UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3759

Variable Insurance Products Fund IV

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2007 |

Item 1. Reports to Stockholders

Fidelity® Variable Insurance Products:

Consumer Discretionary Portfolio

Annual Report

December 31, 2007

(2_fidelity_logos) (Registered_Trademark)

Contents

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion | <Click Here> | The manager's review of fund performance, strategy and outlook. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their

market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and

changes in net assets, as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com (search for "proxy voting guidelines") or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listings, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended December 31, 2007 | Past 1

year | Past 5

years | Life of

fundA |

VIP Consumer Discretionary - Initial Class C | -8.14% | 7.82% | 2.67% |

VIP Consumer Discretionary - Investor Class B, C | -8.29% | 7.76% | 2.63% |

A From July 18, 2001.

B The initial offering of Investor Class shares took place on July 21, 2005. Returns prior to July 21, 2005 are those of Initial Class. If Investor Class's transfer agent fee had been reflected, returns prior to July 21, 2005 would have been lower.

C Prior to October 1, 2006, VIP Consumer Discretionary operated under certain different investment policies. The historical performance for the fund may not represent its current investment policies.

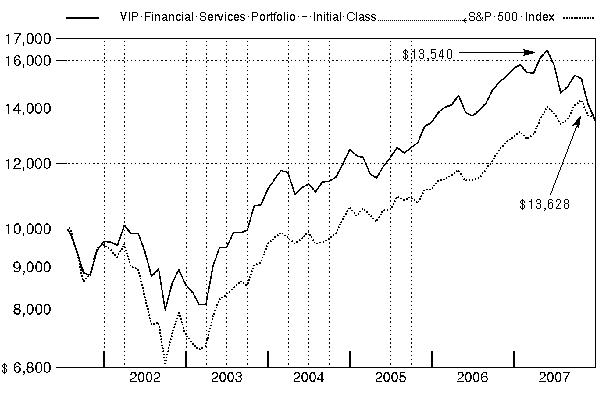

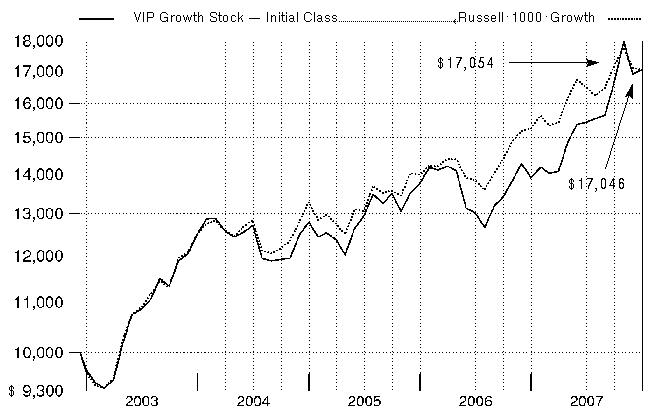

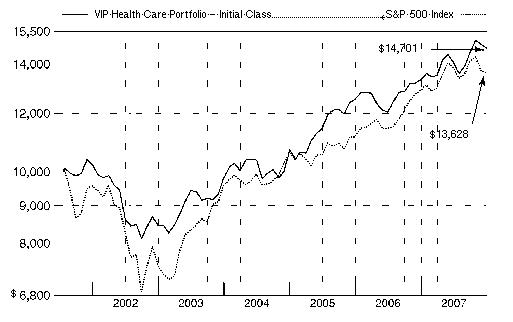

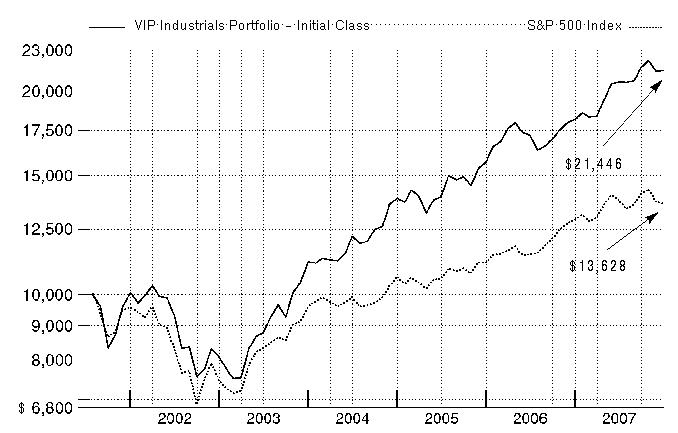

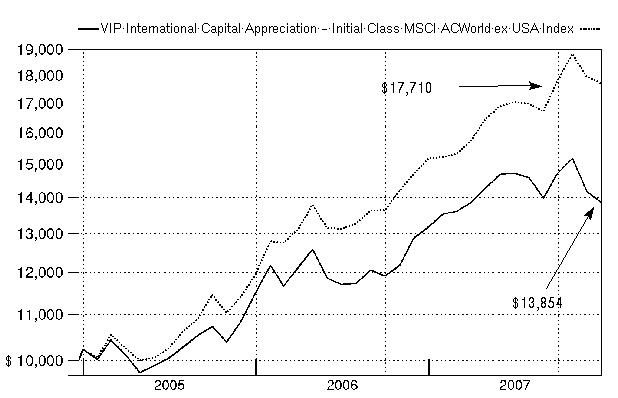

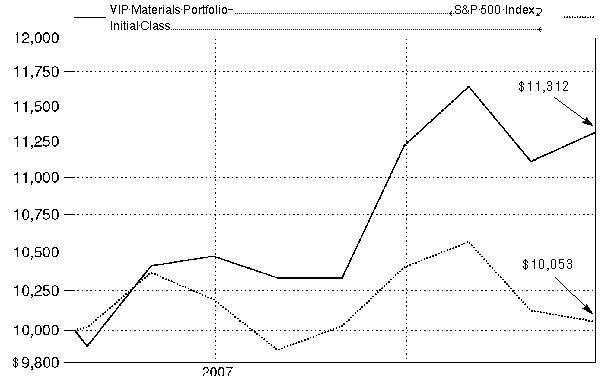

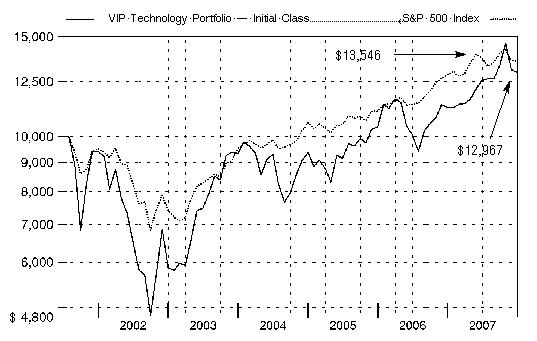

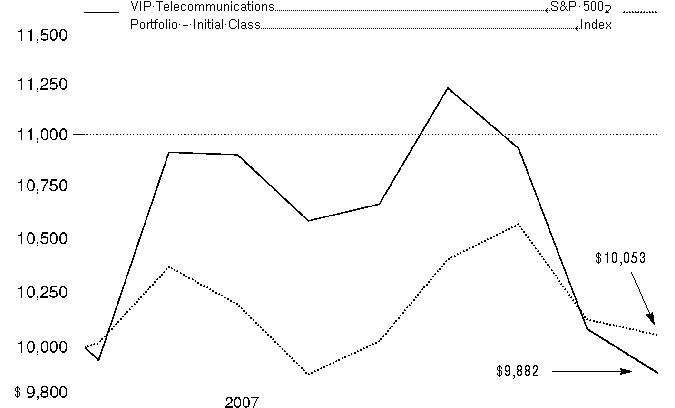

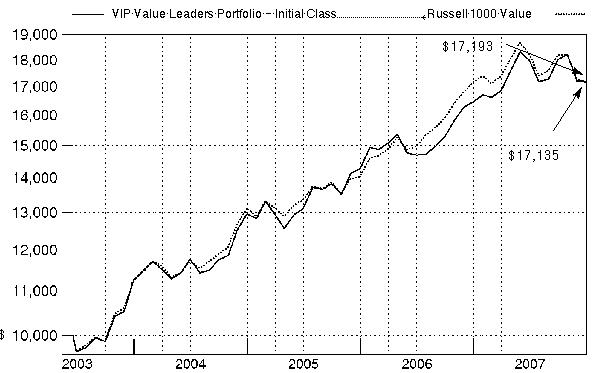

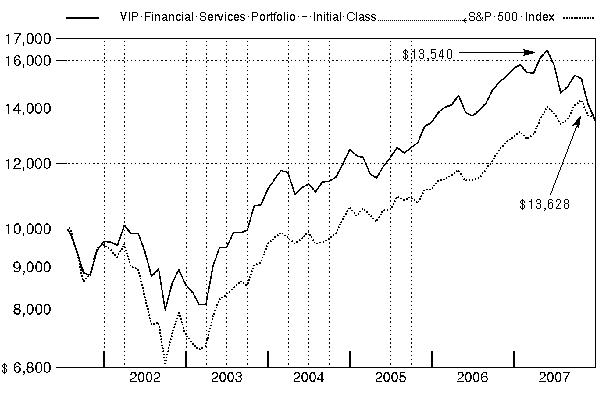

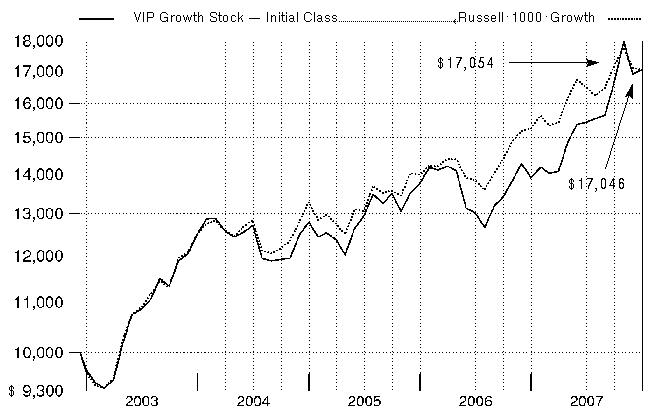

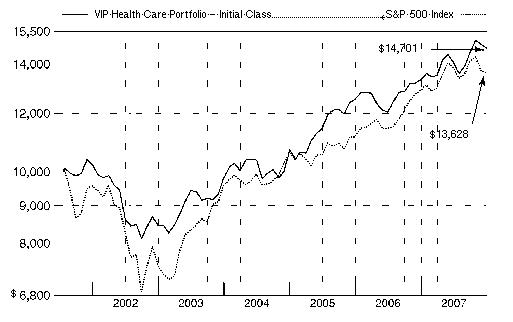

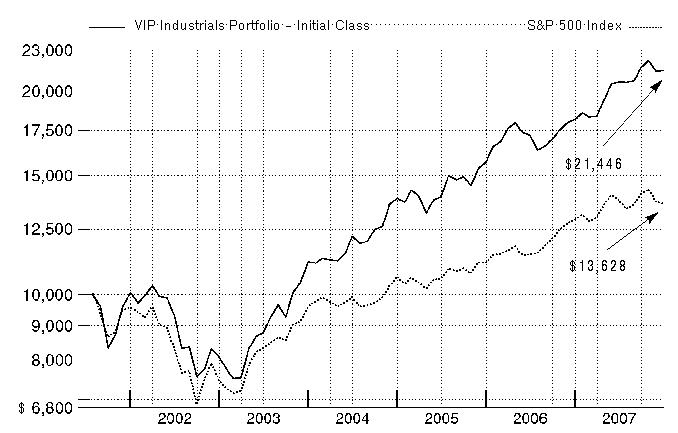

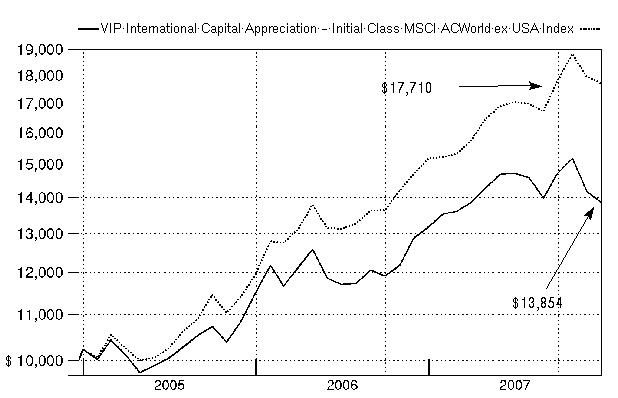

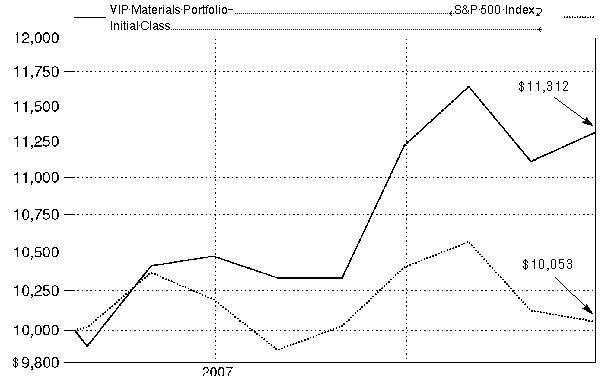

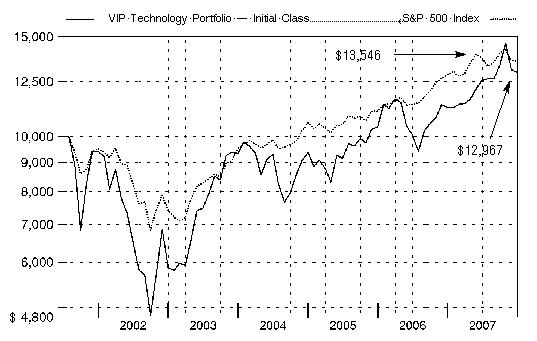

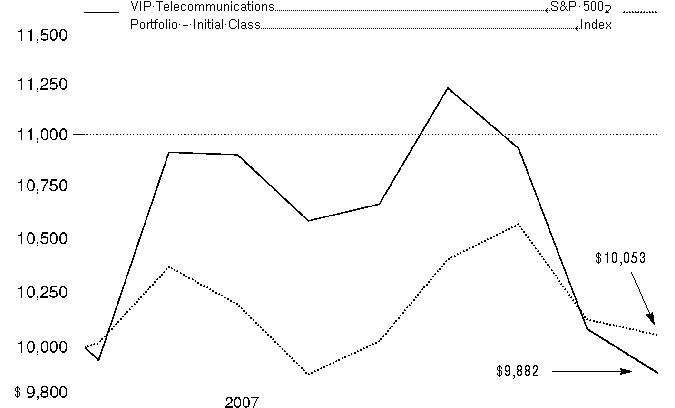

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in VIP Consumer Discretionary Portfolio - Initial Class on July 18, 2001, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Standard & Poor's 500SM Index (S&P 500®) performed over the same period.

Annual Report

Management's Discussion of Fund Performance

Comments from John Harris, Portfolio Manager of VIP Consumer Discretionary Portfolio

U.S. equity markets, as measured by the bellwether Dow Jones Industrial AverageSM and the Standard & Poor's 500SM Index, registered their fifth consecutive year of positive returns in 2007, as the Dow rose 8.88% and the S&P 500® index advanced 5.49%. The tech-heavy NASDAQ Composite® Index did even better, increasing 10.55%. However, credit- and recession-related concerns carved deeply into stock prices late in 2007, pushing some major market measures into negative territory for the year overall, particularly smaller-cap and value-oriented benchmarks. Based largely on a weak U.S. dollar that boosted returns for U.S. investors, the Morgan Stanley Capital InternationalSM Europe, Australasia, and Far East (MSCI® EAFE®) Index - a gauge of developed stock markets outside the United States and Canada - beat most domestic equity measures, gaining 11.33%. Several European countries had outstanding performance, including Finland and Germany, while Australia also did very well. However, fallout from the credit crunch and concerns about export growth tempered U.K. stocks, while fears that Japanese financial companies would become embroiled in the U.S. subprime mortgage crisis contributed to a loss of more than 4% for the Japanese portion of the index. The emerging-markets stock asset class soared 39.78% according to the MSCI Emerging Markets index. The U.S. investment-grade bond market climbed 6.97% as measured by the Lehman Brothers® U.S. Aggregate Index, beating the 2.53% gain for the Merrill Lynch® U.S. High Yield Master II Constrained Index. The emerging-markets bond category shook off a sluggish first half of 2007 to finish the year with a respectable gain of 6.28% as measured by the J.P. Morgan Emerging Markets Bond Index (EMBI) Global, while the Citigroup® Non-U.S. Group of 7 Index - representing the debt performance of major global economies, excluding the United States - rose 13.05%.

For the 12-month period ending December 31, 2007, the fund outperformed the Morgan Stanley Capital InternationalSM (MSCI®) US Investable Market Consumer Discretionary Index, which was down 11.43%, but trailed the S&P 500. (For specific portfolio performance results, please refer to the performance section of this report.) Results relative to the MSCI index during the period were aided by an underweighting and effective stock selection in the hard-hit homebuilding industry, as well as good stock selection in Internet software and services; casinos and gaming; and hotels, resorts and cruise lines. Our out-of-index position in search engine Google did well, as did Costco Wholesale, another holding not included in the MSCI index. Costco was a relatively defensive position; I felt the discount warehouse chain would tend to gain market share as consumers became more price-conscious, and indeed its profit margins and earnings improved in 2007. Shares in footwear marketer Deckers Outdoor performed strongly as the firm expanded the market for its UGG brand. RadioShack's shares rose after the electronics retailer cut costs to increase cash flow, and I sold our position before the stock sank later in the period. On the negative side, I underweighted index component Amazon.com early in the period and missed a large part of the surge in its stock price. R.H. Donnelley, a publisher of print and online phone directories, suffered greater sales declines than I had anticipated. I missed most of the strong performance by sports apparel firm Nike and did not own the stock at period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2007 to December 31, 2007).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

July 1, 2007 | Ending

Account Value

December 31, 2007 | Expenses Paid

During Period*

July 1, 2007 to

December 31, 2007 |

Initial Class | | | |

Actual | $ 1,000.00 | $ 867.30 | $ 4.71 |

HypotheticalA | $ 1,000.00 | $ 1,020.16 | $ 5.09 |

Investor Class | | | |

Actual | $ 1,000.00 | $ 866.40 | $ 5.41** |

HypotheticalA | $ 1,000.00 | $ 1,019.41 | $ 5.85** |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Initial Class | 1.00% |

Investor Class | 1.15%** |

** If changes to transfer agent contracts and voluntary expense limitations, effective February 1, 2008 had been in effect during the entire period, the annualized expense ratio would have been 1.08% and the expenses paid in the actual and hypothetical examples above would have been 5.08 and 5.50, respectively.

Annual Report

Investment Changes

Top Ten Stocks as of December 31, 2007 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

McDonald's Corp. | 6.4 | 5.0 |

Time Warner, Inc. | 5.9 | 6.3 |

Target Corp. | 5.7 | 5.3 |

Staples, Inc. | 3.7 | 2.9 |

Comcast Corp. Class A | 3.5 | 4.5 |

Home Depot, Inc. | 3.4 | 6.0 |

News Corp | 3.1 | 3.0 |

Lowe's Companies, Inc. | 2.9 | 1.6 |

The Walt Disney Co. | 2.7 | 1.1 |

Omnicom Group, Inc. | 2.5 | 0.8 |

| 39.8 | |

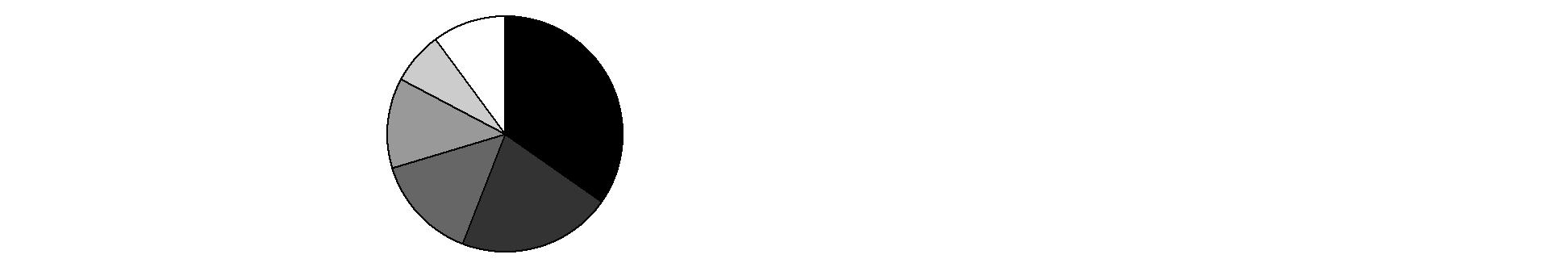

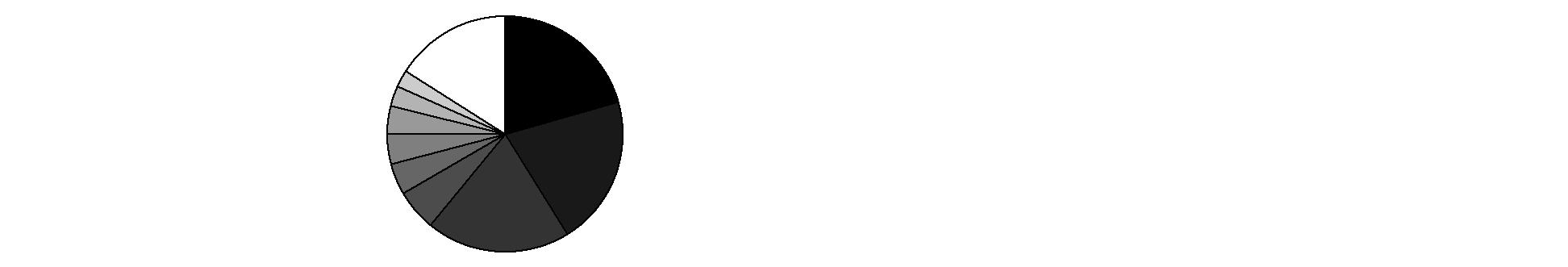

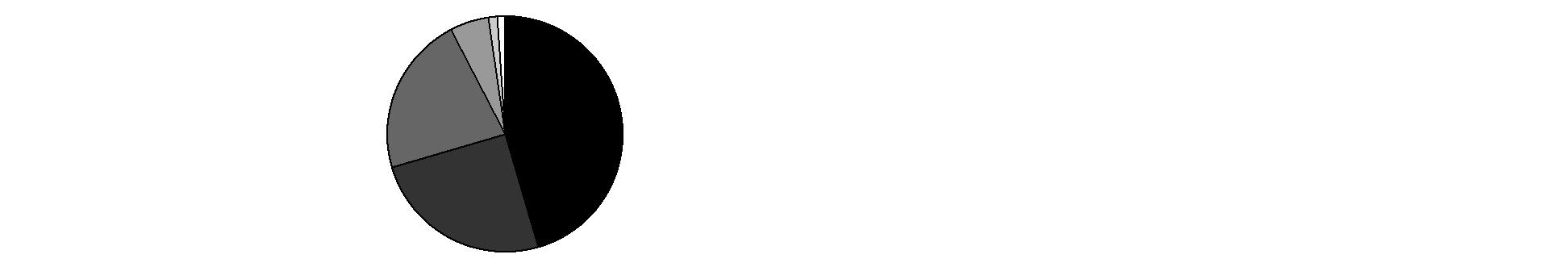

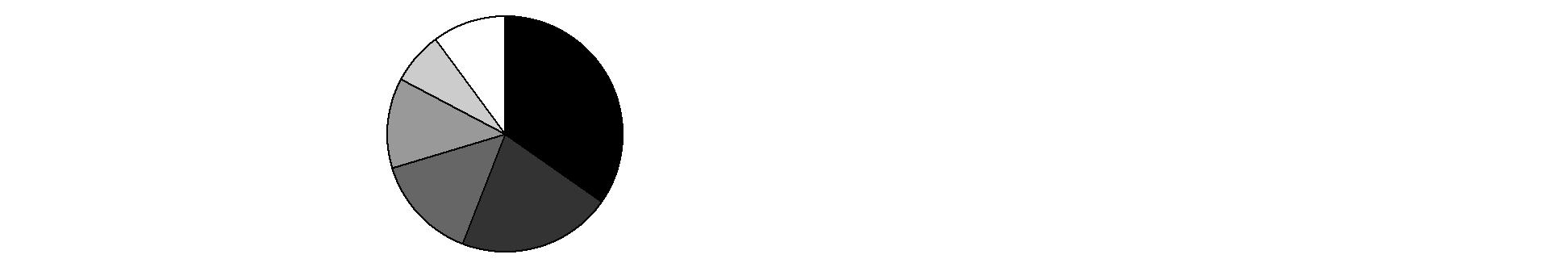

Top Industries (% of fund's net assets) |

As of December 31, 2007 |

| Media | 28.7% | |

| Specialty Retail | 22.4% | |

| Hotels, Restaurants & Leisure | 14.2% | |

| Multiline Retail | 8.1% | |

| Textiles, Apparel & Luxury Goods | 5.6% | |

| All Others* | 21.0% | |

|

As of June 30, 2007 |

| Media | 25.8% | |

| Specialty Retail | 21.3% | |

| Hotels, Restaurants & Leisure | 16.5% | |

| Multiline Retail | 12.2% | |

| Textiles, Apparel & Luxury Goods | 7.0% | |

| All Others* | 17.2% | |

* Includes short-term investments and net other assets. |

Annual Report

Investments December 31, 2007

Showing Percentage of Net Assets

Common Stocks - 99.1% |

| Shares | | Value |

AUTO COMPONENTS - 2.4% |

Auto Parts & Equipment - 2.4% |

Johnson Controls, Inc. | 6,100 | | $ 219,844 |

AUTOMOBILES - 1.4% |

Automobile Manufacturers - 0.6% |

Renault SA | 200 | | 28,315 |

Toyota Motor Corp. sponsored ADR | 300 | | 31,851 |

| | 60,166 |

Motorcycle Manufacturers - 0.8% |

Harley-Davidson, Inc. | 1,500 | | 70,065 |

TOTAL AUTOMOBILES | | 130,231 |

DISTRIBUTORS - 0.3% |

Distributors - 0.3% |

Li & Fung Ltd. | 6,000 | | 24,240 |

DIVERSIFIED CONSUMER SERVICES - 2.5% |

Education Services - 2.1% |

Apollo Group, Inc. Class A (non-vtg.) (a) | 2,100 | | 147,315 |

Career Education Corp. (a) | 700 | | 17,598 |

Princeton Review, Inc. (a) | 1,179 | | 9,821 |

Strayer Education, Inc. | 100 | | 17,058 |

| | 191,792 |

Specialized Consumer Services - 0.4% |

Sotheby's Class A (ltd. vtg.) | 1,100 | | 41,910 |

TOTAL DIVERSIFIED CONSUMER SERVICES | | 233,702 |

FOOD & STAPLES RETAILING - 4.8% |

Drug Retail - 1.9% |

CVS Caremark Corp. | 4,600 | | 182,850 |

Food Distributors - 0.8% |

Sysco Corp. | 2,300 | | 71,783 |

Food Retail - 0.8% |

Susser Holdings Corp. (a) | 3,500 | | 71,750 |

Hypermarkets & Super Centers - 1.3% |

Costco Wholesale Corp. | 1,800 | | 125,568 |

TOTAL FOOD & STAPLES RETAILING | | 451,951 |

HOTELS, RESTAURANTS & LEISURE - 14.2% |

Casinos & Gaming - 3.9% |

International Game Technology | 4,800 | | 210,864 |

Las Vegas Sands Corp. (a) | 900 | | 92,745 |

Penn National Gaming, Inc. (a) | 1,100 | | 65,505 |

| | 369,114 |

Hotels, Resorts & Cruise Lines - 3.9% |

Accor SA | 1,100 | | 87,812 |

Carnival Corp. unit | 3,300 | | 146,817 |

|

| Shares | | Value |

Royal Caribbean Cruises Ltd. | 1,800 | | $ 76,392 |

Starwood Hotels & Resorts Worldwide, Inc. | 1,200 | | 52,836 |

| | 363,857 |

Restaurants - 6.4% |

McDonald's Corp. | 10,100 | | 594,991 |

TOTAL HOTELS, RESTAURANTS & LEISURE | | 1,327,962 |

HOUSEHOLD DURABLES - 0.9% |

Household Appliances - 0.9% |

The Stanley Works | 400 | | 19,392 |

Whirlpool Corp. | 800 | | 65,304 |

| | 84,696 |

INTERNET & CATALOG RETAIL - 3.5% |

Catalog Retail - 1.3% |

Liberty Media Corp. - Interactive

Series A (a) | 6,300 | | 120,204 |

Internet Retail - 2.2% |

Amazon.com, Inc. (a) | 900 | | 83,376 |

Blue Nile, Inc. (a) | 1,800 | | 122,508 |

| | 205,884 |

TOTAL INTERNET & CATALOG RETAIL | | 326,088 |

INTERNET SOFTWARE & SERVICES - 2.0% |

Internet Software & Services - 2.0% |

Google, Inc. Class A (sub. vtg.) (a) | 200 | | 138,296 |

LoopNet, Inc. (a) | 3,400 | | 47,770 |

| | 186,066 |

LEISURE EQUIPMENT & PRODUCTS - 1.3% |

Leisure Products - 0.9% |

Mattel, Inc. | 4,700 | | 89,488 |

Photographic Products - 0.4% |

Eastman Kodak Co. | 1,600 | | 34,992 |

TOTAL LEISURE EQUIPMENT & PRODUCTS | | 124,480 |

MEDIA - 28.7% |

Advertising - 3.5% |

National CineMedia, Inc. | 3,600 | | 90,756 |

Omnicom Group, Inc. | 5,000 | | 237,650 |

| | 328,406 |

Broadcasting & Cable TV - 6.8% |

Clear Channel Communications, Inc. | 3,400 | | 117,368 |

Comcast Corp. Class A (a) | 18,000 | | 328,680 |

Grupo Televisa SA de CV (CPO) sponsored ADR | 6,000 | | 142,620 |

Time Warner Cable, Inc. (a) | 1,600 | | 44,160 |

| | 632,828 |

Movies & Entertainment - 15.0% |

Cinemark Holdings, Inc. | 1,400 | | 23,800 |

Common Stocks - continued |

| Shares | | Value |

MEDIA - CONTINUED |

Movies & Entertainment - continued |

Live Nation, Inc. (a) | 3,622 | | $ 52,591 |

News Corp.: | | | |

Class A | 13,141 | | 269,259 |

Class B | 1,100 | | 23,375 |

Regal Entertainment Group Class A | 12,800 | | 231,296 |

The Walt Disney Co. | 7,800 | | 251,784 |

Time Warner, Inc. | 33,500 | | 553,085 |

| | 1,405,190 |

Publishing - 3.4% |

McGraw-Hill Companies, Inc. | 4,800 | | 210,288 |

R.H. Donnelley Corp. (a) | 2,900 | | 105,792 |

| | 316,080 |

TOTAL MEDIA | | 2,682,504 |

MULTILINE RETAIL - 8.1% |

Department Stores - 2.0% |

JCPenney Co., Inc. | 300 | | 13,197 |

Kohl's Corp. (a) | 1,700 | | 77,860 |

Nordstrom, Inc. | 2,700 | | 99,171 |

| | 190,228 |

General Merchandise Stores - 6.1% |

Dollar Tree Stores, Inc. (a) | 600 | | 15,552 |

Family Dollar Stores, Inc. | 900 | | 17,307 |

Target Corp. | 10,700 | | 535,000 |

| | 567,859 |

TOTAL MULTILINE RETAIL | | 758,087 |

PERSONAL PRODUCTS - 0.7% |

Personal Products - 0.7% |

Bare Escentuals, Inc. (a) | 2,700 | | 65,475 |

SOFTWARE - 0.3% |

Home Entertainment Software - 0.3% |

Activision, Inc. (a) | 1,100 | | 32,670 |

SPECIALTY RETAIL - 22.4% |

Apparel Retail - 4.9% |

Abercrombie & Fitch Co. Class A | 1,100 | | 87,967 |

American Eagle Outfitters, Inc. | 1,100 | | 22,847 |

Casual Male Retail Group, Inc. (a) | 4,950 | | 25,641 |

Citi Trends, Inc. (a) | 1,600 | | 24,704 |

Collective Brands, Inc. (a) | 3,100 | | 53,909 |

Ross Stores, Inc. | 800 | | 20,456 |

TJX Companies, Inc. | 4,300 | | 123,539 |

Tween Brands, Inc. (a) | 2,100 | | 55,608 |

Urban Outfitters, Inc. (a) | 1,500 | | 40,890 |

| | 455,561 |

|

| Shares | | Value |

Automotive Retail - 1.4% |

Advance Auto Parts, Inc. | 2,800 | | $ 106,372 |

Penske Auto Group, Inc. | 1,600 | | 27,936 |

| | 134,308 |

Computer & Electronics Retail - 1.5% |

Best Buy Co., Inc. | 1,050 | | 55,283 |

Gamestop Corp. Class A (a) | 1,300 | | 80,743 |

| | 136,026 |

Home Improvement Retail - 7.0% |

Home Depot, Inc. | 11,784 | | 317,461 |

Lowe's Companies, Inc. | 12,200 | | 275,964 |

Sherwin-Williams Co. | 1,100 | | 63,844 |

| | 657,269 |

Homefurnishing Retail - 0.7% |

Williams-Sonoma, Inc. | 2,500 | | 64,750 |

Specialty Stores - 6.9% |

PetSmart, Inc. | 7,763 | | 182,663 |

Staples, Inc. | 14,950 | | 344,897 |

Tiffany & Co., Inc. | 2,500 | | 115,075 |

| | 642,635 |

TOTAL SPECIALTY RETAIL | | 2,090,549 |

TEXTILES, APPAREL & LUXURY GOODS - 5.6% |

Apparel, Accessories & Luxury Goods - 2.8% |

Burberry Group PLC | 3,900 | | 44,129 |

Coach, Inc. (a) | 5,600 | | 171,248 |

G-III Apparel Group Ltd. (a) | 2,905 | | 42,907 |

Lululemon Athletica, Inc. | 100 | | 4,737 |

| | 263,021 |

Footwear - 2.8% |

Crocs, Inc. (a) | 900 | | 33,129 |

Deckers Outdoor Corp. (a) | 773 | | 119,861 |

Iconix Brand Group, Inc. (a) | 4,200 | | 82,572 |

K-Swiss, Inc. Class A | 1,103 | | 19,964 |

| | 255,526 |

TOTAL TEXTILES, APPAREL & LUXURY GOODS | | 518,547 |

TOTAL COMMON STOCKS (Cost $9,636,270) | 9,257,092 |

Money Market Funds - 1.3% |

| Shares | | Value |

Fidelity Cash Central Fund, 4.58% (b)

(Cost $123,944) | 123,944 | | $ 123,944 |

TOTAL INVESTMENT PORTFOLIO - 100.4% (Cost $9,760,214) | | 9,381,036 |

NET OTHER ASSETS - (0.4)% | | (39,378) |

NET ASSETS - 100% | $ 9,341,658 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 5,680 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

| December 31, 2007 |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers

(cost $9,636,270) | $ 9,257,092 | |

Fidelity Central Funds (cost $123,944) | 123,944 | |

Total Investments (cost $9,760,214) | | $ 9,381,036 |

Receivable for fund shares sold | | 308 |

Dividends receivable | | 8,250 |

Distributions receivable from Fidelity Central Funds | | 187 |

Prepaid expenses | | 36 |

Receivable from investment adviser for expense reductions | | 5,645 |

Total assets | | 9,395,462 |

| | |

Liabilities | | |

Payable to custodian bank | $ 11,801 | |

Payable for fund shares redeemed | 389 | |

Accrued management fee | 4,519 | |

Other affiliated payables | 1,092 | |

Other payables and accrued

expenses | 36,003 | |

Total liabilities | | 53,804 |

| | |

Net Assets | | $ 9,341,658 |

Net Assets consist of: | | |

Paid in capital | | $ 9,702,362 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 18,469 |

Net unrealized appreciation

(depreciation) on investments and assets and liabilities in foreign

currencies | | (379,173) |

Net Assets | | $ 9,341,658 |

Statement of Assets and Liabilities - continued

| December 31, 2007 |

| | |

Initial Class:

Net Asset Value, offering price and redemption price

per share ($6,989,169 ÷ 652,264 shares) | | $ 10.72 |

| | |

Investor Class:

Net Asset Value, offering price and redemption price

per share ($2,352,489 ÷ 219,437 shares) | | $ 10.72 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended December 31, 2007 |

| | |

Investment Income | | |

Dividends | | $ 133,130 |

Interest | | 163 |

Income from Fidelity Central Funds | | 5,680 |

Total income | | 138,973 |

| | |

Expenses | | |

Management fee | $ 82,626 | |

Transfer agent fees | 20,858 | |

Accounting fees and expenses | 5,750 | |

Custodian fees and expenses | 14,356 | |

Independent trustees' compensation | 53 | |

Audit | 41,416 | |

Legal | 124 | |

Miscellaneous | 2,682 | |

Total expenses before reductions | 167,865 | |

Expense reductions | (13,710) | 154,155 |

Net investment income (loss) | | (15,182) |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 1,257,861 | |

Foreign currency transactions | 220 | |

Total net realized gain (loss) | | 1,258,081 |

Change in net unrealized appreciation (depreciation) on: Investment securities | (1,860,259) | |

Assets and liabilities in foreign currencies | (42) | |

Total change in net unrealized appreciation (depreciation) | | (1,860,301) |

Net gain (loss) | | (602,220) |

Net increase (decrease) in net assets resulting from operations | | $ (617,402) |

Statement of Changes in Net Assets

| Year ended

December 31, 2007 | Year ended

December 31, 2006 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ (15,182) | $ 102,515 |

Net realized gain (loss) | 1,258,081 | 1,366,498 |

Change in net unrealized appreciation (depreciation) | (1,860,301) | (45,422) |

Net increase (decrease) in net assets resulting from operations | (617,402) | 1,423,591 |

Distributions to shareholders from net investment income | (27,376) | (77,653) |

Distributions to shareholders from net realized gain | (850,763) | - |

Total distributions | (878,139) | (77,653) |

Share transactions - net increase (decrease) | (7,299,873) | 6,814,768 |

Redemption fees | 15,858 | 5,302 |

Total increase (decrease) in net assets | (8,779,556) | 8,166,008 |

| | |

Net Assets | | |

Beginning of period | 18,121,214 | 9,955,206 |

End of period (including undistributed net investment income of $0 and $24,654, respectively) | $ 9,341,658 | $ 18,121,214 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Initial Class

Years ended December 31, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 12.84 | $ 11.45 | $ 11.12 | $ 10.17 | $ 8.13 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | (.01) | .11 F | (.02) | (.04) | (.03) |

Net realized and unrealized gain (loss) | (1.02) | 1.33 | .35 | .99 | 2.07 |

Total from investment operations | (1.03) | 1.44 | .33 | .95 | 2.04 |

Distributions from net investment income | (.02) | (.06) | - | - | - |

Distributions from net realized gain | (1.08) | - | - | - | - |

Total distributions | (1.10) | (.06) | - | - | - |

Redemption fees added to paid in capital C | .01 | .01 | - H | -H | - H |

Net asset value, end of period | $ 10.72 | $ 12.84 | $ 11.45 | $ 11.12 | $ 10.17 |

Total Return A, B | (8.14)% | 12.63% | 2.97% | 9.34% | 25.09% |

Ratios to Average Net Assets D, G | | | | | |

Expenses before reductions | 1.10% | 1.20% | 1.19% | 1.35% | 1.72% |

Expenses net of fee waivers, if any | 1.01% | 1.15% | 1.14% | 1.35% | 1.50% |

Expenses net of all reductions | 1.01% | 1.14% | 1.12% | 1.31% | 1.46% |

Net investment income (loss) | (.07)% | .90% F | (.19)% | (.42)% | (.34)% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 6,989 | $ 13,866 | $ 9,616 | $ 12,051 | $ 10,959 |

Portfolio turnover rate E | 114% | 189% | 74% | 145% | 108% |

A Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

B Total returns would have been lower had certain expenses not been reduced during the periods shown.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects special dividends which amounted to $.09 per share. Excluding these special dividends, the ratio of net investment income (loss) to average net assets would have been .13%.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

Financial Highlights - Investor Class

Years ended December 31, | 2007 | 2006 | 2005 I |

Selected Per-Share Data | | | |

Net asset value, beginning of period | $ 12.83 | $ 11.44 | $ 11.49 |

Income from Investment Operations | | | |

Net investment income (loss) E | (.03) | .10 H | (.01) |

Net realized and unrealized gain (loss) | (1.02) | 1.33 | (.04) |

Total from investment operations | (1.05) | 1.43 | (.05) |

Distributions from net investment income | (.02) | (.05) | - |

Distributions from net realized gain | (1.05) | - | - |

Total distributions | (1.07) | (.05) | - |

Redemption fees added to paid in capitalE | .01 | .01 | - K |

Net asset value, end of period | $ 10.72 | $ 12.83 | $ 11.44 |

Total Return B, C, D | (8.29)% | 12.62% | (.44)% |

Ratios to Average Net Assets F, J | | | |

Expenses before reductions | 1.24% | 1.41% | 1.61% A |

Expenses net of fee waivers, if any | 1.15% | 1.25% | 1.25% A |

Expenses net of all reductions | 1.15% | 1.24% | 1.23% A |

Net investment income (loss) | (.21)% | .80% H | (.20)% A |

Supplemental Data | | | |

Net assets, end of period (000 omitted) | $ 2,352 | $ 4,256 | $ 339 |

Portfolio turnover rate G | 114% | 189% | 74% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

D Total returns would have been lower had certain expenses not been reduced during the periods shown.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Investment income per share reflects special dividends which amounted to $.09 per share. Excluding these special dividends, the ratio of net investment income (loss) to average net assets would have been .03%.

I For the period July 21, 2005 (commencement of sale of shares) to December 31, 2005.

J Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

K Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended December 31, 2007

1. Organization.

VIP Consumer Discretionary Portfolio (the Fund) is a non-diversified fund of Variable Insurance Products Fund IV (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions also differ by class.

2. Investments in Fidelity Central Funds.

The Fund may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete list of holdings for each Fidelity Central Fund is available upon request or at the SEC's web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the Fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securities markets, reviewing developments in foreign markets and evaluating the performance of ADRs, futures contracts and exchange-traded funds. Because the Fund's utilization of fair value pricing depends on market activity, the frequency with which fair value pricing is used cannot be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The Fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. As a result of a change in the estimate of the return of capital component of dividend income realized in the year ended December 31, 2006, dividend income has been reduced $22,895 with a corresponding increase to net unrealized appreciation (depreciation). The change in estimate has no impact on total net assets or total return of the Fund. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each Fund in the trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. The Fund adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainties in Income Taxes (FIN 48), on June 29, 2007. FIN 48 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The implementation of FIN 48 did not result in any unrecognized tax benefits in the accompanying financial statements. Each of the Fund's federal tax returns for the prior fiscal three years remains subject to examination by the Internal Revenue Service. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, net operating losses and losses deferred due to wash sales.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

Unrealized appreciation | $ 903,721 | |

Unrealized depreciation | (1,333,954) | |

Net unrealized appreciation (depreciation) | (430,233) | |

Undistributed ordinary income | 20,585 | |

Undistributed long-term capital gain | 48,945 | |

| | |

Cost for federal income tax purposes | $ 9,811,269 | |

The tax character of distributions paid was as follows:

| December 31, 2007 | December 31, 2006 |

Ordinary Income | $ 512,049 | $ 77,653 |

Long-term Capital Gains | 366,090 | - |

Total | $ 878,139 | $ 77,653 |

Trading (Redemption) Fees. Shares held less than 60 days are subject to a redemption fee equal to 1% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by FMR, are retained by the Fund and accounted for as an addition to paid in capital.

New Accounting Pronouncement. In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

Annual Report

4. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $16,690,779 and $24,598,360, respectively.

6. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and a group fee rate that averaged .26% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annual management fee rate was .56% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the Fund's transfer, dividend disbursing, and shareholder servicing agent. FIIOC receives an asset-based fee with respect to each class. Each class with the exception of Investor Class pays a transfer agent fee, excluding out of pocket expenses, equal to an annual rate of .07% of average net assets. Investor Class pays a monthly asset-based transfer agent fee of .18% of average net assets. The total transfer agent fees paid by each class to FIIOC, including out of pocket expenses, were as follows:

Initial Class | $ 11,596 |

Investor Class | 9,262 |

| $ 20,858 |

Effective February 1, 2008, the Board of Trustees approved a decrease to Investor Class' asset-based fee from .18% to .15% of average net assets.

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the Fund's accounting records. The fee is based on the level of average net assets for the month.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $697 for the period.

7. Committed Line of Credit.

The Fund participates with other funds managed by FMR in a $4.2 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro rata portion of the line of credit, which amounted to $35 and is reflected in Miscellaneous Expense on the Statement of Operations. During the period, there were no borrowings on this line of credit.

8. Expense Reductions.

FMR voluntarily agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. Some expenses, for example interest expense, including commitment fees, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| Expense

Limitations | Reimbursement

from adviser |

Initial Class | 1.15 - 1.00%* | $ 10,212 |

Investor Class | 1.25 - 1.15%* | 3,341 |

| | $ 13,553 |

* Expense limitation in effect at period end.

Effective February 1, 2008, the expense limitation changed to 1.08% for Investor Class.

Many of the brokers with whom FMR places trades on behalf of the Fund provided services to the Fund in addition to trade execution. These services included payments of certain expenses on behalf of the Fund totaling $153 for the period.

Annual Report

Notes to Financial Statements - continued

9. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, FMR or its affiliates were the owners of record of 100% of the total outstanding shares of the Fund.

The United States Securities and Exchange Commission ("SEC") is conducting an investigation of FMR (covering the years 2002 to 2004) arising from gifts, gratuities and business entertainment provided by certain brokers to certain individuals who were employed on FMR's domestic equity trading desk during that period. FMR is in discussions with the SEC staff regarding the possible resolution of the matter, but as of period-end no final resolution has been reached.

In December 2006, the Independent Trustees completed their own investigation of the matter with the assistance of independent counsel. The Independent Trustees and FMR agree that, despite the absence of proof that the Fidelity mutual funds experienced diminished execution quality as a result of the improper receipt of gifts and business entertainment, the conduct at issue was serious and is worthy of redress. Accordingly, the Independent Trustees have requested and FMR has agreed to pay $42 million to Fidelity mutual funds, plus interest to be determined at the time that payment is made. A method of allocating this payment among the funds has not yet been determined. The total payment to the Fund is not anticipated to have a material impact on the Fund's net assets. In addition, FMR reimbursed related legal expenses which are recorded in the accompanying Statement of Operations as an expense reduction.

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

Years ended December 31, | 2007 | 2006 |

From net investment income | | |

Initial Class | $ 21,493 | $ 59,733 |

Investor Class | 5,883 | 17,920 |

Total | $ 27,376 | $ 77,653 |

From net realized gain | | |

Initial Class | $ 642,099 | $ - |

Investor Class | 208,664 | - |

Total | $ 850,763 | $ - |

11. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

Years ended December 31, | 2007 | 2006 | 2007 | 2006 |

Initial Class | | | | |

Shares sold | 194,438 | 587,575 | $ 2,608,051 | $ 7,314,538 |

Reinvestment of distributions | 60,458 | 4,634 | 663,592 | 59,733 |

Shares redeemed | (682,661) | (351,833) | (9,097,868) | (4,301,667) |

Net increase (decrease) | (427,765) | 240,376 | $ (5,826,225) | $ 3,072,604 |

Investor Class | | | | |

Shares sold | 215,844 | 344,914 | $ 2,882,128 | $ 4,271,675 |

Reinvestment of distributions | 19,548 | 1,391 | 214,547 | 17,920 |

Shares redeemed | (347,583) | (44,309) | (4,570,323) | (547,431) |

Net increase (decrease) | (112,191) | 301,996 | $ (1,473,648) | $ 3,742,164 |

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Variable Insurance Products Fund IV and the Shareholders of VIP Consumer Discretionary Portfolio:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of VIP Consumer Discretionary Portfolio (a fund of Variable Insurance Products Fund IV) at December 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the VIP Consumer Discretionary Portfolio's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2007 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 14, 2008

Annual Report

Trustees and Officers

The Trustees, Members of the Advisory Board, and executive officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, and review the fund's performance. Except for James C. Curvey, each of the Trustees oversees 373 funds advised by FMR or an affiliate. Mr. Curvey oversees 368 funds advised by FMR or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 72nd birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. The executive officers and Advisory Board Members hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-877-208-0098.

Interested Trustees*:

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Edward C. Johnson 3d (77) |

| Year of Election or Appointment: 1983 Mr. Johnson is Chairman of the Board of Trustees. Mr. Johnson serves as President (2006-present), Chief Executive Officer, Chairman, and a Director of FMR LLC; Chairman and a Director of FMR; Chairman and a Director of Fidelity Research & Analysis Company (FRAC); Chairman and a Director of Fidelity Investments Money Management, Inc.; and Chairman (2001-present) and a Director of FMR Co., Inc. In addition, Mr. Johnson serves as Chairman and Director of Fidelity International Limited (FIL). Mr. Edward C. Johnson 3d and Mr. Arthur E. Johnson are not related. |

James C. Curvey (72) |

| Year of Election or Appointment: 2007 Mr. Curvey also serves as Trustee (2007-present) or Member of the Advisory Board (2007-present) of other investment companies advised by FMR. Mr. Curvey is a Director of FMR and FMR Co., Inc. (2007-present). Mr. Curvey is also Vice Chairman (2006-present) and Director of FMR LLC. Mr. Curvey joined Fidelity in 1982 and served in numerous senior management positions, including President and Chief Operating Officer of FMR LLC (1997-2000) and President of Fidelity Strategic Investments (2000-2002). In addition, he serves as a member of the Board of Directors of Geerlings & Wade, Inc. (wine distribution). |

* Trustees have been determined to be "Interested Trustees" by virtue of, among other things, their affiliation with the trust or various entities under common control with FMR. FMR Corp. merged with and into FMR LLC on October 1, 2007. Any references to FMR LLC for prior periods are deemed to be references to the prior entity.

Independent Trustees:

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustees) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Age; Principal Occupation |

Dennis J. Dirks (59) |

| Year of Election or Appointment: 2005 Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC) (1999-2003). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Company (DTC) (1999-2003) and President and Board member of the National Securities Clearing Corporation (NSCC) (1999-2003). In addition, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation (2001-2003) and Chief Executive Officer and Board member of the Mortgage-Backed Securities Clearing Corporation (2001-2003). Mr. Dirks also serves as a Trustee and a member of the Finance Committee of Manhattan College (2005-present) and a Trustee and a member of the Finance Committee of AHRC of Nassau County (2006-present). |

Albert R. Gamper, Jr. (65) |

| Year of Election or Appointment: 2006 Prior to his retirement in December 2004, Mr. Gamper served as Chairman of the Board of CIT Group Inc. (commercial finance). During his tenure with CIT Group Inc. Mr. Gamper served in numerous senior management positions, including Chairman (1987-1989; 1999-2001; 2002-2004), Chief Executive Officer (1987-2004), and President (1989-2002). He currently serves as a member of the Board of Directors of Public Service Enterprise Group (utilities, 2001-present), Chairman of the Board of Governors, Rutgers University (2004-present), and Chairman of the Board of Saint Barnabas Health Care System. |

George H. Heilmeier (71) |

| Year of Election or Appointment: 2004 Dr. Heilmeier is Chairman Emeritus of Telcordia Technologies (communication software and systems), where prior to his retirement, he served as company Chairman and Chief Executive Officer. He currently serves on the Boards of Directors of The Mitre Corporation (systems engineering and information technology support for the government), and HRL Laboratories (private research and development, 2004-present). He is Chairman of the General Motors Science & Technology Advisory Board and a Life Fellow of the Institute of Electrical and Electronics Engineers (IEEE). Dr. Heilmeier is a member of the Defense Science Board and the National Security Agency Advisory Board. He is also a member of the National Academy of Engineering, the American Academy of Arts and Sciences, and the Board of Overseers of the School of Engineering and Applied Science of the University of Pennsylvania. Previously, Dr. Heilmeier served as a Director of TRW Inc. (automotive, space, defense, and information technology, 1992-2002), Compaq (1994-2002), Automatic Data Processing, Inc. (ADP) (technology-based business outsourcing, 1995-2002), INET Technologies Inc. (telecommunications network surveillance, 2001-2004), and Teletech Holdings (customer management services). He is the recipient of the 2005 Kyoto Prize in Advanced Technology for his invention of the liquid crystal display, and a member of the Consumer Electronics Hall of Fame. |

James H. Keyes (67) |

| Year of Election or Appointment: 2007 Prior to his retirement in 2003, Mr. Keyes was Chairman, President, and Chief Executive Officer of Johnson Controls, Inc. (automotive supplier, 1993-2003). He currently serves as a member of the boards of LSI Logic Corporation (semiconductor technologies), Navistar International Corporation (manufacture and sale of trucks, buses, and diesel engines, 2002-present), and Pitney Bowes, Inc. (integrated mail, messaging, and document management solutions). |

Marie L. Knowles (61) |

| Year of Election or Appointment: 2001 Prior to Ms. Knowles' retirement in June 2000, she served as Executive Vice President and Chief Financial Officer of Atlantic Richfield Company (ARCO) (diversified energy, 1996-2000). From 1993 to 1996, she was a Senior Vice President of ARCO and President of ARCO Transportation Company. She served as a Director of ARCO from 1996 to 1998. She currently serves as a Director of Phelps Dodge Corporation (copper mining and manufacturing) and McKesson Corporation (healthcare service, 2002-present). Ms. Knowles is a Trustee of the Brookings Institution and the Catalina Island Conservancy and also serves as a member of the Advisory Board for the School of Engineering of the University of Southern California. |

Ned C. Lautenbach (63) |

| Year of Election or Appointment: 2000 Mr. Lautenbach is Chairman of the Independent Trustees (2006-present). Mr. Lautenbach has been a partner of Clayton, Dubilier & Rice, Inc. (private equity investment firm) since September 1998. Previously, Mr. Lautenbach was with the International Business Machines Corporation (IBM) from 1968 until his retirement in 1998. Mr. Lautenbach serves as a Director of Sony Corporation (2006-present) and Eaton Corporation (diversified industrial) as well as the Philharmonic Center for the Arts in Naples, Florida. He also is a member of the Board of Trustees of Fairfield University (2005-present), as well as a member of the Council on Foreign Relations. |

Cornelia M. Small (63) |

| Year of Election or Appointment: 2005 Ms. Small is a member (2000-present) and Chairperson (2002-present) of the Investment Committee, and a member (2002-present) of the Board of Trustees of Smith College. Previously, she served as Chief Investment Officer (1999-2000), Director of Global Equity Investments (1996-1999), and a member of the Board of Directors of Scudder, Stevens & Clark (1990-1997) and Scudder Kemper Investments (1997-1999). In addition, Ms. Small served as Co-Chair (2000-2003) of the Annual Fund for the Fletcher School of Law and Diplomacy. |

William S. Stavropoulos (68) |

| Year of Election or Appointment: 2001 Mr. Stavropoulos is Chairman Emeritus of the Board of Directors of The Dow Chemical Company. Since joining The Dow Chemical Company in 1967, Mr. Stavropoulos served in numerous senior management positions, including President (1993-2000; 2002-2003), CEO (1995-2000; 2002-2004), and Chairman of the Executive Committee (2000-2004). Currently, he is a Director of NCR Corporation (data warehousing and technology solutions), Chemical Financial Corporation, Maersk Inc. (industrial conglomerate, 2002-present), Tyco International, Inc. (multinational manufacturing and services, 2007-present), and a member of the Advisory Board for Metalmark Capital (private equity investment firm, 2005-present). He is a special advisor to Clayton, Dubilier & Rice, Inc., a private equity investment firm. He also serves as a member of the Board of Trustees of the American Enterprise Institute for Public Policy Research. In addition, Mr. Stavropoulos is a member of The Business Council, J.P. Morgan International Council and the University of Notre Dame Advisory Council for the College of Science. |

Kenneth L. Wolfe (68) |

| Year of Election or Appointment: 2005 Mr. Wolfe is Chairman and a Director of Hershey Foods Corporation (2007-present), where prior to his retirement in 2001, he was Chairman and Chief Executive Officer. Mr. Wolfe currently serves as a member of the board of Revlon Inc. (2004-present). Previously, Mr. Wolfe served as a member of the boards of Adelphia Communications Corporation (2003-2006) and Bausch & Lomb, Inc. (1993-2007). |

Advisory Board Members and Executive Officers**:

Correspondence intended for Mr. Mauriello, Mr. Thomas, Mr. Wiley, Mr. Lacy, and Mr. Arthur Johnson may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235. Correspondence intended for each executive officer and Mr. Lynch may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Arthur E. Johnson (60) |

| Year of Election or Appointment: 2008 Member of the Advisory Board of Variable Insurance Products Fund IV. Mr. Johnson serves as Senior Vice President of Corporate Strategic Development of Lockheed Martin Corporation (defense contractor). In addition, Mr. Johnson serves as a member of the Board of Directors of AGL Resources, Inc. (holding company, 2002-present), and IKON Office Solutions, Inc. (document management systems and services). Mr. Arthur E. Johnson and Mr. Edward C. Johnson 3d are not related. |

Alan J. Lacy (54) |

| Year of Election or Appointment: 2008 Member of the Advisory Board of Variable Insurance Products Fund IV. Mr. Lacy serves as Senior Adviser (2007-present) of Oak Hill Capital Partners, L.P. (a private equity firm). Mr. Lacy also served as Vice Chairman and Chief Executive Officer of Sears Holdings Corporation and Sears, Roebuck and Co. (retail, 2005-2006; 2000-2005). In addition, Mr. Lacy serves as a member of the Board of Directors of The Western Union Company (global money transfer, 2006-present) and Bristol-Myers Squibb (global pharmaceuticals, 2007-present). Mr. Lacy is a Trustee of the National Parks Conservation Association and The Field Museum of Natural History. |

Peter S. Lynch (63) |

| Year of Election or Appointment: 2003 Member of the Advisory Board of Variable Insurance Products Fund IV. Mr. Lynch is Vice Chairman and a Director of FMR, and Vice Chairman (2001-present) and a Director of FMR Co., Inc. Previously, Mr. Lynch served as a Trustee of the Fidelity funds (1990-2003). In addition, he serves as a Trustee of Boston College and as the Chairman of the Inner-City Scholarship Fund. |

Joseph Mauriello (63) |

| Year of Election or Appointment: 2007 Member of the Advisory Board of Variable Insurance Products Fund IV. Prior to his retirement in January 2006, Mr. Mauriello served in numerous senior management positions including Deputy Chairman and Chief Operating Officer (2004-2005), and Vice Chairman of Financial Services (2002-2004) of KPMG LLP US (professional services firm, 1965-2005). Mr. Mauriello currently serves as a member of the Board of Directors of XL Capital Ltd. (global insurance and re-insurance company, 2006-present) and of Arcadia Resources Inc. (health care services and products, 2007-present). He also served as a Director of the Hamilton Funds of the Bank of New York (2006-2007). |

David M. Thomas (58) |

| Year of Election or Appointment: 2007 Member of the Advisory Board of Variable Insurance Products Fund IV. Previously, Mr. Thomas served as Executive Chairman (2005-2006) and Chairman and Chief Executive Officer (2000-2005) of IMS Health, Inc. (pharmaceutical and healthcare information solutions). In addition, Mr. Thomas serves as a member of the Board of Directors of Fortune Brands, Inc. (consumer products holding company), and Interpublic Group of Companies, Inc. (marketing communication, 2004-present). |

Michael E. Wiley (57) |

| Year of Election or Appointment: 2007 Member of the Advisory Board of Variable Insurance Products Fund IV. Mr. Wiley also serves as a member of the Board of Trustees of the University of Tulsa (2000-2006; 2007-present). He serves as a Director of Tesoro Corporation (independent oil refiner and marketer, 2005-present), and a Director of Bill Barrett Corporation (exploration and production company, 2005-present). In addition, he also serves as a Director of Post Oak Bank (privately-held bank, 2004-present). Previously, Mr. Wiley served as a Sr. Energy Advisor of Katzenbach Partners, LLC (consulting firm, 2006-2007), as an Advisory Director of Riverstone Holdings (private investment firm), Chairman, President, and CEO of Baker Hughes, Inc. (oilfield services company, 2000-2004), and as Director of Spinnaker Exploration Company (exploration and production company, 2001-2005). |

Kimberley H. Monasterio (44) |

| Year of Election or Appointment: 2007 President and Treasurer of VIP Consumer Discretionary. Ms. Monasterio also serves as President and Treasurer of other Fidelity funds (2007-present) and is an employee of FMR (2004-present). Previously, Ms. Monasterio served as Deputy Treasurer of the Fidelity funds (2004-2006). Before joining Fidelity Investments, Ms. Monasterio served as Treasurer (2000-2004) and Chief Financial Officer (2002-2004) of the Franklin Templeton Funds and Senior Vice President of Franklin Templeton Services, LLC (2000-2004). |

Brian B. Hogan (43) |

| Year of Election or Appointment: 2007 Vice President of VIP Consumer Discretionary. Mr. Hogan also serves as Vice President of Sector Funds (2007-present). Mr. Hogan is Senior Vice President of Equity Research (2006-present). Mr. Hogan also serves as Vice President of FMR and FMR Co., Inc. Previously, Mr. Hogan served as a portfolio manager. |

Eric D. Roiter (59) |

| Year of Election or Appointment: 2001 Secretary of VIP Consumer Discretionary. He also serves as Secretary of other Fidelity funds; Vice President, General Counsel, and Secretary of FMR Co., Inc. (2001-present) and FMR; Assistant Secretary of Fidelity Management & Research (U.K.) Inc. (2001-present), Fidelity Research & Analysis Company (2001-present), and Fidelity Investments Money Management, Inc. (2001-present). Mr. Roiter is an Adjunct Member, Faculty of Law, at Boston College Law School (2003-present). Previously, Mr. Roiter served as Vice President and Secretary of Fidelity Distributors Corporation (FDC) (1998-2005). |

John B. McGinty, Jr. (45) |

| Year of Election or Appointment: 2008 Assistant Secretary of VIP Consumer Discretionary. Mr. McGinty also serves as Assistant Secretary of other Fidelity funds (2008-present) and is an employee of FMR LLC (2004-present). Mr. McGinty also serves as Senior Vice President, Secretary, and Chief Legal Officer of FDC (2007-present). Before joining Fidelity Investments, Mr. McGinty practiced law at Ropes & Gray, LLP. |

R. Stephen Ganis (41) |

| Year of Election or Appointment: 2006 Anti-Money Laundering (AML) officer of VIP Consumer Discretionary. Mr. Ganis also serves as AML officer of other Fidelity funds (2006-present) and FMR LLC (2003-present). Before joining Fidelity Investments, Mr. Ganis practiced law at Goodwin Procter, LLP (2000-2002). |

Joseph B. Hollis (59) |

| Year of Election or Appointment: 2006 Chief Financial Officer of VIP Consumer Discretionary. Mr. Hollis also serves as Chief Financial Officer of other Fidelity funds. Mr. Hollis is President of Fidelity Pricing and Cash Management Services (FPCMS) (2005-present). Mr. Hollis also serves as President and Director of Fidelity Service Company, Inc. (2006-present). Previously, Mr. Hollis served as Senior Vice President of Cash Management Services (1999-2002) and Investment Management Operations (2002-2005). |

Kenneth A. Rathgeber (60) |

| Year of Election or Appointment: 2004 Chief Compliance Officer of VIP Consumer Discretionary. Mr. Rathgeber also serves as Chief Compliance Officer of other Fidelity funds (2004-present) and Executive Vice President of Risk Oversight for Fidelity Investments (2002-present). He is Chief Compliance Officer of FMR (2005-present), FMR Co., Inc. (2005-present), Fidelity Management & Research (U.K.) Inc. (2005-present), Fidelity Research & Analysis Company (2005-present), Fidelity Investments Money Management, Inc. (2005-present), and Strategic Advisers, Inc. (2005-present). Previously, Mr. Rathgeber served as Executive Vice President and Chief Operating Officer for Fidelity Investments Institutional Services Company, Inc. (1998-2002). |

Bryan A. Mehrmann (46) |

| Year of Election or Appointment: 2005 Deputy Treasurer of VIP Consumer Discretionary. Mr. Mehrmann also serves as Deputy Treasurer of other Fidelity funds (2005-present) and is an employee of FMR. Previously, Mr. Mehrmann served as Vice President of Fidelity Investments Institutional Services Group (FIIS)/Fidelity Investments Institutional Operations Corporation, Inc. (FIIOC) Client Services (1998-2004). |

Kenneth B. Robins (38) |

| Year of Election or Appointment: 2005 Deputy Treasurer of VIP Consumer Discretionary. Mr. Robins also serves as Deputy Treasurer of other Fidelity funds (2005-present) and is an employee of FMR (2004-present). Before joining Fidelity Investments, Mr. Robins worked at KPMG LLP, where he was a partner in KPMG's department of professional practice (2002-2004) and a Senior Manager (1999-2000). In addition, Mr. Robins served as Assistant Chief Accountant, United States Securities and Exchange Commission (2000-2002). |

Robert G. Byrnes (41) |

| Year of Election or Appointment: 2005 Assistant Treasurer of VIP Consumer Discretionary. Mr. Byrnes also serves as Assistant Treasurer of other Fidelity funds (2005-present) and is an employee of FMR (2005-present). Previously, Mr. Byrnes served as Vice President of FPCMS (2003-2005). Before joining Fidelity Investments, Mr. Byrnes worked at Deutsche Asset Management where he served as Vice President of the Investment Operations Group (2000-2003). |

Peter L. Lydecker (53) |

| Year of Election or Appointment: 2004 Assistant Treasurer of VIP Consumer Discretionary. Mr. Lydecker also serves as Assistant Treasurer of other Fidelity funds (2004) and is an employee of FMR. |

Paul M. Murphy (60) |

| Year of Election or Appointment: 2007 Assistant Treasurer of VIP Consumer Discretionary. Mr. Murphy also serves as Assistant Treasurer of other Fidelity funds (2007-present) and is an employee of FMR (2007-present). Previously, Mr. Murphy served as Chief Financial Officer of the Fidelity Funds (2005-2006), Vice President and Associate General Counsel of FMR (2007), and Senior Vice President of Fidelity Pricing and Cash Management Services Group (FPCMS) (1994-2007). |

Gary W. Ryan (49) |

| Year of Election or Appointment: 2005 Assistant Treasurer of VIP Consumer Discretionary. Mr. Ryan also serves as Assistant Treasurer of other Fidelity funds (2005-present) and is an employee of FMR (2005-present). Previously, Mr. Ryan served as Vice President of Fund Reporting in FPCMS (1999-2005). |

** FMR Corp. merged with and into FMR LLC on October 1, 2007. Any references to FMR LLC for prior periods are deemed to be references to the prior entity.

Annual Report

Distributions

The Board of Trustees of VIP IV Consumer Discretionary Portfolio (the Fund) voted to pay to shareholders of record at the opening of business on record date, the following distributions per share derived from capital gains realized from sales of portfolio securities:

| Pay Date | Record Date | Capital Gains |

Initial Class | 02/08/08 | 02/08/08 | $0.085 |

Investor Class | 02/08/08 | 02/08/08 | $0.085 |

Initial Class, and Investor Class designate 58% of the dividends distributed during the fiscal year as qualifying for the dividends-received deduction for corporate shareholders.

The fund will notify shareholders in January 2008 of amounts for use in preparing 2007 income tax returns.

Annual Report

Board Approval of Investment Advisory Contracts and Management Fees

VIP Consumer Discretionary Portfolio