UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES |

Investment Company Act file number: (811- 03897)

Exact name of registrant as specified in charter: Putnam U.S. Government Income Trust

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

Date of fiscal year end: September 30, 2006

Date of reporting period: October 1, 2005—September 30, 2006 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes

Putnam different?

A time-honored tradition in

money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right

for investors

We have below-average expenses and stringent investor protections, and provide a wealth of information about the Putnam funds.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

Putnam

U.S. Government

Income Trust

9| 30| 06

Annual Report

| Message from the Trustees | 1 |

| About the fund | 2 |

| Report from the fund managers | 5 |

| Performance | 10 |

| Expenses | 12 |

| Portfolio turnover | 14 |

| Risk | 14 |

| Your fund’s management | 15 |

| Terms and definitions | 17 |

| Trustee approval of management contract | 18 |

| Other shareholder information | 21 |

| Financial statements | 22 |

| Federal tax information | 44 |

| About the Trustees | 45 |

| Officers | 49 |

Cover photograph: © White-Packert Photography

Message from the Trustees

Putnam U.S. Government Income Trust: seeking

opportunities through mortgage-backed securities

Home ownership is the most common way to invest in the real estate market, but it is not the only way. It is also possible for individuals to invest in the mortgages used to finance homes and businesses through instruments called mortgage-backed securities (MBSs). Since 1984, Putnam U.S. Government Income Trust has invested in some of the highest-quality MBSs with the goal of maximizing income. However, investing in MBSs carries certain risks. As a result, your fund’s team of experienced analysts uses proprietary models to seek out investment opportunities, while striving to maintain an appropriate amount of risk for the fund.

MBSs are essentially securities that represent a stake in the principal from and interest paid on a collection of mortgages. Most MBSs are created when government-sponsored entities, including Fannie Mae, Ginnie Mae, and Freddie Mac, buy mortgages from financial institutions, such as banks or credit unions, and package them together by the thousands. These pools of mortgages act as collateral for the MBSs that government-sponsored entities sell to different investors, including Putnam U.S. Government Income Trust, which currently holds a significant percentage of its assets in MBSs.

With the exception of Ginnie Mae securities, MBSs are not guaranteed directly by the full faith and credit of the United States. Therefore, they carry a higher degree of risk than investments like Treasury bonds, while offering the potential for higher returns. These non-Ginnie Mae securities are backed by a pool of borrowers and are typically guaranteed by the government-sponsored entities that offer them. By seeking opportunities among

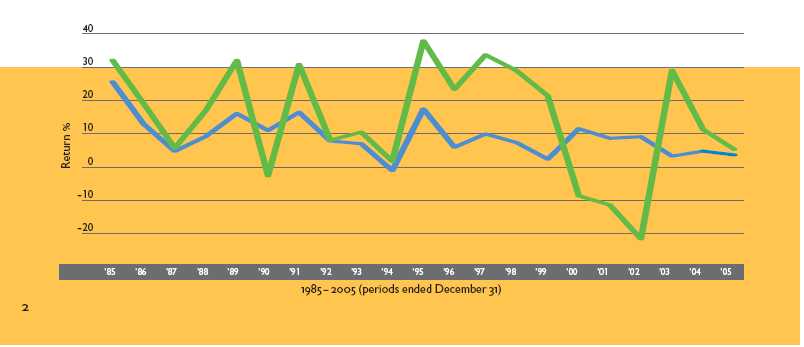

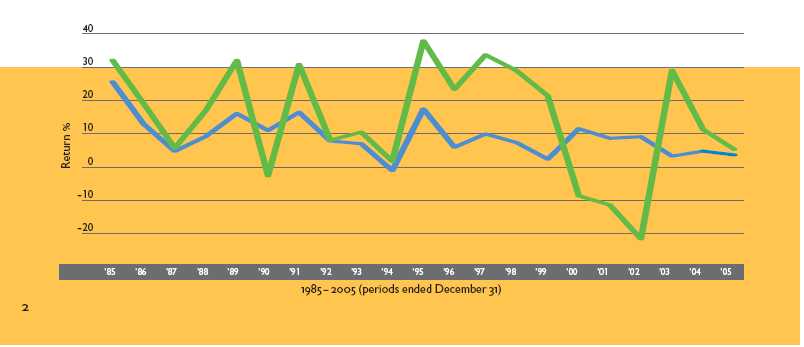

Mortgage-backed securities have historically delivered solid returns,

with fewer ups and downs than stocks along the way.

MBSs, your fund’s management team seeks higher returns than Treasuries can typically offer, but with less volatility than stocks.

Mutual funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. The use of derivatives involves special risks and may result in losses. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

The ABCs of MBSs

MBSs (Mortgage-backed securities): MBSs are pools of mortgages used as collateral for issuing a security. These securities represent claims on the principal and interest payments made by the borrowers whose loans are in the pool.

Fannie Mae (Federal National Mortgage Association): Fannie Mae is a public company established by the U.S. government in 1938 to help make mortgage funds available to buyers. Fannie Mae does business with primary mortgage lenders (savings and loans, commercial banks, credit unions, and housing finance agencies).

Freddie Mac (Federal Home Loan Mortgage Corporation): Freddie Mac is another public company chartered by Congress to increase the funds available to mortgage financiers. Freddie Mac buys mortgages from primary lenders and develops MBSs that offer a guarantee on the payment of principal and interest.

Ginnie Mae (Government National Mortgage Association): Ginnie Mae is a government-owned corporation established in 1968 whose MBSs are backed by the full faith and credit of the U.S. government.

Putnam U.S. Government Income Trust seeks as high a level of current income as we believe is consistent with preservation of capital. The fund attempts to achieve its objective by investing in obligations of the U.S. government and its agencies and instrumentalities, such as Government National Mortgage Association certificates (Ginnie Maes), Federal National Mortgage Association certificates (Fannie Maes), Federal Home Loan Mortgage Corporation certificates (Freddie Macs), and U.S. Treasury securities. Ginnie Maes, Fannie Maes, and Freddie Macs are generally high quality and typically provide higher yields than Treasury securities of similar maturities. The fund may also invest a portion of its assets in highly rated non-government mortgage-backed securities and other asset-backed securities. The fund may be appropriate for investors seeking income, as well as those seeking lower volatility in a well-diversified portfolio.

Highlights

• For the 12 months ended September 30, 2006, Putnam U.S. Government Income Trust’s class A shares returned 3.30% without sales charges.

• The fund’s benchmark, the Lehman GNMA Index, returned 4.10% .

• The average return for the fund’s Lipper category, GNMA Funds, was 3.22% .

• The fund’s dividend increased during the period. See page 8 for details.

• Additional fund performance, comparative performance, and Lipper data can be found in the performance section beginning on page 10.

Performance

Total return for class A shares for periods ended 9/30/06

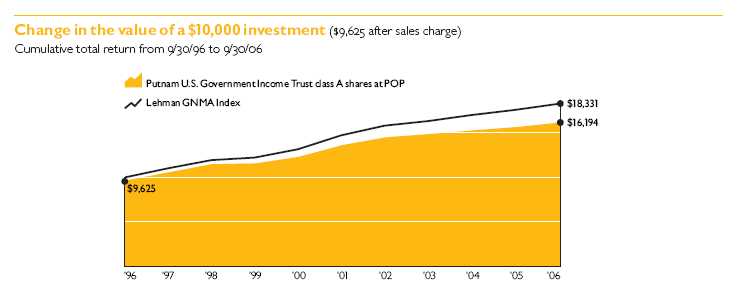

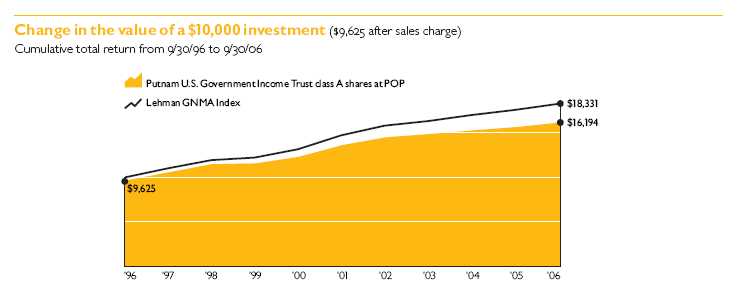

Since the fund’s inception (2/8/84), average annual return is 7.15% at NAV and 6.97% at POP.

| | Average annual return | Cumulative return |

| | NAV | POP | NAV | POP |

|

| 10 years | 5.34% | 4.94% | 68.22% | 61.94% |

|

| 5 years | 3.48 | 2.70 | 18.67 | 14.23 |

|

| 3 years | 2.84 | 1.55 | 8.78 | 4.73 |

|

| 1 year | 3.30 | –0.56 | 3.30 | –0.56 |

|

Data is historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Returns at NAV do not reflect a sales charge of 3.75% . For the most recent month-end performance, visit www.putnam.com. A 1% short-term trading fee may apply.

4

Report from the fund managers

The year in review

For the annual period, your fund posted a modest gain, based on results at net asset value (NAV, or without sales charges). These results were in line with the average for the fund’s peer group, Lipper GNMA Funds, but lagged the results for its benchmark, the Lehman GNMA Index. Like the index, your fund concentrates its investments in GNMA mortgage-backed securities (MBSs), but takes a more flexible approach in that it may also invest in other U.S. government and agency securities. For the period under review, this approach dampened returns relative to the fund’s MBS-focused benchmark. However, the fund’s preference for Fannie Mae securities over Ginnie Maes during the period, and its allocation to “re-performing mortgages” supported by the Federal Housing Administration (FHA) and Veteran’s Administration (VA), contributed favorably to performance relative to its peer group.

Market overview

From October 1, 2005, to September 30, 2006, bond yields in general increased modestly across all maturities. Yields on 10-year Treasuries first rose about 90 basis points (a basis point is one one-hundredth of a percent), and then fell 60 basis points in the fourth quarter of the fund’s fiscal year, ending the period at 4.63% . The net increase for the year was about 30 basis points. Since 2003, the spread, or difference, between yields of 2-year notes and 10-year Treasuries, has continued to narrow. For example, at the end of September 2005, 10-year Treasuries yielded 15 basis points more than 2-year notes. One year later, they actually yielded 6 basis points less than 2-year notes. The yield curve (a graphical representation of the difference in yield between short-term and long-term securities) continued to flatten in 2006 and actually inverted. This is a fairly rare occurrence and is widely accepted as a predictor of slowing economic growth. We believe it indic ates that the market currently expects that the Fed will lower short-term interest rates.

Investors who are seeking higher yield have only two ways to pursue it: by selecting higher-coupon bonds, or benefiting from price changes that result from market

Market sector performance

These indexes provide an overview of performance in different market sectors for the 12 months ended 9/30/06.

| Bonds | |

| Lehman GNMA Index | |

| (Government National Mortgage Association bonds) | 4.10% |

|

| Lehman Aggregate Bond Index | |

| (broad bond market) | 3.67% |

|

| Lehman Municipal Bond Index | |

| (tax-exempt bonds) | 4.45% |

|

| JPMorgan Global High Yield Index | |

| (global high-yield corporate bonds) | 7.67% |

|

| Equities | |

| S&P 500 Index | |

| (broad stock market) | 10.79% |

|

| Russell 1000 Growth Index | |

| (large-company growth stocks) | 6.04% |

|

| Russell 1000 Value Index | |

| (large-company value stocks) | 14.62% |

5

volatility. As the period began, volatility in the fixed-income markets was quite low by historical measures and it continued to decline throughout the period. Consequently, investors preferred higher-yielding (higher-coupon) securities, i.e., corporate bonds, agency bonds, and mortgage-backed securities. The latter outpaced agency bonds, which in turn outperformed Treasuries of comparable maturities during the period.

Strategy overview

There are six key strategy decisions that we make in managing the fund. The first is called term structure. This reflects our views of the direction of interest rates based on factors such as economic indicators, Fed statements and strategy, and market sentiment. We also analyze the shape of the yield curve and strive to position your fund’s portfolio to benefit from expected shifts in the curve. Our second strategic decision involves sector allocation. We seek to determine the relative attractiveness of the different fixed-income sectors in which your fund can invest — Treasuries, agencies, and MBSs — and then position its portfolio to take advantage of our sector preferences. We also weigh the relative attractiveness of the Ginnie Maes, Fannie Maes, and Freddie Macs within the agency market.

We make three other strategic decisions that are specifically related to MBSs: We seek to determine which maturity is most attractive (e.g., 30-year, 15-year, or adjustable-rate); we assess which coupon level (e.g., 5.5%, 6.5%, 7%, etc.) or what combination of coupons provides the best risk/return tradeoff; and we consider the “seasoning” of mortgages. An older, or more seasoned, mortgage is typically less likely to be prepaid. Prepayment would interrupt the income stream and require investors to reinvest principal at current lower rates. Our sixth strategic decision concerns out-of-benchmark exposure. We consider the relative attractiveness of securities that are not in the fund’s benchmark but are allowed under the fund’s investment guidelines.

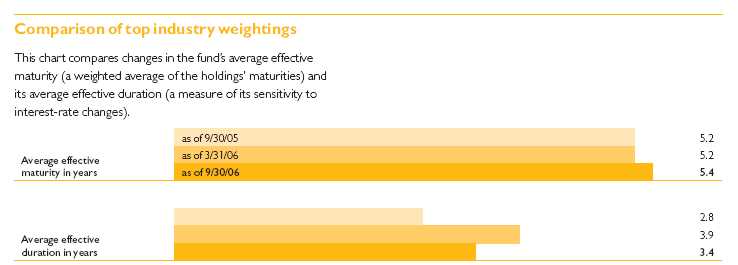

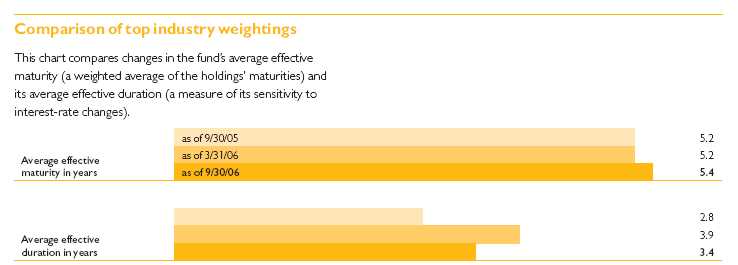

Your fund’s holdings

Throughout the year, we maintained the fund’s relatively short portfolio duration in order to limit its sensitivity to changes in interest rates. As rates rose and bond prices fell during the first three quarters of the fiscal period, this defensive positioning proved helpful. However, as rates fell in the final quarter and bond prices rallied, the fund’s shorter duration limited its ability to benefit from the resulting gains. Also, the fund was positioned to benefit from what we believed would be a steepening of the yield curve. However, as noted earlier, the curve flattened and inverted during the period, which detracted from the fund’s performance relative to its benchmark.

Average effective duration and average effective maturity take into account put and call features, where applicable, and reflect prepayments for mortgage-backed securities.

Duration is usually shorter than maturity because it reflects interest payments on a bond prior to its maturity.

6

We closely monitor the spread between yields of Treasuries, which are generally considered risk-free, and other, higher-risk fixed-income securities. Over time, this spread tends to widen and then narrow in a cyclical manner. For example, when corporations are financially healthy and the economy is stable, the risk of investing in corporate bonds is perceived to be less, and so the yield advantage that they offer in comparison to Treasuries is also less. At such times, the spread is said to be narrow. During the period, the spread to Treasuries had narrowed to such a degree that we believed the cycle was nearing an end. Because we anticipated that the spread would begin to widen (yields would go up and bond prices would fall) the portfolio emphasized lower-yielding government securities. This did not boost the fund’s returns during the period, as higher-yielding agency bonds and mortgages outperfor med. However, we still believe that spreads are poised to widen in the coming months and that the fund retains the ability to benefit should this occur.

With regard to the fund’s MBS holdings, we emphasized lower-coupon MBSs, which, in our view, had been discounted by the market. We sold MBSs with 6.5% and 6% coupons and bought those with 5% coupons. We believed that in a period of rising mortgage rates, existing lower-rate mortgages would have less prepayment risk. Prepayment risk is the risk that mortgage loans will be paid in full and terminated prematurely, reducing an investor’s expected interest income, and necessitating reinvestment of principal at prevailing market rates, which could be lower. In our view, the market was undervaluing the reduced prepayment risk, and once the discrepancy was recognized, these securities would be likely to outperform. However, in an environment where investors were not being appropriately compensated for accepting the risk of longer-term maturities, banks sought shorter-ter m maturities in the form of mortgages with 6.5% coupons. This strong demand drove a rally in 6.5% coupon MBSs while 5% coupon MBSs underperformed.

Our decision to favor Fannie Mae securities over Ginnie Maes worked to the fund’s advantage. In the early part of the year, Asian demand for MBSs — particularly government-guaranteed securities — drove the value of Ginnie Maes higher relative to Fannie Maes. We sold Ginnie Maes, locking in gains, and then bought cheaper Fannie Maes.

We also captured gains by actively managing the fund’s exposure to 15-year and 30-year mortgages, and hybrid adjustable rate mortgages (ARMs). Hybrid ARMs have characteristics of both fixed-rate and adjustable-rate loans, because they provide for an initial period of fixed-rate

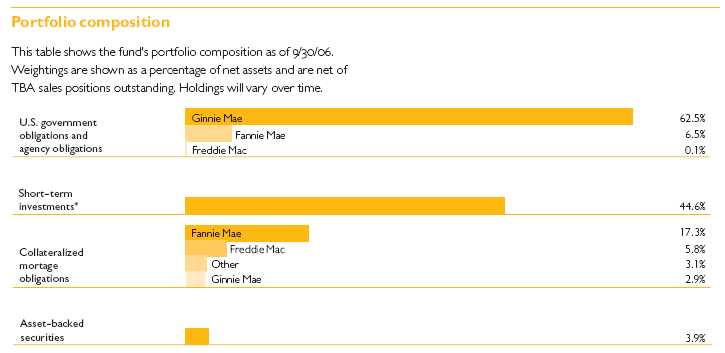

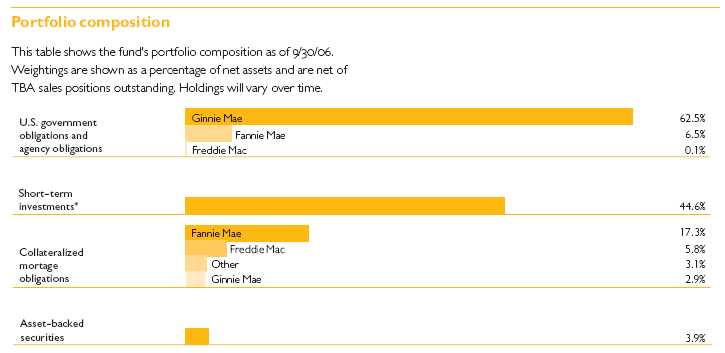

* A significant portion of short-term investments reflects amounts used to settle TBA purchase commitments. For more information, see page 40.

7

payments, after which the interest rate adjusts annually. Nearly half of all new mortgage loans originated in recent years were hybrid loans; however, the popularity of these loans is waning because interest rates are rising. Many of the hybrid ARMs are now trading in the secondary market at what we believe are increasingly attractive levels, given their higher yields. To take advantage of the maturities that appeared most attractive, we adjusted the fund’s holdings in this area several times throughout the year.

The fund’s positions in FHA-VA re-performing mortgages helped performance. These formerly delinquent mortgages have been pooled together and given credit protection from the Federal Housing Administration (FHA), the Veteran’s Administration (VA), and Fannie Mae. We like the limited credit risk of these securities. Also, because mortgage borrowers who have been delinquent in the past are not able to refinance easily and thus, hold their mortgages for longer periods, this type of MBS is less likely to be negatively affected by prepayments. Consequently, these securities are less sensitive to interest-rate changes than typical MBSs. Up to 15% of the portfolio was invested in these securities, which also offer higher yields than typical MBSs.

The fund also owned and benefited from commercial mortgage-backed securities (CMBSs). Unlike residential mortgages, most commercial mortgages are precluded from prepayment. With no prepayment risk, they are typically more stable than home mortgages. CMBSs were inexpensive relative to residential MBSs, and they performed well during the year.

In addition, fund returns were helped by our emphasis on older, more seasoned mortgages, which often have smaller loan balances. Both the seasoning and the lower loan balances tend to reduce prepayment risk, so these securities are relatively stable in price. We find the most attractive way to invest in seasoned mortgages is through collateralized mortgage obligations (CMOs) and FHA-VA re-performing mortgages.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

Of special interest

Fund’s dividend increased

The fund’s monthly dividend increased incrementally during the period, from $0.034 to $0.043 by the close of the fiscal year. This was due in part to an increase in the fund’s interest income. The fund’s other share classes had similar increases.

8

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

While we believe that economic growth could slow in coming months, we also believe that interest rates are currently too low and that the present flat yield curve overstates the potential for slower growth. Although the market may not share this view, we believe that rates will trend higher across the range of bond maturities. Accordingly, we are seeking to limit the portfolio’s interest-rate sensitivity by maintaining its short portfolio duration. We also believe that we are near the end of a credit cycle and that the very small difference between yields of low-risk and high-risk securities will gradually begin to widen. Currently, yield spreads are not compensating investors for buying riskier securities. In light of this, we are fairly conservative in our sector strategies, and we are favoring Treasuries and Aaa-rated securities, such as CMOs, over agencies and mortgages. In our view, Treasuries and Aaa-rated securities appear to offer the best values in the marketplace , and currently, without substantial yield advantages available elsewhere, we believe they are the most prudent choice.

Within the MBS market, we continue to favor Fannie Mae securities over Ginnie Maes. With regard to maturities, we prefer 15-year to 30-year MBSs. We prefer lower coupons to higher coupons, and increased the fund’s exposure to these when, in our view, the market undervalued them in the last quarter of the fiscal year. We continue to prefer seasoned mortgages to newer ones. Out-of-benchmark investments such as FHA-VA re-performing loans, CMBs, and hybrid ARMs still appear attractive, and we believe they are likely to continue to contribute to overall returns. As always, we strive to position the fund to take advantage of attractive opportunities without assuming undue risk.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. The use of derivatives involves special risks and may result in losses. Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

9

Your fund’s performance

This section shows your fund’s performance for periods ended September 30, 2006, the end of its fiscal year. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. For the most recent month-end performance, please visit www.putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

| Fund performance Total return for periods ended 9/30/06 | | | | | | |

|

| |

| | Class A | | Class B | | Class C | | Class M | | Class R | Class Y |

| (inception dates) | (2/8/84) | | (4/27/92) | | (7/26/99) | | (2/6/95) | | (1/21/03) | (4/11/94) |

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 7.15% | 6.97% | 6.27% | 6.27% | 6.34% | 6.34% | 6.80% | 6.65% | 6.88% | 7.30% |

|

| 10 years | 68.22 | 61.94 | 55.92 | 55.92 | 56.10 | 56.10 | 63.83 | 58.56 | 64.07 | 72.52 |

| Annual average | 5.34 | 4.94 | 4.54 | 4.54 | 4.55 | 4.55 | 5.06 | 4.72 | 5.08 | 5.60 |

|

| 5 years | 18.67 | 14.23 | 14.23 | 12.24 | 14.26 | 14.26 | 17.18 | 13.36 | 17.21 | 20.16 |

| Annual average | 3.48 | 2.70 | 2.70 | 2.34 | 2.70 | 2.70 | 3.22 | 2.54 | 3.23 | 3.74 |

|

| 3 years | 8.78 | 4.73 | 6.42 | 3.45 | 6.35 | 6.35 | 7.98 | 4.49 | 7.92 | 9.62 |

| Annual average | 2.84 | 1.55 | 2.10 | 1.14 | 2.07 | 2.07 | 2.59 | 1.47 | 2.57 | 3.11 |

|

| 1 year | 3.30 | –0.56 | 2.52 | –2.43 | 2.50 | 1.51 | 3.10 | –0.25 | 3.04 | 3.60 |

|

Performance assumes reinvestment of distributions and does not account for taxes. Returns at public offering price (POP) for class A and M shares reflect a sales charge of 3.75% and 3.25%, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $15,592 and $15,610, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,675 after sales charge) would have been valued at $15,856 at public offering price. A $10,000 investment in the fund’s class R and class Y shares would have been valued at $16,407 and $17,252, respectively. See first page of performance section for performance calculation method.

10

| Comparative index returns For periods ended 9/30/06 | | |

|

| |

| | Lehman | Lipper GNMA Funds |

| | GNMA Index | category average* |

|

| Annual average | | |

| (life of fund) | 8.70% | 7.66% |

|

| 10 years | 83.31 | 68.85 |

| Annual average | 6.25 | 5.37 |

|

| 5 years | 24.27 | 19.31 |

| Annual average | 4.44 | 3.59 |

|

| 3 years | 12.10 | 8.59 |

| Annual average | 3.88 | 2.78 |

|

| 1 year | 4.10 | 3.22 |

|

Index and Lipper results should be compared to fund performance at net asset value.

*Over the 1-, 3-, 5-, and 10-year periods ended 9/30/06, there were 62, 61, 54, and 30 funds, respectively, in this Lipper category.

| Fund price and distribution information For the 12-month period ended 9/30/06 | | | |

|

| |

| Distributions | Class A | | Class B | Class C | Class M | | Class R | Class Y |

|

| Number | 12 | | 12 | 12 | 12 | | 12 | 12 |

|

| Income | $0.539 | $0.439 | $0.438 | $0.503 | $0.506 | $0.575 |

|

| Capital gains | — | | — | — | — | | — | — |

|

| Total | $0.539 | $0.439 | $0.438 | $0.503 | $0.506 | $0.575 |

|

| Share value: | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 9/30/05 | $13.15 | $13.66 | $13.08 | $13.13 | $13.13 | $13.57 | $13.14 | $13.12 |

|

| 9/30/06 | 13.03 | 13.54 | 12.96 | 13.01 | 13.02 | 13.46 | 13.02 | 13.00 |

|

| Current yield (end of period) | | | | | | | | |

| Current dividend rate1 | 3.96% | 3.81% | 3.15% | 3.14% | 3.69% | 3.57% | 3.69% | 4.25% |

|

| Current 30-day SEC yield2 | 4.32 | 4.15 | 3.57 | 3.57 | 4.07 | 3.93 | 4.07 | 4.57 |

|

1 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

2 Based only on investment income, calculated using SEC guidelines.

11

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial advisor.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam U.S. Government Income Trust from April 1, 2006, to September 30, 2006. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | $ 4.88 | $ 8.67 | $ 8.67 | $ 6.14 | $ 6.14 | $ 3.61 |

|

| Ending value (after expenses) | $1,027.20 | $1,023.30 | $1,023.20 | $1,025.80 | $1,025.80 | $1,028.70 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of net assets for the six months ended 9/30/06. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year. Does not reflect the effect of a non-recurring reimbursement by Putnam. If this amount had been reflected in the table above, expenses for each share class would have been lower.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended September 30, 2006, use the calculation method below. To find the value of your investment on April 1, 2006, go to www.putnam.com and log on to your account. Click on the “Transaction History” tab in your Daily Statement and enter 04/01/2006 in both the “from” and “to” fields. Alternatively, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | $ 4.86 | $ 8.64 | $ 8.64 | $ 6.12 | $ 6.12 | $ 3.60 |

|

| Ending value (after expenses) | $1,020.26 | $1,016.50 | $1,016.50 | $1,019.00 | $1,019.00 | $1,021.51 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of net assets for the six months ended 9/30/06. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year. Does not reflect the effect of a non-recurring reimbursement by Putnam. If this amount had been reflected in the table above, expenses for each share class would have been lower.

12

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s net assets have been used to pay ongoing expenses during the period.

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Your fund’s annualized expense ratio* | 0.96% | 1.71% | 1.71% | 1.21% | 1.21% | 0.71% |

|

| Average annualized expense ratio for Lipper peer group† | 1.01% | 1.76% | 1.76% | 1.26% | 1.26% | 0.76% |

|

* For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights. Does not reflect the effect of a non-recurring reimbursement by Putnam. If this amount had been reflected in the table above, the expense ratio for each share class would have been lower.

† Simple average of the expenses of all front-end load funds in the fund’s Lipper peer group, calculated in accordance with Lipper’s standard method for comparing fund expenses (excluding 12b-1 fees and without giving effect to any expense offset and brokerage service arrangements that may reduce fund expenses). This average reflects each fund’s expenses for its most recent fiscal year available to Lipper as of 9/30/06. To facilitate comparison, Putnam has adjusted this average to reflect the 12b-1 fees carried by each class of shares other than class Y shares, which do not incur 12b-1 fees. The peer group may include funds that are significantly smaller or larger than the fund, which may limit the comparability of the fund’s expenses to the simple average, which typically is higher than the asset-weighted average.

13

Your fund’s portfolio turnover

and Overall Morningstar® Risk

Putnam funds are actively managed by teams of experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s assets within a one-year period. Funds with high turnover may be more likely to generate capital gains and dividends that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Funds that invest in bonds or other fixed-income instruments may have higher turnover than funds that invest only in stocks. Short-term bond funds tend to have higher turnover than longer-term bond funds, because shorter-term bonds will mature or be sold more frequently than longer-term bonds. You can use the table below to compare your fund’s turnover with the average turnover for funds in its Lipper category.

Turnover comparisons

Percentage of holdings that change every year

| | 2006 | 2005 | 2004 | 2003 | 2002 |

|

| Putnam U.S. Government Income Trust | 579%* | 782%* | 198%* | 332%† | 277%† |

|

| Lipper GNMA Funds category average | 307% | 315% | 286% | 383% | 313% |

|

Turnover data for the fund is calculated based on the fund's fiscal-year period, which ends on September 30. Turnover data for the fund's Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund's portfolio turnover rate to the Lipper average. Comparative data for 2006 is based on information available as of 9/30/06.

* Excludes dollar roll transactions.

† Excludes certain Treasury note transactions executed in connection with a short-term trading strategy.

Your fund’s Overall Morningstar® Risk

This risk comparison is designed to help you understand how your fund compares with other funds. The comparison utilizes a risk measure developed by Morningstar, an independent fund-rating agency. This risk measure is referred to as the fund’s Overall Morningstar Risk.

Your fund’s Overall Morningstar Risk is shown alongside that of the average fund in its broad asset class, as determined by Morningstar. The risk bar broadens the comparison by translating the fund’s Overall Morningstar Risk into a percentile, which is based on the fund’s ranking among all funds rated by Morningstar as of September 30, 2006. A higher Overall Morningstar Risk generally indicates that a fund’s monthly returns have varied more widely.

Morningstar determines a fund’s Overall Morningstar Risk by assessing variations in the fund’s monthly returns — with an emphasis on downside variations — over 3-, 5-, and 10-year periods, if available. Those measures are weighted and averaged to produce the fund’s Overall Morningstar Risk. The information shown is provided for the fund’s class A shares only; information for other classes may vary. Overall Morningstar Risk is based on historical data and does not indicate future results. Morningstar does not purport to measure the risk associated with a current investment in a fund, either on an absolute basis or on a relative basis. Low Overall Morningstar Risk does not mean that you cannot lose money on an investment in a fund. Copyright 2006 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warran ted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

14

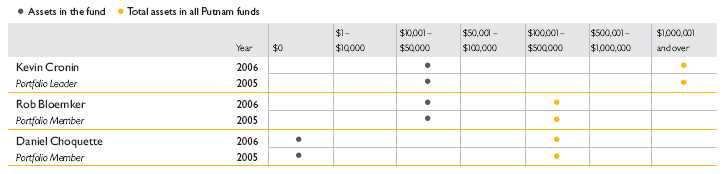

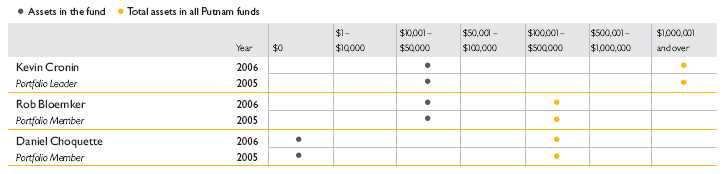

Your fund’s management

Your fund is managed by the members of the Putnam Core Fixed-Income Team. Kevin Cronin is the Portfolio Leader and Rob Bloemker and Daniel Choquette are Portfolio Members of your fund. The Portfolio Leader and Portfolio Members coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Core Fixed-Income Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

Investment team fund ownership

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of September 30, 2006, and September 30, 2005.

Trustee and Putnam employee fund ownership

As of September 30, 2006, all of the 11 Trustees then on the Board of the Putnam funds owned fund shares. The table below shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | | Total assets in |

| | Assets in the fund | all Putnam funds |

|

| Trustees | $ 137,000 | $ 90,000,000 |

|

| Putnam employees | $1,422,000 | $418,000,000 |

|

Fund manager compensation

The total 2005 fund manager compensation that is attributable to your fund is approximately $1,300,000. This amount includes a portion of 2005 compensation paid by Putnam Management to the fund managers listed in this section for their portfolio management responsibilities, calculated based on the fund assets they manage taken as a percentage of the total assets they manage. The compensation amount also includes a portion of the 2005 compensation paid to the Chief Investment Officer of the team and the Group Chief Investment Officer of the fund’s broader investment category for their oversight responsibilities, calculated based on the fund assets they oversee taken as a percentage of the total assets they oversee. This amount does not include compensation of other personnel involved in research, trading, administration, systems, compliance, or fund operations; nor does it include non-compensation costs. These percentages are determined as of the fund’s fiscal period-end. For personnel who joined Putnam Management during or after 2005, the calculation reflects annualized 2005 compensation or an estimate of 2006 compensation, as applicable.

15

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

Kevin Cronin is also a Portfolio Leader of Putnam American Government Income Fund, Putnam Global Income Trust, Putnam Income Fund, and Putnam Limited Duration Government Income Fund. He is also a Portfolio Member of Putnam Equity Income Fund.

Rob Bloemker is also a Portfolio Member of Putnam American Government Income Fund, Putnam Diversified Income Trust, Putnam Income Fund, Putnam Limited Duration Government Income Fund, Putnam Master Intermediate Income Trust, and Putnam Premier Income Trust.

Daniel Choquette is also a Portfolio Member of Putnam American Government Income Fund and Putnam Limited Duration Government Income Fund.

Kevin Cronin, Rob Bloemker, and Daniel Choquette may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

Your fund’s Portfolio Leader and Portfolio Members did not change during the year ended September 30, 2006.

Putnam fund ownership by Putnam’s Executive Board

The table below shows how much the members of Putnam’s Executive Board have invested in all Putnam mutual funds (in dollar ranges). Information shown is as of September 30, 2006, and September 30, 2005.

| | | | $1 – | $10,001 – | $50,001 – | $100,001 – | $500,001 – | $1,000,001 |

| | Year | $0 | $10,000 | $50,000 | $100,000 | $500,000 | $1,000,000 | and over |

|

| Philippe Bibi | 2006 | | | | | | | • |

|

|

| Chief Technology Officer | 2005 | | | | | | | • |

|

| Joshua Brooks | 2006 | | | | | | | • |

|

|

| Deputy Head of Investments | 2005 | | | | | | | • |

|

| William Connolly | 2006 | | | | | | | • |

|

|

| Head of Retail Management | 2005 | | | | | | | • |

|

| Kevin Cronin | 2006 | | | | | | | • |

|

|

| Head of Investments | 2005 | | | | | | | • |

|

| Charles Haldeman, Jr. | 2006 | | | | | | | • |

|

|

| President and CEO | 2005 | | | | | | | • |

|

| Amrit Kanwal | 2006 | | | | | | • | |

|

|

| Chief Financial Officer | 2005 | | | | | | • | |

|

| Steven Krichmar | 2006 | | | | | | • | |

|

|

| Chief of Operations | 2005 | | | | | | | • |

|

| Francis McNamara, III | 2006 | | | | | | | • |

|

|

| General Counsel | 2005 | | | | | | | • |

|

| Jeffrey Peters | 2006 | | | | | | | • |

|

|

| Head of International Business | N/A | | | | | | | |

|

| Richard Robie, III | 2006 | | | | | | • | |

|

|

| Chief Administrative Officer | 2005 | | | | | | • | |

|

| Edward Shadek | 2006 | | | | | | | • |

|

|

| Deputy Head of Investments | 2005 | | | | | | | • |

|

| Sandra Whiston | 2006 | | | | | | • | |

|

|

| Head of Institutional Management | 2005 | | | | | | • | |

|

N/A indicates the individual was not a member of Putnam’s Executive Board as of 9/30/05.

16

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 3.75% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are only available to eligible purchasers, including eligible defined contribution plans or corporate IRAs.

Comparative indexes

JPMorgan Global High Yield Index is an unmanaged index of global high-yield fixed-income securities.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lehman GNMA Index is an unmanaged index of Government National Mortgage Association bonds.

Lehman Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Russell 1000 Growth Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their growth orientation.

Russell 1000 Value Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their value orientation.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

17

Trustee approval

of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2006, the Contract Committee met four times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independe nt Trustees. Upon completion of this review, the Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract, effective July 1, 2006.

This approval was based on the following conclusions:

• That the fee schedule in effect for your fund represents reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That such fee schedule represents an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 60th percentile in management fees and in the 40th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2005 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b- 1) fees and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management, in consultation with the Contract Committee, has committed to maintain at least through 2007. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception. In order to ensure that the expenses of

18

the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to implement an additional expense limitation for certain funds for the twelve months beginning January 1, 2007 equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper based on the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the Lipper custom peer group data for the period ended December 31, 2005. This additional expense limitation will not be applied to your fund.

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. Conversely, as a fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedules in effect for the funds represented an appropriate sharing of economies of scale at current asset levels. In reaching this conclusion, the Trustees considered the Contract Committee’s stated intent to continue to work with Putnam Management to plan for an eventual resumption in the growth of assets, including a study of potential economies that might be produced under various growth assumptions.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis. Because many of the costs incurred by Putnam Management in managing the funds are not readily identifiable to particular funds, the Trustees observed that the methodology for allocating costs is an important factor in evaluating Putnam Management’s costs and profitability, both as to the Putnam fu nds in the aggregate and as to individual funds. The Trustees reviewed Putnam Management’s cost allocation methodology with the assistance of independent consultants and concluded that this methodology was reasonable and well-considered.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Process Committee of the Trustees and the Investment Oversight Committee of the Trustees, which meet on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognize that this does not guarantee favorable investment r esults for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. In particular, they noted the important contributions of Putnam Management’s leadership in attracting, retaining and supporting high-quality investment professionals and in systematically implementing an investment process that seeks to merge the best features of fundamental and quantitative analysis. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group

19

(Lipper GNMA Funds) for the one-, three- and five-year periods ended March 31, 2006 (the first percentile being the best performing funds and the 100th percentile being the worst performing funds):

| One-year period | Three-year period | Five-year period |

|

| 59th | 53rd | 60th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three- and five-year periods ended March 31, 2006, there were 62, 62, and 51 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future performance.)

As a general matter, the Trustees concluded that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company, all of which provide benefits to affiliates of Putnam Management.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on a verage for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper GNMA Funds category for the one-, five- and ten-year periods ended September 30, 2006, were 45%, 55%, and 59%, respectively. Over the one-, five- and ten-year periods ended September 30, 2006, the fund ranked 28th out of 62, 30th out of 54, and 18th out of 30 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

20

Other information for shareholders

Putnam’s policy on confidentiality

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ addresses, telephone numbers, Social Security numbers, and the names of their financial advisors. We use this information to assign an account number and to help us maintain accurate records of transactions and account balances. It is our policy to protect the confidentiality of your information, whether or not you currently own shares of our funds, and in particular, not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use. Under certain circumstances, we share this information with outside vendors who provide services to us, such as mailing and proxy solicitation. In those cases, the service providers enter into confidentiali ty agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. We may also share this information with our Putnam affiliates to service your account or provide you with information about other Putnam products or services. It is also our policy to share account information with your financial advisor, if you’ve listed one on your Putnam account. If you would like clarification about our confidentiality policies or have any questions or concerns, please don’t hesitate to contact us at 1-800-225-1581, Monday through Friday, 8:30 a.m. to 7:00 p.m., or Saturdays from 9:00 a.m. to 5:00 p.m. Eastern Time.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2006, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

21

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

22

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Putnam U.S. Government Income Trust:

We have audited the accompanying statement of assets and liabilities of Putnam U.S. Government Income Trust, including the fund's portfolio, as of September 30, 2006, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years or periods in the period then ended. These financial statements and financial highlights are the responsibility of the fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2006 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam U.S. Government Income Trust as of September 30, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years or periods in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

November 9, 2006

23

The fund’s portfolio 9/30/06

| U.S. GOVERNMENT AND AGENCY | | | |

| MORTGAGE OBLIGATIONS (70.2%)* | | | |

|

| | | Principal amount | | Value |

|

| U.S. Government Guaranteed | | | | |

| Mortgage Obligations (62.5%) | | | | |

| Government National | | | | |

| Mortgage Association | | | | |

| Adjustable Rate Mortgages | | | | |

| 4 1/2s, with due dates from | | | | |

| August 20, 2034 to | | | | |

| February 20, 2035 | | $ | | 86,711,897 | | $ | 86,355,431 |

| 3 3/4s, January 20, 2034 | | 19,301,411 | | 19,100,667 |

| Government National | | | | |

| Mortgage Association | | | | |

| Graduated Payment Mortgages | | | | |

| 13 3/4s, November 20, 2014 | | 5,668 | | 6,850 |

| 13 1/2s, April 15, 2011 | | 20,900 | | 23,733 |

| 13 1/4s, December 20, 2014 | | 17,126 | | 20,484 |

| 12 3/4s, with due dates from | | | | |

| December 15, 2013 to | | | | |

| December 20, 2014 | | 41,943 | | 49,283 |

| 12 1/4s, with due dates from | | | | |

| February 15, 2014 to | | | | |

| March 15, 2014 | | 49,792 | | 57,695 |

| 11 1/4s, with due dates from | | | | |

| September 15, 2015 to | | | | |

| January 15, 2016 | | 144,550 | | 166,251 |

| 10s, with due dates from | | | | |

| November 15, 2009 to | | | | |

| November 15, 2009 | | 16,914 | | 17,805 |

| 9 1/4s, with due dates from | | | | |

| April 15, 2016 to May 15, 2016 | | 27,007 | | 29,497 |

| Government National | | | | |

| Mortgage Association | | | | |

| Pass-Through Certificates | | | | |

| 8 1/2s, with due dates from | | | | |

| December 15, 2006 to | | | | |

| December 15, 2019 | | 14,554 | | 15,483 |

| 8s, with due dates from May 15, | | | | |

| 2024 to August 15, 2032 | | 22,779,957 | | 24,160,577 |

| 8s, with due dates from January 15, | | | |

| 2008 to November 15, 2009 | | 1,477,940 | | 1,512,310 |

| 7 1/2s, with due dates from | | | | |

| October 15, 2021 to | | | | |

| November 15, 2032 | | 29,944,674 | | 31,484,770 |

| 7 1/2s, with due dates from | | | | |

| March 15, 2017 to May 15, 2017 | | 35,007 | | 36,597 |

| 7s, with due dates from March 15, | | | |

| 2022 to May 15, 2032 | | 35,823,024 | | 37,293,338 |

| 7s, with due dates from | | | | |

| October 15, 2007 to August 15, 2012 | 1,610,786 | | 1,637,965 |

| 6 1/2s, with due dates from | | | | |

| October 15, 2023 to March 15, 2035 | 13,006,377 | | 13,396,360 |

| 6s, with due dates from | | | | |

| November 15, 2023 to | | | | |

| October 15, 2033 | | 1,336,080 | | 1,353,339 |

| 6s, TBA, October 1, 2036 | | 49,000,000 | | 49,585,702 |

| 5 1/2s, with due dates from | | | | |

| June 15, 2029 to March 15, 2036 | 36,967,317 | | 36,787,695 |

| 5 1/2s, TBA, October 1, 2036 | | 358,400,000 | | 354,871,982 |

| 5 1/2s, TBA, October 1, 2036 | | 126,600,000 | | 125,749,400 |

| | | | | 783,713,214 |

| U.S. GOVERNMENT AND AGENCY | | | |

| MORTGAGE OBLIGATIONS (70.2%)* continued | |

|

| | | Principal amount | Value |

|

| U.S. Government Agency | | | |

| Mortgage Obligations (7.7%) | | | |

| Federal Home Loan | | | |

| Mortgage Corporation | | | |

| Pass-Through Certificates | | | |

| 5 1/2s, with due dates from | | | |

| August 1, 2013 to May 1, 2020 | | $ | 641,839 $ | 642,470 |

| 5s, May 1, 2034 | | 723,884 | 697,983 |

| Federal National | | | |

| Mortgage Association | | | |

| Pass-Through Certificates | | | |

| 7s, with due dates from | | | |

| September 1, 2028 to | | | |

| March 1, 2029 | | 204,174 | 210,355 |

| 6 1/2s, with due dates from | | | |

| March 1, 2024 to | | | |

| September 1, 2032 | | 166,793 | 170,811 |

| 6 1/2s, March 1, 2016 | | 35,656 | 36,558 |

| 6s, with due dates from | | | |

| September 1, 2021 to | | | |

| August 1, 2036 | | 7,898,584 | 7,937,243 |

| 6s, TBA, October 1, 2021 | | 20,800,000 | 21,112,000 |

| 5 1/2s, with due dates from | | | |

| November 1, 2035 to | | | |

| August 1, 2036 | | 39,367,291 | 38,792,783 |

| 5 1/2s, with due dates from | | | |

| January 1, 2009 to | | | |

| January 1, 2021 | | 974,177 | 975,279 |

| 5s, August 1, 2033 | | 1,940 | 1,871 |

| 4 1/2s, with due dates from | | | |

| March 1, 2021 to | | | |

| September 1, 2035 | | 1,705,820 | 1,598,802 |

| 4 1/2s, TBA, October 1, 2021 | | 12,500,000 | 12,056,640 |

| 4 1/2s, TBA, November 1, 2021 | | 12,500,000 | 12,056,641 |

| | | | 96,289,436 |

|

| |

| Total U.S. government and agency | | | |

| mortgage obligations (cost $874,487,819) $ | 880,002,650 |

|

| |

| |

| COLLATERALIZED MORTGAGE OBLIGATIONS (29.1%)* | |

|

| | | Principal amount | Value |

|

| Banc of America Commercial | | | |

| Mortgage, Inc. | | | |

| Ser. 06-4, Class A4, 5.634s, 2046 | | $ | 1,830,000 $ | 1,866,398 |

| Ser. 06-5, Class A4, 5.414s, 2016 | | 2,228,000 | 2,235,778 |

| FRB Ser. 05-1, Class A5, 5.135s, 2042 | | 583,000 | 578,421 |

| Ser. 04-4, Class A6, 4.877s, 2042 | | 36,000 | 34,812 |

| Commercial Mortgage | | | |

| Pass-Through Certificates | | | |

| Ser. 06-C7, Class A4, 5.962s, 2046 | | 19,036,000 | 19,705,972 |

| FRB Ser. 04-LB3A, Class A5, | | | |

| 5.281s, 2037 | | 20,000 | 20,064 |

| Countrywide Alternative Loan Trust | | | |

| IFB Ser. 06-19CB, Class A2, IO | | | |

| (Interest only), zero %, 2036 | | 884,184 | 2,590 |

| IFB Ser. 06-20CB, Class A14, IO, | | | |

| zero %, 2036 | | 1,805,511 | 3,385 |

24

| COLLATERALIZED MORTGAGE OBLIGATIONS (29.1%)* continued |

|

| | | Principal amount | | Value |

|

| Countrywide Alternative Loan Trust | | | |

| IFB Ser. 06-14CB, Class A9, IO, | | | | |

| zero %, 2036 | | $ | 3,326,041 | | $ | 20,008 |

| IFB Ser. 06-6CB, Class 1A3, IO, | | | | |

| zero %, 2036 | | 15,716,735 | | 41,748 |

| Credit Suisse Mortgage | | | | |

| Capital Certificates | | | | |

| Ser. 06-C4, Class A3, 5.467s, 2039 | | 3,672,000 | | 3,696,367 |

| CS First Boston Mortgage | | | | |

| Securities Corp. | | | | |

| FRB Ser. 04-C3, Class A5, | | | | |

| 5.113s, 2036 | | 213,000 | | 209,837 |

| Ser. 05-C4, Class A5, | | | | |

| 5.104s, 2038 | | 65,000 | | 63,875 |

| FRB Ser. 05-C5, Class A4, | | | | |

| 5.1s, 2038 | | 65,000 | | 63,825 |

| Ser. 04-C3, Class A3, 4.302s, 2036 | 454,000 | | 443,987 |

| Fannie Mae | | | | |

| IFB Ser. 06-70, Class BS, | | | | |

| 14.56s, 2036 | | 345,386 | | 412,415 |

| IFB Ser. 06-62, Class PS, | | | | |

| 7.92s, 2036 | | 2,157,313 | | 2,392,810 |

| IFB Ser. 06-76, Class QB, | | | | |

| 7.62s, 2036 | | 2,373,616 | | 2,620,340 |

| Ser. 02-26, Class A2, 7 1/2s, 2048 | 480,749 | | 502,949 |

| Ser. 05-W3, Class 1A, 7 1/2s, 2045 | 4,026,269 | | 4,247,113 |

| Ser. 04-W8, Class 3A, 7 1/2s, 2044 | 6,808,736 | | 7,164,351 |

| Ser. 04-W11, Class 1A4, 7 1/2s, 2044 | 2,162,668 | | 2,274,597 |

| Ser. 04-W2, Class 5A, 7 1/2s, 2044 | 2,445,350 | | 2,571,883 |

| Ser. 04-T3, Class 1A4, 7 1/2s, 2044 | 2,909,214 | | 3,058,055 |

| Ser. 04-W9, Class 2A3, 7 1/2s, 2044 | 2,515,791 | | 2,642,627 |

| Ser. 04-T2, Class 1A4, 7 1/2s, 2043 | 806,782 | | 848,057 |

| Ser. 03-W4, Class 4A, 7 1/2s, 2042 | 1,168,613 | | 1,220,886 |

| Ser. 02-T18, Class A4, 7 1/2s, 2042 | 1,818,014 | | 1,905,032 |

| Ser. 03-W3, Class 1A3, 7 1/2s, 2042 | 5,302,387 | | 5,554,970 |

| Ser. 02-T16, Class A3, 7 1/2s, 2042 | 12,777 | | 13,382 |

| Ser. 03-W2, Class 1A3, 7 1/2s, 2042 | 6,486,388 | | 6,797,523 |