Exhibit 13.1

| | |

Consolidated Financial Highlights 1 Message to Shareholders 2 Consolidated Statements of Financial Condition 5 Consolidated Statements of Income 6 Consolidated Statements of Cash Flows 7 Consolidated Statements of Changes in Shareholders’ Equity 8 Notes to Consolidated Financial Statements 9 Management’s Report on Internal Control Over Financial Reporting 33 Report of Independent Registered Public Accounting Firm 34 Statistical Information 35 Selected Financial Data - Five Year Comparison 37 Management’s Discussion and Analysis of Financial Condition and Results of Operation 39 Executive Management and Board of Directors 49 Officers 50 Shareholder Information 52 CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | |  |

(in thousands, except per share data)

| | | | | | | | | | |

| | | | | 2008 | | 2007 | | % Change |

For The Year | | | | | | | | | | |

| | Interest Income | | $ | 57,183 | | $ | 53,933 | | 6.0% |

| | Interest Expense | | | 20,583 | | | 22,922 | | (10.2%) |

| | Net Interest Income | | | 36,600 | | | 31,011 | | 18.0% |

| | Non-interest Income | | | 2,490 | | | 8,189 | | (69.6%) |

| | Non-interest Expense | | | 28,801 | | | 25,273 | | 14.0% |

| | Net Income | | | 5,235 | | | 9,134 | | (42.7%) |

| | Operating Earnings* | | | 7,811 | | | 9,719 | | (19.6%) |

| | | | |

| | Net Income Return on: | | | | | | | | |

| | Average Assets | | | 0.55% | | | 1.12% | | (50.9%) |

| | Average Equity | | | 7.88% | | | 12.82% | | (38.5%) |

| | | | |

At Year End | | | | | | | | | | |

| | Assets | | $ | 1,016,518 | | $ | 858,700 | | 18.4% |

| | Loans, net of unearned | | | 671,556 | | | 599,688 | | 12.0% |

| | Deposits | | | 814,596 | | | 659,157 | | 23.6% |

| | Shareholders’ Equity | | | 62,467 | | | 69,283 | | (9.8%) |

| | Trust Assets Under Management | | | | | | | | |

| | (at market value) | | | 179,223 | | | 231,335 | | (22.5%) |

| | | | |

| Per Share Data | | | | | | | | | | |

| | Net Income, diluted | | $ | 0.61 | | $ | 1.05 | | (41.9%) |

| | Dividends | | | 0.645 | | | 0.62 | | 4.0% |

| | Book Value | | | 7.27 | | | 8.10 | | (10.2%) |

| | Market Value | | | 11.19 | | | 13.55 | | (17.4%) |

*2008 and 2007 operating earnings amounts are shown before effect of $2,576 and $585 (after tax) non-cash charges due to write-downs of other-than-temporarily impaired securities.

1 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

| | |

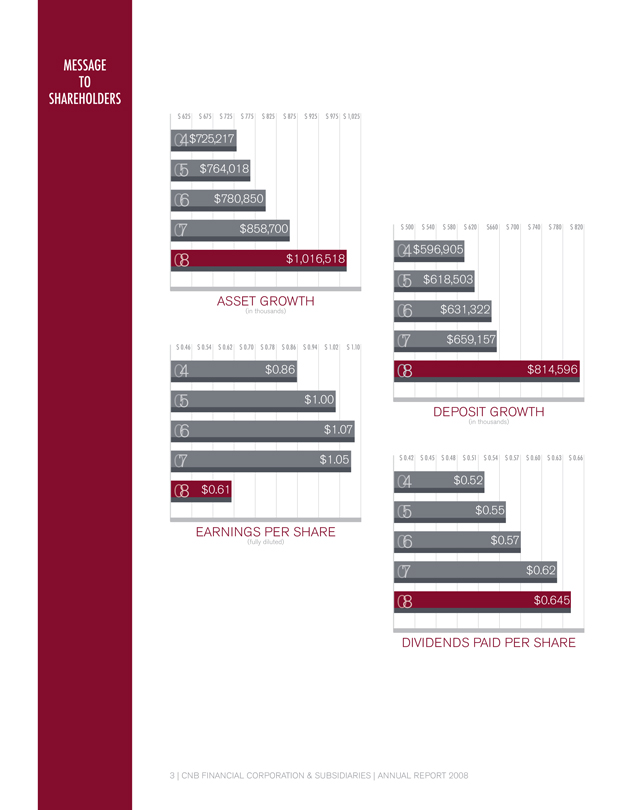

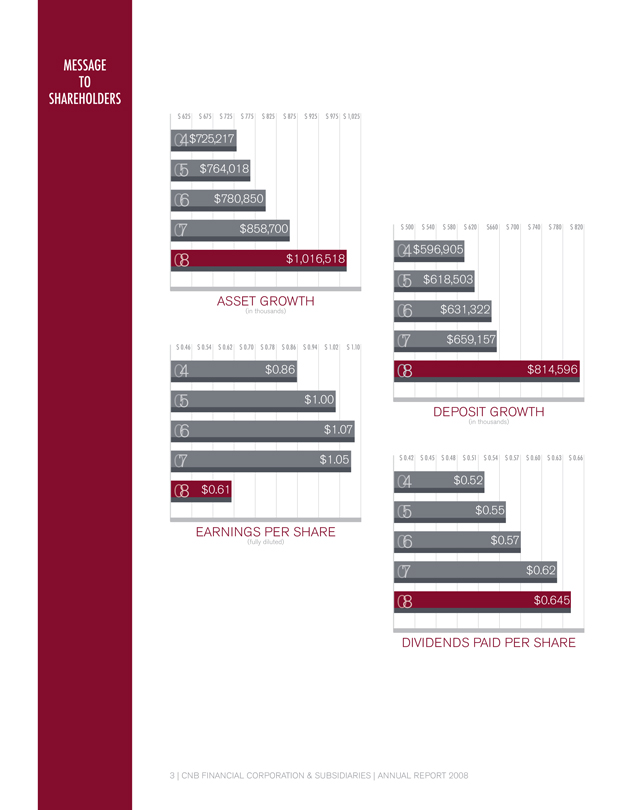

To Our Shareholders, Customers & Friends: The year of 2008 was one of historic significance for CNB Financial Corporation, our country and the world. For our corporation, it was a year when we reached the milestone of $1 billion in assets. For our country, and the world, it was a year of extreme financial turmoil and the beginning of a significant recession, the effects of which will likely be felt for some time. The achievement of our year end asset total was driven by deposit growth of 23.6% which in large part was the result of our expansion into the Erie and Warren, Pennsylvania markets. In Erie, we completed the build out of our four-branch presence of ERIEBANK with the opening of our principal office on Interchange Road and our Harborcreek office in the eastern suburbs. In Warren, we have begun to experience strong deposit growth primarily resulting from inflows from customers of larger regional banks with branches in the market. An important aspect of our deposit growth is that it was driven in large measure by increases in checking and savings balances. The growth of these core deposits is reflective of our focus on building solid, long-term customer relationships. Coupled with our deposit growth was an increase in loans outstanding of 12.0% for the year. This growth occurred across our three major loan segments with consumer loans increasing 23.1%, residential mortgages 19.0%, and commercial loans 7.4%. Our consumer loan growth was significantly impacted by our growth in the Erie market and general increase in our other markets. With our deposit increases exceeding our loan growth during the year by $83.6 million, we deployed the excess funding in our investment portfolio. This resulted in our holdings of United States treasury and agency obligations increasing by $14.2 million, government guaranteed mortgage-backed securities increasing by $49.4 million, and the obligations of state and municipal entities increasing by $26.5 million. These portfolios increases were partially offset by a decrease in our holdings of corporate debt and other securities of $14.7 million. For the year, our net income as stated under Generally Accepted Accounting Principles (GAAP) was $5.2 million compared to $9.1 million in 2007. Our earnings were negatively impacted by other-than-temporary impairment charges associated with certain corporate investments which had an after tax impact of $2.6 million. Excluding these changes our net income from operations would have been $7.8 million. Our earnings were also affected by a higher provision for loan losses of $3.8 million compared to $1.5 million in 2007. This increased provision was the result of our higher level of loans outstanding and the uncertainty regarding the impact of the economic downtown on our loan quality. Our loan quality showed some deterioration during 2008 but remains strong as reflected by key measurements. Net charge-offs for the year totaled $1.8 million, compared to $825 thousand in 2007, representing 0.28% of average loans outstanding. Also, our level of nonperforming loans consisting of loans greater than 90 days past due and nonaccrual loans totaled $3.6 million at year end 2008, compared to $2.4 million at year end 2007, which CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 2 | |  |

| | |

represents a ratio of 0.53% to total loans outstanding. And finally, total loan delinquency, loans past due by 30 or more days, stood at 0.82% compared to 1.04% at year end 2007. We continue to compare very favorably in all three measurements with our peers. Maintaining this level of loan quality will be challenging in 2009 with increasing unemployment affecting consumers and declining revenues affecting businesses. We will be working diligently to assist our borrowers in order to meet these challenges. Since approximately September 2008, our country has been severely impacted by the meltdown of major financial institutions which has resulted in the onset of a major recession. The federal government has taken unprecedented action to inject funding into our financial system and is now attempting to stimulate the economy with various spending programs. The US Treasury has offered a capital purchase program as a part of the plan in order to inject additional capital into the banking system. As stated in a previous release, CNB chose not to participate in the program as the requirements imposed by the government were deemed to not be in the best interest of the shareholders. Instead the Corporation may seek alternative private equity to accomplish its future objectives of growth and expansion. CNB Financial Corporation, as well as most community banks, did not engage in the types of activities which have led our nation into its current state of affairs. Unfortunately, we have suffered to a degree from the actions of the major banks and Wall Street firms. However, we remain a strongly capitalized and profitable institution capable of paying an appropriate level of dividends to our shareholders. We are also fully committed to meeting the credit needs of the individuals and businesses in the communities we serve. We firmly believe that as our country and region recover economically, CNB Financial Corporation will be favorably positioned to profit from the opportunities that will be available to us.

William F. Falger President and Chief Executive Officer CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 4 | |  |

| | | | | | |

| (in thousands, except share data) | | December 31 |

| | 2008 | | 2007 |

| | |

Assets | | | | | | |

Cash and due from banks | | $ | 28,414 | | $ | 23,540 |

Interest bearing deposits with other banks | | | 2,783 | | | 2,125 |

Federal funds sold | | | 59 | | | 773 |

| | | | | | |

CASH AND CASH EQUIVALENTS | | | 31,256 | | | 26,438 |

Interest bearing time deposits with other banks | | | 6,515 | | | 3,498 |

Securities available for sale | | | 237,289 | | | 162,792 |

Trading securities | | | 892 | | | – |

Loans held for sale | | | 3,332 | | | 1,745 |

Loans | | | 676,152 | | | 603,541 |

Less: unearned discount | | | 4,596 | | | 3,853 |

Less: allowance for loan losses | | | 8,719 | | | 6,773 |

| | | | | | |

NET LOANS | | | 662,837 | | | 592,915 |

FHLB and other equity interests | | | 5,815 | | | 5,834 |

Premises and equipment, net | | | 23,578 | | | 19,780 |

Bank owned life insurance | | | 15,720 | | | 15,099 |

Mortgage servicing rights | | | 552 | | | 457 |

Goodwill | | | 10,821 | | | 10,821 |

Other intangible assets | | | 185 | | | 285 |

Accrued interest and other assets | | | 17,726 | | | 19,036 |

| | | | | | |

TOTAL ASSETS | | $ | 1,016,518 | | $ | 858,700 |

| | | | | | |

| | |

Liabilities | | | | | | |

Deposits: | | | | | | |

Non-interest bearing deposits | | $ | 97,999 | | $ | 90,994 |

Interest bearing deposits | | | 716,597 | | | 568,163 |

| | | | | | |

TOTAL DEPOSITS | | | 814,596 | | | 659,157 |

Treasury, tax and loan borrowings | | | 719 | | | 2,000 |

FHLB and other borrowings | | | 107,478 | | | 98,000 |

Subordinated debentures | | | 20,620 | | | 20,620 |

Accrued interest and other liabilities | | | 10,638 | | | 9,640 |

| | | | | | |

TOTAL LIABILITIES | | | 954,051 | | | 789,417 |

| | | | | | |

| | |

Shareholders’ Equity | | | | | | |

Common stock $0 par value | | | | | | |

Authorized 50,000,000 shares | | | | | | |

Issued 9,233,750 shares for 2008 and 2007 | | | - | | | – |

Additional paid in capital | | | 12,913 | | | 13,058 |

Retained earnings | | | 65,890 | | | 66,696 |

Treasury stock, at cost (637,694 shares for 2008 and 679,948 shares for 2007) | | | (9,332) | | | (9,947) |

Accumulated other comprehensive loss | | | (7,004) | | | (524) |

| | | | | | |

| | |

TOTAL SHAREHOLDERS’ EQUITY | | | 62,467 | | | 69,283 |

| | | | | | |

| | |

TOTAL LIABILITIES and SHAREHOLDERS’ EQUITY | | $ | 1,016,518 | | $ | 858,700 |

| | | | | | |

The accompanying notes are an integral part of these statements.

5 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

| | | | | | | | | |

| (in thousands, except per share data) | | Year ended December 31, |

| | | 2008 | | 2007 | | 2006 |

Interest and Dividend Income | | | | | | | | | |

Loans including fees | | $ | 47,355 | | $ | 44,559 | | $ | 40,198 |

Deposits with banks | | | 377 | | | 445 | | | 437 |

Federal funds sold | | | 394 | | | 381 | | | 293 |

Securities: | | | | | | | | | |

Taxable | | | 7,419 | | | 6,669 | | | 5,876 |

Tax-exempt | | | 1,414 | | | 1,457 | | | 1,706 |

Dividends | | | 224 | | | 422 | | | 362 |

| | | | | | | | | |

TOTAL INTEREST AND DIVIDEND INCOME | | | 57,183 | | | 53,933 | | | 48,872 |

| | | |

Interest Expense | | | | | | | | | |

Deposits | | | 14,956 | | | 18,087 | | | 17,106 |

Federal Home Loan Bank advances and other debt | | | 4,609 | | | 3,510 | | | 2,881 |

Subordinated debentures | | | 1,018 | | | 1,325 | | | 866 |

| | | | | | | | | |

TOTAL INTEREST EXPENSE | | | 20,583 | | | 22,922 | | | 20,853 |

| | | | | | | | | |

Net interest income | | | 36,600 | | | 31,011 | | | 28,019 |

Provision for loan losses | | | 3,787 | | | 1,512 | | | 1,371 |

| | | | | | | | | |

Net interest income after provision for loan losses | | | 32,813 | | | 29,499 | | | 26,648 |

| | | |

Non-interest Income | | | | | | | | | |

Trust and asset management fees | | | 1,161 | | | 1,128 | | | 1,077 |

Service charges - deposit accounts | | | 4,335 | | | 4,250 | | | 4,160 |

Other service charges and fees | | | 1,405 | | | 1,045 | | | 644 |

Net realized gains on securities available for sale | | | 117 | | | 501 | | | 338 |

Net realized losses from sales of securities for which fair value was elected | | | (602) | | | – | | | – |

Net unrealized losses on securities for which fair value was elected | | | (2,471) | | | – | | | – |

Loss on other-than-temporarily impaired securities | | | (3,963) | | | (900) | | | – |

Mortgage banking income | | | 447 | | | 347 | | | 406 |

Bank owned life insurance | | | 621 | | | 615 | | | 687 |

Wealth management | | | 724 | | | 622 | | | 519 |

Other | | | 716 | | | 581 | | | 604 |

| | | | | | | | | |

TOTAL NON-INTEREST INCOME | | | 2,490 | | | 8,189 | | | 8,435 |

| | | |

Non-interest Expenses | | | | | | | | | |

Salaries | | | 10,376 | | | 9,207 | | | 8,106 |

Employee benefits | | | 4,404 | | | 3,987 | | | 2,947 |

Net occupancy expense | | | 3,856 | | | 3,271 | | | 2,854 |

Data processing | | | 2,453 | | | 2,075 | | | 2,010 |

State and local taxes | | | 1,113 | | | 1,019 | | | 962 |

Legal, professional and examination fees | | | 798 | | | 722 | | | 704 |

Advertising | | | 792 | | | 680 | | | 529 |

Insurance | | | 639 | | | 228 | | | 247 |

Intangible asset amortization | | | 100 | | | 100 | | | 415 |

Directors fees and benefits | | | 683 | | | 381 | | | 395 |

Other | | | 3,587 | | | 3,603 | | | 2,942 |

| | | | | | | | | |

TOTAL NON-INTEREST EXPENSES | | | 28,801 | | | 25,273 | | | 22,111 |

| | | | | | | | | |

Income before income taxes | | | 6,502 | | | 12,415 | | | 12,972 |

Income tax expense | | | 1,267 | | | 3,281 | | | 3,350 |

| | | | | | | | | |

Net income | | $ | 5,235 | | $ | 9,134 | | $ | 9,622 |

| | | | | | | | | |

| | | |

EARNINGS PER SHARE | | | | | | | | | |

Basic | | $ | 0.61 | | $ | 1.05 | | $ | 1.08 |

Diluted | | $ | 0.61 | | $ | 1.05 | | $ | 1.07 |

The accompanying notes are an integral part of these statements.

CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 6

| | | | | | | | | |

| (in thousands) | | Year ended December 31, |

| | | 2008 | | 2007 | | 2006 |

Cash Flows from Operating Activities: | | | | | | | | | |

Net income | | $ | 5,235 | | $ | 9,134 | | $ | 9,622 |

Adjustments to reconcile net income to net cash provided by operations: | | | | | | | | | |

Provision for loan losses | | | 3,787 | | | 1,512 | | | 1,371 |

Depreciation and amortization | | | 1,881 | | | 1,721 | | | 1,882 |

Amortization, accretion and deferred loan fees and costs | | | 543 | | | (638) | | | (457) |

Deferred taxes | | | (1,319) | | | (272) | | | (150) |

Net realized gains on securities available for sale | | | (117) | | | (501) | | | (338) |

Net realized and unrealized losses on securities for which fair value was elected | | | 3,073 | | | – | | | – |

Loss on other-than-temporarily impaired securities | | | 3,963 | | | 900 | | | – |

Gain on sale of loans | | | (331) | | | (242) | | | (319) |

Net gains on dispositions of premises and equipment and foreclosed assets | | | (66) | | | (92) | | | (57) |

Proceeds from sales of loans | | | 12,532 | | | 11,518 | | | 12,615 |

Origination of loans for sale | | | (14,057) | | | (10,792) | | | (12,246) |

Increase in bank owned life insurance | | | (621) | | | (615) | | | (687) |

Stock based compensation expense | | | 147 | | | 94 | | | 60 |

Changes in: | | | | | | | | | |

Accrued interest receivable and other assets | | | (1,178) | | | (663) | | | (590) |

Accrued interest payable and other liabilities | | | 82 | | | 1,583 | | | 2,219 |

| | | | | | | | | |

Net cash provided by operating activities | | | 13,554 | | | 12,647 | | | 12,925 |

| | | | | | | | | |

Cash Flows from Investing Activities: | | | | | | | | | |

Net (increase) decrease in interest bearing time deposits with other banks | | | (3,017) | | | 799 | | | – |

Proceeds from maturities, prepayments and calls of securities | | | 64,092 | | | 49,848 | | | 43,349 |

Proceeds from sales of securities | | | 17,423 | | | 3,953 | | | 247 |

Purchase of securities | | | (166,057) | | | (70,814) | | | (37,757) |

Loan origination and payments, net | | | (74,512) | | | (53,515) | | | (37,070) |

Redemption (purchase) of FHLB and other equity interests | | | 19 | | | (513) | | | (532) |

Purchase of premises and equipment | | | (5,405) | | | (4,984) | | | (3,602) |

Proceeds from the sale of premises and equipment and foreclosed assets | | | 287 | | | 328 | | | 210 |

| | | | | | | | | |

Net cash used in investing activities | | | (167,170) | | | (74,898) | | | (35,155) |

| | | | | | | | | |

Cash Flows from Financing Activities: | | | | | | | | | |

Net change in: | | | | | | | | | |

Checking, money market and savings accounts | | | 154,405 | | | 41,133 | | | (12,587) |

Certificates of deposit | | | 1,034 | | | (13,298) | | | 25,406 |

Purchase of treasury stock | | | (659) | | | (6,115) | | | (3,367) |

Proceeds from the sale of treasury stock | | | 982 | | | 1,074 | | | 923 |

Proceeds from the exercise of stock options | | | – | | | 79 | | | – |

Cash dividends paid | | | (5,525) | | | (5,395) | | | (5,104) |

Proceeds from long-term borrowings | | | 8,500 | | | 65,000 | | | 10,000 |

Repayments on long-term borrowings | | | (4,022) | | | (22,250) | | | (13,000) |

Issue of subordinated debentures | | | – | | | 20,000 | | | – |

Repayment of subordinated debentures | | | – | | | (10,000) | | | – |

Net change in short-term borrowings | | | 3,719 | | | (2,635) | | | 2,635 |

| | | | | | | | | |

Net cash provided by financing activities | | | 158,434 | | | 67,593 | | | 4,906 |

| | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 4,818 | | | 5,342 | | | (17,324) |

Cash and cash equivalents at beginning of period | | | 26,438 | | | 21,096 | | | 38,420 |

| | | | | | | | | |

Cash and cash equivalents at end of period | | $ | 31,256 | | $ | 26,438 | | $ | 21,096 |

| | | | | | | | | |

Supplemental disclosures of cash flow information: | | | | | | | | | |

Cash paid during the period for: | | | | | | | | | |

Interest | | $ | 20,679 | | $ | 22,999 | | $ | 20,581 |

Income taxes | | | 3,968 | | | 3,360 | | | 3,964 |

Supplemental non cash disclosures: | | | | | | | | | |

Transfers to other real estate owned | | $ | 375 | | $ | 571 | | $ | 249 |

Sales of securities, proceeds not settled | | | – | | | 7,781 | | | – |

Grant of restricted stock awards from treasury stock | | | 177 | | | 179 | | | 198 |

Adoption of FASB Statement No. 159, transfer of securities available for sale to trading securities | | | 7,018 | | | – | | | – |

The accompanying notes are an integral part of these statements.

7 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

Years ended December 31, 2008, 2007 and 2006(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | |

| | | Common

Stock | | Additional

Paid-In

Capital | | Retained

Earnings | | Treasury

Stock | | Accumulated

Other

Comprehensive

Income (Loss) | | Total

Share-

holders’

Equity |

Balance January 1, 2006 | | $ | 9,234 | | $ | 4,160 | | $ | 58,439 | | $ | (3,031) | | $ | 1,166 | | $ | 69,968 |

Comprehensive income: | | | | | | | | | | | | | | | | | | |

Net income for 2006 | | | | | | | | | 9,622 | | | | | | | | | 9,622 |

Other comprehensive income: | | | | | | | | | | | | | | | | | | |

Net change in unrealized gains on available for sale securities, net of taxes of $65 | | | | | | | | | | | | | | | 112 | | | 112 |

| | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | 9,734 |

| | | | | | | | | | | | | | | | | | |

Reclassification adjustment for conversion to no par stock | | | (9,234) | | | 9,234 | | | | | | | | | | | | |

Adjustment to initially apply FAS No. 158, net of tax | | | | | | | | | | | | | | | 65 | | | 65 |

Restricted stock award grants (14,654 shares) | | | | | | (198) | | | | | | 198 | | | | | | |

Stock based compensation expense | | | | | | 60 | | | | | | | | | | | | 60 |

Treasury stock: | | | | | | | | | | | | | | | | | | |

Purchase (240,763 shares) | | | | | | | | | | | | (3,367) | | | | | | (3,367) |

Reissue (66,159 shares) | | | | | | (6) | | | | | | 929 | | | | | | 923 |

Cash dividends declared ($0.57 per share) | | | | | | | | | (5,104) | | | | | | | | | (5,104) |

| | | | | | | | | | | | | | | | | | |

Balance December 31, 2006 | | | | | | 13,250 | | | 62,957 | | | (5,271) | | | 1,343 | | | 72,279 |

Comprehensive income: | | | | | | | | | | | | | | | | | | |

Net income for 2007 | | | | | | | | | 9,134 | | | | | | | | | 9,134 |

Other comprehensive loss: | | | | | | | | | | | | | | | | | | |

Net change in unrealized gains on available for sale securities, net of taxes of ($1,045) | | | | | | | | | | | | | | | (1,940) | | | (1,940) |

Change in actuarial gain, net of amortization and tax effects for post employment health care plan, net of tax of $39 | | | | | | | | | | | | | | | 73 | | | 73 |

| | | | | | | | | | | | | | | | | | |

Total other comprehensive loss | | | | | | | | | | | | | | | | | | (1,867) |

| | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | 7,267 |

Restricted stock award grants (11,929 shares) | | | | | | (179) | | | | | | 179 | | | | | | |

Exercise of 8,750 stock options | | | | | | (52) | | | | | | 131 | | | | | | 79 |

Stock based compensation expense | | | | | | 94 | | | | | | | | | | | | 94 |

Treasury stock: | | | | | | | | | | | | | | | | | | |

Purchase (406,695 shares) | | | | | | | | | | | | (6,115) | | | | | | (6,115) |

Reissue (75,613 shares) | | | | | | (55) | | | | | | 1,129 | | | | | | 1,074 |

Cash dividends declared ($0.62 per share) | | | | | | | | | (5,395) | | | | | | | | | (5,395) |

| | | | | | | | | | | | | | | | | | |

Balance December 31, 2007 | | | | | | 13,058 | | | 66,696 | | | (9,947) | | | (524) | | | 69,283 |

Adjustment to initially apply SFAS No. 159, net of tax (Note 1) | | | | | | | | | (516) | | | | | | 516 | | | |

Comprehensive loss: | | | | | | | | | | | | | | | | | | |

Net income for 2008 | | | | | | | | | 5,235 | | | | | | | | | 5,235 |

Other comprehensive loss: | | | | | | | | | | | | | | | | | | |

Net change in unrealized losses on available for sale securities, net of taxes of ($3,464) | | | | | | | | | | | | | | | (6,434) | | | (6,434) |

Change in actuarial gain, net of amortization and tax effects for post employment health care plan, net of tax of $53 | | | | | | | | | | | | | | | 98 | | | 98 |

Change in fair value of interest rate swap agreement designated as a cash flow hedge, net of tax of ($355) | | | | | | | | | | | | | | | (660) | | | (660) |

| | | | | | | | | | | | | | | | | | |

Total other comprehensive loss | | | | | | | | | | | | | | | | | | (6,996) |

| | | | | | | | | | | | | | | | | | |

Total comprehensive loss | | | | | | | | | | | | | | | | | | (1,761) |

| | | | | | | | | | | | | | | | | | |

Restricted stock award grants (12,433 shares) | | | | | | (177) | | | | | | 177 | | | | | | |

Stock based compensation expense | | | | | | 147 | | | | | | | | | | | | 147 |

Treasury stock: | | | | | | | | | | | | | | | | | | |

Purchase (47,469 shares) | | | | | | | | | | | | (659) | | | | | | (659) |

Reissue (77,290 shares) | | | | | | (115) | | | | | | 1,097 | | | | | | 982 |

Cash dividends declared ($0.645 per share) | | | | | | | | | (5,525) | | | | | | | | | (5,525) |

| | | | | | | | | | | | | | | | | | |

Balance December 31, 2008 | | | | | $ | 12,913 | | $ | 65,890 | | $ | (9,332) | | $ | (7,004) | | $ | 62,467 |

| | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these statements.

CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 8

1. Summary of Significant Accounting Policies

Unless otherwise indicated, amounts are in thousands, except per share data.

Business and Organization:

CNB Financial Corporation (the “Corporation”), is headquartered in Clearfield, Pennsylvania, and provides a full range of banking and related services through its wholly owned subsidiary, CNB Bank (the “Bank”) which also began doing business as ERIEBANK during 2005 in the Erie, Pennsylvania market area. In addition, the Bank provides trust services, including the administration of trusts and estates, retirement plans, and other employee benefit plans as well as a full range of wealth management services. The Bank serves individual and corporate customers and is subject to competition from other financial institutions and intermediaries with respect to these services. In addition to the Bank, the Corporation also entered the consumer discount loan and finance business in 2005 with its wholly owned subsidiary, Holiday Financial Services Corporation. The Corporation and its subsidiaries are subject to examination by federal and state regulators. The Corporation’s market area is primarily concentrated in the central and northwest regions of the state of Pennsylvania.

Basis of Financial Presentation:

The financial statements are consolidated to include the accounts of the Corporation and its subsidiaries, CNB Bank, CNB Securities Corporation, Holiday Financial Services Corporation (“Holiday”), County Reinsurance Company and CNB Insurance Agency. These statements have been prepared in accordance with U.S. generally accepted accounting principles. All significant intercompany accounts and transactions have been eliminated in the consolidated financial statements.

Use of Estimates:

To prepare financial statements in conformity with U.S. generally accepted accounting principles, management makes estimates and assumptions based on available information. These estimates and assumptions affect the amounts reported in the financial statements and the disclosures provided, and actual results could differ. The allowance for loan losses, mortgage servicing rights and fair values of financial instruments are particularly subject to change.

Operating Segments:

While the chief decision-makers monitor the revenue streams of the various products and services, operations are managed and financial performance is evaluated on a Corporation-wide basis. Operating segments are aggregated into one as operating results for all segments are similar. Accordingly, all of the financial service operations are considered by management to be aggregated in one reportable operating segment.

Securities:

When purchased, securities are classified as held to maturity, trading or available for sale. Debt securities are classified as held to maturity when the Corporation has the positive intent and ability to hold the securities to maturity. Held to maturity securities are carried at amortized cost. Debt or equity securities are classified as trading when purchased principally for the purpose of selling them in the near term, or when FASB Statement No. 159 has been elected. Trading securities are recorded at fair value with changes in fair value included in earnings in non-interest income. Available for sale securities are those securities not classified as held to maturity or trading and are carried at their fair market value. Unrealized gains and losses, net of deferred tax, on securities classified as available for sale are recorded as other comprehensive income. Management has not classified any debt or equity securities as held to maturity.

The amortized cost of debt securities classified as held to maturity or available for sale is adjusted for the amortization of premiums and the accretion of discounts over the period through contractual maturity or, in the case of mortgage-backed securities and collateralized mortgage obligations, over the estimated life of the security. Such amortization is included in interest income from securities. Gains and losses on securities sold are recorded on the trade date and based on the specific identification method.

Declines in the fair value of securities below their cost that are other than temporary are reflected as realized losses. In estimating other-than-temporary losses, management considers: the length of time and extent that fair value has been less than cost, the financial condition and near term prospects of the issuer, and the Corporation’s ability and intent to hold the security for a period sufficient to allow for any anticipated recovery in fair value.

Loans:

Loans that management has the intent and ability to hold for the foreseeable future or until maturity or payoff are reported at the principal balance outstanding, net of purchase premiums and discounts, unearned interest, deferred loan fees and costs, and an allowance for loan losses.

Interest income is reported on the interest method and includes amortization of net deferred loan fees and costs over the loan term. Interest income on mortgage and commercial loans is discontinued at the time the loan is 90 days delinquent unless the credit is well-secured and in process of collection. Consumer loans are typically charged off no later than 180 days past due. Past due status is based on the contractual terms of the loan. In all cases, loans are placed on nonaccrual or charged-off at an earlier date if collection of principal or interest is considered doubtful.

9 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

All interest accrued but not received for loans placed on nonaccrual is reversed against interest income. Interest received on such loans is accounted for on the cash-basis or cost-recovery method, until qualifying for return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

Concentration of Credit Risk:

Most of the Corporation’s business activity is with customers located within the state of Pennsylvania. Therefore, the Corporation’s exposure to credit risk is significantly affected by changes in Pennsylvania’s economy.

Loans Held for Sale:

Loans originated and intended for sale in the secondary market are carried at the lower of aggregate cost or market, as determined by outstanding commitments from investors. Net unrealized losses, if any, are recorded as a valuation allowance and charged to earnings.

Mortgage loans held for sale are generally sold with servicing rights retained. The carrying value of the mortgage loan sold is reduced by the amount allocated to the servicing right. Gains and losses on sales of mortgage loans are based on the difference between the selling price and the carrying value of the related loan sold.

Allowance for Loan Losses:

The allowance for loan losses is a valuation allowance for probable incurred credit losses. Loans which are deemed to be uncollectible are charged against the allowance account. Subsequent recoveries, if any, are credited to the allowance account.

Management determines the adequacy of the allowance based on historical patterns of charge-offs and recoveries, information about specific borrower situations, industry experience, and other qualitative factors relevant to the collectability of the loan portfolio. While management believes that the allowance is adequate to absorb probable loan losses incurred at the balance sheet date, future adjustments may be necessary due to circumstances that differ substantially from the assumptions used in evaluating the adequacy of the allowance for loan losses.

A loan is impaired when full payment under the loan terms is not expected. Impairment is evaluated in total for smaller-balance loans of similar nature such as residential mortgage, consumer, and credit card loans, and accordingly, they are not separately identified for impairment disclosures. If a loan is impaired, a portion of the allowance is allocated so that the loan is reported, net, at the present value of estimated future cash flows using the loan’s existing rate or at the fair value of collateral if repayment is expected solely from the collateral.

Federal Home Loan Bank (FHLB) Stock:

The Bank is a member of the FHLB system. Members are required to own a certain amount of stock based on the level of borrowings and other factors, and may invest in additional amounts. FHLB stock is carried at cost, classified as a restricted security, and periodically evaluated for impairment. Because this stock is viewed as long term investment, impairment is based on ultimate recovery of par value.

As of December 31, 2008, the Corporation holds $4,593 of stock in FHLB. In December 2008, FHLB announced that due largely to a decline in the fair value of a segment of its mortgage-backed securities portfolio, it had suspended payment of dividends on the stock and made a decision to no longer purchase “excess stock” from its members. The Corporation’s stock is not transferable and can only be redeemed by FHLB. Further deterioration in the financial condition of FHLB may lead management to a conclusion that the cost of Corporation’s stock in FHLB is not recoverable, which would result in a charge to earnings for impairment of the Corporation’s holdings of this stock. The amount of such a charge, if any, cannot be estimated at this time.

Premises and Equipment:

Premises and equipment are stated at cost less accumulated depreciation. Depreciation of premises and equipment is computed principally by the straight line method. In general, useful lives range from 3 to 39 years with lives for furniture, fixtures and equipment ranging from 3 to 10 years and lives of buildings and building improvements ranging from 15 to 39 years. Amortization of leasehold improvements is computed using the straight-line method over useful lives of the leasehold improvements or the term of the lease, whichever is shorter. Maintenance, repairs and minor renewals are charged to expense as incurred.

Foreclosed Assets:

Assets acquired through or in lieu of loan foreclosure are initially recorded at fair value less estimated selling costs when acquired, establishing a new cost basis. If fair value declines, a valuation allowance is recorded through expense. Costs after acquisition are expensed.

Bank Owned Life Insurance:

The Corporation has purchased life insurance policies on certain key executives. In accordance with EITF 06-05, bank owned life insurance is recorded at the amount that can be realized under the insurance contract at the balance sheet date, which is the cash surrender value adjusted for other charges or other amounts due that are probable at settlement.

CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 10

Goodwill and Other Intangible Assets:

Goodwill results from prior business acquisitions and represents the excess of the purchase price over the fair value of acquired tangible assets and liabilities and identifiable intangible assets. Goodwill is assessed at least annually for impairment and any such impairment will be recognized in the period identified.

Other intangible assets consist of a customer relationship intangible related to Holiday. It was initially measured at fair value and then amortized over its useful life of 5 years.

Long-term Assets:

Premises and equipment, core deposit and other intangible assets, and other long-term assets are reviewed for impairment when events indicate their carrying amount may not be recoverable from future undiscounted cash flows. If impaired, the assets are recorded at fair value.

Loan Commitments and Related Financial Instruments:

Financial instruments include off-balance sheet credit instruments, such as commitments to make loans and commercial letters of credit, issued to meet customer financing needs. The face amount for these items represents the exposure to loss, before considering customer collateral or ability to repay. Such financial instruments are recorded when they are funded.

Derivatives:

Derivative financial instruments are recognized as assets or liabilities at fair value. The Corporation has an interest rate swap agreement, which is used as part of its asset liability management to help manage interest rate risk. The Corporation does not use derivatives for trading purposes.

At the inception of a derivative contract, the Corporation designates the derivative as one of three types based on the Corporation’s intentions and belief as to likely effectiveness as a hedge. These three types are (1) a hedge of the fair value of a recognized asset or liability or of an unrecognized firm commitment (“fair value hedge”), (2) a hedge of a forecasted transaction or the variability of cash flows to be received or paid related to a recognized asset or liability (“cash flow hedge”), or (3) an instrument with no hedging designation (“stand-alone derivative”). For a fair value hedge, the gain or loss on the derivative, as well as the offsetting loss or gain on the hedged item, are recognized in current earnings as fair values change. For a cash flow hedge, the gain or loss on the derivative is reported in other comprehensive income and is reclassified into earnings in the same periods during which the hedged transaction affects earnings. For both types of hedges, changes in the fair value of derivatives that are not highly effective in hedging the changes in fair value or expected cash flows of the hedged item are recognized immediately in current earnings. Changes in the fair value of derivatives that do not qualify for hedge accounting are reported currently in earnings, as noninterest income.

Net cash settlements on derivatives that qualify for hedge accounting are recorded in interest income or interest expense, based on the item being hedged. Net cash settlements on derivatives that do not qualify for hedge accounting are reported in noninterest income. Cash flows on hedges are classified in the cash flow statement the same as the cash flows of the items being hedged.

The Corporation formally documents the relationship between derivatives and hedged items, as well as the risk-management objective and the strategy for undertaking hedge transactions, at the inception of the hedging relationship. This documentation includes linking fair value or cash flow hedges to specific assets and liabilities on the balance sheet or to specific firm commitments or forecasted transactions. The Corporation also formally assesses, both at the hedge’s inception and on an ongoing basis, whether the derivative instruments that are used are highly effective in offsetting changes in fair values or cash flows of the hedged items. The Corporation discontinues hedge accounting when it determines that the derivative is no longer effective in offsetting changes in the fair value or cash flows of the hedged item, the derivative is settled or terminates, a hedged forecasted transaction is no longer probable, a hedged firm commitment is no longer firm, or treatment of the derivative as a hedge is no longer appropriate or intended.

When hedge accounting is discontinued, subsequent changes in fair value of the derivative are recorded as noninterest income. When a fair value hedge is discontinued, the hedged asset or liability is no longer adjusted for changes in fair value and the existing basis adjustment is amortized or accreted over the remaining life of the asset or liability. When a cash flow hedge is discontinued but the hedged cash flows or forecasted transactions are still expected to occur, gains or losses that were accumulated in other comprehensive income are amortized into earnings over the same periods which the hedged transactions will affect earnings.

Advertising Costs:

Advertising costs are generally expensed as incurred and amounted to $792, $680, and $529, for 2008, 2007 and 2006, respectively.

Mortgage Servicing Rights (MSR’s):

Servicing rights are recognized separately when they are acquired through sales of loans. Servicing rights are initially recorded at fair value with the income statement effect recorded in gains on sales of loans. Fair value is based on market prices for comparable mortgage

11 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

servicing contracts, when available, or alternatively, is based on a valuation model that calculates the present value of estimated future net servicing income. The valuation model incorporates assumptions that market participants would use in estimating future net servicing income, such as the cost to service, the discount rate, the custodial earnings rate, an inflation rate, ancillary income, prepayment speeds and default rates and losses. The Corporation compares the valuation model inputs and results to published industry data in order to validate the model results and assumptions. All classes of servicing assets are subsequently measured using the amortization method which requires servicing rights to be amortized into non-interest income in proportion to, and over the period of, the estimated future net servicing income of the underlying loans.

Servicing assets are evaluated for impairment based upon the fair value of the rights as compared to carrying amount. Impairment is determined by stratifying rights into groupings based on predominant risk characteristics, such as interest rate, loan type and investor type. Impairment is recognized through a valuation allowance for an individual grouping, to the extent that fair value is less than the carrying amount. If the Corporation later determines that all or a portion of the impairment no longer exists for a particular grouping, a reduction of the allowance may be recorded as an increase to income. Changes in valuation allowances are reported with mortgage banking income on the income statement. The fair values of servicing rights are subject to significant fluctuations as a result of changes in estimated and actual prepayment speeds and default rates and losses.

Servicing fee income, which is reported on the income statement as mortgage banking income, is recorded for fees earned for servicing loans. The fees are based on a contractual percentage of the outstanding principal or a fixed amount per loan and are recorded as income when earned. The amortization of mortgage servicing rights is netted against loan servicing fee income. Servicing fees totaled $290, $285, and $277 for the years ended December 31, 2008, 2007 and 2006. Late fees and ancillary fees related to loan servicing are not material.

Treasury Stock:

The purchase of the Corporation’s common stock is recorded at cost. Purchases of the stock are made both in the open market and through negotiated private purchases based on market prices. At the date of subsequent reissue, the treasury stock account is reduced by the cost of such stock on a first-in-first-out basis.

Equity

On April 18, 2006, the shareholders of the Corporation voted to increase the aggregate number of authorized shares from 10,000,000 to 50,000,000 as well as approve the change from $1.00 par value to no par stock. The changes had no effect on the dollar amount of total shareholders’ equity and resulted in a reclassification between common stock and additional paid in capital.

Stock-Based Compensation:

The Corporation has a stock incentive plan for key employees and independent directors. The Stock Incentive Plan, which is administered by a committee of the Board of Directors, provides for up to 625,000 shares of common stock in the form of qualified options, nonqualified options, stock appreciation rights or restricted stock. For key employees, the plan vesting schedule is one-fourth of granted stock-based awards per year beginning one year after the grant date with 100% vested on the fourth anniversary. For independent directors, the vesting schedule is one-third of granted stock-based awards per year beginning one year after the grant date with 100% vested on the third anniversary.

Effective January 1, 2006, the Corporation adopted Statement of Financial Accounting Standards (“FAS”) No. 123 (R),Share-based Payment, using the modified prospective transition method. Accordingly, the Corporation has recorded stock-based employee compensation cost using the fair value method starting in 2006.

Stock Options:

For 2006, the adoption of FAS No. 123 (R) resulted in a reduction of income before income taxes of $18 and a reduction in net income of $12 as a result of stock options. Due to the insignificance of the amount, there was no measurable effect on basic and diluted earnings per share in 2006.

No stock options were granted during the years ended December 31, 2008, 2007 and 2006.

Restricted Stock Awards:

During 2008, 2007 and 2006, the Executive Compensation and Personnel Committee of the Board of Directors granted a total of 12,433, 11,929 and 14,654 shares, respectively, of restricted common stock to certain key employees and all independent directors of the Corporation. Compensation expense for the restricted stock awards is recognized over the requisite service period based on the fair value of the shares at the date of grant on a straight-line basis. Unearned restricted stock awards are recorded as a reduction of shareholders’ equity until earned. Compensation expense resulting from these restricted stock awards was $147, $94 and $60 for the years ended December 31, 2008, 2007 and 2006, respectively.

CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 12

Comprehensive Income:

The Corporation presents comprehensive income as part of the Statement of Changes in Shareholders’ Equity. Other comprehensive income (loss) consists of unrealized holding gains (losses) on the available for sale securities portfolio, changes in the unrecognized actuarial gain and transition obligation related to the Corporation’s post retirement benefits plan, and changes in the fair value of the Corporation’s interest rate swap.

Income Taxes:

The Corporation files a consolidated U. S. income tax return that includes all subsidiaries except County Reinsurance Company which files a separate return. Income tax expense is the total of the current year income tax due or refundable and the change in deferred tax assets and liabilities. Deferred tax assets and liabilities are the expected future tax amounts for the temporary differences between carrying amounts and tax bases of assets and liabilities, computed using enacted tax rates. A valuation allowance, if needed, reduces deferred tax assets to the amount expected to be realized.

The Corporation adopted FASB Interpretation No. 48,Accounting for Uncertainty in Income Taxes(“FIN 48”), as of January 1, 2007. A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The adoption had no effect on the Corporation’s financial statements.

The Corporation recognizes interest and/or penalties related to income tax matters in income tax expense.

Retirement Plans:

Employee 401(k) and defined contribution retirement expense is the amount of contributions. Deferred compensation and supplemental retirement plan expenses allocate the benefits over years of service.

Earnings Per Share:

Basic earnings per share is determined by dividing net income by the weighted average number of shares outstanding. Restricted stock awards are considered outstanding as they become earned. Diluted earnings per share is determined by dividing net income by the weighted average number of shares outstanding increased by the number of shares that would be issued assuming the exercise of stock options as well as the dilutive effects of restricted stock awards.

Cash and Cash Equivalents:

For purposes of the consolidated statement of cash flows, the Corporation defines cash and cash equivalents as cash and due from banks, interest bearing deposits with other banks, and Federal funds sold. Net cash flows are reported for customer loan and deposit transactions and borrowings with original maturities of 90 days or less.

Restrictions on Cash:

The Bank is required to maintain average reserve balances with the Federal Reserve Bank or in vault cash. The average amount of these non-interest bearing reserve balances for the year ended December 31, 2008 and 2007, was $50, which was maintained in vault cash.

Loss Contingencies:

Loss contingencies, including claims and legal actions arising in the ordinary course of business, are recorded as liabilities when the likelihood of loss is probable and an amount or range of loss can be reasonably estimated. Management does not believe there are any such matters that will have a material effect on the financial statements.

Fair Value of Financial Instruments:

Fair values of financial instruments are estimated using relevant market information and other assumptions, as more fully disclosed in a separate note. Fair value estimates involve uncertainties and matters of significant judgment regarding interest rates, credit risk, prepayments, and other factors, especially in the absence of broad markets for particular items. Changes in assumptions or in market conditions could significantly affect the estimates.

Adoption of New Accounting Standards:

In September 2006, the FASB issued Statement No. 157,Fair Value Measurements(FAS 157). This Statement defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. This Statement establishes a fair

13 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

value hierarchy about the assumptions used to measure fair value and clarifies assumptions about risk and the effect of a restriction on the sale or use of an asset. The standard was effective for fiscal years beginning after November 15, 2007. In February 2008, the FASB issued Staff Position (FSP) 157-2,Effective Date of FASB Statement No. 157. This FSP delays the effective date of FAS 157 for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value on a recurring basis (at least annually) to fiscal years beginning after November 15, 2008, and interim periods within those fiscal years. The impact of adoption was not material. In October 2008, the FASB issued FSP 157-3,Determining the Fair Value of a Financial Asset when the Market for That Asset Is Not Active. This FSP clarifies the application of FAS 157 in a market that is not active. The impact of adoption was not material.

In February 2007, the FASB issued Statement No. 159,The Fair Value Option for Financial Assets and Financial Liabilities. The standard provides companies with an option to report selected financial assets and liabilities at fair value and establishes presentation and disclosure requirements designed to facilitate comparisons between companies that choose different measurement attributes for similar types of assets and liabilities. The new standard was effective for the Corporation on January 1, 2008. As of January 1, 2008, the Corporation elected the fair value option for certain investment securities with a carrying value of $7,018, which included a net unrealized loss of $793. As a result of Adopting Statement No. 159, the after tax effect of the net unrealized loss was removed from accumulated other comprehensive income which increased this balance by $516. The offset was recorded as a reduction to retained earnings as a cumulative effect adjustment.

In September 2006, the FASB Emerging Issues Task Force finalized Issue No. 06-4,Accounting for Deferred Compensation and Postretirement Benefit Aspects of Endorsement Split-Dollar Life Insurance Arrangements. This issue requires that a liability be recorded during the service period when a split-dollar life insurance agreement continues after participants’ employment or retirement. The required accrued liability will be based on either the post-employment benefit cost for the continuing life insurance or based on the future death benefit depending on the contractual terms of the underlying agreement. This issue was effective for fiscal years beginning after December 15, 2007. The impact of adoption was not material.

On November 5, 2007, the SEC issued Staff Accounting Bulletin No. 109,Written Loan Commitments Recorded at Fair Value through Earnings(“SAB 109”). Previously, SAB 105,Application of Accounting Principles to Loan Commitments, stated that in measuring the fair value of a derivative loan commitment, a company should not incorporate the expected net future cash flows related to the associated servicing of the loan. SAB 109 supersedes SAB 105 and indicates that the expected net future cash flows related to the associated servicing of the loan should be included in measuring fair value for all written loan commitments that are accounted for at fair value through earnings. SAB 105 also indicated that internally-developed intangible assets should not be recorded as part of the fair value of a derivative loan commitment, and SAB 109 retains that view. SAB 109 was effective for derivative loan commitments issued or modified in fiscal quarters beginning after December 15, 2007. The impact of adoption was not material.

Effect of Newly Issued But Not Yet Effective Accounting Standards:

In December 2007, the FASB issued Statement No. 141 (revised 2007), “Business Combinations” (“FAS 141(R)”), which establishes principles and requirements for how an acquirer recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in an acquiree, including the recognition and measurement of goodwill acquired in a business combination. FAS 141(R) is effective for fiscal years beginning on or after December 15, 2008. Earlier adoption is prohibited. The adoption of this standard is not expected to have a material effect on the Corporation’s results of operations or financial position.

In December 2007, the FASB issued Statement No. 160, “Noncontrolling Interest in Consolidated Financial Statements, an amendment of ARB No. 51” (“FAS 160”), which will change the accounting and reporting for minority interests, which will be recharacterized as noncontrolling interests and classified as a component of equity within the consolidated balance sheets. FAS 160 is effective as of the beginning of the first fiscal year beginning on or after December 15, 2008. Earlier adoption is prohibited and the Corporation’s adoption of FAS 160 did not have a significant impact on its results of operations or financial position.

In March 2008, the FASB issued Statement No. 161, “Disclosures about Derivative Instruments and Hedging Activities, an amendment of SFAS No. 133” (“FAS 161”), which amends and expands the disclosure requirements of FAS No. 133 for derivative instruments and hedging activities. FAS 161 requires qualitative disclosure about objectives and strategies for using derivative and hedging instruments, quantitative disclosures about fair value amounts of the instruments and gains and losses on such instruments, as well as disclosures about credit-risk features in derivative agreements. FAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The adoption of this standard did not have a material effect on the Corporation’s results of operations or financial position.

CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 14

2. Earnings Per Share

The computation of basic and diluted EPS is shown below (in thousands, except per share data). For the year ended December 31, 2008, options to purchase 166,125 shares of common stock and for the years ended December 31, 2007 and 2006, options to purchase 110,500 shares of common stock were not considered in computing diluted earnings per common share because they were anti-dilutive. For the years ended December 31, 2008 and 2007, 22,541 and 11,603 average unearned restricted stock awards were not considered in computing diluted earnings per share because they were anti-dilutive.

| | | | | | | | | |

| | | Years Ended December 31 |

| | | 2008 | | 2007 | | 2006 |

| | | |

Basic earnings per share computation: | | | | | | | | | |

Net income | | $ | 5,235 | | $ | 9,134 | | $ | 9,622 |

| | | | | | | | | |

Gross weighted-average shares outstanding | | | 8,570 | | | 8,693 | | | 8,960 |

Less: Average unearned restricted stock | | | 23 | | | 18 | | | 10 |

| | | | | | | | | |

Net weighted-average shares outstanding | | | 8,547 | | | 8,675 | | | 8,950 |

| | | | | | | | | |

Basic earnings per share | | $ | 0.61 | | $ | 1.05 | | $ | 1.08 |

| | | | | | | | | |

| |

| | | Years Ended December 31 |

| | | 2008 | | 2007 | | 2006 |

| | | |

Diluted earnings per share computation: | | | | | | | | | |

Net Income | | $ | 5,235 | | $ | 9,134 | | $ | 9,622 |

| | | | | | | | | |

Weighted average shares outstanding for basic earnings per share | | | 8,547 | | | 8,675 | | | 8,950 |

Add: Dilutive effects of assumed exercises of stock options | | | 19 | | | 23 | | | 24 |

| | | | | | | | | |

Weighted average shares and potentially dilutive shares | | | 8,566 | | | 8,698 | | | 8,974 |

| | | | | | | | | |

Diluted earnings per share | | $ | 0.61 | | $ | 1.05 | | $ | 1.07 |

| | | | | | | | | |

3. Securities

Securities available for sale at December 31, 2008 and 2007 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2008 | | December 31, 2007 |

| | | Amortized | | Unrealized | | Fair | | Amortized | | Unrealized | | Fair |

| | | Cost | | Gains | | Losses | | Value | | Cost | | Gains | | Losses | | Value |

| | | | | | | | |

Securities available for sale: | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. Treasury | | $ | 10,059 | | $ | 257 | | $ | - | | $ | 10,316 | | $ | 10,955 | | $ | 125 | | $ | – | | $ | 11,080 |

U.S. Government sponsored entities | | | 40,779 | | | 486 | | | (1) | | | 41,264 | | | 26,261 | | | 112 | | | (28) | | | 26,345 |

Obligations of States and Political Subdivisions | | | 54,467 | | | 667 | | | (719) | | | 54,415 | | | 27,300 | | | 664 | | | (46) | | | 27,918 |

Mortgage-backed | | | 109,530 | | | 580 | | | (4,830) | | | 105,280 | | | 55,924 | | | 266 | | | (326) | | | 55,864 |

Corporate notes and bonds | | | 30,908 | | | 68 | | | (6,597) | | | 24,379 | | | 33,889 | | | 215 | | | (1,208) | | | 32,896 |

Other securities | | | 1,670 | | | – | | | (35) | | | 1,635 | | | 9,480 | | | 69 | | | (860) | | | 8,689 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total securities available for sale | | $ | 247,413 | | $ | 2,058 | | $ | (12,182) | | $ | 237,289 | | $ | 163,809 | | $ | 1,451 | | $ | (2,468) | | $ | 162,792 |

| | | | | | | | | | | | | | | | | | | | | | | | |

At year end 2008 and 2007, there were no holdings of securities of any one issuer, other than the U.S. Government sponsored entities, in an amount greater than 10% of shareholders’ equity.

At December 31, 2008, securities accounted for under the fair value option of FASB Statement No. 159 and as a result are classified as trading consisted of $31 of floating rate preferred stock of the Federal Home Loan Mortgage Corporation and Federal National Mortgage Association, and $861 of corporate equity securities.

15 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

Securities with unrealized losses at year-end 2008 and 2007, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position, are as follows:

| | | | | | | | | | | | | | | | | | |

| 2008 | | Less than 12 Months | | 12 Months or More | | Total |

Description of Securities | | Fair

Value | | Unrealized

Loss | | Fair

Value | | Unrealized

Loss | | Fair

Value | | Unrealized

Loss |

| | | | | | |

U.S. Treasury | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - |

U.S. Gov’t Sponsored Entities | | | 468 | | | (1) | | | - | | | - | | | 468 | | | (1) |

States & Political Subdivisions | | | 18,217 | | | (599) | | | 3,894 | | | (120) | | | 22,111 | | | (719) |

Mortgage-Backed | | | 35,996 | | | (1,755) | | | 10,134 | | | (3,075) | | | 46,130 | | | (4,830) |

Corporate Notes and Bonds | | | 3,410 | | | (636) | | | 17,685 | | | (5,961) | | | 21,095 | | | (6,597) |

Other Securities | | | 1,134 | | | (35) | | | - | | | - | | | 1,134 | | | (35) |

| | | | | | | | | | | | | | | | | | |

| | $ | 59,225 | | $ | (3,026) | | $ | 31,713 | | $ | (9,156) | | $ | 90,938 | | $ | (12,182) |

| | | | | | | | | | | | | | | | | | |

| | | |

| 2007 | | Less than 12 Months | | 12 Months or More | | Total |

Description of Securities | | Fair

Value | | Unrealized

Loss | | Fair

Value | | Unrealized

Loss | | Fair

Value | | Unrealized

Loss |

| | | | | | |

U.S. Treasury | | $ | – | | $ | – | | $ | – | | $ | – | | $ | – | | $ | – |

U.S. Gov’t Sponsored Entities | | | 1,005 | | | (1) | | | 4,468 | | | (27) | | | 5,473 | | | (28) |

States & Political Subdivisions | | | 4,906 | | | (36) | | | 1,047 | | | (10) | | | 5,953 | | | (46) |

Mortgage-Backed | | | 7,780 | | | (186) | | | 13,217 | | | (140) | | | 20,997 | | | (326) |

Corporate Notes and Bonds | | | 15,934 | | | (742) | | | 8,452 | | | (466) | | | 24,386 | | | (1,208) |

Other Securities | | | 2,275 | | | (545) | | | 1,024 | | | (315) | | | 3,299 | | | (860) |

| | | | | | | | | | | | | | | | | | |

| | $ | 31,900 | | $ | (1,510) | | $ | 28,208 | | $ | (958) | | $ | 60,108 | | $ | (2,468) |

| | | | | | | | | | | | | | | | | | |

The Corporation evaluates securities for other-than-temporary impairment on a quarterly basis, or more frequently when economic or market conditions warrant such an evaluation. Consideration is given to the length of time and the extent to which fair value has been less than cost, the financial condition and near term prospects of the issuer, and the intent and ability of the Corporation to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value. In analyzing an issuer’s financial condition, the Corporation may consider whether the securities are issued by the federal government or its agencies, whether downgrades by bond rating agencies have occurred, and results of reviews of the issuer’s financial condition.

At December 31, 2008, approximately 33% of the total unrealized losses relate to structured trust preferred securities, primarily from issuers in the financial services industry. At December 31, 2008, the pooled trust preferred securities did not trade in an active, open market with readily observable prices and therefore were classified within Level 3 of the valuation hierarchy. The fair value of these securities have been calculated using a discounted cash flow model and market liquidity premium as permitted by FSP 157-3. With the current market conditions, the assumptions used to determine the fair value of Level 3 securities has greater subjectivity due to the lack of observable market transactions. The fair value of these securities have declined due to the fact that subsequent offerings of similar securities pay a higher market rate of return. This higher rate of return reflects the increased credit and liquidity risks in the marketplace. There is no indication of any significant deterioration of the creditworthiness of the underlying entities of the various trust preferred pools. Except as described below, based on management’s evaluation of the pooled trust preferred securities, the present value of the projected cash flows is sufficient for full re-payment of the amortized cost of the securities and, therefore it is believed the decline in fair value is temporary due to current market conditions. However, without recovery of these securities, other-than-temporary impairments may occur in future periods.

The remainder of the unrealized losses is attributable to changes in interest rates, and the Corporation has both the intent and ability to hold the debt securities for the foreseeable future. As a result, except as described below, management does not believe any of the individual unrealized losses on debt securities represents an other-than-temporary impairment.

The Corporation holds a subordinated corporate bond issued by Lehman Brothers Holdings (“Lehman”). On September 15, 2008, Lehman declared bankruptcy resulting in a significant decline in the market value of the Lehman bond below cost. Management of the Corporation has deemed the decline to be other-than-temporary and, accordingly, recognized a charge to earnings for the full amortized cost basis of the security of $1,963 or $1,276, net of tax. In addition, the Corporation holds a pooled trust preferred security issued by US Capital Funding VI, and management has deemed the decline in fair value of this security to be other-than-temporary. As a result, a charge to earnings for the full amortized cost basis of $2,000, or $1,300, net of tax was recognized.

CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 16

The Corporation’s other securities include floating rate preferred stock issued by Federal National Mortgage Association (FNMA) and Federal Home Loan Mortgage Corporation (FHLMC). For the year ended December 31, 2007, the Corporation recognized a $900 pre-tax charge for other-than-temporary decline in fair value of its FNMA securities since management did not believe that the securities would recover in value within a reasonable amount of time as a result of additional preferred stock that FNMA introduced to the capital markets in the fourth quarter of 2007. This security is being carried at fair value under FASB Statement No. 159 effective January 1, 2008.

On December 31, 2008 and 2007, securities carried at $113,847 and $121,822, respectively, were pledged to secure public deposits and for other purposes as provided by law.

The following is a schedule of the contractual maturity of securities available-for-sale, excluding equity securities, at December 31, 2008:

| | | |

| | | Available for Sale

Fair Value |

| |

1 year or less | | $ | 17,791 |

1 year-5 years | | | 44,062 |

5 years-10 years | | | 31,971 |

After 10 years | | | 36,550 |

| | | |

| | | 130,374 |

| |

Mortgage-backed securities | | | 105,280 |

| | | |

Total debt securities | | $ | 235,654 |

| | | |

Mortgage-backed securities are not due at a single date; periodic payments are received based on the payment patterns of the underlying collateral.

Information pertaining to security transactions is as follows:

| | | | | | | | | |

| | | Proceeds | | Gross Gains | | Gross Losses |

| | | |

2008 | | $ | 6,495 | | $ | 135 | | $ | 18 |

2007 | | $ | 11,734 | | $ | 538 | | $ | 37 |

2006 | | $ | 247 | | $ | 343 | | $ | 5 |

The tax provision related to these net realized gains was $41, $175, and $118, respectively.

During 2008, the Corporation sold securities carried at fair value under FASB Statement No. 159. Proceeds were $3,147 resulting in gross losses of $602.

2007 proceeds from sale includes a $7,781 receivable from brokers for securities sold on December 28, 2007 that settled on January 3, 2008. Net gains related to this transaction was $259.

During the first quarter of 2006, the issuer of a financial institution equity security held in the Corporation’s available-for-sale portfolio was acquired by another financial institution. As a result of the acquisition, the Corporation received 1.994 shares of the acquiring entity’s stock in exchange for each share of the equity security that it held. Following current accounting guidance in FAS No. 153,Exchanges of Nonmonetary Assets, the Corporation recorded a $341 realized gain as a result of the difference between its basis in the equity security it held and the fair market value of the shares it received at the date of the exchange.

4. Loans

Total Loans at December 31, 2008 and 2007 are summarized as follows:

| | | | | | |

| | | 2008 | | 2007 |

| | |

Commercial, Industrial and Agricultural | | $ | 228,000 | | $ | 218,839 |

Residential Mortgage | | | 210,080 | | | 176,470 |

Commercial Mortgage | | | 179,420 | | | 160,585 |

Consumer and Other | | | 58,652 | | | 47,647 |

| | | | | | |

| | $ | 676,152 | | $ | 603,541 |

| | | | | | |

At December 31, 2008 and 2007, net unamortized loan costs and fees of $(605) and $(177) respectively, have been included in the carrying value of loans.

The Bank’s outstanding loans and related unfunded commitments are primarily concentrated within Central and Western Pennsylvania. The Bank attempts to limit concentrations within specific industries by utilizing dollar limitations to single industries or customers, and by entering into participation agreements with third parties. Collateral requirements are established based on management’s assessment of the customer.

17 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

Deposit accounts that have overdrawn their current balance, known as overdrafts, are reclassified to loans. Overdrafts included in year-end loans are $859 in 2008 and $1,188 in 2007.

Impaired loans were as follows:

| | | | | | |

| | | 2008 | | 2007 |

| | |

Year-end loans with no allocated allowance for loan losses | | $ | - | | $ | – |

Year-end loans with allocated allowance for loan losses | | | 4,850 | | | 3,434 |

| | | | | | |

Total | | $ | 4,850 | | $ | 3,434 |

| | | | | | |

Amount of the allowance for loan losses allocated | | $ | 1,628 | | $ | 985 |

| | | | | | |

| | | | | | | | | |

| | | 2008 | | 2007 | | 2006 |

| | | |

Average impaired loans outstanding during the year | | $ | 5,086 | | $ | 3,680 | | $ | 2,617 |

Interest income recognized during impairment and cash basis interest income recognized was not material in any year presented.

Nonaccrual loans and loans past 90 days still on accrual were as follows:

| | | | | | |

| | | 2008 | | 2007 |

| | |

Loans past due over 90 days still on accrual | | $ | 533 | | $ | 395 |

Nonaccrual loans | | $ | 3,046 | | $ | 1,979 |

Nonaccrual loans and loans past 90 days still on accrual include impaired loans and smaller balance homogeneous loans, such as residential mortgage and consumer loans, that are collectively evaluated for impairment.

5. Allowance for Loan Losses

Transactions in the Allowance for Loan Losses for the three years ended December 31 were as follows:

| | | | | | | | | |

| | | 2008 | | 2007 | | 2006 |

| | | |

Balance, Beginning of Year | | $ | 6,773 | | $ | 6,086 | | $ | 5,603 |

Charge-offs | | | (2,044) | | | (1,010) | | | (1,091) |

Recoveries | | | 203 | | | 185 | | | 203 |

| | | | | | | | | |

Net Charge-offs | | | (1,841) | | | (825) | | | (888) |

Provision for Loan Losses | | | 3,787 | | | 1,512 | | | 1,371 |

| | | | | | | | | |

Balance, End of Year | | $ | 8,719 | | $ | 6,773 | | $ | 6,086 |

| | | | | | | | | |

6. Secondary Mortgage Market Activities

The following summarizes secondary market mortgage activities for each year:

| | | | | | | | | |

| | | 2008 | | 2007 | | 2006 |

| | | |

Activity during the year: | | | | | | | | | |

Loans originated for resale, | | | | | | | | | |

Net of principal pay downs | | $ | 13,473 | | $ | 8,066 | | $ | 10,047 |

Proceeds from sales of loans held for sale | | | 12,532 | | | 9,115 | | | 10,222 |

Net gains on sales of loans held for sale | | | 331 | | | 242 | | | 319 |

Loan servicing fees | | | 290 | | | 285 | | | 277 |

| | | |

Total loans serviced for others | | $ | 80,014 | | $ | 77,201 | | $ | 75,982 |

Activity for capitalized mortgage servicing rights was as follows:

| | | | | | | | | |

| | | 2008 | | 2007 | | 2006 |

| | | |

Servicing rights: | | | | | | | | | |

Beginning of year | | $ | 457 | | $ | 446 | | $ | 373 |

Additions | | | 269 | | | 191 | | | 263 |

Amortized to expense | | | (174) | | | (180) | | | (190) |

| | | | | | | | | |

End of year | | $ | 552 | | $ | 457 | | $ | 446 |

| | | | | | | | | |

No valuation allowance is deemed necessary as of December 31, 2008, 2007 or 2006.

CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008 | 18

7. Premises and Equipment

The following summarizes Premises and Equipment at December 31:

| | | | | | |

| | | 2008 | | 2007 |

| | |

Land | | $ | 3,927 | | $ | 3,120 |

Premises and Leasehold Improvements | | | 21,187 | | | 18,317 |

Furniture and Equipment | | | 15,327 | | | 12,900 |

Construction In Progress | | | 106 | | | 895 |

| | | | | | |

| | | 40,547 | | | 35,232 |

Less: Accumulated Depreciation | | | 16,969 | | | 15,452 |

| | | | | | |

Premises and Equipment, Net | | $ | 23,578 | | $ | 19,780 |

| | | | | | |

Depreciation on Premises and Equipment amounted to $1,607 in 2008, $1,441 in 2007, and $1,277 in 2006.

The Corporation is committed under twelve noncancelable operating leases for facilities with initial or remaining terms in excess of one year. The minimum annual rental commitments under these leases at December 31, 2008 are as follows:

| | | |

2009 | | $ | 308 |

2010 | | | 263 |

2011 | | | 245 |

2012 | | | 210 |

2013 | | | 147 |

Thereafter | | | 1,645 |

| | | |

| | $ | 2,818 |

| | | |

Rental expense, net of rental income, charged to occupancy expense for 2008, 2007, and 2006, was $345, $247, and $242, respectively.

8. Foreclosed Assets

Foreclosed real estate is reported net of a valuation allowance. Activity was as follows:

| | | | | | | | | |

| | | 2008 | | 2007 | | 2006 |

| | | |

Beginning of year | | $ | 516 | | $ | 181 | | $ | 85 |

Additions | | | 375 | | | 571 | | | 249 |

Sales | | | (220) | | | (236) | | | (153) |

| | | | | | | | | |

End of year | | $ | 671 | | $ | 516 | | $ | 181 |

| | | | | | | | | |

Expenses related to foreclosed assets include:

| | | | | | | | | |

| | | 2008 | | 2007 | | 2006 |

| | | |

Net loss (gain) on sale | | $ | (66) | | $ | (74) | | $ | (57) |

Operating expenses, net of rental income | | | 90 | | | 155 | | | 96 |

| | | | | | | | | |

| | $ | 24 | | $ | 81 | | $ | 39 |

| | | | | | | | | |

9. Goodwill and Intangible Assets

The change in the carrying amount of goodwill for the year is as follows:

| | | | | | |

| | | 2008 | | 2007 |

| | |

Beginning of year | | $ | 10,821 | | $ | 10,821 |

Acquired during the period | | | - | | | – |

| | | | | | |

End of year | | $ | 10,821 | | $ | 10,821 |

| | | �� | | | |

19 | CNB FINANCIAL CORPORATION & SUBSIDIARIES | ANNUAL REPORT 2008

Acquired Intangible Assets

Acquired intangible assets were as follows at year end:

| | | | | | | | | |

| | | 2008 | | 2007 | | 2006 |

| | | |

Amortized intangibles | | $ | 3,652 | | $ | 3,652 | | $ | 3,652 |

Intangible assets acquired during year | | | - | | | – | | | – |

Accumulated amortization | | | (3,467) | | | (3,367) | | | (3,267) |

| | | | | | | | | |

Net | | $ | 185 | | $ | 285 | | $ | 385 |

| | | | | | | | | |

| | | |

Aggregate amortization expense | | $ | 100 | | $ | 100 | | $ | 415 |

In November of 2005, the Corporation acquired the assets of a consumer discount and finance company which the Corporation operates as Holiday Financial Services Corporation. The purchase price was $2,408 for the performing loans and customers of the business. The purchase resulted in the Corporation recording a $500 customer relationship intangible which is being amortized on the straight line method over five years.

Estimated amortization expense for each of the next two years:

10. Deposits

The following table reflects time certificates of deposit accounts included in total deposits and their remaining maturities at December 31:

| | | |

| Time Deposits Maturing: | | 2008 |

2008 | | $ | 79,255 |

2009 | | | 37,286 |

2010 | | | 168,755 |

2011 | | | 28,626 |

2012 | | | 25,054 |

Thereafter | | | 4,667 |

| | | |

| | $ | 343,643 |

| | | |

Certificates of deposit of $100 thousand or more totaled $110,849 and $109,798 at December 31, 2008 and 2007, respectively.

11. Borrowings

Borrowings include $719 and $2,000 of demand notes payable to the U.S. Treasury Department at December 31, 2008 and 2007, respectively. These notes are issued under the U.S. Treasury Department’s program of investing the treasury tax and loan account balances in interest bearing demand notes insured by depository institutions. These notes bear interest at a rate of .25 percent less than the average Federal funds rate as computed by the Federal Reserve Bank.