UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: March 31

Date of reporting period: March 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

March 31, 2014

Annual Report

Touchstone Strategic Trust

Touchstone Flexible Income Fund

Touchstone Focused Fund

Touchstone Growth Opportunities Fund

Touchstone International Value Fund

Touchstone Large Cap Growth Fund

Touchstone Mid Cap Growth Fund

Touchstone Small Cap Growth Fund

Table of Contents

This report identifies the Funds' investments on March 31, 2014. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the 12 months ended March 31, 2014.

During the period, the U.S. economy grew at a moderate pace despite challenges that included uncertainty over federal government budget policies, announcement of tapering of the U.S. Federal Reserve Board’s (Fed) quantitative easing (QE) policy and volatile international events. Job creation accelerated while the unemployment rate continued to decline, with areas having the highest unemployment during the recession declining the most. Home prices continued to move upward throughout the period and home construction increased.

Equity markets moved past any negative headlines during the 12-month period and continued their upward trajectory, outperforming bonds significantly. U.S. growth stocks outpaced value stocks for the period while small capitalization stocks outperformed mid- and large-capitalization stocks. Developed markets outperformed emerging markets by a wide margin, but underperformed U.S. equity markets.

The 10-year Treasury note and the 30-year Treasury bond were both down for the period, while high yield bonds outperformed the rest of the bond market, supported by the moderately expanding economy and default rates that are approaching all-time lows.

Despite the brisk growth in equity markets in recent years, ongoing assessment of your asset allocation strategy, risk tolerance and investment timeframe are critical. We believe that diversification is essential to balancing risk and return. Your financial professional can help you evaluate your diversification strategy to help ensure your financial plan stays on track to meet your long-term goals.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Flexible Income Fund

Sub-Advised by ClearArc Capital, Inc.

(Formerly known as Fifth Third Asset Management, Inc.)

Investment Philosophy

The Touchstone Flexible Income Fund invests in a variety of income-producing asset classes, including debt securities, common stock and preferred stock. The Fund’s investment approach employs a top-down macro perspective along with a bottom-up security selection analysis emphasizing quality, relative value and high current income consistent with reasonable risk. Correlation analysis, the statistical measure of how two securities move in relation to each other, is conducted between asset classes in an effort to build a portfolio with low correlation to both stocks and bonds. Fundamental research, quantitative modeling and capital structure analysis are used to help maximize risk-adjusted returns.

Fund Performance

Touchstone Flexible Income Fund (Class A Shares) outperformed its benchmark, the Barclays U.S. Aggregate Bond Index, for the 12-month period ended March 31, 2014. The Fund’s total return was 1.45 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was -0.10 percent.

Market Environment

The market showed signs of disinflation around the globe and a dovish stance by the U.S. Federal Reserve Board (Fed) and other major central banks. Interest rates rose the last three quarters of 2013, followed by a slight decline in early 2014.

The two biggest surprises during the period were related. The Fed shocked the markets by broaching the subject of ending quantitative easing (QE) in May 2013, hurting bond investors and causing volatility in the equity markets. The announcement sparked a major sell-off in preferred securities triggered by passively managed Exchange Traded Funds (ETFs) that were forced to meet liquidity demands while adhering to index-driven trades. The second surprise was how easily the equity market shrugged off the potential effects of the taper, as well as political noise throughout the year, and continued to roar ahead.

Portfolio Review

Throughout the 12-month period, the Fund was managed within its investment parameters. It seeks to generate a high level of income as well as excess returns from its strategy’s high-quality diversified mix of global assets. With its global, flexible approach, the Fund implemented timely, tactical changes among a variety of income-producing asset classes. The strategy is designed for navigating through changing, unpredictable environments. By investing in corporate bonds and preferreds, the Fund has the potential for outpacing a portfolio of core bonds over time, while maintaining a relatively low correlation to both fixed income vehicles and equities. Over the long term, the strategy may offer attractive, risk-adjusted returns – an objective the strategy achieved transparently over the last year.

Corporate spreads narrowed throughout the period, helping offset some of the effect of rising rates and benefited Fund performance. High yield securities in particular contributed to the Fund’s outperformance. The corporate sector performed in line with the index, and we continued to sell securities that had reached our target. Areas of value within corporates were limited. More recently, asset-backed securities notably contributed to performance of the bond portion of the Fund. Its mortgage allocation slightly outperformed on the strong return of one of the Fund’s interest only (IO) bonds; convertibles also outperformed.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Volatility was relatively subdued for most of the 12-month period, and our efforts to hedge a sustained spike in this area generally dragged returns, whether it was the equity market or the bond market. However, the Fund’s foreign currency hedges and its outright short on the Japanese yen were additive to returns. The Fund also had a slight gain from a position that took advantage of a steepening in forward short-term interest rates.

Throughout the year, we remained cautious on emerging markets. Generally unimpressed with their fundamentals, we focused on country divergence. While South Africa and Turkey, for example, suffered as a result of declining fundamentals, falling commodity prices and poor political environments, other countries like Mexico, which established positive economic structural reforms, weathered the storm more effectively. Without such reforms, other countries that had once benefited from the commodity boom, positive monetary dynamics and capital inflows found themselves struggling through much of the period.

The dividend equity portion of the Fund proved too cautious and detracted from performance. While the Fund was overweight equities, it was not overweight enough in such a strong year. Despite the major sell-off in preferreds, Fund holdings performed well. We added hybrid preferreds as they carry a lower duration than perpetual fixed rate preferreds. Maintaining a fixed rate for five or 10 years, hybrid preferred rates can then float freely and offered a way to temper interest rate risk. They also provided attractive spreads. Because our focus has been on structures that have less susceptibility to rising rates, we sidestepped the wave of new “fixed-for-life” preferred issues that came into the market. However, at the end of the period, these preferreds bounced back, and the Fund was underweight in this sub-sector. Within preferreds, we believe the recent overweight of the asset class has been the right call, especially relative to corporate debt. However, we continued to have a preference for hybrid securities, where the spreads continued to be wider due to the lower duration characteristics.

While we can allocate up to 10 percent of the Fund’s portfolio in equity Real Estate Investment Trusts (REITs), the Fund remained underweight to this sector throughout the period due to the acute sensitivity of REITs to interest rate changes which detracted from results. In 2013, REITs experienced their worst year since 1998, relative to the stock market. While the Fund held some mortgage REITs, our sentiment changed based on our conviction that upward pressure on rates would negatively impact certain REITs, which was later validated. Overall, we avoided the sector except for a few issuers we knew well. One in particular was a hospitality turnaround story with a solid management team. After this REIT appreciated sharply, it reached our target price and it was sold. However, we are seeing some opportunity due to overselling in the sector.

The effective duration of the portfolio related to bonds and preferreds is shorter than the benchmark due to interest rate risk. This contributed to results during the period. We had entered the period expecting rates to rise, but in a limited fashion due to restrained economic progress. We were correct about the fundamentals, but the Fed’s taper talk resulted in rates increasing more than we anticipated. Declining interest rates toward the end of the 12-month period led to certain sector performance reversals, but the portfolio has continued to perform well. Even with the rise and fall of interest rates, security selection across the Fund’s portfolio helped it achieve solid results.

Outlook

In 2013, the stock market had its most impressive performance since 1997. Generally, a positive market year for equities has been followed by another, though slightly less positive year. We think the market will hold true to this view, but the going will be tougher.

Currently, the most interesting dynamic in the market is the assumption of continued and improving growth, with declining inflation virtually everywhere. This is readily apparent in wage growth; without such growth it will be difficult for any economy to reach escape velocity. The new Fed chair, Janet Yellen, is focused on the labor market, and we expect rates will have difficulty breaking out of the present range absent large improvements there. We believe emerging markets will see more volatility and divergence of performance that will represent

Management's Discussion of Fund Performance (Unaudited) (Continued)

opportunity as the year unfolds and anticipate the possibility of a large dislocation in an emerging market. Preferreds continue to offer value relative to other areas within credit, although security selection will become increasingly important everywhere within credit. Instead of a tailwind, the credit markets are expected to be more like a wind whipping around in unpredictable directions.

Rising interest rates could potentially have a larger, more problematic impact on fixed-income markets. Sectors with the greatest exposure to interest rate risk generally offer lower yields. U.S. Treasuries, U.S. Government Agencies and high-quality corporate bonds all fit in this high interest-rate risk category. As we look ahead, we also find ourselves growing increasingly concerned about the impact of narrowing spreads on corporate bonds. To counter risks like these, we employ a wide range of risk management tools within the Fund to navigate through different market environments. With the QE taper now underway and the stock market coming off such a powerful year, we anticipate higher volatility in the quarters ahead.

On the equity side, we believe that margins may be as strong as currently possible, and there is evidence of this as earnings reports are released. With the current economic cycle aging, it will become increasingly difficult for stocks to advance without more good news about investment fundamentals at both corporate and economic policy levels. That said, we think that equities (and convertibles as well) will have a positive year for all of the reasons mentioned. The bull market is still running – or at least walking.

Our outlook for preferreds is positive as well. Spreads have become attractive based on rate worries and the shortening supply of available issues. Despite past difficulties, preferreds present both yield and capital appreciation potential going forward.

We also view international corporate bonds favorably. Selectivity in finding attractive values among developed and emerging market countries is the key. We see municipal bonds as positive, offering some value relative to U.S. Treasuries, but with delayed entry points due to recent bankruptcies. Our sentiment on the mortgage market is mixed. We are positive on select non-agency mortgages, but neutral to slightly negative on agency mortgages. REITs can be a volatile asset class, but offer competitive yields and will likely outperform bonds in a variety of scenarios. However, REITs are vulnerable to a strong and sustained rise in rates as we saw last year.

Even with some disinflation as a possible counterbalance, we anticipate there will be upward pressure on interest rates – which mutes our enthusiasm somewhat for bonds overall. Our corporate bond outlook, accordingly, is neutral at best. We see spreads moving from neutral to negative, although there may be some international opportunities that offer value.

We will be watching the indicators for employment and credit creation to determine if the economy can vault to the next stage of growth. Our outlook for continued economic growth is slightly uncertain, but mostly positive. The Fund’s strategy has been able to perform well in a variety of economic environments, and we believe our team is well experienced to manage through the various upcoming scenarios.

Dividend-paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

Diversification neither assures a profit nor guarantees against loss in a declining market.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

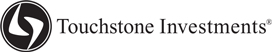

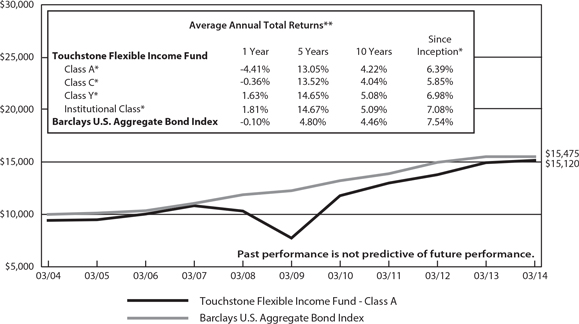

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Flexible Income Fund - Class A* and the Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares commenced operations on April 1, 2004, Class C shares commenced operations on October 29, 2001, Class Y shares commenced operations on September 1, 1998 and Institutional Class shares commenced operations on September 10, 2012. The Class A shares, Class C shares and Class Y shares performance information was calculated using the historical performance of the Fifth Third/ Maxus Income Fund Investor shares, with an inception date of March 10, 1985, for periods prior to April 1, 2004, October 29, 2001 and September 1, 1998, respectively. Institutional Class shares performance information was calculated using the historical performance of Class Y shares for the periods prior to September 10, 2012. The returns have been restated for sales charges and for fees applicable to Class A, Class C, Class Y and Institutional Class shares. The Barclays U.S. Aggregate Bond Index's returns are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00% that will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Focused Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Fund seeks to invest in companies of all capitalizations that are trading below what is believed to be the estimate of their intrinsic value and have a sustainable competitive advantage or a high barrier to entry in place. The barrier(s) to entry can be created through a cost advantage, economies of scale, high customer loyalty or a government barrier (e.g., license or subsidy). Management believes that the strongest barrier to entry is the combination of economies of scale and high customer loyalty.

Fund Performance

The Touchstone Focused Fund (Class A Shares) outperformed its benchmark, the Russell 3000® Index, for the 12-month period ended March 31, 2014. The Fund’s total return was 27.67 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was 22.61 percent.

Market Environment

Equity markets moved broadly higher the last three quarters of 2013, driven by an improved earnings outlook and diminished policy risks domestically. The market then took a breather in the first quarter of 2014 as January witnessed a 4-5 percent sell-off and a dip in bond yields amid concerns about the U.S. economy and emerging markets. The market subsequently recouped its losses in February and went on to post a record high in March as investors shrugged off economic data as being influenced by severe weather. For the period, the market was led by Health Care, Consumer Discretionary, Industrials and Information Technology sector stocks. Sectors lagging included Telecommunication Services, Consumer Staples, Utilities and Energy.

Portfolio Review

The outperformance of the Touchstone Focused Fund can be attributed to stock selection. Its cash holdings as well as its sector allocation detracted from performance. The Fund’s holdings in the Telecommunication Services, Industrials, Consumer Discretionary, Information Technology, Financials and Energy sectors contributed to performance. Sectors that underperformed were Consumer Staples and Health Care. No positions were held in the Utilities sector.

Alliant Techsystems Inc. (Industrials sector) was a top performing stock during the past 12 months as the market realized that a decline in its core business was overly discounted and the company reported several positive earnings announcements. WellPoint Inc. (Health Care sector) outperformed as the company displayed operating resilience in the face of the rollout of the administration’s healthcare mandate. Helen of Troy Limited (Consumer Discretionary sector), Royal Caribbean Cruises Ltd. (Consumer Discretionary sector) and Bank of America Corp. (Financials sector) also outperformed, driven by positive earnings announcements and an optimistic outlook for the future.

Stocks that detracted from performance included Tesco PLC (Consumer Staples sector), which underperformed due to discounted competition in the retail market, and Sysco Corporation (Consumer Staples sector), which was hit by weak volume growth in the restaurant industry. Goldman Sachs Group Inc. (Financials sector) and Owens & Minor Inc. (Health Care sector) also underperformed, as neither company was able to keep up with strong moves in its respective sector. The Fund continues to hold each of these businesses as we like the combination of positive long-term fundamentals and attractive valuations that each possesses.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

During the 12-month period, we increased the Fund’s weight to the Materials, Health Care, Information Technology and Consumer Staples sectors. We decreased the Fund’s weighting in the Financials, Energy, Industrials and Consumer Discretionary sectors.

Outlook

An investor easily could be perplexed by the continuing stream of articles in the media purporting to see the imminent end to this bull market as investors believe the length of the uptrend is long in nature. Quite frankly, we believe it is not really important how long a bull market has been in place (contrary to popular opinion), or how much the market has gained. As the markets or primary trend matures, more and more stocks may fail to fully participate in the advance. At this point, we are seeing minor signs of increased selectivity but certainly not enough to become defensive in a significant way. However, we fully recognize that markets are jittery as we believe investors are more concerned about remaining in the market too long versus leaving too soon.

From a fundamental standpoint, typically, a bull market ends either when inflation accelerates noticeably or when there is a credit bubble. In this regard, inflation is relatively tame as best measured by unit labor costs, and we do not believe a bearish turn in the credit cycle is imminent as monetary conditions are easy, corporate health is still improving and lending standards are reasonable. With regard to returns on capital for corporate America, sales should drive asset efficiency higher with the economy growing. We believe there are also signs that margins will remain stable (versus the consensus view that margins have peaked). These signs include broad-based improvements in pricing power, tame unit labor costs, inventory build-up that has lagged sales growth and capital spending near historical lows.

Therefore, we still have the Fund’s portfolio structured for an improving economic environment with significant relative positions in diversified financials, mid caps and Industrials sector stocks.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

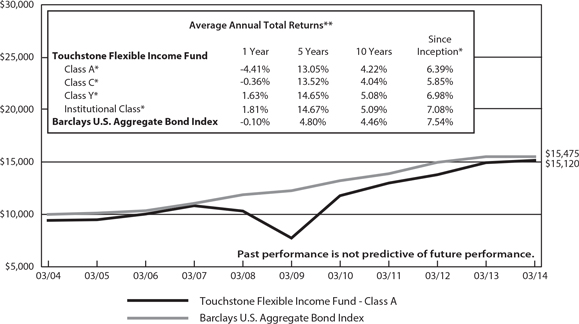

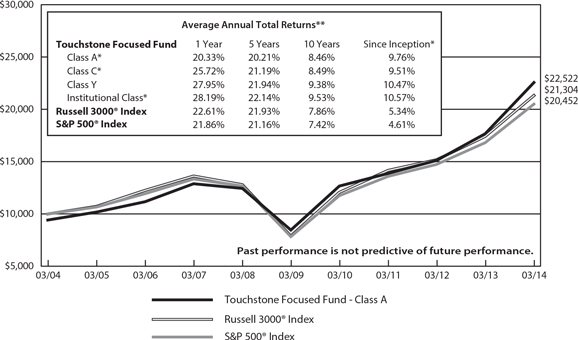

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Focused

Fund - Class A*, the Russell 3000® Index and the S&P 500® Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A, Class C, Class Y and Institutional Class shares commenced operations on September 30, 2003, April 12, 2012, February 12, 1999 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional Class shares performance information was calculated using the historical performance of Class Y shares for the periods prior to September 30, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales charges and for fees applicable to Class A, Class C and Institutional Class shares. The Russell® 3000 Index's and the S&P 500® Index's returns are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00% that will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

The Russell 3000® Index measures the performance of the 3000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

S&P 500® Index is a group of 500 widely held stocks and is commonly regarded to be representative of the large capitalization stock universe.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Growth Opportunities Fund

Sub-Advised by Westfield Capital Management LP

Investment Philosophy

The Touchstone Growth Opportunities Fund seeks long-term capital appreciation by primarily investing in stocks of U.S. companies with large, medium and small market capitalizations. Fund management places focus on companies that are believed to have demonstrated records of achievement with excellent prospects for earnings growth over a 1-3 year period and incorporates a proprietary, research driven, bottom-up approach that seeks to identify quality growth companies with strong management teams, sustainable business models and solid financials.

Fund Performance

The Touchstone Growth Opportunities Fund (Class A Shares) outperformed its benchmark, the Russell 3000® Growth Index, for the 12-month period ended March 31, 2014. The Fund’s total return was 25.84 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was 23.53 percent.

Market Environment

The strength of the U.S. equity markets was in part due to investor confidence in the U.S. Federal Reserve Board’s (Fed) decision to begin tapering the quantitative easing program. This occurred when a series of leading economic indicators (LEI) suggested that the global economy will continue to recover. For the 12-month period, small caps outperformed mid caps which outperformed large caps. By the end of the 12-month period, there was a broadening of the outperformers which may be indicative of investor confidence in the strengthening of the global economy.

The market advance was largely the result of price/earnings (P/E) gains as corporate earnings grew only modestly. An important change in both the U.S. economy and the underlying stock market leadership may be taking place as major market indices consolidated with 0-2 percent gains at the end of the period. These gains were achieved despite miserable weather conditions across the United States, rising global uncertainty related to China’s growth and Russia’s opportunistic strategy toward its neighbors. The underlying appreciation in the U.S. equity markets during the 12-month period came as high price-to-earnings (P/E) stocks significantly underperformed and short-term interest rates trended higher. The equity markets may be foretelling a further pick-up in the economy. As a result, we believe that future stock price gains will be driven by underlying earnings growth, rather than further increases in price-to-earnings multiples.

Portfolio Review

Strength in the Health Care, Consumer Staples and Financials sectors offset weakness in the Energy and Information Technology sectors.

The Health Care sector contributed to relative performance. Actavis PLC, a pharmaceutical firm focused on manufacturing generic and over-the-counter products, was the top contributor to relative performance. Actavis acquired Warner Chilcott PLC, a pharmaceutical firm with core competencies in urology, gastroenterology and dermatology. The merger of Actavis and Warner Chilcott created a premier specialty pharmaceutical company with more than 25 products in various stages of development. During their quarterly earnings recap in January, the company highlighted the strength of cash flow and depth of the product pipeline, as well as their debt reduction process. Actavis achieved an all-time-high after the company announced a definitive agreement to acquire specialty pharmaceutical firm Forest Laboratories, Inc. The acquisition enables Actavis to realize the 50/50 branded to generic drug balance that the company has historically sought. Separately, Jazz Pharmaceuticals

Management’s Discussion of Fund Performance (Unaudited) (Continued)

announced the acquisition of Fund holding Gentium SpA, a manufacturer of biopharmaceuticals. The Fund’s original investment in the stock centered on the belief this underfollowed, yet profitable, orphan biotechnology company was on the cusp of significant growth following a regulatory opinion on Defibrotide, its product for the treatment of hepatic veno-occlusive disease.

The Consumer Staples sector contributed to relative performance, with the continued underweight to the sector as well as stock selection helping results. The Fund held a position in beverage giant Coca-Cola Company for a short period, but the stock was sold because fundamentals in the carbonated soft drink market remain challenging and the health of emerging markets, to which the company has significant exposure, still remains a question mark for many investors. In September, the Fund’s position in Kraft Foods Group Inc. was sold after food giant ConAgra missed expectations for its quarterly results, perhaps indicative of a more aggressive industry pricing/promotional strategy to follow which could dampen results in the industry. We continue to focus on finding investment opportunities in the Consumer Staples sector that represent compelling fundamental growth stories we believe will resonate with investors and distinguish the companies from their purely defensive and slower growth (albeit predictable) investment peers.

Strong stock selection within the Financials sector contributed to performance. Ameriprise Financial Inc., an asset management company with a sizable insurance services business, outperformed its industry peers. We like this provider for its superior profit margins and disciplined approach to returning capital to shareholders. In addition, if short-term interest rates continue to rise, this will have a positive impact on the company’s profits, which are boosted by higher spreads on cash sweep accounts. Insurance providers and banks are among the biggest beneficiaries of rising interest rates and a steeper yield curve. American International Group Inc., a global insurance company, also enhanced excess gains. We are encouraged by the company’s turnaround efforts in the property and casualty business and management’s commitment to returning capital to shareholders. The company recently authorized an additional share repurchase program and increased its dividend. Starwood Property Trust, Inc. was a top contributor to relative returns within the sector. The company exceeded consensus expectations for earnings for three consecutive quarters, benefiting from higher servicing fees in the LNR Property segment, which Starwood acquired.

The Energy sector detracted from relative performance. Refining companies suffered as the feed stock price differential between the West Texas Intermediate/North Sea Brent crude oil varieties diminished. Refiners recovered but then pulled back again. Tesoro Corp. declined along with its industry peers. Sell-side expectations for Tesoro’s quarterly earnings were skewed to the upside, partially due to different views on the Carson acquisition synergies and California product prices. We think Tesoro has multiple catalysts for earnings acceleration and continue to be enthusiastic about the stock’s appreciation potential. National Oilwell Varco, Inc., a manufacturer of oil and gas field equipment, also detracted from relative results. We sold the stock given our belief that its risk/reward profile was deteriorating. Refiner Valero Energy Corp. was also a relative detractor. The company filed to sell its stake in CST Brands, the retail gas station business the company had spun-off to shareholders earlier in the year. The proceeds from the deal should likely be used for further share repurchases. We expect the company to benefit from its geographic exposure to the Gulf Coast, which is seeing new development in regional pipeline and rail networks that will ultimately connect Cushing-based crude inventories to refineries on the Gulf Coast.

The Information Technology sector detracted from Fund performance. The Fund’s underweight of the sector, coupled with the outperformance of mega cap legacy technology company holdings such as Microsoft Corp., hurt incremental performance. Citrix Systems, a cloud computing company that provides virtualization and optimization services, declined after lowering its earnings forecast in late 2013. The company has a diversified book of products and a large recurring revenue base, but its mobile and desktop business segment – the largest by revenue – had been missing revenue targets. While we believe Citrix is focused on the right product categories, the Fund’s position was sold. The timing of our trade actions in RedHat, Inc. and Facebook, Inc. also hurt relative returns. RedHat surged after the company reported surprisingly good quarterly results in its European

Management’s Discussion of Fund Performance (Unaudited) (Continued)

and U.S. Federal Government business segments relative to prior quarters. The stock was sold after the company lowered guidance for the quarter, citing macroeconomic weakness in Europe. The shares were repurchased, encouraged by signs of acceleration in earnings and the fact that the stock trades at a discount to its software-as-a-service peers. Facebook was added to the Fund’s portfolio in advance of the initial public offering of Twitter shares because of our belief that Facebook would benefit from the event. Qlik Technologies Inc., a provider of business intelligence software solutions, was another significant detractor from relative returns. Qlik Technologies shares declined sharply after the company reported third quarter results that were below consensus expectations. We believe the quarterly weakness came down to a handful of deals in the company’s Europe and Asia business segments and was not a product issue. Its North America segment, which is the most competitive geography, was up on a year-over-year basis. We maintained the Fund’s position given our belief that it carries an attractive risk/reward profile among its peers.

As a result of our fundamental, bottom-up research process, the Fund saw increased weights in the Health Care, Financials, Industrials and Information Technology sectors during the period. Weights were decreased in the Consumer Staples, Consumer Discretionary and Energy sectors.

Outlook

In many instances over the past few months, severe winter weather negatively impacted business conditions. However, time and again, our investment team was struck by how upbeat and bullish management teams have become about the longer-term opportunities in the United States. Large road, bridge, pipeline, power transmission and office building projects are just breaking ground. We believe innovation pipelines in the Health Care and Information Technology sectors are healthier than they have been in a decade. Bank lending is accelerating. Although a better economy is good news as a whole, this change in trend can create disruption and volatility in both equity and debt markets. We recognize that long-lasting impact of the Fed’s accommodative monetary policy on financial assets, an economic slowdown in China, and the prospect of further political instability in the former Soviet bloc region could contribute to wider gyrations in stock prices. Times are changing, and in our opinion, market leadership will change. We expect stock picking and active management will become substantially more important in the years ahead. We are focused on identifying companies with accelerating or underappreciated Earnings Per Share growth, trading at reasonable prices. Perhaps just as important, our investment team strives to anticipate what is to come and identify where we can add the most value. We believe that the current market environment offers ample opportunity to identify companies that fit the Fund’s investment profile.

Dividend-paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

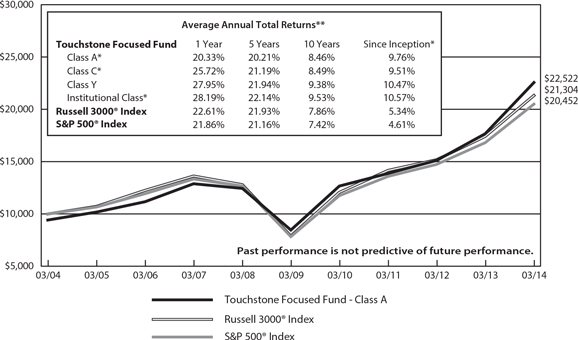

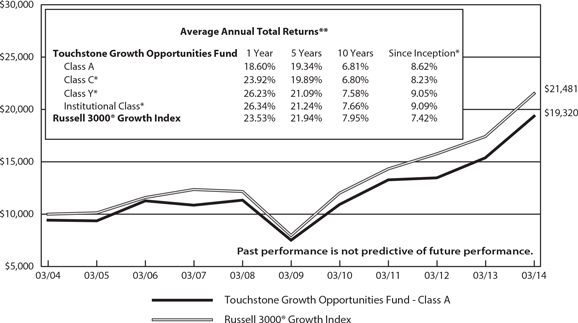

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Growth Opportunities Fund - Class A* and the Russell 3000® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares commenced operations on September 29, 1995, Class C shares commenced operations on August 2, 1999, Class Y shares and Institutional Class shares commenced operations on February 2, 2009. The Class C shares performance information was calculated using the historical performance of Class A shares for periods prior to August 2, 1999, Class Y shares and Institutional shares performance information was calculated using the historical performance of Class A shares for periods prior to February 2, 2009. The returns have been restated for sales charge and for fees applicable to Class C, Class Y and Institutional Class shares. The Russell 3000® Growth Index's returns are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00% that will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

The Russell 3000® Growth Index measures the performance of those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone International Value Fund

Sub-Advised by Barrow, Hanley, Mewhinney & Strauss, LLC

Investment Philosophy

The Touchstone International Value Fund seeks long-term capital growth by primarily investing in equity securities of non-U.S. companies believed to be undervalued and searches for companies that have price-to-earnings and price-to-book ratios below the market, free cash flow ratios at or below the market and dividend yields above the market.

Fund Performance

The Touchstone International Value Fund (Class A Shares) outperformed its benchmark, the MSCI EAFE Index, for the 12-month period ended March 31, 2014. The Fund’s total return was 20.90 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was 17.56 percent.

Market Environment

At the beginning of the fiscal year, the U.S. Federal Reserve Board (Fed) announced the possibility of scaling back its massive bond-buying program, which sparked a rout in the bond market and a pullback in most equity markets. The rapidity and magnitude of the rise in interest rates shocked investors in both bond and equity markets, challenging investors’ perceptions of safety and risk, and interest rates across the credit spectrum were driven lower and for a longer period of time. In Europe, the eurozone remained in the midst of a deflationary cycle and emerging market equities sold off significantly as China’s economy slowed and commodity producers were particularly hard hit. By mid-year 2013, equity markets displayed sharply higher volatility as global investors worried about the implications from escalating tensions in the Middle East, along with the unwinding of quantitative easing and eventual resumption of monetary tightening by the Fed. By the end of 2013, however, U.S. equities were among the strongest in the world and European markets began to show signs of recovery. However, emerging markets were still impacted as a result of concerns over China’s economy and continued weakness in the commodities complex.

The beginning of 2014 brought with it no shortage of worries for investors. In particular, the crisis in Ukraine, a continuation of troubling economic data from China and other emerging markets and disruptive winter weather in the U.S. plagued investors. Despite the many concerns however, U.S. equity markets displayed an uneasy calm. The perceived safe harbor of U.S. equities contributed to their performance advantage over both developed and emerging international markets, and particularly emerging markets, which remained weak. U.S. bond performance kept pace with stocks during the quarter, which went against the consensus view that interest rates would continue to rise, and European markets remained in the midst of a bounce upward despite the potential for negative consequences from the ongoing unrest between Russia and Ukraine.

Portfolio Review

For the period, the Fund’s holdings within the Financials, Consumer Staples, Materials and Utilities sectors contributed to performance, while stock selection in the Industrials, Consumer Discretionary, Information Technology and Telecommunication Services sectors detracted from performance. Among the stocks that contributed to Fund performance during the period were Daimler AG (Consumer Discretionary sector), DS Smith PLC (Materials sector), Delta Lloyd N.V. and AEGON N.V. (both from the Financials sector). Daimler AG, a Germany-based automotive company, posted solid results across all of its business segments, increased its dividend and provided a positive outlook for the remainder of 2014. Daimler continued to capitalize on a favorable product cycle that includes important model changeovers and new model introductions, both of which have driven strong demand globally for Mercedes-Benz. Daimler’s truck business also experienced a recovery during the period, which further helped the stock. DS Smith PLC, a London-based international packaging business,

Management’s Discussion of Fund Performance (Unaudited) (Continued)

experienced several positive developments during the year. DS Smith continued to profit from an accretive acquisition of a Swedish packaging business in 2012, and the company has been in active negotiations with both small- to medium- and large-sized prospects. Additionally, a major international packaged-goods company approached DS Smith about being the exclusive provider of all of its European corrugated packaging, which further benefited the stock. Delta Lloyd, a Netherlands-based financial services provider, saw strong performance as the company continued to benefit from rising interest rates. It also saw improvement in its underlying business as earnings from one of its largest segments, the Dutch pension buyout market, grew considerably and its capital position improved. AEGON, a global provider of pensions, insurance and savings products, provided an attractive dividend yield during the period and, if interest rates continue their upward trend, we believe the stock could continue to provide meaningful upside going forward.

Among the stocks that detracted from Fund performance were Jardine Cycle & Carriage Ltd. (Consumer Discretionary sector), Anglo American plc and Dongyue Group Ltd. (both from the Materials sector). Jardine Cycle & Carriage, a Singapore-based investment company and management services provider, was plagued by numerous issues during the year. In particular, during the fourth quarter of 2013, the drastic underperformance of the Indonesian stock market and the severe deterioration of the Indonesian rupiah against the Singapore dollar impacted company shares the most. Jardine Cycle & Carriage is also a majority holding of Astra International, an Indonesia-based conglomerate, which further negatively impacted the stock. Anglo American, a multinational mining company, underperformed as a result of the broad-based commodity sell-off in which coal, copper, gold and iron ore prices fell precipitously. The stock was further impacted during the year by the company’s poor capital investment, delays in its large-scale Minas Rio project and deterioration in stripping ratios in its Sishen iron ore project. Dongyue Group is a China-based manufacturer of refrigerants and fluropolymers, which have many industrial and consumer uses, including the familiar Teflon® non-stick coating. It was expected that prices for refrigerants were near trough levels and were due for cyclical improvement; however, refrigerant prices remained stable but polymer prices softened due to significant new industry capacity. This resulted in decreases in both the company’s stock price and aggregate margins during the period.

Outlook

Looking forward, the outlook for global equities remains positive but mixed depending, in some cases, on geographical location and valuations. The impact of a slowdown in China continues to weigh on countries with a heavy dependence on exports to China, and particularly those with a strong correlation to the commodities complex. This has been a source of stress on the currencies of Turkey, Brazil, Indonesia, India and Russia, otherwise known as the “fragile five.” Though this uncertainty may last for some time, we believe it will eventually abate and create opportunities in select emerging markets where valuations are becoming more compelling. Europe is in the midst of a continuing rebound in economic stability as evidenced by the narrowing of credit spreads in many of the peripheral countries such as Spain, Italy and Greece. We believe the Fund’s overweight position to the European region should continue to pay off as the Fund holds a portfolio of high-quality companies at very reasonable valuations, particularly within the Industrials and Financials sectors. We are less bullish on Japan, however, and remain unconvinced that the historically significant monetary stimulus engineered by the country’s government will translate into a wholesale change in the philosophies of Japanese corporate managements, which have been less focused on return of capital and profitability measures. Nevertheless, we are finding potential opportunities where management teams seem to be changing slowly to a strategy focused on shareholders and profitability measures.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Our investment discipline is driven by fundamental research which we utilize to build the Fund’s portfolio by analyzing and building our own appraisal of values one company at a time. The Fund is comprised of a basket of companies that we believe offers a better return profile relative to the market and, as such, we believe the Fund is well positioned going forward.

Dividend-paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

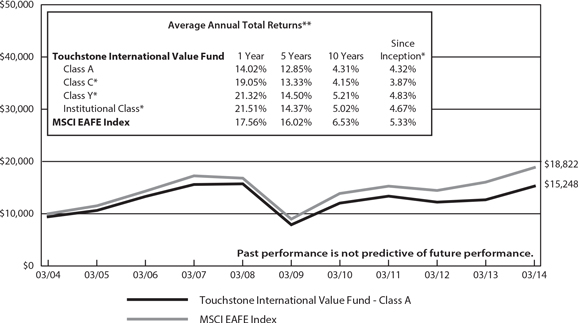

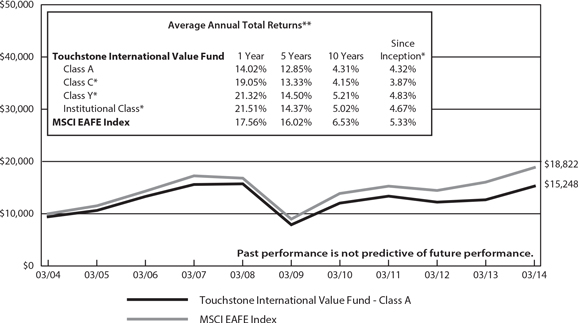

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International

Value Fund - Class A* and the MSCI EAFE Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares commenced operations on August 18, 1994, Class C shares commenced operations on April 25, 1996, Class Y shares commenced operations on October 9, 1998 and Institutional Class shares commenced operations on September 10, 2012. The Class C shares performance information was calculated using the historical performance of Class A shares for periods prior to April 25,1996, Class Y shares performance information was calculated using the historical performance of Class A shares for periods prior to October 9, 1998 and Institutional Class shares performance information was calculated using the historical performance of Class A shares for periods prior to September 10, 2012. The returns have been restated for sales charges and for fees applicable to Class C, Class Y, and Institutional Class shares. The MSCI EAFE Index's returns are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. The maximum offering price per share of Class A shares is equal to the net asset value (”NAV“) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (”CDSC“) of 1.00% that will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance excluding the U.S. and Canada.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Large Cap Growth Fund

Sub-Advised by Navellier & Associates, Inc.

Investment Philosophy

The Touchstone Large Cap Growth Fund seeks long-term growth of capital. The Fund primarily invests in common stocks of large-cap U.S. companies believed to possess strong appreciation potential.

Fund Performance

The Touchstone Large Cap Growth Fund (Class A Shares) underperformed its benchmark, the Russell 1000® Growth Index, for the 12-month period ended March 31, 2014. The Fund’s total return was 21.27 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was 23.22 percent for the same period.

Market Environment

U.S. equity markets finished the period with double-digit gains. Returns were due in part to renewed investor confidence that the U.S Federal Reserve Board’s (Fed) policy to commence tapering of its quantitative easing (QE) program came at the right time – as leading economic indicators suggested that the global economy will stabilize. The gains were achieved despite global volatility and uncertainty related to China’s growth, problems in the Ukraine and the annexation of Crimea as well as one of the harshest winters across the U.S.

The Health Care and Consumer Discretionary sectors led for the first half of the period and small-cap stocks outperformed large caps. The sands shifted in the fourth quarter of 2013 however; as small-cap performance moderated and the Industrials and Information Technology sectors took the lead. Gold was largely down over the first three quarters of the period and then surged during the first quarter of 2014. The resurgence of real estate was evident in the latter half of the period as evidenced by a strong rally in real estate investment trusts (REITs). Investors fled from bonds which saw record outflows last summer during the tapering scare. The selloff in bonds caused interest-rate-sensitive sectors like Utilities, Telecommunication Services and Financials to underperform briefly, but that abated toward the end of the fiscal year.

Portfolio Review

Although the Fund underperformed its benchmark Index for the period, we believe it was a good year for the Touchstone Large Cap Growth Fund.

For the period, sectors that detracted most from Fund performance were Energy, Financials and Consumer Discretionary due to poor stock selection. Of the three sectors, Energy was the largest detractor for the period. The Information Technology and Industrials sectors were the leading contributors to performance due to strong stock selection throughout the fiscal year. The Health Care sector also contributed to performance due to an overweight exposure and stock selection.

Among the stocks that detracted most from performance during the fiscal year were: HollyFrontier Corp. (Energy sector), PulteGroup Inc. (Consumer Discretionary sector) and DaVita HealthCare Partners Inc. (Health Care Sector). HollyFrontier Corp.’s 2013 second quarter earnings fell versus analysts’ forecasts as refinery margins narrowed amid lower production. During the third quarter, oil prices contracted which further hurt the company’s refinery margins and prompted some analyst downgrades. Consequently, HollyFrontier detracted from performance and was sold. PulteGroup Inc.’s second quarter earnings fell as the home builder’s higher costs masked stronger closings and selling prices. Although Pulte’s closings were up at the time, company orders declined compared to a year earlier and the stock was punished when their order and delivery figures fell short of Wall Street consensus estimates and it detracted from Fund performance. DaVita HealthCare reported earnings that were below analyst expectations, which negatively affected the stock’s relative fundamental valuations. In addition, the proposed

Management’s Discussion of Fund Performance (Unaudited) (Continued)

deep cuts in Medicare reimbursements took a toll on kidney dialysis providers, which resulted in The Centers for Medicare and Medicaid Services proposing cut-backs on payments for dialysis patients by 9.4 percent for 2014, more than double the 3 – 4 percent expected. Consequently, the stock was sold.

The Fund had adequate exposure to the more domestically-oriented stocks that outperformed for a significant part of the fiscal year, which aided Fund performance. Among the stocks that contributed to performance were Alliance Data Systems Corp. (Information Technology sector), Actavis PLC (Health Care sector) and Raytheon Co. (Industrials sector). Alliance was the largest contributor due to an improving credit environment and falling unemployment, as well as the continued popularity of tailored electronic marketing. Actavis has been branching out into branded pharmaceuticals and successfully made a series of accretive acquisitions during the period, which affected the share price of the stock positively. Raytheon, maker of the Patriot missile-defense system, contributed to performance. The company is the most diversified of the large U.S. contractors and furthest advanced in winning international business to counter domestic military-budget pressures. In addition, the company managed the latest defense budget cuts well which was also reflected in the share price.

Positions were added to the Fund’s Health Care and Information Technology sectors to take advantage of the strong market performance those sectors began to experience in the third and fourth quarters of 2013. During the period, the Fund began to reduce exposure to the Consumer Discretionary sector due to the effects of the uneven pace of economic growth in the fiscal year. The Fund’s overweight to the Energy sector was reduced from the previous fiscal year due to weakness in refining margins that affected its positions, and the Fund’s overweight to the Utilities sector was also decreased, primarily due to the large swings in long-term interest rates that affected the sector, resulting from QE tapering.

Outlook

The Fund is positioned for a cyclical upswing in the recovering U.S. economy where we believe falling unemployment and a healing housing market will offer opportunities in more cyclical sectors. Should the Russia/Ukraine situation deteriorate, we believe any resulting sanctions against Russia could hurt their largest trading partner, the European Union (EU), thus weakening the recovery in Europe. China has also seen slowing economic numbers. As the largest consumer of commodities and the second largest world economy, should China’s economy further slow, it could affect the world economy disproportionately if that slowdown is not contained. We believe the sector most exposed at this point appears to be Consumer Discretionary, as it encompasses those industries that tend to be most sensitive to economic cycles, such as hotels, restaurants and consumer retailing and services, to name a few.

Going forward, we believe the Fund is positioned to be marginally less exposed to top-down risks. With the U.S. economy outperforming most global economies, the Fund is being positioned to take advantage of the continued economic expansion. We believe QE tapering is a sign from the Fed that the economy can handle slightly higher interest rates, while federal deficits are shrinking and unemployment is falling. Additionally, in this relatively slow earnings growth environment, we believe many of the securities selected for the Fund’s portfolio have the potential to deliver above average earnings-per-share and sales growth in their respective industries.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Large Cap Growth Fund - Class A* and the Russell 1000® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class B, Class C and Class Y shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares commenced operations on December 19, 1997, Class B and Class C shares commenced operations on October 4, 2003 and Class Y shares commenced operations on November 10, 2004. The Class B shares and Class C shares performance information was calculated using the historical performance of Class A shares for periods prior to October 4, 2003 and Class Y shares performance information was calculated using the historical performance of Class A shares for periods prior to November 10, 2004. The returns have been restated for sales charges and for fees applicable to Class B, Class C and Class Y shares. The Russell 1000® Growth Index's returns are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class B shares are subject to a contingent deferred sales charge (“CDSC”) of 5.00% in the event of a shareholder redemption within a one-year period of purchase. The CDSC will be incrementally reduced over time. After the 6th year, there is no CDSC. Class C shares are subject to a CDSC of 1.00% that will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed if redeemed within a one-year period from date of purchase. Class Y shares shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Mid Cap Growth Fund

Sub-Advised by Westfield Capital Management LP

Investment Philosophy

The Touchstone Mid Cap Growth Fund seeks long-term growth by primarily investing in stocks of mid-cap U.S. companies. Fund management places focus on companies that are believed to have demonstrated records of achievement with excellent prospects for earnings growth over a 1-3 year period and incorporates a proprietary, research driven, bottom-up approach that seeks to identify quality growth companies with strong management teams, sustainable business models and solid financials.

Fund Performance

The Touchstone Mid Cap Growth Fund (Class A Shares) outperformed its benchmark, the Russell Midcap® Growth Index for the 12-month period ended March 31, 2014. The Fund’s total return was 24.82 percent (calculated excluding the maximum sales charge), while the total return on the benchmark was 24.22 percent.

Market Environment

The strength of the U.S. equity markets was in part due to investor confidence in the U.S. Federal Reserve Board’s (Fed) decision to begin tapering the quantitative easing program. This occurred when a series of leading economic indicators (LEI) suggested that the global economy will continue to recover. For the 12-month period, small caps outperformed mid caps which outperformed large caps. By the end of the 12-month period, there was a broadening of the outperformers which may be indicative of investor confidence in the strengthening of the global economy.

The market advance was largely the result of price/earnings (P/E) gains as corporate earnings grew only modestly. An important change in both the U.S. economy and the underlying stock market leadership may be taking place as major market indices consolidated with 0-2 percent gains at the end of the period. These gains were achieved despite miserable weather conditions across the United States, rising global uncertainty related to China’s growth and Russia’s opportunistic strategy toward its neighbors. The underlying appreciation in the U.S. equity markets during the 12-month period came as high price-to-earnings (P/E) stocks significantly underperformed and short-term interest rates trended higher. The equity markets may be foretelling a further pick-up in the economy. As a result, we believe that future stock price gains will be driven by underlying earnings growth, rather than further increases in price-to-earnings multiples.

Portfolio Review

The Health Care sector was the greatest source of relative gains during the period; the Information Technology and Financials sectors also contributed significantly to outperformance. Investments in the Consumer Discretionary and Energy sectors underperformed.

The Health Care sector exhibited broad-based strength, contributing to relative results. The Fund’s overweight to the sector helped, but it was positive stock selection, particularly within pharmaceuticals, that drove the bulk of the outperformance. Actavis PLC, which focuses on manufacturing generic and over-the-counter products, acquiredWarner Chilcott PLC, a major player in the generic drug industry, and both stocks appreciated substantially. The merger of Actavis and Warner Chilcott created a leading specialty pharmaceutical company with more than 25 products in various stages of development. Actavis achieved an all-time-high after the company announced a definitive agreement to acquire specialty pharmaceutical firm Forest Laboratories, Inc.,The acquisition enables Actavis to realize the 50/50 branded-to-generic drug balance that the company has historically sought. Drug distributor Cardinal Health, Inc. also contributed meaningfully to performance. The company entered into a joint venture with CVS Caremark Corp. creating the largest generic pharmaceutical product sourcing entity

Management’s Discussion of Fund Performance (Unaudited) (Continued)

in the U.S. However, Cardinal was sold in January as we believed the stock reached its full valuation potential. We remain enthusiastic about investment opportunities within the drug distribution segment. We believe it is well positioned to benefit from the current generic up-cycle, higher volumes brought by the Affordable Care Act and aggressive capital deployment.

The Information Technology sector also contributed to performance. Although the large and mid-capitalization technology companies underperformed the broader market during the period, the Fund’s outperformance in this sector stemmed entirely from positive stock selection. Alliance Data Systems Corp., a private label credit card issuer, significantly outpaced its industry peers. We believe the company has multiple catalysts for earnings acceleration going forward including the mobile and private label retail credit card segments. Akamai Technologies, Inc. contributed meaningfully to relative performance. The company provides services for improving the delivery of content over the Internet and has demonstrated strength in its cloud/security segment and acceleration of media delivery revenues. We believe earnings momentum is likely to continue. The Fund’s exposure to the Information Technology sector was reduced given recent data indicating weakness in enterprise spending and emerging markets. Although the Fund is currently underweight to the sector relative to the benchmark, we continue to look for attractive investment candidates in areas of secular growth. We particularly favor companies exposed to the transition to cloud-based business models, the move to mobile platforms from the desktop and the demand for cyber-security solutions. Several new technology investments were added to the Fund’s portfolio including Citrix Systems, Inc., a virtualization software developer, FEI Company, a maker of scientific instruments, and semiconductor manufacturer Xilinx, Inc. All of them were additive to performance.

The Financials sector outperformed broadly; five out of seven holdings contributed to the Fund’s performance. Much of the price action in the sector continued to be dictated by the direction of the U.S. yield curve. We believe the economy is strengthening, and if it continues, interest rates are bound to rise. We believe stocks that benefit from higher interest rates, such as insurance providers and banks, are good areas for Fund investment. Ameriprise Financial Inc., an asset management company with a sizable insurance services business, was the top performer within the sector. Its wealth management business segment has consistently demonstrated profit margins ahead of management’s targets. Improving inflows into the company’s asset management business, increased client activity and equity market appreciation represent potential catalysts for the stock. Regions Financial Corp. was also a contributor to performance within the sector. The company operates in the Southeast region of the U.S., a faster growing geographical market. During the most recent quarterly recap, management guided to incrementally higher loan growth in 2014. Unlike some of its regional bank competitors, Regions is fully compliant with the Liquidity Coverage Ratio and should be poised to benefit from an improving net interest margin outlook.

The Consumer Discretionary sector detracted from relative results. While there were many strong performers in the sector, such as Wynn Resorts, Ltd. and Jarden Corp., the positive impact of these holdings was offset by stock-specific weakness within apparel retail and homebuilding. In addition, the Fund’s underweight to the sector, and particularly its lack of exposure to high momentum, high growth sub-industries, such as automobile manufacturers and Internet retail, held back excess returns. The teen consumer market was weak, and apparel retailer Abercrombie & Fitch Co. was the biggest source of relative weakness in the sector. Aggressive price promotion and fierce competition in apparel retail has made it difficult for Abercrombie to capitalize on measures to improve profitability and led to the sale of the stock. Homebuilder Toll Brothers, Inc. also detracted from performance. Most housing stocks pulled back sharply in conjunction with the bond market sell-off, which followed the move in interest rates triggered by the Fed’s tapering commentary. Although we continue to believe that U.S. housing fundamentals are improving andToll Brothers, which owns an eight-year inventory of Northeast land, has significant intrinsic value, we sold the Fund’s position.

The Energy sector detracted from performance. U.S.-based refiners were volatile, falling under selling pressure when the West Texas Intermediate (WTI)/North Sea Brent price spread narrowed and pulled back again. The

Management’s Discussion of Fund Performance (Unaudited) (Continued)

WTI/Brent price differential has historically been associated with refiner profitability; however, we believe spreads to other oil grades are more important for the Fund’s refinery investments. The Fund’s oil and gas refiner, Tesoro Corp., detracted from relative performance. We believe Tesoro, which processes crude oil from the Bakken basin, should be able to improve profit margins given lower transportation costs and multiple catalysts for earnings acceleration in the second half of the year.

Outlook

In many instances over the past few months, severe winter weather negatively impacted business conditions. However, time and again, our investment team was struck by how upbeat and bullish management teams have become about the longer-term opportunities in the United States. Large road, bridge, pipeline, power transmission and office building projects are just breaking ground. We believe innovation pipelines in the Health Care and Information Technology sectors are healthier than they have been in a decade. Bank lending is accelerating. Although a better economy is good news as a whole, this change in trend can create disruption and volatility in both equity and debt markets. We recognize that long-lasting impact of the Fed’s accommodative monetary policy on financial assets, an economic slowdown in China, and the prospect of further political instability in the former Soviet bloc region could contribute to wider gyrations in stock prices. Times are changing, and in our opinion, market leadership will change. We expect stock picking and active management will become substantially more important in the years ahead. We are focused on identifying companies with accelerating or underappreciated Earnings Per Share growth, trading at reasonable prices. Perhaps just as important, our investment team strives to anticipate what is to come and identify where we can add the most value. We believe that the current market environment offers ample opportunity to identify companies that fit the Fund’s investment profile.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

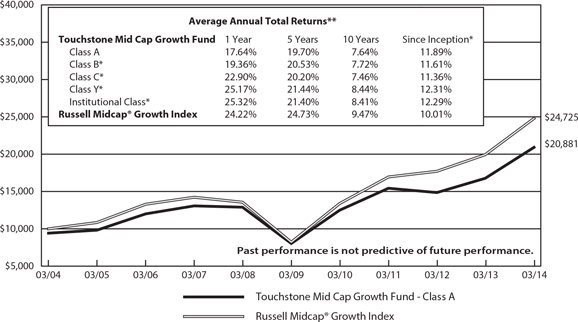

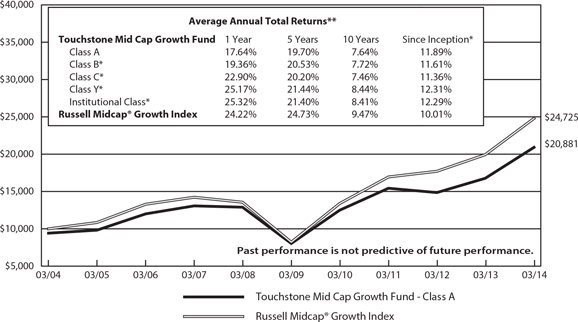

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Midcap

Growth Fund - Class A* and the Russell Midcap® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class B shares, Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. Class A shares and Class C shares commenced operations on October 3, 1994, Class B shares commenced operations on May 1, 2001, Class Y shares commenced operations on February 2, 2009 and Institutional Class shares commenced operations on April 1, 2011. The Class B shares performance information was calculated using the historical performance of Class A shares for periods prior to May 1, 2001, Class Y shares performance information was calculated using the historical performance of Class A shares for periods prior to February 2, 2009 and Institutional shares performance information was calculated using the historical performance of Class A shares for periods prior to April 1, 2011. The returns have been restated for sales charges and for fees applicable to Class B, Class Y, and Institutional Class shares. The Russell Midcap® Growth Index's returns are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class B shares are subject to a contingent deferred sales charge (“CDSC”) of 5.00% in the event of a shareholder redemption within a one-year period of purchase. The CDSC will be incrementally reduced over time. After the 6th year, there is no CDSC. Class C shares are subject to a CDSC of 1.00% that will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

The Russell Midcap® Growth Index measures the performance of those Russell Midcap® companies with higher price-to-book ratios and higher forecasted growth values.

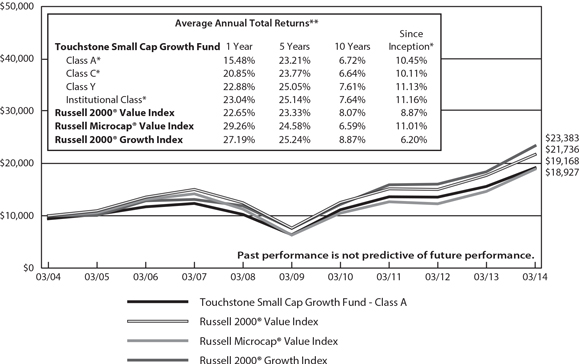

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Small Cap Growth Fund

Sub-Advised by Apex Capital Management, Inc.

Investment Philosophy

The Touchstone Small Cap Growth Fund invests in a diversified portfolio of common stocks of small-cap growth-oriented companies that are selected for their long-term capital appreciation potential and which are expected to grow faster than the U.S. economy. The majority of the portfolio is invested in “established growth” companies which typically provide more stability and consistency in volatile markets. The balance of the portfolio is invested in “emerging growth” companies which typically exhibit more aggressive growth characteristics and may experience positive transformation or a favorable catalyst impacting their long-term growth potential. Fund management uses an approach that combines top-down secular/macro-economic theme analysis with bottom-up security selection.

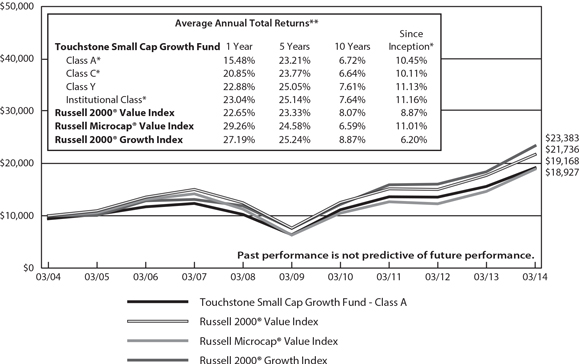

Fund Performance

The Touchstone Small Cap Growth Fund (Class A Shares) underperformed its benchmark, the Russell 2000® Growth Index, for the 12-month period ended March 31, 2014. The Fund’s total return was 22.63 percent (calculated excluding maximum sales charge), while the total return of the benchmark was 27.19 percent for the same period.

The strategy of the Fund changed as of April 26, 2013 and therefore, the benchmark index became the Russell 2000® Growth Index at that time.

Market Environment

Improvement in job growth in the U.S. and the prospects of tapering of Treasury bond purchasing stimulus by the U.S. Federal Reserve Board (Fed) was a dominant theme in the 12-month period. There was a steady rotation into high growth stocks and out of the defensive stocks during the 12-month period. High momentum speculative stocks, especially microcap growth stocks in biotechnology and Internet/cloud software industries, became overpriced. Several global events including increasing challenges in China, concerns about Ukraine and the statement by new Fed Chair Janet Yellen about slowly ending the tapering program sobered the market.

Portfolio Review

With concerns about the high and unsustainable valuations in the high momentum speculative stocks, especially microcap growth stocks in biotechnology and Internet/cloud software industries, we underweighted these areas in the Fund’s portfolio.