UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03732

MFS VARIABLE INSURANCE TRUST II

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Annual Report

December 31, 2021

MFS® Blended Research®

Core Equity Portfolio

MFS® Variable Insurance Trust II

MFS® Blended Research® Core Equity Portfolio

| 1 |

| 2 |

| 3 |

| 5 |

| 7 |

| 8 |

| 13 |

| 14 |

| 15 |

| 16 |

| 18 |

| 24 |

| 25 |

| 28 |

| 31 |

| 31 |

| 31 |

| 31 |

| 31 |

| 32 |

The report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK OR CREDIT UNION GUARANTEE •

NOT A DEPOSIT • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF

MFS Blended Research Core Equity Portfolio

Dear Contract Owners:

After a powerful rally in 2021 that was spurred by the introduction of effective coronavirus vaccines and high levels of monetary and fiscal stimulus, markets have recently experienced a rise in volatility. Rising inflation (mostly due to pandemic-related labor and supply chain disruptions), new COVID-19 variants that are vaccine-resistant, and the prospect of tighter monetary and fiscal policies around the world have all increased investor anxiety.

Rising real (inflation-adjusted) bond yields in the United States are a headwind for richly valued U.S. growth stocks, though many non-U.S. markets have experienced lower levels of turbulence. In recent months, global economic growth has moderated, with the spread of the Delta and Omicron variants and a regulatory crackdown in China featuring prominently. Stress in China’s property development sector has also contributed to the slowdown there. A further concern for investors is the tightening of global energy and raw materials supplies caused in part by geopolitical uncertainty.

However, above-trend economic growth, strong corporate balance sheets, and nascent signs that global supply chain bottlenecks may be easing, along with a dovish policy shift in China, are supportive fundamentals that we feel could help calm recent market jitters.

It is times of market transition that demonstrate the importance of having a deep understanding of company fundamentals, and we have built our global research platform to do just that.

At MFS®, we put our clients’ assets to work responsibly by carefully navigating the increasing complexity of global markets and economies. Guided by our commitment to long-term investing, we tune out the noise and try to uncover what we believe are the best, most durable investment opportunities in the market. Our unique global investment platform combines collective expertise, long-term discipline, and thoughtful risk management to create sustainable value for investors.

Respectfully,

Michael W. Roberge

Chief Executive Officer

MFS Investment Management

February 15, 2022

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

MFS Blended Research Core Equity Portfolio

Top ten holdings

| Microsoft Corp. | 7.9% |

| Apple, Inc. | 6.0% |

| Amazon.com, Inc. | 3.8% |

| Alphabet, Inc., “C” | 3.1% |

| Alphabet, Inc., “A” | 2.8% |

| JPMorgan Chase & Co. | 2.4% |

| Johnson & Johnson | 2.3% |

| Accenture PLC, “A” | 2.2% |

| Meta Platforms, Inc., “A” | 1.9% |

| Applied Materials, Inc. | 1.8% |

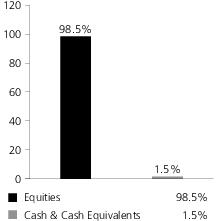

GICS equity sectors (g)

| Information Technology | 29.6% |

| Health Care | 13.9% |

| Consumer Discretionary | 12.2% |

| Financials | 10.5% |

| Communication Services | 10.2% |

| Industrials | 7.2% |

| Consumer Staples | 6.2% |

| Real Estate | 3.5% |

| Energy | 2.6% |

| Materials | 2.0% |

| Utilities | 1.8% |

| (g) | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and S&P Global Market Intelligence Inc. (“S&P Global Market Intelligence”). GICS is a service mark of MSCI and S&P Global Market Intelligence and has been licensed for use by MFS. MFS has applied its own internal sector/industry classification methodology for equity securities and non-equity securities that are unclassified by GICS. |

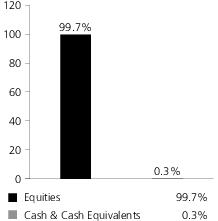

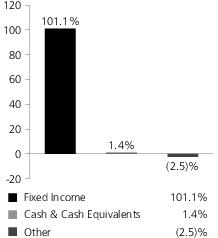

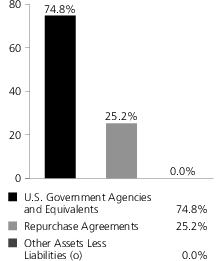

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of December 31, 2021.

The portfolio is actively managed and current holdings may be different.

MFS Blended Research Core Equity Portfolio

Management Review

Summary of Results

For the twelve months ended December 31, 2021, Initial Class shares of the MFS Blended Research Core Equity Portfolio (fund) provided a total return of 29.53%, while Service Class shares of the fund provided a total return of 29.18%. These compare with a return of 28.71% over the same period for the fund's benchmark, the Standard & Poor’s 500 Stock Index (S&P 500 Index).

Market Environment

Over the past year, the global economy was buffeted by an array of crosscurrents as it adjusted to the ebbs and flows of the pandemic. Among the supportive currents were ample fiscal stimulus, loose monetary policy and the rollout of several highly effective coronavirus vaccines. Negative currents included the rapid spread of several coronavirus variants, widespread global production bottlenecks and a surge in inflation. After experiencing a burst of exceptionally strong economic activity as the global economy began to reopen, activity became more muted in the second half of the period amid ongoing supply chain disruptions and a new wave of coronavirus infections, albeit a seemingly milder strain.

Amid rising inflation, markets anticipated a transition from an exceptionally accommodative environment to a more mixed monetary landscape ahead. Indeed, several central banks in emerging markets have already tightened policy and the US Federal Reserve reduced the pace of its asset purchases in November and again in December. However, the European Central Bank, the Bank of Japan and the People's Bank of China are expected to maintain accommodative policies. Sovereign bond yields moved modestly higher during the period amid higher inflation and on expectations of a tighter Fed but remain historically low.

A harsher Chinese regulatory environment toward industries such as online gaming, food delivery and education increased market volatility as has stress in China's highly leveraged property development sector. Trade relations between the United States and China remained quite strained despite a change in presidential administrations.

Signs of excess investor enthusiasm continued to be seen in pockets of the market such as “meme stocks” popular with users of online message boards, cryptocurrencies and heavy retail participation in the market for short-dated options.

Contributors to Performance

Stock selection in the industrials, communication services and information technology sectors benefited the fund’s performance relative to the S&P 500 Index. There were no individual stocks within the industrials sector, either in the fund or in the benchmark, that were among the fund's top relative contributors over the reporting period. Within the communication services sector, the fund’s overweight position in technology company Alphabet, and its underweight position in diversified entertainment company Walt Disney(h), boosted relative performance. The stock price of Alphabet climbed as the company reported strong advertising sales growth across Google Services, particularly in search and YouTube, and continued revenue growth in cloud. Within the information technology sector, the fund’s overweight positions in semiconductor chips and electronics engineering solutions provider Applied Materials, IT servicing firm Accenture and software giant Microsoft also supported relative returns. The share price of Applied Materials advanced on strength in its semiconductor equipment segment and as management raised its 2021 guidance and outlook, citing acceleration in its semiconductor business as demand for semiconductors rose.

Elsewhere, the fund's overweight positions in real estate investment trust Extra Space Storage, financial services firm Bank of America, hospital operator HCA Healthcare, financial services firm Goldman Sachs Group and pharmaceutical company Eli Lilly bolstered relative results. The share price of Extra Space Storage climbed on the back of stronger-than-expected occupancy and rent levels, robust net operating income and lower expenses.

Detractors from Performance

Security selection in the consumer discretionary sector held back relative performance, led by the fund's underweight position in electric vehicle manufacturer Tesla. The share price of Tesla advanced considerably during the second half of the year, following significantly better-than-expected vehicle deliveries and the company's ability to overcome supply chain issues that affected the whole auto industry. Moreover, favorable pricing of its model 3 and Y vehicles helped improve Tesla’s profitability, which also had a positive impact on its share price growth.

Stock selection in both the health care and consumer staples sectors also weakened relative results. Within the health care sector, the fund’s overweight positions in medical device maker Medtronic, pharmaceutical company Merck and diversified medical products maker Johnson & Johnson dampened relative returns. The share price of Medtronic fell as the company reported weaker-than-expected revenue growth, led by impacts from COVID-19 that considerably affected its Cardiovascular and NeuroScience segments. As a result, Medtronic reduced its organic growth guidance, which further pressured the stock price. The timing of the fund’s ownership in shares of pharmaceutical giant Pfizer further weighed on relative performance. Within the consumer staples sector, overweight positions in retail giant Walmart and global consumer products company Colgate-Palmolive were among the fund’s top relative detractors.

MFS Blended Research Core Equity Portfolio

Management Review - continued

Elsewhere, the fund’s underweight positions in computer graphics processor maker NVIDIA and diversified financial services firm Wells Fargo, and its overweight position in cable services provider Charter Communications, further hindered relative results. The share price of NVIDIA appreciated as the company posted strong revenue growth, driven by better-than-anticipated broad-based demand and capacity additions at its Gaming, Datacenter, and Pro Vis segments.

Respectfully,

Portfolio Manager(s)

Jim Fallon, Matt Krummell, Jonathan Sage, and Jed Stocks

| (h) | Security was not held in the portfolio at period end. |

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

MFS Blended Research Core Equity Portfolio

Performance Summary Through 12/31/21

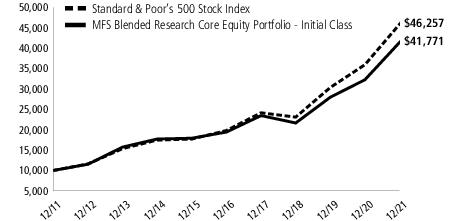

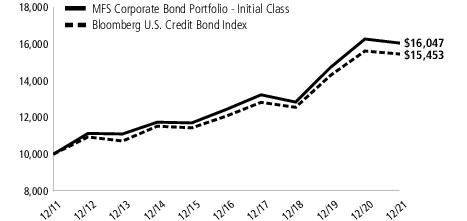

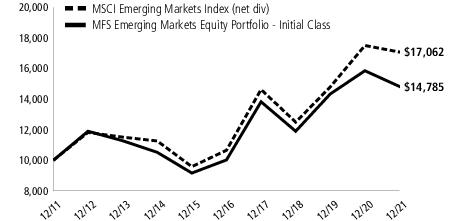

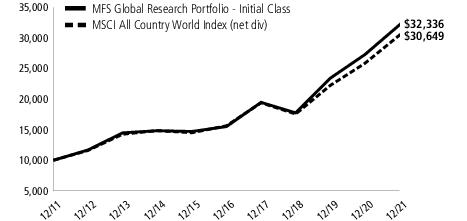

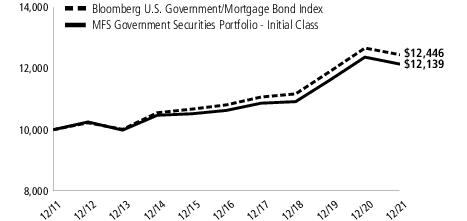

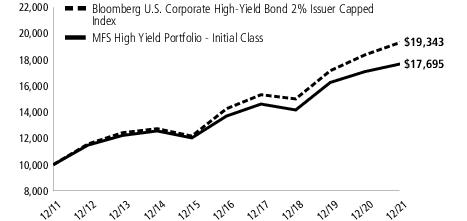

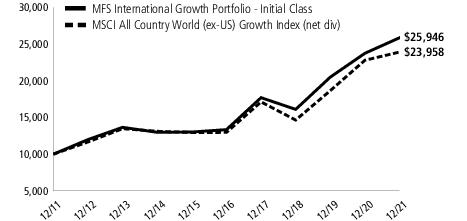

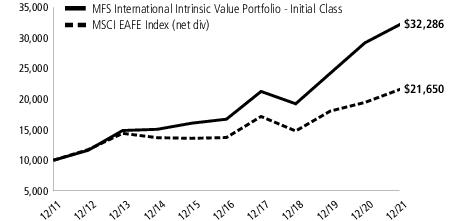

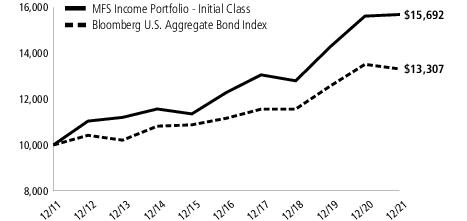

The following chart illustrates the historical performance of the fund in comparison to its benchmark(s). Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect any fees or expenses. The performance of other share classes will be greater than or less than that of the class depicted below. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your units, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a contract holder would pay on fund distributions or the redemption of contract units. The returns for the fund shown also do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges imposed by the insurance company separate accounts. Such expenses would reduce the overall returns shown.

Growth of a Hypothetical $10,000 Investment

Total Returns through 12/31/21

Average annual with sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr |

| Initial Class | 11/14/86 | 29.53% | 16.54% | 15.37% |

| Service Class | 8/24/01 | 29.18% | 16.25% | 15.08% |

Comparative benchmark(s)

| Standard & Poor's 500 Stock Index (f) | 28.71% | 18.47% | 16.55% |

| (f) | Source: FactSet Research Systems Inc. |

Benchmark Definition(s)

Standard & Poor's 500 Stock Index(g) – a market capitalization-weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance.

It is not possible to invest directly in an index.

| (g) | “Standard & Poor's®” and “S&P®” are registered trademarks of Standard & Poor's Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS's product(s) is not sponsored, endorsed, sold, or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, nor their respective affiliates make any representation regarding the advisability of investing in such product(s). |

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund's performance results would be less favorable. Please see the prospectus and financial statements for complete details. All results are historical and assume the reinvestment of any dividends and capital gains distributions.

MFS Blended Research Core Equity Portfolio

Performance Summary – continued

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

MFS Blended Research Core Equity Portfolio

Expense Table

Fund Expenses Borne by the Contract Holders during the Period,

July 1, 2021 through December 31, 2021

As a contract holder of the fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2021 through December 31, 2021.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight the fund's ongoing costs only and do not take into account the fees and expenses imposed under the variable contracts through which your investment in the fund is made. Therefore, the second line for each share class in the table is useful in comparing ongoing costs associated with an investment in vehicles (such as the fund) which fund benefits under variable annuity and variable life insurance contracts and to qualified pension and retirement plans only, and will not help you determine the relative total costs of investing in the fund through variable annuity and variable life insurance contracts. If the fees and expenses imposed under the variable contracts were included, your costs would have been higher.

Share

Class | | Annualized

Expense

Ratio | Beginning

Account Value

7/01/21 | Ending

Account Value

12/31/21 | Expenses

Paid During

Period (p)

7/01/21-12/31/21 |

| Initial Class | Actual | 0.43% | $1,000.00 | $1,103.40 | $2.28 |

| Hypothetical (h) | 0.43% | $1,000.00 | $1,023.04 | $2.19 |

| Service Class | Actual | 0.68% | $1,000.00 | $1,101.89 | $3.60 |

| Hypothetical (h) | 0.68% | $1,000.00 | $1,021.78 | $3.47 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class's annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

MFS Blended Research Core Equity Portfolio

Portfolio of Investments − 12/31/21

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – 99.7% |

| Aerospace & Defense – 1.5% | |

| Honeywell International, Inc. | | 8,574 | $ 1,787,765 |

| Huntington Ingalls Industries, Inc. | | 5,871 | 1,096,350 |

| Northrop Grumman Corp. | | 12,383 | 4,793,088 |

| Raytheon Technologies Corp. | | 6,147 | 529,011 |

| | | | | $8,206,214 |

| Alcoholic Beverages – 0.2% | |

| Constellation Brands, Inc., “A” | | 5,212 | $ 1,308,056 |

| Apparel Manufacturers – 0.2% | |

| NIKE, Inc., “B” | | 7,321 | $ 1,220,191 |

| Automotive – 2.0% | |

| Lear Corp. | | 13,455 | $ 2,461,592 |

| LKQ Corp. | | 26,262 | 1,576,508 |

| Tesla, Inc. (a) | | 6,087 | 6,432,620 |

| | | | | $10,470,720 |

| Biotechnology – 1.5% | |

| Biogen, Inc. (a) | | 10,553 | $ 2,531,876 |

| Gilead Sciences, Inc. | | 15,569 | 1,130,465 |

| Incyte Corp. (a) | | 6,117 | 448,988 |

| Vertex Pharmaceuticals, Inc. (a) | | 17,375 | 3,815,550 |

| | | | | $7,926,879 |

| Brokerage & Asset Managers – 0.6% | |

| Invesco Ltd. | | 83,316 | $ 1,917,934 |

| KKR & Co., Inc. | | 13,849 | 1,031,751 |

| | | | | $2,949,685 |

| Business Services – 2.9% | |

| Accenture PLC, “A” | | 28,620 | $ 11,864,421 |

| Amdocs Ltd. | | 7,899 | 591,161 |

| PayPal Holdings, Inc. (a) | | 17,308 | 3,263,943 |

| | | | | $15,719,525 |

| Cable TV – 1.8% | |

| Charter Communications, Inc., “A” (a) | | 11,225 | $ 7,318,363 |

| Comcast Corp., “A” | | 42,134 | 2,120,604 |

| | | | | $9,438,967 |

| Chemicals – 0.5% | |

| Eastman Chemical Co. | | 23,395 | $ 2,828,689 |

| Computer Software – 10.0% | |

| Adobe Systems, Inc. (a) | | 16,417 | $ 9,309,424 |

| Atlassian Corp. PLC, “A” (a) | | 5,304 | 2,022,362 |

| Microsoft Corp. | | 126,068 | 42,399,190 |

| | | | | $53,730,976 |

MFS Blended Research Core Equity Portfolio

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Computer Software - Systems – 7.9% | |

| Apple, Inc. | | 179,634 | $ 31,897,609 |

| EPAM Systems, Inc. (a) | | 1,840 | 1,229,948 |

| HP, Inc. | | 125,830 | 4,740,016 |

| ServiceNow, Inc. (a) | | 3,027 | 1,964,856 |

| SS&C Technologies Holdings, Inc. | | 18,860 | 1,546,143 |

| Zebra Technologies Corp., “A” (a) | | 1,926 | 1,146,355 |

| | | | | $42,524,927 |

| Construction – 0.5% | |

| Otis Worldwide Corp. | | 14,473 | $ 1,260,164 |

| Sherwin-Williams Co. | | 3,687 | 1,298,414 |

| | | | | $2,558,578 |

| Consumer Products – 1.2% | |

| Colgate-Palmolive Co. | | 73,506 | $ 6,273,002 |

| Consumer Services – 1.1% | |

| Booking Holdings, Inc. (a) | | 2,452 | $ 5,882,912 |

| Electrical Equipment – 1.5% | |

| Johnson Controls International PLC | | 57,808 | $ 4,700,368 |

| TE Connectivity Ltd. | | 20,497 | 3,306,986 |

| | | | | $8,007,354 |

| Electronics – 7.0% | |

| Advanced Micro Devices (a) | | 22,462 | $ 3,232,282 |

| Applied Materials, Inc. | | 62,879 | 9,894,639 |

| Intel Corp. | | 99,235 | 5,110,603 |

| NVIDIA Corp. | | 20,680 | 6,082,195 |

| NXP Semiconductors N.V. | | 20,217 | 4,605,028 |

| Texas Instruments, Inc. | | 44,194 | 8,329,243 |

| | | | | $37,253,990 |

| Energy - Independent – 1.4% | |

| EOG Resources, Inc. | | 29,852 | $ 2,651,753 |

| Valero Energy Corp. | | 65,755 | 4,938,858 |

| | | | | $7,590,611 |

| Food & Beverages – 3.2% | |

| Archer Daniels Midland Co. | | 68,638 | $ 4,639,242 |

| General Mills, Inc. | | 21,281 | 1,433,914 |

| J.M. Smucker Co. | | 15,738 | 2,137,535 |

| Mondelez International, Inc. | | 75,613 | 5,013,898 |

| PepsiCo, Inc. | | 23,395 | 4,063,946 |

| | | | | $17,288,535 |

| Food & Drug Stores – 1.4% | |

| Wal-Mart Stores, Inc. | | 50,636 | $ 7,326,523 |

| Forest & Paper Products – 0.3% | |

| Rayonier, Inc., REIT | | 20,889 | $ 843,080 |

| Weyerhaeuser Co., REIT | | 20,649 | 850,326 |

| | | | | $1,693,406 |

MFS Blended Research Core Equity Portfolio

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Gaming & Lodging – 0.4% | |

| International Game Technology PLC | | 32,903 | $ 951,226 |

| Marriott International, Inc., “A” (a) | | 8,137 | 1,344,558 |

| | | | | $2,295,784 |

| Health Maintenance Organizations – 1.5% | |

| Cigna Corp. | | 19,115 | $ 4,389,377 |

| Humana, Inc. | | 6,502 | 3,016,018 |

| UnitedHealth Group, Inc. | | 1,120 | 562,397 |

| | | | | $7,967,792 |

| Insurance – 3.1% | |

| Berkshire Hathaway, Inc., “B” (a) | | 6,201 | $ 1,854,099 |

| Equitable Holdings, Inc. | | 44,479 | 1,458,466 |

| Everest Re Group Ltd. | | 19,241 | 5,270,495 |

| Hartford Financial Services Group, Inc. | | 8,114 | 560,191 |

| MetLife, Inc. | | 110,214 | 6,887,273 |

| Reinsurance Group of America, Inc. | | 3,901 | 427,120 |

| | | | | $16,457,644 |

| Internet – 8.3% | |

| Alphabet, Inc., “A” (a) | | 5,213 | $ 15,102,270 |

| Alphabet, Inc., “C” (a) | | 5,683 | 16,444,272 |

| Gartner, Inc. (a) | | 8,325 | 2,783,214 |

| Meta Platforms, Inc., “A” (a) | | 29,521 | 9,929,388 |

| | | | | $44,259,144 |

| Leisure & Toys – 1.9% | |

| Brunswick Corp. | | 55,785 | $ 5,619,223 |

| Electronic Arts, Inc. | | 15,140 | 1,996,966 |

| Polaris, Inc. | | 20,870 | 2,293,822 |

| | | | | $9,910,011 |

| Machinery & Tools – 2.0% | |

| AGCO Corp. | | 21,628 | $ 2,509,281 |

| Eaton Corp. PLC | | 35,614 | 6,154,811 |

| Regal Rexnord Corp. | | 12,488 | 2,125,208 |

| | | | | $10,789,300 |

| Major Banks – 5.7% | |

| Bank of America Corp. | | 98,199 | $ 4,368,874 |

| Goldman Sachs Group, Inc. | | 21,819 | 8,346,858 |

| JPMorgan Chase & Co. | | 79,725 | 12,624,454 |

| Wells Fargo & Co. | | 104,640 | 5,020,627 |

| | | | | $30,360,813 |

| Medical & Health Technology & Services – 2.9% | |

| HCA Healthcare, Inc. | | 8,851 | $ 2,273,999 |

| Laboratory Corp. of America Holdings (a) | | 15,835 | 4,975,515 |

| McKesson Corp. | | 32,576 | 8,097,416 |

| | | | | $15,346,930 |

| Medical Equipment – 2.9% | |

| Abbott Laboratories | | 12,849 | $ 1,808,368 |

| Align Technology, Inc. (a) | | 1,453 | 954,883 |

| Boston Scientific Corp. (a) | | 25,126 | 1,067,352 |

MFS Blended Research Core Equity Portfolio

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Medical Equipment – continued | |

| Danaher Corp. | | 5,886 | $ 1,936,553 |

| Medtronic PLC | | 52,450 | 5,425,953 |

| Thermo Fisher Scientific, Inc. | | 6,260 | 4,176,922 |

| | | | | $15,370,031 |

| Natural Gas - Pipeline – 1.0% | |

| Cheniere Energy, Inc. | | 26,618 | $ 2,699,598 |

| ONEOK, Inc. | | 43,095 | 2,532,262 |

| | | | | $5,231,860 |

| Oil Services – 0.2% | |

| NOV, Inc. | | 70,783 | $ 959,110 |

| Other Banks & Diversified Financials – 1.7% | |

| American Express Co. | | 7,968 | $ 1,303,565 |

| SLM Corp. | | 204,260 | 4,017,794 |

| Synchrony Financial | | 21,859 | 1,014,039 |

| Visa, Inc., “A” | | 13,888 | 3,009,668 |

| | | | | $9,345,066 |

| Pharmaceuticals – 5.2% | |

| Bristol-Myers Squibb Co. | | 8,532 | $ 531,970 |

| Eli Lilly & Co. | | 22,990 | 6,350,298 |

| Johnson & Johnson | | 71,524 | 12,235,611 |

| Merck & Co., Inc. | | 103,657 | 7,944,272 |

| Pfizer, Inc. | | 10,006 | 590,854 |

| | | | | $27,653,005 |

| Railroad & Shipping – 1.1% | |

| CSX Corp. | | 160,253 | $ 6,025,513 |

| Real Estate – 3.2% | |

| Extra Space Storage, Inc., REIT | | 33,265 | $ 7,542,174 |

| Life Storage, Inc., REIT | | 21,146 | 3,239,144 |

| Simon Property Group, Inc., REIT | | 31,041 | 4,959,421 |

| Spirit Realty Capital, Inc., REIT | | 31,665 | 1,525,936 |

| | | | | $17,266,675 |

| Restaurants – 1.4% | |

| Starbucks Corp. | | 48,088 | $ 5,624,853 |

| Texas Roadhouse, Inc. | | 23,478 | 2,096,116 |

| | | | | $7,720,969 |

| Specialty Chemicals – 1.2% | |

| Corteva, Inc. | | 48,796 | $ 2,307,075 |

| DuPont de Nemours, Inc. | | 20,425 | 1,649,932 |

| Linde PLC | | 7,543 | 2,613,121 |

| | | | | $6,570,128 |

| Specialty Stores – 5.6% | |

| Amazon.com, Inc. (a) | | 6,142 | $ 20,479,516 |

| AutoZone, Inc. (a) | | 952 | 1,995,763 |

| Home Depot, Inc. | | 14,161 | 5,876,957 |

MFS Blended Research Core Equity Portfolio

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Specialty Stores – continued | |

| Ross Stores, Inc. | | 12,430 | $ 1,420,500 |

| | | | | $29,772,736 |

| Telephone Services – 0.3% | |

| Lumen Technologies, Inc. | | 139,994 | $ 1,756,925 |

| Tobacco – 0.2% | |

| Philip Morris International, Inc. | | 11,763 | $ 1,117,485 |

| Trucking – 1.4% | |

| Knight-Swift Transportation Holdings, Inc. | | 30,360 | $ 1,850,138 |

| United Parcel Service, Inc., “B” | | 26,700 | 5,722,878 |

| | | | | $7,573,016 |

| Utilities - Electric Power – 1.8% | |

| American Electric Power Co., Inc. | | 6,167 | $ 548,678 |

| CenterPoint Energy, Inc. | | 36,244 | 1,011,570 |

| Exelon Corp. | | 138,235 | 7,984,454 |

| | | | | $9,544,702 |

| Total Common Stocks (Identified Cost, $322,426,262) | | $533,494,379 |

| Investment Companies (h) – 0.3% |

| Money Market Funds – 0.3% | |

| MFS Institutional Money Market Portfolio, 0.07% (v) (Identified Cost, $1,708,524) | | | 1,708,524 | $ 1,708,524 |

| Other Assets, Less Liabilities – (0.0)% | | (116,031) |

| Net Assets – 100.0% | $535,086,872 |

| (a) | Non-income producing security. | | | |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $1,708,524 and $533,494,379, respectively. | | | |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. | | | |

| The following abbreviations are used in this report and are defined: |

| REIT | Real Estate Investment Trust |

See Notes to Financial Statements

MFS Blended Research Core Equity Portfolio

| Financial Statements | Statement of Assets and Liabilities |

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| At 12/31/21Assets | |

| Investments in unaffiliated issuers, at value (identified cost, $322,426,262) | $533,494,379 |

| Investments in affiliated issuers, at value (identified cost, $1,708,524) | 1,708,524 |

| Cash | 20,733 |

| Receivables for | |

| Fund shares sold | 4,110 |

| Dividends | 356,534 |

| Other assets | 2,453 |

| Total assets | $535,586,733 |

| Liabilities | |

| Payables for | |

| Fund shares reacquired | $408,924 |

| Payable to affiliates | |

| Investment adviser | 11,371 |

| Administrative services fee | 452 |

| Shareholder servicing costs | 117 |

| Distribution and/or service fees | 3,045 |

| Payable for independent Trustees' compensation | 183 |

| Accrued expenses and other liabilities | 75,769 |

| Total liabilities | $499,861 |

| Net assets | $535,086,872 |

| Net assets consist of | |

| Paid-in capital | $244,442,827 |

| Total distributable earnings (loss) | 290,644,045 |

| Net assets | $535,086,872 |

| Shares of beneficial interest outstanding | 7,847,426 |

| | Net assets | Shares

outstanding | Net asset value

per share |

| Initial Class | $313,788,176 | 4,579,162 | $68.53 |

| Service Class | 221,298,696 | 3,268,264 | 67.71 |

See Notes to Financial Statements

MFS Blended Research Core Equity Portfolio

| Financial Statements | Statement of Operations |

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Year ended 12/31/21 | |

| Net investment income (loss) | |

| Income | |

| Dividends | $7,234,636 |

| Other | 19,505 |

| Dividends from affiliated issuers | 1,289 |

| Income on securities loaned | 903 |

| Foreign taxes withheld | (4,122) |

| Total investment income | $7,252,211 |

| Expenses | |

| Management fee | $2,051,308 |

| Distribution and/or service fees | 527,268 |

| Shareholder servicing costs | 17,906 |

| Administrative services fee | 77,500 |

| Independent Trustees' compensation | 9,279 |

| Custodian fee | 23,112 |

| Shareholder communications | 23,711 |

| Audit and tax fees | 56,230 |

| Legal fees | 2,541 |

| Miscellaneous | 24,811 |

| Total expenses | $2,813,666 |

| Reduction of expenses by investment adviser | (65,158) |

| Net expenses | $2,748,508 |

| Net investment income (loss) | $4,503,703 |

| Realized and unrealized gain (loss) | |

| Realized gain (loss) (identified cost basis) | |

| Unaffiliated issuers | $75,588,447 |

| Change in unrealized appreciation or depreciation | |

| Unaffiliated issuers | $50,895,083 |

| Net realized and unrealized gain (loss) | $126,483,530 |

| Change in net assets from operations | $130,987,233 |

See Notes to Financial Statements

MFS Blended Research Core Equity Portfolio

| Financial Statements | Statements of Changes in Net Assets |

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | Year ended |

| | 12/31/21 | 12/31/20 |

| Change in net assets | | |

| From operations | | |

| Net investment income (loss) | $4,503,703 | $5,213,358 |

| Net realized gain (loss) | 75,588,447 | 34,962,421 |

| Net unrealized gain (loss) | 50,895,083 | 22,756,111 |

| Change in net assets from operations | $130,987,233 | $62,931,890 |

| Total distributions to shareholders | $(40,220,081) | $(29,241,138) |

| Change in net assets from fund share transactions | $(28,019,737) | $(33,385,390) |

| Total change in net assets | $62,747,415 | $305,362 |

| Net assets | | |

| At beginning of period | 472,339,457 | 472,034,095 |

| At end of period | $535,086,872 | $472,339,457 |

See Notes to Financial Statements

MFS Blended Research Core Equity Portfolio

| Financial Statements | Financial Highlights |

The financial highlights table is intended to help you understand the fund's financial performance for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Initial Class | Year ended |

| | 12/31/21 | 12/31/20 | 12/31/19 | 12/31/18 | 12/31/17 |

| Net asset value, beginning of period | $57.28 | $53.06 | $45.29 | $54.23 | $46.62 |

| Income (loss) from investment operations | | | | | |

| Net investment income (loss) (d) | $0.63 | $0.67 | $0.80 | $0.74 | $0.68 |

| Net realized and unrealized gain (loss) | 15.96 | 7.21 | 11.74 | (4.12) | 8.80 |

| Total from investment operations | $16.59 | $7.88 | $12.54 | $(3.38) | $9.48 |

| Less distributions declared to shareholders | | | | | |

| From net investment income | $(0.74) | $(0.88) | $(0.79) | $(0.77) | $(0.78) |

| From net realized gain | (4.60) | (2.78) | (3.98) | (4.79) | (1.09) |

| Total distributions declared to shareholders | $(5.34) | $(3.66) | $(4.77) | $(5.56) | $(1.87) |

| Net asset value, end of period (x) | $68.53 | $57.28 | $53.06 | $45.29 | $54.23 |

| Total return (%) (k)(r)(s)(x) | 29.53 | 15.34 | 29.17 | (7.74) | 20.76 |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | |

| Expenses before expense reductions | 0.45 | 0.45 | 0.45 | 0.45 | 0.46 |

| Expenses after expense reductions | 0.43 | 0.44 | 0.44 | 0.44 | 0.45 |

| Net investment income (loss) | 0.98 | 1.30 | 1.58 | 1.39 | 1.35 |

| Portfolio turnover | 51 | 56 | 46 | 54 | 51 |

| Net assets at end of period (000 omitted) | $313,788 | $280,679 | $285,654 | $256,439 | $320,384 |

| Service Class | Year ended |

| | 12/31/21 | 12/31/20 | 12/31/19 | 12/31/18 | 12/31/17 |

| Net asset value, beginning of period | $56.68 | $52.54 | $44.87 | $53.79 | $46.26 |

| Income (loss) from investment operations | | | | | |

| Net investment income (loss) (d) | $0.47 | $0.54 | $0.67 | $0.61 | $0.55 |

| Net realized and unrealized gain (loss) | 15.76 | 7.12 | 11.64 | (4.11) | 8.73 |

| Total from investment operations | $16.23 | $7.66 | $12.31 | $(3.50) | $9.28 |

| Less distributions declared to shareholders | | | | | |

| From net investment income | $(0.60) | $(0.74) | $(0.66) | $(0.63) | $(0.66) |

| From net realized gain | (4.60) | (2.78) | (3.98) | (4.79) | (1.09) |

| Total distributions declared to shareholders | $(5.20) | $(3.52) | $(4.64) | $(5.42) | $(1.75) |

| Net asset value, end of period (x) | $67.71 | $56.68 | $52.54 | $44.87 | $53.79 |

| Total return (%) (k)(r)(s)(x) | 29.18 | 15.06 | 28.87 | (7.99) | 20.47 |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | |

| Expenses before expense reductions | 0.70 | 0.70 | 0.70 | 0.70 | 0.71 |

| Expenses after expense reductions | 0.68 | 0.69 | 0.69 | 0.69 | 0.70 |

| Net investment income (loss) | 0.73 | 1.05 | 1.33 | 1.14 | 1.10 |

| Portfolio turnover | 51 | 56 | 46 | 54 | 51 |

| Net assets at end of period (000 omitted) | $221,299 | $191,661 | $186,380 | $157,522 | $182,103 |

See Notes to Financial Statements

MFS Blended Research Core Equity Portfolio

Financial Highlights - continued

| (d) | Per share data is based on average shares outstanding. |

| (k) | The total return does not reflect expenses that apply to separate accounts. Inclusion of these charges would reduce the total return figures for all periods shown. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

MFS Blended Research Core Equity Portfolio

Notes to Financial Statements

(1) Business and Organization

MFS Blended Research Core Equity Portfolio (the fund) is a diversified series of MFS Variable Insurance Trust II (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The shareholders of each series of the trust are separate accounts of insurance companies, which offer variable annuity and/or life insurance products, and qualified retirement and pension plans.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies.

(2) Significant Accounting Policies

General — The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

Balance Sheet Offsetting — The fund's accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund's right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations — Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation on their primary market or exchange as provided by a third-party pricing service. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share.

Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halt of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

MFS Blended Research Core Equity Portfolio

Notes to Financial Statements - continued

Various inputs are used in determining the value of the fund's assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment's level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser's own assumptions in determining the fair value of investments. The following is a summary of the levels used as of December 31, 2021 in valuing the fund's assets and liabilities:

| Financial Instruments | Level 1 | Level 2 | Level 3 | Total |

| Equity Securities | $533,494,379 | $— | $— | $533,494,379 |

| Mutual Funds | 1,708,524 | — | — | 1,708,524 |

| Total | $535,202,903 | $— | $— | $535,202,903 |

For further information regarding security characteristics, see the Portfolio of Investments.

Security Loans — Under its Securities Lending Agency Agreement with the fund, State Street Bank and Trust Company, as lending agent, loans the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. Security loans can be terminated at the discretion of either the lending agent or the fund and the related securities must be returned within the earlier of the standard trade settlement period for such securities or within three business days. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. On loans collateralized by cash, the cash collateral is invested in a money market fund. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. The lending agent provides the fund with indemnification against Borrower default. In the event of Borrower default, the lending agent will, for the benefit of the fund, either purchase securities identical to those loaned or, when such purchase is commercially impracticable, pay the fund the market value of the loaned securities. In return, the lending agent assumes the fund's rights to the related collateral. If the collateral value is less than the cost to purchase identical securities, the lending agent is responsible for the shortfall, but only to the extent that such shortfall is not due to a decline in collateral value resulting from collateral reinvestment for which the fund bears the risk of loss. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is separately reported in the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income. At December 31, 2021, there were no securities on loan or collateral outstanding.

Indemnifications — Under the fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund's maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income — Investment transactions are recorded on the trade date. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend payments received in additional securities are recorded on the ex-dividend date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Tax Matters and Distributions — The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements in accordance with the applicable foreign tax law. Foreign income taxes may be withheld by certain countries in which the fund invests. Additionally, capital gains realized by the fund on securities issued in or by certain foreign countries may be subject to capital gains tax imposed by those countries.

MFS Blended Research Core Equity Portfolio

Notes to Financial Statements - continued

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future.

Book/tax differences primarily relate to wash sale loss deferrals.

The tax character of distributions declared to shareholders for the last two fiscal years is as follows:

| | Year ended

12/31/21 | Year ended

12/31/20 |

| Ordinary income (including any short-term capital gains) | $8,025,024 | $6,680,112 |

| Long-term capital gains | 32,195,057 | 22,561,026 |

| Total distributions | $40,220,081 | $29,241,138 |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of 12/31/21 | |

| Cost of investments | $324,625,853 |

| Gross appreciation | 213,958,647 |

| Gross depreciation | (3,381,597) |

| Net unrealized appreciation (depreciation) | $210,577,050 |

| Undistributed ordinary income | 22,857,328 |

| Undistributed long-term capital gain | 57,209,667 |

| Total distributable earnings (loss) | $290,644,045 |

Multiple Classes of Shares of Beneficial Interest — The fund offers multiple classes of shares, which differ in their respective distribution and/or service fees. The fund's income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. The fund’s distributions declared to shareholders as reported in the Statements of Changes in Net Assets are presented by class as follows:

| | Year

ended

12/31/21 | | Year

ended

12/31/20 |

| Initial Class | $23,828,611 | | $17,686,199 |

| Service Class | 16,391,470 | | 11,554,939 |

| Total | $40,220,081 | | $29,241,138 |

(3) Transactions with Affiliates

Investment Adviser — The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at the following annual rates based on the fund's average daily net assets:

| Up to $1 billion | 0.40% |

| In excess of $1 billion and up to $2.5 billion | 0.375% |

| In excess of $2.5 billion | 0.35% |

MFS has agreed in writing to reduce its management fee by a specified amount if certain MFS mutual fund assets exceed thresholds agreed to by MFS and the fund's Board of Trustees. For the year ended December 31, 2021, this management fee reduction amounted to $65,158, which is included in the reduction of total expenses in the Statement of Operations. The management fee incurred for the year ended December 31, 2021 was equivalent to an annual effective rate of 0.39% of the fund's average daily net assets.

Distributor — MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, is the distributor of shares of the fund. The Trustees have adopted a distribution plan for the Service Class shares pursuant to Rule 12b-1 under the Investment Company Act of 1940.

MFS Blended Research Core Equity Portfolio

Notes to Financial Statements - continued

The fund's distribution plan provides that the fund will pay MFD distribution and/or service fees equal to 0.25% per annum of its average daily net assets attributable to Service Class shares as partial consideration for services performed and expenses incurred by MFD and financial intermediaries (including participating insurance companies that invest in the fund to fund variable annuity and variable life insurance contracts, sponsors of qualified retirement and pension plans that invest in the fund, and affiliates of these participating insurance companies and plan sponsors) in connection with the sale and distribution of the Service Class shares. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Shareholder Servicing Agent — MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent. For the year ended December 31, 2021, the fee was $17,113, which equated to 0.0033% annually of the fund's average daily net assets. MFSC also receives reimbursement from the fund for out-of-pocket expenses paid by MFSC on behalf of the fund. For the year ended December 31, 2021, these costs amounted to $793.

Administrator — MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the year ended December 31, 2021 was equivalent to an annual effective rate of 0.0151% of the fund's average daily net assets.

Trustees’ and Officers’ Compensation — The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration from MFS for their services to the fund. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Other — The fund invests in the MFS Institutional Money Market Portfolio which is managed by MFS and seeks current income consistent with preservation of capital and liquidity. This money market fund does not pay a management fee to MFS but does incur investment and operating costs.

The fund is permitted to engage in purchase and sale transactions with funds and accounts for which MFS serves as investment adviser or sub-adviser (“cross-trades”) pursuant to a policy adopted by the Board of Trustees. This policy has been designed to ensure that cross-trades conducted by the fund comply with Rule 17a-7 under the Investment Company Act of 1940. During the year ended December 31, 2021, the fund engaged in sale transactions pursuant to this policy, which amounted to $9,435. The sales transactions resulted in net realized gains (losses) of $2,295.

The adviser has voluntarily undertaken to reimburse the fund from its own resources on a quarterly basis for the cost of investment research embedded in the cost of the fund’s securities trades. This agreement may be rescinded at any time. For the year ended December 31, 2021, this reimbursement amounted to $19,440, which is included in “Other” income in the Statement of Operations.

(4) Portfolio Securities

For the year ended December 31, 2021, purchases and sales of investments, other than short-term obligations, aggregated $257,887,132 and $320,219,004, respectively.

(5) Shares of Beneficial Interest

The fund's Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| | Year ended

12/31/21 | | Year ended

12/31/20 |

| | Shares | Amount | | Shares | Amount |

| Shares sold | | | | | |

| Initial Class | 87,937 | $5,655,805 | | 63,891 | $3,132,327 |

| Service Class | 205,265 | 13,181,638 | | 183,279 | 8,493,425 |

| | 293,202 | $18,837,443 | | 247,170 | $11,625,752 |

Shares issued to shareholders

in reinvestment of distributions | | | | | |

| Initial Class | 363,572 | $23,508,544 | | 326,069 | $17,421,868 |

| Service Class | 256,317 | 16,391,470 | | 218,389 | 11,554,939 |

| | 619,889 | $39,900,014 | | 544,458 | $28,976,807 |

MFS Blended Research Core Equity Portfolio

Notes to Financial Statements - continued

| | Year ended

12/31/21 | | Year ended

12/31/20 |

| | Shares | Amount | | Shares | Amount |

| Shares reacquired | | | | | |

| Initial Class | (772,417) | $(49,707,987) | | (873,552) | $(45,226,511) |

| Service Class | (574,966) | (37,049,207) | | (567,361) | (28,761,438) |

| | (1,347,383) | $(86,757,194) | | (1,440,913) | $(73,987,949) |

| Net change | | | | | |

| Initial Class | (320,908) | $(20,543,638) | | (483,592) | $(24,672,316) |

| Service Class | (113,384) | (7,476,099) | | (165,693) | (8,713,074) |

| | (434,292) | $(28,019,737) | | (649,285) | $(33,385,390) |

(6) Line of Credit

The fund and certain other funds managed by MFS participate in a $1.25 billion unsecured committed line of credit of which $1 billion is reserved for use by the fund and certain other MFS U.S. funds. The line of credit is provided by a syndicate of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the highest of one month LIBOR, the Federal Funds Effective Rate and the Overnight Bank Funding Rate, plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating funds. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at rates equal to customary reference rates plus an agreed upon spread. For the year ended December 31, 2021, the fund’s commitment fee and interest expense were $1,576 and $0, respectively, and are included in “Miscellaneous” expense in the Statement of Operations.

(7) Investments in Affiliated Issuers

An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. For the purposes of this report, the following were affiliated issuers:

| Affiliated Issuers | Beginning

Value | Purchases | Sales

Proceeds | Realized

Gain

(Loss) | Change in

Unrealized

Appreciation or

Depreciation | Ending

Value |

| MFS Institutional Money Market Portfolio | $2,205,534 | $65,904,090 | $66,401,100 | $— | $— | $1,708,524 |

| Affiliated Issuers | Dividend

Income | Capital Gain

Distributions |

| MFS Institutional Money Market Portfolio | $1,289 | $— |

(8) Impacts of COVID-19

The pandemic related to the global spread of novel coronavirus disease (COVID-19), which was first detected in December 2019, has resulted in significant disruptions to global business activity and the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the securities and commodities markets in general. Multiple surges in cases globally, the availability and widespread adoption of vaccines, and the emergence of variant strains of the virus continue to create uncertainty as to the future and long-term impacts resulting from the pandemic including impacts to the prices and liquidity of the fund's investments and the fund's performance.

(9) LIBOR Transition

Certain of the fund's investments, including its investments in derivatives, as well as any debt issued by the fund and other contractual arrangements of the fund may be based on reference interest rates such as the London Interbank Offered Rate (“LIBOR”). In 2017, the regulatory authority that oversees financial services firms in the United Kingdom announced plans to transition away from LIBOR by the end of 2021. In March 2021, the administrator of LIBOR announced the extension of the publication of the more commonly used U.S. dollar LIBOR settings to the end of June 2023. Although the full impacts of the

MFS Blended Research Core Equity Portfolio

Notes to Financial Statements - continued

transition away from LIBOR are not fully known, the transition may result in, among other things, an increase in volatility or illiquidity of the markets for instruments that currently rely on LIBOR to determine interest rates and this could have an adverse impact on the fund's performance. With respect to the fund's accounting for investments, including its investments in derivatives, as well as any debt issued by the fund and other contractual arrangements of the fund that undergo reference rate-related modifications as a result of the transition, management will rely upon the relief provided by FASB Codification Topic 848 – Reference Rate Reform (Topic 848). The guidance in Topic 848 permits the fund to disregard the GAAP accounting requirements around certain contract modifications resulting from the LIBOR transition such that for contracts considered in scope, the fund can account for those modified contracts as a continuation of the existing contracts. While the cessation of the one-week and two-month U.S. dollar LIBOR tenors along with certain other non-U.S. dollar denominated LIBOR settings at December 31, 2021 did not have a material impact on the fund, management is still evaluating the impact to the fund of the June 30, 2023 planned discontinuation of the more commonly used U.S. dollar LIBOR settings.

MFS Blended Research Core Equity Portfolio

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of MFS Variable Insurance Trust II and the Shareholders of MFS Blended Research Core Equity Portfolio:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of MFS Blended Research Core Equity Portfolio (the “Fund”), including the portfolio of investments, as of December 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2021, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2021, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

February 15, 2022

We have served as the auditor of one or more of the MFS investment companies since 1924.

MFS Blended Research Core Equity Portfolio

Trustees and Officers — Identification and Background

The Trustees and Officers of the Trust, as of February 1, 2022, are listed below, together with their principal occupations during the past five years. (Their titles may have varied during that period.) The address of each Trustee and Officer is 111 Huntington Avenue, Boston, Massachusetts 02199-7618.

| Name, Age | | Position(s) Held with Fund | | Trustee/Officer Since(h) | | Number of MFS Funds overseen by the Trustee | | Principal Occupations During

the Past Five Years | | Other Directorships During

the Past Five Years (j) |

| INTERESTED TRUSTEES | | | | | | | | | | |

Michael W. Roberge (k)

(age 55) | | Trustee | | January 2021 | | 135 | | Massachusetts Financial Services Company, Chairman (since January 2021); Chief Executive Officer (since January 2017); Director; Chairman of the Board (since January 2022); President (until December 2018); Chief Investment Officer (until December 2018) | | N/A |

| INDEPENDENT TRUSTEES | | | | | | | | | | |

John P. Kavanaugh

(age 67) | | Trustee and Chair of Trustees | | January 2009 | | 135 | | Private investor | | N/A |

Steven E. Buller

(age 70) | | Trustee | | February 2014 | | 135 | | Private investor | | N/A |

John A. Caroselli

(age 67) | | Trustee | | March 2017 | | 135 | | Private investor; JC Global Advisors, LLC (management consulting), President (since 2015) | | N/A |

Maureen R. Goldfarb

(age 66) | | Trustee | | January 2009 | | 135 | | Private investor | | N/A |

Peter D. Jones

(age 66) | | Trustee | | January 2019 | | 135 | | Private investor | | N/A |

James W. Kilman, Jr.

(age 60) | | Trustee | | January 2019 | | 135 | | Burford Capital Limited (finance and investment management), Senior Advisor (since May 3, 2021), Chief Financial Officer (2019 - May 2, 2021); KielStrand Capital LLC (family office), Chief Executive Officer (since 2016) | | Alpha-En Corporation, Director (2016-2019) |

Clarence Otis, Jr.

(age 65) | | Trustee | | March 2017 | | 135 | | Private investor | | VF Corporation, Director; Verizon Communications, Inc., Director; The Travelers Companies, Director |

Maryanne L. Roepke

(age 65) | | Trustee | | May 2014 | | 135 | | Private investor | | N/A |

Laurie J. Thomsen

(age 64) | | Trustee | | March 2005 | | 135 | | Private investor | | The Travelers Companies, Director; Dycom Industries, Inc., Director |

MFS Blended Research Core Equity Portfolio

Trustees and Officers - continued

| Name, Age | | Position(s) Held with

Fund | | Trustee/Officer Since(h) | | Number of MFS Funds for which the Person is an Officer | | Principal Occupations During

the Past Five Years |

| OFFICERS | | | | | | | | |

Christopher R. Bohane (k)

(age 48) | | Assistant Secretary and Assistant Clerk | | July 2005 | | 135 | | Massachusetts Financial Services Company, Senior Vice President and Associate General Counsel |

Kino Clark (k)

(age 53) | | Assistant Treasurer | | January 2012 | | 135 | | Massachusetts Financial Services Company, Vice President |

John W. Clark, Jr. (k)

(age 54) | | Assistant Treasurer | | April 2017 | | 135 | | Massachusetts Financial Services Company, Vice President (since March 2017); Deutsche Bank (financial services), Department Head - Treasurer's Office (until February 2017) |

Thomas H. Connors (k)

(age 62) | | Assistant Secretary and Assistant Clerk | | September 2012 | | 135 | | Massachusetts Financial Services Company, Vice President and Senior Counsel |

David L. DiLorenzo (k)

(age 53) | | President | | July 2005 | | 135 | | Massachusetts Financial Services Company, Senior Vice President |

Heidi W. Hardin (k)

(age 54) | | Secretary and Clerk | | April 2017 | | 135 | | Massachusetts Financial Services Company, Executive Vice President and General Counsel (since March 2017); Harris Associates (investment management), General Counsel (until January 2017) |

Brian E. Langenfeld (k)

(age 48) | | Assistant Secretary and Assistant Clerk | | June 2006 | | 135 | | Massachusetts Financial Services Company, Vice President and Senior Counsel |

Amanda S. Mooradian (k)

(age 42) | | Assistant Secretary and Assistant Clerk | | September 2018 | | 135 | | Massachusetts Financial Services Company, Assistant Vice President and Senior Counsel |

Susan A. Pereira (k)

(age 51) | | Assistant Secretary and Assistant Clerk | | July 2005 | | 135 | | Massachusetts Financial Services Company, Vice President and Assistant General Counsel |

Kasey L. Phillips (k)

(age 51) | | Assistant Treasurer | | September 2012 | | 135 | | Massachusetts Financial Services Company, Vice President |

Matthew A. Stowe (k)

(age 47) | | Assistant Secretary and Assistant Clerk | | October 2014 | | 135 | | Massachusetts Financial Services Company, Vice President and Assistant General Counsel |

Martin J. Wolin (k)

(age 54) | | Chief Compliance Officer | | July 2015 | | 135 | | Massachusetts Financial Services Company, Senior Vice President and Chief Compliance Officer |

James O. Yost (k)

(age 61) | | Treasurer | | September 1990 | | 135 | | Massachusetts Financial Services Company, Senior Vice President |

| (h) | Date first appointed to serve as Trustee/Officer of an MFS Fund. Each Trustee has served continuously since appointment unless indicated otherwise. From January 2012 through December 2016, Messrs. DiLorenzo and Yost served as Treasurer and Deputy Treasurer of the Funds, respectively. |

| (j) | Directorships or trusteeships of companies required to report to the Securities and Exchange Commission (i.e., “public companies”). |

| (k) | “Interested person” of the Trust within the meaning of the Investment Company Act of 1940 (referred to as the 1940 Act), which is the principal federal law governing investment companies like the fund, as a result of a position with MFS. The address of MFS is 111 Huntington Avenue, Boston, Massachusetts 02199-7618. |

Each Trustee (other than Messrs. Jones, Kilman and Roberge) has been elected by shareholders and each Trustee and Officer holds office until his or her successor is chosen and qualified or until his or her earlier death, resignation, retirement or removal. Mr. Roberge became a Trustee of the Funds on January 1, 2021 and Messrs. Jones and Kilman became Trustees of the Funds on January 1, 2019. The Trust does not hold annual meetings for the purpose of electing Trustees, and Trustees are not elected for fixed terms. Under the terms of the Board's retirement policy, an Independent Trustee shall retire at the end of the calendar year in which he or she reaches the earlier of 75 years of age or 15 years of service on the Board (or, in the case of any Independent Trustee who joined the Board prior to 2015, 20 years of service on the Board).

Messrs. Buller, Kilman and Otis and Ms. Roepke are members of the Trust’s Audit Committee.

MFS Blended Research Core Equity Portfolio

Trustees and Officers - continued

Each of the Interested Trustees and certain Officers hold comparable officer positions with certain affiliates of MFS.

The Statement of Additional Information for a Fund includes further information about the Trustees and is available without charge upon request by calling 1-800-225-2606.

| Investment Adviser | Custodian |

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, MA 02199-7618 | State Street Bank and Trust Company

1 Lincoln Street

Boston, MA 02111-2900 |

| Distributor | Independent Registered Public Accounting Firm |

MFS Fund Distributors, Inc.

111 Huntington Avenue

Boston, MA 02199-7618 | Deloitte & Touche LLP

200 Berkeley Street

Boston, MA 02116 |

| Portfolio Manager(s) | |

Jim Fallon

Matt Krummell

Jonathan Sage

Jed Stocks | |

MFS Blended Research Core Equity Portfolio

Board Review of Investment Advisory Agreement

MFS Blended Research Core Equity Portfolio