UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3651

Touchstone Strategic Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: March 31

Date of reporting period: March 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

March 31, 2012

Annual Report

Touchstone Strategic Trust

Touchstone Diversified Small Cap Growth Fund

Touchstone Growth Opportunities Fund

Touchstone Large Cap Growth Fund

Touchstone Mid Cap Growth Fund

Table of Contents

| | Page |

| Letter from the President | 3 |

| Management's Discussion of Fund Performance (Unaudited) | 4 |

| Tabular Presentation of Portfolios of Investments (Unaudited) | 18 |

| Portfolio Investments: | |

| Touchstone Diversified Small Cap Growth Fund | 19 |

| Touchstone Growth Opportunities Fund | 21 |

| Touchstone Large Cap Growth Fund | 23 |

| Touchstone Mid Cap Growth Fund | 24 |

| Statement of Assets and Liabilities | 26 - 27 |

| Statement of Operations | 28 |

| Statement of Changes in Net Assets | 30 - 33 |

| Financial Highlights | 34 - 42 |

| Notes to Financial Statements | 43 - 55 |

| Report of Independent Registered Public Accounting Firm | 56 |

| Other Items (Unaudited) | 57 - 64 |

| Management of the Trust (Unaudited) | 65 - 67 |

| Privacy Protection Policy | 68 |

Letter from the President

Dear Fellow Shareholder,

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information and manager commentaries for the twelve months ended March 31, 2012.

There is little doubt that the U.S. economy is on more solid footing today than it was a year ago. While fiscal uncertainty and a recessionary perspective marked the first 6 months of the fiscal year, the last 6 months saw U.S. economic data improve. Better than expected economic reports have propped up the markets, which in turn, have boosted confidence that has spurred additional spending by households and hiring by businesses.

The U.S. equity markets posted positive performance for the fiscal year; results were mixed during the period. The markets suffered their worst losses since the 2008-09 financial crisis in the third quarter of 2011. In a reversal of that trend, the first quarter of 2012 proved to be an exceptionally strong one, with the S&P 500 Index posting a total return of 12.6%, its strongest first quarter since 1998.

For the year, the U.S. equity markets outperformed both the developed and emerging international markets. From a market capitalization and style perspective, large cap stocks outpaced both small- and mid-cap stocks, while growth outperformed across most asset classes. Interest rates remain low, and are forecasted to stay low throughout the next two years.

Touchstone is committed to helping investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific area of expertise. We hope that you will find the enclosed commentaries helpful.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management's Discussion of Fund Performance

Touchstone Diversified Small Cap Growth Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy and Process

The Touchstone Diversified Small Cap Growth Fund seeks long-term growth of capital by investing primarily in stocks of small-cap companies. Fund management focuses on companies that are experiencing improving secular or cyclical fundamental trends and high-quality, well-managed companies with competitive business models.

Fund Performance and Market Overview

The total return of the Touchstone Diversified Small Cap Growth Fund was -1.97% for the year ended March 31, 2012. The total return of the Russell 2000®Growth Index was 0.68% for the same period.

If one looked only at the unchanged level of returns for either the market or the Fund, it would appear an uneventful year. Yet the fiscal year period was far from uneventful. The volatility in the equity markets was significant as fiscal quarters two, three and four all were up or down greater than ten percent. The spring of 2011 was marked by the Japanese earthquake and tsunami followed by heightened concerns regarding European debt problems, especially Greece, followed by the fears of an economic slowdown and the debt ceiling battle in the U.S. However, the dramatic drop in the market in the third calendar quarter created some bargains and that, combined with the European Central Banks’ further monetary stimulus and the apparent economic improvement in the U.S. in the fourth quarter, drove stocks to two consecutive double digit quarterly returns.

The U.S. economy does seem to be building a firmer foundation upon which to grow. In addition, the European debt concerns have moderated. The Federal Reserve and the other major central banks of the world will likely continue to apply extraordinary monetary measures should the global economy appear to slow appreciably or the financial markets weaken significantly as occurred in the second and third quarters of 2010 and 2011.

Portfolio Review

Several sectors contributed to relative performance in the year including Health Care, Consumer Discretionary and Energy. Sectors with the largest negative impact on the Fund’s relative performance were Information Technology, Industrials and Consumer Staples.

As of the end of the first quarter of 2012, the Fund’s largest sector overweight position was in Consumer Discretionary while the Industrials, Information Technology and Health Care sectors were very slightly overweight. The Fund’s largest underweight sector was Financials with the Consumer Staples, Energy and Materials sectors modestly underweight.

The Fund’s Consumer Discretionary holdings are generally focused on companies that serve value-conscious consumers and/or have strong organic top line growth driven by domestic geographic expansion and/or recurring revenue. The Fund’s Health Care theme continues to be in orphan-drug producers and device manufacturers with new product introductions. The Fund’s positioning in the Industrials sector is in companies with recurring revenue, transportation, niche capital goods, aerospace and defense and electrical equipment companies. In the Information Technology sector, the Fund is positioned in companies benefitting from the concept of a networked society accomplished through constant connection, mobility, wireless and software as a service.

In the Financials sector we believe the Fund’s holdings in pawn brokers should benefit from the continued contraction in consumer credit and higher gold prices. At this point, the Fund’s portfolio is void of banks and Real Estate Investment Trusts (REITs) as we still consider the risk/return profile for these groups unattractive. In the Energy sector, the Fund is positioned in companies that should benefit from domestic onshore shale plays and international offshore oil & gas drilling. Increased exposure in the Materials sector is more in the form of growth-cyclicals rather than those that have more volatile businesses. In the Consumer Staples sector, the Fund is positioned in a combination of companies with growth product niches or geographic expansion opportunities and traditional food and beverage names.

Management's Discussion of Fund Performance (Continued)

Individual stocks that contributed to performance included SonoSite Inc., Alexion Pharmaceuticals, Inc., Spectranetics Corp., BioMarin Pharmaceutical Inc., Salix Pharmaceuticals, Ltd., and Genomic Health Inc.(Health Care sector); Brigham Exploration Co. (Energy sector), Tractor Supply, Coinstar Inc. and DSW Inc. (Consumer Discretionary sector); and Mellanox Technologies Ltd. and Taleo Corp. (Information Technology sector).

Individual stocks that detracted from performance included NetScout Systems Inc., Riverbed Technology Inc., Cavium Inc., VistaPrint Ltd., Skyworks Solutions Inc., and Acme Packet Inc., (Information Technology sector), Vera Bradley, Inc. and WMS Industrials, Inc.(Consumer Discretionary sector); United Therapeutics Corp. (Health Care sector); and PetroQuest Energy Inc. (Energy sector).

Strategy and Outlook

Going into the new fiscal year (starting April 2012), the Fund generally continues to be positioned in companies that we believe can increase sales and profits in spite of a difficult economic environment. If we find the U.S. economy continues to gain momentum, we will look to add to growth-cyclical companies that should benefit from this uptick.

Management's Discussion of Fund Performance (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone

Diversified Small Cap Growth Fund - Class A* and the Russell 2000® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares and Class Y shares based on the differences in loads and fees paid by shareholders in the different classes. The initial public offering of Class A shares and Class Y shares commenced on September 6, 2006. The initial public offering of Class C shares commenced on August 1, 2007. The returns for Class C shares include performance of the Fund that was achieved prior to the creation of Class C shares (August 1, 2007), which is the same as the performance for Class A shares through August 1, 2007. The returns have been restated for sales charges and for fees applicable to Class C shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Continued)

Touchstone Growth Opportunities Fund

Sub-Advised by Westfield Capital Management LP

Investment Philosophy and Process

The Touchstone Growth Opportunities Fund seeks long-term capital appreciation by primarily investing in stocks of U.S. companies with large, medium and small market capitalizations. Fund management places focus on companies that are believed to have demonstrated records of achievement with excellent prospects for earnings growth over a 1- to 3-year period and incorporates a proprietary, research driven, bottom-up approach that seeks to identify quality growth companies with strong management teams, sustainable business models and solid financials.

Fund Performance and Market Overview

The total return of the Touchstone Growth Opportunities Fund was 1.47% for the twelve month period ended March 31, 2012. The total return of the Russell 3000® Growth Index was 10.14% for the same period. While successful stock picking was evidenced across a range of economic sub-industries, dramatic weakness in select positions led to the performance shortfall. The Consumer Discretionary, Energy, and Health Care sectors were the greatest detractors from relative returns.

Optimism about global economic expansion faded in the spring of 2011, giving way to worries that the “soft patch” of data could be indicative of a more protracted slowdown. The effects of the natural disaster in Japan on the global supply chain were indeed disruptive to industrial production. At the same time, efforts to curb inflation in emerging economies had a negative impact on global demand for various commodities. A decline in crude prices and a 20-plus percent retreat in certain agricultural commodities helped to pressure more cyclically sensitive stocks. A change in investor confidence was also evident in the slowdown in Mergers & Acquisitions (M&A) activity as uncertainty of economic prospects overwhelmed positive factors like record levels of cash on balance sheets and attractive interest rates. Concerns about a double-dip recession intensified during the second half of last year, prompting a retreat from risky assets of all types. Instead, investors were looking for visible, protected growth even if it came at very high price-to-earnings multiples. In general terms, the stocks that worked best in 2011 were either income-producing or those we believe were too expensive. The market dynamics reversed sharply with the start of 2012, when strengthening domestic economy and accommodative monetary policy around the globe helped revive investor appetite for stocks. Most domestic equity indices posted double-digit gains in the first three months of the year, staging the biggest first quarter advance in fourteen years.

Portfolio Review

The Consumer Discretionary sector detracted from relative returns. Solid performance within the Internet retail and department stores sub-industries was overshadowed by declines elsewhere, most notably within auto parts & equipment. Lack of exposure to such areas of strength as restaurants, apparel accessories & luxury goods, and apparel retail also hindered excess returns. The maker of automotive equipment for emissions and ride control Tenneco Inc. was the biggest source of the performance weakness. We viewed the company as one of the best beneficiaries of the ongoing cyclical recovery in the auto market; however, the stock languished in the second half of the year, hurt by concerns over the company’s exposure to Europe and China. Our research indicated that while the U.S. auto trend continued to be strong, European production schedules began to weaken. As we do not anticipate a pick-up in global Seasonally Adjusted Annual Rate (SAAR) growth in 2012, the stock was sold. In addition, sector performance was held by an underweight in the traditional “brick-&-mortar” retail space and restaurants industries. New investments were made in these industries in the last calendar quarter of 2011, and these trades leave the Fund’s portfolio less underweight in the Consumer Discretionary sector. Home Depot Inc., for example, was added to the Fund’s portfolio, as were the home goods retailer Williams-Sonoma Inc. and specialty coffee retailer Starbucks Corp.

Management's Discussion of Fund Performance (Continued)

Investments in the Energy sector had a negative impact on relative results. We witnessed extreme volatility in the Energy sector in the past 12 months. Unrest in the Middle East in the early part of 2011 was a key factor, as Libya’s civil war alone decreased world oil production by 1.3 million barrels a day in an already tight capacity market. As oil prices rose, Energy sector stocks were hit with market trepidations about multiple macro risks including the effect of commodity inflation on the economy. Weatherford International Ltd., in particular, was a disappointing holding for the Fund’s portfolio over the past year. Weatherford International provides oilfield-related services globally, and its growth is correlated with a rising global Gross Domestic Product (GDP), particularly in emerging economies. Middle East and North Africa dislocations and weather across several regions had a significant negative impact on Weatherford’s international revenues and margins. Complicating matters, the company surprised investors during the fourth quarter reporting period by disclosing that it was not able to settle its material accounting weaknesses for certain tax accounts. While the company’s weak financial controls for income taxes is unfortunate, this fact does not overshadow Weatherford’s solid operational results, with revenues growing 27% year-over-year and better-than-expected pre-tax income. We applaud the company’s improving business fundamentals and believe that Weatherford will continue to benefit from its significant exposure to international drilling and significant margin improvement in its North American segment. The Fund portfolio’s holdings within the coal & consumable fuels sub-industry, which drastically lagged the index sector overall, also negatively impacted relative performance. Alpha Natural Resources Inc. underperformed due in part to the perceived risk associated with Alpha Natural finalizing its Massey Energy Co. acquisition. While we remain bullish on the prospects for secular demand growth for coal given its importance to power generation in emerging markets, we sold our shares in the stock.

Investments within the Health Care sector detracted from relative results. An overweight to the sector and positive performance within the healthcare equipment sub-industry helped incrementally, but were offset by turmoil in certain securities such as hospital operating company Community Health Systems Inc. and biotechnology company Vertex Pharmaceuticals Inc. Community Health made a hostile bid for competitor Tenet Healthcare Corp. at the end of 2010, and in April of last year, Tenet Healthcare alleged that Community Health engaged in practices that resulted in its overbilling Medicare. Community Health assembled an immense amount of data and analyses that supported its rebuttal of these claims. While Community Health’s first quarter financials corroborated our thesis that Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) margins were widening while improving employment should drive higher volumes, the litigation impacted the near-term outlook for the stock. As a result, we sold our shares in June. Vertex Pharmaceuticals, which has been primarily focused on developing therapies for the treatment of Hepatitis C, launched Invicek, its first product in this indication in May of 2011. The company’s pipeline is broader than Hepatits C, with two product candidates for Cystic Fibrosis in Phase III trials. However, later in 2011, a competitor presented scientific data that pointed to potential competition for Incivek, which will likely arrest Vertex’s plans for trial activity in combination therapies. We continue to hold the stock, as we believe that doctors are unlikely to hold off on putting patients on Incivek in anticipation of better therapies. Further trials of the competitor’s drug will take many years, and while the market potential may be reduced for Incivek, there are patients who simply cannot wait years for a new treatment while effective and safe medication is available now. Our analysis of prescription trends for Incivek shows that Vertex should demonstrate strong earnings growth, at least for the next several years and we expect that the cash flow generated will be used prudently to reinvest in the company’s product pipeline.

Management's Discussion of Fund Performance (Continued)

The Industrials sector added to relative returns. Sector outperformance was primarily driven by investments within the aerospace & defense sub-industry. The lion’s share of the gains was the result of the Fund’s portfolio owning Goodrich Corp, a supplier of aerospace components and services. In late September, conglomerate United Technologies Corp. offered $127.50 per share to purchase aftermarket-focused Goodrich, representing a 47% premium to Goodrich’s price before the deal. BE Aerospace Inc. also contributed meaningfully to positive results. The company, which supplies cabin interior products both to original equipment manufacturers and aftermarket clients, benefited from an ongoing cyclical recovery within the aerospace industry. BE Aerospace has multiple catalysts for growth, in our opinion, including the industry’s increased focus on aircraft maintenance after the lean years of the downturn and a shift towards more wide-body aircraft. Among other performance drivers within the sector were investments in trucking, industrial machinery, and industrial conglomerates. With China slowing and Europe likely in a recession, our positioning will most likely be more U.S. centric in the next several months. We added shares of Tyco International Ltd. into the portfolio in late 2011, when the company’s fourth fiscal quarter conference call confirmed our thinking that the U.S. economic recovery was taking hold. The company’s diversified group of businesses demonstrated significant year-over-year acceleration in organic growth. Earlier in 2011, Tyco’s management had announced plans to spin off its three businesses into independent entities and the stock’s valuation looked even more attractive when applying sum-of-the-parts analysis to calculate the company’s intrinsic value. Financial results for the first quarter of 2012 were also solidly above consensus expectations, with organic orders growth of 7% from the prior quarter, despite a tougher comparison. We also purchased J.B. HuntTransport Services Inc., a premier intermodal (truck and rail combination) freight carrier in the U.S. In our opinion, this is the secular growth segment of the trucking market and the company’s early entry into the intermodal freight market has allowed it to lock in favorable contracts with its railroad partners. Over the past few years, the company has de-emphasized its legacy truck-load segment to build out its intermodal business. This strategic positioning has produced higher returns on capital but muted revenue growth. Now at the low point of the truck-load decommissioning effort, we believe top line growth is likely to reaccelerate.

Strategy and Outlook

An equity market consolidation is not unlikely given the torrid advance experienced year-to-date. Indeed, fund flows into equity mutual funds would suggest that the average investor remains bearish on the outlook for U.S. stocks. We believe, however, that stock market valuation remains reasonable, earnings growth for U.S. corporations will be steady and increasing evidence of cyclical traction in housing, construction and capital spending should provide a positive backdrop for stocks. U.S. corporations are currently benefiting from a positive business environment domestically. Unit labor costs are well contained and the proliferation of natural gas should provide a cheap source of energy for many years to come. While risk of exogenous shocks persist like the intensifying of the European Financial Crisis or an oil shock from Middle East conflict – we believe the balance of risks favor further upside in U.S. stocks and a fundamentally-driven investment process can deliver excess returns in this environment.

Management's Discussion of Fund Performance (Continued)

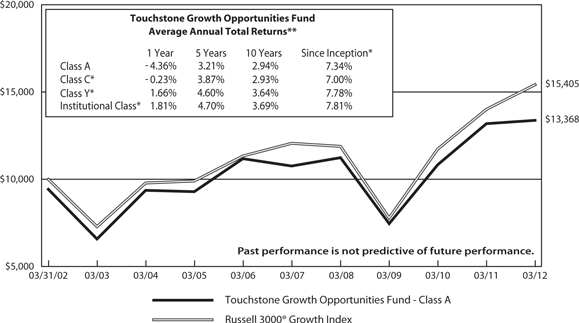

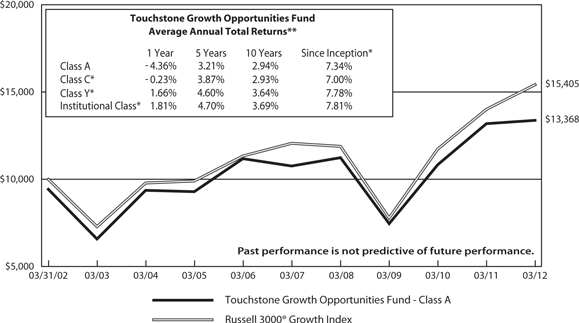

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Growth Opportunities Fund - Class A* and the Russell 3000® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The initial public offering of Class A shares commenced on September 29, 1995, the initial public offering of Class C shares commenced on August 2, 1999 and the initial public offering of Class Y shares and Institutional Class shares commenced on February 2, 2009, respectively. The returns for Class C, Class Y and Institutional Class shares include performance of the Fund that was achieved prior to the creation of Class C, Class Y and Institutional Class shares (August 2, 1999 and February 2, 2009, respectively), which is the same as the performance for Class A shares through August 2, 1999 and February 2, 2009, respectively. The returns have been restated for sales charge and for fees applicable to Class C, Class Y and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Continued)

Touchstone Large Cap Growth Fund

Sub-Advised by Navellier & Associates, Inc.

Investment Philosophy and Process

The Touchstone Large Cap Growth Fund seeks long-term growth of capital. The Fund primarily invests in common stocks of large-cap U.S. companies believed to possess strong appreciation potential.

Fund Performance and Market Overview

The total return of the Touchstone Large Cap Growth Fund was 11.18% for the year ended March 31, 2012. The total return of the Russell 1000® Growth Index was 11.02% for the same period.

The investment environment for the period can be described as somewhat conflicting. A major reason for that assessment can be found in the reaction from the market to news emanating from the ongoing travails of European debt deal announcements and monetary rescue funds. Recall that the market sold off and produced negative returns for the months of May through September, then moved to the upside by double digits in October. It then was essentially flat for November and December, and went on to finish the 12-month period with respectable monthly returns for the first quarter of 2012. We believe such market behavior is one reason why it is so important to mitigate risk.

Portfolio Review

For the past 12 months, the Touchstone Large Cap Growth Fund outperformed its benchmark. At the sector level, Consumer Discretionary, Consumer Staples, and Energy contributed to the Fund’s outperformance for the year. Consumer Discretionary was the largest overweight sector in the Fund relative to the Index and Consumer Staples was the second largest overweight relative to the Index. The Fund held a relatively large, average underweight position in the Energy sector. Sectors that detracted from Fund performance for the year were Industrials, Information Technology and Utilities.

At an individual stock level, contribution to Fund performance for the past 12 months was driven by Consumer Discretionary stocks, Chipotle Mexican Grill Inc., Dollar Tree Stores Inc., TJX Companies, and AutoZone Inc. Chipotle Mexican Grill’s outperformance during the period was driven by strong U.S. and international expansion, with revenues up 23.2 percent year-over-year (YOY) in the latest quarter. Chipotle has seen some pressure on margins due to the higher quality of its ingredients and overall food inflation, but management has chosen to absorb some of the margin pressure and selectively raise prices in some regions, resulting in no slowdown in same-store sales. What is more interesting is that Chipotle successfully tested in Washington, D.C., an Asian version of its patented made-to-order, higher-quality fast Mexican cuisine restaurant concept, which we believe may give the company a whole new restaurant division. Finally, AutoZone contributed to performance, as the auto part chain continues on its aggressive share repurchase program that has resulted in the retirement of 70 percent of shares outstanding since 1998. Similar aggressive buybacks have been tried in the auto parts and other retail sectors, but the fact remains that AutoZone also has an industry-leading operating margin of 18.67 percent, which gives it more money than any competitor for aggressive buybacks, further helping the share price.

Dollar Tree outperformed for the year, despite an improving economy; historically, dollar stores do well in recessions. The key has been the slower-than-normal recovery in employment, keeping many consumers in penny-pinching mode, which is perfect for Dollar Tree; however, there is also Dollar Tree’s superior distribution as the largest such single-price-point retailer, allowing for an industry-leading operating margin of 11.81 percent. Wal-Mart, by comparison, has an operating margin of only 5.94 percent. Another contributor to Fund performance was TJX Companies. TJX has had remarkably consistent earnings-per-share (EPS) growth over time with a 5-year compounded annual growth rate (CAGR) of 19 percent, a 10-year CAGR of 16 percent, and a 15-year CAGR of 19 percent. Discounted brand name merchandise is popular with consumers in penny-pinching mode, but the company has discovered over the years that every recession generates new customers who had not shopped there before and who keep returning after the recession is over, as they like the value proposition of top brands at discounted prices. Management has also made the company more efficient by increasing the pre-tax operating margin by 400 basis points. As the company generated $9 billion in cash over the past 10 years, management returned cash to shareholders via dividends and buybacks.

Management's Discussion of Fund Performance (Continued)

Stocks that detracted from performance included Green Mountain Coffee Roasters Inc. (Consumer Staples sector), Deere & Co., Rockwell Automation, and Caterpillar Inc. (Industrials sector), and Cognizant Technology Solutions Corp. (Information Technology sector). We believe the only one that seemed truly problematic was Green Mountain, while the rest experienced sharp corrections without seeing much deterioration in fundamentals. The Fund’s position in Green Mountain Coffee Roasters came under serious pressure in October 2011 after fund manager David Einhorn shared his skeptical opinion of the company’s growth prospects with the public. Green Mountain had the misfortune to miss quarterly estimates shortly after that but, in the fourth quarter as reported in January 2012, it beat Earnings per Share (EPS) estimates, so we believe the miss was likely more a spike in wholesale coffee prices and overbooking from vendors than anything else. Green Mountain has again come under pressure of late due to Starbucks Corp.’s expected entry into the single-serving coffee brewer market. The position was sold due to the excessive volatility.

The Fund’s position in Rockwell Automation declined in the July-October correction in 2011 due to a growth scare emanating from Europe. Paradoxically, the company kept beating EPS estimates the entire time during the selloff as it has excellent exposure to faster-industrializing emerging markets without the macro problems of Europe. The position in Deere declined in the past 12 months, while also beating EPS estimates but, unfortunately, showing that share prices can substantially deviate from the fundamentals that typically support prices. Deere equipment sales are directly correlated with the level of agricultural commodity prices, which reached records in 2011. The company is on track for record EPS in 2012 and 2013 if agricultural commodity prices stay elevated. Caterpillar declined over the past 12 months due to a 13 percent EPS miss in the June 2011 quarter, which was reversed in the next two quarters. As a blue chip stock, Caterpillar came under significant pressure with worries about the European crisis spilling over into the U.S. and China, which we believe have been unsubstantiated, so the shares have largely recovered. Finally, the Fund’s position in Information Technology outsourcing company, Cognizant, declined with the general market correction last summer even though the company had been reporting higher revenues and EPS than the industry. Cognizant’s management made a decision to aggressively take market share and undercut competitors, which resulted in a lot of repeat business while some competitors struggled during 2011.

Strategy and Outlook

We are optimistic for the coming year. We believe many of the Touchstone Large Cap Growth Fund’s stocks have strong fundamental foundations underneath their respective share prices due to factors such as high dividend yields, stock buyback programs, and a weak U.S. dollar boosting sales and earnings for multi-international stocks. Since overall sales and earnings are now decelerating due to more difficult year-over-year comparisons, the S&P 500 Index’s earnings are expected to grow under 10 percent for all of 2012. In our opinion, the Fund’s stocks that can sustain stronger sales and earnings momentum in a decelerating environment should be able to emerge as market leaders.

In conclusion, we believe we are now in an attractive environment for many growth stocks, and the Navellier stock selection methodology is focused on the 5 percent to 10 percent of stocks that may outperform the overall stock market in the coming months. It remains our belief that the Touchstone Large Cap Growth Fund’s stocks will stand out in 2012, especially as earnings decelerate for the overall stock market.

Management's Discussion of Fund Performance (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Large Cap Growth Fund - Class A* and the Russell 1000® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class B, Class C and Class Y shares based on the differences in loads and fees paid by shareholders in the different classes. The initial public offering of Class A shares commenced on December 19, 1997 and the initial public offering of Class B and Class C shares commenced on October 4, 2003. The initial public offering of Class Y shares commenced on November 10, 2004. The returns for Class B, Class C and Class Y shares include performance of the Fund that was achieved prior to the creation of Class B, Class C and Class Y shares (October 4, 2003 and November 10, 2004, respectively), which is the same performance for Class A shares through October 4, 2003 and November 10, 2004, respectively. The returns have been restated for sales charges and for fees applicable to Class B, Class C and Class Y shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Continued)

Touchstone Mid Cap Growth Fund

Sub-Advised by Westfield Capital Management LP

Investment Philosophy and Process

The Touchstone Mid Cap Growth Fund invests primarily in stocks of domestic mid-cap companies that are believed to have a demonstrated record of achievement with excellent prospects for earnings growth over a 1 to 3 year period. Fund management believes that companies that exhibit faster earnings growth offer the best opportunity for superior real rates of return and that reasonably priced stocks of companies with high forecasted earnings potential are best identified through in-depth, fundamental research and first-hand knowledge of company operations derived through on-site visits and meetings with management.

Fund Performance and Market Overview

The total return of the Touchstone Mid Cap Growth Fund was -3.68% for the twelve month period ended March 31, 2012. The total return of the Russell Midcap® Growth Index was 4.43% for the same period. Weakness within the Health Care, Energy, Materials, and Telecommunication Services sectors overwhelmed relative strength in the Information Technology, Industrials, and Financials sectors.

Optimism about global economic expansion faded in the spring of 2011, giving way to worries that the “soft patch” of data could be indicative of a more protracted slowdown. The effects of the natural disaster in Japan on the global supply chain were indeed disruptive to industrial production. At the same time, efforts to curb inflation in emerging economies had a negative impact on global demand for various commodities. A decline in crude prices and a 20-plus percent retreat in certain agricultural commodities helped to pressure more cyclically sensitive stocks. A change in investor confidence was also evident in the slowdown in Merger & Acquisition (M&A) activity as uncertainty of economic prospects overwhelmed positive factors like record levels of cash on balance sheets and attractive interest rates. Concerns about a double-dip recession intensified during the second half of last year, prompting a retreat from risky assets of all types. Instead, investors were looking for visible, protected growth even if it came at very high price-to-earnings multiples. In general terms, the stocks that worked best in 2011 were either income-producing or those we believe were too expensive. The market dynamics reversed sharply with the start of 2012, when strengthening domestic economy and accommodative monetary policy around the globe helped revive investor appetite for stocks. Most domestic equity indices posted double-digit gains in the first three months of the year, staging the biggest first quarter advance in fourteen years.

Portfolio Review

The Health Care sector detracted from relative returns. Dendreon Corp., which discovers, develops and commercializes novel products for the treatment of cancer, reported disappointing results in August. We sold the position in September after meeting with the company’s CEO and determining that he lacked the skills necessary to communicate effectively with Wall Street, but not before the stock negatively impacted the Fund’s portfolio. United Therapeutics Corp., whose primary focus is to develop therapies for the treatment of pulmonary arterial hypertension (PAH), traded lower. The company reported revenues for its PAH drugs Remodulin and Tyvaso below consensus expectations as inventories continued to work down the supply channel. Our thesis on the stock centers on the potential for the oral version of Remodulin to drive increased sales against very low expectations. We consider the stock’s valuation to be reasonable relative to its growth prospects and believe United Therapeutic Inc.’s cash flows will exhibit significant durability given that the company’s key drugs are difficult to replicate in generic form. Biotechnology company Vertex Pharmaceuticals Inc. also traded lower. A competitor presented positive data that pointed to potential competition for Vertex Pharmaceutical Inc.’s lead drug, Incivek. However, we believe any competition should be delayed given Incivek’s effectiveness and safety profile. Our analysis of prescription trends for Incivek shows that Vertex should demonstrate strong earnings growth, at least for the next several years. We expect that the cash flow generated will be used prudently to reinvest in the company’s product pipeline.

Management's Discussion of Fund Performance (Continued)

The Energy sector detracted from relative returns. Despite trading lower, we believe global oil & gas technology and service provider Weatherford International Ltd. should benefit from its management team’s ability to execute at least well enough to drive a reversion to the company’s historical average margins—a core premise of our investment. Coal & consumable fuel company Alpha Natural Resources Inc. was a detractor during the year due in part to the perceived risk associated with Alpha Natural Resources finalizing its Massey Energy Co. acquisition. The deal was closed in June after shareholders approved all merger-related proposals and the combination of Massey and Alpha created the largest met coal supplier in North America. We sold the stock in December as it bounced with the rest of its peers in the sector and provided a more attractive exit price. While we remain bullish on the prospects for secular demand growth for coal given its importance to power generation in emerging markets, moderating global growth had overwhelmed the secular outlook, in our opinion.

The Materials sector detracted from relative returns. Rare earth mineral producer Molycorp Inc. hindered returns. The company reported disappointing production results and lowered forward guidance. Focusing on the company-specific competitive advantages, we underestimated the pace and severity of price declines due to global growth deceleration and customer inventory drawdowns. As a result, the stock was sold. Scotts Miracle-Gro Co., a manufacturer, marketer, and distributor of lawn and garden products, was sold after we learned the company may delay or cancel outright its launch of a new product from its 2012 fertilizer product line due to toxicity concerns. Investors expected the product to be the next big driver of fertilizer revenue growth with a premium price point and margin, and its exclusion from the pipeline lowers the stock’s risk/reward, in our opinion. Crown Holdings Inc. designs, manufactures and sells packaging products for consumer goods. Working capital has been a massive drag on the company’s cash flows recently driven by higher aluminum and steel prices as well as inventory for new plant startups; the trend in free cash flow going forward will be key for the stock, especially given the decline in raw material prices. We believe the company should benefit as emerging markets enter a growth stage for consumer goods, strengthening beverage can end markets.

The Information Technology sector contributed to relative returns. Alliance Data Systems Corp., a provider of data-driven and transaction-based marketing/customer loyalty solutions, reported better than expected earnings results and raised forward guidance. The company is executing well and showcases business momentum in each of its segments. Red Hat Inc., a developer of open source software solutions, traded higher after reporting operational results ahead of consensus expectations. We have confidence in the company’s management team and remain attracted to its product positioning. NXP Semiconductors N.V., a manufacturer of high-performance mixed-signal semiconductors, also reported better-than-expected results and posted forward guidance that was ahead of Wall Street estimates. NXP should benefit from several product cycles including that of near-field communications technologies, which are used by mobile payment platforms and are driving significant year-over-year growth in the company’s mobility segment.

The Industrials sector contributed to relative returns. Precision Castparts Corp., which manufactures complex components for aerospace and industrial gas turbine applications, benefited from Boeing aircraft production rate increases. The company’s strong balance sheet allows it to grow through strategic acquisitions, such as its deal with Unison Engine Components (Tru-Form), which expands Precision Castparts’ capabilities into the forging segment, and should be accretive to fiscal 2012 earnings. Stanley Black & Decker Inc., which produces and sells tools, hardware, and security products, has significant leverage to improvements in the U.S. construction market. The company is transforming from a building products supplier to a diversified industrial company. We expect substantial sales and earnings in 2012. The stock has forty-four consecutive years of dividend growth, and should participate in stock buybacks.

Management's Discussion of Fund Performance (Continued)

The Financials sector contributed to relative returns. Credit card services provider Discover Financial Services continued to benefit from improving consumer credit metrics. We are comfortable with the company’s decision to diversify the business by growing its student loan segment. We initially purchased commercial bank SunTrust Banks Inc. given its desirable high-growth footprint in the American Southeast and the fact that three key earnings drivers – credit trends, loan growth, and fee income – were becoming more robust. We also believed the stock traded at a meaningful discount to tangible book value per share and that the company was significantly overcapitalized and would be likely to raise its dividend. However, we sold the stock based on concerns over the company’s mortgage servicing business.

Strategy and Outlook

An equity market consolidation is not unlikely given the torrid advance experienced thus far in 2012. Indeed, fund flows into equity mutual funds would suggest that the average investor remains bearish on the outlook for U.S. stocks. We believe, however, that stock market valuation remains reasonable, earnings growth for U.S. corporations will be steady and increasing evidence of cyclical traction in housing, construction and capital spending should provide a positive backdrop for stocks. U.S. corporations are currently benefiting from a positive business environment domestically. Unit labor costs are well contained and the proliferation of natural gas should provide a cheap source of energy for many years to come. While risk of exogenous shocks persist like the intensifying of the European Financial Crisis or an oil shock from Middle East conflict – we believe the balance of risks favor further upside in U.S. stocks and a fundamentally-driven investment process can deliver excess returns in this environment.

Management's Discussion of Fund Performance (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Mid Cap

Growth Fund - Class A* and the Russell Mid Cap® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class B shares, Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The initial public offering of Class A shares and Class C shares commenced on October 3, 1994; the initial public offering of Class B shares commenced on May 1, 2001; the initial public offering of Class Y shares commenced on February 2, 2009 and the initial public offering of Institutional Class shares commenced on April 1, 2011. The returns for Class B, Class Y and Institutional Class shares include performance of the Fund that was achieved prior to the creation of Class B, Class Y and Institutional Class shares (May 1, 2001, February 2, 2009 and April 1, 2011, respectively), which is the same performance for Class A shares through May 1, 2001, February 2, 2009 and April 1, 2011, respectively. The returns have been restated for sales charges and for fees applicable to Class B, Class Y, and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Tabular Presentation of Portfolios of Investments

March 31, 2012

| Touchstone Diversified Small Cap Growth Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 23.3 | % |

| Health Care | | | 19.9 | |

| Consumer Discretionary | | | 17.5 | |

| Industrials | | | 14.7 | |

| Financials | | | 7.9 | |

| Energy | | | 7.4 | |

| Materials | | | 3.5 | |

| Consumer Staples | | | 3.0 | |

| Investment Funds | | | 9.1 | |

| Other Assets/Liabilities (Net) | | | (6.3 | ) |

| Total | | | 100.0 | % |

| Touchstone Growth Opportunities Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 34.4 | % |

| Industrials | | | 19.5 | |

| Consumer Discretionary | | | 10.1 | |

| Health Care | | | 8.9 | |

| Energy | | | 8.2 | |

| Financials | | | 6.1 | |

| Materials | | | 5.5 | |

| Consumer Staples | | | 5.5 | |

| Investment Funds | | | 1.6 | |

| Other Assets/Liabilities (Net) | | | 0.2 | |

| Total | | | 100.0 | % |

| Touchstone Large Cap Growth Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Consumer Discretionary | | | 32.4 | % |

| Information Technology | | | 28.6 | |

| Consumer Staples | | | 16.1 | |

| Health Care | | | 8.7 | |

| Telecommunication Services | | | 4.1 | |

| Utilities | | | 3.9 | |

| Industrials | | | 2.5 | |

| Financials | | | 2.1 | |

| Energy | | | 1.1 | |

| Investment Funds | | | 2.4 | |

| Other Assets/Liabilities (Net) | | | (1.9 | ) |

| Total | | | 100.0 | % |

| Touchstone Mid Cap Growth Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 25.9 | % |

| Consumer Discretionary | | | 17.3 | |

| Industrials | | | 15.2 | |

| Energy | | | 10.9 | |

| Health Care | | | 9.5 | |

| Materials | | | 9.1 | |

| Financials | | | 6.9 | |

| Consumer Staples | | | 2.1 | |

| Telecommunication Services | | | 1.0 | |

| Investment Funds | | | 1.5 | |

| Other Assets/Liabilities (Net) | | | 0.6 | |

| Total | | | 100.0 | % |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®)

Portfolio of Investments

Touchstone Diversified Small Cap Growth Fund – March 31, 2012

| | | | | | Market | |

| | | Shares | | | Value | |

| Common Stocks — 97.2% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 23.3% | | | | | | | | |

| Ancestry.com, Inc.†* | | | 8,645 | | | $ | 196,587 | |

| Aruba Networks, Inc.* | | | 11,891 | | | | 264,931 | |

| Aspen Technology, Inc.* | | | 19,625 | | | | 402,901 | |

| Blackbaud, Inc. | | | 8,610 | | | | 286,110 | |

| Cadence Design Systems, Inc.* | | | 31,850 | | | | 377,104 | |

| Cavium, Inc.* | | | 9,252 | | | | 286,258 | |

| comScore, Inc.* | | | 16,547 | | | | 353,940 | |

| Constant Contact, Inc.* | | | 10,254 | | | | 305,467 | |

| FEI Co.* | | | 8,275 | | | | 406,385 | |

| Finisar Corp.* | | | 14,234 | | | | 286,815 | |

| j2 Global Communications, Inc.† | | | 11,770 | | | | 337,564 | |

| MAXIMUS, Inc. | | | 10,550 | | | | 429,068 | |

| Mellanox Technologies Ltd. (Israel)* | | | 9,200 | | | | 384,836 | |

| MICROS Systems, Inc.* | | | 6,858 | | | | 379,180 | |

| Microsemi Corp.* | | | 19,362 | | | | 415,121 | |

| Multi-Fineline Electronix, Inc.* | | | 6,021 | | | | 165,276 | |

| Parametric Technology Corp.* | | | 19,363 | | | | 541,002 | |

| Polycom, Inc.* | | | 9,805 | | | | 186,981 | |

| RF Micro Devices, Inc.* | | | 47,980 | | | | 238,940 | |

| Riverbed Technology, Inc.* | | | 6,417 | | | | 180,189 | |

| Skyworks Solutions, Inc.* | | | 12,081 | | | | 334,040 | |

| Synaptics, Inc.* | | | 6,580 | | | | 240,236 | |

| VeriFone Systems, Inc.* | | | 8,161 | | | | 423,311 | |

| Virtusa Corp.* | | | 18,595 | | | | 321,136 | |

| VistaPrint NV (Netherlands)†* | | | 8,165 | | | | 315,577 | |

| Vocera Communications, Inc.* | | | 7,318 | | | | 171,241 | |

| | | | | | | | 8,230,196 | |

| | | | | | | | | |

| Health Care — 19.9% | | | | | | | | |

| Acorda Therapeutics, Inc.* | | | 21,615 | | | | 573,878 | |

| Auxilium Pharmaceuticals, Inc.* | | | 21,805 | | | | 404,920 | |

| BioMarin Pharmaceutical, Inc.* | | | 15,276 | | | | 523,203 | |

| DexCom, Inc.* | | | 21,060 | | | | 219,656 | |

| Endologix, Inc.* | | | 9,717 | | | | 142,354 | |

| Fluidigm Corp.* | | | 15,253 | | | | 239,930 | |

| Genomic Health, Inc.†* | | | 16,503 | | | | 505,158 | |

| HMS Holdings Corp.* | | | 15,625 | | | | 487,656 | |

| Impax Laboratories, Inc.* | | | 17,620 | | | | 433,100 | |

| Insulet Corp.* | | | 25,741 | | | | 492,683 | |

| NxStage Medical, Inc.* | | | 30,884 | | | | 595,135 | |

| Onyx Pharmaceuticals, Inc.* | | | 12,415 | | | | 467,797 | |

| RTI Biologics, Inc.* | | | 76,765 | | | | 284,030 | |

| Salix Pharmaceuticals Ltd.* | | | 9,865 | | | | 517,912 | |

| Spectranetics Corp. (The)* | | | 47,040 | | | | 489,216 | |

| Thoratec Corp.* | | | 14,620 | | | | 492,840 | |

| United Therapeutics Corp.* | | | 3,765 | | | | 177,444 | |

| | | | | | | | 7,046,912 | |

| | | | | | | | | |

| Consumer Discretionary — 17.5% | | | | | | | | |

| American Public Education, Inc.* | | | 9,498 | | | | 360,924 | |

| Big Lots, Inc.* | | | 8,469 | | | | 364,336 | |

| BJ's Restaurants, Inc.* | | | 8,439 | | | | 424,904 | |

| Body Central Corp.* | | | 21,840 | | | | 633,797 | |

| Buffalo Wild Wings, Inc.* | | | 4,885 | | | | 443,021 | |

| Cato Corp. (The) - Class A | | | 11,448 | | | | 316,423 | |

| Chico's FAS, Inc. | | | 27,677 | | | | 417,923 | |

| Coinstar, Inc.†* | | | 8,450 | | | | 536,998 | |

| Deckers Outdoor Corp.* | | | 6,113 | | | | 385,425 | |

| DSW, Inc. - Class A | | | 7,485 | | | | 409,953 | |

| Steiner Leisure Ltd. (Bahamas)* | | | 6,040 | | | | 294,933 | |

| Texas Roadhouse, Inc. | | | 23,735 | | | | 394,950 | |

| Tractor Supply Co. | | | 4,847 | | | | 438,944 | |

| Tupperware Brands Corp. | | | 6,730 | | | | 427,355 | |

| Vera Bradley, Inc.†* | | | 11,085 | | | | 334,656 | |

| | | | | | | | 6,184,542 | |

| | | | | | | | | |

| Industrials — 14.7% | | | | | | | | |

| Aerovironment, Inc.* | | | 9,370 | | | | 251,210 | |

| American Science & Engineering, Inc. | | | 298 | | | | 19,982 | |

| Applied Industrial Technologies, Inc. | | | 10,085 | | | | 414,796 | |

| Ceradyne, Inc. | | | 7,981 | | | | 259,861 | |

| CLARCOR, Inc. | | | 7,920 | | | | 388,793 | |

| Clean Harbors, Inc.* | | | 6,302 | | | | 424,314 | |

| ESCO Technologies, Inc. | | | 9,832 | | | | 361,523 | |

| Forward Air Corp. | | | 3,465 | | | | 127,062 | |

| Landstar System, Inc. | | | 4,250 | | | | 245,310 | |

| Lindsay Corp. | | | 5,168 | | | | 342,483 | |

| MasTec, Inc.* | | | 2,772 | | | | 50,145 | |

| Middleby Corp.* | | | 3,362 | | | | 340,167 | |

| Raven Industries, Inc. | | | 4,249 | | | | 259,231 | |

| Rollins, Inc. | | | 17,030 | | | | 362,398 | |

| Toro Co. | | | 4,329 | | | | 307,835 | |

| Triumph Group, Inc. | | | 4,605 | | | | 288,549 | |

| Wabtec Corp. | | | 4,598 | | | | 346,551 | |

| Woodward, Inc. | | | 9,822 | | | | 420,676 | |

| | | | | | | | 5,210,886 | |

| | | | | | | | | |

| Financials — 7.9% | | | | | | | | |

| Cash America International, Inc. | | | 7,910 | | | | 379,126 | |

| Encore Capital Group, Inc.* | | | 16,308 | | | | 367,745 | |

| Ezcorp, Inc. - Class A* | | | 21,230 | | | | 689,020 | |

| Financial Engines, Inc.* | | | 6,685 | | | | 149,477 | |

| First Cash Financial Services, Inc.* | | | 16,190 | | | | 694,389 | |

| Portfolio Recovery Associates, Inc.* | | | 7,363 | | | | 528,074 | |

| | | | | | | | 2,807,831 | |

| | | | | | | | | |

| Energy — 7.4% | | | | | | | | |

| Dril-Quip, Inc.* | | | 4,800 | | | | 312,096 | |

| Energy XXI Bermuda Ltd.* | | | 8,065 | | | | 291,227 | |

| Gulfport Energy Corp.* | | | 12,485 | | | | 363,563 | |

| Lufkin Industries, Inc. | | | 3,220 | | | | 259,693 | |

| Newpark Resources, Inc.* | | | 47,495 | | | | 388,984 | |

| Oasis Petroleum, Inc.* | | | 11,825 | | | | 364,565 | |

| Petroquest Energy, Inc.†* | | | 41,327 | | | | 253,748 | |

| World Fuel Services Corp. | | | 9,329 | | | | 382,489 | |

| | | | | | | | 2,616,365 | |

| | | | | | | | | |

| Materials — 3.5% | | | | | | | | |

| Balchem Corp. - Class B | | | 9,862 | | | | 298,326 | |

| Buckeye Technologies, Inc. | | | 7,885 | | | | 267,853 | |

| Hecla Mining Co. | | | 17,625 | | | | 81,428 | |

| LSB Industries, Inc.* | | | 8,472 | | | | 329,730 | |

Touchstone Diversified Small Cap Growth Fund (Continued)

| | | | | | Market | |

| | | Shares | | | Value | |

| Common Stocks — 97.2% (Continued) | | | | | | | | |

| | | | | | | | | |

| Materials — (Continued) | | | | | | | | |

| NewMarket Corp. | | | 1,316 | | | $ | 246,618 | |

| | | | | | | | 1,223,955 | |

| | | | | | | | | |

| Consumer Staples — 3.0% | | | | | | | | |

| Boston Beer Co., Inc. (The) - Class A†* | | | 1,079 | | | | 115,226 | |

| Darling International, Inc.* | | | 16,020 | | | | 279,068 | |

| Flowers Foods, Inc. | | | 4,100 | | | | 83,517 | |

| Lancaster Colony Corp. | | | 2,077 | | | | 138,037 | |

| Nu Skin Enterprises, Inc. - Class A | | | 3,000 | | | | 173,730 | |

| Pricesmart, Inc. | | | 3,885 | | | | 282,868 | |

| | | | | | | | 1,072,446 | |

| Total Common Stocks | | | | | | $ | 34,393,133 | |

| | | | | | | | | |

| Investment Funds — 9.1% | | | | | | | | |

| Invesco Liquid Assets Portfolio** | | | 2,036,444 | | | | 2,036,444 | |

| Touchstone Institutional Money Market Fund^ | | | 1,196,631 | | | | 1,196,631 | |

| Total Investment Funds | | | | | | $ | 3,233,075 | |

| | | | | | | | | |

| Total Investment Securities —106.3% | | | | | | | | |

| (Cost $32,395,497) | | | | | | $ | 37,626,208 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (6.3%) | | | | | | | (2,222,545 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 35,403,663 | |

| † | All or a portion of the security is on loan. The total value of the securites on loan as of March 31, 2012 was $1,983,956. |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

| ^ | Affiliated Fund, sub-advised by Fort Washington Investment Advisors, Inc. See Note 4 in Notes to Financial Statements. |

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying notes to financial statements.

Valuation inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 34,393,133 | | | $ | — | | | $ | — | | | $ | 34,393,133 | |

| Investment Funds | | | 3,233,075 | | | | — | | | | — | | | | 3,233,075 | |

| | | | | | | | | | | | | | | $ | 37,626,208 | |

See accompanying notes to financial statements.

Portfolio of Investments

Touchstone Growth Opportunities Fund – March 31, 2012

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 98.2% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 34.4% | | | | | | | | |

| Alliance Data Systems Corp.* | | | 31,640 | | | $ | 3,985,374 | |

| Apple, Inc.* | | | 19,490 | | | | 11,683,670 | |

| Broadcom Corp. - Class A* | | | 59,880 | | | | 2,353,284 | |

| Check Point Software Technologies Ltd. (Israel) | | | 47,490 | | | | 3,031,762 | |

| Cisco Systems, Inc. | | | 172,853 | | | | 3,655,841 | |

| EMC Corp.* | | | 116,620 | | | | 3,484,606 | |

| Google, Inc. - Class A* | | | 7,010 | | | | 4,495,092 | |

| Mastercard, Inc. - Class A | | | 7,480 | | | | 3,145,639 | |

| MoneyGram International, Inc.* | | | 111,899 | | | | 2,014,182 | |

| NICE Systems Ltd. ADR (Israel)* | | | 63,847 | | | | 2,509,187 | |

| Nuance Communications, Inc.* | | | 95,700 | | | | 2,448,006 | |

| Qualcomm, Inc. | | | 43,589 | | | | 2,964,924 | |

| Red Hat, Inc.* | | | 60,040 | | | | 3,595,796 | |

| Salesforce.com, Inc.* | | | 18,740 | | | | 2,895,517 | |

| Teradyne, Inc.* | | | 45,250 | | | | 764,272 | |

| | | | | | | | 53,027,152 | |

| | | | | | | | | |

| Industrials — 19.5% | | | | | | | | |

| BE Aerospace, Inc.* | | | 66,050 | | | | 3,069,344 | |

| Danaher Corp. | | | 54,780 | | | | 3,067,680 | |

| Dover Corp. | | | 35,100 | | | | 2,209,194 | |

| General Electric Co. | | | 122,980 | | | | 2,468,209 | |

| Hexcel Corp.* | | | 96,243 | | | | 2,310,794 | |

| IDEX Corp. | | | 71,230 | | | | 3,000,920 | |

| JB Hunt Transport Services, Inc. | | | 37,660 | | | | 2,047,574 | |

| Landstar System, Inc. | | | 41,650 | | | | 2,404,038 | |

| Stanley Black & Decker, Inc. | | | 28,930 | | | | 2,226,453 | |

| Tyco International Ltd. (Switzerland) | | | 42,210 | | | | 2,371,358 | |

| United Technologies Corp. | | | 39,640 | | | | 3,287,742 | |

| WESCO International, Inc.* | | | 25,470 | | | | 1,663,446 | |

| | | | | | | | 30,126,752 | |

| | | | | | | | | |

| Consumer Discretionary — 10.1% | | | | | | | | |

| Amazon.com, Inc.* | | | 8,200 | | | | 1,660,582 | |

| Home Depot, Inc. | | | 31,470 | | | | 1,583,256 | |

| Nordstrom, Inc. | | | 49,410 | | | | 2,753,125 | |

| NVR, Inc.* | | | 4,221 | | | | 3,065,839 | |

| O'Reilly Automotive, Inc.* | | | 16,920 | | | | 1,545,642 | |

| Starbucks Corp. | | | 43,660 | | | | 2,440,157 | |

| Stewart Enterprises, Inc. - Class A | | | 18,540 | | | | 112,538 | |

| Williams-Sonoma, Inc. | | | 63,520 | | | | 2,380,730 | |

| | | | | | | | 15,541,869 | |

| | | | | | | | | |

| Health Care — 8.9% | | | | | | | | |

| Celgene Corp.* | | | 54,220 | | | | 4,203,134 | |

| DENTSPLY International, Inc. | | | 76,390 | | | | 3,065,531 | |

| Mettler-Toledo International, Inc.* | | | 12,183 | | | | 2,250,809 | |

| Thermo Fisher Scientific, Inc. | | | 47,310 | | | | 2,667,338 | |

| Vertex Pharmaceuticals, Inc.* | | | 37,650 | | | | 1,544,026 | |

| | | | | | | | 13,730,838 | |

| | | | | | | | | |

| Energy — 8.2% | | | | | | | | |

| Alpha Natural Resources, Inc.* | | | 73,640 | | | | 1,120,064 | |

| Halliburton Co. | | | 60,970 | | | | 2,023,594 | |

| National Oilwell VarCo., Inc. | | | 29,840 | | | | 2,371,385 | |

| Suncor Energy, Inc. (Canada) | | | 44,220 | | | | 1,445,994 | |

| Tesoro Corp.* | | | 60,063 | | | | 1,612,091 | |

| Valero Energy Corp. | | | 77,310 | | | | 1,992,279 | |

| Weatherford International Ltd. | | | | | | | | |

| (Switzerland) | | | 144,290 | | | | 2,177,336 | |

| | | | | | | | 12,742,743 | |

| | | | | | | | | |

| Financials — 6.1% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 37,820 | | | | 2,160,657 | |

| CBRE Group, Inc. - Class A* | | | 117,920 | | | | 2,353,683 | |

| Citigroup, Inc. | | | 89,350 | | | | 3,265,742 | |

| Wells Fargo & Co. | | | 48,390 | | | | 1,652,035 | |

| | | | | | | | 9,432,117 | |

| | | | | | | | | |

| Materials — 5.5% | | | | | | | | |

| Celanese Corp. | | | 59,880 | | | | 2,765,258 | |

| International Paper Co. | | | 66,760 | | | | 2,343,276 | |

| Westlake Chemical Corp.† | | | 52,491 | | | | 3,400,892 | |

| | | | | | | | 8,509,426 | |

| | | | | | | | | |

| Consumer Staples — 5.5% | | | | | | | | |

| General Mills, Inc. | | | 71,140 | | | | 2,806,473 | |

| Hershey Co. (The) | | | 43,470 | | | | 2,666,015 | |

| Ralcorp Holdings, Inc.* | | | 40,010 | | | | 2,964,341 | |

| | | | | | | | 8,436,829 | |

| Total Common Stocks | | | | | | $ | 151,547,726 | |

| | | | | | | | | |

| Investment Fund — 1.6% | | | | | | | | |

| Invesco Liquid Assets Portfolio** | | | 2,376,000 | | | | 2,376,000 | |

| | | | | | | | | |

| Total Investment Securities —99.8% | | | | | | | | |

| (Cost $150,110,317) | | | | | | $ | 153,923,726 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.2% | | | | | | | 378,366 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 154,302,092 | |

| † | All or a portion of the security is on loan. The total value of the securites on loan as of March 31, 2012 was $2,332,440. |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

Portfolio Abbreviations:

ADR - American Depositary Receipt

Touchstone Growth Opportunities Fund (Continued)

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying notes to financial statements.

| Valuation inputs at Reporting Date: | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 151,547,726 | | | $ | — | | | $ | — | | | $ | 151,547,726 | |

| InvestmentFund | | | 2,376,000 | | | | — | | | | — | | | | 2,376,000 | |

| | | | | | | | | | | | | | | $ | 153,923,726 | |

See accompanying notes to financial statements.

Portfolio of Investments

Touchstone Large Cap Growth Fund – March 31, 2012

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | | | |

| Common Stocks — 99.5% | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 32.4% | | | | | | | | |

| AutoZone, Inc.* | | | 50,575 | | | $ | 18,803,785 | |

| Chipotle Mexican Grill, Inc.* | | | 60,470 | | | | 25,276,460 | |

| Coach, Inc. | | | 194,600 | | | | 15,038,687 | |

| DISH Network Corp. - Class A | | | 589,290 | | | | 19,405,320 | |

| Dollar Tree, Inc.* | | | 164,365 | | | | 15,530,849 | |

| Macy's, Inc. | | | 470,000 | | | | 18,673,100 | |

| McDonald's Corp. | | | 206,140 | | | | 20,222,334 | |

| Ralph Lauren Corp. | | | 92,350 | | | | 16,099,376 | |

| Ross Stores, Inc. | | | 351,815 | | | | 20,440,452 | |

| Starbucks Corp. | | | 341,370 | | | | 19,079,169 | |

| TJX Cos, Inc. | | | 511,230 | | | | 20,300,943 | |

| Ulta Salon Cosmetics & Fragrance, Inc. | | | 201,475 | | | | 18,715,013 | |

| Wyndham Worldwide Corp. | | | 340,270 | | | | 15,825,958 | |

| | | | | | | | 243,411,446 | |

| | | | | | | | | |

| Information Technology — 28.6% | | | | | | | | |

| Alliance Data Systems Corp.†* | | | 192,400 | | | | 24,234,704 | |

| Apple, Inc.* | | | 43,975 | | | | 26,361,693 | |

| Baidu, Inc. ADR (China)* | | | 106,095 | | | | 15,465,468 | |

| Dell, Inc.* | | | 799,830 | | | | 13,277,177 | |

| Equinix, Inc.* | | | 123,242 | | | | 19,404,453 | |

| Intel Corp. | | | 667,900 | | | | 18,774,669 | |

| International Business Machines Corp. | | | 118,190 | | | | 24,660,344 | |

| Mastercard, Inc. - Class A | | | 38,480 | | | | 16,182,379 | |

| Motorola Solutions, Inc. | | | 291,345 | | | | 14,809,066 | |

| Nuance Communications, Inc.* | | | 844,355 | | | | 21,598,601 | |

| Visa, Inc. - Class A | | | 170,959 | | | | 20,173,162 | |

| | | | | | | | 214,941,716 | |

| | | | | | | | | |

| Consumer Staples — 16.1% | | | | | | | | |

| Altria Group, Inc. | | | 470,005 | | | | 14,509,054 | |

| Cia de Bebidas das Americas ADR (Brazil) | | | 368,305 | | | | 15,218,363 | |

| Costco Wholesale Corp. | | | 161,065 | | | | 14,624,701 | |

| Mead Johnson Nutrition Co. | | | 266,610 | | | | 21,989,993 | |

| Monster Beverage Corp.* | | | 325,430 | | | | 20,205,949 | |

| Reynolds American, Inc. | | | 324,330 | | | | 13,440,235 | |

| Whole Foods Market, Inc. | | | 250,000 | | | | 20,800,000 | |

| | | | | | | | 120,788,295 | |

| | | | | | | | | |

| Health Care — 8.7% | | | | | | | | |

| Biogen Idec, Inc.* | | | 140,175 | | | | 17,657,845 | |

| Cerner Corp.* | | | 252,865 | | | | 19,258,198 | |

| Perrigo Co. | | | 134,680 | | | | 13,913,791 | |

| UnitedHealth Group, Inc. | | | 247,370 | | | | 14,579,988 | |

| | | | | | | | 65,409,822 | |

| | | | | | | | | |

| Telecommunication Services — 4.1% | | | | | | | | |

| BCE, Inc. (Canada) | | | 360,060 | | | | 14,424,004 | |

| Tim Participacoes SA ADR (Brazil)† | | | 510,000 | | | | 16,452,600 | |

| | | | | | | | 30,876,604 | |

| | | | | | | | | |

| Utilities — 3.9% | | | | | | | | |

| NiSource, Inc. | | | 612,930 | | | | 14,924,846 | |

| Southern Co. (The) | | | 311,135 | | | | 13,979,296 | |

| | | | | | | | 28,904,142 | |

| | | | | | | | | |

| Industrials — 2.5% | | | | | | | | |

| Fastenal Co. | | | 352,000 | | | | 19,043,200 | |

| | | | | | | | | |

| Financials — 2.1% | | | | | | | | |

| Moody's Corp. | | | 366,660 | | | | 15,436,385 | |

| | | | | | | | | |

| Energy — 1.1% | | | | | | | | |

| Marathon Oil Corp. | | | 261,115 | | | | 8,277,346 | |

| Total Common Stocks | | | | | | $ | 747,088,956 | |

| | | | | | | | | |

| Investment Funds — 2.4% | | | | | | | | |

| Invesco Liquid Assets Portfolio** | | | 10,474,500 | | | | 10,474,500 | |

| Touchstone Institutional Money Market Fund^ | | | 7,532,678 | | | | 7,532,678 | |

| Total Investment Funds | | | | | | $ | 18,007,178 | |

| | | | | | | | | |

| Total Investment Securities —101.9% | | | | | | | | |

| (Cost $582,317,698) | | | | | | $ | 765,096,134 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (1.9%) | | | | | | | (13,898,436 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 751,197,698 | |

| † | All or a portion of the security is on loan. The total value of the securites on loan as of March 31, 2012 was $10,244,740. |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

| ^ | Affiliated Fund, sub-advised by Fort Washington Investment Advisors, Inc. See Note 4 in Notes to Financial Statements. |

Portfolio Abbreviations:

ADR - American Depositary Receipt

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying notes to financial statements.

| Valuation inputs at Reporting Date: | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 747,088,956 | | | $ | — | | | $ | — | | | $ | 747,088,956 | |

| Investment Funds | | | 18,007,178 | | | | — | | | | — | | | | 18,007,178 | |

| | | | | | | | | | | | | | | $ | 765,096,134 | |

See accompanying notes to financial statements.

Portfolio of Investments

Touchstone Mid Cap Growth Fund – March 31, 2012

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 97.9% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 25.9% | | | | | | | | |

| Alliance Data Systems Corp.* | | | 143,120 | | | $ | 18,027,395 | |

| Analog Devices, Inc. | | | 156,460 | | | | 6,320,983 | |

| Autodesk, Inc.* | | | 405,220 | | | | 17,148,910 | |

| Avago Technologies Ltd. (Singapore) | | | 187,464 | | | | 7,305,472 | |

| Check Point Software Technologies Ltd. (Israel) | | | 253,800 | | | | 16,202,592 | |

| Gartner, Inc.* | | | 249,476 | | | | 10,637,657 | |

| JDS Uniphase Corp.* | | | 232,890 | | | | 3,374,576 | |

| Lam Research Corp.†* | | | 147,090 | | | | 6,563,156 | |

| NetApp, Inc.* | | | 152,134 | | | | 6,811,039 | |

| NICE Systems Ltd. ADR (Israel)* | | | 381,430 | | | | 14,990,199 | |

| NXP Semiconductor NV* | | | 336,000 | | | | 8,940,960 | |

| ON Semiconductor Corp.* | | | 499,680 | | | | 4,502,117 | |

| Red Hat, Inc.* | | | 258,130 | | | | 15,459,406 | |

| Salesforce.com, Inc.* | | | 114,645 | | | | 17,713,799 | |

| Teradata Corp.* | | | 221,360 | | | | 15,085,684 | |

| | | | | | | | 169,083,945 | |

| | | | | | | | | |

| Consumer Discretionary — 17.3% | | | | | | | | |

| Bed Bath & Beyond, Inc.* | | | 131,230 | | | | 8,630,997 | |

| Coach, Inc. | | | 204,771 | | | | 15,824,703 | |

| Discovery Communications, Inc.- Class A* | | | 327,350 | | | | 16,563,910 | |

| Dollar General Corp.* | | | 208,380 | | | | 9,627,156 | |

| Lear Corp. | | | 209,820 | | | | 9,754,532 | |

| Mattel, Inc. | | | 294,180 | | | | 9,902,099 | |

| Nordstrom, Inc. | | | 216,310 | | | | 12,052,793 | |

| NVR, Inc.* | | | 17,813 | | | | 12,938,116 | |

| Penn National Gaming, Inc.* | | | 257,048 | | | | 11,047,923 | |

| Wynn Resorts Ltd. | | | 51,910 | | | | 6,482,521 | |

| | | | | | | | 112,824,750 | |

| | | | | | | | | |

| Industrials — 15.2% | | | | | | | | |

| Cooper Industries PLC | | | 237,940 | | | | 15,216,263 | |

| Dover Corp. | | | 154,300 | | | | 9,711,642 | |

| Embraer SA ADR (Brazil) | | | 312,210 | | | | 9,984,476 | |

| IDEX Corp. | | | 311,490 | | | | 13,123,074 | |

| IHS, Inc. - Class A* | | | 69,575 | | | | 6,515,699 | |

| JB Hunt Transport Services, Inc. | | | 205,490 | | | | 11,172,491 | |

| Precision Castparts Corp. | | | 82,920 | | | | 14,336,868 | |

| Stanley Black & Decker, Inc. | | | 163,670 | | | | 12,596,043 | |

| Triumph Group, Inc. | | | 108,150 | | | | 6,776,679 | |

| | | | | | | | 99,433,235 | |

| | | | | | | | | |

| Energy — 10.9% | | | | | | | | |

| CONSOL Energy, Inc. | | | 242,270 | | | | 8,261,407 | |

| Denbury Resources, Inc.* | | | 651,810 | | | | 11,882,496 | |

| Ensco PLC ADR (United Kingdom) | | | 196,120 | | | | 10,380,632 | |

| Tesoro Corp.* | | | 439,830 | | | | 11,805,037 | |

| Valero Energy Corp. | | | 658,300 | | | | 16,964,391 | |

| Weatherford International Ltd. (Switzerland)* | | | 776,550 | | | | 11,718,140 | |

| | | | | | | | 71,012,103 | |

| | | | | | | | | |

| Health Care — 9.5% | | | | | | | | |

| DENTSPLY International, Inc. | | | 405,940 | | | | 16,290,372 | |

| Mettler-Toledo International, Inc.* | | | 89,409 | | | | 16,518,313 | |

| United Therapeutics Corp.* | | | 284,085 | | | | 13,388,926 | |

| Vertex Pharmaceuticals, Inc.* | | | 236,500 | | | | 9,698,865 | |

| Warner Chilcott PLC - Class A (Ireland)* | | | 385,030 | | | | 6,472,354 | |

| | | | | | | | 62,368,830 | |

| | | | | | | | | |

| Materials — 9.1% | | | | | | | | |

| Albemarle Corp. | | | 199,730 | | | | 12,766,742 | |

| Crown Holdings, Inc.* | | | 297,787 | | | | 10,967,495 | |

| Ecolab, Inc. | | | 264,620 | | | | 16,332,346 | |

| Solutia, Inc. | | | 682,818 | | | | 19,077,935 | |

| | | | | | | | 59,144,518 | |

| | | | | | | | | |

| Financials — 6.9% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 273,270 | | | | 15,611,915 | |

| CBRE Group, Inc.- Class A* | | | 503,283 | | | | 10,045,529 | |

| Discover Financial Services | | | 328,070 | | | | 10,937,854 | |

| Willis Group Holdings PLC (United Kingdom) | | | 248,760 | | | | 8,701,625 | |

| | | | | | | | 45,296,923 | |

| | | | | | | | | |

| Consumer Staples — 2.1% | | | | | | | | |

| Ralcorp Holdings, Inc.* | | | 186,030 | | | | 13,782,963 | |

| | | | | | | | | |

| Telecommunication Services — 1.0% | | | | | | | | |

| NII Holdings, Inc.* | | | 361,240 | | | | 6,614,304 | |

| Total Common Stocks | | | | | | $ | 639,561,571 | |

| | | | | | | | | |

| Investment Funds — 1.5% | | | | | | | | |

| Invesco Liquid Assets Portfolio** | | | 6,609,283 | | | | 6,609,283 | |

| Touchstone Institutional Money Market Fund^ | | | 3,494,953 | | | | 3,494,953 | |

| Total Investment Funds | | | | | | $ | 10,104,236 | |

| | | | | | | | | |

| Total Investment Securities —99.4% | | | | | | | | |

| (Cost $564,957,220) | | | | | | $ | 649,665,807 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.6% | | | | | | | 3,659,624 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 653,325,431 | |

| † | All or a portion of the security is on loan. The total value of the securites on loan as of March 31, 2012 was $6,531,699. |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

| ^ | Affiliated Fund, sub-advised by Fort Washington Investment Advisors, Inc. See Note 4 in Notes to Financial Statements. |

Touchstone Mid Cap Growth Fund (Continued)

Portfolio Abbreviations:

ADR - American Depositary Receipt

PLC - Public Limited Company

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying notes to financial statements.

| Valuation inputs at Reporting Date: | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 639,561,571 | | | $ | — | | | $ | — | | | $ | 639,561,571 | |

| Investment Funds | | | 10,104,236 | | | | — | | | | — | | | | 10,104,236 | |