UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | October 31, 2014 |

Item 1. Reports to Stockholders

(Fidelity Investment logo)(registered trademark)

Fidelity Advisor®

Diversified International

Fund - Class A, Class T, Class B

and Class C

Annual Report

October 31, 2014

(Fidelity Cover Art)

Contents

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion of Fund Performance | (Click Here) | The Portfolio Manager's review of fund performance and strategy. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

Board Approval of Investment Advisory Contracts and Management Fees | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2014 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

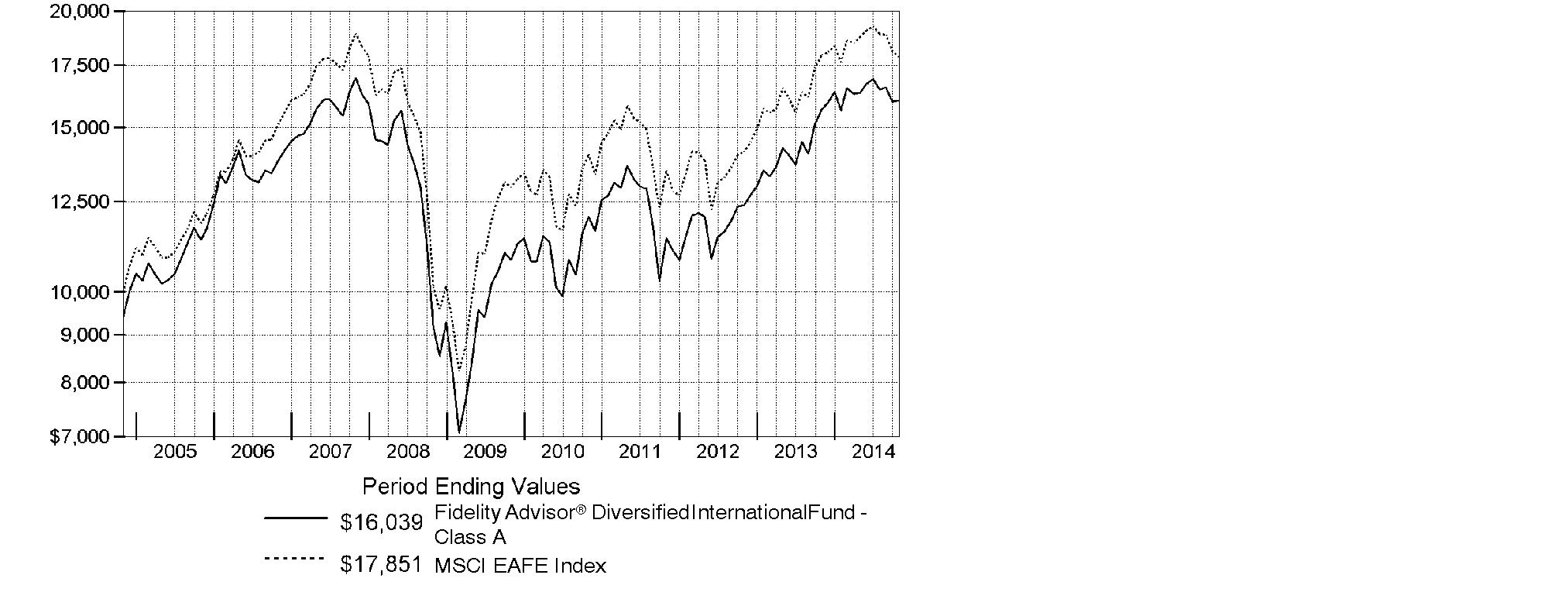

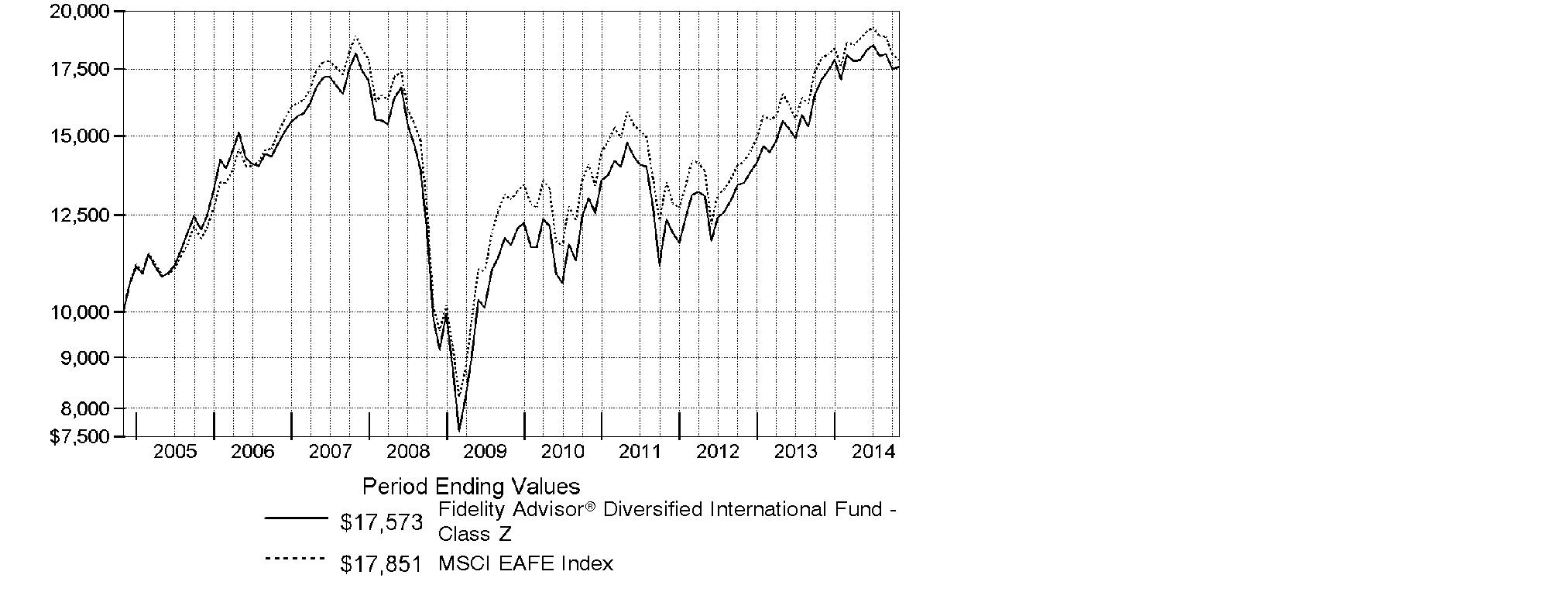

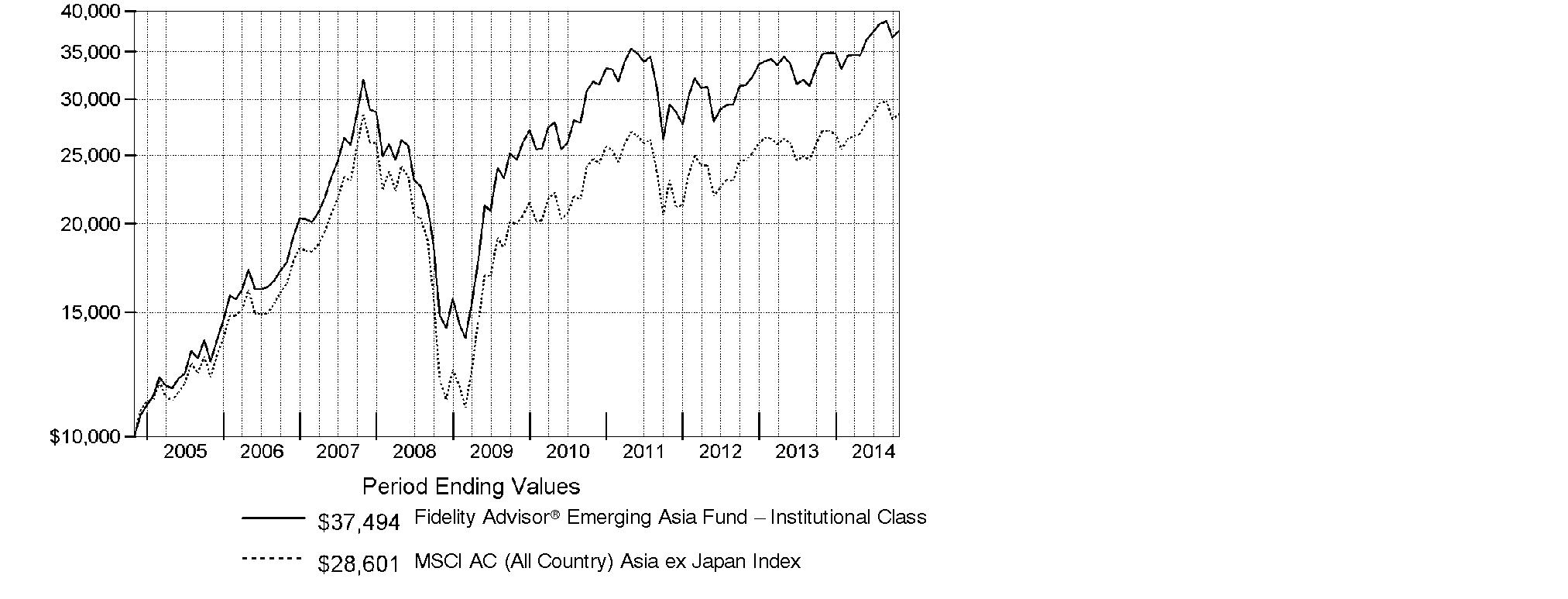

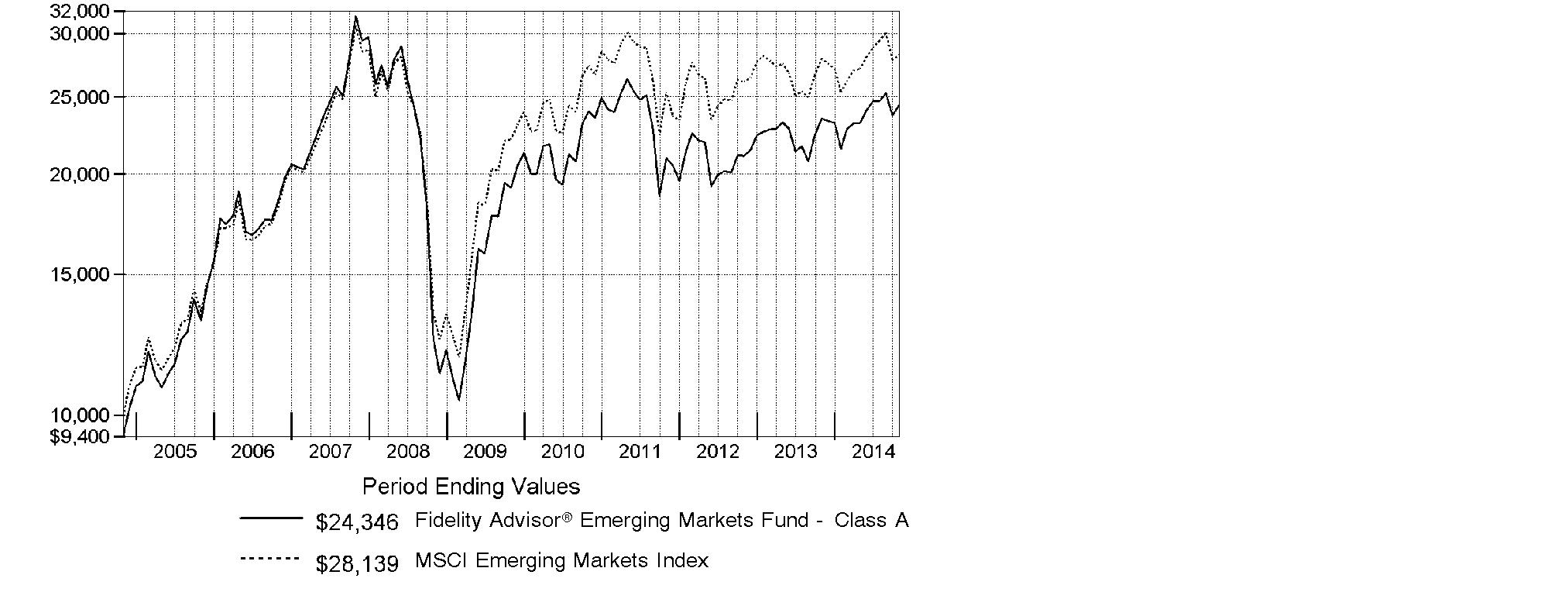

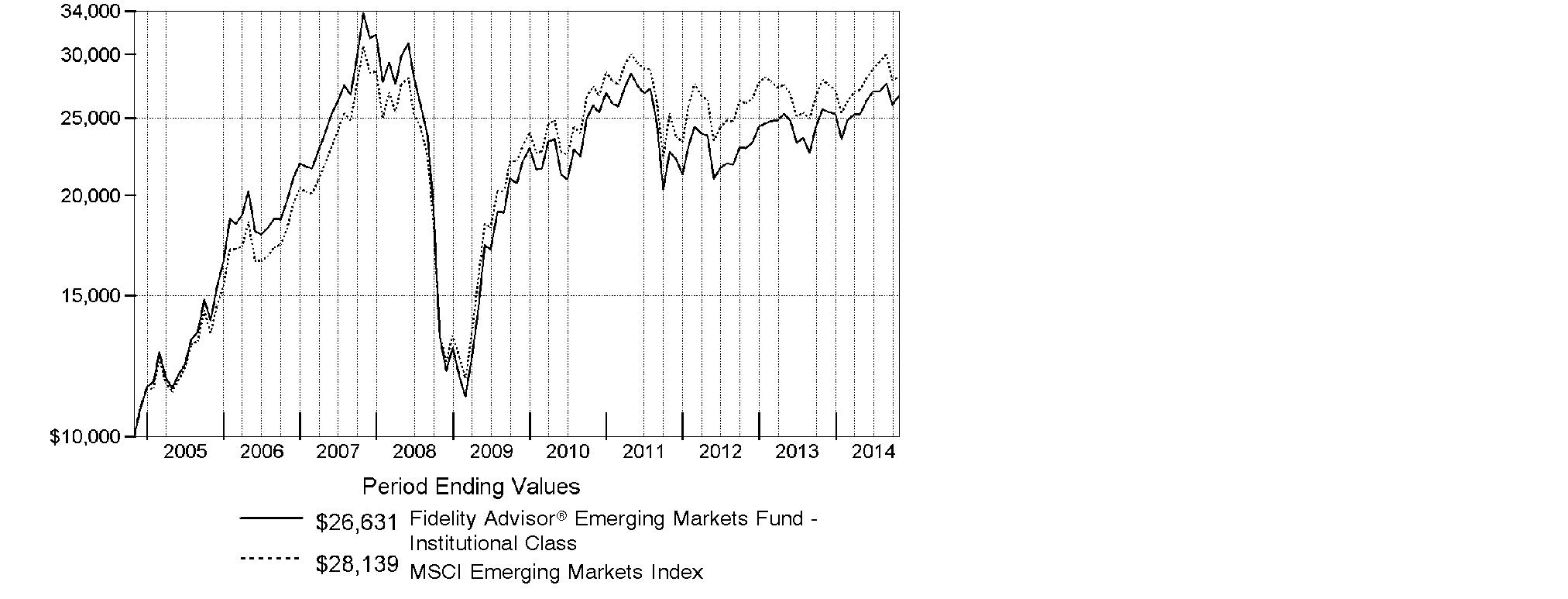

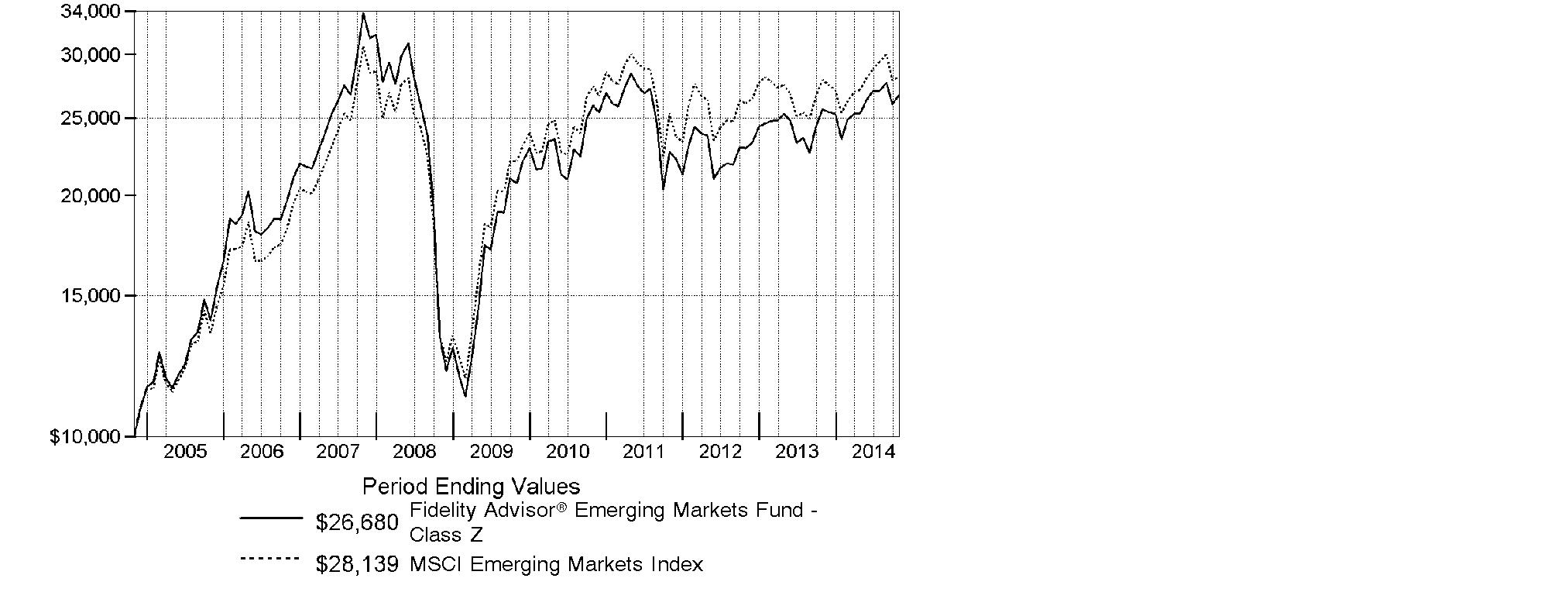

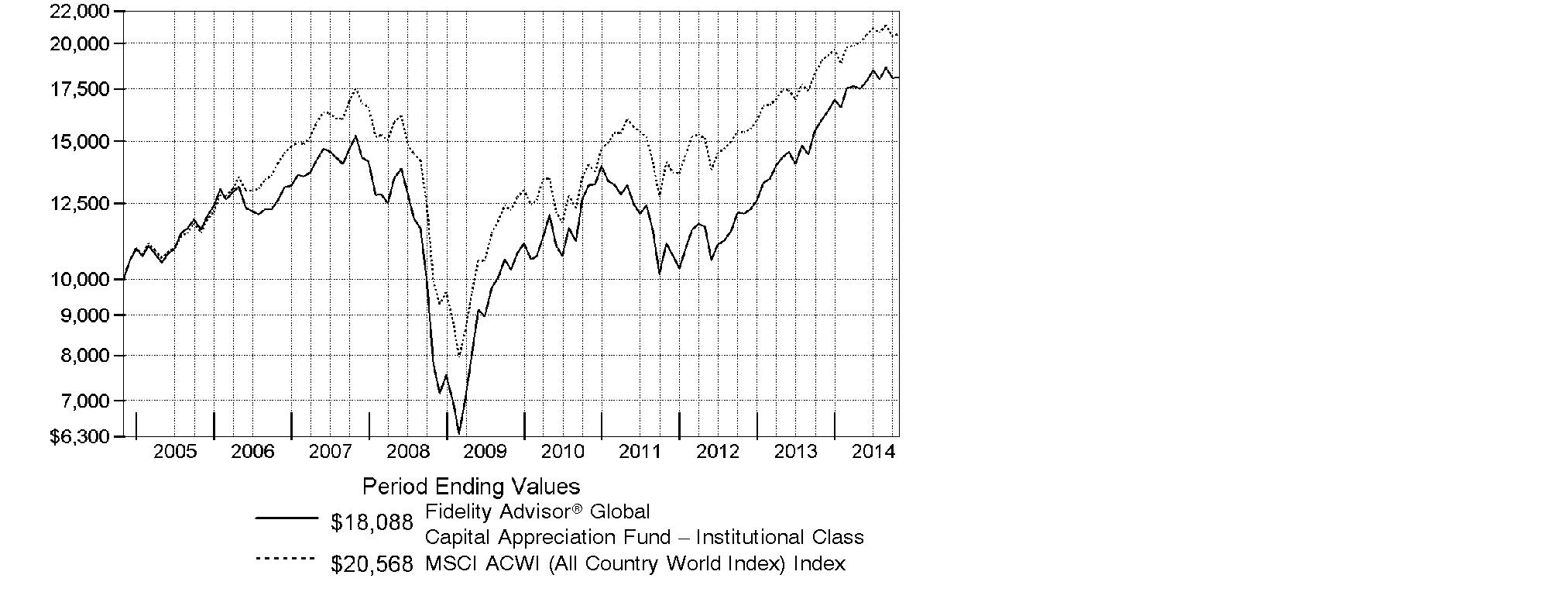

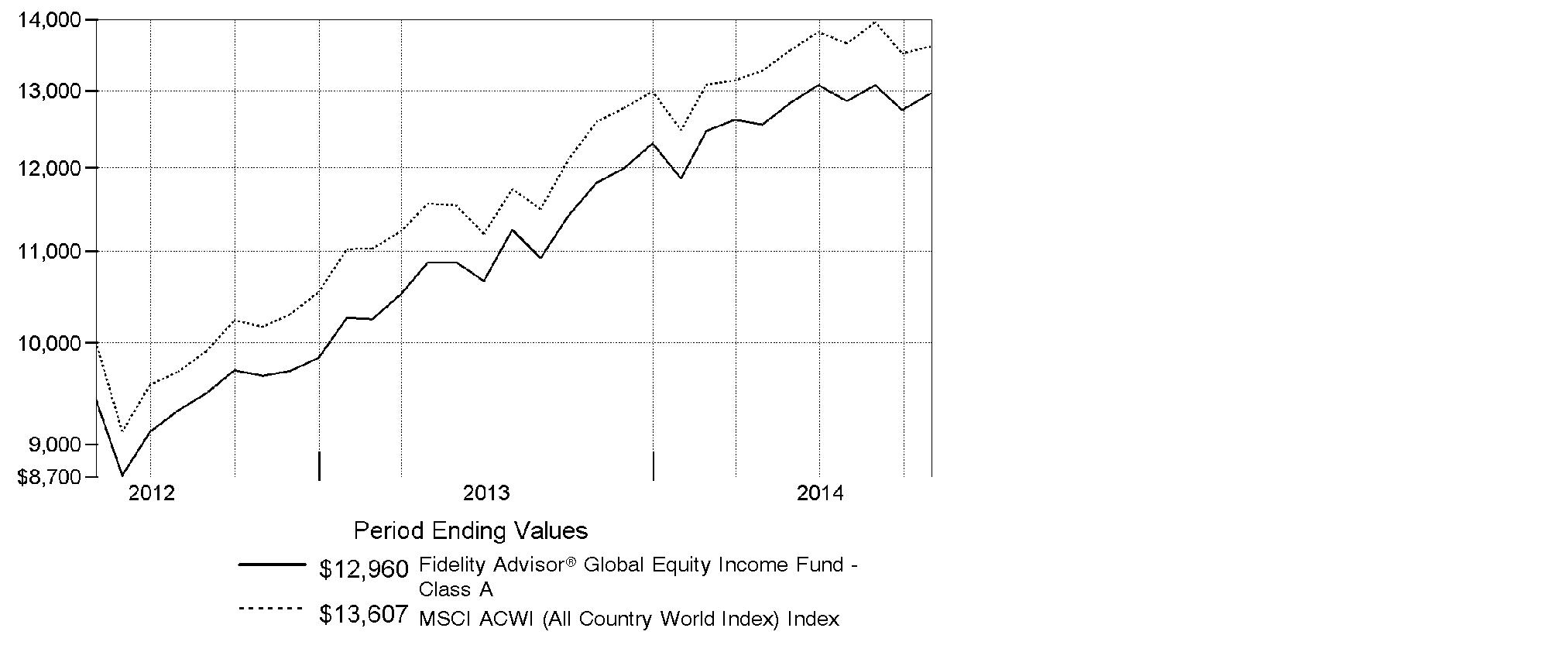

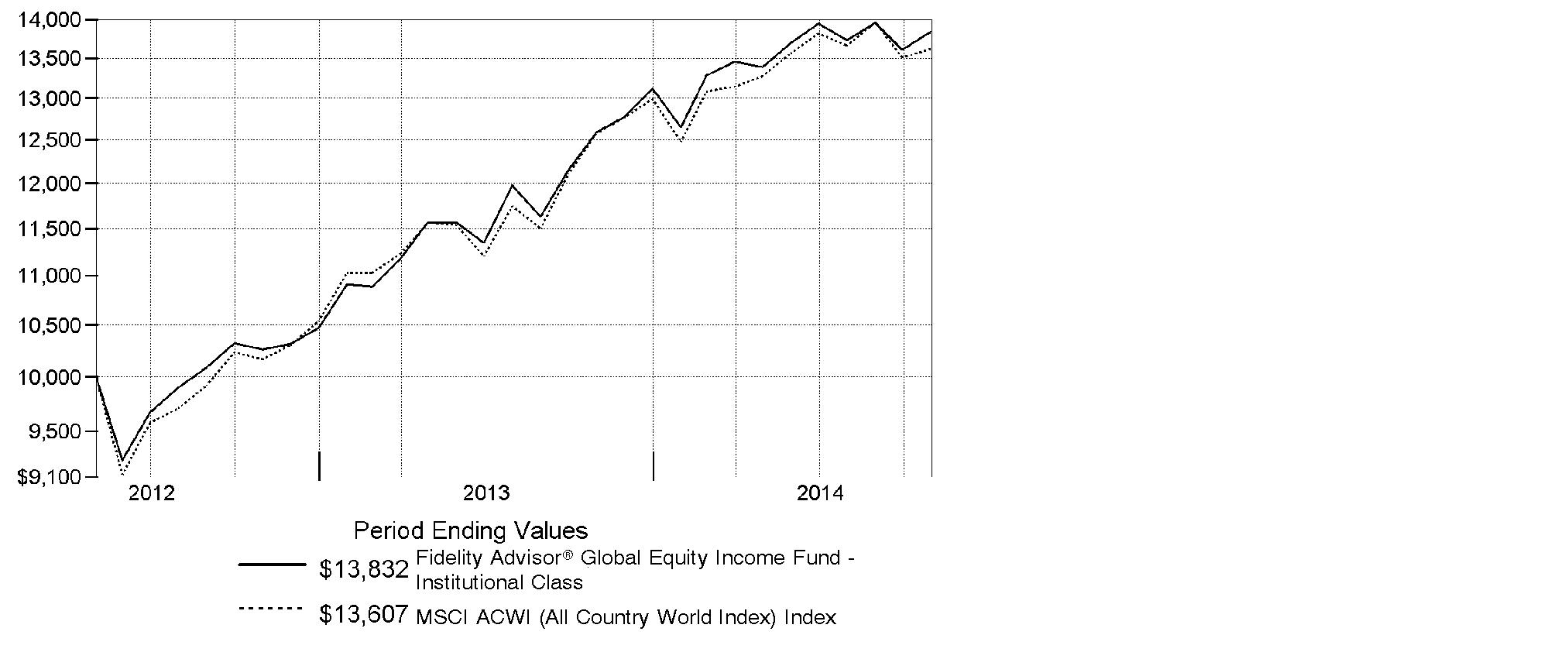

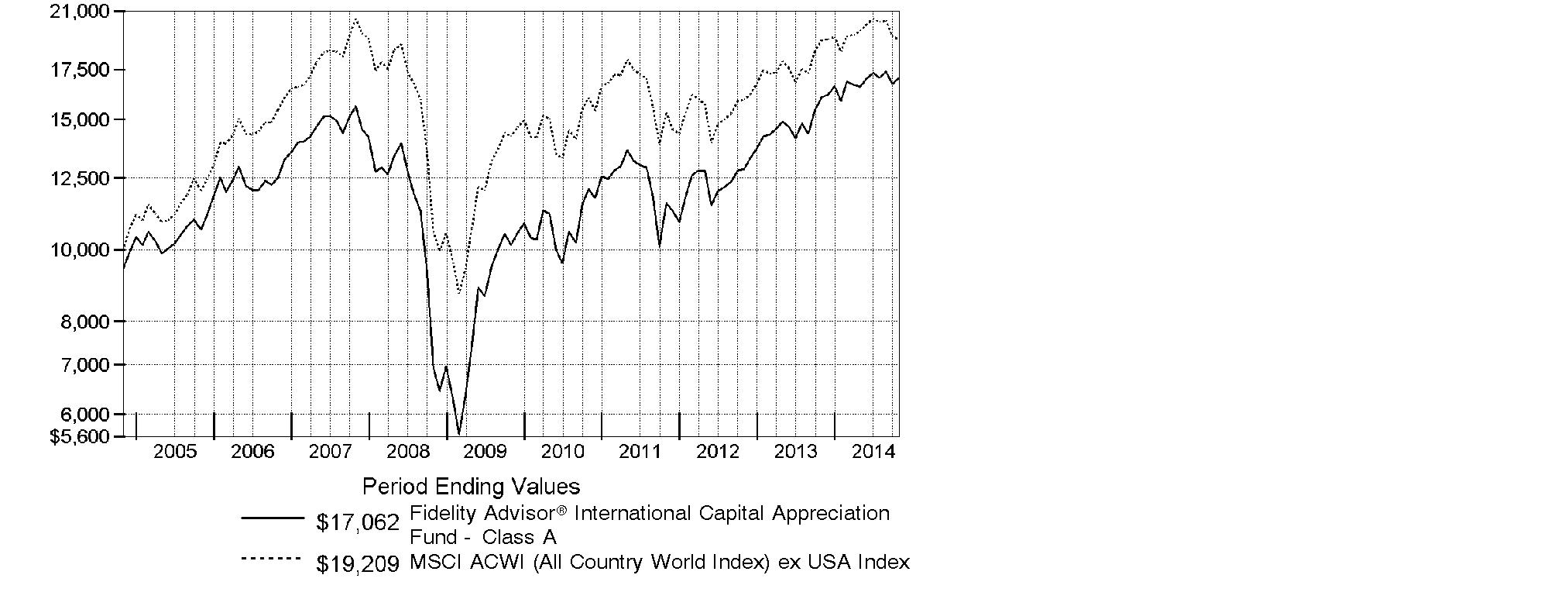

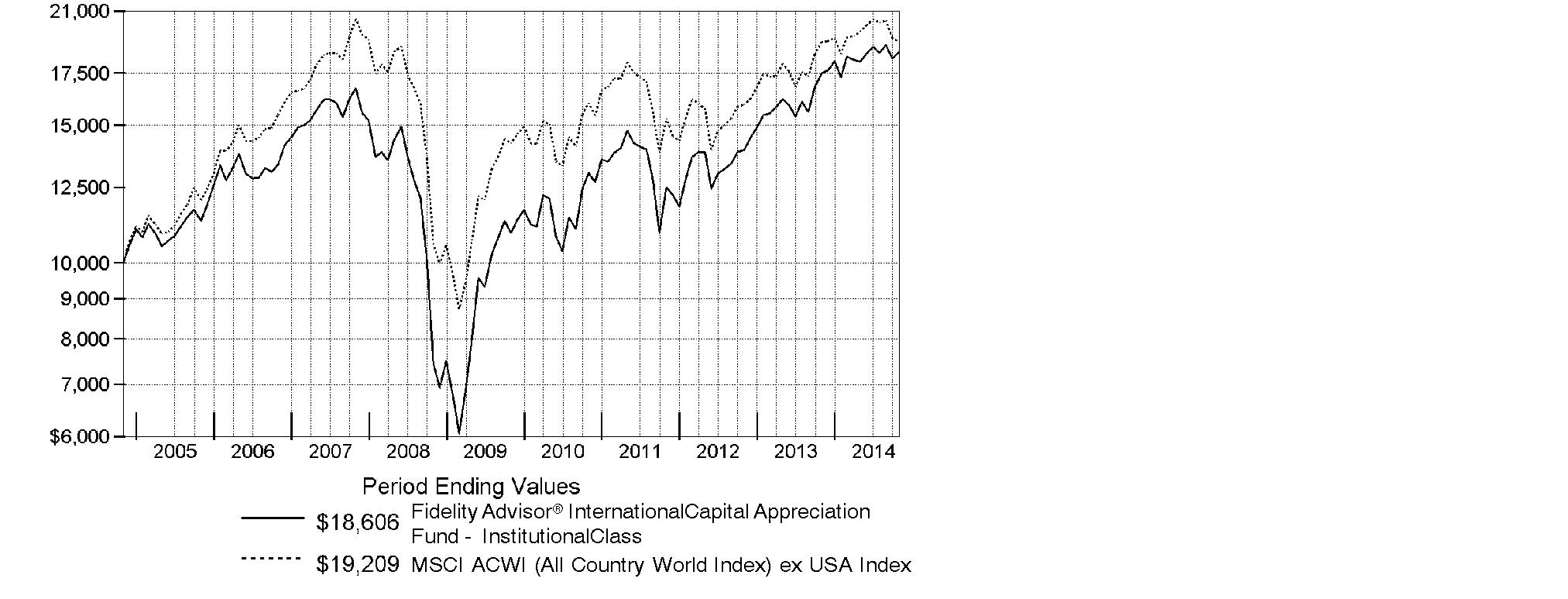

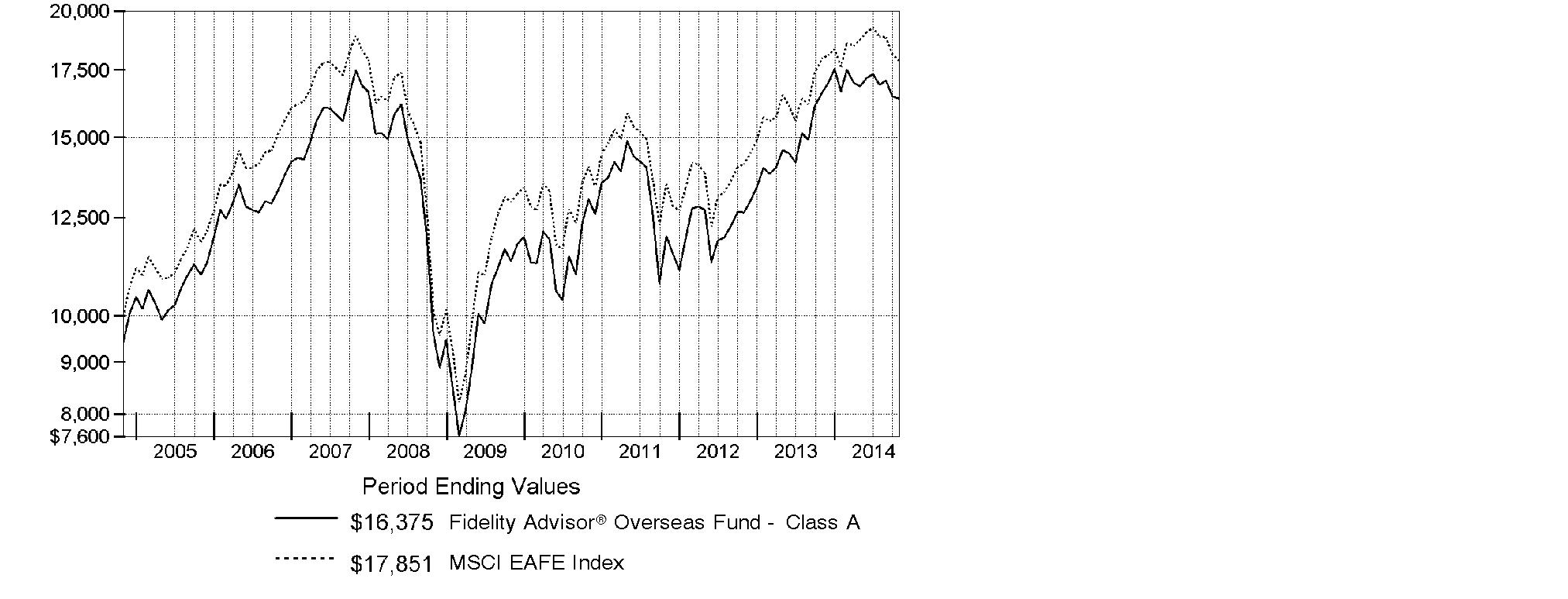

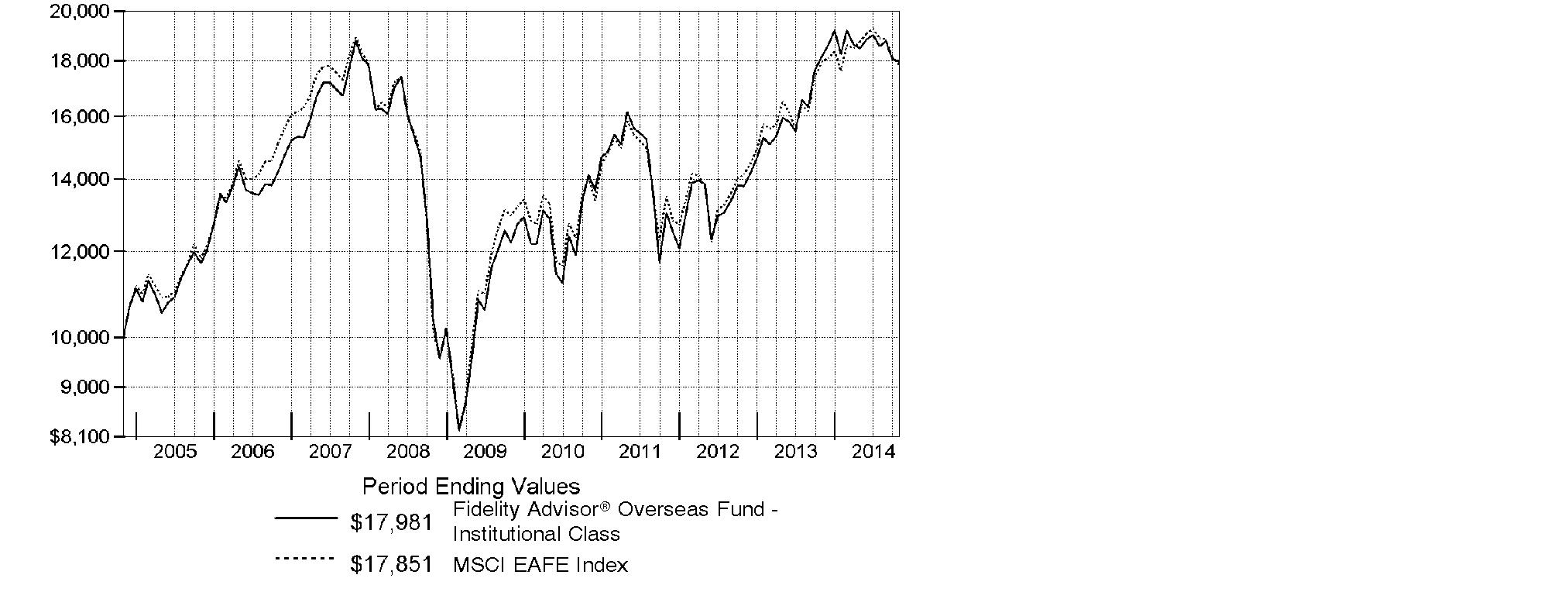

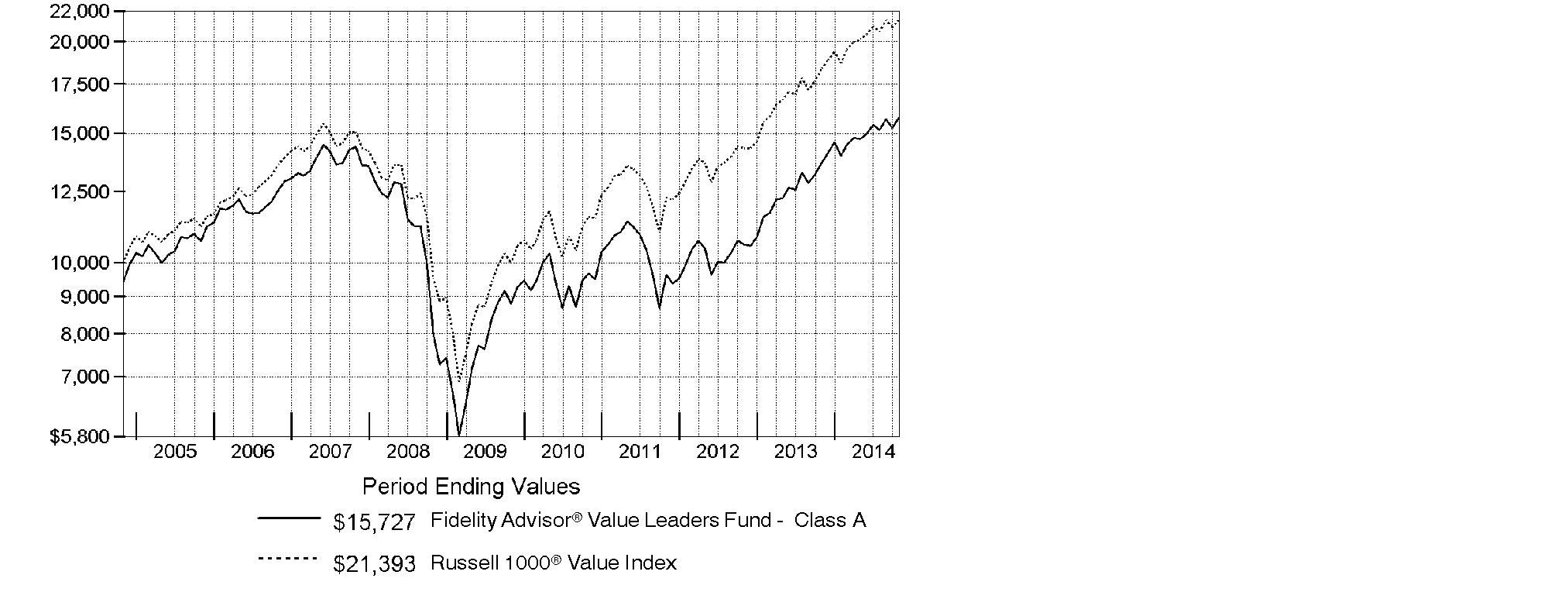

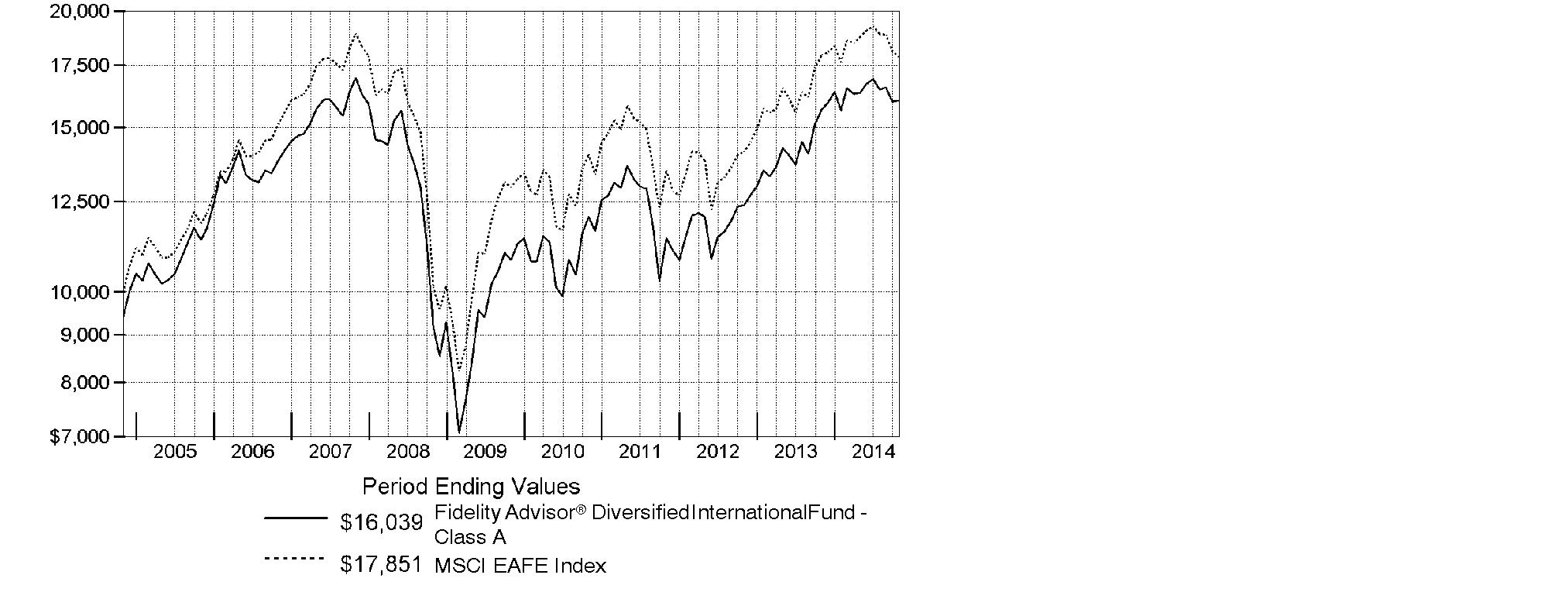

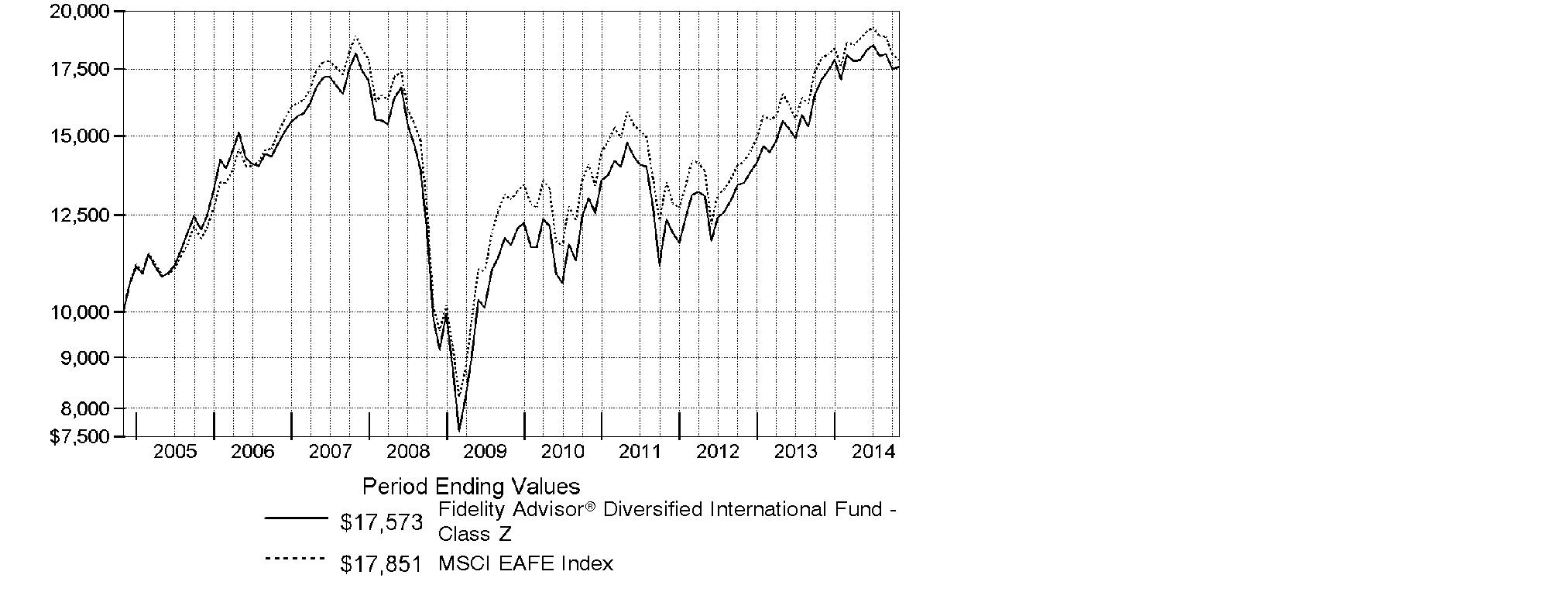

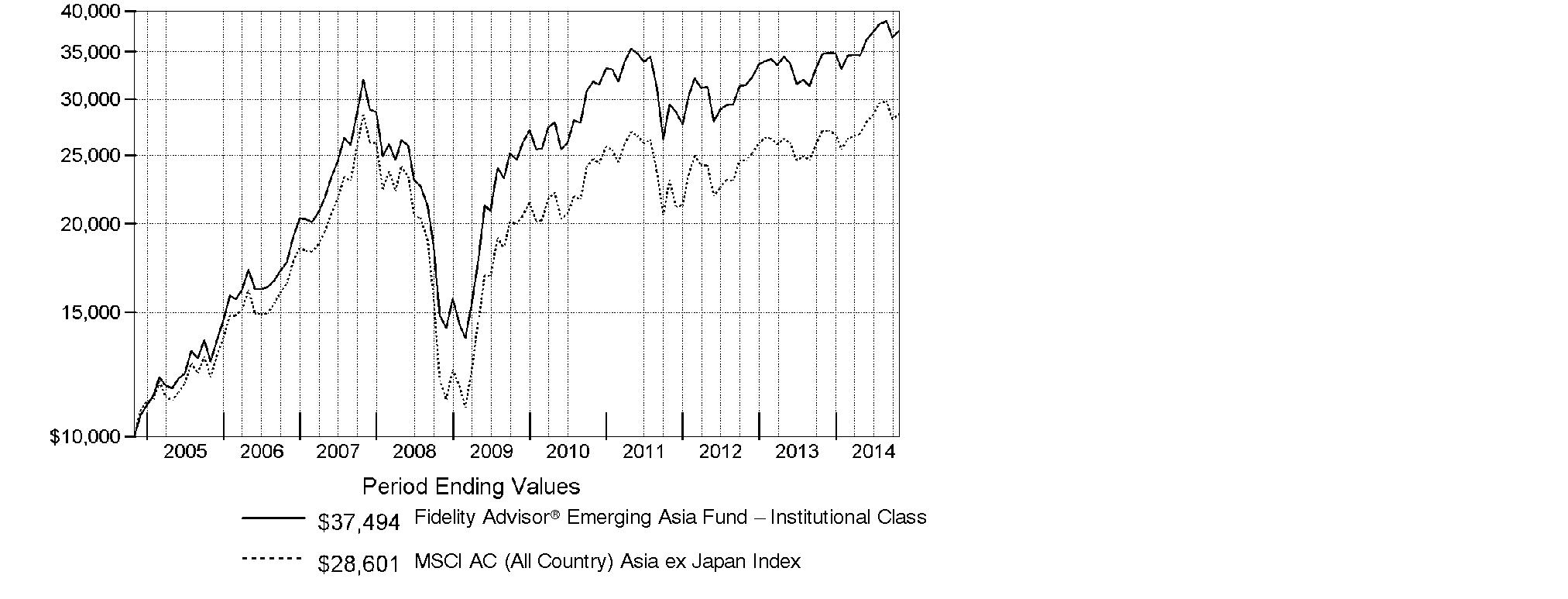

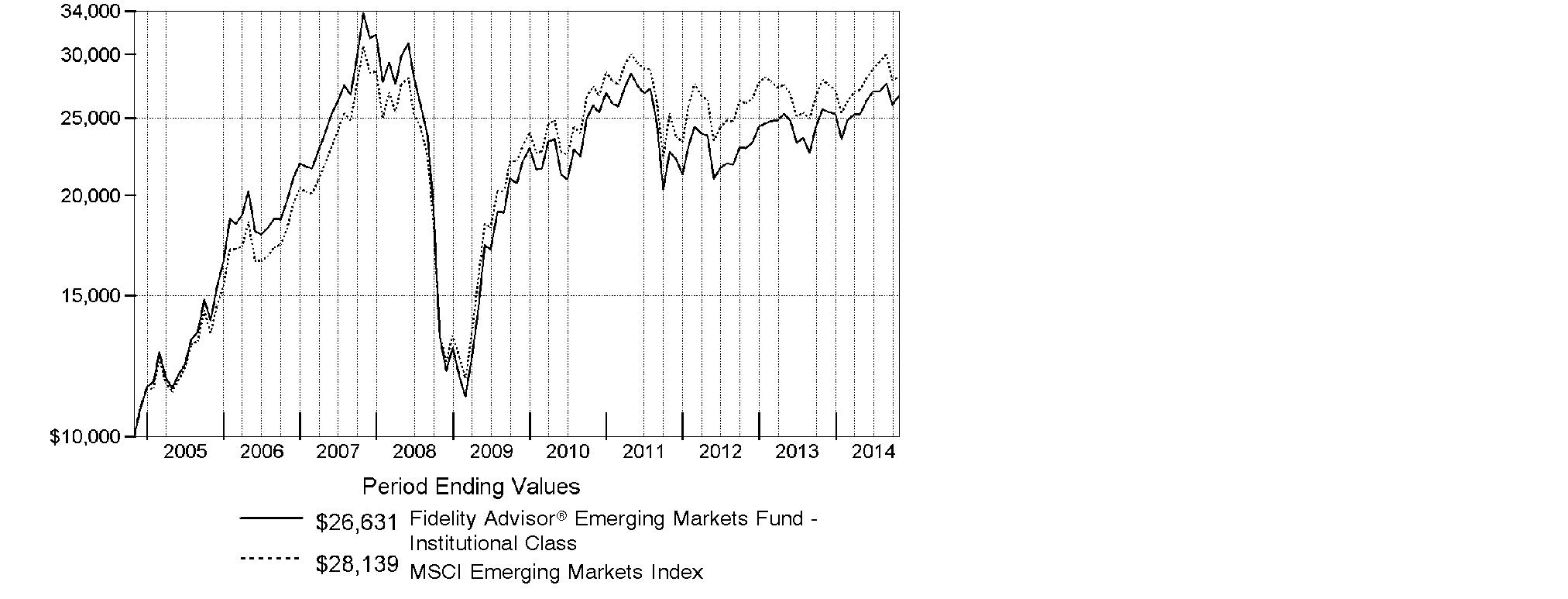

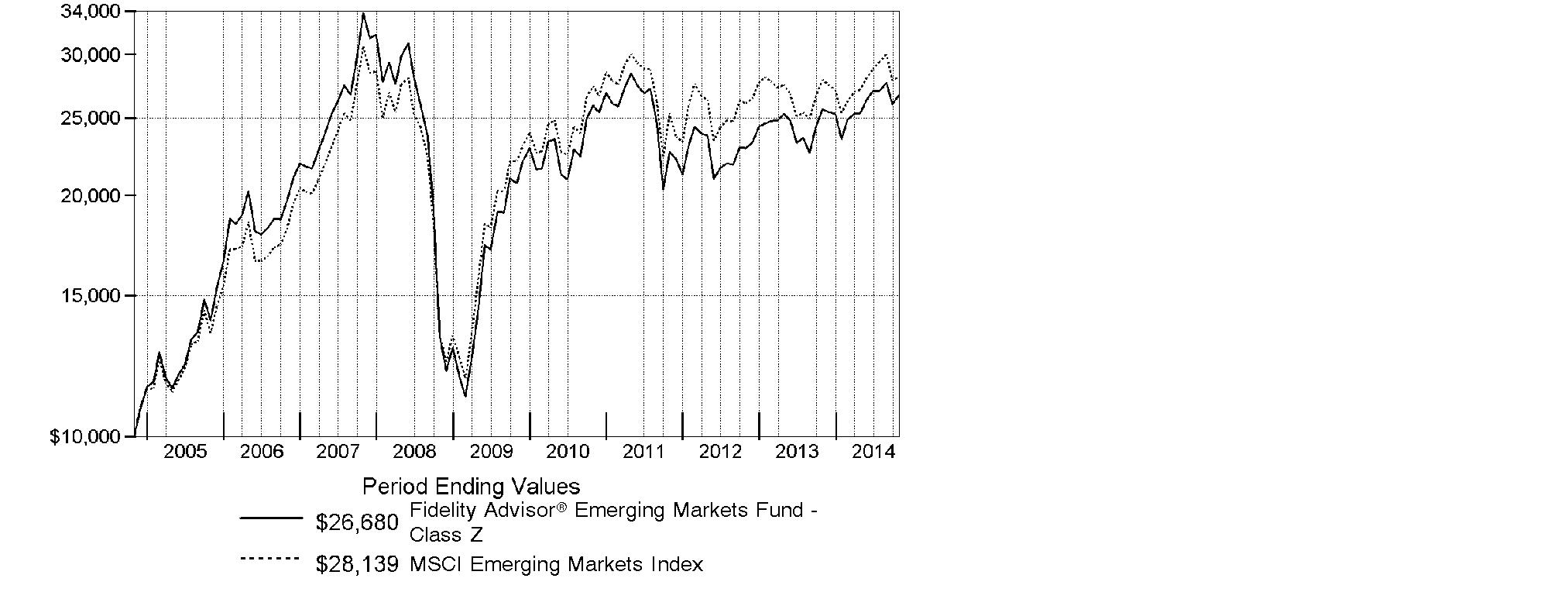

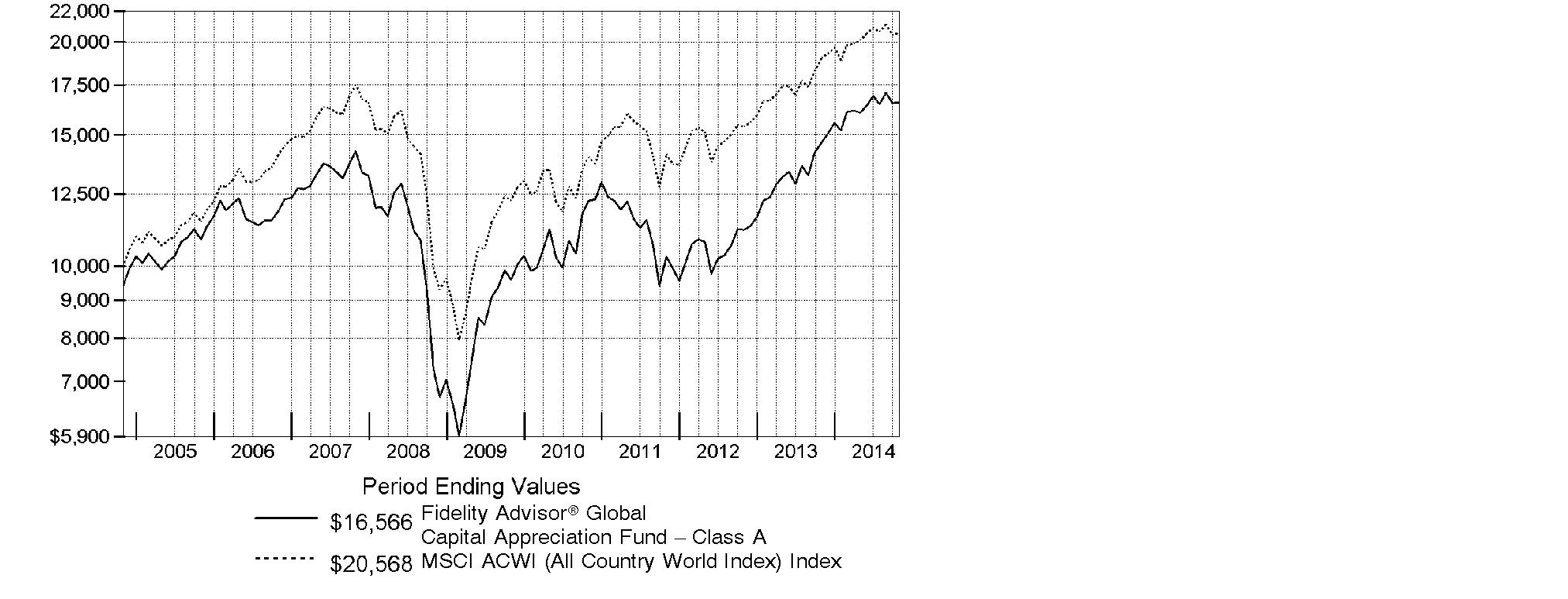

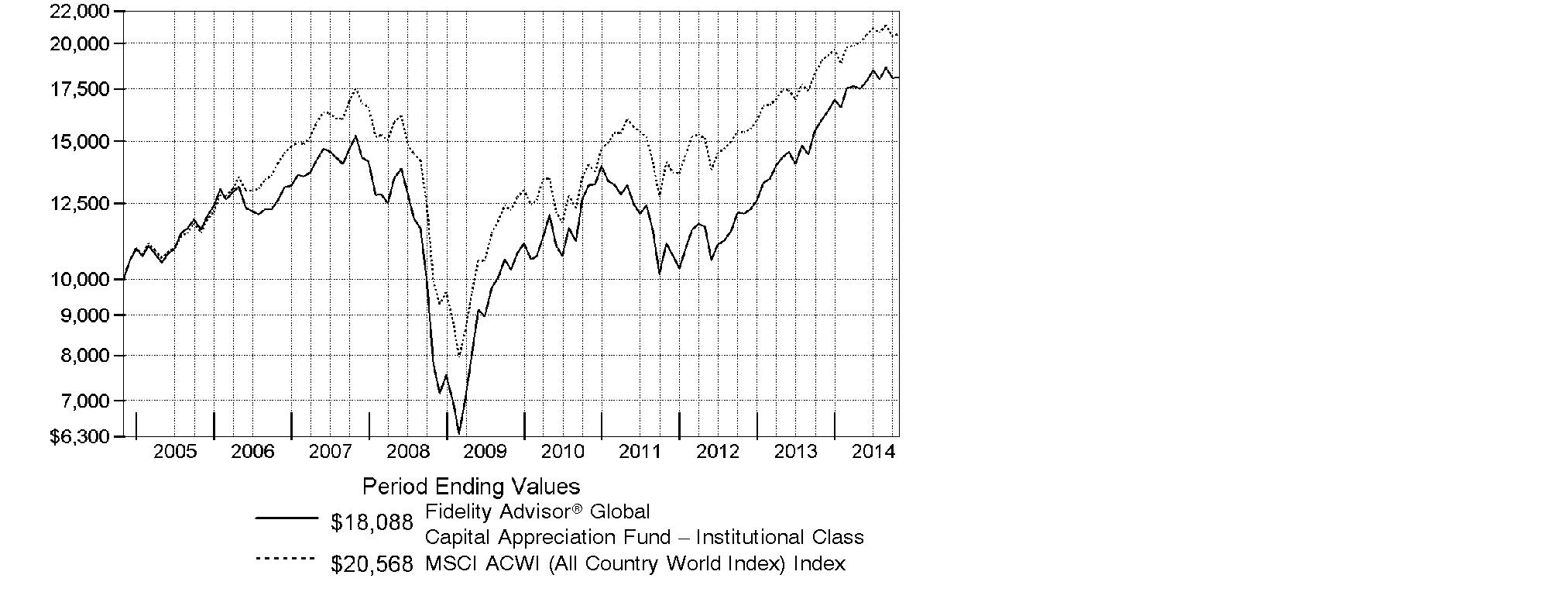

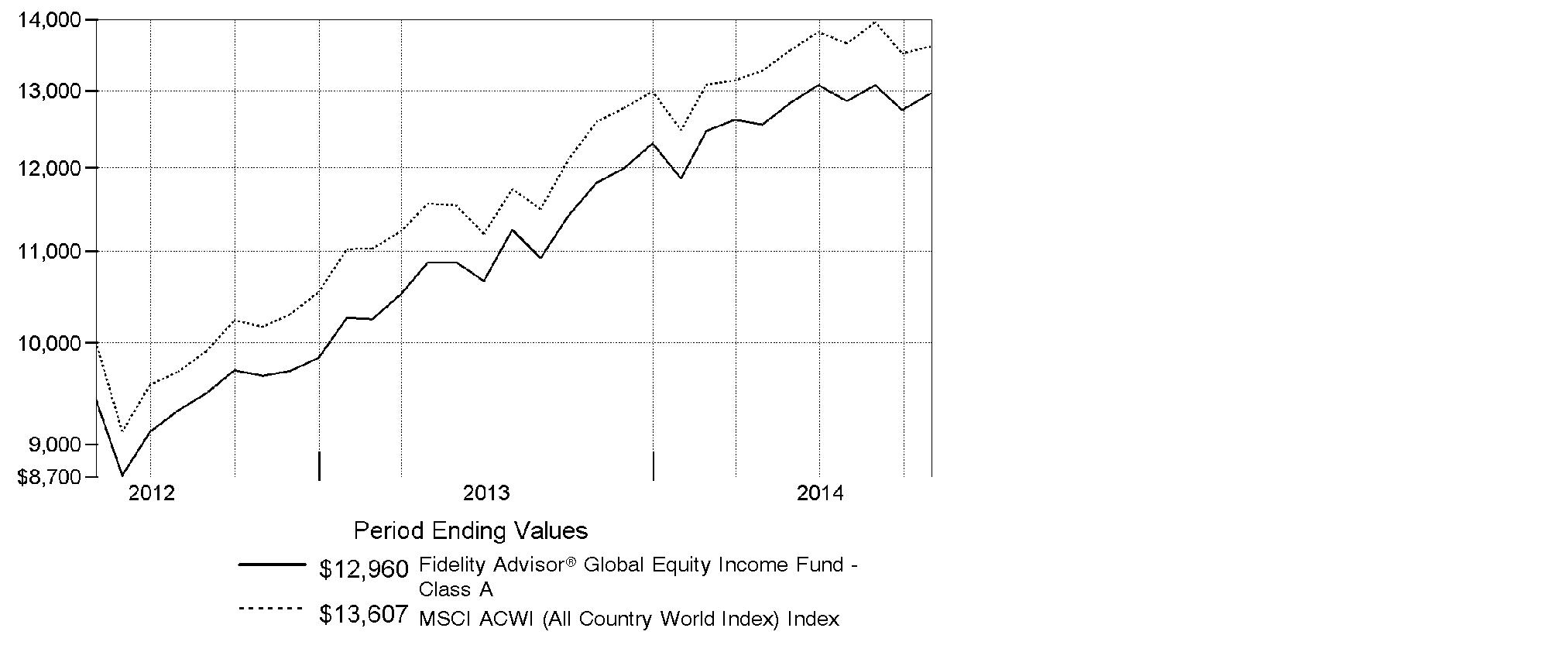

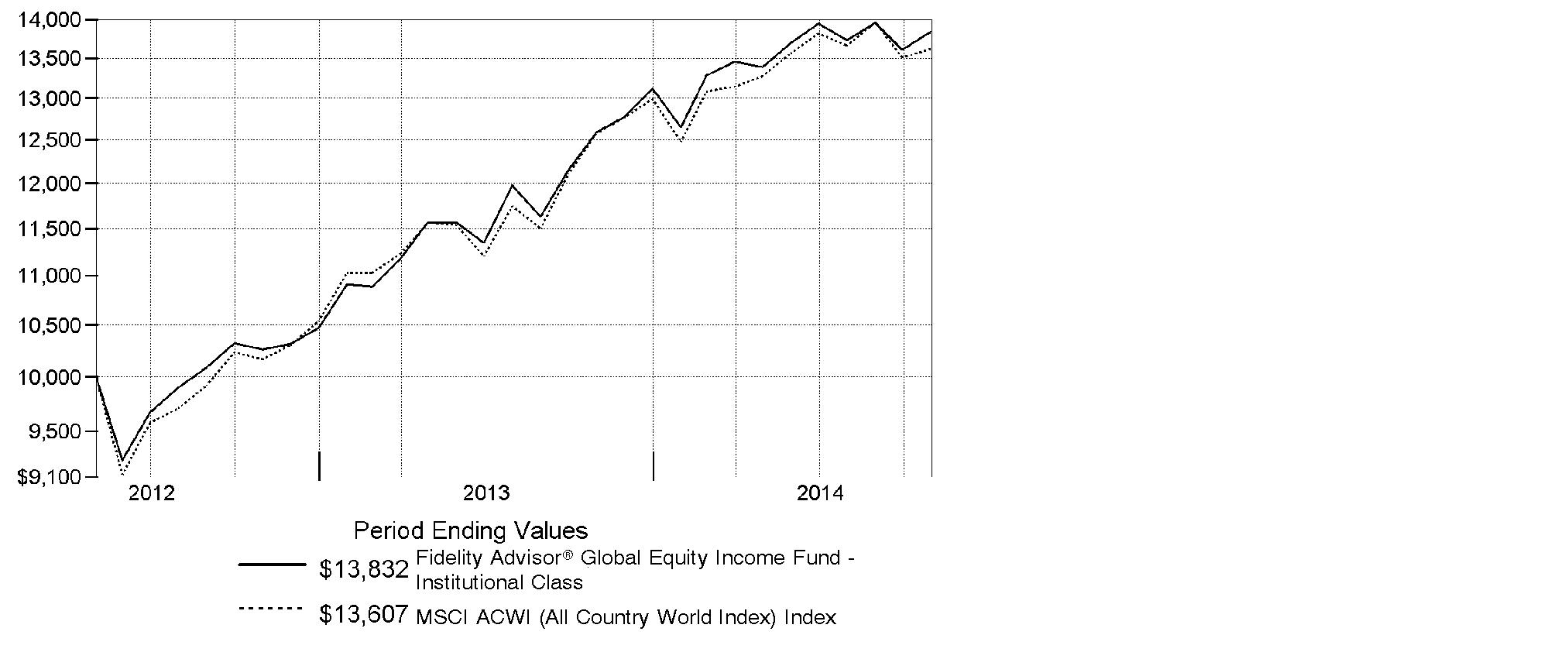

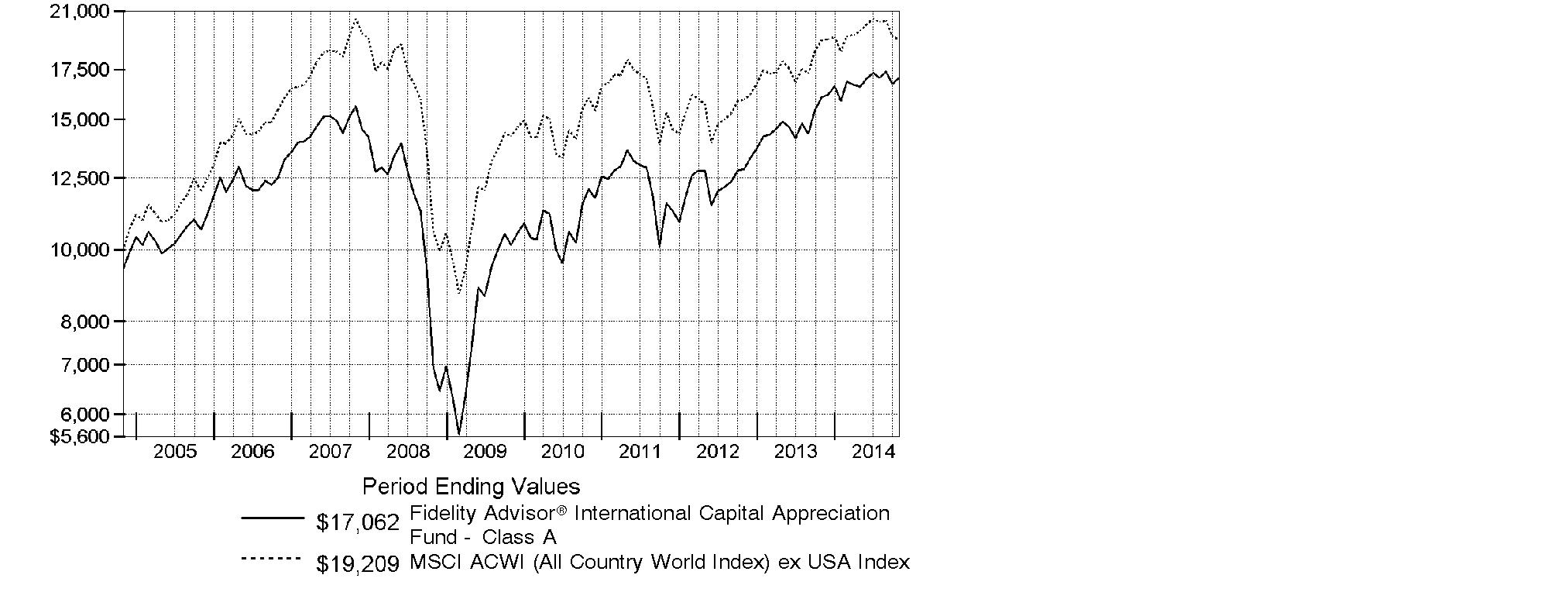

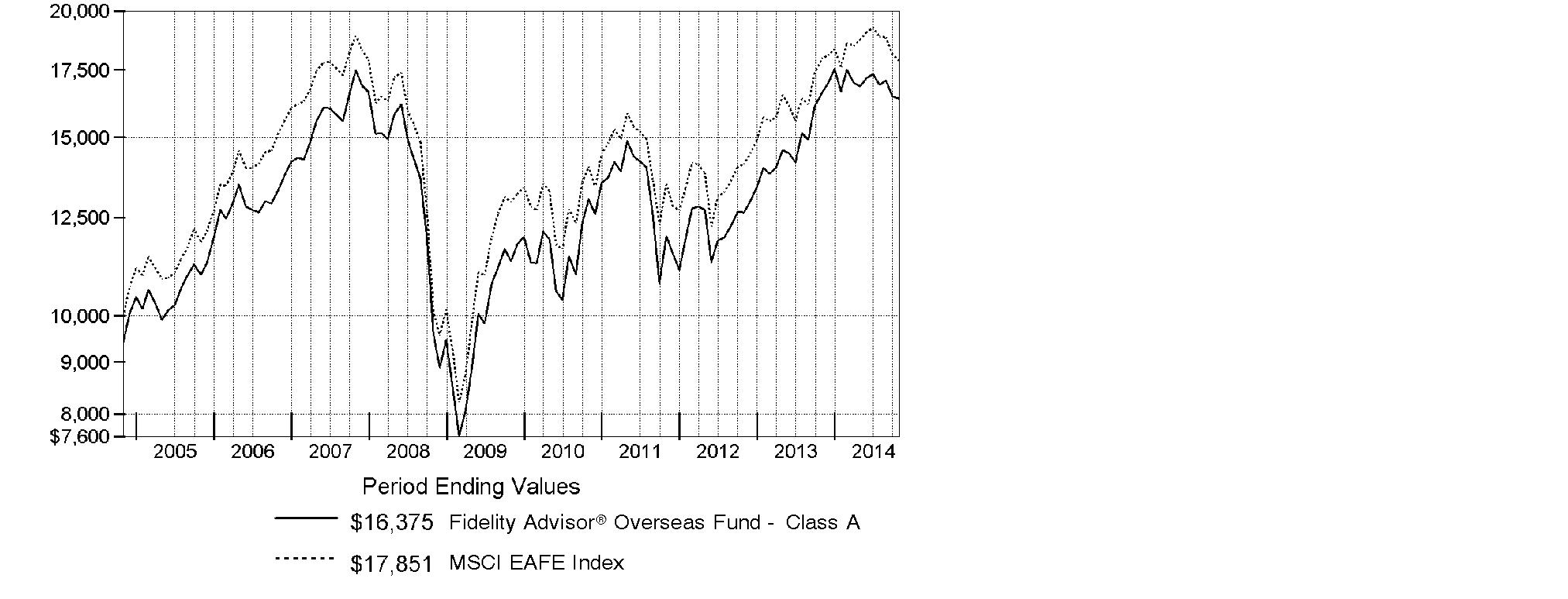

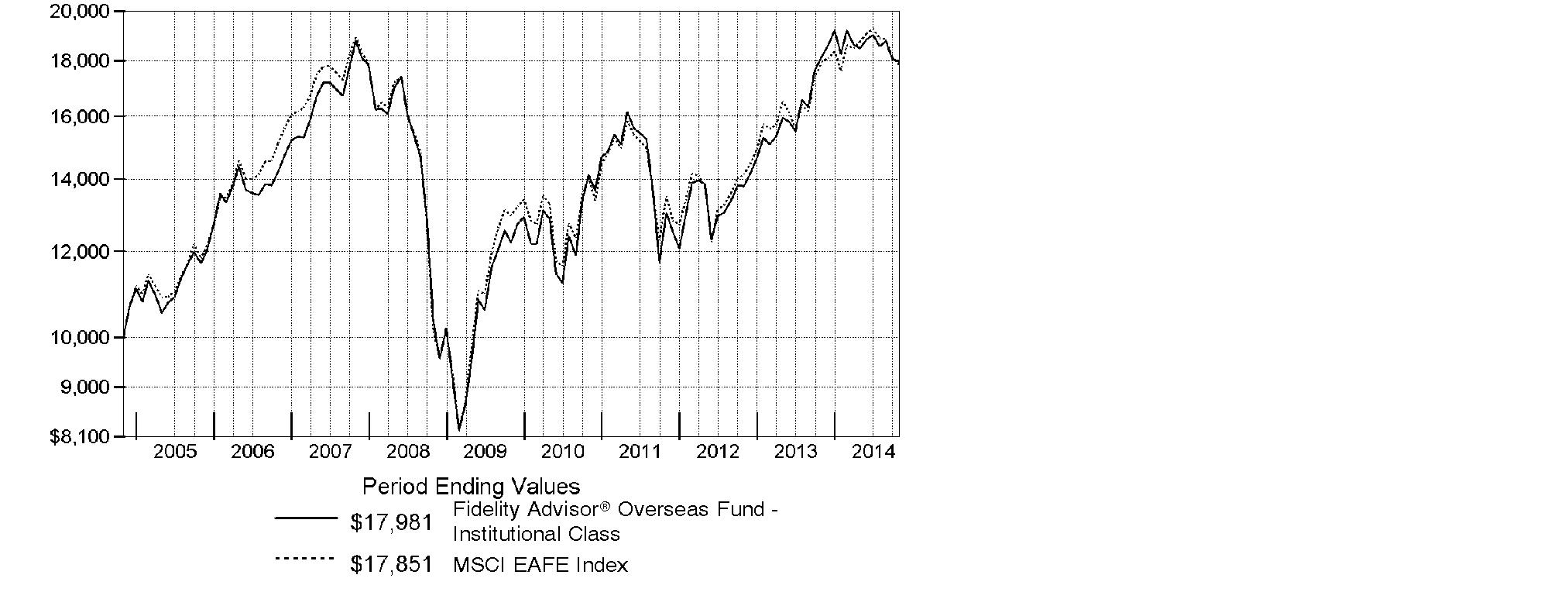

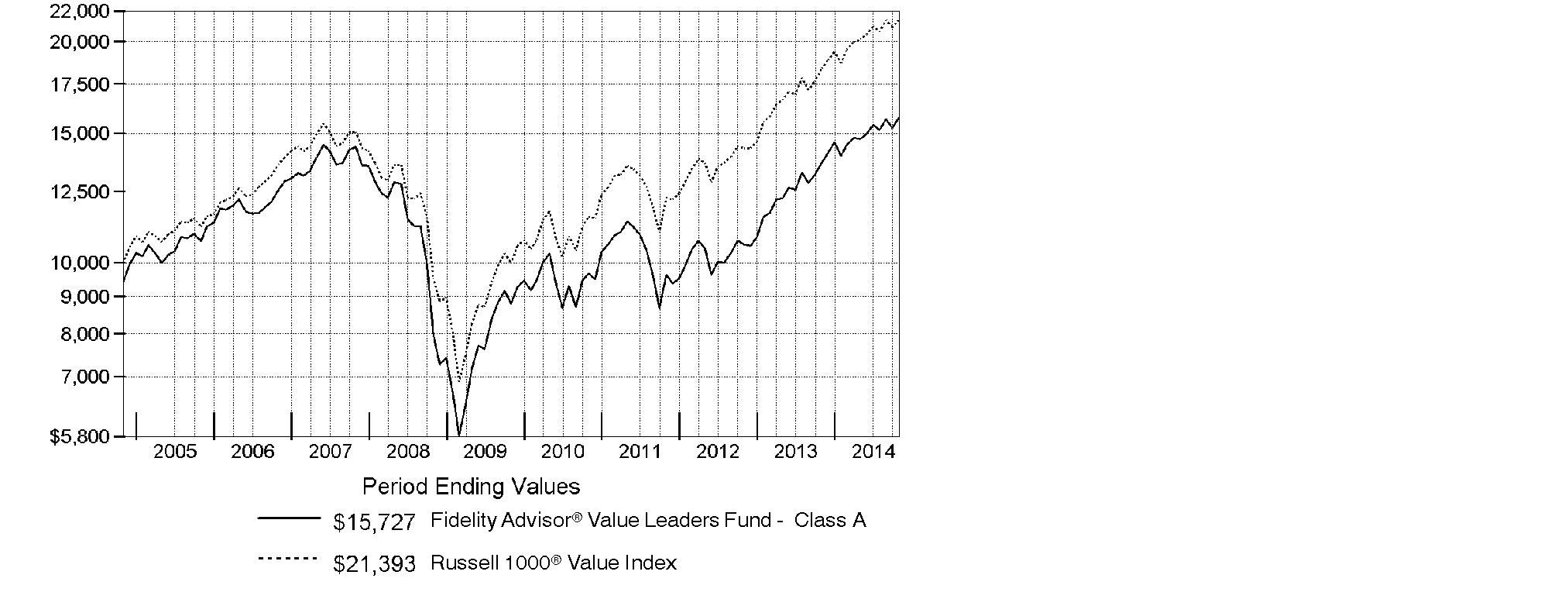

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow. Returns reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

Average Annual Total Returns

Periods ended October 31, 2014 | Past 1

year | Past 5

years | Past 10

years |

Class A (incl. 5.75% sales charge) | -3.60% | 6.91% | 4.84% |

Class T (incl. 3.50% sales charge) | -1.53% | 7.15% | 4.83% |

Class B (incl. contingent deferred sales charge) A | -3.55% | 7.05% | 4.86% |

Class C (incl. contingent deferred sales charge) B | 0.58% | 7.40% | 4.67% |

A Class B shares' contingent deferred sales charges included in the past one year, past five years, and past ten years total return figures are 5%, 2%, and 0%, respectively.

B Class C shares' contingent deferred sales charges included in the past one year, past five years, and past ten years total return figures are 1%, 0%, and 0%, respectively.

Annual Report

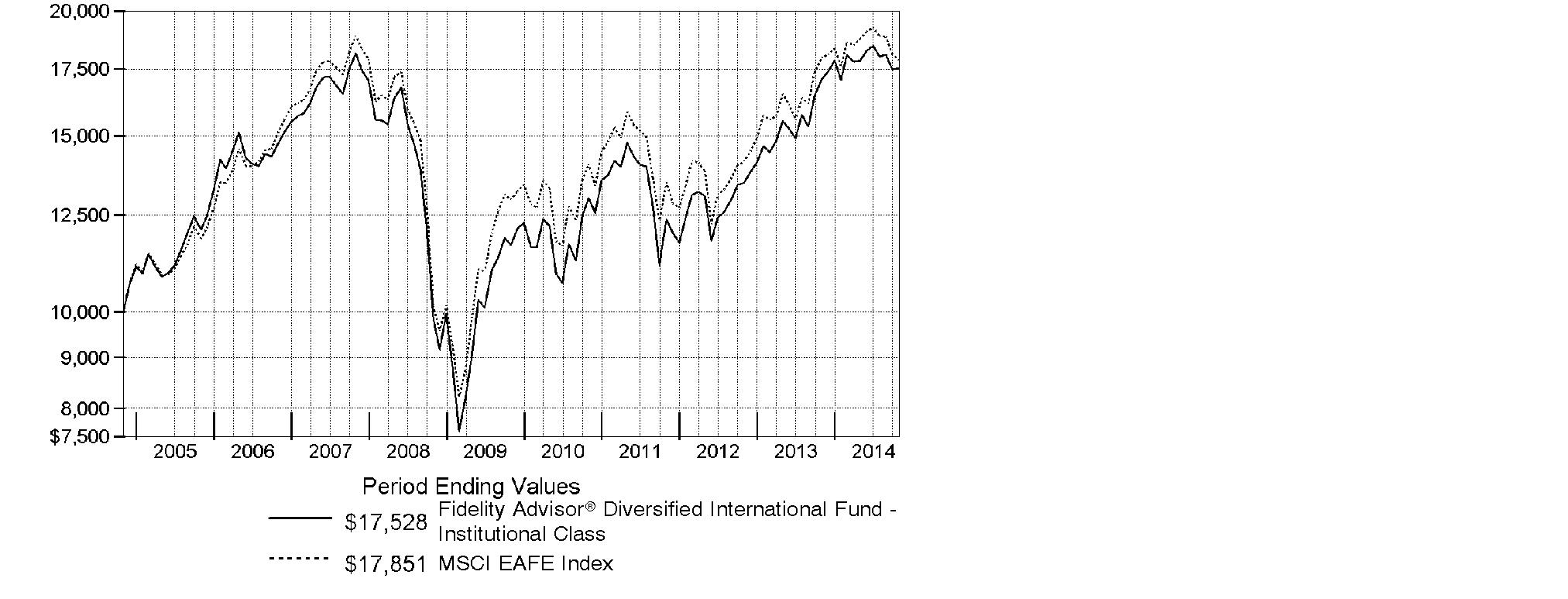

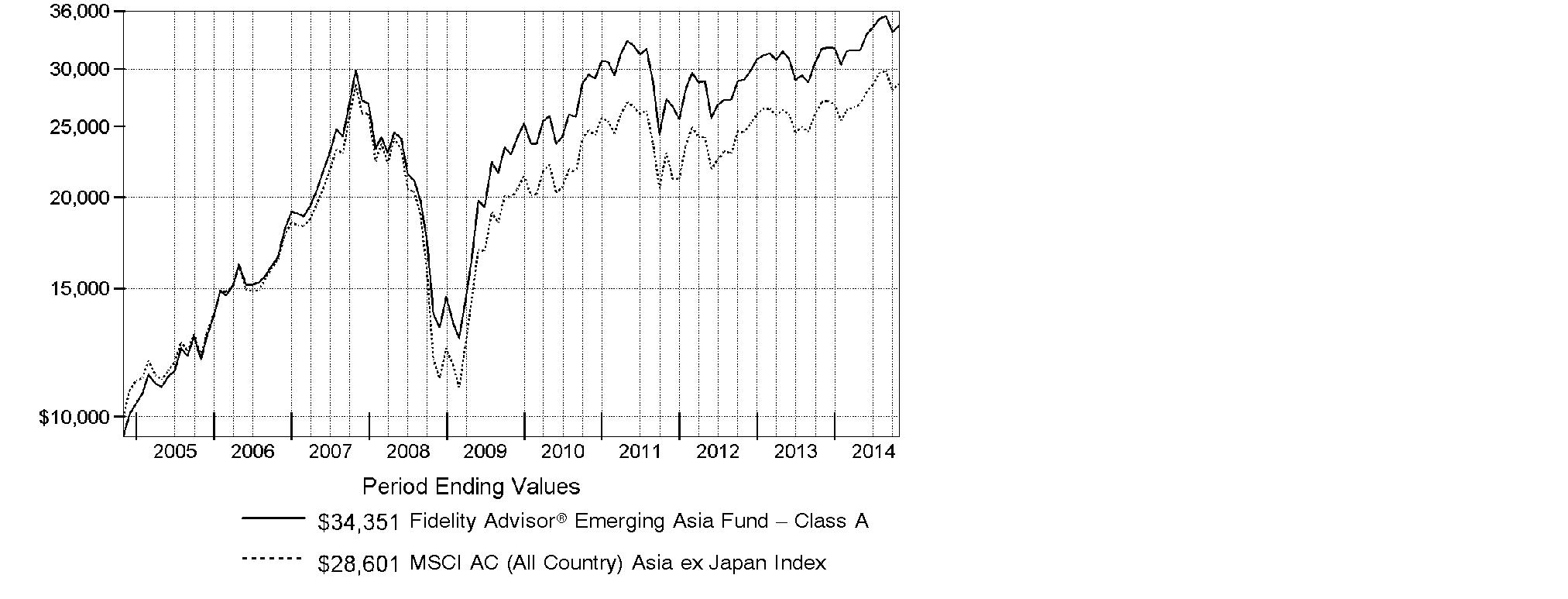

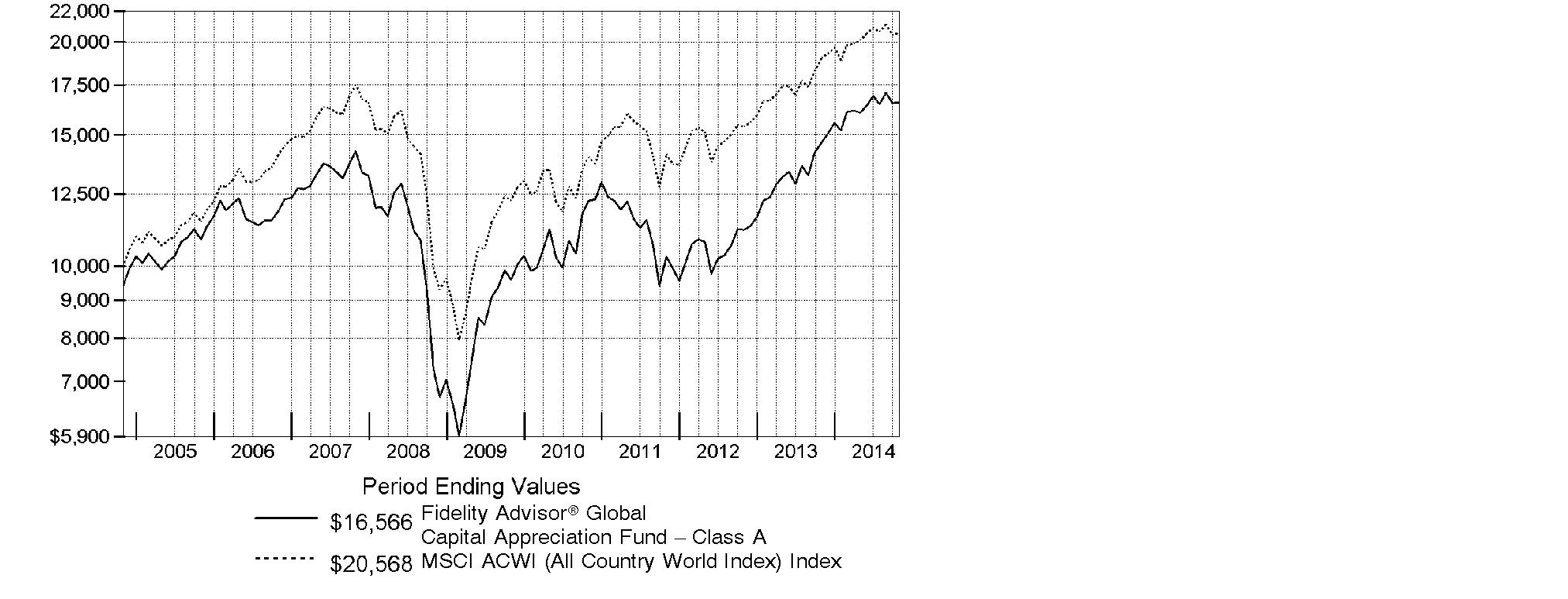

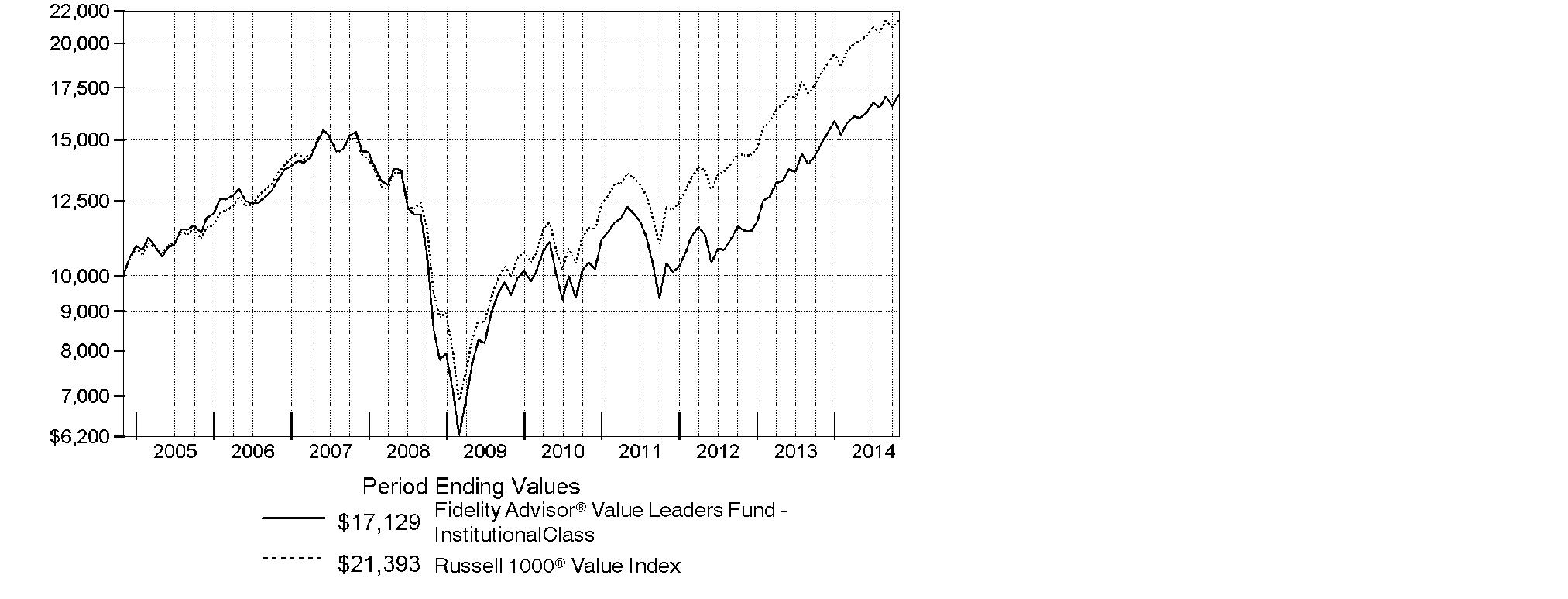

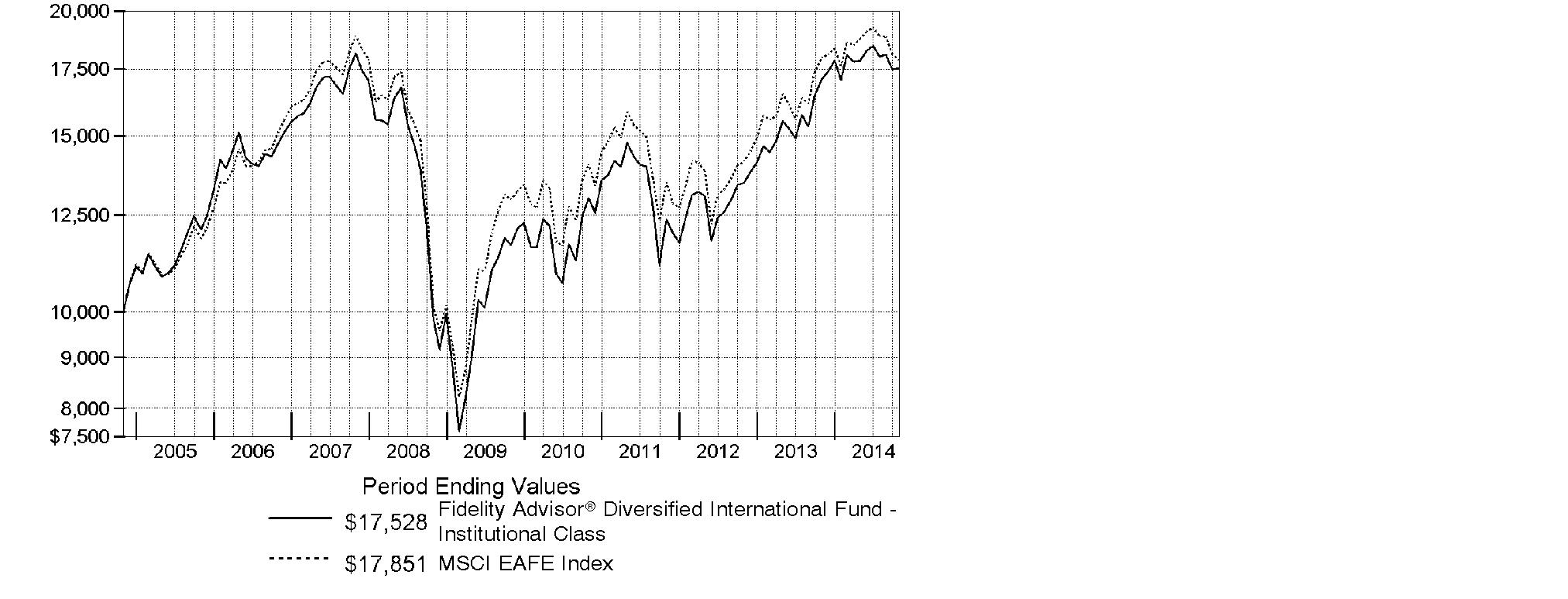

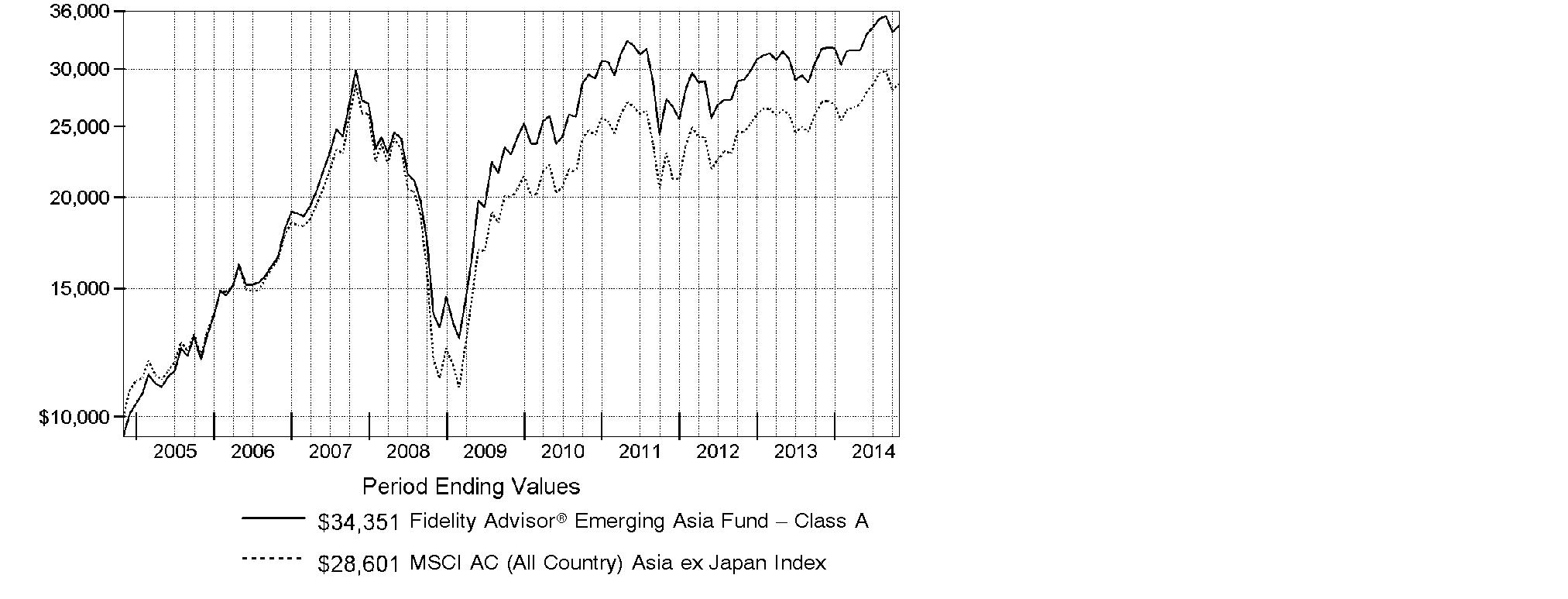

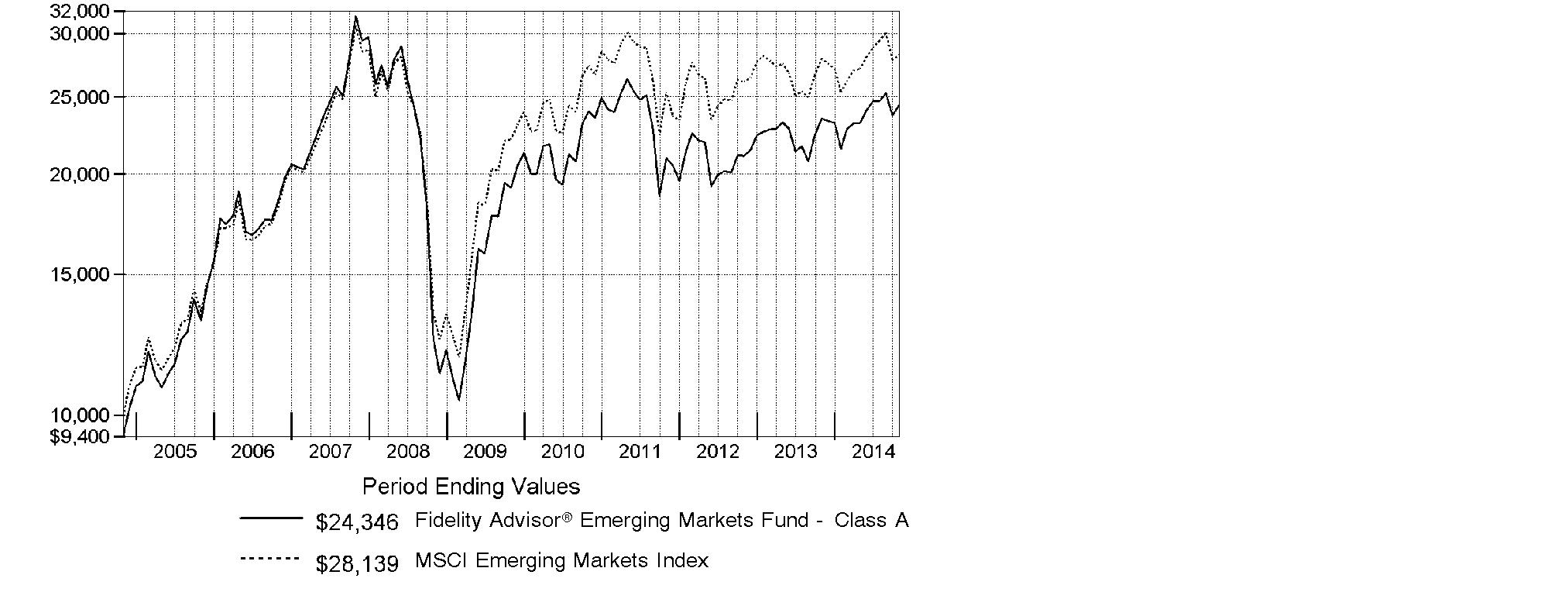

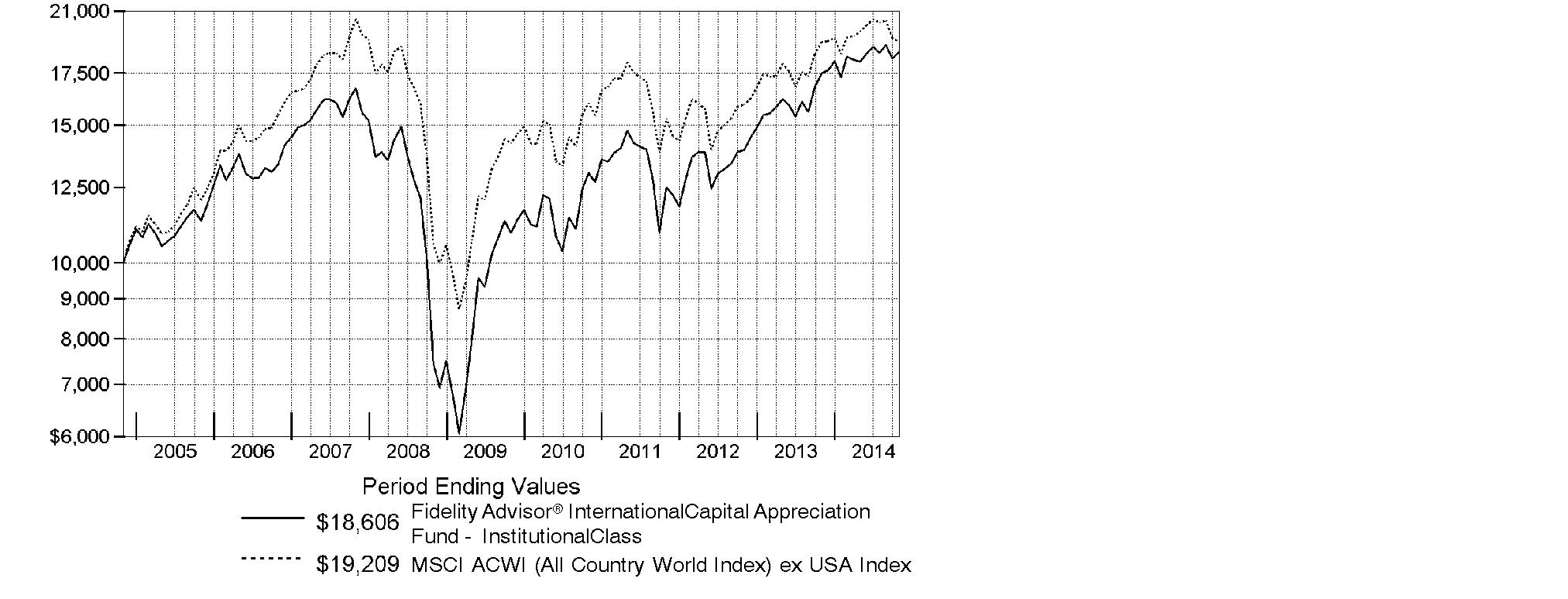

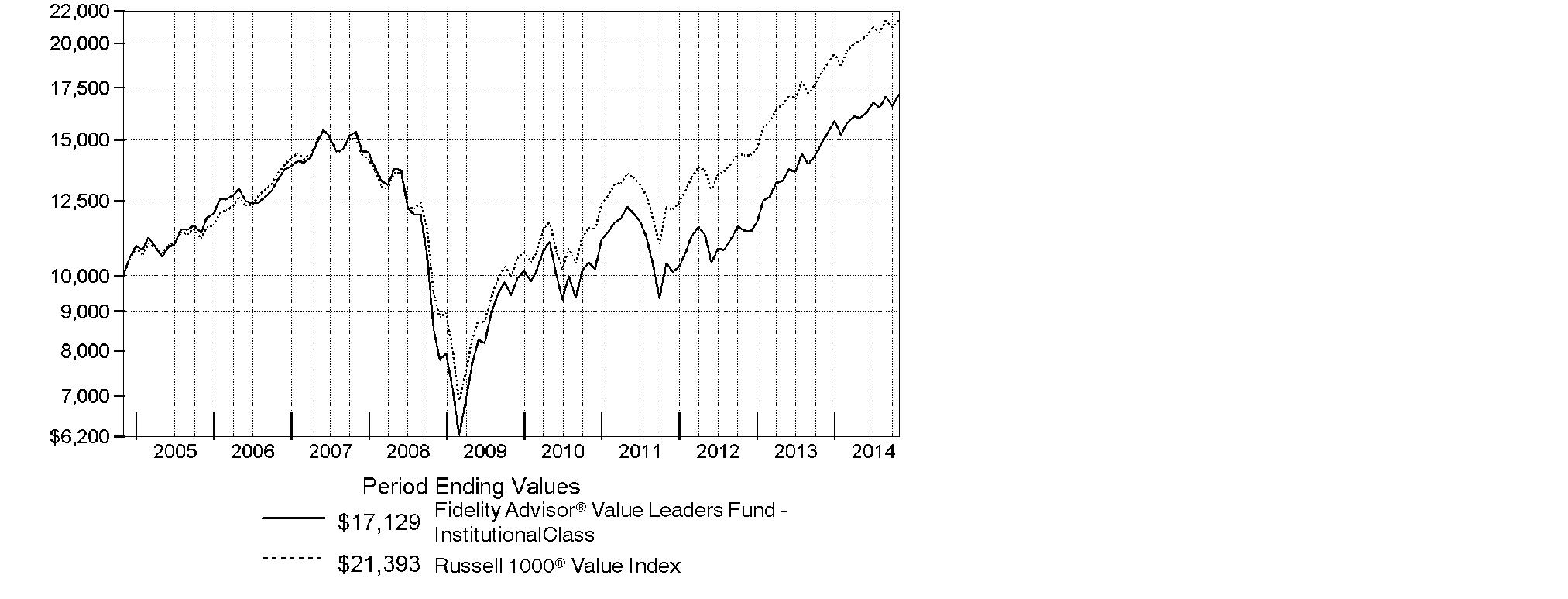

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Diversified International Fund - Class A on October 31, 2004, and the current 5.75% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the MSCI EAFE Index performed over the same period.

Annual Report

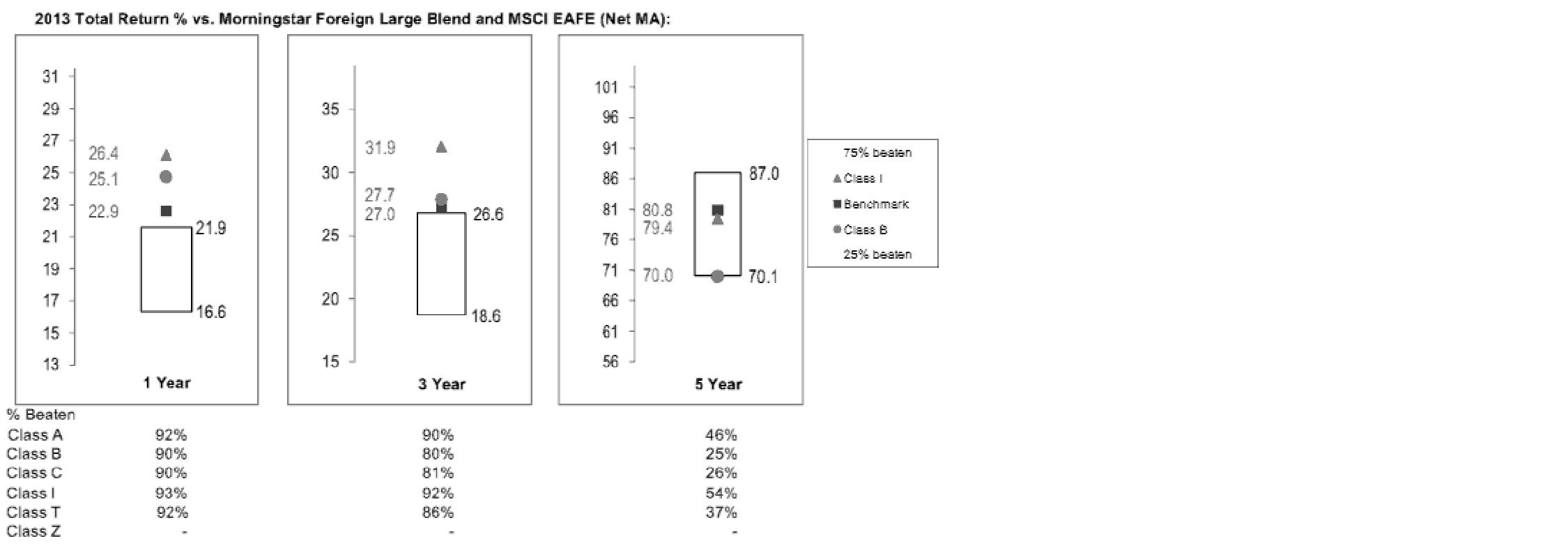

Market Recap: Global equities posted a healthy gain for the 12 months ending October 31, 2014, overcoming an October market decline driven by recessionary pressures in China and tepid growth in Europe. The MSCI ACWI (All Country World Index) Index rose 8.15%, helped by subdued market volatility for much of the period and supported by solid corporate earnings, especially in the United States. Stocks also benefited from easy monetary policies in Japan and the eurozone, as well as increased stimulus efforts in China. All but three of the 24 industry groups that compose the index marked a positive return. The U.S. (+17%) remained a pillar of strength, while a strongly rising dollar in the latter part of the period detracted from investors' returns in most non-U.S. markets. Canada (+5%) notched broad gains outside of its energy and materials sectors, as did Asia-Pacific ex Japan (+4%), led by investor enthusiasm for companies in India. The U.K., Europe and Japan, meanwhile, all underperformed. Among sectors, health care (+24%) led the index, with a strong contribution from the pharmaceuticals, biotechnology & life sciences industry. Information technology (+21%) also outperformed. Conversely, materials (-4%) and energy (-1%) lagged the index due to a higher supply of and lower demand for commodities.

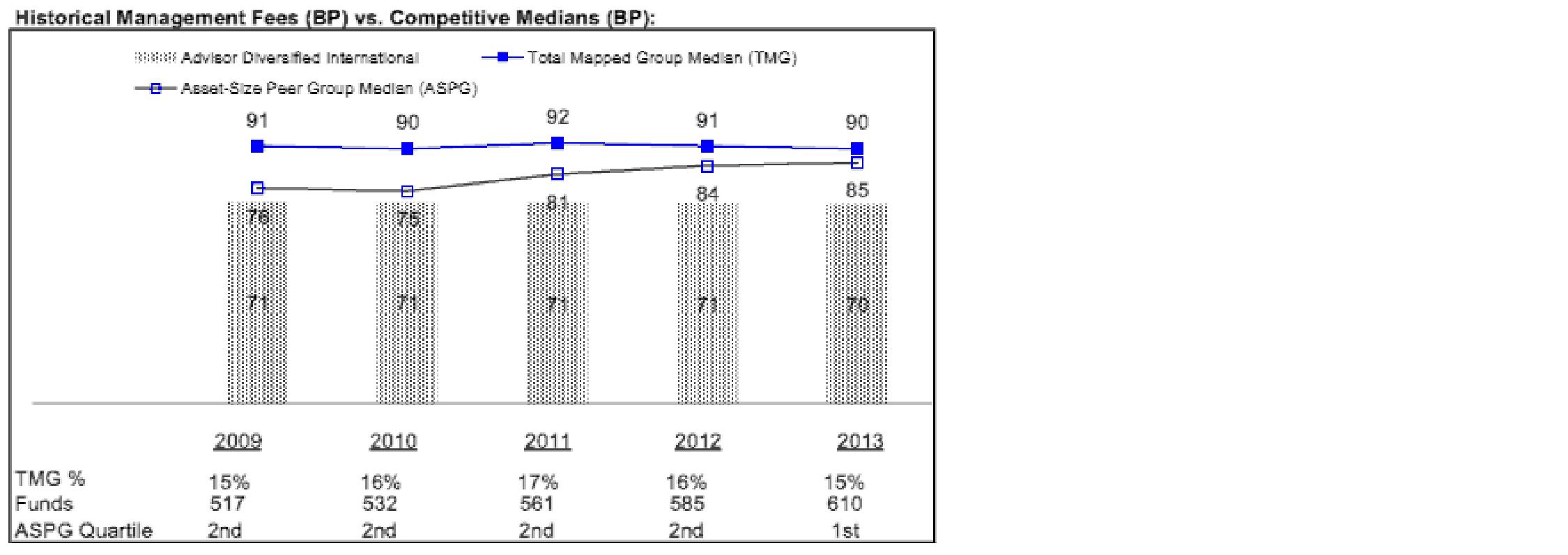

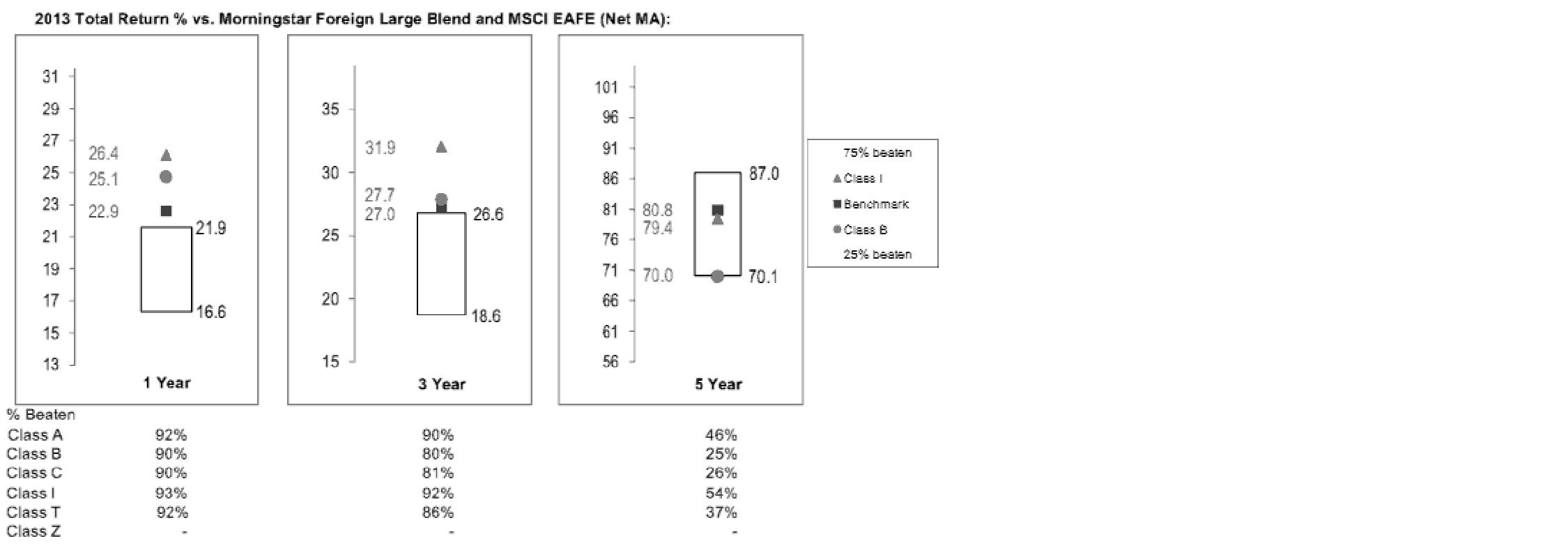

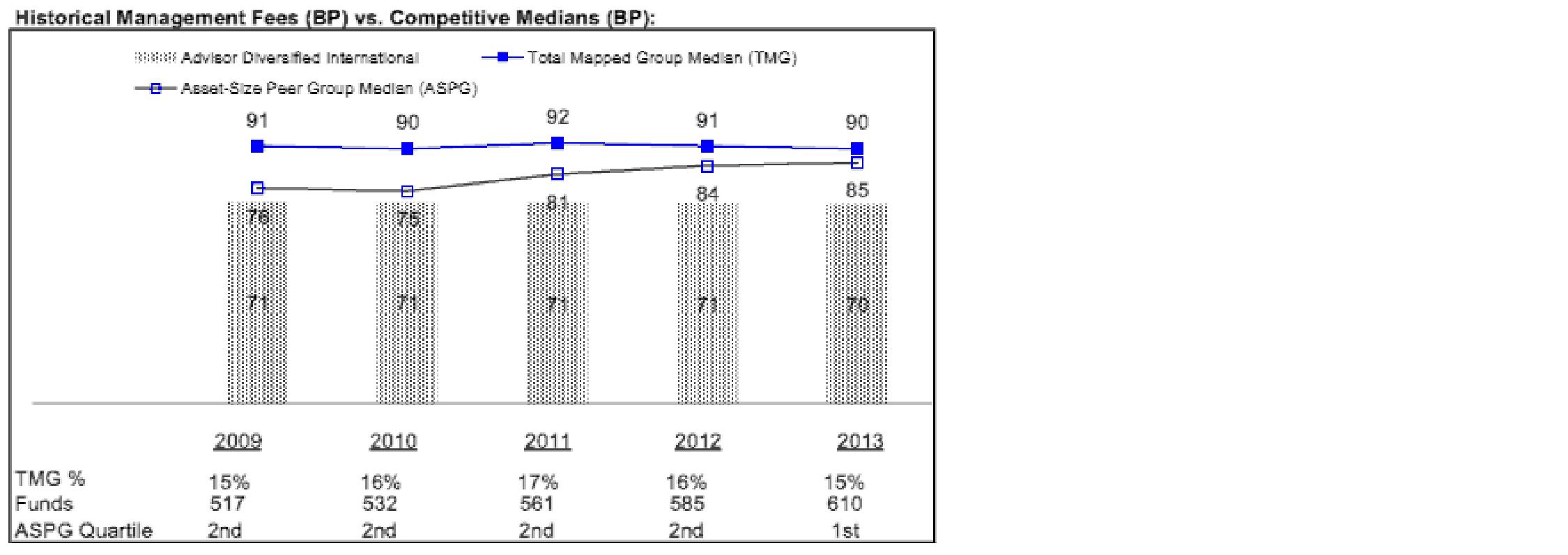

Comments from William Bower, Portfolio Manager of Fidelity Advisor® Diversified International Fund: For the year ending October 31, 2014, the fund's Class A, Class T, Class B and Class C shares gained 2.28%, 2.04%, 1.45% and 1.58%, respectively (excluding sales charges), outpacing the -0.48% result for the MSCI EAFE Index. Stock selection drove relative results, with strong showings in the information technology and health care sectors, with industrials the only notable detractor. Geographically, the fund benefited from out-of-index holdings in emerging markets, the U.S. and Canada. Stock selection helped in six of 10 sectors, and all 10 top relative contributors were overweights or out-of-index positions. Denmark's Novo Nordisk, an insulin producer, was up 38% for the year. Japanese optics maker Hoya also helped. Our holding in Alimentation Couche-Tard was up 51% for the full year. Conversely, picks in industrials hurt most, particularly data purveyor Experian, which was off 25% for the period. In financials, ORIX disappointed. In health care, not owning Switzerland's Novartis or U.K.-based AstraZeneca, two index heavies, weighed on relative results. I reduced its position in Honda Motor and sold out of Toyota Motor and Renault, and established a position in Suzuki Motor.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2014 to October 31, 2014).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

| Annualized

Expense RatioB | Beginning

Account Value

May 1, 2014 | Ending

Account Value

October 31, 2014 | Expenses Paid

During Period*

May 1, 2014

to October 31, 2014 |

Class A | 1.24% | | | |

Actual | | $ 1,000.00 | $ 981.40 | $ 6.19 |

HypotheticalA | | $ 1,000.00 | $ 1,018.95 | $ 6.31 |

Class T | 1.50% | | | |

Actual | | $ 1,000.00 | $ 980.30 | $ 7.49 |

HypotheticalA | | $ 1,000.00 | $ 1,017.64 | $ 7.63 |

Class B | 2.05% | | | |

Actual | | $ 1,000.00 | $ 977.60 | $ 10.22 |

HypotheticalA | | $ 1,000.00 | $ 1,014.87 | $ 10.41 |

Class C | 1.99% | | | |

Actual | | $ 1,000.00 | $ 978.00 | $ 9.92 |

HypotheticalA | | $ 1,000.00 | $ 1,015.17 | $ 10.11 |

Institutional Class | .96% | | | |

Actual | | $ 1,000.00 | $ 983.20 | $ 4.80 |

HypotheticalA | | $ 1,000.00 | $ 1,020.37 | $ 4.89 |

Class Z | .78% | | | |

Actual | | $ 1,000.00 | $ 984.20 | $ 3.90 |

HypotheticalA | | $ 1,000.00 | $ 1,021.27 | $ 3.97 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Annual Report

Investment Changes (Unaudited)

Top Five Stocks as of October 31, 2014 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Novo Nordisk A/S Series B (Denmark, Pharmaceuticals) | 1.9 | 1.9 |

ORIX Corp. (Japan, Diversified Financial Services) | 1.8 | 1.6 |

Bayer AG (Germany, Pharmaceuticals) | 1.6 | 1.7 |

Anheuser-Busch InBev SA NV (Belgium, Beverages) | 1.6 | 1.4 |

Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 1.4 | 0.7 |

| 8.3 | |

Top Five Market Sectors as of October 31, 2014 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 21.2 | 21.1 |

Health Care | 16.7 | 16.1 |

Consumer Discretionary | 15.6 | 15.8 |

Information Technology | 13.9 | 9.8 |

Consumer Staples | 12.0 | 11.9 |

Top Five Countries as of October 31, 2014 |

(excluding cash equivalents) | % of fund's

net assets | % of fund's net assets

6 months ago |

Japan | 17.7 | 15.3 |

United Kingdom | 16.8 | 17.4 |

United States of America | 7.9 | 7.1 |

Germany | 6.2 | 8.4 |

Switzerland | 5.2 | 5.4 |

Percentages are adjusted for the effect of open futures contracts, if applicable. |

Asset Allocation (% of fund's net assets) |

As of October 31, 2014 | As of April 30, 2014 |

| Stocks 98.1% | |  | Stocks 97.7% | |

| Other Investments 0.1% | |  | Other Investments 0.1% | |

| Short-Term

Investments and

Net Other Assets (Liabilities) 1.8% | |  | Short-Term

Investments and

Net Other Assets (Liabilities) 2.2% | |

Annual Report

Investments October 31, 2014

Showing Percentage of Net Assets

Common Stocks - 96.7% |

| Shares | | Value (000s) |

Australia - 2.8% |

Ansell Ltd. | 258,534 | | $ 4,535 |

Australia & New Zealand Banking Group Ltd. | 628,447 | | 18,596 |

BHP Billiton Ltd. sponsored ADR (e) | 217,236 | | 12,913 |

CSL Ltd. | 167,531 | | 11,828 |

Woodside Petroleum Ltd. | 172,944 | | 6,143 |

TOTAL AUSTRALIA | | 54,015 |

Austria - 0.1% |

Andritz AG | 52,900 | | 2,554 |

Bailiwick of Guernsey - 0.2% |

Amdocs Ltd. | 72,600 | | 3,451 |

Bailiwick of Jersey - 2.0% |

Experian PLC | 398,000 | | 5,975 |

Shire PLC | 255,300 | | 17,130 |

Wolseley PLC | 124,370 | | 6,599 |

WPP PLC | 445,924 | | 8,710 |

TOTAL BAILIWICK OF JERSEY | | 38,414 |

Belgium - 2.6% |

Anheuser-Busch InBev SA NV | 272,131 | | 30,178 |

Arseus NV | 61,500 | | 2,458 |

KBC Groupe SA (a) | 246,648 | | 13,213 |

UCB SA | 42,200 | | 3,405 |

TOTAL BELGIUM | | 49,254 |

Bermuda - 0.7% |

BW LPG Ltd. | 339,872 | | 3,220 |

Golar LNG Ltd. | 76,000 | | 4,264 |

Noble Group Ltd. | 3,986,000 | | 3,710 |

Travelport Worldwide Ltd. | 158,100 | | 2,285 |

TOTAL BERMUDA | | 13,479 |

Canada - 3.8% |

Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | 460,900 | | 15,642 |

AutoCanada, Inc. | 36,900 | | 2,050 |

Canadian Natural Resources Ltd. | 110,900 | | 3,870 |

CGI Group, Inc. Class A (sub. vtg.) (a) | 397,700 | | 13,652 |

Constellation Software, Inc. | 25,700 | | 7,240 |

First Quantum Minerals Ltd. | 256,600 | | 3,870 |

Imperial Oil Ltd. | 96,200 | | 4,629 |

Keyera Corp. | 28,900 | | 2,299 |

Potash Corp. of Saskatchewan, Inc. | 115,500 | | 3,942 |

Common Stocks - continued |

| Shares | | Value (000s) |

Canada - continued |

PrairieSky Royalty Ltd. | 38,000 | | $ 1,170 |

Suncor Energy, Inc. | 265,200 | | 9,417 |

Tourmaline Oil Corp. (a) | 100,600 | | 3,609 |

TransForce, Inc. | 77,900 | | 1,905 |

TOTAL CANADA | | 73,295 |

Cayman Islands - 3.2% |

58.com, Inc. ADR | 21,000 | | 831 |

Alibaba Group Holding Ltd. sponsored ADR | 240,900 | | 23,753 |

Baidu.com, Inc. sponsored ADR (a) | 18,500 | | 4,417 |

China Modern Dairy Holdings Ltd. (a)(e) | 6,161,000 | | 2,718 |

GCL-Poly Energy Holdings Ltd. (a) | 16,510,000 | | 5,564 |

Melco Crown Entertainment Ltd. sponsored ADR | 267,500 | | 7,260 |

PW Medtech Group Ltd. (a) | 5,938,000 | | 3,749 |

Sands China Ltd. | 1,554,400 | | 9,695 |

Tencent Holdings Ltd. | 196,800 | | 3,163 |

TOTAL CAYMAN ISLANDS | | 61,150 |

Colombia - 0.2% |

Grupo Aval Acciones y Valores SA ADR | 287,696 | | 3,878 |

Curacao - 0.0% |

Schlumberger Ltd. | 5,400 | | 533 |

Denmark - 2.4% |

A.P. Moller - Maersk A/S Series B | 802 | | 1,869 |

Genmab A/S (a) | 132,800 | | 5,789 |

Novo Nordisk A/S Series B | 789,740 | | 35,698 |

Vestas Wind Systems A/S (a) | 94,134 | | 3,151 |

TOTAL DENMARK | | 46,507 |

Finland - 0.6% |

Nokia Corp. | 647,900 | | 5,414 |

Sampo Oyj (A Shares) | 113,300 | | 5,419 |

TOTAL FINLAND | | 10,833 |

France - 3.7% |

Air Liquide SA | 54,260 | | 6,545 |

Atos Origin SA | 49,027 | | 3,385 |

AXA SA | 444,800 | | 10,262 |

BNP Paribas SA | 221,943 | | 13,945 |

Kering SA | 16,100 | | 3,106 |

LVMH Moet Hennessy - Louis Vuitton SA | 16,998 | | 2,883 |

Numericable Group SA (e) | 33,900 | | 1,253 |

Common Stocks - continued |

| Shares | | Value (000s) |

France - continued |

Numericable Group SA rights 11/12/14 (a) | 33,900 | | $ 1,005 |

Publicis Groupe SA (a) | 140,010 | | 9,697 |

Sanofi SA | 186,347 | | 16,909 |

Tarkett SA | 43,874 | | 1,264 |

TOTAL FRANCE | | 70,254 |

Germany - 4.8% |

adidas AG | 20,690 | | 1,505 |

Bayer AG | 219,452 | | 31,199 |

Brenntag AG | 75,600 | | 3,657 |

Continental AG | 34,600 | | 6,792 |

Drillisch AG | 50,000 | | 1,735 |

Fresenius SE & Co. KGaA | 294,300 | | 15,139 |

Gerry Weber International AG (Bearer) | 59,100 | | 2,372 |

Linde AG | 53,347 | | 9,837 |

OSRAM Licht AG (a) | 62,910 | | 2,204 |

ProSiebenSat.1 Media AG | 90,800 | | 3,659 |

SAP AG (e) | 135,216 | | 9,213 |

Symrise AG | 58,000 | | 3,262 |

TOTAL GERMANY | | 90,574 |

Hong Kong - 1.7% |

AIA Group Ltd. | 4,129,000 | | 23,042 |

Galaxy Entertainment Group Ltd. | 1,059,000 | | 7,241 |

Melco International Development Ltd. | 679,000 | | 1,841 |

TOTAL HONG KONG | | 32,124 |

India - 2.4% |

Apollo Hospitals Enterprise Ltd. (a) | 199,507 | | 3,621 |

Axis Bank Ltd. (a) | 444,940 | | 3,279 |

HDFC Bank Ltd. | 835,563 | | 13,549 |

Housing Development Finance Corp. Ltd. | 655,610 | | 11,807 |

ITC Ltd. (a) | 1,141,123 | | 6,598 |

LIC Housing Finance Ltd. | 201,645 | | 1,187 |

Lupin Ltd. | 127,912 | | 2,962 |

Pidilite Industries Ltd. | 524,041 | | 3,531 |

TOTAL INDIA | | 46,534 |

Indonesia - 0.5% |

PT Bank Central Asia Tbk | 5,215,000 | | 5,630 |

PT Bank Rakyat Indonesia Tbk | 4,102,200 | | 3,759 |

TOTAL INDONESIA | | 9,389 |

Common Stocks - continued |

| Shares | | Value (000s) |

Ireland - 2.1% |

Actavis PLC (a) | 50,000 | | $ 12,137 |

DCC PLC (United Kingdom) | 71,500 | | 3,996 |

Greencore Group PLC | 1,069,521 | | 4,489 |

Perrigo Co. PLC | 71,900 | | 11,608 |

Ryanair Holdings PLC sponsored ADR (a) | 147,800 | | 8,209 |

TOTAL IRELAND | | 40,439 |

Israel - 1.3% |

Check Point Software Technologies Ltd. (a) | 120,100 | | 8,917 |

Teva Pharmaceutical Industries Ltd. sponsored ADR | 295,000 | | 16,659 |

TOTAL ISRAEL | | 25,576 |

Italy - 0.9% |

Telecom Italia SpA (a) | 2,528,504 | | 2,866 |

UniCredit SpA | 1,301,916 | | 9,397 |

World Duty Free SpA (a) | 582,140 | | 4,928 |

TOTAL ITALY | | 17,191 |

Japan - 17.7% |

Ain Pharmaciez, Inc. | 77,700 | | 2,105 |

Aozora Bank Ltd. | 867,000 | | 3,047 |

Astellas Pharma, Inc. | 1,338,800 | | 20,779 |

Daiichikosho Co. Ltd. | 74,400 | | 1,878 |

Don Quijote Holdings Co. Ltd. | 182,000 | | 10,905 |

Fast Retailing Co. Ltd. | 18,500 | | 6,878 |

Fuji Heavy Industries Ltd. | 98,700 | | 3,285 |

GMO Internet, Inc. | 357,500 | | 3,002 |

Honda Motor Co. Ltd. sponsored ADR | 152,306 | | 4,892 |

Hoya Corp. | 650,900 | | 23,033 |

Japan Exchange Group, Inc. | 361,800 | | 8,975 |

Japan Tobacco, Inc. | 686,800 | | 23,433 |

KDDI Corp. | 224,600 | | 14,749 |

Keyence Corp. | 46,800 | | 22,678 |

Komatsu Ltd. | 440,400 | | 10,398 |

Medical System Network Co. Ltd. (e) | 752,500 | | 2,298 |

Misumi Group, Inc. | 34,800 | | 1,098 |

Mitsubishi Electric Corp. | 436,000 | | 5,622 |

Mitsubishi UFJ Financial Group, Inc. | 2,952,200 | | 17,209 |

Nagaileben Co. Ltd. | 117,000 | | 2,249 |

NEC Corp. | 3,756,000 | | 13,283 |

NGK Spark Plug Co. Ltd. | 106,000 | | 2,765 |

Nippon Telegraph & Telephone Corp. | 158,500 | | 9,862 |

Nitori Holdings Co. Ltd. | 86,000 | | 5,450 |

Common Stocks - continued |

| Shares | | Value (000s) |

Japan - continued |

Olympus Corp. (a) | 56,700 | | $ 2,036 |

OMRON Corp. | 163,100 | | 7,720 |

ORIX Corp. | 2,432,400 | | 33,762 |

Rakuten, Inc. | 1,186,500 | | 13,380 |

Recruit Holdings Co. Ltd. (a) | 36,900 | | 1,261 |

Seven & i Holdings Co., Ltd. | 156,700 | | 6,120 |

SHIMANO, Inc. | 51,800 | | 6,869 |

Shinsei Bank Ltd. | 1,893,000 | | 4,254 |

Ship Healthcare Holdings, Inc. | 95,400 | | 2,233 |

SoftBank Corp. | 311,400 | | 22,670 |

Suzuki Motor Corp. | 154,500 | | 5,179 |

Toshiba Plant Systems & Services Corp. | 153,200 | | 2,564 |

Tsuruha Holdings, Inc. | 116,000 | | 6,849 |

VT Holdings Co. Ltd. | 606,600 | | 2,396 |

TOTAL JAPAN | | 337,166 |

Korea (South) - 0.9% |

NAVER Corp. | 10,009 | | 7,024 |

Orion Corp. | 6,412 | | 4,923 |

Samsung Electronics Co. Ltd. | 4,431 | | 5,130 |

Samsung SDS Co. Ltd. (a) | 2,071 | | 366 |

TOTAL KOREA (SOUTH) | | 17,443 |

Luxembourg - 1.3% |

Altice SA | 243,177 | | 15,142 |

Eurofins Scientific SA | 38,800 | | 9,805 |

TOTAL LUXEMBOURG | | 24,947 |

Mexico - 0.3% |

America Movil S.A.B. de CV Series L sponsored ADR | 197,100 | | 4,811 |

Netherlands - 3.5% |

AEGON NV | 2,212,100 | | 18,030 |

AerCap Holdings NV (a) | 75,500 | | 3,272 |

IMCD Group BV | 122,800 | | 3,386 |

ING Groep NV (Certificaten Van Aandelen) (a) | 664,900 | | 9,522 |

LyondellBasell Industries NV Class A | 82,200 | | 7,532 |

Reed Elsevier NV | 213,182 | | 4,906 |

Unilever NV (Certificaten Van Aandelen) (Bearer) | 500,200 | | 19,387 |

TOTAL NETHERLANDS | | 66,035 |

Norway - 0.2% |

Telenor ASA | 187,400 | | 4,212 |

Common Stocks - continued |

| Shares | | Value (000s) |

Philippines - 0.4% |

Alliance Global Group, Inc. | 12,852,154 | | $ 7,229 |

Singapore - 0.4% |

Ezion Holdings Ltd. | 1,479,600 | | 1,742 |

United Overseas Bank Ltd. | 329,000 | | 5,894 |

TOTAL SINGAPORE | | 7,636 |

South Africa - 0.9% |

Naspers Ltd. Class N | 142,100 | | 17,684 |

Spain - 1.6% |

Amadeus IT Holding SA Class A | 266,800 | | 9,796 |

Criteria CaixaCorp SA | 554,945 | | 3,026 |

Inditex SA | 656,784 | | 18,449 |

TOTAL SPAIN | | 31,271 |

Sweden - 2.3% |

ASSA ABLOY AB (B Shares) | 100,600 | | 5,328 |

HEXPOL AB (B Shares) | 16,800 | | 1,486 |

Nordea Bank AB | 1,015,800 | | 13,027 |

Svenska Cellulosa AB (SCA) (B Shares) | 644,300 | | 14,406 |

Svenska Handelsbanken AB (A Shares) | 212,000 | | 10,109 |

TOTAL SWEDEN | | 44,356 |

Switzerland - 5.2% |

Actelion Ltd. | 47,876 | | 5,692 |

Compagnie Financiere Richemont SA Series A | 113,494 | | 9,549 |

Credit Suisse Group AG | 354,987 | | 9,458 |

Nestle SA | 162,022 | | 11,882 |

Roche Holding AG (participation certificate) | 91,362 | | 26,961 |

Syngenta AG (Switzerland) | 53,404 | | 16,516 |

UBS AG | 1,072,643 | | 18,651 |

TOTAL SWITZERLAND | | 98,709 |

Taiwan - 1.1% |

Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 937,900 | | 20,653 |

Thailand - 0.2% |

Kasikornbank PCL (For. Reg.) | 533,300 | | 3,863 |

United Kingdom - 16.8% |

Al Noor Hospitals Group PLC | 266,200 | | 4,339 |

Associated British Foods PLC | 175,100 | | 7,714 |

B&M European Value Retail S.A. | 1,353,586 | | 5,386 |

BG Group PLC | 1,008,869 | | 16,814 |

British American Tobacco PLC sponsored ADR | 167,200 | | 18,987 |

Common Stocks - continued |

| Shares | | Value (000s) |

United Kingdom - continued |

BT Group PLC | 1,879,500 | | $ 11,080 |

Bunzl PLC | 119,000 | | 3,227 |

Capita Group PLC | 100,700 | | 1,767 |

Compass Group PLC | 404,800 | | 6,514 |

Diploma PLC | 350,900 | | 3,904 |

easyJet PLC | 160,900 | | 3,861 |

Exova Group Ltd. PLC (a) | 644,700 | | 1,751 |

Filtrona PLC | 815,100 | | 8,951 |

GlaxoSmithKline PLC | 419,900 | | 9,496 |

Hikma Pharmaceuticals PLC | 238,987 | | 7,245 |

HSBC Holdings PLC sponsored ADR | 490,797 | | 25,040 |

IMI PLC | 189,700 | | 3,708 |

Imperial Tobacco Group PLC | 88,997 | | 3,860 |

ITV PLC | 1,841,700 | | 5,981 |

Johnson Matthey PLC | 121,600 | | 5,785 |

Kingfisher PLC | 1,846,900 | | 8,947 |

Liberty Global PLC: | | | |

Class A (a) | 68,400 | | 3,110 |

Class C | 48,700 | | 2,166 |

Lloyds Banking Group PLC (a) | 17,941,900 | | 22,156 |

Mears Group PLC | 260,100 | | 1,839 |

Meggitt PLC | 539,673 | | 3,894 |

Next PLC | 192,100 | | 19,806 |

Poundland Group PLC (a) | 361,369 | | 1,821 |

Prudential PLC | 1,008,173 | | 23,345 |

Reckitt Benckiser Group PLC | 222,013 | | 18,646 |

Rentokil Initial PLC | 1,109,900 | | 2,187 |

Rolls-Royce Group PLC | 733,500 | | 9,892 |

SABMiller PLC | 169,000 | | 9,530 |

Schroders PLC | 24,900 | | 960 |

Spectris PLC | 138,900 | | 4,004 |

Sports Direct International PLC (a) | 459,400 | | 4,736 |

St. James's Place Capital PLC | 934,800 | | 11,141 |

Standard Chartered PLC (United Kingdom) | 232,764 | | 3,499 |

Travis Perkins PLC | 220,300 | | 5,822 |

Whitbread PLC | 116,872 | | 8,159 |

TOTAL UNITED KINGDOM | | 321,070 |

United States of America - 7.9% |

AbbVie, Inc. | 114,900 | | 7,292 |

Alexion Pharmaceuticals, Inc. (a) | 47,600 | | 9,109 |

Alliance Data Systems Corp. (a) | 20,900 | | 5,922 |

Common Stocks - continued |

| Shares | | Value (000s) |

United States of America - continued |

Amgen, Inc. | 52,700 | | $ 8,547 |

Celldex Therapeutics, Inc. (a) | 41,800 | | 700 |

CF Industries Holdings, Inc. | 14,700 | | 3,822 |

Fidelity National Information Services, Inc. | 96,600 | | 5,640 |

FMC Corp. | 32,700 | | 1,875 |

Freeport-McMoRan, Inc. | 110,100 | | 3,138 |

Gilead Sciences, Inc. (a) | 90,700 | | 10,158 |

Google, Inc.: | | | |

Class A (a) | 13,295 | | 7,550 |

Class C (a) | 19,795 | | 11,067 |

Las Vegas Sands Corp. | 133,000 | | 8,281 |

MasterCard, Inc. Class A | 127,700 | | 10,695 |

McGraw Hill Financial, Inc. | 189,800 | | 17,173 |

Mead Johnson Nutrition Co. Class A | 53,900 | | 5,353 |

Mondelez International, Inc. | 144,300 | | 5,088 |

Noble Energy, Inc. | 148,300 | | 8,547 |

QUALCOMM, Inc. | 75,500 | | 5,928 |

The Blackstone Group LP | 146,100 | | 4,401 |

Visa, Inc. Class A | 44,500 | | 10,744 |

TOTAL UNITED STATES OF AMERICA | | 151,030 |

TOTAL COMMON STOCKS (Cost $1,514,332) |

1,847,559

|

Preferred Stocks - 1.4% |

| | | |

Convertible Preferred Stocks - 0.0% |

United States of America - 0.0% |

NJOY, Inc.: | | | |

Series C (a)(h) | 60,264 | | 486 |

Series D (h) | 18,951 | | 153 |

TOTAL UNITED STATES OF AMERICA | | 639 |

Nonconvertible Preferred Stocks - 1.4% |

Germany - 1.4% |

Henkel AG & Co. KGaA | 132,200 | | 13,051 |

Volkswagen AG | 64,700 | | 13,787 |

TOTAL GERMANY | | 26,838 |

Preferred Stocks - continued |

| Shares | | Value (000s) |

Nonconvertible Preferred Stocks - continued |

United Kingdom - 0.0% |

Rolls-Royce Group PLC | 66,015,000 | | $ 106 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS | | 26,944 |

TOTAL PREFERRED STOCKS (Cost $21,726) |

27,583

|

Preferred Securities - 0.1% |

| Principal Amount (d) (000s) | | |

Ireland - 0.1% |

Baggot Securities Ltd. 10.24% (f)(g)

(Cost $2,488) | EUR | 1,620 | |

2,295

|

Money Market Funds - 2.6% |

| Shares | | |

Fidelity Cash Central Fund, 0.11% (b) | 31,286,373 | | 31,286 |

Fidelity Securities Lending Cash Central Fund, 0.11% (b)(c) | 18,560,972 | | 18,561 |

TOTAL MONEY MARKET FUNDS (Cost $49,847) |

49,847

|

TOTAL INVESTMENT PORTFOLIO - 100.8% (Cost $1,588,393) | | 1,927,284 |

NET OTHER ASSETS (LIABILITIES) - (0.8)% | | (15,807) |

NET ASSETS - 100% | $ 1,911,477 |

Currency Abbreviations |

EUR | - | European Monetary Unit |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Amount is stated in United States dollars unless otherwise noted. |

(e) Security or a portion of the security is on loan at period end. |

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,295,000 or 0.1% of net assets. |

(g) Security is perpetual in nature with no stated maturity date. |

(h) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $639,000 or 0.0% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition

Date | Acquisition

Cost (000s) |

NJOY, Inc. Series C | 6/7/13 | $ 487 |

NJOY, Inc. Series D | 2/14/14 | $ 321 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 26 |

Fidelity Securities Lending Cash Central Fund | 900 |

Total | $ 926 |

Other Information |

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

The following is a summary of the inputs used, as of October 31, 2014, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description

(Amounts in thousands) | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 295,222 | $ 199,164 | $ 95,419 | $ 639 |

Consumer Staples | 233,257 | 121,689 | 111,568 | - |

Energy | 66,257 | 41,558 | 24,699 | - |

Financials | 403,505 | 144,490 | 259,015 | - |

Health Care | 321,467 | 161,281 | 160,186 | - |

Industrials | 123,823 | 91,941 | 31,882 | - |

Information Technology | 263,235 | 170,165 | 93,070 | - |

Materials | 96,391 | 76,344 | 20,047 | - |

Telecommunication Services | 71,985 | 10,758 | 61,227 | - |

Preferred Securities | 2,295 | - | 2,295 | - |

Money Market Funds | 49,847 | 49,847 | - | - |

Total Investments in Securities: | $ 1,927,284 | $ 1,067,237 | $ 859,408 | $ 639 |

The following is a summary of transfers between Level 1 and Level 2 for the period ended October 31, 2014. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements: |

Transfers | Total (000s) |

Level 1 to Level 2 | $ 164,017 |

Level 2 to Level 1 | $ 0 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | October 31, 2014 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $17,707) - See accompanying schedule: Unaffiliated issuers (cost $1,538,546) | $ 1,877,437 | |

Fidelity Central Funds (cost $49,847) | 49,847 | |

Total Investments (cost $1,588,393) | | $ 1,927,284 |

Foreign currency held at value (cost $62) | | 62 |

Receivable for investments sold | | 7,243 |

Receivable for fund shares sold | | 2,290 |

Dividends receivable | | 4,406 |

Distributions receivable from Fidelity Central Funds | | 14 |

Prepaid expenses | | 5 |

Other receivables | | 196 |

Total assets | | 1,941,500 |

| | |

Liabilities | | |

Payable for investments purchased | $ 3,546 | |

Payable for fund shares redeemed | 3,300 | |

Accrued management fee | 1,039 | |

Distribution and service plan fees payable | 468 | |

Other affiliated payables | 443 | |

Other payables and accrued expenses | 2,666 | |

Collateral on securities loaned, at value | 18,561 | |

Total liabilities | | 30,023 |

| | |

Net Assets | | $ 1,911,477 |

Net Assets consist of: | | |

Paid in capital | | $ 4,218,295 |

Undistributed net investment income | | 18,417 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (2,661,534) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 336,299 |

Net Assets | | $ 1,911,477 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities - continued

Amounts in thousands (except per-share amounts) | October 31, 2014 |

| | |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($693,064 ÷ 35,431 shares) | | $ 19.56 |

| | |

Maximum offering price per share (100/94.25 of $19.56) | | $ 20.75 |

Class T:

Net Asset Value and redemption price per share ($283,584 ÷ 14,630 shares) | | $ 19.38 |

| | |

Maximum offering price per share (100/96.50 of $19.38) | | $ 20.08 |

Class B:

Net Asset Value and offering price per share ($19,140 ÷ 1,021 shares)A | | $ 18.75 |

| | |

Class C:

Net Asset Value and offering price per share ($243,431 ÷ 13,034 shares)A | | $ 18.68 |

| | |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($648,208 ÷ 32,552 shares) | | $ 19.91 |

| | |

Class Z:

Net Asset Value, offering price and redemption price per share ($24,050 ÷ 1,207 shares) | | $ 19.93 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Year ended October 31, 2014 |

| | |

Investment Income | | |

Dividends | | $ 45,009 |

Special dividends | | 9,777 |

Income from Fidelity Central Funds | | 926 |

Income before foreign taxes withheld | | 55,712 |

Less foreign taxes withheld | | (3,501) |

Total income | | 52,211 |

| | |

Expenses | | |

Management fee | $ 13,964 | |

Transfer agent fees | 4,638 | |

Distribution and service plan fees | 6,276 | |

Accounting and security lending fees | 896 | |

Custodian fees and expenses | 249 | |

Independent trustees' compensation | 8 | |

Registration fees | 116 | |

Audit | 86 | |

Legal | 8 | |

Miscellaneous | 17 | |

Total expenses before reductions | 26,258 | |

Expense reductions | (27) | 26,231 |

Net investment income (loss) | | 25,980 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 173,972 | |

Foreign currency transactions | (234) | |

Futures contracts | 550 | |

Total net realized gain (loss) | | 174,288 |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $21) | (153,249) | |

Assets and liabilities in foreign currencies | (168) | |

Futures contracts | (491) | |

Total change in net unrealized appreciation (depreciation) | | (153,908) |

Net gain (loss) | | 20,380 |

Net increase (decrease) in net assets resulting from operations | | $ 46,360 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Amounts in thousands | Year ended

October 31,

2014 | Year ended

October 31,

2013 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 25,980 | $ 19,442 |

Net realized gain (loss) | 174,288 | 196,674 |

Change in net unrealized appreciation (depreciation) | (153,908) | 237,976 |

Net increase (decrease) in net assets resulting

from operations | 46,360 | 454,092 |

Distributions to shareholders from net investment income | (17,375) | (23,595) |

Distributions to shareholders from net realized gain | (17,564) | (7,342) |

Total distributions | (34,939) | (30,937) |

Share transactions - net increase (decrease) | (109,770) | (330,363) |

Redemption fees | 19 | 17 |

Total increase (decrease) in net assets | (98,330) | 92,809 |

| | |

Net Assets | | |

Beginning of period | 2,009,807 | 1,916,998 |

End of period (including undistributed net investment income of $18,417 and undistributed net investment income of $17,279, respectively) | $ 1,911,477 | $ 2,009,807 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Years ended October 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 19.47 | $ 15.63 | $ 14.61 | $ 15.63 | $ 14.25 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .27F | .19 | .18 | .22G | .14 |

Net realized and unrealized gain (loss) | .17 | 3.92 | 1.03 | (1.01) | 1.44 |

Total from investment operations | .44 | 4.11 | 1.21 | (.79) | 1.58 |

Distributions from net investment income | (.18) | (.21) | (.19) | (.20) | (.19) |

Distributions from net realized gain | (.17) | (.06) | - | (.03) | (.01) |

Total distributions | (.35) | (.27) | (.19) | (.23) | (.20) |

Redemption fees added to paid in capital C, I | - | - | - | - | - |

Net asset value, end of period | $ 19.56 | $ 19.47 | $ 15.63 | $ 14.61 | $ 15.63 |

Total ReturnA, B | 2.28% | 26.69% | 8.47% | (5.15)% | 11.17% |

Ratios to Average Net Assets D, H | | | | | |

Expenses before reductions | 1.26% | 1.31% | 1.32% | 1.31% | 1.32% |

Expenses net of fee waivers, if any | 1.26% | 1.30% | 1.32% | 1.31% | 1.32% |

Expenses net of all reductions | 1.26% | 1.28% | 1.31% | 1.29% | 1.30% |

Net investment income (loss) | 1.34% F | 1.08% | 1.20% | 1.38% G | .95% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 693 | $ 756 | $ 762 | $ 916 | $ 1,302 |

Portfolio turnover rateE | 40% | 50% | 34% | 48% | 59% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .85%.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .98%.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

Years ended October 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 19.30 | $ 15.49 | $ 14.46 | $ 15.47 | $ 14.11 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .21F | .14 | .14 | .18G | .10 |

Net realized and unrealized gain (loss) | .18 | 3.89 | 1.03 | (.99) | 1.43 |

Total from investment operations | .39 | 4.03 | 1.17 | (.81) | 1.53 |

Distributions from net investment income | (.14) | (.16) | (.14) | (.16) | (.16) |

Distributions from net realized gain | (.17) | (.06) | - | (.03) | (.01) |

Total distributions | (.31) | (.22) | (.14) | (.20) J | (.17) |

Redemption fees added to paid in capital C, I | - | - | - | - | - |

Net asset value, end of period | $ 19.38 | $ 19.30 | $ 15.49 | $ 14.46 | $ 15.47 |

Total ReturnA, B | 2.04% | 26.37% | 8.17% | (5.35)% | 10.88% |

Ratios to Average Net Assets D, H | | | | | |

Expenses before reductions | 1.51% | 1.55% | 1.58% | 1.55% | 1.55% |

Expenses net of fee waivers, if any | 1.51% | 1.55% | 1.58% | 1.55% | 1.55% |

Expenses net of all reductions | 1.51% | 1.53% | 1.57% | 1.53% | 1.53% |

Net investment income (loss) | 1.09% F | .83% | .94% | 1.14% G | .71% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 284 | $ 319 | $ 304 | $ 404 | $ 621 |

Portfolio turnover rateE | 40% | 50% | 34% | 48% | 59% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .60%.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .74%.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

J Total distributions of $.20 per share is comprised of distributions from net investment income of $.164 and distributions from net realized gain of $.034 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Years ended October 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 18.65 | $ 14.95 | $ 13.91 | $ 14.91 | $ 13.61 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .10F | .05 | .06 | .09G | .02 |

Net realized and unrealized gain (loss) | .17 | 3.77 | 1.00 | (.96) | 1.38 |

Total from investment operations | .27 | 3.82 | 1.06 | (.87) | 1.40 |

Distributions from net investment income | - | (.06) | (.02) | (.10) | (.09) |

Distributions from net realized gain | (.17) | (.06) | - | (.03) | (.01) |

Total distributions | (.17) | (.12) | (.02) | (.13) | (.10) |

Redemption fees added to paid in capital C, I | - | - | - | - | - |

Net asset value, end of period | $ 18.75 | $ 18.65 | $ 14.95 | $ 13.91 | $ 14.91 |

Total ReturnA, B | 1.45% | 25.72% | 7.64% | (5.89)% | 10.34% |

Ratios to Average Net Assets D, H | | | | | |

Expenses before reductions | 2.07% | 2.08% | 2.08% | 2.08% | 2.09% |

Expenses net of fee waivers, if any | 2.07% | 2.08% | 2.08% | 2.08% | 2.09% |

Expenses net of all reductions | 2.07% | 2.06% | 2.07% | 2.06% | 2.07% |

Net investment income (loss) | .53%F | .30% | .44% | .61%G | .18% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 19 | $ 36 | $ 59 | $ 94 | $ 157 |

Portfolio turnover rateE | 40% | 50% | 34% | 48% | 59% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.09 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .04%.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .21%.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

Years ended October 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 18.63 | $ 14.97 | $ 13.95 | $ 14.95 | $ 13.65 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .11F | .06 | .06 | .10G | .03 |

Net realized and unrealized gain (loss) | .18 | 3.75 | 1.01 | (.96) | 1.38 |

Total from investment operations | .29 | 3.81 | 1.07 | (.86) | 1.41 |

Distributions from net investment income | (.07) | (.09) | (.05) | (.11) | (.10) |

Distributions from net realized gain | (.17) | (.06) | - | (.03) | (.01) |

Total distributions | (.24) | (.15) | (.05) | (.14) | (.11) |

Redemption fees added to paid in capital C, I | - | - | - | - | - |

Net asset value, end of period | $ 18.68 | $ 18.63 | $ 14.97 | $ 13.95 | $ 14.95 |

Total ReturnA, B | 1.58% | 25.71% | 7.71% | (5.83)% | 10.32% |

Ratios to Average Net Assets D, H | | | | | |

Expenses before reductions | 2.00% | 2.04% | 2.06% | 2.05% | 2.06% |

Expenses net of fee waivers, if any | 2.00% | 2.04% | 2.06% | 2.05% | 2.06% |

Expenses net of all reductions | 2.00% | 2.01% | 2.05% | 2.03% | 2.04% |

Net investment income (loss) | .60%F | .35% | .46% | .64%G | .21% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 243 | $ 264 | $ 246 | $ 302 | $ 419 |

Portfolio turnover rateE | 40% | 50% | 34% | 48% | 59% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.09 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .11%.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .24%.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Institutional Class

Years ended October 31, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 19.80 | $ 15.90 | $ 14.87 | $ 15.90 | $ 14.48 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .33E | .24 | .23 | .28F | .19 |

Net realized and unrealized gain (loss) | .18 | 3.98 | 1.05 | (1.03) | 1.47 |

Total from investment operations | .51 | 4.22 | 1.28 | (.75) | 1.66 |

Distributions from net investment income | (.23) | (.26) | (.25) | (.25) | (.23) |

Distributions from net realized gain | (.17) | (.06) | - | (.03) | (.01) |

Total distributions | (.40) | (.32) | (.25) | (.28) | (.24) |

Redemption fees added to paid in capital B,H | - | - | - | - | - |

Net asset value, end of period | $ 19.91 | $ 19.80 | $ 15.90 | $ 14.87 | $ 15.90 |

Total ReturnA | 2.60% | 27.03% | 8.83% | (4.85)% | 11.55% |

Ratios to Average Net Assets C, G | | | | | |

Expenses before reductions | .97% | .99% | 1.00% | .99% | .99% |

Expenses net of fee waivers, if any | .97% | .99% | 1.00% | .99% | .99% |

Expenses net of all reductions | .97% | .97% | .99% | .97% | .97% |

Net investment income (loss) | 1.63%E | 1.39% | 1.52% | 1.70%F | 1.28% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 648 | $ 636 | $ 546 | $ 723 | $ 1,316 |

Portfolio turnover rateD | 40% | 50% | 34% | 48% | 59% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.14%.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.06 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.30%.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class Z

Years ended October 31, | 2014 | 2013H |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 19.81 | $ 18.54 |

Income from Investment Operations | | |

Net investment income (loss) D | .36G | .03 |

Net realized and unrealized gain (loss) | .19 | 1.24 |

Total from investment operations | .55 | 1.27 |

Distributions from net investment income | (.26) | - |

Distributions from net realized gain | (.17) | - |

Total distributions | (.43) | - |

Redemption fees added to paid in capital D | -J | - |

Net asset value, end of period | $ 19.93 | $ 19.81 |

Total ReturnB, C | 2.81% | 6.85% |

Ratios to Average Net Assets E, I | | |

Expenses before reductions | .81% | .83%A |

Expenses net of fee waivers, if any | .81% | .83%A |

Expenses net of all reductions | .81% | .80%A |

Net investment income (loss) | 1.79%G | .77%A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $ 24,050 | $ 107 |

Portfolio turnover rateF | 40% | 50% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.30%.

H For the period August 13, 2013 (commencement of sale of shares) to October 31, 2013.

I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

J Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended October 31, 2014

(Amounts in thousands except percentages)

1. Organization.

Fidelity Advisor Diversified International Fund (the Fund) is a fund of Fidelity Advisor Series VIII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C, Institutional Class and Class Z shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. In accordance with valuation policies and procedures approved by the Board of Trustees (the Board), the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Fidelity Management & Research Company (FMR) Fair Value Committee (the Committee), in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and is responsible for approving and reporting to the Board all fair value determinations.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Annual Report

3. Significant Accounting Policies - continued

Investment Valuation - continued

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Preferred securities are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. ETFs are valued at their last sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of October 31, 2014, including information on transfers between Levels 1 and 2, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. Large, non-recurring dividends recognized by the Fund are presented separately on the Statement of Operations as "Special Dividends" and the impact of these dividends is presented in the Financial Highlights. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The

Annual Report

3. Significant Accounting Policies - continued

Deferred Trustee Compensation - continued

investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of October 31, 2014, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), deferred trustees compensation, futures transactions, partnerships, capital loss carryforwards, and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 401,047 |

Gross unrealized depreciation | (78,289) |

Net unrealized appreciation (depreciation) on securities | $ 322,758 |

Tax Cost | $ 1,604,526 |

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except percentages)

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax-based components of distributable earnings as of period end were as follows:

Undistributed ordinary income | $ 18,554 |

Capital loss carryforward | $ (2,645,401) |

Net unrealized appreciation (depreciation) on securities and other investments | $ 322,566 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of fiscal period end and is subject to adjustment.

Fiscal year of expiration | |

2017 | $ (2,645,401) |

The tax character of distributions paid was as follows:

| October 31, 2014 | October 31, 2013 |

Ordinary Income | $ 34,939 | $ 30,937 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days may have been subject to a redemption fee equal to 1.00% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

New Accounting Pronouncement. In June 2014, the Financial Accounting Standards Board issued Accounting Standard Update No. 2014-11, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures. The Update amends the accounting for certain repurchase agreements and expands disclosure requirements for reverse repurchase agreements, securities lending and other similar transactions. The disclosure requirements are effective for annual and interim reporting periods beginning after December 15, 2014. Management is currently evaluating the impact of the Update on the Fund's financial statements and related disclosures.

Annual Report

4. Derivative Instruments.