Exhibit 99.5

THOR INVESTOR DAY 2019 | EUROPEAN RV MARKET Bad Waldsee , 14 October 2019

10 - 14 - 2019 THOR INVESTOR DAY 2019 2 Forward Looking Statements This presentation includes certain statements that are “forward looking” statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon Thor, and inherently involve uncertainties and risks . These forward looking statements are not a guarantee of future performance . We cannot assure you that actual results will not differ materially from our expectations . Factors which could cause materially different results include, among others, raw material and commodity price fluctuations ; raw material, commodity or chassis supply restrictions ; the impact of tariffs on material or other input costs ; the level and magnitude of warranty claims incurred ; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers ; the costs of compliance with governmental regulation ; legal and compliance issues including those that may arise in conjunction with recently completed transactions ; lower consumer confidence and the level of discretionary consumer spending ; interest rate fluctuations ; the potential impact of interest rate fluctuations on the general economy and specifically on our dealers and consumers ; restrictive lending practices ; management changes ; the success of new and existing products and services ; consumer preferences ; the ability to efficiently utilize production facilities ; the pace of acquisitions and the successful closing, integration and financial impact thereof ; the potential loss of existing customers of acquisitions ; our ability to retain key management personnel of acquired companies ; a shortage of necessary personnel for production ; the loss or reduction of sales to key dealers ; disruption of the delivery of units to dealers ; increasing costs for freight and transportation ; asset impairment charges ; cost structure changes ; competition ; the impact of potential losses under repurchase or financed receivable agreements ; the potential impact of the strength of the U . S . dollar on international demand for products priced in U . S . dollars ; general economic, market and political conditions ; the impact of changing emissions standards in the various jurisdictions in which our products are sold ; and changes to investment and capital allocation strategies or other facets of our strategic plan . Additional risks and uncertainties surrounding the acquisition of EHG include risks regarding the potential benefits of the acquisition and the anticipated operating value creation, the integration of the business, the impact of exchange rate fluctuations and unknown or understated liabilities related to the acquisition and EHG's business . These and other risks and uncertainties are discussed more fully in Item 1 A of our Annual Report on Form 10 - K for the year ended July 31 , 2019 . We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law .

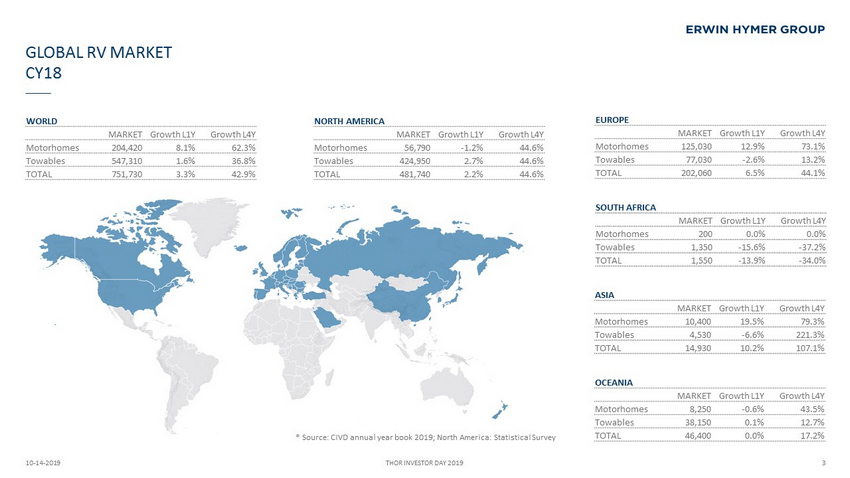

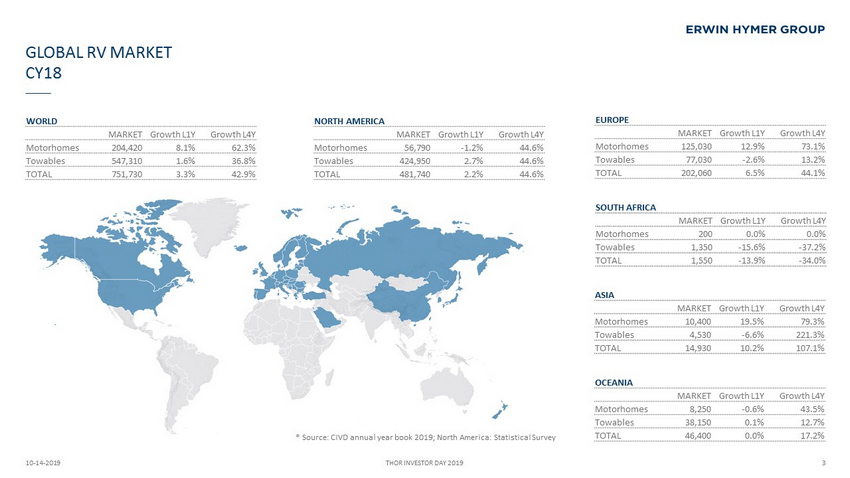

GLOBAL RV MARKET CY 18 10 - 14 - 2019 THOR INVESTOR DAY 2019 3 EUROPE MARKET Growth L1Y Growth L4Y Motorhomes 125,030 12.9 % 73.1 % Towables 77,030 - 2.6 % 13.2 % TOTAL 202,060 6.5 % 44.1 % ASIA MARKET Growth L1Y Growth L4Y Motorhomes 10,400 19.5 % 79.3 % Towables 4,530 - 6.6 % 221.3 % TOTAL 14,930 10.2 % 107.1 % OCEANIA MARKET Growth L1Y Growth L4Y Motorhomes 8,250 - 0.6 % 43.5 % Towables 38,150 0.1 % 12.7 % TOTAL 46,400 0.0 % 17.2 % SOUTH AFRICA MARKET Growth L1Y Growth L4Y Motorhomes 200 0.0 % 0.0 % Towables 1,350 - 15.6 % - 37.2 % TOTAL 1,550 - 13.9 % - 34.0 % WORLD MARKET Growth L1Y Growth L4Y Motorhomes 204,420 8.1 % 62.3% Towables 547,310 1.6 % 36.8% TOTAL 751,730 3.3 % 42.9% NORTH AMERICA MARKET Growth L1Y Growth L4Y Motorhomes 56,790 - 1.2% 44.6% Towables 424,950 2.7 % 44.6% TOTAL 481,740 2.2 % 44.6 % * Source: CIVD annual year book 2019; North America : Statistical Survey

GLOBAL RV MARKET UNITS SOLD NORTH AMERICA & EUROPE* 10 - 14 - 2019 THOR INVESTOR DAY 2019 4 North America: 482,000 RVs Europe: 202,000 RVs * Source: CIVD annual year book 2019; North America : Statistical Survey

GLOBAL RV MARKET PRODUCT SEGMENTS NORTH AMERICA & EUROPE* 10 - 14 - 2019 THOR INVESTOR DAY 2019 5 Fifth wheeler: 90,000 units Travel trailer: 324,000 units Class A: 21,000 units Class C: 30,000 units Class B: 6,000 units Travel t railer: 77,000 units Class A+C: 85,000 units Class B: 40,000 units Fifth wheeler: --- GVWR: < 3,500 kg (80% of market) < 7,700 lbs. GVWR: < 2,300 kg (90% of market) < 5,000 lbs. Other: 11,000 units North America Europe * Source: CIVD annual year book 2019; North America : Statistical Survey

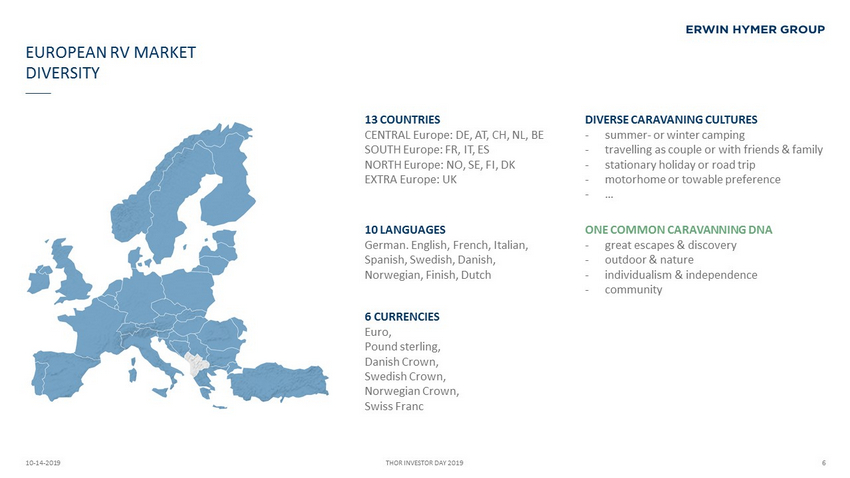

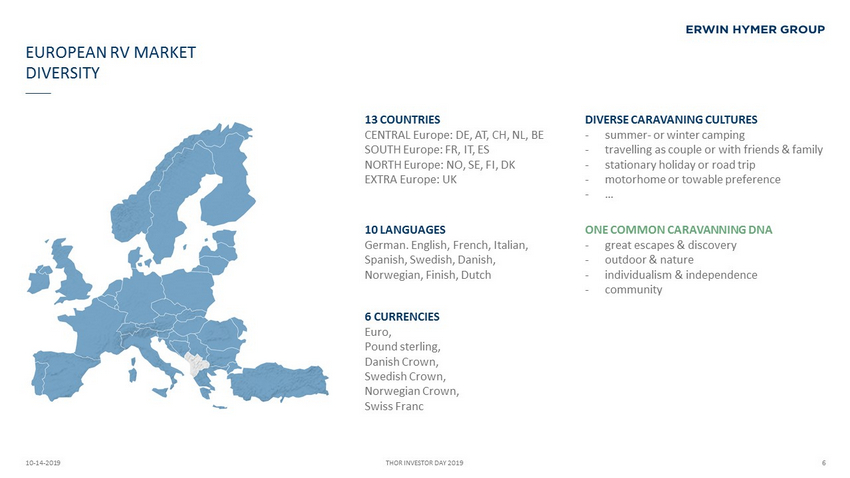

EUROPEAN RV MARKET DIVERSITY 10 - 14 - 2019 THOR INVESTOR DAY 2019 6 DIVERSE CARAVANING CULTURES - summer - or winter camping - travelling as couple or with friends & family - stationary holiday or road trip - motorhome or towable preference - … ONE COMMON CARAVANNING DNA - great escapes & discovery - outdoor & nature - individualism & independence - community 13 COUNTRIES CENTRAL Europe: DE, AT, CH, NL, BE SOUTH Europe: FR, IT, ES NORTH Europe: NO, SE, FI, DK EXTRA Europe: UK 6 CURRENCIES Euro, Pound sterling, Danish Crown, Swedish Crown, Norwegian Crown, Swiss Franc 10 LANGUAGES German. English, French, Italian, Spanish, Swedish, Danish, Norwegian, Finish, Dutch

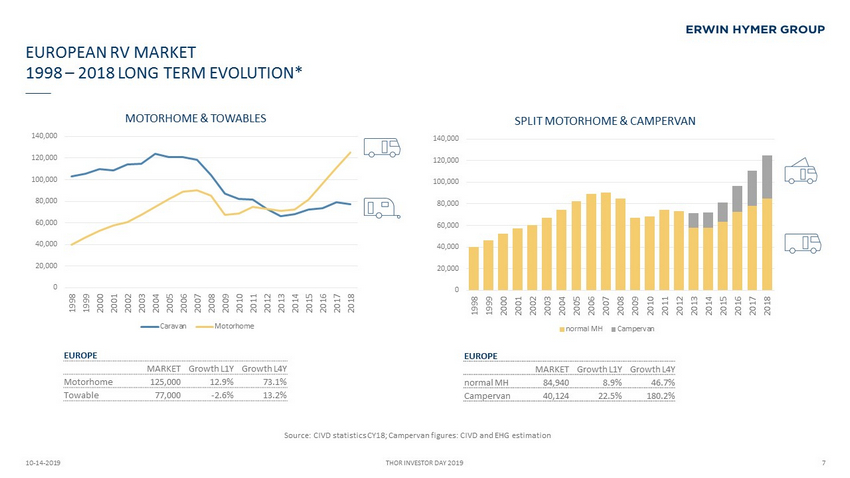

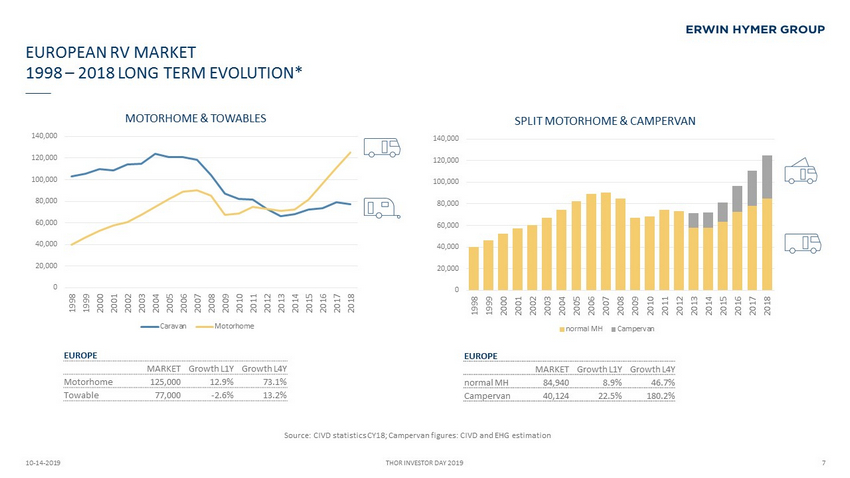

EUROPEAN RV MARKET 1998 – 2018 LONG TERM EVOLUTION* 10 - 14 - 2019 THOR INVESTOR DAY 2019 7 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 MOTORHOME & TOWABLES Caravan Motorhome 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 SPLIT MOTORHOME & CAMPERVAN normal MH Campervan EUROPE MARKET Growth L1Y Growth L4Y Motorhome 125,000 12.9 % 73.1 % Towable 77,000 - 2.6 % 13.2 % EUROPE MARKET Growth L1Y Growth L4Y normal MH 84,940 8.9 % 46.7 % Campervan 40,124 22.5 % 180.2 % Source: CIVD statistics CY18; Campervan figures : CIVD and EHG estimation

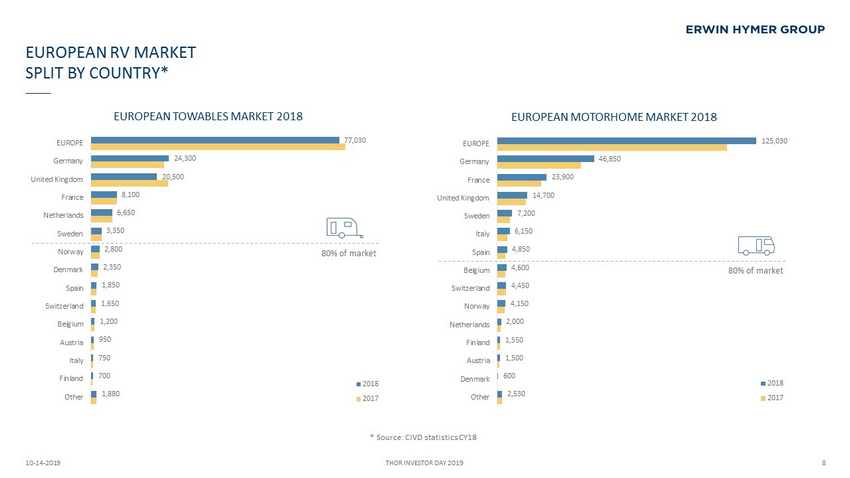

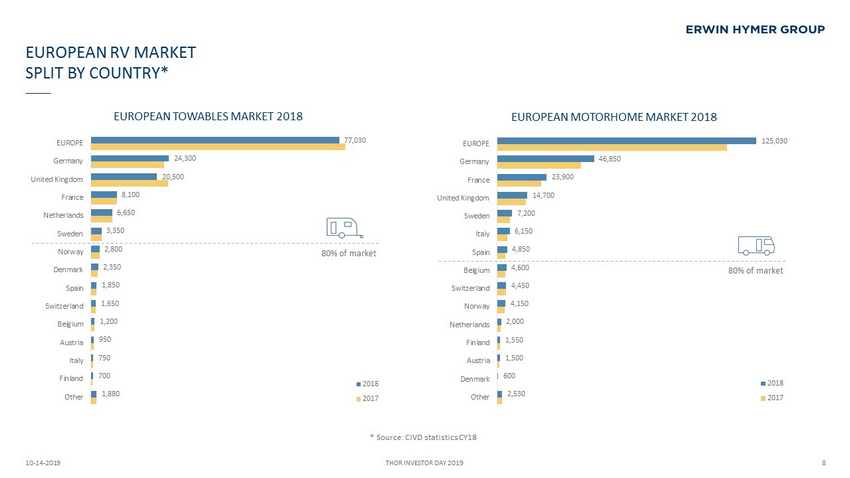

10 - 14 - 2019 THOR INVESTOR DAY 2019 8 1,880 700 750 950 1,200 1,650 1,850 2,350 2,800 3,350 6,650 8,100 20,500 24,300 77,030 Other Finland Italy Austria Belgium Switzerland Spain Denmark Norway Sweden Netherlands France United Kingdom Germany EUROPE EUROPEAN TOWABLES MARKET 2018 2018 2017 80% of market 2,530 600 1,500 1,550 2,000 4,150 4,450 4,600 4,850 6,150 7,200 14,700 23,900 46,850 125,030 Other Denmark Austria Finland Netherlands Norway Switzerland Belgium Spain Italy Sweden United Kingdom France Germany EUROPE EUROPEAN MOTORHOME MARKET 2018 2018 2017 80% of market EUROPEAN RV MARKET SPLIT BY COUNTRY* * Source: CIVD statistics CY18

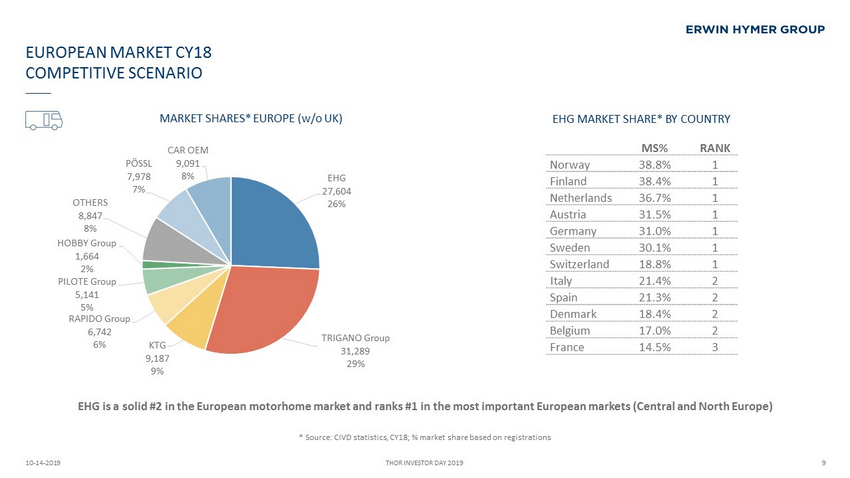

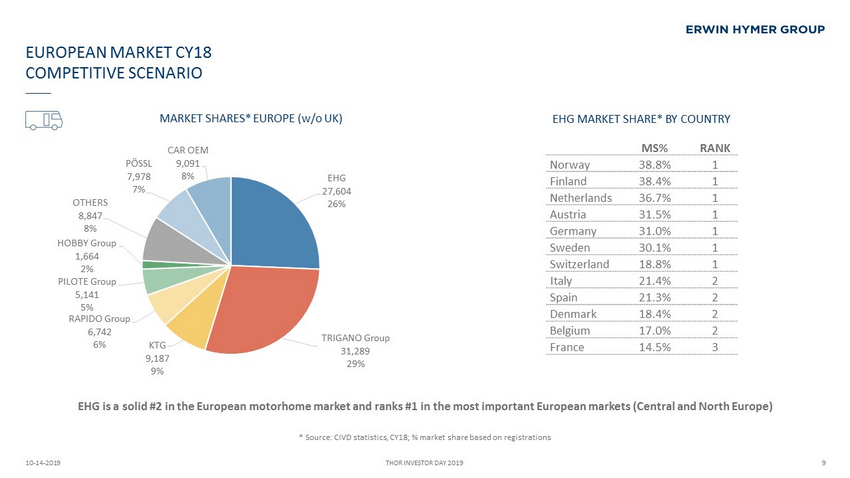

EUROPEAN MARKET CY18 COMPETITIVE SCENARIO 10 - 14 - 2019 THOR INVESTOR DAY 2019 9 EHG is a solid #2 in the European motorhome market and ranks #1 in the most important European markets (Central and North Europe) EHG MARKET SHARE* BY COUNTRY MARKET SHARES* EUROPE (w/o UK) MS% RANK Norway 38.8 % 1 Finland 38.4 % 1 Netherlands 36.7 % 1 Austria 31.5 % 1 Germany 31.0 % 1 Sweden 30.1 % 1 Switzerland 18.8 % 1 Italy 21.4 % 2 Spain 21.3 % 2 Denmark 18.4 % 2 Belgium 17.0 % 2 France 14.5 % 3 * Source: CIVD statistics , CY18; % market share based on registration s EHG 27,604 26% TRIGANO Group 31,289 29% KTG 9,187 9% RAPIDO Group 6,742 6% PILOTE Group 5,141 5% HOBBY Group 1,664 2% OTHERS 8,847 8% PÖSSL 7,978 7% CAR OEM 9,091 8%

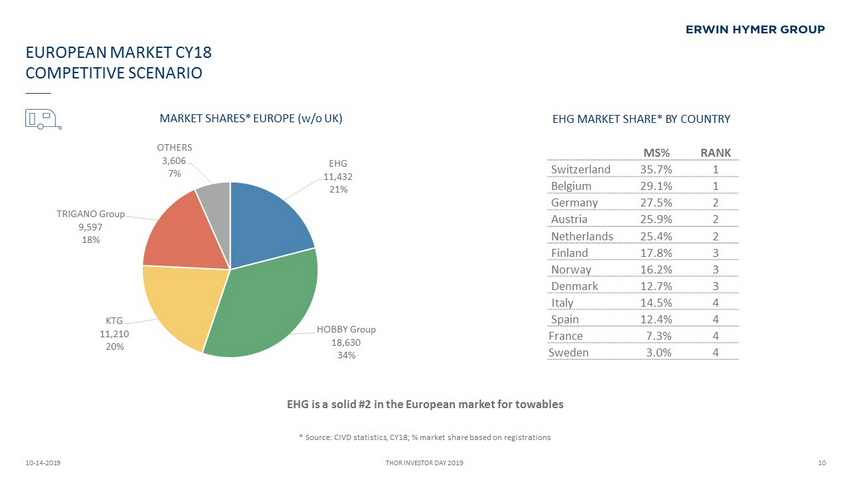

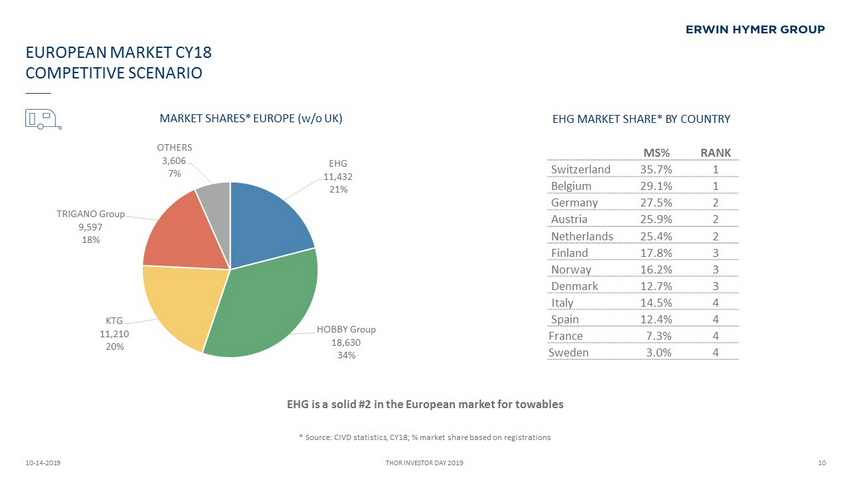

EUROPEAN MARKET CY18 COMPETITIVE SCENARIO 10 - 14 - 2019 THOR INVESTOR DAY 2019 10 MARKET SHARES* EUROPE (w/o UK) EHG is a solid #2 in the European market for towables EHG MARKET SHARE* BY COUNTRY MS% RANK Switzerland 35.7 % 1 Belgium 29.1 % 1 Germany 27.5 % 2 Austria 25.9 % 2 Netherlands 25.4 % 2 Finland 17.8 % 3 Norway 16.2 % 3 Denmark 12.7 % 3 Italy 14.5 % 4 Spain 12.4 % 4 France 7.3 % 4 Sweden 3.0 % 4 * Source: CIVD statistics , CY18; % market share based on registration s EHG 11,432 21% HOBBY Group 18,630 34% KTG 11,210 20% TRIGANO Group 9,597 18% OTHERS 3,606 7%

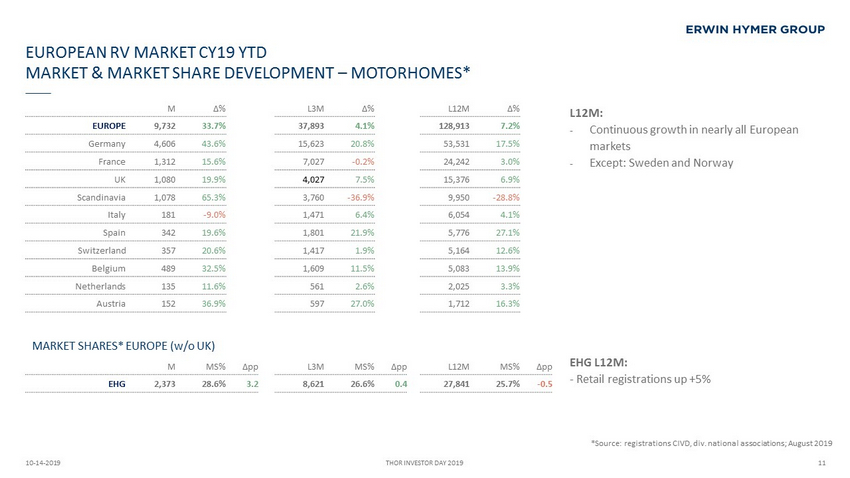

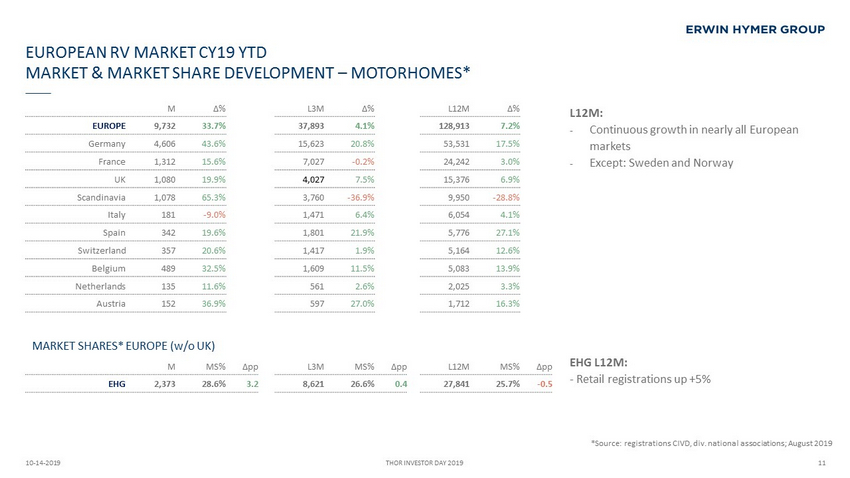

EUROPEAN RV MARKET CY19 YTD MARKET & MARKET SHARE DEVELOPMENT – MOTORHOMES* 10 - 14 - 2019 THOR INVESTOR DAY 2019 11 *Source: registrations CIVD, div. national associations ; August 2019 M MS% Δ pp L3M MS% Δ pp L12M MS% Δ pp EHG 2,373 28.6 % 3.2 8,621 26.6 % 0.4 27,841 25.7 % - 0.5 M Δ% L3M Δ% L12M Δ% EUROPE 9,732 33.7 % 37,893 4.1 % 128,913 7.2 % Germany 4,606 43.6 % 15,623 20.8 % 53,531 17.5 % France 1,312 15.6 % 7,027 - 0.2 % 24,242 3.0 % UK 1,080 19.9 % 4,027 7.5 % 15,376 6.9 % Scandinavia 1,078 65.3 % 3,760 - 36.9 % 9,950 - 28.8 % Italy 181 - 9.0 % 1,471 6.4 % 6,054 4.1 % Spain 342 19.6 % 1,801 21.9 % 5,776 27.1 % Switzerland 357 20.6 % 1,417 1.9 % 5,164 12.6 % Belgium 489 32.5 % 1,609 11.5 % 5,083 13.9 % Netherlands 135 11.6 % 561 2.6 % 2,025 3.3 % Austria 152 36.9 % 597 27.0 % 1,712 16.3 % L12M: - Continuous growth in nearly all European markets - Except: Sweden and Norway EHG L12M: - Retail registrations up +5% MARKET SHARES* EUROPE (w/o UK)

EUROPEAN RV MARKET CY19 YTD MARKET & MARKET SHARE DEVELOPMENT – TOWABLES * 10 - 14 - 2019 THOR INVESTOR DAY 2019 12 M Δ% L3M Δ% L12M Δ% EUROPE 5,369 - 1.4 % 21,574 - 0.3 % 75,471 1.2 % Germany 1,846 7.1 % 8,018 5.8 % 26,305 9.8 % UK 1,388 - 15.8 % 4,075 - 11.6 % 18,447 - 10.5 % Scandinavia 902 6.5 % 3,603 5.9 % 9,244 2.1 % France 266 - 15.6 % 1,858 - 3.3 % 8,040 - 1.9 % Netherlands 577 17.5 % 2,036 - 1.8 % 6,796 3.0 % Spain 120 27.7 % 679 17.3 % 2,177 27.5 % Switzerland 98 - 24.6 % 441 - 12.3 % 1,582 - 2.4 % Belgium 81 - 4.7 % 328 - 7.9 % 1,169 - 0.4 % Austria 73 - 1.4 % 311 - 7.7 % 967 5.0 % Italy 18 - 48.6 % 225 - 17.9 % 744 - 1.5 % M MS% Δ pp L3M MS% Δ pp L12M MS% Δ pp EHG 866 22.3 % 0.1 3,322 19.5 % - 0.7 11,256 20.3 % - 0.4 *Source: registrations CIVD, div. national associations ; August 2019 L12M: - Lowering growth rates on most markets - Strongest decline in UK ( - 10.5 %) - Highest increase in Germany (+9.8 %) EHG L12M: - Retail registrations up +4% MARKET SHARES* EUROPE (w/o UK)

EUROPEAN RV MARKET MARKET FORECAST 10 - 14 - 2019 THOR INVESTOR DAY 2019 13 If no major macro economic turbulences will arise • towable market will show a flat evolution • motorhomes market will continue to rise. with ongoing stronger growth in campervan segment Positive market drivers: • metatrends ( lifestyle camping. escapism & individualism. flexibility • wealthy on growing population 55+ Risks: • BREXIT • increasing global trade barriers. focusing as well on Europe • Pricing (increasing emission based taxations and related holder costs) - 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 EUROPEAN RV MARKET - REGISTRATIONS -30% -20% -10% 0% 10% 20% 30% % CHANGE VS PREV. YEAR *Source: EHG estimation

IS THAT IT? WE DON’T THINK SO * 16% of the German population are camping. caravanning. tenting interested 11.24 Mio target customers 65% of them have a monthly net income higher than 2,500 € 7.34 Mio target customers 32% of them consider to buy a car within the next 1 - 2 years 2.38 Mio target customers 62% of them consider to buy a Minivan/Van or other* 1.48 Mio target customers (*other = not station wagon. sedan. convertible. SUV / off roader. sports car) In words: 1.48 Mio caravaning interested. wealthy Germans consider to buy a Van or Minivan within the next two years. 2018 market* for motorhomes: 52,000 new motorhomes. thereof 21,500 Campervans 10 - 14 - 2019 THOR INVESTOR DAY 2019 14 *Source: b4p database 2018; m arket figures : CIVD statistics , CY18

THOR INVESTOR DAY | EUROPEAN RV MARKET Bad Waldsee , 14 October 2019

EUROPEAN RV MARKET CY19 YTD MARKET & MARKET SHARE DEVELOPMENT – MOTORHOMES* 10 - 14 - 2019 THOR INVESTOR DAY 2019 16 *Source: registrations CIVD, div. national associations ; August 2019 M MS% Δ pp L3M MS% Δ pp L12M MS% Δ pp EHG 2,373 28.6 % 3.2 8,621 26.6 % 0.4 27,841 25.7 % - 0.5 TRIGANO 1,943 23.4 % - 0.6 8,808 27.1 % - 1.1 31,947 29.5 % 0.0 KTG 767 9.2 % - 1.8 2,944 9.1 % 0.0 9,953 9.2 % 0.6 RAPIDO 386 4.7 % - 1.0 2,170 6.7 % - 0.1 6,717 6.2 % - 0.4 PÖSSL 890 10.7 % - 0.3 2,939 9.1 % 1.5 8,932 8.2 % 1.2 L12M: - Continuous growth in nearly all European markets - Except: Sweden and Norway EHG L12M: - Retail registrations up +5% M Δ% L3M Δ% L12M Δ% EUROPE 9,732 33.7 % 37,893 4.1 % 128,913 7.2 % Germany 4,606 43.6 % 15,623 20.8 % 53,531 17.5 % France 1,312 15.6 % 7,027 - 0.2 % 24,242 3.0 % UK 1,080 19.9 % 4,027 7.5 % 15,376 6.9 % Scandinavia 1,078 65.3 % 3,760 - 36.9 % 9,950 - 28.8 % Italy 181 - 9.0 % 1,471 6.4 % 6,054 4.1 % Spain 342 19.6 % 1,801 21.9 % 5,776 27.1 % Switzerland 357 20.6 % 1,417 1.9 % 5,164 12.6 % Belgium 489 32.5 % 1,609 11.5 % 5,083 13.9 % Netherlands 135 11.6 % 561 2.6 % 2,025 3.3 % Austria 152 36.9 % 597 27.0 % 1,712 16.3 %

EUROPEAN RV MARKET CY19 YTD MARKET & MARKET SHARE DEVELOPMENT – TOWABLES * 10 - 14 - 2019 THOR INVESTOR DAY 2019 17 M MS% Δ pp L3M MS% Δ pp L12M MS% Δ pp EHG 866 22.3 % 0.1 3,322 19.5 % - 0.7 11,256 20.3 % - 0.4 TRIGANO 619 15.9 % 0.0 3,062 18.0 % 0.1 9,926 17.9 % 0.3 KTG 754 19.4 % - 0.8 3,390 19.9 % 0.7 11,779 21.2 % 0.9 HOBBY GROUP 1,356 34.9 % 0.9 6,037 35.4 % 0.1 18,967 34.2 % - 0.8 *Source: registrations CIVD. div. national associations ; August 2019 L12M: - Lowering growth rates on most markets - Strongest decline in UK ( - 10.5 %) - Highest increase in Germany (+9.8 %) EHG L12M: - Retail registrations up +4% M Δ% L3M Δ% L12M Δ% EUROPE 5,369 - 1.4 % 21,574 - 0.3 % 75,471 1.2 % Germany 1,846 7.1 % 8,018 5.8 % 26,305 9.8 % UK 1,388 - 15.8 % 4,075 - 11.6 % 18,447 - 10.5 % Scandinavia 902 6.5 % 3,603 5.9 % 9,244 2.1 % France 266 - 15.6 % 1,858 - 3.3 % 8,040 - 1.9 % Netherlands 577 17.5 % 2,036 - 1.8 % 6,796 3.0 % Spain 120 27.7 % 679 17.3 % 2,177 27.5 % Switzerland 98 - 24.6 % 441 - 12.3 % 1,582 - 2.4 % Belgium 81 - 4.7 % 328 - 7.9 % 1,169 - 0.4 % Austria 73 - 1.4 % 311 - 7.7 % 967 5.0 % Italy 18 - 48.6 % 225 - 17.9 % 744 - 1.5 %