dampen demand for industrial metals. Shares of OPAP, a Greek-based gambling company, fell sharply on fears that the country would not be able to uphold the austerity commitments needed to obtain further financial aid.

Outlook and Conclusion

While earlier in the year the expectation was for a decoupled environment with a mix of growth and contraction in key economies, some now worry there will be a more synchronized cooling across the globe. The more uncertain macroeconomic picture has led key central banks to consider further policy accommodations. We believe that

Management's Discussion of Fund Performance (Unaudited) (Continued)

while much of Europe should remain in a recession for the balance of 2012, the U.S. should see a continuation of its modest recovery. In addition, we believe that emerging markets should realize positive but decelerating growth. Coupled with the deep uncertainties in Europe, the U.S. election cycle, and geopolitical stresses in the Middle East and Asia, we believe that the risk of sell-off has risen and that equity markets are likley to be volatile in the months ahead.

Although U.S. data for the second quarter of 2012 has indicated some slowing in the key areas of employment and business surveys, job growth and industrial production continue to show improvement from levels of one year ago— and overall, we believe the growth rate of the U.S. economy appears solid. In Europe, the continuing crisis has caused financial market distress that will likely motivate major central banks to undertake new action. European data continues to slow, with even Germany showing vulnerability of late. With minimal progress toward meaningful fiscal integration thus far, we expect Europe will remain in reaction mode, responding mainly to current crises, and working only within the limitations of the existing political framework. Implementing structural reforms in Greece and other indebted countries will be a slow process, and we believe the realities of implementation are likely to be underestimated by financial markets.

Japan continues to demonstrate moderate recovery, particularly in terms of production and consumer demand — which has been fueled by the reconstruction resulting from damage caused by the earthquake and tsunami. However, going forward, we believe a stronger yen is likely to continue to pose challenges for the country’s export sector, amid the periodic surges of investor demand for safe-haven securities.

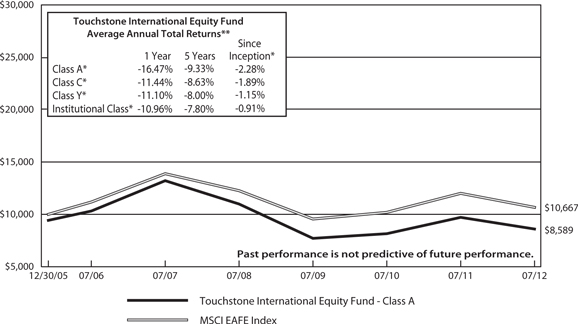

Management's Discussion of Fund Performance (Unaudited) (Continued)

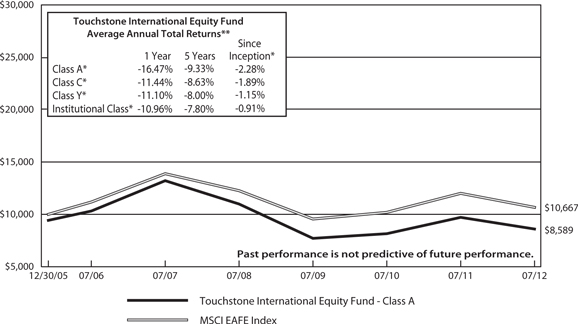

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone International Equity Fund - Class A* and the MSCI EAFE Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares, Class Y shares and Insitutional Class shares commenced operations on December 30, 2005 and Class C shares commenced operations on April 12, 2012. Class C shares performance information is calculated using the historical performance of Class A shares for periods prior to April 12, 2012. The returns have been restated for sales charges and for fees applicable to Class C shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Balanced Allocation Fund

Sub-Advised by Ibbotson Associates, Inc.

Investment Philosophy and Process

The Fund seeks to provide investors with capital appreciation and current income. The Fund is a fund of funds and therefore the value of an investment in the Fund is based on the performance of the underlying funds in which it invests and the allocation of its assets among those funds. This fund of funds primarily invests in a diversified portfolio of underlying equity and fixed income funds. The underlying funds, in turn, invest in a variety of U.S. and foreign equity and fixed income securities and may hold cash, cash equivalents and money market funds. An optimal model allocation among underlying funds is sought, by using an analysis that looks at forecasted returns, standard deviations in historical returns, and the correlation of the performance of different market sectors. The underlying funds are selected and weighted based on historical returns-based style analysis, holdings-based style analysis, manager interviews, relative and absolute performance, including correlations with other underlying funds as well as corresponding benchmarks, and historical volatility (the variability of returns from one period to the next). Under normal circumstances, the Fund expects to allocate its assets among equity and fixed income funds as follows: Equity Fund Allocation: 50–70%, Fixed Income Fund Allocation: 30–50%.

Fund Performance and Market Overview

The total return which has been adjusted for sales charges of the Touchstone Balanced Allocation Fund, Class A Shares, was 2.89% for the fiscal year ended July 31, 2012. The total return of the Barclays U.S. Aggregate Bond Index was 7.25% and the total return of the S&P Composite 1500 Index was 8.27% for this same period. The total return of the 40% Barclays U.S. Aggregate Bond Index / 60% S&P Composite 1500 Index was 8.32% for the period.

During the 12-month period, market volatility persisted as concerns about the global economy and the eurozone crisis continued to dominate headlines. Overall, it was a challenging period given low interest rates and sluggish economic activity. Investors sought safety in U.S. Treasury securities, driving yields down to historic lows, while also bidding up real estate investment trusts (REITs), corporate bonds and high-yield bonds in search of yield. Outside the U.S., worsening conditions in China and Brazil weighed down on emerging market stocks while the eurozone situation affected returns across developed markets.

Portfolio Review

The Fund underperformed its benchmark during the period due to considerable exposure to short-term bonds, small- and mid-cap stocks, and foreign markets. As yields declined during the period, shorter-term bonds and cash lagged as the broad market rose, while foreign bonds were relatively flat. Small- and mid-cap stocks fared considerably worse than large-cap stocks, while foreign equities significantly underperformed the U.S. market, further weighing down on performance. Exposure to global REITs helped to offset these negative effects, as their performance surpassed all asset classes.

During the period, the Fund held multiple dynamic asset allocation positions. In particular, the Fund was underweight equities versus short-term bonds, underweight small/mid-cap stocks versus large-cap stocks, overweight international equities versus domestic equities, underweight global REITs versus large-cap stocks, and overweight short-term bonds versus intermediate-term bonds. Overall, the Fund’s defensive positioning was a slight detractor from performance. This was partially offset by the effects of manager selection, as the underlying managers in aggregate beat their assigned benchmarks.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Outlook and Conclusion

We believe the economic environment is likely to be one of continued apathy as opposed to a plunge into global recession, at least in the near term. In particular, resource utilization rates remain at depressed levels in most advanced economies, and, outside of the eurozone, there is little evidence of a “smoking gun” to warrant immediate concern. It is our view that business cycles do not die of old age and, in the past, recessions have been triggered by a variety of factors: a persistent spike in the price of oil, a large natural disaster, a massive fiscal or monetary policy tightening, or the bursting of an asset bubble. Nothing of that magnitude has happened over the last six to twelve months. Moreover, economic data are not reflecting an abrupt decline in the pace of activity, but rather a lazy descent.

Going forward, we believe the investment outlook continues to be unusually uncertain, and the risks are tilted to the downside. In addition, we believe that a misstep in the handling of China’s banking problems, the exit of Greece from the eurozone, or the always-present threat of a spike in the price of oil could all be factors that may potentially wreck the economy’s wobbly ship. Furthermore, near the end of the year the U.S. government must deal with the “fiscal cliff” dilemma, which would cause an increase in taxes and a reduction in government expenditures worth potentially 3–5% of gross domestic product in 2013 alone. That said, we remain cautious about markets going forward and intend to maintain our defensive positioning accordingly.

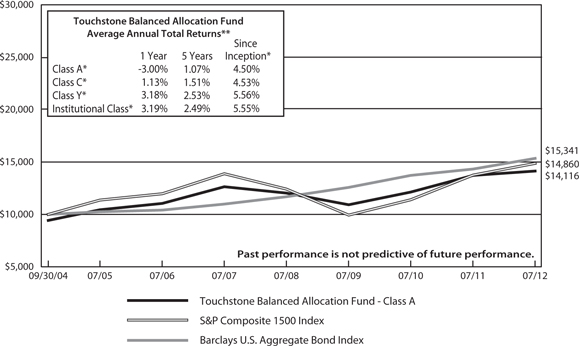

Management's Discussion of Fund Performance (Unaudited) (Continued)

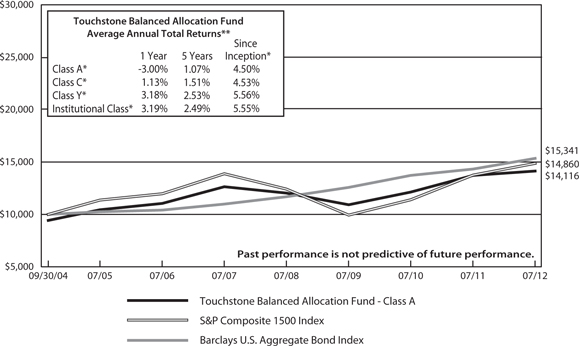

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Balanced Allocation Fund - Class A*, the S&P Composite 1500 Index and

the Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares, Class C shares and Institutional Class shares commenced operations on September 30, 2004 and Class Y shares commenced operations on December 9, 2005. Class Y shares performance information is calculated using the historical performance of Institutional Class shares for periods prior to December 9, 2005. The returns have been restated for sales charges and for fees applicable to Class Y shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales chagres. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Conservative Allocation Fund

Sub-Advised by Ibbotson Associates, Inc.

Investment Philosophy and Process

The Fund seeks to provide investors with current income and preservation of capital. The Fund is a fund of funds and therefore the value of an investment in the Fund is based on the performance of the underlying funds in which it invests and the allocation of its assets among those funds. This fund of funds primarily invests in a diversified portfolio of underlying equity and fixed income funds. The underlying funds, in turn, invest in a variety of U.S. and foreign equity and fixed income securities and may hold cash, cash equivalents and money market funds. An optimal model allocation among underlying funds is sought by using an analysis that looks at forecasted returns, standard deviations in historical returns, and the correlation of the performance of different market sectors. The underlying funds are selected and weighted based on historical returns-based style analysis, holdings-based style analysis, manager interviews, relative and absolute performance, including correlations with other underlying funds as well as corresponding benchmarks, and historical volatility (the variability of returns from one period to the next). Under normal circumstances, the Fund expects to allocate its assets among equity and fixed income funds as follows: Equity Fund Allocation: 20–40%, Fixed Income Fund Allocation: 60–80%.

Fund Performance and Market Overview

The total return which has been adjusted for sales charges of the Touchstone Conservative Allocation Fund, Class A Shares, was 3.23% for the fiscal year ended July 31, 2012.The total return of the Barclays U.S. Aggregate Bond Index was 7.25% and the total return of the S&P Composite 1500 Index was 8.27% for this same period. The total return of the 70% Barclays U.S. Aggregate Bond Index / 30% S&P Composite 1500 Index was 7.96% for the period.

During the 12-month period, market volatility persisted as concerns about the global economy and the eurozone crisis continued to dominate headlines. Overall, it was a challenging period given low interest rates and sluggish economic activity. Investors sought safety in U.S. Treasury securities, driving yields down to historic lows, while also bidding up real estate investment trusts (REITs), corporate bonds and high-yield bonds in search of yield. Outside the U.S., worsening conditions in China and Brazil weighed down on emerging market stocks while the eurozone situation affected returns across developed markets.

Portfolio Review

The Fund underperformed its benchmark during the period due to considerable exposure to short-term bonds and foreign markets. As yields declined during the period, shorter-term bonds and cash lagged as the broad market rose. Foreign bonds and stocks significantly underperformed the U.S. market, further weighing down on performance. Exposure to global REITs helped to offset these negative effects, as their performance surpassed all asset classes.

During the period, the Fund held multiple dynamic asset allocation positions. In particular, the Fund was underweight equities versus short-term bonds, underweight small/mid-cap stocks versus large-cap stocks, overweight international equities versus domestic equities, underweight global REITs versus large-cap stocks, and overweight short-term bonds versus intermediate-term bonds. Overall, the Fund’s defensive positioning was a slight detractor from performance. While several managers performed well versus their assigned benchmarks, in aggregate they did not add value to performance.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Outlook and Conclusion

We believe the economic environment is likely to be one of continued apathy as opposed to a plunge into global recession, at least in the near term. In particular, resource utilization rates remain at depressed levels in most advanced economies, and, outside of the eurozone, there is little evidence of a “smoking gun” to warrant immediate concern. It is our view that business cycles do not die of old age and, in the past, recessions have been triggered by a variety of factors: a persistent spike in the price of oil, a large natural disaster, a massive fiscal or monetary policy tightening, or the bursting of an asset bubble. Nothing of that magnitude has happened over the last six to twelve months. Moreover, economic data are not reflecting an abrupt decline in the pace of activity, but rather a lazy descent.

Going forward, we believe the investment outlook continues to be unusually uncertain, and the risks are tilted to the downside. In addition, we believe that a misstep in the handling of China’s banking problems, the exit of Greece from the eurozone, or the always-present threat of a spike in the price of oil could all be factors that may potentially wreck the economy’s wobbly ship. Furthermore, near the end of the year the U.S. government must deal with the “fiscal cliff” dilemma, which would cause an increase in taxes and a reduction in government expenditures worth potentially 3–5% of gross domestic product in 2013 alone. That said, we remain cautious about markets going forward and intend to maintain our defensive positioning accordingly.

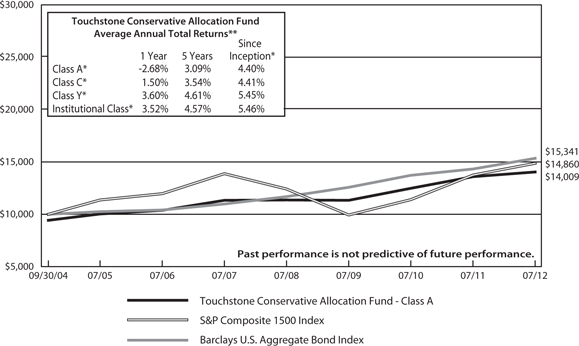

Management's Discussion of Fund Performance (Unaudited) (Continued)

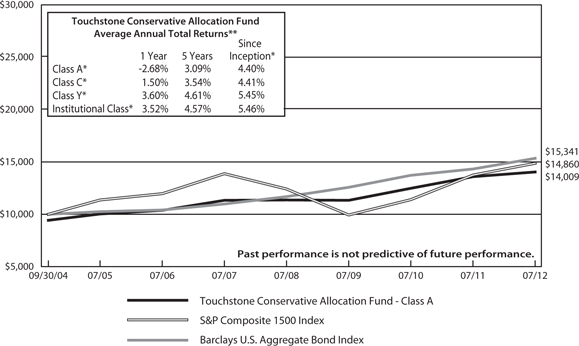

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Conservative Allocation Fund Class - A*, the S&P Composite 1500 Index and

the Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares, Class C shares and Institutional Class shares commenced operations on September 30, 2004 and Class Y shares commenced operations on December 9, 2005. Class Y shares performance information is calculated using the historical performance of Institutional Class shares for periods prior to December 9, 2005. The returns have been restated for sales charges and for fees applicable to Class Y shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Growth Allocation Fund

Sub-Advised by Ibbotson Associates, Inc.

Investment Philosophy and Process

The Fund seeks to provide investors with capital appreciation. The Fund is a fund of funds and therefore the value of an investment in the Fund is based on the performance of the underlying funds in which it invests and the allocation of its assets among those funds. This fund of funds primarily invests in a diversified portfolio of underlying equity and fixed income funds. The underlying funds, in turn, invest in a variety of U.S. and foreign equity and fixed income securities and may hold cash, cash equivalents and money market funds. An optimal model allocation among underlying funds is sought, by using an analysis that looks at forecasted returns, standard deviations in historical returns, and the correlation of the performance of different market sectors. The underlying funds are selected and weighted based on historical returns-based style analysis, holdings-based style analysis, manager interviews, relative and absolute performance, including correlations with other underlying funds as well as corresponding benchmarks, and historical volatility (the variability of returns from one period to the next). Under normal circumstances, the Fund expects to allocate its assets among equity and fixed income funds as follows: Equity Fund Allocation: 90–100%, Fixed Income Fund Allocation: 0–10%.

Fund Performance and Market Overview

The total return which has been adjusted for sales charges of the Touchstone Growth Allocation Fund, Class A Shares, was -0.04% for the fiscal year ended July 31, 2012. The total return of the S&P Composite 1500 Index was 8.27% for the same period.

During the 12-month period, market volatility persisted as concerns about the global economy and the eurozone crisis continued to dominate headlines. Overall, it was a challenging period given low interest rates and sluggish economic activity. Investors sought safety in U.S. Treasury securities, driving yields down to historic lows, while also bidding up real estate investment trusts (REITs), corporate bonds and high-yield bonds in search of yield. Outside the U.S., worsening conditions in China and Brazil weighed down on emerging market stocks while the eurozone situation affected returns across developed markets.

Portfolio Review

The Fund underperformed its benchmark during the period due to considerable exposure to small- and mid-cap stocks and foreign equities. Small- and mid-cap stocks fared considerably worse than large-cap stocks, while foreign equities significantly underperformed the U.S. market, further weighing down on performance. Exposure to global REITs helped to offset these negative effects, as their performance surpassed all asset classes.

During the period, the Fund held multiple dynamic asset allocation positions. In particular, the Fund was underweight equities versus short-term bonds, underweight small/mid-cap stocks versus large-cap stocks, overweight international equities versus domestic equities, and underweight global REITs versus large-cap stocks. Overall, the Fund’s defensive positioning was a detractor from performance. While several managers performed well versus their assigned benchmarks, in aggregate they did not add value to performance.

Outlook and Conclusion

We believe the economic environment is likely to be one of continued apathy as opposed to a plunge into global recession, at least in the near term. In particular, resource utilization rates remain at depressed levels in most advanced economies, and, outside of the eurozone, there is little evidence of a “smoking gun” to warrant immediate concern. It is our view that business cycles do not die of old age and, in the past, recessions have been triggered by a variety of factors: a persistent spike in the price of oil, a large natural disaster, a massive fiscal or monetary policy tightening, or the bursting of an asset bubble. Nothing of that magnitude has happened

Management's Discussion of Fund Performance (Unaudited) (Continued)

over the last six to twelve months. Moreover, economic data are not reflecting an abrupt decline in the pace of activity, but rather a lazy descent.

Going forward, we believe the investment outlook continues to be unusually uncertain, and the risks are tilted to the downside. In addition, we believe that a misstep in the handling of China’s banking problems, the exit of Greece from the eurozone, or the always-present threat of a spike in the price of oil could all be factors that may potentially wreck the economy’s wobbly ship. Furthermore, near the end of the year the U.S. government must deal with the “fiscal cliff” dilemma, which would cause an increase in taxes and a reduction in government expenditures worth potentially 3–5% of gross domestic product in 2013 alone. That said, we remain cautious about markets going forward and intend to maintain our defensive positioning accordingly.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Growth Allocation Fund Class - A* and the S&P Composite 1500 Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares, Class C shares and Institutional Class shares commenced operations on September 30, 2004 and Class Y shares commenced operations on December 9, 2005. Class Y shares performance information is calculated using the historical performance of Institutional Class shares for periods prior to December 9, 2005. The returns have been restated for sales charges and for fees applicable to Class Y shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Moderate Growth Allocation Fund

Sub-Advised by Ibbotson Associates, Inc.

Investment Philosophy and Process

The Fund seeks to provide investors with capital appreciation. The Fund is a fund of funds and therefore the value of an investment in the Fund is based on the performance of the underlying funds in which it invests and the allocation of its assets among those funds. This fund of funds primarily invests in a diversified portfolio of underlying equity and fixed income funds. The underlying funds, in turn, invest in a variety of U.S. and foreign equity and fixed income securities and may hold cash, cash equivalents and money market funds. An optimal model allocation among underlying funds is sought, by using an analysis that looks at forecasted returns, standard deviations in historical returns, and the correlation of the performance of different market sectors. The underlying funds are selected and weighted based on historical returns-based style analysis, holdings-based style analysis, manager interviews, relative and absolute performance, including correlations with other underlying funds as well as corresponding benchmarks, and historical volatility (the variability of returns from one period to the next). Under normal circumstances, the Fund expects to allocate its assets among equity and fixed income funds as follows: Equity Fund Allocation: 70–90%, Fixed Income Fund Allocation: 10–30%.

Fund Performance and Market Overview

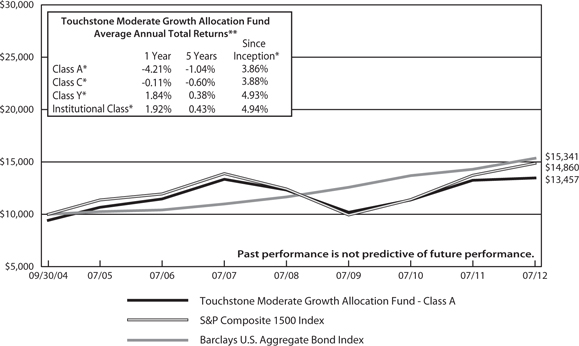

The total return which has been adjusted for sales charges of the Touchstone Moderate Growth Allocation Fund, Class A Shares, was 1.65% for the fiscal year ended July 31, 2012. The total return of the Barclays U.S. Aggregate Bond Index was 7.25% and the total return of the S&P Composite 1500 Index was 8.27% for this same period. The total return of the 20% Barclays U.S. Aggregate Bond Index / 80% S&P Composite 1500 Index was 8.37% for the period.

During the 12-month period, market volatility persisted as concerns about the global economy and the eurozone crisis continued to dominate headlines. Overall, it was a challenging period given low interest rates and sluggish economic activity. Investors sought safety in U.S. Treasury securities, driving yields down to historic lows, while also bidding up real estate investment trusts (REITs), corporate bonds and high-yield bonds in search of yield. Outside the U.S., worsening conditions in China and Brazil weighed down on emerging market stocks while the eurozone situation affected returns across developed markets.

Portfolio Review

The Fund underperformed its benchmark during the period due to considerable exposure to small- and mid-cap stocks and foreign equities. Small- and mid-cap stocks fared considerably worse than large-cap stocks, while foreign equities significantly underperformed the U.S. market, further weighing down on performance. Exposure to global REITs helped to offset these negative effects, as their performance surpassed all asset classes.

During the period, the Fund held multiple dynamic asset allocation positions. In particular, the Fund was underweight equities versus short-term bonds, underweight small/mid-cap stocks versus large-cap stocks, overweight international equities versus domestic equities, underweight global REITs versus large-cap stocks, and overweight short-term bonds versus intermediate-term bonds. Overall, the Fund’s defensive positioning was a detractor from performance. This was partially offset by the effects of manager selection, as the underlying managers in aggregate beat their assigned benchmarks.

Outlook and Conclusion

We believe the economic environment is likely to be one of continued apathy as opposed to a plunge into global recession, at least in the near term. In particular, resource utilization rates remain at depressed levels in most advanced economies, and, outside of the eurozone, there is little evidence of a “smoking gun” to warrant

Management's Discussion of Fund Performance (Unaudited) (Continued)

immediate concern. It is our view that business cycles do not die of old age and, in the past, recessions have been triggered by a variety of factors: a persistent spike in the price of oil, a large natural disaster, a massive fiscal or monetary policy tightening, or the bursting of an asset bubble. Nothing of that magnitude has happened over the last six to twelve months. Moreover, economic data are not reflecting an abrupt decline in the pace of activity, but rather a lazy descent.

Going forward, we believe the investment outlook continues to be unusually uncertain, and the risks are tilted to the downside. In addition, we believe that a misstep in the handling of China’s banking problems, the exit of Greece from the eurozone, or the always-present threat of a spike in the price of oil could all be factors that may potentially wreck the economy’s wobbly ship. Furthermore, near the end of the year the U.S. government must deal with the “fiscal cliff” dilemma, which would cause an increase in taxes and a reduction in government expenditures worth potentially 3–5% of gross domestic product in 2013 alone. That said, we remain cautious about markets going forward and intend to maintain our defensive positioning accordingly.

Management's Discussion of Fund Performance (Unaudited) (Continued)

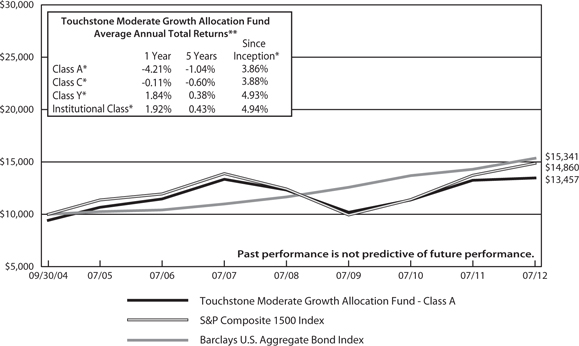

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Moderate Growth Allocation Fund Class-A*, the S&P Composite 1500 Index and

the Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares, Class C shares and Institutional Class shares commenced operations on September 30, 2004 and Class Y shares commenced operations on December 9, 2005. Class Y shares performance information is calculated using the historical performance of Institutional Class shares for periods prior to December 9, 2005. The returns have been restated for sales charges and for fees applicable to Class Y shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales sharges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Tabular Presentation of Portfolios of Investments (Unaudited)

July 31, 2012

The tables below provide each Fund’s sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Dynamic Equity Fund |

| Sector Allocation* | | | (% of Net Assets) | |

| Long Positions | | | | |

| Information Technology | | | 24.0 | % |

| Consumer Discretionary | | | 20.3 | |

| Financials | | | 18.1 | |

| Energy | | | 13.4 | |

| Health Care | | | 12.3 | |

| Consumer Staples | | | 11.5 | |

| Industrials | | | 8.4 | |

| Materials | | | 5.0 | |

| Utilities | | | 5.0 | |

| Telecommunication Services | | | 2.3 | |

| Investment Funds | | | 1.1 | |

| Cash Collateral for Securities Sold Short | | | 0.6 | |

| Other Assets/Liabilities (Net) | | | (0.6 | ) |

| | | | 121.4 | |

| | | | | |

| Short Positions and Written Options | | | | |

| Information Technology | | | (6.8 | ) |

| Consumer Discretionary | | | (4.8 | ) |

| Energy | | | (2.5 | ) |

| Call Options | | | (2.5 | ) |

| Health Care | | | (1.9 | ) |

| Financials | | | (1.3 | ) |

| Industrials | | | (1.0 | ) |

| Utilities | | | (0.5 | ) |

| Put Options | | | (0.1 | ) |

| Materials | | | 0.0 | |

| | | | (21.4 | ) |

| Total | | | 100.0 | % |

| Touchstone Emerging Growth Fund |

| Sector Allocation* | | | (% of Net Assets) | |

| Information Technology | | | 21.5 | % |

| Industrials | | | 21.2 | |

| Consumer Discretionary | | | 17.6 | |

| Health Care | | | 12.0 | |

| Financials | | | 8.6 | |

| Energy | | | 7.9 | |

| Materials | | | 6.9 | |

| Exchange Traded Funds | | | 2.0 | |

| Consumer Staples | | | 1.5 | |

| Investment Funds | | | 3.6 | |

| Other Assets/Liabilities (Net) | | | (2.8 | ) |

| Total | | | 100.0 | % |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone International Equity Fund | | | | |

| Sector Allocation* | | | (% of Net Assets) | |

| Financials | | | 17.6 | % |

| Industrials | | | 16.7 | |

| Energy | | | 13.0 | |

| Materials | | | 12.4 | |

| Health Care | | | 12.2 | |

| Consumer Discretionary | | | 11.7 | |

| Consumer Staples | | | 7.2 | |

| Information Technology | | | 4.0 | |

| Telecommunication Services | | | 3.0 | |

| Utilities | | | 1.0 | |

| Investment Funds | | | 1.3 | |

| Other Assets/Liabilities (Net) | | | (0.1 | ) |

| Total | | | 100.0 | % |

| Touchstone Balanced Allocation Fund | | | | |

| Sector Allocation | | | (% of Net Assets) | |

| Government/Corporate | | | 25.4 | % |

| Value | | | 11.1 | |

| International Equity | | | 10.2 | |

| International Debt | | | 6.1 | |

| Growth | | | 6.0 | |

| Global Equity | | | 5.6 | |

| Emerging Market-Equity | | | 4.1 | |

| Corporate/Preferred-High Yield | | | 4.0 | |

| Blue Chip | | | 4.0 | |

| Value Large-Cap | | | 4.0 | |

| Sector Fund Real-Estate | | | 4.0 | |

| Growth Mid-Cap | | | 4.0 | |

| Various Assets | | | 3.0 | |

| Taxable Govt/Agency-Money Market | | | 3.0 | |

| Value Mid-Cap | | | 2.0 | |

| Growth Large-Cap | | | 2.0 | |

| Value Small-Cap | | | 2.0 | |

| Other Assets/Liabilities (Net) | | | (0.5 | ) |

| Total | | | 100.0 | % |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone Conservative Allocation Fund | | | | |

| Sector Allocation | | | (% of Net Assets) | |

| Government/Corporate | | | 46.4 | % |

| International Debt | | | 9.1 | |

| Value | | | 6.0 | |

| Corporate/Preferred-High Yield | | | 5.0 | |

| Taxable Govt/Agency-Money Market | | | 5.0 | |

| Growth | | | 4.9 | |

| International Equity | | | 4.1 | |

| Blue Chip | | | 4.0 | |

| Various Assets | | | 4.0 | |

| Value Large-Cap | | | 3.0 | |

| Global Equity | | | 2.4 | |

| Sector Fund Real-Estate | | | 2.0 | |

| Value Small-Cap | | | 2.0 | |

| Emerging Market-Equity | | | 1.0 | |

| Growth Mid-Cap | | | 1.0 | |

| Other Assets/Liabilities (Net) | | | 0.1 | |

| Total | | | 100.0 | % |

| Touchstone Moderate Growth Allocation Fund | | | | |

| Sector Allocation | | | (% of Net Assets) | |

| Government/Corporate | | | 16.0 | % |

| Value | | | 14.2 | |

| International Equity | | | 13.3 | |

| Growth | | | 9.0 | |

| Emerging Market-Equity | | | 7.1 | |

| Global Equity | | | 5.4 | |

| Growth Mid-Cap | | | 5.1 | |

| Value Large-Cap | | | 5.0 | |

| Sector Fund Real-Estate | | | 4.1 | |

| Value Small-Cap | | | 4.1 | |

| Blue Chip | | | 3.1 | |

| Value Mid-Cap | | | 3.0 | |

| International Debt | | | 3.0 | |

| Corporate/Preferred-High Yield | | | 3.0 | |

| Various Assets | | | 3.0 | |

| Growth Large-Cap | | | 2.0 | |

| Other Assets/Liabilities (Net) | | | (0.4 | ) |

| Total | | | 100.0 | % |

| Touchstone Growth Allocation Fund | | | | |

| Sector Allocation | | | (% of Net Assets) | |

| International Equity | | | 17.3 | % |

| Value | | | 14.1 | |

| Growth | | | 10.9 | |

| Emerging Market-Equity | | | 10.2 | |

| Global Equity | | | 7.7 | |

| Sector Fund Real-Estate | | | 6.1 | |

| Value Small-Cap | | | 6.0 | |

| Growth Mid-Cap | | | 5.0 | |

| Value Large-Cap | | | 5.0 | |

| Government/Corporate | | | 5.0 | |

| Value Mid-Cap | | | 4.0 | |

| Blue Chip | | | 3.0 | |

| Growth Large-Cap | | | 3.0 | |

| Various Assets | | | 3.0 | |

| Other Assets/Liabilities (Net) | | | (0.3 | ) |

| Total | | | 100.0 | % |

Portfolio of Investments

Touchstone Dynamic Equity Fund – July 31, 2012

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks† — 120.3% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 24.0% | | | | | | | | |

| Akamai Technologies, Inc.* | | | 6,036 | | | $ | 212,346 | |

| Apple, Inc.* | | | 5,020 | | | | 3,066,015 | |

| Avnet, Inc.* | | | 18,039 | | | | 568,228 | |

| CA, Inc. | | | 39,036 | | | | 939,597 | |

| Cisco Systems, Inc. | | | 91,814 | | | | 1,464,433 | |

| FleetCor Technologies, Inc.* | | | 2,681 | | | | 98,983 | |

| Intel Corp. | | | 80,752 | | | | 2,075,326 | |

| International Business Machines Corp. | | | 13,211 | | | | 2,589,092 | |

| LSI Corp.* | | | 70,683 | | | | 487,713 | |

| Microsoft Corp. | | | 96,173 | | | | 2,834,218 | |

| Vishay Intertechnology, Inc.* | | | 3,716 | | | | 36,677 | |

| | | | | | | | 14,372,628 | |

| | | | | | | | | |

| Consumer Discretionary — 20.3% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 9,379 | | | | 657,937 | |

| Brinker International, Inc. | | | 6,354 | | | | 205,933 | |

| Comcast Corp. - Class A | | | 14,086 | | | | 458,499 | |

| Delphi Automotive PLC (United Kingdom)* | | | 31,656 | | | | 898,714 | |

| Dillard's, Inc. - Class A | | | 682 | | | | 44,487 | |

| DIRECTV - Class A* | | | 10,743 | | | | 533,497 | |

| Expedia, Inc. | | | 16,328 | | | | 930,533 | |

| Ford Motor Co. | | | 82,217 | | | | 759,685 | |

| Gannett Co., Inc. | | | 84,815 | | | | 1,196,740 | |

| Garmin Ltd. (Switzerland) | | | 12,486 | | | | 482,084 | |

| General Motors Co.* | | | 12,427 | | | | 244,936 | |

| Home Depot, Inc. (The) | | | 40,821 | | | | 2,130,040 | |

| Macy's, Inc. | | | 30,452 | | | | 1,091,400 | |

| Marriott International, Inc. - Class A | | | 13,129 | | | | 478,158 | |

| priceline.com, Inc.* | | | 1,788 | | | | 1,183,191 | |

| Viacom, Inc. - Class B | | | 18,099 | | | | 845,404 | |

| | | | | | | | 12,141,238 | |

| | | | | | | | | |

| Financials — 18.1% | | | | | | | | |

| American Capital Agency Corp. REIT | | | 46,790 | | | | 1,644,201 | |

| American International Group, Inc.* | | | 45,024 | | | | 1,407,900 | |

| Capital One Financial Corp. | | | 19,598 | | | | 1,107,091 | |

| Citigroup, Inc. | | | 17,754 | | | | 481,666 | |

| Hospitality Properties Trust REIT | | | 15,178 | | | | 368,370 | |

| Invesco Ltd. ADR | | | 15,757 | | | | 348,702 | |

| KeyCorp. | | | 72,321 | | | | 577,122 | |

| MFA Financial, Inc. REIT | | | 54,094 | | | | 437,080 | |

| Plum Creek Timber Co., Inc. REIT | | | 11,280 | | | | 457,855 | |

| Popular, Inc. (Puerto Rico)* | | | 11,655 | | | | 175,641 | |

| Regions Financial Corp. | | | 56,191 | | | | 391,089 | |

| Wells Fargo & Co. | | | 46,659 | | | | 1,577,541 | |

| Weyerhaeuser Co. REIT | | | 78,215 | | | | 1,826,320 | |

| | | | | | | | 10,800,578 | |

| | | | | | | | | |

| Energy — 13.4% | | | | | | | | |

| Chevron Corp. | | | 1,637 | | | | 179,382 | |

| Cobalt International Energy, Inc.* | | | 15,548 | | | | 390,255 | |

| ConocoPhillips | | | 9,668 | | | | 526,326 | |

| Diamond Offshore Drilling, Inc. | | | 9,669 | | | | 632,546 | |

| Exxon Mobil Corp. | | | 37,856 | | | | 3,287,794 | |

| Marathon Oil Corp. | | | 51,729 | | | | 1,369,267 | |

| Phillips 66 | | | 2 | | | | 75 | |

| Sunoco, Inc. | | | 3,569 | | | | 171,990 | |

| Tesoro Corp.* | | | 8,483 | | | | 234,555 | |

| Valero Energy Corp. | | | 40,602 | | | | 1,116,555 | |

| Williams Cos., Inc. (The) | | | 3,664 | | | | 116,479 | |

| | | | | | | | 8,025,224 | |

| | | | | | | | | |

| Health Care — 12.3% | | | | | | | | |

| Agilent Technologies, Inc. | | | 12,435 | | | | 476,136 | |

| Alexion Pharmaceuticals, Inc.* | | | 85 | | | | 8,912 | |

| AmerisourceBergen Corp. | | | 29,158 | | | | 1,157,573 | |

| Amgen, Inc. | | | 26,485 | | | | 2,187,661 | |

| Boston Scientific Corp.* | | | 43,953 | | | | 227,237 | |

| Cardinal Health, Inc. | | | 30,450 | | | | 1,312,090 | |

| Eli Lilly & Co. | | | 1,656 | | | | 72,914 | |

| Forest Laboratories, Inc.* | | | 10,294 | | | | 345,364 | |

| HCA Holdings, Inc. | | | 5,873 | | | | 155,517 | |

| Johnson & Johnson | | | 4,252 | | | | 294,323 | |

| McKesson Corp. | | | 8,079 | | | | 733,008 | |

| UnitedHealth Group, Inc. | | | 7,108 | | | | 363,148 | |

| | | | | | | | 7,333,883 | |

| | | | | | | | | |

| Consumer Staples — 11.5% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 32,437 | | | | 846,281 | |

| Coca-Cola Enterprises, Inc. | | | 1,530 | | | | 44,860 | |

| Herbalife Ltd. (Cayman Islands) | | | 11,434 | | | | 627,612 | |

| Monster Beverage Corp.* | | | 12,478 | | | | 829,413 | |

| Philip Morris International, Inc. | | | 27,414 | | | | 2,506,736 | |

| Safeway, Inc. | | | 65,127 | | | | 1,012,725 | |

| Tyson Foods, Inc. - Class A | | | 68,297 | | | | 1,025,138 | |

| | | | | | | | 6,892,765 | |

| | | | | | | | | |

| Industrials — 8.4% | | | | | | | | |

| Cooper Industries PLC (Ireland) | | | 369 | | | | 26,524 | |

| Delta Air Lines, Inc.* | | | 57,139 | | | | 551,391 | |

| Landstar System, Inc. | | | 2,024 | | | | 100,006 | |

| Pitney Bowes, Inc. | | | 14,858 | | | | 198,503 | |

| Robert Half International, Inc. | | | 50,177 | | | | 1,355,281 | |

| United Parcel Service, Inc. - Class B | | | 7,604 | | | | 574,938 | |

| Waste Management, Inc. | | | 36,550 | | | | 1,257,320 | |

| WESCO International, Inc.* | | | 17,713 | | | | 986,791 | |

| | | | | | | | 5,050,754 | |

| | | | | | | | | |

| Materials — 5.0% | | | | | | | | |

| Ball Corp. | | | 11,823 | | | | 491,364 | |

| Commercial Metals Co. | | | 8,505 | | | | 109,629 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 33,704 | | | | 1,134,814 | |

| Kronos Worldwide, Inc. | | | 7,767 | | | | 131,418 | |

| Royal Gold, Inc. | | | 14,924 | | | | 1,129,448 | |

| | | | | | | | 2,996,673 | |

| | | | | | | | | |

| Utilities — 5.0% | | | | | | | | |

| AES Corp. (The)* | | | 130,460 | | | | 1,573,348 | |

| Duke Energy Corp. | | | 825 | | | | 55,918 | |

| NextEra Energy, Inc. | | | 19,259 | | | | 1,365,463 | |

| | | | | | | | 2,994,729 | |

Touchstone Dynamic Equity Fund (Continued)

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks† — 120.3% (Continued) | | | | | | | | |

| | | | | | | | | |

| Telecommunication Services — 2.3% | | | | | | | | |

| AT&T, Inc. | | | 16,476 | | | $ | 624,770 | |

| Verizon Communications, Inc. | | | 16,408 | | | | 740,657 | |

| | | | | | | | 1,365,427 | |

| Total Common Stocks | | | | | | $ | 71,973,899 | |

| | | | | | | | | |

| Investment Fund — 1.1% | | | | | | | | |

| Touchstone Institutional Money Market Fund^ | | | 645,981 | | | | 645,981 | |

| | | | | | | | | |

| Total Long Positions | | | | | | | | |

| (Cost $65,116,021) | | | | | | $ | 72,619,880 | |

| | | | | | | | | |

| Securities Sold Short — (18.8%) | | | | | | | | |

| | | | | | | | | |

| Common Stocks — (18.8%) | | | | | | | | |

| | | | | | | | | |

| Information Technology — (6.8%) | | | | | | | | |

| Acme Packet, Inc.* | | | (40,357 | ) | | | (639,658 | ) |

| Computer Sciences Corp. | | | (21,462 | ) | | | (528,394 | ) |

| Global Payments, Inc. | | | (16,670 | ) | | | (713,809 | ) |

| Itron, Inc.* | | | (9,784 | ) | | | (381,283 | ) |

| Salesforce.com, Inc.* | | | (2,708 | ) | | | (336,767 | ) |

| Solera Holdings, Inc. | | | (17,199 | ) | | | (671,621 | ) |

| VeriFone Systems, Inc.* | | | (21,197 | ) | | | (769,239 | ) |

| | | | | | | | (4,040,771 | ) |

| | | | | | | | | |

| Consumer Discretionary — (4.8%) | | | | | | | | |

| DeVry, Inc. | | | (13,319 | ) | | | (261,452 | ) |

| Federal-Mogul Corp.* | | | (6,401 | ) | | | (63,690 | ) |

| Gentex Corp. | | | (52,439 | ) | | | (839,548 | ) |

| Hyatt Hotels Corp. - Class A* | | | (11,348 | ) | | | (403,421 | ) |

| Netflix, Inc.* | | | (2,733 | ) | | | (155,371 | ) |

| Visteon Corp.* | | | (32,309 | ) | | | (1,047,781 | ) |

| Washington Post Co. (The) - Class B | | | (287 | ) | | | (97,150 | ) |

| | | | | | | | (2,868,413 | ) |

| | | | | | | | | |

| Energy — (2.5%) | | | | | | | | |

| Alpha Natural Resources, Inc.* | | | (65,750 | ) | | | (460,908 | ) |

| Cheniere Energy, Inc.* | | | (6,397 | ) | | | (87,191 | ) |

| Kosmos Energy Ltd. (Bermuda)* | | | (2,111 | ) | | | (20,139 | ) |

| Range Resources Corp. | | | (5,347 | ) | | | (334,722 | ) |

| Teekay Corp. (Bermuda) | | | (19,686 | ) | | | (604,951 | ) |

| | | | | | | | (1,507,911 | ) |

| | | | | | | | | |

| Health Care — (1.9%) | | | | | | | | |

| Allscripts Healthcare Solutions, Inc.* | | | (48,471 | ) | | | (445,933 | ) |

| Brookdale Senior Living, Inc.* | | | (5,384 | ) | | | (88,621 | ) |

| Endo Health Solutions, Inc.* | | | (13,870 | ) | | | (412,355 | ) |

| Incyte Corp. Ltd.* | | | (1,943 | ) | | | (48,556 | ) |

| Vertex Pharmaceuticals, Inc.* | | | (3,301 | ) | | | (160,132 | ) |

| | | | | | | | (1,155,597 | ) |

| | | | | | | | | |

| Financials — (1.3%) | | | | | | | | |

| Assured Guaranty Ltd. (Bermuda) | | | (15,320 | ) | | | (183,534 | ) |

| Bank of Hawaii Corp. | | | (6,808 | ) | | | (318,002 | ) |

| Jones Lang LaSalle, Inc. | | | (734 | ) | | | (48,950 | ) |

| TCF Financial Corp. | | | (19,761 | ) | | | (204,131 | ) |

| | | | | | | | (754,617 | ) |

| | | | | | | | | |

| Industrials — (1.0%) | | | | | | | | |

| IHS, Inc.* | | | (1,709 | ) | | | (188,451 | ) |

| ITT Corp.* | | | (22,296 | ) | | | (417,827 | ) |

| | | | | | | | (606,278 | ) |

| | | | | | | | | |

| Utilities — (0.5%) | | | | | | | | |

| National Fuel Gas Co. | | | (6,695 | ) | | | (327,653 | ) |

| | | | | | | | | |

| Materials — 0.0% | | | | | | | | |

| Allied Nevada Gold Corp.* | | | (707 | ) | | | (18,276 | ) |

| Total Common Stocks | | | | | | $ | (11,279,516 | ) |

| | | | | | | | | |