UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3759

Variable Insurance Products IV

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2004 |

Item 1. Reports to Stockholders

Fidelity® Variable Insurance Products

Sector Funds

Consumer Industries Portfolio

Cyclical Industries Portfolio

Financial Services Portfolio

Health Care Portfolio

Natural Resources Portfolio

Technology Portfolio

Telecommunications & Utilities Growth Portfolio

Annual Report

December 31, 2004

(2_fidelity_logos) (Registered_Trademark)

Contents

Shareholder Expense Example | 4 | An example of shareholder expenses |

Consumer Industries Portfolio | 5 | Performance |

| 6 | Management's Discussion |

| 7 | Investment Summary |

| 8 | Investments |

| 11 | Financial Statements |

Cyclical Industries Portfolio | 13 | Performance |

| 14 | Management's Discussion |

| 15 | Investment Summary |

| 16 | Investments |

| 20 | Financial Statements |

Financial Services Portfolio | 22 | Performance |

| 23 | Management's Discussion |

| 24 | Investment Summary |

| 25 | Investments |

| 28 | Financial Statements |

Health Care Portfolio | 30 | Performance |

| 31 | Management's Discussion |

| 32 | Investment Summary |

| 33 | Investments |

| 35 | Financial Statements |

Natural Resources Portfolio | 37 | Performance |

| 38 | Management's Discussion |

| 39 | Investment Summary |

| 40 | Investments |

| 42 | Financial Statements |

Technology Portfolio | 44 | Performance |

| 45 | Management's Discussion |

| 46 | Investment Summary |

| 47 | Investments |

| 50 | Financial Statements |

Telecommunications &

Utilities Growth Portfolio | 52 | Performance |

| 53 | Management's Discussion |

| 54 | Investment Summary |

| 55 | Investments |

| 57 | Financial Statements |

Notes to Financial Statements | 59 | Notes to the Financial Statements |

Report of Independent Registered Public Accounting Firm | 64 | |

Trustees and Officers | 65 | |

Distributions | 70 | |

Proxy Voting Results | 71 | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-800-544-5429 to request a free copy of the proxy voting guidelines.

Fidelity Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not

authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2004 to December 31, 2004).

Actual Expenses

The first line of the table below for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower.

Hypothetical Example for Comparison Purposes

The second line of the table below for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value

July 1, 2004 | Ending

Account Value

December 31, 2004 | Expenses Paid

During Period*

July 1, 2004

to December 31, 2004 |

Consumer Industries Portfolio | | | |

Actual | $ 1,000.00 | $ 1,093.40 | $ 7.16 |

HypotheticalA | $ 1,000.00 | $ 1,018.30 | $ 6.90 |

Cyclical Industries Portfolio | | | |

Actual | $ 1,000.00 | $ 1,139.90 | $ 4.73 |

HypotheticalA | $ 1,000.00 | $ 1,020.71 | $ 4.47 |

Financial Services Portfolio | | | |

Actual | $ 1,000.00 | $ 1,101.20 | $ 4.54 |

HypotheticalA | $ 1,000.00 | $ 1,020.81 | $ 4.37 |

Health Care Portfolio | | | |

Actual | $ 1,000.00 | $ 1,033.10 | $ 3.99 |

HypotheticalA | $ 1,000.00 | $ 1,021.22 | $ 3.96 |

Natural Resources Portfolio | | | |

Actual | $ 1,000.00 | $ 1,142.30 | $ 4.09 |

HypotheticalA | $ 1,000.00 | $ 1,021.32 | $ 3.86 |

Technology Portfolio | | | |

Actual | $ 1,000.00 | $ 1,008.60 | $ 3.89 |

HypotheticalA | $ 1,000.00 | $ 1,021.27 | $ 3.91 |

Telecommunications & Utilities Growth Portfolio | | | |

Actual | $ 1,000.00 | $ 1,181.60 | $ 5.15 |

HypotheticalA | $ 1,000.00 | $ 1,020.41 | $ 4.77 |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Consumer Industries Portfolio | 1.36% |

Cyclical Industries Portfolio | .88% |

Financial Services Portfolio | .86% |

Health Care Portfolio | .78% |

Natural Resources Portfolio | .76% |

Technology Portfolio | .77% |

Telecommunications & Utilities Growth Portfolio | .94% |

Annual Report

Fidelity Variable Insurance Products: Consumer Industries Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended December 31, 2004 | Past 1

year | Life of fundA |

Fidelity® VIP: Consumer Industries | 9.34% | 3.15% |

A From July 18, 2001.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Variable Insurance Products: Consumer Industries Portfolio on July 18, 2001, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Fidelity Variable Insurance Products: Consumer Industries Portfolio

Management's Discussion of Fund Performance

Comments from John Roth, Portfolio Manager of Fidelity® Variable Insurance Products: Consumer Industries Portfolio

The year ending December 31, 2004, generally was positive for equity investors, as many stock market benchmarks produced double-digit gains. Broad-based themes included the continued dominance of small-cap stocks, which outperformed large-caps for the sixth consecutive year. The small-cap Russell 2000® Index was up 18.33% in 2004, while the larger-cap Standard & Poor's 500SM Index rose 10.88%. Value stocks ended the year well ahead of growth stocks: The Russell 3000® Value Index advanced 16.94%, compared to 6.93% for the Russell 3000 Growth Index. Energy and basic materials stocks led the market upward. Energy stocks were boosted by record-high oil prices, while strong demand from China helped support commodity prices. The health care sector was among the market's weakest performers. Technology also fell off the pace, though it was helped by a rally late in the year. The tech-heavy NASDAQ Composite® Index returned 9.15%, thanks primarily to a 14.87% jump in the fourth quarter. Elsewhere, the Dow Jones Industrial AverageSM gained 5.37% for the year.

For the 12-month period ending December 31, 2004, the fund underperformed both the Goldman Sachs® Consumer Industries Index, which returned 11.17%, and the S&P 500®. A major factor in the fund's underperformance relative to its benchmarks was a significant overweighting in media stocks with exposure to radio, based in part on an expectation that ad spending would increase along with the economy. Ad spending did come back but accrued instead to non-traditional areas such as Internet advertising. The Goldman Sachs Consumer Industries Index included larger weightings in better-performing consumer staples stocks. The S&P® index holds an even broader range of stocks, including commodities and materials, which did much better than the consumer sector. Positive contributors included Yahoo!, which was very well-positioned to take advantage of new money flowing into Internet advertising, and retailer American Eagle Outfitters, which executed its business strategy very well. The company did well after two years of struggling, successfully turning around its business. Poor performers included doughnut franchiser Krispy Kreme, which was marked by a decelerating growth rate, continuing declines in the profitability of its stores and missed earnings expectations. While Univision successfully created a formidable niche among Hispanic customers, the stock's performance dragged as investors lowered their expectations for the Spanish-language media company's earnings growth.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fidelity Variable Insurance Products: Consumer Industries Portfolio

Investment Summary

Top Five Stocks as of December 31, 2004 |

| % of fund's net assets |

News Corp. Class A | 4.1 |

Home Depot, Inc. | 3.9 |

Procter & Gamble Co. | 3.6 |

Wal-Mart Stores, Inc. | 3.2 |

McDonald's Corp. | 2.9 |

| 17.7 |

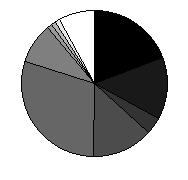

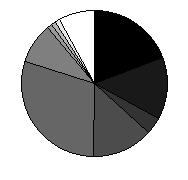

Top Industries as of December 31, 2004 |

% of fund's net assets |

| Media | 17.9% | |

| Hotels, Restaurants & Leisure | 15.5% | |

| Specialty Retail | 11.8% | |

| Food & Staples Retailing | 5.9% | |

| Internet Software & Services | 5.7% | |

| All Others* | 43.2% | |

* Includes short-term investments and net other assets. |

Annual Report

Fidelity Variable Insurance Products: Consumer Industries Portfolio

Investments December 31, 2004

Showing Percentage of Net Assets

Common Stocks - 95.9% |

| Shares | | Value (Note 1) |

AUTOMOBILES - 2.1% |

Automobile Manufacturers - 0.8% |

Thor Industries, Inc. | 2,600 | | $ 96,330 |

Motorcycle Manufacturers - 1.3% |

Harley-Davidson, Inc. | 2,600 | | 157,950 |

TOTAL AUTOMOBILES | | 254,280 |

BEVERAGES - 3.4% |

Brewers - 0.6% |

Anheuser-Busch Companies, Inc. | 1,300 | | 65,949 |

Soft Drinks - 2.8% |

PepsiCo, Inc. | 2,000 | | 104,400 |

The Coca-Cola Co. | 5,730 | | 238,540 |

| | 342,940 |

TOTAL BEVERAGES | | 408,889 |

CHEMICALS - 0.6% |

Fertilizers & Agricultural Chemicals - 0.6% |

Monsanto Co. | 1,300 | | 72,215 |

COMMERCIAL SERVICES & SUPPLIES - 3.6% |

Commercial Printing - 0.2% |

R.R. Donnelley & Sons Co. | 800 | | 28,232 |

Diversified Commercial Services - 3.4% |

Apollo Group, Inc. Class A (a) | 2,300 | | 185,633 |

Bright Horizons Family Solutions, Inc. (a) | 1,027 | | 66,509 |

Cendant Corp. | 4,400 | | 102,872 |

Strayer Education, Inc. | 500 | | 54,895 |

| | 409,909 |

TOTAL COMMERCIAL SERVICES & SUPPLIES | | 438,141 |

FOOD & STAPLES RETAILING - 5.9% |

Drug Retail - 0.7% |

CVS Corp. | 2,000 | | 90,140 |

Food Retail - 0.8% |

Safeway, Inc. (a) | 4,000 | | 78,960 |

Whole Foods Market, Inc. | 200 | | 19,070 |

| | 98,030 |

Hypermarkets & Super Centers - 4.4% |

Costco Wholesale Corp. | 2,900 | | 140,389 |

Wal-Mart Stores, Inc. | 7,280 | | 384,530 |

| | 524,919 |

TOTAL FOOD & STAPLES RETAILING | | 713,089 |

|

| Shares | | Value (Note 1) |

FOOD PRODUCTS - 3.9% |

Agricultural Products - 1.6% |

Bunge Ltd. | 2,400 | | $ 136,824 |

Fresh Del Monte Produce, Inc. | 1,900 | | 56,259 |

| | 193,083 |

Packaged Foods & Meats - 2.3% |

Dean Foods Co. (a) | 2,740 | | 90,283 |

Smithfield Foods, Inc. (a) | 4,400 | | 130,196 |

SunOpta, Inc. (a) | 1,800 | | 12,915 |

The J.M. Smucker Co. | 800 | | 37,656 |

| | 271,050 |

TOTAL FOOD PRODUCTS | | 464,133 |

HOTELS, RESTAURANTS & LEISURE - 15.5% |

Casinos & Gaming - 2.4% |

Caesars Entertainment, Inc. (a) | 2,000 | | 40,280 |

International Game Technology | 1,800 | | 61,884 |

MGM MIRAGE (a) | 2,500 | | 181,850 |

| | 284,014 |

Hotels, Resorts & Cruise Lines - 5.5% |

Carnival Corp. unit | 2,900 | | 167,127 |

Hilton Hotels Corp. | 2,800 | | 63,672 |

Kerzner International Ltd. (a) | 600 | | 36,030 |

Royal Caribbean Cruises Ltd. | 2,500 | | 136,100 |

Starwood Hotels & Resorts Worldwide, Inc. unit | 3,400 | | 198,560 |

Wyndham International, Inc. Class A (a) | 54,800 | | 65,212 |

| | 666,701 |

Leisure Facilities - 0.1% |

International Speedway Corp. Class A | 300 | | 15,840 |

Restaurants - 7.5% |

Brinker International, Inc. (a) | 1,930 | | 67,685 |

Buffalo Wild Wings, Inc. (a) | 200 | | 6,962 |

CBRL Group, Inc. | 700 | | 29,295 |

Krispy Kreme Doughnuts, Inc. (a) | 5,400 | | 68,040 |

McDonald's Corp. | 11,110 | | 356,187 |

Outback Steakhouse, Inc. | 2,680 | | 122,690 |

Starbucks Corp. (a) | 1,000 | | 62,360 |

Wendy's International, Inc. | 2,980 | | 116,995 |

Yum! Brands, Inc. | 1,600 | | 75,488 |

| | 905,702 |

TOTAL HOTELS, RESTAURANTS & LEISURE | | 1,872,257 |

HOUSEHOLD PRODUCTS - 5.1% |

Household Products - 5.1% |

Colgate-Palmolive Co. | 2,700 | | 138,132 |

Kimberly-Clark Corp. | 640 | | 42,118 |

Procter & Gamble Co. | 7,840 | | 431,827 |

| | 612,077 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

INDUSTRIAL CONGLOMERATES - 0.7% |

Industrial Conglomerates - 0.7% |

3M Co. | 1,100 | | $ 90,277 |

INTERNET & CATALOG RETAIL - 1.5% |

Internet Retail - 1.5% |

Amazon.com, Inc. (a) | 1,400 | | 62,006 |

eBay, Inc. (a) | 1,000 | | 116,280 |

| | 178,286 |

INTERNET SOFTWARE & SERVICES - 5.7% |

Internet Software & Services - 5.7% |

Google, Inc. Class A | 1,700 | | 328,270 |

Sina Corp. (a) | 1,200 | | 38,472 |

Sohu.com, Inc. (a) | 800 | | 14,168 |

Yahoo!, Inc. (a) | 7,964 | | 300,084 |

| | 680,994 |

LEISURE EQUIPMENT & PRODUCTS - 4.5% |

Leisure Products - 4.5% |

Brunswick Corp. | 4,200 | | 207,900 |

MarineMax, Inc. (a) | 2,200 | | 65,472 |

Polaris Industries, Inc. | 2,300 | | 156,446 |

RC2 Corp. (a) | 600 | | 19,560 |

SCP Pool Corp. | 2,950 | | 94,105 |

| | 543,483 |

MEDIA - 17.9% |

Advertising - 5.7% |

ADVO, Inc. | 1,300 | | 46,345 |

Harte-Hanks, Inc. | 800 | | 20,784 |

JC Decaux SA (a) | 6,700 | | 195,229 |

Lamar Advertising Co. Class A (a) | 2,870 | | 122,779 |

Omnicom Group, Inc. | 3,500 | | 295,120 |

| | 680,257 |

Broadcasting & Cable TV - 2.3% |

E.W. Scripps Co. Class A | 2,100 | | 101,388 |

EchoStar Communications Corp. Class A | 700 | | 23,268 |

Liberty Media Corp. Class A (a) | 5,210 | | 57,206 |

Liberty Media International, Inc.

Class A (a) | 15 | | 693 |

Radio One, Inc. Class D (non-vtg.) (a) | 1,600 | | 25,792 |

SBS Broadcasting SA (a) | 700 | | 28,161 |

Spanish Broadcasting System, Inc.

Class A (a) | 2,820 | | 29,779 |

Univision Communications, Inc.

Class A (a) | 400 | | 11,708 |

| | 277,995 |

Movies & Entertainment - 7.5% |

Fox Entertainment Group, Inc. Class A (a) | 3,740 | | 116,912 |

News Corp. Class A | 26,300 | | 490,758 |

Walt Disney Co. | 10,600 | | 294,680 |

| | 902,350 |

|

| Shares | | Value (Note 1) |

Publishing - 2.4% |

Gannett Co., Inc. | 1,480 | | $ 120,916 |

McGraw-Hill Companies, Inc. | 700 | | 64,078 |

Reuters Group PLC sponsored ADR | 700 | | 30,065 |

Washington Post Co. Class B | 80 | | 78,642 |

| | 293,701 |

TOTAL MEDIA | | 2,154,303 |

MULTILINE RETAIL - 4.8% |

Department Stores - 1.7% |

Federated Department Stores, Inc. | 1,100 | | 63,569 |

JCPenney Co., Inc. | 1,600 | | 66,240 |

Neiman Marcus Group, Inc. Class A | 400 | | 28,616 |

Nordstrom, Inc. | 900 | | 42,057 |

Saks, Inc. | 600 | | 8,706 |

| | 209,188 |

General Merchandise Stores - 3.1% |

Big Lots, Inc. (a) | 1,800 | | 21,834 |

Family Dollar Stores, Inc. | 1,860 | | 58,088 |

Target Corp. | 5,600 | | 290,808 |

| | 370,730 |

TOTAL MULTILINE RETAIL | | 579,918 |

PAPER & FOREST PRODUCTS - 0.0% |

Paper Products - 0.0% |

Neenah Paper, Inc. (a) | 19 | | 619 |

PERSONAL PRODUCTS - 3.9% |

Personal Products - 3.9% |

Alberto-Culver Co. | 2,400 | | 116,568 |

Avon Products, Inc. | 4,800 | | 185,760 |

Gillette Co. | 3,800 | | 170,164 |

| | 472,492 |

REAL ESTATE - 0.6% |

Real Estate Investment Trusts - 0.3% |

MeriStar Hospitality Corp. (a) | 5,000 | | 41,750 |

Real Estate Management & Development - 0.3% |

ZipRealty, Inc. | 1,800 | | 32,166 |

TOTAL REAL ESTATE | | 73,916 |

SOFTWARE - 0.6% |

Home Entertainment Software - 0.6% |

Electronic Arts, Inc. (a) | 1,200 | | 74,016 |

SPECIALTY RETAIL - 11.8% |

Apparel Retail - 3.5% |

Aeropostale, Inc. (a) | 800 | | 23,544 |

American Eagle Outfitters, Inc. | 4,500 | | 211,950 |

Chico's FAS, Inc. (a) | 1,200 | | 54,636 |

Foot Locker, Inc. | 3,400 | | 91,562 |

Gap, Inc. | 1,100 | | 23,232 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

SPECIALTY RETAIL - CONTINUED |

Apparel Retail - continued |

Hot Topic, Inc. (a) | 800 | | $ 13,752 |

Limited Brands, Inc. | 314 | | 7,228 |

| | 425,904 |

Computer & Electronics Retail - 0.5% |

Best Buy Co., Inc. | 900 | | 53,478 |

Home Improvement Retail - 4.9% |

Home Depot, Inc. | 10,910 | | 466,293 |

Lowe's Companies, Inc. | 2,100 | | 120,939 |

| | 587,232 |

Specialty Stores - 2.9% |

Office Depot, Inc. (a) | 3,300 | | 57,288 |

PETsMART, Inc. | 800 | | 28,424 |

Staples, Inc. | 3,000 | | 101,130 |

Steiner Leisure Ltd. (a) | 3,128 | | 93,465 |

Toys 'R' Us, Inc. (a) | 1,800 | | 36,846 |

West Marine, Inc. (a) | 1,300 | | 32,175 |

| | 349,328 |

TOTAL SPECIALTY RETAIL | | 1,415,942 |

TEXTILES, APPAREL & LUXURY GOODS - 3.8% |

Apparel, Accessories & Luxury Goods - 2.2% |

Coach, Inc. (a) | 1,100 | | 62,040 |

Kenneth Cole Productions, Inc. Class A (sub. vtg.) | 600 | | 18,516 |

Liz Claiborne, Inc. | 2,100 | | 88,641 |

Polo Ralph Lauren Corp. Class A | 1,500 | | 63,900 |

Quiksilver, Inc. (a) | 900 | | 26,811 |

| | 259,908 |

Footwear - 1.6% |

NIKE, Inc. Class B | 2,000 | | 181,380 |

Phoenix Footwear Group, Inc. (a) | 2,100 | | 16,338 |

| | 197,718 |

TOTAL TEXTILES, APPAREL & LUXURY GOODS | | 457,626 |

TOTAL COMMON STOCKS (Cost $9,584,765) | 11,556,953 |

Money Market Funds - 2.8% |

| Shares | | Value (Note 1) |

Fidelity Cash Central Fund, 2.24% (b)

(Cost $338,997) | 338,997 | | $ 338,997 |

TOTAL INVESTMENT PORTFOLIO - 98.7% (Cost $9,923,762) | 11,895,950 |

NET OTHER ASSETS - 1.3% | | 154,821 |

NET ASSETS - 100% | $ 12,050,771 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

Income Tax Information |

At December 31, 2004, the fund had a capital loss carryforward of approximately $2,359,000 of which $1,677,000 and $682,000 will expire on December 31, 2010 and 2011, respectively. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Variable Insurance Products: Consumer Industries Portfolio

Financial Statements

Statement of Assets and Liabilities

December 31, 2004 |

| | |

Assets | | |

Investment in securities, at value (cost $9,923,762) - See accompanying schedule | | $ 11,895,950 |

Cash | | 4,458 |

Receivable for fund shares sold | | 172,852 |

Dividends receivable | | 9,939 |

Interest receivable | | 875 |

Prepaid expenses | | 40 |

Other receivables | | 798 |

Total assets | | 12,084,912 |

| | |

Liabilities | | |

Payable for fund shares redeemed | $ 16 | |

Accrued management fee | 5,469 | |

Other affiliated payables | 3,155 | |

Other payables and accrued expenses | 25,501 | |

Total liabilities | | 34,141 |

| | |

Net Assets | | $ 12,050,771 |

Net Assets consist of: | | |

Paid in capital | | $ 12,517,183 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (2,438,600) |

Net unrealized appreciation (depreciation) on investments | | 1,972,188 |

Net Assets, for 1,083,841 shares outstanding | | $ 12,050,771 |

Net Asset Value, offering price and redemption price per share ($12,050,771 ÷ 1,083,841 shares) | | $ 11.12 |

Statement of Operations

Year ended December 31, 2004 |

| | |

Investment Income | | |

Dividends | | $ 91,289 |

Interest | | 3,832 |

Total income | | 95,121 |

| | |

Expenses | | |

Management fee | $ 61,441 | |

Transfer agent fees | 10,724 | |

Accounting fees and expenses | 30,001 | |

Non-interested trustees' compensation | 58 | |

Custodian fees and expenses | 6,280 | |

Audit | 32,324 | |

Legal | 552 | |

Miscellaneous | 2,999 | |

Total expenses before reductions | 144,379 | |

Expense reductions | (4,059) | 140,320 |

Net investment income (loss) | | (45,199) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 483,108 | |

Foreign currency transactions | 110 | |

Total net realized gain (loss) | | 483,218 |

Change in net unrealized appreciation (depreciation) on investment securities | | 502,895 |

Net gain (loss) | | 986,113 |

Net increase (decrease) in net assets resulting from operations | | $ 940,914 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

December 31,

2004 | Year ended

December 31,

2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (45,199) | $ (34,989) |

Net realized gain (loss) | 483,218 | (424,475) |

Change in net unrealized appreciation (depreciation) | 502,895 | 2,652,701 |

Net increase (decrease) in net assets resulting from operations | 940,914 | 2,193,237 |

Share transactions

Proceeds from sales of shares | 3,448,896 | 2,064,591 |

Cost of shares redeemed | (3,300,182) | (5,477,315) |

Net increase (decrease) in net assets resulting from share transactions | 148,714 | (3,412,724) |

Redemption fees | 2,426 | 1,846 |

Total increase (decrease) in net assets | 1,092,054 | (1,217,641) |

| | |

Net Assets | | |

Beginning of period | 10,958,717 | 12,176,358 |

End of period | $ 12,050,771 | $ 10,958,717 |

Other Information Shares | | |

Sold | 335,214 | 223,933 |

Redeemed | (328,967) | (643,510) |

Net increase (decrease) | 6,247 | (419,577) |

Financial Highlights

Years ended December 31, | 2004 | 2003 | 2002 | 2001F |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 10.17 | $ 8.13 | $ 9.72 | $ 10.00 |

Income from Investment Operations | | | | |

Net investment income (loss)E | (.04) | (.03) | (.03) | .01 |

Net realized and unrealized gain (loss) | .99 | 2.07 | (1.56) | (.29) |

Total from investment operations | .95 | 2.04 | (1.59) | (.28) |

Distributions from net investment income | - | - | (.01) | - |

Redemption fees added to paid in capitalE | -H | -H | .01 | -H |

Net asset value, end of period | $ 11.12 | $ 10.17 | $ 8.13 | $ 9.72 |

Total ReturnB,C,D | 9.34% | 25.09% | (16.27)% | (2.80)% |

Ratios to Average Net AssetsG | | | | |

Expenses before expense reductions | 1.35% | 1.72% | 1.30% | 2.61%A |

Expenses net of voluntary waivers, if any | 1.35% | 1.50% | 1.30% | 1.50%A |

Expenses net of all reductions | 1.31% | 1.46% | 1.27% | 1.48%A |

Net investment income (loss) | (.42)% | (.34)% | (.29)% | .17%A |

Supplemental Data | | | | |

Net assets, end of period (000 omitted) | $ 12,051 | $ 10,959 | $ 12,176 | $ 7,989 |

Portfolio turnover rate | 145% | 108% | 129% | 162%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

D Total returns would have been lower had certain expenses not been reduced during the periods shown.

E Calculated based on average shares outstanding during the period.

F For the period July 18, 2001 (commencement of operations) to December 31, 2001.

G Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund.

H Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Consumer Industries Portfolio

Fidelity Variable Insurance Products: Cyclical Industries Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended December 31, 2004 | Past 1

year | Life of fundA |

Fidelity VIP: Cyclical Industries | 24.10% | 9.97% |

A From July 18, 2001.

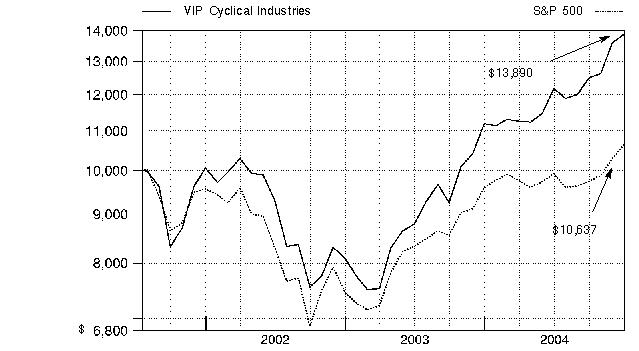

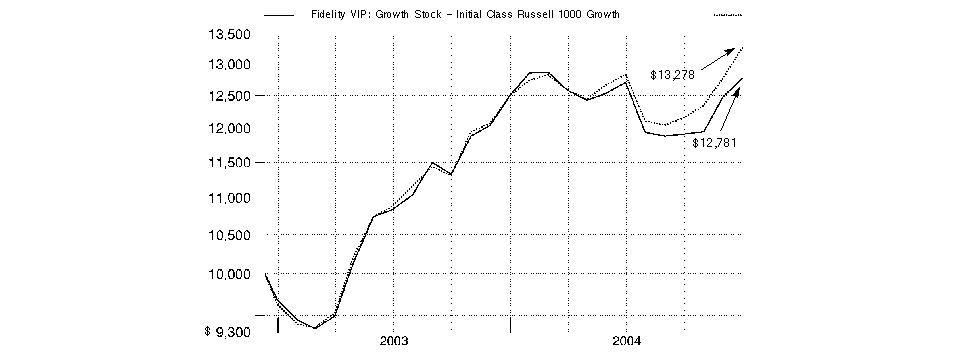

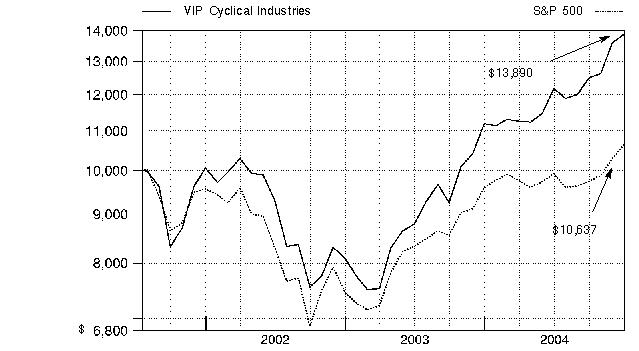

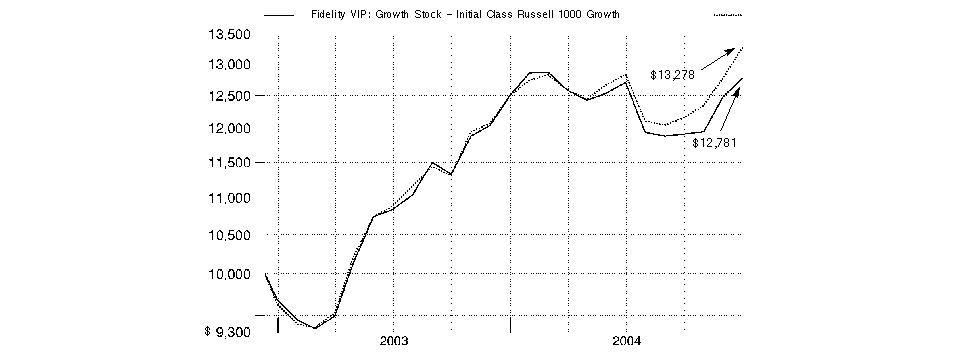

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Variable Insurance Products: Cyclical Industries Portfolio on July 18, 2001, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Fidelity Variable Insurance Products: Cyclical Industries Portfolio

Management's Discussion of Fund Performance

Comments from Matthew Friedman, Portfolio Manager of Fidelity® Variable Insurance Products: Cyclical Industries Portfolio

The year ending December 31, 2004, generally was positive for equity investors, as many stock market benchmarks produced double-digit gains. Broad-based themes included the continued dominance of small-cap stocks, which outperformed large-caps for the sixth consecutive year. The small-cap Russell 2000® Index was up 18.33% in 2004, while the larger-cap Standard & Poor's 500SM Index rose 10.88%. Value stocks ended the year well ahead of growth stocks: The Russell 3000® Value Index advanced 16.94%, compared to 6.93% for the Russell 3000 Growth Index. Energy and basic materials stocks led the market upward. Energy stocks were boosted by record-high oil prices, while strong demand from China helped support commodity prices. The health care sector was among the market's weakest performers. Technology also fell off the pace, though it was helped by a rally late in the year. The tech-heavy NASDAQ Composite® Index returned 9.15%, thanks primarily to a 14.87% jump in the fourth quarter. Elsewhere, the Dow Jones Industrial AverageSM gained 5.37% for the year.

Cyclical stocks outperformed the broad market during the 12 months ending December 31, 2004. Against this backdrop, the portfolio more than doubled the return of the S&P 500® and also beat the Goldman Sachs® Cyclical Industries Index, which returned 19.61%. Early in the period, we switched the portfolio's emphasis from early-cycle industries, such as automobile manufacturers, to late-cycle groups, such as chemical companies. Late-cycle stocks tend to perform better in the later stages of an economic recovery, which we experienced throughout 2004. This strategy helped performance, as did good stock selection overall. Commodity chemical companies Millennium Chemicals and Lyondell Chemical, which merged in December, profited from the combination of low inventories and high overseas demand for their products. Also, not owning or significantly underweighting General Motors, DaimlerChrysler and Ford - all early-cycle stocks and sector index components - helped performance, as high inventories and reduced demand contributed to shrinking profit margins in the industry. Although chemical companies were able to price skyrocketing energy costs into their products, airlines weren't as fortunate. Price competition from discount airlines and higher energy costs weighed on Continental, AirTran and Ireland's Ryanair, each of which detracted from performance.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fidelity Variable Insurance Products: Cyclical Industries Portfolio

Investment Summary

Top Five Stocks as of December 31, 2004 |

| % of fund's net assets |

Tyco International Ltd. | 5.0 |

General Electric Co. | 4.7 |

United Parcel Service, Inc. Class B | 3.6 |

Lyondell Chemical Co. | 3.3 |

Honeywell International, Inc. | 3.2 |

| 19.8 |

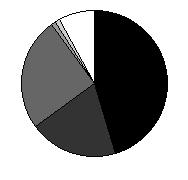

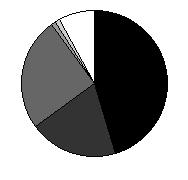

Top Industries as of December 31, 2004 |

% of fund's net assets |

| Aerospace & Defense | 18.4% | |

| Chemicals | 17.7% | |

| Industrial Conglomerates | 14.4% | |

| Air Freight & Logistics | 9.4% | |

| Machinery | 9.2% | |

| All Others* | 30.9% | |

* Includes short-term investments and net other assets. |

Annual Report

Fidelity Variable Insurance Products: Cyclical Industries Portfolio

Investments December 31, 2004

Showing Percentage of Net Assets

Common Stocks - 97.9% |

| Shares | | Value (Note 1) |

AEROSPACE & DEFENSE - 18.4% |

Aerospace & Defense - 18.4% |

BAE Systems PLC | 39,217 | | $ 173,473 |

BE Aerospace, Inc. (a) | 49,800 | | 579,672 |

Bombardier, Inc. Class B (sub. vtg.) | 700 | | 1,388 |

DRS Technologies, Inc. (a) | 3,900 | | 166,569 |

EADS NV | 16,571 | | 480,834 |

EDO Corp. | 15,920 | | 505,460 |

Embraer - Empresa Brasileira de Aeronautica SA sponsored ADR | 5,800 | | 193,952 |

Engineered Support Systems, Inc. | 1,600 | | 94,752 |

Essex Corp. (a) | 1,700 | | 34,425 |

General Dynamics Corp. | 2,300 | | 240,580 |

Goodrich Corp. | 8,800 | | 287,232 |

Hexcel Corp. (a) | 10,400 | | 150,800 |

Honeywell International, Inc. | 56,600 | | 2,004,206 |

L-3 Communications Holdings, Inc. | 5,200 | | 380,848 |

Lockheed Martin Corp. | 19,070 | | 1,059,339 |

Meggitt PLC | 41,200 | | 206,952 |

Northrop Grumman Corp. | 13,758 | | 747,885 |

Precision Castparts Corp. | 9,900 | | 650,232 |

Raytheon Co. | 13,400 | | 520,322 |

Rockwell Collins, Inc. | 9,020 | | 355,749 |

Rolls-Royce Group PLC | 11,800 | | 55,933 |

The Boeing Co. | 29,310 | | 1,517,379 |

United Defense Industries, Inc. (a) | 9,700 | | 458,325 |

United Technologies Corp. | 5,700 | | 589,095 |

| | 11,455,402 |

AIR FREIGHT & LOGISTICS - 9.4% |

Air Freight & Logistics - 9.4% |

Dynamex, Inc. (a) | 24,525 | | 454,448 |

EGL, Inc. (a) | 10,900 | | 325,801 |

Expeditors International of Washington, Inc. | 6,900 | | 385,572 |

FedEx Corp. | 13,400 | | 1,319,766 |

Forward Air Corp. (a) | 10,240 | | 457,728 |

Hub Group, Inc. Class A (a) | 3,132 | | 163,553 |

Park-Ohio Holdings Corp. (a) | 6,047 | | 156,617 |

Ryder System, Inc. | 3,500 | | 167,195 |

United Parcel Service, Inc. Class B | 25,800 | | 2,204,868 |

UTI Worldwide, Inc. | 2,900 | | 197,258 |

| | 5,832,806 |

AIRLINES - 2.0% |

Airlines - 2.0% |

AirTran Holdings, Inc. (a) | 63,400 | | 678,380 |

Alaska Air Group, Inc. (a) | 5,200 | | 174,148 |

AMR Corp. (a) | 400 | | 4,380 |

Southwest Airlines Co. | 22,200 | | 361,416 |

| | 1,218,324 |

|

| Shares | | Value (Note 1) |

AUTO COMPONENTS - 0.2% |

Auto Parts & Equipment - 0.2% |

Amerigon, Inc. (a) | 800 | | $ 2,990 |

BorgWarner, Inc. | 900 | | 48,753 |

Delphi Corp. | 100 | | 902 |

Johnson Controls, Inc. | 800 | | 50,752 |

| | 103,397 |

AUTOMOBILES - 0.6% |

Automobile Manufacturers - 0.6% |

Ford Motor Co. | 300 | | 4,392 |

Hyundai Motor Co. | 3,660 | | 196,223 |

Renault SA | 1,500 | | 125,243 |

Toyota Motor Corp. ADR | 900 | | 73,683 |

| | 399,541 |

BUILDING PRODUCTS - 1.8% |

Building Products - 1.8% |

American Standard Companies, Inc. (a) | 11,810 | | 487,989 |

Masco Corp. | 10,020 | | 366,031 |

York International Corp. | 7,600 | | 262,504 |

| | 1,116,524 |

CHEMICALS - 17.7% |

Commodity Chemicals - 5.4% |

Lyondell Chemical Co. | 71,336 | | 2,063,037 |

NOVA Chemicals Corp. | 15,800 | | 746,550 |

Pioneer Companies, Inc. (a) | 24,100 | | 500,075 |

Spartech Corp. | 1,800 | | 48,762 |

| | 3,358,424 |

Diversified Chemicals - 2.5% |

Dow Chemical Co. | 25,600 | | 1,267,456 |

FMC Corp. (a) | 6,100 | | 294,630 |

| | 1,562,086 |

Fertilizers & Agricultural Chemicals - 3.7% |

Agrium, Inc. | 19,600 | | 330,750 |

Monsanto Co. | 13,300 | | 738,815 |

Mosaic Co. (a) | 14,300 | | 233,376 |

Potash Corp. of Saskatchewan | 11,900 | | 989,188 |

| | 2,292,129 |

Industrial Gases - 2.7% |

Air Products & Chemicals, Inc. | 14,300 | | 828,971 |

Airgas, Inc. | 6,500 | | 172,315 |

Praxair, Inc. | 15,800 | | 697,570 |

| | 1,698,856 |

Specialty Chemicals - 3.4% |

Albemarle Corp. | 8,300 | | 321,293 |

Cytec Industries, Inc. | 9,300 | | 478,206 |

Ecolab, Inc. | 19,000 | | 667,470 |

Ferro Corp. | 8,530 | | 197,811 |

PolyOne Corp. (a) | 8,230 | | 74,564 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CHEMICALS - CONTINUED |

Specialty Chemicals - continued |

Rohm & Haas Co. | 200 | | $ 8,846 |

Valspar Corp. | 7,100 | | 355,071 |

| | 2,103,261 |

TOTAL CHEMICALS | | 11,014,756 |

COMMERCIAL SERVICES & SUPPLIES - 1.4% |

Employment Services - 0.2% |

Heidrick & Struggles International, Inc. (a) | 1,700 | | 58,259 |

Korn/Ferry International (a) | 2,500 | | 51,875 |

| | 110,134 |

Environmental Services - 0.7% |

Waste Connections, Inc. (a) | 4,500 | | 154,125 |

Waste Services, Inc. (a) | 76,600 | | 279,590 |

| | 433,715 |

Office Services & Supplies - 0.5% |

Herman Miller, Inc. | 12,666 | | 349,962 |

TOTAL COMMERCIAL SERVICES & SUPPLIES | | 893,811 |

COMMUNICATIONS EQUIPMENT - 0.5% |

Communications Equipment - 0.5% |

Harris Corp. | 4,700 | | 290,413 |

CONSTRUCTION & ENGINEERING - 3.1% |

Construction & Engineering - 3.1% |

Dycom Industries, Inc. (a) | 18,300 | | 558,516 |

EMCOR Group, Inc. (a) | 1,600 | | 72,288 |

Fluor Corp. | 2,900 | | 158,079 |

Foster Wheeler Ltd. (a) | 7,170 | | 113,788 |

Granite Construction, Inc. | 5,500 | | 146,300 |

Jacobs Engineering Group, Inc. (a) | 12,400 | | 592,596 |

Perini Corp. (a) | 7,700 | | 128,513 |

Shaw Group, Inc. (a) | 100 | | 1,785 |

Washington Group International, Inc. (a) | 3,500 | | 144,375 |

| | 1,916,240 |

CONSTRUCTION MATERIALS - 1.5% |

Construction Materials - 1.5% |

Eagle Materials, Inc. | 3,420 | | 295,317 |

Eagle Materials, Inc. Class B | 1,400 | | 118,020 |

Florida Rock Industries, Inc. | 1,200 | | 71,436 |

Texas Industries, Inc. | 3,600 | | 224,568 |

Vulcan Materials Co. | 3,900 | | 212,979 |

| | 922,320 |

|

| Shares | | Value (Note 1) |

CONTAINERS & PACKAGING - 0.7% |

Metal & Glass Containers - 0.7% |

Owens-Illinois, Inc. (a) | 11,950 | | $ 270,668 |

Pactiv Corp. (a) | 5,700 | | 144,153 |

| | 414,821 |

DISTRIBUTORS - 0.3% |

Distributors - 0.3% |

WESCO International, Inc. (a) | 5,600 | | 165,984 |

ELECTRICAL EQUIPMENT - 1.6% |

Electrical Components & Equipment - 1.6% |

A.O. Smith Corp. | 1,700 | | 50,898 |

A.O. Smith Corp. Class A | 200 | | 6,000 |

AMETEK, Inc. | 4,200 | | 149,814 |

Cooper Industries Ltd. Class A | 900 | | 61,101 |

Emerson Electric Co. | 2,900 | | 203,290 |

NEOMAX Co. Ltd. | 2,000 | | 35,497 |

Rockwell Automation, Inc. | 3,200 | | 158,560 |

Roper Industries, Inc. | 5,870 | | 356,720 |

| | 1,021,880 |

ELECTRONIC EQUIPMENT & INSTRUMENTS - 0.2% |

Electronic Equipment & Instruments - 0.2% |

Cognex Corp. | 1,600 | | 44,640 |

Dionex Corp. (a) | 1,940 | | 109,940 |

| | 154,580 |

FOOD PRODUCTS - 0.1% |

Agricultural Products - 0.1% |

Delta & Pine Land Co. | 2,700 | | 73,656 |

HEALTH CARE EQUIPMENT & SUPPLIES - 0.0% |

Health Care Equipment - 0.0% |

Thermo Electron Corp. (a) | 710 | | 21,435 |

HOUSEHOLD DURABLES - 5.7% |

Home Furnishings - 0.9% |

Dixie Group, Inc. (a) | 3,700 | | 62,382 |

Interface, Inc. Class A (a) | 32,400 | | 323,028 |

Tempur-Pedic International, Inc. | 7,200 | | 152,640 |

| | 538,050 |

Homebuilding - 3.9% |

D.R. Horton, Inc. | 10,650 | | 429,302 |

KB Home | 6,300 | | 657,720 |

Ryland Group, Inc. | 10,280 | | 591,511 |

Standard Pacific Corp. | 100 | | 6,414 |

Toll Brothers, Inc. (a) | 10,900 | | 747,849 |

| | 2,432,796 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HOUSEHOLD DURABLES - CONTINUED |

Household Appliances - 0.9% |

Blount International, Inc. (a) | 17,800 | | $ 310,076 |

Maytag Corp. | 11,900 | | 251,090 |

| | 561,166 |

TOTAL HOUSEHOLD DURABLES | | 3,532,012 |

INDUSTRIAL CONGLOMERATES - 14.4% |

Industrial Conglomerates - 14.4% |

3M Co. | 20,460 | | 1,679,152 |

Carlisle Companies, Inc. | 400 | | 25,968 |

General Electric Co. | 81,160 | | 2,962,340 |

Siemens AG sponsored ADR | 14,700 | | 1,244,649 |

Tyco International Ltd. | 86,540 | | 3,092,939 |

| | 9,005,048 |

MACHINERY - 9.2% |

Construction & Farm Machinery & Heavy Trucks - 4.2% |

AGCO Corp. (a) | 25,510 | | 558,414 |

Bucyrus International, Inc. Class A | 14,600 | | 593,344 |

Caterpillar, Inc. | 3,800 | | 370,538 |

Daewoo Shipbuilding & Marine Engineering Co. Ltd. | 19,120 | | 284,436 |

Navistar International Corp. (a) | 10,480 | | 460,910 |

PACCAR, Inc. | 1,240 | | 99,795 |

Toro Co. | 900 | | 73,215 |

Wabash National Corp. (a) | 7,600 | | 204,668 |

| | 2,645,320 |

Industrial Machinery - 5.0% |

Briggs & Stratton Corp. | 1,800 | | 74,844 |

CUNO, Inc. (a) | 2,300 | | 136,620 |

Danaher Corp. | 3,700 | | 212,417 |

Dover Corp. | 5,900 | | 247,446 |

Gardner Denver, Inc. (a) | 2,000 | | 72,580 |

IDEX Corp. | 3,830 | | 155,115 |

Ingersoll-Rand Co. Ltd. Class A | 1,700 | | 136,510 |

ITT Industries, Inc. | 9,000 | | 760,050 |

Kennametal, Inc. | 540 | | 26,876 |

Manitowoc Co., Inc. | 9,600 | | 361,440 |

Pall Corp. | 5,700 | | 165,015 |

Pentair, Inc. | 4,380 | | 190,793 |

SPX Corp. | 9,200 | | 368,552 |

|

| Shares | | Value (Note 1) |

Timken Co. | 4,400 | | $ 114,488 |

Watts Water Technologies, Inc. Class A | 2,300 | | 74,152 |

| | 3,096,898 |

TOTAL MACHINERY | | 5,742,218 |

MARINE - 0.1% |

Marine - 0.1% |

Alexander & Baldwin, Inc. | 820 | | 34,784 |

METALS & MINING - 0.2% |

Diversified Metals & Mining - 0.2% |

Brush Engineered Materials, Inc. (a) | 1,400 | | 25,900 |

Massey Energy Co. | 2,800 | | 97,860 |

| | 123,760 |

OIL & GAS - 1.7% |

Oil & Gas Refining & Marketing & Transportation - 1.7% |

Ashland, Inc. | 9,800 | | 572,124 |

Frontline Ltd. (NY Shares) | 5,600 | | 248,416 |

Ship Finance International Ltd. | 706 | | 14,487 |

Teekay Shipping Corp. | 2,500 | | 105,275 |

Top Tankers, Inc. | 7,900 | | 128,375 |

| | 1,068,677 |

ROAD & RAIL - 6.0% |

Railroads - 5.4% |

Burlington Northern Santa Fe Corp. | 14,200 | | 671,802 |

Canadian National Railway Co. | 18,700 | | 1,138,674 |

Canadian Pacific Railway Ltd. | 200 | | 6,850 |

CSX Corp. | 15,220 | | 610,018 |

Norfolk Southern Corp. | 26,860 | | 972,063 |

| | 3,399,407 |

Trucking - 0.6% |

Laidlaw International, Inc. (a) | 1,200 | | 25,680 |

Landstar System, Inc. (a) | 2,478 | | 182,480 |

Swift Transportation Co., Inc. (a) | 6,600 | | 141,768 |

| | 349,928 |

TOTAL ROAD & RAIL | | 3,749,335 |

SPECIALTY RETAIL - 0.5% |

Specialty Stores - 0.5% |

Advance Auto Parts, Inc. (a) | 1,800 | | 78,624 |

Asbury Automotive Group, Inc. (a) | 8,400 | | 115,752 |

AutoNation, Inc. (a) | 2,600 | | 49,946 |

The Pep Boys - Manny, Moe & Jack | 5,700 | | 97,299 |

| | 341,621 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

TRADING COMPANIES & DISTRIBUTORS - 0.6% |

Trading Companies & Distributors - 0.6% |

MSC Industrial Direct Co., Inc. Class A | 5,500 | | $ 197,890 |

W.W. Grainger, Inc. | 2,320 | | 154,558 |

| | 352,448 |

TOTAL COMMON STOCKS (Cost $52,651,715) | 60,965,793 |

Money Market Funds - 2.2% |

| | | |

Fidelity Cash Central Fund, 2.24% (b)

(Cost $1,395,448) | 1,395,448 | | 1,395,448 |

TOTAL INVESTMENT PORTFOLIO - 100.1% (Cost $54,047,163) | 62,361,241 |

NET OTHER ASSETS - (0.1)% | (62,144) |

NET ASSETS - 100% | $ 62,299,097 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

Other Information |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: |

United States of America | 88.5% |

Canada | 5.1% |

Germany | 2.0% |

Others (individually less than 1%) | 4.4% |

| 100.0% |

Income Tax Information |

The fund hereby designates as capital gain dividends: For dividends with respect to the taxable year ended December 31, 2004, $189,000 or, if different, the net capital gain of such year. |

See accompanying notes which are an integral part of the financial statements.

Cyclical Industries Portfolio

Fidelity Variable Insurance Products: Cyclical Industries Portfolio

Financial Statements

Statement of Assets and Liabilities

December 31, 2004 |

| | |

Assets | | |

Investment in securities, at value (cost $54,047,163) - See accompanying schedule | | $ 62,361,241 |

Foreign currency held at value

(cost $2) | | 2 |

Receivable for investments sold | | 605,871 |

Receivable for fund shares sold | | 432,782 |

Dividends receivable | | 93,573 |

Interest receivable | | 3,869 |

Prepaid expenses | | 108 |

Other receivables | | 6,837 |

Total assets | | 63,504,283 |

| | |

Liabilities | | |

Payable for investments purchased | $ 1,140,406 | |

Accrued management fee | 28,413 | |

Other affiliated payables | 5,901 | |

Other payables and accrued expenses | 30,466 | |

Total liabilities | | 1,205,186 |

| | |

Net Assets | | $ 62,299,097 |

Net Assets consist of: | | |

Paid in capital | | $ 53,909,386 |

Undistributed net investment income | | 25,010 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 50,559 |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 8,314,142 |

Net Assets, for 4,509,629 shares outstanding | | $ 62,299,097 |

Net Asset Value, offering price and redemption price per share ($62,299,097 ÷ 4,509,629 shares) | | $ 13.81 |

Statement of Operations

Year ended December 31, 2004 |

| | |

Investment Income | | |

Dividends (a) | | $ 437,544 |

Interest | | 30,587 |

Security lending | | 827 |

Total income | | 468,958 |

| | |

Expenses | | |

Management fee | $ 174,752 | |

Transfer agent fees | 24,764 | |

Accounting and security lending fees | 30,009 | |

Non-interested trustees' compensation | 150 | |

Custodian fees and expenses | 20,451 | |

Audit | 32,388 | |

Legal | 691 | |

Miscellaneous | 6,339 | |

Total expenses before reductions | 289,544 | |

Expense reductions | (13,629) | 275,915 |

Net investment income (loss) | | 193,043 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 2,225,822 | |

Foreign currency transactions | (1,967) | |

Total net realized gain (loss) | | 2,223,855 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 5,631,494 | |

Assets and liabilities in foreign currencies | 81 | |

Total change in net unrealized appreciation (depreciation) | | 5,631,575 |

Net gain (loss) | | 7,855,430 |

Net increase (decrease) in net assets resulting from operations | | $ 8,048,473 |

(a) As a result of the change in the estimate of the return of capital component of dividend income realized in the year ended December 31, 2003, dividend income has been reduced by $12,216, with a corresponding increase to net realized gain (loss) and net unrealized appreciation (depreciation). |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Variable Insurance Products: Cyclical Industries Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

December 31,

2004 | Year ended

December 31,

2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 193,043 | $ 32,891 |

Net realized gain (loss) | 2,223,855 | 273,942 |

Change in net unrealized appreciation (depreciation) | 5,631,575 | 3,052,010 |

Net increase (decrease) in net assets resulting from operations | 8,048,473 | 3,358,843 |

Distributions to shareholders from net investment income | (176,284) | (33,211) |

Share transactions

Proceeds from sales of shares | 42,450,936 | 11,594,535 |

Reinvestment of distributions | 176,284 | 33,211 |

Cost of shares redeemed | (7,859,383) | (3,630,929) |

Net increase (decrease) in net assets resulting from share transactions | 34,767,837 | 7,996,817 |

Redemption fees | 41,074 | 11,897 |

Total increase (decrease) in net assets | 42,681,100 | 11,334,346 |

| | |

Net Assets | | |

Beginning of period | 19,617,997 | 8,283,651 |

End of period (including undistributed net investment income of $25,010 and $0, respectively) | $ 62,299,097 | $ 19,617,997 |

Other Information Shares | | |

Sold | 3,437,474 | 1,144,472 |

Issued in reinvestment of distributions | 12,719 | 2,995 |

Redeemed | (697,784) | (415,929) |

Net increase (decrease) | 2,752,409 | 731,538 |

Financial Highlights

Years ended December 31, | 2004 | 2003 | 2002 | 2001F |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 11.16 | $ 8.08 | $ 10.06 | $ 10.00 |

Income from Investment Operations | | | | |

Net investment income (loss)E | .08H | .03 | (.01) | .01 |

Net realized and unrealized gain (loss) | 2.59 | 3.06 | (1.98) | .04 |

Total from investment operations | 2.67 | 3.09 | (1.99) | .05 |

Distributions from net investment income | (.04) | (.02) | (.01) | - |

Redemption fees added to paid in capitalE | .02 | .01 | .02 | .01 |

Net asset value, end of period | $ 13.81 | $ 11.16 | $ 8.08 | $ 10.06 |

Total ReturnB,C,D | 24.10% | 38.37% | (19.60)% | .60% |

Ratios to Average Net AssetsG | | | | |

Expenses before expense reductions | .95% | 1.85% | 1.44% | 2.70%A |

Expenses net of voluntary waivers, if any | .95% | 1.50% | 1.44% | 1.50%A |

Expenses net of all reductions | .90% | 1.47% | 1.42% | 1.50%A |

Net investment income (loss) | .63%H | .35% | (.06)% | .18%A |

Supplemental Data | | | | |

Net assets, end of period (000 omitted) | $ 62,299 | $ 19,618 | $ 8,284 | $ 10,290 |

Portfolio turnover rate | 121% | 117% | 143% | 29%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

D Total returns would have been lower had certain expenses not been reduced during the periods shown.

E Calculated based on average shares outstanding during the period.

F For the period July 18, 2001 (commencement of operations) to December 31, 2001.

G Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund.

H As a result of the change in the estimate of the return of capital component of dividend income realized in the year ended December 31, 2003, net investment income per share and the ratio of net investment income to average net assets for the year ended December 31, 2004, have been reduced by $.00 per share and .04%, respectively. The change in estimate has no impact on total net assets or total return of the fund.

See accompanying notes which are an integral part of the financial statements.

Cyclical Industrites Portfolio

Fidelity Variable Insurance Products: Financial Services Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended December 31, 2004 | Past 1

year | Life of fundA |

Fidelity VIP: Financial Services | 11.73% | 6.63% |

A From July 18, 2001.

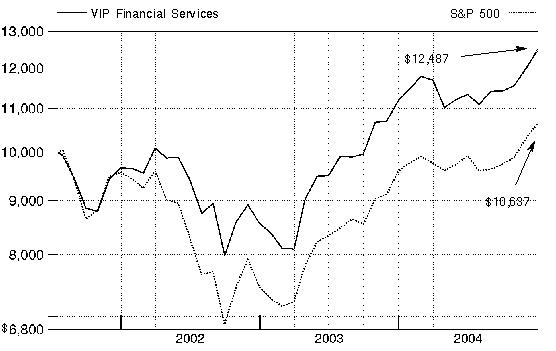

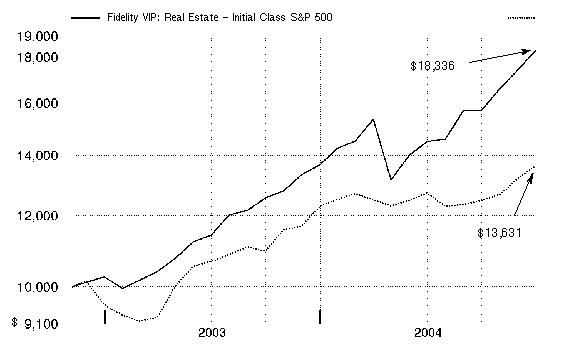

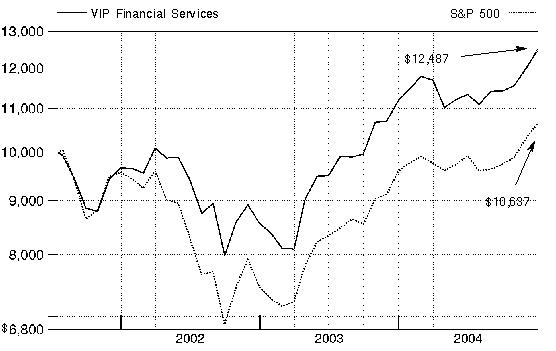

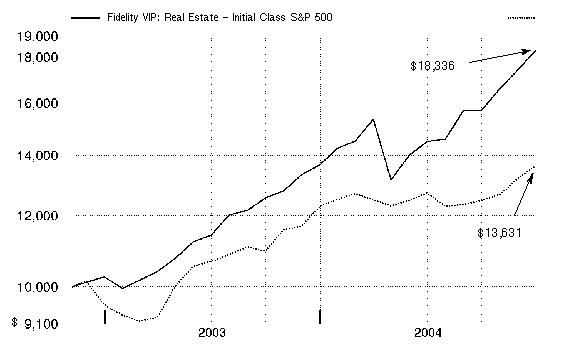

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity® Variable Insurance Products: Financial Services Portfolio on July 18, 2001, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Fidelity Variable Insurance Products: Financial Services Portfolio

Management's Discussion of Fund Performance

Comments from Matthew Fruhan, Portfolio Manager of Fidelity® Variable Insurance Products: Financial Services Portfolio

The year ending December 31, 2004, generally was positive for equity investors, as many stock market benchmarks produced double-digit gains. Broad-based themes included the continued dominance of small-cap stocks, which outperformed large-caps for the sixth consecutive year. The small-cap Russell 2000® Index was up 18.33% in 2004, while the larger-cap Standard & Poor's 500SM Index rose 10.88%. Value stocks ended the year well ahead of growth stocks: The Russell 3000® Value Index advanced 16.94%, compared to 6.93% for the Russell 3000 Growth Index. Energy and basic materials stocks led the market upward. Energy stocks were boosted by record-high oil prices, while strong demand from China helped support commodity prices. The health care sector was among the market's weakest performers. Technology also fell off the pace, though it was helped by a rally late in the year. The tech-heavy NASDAQ Composite® Index returned 9.15%, thanks primarily to a 14.87% jump in the fourth quarter. Elsewhere, the Dow Jones Industrial AverageSM gained 5.37% for the year.

For the 12 months that ended December 31, 2004, Financial Services Portfolio trailed the Goldman Sachs® Financial Services Index, which returned 14.33%, while outperforming the S&P 500®. The portfolio's underweighting of both real estate investment trusts (REITs) and regional banks, two industries that performed well early in 2004, was a major factor in its underperformance relative to the Goldman Sachs index. In addition, Fannie Mae, Freddie Mac and American International Group (AIG), three major portfolio holdings, all struggled after encountering regulatory scrutiny. I reduced the weightings in Fannie Mae and Freddie Mac, two government-sponsored mortgage entities, but I increased the position in insurer AIG because I didn't think its long-term earnings outlook would be hurt by recent controversies. Despite disappointing results early in 2004, the portfolio remained underweighted in REITs and regional banks because of the risk of slowing profits when interest rates finally began rising. At the same time, I kept the portfolio overweighted in firms that I felt could continue to increase their earnings, even in a rising interest rate environment. These included: security brokers, especially those that do significant business in the equity market and in mergers and acquisitions; and consumer finance companies, particularly credit card businesses. First Marblehead, whose primary business is securitizing student loans, was a very strong contributor, as was online financial services firm Ameritrade, which appreciated significantly in the final months of 2004 as the stock market rallied. CIT Group, a commercial lender to mid-sized companies, also performed well as its earnings rose and its growth prospects improved.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Fidelity Variable Insurance Products: Financial Services Portfolio

Investment Summary

Top Five Stocks as of December 31, 2004 |

| % of fund's net assets |

Bank of America Corp. | 9.1 |

American International Group, Inc. | 8.1 |

Morgan Stanley | 5.1 |

Merrill Lynch & Co., Inc. | 4.5 |

Wachovia Corp. | 3.8 |

| 30.6 |

Top Industries as of December 31, 2004 |

% of fund's net assets |

| Commercial Banks | 24.9% | |

| Capital Markets | 21.2% | |

| Insurance | 20.2% | |

| Consumer Finance | 9.2% | |

| Thrifts & Mortgage Finance | 7.7% | |

| All Others* | 16.8% | |

* Includes short-term investments and net other assets. |

Annual Report

Fidelity Variable Insurance Products: Financial Services Portfolio

Investments December 31, 2004

Showing Percentage of Net Assets

Common Stocks - 96.4% |

| Shares | | Value (Note 1) |

CAPITAL MARKETS - 21.2% |

Asset Management & Custody Banks - 4.0% |

American Capital Strategies Ltd. | 1,000 | | $ 33,350 |

Bank of New York Co., Inc. | 3,650 | | 121,983 |

Calamos Asset Management, Inc.

Class A | 1,200 | | 32,400 |

Federated Investors, Inc. Class B (non-vtg.) | 1,580 | | 48,032 |

Firstcity Financial Corp. (a) | 2,228 | | 22,458 |

Franklin Resources, Inc. | 3,700 | | 257,705 |

Investors Financial Services Corp. | 2,400 | | 119,952 |

Legg Mason, Inc. | 1,500 | | 109,890 |

Northern Trust Corp. | 4,450 | | 216,181 |

State Street Corp. | 11,400 | | 559,968 |

Waddell & Reed Financial, Inc. Class A | 5,510 | | 131,634 |

| | 1,653,553 |

Diversified Capital Markets - 0.5% |

UBS AG (NY Shares) | 2,500 | | 209,600 |

Investment Banking & Brokerage - 16.7% |

Ameritrade Holding Corp. (a) | 47,600 | | 676,872 |

Bear Stearns Companies, Inc. | 1,780 | | 182,112 |

Charles Schwab Corp. | 19,200 | | 229,632 |

E*TRADE Financial Corp. (a) | 22,000 | | 328,900 |

Goldman Sachs Group, Inc. | 7,140 | | 742,846 |

LaBranche & Co., Inc. (a)(d) | 2,230 | | 19,981 |

Lehman Brothers Holdings, Inc. | 7,580 | | 663,098 |

Merrill Lynch & Co., Inc. | 31,000 | | 1,852,870 |

Morgan Stanley | 38,210 | | 2,121,419 |

Piper Jaffray Companies (a) | 183 | | 8,775 |

TradeStation Group, Inc. (a) | 20,195 | | 141,769 |

| | 6,968,274 |

TOTAL CAPITAL MARKETS | | 8,831,427 |

COMMERCIAL BANKS - 24.9% |

Diversified Banks - 20.4% |

Banco Popolare di Verona e Novara | 8,000 | | 162,352 |

Bangkok Bank Ltd. PCL (For. Reg.) | 29,000 | | 85,044 |

Bank of America Corp. | 80,196 | | 3,768,407 |

HDFC Bank Ltd. sponsored ADR | 3,700 | | 167,832 |

HSBC Holdings PLC sponsored ADR | 300 | | 25,542 |

Mitsubishi Tokyo Financial Group, Inc. (MTFG) sponsored ADR | 15,000 | | 153,300 |

National Bank of Canada | 5,600 | | 231,280 |

Royal Bank of Canada | 4,160 | | 222,733 |

State Bank of India | 8,430 | | 137,833 |

U.S. Bancorp, Delaware | 24,800 | | 776,736 |

Wachovia Corp. | 30,497 | | 1,604,142 |

Wells Fargo & Co. | 18,800 | | 1,168,420 |

| | 8,503,621 |

Regional Banks - 4.5% |

Cathay General Bancorp | 4,822 | | 180,825 |

|

| Shares | | Value (Note 1) |

Center Financial Corp., California | 4,800 | | $ 96,096 |

City National Corp. | 800 | | 56,520 |

East West Bancorp, Inc. | 3,900 | | 163,644 |

Hanmi Financial Corp. | 4,300 | | 154,542 |

M&T Bank Corp. | 400 | | 43,136 |

Nara Bancorp, Inc. | 400 | | 8,508 |

North Fork Bancorp, Inc., New York | 10,450 | | 301,483 |

Silicon Valley Bancshares (a) | 2,900 | | 129,978 |

Synovus Financial Corp. | 100 | | 2,858 |

UCBH Holdings, Inc. | 6,800 | | 311,576 |

Valley National Bancorp | 18 | | 498 |

Westcorp | 8,800 | | 404,184 |

| | 1,853,848 |

TOTAL COMMERCIAL BANKS | | 10,357,469 |

COMMERCIAL SERVICES & SUPPLIES - 1.3% |

Diversified Commercial Services - 1.3% |

Asset Acceptance Capital Corp. | 18,057 | | 384,614 |

Jackson Hewitt Tax Service, Inc. | 6,800 | | 171,700 |

| | 556,314 |

CONSUMER FINANCE - 9.2% |

Consumer Finance - 9.2% |

American Express Co. | 24,940 | | 1,405,868 |

Capital One Financial Corp. | 6,200 | | 522,102 |

First Marblehead Corp. (a) | 7,400 | | 416,250 |

MBNA Corp. | 44,805 | | 1,263,053 |

QC Holdings, Inc. | 1,216 | | 23,299 |

SLM Corp. | 3,640 | | 194,340 |

| | 3,824,912 |

DIVERSIFIED FINANCIAL SERVICES - 7.4% |

Other Diversifed Financial Services - 6.5% |

Citigroup, Inc. | 24,130 | | 1,162,583 |

J.P. Morgan Chase & Co. | 36,238 | | 1,413,644 |

Principal Financial Group, Inc. | 2,700 | | 110,538 |

| | 2,686,765 |

Specialized Finance - 0.9% |

Archipelago Holdings, Inc. | 4,000 | | 83,880 |

CIT Group, Inc. | 4,100 | | 187,862 |

Encore Capital Group, Inc. (a) | 2,300 | | 54,694 |

eSpeed, Inc. Class A (a) | 3,900 | | 48,243 |

| | 374,679 |

TOTAL DIVERSIFIED FINANCIAL SERVICES | | 3,061,444 |

INDUSTRIAL CONGLOMERATES - 1.2% |

Industrial Conglomerates - 1.2% |

General Electric Co. | 13,700 | | 500,050 |

INSURANCE - 20.2% |

Life & Health Insurance - 3.1% |

AFLAC, Inc. | 7,500 | | 298,800 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

INSURANCE - CONTINUED |

Life & Health Insurance - continued |

Lincoln National Corp. | 500 | | $ 23,340 |

MetLife, Inc. | 11,010 | | 446,015 |

Protective Life Corp. | 1,200 | | 51,228 |

Sun Life Financial, Inc. | 12,090 | | 404,511 |

Torchmark Corp. | 1,400 | | 79,996 |

| | 1,303,890 |

Multi-Line Insurance - 9.8% |

American International Group, Inc. | 51,610 | | 3,389,229 |

Genworth Financial, Inc. Class A | 2,100 | | 56,700 |

Hartford Financial Services Group, Inc. | 6,960 | | 482,398 |

HCC Insurance Holdings, Inc. | 2,220 | | 73,526 |

Unitrin, Inc. | 1,700 | | 77,265 |

| | 4,079,118 |

Property & Casualty Insurance - 5.4% |

ACE Ltd. | 15,150 | | 647,663 |

AMBAC Financial Group, Inc. | 1,510 | | 124,016 |

Berkshire Hathaway, Inc. Class B (a) | 331 | | 971,816 |

Fidelity National Financial, Inc. | 2,642 | | 120,660 |

MBIA, Inc. | 4,060 | | 256,917 |

St. Paul Travelers Companies, Inc. | 2,800 | | 103,796 |

XL Capital Ltd. Class A | 500 | | 38,825 |

| | 2,263,693 |

Reinsurance - 1.9% |

Endurance Specialty Holdings Ltd. | 13,560 | | 463,752 |

Max Re Capital Ltd. | 2,916 | | 62,198 |

Montpelier Re Holdings Ltd. | 1,800 | | 69,210 |

PartnerRe Ltd. | 1,900 | | 117,686 |

Scottish Re Group Ltd. | 2,200 | | 56,980 |

| | 769,826 |

TOTAL INSURANCE | | 8,416,527 |

IT SERVICES - 0.2% |

Data Processing & Outsourced Services - 0.2% |

First Data Corp. | 2,000 | | 85,080 |

REAL ESTATE - 3.3% |

Real Estate Investment Trusts - 3.3% |

Apartment Investment & Management Co. Class A | 10,030 | | 386,556 |

CBL & Associates Properties, Inc. | 900 | | 68,715 |

Duke Realty Corp. | 1,830 | | 62,476 |

Equity Lifestyle Properties, Inc. | 1,000 | | 35,750 |

Equity Residential (SBI) | 2,390 | | 86,470 |

Federal Realty Investment Trust (SBI) | 580 | | 29,957 |

Healthcare Realty Trust, Inc. | 3,600 | | 146,520 |

Novastar Financial, Inc. | 900 | | 44,550 |

Reckson Associates Realty Corp. | 1,800 | | 59,058 |

Simon Property Group, Inc. | 4,600 | | 297,482 |

Spirit Finance Corp. | 9,000 | | 113,850 |

|

| Shares | | Value (Note 1) |

The Mills Corp. | 700 | | $ 44,632 |

Vornado Realty Trust | 60 | | 4,568 |

| | 1,380,584 |

THRIFTS & MORTGAGE FINANCE - 7.5% |

Thrifts & Mortgage Finance - 7.5% |

Countrywide Financial Corp. | 14,963 | | 553,781 |

Doral Financial Corp. | 50 | | 2,463 |

Fannie Mae | 5,850 | | 416,579 |

First Niagara Financial Group, Inc. | 3,200 | | 44,640 |

Freddie Mac | 5,700 | | 420,090 |

Golden West Financial Corp., Delaware | 5,400 | | 331,668 |

Hudson City Bancorp, Inc. | 3,600 | | 132,552 |

MGIC Investment Corp. | 1,400 | | 96,474 |

New York Community Bancorp, Inc. | 4,533 | | 93,244 |

Provident Financial Services, Inc. | 6,700 | | 129,779 |

Radian Group, Inc. | 1,625 | | 86,515 |

Sovereign Bancorp, Inc. | 19,490 | | 439,500 |

The PMI Group, Inc. | 2,300 | | 96,025 |

W Holding Co., Inc. | 3,774 | | 86,576 |

Washington Mutual, Inc. | 3,900 | | 164,892 |

| | 3,094,778 |

TOTAL COMMON STOCKS (Cost $31,259,815) | 40,108,585 |

Convertible Preferred Stocks - 0.2% |

| | | |

THRIFTS & MORTGAGE FINANCE - 0.2% |

Thrifts & Mortgage Finance - 0.2% |

Fannie Mae 5.375%

(Cost $100,000) | 1 | | 105,375 |

Money Market Funds - 3.6% |

| | | |

Fidelity Cash Central Fund, 2.24% (b) | 1,459,475 | | 1,459,475 |

Fidelity Securities Lending Cash Central Fund, 2.23% (b)(c) | 20,000 | | 20,000 |

TOTAL MONEY MARKET FUNDS (Cost $1,479,475) | 1,479,475 |

TOTAL INVESTMENT PORTFOLIO - 100.2% (Cost $32,839,290) | 41,693,435 |

NET OTHER ASSETS - (0.2)% | (98,763) |

NET ASSETS - 100% | $ 41,594,672 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

(c) Includes investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Income Tax Information |

At December 31, 2004, the fund had a capital loss carryforward of approximately $1,758,000 all of which will expire on December 31, 2011. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Variable Insurance Products: Financial Services Portfolio

Financial Statements

Statement of Assets and Liabilities

December 31, 2004 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $17,920) (cost $32,839,290) - See accompanying schedule | | $ 41,693,435 |

Receivable for investments sold | | 331,318 |

Dividends receivable | | 36,560 |

Interest receivable | | 3,679 |

Prepaid expenses | | 152 |

Other receivables | | 2,295 |

Total assets | | 42,067,439 |

| | |

Liabilities | | |

Payable to custodian bank | $ 41,722 | |

Payable for investments purchased | 294,631 | |

Payable for fund shares redeemed | 59,832 | |

Accrued management fee | 19,703 | |

Other affiliated payables | 4,792 | |

Other payables and accrued expenses | 32,087 | |

Collateral on securities loaned, at value | 20,000 | |

Total liabilities | | 472,767 |

| | |

Net Assets | | $ 41,594,672 |

Net Assets consist of: | | |

Paid in capital | | $ 34,218,272 |

Undistributed net investment income | | 449,474 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (1,924,995) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 8,851,921 |

Net Assets, for 3,413,537 shares outstanding | | $ 41,594,672 |

Net Asset Value, offering price and redemption price per share ($41,594,672 ÷ 3,413,537 shares) | | $ 12.19 |

Statement of Operations

Year ended December 31, 2004 |

| | |

Investment Income | | |

Dividends | | $ 766,281 |

Interest | | 18,080 |

Security lending | | 1,776 |

Total income | | 786,137 |

| | |

Expenses | | |

Management fee | $ 234,228 | |

Transfer agent fees | 30,216 | |

Accounting and security lending fees | 30,031 | |

Non-interested trustees' compensation | 223 | |

Custodian fees and expenses | 9,804 | |

Audit | 32,458 | |

Legal | 886 | |

Miscellaneous | 8,643 | |

Total expenses before reductions | 346,489 | |

Expense reductions | (9,826) | 336,663 |

Net investment income (loss) | | 449,474 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 2,977,097 | |

Foreign currency transactions | (3,542) | |

Total net realized gain (loss) | | 2,973,555 |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $2,253) | 668,312 | |

Assets and liabilities in foreign currencies | (62) | |

Total change in net unrealized appreciation (depreciation) | | 668,250 |

Net gain (loss) | | 3,641,805 |

Net increase (decrease) in net assets resulting from operations | | $ 4,091,279 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Fidelity Variable Insurance Products: Financial Services Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

December 31,

2004 | Year ended

December 31,

2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 449,474 | $ 380,590 |

Net realized gain (loss) | 2,973,555 | (623,543) |

Change in net unrealized appreciation (depreciation) | 668,250 | 9,630,683 |

Net increase (decrease) in net assets resulting from operations | 4,091,279 | 9,387,730 |

Distributions to shareholders from net investment income | - | (403,705) |

Share transactions

Proceeds from sales of shares | 10,285,693 | 13,759,235 |

Reinvestment of distributions | - | 403,705 |

Cost of shares redeemed | (13,703,290) | (17,000,774) |

Net increase (decrease) in net assets resulting from share transactions | (3,417,597) | (2,837,834) |

Redemption fees | 20,525 | 30,113 |

Total increase (decrease) in net assets | 694,207 | 6,176,304 |

| | |

Net Assets | | |

Beginning of period | 40,900,465 | 34,724,161 |

End of period (including undistributed net investment income of $449,474 and $0, respectively) | $ 41,594,672 | $ 40,900,465 |

Other Information Shares | | |

Sold | 907,842 | 1,431,706 |

Issued in reinvestment of distributions | - | 37,554 |

Redeemed | (1,241,488) | (1,836,791) |

Net increase (decrease) | (333,646) | (367,531) |

Financial Highlights

Years ended December 31, | 2004 | 2003 | 2002 | 2001F |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 10.91 | $ 8.44 | $ 9.64 | $ 10.00 |

Income from Investment Operations | | | | |

Net investment income (loss)E | .12 | .10 | .10 | .03 |

Net realized and unrealized gain (loss) | 1.15 | 2.47 | (1.21) | (.38) |