|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBER 811-3967 |

| |

| FIRST INVESTORS INCOME FUNDS |

| (Exact name of registrant as specified in charter) |

| |

| 110 Wall Street |

| New York, NY 10005 |

| (Address of principal executive offices) (Zip code) |

| |

| Joseph I. Benedek |

| First Investors Management Company, Inc. |

| Raritan Plaza I |

| Edison, NJ 08837-3620 |

| (Name and address of agent for service) |

| |

| REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: |

| 1-212-858-8000 |

| |

| DATE OF FISCAL YEAR END: SEPTEMBER 30, 2012 |

| |

| DATE OF REPORTING PERIOD: SEPTEMBER 30, 2012 |

| |

| Item 1. | Reports to Stockholders |

| | |

| | The annual report to stockholders follows |

This report is for the information of the shareholders of the Funds. It is the policy of each Fund described in this report to mail only one copy of a Fund’s prospectus, annual report, semi-annual report and proxy statements to all shareholders who share the same mailing address and share the same last name and have invested in a Fund covered by the same document. You are deemed to consent to this policy unless you specifically revoke this policy and request that separate copies of such documents be mailed to you. In such case, you will begin to receive your own copies within 30 days after our receipt of the revocation. You may request that separate copies of these disclosure documents be mailed to you by writing to us at: Administrative Data Management Corp., Raritan Plaza I, Edison, NJ 08837-3620 or calling us at 1-800-423-4026.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: First Investors Corporation, 110 Wall Street, New York, NY 10005, or by visiting our website at www.firstinvestors.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about its Trustees.

Portfolio Manager’s Letter

CASH MANAGEMENT FUND

Dear Investor:

This is the annual report for the First Investors Cash Management Fund for the fiscal year ended September 30, 2012. During the period, the Fund’s return on a net asset value basis was 0.0% for Class A shares and Class B shares. The Fund maintained a $1.00 net asset value per share for each class of shares throughout the year.

The last few years have been difficult for investors in money market funds, as the Federal Reserve (“the Fed”) has maintained interest rates at record lows since late 2008. Furthermore, the Fed has indicated its intention to keep rates near zero until mid-2015. As this environment has persisted for several years and is fully expected to continue for a few more, the money market yield curve remains remarkably flat. As a result, there is only a marginal difference between shorter maturity investments and those with longer maturities.

The Fund maintained a significant amount of liquidity with more than 25% of its assets considered liquid within one day and a weighted average maturity of 40 days as of September 30, 2012. Money market product and quality spreads have compressed sharply given the massive amount of liquidity in the market, hence risk was barely compensated. For this reason, the Fund has had greater-than-average exposure to U.S. Treasury and agency securities, which are generally considered the lowest risk investments available.

First Investors Management Company (“FIMCO”), the Fund’s investment advisor, continued to absorb expenses to the Fund and waived management fees in an effort to avoid a negative yield to its shareholders. In addition, in an effort to mitigate expenses, certain shareholder privileges remained limited. FIMCO expects this situation to continue and consequently, the yield to shareholders should be at or near zero for the foreseeable future.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Although money market funds, in general, are relatively conservative vehicles, there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. Money market mutual funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

Understanding Your Fund’s Expenses (unaudited)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, including a sales charge (load) on purchase payments (on Class A shares only) and a contingent deferred sales charge on redemptions (on Class B shares only); and (2) ongoing costs, including advisory fees; distribution and service fees (12b-1); and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, April 1, 2012, and held for the entire six-month period ended September 30, 2012. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To estimate the expenses you paid on your account during this period, simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expenses Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for Class A and Class B shares, and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transaction costs, such as front-end or contingent deferred sales charges (loads). Therefore, the hypothetical expenses example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Fund Expenses (unaudited)

CASH MANAGEMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 2 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (4/1/12) | (9/30/12) | (4/1/12–9/30/12)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,000.00 | $0.70 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,024.30 | $0.71 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,000.00 | $0.70 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,024.30 | $0.71 |

| |

| * | Expenses are equal to the annualized expense ratio of .14% for Class A shares and .14% for Class B |

| shares, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the |

| one-half year period). Expenses paid during the period are net of expenses waived and/or assumed. |

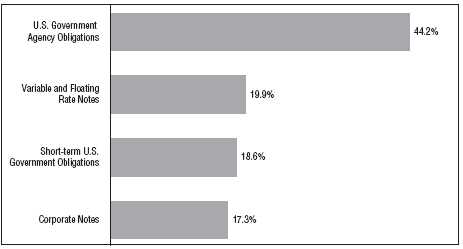

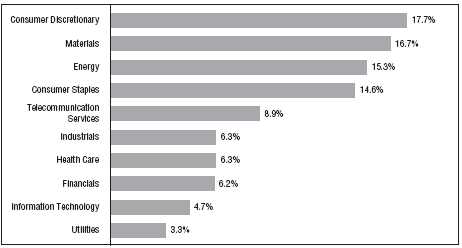

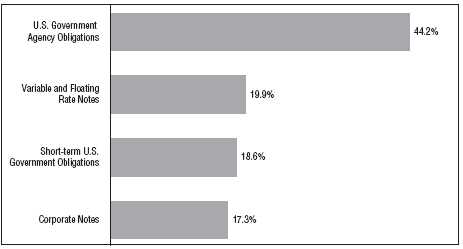

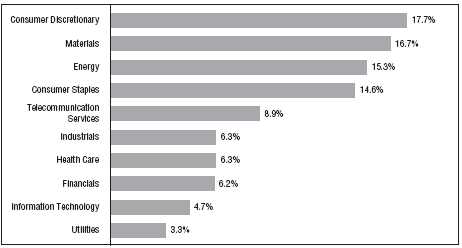

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2012, |

| and are based on the total value of investments. |

Portfolio of Investments

CASH MANAGEMENT FUND

September 30, 2012

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | U.S. GOVERNMENT AGENCY | | | | | |

| | | OBLIGATIONS—43.7% | | | | | |

| $8,000M | | Fannie Mae, 12/26/2012 | | | 0.13 | % | $ 7,997,611 |

| | | Federal Home Loan Bank: | | | | | |

| 5,000M | | 10/3/12 | | | 0.11 | | 4,999,969 |

| 6,500M | | 10/10/12 | | | 0.11 | | 6,499,829 |

| 9,000M | | 10/15/12 | | | 0.11 | | 8,999,632 |

| 6,000M | | 11/21/12 | | | 0.12 | | 5,999,022 |

| 4,923M | | 12/5/12 | | | 0.14 | | 4,921,800 |

| 5,000M | | 12/14/12 | | | 0.14 | | 4,998,612 |

| 3,000M | | 12/17/12 | | | 0.08 | | 2,999,487 |

| 1,185M | | 12/21/12 | | | 0.14 | | 1,184,627 |

| 3,750M | | 7/17/13 | | | 0.27 | | 3,750,929 |

| | | Freddie Mac: | | | | | |

| 1,000M | | 10/15/12 | | | 0.10 | | 999,961 |

| 6,000M | | 12/17/12 | | | 0.13 | | 5,998,396 |

| Total Value of U.S. Government Agency Obligations (cost $59,349,875) | | 59,349,875 |

| | | VARIABLE AND FLOATING RATE NOTES—19.7% | | |

| | | Federal Farm Credit Bank: | | | | | |

| 5,100M | | 3/6/13 | | | 0.26 | | 5,100,330 |

| 3,000M | | 9/16/13 | | | 0.39 | | 3,005,821 |

| 1,000M | | 10/15/13 | | | 0.28 | | 1,000,945 |

| | | Freddie Mac: | | | | | |

| 1,290M | | 10/12/12 | | | 0.28 | | 1,290,035 |

| 4,800M | | 3/21/13 | | | 0.18 | | 4,800,930 |

| 5,700M | | Mississippi Business Finance Corp. | | | | | |

| | | (Chevron USA, Inc.), 12/1/2030 | | | 0.20 | | 5,700,000 |

| 5,835M | | Valdez, Alaska Marine Terminal Rev. | | | | | |

| | | (Exxon Pipeline Co., Project B), 12/1/2033 | | | 0.20 | | 5,835,000 |

| Total Value of Variable and Floating Rate Notes (cost $26,733,061) | | | | | 26,733,061 |

| | | CORPORATE NOTES—17.1% | | | | | |

| 5,000M | | Coca-Cola Co., 10/4/2012 (a) | | | 0.23 | | 4,999,904 |

| 2,000M | | Google, Inc., 10/24/2012 (a) | | | 0.12 | | 1,999,847 |

| | | Johnson & Johnson: | | | | | |

| 2,300M | | 10/4/12 (a) | | | 0.15 | | 2,299,971 |

| 3,000M | | 11/19/12 (a) | | | 0.09 | | 2,999,633 |

| 5,000M | | Procter & Gamble Co., 10/29/2012 (a) | | | 0.14 | | 4,999,455 |

| 6,000M | | Wal-Mart Stores, Inc., 10/5/2012 (a) | | | 0.11 | | 5,999,927 |

| Total Value of Corporate Notes (cost $23,298,737) | | | | | 23,298,737 |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | SHORT-TERM U.S. GOVERNMENT | | | | | |

| | | OBLIGATIONS—18.4% | | | | | |

| | | U.S. Treasury Bills: | | | | | |

| $3,000M | | 10/18/12 | | | 0.08 | % | $ 2,999,887 |

| 7,500M | | 10/25/12 | | | 0.10 | | 7,499,504 |

| 5,500M | | 11/1/12 | | | 0.09 | | 5,499,597 |

| 3,000M | | 11/15/12 | | | 0.09 | | 2,999,663 |

| 6,000M | | 12/13/12 | | | 0.08 | | 5,998,978 |

| Total Value of Short-Term U.S. Government Obligations (cost $24,997,629) | | 24,997,629 |

| Total Value of Investments (cost $134,379,302)** | 98.9 | % | | | 134,379,302 |

| Other Assets, Less Liabilities | 1.1 | | | | 1,544,011 |

| Net Assets | | | 100.0 | % | | | $135,923,313 |

| |

| * | The interest rates shown are the effective rates at the time of purchase by the Fund. The interest |

| rates shown on variable and floating rate notes are adjusted periodically; the rates shown are the |

| rates in effect at September 30, 2012. |

| |

| ** | Aggregate cost for federal income tax purposes is the same. |

| |

| (a) | Security exempt from registration under Section 4(2) of the Securities Act of 1933 (see Note 4). |

Portfolio of Investments (continued)

CASH MANAGEMENT FUND

September 30, 2012

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of September 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | $ | — | | $ | 59,349,875 | | $ | — | | $ | 59,349,875 |

| Variable and Floating Rate Notes: | | | | | | | | | | | | |

| Municipal Bonds | | | — | | | 11,535,000 | | | — | | | 11,535,000 |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | | — | | | 15,198,061 | | | — | | | 15,198,061 |

| Corporate Notes | | | — | | | 23,298,737 | | | — | | | 23,298,737 |

| Short-Term U.S. Government | | | | | | | | | | | | |

| Obligations | | | — | | | 24,997,629 | | | — | | | 24,997,629 |

| Total Investments in Securities | | $ | — | | $ | 134,379,302 | | $ | — | | $ | 134,379,302 |

|

| There were no transfers into or from Level 1 or Level 2 by the Fund during the year ended |

| September 30, 2012. Transfers, if any, between Levels are recognized at the end of the |

| reporting period. |

| | |

| 6 | See notes to financial statements | |

Portfolio Manager’s Letter

GOVERNMENT FUND

Dear Investor:

This is the annual report for the First Investors Government Fund for the fiscal year ended September 30, 2012. During the period, the Fund’s return on a net asset value basis was 2.7% for Class A shares and 2.1% for Class B shares, including dividends of 37.9 cents per share on Class A shares and 30.2 cents per share on Class B shares.

The Fund’s performance was driven mainly by broad economic trends that affected the fixed income markets in general. Long-term interest rates continued their multi-year decline during the review period, falling to all-time lows in July before rising slightly. Several factors contributed to this low interest rate environment: the Federal Reserve’s (“the Fed’s”) very accommodative monetary policy, the subpar economic recovery, and safe haven flows from overseas into the U.S. bond market. Reviewing benchmark U.S. Treasury yields, the two-year U.S. Treasury note yield, which is anchored by the Fed’s commitment to keep short-term rates very low, barely moved during the review period, ending at 0.23%. The 10-year U.S. Treasury note yield fell from 1.92% to 1.63%.

The broad U.S. bond market returned 5.4%, according to Bank of America Merrill Lynch. Riskier fixed-income sectors had very strong performance, as the Fed’s success in depressing risk-free yields forced investors to take more risk. Consequently, high yield — or “junk” bonds — returned 18.9% and investment grade corporate bonds gained close to 11%. Higher quality sectors had notably lower, although positive, returns. The broad mortgage-backed securities market returned 3.7%. Of note, 30-year mortgage rates fell to an all-time low. The Treasury market returned 3.2%, although Treasury securities with maturities ten years and longer were up over 6% due to the decline in long-term interest rates.

The Fund’s benchmark, the Bank of America Merrill Lynch Ginnie Mae (“GNMA”) Index, returned 4.1% for the review period. Approximately 95% of the Fund is invested in GNMA mortgage-backed bonds. Within the GNMA market, lower coupon GNMA mortgage-backed bonds substantially outperformed higher coupon bonds. This reflected several factors. First, lower coupon mortgage-backed bonds have greater interest rate sensitivity so they benefited more from the decline in long-term interest rates. Second, elevated prepayments on mortgage-backed bonds, as homeowners took advantage of record low mortgage rates to refinance outstanding higher interest-rate mortgages, hurt the returns of higher coupon mortgage-backed bonds more than those of lower coupons. Third, the Fed initiated an open-ended program to buy mortgage-backed securities in September in order to lower interest rates and help spur the economy. The program focused on purchasing lower coupon mortgage-backed bonds, thus contributing to their outperformance.

Portfolio Manager’s Letter (continued)

GOVERNMENT FUND

The Fund underperformed its benchmark due to an underweight in lower coupon mortgage-backed bonds and a commensurate overweight in higher coupon mortgage-backed bonds. At the end of the review period, the Fund had an 18% underweight in GNMA 3%–3.5% coupons, the lowest actively traded coupons, and overweights in 4%–6% coupons. The underweight was intended to reduce the interest rate sensitivity of the Fund in order to protect shareholders from the negative impact of a potential rise in interest rates. In periods of falling interest rates, the Fund will normally underperform its benchmark, although the degree of underperformance in this review period was larger than expected due, in great measure, to the extraordinary actions taken by the Fed.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Fund Expenses (unaudited)

GOVERNMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 2 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (4/1/12) | (9/30/12) | (4/1/12–9/30/12)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,014.21 | $5.54 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,019.50 | $5.55 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,011.69 | $9.05 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,016.00 | $9.07 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.10% for Class A shares and 1.80% for |

| Class B shares, multiplied by the average account value over the period, multiplied by 183/366 (to |

| reflect the one-half year period). Expenses paid during the period are net of expenses waived. |

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2012, |

| and are based on the total value of investments. |

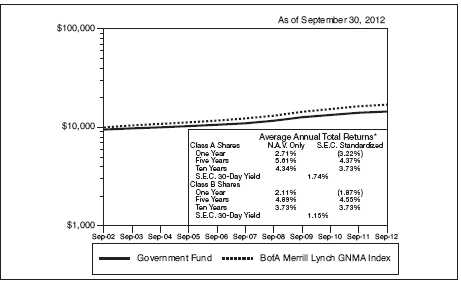

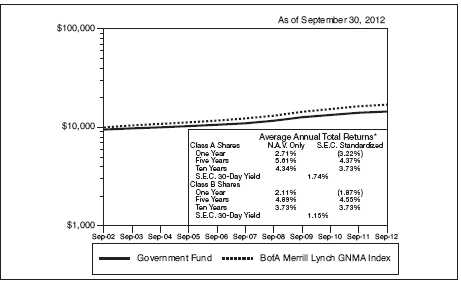

Cumulative Performance Information (unaudited)

GOVERNMENT FUND

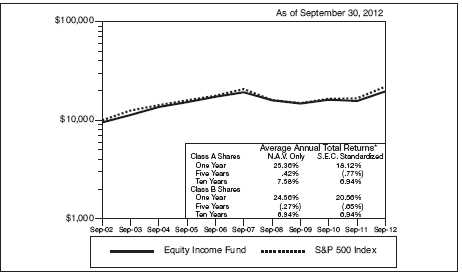

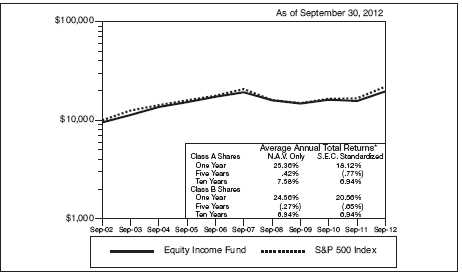

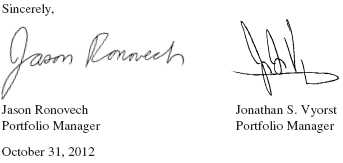

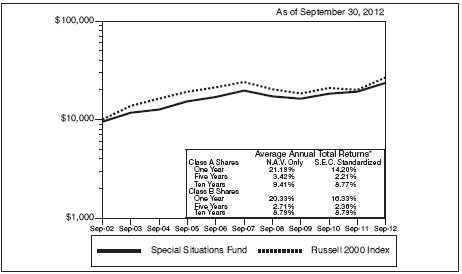

Comparison of change in value of $10,000 investment in the First Investors Government Fund (Class A shares) and the Bank of America (“BofA”) Merrill Lynch GNMA Master Index.

The graph compares a $10,000 investment in the First Investors Government Fund (Class A shares) beginning 9/30/02 with a theoretical investment in the BofA Merrill Lynch GNMA Master Index (the “Index”). The Index is a market capitalization-weighted index of securities backed by mortgage pools of the Government National Mortgage Association (GNMA). It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table, unless otherwise indicated, it has been assumed that the maximum sales charge was deducted from the initial $10,000 investment in the Fund and all dividends and distributions were reinvested. Class B shares performance may be greater than or less than that shown in the line graph above for Class A shares based on differences in sales loads and fees paid by shareholders investing in the different classes.

* Average Annual Total Return figures (for the periods ended 9/30/12) include the reinvestment of all dividends and distributions. “N.A.V. Only” returns are calculated without sales charges. The Class A “S.E.C. Standardized” returns shown are based on the maximum sales charge of 5.75%. The Class B “S.E.C. Standardized” returns are adjusted for the applicable deferred sales charge (maximum of 4% in the first year). During the periods shown, some of the expenses of the Fund were waived or assumed. If such expenses had been paid by the Fund, the Class A “S.E.C. Standardized” Average Annual Total Return for One Year, Five Years and Ten Years would have been (3.33%), 4.25% and 3.52%, respectively, and the S.E.C. 30-Day Yield for September 2012 would have been 1.63%. The Class B “S.E.C. Standardized” Average Annual Total Return for One Year, Five Years and Ten Years would have been (1.98%), 4.43% and 3.52%, respectively, and the S.E.C. 30-Day Yield for September 2012 would have been 1.05%. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Index figures are from Bank of America Merrill Lynch & Co. and all other figures are from First Investors Management Company, Inc.

Portfolio of Investments

GOVERNMENT FUND

September 30, 2012

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | RESIDENTIAL MORTGAGE-BACKED | | | | |

| | | SECURITIES—99.4% | | | | | |

| | | Fannie Mae—4.0% | | | | | |

| $ 6,726M | | 5%, 8/1/2039 – 11/1/2039 | | | | | $ 7,475,690 |

| 7,035M | | 5.5%, 7/1/2033 – 10/1/2039 | | | | | 7,854,375 |

| | | | | | | | 15,330,065 |

| | | Government National Mortgage Association I | | | | |

| | | Program—81.2% | | | | | |

| 28,327M | | 4%, 7/15/2040 – 1/15/2042 | | | | | 31,365,522 |

| 118,478M | | 4.5%, 9/15/2033 – 8/15/2041 | | | | | 130,942,463 |

| 66,306M | | 5%, 6/15/2033 – 6/15/2040 | | | | | 73,887,439 |

| 34,336M | | 5.5%, 3/15/2033 – 10/15/2039 | | | | | 38,531,878 |

| 29,912M | | 6%, 3/15/2031 – 5/15/2040 | | | | | 34,147,010 |

| 2,222M | | 6.5%, 6/15/2034 – 3/15/2038 | | | | | 2,643,558 |

| 3,372M | | 7%, 6/15/2023 – 4/15/2034 | | | | | 4,042,836 |

| | | | | | | | 315,560,706 |

| | | Government National Mortgage Association II | | | | |

| | | Program—14.2% | | | | | |

| 50,187M | | 4%, 3/20/2040 – 7/20/2042 | | | | | 55,295,324 |

| Total Value of Residential Mortgage-Backed Securities | | | | | |

| (cost $368,405,735) | 99.4 | % | | | 386,186,095 |

| Other Assets, Less Liabilities | .6 | | | | 2,271,007 |

| Net Assets | | | 100.0 | % | | | $388,457,102 |

Portfolio of Investments (continued)

GOVERNMENT FUND

September 30, 2012

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of September 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Residential Mortgage-Backed | | | | | | | | | | | | |

| Securities | | $ | — | | $ | 386,186,095 | | $ | — | | $ | 386,186,095 |

|

| There were no transfers into or from Level 1 or Level 2 by the Fund during the year ended |

| September 30, 2012. Transfers, if any, between Levels are recognized at the end of the |

| reporting period. |

| | |

| 12 | See notes to financial statements | |

Portfolio Managers’ Letter

INVESTMENT GRADE FUND

Dear Investor:

This is the annual report for the First Investors Investment Grade Fund for the fiscal year ended September 30, 2012. During the period, the Fund’s return on a net asset value basis was 11.2% for Class A shares and 10.4% for Class B shares, including dividends of 40.7 cents per share on Class A shares and 34.3 cents on Class B shares.

The Fund invests in investment grade fixed income securities. The majority of the Fund’s assets were invested in investment grade corporate bonds. The Fund also had as much as 5.5% of its assets invested in municipal bonds and 5% in mortgage-backed securities.

Long-term interest rates continued their multi-year decline during the review period, falling to all-time lows in July before rising slightly. Several factors contributed to this low interest-rate environment: the Federal Reserve’s (“the Fed’s”) very accommodative monetary policy, the subpar economic recovery, and safe haven flows from overseas into the U.S. bond market. Reviewing benchmark U.S. Treasury yields, the two-year U.S. Treasury note yield, which is anchored by the Fed’s commitment to keep short-term rates very low, barely moved during the review period, ending at 0.23%. The 10-year U.S. Treasury note yield fell from 1.92% to 1.63%.

The broad U.S. bond market returned 5.4%, according to Bank of America Merrill Lynch. Riskier fixed income sectors had very strong performance, as the Fed’s success in depressing risk-free yields forced investors to take more risk. Consequently, high yield — or “junk” bonds — returned 18.9% and investment grade corporate bonds gained close to 11%. Higher quality sectors had notably lower, although positive, returns. The broad mortgage-backed securities market returned 3.7%. Of note, 30-year mortgage rates fell to an all-time low. The Treasury market returned 3.2%, although Treasury securities with maturities ten years and longer, were up over 6%, due to the decline in long-term interest rates.

The review period began with continued confidence in the financial strength of corporate issuers. Deleveraging of corporate balance sheets, credit availability and accommodative monetary policy pointed toward a favorable outlook for investment grade corporate credit. The positive tone was somewhat offset by fallout from the European debt crisis and fear of a global economic slowdown. However, the Fed’s announcement of another round of quantitative easing, and the European Central Bank’s details of its bond-buying program, gave an indication to investors that global central banks were highly disposed toward continued monetary support. The constraint of low yields continued to dominate asset allocation behavior during the review period,

Portfolio Managers’ Letter (continued)

INVESTMENT GRADE FUND

favoring investment grade credit, particularly corporate bonds. By the end of the review period, demand for corporate credit continued to bring corporate spreads tighter. Corporate issuers continued to take advantage of historic low yields and were met with significant investor demand. The positive returns of the corporate bond market were led by falling interest rates and compressed bond spreads.

The Fund outperformed the Bank of America Merrill Lynch Corporate Index during the review period. The relative performance was predominantly a function of the Fund’s overweight in corporate bonds. Specifically, the Fund benefited from its overweight in BBB-rated corporate bonds, which had the highest returns during the review period. This was somewhat offset by the Fund’s underweight in corporate bonds with maturities greater than 10 years, which benefited from falling 30-year U.S. Treasury yields.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Fund Expenses (unaudited)

INVESTMENT GRADE FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 2 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (4/1/12) | (9/30/12) | (4/1/12–9/30/12)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,064.56 | $5.57 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,019.60 | $5.45 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,061.26 | $9.17 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,016.10 | $8.97 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.08% for Class A shares and 1.78% for |

| Class B shares, multiplied by the average account value over the period, multiplied by 183/366 |

| (to reflect the one-half year period). Expenses paid during the period are net of expenses waived. |

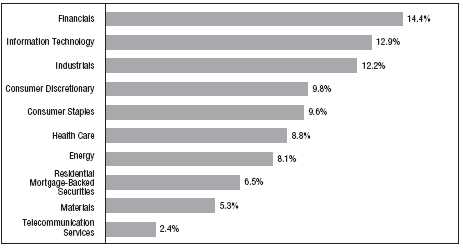

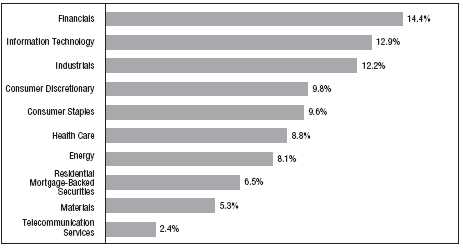

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2012, |

| and are based on the total value of investments. |

Cumulative Performance Information (unaudited)

INVESTMENT GRADE FUND

Comparison of change in value of $10,000 investment in the First Investors Investment Grade Fund (Class A shares) and the Bank of America (“BofA”) Merrill Lynch U.S. Corporate Master Index.

The graph compares a $10,000 investment in the First Investors Investment Grade Fund (Class A shares) beginning 9/30/02 with a theoretical investment in the BofA Merrill Lynch U.S. Corporate Master Index (the “Index”). The Index tracks the performance of U.S. dollar-denominated investment grade corporate public debt issued in the U.S. domestic bond market. Qualifying bonds must have at least one year remaining term to maturity, a fixed coupon schedule and a minimum amount outstanding of $250 million. Bonds must be rated investment grade based on a composite of Moody’s and S&P. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table, unless otherwise indicated, it has been assumed that the maximum sales charge was deducted from the initial $10,000 investment in the Fund and all dividends and distributions were reinvested. Class B shares performance may be greater than or less than that shown in the line graph above for Class A shares based on differences in sales loads and fees paid by shareholders investing in the different classes.

* Average Annual Total Return figures (for the periods ended 9/30/12) include the reinvestment of all dividends and distributions. “N.A.V. Only” returns are calculated without sales charges. The Class A “S.E.C. Standardized” returns shown are based on the maximum sales charge of 5.75%. The Class B “S.E.C. Standardized” returns are adjusted for the applicable deferred sales charge (maximum of 4% in the first year). During the periods shown, some of the expenses of the Fund were waived or assumed. If such expenses had been paid by the Fund, the Class A “S.E.C. Standardized” Average Annual Total Return for One Year, Five Years and Ten Years would have been 4.69%, 5.40% and 4.69%, respectively, and the S.E.C. 30-Day Yield for September 2012 would have been 1.89%. The Class B “S.E.C. Standardized” Average Annual Total Return for One Year, Five Years and Ten Years would have been 6.30%, 5.57% and 4.70%, respectively, and the S.E.C. 30-Day Yield for September 2012 would have been 1.32%. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Index figures are from Bank of America Merrill Lynch & Co. and all other figures are from First Investors Management Company, Inc.

Portfolio of Investments

INVESTMENT GRADE FUND

September 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | CORPORATE BONDS—98.3% | | |

| | | Aerospace/Defense—.3% | | |

| $1,800M | | BAE Systems Holdings, Inc., 4.95%, 6/1/2014 (a) | | $ 1,893,400 |

| | | Agriculture—1.3% | | |

| 2,725M | | Cargill, Inc., 6%, 11/27/2017 (a) | | 3,303,828 |

| 2,825M | | CF Industries, Inc., 7.125%, 5/1/2020 | | 3,552,437 |

| | | | | 6,856,265 |

| | | Automotive—.8% | | |

| 4,000M | | Daimler Finance NA, LLC, 2.95%, 1/11/2017 (a) | | 4,215,800 |

| | | Chemicals—.8% | | |

| 4,000M | | Dow Chemical Co., 4.25%, 11/15/2020 | | 4,416,256 |

| | | Consumer Durables—1.0% | | |

| 1,550M | | Newell Rubbermaid, Inc., 4.7%, 8/15/2020 | | 1,705,756 |

| 3,000M | | Stanley Black & Decker, 5.2%, 9/1/2040 | | 3,446,445 |

| | | | | 5,152,201 |

| | | Energy—11.6% | | |

| 3,900M | | Canadian Oil Sands, Ltd., 7.75%, 5/15/2019 (a) | | 4,920,665 |

| 4,800M | | DCP Midstream, LLC, 9.75%, 3/15/2019 (a) | | 6,177,758 |

| 5,000M | | Enbridge Energy Partners, LP, 4.2%, 9/15/2021 | | 5,419,580 |

| 4,000M | | Kinder Morgan Energy Partners, LP, 3.45%, 2/15/2023 | | 4,127,092 |

| 1,757M | | Maritime & Northeast Pipeline, LLC, 7.5%, 5/31/2014 (a) | | 1,869,037 |

| 4,000M | | Nabors Industries, Inc., 6.15%, 2/15/2018 | | 4,703,136 |

| 4,000M | | ONEOK Partners, LP, 3.375%, 10/1/2022 | | 4,027,968 |

| 5,000M | | Petrobras International Finance Co., 5.375%, 1/27/2021 | | 5,658,855 |

| 4,100M | | Reliance Holdings USA, Inc., 4.5%, 10/19/2020 (a) | | 4,209,134 |

| 5,800M | | Spectra Energy Capital, LLC, 6.2%, 4/15/2018 | | 7,023,603 |

| 4,400M | | Suncor Energy, Inc., 6.85%, 6/1/2039 | | 6,089,710 |

| 2,700M | | Valero Energy Corp., 9.375%, 3/15/2019 | | 3,671,795 |

| 4,000M | | Weatherford International, Inc., 6.35%, 6/15/2017 | | 4,661,912 |

| | | | | 62,560,245 |

Portfolio of Investments (continued)

INVESTMENT GRADE FUND

September 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Financial Services—13.7% | | |

| $2,250M | | Aflac, Inc., 8.5%, 5/15/2019 | | $ 3,017,671 |

| 6,000M | | American Express Co., 7%, 3/19/2018 | | 7,602,600 |

| 4,000M | | American International Group, Inc., 4.875%, 9/15/2016 | | 4,469,024 |

| 3,800M | | Berkshire Hathaway, Inc., 3.4%, 1/31/2022 | | 4,069,078 |

| 4,000M | | BlackRock, Inc., 5%, 12/10/2019 | | 4,760,476 |

| 3,510M | | CoBank, ACB, 7.875%, 4/16/2018 (a) | | 4,398,778 |

| 1,800M | | Compass Bank, 6.4%, 10/1/2017 | | 1,903,082 |

| | | ERAC USA Finance Co.: | | |

| 2,950M | | 6.375%, 10/15/2017 (a) | | 3,528,014 |

| 2,800M | | 4.5%, 8/16/2021 (a) | | 3,065,014 |

| 6,200M | | Ford Motor Credit Co., LLC, 5%, 5/15/2018 | | 6,784,183 |

| | | General Electric Capital Corp.: | | |

| 4,000M | | 5.625%, 9/15/2017 | | 4,715,836 |

| 2,700M | | 5.5%, 1/8/2020 | | 3,199,027 |

| 4,000M | | Glencore Funding, LLC, 6%, 4/15/2014 (a) | | 4,205,256 |

| 3,800M | | Harley-Davidson Funding Corp., 5.75%, 12/15/2014 (a) | | 4,144,223 |

| 4,000M | | Liberty Mutual Group, Inc., 4.95%, 5/1/2022 (a) | | 4,191,980 |

| 4,000M | | Protective Life Corp., 7.375%, 10/15/2019 | | 4,771,232 |

| 4,600M | | Prudential Financial Corp., 4.75%, 9/17/2015 | | 5,069,517 |

| | | | | 73,894,991 |

| | | Financials—17.8% | | |

| | | Bank of America Corp.: | | |

| 1,900M | | 5.65%, 5/1/2018 | | 2,168,962 |

| 1,800M | | 5%, 5/13/2021 | | 1,982,020 |

| 900M | | 5.875%, 2/7/2042 | | 1,055,986 |

| 2,700M | | Barclays Bank, PLC, 5.125%, 1/8/2020 | | 3,039,582 |

| 3,168M | | Bear Stearns Cos., Inc., 7.25%, 2/1/2018 | | 3,957,710 |

| | | Citigroup, Inc.: | | |

| 3,400M | | 6.375%, 8/12/2014 | | 3,701,580 |

| 6,800M | | 6.125%, 11/21/2017 | | 8,010,162 |

| 2,000M | | 4.5%, 1/14/2022 | | 2,200,168 |

| 3,000M | | Fifth Third Bancorp, 3.5%, 3/15/2022 | | 3,204,642 |

| | | Goldman Sachs Group, Inc.: | | |

| 6,000M | | 6.15%, 4/1/2018 | | 7,011,384 |

| 1,900M | | 5.75%, 1/24/2022 | | 2,192,592 |

| 1,600M | | 6.125%, 2/15/2033 | | 1,803,744 |

| 2,750M | | 6.75%, 10/1/2037 | | 2,955,197 |

| | | JPMorgan Chase & Co.: | | |

| 6,000M | | 6%, 1/15/2018 | | 7,161,864 |

| 2,000M | | 4.5%, 1/24/2022 | | 2,222,766 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Financials (continued) | | |

| | | Merrill Lynch & Co., Inc.: | | |

| $4,000M | | 5%, 1/15/2015 | | $ 4,298,684 |

| 3,600M | | 6.4%, 8/28/2017 | | 4,192,592 |

| | | Morgan Stanley: | | |

| 5,800M | | 5.95%, 12/28/2017 | | 6,522,233 |

| 5,000M | | 6.625%, 4/1/2018 | | 5,751,415 |

| 6,000M | | SunTrust Banks, Inc., 6%, 9/11/2017 | | 6,995,070 |

| 6,000M | | UBS AG, 4.875%, 8/4/2020 | | 6,721,458 |

| | | Wells Fargo & Co.: | | |

| 4,000M | | 5.625%, 12/11/2017 | | 4,808,008 |

| 1,800M | | 4.6%, 4/1/2021 | | 2,082,901 |

| 1,800M | | 3.5%, 3/8/2022 | | 1,923,494 |

| | | | | 95,964,214 |

| | | Food/Beverage/Tobacco—8.2% | | |

| 4,000M | | Altria Group, Inc., 9.7%, 11/10/2018 | | 5,736,292 |

| 4,000M | | Anheuser-Busch InBev Worldwide, Inc., 5.375%, 1/15/2020 | | 4,974,396 |

| 2,700M | | Bottling Group, LLC, 5.125%, 1/15/2019 | | 3,213,000 |

| 3,000M | | Bunge Limited, Finance Corp., 3.2%, 6/15/2017 | | 3,148,686 |

| 4,000M | | Corn Products International, Inc., 4.625%, 11/1/2020 | | 4,489,964 |

| 4,000M | | Dr. Pepper Snapple Group, Inc., 6.82%, 5/1/2018 | | 5,076,344 |

| 4,000M | | Lorillard Tobacco Co., 6.875%, 5/1/2020 | | 4,917,956 |

| 3,000M | | Mead Johnson Nutrition Co., 4.9%, 11/1/2019 | | 3,428,379 |

| 4,000M | | Philip Morris International, Inc., 5.65%, 5/16/2018 | | 4,906,564 |

| 4,000M | | SABMiller Holdings, Inc., 3.75%, 1/15/2022 (a) | | 4,352,320 |

| | | | | 44,243,901 |

| | | Forest Products/Container—.6% | | |

| 2,200M | | International Paper Co., 9.375%, 5/15/2019 | | 2,978,789 |

| | | Gaming/Leisure—.7% | | |

| 4,000M | | Marriott International, Inc., 3.25%, 9/15/2022 | | 4,029,232 |

| | | Health Care—3.3% | | |

| | | Aristotle Holding, Inc.: | | |

| 2,700M | | 4.75%, 11/15/2021 (a) | | 3,129,916 |

| 1,350M | | 3.9%, 2/15/2022 (a) | | 1,473,665 |

| 4,000M | | Biogen IDEC, Inc., 6.875%, 3/1/2018 | | 4,926,672 |

Portfolio of Investments (continued)

INVESTMENT GRADE FUND

September 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Health Care (continued) | | |

| $4,000M | | Laboratory Corp. of America Holdings, 3.75%, 8/23/2022 | | $ 4,194,116 |

| 2,400M | | Novartis Securities Investments, Ltd., 5.125%, 2/10/2019 | | 2,887,889 |

| 1,000M | | Roche Holdings, Inc., 6%, 3/1/2019 (a) | | 1,257,217 |

| | | | | 17,869,475 |

| | | Information Technology—5.5% | | |

| 3,500M | | Corning, Inc., 4.75%, 3/15/2042 | | 3,797,930 |

| 3,000M | | Dell, Inc., 5.875%, 6/15/2019 | | 3,555,429 |

| 4,000M | | Harris Corp., 4.4%, 12/15/2020 | | 4,355,072 |

| 5,000M | | Motorola Solutions, Inc., 6%, 11/15/2017 | | 5,974,175 |

| 4,000M | | Pitney Bowes, Inc., 5.75%, 9/15/2017 | | 4,364,500 |

| 4,000M | | Symantec Corp., 3.95%, 6/15/2022 | | 4,056,108 |

| 3,100M | | Western Union Co., 6.2%, 11/17/2036 | | 3,541,288 |

| | | | | 29,644,502 |

| | | Manufacturing—3.9% | | |

| 3,000M | | CRH America, Inc., 8.125%, 7/15/2018 | | 3,652,578 |

| 2,700M | | General Electric Co., 5.25%, 12/6/2017 | | 3,198,285 |

| 4,000M | | Ingersoll-Rand Global Holdings Co., Ltd., 6.875%, 8/15/2018 | | 4,952,464 |

| 3,200M | | Johnson Controls, Inc., 5%, 3/30/2020 | | 3,646,813 |

| 2,725M | | Tyco Electronics Group SA, 6.55%, 10/1/2017 | | 3,298,983 |

| 2,500M | | Tyco Flow Control International, Ltd., 3.15%, 9/15/2022 (a) | | 2,514,215 |

| | | | | 21,263,338 |

| | | Media-Broadcasting—3.2% | | |

| 3,950M | | British Sky Broadcasting Group, PLC, 9.5%, 11/15/2018 (a) | | 5,471,892 |

| 4,000M | | Comcast Corp., 5.15%, 3/1/2020 | | 4,766,024 |

| 3,000M | | DirecTV Holdings, LLC, 5.15%, 3/15/2042 | | 3,063,759 |

| 3,000M | | Time Warner Entertainment Co., LP, 8.375%, 3/15/2023 | | 4,234,491 |

| | | | | 17,536,166 |

| | | Media-Diversified—1.8% | | |

| | | McGraw-Hill Cos., Inc.: | | |

| 1,800M | | 5.9%, 11/15/2017 | | 2,119,977 |

| 2,300M | | 6.55%, 11/15/2037 | | 2,783,674 |

| 4,000M | | Vivendi SA, 6.625%, 4/4/2018 (a) | | 4,667,120 |

| | | | | 9,570,771 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Metals/Mining—5.4% | | |

| $4,000M | | Alcoa, Inc., 6.15%, 8/15/2020 | | $ 4,421,220 |

| 4,000M | | ArcelorMittal, 6.125%, 6/1/2018 | | 3,978,492 |

| 3,800M | | Newmont Mining Corp., 5.125%, 10/1/2019 | | 4,341,603 |

| 5,000M | | Rio Tinto Finance USA, Ltd., 3.75%, 9/20/2021 | | 5,336,575 |

| | | Vale Overseas, Ltd.: | | |

| 4,000M | | 5.625%, 9/15/2019 | | 4,520,072 |

| 2,000M | | 4.375%, 1/11/2022 | | 2,112,322 |

| 4,000M | | Xstrata Canada Financial Corp., 4.95%, 11/15/2021 (a) | | 4,293,432 |

| | | | | 29,003,716 |

| | | Real Estate Investment Trusts—5.7% | | |

| 5,000M | | Boston Properties, LP, 5.875%, 10/15/2019 | | 5,988,735 |

| 5,000M | | Digital Realty Trust, LP, 5.25%, 3/15/2021 | | 5,572,485 |

| 5,000M | | HCP, Inc., 5.375%, 2/1/2021 | | 5,713,845 |

| 4,000M | | ProLogis, LP, 6.625%, 5/15/2018 | | 4,785,020 |

| 4,000M | | Simon Property Group, LP, 5.75%, 12/1/2015 | | 4,527,888 |

| 4,000M | | Ventas Realty, LP, 4.75%, 6/1/2021 | | 4,403,812 |

| | | | | 30,991,785 |

| | | Retail-General Merchandise—1.5% | | |

| 2,500M | | GAP, Inc., 5.95%, 4/12/2021 | | 2,789,512 |

| 4,000M | | Home Depot, Inc., 5.875%, 12/16/2036 | | 5,289,672 |

| | | | | 8,079,184 |

| | | Telecommunications—3.5% | | |

| 3,700M | | BellSouth Corp., 6.55%, 6/15/2034 | | 4,486,738 |

| 1,200M | | BellSouth Telecommunications, 6.375%, 6/1/2028 | | 1,437,154 |

| 3,000M | | Deutsche Telekom International Finance BV, 4.875%, 3/6/2042 (a) | | 3,238,458 |

| 3,300M | | GTE Corp., 6.84%, 4/15/2018 | | 4,174,784 |

| 4,045M | | Verizon New York, Inc., 7.375%, 4/1/2032 | | 5,378,370 |

| | | | | 18,715,504 |

| | | Transportation—2.0% | | |

| 3,000M | | Con-way, Inc., 7.25%, 1/15/2018 | | 3,516,513 |

| 3,100M | | GATX Corp., 4.75%, 6/15/2022 | | 3,282,153 |

| 4,000M | | Penske Truck Leasing Co., LP, 4.875%, 7/11/2022 (a) | | 4,000,648 |

| | | | | 10,799,314 |

Portfolio of Investments (continued)

INVESTMENT GRADE FUND

September 30, 2012

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | Utilities—4.9% | | | | | |

| $4,000M | | Arizona Public Service Co., 4.5%, 4/1/2042 | | | | | $ 4,336,496 |

| 3,000M | | E.ON International Finance BV, 5.8%, 4/30/2018 (a) | | | | 3,636,066 |

| 1,900M | | Electricite de France SA, 6.5%, 1/26/2019 (a) | | | | 2,327,333 |

| 4,000M | | Exelon Generation Co., LLC, 5.2%, 10/1/2019 | | | | 4,548,264 |

| | | Great River Energy Co.: | | | | | |

| 496M | | 5.829%, 7/1/2017 (a) | | | | | 537,566 |

| 3,652M | | 4.478%, 7/1/2030 (a) | | | | | 4,075,548 |

| 3,000M | | Ohio Power Co., 5.375%, 10/1/2021 | | | | | 3,679,503 |

| 2,561M | | Sempra Energy, 9.8%, 2/15/2019 | | | | | 3,615,727 |

| | | | | | | | 26,756,503 |

| | | Waste Management—.8% | | | | | |

| 3,755M | | Republic Services, Inc., 3.8%, 5/15/2018 | | | | | 4,180,562 |

| Total Value of Investments (cost $474,606,522) | 98.3 | % | | | 530,616,114 |

| Other Assets, Less Liabilities | 1.7 | | | | 9,315,665 |

| Net Assets | | | 100.0 | % | | | $539,931,779 |

| |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of September 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Corporate Bonds* | | $ | — | | $ | 530,616,114 | | $ | — | | $ | 530,616,114 |

| |

| * | The Portfolio of Investments provides information on the industry categorization for corporate bonds. |

| |

| There were no transfers into or from Level 1 or Level 2 by the Fund during the year ended |

| September 30, 2012. Transfers, if any, between Levels are recognized at the end of the |

| reporting period. |

| | |

| See notes to financial statements | 23 |

Portfolio Manager’s Letter

INTERNATIONAL OPPORTUNITIES BOND FUND

Dear Investor:

This is the annual report for the First Investors International Opportunities Bond Fund for the fiscal year ended September 30, 2012. During the period, the Fund’s return on a net asset value basis was 2.4% for Class A shares, including dividends of 1.5 cents per share on Class A shares.

We live in extraordinary economic and financial times. The third quarter of 2012 was another example of that. For the first time since 2008-2009, all the world’s major central banks pulled in the same direction. The Federal Reserve (“the Fed”) announced open-ended quantitative easing operations. The European Central Bank (“ECB”) presented the Outright Monetary Transaction (“OMT”) program for backstopping the debt of troubled European Union countries. The Bank of Japan quickly followed with a dramatic increase in the budget of its asset acquisition program. The Bank of England continued to fund asset purchases, while the People’s Bank of China lowered reserve requirements another notch. Select emerging markets have reacted to the competitive pressures triggered by these measures with their own actions.

The softening in global growth is mostly attributable to Europe. Europe’s sovereign debt crisis infected its financial system last year by forcing banks to boost capital provisions through asset sales, a process that threatened a massive credit crunch. The ECB tried to deal with this issue late in 2011 through the Long-Term Refinancing Operation (“LTRO”) program. But this program focused on liquidity — not solvency in the banking system — and the program fell short by the end of the first quarter. In our view, the OMT program is a game changer because it promises unlimited support for the assets depressing bank capital, namely the sovereign debts of Europe’s periphery.

The initiatives taken by the ECB and Fed reduce tail risk, in our view. This view is corroborated by the decline in European swap spreads, inter-bank interest rates and commercial bank deposits held at the ECB. Similarly, the range of performance across the spectrum of risk assets has widened noticeably. We interpret this trend as a signal that investors have become more discriminating in assessing where risk is concentrated, as the threat of a systemic economic collapse recedes.

In our view, the bigger risk to the investment outlook is not that central bank initiatives will fail to produce economic traction; the bigger risk is that central bank actions are very successful. The great irony is that the sight of economic traction and the return of more sustainable growth could lead to a sea change in investor sentiment precisely at the time that this risk is picking up. Timing is everything, though, and we do not believe that a marked change in sentiment is a meaningful risk anytime soon. Across all major economic zones, however, clear signs of economic progress exist in spite of this year’s softness.

Overall, we continue to believe that the safe-haven bond markets of the world offer little value. Real yields in most of these markets are zero or negative across much of the curve. Correspondingly, we are not significantly invested in these markets. Our portfolio duration is now roughly in line with the Citigroup WGBI ex-U.S. benchmark. However, most of our duration comes from exposures outside of safe haven bond markets. We think there is significant price risk in these securities. But the absence of much private credit growth has inhibited any tendency for yields to rise in a sustainable fashion. The path of fiscal consolidation will affect the level of safe-haven yields, but the upcoming trend seems clear.

The Fund incepted late in the annual period, so meaningful attribution is difficult to calculate given the impact of cash-flow effects. Accounts invested similarly from the inception date underperformed their benchmark during the five-week period through September 30, 2012. A strengthening yen and euro likely accounted for nearly all of the underperformance, while bond positioning decisions offset this weakness. Owning higher yielding currencies benefited relative performance, but did not fully offset the relative underperformance related to avoiding the yen and euro currencies.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Fund Expenses (unaudited)

INTERNATIONAL OPPORTUNITIES BOND FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 2 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (8/20/12) | (9/30/12) | (8/20/12–9/30/12) |

| Expense Example | | | |

| Actual | $1,000.00 | $1,023.50 | $1.62* |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.50 | $6.56** |

| |

| * | Actual expenses reflect only from the commencement of operations to the end of the period cov- |

| ered (August 20, 2012 to September 30, 2012). Therefore expenses shown are lower than would |

| be expected for a six-month period. Actual expenses for the six-month period will be reflected in |

| future reports. Expenses are equal to the annualized expense ratio of 1.30% multiplied by the aver- |

| age account value over the period, multiplied by 45/366 (to reflect the inception period). Expenses |

| paid during during the period are net of expenses waived and/or assumed. |

| |

| ** | Expenses are equal to the annualized expense ratio of 1.30% multiplied by the average account |

| value over the period, multiplied by 183/366 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived and/or assumed. |

Portfolio Composition

TOP SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2012, |

| and are based on the total value of investments. |

Portfolio of Investments

INTERNATIONAL OPPORTUNITIES BOND FUND

September 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | † | Security | | Value |

| | | SOVEREIGN BONDS—82.1% | | |

| | | United Kingdom—16.9% | | |

| | | United Kingdom Gilt: | | |

| 885M | GBP | 4.5%, 3/7/2013 | | $ 1,455,236 |

| 930M | GBP | 4.25%, 3/7/2036 | | 1,856,241 |

| | | | | 3,311,477 |

| | | Mexico—13.7% | | |

| | | United Mexican States: | | |

| 109M | MXN | 7%, 6/19/2014 | | 884,901 |

| 149M | MXN | 8.5%, 5/31/2029 | | 1,455,625 |

| 35M | MXN | 8.5%, 11/18/2038 | | 339,602 |

| | | | | 2,680,128 |

| | | Australia—10.3% | | |

| 690M | AUD | New South Wales Treasury Corp., 6%, 4/1/2016 | | 787,404 |

| | | Queensland Treasury Corp.: | | |

| 535M | AUD | 6.25%, 2/21/2020 | | 640,727 |

| 175M | AUD | 6%, 7/21/2022 | | 210,808 |

| 320M | AUD | Treasury Corp. of Victoria, 5.75%, 11/15/2016 (a) | | 366,754 |

| | | | | 2,005,693 |

| | | Italy—9.2% | | |

| 1,550M | EUR | Buoni Poliennali Del Tesoro, 5%, 8/1/2039 | | 1,802,558 |

| | | Poland—5.7% | | |

| | | Republic of Poland: | | |

| 680M | PLN | 5.25%, 10/25/2020 | | 222,067 |

| 2,665M | PLN | 5.75%, 9/23/2022 | | 902,038 |

| | | | | 1,124,105 |

| | | South Korea—4.3% | | |

| | | Republic of Korea: | | |

| 170,000M | KRW | 3%, 12/10/2013 | | 153,364 |

| 662,000M | KRW | 5.75%, 9/10/2018 | | 688,692 |

| | | | | 842,056 |

| | | Malaysia—4.2% | | |

| 2,455M | MYR | Federation of Malaysia, 3.741%, 2/27/2015 | | 814,371 |

Portfolio of Investments (continued)

INTERNATIONAL OPPORTUNITIES BOND FUND

September 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | New Zealand—4.0% | | |

| | | Dominion of New Zealand: | | |

| 435M | NZD | 5%, 3/15/2019 | | $ 402,376 |

| 395M | NZD | 5.5%, 4/15/2023 | | 386,509 |

| | | | | 788,885 |

| | | Turkey—3.7% | | |

| 1,275M | TRY | Republic of Turkey, 9%, 3/5/2014 | | 727,466 |

| | | Hungary—3.7% | | |

| 165,000M | HUF | Hungary Government Bond, 5.5%, 2/12/2016 | | 722,400 |

| | | South Africa—3.7% | | |

| | | Republic of South Africa: | | |

| 3,715M | ZAR | 6.75%, 3/31/2021 | | 455,901 |

| 2,645M | ZAR | 6.5%, 2/28/2041 | | 263,115 |

| | | | | 719,016 |

| | | Ireland—2.7% | | |

| | | Republic of Ireland: | | |

| 50M | EUR | 4.5%, 4/18/2020 | | 62,522 |

| 355M | EUR | 5%, 10/18/2020 | | 457,161 |

| | | | | 519,683 |

| Total Value of Sovereign Bonds (cost $15,722,693) | | 16,057,838 |

| | | CORPORATE BONDS—2.7% | | |

| | | Germany—2.1% | | |

| | | Financials | | |

| 350M | AUD | Kreditanstalt fuer Wiederaufbau, 6.25%, 12/4/2019 (b) | | 413,993 |

| | | United States—.3% | | |

| | | Energy | | |

| 50M | EUR | Chesapeake Energy Corp., 6.25%, 1/15/2017 | | 66,576 |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | South Africa—.3% | | | | | |

| | | Consumer Discretionary | | | | | |

| 50M | EUR | Edcon Proprietary, Ltd., 3.502%, 6/15/2014 (c) | | | | $ 60,144 |

| Total Value of Corporate Bonds (cost $528,619) | | | | | 540,713 |

| Total Value of Investments (cost $16,251,312) | 84.8 | % | | | 16,598,551 |

| Other Assets, Less Liabilities | 15.2 | | | | 2,964,943 |

| Net Assets | | | 100.0 | % | | | $19,563,494 |

| | |

| (a) | A portion or all of the security purchased on a when-issued or delayed delivery basis |

| (see Note 1G). |

| |

| (b) | The Federal Republic of Germany guarantees all existing and future obligations of Kreditanstalt |

| fuer Wiederaufbau (“KFW”) in respect of money borrowed, bonds issued, and derivative trans- |

| actions entered into by KFW, as well as third party obligations that are expressly guaranteed |

| by KFW. |

| |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

| |

| Abbreviations: |

| AUD | Australian Dollar |

| EUR | Euro |

| GBP | British Pound |

| HUF | Hungarian Forint |

| KRW | South Korean Won |

| MXN | Mexican Peso |

| MYR | Malaysian Ringgit |

| NZD | New Zealand Dollar |

| PLN | Polish Zloty |

| TRY | Turkish Lira |

| ZAR | South African Rand |

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

Portfolio of Investments (continued)

INTERNATIONAL OPPORTUNITIES BOND FUND

September 30, 2012

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of September 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Sovereign Bonds | | | | | | | | | | | | |

| United Kingdom | | $ | — | | $ | 3,311,477 | | $ | — | | $ | 3,311,477 |

| Mexico | | | — | | | 2,680,128 | | | — | | | 2,680,128 |

| Australia | | | — | | | 2,005,693 | | | — | | | 2,005,693 |

| Italy | | | — | | | 1,802,558 | | | — | | | 1,802,558 |

| Poland | | | — | | | 1,124,105 | | | — | | | 1,124,105 |

| South Korea | | | — | | | 842,056 | | | — | | | 842,056 |

| Malaysia | | | — | | | 814,371 | | | — | | | 814,371 |

| New Zealand | | | — | | | 788,885 | | | — | | | 788,885 |

| Turkey | | | — | | | 727,466 | | | — | | | 727,466 |

| Hungary | | | — | | | 722,400 | | | — | | | 722,400 |

| South Africa | | | — | | | 719,016 | | | — | | | 719,016 |

| Ireland | | | — | | | 519,683 | | | — | | | 519,683 |

| Corporate Bonds | | | | | | | | | | | | |

| Germany | | | — | | | 413,993 | | | — | | | 413,993 |

| United States | | | — | | | 66,576 | | | — | | | 66,576 |

| South Africa | | | — | | | 60,144 | | | — | | | 60,144 |

| Total Investments in Securities | | $ | — | | $ | 16,598,551 | | $ | — | | $ | 16,598,551 |

| Other Financial Instruments* | | $ | — | | $ | 26,381 | | $ | — | | $ | 26,381 |

| |

| * | Other financial instruments are foreign exchange contracts and are considered derivative instruments, |

| which are valued at the net unrealized appreciation on the instrument. |

| |

| During the period ended September 30, 2012, there were no transfers between Level 1 investments |

| and Level 2 investments that had a material impact to the Fund. Transfers, if any, between Levels are |

| recognized at the end of the reporting period. |

| | |

| 30 | See notes to financial statements | |

Portfolio Manager’s Letter

FUND FOR INCOME

Dear Investor:

This is the annual report for the First Investors Fund For Income for the fiscal year ended September 30, 2012. During the period, the Fund’s return on a net asset value basis was 17.8% for Class A shares and 17.0% for Class B shares, including dividends of 15.8 cents per share on Class A shares and 14.2 cents on Class B shares.

Throughout the period, the U.S. high yield market offered investors an attractive opportunity from a fundamental perspective. Companies sitting on record cash balances saw few defaults and focused on debt refinancing, cost containment and fiscal responsibility. Despite strong fundamental characteristics, U.S. high yield markets were not immune to headline news abroad, which caused negative return months over the period in November, March and May. Such pullbacks were short and swift, creating volatility that followed the news in a generally upward-bound market.

At the start of 2012, a second Greek bailout combined with the Long Term Refinancing Operation (“LTRO”) bolstered market sentiment that a full blown crisis in Greece, or a banking crisis in Europe, could be avoided. By the second quarter, however, European sovereign concerns were, once again, at the forefront. As a result, Greece experienced significant bank deposit withdrawals and investor fear spread to Spanish banks.

In June, investors began to receive some of the positive news they needed to reinvest in risk assets. Greek elections narrowly supported continued Greek membership in the Eurozone and the European Leaders Summit developed a plan to recapitalize Spanish banks. By the third quarter, many of the macro milestones investors eagerly anticipated had outcomes viewed as largely favorable to the market.

In July, European Central Bank (“ECB”) president, Mario Draghi, announced to the delight of investors that he will “do whatever it takes” to bring the Eurozone crisis under control. In September, the ECB sent markets a strong signal by offering to purchase unlimited amounts of Eurozone countries’ short-term bonds. The following week, the German constitutional court approved the Eurozone’s new bailout fund and budget pact. Finally, the Federal Reserve (“the Fed”) announced QE3.

Risky assets like high yield rallied strongly on the back of these developments throughout the year. In keeping with the risk-on sentiment, high yield outperformed investment grade corporate and high quality government securities which, in the U.S., delivered returns of 10.98%i and 5.66%ii, respectively. A strong technical bid further bolstered high yield investor demand for the asset class, which remained robust for the year, with the exception of the second quarter. Issuers took advantage of the low yields to borrow at attractive rates and, in many cases, refinanced older, more expensive outstanding bonds.

Portfolio Manager’s Letter (continued)

FUND FOR INCOME

In this environment, the Fund generated strong performance in line with its benchmark on a net basis. From an industry perspective, the Fund enjoyed its strongest performance relative to the market in the energy, auto and health care sectors. The Fund lagged the market in the home building sector, and more significantly in metals and mining — where we have tended to be overweight — and in banking, where we have tended to be underweight. Metals have been a volatile sector where we looked to acquire positions during market dips, which we believe offered strong value. As with prior years, we remained largely absent from the banking sector, where a great deal of the available paper has equity-like features we believe inappropriate in a fixed income portfolio.

In the U.S., companies are awaiting the outcome of the U.S. presidential election and clarity on next year’s tax regime and fiscal cliff negotiations. China is also in the midst of a change of leadership, an event causing Chinese companies to take pause. Lastly, continued noise out of Europe, as exemplified by recent riots in Spain, Greece and instability in the Middle East, continue to hold company managements back from taking longer-term strategic decisions. We expect to see a resolution to many of these issues — particularly in the U.S. — by the start of the new year. It is important to emphasize that regardless of the outcome of these macro events, high yield companies do not require strong growth to meet their contractual obligations.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Fund Expenses (unaudited)

FUND FOR INCOME

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 2 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (4/1/12) | (9/30/12) | (4/1/12–9/30/12)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,054.54 | $6.47 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.70 | $6.36 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,050.86 | $10.05 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,015.20 | $9.87 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.26% for Class A shares and 1.96% for |

| Class B shares, multiplied by the average account value over the period, multiplied by 183/366 |

| (to reflect the one-half year period). Expenses paid during the period are net of expenses waived. |

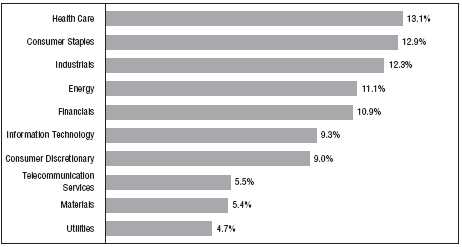

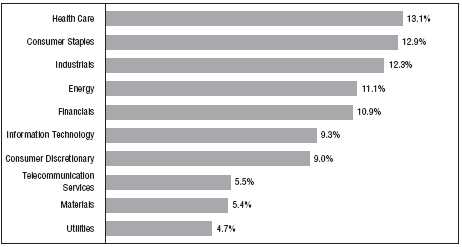

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2012, |

| and are based on the total value of investments. |

Cumulative Performance Information (unaudited)

FUND FOR INCOME

Comparison of change in value of $10,000 investment in the First Investors Fund For Income (Class A shares), the Bank of America (“BofA”) Merrill Lynch BB-B U.S. Cash Pay High Yield Constrained Index.

The graph compares a $10,000 investment in the First Investors Fund For Income (Class A shares) beginning 9/30/02 with a theoretical investment in the BofA Merrill Lynch BB-B U.S. Cash Pay High Yield Constrained Index (the “Index”). The Index contains all securities in the BofA Merrill Lynch U.S. Cash Pay High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table it is assumed that all dividends and distributions were reinvested. Class B shares performance may be greater than or less than that shown in the line graph above for Class A shares based on differences in sales loads and fees paid by shareholders investing in the different classes.

* Average Annual Total Return figures (for the periods ended 9/30/12) include the reinvestment of all dividends and distributions. “N.A.V. Only” returns are calculated without sales charges. The Class A “S.E.C. Standardized” returns shown are based on the maximum sales charge of 5.75%. The Class B “S.E.C. Standardized” returns are adjusted for the applicable deferred sales charge (maximum of 4% in the first year). During the periods shown, some of the expenses of the Fund were waived or assumed. If such expenses had been paid by the Fund, the Class A “S.E.C. Standardized” Average Annual Total Return for One Year, Five Years and Ten Years would have been 11.13%, 3.63% and 6.96%, respectively, and the S.E.C. 30-Day Yield for September 2012 would have been 4.10%. The Class B “S.E.C. Standardized” Average Annual Total Return for One Year, Five Years and Ten Years would have been 12.98%, 3.79% and 6.98%, respectively, and the S.E.C. 30-Day Yield for September 2012 would have been 3.66%. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The issuers of high yield bonds, in which the Fund primarily invests, pay higher interest rates because they have a greater likelihood of financial difficulty, which could result in their inability to repay the bonds fully when due. Prices of high yield bonds are also subject to greater fluctuations. Index figures are from Bank of America Merrill Lynch and all other figures are from First Investors Management Company, Inc.

Portfolio of Investments

FUND FOR INCOME

September 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | CORPORATE BONDS—92.2% | | |

| | | Automotive—4.2% | | |

| $ 675M | | American Axle & Manufacturing, Inc., 6.625%, 10/15/2022 | | $ 686,812 |

| | | Chrysler Group, LLC/CG Co-Issuer, Inc.: | | |

| 1,925M | | 8%, 6/15/2019 | | 2,050,125 |

| 3,025M | | 8.25%, 6/15/2021 | | 3,236,750 |

| 3,000M | | Cooper Tire & Rubber Co., 8%, 12/15/2019 | | 3,420,000 |

| 2,825M | | Cooper-Standard Automotive, Inc., 8.5%, 5/1/2018 | | 3,072,187 |

| 3,950M | | Exide Technologies, 8.625%, 2/1/2018 | | 3,441,437 |

| 1,925M | | Ford Motor Co., 6.625%, 10/1/2028 | | 2,159,546 |

| 1,225M | | Jaguar Land Rover, PLC, 7.75%, 5/15/2018 (a) | | 1,327,594 |

| 2,100M | | Oshkosh Corp., 8.5%, 3/1/2020 | | 2,362,500 |

| | | Schaeffler Finance BV: | | |

| 1,725M | | 7.75%, 2/15/2017 (a) | | 1,914,750 |

| 1,900M | | 8.5%, 2/15/2019 (a) | | 2,137,500 |

| | | | | 25,809,201 |

| | | Building Materials—2.8% | | |

| 2,650M | | Associated Materials, LLC, 9.125%, 11/1/2017 | | 2,610,250 |

| | | Building Materials Corp.: | | |

| 3,625M | | 6.875%, 8/15/2018 (a) | | 3,905,937 |

| 1,375M | | 7.5%, 3/15/2020 (a) | | 1,512,500 |

| 6,175M | | McJunkin Red Man Corp., 9.5%, 12/15/2016 | | 6,692,156 |

| 2,150M | | Texas Industries, Inc., 9.25%, 8/15/2020 | | 2,289,750 |

| | | | | 17,010,593 |

| | | Capital Goods—.6% | | |

| | | Belden, Inc.: | | |

| 2,650M | | 9.25%, 6/15/2019 | | 3,014,375 |

| 1,000M | | 5.5%, 9/1/2022 (a) | | 1,027,500 |

| | | | | 4,041,875 |

| | | Chemicals—3.0% | | |

| 2,950M | | Ferro Corp., 7.875%, 8/15/2018 | | 2,861,500 |

| 2,575M | | Kinove German Bondco GmbH, 9.625%, 6/15/2018 (a) | | 2,832,500 |

| | | LyondellBasell Industries NV: | | |

| 1,200M | | 5%, 4/15/2019 | | 1,281,000 |

| 1,250M | | 6%, 11/15/2021 | | 1,431,250 |

| 2,475M | | PolyOne Corp., 7.375%, 9/15/2020 | | 2,691,563 |

| 6,325M | | Rhodia SA, 6.875%, 9/15/2020 (a) | | 7,131,438 |

| | | | | 18,229,251 |

Portfolio of Investments (continued)

FUND FOR INCOME

September 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Consumer Non-Durables—2.5% | | |

| $ 2,400M | | Easton-Bell Sports, Inc., 9.75%, 12/1/2016 | | $ 2,601,000 |

| | | Levi Strauss & Co.: | | |

| 925M | | 7.625%, 5/15/2020 | | 1,003,625 |

| 2,625M | | 6.875%, 5/1/2022 | | 2,749,688 |

| 1,125M | | Libbey Glass, Inc., 6.875%, 5/15/2020 (a) | | 1,215,000 |

| 3,025M | | Phillips Van-Heusen Corp., 7.375%, 5/15/2020 | | 3,433,375 |

| 3,025M | | Reynolds Group Issuer, Inc., 5.75%, 10/15/2020 (a) | | 3,028,781 |

| 900M | | Wolverine World Wide, Inc., 6.125%, 10/15/2020 (a)(b) | | 931,500 |

| | | | | 14,962,969 |

| | | Energy—14.5% | | |

| | | AmeriGas Finance, LLC: | | |

| 550M | | 6.75%, 5/20/2020 | | 588,500 |

| 1,500M | | 7%, 5/20/2022 | | 1,620,000 |

| | | Basic Energy Services, Inc.: | | |

| 450M | | 7.125%, 4/15/2016 | | 456,750 |

| 1,025M | | 7.75%, 2/15/2019 | | 1,055,750 |

| 2,475M | | Berry Petroleum Co., 6.375%, 9/15/2022 | | 2,617,312 |

| 2,125M | | Calumet Specialty Products Partners, LP, 9.625%, 8/1/2020 (a) | | 2,300,312 |

| | | Chesapeake Energy Corp.: | | |

| 2,650M | | 7.25%, 12/15/2018 | | 2,862,000 |

| 125M | | 6.625%, 8/15/2020 | | 129,531 |

| 1,000M | | Chesapeake Midstream Partners, LP, 6.125%, 7/15/2022 | | 1,062,500 |

| | | Concho Resources, Inc.: | | |

| 2,300M | | 8.625%, 10/1/2017 | | 2,547,250 |

| 1,275M | | 5.5%, 4/1/2023 | | 1,333,969 |

| | | Consol Energy, Inc.: | | |

| 1,875M | | 8%, 4/1/2017 | | 1,968,750 |

| 3,700M | | 8.25%, 4/1/2020 | | 3,894,250 |

| | | Copano Energy, LLC: | | |

| 500M | | 7.75%, 6/1/2018 | | 527,500 |