OMB APPROVAL

OMB Number: 3235-0570

Expires: January 31, 2014

Estimated average burden

hours per response..... 20.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3790

Pear Tree Funds

(Exact name of registrant as specified in charter)

55 Old Bedford Road, Lincoln, MA 01773

(Address of principal executive offices)

Willard L. Umphrey

Pear Tree Advisors, Inc.

55 Old Bedford Road, Lincoln, MA 01773

(Name and address of agent for service)

Registrant’s telephone number, including area code: (781) 676-5900

Date of fiscal year end: March 31

Date of reporting period: April 1, 2011 through March 31, 2012

ITEM 1. REPORTS TO SHAREOWNERS.

[PEAR TREE FUNDS COVER]

PEAR TREE FUNDS

Pear Tree Columbia Small Cap Fund

Pear Tree Columbia Micro Cap Fund

Pear Tree Quality Fund

Pear Tree PanAgora Dynamic Emerging Markets Fund

Pear Tree Polaris Foreign Value Fund

Pear Tree Polaris Foreign Value Small Cap Fund

ANNUAL REPORT

March 31, 2012

TABLE OF CONTENTS

President’s Letter 1

Fund Expenses 2

Portfolio Manager Commentaries 4

Pear Tree Columbia Small Cap Fund 4

Pear Tree Columbia Micro Cap Fund 7

Pear Tree Quality Fund 9

Pear Tree PanAgora Dynamic Emerging Markets Fund 11

Pear Tree Polaris Foreign Value Fund 13

Pear Tree Polaris Foreign Value Small Cap Fund 16

Schedules of Investments 19

Pear Tree Columbia Small Cap Fund 19

Pear Tree Columbia Micro Cap Fund 27

Pear Tree Quality Fund 32

Pear Tree PanAgora Dynamic Emerging Markets Fund 36

Pear Tree Polaris Foreign Value Fund 45

Pear Tree Polaris Foreign Value Small Cap Fund 48

Statements of Assets and Liabilities 52

Statements of Operations 56

Statements of Changes in Net Assets 58

Financial Highlights 64

Notes to Financial Statements 76

Information for Shareholders 94

Management Contract and Advisory Contract Approval 95

Report of Independent Registered Public Accounting Firm 97

Privacy Notice 98

Trustees and Officers 101

Service Providers inside back cover

This report must be preceded or accompanied by a current Pear Tree Funds prospectus for individuals who are not current shareholders of the Funds. If you are not a shareholder of a Pear Tree Fund, you should read the prospectus carefully before investing because it contains more complete information on the Pear Tree Funds’ investment objectives, risks, charges and expenses. Please consider this information carefully. For a prospectus and other information, visit www.peartreefunds.com or call (800) 326-2151.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither Pear Tree Funds nor U.S. Boston Capital Corporation is a bank.

PEAR TREE FUNDS

Dear Fellow Shareholder,

We are pleased to provide you with the Pear Tree Funds’ Annual Report for the twelve months ended March 31, 2012 and to update you on recent market conditions and the performance of the Pear Tree Funds.

For current performance information, please visit our website at www.peartreefunds.com. We thank you for your continued confidence in the Pear Tree Funds. Please feel free to e-mail us at feedback@peartreefunds.com or call us at 800-326-2151 with any questions or for assistance on your account.

Sincerely,

Willard Umphrey

President and Chairman

Any statements in this report regarding market or economic trends or the factors influencing the historical or future performance of the Pear Tree Funds are the views of Fund management as of the date of this report. These views are subject to change at any time based upon market and other conditions, and Fund management and the subadvisors to the Funds disclaim any responsibility to update such views. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any Pear Tree Fund. Any references to specific securities are not recommendations of such securities and may not be representative of any Pear Tree Fund’s current or future investments.

Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

PEAR TREE FUNDS

FUND EXPENSES

We believe it’s important for Fund shareholders to have a clear understanding of fund expenses and the impact expenses have on investment returns. The following is important information about each Fund’s Expense Example, which appears below.

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution (12b-1) fees (on Ordinary Shares) and other Fund expenses. The example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on $1,000 invested at the beginning of the period and held for the entire period from October 1, 2011 to March 31, 2012.

Actual Expenses

The first line for each Share Class for each Fund provides information about actual account returns and actual expenses. You may use the information in this line, together with the amount you invested for that Fund and Share Class, to estimate the expenses that you paid over the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000, then multiply the result by the number under the heading “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line for each Share Class for each Fund shows you hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return.

The hypothetical account values and hypothetical expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing expenses of investing in the Fund with the ongoing expenses of other funds. To do so, compare the Fund’s 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

PEAR TREE FUNDS

Expense Example for the 6 months ended March 31, 2012

| Pear Tree Fund | Share Class | Total Return Description | Beginning Account Value 10/1/11 | Ending Account Value 3/31/2012 | Annualized Expense Ratio | Expenses Paid* 10/1/11 – 3/31/2012 | |

| Small Cap | Ordinary | Actual | $1,000.00 | $1,285.50 | 1.70% | $ 9.71 | |

| Hypothetical | $1,000.00 | $1,016.51 | 1.70% | $8.56 | |||

| Institutional | Actual | $1,000.00 | $1,287.80 | 1.44% | $8.26 | ||

| Hypothetical | $1,000.00 | $1,017.78 | 1.44% | $7.29 | |||

| Quality | Ordinary | Actual | $1,000.00 | $1,208.00 | 1.51% | $8.31 | |

| Hypothetical | $1,000.00 | $1,017.47 | 1.51% | $7.60 | |||

| Institutional | Actual | $1,000.00 | $1,211.60 | 1.00% | $5.55 | ||

| Hypothetical | $1,000.00 | $1,019.98 | 1.00% | $5.07 | |||

| Emerging Markets | Ordinary | Actual | $1,000.00 | $1,182.10 | 1.77% | $9.64 | |

| Hypothetical | $1,000.00 | $1,016.17 | 1.77% | $8.91 | |||

| Institutional | Actual | $1,000.00 | $1,183.50 | 1.52% | $8.28 | ||

| Hypothetical | $1,000.00 | $1,017.42 | 1.52% | $7.65 | |||

| Foreign Value | Ordinary | Actual | $1,000.00 | $1,167.50 | 1.66% | $9.02 | |

| Hypothetical | $1,000.00 | $1,016.68 | 1.66% | $8.39 | |||

| Institutional | Actual | $1,000.00 | $1,169.10 | 1.41% | $7.64 | ||

| Hypothetical | $1,000.00 | $1,017.95 | 1.41% | $7.11 | |||

| Foreign Value | Ordinary | Actual | $1,000.00 | $1,126.40 | 1.72% | $9.17 | |

| Small Cap | Hypothetical | $1,000.00 | $1,016.38 | 1.72% | $8.70 | ||

| Institutional | Actual | $1,000.00 | $1,127.30 | 1.48% | $7.88 | ||

| Hypothetical | $1,000.00 | $1,017.59 | 1.48% | $7.47 | |||

| Micro-Cap | Ordinary | Actual | $1,000.00 | $1,246.10 | 2.00% | $11.23 | |

| Hypothetical | $1,000.00 | $1,013.74 | 2.00% | $10.08 | |||

| Institutional | Actual | $1,000.00 | $1,248.90 | 1.73% | $9.73 | ||

| Hypothetical | $1,000.00 | $1,015.00 | 1.73% | $8.72 |

| * | “Expenses Paid” for each Fund share class relating to actual or hypothetical returns, is the amount equal to the product of (a) that Fund’s and Share Class’ average account value for the six-month period ended March 31, 2012, multiplied by (b) the corresponding “Annualized Expense Ratio” multiplied by (c) the fraction 183/366 (which reflects the six-month period covered by this report). |

PEAR TREE COLUMBIASMALL CAP FUND

INVESTMENT PROFILE

All Data as of March 31, 2012

Investment Commentary

For the fiscal year period ended March 31, 2012 the Pear Tree Columbia Small Cap Fund’s Ordinary Shares (the “Fund”) outperformed its benchmark, the Russell 2000 Index. The Fund achieved a return of 2.48% at net asset value compared to –0.18% for the Index.

| Fund Information | ||

| Net Assets Under Management | $102.1 Million | |

| Number of Companies | 176 | |

| Price to Book Ratio | 3.0 | |

| Price to Earnings Ratio | 25.9 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Net) | 1.67% | 1.42% |

| Ticker Symbol | USBNX | QBNAX |

Market Conditions and Investment Strategies

One year ago the markets were assessing the ramifications of the devastating earthquake that hit Japan in March 2011. Initially, equity markets around the world fell but bottomed quickly and rallied back. The momentum continued into April, with the Index hitting new recovery highs. The old adage “sell in May and go away” was then sounded. By mid-June, the Russell 2000 Index had fallen by more than 10% but reversed, recovering most losses by early July. In August, Standard & Poor’s downgraded the credit rating of U.S. Treasury bonds for the first time in history. Equity markets around the world experienced their most volatile week since the financial crisis. Small cap stocks were hit particularly hard in September and investors were stunned. They took events in stride, however, and stocks rebounded nicely late in the year to finish 2011 in good stead. Positive momentum continued into 2012 as equity markets posted the best first quarter returns since 1998.

Small cap stocks were volatile throughout the year. Our strategy of buying high quality companies, which tends to protect capital in down markets, helped us to earn a positive return and outperform the benchmark for the period. Within the Russell 2000 Index, the defensive Consumer Staples, Health Care and Utilities sectors were the top three performers posting returns of roughly 10%, 9% and 8% respectively for the year. Consumer Discretionary, Financials and Telecommunications Services also had positive returns for the period. Energy and Materials were the worst performers posting losses of over 15% and 13% respectively. Information Technology and Industrials also posted single digit negative returns.

Analyzing our performance versus the benchmark for the year, Information Technology was our biggest contributor adding 2.3% to our return. Portfolio holding Alliance Data Systems Inc. gained nearly 47% for the period as the outsourcing company announced several new business wins. We also outperformed in Energy, which contributed 1.8% to returns due primarily to holding Core Laboratories N.V., which posted strong earnings from their oil field services. Telecommunications Services contributed over 1.1% versus the Index as SBA Communications Corp. gained over 28% as demand for wireless transmission infrastructure remained robust.

Conversely, we underperformed relative to the Index during the year in Materials where our stock selection detracted 1.0% from our return. This was due in part to the performance of portfolio holding Stillwater Mining Co., which declined over 53% during the year. Stillwater made a controversial acquisition and fell significantly on the announcement. In light of this change in strategy the security was sold. Our stock selection in Health Care and Financials also detracted from our return for the year versus the Index.

Portfolio Changes

The Financials, Consumer Discretionary, Consumer Staples, and Telecommunications Services sector weightings increased during the year, while the Industrials, Energy, and Materials sectors declined. Changes in all other sectors were not material.

PEAR TREE COLUMBIA SMALL CAP FUND

A Look Ahead

We are encouraged by the strength of the market, but we are reluctant to predict a continuation of this recent rally. There is a large contingent of investors, however, who have found refuge in low yielding bonds and have missed the recent move. They may capitulate at some point and drive prices higher as performance anxiety sets in.

The Fund is co-managed by Robert von Pentz, CFA, and Rhys Williams, CFA of Columbia Partners, L.L.C. Investment Management.

PEAR TREE COLUMBIA SMALL CAP FUND

Top 10 Holdings

| Percentage of total net assets | 34.4% |

| Acacia Research Corporation—Acacia Technologies | 4.7% |

| SBA Communications Corp., Class A | 4.6% |

| Core Laboratories N.V. | 4.5% |

| Alliance Data Systems Corporation | 4.1% |

| Entertainment Properties Trust | 4.0% |

| Hersha Hospitality Trust | 3.7% |

| SXC Health Solutions Corp. | 2.6% |

| Gardner Denver, Inc. | 2.1% |

| United Natural Foods, Inc. | 2.1% |

| F.N.B. Corporation | 2.0% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Financials | 21.1% |

| Information Technology | 18.9% |

| Industrials | 15.5% |

| Health Care | 11.7% |

| Consumer Discretionary | 11.2% |

| Energy | 7.8% |

| Consumer Staples | 6.0% |

| Telecommunication Services | 4.7% |

| Materials | 0.1% |

| CASH + other assets (net) | 3.0% |

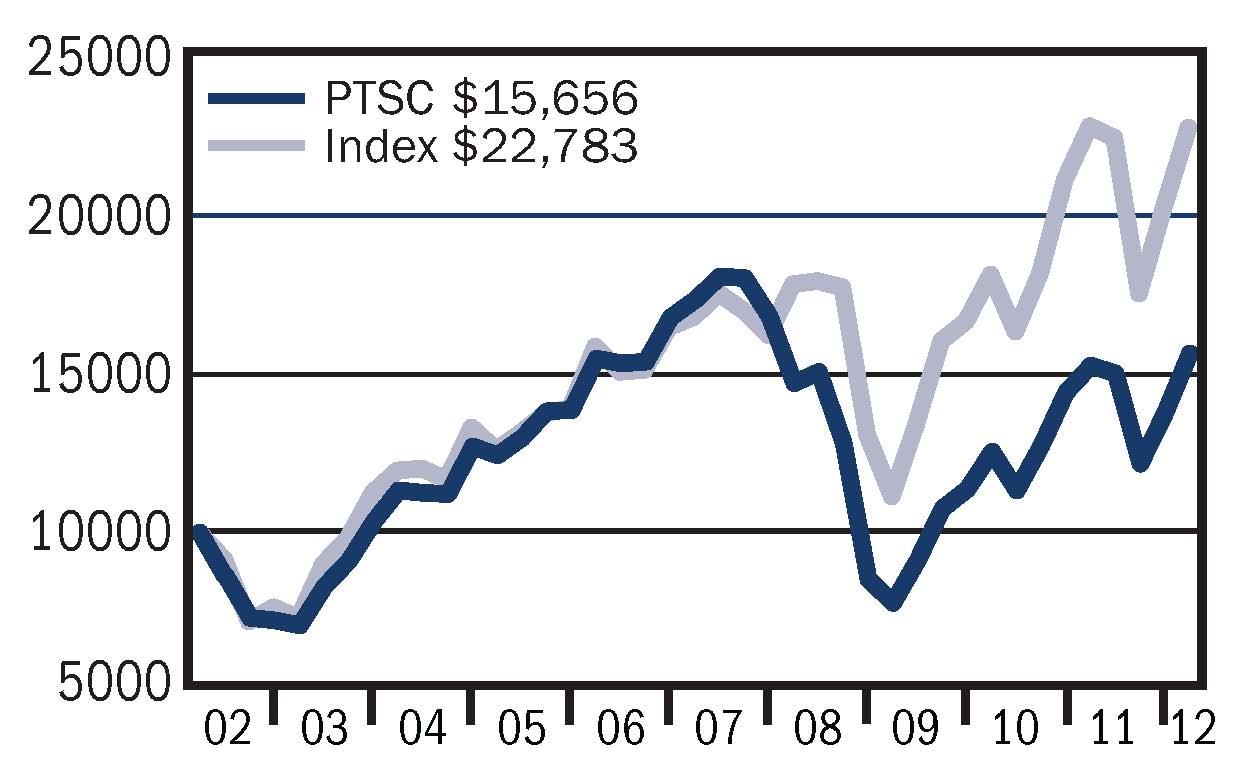

Value of a $10,000 Investment

Pear Tree Small Cap (PTSC) Ordinary Shares vs.

Russell 2000 Index

Average Annual Total Returns

| 1Q 2012 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

Ordinary Shares | 13.62% | 28.55% | 2.48% | –2.03% | 4.59% | 10.06% | 08/03/92 |

Institutional Shares1 | 13.64% | 28.73% | 2.69% | –1.78% | 4.98% | 9.34% | 01/06/93 |

Russell 20002 | 12.44% | 29.83% | –0.18% | 2.13% | 6.45% | 9.36% |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The Russell 2000 Index is a market capitalization-weighted index of 2,000 small company stocks. It is widely recognized as representative of the general market for small company stocks. Index returns assume the reinvestment of dividends and, unlike Fund returns, do no reflect any fees or expenses. You cannot invest directly in an Index. The beginning date of the Index is 08/3/92.

Small company stocks may trade less frequently and in a limited volume, and their prices may fluctuate more than stocks of other companies. Small company stocks may therefore be more vulnerable to adverse developments than those of larger companies. The Fund may invest in the issuers in the real estate industry. Changes in real estate values or economic downturns can have a significant negative effect on these issuers.

PEAR TREE COLUMBIA MICRO CAP FUND

INVESTMENT PROFILE

All Data as of March 31, 2012

Investment Commentary

For the period since inception, beginning September 12, 2011, and ending March 31, 2012, the Pear Tree Columbia Micro Cap Fund’s Ordinary Shares (the “Fund”) underperformed its benchmark, the Russell Micro Cap Index (the “Index”). The Fund achieved a return of 18.36% at net asset value compared to 19.87% for the Index.

| Fund Information | ||

| Net Assets Under Management | $4.3 Million | |

| Number of Companies | 95 | |

| Price to Book Ratio | 2.4 | |

| Price to Earnings Ratio | 15.2 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Net) | 2.00% | 1.75% |

| Ticker Symbol | PTFMX | MICRX |

Market Conditions and Investment Strategies

Reading the financial headlines over the past six months, one would conclude there was ample opportunity for equities to decline: the European Union was near collapse; indications were that China’s economy was faltering; and political dysfunction was never more evident. The financial markets, however, confounded the skeptics and rebounded from last summer’s retreat posting two back-to-back quarters of double digit returns. While most of the focus has been on the geopolitical drama unfolding across the pond, here at home economic prospects appear to be improving, albeit slowly. We’re still a long way from robust growth, but on the margin some improvement in economic data has been seen. The unemployment rate has declined gradually with a consequent improvement consumer confidence. This being a Presidential election year, we doubt if the incumbents will allow the economy to falter, at least until after November.

Since last September the market drivers in the Index on a sector level have been Consumer Discretionary and Health Care with gains of 33% and 31% respectively followed by Materials, Financials, Industrials, Consumer Staples and Energy all with gains of over 20% for the period. Information Technology, Telecommunications Services, and Utilities were the laggards with positive returns of 16%, 12% and 8% respectively.

The Fund’s performance relative to the benchmark index was derived from security selection. One half of our underperformance was a result of stock selection in the strong Consumer Discretionary sector where we gave up 2.3% of return. Portfolio holding Overstock.com was partially responsible as the stock fell 32% during the period. Selection in Consumer Staples cost an additional 1% of relative return as Coffee Holding Co. Inc. declined 42%. Also, our marginal cash position in a strong up market detracted 0.8% from returns.

Conversely, our stock selections in Energy contributed 0.3% of return versus the Index and our lower allocation to the poor performing Utilities sector also added 0.2% of relative return.

Portfolio Changes

During the period, we added the most weight to the Consumer Discretionary and Consumer Staples sectors, which by period end represented the largest relative positions. The weighting in the Energy sector also increased. We significantly reduced the holdings in Health Care to the point that it was the greatest relative underweight sector as of period end. The Industrials, Information Technology, Materials, Telecommunications Services and Utilities sectors also declined in weight during the period.

A Look Ahead

We remain constructive in our outlook for microcap stocks, and believe they should continue to perform well as the economic recovery still has momentum. They also tend to benefit from mergers and acquisitions activity, which we believe likely to gain steam given the record amount of cash held by corporations and private equity.

The Fund is managed by Robert von Pentz, CFA, of Columbia Partners, L.L.C. Investment Management.

PEAR TREE COLUMBIA MICRO CAP FUND

Top 10 Holdings

| Percentage of total net assets | 16.3% |

| iShares Russell Microcap Index | 4.3% |

| Adams Resources & Energy, Inc. | 1.6% |

| TESSCO Technologies, Inc. | 1.5% |

| Gordmans Stores, Inc. | 1.4% |

| Rentech, Inc. | 1.3% |

| CompuCredit Holdings Corporation | 1.3% |

| Ascent Solar Technologies, Inc. | 1.3% |

| TravelCenters of America LLC | 1.2% |

| Sturm, Ruger& Co., Inc. | 1.2% |

| Coffee Holding Co., Inc. | 1.2% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Financials | 23.0% |

| Consumer Discretionary | 21.0% |

| Industrials | 17.6% |

| Information Technology | 10.8% |

| Consumer Staples | 9.8% |

| Energy | 4.2% |

| Materials | 3.9% |

| Health Care | 1.0% |

| Telecommunication Services | 1.6% |

| Exchange Traded Funds | 4.3% |

| Cash and Other Assets (Net) | 2.8% |

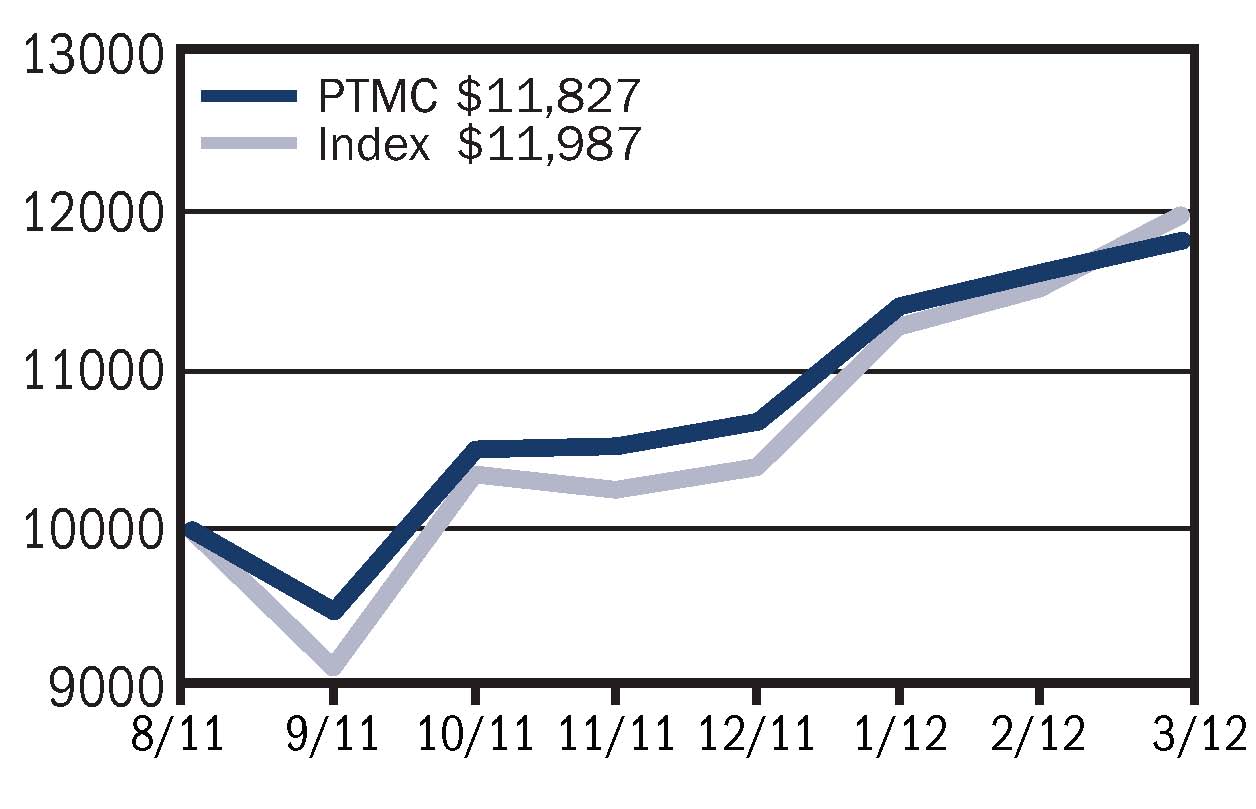

Value of a $10,000 Investment

Pear Tree Columbia Micro Cap (PTMC) Ordinary Shares vs.

Russell Microcap Index

Average Annual Total Returns

| 1Q 2012 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 10.78% | 24.72% | 18.36% | 9/12/2011 | |||

Institutional Shares1 | 10.94% | 25.00% | 14.75% | 9/7/2011 | |||

Russell Microcap Index2 | 15.29% | 31.23% | 19.87% |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. Microcap stocks make up less than 3% of the U.S. equity market (by market cap) and consist of the smallest 1,000 securities in the small-cap Russell 2000®Index, plus the next smallest eligible securities by market cap. The Russell Microcap Index is constructed to provide a comprehensive and unbiased barometer for the microcap segment trading on national exchanges, while excluding lesser-regulated OTC bulletin board securities and pink-sheet stocks due to their failure to meet national exchange listing requirements. The Russell Microcap is completely reconstituted annually to ensure larger stocks do not distort performance and characteristics of the true microcap opportunity set.

Investing in foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE QUALITY FUND

INVESTMENT PROFILE

All Data as of March 31, 2012

Investment Commentary

For the fiscal year period ended March 31, 2012, the Pear Tree Quality Fund’s Ordinary Shares (the “Fund”) outperformed its benchmark, S&P 500 (the “Index”). The Fund achieved a return of 16.99% at net asset value compared to 8.54% for the Index.

| Fund Information | ||

| Net Assets Under Management | $95.1 Million | |

| Number of Companies | 67 | |

| Price to Book Ratio | 3.4 | |

| Price to Earnings Ratio | 13.0 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Net) | 1.51% | 1.00% |

| Ticker Symbol | USBOX | QGIAX |

Market Conditions and Investment Strategies

The Fund’s investment manager currently chooses securities for the Fund by periodically selecting a mutual fund (the “Target Portfolio”) and monitoring the Target Portfolio’s holdings. The Fund’s investment adviser, at the direction of the investment manager, rebalances the Fund’s portfolio to correspond to the Target Portfolio’s most recent holdings as publicly reported. From April 1, 2011 to March 31, 2012, the Fund’s Ordinary Shares, when compared to the Target Portfolio, had a tracking error of 0.27.

Over the previous twelve months, the Consumer Staples sector was the largest positive contributor to the Fund’s performance. The fact that the Fund has no holdings in the Financials sector also provided strong outperformance relative to the benchmark. The Fund’s overweight positions in the Healthcare and Information Technology sectors also contributed to outperformance.

The greatest detractor to performance came from the Utilities sector where the underweighting negatively affected relative performance. Other detractors were sector allocation in Consumer Discretionary and stock selection in the Industrials sector.

Portfolio Changes

We expect the Fund to have a relatively low turnover rate given the historical stability and relatively low turnover rate of the current Target Portfolio.

For the twelve-month period ending March 31, 2012, the Fund rebalanced the holdings four times to replicate the publicly disclosed holdings of the current target portfolio. The four rebalances resulted in the sale of twenty positions. Also as a result of the rebalances, the Fund opened new positions in twelve companies, six Healthcare companies, three Technology companies, two Consumer Staple companies and one Consumer Discretionary company.

A Look Ahead

For the foreseeable future, the Fund’s investment manager expects the Target Portfolio to remain the same. For more information on the selection of the Target Portfolio(s), please see the Fund’s Prospectus.

The Fund’s target portfolio is GMO Quality Fund III (GQETX) and the Fund is managed by Robert von Pentz, CFA of Columbia Partners, L.L.C. Investment Management.

PEAR TREE QUALITY FUND

Top 10 Holdings

| Percentage of total net assets | 45.7% |

| Microsoft Corporation | 6.2% |

| Cisco Systems, Inc. | 5.5% |

| Philip Morris International, Inc. | 5.4% |

| Johnson & Johnson | 5.1% |

| Apple, Inc. | 4.7% |

| Coca-Cola Company (The) | 4.1% |

| Google, Inc. | 4.1% |

| Pfizer Inc. | 3.8% |

| Oracle Corporation | 3.7% |

| Wal-Mart Stores, Inc. | 3.1% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Information Technology | 32.3% |

| Consumer Staples | 27.5% |

| Health Care | 23.8% |

| Energy | 11.2% |

| Consumer Discretionary | 4.2% |

| Industrials | 0.1% |

| Telecommunication Services | 0.0% |

| CASH + other assets (net) | 0.9% |

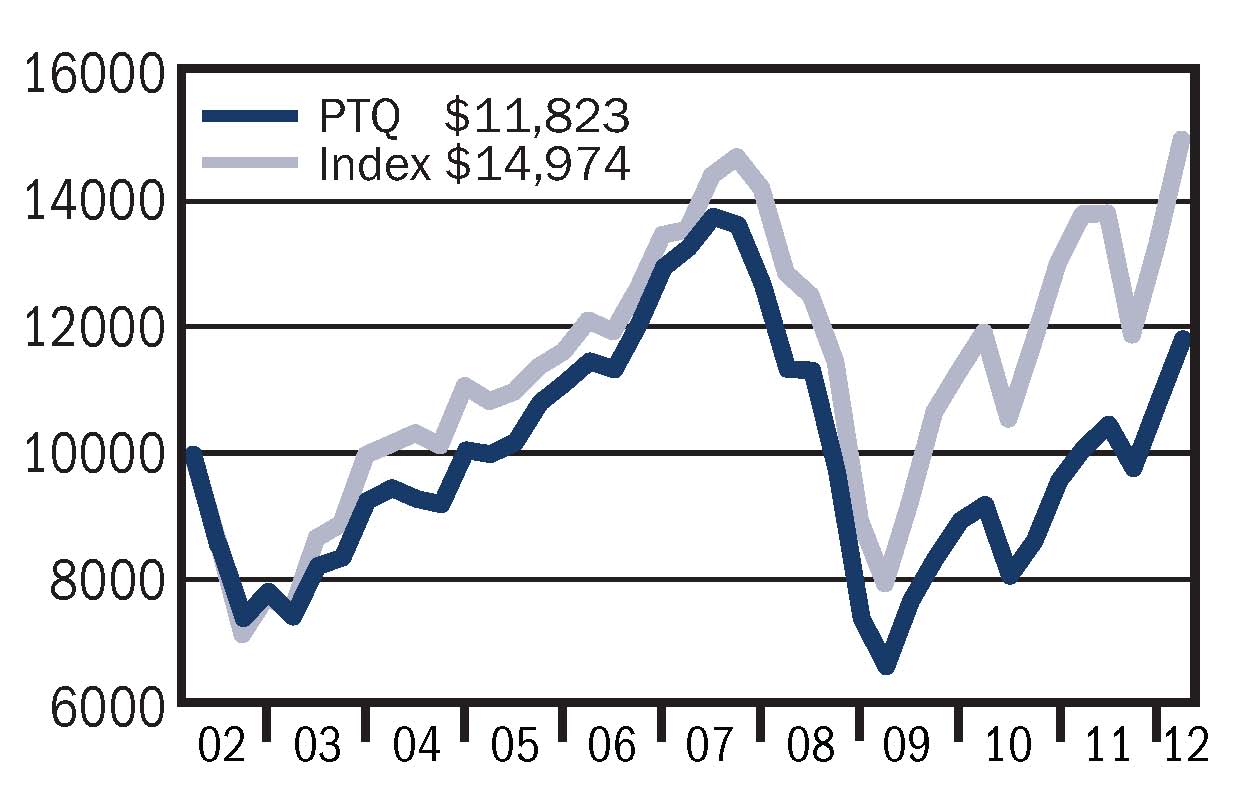

Value of a $10,000 Investment

Pear Tree Quality (PTQ) Ordinary Shares vs.

S&P 500 Index

Average Annual Total Returns

| 1Q 2012 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 9.31% | 20.80% | 16.99% | –2.27% | 1.69% | 8.83% | 05/06/85 |

Institutional Shares1 | 9.44% | 21.16% | 17.57% | –2.18% | 1.98% | 7.23% | 03/25/91 |

S&P 5002 | 12.59% | 25.89% | 8.54% | 2.01% | 4.12% | 10.55% |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The S&P 500 Index is an unmanaged index of stocks chosen to their size industry characteristics. It is widely recognized as representative of stocks in the United States. Index returns assume the reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. You cannot invest directly in the Index. The beginning date for the Index is 05/29/85.

Investing in foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE PANAGORA DYNAMIC EMERGING MARKETS FUND

INVESTMENT PROFILE

All Data as of March 31, 2012

Investment Commentary

For the fiscal year ended March 31, 2012, the Pear Tree PanAgora Dynamic Emerging Markets Fund’s Ordinary Shares (the “Fund”) outperformed its benchmark, MSCI Emerging Markets Index (the “Index”). The Fund achieved a return of –7.80% at net asset value compared to –8.52% for the Index.

| Fund Information | ||

| Net Assets Under Management | $160.8 Million | |

| Number of Companies | 217 | |

| Price to Book Ratio | 1.6 | |

| Price to Earnings Ratio | 9.7 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Net) | 1.76% | 1.52% |

| Ticker Symbol | QFFOX | QEMAX |

Market Conditions and Investment Strategies

On a country basis, the largest contributors were Taiwan (+0.98%) and Brazil (+0.90%). Among holdings in Taiwan, the largest contributor was an overweight to Radiant Opto-Electronic while among holdings in Brazil, the largest contributor was an overweight to Companhia De Bebidas. The largest detractors were India (–0.44%) and Russia (–0.38%). Among holdings in India the largest detractor was an overweight to Bank of Baroda while among holdings in Russia the largest detractor was an overweight to Evraz Group S.A.

On a sector basis, the largest contributors were Industrials (+0.86%) and Consumer Staples (+0.71%). Among the holdings in Industrials the largest contributor was an overweight to L.G. International Corp. while among holdings in Consumer Staples the largest contributor was an overweight to FomentoEconomicoMexicano. The largest detractors were Materials (–0.22%) and Health Care (–0.21%). Among holdings in Materials the largest detractor was an overweight to KP Chemical Corp. while among holdings in Health Care the largest detractor was an overweight to China Pharmaceutical.

During the period, our proprietary Dynamic Alpha model performed well — our best ranked alpha stocks outperformed the worst ranked alpha stocks.

Our proprietary Valuation composite performed well — stocks with attractive valuations outperformed their more expensive peers.

Our proprietary Quality composite performed well — stocks with strong business and management quality metrics outperformed lower quality peers.

Our proprietary Momentum composite performed well — stocks with positive market sentiment outperformed stocks with poor earnings and price momentum.

Portfolio Changes

There were no significant portfolio changes during the fiscal year ended March 31, 2012.

A Look Ahead

As a quantitative investment firm, we tend not to provide strategy-specific forward looking commentary. We believe that our systematic investment approach ensures that we deliver a portfolio of our highest conviction of ideas to all of our clients.

The Fund’s portfolio is managed by a team of portfolio managers at PanAgora Asset Management, Inc.

PEAR TREE PANAGORA DYNAMIC EMERGING MARKETS FUND

Top 10 Holdings

| Percentage of total net assets | 20.4% |

| Samsung Electronics Co., Ltd. | 4.4% |

| Vale SA | 2.5% |

| PetroleoBrasileiro SA | 2.2% |

| Gazprom | 1.9% |

| CNOOC Limited | 1.8% |

| China Construction Bank Corporation | 1.7% |

| LUKoil | 1.6% |

Taiwan Semiconductor Manufacturing Co., Ltd. | 1.6% |

| Hyundai Motor Co. | 1.4% |

| Hon HaiPrecision Industry Co., Ltd. | 1.3% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Financials | 21.2% |

| Information Technology | 15.6% |

| Energy | 14.7% |

| Materials | 12.3% |

| Consumer Discretionary | 10.2% |

| Consumer Staples | 10.0% |

| Industrials | 6.8% |

| Telecommunication Services | 5.9% |

| Utilities | 2.0% |

| Health Care | 0.6% |

| Exchange Traded Funds | 0.1% |

| CASH + other assets (net) | 0.6% |

Top 10 Country Allocations

| Percentage of total net assets | 85.1% |

| South Korea | 14.8% |

| Brazil | 13.7% |

| Taiwan | 13.7% |

| China | 11.1% |

| South Africa | 7.2% |

| Hong Kong | 6.2% |

| Russia | 5.5% |

| India | 5.0% |

| Malaysia | 4.2% |

| Mexico | 3.7% |

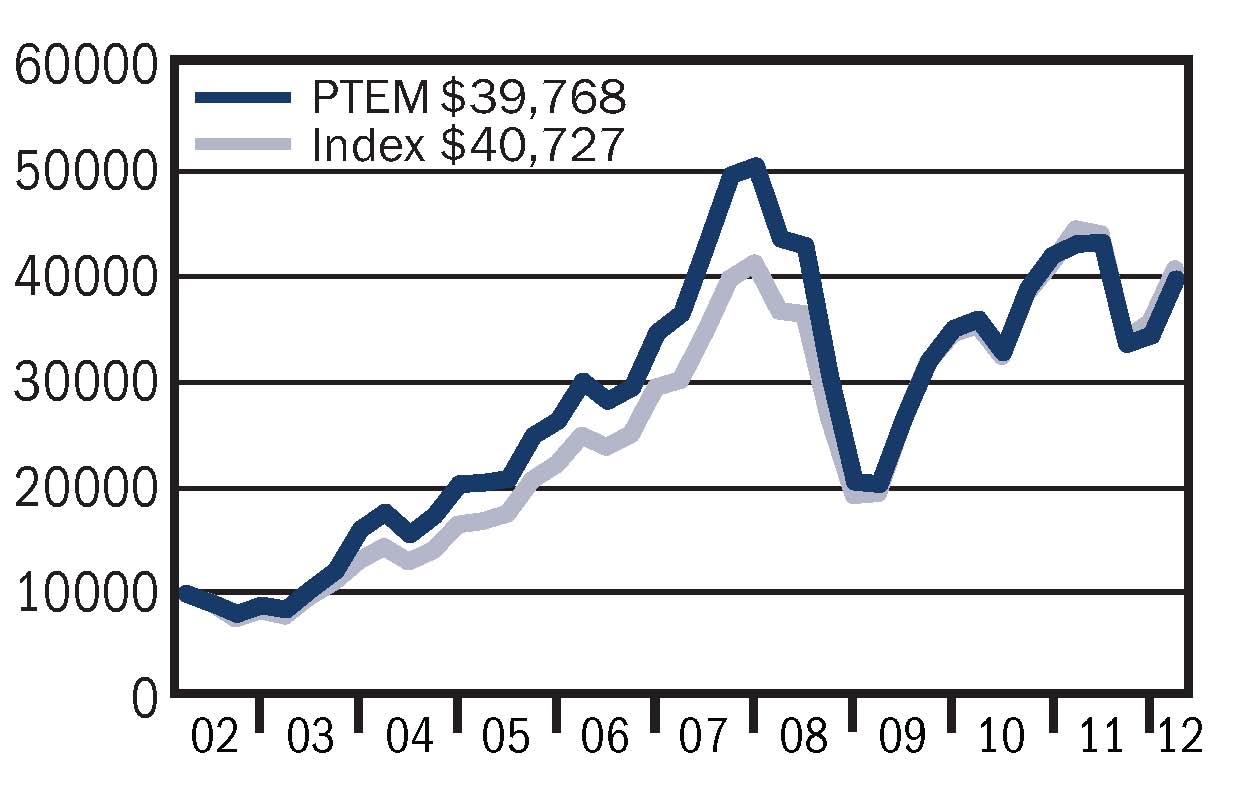

Value of a $10,000 Investment

Pear Tree Emerging Markets (PTEM) Ordinary Shares vs. MSCI EM Index

Average Annual Total Returns

| 1Q 2012 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 15.43% | 18.21% | –7.80% | 1.71% | 14.80% | 6.56% | 09/30/94 |

Institutional Shares1 | 15.49% | 18.35% | –7.56% | 1.96% | 15.18% | 8.52% | 04/02/96 |

MSCI EM2 | 14.14% | 19.22% | –8.52% | 4.97% | 14.47% | 6.14% |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The Morgan Stanley Capital International Emerging Markets (“MSCI EM”) Index is an unmanaged index comprised of stocks located in countries other than the United States. It is widely recognized as representative of the general market for emerging markets. Index returns assume the reinvestment of dividends and, unlike Fund returns, do not reflect fees or expenses. You cannot invest directly in an Index. The beginning date for the Index is 09/30/94.

Investing in foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE POLARIS FOREIGN VALUE FUND

INVESTMENT PROFILE

All Data as of March 31, 2012

Investment Commentary

For the fiscal year ended March 31, 2012, the Pear Tree Polaris Foreign Value Fund’s Ordinary Shares (the “Fund”) underperformed its benchmark, the MSCI EAFE Index (the “Index”). The Fund achieved a return of –6.55% at net asset value compared to –5.31% for the Index.

| Fund Information | ||

| Net Assets Under Management | $93.3 Million | |

| Number of Companies | 68 | |

| Price to Book Ratio | 1.9 | |

| Price to Earnings Ratio | 15.1 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Net) | 1.70% | 1.43% |

| Ticker Symbol | QUSOX | QUSIX |

Market Conditions and Investment Strategies

Top contributions to Fund returns came from Consumer Discretionary and Consumer Staples holdings. In particular, all four British homebuilders posted double-digit returns. Mortgage approvals rose to a two-year high in January. All companies reported good results through calendar year-end 2011 and most noted satisfactory progress in forward sales led by new sites and sales per site.

In Consumer Staples,Greencore posted strong underlying sales growth in its convenience food division, even excluding the contribution from Uniq, which was acquired last year. The stock price was up on news of a potential takeover bid that management rejected on valuation grounds. Japanese companies Meiji Holdings, Asahi Group and Nichirei also produced strong returns throughout the year.

The largest deterrent to returns was Industrials, as shipping companies were negatively impacted by concerns of recession in some European countries, and by the glut of supply due to China’s new ship builds.

Among our current European holdings, UK-based Lloyds TSB Group and Belgian KBC Bank underperformed for the year on expectations of higher capital requirements; the two stocks were sold. DnB NOR ASA and SvenskaHandelsbanken, which suffered along with its Nordic peers in 2011, rebounded strong in early 2012, benefitting from budget surpluses and faster economic growth rates. Through calendar year 2011, a weakening South African Rand and higher energy prices helped Sasol Ltd. post an 83% profit increase at the December interim report. However, the stock declined from March 2011.

Portfolio Changes

During the fiscal year, the Fund sold holdings in companies that had reached their valuation limits or where analysis revealed deterioration in individual company fundamentals. We sold six Industrials, two of which reached their valuation limits on positive news of takeovers (Demag Cranes and Tognum AG). In similar fashion, when South African-based mining company Metorex was acquired by the Jinchuan Group of China for its assets in the Democratic Republic of the Congo, our holdings in the company were sold for cash. Additional holdings in Energy, Financials, Telecommunications and Utilities sectors were sold.

Cash from sales was deployed to new purchases including a German telecom provider, a Hong Kong water utility, an Israeli pharmaceutical company and a French oil exploration and production company. We also increased our positions in some promising companies, including an Indian global technology services corporation.

PEAR TREE POLARIS FOREIGN VALUE FUND

A Look Ahead

Although we are seeing signs of a market rebound, spurred on by growth inflections in the U.S.and emerging world, we believe that macro-economic conditions remain tenuous. Cautious optimism must be balanced with concerns of ongoing market volatility and the European debt burden. After numerous sales throughout the year, we increased our cash position readying our portfolio for buying opportunities predicated on negative news.

Our research pipeline has identified a significantly larger number of international companies trading at attractive valuations than at any time since early 2009. We are optimistic about the companies currently appearing in our investment analysis, and continue to conduct extensive on-the-ground research of stock candidates. We expect to make new purchases carefully to attempt to capture maximum upside potential.

The Fund’s lead portfolio manager is Bernard R. Horn, Jr., of Polaris Capital Management, LLC

PEAR TREE POLARIS FOREIGN VALUE FUND

Top 10 Holdings

| Percentage of total net assets | 25.7% |

| Samsung Electroinics Company Ltd. | 3.8% |

| Taylor Wimpey plc | 3.0% |

| Barratt Developments plc | 2.5% |

| Kone OYJ, Class B | 2.4% |

| Persimmon plc | 2.4% |

| BASF SE | 2.4% |

| Greencore Group plc | 2.3% |

| Investor AB, Class B | 2.3% |

| Methanex Corporation | 2.3% |

| DnB Bank ASA | 2.3% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Materials | 17.2% |

| Consumer Discretionary | 14.5% |

| Financials | 12.1% |

| Consumer Staples | 8.4% |

| Information Technology | 7.2% |

| Industrials | 6.7% |

| Energy | 5.4% |

| Health Care | 4.5% |

| Telecommunication Services | 3.7% |

| Utilities | 1.2% |

| Cash and Other Assets (Net) | 19.1% |

Top 10 Country Allocations

| Percentage of total net assets | 65.2% |

| Germany | 11.6% |

| United Kingdom | 10.5% |

| Japan | 10.3% |

| Sweden | 6.7% |

| Ireland | 5.7% |

| France | 5.6% |

| Finland | 5.5% |

| South Korea | 3.8% |

| India | 3.2% |

| Canada | 2.3% |

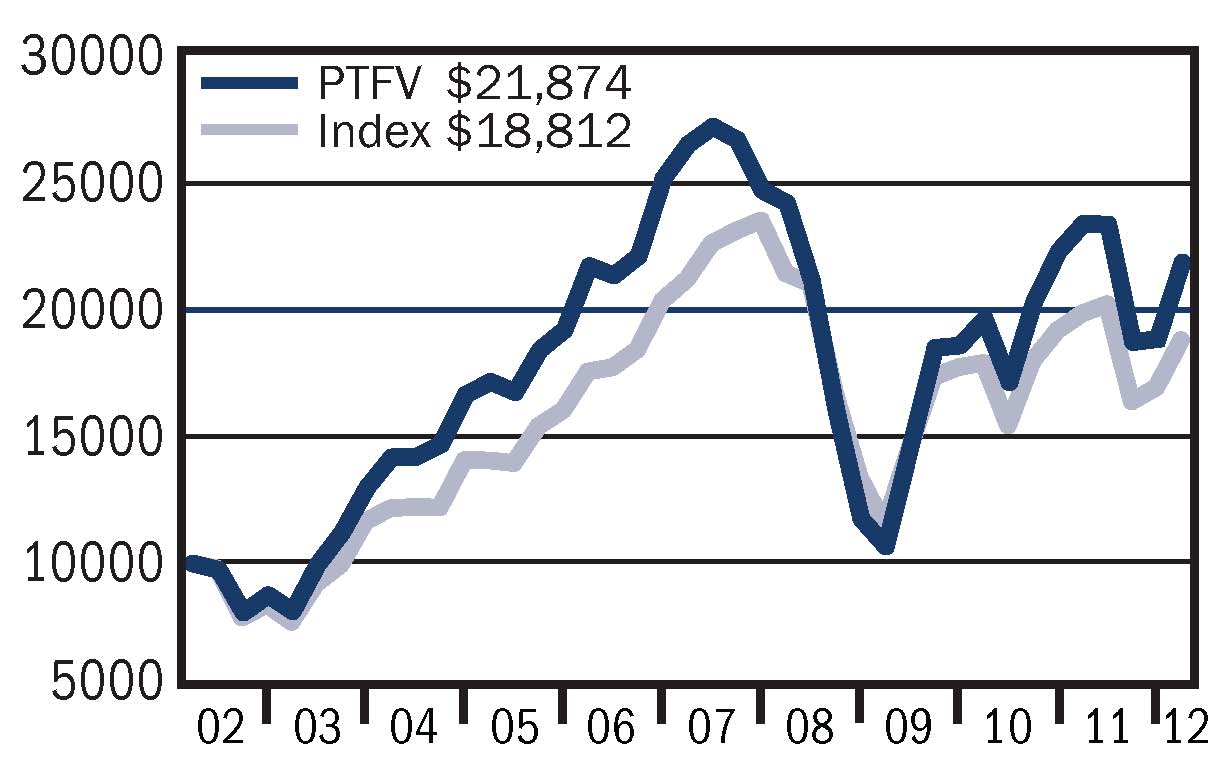

Value of a $10,000 Investment

Pear Tree Foreign Value (PTFV) Ordinary Shares vs.

MSCI EAFE Index

Average Annual Total Returns

| 1Q 2012 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 15.99% | 16.75% | –6.55% | –3.79% | 8.14% | 5.86% | 05/15/98 |

Institutional Shares1 | 16.10% | 16.91% | –6.34% | –3.60% | 8.38% | 7.72% | 12/18/98 |

MSCI EAFE2 | 10.98% | 14.73% | –5.31% | –3.04% | 6.16% | 3.82% |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The Morgan Stanley Capital International Europe, Australia, and Far East (“MSCI EAFE”) Index is an unmanaged index comprised of stocks located in countries other than the United States. It is widely recognized as representative of the general market for emerging markets. Index returns assume the reinvestment of dividends and, unlike Fund returns, do not reflect fees or expenses. You cannot invest directly in an Index. The beginning date for the Index is 05/29/98.

Investing in foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE POLARIS FOREIGN VALUE SMALL CAP FUND

INVESTMENT PROFILE

All Data as of March 31, 2012

Investment Commentary

For the fiscal year ended March 31, 2012, the Pear Tree Polaris Foreign Value Small Cap Fund’s Ordinary Shares (the “Fund”) underperformed its benchmark, the S&P EPAC Small Cap Index (the “Index“). The Fund achieved a return of –8.20% at net asset value compared to –5.99% for the Index.

| Fund Information | ||

| Net Assets Under Management | $93.3 Million | |

| Number of Companies | 68 | |

| Price to Book Ratio | 1.9 | |

| Price to Earnings Ratio | 15.1 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Net) | 1.70% | 1.43% |

| Ticker Symbol | QUSOX | QUSIX |

Market Conditions and Investment Strategies

Macro-economic trends were mixed, with a modest GDP slowdown in China and Indiaoffset by growth in other emerging countries. Pessimistic markets expected cash flows of global companies to slow down, yet the majority of the Fund’s holdings produced strong earnings on a quarterly and yearly basis.

Defensive sector holdings helped mitigate the persistent volatility throughout the year, as the Fund’s Telecommunications, Utilities and Consumer Discretionary stocks posted strong returns. In the Telecommunications sector, Singapore-based M1 LTD and U.K.-based Alternative Networks posted double-digit returns, as both companies gained market share and customers.

In Utilities, Manila Water Company achieved strong annual returns due to rate adjustments, control of operating expenses and a revenue uptick. Equatorial Energia SA, a Brazilian electricity distributor, catered to robust demand in Northwest Brazil.

In Consumer Discretionary, Italian coffee machine company De’Longhi, Canada’s Astral Media and Belgian movie chain Kinepolis contributed to returns. Kinepolis increased its targeted theater marketing campaign, business-to-business plans and real estate development, while reducing debt.

Industrial holdings detracted from Fund performance due to continued slow global trade. During the year, the Fund sold out of seven stocks in this sector mostly due to structural changes in their fundamentals. Among retained holdings, TreviFinanziaria proved to be a fundamentally strong company, with growth in the foundation and oil drilling businesses. However, the stock dropped during the year due to expectations of lower demand and margins in the short term.

India’s Manappuram General Finance suffered losses due to loans collateralized on gold (as gold prices dropped) and recent government regulations. Among other Financials, Sparebanken of Norway experienced positive loan and deposit growth, but its stock declined due to the European debt crisis.

Portfolio Changes

For the fiscal year ended March 31, 2012, the Fund sold holdings in Materials, Industrials, Healthcare and Utilities. A number of Chinese companies were sold on corporate governance concerns although they continued their growth momentum. The Fund also sold stocks that had reached their valuation limits or were subject to takeover bids, redeploying the cash to more defensive names. The Fund purchased seven new companies diversified across industry and country.

PEAR TREE POLARIS FOREIGN VALUE SMALL CAP FUND

A Look Ahead

Over the past year, we witnessed a modest turnaround in investor sentiment, as a spate of good news led to generally positive global equity market performance. The U.S. maintained its tenuous slow growth trajectory, backed by lower unemployment and stabilized housing rates. Cautious optimism must be balanced with concerns about the European debt burden and slowing GDP in many Asian countries.

We still expect slow, volatile and mixed growth in GDP all across the world. We believe our portfolio is well-balanced and positioned for such an outlook. At the same time, we are on the constant lookout for companies that have attractive risk-return profiles in a portfolio management context, and will add to new stocks to the Fund on an opportunistic basis.

The Fund’s lead portfolio manager is Bernard R. Horn, Jr., of Polaris Capital Management, LLC

PEAR TREE COLUMBIA SMALL CAP FUND

Top 10 Holdings

| Percentage of total net assets | 21.7% |

| Manila Water Company, Inc. | 2.4% |

| Dr|$$|Adaegerwerk AG | 2.3% |

| Equatorial Energia S.A. | 2.2% |

| Freenet AG | 2.2% |

| M1 Ltd. | 2.1% |

| Alternative Networks PLC | 2.1% |

| Galliford Try PLC | 2.1% |

| Dockwise Ltd. | 2.1% |

| United Drug PLC | 2.1% |

| VST Holdings Ltd. | 2.1% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Consumer Discretionary | 25.3% |

| Consumer Staples | 12.0% |

| Information Technology | 11.6% |

| Industrials | 11.0% |

| Financials | 10.4% |

| Telecommunication Services | 6.5% |

| Health Care | 6.4% |

| Utilities | 6.3% |

| Materials | 6.2% |

| Energy | 2.1% |

| Cash and Other Assets (Net) | 2.2% |

Top 10 Country Allocations

| Percentage of total net assets | 73.2% |

| United Kingdom | 15.3% |

| Japan | 11.7% |

| Hong Kong | 8.2% |

| India | 8.2% |

| Ireland | 7.0% |

| Norway | 5.5% |

| Thailand | 5.0% |

| Germany | 4.5% |

| Sweden | 4.3% |

| Singapore | 3.5% |

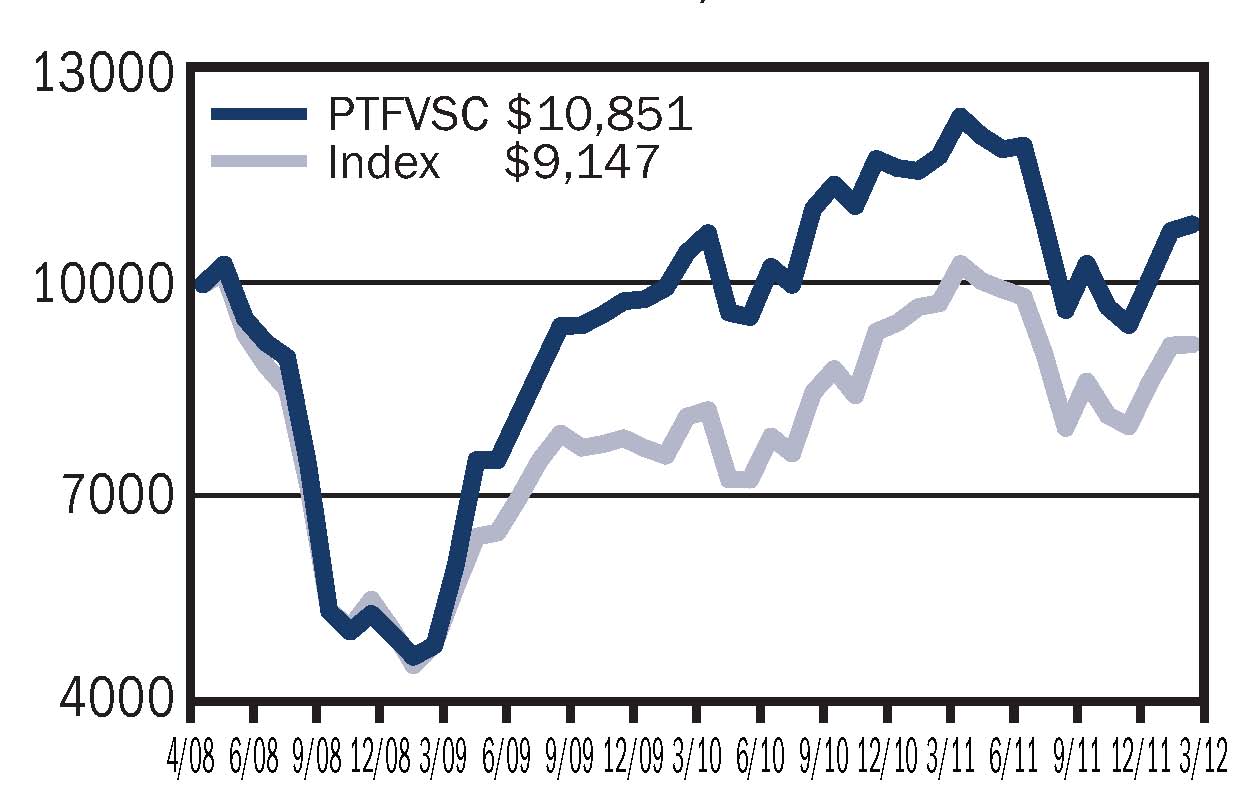

Value of a $10,000 Investment

Pear Tree Foreign Value Small Cap (PTFVSC) Ordinary Shares vs. S&P EPAC Small Cap Index

Average Annual Total Returns

| 1Q 2012 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 15.20% | 12.64% | –8.20% | 2.07% | 5/1/2008 | ||

Institutional Shares1 | 15.33% | 12.73% | –7.99% | 2.28% | 5/1/2008 | ||

S&P/EPAC Small Cap Index2 | 14.56% | 14.88% | –5.99% | –1.80% |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The S&P/Europe Pacific Asia Composite (“S&P/EPAC”) Index measures the bottom 20% of institutionary investable capital of developed and emerging (after 09/30/1994) countries, selected by the index sponsor outside of the United States. It is widely recognized as representative of the general market for foreign markets. Index returns assume the reinvestment of dividends and, unlike Fund returns, do no reflect any fees or expenses. You cannot invest directly in an Index. The Index was established in 1989.

Investing in foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE COLUMBIA SMALL CAP FUND

SCHEDULE OF INVESTMENTS

March 31, 2012

Common Stock—97.0%

| Shares | Value | |

| AIR FREIGHT & LOGISTICS—0.0% | ||

| Echo Global Logistics, Inc. (a) | 1,946 | $ 31,331 |

| BANKS—5.6% | ||

| 1st Source Corporation | 1,241 | 30,367 |

| Capital Bank Corporation (a) | 11,572 | 25,921 |

| Central Pacific Financial Corp. (a) | 2,433 | 31,507 |

| Citizens Republic Bancorp, Inc. (a) | 2,756 | 43,021 |

| CoBiz Financial, Inc. | 95,356 | 674,167 |

| Enterprise Financial Services Corp. | 2,123 | 24,924 |

| First Financial Northwest, Inc. (a) | 5,327 | 41,124 |

| F.N.B. Corporation | 166,616 | 2,012,721 |

| Northeast Bancorp | 1,818 | 21,507 |

| Pinnacle Financial Partners, Inc. (a) | 51,685 | 948,420 |

| Popular, Inc. (a) | 294,943 | 604,633 |

| Provident Financial Holdings, Inc. | 2,689 | 29,391 |

| Republic Bancorp, Inc., Class A | 1,373 | 32,842 |

| Southern Missouri Bancorp, Inc. | 1,398 | 35,789 |

| Susquehanna Bancshares, Inc. | 68,081 | 672,636 |

| United Bankshares, Inc. (b) | 17,339 | 500,404 |

| Virginia Commerce Bancorp, Inc. (a) | 4,066 | 35,700 |

5,765,074 | ||

| BEVERAGES—0.1% | ||

| Coffee Holding Co., Inc. (b) | 4,008 | 45,411 |

| National Beverage Corp. | 1,956 | 31,374 |

| 76,785 | ||

| CHEMICALS—0.1% | ||

| Rentech, Inc. (a) | 23,990 | 49,899 |

| COMMERCIAL SERVICES & SUPPLIES—10.4% | ||

| Acacia Research Corporation—Acacia Technologies (a) | 114,402 | 4,775,140 |

| Advance America, Cash Advance Centers, Inc. | 3,511 | 36,830 |

| American Public Education, Inc. (a) | 727 | 27,626 |

| Brightpoint, Inc. (a) | 2,920 | 23,506 |

| Collectors Universe, Inc. | 2,157 | 37,187 |

| Core-Mark Holding Company, Inc. | 794 | 32,506 |

| GasLog Ltd. (a) | 12,867 | 159,680 |

| Heartland Payment Systems, Inc. | 45,169 | 1,302,674 |

| Hudson Highland Group, Inc. (a) | 6,560 | 35,293 |

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| Insignia Systems, Inc. | 12,663 | 22,920 |

| Kforce, Inc. (a) | 125,366 | 1,867,953 |

| LML Payment Systems, Inc. (a) | 13,487 | 27,379 |

| Perma-Fix Environmental Services, Inc. (a) | 20,275 | $32,237 |

| SeaCube Container Leasing Ltd. | 2,122 | 36,498 |

| Standard Parking Corporation (a) | 1,759 | 36,060 |

| U.S. Ecology, Inc. | 38,541 | 837,881 |

| Waste Connections, Inc. | 40,544 | 1,318,896 |

| Willis Lease Finance Corporation (a) | 2,630 | 34,216 |

10,644,482 | ||

| COMMUNICATIONS EQUIPMENT—1.7% | ||

| NICE-Systems Ltd. (a)(c) | 43,431 | 1,706,838 |

| COMPUTERS & PERIPHERALS—0.0% | ||

| Xyratex Ltd. | 2,359 | 37,532 |

| CONSTRUCTION & ENGINEERING—0.0% | ||

| Primoris Services Corporation | 2,104 | 33,790 |

| DISTRIBUTORS—0.0% | ||

| AMCON Distributing Company | 317 | 19,892 |

| DIVERSIFIED FINANCIALS—4.1% | ||

| BlackRock Kelso Capital Corporation | 3,851 | 37,817 |

| Cascade Bancorp (a) | 6,706 | 38,090 |

| CompuCredit Holdings Corporation (a) | 8,493 | 49,259 |

| Diamond Hill Investment Group, Inc. | 425 | 31,301 |

| EZCORP, Inc., Class A (a) | 23,729 | 770,125 |

| First Cash Financial Services, Inc. (a) | 37,191 | 1,595,122 |

| Fortress Investment Group LLC, Class A | 9,298 | 33,101 |

| Gladstone Investment Corporation | 4,323 | 32,725 |

| Green Dot Corporation, Class A (a) | 29,265 | 776,108 |

| Hanmi Financial Corporation (a) | 4,247 | 42,980 |

| Hercules Technology Growth Capital, Inc. | 60,695 | 672,501 |

| Nicholas Financial, Inc. | 2,452 | 32,342 |

| TexasPacificLand Trust | 773 | 36,447 |

| White River Capital, Inc. | 1,552 | 34,532 |

| 4,182,450 | ||

| DIVERSIFIED TELECOMMUNICATION—0.0% | ||

| Vonage Holdings Corp. (a) | 12,827 | 28,348 |

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| ELECTRONIC EQUIPMENT & INSTRUMENTS—3.4% | ||

| Ascent Solar Technologies, Inc. (a) | 46,288 | 29,161 |

| DDi Corp. | 3,368 | 41,090 |

| Finisar Corporation (a) | 78,378 | 1,579,317 |

| OSI Systems, Inc. (a) | 28,647 | 1,756,061 |

| TESSCO Technologies, Inc. | 2,274 | $57,919 |

3,463,548 | ||

| ENERGY EQUIPMENT & SERVICES—7.2% | ||

| Core Laboratories N.V. | 35,388 | 4,655,999 |

| Dawson Geophysical Company (a) | 40,687 | 1,397,598 |

| Hornbeck Offshore Services, Inc. (a) | 30,145 | 1,266,994 |

| T.G.C. Industries, Inc. (a) | 4,402 | 43,668 |

| 7,364,259 | ||

| FINANCE—1.0% | ||

| Medley Capital Corporation | 63,193 | 712,185 |

| FOOD & DRUG RETAILING—2.2% | ||

| Arden Group, Inc. | 349 | 31,721 |

| Nash Finch Company | 1,073 | 30,495 |

| Pizza Inn Holdings, Inc. (a) | 5,714 | 27,656 |

| Spartan Stores, Inc. | 1,699 | 30,786 |

| United Natural Foods, Inc. (a) | 45,237 | 2,110,758 |

| Village Super Market, Inc. | 1,104 | 34,875 |

| 2,266,291 | ||

| FOOD PRODUCTS—3.6% | ||

| Andersons, Inc. (The) | 32,658 | 1,590,118 |

| Chefs’ Warehouse, Inc. (The) (a) | 1,760 | 40,726 |

| Hain Celestial Group, Inc. (a) | 36,319 | 1,591,135 |

| Roundy’s, Inc. (a) | 43,483 | 465,268 |

| USANA Health Sciences, Inc. (a) | 1,035 | 38,637 |

| 3,725,884 | ||

| HEALTH CARE EQUIPMENT & SUPPLIES—5.8% | ||

| Accuray Incorporated (a) | 56,524 | 399,059 |

| Align Technology, Inc. (a) | 46,186 | 1,272,424 |

| Natus Medical, Inc. (a) | 55,411 | 661,053 |

| SXC Health Solutions Corp. (a) | 35,759 | 2,680,495 |

| Syneron Medical Ltd. (a) | 81,320 | 871,750 |

| 5,884,781 | ||

| HEALTH CARE PROVIDERS & SERVICES—3.3% | ||

| BioScrip, Inc. (a) | 17,591 | 413,564 |

| Catalyst Health Solutions, Inc. (a) | 22,458 | 1,431,248 |

| Henry Schein, Inc. (a) | 20,031 | 1,515,946 |

| Metropolitan Health Networks, Inc. (a) | 4,206 | 39,410 |

| 3,400,168 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| HOTELS, RESTAURANTS & LEISURE—1.0% | ||

| Caribou Coffee Company, Inc. (a) | 2,253 | $41,996 |

| Great Wolf Resorts, Inc. (a) | 23,839 | 136,359 |

| Multimedia Games Holding Company, Inc. (a) | 3,958 | 43,380 |

| National CineMedia, Inc. | 51,249 | 784,110 |

1,005,845 | ||

| HOUSEHOLD DURABLES—0.5% | ||

| Emerson Radio Corp. (a) | 14,698 | 29,543 |

| M.D.C. Holdings, Inc. | 18,472 | 476,393 |

| U.S. Home Systems, Inc. | 4,725 | 44,037 |

| 549,973 | ||

| INSURANCE—0.0% | ||

| Crawford & Company, Class B | 5,101 | 24,995 |

| INTERNET & CATALOG RETAIL—0.3% | ||

| CafePress, Inc. (a) | 6,025 | 115,379 |

| Insight Enterprises, Inc. (a) | 2,056 | 45,088 |

| NutriSystem, Inc. | 2,430 | 27,289 |

| Overstock.com, Inc. (a) | 4,008 | 21,002 |

| PC Mall, Inc. (a) | 5,004 | 30,074 |

| Systemax, Inc. (a) | 1,915 | 32,287 |

| 271,119 | ||

| INTERNET SOFTWARE & SERVICES—4.8% | ||

| Allot Communications Ltd. (a) | 38,088 | 885,546 |

| Ancestry.com, Inc. (a)(b) | 48,709 | 1,107,643 |

| eGain Communications Corporation (a) | 4,549 | 27,294 |

| ICG Group, Inc. (a) | 121,201 | 1,084,749 |

| LivePerson (a) | 38,481 | 645,326 |

| LogMeIn, Inc. (a) | 33,495 | 1,180,029 |

| 4,930,587 | ||

| IT CONSULTING & SERVICES—6.3% | ||

| Alliance Data Systems Corporation (a) | 33,633 | 4,236,413 |

| Analysts International Corporation (a) | 5,467 | 29,576 |

| Computer Task Group, Inc. (a) | 2,232 | 34,194 |

| Glu Mobile, Inc. (a) | 155,845 | 755,848 |

| InterNAP Network Services Corporation (a) | 174,125 | 1,278,078 |

| Multiband Corporation (a) | 9,730 | 29,287 |

| Wayside Technology Group, Inc. | 2,575 | 36,591 |

| 6,399,987 | ||

| LEISURE EQUIPMENT & PRODUCTS—1.1% | ||

| Artic Cat, Inc. (a) | 13,945 | $597,264 |

| Callaway Golf Company | 72,487 | 490,012 |

| Sturm, Ruger& Co., Inc. | 939 | 46,105 |

1,133,381 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| MACHINERY—3.8% | ||

| Actuant Corporation | 39,433 | 1,143,163 |

| Argan, Inc. (a) | 2,066 | 33,139 |

| Gardner Denver, Inc. | 34,724 | 2,188,306 |

| Titan International, Inc. | 23,332 | 551,802 |

| 3,916,410 | ||

| MEDIA—5.3% | ||

| Cinemark Holdings, Inc. | 85,813 | 1,883,595 |

| IMAX Corporation (a) | 36,830 | 900,125 |

| Regal Entertainment Group, Class A (b) | 122,258 | 1,662,709 |

| TiVo Inc. (a) | 84,261 | 1,010,289 |

| 5,456,718 | ||

| METALS & MINING—0.1% | ||

| Friedman Industries, Inc. | 2,981 | 32,493 |

| Great Northern IronOre Properties (b) | 285 | 27,372 |

| Mesabi Trust | 1,252 | 38,361 |

| 98,226 | ||

| MULTILINE RETAIL—0.1% | ||

| Fred’’s, Inc., Class A | 2,155 | 31,484 |

| Gordmans Stores, Inc. (a) | 2,500 | 54,925 |

| 86,409 | ||

| OIL & GAS—0.6% | ||

| Abraxas Petroleum Corp. (a)(b) | 124,859 | 389,560 |

| Adams Resources & Energy, Inc. | 1,080 | 61,754 |

| Delek US Holdings, Inc. | 2,754 | 42,715 |

| Matador Resources Company | 331 | 3,624 |

| Natural Gas Services Group, Inc. (a) | 10,744 | 141,821 |

| SMF Energy Corporation | 11,027 | 12,902 |

| 652,376 | ||

| PERSONAL PRODUCTS—0.1% | ||

| Medifast, Inc. (a) | 2,291 | 40,001 |

| Natural Alternatives International, Inc. (a) | 3,555 | 22,218 |

| 62,219 | ||

| PHARMACEUTICALS—2.6% | ||

| Impax Laboratories, Inc. (a) | 61,506 | $1,511,818 |

| Par Pharmaceutical Companies, Inc. (a) | 30,151 | 1,167,748 |

2,679,566 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| REAL ESTATE—10.6% | ||

| American Campus Communities, Inc. | 32,060 | 1,433,723 |

| Brandywine Realty Trust | 87,196 | 1,001,011 |

| Dynex Capital, Inc. | 3,442 | 32,871 |

| Education Realty Trust, Inc. | 46,514 | 504,212 |

| Entertainment Properties Trust | 87,517 | 4,059,038 |

| Hersha Hospitality Trust | 684,772 | 3,738,855 |

| InterGroup Corporation (a) | 1,548 | 30,914 |

| Newcastle Investment Corp. | 6,758 | 42,440 |

| 10,843,064 | ||

| ROAD & RAIL—1.2% | ||

| Old Dominion Freight Line (a) | 21,778 | 1,038,157 |

| Pacer International, Inc. (a) | 5,874 | 37,124 |

| Quality Distribution, Inc. (a) | 2,793 | 38,488 |

| TravelCenters of America LLC (a) | 7,394 | 46,878 |

| Universal Truckload Services, Inc. | 1,732 | 26,084 |

| 1,186,731 | ||

| SEMICONDUCTOR EQUIPMENT & PRODUCTS—1.7% | ||

| MIPS Technologies, Inc. (a) | 147,788 | 803,967 |

| Nova Measuring Instruments Ltd. (a) | 4,265 | 38,214 |

| Tessera Technologies, Inc. (a) | 53,604 | 924,669 |

| 1,766,850 | ||

| SOFTWARE—1.0% | ||

| Majesco Entertainment Company (a) | 12,880 | 31,814 |

| MicroStrategy, Inc. (a) | 3,706 | 518,840 |

| Verint Systems, Inc. (a) | 13,124 | 425,086 |

| 975,740 | ||

| SPECIALTY RETAIL—1.3% | ||

| Asbury Automotive Group, Inc. (a) | 1,458 | 39,366 |

| hhgregg, Inc. (a) | 2,174 | 24,740 |

| PC Connection, Inc. | 2,834 | 23,296 |

| Pier 1 Imports, Inc. (a) | 60,669 | 1,102,962 |

| Sonic Automotive, Inc., Class A | 2,122 | 38,005 |

| Susser Holdings Corp. (a) | 1,389 | 35,656 |

| Trans World Entertainment Corporation (a) | 8,777 | $ 18,607 |

| Winmark Corporation | 547 | 31,693 |

| 1,314,325 | ||

| TEXTILES & APPAREL—1.5% | ||

| Body Central Corp. (a) | 1,259 | 36,536 |

| DGSE Companies, Inc. (a) | 4,206 | 31,461 |

| Kingold Jewelry, Inc. (a) | 27,277 | 40,916 |

| Liz Claiborne, Inc. (a) | 48,769 | 651,554 |

| Vera Bradley, Inc. (b) | 27,047 | 816,549 |

| 1,577,016 |

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| WIRELESS TELECOMMUNICATION SERVICES—4.6% | ||

| Pendrell Corporation (a) | 12,277 | 32,043 |

| SBA Communications Corp., Class A (a) | 92,526 | 4,701,246 |

| 4,733,289 | ||

| TOTAL COMMON STOCK | ||

| (Cost $73,094,597) | 99,058,363 | |

| Short Term Investments—0.0% | ||

| Par Value | Value | |

| State Street Bank &Trust Co., Repurchase Agreement .01%, 04/02/12, (Dated 03/30/12), Collateralized by $15,000 par U.S. Treasury Note-3.125% due 05/15/2021, Market Value $16,757, Repurchase Proceeds $15,352 (Cost $15,352) | $15,352 | 15,352 |

TOTAL INVESTMENTS (EXCLUDING INVESTMENTS PURCHASED WITH CASH COLLATERAL FROM SECURITIES LOANED)—97.0% (Cost $73,109,949) | 99,073,715 | |

INVESTMENTS PURCHASED WITH CASH COLLATERAL FROM SECURITIES LOANED—4.2% | ||

| Money Market—4.2% | ||

Western Asset Institutional Cash Reserve-Inst. (Cost $4,251,048) | 4,251,048 | 4,251,048 |

TOTAL INVESTMENTS—101.2% (Cost $77,360,997) (d) | 103,324,763 | |

| OTHER ASSETS & LIABILITIES (NET)—(1.2%) | (1,213,657) | |

| NET ASSETS—100% | $102,111,106 | |

The accompanying notes are an integral part of these financial statements.

| (a) | Non-income producing security |

| (b) | All or a portion of this security was out on loan. |

| (c) | ADR—American Depositary Receipts |

| (d) | At March 31, 2012, the unrealized appreciation of investments based on aggregate cost for federal tax purposes of $78,530,868 was as follows: |

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $26,595,354 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (1,801,459) |

| Net unrealized appreciation / (depreciation) | $24,793,895 |

The accompanying notes are an integral part of these financial statements.

PEAR TREE COLUMBIA MICRO CAP FUND

SCHEDULE OF INVESTMENTS

March 31, 2012

Common Stock—92.9%

| Shares | Value | |

| AIR FREIGHT & LOGISTICS—0.8% | ||

| Echo Global Logistics, Inc. (a) | 2,217 | $35,694 |

| BANKS—9.7% | ||

| 1st Source Corporation | 1,412 | 34,552 |

| Capital Bank Corporation (a) | 17,145 | 38,405 |

| Central Pacific Financial Corp. (a) | 2,772 | 35,897 |

| Citizens Republic Bancorp, Inc. (a) | 3,142 | 49,047 |

| Enterprise Financial Services Corp. | 2,420 | 28,411 |

| First Financial Northwest, Inc. (a) | 6,070 | 46,860 |

| Northeast Bancorp | 2,500 | 29,575 |

| Provident Financial Holdings, Inc. | 3,729 | 40,758 |

| Republic Bancorp, Inc., Class A | 1,564 | 37,411 |

| Southern Missouri Bancorp, Inc. | 1,594 | 40,806 |

| Virginia Commerce Bancorp, Inc. (a) | 4,633 | 40,678 |

422,400 | ||

| BEVERAGES—2.0% | ||

| Coffee Holding Co., Inc. | 4,568 | 51,755 |

| National Beverage Corp. | 2,229 | 35,753 |

| 87,508 | ||

| CHEMICALS—1.3% | ||

| Rentech, Inc. (a) | 27,337 | 56,861 |

| COMMERCIAL SERVICES & SUPPLIES—11.1% | ||

| Advance America, Cash Advance Centers, Inc. | 4,002 | 41,981 |

| American Public Education, Inc. (a) | 827 | 31,426 |

| Brightpoint, Inc. (a) | 3,328 | 26,790 |

| Collectors Universe, Inc. | 2,457 | 42,359 |

| Core-Mark Holding Company, Inc. | 904 | 37,010 |

| Heartland Payment Systems, Inc. | 1,471 | 42,424 |

| Hudson Highland Group, Inc. (a) | 7,477 | 40,226 |

| Insignia Systems, Inc. | 17,325 | 31,358 |

| LML Payment Systems, Inc. (a) | 15,370 | 31,201 |

| Perma-Fix Environmental Services, Inc. (a) | 23,105 | 36,737 |

| SeaCube Container Leasing Ltd. | 2,419 | 41,607 |

| Standard Parking Corporation (a) | 2,004 | 41,082 |

| Willis Lease Finance Corporation (a) | 2,997 | 38,991 |

| 483,192 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| COMPUTERS & PERIPHERALS—1.0% | ||

| Xyratex Ltd. | 2,689 | 42,782 |

| CONSTRUCTION & ENGINEERING—0.9% | ||

| Primoris Services Corporation | 2,399 | $38,528 |

| DISTRIBUTORS—0.6% | ||

| AMCON Distributing Company | 409 | 25,665 |

| DIVERSIFIED FINANCIALS—9.7% | ||

| BlackRock Kelso Capital Corporation | 4,388 | 43,090 |

| Cascade Bancorp (a) | 8,099 | 46,002 |

| CompuCredit Holdings Corporation (a) | 9,679 | 56,138 |

| Diamond Hill Investment Group, Inc. | 484 | 35,647 |

| Fortress Investment Group LLC, Class A | 10,596 | 37,722 |

| Gladstone Investment Corporation | 4,926 | 37,290 |

| Hanmi Financial Corporation (a) | 4,839 | 48,971 |

| Nicholas Financial, Inc. | 2,794 | 36,853 |

| TexasPacificLand Trust | 881 | 41,539 |

| White River Capital, Inc. | 1,769 | 39,360 |

422,612 | ||

| DIVERSIFIED TELECOMMUNICATION—0.7% | ||

| Vonage Holdings Corp. (a) | 14,618 | 32,306 |

| ELECTRONIC EQUIPMENT& INSTRUMENTS—3.9% | ||

| Ascent Solar Technologies, Inc. (a) | 86,147 | 54,273 |

| DDi Corp. | 3,839 | 46,836 |

| TESSCO Technologies, Inc. | 2,592 | 66,018 |

| 167,127 | ||

| ENERGY EQUIPMENT & SERVICES—1.2% | ||

| T.G.C. Industries, Inc. (a) | 5,016 | 49,759 |

| FOOD & DRUG RETAILING—4.1% | ||

| Arden Group, Inc. | 398 | 36,174 |

| Nash Finch Company | 1,223 | 34,758 |

| Pizza Inn Holdings, Inc. (a) | 6,511 | 31,513 |

| Spartan Stores, Inc. | 1,935 | 35,062 |

| Village Super Market, Inc. | 1,259 | 39,772 |

| 177,279 | ||

| FOOD PRODUCTS—2.1% | ||

| Chefs’ Warehouse, Inc. (The) (a) | 2,005 | 46,396 |

| USANA Health Sciences, Inc. (a) | 1,179 | 44,012 |

| 90,408 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| HEALTH CARE PROVIDERS & SERVICES—1.0% | ||

| Metropolitan Health Networks, Inc. (a) | 4,794 | 44,920 |

| HOTELS, RESTAURANTS & LEISURE—2.2% | ||

| Caribou Coffee Company, Inc. (a) | 2,567 | $47,849 |

| Multimedia Games Holding Company, Inc. (a) | 4,511 | 49,440 |

| 97,289 | ||

| HOUSEHOLD DURABLES—2.2% | ||

| Emerson Radio Corp. (a) | 21,684 | 43,585 |

| U.S. Home Systems, Inc. | 5,385 | 50,188 |

| 93,773 | ||

| INSURANCE—0.7% | ||

| Crawford & Company, Class B | 5,814 | 28,489 |

| INTERNET & CATALOG RETAIL—4.0% | ||

| Insight Enterprises, Inc. (a) | 2,194 | 48,114 |

| NutriSystem, Inc. | 2,770 | 31,107 |

| Overstock.com, Inc. (a) | 4,568 | 23,936 |

| PC Mall, Inc. (a) | 5,703 | 34,275 |

| Systemax, Inc. (a) | 2,182 | 36,789 |

174,221 | ||

| INTERNET SOFTWARE & SERVICES—0.7% | ||

| eGain Communications Corporation (a) | 5,183 | 31,098 |

| IT CONSULTING & SERVICES—3.4% | ||

| Analysts International Corporation (a) | 6,390 | 34,570 |

| Computer Task Group, Inc. (a) | 2,544 | 38,974 |

| Multiband Corporation (a) | 11,087 | 33,372 |

| Wayside Technology Group, Inc. | 2,936 | 41,720 |

| 148,636 | ||

| LEISURE EQUIPMENT & PRODUCTS—1.2% | ||

| Sturm, Ruger& Co., Inc. | 1,071 | 52,586 |

| MACHINERY—0.9% | ||

| Argan, Inc. (a) | 2,354 | 37,758 |

| METALS & MINING—2.6% | ||

| Friedman Industries, Inc. | 3,398 | 37,038 |

| Great Northern IronOre Properties | 325 | 31,213 |

| Mesabi Trust | 1,426 | 43,693 |

| 111,944 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| MULTILINE RETAIL—2.3% | ||

| Fred’’s, Inc., Class A | 2,456 | 35,882 |

| Gordmans Stores, Inc. (a) | 2,849 | 62,593 |

| 98,475 | ||

| OIL & GAS—3.1% | ||

| Adams Resources & Energy, Inc. | 1,231 | $70,389 |

| Delek US Holdings, Inc. | 3,138 | 48,670 |

| SMF Energy Corporation | 12,565 | 14,701 |

133,760 | ||

| PERSONAL PRODUCTS—1.6% | ||

| Medifast, Inc. (a) | 2,610 | 45,570 |

| Natural Alternatives International, Inc. (a) | 4,051 | 25,319 |

| 70,889 | ||

| REAL ESTATE—2.9% | ||

| Dynex Capital, Inc. | 3,922 | 37,455 |

| InterGroup Corporation (a) | 1,957 | 39,081 |

| Newcastle Investment Corp. | 7,701 | 48,362 |

| 124,898 | ||

| ROAD & RAIL—3.9% | ||

| Pacer International, Inc. (a) | 6,694 | 42,306 |

| Quality Distribution, Inc. (a) | 3,183 | 43,862 |

| TravelCenters of America LLC (a) | 8,427 | 53,427 |

| Universal Truckload Services, Inc. | 1,974 | 29,728 |

| 169,323 | ||

| SEMICONDUCTOR EQUIPMENT & PRODUCTS—1.0% | ||

| Nova Measuring Instruments Ltd. (a) | 4,859 | 43,537 |

| SOFTWARE—0.8% | ||

| Majesco Entertainment Company (a) | 14,677 | 36,252 |

| SPECIALTY RETAIL—5.6% | ||

| Asbury Automotive Group, Inc. (a) | 1,662 | 44,874 |

| hhgregg, Inc. (a) | 2,478 | 28,200 |

| PC Connection, Inc. | 3,229 | 26,542 |

| Sonic Automotive, Inc., Class A | 2,419 | 43,324 |

| Susser Holdings Corp. (a) | 1,583 | 40,636 |

| Trans World Entertainment Corporation (a) | 10,824 | 22,947 |

| Winmark Corporation | 624 | 36,154 |

| 242,677 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| TEXTILES & APPAREL—2.9% | ||

| Body Central Corp. (a) | 1,436 | 41,673 |

| DGSE Companies, Inc. (a) | 4,794 | 35,859 |

| Kingold Jewelry, Inc. (a) | 31,366 | 47,049 |

| 124,581 | ||

| WIRELESS TELECOMMUNICATION SERVICES—0.8% | ||

| Pendrell Corporation (a) | 13,990 | $36,514 |

| TOTAL COMMON STOCK | ||

| (Cost $3,673,622) | 4,033,741 | |

| Exchange Traded Funds—4.3% | ||

| iShares Russell Microcap Index | ||

| (Cost $185,313) | 3,601 | 185,091 |

| Short Term Investments—4.6% | ||

| Par Value | Value | |

| State Street Bank &Trust Co., Repurchase Agreement .01%, 04/02/12, (Dated 03/30/12), Collateralized by $185,000 par U.S. Treasury Note-3.125% due 05/15/2021, Market Value $206,664, Repurchase Proceeds $198,431 (Cost $198,431) | $198,431 | 198,431 |

TOTAL INVESTMENTS—101.8% (Cost $4,057,366) (b) | 4,417,263 | |

| OTHER ASSETS & LIABILITIES (NET)—(1.8%) | (73,373) | |

| NET ASSETS—100% | $4,343,890 | |

| (a) | Non-income producing security |

| (b) | At March 31, 2012, the unrealized appreciation of investments based on aggregate cost for federal tax purposes of $4,057,228 was as follows: |

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $491,481 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (131,446) |

| Net unrealized appreciation / (depreciation) | $360,035 |

The accompanying notes are an integral part of these financial statements.

PEAR TREE QUALITY FUND

SCHEDULE OF INVESTMENTS

March 31, 2012

Common Stock—99.1%

| Shares | Value | |

| AEROSPACE & DEFENSE—0.0% | ||

| United Technologies Corporation | 45 | $ 3,732 |

| BEVERAGES—5.5% | ||

| Anheuser-Busch InBev SA (b) | 8,876 | 645,463 |

| Coca-Cola Company (The) | 52,962 | 3,919,717 |

| Monster Beverage Corporation (a) | 10,119 | 628,289 |

| 5,193,469 | ||

| COMMUNICATIONS EQUIPMENT—1.5% | ||

| QUALCOMM Incorporated | 20,615 | 1,402,232 |

| COMPUTERS & PERIPHERALS—8.1% | ||

| Apple, Inc. (a) | 7,406 | 4,439,675 |

| Hewlett-Packard Company | 45,641 | 1,087,625 |

| International Business Machines | 10,398 | 2,169,543 |

| 7,696,843 | ||

| FOOD PRODUCTS—3.1% | ||

| Nestle, S.A. (b) | 18,243 | 1,149,309 |

| Unilever NA (b) | 52,231 | 1,777,421 |

| 2,926,730 | ||

| FOOD STAPLES & DRUG RETAILING—6.3% | ||

| PepsiCo, Inc. | 32,883 | 2,181,787 |

| SYSCO Corporation | 9,994 | 298,421 |

| Wal-Mart Stores, Inc. | 47,977 | 2,936,193 |

| Walgreen Co. | 17,156 | 574,554 |

| 5,990,955 | ||

| HEALTH CARE EQUIPMENT & SERVICES—5.0% | ||

| Baxter International Inc. | 212 | 12,673 |

| Express Scripts, Inc. (a) | 22,760 | 1,233,137 |

| Intuitive Surgical, Inc. (a) | 53 | 28,713 |

| Medtronic, Inc. | 26,389 | 1,034,185 |

| UnitedHealth Group, Inc. | 30,738 | 1,811,698 |

| Zimmer Holdings, Inc. (a) | 10,195 | 655,334 |

| 4,775,740 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| HEALTH CARE PROVIDERS & SERVICES—0.4% | ||

| Cerner Corporation (a) | 173 | 13,176 |

| Henry Schein, Inc. (a) | 1,429 | 108,147 |

| Laboratory Corporation of America Holdings (a) | 328 | 30,025 |

| Lincare Holdings, Inc. | 2,846 | 73,654 |

| Quest Diagnostics Incorporated | 1,707 | 104,383 |

| WellPoint, Inc. | 163 | 12,029 |

| 341,414 | ||

| HOTELS, RESTAURANTS &LEISURE—0.5% | ||

| McDonald’s Corporation | 4,672 | $458,323 |

| HOUSEHOLD PRODUCTS—3.9% | ||

| Church & Dwight Co., Inc. | 3,386 | 166,557 |

| Colgate-Palmolive Company | 14,440 | 1,411,943 |

| Procter & Gamble Company | 31,074 | 2,088,484 |

| 3,666,984 | ||

| INDUSTRIAL CONGLOMERATES—0.1% | ||

| 3M Company | 1,336 | 119,185 |

| MULTILINE RETAIL—1.2% | ||

| Target Corporation | 20,584 | 1,199,430 |

| OIL & GAS—11.2% | ||

| BP plc (b) | 52,417 | 2,358,765 |

| Chevron Corporation | 26,383 | 2,829,313 |

| Exxon Mobil Corporation | 24,761 | 2,147,522 |

| Royal Dutch Shell plc (b) | 30,196 | 2,117,645 |

| TOTAL S.A. (b) | 23,521 | 1,202,393 |

| 10,655,638 | ||

| PHARMACEUTICALS &BIOTECHNOLOGY—18.4% | ||

| Abbott Laboratories | 35,404 | 2,169,911 |

| Amgen, Inc. | 14,510 | 986,535 |

| AstraZeneca PLC (b) | 11,605 | 516,306 |

| Bristol-Myers Squibb Company | 251 | 8,471 |

| Eli Lilly and Company | 5,780 | 232,761 |

| Gilead Sciences, Inc. (a) | 2,164 | 105,711 |

| GlaxoSmithKline plc (b) | 41,925 | 1,882,852 |

| Johnson & Johnson | 72,823 | 4,803,405 |

| Merck & Co., Inc. | 34,588 | 1,328,179 |

| Novartis AG (b) | 19,353 | 1,072,350 |

| Pfizer, Inc. | 161,263 | 3,654,220 |

| Roche Holding Ltd (b) | 5,825 | 254,203 |

| Sanofi-Aventis (b) | 11,336 | 439,270 |

| Takeda Pharmaceutical Company Limited (b) | 4,366 | 96,052 |

| 17,550,226 | ||

The accompanying notes are an integral part of these financial statements.

| Shares | Value | |

| SOFTWARE & SERVICES—22.7% | ||

| Cisco Systems, Inc. | 245,018 | 5,182,131 |

| Google, Inc. (a) | 6,097 | 3,909,640 |

| MasterCard Incorporated | 2,246 | 944,533 |

| Microsoft Corporation | 183,694 | 5,924,132 |

| Oracle Corporation (a) | 121,784 | 3,551,221 |

| SAP AG (b) | 12,217 | 852,991 |

| Visa, Inc. | 10,097 | $1,191,446 |

| Yahoo! Inc. (a) | 402 | 6,118 |

| 21,562,212 | ||

| SPECIALTY RETAIL—1.2% | ||

| Lowe’s Companies, Inc. | 36,525 | 1,146,155 |

| TEXTILES & APPAREL—1.3% | ||

| Nike, Inc. | 11,095 | 1,203,142 |

| TOBACCO—8.7% | ||

| Altria Group, Inc. | 846 | 26,116 |

| British American Tobacco p.l.c. (b) | 25,052 | 2,535,764 |

| Lorillard, Inc. | 4,959 | 642,091 |

| Philip Morris International, Inc. | 57,858 | 5,126,797 |

| Reynolds American, Inc. | 69 | 2,860 |

| 8,333,628 | ||

| WIRELESS TELECOMMUNICATIONS—0.0% | ||

| NTT DOCOMO, Inc. (b) | 457 | 7,618 |

| TOTAL COMMON STOCK | ||

| (Cost $84,044,635) | 94,233,656 | |

| Short Term Investments—0.3% | ||

| Par Value | Value | |

| State Street Bank & Trust Co., Repurchase Agreement .01%, 04/02/12, (Dated 03/30/12), Collateralized by 255,000 par U.S. Treasury Note-3.125% due 05/15/2021, Market Value $284,861, Repurchase Proceeds $276,268 (Cost $276,268) | $276,268 | 276,268 |

| TOTAL SHORT TERM INVESTMENTS—0.3% | 276,268 | |

TOTAL INVESTMENTS—99.4% (Cost $84,320,903) (c) | 94,509,924 | |

| OTHER ASSETS & LIABILITIES (NET)—0.6% | 605,434 | |

| NET ASSETS—100% | $95,115,358 | |

The accompanying notes are an integral part of these financial statements.

| (a) | Non-Income producing security |

| (b) | ADR—American Depositary Receipts |

| (c) | At March 31, 2012, the unrealized appreciation of investments based on aggregate cost for federal tax purposes of $84,912,182 was as follows: |

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $10,532,194 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (934,452) |

| Net unrealized appreciation / (depreciation) | $9,597,742 |

| The percentage of each investment category is calculated as a percentage of net assets. |

The accompanying notes are an integral part of these financial statements.

PEAR TREE PANAGORA DYNAMIC EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS

March 31, 2012

Common Stock—93.7%

| Shares | Value | |

| BRAZIL—8.1% | ||

| Banco do Brasil SA | 102,010 | $1,453,365 |

| BM&F Bovespa SA | 205,725 | 1,269,545 |

| Companhia de Bebidas das Americas (c) | 9,172 | 702,759 |

| Companhia de SaneamentoBasico (c) | 44,669 | 1,845,723 |

| Cosan SA Industria e Comercio | 34,535 | 643,905 |

| EZ TEC Empreendimentos e Participacoes SA | 24,935 | 308,025 |

| Gerdau SA (c) | 11,062 | 106,527 |

| ObrasconHuarte Lain Brasil SA | 5,020 | 212,194 |

| PetroleoBrasileiro SA | 92,583 | 1,235,186 |

| PetroleoBrasileiro SA (c) | 87,485 | 2,236,117 |

| Sao Martinho SA | 14,418 | 185,153 |

| Sul America SA | 85,383 | 801,608 |

| Tele Norte LesteParticipacoes SA (c) | 60,130 | 682,475 |

| Vale SA | 59,853 | 1,409,736 |

13,092,318 | ||

| CHILE—1.8% | ||

| BancoSantanderChile (c) | 8,379 | 721,348 |

| CompaniaCerveceriasUnidas SA (c) | 6,908 | 543,591 |

| Enersis SA (c) | 42,207 | 852,159 |

| Lan Airlines SA (b)(c) | 26,892 | 782,288 |

| 2,899,386 | ||

| CHINA—11.1% | ||

| Bank of China Ltd., Class H | 4,945,902 | 1,987,470 |

| China Communications Construction Co., Ltd., Class H (a) | 681,680 | 681,307 |

| China Construction Bank Corporation | 3,558,733 | 2,754,675 |

| China Petroleum & Chemical Corporation | 1,722,000 | 1,874,090 |

| China Pharmaceutical Group Limited | 831,011 | 190,514 |

| China Shenhua Energy Co., Ltd. | 252,105 | 1,061,768 |

| China Yuchai International Ltd. | 23,261 | 369,152 |

| Dongfeng Motor Group Company Limited | 808,881 | 1,458,523 |

| Giant Interactive Group, Inc. (b)(c) | 47,823 | 234,333 |

| Great Wall Motor Co., Ltd. (b) | 799,500 | 1,556,936 |