OMB APPROVAL

OMB Number: 3235-0570

Expires: January 31, 2017

Estimated average burden

hours per response..... 20.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3790

Pear Tree Funds

(Exact name of registrant as specified in charter)

55 Old Bedford Road, Lincoln, MA 01773

(Address of principal executive offices)

Willard L. Umphrey

Pear Tree Advisors, Inc.

55 Old Bedford Road, Lincoln, MA 01773

(Name and address of agent for service)

Registrant’s telephone number, including area code: (781) 676-5900

Date of fiscal year end: March 31

Date of reporting period: April 1, 2013 through March 31, 2014

ITEM 1. REPORTS TO SHAREOWNERS.

PEAR TREE FUNDS

Pear Tree Columbia Small Cap Fund

Pear Tree Quality Fund

Pear Tree PanAgora Dynamic Emerging Markets Fund

Pear Tree PanAgora Risk Parity Emerging Markets Fund

Pear Tree Polaris Foreign Value Fund

Pear Tree Polaris Foreign Value Small Cap Fund

ANNUAL REPORT

March 31, 2014

TABLE OF CONTENTS

| President’s Letter | 1 |

| Fund Expenses | 2 |

| Portfolio Manager Commentaries | 4 |

| Pear Tree Columbia Small Cap Fund | 4 |

| Pear Tree Quality Fund | 6 |

| Pear Tree PanAgora Dynamic Emerging Markets Fund | 8 |

| Pear Tree PanAgora Risk Parity Emerging Markets Fund | 10 |

| Pear Tree Polaris Foreign Value Fund | 12 |

| Pear Tree Polaris Foreign Value Small Cap Fund | 16 |

| Schedules of Investments | 20 |

| Pear Tree Columbia Small Cap Fund | 20 |

| Pear Tree Quality Fund | 25 |

| Pear Tree PanAgora Dynamic Emerging Markets Fund | 30 |

| Pear Tree PanAgora Risk Parity Emerging Markets Fund | 39 |

| Pear Tree Polaris Foreign Value Fund | 57 |

| Pear Tree Polaris Foreign Value Small Cap Fund | 60 |

| Statements of Assets and Liabilities | 64 |

| Statements of Operations | 68 |

| Statements of Changes in Net Assets | 70 |

| Financial Highlights | 76 |

| Notes to Financial Statements | 88 |

| Report of Independent Registered Public Accounting Firm | 107 |

| Information for Shareholders | 108 |

| Management Contract and Advisory Contract Approval | 109 |

| Privacy Notice | 111 |

| Trustees and Officers | 114 |

| Service Providers | inside back cover |

This report must be preceded or accompanied by a current Pear Tree Funds prospectus for individuals who are not current shareholders of the Funds. If you are not a shareholder of a Pear Tree Fund, you should read the prospectus carefully before investing because it contains more complete information on the Pear Tree Funds’ investment objectives, risks, charges and expenses. Please consider this information carefully. For a prospectus and other information, visit www.peartreefunds.com or call (800) 326-2151.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither Pear Tree Funds nor U.S. Boston Capital Corporation is a bank.

Dear Fellow Shareholder,

We are pleased to provide you with the Pear Tree Funds’ Annual Report for the twelve-month period ended March 31, 2014 and to update you on recent market conditions and the performance of the Pear Tree Funds.

For current performance information, please visit our website at www.peartreefunds.com. We thank you for your continued confidence in the Pear Tree Funds. Please feel free to e-mail us at feedback@peartreefunds.com or call us at 800-326-2151 with any questions or for assistance on your account.

Sincerely,

Willard Umphrey

President and Chairman

Any statements in this report regarding market or economic trends or the factors influencing the historical or future performance of the Pear Tree Funds are the views of the Funds’ Investment Manager and Sub-Advisers as of the date of this report. These views are subject to change at any time based upon market and other conditions, and Fund management and the subadvisors to the Funds disclaim any responsibility to update such views. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any Pear Tree Fund. Any references to specific securities are not recommendations of such securities and may not be representative of any Pear Tree Fund’s current or future investments.

Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

PEAR TREE FUNDS

FUND EXPENSES

We believe it’s important for Fund shareholders to have a clear understanding of fund expenses and the impact expenses have on investment returns. The following is important information about each Fund’s Expense Example, which appears below.

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution (12b-1) fees (on Ordinary Shares) and other Fund expenses. The example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on $1,000 being invested at the beginning of the period and held for the entire period from October 1, 2013 to March 31, 2014.

Actual Expenses

The first line for each Share Class for each Fund provides information about actual account returns and actual expenses. You may use the information in this line, together with the amount you invested for that Fund and Share Class, to estimate the expenses that you paid over the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000, then multiply the result by the number under the heading “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line for each Share Class for each Fund shows you hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return.

The hypothetical account values and hypothetical expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information only to compare the ongoing expenses of investing in the Fund with the ongoing expenses of other funds. To do so, compare the Fund’s 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expense Example for the 6 months ended March 31, 2014

| Pear Tree Fund | Share Class | Total Return Description | Beginning Account Value 10/1/13 | Ending Account Value 3/31/2014 | Annualized Expense Ratio | Expenses Paid* 10/1/2013 – 3/31/2014 |

| Small Cap | Ordinary | Actual | $1,000.00 | $1,077.60 | 1.55% | $8.02 |

| Hypothetical | $1,000.00 | $1,017.21 | 1.55% | $7.78 | ||

| Institutional | Actual | $1,000.00 | $1,079.10 | 1.30% | $6.74 | |

| Hypothetical | $1,000.00 | $1,018.44 | 1.30% | $6.55 | ||

| Quality | Ordinary | Actual | $1,000.00 | $1,117.30 | 1.31% | $6.91 |

| Hypothetical | $1,000.00 | $1,018.40 | 1.31% | $6.59 | ||

| Institutional | Actual | $1,000.00 | $1,118.90 | 1.07% | $5.67 | |

| Hypothetical | $1,000.00 | $1,019.58 | 1.07% | $5.40 | ||

| Emerging Markets | Ordinary | Actual | $1,000.00 | $1,003.80 | 1.47% | $7.33 |

| Hypothetical | $1,000.00 | $1,017.62 | 1.47% | $7.38 | ||

| Institutional | Actual | $1,000.00 | $1,005.30 | 1.22% | $6.10 | |

| Hypothetical | $1,000.00 | $1,018.85 | 1.22% | $6.14 | ||

| Risk Parity | Ordinary | Actual | $1,000.00 | $1,003.70 | 2.10% | $10.50 |

| Emerging Markets | Hypothetical | $1,000.00 | $1,014.45 | 2.10% | $10.56 | |

| Institutional | Actual | $1,000.00 | $1,008.70 | 1.70% | $8.52 | |

| Hypothetical | $1,000.00 | $1,016.45 | 1.70% | $8.55 | ||

| Foreign Value | Ordinary | Actual | $1,000.00 | $1,138.60 | 1.53% | $8.18 |

| Hypothetical | $1,000.00 | $1,017.28 | 1.53% | $7.72 | ||

| Institutional | Actual | $1,000.00 | $1,140.70 | 1.28% | $6.83 | |

| Hypothetical | $1,000.00 | $1,018.55 | 1.28% | $6.44 | ||

| Foreign Value | Ordinary | Actual | $1,000.00 | $1,203.80 | 1.57% | $8.63 |

| Small Cap | Hypothetical | $1,000.00 | $1,017.10 | 1.57% | $7.90 | |

| Institutional | Actual | $1,000.00 | $1,205.10 | 1.32% | $7.27 | |

| Hypothetical | $1,000.00 | $1,018.34 | 1.32% | $6.66 |

* “Expenses Paid” for each Fund share class relating to actual or hypothetical returns, is the amount equal to the product of (a) that Fund’s and Share Class’ average account value for the six-month period ended March 31, 2014, multiplied by (b) the corresponding “Annualized Expense Ratio” multiplied by (c) the fraction 182/365 (which reflects the six-month period covered by this report).

PEAR TREE COLUMBIA SMALL CAP FUND

INVESTMENT PROFILE

All Data as of March 31, 2014

| Fund Information | ||

| Net Assets Under Management | $117.2 Million | |

| Number of Companies | 78 | |

| Price to Book Ratio | 4.0 | |

| Price to Earnings Ratio | 29.7 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Gross)* | 1.80% | 1.55% |

| Total Expense Ratio (Net)* | 1.80% | 1.55% |

| Ticker Symbol | USBNX | QBNAX |

| * per prospectus dated August 1, 2013. See financial highlights for total expense ratios for the fiscal year ended March 31, 2014. | ||

Investment Commentary

For the annual period ended March 31, 2014 the Pear Tree Columbia Small Cap Fund’s Ordinary Shares (the “Fund”) underperformed its benchmark, the Russell 2000 Index. The Fund achieved a return of 22.76% at net asset value compared to 24.90% for the Index.

Market Conditions and Investment Strategies

It was a great year for equity markets and for small cap stocks in particular. Despite modest economic growth, stocks were the beneficiary of the Federal Reserve’s low interest rate policy which was a major catalyst for investors to seek higher yields and greater risk in the stock market.

Analyzing our relative performance for the year, our stock selection in the Consumer Staples, Materials and Information Technology sectors contributed to returns, while our selections in Financials, Health Care, Industrials and Consumer Discretionary detracted. In Consumer Staples, we outperformed due to the outstanding performance of Nu Skin Enterprises Inc., which direct sells personal care products globally, and gained over 87% for the period. Our second best performer was Alliance Data Systems Corp., which gained over 68% for the year. The company, which provides marketing and credit card solutions, continues to see strong demand for its services.

The Financials and Industrials sectors were among our weakest sectors. Our stock selection in Financials detracted from our relative return as Real Estate Invest Trust holdings American Campus Communities Inc. and Campus Crest Communities Inc. declined 17% and 35% respectively, when the education REIT group fell out of favor with investors. Our relative underperformance in Industrials was due primarily to Acacia Research Corp. which fell 49% for the period and detracted nearly 2% from our relative return. The company, which licenses intellectual property, failed to meet analyst estimates as proposed government regulations delayed settlements on pending patent cases.

Portfolio Changes

The Information Technology, Industrials, Health Care and Financials sectors increased during the year while the Consumer Discretionary, Consumer Staples and Materials sectors declined. Changes in other sectors were not material.

A Look Ahead

Despite the strong performance of the equity markets over the past year, we continue to find many attractive opportunities in the small cap landscape. We believe that our relative performance should improve in the coming quarters as the Fed’s stimulus is withdrawn and company fundamentals take precedence. We believe that our strategy of investing in high quality companies that have unique and growing businesses and strong managements will put us in a position to outperform the benchmark index.

The Fund is co-managed by Robert von Pentz, CFA, and Rhys Williams, CFA of Columbia Partners, L.L.C. Investment Management.

PEAR TREE COLUMBIA SMALL CAP FUND

Top 10 Holdings

| Percentage of total net assets | 29.2% |

| Alliance Data Systems Corporation | 4.7% |

| EPR Properties | 4.5% |

| Finisar Corporation | 2.8% |

| Proto Labs, Inc. | 2.6% |

| MasTec, Inc. | 2.6% |

| ICG Group, Inc. | 2.5% |

| Core Laboratories N.V. | 2.5% |

| Ferro Corporation | 2.4% |

| BioTelemetry, Inc. | 2.3% |

| IMAX Corporation | 2.3% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Industrials | 20.0% |

| Information Technology | 18.3% |

| Consumer Discretionary | 17.7% |

| Financials | 15.8% |

| Health Care | 14.4% |

| Consumer Staples | 5.5% |

| Materials | 5.0% |

| Energy | 3.5% |

| Telecommunication Services | 0.0% |

| CASH + other assets (net) | –0.2% |

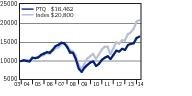

Value of a $10,000 Investment

Pear Tree Columbia Small Cap (PTSC) Ordinary Shares

vs. Russell 2000 Index

Average Annual Total Returns

| 1Q 2014 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | –3.05% | 7.76% | 22.76% | 22.23% | 6.48% | 10.64% | 08/03/92 |

Institutional Shares1 | –3.00% | 7.91% | 23.12% | 22.56% | 6.84% | 10.02% | 01/06/93 |

Russell 20002 | 1.12% | 9.94% | 24.90% | 24.31% | 8.53% | 10.12% | ________ |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The Russell 2000 Index is a market capitalization-weighted index of 2,000 small company stocks. It is widely recognized as representative of the general market for small company stocks. Index returns assume the reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. You cannot invest directly in an Index. The beginning date of the Index is 08/3/92.

Small company stocks may trade less frequently and in a limited volume, and their prices may fluctuate more than stocks of other companies. Small company stocks may therefore be more vulnerable to adverse developments than those of larger companies. The Fund may invest in issuers in the real estate industry. Changes in real estate values or economic downturns can have a significant negative effect on these issuers. The Fund may invest in foreign issuers that trade on U.S. stock exchanges. These issuers may be subject to special risks including different corporate governance rules and bankruptcy laws.

PEAR TREE QUALITY FUND

INVESTMENT PROFILE

All Data as of March 31, 2014

| Fund Information | ||

| Net Assets Under Management | $124.9 Million | |

| Number of Companies | 96 | |

| Price to Book Ratio | 4.0 | |

| Price to Earnings Ratio | 16.3 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Gross)* | 1.62% | 1.35% |

| Total Expense Ratio (Net)** | 1.37% | 1.10% |

| Ticker Symbol | USBOX | QGIAX |

| ** per prospectus dated August 1, 2013. See financial highlights for total expense ratios for the fiscal year ended March 31, 2014. | ||

| ** Reflects all fee waivers currently in effect. Fee waivers may not be amended, rescinded or terminated before July 31, 2014 without the consent of the Fund’s board. | ||

Investment Commentary

For the annual period ended March 31, 2014, the Pear Tree Quality Fund’s Ordinary Shares (the “Fund”) underperformed its benchmark, S&P 500 (the “Index“). The Fund achieved a return of 15.40% at net asset value compared to 21.86% for the Index.

Market Conditions and Investment Strategies

The Fund’s investment manager currently chooses securities for the Fund by periodically selecting a mutual fund (the ”Target Portfolio“) and monitoring the Target Portfolio’s holdings. The Fund’s investment adviser, at the direction of the investment manager, rebalances the Fund’s portfolio to correspond to the Target Portfolio’s most recent holdings as publicly reported. From April 1, 2013 to March 31, 2014, the Fund’s Ordinary Shares, when compared to the Target Portfolio, had a tracking error of 0.25.

Over the previous twelve months, the Information Technology sector was the largest positive contributor to the Fund’s performance due to a large overweight position and positive stock selection. The Fund’s underweight positions in the Telecommunication, Utilities and Energy sectors also contributed to performance.

The greatest detractors from performance came from the Consumer Staples sector where a very large overweight position and stock selection negatively affected relative performance. Other detractors were stock selection in the Health Care and Consumer Discretionary sectors.

Portfolio Changes

We expect the Fund to have a relatively low turnover rate given the historical stability and relatively low turnover rate of the current Target Portfolio.

For the twelve month period ending March 31, 2014, the Fund rebalanced the holdings four times to replicate the publicly disclosed holdings of the current target portfolio. The four rebalances resulted in the sale of three positions. Also as a result of the rebalances, the Fund opened new positions in twenty-five companies; one Materials company, four Health Care companies, five Consumer Discretionary companies, seven Industrial companies and eight Information Technology companies.

A Look Ahead

For the foreseeable future, the Fund’s investment manager expects the Target Portfolio to remain the same. For more information on the selection of the Target Portfolio(s), please see the Fund’s Prospectus.

The Fund’s target portfolio is GMO Quality Fund III (GQETX) and the Fund is managed by Robert von Pentz, CFA of Columbia Partners, L.L.C. Investment Management.

PEAR TREE QUALITY FUND

Top 10 Holdings

| Percentage of total net assets | 44.9% |

| Microsoft Corporation | 5.9% |

| Google, Inc. | 5.6% |

| Johnson & Johnson | 5.5% |

| Oracle Corporation | 5.3% |

| Procter & Gamble Company | 4.1% |

| International Business Machines | 4.1% |

| Coca-Cola Company (The) | 4.1% |

| Chevron Corporation | 4.0% |

| Philip Morris International, Inc. | 3.4% |

| Wal-Mart Stores, Inc. | 2.9% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Information Technology | 31.7% |

| Health Care | 27.8% |

| Consumer Staples | 24.6% |

| Energy | 7.0% |

| Consumer Discretionary | 4.1% |

| Industrials | 4.1% |

| Telecommunication Services | 0.2% |

| Materials | 0.1% |

| Financials | 0.0% |

| Utilities | 0.0% |

| CASH + other assets (net) | 0.4% |

Value of a $10,000 Investment

Pear Tree Quality (PTQ) Ordinary Shares vs.

S&P 500 Index

Average Annual Total Returns

| 1Q 2014 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 2.20% | 11.73% | 15.40% | 18.05% | 4.89% | 9.15% | 05/06/85 |

Institutional Shares1 | 2.27% | 11.89% | 15.74% | 18.48% | 5.17% | 7.81% | 03/25/91 |

S & P 5002 | 1.81% | 12.51% | 21.86% | 21.16% | 7.42% | 10.84% | ________ |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The S&P 500 Index is an unmanaged index of stocks chosen to their size industry characteristics. It is widely recognized as representative of stocks in the United States. Index returns assume the reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. You cannot invest directly in the Index. The beginning date for the Index is 05/29/85.

* S&P 500 Index is the registered mark of Standard & Poor’s.

Investing in foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE PANAGORA DYNAMIC EMERGING MARKETS FUND

INVESTMENT PROFILE

All Data as of March 31, 2014

| Fund Information | ||

| Net Assets Under Management | $147.3 Million | |

| Number of Companies | 223 | |

| Price to Book Ratio | 1.4 | |

| Price to Earnings Ratio | 9.8 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Gross)* | 1.92% | 1.65% |

| Total Expense Ratio (Net)* | 1.92% | 1.65% |

| Ticker Symbol | QFFOX | QEMAX |

| * per prospectus dated August 1, 2013. See financial highlights for total expense ratios for the fiscal year ended March 31, 2014. | ||

Investment Commentary

For the annual period ended March 31, 2014, the Pear Tree PanAgora Dynamic Emerging Markets Fund’s Ordinary Shares (the ”Fund“) underperformed its benchmark, The MSCI Emerging Markets Index (the Index”). The Fund achieved a return of –4.77% at net asset value compared to –1.07% for the Index.

Market Conditions and Investment Strategies

On a country basis, the largest detractors were India (–1.07%) and South Korea (–0.98%). Among holdings in India the largest detractor was overweight position Gitanjali Gems Ltd. while among holdings in South Korea the largest detractor was underweight position Naver Corp. The largest contributors were Mexico (+0.96%) and China (+0.59%). Among holdings in Mexico, the largest contributor was overweight position Gruma S.A.B. de C.V. while among holdings in China the largest contributor was underweight position Cencosud SA.

On a sector basis, the largest detractors were Information Technology (–1.11%) and Consumer Discretionary (–0.90%). Among holdings in Information Technology the largest detractor was underweight position Tencent Holdings, while among holdings in Consumer Discretionary the largest detractor was overweight position Gitanjali Gems Ltd.. The largest contributors were Consumer Staples (+0.92%) and Industrials (+0.47%). Among holdings in Consumer Staples the largest contributor was overweight position Gruma S.A.B. de C.V. while among holdings in Industrials the largest contributor was overweight position Teco Electric & Machinery Co.

For the annual period ending March 2014, our proprietary Dynamic Alpha model performed well — best-ranked alpha stocks outperformed the worst ranked alpha stocks. Our proprietary Valuation composite did not perform well — stocks with attractive valuations underperformed their more expensive peers. Our proprietary Quality composite performed well — stocks with strong business and management quality metrics outperformed lower quality peers. Our proprietary Momentum composite also performed well — stocks with positive market sentiment outperformed stocks with poor earnings momentum.

Portfolio Changes

The addition of the Risk Parity strategy was a significant portfolio change during the annual period ended March 31, 2014.

A Look Ahead

As a quantitative investment firm, we tend not to provide strategy-specific forward looking commentary. We believe that our systematic investment approach ensures that we deliver a portfolio of our highest conviction of ideas to all of our clients.

The Fund’s portfolio is managed by Dmitri Kantsyrev Ph.D., CFA and Jane Zhou, Ph.D of PanAgora Asset Management, Inc.

PEAR TREE PANAGORA DYNAMIC EMERGING MARKETS FUND

Top 10 Holdings3

| Percentage of total net assets | 37.9% |

Pear Tree PanAgora Risk Parity Emerging Markets | 22.4% |

| Samsung Electronics Company, Ltd. | 3.2% |

iShares MSCI Emerging Markets Index Fund | 3.1% |

Taiwan Semiconductor Manufacturing Co., Ltd. | 1.7% |

| China Construction Bank Corporation | 1.5% |

| China Mobile Limited | 1.3% |

| Sasol Ltd. | 1.3% |

| Bank of China Ltd. H | 1.2% |

| Tencent Holdings Limited | 1.1% |

| China Petroleum & Chemical Corporation | 1.1% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation3

| Percentage of total net assets | 100.0% |

| Financials | 19.4% |

| Information Technology | 13.4% |

| Energy | 8.9% |

| Consumer Discretionary | 7.9% |

| Materials | 5.7% |

| Industrials | 5.6% |

| Consumer Staples | 5.2% |

| Telecommunication Services | 4.5% |

| Utilities | 2.1% |

| Health Care | 1.3% |

| Mutual Funds | 25.5% |

| CASH + other assets (net) | 0.5% |

Top 10 Country Allocations3

| Percentage of total net assets | 66.1% |

| Taiwan | 11.0% |

| China | 10.4% |

| South Korea | 10.2% |

| Brazil | 8.1% |

| South Africa | 6.0% |

| Hong Kong | 5.5% |

| India | 4.9% |

| Russia | 4.0% |

| Malaysia | 3.1% |

| Mexico | 2.9% |

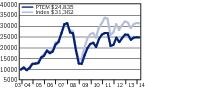

Value of a $10,000 Investment

Pear Tree PanAgora Dynamic Emerging Markets (PTEM)

Ordinary Shares vs. MSCI EM Index

Average Annual Total Returns

| 1Q 2014 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | –0.32% | 0.38% | –4.77% | 14.39% | 8.47% | 5.89% | 09/30/94 |

Institutional Shares1 | –0.22% | 0.53% | –4.52% | 14.68% | 8.79% | 7.59% | 04/02/96 |

MSCI EM2 | –0.37% | 1.49% | –1.07% | 14.83% | 10.45% | 5.40% | ________ |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The Morgan Stanley Capital International Emerging Markets (“MSCI EM”) Index is an unmanaged index comprised of stocks located in countries other than the United States. It is widely recognized as representative of the general market for emerging markets. Index returns assume the reinvestment of dividends and, unlike Fund returns, do not reflect fees or expenses. You cannot invest directly in an Index. The beginning date for the Index is 09/30/94.

3 “Top 10 Holdings”, “Sector Allocation”, and “Top 10 Country Allocation” reflect the direct and indirect (through the Fund’s investment in Pear Tree PanAgora Risk Parity Emerging Markets Fund) securities holdings.

Investing in foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE PANAGORA RISK PARITY EMERGING MARKETS FUND

INVESTMENT PROFILE

All Data as of March 31, 2014

| Fund Information | ||

| Net Assets Under Management | $33.7 Million | |

| Number of Companies | 566 | |

| Price to Book Ratio | 1.7 | |

| Price to Earnings Ratio | 16.0 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Gross)* | 1.37% | 1.12% |

| Total Expense Ratio (Net)* | 1.37% | 1.12% |

| Ticker Symbol | RPEMX | EMPRX |

| * 2013 Initial Prospectus estimated expense ratio. See financial highlights for total expense ratios for the period ended March 31, 2014. | ||

Investment Commentary

The Pear Tree PanAgora Risk Parity Emerging Markets fund incepted on June 27, 2013. For the since inception period, June 27, 2014 to March 31, 2014, the Pear Tree PanAgora Risk Parity Emerging Markets Fund’s Ordinary Shares (the “Fund”) underperformed its benchmark, The MSCI Emerging Markets Index (the “Index”). The Fund achieved a return of 4.84% at net asset value compared to 9.94% for the Index.

Market Conditions and Investment Strategies

PanAgora’s proprietary Risk Parity portfolio construction approach is centered on the belief that diversification is the key to generating better risk-adjusted returns and that avoiding risk concentration is the best way to achieve true portfolio diversification. The Risk Parity Emerging Markets Equity strategy, therefore, seeks to achieve true diversification by balancing risk exposures at many levels. In an effort to mitigate risk concentration, Risk Parity is applied within countries to simultaneously balance risk across sector and stock exposures, and is then applied across countries so that each country contributes equally to risk at the aggregate portfolio level. The expected result is a more diversified, risk-balanced emerging markets equity portfolio that has lower volatility and more downside protection than a more concentrated approach, such as those based on capitalization-weighted indices, without sacrificing return potential.

At the country level, the top contributors to performance on an absolute basis were holdings in South Korea (1.16%) and China (0.89%). Positions held in Chile (–0.84%) and Indonesia (–0.57%) detracted. Sectors that contributed to absolute portfolio performance included Financials (1.03%) and Information Technology (1.03%). The Consumer Staples sector detracted from absolute portfolio performance (–0.13%).

Portfolio Changes

The Pear Tree PanAgora Risk Parity Emerging Markets fund incepted on June 27, 2013.

A Look Ahead

As a quantitative investment firm, we tend not to provide strategy-specific forward looking commentary. We believe that our systematic investment approach ensures that we deliver a portfolio of our highest conviction of ideas to all of our clients.

The Fund’s portfolio is managed by Edward Qian, Ph.D., CFA and Mark Barnes of PanAgora Asset Management, Inc.

PEAR TREE PANAGORA RISK PARITY EMERGING MARKETS FUND

Top 10 Holdings

| Percentage of total net assets | 12.4% |

| iPath MSCI India Index ETN | 5.0% |

| Vanguard FTSE Emerging Markets ETF | 2.4% |

Empresa Nacional de Telecomunicaciones S.A. | 0.7% |

| Almacees Exito S.A. | 0.7% |

| Jollibee Foods Corporation | 0.6% |

| IHH Healthcare Berhad | 0.6% |

| Isagen S.A. E.S.P. | 0.6% |

| Bankok Dusit Medical Services F | 0.6% |

| American Movil S.A.B. Series L | 0.6% |

| Ecopetrol S.A. | 0.6% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Financials | 15.0% |

| Consumer Staples | 12.0% |

| Telecommunication Services | 11.8% |

| Materials | 10.6% |

| Consumer Discretionary | 9.7% |

| Industrials | 9.3% |

| Utilities | 8.7% |

| Energy | 8.2% |

| Mutual Funds | 7.4% |

| Health Care | 5.0% |

| Information Technology | 1.9% |

| Cash and Other Assets (Net) | 0.4% |

Top 10 Holdings

| Percentage of total net assets | 12.4% |

| iPath MSCI India Index ETN | 5.0% |

| Vanguard FTSE Emerging Markets ETF | 2.4% |

Empresa Nacional de Telecomunicaciones S.A. | 0.7% |

| Almacees Exito S.A. | 0.7% |

| Jollibee Foods Corporation | 0.6% |

| IHH Healthcare Berhad | 0.6% |

| Isagen S.A. E.S.P. | 0.6% |

| Bankok Dusit Medical Services F | 0.6% |

| American Movil S.A.B. Series L | 0.6% |

| Ecopetrol S.A. | 0.6% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

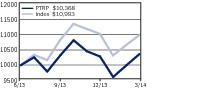

Value of a $10,000 Investment

Pear Tree PanAgora Risk Parity Emerging Markets

(PTRP) Ordinary Shares vs. MSCI EM Index

Average Annual Total Returns

| 1Q 2014 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 0.78% | 4.84% | 6/27/2013 | ||||

Institutional Shares1 | 0.88% | 5.51% | 6/27/2013 | ||||

MSCI EM2 | –0.37% | 9.94% | ________ |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The Morgan Stanley Capital International Emerging Markets (”MSCI EM“) Index is an unmanaged index comprised of stocks located in countries other than the United States. It is widely recognized as representative of the general market for emerging markets. Index returns assume the reinvestment of dividends and, unlike Fund returns, do not reflect fees or expenses. You cannot invest directly in an Index. The beginning date for the Index is 06/27/2013.

Investing in foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE POLARIS FOREIGN VALUE FUND

INVESTMENT PROFILE

All Data as of March 31, 2014

| Fund Information | ||

| Net Assets Under Management | $1,478.9 Million | |

| Number of Companies | 51 | |

| Price to Book Ratio | 1.9 | |

| Price to Earnings Ratio | 17.3 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Gross)* | 1.59% | 1.33% |

| Total Expense Ratio (Net)* | 1.59% | 1.33% |

| Ticker Symbol | QFVOX | QFVIX |

| * per prospectus dated August 1, 2013. See financial highlights for total expense ratios for the fiscal year ended March 31, 2014. | ||

Investment Commentary

For the fiscal year period ended March 31, 2014, the Pear Tree Polaris Foreign Value Fund’s Ordinary Shares (the ”Fund“) outperformed its benchmark, the MSCI EAFE Index (the ”Index“). The Fund achieved a return of 23.28% at net asset value compared to 18.06% for the Index.

Market Conditions and Investment Strategies

The Fund’s outperformance is attributed to positive absolute results in nine of ten sectors, with top contributions from Consumer Discretionary, Materials and Consumer Staples. More than 75% of portfolio holdings posted double-digit returns for the fiscal year.

British homebuilders continued to top performance in the consumer discretionary sector, benefiting from rising prices and volume gains in new housing. Additionally, the U.K. government extended its new home buying program beyond 2016, upon which homebuilders may capitalize. Canadian methanol producer Methanex Corporation was the largest contributor to the Materials sector, as it capitalized on high prices for methanol due to tight supply versus demand. Within Consumer Staples, Irish convenience food producer Greencore Group Plc continued to increase its market share in the U.S., purchasing a food-to-go manufacturer and announcing a greenfield sandwich manufacturing facility. In the U.K., Greencore is capitalizing on growth in the ready-to-eat chilled foods grocery category.

Telecom sector holdings produced strong returns for the year. Deutsche Telekom AG held on to good revenues and earnings, largely due to its T-Mobile/MetroPCS merger. Freenet exceeded its own guidance for 2013, capitalizing on its mobile communications and digital lifestyle services. Financial holdings were led by Germany reinsurers Muenchener Rueckverag AG and Hannover Rueck SE, and two Swedish companies, Svenska Handelsbanken AB and Investor AB.

Energy was the only sector in negative territory for the fiscal year. Maurel et Prom dropped in the March 2014 quarter when it eliminated the dividend, even though it reported a 2013 profit jump. Tullow Oil Plc was down after announcing lackluster 2013 results, with rising revenues but fading operating profit due to exploration write-offs. Thai Oil PCL was affected by the political turbulence in Thailand.

Portfolio Changes

During the fiscal year period ended March 31, 2014, the Fund had an influx of cash flows, which was invested within existing holdings as well as six new stock purchases. Among the new purchases were: Ipsos SA, which conducts market research for global consumer product companies; Tullow Oil Plc, an independent oil explorer focused in Africa; Norway-based fertilizer company, Yara International ASA, which sources natural gas and converts it to upgraded fertilizer; Lanxess AG, a specialty chemical company engaged in synthetic rubber and tire durability products; Finnish building service company Caverion Corporation which was a spin-off from portfolio holding YIT Oyj; and Norwegian savings bank Sparebank 1 SR Bank ASA, which has low loan losses and improving net interest margins. No positions were liquidated during the year.

A Look Ahead

Sectors most prominent in our international research include financials, industrials, consumer discretionary and information technology. The geographies at the top of our list include Japan, Asian countries, emerging markets and the U.K. We have also noticed a significant number of new companies coming on the market, as global macro-economic conditions slowly improve. We have further refined our screening technology to ensure availability of a broad range of investment ideas and added another analyst to our experienced research team.

We believe that the Fund’s fundamental international value investing strategy continue to produce excellent risk-adjusted returns, as evidenced by the Fund’s 16-year performance record. We will strive to maintain this level of success to benefit the Fund’s shareholders.

The Fund’s lead portfolio manager is Bernard R. Horn, Jr., of Polaris Capital Management, LLC

PEAR TREE POLARIS FOREIGN VALUE FUND

Top 10 Holdings

| Percentage of total net assets | 24.6% |

| Greencore Group plc | 3.0% |

| Barratt Developments plc | 2.5% |

| Teva Pharmaceuticals SP | 2.5% |

| Deutsche Telekom AG | 2.5% |

| Methanex Corporation | 2.5% |

| Freenet AG | 2.4% |

| Taylor Wimpey plc | 2.4% |

| Trevi Finanziaria SpA | 2.3% |

| Sasol Ltd. | 2.3% |

| Christian Dior S.A. | 2.2% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Materials | 20.1% |

| Consumer Discretionary | 15.8% |

| Financials | 12.9% |

| Industrials | 9.9% |

| Energy | 7.7% |

| Consumer Staples | 7.2% |

| Telecommunication Services | 7.1% |

| Information Technology | 6.2% |

| Health Care | 4.8% |

| Utilities | 1.6% |

| Cash and Other Assets (Net) | 6.7% |

Top 10 Country Allocations

| Percentage of total net assets | 74.5% |

| Germany | 16.3% |

| United Kingdom | 16.2% |

| Japan | 8.0% |

| Sweden | 7.3% |

| France | 6.9% |

| Ireland | 5.1% |

| Finland | 4.8% |

| Italy | 4.3% |

| Norway | 3.1% |

| Canada | 2.5% |

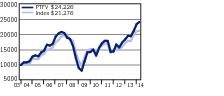

Value of a $10,000 Investment

Pear Tree Polaris Foreign Value (PTFV)

Ordinary Shares vs. MSCI EAFE Index

Average Annual Total Returns

| 1Q 2014 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 3.09% | 13.86% | 23.28% | 24.15% | 8.29% | 7.54% | 05/15/98 |

Institutional Shares1 | 3.19% | 14.07% | 23.58% | 24.41% | 8.55% | 9.29% | 12/18/98 |

MSCI EAFE2 | 0.77% | 6.56% | 18.06% | 16.56% | 7.01% | 5.03% | ________ |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The Morgan Stanley Capital International Europe, Australia, and Far East (”MSCI EAFE“) Index is an unmanaged index comprised of stocks located in countries other than the United States. It is widely recognized as representative of the general market for emerging markets. Index returns assume the reinvestment of dividends and, unlike Fund returns, do not reflect fees or expenses. You cannot invest directly in an Index. The beginning date for the Index is 05/29/98.

Investing in foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE POLARIS FOREIGN VALUE SMALL CAP FUND

INVESTMENT PROFILE

All Data as of March 31, 2014

| Fund Information | ||

| Net Assets Under Management | $185.7 Million | |

| Number of Companies | 68 | |

| Price to Book Ratio | 1.9 | |

| Price to Earnings Ratio | 16.7 | |

| Ordinary | Institutional | |

| Total Expense Ratio (Gross)* | 1.66% | 1.41% |

| Total Expense Ratio (Net)* | 1.66% | 1.41% |

| Ticker Symbol | QUSOX | QUSIX |

| * per prospectus dated August 1, 2013. See financial highlights for total expense ratios for the fiscal year ended March 31, 2014. | ||

Investment Commentary

For the fiscal year period ended March 31, 2014, the Pear Tree Polaris Foreign Value Small Cap Fund’s Ordinary Shares (the ”Fund“) outperformed its benchmark, the MSCI ACWI ex USA Small Cap Index (the Index”)1 The Fund achieved a return of 26.80% at net asset value compared to 16.69% for the Index.

Market Conditions and Investment Strategies

Nine of 10 sectors contributed to the Fund’s outperformance, led by Industrials, Consumer Staples, Consumer Discretionary and Information Technology. The vast majority of portfolio holdings produced double-digit returns for the period, with nearly a quarter of holdings up in excess of 50%.

In Industrials, construction company Galliford Try Plc benefited from a rebounding U.K. economy, as both price and volumes increased in new home sales. Shanghai Mechanical, a manufacturer of elevators and escalators, was up more than 70%, capitalizing on construction and affordable housing growth in China.

Within Consumer Staples, Irish convenience food producer Greencore Group plc continued to increase its market share in the U.S., purchasing a food-to-go manufacturer and announced a greenfield sandwich manufacturing facility. In the U.K., Greencore is capitalizing on growth in the ready-to-eat chilled foods grocery category.

The Restaurant Group plc and J D Wetherspoon plc led gains in the Consumer Discretionary sector, as U.K. economic optimism led to dining-out trends. With a focus on value for money and unique menus, both companies saw an influx of customers. Theater operator Kinepolis was up after successfully executing its business strategy of cutting costs, driving up revenue per customer and offering B2B events.

The only sector in negative territory was Utilities. Manila Water’s decline was attributable to the on-going court arbitration associated with tariffs disputes. Political turmoil in Thailand affected results for Ratchaburi Electric. Brazil’s Equatorial Energia SA was restricted by higher costs in a weakening economy.

Portfolio Changes

During the fiscal year period ended March 31, 2014, the Fund sold positions in Sichuan Expressway and Manappuram General Finance. Cash was redeployed to eight new positions, each of which was attractively valued with sustainable business models and strong free cash flows. Among the new holdings were: Ipsos, which conducts market research for consumer companies; PKC Group OYJ, a producer of truck electrical controls; Shanghai Mechanical; Semperit AG Holding, a manufacturer of rubber and plastic products; WT Microelectronics Co., Ltd., a Taiwanese electronics distributor; AIN Pharmaciez, Inc., one of the largest Japanese pharmacy companies; and Higashi Nihon House Co. Ltd., a niche homebuilder in Japan. We also purchased Indian IT company Hexaware Technologies during the June quarter. In mid-October, Hexaware was acquired by Baring Private Equity in a $400 million deal. The Fund tendered its shares for a healthy profit.

1 As of August 1, 2013, the Fund replaced its benchmark with the MSCI ACWI (ex USA small cap) because it believes the new index represents the emerging market exposure in the Fund better that the S&P EPAC Index.

A Look Ahead

Sectors most prominent in our small-cap research include Financials, Industrials, Consumer Discretionary and Information Technology. The geographies currently at the top of our list include Japan, Southeast Asian countries, emerging markets and the U.K. We have also noticed a significant number of new small cap companies coming on the market, as global macro-economic conditions slowly improve. We have further refined our screening technology to ensure availability of a broad range of small cap investment ideas and added another analyst to our experienced research team.

We believe that the Fund’s fundamental small-cap value investing strategy can continue to produce excellent top risk-adjusted returns, as evidenced by the Fund’s nearly six-year performance record. We will strive to maintain this level of success to benefit the Fund’s shareholders.

The Fund’s lead portfolio manager is Bernard R. Horn, Jr., of Polaris Capital Management, LLC

PEAR TREE POLARIS FOREIGN VALUE SMALL CAP FUND

Top 10 Holdings

| Percentage of total net assets | 22.8% |

| Greencore Group plc | 3.5% |

| Freenet AG | 2.4% |

| Galliford Try plc | 2.3% |

| UDG Healthcare plc | 2.3% |

| Alternative Networks plc | 2.2% |

| BML, Inc. | 2.1% |

| Chugoku Marine Paints Ltd. | 2.1% |

| Equatorial Energia S.A. | 2.0% |

| M1 Ltd. | 2.0% |

| Vetropack Holding AG | 1.9% |

There is no guarantee that such securities will continue to be viewed favorably or held in the Fund’s portfolio.

Sector Allocation

| Percentage of total net assets | 100.0% |

| Consumer Discretionary | 21.3% |

| Industrials | 14.5% |

| Consumer Staples | 12.1% |

| Information Technology | 10.2% |

| Financials | 9.3% |

| Telecommunication Services | 8.1% |

| Health Care | 6.2% |

| Materials | 5.8% |

| Utilities | 4.7% |

| Cash and Other Assets (Net) | 7.8% |

Top 10 Country Allocations

| Percentage of total net assets | 70.0% |

| United Kingdom | 13.7% |

| Japan | 11.3% |

| Ireland | 8.8% |

| Germany | 7.2% |

| India | 6.3% |

| Hong Kong | 5.4% |

| Norway | 5.2% |

| Sweden | 4.4% |

| Thailand | 4.3% |

| Singapore | 3.4% |

Value of a $10,000 Investment

Pear Tree Polaris Foreign Value Small Cap (PTFVSC)

Ordinary Shares vs. MSCI ACWI ex USA Small Cap Index

Average Annual Total Returns

| 1Q 2014 | Six Months | One Year | Five Year | Ten Year | Since Inception | Inception Date | |

| Ordinary Shares | 8.84% | 20.38% | 26.80% | 27.24% | 8.56% | 5/1/2008 | |

Institutional Shares1 | 8.92% | 20.51% | 27.16% | 27.55% | 8.80% | 5/1/2008 | |

MSCI ACWI ex USA Small Cap2 | 3.56% | 8.39% | 16.69% | 21.59% | 4.75% | ________ | |

S&P/EPAC Small Cap3 | 3.81% | 9.96% | 23.89% | 21.24% | 4.60% | ________ |

1 Institutional Shares may only be purchased by certain categories of investors and are not subject to sales charges or distribution fees.

2 The MSCI ACWI ex USA Small Cap Index captures small cap representation across 23 developed markets and 21 emerging market countries

3 The S&P/Europe Pacific Asia Composite (“S&P/EPAC”) Index measures the bottom 20% of institutionary investable capital of developed and emerging (after 09/30/1994) countries, selected by the index sponsor outside of the United States. It is widely recognized as representative of the general market for foreign markets. Index returns assume the reinvestment of dividends and, unlike Fund returns, do no reflect any fees or expenses. You cannot invest directly in an Index. The beginning date for the Index is 5/1/2008.

Investing in foreign markets, particularly emerging markets, can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently than the U.S. market.

PEAR TREE COLUMBIA SMALL CAP FUND

SCHEDULE OF INVESTMENTS

March 31, 2014

Common Stock—100.2%

| Shares | Value | |

| AIRLINES—1.0% | ||

| Spirit Airlines, Inc. (a) | 19,467 | $ 1,156,340 |

| BANKS—3.6% | ||

| Central Pacific Financial Corp. | 49,358 | 997,032 |

| CoBiz Financial, Inc. | 109,129 | 1,257,166 |

| F.N.B. Corporation | 146,970 | 1,969,398 |

| 4,223,596 | ||

| BUILDING PRODUCTS—3.7% | ||

| Builders FirstSource, Inc. (a) | 187,687 | 1,709,828 |

| Drew Industries, Inc. | 25,269 | 1,369,580 |

| NCI Building Systems, Inc. (a) | 72,848 | 1,271,927 |

| 4,351,335 | ||

| CHEMICALS—4.0% | ||

| Cambrex Corporation (a) | 95,064 | 1,793,858 |

| Ferro Corporation (a) | 209,182 | 2,857,426 |

| 4,651,284 | ||

| COMMERCIAL SERVICES & SUPPLIES—9.6% | ||

| Acacia Research Corporation—Acacia Technologies (b) | 27,892 | 426,190 |

| Cardtronics, Inc. (a) | 37,296 | 1,448,950 |

| Euronet Worldwide, Inc. (a) | 29,290 | 1,218,171 |

| Heartland Payment Systems, Inc. | 19,352 | 802,140 |

| Kforce, Inc. | 123,417 | 2,631,250 |

| On Assignment, Inc. (a) | 25,258 | 974,706 |

| WageWorks, Inc. (a) | 38,825 | 2,178,471 |

| Waste Connections, Inc. | 35,764 | 1,568,609 |

| 11,248,487 | ||

| COMMUNICATIONS EQUIPMENT—3.0% | ||

| Allot Communications Ltd. (a)(b) | 68,769 | 925,631 |

| NICE-Systems Ltd. (c) | 38,310 | 1,710,924 |

| Ubiquiti Networks, Inc. (a)(b) | 19,751 | 898,078 |

| 3,534,633 | ||

| CONSTRUCTION & ENGINEERING—2.6% | ||

| MasTec, Inc. (a) | 70,114 | 3,045,752 |

| CONSTRUCTION MATERIALS—1.0% | ||

| Trex Company, Inc. (a) | 15,658 | 1,145,539 |

| DIVERSIFIED FINANCIALS—3.4% | ||

| Hercules Technology Growth Capital, Inc. | 71,640 | 1,007,975 |

| ICG Group, Inc. (a) | 145,952 | 2,980,340 |

| 3,988,315 | ||

| ELECTRONIC EQUIPMENT & INSTRUMENTS—3.8% | ||

| Applied Optoelectronics, Inc. (a) | 46,223 | 1,140,321 |

| Finisar Corporation (a) | 125,345 | 3,322,896 |

| 4,463,217 | ||

| ENERGY EQUIPMENT & SERVICES—2.5% | ||

| Core Laboratories N.V. | 14,707 | 2,918,457 |

| FOOD & DRUG RETAILING—1.0% | ||

| United Natural Foods, Inc. (a) | 16,409 | 1,163,726 |

| FOOD PRODUCTS—1.6% | ||

| Boulder Brands, Inc. (a) | 111,123 | 1,957,987 |

| HEALTH CARE EQUIPMENT & SUPPLIES—10.2% | ||

| Accuray Incorporated (a)(b) | 252,842 | 2,427,283 |

| BioTelemetry, Inc. (a) | 269,221 | 2,716,440 |

| Cardiovascular Systems, Inc. (a) | 43,114 | 1,370,594 |

| Halozyme Therapeutics, Inc. (a) | 37,906 | 481,406 |

| LDR Holding Corporation (a) | 22,359 | 767,585 |

| Natus Medical, Inc. (a) | 53,502 | 1,380,352 |

| Novadaq Technologies, Inc. (a) | 41,293 | 920,008 |

| Spectranetics Corporation (The) (a) | 52,538 | 1,592,427 |

| STAAR Surgical Company (a) | 18,778 | 353,026 |

| 12,009,121 | ||

| HEALTH CARE PROVIDERS & SERVICES—2.9% | ||

| Catamaran Corporation (a) | 27,814 | 1,244,955 |

| Henry Schein, Inc. (a) | 17,669 | 2,109,148 |

| 3,354,103 | ||

| HOTELS, RESTAURANTS & LEISURE—1.0% | ||

| National CineMedia, Inc. | 78,030 | 1,170,450 |

| HOUSEHOLD DURABLES—0.9% | ||

| Standard Pacific Corporation (a) | 131,447 | 1,092,325 |

| INSURANCE—0.5% | ||

| United Insurance Holdings Corp. | 41,656 | 608,594 |

| INTERNET SOFTWARE & SERVICES—0.9% | ||

| Brightcove, Inc. (a) | 86,010 | 845,478 |

| eGain Corporation (a) | 31,147 | 219,898 |

1,065,376 | ||

| IT CONSULTING & SERVICES—5.9% | ||

| Alliance Data Systems Corporation (a) | 20,071 | 5,468,344 |

| EPAM Systems, Inc. (a) | 43,781 | 1,440,395 |

| 6,908,739 | ||

| MACHINERY—3.1% | ||

| Actuant Corporation, Class A | 17,783 | 607,290 |

| Proto Labs, Inc. (a) | 45,205 | 3,059,022 |

| 3,666,312 | ||

| MEDIA—9.6% | ||

| AMC Entertainment Holdings, Inc., Class A (a) | 47,372 | 1,148,771 |

| Cinemark Holdings, Inc. | 61,945 | 1,797,024 |

| Entravision Communications Corporation, Class A | 239,838 | 1,606,915 |

| Gray Television, Inc. (a) | 86,400 | 895,968 |

| IMAX Corporation (a) | 96,485 | 2,636,935 |

| Nexstar Broadcasting Group, Inc., Class A | 34,061 | 1,277,969 |

| Regal Entertainment Group, Class A | 101,386 | 1,893,890 |

| 11,257,472 | ||

| OIL & GAS—1.0% | ||

| Bonanza Creek Energy, Inc. | 25,431 | 1,129,136 |

| PERSONAL PRODUCTS—2.9% | ||

| Elizabeth Arden, Inc. (a) | 46,058 | 1,359,171 |

| Nu Skin Enterprises, Inc., Class A | 24,262 | 2,010,107 |

| 3,369,278 | ||

| PHARMACEUTICALS & BIOTECHNOLOGY—1.3% | ||

| Orexigen Therapeutics, Inc. (a) | 82,624 | 537,056 |

| Receptos, Inc. (a) | 14,052 | 589,341 |

| Tetraphase Pharmaceuticals, Inc. (a) | 37,886 | 412,579 |

| 1,538,976 | ||

| REAL ESTATE—8.3% | ||

| Brandywine Realty Trust | 61,681 | 891,907 |

| DuPont Fabros Technology, Inc. | 44,638 | 1,074,437 |

| EPR Properties | 98,474 | 5,257,527 |

| Hersha Hospitality Trust | 293,779 | 1,712,731 |

| Physicians Realty Trust | 38,158 | 531,159 |

| Terreno Realty Corporation | 12,936 | 244,620 |

| 9,712,381 | ||

| SEMICONDUCTOR EQUIPMENT & PRODUCTS—1.0% | ||

| 8x8, Inc. (a) | 109,131 | 1,179,706 |

| SOFTWARE—3.7% | ||

| Ambarella, Inc. (a)(b) | 37,870 | 1,011,508 |

| Control4 Corporation (a)(b) | 65,573 | 1,390,803 |

| Rally Software Development Corp. (a) | 34,775 | 465,290 |

| Rocket Fuel, Inc. (a)(b) | 20,205 | 866,390 |

| Verint Systems, Inc. (a) | 11,576 | 543,262 |

| 4,277,253 | ||

| SPECIALTY RETAIL—4.1% | ||

| Asbury Automotive Group, Inc. (a) | 44,413 | 2,456,483 |

| Pier 1 Imports, Inc. | 52,191 | 985,366 |

| Restoration Hardware Holdings, Inc. (a) | 17,706 | 1,302,985 |

| 4,744,834 | ||

| TEXTILES & APPAREL—2.1% | ||

| Kate Spade & Company (a) | 66,213 | 2,455,840 |

| TOTAL COMMON STOCK | ||

| (Cost $84,013,749) | 117,388,564 | |

| Short Term Investments—0.6% | ||

| Par Value | Value | |

| State Street Bank & Trust Co., Repurchase Agreement 0.0%, 04/01/14, (Dated 03/31/14), Collateralized by $730,000 par U.S. Treasury Note-0.625% due 11/30/2017, Market Value $714,122, Repurchase Proceeds $696,991 (Cost $696,991) | $696,991 | $696,991 |

| TOTAL INVESTMENTS (EXCLUDING INVESTMENTS PURCHASED WITH CASH COLLATERAL FROM SECURITIES LOANED)—100.8% | ||

| (Cost $84,710,740) | 118,085,555 | |

| INVESTMENTS PURCHASED WITH CASH COLLATERAL FROM SECURITIES LOANED—5.6% | ||

| Money Market—5.6% | ||

| Western Asset Institutional Cash Reserves—Inst. | ||

| (Cost $6,571,585) | 6,571,585 | |

TOTAL INVESTMENTS—106.4% (Cost $91,282,325) | 124,657,140 | |

| OTHER ASSETS & LIABILITIES (NET)—(6.4%) | (7,475,061) | |

| NET ASSETS—100% | $117,182,079 |

| (a) | Non-income producing security |

| (b) | All or a portion of this security was out on loan. |

| (c) | ADR—American Depositary Receipts |

| (d) | At March 31, 2014, the unrealized appreciation of investments based on aggregate cost for federal tax purposes of $91,741,379 was as follows: |

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $35,591,625 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (2,675,864) |

| Net unrealized appreciation / (depreciation) | $32,915,761 |

| The percentage of each investment category is calculated as a percentage of net assets. |

PEAR TREE QUALITY FUND

SCHEDULE OF INVESTMENTS

March 31, 2014

Common Stock—99.5%

| Shares | Value | |

| AEROSPACE & DEFENSE—0.8% | ||

| Precision Castparts Corp. | 686 | $173,393 |

| United Technologies Corporation | 7,585 | 886,232 |

| 1,059,625 | ||

| BEVERAGES—4.2% | ||

| Anheuser-Busch InBev S.A. (c) | 1,768 | 186,170 |

| Coca-Cola Company (The) | 132,336 | 5,116,110 |

| 5,302,280 | ||

| CHEMICALS—0.1% | ||

| Monsanto Company | 1,672 | 190,223 |

| COMMUNICATIONS EQUIPMENT—1.8% | ||

| QUALCOMM Incorporated | 27,925 | 2,202,166 |

| COMPUTERS & PERIPHERALS—7.6% | ||

| Apple, Inc. | 3,930 | 2,109,388 |

| EMC Corporation | 29,405 | 805,991 |

| Hewlett-Packard Company | 45,066 | 1,458,336 |

| International Business Machines | 26,692 | 5,137,943 |

| 9,511,658 | ||

| CONSUMER SERVICES—0.3% | ||

| McKesson Corporation | 1,736 | 306,525 |

| DISTRIBUTORS—0.1% | ||

| Genuine Parts Company | 1,575 | 136,789 |

| ELECTRONIC EQUIPMENT & INSTRUMENTS—0.5% | ||

| Emerson Electric Co. | 8,516 | 568,869 |

| FOOD PRODUCTS—0.8% | ||

| Nestle, S.A. (c) | 7,152 | 537,973 |

| Unilever N.V. | 11,396 | 468,604 |

| Unilever N.V. (c) | 4 | 171 |

| 1,006,748 | ||

| FOOD STAPLES & DRUG RETAILING—8.4% | ||

| Costco Wholesale Corporation | 5,721 | 638,921 |

| CVS Caremark Corporation | 10,252 | 767,465 |

| General Mills, Inc. | 9,082 | 470,629 |

| PepsiCo, Inc. | 40,590 | 3,389,265 |

| SYSCO Corporation | 17,082 | 617,173 |

| Tesco PLC (a)(c) | 11,408 | 170,322 |

| Walgreen Co. | 11,711 | 773,277 |

| Wal-Mart Stores, Inc. | 48,109 | 3,676,971 |

| 10,504,023 | ||

| HEALTH CARE EQUIPMENT & SERVICES—8.3% | ||

| Baxter International, Inc. | 9,098 | 669,431 |

| Becton, Dickinson and Company | 5,355 | 626,963 |

| Covidien plc | 2,286 | 168,387 |

| Express Scripts, Inc. (a) | 45,791 | 3,438,446 |

| Humana Inc. (a) | 487 | 54,895 |

| Medtronic, Inc. | 33,810 | 2,080,667 |

| Stryker Corporation | 8,289 | 675,305 |

| UnitedHealth Group, Inc. | 23,528 | 1,929,061 |

| Zimmer Holdings, Inc. (a) | 7,788 | 736,589 |

| 10,379,744 | ||

| HEALTH CARE PROVIDERS & SERVICES—0.7% | ||

| Laboratory Corporation of America Holdings (a) | 3,427 | 336,566 |

| Quest Diagnostics Incorporated | 4,316 | 249,983 |

| WellPoint, Inc. | 3,244 | 322,940 |

| 909,489 | ||

| HOTELS, RESTAURANTS & LEISURE—1.6% | ||

| McDonald’s Corporation | 19,070 | 1,869,432 |

| YUM! Brands, Inc. | 908 | 68,454 |

| 1,937,886 | ||

| HOUSEHOLD PRODUCTS—6.4% | ||

| Church & Dwight Co., Inc. | 2,427 | 167,633 |

| Colgate-Palmolive Company | 31,748 | 2,059,493 |

| Kimberly-Clark Corporation | 5,369 | 591,932 |

| Procter & Gamble Company | 63,805 | 5,142,683 |

| Reckitt Benckiser Group plc (a) | 3 | 247 |

| 7,961,988 | ||

| INDUSTRIAL CONGLOMERATES—2.0% | ||

| 3M Company | 17,986 | 2,439,981 |

| IT CONSULTING & SERVICES—0.6% | ||

| Accenture plc | 4,285 | 341,600 |

| Automatic Data Processing, Inc. | 1,873 | 144,708 |

| Cognizant Technology Solutions Corporation (a) | 3,958 | 200,315 |

| Paychex, Inc. | 900 | 38,340 |

| 724,963 | ||

| LEISURE EQUIPMENT & PRODUCTS—0.0% | ||

| Mattel, Inc. | 1,004 | 40,270 |

| MACHINERY—0.7% | ||

| Cummins, Inc. | 387 | 57,659 |

| Danaher Corporation | 5,417 | 406,275 |

| Illinois Tool Works Inc. | 4,705 | 382,658 |

| 846,592 | ||

| MULTILINE RETAIL—0.7% | ||

| Target Corporation | 14,367 | 869,347 |

| OIL & GAS—7.0% | ||

| BP plc (c) | 6,274 | 301,779 |

| Chevron Corporation | 42,209 | 5,019,072 |

| Exxon Mobil Corporation | 27,489 | 2,685,126 |

| Royal Dutch Shell plc (c) | 5,427 | 396,497 |

| TOTAL S.A. (b)(c) | 5,440 | 356,864 |

| 8,759,338 | ||

| PHARMACEUTICALS & BIOTECHNOLOGY—18.8% | ||

| Abbott Laboratories | 52,932 | 2,038,411 |

| Allergan, Inc. | 1,881 | 233,432 |

| Amgen, Inc. | 10,732 | 1,323,685 |

| AstraZeneca PLC (c) | 15,564 | 1,009,792 |

| Bristol-Myers Squibb Company | 29,335 | 1,523,953 |

| Eli Lilly and Company | 19,556 | 1,151,066 |

| Gilead Sciences, Inc. (a) | 11,881 | 841,888 |

| GlaxoSmithKline plc (c) | 24,489 | 1,308,447 |

| Johnson & Johnson | 69,853 | 6,861,660 |

| Merck & Co., Inc. | 28,586 | 1,622,827 |

| Novartis AG (c) | 5,811 | 494,051 |

| Novo Nordisk A/S (c) | 2,435 | 111,158 |

| Pfizer Inc. | 112,375 | 3,609,485 |

| Roche Holding Ltd. (c) | 24,354 | 918,633 |

| Sanofi-Aventis (c) | 7,948 | 415,522 |

| Takeda Pharmaceutical Company Limited (a)(c) | 38 | 901 |

| 23,464,911 | ||

| RETAILING—0.4% | ||

| Home Depot, Inc. (The) | 4,566 | 361,308 |

| TJX Companies, Inc. (The) | 3,017 | 182,981 |

| 544,289 | ||

| SEMICONDUCTOR EQUIPMENT—0.1% | ||

| Texas Instruments, Inc. | 3,650 | 172,097 |

| SOFTWARE & SERVICES—21.6% | ||

| Adobe Systems Incorporated | 4,883 | 321,008 |

| Cisco Systems, Inc. | 150,174 | 3,365,399 |

| eBay, Inc. (a) | 10,565 | 583,611 |

| Google, Inc. (a) | 6,291 | 7,011,382 |

| Intuit Inc. | 5,340 | 415,078 |

| MasterCard Incorporated | 7,736 | 577,879 |

| Microsoft Corporation | 179,829 | 7,371,191 |

| Oracle Corporation | 162,401 | 6,643,825 |

| SAP AG (c) | 3,106 | 252,549 |

| Visa, Inc. | 1,940 | 418,769 |

| 26,960,691 | ||

| SPECIALTY RETAIL—0.2% | ||

| Bed Bath & Beyond Inc. | 3,541 | 243,621 |

| TEXTILES & APPAREL—0.8% | ||

| Nike, Inc. | 13,224 | 976,725 |

| V.F. Corporation | 206 | 12,747 |

| 989,472 | ||

| TOBACCO—4.7% | ||

| British American Tobacco p.l.c. (c) | 4,013 | 447,168 |

| Japan Tobacco Inc. (a) | 20,000 | 624,000 |

| Lorillard, Inc. | 10,727 | 580,116 |

| Philip Morris International, Inc. | 52,172 | 4,271,322 |

| 5,922,606 | ||

| TRADING COMPANIES & DISTRIBUTION—0.1% | ||

| W.W. Grainger, Inc. | 554 | 139,973 |

| WIRELESS TELECOMMUNICATIONS—0.2% | ||

| NTT DOCOMO, Inc. (a)(b)(c) | 13,151 | 207,391 |

TOTAL COMMON STOCK (Cost $102,593,571) | 124,303,555 |

Short Term Investments—0.3%

| Par Value | Value | |

| State Street Bank & Trust Co., Repurchase Agreement .0%, 04/01/14, (Dated 03/31/14), Collateralized by 415,000 par U.S. Treasury Note-.625% due 11/30/2017, Market Value $405,973, Repurchase Proceeds $394,596 (Cost $394,596) | $394,596 | $394,596 |

| TOTAL INVESTMENTS (EXCLUDING INVESTMENTS PURCHASED WITH CASH COLLATERAL FROM SECURITIES LOANED)—99.8% | ||

| (Cost $102,988,167) | 124,698,151 | |

| Money Market—0.5% | ||

Western Asset Institutional Cash Reserves—Inst. (Cost $566,740) | 566,740 | 566,740 |

TOTAL INVESTMENTS 100.3% (Cost $103,554,907) | 125,264,891 | |

| OTHER ASSETS & LIABILITIES (NET)—(0.3%) | (362,738) | |

| NET ASSETS—100% | $124,902,153 |

| (a) | Non-Income producing security |

| (b) | All or a portion of this security is out on loan |

| (c) | ADR—American Depositary Receipts |

| (d) | At March 31, 2014, the unrealized appreciation of investments based on aggregate cost for federal tax purposes of $103,908,536 was as follows: |

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $21,552,775 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (196,420) |

| Net unrealized appreciation / (depreciation) | $21,356,355 |

| The percentage of each investment category is calculated as a percentage of net assets. |

PEAR TREE PANAGORA DYNAMIC EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS

March 31, 2014

Common Stock—71.7%

| Shares | Value | |

| BRAZIL—5.8% | ||

| Ambev SA (c) | 149,030 | $ 1,104,312 |

| Banco do Brasil S.A. | 94,412 | 954,333 |

| BM&F Bovespa S.A. | 111,024 | 553,742 |

| CIA Paranaense Ener. SP ADR (c) | 29,309 | 384,241 |

| Cyrela Brazil Realty S.A. Empreendimentos e Participacoes | 138,900 | 841,184 |

| Even Construtora e Incorporadora S.A. | 191,600 | 645,575 |

| EZ Tec Empreendimentos e Participacoes S.A. | 42,835 | 534,583 |

| JBS S.A. | 219,300 | 754,464 |

| Petroleo Brasileiro S.A. | 72,283 | 479,408 |

| Petroleo Brasileiro S.A. (c) | 65,765 | 912,161 |

| Sao Martinho S.A. | 15,318 | 210,524 |

| Sul America S.A. | 80,118 | 538,122 |

| Vale S.A. | 44,953 | 626,185 |

| 8,538,834 | ||

| CHINA—10.4% | ||

| Bank of China Ltd., H | 3,943,392 | 1,748,834 |

| China BlueChemical Ltd. H | 272,000 | 139,914 |

| China Construction Bank Corporation | 3,146,422 | 2,202,607 |

| China Life Insurance Co,. Limited | 99,000 | 280,788 |

| China Pacific Insurance Group H Shares | 81,000 | 290,302 |

| China Petroleum & Chemical Corporation | 1,735,810 | 1,557,513 |

| China Power International Development Ltd. (b) | 550,000 | 190,737 |

| China Shenhua Energy Co., Ltd. | 168,605 | 486,899 |

| China Yuchai International Ltd. | 14,573 | 308,656 |

| Dongfeng Motor Group Company Limited | 198,881 | 282,550 |

| Fosun International (b) | 216,000 | 271,227 |

| Giant Interactive Group, Inc. (c) | 45,346 | 524,653 |

| Guangzhou R&F Properties Co., Ltd. H | 79,200 | 114,153 |

| Industrial & Commercial Bank of China Ltd. | 1,639,911 | 1,008,460 |

| Kingsoft Corporation Ltd. (b) | 228,000 | 897,979 |

| Mindray Medical International Ltd. (b)(c) | 12,441 | 402,591 |

| PetroChina Company Limited | 935,778 | 1,019,412 |

| Ping An Insurance Group H Share | 36,000 | 298,424 |

| Sino Biopharmaceutical Limited | 560,000 | 476,488 |

| SINOPEC Engineering (Group) Co., Ltd. Class H | 352,000 | 380,283 |

| Sinotrans Ltd. H Shares | 662,000 | 331,139 |

| Tencent Holdings Limited | 23,600 | 1,641,435 |

| Tong Ren Tang Technologies Co., Ltd. H | 47,000 | 151,784 |

| Zhejiang Expressway Co., Ltd. | 400,000 | 364,586 |

15,371,414 | ||

| COLOMBIA—0.4% | ||

| Ecopetrol S.A. (b)(c) | 14,251 | $581,298 |

| CZECH REPUBLIC—0.2% | ||

| CEZ A.S. (b) | 10,307 | 295,423 |

| HONG KONG—5.5% | ||

| Agile Property Holdings Ltd. | 400,000 | 327,972 |

| Central China Real Estate Ltd. | 252,371 | 66,047 |

| Champion Real Estate Investment Trust | 504,000 | 230,014 |

| China Mobile Limited | 215,779 | 1,975,094 |

| China South City Holdings Limited (b) | 394,000 | 179,812 |

| Chongqing Rural Commercial Bank Co. | 838,687 | 368,701 |

| CNOOC Limited | 956,218 | 1,437,393 |

| COSCO International Holdings Ltd. | 173,193 | 69,887 |

| Dongyue Group Ltd. (b) | 410,000 | 166,500 |

| FIH Mobile Ltd. (a) | 663,000 | 365,829 |

| Geely Automobile Holdings Ltd. | 1,740,000 | 684,178 |

| Giordano International Limited | 326,000 | 210,140 |

| KWG Property Holding Limited | 568,919 | 312,450 |

| Shanghai Industrial Holdings Limited | 60,000 | 198,408 |

| Shun Tak Holdings Ltd. | 270,000 | 139,234 |

| SJM Holdings Limited | 253,000 | 711,045 |

| Soho China Limited | 842,479 | 692,947 |

| 8,135,651 | ||

| HUNGARY—0.3% | ||

| Richter Gedeon Nyrt (b) | 28,085 | 489,883 |

| INDIA—4.9% | ||

| Allahabad Bank | 29,921 | 45,365 |

| Andhra Bank | 214,842 | 229,150 |

| Bajaj Holdings & Investment Limited | 11,984 | 204,675 |

| Bank of Baroda | 16,624 | 200,136 |

| Bharat Petroleum Corporation Ltd. | 38,113 | 293,366 |

| Cairn India Ltd. | 20,649 | 114,858 |

| Chambal Fertilizers & Chemicals Ltd. | 128,923 | 86,024 |

| Gitanjali Gems Limited | 62,659 | 62,216 |

| HDFC Bank Ltd. (c) | 5,128 | 210,402 |

| Hexaware Technologies Limited | 192,114 | 485,733 |

| Housing Development Finance Corp Ltd. | 14,075 | 207,393 |

| Indiabulls Housing Finance Limited | 158,659 | 624,302 |

| Indian Bank | 104,046 | 201,045 |

| Infosys Technologies Ltd. (c) | 7,778 | 421,412 |

| Oil and Natural Gas Corp. Limited | 176,612 | 941,576 |

| Oil India Limited | 16,727 | 134,718 |

| Power Finance Corporation Limited | 146,519 | 473,125 |

| Reliance Industries Ltd. | 14,789 | 232,226 |

| Rural Electrification Corporation Limited | 202,813 | 777,666 |

| South Indian Bank Ltd. | 179,919 | 67,181 |

| Syndicate Bank | 174,771 | 279,616 |

| Tata Consultancy Services Ltd. | 4,185 | 149,888 |

| UCO Bank | 259,116 | 316,723 |

| United Phosphorus Limited | 161,084 | 499,658 |

| 7,258,454 | ||

| INDONESIA—0.7% | ||

| PT Bank Bukopin Tbk | 2,989,500 | 168,423 |

| PT PP London Sumatra Indonesia Tbk | 1,256,840 | 244,508 |

| PT Surya Semesta Internusa Tbk | 1,206,000 | 101,385 |

| PT Telekomunikasi Indonesia Persero Tbk | 2,823,290 | 550,492 |

| 1,064,808 | ||

| ISRAEL—0.5% | ||

| First International Bank of Israel Ltd. | 4,735 | 78,181 |

| Mizrahi Tefahot Bank Ltd. | 44,721 | 611,108 |

| 689,289 | ||

| MALAYSIA—3.1% | ||

| Affin Holdings Berhad | 161,900 | 191,871 |

| Berjaya Sports Toto Berhad | 119,154 | 144,860 |

| British American Tobacco (Malaysia) Berhad | 21,344 | 386,421 |

| DRB-HICOM Berhad | 221,399 | 167,465 |

| Genting Malaysia Berhad | 388,609 | 499,819 |

| JCY International Berhad | 341,400 | 75,797 |

| KLCC Property Holdings Berhad | 66,800 | 129,897 |

| Kuala Lumpur Kepong Berhad | 47,200 | 349,790 |

| Lafarge Malaysia Berhad | 33,880 | 93,791 |

| Malaysia Building Society Berhad | 437,112 | 291,810 |

| Parkson Holdings Berhad | 117,800 | 108,222 |

| Petronas Chemicals Group Berhad | 174,200 | 368,618 |

| Telekom Malaysia Berhad | 205,478 | 370,622 |

| Tenaga Nasional Berhad | 226,300 | 828,831 |

| UMW Holdings Berhad | 179,293 | 602,859 |

4,610,673 | ||

| MEXICO—2.9% | ||

| Alfa S.A.B. de C.V., Series A | 84,490 | 213,530 |

| America Movil S.A.B. de C.V., Series L | 934,370 | 931,687 |

| Controladora Comercial Mexicana S.A. de C.V. (b) | 59,500 | 246,749 |

| Fomento Economico Mexicano S.A.B. (c) | 2,734 | 254,918 |

| GRUMA, S.A.B. de C.V., Series B (a) | 108,807 | 899,955 |

| Grupo Aeroportuario del Pacifico S.A.B. (c) | 5,600 | 327,544 |

| Grupo Carso SAB de C.V., Series A1 | 55,000 | 288,532 |

| Grupo Financiero Banorte SAB de C.V. | 28,800 | 194,735 |

| Grupo Herdez, S. A. B. de C. V., Series | 13,854 | 41,167 |

| Grupo Mexico S.A.B. de C.V., Series B | 90,198 | 284,599 |

| Grupo Televisa S.A.B. (c) | 11,859 | 394,786 |

| Organizacion Soriana S.A.B. de C.V., Series B (a) | 20,200 | 62,189 |

| Wal-Mart de Mexico, S.A.B. de C.V. | 37,400 | 89,078 |

| 4,229,469 | ||

| PHILIPPINES—0.4% | ||

| Aboitiz Equity Ventures, Inc. | 46,340 | 57,867 |

| Alliance Global Group, Inc. | 588,600 | 374,069 |

| Rizal Commercial Banking Corporation | 58,690 | 61,510 |

| Universal Robina Corporation | 47,920 | 151,737 |

| 645,183 | ||

| POLAND—1.2% | ||

| Asseco Poland S.A. | 6,825 | 105,888 |

| KGHM Polska Miedz S.A. (b) | 17,677 | 636,130 |

| PGE S.A. | 132,280 | 826,163 |

| Tauron Polska Energia S.A. | 137,757 | 238,992 |

| 1,807,173 | ||

| RUSSIA—4.0% | ||

| Gazprom (c) | 180,222 | 1,387,709 |

| LUKoil (c) | 27,821 | 1,545,735 |

| Magnit OJSC (Reg S) (d) | 2,789 | 152,837 |

| Mail.ru Group Ltd. (a)(d) | 4,212 | 149,315 |

| MegaFon (d) | 8,247 | 232,153 |

| Mobile TeleSystems (c) | 13,485 | 235,853 |

| Norilsk Nickel Mining and Metallurgical Co. (c) | 26,342 | 438,067 |

| PhosAgro (d) | 9,427 | 105,111 |

| Sberbank of Russia (a)(c) | 101,115 | 982,838 |

| Severstal (b)(d) | 59,106 | 447,433 |

| Sistema JSFC (Reg S) (d) | 8,812 | 198,358 |

| 5,875,409 | ||

| SINGAPORE—0.8% | ||

| ComfortDelGro Corporation Limited | 380,000 | 599,436 |

| DBS Group Holdings Ltd. | 11,000 | 141,352 |

| UOL Group Limited | 76,000 | 378,082 |

| 1,118,870 | ||

| SOUTH AFRICA—6.0% | ||

| African Rainbow Minerals Limited | 23,435 | 464,260 |

| Barloworld Limited | 42,061 | 440,473 |

| FirstRand Limited | 336,453 | 1,153,489 |

| Gold Fields Ltd. (c) | 93,079 | 343,461 |

| Imperial Holdings Limited | 35,437 | 634,381 |

| Liberty Holdings Limited | 67,904 | 801,905 |

| Mondi Limited | 17,427 | 306,031 |

| MTN Group Limited | 39,638 | 811,413 |

| Naspers Limited N Shs | 9,062 | 999,460 |

| Reunert Limited | 26,510 | 162,387 |

| RMB Holdings Ltd. | 161,113 | 733,824 |

| Sasol Ltd. | 32,879 | 1,840,924 |

| Tongaat Hulett Limited | 7,879 | 85,062 |

| 8,777,070 | ||

| SOUTH KOREA—10.2% | ||

| Daelim Industrial Co., Ltd. | 8,741 | 711,959 |

| Daewoong Pharmaceutical Company Ltd. | 1,622 | 106,818 |

| Daishin Securities Company | 9,781 | 82,056 |

| Daou Technology, Inc. | 21,495 | 288,767 |

| DGB Financial Group Inc. | 12,280 | 177,662 |

| GS Home Shopping, Inc. | 544 | 121,122 |

| Hana Financial Group, Inc. | 11,700 | 427,573 |

| Hankook Tire Co. Ltd. | 8,910 | 176,199 |

| Hanwha Corporation | 8,370 | 252,409 |

| Hyundai Motor Company Ltd. | 5,986 | 1,411,514 |

| Industrial Bank of Korea (b) | 45,960 | 582,893 |

| Kangwon Land Inc. | 7,320 | 213,180 |

| KB Financial Group Inc. | 2,750 | 96,235 |

| KCC Corporation | 1,393 | 713,218 |

| Kia Motors Corporation | 8,599 | 479,046 |

| KT Corporation | 10,020 | 278,163 |

| KT&G Corporation | 8,703 | 654,084 |

| LG Display Co., Ltd. (a) | 1,240 | 31,045 |

| LG Fashion Corp. | 6,440 | 168,797 |

| Meritz Fire & Marine Insurance Co., Ltd. | 16,280 | 227,120 |

| Naver Corp. | 365 | 265,405 |

| POSCO | 869 | 241,650 |

| Samsung Electronics Company, Ltd. | 3,776 | 4,764,120 |

| Shinhan Financial Group Co., Ltd. | 5,260 | 232,252 |

| SK Holdings Co., Ltd. | 3,310 | 600,150 |

| SK Hynix Inc. (a) | 5,970 | 201,907 |

| SK Innovation Co., Ltd. | 1,879 | 215,358 |

| SK Telecom Co., Ltd. (c) | 17,436 | 393,531 |

| Soulbrain Co., Ltd. | 8,605 | 310,021 |

| Sungwoo Hitech Co., Ltd. | 34,625 | 549,732 |

| 14,973,986 | ||

| TAIWAN—11.0% | ||

| ASUSTeK Computer, Inc. | 108,488 | 1,074,103 |

| Chailease Holding Co., Ltd. | 97,200 | 233,325 |

| Chicony Electronics Co., Ltd. | 116,473 | 302,155 |

| Chinatrust Financial Holding Co., Ltd. | 935,570 | 585,259 |

| Chunghwa Telecom Co., Ltd. | 212,600 | 654,154 |

| Farglory Land Development Co., Ltd. | 248,302 | 423,180 |

| Fubon Financial Holding Co., Ltd. | 681,000 | 923,579 |

| Highwealth Construction Corp. | 131,916 | 311,028 |

| Hon Hai Precision Industry Co., Ltd. | 332,209 | 941,454 |

| Inventec Corporation | 716,000 | 705,361 |

| Lite-On Technology Corp. | 398,994 | 594,839 |

| Pegatron Corporation | 93,416 | 139,115 |

| Phison Electronics Corp. | 104,015 | 669,467 |

| Pou Chen Corporation | 619,631 | 873,923 |

| Powertech Technology, Inc. | 324,000 | 489,950 |

| President Chain Store Corp. | 134,915 | 952,524 |

| Radiant Opto-Electronics Corporation | 202,409 | 817,545 |

| Realtek Semiconductor Corporation | 136,000 | 409,976 |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 658,270 | 2,561,530 |

| TECO Electric & Machinery Co., Ltd. | 934,983 | 1,042,367 |

| Uni-President Enterprises Corporation | 588,424 | 1,024,102 |

| United Microelectronics Corporation | 1,119,401 | 472,352 |

| 16,201,288 | ||

| THAILAND—1.8% | ||

| Delta Electronics PCL Nvdr | 104,500 | 190,058 |

| Electricity Generating PCL | 52,679 | 212,730 |

| Kiatnakin Bank PCL | 169,100 | 221,540 |

| Krung Thai Bank PCL | 1,559,646 | 899,056 |

| PTT Global Chemical PCL | 363,400 | 809,360 |

| Thanachart Capital PCL | 302,000 | 335,142 |

| 2,667,886 | ||

| TURKEY—1.6% | ||

| Eis Eczacibasi Ilac Ve Sinai | 279,198 | 280,326 |

| Enka Ins¸aat ve Sanayi A.S¸. | 84,559 | 252,332 |

| Eregli Demir ve Celik Fabrikalari T.A.S. | 561,594 | 723,842 |

| Gubre Fabrikalari TAS (a) | 101,756 | 179,624 |

| Tekfen Holding A.S. | 94,774 | 215,984 |

| Tofas Turk Otomobil Fabrikasi A.S. | 46,298 | 262,695 |

| Turkiye Sise ve Cam Fabrikalari A.S. | 344,784 | 373,549 |

| 2,288,352 | ||

| TOTAL COMMON STOCK | ||

| (Cost $104,112,347) | 105,620,413 | |

| Preferred Stock—2.3% | ||

| BRAZIL—2.3% | ||

| Banco Bradesco S.A. | 35,889 | 496,266 |

| Banco Estado Rio Gran Pref B | 48,930 | 284,608 |

| Eletropaulo Metropolitana S.A. | 34,480 | 130,699 |

| Itau Unibanco Holding S.A. | 48,519 | 729,205 |

| Itausa-Investimentos Itau S.A. | 290,000 | 1,189,262 |

| Vale S.A., Class A | 44,571 | 560,200 |

| TOTAL PREFERRED STOCK | ||

| (Cost $4,640,871) | 3,390,240 | |

| Exchange Traded Funds—3.1% | ||

| United States—3.1% | ||

iShares MSCI Emerging Markets Index Fund (b) (Cost $4,446,158) | 111,697 | 4,578,460 |

| Mutual Funds—22.4% | ||

| United States—22.4% | ||

Pear Tree PanAgora Risk Parity Emerging Markets Fund* (Cost $32,104,404) | 3,179,734 | 32,910,247 |

Short Term Investments—1.4%

| Par Value | Value | |

| State Street Bank & Trust Co., Repurchase Agreement .0%, 04/01/14, (Dated 03/31/14), Collateralized by 2,185,000 par U.S. Treasury Note-.625% due 11/30/2017, Market Value $2,137,474, Repurchase Proceeds $2,090,917 (Cost $2,090,917) | $2,090,917 | $2,090,917 |