UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | October 31, 2021 |

Item 1.

Reports to Stockholders

Fidelity Advisor® Diversified International Fund

Annual Report

October 31, 2021

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

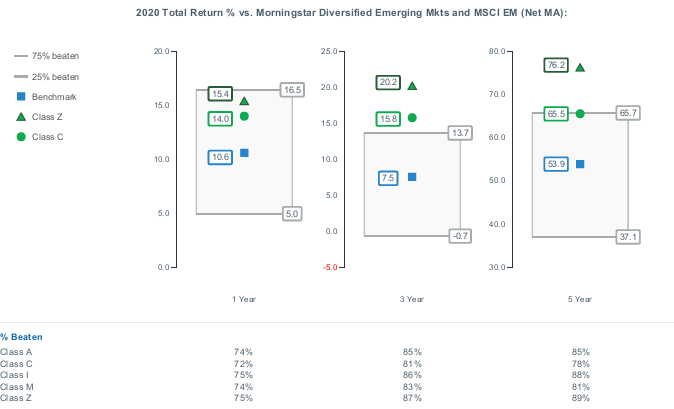

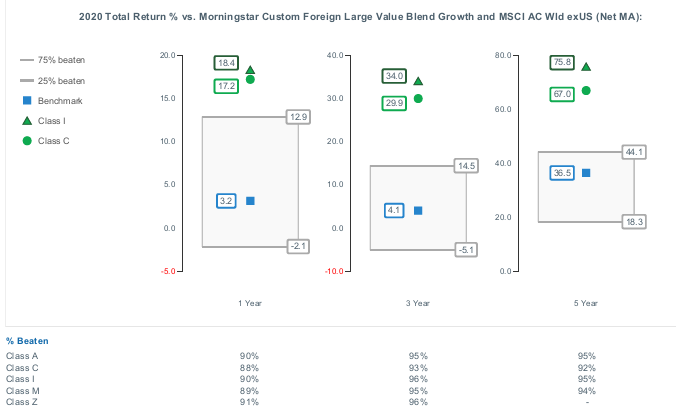

Average Annual Total Returns

| For the periods ended October 31, 2021 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | 22.11% | 11.40% | 9.29% |

| Class M (incl. 3.50% sales charge) | 24.67% | 11.63% | 9.27% |

| Class C (incl. contingent deferred sales charge) | 27.55% | 11.86% | 9.29% |

| Class I | 29.87% | 13.02% | 10.25% |

| Class Z | 30.10% | 13.20% | 10.39% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

The initial offering of Class Z shares took place on August 13, 2013. Returns prior to August 13, 2013, are those of Class I.

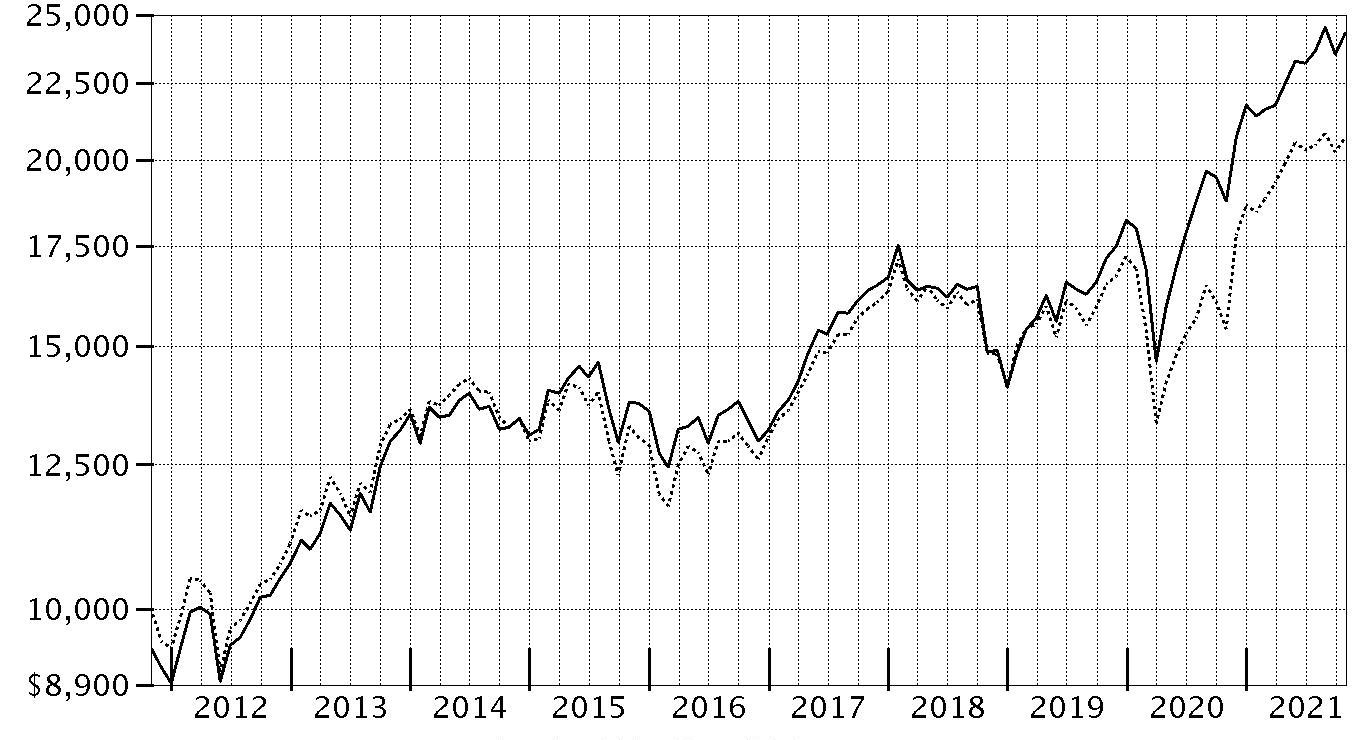

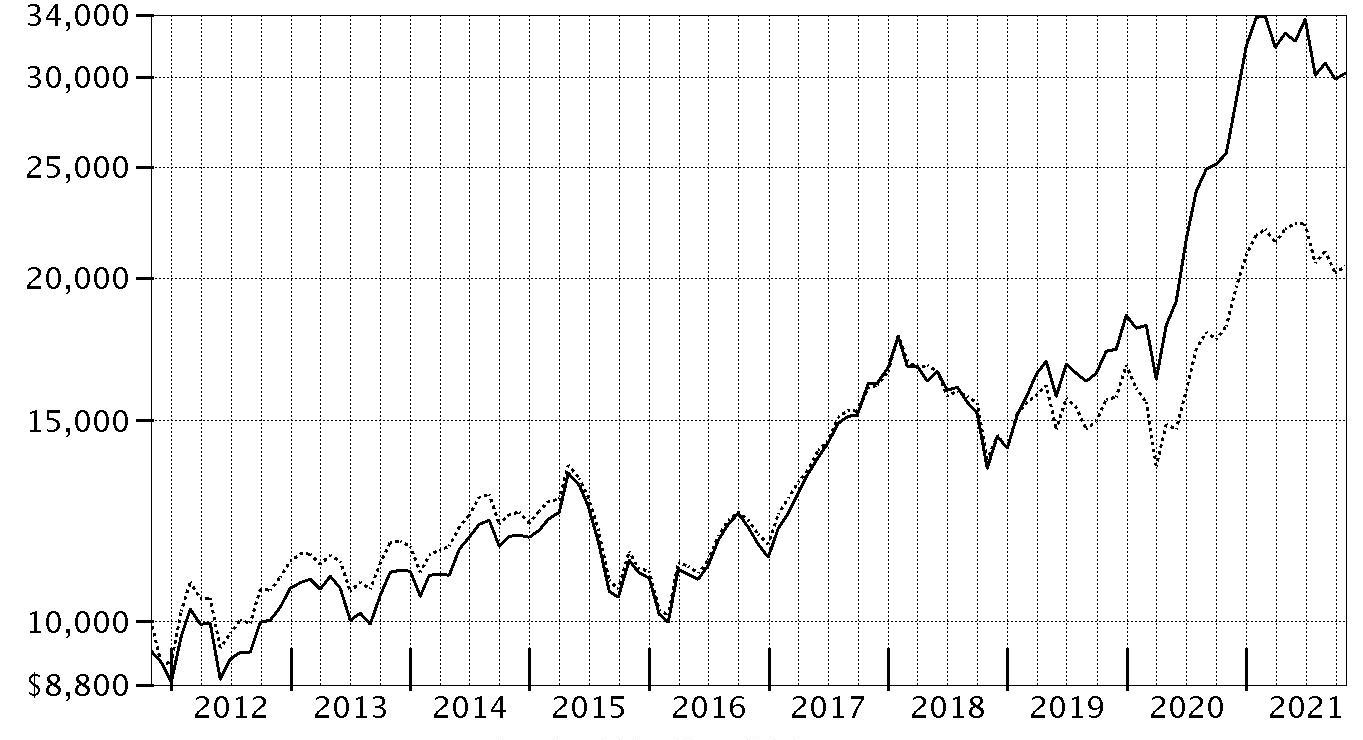

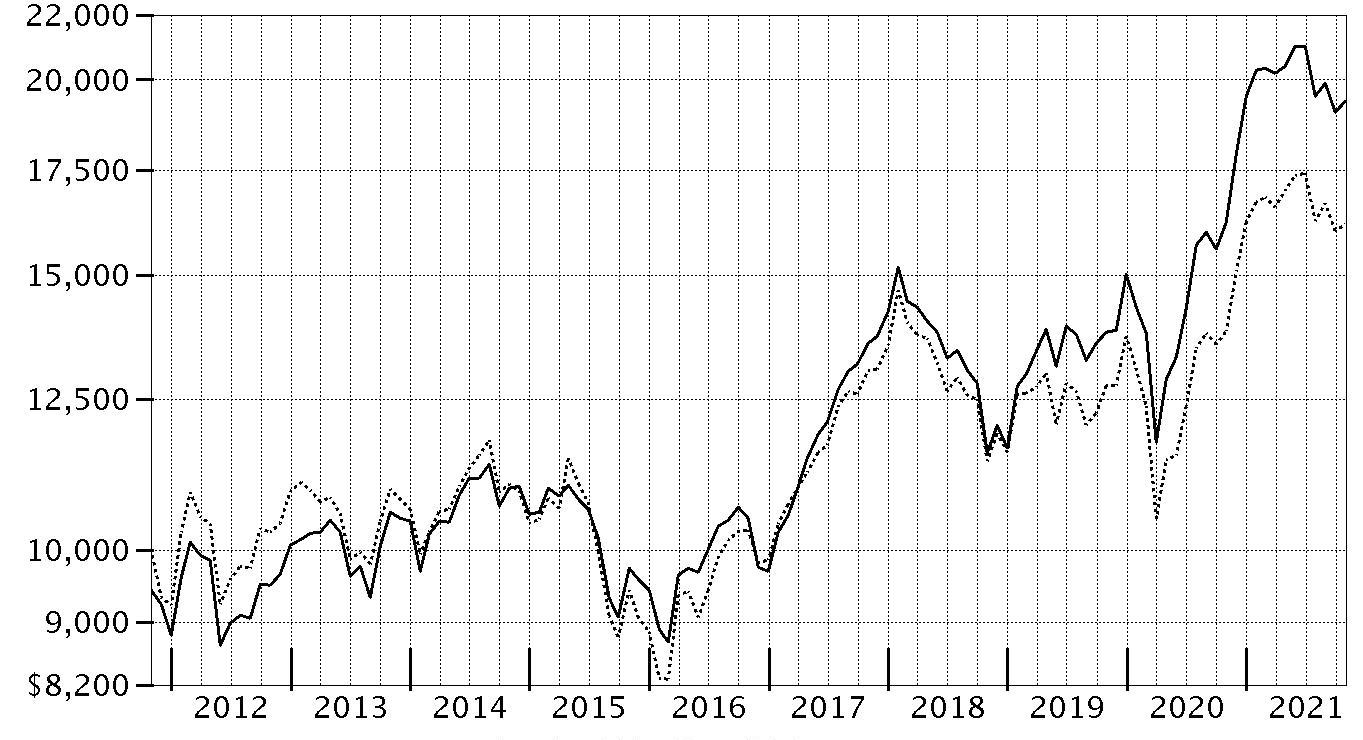

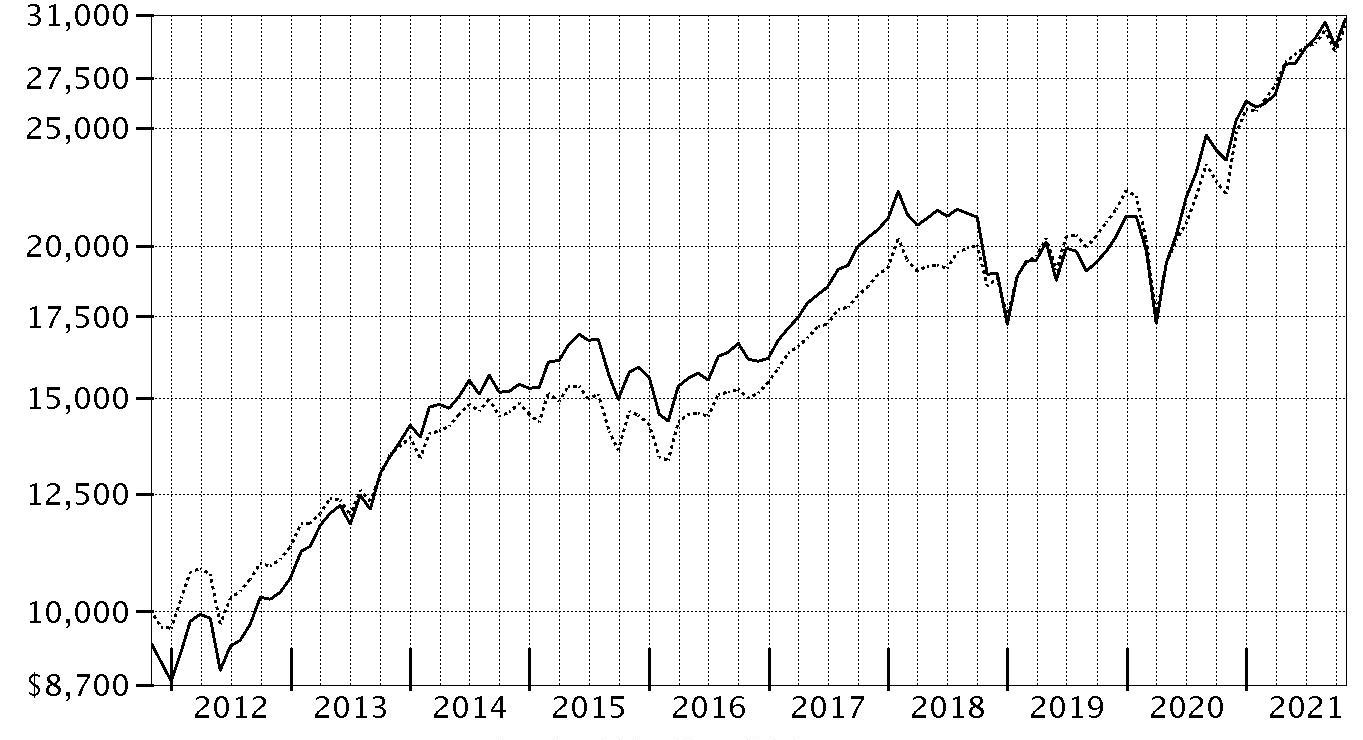

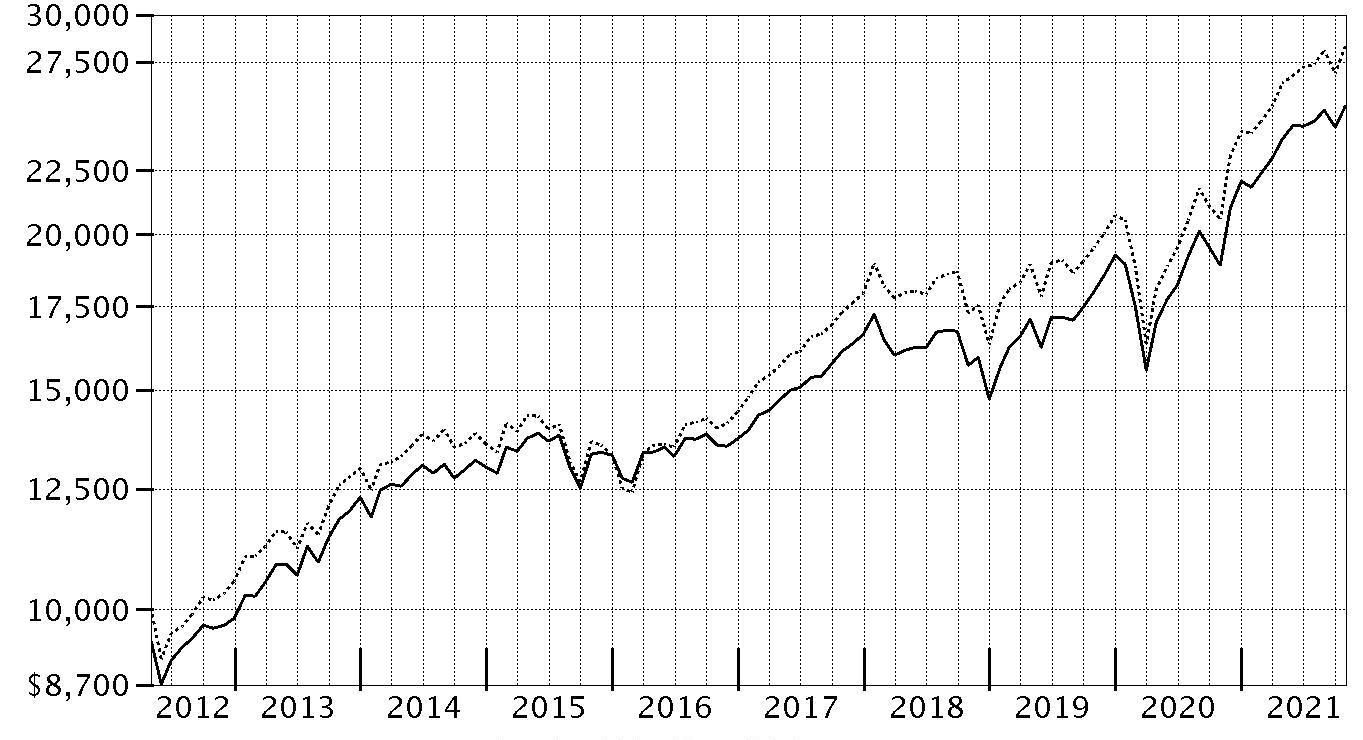

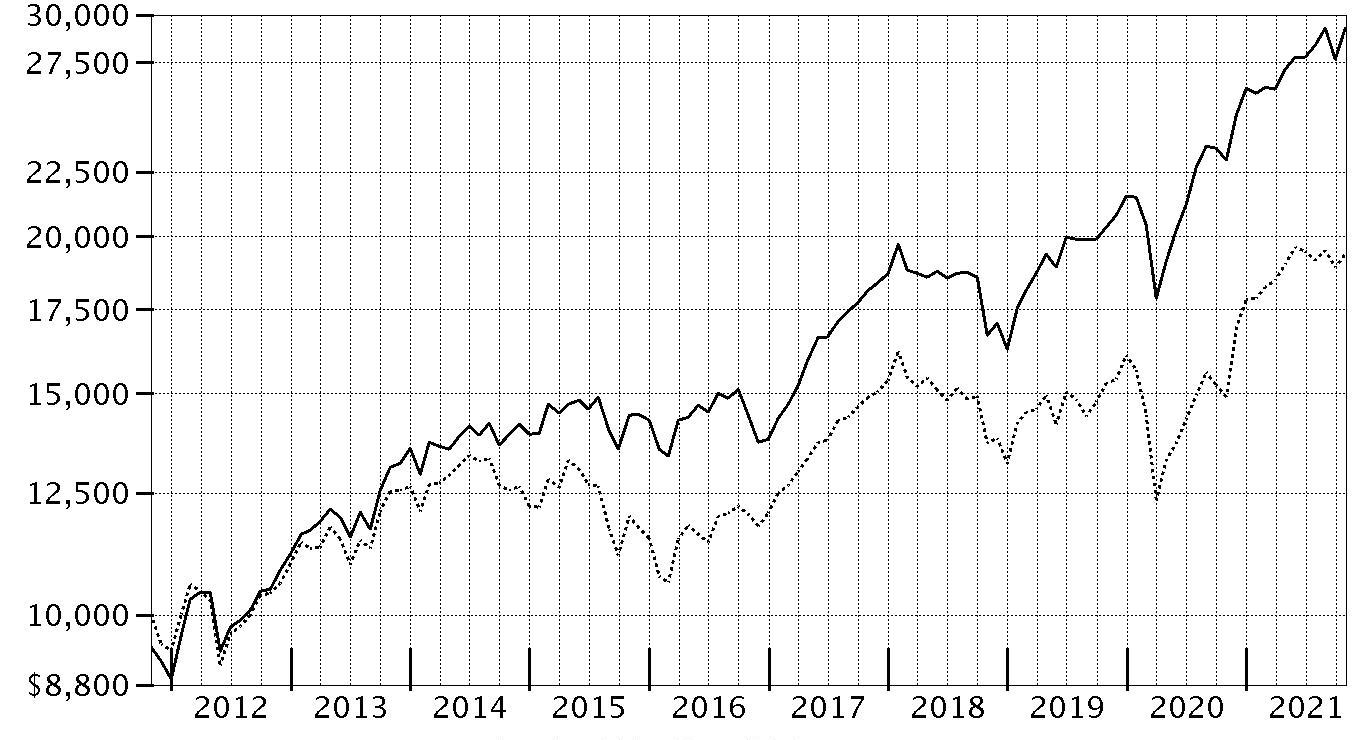

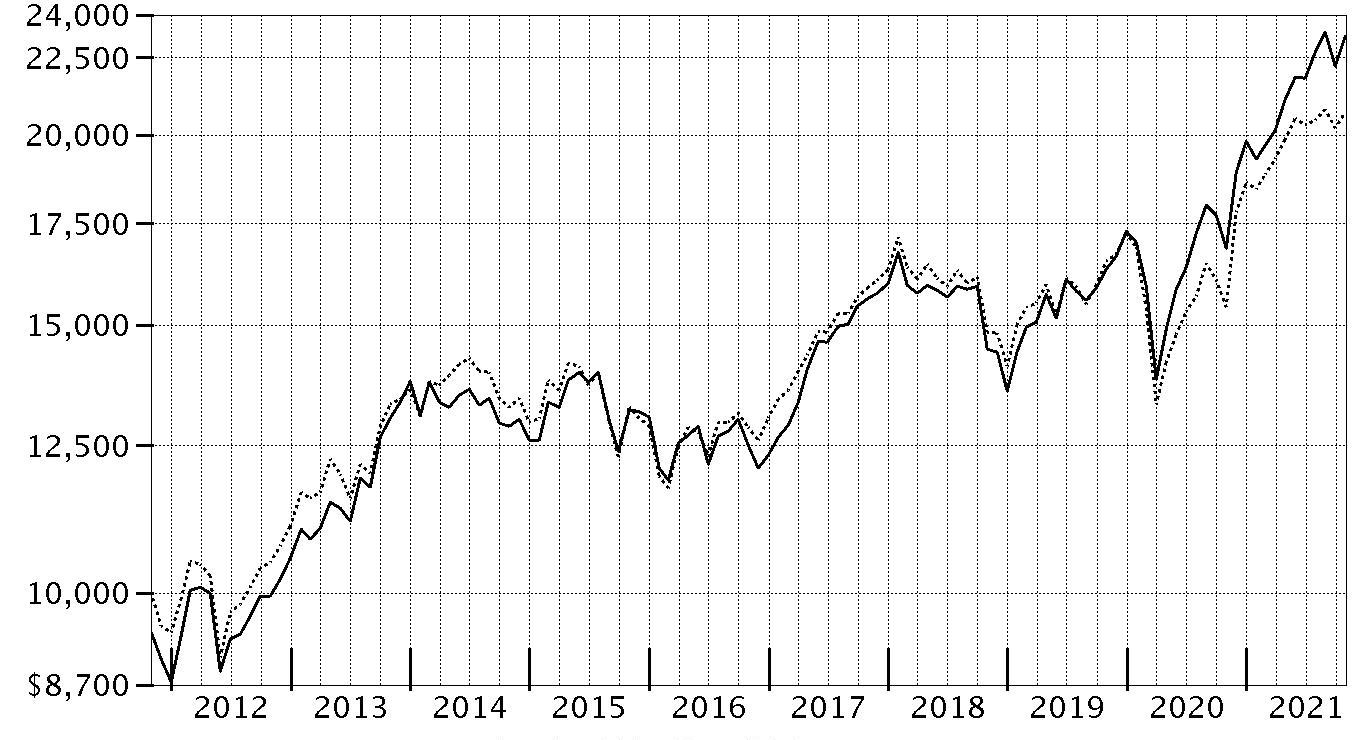

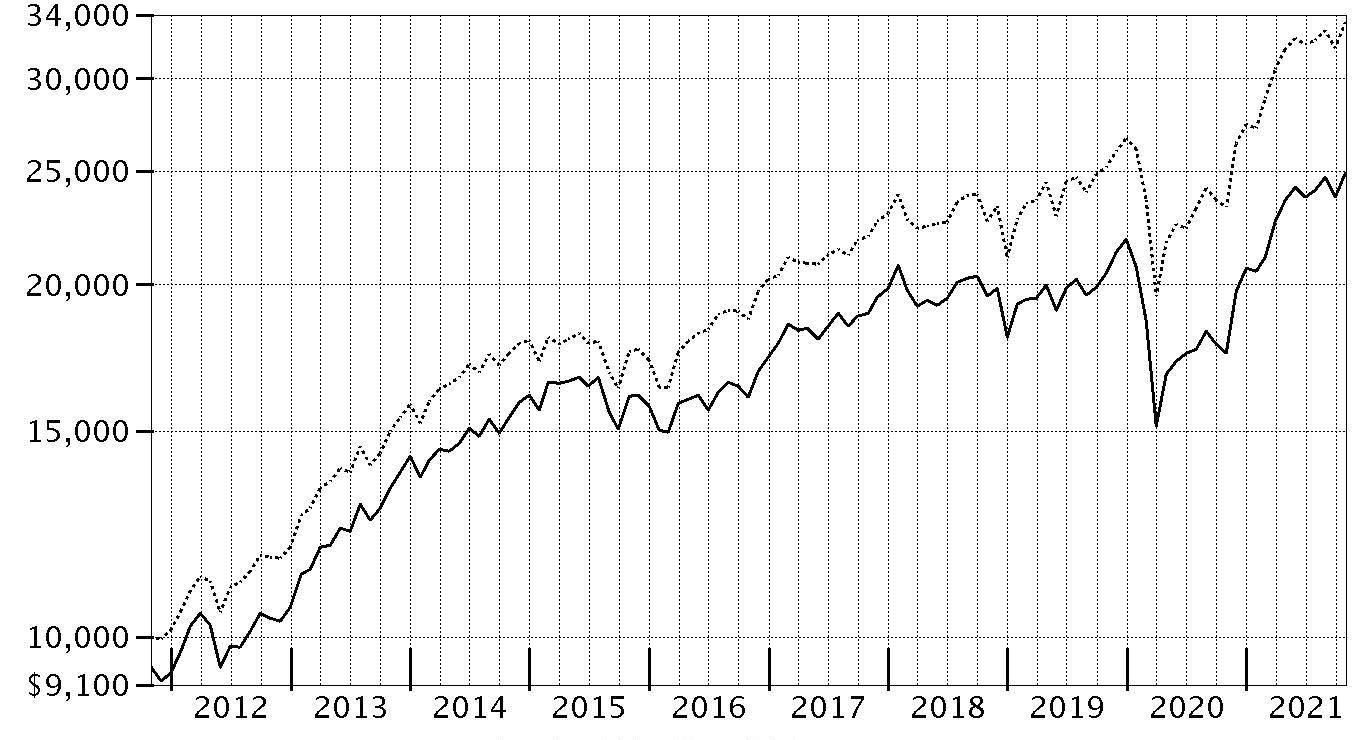

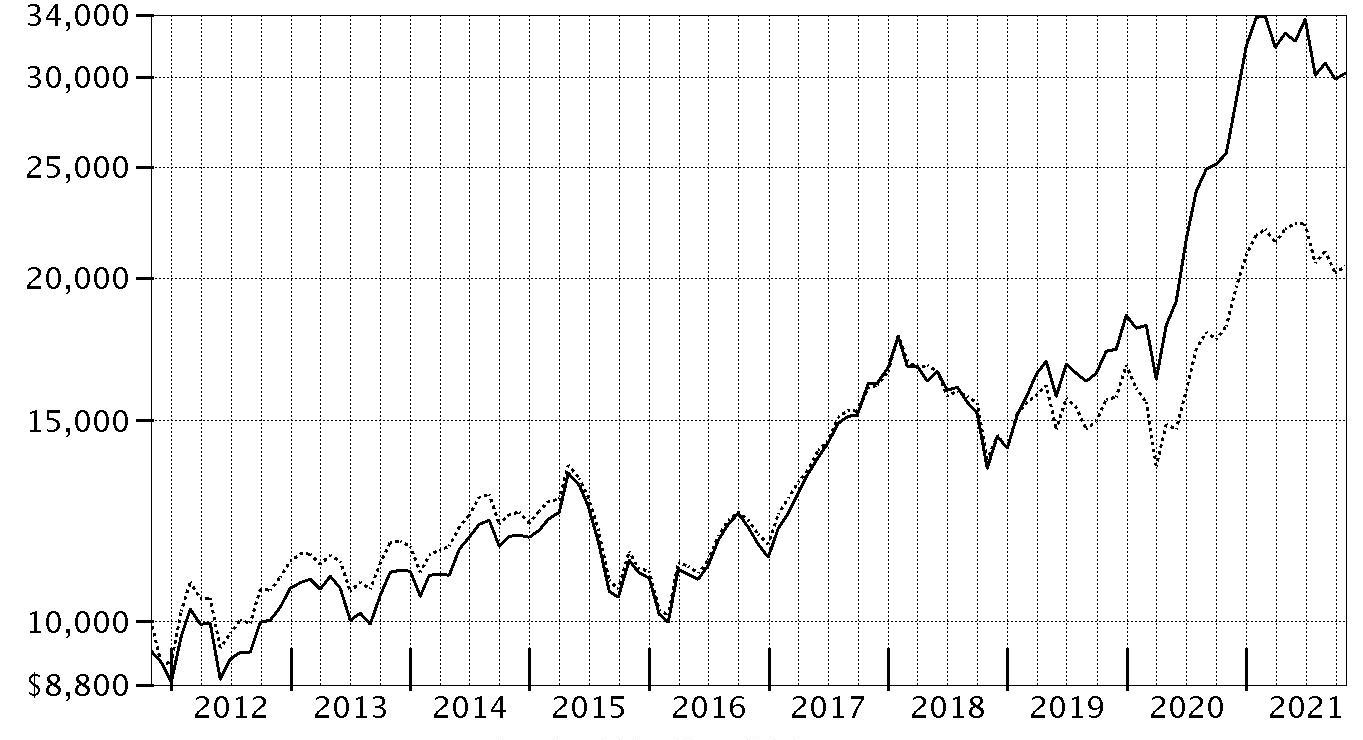

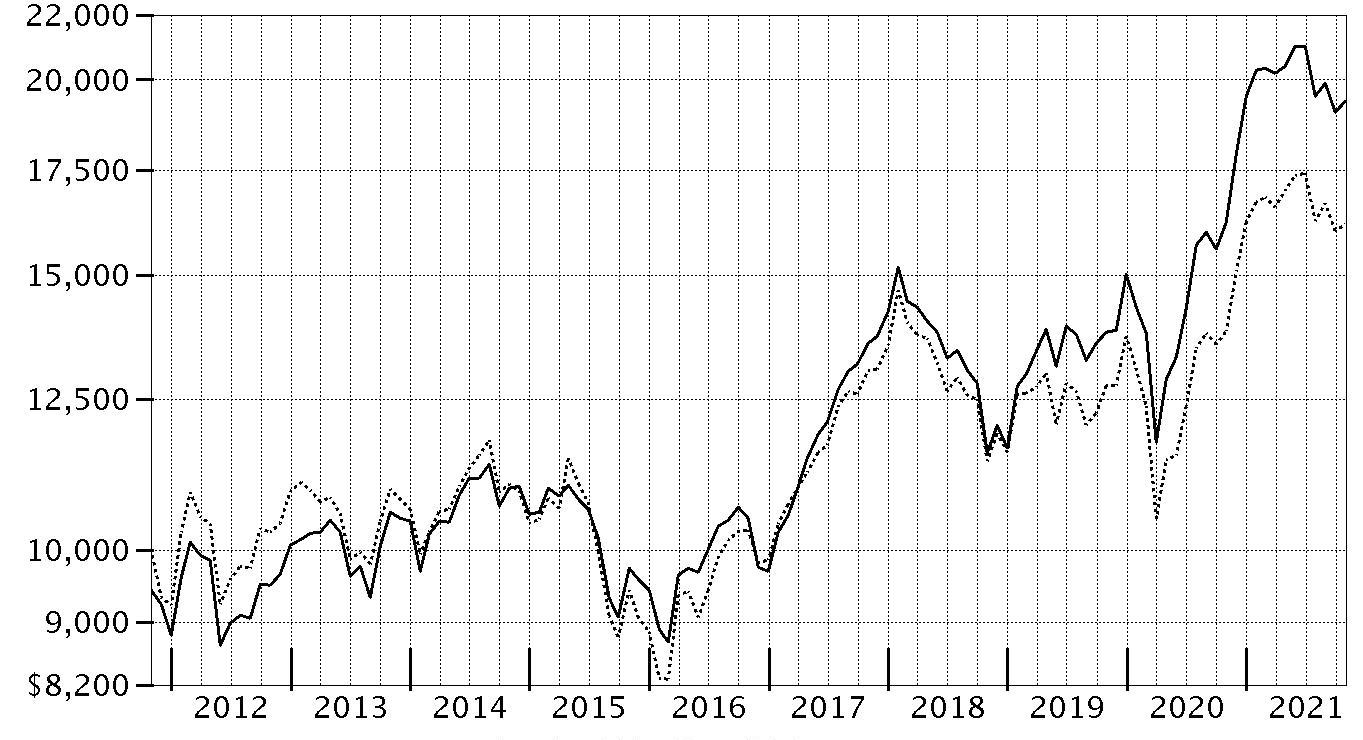

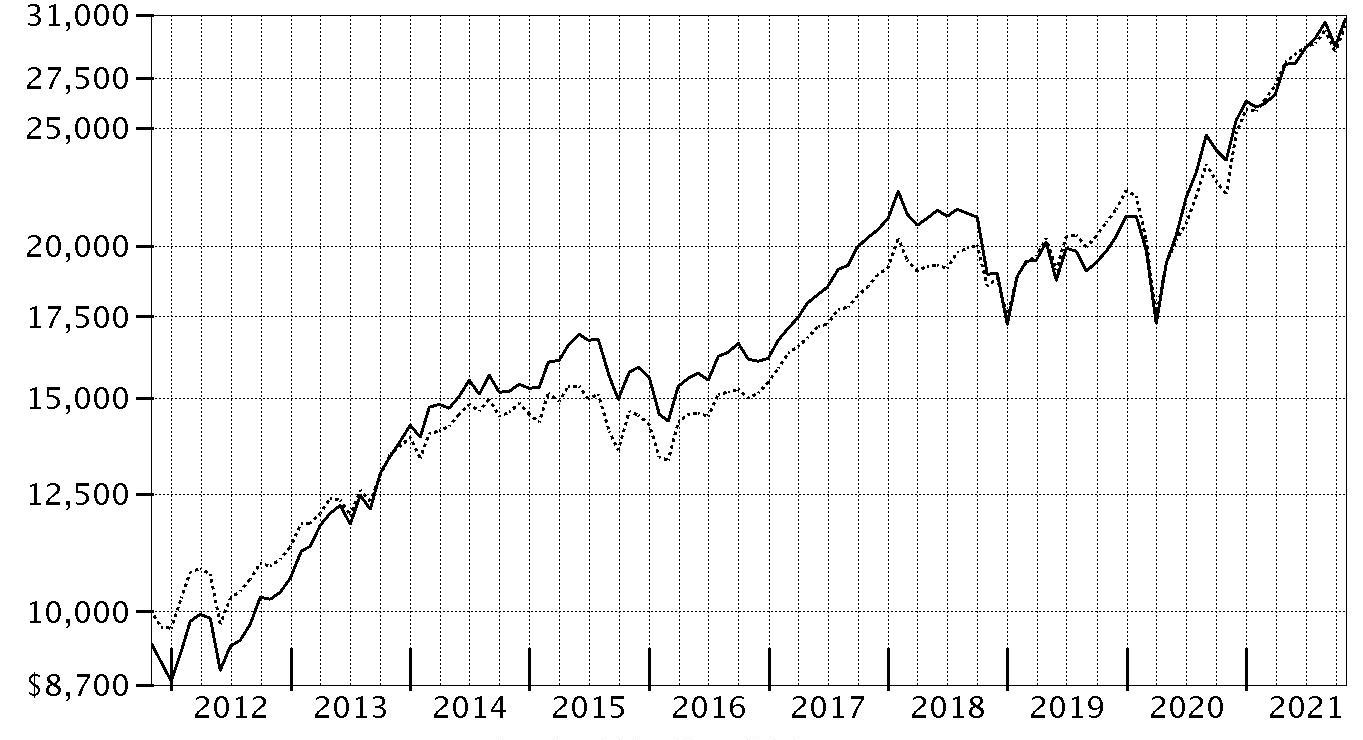

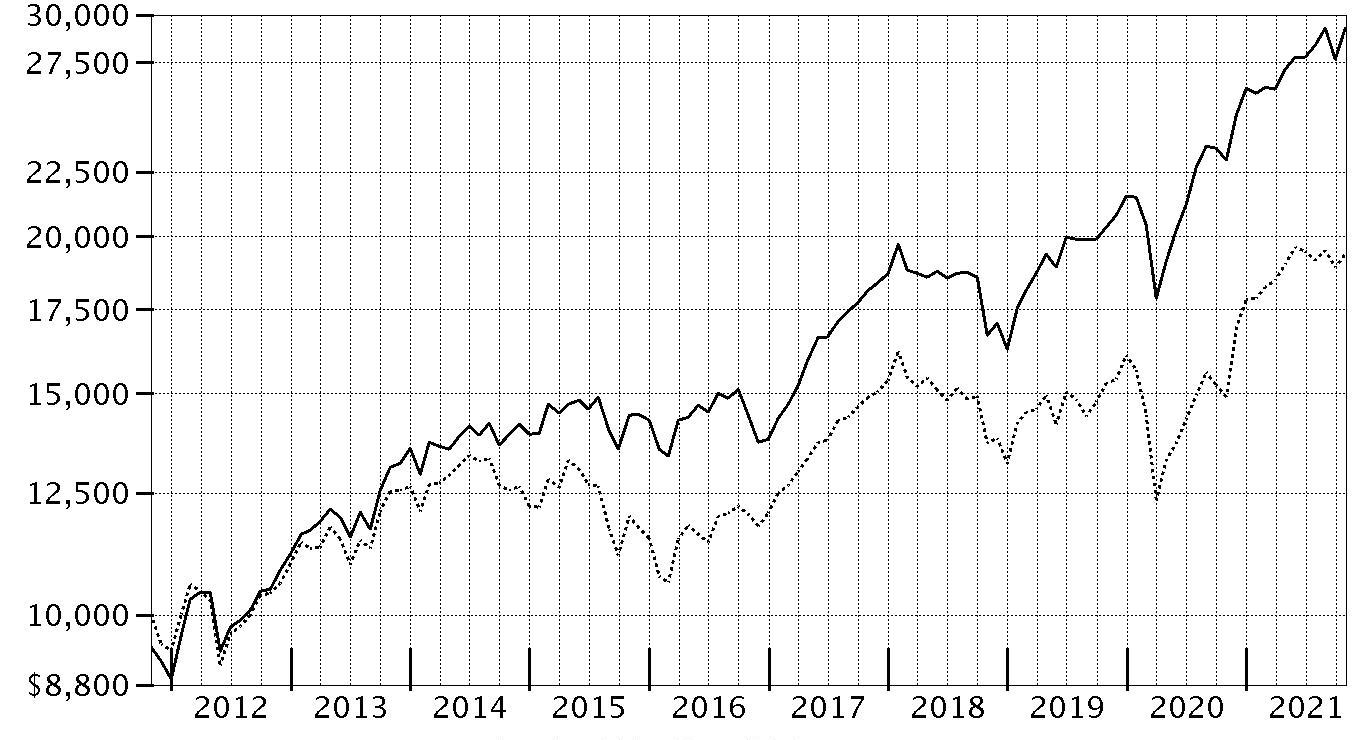

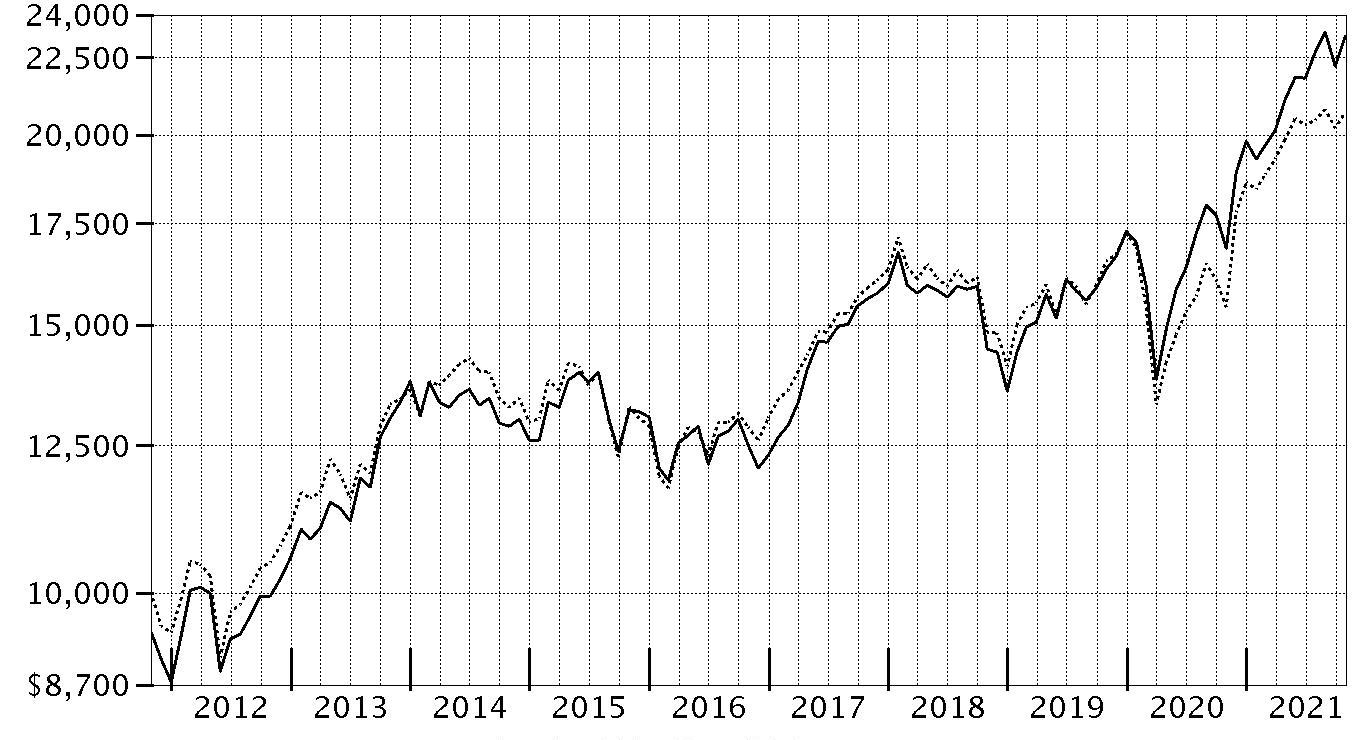

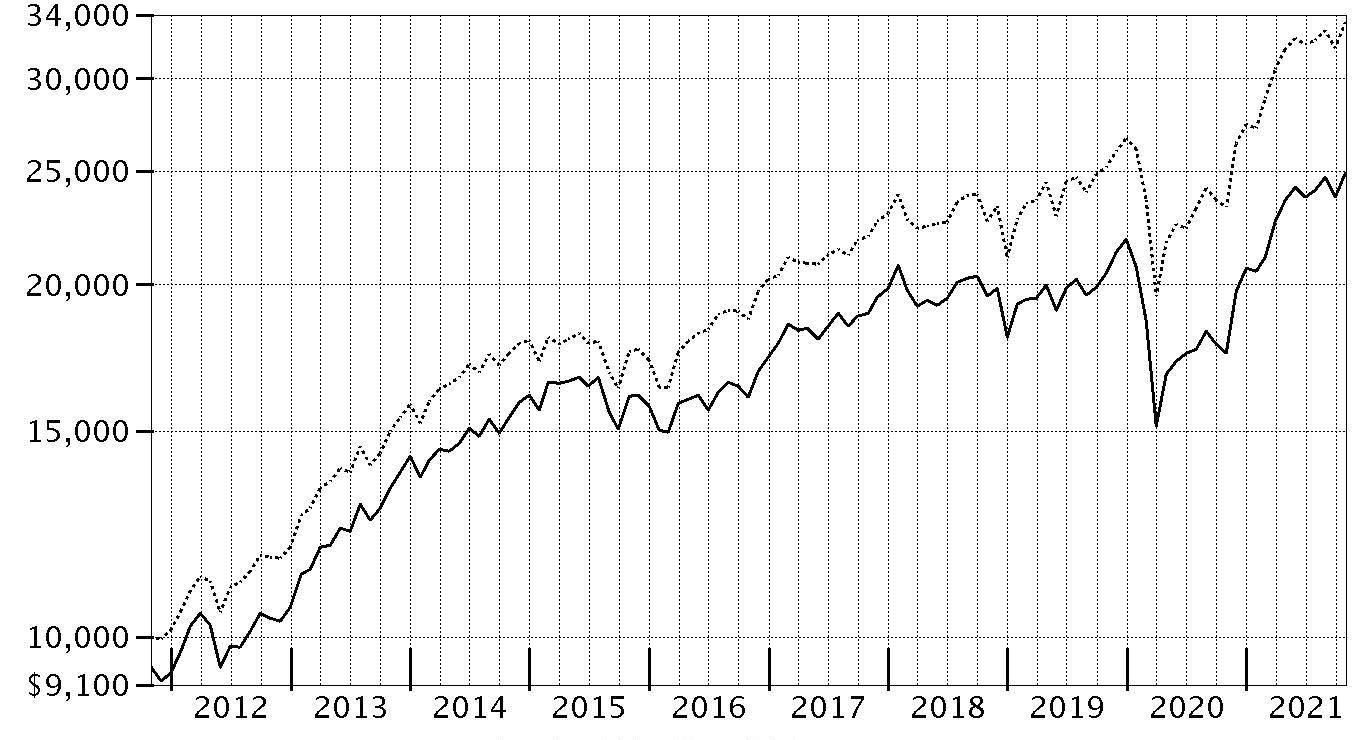

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Diversified International Fund - Class A on October 31, 2011, and the current 5.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the MSCI EAFE Index performed over the same period.

| Period Ending Values |

| $24,319 | Fidelity Advisor® Diversified International Fund - Class A |

| $20,722 | MSCI EAFE Index |

Management's Discussion of Fund Performance

Market Recap: The MSCI ACWI (All Country World Index) ex USA Index gained 29.85% for the 12 months ending October 31, 2021, with international equities rising amid an improved outlook for global economic growth, widespread COVID-19 vaccination, fiscal stimulus in the U.S. and abroad, and government spending programs. As 2021 began, investors saw reasons to be hopeful and the index recorded steady monthly gains. As part of the economic “reopening” trade, investors generally moved out of tech-driven mega-caps that had thrived due to the work-from-home trend in favor of cheap, smaller companies they believed stood to benefit from a broad cyclical recovery. In early September, sentiment turned broadly negative due to inflationary pressure from surging energy/other commodity prices, rising bond yields, supply constraints and disruption, valuation concerns, and the fast-spreading delta variant of the coronavirus. International stocks returned -3.18% for the month, but rebounded in October (+2.39%) amid strength in corporate earnings and notable improvement in the global economy. By region, Canada (+50%) led the way, followed by the U.K. (+44%) and Europe ex U.K (+41%). Conversely, emerging markets (+17%) and Japan (+20%) lagged most. By sector, energy (+74%) fared best by a wide margin. Financials (+50%) and information technology (+43%) also stood out. In contrast, communication services (+6%), consumer discretionary (+14%) and real estate (+17%) notably trailed the index.

Comments from Portfolio Manager Bill Bower: For the fiscal year ending October 31, 2021, the fund's share classes (excluding sales charges, if applicable) gained roughly 28% to 30%, underperforming the 34.45% result of the benchmark MSCI EAFE Index (Net MA). From a regional standpoint, stock picks and an underweighting in Europe ex U.K. and an overweighting emerging markets, specifically China, hindered the fund's relative result. By sector, the primary detractors from performance versus the benchmark were stock selection and an underweighting in financials. Weak picks in consumer discretionary also hurt. Also detracting from performance was security selection in consumer staples, especially within the food & staples retailing industry. Our biggest individual relative detractor was an out-of-benchmark stake in Alibaba Group Holding (-46%). We reduced our position this period. Our position in Tencent Holdings (-15%) was a key detractor. We decreased our out-of-benchmark stake the past 12 months. Another notable relative detractor was an outsized stake in London Stock Exchange Group (-9%). This period we reduced our stake. Conversely, a non-benchmark allocation to the U.S. and an underweighting and stock picks in Japan contributed most to the fund's relative result. By sector, the primary contributor to performance versus the benchmark was our stock selection in industrials. An overweighting and stock picks in information technology and security selection in health care also helped. The biggest individual relative contributor was an overweight position in ASML Holding (+126%), the fund's largest holding. The fund's non-benchmark stake in Rivian Automotive gained approximately 294%. Another notable relative contributor was an overweighting in Capgemini (+103%). Notable changes in positioning include increased exposure to France and a lower allocation to Germany. By sector, meaningful changes in positioning include increased exposure to financials and industrials.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Five Stocks as of October 31, 2021

| | % of fund's net assets |

| ASML Holding NV (Netherlands, Semiconductors & Semiconductor Equipment) | 2.9 |

| Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 2.6 |

| Nestle SA (Reg. S) (Switzerland, Food Products) | 2.1 |

| Hoya Corp. (Japan, Health Care Equipment & Supplies) | 2.1 |

| LVMH Moet Hennessy Louis Vuitton SE (France, Textiles, Apparel & Luxury Goods) | 1.9 |

| | 11.6 |

Top Five Market Sectors as of October 31, 2021

| | % of fund's net assets |

| Industrials | 20.5 |

| Information Technology | 17.2 |

| Financials | 16.0 |

| Health Care | 13.2 |

| Consumer Discretionary | 11.0 |

Top Five Countries as of October 31, 2021

| (excluding cash equivalents) | % of fund's net assets |

| Japan | 18.8 |

| France | 9.4 |

| United Kingdom | 8.5 |

| Switzerland | 8.3 |

| Germany | 7.4 |

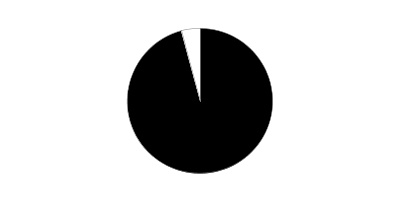

Asset Allocation (% of fund's net assets)

| As of October 31, 2021 |

| | Stocks | 97.7% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 2.3% |

Schedule of Investments October 31, 2021

Showing Percentage of Net Assets

| Common Stocks - 96.8% | | | |

| | | Shares | Value (000s) |

| Australia - 0.8% | | | |

| Aristocrat Leisure Ltd. | | 331,624 | $11,645 |

| Lynas Rare Earths Ltd. (a) | | 637,410 | 3,515 |

|

| TOTAL AUSTRALIA | | | 15,160 |

|

| Austria - 0.2% | | | |

| Erste Group Bank AG | | 84,200 | 3,611 |

| Bailiwick of Jersey - 2.3% | | | |

| Experian PLC | | 242,500 | 11,108 |

| Ferguson PLC | | 115,646 | 17,401 |

| Glencore Xstrata PLC | | 1,310,600 | 6,554 |

| WPP PLC | | 655,900 | 9,481 |

|

| TOTAL BAILIWICK OF JERSEY | | | 44,544 |

|

| Belgium - 1.9% | | | |

| Azelis Group NV | | 92,000 | 2,978 |

| KBC Groep NV | | 261,680 | 24,370 |

| UCB SA | | 83,700 | 9,976 |

|

| TOTAL BELGIUM | | | 37,324 |

|

| Bermuda - 1.2% | | | |

| Hiscox Ltd. | | 572,266 | 6,524 |

| IHS Markit Ltd. | | 125,288 | 16,378 |

|

| TOTAL BERMUDA | | | 22,902 |

|

| Brazil - 0.0% | | | |

| Natura & Co. Holding SA (a) | | 149,200 | 1,028 |

| Canada - 2.8% | | | |

| Canadian Natural Resources Ltd. | | 376,100 | 15,985 |

| Constellation Software, Inc. | | 7,500 | 13,181 |

| Fairfax India Holdings Corp. (a)(b) | | 214,600 | 2,790 |

| First Quantum Minerals Ltd. | | 182,100 | 4,311 |

| Franco-Nevada Corp. | | 59,200 | 8,447 |

| Thomson Reuters Corp. | | 48,400 | 5,822 |

| Tourmaline Oil Corp. | | 125,200 | 4,525 |

|

| TOTAL CANADA | | | 55,061 |

|

| Cayman Islands - 2.3% | | | |

| Alibaba Group Holding Ltd. sponsored ADR (a) | | 35,100 | 5,789 |

| Anta Sports Products Ltd. | | 491,000 | 7,674 |

| GlobalFoundries, Inc. | | 112,100 | 5,464 |

| Li Ning Co. Ltd. | | 825,500 | 9,178 |

| Medlive Technology Co. Ltd. (b) | | 52,000 | 270 |

| Medlive Technology Co. Ltd. | | 138,500 | 684 |

| Sea Ltd. ADR (a) | | 10,800 | 3,711 |

| Tencent Holdings Ltd. | | 147,100 | 8,948 |

| Zai Lab Ltd. ADR (a) | | 27,054 | 2,824 |

|

| TOTAL CAYMAN ISLANDS | | | 44,542 |

|

| China - 0.7% | | | |

| Kweichow Moutai Co. Ltd. (A Shares) | | 39,676 | 11,310 |

| Shenzhen Mindray Bio-Medical Electronics Co. Ltd. (A Shares) | | 34,900 | 2,049 |

| Shenzhen YUTO Packaging Technology Co. Ltd. (A Shares) | | 213,100 | 1,089 |

|

| TOTAL CHINA | | | 14,448 |

|

| Curacao - 0.3% | | | |

| Schlumberger Ltd. | | 201,900 | 6,513 |

| Denmark - 1.8% | | | |

| DSV A/S | | 102,200 | 23,751 |

| GN Store Nord A/S | | 76,100 | 4,618 |

| Vestas Wind Systems A/S | | 140,500 | 6,076 |

|

| TOTAL DENMARK | | | 34,445 |

|

| France - 9.4% | | | |

| Amundi SA (b) | | 81,658 | 7,273 |

| BNP Paribas SA | | 306,900 | 20,543 |

| Capgemini SA | | 93,600 | 21,781 |

| Dassault Systemes SA | | 176,300 | 10,295 |

| Edenred SA | | 84,000 | 4,542 |

| Hermes International SCA | | 1,700 | 2,693 |

| Legrand SA | | 109,400 | 11,934 |

| LVMH Moet Hennessy Louis Vuitton SE | | 47,543 | 37,279 |

| Pernod Ricard SA | | 89,300 | 20,512 |

| Sanofi SA | | 39,155 | 3,933 |

| Sartorius Stedim Biotech | | 17,000 | 9,358 |

| Societe Generale Series A | | 250,900 | 8,381 |

| Teleperformance | | 43,600 | 18,200 |

| Worldline SA (a)(b) | | 144,800 | 8,433 |

|

| TOTAL FRANCE | | | 185,157 |

|

| Germany - 7.4% | | | |

| adidas AG | | 53,509 | 17,524 |

| Allianz SE | | 86,400 | 20,091 |

| Auto1 Group SE (b) | | 66,200 | 2,602 |

| Brenntag SE | | 55,487 | 5,275 |

| Deutsche Post AG | | 354,526 | 21,934 |

| Hannover Reuck SE | | 53,600 | 9,790 |

| Linde PLC | | 70,738 | 22,774 |

| Merck KGaA | | 50,300 | 11,874 |

| SAP SE | | 60,173 | 8,714 |

| Siemens Healthineers AG (b) | | 215,700 | 14,328 |

| SUSE SA (a) | | 75,500 | 3,258 |

| Symrise AG | | 46,700 | 6,454 |

|

| TOTAL GERMANY | | | 144,618 |

|

| Greece - 0.1% | | | |

| Piraeus Financial Holdings SA (a) | | 711,900 | 1,210 |

| Hong Kong - 2.5% | | | |

| AIA Group Ltd. | | 2,901,800 | 32,521 |

| Hong Kong Exchanges and Clearing Ltd. | | 93,189 | 5,639 |

| Techtronic Industries Co. Ltd. | | 536,500 | 11,040 |

|

| TOTAL HONG KONG | | | 49,200 |

|

| India - 4.2% | | | |

| Axis Bank Ltd. (a) | | 370,400 | 3,667 |

| HDFC Bank Ltd. | | 874,142 | 18,499 |

| Housing Development Finance Corp. Ltd. | | 405,587 | 15,393 |

| Kotak Mahindra Bank Ltd. (a) | | 479,840 | 13,003 |

| Reliance Industries Ltd. | | 63,367 | 1,608 |

| Reliance Industries Ltd. | | 874,808 | 29,601 |

|

| TOTAL INDIA | | | 81,771 |

|

| Indonesia - 0.7% | | | |

| PT Bank Central Asia Tbk | | 11,522,500 | 6,079 |

| PT Bank Rakyat Indonesia Tbk | | 22,517,133 | 6,759 |

|

| TOTAL INDONESIA | | | 12,838 |

|

| Ireland - 2.1% | | | |

| Aon PLC | | 39,800 | 12,733 |

| Flutter Entertainment PLC (a) | | 40,500 | 7,646 |

| Kingspan Group PLC (Ireland) | | 103,981 | 11,977 |

| Ryanair Holdings PLC sponsored ADR (a) | | 85,836 | 9,743 |

|

| TOTAL IRELAND | | | 42,099 |

|

| Isle of Man - 0.2% | | | |

| Entain PLC (a) | | 144,500 | 4,050 |

| Italy - 0.9% | | | |

| FinecoBank SpA | | 388,200 | 7,411 |

| GVS SpA (b) | | 66,500 | 988 |

| Recordati SpA | | 80,000 | 5,005 |

| Reply SpA | | 20,400 | 3,955 |

|

| TOTAL ITALY | | | 17,359 |

|

| Japan - 18.8% | | | |

| Daikin Industries Ltd. | | 40,900 | 8,958 |

| FUJIFILM Holdings Corp. | | 156,475 | 12,092 |

| Fujitsu Ltd. | | 36,100 | 6,239 |

| Hitachi Ltd. | | 363,000 | 20,918 |

| Hoya Corp. | | 278,200 | 40,953 |

| Itochu Corp. | | 492,100 | 14,035 |

| Keyence Corp. | | 53,100 | 32,052 |

| Minebea Mitsumi, Inc. | | 813,400 | 20,593 |

| Misumi Group, Inc. | | 212,100 | 8,871 |

| Money Forward, Inc. (a) | | 32,600 | 2,215 |

| Murata Manufacturing Co. Ltd. | | 107,800 | 7,996 |

| Nitori Holdings Co. Ltd. | | 28,103 | 5,163 |

| NOF Corp. | | 44,900 | 2,253 |

| ORIX Corp. | | 595,200 | 11,830 |

| Pan Pacific International Holdings Ltd. | | 271,100 | 5,692 |

| Persol Holdings Co. Ltd. | | 376,700 | 10,125 |

| Recruit Holdings Co. Ltd. | | 338,500 | 22,517 |

| Relo Group, Inc. | | 226,700 | 4,715 |

| Seven & i Holdings Co. Ltd. | | 101,200 | 4,249 |

| Shin-Etsu Chemical Co. Ltd. | | 136,900 | 24,414 |

| Shiseido Co. Ltd. | | 122,892 | 8,200 |

| SMC Corp. | | 25,900 | 15,456 |

| Sony Group Corp. | | 190,500 | 22,059 |

| Sugi Holdings Co. Ltd. | | 36,600 | 2,621 |

| TIS, Inc. | | 210,600 | 5,737 |

| Tokyo Electron Ltd. | | 37,400 | 17,430 |

| Tsuruha Holdings, Inc. | | 85,100 | 10,497 |

| Welcia Holdings Co. Ltd. | | 203,312 | 7,590 |

| Z Holdings Corp. | | 1,542,700 | 9,577 |

| ZOZO, Inc. | | 144,500 | 4,638 |

|

| TOTAL JAPAN | | | 369,685 |

|

| Korea (South) - 1.0% | | | |

| NAVER Corp. | | 18,140 | 6,275 |

| Samsung Electronics Co. Ltd. | | 225,080 | 13,407 |

|

| TOTAL KOREA (SOUTH) | | | 19,682 |

|

| Luxembourg - 1.0% | | | |

| B&M European Value Retail SA | | 1,438,295 | 12,464 |

| Eurofins Scientific SA | | 60,530 | 7,133 |

|

| TOTAL LUXEMBOURG | | | 19,597 |

|

| Netherlands - 6.8% | | | |

| Adyen BV (a)(b) | | 4,573 | 13,798 |

| Airbus Group NV (a) | | 105,700 | 13,559 |

| Argenx SE (a) | | 9,300 | 2,800 |

| ASML Holding NV | | 71,100 | 57,796 |

| Corbion NV | | 1,869 | 89 |

| IMCD NV | | 61,050 | 13,554 |

| NXP Semiconductors NV | | 67,100 | 13,478 |

| Wolters Kluwer NV | | 178,600 | 18,714 |

|

| TOTAL NETHERLANDS | | | 133,788 |

|

| New Zealand - 0.2% | | | |

| Ryman Healthcare Group Ltd. | | 311,645 | 3,227 |

| Norway - 0.8% | | | |

| Schibsted ASA (A Shares) | | 312,000 | 16,091 |

| Spain - 1.6% | | | |

| Cellnex Telecom SA (b) | | 283,744 | 17,443 |

| Industria de Diseno Textil SA (c) | | 409,800 | 14,799 |

|

| TOTAL SPAIN | | | 32,242 |

|

| Sweden - 2.2% | | | |

| EQT AB | | 77,000 | 4,058 |

| Hexagon AB (B Shares) | | 789,300 | 12,703 |

| Indutrade AB | | 505,500 | 14,709 |

| Investor AB (B Shares) (c) | | 341,100 | 7,860 |

| Kry International AB (d) | | 332 | 137 |

| Nibe Industrier AB (B Shares) | | 60,000 | 893 |

| Nordnet AB | | 111,300 | 2,134 |

|

| TOTAL SWEDEN | | | 42,494 |

|

| Switzerland - 8.3% | | | |

| Dufry AG (a) | | 92,324 | 4,888 |

| Idorsia Ltd. (a) | | 30,216 | 622 |

| Julius Baer Group Ltd. | | 73,680 | 5,329 |

| Lonza Group AG | | 29,366 | 24,074 |

| Nestle SA (Reg. S) | | 316,160 | 41,704 |

| Roche Holding AG (participation certificate) | | 131,337 | 50,879 |

| Sika AG | | 68,078 | 23,050 |

| Sonova Holding AG | | 25,003 | 10,331 |

| Zur Rose Group AG (a) | | 7,277 | 2,583 |

|

| TOTAL SWITZERLAND | | | 163,460 |

|

| Taiwan - 1.0% | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | | 169,900 | 19,318 |

| United Kingdom - 8.5% | | | |

| AstraZeneca PLC (United Kingdom) | | 184,679 | 23,104 |

| Big Yellow Group PLC | | 313,300 | 6,341 |

| Bridgepoint Group Holdings Ltd. (b) | | 708,800 | 4,811 |

| Compass Group PLC (a) | | 422,992 | 8,976 |

| Diageo PLC | | 331,800 | 16,508 |

| Harbour Energy PLC (a) | | 614,600 | 2,956 |

| JD Sports Fashion PLC | | 557,397 | 8,300 |

| Jet2 PLC (a) | | 104,518 | 1,744 |

| Lloyds Banking Group PLC | | 16,538,800 | 11,319 |

| London Stock Exchange Group PLC | | 64,500 | 6,279 |

| Ocado Group PLC (a) | | 120,600 | 2,976 |

| Prudential PLC (a) | | 802,194 | 16,407 |

| Prudential PLC (Hong Kong) (a) | | 190,100 | 3,860 |

| RELX PLC (Euronext N.V.) | | 773,047 | 23,976 |

| Rentokil Initial PLC | | 1,511,800 | 12,174 |

| S4 Capital PLC (a) | | 338,800 | 3,366 |

| Smith & Nephew PLC | | 697,100 | 12,039 |

| Starling Bank Ltd. Series D (a)(d)(e) | | 1,081,500 | 1,916 |

| WH Smith PLC (a) | | 36,500 | 780 |

|

| TOTAL UNITED KINGDOM | | | 167,832 |

|

| United States of America - 4.8% | | | |

| Alphabet, Inc. Class C (a) | | 4,349 | 12,897 |

| Booking Holdings, Inc. (a) | | 2,300 | 5,568 |

| Boston Scientific Corp. (a) | | 88,600 | 3,821 |

| Dlocal Ltd. | | 44,700 | 2,168 |

| IQVIA Holdings, Inc. (a) | | 57,700 | 15,084 |

| Marsh & McLennan Companies, Inc. | | 76,800 | 12,810 |

| Marvell Technology, Inc. | | 183,800 | 12,590 |

| MasterCard, Inc. Class A | | 28,500 | 9,562 |

| NICE Systems Ltd. sponsored ADR (a) | | 37,500 | 10,613 |

| Visa, Inc. Class A | | 43,300 | 9,170 |

|

| TOTAL UNITED STATES OF AMERICA | | | 94,283 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $1,084,687) | | | 1,899,579 |

|

| Preferred Stocks - 0.9% | | | |

| Convertible Preferred Stocks - 0.9% | | | |

| United States of America - 0.9% | | | |

| Rivian Automotive, Inc.: | | | |

| Series E (a)(e) | | 152,975 | 10,739 |

| Series F (e) | | 36,409 | 2,556 |

| Wasabi Holdings, Inc. Series C (d)(e) | | 372,910 | 4,052 |

| | | | 17,347 |

| Nonconvertible Preferred Stocks - 0.0% | | | |

| Sweden - 0.0% | | | |

| Kry International AB Series E (d) | | 1,920 | 836 |

| TOTAL PREFERRED STOCKS | | | |

| (Cost $8,642) | | | 18,183 |

|

| Money Market Funds - 3.4% | | | |

| Fidelity Cash Central Fund 0.06% (f) | | 49,319,992 | 49,330 |

| Fidelity Securities Lending Cash Central Fund 0.06% (f)(g) | | 16,663,107 | 16,665 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $65,995) | | | 65,995 |

| TOTAL INVESTMENT IN SECURITIES - 101.1% | | | |

| (Cost $1,159,324) | | | 1,983,757 |

| NET OTHER ASSETS (LIABILITIES) - (1.1)% | | | (21,504) |

| NET ASSETS - 100% | | | $1,962,253 |

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Non-income producing

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $72,736,000 or 3.7% of net assets.

(c) Security or a portion of the security is on loan at period end.

(d) Level 3 security

(e) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $19,263,000 or 1.0% of net assets.

(f) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(g) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| Rivian Automotive, Inc. Series E | 7/10/20 | $2,370 |

| Rivian Automotive, Inc. Series F | 1/19/21 | $1,342 |

| Starling Bank Ltd. Series D | 6/18/21 | $1,934 |

| Wasabi Holdings, Inc. Series C | 3/31/21 | $4,052 |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.06% | $55,799 | $259,904 | $266,372 | $30 | $-- | $(1) | $49,330 | 0.1% |

| Fidelity Securities Lending Cash Central Fund 0.06% | 3,813 | 114,810 | 101,958 | 21 | -- | -- | 16,665 | 0.0% |

| Total | $59,612 | $374,714 | $368,330 | $51 | $-- | $(1) | $65,995 | |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $87,789 | $53,508 | $34,281 | $-- |

| Consumer Discretionary | 216,754 | 110,712 | 101,990 | 4,052 |

| Consumer Staples | 129,778 | 38,409 | 91,369 | -- |

| Energy | 61,188 | 61,188 | -- | -- |

| Financials | 314,900 | 191,524 | 121,460 | 1,916 |

| Health Care | 259,974 | 125,582 | 134,392 | -- |

| Industrials | 394,413 | 247,447 | 146,966 | -- |

| Information Technology | 338,960 | 195,309 | 142,678 | 973 |

| Materials | 102,950 | 69,729 | 33,221 | -- |

| Real Estate | 11,056 | 6,341 | 4,715 | -- |

| Money Market Funds | 65,995 | 65,995 | -- | -- |

| Total Investments in Securities: | $1,983,757 | $1,165,744 | $811,072 | $6,941 |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | October 31, 2021 |

| Assets | | |

Investment in securities, at value (including securities loaned of $15,737) — See accompanying schedule:

Unaffiliated issuers (cost $1,093,329) | $1,917,762 | |

| Fidelity Central Funds (cost $65,995) | 65,995 | |

| Total Investment in Securities (cost $1,159,324) | | $1,983,757 |

| Receivable for investments sold | | 2,113 |

| Receivable for fund shares sold | | 817 |

| Dividends receivable | | 4,925 |

| Reclaims receivable | | 3,346 |

| Distributions receivable from Fidelity Central Funds | | 7 |

| Prepaid expenses | | 3 |

| Other receivables | | 116 |

| Total assets | | 1,995,084 |

| Liabilities | | |

| Payable for investments purchased | $7,107 | |

| Payable for fund shares redeemed | 3,944 | |

| Accrued management fee | 1,044 | |

| Distribution and service plan fees payable | 236 | |

| Other affiliated payables | 330 | |

| Other payables and accrued expenses | 3,505 | |

| Collateral on securities loaned | 16,665 | |

| Total liabilities | | 32,831 |

| Net Assets | | $1,962,253 |

| Net Assets consist of: | | |

| Paid in capital | | $967,159 |

| Total accumulated earnings (loss) | | 995,094 |

| Net Assets | | $1,962,253 |

| Net Asset Value and Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($621,221 ÷ 19,102.8 shares)(a) | | $32.52 |

| Maximum offering price per share (100/94.25 of $32.52) | | $34.50 |

| Class M: | | |

| Net Asset Value and redemption price per share ($183,285 ÷ 5,696.8 shares)(a) | | $32.17 |

| Maximum offering price per share (100/96.50 of $32.17) | | $33.34 |

| Class C: | | |

| Net Asset Value and offering price per share ($39,465 ÷ 1,279.8 shares)(a) | | $30.84 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($725,432 ÷ 21,847.9 shares) | | $33.20 |

| Class Z: | | |

| Net Asset Value, offering price and redemption price per share ($392,850 ÷ 11,836.8 shares) | | $33.19 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Year ended October 31, 2021 |

| Investment Income | | |

| Dividends | | $28,231 |

| Foreign tax reclaims | | 3,465 |

| Income from Fidelity Central Funds (including $21 from security lending) | | 51 |

| Income before foreign taxes withheld | | 31,747 |

| Less foreign taxes withheld | | (4,354) |

| Total income | | 27,393 |

| Expenses | | |

| Management fee | $12,232 | |

| Transfer agent fees | 3,079 | |

| Distribution and service plan fees | 2,880 | |

| Accounting fees | 833 | |

| Custodian fees and expenses | 239 | |

| Independent trustees' fees and expenses | 7 | |

| Registration fees | 82 | |

| Audit | 76 | |

| Legal | 5 | |

| Miscellaneous | 7 | |

| Total expenses before reductions | 19,440 | |

| Expense reductions | (30) | |

| Total expenses after reductions | | 19,410 |

| Net investment income (loss) | | 7,983 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers (net of foreign taxes of $2) | 176,166 | |

| Foreign currency transactions | (54) | |

| Total net realized gain (loss) | | 176,112 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers (net of increase in deferred foreign taxes of $2,096) | 284,905 | |

| Fidelity Central Funds | (1) | |

| Assets and liabilities in foreign currencies | (116) | |

| Total change in net unrealized appreciation (depreciation) | | 284,788 |

| Net gain (loss) | | 460,900 |

| Net increase (decrease) in net assets resulting from operations | | $468,883 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Year ended October 31, 2021 | Year ended October 31, 2020 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $7,983 | $4,407 |

| Net realized gain (loss) | 176,112 | 36,779 |

| Change in net unrealized appreciation (depreciation) | 284,788 | 91,127 |

| Net increase (decrease) in net assets resulting from operations | 468,883 | 132,313 |

| Distributions to shareholders | (621) | (23,410) |

| Share transactions - net increase (decrease) | (110,537) | (123,276) |

| Total increase (decrease) in net assets | 357,725 | (14,373) |

| Net Assets | | |

| Beginning of period | 1,604,528 | 1,618,901 |

| End of period | $1,962,253 | $1,604,528 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Advisor Diversified International Fund Class A

| Years ended October 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $25.10 | $23.28 | $21.08 | $23.43 | $19.38 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .09 | .04 | .21 | .21 | .17 |

| Net realized and unrealized gain (loss) | 7.33 | 2.11 | 2.90 | (2.33)B | 4.11 |

| Total from investment operations | 7.42 | 2.15 | 3.11 | (2.12) | 4.28 |

| Distributions from net investment income | – | (.26) | (.17) | (.16) | (.19) |

| Distributions from net realized gain | – | (.07) | (.74) | (.07) | (.05) |

| Total distributions | – | (.33) | (.91) | (.23) | (.23)C |

| Redemption fees added to paid in capitalA | – | – | – | – | –D |

| Net asset value, end of period | $32.52 | $25.10 | $23.28 | $21.08 | $23.43 |

| Total ReturnE,F | 29.56% | 9.32% | 15.57% | (9.14)%B | 22.39% |

| Ratios to Average Net AssetsG,H | | | | | |

| Expenses before reductions | 1.16% | 1.18% | 1.19% | 1.19% | 1.21% |

| Expenses net of fee waivers, if any | 1.15% | 1.18% | 1.19% | 1.19% | 1.21% |

| Expenses net of all reductions | 1.15% | 1.17% | 1.19% | 1.17% | 1.20% |

| Net investment income (loss) | .30% | .16% | .97% | .89% | .82% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $621 | $514 | $530 | $463 | $579 |

| Portfolio turnover rateI | 30% | 30% | 37%I | 32% | 44% |

A Calculated based on average shares outstanding during the period.

B Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (9.62)%.

C Total distributions per share do not sum due to rounding.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Diversified International Fund Class M

| Years ended October 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $24.90 | $23.10 | $20.91 | $23.24 | $19.21 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .01 | (.03) | .15 | .14 | .12 |

| Net realized and unrealized gain (loss) | 7.26 | 2.10 | 2.88 | (2.31)B | 4.08 |

| Total from investment operations | 7.27 | 2.07 | 3.03 | (2.17) | 4.20 |

| Distributions from net investment income | – | (.20) | (.11) | (.09) | (.13) |

| Distributions from net realized gain | – | (.07) | (.74) | (.07) | (.05) |

| Total distributions | – | (.27) | (.84)C | (.16) | (.17)C |

| Redemption fees added to paid in capitalA | – | – | – | – | –D |

| Net asset value, end of period | $32.17 | $24.90 | $23.10 | $20.91 | $23.24 |

| Total ReturnE,F | 29.20% | 9.04% | 15.27% | (9.40)%B | 22.10% |

| Ratios to Average Net AssetsG,H | | | | | |

| Expenses before reductions | 1.41% | 1.45% | 1.46% | 1.46% | 1.48% |

| Expenses net of fee waivers, if any | 1.41% | 1.45% | 1.46% | 1.46% | 1.47% |

| Expenses net of all reductions | 1.41% | 1.44% | 1.46% | 1.44% | 1.47% |

| Net investment income (loss) | .04% | (.11)% | .70% | .62% | .56% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $183 | $159 | $173 | $175 | $224 |

| Portfolio turnover rateI | 30% | 30% | 37%J | 32% | 44% |

A Calculated based on average shares outstanding during the period.

B Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (9.88)%

C Total distributions per share do not sum due to rounding.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

J Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Diversified International Fund Class C

| Years ended October 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $23.99 | $22.20 | $20.11 | $22.35 | $18.48 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | (.14) | (.14) | .04 | .03 | .01 |

| Net realized and unrealized gain (loss) | 6.99 | 2.01 | 2.79 | (2.23)B | 3.94 |

| Total from investment operations | 6.85 | 1.87 | 2.83 | (2.20) | 3.95 |

| Distributions from net investment income | – | (.01) | – | – | (.03) |

| Distributions from net realized gain | – | (.07) | (.74) | (.04) | (.05) |

| Total distributions | – | (.08) | (.74) | (.04) | (.08) |

| Redemption fees added to paid in capitalA | – | – | – | – | –C |

| Net asset value, end of period | $30.84 | $23.99 | $22.20 | $20.11 | $22.35 |

| Total ReturnD,E | 28.55% | 8.44% | 14.72% | (9.85)%B | 21.46% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | 1.95% | 1.98% | 1.98% | 1.95% | 1.96% |

| Expenses net of fee waivers, if any | 1.95% | 1.98% | 1.98% | 1.95% | 1.96% |

| Expenses net of all reductions | 1.95% | 1.96% | 1.97% | 1.94% | 1.96% |

| Net investment income (loss) | (.50)% | (.64)% | .18% | .13% | .07% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $39 | $48 | $59 | $150 | $211 |

| Portfolio turnover rateH | 30% | 30% | 37%H | 32% | 44% |

A Calculated based on average shares outstanding during the period.

B Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (10.33)%.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Diversified International Fund Class I

| Years ended October 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $25.57 | $23.68 | $21.44 | $23.85 | $19.73 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .17 | .10 | .27 | .27 | .24 |

| Net realized and unrealized gain (loss) | 7.47 | 2.16 | 2.95 | (2.37)B | 4.18 |

| Total from investment operations | 7.64 | 2.26 | 3.22 | (2.10) | 4.42 |

| Distributions from net investment income | (.01) | (.30) | (.24) | (.24) | (.25) |

| Distributions from net realized gain | – | (.07) | (.74) | (.07) | (.05) |

| Total distributions | (.01) | (.37) | (.98) | (.31) | (.30) |

| Redemption fees added to paid in capitalA | – | – | – | – | –C |

| Net asset value, end of period | $33.20 | $25.57 | $23.68 | $21.44 | $23.85 |

| Total ReturnD | 29.87% | 9.63% | 15.89% | (8.94)%B | 22.75% |

| Ratios to Average Net AssetsE,F | | | | | |

| Expenses before reductions | .90% | .92% | .92% | .92% | .93% |

| Expenses net of fee waivers, if any | .90% | .92% | .92% | .92% | .93% |

| Expenses net of all reductions | .90% | .91% | .91% | .91% | .92% |

| Net investment income (loss) | .55% | .42% | 1.24% | 1.16% | 1.10% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $725 | $595 | $583 | $807 | $953 |

| Portfolio turnover rateG | 30% | 30% | 37%H | 32% | 44% |

A Calculated based on average shares outstanding during the period.

B Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (9.42)%.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

H Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Diversified International Fund Class Z

| Years ended October 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $25.55 | $23.67 | $21.44 | $23.85 | $19.73 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .22 | .14 | .30 | .31 | .27 |

| Net realized and unrealized gain (loss) | 7.46 | 2.15 | 2.94 | (2.37)B | 4.18 |

| Total from investment operations | 7.68 | 2.29 | 3.24 | (2.06) | 4.45 |

| Distributions from net investment income | (.04) | (.34) | (.28) | (.28) | (.28) |

| Distributions from net realized gain | – | (.07) | (.74) | (.07) | (.05) |

| Total distributions | (.04) | (.41) | (1.01)C | (.35) | (.33) |

| Redemption fees added to paid in capitalA | – | – | – | – | –D |

| Net asset value, end of period | $33.19 | $25.55 | $23.67 | $21.44 | $23.85 |

| Total ReturnE | 30.10% | 9.78% | 16.04% | (8.78)%B | 22.94% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | .76% | .77% | .77% | .78% | .78% |

| Expenses net of fee waivers, if any | .76% | .77% | .77% | .78% | .78% |

| Expenses net of all reductions | .76% | .76% | .77% | .76% | .78% |

| Net investment income (loss) | .70% | .57% | 1.39% | 1.30% | 1.25% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $393 | $289 | $274 | $298 | $286 |

| Portfolio turnover rateH | 30% | 30% | 37%H | 32% | 44% |

A Calculated based on average shares outstanding during the period.

B Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.11 per share. Excluding these litigation proceeds, the total return would have been (9.26)%.

C Total distributions per share do not sum due to rounding.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended October 31, 2021

(Amounts in thousands except percentages)

1. Organization.

Fidelity Advisor Diversified International Fund (the Fund) is a fund of Fidelity Advisor Series VIII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Effective June 21, 2021, Class C shares will automatically convert to Class A shares after a holding period of eight years from the initial date of purchase, with certain exceptions. Prior to June 21, 2021, Class C shares automatically converted to Class A shares after a holding period of ten years from the initial date of purchase, with certain exceptions.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio(a) |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

(a) Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of October 31, 2021 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Realized gains and losses on foreign currency transactions arise from the disposition of foreign currency, realized changes in the value of foreign currency between the trade and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on transaction date and the U.S. dollar equivalent of the amounts actually received or paid. Unrealized gains and losses on assets and liabilities in foreign currencies arise from changes in the value of foreign currency, and from assets and liabilities denominated in foreign currencies, other than investments, which are held at period end.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Funds may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any withholding tax reclaims income is included in the Statement of Operations in foreign tax reclaims. Any receivables for withholding tax reclaims are included in the Statement of Assets and Liabilities in reclaims receivable. The Fund has filed tax reclaims for previously withheld taxes on dividends earned in certain European Union (EU) countries. These additional filings are subject to various administrative proceedings by the local jurisdictions' tax authorities within the EU, as well as a number of related judicial proceedings. Income recognized for EU reclaims is included with other reclaims in the Statement of Operations in foreign tax reclaims. These reclaims are recorded when the amount is known and there are no significant uncertainties on collectability.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of a fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of a fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred, as applicable. Certain expense reductions may also differ by class, if applicable. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of October 31, 2021, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC), capital loss carryforwards and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $824,585 |

| Gross unrealized depreciation | (16,283) |

| Net unrealized appreciation (depreciation) | $808,302 |

| Tax Cost | $1,175,455 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $22,954 |

| Undistributed long-term capital gain | $167,226 |

| Net unrealized appreciation (depreciation) on securities and other investments | $808,327 |

The tax character of distributions paid was as follows:

| | October 31, 2021 | October 31, 2020 |

| Ordinary Income | $621 | $ 23,410 |

Restricted Securities (including Private Placements). Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities held at period end is included at the end of the Schedule of Investments, if applicable.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| Fidelity Advisor Diversified International Fund | 539,320 | 629,593 |

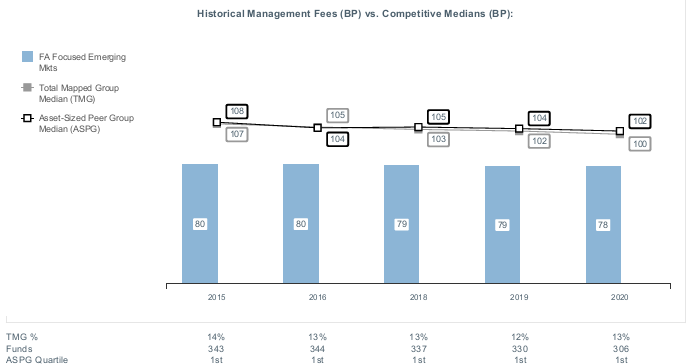

5. Fees and Other Transactions with Affiliates.

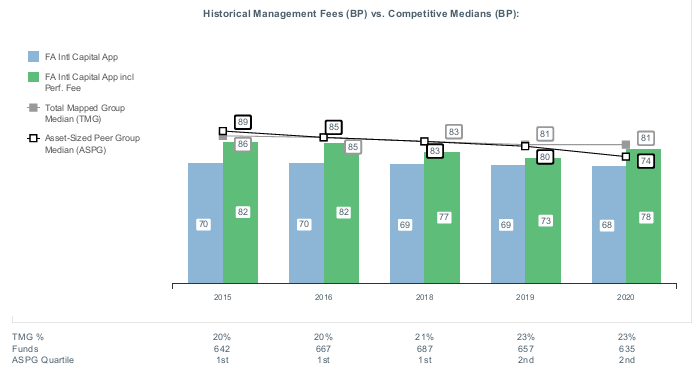

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .424% of the Fund's average net assets and an annualized group fee rate that averaged .23% during the period. The group fee rate is based upon the monthly average net assets of a group of registered investment companies with which the investment adviser has management contracts. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .65% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Company LLC (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution Fee | Service Fee | Total Fees | Retained by FDC |

| Class A | -% | .25% | $1,512 | $16 |

| Class M | .25% | .25% | 906 | 13 |

| Class C | .75% | .25% | 462 | 31 |

| | | | $2,880 | $60 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges are 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained by FDC |

| Class A | $39 |

| Class M | 6 |

| Class C(a) | 2 |

| | $47 |

(a) When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund, except for Class Z. FIIOC receives an asset-based fee of Class Z's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets |

| Class A | $1,151 | .19 |

| Class M | 360 | .20 |

| Class C | 108 | .23 |

| Class I | 1,311 | .19 |

| Class Z | 149 | .04 |

| | $3,079 | |

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. For the period, the fees were equivalent to the following annual rates:

| | % of Average Net Assets |

| Fidelity Advisor Diversified International Fund | .04 |

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| | Amount |

| Fidelity Advisor Diversified International Fund | $1 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. Interfund trades during the period are noted in the table below.

| | Purchases ($) | Sales ($) | Realized Gain (Loss) ($) |

| Fidelity Advisor Diversified International Fund | 8,240 | 11,831 | 5,857 |

Other. During the period, the investment adviser reimbursed the Fund for certain losses as follows:

| | Amount ($) |

| Fidelity Advisor Diversified International Fund | 16 |

6. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Statement of Operations, and are listed below. During the period, there were no borrowings on this line of credit.

| | Amount |

| Fidelity Advisor Diversified International Fund | $3 |

7. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End |

| Fidelity Advisor Diversified International Fund | $2 | $– | $– |

8. Expense Reductions.

During the period the investment adviser or an affiliate reimbursed and/or waived a portion of fund-level operating expenses in the amount of $30.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended

October 31, 2021 | Year ended

October 31, 2020 |

| Fidelity Advisor Diversified International Fund | | |

| Distributions to shareholders | | |

| Class A | $– | $7,383 |

| Class M | – | 1,999 |

| Class C | – | 209 |

| Class I | 139 | 9,229 |

| Class Z | 482 | 4,590 |

| Total | $621 | $23,410 |

10. Share Transactions.

Share transactions for each class were as follows and may contain in-kind transactions, automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Year ended October 31, 2021 | Year ended October 31, 2020 | Year ended October 31, 2021 | Year ended October 31, 2020 |

| Fidelity Advisor Diversified International Fund | | | | |

| Class A | | | | |

| Shares sold | 1,931 | 1,999 | $57,801 | $45,151 |

| Reinvestment of distributions | – | 295 | – | 6,962 |

| Shares redeemed | (3,291) | (4,592) | (99,463) | (107,952) |

| Net increase (decrease) | (1,360) | (2,298) | $(41,662) | $(55,839) |

| Class M | | | | |

| Shares sold | 287 | 277 | $8,523 | $6,529 |

| Reinvestment of distributions | – | 83 | – | 1,957 |

| Shares redeemed | (971) | (1,460) | (29,122) | (33,466) |

| Net increase (decrease) | (684) | (1,100) | $(20,599) | $(24,980) |

| Class C | | | | |

| Shares sold | 133 | 121 | $3,803 | $2,737 |

| Reinvestment of distributions | – | 9 | – | 200 |

| Shares redeemed | (843) | (808) | (24,305) | (17,926) |

| Net increase (decrease) | (710) | (678) | $(20,502) | $(14,989) |

| Class I | | | | |

| Shares sold | 3,394 | 7,900 | $104,382 | $192,033 |

| Reinvestment of distributions | 4 | 311 | 102 | 7,450 |

| Shares redeemed | (4,825) | (9,542) | (149,482) | (225,440) |

| Net increase (decrease) | (1,427) | (1,331) | $(44,998) | $(25,957) |

| Class Z | | | | |

| Shares sold | 2,717 | 5,705 | $84,432 | $137,712 |

| Reinvestment of distributions | 16 | 148 | 452 | 3,531 |

| Shares redeemed | (2,214) | (6,124) | (67,660) | (142,755) |

| Net increase (decrease) | 519 | (271) | $17,224 | $(1,512) |

11. Other.

Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

12. Coronavirus (COVID-19) Pandemic.

An outbreak of COVID-19 first detected in China during December 2019 has since spread globally and was declared a pandemic by the World Health Organization during March 2020. Developments that disrupt global economies and financial markets, such as the COVID-19 pandemic, may magnify factors that affect the Fund's performance.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Fidelity Advisor Series VIII and Shareholders of Fidelity Advisor Diversified International Fund

Opinion on the Financial Statements