UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-03916 | |

Name of Registrant: | Vanguard Specialized Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: January 31 | |

Date of reporting period: February 1, 2013 – January 31, 2014 |

Item 1: Reports to Shareholders | |

Annual Report | January 31, 2014

Vanguard Energy Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles,

grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 9 |

| Fund Profile. | 13 |

| Performance Summary. | 15 |

| Financial Statements. | 17 |

| Your Fund’s After-Tax Returns. | 31 |

| About Your Fund’s Expenses. | 32 |

| Glossary. | 34 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship’s wheel represents leadership and guidance, essential qualities in navigating difficult seas.

This one is a replica based on an 18th-century British vessel. The HMSVanguard, another ship of that era, served as the

flagship for British Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

Your Fund’s Total Returns

| |

| Fiscal Year Ended January 31, 2014 | |

| |

| | Total |

| | Returns |

| Vanguard Energy Fund | |

| Investor Shares | 5.88% |

| Admiral™ Shares | 5.94 |

| MSCI ACWI Energy Index | 0.74 |

| Global Natural Resources Funds Average | 2.40 |

| Global Natural Resources Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| January 31, 2013, Through January 31, 2014 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | | |

| | Share | Share | Income | Capital |

| | Price | Price | Dividends | Gains |

| Vanguard Energy Fund | | | | |

| Investor Shares | $62.66 | $63.85 | $1.277 | $1.237 |

| Admiral Shares | 117.63 | 119.83 | 2.500 | 2.321 |

1

Chairman’s Letter

Dear Shareholder,

Vanguard Energy Fund returned almost 6% for the 12 months ended January 31, 2014. A January pullback by the U.S. stock market in general—and energy stocks in particular—cut the fund’s fiscal-year return almost in half.

Still, the fund’s larger allocation to some U.S.-based oil and gas exploration companies helped it outpace the 0.74% return of its benchmark index. Your fund also maintained its edge over its global natural resource peer funds, whose average return was 2.40%. Many of those peer funds have significant allocations to sectors other than energy, such as materials, which lagged.

The energy sector lagged the broad U.S. stock market for the third consecutive year. Investors looked favorably on companies involved in the shale oil and gas production boom in North Dakota, Pennsylvania, and elsewhere in the United States. But forecasts of slower growth in global energy demand have tempered the outlook for the sector.

If you invest in the Energy Fund through a taxable account, you may wish to review information about the fund’s after-tax performance provided later in this report.

U.S. stocks found a groove before recent volatility

After delivering exceptional returns in 2013, U.S. stocks slid in January because of economic concerns at home and abroad.

2

Nevertheless, U.S. stocks produced impressive gains of nearly 23% for the 12 months ended January 31.

Strong corporate earnings growth and investors’ willingness to pay for those earnings drove stock markets, with support from the Federal Reserve’s stimulative bond-buying program. The Fed, noting the economy’s improvement, began paring back its bond purchases in January (and announced that it would continue tapering in February).

Overall, international stocks advanced about 6% for the 12 months, with the developed markets of Europe and the Pacific region posting positive returns. Concerns about China’s slower growth and tighter U.S. monetary policy were among the factors that hurt stocks and currencies in various emerging-market countries.

For 2014, Vanguard Chief Economist Joe Davis and his team are guarded in their outlook for global stock returns, and their forecast for the bond market remains muted. Although Joe readily acknowledges that such forecasts are accompanied by uncertainty, he writes, “We believe that a long-term, strategic approach with a balanced, diversified, low-cost portfolio can remain a high-value proposition in the decade ahead.” (You can read more about our expectations for bond and stock returns in Vanguard’s Economic and Investment Outlook, available at vanguard.com/research.)

| | | |

| Market Barometer | | | |

| |

| | Average Annual Total Returns |

| | Periods Ended January 31, 2014 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 22.23% | 14.14% | 19.84% |

| Russell 2000 Index (Small-caps) | 27.03 | 14.69 | 22.26 |

| Russell 3000 Index (Broad U.S. market) | 22.60 | 14.18 | 20.03 |

| FTSE All-World ex US Index (International) | 5.78 | 3.37 | 14.38 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 0.12% | 3.73% | 4.93% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | -1.07 | 5.76 | 5.54 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.05 | 0.06 | 0.09 |

| |

| CPI | | | |

| Consumer Price Index | 1.58% | 2.03% | 2.07% |

3

Bond returns were flat as the Fed firmed its strategy

Investors spurned bonds for most of the 12-month period, wary of the Fed’s expected curtailment of its bond-buying program. In January, however, despite the start of that tapering, fixed income investments regained appeal as stocks slumped.

The broad U.S. taxable bond market returned 0.12% for the fiscal year, while municipal bonds returned –1.07%. The yield of the benchmark 10-year Treasury note generally increased during the period, eclipsing 3.00% at times, and finished at about 2.70%. (Bond prices and yields move in opposite directions.) The Fed’s continued target of 0%–0.25% for short-term interest rates tightly restricted returns of money market funds and savings accounts.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –1.24%.

Some integrated giants stalled, other energy businesses advanced Higher natural gas prices made news in January, when much of the United States was in the grip of a deep freeze; prices ended the fiscal year higher than where they began. In contrast, crude oil prices

| | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| Energy Fund | 0.31% | 0.26% | 1.34% |

The fund expense ratios shown are from the prospectus dated May 28, 2013, and represent estimated costs for the current fiscal year. For the

fiscal year ended January 31, 2014, the fund’s expense ratios were 0.38% for Investor Shares and 0.32% for Admiral Shares. This increase

from the estimated expense ratio reflects a performance-based investment advisory fee adjustment. When the performance adjustment is

positive, the fund’s expenses increase; when it is negative, expenses decrease. The peer-group expense ratio is derived from data provided

by Lipper, a Thomson Reuters Company, and captures information through year-end 2013.

Peer group: Global Natural Resources Funds.

4

rose at times over the fiscal year amid concerns about strife in the Middle East and Sudan (an oil producer), but ended the period near where they began. These price trends were reflected in varying degrees in the performance of the fund’s holdings.

The returns of exploration and production companies and of integrated oil and gas giants, which together represented more than three-quarters of the fund’s average assets, diverged notably. Explorers and producers, especially U.S. firms that rank among the fund’s top-ten holdings, sprinted ahead of the less-nimble global giants during the first half of the fiscal year.

They then widened their lead—buoyed in part by strong prices and optimism about U.S. production trends. The fund’s oil and gas exploration and production holdings returned almost 13% as a group, with individual company returns approaching 50% or more.

At the other end of the results scale, the major international oil and gas companies as a group were about flat for the year. Some of the fund’s largest holdings posted modest gains, but many emerging-market firms struggled amid the downdraft in developing markets and concern about growth prospects.

| |

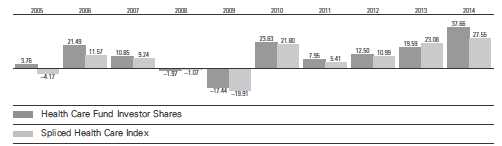

| Total Returns | |

| Ten Years Ended January 31, 2014 | |

| | Average |

| | Annual Return |

| Energy Fund Investor Shares | 12.57% |

| Spliced Energy Index | 10.01 |

| Global Natural Resources Funds Average | 8.73 |

For a benchmark description, see the Glossary.

Global Natural Resources Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be

lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our

website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so

an investor’s shares, when sold, could be worth more or less than their original cost.

5

|

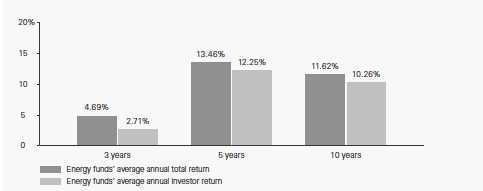

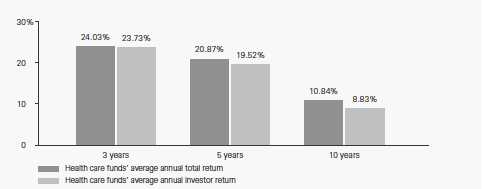

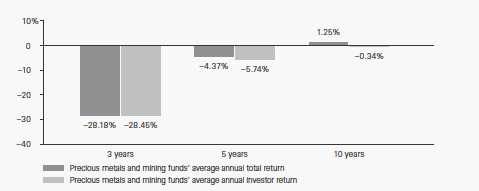

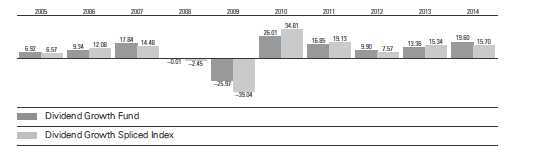

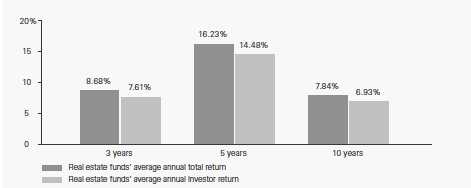

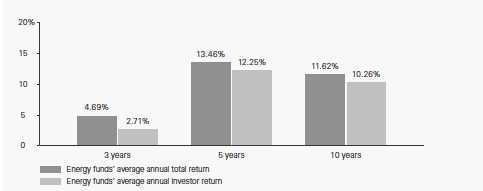

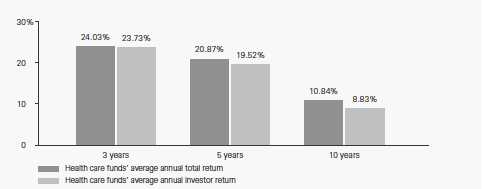

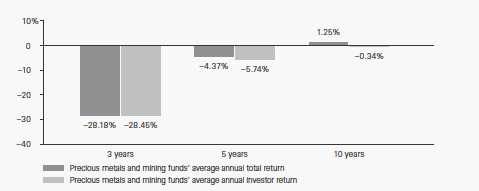

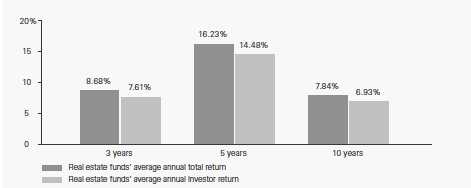

| Beware of chasing a sector’s ups and downs |

| |

| Funds that focus on a single sector—as Vanguard Energy Fund does—can be more volatile |

| than more broadly diversified funds. Sector funds can soar one year and plunge the next. |

| This tendency toward volatility can stir up investors’ worst instincts, tempting them to |

| invest during times of strong performance and to bail as prices inevitably recede. |

| |

| As we all know, buying high and selling low hurts performance. Because many sector fund |

| investors do fall prey to the temptation to jump in and out of the market, the average annual |

| return experienced by sector fund investors (the “investor return”) is often lower than the |

| average annual total return of the funds themselves over the same period.1 |

| |

| The chart below will give you an idea of the price that sector fund investors can pay for chasing |

| performance. It compares the average annual total returns for U.S. energy funds with the |

| average annual investor returns for these funds for recent three-, five-, and ten-year periods. |

| |

| While sector funds can play a valuable supplemental role in your portfolio, you shouldn’t let |

| their inherent volatility affect your level of investment in them. |

| |

| Energy funds: Their returns vs. their investors’ returns |

| Periods ended December 31, 2013 |

| Notes: Fund averages assume all distributions were reinvested. All returns were calculated on a month-end basis. |

| Source: Vanguard calculations, derived from data provided by Morningstar, Inc. |

| |

| |

| 1 The investor return is based on a money-weighted calculation that takes into account the timing of investors’ cash inflows |

| and outflows. |

Compared with the benchmark index, the Energy Fund’s advisors added the most value with their choices of U.S. exploration and production companies. Refiners and marketers, as well as providers of equipment and services, also lifted relative returns, which were held back by some integrated multinationals.

The Advisors’ Report that follows this letter provides additional details about the management of the fund during the fiscal year.

Discipline and focus produced strong long-term results

The Energy Fund’s long-term performance continued to impress. For the ten years ended January 31, 2014, the average annual return of Investor Shares was 12.57%, more than 2 percentage points ahead of the benchmark index and almost 4 percentage points ahead of peer funds. Your fund also outperformed the broad U.S. stock market by about 5 percentage points.

In May, Vanguard Energy Fund will mark its 30th anniversary. Since its inception, the fund has been ably guided by Wellington Management Company. I thank Wellington for its ongoing distinguished service, dedication, and expertise. (Since 2005, a portion of the fund has also been managed by Vanguard Equity Investment Group.)

When traveling a long, bumpy road, be sure to pack some patience

Over time, even a small degree of outperformance can meaningfully affect a portfolio’s value. That’s why many investors remain drawn to active management—they want the opportunity for market-beating returns, even though considerable research has shown that only a minority of active managers consistently outperform their benchmarks.

Long-term outperformance is uncommon largely because active management tends to be costlier than indexing. The higher a fund’s expense ratio, the higher the hurdle it must overcome to beat its benchmark after accounting for expenses.

For investors, impatience can create a still higher hurdle. Even managers with the best market-beating records can’t avoid short periods of underperformance. An investor who is unwilling to endure some lean years could unwisely abandon a talented manager and miss out on long-term rewards. (You can read more in The Bumpy Road to Outperformance, available at vanguard.com/research.)

7

That’s why Vanguard recommends that you pay attention to costs and take a patient, long-term view. Vanguard does its part to try to give investors the best chance for success by offering access to world-class active managers and by operating our funds at costs well below industry averages.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

February 13, 2014

8

Advisors’ Report

Vanguard Energy Fund returned 5.88% for Investor Shares and 5.94% for Admiral Shares in the fiscal year ended January 31, 2014, ahead of the 0.74% return of its benchmark index and the 2.40% average return of global natural resources peer funds. Your fund is managed by two advisors, a strategy that can enhance the fund’s diversification by providing exposure to distinct yet complementary investment approaches. It’s not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors have also provided a discussion of the investment environment that existed during the year and of how their portfolio positioning reflects this assessment. These reports were prepared on February 12, 2014.

Wellington Management Company, llp

Portfolio Manager:

Karl E. Bandtel, Senior Vice President

The investment environment

Global equities advanced during the fiscal year ended January 31, 2014. Despite liquidity concerns in China and tepid economic growth in Europe, investors were emboldened by signs of stronger

| | | |

| Vanguard Energy Fund Investment Advisors | |

| |

| | Fund Assets Managed | |

| Investment Advisor | % | $ Million | Investment Strategy |

| Wellington Management | 95 | 11,112 | Emphasizes long-term total-return opportunities from |

| Company, LLP | | | the various energy subsectors: international oils, |

| | | | foreign integrated oils and foreign producers, North |

| | | | American producers, oil services and equipment, |

| | | | transportation and distribution, and refining and |

| | | | marketing. |

| Vanguard Equity Investment | 3 | 390 | Employs a quantitative fundamental management |

| Group | | | approach, using models that assess valuation, |

| | | | management decisions, market sentiment, and |

| | | | earnings and balance-sheet quality of companies as |

| | | | compared with their peers. |

| Cash Investments | 2 | 176 | These short-term reserves are invested by Vanguard in |

| | | | equity index products to simulate investments in stock. |

| | | | Each advisor may also maintain a modest cash |

| | | | position. |

9

growth in the United States and Japan. U.S. stock returns were particularly strong, and more volatile smaller-company stocks led the way. Emerging-market stocks trailed their developed-market counterparts. As a group, stocks in the global energy sector finished roughly where they started, lagging the approximately 13% return of the broad MSCI All Country World Index.

Energy commodity spot price movements were mixed. The price of West Texas Intermediate (WTI) crude oil (a benchmark based on oil produced domestically) was flat for the period, closing at $98 per barrel. However, the spread between Brent (a benchmark based on oil produced outside the United States) and WTI crude oil prices narrowed, as Brent declined from $116 to $108 per barrel. Henry Hub natural gas prices rose from $3.33 to just over $5 per million Btu. In our view, the market does not fully appreciate the long-term natural gas demand story, and we expect that the prospect of increased demand in the next few years will support healthy prices.

Our successes

Stock selection within the oil and gas sub-sector was the key driver of our success. We also benefited from favorable security selection within the energy equipment and services subsector.

Top individual contributors included Cabot Oil & Gas, Pioneer Natural Resources, EQT, EOG Resources, and Baker Hughes, all based in the United States. In fact, nine of our top 10 absolute contributors during this period were stocks of U.S.-domiciled companies.

Pioneer Natural Resources is engaged in oil and gas exploration and production. The company has unconventional oil production sources in the Permian Basin in the U.S. Southwest, and recent appraisal drilling gave reason for optimism about the size and quality of these reserves. This bolstered investor confidence, supporting the company’s stock price.

We are optimistic about the company’s growth prospects, and we increased our position.

EOG Resources is an exploration and production company focused primarily in North America. EOG has a strong asset portfolio, and reserves could be significantly higher than current estimates. The company’s focus on organic growth, operational efficiency, and cost control has resulted in strong profitability metrics, yet the shares remain attractively priced in our view. We added to our position during the period.

Our shortfalls

Our most significant detractors during the period included Petrobras (Brazil), PetroChina (China), Cenovus Energy (Canada), Inpex (Japan), and Cobalt International Energy (United States).

Petrobras, an integrated oil and gas company, experienced production delays related to the deployment of drilling platforms. That, coupled with a broader sell-off across emerging markets (Brazil in particular), depressed the stock. We believe that production growth will improve and accelerate into 2014. We expect that

10

downstream retail margins, previously disappointing, should also improve to more normal levels. We continue to hold our position.

Cobalt International Energy is an oil-focused exploration and production company. Following disappointing drilling results this summer, Cobalt’s stock price remained under pressure as investors maintained high expectations for the company. We are closely monitoring important prospects and appraisals that could be significant catalysts for the stock, and maintain a position.

The fund’s positioning

Our long-term outlook for the energy sector remains favorable. However, as always, we urge caution regarding the near-term direction of commodity prices and, by extension, the inherent volatility that accompanies investing in stocks of energy companies.

Over time, we believe that substituting natural gas for coal—in North America and overseas—is a significant opportunity for patient investors. Such substitutions, combined with the impact of several projects under way to enable the export of U.S. natural gas, are likely to keep narrowing the wide disparity between global energy prices and North American natural gas prices.

We hold stocks domiciled in 14 countries. Over 35% of the portfolio’s assets are invested in international stocks (including roughly 5% in emerging markets), and we will probably seek opportunities to increase

this exposure as we pare back positions in North America on the margin and redeploy the proceeds into investments with more attractive valuations.

Our portfolio remains skewed toward low-cost producers with compelling valuations, based on our assessment of their long-term resource bases. We believe many of these companies are able to create value for shareholders absent generally rising commodity prices.

Our low-turnover investment process remains steady with an emphasis on finding mid- and large-capitalization integrated oil and exploration and production companies that are attractively valued. We will continue to focus on stocks of companies that have clean balance sheets, long-lived resources, and high-quality management teams.

Vanguard Equity Investment Group

Portfolio Managers:

James D. Troyer, CFA, Principal

James P. Stetler, Principal

Michael R. Roach, CFA

Generally, the fiscal year was a weak period for energy stocks; the fund’s benchmark underperformed the broad global equity market (as represented by the MSCI All Country World Index) in each of the four quarters. The first quarter’s relative performance was the weakest: The fund’s benchmark lagged by more than 6 percentage points.

11

From a macroeconomic perspective, the changing of the guard at the Federal Reserve created market volatility because of uncertainty about its approach to monetary policy, leading to sharp fluctuations in interest rates. Emerging markets have been under pressure because of the Fed’s tapering and slowing economic growth. As a result, the demand for commodities has been relatively flat. Crude oil prices in the United States finished the year nearly unchanged. All these factors led to a relatively weak performance by the energy stocks throughout this reporting period.

We use a quantitative approach to investing that focuses on specific stock fundamentals. We do not take a stand on the overall market for energy stocks. In addition, we do not attempt to make predictions on different geographic regions. We focus our investment process on identifying stocks that we believe are undervalued based on our multi-signal model.

Over the period ended January 31, our most successful overweighted holdings included the following: in the United States, First Solar (+80%), Noble Energy (+17%), and Chesapeake Energy (+35%); in Japan, Showa Shell Sekiyu K.K. (+93%); and in China, China Oilfield Services Limited Class H (+27%). Our performance was aided significantly by our ability to underweight exposures that did not do as well, such as Ecopetrol SA (–34%) in Colombia and PetroChina Co. Ltd. Class H (–29%) in China.

Our results were hurt by overweighting Tatneft (–21%) and Rosneft (–19%) in Russia; PTT Public (–16%) in Thailand; and Turkiye Petrol Rafinerileri (–36%) in Turkey and by underweighting U.S.-based Pioneer Natural Resources (+44%).

Although exceptional performance by the broad stock market did not translate into a very robust year for energy stocks, our model was able to effectively capture a spread between overvalued and undervalued energy stocks. While it is difficult to predict the direction of the sector returns, we are confident that our model should continue to capture the relative attractiveness of individual stocks. Attractive fundamentals remain one of the main drivers of our strategy, which the market should reward in the long run. We thank you for your investment and look forward to the next productive fiscal year.

12

Energy Fund

Fund Profile

As of January 31, 2014

| | |

| Share-Class Characteristics | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VGENX | VGELX |

| Expense Ratio1 | 0.31% | 0.26% |

| 30-Day SEC Yield | 1.79% | 1.85% |

| | | |

| Portfolio Characteristics | | |

| | | | DJ |

| | | | U.S. |

| | | | Total |

| | | MSCI | Market |

| | | ACWI | FA |

| | Fund | Energy | Index |

| Number of Stocks | 124 | 168 | 3,635 |

| Median Market Cap | $42.9B | $70.6B | $41.3B |

| Price/Earnings Ratio | 14.0x | 12.0x | 19.1x |

| Price/Book Ratio | 1.7x | 1.5x | 2.6x |

| Return on Equity | 12.8% | 15.4% | 16.5% |

| Earnings Growth | | | |

| Rate | -0.8% | 2.7% | 11.4% |

| Dividend Yield | 2.2% | 3.1% | 1.9% |

| Foreign Holdings | 35.6% | 49.4% | 0.0% |

| Turnover Rate | 17% | — | — |

| Short-Term Reserves | 2.9% | — | — |

| | |

| Volatility Measures | | |

| | | DJ |

| | MSCI | U.S. Total |

| | ACWI | Market |

| | Energy | FA Index |

| R-Squared | 0.98 | 0.80 |

| Beta | 1.04 | 1.39 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

| | |

| Ten Largest Holdings (% of total net assets) |

| Exxon Mobil Corp. | Integrated Oil & Gas | 8.8% |

| Royal Dutch Shell plc | Integrated Oil & Gas | 5.0 |

| Chevron Corp. | Integrated Oil & Gas | 4.9 |

| Schlumberger Ltd. | Oil & Gas Equipment | |

| | & Services | 4.0 |

| BP plc | Integrated Oil & Gas | 3.7 |

| Total SA | Integrated Oil & Gas | 3.3 |

| Pioneer Natural | Oil & Gas Exploration | |

| Resources Co. | & Production | 3.2 |

| Cabot Oil & Gas Corp. | Oil & Gas Exploration | |

| | & Production | 3.0 |

| EOG Resources Inc. | Oil & Gas Exploration | |

| | & Production | 2.9 |

| CONSOL Energy Inc. | Coal & Consumable | |

| | Fuels | 2.4 |

| Top Ten | | 41.2% |

| The holdings listed exclude any temporary cash investments and equity index products. |

1 The expense ratios shown are from the prospectus dated May 28, 2013, and represent estimated costs for the current fiscal year. For the fiscal

year ended January 31, 2014, the expense ratios were 0.38% for Investor Shares and 0.32% for Admiral Shares.

13

Energy Fund

| |

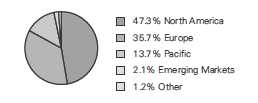

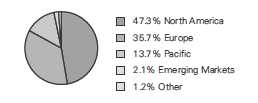

| Market Diversification (% of equity exposure) |

| |

| Europe | |

| United Kingdom | 11.0% |

| France | 3.8 |

| Italy | 2.1 |

| Other | 2.5 |

| Subtotal | 19.4% |

| Pacific | |

| Japan | 1.6% |

| Other | 0.5 |

| Subtotal | 2.1% |

| Emerging Markets | |

| China | 2.0% |

| Russia | 1.9 |

| Brazil | 1.1 |

| Other | 0.8 |

| Subtotal | 5.8% |

| North America | |

| United States | 63.6% |

| Canada | 9.1 |

| Subtotal | 72.7% |

| | |

| Subindustry Diversification (% of equity exposure) | |

| | | MSCI |

| | | ACWI |

| | Fund | Energy |

| Coal & Consumable Fuels | 3.0% | 1.3% |

| Industrials | 0.1 | 0.0 |

| Integrated Oil & Gas | 43.4 | 53.3 |

| Oil & Gas Drilling | 1.1 | 2.3 |

| Oil & Gas Equipment & | | |

| Services | 10.2 | 10.2 |

| Oil & Gas Exploration & | | |

| Production | 33.8 | 21.1 |

| Oil & Gas Refining & | | |

| Marketing | 6.0 | 6.0 |

| Oil & Gas Storage & | | |

| Transportation | 1.4 | 5.8 |

| Other | 1.0 | 0.0 |

14

Energy Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

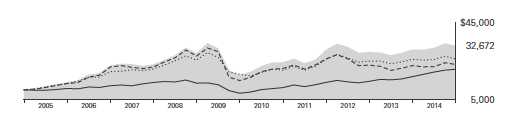

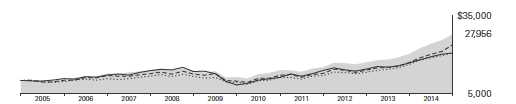

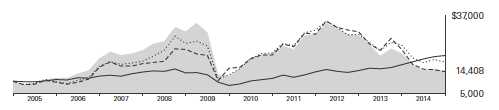

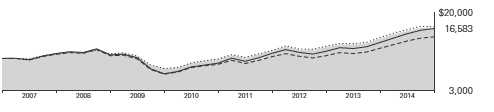

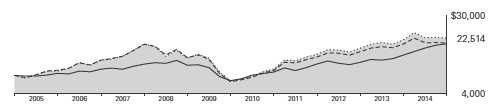

Cumulative Performance: January 31, 2004, Through January 31, 2014

Initial Investment of $10,000

| | | | | |

| | | Average Annual Total Returns | |

| | | Periods Ended January 31, 2014 | |

| | | | | | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| | Energy Fund*Investor Shares | 5.88% | 12.93% | 12.57% | $32,672 |

| •••••••• | Spliced Energy Index | 0.74 | 7.64 | 10.01 | 25,969 |

| – – – – | Global Natural Resources Funds | | | | |

| | Average | 2.40 | 9.31 | 8.73 | 23,099 |

| | Dow Jones U.S. Total Stock Market | | | | |

| | Float Adjusted Index | 22.53 | 20.13 | 7.51 | 20,637 |

| For a benchmark description, see the Glossary. |

| Global Natural Resources Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

| | | | |

| | | | | Final Value |

| | One | Five | Ten | of a $50,000 |

| | Year | Years | Years | Investment |

| Energy Fund Admiral Shares | 5.94% | 13.00% | 12.64% | $164,438 |

| Spliced Energy Index | 0.74 | 7.64 | 10.01 | 129,847 |

| Dow Jones U.S. Total Stock Market Float | | | | |

| Adjusted Index | 22.53 | 20.13 | 7.51 | 103,186 |

See Financial Highlights for dividend and capital gains information.

15

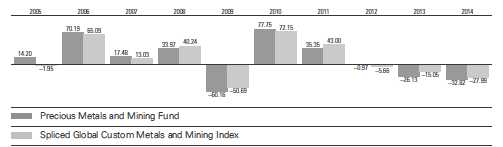

Energy Fund

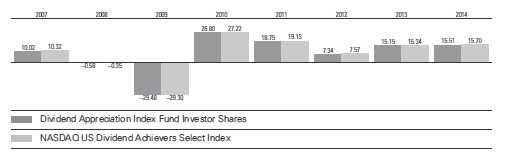

Fiscal-Year Total Returns (%): January 31, 2004, Through January 31, 2014

For a benchmark description, see the Glossary.

Average Annual Total Returns: Periods Ended December 31, 2013

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 5/23/1984 | 18.14% | 13.34% | 13.22% |

| Admiral Shares | 11/12/2001 | 18.22 | 13.41 | 13.29 |

16

Energy Fund

Financial Statements

Statement of Net Assets

As of January 31, 2014

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (96.0%)1 | | |

| United States (60.4%) | | |

| Energy Equipment & Services (10.5%) | |

| | Schlumberger Ltd. | 5,349,319 | 468,440 |

| | Baker Hughes Inc. | 4,858,970 | 275,212 |

| | Halliburton Co. | 3,846,172 | 188,501 |

| | Ensco plc Class A | 2,366,024 | 119,177 |

| | National Oilwell Varco | | |

| | Inc. | 1,155,496 | 86,674 |

| * | SEACOR Holdings Inc. | 875,753 | 73,721 |

| | Transocean Ltd. | 85,330 | 3,693 |

| * | Weatherford International | | |

| | Ltd. | 225,400 | 3,052 |

| | Patterson-UTI Energy Inc. | 105,200 | 2,702 |

| | | | 1,221,172 |

| Oil, Gas & Consumable Fuels (49.5%) | |

| | Coal & Consumable Fuels (2.4%) | |

| | CONSOL Energy Inc. | 7,556,085 | 282,220 |

| |

| | Integrated Oil & Gas (16.5%) | |

| | Exxon Mobil Corp. | 11,131,244 | 1,025,855 |

| | Chevron Corp. | 5,176,740 | 577,880 |

| | Occidental Petroleum | | |

| | Corp. | 2,860,323 | 250,478 |

| | Hess Corp. | 892,039 | 67,340 |

| |

| | Oil & Gas Exploration & Production (26.0%) |

| | Pioneer Natural | | |

| | Resources Co. | 2,188,865 | 370,619 |

| | Cabot Oil & Gas Corp. | 8,652,714 | 345,935 |

| | EOG Resources Inc. | 2,080,741 | 343,822 |

| | Range Resources Corp. | 3,151,190 | 271,601 |

| | Anadarko Petroleum | | |

| | Corp. | 2,959,000 | 238,762 |

| | EQT Corp. | 2,348,870 | 217,999 |

| | Noble Energy Inc. | 2,964,978 | 184,807 |

| | | |

| * | Southwestern Energy Co. | 4,377,085 | 178,104 |

| * | Denbury Resources Inc. | 8,530,204 | 137,080 |

| | ConocoPhillips | 2,057,809 | 133,655 |

| | Devon Energy Corp. | 1,702,625 | 100,829 |

| | Energen Corp. | 1,338,117 | 94,632 |

| | Apache Corp. | 850,250 | 68,241 |

| * | Cobalt International | | |

| | Energy Inc. | 4,071,172 | 66,645 |

| * | Whiting Petroleum Corp. | 1,085,355 | 63,363 |

| * | Newfield Exploration Co. | 2,445,858 | 60,584 |

| | Marathon Oil Corp. | 1,790,746 | 58,718 |

| * | Antero Resources Corp. | 766,205 | 45,007 |

| | Murphy Oil Corp. | 693,800 | 39,276 |

| * | Rice Energy Inc. | 625,700 | 14,716 |

| | Chesapeake Energy Corp. | 161,300 | 4,340 |

| * | Ultra Petroleum Corp. | 114,100 | 2,733 |

| | Cimarex Energy Co. | 2,900 | 284 |

| |

| | Oil & Gas Refining & Marketing (4.6%) |

| | Valero Energy Corp. | 3,702,684 | 189,207 |

| | Phillips 66 | 2,395,184 | 175,064 |

| | Marathon Petroleum | | |

| | Corp. | 1,988,150 | 173,069 |

| |

| | Oil & Gas Storage & Transportation (0.0%) |

| | Williams Cos. Inc. | 30,900 | 1,251 |

| | Kinder Morgan Inc. | 24,573 | 836 |

| | | | 5,784,952 |

| Other (0.4%) | | |

| ^,2 | Vanguard Energy ETF | 363,000 | 43,103 |

| |

| Semiconductors & | | |

| Semiconductor Equipment (0.0%) | |

| * | First Solar Inc. | 47,850 | 2,420 |

| Total United States | | 7,051,647 |

17

Energy Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| International (35.6%) | | |

| Australia (0.5%) | | |

| | Oil Search Ltd. | 7,880,526 | 55,385 |

| | Woodside Petroleum Ltd. | 137,420 | 4,481 |

| | Caltex Australia Ltd. | 131,971 | 2,231 |

| | | | 62,097 |

| Austria (0.0%) | | |

| | OMV AG | 61,211 | 2,648 |

| |

| Brazil (1.1%) | | |

| | Petroleo Brasileiro SA | | |

| | ADR | 10,710,075 | 120,060 |

| | Petroleo Brasileiro SA | | |

| | Prior Pfd. | 385,244 | 2,329 |

| | Petroleo Brasileiro SA | 249,132 | 1,405 |

| | Petroleo Brasileiro SA | | |

| | ADR Type A | 3,950 | 47 |

| | | | 123,841 |

| Canada (8.8%) | | |

| | Suncor Energy Inc. XNYS | 6,858,682 | 225,170 |

| | Canadian Natural | | |

| | Resources Ltd. XNYS | 5,263,443 | 172,378 |

| | Enbridge Inc. XTSE | 3,623,600 | 152,155 |

| | Cenovus Energy Inc. | | |

| | XTSE | 5,084,180 | 132,951 |

| | Encana Corp. XNYS | 6,104,390 | 109,696 |

| * | Tourmaline Oil Corp. | 2,090,870 | 88,403 |

| | Pacific Rubiales Energy | | |

| | Corp. | 4,928,495 | 74,918 |

| | Cameco Corp. | 2,573,670 | 54,613 |

| | Suncor Energy Inc. XTSE | 249,134 | 8,185 |

| | Canadian Natural | | |

| | Resources Ltd. XTSE | 200,678 | 6,580 |

| | Enbridge Inc. XYNS | 52,350 | 2,198 |

| | Encana Corp. XTSE | 106,100 | 1,907 |

| | TransCanada Corp. | 41,996 | 1,826 |

| | Cenovus Energy Inc. | | |

| | XNYS | 21,139 | 553 |

| | Husky Energy Inc. | 9,500 | 282 |

| | Canadian Oil Sands Ltd. | 15,700 | 282 |

| | Penn West Petroleum Ltd. | 27,900 | 209 |

| | | | 1,032,306 |

| China (1.9%) | | |

| ^ | PetroChina Co. Ltd. ADR | 1,576,895 | 151,240 |

| | Kunlun Energy Co. Ltd. | 37,747,555 | 62,186 |

| | China Petroleum | | |

| | & Chemical Corp. | 5,907,600 | 4,649 |

| * | GCL-Poly Energy | | |

| | Holdings Ltd. | 7,465,000 | 2,542 |

| | China Longyuan | | |

| | Power Group Corp. | 2,044,000 | 2,434 |

| | CNOOC Ltd. | 887,717 | 1,373 |

| | PetroChina Co. Ltd. | 770,000 | 739 |

| | | | 225,163 |

| | | |

| Finland (0.0%) | | |

| ^ | Neste Oil Oyj | 122,111 | 2,178 |

| |

| France (3.7%) | | |

| | Total SA ADR | 6,428,920 | 367,542 |

| | Technip SA | 583,816 | 49,726 |

| | Total SA | 290,072 | 16,564 |

| | | | 433,832 |

| Hong Kong (0.0%) | | |

| * | Brightoil Petroleum | | |

| | Holdings Ltd. | 1,494,000 | 404 |

| |

| Hungary (0.0%) | | |

| | MOL Hungarian Oil | | |

| | & Gas plc | 33,756 | 2,071 |

| |

| India (0.7%) | | |

| | Reliance Industries Ltd. | 5,656,658 | 75,118 |

| | Cairn India Ltd. | 449,366 | 2,323 |

| | Bharat Petroleum Corp. | | |

| | Ltd. | 302,008 | 1,750 |

| | | | 79,191 |

| Israel (0.0%) | | |

| | Paz Oil Co. Ltd. | 7,768 | 1,150 |

| * | Oil Refineries Ltd. | 1,715,759 | 489 |

| | | | 1,639 |

| Italy (2.1%) | | |

| ^ | Eni SPA ADR | 5,126,205 | 232,730 |

| | Eni SPA | 395,517 | 8,962 |

| | | | 241,692 |

| Japan (1.6%) | | |

| | Inpex Corp. | 10,910,400 | 128,362 |

| | JX Holdings Inc. | 10,593,570 | 50,888 |

| * | Cosmo Oil Co. Ltd. | 1,221,000 | 2,273 |

| | Showa Shell Sekiyu KK | 229,300 | 2,167 |

| | | | 183,690 |

| Malaysia (0.0%) | | |

| | Petronas Dagangan Bhd. | 30,500 | 279 |

| |

| Netherlands (0.0%) | | |

| * | SBM Offshore NV | 123,968 | 2,386 |

| |

| Norway (0.9%) | | |

| | Statoil ASA ADR | 4,090,890 | 96,995 |

| | Statoil ASA | 128,174 | 3,042 |

| | | | 100,037 |

| Poland (0.0%) | | |

| | Polskie Gornictwo | | |

| | Naftowe | | |

| | i Gazownictwo SA | 1,499,525 | 2,205 |

| | Polski Koncern Naftowy | | |

| | Orlen SA | 47,146 | 582 |

| | | | 2,787 |

18

Energy Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Portugal (0.8%) | | |

| | Galp Energia SGPS SA | 6,012,388 | 93,001 |

| |

| Russia (1.8%) | | |

| | Gazprom OAO ADR | 13,064,048 | 107,713 |

| | Rosneft OAO GDR | 13,826,431 | 94,790 |

| | Lukoil OAO ADR | 94,591 | 5,373 |

| | Tatneft OAO ADR | 82,155 | 2,717 |

| | AK Transneft OAO | | |

| | Prior Pfd. | 1,082 | 2,459 |

| | Gazprom OAO | 124,674 | 516 |

| | | | 213,568 |

| Singapore (0.0%) | | |

| | Sembcorp Industries Ltd. | 246,000 | 1,012 |

| |

| South Africa (0.1%) | | |

| | Sasol Ltd. | 110,232 | 5,298 |

| |

| South Korea (0.0%) | | |

| | SK Holdings Co. Ltd. | 15,004 | 2,509 |

| |

| Spain (0.8%) | | |

| | Repsol SA | 3,874,697 | 90,722 |

| |

| Thailand (0.1%) | | |

| | PTT PCL (Foreign) | 345,700 | 2,885 |

| | PTT Exploration & | | |

| | Production PCL (Foreign) | 608,900 | 2,745 |

| * | PTT Global Chemical PCL | 1,079,000 | 2,327 |

| | Thai Oil PCL (Foreign) | 370,900 | 592 |

| | | | 8,549 |

| Turkey (0.0%) | | |

| | Tupras Turkiye | | |

| | Petrol Rafinerileri AS | 108,194 | 1,785 |

| |

| United Kingdom (10.7%) | | |

| | Royal Dutch Shell plc | | |

| | ADR | 7,946,585 | 549,109 |

| | BP plc ADR | 8,889,185 | 416,814 |

| | BG Group plc | 9,997,141 | 167,763 |

| * | Ophir Energy plc | 13,649,538 | 62,471 |

| | BP plc | 2,616,674 | 20,505 |

| | Royal Dutch Shell plc | | |

| | Class B | 342,693 | 12,512 |

| | Royal Dutch Shell plc | | |

| | Class A | 331,089 | 11,436 |

| | Royal Dutch | | |

| | Shell plc Class A | | |

| | (Amsterdam Shares) | 174,727 | 6,038 |

| * | Essar Energy plc | 419,393 | 397 |

| * | Cairn Energy plc | 1 | — |

| | | | 1,247,045 |

| Total International | | 4,159,730 |

| Total Common Stocks | | |

| (Cost $6,820,860) | | 11,211,377 |

| | | |

| Temporary Cash Investments (4.1%)1 | |

| Money Market Fund (1.2%) | | |

| 3,4 | Vanguard Market Liquidity | |

| | Fund, 0.130% | 139,960,034 | 139,960 |

| |

| | | Face | |

| | | Amount | |

| | | ($000) | |

| Repurchase Agreement (2.8%) | |

| | RBS Securities, Inc. 0.020%, | |

| | 2/3/14 (Dated 1/31/14, | | |

| | Repurchase Value | | |

| | $329,601,000, collateralized | |

| | by U.S. Treasury Note/Bonds | |

| | 0.250%-3.250%, | | |

| | 9/30/15–7/31/18, | | |

| | with a value of | | |

| | $336,194,000) | 329,600 | 329,600 |

| |

| U.S. Government and Agency Obligations (0.1%) |

| 5,6 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.070%, 2/5/14 | 2,400 | 2,400 |

| 5,6 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.070%, 3/12/14 | 2,900 | 2,899 |

| 5,6 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.090%, 3/21/14 | 300 | 300 |

| 5,6 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.062%, 4/21/14 | 6,800 | 6,797 |

| | | | 12,396 |

| Total Temporary Cash Investments | |

| (Cost $481,959) | | 481,956 |

| Total Investments (100.1%) | | |

| (Cost $7,302,819) | | 11,693,333 |

| Other Assets and Liabilities (-0.1%) | |

| Other Assets | | 51,229 |

| Liabilities4 | | (66,736) |

| | | | (15,507) |

| Net Assets (100%) | | 11,677,826 |

19

Energy Fund

| |

| At January 31, 2014, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 7,275,356 |

| Overdistributed Net Investment Income | (26,108) |

| Accumulated Net Realized Gains | 42,134 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 4,390,514 |

| Futures Contracts | (4,012) |

| Foreign Currencies | (58) |

| Net Assets | 11,677,826 |

| |

| |

| Investor Shares—Net Assets | |

| Applicable to 64,815,764 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 4,138,303 |

| Net Asset Value Per Share— | |

| Investor Shares | $63.85 |

| |

| |

| Admiral Shares—Net Assets | |

| Applicable to 62,920,073 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 7,539,523 |

| Net Asset Value Per Share— | |

| Admiral Shares | $119.83 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $12,945,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures

investments, the fund’s effective common stock and temporary cash investment positions represent 97.1% and 3.0%, respectively, of net

assets.

2 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

3 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

4 Includes $13,653,000 of collateral received for securities on loan.

5 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the full

faith and credit of the U.S. government.

6 Securities with a value of $7,898,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

GDR—Global Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

20

Energy Fund

Statement of Operations

| |

| | Year Ended |

| | January 31, 2014 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1,2 | 274,816 |

| Interest2 | 322 |

| Securities Lending | 7,177 |

| Total Income | 282,315 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 17,090 |

| Performance Adjustment | 4,627 |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 8,420 |

| Management and Administrative—Admiral Shares | 8,251 |

| Marketing and Distribution—Investor Shares | 922 |

| Marketing and Distribution—Admiral Shares | 1,112 |

| Custodian Fees | 398 |

| Auditing Fees | 30 |

| Shareholders’ Reports—Investor Shares | 82 |

| Shareholders’ Reports—Admiral Shares | 27 |

| Trustees’ Fees and Expenses | 25 |

| Total Expenses | 40,984 |

| Net Investment Income | 241,331 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2 | 299,600 |

| Futures Contracts | 24,012 |

| Foreign Currencies | (811) |

| Realized Net Gain (Loss) | 322,801 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 134,824 |

| Futures Contracts | (8,595) |

| Foreign Currencies | (78) |

| Change in Unrealized Appreciation (Depreciation) | 126,151 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 690,283 |

| 1 Dividends are net of foreign withholding taxes of $19,164,000. |

| 2 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $796,000, $103,000, and |

| $4,048,000, respectively. |

See accompanying Notes, which are an integral part of the Financial Statements.

21

Energy Fund

Statement of Changes in Net Assets

| | |

| | Year Ended January 31, |

| | 2014 | 2013 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 241,331 | 262,512 |

| Realized Net Gain (Loss) | 322,801 | 25,428 |

| Change in Unrealized Appreciation (Depreciation) | 126,151 | 161,584 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 690,283 | 449,524 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (84,107) | (114,465) |

| Admiral Shares | (153,175) | (147,695) |

| Realized Capital Gain1 | | |

| Investor Shares | (78,608) | (98,885) |

| Admiral Shares | (143,323) | (111,067) |

| Total Distributions | (459,213) | (472,112) |

| Capital Share Transactions | | |

| Investor Shares | (1,350,467) | (570,595) |

| Admiral Shares | 678,643 | 10,358 |

| Net Increase (Decrease) from Capital Share Transactions | (671,824) | (560,237) |

| Total Increase (Decrease) | (440,754) | (582,825) |

| Net Assets | | |

| Beginning of Period | 12,118,580 | 12,701,405 |

| End of Period2 | 11,677,826 | 12,118,580 |

| 1 Includes fiscal 2014 and 2013 short-term gain distributions totaling $ 6,818,000 and $0. Short-term gain distributions are treated as ordinary |

| income dividends for tax purposes. |

| 2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($26,108,000) and ($22,363,000). |

See accompanying Notes, which are an integral part of the Financial Statements.

22

Energy Fund

Financial Highlights

| | | | | |

| Investor Shares | | | | | |

| |

| For a Share Outstanding | Year Ended January 31, |

| Throughout Each Period | 2014 | 2013 | 2012 | 2011 | 2010 |

| Net Asset Value, Beginning of Period | $62.66 | $62.60 | $69.20 | $57.17 | $42.62 |

| Investment Operations | | | | | |

| Net Investment Income | 1.291 | 1.336 | 1.072 | 1.053 | .910 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 2.413 | 1.098 | (3.949) | 14.103 | 14.591 |

| Total from Investment Operations | 3.704 | 2.434 | (2.877) | 15.156 | 15.501 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.277) | (1.340) | (1.102) | (.977) | (.951) |

| Distributions from Realized Capital Gains | (1.237) | (1.034) | (2.621) | (2.149) | — |

| Total Distributions | (2.514) | (2.374) | (3.723) | (3.126) | (.951) |

| Net Asset Value, End of Period | $63.85 | $62.66 | $62.60 | $69.20 | $57.17 |

| |

| Total Return1 | 5.88% | 4.07% | -3.82% | 27.17% | 36.28% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $4,138 | $5,340 | $5,945 | $6,731 | $6,536 |

| Ratio of Total Expenses to Average Net Assets2 | 0.38% | 0.31% | 0.34% | 0.34% | 0.38% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.97% | 2.15% | 1.67% | 1.74% | 1.73% |

| Portfolio Turnover Rate | 17% | 18% | 24% | 31% | 27% |

1 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide

information about any applicable transaction and account service fees.

2 Includes performance-based investment advisory fee increases (decreases) of 0.04%, (0.02%), 0.01%, 0.00%, and 0.03%.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Energy Fund

Financial Highlights

| | | | | |

| Admiral Shares | | | | | |

| |

| For a Share Outstanding | Year Ended January 31, |

| Throughout Each Period | 2014 | 2013 | 2012 | 2011 | 2010 |

| Net Asset Value, Beginning of Period | $117.63 | $117.52 | $129.93 | $107.34 | $80.02 |

| Investment Operations | | | | | |

| Net Investment Income | 2.530 | 2.586 | 2.101 | 2.045 | 1.780 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 4.491 | 2.060 | (7.432) | 26.479 | 27.395 |

| Total from Investment Operations | 7.021 | 4.646 | (5.331) | 28.524 | 29.175 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (2.500) | (2.595) | (2.159) | (1.899) | (1.855) |

| Distributions from Realized Capital Gains | (2.321) | (1.941) | (4.920) | (4.035) | — |

| Total Distributions | (4.821) | (4.536) | (7.079) | (5.934) | (1.855) |

| Net Asset Value, End of Period | $119.83 | $117.63 | $117.52 | $129.93 | $107.34 |

| |

| Total Return1 | 5.94% | 4.14% | -3.76% | 27.24% | 36.37% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $7,540 | $6,778 | $6,756 | $6,871 | $4,439 |

| Ratio of Total Expenses to Average Net Assets2 | 0.32% | 0.26% | 0.28% | 0.28% | 0.31% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 2.03% | 2.20% | 1.73% | 1.80% | 1.80% |

| Portfolio Turnover Rate | 17% | 18% | 24% | 31% | 27% |

1 Total returns do not include transaction fees that may have applied in the periods shown. Fund prospectuses provide information about any

applicable transaction fees.

2 Includes performance-based investment advisory fee increases (decreases) of 0.04%, (0.02%), 0.01%, 0.00%, and 0.03%.

See accompanying Notes, which are an integral part of the Financial Statements.

24

Energy Fund

Notes to Financial Statements

Vanguard Energy Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of U.S. corporations. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

25

Energy Fund

Futures contracts are valued at their quoted daily settlement prices. The aggregate notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended January 31, 2014, the fund’s average investments in long and short futures contracts represented 1% and 0% of net assets, respectively, based on quarterly average aggregate settlement values.

4. Repurchase Agreements: The fund enters into repurchase agreements with institutional counterparties. Securities pledged as collateral to the fund under repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. The fund further mitigates its counterparty risk by entering into repurchase agreements only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master repurchase agreements with its counterparties. The master repurchase agreements provide that, in the event of a counter-party’s default (including bankruptcy), the fund may terminate any repurchase agreements with that counterparty, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund. Such action may be subject to legal proceedings, which may delay or limit the disposition of collateral.

5. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (January 31, 2011–2014), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

6. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

7. Securities Lending: To earn additional income, the fund may lend its securities to qualified institutional borrowers. Security loans are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the absence of a default the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan.

26

Energy Fund

8. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. Wellington Management Company, LLP, provides investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee is subject to quarterly adjustments based on performance for the preceding three years relative to the MSCI ACWI Energy Index.

The Vanguard Group provides investment advisory services to a portion of the fund on an at-cost basis; the fund paid Vanguard advisory fees of $387,000 for the year ended January 31, 2014.

For the year ended January 31, 2014, the aggregate investment advisory fee represented an effective annual basic rate of 0.14% of the fund’s average net assets, before an increase of $4,627,000 (0.04%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At January 31, 2014, the fund had contributed capital of $1,375,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.55% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

27

Energy Fund

The following table summarizes the market value of the fund’s investments as of January 31, 2014, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks—United States | 7,051,647 | — | — |

| Common Stocks—International | 2,966,842 | 1,192,888 | — |

| Temporary Cash Investments | 139,960 | 341,996 | — |

| Futures Contracts—Assets1 | 35 | — | — |

| Futures Contracts—Liabilities1 | (420) | — | — |

| Total | 10,158,064 | 1,534,884 | — |

| 1 Represents variation margin on the last day of the reporting period. |

E. At January 31, 2014, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| E-mini S&P 500 Index | March 2014 | 1,309 | 116,278 | (4,093) |

| S&P 500 Index | March 2014 | 40 | 17,766 | 81 |

| | | | | (4,012) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

F. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended January 31, 2014, the fund realized net foreign currency losses of $811,000, which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized gains to overdistributed net investment income. Certain of the fund’s investments are in securities considered to be passive foreign investment companies, for which any unrealized appreciation and/or realized gains are required to be included in distributable net income for tax purposes. During the year ended January 31, 2014, the fund realized gains on the sale of passive foreign investment companies of $3,239,000, which have been included in current and prior periods’ taxable income; accordingly, such gains have been reclassified from accumulated net realized gains to overdistributed net investment income.

28

Energy Fund

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from net investment income and realized capital gains. Accordingly, the fund has reclassified $10,222,000 from overdistributed net investment income, and $28,270,000 from accumulated net realized gains, to paid-in capital.

The fund used a capital loss carryforward of $15,701,000 to offset taxable capital gains realized during the year ended January 31, 2014, reducing the amount of capital gains that would otherwise be available to distribute to shareholders. For tax purposes, at January 31, 2014, the fund had $39,110,000 of long-term capital gains available for distribution.

At January 31, 2014, the cost of investment securities for tax purposes was $7,306,557,000. Net unrealized appreciation of investment securities for tax purposes was $4,386,776,000, consisting of unrealized gains of $4,628,427,000 on securities that had risen in value since their purchase and $241,651,000 in unrealized losses on securities that had fallen in value since their purchase.

G. During the year ended January 31, 2014, the fund purchased $1,971,275,000 of investment securities and sold $2,699,382,000 of investment securities, other than temporary cash investments.

H. Capital share transactions for each class of shares were:

| | | | |

| | Year Ended January 31, |

| | 2014 | 2013 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 502,609 | 7,800 | 695,926 | 11,544 |

| Issued in Lieu of Cash Distributions | 153,964 | 2,391 | 204,348 | 3,375 |

| Redeemed1 | (2,007,040) | (30,600) | (1,470,869) | (24,672) |

| Net Increase (Decrease)—Investor Shares | (1,350,467) | (20,409) | (570,595) | (9,753) |

| Admiral Shares | | | | |

| Issued | 1,701,087 | 13,744 | 1,015,171 | 9,110 |

| Issued in Lieu of Cash Distributions | 266,568 | 2,204 | 233,904 | 2,064 |

| Redeemed1 | (1,289,012) | (10,651) | (1,238,717) | (11,038) |

| Net Increase (Decrease) —Admiral Shares | 678,643 | 5,297 | 10,358 | 136 |

| 1 Net of redemption fees for fiscal 2013 of $642,000 (fund total). Effective May 23, 2012, the redemption fee was eliminated. |

I. Management has determined that no material events or transactions occurred subsequent to January 31, 2014, that would require recognition or disclosure in these financial statements.

29

Report of Independent Registered

Public Accounting Firm

To the Trustees of Vanguard Specialized Funds and the Shareholders of Vanguard Energy Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Energy Fund (constituting a separate portfolio of Vanguard Specialized Funds, hereafter referred to as the “Fund”) at January 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at January 31, 2014 by correspondence with the custodians and brokers and by agreement to the underlying ownership records of the transfer agent, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

March 13, 2014

Special 2013 tax information (unaudited) for Vanguard Energy Fund

This information for the fiscal year ended January 31, 2014, is included pursuant to provisions of the

Internal Revenue Code.

The fund distributed $239,401,000 as capital gain dividends (from net long-term capital gains) to

shareholders during the fiscal year.

For nonresident alien shareholders, 100% of short-term capital gain dividends distributed by the fund

are qualified short-term capital gains.

The fund distributed $192,815,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 52.0% of investment income (dividend income plus short-term gains, if

any) qualifies for the dividends-received deduction.

30

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2014. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

The table shows returns for one share class only; returns for other share classes will differ. Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

Average Annual Total Returns: Energy Fund Investor Shares

Periods Ended January 31, 2014

| | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 5.88% | 12.93% | 12.57% |

| Returns After Taxes on Distributions | 4.85 | 12.06 | 11.70 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 4.04 | 10.48 | 10.64 |

31

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

32

| | | |

| Six Months Ended January 31, 2014 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Energy Fund | 7/31/2013 | 1/31/2014 | Period |

| Based on Actual Fund Return | | | |

| Investor Shares | $1,000.00 | $1,029.69 | $1.94 |

| Admiral Shares | 1,000.00 | 1,030.10 | 1.64 |

| Based on Hypothetical 5% Yearly Return | | | |

| Investor Shares | $1,000.00 | $1,023.29 | $1.94 |

| Admiral Shares | 1,000.00 | 1,023.59 | 1.63 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that