UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03942

LORD ABBETT MUNICIPAL INCOME FUND, INC.

(Exact name of Registrant as specified in charter)

30 Hudson Street, Jersey City, New Jersey 07302-4804

(Address of principal executive offices) (Zip code)

Randolph A. Stuzin, Esq.

Vice President and Assistant Secretary

30 Hudson Street, Jersey City, New Jersey 07302-4804

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 522-2388

Date of fiscal year end: 9/30

Date of reporting period: 9/30/2024

| Item 1: | Report(s) to Shareholders. |

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett High Income Municipal Bond Fund for the period of October 1, 2023 to September 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $88 | 0.82% |

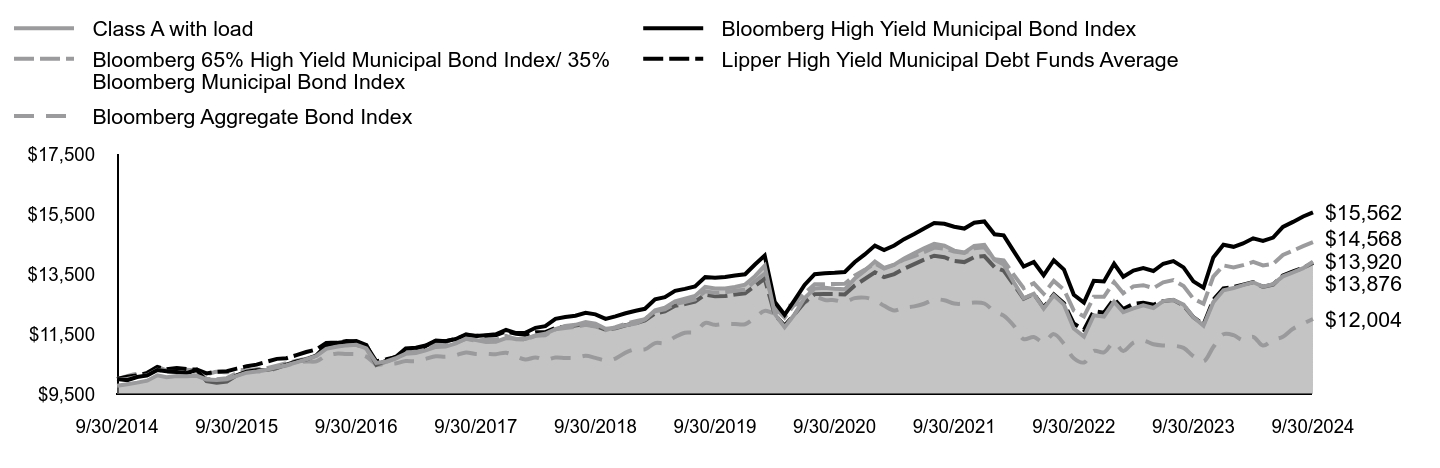

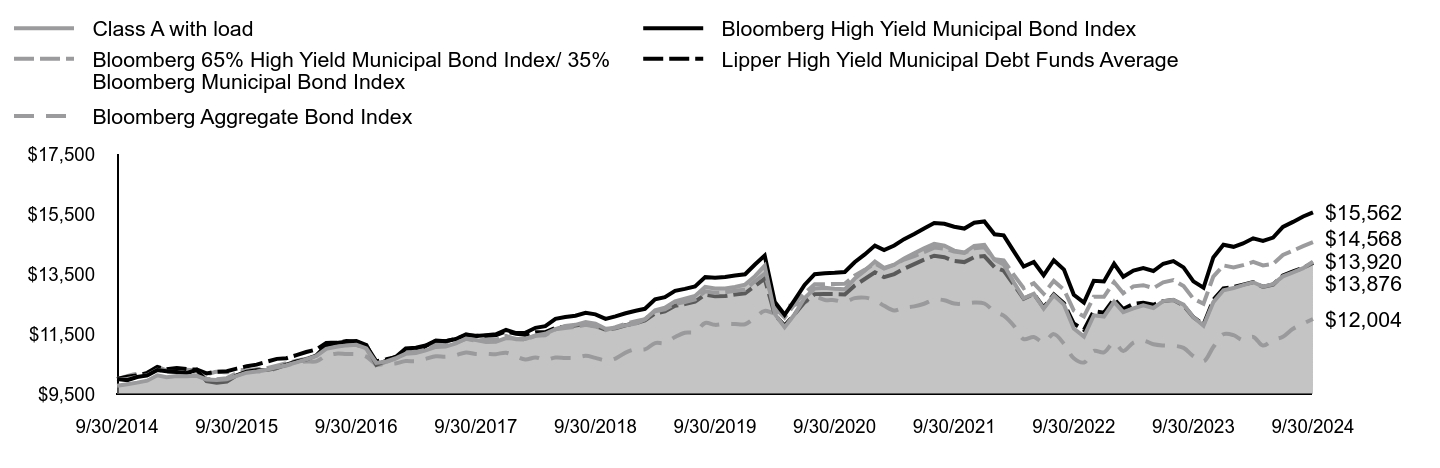

How did the Fund perform last year and what affected its performance?

For the fiscal year ended September 30, 2024, the Fund returned 15.38%, reflecting performance at the net asset value (NAV) of Class A shares, compared to the 17.38% of a securities market index with investment characteristics similar to those of the Fund, the Bloomberg High Yield Municipal Bond Index. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 11.57% over the same period.

Positive factors for the municipal market included decreasing Treasury yields, easing inflationary pressures and the start of interest rate cuts by the U.S. Federal Reserve. Also supporting the market was increased demand for municipal bond funds and a strong fundamental backdrop as evidenced by growing tax revenue and positive ratings actions by public ratings agencies. Negative factors included a significant increase in municipal bond supply, which pressured the market in second half of the fiscal year, and periods of interest rate volatility driven by sticky inflation readings at points throughout the fiscal year. Against this backdrop, municipal bonds delivered strong returns.

Top contributors to the Fund’s performance: Security selection within the Education, Health Care and Tobacco sectors contributed to relative performance. An overweight allocation to the Health Care sector and underweight allocation to the Education sector contributed to relative performance.

Top detractors from the Fund’s performance: The Fund’s allocation to investment grade bonds was the primary detractor from relative performance. The Fund’s yield curve positioning led to a modest negative impact on relative performance. In particular, an overweight allocation to intermediate maturity bonds detracted as yields fell less at this part of the curve.

Total Return Based on $10,000 Investment

| Class A with load | Bloomberg High Yield Municipal Bond Index | Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | Lipper High Yield Municipal Debt Funds Average | Bloomberg Aggregate Bond Index |

|---|

| 9/30/2014 | $9,774 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $9,827 | $9,964 | $10,000 | $10,077 | $10,098 |

| 11/30/2014 | $9,880 | $10,067 | $10,074 | $10,117 | $10,170 |

| 12/31/2014 | $9,945 | $10,121 | $10,127 | $10,206 | $10,179 |

| 1/31/2015 | $10,125 | $10,302 | $10,307 | $10,402 | $10,393 |

| 2/28/2015 | $10,061 | $10,261 | $10,243 | $10,324 | $10,295 |

| 3/31/2015 | $10,100 | $10,234 | $10,236 | $10,364 | $10,343 |

| 4/30/2015 | $10,095 | $10,192 | $10,190 | $10,330 | $10,306 |

| 5/31/2015 | $10,107 | $10,307 | $10,255 | $10,315 | $10,281 |

| 6/30/2015 | $9,984 | $9,927 | $10,006 | $10,188 | $10,169 |

| 7/31/2015 | $9,964 | $9,873 | $9,996 | $10,240 | $10,240 |

| 8/31/2015 | $9,994 | $9,914 | $10,030 | $10,261 | $10,225 |

| 9/30/2015 | $10,103 | $10,124 | $10,194 | $10,348 | $10,294 |

| 10/31/2015 | $10,212 | $10,248 | $10,288 | $10,424 | $10,296 |

| 11/30/2015 | $10,252 | $10,289 | $10,330 | $10,481 | $10,269 |

| 12/31/2015 | $10,309 | $10,304 | $10,365 | $10,577 | $10,235 |

| 1/31/2016 | $10,395 | $10,363 | $10,447 | $10,672 | $10,376 |

| 2/29/2016 | $10,461 | $10,477 | $10,527 | $10,693 | $10,450 |

| 3/31/2016 | $10,554 | $10,587 | $10,611 | $10,796 | $10,546 |

| 4/30/2016 | $10,657 | $10,652 | $10,680 | $10,900 | $10,586 |

| 5/31/2016 | $10,769 | $10,792 | $10,782 | $10,987 | $10,589 |

| 6/30/2016 | $11,008 | $11,127 | $11,059 | $11,204 | $10,779 |

| 7/31/2016 | $11,076 | $11,200 | $11,109 | $11,219 | $10,847 |

| 8/31/2016 | $11,122 | $11,240 | $11,140 | $11,265 | $10,835 |

| 9/30/2016 | $11,142 | $11,270 | $11,140 | $11,241 | $10,829 |

| 10/31/2016 | $11,024 | $11,130 | $11,009 | $11,107 | $10,746 |

| 11/30/2016 | $10,538 | $10,468 | $10,440 | $10,589 | $10,492 |

| 12/31/2016 | $10,585 | $10,613 | $10,576 | $10,659 | $10,506 |

| 1/31/2017 | $10,709 | $10,761 | $10,697 | $10,737 | $10,527 |

| 2/28/2017 | $10,841 | $11,018 | $10,889 | $10,856 | $10,598 |

| 3/31/2017 | $10,870 | $11,043 | $10,913 | $10,913 | $10,592 |

| 4/30/2017 | $10,956 | $11,118 | $10,989 | $11,101 | $10,674 |

| 5/31/2017 | $11,071 | $11,288 | $11,159 | $11,271 | $10,756 |

| 6/30/2017 | $11,081 | $11,263 | $11,129 | $11,263 | $10,745 |

| 7/31/2017 | $11,185 | $11,337 | $11,208 | $11,336 | $10,792 |

| 8/31/2017 | $11,350 | $11,493 | $11,339 | $11,457 | $10,888 |

| 9/30/2017 | $11,299 | $11,432 | $11,279 | $11,445 | $10,836 |

| 10/31/2017 | $11,232 | $11,463 | $11,309 | $11,445 | $10,843 |

| 11/30/2017 | $11,241 | $11,492 | $11,306 | $11,462 | $10,829 |

| 12/31/2017 | $11,366 | $11,641 | $11,443 | $11,587 | $10,879 |

| 1/31/2018 | $11,345 | $11,532 | $11,326 | $11,513 | $10,753 |

| 2/28/2018 | $11,335 | $11,540 | $11,319 | $11,480 | $10,651 |

| 3/31/2018 | $11,451 | $11,709 | $11,442 | $11,557 | $10,720 |

| 4/30/2018 | $11,508 | $11,762 | $11,461 | $11,562 | $10,640 |

| 5/31/2018 | $11,663 | $12,008 | $11,663 | $11,710 | $10,716 |

| 6/30/2018 | $11,770 | $12,068 | $11,704 | $11,746 | $10,703 |

| 7/31/2018 | $11,808 | $12,110 | $11,740 | $11,786 | $10,705 |

| 8/31/2018 | $11,905 | $12,207 | $11,812 | $11,832 | $10,774 |

| 9/30/2018 | $11,845 | $12,159 | $11,755 | $11,772 | $10,705 |

| 10/31/2018 | $11,676 | $12,007 | $11,634 | $11,646 | $10,620 |

| 11/30/2018 | $11,706 | $12,091 | $11,732 | $11,694 | $10,683 |

| 12/31/2018 | $11,797 | $12,195 | $11,847 | $11,794 | $10,880 |

| 1/31/2019 | $11,847 | $12,277 | $11,930 | $11,859 | $10,995 |

| 2/28/2019 | $11,995 | $12,343 | $11,994 | $11,954 | $10,989 |

| 3/31/2019 | $12,289 | $12,662 | $12,262 | $12,189 | $11,200 |

| 4/30/2019 | $12,381 | $12,733 | $12,323 | $12,257 | $11,203 |

| 5/31/2019 | $12,595 | $12,940 | $12,512 | $12,444 | $11,402 |

| 6/30/2019 | $12,677 | $13,007 | $12,571 | $12,501 | $11,545 |

| 7/31/2019 | $12,769 | $13,089 | $12,658 | $12,583 | $11,570 |

| 8/31/2019 | $13,075 | $13,404 | $12,926 | $12,818 | $11,870 |

| 9/30/2019 | $13,022 | $13,377 | $12,872 | $12,760 | $11,807 |

| 10/31/2019 | $13,020 | $13,405 | $12,898 | $12,768 | $11,842 |

| 11/30/2019 | $13,070 | $13,457 | $12,942 | $12,819 | $11,836 |

| 12/31/2019 | $13,151 | $13,497 | $12,981 | $12,862 | $11,828 |

| 1/31/2020 | $13,440 | $13,830 | $13,270 | $13,112 | $12,056 |

| 2/29/2020 | $13,782 | $14,121 | $13,512 | $13,348 | $12,273 |

| 3/31/2020 | $12,174 | $12,568 | $12,375 | $12,136 | $12,201 |

| 4/30/2020 | $11,729 | $12,144 | $12,049 | $11,785 | $12,417 |

| 5/31/2020 | $12,169 | $12,640 | $12,503 | $12,164 | $12,475 |

| 6/30/2020 | $12,705 | $13,141 | $12,861 | $12,564 | $12,554 |

| 7/31/2020 | $13,019 | $13,497 | $13,163 | $12,833 | $12,741 |

| 8/31/2020 | $13,046 | $13,533 | $13,164 | $12,838 | $12,638 |

| 9/30/2020 | $13,010 | $13,546 | $13,174 | $12,834 | $12,632 |

| 10/31/2020 | $12,994 | $13,571 | $13,175 | $12,822 | $12,575 |

| 11/30/2020 | $13,345 | $13,897 | $13,451 | $13,116 | $12,699 |

| 12/31/2020 | $13,610 | $14,157 | $13,643 | $13,338 | $12,716 |

| 1/31/2021 | $13,917 | $14,452 | $13,859 | $13,564 | $12,625 |

| 2/28/2021 | $13,705 | $14,301 | $13,687 | $13,399 | $12,443 |

| 3/31/2021 | $13,818 | $14,456 | $13,813 | $13,503 | $12,287 |

| 4/30/2021 | $14,018 | $14,667 | $13,985 | $13,682 | $12,384 |

| 5/31/2021 | $14,192 | $14,836 | $14,104 | $13,836 | $12,425 |

| 6/30/2021 | $14,359 | $15,024 | $14,234 | $13,982 | $12,512 |

| 7/31/2021 | $14,515 | $15,204 | $14,386 | $14,114 | $12,652 |

| 8/31/2021 | $14,450 | $15,181 | $14,353 | $14,064 | $12,628 |

| 9/30/2021 | $14,285 | $15,081 | $14,256 | $13,937 | $12,518 |

| 10/31/2021 | $14,220 | $15,020 | $14,204 | $13,902 | $12,515 |

| 11/30/2021 | $14,443 | $15,217 | $14,367 | $14,069 | $12,552 |

| 12/31/2021 | $14,479 | $15,257 | $14,399 | $14,103 | $12,520 |

| 1/31/2022 | $13,978 | $14,830 | $14,000 | $13,730 | $12,250 |

| 2/28/2022 | $13,823 | $14,795 | $13,961 | $13,616 | $12,114 |

| 3/31/2022 | $13,231 | $14,261 | $13,474 | $13,149 | $11,777 |

| 4/30/2022 | $12,695 | $13,754 | $13,033 | $12,680 | $11,330 |

| 5/31/2022 | $12,844 | $13,905 | $13,194 | $12,837 | $11,403 |

| 6/30/2022 | $12,352 | $13,461 | $12,844 | $12,385 | $11,224 |

| 7/31/2022 | $12,797 | $13,964 | $13,275 | $12,826 | $11,498 |

| 8/31/2022 | $12,482 | $13,653 | $12,981 | $12,527 | $11,174 |

| 9/30/2022 | $11,687 | $12,812 | $12,287 | $11,851 | $10,691 |

| 10/31/2022 | $11,417 | $12,549 | $12,087 | $11,639 | $10,552 |

| 11/30/2022 | $12,125 | $13,280 | $12,742 | $12,261 | $10,940 |

| 12/31/2022 | $12,086 | $13,258 | $12,742 | $12,211 | $10,891 |

| 1/31/2023 | $12,576 | $13,847 | $13,237 | $12,675 | $11,226 |

| 2/28/2023 | $12,235 | $13,412 | $12,862 | $12,333 | $10,936 |

| 3/31/2023 | $12,358 | $13,620 | $13,092 | $12,507 | $11,214 |

| 4/30/2023 | $12,458 | $13,699 | $13,131 | $12,548 | $11,282 |

| 5/31/2023 | $12,371 | $13,604 | $13,032 | $12,477 | $11,159 |

| 6/30/2023 | $12,600 | $13,846 | $13,228 | $12,600 | $11,119 |

| 7/31/2023 | $12,642 | $13,936 | $13,302 | $12,634 | $11,111 |

| 8/31/2023 | $12,484 | $13,724 | $13,104 | $12,456 | $11,040 |

| 9/30/2023 | $12,065 | $13,258 | $12,680 | $12,064 | $10,760 |

| 10/31/2023 | $11,778 | $13,045 | $12,511 | $11,821 | $10,590 |

| 11/30/2023 | $12,565 | $14,057 | $13,419 | $12,642 | $11,069 |

| 12/31/2023 | $12,961 | $14,479 | $13,790 | $13,023 | $11,493 |

| 1/31/2024 | $13,036 | $14,411 | $13,724 | $13,072 | $11,462 |

| 2/29/2024 | $13,135 | $14,525 | $13,800 | $13,151 | $11,300 |

| 3/31/2024 | $13,228 | $14,697 | $13,906 | $13,230 | $11,404 |

| 4/30/2024 | $13,084 | $14,607 | $13,791 | $13,073 | $11,116 |

| 5/31/2024 | $13,168 | $14,718 | $13,844 | $13,152 | $11,304 |

| 6/30/2024 | $13,426 | $15,078 | $14,139 | $13,458 | $11,412 |

| 7/31/2024 | $13,562 | $15,243 | $14,285 | $13,595 | $11,678 |

| 8/31/2024 | $13,697 | $15,423 | $14,434 | $13,706 | $11,846 |

| 9/30/2024 | $13,920 | $15,562 | $14,568 | $13,876 | $12,004 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A at NAV | 15.38% | 1.34% | 3.60% |

| Class A with sales charge | 12.81% | 0.88% | 3.36% |

| Bloomberg High Yield Municipal Bond Index | 17.38% | 3.07% | 4.52% |

| Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | 14.89% | 2.51% | 3.83% |

| Lipper High Yield Municipal Debt Funds Average | 15.02% | 1.69% | 3.33% |

Bloomberg Aggregate Bond IndexFootnote Reference* | 11.57% | 0.33% | 1.84% |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

(as of September 30, 2024)

| Total Net Assets | $4,098,713,523 |

| # of Portfolio Holdings | 611 |

| Portfolio Turnover Rate | 27% |

| Total Advisory Fees Paid | $16,137,454 |

What did the Fund invest in?

(as of September 30, 2024)

Credit Rating S&P or Moody'sFootnote Reference(a) | %Footnote Reference** |

|---|

| |

- A3.12%

- A-3.62%

- A+4.07%

- AA4.24%

- AA-2.36%

- AA+0.32%

- AAA1.03%

- B0.75%

- B-2.26%

- B+2.14%

- BB6.67%

- BB-5.00%

- BB+6.47%

- BBB3.00%

- BBB-8.39%

- BBB+4.73%

- CCC0.30%

- CCC-1.01%

- CCC+0.36%

- NR40.16%

- Total 100.00%

| Footnote | Description |

Footnote** | Represents percent of total investments, which excludes derivatives. |

Footnote(a) | Investments in investment grade municipal bonds, which as bonds that are rated, at the time of purchase, within the four highest grades assigned by an independent rating agency such as Moody’s, S&P, or Fitch, or an equivalent short-term rating, as applicable, or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. Lower rated municipal bonds are rated, at the time of purchase, or an equivalent short-term rating, as applicable, by an independent rating agency or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

TSR-A-1430-A

11/24

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett High Income Municipal Bond Fund for the period of October 1, 2023 to September 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

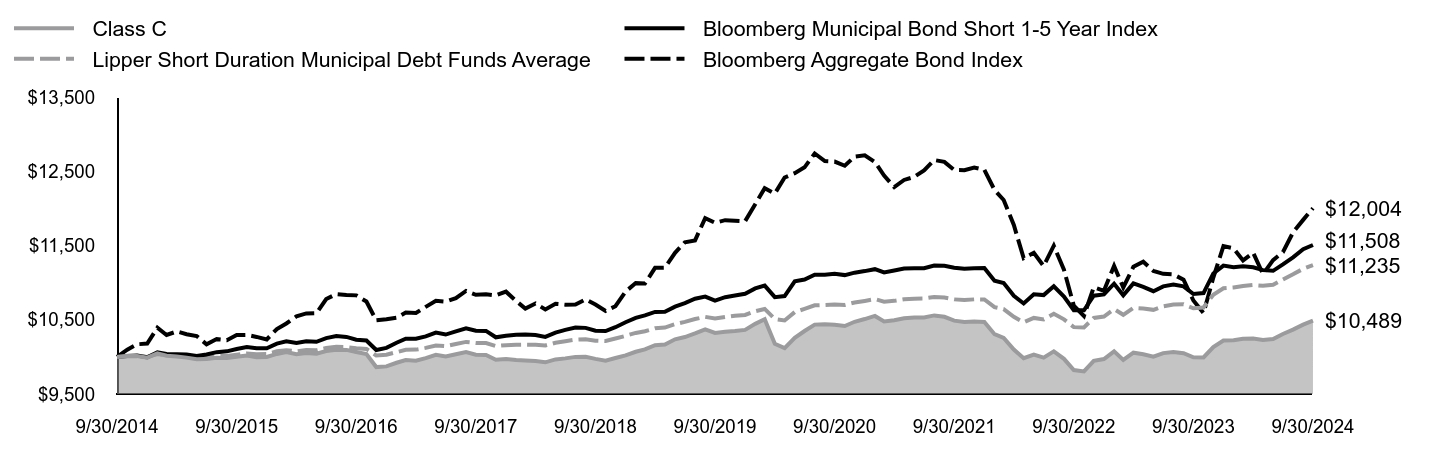

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $153 | 1.43% |

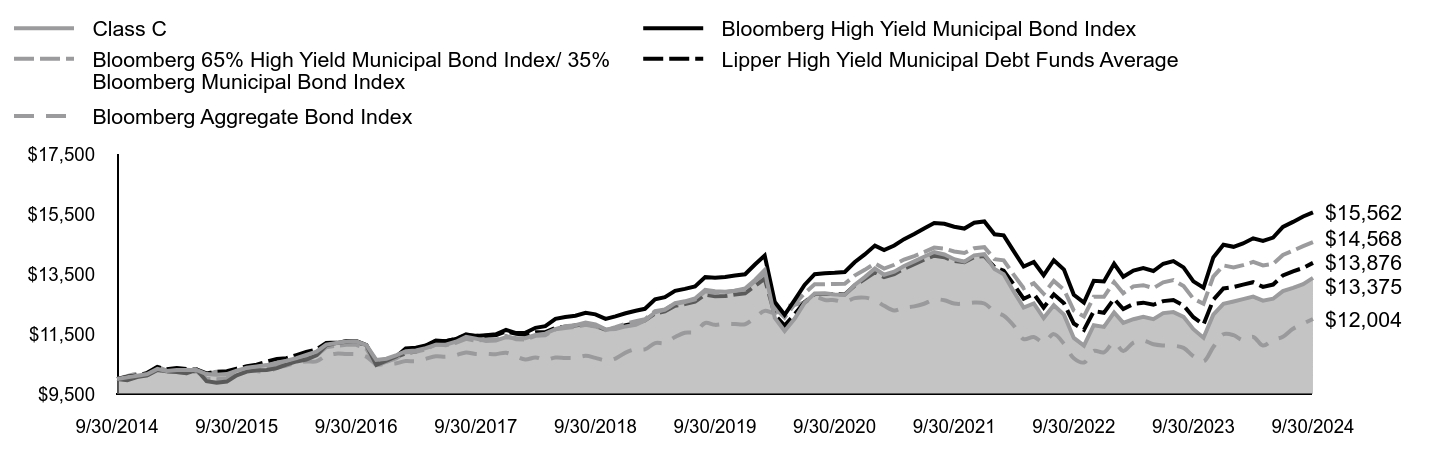

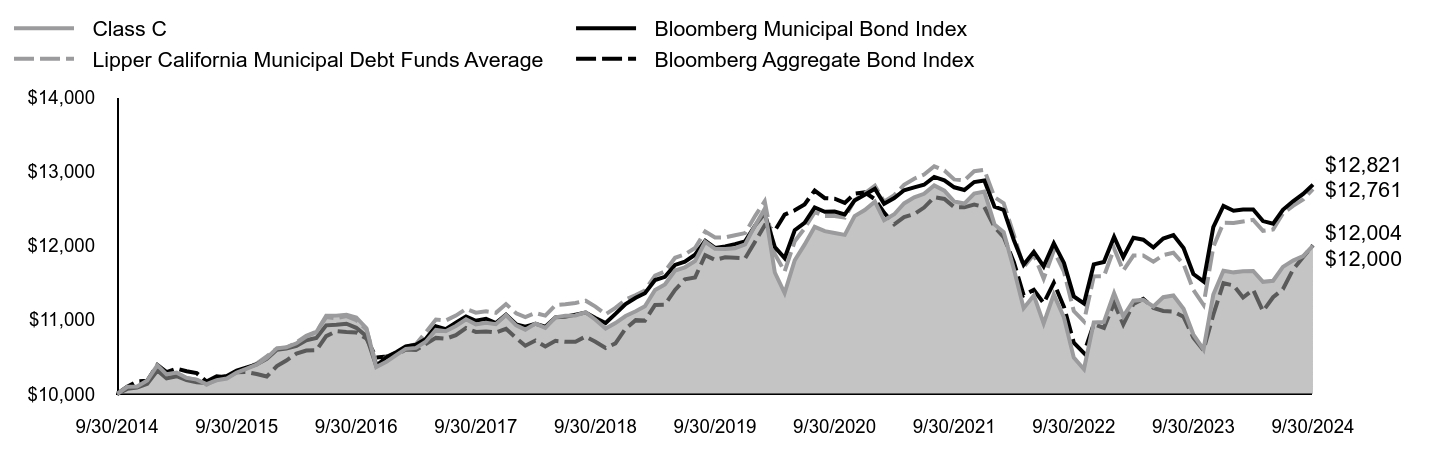

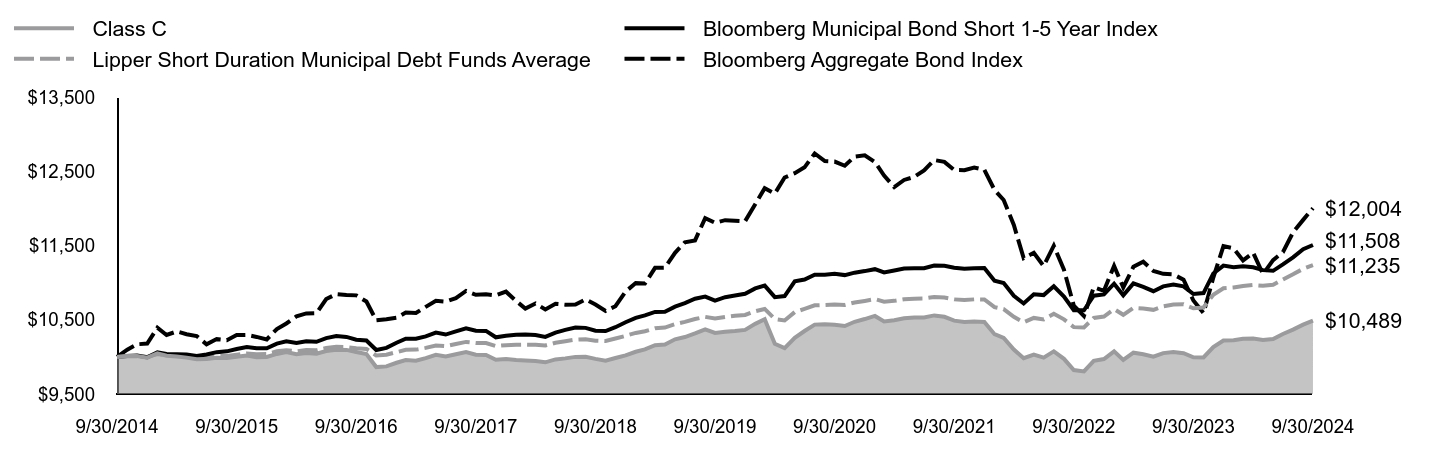

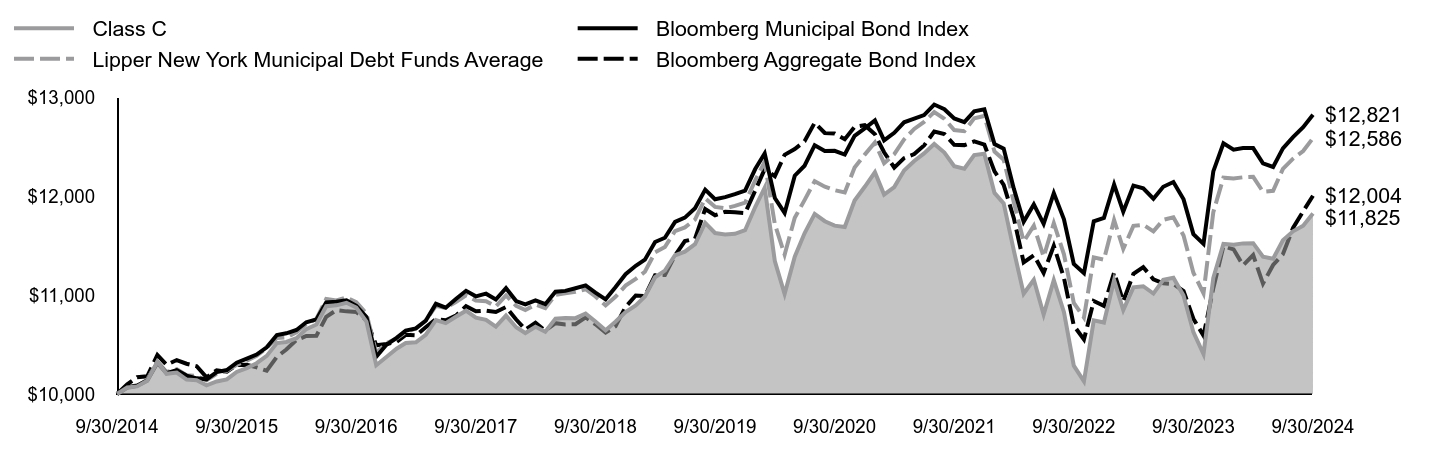

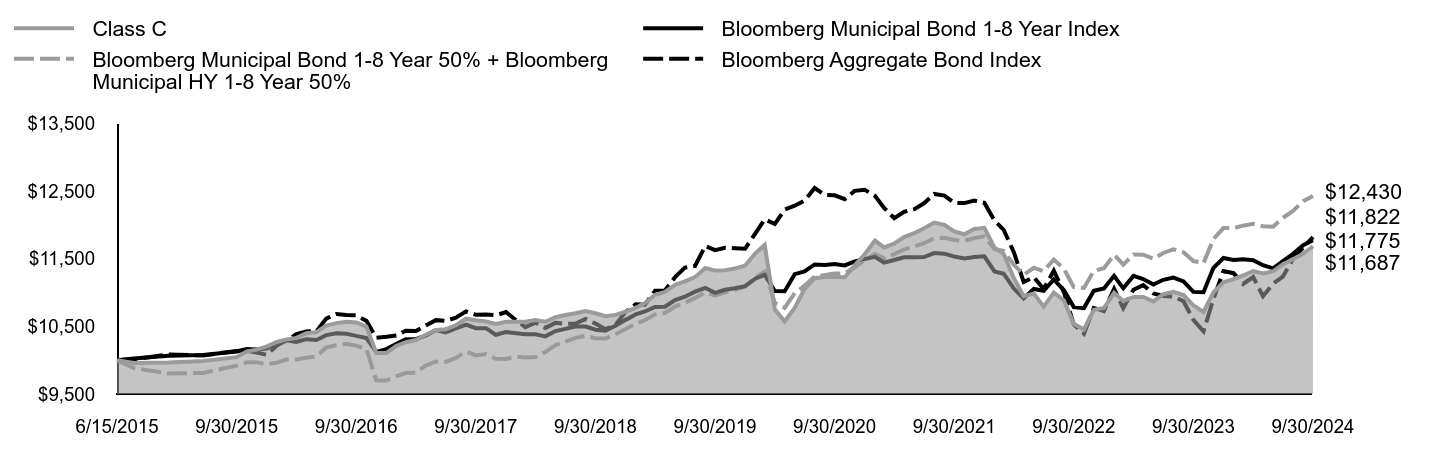

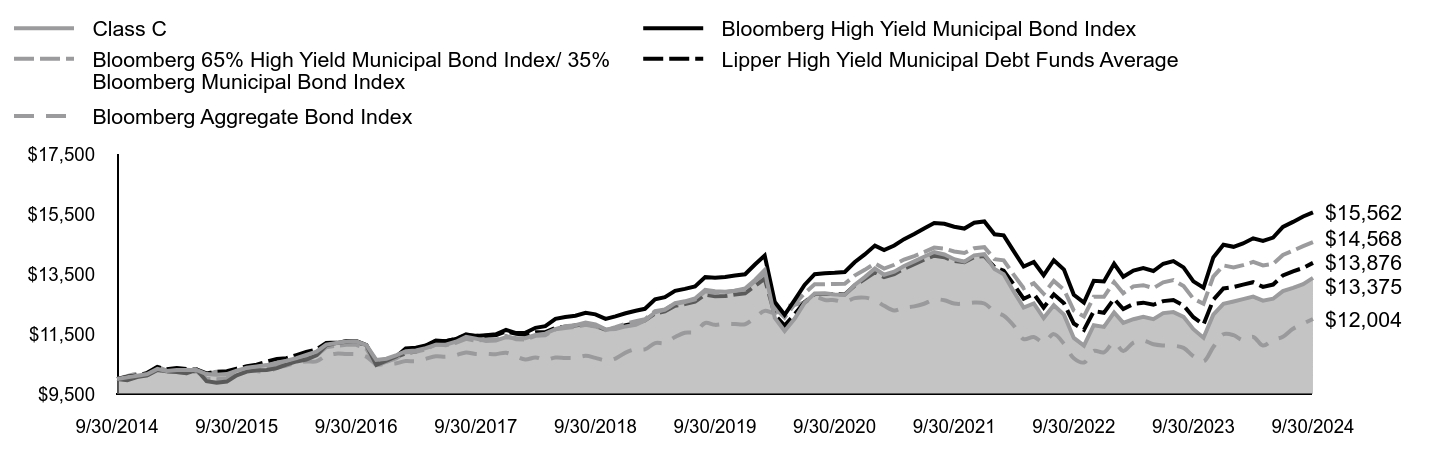

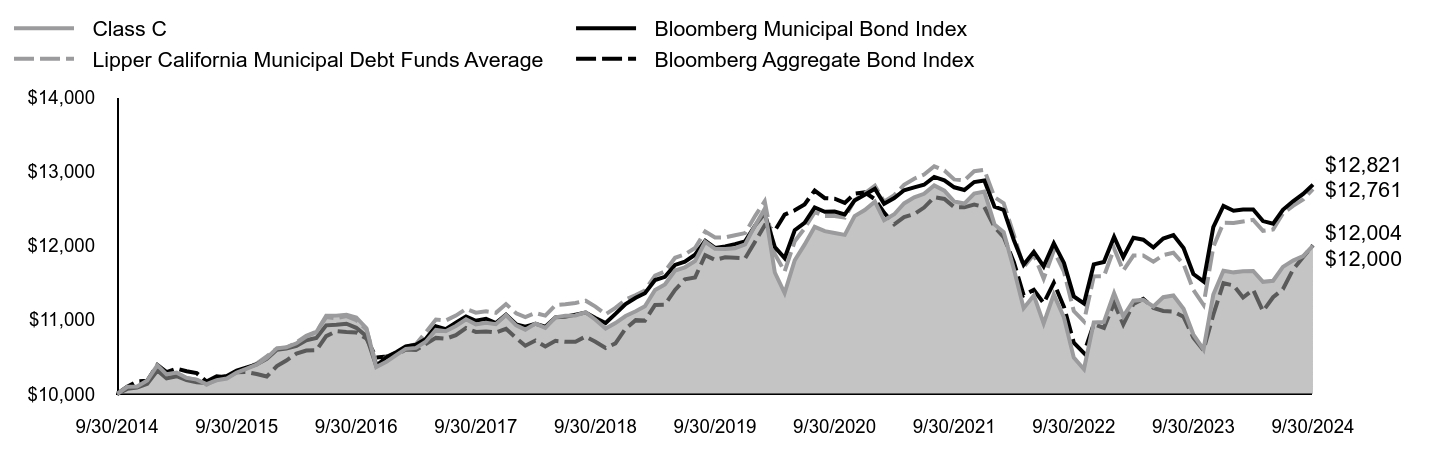

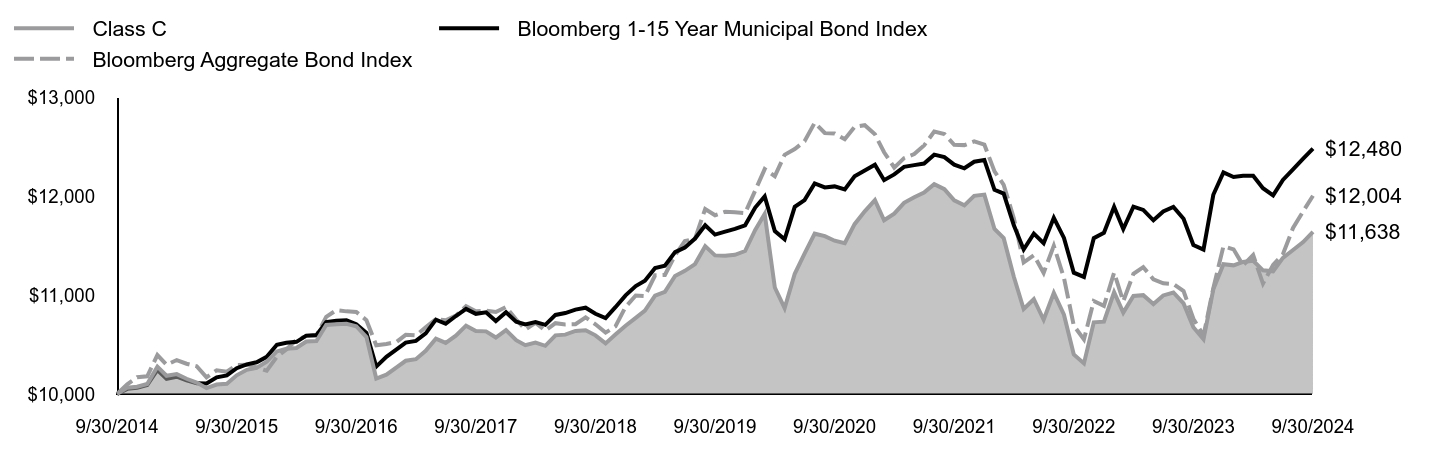

How did the Fund perform last year and what affected its performance?

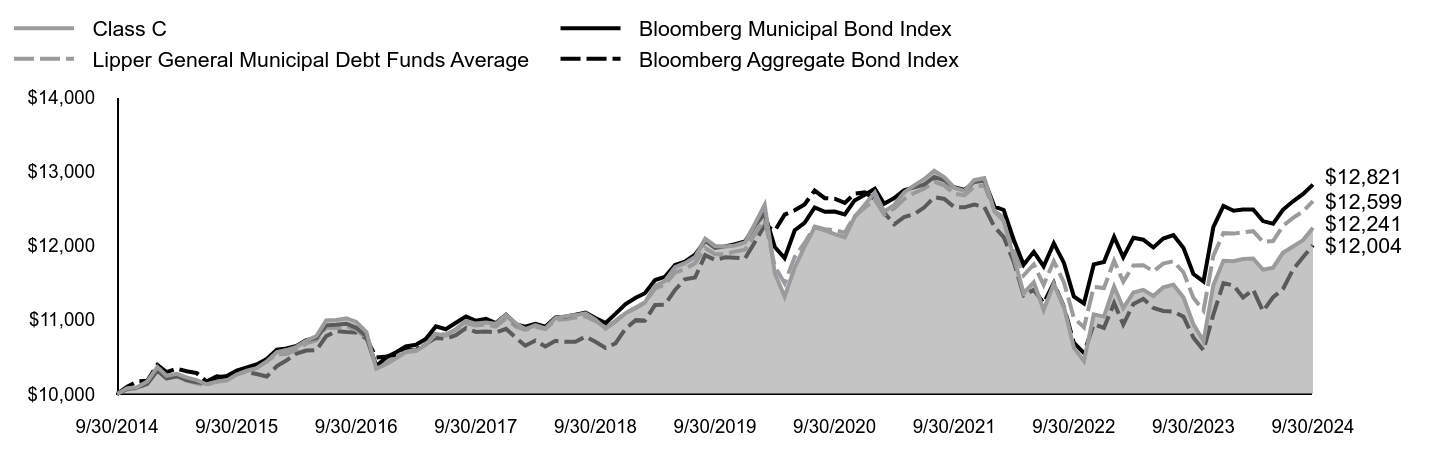

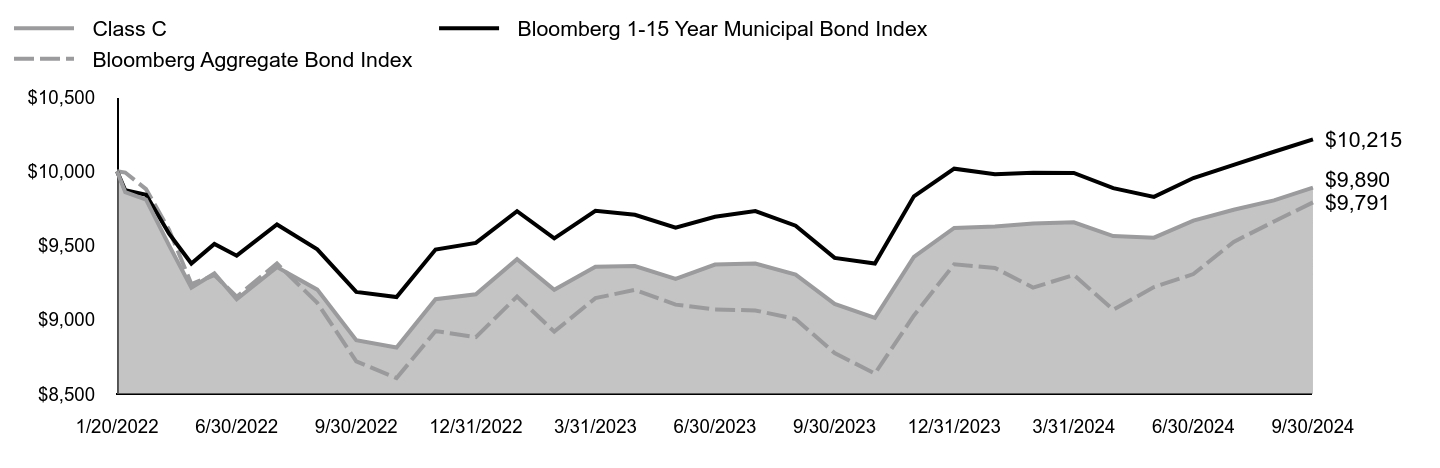

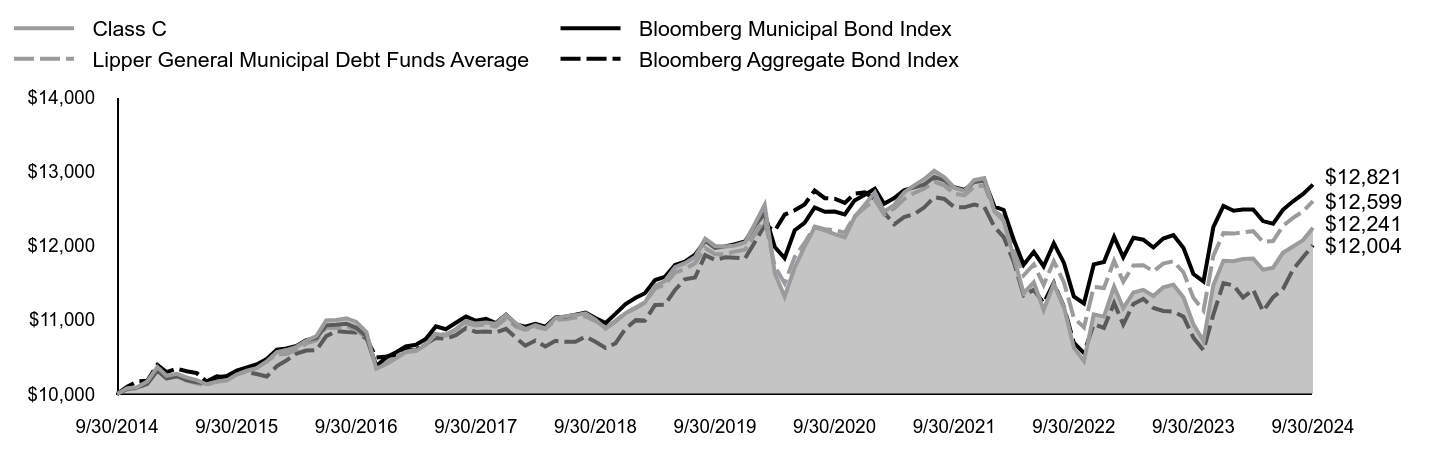

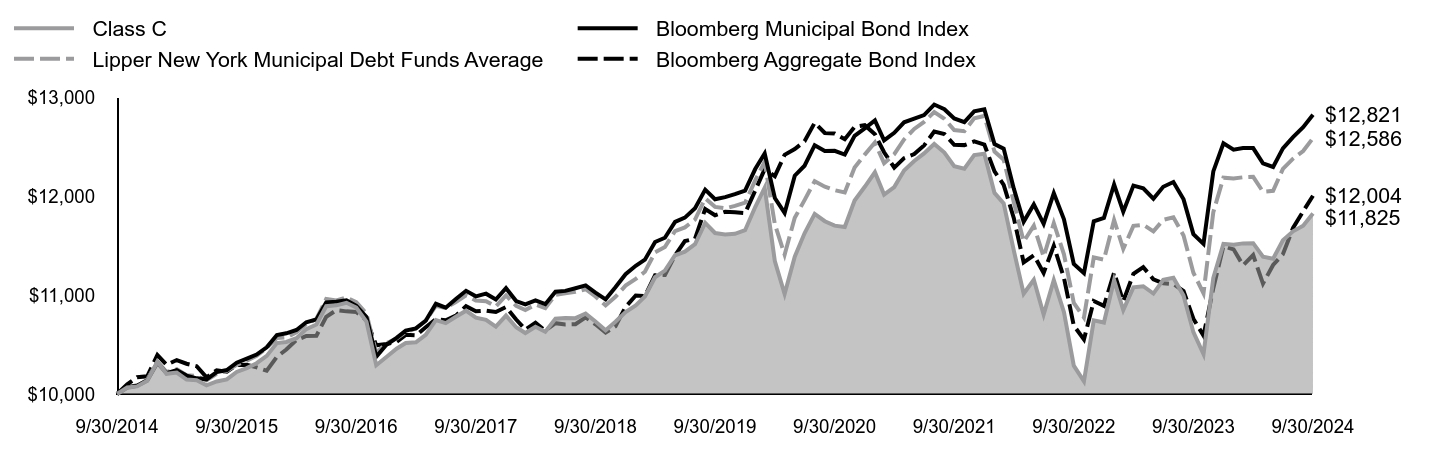

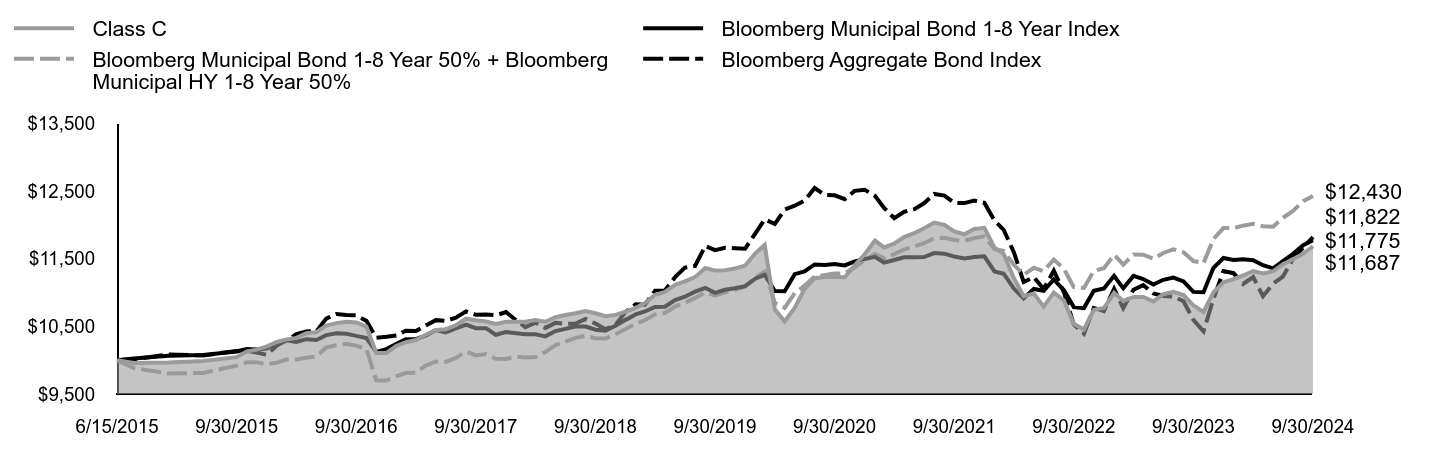

For the fiscal year ended September 30, 2024, the Fund returned 14.68%, reflecting performance at the net asset value (NAV) of Class C shares, compared to the 17.38% of a securities market index with investment characteristics similar to those of the Fund, the Bloomberg High Yield Municipal Bond Index. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 11.57% over the same period.

Positive factors for the municipal market included decreasing Treasury yields, easing inflationary pressures and the start of interest rate cuts by the U.S. Federal Reserve. Also supporting the market was increased demand for municipal bond funds and a strong fundamental backdrop as evidenced by growing tax revenue and positive ratings actions by public ratings agencies. Negative factors included a significant increase in municipal bond supply, which pressured the market in second half of the fiscal year, and periods of interest rate volatility driven by sticky inflation readings at points throughout the fiscal year. Against this backdrop, municipal bonds delivered strong returns.

Top contributors to the Fund’s performance: Security selection within the Education, Health Care and Tobacco sectors contributed to relative performance. An overweight allocation to the Health Care sector and underweight allocation to the Education sector contributed to relative performance.

Top detractors from the Fund’s performance: The Fund’s allocation to investment grade bonds was the primary detractor from relative performance. The Fund’s yield curve positioning led to a modest negative impact on relative performance. In particular, an overweight allocation to intermediate maturity bonds detracted as yields fell less at this part of the curve.

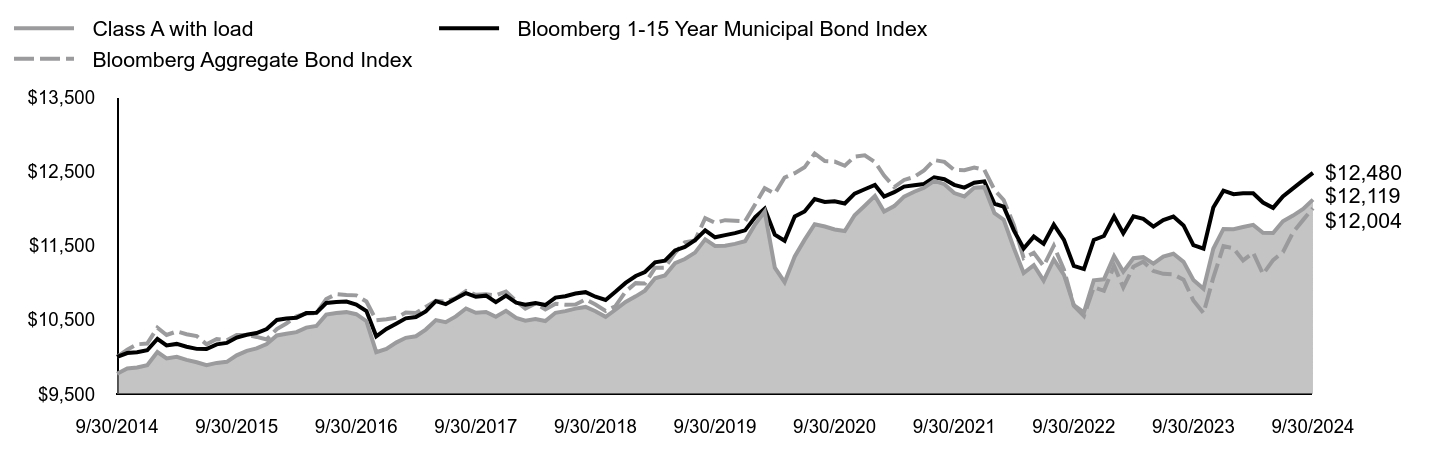

Total Return Based on $10,000 Investment

| Class C | Bloomberg High Yield Municipal Bond Index | Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | Lipper High Yield Municipal Debt Funds Average | Bloomberg Aggregate Bond Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,058 | $9,964 | $10,000 | $10,077 | $10,098 |

| 11/30/2014 | $10,106 | $10,067 | $10,074 | $10,117 | $10,170 |

| 12/31/2014 | $10,167 | $10,121 | $10,127 | $10,206 | $10,179 |

| 1/31/2015 | $10,338 | $10,302 | $10,307 | $10,402 | $10,393 |

| 2/28/2015 | $10,267 | $10,261 | $10,243 | $10,324 | $10,295 |

| 3/31/2015 | $10,301 | $10,234 | $10,236 | $10,364 | $10,343 |

| 4/30/2015 | $10,299 | $10,192 | $10,190 | $10,330 | $10,306 |

| 5/31/2015 | $10,297 | $10,307 | $10,255 | $10,315 | $10,281 |

| 6/30/2015 | $10,167 | $9,927 | $10,006 | $10,188 | $10,169 |

| 7/31/2015 | $10,141 | $9,873 | $9,996 | $10,240 | $10,240 |

| 8/31/2015 | $10,166 | $9,914 | $10,030 | $10,261 | $10,225 |

| 9/30/2015 | $10,281 | $10,124 | $10,194 | $10,348 | $10,294 |

| 10/31/2015 | $10,377 | $10,248 | $10,288 | $10,424 | $10,296 |

| 11/30/2015 | $10,421 | $10,289 | $10,330 | $10,481 | $10,269 |

| 12/31/2015 | $10,465 | $10,304 | $10,365 | $10,577 | $10,235 |

| 1/31/2016 | $10,547 | $10,363 | $10,447 | $10,672 | $10,376 |

| 2/29/2016 | $10,609 | $10,477 | $10,527 | $10,693 | $10,450 |

| 3/31/2016 | $10,698 | $10,587 | $10,611 | $10,796 | $10,546 |

| 4/30/2016 | $10,805 | $10,652 | $10,680 | $10,900 | $10,586 |

| 5/31/2016 | $10,913 | $10,792 | $10,782 | $10,987 | $10,589 |

| 6/30/2016 | $11,149 | $11,127 | $11,059 | $11,204 | $10,779 |

| 7/31/2016 | $11,203 | $11,200 | $11,109 | $11,219 | $10,847 |

| 8/31/2016 | $11,254 | $11,240 | $11,140 | $11,265 | $10,835 |

| 9/30/2016 | $11,258 | $11,270 | $11,140 | $11,241 | $10,829 |

| 10/31/2016 | $11,133 | $11,130 | $11,009 | $11,107 | $10,746 |

| 11/30/2016 | $10,637 | $10,468 | $10,440 | $10,589 | $10,492 |

| 12/31/2016 | $10,679 | $10,613 | $10,576 | $10,659 | $10,506 |

| 1/31/2017 | $10,799 | $10,761 | $10,697 | $10,737 | $10,527 |

| 2/28/2017 | $10,926 | $11,018 | $10,889 | $10,856 | $10,598 |

| 3/31/2017 | $10,950 | $11,043 | $10,913 | $10,913 | $10,592 |

| 4/30/2017 | $11,031 | $11,118 | $10,989 | $11,101 | $10,674 |

| 5/31/2017 | $11,140 | $11,288 | $11,159 | $11,271 | $10,756 |

| 6/30/2017 | $11,145 | $11,263 | $11,129 | $11,263 | $10,745 |

| 7/31/2017 | $11,244 | $11,337 | $11,208 | $11,336 | $10,792 |

| 8/31/2017 | $11,404 | $11,493 | $11,339 | $11,457 | $10,888 |

| 9/30/2017 | $11,347 | $11,432 | $11,279 | $11,445 | $10,836 |

| 10/31/2017 | $11,273 | $11,463 | $11,309 | $11,445 | $10,843 |

| 11/30/2017 | $11,286 | $11,492 | $11,306 | $11,462 | $10,829 |

| 12/31/2017 | $11,396 | $11,641 | $11,443 | $11,587 | $10,879 |

| 1/31/2018 | $11,369 | $11,532 | $11,326 | $11,513 | $10,753 |

| 2/28/2018 | $11,363 | $11,540 | $11,319 | $11,480 | $10,651 |

| 3/31/2018 | $11,473 | $11,709 | $11,442 | $11,557 | $10,720 |

| 4/30/2018 | $11,515 | $11,762 | $11,461 | $11,562 | $10,640 |

| 5/31/2018 | $11,664 | $12,008 | $11,663 | $11,710 | $10,716 |

| 6/30/2018 | $11,765 | $12,068 | $11,704 | $11,746 | $10,703 |

| 7/31/2018 | $11,797 | $12,110 | $11,740 | $11,786 | $10,705 |

| 8/31/2018 | $11,888 | $12,207 | $11,812 | $11,832 | $10,774 |

| 9/30/2018 | $11,821 | $12,159 | $11,755 | $11,772 | $10,705 |

| 10/31/2018 | $11,656 | $12,007 | $11,634 | $11,646 | $10,620 |

| 11/30/2018 | $11,671 | $12,091 | $11,732 | $11,694 | $10,683 |

| 12/31/2018 | $11,755 | $12,195 | $11,847 | $11,794 | $10,880 |

| 1/31/2019 | $11,808 | $12,277 | $11,930 | $11,859 | $10,995 |

| 2/28/2019 | $11,950 | $12,343 | $11,994 | $11,954 | $10,989 |

| 3/31/2019 | $12,226 | $12,662 | $12,262 | $12,189 | $11,200 |

| 4/30/2019 | $12,311 | $12,733 | $12,323 | $12,257 | $11,203 |

| 5/31/2019 | $12,528 | $12,940 | $12,512 | $12,444 | $11,402 |

| 6/30/2019 | $12,593 | $13,007 | $12,571 | $12,501 | $11,545 |

| 7/31/2019 | $12,688 | $13,089 | $12,658 | $12,583 | $11,570 |

| 8/31/2019 | $12,975 | $13,404 | $12,926 | $12,818 | $11,870 |

| 9/30/2019 | $12,926 | $13,377 | $12,872 | $12,760 | $11,807 |

| 10/31/2019 | $12,916 | $13,405 | $12,898 | $12,768 | $11,842 |

| 11/30/2019 | $12,949 | $13,457 | $12,942 | $12,819 | $11,836 |

| 12/31/2019 | $13,022 | $13,497 | $12,981 | $12,862 | $11,828 |

| 1/31/2020 | $13,312 | $13,830 | $13,270 | $13,112 | $12,056 |

| 2/29/2020 | $13,633 | $14,121 | $13,512 | $13,348 | $12,273 |

| 3/31/2020 | $12,036 | $12,568 | $12,375 | $12,136 | $12,201 |

| 4/30/2020 | $11,600 | $12,144 | $12,049 | $11,785 | $12,417 |

| 5/31/2020 | $12,018 | $12,640 | $12,503 | $12,164 | $12,475 |

| 6/30/2020 | $12,540 | $13,141 | $12,861 | $12,564 | $12,554 |

| 7/31/2020 | $12,854 | $13,497 | $13,163 | $12,833 | $12,741 |

| 8/31/2020 | $12,863 | $13,533 | $13,164 | $12,838 | $12,638 |

| 9/30/2020 | $12,820 | $13,546 | $13,174 | $12,834 | $12,632 |

| 10/31/2020 | $12,809 | $13,571 | $13,175 | $12,822 | $12,575 |

| 11/30/2020 | $13,137 | $13,897 | $13,451 | $13,116 | $12,699 |

| 12/31/2020 | $13,400 | $14,157 | $13,643 | $13,338 | $12,716 |

| 1/31/2021 | $13,685 | $14,452 | $13,859 | $13,564 | $12,625 |

| 2/28/2021 | $13,481 | $14,301 | $13,687 | $13,399 | $12,443 |

| 3/31/2021 | $13,584 | $14,456 | $13,813 | $13,503 | $12,287 |

| 4/30/2021 | $13,773 | $14,667 | $13,985 | $13,682 | $12,384 |

| 5/31/2021 | $13,926 | $14,836 | $14,104 | $13,836 | $12,425 |

| 6/30/2021 | $14,082 | $15,024 | $14,234 | $13,982 | $12,512 |

| 7/31/2021 | $14,238 | $15,204 | $14,386 | $14,114 | $12,652 |

| 8/31/2021 | $14,156 | $15,181 | $14,353 | $14,064 | $12,628 |

| 9/30/2021 | $13,998 | $15,081 | $14,256 | $13,937 | $12,518 |

| 10/31/2021 | $13,916 | $15,020 | $14,204 | $13,902 | $12,515 |

| 11/30/2021 | $14,127 | $15,217 | $14,367 | $14,069 | $12,552 |

| 12/31/2021 | $14,165 | $15,257 | $14,399 | $14,103 | $12,520 |

| 1/31/2022 | $13,668 | $14,830 | $14,000 | $13,730 | $12,250 |

| 2/28/2022 | $13,499 | $14,795 | $13,961 | $13,616 | $12,114 |

| 3/31/2022 | $12,913 | $14,261 | $13,474 | $13,149 | $11,777 |

| 4/30/2022 | $12,383 | $13,754 | $13,033 | $12,680 | $11,330 |

| 5/31/2022 | $12,522 | $13,905 | $13,194 | $12,837 | $11,403 |

| 6/30/2022 | $12,036 | $13,461 | $12,844 | $12,385 | $11,224 |

| 7/31/2022 | $12,463 | $13,964 | $13,275 | $12,826 | $11,498 |

| 8/31/2022 | $12,149 | $13,653 | $12,981 | $12,527 | $11,174 |

| 9/30/2022 | $11,370 | $12,812 | $12,287 | $11,851 | $10,691 |

| 10/31/2022 | $11,112 | $12,549 | $12,087 | $11,639 | $10,552 |

| 11/30/2022 | $11,794 | $13,280 | $12,742 | $12,261 | $10,940 |

| 12/31/2022 | $11,738 | $13,258 | $12,742 | $12,211 | $10,891 |

| 1/31/2023 | $12,220 | $13,847 | $13,237 | $12,675 | $11,226 |

| 2/28/2023 | $11,872 | $13,412 | $12,862 | $12,333 | $10,936 |

| 3/31/2023 | $11,996 | $13,620 | $13,092 | $12,507 | $11,214 |

| 4/30/2023 | $12,075 | $13,699 | $13,131 | $12,548 | $11,282 |

| 5/31/2023 | $11,995 | $13,604 | $13,032 | $12,477 | $11,159 |

| 6/30/2023 | $12,200 | $13,846 | $13,228 | $12,600 | $11,119 |

| 7/31/2023 | $12,234 | $13,936 | $13,302 | $12,634 | $11,111 |

| 8/31/2023 | $12,075 | $13,724 | $13,104 | $12,456 | $11,040 |

| 9/30/2023 | $11,663 | $13,258 | $12,680 | $12,064 | $10,760 |

| 10/31/2023 | $11,380 | $13,045 | $12,511 | $11,821 | $10,590 |

| 11/30/2023 | $12,147 | $14,057 | $13,419 | $12,642 | $11,069 |

| 12/31/2023 | $12,511 | $14,479 | $13,790 | $13,023 | $11,493 |

| 1/31/2024 | $12,588 | $14,411 | $13,724 | $13,072 | $11,462 |

| 2/29/2024 | $12,666 | $14,525 | $13,800 | $13,151 | $11,300 |

| 3/31/2024 | $12,749 | $14,697 | $13,906 | $13,230 | $11,404 |

| 4/30/2024 | $12,616 | $14,607 | $13,791 | $13,073 | $11,116 |

| 5/31/2024 | $12,679 | $14,718 | $13,844 | $13,152 | $11,304 |

| 6/30/2024 | $12,932 | $15,078 | $14,139 | $13,458 | $11,412 |

| 7/31/2024 | $13,044 | $15,243 | $14,285 | $13,595 | $11,678 |

| 8/31/2024 | $13,168 | $15,423 | $14,434 | $13,706 | $11,846 |

| 9/30/2024 | $13,375 | $15,562 | $14,568 | $13,876 | $12,004 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class C at NAV | 14.68% | 0.69% | 2.95% |

| Class C with sales charge | 13.68% | 0.69% | 2.95% |

| Bloomberg High Yield Municipal Bond Index | 17.38% | 3.07% | 4.52% |

| Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | 14.89% | 2.51% | 3.83% |

| Lipper High Yield Municipal Debt Funds Average | 15.02% | 1.69% | 3.33% |

Bloomberg Aggregate Bond IndexFootnote Reference* | 11.57% | 0.33% | 1.84% |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

(as of September 30, 2024)

| Total Net Assets | $4,098,713,523 |

| # of Portfolio Holdings | 611 |

| Portfolio Turnover Rate | 27% |

| Total Advisory Fees Paid | $16,137,454 |

What did the Fund invest in?

(as of September 30, 2024)

Credit Rating S&P or Moody'sFootnote Reference(a) | %Footnote Reference** |

|---|

| |

- A3.12%

- A-3.62%

- A+4.07%

- AA4.24%

- AA-2.36%

- AA+0.32%

- AAA1.03%

- B0.75%

- B-2.26%

- B+2.14%

- BB6.67%

- BB-5.00%

- BB+6.47%

- BBB3.00%

- BBB-8.39%

- BBB+4.73%

- CCC0.30%

- CCC-1.01%

- CCC+0.36%

- NR40.16%

- Total 100.00%

| Footnote | Description |

Footnote** | Represents percent of total investments, which excludes derivatives. |

Footnote(a) | Investments in investment grade municipal bonds, which as bonds that are rated, at the time of purchase, within the four highest grades assigned by an independent rating agency such as Moody’s, S&P, or Fitch, or an equivalent short-term rating, as applicable, or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. Lower rated municipal bonds are rated, at the time of purchase, or an equivalent short-term rating, as applicable, by an independent rating agency or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

TSR-A-1432-C

11/24

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

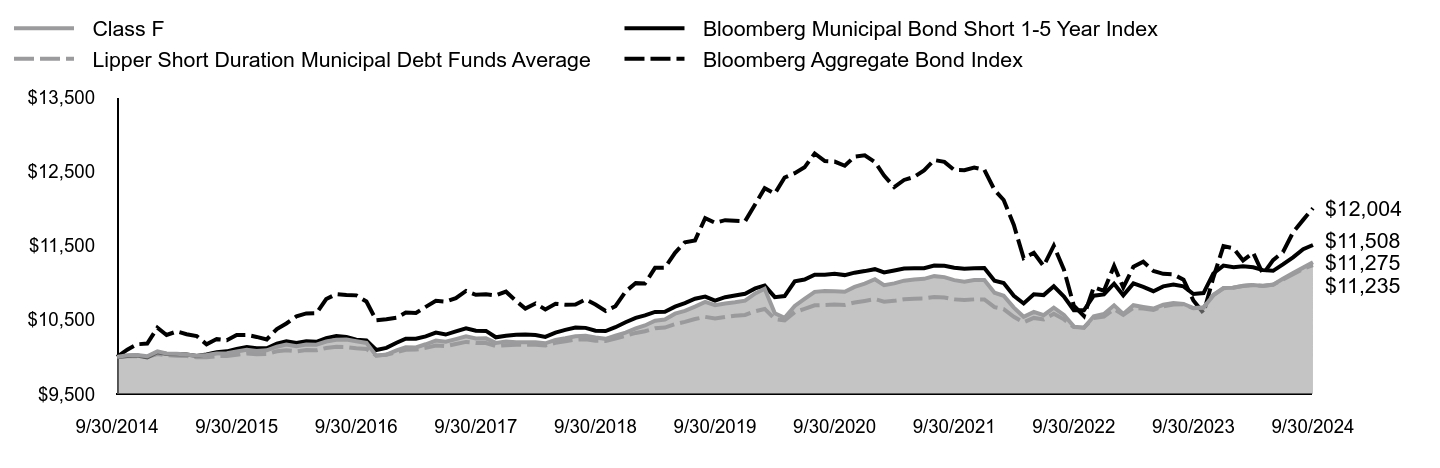

This annual shareholder report contains important information about the Lord Abbett High Income Municipal Bond Fund for the period of October 1, 2023 to September 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class F | $78 | 0.72% |

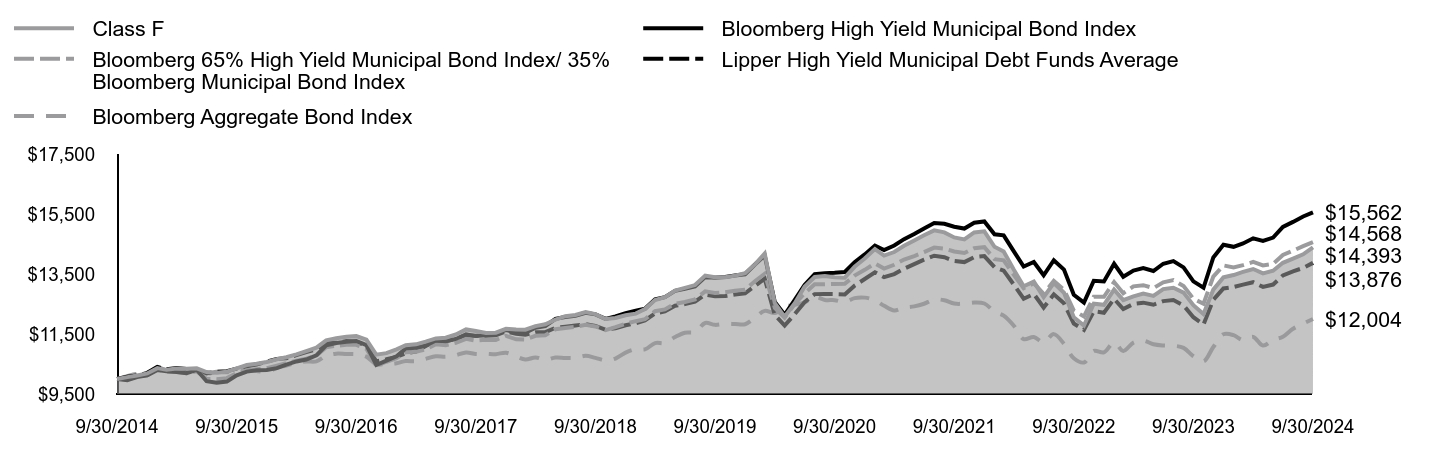

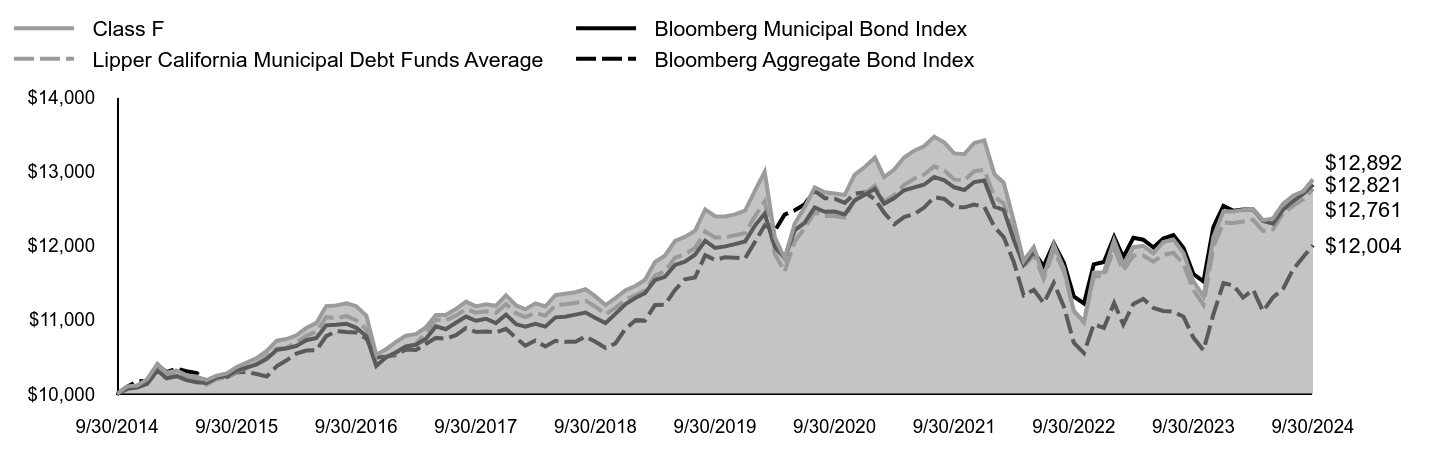

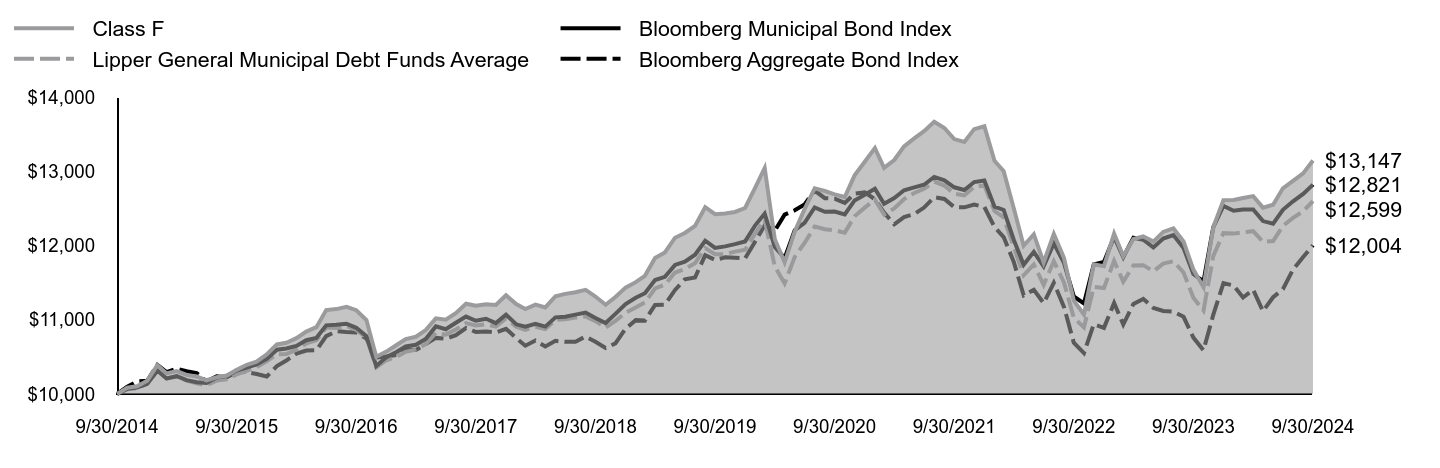

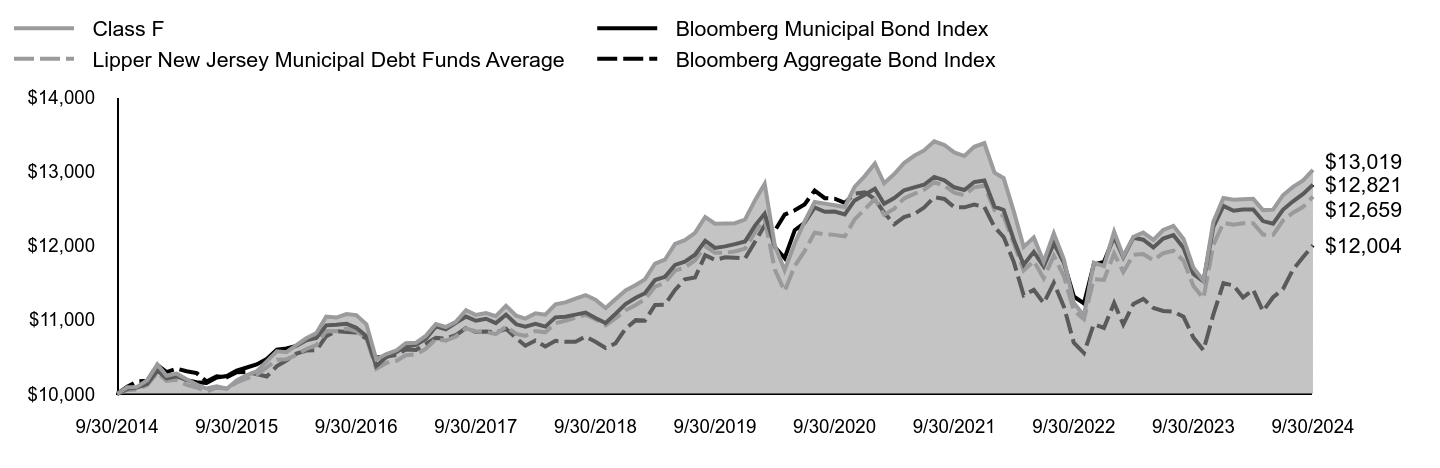

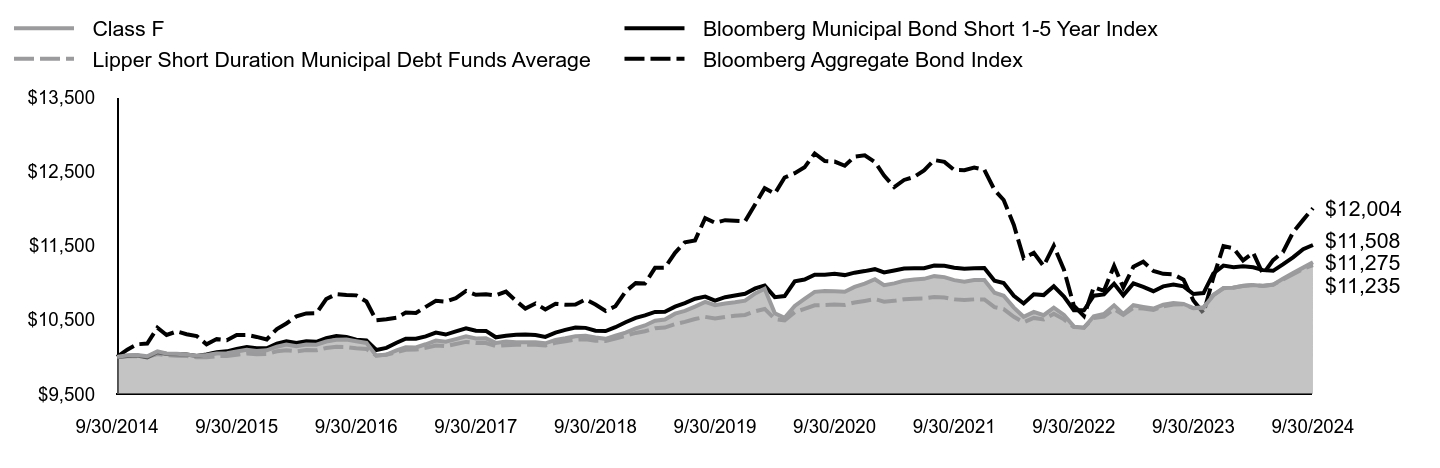

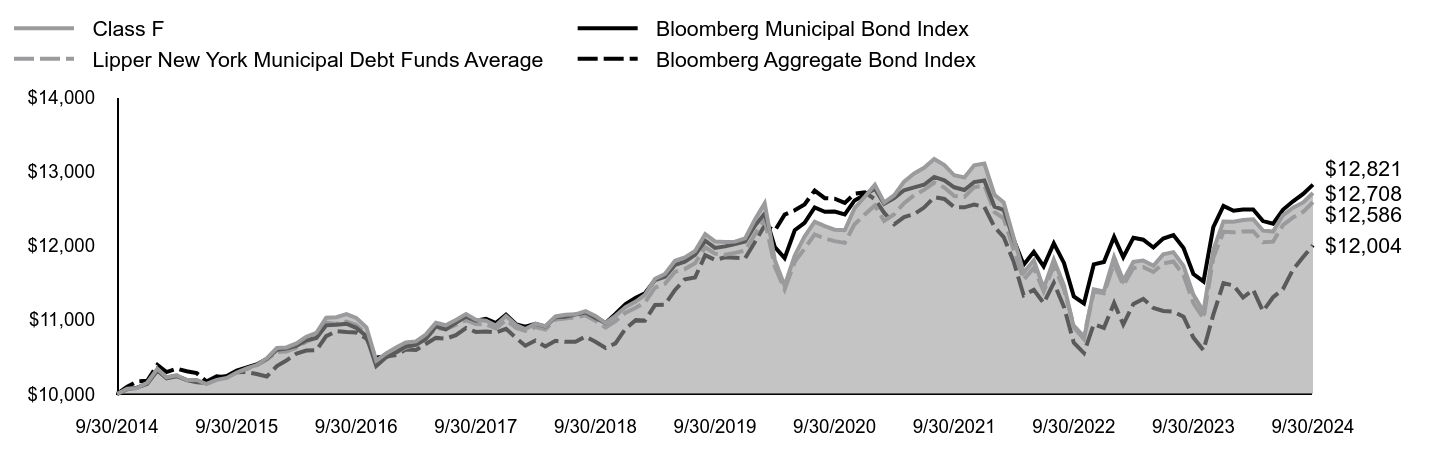

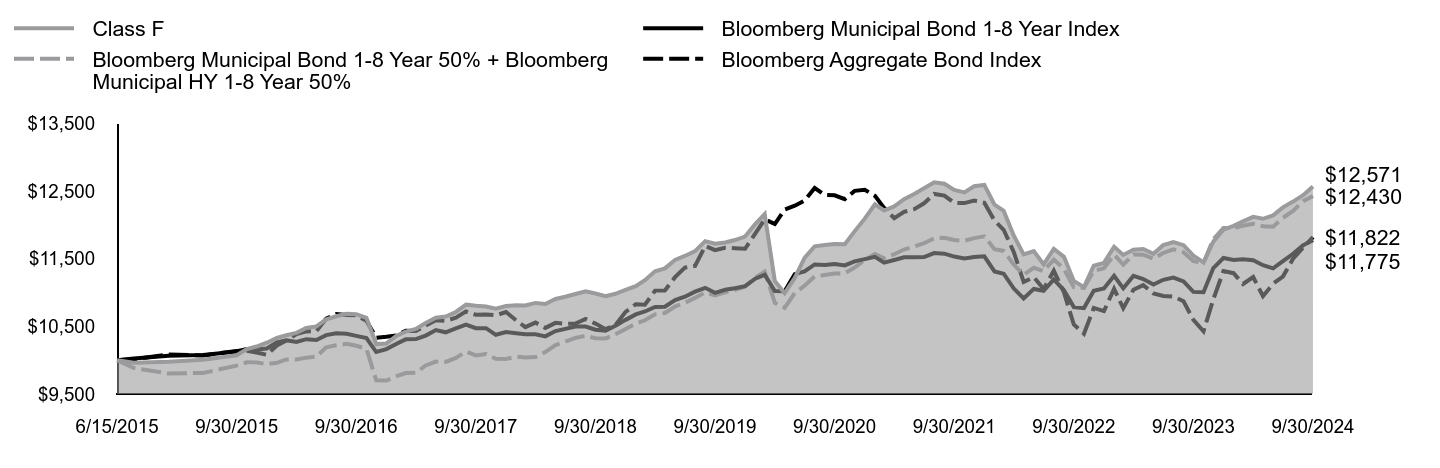

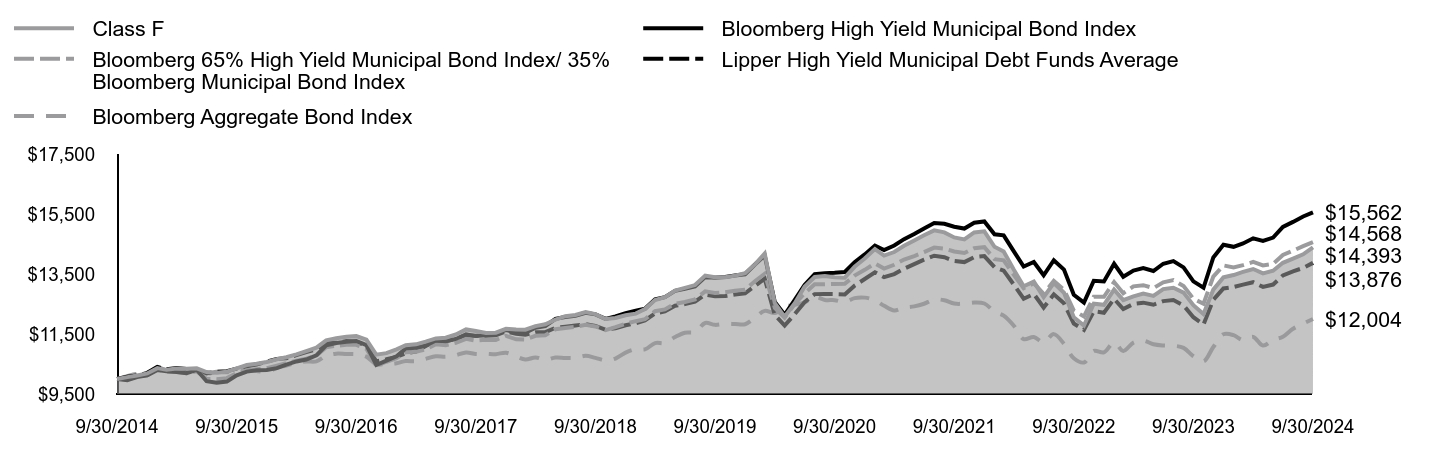

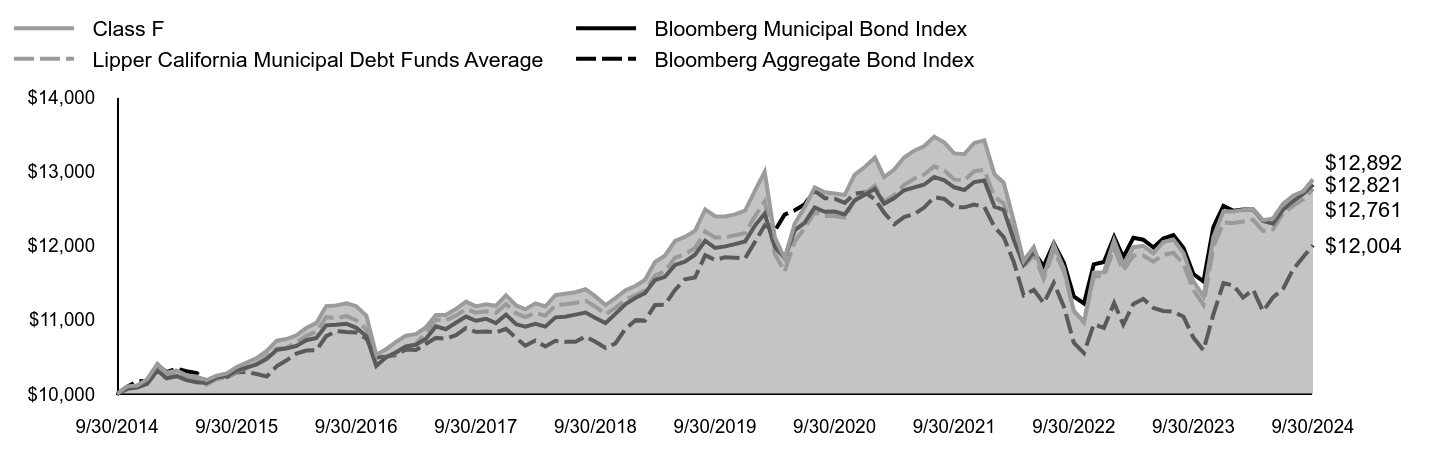

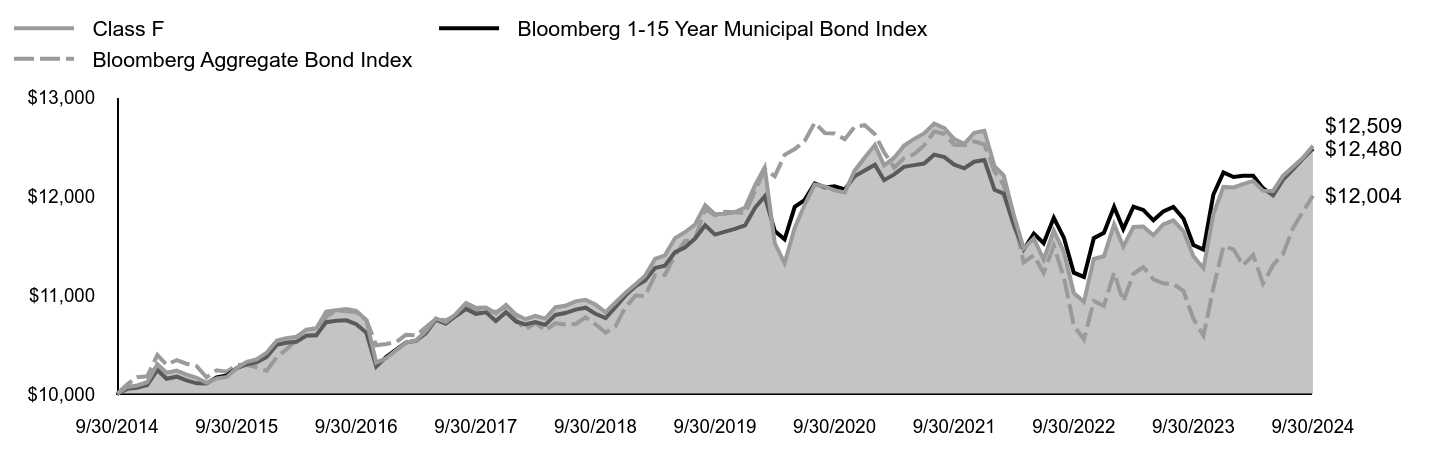

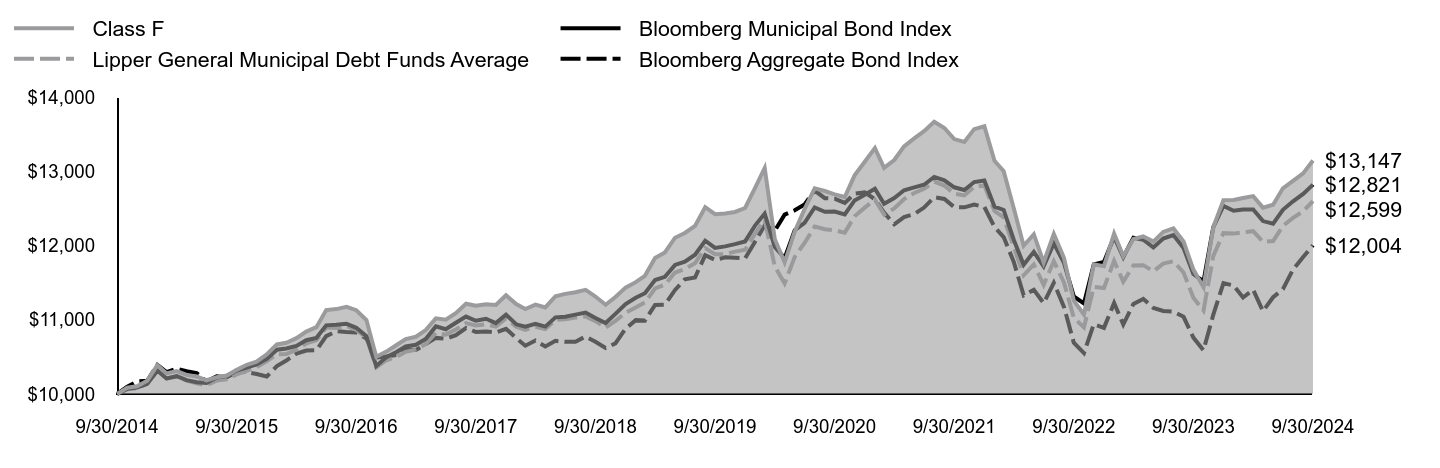

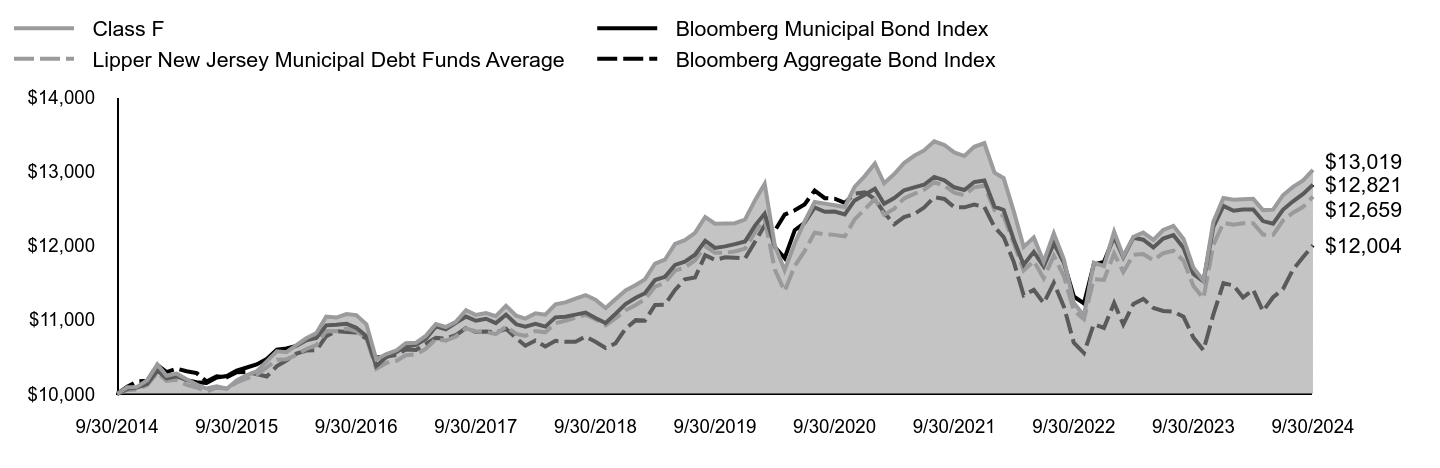

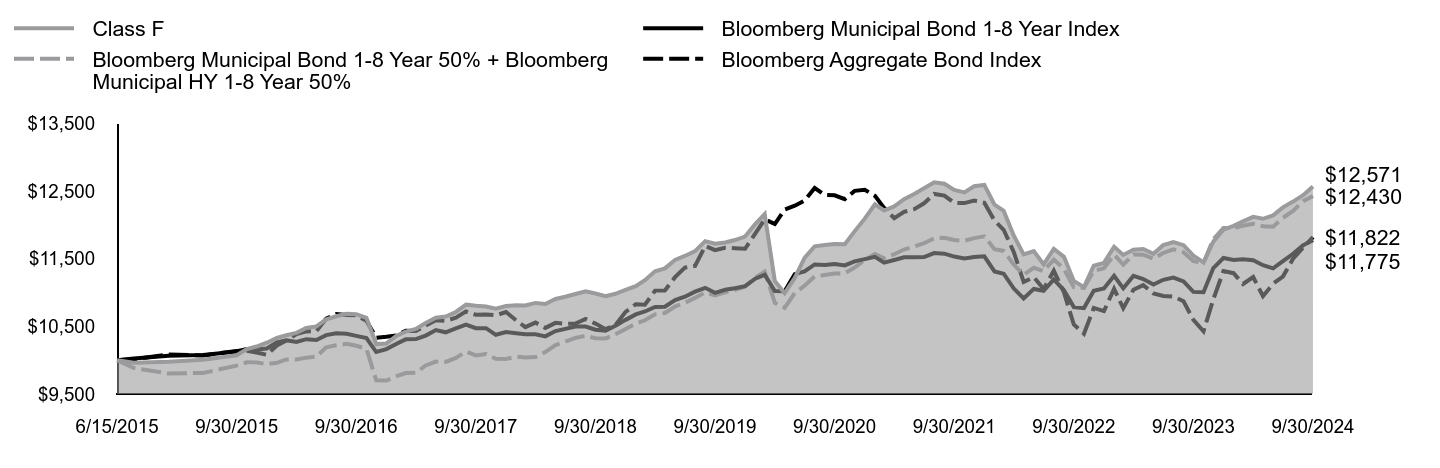

How did the Fund perform last year and what affected its performance?

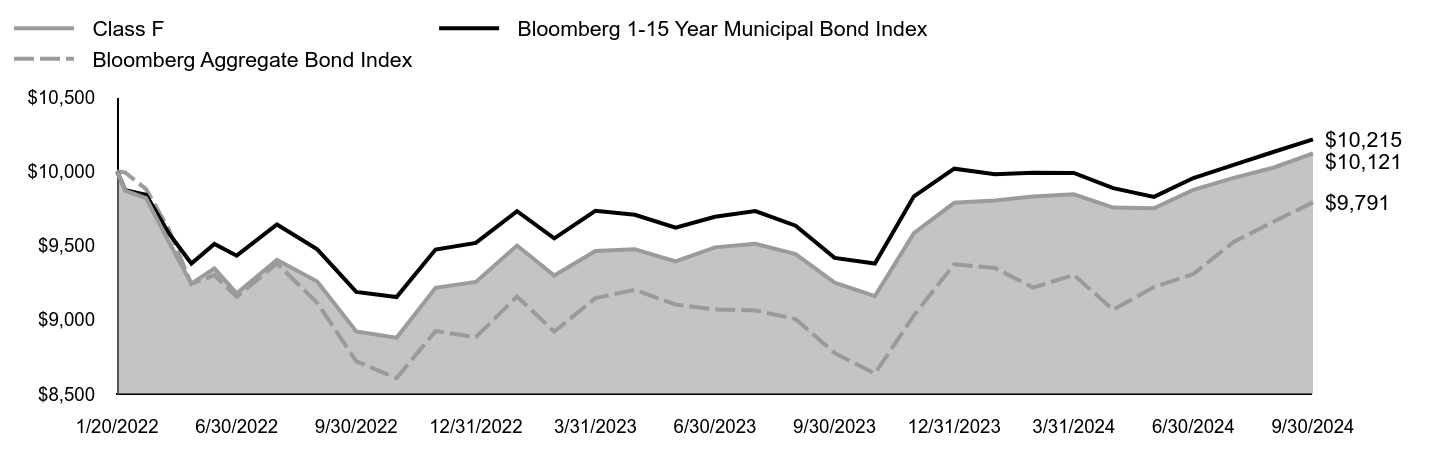

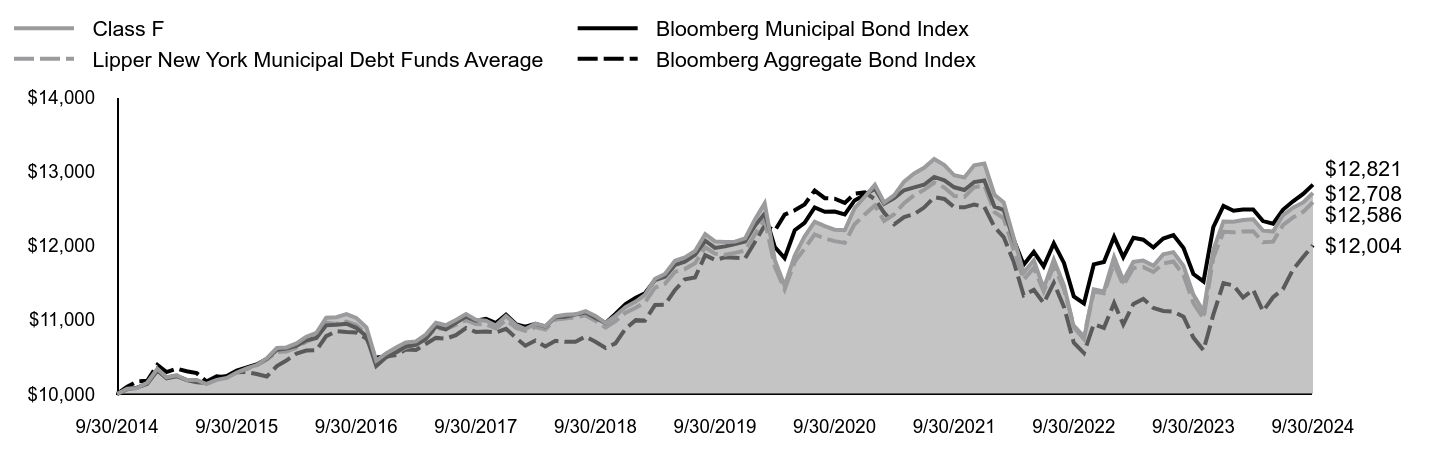

For the fiscal year ended September 30, 2024, the Fund returned 15.48%, reflecting performance at the net asset value (NAV) of Class F shares, compared to the 17.38% of a securities market index with investment characteristics similar to those of the Fund, the Bloomberg High Yield Municipal Bond Index. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 11.57% over the same period.

Positive factors for the municipal market included decreasing Treasury yields, easing inflationary pressures and the start of interest rate cuts by the U.S. Federal Reserve. Also supporting the market was increased demand for municipal bond funds and a strong fundamental backdrop as evidenced by growing tax revenue and positive ratings actions by public ratings agencies. Negative factors included a significant increase in municipal bond supply, which pressured the market in second half of the fiscal year, and periods of interest rate volatility driven by sticky inflation readings at points throughout the fiscal year. Against this backdrop, municipal bonds delivered strong returns.

Top contributors to the Fund’s performance: Security selection within the Education, Health Care and Tobacco sectors contributed to relative performance. An overweight allocation to the Health Care sector and underweight allocation to the Education sector contributed to relative performance.

Top detractors from the Fund’s performance: The Fund’s allocation to investment grade bonds was the primary detractor from relative performance. The Fund’s yield curve positioning led to a modest negative impact on relative performance. In particular, an overweight allocation to intermediate maturity bonds detracted as yields fell less at this part of the curve.

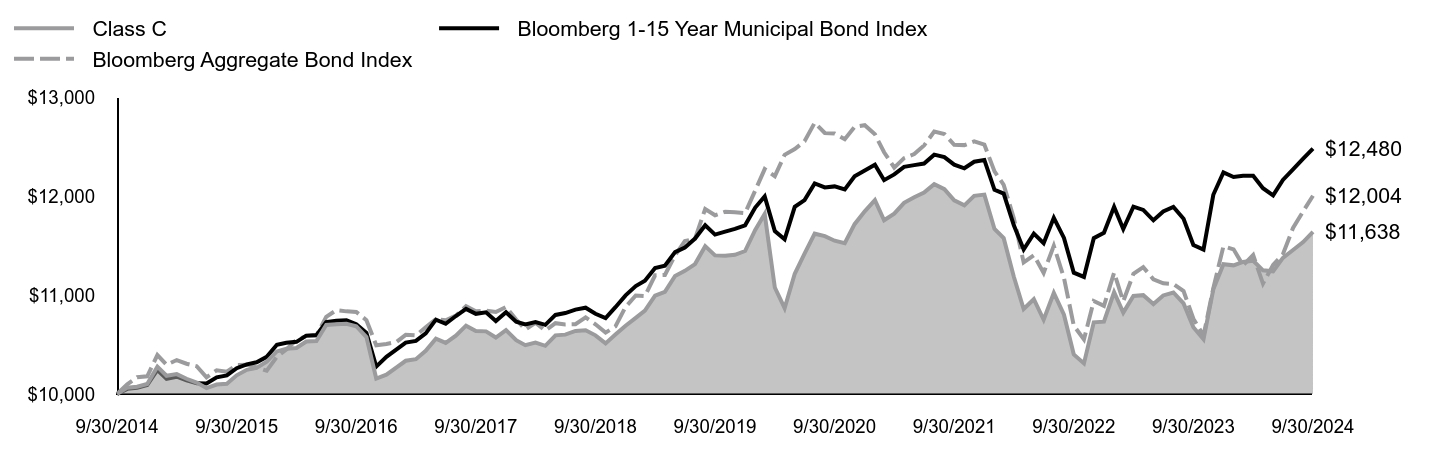

Total Return Based on $10,000 Investment

| Class F | Bloomberg High Yield Municipal Bond Index | Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | Lipper High Yield Municipal Debt Funds Average | Bloomberg Aggregate Bond Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,064 | $9,964 | $10,000 | $10,077 | $10,098 |

| 11/30/2014 | $10,118 | $10,067 | $10,074 | $10,117 | $10,170 |

| 12/31/2014 | $10,186 | $10,121 | $10,127 | $10,206 | $10,179 |

| 1/31/2015 | $10,363 | $10,302 | $10,307 | $10,402 | $10,393 |

| 2/28/2015 | $10,306 | $10,261 | $10,243 | $10,324 | $10,295 |

| 3/31/2015 | $10,347 | $10,234 | $10,236 | $10,364 | $10,343 |

| 4/30/2015 | $10,343 | $10,192 | $10,190 | $10,330 | $10,306 |

| 5/31/2015 | $10,356 | $10,307 | $10,255 | $10,315 | $10,281 |

| 6/30/2015 | $10,231 | $9,927 | $10,006 | $10,188 | $10,169 |

| 7/31/2015 | $10,211 | $9,873 | $9,996 | $10,240 | $10,240 |

| 8/31/2015 | $10,243 | $9,914 | $10,030 | $10,261 | $10,225 |

| 9/30/2015 | $10,355 | $10,124 | $10,194 | $10,348 | $10,294 |

| 10/31/2015 | $10,468 | $10,248 | $10,288 | $10,424 | $10,296 |

| 11/30/2015 | $10,510 | $10,289 | $10,330 | $10,481 | $10,269 |

| 12/31/2015 | $10,569 | $10,304 | $10,365 | $10,577 | $10,235 |

| 1/31/2016 | $10,658 | $10,363 | $10,447 | $10,672 | $10,376 |

| 2/29/2016 | $10,727 | $10,477 | $10,527 | $10,693 | $10,450 |

| 3/31/2016 | $10,823 | $10,587 | $10,611 | $10,796 | $10,546 |

| 4/30/2016 | $10,929 | $10,652 | $10,680 | $10,900 | $10,586 |

| 5/31/2016 | $11,045 | $10,792 | $10,782 | $10,987 | $10,589 |

| 6/30/2016 | $11,290 | $11,127 | $11,059 | $11,204 | $10,779 |

| 7/31/2016 | $11,361 | $11,200 | $11,109 | $11,219 | $10,847 |

| 8/31/2016 | $11,410 | $11,240 | $11,140 | $11,265 | $10,835 |

| 9/30/2016 | $11,431 | $11,270 | $11,140 | $11,241 | $10,829 |

| 10/31/2016 | $11,311 | $11,130 | $11,009 | $11,107 | $10,746 |

| 11/30/2016 | $10,814 | $10,468 | $10,440 | $10,589 | $10,492 |

| 12/31/2016 | $10,863 | $10,613 | $10,576 | $10,659 | $10,506 |

| 1/31/2017 | $10,991 | $10,761 | $10,697 | $10,737 | $10,527 |

| 2/28/2017 | $11,127 | $11,018 | $10,889 | $10,856 | $10,598 |

| 3/31/2017 | $11,158 | $11,043 | $10,913 | $10,913 | $10,592 |

| 4/30/2017 | $11,247 | $11,118 | $10,989 | $11,101 | $10,674 |

| 5/31/2017 | $11,356 | $11,288 | $11,159 | $11,271 | $10,756 |

| 6/30/2017 | $11,377 | $11,263 | $11,129 | $11,263 | $10,745 |

| 7/31/2017 | $11,485 | $11,337 | $11,208 | $11,336 | $10,792 |

| 8/31/2017 | $11,655 | $11,493 | $11,339 | $11,457 | $10,888 |

| 9/30/2017 | $11,604 | $11,432 | $11,279 | $11,445 | $10,836 |

| 10/31/2017 | $11,536 | $11,463 | $11,309 | $11,445 | $10,843 |

| 11/30/2017 | $11,546 | $11,492 | $11,306 | $11,462 | $10,829 |

| 12/31/2017 | $11,675 | $11,641 | $11,443 | $11,587 | $10,879 |

| 1/31/2018 | $11,655 | $11,532 | $11,326 | $11,513 | $10,753 |

| 2/28/2018 | $11,645 | $11,540 | $11,319 | $11,480 | $10,651 |

| 3/31/2018 | $11,765 | $11,709 | $11,442 | $11,557 | $10,720 |

| 4/30/2018 | $11,825 | $11,762 | $11,461 | $11,562 | $10,640 |

| 5/31/2018 | $11,985 | $12,008 | $11,663 | $11,710 | $10,716 |

| 6/30/2018 | $12,096 | $12,068 | $11,704 | $11,746 | $10,703 |

| 7/31/2018 | $12,136 | $12,110 | $11,740 | $11,786 | $10,705 |

| 8/31/2018 | $12,237 | $12,207 | $11,812 | $11,832 | $10,774 |

| 9/30/2018 | $12,166 | $12,159 | $11,755 | $11,772 | $10,705 |

| 10/31/2018 | $12,003 | $12,007 | $11,634 | $11,646 | $10,620 |

| 11/30/2018 | $12,035 | $12,091 | $11,732 | $11,694 | $10,683 |

| 12/31/2018 | $12,129 | $12,195 | $11,847 | $11,794 | $10,880 |

| 1/31/2019 | $12,182 | $12,277 | $11,930 | $11,859 | $10,995 |

| 2/28/2019 | $12,335 | $12,343 | $11,994 | $11,954 | $10,989 |

| 3/31/2019 | $12,638 | $12,662 | $12,262 | $12,189 | $11,200 |

| 4/30/2019 | $12,734 | $12,733 | $12,323 | $12,257 | $11,203 |

| 5/31/2019 | $12,954 | $12,940 | $12,512 | $12,444 | $11,402 |

| 6/30/2019 | $13,040 | $13,007 | $12,571 | $12,501 | $11,545 |

| 7/31/2019 | $13,135 | $13,089 | $12,658 | $12,583 | $11,570 |

| 8/31/2019 | $13,451 | $13,404 | $12,926 | $12,818 | $11,870 |

| 9/30/2019 | $13,398 | $13,377 | $12,872 | $12,760 | $11,807 |

| 10/31/2019 | $13,396 | $13,405 | $12,898 | $12,768 | $11,842 |

| 11/30/2019 | $13,449 | $13,457 | $12,942 | $12,819 | $11,836 |

| 12/31/2019 | $13,533 | $13,497 | $12,981 | $12,862 | $11,828 |

| 1/31/2020 | $13,832 | $13,830 | $13,270 | $13,112 | $12,056 |

| 2/29/2020 | $14,185 | $14,121 | $13,512 | $13,348 | $12,273 |

| 3/31/2020 | $12,532 | $12,568 | $12,375 | $12,136 | $12,201 |

| 4/30/2020 | $12,076 | $12,144 | $12,049 | $11,785 | $12,417 |

| 5/31/2020 | $12,529 | $12,640 | $12,503 | $12,164 | $12,475 |

| 6/30/2020 | $13,081 | $13,141 | $12,861 | $12,564 | $12,554 |

| 7/31/2020 | $13,406 | $13,497 | $13,163 | $12,833 | $12,741 |

| 8/31/2020 | $13,434 | $13,533 | $13,164 | $12,838 | $12,638 |

| 9/30/2020 | $13,398 | $13,546 | $13,174 | $12,834 | $12,632 |

| 10/31/2020 | $13,383 | $13,571 | $13,175 | $12,822 | $12,575 |

| 11/30/2020 | $13,745 | $13,897 | $13,451 | $13,116 | $12,699 |

| 12/31/2020 | $14,019 | $14,157 | $13,643 | $13,338 | $12,716 |

| 1/31/2021 | $14,336 | $14,452 | $13,859 | $13,564 | $12,625 |

| 2/28/2021 | $14,120 | $14,301 | $13,687 | $13,399 | $12,443 |

| 3/31/2021 | $14,237 | $14,456 | $13,813 | $13,503 | $12,287 |

| 4/30/2021 | $14,444 | $14,667 | $13,985 | $13,682 | $12,384 |

| 5/31/2021 | $14,624 | $14,836 | $14,104 | $13,836 | $12,425 |

| 6/30/2021 | $14,798 | $15,024 | $14,234 | $13,982 | $12,512 |

| 7/31/2021 | $14,959 | $15,204 | $14,386 | $14,114 | $12,652 |

| 8/31/2021 | $14,893 | $15,181 | $14,353 | $14,064 | $12,628 |

| 9/30/2021 | $14,725 | $15,081 | $14,256 | $13,937 | $12,518 |

| 10/31/2021 | $14,659 | $15,020 | $14,204 | $13,902 | $12,515 |

| 11/30/2021 | $14,890 | $15,217 | $14,367 | $14,069 | $12,552 |

| 12/31/2021 | $14,928 | $15,257 | $14,399 | $14,103 | $12,520 |

| 1/31/2022 | $14,413 | $14,830 | $14,000 | $13,730 | $12,250 |

| 2/28/2022 | $14,255 | $14,795 | $13,961 | $13,616 | $12,114 |

| 3/31/2022 | $13,646 | $14,261 | $13,474 | $13,149 | $11,777 |

| 4/30/2022 | $13,095 | $13,754 | $13,033 | $12,680 | $11,330 |

| 5/31/2022 | $13,250 | $13,905 | $13,194 | $12,837 | $11,403 |

| 6/30/2022 | $12,732 | $13,461 | $12,844 | $12,385 | $11,224 |

| 7/31/2022 | $13,203 | $13,964 | $13,275 | $12,826 | $11,498 |

| 8/31/2022 | $12,879 | $13,653 | $12,981 | $12,527 | $11,174 |

| 9/30/2022 | $12,061 | $12,812 | $12,287 | $11,851 | $10,691 |

| 10/31/2022 | $11,784 | $12,549 | $12,087 | $11,639 | $10,552 |

| 11/30/2022 | $12,515 | $13,280 | $12,742 | $12,261 | $10,940 |

| 12/31/2022 | $12,475 | $13,258 | $12,742 | $12,211 | $10,891 |

| 1/31/2023 | $12,982 | $13,847 | $13,237 | $12,675 | $11,226 |

| 2/28/2023 | $12,632 | $13,412 | $12,862 | $12,333 | $10,936 |

| 3/31/2023 | $12,760 | $13,620 | $13,092 | $12,507 | $11,214 |

| 4/30/2023 | $12,852 | $13,699 | $13,131 | $12,548 | $11,282 |

| 5/31/2023 | $12,775 | $13,604 | $13,032 | $12,477 | $11,159 |

| 6/30/2023 | $13,000 | $13,846 | $13,228 | $12,600 | $11,119 |

| 7/31/2023 | $13,045 | $13,936 | $13,302 | $12,634 | $11,111 |

| 8/31/2023 | $12,883 | $13,724 | $13,104 | $12,456 | $11,040 |

| 9/30/2023 | $12,463 | $13,258 | $12,680 | $12,064 | $10,760 |

| 10/31/2023 | $12,168 | $13,045 | $12,511 | $11,821 | $10,590 |

| 11/30/2023 | $12,982 | $14,057 | $13,419 | $12,642 | $11,069 |

| 12/31/2023 | $13,392 | $14,479 | $13,790 | $13,023 | $11,493 |

| 1/31/2024 | $13,470 | $14,411 | $13,724 | $13,072 | $11,462 |

| 2/29/2024 | $13,574 | $14,525 | $13,800 | $13,151 | $11,300 |

| 3/31/2024 | $13,671 | $14,697 | $13,906 | $13,230 | $11,404 |

| 4/30/2024 | $13,524 | $14,607 | $13,791 | $13,073 | $11,116 |

| 5/31/2024 | $13,612 | $14,718 | $13,844 | $13,152 | $11,304 |

| 6/30/2024 | $13,878 | $15,078 | $14,139 | $13,458 | $11,412 |

| 7/31/2024 | $14,020 | $15,243 | $14,285 | $13,595 | $11,678 |

| 8/31/2024 | $14,161 | $15,423 | $14,434 | $13,706 | $11,846 |

| 9/30/2024 | $14,393 | $15,562 | $14,568 | $13,876 | $12,004 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class F at NAV | 15.48% | 1.44% | 3.71% |

| Bloomberg High Yield Municipal Bond Index | 17.38% | 3.07% | 4.52% |

| Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | 14.89% | 2.51% | 3.83% |

| Lipper High Yield Municipal Debt Funds Average | 15.02% | 1.69% | 3.33% |

Bloomberg Aggregate Bond IndexFootnote Reference* | 11.57% | 0.33% | 1.84% |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

(as of September 30, 2024)

| Total Net Assets | $4,098,713,523 |

| # of Portfolio Holdings | 611 |

| Portfolio Turnover Rate | 27% |

| Total Advisory Fees Paid | $16,137,454 |

What did the Fund invest in?

(as of September 30, 2024)

Credit Rating S&P or Moody'sFootnote Reference(a) | %Footnote Reference** |

|---|

| |

- A3.12%

- A-3.62%

- A+4.07%

- AA4.24%

- AA-2.36%

- AA+0.32%

- AAA1.03%

- B0.75%

- B-2.26%

- B+2.14%

- BB6.67%

- BB-5.00%

- BB+6.47%

- BBB3.00%

- BBB-8.39%

- BBB+4.73%

- CCC0.30%

- CCC-1.01%

- CCC+0.36%

- NR40.16%

- Total 100.00%

| Footnote | Description |

Footnote** | Represents percent of total investments, which excludes derivatives. |

Footnote(a) | Investments in investment grade municipal bonds, which as bonds that are rated, at the time of purchase, within the four highest grades assigned by an independent rating agency such as Moody’s, S&P, or Fitch, or an equivalent short-term rating, as applicable, or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. Lower rated municipal bonds are rated, at the time of purchase, or an equivalent short-term rating, as applicable, by an independent rating agency or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

TSR-A-1038-F

11/24

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

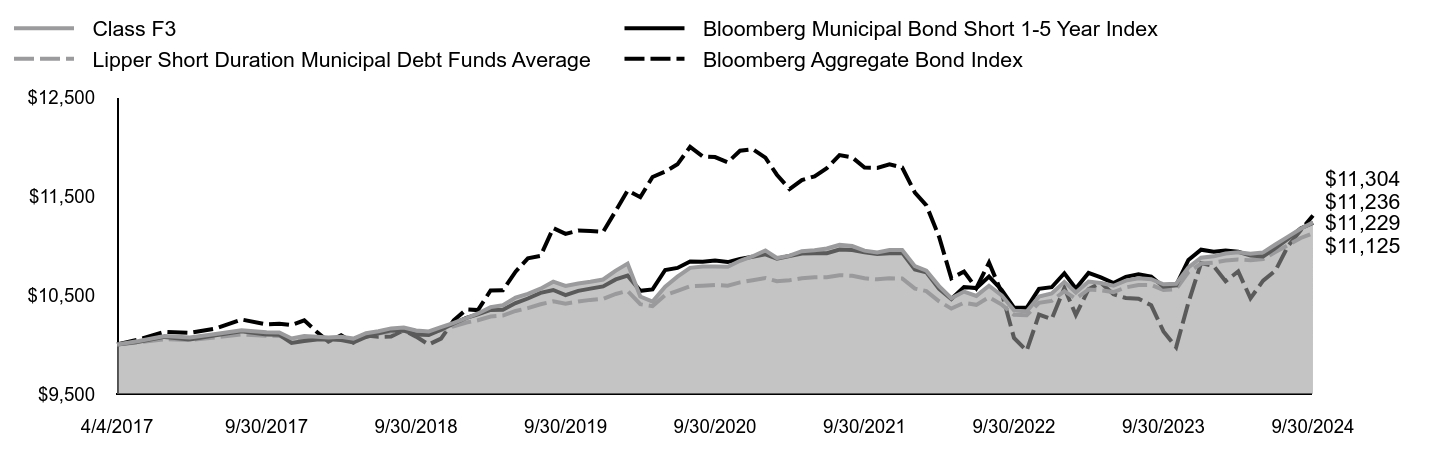

This annual shareholder report contains important information about the Lord Abbett High Income Municipal Bond Fund for the period of October 1, 2023 to September 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class F3 | $60 | 0.56% |

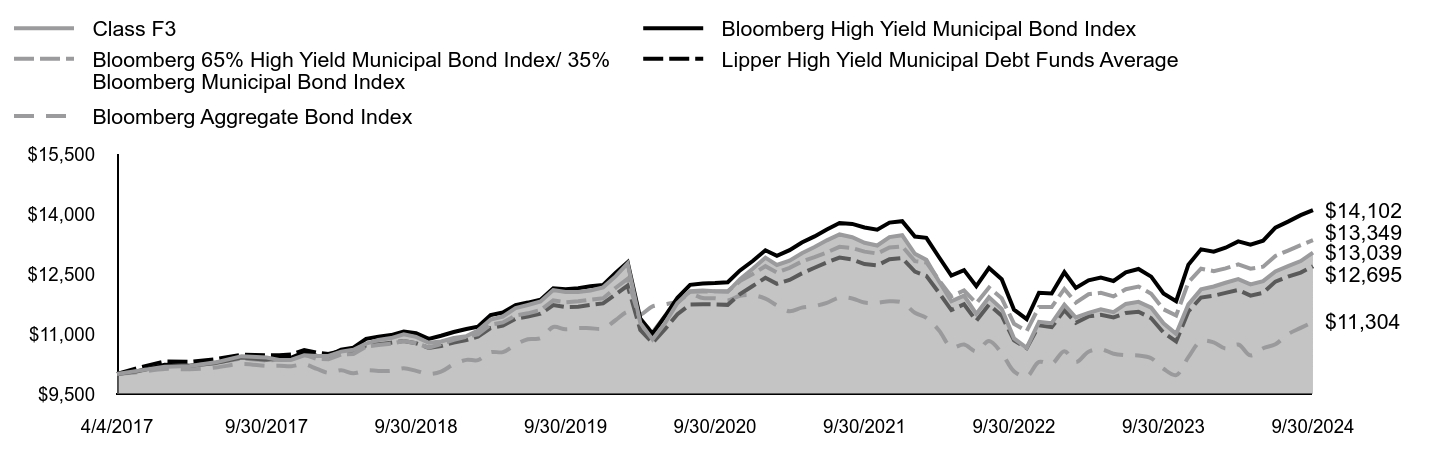

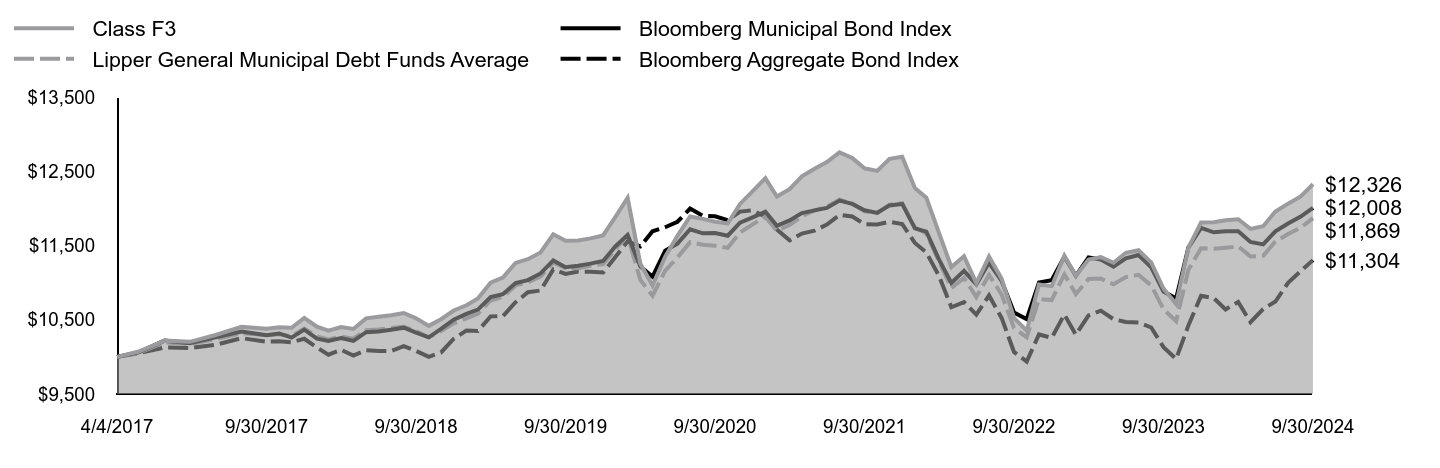

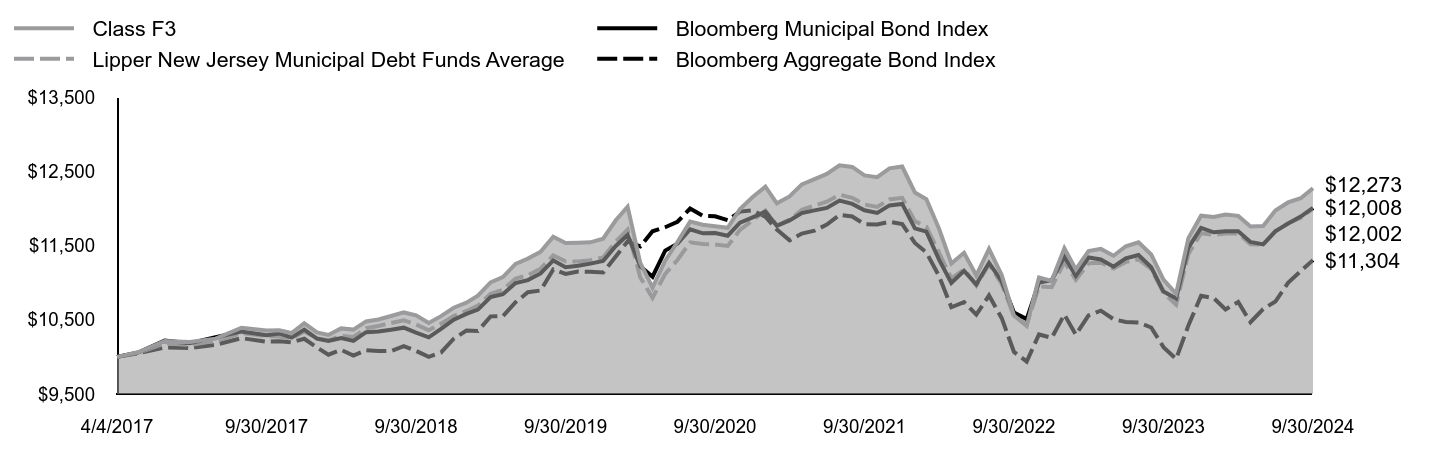

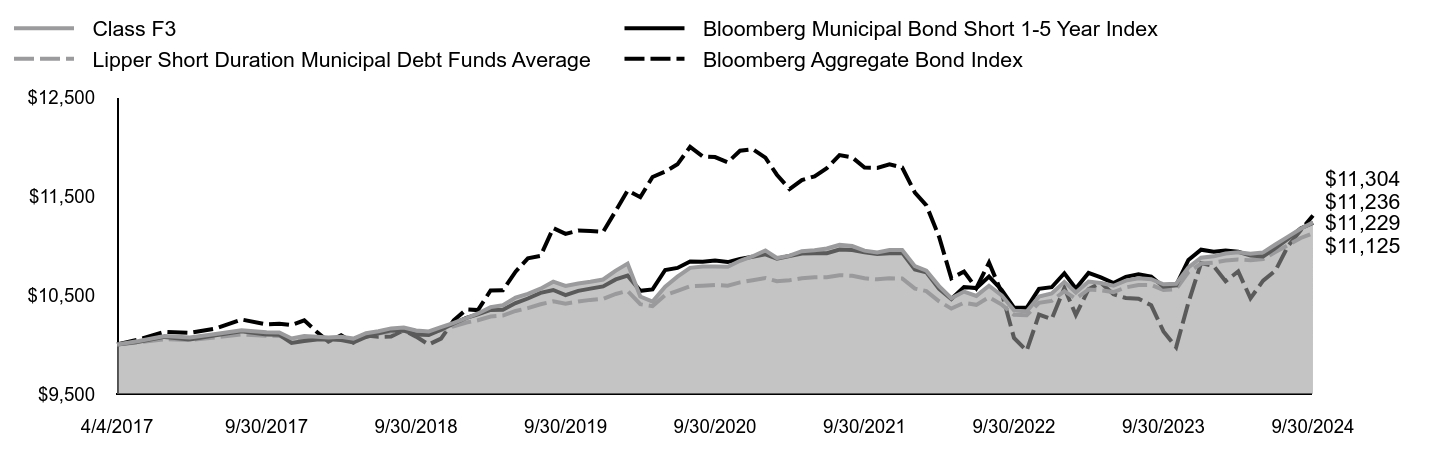

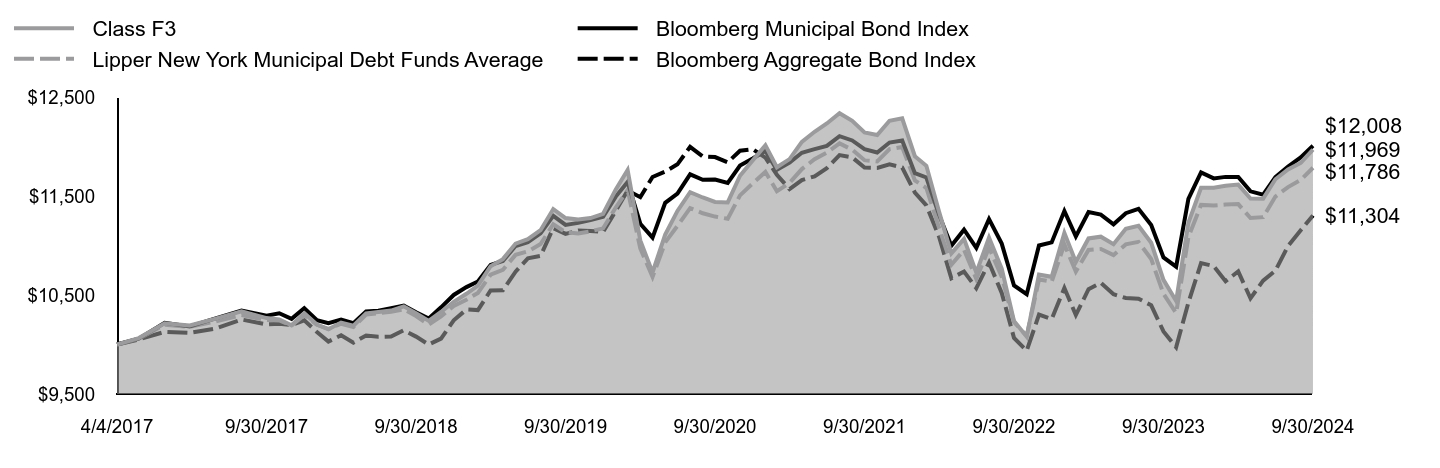

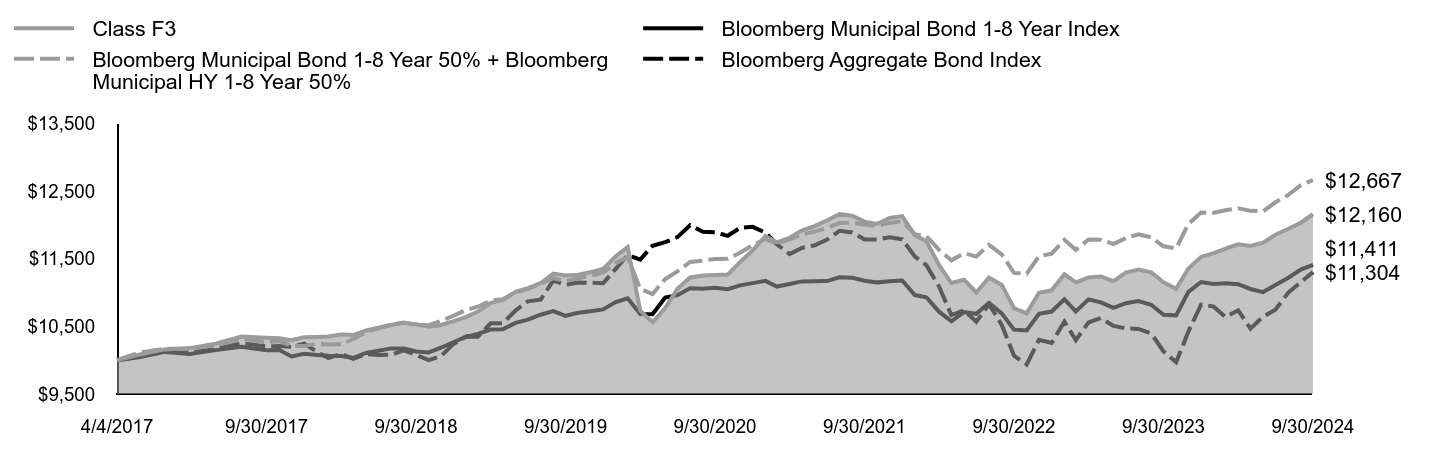

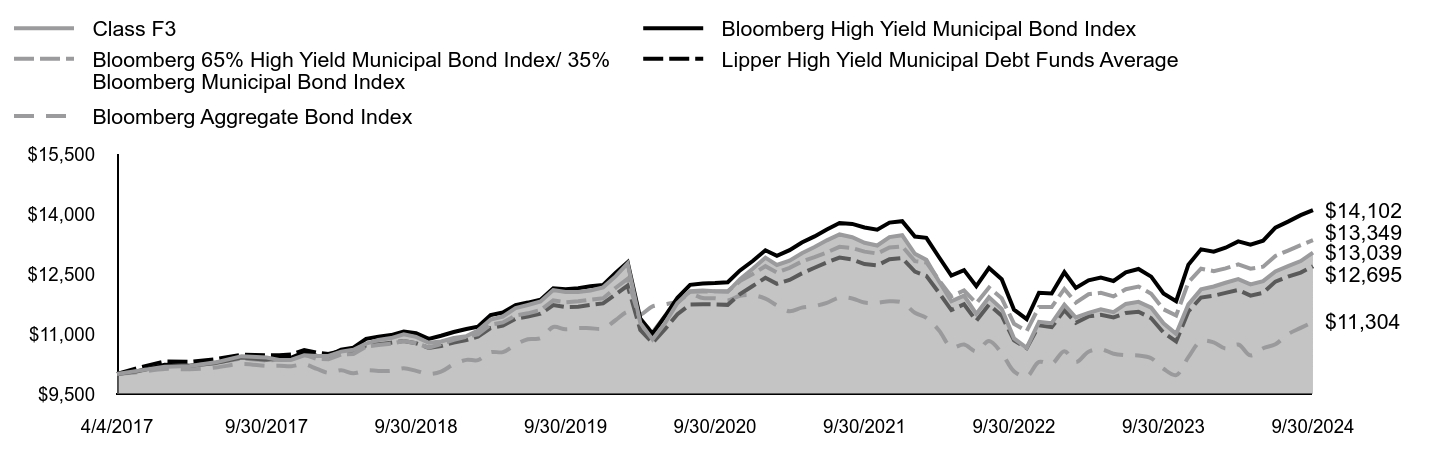

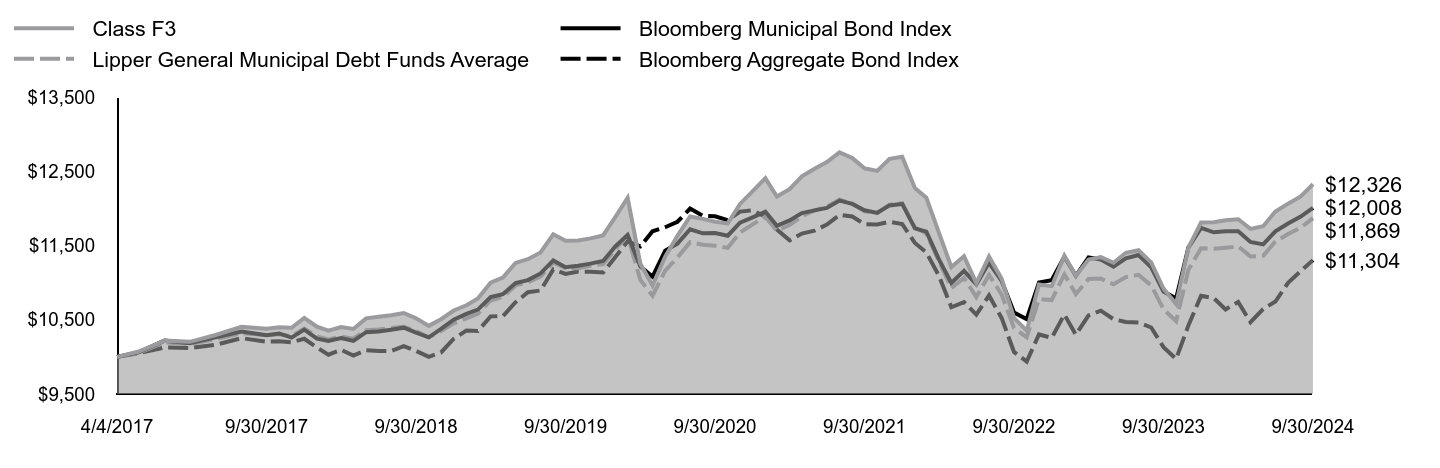

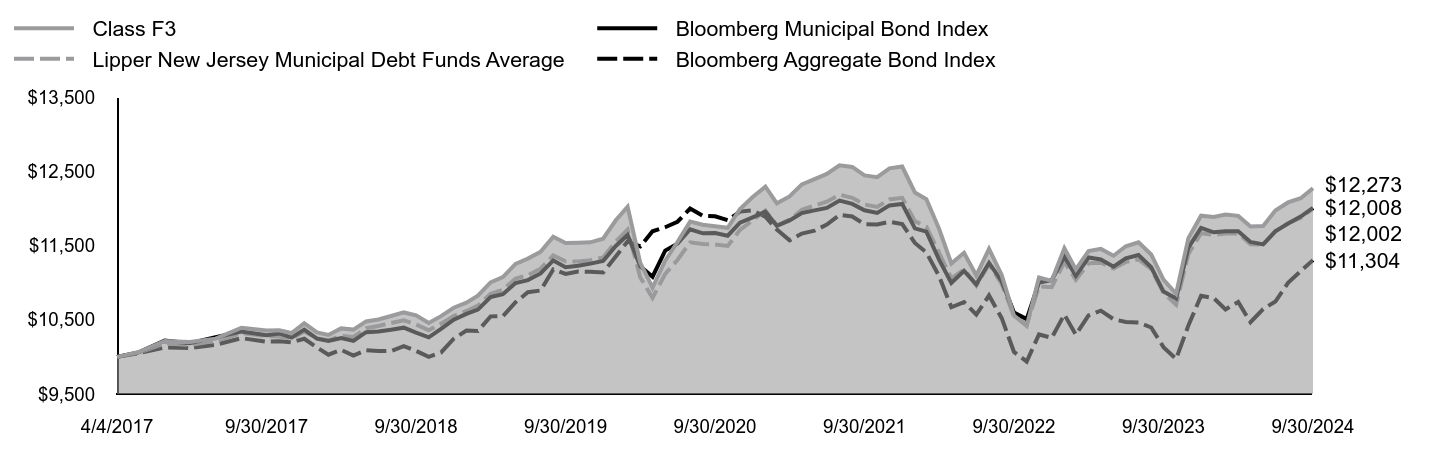

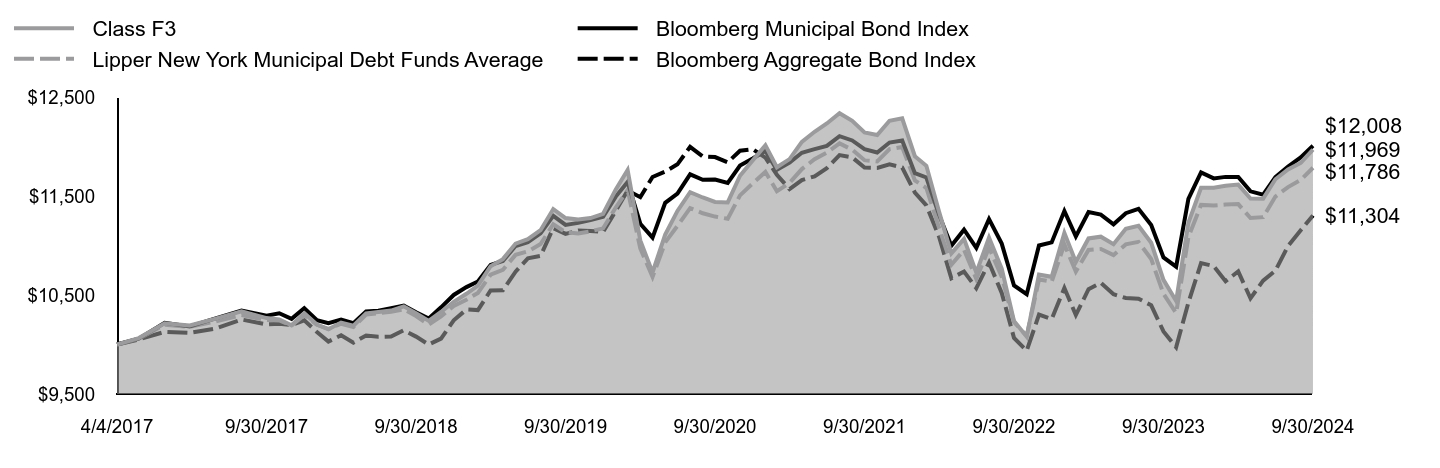

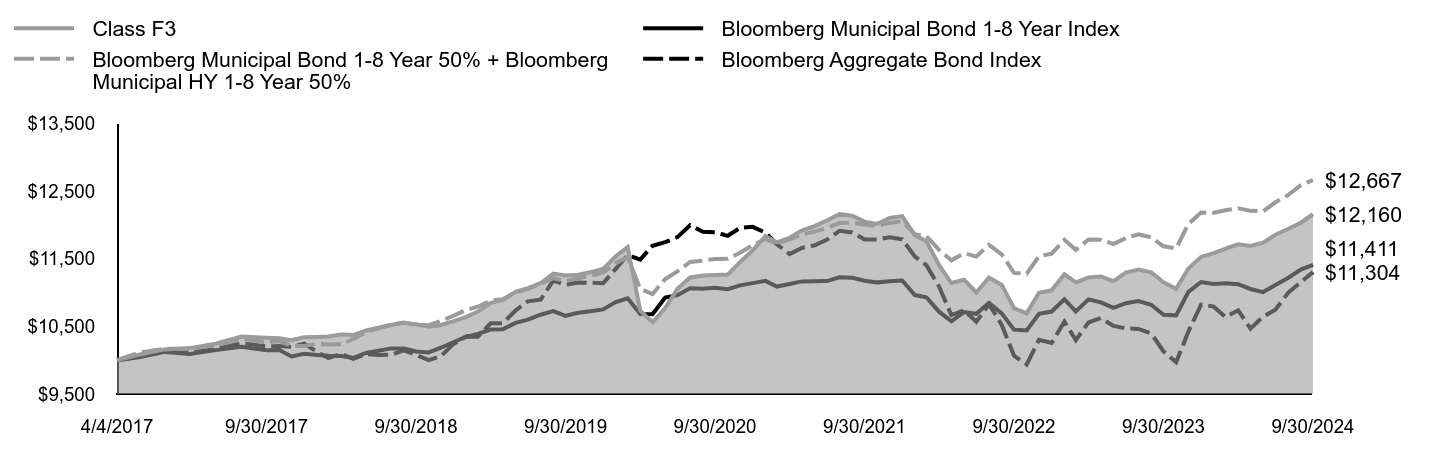

How did the Fund perform last year and what affected its performance?

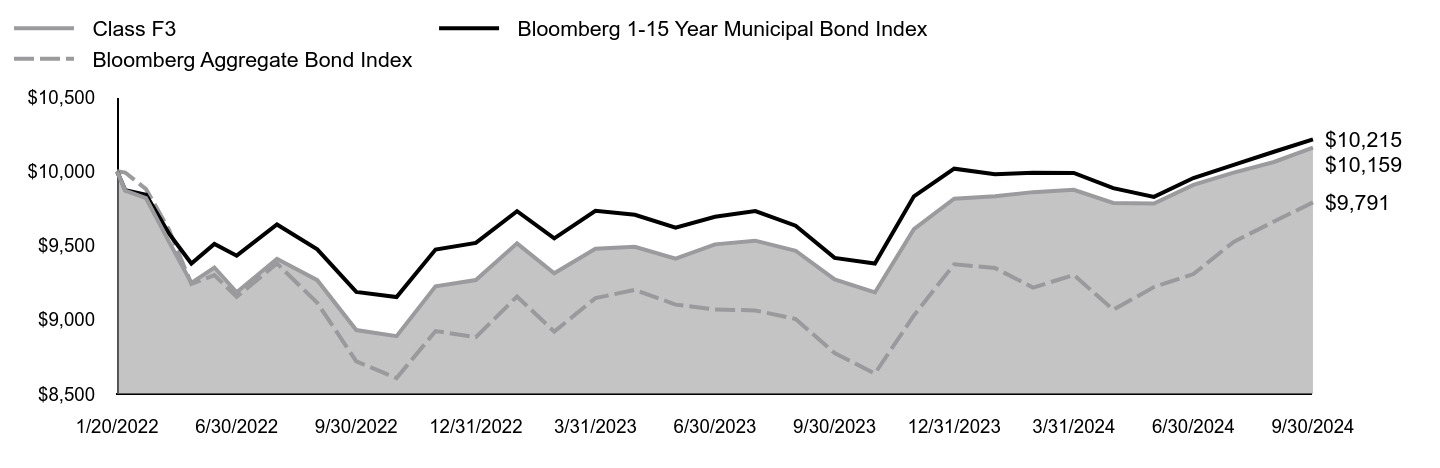

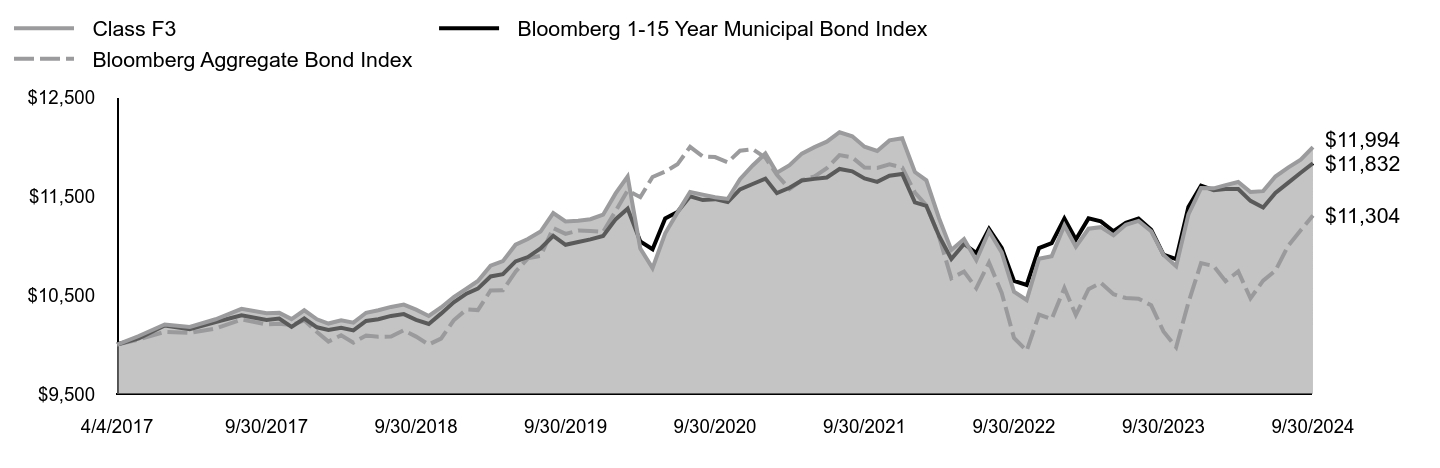

For the fiscal year ended September 30, 2024, the Fund returned 15.69%, reflecting performance at the net asset value (NAV) of Class F3 shares, compared to the 17.38% of a securities market index with investment characteristics similar to those of the Fund, the Bloomberg High Yield Municipal Bond Index. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 11.57% over the same period.

Positive factors for the municipal market included decreasing Treasury yields, easing inflationary pressures and the start of interest rate cuts by the U.S. Federal Reserve. Also supporting the market was increased demand for municipal bond funds and a strong fundamental backdrop as evidenced by growing tax revenue and positive ratings actions by public ratings agencies. Negative factors included a significant increase in municipal bond supply, which pressured the market in second half of the fiscal year, and periods of interest rate volatility driven by sticky inflation readings at points throughout the fiscal year. Against this backdrop, municipal bonds delivered strong returns.

Top contributors to the Fund’s performance: Security selection within the Education, Health Care and Tobacco sectors contributed to relative performance. An overweight allocation to the Health Care sector and underweight allocation to the Education sector contributed to relative performance.

Top detractors from the Fund’s performance: The Fund’s allocation to investment grade bonds was the primary detractor from relative performance. The Fund’s yield curve positioning led to a modest negative impact on relative performance. In particular, an overweight allocation to intermediate maturity bonds detracted as yields fell less at this part of the curve.

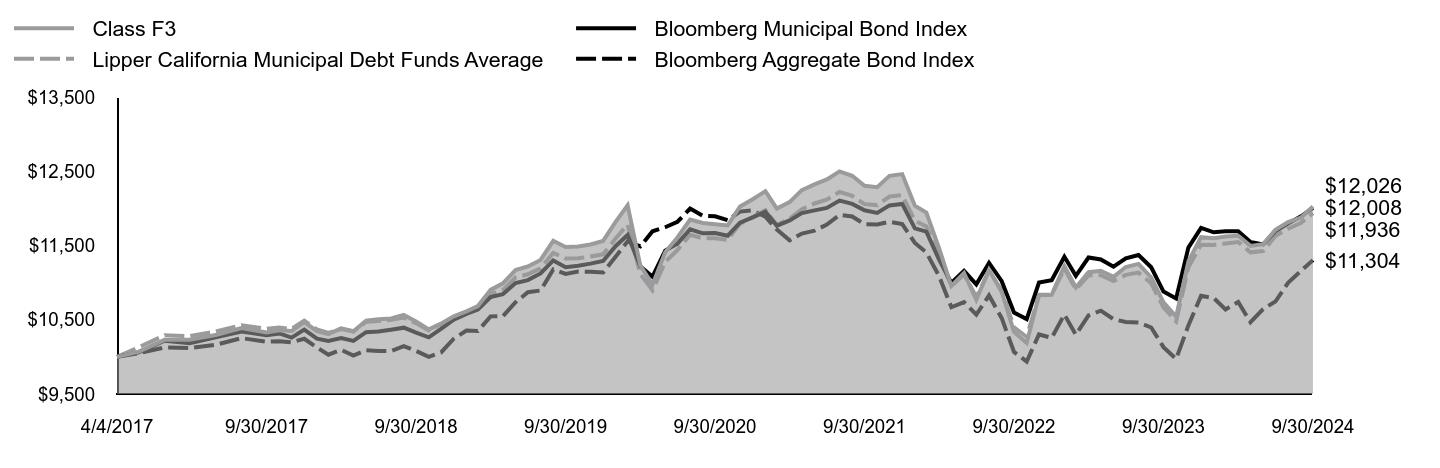

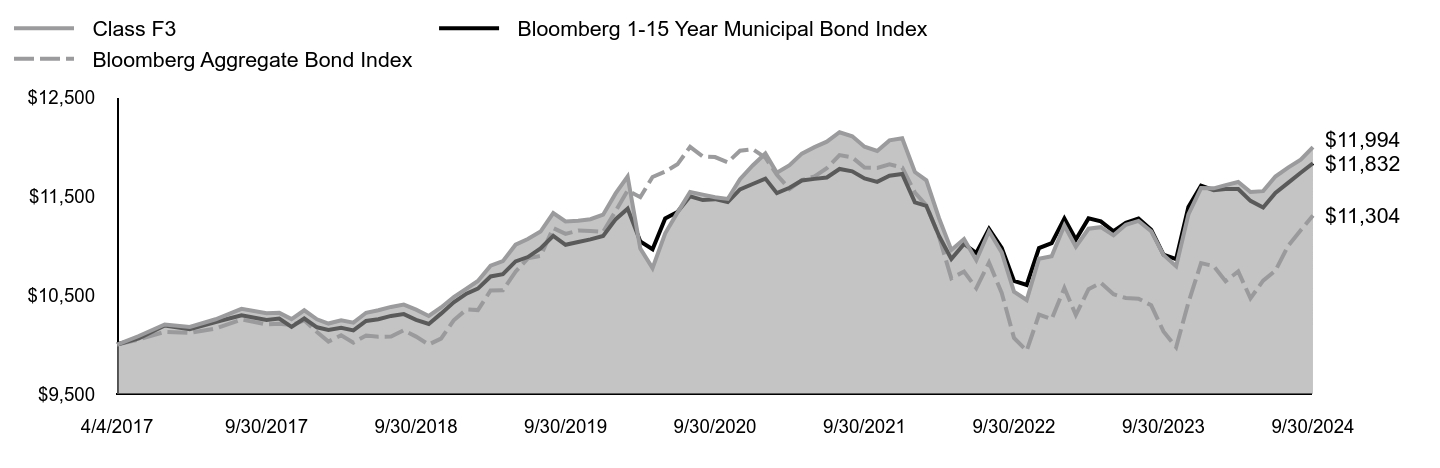

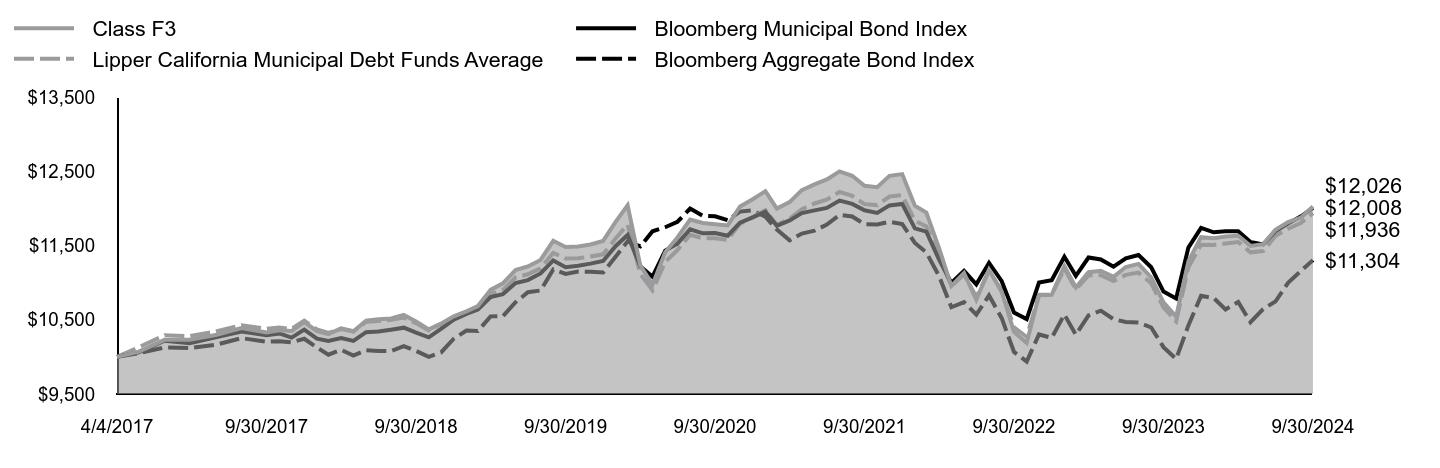

Total Return Based on $10,000 Investment

| Class F3 | Bloomberg High Yield Municipal Bond Index | Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | Lipper High Yield Municipal Debt Funds Average | Bloomberg Aggregate Bond Index |

|---|

| 4/4/2017 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 4/30/2017 | $10,085 | $10,075 | $10,070 | $10,156 | $10,051 |

| 5/31/2017 | $10,183 | $10,229 | $10,226 | $10,312 | $10,128 |

| 6/30/2017 | $10,203 | $10,207 | $10,198 | $10,305 | $10,118 |

| 7/31/2017 | $10,292 | $10,274 | $10,271 | $10,371 | $10,162 |

| 8/31/2017 | $10,447 | $10,415 | $10,390 | $10,482 | $10,253 |

| 9/30/2017 | $10,411 | $10,360 | $10,335 | $10,471 | $10,204 |

| 10/31/2017 | $10,350 | $10,388 | $10,363 | $10,471 | $10,210 |

| 11/30/2017 | $10,360 | $10,414 | $10,360 | $10,487 | $10,197 |

| 12/31/2017 | $10,468 | $10,549 | $10,486 | $10,601 | $10,244 |

| 1/31/2018 | $10,451 | $10,451 | $10,379 | $10,533 | $10,126 |

| 2/28/2018 | $10,452 | $10,458 | $10,372 | $10,503 | $10,030 |

| 3/31/2018 | $10,561 | $10,611 | $10,485 | $10,574 | $10,094 |

| 4/30/2018 | $10,607 | $10,659 | $10,502 | $10,578 | $10,019 |

| 5/31/2018 | $10,761 | $10,882 | $10,687 | $10,714 | $10,091 |

| 6/30/2018 | $10,854 | $10,936 | $10,725 | $10,747 | $10,078 |

| 7/31/2018 | $10,900 | $10,974 | $10,758 | $10,783 | $10,080 |

| 8/31/2018 | $10,992 | $11,062 | $10,824 | $10,825 | $10,145 |

| 9/30/2018 | $10,929 | $11,019 | $10,772 | $10,770 | $10,080 |

| 10/31/2018 | $10,784 | $10,881 | $10,661 | $10,655 | $10,000 |

| 11/30/2018 | $10,813 | $10,957 | $10,751 | $10,699 | $10,060 |

| 12/31/2018 | $10,900 | $11,051 | $10,856 | $10,790 | $10,245 |

| 1/31/2019 | $10,948 | $11,125 | $10,932 | $10,850 | $10,354 |

| 2/28/2019 | $11,087 | $11,185 | $10,991 | $10,937 | $10,348 |

| 3/31/2019 | $11,361 | $11,474 | $11,236 | $11,152 | $10,546 |

| 4/30/2019 | $11,439 | $11,539 | $11,292 | $11,214 | $10,549 |

| 5/31/2019 | $11,649 | $11,726 | $11,466 | $11,385 | $10,736 |

| 6/30/2019 | $11,727 | $11,788 | $11,519 | $11,437 | $10,871 |

| 7/31/2019 | $11,814 | $11,862 | $11,599 | $11,512 | $10,895 |

| 8/31/2019 | $12,100 | $12,147 | $11,844 | $11,727 | $11,177 |

| 9/30/2019 | $12,053 | $12,122 | $11,796 | $11,674 | $11,118 |

| 10/31/2019 | $12,053 | $12,148 | $11,819 | $11,682 | $11,151 |

| 11/30/2019 | $12,092 | $12,195 | $11,859 | $11,728 | $11,146 |

| 12/31/2019 | $12,169 | $12,231 | $11,895 | $11,768 | $11,138 |

| 1/31/2020 | $12,449 | $12,533 | $12,160 | $11,996 | $11,352 |

| 2/29/2020 | $12,769 | $12,797 | $12,382 | $12,212 | $11,557 |

| 3/31/2020 | $11,279 | $11,390 | $11,339 | $11,103 | $11,489 |

| 4/30/2020 | $10,868 | $11,005 | $11,041 | $10,782 | $11,693 |

| 5/31/2020 | $11,279 | $11,454 | $11,457 | $11,129 | $11,747 |

| 6/30/2020 | $11,779 | $11,908 | $11,785 | $11,495 | $11,821 |

| 7/31/2020 | $12,073 | $12,231 | $12,062 | $11,741 | $11,998 |

| 8/31/2020 | $12,091 | $12,264 | $12,063 | $11,746 | $11,901 |

| 9/30/2020 | $12,069 | $12,276 | $12,072 | $11,742 | $11,894 |

| 10/31/2020 | $12,057 | $12,298 | $12,073 | $11,731 | $11,841 |

| 11/30/2020 | $12,375 | $12,593 | $12,325 | $12,000 | $11,958 |

| 12/31/2020 | $12,634 | $12,829 | $12,502 | $12,203 | $11,974 |

| 1/31/2021 | $12,912 | $13,097 | $12,699 | $12,410 | $11,888 |

| 2/28/2021 | $12,728 | $12,960 | $12,542 | $12,259 | $11,716 |

| 3/31/2021 | $12,835 | $13,100 | $12,657 | $12,354 | $11,570 |

| 4/30/2021 | $13,023 | $13,292 | $12,815 | $12,518 | $11,662 |

| 5/31/2021 | $13,177 | $13,444 | $12,924 | $12,659 | $11,700 |

| 6/30/2021 | $13,346 | $13,615 | $13,043 | $12,792 | $11,782 |

| 7/31/2021 | $13,493 | $13,778 | $13,183 | $12,913 | $11,914 |

| 8/31/2021 | $13,425 | $13,757 | $13,152 | $12,867 | $11,891 |

| 9/30/2021 | $13,285 | $13,667 | $13,063 | $12,751 | $11,788 |

| 10/31/2021 | $13,216 | $13,611 | $13,015 | $12,719 | $11,785 |

| 11/30/2021 | $13,427 | $13,790 | $13,165 | $12,872 | $11,820 |

| 12/31/2021 | $13,473 | $13,826 | $13,195 | $12,903 | $11,789 |

| 1/31/2022 | $13,009 | $13,439 | $12,828 | $12,562 | $11,535 |

| 2/28/2022 | $12,857 | $13,408 | $12,793 | $12,457 | $11,407 |

| 3/31/2022 | $12,318 | $12,923 | $12,347 | $12,030 | $11,090 |

| 4/30/2022 | $11,820 | $12,464 | $11,943 | $11,601 | $10,669 |

| 5/31/2022 | $11,962 | $12,601 | $12,090 | $11,745 | $10,738 |

| 6/30/2022 | $11,505 | $12,199 | $11,770 | $11,331 | $10,569 |

| 7/31/2022 | $11,923 | $12,654 | $12,164 | $11,735 | $10,828 |

| 8/31/2022 | $11,631 | $12,372 | $11,895 | $11,461 | $10,522 |

| 9/30/2022 | $10,892 | $11,610 | $11,259 | $10,843 | $10,067 |

| 10/31/2022 | $10,653 | $11,372 | $11,076 | $10,649 | $9,937 |

| 11/30/2022 | $11,305 | $12,034 | $11,676 | $11,218 | $10,302 |

| 12/31/2022 | $11,271 | $12,014 | $11,676 | $11,172 | $10,256 |

| 1/31/2023 | $11,732 | $12,548 | $12,130 | $11,597 | $10,571 |

| 2/28/2023 | $11,415 | $12,154 | $11,786 | $11,284 | $10,298 |

| 3/31/2023 | $11,532 | $12,343 | $11,997 | $11,443 | $10,559 |

| 4/30/2023 | $11,617 | $12,414 | $12,032 | $11,480 | $10,623 |

| 5/31/2023 | $11,548 | $12,328 | $11,942 | $11,415 | $10,508 |

| 6/30/2023 | $11,754 | $12,547 | $12,122 | $11,528 | $10,470 |

| 7/31/2023 | $11,807 | $12,629 | $12,190 | $11,559 | $10,463 |

| 8/31/2023 | $11,661 | $12,437 | $12,008 | $11,396 | $10,396 |

| 9/30/2023 | $11,271 | $12,014 | $11,620 | $11,038 | $10,132 |

| 10/31/2023 | $11,005 | $11,822 | $11,464 | $10,815 | $9,972 |

| 11/30/2023 | $11,744 | $12,738 | $12,296 | $11,566 | $10,424 |

| 12/31/2023 | $12,118 | $13,121 | $12,636 | $11,915 | $10,823 |

| 1/31/2024 | $12,190 | $13,060 | $12,576 | $11,960 | $10,793 |

| 2/29/2024 | $12,285 | $13,162 | $12,645 | $12,032 | $10,640 |

| 3/31/2024 | $12,376 | $13,319 | $12,743 | $12,104 | $10,739 |

| 4/30/2024 | $12,243 | $13,237 | $12,637 | $11,961 | $10,467 |

| 5/31/2024 | $12,324 | $13,337 | $12,686 | $12,033 | $10,645 |

| 6/30/2024 | $12,568 | $13,664 | $12,956 | $12,313 | $10,746 |

| 7/31/2024 | $12,698 | $13,814 | $13,090 | $12,438 | $10,997 |

| 8/31/2024 | $12,828 | $13,976 | $13,226 | $12,540 | $11,155 |

| 9/30/2024 | $13,039 | $14,102 | $13,349 | $12,695 | $11,304 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since Inception 4/4/17 |

|---|

| Class F3 at NAV | 15.69% | 1.59% | 3.61% |

| Bloomberg High Yield Municipal Bond Index | 17.38% | 3.07% | 4.70% |

| Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | 14.89% | 2.51% | 3.93% |

| Lipper High Yield Municipal Debt Funds Average | 15.02% | 1.69% | 3.24% |

Bloomberg Aggregate Bond IndexFootnote Reference* | 11.57% | 0.33% | 1.65% |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

(as of September 30, 2024)

| Total Net Assets | $4,098,713,523 |

| # of Portfolio Holdings | 611 |

| Portfolio Turnover Rate | 27% |

| Total Advisory Fees Paid | $16,137,454 |

What did the Fund invest in?

(as of September 30, 2024)

Credit Rating S&P or Moody'sFootnote Reference(a) | %Footnote Reference** |

|---|

| |

- A3.12%

- A-3.62%

- A+4.07%

- AA4.24%

- AA-2.36%

- AA+0.32%

- AAA1.03%

- B0.75%

- B-2.26%

- B+2.14%

- BB6.67%

- BB-5.00%

- BB+6.47%

- BBB3.00%

- BBB-8.39%

- BBB+4.73%

- CCC0.30%

- CCC-1.01%

- CCC+0.36%

- NR40.16%

- Total 100.00%

| Footnote | Description |

Footnote** | Represents percent of total investments, which excludes derivatives. |

Footnote(a) | Investments in investment grade municipal bonds, which as bonds that are rated, at the time of purchase, within the four highest grades assigned by an independent rating agency such as Moody’s, S&P, or Fitch, or an equivalent short-term rating, as applicable, or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. Lower rated municipal bonds are rated, at the time of purchase, or an equivalent short-term rating, as applicable, by an independent rating agency or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

TSR-A-8986-F3

11/24

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

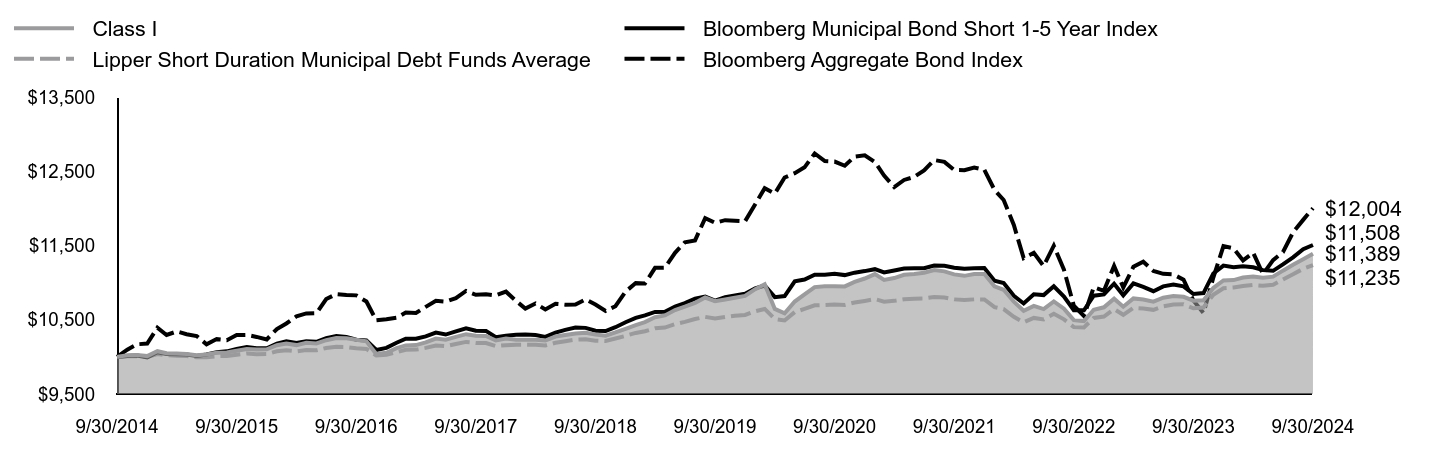

This annual shareholder report contains important information about the Lord Abbett High Income Municipal Bond Fund for the period of October 1, 2023 to September 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $67 | 0.62% |

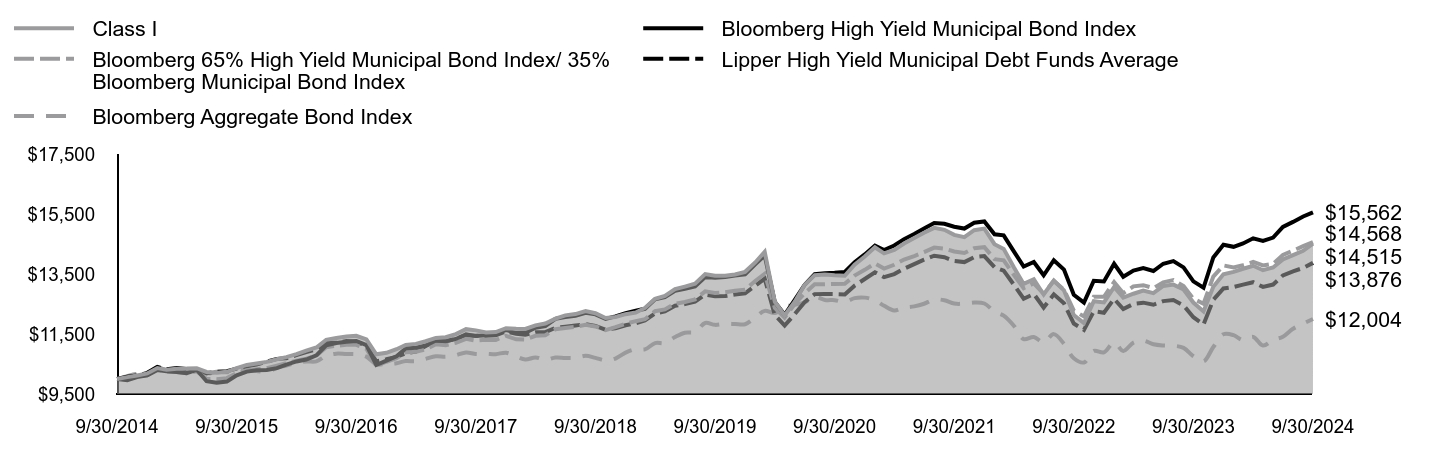

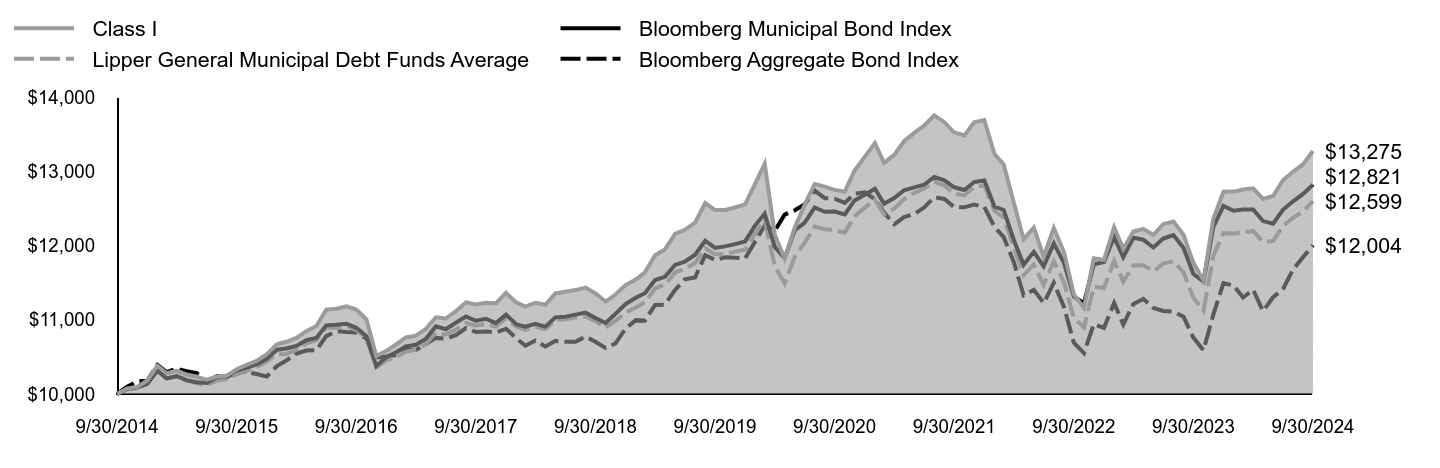

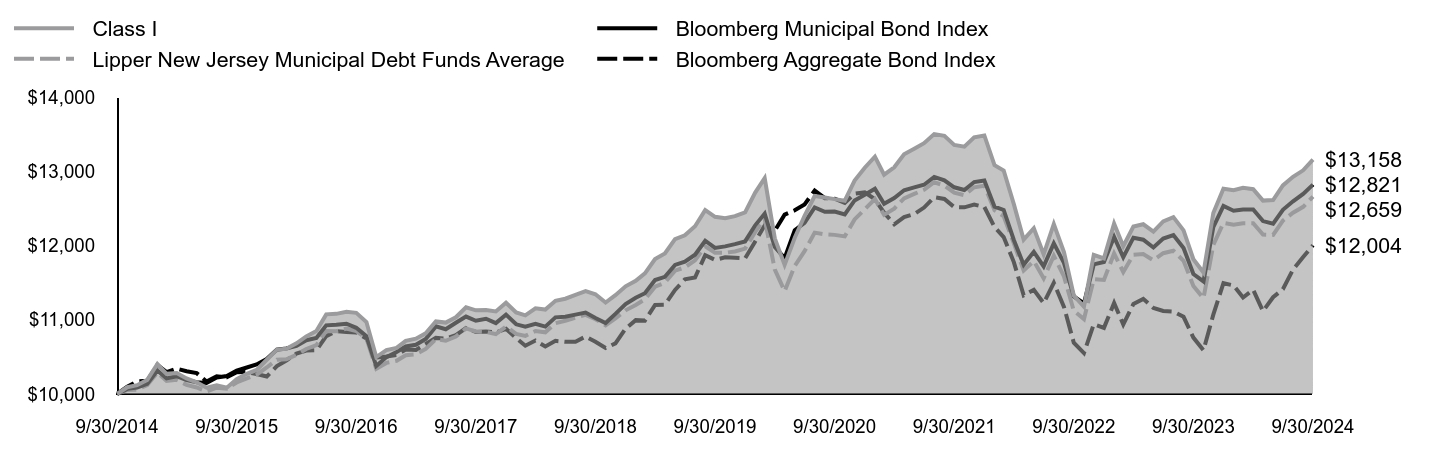

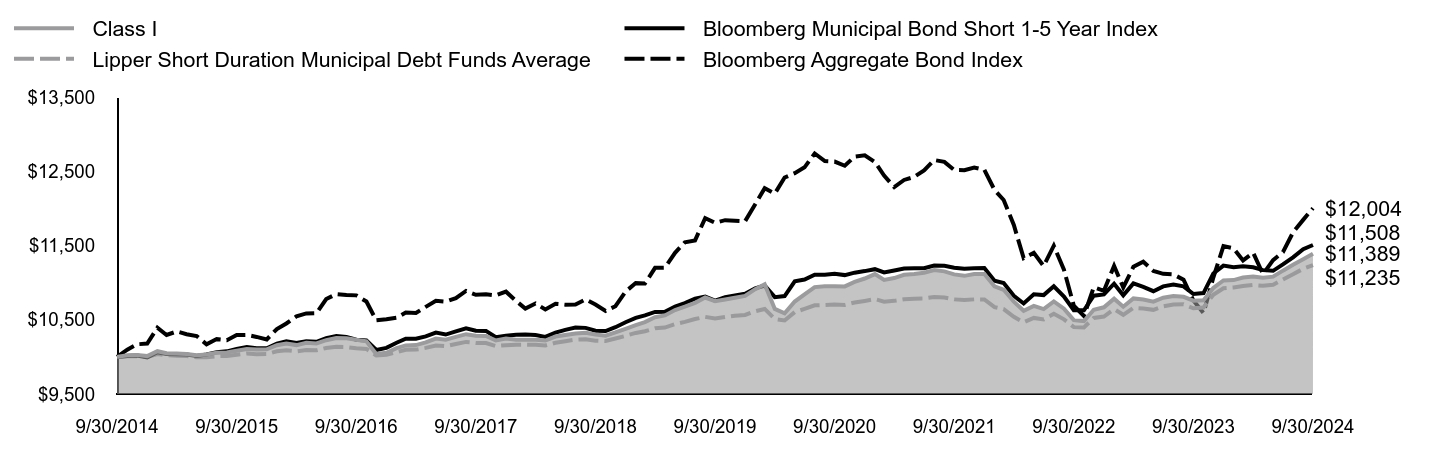

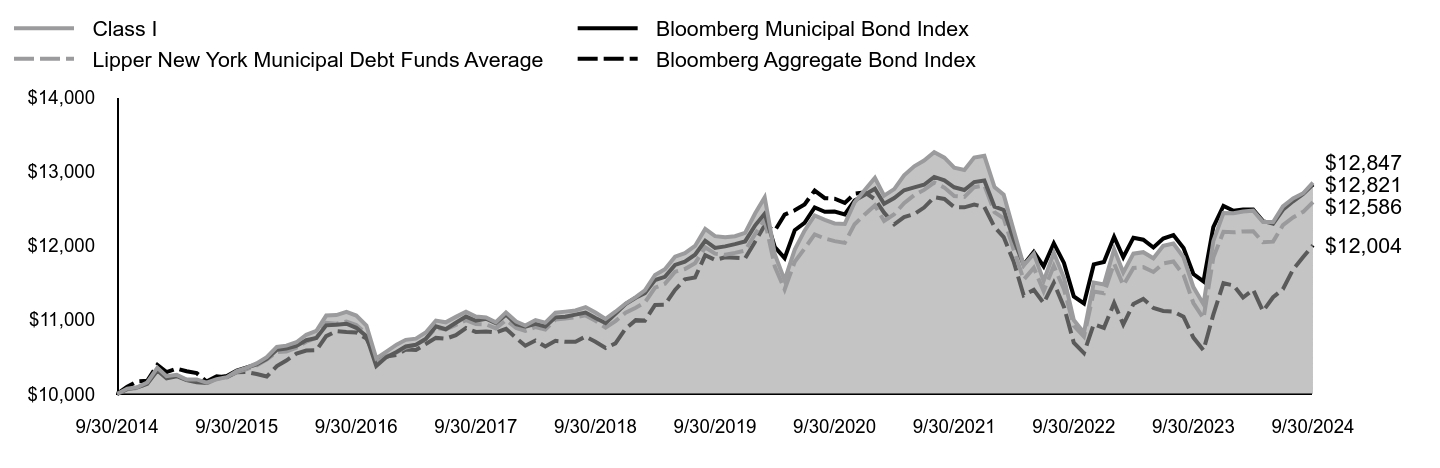

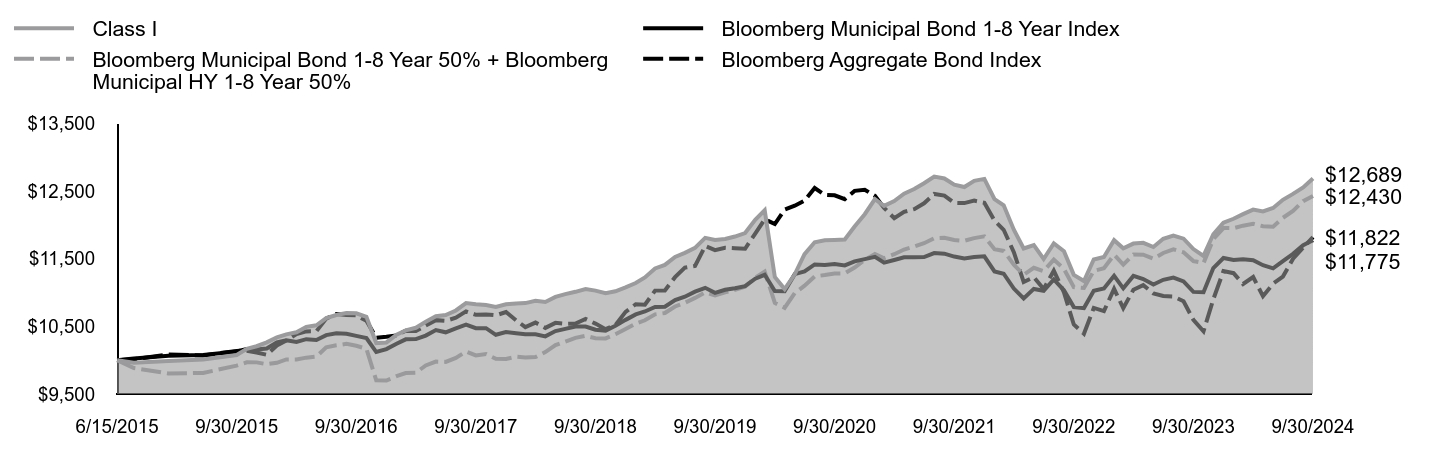

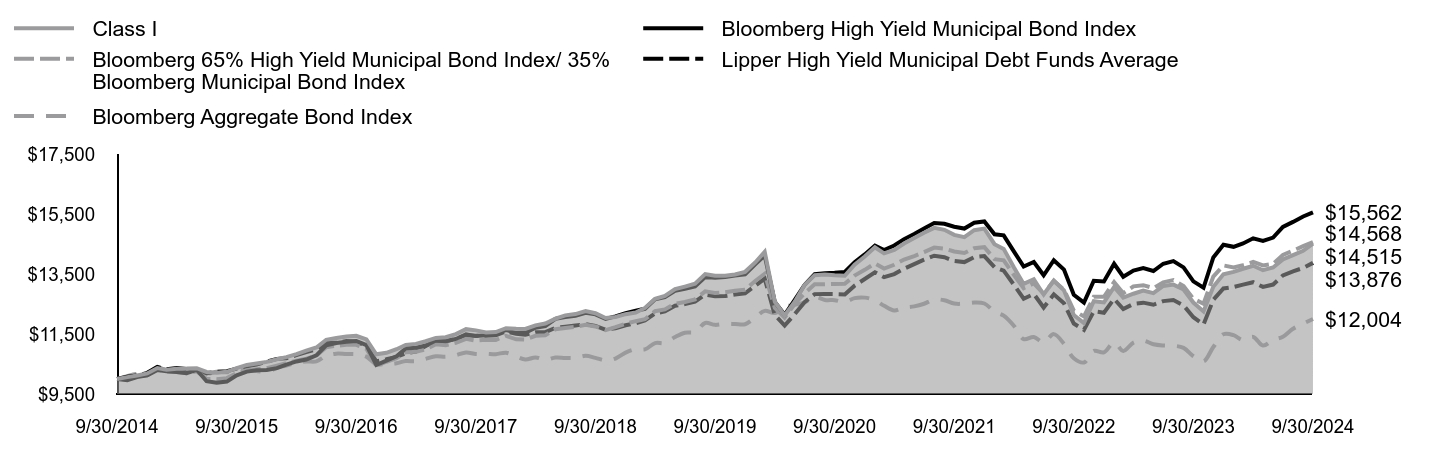

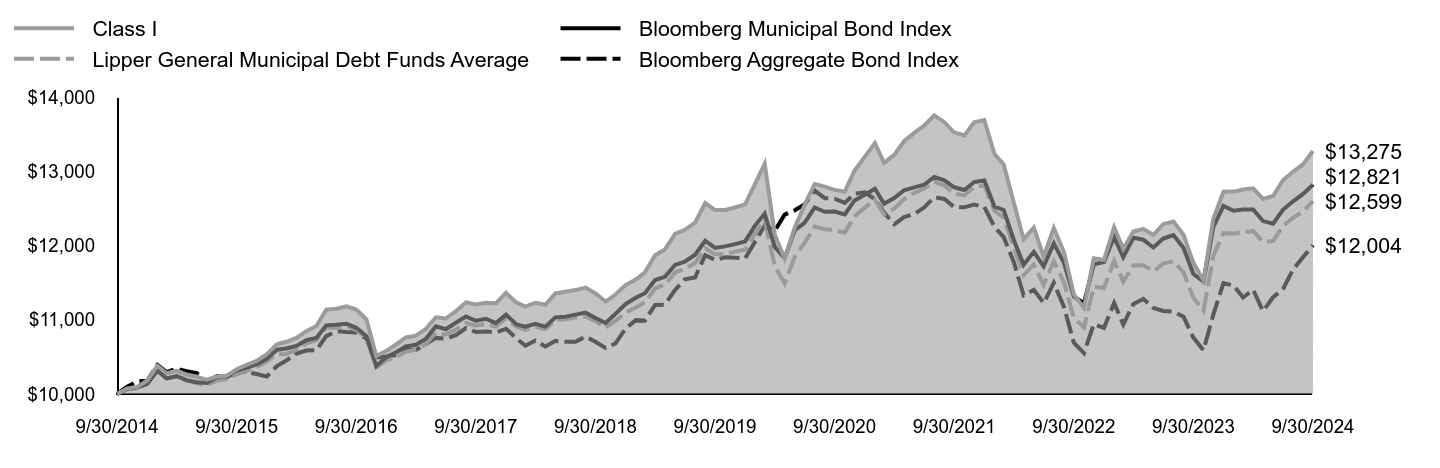

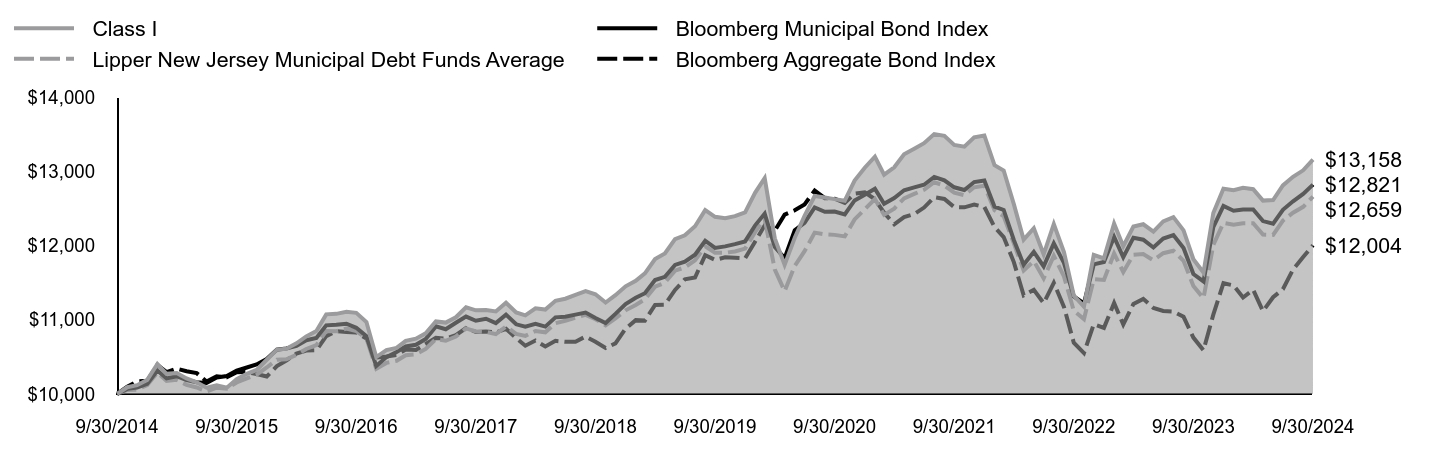

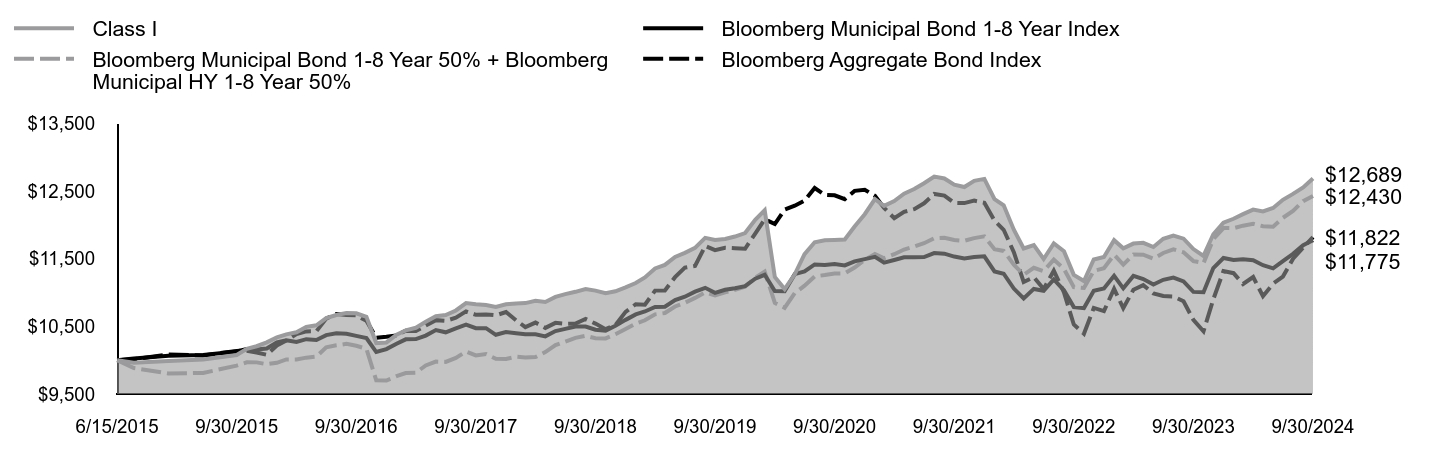

How did the Fund perform last year and what affected its performance?

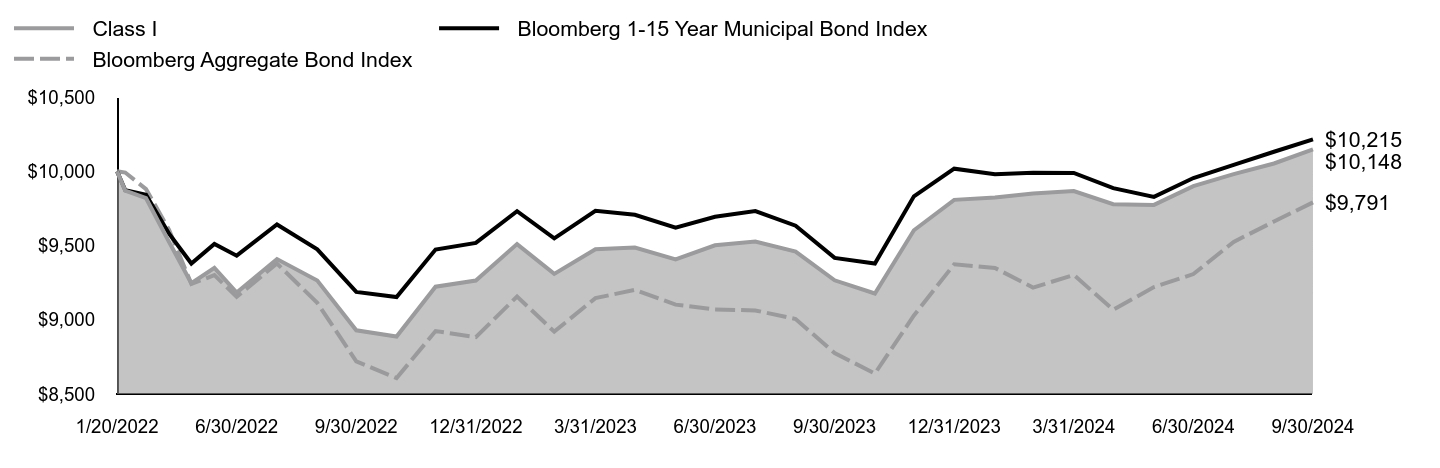

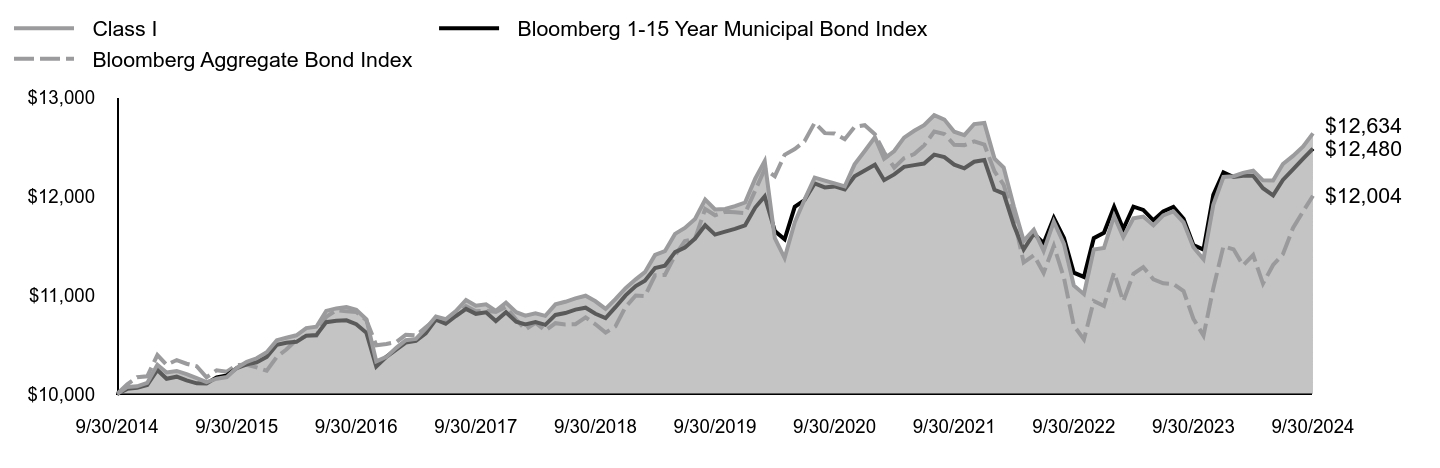

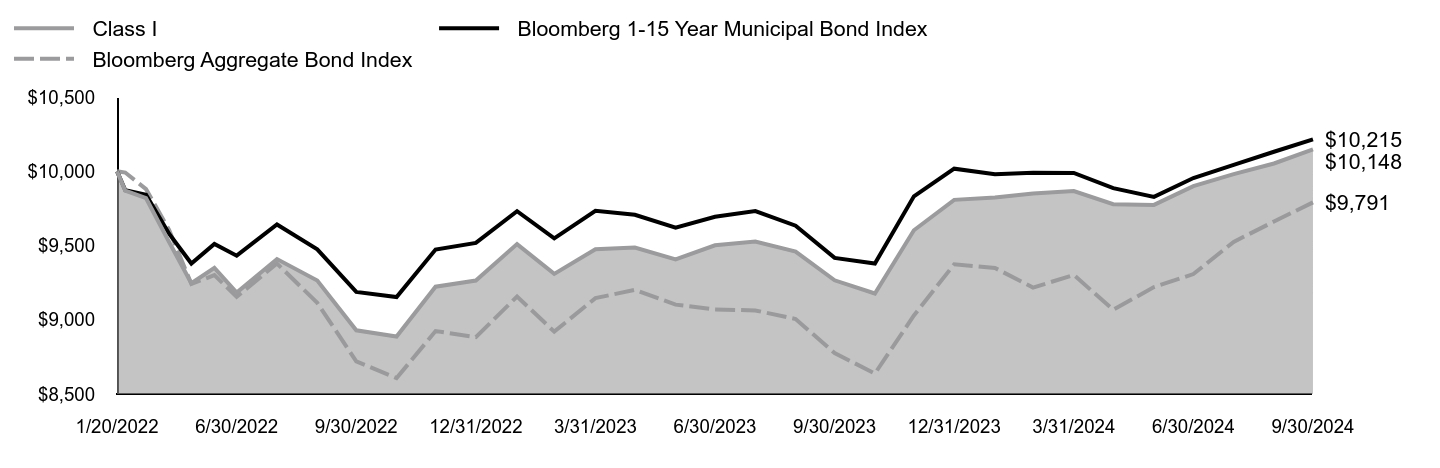

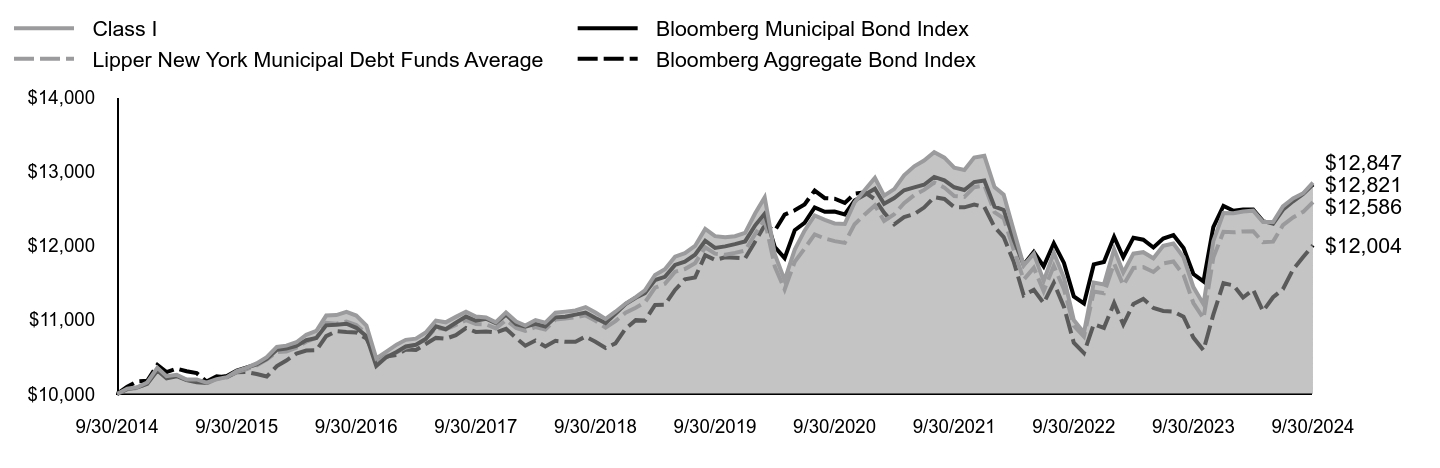

For the fiscal year ended September 30, 2024, the Fund returned 15.63%, reflecting performance at the net asset value (NAV) of Class I shares, compared to the 17.38% of a securities market index with investment characteristics similar to those of the Fund, the Bloomberg High Yield Municipal Bond Index. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 11.57% over the same period.

Positive factors for the municipal market included decreasing Treasury yields, easing inflationary pressures and the start of interest rate cuts by the U.S. Federal Reserve. Also supporting the market was increased demand for municipal bond funds and a strong fundamental backdrop as evidenced by growing tax revenue and positive ratings actions by public ratings agencies. Negative factors included a significant increase in municipal bond supply, which pressured the market in second half of the fiscal year, and periods of interest rate volatility driven by sticky inflation readings at points throughout the fiscal year. Against this backdrop, municipal bonds delivered strong returns.

Top contributors to the Fund’s performance: Security selection within the Education, Health Care and Tobacco sectors contributed to relative performance. An overweight allocation to the Health Care sector and underweight allocation to the Education sector contributed to relative performance.

Top detractors from the Fund’s performance: The Fund’s allocation to investment grade bonds was the primary detractor from relative performance. The Fund’s yield curve positioning led to a modest negative impact on relative performance. In particular, an overweight allocation to intermediate maturity bonds detracted as yields fell less at this part of the curve.

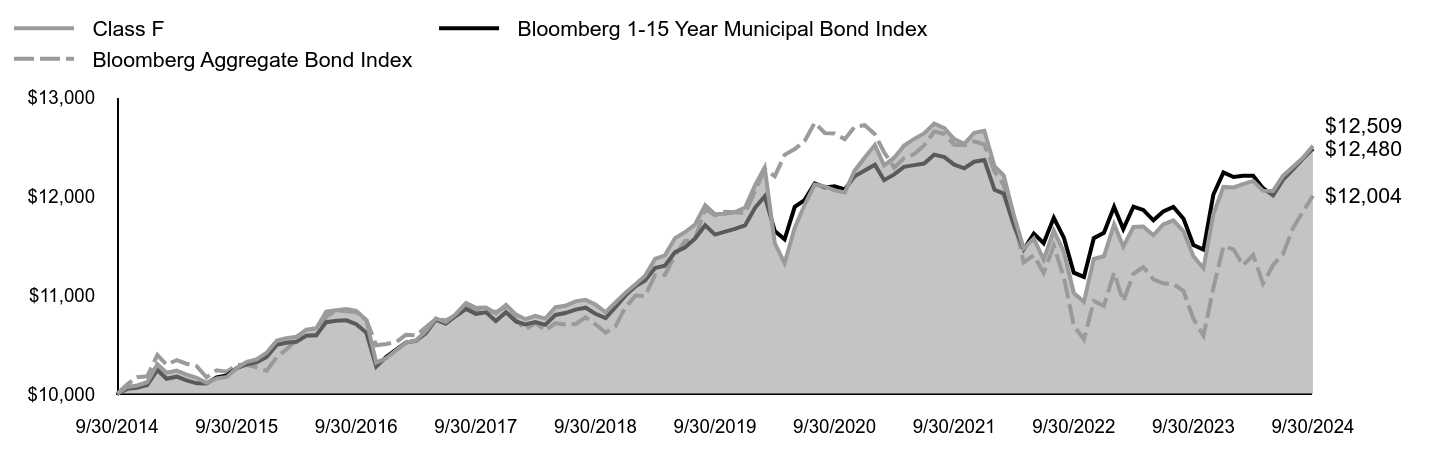

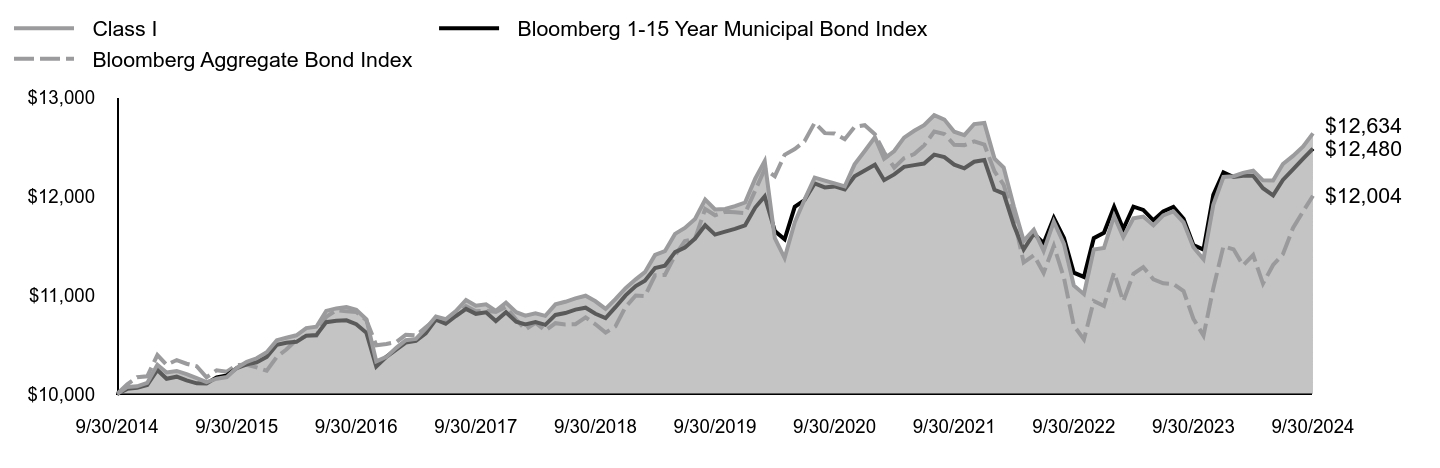

Total Return Based on $10,000 Investment

| Class I | Bloomberg High Yield Municipal Bond Index | Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | Lipper High Yield Municipal Debt Funds Average | Bloomberg Aggregate Bond Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,064 | $9,964 | $10,000 | $10,077 | $10,098 |

| 11/30/2014 | $10,119 | $10,067 | $10,074 | $10,117 | $10,170 |

| 12/31/2014 | $10,187 | $10,121 | $10,127 | $10,206 | $10,179 |

| 1/31/2015 | $10,366 | $10,302 | $10,307 | $10,402 | $10,393 |

| 2/28/2015 | $10,310 | $10,261 | $10,243 | $10,324 | $10,295 |

| 3/31/2015 | $10,343 | $10,234 | $10,236 | $10,364 | $10,343 |

| 4/30/2015 | $10,348 | $10,192 | $10,190 | $10,330 | $10,306 |

| 5/31/2015 | $10,362 | $10,307 | $10,255 | $10,315 | $10,281 |

| 6/30/2015 | $10,237 | $9,927 | $10,006 | $10,188 | $10,169 |

| 7/31/2015 | $10,209 | $9,873 | $9,996 | $10,240 | $10,240 |

| 8/31/2015 | $10,242 | $9,914 | $10,030 | $10,261 | $10,225 |

| 9/30/2015 | $10,364 | $10,124 | $10,194 | $10,348 | $10,294 |

| 10/31/2015 | $10,469 | $10,248 | $10,288 | $10,424 | $10,296 |

| 11/30/2015 | $10,520 | $10,289 | $10,330 | $10,481 | $10,269 |

| 12/31/2015 | $10,572 | $10,304 | $10,365 | $10,577 | $10,235 |

| 1/31/2016 | $10,661 | $10,363 | $10,447 | $10,672 | $10,376 |

| 2/29/2016 | $10,731 | $10,477 | $10,527 | $10,693 | $10,450 |

| 3/31/2016 | $10,828 | $10,587 | $10,611 | $10,796 | $10,546 |

| 4/30/2016 | $10,945 | $10,652 | $10,680 | $10,900 | $10,586 |

| 5/31/2016 | $11,052 | $10,792 | $10,782 | $10,987 | $10,589 |

| 6/30/2016 | $11,309 | $11,127 | $11,059 | $11,204 | $10,779 |

| 7/31/2016 | $11,371 | $11,200 | $11,109 | $11,219 | $10,847 |

| 8/31/2016 | $11,421 | $11,240 | $11,140 | $11,265 | $10,835 |

| 9/30/2016 | $11,442 | $11,270 | $11,140 | $11,241 | $10,829 |

| 10/31/2016 | $11,322 | $11,130 | $11,009 | $11,107 | $10,746 |

| 11/30/2016 | $10,824 | $10,468 | $10,440 | $10,589 | $10,492 |

| 12/31/2016 | $10,874 | $10,613 | $10,576 | $10,659 | $10,506 |

| 1/31/2017 | $10,994 | $10,761 | $10,697 | $10,737 | $10,527 |

| 2/28/2017 | $11,140 | $11,018 | $10,889 | $10,856 | $10,598 |

| 3/31/2017 | $11,172 | $11,043 | $10,913 | $10,913 | $10,592 |

| 4/30/2017 | $11,261 | $11,118 | $10,989 | $11,101 | $10,674 |

| 5/31/2017 | $11,371 | $11,288 | $11,159 | $11,271 | $10,756 |

| 6/30/2017 | $11,393 | $11,263 | $11,129 | $11,263 | $10,745 |

| 7/31/2017 | $11,501 | $11,337 | $11,208 | $11,336 | $10,792 |

| 8/31/2017 | $11,664 | $11,493 | $11,339 | $11,457 | $10,888 |

| 9/30/2017 | $11,623 | $11,432 | $11,279 | $11,445 | $10,836 |

| 10/31/2017 | $11,555 | $11,463 | $11,309 | $11,445 | $10,843 |

| 11/30/2017 | $11,566 | $11,492 | $11,306 | $11,462 | $10,829 |

| 12/31/2017 | $11,697 | $11,641 | $11,443 | $11,587 | $10,879 |

| 1/31/2018 | $11,677 | $11,532 | $11,326 | $11,513 | $10,753 |

| 2/28/2018 | $11,669 | $11,540 | $11,319 | $11,480 | $10,651 |

| 3/31/2018 | $11,790 | $11,709 | $11,442 | $11,557 | $10,720 |

| 4/30/2018 | $11,851 | $11,762 | $11,461 | $11,562 | $10,640 |

| 5/31/2018 | $12,012 | $12,008 | $11,663 | $11,710 | $10,716 |

| 6/30/2018 | $12,125 | $12,068 | $11,704 | $11,746 | $10,703 |

| 7/31/2018 | $12,166 | $12,110 | $11,740 | $11,786 | $10,705 |

| 8/31/2018 | $12,268 | $12,207 | $11,812 | $11,832 | $10,774 |

| 9/30/2018 | $12,197 | $12,159 | $11,755 | $11,772 | $10,705 |

| 10/31/2018 | $12,035 | $12,007 | $11,634 | $11,646 | $10,620 |

| 11/30/2018 | $12,068 | $12,091 | $11,732 | $11,694 | $10,683 |

| 12/31/2018 | $12,164 | $12,195 | $11,847 | $11,794 | $10,880 |

| 1/31/2019 | $12,218 | $12,277 | $11,930 | $11,859 | $10,995 |

| 2/28/2019 | $12,372 | $12,343 | $11,994 | $11,954 | $10,989 |

| 3/31/2019 | $12,678 | $12,662 | $12,262 | $12,189 | $11,200 |

| 4/30/2019 | $12,775 | $12,733 | $12,323 | $12,257 | $11,203 |

| 5/31/2019 | $12,998 | $12,940 | $12,512 | $12,444 | $11,402 |

| 6/30/2019 | $13,085 | $13,007 | $12,571 | $12,501 | $11,545 |

| 7/31/2019 | $13,182 | $13,089 | $12,658 | $12,583 | $11,570 |

| 8/31/2019 | $13,501 | $13,404 | $12,926 | $12,818 | $11,870 |

| 9/30/2019 | $13,448 | $13,377 | $12,872 | $12,760 | $11,807 |

| 10/31/2019 | $13,447 | $13,405 | $12,898 | $12,768 | $11,842 |

| 11/30/2019 | $13,490 | $13,457 | $12,942 | $12,819 | $11,836 |

| 12/31/2019 | $13,577 | $13,497 | $12,981 | $12,862 | $11,828 |

| 1/31/2020 | $13,889 | $13,830 | $13,270 | $13,112 | $12,056 |

| 2/29/2020 | $14,245 | $14,121 | $13,512 | $13,348 | $12,273 |

| 3/31/2020 | $12,582 | $12,568 | $12,375 | $12,136 | $12,201 |

| 4/30/2020 | $12,123 | $12,144 | $12,049 | $11,785 | $12,417 |

| 5/31/2020 | $12,581 | $12,640 | $12,503 | $12,164 | $12,475 |

| 6/30/2020 | $13,138 | $13,141 | $12,861 | $12,564 | $12,554 |

| 7/31/2020 | $13,466 | $13,497 | $13,163 | $12,833 | $12,741 |

| 8/31/2020 | $13,484 | $13,533 | $13,164 | $12,838 | $12,638 |

| 9/30/2020 | $13,460 | $13,546 | $13,174 | $12,834 | $12,632 |

| 10/31/2020 | $13,446 | $13,571 | $13,175 | $12,822 | $12,575 |

| 11/30/2020 | $13,812 | $13,897 | $13,451 | $13,116 | $12,699 |

| 12/31/2020 | $14,088 | $14,157 | $13,643 | $13,338 | $12,716 |

| 1/31/2021 | $14,398 | $14,452 | $13,859 | $13,564 | $12,625 |

| 2/28/2021 | $14,192 | $14,301 | $13,687 | $13,399 | $12,443 |

| 3/31/2021 | $14,311 | $14,456 | $13,813 | $13,503 | $12,287 |

| 4/30/2021 | $14,521 | $14,667 | $13,985 | $13,682 | $12,384 |

| 5/31/2021 | $14,704 | $14,836 | $14,104 | $13,836 | $12,425 |

| 6/30/2021 | $14,880 | $15,024 | $14,234 | $13,982 | $12,512 |

| 7/31/2021 | $15,043 | $15,204 | $14,386 | $14,114 | $12,652 |

| 8/31/2021 | $14,978 | $15,181 | $14,353 | $14,064 | $12,628 |

| 9/30/2021 | $14,810 | $15,081 | $14,256 | $13,937 | $12,518 |

| 10/31/2021 | $14,733 | $15,020 | $14,204 | $13,902 | $12,515 |

| 11/30/2021 | $14,967 | $15,217 | $14,367 | $14,069 | $12,552 |

| 12/31/2021 | $15,018 | $15,257 | $14,399 | $14,103 | $12,520 |

| 1/31/2022 | $14,500 | $14,830 | $14,000 | $13,730 | $12,250 |

| 2/28/2022 | $14,342 | $14,795 | $13,961 | $13,616 | $12,114 |

| 3/31/2022 | $13,729 | $14,261 | $13,474 | $13,149 | $11,777 |

| 4/30/2022 | $13,174 | $13,754 | $13,033 | $12,680 | $11,330 |

| 5/31/2022 | $13,331 | $13,905 | $13,194 | $12,837 | $11,403 |

| 6/30/2022 | $12,821 | $13,461 | $12,844 | $12,385 | $11,224 |

| 7/31/2022 | $13,286 | $13,964 | $13,275 | $12,826 | $11,498 |

| 8/31/2022 | $12,960 | $13,653 | $12,981 | $12,527 | $11,174 |

| 9/30/2022 | $12,136 | $12,812 | $12,287 | $11,851 | $10,691 |

| 10/31/2022 | $11,869 | $12,549 | $12,087 | $11,639 | $10,552 |

| 11/30/2022 | $12,595 | $13,280 | $12,742 | $12,261 | $10,940 |

| 12/31/2022 | $12,556 | $13,258 | $12,742 | $12,211 | $10,891 |

| 1/31/2023 | $13,069 | $13,847 | $13,237 | $12,675 | $11,226 |

| 2/28/2023 | $12,716 | $13,412 | $12,862 | $12,333 | $10,936 |

| 3/31/2023 | $12,846 | $13,620 | $13,092 | $12,507 | $11,214 |

| 4/30/2023 | $12,952 | $13,699 | $13,131 | $12,548 | $11,282 |

| 5/31/2023 | $12,864 | $13,604 | $13,032 | $12,477 | $11,159 |

| 6/30/2023 | $13,104 | $13,846 | $13,228 | $12,600 | $11,119 |

| 7/31/2023 | $13,151 | $13,936 | $13,302 | $12,634 | $11,111 |

| 8/31/2023 | $12,988 | $13,724 | $13,104 | $12,456 | $11,040 |

| 9/30/2023 | $12,553 | $13,258 | $12,680 | $12,064 | $10,760 |

| 10/31/2023 | $12,255 | $13,045 | $12,511 | $11,821 | $10,590 |

| 11/30/2023 | $13,079 | $14,057 | $13,419 | $12,642 | $11,069 |

| 12/31/2023 | $13,494 | $14,479 | $13,790 | $13,023 | $11,493 |

| 1/31/2024 | $13,574 | $14,411 | $13,724 | $13,072 | $11,462 |

| 2/29/2024 | $13,679 | $14,525 | $13,800 | $13,151 | $11,300 |

| 3/31/2024 | $13,779 | $14,697 | $13,906 | $13,230 | $11,404 |

| 4/30/2024 | $13,631 | $14,607 | $13,791 | $13,073 | $11,116 |

| 5/31/2024 | $13,721 | $14,718 | $13,844 | $13,152 | $11,304 |

| 6/30/2024 | $13,991 | $15,078 | $14,139 | $13,458 | $11,412 |

| 7/31/2024 | $14,136 | $15,243 | $14,285 | $13,595 | $11,678 |

| 8/31/2024 | $14,280 | $15,423 | $14,434 | $13,706 | $11,846 |

| 9/30/2024 | $14,515 | $15,562 | $14,568 | $13,876 | $12,004 |

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume the reinvestment of dividends and capital gains.

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class I at NAV | 15.63% | 1.54% | 3.80% |

| Bloomberg High Yield Municipal Bond Index | 17.38% | 3.07% | 4.52% |

| Bloomberg 65% High Yield Municipal Bond Index/ 35% Bloomberg Municipal Bond Index | 14.89% | 2.51% | 3.83% |

| Lipper High Yield Municipal Debt Funds Average | 15.02% | 1.69% | 3.33% |

Bloomberg Aggregate Bond IndexFootnote Reference* | 11.57% | 0.33% | 1.84% |

| Footnote | Description |

Footnote* | The Fund has adopted the Bloomberg Aggregate Bond Index as its broad-based securities market index. |

The Fund's past performance is no guarantee of future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

(as of September 30, 2024)

| Total Net Assets | $4,098,713,523 |

| # of Portfolio Holdings | 611 |

| Portfolio Turnover Rate | 27% |

| Total Advisory Fees Paid | $16,137,454 |

What did the Fund invest in?

(as of September 30, 2024)

Credit Rating S&P or Moody'sFootnote Reference(a) | %Footnote Reference** |

|---|

| |

- A3.12%

- A-3.62%

- A+4.07%

- AA4.24%

- AA-2.36%

- AA+0.32%

- AAA1.03%

- B0.75%

- B-2.26%

- B+2.14%

- BB6.67%

- BB-5.00%

- BB+6.47%

- BBB3.00%

- BBB-8.39%

- BBB+4.73%

- CCC0.30%

- CCC-1.01%

- CCC+0.36%

- NR40.16%

- Total 100.00%

| Footnote | Description |

Footnote** | Represents percent of total investments, which excludes derivatives. |

Footnote(a) | Investments in investment grade municipal bonds, which as bonds that are rated, at the time of purchase, within the four highest grades assigned by an independent rating agency such as Moody’s, S&P, or Fitch, or an equivalent short-term rating, as applicable, or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. Lower rated municipal bonds are rated, at the time of purchase, or an equivalent short-term rating, as applicable, by an independent rating agency or are unrated by rating agencies but deemed by Lord Abbett to be of comparable quality. |

There were no material fund changes during the period.

Where can I find additional information about the Fund?

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information, please visit lordabbett.com/FundDocuments.

The Fund has adopted a policy that allows it to send only one copy of the Fund's prospectus, proxy material, annual report and semiannual report (or related notice of internet availability of annual report and semiannual report) to certain shareholders residing at the same "household." This reduces Fund expenses, which benefits you and other shareholders.If you need additional copies or do not want your mailings to be "householded," please call Lord Abbett at 888-522-2388.

Lord Abbett High Income Municipal Bond Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

TSR-A-1451-I

11/24

Lord Abbett California Tax Free Fund

Annual Shareholder Report

September 30, 2024

lordabbett.com/FundDocuments

This annual shareholder report contains important information about the Lord Abbett California Tax Free Fund for the period of October 1, 2023 to September 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at lordabbett.com/FundDocuments. You can also request this information by contacting us at 888-522-2388.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $82 | 0.77% |

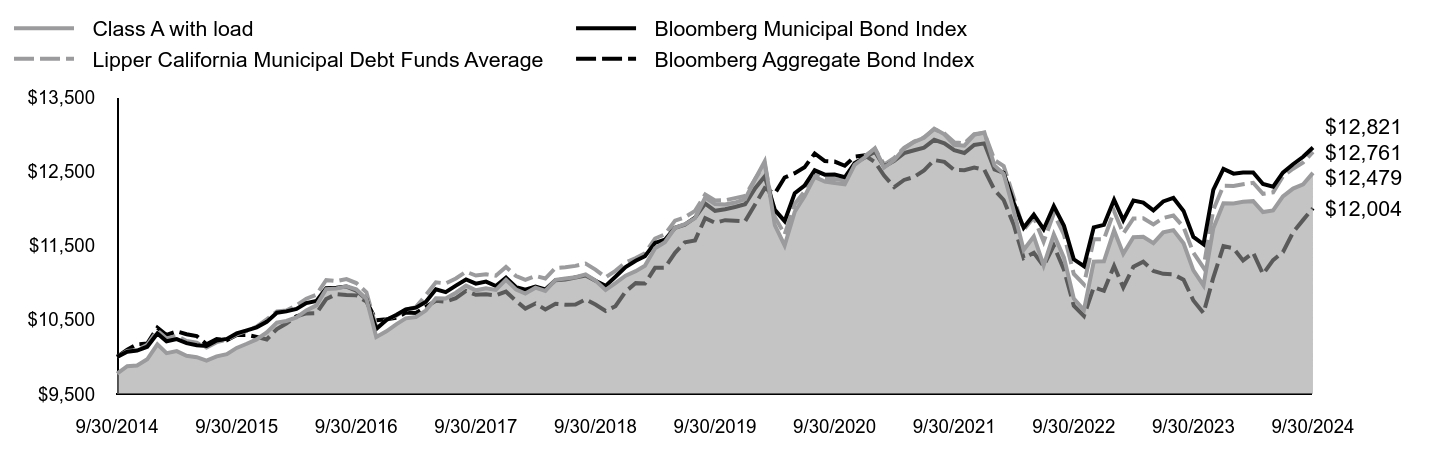

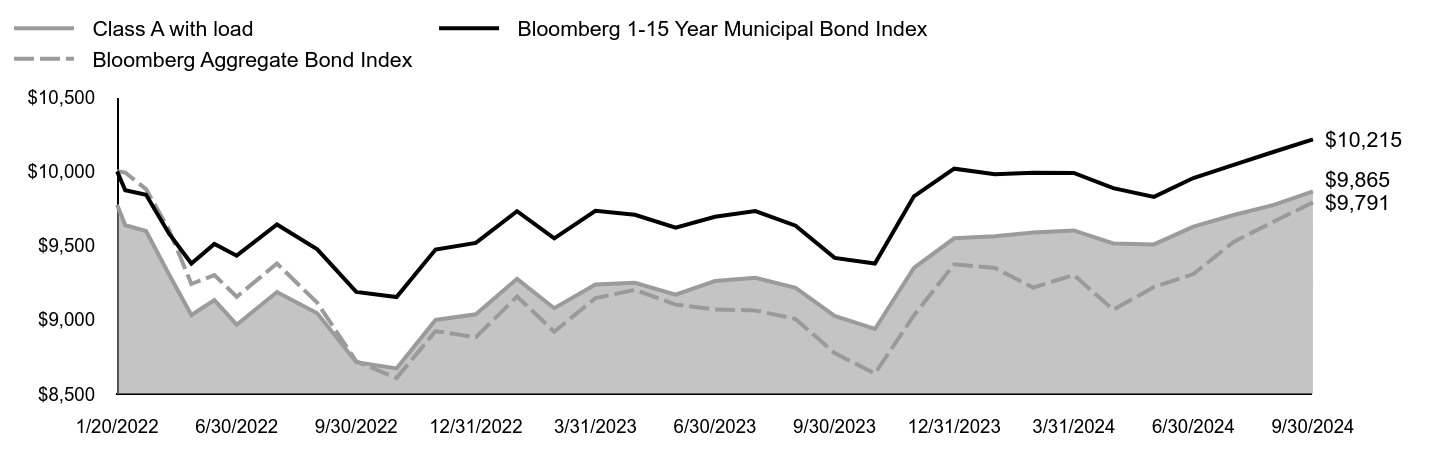

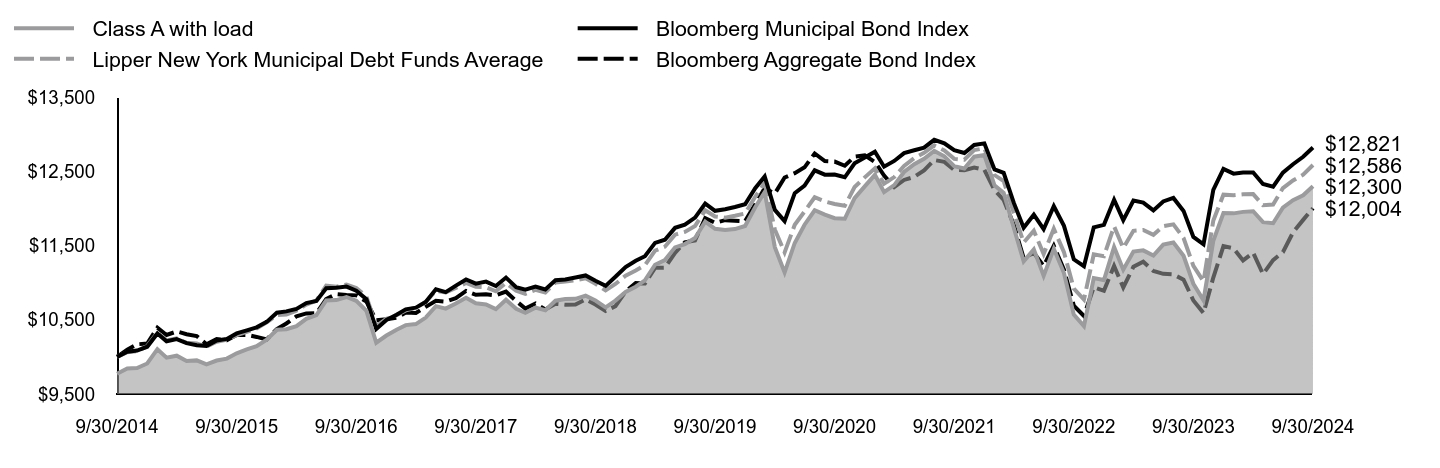

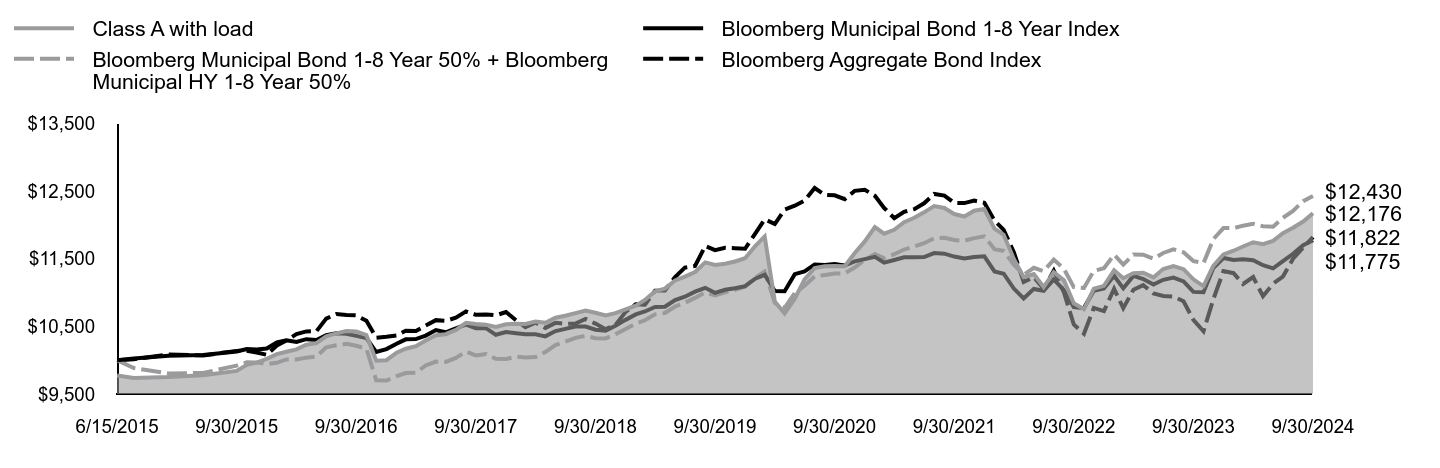

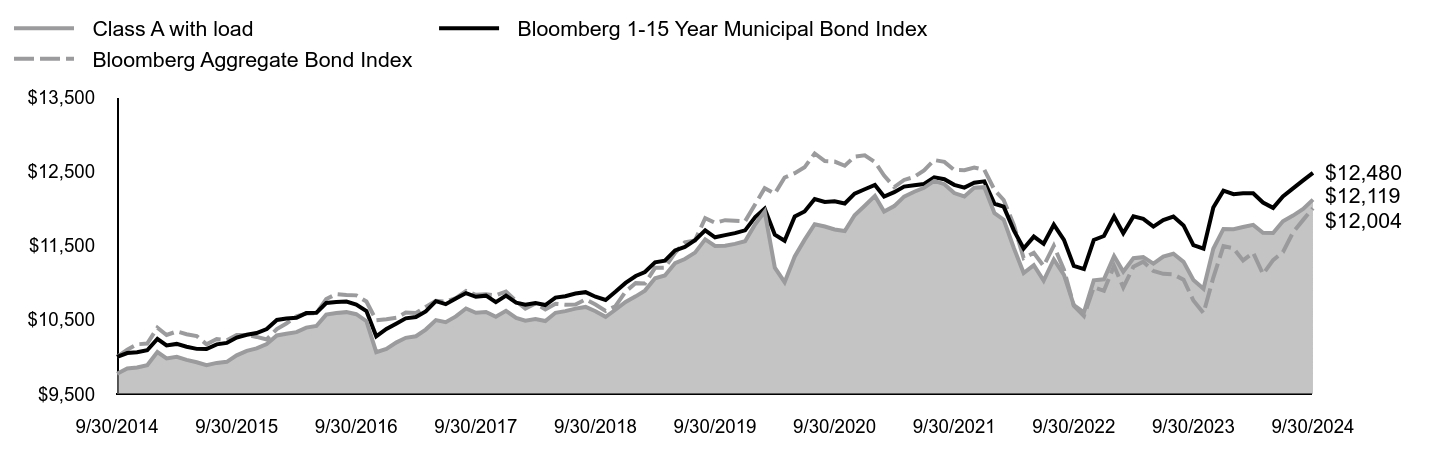

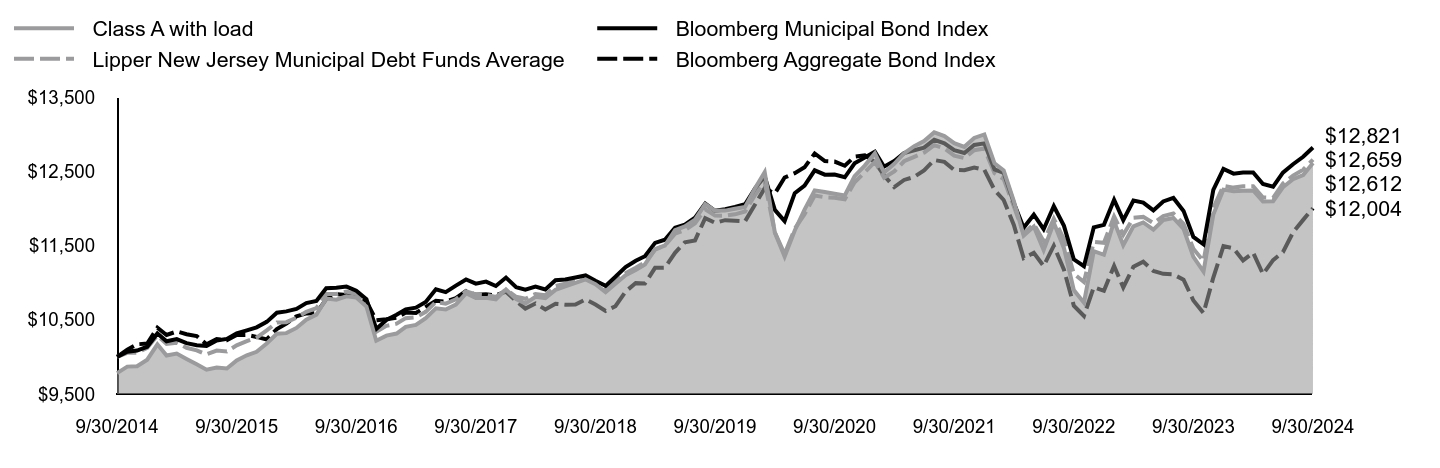

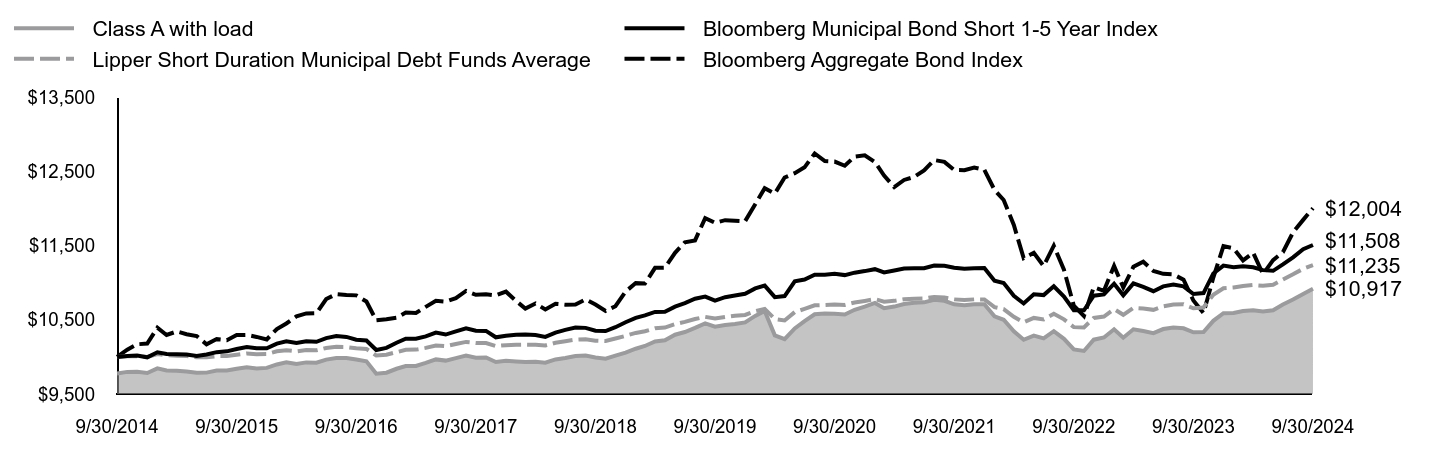

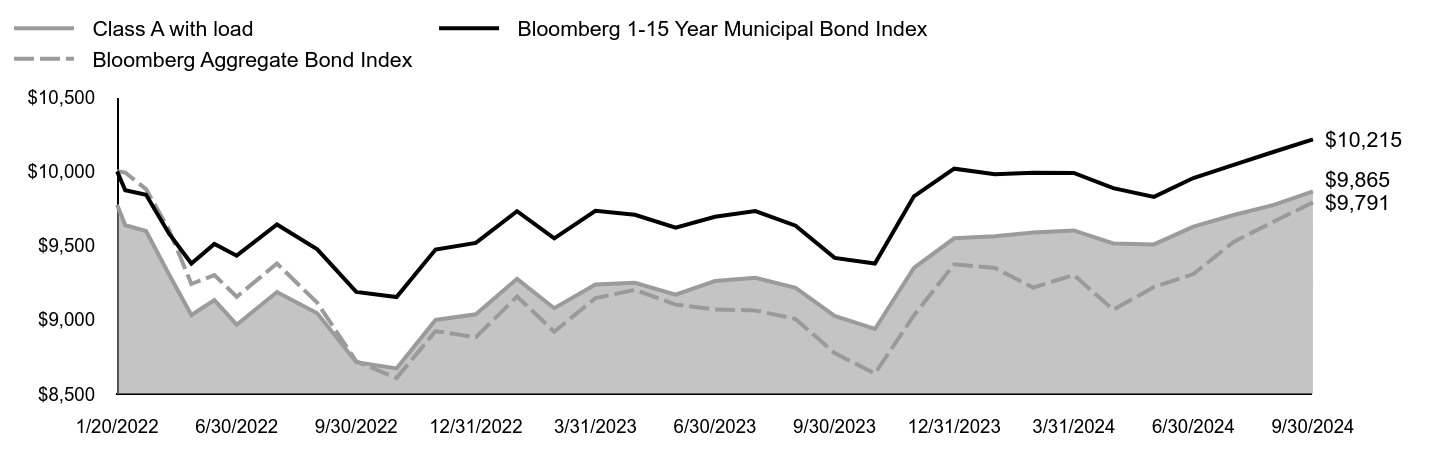

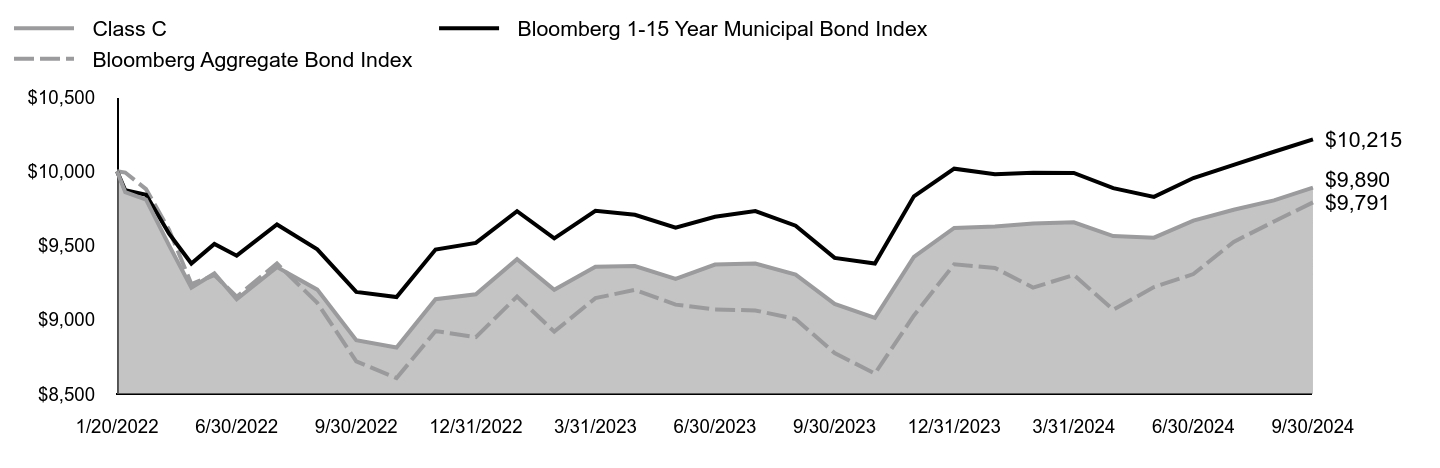

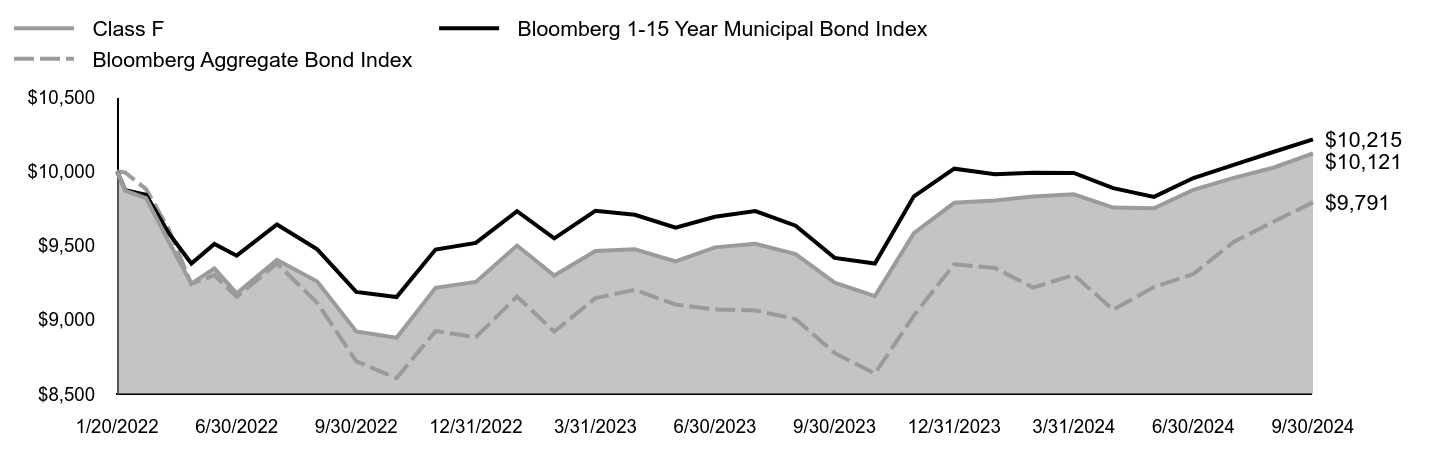

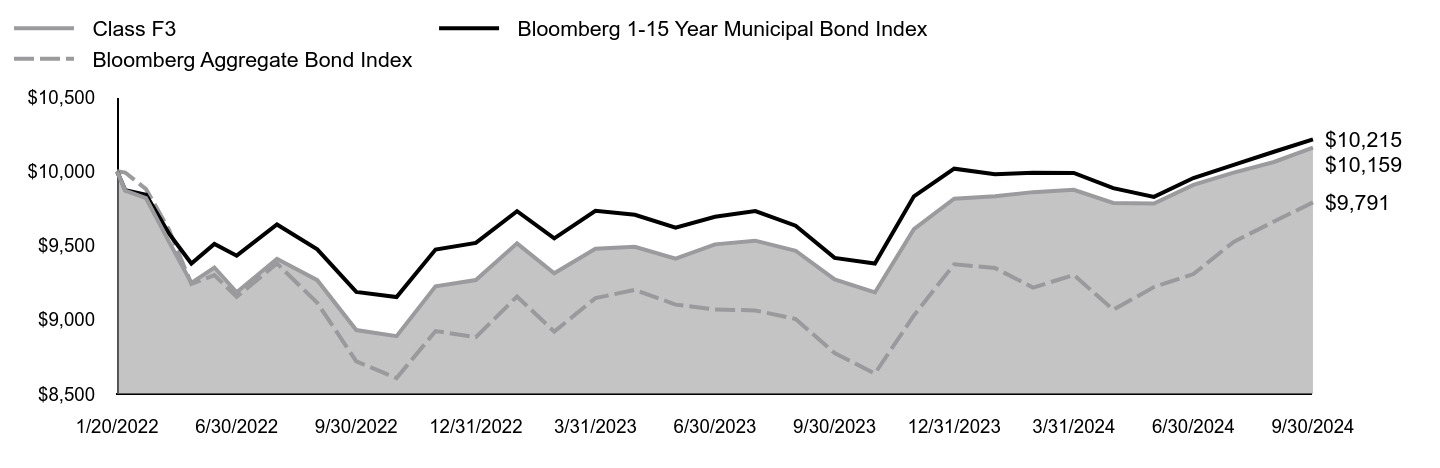

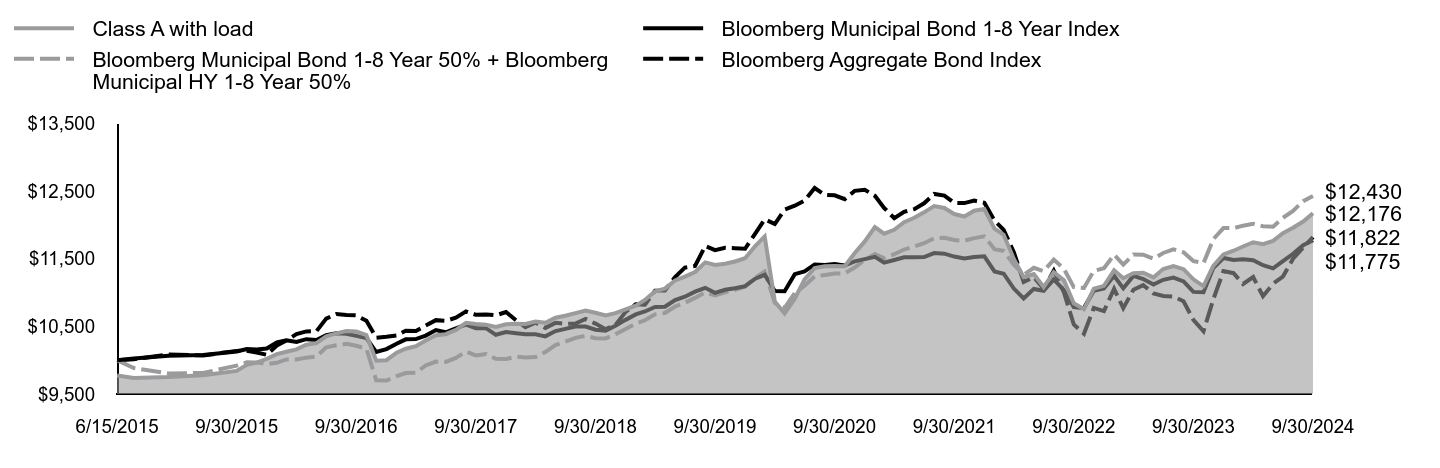

How did the Fund perform last year and what affected its performance?

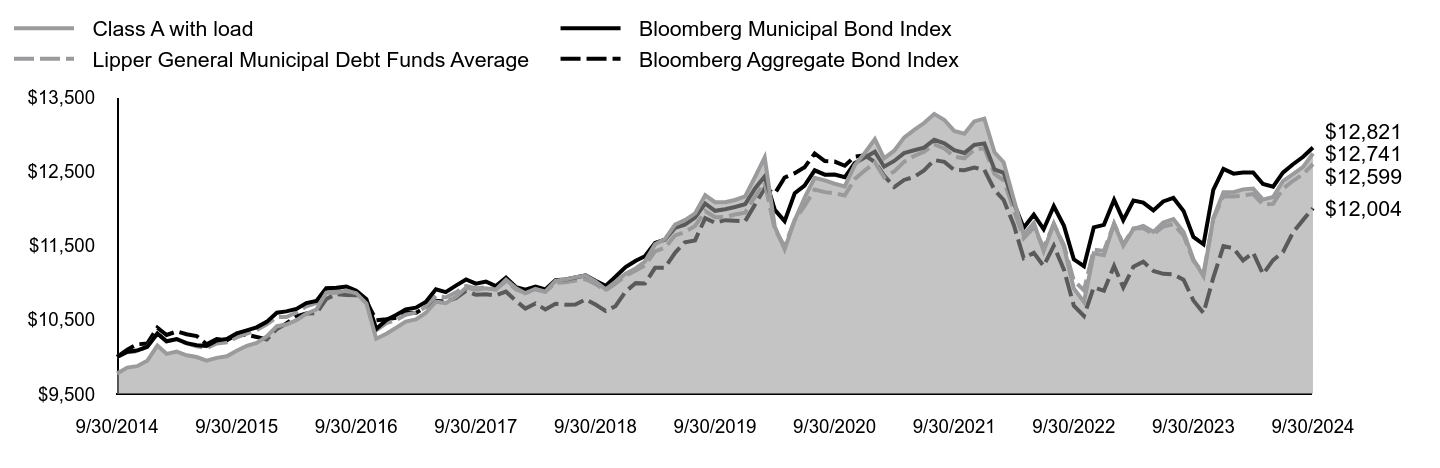

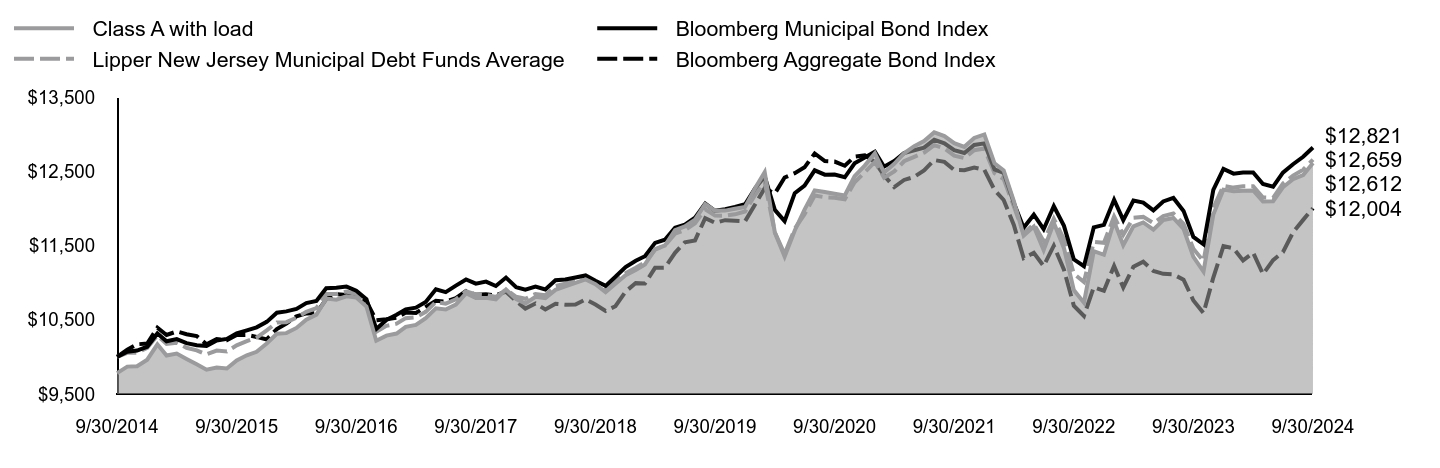

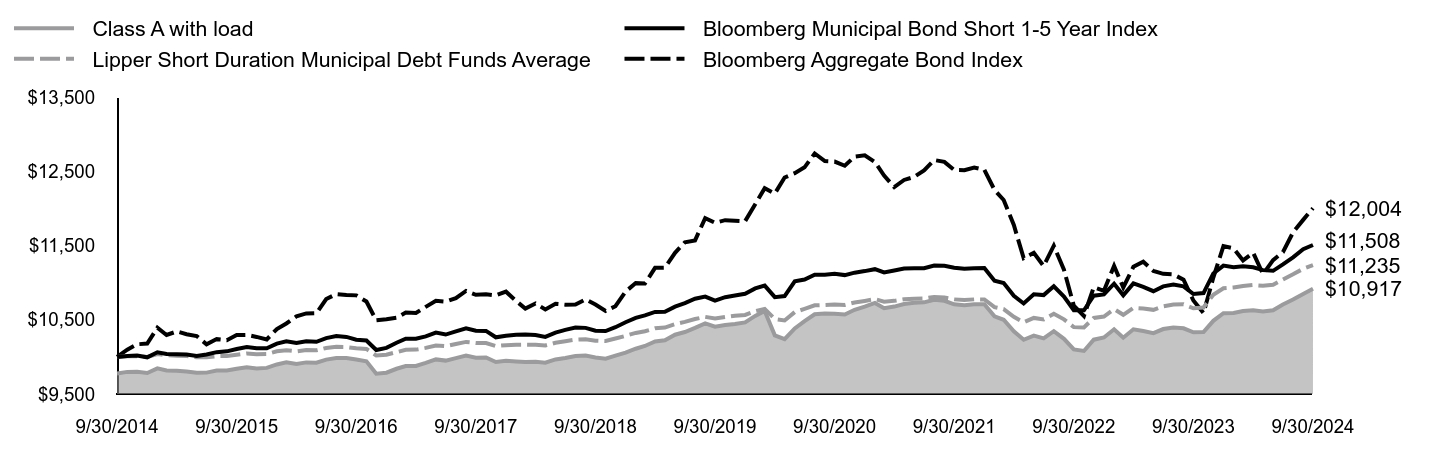

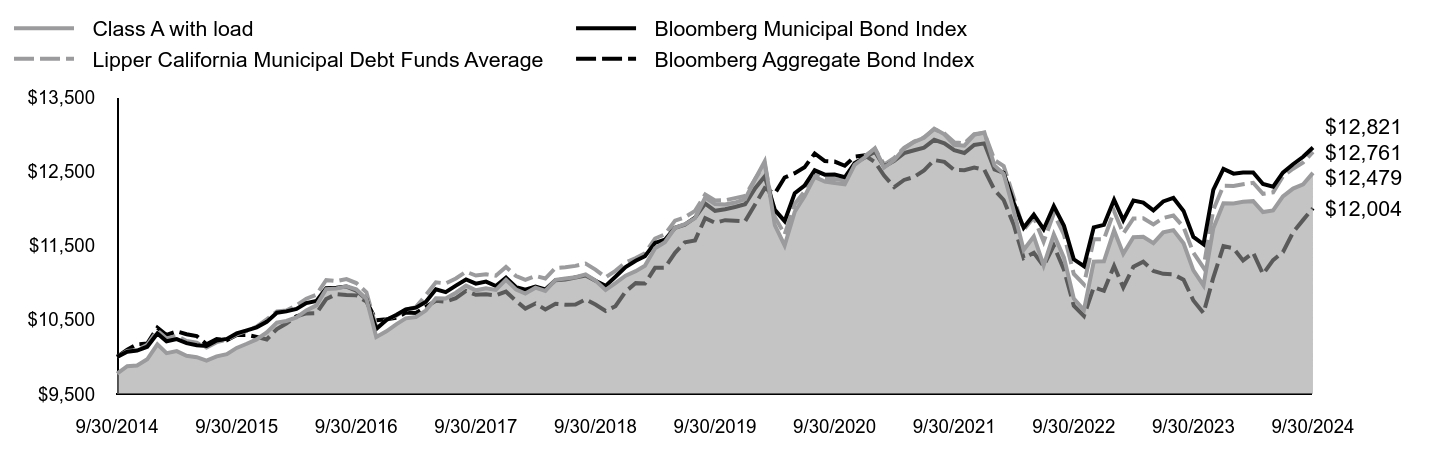

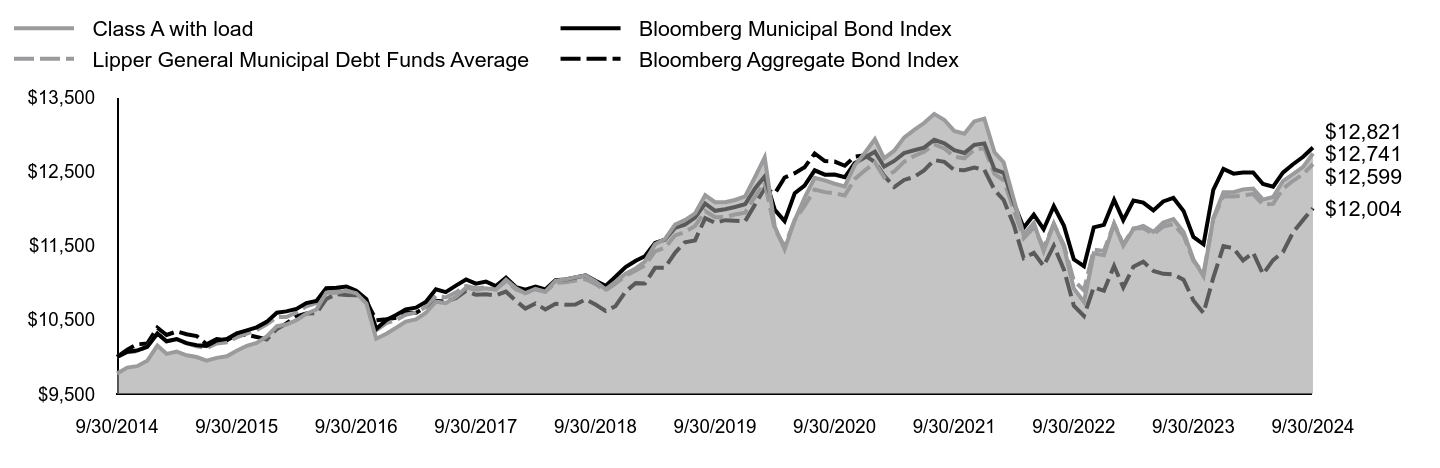

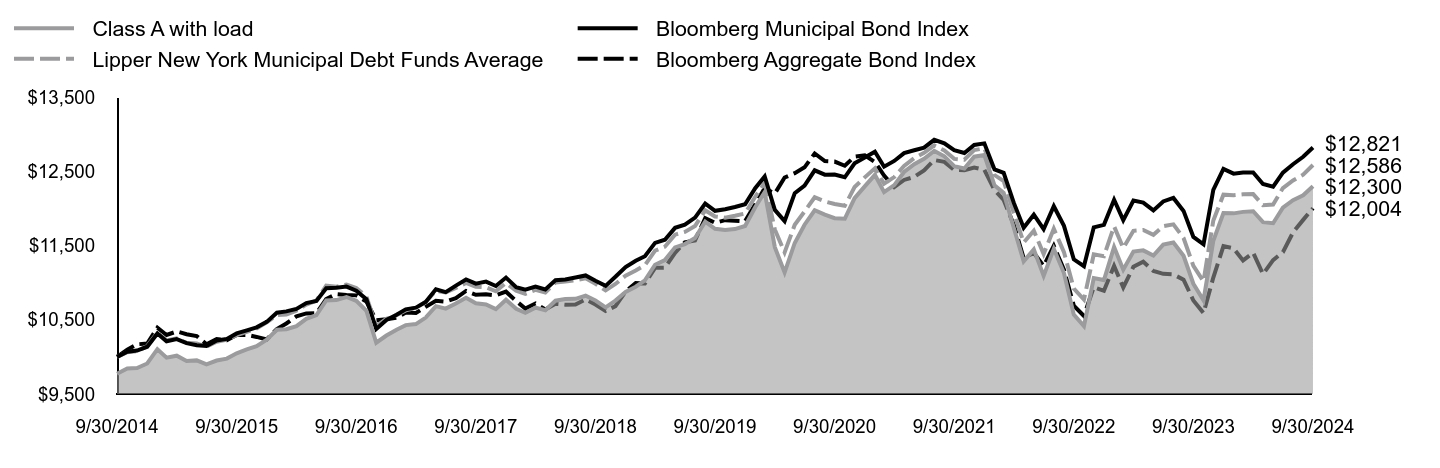

For the fiscal year ended September 30, 2024, the Fund returned 11.78%, reflecting performance at the net asset value (NAV) of Class A shares, compared to the 10.37% of a securities market index with investment characteristics similar to those of the Fund, the Bloomberg Municipal Bond Index. The Fund's broad-based market index, the Bloomberg Aggregate Bond Index, returned 11.57% over the same period.

Positive factors for the municipal market included decreasing Treasury yields, easing inflationary pressures and the start of interest rate cuts by the U.S. Federal Reserve. Also supporting the market was increased demand for municipal bond funds and a strong fundamental backdrop as evidenced by growing tax revenue and positive ratings actions by public ratings agencies. Negative factors included a significant increase in municipal bond supply, which pressured the market in second half of the fiscal year, and periods of interest rate volatility driven by sticky inflation readings at points throughout the fiscal year. Against this backdrop, municipal bonds delivered strong returns.

Top contributors to the Fund’s performance: The Fund’s longer duration positioning contributed to relative performance with the fall in rates over the period. An overweight allocation to BBB-rated and non-investment grade bonds contributed to relative performance. An overweight allocation to the Tobacco and Industrial Development sectors contributed to relative performance.

Top detractors from the Fund’s performance: Security selection within the Transportation, Local General Obligation and Education sectors detracted from relative performance.

Total Return Based on $10,000 Investment

| Class A with load | Bloomberg Municipal Bond Index | Lipper California Municipal Debt Funds Average | Bloomberg Aggregate Bond Index |

|---|

| 9/30/2014 | $9,775 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $9,875 | $10,069 | $10,080 | $10,098 |

| 11/30/2014 | $9,885 | $10,086 | $10,093 | $10,170 |

| 12/31/2014 | $9,967 | $10,137 | $10,163 | $10,179 |

| 1/31/2015 | $10,168 | $10,316 | $10,356 | $10,393 |

| 2/28/2015 | $10,050 | $10,210 | $10,248 | $10,295 |

| 3/31/2015 | $10,078 | $10,240 | $10,282 | $10,343 |

| 4/30/2015 | $10,014 | $10,186 | $10,215 | $10,306 |

| 5/31/2015 | $9,996 | $10,158 | $10,191 | $10,281 |

| 6/30/2015 | $9,951 | $10,148 | $10,126 | $10,169 |

| 7/31/2015 | $10,008 | $10,222 | $10,199 | $10,240 |

| 8/31/2015 | $10,037 | $10,242 | $10,230 | $10,225 |

| 9/30/2015 | $10,121 | $10,316 | $10,303 | $10,294 |

| 10/31/2015 | $10,177 | $10,357 | $10,350 | $10,296 |

| 11/30/2015 | $10,235 | $10,398 | $10,409 | $10,269 |

| 12/31/2015 | $10,330 | $10,472 | $10,506 | $10,235 |

| 1/31/2016 | $10,463 | $10,596 | $10,612 | $10,376 |

| 2/29/2016 | $10,484 | $10,613 | $10,624 | $10,450 |

| 3/31/2016 | $10,532 | $10,647 | $10,694 | $10,546 |

| 4/30/2016 | $10,627 | $10,725 | $10,784 | $10,586 |

| 5/31/2016 | $10,694 | $10,754 | $10,839 | $10,589 |

| 6/30/2016 | $10,914 | $10,925 | $11,036 | $10,779 |

| 7/31/2016 | $10,923 | $10,932 | $11,021 | $10,847 |

| 8/31/2016 | $10,950 | $10,947 | $11,049 | $10,835 |

| 9/30/2016 | $10,910 | $10,892 | $10,995 | $10,829 |

| 10/31/2016 | $10,783 | $10,778 | $10,870 | $10,746 |

| 11/30/2016 | $10,269 | $10,376 | $10,394 | $10,492 |

| 12/31/2016 | $10,345 | $10,497 | $10,502 | $10,506 |

| 1/31/2017 | $10,442 | $10,567 | $10,558 | $10,527 |

| 2/28/2017 | $10,519 | $10,640 | $10,634 | $10,598 |

| 3/31/2017 | $10,537 | $10,663 | $10,671 | $10,592 |

| 4/30/2017 | $10,624 | $10,740 | $10,830 | $10,674 |

| 5/31/2017 | $10,790 | $10,911 | $11,004 | $10,756 |

| 6/30/2017 | $10,788 | $10,872 | $10,990 | $10,745 |

| 7/31/2017 | $10,865 | $10,960 | $11,056 | $10,792 |

| 8/31/2017 | $10,960 | $11,043 | $11,147 | $10,888 |

| 9/30/2017 | $10,897 | $10,987 | $11,096 | $10,836 |

| 10/31/2017 | $10,925 | $11,014 | $11,114 | $10,843 |

| 11/30/2017 | $10,902 | $10,955 | $11,094 | $10,829 |

| 12/31/2017 | $11,040 | $11,069 | $11,212 | $10,879 |

| 1/31/2018 | $10,906 | $10,939 | $11,088 | $10,753 |

| 2/28/2018 | $10,854 | $10,906 | $11,037 | $10,651 |

| 3/31/2018 | $10,932 | $10,947 | $11,091 | $10,720 |

| 4/30/2018 | $10,889 | $10,908 | $11,056 | $10,640 |

| 5/31/2018 | $11,039 | $11,033 | $11,198 | $10,716 |

| 6/30/2018 | $11,056 | $11,042 | $11,209 | $10,703 |

| 7/31/2018 | $11,074 | $11,069 | $11,226 | $10,705 |

| 8/31/2018 | $11,112 | $11,097 | $11,257 | $10,774 |

| 9/30/2018 | $11,028 | $11,025 | $11,177 | $10,705 |

| 10/31/2018 | $10,903 | $10,957 | $11,073 | $10,620 |

| 11/30/2018 | $10,994 | $11,079 | $11,160 | $10,683 |

| 12/31/2018 | $11,095 | $11,211 | $11,272 | $10,880 |

| 1/31/2019 | $11,155 | $11,296 | $11,333 | $10,995 |

| 2/28/2019 | $11,227 | $11,357 | $11,395 | $10,989 |

| 3/31/2019 | $11,464 | $11,536 | $11,595 | $11,200 |

| 4/30/2019 | $11,545 | $11,579 | $11,651 | $11,203 |

| 5/31/2019 | $11,740 | $11,739 | $11,836 | $11,402 |

| 6/30/2019 | $11,789 | $11,782 | $11,881 | $11,545 |

| 7/31/2019 | $11,869 | $11,877 | $11,967 | $11,570 |

| 8/31/2019 | $12,148 | $12,065 | $12,189 | $11,870 |

| 9/30/2019 | $12,059 | $11,968 | $12,108 | $11,807 |

| 10/31/2019 | $12,053 | $11,989 | $12,111 | $11,842 |

| 11/30/2019 | $12,080 | $12,019 | $12,139 | $11,836 |

| 12/31/2019 | $12,127 | $12,056 | $12,168 | $11,828 |

| 1/31/2020 | $12,397 | $12,273 | $12,401 | $12,056 |

| 2/29/2020 | $12,635 | $12,431 | $12,596 | $12,273 |

| 3/31/2020 | $11,775 | $11,980 | $11,886 | $12,201 |