Exhibit 13

TABLE OF CONTENTS

| | |

Consolidated Financial Highlights | | 1 |

| |

Message to Shareholders | | 2 |

| |

Consolidated Statements of Financial Condition | | 5 |

| |

Consolidated Statements of Income | | 6 |

| |

Consolidated Statements of Cash Flows | | 7 |

| |

Consolidated Statements of Changes in Shareholders’ Equity | | 8 |

| |

Notes to Consolidated Financial Statements | | 9 |

| |

Management’s Report on Internal Control Over Financial Reporting | | 27 |

| |

Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting | | 28 |

| |

Report of Independent Registered Public Accounting Firm | | 29 |

| |

Statistical Information | | 30 |

| |

Selected Financial Data - Five Year Comparison | | 31 |

| |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 32 |

| |

Applications of Critical Accounting Policies | | 41 |

| |

Executive Management and Board of Directors | | 42 |

| |

Officers | | 43 |

| |

Shareholder Information | | 45 |

| | |

| | CNB Financial Corporation 2005 Annual Report |

CONSOLIDATED FINANCIAL HIGHLIGHTS

(in thousands, except per share data)

| | | | | | | | | | | |

| | | 2005 | | | 2004 | | | % Change | |

For The Year | | | | | | | | | | | |

Interest Income | | $ | 41,884 | | | $ | 37,473 | | | 11.8 | % |

Interest Expense | | | 15,955 | | | | 13,128 | | | 21.5 | % |

Net Interest Income | | | 25,929 | | | | 24,345 | | | 6.5 | % |

Non-interest Income | | | 7,339 | | | | 5,622 | | | 30.5 | % |

Non-interest Expense | | | 20,358 | | | | 19,332 | | | 5.3 | % |

Net Income | | | 9,138 | | | | 7,871 | | | 16.1 | % |

Operating Earnings* | | | 9,294 | | | | 8,781 | | | 5.8 | % |

Net Income Return on: | | | | | | | | | | | |

Average Assets | | | 1.23 | % | | | 1.11 | % | | 10.8 | % |

Average Equity | | | 13.42 | % | | | 12.04 | % | | 11.5 | % |

Operating Earnings Return on: | | | | | | | | | | | |

Average Assets | | | 1.25 | % | | | 1.24 | % | | 0.8 | % |

Average Equity | | | 13.65 | % | | | 13.43 | % | | 1.6 | % |

At Year End | | | | | | | | | | | |

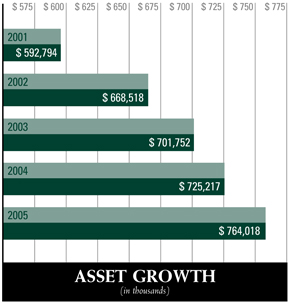

Assets | | $ | 764,018 | | | $ | 725,217 | | | 5.4 | % |

Loans, net of unearned | | | 510,613 | | | | 481,937 | | | 6.0 | % |

Deposits | | | 618,503 | | | | 596,905 | | | 3.6 | % |

Shareholders’ Equity | | | 69,968 | | | | 68,710 | | | 1.8 | % |

Trust Assets Under Management (at market value) | | | 179,738 | | | | 192,361 | | | (6.6 | )% |

Per Share Data | | | | | | | | | | | |

Net Income, diluted | | $ | 1.00 | | | $ | 0.86 | | | 16.3 | % |

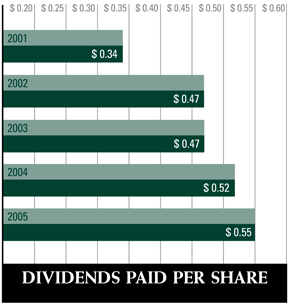

Dividends | | | 0.55 | | | | 0.52 | | | 5.8 | % |

Book Value | | | 7.76 | | | | 7.54 | | | 2.9 | % |

Market Value | | | 14.11 | | | | 15.27 | | | (7.6 | )% |

| * | Operating Earnings amount is shown before the effect of after tax non-cash charges due to write downs of other-than-temporarily impaired securities of $156 in 2005 and $910 in 2004. |

| | |

1 CNB Financial Corporation 2005 Annual Report | | |

MESSAGE TO SHAREHOLDERS

To Our Shareholders, Customers & Friends:

The year of 2005 was very rewarding for CNB Financial Corporation as net income reached a record level of $9.14 million representing a 16.1% increase over the prior year. The operating earnings grew to $9.29 million from $8.78 million for a 5.8% increase. We are proud of this performance and pleased to present this report.

Our earnings growth was driven by a combination of increased net interest income and non-interest income. The growth in net interest income of $1.6 million or 6.5% resulted from a higher level of earning assets that was primarily the result of loans outstanding which grew at a rate of 6.0% during the year. We continue to execute our strategy of focusing on lending to small and medium sized businesses within our markets supplemented by meeting the borrowing needs of consumers. Commercial loans and commercial real estate loans outstanding at year end 2005 were $329.5 million representing 64.5% of total loans outstanding.

Our non-interest income also showed strong growth during 2005 increasing by $1.7 million or 30.5%. This was a result of increases in several categories including service charges and fees, income from bank owned life insurance and wealth management income. In addition, there was a significant decline of $1.2 million in the losses taken for other-than-temporarily impaired securities. Excluding this item, our non-interest income from core areas increased by $0.6 million or 7.9%. We are particularly pleased with the revenue generated by our wealth management operations, which yielded over $0.5 million up 156% over the prior year. Offsetting some of the growth were declines in income from trust and asset management and the sale of loans.

As we continue to grow, we experience increases in our costs of operation; however, these costs continue to be well controlled increasing 5.3% during 2005. These costs primarily include salaries and benefits, data processing and occupancy expense. For 2005, our total non-interest expense was 2.66% of total assets with this ratio unchanged from the prior year. In addition, this ratio compares favorably to the 3.03% level of our peer institutions. We have initiated several long term strategic growth initiatives which will cause our operating costs to continue to increase. However, we believe these increasing costs will be more than offset over the long-term by related revenues from the continued earning asset growth generated by these initiatives.

We are maintaining a strong emphasis on asset quality as demonstrated by several key performance indicators. During 2005 our net charge-offs of loans were $765 thousand representing 0.15% of year-end loans down from 0.21% in 2004 and 0.18% in 2003. Our level of nonperforming assets consisting of loans greater than ninety days past due, non-accrual loans and assets acquired through foreclosure declined to $2.1 million from $2.7 million in 2004 for a reduction of 21.6%. The level of nonperforming assets to total assets was 0.28% at year end 2005 which compares favorably to our level of 0.37% at year end 2004 and to our peer institutions ratio of 0.44%. Maintaining the quality of our assets remains a crucial element of our strategy of continued growth and expansion of our corporation.

Our overall financial performance in 2005 yielded a return on average assets of 1.23% and a return on average equity of 13.42%. In May 2005, we increased the dividend payable on our common stock which resulted in a total dividend per share of $0.55 paid in 2005 up from $0.52 per share paid in 2004 for an increase of 5.8%. Our stock traded in a fairly narrow range during the past year down somewhat from the prior year. This is indicative of a general trend in community and smaller regional bank stocks over the same period. We remain strongly committed to growing our corporation and delivering a solid level of financial performance in order to provide continuing value to our shareholders.

| | |

| | CNB Financial Corporation 2005 Annual Report 2 |

MESSAGE TO SHAREHOLDERS

| | |

3 CNB Financial Corporation 2005 Annual Report | | |

MESSAGE TO SHAREHOLDERS

As we move forward into 2006, we will be focused on the execution of several strategies to expand our opportunities for future growth. First, in mid year we will open our full service office in Warren, Pennsylvania. For the past several years we have successfully operated a loan production office in this community and look forward to offering our full range of banking services from this new office. Secondly, we will expand the number of locations of our new subsidiary, Holiday Financial Services Corporation. This entity, formed in the third quarter of 2005, is a consumer loan company which we will expand from its current single location near Johnstown, Pennsylvania to multiple locations during 2006. We are optimistic that we can grow this entity into a materially productive subsidiary of our corporation.

During 2006 we will be opening the first offices of ERIEBANK, a newly formed division of our principal subsidiary, County National Bank. We are anticipating opening four new offices of ERIEBANK over the next two years to serve the Erie, Pennsylvania market. By expanding into Erie we are doubling our existing market and adding a significant opportunity for the growth of our corporation. This bank will be headed by David Zimmer, an Erie native and twenty year banking veteran, and be complemented by a Regional Board of Directors of Erie business and community leaders.

With these new initiatives and the continued expansion of market share in our current markets, we are confident about the future success of CNB Financial Corporation.

Finally, in December 2005 James P. Moore retired from our Board of Directors culminating his career spanning 54 years with our organization. This career included 50 years as an active employee rising to the position of Chairman and Chief Executive Officer and 21 years as a director. We sincerely appreciate Jim’s years of service and dedication and wish him many happy and healthy years of retirement.

|

|

|

William F. Falger President and Chief Executive Officer |

| | |

| | CNB Financial Corporation 2005 Annual Report 4 |

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

| | | | | | | | |

| (in thousands, except share data) | | December 31 | |

| | | 2005 | | | 2004 | |

Assets | | | | | | | | |

Cash and due from banks | | $ | 19,146 | | | $ | 14,296 | |

Interest bearing deposits with other banks | | | 23,871 | | | | 15,616 | |

| | | | | | | | |

CASH AND CASH EQUIVALENTS | | | 43,017 | | | | 29,912 | |

Securities available for sale | | | 161,897 | | | | 164,202 | |

Loans held for sale | | | 2,733 | | | | 3,499 | |

Loans and leases | | | 511,042 | | | | 482,048 | |

Less: unearned discount | | | 429 | | | | 111 | |

Less: allowance for loan losses | | | 5,603 | | | | 5,585 | |

| | | | | | | | |

NET LOANS | | | 505,010 | | | | 476,352 | |

FHLB, FRB, and other equity interests | | | 4,789 | | | | 4,792 | |

Premises and equipment, net | | | 13,912 | | | | 13,761 | |

Bank owned life insurance | | | 13,797 | | | | 13,182 | |

Mortgage servicing rights | | | 373 | | | | 411 | |

Goodwill | | | 10,821 | | | | 10,821 | |

Other intangible assets | | | 800 | | | | 630 | |

Accrued interest and other assets | | | 6,869 | | | | 7,655 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 764,018 | | | $ | 725,217 | |

| | | | | | | | |

Liabilities | | | | | | | | |

Deposits: | | | | | | | | |

Non-interest bearing deposits | | $ | 80,874 | | | $ | 71,968 | |

Interest bearing deposits | | | 537,629 | | | | 524,937 | |

| | | | | | | | |

TOTAL DEPOSITS | | | 618,503 | | | | 596,905 | |

Short-term borrowings | | | 2,000 | | | | 2,000 | |

Federal Home Loan Bank advances | | | 58,250 | | | | 40,000 | |

Accrued interest and other liabilities | | | 4,987 | | | | 7,292 | |

Subordinated debentures | | | 10,310 | | | | 10,310 | |

| | | | | | | | |

TOTAL LIABILITIES | | | 694,050 | | | | 656,507 | |

| | | | | | | | |

Shareholders’ Equity | | | | | | | | |

Common stock $1.00 par value Authorized 10,000,000 shares Issued 9,233,750 shares for 2005 and 2004 | | | 9,234 | | | | 9,234 | |

Additional paid in capital | | | 4,160 | | | | 4,243 | |

Retained earnings | | | 58,439 | | | | 54,347 | |

Treasury stock, at cost (209,596 shares for 2005 and 123,240 shares for 2004) | | | (3,031 | ) | | | (1,796 | ) |

Accumulated other comprehensive income | | | 1,166 | | | | 2,682 | |

| | | | | | | | |

TOTAL SHAREHOLDERS’ EQUITY | | | 69,968 | | | | 68,710 | |

| | | | | | | | |

TOTAL LIABILITIES and SHAREHOLDERS’ EQUITY | | $ | 764,018 | | | $ | 725,217 | |

| | | | | | | | |

The accompanying notes are an integral part of these statements.

| | |

5 CNB Financial Corporation 2005 Annual Report | | |

CONSOLIDATED STATEMENTS OF INCOME

| | | | | | | | | | | |

| (in thousands, except per share data) | | Year ended December 31, |

| | | 2005 | | | 2004 | | | 2003 |

Interest and Dividend Income | | | | | | | | | | | |

Loans including fees | | $ | 34,193 | | | $ | 31,005 | | | $ | 30,328 |

Deposits with banks | | | 316 | | | | 117 | | | | 44 |

Federal funds sold | | | 394 | | | | 120 | | | | 180 |

Securities: | | | | | | | | | | | |

Taxable | | | 4,817 | | | | 3,746 | | | | 4,457 |

Tax-exempt | | | 1,837 | | | | 2,008 | | | | 2,178 |

Dividends | | | 327 | | | | 477 | | | | 399 |

| | | | | | | | | | | |

TOTAL INTEREST AND DIVIDEND INCOME | | | 41,884 | | | | 37,473 | | | | 37,586 |

Interest Expense | | | | | | | | | | | |

Deposits | | | 12,633 | | | | 10,551 | | | | 10,882 |

Federal Home Loan Bank advances and other debt | | | 2,637 | | | | 2,075 | | | | 2,047 |

Subordinated debentures | | | 685 | | | | 502 | | | | 471 |

| | | | | | | | | | | |

TOTAL INTEREST EXPENSE | | | 15,955 | | | | 13,128 | | | | 13,400 |

| | | | | | | | | | | |

Net interest income | | | 25,929 | | | | 24,345 | | | | 24,186 |

Provision for loan losses | | | 783 | | | | 800 | | | | 1,535 |

| | | | | | | | | | | |

Net interest income after provision for loan losses | | | 25,146 | | | | 23,545 | | | | 22,651 |

Non-interest Income | | | | | | | | | | | |

Trust and asset management fees | | | 977 | | | | 1,005 | | | | 1,001 |

Service charges - deposit accounts | | | 4,060 | | | | 3,988 | | | | 3,457 |

Other service charges and fees | | | 512 | | | | 469 | | | | 511 |

Net security gains | | | 322 | | | | 313 | | | | 270 |

Loss on other-than-temporarily impaired securities | | | (240 | ) | | | (1,400 | ) | | | — |

Net gain on sale of loans | | | 113 | | | | 162 | | | | 557 |

Bank owned life insurance | | | 615 | | | | 500 | | | | 488 |

Wealth management | | | 533 | | | | 208 | | | | 259 |

Other | | | 447 | | | | 377 | | | | 593 |

| | | | | | | | | | | |

TOTAL NON-INTEREST INCOME | | | 7,339 | | | | 5,622 | | | | 7,136 |

Non-interest Expenses | | | | | | | | | | | |

Salaries | | | 7,518 | | | | 6,996 | | | | 6,733 |

Employee benefits | | | 2,970 | | | | 2,995 | | | | 2,573 |

Net occupancy expense | | | 2,714 | | | | 2,607 | | | | 2,400 |

Data processing | | | 1,641 | | | | 1,443 | | | | 1,411 |

State and local taxes | | | 911 | | | | 839 | | | | 771 |

Intangible asset amortization | | | 524 | | | | 509 | | | | 517 |

Directors fees | | | 471 | | | | 332 | | | | 578 |

Other | | | 3,609 | | | | 3,611 | | | | 2,942 |

| | | | | | | | | | | |

TOTAL NON-INTEREST EXPENSES | | | 20,358 | | | | 19,332 | | | | 17,925 |

| | | | | | | | | | | |

Income before income taxes | | | 12,127 | | | | 9,835 | | | | 11,862 |

Income tax expense | | | 2,989 | | | | 1,964 | | | | 2,805 |

| | | | | | | | | | | |

Net income | | $ | 9,138 | | | $ | 7,871 | | | $ | 9,057 |

| | | | | | | | | | | |

EARNINGS PER SHARE | | | | | | | | | | | |

Basic | | $ | 1.01 | | | $ | 0.86 | | | $ | 0.99 |

Diluted | | $ | 1.00 | | | $ | 0.86 | | | $ | 0.98 |

The accompanying notes are an integral part of these statements.

| | |

| | CNB Financial Corporation 2005 Annual Report 6 |

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | |

| (in thousands) | | Year ended December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

Cash Flows from Operating Activities: | | | | | | | | | | | | |

Net income | | $ | 9,138 | | | $ | 7,871 | | | $ | 9,057 | |

Adjustments to reconcile net income to net cash provided by operations: | | | | | | | | | | | | |

Provision for loan losses | | | 783 | | | | 800 | | | | 1,535 | |

Depreciation and amortization | | | 1,856 | | | | 1,764 | | | | 1,668 | |

Amortization, accretion and deferred loan fees | | | (39 | ) | | | 49 | | | | 525 | |

Deferred taxes | | | (674 | ) | | | (735 | ) | | | (1,289 | ) |

Security gains | | | (322 | ) | | | (313 | ) | | | (270 | ) |

Loss on other-than-temporarily impaired securities | | | 240 | | | | 1,400 | | | | — | |

Gain on sale of loans | | | (113 | ) | | | (162 | ) | | | (557 | ) |

Net (gains) losses on dispositions of acquired property | | | 21 | | | | (68 | ) | | | (28 | ) |

Proceeds from sales of loans | | | 14,669 | | | | 14,481 | | | | 42,411 | |

Origination of loans for sale | | | (13,945 | ) | | | (14,719 | ) | | | (41,029 | ) |

Increase in bank owned life insurance | | | (615 | ) | | | (500 | ) | | | (488 | ) |

Changes in: | | | | | | | | | | | | |

Interest receivable and other assets | | | (460 | ) | | | (1,850 | ) | | | (238 | ) |

Interest payable and other liabilities | | | (811 | ) | | | (39 | ) | | | 366 | |

| | | | | | | | | | | | |

Net cash provided by operating activities | | | 9,728 | | | | 7,979 | | | | 11,663 | |

Cash Flows from Investing Activities: | | | | | | | | | | | | |

Proceeds from maturities, prepayments and calls of: | | | | | | | | | | | | |

Securities available for sale | | | 40,438 | | | | 42,090 | | | | 73,351 | |

Proceeds from sales of securities available for sale | | | 8,038 | | | | 6,805 | | | | 10,608 | |

Purchase of securities available for sale | | | (48,852 | ) | | | (39,573 | ) | | | (76,243 | ) |

Loan origination and payments, net | | | (29,055 | ) | | | (24,073 | ) | | | (38,071 | ) |

Purchase of bank owned life insurance | | | — | | | | — | | | | (6,000 | ) |

Redemption (Purchase) of FHLB, FRB and other equity interests | | | 3 | | | | 240 | | | | (433 | ) |

Net, purchase of premises and equipment | | | (1,761 | ) | | | (2,082 | ) | | | (1,956 | ) |

Proceeds from the sale of assets | | | 1,082 | | | | 529 | | | | 215 | |

| | | | | | | | | | | | |

Net cash used in investing activities | | | (30,107 | ) | | | (16,064 | ) | | | (38,529 | ) |

Cash Flows from Financing Activities: | | | | | | | | | | | | |

Net change in: | | | | | | | | | | | | |

Checking, money market and savings accounts | | | 11,160 | | | | 8,165 | | | | 8,987 | |

Certificates of deposit | | | 10,438 | | | | 13,302 | | | | 21,314 | |

Purchase treasury stock | | | (2,222 | ) | | | (1,261 | ) | | | (1,014 | ) |

Proceeds from the sale of treasury stock | | | 832 | | | | 798 | | | | 597 | |

Proceeds from the exercise of stock options | | | 72 | | | | 96 | | | | 458 | |

Cash dividends paid | | | (5,046 | ) | | | (4,771 | ) | | | (4,335 | ) |

Advances from long-term borrowings | | | 18,250 | | | | — | | | | — | |

Net change in short-term borrowings | | | — | | | | 687 | | | | (687 | ) |

| | | | | | | | | | | | |

Net cash provided by financing activities | | | 33,484 | | | | 17,016 | | | | 25,320 | |

| | | | | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 13,105 | | | | 8,931 | | | | (1,546 | ) |

Cash and cash equivalents at beginning of period | | | 29,912 | | | | 20,981 | | | | 22,527 | |

| | | | | | | | | | | | |

Cash and cash equivalents at end of period | | $ | 43,017 | | | $ | 29,912 | | | $ | 20,981 | |

| | | | | | | | | | | | |

Supplemental disclosures of cash flow information: | | | | | | | | | | | | |

Cash paid during the period for: | | | | | | | | | | | | |

Interest | | $ | 15,618 | | | $ | 12,568 | | | $ | 12,971 | |

Income taxes | | | 3,178 | | | | 2,932 | | | | 3,530 | |

Supplemental non cash disclosures: | | | | | | | | | | | | |

Transfers to other real estate owned | | $ | 80 | | | $ | 1,005 | | | $ | 257 | |

The accompanying notes are an integral part of these statements.

| | |

7 CNB Financial Corporation 2005 Annual Report | | |

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | Additional

Paid-In

Capital | | | Retained

Earnings | | | Treasury

Stock | | | Accumulated

Other

Comprehensive

Income | | | Total

Share-

holders’

Equity | |

Balance January 1, 2003 | | $ | 3,694 | | $ | 3,747 | | | $ | 52,065 | | | $ | (974 | ) | | $ | 3,501 | | | $ | 62,033 | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | |

Net income for 2003 | | | | | | | | | | 9,057 | | | | | | | | | | | | 9,057 | |

Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | |

Net change in unrealized gains on available for sale securities, net of taxes of $180 and adjustment for after tax gains of $176 | | | | | | | | | | | | | | | | | | (349 | ) | | | (349 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | 8,708 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Treasury stock: | | | | | | | | | | | | | | | | | | | | | | | |

Purchase (24,468 shares) | | | | | | | | | | | | | | (1,014 | ) | | | | | | | (1,014 | ) |

Reissue (33,480 shares) | | | | | | 376 | | | | | | | | 679 | | | | | | | | 1,055 | |

Cash dividends declared ($0.47 per share) | | | | | | | | | | (4,335 | ) | | | | | | | | | | | (4,335 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance December 31, 2003 | | | 3,694 | | | 4,123 | | | | 56,787 | | | | (1,309 | ) | | | 3,152 | | | | 66,447 | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | |

Net income for 2004 | | | | | | | | | | 7,871 | | | | | | | | | | | | 7,871 | |

Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | |

Net change in unrealized gains on available for sale securities, net of taxes of $178 and adjustment for after tax losses of $707 | | | | | | | | | | | | | | | | | | (470 | ) | | | (470 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | 7,401 | |

| | | | | | | | | | | | | | | | | | | | | | | |

2 1/2 for 1 stock split (5,540,250 shares) | | | 5,540 | | | | | | | (5,540 | ) | | | | | | | | | | | | |

Treasury stock: | | | | | | | | | | | | | | | | | | | | | | | |

Purchase (91,848 shares) | | | | | | | | | | | | | | (1,261 | ) | | | | | | | (1,261 | ) |

Reissue (62,493 shares) | | | | | | 120 | | | | | | | | 774 | | | | | | | | 894 | |

Cash dividends declared ($0.52 per share) | | | | | | | | | | (4,771 | ) | | | | | | | | | | | (4,771 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance December 31, 2004 | | | 9,234 | | | 4,243 | | | | 54,347 | | | | (1,796 | ) | | | 2,682 | | | | 68,710 | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | |

Net income for 2005 | | | | | | | | | | 9,138 | | | | | | | | | | | | 9,138 | |

Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | |

Net change in unrealized gains on available for sale securities, net of taxes of $820 and adjustment for after tax gains of $53 | | | | | | | | | | | | | | | | | | (1,516 | ) | | | (1,516 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | 7,622 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Treasury stock: | | | | | | | | | | | | | | | | | | | | | | | |

Purchase (150,027 shares) | | | | | | | | | | | | | | (2,222 | ) | | | | | | | (2,222 | ) |

Reissue (63,671 shares) | | | | | | (83 | ) | | | | | | | 987 | | | | | | | | 904 | |

Cash dividends declared ($0.55 per share) | | | | | | | | | | (5,046 | ) | | | | | | | | | | | (5,046 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance December 31, 2005 | | $ | 9,234 | | $ | 4,160 | | | $ | 58,439 | | | $ | (3,031 | ) | | $ | 1,166 | | | $ | 69,968 | |

| | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these statements.

| | |

| | CNB Financial Corporation 2005 Annual Report 8 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARYOF SIGNIFICANT ACCOUNTING POLICIES

Unless otherwise indicated, amounts are in thousands, except per share data.

Business and Organization:

CNB Financial Corporation (the “Corporation”), is headquartered in Clearfield, Pennsylvania, and provides a full range of banking and related services through its wholly owned subsidiary, County National Bank (the “Bank”) which also began doing business as ERIEBANK during 2005 in the Erie, Pennsylvania market area. In addition, the Bank provides trust services, including the administration of trusts and estates, retirement plans, and other employee benefit plans as well as a full range of wealth management services. The Bank serves individual and corporate customers and is subject to competition from other financial institutions and intermediaries with respect to these services. The Corporation and the Bank are subject to examination by Federal regulators. The Corporation’s market area is primarily concentrated in the central region of the state of Pennsylvania.

Basis of Financial Presentation:

The financial statements are consolidated to include the accounts of the Corporation and its subsidiaries, County National Bank, CNB Investment Corporation, CNB Securities Corporation, Holiday Financial Services Corporation, County Reinsurance Company and CNB Insurance Agency. These statements have been prepared in accordance with U.S. generally accepted accounting principles. All significant intercompany accounts and transactions have been eliminated in the consolidated financial statements.

Use of Estimates:

To prepare financial statements in conformity with U.S. generally accepted accounting principles, management makes estimates and assumptions based on available information. These estimates and assumptions affect the amounts reported in the financial statements and the disclosures provided, and actual results could differ. The allowance for loan losses, mortgage servicing rights and fair values of financial instruments are particularly subject to change.

Operating Segments:

Statement of Financial Accounting Standards (“FAS”) No. 131 requires disclosures about an enterprise’s operating segments in financial reports issued to shareholders. The Statement defines an operating segment as a component of an enterprise that engages in business activities that generate revenue and incur expense, and the operating results of which are reviewed by the chief operating decision maker in the determination of resource allocation and performance. While the Corporation’s chief decision makers monitor the revenue streams of the various Corporation’s products and services, operations are managed and financial performance is evaluated on a Corporation-wide basis. Accordingly, the Corporation’s business activities are currently confined to one segment which is community banking.

Securities:

When purchased, securities are classified as held to maturity, trading or available for sale. Debt securities are classified as held to maturity when the Corporation has the positive intent and ability to hold the securities to maturity. Held to maturity securities are stated at amortized cost. Debt or equity securities are classified as trading when purchased principally for the purpose of selling them in the near term. Available for sale securities are those securities not classified as held to maturity or trading and are carried at their fair market value. Unrealized gains and losses, net of deferred tax, on securities classified as available for sale are recorded as other comprehensive income. Unrealized gains and losses on securities classified as trading are included in other income. Management has not classified any debt or equity securities as trading or held to maturity.

The amortized cost of debt securities classified as held to maturity or available for sale is adjusted for the amortization of premiums and the accretion of discounts over the period through contractual maturity or, in the case of mortgage-backed securities and collateralized mortgage obligations, over the estimated life of the security. Such amortization is included in interest income from securities. Gains and losses on securities sold are based on the specific identification method.

Declines in the fair value of securities below their cost that are other than temporary are reflected as realized losses. In estimating other-than-temporary losses, management considers: (1) the length of time and extent that fair value has been less than cost, (2) the financial condition and near term prospects of the issuer, (3) and the Corporation’s ability and intent to hold the security for a period sufficient to allow for any anticipated recovery in fair value.

Loans:

Loans that management has the intent and ability to hold for the foreseeable future or until maturity or payoff are reported at the principal balance outstanding, net of unearned interest, deferred loan fees and costs, and an allowance for loan losses.

| | |

9 CNB Financial Corporation 2005 Annual Report | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Interest income is reported on the interest method and includes amortization of net deferred loan fees and costs over the loan term. Interest income on mortgage and commercial loans is discontinued at the time the loan is 90 days delinquent unless the credit is well-secured and in process of collection. Consumer loans are typically charged off no later than 180 days past due. Past due status is based on the contractual terms of the loan. In all cases, loans are placed on nonaccrual or charged-off at an earlier date if collection of principal or interest is considered doubtful.

All interest accrued but not received for loans placed on nonaccrual is reversed against interest income. Interest received on such loans is accounted for on the cash-basis or cost-recovery method, until qualifying for return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

Loans Held for Sale:

Loans originated and intended for sale in the secondary market are carried at the lower of aggregate cost or market as determined by outstanding committments from investors. Net unrealized losses, if any, are recorded as a valuation allowance and charged to earnings.

Direct Lease Financing:

Financing of equipment, principally consisting of automobiles, is provided to customers under lease arrangements accounted for as direct financing leases. These leases are reported in loans as a net amount, consisting of the aggregate of lease payments receivable and estimated residual values, less unearned income. Income is recognized in a manner which results in an approximate level yield over the lease term.

Allowance for Loan Losses:

The allowance for loan losses is a valuation allowance for probable incurred credit losses. Loans which are deemed to be uncollectible are charged against the allowance account. Subsequent recoveries, if any, are credited to the allowance account.

Management determines the adequacy of the allowance based on historical patterns of charge-offs and recoveries, information about specific borrower situations, industry experience, and other qualitative factors relevant to the collectability of the loan portfolio. While management believes that the allowance is adequate to absorb probable loan losses incurred at the balance sheet date, future adjustments may be necessary due to circumstances that differ substantially from the assumptions used in evaluating the adequacy of the allowance for loan losses.

A loan is impaired when full payment under the loan terms is not expected. Impairment is evaluated in total for smaller-balance loans of similar nature such as residential mortgage, consumer, and credit card loans, and accordingly, they are not separately identified for impairment disclosures. If a loan is impaired, a portion of the allowance is allocated so that the loan is reported, net, at the present value of estimated future cash flows using the loan’s existing rate or at the fair value of collateral if repayment is expected solely from the collateral.

Federal Home Loan Bank (FHLB) Stock:

The Bank is a member of the FHLB system. Members are required to own a certain amount of stock based on the level of borrowings and other factors, and may invest in additional amounts. FHLB stock is carried at cost, classified as a restricted security, and periodically evaluated for impairment. Because this stock is viewed as long term investment, impairment is based on ultimate recovery of par value.

Premises and Equipment:

Premises and equipment are stated at cost less accumulated depreciation. Depreciation of premises and equipment is computed principally by the straight line method. In general, useful lives range from 3 to 39 years with lives for furniture, fixtures and equipment ranging from 3 to 10 years and lives of buildings and building improvements ranging from 15 to 39 years. Amortization of leasehold improvements is computed using the straight-line method over useful lives of the leasehold improvements or the term of the lease, whichever is shorter. Maintenance, repairs and minor renewals are charged to expense as incurred.

Foreclosed Assets:

Assets acquired through or in lieu of loan foreclosure are initially recorded at fair value when acquired, establishing a new cost basis. If fair value declines, a valuation allowance is recorded through expense. Costs after acquisition are expensed.

Bank Owned Life Insurance:

The Corporation owns insurance on the lives of a certain group of key employees. The cash surrender value of these policies, or the amount that can be realized, is included on the consolidated statements of financial condition and any increase in cash surrender value is recorded as non-interest income on the consolidated statements of income.

| | |

| | CNB Financial Corporation 2005 Annual Report 10 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Goodwill and Other Intangible Assets:

Goodwill results from prior business acquisitions and represents the excess of the purchase price over the fair value of acquired tangible assets and liabilities and identifiable intangible assets. Goodwill is assessed at least annually for impairment and any such impairment will be recognized in the period identified.

Other intangible assets consist of acquired customer relationship intangible assets arising from the purchase of customer lists on branch acquisitions and a customer relationship intangible related to our consumer discount finance company. They are initially measured at fair value and then are amortized over their useful lives which range from 5 to 10 years.

Long-term Assets:

Premises and equipment, core deposit and other intangible assets, and other long-term assets are reviewed for impairment when events indicate their carrying amount may not be recoverable from future undiscounted cash flows. If impaired, the assets are recorded at fair value.

Loan Commitments and Related Financial Instruments:

Financial instruments include off-balance sheet credit instruments, such as commitments to make loans and commercial letters of credit, issued to meet customer financing needs. The face amount for these items represents the exposure to loss, before considering customer collateral or ability to repay. Such financial instruments are recorded when they are funded.

Advertising Costs:

Advertising costs are generally expensed as incurred.

Income Taxes:

The Corporation files a consolidated U. S. income tax return that includes all subsidiaries except County Reinsurance Company which files a separate return. Deferred taxes are recognized for the expected future tax consequences of existing differences between the financial reporting and tax reporting bases of assets and liabilities using enacted tax laws and rates. Income tax expense is the total of the current year income tax due or refundable and the changes in deferred tax assets and liabilities.

Mortgage Servicing Rights (MSR’s):

Servicing rights represent the allocated value of retained servicing rights on loans sold and the cost of purchased rights. Servicing assets are expensed in proportion to, and over the period of, estimated net servicing revenues. Impairment is evaluated based on the fair value of the assets. Fair value is determined using prices for similar assets with similar characteristics, when available, or based upon discounted cash flows using market-based assumptions. Any impairment of a grouping is reported as a valuation allowance, to the extent that fair value is less than the capitalized amount for a grouping.

Treasury Stock:

The purchase of the Corporation’s common stock is recorded at cost. Purchases of the stock are made both in the open market and through negotiated private purchases based on market prices. At the date of subsequent reissue, the treasury stock account is reduced by the cost of such stock on a first-in-first-out basis.

Stock Compensation:

The Corporation has a stock incentive plan for key employees and independent directors. The Stock Incentive Plan, which is administered by a committee of the Board of Directors, provides for up to 625,000 shares of common stock in the form of qualified options, nonqualified options, stock appreciation rights or restricted stock. For key employees, the plan vesting schedule is one-fourth of granted options per year beginning one year after the grant date with 100% vested on the fourth anniversary. For independent directors, the vesting schedule is one-third of granted options per year beginning one year after the grant date with 100% vested on the third anniversary.

The Corporation applies Accounting Principles Board Opinion 25 and related interpretations in accounting for its common stock incentive plan. Accordingly, no compensation expense has been recognized for the plan. Had compensation cost for the plan been determined based on the fair values at the grant dates for awards, consistent with the method of FAS No. 123, net income and earnings per share for 2005, 2004 and 2003 would have been adjusted to the pro forma amounts indicated below:

| | | | | | | | | | | |

| | | | | 2005 | | 2004 | | 2003 |

Net income, as reported | | $ | 9,138 | | $ | 7,871 | | $ | 9,057 |

Pro forma compensation expense, net of tax | | | 197 | | | 74 | | | 81 |

| | | | | | | | | | | |

Pro forma net income | | $ | 8,941 | | $ | 7,797 | | $ | 8,976 |

| | | | | | | | | | | |

Earnings Per Share-Basic | | As reported | | $ | 1.01 | | $ | 0.86 | | $ | 0.99 |

| | Pro forma | | $ | 0.98 | | $ | 0.85 | | $ | 0.98 |

Earnings Per Share - Diluted | | As reported | | $ | 1.00 | | $ | 0.86 | | $ | 0.98 |

| | Pro forma | | $ | 0.98 | | $ | 0.85 | | $ | 0.98 |

| | |

11 CNB Financial Corporation 2005 Annual Report | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

During 2005, the Corporation opted to accelerate the vesting of all unvested options with an exercise price greater than $15.00, the closing price of the Corporations common stock on the NASDAQ on May 10, 2005. As a result of the acceleration, all unvested shares granted in 2003 and 2004 became immediately exercisable resulting in the significant increase in pro forma compensation expense for the year ended December 31, 2005 as compared to prior periods and noted in the preceding table.

For purposes of the pro forma calculations above, the fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing model with the following weighted average assumptions as of the grant date.

There were no stock option grants during 2005.

| | | | | | |

| | | 2004 | | | 2003 | |

Dividend yield | | 3.4 | % | | 2.8 | % |

Expected stock price volatility | | 23.5 | % | | 23.6 | % |

Risk-free interest rates | | 3.8 | % | | 3.4 | % |

Expected option lives | | 6.0 years | | | 6.0 years | |

Comprehensive Income:

The Corporation presents comprehensive income as part of the Statement of Changes in Shareholders’ Equity. Other comprehensive income (loss) is comprised exclusively of unrealized holding gains (losses) on the available for sale securities portfolio.

Earnings per Share:

Basic earnings per share is determined by dividing net income by the weighted average number of shares outstanding. Diluted earnings per share is determined by dividing net income by the weighted average number of shares outstanding increased by the number of shares that would be issued assuming the exercise of stock options. Earnings and dividends per share for 2003 are restated to reflect a 2 1/2 for 1 stock split which occurred during 2004.

Cash and Cash Equivalents:

For purposes of the consolidated statement of cash flows, the Corporation defines cash and cash equivalents as cash and due from banks, interest bearing deposits with other banks, and Federal funds sold. Net cash flows are reported for customer loan and deposit transactions and borrowings with original maturities of 90 days or less.

Restrictions on Cash:

The Bank is required to maintain average reserve balances with the Federal Reserve Bank or in vault cash. The average amount of these reserve balances for the year ended December 31, 2005 and 2004, was $50, which was maintained in vault cash.

Effect of Newly Issued But Not Yet Effective Accounting Standards:

In December 2004, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 123 (revised 2004), Share-Based Payment (FAS No. 123R). FAS No. 123R revised FAS No. 123, Accounting for Stock-Based Compensation, and supersedes APB Opinion No. 25, Accounting for Stock Issued to Employees, and its related implementation guidance. FAS No. 123R will require compensation costs related to share-based payment transactions to be recognized in the financial statement (with limited exceptions). The amount of compensation cost will be measured based on the grant-date fair value of the equity or liability instruments issued. Compensation cost will be recognized over the period that an employee provides service in exchange for the award.

The Company will adopt FAS No. 123R on January 1, 2006. The Company will elect the modified prospective transition method. Under this method, the Company estimates that the adoption of FAS 123R will require the Company to record approximately $11 of stock compensation expense in the year ended December 31, 2006 related to unvested outstanding options at December 31, 2005. The impact of this Statement on the Company in fiscal 2006 and beyond will depend upon various factors, among them being our future compensation strategy.

In March 2005, the Securities and Exchange Commission (“SEC”) issued Staff Accounting Bulletin No. 107 (“SAB No. 107”), Share-Based Payment, providing guidance on option valuation methods, the accounting for income tax effects of share-based payment arrangements upon adoption of FAS No. 123R, and the disclosures in MD&A subsequent to the adoption. The Company will provide SAB No. 107 required disclosures upon adoption of FAS No. 123R on January 1, 2006.

In June 2005, the FASB issued FAS No. 154, Accounting Changes and Errors Corrections, a replacement of APB Opinion No. 20 and FAS No. 3. The Statement applies to all voluntary changes in accounting principle, and changes the requirements for accounting for and reporting of a change in accounting principle. FAS No. 154 requires retrospective application to prior periods’ financial statements of a voluntary change in accounting principle unless it is impractical. APB Opinion No. 20 previously required that most voluntary changes in accounting principle be recognized by including in net income of the period of the

| | |

| | CNB Financial Corporation 2005 Annual Report 12 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

change the cumulative effect of changing to the new accounting principle. FAS No.154 improves the financial reporting because its requirements enhance the consistency of financial reporting between periods. The provisions of FAS No. 154 are effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005. The adoption of this standard is not expected to have a material effect on the Company’s results of operations or financial position.

Loss Contingencies:

Loss contingencies, including claims and legal actions arising in the ordinary course of business, are recorded as liabilities when the likelihood of loss is probable and an amount or range of loss can be reasonably estimated. Management does not believe there now are such matters that will have a material effect on the financial statements.

Fair Value of Financial Instruments:

Fair values of financial instruments are estimated using relevant market information and other assumptions, as more fully disclosed in a separate note. Fair value estimates involve uncertainties and matters of significant judgment regarding interest rates, credit risk, prepayments, and other factors, especially in the absence of broad markets for particular items. Changes in assumptions or in market conditions could significantly affect the estimates.

Reclassifications:

Certain prior year amounts have been reclassified for comparative purposes.

2. EARNINGS PER SHARE

Basic earnings per share is computed by dividing net income by the weighted average number of shares outstanding during the period. Diluted earnings per share is computed using the weighted average number of shares determined for the basic computation plus the dilutive effect of potential common shares issuable under stock options. For the years ended December 31, 2005, 2004 and 2003, options to purchase 110,500, 58,918, and 56,250 shares of common stock, respectively, were not considered in computing diluted earnings per common share because they were anti-dilutive. Earnings per share calculations for 2003 were restated to reflect a 2 1/2 for 1 stock split for shares owned and recorded on April 21, 2004. The computation of basic and diluted EPS is shown below (in thousands, except per share data):

| | | | | | | | | |

| | | Years Ended December 31 |

| | | 2005 | | 2004 | | 2003 |

Net income | | $ | 9,138 | | $ | 7,871 | | $ | 9,057 |

| | | | | | | | | |

Weighted-average common shares outstanding (basic) | | | 9,085 | | | 9,131 | | | 9,115 |

Effect of stock options | | | 30 | | | 57 | | | 75 |

| | | | | | | | | |

Weighted-average common shares outstanding (diluted) | | | 9,115 | | | 9,188 | | | 9,190 |

| | | | | | | | | |

Earnings per share: | | | | | | | | | |

Basic | | $ | 1.01 | | $ | 0.86 | | $ | 0.99 |

Diluted | | $ | 1.00 | | $ | 0.86 | | $ | 0.98 |

3. SECURITIES

Securities at December 31, 2005 and 2004 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2005 | | December 31, 2004 |

| | | Amortized Cost | | Unrealized | | | Fair Value | | Amortized Cost | | Unrealized | | | Fair Value |

| | | | Gains | | Losses | | | | | Gains | | Losses | | |

Securities available for sale: | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. Treasury | | $ | 11,961 | | $ | — | | $ | (111 | ) | | $ | 11,850 | | $ | 13,096 | | $ | — | | $ | (85 | ) | | $ | 13,011 |

U.S. Government agencies and corporations | | | 31,378 | | | 6 | | | (415 | ) | | | 30,969 | | | 30,563 | | | — | | | (303 | ) | | | 30,260 |

Obligations of States and Political Subdivisions | | | 39,352 | | | 1,340 | | | (20 | ) | | | 40,672 | | | 41,712 | | | 2,567 | | | — | | | | 44,279 |

Mortgage-backed | | | 39,907 | | | 71 | | | (551 | ) | | | 39,427 | | | 40,489 | | | 241 | | | (50 | ) | | | 40,680 |

Corporate notes and bonds | | | 29,820 | | | 815 | | | (187 | ) | | | 30,448 | | | 26,404 | | | 1,558 | | | (97 | ) | | | 27,865 |

Marketable equities | | | 7,688 | | | 986 | | | (143 | ) | | | 8,531 | | | 7,811 | | | 665 | | | (369 | ) | | | 8,107 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total securities available for sale | | $ | 160,106 | | $ | 3,218 | | $ | (1,427 | ) | | $ | 161,897 | | $ | 160,075 | | $ | 5,031 | | $ | (904 | ) | | $ | 164,202 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

At year end 2005 and 2004, there were no holdings of securities of any one issuer, other than the U.S. Government and its agencies, in an amount greater than 10% of shareholders’ equity.

| | |

13 CNB Financial Corporation 2005 Annual Report | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Securities with unrealized losses at year-end 2005 and 2004, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position, are as follows:

| | | | | | | | | | | | | | | | | | | | | |

| 2005 | | Less than 12 Months | | | 12 Months or More | | | Total | |

Description of Securities | | Fair

Value | | Unrealized

Loss | | | Fair

Value | | Unrealized

Loss | | | Fair

Value | | Unrealized

Loss | |

U.S. Treasury | | $ | 4,940 | | $

|

(39 |

) | | $ | 5,935 | | $

|

(72 |

) | | $ | 10,875 | | $ | (111 | ) |

U.S. Gov’t Agencies & Corps | | | 11,056 | | | (127 | ) | | | 16,198 | | | (288 | ) | | | 27,254 | | | (415 | ) |

States & Political Subdivisions | | | 3,268 | | | (16 | ) | | | 705 | | | (4 | ) | | | 3,973 | | | (20 | ) |

Mortgage-Backed | | | 19,548 | | | (356 | ) | | | 9,789 | | | (195 | ) | | | 29,337 | | | (551 | ) |

Corporate Notes and Bonds | | | 8,906 | | | (70 | ) | | | 4,258 | | | (117 | ) | | | 13,164 | | | (187 | ) |

Marketable Equities | | | 1,036 | | | (43 | ) | | | 1,390 | | | (100 | ) | | | 2,426 | | | (143 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | $ | 48,754 | | $ | (651 | ) | | $ | 38,275 | | $ | (776 | ) | | $ | 87,029 | | $ | (1,427 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | | |

| 2004 | | Less than 12 Months | | | 12 Months or More | | | Total | |

Description of Securities | | Fair

Value | | Unrealized

Loss | | | Fair

Value | | Unrealized

Loss | | | Fair

Value | | Unrealized

Loss | |

U.S. Treasury | | $ | 11,023 | | $ | (74 | ) | | $ | 1,988 | | $ | (11 | ) | | $ | 13,011 | | $ | (85 | ) |

U.S. Gov’t Agencies & Corps | | | 23,282 | | | (243 | ) | | | 5,977 | | | (60 | ) | | | 29,259 | | | (303 | ) |

Mortgage-Backed | | | 11,429 | | | (42 | ) | | | 2,544 | | | (8 | ) | | | 13,973 | | | (50 | ) |

Corporate Notes and Bonds | | | 500 | | | (7 | ) | | | 3,779 | | | (90 | ) | | | 4,279 | | | (97 | ) |

Marketable Equities | | | 81 | | | (18 | ) | | | 1,676 | | | (351 | ) | | | 1,757 | | | (369 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | $ | 46,315 | | $ | (384 | ) | | $ | 15,964 | | $ | (520 | ) | | $ | 62,279 | | $ | (904 | ) |

| | | | | | | | | | | | | | | | | | | | | |

The Corporation evaluates securities for other-than-temporary impairment on a quarterly basis, or more frequently when economic or market conditions warrant such an evaluation. Consideration is given to the length of time and the extent to which fair value has been less than cost, the financial condition and near term prospects of the issuer, and the intent and ability of the Corporation to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value. In analyzing an issuer’s financial condition, the Corporation may consider whether the securities are issued by the federal government or its agencies, whether downgrades by bond rating agencies have occurred, and results of reviews of the issuer’s financial condition. The following comments relate to those securities which have been in a continuous unrealized loss position for more than twelve months.

Included in the $776 of unrealized losses at December 31, 2005 on investment securities that have been in a continuous unrealized loss position for 12 months or more are $676 of unrealized losses on debt securities. Management does not believe any of the individual unrealized losses on debt securities represents an other-than-temporary impairment since these losses are primarily attributable to changes in interest rates and the Corporation has both the intent and ability to hold the debt securities to maturity.

Unrealized losses on equity securities, which compromise the remainder of the $776 and amount to $100, were not individually significant and also considered to be temporary in nature.

During 2005 and 2004, the Corporation recognized impairment losses of $240 and $1,400 before tax, respectively, on government sponsored preferred securities that were determined to be other-than-temporarily impaired because management did not believe the securities would recover to the Corporation’s cost basis in a reasonable period of time.

On December 31, 2005 and 2004, securities carried at $80,436 and $44,579, respectively, were pledged to secure public deposits and for other purposes as provided by law.

| | |

| | CNB Financial Corporation 2005 Annual Report 14 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The following is a schedule of the contractual maturity of securities available-for-sale excluding equity securities, at December 31, 2005:

| | | |

| | | Available for Sale

Fair Value |

1 year or less | | $ | 22,948 |

1 year-5 years | | | 40,649 |

5 years-10 years | | | 10,937 |

After 10 years | | | 39,405 |

| | | |

| | | 113,939 |

Mortgage-backed securities | | | 39,427 |

| | | |

Total securities | | $ | 153,366 |

| | | |

Mortgage-backed securities are not due at a single date; periodic payments are received based on the payment patterns of the underlying collateral.

Information pertaining to security sales is as follows:

| | | | | | | | | |

| | | Proceeds | | Gross Gains | | Gross Losses |

2005 | | $ | 8,038 | | $ | 387 | | $ | 65 |

2004 | | $ | 6,805 | | $ | 339 | | $ | 26 |

2003 | | $ | 10,608 | | $ | 306 | | $ | 36 |

The tax provision related to these net realized gains was $113, $109 and $95, respectively.

4. LOANS

Total Loans at December 31, 2005 and 2004 are summarized as follows:

| | | | | | |

| | | 2005 | | 2004 |

Commercial, Financial and Agricultural | | $ | 194,044 | | $ | 187,261 |

Residential Mortgage | | | 153,130 | | | 149,621 |

Commercial Mortgage | | | 135,417 | | | 115,566 |

Installment | | | 27,840 | | | 27,526 |

Lease Receivables | | | 611 | | | 2,074 |

| | | | | | |

| | $ | 511,042 | | $ | 482,048 |

| | | | | | |

Lease receivables at December 31, 2005 and 2004 are summarized as follows:

| | | | | | | | |

| | | 2005 | | | 2004 | |

Lease payment receivable | | $ | 198 | | | $ | 748 | |

Estimated residual values | | | 413 | | | | 1,326 | |

| | | | | | | | |

Gross lease receivables | | | 611 | | | | 2,074 | |

Less unearned income | | | (25 | ) | | | (111 | ) |

| | | | | | | | |

Net lease receivables | | $ | 586 | | | $ | 1,963 | |

| | | | | | | | |

At December 31, 2005 and 2004, net unamortized loan costs of $226 and $283, respectively, have been included in the carrying value of loans.

The Bank’s outstanding loans and related unfunded commitments are primarily concentrated within Central Pennsylvania. The Bank attempts to limit concentrations within specific industries by utilizing dollar limitations to single industries or customers, and by entering into participation agreements with third parties. Collateral requirements are established based on management’s assessment of the customer.

| | |

15 CNB Financial Corporation 2005 Annual Report | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Deposit accounts that have overdrawn their current balance, known as overdrafts, are reclassified to loans. Overdrafts included in year-end loans are $2,278 in 2005 and $2,928 in 2004.

Impaired loans were as follows:

| | | | | | |

| | | 2005 | | 2004 |

Year-end loans with no allocated allowance for loan losses | | $ | 788 | | $ | 825 |

Year-end loans with allocated allowance for loan losses | | | 886 | | | 1,421 |

| | | | | | |

Total | | $ | 1,674 | | $ | 2,246 |

| | | | | | |

Amount of the allowance for loan losses allocated | | $ | 446 | | $ | 309 |

| | | | | | |

| | | | | | | | | |

| | | 2005 | | 2004 | | 2003 |

Average impaired loans outstanding during the year | | $ | 1,939 | | $ | 2,272 | | $ | 1,434 |

Interest income recognized during impairment | | | — | | | — | | | — |

Cash-basis interest income recognized | | | — | | | — | | | — |

Nonperforming loans were as follows:

| | | | | | |

| | | 2005 | | 2004 |

Loans past due over 90 days still on accrual | | $ | 462 | | $ | 177 |

Nonaccrual loans | | $ | 1,561 | | $ | 1,683 |

Nonperforming loans include all (or almost all) impaired loans and smaller balance homogeneous loans, such as residential mortgage and consumer loans, that are collectively evaluated for impairment.

5. ALLOWANCEFOR LOAN LOSSES

Transactions in the Allowance for Loan Losses for the three years ended December 31 were as follows:

| | | | | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Balance, Beginning of Year | | $ | 5,585 | | | $ | 5,764 | | | $ | 5,036 | |

Charge-offs | | | (975 | ) | | | (1,099 | ) | | | (924 | ) |

Recoveries | | | 210 | | | | 120 | | | | 117 | |

| | | | | | | | | | | | |

Net Charge-offs | | | (765 | ) | | | (979 | ) | | | (807 | ) |

Provision for Loan Losses | | | 783 | | | | 800 | | | | 1,535 | |

| | | | | | | | | | | | |

Balance, End of Year | | $ | 5,603 | | | $ | 5,585 | | | $ | 5,764 | |

| | | | | | | | | | | | |

6. SECONDARY MORTGAGE MARKET ACTIVITIES

The following summarizes secondary mortgage market activities for each year:

| | | | | | | | | |

| | | 2005 | | 2004 | | 2003 |

Activity during the year: | | | | | | | | | |

Loans originated for resale, Net of principal pay downs | | $ | 11,868 | | $ | 11,724 | | $ | 39,306 |

Proceeds from sales of loans held for sale | | $ | 12,308 | | $ | 11,866 | | $ | 39,819 |

Net gains on sales of loans held for sale | | $ | 95 | | $ | 142 | | $ | 513 |

Loan servicing fees, net | | $ | 225 | | $ | 186 | | $ | 204 |

Total loans serviced for others | | $ | 73,088 | | $ | 69,240 | | $ | 68,784 |

| | |

| | CNB Financial Corporation 2005 Annual Report 16 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Activity for capitalized mortgage servicing rights was as follows:

| | | | | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Servicing rights: | | | | | | | | | | | | |

Beginning of year | | $ | 411 | | | $ | 481 | | | $ | 512 | |

Additions | | | 155 | | | | 124 | | | | 170 | |

Amortized to expense | | | (193 | ) | | | (194 | ) | | | (201 | ) |

| | | | | | | | | | | | |

End of year | | $ | 373 | | | $ | 411 | | | $ | 481 | |

| | | | | | | | | | | | |

No valuation allowance is deemed necessary as of December 31, 2005, 2004 or 2003.

7. PREMISESAND EQUIPMENT

The following summarizes Premises and Equipment at December 31:

| | | | | | |

| | | 2005 | | 2004 |

Land | | $ | 2,248 | | $ | 2,223 |

Premises and Leasehold Improvements | | | 13,697 | | | 12,897 |

Furniture and Equipment | | | 10,720 | | | 10,331 |

| | | | | | |

| | | 26,665 | | | 25,451 |

Less Accumulated Depreciation and Amortization | | | 12,753 | | | 11,690 |

| | | | | | |

Premises and Equipment, Net | | $ | 13,912 | | $ | 13,761 |

| | | | | | |

Depreciation on Premises and Equipment amounted to $1,333 in 2005, $1,255 in 2004, and $1,151 in 2003.

The Corporation is committed under four noncancelable operating leases for facilities with initial or remaining terms in excess of one year. The minimum annual rental commitments under these leases at December 31, 2005 are as follows:

| | | |

2006 | | $ | 119 |

2007 | | | 117 |

2008 | | | 110 |

2009 | | | 110 |

2010 | | | 90 |

Thereafter | | | 1,259 |

| | | |

| | $ | 1,805 |

| | | |

Rental expense, net of rental income, charged to occupancy expense for 2005, 2004, and 2003 was $190, $209, and $217, respectively.

8. FORECLOSED ASSETS

Foreclosed real estate is reported net of a valuation allowance. Activity was as follows:

| | | | | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Beginning of year | | $ | 830 | | | $ | 286 | | | $ | 212 | |

Additions | | | 80 | | | | 1,005 | | | | 257 | |

Direct write-downs | | | — | | | | (40 | ) | | | — | |

Sales | | | (825 | ) | | | (421 | ) | | | (183 | ) |

| | | | | | | | | | | | |

End of year | | $ | 85 | | | $ | 830 | | | $ | 286 | |

| | | | | | | | | | | | |

| | |

17 CNB Financial Corporation 2005 Annual Report | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

9. GOODWILLAND INTANGIBLE ASSETS

The change in the carrying amount of goodwill for the year is as follows:

| | | | | | |

| | | 2005 | | 2004 |

Beginning of year | | $ | 10,821 | | $ | 10,821 |

Acquired during the period | | | — | | | — |

| | | | | | |

End of year | | $ | 10,821 | | $ | 10,821 |

| | | | | | |

| | | | | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Acquired Intangible Assets | | | | | | | | | | | | |

Amortized intangibles | | $ | 3,152 | | | $ | 3,152 | | | $ | 3,152 | |

Intangible assets acquired during year | | | 500 | | | | — | | | | — | |

Accumulated amortization | | | (2,852 | ) | | | (2,522 | ) | | | (2,206 | ) |

| | | | | | | | | | | | |

Net | | $ | 800 | | | $ | 630 | | | $ | 946 | |

| | | | | | | | | | | | |

Aggregate amortization expense | | $ | 330 | | | $ | 316 | | | $ | 315 | |

In November of 2005, the Corporation acquired the assets of a consumer discount and finance company which the Corporation operates as Holiday Financial Services Corporation. The purchase price was $2,408 for the performing loans and customers of the business. The purchase resulted in the Corporation recording a $500 customer relationship intangible.

Estimated amortization expense for each of the next five years:

| | | |

2006 | | $ | 415 |

2007 | | $ | 100 |

2008 | | $ | 100 |

2009 | | $ | 100 |

2010 | | $ | 85 |

10. DEPOSITS

The following table reflects time certificates of deposit and IRA accounts included in total deposits and their remaining maturities at December 31:

| | | |

| | | 2005 |

Time Deposits Maturing: | | | |

2006 | | $ | 100,845 |

2007 | | | 56,572 |

2008 | | | 130,646 |

2009 | | | 22,074 |

2010 | | | 12,120 |

Thereafter | | | 8,243 |

| | | |

| | $ | 330,500 |

| | | |

Certificates of Deposit of $100 thousand or more totaled $99,542, and $93,065 at December 31, 2005 and 2004, respectively.

11. BORROWINGS

Borrowings include $2,000 of demand notes payable to the U.S. Treasury Department at December 31, 2005 and 2004. These notes are issued under the U.S. Treasury Department’s program of investing the treasury tax and loan account balances in interest bearing demand notes insured by depository institutions. These notes bear interest at a rate of .25 percent less than the average Federal funds rate as computed by the Federal Reserve Bank. The Corporation has available a $5 million line of credit with an unaffiliated institution. Terms of the line are floating at 30 day LIBOR plus 180 basis points. The outstanding balance on the loan at year end 2005 and 2004 was $0.

| | |

| | CNB Financial Corporation 2005 Annual Report 18 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

At year end 2005, the Bank had remaining borrowing capacity with the Federal Home Loan Bank (FHLB) of $105 million. Borrowings with the FHLB are secured by a blanket pledge of selected securities in the amount of $78,782 and certain mortgage loans with a balance of $150,816. Borrowings from the FHLB at December 31, 2005, and 2004 are as follows:

| | | | | | | | |

| | | | | December 31, |

Interest Rate | | Maturity | | 2005 | | 2004 |

(a) | | 05/03/06 | | $ | 1,250 | | | |

(b) | | 11/03/06 | | | 1,750 | | | |

(c) | | 05/03/07 | | | 2,250 | | | |

(d) | | 05/05/08 | | | 4,000 | | | |

(e) | | 05/04/09 | | | 4,500 | | | |

(f) | | 03/01/10 | | | 10,000 | | $ | 10,000 |

(g) | | 05/03/10 | | | 4,500 | | | — |

(h) | | 01/03/11 | | | 10,000 | | | 10,000 |

(i) | | 01/24/12 | | | 20,000 | | | 20,000 |

| | | | | | | | |

Total FHLB Borrowings | | | | $ | 58,250 | | $ | 40,000 |

| | | | | | | | |

(a), (b), (c), (d), (e), (g) - Items (a) through (e) and (g) are fixed rate borrowings at interest rates of 3.69%, 3.83%, 4.00%, 4.14%, 4.35% and 4.43%, respectively.

(f) FHLB has option to float the interest rate based on the 3 month LIBOR +.16%, the interest rate was 6.09% at December 31, 2005 and 2004.

(h) Interest rate was fixed for one year after which time the FHLB has option to float the interest rate based on the 3 month LIBOR +.20%. The interest rate was 4.95% at December 31, 2005 and 2004.

(i) Interest rate was fixed for two years after which time FHLB converted to a floating interest rate based on the 3 month LIBOR +.18% if the 3 month LIBOR is equal to or greater than 8.0%. The interest rate was 4.52% as of December 31, 2005 and 2004.

The terms of the above borrowings are interest only payments with principal due at maturity.

Subordinated Debentures:

A trust formed by the Corporation issued $10,000 of floating rate trust preferred securities in 2002 as part of a pooled offering of such securities. The interest rate is determined quarterly and floats based on the 3 month LIBOR plus 3.45% and was 7.97% at December 31, 2005 and 6.00% at December 31, 2004. The Corporation may redeem the debentures, in whole or in part, at face value after June 26, 2007. The Corporation issued subordinated debentures to the trust in exchange for the proceeds of the offering, which debentures represent the sole asset of the trust. The subordinated debentures must be redeemed no later than 2032.

Under FASB Interpretation No. 46, as revised in December 2003, the trust is not consolidated with the Corporation. Accordingly, the Corporation does not report the securities issued by the trust as liabilities, and instead reports as liabilities the subordinated debentures issued by the Corporation and held by the trust, as these are not eliminated in consolidation.

Following are maturities of all borrowed funds as of December 31, 2005:

| | | |

2006 | | $ | 5,000 |

2007 | | | 2,250 |

2008 | | | 4,000 |

2009 | | | 4,500 |

2010 | | | 14,500 |

Thereafter | | | 40,310 |

| | | |

Total Borrowed Funds | | $ | 70,560 |

| | | |

| | |

19 CNB Financial Corporation 2005 Annual Report | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

12. INCOME TAXES

The following is a summary of income tax expense:

| | | | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

Current | | 3,663 | | | $ | 2,699 | | | $ | 4,094 | |

Deferred | | (674 | ) | | | (735 | ) | | | (1,289 | ) |

| | | | | | | | | | | |

Income tax expense | | 2,989 | | | $ | 1,964 | | | $ | 2,805 | |

| | | | | | | | | | | |

The components of the net deferred tax asset (liability) as of December 31, 2005 and 2004 are as follows:

| | | | | | | |

| | | 2005 | | 2004 | |

Deferred tax assets | | | | | | | |

Allowance for loan losses | | $ | 1,961 | | $ | 1,955 | |

Deferred compensation | | | 757 | | | 618 | |

Impaired security valuation | | | 574 | | | 490 | |

Post-retirement benefits | | | 237 | | | 212 | |

Merger costs | | | 30 | | | 38 | |

Other | | | 180 | | | 90 | |

| | | | | | | |

| | | 3,739 | | | 3,403 | |

Deferred tax liabilities | | | | | | | |

Unrealized gain on securities available for sale | | | 624 | | | 1,444 | |

Premises and equipment | | | 514 | | | 598 | |

Intangibles - section 197 | | | 593 | | | 297 | |

Vehicle leasing | | | 164 | | | 574 | |

Prepaid expenses | | | 116 | | | 146 | |

Intangibles - mortgage servicing rights | | | 130 | | | 144 | |

Deferred loan fees/costs | | | 50 | | | 113 | |

Other | | | 113 | | | 146 | |

| | | | | | | |

| | | 2,304 | | | 3,462 | |

| | | | | | | |

Net deferred tax asset (liability) | | $ | 1,435 | | $ | (59 | ) |

| | | | | | | |

The reconciliation of income tax attributable to pre-tax income at the Federal statutory tax rates to income tax expense is as follows:

| | | | | | | | | | | | | | | | | | | | | |

| | | 2005 | | | % | | | 2004 | | | % | | | 2003 | | | % | |

Tax at statutory rate | | $ | 4,244 | | | 35.0 | | | $ | 3,443 | | | 35.0 | | | $ | 4,152 | | | 35.0 | |

Tax exempt income, net | | | (881 | ) | | (7.3 | ) | | | (1,004 | ) | | (10.2 | ) | | | (1,007 | ) | | (8.5 | ) |

Bank owned life insurance | | | (215 | ) | | (1.8 | ) | | | (175 | ) | | (1.8 | ) | | | (171 | ) | | (1.5 | ) |

Other | | | (159 | ) | | (1.3 | ) | | | (300 | ) | | (3.0 | ) | | | (169 | ) | | (1.4 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Income tax expense | | | 2,989 | | | 24.6 | | | $ | 1,964 | | | 20.0 | | | $ | 2,805 | | | 23.6 | |

| | | | | | | | | | | | | | | | | | | | | |

13. EMPLOYEE BENEFIT PLANS

The Corporation provides a defined contribution retirement plan that covers all active officers and employees twenty-one years of age or older, employed by the Corporation for one year. Contributions to the plan for 2005, 2004 and 2003 based on current year compensation, are 6 percent of total compensation plus 5.7 percent of the compensation in excess of $90. The Corporation recognized expense of $377 in 2005, $375 in 2004, and $325 in 2003.

In addition, the Corporation sponsors a contributory defined contribution Section 401(k) plan in which substantially all employees participate. The plan permits employees to make pre-tax contributions which are matched by the Corporation, in 2005,

| | |

| | CNB Financial Corporation 2005 Annual Report 20 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2004 and 2003, at 100% for every 1% contributed up to three percent then 50% for every 1% contributed up to four percent in total of the employee’s compensation. The Corporation’s contributions were $176, $148, and $171 in 2005, 2004, and 2003, respectively.

During 2003, the Corporation adopted a non-qualified supplemental executive retirement plan (“SERP”) for certain executives to compensate those executive participants in the Corporation’s retirement plan whose benefits are limited by compensation limitations under current tax law. The SERP is considered an unfunded plan for tax and ERISA purposes and all obligations arising under the SERP are payable from the general assets of the Corporation. At December 31, 2005 and 2004, obligations of $1,218 and $857, respectively, were included in other liabilities for this plan. Expense related to this plan were $405 in 2005, $428 in 2004 and $429 in 2003.

During 2003, the Corporation established a Survivor Benefit Plan (the Plan) for the benefit of outside directors. The purpose of the plan is to provide life insurance benefits to beneficiaries of the Corporation’s board of directors who at the time of their death are participants in the plan. The plan is considered an unfunded plan for tax and ERISA purposes and all obligations arising under the plan are payable from the general assets of the Corporation. At December 31, 2005 and 2004, obligations of $328 and $226, respectively, were included in other liabilities for this plan. Expenses related to this plan were $103 in 2005, $123 in 2004 and $103 in 2003.

The Corporation provides certain health care benefits for retired employees and their qualifying dependents. The following table sets forth the change in the benefit obligation and funded status:

| | | | | | | | | | | | |

| December 31 | | 2005 | | | 2004 | | | 2003 | |

Benefit obligation at beginning of year | | $ | 580 | | | $ | 654 | | | $ | 637 | |

Interest cost | | | 34 | | | | 42 | | | | 45 | |

Service cost | | | 31 | | | | 34 | | | | 37 | |

Actual claim expense | | | (16 | ) | | | (10 | ) | | | (35 | ) |

Interest on claim expense | | | — | | | | — | | | | (1 | ) |

Actuarial (gain)/loss | | | (30 | ) | | | (140 | ) | | | (29 | ) |

| | | | | | | | | | | | |

Benefit obligation at end of year | | $ | 599 | | | $ | 580 | | | $ | 654 | |

| | | | | | | | | | | | |

| | | |

| December 31 | | 2005 | | | 2004 | | | 2003 | |

Funded status of plan | | $ | (599 | ) | | $ | (580 | ) | | $ | (654 | ) |

Unrecognized actuarial (gain)/loss | | | (121 | ) | | | (92 | ) | | | 48 | |

Unrecognized transition obligation | | | 59 | | | | 66 | | | | 73 | |

| | | | | | | | | | | | |

Accrued benefit cost | | $ | (661 | ) | | $ | (606 | ) | | $ | (533 | ) |

| | | | | | | | | | | | |

| | | |

| December 31 | | 2005 | | | 2004 | | | 2003 | |

Net periodic post-retirement benefit cost: | | | | | | | | | | | | |

Service cost | | $ | 31 | | | $ | 34 | | | $ | 37 | |

Interest cost | | | 34 | | | | 42 | | | | 45 | |

Amortization of transition obligation over 21 years | | | 6 | | | | 7 | | | | 8 | |

| | | | | | | | | | | | |

| | $ | 71 | | | $ | 83 | | | $ | 90 | |

| | | | | | | | | | | | |

The weighted average discount rate used to calculate net periodic benefit cost was 6.0% in 2005, 6.0% in 2004 and 6.5% in 2003. The weighted average rate used to calculate accrued benefit obligations was 6.0% in 2005, 6.0% in 2004 and 6.5% in 2003. The health care cost trend rate used to measure the expected costs of benefits for 2006 is 7.0%, 6.0% for 2007, and 5% for 2008 and thereafter. A one percent increase in the health care trend rates would result in an increase of $86 in the benefit obligation of December 31, 2005, and would increase the service and interest costs by $12 in future periods. A similar one percent decrease in health care trend rates would result in a decrease of $74 and $10 in the benefit obligation and service and interest costs, respectively, at December 31, 2005. The presentation above for the years 2005, 2004 and 2003 reflects a policy which grants eligibility to these benefits to employees at least 60 years of age with 30 years of service.

14. DEFERRED COMPENSATION PLANS

Deferred compensation plans cover all directors and certain officers. Under the plans, the Corporation pays each participant, or their beneficiary, the amount of fees or compensation deferred plus gains or net of losses over a maximum period of 10 years,

| | |

21 CNB Financial Corporation 2005 Annual Report | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

beginning with the individuals termination of service. A liability is accrued for the obligation under these plans. The expense incurred for deferred compensation for 2005, 2004 and 2003 was $64, $39 and $308, respectively, resulting in a deferred compensation liability of $941 and $908 as of year-end 2005 and 2004, respectively.

15. STOCK OPTIONS

A summary of the status of the common stock incentive plan, adjusted retroactively for the effects of stock splits, is presented below:

| | | | | | |

| | | Stock

Options | | | Weighted - average Exercise Price |

Outstanding, at January 1, 2003 | | 225,113 | | | $ | 10.20 |

Granted | | 56,250 | | | | 17.54 |

Exercised | | (48,077 | ) | | | 9.53 |

Forfeited | | (313 | ) | | | 9.50 |

| | | | | | |

Outstanding, at December 31, 2003 | | 232,973 | | | | 12.08 |

Granted | | 54,250 | | | | 16.04 |

Exercised | | (11,017 | ) | | | 8.70 |

Forfeited | | — | | | | — |

| | | | | | |

Outstanding, at December 31, 2004 | | 276,206 | | | | 13.02 |

Granted | | — | | | | — |

Exercised | | (7,850 | ) | | | 9.10 |

Forfeited | | (313 | ) | | | 9.50 |

| | | | | | |

Outstanding, at December 31, 2005 | | 268,043 | | | $ | 13.14 |

| | | | | | |

| | | | | | | | |

| | | 2005 | | 2004 | | 2003 |

Options exercisable at year-end | | 259,135 | | | 155,183 | | | 123,347 |

Fair value of options granted during the year | | — | | $ | 2.69 | | $ | 3.20 |

Number of authorized stock options remaining to grant | | 289,388 | | | 289,075 | | | 343,325 |

Options outstanding at year-end 2005 were as follows:

| | | | | | | | | |

| | | Outstanding | | Exerciseable |

Range of Exercise Prices | | Number | | Weighted Average

Remaining

Contractual Life | | Number | | Weighted Average

Exercise Price |

$ 7.40 - 9.50 | | 82,269 | | 5.5 years | | 82,269 | | $ | 8.54 |

11.30 - 13.30 | | 75,274 | | 6.2 years | | 66,366 | | | 12.71 |

16.04 - 17.54 | | 110,500 | | 8.5 years | | 110,500 | | | 16.80 |

| | | | | | | | | |