UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3759

Variable Insurance Products Fund IV

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2010 |

Item 1. Reports to Stockholders

Fidelity® Variable Insurance Products:

Consumer Discretionary Portfolio

Annual Report

December 31, 2010

(2_fidelity_logos) (Registered_Trademark)

Contents

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion of Fund Performance | <Click Here> | The Portfolio Manager's review of fund performance and strategy. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

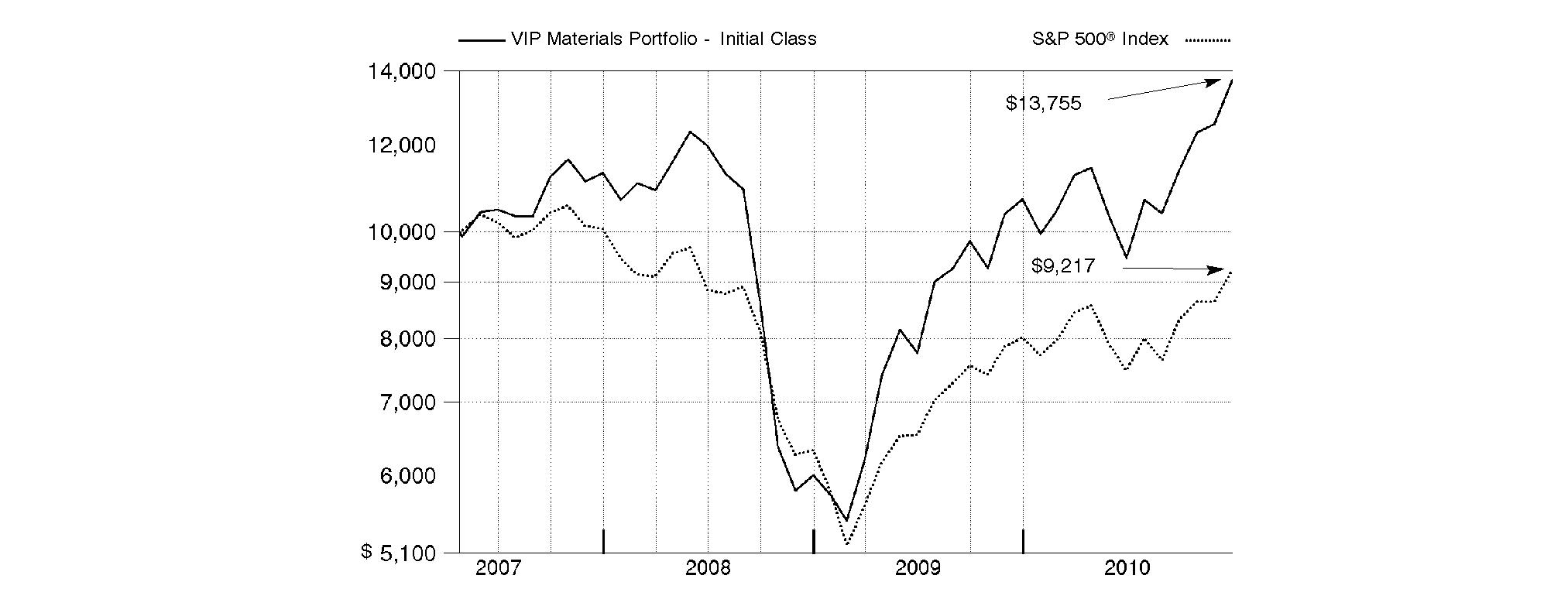

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

The general research services agreement with Fidelity Research & Analysis Company has been terminated and is no longer in effect for the fund.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listings, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

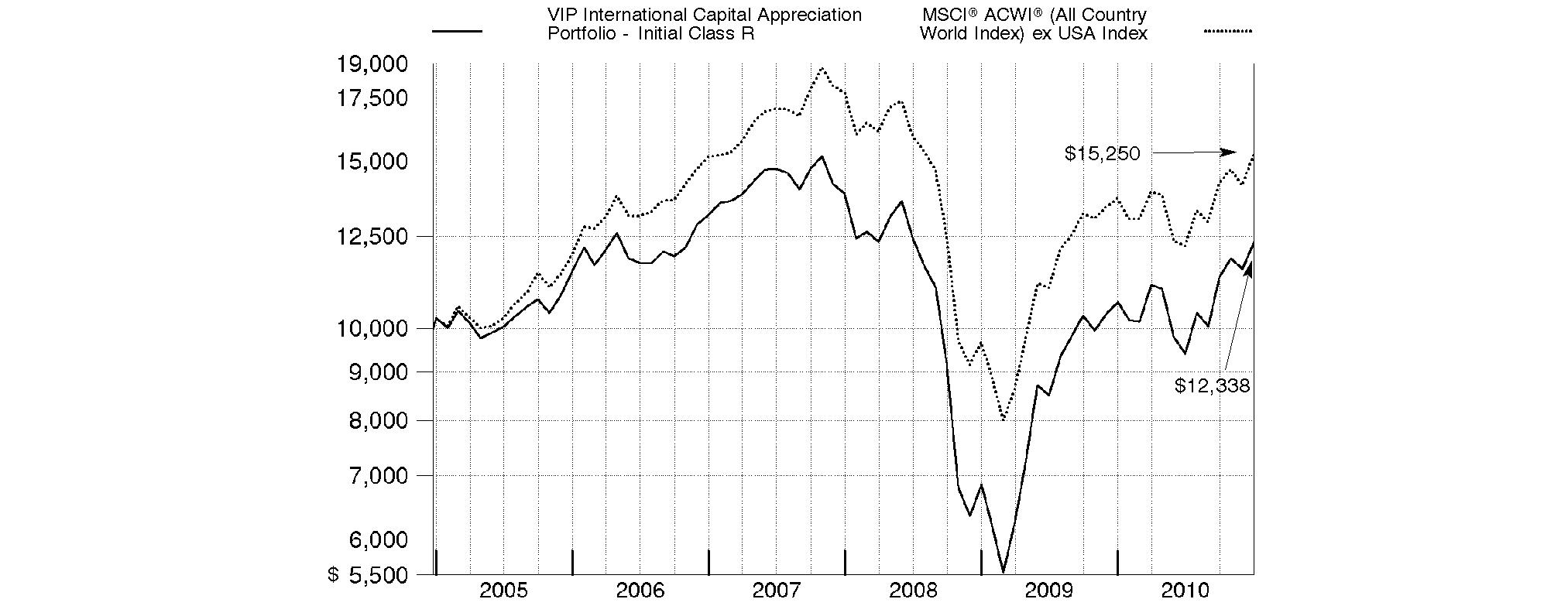

Annual Report

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

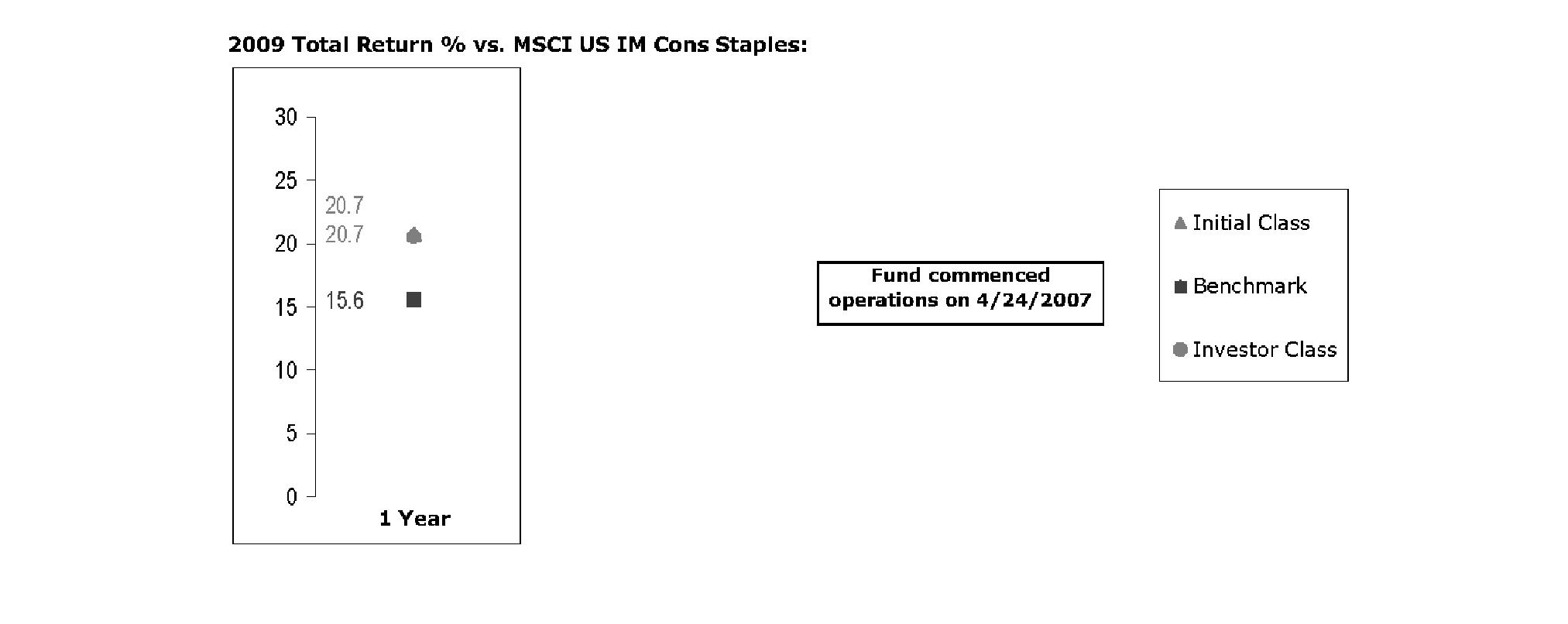

Average Annual Total Returns

Periods ended December 31, 2010 | Past 1

year | Past 5

years | Life of

fundA |

VIP Consumer Discretionary Portfolio - Initial Class C | 31.29% | 4.37% | 3.77% |

VIP Consumer Discretionary Portfolio - Investor Class B, C | 31.16% | 4.29% | 3.72% |

A From July 18, 2001.

B The initial offering of Investor Class shares took place on July 21, 2005. Returns prior to July 21, 2005 are those of Initial Class. Had Investor Class's transfer agent fee been reflected, returns prior to July 21, 2005 would have been lower.

C Prior to October 1, 2006, VIP Consumer Discretionary Portfolio operated under certain different investment policies. The historical performance for the fund may not represent its current investment policies.

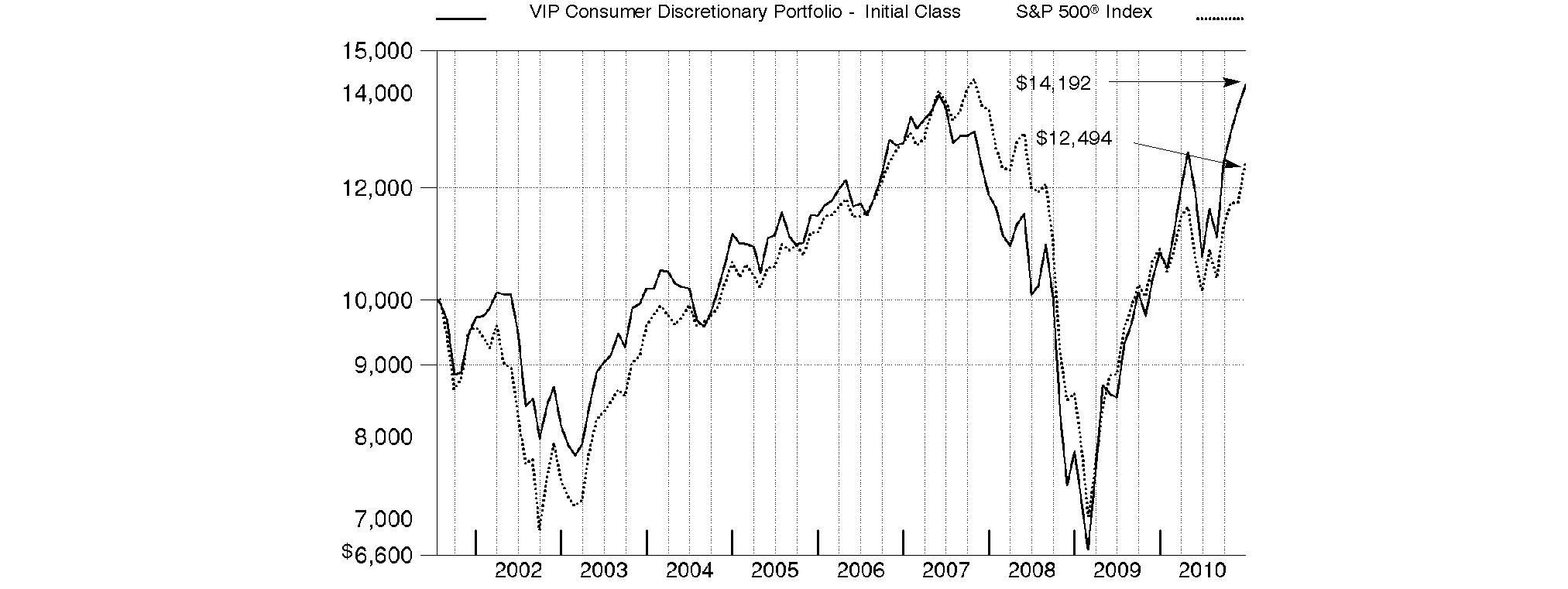

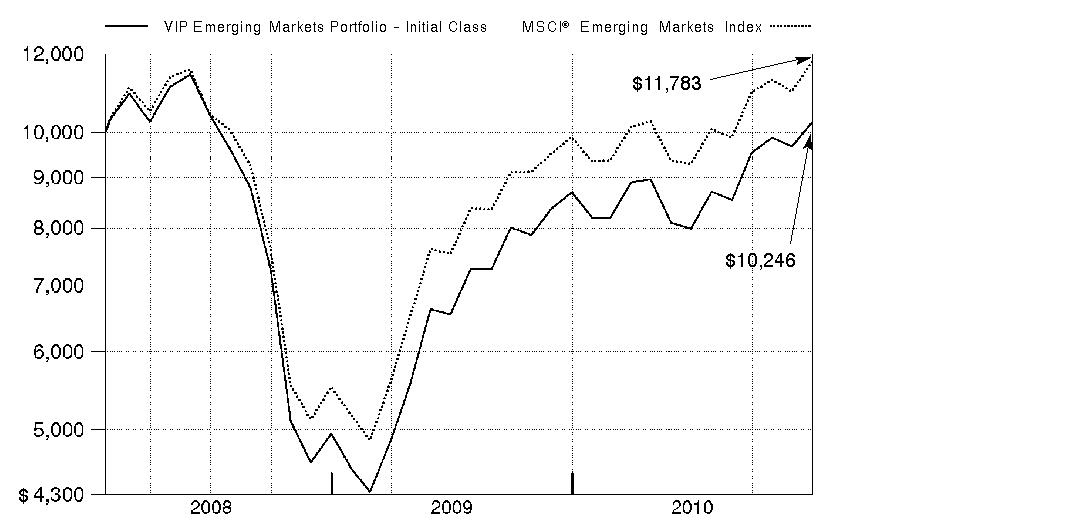

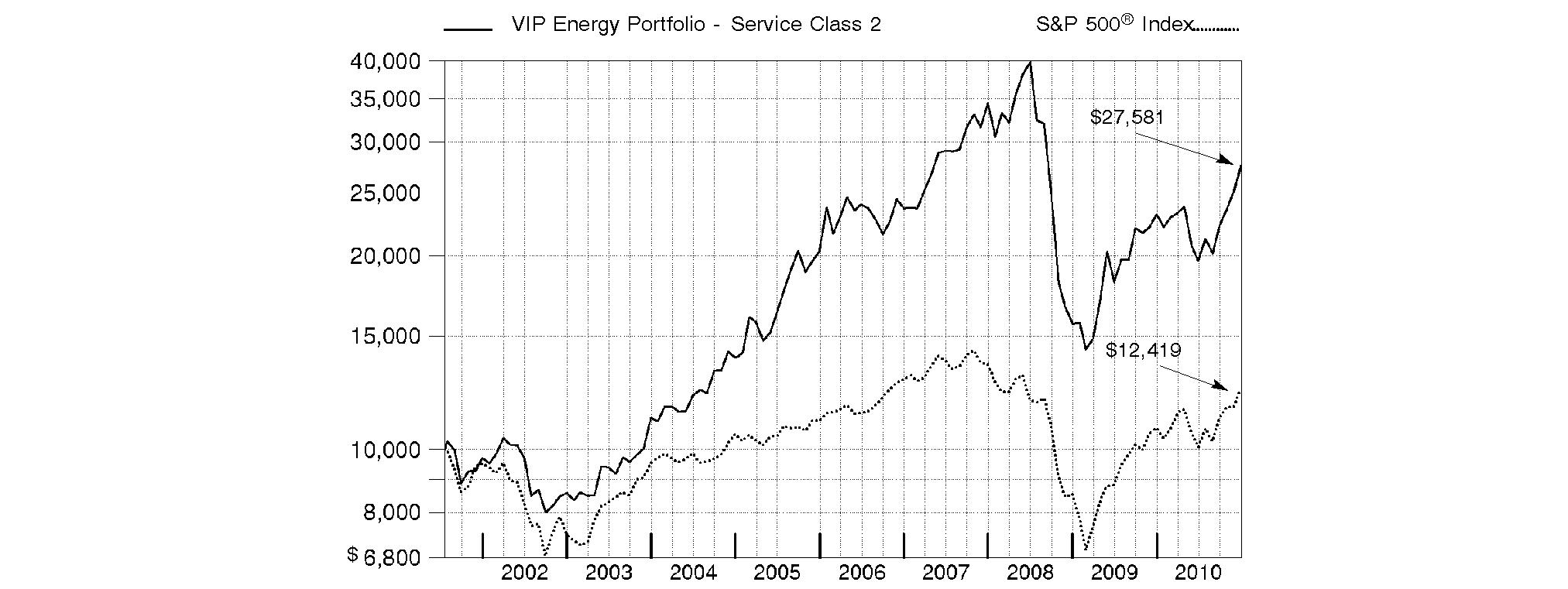

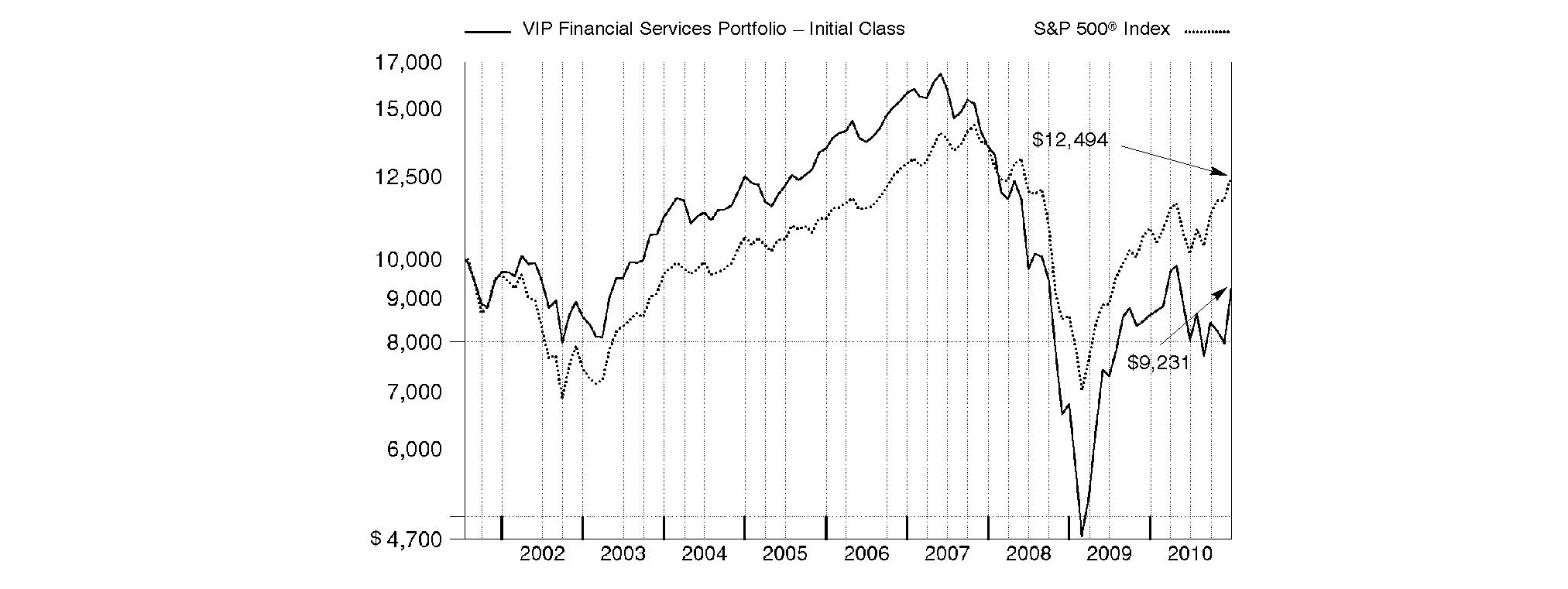

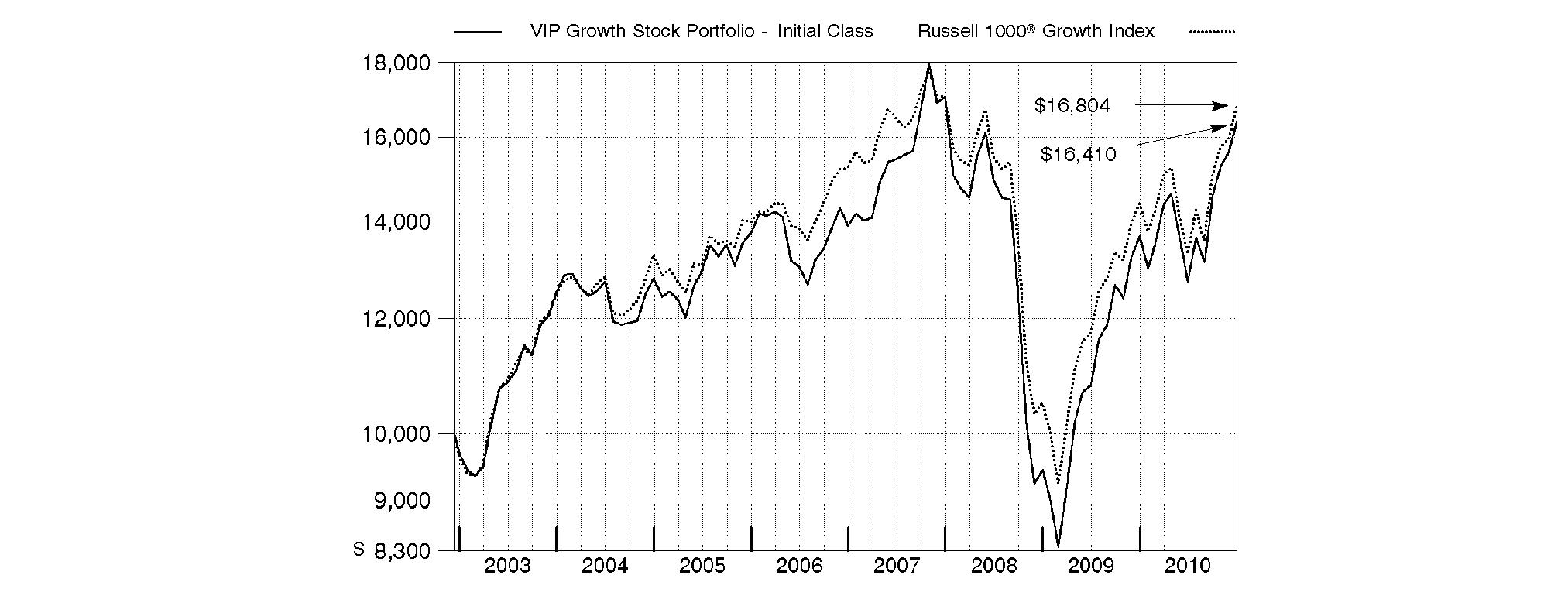

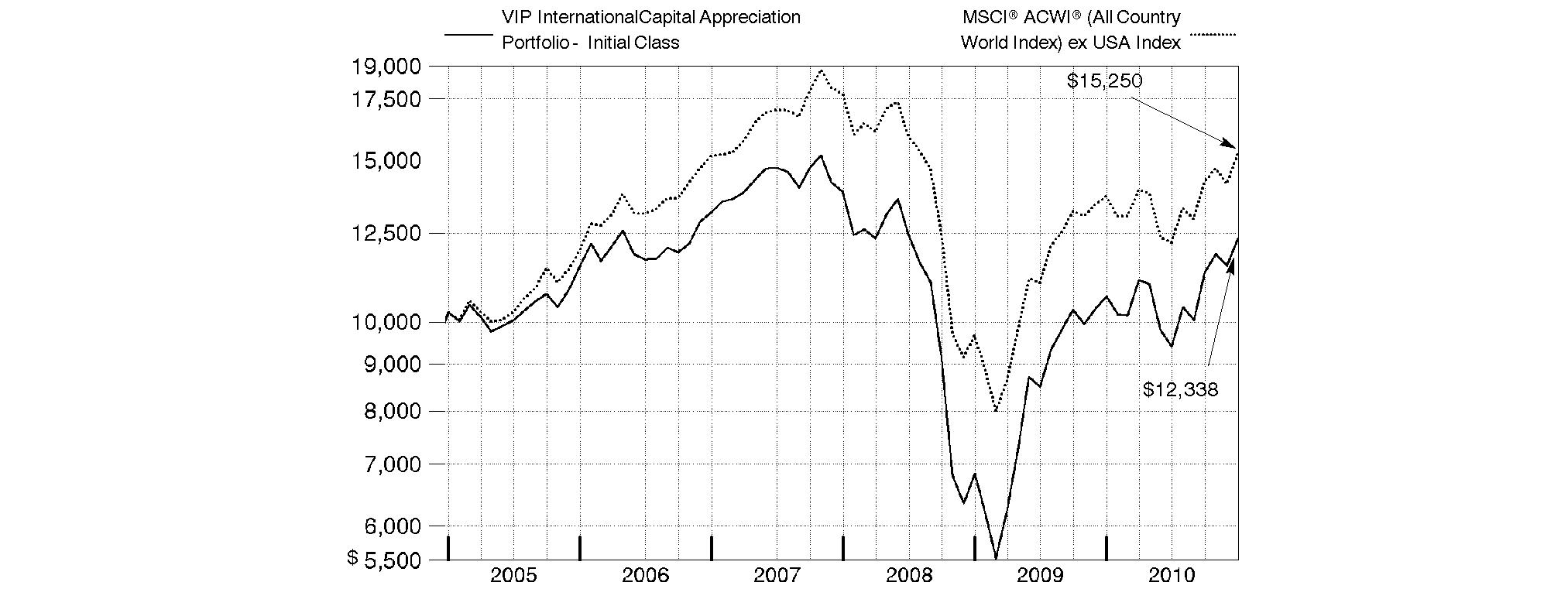

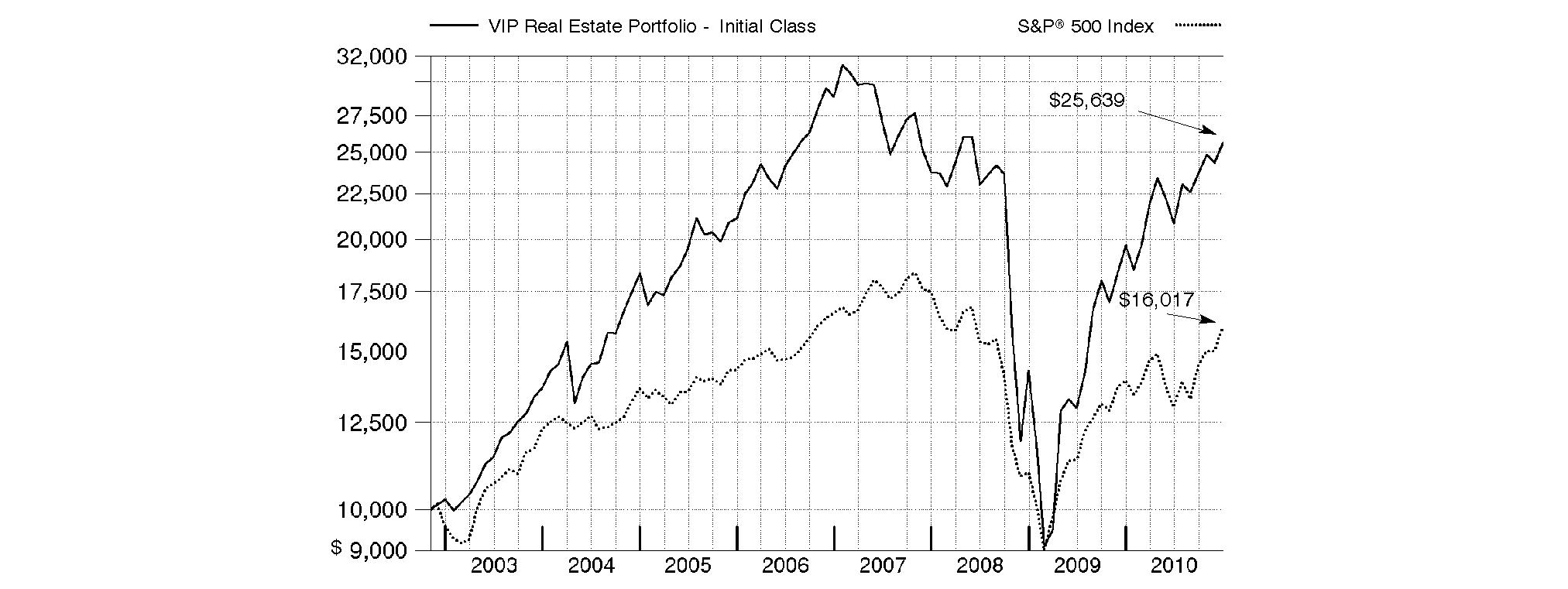

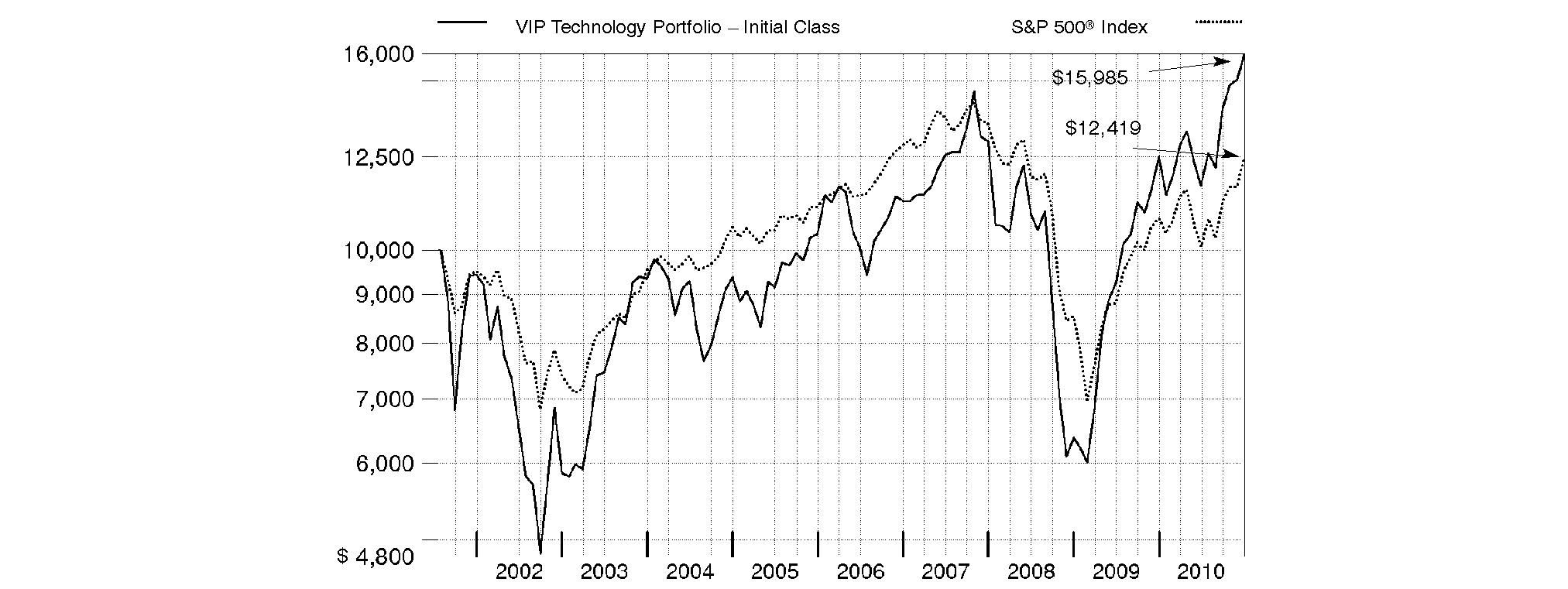

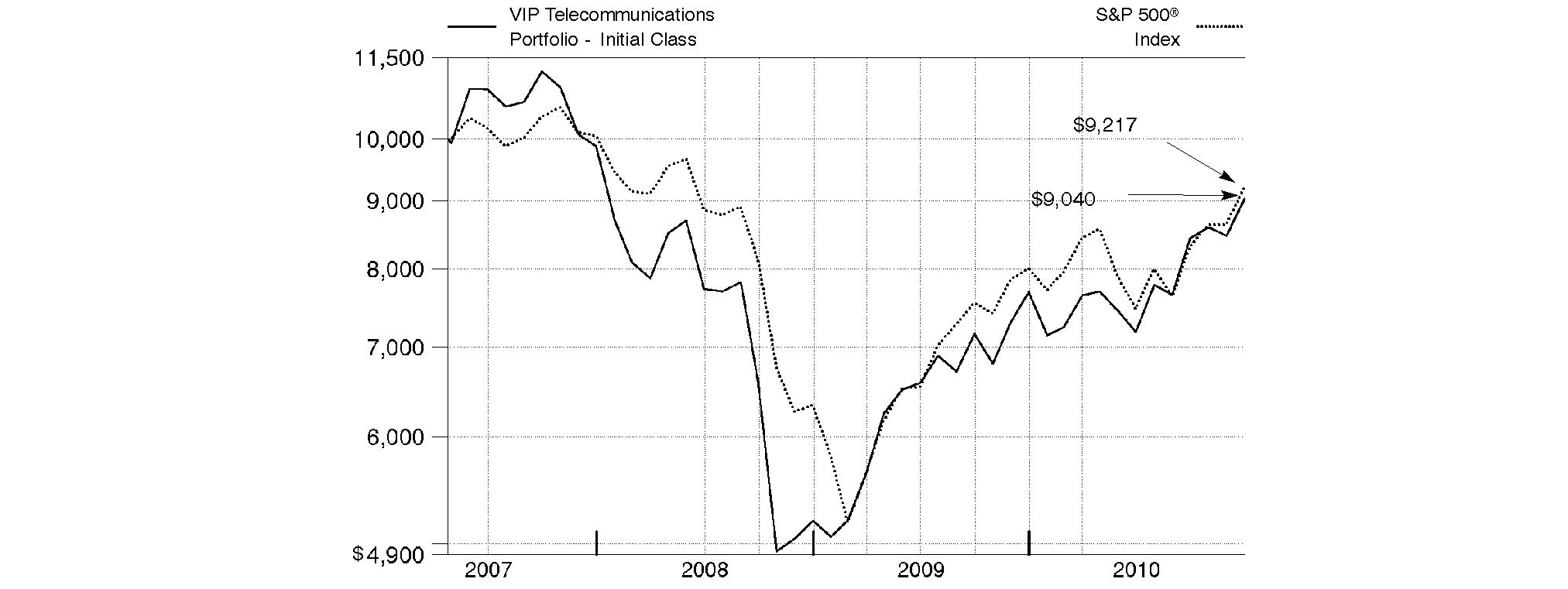

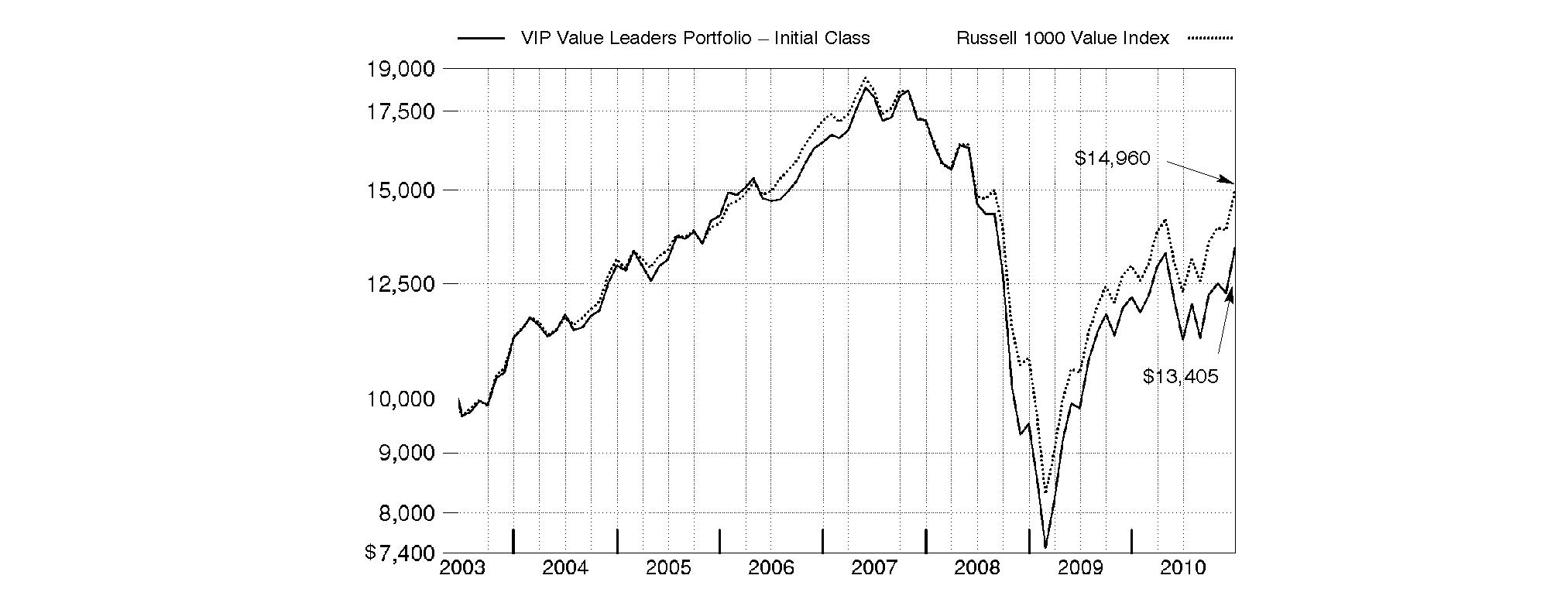

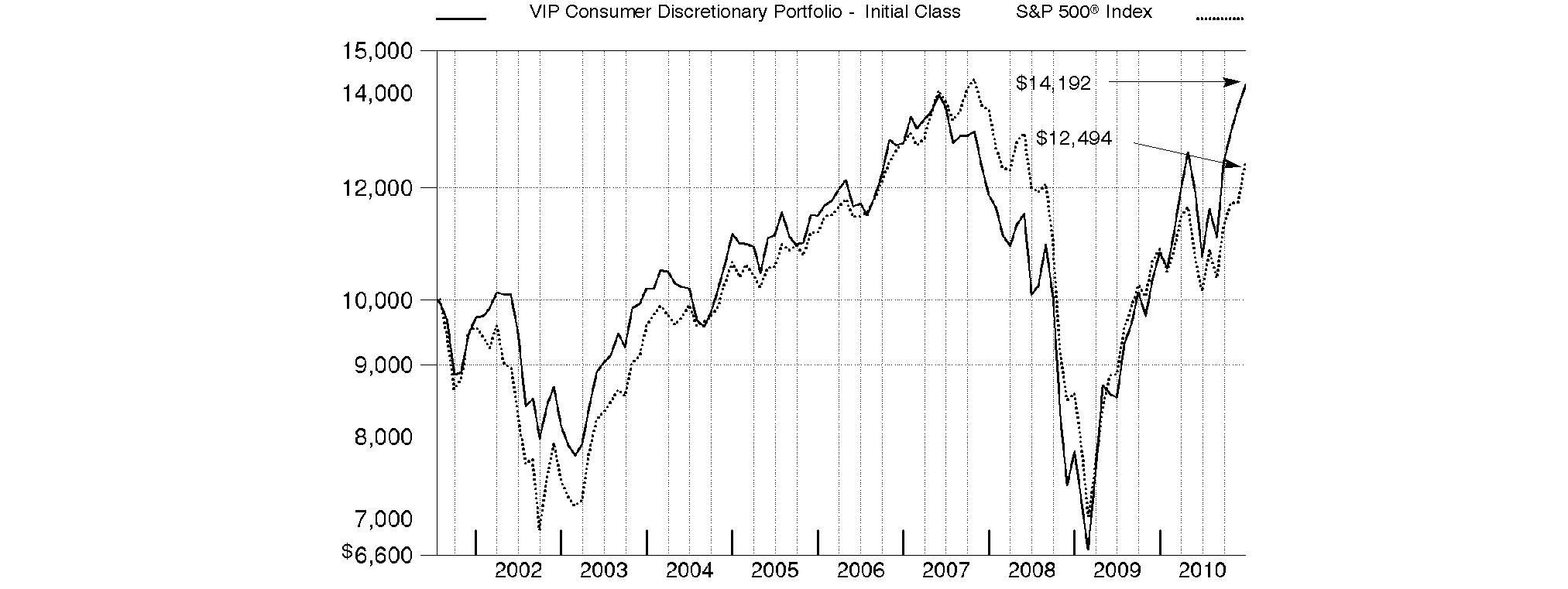

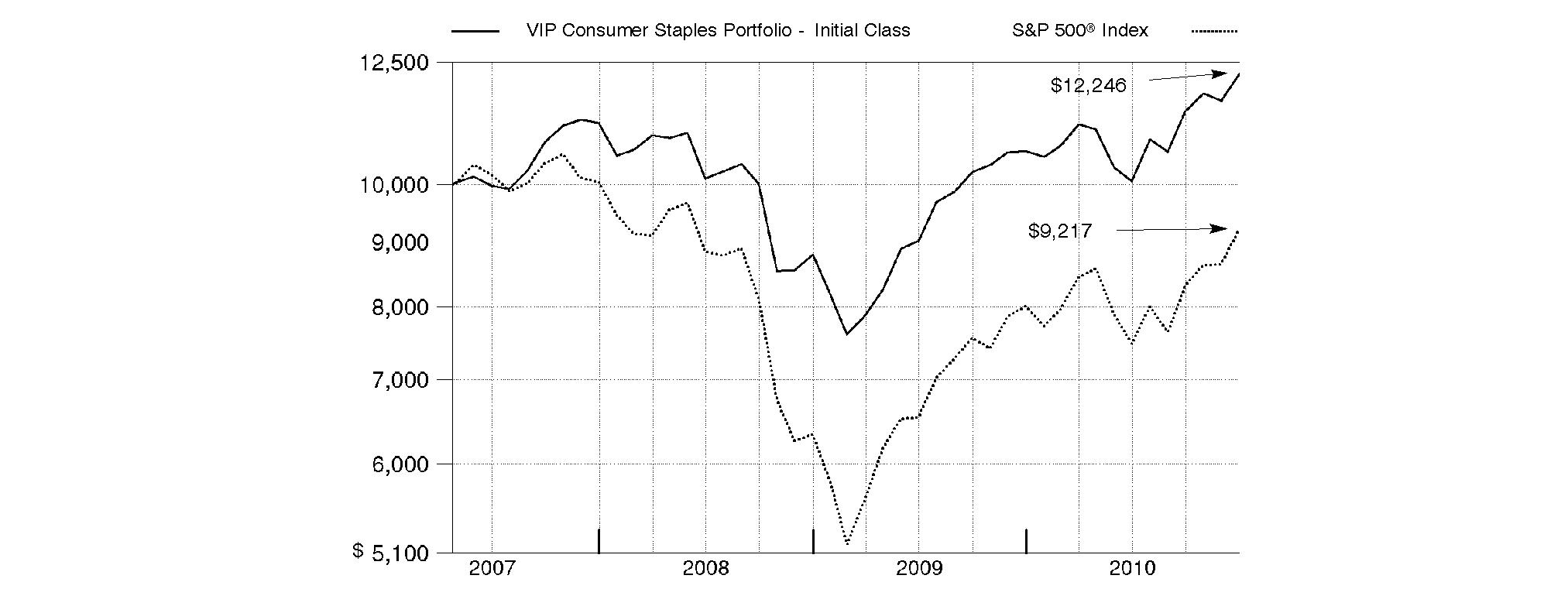

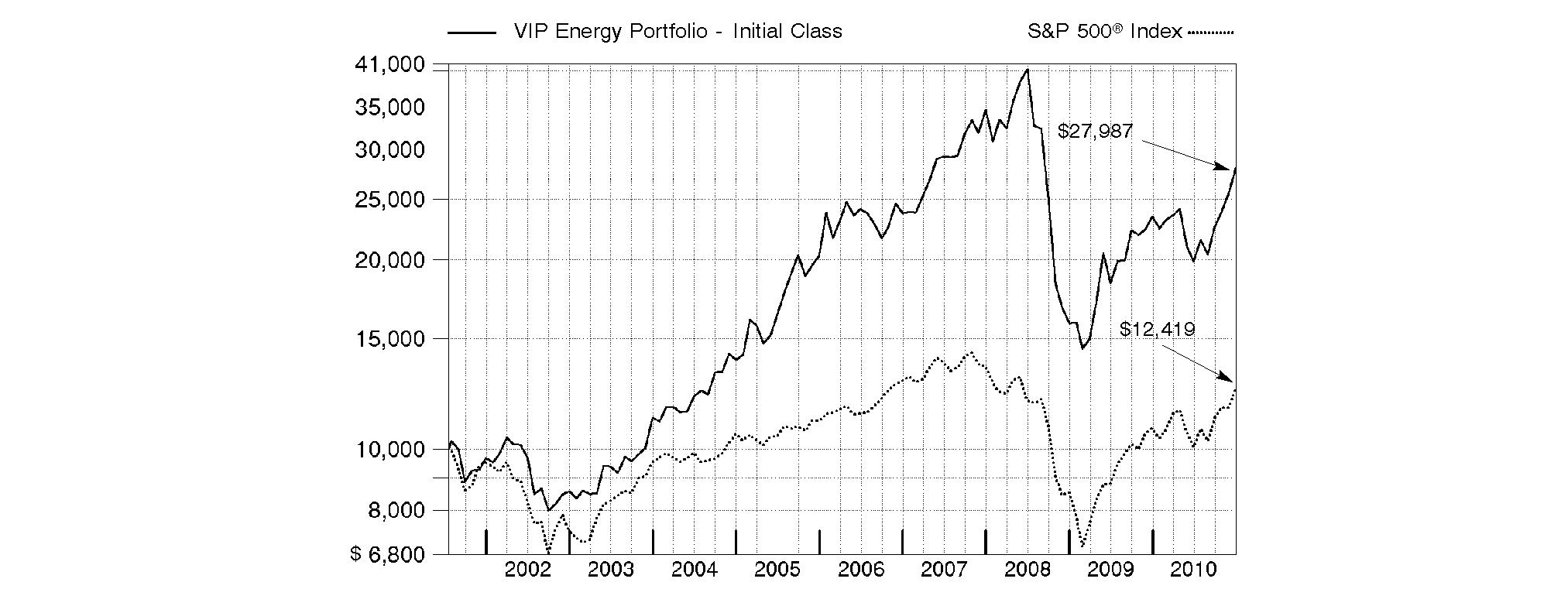

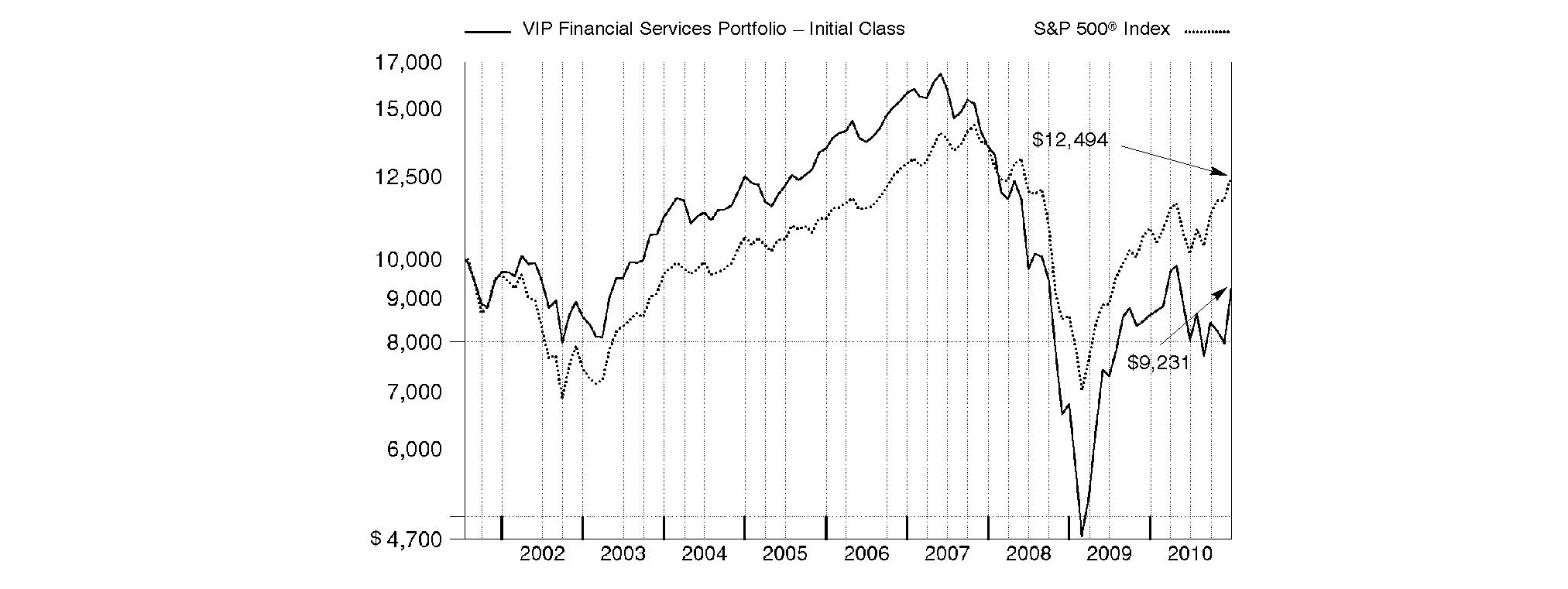

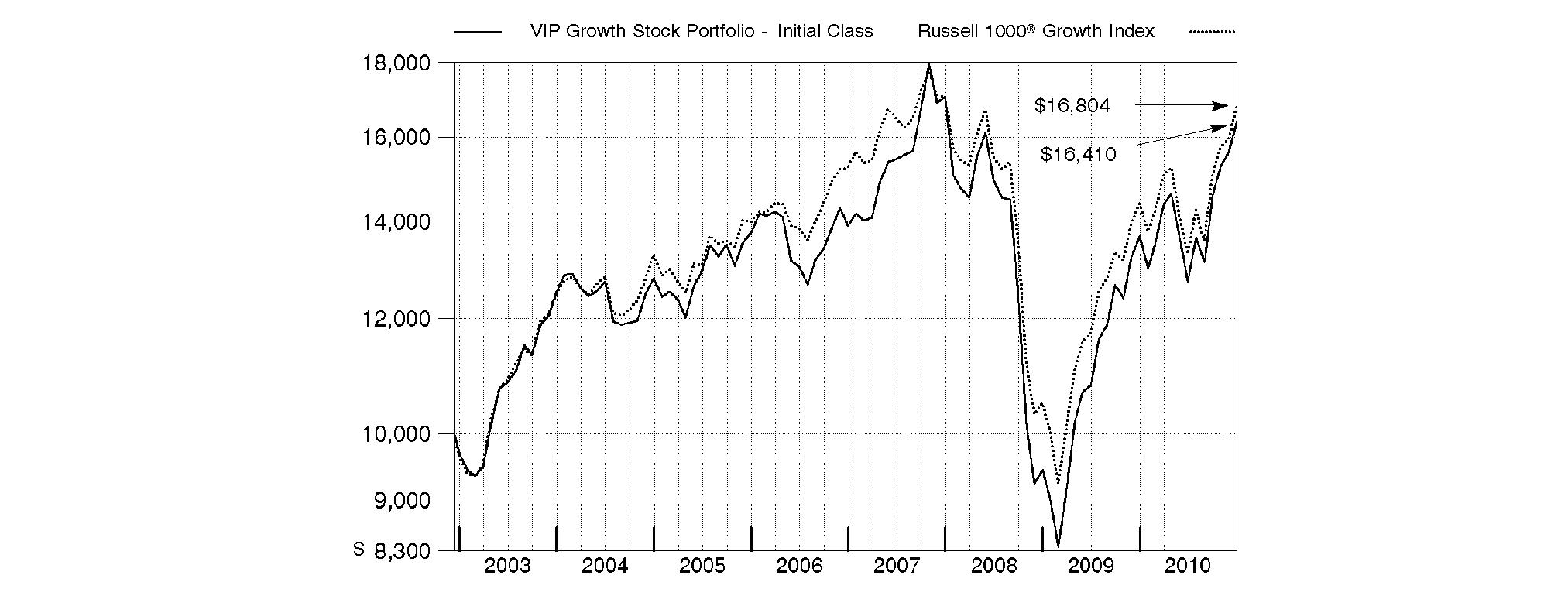

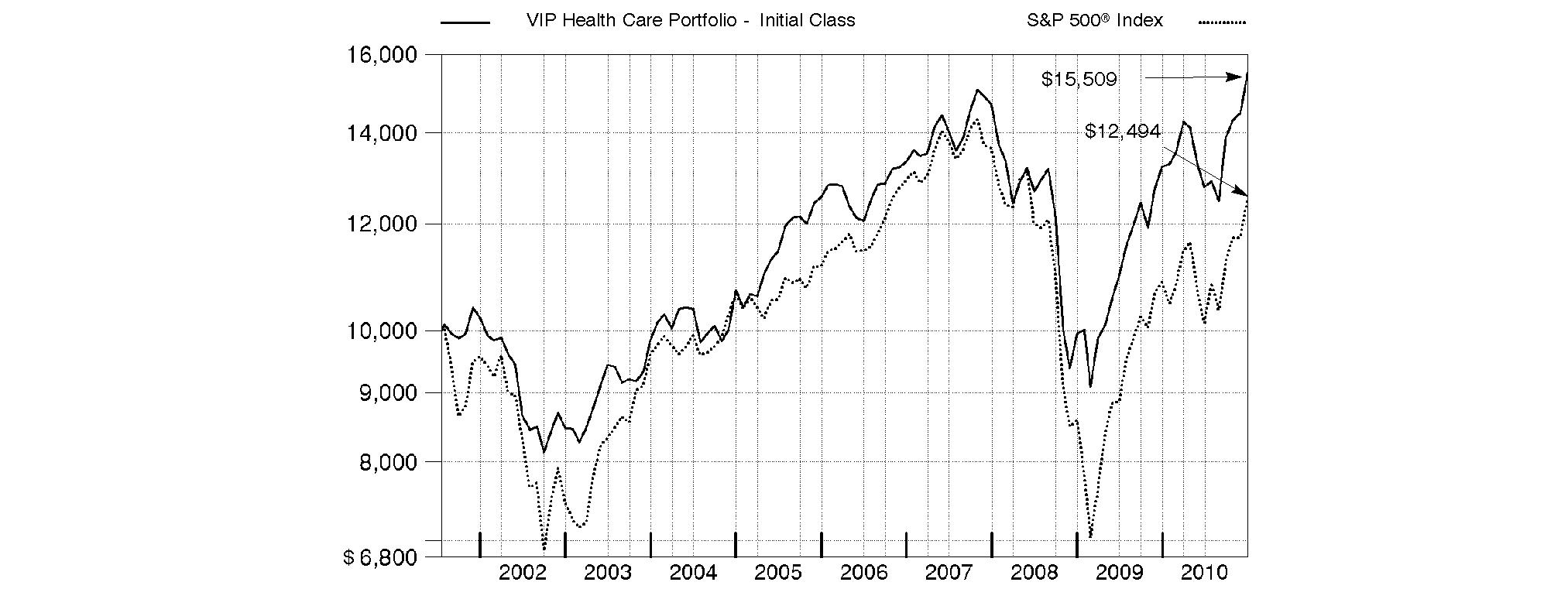

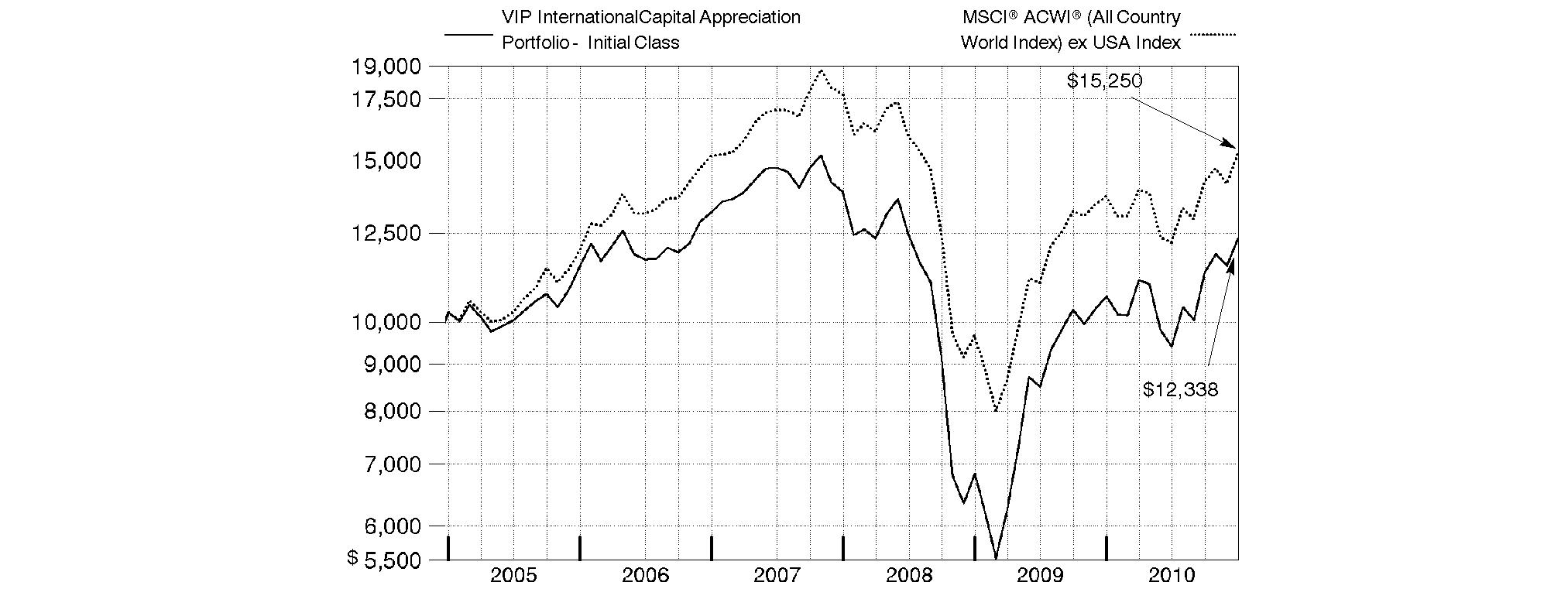

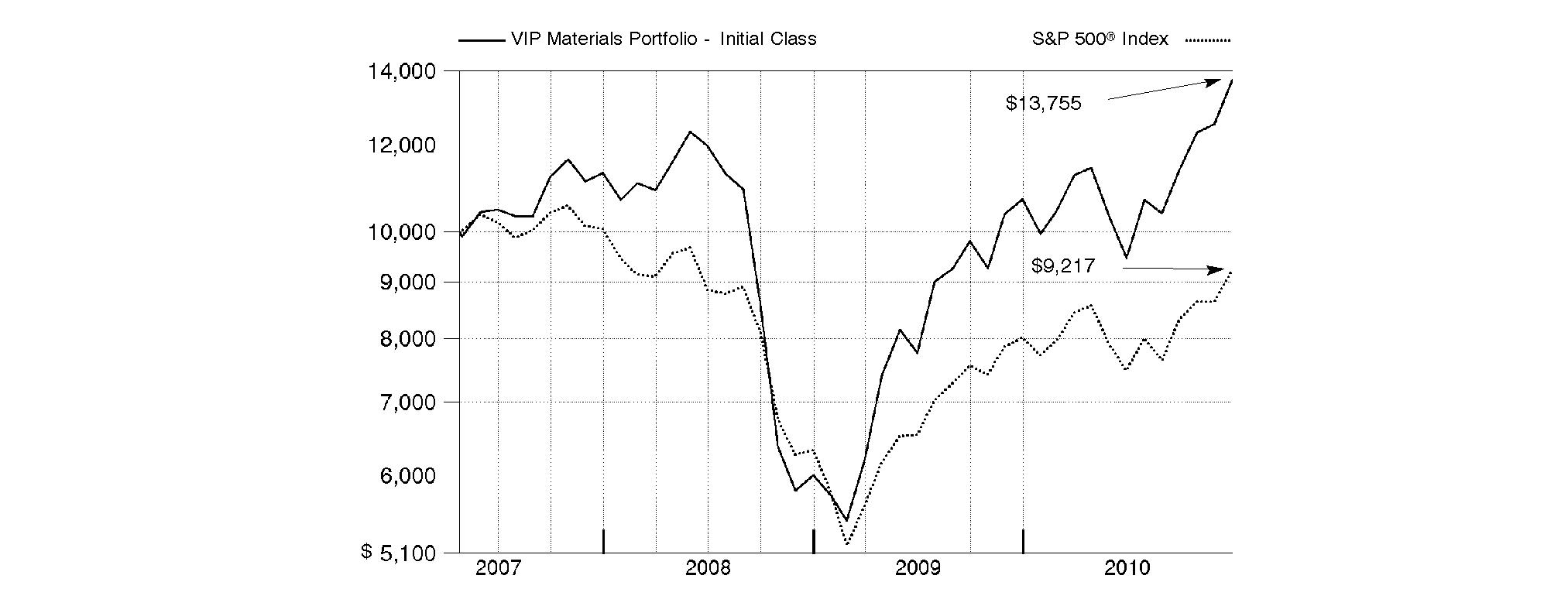

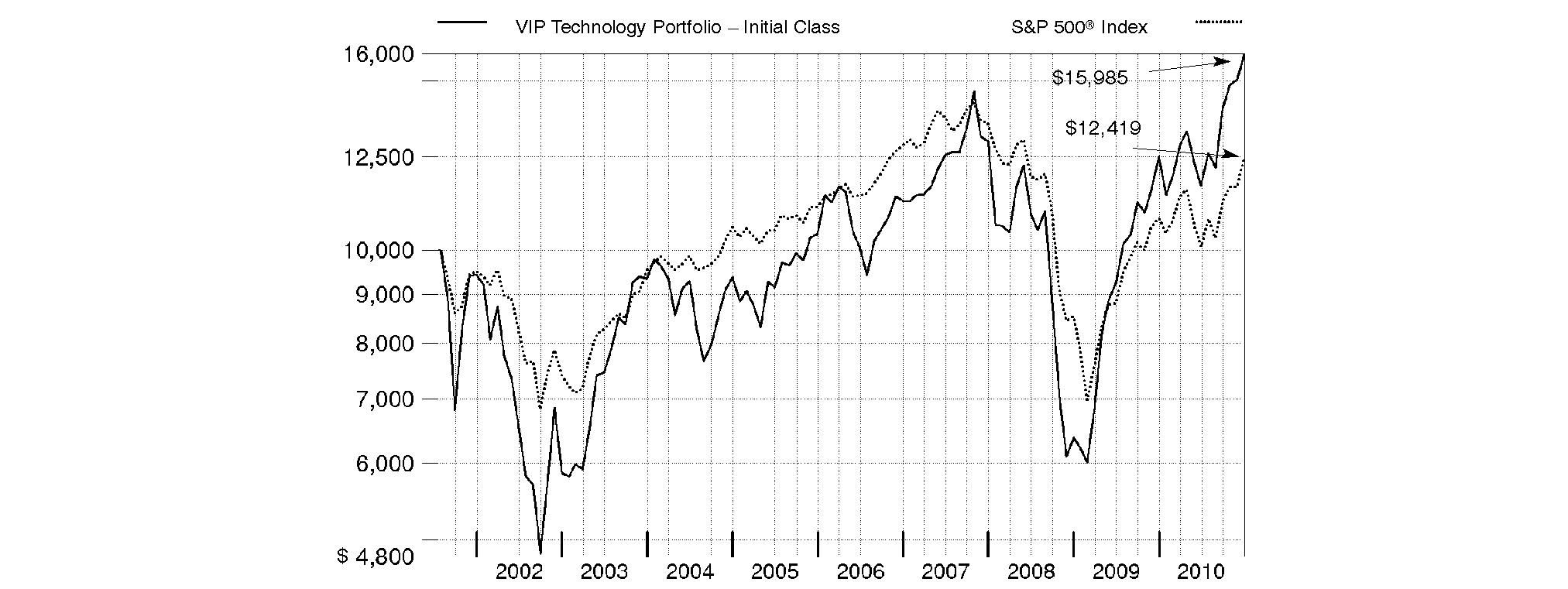

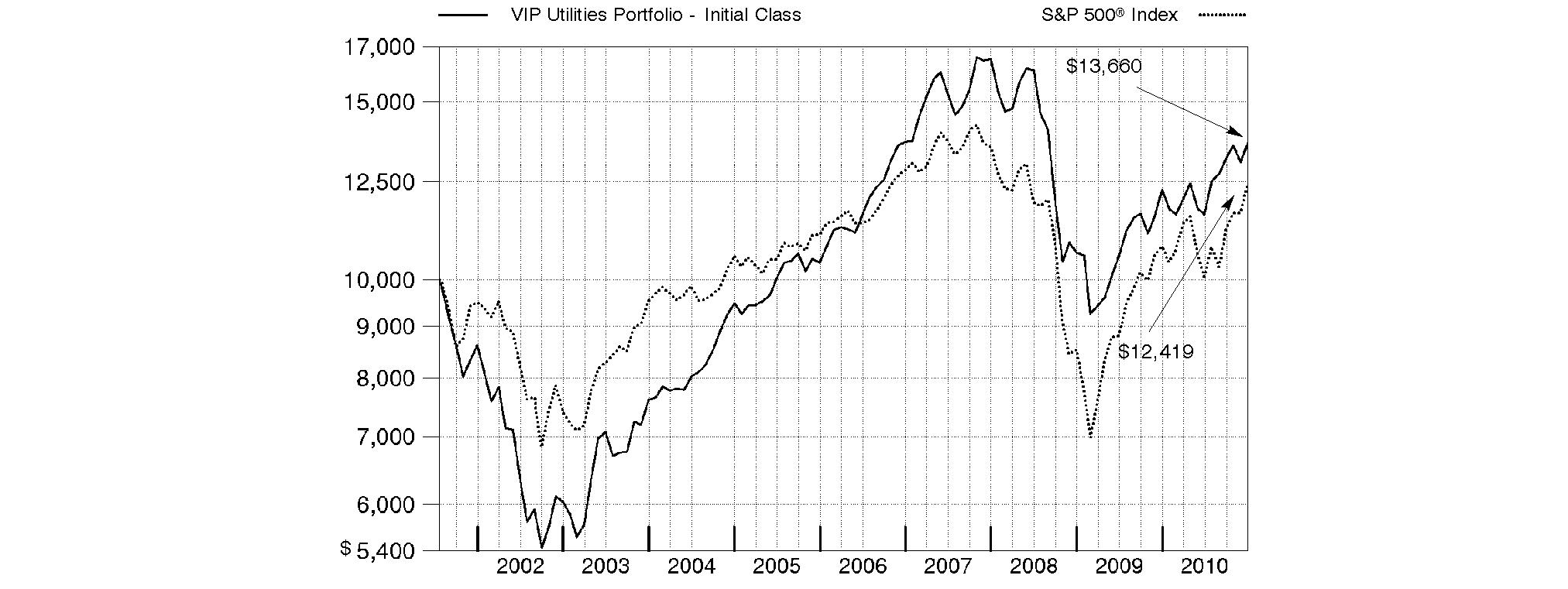

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in VIP Consumer Discretionary Portfolio - Initial Class on July 18, 2001, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Market Recap: While market improvements around the world hit a speed bump in the first half of the 12-month period ending December 31, 2010, world economies re-accelerated in August, supported by a broadening recovery and low inflation in the U.S. Domestic stock markets recorded solid gains for the year, lifted by a strong second-half rally fueled by economic optimism, encouraging earnings reports and a wave of corporate mergers. The large-cap S&P 500® Index rose 15.06%, the blue-chip-laden Dow Jones Industrial AverageSM added 14.06% and the technology-heavy Nasdaq Composite® Index climbed 18.02%. Meanwhile, international stocks, as represented by the MSCI® ACWI® (All Country World Index) ex USA Index, gained 11.29%, boosted in part by a depreciating U.S. dollar. In the fixed-income arena, U.S. taxable investment-grade bonds generated positive results during 2010, as the Barclays Capital® U.S. Aggregate Bond Index gained 6.54%. With ultra-low interest rates bolstering nearly all fixed-income securities for most of the year, sectors in the index with higher yields and more credit risk generally fared best, while most high-quality bonds generated more-moderate returns. Meanwhile, high-yield bonds, as represented by The BofA Merrill LynchSM US High Yield Constrained Index, returned 15.07%, a result of improved economic data and strengthening investor demand. Overseas, foreign bond markets showed mixed results, with a sizable disparity between the 3.97% return of the Citigroup® Non-U.S. Group of 7 Index - which measures the performance of sovereign debt of the major global economies outside the U.S. - and the 12.04% advance of the JPMorgan Emerging Markets Bond Index Global (EMBI Global), which benefited from the rising overall credit quality of emerging-markets debt issuers.

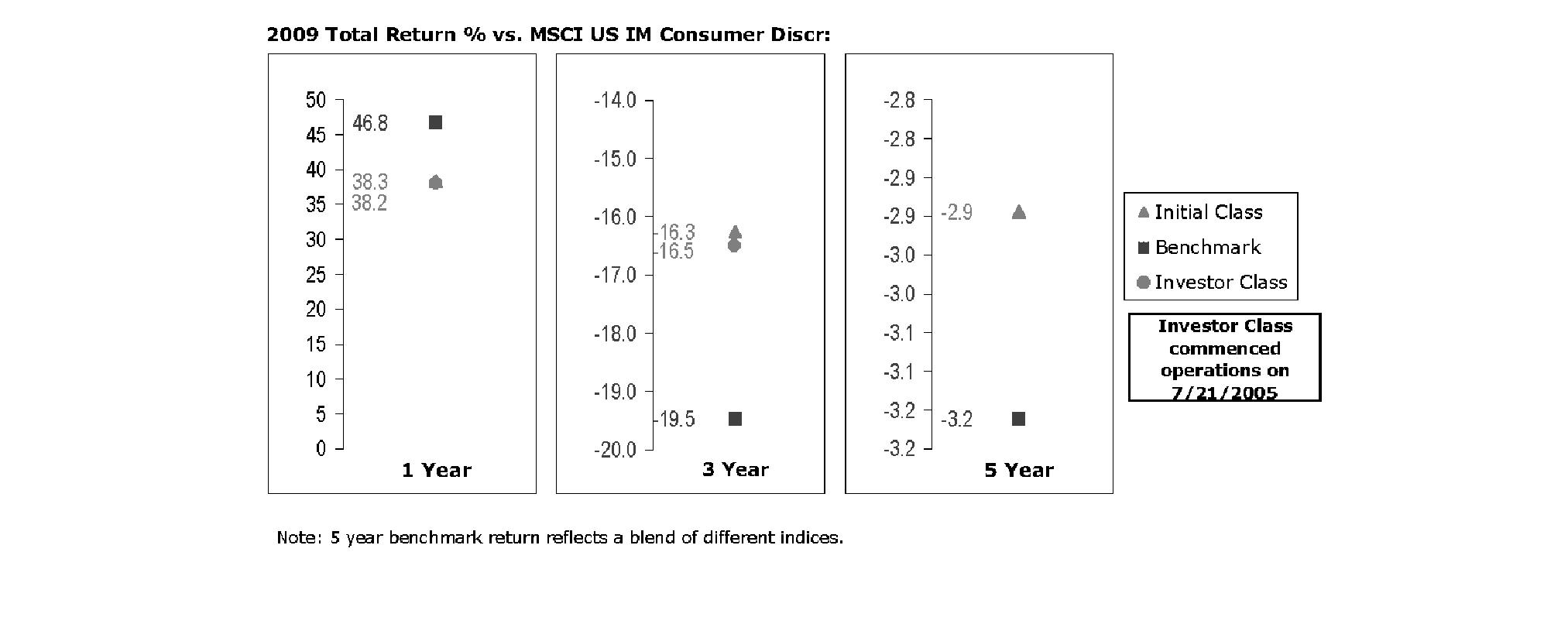

Comments from John Harris, Portfolio Manager of VIP Consumer Discretionary Portfolio: For the 12 months ending December 31, 2010, the fund's share classes handily outperformed the broadly based S&P 500® and also topped the 30.87% gain of the MSCI® U.S. IM Consumer Discretionary 25/50 Index, which was adopted in January 2010 as a better representation of the fund's investment universe. (For specific portfolio results, please refer to the performance section of this report.) Solid positioning in casinos and gaming led the fund's outperformance, including a significant overweighting in casino operator Las Vegas Sands. The firm's shares benefited from an improving economy and increased consumer spending in the U.S., coupled with the successful opening of the firm's Singapore property. An overweighting in hotels, resorts and cruise lines was another key contributor, with a stake in Starwood Hotels & Resorts Worldwide aiding returns. Favorable picks in specialized consumer services helped, such as not owning tax preparer H&R Block, an index component that was hurt by weak results in its core tax-preparation business and concern related to the company's former mortgage-origination business. Security selection within some automotive-related groups was a bright spot, led by an out-of-index position in BMW and an overweighting in parts supplier Tenneco. Media stocks contributed, with shares of U.K. cable TV provider Virgin Media moving up. Underweighting global media conglomerate News Corp. paid off when the firm's stock underperformed during the period. On the flip side, unfavorable positioning in the home improvement retail industry was a big disappointment, where a sizable overweighting in Lowe's, the fund's largest holding, continued to struggle in the face of weak housing reports and sluggish sales of big-ticket items such as appliances. Weak picks in Internet retail and Internet software/services also detracted, including not owning movie-subscription service and index constituent Netflix and an out-of-index stake in Internet search leader Google. Elsewhere, the apparel retail industry had some poor performers. Urban-oriented off-price retailer Citi Trends detracted when the chain missed its second-quarter numbers, while unfavorable positioning in discount retailer TJX Companies also hurt. Some of the stocks I've discussed were sold prior to period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2010 to December 31, 2010).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized

Expense Ratio | Beginning

Account Value

July 1, 2010 | Ending

Account Value

December 31, 2010 | Expenses Paid

During Period*

July 1, 2010

to December 31, 2010 |

Initial Class | 1.00% | | | |

Actual | | $ 1,000.00 | $ 1,322.60 | $ 5.85 |

Hypothetical A | | $ 1,000.00 | $ 1,020.16 | $ 5.09 |

Investor Class | 1.08% | | | |

Actual | | $ 1,000.00 | $ 1,322.70 | $ 6.32 |

Hypothetical A | | $ 1,000.00 | $ 1,019.76 | $ 5.50 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Annual Report

Investment Changes (Unaudited)

Top Ten Stocks as of December 31, 2010 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Lowe's Companies, Inc. | 5.7 | 6.4 |

The Walt Disney Co. | 5.4 | 5.9 |

McDonald's Corp. | 5.2 | 6.4 |

Amazon.com, Inc. | 4.6 | 3.8 |

Target Corp. | 4.2 | 4.2 |

News Corp. Class A | 2.9 | 0.0 |

Bed Bath & Beyond, Inc. | 2.9 | 2.1 |

DIRECTV | 2.7 | 3.2 |

Virgin Media, Inc. | 2.3 | 1.6 |

Starbucks Corp. | 2.3 | 2.0 |

| 38.2 | |

Top Industries (% of fund's net assets) |

As of December 31, 2010 |

| Media | 24.0% | |

| Hotels, Restaurants & Leisure | 21.9% | |

| Specialty Retail | 20.4% | |

| Textiles, Apparel & Luxury Goods | 7.0% | |

| Internet & Catalog Retail | 5.6% | |

| All Others* | 21.1% | |

|

As of June 30, 2010 |

| Media | 26.8% | |

| Hotels, Restaurants & Leisure | 21.4% | |

| Specialty Retail | 21.2% | |

| Multiline Retail | 6.7% | |

| Household Durables | 4.8% | |

| All Others* | 19.1% | |

* Includes short-term investments and net other assets. |

Annual Report

Investments December 31, 2010

Showing Percentage of Net Assets

Common Stocks - 98.9% |

| Shares | | Value |

AUTO COMPONENTS - 3.7% |

Auto Parts & Equipment - 3.7% |

Autoliv, Inc. | 7,495 | | $ 591,655 |

Tenneco, Inc. (a) | 12,233 | | 503,510 |

TRW Automotive Holdings Corp. (a) | 9,300 | | 490,110 |

| | 1,585,275 |

AUTOMOBILES - 2.2% |

Automobile Manufacturers - 2.2% |

Bayerische Motoren Werke AG (BMW) | 2,226 | | 175,147 |

General Motors Co. | 20,602 | | 759,390 |

Volkswagen AG | 18 | | 2,549 |

| | 937,086 |

DISTRIBUTORS - 0.3% |

Distributors - 0.3% |

Li & Fung Ltd. | 18,000 | | 104,445 |

DIVERSIFIED CONSUMER SERVICES - 2.9% |

Education Services - 1.6% |

DeVry, Inc. | 6,800 | | 326,264 |

Grand Canyon Education, Inc. (a) | 18,074 | | 354,070 |

| | 680,334 |

Specialized Consumer Services - 1.3% |

Sotheby's Class A (ltd. vtg.) | 8,697 | | 391,365 |

Steiner Leisure Ltd. (a) | 3,021 | | 141,081 |

| | 532,446 |

TOTAL DIVERSIFIED CONSUMER SERVICES | | 1,212,780 |

ELECTRONIC EQUIPMENT & COMPONENTS - 0.2% |

Technology Distributors - 0.2% |

Funtalk China Holdings Ltd. (a) | 15,600 | | 88,452 |

FOOD & STAPLES RETAILING - 1.4% |

Hypermarkets & Super Centers - 1.4% |

BJ's Wholesale Club, Inc. (a) | 2,800 | | 134,120 |

Costco Wholesale Corp. | 6,369 | | 459,905 |

| | 594,025 |

HOTELS, RESTAURANTS & LEISURE - 21.9% |

Casinos & Gaming - 4.7% |

Betfair Group PLC | 7,400 | | 111,295 |

Las Vegas Sands Corp. unit | 773 | | 601,487 |

MGM Mirage, Inc. (a) | 35,483 | | 526,923 |

Pinnacle Entertainment, Inc. (a) | 16,956 | | 237,723 |

WMS Industries, Inc. (a) | 11,040 | | 499,450 |

| | 1,976,878 |

Hotels, Resorts & Cruise Lines - 5.3% |

Accor SA | 4,874 | | 217,001 |

China Lodging Group Ltd. ADR | 6,215 | | 135,425 |

Home Inns & Hotels Management, Inc. sponsored ADR (a) | 7,100 | | 290,816 |

Marriott International, Inc. Class A | 7,716 | | 320,523 |

|

| Shares | | Value |

Starwood Hotels & Resorts Worldwide, Inc. | 11,729 | | $ 712,889 |

Wyndham Worldwide Corp. | 18,745 | | 561,600 |

| | 2,238,254 |

Restaurants - 11.9% |

BJ's Restaurants, Inc. (a) | 8,116 | | 287,550 |

Bravo Brio Restaurant Group, Inc. | 3,400 | | 65,178 |

Darden Restaurants, Inc. | 12,827 | | 595,686 |

McDonald's Corp. | 28,615 | | 2,196,487 |

P.F. Chang's China Bistro, Inc. | 7,013 | | 339,850 |

Ruth's Hospitality Group, Inc. (a) | 29,581 | | 136,960 |

Starbucks Corp. | 30,390 | | 976,431 |

Texas Roadhouse, Inc. Class A (a) | 27,495 | | 472,089 |

| | 5,070,231 |

TOTAL HOTELS, RESTAURANTS & LEISURE | | 9,285,363 |

HOUSEHOLD DURABLES - 2.1% |

Home Furnishings - 0.8% |

Tempur-Pedic International, Inc. (a) | 8,200 | | 328,492 |

Homebuilding - 0.9% |

Lennar Corp. Class A | 14,100 | | 264,375 |

Toll Brothers, Inc. (a) | 7,194 | | 136,686 |

| | 401,061 |

Household Appliances - 0.4% |

Stanley Black & Decker, Inc. | 2,421 | | 161,892 |

TOTAL HOUSEHOLD DURABLES | | 891,445 |

INTERNET & CATALOG RETAIL - 5.6% |

Internet Retail - 5.6% |

Amazon.com, Inc. (a) | 10,800 | | 1,944,000 |

Expedia, Inc. | 9,389 | | 235,570 |

Ocado Group PLC (a) | 11,500 | | 31,990 |

Priceline.com, Inc. (a) | 440 | | 175,802 |

| | 2,387,362 |

INTERNET SOFTWARE & SERVICES - 1.0% |

Internet Software & Services - 1.0% |

eBay, Inc. (a) | 15,645 | | 435,400 |

LEISURE EQUIPMENT & PRODUCTS - 0.7% |

Leisure Products - 0.7% |

Polaris Industries, Inc. | 3,700 | | 288,674 |

MEDIA - 24.0% |

Advertising - 3.0% |

Interpublic Group of Companies, Inc. (a) | 33,400 | | 354,708 |

Lamar Advertising Co. Class A (a) | 10,282 | | 409,635 |

National CineMedia, Inc. | 24,568 | | 489,149 |

| | 1,253,492 |

Broadcasting - 0.8% |

Scripps Networks Interactive, Inc. Class A | 6,800 | | 351,900 |

Common Stocks - continued |

| Shares | | Value |

MEDIA - CONTINUED |

Cable & Satellite - 11.2% |

Comcast Corp.: | | | |

Class A | 30,800 | | $ 676,676 |

Class A (special) (non-vtg.) | 25,644 | | 533,652 |

DIRECTV (a) | 28,612 | | 1,142,477 |

Kabel Deutschland Holding AG | 9,217 | | 429,769 |

Sirius XM Radio, Inc. (a) | 172,200 | | 282,408 |

Time Warner Cable, Inc. | 10,852 | | 716,558 |

Virgin Media, Inc. | 35,900 | | 977,916 |

| | 4,759,456 |

Movies & Entertainment - 8.3% |

News Corp. Class A | 84,611 | | 1,231,936 |

The Walt Disney Co. | 61,146 | | 2,293,586 |

| | 3,525,522 |

Publishing - 0.7% |

United Business Media Ltd. | 26,700 | | 287,426 |

TOTAL MEDIA | | 10,177,796 |

MULTILINE RETAIL - 5.5% |

Department Stores - 1.3% |

Nordstrom, Inc. | 9,790 | | 414,900 |

Retail Ventures, Inc. (a) | 8,200 | | 133,660 |

| | 548,560 |

General Merchandise Stores - 4.2% |

Droga Raia SA | 1,000 | | 15,329 |

Target Corp. | 29,493 | | 1,773,414 |

| | 1,788,743 |

TOTAL MULTILINE RETAIL | | 2,337,303 |

SPECIALTY RETAIL - 20.4% |

Apparel Retail - 5.7% |

Chico's FAS, Inc. | 14,800 | | 178,044 |

Citi Trends, Inc. (a) | 10,425 | | 255,934 |

DSW, Inc. Class A (a) | 3,701 | | 144,709 |

Fast Retailing Co. Ltd. | 700 | | 111,445 |

Inditex SA | 2,832 | | 212,151 |

TJX Companies, Inc. | 21,078 | | 935,652 |

Urban Outfitters, Inc. (a) | 16,093 | | 576,290 |

| | 2,414,225 |

Automotive Retail - 1.0% |

Advance Auto Parts, Inc. | 5,670 | | 375,071 |

Lentuo International, Inc. ADR | 8,400 | | 58,800 |

| | 433,871 |

Computer & Electronics Retail - 1.3% |

Best Buy Co., Inc. | 6,600 | | 226,314 |

hhgregg, Inc. (a) | 15,855 | | 332,162 |

| | 558,476 |

|

| Shares | | Value |

Home Improvement Retail - 7.0% |

Home Depot, Inc. | 8,354 | | $ 292,891 |

Lowe's Companies, Inc. | 96,545 | | 2,421,351 |

Lumber Liquidators Holdings, Inc. (a) | 9,500 | | 236,645 |

| | 2,950,887 |

Homefurnishing Retail - 2.9% |

Bed Bath & Beyond, Inc. (a) | 24,848 | | 1,221,279 |

Specialty Stores - 2.5% |

Hengdeli Holdings Ltd. | 360,000 | | 214,448 |

OfficeMax, Inc. (a) | 18,010 | | 318,777 |

Tractor Supply Co. | 8,766 | | 425,063 |

Ulta Salon, Cosmetics & Fragrance, Inc. (a) | 3,700 | | 125,800 |

| | 1,084,088 |

TOTAL SPECIALTY RETAIL | | 8,662,826 |

TEXTILES, APPAREL & LUXURY GOODS - 7.0% |

Apparel, Accessories & Luxury Goods - 5.5% |

China Xiniya Fashion Ltd. ADR | 11,100 | | 101,676 |

Christian Dior SA | 800 | | 114,340 |

Coach, Inc. | 12,088 | | 668,587 |

Phillips-Van Heusen Corp. | 6,300 | | 396,963 |

Polo Ralph Lauren Corp. Class A | 4,660 | | 516,887 |

Titan Industries Ltd. | 3,115 | | 250,451 |

Vera Bradley, Inc. | 7,900 | | 260,700 |

| | 2,309,604 |

Footwear - 1.5% |

Iconix Brand Group, Inc. (a) | 9,800 | | 189,238 |

NIKE, Inc. Class B | 5,200 | | 444,184 |

| | 633,422 |

TOTAL TEXTILES, APPAREL & LUXURY GOODS | | 2,943,026 |

TOTAL COMMON STOCKS (Cost $37,868,870) | 41,931,258 |

Nonconvertible Preferred Stocks - 0.5% |

| | | |

AUTOMOBILES - 0.5% |

Automobile Manufacturers - 0.5% |

Volkswagen AG

(Cost $217,857) | 1,300 | | 211,005 |

Money Market Funds - 3.0% |

| Shares | | Value |

Fidelity Cash Central Fund, 0.19% (b)

(Cost $1,284,658) | 1,284,658 | | $ 1,284,658 |

TOTAL INVESTMENT PORTFOLIO - 102.4% (Cost $39,371,385) | | 43,426,921 |

NET OTHER ASSETS (LIABILITIES) - (2.4)% | | (1,032,810) |

NET ASSETS - 100% | $ 42,394,111 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 1,127 |

Other Information |

The following is a summary of the inputs used, as of December 31, 2010, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section at the end of this in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Common Stocks | $ 41,931,258 | $ 41,329,771 | $ 601,487 | $ - |

Nonconvertible Preferred Stocks | 211,005 | 211,005 | - | - |

Money Market Funds | 1,284,658 | 1,284,658 | - | - |

Total Investments in Securities: | $ 43,426,921 | $ 42,825,434 | $ 601,487 | $ - |

Income Tax Information |

At December 31, 2010, the Fund had a capital loss carryforward of approximately $1,260,189 of which $171,972 and $1,088,217 will expire in fiscal 2016 and 2017, respectively. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

| December 31, 2010 |

| | |

Assets | | |

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $38,086,727) | $ 42,142,263 | |

Fidelity Central Funds (cost $1,284,658) | 1,284,658 | |

Total Investments (cost $39,371,385) | | $ 43,426,921 |

Receivable for investments sold | | 362,089 |

Receivable for fund shares sold | | 191,306 |

Dividends receivable | | 23,790 |

Distributions receivable from Fidelity Central Funds | | 308 |

Prepaid expenses | | 54 |

Other receivables | | 1,017 |

Total assets | | 44,005,485 |

| | |

Liabilities | | |

Payable for investments purchased | $ 1,470,424 | |

Payable for fund shares redeemed | 75,466 | |

Accrued management fee | 19,956 | |

Other affiliated payables | 4,826 | |

Other payables and accrued expenses | 40,702 | |

Total liabilities | | 1,611,374 |

| | |

Net Assets | | $ 42,394,111 |

Net Assets consist of: | | |

Paid in capital | | $ 39,772,179 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (1,431,269) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 4,053,201 |

Net Assets | | $ 42,394,111 |

Statement of Assets and Liabilities - continued

| December 31, 2010 |

| | |

Initial Class:

Net Asset Value, offering price and redemption price per share ($18,112,697 ÷ 1,442,296 shares) | | $ 12.56 |

| | |

Investor Class:

Net Asset Value, offering price and redemption price per share ($24,281,414 ÷ 1,936,415 shares) | | $ 12.54 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended December 31, 2010 |

| | |

Investment Income | | |

Dividends | | $ 227,801 |

Interest | | 3 |

Income from Fidelity Central Funds | | 1,127 |

Total income | | 228,931 |

| | |

Expenses | | |

Management fee | $ 104,595 | |

Transfer agent fees | 28,885 | |

Accounting fees and expenses | 7,279 | |

Custodian fees and expenses | 32,457 | |

Independent trustees' compensation | 92 | |

Audit | 37,346 | |

Legal | 64 | |

Miscellaneous | 155 | |

Total expenses before reductions | 210,873 | |

Expense reductions | (16,376) | 194,497 |

Net investment income (loss) | | 34,434 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 809,233 | |

Foreign currency transactions | 181 | |

Total net realized gain (loss) | | 809,414 |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $2,466) | 3,250,811 | |

Assets and liabilities in foreign currencies | 133 | |

Total change in net unrealized appreciation (depreciation) | | 3,250,944 |

Net gain (loss) | | 4,060,358 |

Net increase (decrease) in net assets resulting from operations | | $ 4,094,792 |

Statement of Changes in Net Assets

| Year ended

December 31, 2010 | Year ended

December 31, 2009 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 34,434 | $ 36,995 |

Net realized gain (loss) | 809,414 | (649,462) |

Change in net unrealized appreciation (depreciation) | 3,250,944 | 2,832,342 |

Net increase (decrease) in net assets resulting

from operations | 4,094,792 | 2,219,875 |

Distributions to shareholders from net investment income | (46,369) | (39,751) |

Share transactions - net increase (decrease) | 29,996,122 | 1,609,010 |

Redemption fees | 27,571 | 8,313 |

Total increase (decrease) in net assets | 34,072,116 | 3,797,447 |

| | |

Net Assets | | |

Beginning of period | 8,321,995 | 4,524,548 |

End of period | $ 42,394,111 | $ 8,321,995 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Initial Class

Years ended December 31, | 2010 | 2009 | 2008 | 2007 | 2006 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 9.58 | $ 6.96 | $ 10.72 | $ 12.84 | $ 11.45 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .02 | .04 | .04 | (.01) | .11 F |

Net realized and unrealized gain (loss) | 2.96 | 2.62 | (3.68) | (1.02) | 1.33 |

Total from investment operations | 2.98 | 2.66 | (3.64) | (1.03) | 1.44 |

Distributions from net investment income | (.02) | (.05) | (.05) | (.02) | (.06) |

Distributions from net realized gain | - | - | (.09) | (1.08) | - |

Total distributions | (.02) | (.05) | (.13) H | (1.10) | (.06) |

Redemption fees added to paid in capital C | .02 | .01 | .01 | .01 | .01 |

Net asset value, end of period | $ 12.56 | $ 9.58 | $ 6.96 | $ 10.72 | $ 12.84 |

Total Return A, B | 31.29% | 38.32% | (34.10)% | (8.14)% | 12.63% |

Ratios to Average Net Assets D, G | | | | | |

Expenses before reductions | 1.08% | 1.43% | 1.40% | 1.10% | 1.20% |

Expenses net of fee waivers, if any | 1.00% | 1.00% | 1.00% | 1.01% | 1.15% |

Expenses net of all reductions | .98% | .99% | 1.00% | 1.01% | 1.14% |

Net investment income (loss) | .23% | .57% | .48% | (.07)% | .90% F |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 18,113 | $ 4,098 | $ 3,212 | $ 6,989 | $ 13,866 |

Portfolio turnover rate E | 191% | 166% | 81% | 114% | 189% |

A Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

B Total returns would have been lower had certain expenses not been reduced during the periods shown.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects special dividends which amounted to $.09 per share. Excluding these special dividends, the ratio of net investment income (loss) to average net assets would have been .13%.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Total distributions of $.13 per share is comprised of distributions from net investment income of $.046 and distributions from net realized gain of $.085 per share.

Financial Highlights - Investor Class

Years ended December 31, | 2010 | 2009 | 2008 | 2007 | 2006 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 9.57 | $ 6.96 | $ 10.72 | $ 12.83 | $ 11.44 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .02 | .04 | .04 | (.03) | .10 F |

Net realized and unrealized gain (loss) | 2.94 | 2.61 | (3.68) | (1.02) | 1.33 |

Total from investment operations | 2.96 | 2.65 | (3.64) | (1.05) | 1.43 |

Distributions from net investment income | (.01) | (.05) | (.05) | (.02) | (.05) |

Distributions from net realized gain | - | - | (.09) | (1.05) | - |

Total distributions | (.01) | (.05) | (.13) H | (1.07) | (.05) |

Redemption fees added to paid in capital C | .02 | .01 | .01 | .01 | .01 |

Net asset value, end of period | $ 12.54 | $ 9.57 | $ 6.96 | $ 10.72 | $ 12.83 |

Total Return A, B | 31.16% | 38.17% | (34.10)% | (8.29)% | 12.62% |

Ratios to Average Net Assets D, G | | | | | |

Expenses before reductions | 1.14% | 1.51% | 1.54% | 1.24% | 1.41% |

Expenses net of fee waivers, if any | 1.08% | 1.08% | 1.09% | 1.15% | 1.25% |

Expenses net of all reductions | 1.06% | 1.08% | 1.09% | 1.15% | 1.24% |

Net investment income (loss) | .15% | .48% | .39% | (.21)% | .80% F |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 24,281 | $ 4,224 | $ 1,313 | $ 2,352 | $ 4,256 |

Portfolio turnover rate E | 191% | 166% | 81% | 114% | 189% |

A Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

B Total returns would have been lower had certain expenses not been reduced during the periods shown.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects special dividends which amounted to $.09 per share. Excluding these special dividends, the ratio of net investment income (loss) to average net assets would have been .03%.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Total distributions of $.13 per share is comprised of distributions from net investment income of $.046 and distributions from net realized gain of $.085 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended December 31, 2010

1. Organization.

VIP Consumer Discretionary Portfolio (the Fund) is a non-diversified fund of Variable Insurance Products Fund IV (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class.

2. Investments in Fidelity Central Funds.

The Fund may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Fund uses independent pricing services approved by the Board of Trustees to value its investments. When current market prices or quotations are not readily available or reliable, valuations may be determined in good faith in accordance with procedures adopted by the Board of Trustees. Factors used in determining value may include market or security specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The value used for net asset value (NAV) calculation under these procedures may differ from published prices for the same securities.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below.

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of December 31, 2010, is included at the end of the Fund's Schedule of Investments. Valuation techniques used to value the Fund's investments by major category are as follows.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when significant market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-traded funds (ETFs) and certain indexes as well as quoted prices for similar securities are used and are categorized as Level 2 in the hierarchy in these circumstances. Utilizing these techniques may result in transfers between Level 1 and Level 2. For restricted equity securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day and are categorized as Level 1 in the hierarchy.

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Foreign Currency. The Fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year the Fund intends to qualify as a regulated investment company, including distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. As of December 31, 2010, the Fund did not have any unrecognized tax benefits in the accompanying financial statements. A fund's federal tax return is subject to examination by the Internal Revenue Service (IRS) for a period of three years. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on realized short term capital gains on securities of certain issuers domiciled in India. An estimated deferred tax liability for net unrealized gains on these securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, capital loss carryforwards and losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 4,443,348 |

Gross unrealized depreciation | (558,893) |

Net unrealized appreciation (depreciation) | $ 3,884,455 |

| |

Tax Cost | $ 39,542,466 |

The tax-based components of distributable earnings as of period end were as follows:

Capital loss carryforward | $ (1,260,189) |

Net unrealized appreciation (depreciation) | $ 3,884,585 |

The tax character of distributions paid was as follows:

| December 31, 2010 | December 31, 2009 |

Ordinary Income | $ 46,369 | $ 39,751 |

Annual Report

3. Significant Accounting Policies - continued

Trading (Redemption) Fees. Initial Class shares and Investor Class shares held by investors less than 60 days are subject to a redemption fee equal to 1% of the net asset value of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

4. Purchases and Sales of Investments.

Purchases and sales of securities short-term securities, aggregated $65,791,630 and $35,950,977, respectively.

5. Fees and Other Transactions with Affiliates.

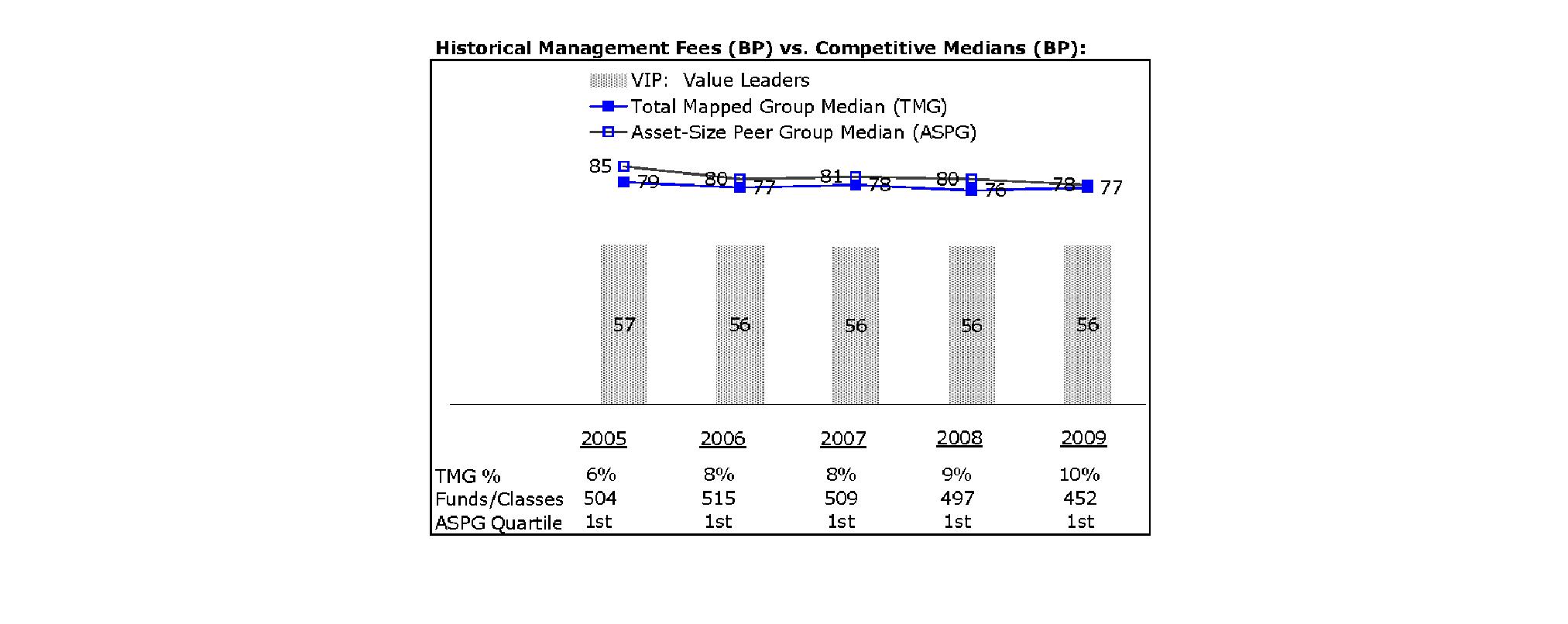

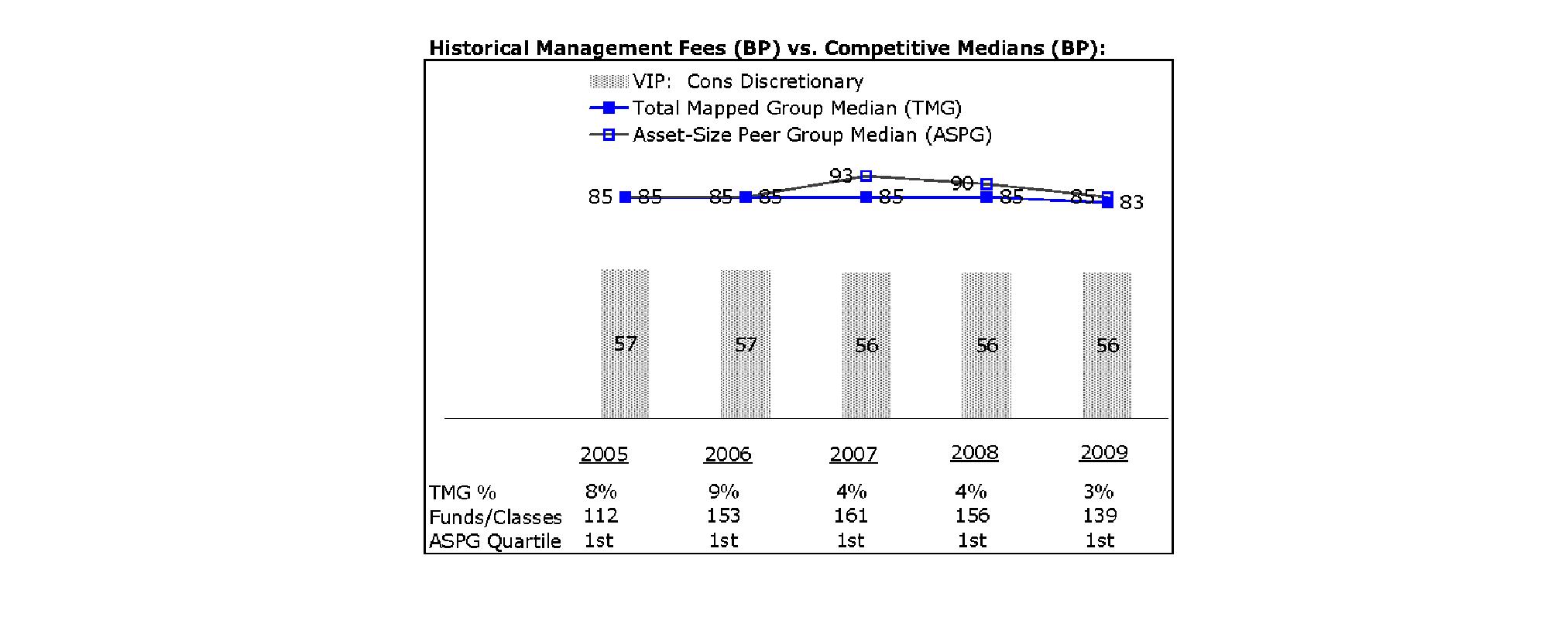

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and a group fee rate that averaged .26% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annual management fee rate was .55% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the Fund's transfer, dividend disbursing, and shareholder servicing agent. FIIOC receives an asset-based fee with respect to each class. Each class (with the exception of Investor Class) pays a transfer agent fee, excluding out of pocket expenses, equal to an annual rate of .07% of average net assets. Investor Class pays a monthly asset-based transfer agent fee of .15% of average net assets. In addition, FIIOC receives an asset-based fee of .01% of average net assets for typesetting, printing and mailing of shareholder reports, except proxy statements. FIIOC has agreed to voluntarily waive this fee until December 31, 2010. (See Note 7: Expense Reductions.) For the period, transfer agent fees for each class, including printing and out of pocket expenses, were as follows:

Initial Class | $ 8,998 |

Investor Class | 19,887 |

| $ 28,885 |

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the Fund's accounting records. The fee is based on the level of average net assets for the month.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $3,310 for the period.

6. Committed Line of Credit.

The Fund participates with other funds managed by FMR or an affiliate in a $3.75 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $53 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, there were no borrowings on this line of credit.

7. Expense Reductions.

In addition to FIIOC waiving a portion of its transfer agent fees, FMR voluntarily agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. Some expenses, for example interest expense, including commitment fees, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| Expense

Limitations | Reimbursement/

Waiver |

Initial Class | 1.00% | $ 7,081 |

Investor Class | 1.08 | 6,905 |

| | $ 13,986 |

Many of the brokers with whom FMR places trades on behalf of the Fund provided services to the Fund in addition to trade execution. These services included payments of certain expenses on behalf of the Fund totaling $2,390 for the period

Annual Report

Notes to Financial Statements - continued

8. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

Years ended December 31, | 2010 | 2009 |

From net investment income | | |

Initial Class | $ 24,605 | $ 19,436 |

Investor Class | 21,764 | 20,315 |

Total | $ 46,369 | $ 39,751 |

9. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

Years ended December 31, | 2010 | 2009 | 2010 | 2009 |

Initial Class | | | | |

Shares sold | 1,403,892 | 387,558 | $ 16,356,186 | $ 2,878,099 |

Reinvestment of distributions | 1,962 | 2,071 | 24,605 | 19,436 |

Shares redeemed | (391,168) | (423,292) | (4,016,992) | (3,190,755) |

Net increase (decrease) | 1,014,686 | (33,663) | $ 12,363,799 | $ (293,220) |

Investor Class | | | | |

Shares sold | 1,964,116 | 573,242 | $ 22,469,975 | $ 4,445,239 |

Reinvestment of distributions | 1,738 | 2,151 | 21,764 | 20,315 |

Shares redeemed | (470,793) | (322,598) | (4,859,416) | (2,563,324) |

Net increase (decrease) | 1,495,061 | 252,795 | $ 17,632,323 | $ 1,902,230 |

10. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, FMR or its affiliates were the owners of record of 100% of the total outstanding shares of the Fund.

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Variable Insurance Products Fund IV and the Shareholders of VIP Consumer Discretionary Portfolio:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of VIP Consumer Discretionary Portfolio (a fund of Variable Insurance Products Fund IV) at December 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the VIP Consumer Discretionary Portfolio's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 17, 2011

Annual Report

The Trustees, Members of the Advisory Board, and executive officers of the trust and funds, as applicable, are listed below. The Board of Trustees governs each fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee each fund's activities, review contractual arrangements with companies that provide services to each fund, oversee management of the risks associated with such activities and contractual arrangements, and review each fund's performance. Except for James C. Curvey, each of the Trustees oversees 219 funds advised by FMR or an affiliate. Mr. Curvey oversees 408 funds advised by FMR or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 72nd birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. The executive officers and Advisory Board Members hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

Experience, Skills, Attributes, and Qualifications of the Fund's Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing each fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the funds, is provided below.

Board Structure and Oversight Function. James C. Curvey is an interested person (as defined in the 1940 Act) and currently serves as Acting Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the funds. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Ned C. Lautenbach serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity funds are overseen by different Boards of Trustees. The funds' Board oversees Fidelity's equity and high income funds and another Board oversees Fidelity's investment-grade bond, money market, and asset allocation funds. The asset allocation funds may invest in Fidelity funds overseen by the funds' Board. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, each fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the funds' activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the funds' business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the funds are carried out by or through FMR, its affiliates and other service providers, the funds' exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the funds' activities, oversight is exercised primarily through the Operations, Audit, and Compliance Committees. Appropriate personnel, including but not limited to the funds' Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the funds' Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate. The responsibilities of each committee, including their oversight responsibilities, are described further under "Standing Committees of the Fund's Trustees."

Annual Report

Trustees and Officers - continued

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-877-208-0098.

Interested Trustees*:

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupations and Other Relevant Experience+ |

James C. Curvey (75) |

| Year of Election or Appointment: 2007 Mr. Curvey is Trustee and Acting Chairman of the Board of Trustees of certain Trusts. Mr. Curvey also serves as Trustee (2007-present) of other investment companies advised by FMR. Mr. Curvey is a Director of Fidelity Investments Money Management, Inc. (2009-present), Director of Fidelity Research & Analysis Co. (2009-present) and Director of FMR and FMR Co., Inc. (2007-present). Mr. Curvey is also Vice Chairman (2007-present) and Director of FMR LLC. In addition, Mr. Curvey serves as an Overseer for the Boston Symphony Orchestra and a member of the Trustees of Villanova University. Previously, Mr. Curvey was the Vice Chairman (2006-2007) and Director (2000-2007) of FMR Corp. |

Ronald P. O'Hanley (54) |

| Year of Election or Appointment: 2011 Mr. O'Hanley is President of Fidelity Asset Management and Corporate Services and a member of Fidelity's Executive Committee (2010-present). Previously, Mr. O'Hanley served as President and Chief Executive Officer of BNY Mellon Asset Management (2007-2010). Mr. O'Hanley also served as Vice Chairman of Bank New York Mellon Corp. and a member of that firm's Executive Committee. Prior to the 2007 merger of The Bank of New York and Mellon Financial Corporation, he was Vice Chairman of Mellon Financial Corporation and President and Chief Executive Officer of Mellon Asset Management. He joined Mellon in February 1997. Mr. O'Hanley currently serves as Chairman of the Boston Public Library Foundation Board of Directors and sits on the Board of Directors of Beth Israel Deaconess Medical Center, the Board of Trustees of the Marine Biological Laboratory and the Advisory Board of the Maxwell School of Citizenship and Public Administration at Syracuse University. Mr. O'Hanley also chairs the Council on Asset Management for the Financial Services Roundtable and is a member of the Board of Directors of Institutional Investor's U.S. Institute. |

* Trustees have been determined to be "Interested Trustees" by virtue of, among other things, their affiliation with the trust or various entities under common control with FMR.

+ The information above includes each Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each Trustee's qualifications to serve as a Trustee, which led to the conclusion that each Trustee should serve as a Trustee for each fund.

Independent Trustees:

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustees) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Age; Principal Occupations and Other Relevant Experience+ |

Dennis J. Dirks (62) |

| Year of Election or Appointment: 2005 Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Company (DTC) and President and Board member of the National Securities Clearing Corporation (NSCC). In addition, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation, Chief Executive Officer and Board member of the Mortgage-Backed Securities Clearing Corporation, as a Trustee and a member of the Finance Committee of Manhattan College (2005-2008), and as a Trustee and a member of the Finance Committee of AHRC of Nassau County (2006-2008). Mr. Dirks is a member of the Independent Directors Council (IDC) Governing Council (2010-Present) and Board of Directors for The Brookville Center for Children's Services, Inc. (2009-present). |

Alan J. Lacy (57) |

| Year of Election or Appointment: 2008 Mr. Lacy serves as Senior Adviser (2007-present) of Oak Hill Capital Partners, L.P. (private equity). Mr. Lacy also served as Chief Executive Officer (2000-2005) and Vice Chairman (2005-2006) of Sears Holdings Corporation and Sears, Roebuck and Co. (retail). In addition, Mr. Lacy serves as a member of the Board of Directors of The Western Union Company (global money transfer, 2006-present) and Bristol-Myers Squibb Company (global pharmaceuticals, 2007-present). Mr. Lacy is Chairman (2008-present) and a member (2006-present) of the Board of Trustees of The National Parks Conservation Association. |

Ned C. Lautenbach (66) |

| Year of Election or Appointment: 2000 Mr. Lautenbach is Chairman of the Independent Trustees of the Equity and High Income Funds (2006-present). Mr. Lautenbach currently serves as the Lead Director of the Eaton Corporation Board of Directors (diversified industrial, 1997-present). Mr. Lautenbach is also a member of the Board of Directors of the Philharmonic Center for the Arts in Naples, Florida (1999-present); a member of the Board of Trustees of Fairfield University (2005-present); and a member of the Council on Foreign Relations (1994-present). Previously, Mr. Lautenbach was a Partner/Advisory Partner at Clayton, Dubilier & Rice, Inc. (private equity investment, 1998-2010), as well as a Director of Sony Corporation (2006-2007). |

Joseph Mauriello (66) |

| Year of Election or Appointment: 2008 Prior to his retirement in January 2006, Mr. Mauriello served in numerous senior management positions including Deputy Chairman and Chief Operating Officer (2004-2005), and Vice Chairman of Financial Services (2002-2004) of KPMG LLP US (professional services, 1965-2005). Mr. Mauriello currently serves as a member of the Board of Directors of XL Group plc. (global insurance and re-insurance, 2006-present) and of Arcadia Resources Inc. (health care services and products, 2007-present). Previously, Mr. Mauriello served as a Director of the Hamilton Funds of the Bank of New York (2006-2007). |

Cornelia M. Small (66) |

| Year of Election or Appointment: 2005 Ms. Small is a member of the Board of Directors of the Teagle Foundation (2009-present). Ms. Small is also a member of the Investment Committee, and Chair (2008-present) and a member of the Board of Trustees of Smith College. In addition, Ms. Small serves on the Investment Committee of the Berkshire Taconic Community Foundation (2008-present). Previously, Ms. Small served as Chairperson of the Investment Committee (2002-2008) of Smith College. In addition, Ms. Small served as Chief Investment Officer, Director of Global Equity Investments, and a member of the Board of Directors of Scudder, Stevens & Clark and Scudder Kemper Investments. |

William S. Stavropoulos (71) |

| Year of Election or Appointment: 2001 Mr. Stavropoulos is Vice Chairman of the Independent Trustees of the Equity and High Income Funds (2006-present). Mr. Stavropoulos serves as President and Founder of the Michigan Baseball Foundation, the Great Lakes Loons (2007-present). Mr. Stavropoulos is Chairman Emeritus of the Board of Directors of The Dow Chemical Company, where he previously served in numerous senior management positions, including President, CEO (1995-2000; 2002-2004), Chairman of the Executive Committee (2000-2006), and as a member of the Board of Directors (1990-2006). Currently, Mr. Stavropoulos is Chairman of Univar (global distributor of commodity and specialty chemicals, 2010-present), a Director of Teradata Corporation (data warehousing and technology solutions, 2008-present), Chemical Financial Corporation, Maersk Inc. (industrial conglomerate), Tyco International, Inc. (multinational manufacturing and services, 2007-present), and a member of the Advisory Board for Metalmark Capital (private equity investment, 2005-present). Mr. Stavropoulos is a special advisor to Clayton, Dubilier & Rice, LLC (private equity investment). In addition, Mr. Stavropoulos is a member of the University of Notre Dame Advisory Council for the College of Science. |

David M. Thomas (61) |

| Year of Election or Appointment: 2008 Previously, Mr. Thomas served as Executive Chairman (2005-2006) and Chairman and Chief Executive Officer (2000-2005) of IMS Health, Inc. (pharmaceutical and healthcare information solutions). In addition, Mr. Thomas serves as a member of the Board of Directors of Fortune Brands, Inc. (consumer products), and Interpublic Group of Companies, Inc. (marketing communication, 2004-present). |

Michael E. Wiley (60) |

| Year of Election or Appointment: 2008 Mr. Wiley also serves as a Director of Asia Pacific Exploration Consolidated (international oil and gas exploration and production, 2008-present). Mr. Wiley serves as a Director of Tesoro Corporation (independent oil refiner and marketer, 2005-present), and a Director of Bill Barrett Corporation (exploration and production, 2005-present). In addition, Mr. Wiley also serves as a Director of Post Oak Bank (privately-held bank, 2004-present). Previously, Mr. Wiley served as a member of the Board of Trustees of the University of Tulsa (2000-2006; 2007-2010), as a Senior Energy Advisor of Katzenbach Partners, LLC (consulting, 2006-2007), as an Advisory Director of Riverstone Holdings (private investment), Chairman, President, and CEO of Baker Hughes, Inc. (oilfield services, 2000-2004), and as Director of Spinnaker Exploration Company (exploration and production, 2001-2005). |

+ The information above includes each Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each Trustee's qualifications to serve as a Trustee, which led to the conclusion that each Trustee should serve as a Trustee for each fund.

Annual Report

Trustees and Officers - continued

Advisory Board Members and Executive Officers:

Correspondence intended for each executive officer, Edward C. Johnson 3d, and and Peter S. Lynch may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Edward C. Johnson 3d (80) |

| Year of Election or Appointment: 2011 Member of the Advisory Board of Fidelity's Equity and High Income Funds. Formerly Trustee and Chairman of the Board of Trustees of certain Trusts, Mr. Johnson serves as Chief Executive Officer, Chairman, and a Director of FMR LLC; Chairman and a Director of FMR; and Chairman and a Director of FMR Co., Inc. In addition, Mr. Johnson serves as Chairman and Director of FIL Limited. Previously, Mr. Johnson served as President of FMR LLC (2006-2007). |

Peter S. Lynch (66) |

| Year of Election or Appointment: 2003 Member of the Advisory Board of Fidelity's Equity and High Income Funds. Mr. Lynch is Vice Chairman and a Director of FMR and FMR Co., Inc. In addition, Mr. Lynch serves as a Trustee of Boston College and as the Chairman of the Inner-City Scholarship Fund. Previously, Mr. Lynch served on the Special Olympics International Board of Directors (1997-2006). |

Kenneth B. Robins (41) |

| Year of Election or Appointment: 2008 President and Treasurer of Fidelity's Equity and High Income Funds. Mr. Robins also serves as President and Treasurer (2010-present) and Assistant Treasurer (2009-present) of other Fidelity funds and is an employee of Fidelity Investments (2004-present). Previously, Mr. Robins served as Deputy Treasurer of the Fidelity funds (2005-2008) and Treasurer and Chief Financial Officer of The North Carolina Capital Management Trust: Cash and Term Portfolios (2006-2008). |

Brian B. Hogan (46) |

| Year of Election or Appointment: 2009 Vice President of certain Equity Funds and Vice President of Sector Funds. Mr. Hogan also serves as President of FMR's Equity Division (2009-present). Previously, Mr. Hogan served as Senior Vice President, Equity Research of FMR (2006-2009) and as a portfolio manager. |

Christopher S. Bartel (39) |

| Year of Election or Appointment: 2009 Vice President of Fidelity's Sector and Real Estate Equity Funds. Mr. Bartel also serves as Senior Vice President of Equity Research (2009-present). Previously, Mr. Bartel served as Managing Director of Research (2006-2009) and an analyst and portfolio manager (2000-2006). |

Scott C. Goebel (42) |

| Year of Election or Appointment: 2008 Secretary and Chief Legal Officer (CLO) of the Fidelity funds. Mr. Goebel also serves as Secretary and CLO of The North Carolina Capital Management Trust: Cash and Term Portfolio (2008-present); General Counsel, Secretary, and Senior Vice President of FMR (2008-present) and FMR Co., Inc. (2008-present); Deputy General Counsel of FMR LLC; Chief Legal Officer of Fidelity Management & Research (Hong Kong) Limited (2008-present) and Assistant Secretary of Fidelity Management & Research (Japan) Inc. (2008-present), Fidelity Investments Money Management, Inc. (2008-present), Fidelity Management & Research (U.K.) Inc. (2008-present), and Fidelity Research and Analysis Company (2008-present). Previously, Mr. Goebel served as Assistant Secretary of the Funds (2007-2008) and as Vice President and Secretary of Fidelity Distributors Corporation (FDC) (2005-2007). |

William C. Coffey (41) |

| Year of Election or Appointment: 2009 Assistant Secretary of Fidelity's Equity and High Income Funds. Mr. Coffey also serves as Senior Vice President and Deputy General Counsel of FMR LLC (2010-present), and is an employee of Fidelity Investments. Previously, Mr. Coffey served as Vice President and Associate General Counsel of FMR LLC (2005-2009). |

Holly C. Laurent (56) |

| Year of Election or Appointment: 2008 Anti-Money Laundering (AML) Officer of the Fidelity funds. Ms. Laurent also serves as AML Officer of The North Carolina Capital Management Trust: Cash and Term Portfolio (2008-present) and is an employee of Fidelity Investments. Previously, Ms. Laurent was Senior Vice President and Head of Legal for Fidelity Business Services India Pvt. Ltd. (2006-2008), and Senior Vice President, Deputy General Counsel and Group Head for FMR LLC (2005-2006). |

Christine Reynolds (52) |