UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-03940 |

| |

| BNY Mellon Strategic Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 240 Greenwich Street New York, New York 10286 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 11/30 | |

Date of reporting period: | 11/30/2020 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Select Managers Small Cap Value Fund

BNY Mellon U.S. Equity Fund

BNY Mellon Global Stock Fund

BNY Mellon International Stock Fund

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Select Managers Small Cap Value Fund

| |

ANNUAL REPORT November 30, 2020 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from December 1, 2019 through November 30, 2020, as provided by portfolio allocation managers Stephen Kolano and Elena Goncharova

Market and Fund Performance Overview

For the 12-month period ended November 30, 2020, BNY Mellon Select Managers Small Cap Value Fund’s Class A shares, Class C shares, Class I shares and Class Y shares at NAV produced total returns of 11.21%, 10.42%, 11.53% and 11.58%, respectively.1 In comparison, the Russell 2000® Value Index (the “Index”), the fund’s benchmark, returned 0.35% for the same period.2

Small-cap stocks produced gains over the reporting period as markets began to anticipate an economic recovery that is likely with the widespread distribution of COVID-19 vaccines. The fund outperformed the Index, mainly due to strong sector allocation decisions and security selections.

The fund’s board has approved Heartland Advisors, Inc. (Heartland) and Rice Hall James & Associates, LLC (RHJ) as additional subadvisers to the fund, effective on or about September 15, 2020. In addition, with the fund board's approval, BNY Mellon Investment Adviser, Inc., the fund's investment adviser and portfolio allocation manager, has terminated the agreement with Kayne Anderson Rudnick Investment Management, LLC.

The Fund’s Investment Approach

The fund seeks capital appreciation. To pursue its goal, the fund normally invests at least 80% of its net assets in the stocks of small-cap companies. The fund currently considers small-cap companies to be those companies with market capitalizations that fall within the range of companies in the Index, the fund’s benchmark index. The fund’s portfolio is constructed to have a value tilt.

The fund uses a “multi-manager” approach by selecting various subadvisers to manage its assets. We may hire, terminate or replace subadvisers and modify material terms and conditions of subadvisory arrangements without shareholder approval.

As of September 30, 2020, the fund’s assets will be allocated among six subadvisers – Channing Capital Management, LLC, Eastern Shore Capital Management, Neuberger Berman Investment Advisers LLC, Walthausen & Co. LLC, Heartland and RHJ. The target percentage of the fund’s assets to be allocated over time to the subadvisers is approximately 23% to Channing; 20% to Eastern Shore; 18% to Neuberger Berman; 22% to Walthausen; 15% to Heartland and 2% to RHJ. The portion of the fund’s assets previously allocated to Kayne (approximately 15% of the fund’s assets) will be re-allocated to the other subadvisers over time in accordance with the target amounts noted above. The target percentages of the fund's assets to be allocated to Heartland and RHJ, and any modification to the target percentage of the fund’s assets currently allocated to the other subadvisers, will occur over time. In addition, BNYM Investment Adviser is permitted to adjust those allocations by up to 20% of the fund’s assets without board approval. Subject to board approval, the fund may hire, terminate or replace subadvisers and modify material terms and conditions of subadvisory arrangements without shareholder approval.

2

Markets Rebound, Led by Growth Stocks

The reporting period began with the market continuing to benefit from the Federal Reserve’s (the “Fed”) accommodative policy, which had been prompted by concerns about economic growth and corporate earnings. Stocks also benefited from the announcement of a “Phase One” trade deal between the U.S. and China, and from the approval of the new U.S.-Mexico-Canada Trade Agreement.

Early in 2020, developed markets experienced a correction amid growing concerns about the COVID-19 virus. As a result, the Fed reduced the federal funds rate twice in March, bringing the target rate down to 0.00%-0.25%. In addition, the Fed and other central banks initiated various programs to ease liquidity concerns in certain markets, and government authorities introduced programs to keep small businesses afloat. Steps were also taken to provide relief to employees who had lost their jobs as a result of government-mandated business shutdowns.

In the second half of the reporting period, the economy began to show signs of recovery. Retail sales rebounded, and the outlook for manufacturing also improved. Job creation surged, beating economists’ expectations, and markets began to rebound as relief programs took effect, government shutdowns began to ease and hope for a COVID-19 vaccine or effective therapy took hold.

Late in the reporting period, markets benefited from the announcement that one or more COVID-19 vaccines would be available within a few months. Uncertainty surrounding the November 2020 election also eased, and investors began to factor the likelihood of additional stimulus and infrastructure spending into their calculations. With the end of the pandemic in view and continued economic rebound likely, investors began to shift away from growth-oriented stocks and into value-oriented stocks.

Allocations and Security Selections Benefited Fund Performance

The fund’s outperformance versus the Index was mainly the result of successful sector allocation decisions and stock selections by the underlying portfolio managers. In addition, the fund normally has a somewhat more growth-oriented orientation than the benchmark, and this contributed to the fund’s relatively strong performance, as growth stocks outperformed value stocks during the reporting period. The fund’s overweight to the health care sector was the largest positive contributor to performance, followed by a large underweight to the financial sector. In the financial sector, regional banks and insurance companies, in particular, were hurt by the flattening of the yield curve. The fund’s underweight positions in the energy, real estate and utilities sectors also contributed to relative performance. Stock selections were particularly effective in the financials, information technology and industrials sectors.

On the other hand, the fund’s underweight position in the consumer discretionary sector detracted from performance, as this sector rebounded late in the reporting period. Positions in the restaurant and consumer services industries were especially disadvantageous.

An Optimistic Outlook

Our outlook for the coming months reflects ongoing optimism about the economic recovery that is likely to occur as COVID-19 vaccines are distributed. Although the economy could

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

weaken in the meantime as governments continue to address the spread of the virus, the market is likely to look past this to the recovery that could take off in the third quarter of 2021, assisted by supportive fiscal and monetary policy. In addition, although inflation has been quiescent, we will continue to monitor it, particularly as the recovery takes hold.

December 15, 2020

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Return figures provided reflect the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an undertaking in effect through March 31, 2021, at which time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Lipper Inc. — The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies that are considered more value-oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell 2000® Value Index is constructed to provide a comprehensive and unbiased barometer for the small-cap value segment. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set, and that the represented companies continue to reflect value characteristics. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The prices of small company stocks tend to be more volatile than the prices of large company stocks, mainly because these companies have less established and more volatile earnings histories. They also tend to be less liquid than larger company stocks.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

Multi-manager risk means each sub adviser makes investment decisions independently, and it is possible that the investment styles of the sub advisers may not complement one another. Consequently, the fund’s exposure to a given stock, industry or investment style could be greater or smaller than if the fund had a single adviser.

4

FUND PERFORMANCE (Unaudited)

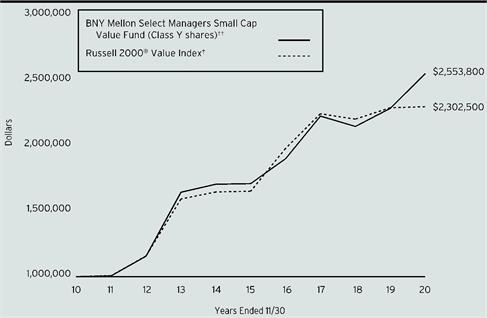

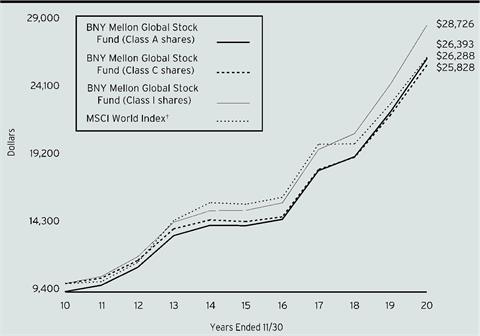

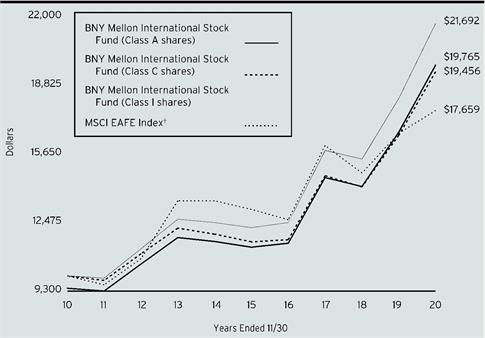

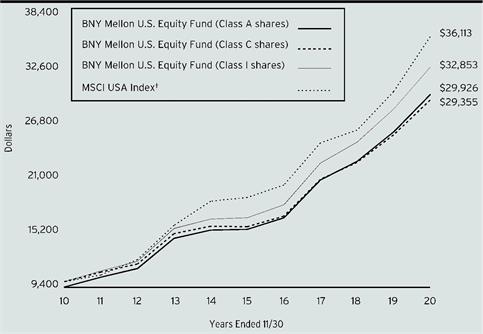

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares and Class I shares of BNY Mellon Select Managers Small Cap Value Fund with a hypothetical investment of $10,000 in the Russell 2000® Value Index (the “Index”)

† Source: Lipper Inc.

Past performance is not predictive of future performance. The above graph compares a hypothetical $10,000 investment made in each of the Class A shares, Class C shares and Class I shares of BNY Mellon Select Managers Small Cap Value Fund on 11/30/10 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on Class A shares, Class C shares and Class I shares. The Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies that are considered more value-oriented relative to the overall market as defined by Russell’s leading style methodology. The Index is constructed to provide a comprehensive and unbiased barometer for the small-cap value segment. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect value characteristics. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

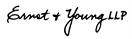

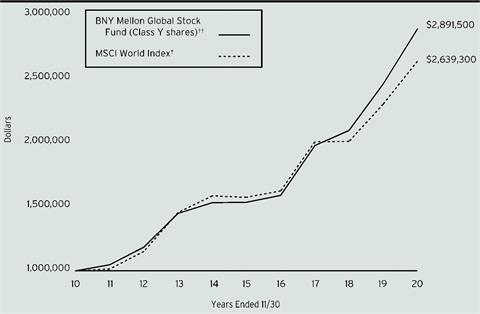

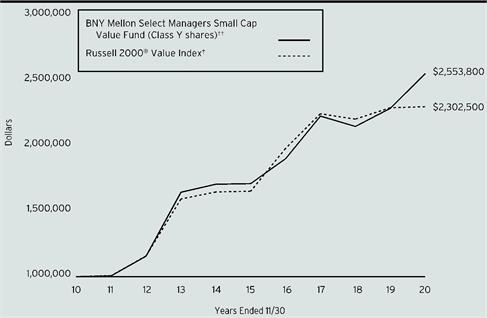

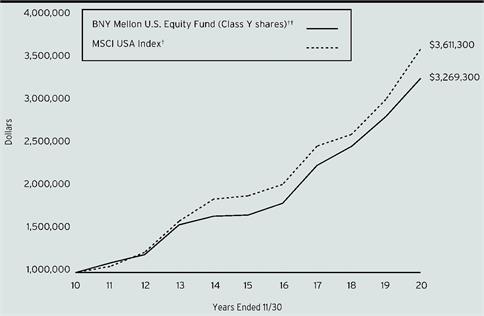

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Select Managers Small Cap Value Fund with a hypothetical investment of $1,000,000 in the Russell 2000® Value Index (the “Index”)

† Source: Lipper Inc.

†† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

Past performance is not predictive of future performance. The above graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon Select Managers Small Cap Value Fund on 11/30/10 to a hypothetical investment of $1,000,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all other applicable fees and expenses of fund’s Class Y shares. The Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies that are considered more value-oriented relative to the overall market as defined by Russell’s leading style methodology. The Index is constructed to provide a comprehensive and unbiased barometer for the small-cap value segment. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect value characteristics. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

Average Annual Total Returns as of 11/30/2020 |

| | Inception | | | |

| Date | 1 Year | 5 Years | 10 Years |

Class A shares | | | | |

with maximum sales charge (5.75%) | 12/17/08 | 4.82% | 6.66% | 8.80% |

without sales charge | 12/17/08 | 11.21% | 7.93% | 9.45% |

Class C shares | | | | |

with applicable redemption charge† | 12/17/08 | 9.42% | 7.15% | 8.65% |

without redemption | 12/17/08 | 10.42% | 7.15% | 8.65% |

Class I shares | 12/17/08 | 11.53% | 8.27% | 9.81% |

Class Y shares | 7/1/13 | 11.58% | 8.31% | 9.83%†† |

Russell 2000® Value Index | | 0.35% | 6.83% | 8.70% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Select Managers Small Cap Value Fund from June 1, 2020 to November 30, 2020. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended November 30, 2020 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expense paid per $1,000† | $7.38 | $11.62 | $5.91 | $5.63 | |

Ending value (after expenses) | $1,270.70 | $1,266.40 | $1,272.60 | $1,273.20 | |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended November 30, 2020 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expense paid per $1,000† | $6.56 | $10.33 | $5.25 | $5.00 | |

Ending value (after expenses) | $1,018.50 | $1,014.75 | $1,019.80 | $1,020.05 | |

†Expenses are equal to the fund’s annualized expense ratio of 1.30% for Class A, 2.05% for Class C, 1.04% for Class I and .99% for Class Y, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

November 30, 2020

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% | | | | | |

Automobiles & Components - 1.3% | | | | | |

Fox Factory Holding | | | | 13,230 | a,b | 1,154,582 | |

Gentherm | | | | 3,293 | b | 187,240 | |

LCI Industries | | | | 25,085 | | 3,155,191 | |

Thor Industries | | | | 1,611 | | 155,478 | |

Visteon | | | | 11,315 | b | 1,367,418 | |

Workhorse Group | | | | 18,505 | a,b | 469,472 | |

| | | | | 6,489,381 | |

Banks - 13.1% | | | | | |

Associated Banc-Corp | | | | 92,972 | | 1,424,331 | |

BankUnited | | | | 62,316 | | 1,776,629 | |

Banner | | | | 66,149 | | 2,733,938 | |

Brookline Bancorp | | | | 89,956 | | 1,022,799 | |

Bryn Mawr Bank | | | | 38,130 | | 1,137,037 | |

Camden National | | | | 26,930 | | 925,046 | |

Cathay General Bancorp | | | | 4,093 | | 115,627 | |

City Holding | | | | 16,330 | | 1,072,718 | |

Columbia Banking System | | | | 60,180 | | 1,902,289 | |

Community Bank System | | | | 17,915 | | 1,115,209 | |

CVB Financial | | | | 31,080 | | 590,209 | |

Dime Community Bancshares | | | | 4,369 | | 63,132 | |

Enterprise Financial Services | | | | 3,045 | | 103,560 | |

Essent Group | | | | 61,640 | | 2,703,531 | |

F.N.B. | | | | 15,781 | | 139,346 | |

Federal Agricultural Mortgage, Cl. C | | | | 1,998 | | 135,265 | |

First Bancorp | | | | 40,900 | | 1,283,442 | |

First Financial | | | | 26,220 | | 992,951 | |

First Horizon | | | | 7,539 | | 92,127 | |

Glacier Bancorp | | | | 36,204 | | 1,476,037 | |

Great Southern Bancorp | | | | 24,120 | | 1,107,108 | |

Great Western Bancorp | | | | 6,692 | | 109,950 | |

Heartland Financial USA | | | | 28,912 | | 1,126,990 | |

Hope Bancorp | | | | 12,396 | | 117,514 | |

Independent Bank | | | | 102,024 | | 6,900,903 | |

Lakeland Financial | | | | 22,150 | | 1,124,998 | |

NBT Bancorp | | | | 29,330 | | 878,434 | |

OceanFirst Financial | | | | 51,090 | | 805,689 | |

Old National Bancorp | | | | 78,465 | | 1,242,101 | |

PacWest Bancorp | | | | 43,050 | | 1,001,343 | |

Pinnacle Financial Partners | | | | 19,242 | | 1,042,147 | |

Renasant | | | | 91,064 | | 2,811,146 | |

Seacoast Banking Corp. of Florida | | | | 92,166 | b | 2,328,113 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Banks - 13.1% (continued) | | | | | |

Sterling Bancorp | | | | 70,070 | | 1,119,719 | |

Stock Yards Bancorp | | | | 20,565 | | 819,310 | |

Synovus Financial | | | | 100,644 | | 3,177,331 | |

TCF Financial | | | | 42,256 | | 1,419,801 | |

Texas Capital Bancshares | | | | 35,642 | b | 1,992,388 | |

TriCo Bancshares | | | | 26,990 | | 884,192 | |

Triumph Bancorp | | | | 26,289 | b | 1,194,572 | |

Walker & Dunlop | | | | 26,695 | | 2,135,867 | |

Washington Trust Bancorp | | | | 16,750 | | 658,610 | |

WesBanco | | | | 26,900 | | 770,147 | |

Wintrust Financial | | | | 88,817 | | 4,839,638 | |

WSFS Financial | | | | 72,695 | | 2,771,860 | |

| | | | | 63,185,094 | |

Capital Goods - 14.0% | | | | | |

AerCap Holdings | | | | 41,700 | b | 1,532,892 | |

Alamo Group | | | | 906 | | 122,962 | |

Albany International, Cl. A | | | | 25,950 | | 1,778,353 | |

Allied Motion Technologies | | | | 20,078 | | 814,564 | |

Altra Industrial Motion | | | | 33,415 | | 1,896,635 | |

Ameresco, Cl. A | | | | 23,710 | b | 1,056,280 | |

Astec Industries | | | | 23,109 | | 1,340,322 | |

AZZ | | | | 27,990 | | 1,248,074 | |

Babcock & Wilcox Enterprises | | | | 57,792 | b | 242,726 | |

Bloom Energy, Cl. A | | | | 47,500 | a,b | 1,164,700 | |

Chart Industries | | | | 13,380 | b | 1,382,957 | |

Colfax | | | | 5,307 | a,b | 191,477 | |

Comfort Systems USA | | | | 10,265 | | 517,253 | |

Curtiss-Wright | | | | 1,208 | | 139,234 | |

Donaldson | | | | 15,628 | | 832,035 | |

EMCOR Group | | | | 12,850 | | 1,107,413 | |

Enerpac Tool Group | | | | 105,022 | | 2,351,442 | |

EnerSys | | | | 9,225 | | 754,697 | |

ESCO Technologies | | | | 10,294 | | 1,018,077 | |

GATX | | | | 4,800 | a | 382,848 | |

Great Lakes Dredge & Dock | | | | 117,684 | b | 1,328,652 | |

Griffon | | | | 46,830 | | 976,405 | |

Hexcel | | | | 14,850 | | 735,372 | |

Hillenbrand | | | | 94,100 | | 3,525,927 | |

Hyster-Yale Materials Handling | | | | 14,042 | | 772,872 | |

ITT | | | | 12,810 | | 930,390 | |

John Bean Technologies | | | | 22,411 | a | 2,477,760 | |

Kennametal | | | | 159,492 | a | 5,580,625 | |

Kratos Defense & Security Solutions | | | | 49,472 | b | 1,047,322 | |

10

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Capital Goods - 14.0% (continued) | | | | | |

Lydall | | | | 38,400 | b | 1,052,160 | |

Mercury Systems | | | | 10,690 | b | 761,342 | |

Miller Industries | | | | 27,780 | | 927,574 | |

Moog, Cl. A | | | | 10,300 | | 796,808 | |

MSC Industrial Direct, Cl. A | | | | 8,875 | | 739,465 | |

Mueller Industries | | | | 25,910 | | 848,812 | |

Oshkosh | | | | 5,995 | | 482,598 | |

Park Aerospace | | | | 37,074 | | 471,952 | |

Plug Power | | | | 48,915 | a,b | 1,290,867 | |

Regal Beloit | | | | 943 | | 112,255 | |

Resideo Technologies | | | | 130,443 | b | 2,411,891 | |

Rexnord | | | | 114,332 | | 4,288,593 | |

Simpson Manufacturing | | | | 9,925 | | 912,108 | |

SiteOne Landscape Supply | | | | 9,050 | b | 1,249,805 | |

Spirit AeroSystems Holdings, Cl. A | | | | 18,510 | | 629,340 | |

SPX | | | | 56,491 | b | 2,894,034 | |

SPX FLOW | | | | 64,558 | b | 3,459,018 | |

Systemax | | | | 17,200 | | 529,244 | |

Teledyne Technologies | | | | 2,640 | b | 997,762 | |

Textainer Group Holdings | | | | 62,210 | b | 1,145,908 | |

The Shyft Group | | | | 38,730 | | 1,004,269 | |

TPI Composites | | | | 22,625 | b | 910,204 | |

Triton International | | | | 22,130 | | 1,001,604 | |

Twin Disc | | | | 21,620 | b | 132,963 | |

Valmont Industries | | | | 5,200 | | 847,496 | |

Welbilt | | | | 61,700 | b | 583,065 | |

| | | | | 67,731,403 | |

Commercial & Professional Services - 4.4% | | | | | |

ABM Industries | | | | 15,060 | | 579,810 | |

ASGN | | | | 11,955 | b | 934,642 | |

Brady, Cl. A | | | | 38,983 | | 1,722,269 | |

CBIZ | | | | 7,294 | b | 176,661 | |

Clean Harbors | | | | 12,200 | b | 882,914 | |

Covanta Holding | | | | 62,540 | | 775,496 | |

Deluxe | | | | 41,125 | | 1,058,557 | |

Harsco | | | | 242,687 | b | 4,113,545 | |

Heritage-Crystal Clean | | | | 44,880 | b | 864,838 | |

Herman Miller | | | | 5,009 | | 178,521 | |

HNI | | | | 24,360 | | 888,166 | |

KAR Auction Services | | | | 65,790 | | 1,187,509 | |

Kelly Services, Cl. A | | | | 47,760 | | 977,170 | |

McGrath RentCorp | | | | 28,050 | | 1,785,102 | |

MSA Safety | | | | 19,639 | | 2,934,852 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Commercial & Professional Services - 4.4% (continued) | | | | | |

Stericycle | | | | 32,900 | b | 2,317,476 | |

| | | | | 21,377,528 | |

Consumer Durables & Apparel - 3.3% | | | | | |

Acushnet Holdings | | | | 31,791 | | 1,198,521 | |

Brunswick | | | | 15,415 | | 1,150,576 | |

Carter's | | | | 1,387 | | 123,429 | |

Cavco Industries | | | | 4,070 | b | 732,641 | |

Deckers Outdoor | | | | 3,020 | b | 768,862 | |

Helen of Troy | | | | 5,587 | a,b | 1,128,518 | |

Installed Building Products | | | | 8,875 | b | 877,028 | |

KB Home | | | | 37,595 | | 1,323,344 | |

M.D.C. Holdings | | | | 8,170 | | 394,366 | |

M/I Homes | | | | 10,170 | b | 462,227 | |

Malibu Boats, Cl. A | | | | 17,405 | b | 991,911 | |

PVH | | | | 15,003 | | 1,192,588 | |

Ralph Lauren | | | | 19,342 | | 1,658,576 | |

Tapestry | | | | 36,130 | | 1,023,202 | |

Tempur Sealy International | | | | 53,600 | b | 1,350,184 | |

Vista Outdoor | | | | 28,910 | b | 596,413 | |

Wolverine World Wide | | | | 33,965 | | 980,230 | |

| | | | | 15,952,616 | |

Consumer Services - 3.6% | | | | | |

Boyd Gaming | | | | 91,249 | | 3,512,174 | |

Brinker International | | | | 54,083 | | 2,710,099 | |

Frontdoor | | | | 32,725 | b | 1,549,201 | |

International Game Technology | | | | 93,910 | a | 1,182,327 | |

Marriott Vacations Worldwide | | | | 37,408 | | 4,763,160 | |

OneSpaWorld Holdings | | | | 328,615 | a | 2,904,957 | |

SeaWorld Entertainment | | | | 18,800 | b | 524,520 | |

| | | | | 17,146,438 | |

Diversified Financials - 3.8% | | | | | |

Aaron's Holdings | | | | 2,276 | | 143,229 | |

Artisan Partners Asset Management, Cl. A | | | | 95,912 | | 4,316,040 | |

B Riley Financial | | | | 74,734 | | 2,700,887 | |

Cohen & Steers | | | | 17,645 | | 1,248,737 | |

Evercore, Cl. A | | | | 1,455 | | 132,303 | |

FirstCash | | | | 27,397 | | 1,759,983 | |

Focus Financial Partners, Cl. A | | | | 60,925 | b | 2,413,239 | |

Stifel Financial | | | | 79,339 | | 5,498,192 | |

| | | | | 18,212,610 | |

Energy - 1.2% | | | | | |

ChampionX | | | | 104,423 | b | 1,240,545 | |

12

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Energy - 1.2% (continued) | | | | | |

CNX Resources | | | | 55,490 | b | 522,161 | |

Devon Energy | | | | 44,100 | | 616,959 | |

Dril-Quip | | | | 12,100 | b | 343,882 | |

Forum Energy Technologies | | | | 3,900 | a,b | 52,260 | |

Geopark | | | | 6,646 | a | 60,678 | |

ION Geophysical | | | | 18,624 | a,b | 35,199 | |

Oil States International | | | | 27,500 | b | 122,100 | |

Patterson-UTI Energy | | | | 37,000 | | 159,470 | |

Renewable Energy Group | | | | 15,495 | b | 899,950 | |

Southwestern Energy | | | | 269,220 | b | 837,274 | |

TETRA Technologies | | | | 111,390 | b | 90,304 | |

World Fuel Services | | | | 28,759 | | 817,331 | |

| | | | | 5,798,113 | |

Food & Staples Retailing - .5% | | | | | |

BJ's Wholesale Club Holdings | | | | 25,930 | b | 1,062,871 | |

Casey's General Stores | | | | 4,530 | | 823,010 | |

The Andersons | | | | 22,320 | | 507,334 | |

| | | | | 2,393,215 | |

Food, Beverage & Tobacco - 3.0% | | | | | |

Calavo Growers | | | | 1,712 | | 122,631 | |

Darling Ingredients | | | | 75,941 | b | 3,666,432 | |

Lancaster Colony | | | | 5,855 | | 991,427 | |

Landec | | | | 110,370 | b | 1,142,329 | |

Sanderson Farms | | | | 6,790 | | 928,397 | |

The Hain Celestial Group | | | | 92,921 | a,b | 3,577,459 | |

TreeHouse Foods | | | | 93,594 | b | 3,849,521 | |

| | | | | 14,278,196 | |

Health Care Equipment & Services - 5.4% | | | | | |

Acadia Healthcare | | | | 46,500 | b | 1,973,925 | |

Accuray | | | | 213,990 | b | 954,395 | |

AMN Healthcare Services | | | | 39,734 | b | 2,589,067 | |

AngioDynamics | | | | 46,162 | b | 656,424 | |

AtriCure | | | | 25,800 | b | 1,121,784 | |

Avanos Medical | | | | 60,929 | b | 2,582,780 | |

BioTelemetry | | | | 14,810 | a,b | 820,622 | |

Cantel Medical | | | | 2,063 | | 122,604 | |

CONMED | | | | 11,315 | | 1,152,885 | |

Cross Country Healthcare | | | | 179,069 | b | 1,557,900 | |

CryoPort | | | | 26,950 | a,b | 1,311,117 | |

Cytosorbents | | | | 31,700 | b | 265,963 | |

Encompass Health | | | | 14,460 | | 1,165,187 | |

HealthEquity | | | | 17,405 | b | 1,247,764 | |

LHC Group | | | | 4,530 | b | 889,330 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Health Care Equipment & Services - 5.4% (continued) | | | | | |

MEDNAX | | | | 38,100 | a,b | 770,001 | |

Meridian Bioscience | | | | 26,105 | b | 493,385 | |

Merit Medical Systems | | | | 15,770 | b | 868,454 | |

Mesa Laboratories | | | | 7,345 | | 1,996,077 | |

Molina Healthcare | | | | 8,500 | b | 1,735,105 | |

OraSure Technologies | | | | 47,700 | b | 572,400 | |

Patterson Companies | | | | 41,100 | a | 1,140,936 | |

The Ensign Group | | | | 3,305 | | 237,530 | |

| | | | | 26,225,635 | |

Household & Personal Products - .4% | | | | | |

Spectrum Brands Holdings | | | | 30,867 | | 2,062,842 | |

Insurance - 2.5% | | | | | |

AMERISAFE | | | | 5,680 | | 310,866 | |

Axis Capital Holdings | | | | 20,880 | | 1,046,297 | |

First American Financial | | | | 15,420 | | 746,945 | |

HCI Group | | | | 1,000 | | 52,150 | |

Horace Mann Educators | | | | 62,886 | | 2,510,409 | |

Kemper | | | | 35,935 | | 2,693,328 | |

Old Republic International | | | | 39,122 | | 701,066 | |

Primerica | | | | 7,380 | | 961,393 | |

Selective Insurance Group | | | | 1,011 | | 62,500 | |

Stewart Information Services | | | | 17,690 | | 740,680 | |

The Hanover Insurance Group | | | | 21,480 | | 2,413,278 | |

| | | | | 12,238,912 | |

Materials - 6.2% | | | | | |

Allegheny Technologies | | | | 214,799 | b | 2,897,639 | |

American Vanguard | | | | 122,973 | | 1,864,271 | |

Avery Dennison | | | | 18,620 | | 2,780,711 | |

Avient | | | | 105,363 | | 3,851,018 | |

Balchem | | | | 9,575 | | 992,832 | |

Cleveland-Cliffs | | | | 85,730 | a | 943,887 | |

Crown Holdings | | | | 30,151 | b | 2,841,732 | |

Eagle Materials | | | | 16,365 | | 1,489,051 | |

Glatfelter | | | | 59,097 | | 950,280 | |

Innospec | | | | 788 | | 64,845 | |

Louisiana-Pacific | | | | 113,794 | | 3,895,169 | |

Materion | | | | 22,246 | | 1,296,942 | |

Neenah | | | | 1,689 | | 81,933 | |

Schnitzer Steel Industries, Cl. A | | | | 46,066 | | 1,180,211 | |

Schweitzer-Mauduit International | | | | 13,489 | | 469,147 | |

Sensient Technologies | | | | 19,334 | | 1,386,634 | |

Silgan Holdings | | | | 20,890 | | 706,082 | |

Stepan | | | | 8,287 | | 962,618 | |

14

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Materials - 6.2% (continued) | | | | | |

Worthington Industries | | | | 21,517 | | 1,112,859 | |

| | | | | 29,767,861 | |

Media & Entertainment - 1.7% | | | | | |

Criteo, ADR | | | | 126,866 | a,b | 2,457,394 | |

Gray Television | | | | 158,381 | b | 2,797,008 | |

Nexstar Media Group, Cl. A | | | | 26,279 | | 2,765,865 | |

| | | | | 8,020,267 | |

Pharmaceuticals Biotechnology & Life Sciences - 4.2% | | | | | |

Amneal Pharmaceuticals | | | | 141,000 | a,b | 556,950 | |

Axsome Therapeutics | | | | 8,010 | a,b | 580,645 | |

Bicycle Therapeutics, ADR | | | | 13,920 | a,b | 297,331 | |

Bioxcel Therapeutics | | | | 3,830 | b | 168,520 | |

Charles River Laboratories International | | | | 14,040 | b | 3,292,661 | |

ChemoCentryx | | | | 6,785 | b | 374,193 | |

Deciphera Pharmaceuticals | | | | 11,490 | b | 710,082 | |

Dicerna Pharmaceuticals | | | | 18,280 | b | 461,936 | |

Emergent BioSolutions | | | | 4,530 | b | 371,143 | |

Esperion Therapeutics | | | | 12,180 | a,b | 344,938 | |

FibroGen | | | | 10,615 | b | 438,506 | |

Fluidigm | | | | 162,525 | a,b | 1,017,406 | |

Intersect ENT | | | | 35,955 | b | 687,819 | |

Invitae | | | | 29,420 | a,b | 1,460,703 | |

Iovance Biotherapeutics | | | | 18,970 | a,b | 736,226 | |

Karuna Therapeutics | | | | 5,920 | a,b | 590,638 | |

Luminex | | | | 34,800 | | 825,804 | |

Natera | | | | 20,195 | b | 1,782,613 | |

NeoGenomics | | | | 17,405 | b | 828,130 | |

Novavax | | | | 4,180 | a,b | 583,110 | |

Phibro Animal Health, Cl. A | | | | 77,120 | | 1,456,797 | |

Quanterix | | | | 15,670 | b | 676,787 | |

TCR2 Therapeutics | | | | 23,675 | b | 645,025 | |

TG Therapeutics | | | | 14,270 | a,b | 418,682 | |

Ultragenyx Pharmaceutical | | | | 5,045 | b | 598,034 | |

Zymeworks | | | | 6,270 | a,b | 330,116 | |

| | | | | 20,234,795 | |

Real Estate - 4.2% | | | | | |

Apple Hospitality REIT | | | | 7,185 | c | 95,273 | |

CareTrust REIT | | | | 9,135 | c | 177,493 | |

Corporate Office Properties Trust | | | | 104,390 | c | 2,779,906 | |

Global Medical REIT | | | | 51,490 | c | 704,898 | |

Hudson Pacific Properties | | | | 36,860 | c | 958,360 | |

Industrial Logistics Properties Trust | | | | 42,380 | c | 920,917 | |

Jones Lang LaSalle | | | | 990 | b | 130,967 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Real Estate - 4.2% (continued) | | | | | |

Lamar Advertising, Cl. A | | | | 29,998 | c | 2,388,141 | |

Lexington Realty Trust | | | | 12,487 | c | 127,492 | |

National Health Investors | | | | 1,773 | c | 114,642 | |

Newmark Group, Cl. A | | | | 11,689 | | 82,057 | |

Omega Healthcare Investors | | | | 4,349 | c | 153,172 | |

Physicians Realty Trust | | | | 118,971 | c | 2,064,147 | |

Piedmont Office Realty Trust, Cl. A | | | | 7,672 | c | 119,913 | |

Potlatchdeltic | | | | 58,248 | c | 2,710,862 | |

QTS Realty Trust, Cl. A | | | | 38,969 | a,c | 2,315,149 | |

Rexford Industrial Realty | | | | 30,110 | a,c | 1,442,871 | |

Terreno Realty | | | | 22,110 | c | 1,281,053 | |

UMH Properties | | | | 100,820 | c | 1,444,751 | |

| | | | | 20,012,064 | |

Retailing - 1.8% | | | | | |

1-800-Flowers.com, Cl. A | | | | 16,930 | a,b | 396,839 | |

Chico's FAS | | | | 85,000 | | 128,350 | |

Express | | | | 43,170 | b | 65,618 | |

Lithia Motors, Cl. A | | | | 10,739 | a | 3,106,793 | |

Monro | | | | 25,998 | | 1,222,166 | |

Sonic Automotive, Cl. A | | | | 56,710 | | 2,289,950 | |

The Children's Place | | | | 10,300 | a | 442,694 | |

The ODP | | | | 24,108 | | 691,176 | |

The RealReal | | | | 30,110 | b | 417,024 | |

| | | | | 8,760,610 | |

Semiconductors & Semiconductor Equipment - 5.4% | | | | | |

Axcelis Technologies | | | | 20,070 | b | 541,489 | |

Brooks Automation | | | | 14,795 | | 1,079,887 | |

CEVA | | | | 19,830 | b | 778,922 | |

CMC Materials | | | | 21,274 | | 3,282,153 | |

DSP Group | | | | 81,389 | b | 1,369,777 | |

Entegris | | | | 10,300 | | 953,986 | |

Impinj | | | | 13,200 | a,b | 551,628 | |

Kulicke & Soffa Industries | | | | 33,530 | | 1,020,988 | |

MACOM Technology Solutions Holdings | | | | 62,555 | b | 2,794,957 | |

MaxLinear | | | | 145,476 | b | 4,546,124 | |

Onto Innovation | | | | 27,320 | b | 1,207,817 | |

Power Integrations | | | | 13,920 | | 993,749 | |

Rambus | | | | 108,780 | b | 1,710,022 | |

Semtech | | | | 13,330 | b | 899,376 | |

Silicon Laboratories | | | | 12,355 | b | 1,448,130 | |

SunPower | | | | 38,695 | a,b | 857,481 | |

Synaptics | | | | 7,362 | a,b | 572,542 | |

16

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Semiconductors & Semiconductor Equipment - 5.4% (continued) | | | | | |

Veeco Instruments | | | | 76,100 | b | 1,264,782 | |

| | | | | 25,873,810 | |

Software & Services - 7.8% | | | | | |

BlackLine | | | | 11,140 | b | 1,369,106 | |

Box, Cl. A | | | | 40,900 | b | 764,421 | |

CACI International, Cl. A | | | | 603 | b | 143,086 | |

Cerence | | | | 19,320 | a,b | 1,753,290 | |

Cloudera | | | | 191,800 | a,b | 2,240,224 | |

Conduent | | | | 220,500 | b | 930,510 | |

FireEye | | | | 128,200 | a,b | 1,926,846 | |

KBR | | | | 68,140 | | 1,892,248 | |

LivePerson | | | | 23,150 | a,b | 1,352,423 | |

ManTech International, Cl. A | | | | 33,766 | | 2,598,969 | |

MAXIMUS | | | | 13,266 | | 952,632 | |

MicroStrategy, Cl. A | | | | 9,194 | a,b | 3,151,427 | |

New Relic | | | | 5,500 | b | 328,515 | |

Nuance Communications | | | | 83,450 | a,b | 3,599,198 | |

OneSpan | | | | 38,700 | b | 765,486 | |

Qualys | | | | 5,920 | b | 562,459 | |

Sprout Social, Cl. A | | | | 21,370 | b | 1,097,991 | |

Switch, Cl. A | | | | 68,930 | | 1,088,405 | |

Talend, ADR | | | | 16,300 | a,b | 611,739 | |

The Hackett Group | | | | 35,390 | | 498,291 | |

Unisys | | | | 114,200 | b | 1,665,036 | |

Upland Software | | | | 53,339 | b | 2,440,259 | |

Varonis Systems | | | | 5,570 | b | 671,965 | |

Verint Systems | | | | 44,869 | b | 2,555,738 | |

Vertex, Cl. A | | | | 43,515 | a,b | 1,098,319 | |

Xperi Holding | | | | 93,575 | | 1,785,411 | |

| | | | | 37,843,994 | |

Technology Hardware & Equipment - 5.4% | | | | | |

Ciena | | | | 62,130 | b | 2,783,424 | |

Diebold Nixdorf | | | | 94,400 | b | 893,968 | |

FLIR Systems | | | | 2,903 | | 111,011 | |

II-VI | | | | 69,294 | a,b | 4,687,740 | |

Infinera | | | | 137,598 | a,b | 1,164,079 | |

InterDigital | | | | 19,555 | | 1,171,540 | |

Itron | | | | 27,730 | b | 2,179,855 | |

Kimball Electronics | | | | 54,940 | b | 846,625 | |

Knowles | | | | 106,250 | b | 1,804,125 | |

Methode Electronics | | | | 65,812 | | 2,304,737 | |

OSI Systems | | | | 17,580 | b | 1,548,798 | |

17

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 97.7% (continued) | | | | | |

Technology Hardware & Equipment - 5.4% (continued) | | | | | |

PC Connection | | | | 8,140 | b | 371,591 | |

Plexus | | | | 6,714 | b | 501,603 | |

Quantum | | | | 71,103 | b | 407,420 | |

Radware | | | | 14,200 | b | 357,982 | |

Ribbon Communications | | | | 111,900 | b | 767,634 | |

Rogers | | | | 6,670 | b | 979,890 | |

Stratasys | | | | 46,400 | a,b | 793,440 | |

Viavi Solutions | | | | 106,200 | b | 1,438,479 | |

Vishay Intertechnology | | | | 40,700 | | 787,952 | |

| | | | | 25,901,893 | |

Telecommunication Services - .7% | | | | | |

ATN International | | | | 34,631 | | 1,694,841 | |

Bandwidth, Cl. A | | | | 7,310 | b | 1,109,512 | |

Vonage Holdings | | | | 42,500 | b | 546,550 | |

| | | | | 3,350,903 | |

Transportation - 1.9% | | | | | |

Allegiant Travel | | | | 16,101 | | 2,740,229 | |

Avis Budget Group | | | | 33,400 | b | 1,174,678 | |

Heartland Express | | | | 67,749 | | 1,252,002 | |

Hub Group, Cl. A | | | | 15,350 | b | 838,417 | |

Knight-Swift Transportation Holdings | | | | 3,618 | | 149,387 | |

Marten Transport | | | | 64,227 | | 1,132,322 | |

Ryder System | | | | 8,570 | | 507,515 | |

SEACOR Holdings | | | | 18,250 | b | 606,265 | |

Werner Enterprises | | | | 21,410 | | 856,186 | |

| | | | | 9,257,001 | |

Utilities - 1.9% | | | | | |

ALLETE | | | | 16,081 | | 904,396 | |

Atlantic Power | | | | 730,350 | a,b | 1,504,521 | |

Avista | | | | 3,393 | | 127,305 | |

IDACORP | | | | 1,631 | | 147,736 | |

MDU Resources Group | | | | 19,626 | | 489,472 | |

NorthWestern | | | | 16,320 | | 946,560 | |

Ormat Technologies | | | | 17,626 | a | 1,389,105 | |

Portland General Electric | | | | 9,780 | | 404,696 | |

South Jersey Industries | | | | 47,690 | a | 1,097,824 | |

Southwest Gas Holdings | | | | 14,970 | | 961,822 | |

Vistra Energy | | | | 70,852 | | 1,323,515 | |

| | | | | 9,296,952 | |

Total Common Stocks (cost $361,083,564) | | | | 471,412,133 | |

18

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Exchange-Traded Funds - .9% | | | | | |

Registered Investment Companies - .9% | | | | | |

iShares Russell 2000 ETF

(cost $4,119,449) | | | | 24,000 | a | 4,344,480 | |

| | | 1-Day

Yield (%) | | | | | |

Investment Companies - 1.4% | | | | | |

Registered Investment Companies - 1.4% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $6,924,724) | | 0.10 | | 6,924,724 | d | 6,924,724 | |

| | | | | | | | |

Investment of Cash Collateral for Securities Loaned - 2.0% | | | | | |

Registered Investment Companies - 2.0% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares

(cost $9,625,934) | | 0.10 | | 9,625,934 | d | 9,625,934 | |

Total Investments (cost $381,753,671) | | 102.0% | | 492,307,271 | |

Liabilities, Less Cash and Receivables | | (2.0%) | | (9,515,195) | |

Net Assets | | 100.0% | | 482,792,076 | |

ADR—American Depository Receipt

ETF—Exchange-Traded Fund

REIT—Real Estate Investment Trust

a Security, or portion thereof, on loan. At November 30, 2020, the value of the fund’s securities on loan was $48,819,878 and the value of the collateral was $50,666,177, consisting of cash collateral of $9,625,934 and U.S. Government & Agency securities valued at $41,040,243.

b Non-income producing security.

c Investment in real estate investment trust within the United States.

d Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

19

STATEMENT OF INVESTMENTS (continued)

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Industrials | 20.4 |

Financials | 19.4 |

Information Technology | 18.6 |

Consumer Discretionary | 10.0 |

Health Care | 9.6 |

Materials | 6.2 |

Investment Companies | 4.3 |

Real Estate | 4.1 |

Consumer Staples | 3.9 |

Communication Services | 2.4 |

Utilities | 1.9 |

Energy | 1.2 |

Financial | .0 |

| | 102.0 |

† Based on net assets.

See notes to financial statements.

20

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | | | | |

Investment Companies | Value

11/30/19 ($) | Purchases ($)† | Sales ($) | Value

11/30/20 ($) | Net

Assets(%) | Dividends/

Distributions ($) |

Registered Investment Companies; |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 12,306,693 | 287,042,935 | (292,424,904) | 6,924,724 | 1.4 | 76,792 |

Investment of Cash Collateral for Securities Loaned:†† |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 13,991,191 | 83,828,983 | (97,820,174) | - | - | 209,105††† |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares | - | 15,319,972 | (5,694,038) | 9,625,934 | 2.0 | 13,403††† |

Total | 26,297,884 | 386,191,890 | (395,939,116) | 16,550,658 | 3.4 | 299,300 |

† Included reinvested dividends/distributions.

†† Effective November 9, 2020, cash collateral for securities lending was transferred from Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares to Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares.

††† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

21

STATEMENT OF ASSETS AND LIABILITIES

November 30, 2020

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $48,819,878)—Note 1(c): | | | |

Unaffiliated issuers | 365,203,013 | | 475,756,613 | |

Affiliated issuers | | 16,550,658 | | 16,550,658 | |

Cash | | | | | 312 | |

Receivable for investment securities sold | | 1,612,476 | |

Dividends and securities lending income receivable | | 326,794 | |

Receivable for shares of Common Stock subscribed | | 49,407 | |

Prepaid expenses | | | | | 44,385 | |

| | | | | 494,340,645 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) | | 359,770 | |

Liability for securities on loan—Note 1(c) | | 9,625,934 | |

Payable for investment securities purchased | | 1,297,758 | |

Payable for shares of Common Stock redeemed | | 186,416 | |

Directors’ fees and expenses payable | | 6,973 | |

Other accrued expenses | | | | | 71,718 | |

| | | | | 11,548,569 | |

Net Assets ($) | | | 482,792,076 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 354,431,147 | |

Total distributable earnings (loss) | | | | | 128,360,929 | |

Net Assets ($) | | | 482,792,076 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 1,025,463 | 117,326 | 13,850,911 | 467,798,376 | |

Shares Outstanding | 42,490 | 5,473 | 562,974 | 19,046,669 | |

Net Asset Value Per Share ($) | 24.13 | 21.44 | 24.60 | 24.56 | |

| | | | | |

See notes to financial statements. | | | | | |

22

STATEMENT OF OPERATIONS

Year Ended November 30, 2020

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $1,295 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 6,348,280 | |

Affiliated issuers | | | 75,401 | |

Income from securities lending—Note 1(c) | | | 222,508 | |

Total Income | | | 6,646,189 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 4,146,161 | |

Professional fees | | | 113,732 | |

Registration fees | | | 65,402 | |

Directors’ fees and expenses—Note 3(d) | | | 43,926 | |

Custodian fees—Note 3(c) | | | 41,277 | |

Chief Compliance Officer fees—Note 3(c) | | | 28,248 | |

Loan commitment fees—Note 2 | | | 16,093 | |

Shareholder servicing costs—Note 3(c) | | | 12,608 | |

Prospectus and shareholders’ reports | | | 11,464 | |

Distribution fees—Note 3(b) | | | 1,201 | |

Miscellaneous | | | 41,512 | |

Total Expenses | | | 4,521,624 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (1,803) | |

Net Expenses | | | 4,519,821 | |

Investment Income—Net | | | 2,126,368 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments | 22,618,427 | |

Capital gain distributions from affiliated issuers | 1,391 | |

Net Realized Gain (Loss) | | | 22,619,818 | |

Net change in unrealized appreciation (depreciation) on investments | (3,360,978) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 19,258,840 | |

Net Increase in Net Assets Resulting from Operations | | 21,385,208 | |

| | | | | | |

See notes to financial statements. | | | | | |

23

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended November 30, |

| | | | 2020 | | 2019 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 2,126,368 | | | | 2,922,839 | |

Net realized gain (loss) on investments | | 22,619,818 | | | | 10,986,108 | |

Net change in unrealized appreciation

(depreciation) on investments | | (3,360,978) | | | | 5,498,777 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 21,385,208 | | | | 19,407,724 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (22,327) | | | | (110,050) | |

Class C | | | (6,338) | | | | (66,106) | |

Class I | | | (347,742) | | | | (2,598,752) | |

Class Y | | | (13,642,241) | | | | (78,332,501) | |

Total Distributions | | | (14,018,648) | | | | (81,107,409) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 175,195 | | | | 172,405 | |

Class C | | | - | | | | 61,907 | |

Class I | | | 7,421,325 | | | | 10,583,723 | |

Class Y | | | 67,966,466 | | | | 56,189,198 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 22,065 | | | | 108,467 | |

Class C | | | 6,160 | | | | 65,008 | |

Class I | | | 279,227 | | | | 2,072,895 | |

Class Y | | | 5,611,816 | | | | 33,919,144 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (334,715) | | | | (149,257) | |

Class C | | | (284,260) | | | | (199,960) | |

Class I | | | (10,260,196) | | | | (19,225,627) | |

Class Y | | | (190,954,260) | | | | (229,849,785) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (120,351,177) | | | | (146,251,882) | |

Total Increase (Decrease) in Net Assets | (112,984,617) | | | | (207,951,567) | |

Net Assets ($): | |

Beginning of Period | | | 595,776,693 | | | | 803,728,260 | |

End of Period | | | 482,792,076 | | | | 595,776,693 | |

24

| | | | | | | | | | |

| | | | Year Ended November 30, |

| | | | 2020 | | 2019 | |

Capital Share Transactions (Shares): | |

Class Aa,b | | | | | | | | |

Shares sold | | | 9,139 | | | | 8,195 | |

Shares issued for distributions reinvested | | | 1,033 | | | | 5,940 | |

Shares redeemed | | | (18,464) | | | | (7,120) | |

Net Increase (Decrease) in Shares Outstanding | (8,292) | | | | 7,015 | |

Class Ca | | | | | | | | |

Shares sold | | | - | | | | 3,243 | |

Shares issued for distributions reinvested | | | 323 | | | | 3,942 | |

Shares redeemed | | | (16,516) | | | | (10,748) | |

Net Increase (Decrease) in Shares Outstanding | (16,193) | | | | (3,563) | |

Class Ib | | | | | | | | |

Shares sold | | | 370,345 | | | | 495,011 | |

Shares issued for distributions reinvested | | | 12,980 | | | | 111,506 | |

Shares redeemed | | | (525,982) | | | | (920,408) | |

Net Increase (Decrease) in Shares Outstanding | (142,657) | | | | (313,891) | |

Class Yb | | | | | | | | |

Shares sold | | | 3,544,829 | | | | 2,676,747 | |

Shares issued for distributions reinvested | | | 262,316 | | | | 1,826,449 | |

Shares redeemed | | | (10,363,216) | | | | (10,760,520) | |

Net Increase (Decrease) in Shares Outstanding | (6,556,071) | | | | (6,257,324) | |

| | | | | | | | | |

aDuring the period ended November 30, 2020, 43 Class C shares representing $574 were automatically converted to 38 Class A shares and during the period ended November 30, 2019, 215 Class C shares representing $4,177 were automatically converted to 194 Class A shares. | |

bDuring the period ended November 30, 2020, 317,496 Class Y shares representing $6,477,388 were exchanged for 316,961 Class I shares. During the period ended November 30, 2019, 478,261 Class Y shares representing $10,173,491 were exchanged for 477,696 Class I shares and 329 Class Y shares representing $7,445 were exchanged for 335 Class A shares. | |

See notes to financial statements. | | | | | | | | |

25

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | Year Ended November 30, |

Class A Shares | | 2020 | 2019 | 2018 | 2017 | 2016 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 22.15 | 23.94 | 26.44 | 22.72 | 22.02 |

Investment Operations: | | | | | | |

Investment income (loss)—neta | | .03 | .02 | (.01) | .00b | .09 |

Net realized and unrealized

gain (loss) on investments | | 2.39 | .86 | (.98) | 3.79 | 2.02 |

Total from Investment Operations | | 2.42 | .88 | (.99) | 3.79 | 2.11 |

Distributions: | | | | | | |

Dividends from investment income—net | | (.01) | - | - | (.07) | (.11) |

Dividends from net realized

gain on investments | | (.43) | (2.67) | (1.51) | - | (1.30) |

Total Distributions | | (.44) | (2.67) | (1.51) | (.07) | (1.41) |

Net asset value, end of period | | 24.13 | 22.15 | 23.94 | 26.44 | 22.72 |

Total Return (%)c | | 11.21 | 6.07 | (3.93) | 16.74 | 10.72 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.44 | 1.38 | 1.35 | 1.30 | 1.30 |

Ratio of net expenses

to average net assets | | 1.30 | 1.30 | 1.30 | 1.28 | 1.30 |

Ratio of net investment income (loss)

to average net assets | | .14 | .12 | (.05) | .01 | .44 |

Portfolio Turnover Rate | | 86.50 | 57.74 | 58.85 | 67.90 | 66.57 |

Net Assets, end of period ($ x 1,000) | | 1,025 | 1,125 | 1,048 | 1,076 | 2,862 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Exclusive of sales charge.

See notes to financial statements.

26

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | Year Ended November 30, |

Class C Shares | | 2020 | 2019 | 2018 | 2017 | 2016 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 19.86 | 21.92 | 24.51 | 21.15 | 20.68 |

Investment Operations: | | | | | | |

Investment (loss)—neta | | (.10) | (.12) | (.19) | (.16) | (.07) |

Net realized and unrealized

gain (loss) on investments | | 2.11 | .73 | (.89) | 3.52 | 1.90 |

Total from Investment Operations | | 2.01 | .61 | (1.08) | 3.36 | 1.83 |

Distributions: | | | | | | |

Dividends from investment income—net | | - | - | - | - | (.06) |

Dividends from net realized

gain on investments | | (.43) | (2.67) | (1.51) | - | (1.30) |

Total Distributions | | (.43) | (2.67) | (1.51) | - | (1.36) |

Net asset value, end of period | | 21.44 | 19.86 | 21.92 | 24.51 | 21.15 |

Total Return (%)b | | 10.42 | 5.28 | (4.65) | 15.89 | 9.94 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 2.39 | 2.12 | 2.15 | 2.31 | 2.33 |

Ratio of net expenses

to average net assets | | 2.05 | 2.05 | 2.05 | 2.04 | 2.05 |

Ratio of net investment (loss)

to average net assets | | (.55) | (.61) | (.82) | (.74) | (.39) |

Portfolio Turnover Rate | | 86.50 | 57.74 | 58.85 | 67.90 | 66.57 |

Net Assets, end of period ($ x 1,000) | | 117 | 430 | 553 | 179 | 146 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

27

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | Year Ended November 30, |

Class I Shares | | 2020 | 2019 | 2018 | 2017 | 2016 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 22.61 | 24.41 | 26.90 | 23.09 | 22.36 |

Investment Operations: | | | | | | |

Investment income—neta | | .08 | .10 | .07 | .07 | .15 |

Net realized and unrealized

gain (loss) on investments | | 2.44 | .86 | (1.00) | 3.87 | 2.06 |

Total from Investment Operations | | 2.52 | .96 | (.93) | 3.94 | 2.21 |

Distributions: | | | | | | |

Dividends from

investment income—net | | (.10) | (.09) | (.05) | (.13) | (.18) |

Dividends from net realized

gain on investments | | (.43) | (2.67) | (1.51) | - | (1.30) |

Total Distributions | | (.53) | (2.76) | (1.56) | (.13) | (1.48) |

Net asset value, end of period | | 24.60 | 22.61 | 24.41 | 26.90 | 23.09 |

Total Return (%) | | 11.53 | 6.40 | (3.63) | 17.14 | 11.09 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.03 | .99 | .97 | 1.00 | .99 |

Ratio of net expenses

to average net assets | | 1.03 | .99 | .97 | .98 | .99 |

Ratio of net investment income

to average net assets | | .41 | .45 | .27 | .29 | .75 |

Portfolio Turnover Rate | | 86.50 | 57.74 | 58.85 | 67.90 | 66.57 |

Net Assets, end of period ($ x 1,000) | | 13,851 | 15,955 | 24,890 | 20,566 | 16,478 |

a Based on average shares outstanding.

See notes to financial statements.

28

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | Year Ended November 30, |

Class Y Shares | | 2020 | 2019 | 2018 | 2017 | 2016 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 22.59 | 24.40 | 26.88 | 23.08 | 22.35 |

Investment Operations: | | | | | | |

Investment income—neta | | .10 | .10 | .08 | .08 | .16 |

Net realized and unrealized

gain (loss) on investments | | 2.42 | .86 | (.99) | 3.86 | 2.06 |

Total from Investment Operations | | 2.52 | .96 | (.91) | 3.94 | 2.22 |

Distributions: | | | | | | |

Dividends

from investment income—net | | (.12) | (.10) | (.06) | (.14) | (.19) |

Dividends from net realized

gain on investments | | (.43) | (2.67) | (1.51) | - | (1.30) |

Total Distributions | | (.55) | (2.77) | (1.57) | (.14) | (1.49) |

Net asset value, end of period | | 24.56 | 22.59 | 24.40 | 26.88 | 23.08 |

Total Return (%) | | 11.58 | 6.41 | (3.56) | 17.15 | 11.13 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .98 | .95 | .94 | .94 | .95 |

Ratio of net expenses

to average net assets | | .98 | .95 | .94 | .93 | .95 |

Ratio of net investment income

to average net assets | | .46 | .48 | .31 | .35 | .79 |

Portfolio Turnover Rate | | 86.50 | 57.74 | 58.85 | 67.90 | 66.57 |

Net Assets, end of period ($ x 1,000) | | 467,798 | 578,267 | 777,237 | 942,613 | 797,087 |

a Based on average shares outstanding.

See notes to financial statements.

29

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Select Managers Small Cap Value Fund (the “fund”) is a separate non-diversified series of BNY Mellon Strategic Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering six series, including the fund. The fund’s investment objective is to seek capital appreciation. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser and the fund’s portfolio allocation manager. Walthausen & Co., LLC (“Walthausen”), Neuberger Berman Investment Advisers LLC (“Neuberger Berman”), Channing Capital Management, LLC (“Channing”), Eastern Shore Capital Management (“Eastern Shore”), Heartland Advisors, Inc. (“Heartland”) and Rice Hall James & Associates, LLC (“RHJ”), serve as the fund’s sub-investment advisers, each managing an allocated portion of the fund’s portfolio.

The Company’s Board of Directors (the “Board”) approved, effective September 15, 2020 (the “Effective Date”) Heartland Advisors, Inc. and Rice Hall James & Associates, LLC as additional subadvisers to the fund. In addition, as of the effective date, the board terminated the Sub-Investment Advisory Agreement between the Adviser and Kayne Anderson Rudnick Investment Management, LLC.

The Board approved, effective December 31, 2019 (the “Effective Date”), the termination of the fund’s authorized Class T shares. Prior to the Effective Date, the fund did not offer such Class T shares for purchase. The authorized Class T shares were reallocated to authorized Class Y shares, increasing authorized Class Y shares from 100 million to 200 million.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue 500 million shares of $.001 par value Common Stock. The fund currently has authorized four classes of shares: Class A (100 million shares authorized), Class C (100 million shares authorized), Class I (100 million shares authorized) and Class Y (200 million shares authorized). Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within

30

one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares ten years after the date of purchase, without the imposition of a sales charge. Class I and Class Y shares are sold at net asset value per share generally to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether

31

NOTES TO FINANCIAL STATEMENTS (continued)

such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

32

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of November 30, 2020 in valuing the fund’s investments:

| | | | | |

| | Level 1 – Unadjusted

Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 -Significant Unobservable Inputs | Total |

Assets ($) | | | |

Investments in Securities:† | | | |

Equity Securities - Common Stocks | 471,412,133 | - | - | 471,412,133 |

Exchange-Traded Funds | 4,344,480 | - | - | 4,344,480 |

Investment Companies | 16,550,658 | - | - | 16,550,658 |

† See Statement of Investments for additional detailed categorizations, if any.

(b) Foreign Taxes: The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the fund invests. These foreign taxes, if any, are paid by the fund and are reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred or those subject to reclaims as of November 30, 2020, if any, are disclosed in the fund’s Statement of Assets and Liabilities.

33

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of the Adviser, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended November 30, 2020, The Bank of New York Mellon earned $43,688 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

(e) Risk: Certain events particular to the industries in which the fund’s investments conduct their operations, as well as general economic, political and public health conditions, may have a significant negative impact on the investee’s operations and profitability. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-

34

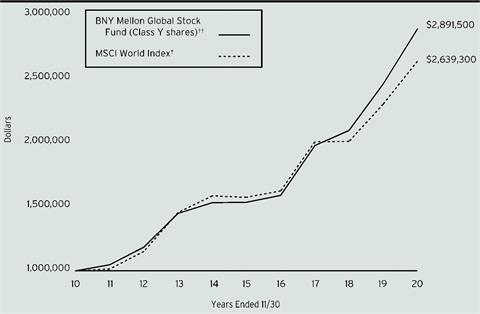

wide. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.