UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03916

Name of Registrant: Vanguard Specialized Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: January 31

Date of reporting period: February 1, 2012 – January 31, 2013

Item 1: Reports to Shareholders

|

| Annual Report | January 31, 2013 |

| Vanguard Energy Fund |

|

|

> Vanguard Energy Fund returned about 4% for the 12 months ended January 31, 2013.

> The fund’s return was slightly higher than that of its benchmark index and exceeded the average return of similar funds.

> The energy sector underperformed the broad U.S. stock market. Integrated oil and gas companies weighed on returns, while refining and marketing firms did particularly well.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 8 |

| Fund Profile. | 13 |

| Performance Summary. | 15 |

| Financial Statements. | 17 |

| Your Fund’s After-Tax Returns. | 31 |

| About Your Fund’s Expenses. | 32 |

| Glossary. | 34 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Our cover photograph shows rigging on the HMSSurprise, a replica of an 18th-century Royal Navy frigate. It was featured in the 2003 movie Master and Commander: The Far Side of the World, which was based on Patrick O’Brian’s sea novels, set amid the Napoleonic Wars. Vanguard was named for another ship of that era, the HMSVanguard, which was the flagship of British Admiral Horatio Nelson at the Battle of the Nile.

| |

| Your Fund’s Total Returns | |

| |

| |

| |

| |

| Fiscal Year Ended January 31, 2013 | |

| |

| | Total |

| | Returns |

| Vanguard Energy Fund | |

| Investor Shares | 4.07% |

| Admiral™ Shares | 4.14 |

| MSCI ACWI Energy Index | 3.56 |

| Global Natural Resources Funds Average | -0.94 |

Global Natural Resources Funds Average: Derived from data provided by Lipper Inc.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

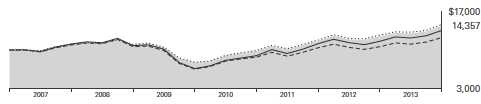

Your Fund’s Performance at a Glance

January 31, 2012, Through January 31, 2013

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Energy Fund | | | | |

| Investor Shares | $62.60 | $62.66 | $1.340 | $1.034 |

| Admiral Shares | 117.52 | 117.63 | 2.595 | 1.941 |

1

Chairman’s Letter

Dear Shareholder,

Vanguard Energy Fund returned about 4% for the fiscal year ended January 31, 2013. The fund’s result slightly surpassed that of its benchmark index and was well ahead of the average return of global natural resources funds, which invest in both energy and materials stocks.

After a disappointing first half of the period, crude oil and natural gas prices rebounded, which in turn helped energy stocks to end up in positive territory for the 12 months. Profitable selections among some refining and marketing firms were offset by setbacks in several large integrated oil and gas firms.

For the second straight fiscal year, the energy sector trailed the performance of the broader market. But unlike the situation in the previous year, when the Energy Fund’s return was negative, investors’ brighter outlook for the global economy helped push up energy consumption.

If you invest in the Energy Fund through a taxable account, you may wish to review information about the fund’s after-tax performance provided later in this report.

Led by European shares, stocks saw double-digit returns

Global stock markets rose sharply in the 12 months ended January 31, with European equities delivering the most robust results. Investors seemed buoyed by progress in addressing fiscal challenges in Europe and elsewhere.

2

European stocks gained about 20% even as economic woes persisted for many countries in the region. This disparity is less unusual than it may appear. Vanguard research has found that the relationship between a country’s economic growth and its stock market returns has typically been weak over time.

In the United States, attention to federal budget challenges intensified as 2012 drew to a close. The focus on the “fiscal cliff” led to investor anxiety before policymakers reached a limited tax rate agreement on the cusp of the new year. Although a credible long-term deficit-reduction strategy has yet to be crafted, investors propelled U.S. stocks to a 12-month gain of nearly 17%.

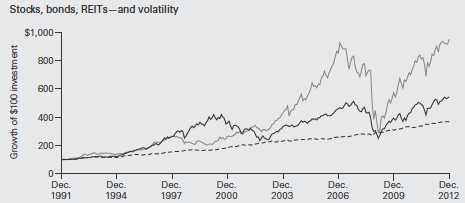

Bonds’ advance slowed; challenges may lie ahead

The broad U.S. taxable bond market returned a little more than 2.5% for the fiscal year. That modest result contrasts with the strong returns to which bond investors may have grown accustomed over recent years.

Bonds have been in a long-running bull market, as prices climbed and yields tumbled over many years. (Bond prices and yields move in opposite directions.) The yield of the 10-year U.S. Treasury note slipped to a record low in July, closing below 1.5%. That trend later reversed, and the 10-year yield broke 2% in late January.

| | | |

| Market Barometer | | | |

| |

| | | Average Annual Total Returns |

| | | Periods Ended January 31, 2013 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 17.03% | 14.48% | 4.28% |

| Russell 2000 Index (Small-caps) | 15.47 | 15.98 | 6.31 |

| Russell 3000 Index (Broad U.S. market) | 16.90 | 14.60 | 4.44 |

| MSCI All Country World Index ex USA (International) | 13.86 | 7.03 | -0.10 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 2.59% | 5.41% | 5.45% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 4.80 | 6.53 | 5.73 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.08 | 0.09 | 0.38 |

| |

| CPI | | | |

| Consumer Price Index | 1.59% | 2.05% | 1.76% |

3

Bonds can provide critical diversification benefits to a portfolio, but their return prospects look much less promising than they have in recent years. As yields have dropped, the opportunity for price appreciation has greatly diminished. (You can read more about our expectations for bond and stock returns in Vanguard’s Economic and Investment Outlook, available at vanguard.com/research.)

As for money market funds and savings accounts, their returns barely budged as the Federal Reserve held short-term interest rates between 0% and 0.25%, a policy in place since late 2008.

Rebounding fuel prices helped energy stocks finish in the black

The energy sector rose during the 12-month period, but not as much as the market overall. The industry’s comparatively tepid performance was reflected in the Energy Fund’s return of about 4%, which lagged returns from U.S. and international markets.

During the first half of the period, energy stocks retreated modestly as sovereign-debt worries weighed down the European economy, growth in China appeared to decelerate, and oil prices declined, crimping profit margins for oil companies. Furthermore, overproduction and an unusually warm winter kept natural gas prices near decade lows.

Expense Ratios

Your Fund Compared With Its Peer Group

| | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| Energy Fund | 0.34% | 0.28% | 1.32% |

The fund expense ratios shown are from the prospectus dated May 29, 2012, and represent estimated costs for the current fiscal year. For the fiscal year ended January 31, 2013, the fund’s expense ratios were 0.31% for Investor Shares and 0.26% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2012.

Peer group: Global Natural Resources Funds.

4

But the sector turned around in the period’s second half. Oil prices rebounded, with Brent crude, a benchmark based on oil produced outside the United States, soaring about 30% from June to January and finishing the 12 months up nearly 5%. In an unusual divergence, West Texas Intermediate Crude, a benchmark based on oil produced domestically, fell 1% during the 12 months as increased U.S. and Canadian production and a temporary distribution bottleneck held down prices in North America.

The fluctuations in global petroleum prices are noteworthy because the Energy Fund, its benchmark, and its peer group funds have all tended to follow the ups and downs of oil more in recent years than they did previously. Natural gas prices, meanwhile, finished the period up about one-third after U.S. gas drillers recalibrated their production to reduce oversupply.

U.S. refining and marketing stocks offset losses from foreign firms

The unexpected boost in U.S. energy production is remaking the energy landscape. Amidst these changes, your fund’s advisors continue to invest across the globe, seeking the best long-term energy-related investments. The fund’s strongest performers this past fiscal year included U.S. refining and marketing companies, a relatively small segment of the fund’s holdings that soared about 63%. These companies took advantage of being able to buy cheaper U.S. oil, which boosted profit margins.

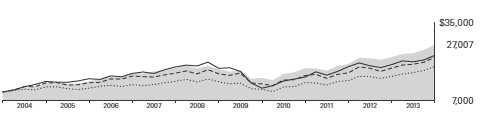

Total Returns

Ten Years Ended January 31, 2013

| |

| | Average |

| | Annual Return |

| Energy Fund Investor Shares | 15.46% |

| Spliced Energy Index | 12.91 |

| Global Natural Resources Funds Average | 12.13 |

For a benchmark description, see the Glossary.

Global Natural Resources Funds Average: Derived from data provided by Lipper Inc.

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

Oil and gas exploration and production companies, the fund’s second-largest segment by asset size, rose modestly (+4%). The fund’s holdings in this subsector outperformed their counterparts in the benchmark index.

On the other hand, the fund’s holdings in integrated oil and gas companies—the largest subsector in both the fund and the index—barely gained ground, underperforming their counterparts in the index. Returns were especially

|

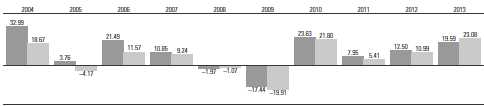

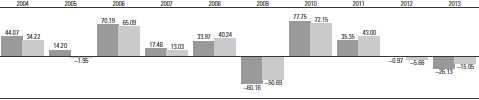

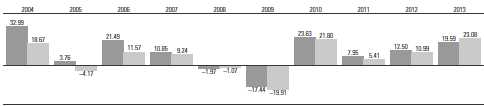

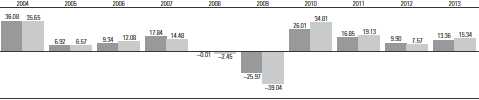

| Investment insight |

| A reminder about volatility |

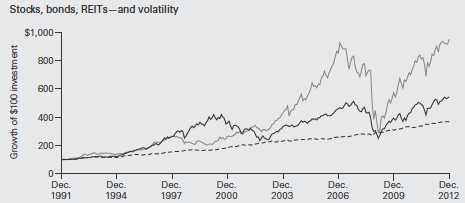

| Energy stocks, like most industry sectors, tend to be more volatile than the broad |

| market. During the past ten years, the Spliced Energy Index, Vanguard Energy |

| Fund’s performance benchmark, has often risen or fallen to a greater degree |

| month-by-month than the S&P 500 Index, as the chart below shows. |

| |

| Such a result should be no surprise. After all, less diversification generally means |

| more risk. In the energy sector, the ups and downs are also consistent with the |

| dynamic variables inherent to the industry. These factors include dramatic price |

| spikes or declines, new drilling technologies, refining and distribution problems, and |

| geopolitical tumult—all of which have affected energy prices in recent years. The |

| sector’s volatility is one reason we suggest that the Energy Fund should typically |

| represent only a modest portion of a stock portfolio. |

| |

| Performance difference of energy stocks from S&P 500 Index |

| (January 31, 2003–January 31, 2013) |

|

|

|

|

6

constrained by steep losses among some of the largest oil producers in South America.

For the ten years ended January 31, 2013, the fund had an average annual return of 15.46%, more than 2 percentage points ahead of its benchmark index and peer-group average. The broad market, as measured by the Dow Jones U.S. Total Stock Market Float Adjusted Index, had an average annual return of 8.8% for the same period.

The Advisors’ Report that follows this letter provides additional details about the management of the fund during the fiscal year.

Following four principles can help investors succeed

Our clients often ask what they should do to cope with uncertainties in the market. How should they react? Should they do something different with their money? The first point to keep in mind is that investing has always involved uncertainties. The financier J.P. Morgan, when asked what he thought the stock market would do, had a standard response: “It will fluctuate.”

In our view, the most sensible approach is to focus on what’s within your control. In short, we believe investors can give themselves a greater chance for success by acting on four key points:

• Goals. What are you investing for? Each goal should be measurable and attainable. Getting there shouldn’t depend on outsize returns, or on impractical budgeting requirements.

• Balance. After identifying your goals, pursue them through a balanced asset allocation using broadly diversified funds.

• Cost. You won’t be surprised to hear that we place a big emphasis on controlling cost. The lower your costs, the greater the share of an investment’s return that you keep.

• Discipline. All the rest depends on this: In the face of market turmoil, discipline and long-term perspective can help you stay on track toward your goals.

Successful investing doesn’t have to be complicated, but that’s not to say it’s easy. Investing can provoke strong emotions, and it’s hard to stay levelheaded during times of volatility. If you’re getting pulled off course, try to redirect your attention to the principles I’ve outlined. These principles—which reflect the core philosophy Vanguard has held for decades—can be the answer to uncertainty.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

February 13, 2013

7

Advisors’ Report

Vanguard Energy Fund returned 4.07% for Investor Shares and 4.14% for Admiral Shares in the fiscal year ended January 31, 2013. Your fund is managed by two advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct yet complementary investment approaches. It’s not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors have also provided a discussion of the investment environment that existed during the year and of how their portfolio positioning reflects this assessment. These reports were prepared on February 19, 2013.

Wellington Management Company, LLP

Portfolio Manager:

Karl E. Bandtel, Senior Vice President

The investment environment

Broad-market equities around the world posted solid performance during the 12 months ended January 31, 2013, as the MSCI All Country World Index returned 15.5% (in U.S. dollar terms), outpacing the more modest performance of stocks in the energy sector.

| | | |

| Vanguard Energy Fund Investment Advisors | |

| |

| | Fund Assets Managed | |

| Investment Advisor | % | $ Million | Investment Strategy |

| Wellington Management | 95 | 11,507 | Emphasizes long-term total-return opportunities from |

| Company, LLP | | | the various energy subsectors: international oils, |

| | | | foreign integrated oils and foreign producers, North |

| | | | American producers, oil services and equipment, |

| | | | transportation and distribution, and refining and |

| | | | marketing. |

| Vanguard Equity Investment | 3 | 384 | Employs a quantitative fundamental management |

| Group | | | approach, using models that assess valuation, market |

| | | | sentiment, earnings quality and growth, and |

| | | | management decisions of companies relative to their |

| | | | peers. |

| Cash Investments | 2 | 228 | These short-term reserves are invested by Vanguard in |

| | | | equity index products to simulate investments in stock. |

| | | | Each advisor may also maintain a modest cash |

| | | | position. |

8

In commodities markets, competing crosscurrents were at play, particularly with oil. On the one hand, increasing production in the United States and Iraq, coupled with falling demand from developed markets, is exerting downward pressure on prices. On the other, increased demand from emerging markets and declining production outside North America and OPEC are supportive of higher prices. The price of crude oil fluctuated throughout the period, but it finished close to $98 per barrel (West Texas Intermediate), about where it started.

The price of natural gas in the United States, which began the fiscal year near $2.50 per million BTUs (Henry Hub), fell below $2 before advancing to $3.33 at the period’s close. Although its price rebounded from historical lows, natural gas remains, in our view, inexpensive compared with coal and oil, at least in North America. Over time, we believe that the replacement of oil with natural gas as a fuel source in the United States, Europe, and Asia presents a significant opportunity. This substitution, combined with the impact of several projects under way to facilitate the export of U.S. natural gas, is likely to further shrink the wide price disparity between global energy prices and North American natural gas.

Our successes

Stock selection within the energy equipment and services subsector—along with modest exposure to Beijing Enterprises Holdings, a Hong Kong-based industrial conglomerate—bolstered the portfolio’s relative returns.

Our position in shares of natural gas producer Cabot Oil & Gas was a notable contributor to the portfolio’s performance. The company announced strong results, driven largely by robust production in Pennsylvania’s Marcellus Shale. Cabot, whose entire resource base is in the continental United States, is a low-cost producer with a strong balance sheet. We believe the company should benefit from reduced natural gas production industrywide as prices remain below marginal cost. This cutback in production should ultimately lead to higher natural gas prices. We continue to hold the stock.

Marathon Petroleum is a U.S. refiner and marketer of petroleum products. Share prices nearly doubled during the period because of continued low feedstock costs as West Texas Intermediate crude remained inexpensive compared with global oil prices. In October, Marathon announced a deal to buy a refinery at an attractive valuation. We trimmed our position as the stock climbed.

9

Our shortfalls

Security selection among integrated oil and gas companies hindered relative returns. The portfolio’s significant detractors during the period included YPF, an Argentine integrated company. Shares fell when Argentina’s government took over day-to-day control (and a 51% majority stake) of the company by decree. YPF has an attractive asset profile at an inexpensive valuation relative to the rest of the energy universe, but our concerns that the government would not treat the company’s minority shareholders well did not diminish. We began reducing our holdings in YPF midway through the year and eliminated them altogether shortly before the period’s close.

Another detractor was Occidental Petroleum, an energy exploration and production company that operates principally in the United States (with promising assets in Texas, California, and North Dakota) and the Middle East. Occidental is among a select few exploration and production firms that have increased production while maintaining attractive returns on capital, generating excess free cash flow, and prioritizing the dividend.

The stock was out of favor during the fiscal year, at least in part because of investors’ concerns about performance in California and skepticism about large investments in Texas and the Mideast. In our view, the market’s concerns are overdone. Occidental has high leverage to oil, a strong outlook for production growth, and a solid track record of financial discipline. This discipline is reflected in the company’s sound balance sheet, robust cash flow, and commitment to maintaining dividend growth. We continue to hold the stock.

In a rising equity market, our cash position was also a slight drag on performance.

The fund’s positioning

Our long-term outlook for the energy sector remains favorable. However, as always, we urge caution regarding the near-term direction of commodity prices and the volatility inherent in investing in energy stocks. Over the long term, energy prices are likely to be bound by marginal cost on the low end and marginal utility on the high end. Crude oil prices will keep varying with changes to the outlook for both supply and demand. And although regional factors still drive natural gas pricing, we believe that the wide price disparity with other fuels and changing views about both coal-fired and nuclear power generation will drive global long-term demand.

The trends of growing demand, shrinking spare capacity, and logistical challenges favor resource owners, particularly those with high-quality assets and experienced management teams. We believe such companies are best positioned to succeed in an environment of a tight supply-and-demand balance and rising capital intensity. Given our view that the basic drivers of

10

energy prices persist, we remain focused on analyzing company fundamentals, with an eye toward taking advantage of cyclical opportunities. We also focus on capital allocation and cost structure to identify companies with a relative cost advantage.

The portfolio remains focused on upstream companies and skewed in favor of low-cost producers with compelling valuations, based on our assessment of their long-term resource bases. We believe that many of these companies can create value for shareholders absent generally rising commodity prices. Our investment process remains consistent, emphasizing large-capitalization integrated oil and exploration and production companies. Maintaining a large-cap, low-turnover bias, this global portfolio has representation across energy’s subsectors.

Vanguard Equity Investment Group

Portfolio Managers:

James D. Troyer, CFA, Principal

James P. Stetler, Principal Michael R. Roach, CFA

Energy stocks recovered in the second half of the fiscal year, along with the rest of the global market, but not enough to make up for a poor first half.

Our quantitative approach to investing focuses on specific stock fundamentals. Because we believe there is no single indicator for identifying outperforming stocks, we diversify our analysis across multiple factors:

• Valuation, which measures the price we pay for earnings and cash flows.

• Management decisions, which assesses the actions taken by company management that signal its informed opinions regarding a firm’s prospects and earnings.

• Market sentiment, which captures how investors reflect their opinions of a company through their activity in the market.

• Quality, which measures balance-sheet strength and the sustainability of earnings.

Our risk-control process then neutralizes the portfolio’s variance from our benchmark in market capitalization, volatility, and other factors. In our view, the possible rewards do not justify such risk exposures.

The results from our stock selection model were positive as a whole. Our quality model was flat, but all other factors contributed positively, with valuation the strongest.

For the period, our most successful holdings were spread throughout various global regions, including Marathon Petroleum (+99%) and HollyFrontier (+93%) in the United States, Lukoil (+22%) in Russia, and Polski Koncern Naftowy (+39%) in Poland. Equally important to performance was our ability to limit or avoid exposure to underperforming stocks, such as Italy’s Saipem (–38%) and Brazil’s OGX Petróleo (–78%).

11

The portfolio’s results were dampened by our overweighting of Japan Petroleum Exploration (–15%) and the Netherlands’ SBM Offshore (–26%), two energy stocks that underperformed the benchmark as a whole. In addition, our underweighting of stronger-performing stocks such as Transocean (+21%), based in Switzerland, and Colombia-based Ecopetrol (+32%) hurt results relative to the benchmark.

Since the 2008–2009 market decline ended, investors have been rewarded with attractive returns across asset classes. However, even with the United States recently averting the “fiscal cliff,” many serious issues remain. Low investor confidence and higher volatility—whether caused by sluggish economic growth here or abroad, unresolved deficit and debt levels, high unemployment, or ambiguity about corporate profits—may be with us for a while.

We cannot predict how broader economic or political events will affect the markets, but we are confident that our strategy to capture the spread between undervalued and overvalued stocks will deliver worthwhile returns for long-term investors and remain an important part of a diversified investment plan.

We thank you for your investment and look forward to the new fiscal year.

12

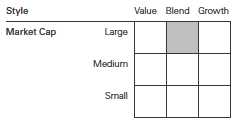

Energy Fund

Fund Profile

As of January 31, 2013

| | |

| Share-Class Characteristics | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VGENX | VGELX |

| Expense Ratio1 | 0.34% | 0.28% |

| 30-Day SEC Yield | 1.83% | 1.89% |

| | | |

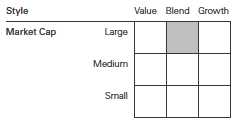

| Portfolio Characteristics | | |

| | | | DJ U.S. |

| | | | Total |

| | | MSCI | Market |

| | | ACWI | FA |

| | Fund | Energy | Index |

| Number of Stocks | 128 | 170 | 3,595 |

| Median Market Cap | $40.0B | $73.3B | $37.6B |

| Price/Earnings Ratio | 12.2x | 11.3x | 17.2x |

| Price/Book Ratio | 1.6x | 1.6x | 2.2x |

| Return on Equity | 16.2% | 18.4% | 16.8% |

| Earnings Growth Rate | -2.2% | 1.6% | 9.1% |

| Dividend Yield | 2.2% | 2.9% | 2.0% |

| Foreign Holdings | 37.5% | 53.0% | 0.0% |

| Turnover Rate | 18% | — | — |

| Short-Term Reserves | 3.9% | — | — |

| | |

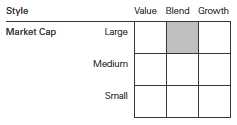

| Volatility Measures | | |

| | | DJ U.S. |

| | | Total |

| | Spliced | Market |

| | Energy | FA |

| | Index | Index |

| R-Squared | 0.98 | 0.84 |

| Beta | 1.03 | 1.36 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| | |

| Ten Largest Holdings (% of total net assets) |

| Exxon Mobil Corp. | Integrated Oil & Gas | 8.7% |

| Royal Dutch Shell plc | Integrated Oil & Gas | 5.4 |

| Chevron Corp. | Integrated Oil & Gas | 5.2 |

| BP plc | Integrated Oil & Gas | 4.1 |

| Occidental Petroleum | | |

| Corp. | Integrated Oil & Gas | 3.3 |

| Total SA | Integrated Oil & Gas | 3.0 |

| Schlumberger Ltd. | Oil & Gas Equipment | |

| | & Services | 2.3 |

| Anadarko Petroleum | Oil & Gas Exploration | |

| Corp. | & Production | 2.3 |

| Eni SPA | Integrated Oil & Gas | 2.1 |

| CONSOL Energy Inc. | Coal & Consumable | |

| | Fuels | 2.1 |

| Top Ten | | 38.5% |

The holdings listed exclude any temporary cash investments and equity index products.

1 The expense ratios shown are from the prospectus dated May 29, 2012, and represent estimated costs for the current fiscal year. For the fiscal year ended January 31, 2013, the expense ratios were 0.31% for Investor Shares and 0.26% for Admiral Shares.

13

Energy Fund

| |

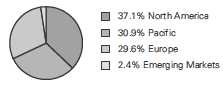

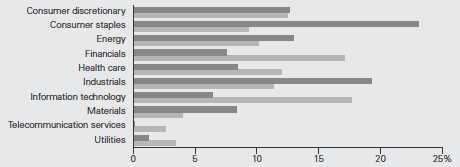

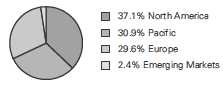

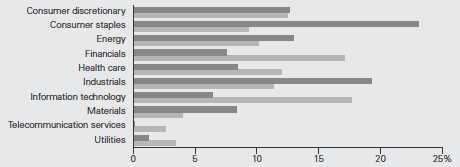

| Market Diversification (% of equity exposure) |

| |

| Europe | |

| United Kingdom | 11.5% |

| France | 3.5 |

| Italy | 2.2 |

| Norway | 1.0 |

| Other | 1.6 |

| Subtotal | 19.8% |

| Pacific | |

| Japan | 2.0% |

| Other | 0.3 |

| Subtotal | 2.3% |

| Emerging Markets | |

| China | 2.5% |

| Russia | 2.3 |

| Brazil | 1.5 |

| Other | 1.0 |

| Subtotal | 7.3% |

| North America | |

| United States | 61.0% |

| Canada | 9.6 |

| Subtotal | 70.6% |

| | |

| Subindustry Diversification (% of equity exposure) | |

| | | MSCI |

| | | ACWI |

| | Fund | Energy |

| Coal & Consumable Fuels | 3.6% | 1.9% |

| Industrials | 0.9 | 0.0 |

| Integrated Oil & Gas | 46.7 | 54.9 |

| Oil & Gas Drilling | 2.2 | 2.6 |

| Oil & Gas Equipment & | | |

| Services | 9.0 | 9.6 |

| Oil & Gas Exploration & | | |

| Production | 29.7 | 20.3 |

| Oil & Gas Refining & Marketing | 5.6 | 5.8 |

| Oil & Gas Storage & | | |

| Transportation | 1.3 | 4.9 |

| Other | 1.0 | 0.0 |

14

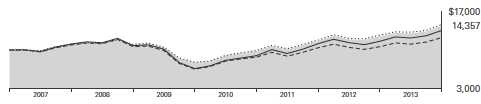

Energy Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

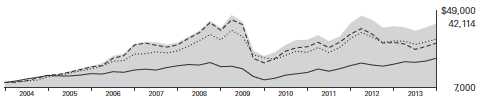

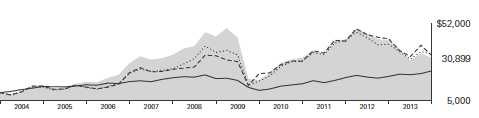

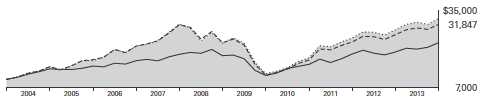

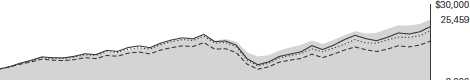

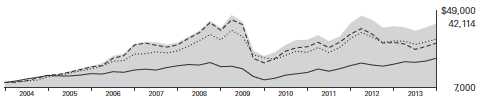

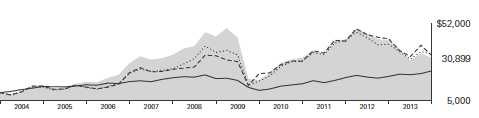

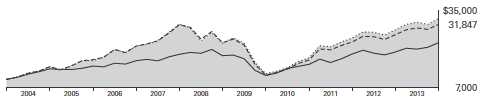

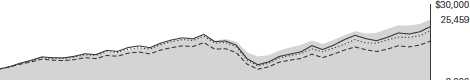

Cumulative Performance: January 31, 2003, Through January 31, 2013

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | |

| | Periods Ended January 31, 2013 | |

| |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| |

| Energy Fund Investor Shares | 4.07% | 1.30% | 15.46% | $42,114 |

| |

| Spliced Energy Index | 3.56 | 0.31 | 12.91 | 33,662 |

| Global Natural Resources Funds | | | | |

| Average | -0.94 | -3.89 | 12.13 | 31,410 |

| Dow Jones U.S. Total Stock Market | | | | |

| Float Adjusted Index | 16.88 | 4.61 | 8.80 | 23,250 |

For a benchmark description, see the Glossary.

Global Natural Resources Funds Average: Derived from data provided by Lipper Inc.

| | | | |

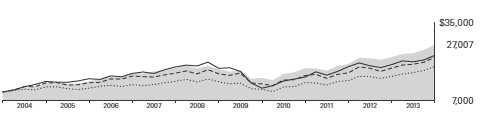

| | | | | Final Value |

| | One | Five | Ten | of a $50,000 |

| | Year | Years | Years | Investment |

| Energy Fund Admiral Shares | 4.14% | 1.36% | 15.54% | $211,989 |

| Spliced Energy Index | 3.56 | 0.31 | 12.91 | 168,311 |

| Dow Jones U.S. Total Stock Market Float | | | | |

| Adjusted Index | 16.88 | 4.61 | 8.80 | 116,248 |

See Financial Highlights for dividend and capital gains information.

15

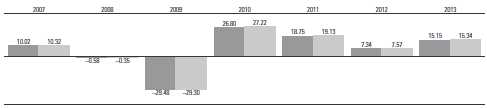

Energy Fund

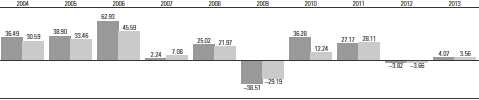

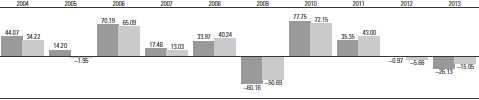

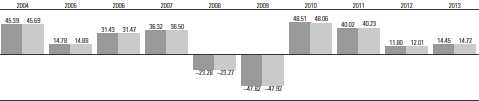

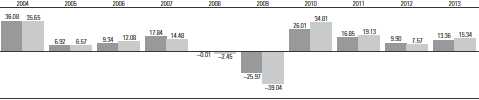

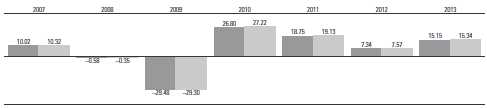

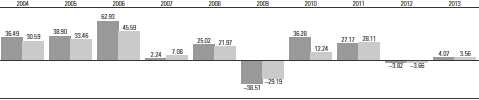

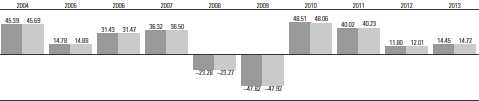

Fiscal-Year Total Returns (%): January 31, 2003, Through January 31, 2013

|

| Energy Fund Investor Shares |

| Spliced Energy Index |

For a benchmark description, see the Glossary.

Average Annual Total Returns: Periods Ended December 31, 2012

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 5/23/1984 | 2.67% | -1.99% | 14.64% |

| Admiral Shares | 11/12/2001 | 2.73 | -1.92 | 14.71 |

16

Energy Fund

Financial Statements

Statement of Net Assets

As of January 31, 2013

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (94.8%)1 | | |

| United States (57.3%) | | |

| Energy Equipment & Services (10.2%) | | |

| | Schlumberger Ltd. | 3,612,154 | 281,929 |

| | Baker Hughes Inc. | 5,246,680 | 234,632 |

| | Halliburton Co. | 5,291,397 | 215,254 |

| | Ensco plc Class A | 2,913,941 | 185,239 |

| | National Oilwell Varco Inc. | 1,252,206 | 92,839 |

| | SEACOR Holdings Inc. | 875,753 | 79,667 |

| * | Weatherford | | |

| | International Ltd. | 4,760,750 | 63,556 |

| | Transocean Ltd. | 1,115,307 | 63,249 |

| | Bristow Group Inc. | 199,882 | 11,389 |

| | Diamond Offshore | | |

| | Drilling Inc. | 35,800 | 2,688 |

| * | Nabors Industries Ltd. | 158,300 | 2,639 |

| | | | 1,233,081 |

| Exchange-Traded Fund (0.6%) | |

| ^,2 | Vanguard Energy ETF | 663,000 | 73,228 |

| |

| Oil, Gas & Consumable Fuels (46.5%) | |

| | Coal & Consumable Fuels (2.5%) | |

| | CONSOL Energy Inc. | 8,144,580 | 255,251 |

| | Peabody Energy Corp. | 2,050,985 | 51,582 |

| |

| | Integrated Oil & Gas (18.2%) | |

| | Exxon Mobil Corp. | 11,669,894 | 1,049,940 |

| | Chevron Corp. | 5,493,855 | 632,617 |

| | Occidental | | |

| | Petroleum Corp. | 4,514,416 | 398,488 |

| | Hess Corp. | 1,210,099 | 81,270 |

| | Murphy Oil Corp. | 792,400 | 47,164 |

| |

| | Oil & Gas Exploration & Production (21.4%) |

| | Anadarko Petroleum Corp. | 3,460,125 | 276,879 |

| | Cabot Oil & Gas Corp. | 4,531,452 | 239,170 |

| | EOG Resources Inc. | 1,616,891 | 202,079 |

| | Devon Energy Corp. | 3,502,355 | 200,300 |

| * | Southwestern Energy Co. | 4,962,040 | 170,198 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Denbury Resources Inc. | 8,950,734 | 166,752 |

| | Noble Energy Inc. | 1,506,179 | 162,351 |

| | EQT Corp. | 2,555,315 | 151,811 |

| | Range Resources Corp. | 2,224,125 | 149,394 |

| | ConocoPhillips | 2,500,754 | 145,044 |

| | Apache Corp. | 1,707,595 | 143,028 |

| | Pioneer Natural | | |

| | Resources Co. | 827,195 | 97,229 |

| | Chesapeake Energy Corp. | 4,594,432 | 92,716 |

| * | Cobalt International | | |

| | Energy Inc. | 3,074,622 | 74,437 |

| * | WPX Energy Inc. | 4,228,689 | 63,557 |

| | Marathon Oil Corp. | 1,850,346 | 62,190 |

| * | Whiting Petroleum Corp. | 1,250,655 | 59,506 |

| * | Newfield Exploration Co. | 1,855,658 | 54,742 |

| | Energen Corp. | 718,861 | 34,606 |

| * | Kosmos Energy Ltd. | 1,765,010 | 21,851 |

| *,^ | Ultra Petroleum Corp. | 634,916 | 11,568 |

| * | Laredo Petroleum | | |

| | Holdings Inc. | 471,700 | 8,703 |

| * | Plains Exploration & | | |

| | Production Co. | 36,020 | 1,720 |

| |

| | Oil & Gas Refining & Marketing (3.9%) |

| | Valero Energy Corp. | 4,593,974 | 200,894 |

| | Marathon Petroleum Corp. 2,028,175 | 150,511 |

| | Phillips 66 | 1,611,754 | 97,624 |

| * | PBF Energy Inc. | 443,200 | 14,803 |

| | HollyFrontier Corp. | 64,900 | 3,389 |

| |

| | Oil & Gas Storage & Transportation (0.5%) |

| | Kinder Morgan Inc. | 1,629,016 | 61,023 |

| | Williams Cos. Inc. | 123,300 | 4,322 |

| | | | 5,638,709 |

| Total United States | | 6,945,018 |

| International (37.5%) | | |

| Australia (0.3%) | | |

| | Oil Search Ltd. | 3,897,262 | 29,761 |

| | Caltex Australia Ltd. | 116,620 | 2,367 |

17

| | | |

| Energy Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Woodside Petroleum Ltd. | 22,387 | 829 |

| | | | 32,957 |

| Austria (0.0%) | | |

| | OMV AG | 70,995 | 2,925 |

| |

| Brazil (1.4%) | | |

| | Petroleo Brasileiro | | |

| | SA ADR | 9,057,270 | 165,567 |

| | Petroleo Brasileiro | | |

| | SA Prior Pfd. | 385,244 | 3,498 |

| | Petroleo Brasileiro | | |

| | SA | 249,132 | 2,281 |

| | Petroleo Brasileiro | | |

| | SA ADR Type A | 81,450 | 1,473 |

| | | | 172,819 |

| Canada (9.2%) | | |

| | Canadian Natural | | |

| | Resources Ltd. | 7,839,568 | 236,912 |

| | Suncor Energy Inc. | 5,733,817 | 195,064 |

| | Cenovus Energy Inc. | 4,770,205 | 158,562 |

| | Encana Corp. | 7,078,325 | 137,036 |

| | TransCanada Corp. | 1,729,401 | 81,858 |

| * | Tourmaline Oil Corp. | 1,856,200 | 62,996 |

| | Canadian Oil Sands Ltd. | 2,826,210 | 59,393 |

| | Cameco Corp. | 2,573,670 | 55,463 |

| | Pacific Rubiales | | |

| | Energy Corp. | 2,061,295 | 48,091 |

| | Penn West | | |

| | Petroleum Ltd. | 2,608,021 | 26,393 |

| | Petrominerales Ltd. | 2,260,180 | 20,123 |

| * | Athabasca Oil Corp. | 1,519,900 | 16,138 |

| | Suncor Energy Inc. | 235,234 | 7,995 |

| | Encana Corp. | 180,400 | 3,487 |

| | Husky Energy Inc. | 102,600 | 3,199 |

| | Enbridge Inc. | 46,550 | 2,046 |

| | Canadian Natural | | |

| | Resources Ltd. | 65,078 | 1,965 |

| | Cenovus Energy Inc. | 33,639 | 1,117 |

| | Canadian Oil Sands Ltd. | | |

| | (Toronto Shares) | 40,900 | 861 |

| | | | 1,118,699 |

| China (2.4%) | | |

| | PetroChina Co. Ltd. ADR | 934,610 | 132,902 |

| | Beijing Enterprises | | |

| | Holdings Ltd. | 12,171,235 | 87,755 |

| | China Shenhua | | |

| | Energy Co. Ltd. | 11,588,390 | 49,831 |

| | CNOOC Ltd. | 2,962,717 | 6,097 |

| | China Petroleum & | | |

| | Chemical Corp. | 3,672,000 | 4,455 |

| | China Oilfield | | |

| | Services Ltd. | 1,114,000 | 2,412 |

| | PetroChina Co. Ltd. | 1,112,000 | 1,577 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | China High Speed | | |

| | Transmission Equipment | | |

| | Group Co. Ltd. | 516,000 | 206 |

| | | | 285,235 |

| Finland (0.0%) | | |

| | Neste Oil Oyj | 152,229 | 2,429 |

| |

| France (3.4%) | | |

| | Total SA ADR | 6,392,765 | 347,063 |

| | Technip SA | 378,135 | 40,945 |

| | Total SA | 298,394 | 16,171 |

| * | Cie Generale de | | |

| | Geophysique - Veritas | 80,374 | 2,328 |

| | | | 406,507 |

| Hungary (0.0%) | | |

| | MOL Hungarian Oil | | |

| | and Gas plc | 31,961 | 2,752 |

| |

| India (0.8%) | | |

| | Reliance Industries Ltd. | 5,740,902 | 95,707 |

| | Oil & Natural Gas | | |

| | Corp. Ltd. | 444,511 | 2,839 |

| | Cairn India Ltd. | 322,307 | 1,959 |

| | | | 100,505 |

| Israel (0.0%) | | |

| | Delek Group Ltd. | 3,000 | 741 |

| |

| Italy (2.1%) | | |

| | Eni SPA ADR | 4,985,140 | 248,908 |

| | Eni SPA | 390,833 | 9,762 |

| | | | 258,670 |

| Japan (1.9%) | | |

| | Inpex Corp. | 28,493 | 164,968 |

| | JX Holdings Inc. | 11,176,470 | 65,939 |

| | Idemitsu Kosan Co. Ltd. | 23,700 | 2,078 |

| | | | 232,985 |

| Malaysia (0.0%) | | |

| | Petronas Dagangan Bhd. | 274,500 | 2,014 |

| |

| Norway (0.9%) | | |

| | Statoil ASA ADR | 3,968,560 | 105,286 |

| | Statoil ASA | 220,901 | 5,885 |

| | Aker Solutions ASA | 119,458 | 2,613 |

| | | | 113,784 |

| Poland (0.0%) | | |

| * | Polski Koncern Naftowy | | |

| | Orlen SA | 155,742 | 2,465 |

| * | Grupa Lotos SA | 147,504 | 1,911 |

| | | | 4,376 |

| Portugal (0.7%) | | |

| | Galp Energia SGPS SA | 4,956,196 | 80,451 |

| | |

| Energy Fund | | |

| |

| |

| |

| | | Market |

| | | Value |

| | Shares | ($000) |

| Russia (2.2%) | | |

| Gazprom OAO ADR | 16,615,955 | 156,489 |

| Rosneft OAO GDR | 10,482,740 | 92,027 |

| Lukoil OAO ADR | 102,145 | 6,887 |

| Tatneft OAO ADR | 75,220 | 3,465 |

| AK Transneft OAO | | |

| Prior Pfd. | 1,074 | 2,525 |

| TMK OAO GDR | 128,997 | 1,964 |

| Gazprom OAO | 124,674 | 590 |

| | | 263,947 |

| South Africa (0.1%) | | |

| Sasol Ltd. | 117,950 | 5,094 |

| |

| Spain (0.9%) | | |

| * Repsol SA | 4,885,444 | 108,952 |

| |

| Thailand (0.1%) | | |

| PTT PCL (Foreign) | 265,500 | 3,045 |

| PTT Exploration & | | |

| Production PCL (Foreign) | 516,000 | 2,882 |

| Thai Oil PCL (Foreign) | 930,700 | 2,302 |

| | | 8,229 |

| United Kingdom (11.1%) | | |

| Royal Dutch Shell | | |

| plc ADR | 6,798,495 | 479,430 |

| BP plc ADR | 10,614,065 | 472,538 |

| BG Group plc | 10,148,942 | 180,135 |

| Royal Dutch Shell | | |

| plc Class B | 4,168,037 | 151,497 |

| BP plc | 2,484,319 | 18,390 |

| * Genel Energy plc | 1,288,081 | 15,706 |

| Royal Dutch Shell | | |

| plc Class A | 387,301 | 13,730 |

| Royal Dutch Shell | | |

| plc Class A | | |

| (Amsterdam Shares) | 132,417 | 4,683 |

| AMEC plc | 127,701 | 2,188 |

| Tullow Oil plc | 16,591 | 299 |

| Cairn Energy plc | 1 | — |

| | | 1,338,596 |

| Total International | | 4,542,667 |

| Total Common Stocks | | |

| (Cost $7,231,992) | | 11,487,685 |

| | | | |

| | | | | Market |

| | | | | Value |

| | | | Shares | ($000) |

| Temporary Cash Investments (5.2%)1 | |

| Money Market Fund (1.2%) | | |

| 3,4 | Vanguard Market | | | |

| | Liquidity Fund, | | | |

| | 0.143% | 142,615,651 | 142,616 |

| |

| | | | Face | |

| | | | Amount | |

| | | | ($000) | |

| Repurchase Agreement (3.8%) | | |

| | RBS Securities, Inc. 0.130%, | | |

| | 2/1/13 (Dated 1/31/13, | | |

| | Repurchase Value | | | |

| | $463,502,000, collateralized | | |

| | by U.S. Treasury Note/Bonds | |

| | 0.250%–3.250%, | | | |

| | 2/28/13–12/31/16) | | 463,500 | 463,500 |

| |

| U.S. Government and Agency Obligations (0.2%) |

| 5,6 | Fannie Mae Discount | | |

| | Notes, 0.097%, 3/27/13 | 10,100 | 10,097 |

| 5 | Fannie Mae Discount | | |

| | Notes, 0.100%, 4/3/13 | 15,000 | 14,996 |

| 5,6 | Freddie Mac Discount | | |

| | Notes, 0.125%, 2/19/13 | 100 | 100 |

| | | | | 25,193 |

| Total Temporary Cash Investments | |

| (Cost $631,312) | | | 631,309 |

| Total Investments (100.0%) | | |

| (Cost $7,863,304) | | | 12,118,994 |

| Other Assets and Liabilities (0.0%) | |

| Other Assets | | | 67,588 |

| Liabilities4 | | | (68,002) |

| | | | | (414) |

| Net Assets (100%) | | | 12,118,580 |

19

| |

| Energy Fund | |

| |

| |

| |

| At January 31, 2013, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 7,908,688 |

| Overdistributed Net Investment Income | (22,363) |

| Accumulated Net Realized Losses | (28,038) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 4,255,690 |

| Futures Contracts | 4,583 |

| Foreign Currencies | 20 |

| Net Assets | 12,118,580 |

| |

| |

| Investor Shares—Net Assets | |

| Applicable to 85,224,294 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 5,340,387 |

| Net Asset Value Per Share— | |

| Investor Shares | $62.66 |

| |

| |

| Admiral Shares—Net Assets | |

| Applicable to 57,623,003 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 6,778,193 |

| Net Asset Value Per Share— | |

| Admiral Shares | $117.63 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $9,307,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 96.0% and 4.0%, respectively, of net assets.

2 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

3 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

4 Includes $9,575,000 of collateral received for securities on loan.

5 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as needed to maintain a positive net worth, in exchange for senior preferred stock.

6 Securities with a value of $7,398,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

GDR—Global Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

20

| |

| Energy Fund | |

| |

| |

| Statement of Operations | |

| |

| | Year Ended |

| | January 31, 2013 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1,2 | 287,135 |

| Interest2 | 749 |

| Security Lending | 8,556 |

| Total Income | 296,440 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 17,136 |

| Performance Adjustment | (2,933) |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 9,295 |

| Management and Administrative—Admiral Shares | 7,411 |

| Marketing and Distribution—Investor Shares | 1,188 |

| Marketing and Distribution—Admiral Shares | 1,142 |

| Custodian Fees | 494 |

| Auditing Fees | 30 |

| Shareholders’ Reports—Investor Shares | 108 |

| Shareholders’ Reports—Admiral Shares | 26 |

| Trustees’ Fees and Expenses | 31 |

| Total Expenses | 33,928 |

| Net Investment Income | 262,512 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2 | 5,231 |

| Futures Contracts | 20,640 |

| Foreign Currencies | (443) |

| Realized Net Gain (Loss) | 25,428 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 164,580 |

| Futures Contracts | (2,979) |

| Foreign Currencies | (17) |

| Change in Unrealized Appreciation (Depreciation) | 161,584 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 449,524 |

1 Dividends are net of foreign withholding taxes of $18,609,000.

2 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $2,245,000, $155,000, and ($21,736,000), respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

21

| | |

| Energy Fund | | |

| |

| |

| Statement of Changes in Net Assets | | |

| |

| | Year Ended January 31, |

| | 2013 | 2012 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 262,512 | 224,513 |

| Realized Net Gain (Loss) | 25,428 | 612,079 |

| Change in Unrealized Appreciation (Depreciation) | 161,584 | (1,387,420) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 449,524 | (550,828) |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (114,465) | (99,757) |

| Admiral Shares | (147,695) | (118,812) |

| Realized Capital Gain1 | | |

| Investor Shares | (98,885) | (241,252) |

| Admiral Shares | (111,067) | (269,367) |

| Total Distributions | (472,112) | (729,188) |

| Capital Share Transactions | | |

| Investor Shares | (570,595) | (156,067) |

| Admiral Shares | 10,358 | 535,094 |

| Net Increase (Decrease) from Capital Share Transactions | (560,237) | 379,027 |

| Total Increase (Decrease) | (582,825) | (900,989) |

| Net Assets | | |

| Beginning of Period | 12,701,405 | 13,602,394 |

| End of Period2 | 12,118,580 | 12,701,405 |

1 Includes fiscal 2013 and 2012 short-term gain distributions totaling $0 and $54,868,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($22,363,000) and ($25,183,000).

See accompanying Notes, which are an integral part of the Financial Statements.

22

| | | | | |

| Energy Fund | | | | | |

| |

| |

| Financial Highlights | | | | | |

| |

| |

| Investor Shares | | | | | |

| |

| For a Share Outstanding | | | Year Ended January 31, |

| Throughout Each Period | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $62.60 | $69.20 | $57.17 | $42.62 | $73.93 |

| Investment Operations | | | | | |

| Net Investment Income | 1.336 | 1.072 | 1.053 | .910 | 1.2761 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 1.098 | (3.949) | 14.103 | 14.591 | (28.853) |

| Total from Investment Operations | 2.434 | (2.877) | 15.156 | 15.501 | (27.577) |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.340) | (1.102) | (.977) | (.951) | (1.264) |

| Distributions from Realized Capital Gains | (1.034) | (2.621) | (2.149) | — | (2.469) |

| Total Distributions | (2.374) | (3.723) | (3.126) | (.951) | (3.733) |

| Net Asset Value, End of Period | $62.66 | $62.60 | $69.20 | $57.17 | $42.62 |

| |

| Total Return2 | 4.07% | -3.82% | 27.17% | 36.28% | -38.51% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $5,340 | $5,945 | $6,731 | $6,536 | $4,434 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets3 | 0.31% | 0.34% | 0.34% | 0.38% | 0.28% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 2.15% | 1.67% | 1.74% | 1.73% | 1.84% |

| Portfolio Turnover Rate | 18% | 24% | 31% | 27% | 21% |

1 Calculated based on average shares outstanding.

2 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable transaction and account service fees.

3 Includes performance-based investment advisory fee increases (decreases) of (0.02%), 0.01%, 0.00%, 0.03%, and 0.01%.

See accompanying Notes, which are an integral part of the Financial Statements.

23

| | | | | |

| Energy Fund | | | | | |

| |

| |

| Financial Highlights | | | | | |

| |

| |

| Admiral Shares | | | | | |

| |

| For a Share Outstanding | | | Year Ended January 31, |

| Throughout Each Period | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $117.52 | $129.93 | $107.34 | $80.02 | $138.86 |

| Investment Operations | | | | | |

| Net Investment Income | 2.586 | 2.101 | 2.045 | 1.780 | 2.4801 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 2.060 | (7.432) | 26.479 | 27.395 | (54.203) |

| Total from Investment Operations | 4.646 | (5.331) | 28.524 | 29.175 | (51.723) |

| Distributions | | | | | |

| Dividends from Net Investment Income | (2.595) | (2.159) | (1.899) | (1.855) | (2.480) |

| Distributions from Realized Capital Gains | (1.941) | (4.920) | (4.035) | — | (4.637) |

| Total Distributions | (4.536) | (7.079) | (5.934) | (1.855) | (7.117) |

| Net Asset Value, End of Period | $117.63 | $117.52 | $129.93 | $107.34 | $80.02 |

| |

| Total Return2 | 4.14% | -3.76% | 27.24% | 36.37% | -38.46% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $6,778 | $6,756 | $6,871 | $4,439 | $2,889 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets3 | 0.26% | 0.28% | 0.28% | 0.31% | 0.21% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 2.20% | 1.73% | 1.80% | 1.80% | 1.91% |

| Portfolio Turnover Rate | 18% | 24% | 31% | 27% | 21% |

1 Calculated based on average shares outstanding.

2 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable transaction and account service fees.

3 Includes performance-based investment advisory fee increases (decreases) of (0.02%), 0.01%, 0.00%, 0.03%, and 0.01%.

See accompanying Notes, which are an integral part of the Financial Statements.

24

Energy Fund

Notes to Financial Statements

Vanguard Energy Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of U.S. corporations. The fund offers two classes of shares: Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

25

Energy Fund

During the year ended January 31, 2013, the fund’s average investment in futures contracts represented 1% of net assets, based on quarterly average aggregate settlement values.

4. Repurchase Agreements: The fund may enter into repurchase agreements. Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. In the event of default or bankruptcy by the other party to the agreement, the fund may sell or retain the collateral; however, such action may be subject to legal proceedings.

5. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (January 31, 2010–2013), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

6. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

7. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents fees charged to borrowers plus income earned on investing cash collateral, less expenses associated with the loan.

8. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares prior to May 23, 2012, were credited to paid-in capital.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. Wellington Management Company, LLP, provides investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee is subject to quarterly adjustments based on performance for the preceding three years relative to a combined index composed of the S&P Citigroup BMI World Energy Index and the S&P 500 Energy Equal Weighted Blend Index through July 31, 2010, and the current benchmark, MSCI ACWI Energy Index, thereafter. The benchmark will be fully phased in by July 2013.

The Vanguard Group provides investment advisory services to a portion of the fund on an at-cost basis; the fund paid Vanguard advisory fees of $342,000 for the year ended January 31, 2013.

For the year ended January 31, 2013, the aggregate investment advisory fee represented an effective annual basic rate of 0.14% of the fund’s average net assets, before a decrease of $2,933,000 (0.02%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital

26

Energy Fund

contributions to Vanguard. At January 31, 2013, the fund had contributed capital of $1,558,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.62% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the market value of the fund’s investments as of January 31, 2013, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks—United States | 6,945,018 | — | — |

| Common Stocks—International | 3,077,645 | 1,465,022 | — |

| Temporary Cash Investments | 142,616 | 488,693 | — |

| Futures Contracts—Liabilities1 | (202) | — | — |

| Total | 10,165,077 | 1,953,715 | — |

| 1 Represents variation margin on the last day of the reporting period. |

E. At January 31, 2013, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| E-mini S&P 500 Index | March 2013 | 1,545 | 115,357 | 2,930 |

| S&P 500 Index | March 2013 | 95 | 35,466 | 1,653 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

F. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

27

Energy Fund

During the year ended January 31, 2013, the fund realized net foreign currency losses of $443,000, which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized losses to overdistributed net investment income. Certain of the fund’s investments are in securities considered to be “passive foreign investment companies,” for which any unrealized appreciation and/or realized gains are required to be included in distributable net investment income for tax purposes. During the year ended January, 31, 2013, the fund realized gains on the sale of passive foreign investment companies of $2,914,000 which have been included in current and prior periods’ taxable income; accordingly, such gains have been reclassified from accumulated net realized losses to overdistributed net investment income. Passive foreign investment companies held at January 31, 2013, had unrealized appreciation of $28,046,000.

For tax purposes, at January 31, 2013, the fund had $28,735,000 of ordinary income available for distribution. At January 31, 2013, the fund had available capital losses totaling $15,701,000 that may be carried forward indefinitely to offset future net capital gains.

At January 31, 2013, the cost of investment securities for tax purposes was $7,898,962,000. Net unrealized appreciation of investment securities for tax purposes was $4,220,032,000, consisting of unrealized gains of $4,418,274,000 on securities that had risen in value since their purchase and $198,242,000 in unrealized losses on securities that had fallen in value since their purchase.

G. During the year ended January 31, 2013, the fund purchased $2,131,318,000 of investment securities and sold $3,050,032,000 of investment securities, other than temporary cash investments.

H. Capital share transactions for each class of shares were:

| | | | |

| | | | Year Ended January 31, |

| | | 2013 | | 2012 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 695,926 | 11,544 | 1,166,296 | 17,219 |

| Issued in Lieu of Cash Distributions | 204,348 | 3,375 | 328,737 | 5,528 |

| Redeemed1 | (1,470,869) | (24,672) | (1,651,100) | (25,049) |

| Net Increase (Decrease)—Investor Shares | (570,595) | (9,753) | (156,067) | (2,302) |

| Admiral Shares | | | | |

| Issued | 1,015,171 | 9,110 | 1,350,158 | 10,745 |

| Issued in Lieu of Cash Distributions | 233,904 | 2,064 | 352,941 | 3,171 |

| Redeemed1 | (1,238,717) | (11,038) | (1,168,005) | (9,311) |

| Net Increase (Decrease)—Admiral Shares | 10,358 | 136 | 535,094 | 4,605 |

1 Net of redemption fees for fiscal 2013 and 2012 of $642,000 and $2,001,000, respectively (fund totals). Effective May 23, 2012, the redemption fee was eliminated.

28

Energy Fund

I. The fund invested in a company that was considered to be an affiliated company of the fund because the fund owned more than 5% of the outstanding voting securities of the company. Transactions during the period in securities of this company were as follows:

| | | | | |

| | | | Current Period Transactions | |

| | Jan. 31, 2012 | | Proceeds from | | Jan. 31, 2013 |

| | Market | Purchases | Securities | Dividend | Market |

| | Value | at Cost | Sold | Income | Value |

| | ($000) | ($000) | ($000) | ($000) | ($000) |

| Nordic American Tankers Ltd. | 43,932 | — | 38,132 | 923 | — |

J. In preparing the financial statements as of January 31, 2013, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

29

Report of Independent Registered

Public Accounting Firm

To the Trustees of Vanguard Specialized Funds and the Shareholders of Vanguard Energy Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Energy Fund (constituting a separate portfolio of Vanguard Specialized Funds, hereafter referred to as the “Fund”) at January 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at January 31, 2013 by correspondence with the custodians and brokers and by agreement to the underlying ownership records of the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

March 13, 2013

| |

| Special 2012 tax information (unaudited) for Vanguard Energy Fund |

This information for the fiscal year ended January 31, 2013, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $209,952,000 as capital gain dividends (from net long-term capital gains) to shareholders during the fiscal year.

The fund distributed $216,964,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 40.7% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

30

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2013. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

The table shows returns for Investor Shares only; returns for other share classes will differ. Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

Average Annual Total Returns: Energy Fund Investor Shares

Periods Ended January 31, 2013

| | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 4.07% | 1.30% | 15.46% |

| Returns After Taxes on Distributions | 3.39 | 0.50 | 14.62 |

| Returns After Taxes on Distributions and Sale of | | | |

| Fund Shares | 3.30 | 1.16 | 13.28 |

31

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

32

| | | |

| Six Months Ended January 31, 2013 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Energy Fund | 7/31/2012 | 1/31/2013 | Period |

| Based on Actual Fund Return | | | |

| Investor Shares | $1,000.00 | $1,107.75 | $1.75 |

| Admiral Shares | 1,000.00 | 1,108.18 | 1.43 |

| Based on Hypothetical 5% Yearly Return | | | |

| Investor Shares | $1,000.00 | $1,023.54 | $1.68 |

| Admiral Shares | 1,000.00 | 1,023.84 | 1.38 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.33% for Investor Shares and 0.27% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

33

Glossary