Neuberger Berman

Advisers Management Trust

Short Duration Bond Portfolio

I Class Shares

Annual Report

December 31, 2021

As permitted by regulations adopted by the U.S. Securities and Exchange Commission, you may no longer receive paper copies of the Fund's annual and semi-annual shareholder reports by mail from the insurance company that issued your variable annuity and variable life insurance contract or from the financial intermediary that administers your qualified pension or retirement plan, unless you specifically request paper copies of the reports from your insurance company or financial intermediary. Instead, the reports will be made available on the Fund's website www.nb.com/AMTliterature, and may also be available on a website from the insurance company or financial intermediary that offers your contract or administers your retirement plan, and such insurance company or financial intermediary will notify you by mail each time a report is posted and provide you with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company or financial intermediary electronically by following the instructions provided by the insurance company or financial intermediary. If offered by your insurance company or financial intermediary, you may elect to receive all future reports in paper and free of charge from the insurance company or financial intermediary. You can contact your insurance company or financial intermediary if you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds available under your contract or retirement plan.

Short Duration Bond Portfolio Commentary (Unaudited)

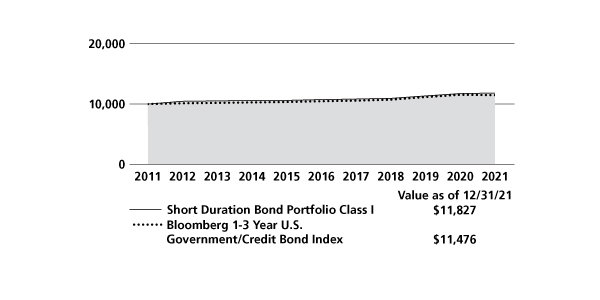

The Neuberger Berman Advisers Management Trust Short Duration Bond Portfolio Class I posted a 0.74% total return for the fiscal year ended December 31, 2021 (the reporting period), outperforming its benchmark, the Bloomberg 1-3 Year U.S. Government/Credit Bond Index (the Index), which returned –0.47% for the same period.

The overall taxable investment-grade U.S. bond market, as measured by the Bloomberg U.S. Aggregate Bond Index, modestly declined during the reporting period. Both short and long-term U.S. Treasury yields moved sharply higher as the economic recovery from the depths of the pandemic continued and inflation moved higher. Against this backdrop, the U.S. Federal Reserve Board (Fed) pivoted from its highly accommodative monetary policy stance. In November 2021, the Fed announced that it would begin reducing its monthly purchase of Treasury and agency mortgage-backed securities. At the Fed's meeting in December, it further accelerated the reduction of its monthly bond purchases. The Fed's asset purchases are expected to end in mid-March 2022, setting the stage for interest rate hikes shortly thereafter. Fed officials now expect to raise rates three times in 2022. Generally speaking, the spread sectors (non-U.S. Treasury securities) produced mixed results relative to similar duration Treasuries during the reporting period.

The largest contributor to the Fund's performance was its overweight exposure to corporate bonds. Their spreads narrowed during the reporting period as the economy continued to recover, and investor demand for incremental yield was strong overall. Also supporting the sector was continued monetary and fiscal stimulus and corporate earnings that generally exceeded expectations. Elsewhere, an out-of-benchmark allocation to structured products, including commercial mortgage-backed securities, asset-backed securities (ABS) and mortgage credit, contributed to returns. Finally, an opportunistic allocation to U.S. Treasury Inflation-Protected Securities was rewarded.

The Fund's use of futures contracts contributed positively to performance during the reporting period.

During the reporting period, we maintained the Fund's overweight to non-Treasury securities and underweights to Treasuries, agency debt and non-corporate securities. We increased the Fund's allocation to agency pass-through securities in the spring of 2020 given their attractive valuations at that time. We later largely eliminated this position as they performed well and reached our estimate of fair value. The proceeds from these sales were primarily allocated to corporate bonds, as well as ABS.

We continue to anticipate higher volatility in the bond markets in 2022. Drivers of volatility will likely be macro and policy trends—specifically, the evolution of inflation and central bank policy. With elevated levels of core inflation in the U.S., Europe and numerous key emerging markets, we believe the debate is not about whether inflation will exceed central bank targets, but for how long. We believe it is the Fed's reaction function that will be most important as a driver of real yields, the dollar and risk markets in general. A second potential driver of volatility, related to persistent higher inflation, is the market's expectation for a global interest rate hiking cycle in 2022. In our view, the hiking cycle in 2022 will be more about ending "emergency" policy rather than attempting to significantly slow global growth. As such, we do not anticipate these policy changes to fundamentally alter the global growth environment. In conclusion, we believe investors should maintain defensive positioning to interest rates, particularly in the U.S. With fundamental credit risk limited, in our view, we still favor overweighting credit markets.

Sincerely,

MICHAEL FOSTER, MATTHEW MCGINNIS, WOOLF NORMAN MILNER AND DAVID M. BROWN

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

1

Short Duration Bond Portfolio (Unaudited)

PORTFOLIO BY TYPE OF INVESTMENT

(as a % of Total Net Assets) | |

Asset-Backed Securities | | | 16.1 | % | |

Corporate Bonds | | | 48.2 | | |

Exchange-Traded Funds | | | 2.5 | | |

Mortgage-Backed Securities | | | 31.0 | | |

U.S. Treasury Obligations | | | 0.7 | | |

Short-Term Investments | | | 2.0 | | |

Liabilities Less Other Assets | | | (0.5 | )* | |

Total | | | 100.0 | % | |

* Includes the impact of the Fund's open positions in derivatives, if any.

PERFORMANCE HIGHLIGHTS

| | Inception | | Average Annual Total Return

Ended 12/31/2021 | |

| | Date | | 1 Year | | 5 Years | | 10 Years | | Life of Fund | |

Class I | | 09/10/1984 | | | 0.74 | % | | | 1.95 | % | | | 1.69 | % | | | 4.50 | % | |

Bloomberg 1-3 Year

U.S. Government/Credit

Bond Index*,1,2 | | | | | –0.47 | % | | | 1.85 | % | | | 1.39 | % | | | 5.00 | % | |

* Effective August 24, 2021, the Bloomberg Barclays 1-3 Year U.S. Government/Credit Bond Index changes its name to the Bloomberg 1-3 Year U.S. Government/Credit Bond Index.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit http://www.nb.com/amtportfolios/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. The results do not reflect fees and expenses of the variable annuity and variable life insurance policies or the qualified pension and retirement plans whose proceeds are invested in the Fund.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/ or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

For the period ended December 31, 2021, the 30-day SEC yield was 2.61% for Class I shares.

As stated in the Fund's most recent prospectus, the total annual operating expense ratio for fiscal year 2020 was 0.86% for Class I shares (before expense reimbursements and/or fee waivers, if any, and after restatement). The expense ratios for the annual period ended December 31, 2021 can be found in the Financial Highlights section of this report.

2

Short Duration Bond Portfolio (Unaudited)

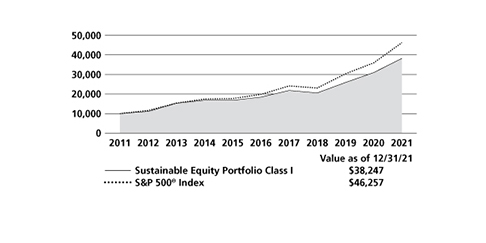

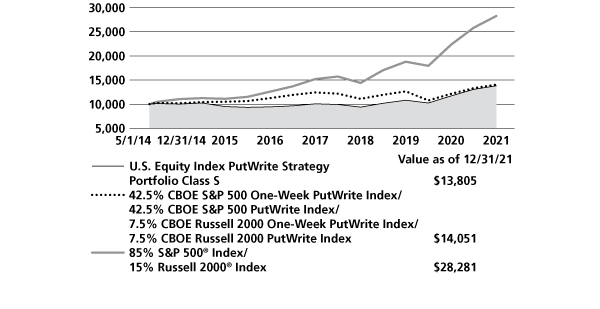

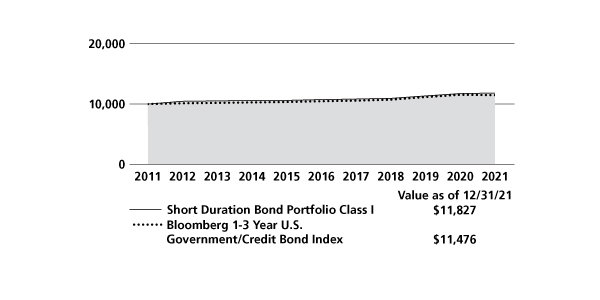

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception, if it has not operated for 10 years. The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. The results do not reflect fees and expenses of the variable annuity and variable life insurance policies or the qualified pension and retirement plans whose proceeds are invested in the Fund. Results represent past performance and do not indicate future results.

Please see Endnotes for additional information.

3

1 The date used to calculate Life of Fund performance for the index is September 10, 1984, the Fund's commencement of operations.

2 The Bloomberg 1-3 Year U.S. Government/Credit Bond Index is the 1-3 year component of the Bloomberg U.S. Government/Credit Bond Index. The Bloomberg U.S. Government/Credit Bond Index is the non-securitized component of the Bloomberg U.S. Aggregate Bond Index and includes Treasuries and government-related (agency, sovereign, supranational, and local authority debt) and corporate securities. Effective August 24, 2021 all Bloomberg Barclays fixed income indices were rebranded as "Bloomberg indices". Please note that the indices described in this report do not take into account any fees, expenses or tax consequences of investing in the individual securities that they track, and that individuals cannot invest directly in any index. Data about the performance of an index are prepared or obtained by Neuberger Berman Investment Advisers LLC and reflect the reinvestment of income dividends and other distributions, if any. The Fund may invest in securities not included in a described index and generally does not invest in all securities included in a described index.

The investments for the Fund are managed by the same portfolio manager(s) who manage(s) one or more other registered funds that have names, investment objectives and investment styles that are similar to those of the Fund. You should be aware that the Fund is likely to differ from those other mutual fund(s) in size, cash flow pattern and tax matters. Accordingly, the holdings and performance of the Fund can be expected to vary from those of the other mutual fund(s).

Shares of the separate Neuberger Berman Advisers Management Trust Portfolios, including the Fund, are not available to the general public. Shares of the Fund may be purchased only by life insurance companies to be held in their separate accounts, which fund variable annuity and variable life insurance policies, and by qualified pension and retirement plans. Statistics and projections in this report are derived from sources deemed to be reliable but cannot be regarded as a representation of future results of the Fund. This report is prepared for the general information of shareholders and is not an offer of shares of the Fund. Shares are sold only through the currently effective prospectus, which must precede or accompany this report.

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" name are registered service marks of Neuberger Berman Group LLC. The individual Fund name in this piece is either a service mark or registered service mark of Neuberger Berman Investment Advisers LLC, an affiliate of Neuberger Berman BD LLC, distributor, member FINRA.

© 2022 Neuberger Berman BD LLC, distributor. All rights reserved.

4

Information About Your Fund's Expenses (Unaudited)

As a Fund shareholder, you incur two types of costs: (1) transaction costs such as fees and expenses that are, or may be, imposed under your variable contract or qualified pension plan; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (if applicable), and other Fund expenses. This example is intended to help you understand your ongoing costs (in U.S. dollars) of investing in the Fund and compare these costs with the ongoing costs of investing in other mutual funds.

This table is designed to provide information regarding costs related to your investments. The following examples are based on an investment of $1,000 made at the beginning of the six month period ended December 31, 2021 and held for the entire period. The table illustrates the Fund's costs in two ways:

Actual Expenses and Performance: | | The first section of the table provides information about actual account values and actual expenses in dollars, based on the Fund's actual performance during the period indicated. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section of the table under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid over the period. | |

Hypothetical Example for

Comparison Purposes: | | The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return at 5% per year before expenses. This return is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in this Fund versus other funds. To do so, compare the expenses shown in this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | |

Please note that the expenses in the table are meant to highlight your ongoing costs only and do not include any transaction costs, such as fees and expenses that are, or may be imposed under your variable contract or qualified pension plan. Therefore, the information under the heading "Hypothetical (5% annual return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expense Example (Unaudited)

NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST SHORT DURATION BOND PORTFOLIO

Actual | | Beginning Account

Value

7/1/21 | | Ending Account

Value

12/31/21 | | Expenses Paid During

the Period

7/1/21 - 12/31/21 | |

Class I | | $ | 1,000.00 | | | $ | 996.20 | | | $ | 3.92 | (a) | |

Hypothetical (5% annual return before expenses) | |

Class I | | $ | 1,000.00 | | | $ | 1,021.27 | | | $ | 3.97 | (b) | |

(a) Expenses are equal to the annualized expense ratio of 0.78%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown).

(b) Hypothetical expenses are equal to the annualized expense ratio of 0.78%, multiplied by the average account value over the period (assuming a 5% annual return), multiplied by 184/365 (to reflect the one-half year period shown).

5

Legend Short Duration Bond Portfolio (Unaudited)

December 31, 2021

Benchmarks:

LIBOR = London Interbank Offered Rate

SOFR30A = 30 Day Average Secured Overnight Financing Rate

Currency Abbreviations:

USD = United States Dollar

Counterparties:

SSB = State Street Bank and Trust Company

Index Periods/Payment Frequencies:

1M = 1 Month

3M = 3 Months

6

Schedule of Investments Short Duration Bond Portfolio^ December 31, 2021

PRINCIPAL AMOUNT | | | | VALUE | |

U.S. Treasury Obligations 0.7% | | | |

$ | 720,000 | | | U.S. Treasury Note, 0.13%, due 4/30/2023 (Cost $719,640) | | $ | 716,147 | | |

Mortgage-Backed Securities 31.0% | | | |

Adjustable Mixed Balance 0.1% | | | |

| 100,395 |

| | Harborview Mortgage Loan Trust, Ser. 2004-4, Class 3A, (1M USD LIBOR + 1.13%),

1.22%, due 6/19/2034 | |

| 100,185 | (a) | |

Collateralized Mortgage Obligations 12.3% | | | |

| | 273,574 | | | Angel Oak Mortgage Trust, Ser. 2019-6, Class A1, 2.62%, due 11/25/2059 | | | 273,243 | (b)(c) | |

| | 964,223 | | | Brass No. 10 PLC, Ser. 10A, Class A1, 0.67%, due 4/16/2069 | | | 958,901 | (b)(c) | |

| | | | | Connecticut Avenue Securities Trust | | | | | |

| | 115,799 | | | Ser. 2019-R02, Class 1M2, (1M USD LIBOR + 2.30%), 2.40%, due 8/25/2031 | | | 116,277 | (a)(b) | |

| | 236,000 | | | Ser. 2021-R01, Class 1M2, (SOFR30A + 1.55%), 1.60%, due 10/25/2041 | | | 236,285 | (a)(b) | |

| | | | | Fannie Mae Connecticut Avenue Securities | | | | | |

| | 862,030 | | | Ser. 2016-C02, Class 1M2, (1M USD LIBOR + 6.00%), 6.10%, due 9/25/2028 | | | 890,692 | (a) | |

| | 294,405 | | | Ser. 2016-C03, Class 1M2, (1M USD LIBOR + 5.30%), 5.40%, due 10/25/2028 | | | 304,956 | (a) | |

| | 986,012 | | | Ser. 2016-C04, Class 1M2, (1M USD LIBOR + 4.25%), 4.35%, due 1/25/2029 | | | 1,011,269 | (a) | |

| | 697,853 | | | Ser. 2016-C06, Class 1M2, (1M USD LIBOR + 4.25%), 4.35%, due 4/25/2029 | | | 720,459 | (a) | |

| | 266,469 | | | Ser. 2016-C07, Class 2M2, (1M USD LIBOR + 4.35%), 4.45%, due 5/25/2029 | | | 276,634 | (a) | |

| | 1,024,219 | | | Ser. 2017-C03, Class 1M2, (1M USD LIBOR + 3.00%), 3.10%, due 10/25/2029 | | | 1,047,976 | (a) | |

| | 885,963 | | | Ser. 2017-C05, Class 1M2, (1M USD LIBOR + 2.20%), 2.30%, due 1/25/2030 | | | 901,097 | (a) | |

| | 915,549 | | | Ser. 2018-C01, Class 1M2, (1M USD LIBOR + 2.25%), 2.35%, due 7/25/2030 | | | 925,890 | (a) | |

| | | | | Freddie Mac Structured Agency Credit Risk Debt Notes | | | | | |

| | 1,016,816 | | | Ser. 2017-DNA1, Class M2, (1M USD LIBOR + 3.25%), 3.35%, due 7/25/2029 | | | 1,038,492 | (a) | |

| | 665,720 | | | Ser. 2017-DNA3, Class M2, (1M USD LIBOR + 2.50%), 2.60%, due 3/25/2030 | | | 678,532 | (a) | |

| | 1,067,476 | | | Ser. 2017-HQA3, Class M2, (1M USD LIBOR + 2.35%), 2.45%, due 4/25/2030 | | | 1,084,301 | (a) | |

| | 264,744 | | | Ser. 2019-DNA2, Class M2, (1M USD LIBOR + 2.45%), 2.55%, due 3/25/2049 | | | 267,440 | (a)(b) | |

| 228,648 |

| | Freddie Mac Structured Agency Credit Risk Debt Notes Real Estate Mortgage Investment

Conduits, Ser. 2021-DNA1, Class M1, (SOFR30A + 0.65%), 0.70%, due 1/25/2051 | |

| 228,580 | (a)(b) | |

| | | | | GCAT Trust | | | | | |

| | 368,649 | | | Ser. 2019-NQM3, Class A1, 2.69%, due 11/25/2059 | | | 370,642 | (b)(c) | |

| | 617,675 | | | Ser. 2021-NQM5, Class A1, 1.26%, due 7/25/2066 | | | 608,835 | (b)(c) | |

| | 527,820 | | | SGR Residential Mortgage Trust, Ser. 2021-2, Class A1, 1.74%, due 12/25/2061 | | | 523,660 | (b)(c) | |

| | 73,267 | | | Starwood Mortgage Residential Trust, Ser. 2019-INV1, Class A1, 2.61%, due 9/27/2049 | | | 73,718 | (b)(c) | |

| | | | | Verus Securitization Trust | | | | | |

| | 685,392 | | | Ser. 2021-3, Class A3, 1.44%, due 6/25/2066 | | | 677,100 | (b)(c) | |

| | 547,793 | | | Ser. 2021-6, Class A3, 1.89%, due 10/25/2066 | | | 543,709 | (b)(c) | |

| | | | 13,758,688 | | |

Commercial Mortgage-Backed 17.3% | | | |

| | 1,313,795 | | | BANK, Ser. 2020-BN30, Class A1, 0.45%, due 12/15/2053 | | | 1,292,912 | | |

| | 510,000 | | | BB-UBS Trust, Ser. 2012-SHOW, Class A , 3.43%, due 11/5/2036 | | | 528,151 | (b) | |

| | 5,396,962 | | | BBCMS Mortgage Trust, Ser. 2021-C11, Class XA, 1.39%, due 9/15/2054 | | | 548,160 | (c)(d) | |

| | | | | Benchmark Mortgage Trust | | | | | |

| | 97,000 | | | Ser. 2021-B31, Class E, 2.25%, due 12/15/2054 | | | 74,456 | (b) | |

| | 227,000 | | | Ser. 2021-B31, Class D, 2.25%, due 12/15/2054 | | | 192,326 | (b) | |

| 1,150,000 |

| | BX Commercial Mortgage Trust, Ser. 2021-VOLT, Class D, (1M USD LIBOR + 1.65%),

1.76%, due 9/15/2036 | |

| 1,139,843 | (a)(b) | |

| | 587,000 | | | BX Trust, Ser. 2021-SDMF, Class E, (1M USD LIBOR + 1.59%), 1.70%, due 9/15/2034 | | | 574,686 | (a)(b) | |

| | 320,000 | | | BXMT Ltd., Ser. 2020-FL2, Class A, (SOFR30A + 1.01%), 1.06%, due 2/15/2038 | | | 319,500 | (a)(b) | |

| | | | | CAMB Commercial Mortgage Trust | | | | | |

| | 1,006,000 | | | Ser. 2019-LIFE, Class D, (1M USD LIBOR + 1.75%), 1.86%, due 12/15/2037 | | | 1,005,075 | (a)(b) | |

| | 130,000 | | | Ser. 2019-LIFE, Class F, (1M USD LIBOR + 2.55%), 2.66%, due 12/15/2037 | | | 129,713 | (a)(b) | |

See Notes to Financial Statements

7

Schedule of Investments Short Duration Bond Portfolio^ (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

| | | | | Citigroup Commercial Mortgage Trust | | | | | |

$ | 162,217 | | | Ser. 2012-GC8, Class AAB, 2.61%, due 9/10/2045 | | $ | 162,545 | | |

| | 830,000 | | | Ser. 2015-P1, Class A5, 3.72%, due 9/15/2048 | | | 885,734 | | |

| | 99,427 | | | Ser. 2016-P3, Class A2, 2.74%, due 4/15/2049 | | | 99,363 | | |

| | | | | Commercial Mortgage Trust | | | | | |

| | 1,111,000 | | | Ser. 2012-CR4, Class AM, 3.25%, due 10/15/2045 | | | 1,119,132 | | |

| | 12,120,166 | | | Ser. 2014-CR18, Class XA, 1.00%, due 7/15/2047 | | | 248,335 | (c)(d) | |

| | 16,384,063 | | | CSAIL Commercial Mortgage Trust, Ser. 2016-C5, Class XA, 0.93%, due 11/15/2048 | | | 484,313 | (c)(d) | |

| | 800,000 | | | Eleven Madison Mortgage Trust, Ser. 2015-11MD, Class A, 3.55%, due 9/10/2035 | | | 836,293 | (b)(c) | |

| | | | | Freddie Mac Multiclass Certificates | | | | | |

| | 2,420,000 | | | Ser. 2020-RR03, Class X1, 1.71%, due 7/27/2028 | | | 239,927 | (d) | |

| | 1,500,000 | | | Ser. 2020-RR02, Class DX, 1.82%, due 9/27/2028 | | | 161,156 | (c)(d) | |

| | 1,535,000 | | | Ser. 2020-RR02, Class CX, 1.27%, due 3/27/2029 | | | 122,550 | (c)(d) | |

| 26,676,696 |

| | Freddie Mac Multifamily Structured Pass Through Certificates, Ser. K737, Class X1, 0.64%,

due 10/25/2026 | |

| 697,697 | (c)(d) | |

| | | | | GS Mortgage Securities Trust | | | | | |

| | 520,000 | | | Ser. 2019-BOCA, Class A, (1M USD LIBOR + 1.20%), 1.31%, due 6/15/2038 | | | 519,677 | (a)(b) | |

| | 915,000 | | | Ser. 2010-C1, Class B, 5.15%, due 8/10/2043 | | | 916,034 | (b) | |

| | 95,000 | | | Ser. 2012-GCJ7, Class B, 4.74%, due 5/10/2045 | | | 95,864 | | |

| | 175,738,695 | | | Ser. 2013-GC13, Class XA, 0.06%, due 7/10/2046 | | | 155,775 | (c)(d) | |

| | 1,000,000 | | | Ser. 2014-GC22, Class A4, 3.59%, due 6/10/2047 | | | 1,027,869 | | |

| | 18,234,471 | | | Ser. 2015-GC30, Class XA, 0.74%, due 5/10/2050 | | | 399,415 | (c)(d) | |

| | | | | JP Morgan Chase Commercial Mortgage Securities Trust | | | | | |

| | 285,000 | | | Ser. 2012-HSBC, Class B, 3.72%, due 7/5/2032 | | | 287,097 | (b) | |

| | 285,000 | | | Ser. 2012-HSBC, Class C, 4.02%, due 7/5/2032 | | | 287,201 | (b) | |

| | | | | JPMBB Commercial Mortgage Securities Trust | | | | | |

| | 293,640 | | | Ser. 2013-C12, Class ASB, 3.16%, due 7/15/2045 | | | 295,114 | | |

| | 322,214 | | | Ser. 2015-C29, Class ASB, 3.30%, due 5/15/2048 | | | 332,489 | | |

| 166,000 |

| | Morgan Stanley Bank of America Merrill Lynch Trust, Ser. 2013-C9, Class B, 3.71%,

due 5/15/2046 | |

| 169,372 | (c) | |

| 165,000 |

| | ONE Park Mortgage Trust, Ser. 2021-PARK, Class E, (1M USD LIBOR + 1.75%), 1.86%,

due 3/15/2036 | |

| 163,344 | (a)(b) | |

| | 334,716 | | | UBS Commercial Mortgage Trust, Ser. 2018-C14, Class A1, 3.38%, due 12/15/2051 | | | 339,421 | | |

| | 893,000 | | | VNDO Mortgage Trust, Ser. 2012-6AVE, Class E, 3.34%, due 11/15/2030 | | | 905,574 | (b)(c) | |

| | | | | Wells Fargo Commercial Mortgage Trust | | | | | |

| | 293,780 | | | Ser. 2012-LC5, Class A3, 2.92%, due 10/15/2045 | | | 296,006 | | |

| | 649,707 | | | Ser. 2020-C58, Class A1, 0.55%, due 7/15/2053 | | | 640,019 | | |

| | | | | WF-RBS Commercial Mortgage Trust | | | | | |

| | 16,842,695 | | | Ser. 2014-LC14, Class XA, 1.25%, due 3/15/2047 | | | 352,164 | (c)(d) | |

| | 1,130,000 | | | Ser. 2014-C25, Class A5, 3.63%, due 11/15/2047 | | | 1,189,302 | | |

| | | | 19,233,604 | | |

Fannie Mae 0.7% | | | |

| | 731,408 | | | Pass-Through Certificates, 4.50%, due 5/1/2041 – 5/1/2044 | | | 806,021 | | |

Freddie Mac 0.6% | | | |

| | | | | Pass-Through Certificates | | | | | |

| | 263,985 | | | 3.50%, due 5/1/2026 | | | 277,891 | | |

| | 375,196 | | | 4.50%, due 11/1/2039 | | | 415,122 | | |

| | | | 693,013 | | |

| | | | | Total Mortgage-Backed Securities (Cost $36,101,014) | | | 34,591,511 | | |

Corporate Bonds 48.2% | | | |

Advertising 0.1% | | | |

| | 140,000 | | | Outfront Media Capital LLC/Outfront Media Capital Corp., 6.25%, due 6/15/2025 | | | 145,600 | (b) | |

See Notes to Financial Statements

8

Schedule of Investments Short Duration Bond Portfolio^ (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

Aerospace & Defense 1.8% | | | |

$ | 1,400,000 | | | Boeing Co., 2.20%, due 2/4/2026 | | $ | 1,399,666 | | |

| | 410,000 | | | Spirit AeroSystems, Inc., 7.50%, due 4/15/2025 | | | 429,988 | (b) | |

| | 230,000 | | | TransDigm, Inc., 6.25%, due 3/15/2026 | | | 239,056 | (b) | |

| | | | 2,068,710 | | |

Agriculture 0.5% | | | |

| | 535,000 | | | BAT Capital Corp., 2.26%, due 3/25/2028 | | | 521,323 | | |

Airlines 3.1% | | | |

| | 1,160,000 | | | American Airlines, Inc./AAdvantage Loyalty IP Ltd., 5.50%, due 4/20/2026 | | | 1,206,255 | (b) | |

| | 140,000 | | | Delta Air Lines, Inc., 7.00%, due 5/1/2025 | | | 160,077 | (b) | |

| | 535,000 | | | Delta Air Lines, Inc./SkyMiles IP Ltd., 4.50%, due 10/20/2025 | | | 562,291 | (b) | |

| | 255,000 | | | United Airlines, Inc., 4.38%, due 4/15/2026 | | | 265,898 | (b) | |

| | | | | United Continental Holdings, Inc. | | | | | |

| | 170,000 | | | 4.25%, due 10/1/2022 | | | 172,550 | | |

| | 1,090,000 | | | 4.88%, due 1/15/2025 | | | 1,121,338 | (e) | |

| | | | 3,488,409 | | |

Auto Manufacturers 2.0% | | | |

| | | | | General Motors Financial Co., Inc. | | | | | |

| | 530,000 | | | 2.75%, due 6/20/2025 | | | 546,895 | | |

| | 400,000 | | | 2.70%, due 8/20/2027 | | | 406,866 | (e) | |

| | 250,000 | | | Jaguar Land Rover Automotive PLC, 7.75%, due 10/15/2025 | | | 270,371 | (b) | |

| | | | | Volkswagen Group of America Finance LLC | | | | | |

| | 610,000 | | | 0.88%, due 11/22/2023 | | | 605,926 | (b) | |

| | 370,000 | | | 3.35%, due 5/13/2025 | | | 389,276 | (b) | |

| | | | 2,219,334 | | |

Auto Parts & Equipment 0.1% | | | |

| | 60,000 | | | Meritor, Inc., 6.25%, due 6/1/2025 | | | 62,550 | (b) | |

Banks 8.1% | | | |

| | 550,000 | | | Banco Santander SA, 2.75%, due 5/28/2025 | | | 568,475 | | |

| | 650,000 | | | Bank of America Corp., Ser. L, 3.95%, due 4/21/2025 | | | 694,786 | | |

| | 1,070,000 | | | Citigroup, Inc., 3.35%, due 4/24/2025 | | | 1,117,239 | (f) | |

| | | | | Goldman Sachs Group, Inc. | | | | | |

| | 795,000 | | | (3M USD LIBOR + 1.60%), 1.78%, due 11/29/2023 | | | 811,068 | (a) | |

| | 1,270,000 | | | 1.95%, due 10/21/2027 | | | 1,264,412 | (f) | |

| | 700,000 | | | JPMorgan Chase & Co., 2.30%, due 10/15/2025 | | | 715,895 | (f) | |

| | 1,065,000 | | | Lloyds Banking Group PLC, 1.33%, due 6/15/2023 | | | 1,066,789 | (f) | |

| | 1,700,000 | | | Morgan Stanley, 0.79%, due 5/30/2025 | | | 1,677,783 | (f) | |

| | 1,060,000 | | | Wells Fargo & Co., 3.75%, due 1/24/2024 | | | 1,112,956 | | |

| | | | 9,029,403 | | |

Chemicals 0.2% | | | |

| | 200,000 | | | SCIL IV LLC/SCIL USA Holdings LLC, 5.38%, due 11/1/2026 | | | 205,250 | (b) | |

Commercial Services 0.6% | | | |

| | 410,000 | | | Global Payments, Inc., 1.50%, due 11/15/2024 | | | 410,057 | | |

| | 240,000 | | | Prime Security Services Borrower LLC/Prime Finance, Inc., 5.25%, due 4/15/2024 | | | 255,395 | (b) | |

| | | | 665,452 | | |

See Notes to Financial Statements

9

Schedule of Investments Short Duration Bond Portfolio^ (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

Distribution-Wholesale 0.3% | | | |

$ | 290,000 | | | KAR Auction Services, Inc., 5.13%, due 6/1/2025 | | $ | 294,350 | (b) | |

Diversified Financial Services 2.4% | | | |

| | | | | AerCap Ireland Capital DAC/AerCap Global Aviation Trust | | | | | |

| | 800,000 | | | 4.50%, due 9/15/2023 | | | 839,138 | | |

| | 540,000 | | | 6.50%, due 7/15/2025 | | | 617,079 | | |

| | 1,290,000 | | | Global Aircraft Leasing Co. Ltd., 6.50% Cash/7.25% PIK, 6.50%, due 9/15/2024 | | | 1,244,850 | (b)(g) | |

| | | | 2,701,067 | | |

Electric 0.1% | | | |

| | 150,000 | | | Talen Energy Supply LLC, 10.50%, due 1/15/2026 | | | 64,500 | (b) | |

Entertainment 0.9% | | | |

| | 250,000 | | | Cinemark USA, Inc., 8.75%, due 5/1/2025 | | | 265,000 | (b) | |

| | 215,000 | | | Int'l Game Technology PLC, 4.13%, due 4/15/2026 | | | 221,465 | (b) | |

| | 260,000 | | | Live Nation Entertainment, Inc., 4.88%, due 11/1/2024 | | | 262,600 | (b) | |

| | 230,000 | | | Six Flags Theme Parks, Inc., 7.00%, due 7/1/2025 | | | 245,627 | (b) | |

| | | | 994,692 | | |

Food 0.9% | | | |

| | 970,000 | | | JBS Finance Luxembourg S.a.r.l., 2.50%, due 1/15/2027 | | | 959,097 | (b) | |

Food Service 0.2% | | | |

| | | | | Aramark Services, Inc. | | | | | |

| | 150,000 | | | 5.00%, due 4/1/2025 | | | 153,030 | (b) | |

| | 80,000 | | | 6.38%, due 5/1/2025 | | | 83,600 | (b) | |

| | | | 236,630 | | |

Gas 0.9% | | | |

| | 1,035,000 | | | CenterPoint Energy Resources Corp., (3M USD LIBOR + 0.50%), 0.67%, due 3/2/2023 | | | 1,032,589 | (a) | |

Healthcare-Products 0.8% | | | |

| | 945,000 | | | Baxter Int'l, Inc., 1.32%, due 11/29/2024 | | | 943,677 | (b) | |

Housewares 0.2% | | | |

| | 180,000 | | | CD&R Smokey Buyer, Inc., 6.75%, due 7/15/2025 | | | 189,000 | (b) | |

Insurance 0.3% | | | |

| | 380,000 | | | Jackson Financial, Inc., 1.13%, due 11/22/2023 | | | 379,297 | (b) | |

Leisure Time 1.2% | | | |

| | | | | Carnival Corp. | | | | | |

| | 785,000 | | | 10.50%, due 2/1/2026 | | | 896,074 | (b) | |

| | 280,000 | | | 5.75%, due 3/1/2027 | | | 280,000 | (b) | |

| | 143,000 | | | NCL Corp. Ltd., 12.25%, due 5/15/2024 | | | 169,455 | (b) | |

| | | | 1,345,529 | | |

Lodging 0.2% | | | |

| | 260,000 | | | Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., 5.50%, due 3/1/2025 | | | 267,800 | (b) | |

See Notes to Financial Statements

10

Schedule of Investments Short Duration Bond Portfolio^ (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

Machinery-Diversified 1.2% | | | |

$ | 1,385,000 | | | Otis Worldwide Corp., (3M USD LIBOR + 0.45%), 0.58%, due 4/5/2023 | | $ | 1,385,038 | (a) | |

Media 2.2% | | | |

| | | | | Charter Communications Operating LLC/Charter Communications Operating Capital | | | | | |

| | 430,000 | | | 4.91%, due 7/23/2025 | | | 473,477 | | |

| | 535,000 | | | 2.25%, due 1/15/2029 | | | 521,998 | | |

| | 343,000 | | | Cumulus Media New Holdings, Inc., 6.75%, due 7/1/2026 | | | 355,863 | (b)(e) | |

| | 550,000 | | | Fox Corp., 3.05%, due 4/7/2025 | | | 577,326 | | |

| | 180,000 | | | iHeartCommunications, Inc., 6.38%, due 5/1/2026 | | | 186,750 | | |

| | 310,000 | | | Radiate Holdco LLC/Radiate Finance, Inc., 4.50%, due 9/15/2026 | | | 313,100 | (b) | |

| | | | 2,428,514 | | |

Mining 0.3% | | | |

| | 320,000 | | | First Quantum Minerals Ltd., 7.50%, due 4/1/2025 | | | 329,184 | (b) | |

Miscellaneous Manufacturer 2.0% | | | |

| | 2,185,000 | | | General Electric Capital Corp., (3M USD LIBOR + 1.00%), 1.20%, due 3/15/2023 | | | 2,194,063 | (a) | |

Office-Business Equipment 1.1% | | | |

| | 1,200,000 | | | CDW LLC/CDW Finance Corp., 2.67%, due 12/1/2026 | | | 1,229,526 | | |

Oil & Gas 1.3% | | | |

| | 260,000 | | | Apache Corp., 4.63%, due 11/15/2025 | | | 279,175 | | |

| | 210,000 | | | Occidental Petroleum Corp., 5.50%, due 12/1/2025 | | | 232,968 | | |

| | 90,000 | | | PDC Energy, Inc., 5.75%, due 5/15/2026 | | | 93,005 | | |

| | 550,000 | | | Petroleos Mexicanos, (3M USD LIBOR + 3.65%), 3.85%, due 3/11/2022 | | | 550,000 | (a) | |

| | 250,000 | | | Range Resources Corp., 9.25%, due 2/1/2026 | | | 269,448 | | |

| | | | 1,424,596 | | |

Oil & Gas Services 0.1% | | | |

| | 150,000 | | | USA Compression Partners L.P./USA Compression Finance Corp., 6.88%, due 4/1/2026 | | | 156,000 | | |

Pharmaceuticals 1.1% | | | |

| | 1,135,000 | | | Upjohn, Inc., 1.65%, due 6/22/2025 | | | 1,130,699 | | |

| | 140,000 | | | Valeant Pharmaceuticals Int'l, Inc., 5.50%, due 11/1/2025 | | | 142,275 | (b) | |

| | | | 1,272,974 | | |

Pipelines 2.4% | | | |

| | 365,000 | | | Blue Racer Midstream LLC/Blue Racer Finance Corp., 7.63%, due 12/15/2025 | | | 386,900 | (b) | |

| | 130,000 | | | EQM Midstream Partners L.P., 6.00%, due 7/1/2025 | | | 141,375 | (b) | |

| | 160,000 | | | Genesis Energy L.P./Genesis Energy Finance Corp., 6.50%, due 10/1/2025 | | | 158,000 | | |

| | 660,000 | | | MPLX L.P., 4.88%, due 6/1/2025 | | | 722,211 | | |

| | | | | New Fortress Energy, Inc. | | | | | |

| | 260,000 | | | 6.75%, due 9/15/2025 | | | 262,600 | (b) | |

| | 720,000 | | | 6.50%, due 9/30/2026 | | | 714,600 | (b) | |

| | 90,000 | | | Rattler Midstream L.P., 5.63%, due 7/15/2025 | | | 93,600 | (b) | |

| | 140,000 | | | Tallgrass Energy Partners L.P./Tallgrass Energy Finance Corp., 7.50%, due 10/1/2025 | | | 151,550 | (b) | |

| | | | 2,630,836 | | |

Real Estate 0.2% | | | |

| | 215,000 | | | Realogy Group LLC/Realogy Co-Issuer Corp., 7.63%, due 6/15/2025 | | | 227,900 | (b) | |

See Notes to Financial Statements

11

Schedule of Investments Short Duration Bond Portfolio^ (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

Real Estate Investment Trusts 2.6% | | | |

| | | | | American Tower Corp. | | | | | |

$ | 645,000 | | | 1.60%, due 4/15/2026 | | $ | 638,401 | | |

| | 805,000 | | | 1.45%, due 9/15/2026 | | | 787,674 | | |

| 115,000 |

| | MGM Growth Properties Operating Partnership L.P./MGP Finance Co-Issuer, Inc., 4.63%,

due 6/15/2025 | |

| 122,600 | (b) | |

| | 565,000 | | | Service Properties Trust, 4.35%, due 10/1/2024 | | | 553,703 | | |

| | 530,000 | | | Starwood Property Trust, Inc., 5.50%, due 11/1/2023 | | | 548,550 | (b) | |

| | 250,000 | | | Uniti Group L.P./Uniti Fiber Holdings, Inc./CSL Capital LLC, 7.88%, due 2/15/2025 | | | 260,937 | (b) | |

| | | | 2,911,865 | | |

Retail 1.0% | | | |

| | 1,100,000 | | | Lowe's Cos., Inc., 1.70%, due 9/15/2028 | | | 1,077,848 | | |

Semiconductors 1.5% | | | |

| | 750,000 | | | Broadcom, Inc., 3.15%, due 11/15/2025 | | | 785,210 | | |

| | 850,000 | | | Marvell Technology, Inc., 1.65%, due 4/15/2026 | | | 839,953 | | |

| | | | 1,625,163 | | |

Software 2.5% | | | |

| | 540,000 | | | Infor, Inc., 1.45%, due 7/15/2023 | | | 541,637 | (b) | |

| | 1,700,000 | | | Oracle Corp., 1.65%, due 3/25/2026 | | | 1,686,856 | | |

| | 530,000 | | | VMware, Inc., 1.00%, due 8/15/2024 | | | 524,883 | | |

| | | | 2,753,376 | | |

Telecommunications 3.8% | | | |

| | | | | AT&T, Inc. | | | | | |

| | 1,370,000 | | | 1.70%, due 3/25/2026 | | | 1,362,924 | | |

| | 550,000 | | | 1.65%, due 2/1/2028 | | | 538,354 | | |

| | 200,000 | | | Iliad Holding SAS, 6.50%, due 10/15/2026 | | | 210,146 | (b) | |

| | 550,000 | | | T-Mobile USA, Inc., 3.50%, due 4/15/2025 | | | 582,711 | | |

| | | | | Verizon Communications, Inc. | | | | | |

| | 1,025,000 | | | 1.45%, due 3/20/2026 | | | 1,019,803 | | |

| | 550,000 | | | 2.63%, due 8/15/2026 | | | 573,020 | | |

| | | | 4,286,958 | | |

| | | | | Total Corporate Bonds (Cost $53,448,203) | | | 53,748,100 | | |

Asset-Backed Securities 16.1% | | | |

| 1,125,000 |

| | 37 Capital CLO I Ltd., Ser. 2021-1A, Class A, (3M USD LIBOR + 1.20%), 1.40%,

due 10/15/2034 | |

| 1,124,994 | (a)(b) | |

| | 1,000,000 | | | AM Capital Funding LLC, Ser. 2018-1, Class A, 4.98%, due 12/15/2023 | | | 1,027,686 | (b) | |

| | 408,735 | | | Aqua Finance Trust, Ser. 2021-A, Class A, 1.54%, due 7/17/2046 | | | 405,086 | (b) | |

| 500,000 |

| | Benefit Street Partners CLO XIX Ltd., Ser. 2019-19A, Class D, (3M USD LIBOR + 3.80%),

3.92%, due 1/15/2033 | |

| 500,291 | (a)(b) | |

| 145,956 |

| | Consumer Loan Underlying Bond Club Certificate Issuer Trust I, Ser. 2019-HP1, Class A,

2.59%, due 12/15/2026 | |

| 146,459 | (b) | |

| | 1,400,000 | | | Crown Castle Towers LLC, 3.66%, due 5/15/2025 | | | 1,456,674 | (b) | |

| 565,000 |

| | Fort Washington CLO Ltd., Ser. 2021-2A, Class A, (3M USD LIBOR + 1.22%), 1.34%,

due 10/20/2034 | |

| 565,959 | (a)(b) | |

| 1,900,000 |

| | Gulf Stream Meridian 3 Ltd., Ser. 2021-IIA, Class A1, (3M USD LIBOR + 1.32%), 1.44%,

due 4/15/2034 | |

| 1,902,987 | (a)(b) | |

| | 951,813 | | | JPMorgan Chase Bank NA , Ser. 2021-3, Class B, 0.76%, due 2/26/2029 | | | 945,846 | (b) | |

| | 500,000 | | | Milos CLO Ltd., Ser. 2017-1A, Class DR, (3M USD LIBOR + 2.75%), 2.88%, due 10/20/2030 | | | 492,932 | (a)(b) | |

| | 134,522 | | | MVW LLC, Ser. 2021-1WA, Class B, 1.44%, due 1/22/2041 | | | 132,529 | (b) | |

See Notes to Financial Statements

12

Schedule of Investments Short Duration Bond Portfolio^ (cont'd)

PRINCIPAL AMOUNT | | | | VALUE | |

| | | | | MVW LLC | | | | | |

$ | 567,000 | | | Ser. 2021-2A, Class A, 1.43%, due 5/20/2039 | | $ | 560,179 | (b) | |

| | 393,000 | | | Ser. 2021-2A, Class B, 1.83%, due 5/20/2039 | | | 390,432 | (b) | |

| | 511,446 | | | Navient Private Ed. Refi Loan Trust, Ser. 2021-EA, Class A, 0.97%, due 12/16/2069 | | | 502,718 | (b) | |

| 500,000 |

| | OHA Loan Funding Ltd., Ser. 2016-1A, Class DR, (3M USD LIBOR + 3.00%), 3.13%,

due 1/20/2033 | |

| 496,556 | (a)(b) | |

| 500,000 |

| | Palmer Square CLO Ltd., Ser. 2015-2A, Class CR2, (3M USD LIBOR + 2.75%), 2.88%,

due 7/20/2030 | |

| 493,355 | (a)(b) | |

| | 1,195,000 | | | PFS Financing Corp., Ser. 2021-A, Class A, 0.71%, due 4/15/2026 | | | 1,178,102 | (b) | |

| | 565,000 | | | Prestige Auto Receivables Trust, Ser. 2021-1A, Class D, 2.08%, due 2/15/2028 | | | 561,618 | (b) | |

| | | | | Sierra Timeshare Receivables Funding LLC | | | | | |

| | 142,150 | | | Ser. 2019-2A, Class A, 2.59%, due 5/20/2036 | | | 143,738 | (b) | |

| | 169,668 | | | Ser. 2020-2A, Class C, 3.51%, due 7/20/2037 | | | 172,474 | (b) | |

| 500,000 |

| | Signal Peak CLO 2 LLC, Ser. 2015-1A, Class DR2, (3M USD LIBOR + 2.85%), 2.98%,

due 4/20/2029 | |

| 493,491 | (a)(b) | |

| 524,954 |

| | SLM Student Loan Trust, Ser. 2013-2, Class A, (1M USD LIBOR + 0.45%), 0.55%,

due 6/25/2043 | |

| 519,799 | (a) | |

| | 114,375 | | | SoFi Consumer Loan Program Trust, Ser. 2020-1, Class A, 2.02%, due 1/25/2029 | | | 114,823 | (b) | |

| | 487,638 | | | SoFi Professional Loan Program Trust, Ser. 2021-A, Class AFX, 1.03%, due 8/17/2043 | | | 480,833 | (b) | |

| 500,000 |

| | Symphony CLO XXII Ltd., Ser. 2020-22A, Class D, (3M USD LIBOR + 3.15%), 3.27%,

due 4/18/2033 | |

| 498,801 | (a)(b) | |

| | 500,000 | | | TICP CLO VII Ltd., Ser. 2017-7A, Class DR, (3M USD LIBOR + 3.20%), 3.32%, due 4/15/2033 | | | 500,238 | (a)(b) | |

| | 500,000 | | | TICP CLO XV Ltd., Ser. 2020-15A, Class D, (3M USD LIBOR + 3.15%), 3.28%, due 4/20/2033 | | | 501,064 | (a)(b) | |

| 500,000 |

| | TRESTLES CLO III Ltd., Ser. 2020-3A, Class D, (3M USD LIBOR + 3.25%), 3.38%,

due 1/20/2033 | |

| 499,994 | (a)(b) | |

| 1,125,000 |

| | Whitebox CLO III Ltd., Ser. 2021-3A , Class A1, (3M USD LIBOR + 1.22%), 1.34%,

due 10/15/2034 | |

| 1,125,523 | (a)(b) | |

| | | | | Total Asset-Backed Securities (Cost $18,061,072) | | | 17,935,181 | | |

NUMBER OF SHARES | | | | | |

Exchange-Traded Funds 2.5% | | | |

| | 101,945 | | | SPDR Bloomberg Barclays Short Term High Yield Bond ETF (Cost $2,778,635) | | | 2,767,807 | | |

Short-Term Investments 2.0% | | | |

Investment Companies 2.0% | | | |

| | 811,909 | | | State Street Institutional U.S. Government Money Market Fund Premier Class, 0.03%(h) | | | 811,909 | (i) | |

| | 1,446,618 | | | State Street Navigator Securities Lending Government Money Market Portfolio, 0.03%(h) | | | 1,446,618 | (j) | |

| | | | | Total Short-Term Investments (Cost $2,258,527) | | | 2,258,527 | | |

| | | | | Total Investments 100.5% (Cost $113,367,091) | | | 112,017,273 | | |

| | | | | Liabilities Less Other Assets (0.5)% | | | (540,093 | )(k) | |

| | | | | Net Assets 100.0% | | $ | 111,477,180 | | |

(a) Variable or floating rate security. The interest rate shown was the current rate as of December 31, 2021 and changes periodically.

(b) Securities were purchased under Rule 144A of the Securities Act of 1933, as amended, or are otherwise restricted and, unless registered under the Securities Act of 1933 or exempted from registration, may only be sold to qualified institutional investors or may have other restrictions on resale. At December 31, 2021, these securities amounted to $46,692,914, which represents 41.9% of net assets of the Fund.

See Notes to Financial Statements

13

Schedule of Investments Short Duration Bond Portfolio^ (cont'd)

(c) Variable or floating rate security where the stated interest rate is not based on a published reference rate and spread. Rather, the interest rate adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. The interest rate shown was the current rate as of December 31, 2021.

(d) Interest only security. These securities represent the right to receive the monthly interest payments on an underlying pool of mortgages. Payments of principal on the pool reduce the value of the "interest only" holding.

(e) The security or a portion of this security is on loan at December 31, 2021. Total value of all such securities at December 31, 2021 amounted to $1,418,868 for the Fund (see Note A of the Notes to Financial Statements).

(f) Security issued at a fixed coupon rate, which converts to a variable rate at a future date. Rate shown is the rate in effect as of period end.

(g) Payment-in-kind (PIK) security.

(h) Represents 7-day effective yield as of December 31, 2021.

(i) All or a portion of this security is segregated in connection with obligations for futures contracts with a total value of $811,909.

(j) Represents investment of cash collateral received from securities lending.

(k) Includes the impact of the Fund's open positions in derivatives at December 31, 2021.

POSITIONS BY COUNTRY

Country | | Investments

at Value | | Percentage of

Net Assets | |

United States | | $ | 92,565,094 | | | | 83.1 | % | |

Cayman Islands | | | 10,267,044 | | | | 9.2 | % | |

United Kingdom | | | 2,817,384 | | | | 2.5 | % | |

Ireland | | | 1,456,217 | | | | 1.3 | % | |

Germany | | | 995,202 | | | | 0.9 | % | |

Spain | | | 568,475 | | | | 0.5 | % | |

Mexico | | | 550,000 | | | | 0.5 | % | |

Zambia | | | 329,184 | | | | 0.3 | % | |

France | | | 210,146 | | | | 0.2 | % | |

Short-Term Investments and Other Liabilities-Net | | | 1,718,434 | | | | 1.5 | % | |

| | | $ | 111,477,180 | | | | 100.0 | % | |

Derivative Instruments

Futures contracts ("futures")

At December 31, 2021, open positions in futures for the Fund were as follows:

Long Futures:

Expiration Date | | Number of

Contracts | | Open Contracts | | Notional

Amount | | Value and

Unrealized

Appreciation/

(Depreciation) | |

3/2022 | | | 261 | | | U.S. Treasury Note, 2 Year | | $ | 56,942,860 | | | $ | (45,453 | ) | |

12/2022 | | | 90 | | | Euro, 90 day | | | 22,264,875 | | | | (57,937 | ) | |

Total Long Positions | | | | | | $ | 79,207,735 | | | $ | (103,390 | ) | |

See Notes to Financial Statements

14

Schedule of Investments Short Duration Bond Portfolio^ (cont'd)

Short Futures:

Expiration Date | | Number of

Contracts | | Open Contracts | | Notional

Amount | | Value and

Unrealized

Appreciation/

(Depreciation) | |

3/2022 | | | 163 | | | U.S. Treasury Note, 5 Year | | $ | (19,719,180 | ) | | $ | (89,555 | ) | |

3/2022 | | | 25 | | | U.S. Treasury Note, 10 Year | | | (3,261,719 | ) | | | (38,281 | ) | |

3/2022 | | | 4 | | | U.S. Treasury Note, Ultra 10 Year | | | (585,750 | ) | | | (9,813 | ) | |

Total Short Positions | | | | | | $ | (23,566,649 | ) | | $ | (137,649 | ) | |

Total Futures | | | | | | | | $ | (241,039 | ) | |

At December 31, 2021, the Fund had $465,119 deposited in a segregated account to cover margin requirements on open futures.

For the year ended December 31, 2021, the average notional value for the months where the Fund had futures outstanding was $63,484,302 for long positions and $(24,191,421) for short positions.

The following is a summary, categorized by Level (see Note A of Notes to Financial Statements), of inputs used to value the Fund's investments as of December 31, 2021:

Asset Valuation Inputs | | Level 1 | | Level 2 | | Level 3 | | Total | |

Investments: | |

U.S. Treasury Obligations | | $ | — | | | $ | 716,147 | | | $ | — | | | $ | 716,147 | | |

Mortgage-Backed Securities(a) | | | — | | | | 34,591,511 | | | | — | | | | 34,591,511 | | |

Corporate Bonds(a) | | | — | | | | 55,204,774 | | | | — | | | | 55,204,774 | | |

Asset-Backed Securities | | | — | | | | 16,478,507 | | | | — | | | | 16,478,507 | | |

Exchange-Traded Funds | | | 2,767,807 | | | | — | | | | — | | | | 2,767,807 | | |

Short-Term Investments | | | — | | | | 2,258,527 | | | | — | | | | 2,258,527 | | |

Total Investments | | $ | 2,767,807 | | | $ | 109,249,466 | | | $ | — | | | $ | 112,017,273 | | |

(a) The Schedule of Investments provides information on the industry or sector categorization as well as a Positions by Country summary.

The following is a summary, categorized by Level (see Note A of Notes to Financial Statements), of inputs used to value the Fund's derivatives as of December 31, 2021:

Other Financial Instruments | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Futures(a) | |

Liabilities | | $ | (241,039 | ) | | $ | — | | | $ | — | | | $ | (241,039 | ) | |

Total | | $ | (241,039 | ) | | $ | — | | | $ | — | | | $ | (241,039 | ) | |

(a) Futures are reported at the cumulative unrealized appreciation/(depreciation) of the instrument.

^ A balance indicated with a "—", reflects either a zero balance or an amount that rounds to less than 1.

See Notes to Financial Statements

15

Statement of Assets and Liabilities

Neuberger Berman Advisers Management Trust

| | | SHORT DURATION

BOND PORTFOLIO | |

| | | December 31, 2021 | |

Assets | |

Investments in securities, at value*† (Note A)—see Schedule of Investments: | |

| Unaffiliated issuers(a) | | $ | 112,017,273 | | |

Cash collateral segregated for futures contracts (Note A) | | | 465,119 | | |

Interest receivable | | | 631,877 | | |

Receivable for Fund shares sold | | | 205,076 | | |

Receivable for securities lending income (Note A) | | | 1,947 | | |

Prepaid expenses and other assets | | | 2,876 | | |

Total Assets | | | 113,324,168 | | |

Liabilities | |

Payable to investment manager (Note B) | | | 16,073 | | |

Payable for Fund shares redeemed | | | 14,462 | | |

Payable for accumulated variation margin on futures contracts (Note A) | | | 241,039 | | |

Payable to administrator—net (Note B) | | | 37,820 | | |

Payable for loaned securities collateral (Note A) | | | 1,446,618 | | |

Other accrued expenses and payables | | | 90,976 | | |

Total Liabilities | | | 1,846,988 | | |

Net Assets | | $ | 111,477,180 | | |

Net Assets consist of: | |

Paid-in capital | | $ | 136,286,808 | | |

Total distributable earnings/(losses) | | | (24,809,628 | ) | |

Net Assets | | $ | 111,477,180 | | |

Shares Outstanding ($.001 par value; unlimited shares authorized) | | | 10,642,158 | | |

Net Asset Value, offering and redemption price per share | | $ | 10.48 | | |

†Securities on loan, at value: | |

Unaffiliated issuers | | $ | 1,418,868 | | |

*Cost of Investments: | |

(a) Unaffiliated Issuers | | $ | 113,367,091 | | |

See Notes to Financial Statements

16

Neuberger Berman Advisers Management Trust

| | | SHORT DURATION

BOND PORTFOLIO | |

| | | For the

Fiscal Year Ended

December 31, 2021 | |

Investment Income: | |

Income (Note A): | |

Dividend income—unaffiliated issuers | | $ | 217,784 | | |

Interest and other income—unaffiliated issuers | | | 3,402,471 | | |

Income from securities loaned—net | | | 12,843 | | |

Total income | | $ | 3,633,098 | | |

Expenses: | |

Investment management fees (Note B) | | | 188,777 | | |

Administration fees (Note B) | | | 444,180 | | |

Shareholder servicing agent fees | | | 7,109 | | |

Audit fees | | | 51,172 | | |

Custodian and accounting fees | | | 81,760 | | |

Insurance | | | 3,230 | | |

Legal fees | | | 24,505 | | |

Shareholder reports | | | 30,578 | | |

Trustees' fees and expenses | | | 47,253 | | |

Interest | | | 895 | | |

Miscellaneous and other fees | | | 9,163 | | |

Total expenses | | | 888,622 | | |

Net investment income/(loss) | | $ | 2,744,476 | | |

Realized and Unrealized Gain/(Loss) on Investments (Note A): | |

Net realized gain/(loss) on: | |

Transactions in investment securities of unaffiliated issuers | | | 896,404 | | |

Expiration or closing of futures contracts | | | 281,087 | | |

Change in net unrealized appreciation/(depreciation) in value of: | |

Investment securities of unaffiliated issuers | | | (2,960,825 | ) | |

Futures contracts | | | (256,687 | ) | |

Net gain/(loss) on investments | | | (2,040,021 | ) | |

Net increase/(decrease) in net assets resulting from operations | | $ | 704,455 | | |

See Notes to Financial Statements

17

Statements of Changes in Net Assets

Neuberger Berman Advisers Management Trust

| | | SHORT DURATION

BOND PORTFOLIO | |

| | | Fiscal Year

Ended

December 31,

2021 | | Fiscal Year

Ended

December 31,

2020 | |

Increase/(Decrease) in Net Assets: | |

From Operations (Note A): | |

Net investment income/(loss) | | $ | 2,744,476 | | | $ | 2,314,134 | | |

Net realized gain/(loss) on investments | | | 1,177,491 | | | | (489,300 | ) | |

Change in net unrealized appreciation/(depreciation) of investments | | | (3,217,512 | ) | | | 1,273,414 | | |

Net increase/(decrease) in net assets resulting from operations | | | 704,455 | | | | 3,098,248 | | |

Distributions to Shareholders From (Note A): | |

Distributable earnings | | | (2,940,011 | ) | | | (2,399,936 | ) | |

From Fund Share Transactions (Note D): | |

Proceeds from shares sold | | | 27,040,918 | | | | 25,404,721 | | |

Proceeds from reinvestment of dividends and distributions | | | 2,940,011 | | | | 2,399,936 | | |

Payments for shares redeemed | | | (19,321,469 | ) | | | (32,484,510 | ) | |

Net increase/(decrease) from Fund share transactions | | | 10,659,460 | | | | (4,679,853 | ) | |

Net Increase/(Decrease) in Net Assets | | | 8,423,904 | | | | (3,981,541 | ) | |

Net Assets: | |

Beginning of year | | | 103,053,276 | | | | 107,034,817 | | |

End of year | | $ | 111,477,180 | | | $ | 103,053,276 | | |

See Notes to Financial Statements

18

Notes to Financial Statements Short Duration Bond Portfolio

Note A—Summary of Significant Accounting Policies:

1 General: Neuberger Berman Advisers Management Trust (the "Trust") is a Delaware statutory trust organized pursuant to an Amended and Restated Trust Instrument dated March 27, 2014. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the "1940 Act"), and its shares are registered under the Securities Act of 1933, as amended. Neuberger Berman Advisers Management Trust Short Duration Bond Portfolio (the "Fund") is a separate operating series of the Trust and is diversified. The Fund currently offers only Class I shares. The Trust's Board of Trustees (the "Board") may establish additional series or classes of shares without the approval of shareholders.

A balance indicated with a "—", reflects either a zero balance or a balance that rounds to less than 1.

The assets of the Fund belong only to the Fund, and the liabilities of the Fund are borne solely by the Fund and no other series of the Trust.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 946 "Financial Services—Investment Companies."

The preparation of financial statements in accordance with U.S. generally accepted accounting principles ("GAAP") requires Neuberger Berman Investment Advisers LLC ("Management" or "NBIA") to make estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates.

Shares of the Fund are not available to the general public and may be purchased only by life insurance companies to serve as an investment vehicle for premiums paid under their variable annuity and variable life insurance contracts and to certain qualified pension and other retirement plans.

2 Portfolio valuation: In accordance with ASC 820 "Fair Value Measurement" ("ASC 820"), all investments held by the Fund are carried at the value that Management believes the Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment under current market conditions. Various inputs, including the volume and level of activity for the asset or liability in the market, are considered in valuing the Fund's investments, some of which are discussed below. Significant Management judgment may be necessary to value investments in accordance with ASC 820.

ASC 820 established a three-tier hierarchy of inputs to create a classification of value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

• Level 1—unadjusted quoted prices in active markets for identical investments

• Level 2—other observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, amortized cost, etc.)

• Level 3—unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing an investment are not necessarily an indication of the risk associated with investing in those securities.

The value of the Fund's investments in exchange-traded funds ("ETFs"), for which market quotations are readily available, is generally determined by Management by obtaining valuations from independent pricing services based on the latest sale price quoted on a principal exchange or market for that Security (Level 1 inputs). Securities traded primarily on the NASDAQ Stock Market are normally valued at the NASDAQ Official Closing Price ("NOCP") provided by NASDAQ each business day. The NOCP is the most recently reported price as of 4:00:02 p.m., Eastern Time, unless that price is outside the range of the "inside" bid and asked prices (i.e., the bid and asked prices that

19

dealers quote to each other when trading for their own accounts); in that case, NASDAQ will adjust the price to equal the inside bid or asked price, whichever is closer. Because of delays in reporting trades, the NOCP may not be based on the price of the last trade to occur before the market closes. If there is no sale of a security on a particular day, the independent pricing services may value the security based on market quotations.

The value of the Fund's investments in debt securities is determined by Management primarily by obtaining valuations from independent pricing services based on readily available bid quotations, or if quotations are not available, by methods which include various considerations based on security type (generally Level 2 inputs). In addition to the consideration of yields or prices of securities of comparable quality, coupon, maturity and type, indications as to values from dealers, and general market conditions, the following is a description of other Level 2 inputs and related valuation techniques used by independent pricing services to value certain types of debt securities held by the Fund:

Corporate Bonds. Inputs used to value corporate debt securities generally include relevant credit information, observed market movements, sector news, U.S. Treasury yield curve or relevant benchmark curve, and other market information, which may include benchmark yield curves, reported trades, broker-dealer quotes, issuer spreads, comparable securities, and reference data, such as market research publications, when available ("Other Market Information").

U.S. Treasury Obligations. Inputs used to value U.S. Treasury securities generally include quotes from several inter-dealer brokers and Other Market Information.

Asset-Backed Securities and Mortgage-Backed Securities. Inputs used to value asset-backed securities and mortgage-backed securities generally include models that consider a number of factors, which may include the following: prepayment speeds, cash flows, spread adjustments and Other Market Information.

The value of futures contracts is determined by Management by obtaining valuations from independent pricing services at the settlement price at the market close (Level 1 inputs).

Management has developed a process to periodically review information provided by independent pricing services for all types of securities.

Investments in non-exchange traded investment companies with a readily determinable fair value are valued using the respective fund's daily calculated net asset value ("NAV") per share (Level 2 inputs).

If a valuation is not available from an independent pricing service, or if Management has reason to believe that the valuation received does not represent the amount the Fund might reasonably expect to receive on a current sale in an orderly transaction, Management seeks to obtain quotations from brokers or dealers (generally considered Level 2 or Level 3 inputs depending on the number of quotes available). If such quotations are not readily available, the security is valued using methods the Board has approved in the good-faith belief that the resulting valuation will reflect the fair value of the security. Inputs and assumptions considered in determining the fair value of a security based on Level 2 or Level 3 inputs may include, but are not limited to, the type of the security; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer and/or analysts; an analysis of the company's or issuer's financial statements; an evaluation of the inputs that influence the issuer and the market(s) in which the security is purchased and sold.

Fair value prices are necessarily estimates, and there is no assurance that such a price will be at or close to the price at which the security is next quoted or next trades.

In December 2020, the Securities and Exchange Commission ("SEC") adopted Rule 2a-5 under the 1940 Act, which establishes requirements for determining fair value in good faith for purposes of the 1940 Act, including related oversight and reporting requirements. The rule also defines when market quotations are "readily available" for purposes of the 1940 Act, which is the threshold for determining whether a fund must fair value a security. The

20

rule became effective on March 8, 2021, however, the SEC adopted an eighteen-month transition period beginning from the effective date. Management is currently evaluating the rule.

3 Foreign currency translations: The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are normally translated into U.S. dollars using the exchange rate as of 4:00 p.m. Eastern Time, on days the NYSE is open for business, to determine the value of investments, other assets and liabilities. Purchase and sale prices of securities, and income and expenses, are translated into U.S. dollars at the prevailing rate of exchange on the respective dates of such transactions. Net unrealized foreign currency gain/(loss), if any, arises from changes in the value of assets and liabilities, other than investments in securities, as a result of changes in exchange rates and is stated separately in the Statement of Operations.

4 Securities transactions and investment income: Securities transactions are recorded on trade date for financial reporting purposes. Dividend income is recorded on the ex-dividend date or, for certain foreign dividends, as soon as the Fund becomes aware of the dividends. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including accretion of discount (adjusted for original issue discount, where applicable) and amortization of premium, where applicable, is recorded on the accrual basis. Realized gains and losses from securities transactions and foreign currency transactions, if any, are recorded on the basis of identified cost and stated separately in the Statement of Operations. Included in net realized gain/(loss) on investments are proceeds from the settlement of class action litigation(s) in which the Fund participated as a class member. The amount of such proceeds for the year ended December 31, 2021, was $9,209.

5 Income tax information: The Fund is treated as a separate entity for U.S. federal income tax purposes. It is the policy of the Fund to continue to qualify for treatment as a regulated investment company ("RIC") by complying with the requirements of the U.S. Internal Revenue Code applicable to RICs and to distribute substantially all of its net investment income and net realized capital gains to its shareholders. To the extent the Fund distributes substantially all of its net investment income and net realized capital gains to shareholders, no federal income or excise tax provision is required.

The Fund has adopted the provisions of ASC 740 "Income Taxes" ("ASC 740"). ASC 740 sets forth a minimum threshold for financial statement recognition of a tax position taken, or expected to be taken, in a tax return. The Fund recognizes interest and penalties, if any, related to unrecognized tax positions as an income tax expense in the Statement of Operations. The Fund is subject to examination by U.S. federal and state tax authorities for returns filed for the tax years for which the applicable statutes of limitations have not yet expired. As of December 31, 2021, the Fund did not have any unrecognized tax positions.

For federal income tax purposes, the estimated cost of investments held at December 31, 2021 was $113,693,762. The estimated gross unrealized appreciation was $961,791 and estimated gross unrealized depreciation was $2,638,277 resulting in net unrealized depreciation in value of investments of $(1,676,486) based on cost for U.S. federal income tax purposes.

Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund. The Fund may also utilize earnings and profits distributed to shareholders on redemption of their shares as a part of the dividends-paid deduction for income tax purposes.

Any permanent differences resulting from different book and tax treatment are reclassified at year-end and have no impact on net income, NAV or NAV per share of the Fund. For the year ended December 31, 2021, the Fund recorded permanent reclassifications related to prior year true up adjustments:

| Paid-in Capital | | Total

Distributable

Earnings/(Loss) | |

| | (138,249 | ) | | | 138,249 | | |

21

The tax character of distributions paid during the years ended December 31, 2021, and December 31, 2020, was as follows:

| | | Distributions Paid From: | |

| | | Ordinary Income | | Long-Term Capital Gain | | Total | |

| | | 2021 | | 2020 | | 2021 | | 2020 | | 2021 | | 2020 | |

| | | | | $ | 2,940,011 | | | $ | 2,399,936 | | | $ | — | | | $ | — | | | $ | 2,940,011 | | | $ | 2,399,936 | | |

As of December 31, 2021, the components of distributable earnings (accumulated losses) on a U.S. federal income tax basis were as follows:

Undistributed

Ordinary

Income | | Undistributed

Long-Term

Capital Gain | | Unrealized

Appreciation/

(Depreciation) | | Loss

Carryforwards

and Deferrals | | Other

Temporary

Differences | | Total | |

| $ | 3,373,896 | | | $ | — | | | $ | (1,676,487 | ) | | $ | (26,507,037 | ) | | $ | — | | | $ | (24,809,628 | ) | |

The temporary differences between book basis and tax basis distributable earnings are primarily due to losses disallowed and recognized on wash sales, amortization of bond premium and mark-to-market adjustments on futures.

To the extent the Fund's net realized capital gains, if any, can be offset by capital loss carryforwards, it is the policy of the Fund not to distribute such gains. Capital loss carryforward rules allow for RICs to carry forward capital losses indefinitely and to retain the character of capital loss carryforwards as short-term or long-term. As determined at December 31, 2021, the Fund had unused capital loss carryforwards available for federal income tax purposes to offset future net realized capital gains, if any, as follows:

Capital Loss Carryforwards | |

Long-Term | | Short-Term | |

$ | 23,846,906 | | | $ | 2,660,131 | | |

During the fiscal year ended December 31, 2021, the Fund utilized capital loss carryforwards of $515,446.

6 Distributions to shareholders: The Fund may earn income, net of expenses, daily on its investments. Distributions from net investment income and net realized capital gains, if any, are generally distributed once a year (usually in October) and are recorded on the ex-date.

7 Foreign taxes: Foreign taxes withheld, if any, represent amounts withheld by foreign tax authorities, net of refunds recoverable.

8 Expense allocation: Certain expenses are applicable to multiple funds within the complex of related investment companies. Expenses directly attributable to a fund are charged to that fund. Expenses of the Trust that are not directly attributable to a particular series of the Trust (e.g., the Fund) are allocated among the series of the Trust, on the basis of relative net assets, except where a more appropriate allocation of expenses to each of the series can otherwise be made fairly. Expenses borne by the complex of related investment companies, which includes open-end and closed-end investment companies for which NBIA serves as investment manager, that are not directly attributable to a particular investment company in the complex (e.g., the Trust) or series thereof are allocated among the investment companies in the complex or series thereof on the basis of relative net assets, except where a more appropriate allocation of expenses to each of the investment companies in the complex or series thereof can otherwise be made fairly.

9 Investments in foreign securities: Investing in foreign securities may involve sovereign and other risks, in addition to the credit and market risks normally associated with domestic securities. These additional risks include the possibility of adverse political and economic developments (including political instability, nationalization, expropriation, or confiscatory taxation) and the potentially adverse effects of unavailability of public information regarding issuers, less governmental supervision and regulation of financial markets, reduced liquidity of certain financial markets, and the lack of uniform accounting, auditing, and financial reporting standards or the

22

application of standards that are different or less stringent than those applied in the United States. Foreign securities also may experience greater price volatility, higher rates of inflation, and delays in settlement.

10 Investment company securities and exchange-traded funds: The Fund may invest in shares of other registered investment companies, including exchange-traded funds ("ETFs"), within the limitations prescribed by (a) the 1940 Act, (b) the exemptive order from the SEC that permits the Fund to invest in both affiliated and unaffiliated investment companies, including ETFs, in excess of the limits in Section 12(d)(1)(A) of the 1940 Act, subject to the terms and conditions of such order, or (c) the ETF's exemptive order or other relief. Some ETFs seek to track the performance of a particular market index. These indices include both broad-based market indices and more narrowly-based indices, including those relating to particular sectors, markets, regions or industries. However, some ETFs have an actively-managed investment objective. ETF shares are traded like traditional equity securities on a national securities exchange or NASDAQ. The Fund will indirectly bear its proportionate share of any management fees and other expenses paid by such other investment companies, which will decrease returns.

In October 2020, the SEC adopted Rule 12d1-4, which permits a fund to exceed the limits prescribed by Section 12 of the 1940 Act in the absence of an exemptive order, if the Fund complies with the adopted framework for fund of funds arrangements. Rule 12d1-4 contains elements from the SEC's current exemptive orders and rules permitting fund of funds arrangements, and includes (i) limits on control and voting; (ii) required evaluations and findings; (iii) required fund of funds investment agreements; and (iv) limits on complex structures. In connection with the new rule, on or about January 19, 2022, the SEC is expected to rescind the Fund's current exemptive order and Rule 12d1-2 under the 1940 Act. After this occurs, a fund seeking to exceed the limits in Section 12 of the 1940 Act will need to rely on Rule 12d1-4.

11 When-issued/delayed delivery securities: The Fund may purchase securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase a security, the transaction is recorded and the value of the security is reflected in the NAV. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. No interest accrues to the Fund until payment takes place. At the time the Fund enters into this type of transaction it is required to segregate cash or other liquid assets at least equal to the amount of the commitment. When-issued and delayed delivery transactions can have a leverage-like effect on the Fund, which can increase fluctuations in the Fund's NAV. Certain risks may arise upon entering into when-issued or delayed delivery securities transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

The Fund may also enter into a TBA agreement and "roll over" such agreement prior to the settlement date by selling the obligation to purchase the pools set forth in the agreement and entering into a new TBA agreement for future delivery of pools of mortgage-backed securities. TBA mortgage-backed securities may increase prepayment risks because the underlying mortgages may be less favorable than anticipated by the Fund.

12 Derivative instruments: The Fund's use of derivatives during the year ended December 31, 2021, is described below. Please see the Schedule of Investments for the Fund's open positions in derivatives, if any, at December 31, 2021. The Fund has adopted the provisions of ASC 815 "Derivatives and Hedging" ("ASC 815"). The disclosure requirements of ASC 815 distinguish between derivatives that qualify for hedge accounting and those that do not. Because investment companies value their derivatives at fair value and recognize changes in fair value through the Statement of Operations, they do not qualify for hedge accounting. Accordingly, even though the Fund's investments in derivatives may represent economic hedges, they are considered non-hedge transactions for purposes of this disclosure.

In October 2020, the SEC adopted new regulations governing the use of derivatives by registered investment companies. Rule 18f-4 will impose limits on the amount of derivatives a fund could enter into, eliminate the asset segregation framework currently used by funds to comply with Section 18 of the 1940 Act, and require funds whose use of derivatives is more than a limited specified exposure to establish and maintain a derivatives risk

23

management program and appoint a derivatives risk manager. While the new rule became effective February 19, 2021, funds will not be required to fully comply with the new rule until August 19, 2022. It is not currently clear what impact, if any, the new rule will have on the availability, liquidity or performance of derivatives. When fully implemented, the new rule may require changes in how the Fund will use derivatives, may adversely affect the Fund's performance and may increase costs related to the Fund's use of derivatives.

Futures contracts: During the year ended December 31, 2021, the Fund used U.S. Treasury and Eurodollar futures to manage the duration of the Fund.

At the time the Fund enters into a futures contract, it is required to deposit with the futures commission merchant a specified amount of cash or liquid securities, known as "initial margin," which is a percentage of the value of the futures contract being traded that is set by the exchange upon which the futures contract is traded. Each day, the futures contract is valued at the official settlement price of the board of trade or U.S. commodity exchange on which such futures contract is traded. Subsequent payments, known as "variation margin," to and from the broker are made on a daily basis, or as needed, as the market price of the futures contract fluctuates. Daily variation margin adjustments, arising from this "mark to market," are recorded by the Fund as unrealized gains or losses.