Exhibit 99.3

THOR INVESTOR DAY 2019 | BUSINESS BEYOND VEHICLES Bad Waldsee , 14 October 2019

10 - 14 - 2019 THOR INVESTOR DAY 2019 2 Forward Looking Statements This presentation includes certain statements that are “forward looking” statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon Thor, and inherently involve uncertainties and risks . These forward looking statements are not a guarantee of future performance . We cannot assure you that actual results will not differ materially from our expectations . Factors which could cause materially different results include, among others, raw material and commodity price fluctuations ; raw material, commodity or chassis supply restrictions ; the impact of tariffs on material or other input costs ; the level and magnitude of warranty claims incurred ; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers ; the costs of compliance with governmental regulation ; legal and compliance issues including those that may arise in conjunction with recently completed transactions ; lower consumer confidence and the level of discretionary consumer spending ; interest rate fluctuations ; the potential impact of interest rate fluctuations on the general economy and specifically on our dealers and consumers ; restrictive lending practices ; management changes ; the success of new and existing products and services ; consumer preferences ; the ability to efficiently utilize production facilities ; the pace of acquisitions and the successful closing, integration and financial impact thereof ; the potential loss of existing customers of acquisitions ; our ability to retain key management personnel of acquired companies ; a shortage of necessary personnel for production ; the loss or reduction of sales to key dealers ; disruption of the delivery of units to dealers ; increasing costs for freight and transportation ; asset impairment charges ; cost structure changes ; competition ; the impact of potential losses under repurchase or financed receivable agreements ; the potential impact of the strength of the U . S . dollar on international demand for products priced in U . S . dollars ; general economic, market and political conditions ; the impact of changing emissions standards in the various jurisdictions in which our products are sold ; and changes to investment and capital allocation strategies or other facets of our strategic plan . Additional risks and uncertainties surrounding the acquisition of EHG include risks regarding the potential benefits of the acquisition and the anticipated operating value creation, the integration of the business, the impact of exchange rate fluctuations and unknown or understated liabilities related to the acquisition and EHG's business . These and other risks and uncertainties are discussed more fully in Item 1 A of our Annual Report on Form 10 - K for the year ended July 31 , 2019 . We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law .

EHG BUSINESS BEYOND VEHICLES MOVERA 10 - 14 - 2019 THOR INVESTOR DAY 2019 3 Multichannel Accessories Whole s ale Brand

MOVERA BUSINESS FACTS 10 - 14 - 2019 THOR INVESTOR DAY 2019 4 35 1,000 20,000 15% Export Countries worldwide Satisfied dealers all over the world Accessories for recreational vehicles, outdoor equipment and spare parts every year Of our b2b customers have no relationship with the Erwin Hymer Group

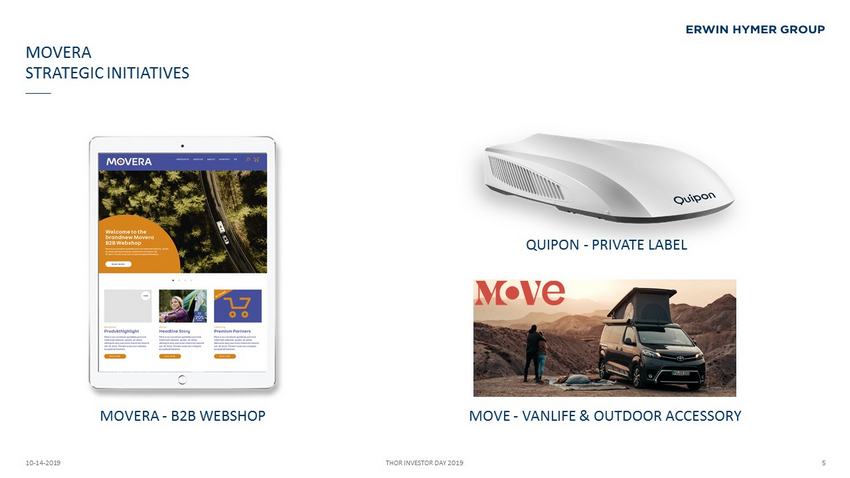

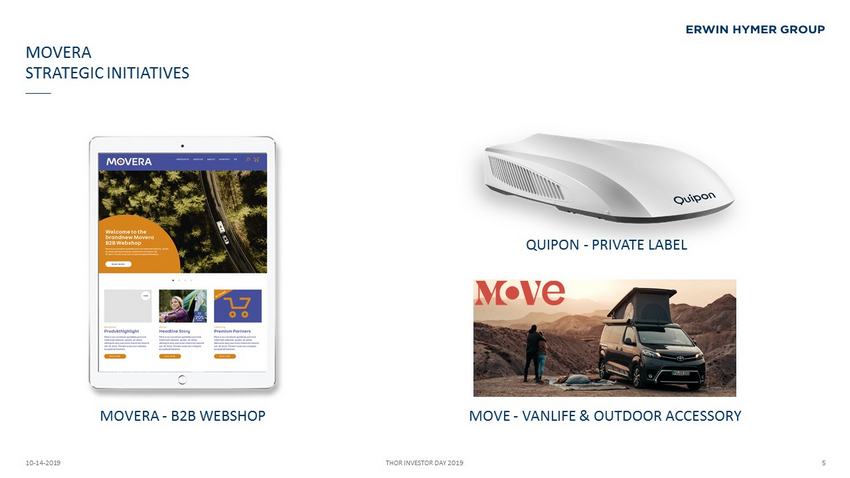

10 - 14 - 2019 THOR INVESTOR DAY 2019 5 MOVERA STRATEGIC INITIATIVES QUIPON - PRIVATE LABEL MOVERA - B2B WEBSHOP MOVE - VANLIFE & OUTDOOR ACCESSORY

MOVERA BUSINESS FACTS 10 - 14 - 2019 THOR INVESTOR DAY 2019 6 35% 30% 75% 50% Sales growth in the last 6 years EBIT growth in the last 6 years Of sales are generated by components for workshops Of sales are generated by our b2b webshop

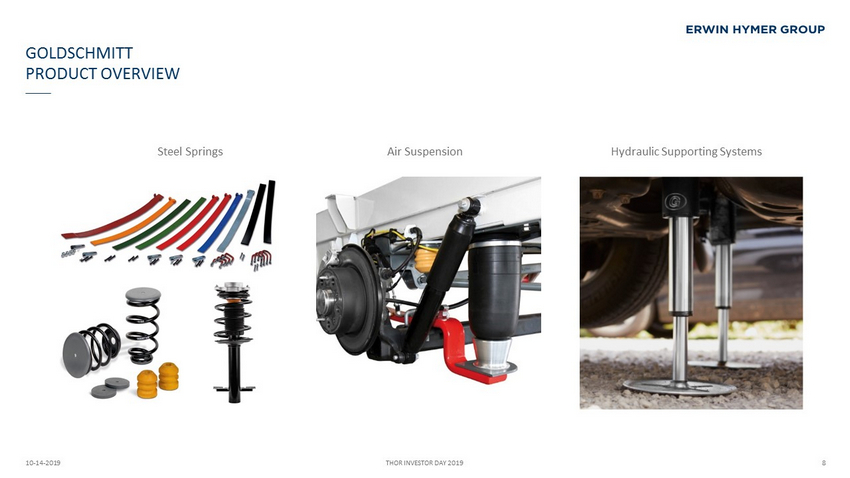

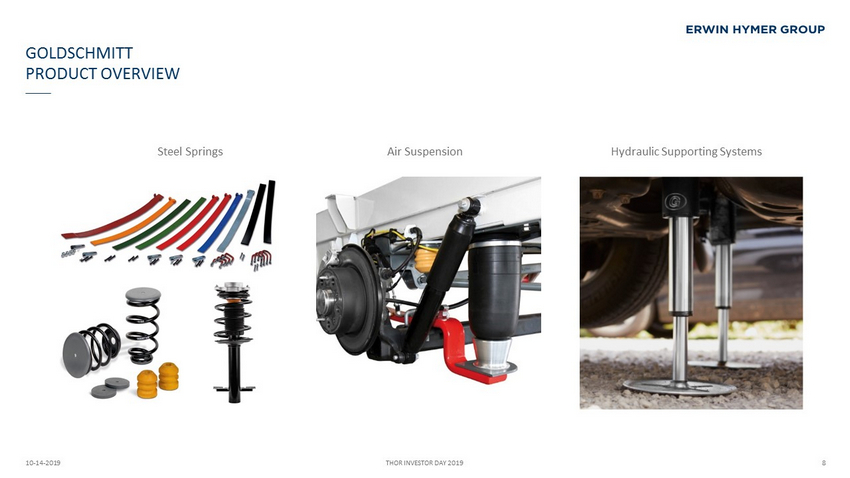

EHG BUSINESS BEYOND VEHICLES GOLDSCHMITT 10 - 14 - 2019 THOR INVESTOR DAY 2019 7 Leaf springs air suspensions Spacers load increase Jack system aluminium rims coil springs shock absorber damper

GOLDSCHMITT PRODUCT OVERVIEW 10 - 14 - 2019 THOR INVESTOR DAY 2019 8 Steel Springs Air Suspension Hydraulic Supporting Systems

GOLDSCHMITT KNOW - HOW 10 - 14 - 2019 THOR INVESTOR DAY 2019 9 Development of Chassis components for ▪ Payload increase ▪ Improvement of drive comfort

GOLDSCHMITT KNOW - HOW 10 - 14 - 2019 THOR INVESTOR DAY 2019 10 Goldschmitt Pro Series Advanced technology with excellent safety concept and innovative operation Quality features of the Pro series ▪ Fully automatic leveling at one touch button ▪ Available for vehicles from 3.5 to 24 tons ▪ Up to 4.5 tons carrying capacity per jacks ▪ Special versions up to 10 tons carrying capacity possible ▪ Retrofitting in almost all motorhomes possible ▪ Made in Germany

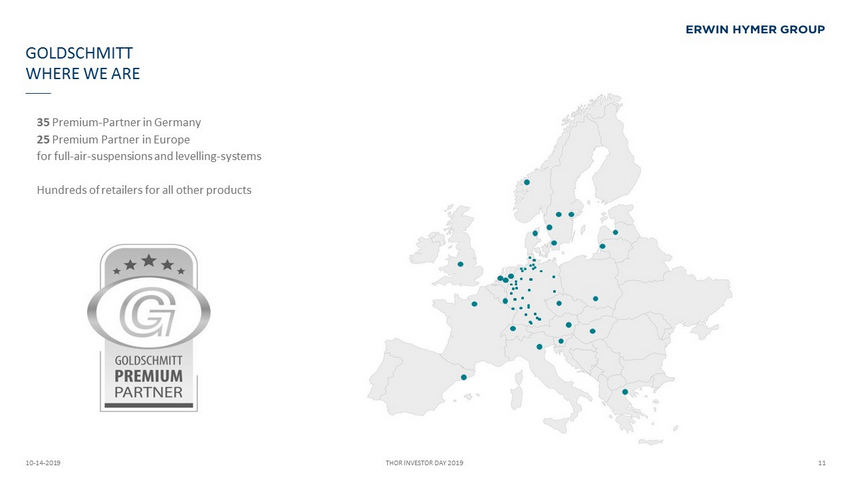

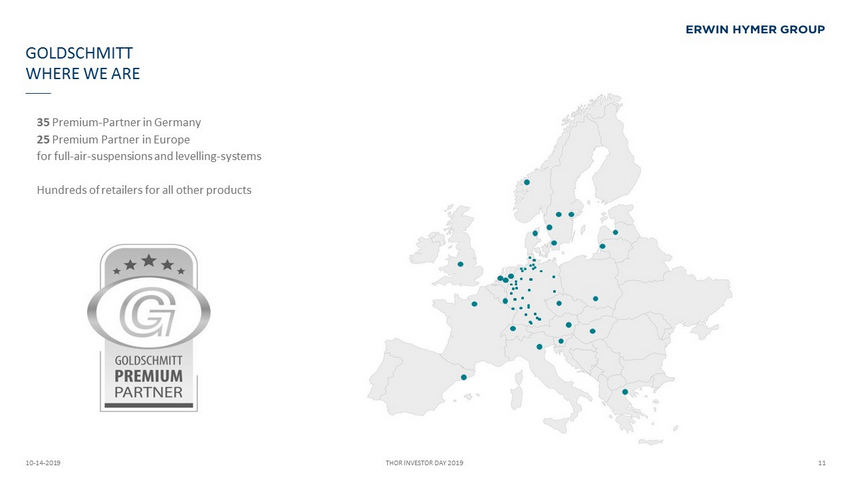

GOLDSCHMITT WHERE WE ARE 10 - 14 - 2019 THOR INVESTOR DAY 2019 11 35 Premium - Partner in Germany 25 Premium Partner in Europe for full - air - suspensions and levelling - systems Hundreds of retailers for all other products

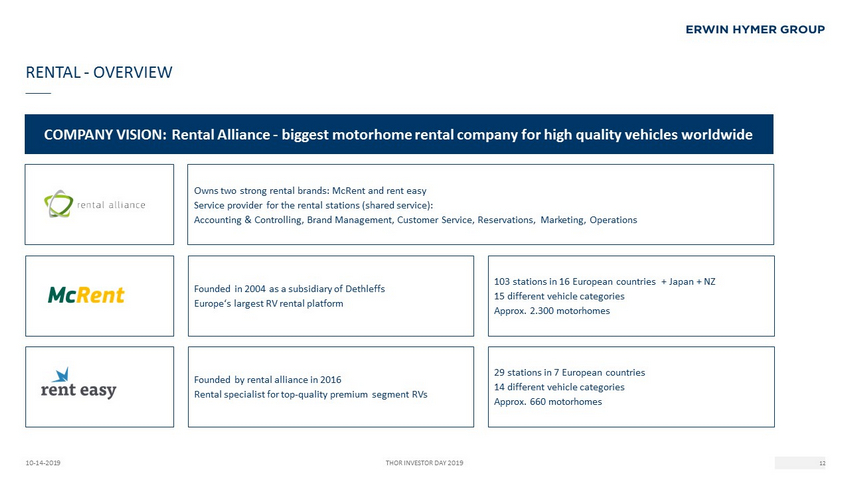

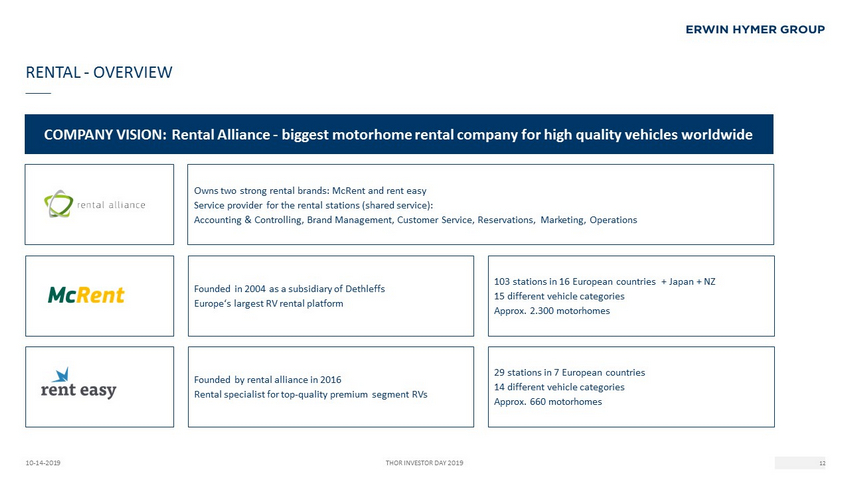

RENTAL - OVERVIEW 10 - 14 - 2019 THOR INVESTOR DAY 2019 12 COMPANY VISION: Rental Alliance - biggest motorhome rental company for high quality vehicles worldwide 103 stations in 16 European countries + Japan + NZ 15 different vehicle categories Approx . 2.300 motorhomes 29 stations in 7 European countries 14 different vehicle categories Approx . 660 motorhomes Founded in 2004 as a subsidiary of Dethleffs Europe‘s largest RV rental platform Founded by rental alliance in 2016 Rental specialist for top - quality premium segment RVs O wns two strong rental brands: McRent and rent easy Service provider for the rental stations (shared service): Accounting & Controlling, Brand Management, Customer Service, Reservations, Marketing, Operations

RENTAL - GLOBAL PRESENCE 10 - 14 - 2019 THOR INVESTOR DAY 2019 13 Japan — Hiratsuka — Kofu — Nagano New Zealand — Auckland — Christchurch 132 STATIONS IN 20 COUNTRIES WITH 3,000 MOTORHOMES

RENTAL - VALUE ADDED 10 - 14 - 2019 THOR INVESTOR DAY 2019 14 — Profitable business with less cyclicality (revenue streams from rental and vehicle sales) — Benefiting from trend towards sharing/ rental, particular amongst the younger generation — Additional customers through tour operators and travel agencies worldwide (100 +) — Worldwide/Europe - wide approach of Rental Alliance allows customers to rent each year in different locations — Generally Rental is the first point of contact with RVs for many users and potential future owners — Additional revenues and profits from rental business for manufacturers within EHG (approx. 2.000 new vehicles per year) — No additional marketing efforts are needed for vehicle sales (compared to sales directly from the manufacturer) — High renewal rates of the rental fleet leads to the latest EHG models on the streets — Levelling of production cycles, as rental vehicles are being produced in low - utilization months (between November and February)

RENTAL - BUSINESS MODEL JOINT VENTURE 10 - 14 - 2019 THOR INVESTOR DAY 2019 15 EHG manufacturing brands McRent / rent easy Joint Venture companies Local dealer (Joint Venture Partner) End customer Rental Alliance GmbH (Holding company ) sell vehicles to … sell used vehicles to … rent vehicles out to … sell used vehicles to … 1 2 3 shared services 4 Revenue streams EHG 1 - 3

RENTAL - BUSINESS MODEL FRANCHISE 10 - 14 - 2019 THOR INVESTOR DAY 2019 16 McRent / rent easy Franchise Partner = Dealer End customer Rental Alliance GmbH (Holding company) Rent and sells vehicles out to… 1 2 shared services Revenue streams EHG 1 - 2 EHG manufacturing brands sell vehicles to …

THOR INVESTOR DAY 2019 | BUSINESS BEYOND VEHICLES Bad Waldsee , 14 October 2019