UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: | | 811-03981 |

| |

Exact name of registrant as specified in charter: | | Prudential World Fund, Inc. |

| |

Address of principal executive offices: | | Gateway Center 3 100 Mulberry Street Newark, New Jersey 07102 |

| |

Name and address of agent for service: | | Jonathan D. Shain Gateway Center 3 100 Mulberry Street Newark, New Jersey 07102 |

| |

Registrant’s telephone number, including area code: | | 973-802-6469 |

| |

Date of fiscal year end: | | October 31, 2003 |

| |

Date of reporting period: | | October 31, 2003 |

Item 1 – Reports to Stockholders

[SHAREHOLDER REPORT TO BE INSERTED HERE IN THE EDGAR VERSION]

Jennison Global Growth Fund

Formerly known as Prudential Global Growth Fund

|

| OCTOBER 31, 2003 | | ANNUAL REPORT |

FUND TYPE

Global stock

OBJECTIVE

Long-term growth of capital

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden is a service mark of The Prudential Insurance Company of America.

Dear Shareholder,

December 16, 2003

As you may know, the mutual fund industry recently has been the subject of much media attention. There has been press coverage of Prudential, and recently, administrative complaints were filed against Prudential Securities* and some of its former brokers and branch managers in Massachusetts. As president of your Fund, I’d like to provide you with an update on the issues as they pertain to JennisonDryden mutual funds.

State and federal authorities have requested information regarding trading practices from many mutual fund companies across the nation. Our fund family has been cooperating with inquiries it has received, and at the same time, Prudential Financial, Inc. has been conducting its own internal review. This review encompasses the policies, systems, and procedures of our fund family, Prudential Financial’s investment units and its proprietary distribution channels, including the former Prudential Securities. The review also includes mutual fund trading activity by investment professionals who manage our funds.

Market timing

Prudential Investments LLC, the Fund’s investment manager, has actively discouraged disruptive market timing, and for years, our mutual fund prospectuses have identified and addressed this issue. Prudential Investments has established operating policies and procedures that are designed to detect and deter frequent trading activities that would be disruptive to the management of our mutual fund portfolios, and has rejected numerous orders placed by market timers in the past.

* Prudential Investments LLC, the manager of JennisonDryden mutual funds, and Prudential Investment Management Services LLC, the distributor of the funds, are part of the Investment Management segment of Prudential Financial, Inc. and are separate legal entities from the entity formerly known as Prudential Securities Incorporated, a retail brokerage firm. In February 2003, Prudential Financial and Wachovia Corporation announced they were combining their retail brokerage forces. The transaction was completed in July 2003. Wachovia Corporation has a 62% interest in the new firm, which is now known as Wachovia Securities LLC, and Prudential Financial owns the remaining 38%.

Late trading

The Securities and Exchange Commission requires that orders to purchase or redeem mutual fund shares be received either by the fund or by an intermediary (such as a broker, financial adviser, or 401(k) record keeper) before the time at which the fund calculates its net asset value (normally 4:00 p.m., Eastern time) if they are to receive that day’s price. The policies of our mutual funds do not make and have not made allowances for the practice known as “late trading”.

For more than 40 years we have offered investors quality investment products, financial guidance, and responsive customer service. Today we remain committed to this heritage and to the highest ethical principles in our investment practices.

Sincerely,

Judy A. Rice, President

Prudential World Fund, Inc./Jennison Global Growth Fund

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 1 |

Your Fund’s Performance

Fund Objective

The investment objective of the Jennison Global Growth Fund (the Fund) is long-term growth of capital. There can be no assurance that the Fund will achieve its investment objective. Effective November 21, 2003, the Prudential Pacific Growth Fund, Inc. and the Prudential Europe Growth Fund, Inc. were merged into the Jennison Global Growth Fund, which is a series of Prudential World Fund, Inc.

|

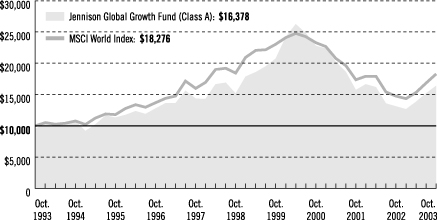

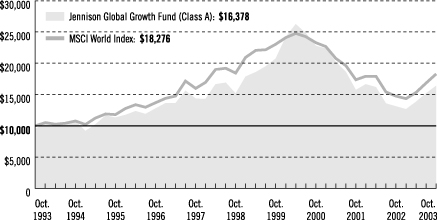

| Cumulative Total Returns1 as of 10/31/03 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 | |

Class A | | 24.58 | % | | 8.02 | % | | 72.40 | % | | 123.58 | % |

|

Class B | | 23.95 | | | 4.64 | | | 61.32 | | | 444.11 | |

|

Class C | | 23.66 | | | 4.24 | | | N/A | | | 48.06 | |

|

Class Z | | 24.90 | | | 9.30 | | | N/A | | | 41.07 | |

|

MSCI World Index3 | | 23.71 | | | –0.92 | | | 82.78 | | | *** | |

|

Lipper Global Funds Avg.4 | | 23.59 | | | 17.23 | | | 107.19 | | | **** | |

|

| | | | | | | | | | | | | |

|

| Average Annual Total Returns1 as of 9/30/03 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 | |

Class A | | 21.37 | % | | 0.33 | % | | 4.93 | % | | 5.16 | % |

|

Class B | | 22.14 | | | 0.58 | | | 4.77 | | | 8.89 | |

|

Class C | | 24.53 | | | 0.45 | | | N/A | | | 3.54 | |

|

Class Z | | 28.10 | | | 1.61 | | | N/A | | | 3.75 | |

|

MSCI World Index3 | | 25.40 | | | 0.39 | | | 5.89 | | | *** | |

|

Lipper Global Funds Avg.4 | | 23.38 | | | 3.09 | | | 7.18 | | | **** | |

|

Past performance is not indicative of future results. Principal value and investment return will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. 1Source: Prudential Investments LLC and Lipper Inc. The cumulative total returns do not take into account applicable sales charges. The average annual total returns do take into account applicable sales charges. Without the distribution and service (12b-1) fee waiver of 0.05% for Class A shares annually, the returns would have been lower. The Fund charges a maximum front-end sales charge of 5% for Class A shares in most circumstances, and a 12b-1 fee of up to 0.30% annually. In some circumstances, Class A shares may not be subject to a front-end sales charge, but may be subject to a 1% contingent deferred sales charge (CDSC) for the first year. Class B shares are subject to a declining CDSC of 5%, 4%, 3%, 2%, 1%, and 1% for the first six years respectively after purchase, and a 12b-1 fee of 1% annually. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class C shares are subject to a front-end sales charge of 1%, a CDSC of 1% for shares redeemed within 18 months of purchase, and a 12b-1 fee of 1% annually. Class Z shares are not subject to a sales charge or 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on fund distributions or following the redemption of fund shares. 2Inception dates: Class A, 1/22/90; Class B, 5/15/84; Class C, 8/1/94; and Class Z, 3/1/96. 3The Morgan Stanley Capital International (MSCI) World Index is an unmanaged, weighted index of performance of approximately 1,500 securities listed on the stock exchanges of Australia, Canada, Europe, the Far East, and the United States. 4The Lipper Global Funds Average (Lipper Average) represents returns based on an average return of all funds in the

| 2 | | Visit our website at www.jennisondryden.com |

Lipper Global Funds category. Funds in the Lipper Global Funds category invest at least 25% of their portfolios in securities traded outside the United States and may own U.S. securities as well. Investors cannot invest directly in an index. The returns for the MSCI World Index and the Lipper Average would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses of a mutual fund, but not sales charges or taxes. ***MSCI World Index Since Inception cumulative total returns as of 10/31/03 are 120.96% for Class A, 668.13% for Class B, 75.03% for Class C, and 42.28% for Class Z. MSCI World Index Since Inception average annual total returns as of 9/30/03 are 5.53% for Class A, 10.79% for Class B, 5.63% for Class C, and 3.97% for Class Z. ****Lipper Average Since Inception cumulative total returns as of 10/31/03 are 196.50% for Class A, 814.78% for Class B, 94.20% for Class C, and 57.59% for Class Z. Lipper Average Since Inception average annual total returns as of 9/30/03 are 7.45% for Class A, 11.38% for Class B, 6.71% for Class C, and 5.28% for Class Z.

| |

| Five Largest Holdings expressed as a percentage of net assets as of 10/31/03 | | | |

InterActiveCorp., Internet & Catalog Retail | | 2.9 | % |

|

Citigroup, Inc., Diversified Financial Services | | 2.4 | |

|

Exel PLC, Air Freight & Couriers | | 2.3 | |

|

Mitsubishi Corp., Trading Companies & Distributors | | 2.2 | |

|

Cosco Pacific, Ltd., Transportation Infrastructure | | 2.2 | |

|

Holdings are subject to change.

| |

| Five Largest Industries expressed as a percentage of net assets as of 10/31/03 | | | |

Pharmaceuticals | | 6.4 | % |

|

Commercial Banks | | 6.3 | |

|

Media | | 6.0 | |

|

Semiconductors & Semiconductor Equipment | | 5.7 | |

|

Capital Markets | | 5.5 | |

|

Industry weightings are subject to change.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 3 |

Investment Adviser’s Report

Market and performance overview

World stock markets began to rise sharply—in late March of 2003 in the United States, in early April elsewhere—as the speed and extent of U.S. military success in Iraq removed what investors appear to have believed to be the last significant impediment to global economic progress. Stocks continued to advance in this more benign environment as capital markets gradually reopened to the weakest firms, which had been starved of cash. Toward the end of the period, economic reports also gave the first hints that business spending on large-scale IT projects was starting up for the first time in three years. All the while, consumer spending remained firm and interest rates stayed low. These factors combined to make the second half of the Fund’s fiscal year a period of strong absolute returns. The Fund outperformed its Lipper peers over this period.

Perhaps the most striking feature of the latter six months of the Fund’s reporting period was the unusually wide performance gap in favor of the shares of the most financially and operationally leveraged firms over their healthier rivals. As a growth stock investor, the Fund tries to find the strongest firms in the areas where it invests. So it was a struggle for us throughout the period to keep pace with our benchmark MSCI World Index. We have great confidence in our portfolio, however, and expect that as the stock market refocuses on actual earnings results, our stocks will be strong relative performers.

We did have a number of notable stocks during the period. Cosco Pacific (see Comments on Largest Holdings) and China Merchants, two Hong Kong-based operators of container terminals, gained from the booming trans-Pacific and intra-Asian trade. Our specialty retail stocks, like Signet (jewelry), Tod’s (accessories), and Aoyama Trading (suits), did well, as did State Street and HSBC Holdings among our financial stocks. Mitsubishi Corp. (see Comments on Largest Holdings), a restructuring Japanese distribution company, was a stellar performer.

We also had disappointments. Kohl’s, a mid-priced apparel retailer, did poorly despite its expansion into the potentially attractive California market. And although energy prices remained high, as we expected, this did not translate into

expanded drilling for oil and gas. As a result, our oilfield services stocks were relatively weak. We have reduced exposure to both areas.

Looking ahead

It appears that the long-awaited pickup in business spending in the United States is finally underway. Overall U.S. economic activity will be stimulated somewhat by the dollar’s decline. Consumer spending remains resilient, but we continue to think that

| 4 | | Visit our website at www.jennisondryden.com |

the current cyclical upturn will be modest by historical standards. If we are correct, the dollar’s decline will have negative consequences for export-oriented industries in Europe and Japan. While ultimately this will likely lead to lower interest rates in Europe and faster restructuring of non-competitive firms abroad, in the short term overall growth should slow.

So although we do have business-cycle exposure in the portfolio, we continue to focus the portfolio in three areas: companies that can gain market share from rivals; areas of long-term structural change, like broadband and biotech; and beneficiaries of growth in world trade, especially in the rapidly developing economies of the Pacific Basin.

Jennison Global Growth Fund Management Team

The Portfolio of Investments following this report shows the size of the Fund’s positions at period-end.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 5 |

Comments on Largest Holdings

Holdings expressed as a percentage of the Fund’s net assets as of 10/31/03.

| 2.9% | InterActiveCorp./Internet & Catalog Retail, U.S. |

InterActiveCorp. is an interactive commerce company with a multi-brand strategy. The company comprises Expedia, Inc.; Hotels.com; HSN; Ticketmaster; Match.com; Entertainment Publications; Citysearch; Precision Response Corporation; LendingTree; and Hotwire.com.

| 2.4% | Citigroup, Inc./Diversified Financial Services, U.S. |

Citigroup, Inc. is a diversified financial services holding company that provides a broad range of financial services to consumer and corporate customers around the world. The company’s services include investment banking, retail brokerage, corporate banking, and cash management products and services.

| 2.3% | Exel PLC/Air Freight & Couriers, U.K. |

Exel, via its subsidiaries, provides industrial and distribution services. The company’s businesses encompass international air freight forwarding, contract distribution and logistics services, in addition to a range of environmental services, which encompass waste management and landfill operations. Exel has some 1,300 locations in over 120 countries.

| 2.2% | Mitsubishi Corp./Trading Companies & Distributors, Japan |

Mitsubishi Corporation is a general trading and distribution company. The company’s diversified businesses include new business initiatives, IT & electronics, fuels, metals, machinery, chemicals, living essentials, and professional services.

| 2.2% | Cosco Pacific, Ltd./Transportation Infrastructure, Hong Kong |

Cosco Pacific Limited, through its subsidiaries, provides shipping container leasing services worldwide. The company also operates container terminals and provides container handling, storage, transportation and management services, as well as depot handling and stevedoring services.

Holdings are subject to change.

| 6 | | Visit our website at www.jennisondryden.com |

Financial Statements

|

| OCTOBER 31, 2003 | | ANNUAL REPORT |

Jennison Global Growth Fund

Portfolio of Investments

as of October 31, 2003

| Shares | | Description | | Value (Note 1) |

| | | | | | |

LONG-TERM INVESTMENTS 98.3% | | | |

| |

COMMON STOCKS | | | |

| |

Australia 2.8% | | | |

|

| 451,200 | | Amcor, Ltd. | | $ | 2,721,266 |

| 505,131 | | BHP Billiton Ltd. | | | 4,200,632 |

| 129,015 | | CRA Ltd. | | | 3,263,493 |

| | | | |

|

|

| | | | | | 10,185,391 |

| | | | |

|

|

| |

Brazil 0.6% | | | |

|

| 96,300 | | Unibanco—Uniao de Bancos Brasileiros SA (ADR) | | | 2,129,193 |

| |

China 0.7% | | | |

|

| 8,708,100 | | China Oilfield Services, Ltd., Ser. H | | | 2,523,047 |

| |

Finland 0.9% | | | |

|

| 183,860 | | Nokia Oyj | | | 3,122,701 |

| |

France 2.0% | | | |

|

| 44,993 | | Total SA | | | 6,993,094 |

| |

Germany 2.2% | | | |

|

| 82,814 | | Deutsche Boerse AG | | | 4,603,693 |

| 94,200 | | SAP AG (ADR)(b) | | | 3,442,068 |

| | | | |

|

|

| | | | | | 8,045,761 |

| | | | |

|

|

| |

Hong Kong 2.2% | | | |

|

| 5,696,000 | | Cosco Pacific Ltd. | | | 7,738,234 |

| |

Ireland 1.2% | | | |

|

| 359,000 | | Anglo Irish Bank Corp. PLC | | | 4,311,097 |

| |

Israel 1.1% | | | |

|

| 67,800 | | Teva Pharmaceutical Industries, Ltd. (ADR)(b) | | | 3,857,142 |

| |

Italy 2.8% | | | |

|

| 232,400 | | Eni SpA | | | 3,690,454 |

| 246,284 | | Riunione Adriatica di Sicurta SpA | | | 3,847,941 |

| 67,645 | | Tod’s SpA(b) | | | 2,630,418 |

| | | | |

|

|

| | | | | | 10,168,813 |

| | | | |

|

|

| |

Japan 11.2% | | | |

|

| 318,300 | | Aoyama Trading Co. Ltd. | | | 5,906,508 |

| 70,000 | | Canon, Inc. | | | 3,387,456 |

See Notes to Financial Statements.

| 8 | | Visit our website at www.jennisondryden.com |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

| 779,000 | | Mitsubishi Corp. | | $ | 8,085,132 |

| 273 | | Mitsubishi Tokyo Financial Group, Inc. | | | 1,961,796 |

| 1,214,000 | | Mitsui Mining & Smelting Co. Ltd. | | | 4,858,871 |

| 340 | | Sumitomo Mitsui Financial Group, Inc. | | | 1,710,283 |

| 688,000 | | Sumitomo Realty & Development Co. Ltd. | | | 6,383,408 |

| 1,258,000 | | Taisei Corp. | | | 4,371,274 |

| 1,052,700 | | Tokyo Gas Co. Ltd. | | | 3,610,023 |

| | | | |

|

|

| | | | | | 40,274,751 |

| | | | |

|

|

| |

Mexico 1.4% | | | |

|

| 152,300 | | Telefonos de Mexico SA de CV, Ser. L (ADR) | | | 4,896,445 |

| |

Netherlands 1.0% | | | |

|

| 176,300 | | ING Groep NV | | | 3,660,385 |

| |

South Korea 1.8% | | | |

|

| 16,700 | | Samsung Electronics Co. Ltd. | | | 6,632,024 |

| |

Spain 2.0% | | | |

|

| 981 | | Antena 3 Television SA(a) | | | 32,046 |

| 69,741 | | Banco Popular Espanol SA | | | 3,626,436 |

| 290,059 | | Telefonica SA | | | 3,607,972 |

| | | | |

|

|

| | | | | | 7,266,454 |

| | | | |

|

|

| |

Sweden 0.2% | | | |

|

| 12,100 | | Tele2 AB, Class A(a) | | | 608,812 |

| |

Switzerland 2.5% | | | |

|

| 55,200 | | Roche Holding AG (ADR) | | | 4,567,723 |

| 73,700 | | UBS AG | | | 4,525,705 |

| | | | |

|

|

| | | | | | 9,093,428 |

| | | | |

|

|

| |

Taiwan 1.6% | | | |

|

| 2,981,880 | | Taiwan Semiconductor Manufacturing Co., Ltd.(a) | | | 5,880,381 |

| |

United Kingdom 13.0% | | | |

|

| 86,000 | | AstraZeneca PLC (ADR)(b) | | | 4,100,480 |

| 281,300 | | Bunzl PLC | | | 2,195,818 |

| 225,200 | | EGG PLC(a) | | | 534,059 |

| 641,399 | | Exel PLC | | | 8,255,675 |

| 1,035,845 | | GKN PLC | | | 4,851,461 |

| 311,300 | | HSBC Holdings PLC | | | 4,675,102 |

| 143,500 | | Reckitt Benckiser PLC | | | 3,019,551 |

| 131,511 | | Royal Bank Scotland Group PLC(a) | | | 3,523,814 |

See Notes to Financial Statements.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 9 |

Portfolio of Investments

as of October 31, 2003 Cont’d.

| Shares | | Description | | Value (Note 1) |

| | | | | | |

| 2,780,400 | | Signet Group PLC | | $ | 4,883,333 |

| 1,101,600 | | Tesco PLC | | | 4,416,360 |

| 3,051,476 | | Vodafone Group PLC | | | 6,408,020 |

| | | | |

|

|

| | | | | | 46,863,673 |

| | | | |

|

|

| |

United States 47.1% | | | |

|

| 72,800 | | Air Products and Chemicals, Inc.(b) | | | 3,305,848 |

| 46,100 | | Allergan, Inc.(b) | | | 3,486,082 |

| 61,300 | | Ambac Financial Group, Inc.(b) | | | 4,336,362 |

| 40,400 | | American International Group, Inc. | | | 2,457,532 |

| 62,700 | | AmerisourceBergen Corp.(b) | | | 3,559,479 |

| 83,100 | | Amgen, Inc.(a) | | | 5,132,256 |

| 144,300 | | Bank of New York Co., Inc. (The) | | | 4,500,717 |

| 166,200 | | Bed, Bath & Beyond, Inc.(a) | | | 7,020,288 |

| 123,600 | | BJ Services Co.(a) | | | 4,055,316 |

| 73,400 | | Boise Cascade Corp.(b) | | | 2,058,870 |

| 73,300 | | Caremark Rx, Inc.(a)(b) | | | 1,836,165 |

| 56,000 | | CarMax, Inc.(a) | | | 1,764,560 |

| 230,900 | | Cisco Systems, Inc.(a) | | | 4,844,282 |

| 184,983 | | Citigroup, Inc. | | | 8,768,194 |

| 87,200 | | Clear Channel Communications, Inc.(b) | | | 3,559,504 |

| 31,100 | | Colgate-Palmolive Co. | | | 1,654,209 |

| 92,100 | | ComCast Corp., Class A Special(a)(b) | | | 3,004,302 |

| 113,700 | | Dell, Inc.(a)(b) | | | 4,106,844 |

| 171,600 | | General Electric Co. | | | 4,978,116 |

| 149,500 | | General Motors Corp., Class H(a) | | | 2,456,285 |

| 80,000 | | Gilead Sciences, Inc.(a) | | | 4,366,400 |

| 32,600 | | Goldman Sachs Group, Inc. (The) | | | 3,061,140 |

| 113,700 | | Intel Corp.(b) | | | 3,757,785 |

| 285,350 | | InterActiveCorp.(a)(b) | | | 10,475,198 |

| 99,100 | | International Paper Co. | | | 3,899,585 |

| 32,300 | | Kohl’s Corp.(a)(b) | | | 1,811,061 |

| 61,600 | | MedImmune, Inc.(a) | | | 1,642,256 |

| 73,100 | | Merrill Lynch & Co., Inc.(b) | | | 4,327,520 |

| 269,800 | | Microsoft Corp.(a) | | | 7,055,270 |

| 44,300 | | Northrop Grumman Corp.(b) | | | 3,960,420 |

| 48,900 | | Omnicom Group, Inc.(b) | | | 3,902,220 |

| 210,760 | | Pfizer, Inc. | | | 6,660,016 |

| 27,800 | | Procter & Gamble Co. (The) | | | 2,732,462 |

| 115,400 | | Smith International, Inc.(a) | | | 4,296,342 |

| 74,100 | | State Street Corp. | | | 3,879,876 |

| 131,500 | | Texas Instruments, Inc. | | | 3,802,980 |

| 65,200 | | UnitedHealth Group, Inc.(b) | | | 3,317,376 |

See Notes to Financial Statements.

| 10 | | Visit our website at www.jennisondryden.com |

| Shares | | Description | | Value (Note 1) | |

| | | | | | | |

| 144,600 | | Univision Communications, Inc., Class A(a)(b) | | $ | 4,909,170 | |

| 87,900 | | Viacom, Inc., Class B | | | 3,504,573 | |

| 105,000 | | Wal-Mart Stores, Inc. | | | 6,189,750 | |

| 125,100 | | Wendy’s International, Inc. | | | 4,634,955 | |

| | | | |

|

|

|

| | | | | | 169,071,566 | |

| | | | |

|

|

|

| | | Total long-term investments

(cost $282,041,624) | | | 353,322,392 | |

| | | | |

|

|

|

SHORT-TERM INVESTMENTS 20.2% | | | | |

| |

Mutual Fund 20.2% | | | | |

|

| | | Dryden Core Investment Fund - Taxable Money Market Series(c) | | | | |

| 72,483,820 | | (Note 3) (cost $72,483,820) | | | 72,483,820 | |

Principal Amount

(000) | | | | | |

| |

Repurchase Agreement | | | | |

|

| | | State Street Bank and Trust Co., dated | | | | |

| $34 | | 10/31/03, 0.05%, due 11/3/03(d) (cost $34,000) | | | 34,000 | |

| | | | |

|

|

|

| | | Total short-term investments

(cost $72,517,820) | | | 72,517,820 | |

| | | | |

|

|

|

| | | Total Investments 118.5%

(cost $354,559,444; Note 5) | | | 425,840,212 | |

| | | Liabilities in excess of other assets (18.5%) | | | (66,475,145 | ) |

| | | | |

|

|

|

| | | Net Assets 100% | | $ | 359,365,067 | |

| | | | |

|

|

|

| (a) | Non-income producing security. |

| (b) | Security or portion thereof, on loan, see Note 4. |

| (c) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan. |

| (d) | Repurchase price of $34,000. Collateralized by $35,000 U.S. Treasury Notes with a rate of 3.50%, maturity date of 11/15/2006, and aggregate market value, including accrued interest, of $37,235. |

The following abbreviations are used in portfolio descriptions:

ADR—American Depositary Receipt.

See Notes to Financial Statements.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 11 |

Portfolio of Investments

as of October 31, 2003 Cont’d.

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2003 was as follows:

Short-Term Investments | | 20.2 | % |

Pharmaceuticals | | 6.3 | |

Commercial Banks | | 6.3 | |

Media | | 6.0 | |

Capital Markets | | 5.7 | |

Semiconductors & Semiconductor Equipment | | 5.5 | |

Specialty Retail | | 5.5 | |

Diversified Financial Services | | 4.7 | |

Metals & Mining | | 3.4 | |

Biotechnology | | 3.1 | |

Oil & Gas | | 3.0 | |

Insurance | | 3.0 | |

Energy Equipment & Services | | 3.0 | |

Software | | 2.9 | |

Internet & Catalog Retail | | 2.9 | |

Food & Staples Retailing | | 2.9 | |

Diversified Telecommunication Services | | 2.5 | |

Healthcare Providers & Services | | 2.4 | |

Air Freight & Couriers | | 2.3 | |

Trading Companies & Distributors | | 2.2 | |

Transportation Infrastructure | | 2.2 | |

Communications Equipment | | 2.2 | |

Household Products | | 2.1 | |

Wireless Telecommunication Services | | 1.8 | |

Real Estate | | 1.8 | |

Paper & Forest Products | | 1.7 | |

Industrial Conglomerates | | 1.4 | |

Auto Components | | 1.4 | |

Hotels, Restaurants & Leisure | | 1.3 | |

Construction & Engineering | | 1.2 | |

Computers & Peripherals | | 1.1 | |

Aerospace & Defense | | 1.1 | |

Gas Utilities | | 1.0 | |

Office Electronics | | 0.9 | |

Chemicals | | 0.9 | |

Containers & Packaging | | 0.8 | |

Textiles & Apparel | | 0.7 | |

Commercial Services & Supplies | | 0.6 | |

Multiline Retail | | 0.5 | |

| | |

|

|

| | | 118.5 | |

Liabilities in excess of other assets | | (18.5 | ) |

| | |

|

|

| | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

| 12 | | Visit our website at www.jennisondryden.com |

Statements of Assets and Liabilities

|

| OCTOBER 31, 2003 | | ANNUAL REPORT |

Jennison Global Growth Fund

Statement of Assets and Liabilities

as of October 31, 2003

Assets | | | | |

|

Investments, at value, including securities on loan of $65,601,148

(cost $354,559,444) | | $ | 425,840,212 | |

Foreign currency, at value (cost $2,349,681) | | | 2,358,121 | |

Cash | | | 27,041 | |

Dividends and interest receivable | | | 389,763 | |

Receivable for investments sold | | | 445,882 | |

Receivable for Series shares sold | | | 174,388 | |

Foreign tax reclaim receivable | | | 146,543 | |

Other assets | | | 13,061 | |

| | |

|

|

|

Total assets | | | 429,395,011 | |

| | |

|

|

|

| |

Liabilities | | | | |

|

Payable to broker for collateral for securities on loan | | | 68,037,404 | |

Payable for Series shares reacquired | | | 677,782 | |

Accrued expenses | | | 647,114 | |

Payable for investments purchased | | | 341,087 | |

Management fee payable | | | 227,506 | |

Distribution fee payable | | | 99,051 | |

| | |

|

|

|

Total liabilities | | | 70,029,944 | |

| | |

|

|

|

| |

Net assets | | $ | 359,365,067 | |

| | |

|

|

|

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 287,472 | |

Paid-in capital in excess of par | | | 457,812,379 | |

| | |

|

|

|

| | | | 458,099,851 | |

Undistributed net investment income | | | 1,082,198 | |

Accumulated net realized loss on investments and foreign currency transactions | | | (171,126,796 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 71,309,814 | |

| | |

|

|

|

| |

Net assets, October 31, 2003 | | $ | 359,365,067 | |

| | |

|

|

|

See Notes to Financial Statements.

| 14 | | Visit our website at www.jennisondryden.com |

Class A | | | |

|

Net asset value and redemption price per share ($256,105,810 ÷ 20,128,415 shares of common stock issued and outstanding) | | $ | 12.72 |

Maximum sales charge (5% of offering price) | | | .67 |

| | |

|

|

Maximum offering price to public | | $ | 13.39 |

| | |

|

|

| |

Class B | | | |

|

Net asset value, offering price and redemption price per share ($53,834,056 ÷ 4,663,603 shares of common stock issued and outstanding) | | $ | 11.54 |

| | |

|

|

| |

Class C | | | |

|

Net asset value and redemption price per share ($13,053,225 ÷ 1,134,643 shares of common stock issued and outstanding) | | $ | 11.50 |

Sales charge (1% of offering price) | | | .12 |

| | |

|

|

Offering price to public | | $ | 11.62 |

| | |

|

|

| |

Class Z | | | |

|

Net asset value, offering price and redemption price per share ($36,371,976 ÷ 2,820,572 shares of common stock issued and outstanding) | | $ | 12.90 |

| | |

|

|

See Notes to Financial Statements.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 15 |

Statement of Operations

Year Ended October 31, 2003

Net Investment Income | | | | |

|

Income | | | | |

Dividends (net of foreign withholding taxes of $511,393) | | $ | 5,531,398 | |

Interest | | | 13,299 | |

Income from securities lending (net) | | | 273,452 | |

| | |

|

|

|

Total income | | | 5,818,149 | |

| | |

|

|

|

| |

Expenses | | | | |

Management fee | | | 2,508,601 | |

Distribution fee—Class A | | | 575,258 | |

Distribution fee—Class B | | | 441,319 | |

Distribution fee—Class C | | | 120,913 | |

Transfer agent’s fees and expenses | | | 1,104,000 | |

Reports to shareholders | | | 394,000 | |

Custodian’s fees and expenses | | | 312,000 | |

Registration fees | | | 55,000 | |

Audit fees | | | 39,000 | |

Legal fees and expenses | | | 38,000 | |

Directors’ fees | | | 10,000 | |

Miscellaneous | | | 19,156 | |

| | |

|

|

|

Total expenses | | | 5,617,247 | |

| | |

|

|

|

Net investment income | | | 200,902 | |

| | |

|

|

|

| |

Realized And Unrealized Gain (Loss) On Investments And Foreign Currency Transactions | | | | |

|

Net realized gain (loss) on: | | | | |

Investment transactions | | | (681,622 | ) |

Foreign currency transactions | | | 881,296 | |

Written option transactions | | | 2,190 | |

| | |

|

|

|

| | | | 201,864 | |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 73,919,235 | |

Foreign currencies | | | (15,441 | ) |

| | |

|

|

|

| | | | 73,903,794 | |

| | |

|

|

|

Net gain on investments and foreign currencies | | | 74,105,658 | |

| | |

|

|

|

Net Increase In Net Assets Resulting From Operations | | $ | 74,306,560 | |

| | |

|

|

|

See Notes to Financial Statements.

| 16 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| |

| | | Year Ended October 31,

| |

| | | 2003 | | | 2002 | |

Increase (Decrease) In Net Assets | | | | | | | | |

|

Operations | | | | | | | | |

Net investment income (loss) | | $ | 200,902 | | | $ | (1,396,717 | ) |

Net realized gain (loss) on investments and foreign currency transactions | | | 201,864 | | | | (74,555,483 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | 73,903,794 | | | | 3,647,687 | |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets resulting from operations | | | 74,306,560 | | | | (72,304,513 | ) |

| | |

|

|

| |

|

|

|

| | |

Series share transactions (net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 65,971,140 | | | | 87,551,827 | |

Cost of shares reacquired | | | (120,626,072 | ) | | | (169,079,854 | ) |

| | |

|

|

| |

|

|

|

Net decrease in net assets from Series share transactions | | | (54,654,932 | ) | | | (81,528,027 | ) |

| | |

|

|

| |

|

|

|

Total increase (decrease) | | | 19,651,628 | | | | (153,832,540 | ) |

| | |

Net Assets | | | | | | | | |

|

Beginning of year | | | 339,713,439 | | | | 493,545,979 | |

| | |

|

|

| |

|

|

|

End of year(a) | | $ | 359,365,067 | | | $ | 339,713,439 | |

| | |

|

|

| |

|

|

|

(a) Includes undistributed net investment income of: | | $ | 1,082,198 | | | $ | — | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 17 |

Notes to Financial Statements

Prudential World Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as an open-end, diversified management investment company and currently consists of three series: Jennison Global Growth Fund (the “Series”), Strategic Partners International Value Fund and Jennison International Growth Fund, formerly known as Prudential Global Growth Fund, Prudential International Value Fund and Prudential International Growth Fund, respectively. The financial statements of the other series are not presented herein. The Series commenced investment operations in May, 1984.

The investment objective of the Series is to seek long-term capital growth, with income as a secondary objective, by investing in a diversified portfolio of securities consisting of marketable securities of U.S. and non-U.S. issuers.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund, and the Series, in the preparation of its financial statements.

Securities Valuation: Securities listed on a securities exchange are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices or at the last bid price on such day in the absence of an asked price. Securities traded via Nasdaq are valued at the official closing price as provided by Nasdaq. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI or Manager”), in consultation with the subadviser, to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker (if available, otherwise a principal market maker or a primary market dealer). Options on securities and indices traded on an exchange are valued on their last sales price as of the close of trading on the applicable exchange or, if there was no sale, at the mean between the most recently quoted bid and asked prices on such exchange. Securities for which reliable market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Series’ normal pricing time, are valued at fair value in accordance with Board of Directors’ approved fair valuation procedures.

| 18 | | Visit our website at www.jennisondryden.com |

Investments in mutual funds are valued at the net asset value as of the close of the New York Stock Exchange on the date of valuation.

Short-term securities which mature in 60 days or less are valued at amortized cost which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term securities which mature in more than 60 days are valued based upon current market quotations.

Repurchase Agreements: In connection with transactions in repurchase agreements with U.S. financial institutions, it is the Series’ policy that its custodian or designated subcustodians under triparty repurchase agreements, as the case may be, take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market on a daily basis to ensure the adequacy of the collateral. If the seller defaults and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Series may be delayed or limited.

Foreign Currency Translation: The books and records of the Series are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities—at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses—at the rate of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Series are presented at the foreign exchange rates and market values at the close of the period, the Series does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held at period end. Similarly, the Series does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, these realized foreign currency gains or losses are included in the reported net realized gains or losses on investment transactions.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 19 |

Notes to Financial Statements

Cont’d

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from holdings of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign taxes recorded on the Series’ books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on foreign currencies.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political and economic instability and the level of governmental supervision and regulation of foreign securities markets.

Options: The Series may either purchase or write options in order to hedge against adverse market movements or fluctuations in value caused by changes in prevailing interest rates or foreign currency exchange rates with respect to securities or currencies which the Series currently owns or intends to purchase. The Series’ principal reason for writing options is to realize, through receipt of premiums, greater current return than would be realized on the underlying security alone. When the Series purchases an option, it pays a premium and an amount equal to that premium is recorded as an asset. When the Series writes an option, it receives a premium and an amount equal to that premium is recorded as a liability. The asset or liability is adjusted daily to reflect the current market value of the options.

If an option expires unexercised, the Series realizes a gain or loss to the extent of the premium received or paid. If an option is exercised, the premium received or paid is recorded as an adjustment to the proceeds from the sale or the cost basis of the purchase in determining whether the Series has realized a gain or loss. The difference between the premium and the amount received or paid on effecting a closing purchase or sale transaction is also treated as a realized gain or loss. Gain or loss on purchased options is included in net realized gain or loss on investment transactions. Gain or loss on written options is presented separately as net realized gain or loss on written option transactions.

The Series, as writer of an option, has no control over whether the underlying securities or currencies may be sold (called) or purchased (put). As a result, the Series

| 20 | | Visit our website at www.jennisondryden.com |

bears the market risk of an unfavorable change in the price of the security or currency underlying the written option. The Series, as purchaser of an option, bears the risk of the potential inability of the counterparties to meet the terms of their contracts.

Options involve elements of both market and credit risk in excess of the amounts reflected on the Statement of Assets and Liabilities.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses from investment and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on an accrual basis. Expenses are recorded on an accrual basis which may require the use of certain estimates by management.

Net investment income or loss, (other than distribution fees, which are charged directly to the respective class) other than distribution fees, and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Dividends and Distributions: The Series expects to pay dividends of net investment income and distributions of net realized capital and currency gains, if any, annually. Dividends and distributions, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences relating to income and gains are reclassified to paid-in capital when they arise.

Taxes: For federal income tax purposes, each series in the Fund is treated as a separate taxpaying entity. It is the Series’ policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends are recorded net of reclaimable amounts, at the time the related income is earned.

Securities Lending: The Series may lend its portfolio securities to broker-dealers. The loans are secured by collateral at least equal at all times to the market value of the securities loaned. Loans are subject to termination at the option of the borrower or the Series. Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. Should the borrower of the securities fail financially,

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 21 |

Notes to Financial Statements

Cont’d

the Series has the right to repurchase the securities using the collateral in the open market. The Series recognizes income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The Series also continues to receive interest and dividends or amounts equivalent thereto, on the securities loaned and recognizes any unrealized gain or loss in the market price of the securities loaned that may occur during the term of the loan.

Note 2. Agreements

The Fund has a management agreement for the Series with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisor’s performance of such services. PI has entered into a subadvisory agreement with Jennison Associates LLC (“Jennison”). The subadvisory agreement provides that Jennison furnishes investment advisory services in connection with the management of the Series. In connection therewith, Jennison is obligated to keep certain books and records of the Series. PI pays for the services of Jennison, the cost of compensation of officers of the Series, occupancy and certain clerical and bookkeeping costs of the Series. The Series bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly, at an annual rate of .75% of the Series’ average daily net assets.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, B, C and Z shares of the Series. The Series compensates PIMS for distributing and servicing the Series’ Class A, Class B and Class C shares, pursuant to plans of distribution, (the “Class A, B and C Plans”), regardless of expenses actually incurred by them. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor for the Class Z shares of the Series.

Pursuant to the Class A Plan, the Series compensates PIMS with respect to Class A shares, for distribution-related activities at an annual rate of up to .30 of 1% of the average daily net assets of the Class A shares. Pursuant to the Class B and C Plans, the Series compensates PIMS for distribution-related activities at the annual rate of .75 of 1% of the average daily net assets of Class B shares up to the level of average daily net assets as of February 26, 1986, plus 1% of the average daily net assets in excess of

| 22 | | Visit our website at www.jennisondryden.com |

such level of the Class B shares, and 1% of average daily net assets of Class C shares. For the year ended October 31, 2003, PIMS contractually agreed to limit such fees to .25 of 1% of the average daily net assets of the Class A shares.

PIMS has advised the Series that for the year ended October 31, 2003, it received approximately $40,300 and $4,300 in front-end sales charges resulting from sales of Class A and Class C shares, respectively. From these fees, PIMS paid such sales charges to affiliated broker-dealers, which in turn paid commissions to salespersons and incurred other distribution costs.

PIMS has advised the Series that during the year ended October 31, 2003, it received approximately $88,300 and $500 in contingent deferred sales charges imposed upon certain redemptions by Class B and C shareholders, respectively.

PI, PIMS, and Jennison are indirect, wholly owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

The Series, along with other affiliated registered investment companies (the “Funds”), is a party to a syndicated credit agreement (“SCA”) with a group of banks. The SCA provides for a commitment of $800 million and allows the Funds to increase the commitment to $1 billion, if necessary. Interest on any borrowings will be incurred at market rates. The Funds pay a commitment fee of .08 of 1% of the unused portion of the SCA. The commitment fee is accrued and allocated to the Funds pro rata based on net assets. The purpose of the SCA is to serve as an alternative source of funding for capital share redemptions. The expiration date of the SCA was May 2, 2003. On May 2, 2003, the SCA was renewed under the same terms and conditions (“May 2003 renewal”). The expiration date of the May 2003 renewal is April 30, 2004. The Series did not borrow any amounts pursuant to the SCA during the year ended October 31, 2003.

Note 3. Other Transactions With Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent and during the year ended October 31, 2003, the Series incurred fees of approximately $807,300 for the services of PMFS. As of October 31, 2003, approximately $62,800 of such fees were due to PMFS. Transfer agent fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to nonaffiliates, where applicable.

The Series pays networking fees to affiliated and unaffiliated broker/dealers. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. The Series incurred approximately

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 23 |

Notes to Financial Statements

Cont’d

$87,500 in total networking fees, of which the amount paid to Wachovia Securities LLC (“Wachovia”) and Prudential Securities Incorporated (“PSI”), affiliates of PI, was approximately $75,600 for the year ended October 31, 2003. Effective July 1, 2003, Prudential and Wachovia Corp. formed a joint venture (“Wachovia Securities, LLC”) whereby Prudential and Wachovia Corp. combined their brokerage business with Prudential holding a minority interest. Prior to July 1, 2003, PSI was an indirect, wholly-owned subsidiary of Prudential. As of October 31, 2003, approximately $5,800 of such fees were due to Wachovia. These amounts are included in transfer agent’s fees and expenses in the Statement of Operations.

PSI was the securities lending agent for the Series. Effective July 1, 2003, Prudential Investment Management, Inc. (“PIM”), an indirect, wholly-owned subsidiary of Prudential, became the Series’s securities lending agent. For the year ended October 31, 2003, PSI and PIM have been compensated approximately $56,000 and $9,400 for these services, respectively.

The Series invests in the Taxable Money Market Series (the “Portfolio”), a portfolio of Dryden Core Investment Fund, formerly Prudential Core Investment Fund, pursuant to an exemptive order received from the Securities and Exchange Commission. The Portfolio is a money market mutual fund registered under the Investment Company Act of 1940, as amended, and managed by PI. During the year ended October 31, 2003, the Series earned income from the Portfolio of approximately $54,800 and $273,500 by investing its excess cash and collateral received from securities lending, respectively.

Included in the realized gain (loss) on investments, in the Statement of Operations, for the year ended October 31, 2003, is an amount of approximately $54,000, reimbursed by PSI in connection with a securities lending error.

Note 4. Portfolio Securities

Purchases and sales of investment securities, other than short-term investments, for the year ended October 31, 2003 were $253,778,556 and $302,889,672, respectively.

| 24 | | Visit our website at www.jennisondryden.com |

Transactions in options written during the year ended October 31, 2003, were as follows:

| | | Number of

Contracts

| | | Premiums

Received

| |

Options outstanding as of October 31, 2002 | | — | | | | — | |

Options written | | 219 | | | $ | 2,190 | |

Options expired | | (219 | ) | | | (2,190 | ) |

| | |

|

| |

|

|

|

Options outstanding as of October 31, 2003 | | — | | | $ | — | |

| | |

|

| |

|

|

|

As of October 31, 2003, the Series had securities on loan with an aggregate market value of $65,601,148. The Series received $68,037,404 in cash as collateral for securities on loan which was used to purchase highly liquid short-term investments in accordance with Fund’s securities lending procedures.

Note 5. Tax Information

In order to present undistributed net investment income or loss and accumulated net realized gains or losses on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to paid-in-capital in excess of par, undistributed net investment income or loss and accumulated net realized gain or loss on investments. For the year ended October 31, 2003, the adjustments were to increase accumulated net realized loss and undistributed net investment income by $881,296. Net investment income, net realized gains and net assets were not affected by this change.

As of October 31, 2003, the accumulated undistributed earnings on a tax basis were $1,082,198.

For federal income tax purposes, the Series had a capital loss carryforward as of October 31, 2003, of approximately $169,716,500, of which $95,156,900 expires in 2009, $73,669,800 expires in 2010 and $889,800 expires in 2011. Accordingly, no capital gains distribution is expected to be paid to shareholders until net gains have been realized in excess of such carryforward.

The United States federal income tax basis of the Series’ investments and the net unrealized appreciation as of October 31, 2003 were as follows:

Tax Basis

| | Appreciation

| | Depreciation

| | Other Cost Basis Adjustments

| | Total Net

Unrealized

Appreciation

|

| $355,969,790 | | $77,579,123 | | $7,708,701 | | $29,046 | | $69,899,468 |

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 25 |

Notes to Financial Statements

Cont’d

The difference between book basis and tax basis is primarily attributable to the wash sales. The other cost basis adjustments are primarily attributable to appreciation of foreign currency and mark to market of receivables and payables.

Note 6. Capital

The Series offers Class A, Class B, Class C and Class Z shares. Class A shares are sold with a front-end sales charge of up to 5%. In some limited circumstances, Class A shares may not be subject to a front-end sales charge, but may be subject to a 1% contingent deferred sales charge for the fiscal year. Class B shares are sold with a contingent deferred sales charge which declines from 5% to zero depending

on the period of time the shares are held. Class C shares are sold with a front-end sales charge of 1% and a contingent deferred sales charge of 1% during the first 18 months. Class B shares will automatically convert to Class A shares on a quarterly basis approximately seven periods after purchase. A special exchange privilege is also available for shareholders who qualify to purchase Class A shares at net asset value. Class Z shares are not subject to any sales or redemption charge and are offered exclusively for sale to a limited group of investors.

There are 500 million authorized shares of $.01 par value common stock, divided equally into four classes, designated Class A, Class B, Class C and Class Z common stock.

Transactions in shares of common stock were as follows:

Class A

| | Shares

| | | Amount

| |

Year ended October 31, 2003: | | | | | | | |

Shares sold | | 3,904,829 | | | $ | 42,792,755 | |

Shares reacquired | | (7,306,255 | ) | | | (80,277,136 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding before conversion | | (3,401,426 | ) | | | (37,484,381 | ) |

Shares issued upon conversion from Class B | | 1,662,325 | | | | 18,348,560 | |

| | |

|

| |

|

|

|

Net decrease in shares outstanding | | (1,739,101 | ) | | $ | (19,135,821 | ) |

| | |

|

| |

|

|

|

Year ended October 31, 2002: | | | | | | | |

Shares sold | | 4,346,549 | | | $ | 52,196,038 | |

Shares reacquired | | (9,029,142 | ) | | | (107,379,582 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding before conversion | | (4,682,593 | ) | | | (55,183,544 | ) |

Shares issued upon conversion from Class B | | 1,634,990 | | | | 19,966,253 | |

| | |

|

| |

|

|

|

Net decrease in shares outstanding | | (3,047,603 | ) | | $ | (35,217,291 | ) |

| | |

|

| |

|

|

|

| 26 | | Visit our website at www.jennisondryden.com |

Class B

| | Shares

| | | Amount

| |

Year ended October 31, 2003: | | | | | | | |

Shares sold | | 547,053 | | | $ | 5,520,526 | |

Shares reacquired | | (1,663,518 | ) | | | (16,230,978 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding before conversion | | (1,116,465 | ) | | | (10,710,452 | ) |

Shares reacquired upon conversion into Class A | | (1,827,256 | ) | | | (18,348,560 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding | | (2,943,721 | ) | | $ | (29,059,012 | ) |

| | |

|

| |

|

|

|

Year ended October 31, 2002: | | | | | | | |

Shares sold | | 990,875 | | | $ | 11,070,227 | |

Shares reacquired | | (3,194,031 | ) | | | (33,784,498 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding before conversion | | (2,203,156 | ) | | | (22,714,271 | ) |

Shares reacquired upon conversion into Class A | | (1,787,584 | ) | | | (19,966,253 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding | | (3,990,740 | ) | | $ | (42,680,524 | ) |

| | |

|

| |

|

|

|

Class C

| | | | | | |

Year ended October 31, 2003: | | | | | | | |

Shares sold | | 328,437 | | | $ | 3,315,995 | |

Shares reacquired | | (537,080 | ) | | | (5,369,261 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding | | (208,643 | ) | | $ | (2,053,266 | ) |

| | |

|

| |

|

|

|

Year ended October 31, 2002: | | | | | | | |

Shares sold | | 694,302 | | | $ | 7,308,297 | |

Shares reacquired | | (774,969 | ) | | | (8,266,673 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding | | (80,667 | ) | | $ | (958,376 | ) |

| | |

|

| |

|

|

|

Class Z

| | | | | | |

Year ended October 31, 2003: | | | | | | | |

Shares sold | | 1,308,315 | | | $ | 14,341,864 | |

Shares reacquired | | (1,707,766 | ) | | | (18,748,697 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding | | (399,451 | ) | | $ | (4,406,833 | ) |

| | |

|

| |

|

|

|

Year ended October 31, 2002: | | | | | | | |

Shares sold | | 1,442,935 | | | $ | 16,977,265 | |

Shares reacquired | | (1,667,949 | ) | | | (19,649,101 | ) |

| | |

|

| |

|

|

|

Net decrease in shares outstanding | | (225,014 | ) | | $ | (2,671,836 | ) |

| | |

|

| |

|

|

|

Note 7. Plan of Reorganization

On November 21, 2003, Jennison Global Growth Fund acquired all of the net assets of Prudential Pacific Growth Fund, Inc. and the Prudential Europe Growth Fund, Inc. pursuant to a plan of reorganization approved by the Jennison Global Growth shareholders on November 20, 2003. The acquisition was accomplished by a tax-free exchange of Class A , Class B, Class C and Class Z shares.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 27 |

Financial Highlights

| | | Class A

| |

| | | Year Ended October 31, 2003 | |

|

Per Share Operating Performance(a): | | | | |

Net Asset Value, Beginning Of Year | | $ | 10.21 | |

| | |

|

|

|

Income From Investment Operations: | | | | |

Net investment income (loss) | | | .02 | |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 2.49 | |

| | |

|

|

|

Total from investment operations | | | 2.51 | |

| | |

|

|

|

Less Dividends and Distributions: | | | | |

Distributions in excess of net investment income | | | — | |

Distributions from net realized capital gains | | | — | |

| | |

|

|

|

Total dividends and distributions | | | — | |

| | |

|

|

|

Net asset value, end of year | | $ | 12.72 | |

| | |

|

|

|

Total Return(b): | | | 24.58 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 256,106 | |

Average net assets (000) | | $ | 230,103 | |

Ratios to average net assets: | | | | |

Operating expenses, including distribution and service (12b-1 fees)(c) | | | 1.59 | % |

Operating expenses, excluding distribution and service (12b-1 fees) | | | 1.34 | % |

Net investment income (loss) | | | .15 | % |

For Class A, B, C and Z shares: | | | | |

Portfolio turnover rate | | | 79 | % |

| (a) | Based on average shares outstanding. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. |

| (c) | The distributor of the Series has contractually agreed to reduce its distribution and service (12b-1) for Class A shares to .25 of 1% of the average net assets. |

See Notes to Financial Statements.

| 28 | | Visit our website at www.jennisondryden.com |

| Class A | |

|

| Year Ended October 31, | |

|

| 2002 | | | 2001 | | | 2000 | | | 1999 | |

|

| | | | | | | | | | | | | | | |

| $ | 12.23 | | | $ | 21.35 | | | $ | 21.19 | | | $ | 16.16 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | (.01 | ) | | | .01 | | | | (.09 | ) | | | (.05 | ) |

| | (2.01 | ) | | | (5.83 | ) | | | 2.25 | | | | 5.82 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (2.02 | ) | | | (5.82 | ) | | | 2.16 | | | | 5.77 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | — | | | | — | | | | (.19 | ) | | | (.14 | ) |

| | — | | | | (3.30 | ) | | | (1.81 | ) | | | (.60 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | — | | | | (3.30 | ) | | | (2.00 | ) | | | (.74 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 10.21 | | | $ | 12.23 | | | $ | 21.35 | | | $ | 21.19 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (16.52 | )% | | | (30.87 | )% | | | 9.80 | % | | | 36.83 | % |

| | | | | | | | | | | | | | | |

| $ | 223,191 | | | $ | 304,777 | | | $ | 396,870 | | | $ | 339,620 | |

| $ | 284,046 | | | $ | 353,879 | | | $ | 415,035 | | | $ | 298,009 | |

| | | | | | | | | | | | | | | |

| | 1.46 | % | | | 1.37 | % | | | 1.27 | % | | | 1.32 | % |

| | 1.21 | % | | | 1.12 | % | | | 1.02 | % | | | 1.07 | % |

| | (.18 | )% | | | .06 | % | | | (.38 | )% | | | (.27 | )% |

| | | | | | | | | | | | | | | |

| | 67 | % | | | 72 | % | | | 82 | % | | | 59 | % |

See Notes to Financial Statements.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 29 |

Financial Highlights

Cont’d.

| | | Class B

| |

| | | Year Ended October 31, 2003 | |

|

Per Share Operating Performance(a): | | | | |

Net Asset Value, Beginning Of Year | | $ | 9.31 | |

| | |

|

|

|

Income From Investment Operations: | | | | |

Net investment loss | | | (.04 | ) |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 2.27 | |

| | |

|

|

|

Total from investment operations | | | 2.23 | |

| | |

|

|

|

Less Dividends and Distributions: | | | | |

Distributions in excess of net investment income | | | — | |

Distributions from net realized capital gains | | | — | |

| | |

|

|

|

Total dividends and distributions | | | — | |

| | |

|

|

|

Net asset value, end of year | | $ | 11.54 | |

| | |

|

|

|

Total Return(b): | | | 23.95 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 53,834 | |

Average net assets (000) | | $ | 58,843 | |

Ratios to average net assets: | | | | |

Operating expenses, including distribution and service (12b-1 fees) | | | 2.09 | % |

Operating expenses, excluding distribution and service (12b-1 fees) | | | 1.34 | % |

Net investment loss | | | (.37 | )% |

| (a) | Based on average shares outstanding. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. |

See Notes to Financial Statements.

| 30 | | Visit our website at www.jennisondryden.com |

| Class B | |

|

| Year Ended October 31, | |

|

| 2002 | | | 2001 | | | 2000 | | | 1999 | |

|

| | | | | | | | | | | | | | | |

| $ | 11.23 | | | $ | 20.00 | | | $ | 19.98 | | | $ | 15.26 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | (.08 | ) | | | (.08 | ) | | | (.24 | ) | | | (.17 | ) |

| | (1.84 | ) | | | (5.39 | ) | | | 2.12 | | | | 5.51 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (1.92 | ) | | | (5.47 | ) | | | 1.88 | | | | 5.34 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | — | | | | — | | | | (.05 | ) | | | (.02 | ) |

| | — | | | | (3.30 | ) | | | (1.81 | ) | | | (.60 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | — | | | | (3.30 | ) | | | (1.86 | ) | | | (.62 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 9.31 | | | $ | 11.23 | | | $ | 20.00 | | | $ | 19.98 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (17.10 | )% | | | (31.27 | )% | | | 8.94 | % | | | 36.00 | % |

| | | | | | | | | | | | | | | |

| $ | 70,804 | | | $ | 130,201 | | | $ | 288,418 | | | $ | 310,458 | |

| $ | 109,004 | | | $ | 195,461 | | | $ | 355,100 | | | $ | 297,322 | |

| | | | | | | | | | | | | | | |

| | 2.00 | % | | | 2.00 | % | | | 1.96 | % | | | 1.99 | % |

| | 1.21 | % | | | 1.12 | % | | | 1.02 | % | | | 1.07 | % |

| | (.73 | )% | | | (.58 | )% | | | (1.07 | )% | | | (.96 | )% |

See Notes to Financial Statements.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 31 |

Financial Highlights

Cont’d.

| | | Class C

| |

| | | Year Ended

October 31, 2003 | |

|

Per Share Operating Performance(a): | | | | |

Net Asset Value, Beginning Of Year | | $ | 9.30 | |

| | |

|

|

|

Income From Investment Operations: | | | | |

Net investment income loss | | | (.06 | ) |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 2.26 | |

| | |

|

|

|

Total from investment operations | | | 2.20 | |

| | |

|

|

|

Less Dividends and Distributions: | | | | |

Distributions in excess of net investment income | | | — | |

Distributions from net realized capital gains | | | — | |

| | |

|

|

|

Total dividends and distributions | | | — | |

| | |

|

|

|

Net asset value, end of year | | $ | 11.50 | |

| | |

|

|

|

Total Return(b): | | | 23.66 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 13,053 | |

Average net assets (000) | | $ | 12,091 | |

Ratios to average net assets: | | | | |

Operating expenses, including distribution and service (12b-1 fees) | | | 2.34 | % |

Operating expenses, excluding distribution and service (12b-1 fees) | | | 1.34 | % |

Net investment loss | | | (.60 | )% |

| (a) | Based on average shares outstanding. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. |

See Notes to Financial Statements.

| 32 | | Visit our website at www.jennisondryden.com |

| Class C | |

|

| Year Ended October 31, | |

|

| 2002 | | | 2001 | | | 2000 | | | 1999 | |

|

| | | | | | | | | | | | | | | |

| $ | 11.24 | | | $ | 19.99 | | | $ | 19.97 | | | $ | 15.25 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | (.10 | ) | | | (.09 | ) | | | (.24 | ) | | | (.18 | ) |

| | (1.84 | ) | | | (5.36 | ) | | | 2.11 | | | | 5.51 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (1.94 | ) | | | (5.45 | ) | | | 1.87 | | | | 5.33 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | — | | | | — | | | | (.04 | ) | | | (.01 | ) |

| | — | | | | (3.30 | ) | | | (1.81 | ) | | | (.60 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | — | | | | (3.30 | ) | | | (1.85 | ) | | | (.61 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 9.30 | | | $ | 11.24 | | | $ | 19.99 | | | $ | 19.97 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (17.26 | )% | | | (31.17 | )% | | | 8.89 | % | | | 35.94 | % |

| | | | | | | | | | | | | | | |

| $ | 12,490 | | | $ | 16,006 | | | $ | 21,377 | | | $ | 14,184 | |

| $ | 14,897 | | | $ | 18,330 | | | $ | 18,886 | | | $ | 11,866 | |

| | | | | | | | | | | | | | | |

| | 2.21 | % | | | 2.12 | % | | | 2.02 | % | | | 2.07 | % |

| | 1.21 | % | | | 1.12 | % | | | 1.02 | % | | | 1.07 | % |

| | (.92 | )% | | | (.68 | )% | | | (1.11 | )% | | | (1.02 | )% |

See Notes to Financial Statements.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 33 |

Financial Highlights

Cont’d.

| | | Class Z

| |

| | | Year Ended October 31, 2003 | |

|

Per Share Operating Performance(a): | | | | |

Net Asset Value, Beginning Of Year | | $ | 10.32 | |

| | |

|

|

|

Income From Investment Operations: | | | | |

Net investment income (loss) | | | .05 | |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 2.53 | |

| | |

|

|

|

Total from investment operations | | | 2.58 | |

| | |

|

|

|

Less Dividends and Distributions: | | | | |

Distributions in excess of net investment income | | | — | |

Distributions from net realized capital gains | | | — | |

| | |

|

|

|

Total dividends and distributions | | | — | |

| | |

|

|

|

Net asset value, end of year | | $ | 12.90 | |

| | |

|

|

|

Total Return(b): | | | 24.90 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 36,372 | |

Average net assets (000) | | $ | 33,443 | |

Ratios to average net assets: | | | | |

Expenses, including distribution and service (12b-1 fees) | | | 1.34 | % |

Expenses, excluding distribution and service (12b-1 fees) | | | 1.34 | % |

Net investment income (loss) | | | .40 | % |

| (a) | Based on average shares outstanding. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each period reported and includes reinvestment of dividends and distributions. |

See Notes to Financial Statements.

| 34 | | Visit our website at www.jennisondryden.com |

| Class Z | |

|

| Year Ended October 31, | |

|

| 2002 | | | 2001 | | | 2000 | | | 1999 | |

|

| | | | | | | | | | | | | | | |

| $ | 12.35 | | | $ | 21.46 | | | $ | 21.29 | | | $ | 16.23 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | .01 | | | | .05 | | | | (.02 | ) | | | — | |

| | (2.04 | ) | | | (5.86 | ) | | | 2.23 | | | | 5.84 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (2.03 | ) | | | (5.81 | ) | | | 2.21 | | | | 5.84 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | — | | | | — | | | | (.23 | ) | | | (.18 | ) |

| | — | | | | (3.30 | ) | | | (1.81 | ) | | | (.60 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | — | | | | (3.30 | ) | | | (2.04 | ) | | | (.78 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 10.32 | | | $ | 12.35 | | | $ | 21.46 | | | $ | 21.29 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (16.50 | )% | | | (30.57 | )% | | | 9.97 | % | | | 37.25 | % |

| | | | | | | | | | | | | | | |

| $ | 33,228 | | | $ | 42,562 | | | $ | 70,956 | | | $ | 48,430 | |

| $ | 40,960 | | | $ | 54,387 | | | $ | 77,989 | | | $ | 42,312 | |

| | | | | | | | | | | | | | | |

| | 1.21 | % | | | 1.12 | % | | | 1.02 | % | | | 1.07 | % |

| | 1.21 | % | | | 1.12 | % | | | 1.02 | % | | | 1.07 | % |

| | .08 | % | | | .32 | % | | | (.08 | )% | | | (.02 | )% |

See Notes to Financial Statements.

| Prudential World Fund, Inc./Jennison Global Growth Fund | | 35 |

Report of Independent Auditors

To the Board of Directors and Shareholders of

Prudential World Fund, Inc.—Jennison Global Growth Fund