UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-03981 |

| |

Exact name of registrant as specified in charter: | | Prudential World Fund, Inc. |

| |

Address of principal executive offices: | | Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102 |

| |

Name and address of agent for service: | | Jonathan D. Shain

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102 |

| |

Registrant’s telephone number, including area code: | | 973-802-6469 |

| |

Date of fiscal year end: | | 10/31/2004 |

| |

Date of reporting period: | | 10/31/2004 |

Item 1 – Reports to Stockholders – [ INSERT REPORT ]

Jennison Global Growth Fund

| | |

| OCTOBER 31, 2004 | | ANNUAL REPORT |

FUND TYPE

Global stock

OBJECTIVE

Long-term growth of capital

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden is a registered trademark of The Prudential Insurance Company of America.

Dear Shareholder,

December 15, 2004

We hope that you find the annual report for the Jennison Global Growth Fund informative and useful. As a JennisonDryden mutual fund shareholder, you may be thinking where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope that history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

We believe it is wise to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity of having at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds that cover all the basic asset classes and is reflective of your personal investor profile and tolerance for risk.

JennisonDryden mutual funds give you a wide range of choices that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of three leading asset managers. They are recognized and respected in the institutional market and by discerning investors for excellence in their respective strategies. JennisonDryden equity funds are advised by Jennison Associates LLC and/or Quantitative Management Associates LLC (QMA). Prudential Investment Management, Inc. (PIM) advises the JennisonDryden fixed income and money market funds. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies.

Thank you for choosing JennisonDryden mutual funds.

Sincerely,

Judy A. Rice, President

Jennison Global Growth Fund

| | |

| Jennison Global Growth Fund | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Jennison Global Growth Fund (the Fund) is long-term growth of capital. There can be no assurance that the Fund will achieve its investment objective.

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. The maximum initial sales charge is 5.50% (Class A shares).

| | | | | | | | | | | |

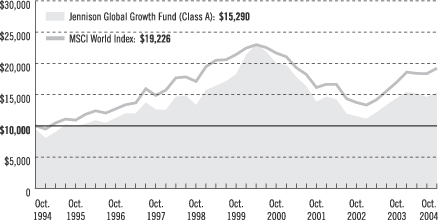

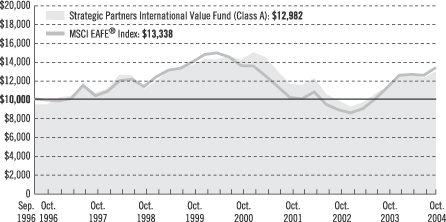

| Cumulative Total Returns1 as of 10/31/04 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Class A | | 6.11 | % | | –16.23 | % | | 61.80 | % | | 137.25% |

Class B | | 5.55 | | | –18.79 | | | 51.64 | | | 485.97 (476.34) |

Class C | | 5.30 | | | –19.25 | | | 50.55 | | | 55.91 |

Class Z | | 6.32 | | | –15.34 | | | N/A | | | 49.99 |

MSCI World Index3 | | 13.25 | | | –10.17 | | | 92.29 | | | *** |

Lipper Global Multi-Cap Growth Funds Avg.4 | | 11.75 | | | 17.83 | | | 109.84 | | | **** |

| | | | | | | | | | | | |

| Average Annual Total Returns1 as of 9/30/04 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception2 |

Class A | | 4.54 | % | | –4.09 | % | | 4.40 | % | | 5.48% |

Class B | | 4.98 | | | –3.74 | | | 4.31 | | | 8.94 (8.85) |

Class C | | 8.73 | | | –3.70 | | | 4.25 | | | 4.23 |

Class Z | | 10.78 | | | –2.78 | | | N/A | | | 4.54 |

MSCI World Index3 | | 17.10 | | | –1.60 | | | 6.80 | | | *** |

Lipper Global Multi-Cap Growth Funds Avg.4 | | 15.75 | | | 2.45 | | | 7.34 | | | **** |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. Class A shares are subject to a maximum front-end sales charge of 5.50%. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B and Class C shares are subject to a maximum CDSC of 5% and 1% respectively. Class Z shares are not subject to a sales charge.

1Source: Prudential Investments LLC and Lipper Inc. The average annual total returns take into account applicable sales charges. During certain periods shown, fee waivers and/or expense reimbursements were in

| | |

| 2 | | Visit our website at www.jennisondryden.com |

effect. Without such fee waivers and expense reimbursements, the returns for the classes would have been lower, as indicated in parentheses. Class A, Class B, and Class C shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 1.00%, and 1.00% respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on fund distributions or following the redemption of fund shares.

2Inception dates: Class A, 1/22/90; Class B, 5/15/84; Class C, 8/1/94; and Class Z, 3/1/96.

3The Morgan Stanley Capital International (MSCI) World Index is an unmanaged, weighted index of performance that reflects the stock price movement in securities listed on the stock exchanges of Australia, Canada, Europe, the Far East, and the United States.

4The Lipper Global Multi-Cap Growth Funds Average (Lipper Average) represents returns based on an average return of all funds in the Lipper Global Multi-Cap Growth Funds category. Funds in the Lipper Average invest in a variety of market-capitalization ranges without concentrating 75% of their equity assets in any one market-capitalization range over an extended period of time. Multi-cap funds typically have 25% to 75% of their assets invested in companies both inside and outside of the United States with market capitalizations (on a three-year weighted basis) greater than the 500th largest company in the S&P/Citigroup World Broad Market Index. Multi-cap growth funds typically have an above-average price-to-cash flow ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P/Citigroup BMI.

Investors cannot invest directly in an index. The returns for the MSCI World Index and the Lipper Average would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses of a mutual fund, but not sales charges or taxes.

***MSCI World Index Closest Month-End to Inception cumulative total returns as of 10/31/04 are 150.24% for Class A, 769.92% for Class B, 98.23% for Class C, and 61.14% for Class Z. MSCI World Index Closest Month-End to Inception average annual total returns as of 9/30/04 are 6.28% for Class A, 11.09% for Class B, 6.71% for Class C, and 5.42% for Class Z.

****Lipper Average Closest Month-End to Inception cumulative total returns as of 10/31/04 are 205.41% for Class A, 947.97% for Class B, 125.13% for Class C, and 93.95% for Class Z. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/04 are 7.39% for Class A, 11.57% for Class B, 7.80% for Class C, and 7.48% for Class Z.

| | | |

| Five Largest Holdings expressed as a percentage of net assets as of 10/31/04 | | | |

Total S.A., Oil & Gas | | 2.7 | % |

JPMorgan Chase & Co., Diversified Financial Services | | 1.8 | |

Monsanto Co., Chemicals | | 1.8 | |

UBS AG, Capital Markets | | 1.8 | |

Tesco PLC, Food & Staples Retailing | | 1.7 | |

Holdings are subject to change.

| | | |

| Five Largest Industries expressed as a percentage of net assets as of 10/31/04 | | | |

Pharmaceuticals | | 7.0 | % |

Commercial Banks | | 6.6 | |

Software | | 5.8 | |

Oil & Gas | | 5.7 | |

Industrial Conglomerates | | 5.1 | |

Industry weightings are subject to change.

| | |

| Jennison Global Growth Fund | | 3 |

Investment Adviser’s Report

Jennison Associates LLC

A difficult market for growth investors

The Fund’s return trailed that of the MSCI World Index. Investors were generally worried that future interest-rate increases, high oil prices, and a possible slowing of the Chinese economy would ultimately dampen the global economic recovery and earnings growth. This created a challenging environment for growth stocks generally throughout a substantial portion of the reporting period.

In 2003 the U.S. Federal Reserve (the Fed) reduced interest rates to historically low levels to revive a faltering domestic economy. The stimulus provided by these low rates was effective in spurring economic growth. Consequently, in January of this year, the Fed indicated its intention to raise interest rates to more normal levels. Because it telegraphed its intentions far in advance, many investors expected that the Fed would implement a 25-basis-point increase in June rather than late 2004 or early 2005. We further believed that share prices reflected this expectation prior to the actual announcement. Indeed, the market reaction was muted when the long-expected 25-basis-point increase was announced at the end of June. However, concerns regarding the size of future interest-rate increases continued to weigh on stocks.

As economic statistics for the second quarter of the calendar year were released, concerns regarding future interest-rate increases were replaced by fears that economic growth was already slowing. The preliminary estimate of second-quarter U.S. GDP growth of 3.0% was below expectations and below the 4.5% rate reported for the first quarter. Second-quarter earnings reports corroborated this economic data. While generally strong, earnings growth was lower than in the first quarter. These indications led to generally flat-to-weak markets. Growth stocks were particularly sensitive to these developments.

Concerns of sustained strength in oil prices also pressured markets during the reporting period, perhaps more than events warranted. Although the rise in the price of energy trimmed the rate of real growth this year, the bite on the consumer has been significantly less than anticipated. Over the past four calendar quarters, consumers’ wage gains have dwarfed their additional outlays on energy.

The state of the Chinese economy also was a dominant theme in global stock markets. Concerned that a bad loan crisis was brewing, the Chinese government ordered banks to halt indiscriminate lending to the construction sector. Investors were very skeptical about the government’s ability to slow growth in this sector without dire consequences for China’s—and possibly the world’s—overall economy. The Chinese political leadership has since indicated that its actions have been successful and that, for now, no additional measures are required. Consequently, it appears that an economic “hard landing” in China is unlikely. Investor skepticism about

| | |

| 4 | | Visit our website at www.jennisondryden.com |

government policies has finally diminished as well. While it is still possible that the government will have to take further actions to rein in the economy, we are more confident in its ability to do so successfully.

Economic and geographic sector exposure detracted from return

The Fund’s overall sector exposure detracted somewhat from its return. We had substantial holdings in the healthcare and technology sectors, which were the weakest sectors worldwide over the fiscal year. Our underweight in utilities also hurt. On the other hand, the Fund’s holdings in the energy sector made a significant positive contribution to its return.

Our Japanese holdings showed weakness in the spring of 2004. We believed that Japanese domestic demand would remain stronger that it ultimately did. As a result, we held bank and construction stocks for too long, missing a significant Tokyo stock market movement away from these shares and into export-oriented manufacturing stocks.

Some individual positions moved significantly

The Fund’s substantial position in InterActiveCorp, which had been a profitable holding for a long time, detracted significantly from its return during this fiscal year. InterActiveCorp, under the leadership of Barry Diller, has transformed itself from a traditional media company into an Internet conglomerate. We thought that it had a very good chance of becoming a dominant force in the Internet travel business in the way that Yahoo! and Ebay have done in their respective areas. We expected continuing strong profit growth and expansion of its price-earnings multiple (the premium investors are willing to pay for future growth potential). Instead, slower-than-expected growth, operational miscues, and very poor communication with Wall Street produced a sharp decline in the share price. We reduced our exposure to InterActiveCorp, but we maintain a smaller position because we believe the market reaction was overdone.

We also had some significant successes. We made substantial profits on Apple Computer, where the success of the iPod has also sparked consumer demand for the company’s personal computer line. Marvell Technology, a semiconductor firm that designs chips for storage and communications devices, was also a strong performer.

We reoriented the portfolio mid-period

During the second half of the fiscal year, we determined that it was necessary to reorient the portfolio toward areas of greater economic and market strength. This refocus took three forms. We trimmed or eliminated our exposure to underperforming stocks. We also rebalanced our holdings in Japan to more closely reflect the new

| | |

| Jennison Global Growth Fund | | 5 |

Investment Advisor’s Report (continued)

opportunities in that market. Finally, to lessen portfolio volatility, we reduced the size of our largest positions and shifted our exposure somewhat away from companies with smaller market capitalizations. These changes improved our performance relative to the Fund’s benchmark over the last few months of the fiscal year.

Looking Ahead

Our primary focus remains identifying companies with factors such as strong management and unique products that we believe will lead to above-average earnings growth. We believe that much of the negative news that has concerned investors in recent months—slower global economic growth, high oil prices, and the possibility of a sharp slowdown in China’s economy—is already reflected in share prices, but lingering uncertainties remain. As a result, shares may trade within a narrow range for a while yet.

Perhaps the most important of these concerns is the dependence of much of the world’s economic vigor on consumption in the United States. Our increasing appetite for imported goods, combined with slower growth in the rest of the developed world, has resulted in the build-up of a very large, and ultimately unsustainable, U.S. trade deficit. Trade and federal budget deficits are key reasons for the dollar’s fall over the past 12 months. This is an issue that bears close monitoring.

Overall, we believe that the global economic environment will remain favorable for growth stocks. The global economy may be emerging from the shadow of recession. Historically, when the driving force for profit growth shifts from cyclical economic recovery to long-term growth trends, investors have made a corresponding shift from value stocks to growth stocks to seek out the beneficiaries of this move.

The Portfolio of Investments following this report shows the size of the Fund’s positions at period-end.

| | |

| 6 | | Visit our website at www.jennisondryden.com |

Comments on Largest Holdings

Holdings expressed as a percentage of the Fund’s net assets as of 10/31/04.

Total is France’s largest oil company. It is an integrated oil company that explores for, produces, refines, and markets crude oil and finished products in more than 100 countries. The company also operates a chain of service stations primarily in Europe and Africa. Total has benefited from continued strength in crude oil prices.

| 1.8% | JPMorgan Chase & Co./Diversified Financial Services |

JPMorgan Chase is a global financial services firm that operates in more than 50 countries, providing investment banking, investment management, private banking, and traditional consumer and small business banking services. In July 2004, the company merged with Bank One, which we believe will create synergies across all of its divisions. We also anticipate that capital market activities will return to normal levels after a period of seasonal weakness, and we therefore feel that the fundamental outlook for JPMorgan Chase is positive.

| 1.8% | Monsanto Co./Chemicals |

Monsanto is the leading agricultural genomics company. It produces genetically modified seed traits that control characteristics such as resistance to herbicides, insects, and/or drought. Monsanto also produces the herbicide Roundup. The company is enjoying strong global sales for its genetic trait seeds, and we believe it should see an improved pricing environment for its herbicide business.

| 1.8% | UBS AG/Capital Markets |

UBS is a Switzerland-based global banking services firm, providing private wealth management, consumer banking, investment banking, and asset management services. After a period of seasonal weakness, we anticipate that capital market activities will return to normal levels, and we feel that the fundamental outlook for UBS is therefore positive.

| 1.7% | Tesco PLC/Food & Staples Retailing |

Tesco is a United Kingdom-based food retailer, operating stores globally. The company continues to report strong sales in the UK and internationally.

Holdings are subject to change.

| | |

| Jennison Global Growth Fund | | 7 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2004, at the beginning of the period and held through the six-month period ended October 31, 2004.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period. The Fund may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table. These fees apply to Individual Retirement Accounts (IRAs), 403(b) accounts, and Section 529 plan accounts. As of the close of the six months covered by the table, IRA fees included a setup fee of $5, a maintenance fee of up to $36 annually ($18 for the six-month period), and a termination fee of $10. 403(b) accounts and Section 529 plan accounts are each charged an annual $25 fiduciary maintenance fee ($12.50 for the six-month period). Some of the fees vary in amount, or are waived, based on your total account balance or the number of JennisonDryden or Strategic Partners funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5%

| | |

| 8 | | Visit our website at www.jennisondryden.com |

hypothetical examples that appear in the shareholder reports of the other funds. The Fund may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table. These fees apply to Individual Retirement Accounts (IRAs), 403(b) accounts, and Section 529 plan accounts. As of the close of the six months covered by the table, IRA fees included a setup fee of $5, a maintenance fee of up to $36 annually ($18 for the six-month period), and a termination fee of $10. 403(b) accounts and Section 529 plan accounts are each charged an annual $25 fiduciary maintenance fee ($12.50 for the six-month period). Some of the fees vary in amount, or are waived, based on your total account balance or the number of JennisonDryden or Strategic Partners funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as such additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Jennison Global

Growth Fund | | Beginning Account

Value May 1, 2004 | | Ending Account

Value October 31, 2004 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000 | | $ | 1,009 | | 1.41 | % | | $ | 7.12 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,018 | | 1.41 | % | | $ | 7.15 |

| | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000 | | $ | 1,006 | | 1.91 | % | | $ | 9.63 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,016 | | 1.91 | % | | $ | 9.68 |

| | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000 | | $ | 1,005 | | 2.16 | % | | $ | 10.89 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,014 | | 2.16 | % | | $ | 10.94 |

| | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000 | | $ | 1,010 | | 1.16 | % | | $ | 5.86 |

| | | Hypothetical | | $ | 1,000 | | $ | 1,019 | | 1.16 | % | | $ | 5.89 |

| | | | | | | | | | | | | | | |

* Fund expenses for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2004, and divided by the 366 days in the year ended October 31, 2004, (to reflect the six-month period).

| | |

| Jennison Global Growth Fund | | 9 |

This Page Intentionally Left Blank

Portfolio of Investments

as of October 31, 2004

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

LONG-TERM INVESTMENTS 99.0% | | | |

COMMON STOCKS | | | |

| |

Australia 0.4% | | | |

| 71,000 | | BHP Billiton Ltd | | $ | 734,513 |

| 34,000 | | News Corp. Ltd. (The) | | | 273,518 |

| 23,500 | | Rio Tinto Ltd. | | | 642,452 |

| | | | |

|

|

| | | | | | 1,650,483 |

| |

Bermuda 2.0% | | | |

| 177,400 | | Marvell Technology Group Ltd.(a) | | | 5,068,318 |

| 105,300 | | Tyco International Ltd. | | | 3,280,095 |

| | | | |

|

|

| | | | | | 8,348,413 |

| |

Canada 1.6% | | | |

| 27,700 | | Research in Motion Ltd.(a)(b) | | | 2,443,140 |

| 121,100 | | Suncor Energy, Inc. | | | 4,129,510 |

| | | | |

|

|

| | | | | | 6,572,650 |

| |

France 4.2% | | | |

| 49,907 | | France Telecom S.A. | | | 1,424,585 |

| 70,100 | | Schneider Electric S.A. | | | 4,627,957 |

| 54,663 | | Total S.A. | | | 11,334,048 |

| | | | |

|

|

| | | | | | 17,386,590 |

| |

Germany 5.5% | | | |

| 23,908 | | Deutsche Bank AG | | | 1,812,260 |

| 279,600 | | Deutsche Telekom AG(a) | | | 5,342,089 |

| 119,700 | | Metro AG | | | 5,699,253 |

| 6,820 | | SAP AG | | | 1,158,423 |

| 79,200 | | SAP AG (ADR) | | | 3,377,880 |

| 76,454 | | Siemens AG | | | 5,674,728 |

| | | | |

|

|

| | | | | | 23,064,633 |

| |

Hong Kong 0.8% | | | |

| 1,806,000 | | Cosco Pacific Ltd. | | | 3,120,834 |

| 21,337 | | HSBC Holdings PLC | | | 345,410 |

| | | | |

|

|

| | | | | | 3,466,244 |

| |

India 0.1% | | | |

| 16,500 | | Reliance Industries Ltd. (GDR) | | | 405,900 |

| |

Ireland 1.0% | | | |

| 230,875 | | Anglo-Irish Bank Corp. PLC | | | 4,375,898 |

See Notes to Financial Statements.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 11 |

Portfolio of Investments

as of October 31, 2004 Cont’d.

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

Italy 3.2% | | | |

| 526,700 | | Enel SpA | | $ | 4,750,218 |

| 140,667 | | Eni SpA | | | 3,185,049 |

| 259,676 | | Riunione Adriatica di Sicurta SpA | | | 5,470,111 |

| | | | |

|

|

| | | | | | 13,405,378 |

| |

Japan 11.4% | | | |

| 500,000 | | Asahi Glass Co. Ltd. | | | 4,586,119 |

| 96,300 | | Canon, Inc. | | | 4,742,904 |

| 7,100 | | FANUC Ltd. | | | 427,912 |

| 18,200 | | Honda Motor Corp. Ltd. | | | 877,521 |

| 5,600 | | Hoya Corp. | | | 573,764 |

| 257,100 | | JFE Holdings, Inc. | | | 6,888,120 |

| 1,400 | | Keyence Corp. | | | 314,832 |

| 39,000 | | Mitsubishi Corp. | | | 430,069 |

| 567,000 | | Mitsubishi Estate Co. Ltd. | | | 5,974,885 |

| 88 | | Mitsubishi Tokyo Financial Group, Inc. | | | 745,833 |

| 646,000 | | Mitsui & Co. Ltd. | | | 5,420,341 |

| 50,400 | | Nidec Corp. | | | 5,448,649 |

| 374,900 | | Nissan Motor Co. Ltd. | | | 4,218,905 |

| 11,300 | | Nitto Denko Corp. | | | 535,258 |

| 72 | | NTT DoCoMo, Inc. | | | 126,792 |

| 11,000 | | Olympus Optical Co. Ltd. | | | 212,873 |

| 3,700 | | ORIX Corp. | | | 433,101 |

| 48,000 | | Sharp Corp. | | | 661,757 |

| 384,000 | | Sumitomo Realty & Development Co. Ltd. | | | 4,212,826 |

| 13,200 | | Takeda Pharmaceutical Co. Ltd. | | | 636,444 |

| | | | |

|

|

| | | | | | 47,468,905 |

| |

Netherlands 0.2% | | | |

| 36,885 | | ING Groep NV | | | 973,580 |

| |

South Korea 0.4% | | | |

| 8,700 | | Hyundai Mobis Co. | | | 446,074 |

| 2,580 | | Samsung Electronics Co. Ltd. | | | 1,012,872 |

| | | | |

|

|

| | | | | | 1,458,946 |

| |

Spain 2.4% | | | |

| 327,284 | | Banco Bilbao Vizcaya Argentaria S.A. | | | 5,120,753 |

| 285,702 | | Telefonica S.A. | | | 4,702,746 |

| | | | |

|

|

| | | | | | 9,823,499 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

Switzerland 6.4% | | | |

| 70,200 | | Alcon, Inc.(b) | | $ | 4,998,240 |

| 77,300 | | Novartis AG (ADR) | | | 3,711,173 |

| 88,695 | | Novartis AG | | | 4,215,310 |

| 12,813 | | Roche Holding AG | | | 1,305,349 |

| 50,800 | | Roche Holding AG (ADR) | | | 5,175,347 |

| 102,762 | | UBS AG | | | 7,381,381 |

| | | | |

|

|

| | | | | | 26,786,800 |

| |

Taiwan 0.1% | | | |

| 193,947 | | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 254,300 |

| 239,870 | | Wan Hai Lines Ltd. | | | 230,499 |

| | | | |

|

|

| | | | | | 484,799 |

| |

United Kingdom 9.5% | | | |

| 25,129 | | Anglo American PLC | | | 549,764 |

| 26,946 | | AstraZeneca PLC | | | 1,102,009 |

| 68,900 | | AstraZeneca PLC (ADR) | | | 2,838,680 |

| 188,700 | | BHP Billition PLC | | | 1,913,755 |

| 477,232 | | BP PLC | | | 4,612,631 |

| 63,520 | | British Sky Broadcasting Group PLC | | | 591,832 |

| 150,738 | | Centrica PLC | | | 664,946 |

| 324,699 | | Exel PLC | | | 4,209,244 |

| 191,722 | | HSBC Holdings PLC | | | 3,089,616 |

| 24,920 | | Reckitt Benckiser PLC | | | 682,174 |

| 242,340 | | Royal Bank Scotland Group PLC (The) | | | 7,126,837 |

| 1,361,800 | | Tesco PLC | | | 7,161,301 |

| 2,036,966 | | Vodafone Group PLC | | | 5,206,606 |

| | | | |

|

|

| | | | | | 39,749,395 |

| |

United States 49.8% | | | |

| 158,200 | | Activision, Inc.(a)(b) | | | 2,290,736 |

| 133,200 | | Agilent Technologies, Inc.(a) | | | 3,337,992 |

| 82,600 | | American Express Co.(b) | | | 4,383,582 |

| 57,800 | | American International Group, Inc. | | | 3,509,038 |

| 84,200 | | Amgen, Inc.(a) | | | 4,782,560 |

| 130,200 | | Apple Computer, Inc.(a)(b) | | | 6,839,406 |

| 149,600 | | Bank of America Corp.(b) | | | 6,700,584 |

| 125,200 | | Bank of New York Co., Inc. (The) | | | 4,063,992 |

| 148,400 | | Bed, Bath & Beyond, Inc.(a)(b) | | | 6,053,236 |

| 77,800 | | BJ Services Co. | | | 3,967,800 |

| 132,700 | | Cendant Corp.(b) | | | 2,732,293 |

| 99,200 | | Chico’s FAS, Inc.(a)(b) | | | 3,970,976 |

See Notes to Financial Statements.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 13 |

Portfolio of Investments

as of October 31, 2004 Cont’d.

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | | |

| 192,800 | | Cisco Systems, Inc.(a) | | $ | 3,703,688 |

| 20,300 | | Citigroup, Inc. | | | 900,711 |

| 78,800 | | Costco Wholesale Corp.(b) | | | 3,777,672 |

| 116,100 | | Dell, Inc.(a)(b) | | | 4,070,466 |

| 215,400 | | DIRECTV Group, Inc.(a) | | | 3,612,258 |

| 12,700 | | eBay, Inc.(a) | | | 1,239,647 |

| 89,600 | | Electronic Arts, Inc.(a)(b) | | | 4,024,832 |

| 64,100 | | Eli Lilly and Co. (The) | | | 3,519,731 |

| 142,900 | | ENSCO International, Inc. | | | 4,365,595 |

| 209,800 | | General Electric Co. | | | 7,158,376 |

| 180,200 | | Gilead Sciences, Inc.(a) | | | 6,240,326 |

| 78,700 | | Guidant Corp. | | | 5,242,994 |

| 182,550 | | IAC/InterActiveCorp(a)(b) | | | 3,946,731 |

| 159,000 | | IVAX Corp.(a)(b) | | | 2,877,900 |

| 198,600 | | JPMorgan Chase & Co. | | | 7,665,960 |

| 211,200 | | Kroger Co. (The)(a) | | | 3,191,232 |

| 37,200 | | Lehman Brothers Holdings, Inc. | | | 3,055,980 |

| 111,800 | | Lowe’s Companies, Inc.(b) | | | 6,292,104 |

| 96,200 | | Mercury Interactive Corp.(a)(b) | | | 4,177,966 |

| 220,600 | | Microsoft Corp. | | | 6,174,594 |

| 176,500 | | Monsanto Co.(b) | | | 7,545,375 |

| 75,700 | | P.F. Chang’s China Bistro, Inc.(a)(b) | | | 3,848,588 |

| 70,200 | | PETsMART, Inc. | | | 2,244,996 |

| 128,160 | | Pfizer, Inc. | | | 3,710,232 |

| 59,100 | | Phelps Dodge Corp. | | | 5,173,614 |

| 109,500 | | Praxair, Inc. | | | 4,620,900 |

| 96,100 | | Procter & Gamble Co. (The) | | | 4,918,398 |

| 108,100 | | QUALCOMM, Inc.(b) | | | 4,519,661 |

| 109,600 | | Schlumberger Ltd. | | | 6,898,224 |

| 67,000 | | Smith International, Inc.(a)(b) | | | 3,891,360 |

| 68,500 | | State Street Corp.(b) | | | 3,085,925 |

| 52,400 | | Symantec Corp.(a)(b) | | | 2,983,656 |

| 91,000 | | Target Corp. | | | 4,551,820 |

| 189,200 | | Univision Communications, Inc., Class A(a)(b) | | | 5,857,632 |

| 55,400 | | Williams-Sonoma, Inc. (The)(a)(b) | | | 2,114,618 |

| 100,200 | | Yahoo! Inc.(a)(b) | | | 3,626,238 |

| | | | |

|

|

| | | | | | 207,462,195 |

| | | | |

|

|

| | | Total long-term investments

(cost $364,565,414) | | | 412,884,308 |

| | | | |

|

|

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | | |

SHORT-TERM INVESTMENTS 20.5% | | | | |

| |

Mutual Fund | | | | |

| 85,295,882 | | Dryden Core Investment Fund - Taxable Money Market Series(c)

(cost $85,295,882) (Note 3) | | $ | 85,295,882 | |

| | | | |

|

|

|

| | | Total Investments 119.5%

(cost $449,861,296; Note 5) | | | 498,180,190 | |

| | | Liabilities in excess of other assets (19.5%) | | | (81,384,883 | ) |

| | | | |

|

|

|

| | | Net Assets 100% | | $ | 416,795,307 | |

| | | | |

|

|

|

| (a) | Non-income producing security. |

| (b) | Portion of securities on loan with an aggregate market value of $76,941,436; cash collateral of $78,061,666 was received with which the portfolio purchased with highly liquid securities. |

| (c) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan. |

The following abbreviations are used in portfolio descriptions:

ADR—American Depositary Receipt.

GDR—Guaranteed Depositary Receipt.

See Notes to Financial Statements.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 15 |

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2004 is as follows:

| | | |

Mutual Fund | | 20.5 | % |

Pharmaceuticals | | 7.0 | |

Commercial Banks | | 6.6 | |

Software | | 5.8 | |

Oil & Gas | | 5.7 | |

Industrial Conglomerates | | 5.1 | |

Specialty Retail | | 5.0 | |

Food & Staples Retailing | | 4.8 | |

Capital Markets | | 4.7 | |

Energy Equipment & Services | | 4.6 | |

Chemicals | | 3.0 | |

Diversified Telecommunication Services | | 2.7 | |

Biotechnology | | 2.6 | |

Communications Equipment | | 2.6 | |

Computers & Peripherals | | 2.6 | |

Metals & Mining | | 2.6 | |

Health Care Equipment & Supplies | | 2.5 | |

Media | | 2.5 | |

Real Estate | | 2.4 | |

Diversified Financials | | 2.3 | |

Electronic Equipment & Instruments | | 2.3 | |

Insurance | | 2.1 | |

Semiconductor Equipment & Products | | 1.5 | |

Trading Companies & Distributors | | 1.4 | |

Household Products | | 1.3 | |

Wireless Telecommunication Services | | 1.3 | |

Automobiles | | 1.2 | |

Consumer Finance | | 1.2 | |

Internet & Catalog Retail | | 1.2 | |

Building Products | | 1.1 | |

Electric Utilities | | 1.1 | |

Electrical Equipment | | 1.1 | |

Multiline Retail | | 1.1 | |

Office Electronics | | 1.1 | |

Air Freight & Logistics | | 1.0 | |

Hotels Restaurants & Leisure | | 0.9 | |

Internet Software & Services | | 0.9 | |

Commercial Services & Supplies | | 0.7 | |

Transportation Infrastructure | | 0.7 | |

Gas Utilities | | 0.2 | |

Household Durables | | 0.2 | |

Auto Components | | 0.1 | |

Machinery | | 0.1 | |

Marine | | 0.1 | |

| | |

|

|

| | | 119.5 | |

Liabilities in excess of other assets | | (19.5 | ) |

| | |

|

|

| | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

Financial Statements

| | |

| OCTOBER 31, 2004 | | ANNUAL REPORT |

Jennison Global Growth Fund

Statement of Assets and Liabilities

as of October 31, 2004

| | | | |

Assets | | | | |

Investments, at value including securities on loan of $76,941,436 (cost $449,861,296) | | $ | 498,180,190 | |

Foreign currency, at value (cost $914,652) | | | 948,452 | |

Receivable for investments sold | | | 727,316 | |

Dividends and interest receivable | | | 454,513 | |

Foreign tax reclaim receivable | | | 327,121 | |

Receivable for Series shares sold | | | 93,513 | |

Prepaid expenses | | | 25,843 | |

| | |

|

|

|

Total assets | | | 500,756,948 | |

| | |

|

|

|

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan (Note 4) | | | 78,061,666 | |

Payable for investments purchased | | | 3,266,704 | |

Payable for Series shares reacquired | | | 1,731,277 | |

Accrued expenses | | | 431,198 | |

Management fee payable | | | 264,142 | |

Distribution fee payable | | | 121,916 | |

Payable to custodian | | | 45,703 | |

Foreign taxes payable | | | 26,619 | |

Deferred directors’ fees payable | | | 12,416 | |

| | |

|

|

|

Total liabilities | | | 83,961,641 | |

| | |

|

|

|

| |

Net Assets | | $ | 416,795,307 | |

| | |

|

|

|

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 316,219 | |

Paid-in capital in excess of par | | | 515,254,004 | |

| | |

|

|

|

| | | | 515,570,223 | |

Accumulated net investment loss | | | (149,951 | ) |

Accumulated net realized loss on investments and foreign currency transactions | | | (147,039,070 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 48,414,105 | |

| | |

|

|

|

Net assets, October 31, 2004 | | $ | 416,795,307 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

| | | |

Class A | | | |

Net asset value and redemption price per share

($315,213,591 ÷ 23,443,403 shares of common stock issued and outstanding) | | $ | 13.45 |

Maximum sales charge (5.50% of offering price) | | | 0.78 |

| | |

|

|

Maximum offering price to public | | $ | 14.23 |

| | |

|

|

| |

Class B | | | |

Net asset value, offering price and redemption price per share

($65,603,025 ÷ 5,386,927 shares of common stock issued and outstanding) | | $ | 12.18 |

| | |

|

|

| |

Class C | | | |

Net asset value, offering price and redemption price per share

($16,343,319 ÷ 1,349,775 shares of common stock issued and outstanding) | | $ | 12.11 |

| | |

|

|

| |

Class Z | | | |

Net asset value, offering price and redemption price per share

($19,635,372 ÷ 1,441,769 shares of common stock issued and outstanding) | | $ | 13.62 |

| | |

|

|

See Notes to Financial Statements.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 19 |

Statement of Operations

Year Ended October 31, 2004

| | | | |

Net Investment Loss | | | | |

Income | | | | |

Dividends (net of foreign withholding taxes of $515,000) | | $ | 5,834,130 | |

Interest | | | 15 | |

Income from securities lending, net | | | 91,343 | |

| | |

|

|

|

Total income | | | 5,925,488 | |

| | |

|

|

|

| |

Expenses | | | | |

Management fee | | | 3,343,319 | |

Distribution fee—Class A | | | 819,038 | |

Distribution fee—Class B | | | 567,050 | |

Distribution fee—Class C | | | 176,825 | |

Transfer agent’s fees and expenses | | | 1,060,000 | |

Custodian’s fees and expenses | | | 368,000 | |

Reports to shareholders | | | 122,000 | |

Legal fees and expenses | | | 80,000 | |

Registration fees | | | 32,000 | |

Directors’ fees | | | 27,000 | |

Audit fees | | | 21,000 | |

Miscellaneous | | | 30,357 | |

| | |

|

|

|

Total expenses | | | 6,646,589 | |

| | |

|

|

|

Net investment loss | | | (721,101 | ) |

| | |

|

|

|

| |

Realized And Unrealized Gain (Loss) On Investments And Foreign Currency Transactions | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions (net of Thailand capital gains taxes of $26,880) | | �� | 71,598,710 | |

Foreign currency transactions | | | (239,308 | ) |

| | |

|

|

|

| | | | 71,359,402 | |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (38,976,221 | ) |

Foreign currencies | | | 66,165 | |

| | |

|

|

|

| | | | (38,910,056 | ) |

| | |

|

|

|

Net gain on investments and foreign currencies | | | 32,449,346 | |

| | |

|

|

|

Net Increase In Net Assets Resulting From Operations | | $ | 31,728,245 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31,

| |

| | | 2004 | | | 2003 | |

Increase In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | (721,101 | ) | | $ | 200,902 | |

Net realized gain on investments and foreign currency transactions | | | 71,359,402 | | | | 201,864 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | (38,910,056 | ) | | | 73,903,794 | |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 31,728,245 | | | | 74,306,560 | |

| | |

|

|

| |

|

|

|

Dividends and distributions (Note 1) | | | | | | | | |

Dividends from net investment income | | | | | | | | |

Class A | | | (862,951 | ) | | | — | |

Class Z | | | (219,096 | ) | | | — | |

| | |

|

|

| |

|

|

|

| | | | (1,082,047 | ) | | | — | |

| | |

|

|

| |

|

|

|

| | |

Series share transactions (net of share conversions) (Note 6 and 7) | | | | | | | | |

Net proceeds from shares sold(b) | | | 165,492,705 | | | | 65,971,140 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 1,041,505 | | | | — | |

Cost of shares reacquired | | | (139,750,168 | ) | | | (120,626,072 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets from Series share transactions | | | 26,784,042 | | | | (54,654,932 | ) |

| | |

|

|

| |

|

|

|

Total increase | | | 57,430,240 | | | | 19,651,628 | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 359,365,067 | | | | 339,713,439 | |

| | |

|

|

| |

|

|

|

End of year | | $ | 416,795,307 | | | $ | 359,365,067 | |

| | |

|

|

| |

|

|

|

(a) Includes undistributed net investment income of: | | $ | — | | | $ | 1,082,198 | |

| | |

|

|

| |

|

|

|

| (b) | For the year ended October 31, 2004, includes $127,577,448 for shares issued in connection with the acquisition of Prudential Pacific Growth, Inc. and Prudential Europe Growth, Inc. |

See Notes to Financial Statements.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 21 |

Notes to Financial Statements

Prudential World Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as an open-end, diversified management investment company and currently consists of three series: Jennison Global Growth Fund (the “Series”), Strategic Partners International Value Fund and Jennison International Growth Fund, formerly known as Prudential Global Growth Fund, Prudential International Value Fund and Prudential International Growth Fund, respectively. The financial statements of the other series are not presented herein. The Series commenced investment operations in May, 1984.

The investment objective of the Series is to seek long-term capital growth, with income as a secondary objective, by investing in a diversified portfolio of securities consisting of marketable securities of U.S. and non-U.S. issuers.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund, and the Series, in the preparation of its financial statements.

Securities Valuation: Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities traded via Nasdaq are valued at the official closing price as provided by Nasdaq. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI or Manager”), in consultation with the subadviser(s); to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Futures contracts and options thereon traded on commodities exchange or board of trade are valued on their last sales price as of the close of trading on such exchange or board of trade on such day, at the mean between the most recently quoted bid and asked prices on such exchange or board of trade or at the last bid price in the abscense of an asked price. Securities for which market quotations are not readily available, or whose values have been effected by events occurring after the close of the security’s foreign market and before the fund’s normal pricing time, are valued at fair value in accordance with the Board of Directors’ approved fair valuation procedures. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values. As of October 31, 2004, there were no securities valued in accordance with such procedures.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

Investments in mutual funds are valued at the net asset value as of the close of the New York Stock Exchange on the date of valuation.

Short-term securities, which mature in sixty days or less, are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term securities which mature in more than sixty days are valued at current market quotations.

Foreign Currency Translation: The books and records of the Series are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities-at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses-at the rate of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Series are presented at the foreign exchange rates and market values at the close of the fiscal period, the Series does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term securities held at the end of the fiscal period. Similarly, the Series does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the fiscal period. Accordingly, realized foreign currency gains or losses are included in the reported net realized gains or losses on investment transactions.

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from holdings of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign taxes recorded on the Series’ books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net unrealized appreciation or depreciation on investments and foreign currencies.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political and economic instability and the level of governmental supervision and regulation of foreign securities markets.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 23 |

Notes to Financial Statements

Cont’d

Forward Currency Contracts: A forward currency contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. The Series enters into forward currency contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings or on specific receivables and payables denominated in a foreign currency. The contracts are valued daily at current exchange rates and any unrealized gain or loss is included in net unrealized appreciation or depreciation on foreign currencies. Gain or loss is realized on the settlement date of the contract equal to the difference between the settlement value of the original and renegotiated forward contracts. This gain or loss, if any, is included in net realized gain or loss on foreign currency transactions. Risks may arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

Forward currency contracts involve elements of both market and credit risk in excess of the amounts reflected on the Statement of Assets and Liabilities.

Securities Lending: The Series may lend its portfolio securities to qualified institutions. The loans are secured by collateral at least equal at all times, to the market value of the securities loaned. The Series may bear the risk of delay in recovery of, or even loss of rights in, the securities loaned should the borrower of the securities fail financially. The Series receives compensation, net of any rebate, for lending its securities in the form of interest or dividends on the collateral received for the securities loaned, and any gain or loss in the market price of the securities loaned that may occur during the term of the loan.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses from investment and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date, and interest income is recorded on an accrual basis. Expenses are recorded on the accrual basis.

Net investment income or loss, (other than distribution fees, which are charged directly to the respective class) unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Dividends and Distributions: The Series expects to pay dividends of net investment income and distributions of net realized capital and currency gains, if any, annually.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

Dividends and distributions, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences relating to income and gains are reclassified amongst undistributed net investment income, accumulated net realized gain or loss and to paid-in capital in excess of par, as appropriate.

Taxes: For federal income tax purposes, each series in the Fund is treated as a separate taxpaying entity. It is the Series’ policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends are recorded net of reclaimable amounts, at the time the related income is earned.

Estimates: The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement for the Series with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisor’s performance of such services. PI has entered into a subadvisory agreement with Jennison Associates LLC (“Jennison”). The subadvisory agreement provides that Jennison furnishes investment advisory services in connection with the management of the Series. In connection therewith, Jennison is obligated to keep certain books and records of the Series. PI pays for the services of Jennison, the cost of compensation of officers of the Series, occupancy and certain clerical and bookkeeping costs of the Series. The Series bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly, at an annual rate of .75% of the Series’ average daily net assets.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, B, C and Z shares of the Series. The Series compensates PIMS for distributing and servicing the Series’ Class A, Class B and Class C shares, pursuant to plans of distribution, (the “Class A, B and C Plans”), regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor for the Class Z shares of the Series.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 25 |

Notes to Financial Statements

Cont’d

Pursuant to the Class A Plan, the Series compensates PIMS, for distribution-related activities at an annual rate of up to .30 of 1% of the average daily net assets of the Class A shares. PIMS has contractually agreed to limit such fees to .25% on the average daily net assets of the Class A shares. Pursuant to the Class B and C Plans, the Series compensates PIMS for distribution-related activities at the annual rate of .75 of 1% of the average daily net assets of Class B shares up to the level of average daily net assets as of February 26,1986, plus 1% of the average daily net assets in excess of such level of the Class B shares, and 1% of average daily net assets of Class C shares.

PIMS has advised the Series that it received approximately $64,100 and $900 in front-end sales charges resulting from sales of Class A and Class C shares, respectively, during the year ended October 31, 2004. From these fees, PIMS paid such sales charges to affiliated broker-dealers, which in turn paid commissions to salespersons and incurred other distribution costs.

PI has advised the Series that it received approximately $111,500 and $1,300 in contingent deferred sales charges imposed upon certain redemptions by Class B and C shareholders, respectively, during the year ended October 31, 2004.

PI, PIMS, and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

The Series, along with other affiliated registered investment companies (the “Funds”), is a party to a syndicated credit agreement (“SCA”) with a group of banks. For the period from October 1, 2003 through April 30, 2004, the SCA provided for a commitment of $800 million and allowed the Funds to increase the commitment to $1 billion, if necessary. Effective May 3, 2004, the SCA provided for a commitment of $500 million. Interest on any borrowings under the SCA would be incurred at market rates. The Funds pay a commitment fee of .08 of 1% of the unused portion of the SCA. The commitment fee is accrued daily and paid quarterly and is allocated to the Funds pro rata, based on net assets. The purpose of the SCA is to serve as an alternative source of funding for capital share redemptions. The expiration date of the SCA is October 29, 2004. Effective October 29, 2004, the Funds entered into a revised credit agreement with two banks. The commitment under the revised credit agreement is $500 million. The Funds pay a commitment fee of .075 of 1% of the unused portion of the revised credit agreement. The expiration date of the revised credit agreement will be October 28, 2005. The Series did not borrow any amounts pursuant to the SCA during the year ended October 31, 2004.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

Note 3. Other Transactions With Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. During the year ended October 31, 2004, the Series incurred fees of approximately $858,400 for the services of PMFS. As of October 31, 2004, approximately $79,700 of such fees were due to PMFS. Transfer agent fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Series pays networking fees to affiliated and unaffiliated broker/dealers. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. The Fund incurred approximately $121,000 in total networking fees, of which the amount relating to the services of Wachovia Securities, LLC (“Wachovia”) an affiliate of PI was approximately $89,800 for the year ended October 31, 2004. As of October 31, 2004, approximately $23,100 of such fees were due to Wachovia. These amounts are included in transfer agent’s fees and expenses in the Statement of Operations.

The Series invests in the Taxable Money Market Series (the “Portfolio”), a portfolio of Dryden Core Investment Fund, pursuant to an exemptive order received from the Securities and Exchange Commission. The Series is a money market mutual fund registered under the Investment Company Act of 1940, as amended, and managed by PI. During the year ended October 31, 2004, the Series earned income from the Portfolio of $25,319 and $91,343 by investing collateral received from securities lending and excess cash.

For the year ended October 31, 2004, Wachovia earned approximately $300 in brokerage commissions from portfolio transactions executed on behalf of the Series.

Prudential Investment Management, Inc., (“PIM”), an indirect, wholly-owned subsidiary of Prudential, is the Series’ security lending agent. For the year ended October 31, 2004, PIM has been compensated approximately $30,400 for this service.

Note 4. Portfolio Securities

Purchases and sales of investment securities, other than short-term investments, for the year ended October 31, 2004 aggregated $552,314,027 and $653,852,385, respectively.

As of October 31, 2004, the Series had securities on loan with an aggregate market value of $76,941,436. The Series received $78,061,666 in cash as collateral for securities on loan which was used to purchase highly liquid short-term investments in accordance with Fund’s securities lending procedures.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 27 |

Notes to Financial Statements

Cont’d

Note 5. Distributions and Tax Information

Distributions to shareholders, which are determined in accordance with federal income tax regulations, which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. In order to present accumulated net investment loss and accumulated net realized losses on investments and foreign currency transactions on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to paid-in-capital in excess of par, accumulated net investment loss and accumulated net realized loss on investments and foreign currency transactions. For the year ended October 31, 2004, the adjustments were to decrease accumulated net investment loss by $570,999, to increase accumulated net realized loss on investments and foreign currency transactions by $47,271,676 and increase paid-in capital in excess of par by $46,700,677. These differences are due to net operating loss, due to the treatment for book and tax purposes of certain transactions involving foreign currency transactions, tax adjustments pertaining to the treatment of passive foreign investment companies and other tax adjustments due to the merger. Net investment income, net realized gains and net assets were not affected by this change.

For the fiscal year ended October 31, 2004, the tax character of dividends paid of $1,082,047 was ordinary income. There was no dividends paid for the fiscal year ended October 31, 2003.

As of October 31, 2004, the Series did not have accumulated undistributed earnings on a tax basis.

The United States federal income tax basis of the Series’ investments and the net unrealized appreciation as of October 31, 2004 were as follows:

| | | | | | | | |

Tax Basis

| | Appreciation

| | Depreciation

| | Other Cost Basis

Adjustment

| | Total Net

Unrealized

Appreciation

|

| $452,225,368 | | $54,614,265 | | $(8,659,443) | | $95,211 | | $46,050,033 |

The difference between book basis and tax basis is primarily attributable to deferred losses on wash sales and passive foreign investment companies for book and tax purposes.

| | |

| 28 | | Visit our website at www.jennisondryden.com |

For federal income tax purposes, the Series had a capital loss carryforward as of October 31, 2004, of approximately $144,812,500 of which $1,715,100 expires in 2005, $6,860,500 expires in 2008, $32,419,400 expires in 2009, $95,037,000 expires in 2010 and $8,780,500 expires in 2011. Approximately $66,968,700 of capital loss carryforward was used to offset net taxable gains realized in the fiscal year ended October 31, 2004. Accordingly, no capital gains distribution in expected to be paid to shareholders until net gains have been realized in excess of such carryforward.

Note 6. Capital

The Fund offers Class A, Class B, Class C and Class Z shares. Class A shares are sold with a front-end sales charge of up to 5.50%. Prior to March 15, 2004, Class A shares were sold with a front-end sales charge of 5.00%. Effective March 15, 2004, all investors who purchase Class A shares in an amount of 1 million or more and sell these shares within 12 months of purchase are subject to a contingent deferred sales charge (CDSC) of 1%, including investors who purchase their shares through broker-dealers affiliated with Prudential Financial, Inc. Class B shares are sold with a contingent deferred sales charge which declines from 5% to zero depending on the period of time the shares are held. Prior to February 2, 2004, Class C shares were sold with a front-end sales charge of 1% and a contingent deferred sales charge of 1% during the first 18 months. Class C shares purchased on or after February 2, 2004 are not subject to a front-end sales charge and the contingent deferred sales charge (CDSC) for Class C shares will be effective during the 12 months from the date of purchase. Class B shares automatically convert to Class A shares on a quarterly basis approximately seven years after purchase. A special exchange privilege is also available for shareholders who qualified to purchase Class A shares at net asset value. Class Z shares are not subject to any sales or redemption charge and are offered exclusively for sale to a limited group of investors.

There are 500 million authorized shares of $.01 par value common stock, divided equally into four classes, designated Class A, Class B, Class C and Class Z common stock.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 29 |

Notes to Financial Statements

Cont’d

Transactions in shares of common stock were as follows:

| | | | | | | |

Class A

| | Shares

| | | Amount

| |

Year ended October 31, 2004: | | | | | | | |

Shares sold | | 1,538,249 | | | $ | 20,512,794 | |

Shares issued in connection with reorganization (Note 7) | | 6,721,815 | | | | 82,815,672 | |

Shares issued in reinvestment of dividends and distributions | | 67,011 | | | | 822,896 | |

Shares reacquired | | (6,359,527 | ) | | | (84,267,038 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | 1,967,548 | | | | 19,884,324 | |

Shares issued upon conversion from Class B | | 1,347,440 | | | | 17,751,465 | |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 3,314,988 | | | $ | 37,635,789 | |

| | |

|

| |

|

|

|

Year ended October 31, 2003: | | | | | | | |

Shares sold | | 3,904,829 | | | $ | 42,792,755 | |

Shares reacquired | | (7,306,255 | ) | | | (80,277,136 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (3,401,426 | ) | | | (37,484,381 | ) |

Shares issued upon conversion from Class B | | 1,662,325 | | | | 18,348,560 | |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (1,739,101 | ) | | $ | (19,135,821 | ) |

| | |

|

| |

|

|

|

Class B

| | | | | | |

Year ended October 31, 2004: | | | | | | | |

Shares sold | | 389,763 | | | $ | 4,673,326 | |

Shares issued in connection with reorganization (Note 7) | | 3,009,169 | | | | 33,720,649 | |

Shares reacquired | | (1,191,791 | ) | | | (14,299,947 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | 2,207,141 | | | | 24,094,028 | |

Shares reacquired upon conversion into Class A | | (1,483,817 | ) | | | (17,751,465 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 723,324 | | | $ | 6,342,563 | |

| | |

|

| |

|

|

|

Year ended October 31, 2003: | | | | | | | |

Shares sold | | 547,053 | | | $ | 5,520,526 | |

Shares reacquired | | (1,663,518 | ) | | | (16,230,978 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding before conversion | | (1,116,465 | ) | | | (10,710,452 | ) |

Shares reacquired upon conversion into Class A | | (1,827,256 | ) | | | (18,348,560 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (2,943,721 | ) | | $ | (29,059,012 | ) |

| | |

|

| |

|

|

|

Class C

| | | | | | |

Year ended October 31, 2004: | | | | | | | |

Shares sold | | 193,525 | | | $ | 2,327,258 | |

Shares issued in connection with reorganization (Note 7) | | 544,826 | | | | 6,083,476 | |

Shares reacquired | | (523,219 | ) | | | (6,278,087 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | 215,132 | | | $ | 2,132,647 | |

| | |

|

| |

|

|

|

| | |

| 30 | | Visit our website at www.jennisondryden.com |

| | | | | | | |

Class C

| | Shares

| | | Amount

| |

Year ended October 31, 2003: | | | | | | | |

Shares sold | | 328,437 | | | $ | 3,315,995 | |

Shares reacquired | | (537,080 | ) | | | (5,369,261 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (208,643 | ) | | $ | (2,053,266 | ) |

| | |

|

| |

|

|

|

Class Z

| | | | | | |

Year ended October 31, 2004: | | | | | | | |

Shares sold | | 787,823 | | | $ | 10,401,879 | |

Shares issued in connection with reorganization (Note 7) | | 398,158 | | | | 4,957,651 | |

Shares issued in reinvestment of dividends and distributions | | 17,616 | | | | 218,609 | |

Shares reacquired | | (2,582,400 | ) | | | (34,905,096 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (1,378,803 | ) | | $ | (19,326,957 | ) |

| | |

|

| |

|

|

|

Year ended October 31, 2003: | | | | | | | |

Shares sold | | 1,308,315 | | | $ | 14,341,864 | |

Shares reacquired | | (1,707,766 | ) | | | (18,748,697 | ) |

| | |

|

| |

|

|

|

Net increase (decrease) in shares outstanding | | (399,451 | ) | | $ | (4,406,833 | ) |

| | |

|

| |

|

|

|

Note 7. Plan of Reorganization

On November 21, 2003, Jennison Global Growth Fund acquired all of the net assets of Prudential Pacific Growth Fund, Inc. and the Prudential Europe Growth Fund, Inc. pursuant to a plan of reorganization approved by the Jennison Global Growth Fund shareholders on November 20, 2003. The acquisition was accomplished by a tax-free exchange of Class A, Class B, Class C and Class Z shares.

| | | | | | | | | | | | | |

Prudential Pacific

Growth Fund, Inc.

| | Prudential Europe

Growth Fund, Inc.

| | Jennison Global Growth Fund

| | Value

|

| Class A | | 3,474,325 | | Class A | | 4,455,047 | | Class A | | 6,721,815 | | $ | 82,815,672 |

| B | | 981,473 | | B | | 2,260,273 | | B | | 3,009,169 | | | 33,720,649 |

| C | | 192,708 | | C | | 396,713 | | C | | 544,826 | | | 6,083,476 |

| Z | | 52,978 | | Z | | 360,412 | | Z | | 398,158 | | | 4,957,651 |

The aggregate net assets including unrealized appreciation (depreciation) of the Prudential Pacific Growth Fund, Inc., the Prudential Europe Growth Fund, Inc. and the Jennison Global Growth Fund immediately before the acquisition were $36,184,191, $91,393,257 and $345,758,607, respectively.

The future utilization of the acquired capital loss carryforwards from Prudential Pacific Growth Fund, Inc. and Prudential Europe Growth Fund, Inc. in the amounts of $41,646,269 and $29,257,940, respectively, will be limited under certain conditions defined in the Internal Revenue Code of 1986, as amended.

| | |

| Prudential World Funds, Inc./Jennison Global Growth Fund | | 31 |

Financial Highlights

| | | | |

| | | Class A

| |

| | | Year Ended October 31, 2004 | |

Per Share Operating Performance(a): | | | | |

Net Asset Value, Beginning Of Year | | $ | 12.72 | |

| | |

|

|

|

Income (Loss) From Investment Operations: | | | | |

Net investment income (loss) | | | (.01 | ) |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | .78 | |

| | |

|

|

|

Total from investment operations | | | .77 | |

| | |

|

|

|

Less Dividends and Distributions: | | | | |

Dividends from net investment income | | | (.04 | ) |

Distributions in excess of net investment income | | | — | |

Distributions from net realized capital gains | | | — | |

| | |

|

|

|

Total dividends and distributions | | | (.04 | ) |

| | |

|

|

|

Net asset value, end of year | | $ | 13.45 | |

| | |

|

|

|

Total Return(b): | | | 6.11 | % |

Ratios/Supplemental Data: | | | | |

Net assets, end of year (000) | | $ | 315,214 | |

Average net assets (000) | | $ | 327,615 | |

Ratios to average net assets: | | | | |

Operating expenses, including distribution and service (12b-1 fees)(c) | | | 1.39 | % |

Operating expenses, excluding distribution and service (12b-1 fees) | | | 1.14 | % |

Net investment income (loss) | | | (.06 | )% |

For Class A, B, C and Z shares: | | | | |

Portfolio turnover rate | | | 125 | % |

| (a) | Based on average shares outstanding. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions. |

| (c) | The distributor of the Series has contractually agreed to reduce its distribution and service (12b-1) for Class A shares to .25 of 1% of the average net assets. |

See Notes to Financial Statements.

| | |

| 32 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | | |

| Class A | |

| Year Ended October 31, | |

| 2003 | | | 2002 | | | 2001 | | | 2000 | |

| | | | | | | | | | | | | | | |

| $ | 10.21 | | | $ | 12.23 | | | $ | 21.35 | | | $ | 21.19 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | |

| | .02 | | | | (.01 | ) | | | .01 | | | | (.09 | ) |

| | 2.49 | | | | (2.01 | ) | | | (5.83 | ) | | | 2.25 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 2.51 | | | | (2.02 | ) | | | (5.82 | ) | | | 2.16 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | — | | | | (.19 | ) |

| | — | | | | — | | | | (3.30 | ) | | | (1.81 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | — | | | | — | | | | (3.30 | ) | | | (2.00 | ) |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| $ | 12.72 | | | $ | 10.21 | | | $ | 12.23 | | | $ | 21.35 | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | 24.58 | % | | | (16.52 | )% | | | (30.87 | )% | | | 9.80 | % |

| | | | | | | | | | | | | | | |