UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03759

Variable Insurance Products Fund IV

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

William C. Coffey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | June 30, 2019 |

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products: Technology Portfolio

Semi-Annual Report June 30, 2019 |

|

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, and if your insurance carrier elects to participate, you may not be receiving paper copies of the Fund’s shareholder reports from the insurance company that offers your variable insurance product unless you specifically request paper copies from your financial professional or the administrator of your variable insurance product. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically, by contacting your financial professional or the administrator of your variable insurance product. If you own a Fidelity-administered variable insurance product, please visit fidelity.com/mailpreferences to make your election or call 1-800-343-3548.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial professional or the administrator of your variable insurance product. If you own a Fidelity-administered variable insurance product, please visit fidelity.com/mailpreferences to make your election or call 1-800-343-3548. Your election to receive reports in paper will apply to all funds available under your variable insurance product.

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Ten Stocks as of June 30, 2019

| | % of fund's net assets |

| Microsoft Corp. | 17.4 |

| Apple, Inc. | 16.4 |

| Visa, Inc. Class A | 5.9 |

| MasterCard, Inc. Class A | 3.8 |

| Adobe, Inc. | 3.3 |

| Netflix, Inc. | 2.8 |

| Salesforce.com, Inc. | 2.4 |

| PayPal Holdings, Inc. | 2.0 |

| Broadcom, Inc. | 1.9 |

| Accenture PLC Class A | 1.9 |

| | 57.8 |

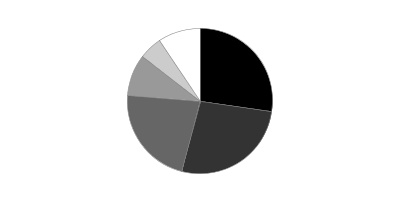

Top Industries (% of fund's net assets)

| As of June 30, 2019 |

| | Software | 31.4% |

| | IT Services | 22.3% |

| | Technology Hardware, Storage & Peripherals | 17.1% |

| | Semiconductors & Semiconductor Equipment | 15.2% |

| | Entertainment | 2.8% |

| | All Others* | 11.2% |

* Includes short-term investments and net other assets (liabilities).

Schedule of Investments June 30, 2019 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 98.9% | | | |

| | | Shares | Value |

| Communications Equipment - 2.2% | | | |

| Communications Equipment - 2.2% | | | |

| Arista Networks, Inc. (a) | | 6,600 | $1,713,492 |

| Cisco Systems, Inc. | | 212,083 | 11,607,303 |

| Motorola Solutions, Inc. | | 20,800 | 3,467,984 |

| | | | 16,788,779 |

| Electronic Equipment & Components - 2.2% | | | |

| Electronic Components - 0.9% | | | |

| Amphenol Corp. Class A | | 35,669 | 3,422,084 |

| Corning, Inc. | | 99,656 | 3,311,569 |

| | | | 6,733,653 |

| Electronic Equipment & Instruments - 0.5% | | | |

| Keysight Technologies, Inc. (a) | | 22,489 | 2,019,737 |

| Zebra Technologies Corp. Class A (a) | | 6,600 | 1,382,634 |

| | | | 3,402,371 |

| Electronic Manufacturing Services - 0.5% | | | |

| TE Connectivity Ltd. | | 42,800 | 4,099,384 |

| Technology Distributors - 0.3% | | | |

| CDW Corp. | | 18,400 | 2,042,400 |

|

| TOTAL ELECTRONIC EQUIPMENT & COMPONENTS | | | 16,277,808 |

|

| Entertainment - 2.8% | | | |

| Movies & Entertainment - 2.8% | | | |

| Netflix, Inc. (a) | | 58,132 | 21,353,046 |

| Equity Real Estate Investment Trusts (REITs) - 0.6% | | | |

| Diversified REITs - 0.6% | | | |

| Ant International Co. Ltd. Class C (a)(b)(c) | | 567,730 | 4,275,007 |

| Food & Staples Retailing - 0.0% | | | |

| Food Retail - 0.0% | | | |

| Grocery Outlet Holding Corp. | | 1,900 | 62,472 |

| Health Care Equipment & Supplies - 0.0% | | | |

| Health Care Equipment - 0.0% | | | |

| China Medical Technologies, Inc. sponsored ADR (a)(c) | | 300 | 0 |

| Interactive Media & Services - 1.7% | | | |

| Interactive Media & Services - 1.7% | | | |

| Alphabet, Inc. Class C (a) | | 12,161 | 13,144,947 |

| Internet & Direct Marketing Retail - 2.7% | | | |

| Internet & Direct Marketing Retail - 2.7% | | | |

| Amazon.com, Inc. (a) | | 4,000 | 7,574,520 |

| eBay, Inc. | | 149,400 | 5,901,300 |

| Meituan Dianping Class B | | 802,634 | 7,038,216 |

| | | | 20,514,036 |

| IT Services - 22.3% | | | |

| Data Processing & Outsourced Services - 17.6% | | | |

| Alliance Data Systems Corp. | | 5,800 | 812,754 |

| Automatic Data Processing, Inc. | | 53,101 | 8,779,188 |

| Broadridge Financial Solutions, Inc. | | 13,940 | 1,779,859 |

| Fidelity National Information Services, Inc. | | 39,604 | 4,858,619 |

| First Data Corp. Class A (a) | | 60,189 | 1,629,316 |

| Fiserv, Inc. (a) | | 50,000 | 4,558,000 |

| FleetCor Technologies, Inc. (a) | | 11,400 | 3,201,690 |

| Global Payments, Inc. | | 19,900 | 3,186,587 |

| Jack Henry & Associates, Inc. | | 9,233 | 1,236,483 |

| MasterCard, Inc. Class A | | 109,100 | 28,860,223 |

| Paychex, Inc. | | 39,555 | 3,254,981 |

| PayPal Holdings, Inc. (a) | | 133,300 | 15,257,518 |

| Square, Inc. (a) | | 38,000 | 2,756,140 |

| The Western Union Co. | | 52,690 | 1,048,004 |

| Total System Services, Inc. | | 20,800 | 2,668,016 |

| Visa, Inc. Class A | | 256,500 | 44,515,575 |

| Worldpay, Inc. (a) | | 38,600 | 4,730,430 |

| | | | 133,133,383 |

| Internet Services & Infrastructure - 2.2% | | | |

| Akamai Technologies, Inc. (a) | | 20,200 | 1,618,828 |

| GoDaddy, Inc. (a) | | 21,100 | 1,480,165 |

| MongoDB, Inc. Class A (a)(d) | | 43,000 | 6,539,870 |

| Okta, Inc. (a) | | 33,100 | 4,088,181 |

| VeriSign, Inc. (a) | | 13,370 | 2,796,469 |

| | | | 16,523,513 |

| IT Consulting & Other Services - 2.5% | | | |

| Accenture PLC Class A | | 76,010 | 14,044,368 |

| DXC Technology Co. | | 35,200 | 1,941,280 |

| Gartner, Inc. (a) | | 10,803 | 1,738,635 |

| Leidos Holdings, Inc. | | 15,185 | 1,212,522 |

| | | | 18,936,805 |

|

| TOTAL IT SERVICES | | | 168,593,701 |

|

| Life Sciences Tools & Services - 0.0% | | | |

| Life Sciences Tools & Services - 0.0% | | | |

| JHL Biotech, Inc. (a)(c) | | 94,814 | 94,113 |

| Road & Rail - 0.7% | | | |

| Trucking - 0.7% | | | |

| Lyft, Inc. | | 4,200 | 275,982 |

| Lyft, Inc. | | 45,297 | 2,827,643 |

| Uber Technologies, Inc. | | 45,124 | 1,883,566 |

| | | | 4,987,191 |

| Semiconductors & Semiconductor Equipment - 15.2% | | | |

| Semiconductor Equipment - 3.5% | | | |

| Applied Materials, Inc. | | 311,000 | 13,967,010 |

| ASML Holding NV (Netherlands) | | 13,000 | 2,705,169 |

| KLA-Tencor Corp. | | 20,100 | 2,375,820 |

| Lam Research Corp. | | 38,500 | 7,231,840 |

| | | | 26,279,839 |

| Semiconductors - 11.7% | | | |

| Advanced Micro Devices, Inc. (a) | | 115,500 | 3,507,735 |

| Analog Devices, Inc. | | 44,700 | 5,045,289 |

| Broadcom, Inc. | | 50,803 | 14,624,152 |

| Intel Corp. | | 213,608 | 10,225,415 |

| Marvell Technology Group Ltd. | | 222,700 | 5,315,849 |

| Microchip Technology, Inc. (d) | | 28,600 | 2,479,620 |

| Micron Technology, Inc. (a) | | 142,100 | 5,483,639 |

| NVIDIA Corp. | | 69,300 | 11,381,139 |

| NXP Semiconductors NV | | 37,300 | 3,640,853 |

| ON Semiconductor Corp. (a) | | 52,185 | 1,054,659 |

| Qorvo, Inc. (a) | | 16,500 | 1,099,065 |

| Qualcomm, Inc. | | 169,550 | 12,897,669 |

| Skyworks Solutions, Inc. | | 23,100 | 1,784,937 |

| Texas Instruments, Inc. | | 83,048 | 9,530,588 |

| | | | 88,070,609 |

|

| TOTAL SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT | | | 114,350,448 |

|

| Software - 31.4% | | | |

| Application Software - 11.8% | | | |

| Adobe, Inc. (a) | | 84,900 | 25,015,785 |

| ANSYS, Inc. (a) | | 9,322 | 1,909,332 |

| Atlassian Corp. PLC (a) | | 25,704 | 3,363,111 |

| Autodesk, Inc. (a) | | 27,800 | 4,528,620 |

| Cadence Design Systems, Inc. (a) | | 33,970 | 2,405,416 |

| Citrix Systems, Inc. | | 16,400 | 1,609,496 |

| Intuit, Inc. | | 45,300 | 11,838,249 |

| Nutanix, Inc. Class B (a)(e) | | 6,397 | 165,938 |

| Parametric Technology Corp. (a) | | 88,642 | 7,956,506 |

| Salesforce.com, Inc. (a) | | 121,700 | 18,465,541 |

| Splunk, Inc. (a) | | 16,400 | 2,062,300 |

| SS&C Technologies Holdings, Inc. | | 66,000 | 3,802,260 |

| Synopsys, Inc. (a) | | 16,468 | 2,119,267 |

| Workday, Inc. Class A (a) | | 18,000 | 3,700,440 |

| | | | 88,942,261 |

| Systems Software - 19.6% | | | |

| Crowdstrike Holdings, Inc. | | 1,200 | 81,948 |

| Fortinet, Inc. (a) | | 17,108 | 1,314,408 |

| Microsoft Corp. | | 980,500 | 131,347,778 |

| Palo Alto Networks, Inc. (a) | | 11,300 | 2,302,488 |

| Red Hat, Inc. (a) | | 21,400 | 4,018,064 |

| ServiceNow, Inc. (a) | | 21,300 | 5,848,341 |

| Symantec Corp. | | 75,000 | 1,632,000 |

| Tableau Software, Inc. (a) | | 8,400 | 1,394,568 |

| | | | 147,939,595 |

|

| TOTAL SOFTWARE | | | 236,881,856 |

|

| Technology Hardware, Storage & Peripherals - 17.1% | | | |

| Technology Hardware, Storage & Peripherals - 17.1% | | | |

| Apple, Inc. | | 627,515 | 124,197,769 |

| NetApp, Inc. | | 31,500 | 1,943,550 |

| Seagate Technology LLC | | 32,600 | 1,536,112 |

| Western Digital Corp. | | 34,900 | 1,659,495 |

| | | | 129,336,926 |

| TOTAL COMMON STOCKS | | | |

| (Cost $555,395,963) | | | 746,660,330 |

|

| Convertible Preferred Stocks - 0.4% | | | |

| Food & Staples Retailing - 0.3% | | | |

| Food Retail - 0.3% | | | |

| Roofoods Ltd. Series F (a)(b)(c) | | 4,211 | 1,759,777 |

| Internet & Direct Marketing Retail - 0.1% | | | |

| Internet & Direct Marketing Retail - 0.1% | | | |

| Reddit, Inc. Series D (b)(c) | | 33,900 | 735,166 |

| Software - 0.0% | | | |

| Application Software - 0.0% | | | |

| UiPath, Inc.: | | | |

| Series A1 (b)(c) | | 3,467 | 136,432 |

| Series B1 (b)(c) | | 173 | 6,808 |

| Series B2 (b)(c) | | 860 | 33,842 |

| | | | 177,082 |

| TOTAL CONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $2,401,134) | | | 2,672,025 |

|

| Money Market Funds - 1.9% | | | |

| Fidelity Cash Central Fund 2.42% (f) | | 6,052,581 | 6,053,792 |

| Fidelity Securities Lending Cash Central Fund 2.42% (f)(g) | | 8,585,250 | 8,586,108 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $14,639,900) | | | 14,639,900 |

| TOTAL INVESTMENT IN SECURITIES - 101.2% | | | |

| (Cost $572,436,997) | | | 763,972,255 |

| NET OTHER ASSETS (LIABILITIES) - (1.2)% | | | (8,727,970) |

| NET ASSETS - 100% | | | $755,244,285 |

Legend

(a) Non-income producing

(b) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $6,947,032 or 0.9% of net assets.

(c) Level 3 security

(d) Security or a portion of the security is on loan at period end.

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $165,938 or 0.0% of net assets.

(f) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(g) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| Ant International Co. Ltd. Class C | 5/16/18 | $3,184,965 |

| Reddit, Inc. Series D | 2/4/19 | $735,166 |

| Roofoods Ltd. Series F | 9/12/17 | $1,488,886 |

| UiPath, Inc. Series A1 | 6/14/19 | $136,432 |

| UiPath, Inc. Series B1 | 6/14/19 | $6,808 |

| UiPath, Inc. Series B2 | 6/14/19 | $33,842 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $58,964 |

| Fidelity Securities Lending Cash Central Fund | 522,078 |

| Total | $581,042 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of payments to and from borrowers of securities.

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2019, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Common Stocks | $746,660,330 | $734,874,832 | $7,416,378 | $4,369,120 |

| Convertible Preferred Stocks | 2,672,025 | -- | -- | 2,672,025 |

| Money Market Funds | 14,639,900 | 14,639,900 | -- | -- |

| Total Investments in Securities: | $763,972,255 | $749,514,732 | $7,416,378 | $7,041,145 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| Investments in Securities: | |

| Beginning Balance | $8,684,070 |

| Total Realized Gain (Loss) | -- |

| Total Unrealized Gain (Loss) | 289,827 |

| Cost of Purchases | 912,248 |

| Proceeds of Sales | (2,845,000) |

| Amortization/Accretion | -- |

| Transfers in to Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $7,041,145 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at June 30, 2019 | $1,790,514 |

The information used in the above reconciliations represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliations are included in Net Gain (Loss) on the Fund's Statement of Operations.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | June 30, 2019 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $8,417,669) — See accompanying schedule:

Unaffiliated issuers (cost $557,797,097) | $749,332,355 | |

| Fidelity Central Funds (cost $14,639,900) | 14,639,900 | |

| Total Investment in Securities (cost $572,436,997) | | $763,972,255 |

| Receivable for fund shares sold | | 263,152 |

| Dividends receivable | | 304,112 |

| Distributions receivable from Fidelity Central Funds | | 9,419 |

| Prepaid expenses | | 5,464 |

| Other receivables | | 1,926 |

| Total assets | | 764,556,328 |

| Liabilities | | |

| Payable for fund shares redeemed | $250,513 | |

| Accrued management fee | 330,213 | |

| Other affiliated payables | 100,935 | |

| Other payables and accrued expenses | 50,977 | |

| Collateral on securities loaned | 8,579,405 | |

| Total liabilities | | 9,312,043 |

| Net Assets | | $755,244,285 |

| Net Assets consist of: | | |

| Paid in capital | | $590,098,025 |

| Total distributable earnings (loss) | | 165,146,260 |

| Net Assets | | $755,244,285 |

| Net Asset Value and Maximum Offering Price | | |

| Initial Class: | | |

| Net Asset Value, offering price and redemption price per share ($150,946,564 ÷ 9,315,536 shares) | | $16.20 |

| Investor Class: | | |

| Net Asset Value, offering price and redemption price per share ($604,297,721 ÷ 37,858,936 shares) | | $15.96 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended June 30, 2019 (Unaudited) |

| Investment Income | | |

| Dividends | | $4,143,367 |

| Income from Fidelity Central Funds (including $522,078 from security lending) | | 581,042 |

| Total income | | 4,724,409 |

| Expenses | | |

| Management fee | $1,908,777 | |

| Transfer agent fees | 457,635 | |

| Accounting and security lending fees | 126,539 | |

| Custodian fees and expenses | 32,639 | |

| Independent trustees' fees and expenses | 1,667 | |

| Audit | 33,623 | |

| Legal | 1,267 | |

| Miscellaneous | 4,591 | |

| Total expenses before reductions | 2,566,738 | |

| Expense reductions | (19,666) | |

| Total expenses after reductions | | 2,547,072 |

| Net investment income (loss) | | 2,177,337 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 4,187,344 | |

| Fidelity Central Funds | 702 | |

| Foreign currency transactions | (2,048) | |

| Total net realized gain (loss) | | 4,185,998 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 161,705,311 | |

| Fidelity Central Funds | (58) | |

| Assets and liabilities in foreign currencies | (786) | |

| Total change in net unrealized appreciation (depreciation) | | 161,704,467 |

| Net gain (loss) | | 165,890,465 |

| Net increase (decrease) in net assets resulting from operations | | $168,067,802 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended June 30, 2019 (Unaudited) | Year ended December 31, 2018 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $2,177,337 | $1,676,472 |

| Net realized gain (loss) | 4,185,998 | 102,912,665 |

| Change in net unrealized appreciation (depreciation) | 161,704,467 | (163,403,448) |

| Net increase (decrease) in net assets resulting from operations | 168,067,802 | (58,814,311) |

| Distributions to shareholders | (133,266,077) | (52,270,559) |

| Share transactions - net increase (decrease) | 108,340,391 | 30,975,773 |

| Total increase (decrease) in net assets | 143,142,116 | (80,109,097) |

| Net Assets | | |

| Beginning of period | 612,102,169 | 692,211,266 |

| End of period | $755,244,285 | $612,102,169 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

VIP Technology Portfolio Initial Class

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $15.76 | $18.43 | $12.76 | $11.91 | $11.83 | $12.43 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .05 | .05 | .01 | .02 | .02 | .01 |

| Net realized and unrealized gain (loss) | 3.81 | (1.34) | 6.41 | 1.22 | .71 | 1.38 |

| Total from investment operations | 3.86 | (1.29) | 6.42 | 1.24 | .73 | 1.39 |

| Distributions from net investment income | (.01) | – | –B | (.02) | (.02) | (.01) |

| Distributions from net realized gain | (3.40) | (1.38) | (.75) | (.37) | (.63) | (1.98) |

| Total distributions | (3.42)C | (1.38) | (.75) | (.39) | (.65) | (1.99) |

| Redemption fees added to paid in capitalA | – | – | –B | –B | –B | –B |

| Net asset value, end of period | $16.20 | $15.76 | $18.43 | $12.76 | $11.91 | $11.83 |

| Total ReturnD,E,F | 27.96% | (7.62)% | 50.78% | 11.37% | 6.27% | 11.91% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | .66%I | .66% | .68% | .70% | .69% | .70% |

| Expenses net of fee waivers, if any | .66%I | .66% | .68% | .70% | .69% | .69% |

| Expenses net of all reductions | .65%I | .64% | .67% | .69% | .68% | .69% |

| Net investment income (loss) | .68%I | .27% | .03% | .17% | .16% | .13% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $150,947 | $123,867 | $154,984 | $75,480 | $70,596 | $69,964 |

| Portfolio turnover rateJ | 12%I | 139% | 68% | 67% | 68% | 67% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total distributions of $3.42 per share is comprised of distributions from net investment income of $.012 and distributions from net realized gain of $3.404 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

VIP Technology Portfolio Investor Class

| | Six months ended (Unaudited) June 30, | Years endedDecember 31, | | | | |

| | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $15.57 | $18.23 | $12.63 | $11.79 | $11.73 | $12.34 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .05 | .04 | (.01) | .01 | .01 | .01 |

| Net realized and unrealized gain (loss) | 3.75 | (1.34) | 6.35 | 1.21 | .69 | 1.36 |

| Total from investment operations | 3.80 | (1.30) | 6.34 | 1.22 | .70 | 1.37 |

| Distributions from net investment income | (.01) | – | –B | (.01) | (.01) | (.01) |

| Distributions from net realized gain | (3.40) | (1.36) | (.74) | (.37) | (.63) | (1.98) |

| Total distributions | (3.41) | (1.36) | (.74) | (.38) | (.64) | (1.98)C |

| Redemption fees added to paid in capitalA | – | – | –B | –B | –B | –B |

| Net asset value, end of period | $15.96 | $15.57 | $18.23 | $12.63 | $11.79 | $11.73 |

| Total ReturnD,E,F | 27.96% | (7.73)% | 50.67% | 11.34% | 6.08% | 11.86% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | .74%I | .74% | .76% | .78% | .77% | .78% |

| Expenses net of fee waivers, if any | .74%I | .73% | .76% | .78% | .77% | .77% |

| Expenses net of all reductions | .73%I | .72% | .75% | .77% | .76% | .77% |

| Net investment income (loss) | .60%I | .20% | (.05)% | .09% | .08% | .05% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $604,298 | $488,235 | $537,227 | $254,287 | $241,491 | $180,147 |

| Portfolio turnover rateJ | 12%I | 139% | 68% | 67% | 68% | 67% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total distributions of $1.98 per share is comprised of distributions from net investment income of $.005 and distributions from net realized gain of $1.977 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended June 30, 2019

1. Organization.

VIP Technology Portfolio (the Fund) is a non-diversified fund of Variable Insurance Products Fund IV (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of June 30, 2019, as well as a roll forward of Level 3 investments, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC) and losses deferred due to wash sales and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $197,311,302 |

| Gross unrealized depreciation | (8,374,953) |

| Net unrealized appreciation (depreciation) | $188,936,349 |

| Tax cost | $575,035,906 |

The Fund elected to defer to its next fiscal year approximately $26,383,527 of capital losses recognized during the period November 1, 2018 to December 31, 2018.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $42,932,161 and $69,928,909, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity SelectCo, LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .24% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by Fidelity Management & Research Company (FMR) and the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annualized management fee rate was .54% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing, and shareholder servicing agent. FIIOC receives an asset-based fee with respect to each class. Each class pays a fee for transfer agent services, typesetting and printing and mailing of shareholder reports, excluding mailing of proxy statements, equal to an annual rate of class-level average net assets. The annual rate for Investor Class is .15% and the annual rate for all other classes is .07%. For the period, transfer agent fees for each class were as follows:

| Initial Class | $46,149 |

| Investor Class | 411,486 |

| | $457,635 |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Prior to April 1, 2019, FSC had a separate agreement with the Fund for administration of the security lending program, based on the number and duration of lending transactions. For the period, the total fees paid for accounting and administration of securities lending were equivalent to an annualized rate of .04%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $1,655 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $992 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities from time to time in order to earn additional income. For equity securities, lending agents are used, including National Financial Services (NFS), an affiliate of the Fund. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of daily lending revenue, for its services as lending agent. The Fund may lend securities to certain qualified borrowers. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $17,093 for the period. Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $10.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $2,563.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended

June 30, 2019 | Year ended

December 31, 2018 |

| Distributions to shareholders | | |

| Initial Class | $26,569,001 | $11,544,861 |

| Investor Class | 106,697,076 | 40,725,698 |

| Total | $133,266,077 | $52,270,559 |

10. Share Transactions.

Transactions for each class of shares were as follows:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended June 30, 2019 | Year ended December 31, 2018 | Six months ended June 30, 2019 | Year ended December 31, 2018 |

| Initial Class | | | | |

| Shares sold | 601,369 | 1,652,009 | $9,505,041 | $31,765,341 |

| Reinvestment of distributions | 1,904,588 | 670,181 | 26,569,001 | 11,544,861 |

| Shares redeemed | (1,049,901) | (2,873,325) | (16,083,336) | (53,337,180) |

| Net increase (decrease) | 1,456,056 | (551,135) | $19,990,706 | $(10,026,978) |

| Investor Class | | | | |

| Shares sold | 1,971,388 | 7,335,943 | $30,349,201 | $138,857,274 |

| Reinvestment of distributions | 7,759,787 | 2,392,513 | 106,697,076 | 40,725,698 |

| Shares redeemed | (3,220,223) | (7,857,912) | (48,696,592) | (138,580,221) |

| Net increase (decrease) | 6,510,952 | 1,870,544 | $88,349,685 | $41,002,751 |

11. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, the investment adviser or its affiliates were the owners of record of 100% of the total outstanding shares of the Fund.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2019 to June 30, 2019).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The estimate of expenses does not include any fees or other expenses of any variable annuity or variable life insurance product. If they were, the estimate of expenses you paid during the period would be higher, and your ending account value would be lower. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | Annualized Expense Ratio-A | Beginning

Account Value

January 1, 2019 | Ending

Account Value

June 30, 2019 | Expenses Paid

During Period-B

January 1, 2019

to June 30, 2019 |

| Initial Class | .66% | | | |

| Actual | | $1,000.00 | $1,279.60 | $3.73 |

| Hypothetical-C | | $1,000.00 | $1,021.52 | $3.31 |

| Investor Class | .74% | | | |

| Actual | | $1,000.00 | $1,279.60 | $4.18 |

| Hypothetical-C | | $1,000.00 | $1,021.12 | $3.71 |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

C 5% return per year before expenses

Board Approval of Investment Advisory Contracts and Management Fees

VIP Technology Portfolio

Each year, the Board of Trustees, including the Independent Trustees (together, the Board), votes on the renewal of the management contract with Fidelity SelectCo, LLC (SelectCo), an affiliate of Fidelity Management & Research Company (FMR), and the sub-advisory agreements with affiliates of FMR (together, the Advisory Contracts) for the fund. SelectCo and the sub-advisers are referred to herein as the Investment Advisers. The Board, assisted by the advice of fund counsel and Independent Trustees' counsel, requests and considers a broad range of information relevant to the renewal of the Advisory Contracts throughout the year.

The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the fund's Advisory Contracts, including the services and support provided to the fund and its shareholders. The Board has established various standing committees (Committees), each composed of and chaired by Independent Trustees with varying backgrounds, to which the Board has assigned specific subject matter responsibilities in order to enhance effective decision-making by the Board. The Board, acting directly and through its Committees, requests and receives information concerning the annual consideration of the renewal of the fund's Advisory Contracts. The Board also meets as needed to review matters specifically related to the Board's annual consideration of the renewal of the Advisory Contracts. Members of the Board may also meet with trustees of other Fidelity funds through joint ad hoc committees to discuss certain matters relevant to all of the Fidelity funds.

At its January 2019 meeting, the Board unanimously determined to renew the fund's Advisory Contracts. In reaching its determination, the Board considered all factors it believed relevant, including (i) the nature, extent, and quality of the services to be provided to the fund and its shareholders (including the investment performance of the fund); (ii) the competitiveness of the fund's management fee and total expense ratio relative to peer funds; (iii) the total costs of the services to be provided by and the profits to be realized by Fidelity from its relationships with the fund; and (iv) the extent to which, if any, economies of scale exist and would be realized as the fund grows, and whether any economies of scale are appropriately shared with fund shareholders.

In considering whether to renew the Advisory Contracts for the fund, the Board reached a determination, with the assistance of fund counsel and Independent Trustees' counsel and through the exercise of its business judgment, that the renewal of the Advisory Contracts was in the best interests of the fund and its shareholders and that the compensation payable under the Advisory Contracts was fair and reasonable. The Board's decision to renew the Advisory Contracts was not based on any single factor, but rather was based on a comprehensive consideration of all the information provided to the Board at its meetings throughout the year. The Board, in reaching its determination to renew the Advisory Contracts, was aware that shareholders of the fund have a broad range of investment choices available to them, including a wide choice among funds offered by Fidelity's competitors, and that the fund's shareholders, who have the opportunity to review and weigh the disclosure provided by the fund in its prospectus and other public disclosures, have chosen to invest in this fund, which is part of the Fidelity family of funds.

Nature, Extent, and Quality of Services Provided. The Board considered Fidelity's staffing as it relates to the fund, including the backgrounds of investment personnel of Fidelity, and also considered the fund's investment objective, strategies, and related investment philosophy. The Independent Trustees also had discussions with senior management of Fidelity's investment operations and investment groups. The Board considered the structure of the investment personnel compensation program and whether this structure provides appropriate incentives to act in the best interests of the fund. Additionally, the Board considered the portfolio managers' investments, if any, in the funds that they manage.

Resources Dedicated to Investment Management and Support Services. The Board and the Fund Oversight and Research Committees reviewed the general qualifications and capabilities of Fidelity's investment staff, including its size, education, experience, and resources, as well as Fidelity's approach to recruiting, training, managing, and compensating investment personnel. The Board noted that Fidelity has continued to increase the resources devoted to non-U.S. offices, including expansion of Fidelity's global investment organization. The Board also noted that Fidelity's analysts have extensive resources, tools and capabilities that allow them to conduct sophisticated quantitative and fundamental analysis, as well as credit analysis of issuers, counterparties and guarantors. Further, the Board considered that Fidelity's investment professionals have sufficient access to global information and data so as to provide competitive investment results over time, and that those professionals also have access to sophisticated tools that permit them to assess portfolio construction and risk and performance attribution characteristics continuously, as well as to transmit new information and research conclusions rapidly around the world. Additionally, in its deliberations, the Board considered Fidelity's trading, risk management, compliance, and technology and operations capabilities and resources, which are integral parts of the investment management process.

Shareholder and Administrative Services. The Board considered (i) the nature, extent, quality, and cost of advisory, administrative, and shareholder services performed by the Investment Advisers and their affiliates under the Advisory Contracts and under separate agreements covering transfer agency, pricing and bookkeeping, and securities lending services for the fund; (ii) the nature and extent of the supervision of third party service providers, principally custodians, subcustodians, and pricing vendors; and (iii) the resources devoted to, and the record of compliance with, the fund's compliance policies and procedures. The Board also reviewed the allocation of fund brokerage, including allocations to brokers affiliated with the Investment Advisers, the use of brokerage commissions to pay fund expenses, and the use of "soft" commission dollars to pay for research services.

The Board noted that the growth of fund assets over time across the complex allows Fidelity to reinvest in the development of services designed to enhance the value and convenience of the Fidelity funds as investment vehicles. These services include 24-hour access to account information and market information through telephone representatives and over the Internet, investor education materials and asset allocation tools, and the expanded availability of Fidelity Investor Centers.

The Board noted that it and the boards of certain other Fidelity funds had formed an ad hoc Committee on Transfer Agency Fees to review the variety of transfer agency fee structures throughout the industry and Fidelity's competitive positioning with respect to industry participants.

Investment in a Large Fund Family. The Board considered the benefits to shareholders of investing in a Fidelity fund, including the benefits of investing in a fund that is part of a large family of funds offering a variety of investment disciplines and providing a large variety of mutual fund investor services. The Board noted that Fidelity had taken, or had made recommendations that resulted in the Fidelity funds taking, a number of actions over the previous year that benefited particular funds, including: (i) continuing to dedicate additional resources to Fidelity's investment research process, which includes meetings with management of issuers of securities in which the funds invest, and to the support of the senior management team that oversees asset management; (ii) continuing efforts to enhance Fidelity's global research capabilities; (iii) launching new funds and making other enhancements to meet client needs; (iv) launching new share classes of existing funds; (v) eliminating purchase minimums and broadening eligibility requirements for certain funds and share classes; (vi) reducing management fees and total expenses for certain growth equity funds and index funds; (vii) lowering expense caps for certain existing funds and classes, and converting certain voluntary expense caps to contractual caps, to reduce expenses borne by shareholders; (viii) eliminating short-term redemption fees for funds that had such fees; (ix) rationalizing product lines and gaining increased efficiencies from fund mergers and share class consolidations; (x) continuing to develop, acquire and implement systems and technology to improve services to the funds and shareholders, strengthen information security, and increase efficiency; and (xi) continuing to implement enhancements to further strengthen Fidelity's product line to increase investors' probability of success in achieving their investment goals, including retirement income goals.

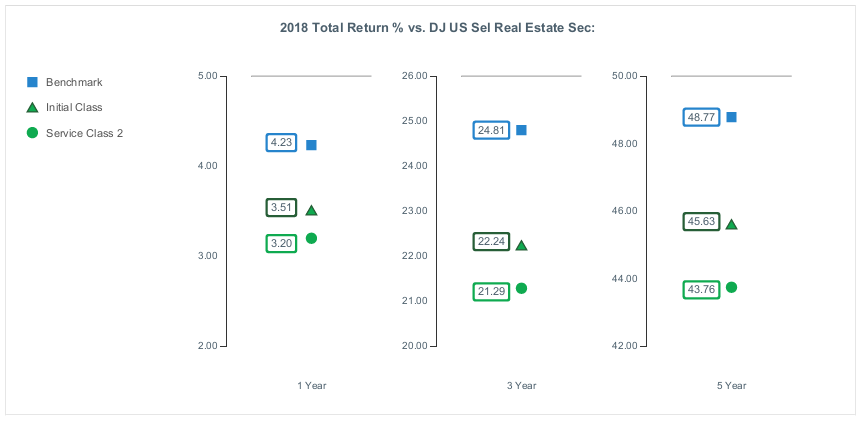

Investment Performance. The Board considered whether the fund has operated in accordance with its investment objective, as well as its record of compliance with its investment restrictions and its performance history. The fund had a portfolio manager change in July 2018. The Board will continue to monitor closely the fund's performance, taking into account the portfolio manager change.

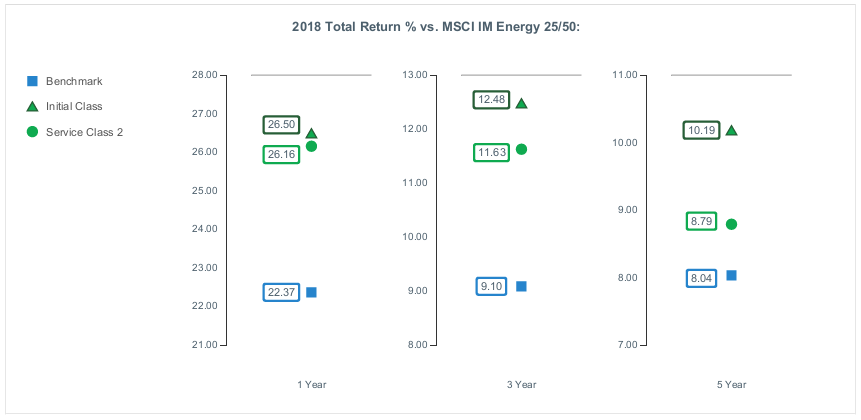

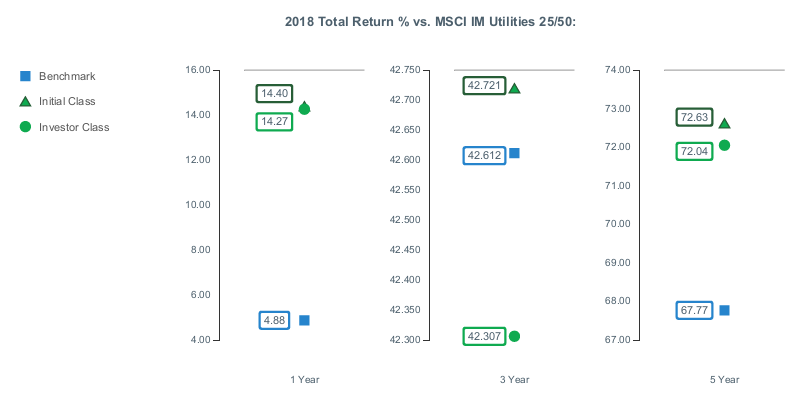

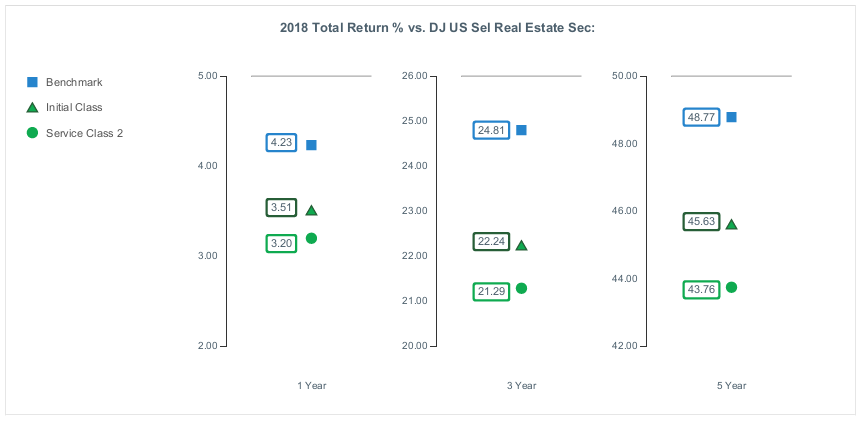

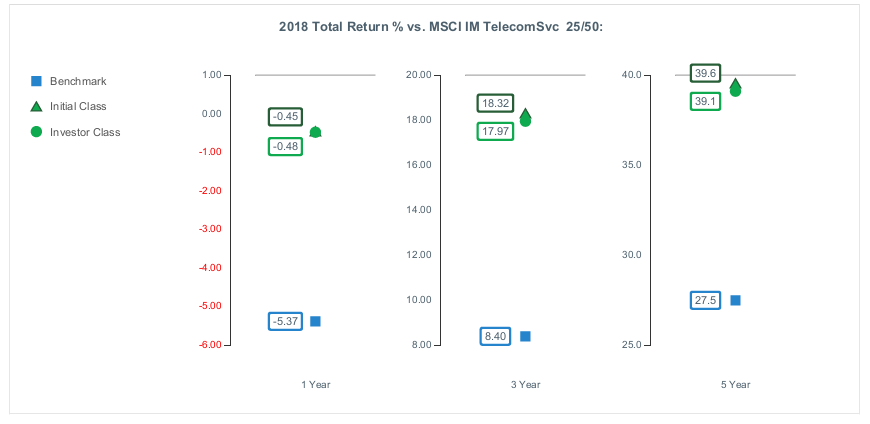

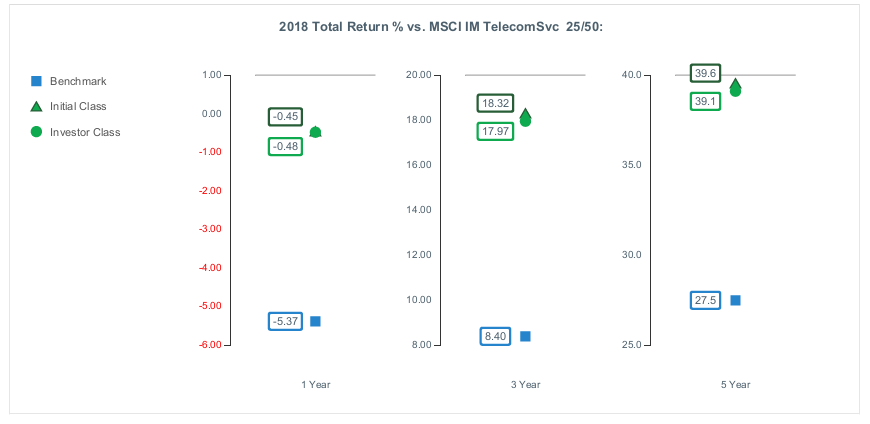

The Board took into account discussions that occur at Board meetings throughout the year with representatives of the Investment Advisers about fund investment performance. In this regard the Board noted that as part of regularly scheduled fund reviews and other reports to the Board on fund performance, the Board considers annualized return information for the fund for different time periods, measured against an appropriate securities market index ("benchmark index"). In its evaluation of fund investment performance, the Board gave particular attention to information indicating changes in performance of certain Fidelity funds for specific time periods and discussed with the Investment Advisers the reasons for any overperformance or underperformance.

In addition to reviewing absolute and relative fund performance, the Independent Trustees periodically consider the appropriateness of fund performance metrics in evaluating the results achieved. In general, the Independent Trustees believe that fund performance should be evaluated based on net performance (after fees and expenses) of both the highest performing and lowest performing fund share classes, where applicable, compared to appropriate benchmark indices, over appropriate time periods that may include full market cycles, taking into account relevant factors including the following: general market conditions; issuer-specific information; and fund cash flows and other factors.

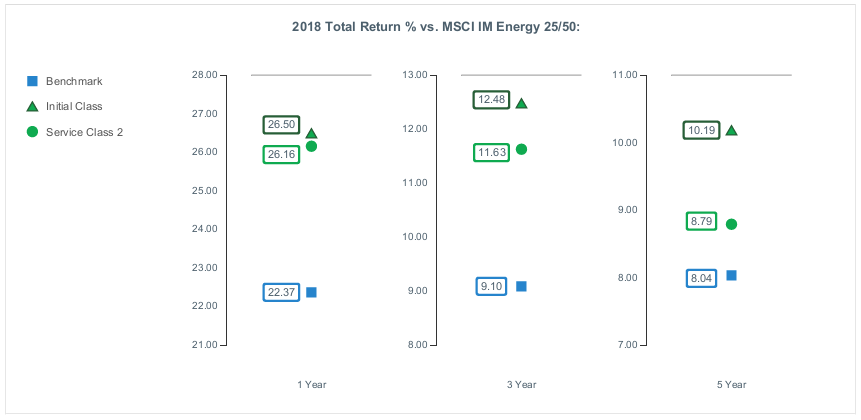

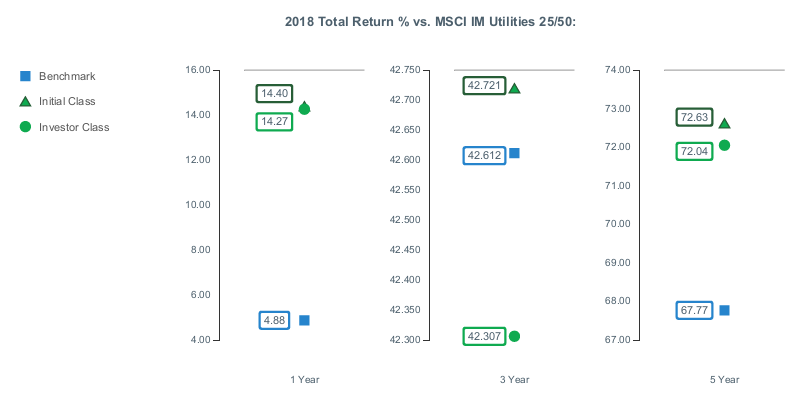

The Independent Trustees recognize that shareholders evaluate performance on a net basis over their own holding periods, for which one-, three-, and five-year periods are often used as a proxy. For this reason, the performance information reviewed by the Board also included net cumulative total return information for the fund and an appropriate benchmark index for the most recent one-, three-, and five-year periods ended June 30, 2018, as shown below.

VIP Technology Portfolio

Based on its review, the Board concluded that the nature, extent, and quality of services provided to the fund under the Advisory Contracts should continue to benefit the shareholders of the fund.

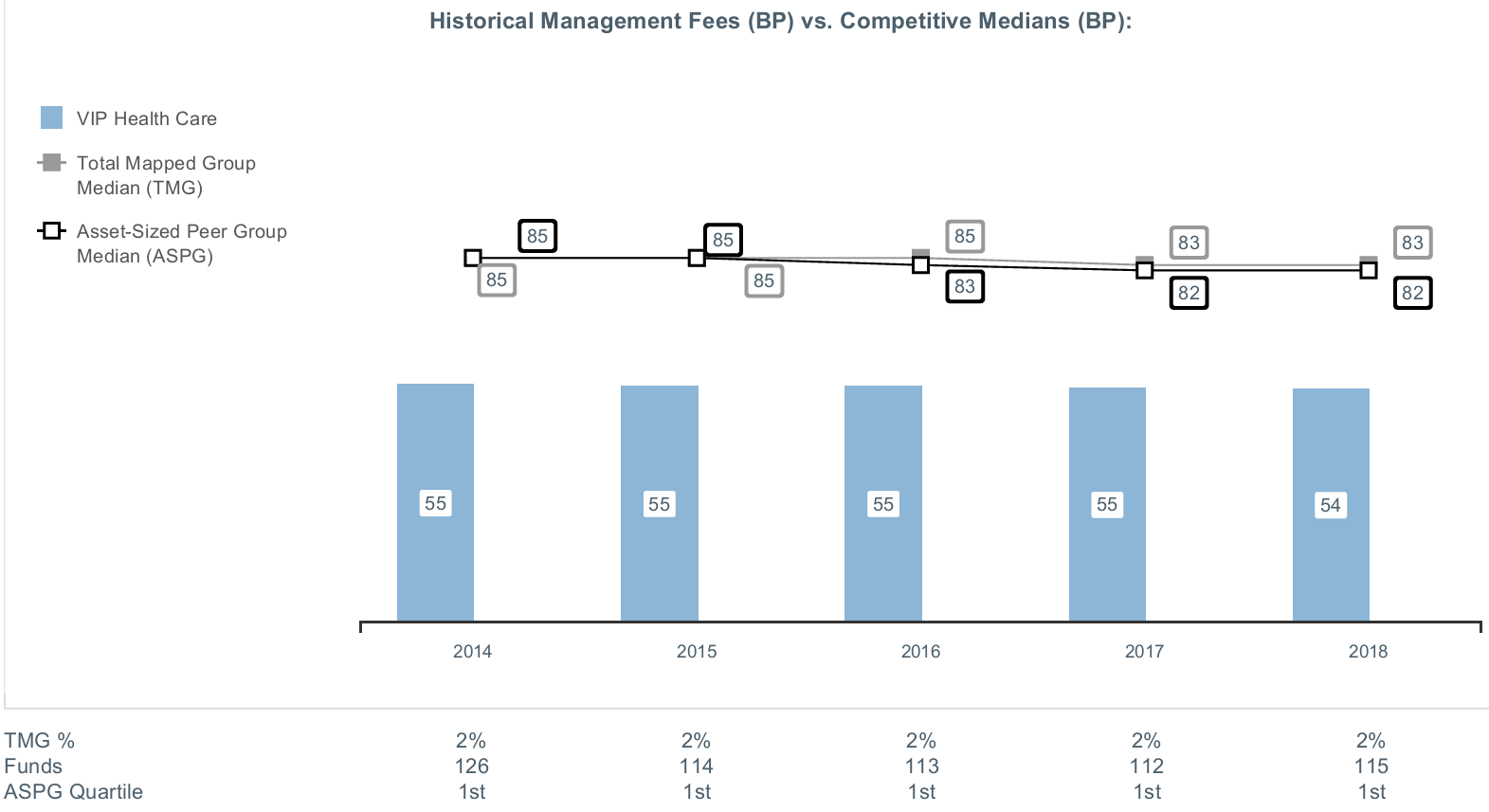

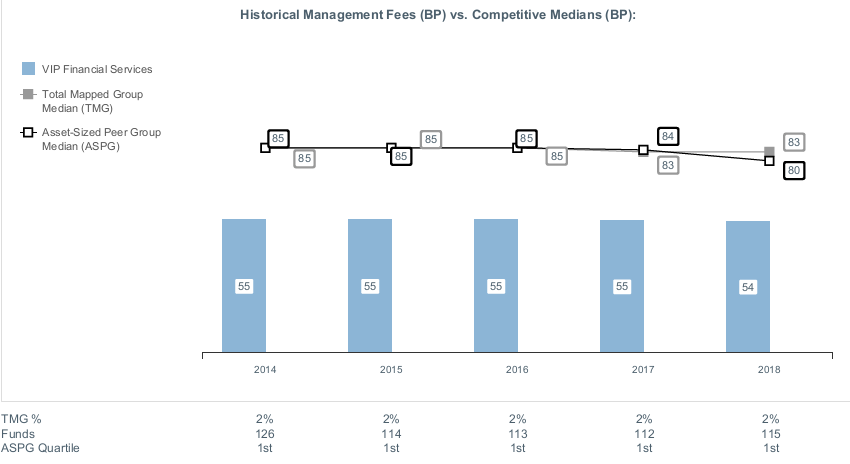

Competitiveness of Management Fee and Total Expense Ratio. The Board considered the fund's management fee and total expense ratio compared to "mapped groups" of competitive funds and classes created for the purpose of facilitating the Trustees' competitive analysis of management fees and total expenses. Fidelity creates "mapped groups" by combining similar Lipper investment objective categories that have comparable investment mandates. For this purpose, all sector focused equity variable annuity funds are grouped in the same mapped group. Combining Lipper investment objective categories aids the Board's management fee and total expense ratio comparisons by broadening the competitive group used for comparison.

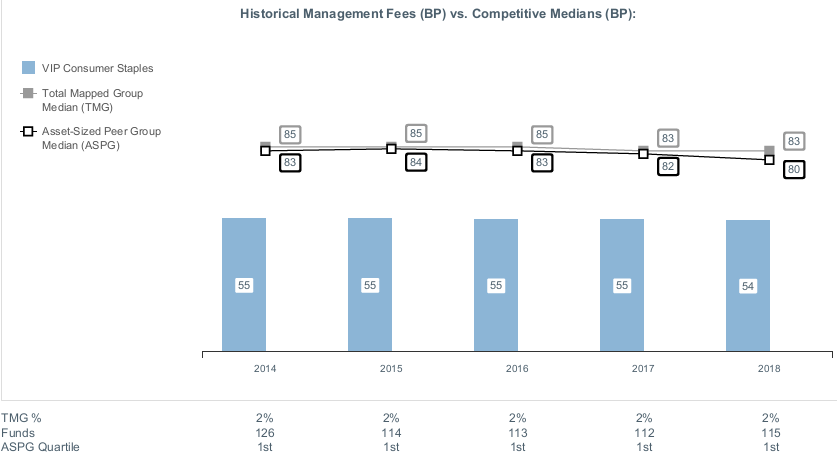

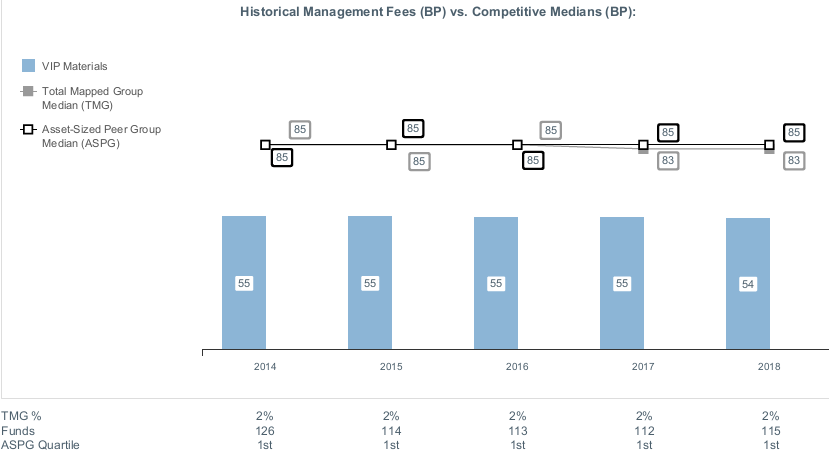

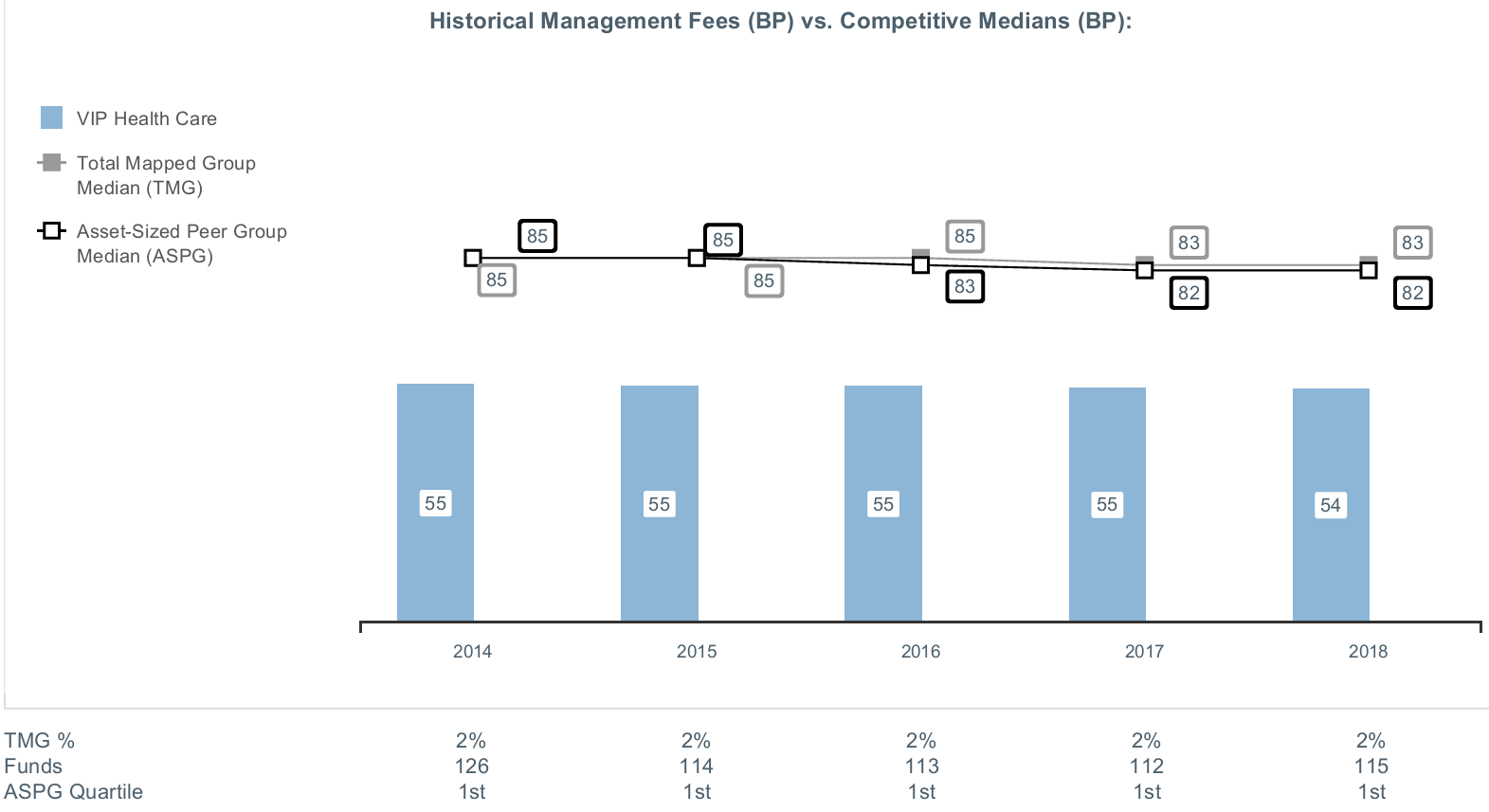

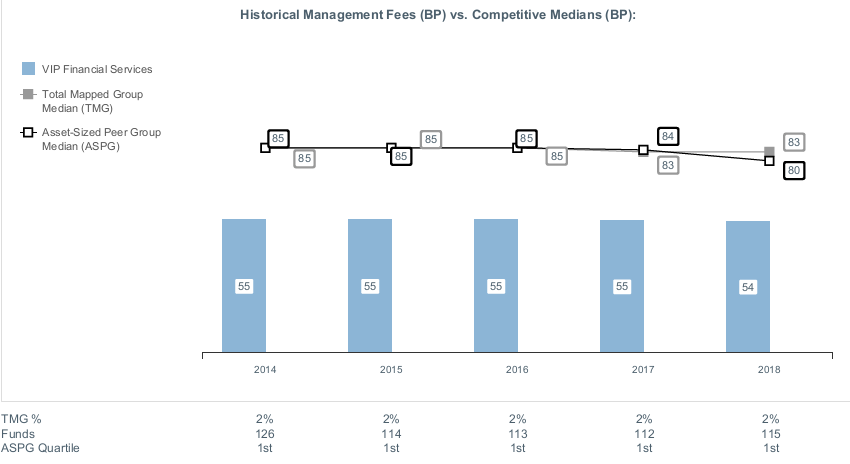

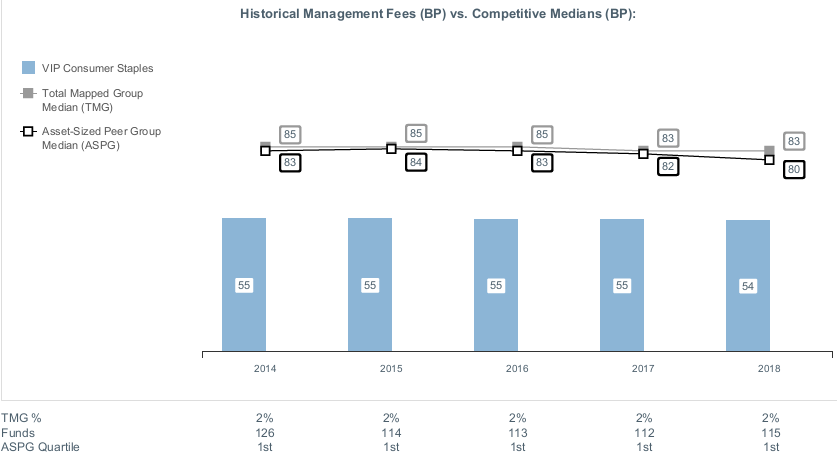

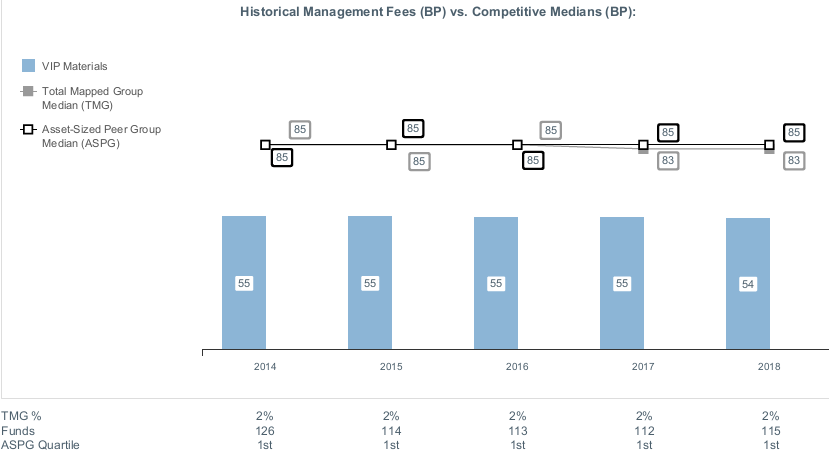

Management Fee. The Board considered two proprietary management fee comparisons for the 12-month periods ended June 30 shown in basis points (BP) in the chart below. The group of Lipper funds used by the Board for management fee comparisons is referred to below as the "Total Mapped Group." The Total Mapped Group comparison focuses on a fund's standing in terms of gross management fees before expense reimbursements or caps relative to the total universe of funds with comparable investment mandates (i.e., sector equities), regardless of whether their management fee structures also are comparable. Funds with comparable management fee structures have similar management fee contractual arrangements (

e.g., flat rate charged for advisory services, all-inclusive fee rate,

etc.). "TMG %" represents the percentage of funds in the Total Mapped Group that had management fees that were lower than the fund's. For example, a hypothetical TMG % of 20% would mean that 80% of the funds in the Total Mapped Group had higher, and 20% had lower, management fees than the fund. The fund's actual TMG %s and the number of funds in the Total Mapped Group are in the chart below. The "Asset-Size Peer Group" (ASPG) comparison focuses on a fund's standing relative to a subset of non-Fidelity funds within the Total Mapped Group that are similar in size and management fee structure. For example, if a fund is in the first quartile of the ASPG, the fund's management fee ranks in the least expensive or lowest 25% of funds in the ASPG. The ASPG represents at least 15% of the funds in the Total Mapped Group with comparable asset size and management fee structures, subject to a minimum of 50 funds (or all funds in the Total Mapped Group if fewer than 50). Additional information, such as the ASPG quartile in which the fund's management fee rate ranked, is also included in the chart and was considered by the Board.

VIP Technology Portfolio

The Board noted that the fund's management fee rate ranked below the median of its Total Mapped Group and below the median of its ASPG for the 12-month period ended June 30, 2018.

The Board noted that it and the boards of other Fidelity funds formed an ad hoc Committee on Group Fee, which meets periodically, to conduct an in-depth review of the "group fee" component of the management fee of funds with such management fee structures. The Committee's focus included the mechanics of the group fee, the competitive landscape of group fee structures, Fidelity funds with no group fee component and investment products not included in group fee assets. The Board also considered that, for funds subject to the group fee, FMR agreed to voluntarily waive fees over a specified period of time in amounts designed to account for assets converted from certain funds to certain collective investment trusts.

Based on its review, the Board concluded that the fund's management fee is fair and reasonable in light of the services that the fund receives and the other factors considered.

Total Expense Ratio. In its review of each class's total expense ratio, the Board considered the fund's management fee rate as well as other fund or class expenses, as applicable, such as transfer agent fees, pricing and bookkeeping fees, and custodial, legal, and audit fees. The Board also noted that Fidelity may agree to waive fees and expenses from time to time, and the extent to which, if any, it has done so for the fund. As part of its review, the Board also considered the current and historical total expense ratios of each class of the fund compared to competitive fund median expenses. Each class of the fund is compared to those funds and classes in the Total Mapped Group (used by the Board for management fee comparisons) that have a similar sales load structure.

The Board noted that the total expense ratio of each class ranked below the competitive median for the 12-month period ended June 30, 2018.

Fees Charged to Other Fidelity Clients. The Board also considered Fidelity fee structures and other information with respect to clients of Fidelity, such as other funds advised or subadvised by Fidelity, pension plan clients, and other institutional clients with similar mandates. The Board noted that a joint ad hoc committee created by it and the boards of other Fidelity funds periodically reviews and compares Fidelity's institutional investment advisory business with its business of providing services to the Fidelity funds, and also noted the most recent findings of the committee. The Board noted that the committee's review included a consideration of the differences in services provided, fees charged, and costs incurred, as well as competition in the markets serving the different categories of clients.

Based on its review of total expense ratios and fees charged to other Fidelity clients, the Board concluded that the total expense ratio of each class of the fund was reasonable in light of the services that the fund and its shareholders receive and the other factors considered.

Costs of the Services and Profitability. The Board considered the revenues earned and the expenses incurred by Fidelity in conducting the business of developing, marketing, distributing, managing, administering and servicing the fund and servicing the fund's shareholders. The Board also considered the level of Fidelity's profits in respect of all the Fidelity funds.

On an annual basis, Fidelity presents to the Board information about the profitability of its relationships with the fund. Fidelity calculates profitability information for each fund, as well as aggregate profitability information for groups of Fidelity funds and all Fidelity funds, using a series of detailed revenue and cost allocation methodologies which originate with the books and records of Fidelity on which Fidelity's audited financial statements are based. The Audit Committee of the Board reviews any significant changes from the prior year's methodologies.

PricewaterhouseCoopers LLP (PwC), auditor to Fidelity and certain Fidelity funds, has been engaged annually by the Board as part of the Board's assessment of Fidelity's profitability analysis. PwC's engagement includes the review and assessment of the methodologies used by Fidelity in determining the revenues and expenses attributable to Fidelity's mutual fund business, and completion of agreed-upon procedures in respect of the mathematical accuracy of the fund profitability information and its conformity to established allocation methodologies. After considering PwC's reports issued under the engagement and information provided by Fidelity, the Board concluded that while other allocation methods may also be reasonable, Fidelity's profitability methodologies are reasonable in all material respects.

The Board also reviewed Fidelity's non-fund businesses and potential indirect benefits such businesses may have received as a result of their association with Fidelity's mutual fund business (i.e., fall-out benefits) as well as cases where Fidelity's affiliates may benefit from the fund's business. The Board noted that changes to fall-out benefits year-over-year reflect business developments at Fidelity's various businesses.

The Board considered the costs of the services provided by and the profits realized by Fidelity in connection with the operation of the fund and was satisfied that the profitability was not excessive.

Economies of Scale. The Board considered whether there have been economies of scale in respect of the management of the Fidelity funds, whether the Fidelity funds (including the fund) have appropriately benefited from any such economies of scale, and whether there is potential for realization of any further economies of scale. The Board considered the extent to which the fund will benefit from economies of scale as assets grow through increased services to the fund, through waivers or reimbursements, or through fee or expense ratio reductions. The Board also noted that a committee (the Economies of Scale Committee) created by it and the boards of other Fidelity funds periodically analyzes whether Fidelity attains economies of scale in respect of the management and servicing of the Fidelity funds, whether the Fidelity funds have appropriately benefited from such economies of scale, and whether there is potential for realization of any further economies of scale.

The Board recognized that the fund's management contract incorporates a "group fee" structure, which provides for lower group fee rates as total group assets increase, and for higher group fee rates as total group assets decrease (with "group assets" defined to include fund assets under SelectCo's management plus assets under FMR's management). SelectCo calculates the group fee rates based on a tiered asset "breakpoint" schedule that varies based on asset class. The Board considered that the group fee is designed to deliver the benefits of economies of scale to fund shareholders when total group assets increase, even if assets of any particular fund are unchanged or have declined, because some portion of Fidelity's costs are attributable to services provided to all Fidelity funds, and all funds benefit if those costs can be allocated among more assets. The Board concluded that, given the group fee structure, fund shareholders will benefit from lower management fees as group assets increase at the fund complex level, regardless of whether Fidelity achieves any such economies of scale.

The Board concluded, taking into account the analysis of the Economies of Scale Committee, that economies of scale, if any, are being appropriately shared between fund shareholders and Fidelity.

Additional Information Requested by the Board. In order to develop fully the factual basis for consideration of the Fidelity funds' advisory contracts, the Board requested and received additional information on certain topics, including: (i) fund performance trends, in particular the underperformance of certain funds, and Fidelity's long-term strategies for certain funds; (ii) Fidelity's fund profitability methodology, profitability trends for certain funds, and the impact of certain factors on fund profitability results; (iii) metrics for evaluating index fund and ETF performance and information about ETF trading characteristics; (iv) the methodology with respect to the evaluation of competitive fund data and peer group classifications and fee comparisons; (v) the expense structures for different funds and classes; (vi) information regarding other accounts managed by Fidelity, including collective investment trusts; and (vii) Fidelity's philosophies and strategies for evaluating funds and classes with lower or declining asset levels.

Based on its evaluation of all of the conclusions noted above, and after considering all factors it believed relevant, the Board concluded that the advisory fee arrangements are fair and reasonable, and that the fund's Advisory Contracts should be renewed.

VTECIC-SANN-0819

1.817388.114

Fidelity® Variable Insurance Products: Energy Portfolio

Semi-Annual Report June 30, 2019 |

|