UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust – June Funds

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: June 30

Date of reporting period: June 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

June 30, 2012

Annual Report

Touchstone Strategic Trust

Touchstone Capital Growth Fund

Touchstone International Small Cap Fund

Touchstone Mid Cap Value Opportunities Fund

Touchstone Small Cap Value Opportunities Fund

Touchstone U.S. Long/Short Fund

Touchstone Value Fund

Table of Contents

| | Page |

| Letter from the President | 3 |

| Tabular Presentation of Portfolios of Investments (Unaudited) | 28 - 29 |

| Portfolio of Investments: | |

| Touchstone Capital Growth Fund | 30 |

| Touchstone International Small Cap Fund | 32 |

| Touchstone Mid Cap Value Opportunities Fund | 35 |

| Touchstone Small Cap Value Opportunities Fund | 37 |

| Touchstone U.S. Long/Short Fund | 39 |

| Touchstone Value Fund | 41 |

| Statements of Assets and Liabilities | 44 - 47 |

| Statements of Operations | 48 - 49 |

| Statements of Changes in Net Assets | 50 - 53 |

| Statements of Changes in Net Assets - Capital Stock Activity | 54 - 59 |

| Statement of Cash Flows | 60 |

| Financial Highlights | 61 - 76 |

| Notes to Financial Statements | 77 - 91 |

| Report of Independent Registered Public Accounting Firm | 92 |

| Other Items (Unaudited) | 93 - 100 |

| Management of the Trust (Unaudited) | 101 - 103 |

| Privacy Protection Policy | 104 |

Letter from the President

Dear Fellow Shareholder,

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. You are receiving this “shortened” annual report because when Touchstone announced the completed acquisition of the Old Mutual Funds in April, the fiscal year end of the newly acquired Old Mutual Fund Trust was changed from March 31 to June 30. Inside you will find key financial information and manager commentaries that cover the period from April 1, 2012 to June 30, 2012.

During the period, risk aversion was the dominant sentiment from investors throughout the world. Global and domestic market volatility continued, with headwinds blowing in from seemingly every direction due to unrelenting global developments. Emerging markets were particularly hard hit as weak economic data from China raised concerns about the country’s ability to continue to be the engine for global growth. Europe was once again thrust in the limelight as sovereign debt issues came to the forefront once more and data continued to show anemic economic activity across the continent. The U.S. was the relative bright spot but still lost ground as weak data, particularly stagnant employment figures, raised concerns of a faltering economic recovery. Additionally, concerns in the U.S. regarding the pending fiscal cliff at year-end led many economists to reduce their GDP growth forecasts.

In June, the Federal Reserve voted to extend “Operation Twist,” which was initiated in September 2011, by selling short-term Treasury securities and purchasing an equal amount of longer-term Treasuries, with a goal of ultimately providing additional stimulus to the economy. The Fed also kept interest rates low at a target range of 0% to 0.25% and indicated its expectation that economic conditions would warrant this exceptionally low range until late 2014.

For the period, the U.S. equity market outperformed both developed and emerging international markets. Value stocks declined less than their growth counterparts and large cap stocks marginally performed better than their small- and mid-cap counterparts.

It is more important than ever to focus on the long-term composition of your investment portfolio as we believe that diversification is essential to balancing risk and return. We recommend that you continue to work with your financial professional on a sound asset allocation strategy to help keep your financial goals on course.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Capital Growth Fund

Sub-Advised by Ashfield Capital Partners, LLC

Investment Philosophy and Process

The Fund seeks long-term capital growth by primarily investing in equity securities of large capitalization companies believed to possess above average growth potential by utilizing an integrated systematic investment process that combines quantitative and fundamental analysis with a top-down, thematic overlay to construct the Fund’s portfolio.

Performance and Market Recap

The total return of the Touchstone Capital Growth Fund Class A Shares was -7.47% for the quarter ended June 30, 2012. The total return of the Russell 1000® Growth Index was -4.02% for the same period.

The second quarter of 2012 began with April’s earnings season and, in the U.S., relatively healthy corporations continued to show earnings strength. Which provided support to a rally. However, equity markets experienced a reversal of fortunes as the reasonably healthy earnings reports of U.S. corporations did little to assuage the fears of a global slowdown, which arose from the suspicions of a eurozone contagion and a Chinese economic deceleration. Furthermore, in May, voters in France and Greece signaled to global markets that, while the problems in Europe may be solvable, austerity-driven low employment and economic growth was not going to be the solution. The result was the sharpest pullback that equity markets have seen year to date. In June, the fear of contagion in peripheral Europe was once again put to ease, as Spanish banks received a bailout and voters in Greece ultimately decided to remain in the European Union. Meanwhile, the global stimulus continued as central banks provided monetary stimulus in order to combat the weakening economic data coming from several regions.

Portfolio Review

The Fund’s focus on global growth detracted from performance during the quarter, which was a reversal of last quarter. On a relative basis, the Fund’s best performing sectors from an allocation standpoint were Health Care, Information Technology and Materials. The Fund had overweight positions to the Health Care and Information Technology sectors, and an underweight position to the Materials sector. On a relative basis, the Fund’s worst performing sector was Consumer Staples where both an underweight to the sector as well as stock selection detracted from returns. Specific underperforming stocks in the sector included Estee Lauder Cos. Inc. and Companhia de Bebidas das Americas Ambev. Overall, stocks election detracted the most from the Fund’s performance; specifically, stock selection within the Health Care and Energy sectors.

Sector allocation also detracted from the Fund’s performance. Characteristically, the better performing sectors were those with higher yields, higher price-to-earnings ratios, lower long-term future growth rates and higher capitalization ranges. Alternatively, the market was decidedly risk averse as sectors with the larger, slower growing companies — especially those with high income to offset risk — were in vogue, while the faster growing, relatively smaller companies were punished regardless of their balance-sheet fundamentals or potential growth profiles. As a result, the Fund’s allocation of faster growing, smaller companies detracted from its performance.

Stocks that contributed most positively to Fund performance during the period included Equinix Inc., eBay Inc. (Information Technology), and Diageo plc (Consumer Staples). Equinix, a provider of global data center services, announced the launch of its second international data center in Singapore, which is expected to accommodate the increasing market demand from cloud and financial service providers. The company’s successful string of earnings, and guidance reports on future earnings, also drove the stock higher. Shares of eBay, an Internet software and services company, saw an increase after the company raised its fiscal 2012 earnings guidance. In addition, the company now provides video sessions to better inform sellers on beginner and advanced topics,

Management's Discussion of Fund Performance (Unaudited) (Continued)

which was seen as a positive for the stock. Shares of Diageo, a worldwide beverage company, also performed well during the quarter. Diageo saw widening margins and an overall improvement in its U.S. business. Additionally, growth remained very strong in its international and emerging markets, and the company made a number of accretive and strategic acquisitions in the growth markets of Turkey, China, Vietnam and Africa.

The Fund’s long-term investment themes were focused on six major areas during the period: United States: companies that embrace the re-emergence of America as the global leader in innovation, brand awareness and manufacturing; Essentials: companies that can supply the input needs for a developing global economy;Technology: companies that can successfully provide mobile, connectivity and “big data” solutions; Global Development: companies that believe in the premise that consumers rule, from the third world to the first world; Health Care: companies that can do more for less and are successful in cost containment, innovation and scientific progress; and Infrastructure: companies that are active in capital spending.

Outlook and Conclusion

During the second quarter in particular, domestic earnings growth reconnected with stock price performance and fundamental factors garnered attention at the company level; however, the correction in May widened the gap between these historically high-correlated items. And, while the massive government intervention helped, the issues facing the global economy are many. Though at times market participants began to look further into the future and pay attention to more fundamental, company-specific factors when determining the validity of an investment, other times macroeconomic concerns drove participants’ emotional buy and sell decisions. The markets have seen this before and, while policy makers search for the right answers, equities continue to remain cheaper than they have been in many years. In fact, we believe the Fund has the opportunity to own globally positioned earnings streams at discounted prices in the safest equity markets in the world, which does not come along very often. However, we note, the continued proof of an ongoing profits recovery, sustainability of margins and organic growth are still concerns, and recent geopolitical and global events have reminded participants that these economic gains can be fleeting. That said, China and the developing world continue to grow while the U.S. reaches for higher levels of austerity within federal and state budgets, all of which are longer-term positives. On a cyclical basis, we note that investors may soon become attracted to growth-oriented investments, owing to their strong balance sheets, significant cash flows and lack of debt reliance. We believe international sources of revenues should also continue to grow, primarily to the benefit of large-cap and growth companies. Going forward, we believe that, as the economy continues to gain solid footing and uncertainties continue to subside, companies of this nature are expected to once again garner premium pricing in the market.

Overall, in our opinion, both the global and U.S. economies have seemed to successfully navigate a very fragile phase of the recovery. However, while the expected stabilization arising from the revitalization efforts of the past 18 months has helped, questions remain domestically about the housing sector and labor markets. While housing data is starting to turn positive, recent employment data has begun to fall short of expectations, which has caused investors to speculate whether the U.S. Federal Reserve Board will continue with further action. In addition, U.S. politicians will be forced to address the “fiscal cliff” that could have drastic implications in terms of the trade-off between gross domestic product (GDP) growth and deficit growth at the end of the year. Meanwhile, Europe continues its reactionary attitude of dealing with impending crises as they come along, and ultimately doing what is necessary to avert a sovereign default and preserving the European Union. At the same time, the response to softening global economic data appears to be focused on monetary stimulus going forward, as central banks cut rates around the world. As the markets continue through this period of transition— where recovering economies are endeavoring to move into a more sustainable, albeit slower, growth trajectory — we expect to see some variability in investor sentiment and expectations as market participants digest these recurring issues and subsequent solutions.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Though we remain wary of the issues at hand, we are also cognizant that any attempts to predict exactly when the solution will present itself can often lead to poor long-term performance at the expense of short-term relief. As such, our goal remains the purchase and continued ownership of companies exhibiting positive earnings and revenue trends with the potential to sustain those trends. As a result, during this highly volatile second quarter, the Fund was marginally repositioned to a higher earnings growth rate than that of the Index while maintaining a price-to-earnings ratio similar to that of the Index. As such, we believe that the Fund is positioned to potentially benefit when stock price performance again reconnects to the underlying earnings trajectory and this should provide an advantage.

Management's Discussion of Fund Performance (Unaudited) (Continued)

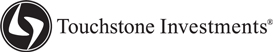

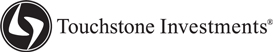

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Capital Growth Fund - Class A* and the Russell 1000® Growth Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on September 30, 2003, April 12, 2012, November 29, 1996 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional shares performance was calculated using the historical performance of Class Y shares for the periods prior to September 30, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Touchstone International Small Cap Fund

Sub-Advised by Copper Rock Capital Partners LLC

Investment Philosophy and Process

The Touchstone International Small Cap Fund seeks capital appreciation by primarily investing in equity securities of non-U.S. small-cap companies diversified across sectors and industries. The Fund’s investment process seeks to add value through bottom-up stock selection and in-depth fundamental research and searches for companies believed to have strong management, superior earnings growth prospects and attractive relative valuations.

Fund Performance and Market Recap

The total return of the Touchstone International Small Cap Fund Class A Shares was -7.28% for the quarter ended June 30, 2012. The total return of the S&P Developed Ex-U.S. Small Cap Index was -8.47% for the same period.

World markets declined during the second quarter of 2012. Most of the decline was registered in the middle of the quarter when fears of bond defaults in Europe intensified. Efforts by the European Central Bank and the European Union to recapitalize the Spanish banks eased those fears in early June, allowing markets to rally worldwide in the final month of the quarter. (Spanish banks were previously at risk of default as a result of losses incurred by Spain’s housing bubble that escalated from 2002 to 2008.) However, the market’s awareness of broader debt burdens in Italy and France muted the recovery, and the corporate world responded to the near-defaults in Spain and to other increases in global bond risk by trimming inventories and imposing more cautious positions on new production.

During the period, regions around the world performed similarly to Spain, as the prospect of Europe’s stalled growth impacted all economies. As such, all world regions declined during the quarter. North America, the most consumer-driven economy, was impacted the least by market performance. The Pacific ex-Japan region, a major supplier of industrial inputs, was most negatively impacted.

With regard to sectors, those with high visibility and stable demand such as Consumer Staples, Health Care, and Telecommunications were hurt the least during the quarter. The Energy and Materials sectors, which represent input factors for industrial production, were impacted most negatively by the cautious outlook of producers, as evidenced at the end of the quarter.

Portfolio Review

Despite the extreme volatility and stream of negative news stemming from Europe during the middle of the period, the Fund’s stock selection in the Consumer Discretionary, Materials, Energy, Industrials, and Financials sectors contributed to the Fund’s outperformance versus its benchmark. In addition, despite the macroeconomic headwinds that persisted on the European continent, stock selection in growth companies based in Canada and Continental Europe led all other regions, with the exception of stock selection in the Pacific ex-Japan and United Kingdom regions, which detracted from relative return.

Among the individual stocks that contributed most to performance were Dollarama Inc., Andritz AG, and Black Diamond Group Ltd.

Dollarama, a Canadian discount retailer, reported solid revenue and earnings momentum during the period, which was driven by strong same-store sales comparables, good product gross margins, and effective expense control and productivity improvements. Andritz AG is an engineering company that is primarily involved in hydro energy and pulp mill construction. The company’s stock outperformed as a result of highly visible sales growth in its consistently growing backlog, which was supported by the continuous renovation demands at hydro plants and pulp mills globally. Finally, shares of Black Diamond Group, a Canadian provider of rented

Management's Discussion of Fund Performance (Unaudited) (Continued)

modular structures for the resources sector, advanced as a result of continued growth in the oil-rich area of western Canada. Black Diamond Group has continued to report results ahead of consensus estimates, and the company has also continued to expand its geographical footprint and diversify its customer base.

Among the stocks that impacted the Fund most negatively were NRW Holdings Ltd., Computacenter PLC, and Atlas Iron Ltd.

NRW Holdings, a mining services and civil contracting company in Australia, was a previous outperformer for the Fund. However, the stock traded lower along with its peers due to fears over Chinese and global growth, and weak underlying commodity prices. That said, given the Fund’s constructive outlook on the global economy and fundamental research approach, we expect contract volume growth to continue and have chosen to remain owners of the stock. Computacenter PLC, a U.K.-based company that provides IT infrastructure services to the private and public sector, warned that its profits could move lower due to higher-than-expected new contracts on boarding costs, which led to a lower forecasted return on investment for the company. Furthermore, given the company’s exposure to Europe, associated risks with IT spending, and a declining euro, we exited the position. Shares of Atlas Iron, an Australian-based iron ore producer, moved lower in tandem with stocks like NRW Holdings, as concerns over global growth and mineral prices put pressure on the share price. However, we believe the stock remains highly rated in its quantitative model because of the company’s attractive valuation and, as such, the stock’s position was increased to reflect our constructive outlook for growth.

In addition, a handful of other stocks in the Information Technology and Materials sectors moved lower during the period, primarily in response to the macroeconomic headwinds and uncertainty over the pace of global growth and economic recovery.

Outlook and Conclusion

Despite the constant barrage of weak economic news since the early part of May, we maintain our thesis that the global economy is recovering, albeit slowly. The news that has battered markets focuses on slowing rates of recovery, rather than negative growth rates for the full global economy.

Regional differences have also become more pronounced. For example, Europe is contracting, but North America, Japan, Asia ex-Japan, Latin America, Middle East and Africa continue to grow. And, we believe the fact that the rest of the world is able to continue climbing despite the stall in Europe is testimony to the underlying strength of the continuing growth of consumer demand.

We believe there are two major obstacles to strong global economic expansion, 1) the defense of the euro, and 2) the fiscal uncertainties in the U.S. that have intensified because of the presidential campaign. Neither obstacle will be quickly removed. However, continued progress in global economic growth and in U.S. employment growth should create a platform for corporate growth. And, although we are still in a period of recovery for the overall global economy, albeit slower than anticipated, we believe broadening retail consumption around the world and corporate investment in productivity will remain the drivers going forward.

We maintain our position that growth rates for the European countries will be close to zero (small positives or small negatives) for the near term and will slowly improve over the upcoming two-year period. We believe Germany will continue to pressure other European countries to make the national cost adjustments that it made nearly ten years ago to enhance the country’s competitiveness.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Furthermore, China’s transition from rural to urban, and from an export focus to a consumption emphasis, will determine the pace of growth.

Finally, we are still finding attractive opportunities in the emerging markets arena and will continue to carefully select those companies that meet the Fund’s underlying investment criteria regardless of their home base. We will also continue to search for growth in unique, entrepreneurial companies that show margin expansion and the ability to self-finance during all market environments due to strength demonstrated from a bottom-up perspective.

Management's Discussion of Fund Performance (Unaudited) (Continued)

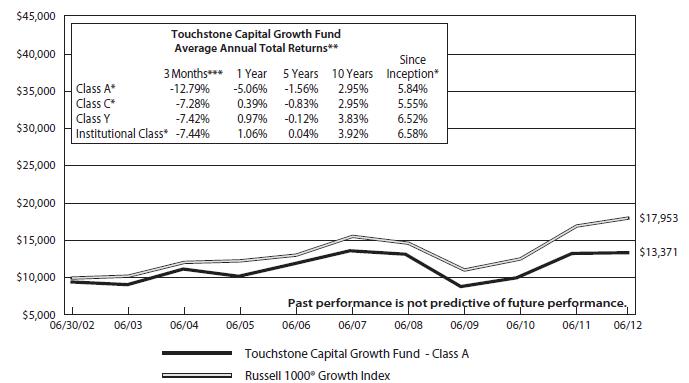

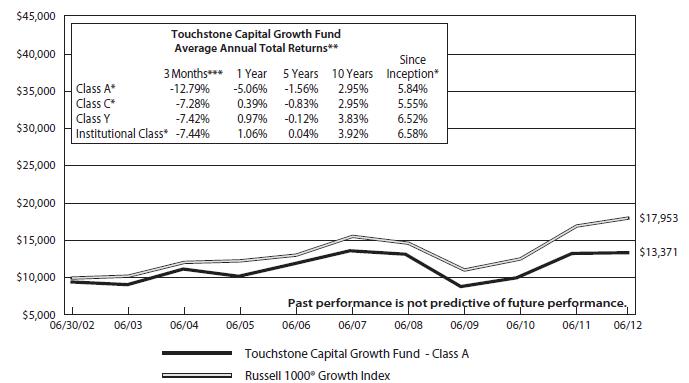

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone International Small Cap Fund - Class A* and the S&P Developed Ex-U.S. Small Cap Index

| | * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on July 31, 2003, April 12, 2012, December 31, 1996 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional shares performance was calculated using the historical performance of Class Y shares for the periods prior to July 31, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| | ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Touchstone Mid Cap Value Opportunities Fund

Sub-Advised by Thompson Siegel & Walmsley LLC

Investment Philosophy and Process

The Fund seeks long-term capital growth by primarily investing in equity securities of mid-cap companies that are believed to present value that is not reflected by prevailing market prices or that have experienced fundamental changes and are intrinsically undervalued by the investment community. Using a combination of quantitative and qualitative methods, a company’s attractiveness is assessed in an effort to understand why the market may be mispricing the stocks, what factors are changing that can return the stock to fair value and whether those changes are sustainable over a medium term investment horizon based on both absolute and sector-relative valuation of cash flows, the relative earnings prospects of the company and the stock’s recent price action.

Fund Performance and Market Recap

The total return of the Touchstone Mid Cap Value Opportunities Fund Class A Shares was -2.21% for the quarter ended June 30, 2012. The total return of the Russell Midcap® Value Index was -3.26% for the same period.

During the second quarter, volatility and stock correlations rose, and risk assets retreated, as global macroeconomic concerns reasserted their dominance over market returns. Investors seemed to ignore valuation and the majority of fundamentals, and focused primarily on the shrinking group of already expensive stocks exhibiting stable growth such as those in the Utilities and Consumer Staples sectors.

Portfolio Review

The Fund was able to outperform its benchmark as a result of its more defensive posture. The Fund’s relative return was attributable to stock selection, which was positive in nine out of ten sectors and especially additive in higher beta1 sectors such as Energy, Materials and Financials. On the other hand, sector allocation was a detractor, which was mainly due to an overweight position in the Information Technology sector. The sector, with its higher exposure to foreign sales and greater market sensitivity, was by far the Fund’s worst performing sector during the period.

Though the Energy and Materials sectors were each down nearly ten percent as a result of the sharp decline in commodity prices, these sectors were among the top contributors to relative returns during the quarter. Within the Energy sector, a takeover involving Sunoco, Inc. and another takeover involving Holly Frontier Corp. contributed to returns. Within the Materials sector, the Fund’s strong stock selection in the paper, fertilizer and packaging industries — as well as avoidance of steel and building materials — provided solid downside protection.

Additions to the Information Technology and Consumer Discretionary sectors, funded by small reductions in most other sectors, constituted the most notable changes to portfolio positioning during the second quarter. As a result, the Consumer Discretionary sector replaced Health Care as the second-largest sector relative to the Russell Midcap Value® Index weight. Even with these changes, the Fund’s portfolio structure remained relatively stable.

During the quarter, the Fund was most underweight the Financials and Industrials sectors. Within the Financials sector, banks and real estate investment trusts (REITs) continued to face headwinds as a result of their vulnerability to regulatory reform and other earnings growth challenges. The Fund’s underweight position in the Industrials sector was derived from higher valuations among some cyclical stocks and concern about reductions in government spending for defense-related companies. The engineering and construction industry was an exception in this sector with its high cash-flow yields and exposure to growth in energy and transportation infrastructure. Stock

Management's Discussion of Fund Performance (Unaudited) (Continued)

selection in the more defensive Consumer Staples sector was positive during the period, but the Fund’s underweight to the sector detracted from performance.

Among the individual stocks that contributed to the Fund’s performance were Sunoco Inc. (Energy sector), Annaly Capital Management Inc. (Financials sector) and NRG Energy Inc., Wisconsin Energy Corp., and CMS Energy Corp. (Utilities sector). Oil refiner Sunoco was acquired by Energy Transfer Partners L.P. at an attractive premium during the period, which positively impacted the stock. Annaly Capital Management, a mortgage real estate investment trust (REIT), continued to benefit from the low interest rate environment. Additionally, investors were attracted to the REIT because of its dividend yield as they searched for safety during the quarter. Shares of NRG Energy, an independent power company, rose higher during the period as the company ramped up production in Texas as it anticipated a summer of high-energy usage. Wisconsin Energy Group, an electric utility provider, surpassed earnings expectations as a result of cost controls and operational efficiencies, despite a mild winter and lower-than-expected utilization rates. CMS Energy, a Michigan-based electric utility, attracted investors because of its dividend yield and defensive earnings visibility.

On the other side of the equation, stocks that detracted from Fund performance included Symantec Corp., Western Digital Corp., Endo Pharmaceutical Holdings Inc. and SanDisk Corp. (Information Technology sector), and Lear Corp. (Consumer Discretionary sector). Symantec, security software provider was weighed down during the period by its exposure to European markets. Western Digital, a hard-drive maker, experienced a decline in personal computer (PC) sales as consumers awaited the release of Windows 8, and its stock was negatively impacted as a result. Endo Health Solutions, a specialty drug maker, was under pressure during the quarter after the Food and Drug Administration instructed the company to transition its painkiller drug to a crush-resistant material. Shares of SanDisk, a chipmaker and designer of data storage solutions, declined in sympathy with its group, as weakness in Europe and concerns about PC sales weighed on the industry. Lear, an automobile parts maker, saw its shares being weighed down by uncertainty revolving Europe’s economy, despite surpassing earnings expectations and reaffirming full-year guidance.

Outlook and Conclusion

Signs of a global slowdown continued to accumulate during the quarter. Economic reports were weak and company managements provided increasingly conservative earnings guidance. Investors seemed to respond by chasing the dwindling cohort of stocks that managed to maintain growth, which kept their valuations high. It also positioned those companies that reported disappointing earnings for steep declines. Going forward, we believe the market will be volatile characterized by short-term sentiment changes and odd individual stock behavior. While this can be frustrating to watch, we believe it can be an exciting environment for the longer-term investor seeking mispriced stocks. We note that in many cases, current valuations fairly reflect the widespread, deeply pessimistic macroeconomic outlook. However, these valuations do not fully credit companies for the factors that differentiate them from their peers and for investment catalysts that have the potential to generate better-than-expected growth. We believe that valuation is the key to long-term success and the Fund exhibits a significant discount on earnings and cash-flow valuation compared to its value style benchmark. It is also finding companies with sustainable positive change as evidenced by the Fund’s growth characteristics.

As we look to the future, we share our insights on the market and various investment opportunities going forward. We believe that the Information Technology sector is arguably the least expensive economic sector today, especially following this quarter’s market-leading declines. Some industries mature and others are affected by the halted pace of economic recovery, growth has become less uniform across this sector than it once was. We note that this can create opportunities for value investors focused on catalysts such as industry consolidation and capacity rationalization, or on companies poised to capitalize on changes in production technology. With regard to the Consumer Discretionary sector, we believe that, while the sector is not inexpensive, there are several company-specific situations where management initiatives or other circumstances can generate better

Management's Discussion of Fund Performance (Unaudited) (Continued)

earnings than what the market anticipates in the upcoming years. Furthermore, we view the American natural gas story as under-recognized both for the economic opportunities it affords — in the form of increased exports of liquefied natural gas and as an alternative to foreign energy sources — and also for the variety of investment themes it presents for companies involved with energy infrastructure, pipelines, refiners, etc.

As always, the Fund’s portfolio structure is driven by our stock selection process, which emphasizes inexpensive companies experiencing sustainable positive change. We seek to overweight economic sectors where this process uncovers concentrations of such companies and underweight the sectors where they are scarce.

| | 1 | Beta is a measure of the volatility of a portfolio relative to its benchmark. |

Management's Discussion of Fund Performance (Unaudited) (Continued)

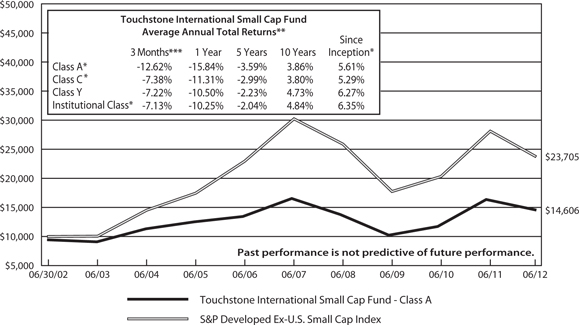

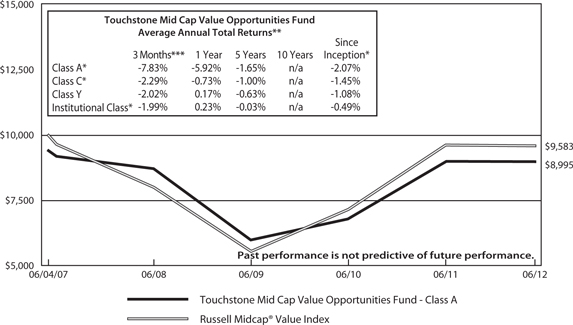

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Mid Cap Value

Opportunities Fund - Class A* and the Russell Midcap® Value Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on June 4, 2007, April 12, 2012, December 9, 2008 and June 4, 2007, respectively. Class C shares and Class Y shares performance was calculated using the historical performance of Class A shares for the periods prior to April 12, 2012 and December 9, 2008, resepectively. The returns have been restated for sales charges and for fees applicable to Class C and Class Y shares. |

| | |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

| | |

| *** | Not annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Touchstone Small Cap Value Opportunities Fund

Sub-Advised by Thompson, Siegel & Walmsley LLC

Investment Philosophy and Process

The Fund seeks long-term capital growth by primarily investing in equity securities of small-cap companies that are believed to present value that is not reflected by prevailing market prices or that have experienced fundamental changes and are intrinsically undervalued by the investment community. Using a combination of quantitative and qualitative methods, a company’s attractiveness is assessed in an effort to understand why the market may be mispricing the stocks, what factors are changing that can return the stock to fair value and whether those changes are sustainable of a medium term investment horizon based on both absolute and sector-relative valuation of cash flows, the relative earnings prospects of the company and the stock’s recent price action.

Fund Performance and Market Recap

The total return of the Touchstone Small Cap Value Opportunities Fund Class A Shares was -3.09% for the quarter ended June 30, 2012. The total return of the Russell 2000® Value Index was -3.01% for the same period.

The second quarter of 2012 was again dominated by headlines about global economic concerns and sovereign debt crises, which weighed heavily on investors and pushed market returns into negative territory. During the period, equity correlations and market volatility were on the rise, as the overhang from the European debt crisis, lackluster economic reports, and the continued political uncertainty were major drivers of equity returns, rather than differentiating characteristics of individual companies. The decline in the equity markets during the second quarter essentially erased much of the gains from the previous quarter. Furthermore, investors reverted to the risk-off trade, thereby causing less cyclical stocks to outperform.

Portfolio Review

Among the sectors that contributed most to the Fund’s performance relative to the benchmark were Health Care and Consumer Staples. Within the Health Care sector, one of the portfolio’s drug makers, Questcor Pharmaceuticals Inc., continued to profit during the quarter as a result of increased utilization of its anti-seizure drug. Also within the Health Care sector, the Supreme Court of the United States largely upheld the Affordable Care Act late in the three-month period, and the Fund’s medical facility positions rallied. Within the Consumer Staples sector, the Fund benefited from company-specific events. In particular, Susser Holdings Corp., one of the Fund’s convenience-store operators, announced plans to spin off its fuel operations, thereby unlocking shareholder value. In addition, Hain Celestial Group Inc., an organic food manufacturer, experienced increased demand, which drove the company’s stock higher. On the mergers and acquisitions front, Charming Shoppes Inc., a women’s apparel retailer, was acquired at an attractive premium, which drove the stock higher. Also, oil refiner CVR Energy Inc. was the target of activist investor, Carl Icahn, which positively impacted the company’s stock.

During the quarter, the primary detractor from the Fund’s relative returns was stock selection in the Consumer Discretionary and Industrials sectors. Macroeconomic woes weighed on the outlook for consumer discretionary spending in general and, in particular, the consumer electronics segment, where the portfolio had exposure. In addition, Select Comfort Corp., traded off in sympathy with a major competitor that issued markedly lower guidance during the quarter. While the Fund’s underweight exposure to the Industrials sector was additive to performance, fears of a slowing global demand negatively affected the Fund’s industrial machinery positions.

Among the individual stocks that contributed to the Fund’s performance were Western Refining Inc. (Energy sector), Charming Shoppes Inc. (Consumer Discretionary sector), Ocwen Financial Corp. (Financials sector), Questcor Pharmaceuticals Inc. (Health Care sector), and Cardtronics Inc. (Information Technology sector). Western

Management's Discussion of Fund Performance (Unaudited) (Continued)

Refining, an independent crude oil producer, benefited from cost controls and lower-priced crude, which helped the company’s profit margins. Charming Shoppes Inc., a women’s specialty apparel retailer was acquired by Ascena Retail Group Inc. at an attractive premium, which sent the company’s stock higher. Ocwen Financial, a provider of mortgage loan servicing that specializes in distressed loans, continued to capitalize from historic levels from a nationwide foreclosure backlog. Questcor Pharmaceuticals, a specialty biopharmaceutical company, benefited from its primary multiple sclerosis drug, H.P. Acthar® Gel, which was also proven to be effective in the rheumatology market. Cardtronics, a provider of automated consumer financial services, posted better-than-expected earnings and raised full-year guidance as the company continued to grow its pipeline of contracts.

Among the top detractors from Fund performance were Select Comfort Corp. and Men’sWearhouse Inc. (Consumer Discretionary sector), Kulicke & Soffa Industries Inc. and TiVo Inc. (Information Technology sector), and Twin Disc Inc. (Industrials sector). Select Comfort Corp., a specialty mattress manufacturer and retailer, traded off in sympathy after a major competitor,Tempur-Pedic International Inc., reported a revised downward outlook. Shares of Kulicke & Soffa Industries, a maker of technology equipment, were weighed down by their exposure to European markets during the quarter. And, while TiVo, a developer and provider of television technology, recently won legal cases against Dish Network Corp. and AT&T Inc. for use of TiVo’s patented technology, ongoing litigation with Verizon Communications Inc.,Time Warner Cable Inc., and Cisco Systems Inc. hindered the stock during the quarter. Twin Disc Inc., an industrial equipment maker, saw its shares decline as a result of an uncertain outlook in oil and gas-pumping demand due to falling natural gas prices. Shares of Men’s Wearhouse Inc., a men’s clothing retailer, declined in sympathy with consumer spending-related positions, as global economic concerns weighed on the market.

During the quarter, the Health Care and Consumer Discretionary sectors were the portfolio’s largest overweight positions. Within the Health Care sector, the Fund was overweight cash-flow rich pharmaceutical companies with unique catalysts, in addition to facility companies, which are expected to benefit from greater utilization rates. Stocks within the Consumer Discretionary sector are typically not inexpensive overall, but we believe we continued to find isolated pockets where valuations were attractive and consumer trends or business initiatives appeared promising.

The portfolio’s positioning changed modestly during the period, as additions were made to the Information Technology sector and reductions were made to the Industrials sector weighting. Within the Information Technology sector, we took advantage of valuation opportunities stemming from the sell-off of internationally exposed companies. Conversely, we trimmed the portfolio’s Industrials sector weighting after many of the Fund’s holdings rallied during the first quarter. Overall, the market experienced a reversal in momentum, which favored less-cyclical positions, along with a lessening concern with valuation — both of which detracted from performance.

Although the Fund remained underweight the Financials sector, we added to its banking holdings that exhibited solid balance sheets and stable or growing loan portfolios. We also continued to see value in consumer finance companies that serve the non-bank consumer. The portfolio remained underweight the Industrials sector, partly due to uncertainty surrounding the outlook for government spending and its impact on aerospace and defense-related positions.

Outlook and Conclusion

Overall, we believe the market’s preoccupation with global headlines has created opportunities for its disciplined, value-investing process, especially in companies with foreign sales exposure. For example, small companies with foreign sales exposure have been unduly punished in the market, and, as a result, we have added a couple of these stocks to the Fund’s portfolio and are researching other opportunities. Going forward, we expect to look closely at a number of technology companies in faster growing niche industries, as we believe the Information Technology sector appears to be at historically attractive valuation levels — partly due to its higher foreign sales. While the short-term market picture may continue to be obscured by headlines of global economic uncertainty,

Management's Discussion of Fund Performance (Unaudited) (Continued)

we believe there are also a number of more positive developments: employment levels have remained stable, the housing sector appears to show improvement, and conditions appear fertile for increased mergers and acquisitions activity.

As always, the Fund’s portfolio structure is driven by our stock selection process, which emphasizes inexpensive companies experiencing sustainable positive change. We seek to overweight economic sectors where this process uncovers concentrations of such companies and underweight the sectors where they are scarce.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone

Small Cap Value Opportunities Fund - Class A* and the Russell 2000® Value Index

| | * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on July 31, 2003 April 12, 2012, July 25, 2003 and December 9, 2008, respectively. Performance information presented prior to July 25, 2003 for Class Y shares includes performance of a predecessor fund whose inception date was July 31, 2000. Class A shares, Class C shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for periods prior to July 31, 2003, April 12, 2012 and December 9, 2008, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| | ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Touchstone U.S. Long/Short Fund

Sub-Advised by Analytic Investors, LLC

Investment Philosophy and Process

The Touchstone U.S. Long/Short Fund seeks to provide investors with above-average returns by investing primarily in equity securities of large and mid-cap companies whose securities are traded in U.S. markets and are tied economically to the United States. The Fund buys securities “long” on the belief that they will outperform and sells securities “short” on the belief that they will underperform. Fund management utilizes a proprietary system that ranks stocks according to a mathematical model and seeks to determine a security’s intrinsic value by evaluating variables such as relative valuation, price momentum, company fundamentals, liquidity and risk. The investment process utilizes portfolio optimization to select securities that it believes will maximize return, minimize volatility, and diversify assets.

Fund Performance and Market Recap

The total return of the Touchstone U.S. Long/Short Fund Class A Shares was -2.50% for the quarter ended June 30, 2012. The total return of the S&P 500 Index was -2.75% for the same period.

Despite a good corporate earnings season during the second quarter, the strong negative headwinds from the Euro zone, a slowdown in China, and the U.S. policy stalemate kept investors on edge and impacted equity markets globally. Apparent progress on the policy front in Europe helped drive a relief rally in June, but all major global equity indexes still finished the second quarter in negative territory. In general, the more defensive sectors of the economy such as Telecommunications, Utilities, and Consumer Staples performed well during the second quarter, while more cyclical sectors such as Financials, Energy, and Information Technology lagged.

Portfolio Review

The Fund’s investment process is based on the premise that investor behavior changes, but changes slowly, and is fairly persistent from month to month. The Fund’s investment process uses a multi-characteristic approach when valuing securities. During the quarter, an emphasis on stocks with above-average quality characteristics — such as strong asset utilization and above-average profit margins — helped performance, as investors rewarded these quality traits. In addition, an emphasis on price momentum also helped, as stocks continued their return path, especially over the six-month-return period. For example, stocks with positive six-month returns generally continued to outperform, whereas stocks with negative six-month returns continued to underperform. During the period, the Fund was negatively impacted as a result of avoiding companies with above-average analyst dispersion — which is when analysts differ in opinion regarding future earnings — as these companies performed well during the quarter.

The Fund is structured to be sector, style and beta1 neutral relative to the S&P 500, and attempts to deliver outperformance from stock selection. Stock selection was particularly strong within the Consumer Discretionary sector.

Among the stocks that contributed most during the quarter were Expedia Inc., Alpha Natural Resources Inc., Rovi Corp., MEMC Electronic Materials Inc., and Dendreon Corp. Expedia, an online travel company, posted strong profit and revenue results that exceeded analyst expectations. A short position in Alpha Natural Resources, a supplier and exporter of metallurgical coal, contributed to Fund performance after the company’s stock was negatively impacted by the collapse in U.S. coal prices. A short position in Rovi, a digital entertainment solutions company, helped performance after the company reported earnings that were in-line with expectations but missed its revenue number. In addition, Rovi’s chief financial officer announced he was leaving, which weighed further on the stock price. A short position in MEMC Electronic Materials, a developer and manufacturer of

Management's Discussion of Fund Performance (Unaudited) (Continued)

silicon wafers, positively impacted the Fund after the company suffered its worst market decline in more than 10 years after posting a large first-quarter loss and revenue that dropped over 30 percent versus the prior year.

Among the stocks that detracted from Fund performance were Human Genome Sciences Inc., Jabil Circuit Inc., Marathon Oil Corp., and Ariba Inc. A short position in Human Genome Sciences, a biopharmaceutical company, had the largest negative impact to relative performance. Shares of Human Genome Sciences rallied after the biotechnology company rejected a $2.59 billion acquisition offer from GlaxoSmithKline PLC. Jabil Circuit, a provider of worldwide electronic manufacturing services and solutions, reported earnings and revenue that were lower than analyst expectations. In addition, one of Jabil Circuit’s major manufacturing partners, Research in Motion Ltd., suffered from a deteriorating smartphone market position, which also hurt Jabil Circuit. Marathon Oil, an integrated energy company engaged in exploration and production, reported lower-than-expected first-quarter results. A short position in Ariba, a provider of collaborative business commerce solutions, negatively impacted performance after it was announced that SAP AG, the largest maker of enterprise applications software, agreed to buy the company.

Outlook and Conclusion

We practice an investment process that is based on the fundamental belief that there is persistency in the types of characteristics investors prefer. If this holds going forward, we believe the Fund should benefit from being properly positioned toward stocks with characteristics favored by investors.

With regard to market factors, we continue to favor certain valuation characteristics, such as companies with attractive sales-to-price and cash flow-to-price ratios, and deemphasize stocks with above-average dividend yields. In addition, we expect to continue to position the Fund toward stocks with certain quality metrics, such as companies with strong return on equity and above-average profit margins. With regard to growth, we expect to favor an emphasis on stocks with above-average recent earnings-per-share growth and growth in profitability. Finally, we expect to continue to avoid certain risk factors, such as stocks with above-average trading volume and stocks with wide-ranging earnings estimates from analysts.

| | 1 | Beta is a measure of the volatility of a portfolio relative to its benchmark. |

Management's Discussion of Fund Performance (Unaudited) (Continued)

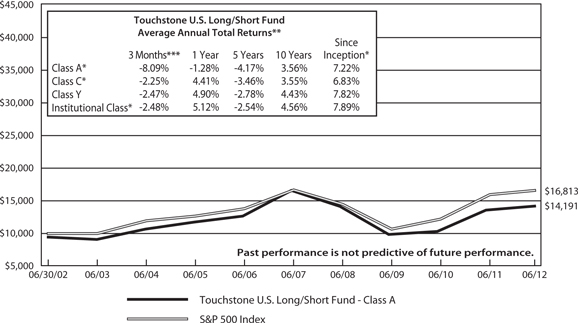

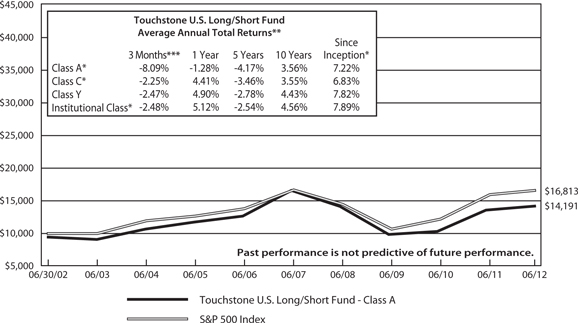

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone U.S. Long/Short Fund - Class A* and the

S&P 500 Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on July 31, 2003, April 12, 2012, July 1, 1993 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for the periods prior to July 31, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| | |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

| | |

| *** | Not annualized. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Touchstone Value Fund

Sub-Advised by Barrow, Hanley, Mewhinney & Strauss, LLC

Investment Philosophy and Process

The Touchstone Value Fund seeks long-term growth by primarily investing in equity securities of large- and mid-cap companies believed to be undervalued. The Fund uses traditional methods of stock selection - research and analysis - to identify companies that have price-to-earnings and price-to-book ratios below the market, that also have above average dividend yields and focuses on companies that are out of favor due to internal or external challenges judged to be short-term in nature. Stock selection is driven by fundamental analysis on individual companies rather than by broad market themes.

Fund Performance and Market Recap

The total return of the Touchstone Value Fund Class A Shares was -1.83% for the quarter ended June 30, 2012. The total return of the Russell 1000® Value Index was -2.20% for the same period.

Global stock markets endured ongoing concerns about Europe and growth prospects for the world’s largest economies during the second quarter. As such, risk aversion was the dominant sentiment from investors throughout the world. The U.S. stock market, however, was viewed as a relative safe haven during the period even though performance was down for the quarter, based on the S&P 500 Index. This viewpoint was due to investors’ preference for U.S. dollar-denominated assets and the perception that U.S. economic growth, while painfully slow, was relatively better than many other regions of the world. Nevertheless, investor sentiment was tested during the quarter, as economic readings slowed, thereby increasing investor fears of a slowdown in corporate earnings.

Within U.S. markets, value benchmarks outperformed growth benchmarks for the quarter. Large-cap stocks outperformed small-cap stocks for the second calendar quarter. Returns for the S&P 500, as well as the NASDAQ and Russell 1000® Growth Index, continued to be strongly influenced by their largest component, Apple Inc. For example, the weighting of Apple within the S&P 500 was so large at the end of the period that it singularly outweighed the market capitalization of three individual sectors: Utilities, Materials, and Telecommunication Services.

Investor preference for yield remained a dominant theme during the quarter. Retail investors continued to shift more assets from equities to the perceived safety of bonds, despite the already historically low fixed income yields. Within domestic equity markets, sectors that are normally associated with higher dividend yields, Telecommunications Services and Utilities in particular, were strong performers during the quarter.

Portfolio Review

Stock selection and an overweight position in the Consumer Staples sector were significant contributors to outperformance relative to the Index, in part due to strong returns by the tobacco company Altria Group Inc. and beverage producer Diageo PLC. Altria Group, the largest tobacco company in the U.S., gained for the quarter, as investors rewarded high-dividend companies who also have the ability to raise their dividend over time. There were also positive industry and company-specific developments for Altria Group. Voters in California, a politically important state for the company, defeated Proposition 29, which would have resulted in an excise tax increase of $1 per pack on cigarette sales — an increase of 115 percent. As a result, the decline in cigarette consumption eased and the pricing environment remained favorable. Atria Group also led the way as it and its closest competitors, RJ ReynoldsTobacco Company and Lorillard Inc., raised prices on cigarettes and smokeless products, which more than offset unit declines and resulted in steadily rising revenues and profits. In addition, Altria Group’s flagship brand, Marlboro, achieved market share gains as the company successfully rolled out line extensions to the brand. There were also positive developments on the legal front, in particular with the

Management's Discussion of Fund Performance (Unaudited) (Continued)

so-called Engle progeny cases in Florida. Finally, the company executed a smooth transition to a new Chairman and CEO as the former head of Altria Group retired, which was well-received by investors.

Diageo was another defensive, high-yielding stock in the Fund’s portfolio, which also performed well during the quarter. Diageo’s prospects improved in its U.S. business, which some considered directly related to the traffic increase in its high-margin, on-premise restaurant and bar business. During the last several recession years, the company implemented a successful plan to increase promotional spending in an effort to maintain market share. Diageo recently eased off on these promotions and has been successful in raising prices. As such, the company’s margins in the U.S. have widened, and the continued strength of the U.S. dollar against the British pound has been an added positive. Furthermore, Diageo made a number of accretive and strategic acquisitions in the growth markets of Turkey, China, Vietnam and Africa. Another contributor to Fund performance during the quarter was Industrials sector stock, Cooper Industries PLC, which is a Dublin-based company that manufactures electrical components and tools. Shares of Cooper Industries ticked higher after the company agreed to be acquired by Eaton Corp. at a significant premium to where the stock was trading prior to the announcement.

On the other hand, stocks within the Financials sector, which had a very strong first quarter, generally sold off during the second quarter. The Fund’s underweight position in the sector versus the Index contributed to the Fund’s relative performance. Primary reasons for the weakness included continuing fears surrounding the Eurozone debt crisis and a slowdown in the U.S. economy. Fears also continued to mount over a breakup in Europe, pressuring financial stocks with exposure to capital markets. Fund holdings with large capital markets operations — Citigroup Inc., JPMorgan Chase & Co., and Bank of America Corp. — were all weak performers during the quarter which detracted from performance. It appeared that investors’ fears of the unknown, particularly surrounding counterparty risk, pressured shares of these capital markets participants while concerns over the euro were on the rise. In reality, the average exposure that these three banks have to Europe is currently less than one percent of their respective assets. Furthermore, in our opinion, their average valuations reflect much of the breakup fears. Shares of JPMorgan Chase & Co. were under additional pressure as a result of the company’s well-publicized trading loss. The trading loss appeared to damage management’s credibility and ignite a new political incentive to punish large banks, which could likely keep a cap on price multiples for the time being. However, we note that even if the trading loss reaches the highest estimate in print ($9 billion), it should not be a capital issue for the bank and may likely only impact the pace of buybacks this year. We expect the Fund to continue to hold these financial stocks due to their attractive valuations and opportunities for future earnings growth. In addition, the majority of the Fund’s companies in the Financials sector are consumer finance companies and regional banks, which do not have large capital markets operations.

The major detractor from the Fund’s relative performance was stock selection within the Health Care sector. Many Health Care stocks exhibited higher-than-normal volatility during the quarter, as expectations grew for the U.S. Supreme Court to overturn the health reform act. The court largely upheld the law and WellPoint Inc., a managed-care company in the Fund, fell sharply during the last few days of the quarter as a result. WellPoint faced additional pressure due to its higher-than-average consumer and small group exposure, where the proposed health exchanges could erode some of its market share. Additionally, the company suffered from management missteps in executing its overall strategy during the period. However, we believe pricing in the industry remains rational and WellPoint’s size and strong brand should continue to provide meaningful advantages. Additionally, WellPoint recently announced it will acquire a best-in-class Medicaid insurer, Amerigroup Corp., and will be able to leverage their process to enhance its own. Another Health Care company, Baxter International Inc., fell during the quarter. Baxter International, which refines blood donations into several drugs, continued to recover from a cyclical downturn in the plasma therapeutics business. The stock also suffered when the Food and Drug Administration requested more data before approving one of the company’s new pipeline drugs. We believe the near-term earnings impact is not significant, as the clinical trial data appears to be positive. We

Management's Discussion of Fund Performance (Unaudited) (Continued)

note that though the plasma therapeutics business continues to recover, the core hospital supply business continues to perform well, and Baxter International’s pipeline of new products is improving rapidly overall.

We believe there are some unique situations within the Utilities sector that are attractive to the Fund, even though the sector is typically seen as expensive. Public Service Enterprise Group Inc. fits that definition, and was a new position and relative contributor during the quarter. Public Service Enterprise Group is a merchant and regulated utility with its primary regulated operations in New Jersey. Though the stock declined along with electricity and natural gas prices, management has plans to grow its regulated business from 20 percent of earnings in 2009 to more than 50 percent of earnings in 2012–2014. This growth is being funded internally with debt to maintain leverage at the regulated business level and with cash flow from the merchant business, which translates into no equity issuance that would dilute existing shareholders. Accordingly, we believe there are two ways to benefit with the holding: investors may get excited about the regulated business and price the stock more in line with other traditional regulated utilities, or electricity prices could recover and drive stronger earnings in the merchant power business earnings.

Within the Energy sector, we initiated a Fund position in Seadrill Ltd. during the period. Seadrill is an international offshore drilling contractor with 50 of the most modern drilling units in the world. The youth of its fleet relative to its peers has resulted in a high percentage of its rigs contracted through 2012 — a period in which many expected to see the greatest softness in rig pricing and utilization. As a result of strong build demand for its rigs, Seadrill’s order backlog is reminiscent of 2008 levels. In addition, most of this backlog is in deep-water, semi-submersible rigs and drillships, which command long-term contracts. Moreover, Seadrill could benefit in the post-Macondo spill environment as increased safety and integrity regulations could raise demand for the high-specification, modern rigs that Seadrill employs. Furthermore,we believe the industry is ripe for consolidation. As previously discussed, we believe Seadrill is capable of weathering the storm of low energy prices because most of its backlog has been secured. We also believe Seadrill’s potential lies in its opportunity to acquire some of the high-quality rigs that may come available because they are owned by operationally inexperienced or financially unstable entities. Seadrill has the opportunity to use its shares, cash and debt capacity for selective acquisitions of assets and companies. On the other hand, Seadrill could become a target for bigger rivals looking to acquire its young fleet and strong operational track record.

The Telecommunication Services sector was a bright spot for the Fund in the second quarter. It posted the highest return of any sector in the benchmark Index, and provided the greatest contribution to the Fund’s absolute performance. The continued growth of wireless data usage along with an improved pricing environment drove earnings growth expectations higher within the sector. Reasonable valuations and high-dividend yields also attracted investors. Two of the Fund’s contributors during the period were Verizon Communications Inc. and AT&T Inc. Both companies continued to gain market share and were far ahead of competitors in offering high-speed wireless data.

Outlook and Conclusion

The list of macro concerns dampening equity markets remains long. Concerns include the European debt crisis, slowing growth in major economies such as the U.S. and China, and the looming elections, to name a few. Additionally, there is a growing concern that, given the exceptionally low levels of interest rates, central banks are running out of levers to stimulate growth. Given the previously mentioned concerns and continued lack of clarity, sentiment among many strategists and investors is decidedly negative. However, to value investors like Barrow Hanley, negative sentiment and a lack of clarity are often starting points for exploiting market inefficiencies. When confronted with uncertainty, we look for a margin of safety, which can be seen in the form of discounted valuations with strong (and growing) free-cash-flow and dividend yields. Going forward, we believe the bond market remains the most significant competitor to equities. As investors have oscillated between “risk-on” and “risk-off” sentiments, there has been a massive flight to U.S. Treasuries. The one-year

Management's Discussion of Fund Performance (Unaudited) (Continued)

correlation between stocks and U.S. Treasuries also reached an all-time low during the quarter. As a result, the competitive environment for domestic equities is continuing to improve, as most stocks now yield more than U.S. Treasury bonds. Within the Fund, the vast majority of stocks have higher yields than Treasuries. More importantly, some of the Fund’s holdings have an advantage over the fixed income alternatives because of their ability to increase dividends going forward. As we have noted in the past, companies that can effectively produce and return capital to shareholders should outperform over time. That said, a significant number of companies within the Fund have implemented meaningful dividend increases over the past year and we expect the trend to continue.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Value Fund - Class A* and the Russell 1000® Value Index

| | * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on July 31, 2003, April 12, 2012, September 10, 1998 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for the periods prior to July 31, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. |

| | ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The past performance is not predictive of future results.

Tabular Presentation of Portfolios of Investments (Unaudited)

June 30, 2012

The tables below provide each Fund’s sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Capital Growth Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 34.2 | % |

| Consumer Discretionary | | | 18.0 | |

| Industrials | | | 13.5 | |

| Health Care | | | 12.5 | |

| Energy | | | 10.5 | |

| Consumer Staples | | | 6.5 | |

| Financials | | | 2.6 | |

| Materials | | | 1.5 | |

| Investment Funds | | | 1.7 | |

| Other Assets/Liabilities (Net) | | | (1.0 | ) |

| Total | | | 100.0 | % |

| Touchstone International Small Cap Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Industrials | | | 23.2 | % |

| Consumer Discretionary | | | 15.7 | |

| Financials | | | 14.9 | |

| Information Technology | | | 11.8 | |

| Materials | | | 9.1 | |

| Energy | | | 6.9 | |

| Consumer Staples | | | 4.9 | |

| Health Care | | | 4.1 | |

| Exchange Traded Funds | | | 3.6 | |

| Telecommunication Services | | | 2.3 | |

| Utilities | | | 1.7 | |

| Investment Funds | | | 5.6 | |

| Other Assets/Liabilities (Net) | | | (3.8 | ) |

| Total | | | 100.0 | % |

| Touchstone Mid Cap Value Opportunities Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Information Technology | | | 20.7 | % |

| Financials | | | 16.7 | |

| Consumer Discretionary | | | 15.0 | |

| Utilities | | | 13.3 | |

| Health Care | | | 12.1 | |

| Industrials | | | 7.6 | |

| Materials | | | 5.1 | |

| Energy | | | 3.0 | |

| Telecommunication Services | | | 2.2 | |

| Consumer Staples | | | 1.0 | |

| Investment Funds | | | 7.7 | |

| Other Assets/Liabilities (Net) | | | (4.4 | ) |

| Total | | | 100.0 | % |

| Touchstone Small Cap Value Opportunities Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 25.9 | % |

| Industrials | | | 15.7 | |

| Consumer Discretionary | | | 14.7 | |

| Information Technology | | | 12.9 | |

| Health Care | | | 9.0 | |

| Utilities | | | 5.4 | |

| Energy | | | 5.1 | |

| Consumer Staples | | | 4.0 | |

| Materials | | | 3.4 | |

| Exchange Traded Fund | | | 1.4 | |

| Investment Funds | | | 9.0 | |

| Other Assets/Liabilities (Net) | | | (6.5 | ) |

| Total | | | 100.0 | % |

| | * | Sector classifications are based upon the Global Industry Classification Standard (GICS®). |

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone U.S. Long/Short Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Long Positions | | | | |

| Information Technology | | | 25.3 | % |

| Consumer Discretionary | | | 18.1 | |

| Financials | | | 16.9 | |

| Health Care | | | 13.2 | |

| Energy | | | 11.6 | |

| Consumer Staples | | | 10.3 | |

| Materials | | | 6.3 | |

| Industrials | | | 5.9 | |

| Utilities | | | 4.0 | |

| Telecommunication Services | | | 2.1 | |

| Exchange Traded Fund | | | 3.4 | |

| Investment Fund | | | 1.2 | |

| Other Assets/Liabilities (Net) | | | (0.6 | ) |

| | | | 117.7 | % |

| Short Positions | | | | |

| Information Technology | | | (7.2 | ) |

| Health Care | | | (3.2 | ) |

| Energy | | | (2.9 | ) |

| Consumer Discretionary | | | (1.8 | ) |

| Financials | | | (1.6 | ) |

| Utilities | | | (1.0 | ) |

| | | | (17.7 | ) |

| Total | | | 100.0 | % |

| Touchstone Value Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 20.2 | % |

| Health Care | | | 13.2 | |

| Consumer Staples | | | 13.0 | |

| Industrials | | | 12.8 | |

| Energy | | | 12.7 | |

| Utilities | | | 8.0 | |

| Information Technology | | | 7.0 | |

| Telecommunication Services | | | 6.4 | |

| Consumer Discretionary | | | 4.2 | |

| Materials | | | 1.0 | |

| Investment Funds | | | 7.7 | |

| Other Assets/Liabilities (Net) | | | (6.2 | ) |

| Total | | | 100.0 | % |

| | * | Sector classifications are based upon the Global Industry Classification Standard (GICS®). |

Portfolio of Investments

Touchstone Capital Growth Fund – June 30, 2012

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | | | |

| Common Stocks — 99.3% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 34.2% | | | | | | | | |

| Accenture PLC - Class A | | | 38,140 | | | $ | 2,291,833 | |

| Apple, Inc.* | | | 20,890 | | | | 12,199,759 | |

| Baidu, Inc., ADR* | | | 18,315 | | | | 2,105,859 | |

| Broadcom Corp. - Class A | | | 80,615 | | | | 2,724,787 | |

| Cisco Systems, Inc. | | | 133,315 | | | | 2,289,019 | |

| Cognizant Technology Solutions Corp. - Class A* | | | 36,990 | | | | 2,219,399 | |

| eBay, Inc.* | | | 87,270 | | | | 3,666,213 | |

| EMC Corp.* | | | 127,551 | | | | 3,269,132 | |

| Equinix, Inc.* | | | 23,805 | | | | 4,181,348 | |

| Google, Inc. - Class A* | | | 7,829 | | | | 4,541,368 | |

| International Business Machines Corp. | | | 26,007 | | | | 5,086,449 | |

| Microsoft Corp. | | | 190,076 | | | | 5,814,425 | |

| NetEase, Inc., ADR* | | | 31,005 | | | | 1,824,644 | |

| Texas Instruments, Inc. | | | 76,355 | | | | 2,190,625 | |

| VMware, Inc. - Class A* | | | 24,570 | | | | 2,236,853 | |

| | | | | | | | 56,641,713 | |

| | | | | | | | | |

| Consumer Discretionary — 18.0% | | | | | | | | |

| Amazon.Com, Inc.* | | | 9,485 | | | | 2,165,900 | |

| BorgWarner, Inc.* | | | 48,520 | | | | 3,182,427 | |

| DIRECTV - Class A* | | | 43,804 | | | | 2,138,511 | |

| Gap, Inc. (The) | | | 104,870 | | | | 2,869,243 | |

| Lululemon Athletica, Inc.†* | | | 23,380 | | | | 1,394,149 | |

| McDonald's Corp. | | | 29,980 | | | | 2,654,129 | |

| Michael Kors Holdings Ltd.* | | | 42,390 | | | | 1,773,598 | |

| NIKE, Inc. - Class B | | | 38,760 | | | | 3,402,353 | |

| priceline.com, Inc.* | | | 6,850 | | | | 4,551,961 | |

| Ralph Lauren Corp. | | | 15,480 | | | | 2,168,129 | |

| Walt Disney Co. (The) | | | 38,970 | | | | 1,890,045 | |