UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-03980 |

|

Morgan Stanley Institutional Fund Trust |

(Exact name of registrant as specified in charter) |

|

522 Fifth Avenue, New York, New York | | 10036 |

(Address of principal executive offices) | | (Zip code) |

|

John H. Gernon 522 Fifth Avenue, New York, New York 10036 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-296-0289 | |

|

Date of fiscal year end: | September 30, | |

|

Date of reporting period: | September 30, 2017 | |

| | | | | | | | |

Item 1 - Report to Shareholders

Morgan Stanley Institutional Fund Trust

Core Plus Fixed Income Portfolio

Annual Report

September 30, 2017

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Shareholders' Letter | | | 2 | | |

Expense Example | | | 3 | | |

Investment Overview | | | 4 | | |

Portfolio of Investments | | | 6 | | |

Statement of Assets and Liabilities | | | 16 | | |

Statement of Operations | | | 18 | | |

Statements of Changes in Net Assets | | | 19 | | |

Financial Highlights | | | 20 | | |

Notes to Financial Statements | | | 24 | | |

Report of Independent Registered Public Accounting Firm | | | 36 | | |

Investment Advisory Agreement Approval | | | 37 | | |

Privacy Notice | | | 39 | | |

Trustee and Officer Information | | | 42 | | |

This report is authorized for distribution only when preceded or accompanied by a prospectus or summary prospectus of the applicable Fund of the Morgan Stanley Institutional Fund Trust. To receive a prospectus and/or statement of additional information (SAI), which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations, and describes in detail each of the Fund's investment policies to the prospective investor, please call toll free 1 (800) 548-7786. Please read the prospectuses carefully before you invest or send money.

Additionally, you can access information about the Fund, including performance, characteristics, and investment team commentary, through Morgan Stanley Investment Management's website: www.morganstanley.com/im.

Market forecasts provided in this report may not necessarily come to pass. There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future. There is no assurance that a fund will achieve its investment objective. Funds are subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

1

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Shareholders' Letter (unaudited)

Dear Shareholders,

We are pleased to provide this Annual report, in which you will learn how your investment in Core Plus Fixed Income Portfolio (the "Fund") performed during the latest twelve-month period.

Morgan Stanley Investment Management is a client-centric, investor-led organization. Our global presence, intellectual capital, and breadth of products and services enable us to partner with investors to meet the evolving challenges of today's financial markets. We aim to deliver superior investment service and to empower our clients to make the informed decisions that help them reach their investment goals.

As always, we thank you for selecting Morgan Stanley Investment Management, and look forward to working with you in the months and years ahead.

Sincerely,

John H. Gernon

President and Principal Executive Officer

October 2017

2

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Expense Example (unaudited)

Core Plus Fixed Income Portfolio

As a shareholder of the Fund, you may incur two types of costs: (1) transactional costs, including sales charge (loads) on purchase payments; and (2) ongoing costs, which may include advisory fees, administration fees, distribution and shareholder services fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the six-month period ended September 30, 2017 and held for the entire six-month period.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled "Actual Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads, if applicable). Therefore, the information for each class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value

4/1/17 | | Actual Ending

Account

Value

9/30/17 | | Hypothetical

Ending Account

Value | | Actual

Expenses

Paid

During

Period* | | Hypothetical

Expenses Paid

During Period* | | Net

Expense

Ratio

During

Period** | |

Core Plus Fixed Income Portfolio Class I | | $ | 1,000.00 | | | $ | 1,040.30 | | | $ | 1,023.06 | | | $ | 2.05 | | | $ | 2.03 | | | | 0.40 | % | |

Core Plus Fixed Income Portfolio Class A | | | 1,000.00 | | | | 1,038.30 | | | | 1,021.31 | | | | 3.83 | | | | 3.80 | | | | 0.75 | | |

Core Plus Fixed Income Portfolio Class L | | | 1,000.00 | | | | 1,037.40 | | | | 1,020.05 | | | | 5.11 | | | | 5.06 | | | | 1.00 | | |

Core Plus Fixed Income Portfolio Class C | | | 1,000.00 | | | | 1,034.10 | | | | 1,017.50 | | | | 7.70 | | | | 7.64 | | | | 1.51 | | |

* Expenses are calculated using each Fund Class' annualized net expense ratio (as disclosed), multiplied by the average account value over the period, and multiplied by 183/365 (to reflect the most recent one-half year period).

** Annualized.

3

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Investment Overview (unaudited)

Core Plus Fixed Income Portfolio

The Fund seeks above-average total return over a market cycle of three to five years.

Performance

For the fiscal year ended September 30, 2017, the Fund's Class I shares had a total return based on net asset value and reinvestment of distributions per share of 2.79%, net of fees. The Fund's Class I shares outperformed against the Fund's benchmark, the Bloomberg Barclays U.S. Aggregate Index (the "Index"), which returned 0.07%.

Factors Affecting Performance

• Benign economic performance of major countries and low interest rates, due to continued aggressive central bank actions, led to strong demand for bonds that offer additional yields over government securities. The result was strong performance in most credit sectors. The Fund benefited from overweights to these better-performing credit sectors — namely, investment-grade and high-yield corporates, convertibles, emerging market debt, asset-backed securities, and non-agency residential and commercial mortgage-backed securities. The Fund's underweight to agency mortgage-backed securities slightly detracted from relative performance. The Fund's credit exposures are managed, in part, using credit-default swaps.

• U.S. Treasury yields rose over the period. They initially jumped after the election. Shorter maturities continued to rise as the Federal Reserve (Fed) increased the target fed funds rate by 75 basis points over the period. Longer maturity yields fluctuated in a relatively narrow band post-election. The impact on the Fund was small, as it only had a small short duration exposure. The Fund did benefit from an exposure to inflation-linked bonds, which performed well early in the period. The Fund's U.S. interest rate exposures are managed, in part, using interest-rate futures and swaps.

• Non-U.S. interest rate exposures helped performance over the period. The Portfolio has exposure to emerging markets, where rates mostly fell. It also was overweight peripheral Europe relative to Germany, which also helped as these spreads narrowed. Currency positioning, in both developed and emerging markets, also helped performance. The Fund's non-U.S. interest rate exposures are managed, in part, using interest-rate futures. The Fund's currency exposures are managed, in part, using foreign exchange forwards.

• The Fund also benefited from the receipt of proceeds from legal settlements, as described below.

• During fiscal year 2017, the Fund received monies related to certain nonrecurring litigation settlements. If these monies were not received, any period returns which include these settlement monies would have been lower. For example, the 2017 fiscal year total return would have been 2.33% for Class I shares as of September 30, 2017. The returns on the other Share Classes would also have been similarly impacted. These were one-time settlements, and as a result, the impact on the net asset value and consequently the performance will not likely be repeated in the future. Please call 1-800-548-7786 for additional information.

Management Strategies

• Though we are still overweight credit sectors, we have been reducing overall portfolio risk recently. The Fed has appeared to shift its reaction function, i.e., how its policy decisions will be made based on the economic climate. The big change is that the Fed is underweighting the sharp drop in inflation since February 2017, calling it "noise" and overweighting market indicators such as equities, credit spreads, level of the U.S. dollar and level of Treasury yields (a.k.a. financial conditions) under the guise of financial stability. Financial conditions have been loosening for most of 2017 despite hikes by the Fed, which would suggest that Fed policy should be even tighter.

• We expect more clarity in the near future on tax reform. The White House's tax proposals provided broad directions, but details remains to be hashed out. Since Congress will likely use reconciliation to pass tax reform, the debate must solidify soon so that major tax measures could be passed with the budget bill in November 2017. Market odds of tax reform passage have declined substantially.

• Either event — a change in Fed reaction function or a surprisingly strong tax bill — could lead to higher Treasury yields and a stronger U.S. dollar. This could also lead to wider spreads, especially for sectors that are dollar-sensitive, such as emerging market debt and export-dependent corporates. As a result, we think it is best to approach risk-taking cautiously.

4

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Investment Overview (unaudited) (cont'd)

Core Plus Fixed Income Portfolio

* Minimum Investment

In accordance with SEC regulations, the Fund's performance shown assumes that all recurring fees (including management fees) were deducted and all dividends and distributions were reinvested. The performance of Class A, Class L and Class C shares will vary from the performance of Class I shares based upon their different inception dates and will be negatively impacted by additional fees assessed to those classes.

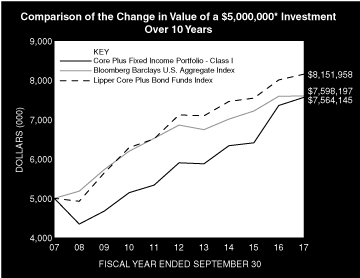

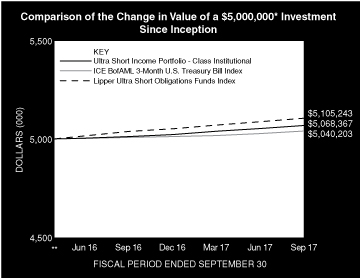

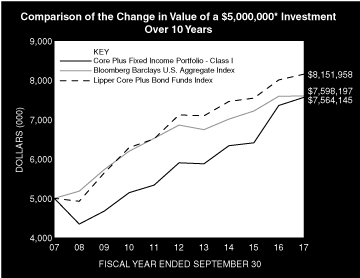

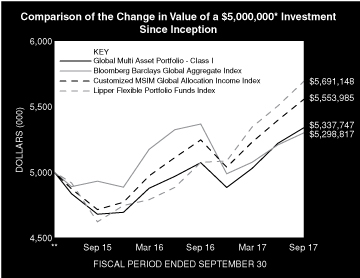

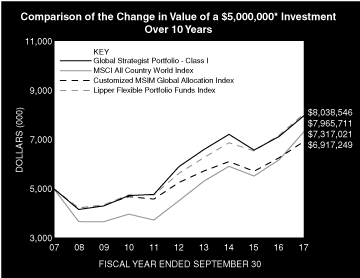

Performance Compared to the Bloomberg Barclays U.S. Aggregate Index(1) and the Lipper Core Plus Bond Funds Index(2)

| | | Period Ended September 30, 2017

Total Returns(3) | |

| | | | | Average Annual | |

| | | One

Year | | Five

Years | | Ten

Years | | Since

Inception(8) | |

Fund — Class I Shares

w/o sales charges(4) | | | 2.79 | % | | | 5.09 | % | | | 4.23 | % | | | 7.32 | % | |

Fund — Class A Shares

w/o sales charges(5) | | | 2.43 | | | | 4.72 | | | | 3.93 | | | | 4.92 | | |

Fund — Class A Shares with

maximum 4.25% sales charges(5) | | | –1.93 | | | | 3.81 | | | | 3.47 | | | | 4.71 | | |

Fund — Class L Shares

w/o sales charges(6) | | | 2.16 | | | | 4.48 | | | | — | | | | 4.98 | | |

Fund — Class C Shares

w/o sales charges(7) | | | 1.57 | | | | — | | | | — | | | | 5.17 | | |

Fund — Class C Shares

with maximum 1.00% deferred

sales charges(7) | | | 0.58 | | | | — | | | | — | | | | 5.17 | | |

Bloomberg Barclays U.S.

Aggregate Index | | | 0.07 | | | | 2.06 | | | | 4.27 | | | | 7.05 | | |

Lipper Core Plus Bond Funds Index | | | 1.80 | | | | 2.74 | | | | 5.01 | | | | — | | |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance assumes that all dividends and distributions, if any, were reinvested. For the most recent month-end performance figures, please visit www.morganstanley.com/im. Investment returns and principal value will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of share classes will vary due to differences in sales charges and expenses.

(1) The Bloomberg Barclays U.S. Aggregate Index tracks the performance of U.S. government agency and Treasury securities, investment-grade corporate debt securities, agency mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Lipper Core Plus Bond Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper Core Plus Bond Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. As of the date of this report, the Fund was in the Lipper Core Plus Bond Funds classification.

(3) Total returns for the Fund reflect expenses waived and/or reimbursed, if applicable, by the Adviser. Without such waivers and/or reimbursements, total returns would have been lower.

(4) Commenced operations on November 14, 1984.

(5) Commenced operations on November 7, 1996.

(6) Commenced operations on April 27, 2012.

(7) Commenced operations on April 30, 2015.

(8) For comparative purposes, average annual since inception returns listed for the Indexes refer to the inception date of Class I of the Fund, not the inception of the Indexes.

5

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Fixed Income Securities (89.8%) | |

Agency Adjustable Rate Mortgage (0.1%) | |

Federal Home Loan Mortgage Corporation,

Conventional Pool:

12 Month USD LIBOR + 1.62%,

2.51%, 7/1/45 | | $ | 171 | | | $ | 175 | | |

Agency Fixed Rate Mortgages (18.5%) | |

Federal Home Loan Mortgage Corporation, | |

Gold Pools: | |

3.00%, 3/1/47 | | | 2,701 | | | | 2,714 | | |

3.50%, 1/1/44 - 2/1/45 | | | 2,079 | | | | 2,157 | | |

4.00%, 6/1/44 - 10/1/44 | | | 1,047 | | | | 1,103 | | |

5.41%, 7/1/37 - 8/1/37 | | | 23 | | | | 25 | | |

5.44%, 1/1/37 - 6/1/38 | | | 87 | | | | 98 | | |

5.46%, 5/1/37 - 1/1/38 | | | 94 | | | | 103 | | |

5.48%, 8/1/37 - 10/1/37 | | | 62 | | | | 67 | | |

5.50%, 8/1/37 - 4/1/38 | | | 110 | | | | 122 | | |

5.52%, 9/1/37 - 1/1/38 | | | 28 | | | | 31 | | |

5.62%, 12/1/36 - 12/1/37 | | | 90 | | | | 99 | | |

6.00%, 10/1/36 - 8/1/38 | | | 247 | | | | 277 | | |

6.50%, 12/1/25 - 8/1/33 | | | 162 | | | | 179 | | |

7.00%, 6/1/28 - 11/1/31 | | | 52 | | | | 56 | | |

Federal National Mortgage Association, | |

Conventional Pools: | |

3.00%, 5/1/30 - 11/1/46 | | | 5,478 | | | | 5,515 | | |

3.50%, 8/1/45 - 3/1/47 | | | 4,736 | | | | 4,910 | | |

4.00%, 11/1/41 - 8/1/46 | | | 5,937 | | | | 6,282 | | |

4.50%, 3/1/41 - 11/1/44 | | | 2,064 | | | | 2,255 | | |

5.00%, 3/1/41 | | | 296 | | | | 324 | | |

5.50%, 6/1/35 - 1/1/37 | | | 87 | | | | 98 | | |

5.62%, 12/1/36 | | | 34 | | | | 36 | | |

6.50%, 4/1/24 - 1/1/34 | | | 1,202 | | | | 1,334 | | |

7.00%, 11/1/17 - 12/1/33 | | | 224 | | | | 239 | | |

9.50%, 4/1/30 | | | 158 | | | | 184 | | |

November TBA: | |

3.50%, 11/1/47 (a) | | | 15,109 | | | | 15,549 | | |

October TBA: | |

3.00%, 10/1/32 (a) | | | 2,260 | | | | 2,322 | | |

4.00%, 10/1/47 (a) | | | 6,370 | | | | 6,707 | | |

4.50%, 10/1/47 (a) | | | 2,870 | | | | 3,081 | | |

Government National Mortgage Association, | |

October TBA: | |

3.50%, 10/20/47 (a) | | | 680 | | | | 707 | | |

Various Pools: | |

3.50%, 11/20/40 - 7/20/46 | | | 3,205 | | | | 3,337 | | |

4.00%, 8/20/41 - 3/20/43 | | | 726 | | | | 771 | | |

5.48%, 9/20/37 | | | 9 | | | | 10 | | |

6.50%, 5/15/40 | | | 784 | | | | 932 | | |

| | | | 61,624 | | |

Asset-Backed Securities (6.8%) | |

2010 U-Haul S Fleet LLC, | |

4.90%, 10/25/23 (b) | | | 571 | | | | 571 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Accredited Mortgage Loan Trust, | |

1 Month USD LIBOR + 0.60%, 1.84%,

4/25/34 (c) | | $ | 1,133 | | | $ | 1,096 | | |

American Homes 4 Rent Trust, | |

6.07%, 10/17/45 (b) | | | 601 | | | | 675 | | |

AMSR Trust, | |

1 Month LIBOR + 1.40%, 2.63%,

11/17/33 (b)(c) | | | 1,000 | | | | 1,010 | | |

Blackbird Capital Aircraft Lease

Securitization Ltd., | |

5.68%, 12/16/41 (b) | | | 719 | | | | 725 | | |

CAM Mortgage Trust, | |

4.00%, 1/15/56 (b) | | | 76 | | | | 76 | | |

ContiMortgage Home Equity Loan Trust, | |

8.10%, 8/15/25 | | | 25 | | | | 18 | | |

CVS Pass-Through Trust, | |

6.04%, 12/10/28 | | | 658 | | | | 745 | | |

GMAT Trust, | |

4.25%, 9/25/20 (b) | | | 650 | | | | 650 | | |

Green Tree Agency Advance Funding Trust I, | |

2.38%, 10/15/48 (b) | | | 800 | | | | 796 | | |

Invitation Homes Trust, | |

1 Month LIBOR + 4.00%, 5.23%,

9/17/31 (b)(c) | | | 1,000 | | | | 1,005 | | |

1 Month LIBOR + 4.75%, 5.98%,

8/17/32 (b)(c) | | | 997 | | | | 1,021 | | |

Labrador Aviation Finance Ltd., | |

5.68%, 1/15/42 (b) | | | 555 | | | | 565 | | |

Nationstar HECM Loan Trust, | |

3.97%, 9/25/27 (b)(c) | | | 1,000 | | | | 1,000 | | |

4.70%, 5/25/27 (b) | | | 800 | | | | 810 | | |

5.68%, 8/25/26 (b) | | | 475 | | | | 486 | | |

6.54%, 6/25/26 (b)(c) | | | 450 | | | | 457 | | |

OnDeck Asset Securitization Trust II LLC, | |

4.21%, 5/17/20 (b) | | | 450 | | | | 453 | | |

PNMAC GMSR Issuer Trust, | |

5.24%, 8/25/23 (b)(c) | | | 400 | | | | 401 | | |

1 Month USD LIBOR + 4.75%, 5.99%,

2/25/50 (b)(c) | | | 900 | | | | 903 | | |

Pretium Mortgage Credit Partners I LLC, | |

3.25%, 8/27/32 - 3/28/57 (b) | | | 1,716 | | | | 1,718 | | |

3.50%, 10/27/31 - 4/29/32 (b) | | | 1,374 | | | | 1,382 | | |

PRPM LLC, | |

4.00%, 9/27/21 (b) | | | 397 | | | | 397 | | |

RCO Mortgage LLC, | |

3.38%, 8/25/22 (b) | | | 1,079 | | | | 1,083 | | |

S-Jets Ltd., | |

7.02%, 8/15/42 (b) | | | 1,484 | | | | 1,485 | | |

Skopos Auto Receivables Trust, | |

3.10%, 12/15/23 (b) | | | 15 | | | | 15 | | |

3.55%, 2/15/20 (b) | | | 47 | | | | 47 | | |

Tricon American Homes Trust, | |

5.15%, 9/17/34 (b) | | | 450 | | | | 448 | | |

5.77%, 11/17/33 (b) | | | 630 | | | | 651 | | |

The accompanying notes are an integral part of the financial statements.

6

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Asset-Backed Securities (cont'd) | |

VOLT LIV LLC, | |

3.50%, 2/25/47 (b) | | $ | 504 | | | $ | 508 | | |

VOLT LIX LLC, | |

3.25%, 5/25/47 (b) | | | 602 | | | | 605 | | |

VOLT NPL X LLC, | |

4.75%, 10/26/54 (b) | | | 64 | | | | 65 | | |

VOLT XIX LLC, | |

5.00%, 4/25/55 (b) | | | 300 | | | | 301 | | |

VOLT XXII LLC, | |

4.25%, 2/25/55 (b) | | | 299 | | | | 301 | | |

| | | | 22,469 | | |

Collateralized Mortgage Obligations — Agency Collateral Series (1.2%) | |

Federal Home Loan Mortgage Corporation, | |

4.09%, 10/25/48 (b)(c) | | | 750 | | | | 705 | | |

1 Month LIBOR + 4.35%, 5.58%,

12/25/26 (b)(c) | | | 300 | | | | 304 | | |

1 Month LIBOR + 5.05%, 6.29%, 7/25/23 (c) | | | 364 | | | | 368 | | |

1 Month LIBOR + 5.25%, 6.48%,

7/25/26 (b)(c) | | | 268 | | | | 274 | | |

IO REMIC | |

6.00% - 1 Month LIBOR, 4.77%, 11/15/43 (c) | | | 1,375 | | | | 185 | | |

6.05% - 1 Month LIBOR, 4.82%, 4/15/39 (c) | | | 1,189 | | | | 98 | | |

IO STRIPS | |

7.50%, 12/15/29 | | | 36 | | | | 10 | | |

PAC REMIC | |

9.50%, 4/15/20 | | | — | @ | | | — | @ | |

Federal National Mortgage Association, | |

IO | |

6.39% - 1 Month LIBOR, 5.15%, 9/25/20 (c) | | | 4,201 | | | | 422 | | |

IO PAC REMIC | |

8.00%, 9/18/27 | | | 137 | | | | 30 | | |

IO REMIC | |

6.00%, 7/25/33 | | | 87 | | | | 17 | | |

IO STRIPS | |

6.50%, 9/25/29 - 12/25/29 | | | 536 | | | | 93 | | |

8.00%, 4/25/24 | | | 126 | | | | 18 | | |

8.50%, 10/25/25 | | | 48 | | | | 10 | | |

9.00%, 11/25/26 | | | 44 | | | | 9 | | |

REMIC | |

7.00%, 9/25/32 | | | 265 | | | | 309 | | |

56.76%, 9/25/20 (d) | | | — | @ | | | — | @ | |

Government National Mortgage Association, | |

IO | |

3.50%, 5/20/43 | | | 1,570 | | | | 333 | | |

6.05% - 1 Month LIBOR, 4.82%, 11/16/40 (c) | | | 1,888 | | | | 332 | | |

6.10% - 1 Month LIBOR, 4.87%, 7/16/33 (c) | | | 1,716 | | | | 85 | | |

6.23% - 1 Month LIBOR, 4.99%, 3/20/43 (c) | | | 669 | | | | 113 | | |

5.00%, 2/16/41 | | | 301 | | | | 67 | | |

6.50% - 1 Month LIBOR, 5.26%, 5/20/40 (c) | | | 816 | | | | 154 | | |

IO PAC | |

6.15% - 1 Month LIBOR, 4.91%, 10/20/41 (c) | | | 2,131 | | | | 194 | | |

| | | | 4,130 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Commercial Mortgage-Backed Securities (6.3%) | |

BBCCRE Trust, | |

4.71%, 8/10/33 (b)(c) | | $ | 750 | | | $ | 636 | | |

BBCMS Trust, | |

4.43%, 9/10/28 (b)(c) | | | 1,037 | | | | 1,016 | | |

CGDB Commercial Mortgage Trust, | |

1 Month LIBOR + 2.50%, 3.73%,

5/15/30 (b)(c) | | | 290 | | | | 291 | | |

Citigroup Commercial Mortgage Trust, | |

1 Month LIBOR + 2.94%, 4.17%,

9/15/27 (b)(c) | | | 650 | | | | 641 | | |

IO | |

1.04%, 11/10/48 (c) | | | 2,808 | | | | 139 | | |

1.12%, 9/10/58 (c) | | | 9,764 | | | | 569 | | |

COMM Mortgage Trust, | |

5.21%, 8/10/46 (b)(c) | | | 800 | | | | 786 | | |

IO | |

0.25%, 7/10/45 (c) | | | 14,899 | | | | 90 | | |

1.11%, 10/10/47 (c) | | | 4,578 | | | | 175 | | |

1.39%, 7/15/47 (c) | | | 4,119 | | | | 208 | | |

Commercial Mortgage Pass-Through

Certificates, | |

4.75%, 2/10/47 (b)(c) | | | 575 | | | | 537 | | |

Cosmopolitan Hotel Trust, | |

1 Month LIBOR + 3.50%, 4.73%,

11/15/33 (b)(c) | | | 400 | | | | 403 | | |

CSMC Trust, | |

1 Month LIBOR + 4.15%, 5.38%,

3/15/28 (b)(c) | | | 200 | | | | 201 | | |

1 Month LIBOR + 4.60%, 5.83%,

11/15/33 (b)(c) | | | 777 | | | | 784 | | |

1 Month LIBOR + 4.75%, 5.98%,

4/15/29 (b)(c) | | | 1,000 | | | | 1,008 | | |

GS Mortgage Securities Trust, | |

4.92%, 8/10/46 (b)(c) | | | 500 | | | | 475 | | |

IO | |

0.98%, 9/10/47 (c) | | | 5,811 | | | | 242 | | |

1.40%, 10/10/49 (c) | | | 8,143 | | | | 683 | | |

1.52%, 10/10/48 (c) | | | 5,379 | | | | 436 | | |

HILT Mortgage Trust, | |

3.75% - 1 Month LIBOR, 3.23%,

7/15/29 (b)(c) | | | 600 | | | | 576 | | |

HMH Trust, | |

6.29%, 7/5/31 (b) | | | 450 | | | | 450 | | |

JP Morgan Chase Commercial Mortgage

Securities Trust, | |

4.72%, 7/15/47 (b)(c) | | | 1,135 | | | | 934 | | |

IO | |

0.69%, 4/15/46 (c) | | | 6,956 | | | | 189 | | |

0.96%, 12/15/49 (c) | | | 4,593 | | | | 213 | | |

1.27%, 7/15/47 (c) | | | 10,433 | | | | 438 | | |

JPMBB Commercial Mortgage Securities Trust, | |

4.11%, 9/15/47 (b)(c) | | | 1,105 | | | | 949 | | |

4.82%, 4/15/47 (b)(c) | | | 775 | | | | 696 | | |

The accompanying notes are an integral part of the financial statements.

7

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Commercial Mortgage-Backed Securities (cont'd) | |

IO | |

1.23%, 8/15/47 (c) | | $ | 4,483 | | | $ | 246 | | |

LB-UBS Commercial Mortgage Trust, | |

6.39%, 9/15/45 (c) | | | 550 | | | | 559 | | |

Morgan Stanley Bank of America Merrill Lynch

Trust, | |

4.75%, 12/15/46 (b) | | | 835 | | | | 827 | | |

Wells Fargo Commercial Mortgage Trust, | |

3.94%, 8/15/50 (b) | | | 625 | | | | 515 | | |

4.65%, 9/15/58 (b)(c) | | | 471 | | | | 415 | | |

IO | |

1.19%, 12/15/49 (c) | | | 6,838 | | | | 394 | | |

1.80%, 11/15/49 (c) | | | 6,925 | | | | 693 | | |

WFRBS Commercial Mortgage Trust, | |

3.50%, 8/15/47 (b) | | | 1,400 | | | | 1,104 | | |

3.80%, 11/15/47 (b)(c) | | | 950 | | | | 722 | | |

3.99%, 5/15/47 (b) | | | 580 | | | | 446 | | |

4.27%, 5/15/45 (b)(c) | | | 425 | | | | 395 | | |

5.15%, 9/15/46 (b)(c) | | | 805 | | | | 770 | | |

| | | | 20,851 | | |

Corporate Bonds (33.1%) | |

Finance (14.8%) | |

AerCap Ireland Capital DAC/AerCap Global

Aviation Trust, | |

3.75%, 5/15/19 | | | 380 | | | | 389 | | |

Alexandria Real Estate Equities, Inc., | |

3.95%, 1/15/27 | | | 175 | | | | 179 | | |

Ally Financial, Inc., | |

3.25%, 2/13/18 | | | 10 | | | | 10 | | |

4.25%, 4/15/21 | | | 525 | | | | 545 | | |

American International Group, Inc., | |

4.88%, 6/1/22 | | | 375 | | | | 412 | | |

AvalonBay Communities, Inc., | |

Series G | |

2.95%, 5/11/26 | | | 375 | | | | 370 | | |

Bank of America Corp., | |

4.24%, 4/24/38 | | | 225 | | | | 238 | | |

6.11%, 1/29/37 | | | 250 | | | | 314 | | |

MTN | |

4.00%, 1/22/25 | | | 1,055 | | | | 1,093 | | |

4.25%, 10/22/26 | | | 1,088 | | | | 1,140 | | |

Bank of New York Mellon Corp. (The), | |

MTN | |

3.65%, 2/4/24 | | | 525 | | | | 550 | | |

BNP Paribas SA, | |

3.80%, 1/10/24 (b)(e) | | | 500 | | | | 520 | | |

5.00%, 1/15/21 | | | 175 | | | | 190 | | |

Boston Properties LP, | |

3.80%, 2/1/24 | | | 700 | | | | 733 | | |

| BPCE SA, | |

5.15%, 7/21/24 (b) | | | 1,075 | | | | 1,161 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Brighthouse Financial, Inc., | |

3.70%, 6/22/27 (b) | | $ | 1,175 | | | $ | 1,156 | | |

Brookfield Finance LLC, | |

4.00%, 4/1/24 | | | 775 | | | | 804 | | |

Capital One Bank USA NA, | |

3.38%, 2/15/23 | | | 1,625 | | | | 1,651 | | |

Citigroup, Inc., | |

3.89%, 1/10/28 | | | 1,500 | | | | 1,542 | | |

6.68%, 9/13/43 | | | 120 | | | | 163 | | |

8.13%, 7/15/39 | | | 350 | | | | 555 | | |

Citizens Bank NA, | |

MTN | |

2.55%, 5/13/21 | | | 250 | | | | 251 | | |

Colony NorthStar, Inc., | |

5.00%, 4/15/23 | | | 375 | | | | 386 | | |

Cooperatieve Rabobank UA, | |

3.95%, 11/9/22 | | | 650 | | | | 683 | | |

Credit Agricole SA, | |

3.88%, 4/15/24 (b) | | | 500 | | | | 531 | | |

Credit Suisse Group AG, | |

3.57%, 1/9/23 (b) | | | 250 | | | | 256 | | |

Credit Suisse Group Funding Guernsey Ltd., | |

4.55%, 4/17/26 | | | 1,150 | | | | 1,235 | | |

Deutsche Bank AG, | |

2.70%, 7/13/20 | | | 625 | | | | 628 | | |

Discover Bank, | |

7.00%, 4/15/20 | | | 250 | | | | 276 | | |

Discover Financial Services, | |

3.95%, 11/6/24 | | | 750 | | | | 769 | | |

Extra Space Storage LP, | |

3.13%, 10/1/35 (b) | | | 250 | | | | 273 | | |

Federal Realty Investment Trust, | |

3.63%, 8/1/46 | | | 250 | | | | 227 | | |

Five Corners Funding Trust, | |

4.42%, 11/15/23 (b) | | | 500 | | | | 542 | | |

GE Capital International Funding Co.,

Unlimited Co., | |

4.42%, 11/15/35 | | | 615 | | | | 670 | | |

Goldman Sachs Group, Inc. (The), | |

6.75%, 10/1/37 | | | 615 | | | | 813 | | |

MTN | |

4.80%, 7/8/44 | | | 350 | | | | 393 | | |

Guardian Life Insurance Co. of America (The), | |

4.85%, 1/24/77 (b) | | | 475 | | | | 509 | | |

Hartford Financial Services Group, Inc. (The), | |

5.50%, 3/30/20 | | | 295 | | | | 318 | | |

HBOS PLC, | |

Series G | |

6.75%, 5/21/18 (b) | | | 813 | | | | 837 | | |

Healthcare Trust of America Holdings LP, | |

3.70%, 4/15/23 | | | 350 | | | | 359 | | |

HSBC Finance Corp., | |

6.68%, 1/15/21 | | | 237 | | | | 268 | | |

The accompanying notes are an integral part of the financial statements.

8

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Finance (cont'd) | |

HSBC Holdings PLC, | |

4.25%, 3/14/24 | | $ | 1,900 | | | $ | 1,989 | | |

HSBC USA, Inc., | |

3.50%, 6/23/24 | | | 225 | | | | 232 | | |

Humana, Inc., | |

3.95%, 3/15/27 | | | 350 | | | | 366 | | |

ING Bank N.V., | |

5.80%, 9/25/23 (b) | | | 770 | | | | 880 | | |

ING Groep N.V., | |

6.00%, 4/16/20 (e)(f) | | | 200 | | | | 206 | | |

Intesa Sanpaolo SpA, | |

5.25%, 1/12/24 | | | 610 | | | | 673 | | |

Jefferies Finance LLC/JFIN Co-Issuer Corp., | |

7.38%, 4/1/20 (b) | | | 380 | | | | 393 | | |

JPMorgan Chase & Co., | |

3.78%, 2/1/28 | | | 1,525 | | | | 1,571 | | |

4.13%, 12/15/26 | | | 1,075 | | | | 1,123 | | |

LeasePlan Corp N.V., | |

2.88%, 1/22/19 (b) | | | 475 | | | | 476 | | |

Liberty Mutual Group, Inc., | |

4.85%, 8/1/44 (b) | | | 150 | | | | 164 | | |

Macquarie Bank Ltd., | |

6.63%, 4/7/21 (b) | | | 490 | | | | 551 | | |

MetLife, Inc. (See Note G), | |

5.70%, 6/15/35 | | | 175 | | | | 217 | | |

Mizuho Financial Group, Inc., | |

2.63%, 4/12/21 (b) | | | 600 | | | | 600 | | |

MPT Operating Partnership LP/MPT

Finance Corp., | |

5.00%, 10/15/27 | | | 800 | | | | 822 | | |

Nationwide Building Society, | |

3.90%, 7/21/25 (b)(e) | | | 400 | | | | 420 | | |

6.25%, 2/25/20 (b) | | | 645 | | | | 706 | | |

New York Life Global Funding, | |

1.70%, 9/14/21 (b) | | | 600 | | | | 588 | | |

PNC Financial Services Group, Inc. (The), | |

3.15%, 5/19/27 | | | 825 | | | | 826 | | |

3.90%, 4/29/24 | | | 360 | | | | 378 | | |

Realty Income Corp., | |

3.25%, 10/15/22 | | | 400 | | | | 410 | | |

Royal Bank of Scotland Group PLC, | |

3.88%, 9/12/23 | | | 875 | | | | 897 | | |

Santander Issuances SAU, | |

5.18%, 11/19/25 | | | 600 | | | | 647 | | |

Santander UK Group Holdings PLC, | |

3.57%, 1/10/23 | | | 1,125 | | | | 1,152 | | |

Shutterfly, Inc., | |

0.25%, 5/15/18 | | | 400 | | | | 398 | | |

Skandinaviska Enskilda Banken AB, | |

2.63%, 11/17/20 (b)(e) | | | 500 | | | | 507 | | |

Spirit Realty Capital, Inc., | |

3.75%, 5/15/21 (e) | | | 375 | | | | 384 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Standard Chartered PLC, | |

3.05%, 1/15/21 (b) | | $ | 325 | | | $ | 330 | | |

Swedbank AB, | |

2.38%, 2/27/19 (b) | | | 525 | | | | 529 | | |

Synchrony Bank, | |

3.00%, 6/15/22 | | | 625 | | | | 624 | | |

TD Ameritrade Holding Corp., | |

3.63%, 4/1/25 | | | 500 | | | | 518 | | |

Toronto-Dominion Bank (The), | |

3.63%, 9/15/31 | | | 725 | | | | 723 | | |

Travelers Cos., Inc. (The), | |

3.75%, 5/15/46 | | | 275 | | | | 273 | | |

UBS Group Funding Switzerland AG, | |

2.95%, 9/24/20 (b) | | | 525 | | | | 533 | | |

UnitedHealth Group, Inc., | |

2.88%, 3/15/23 | | | 1,025 | | | | 1,046 | | |

3.75%, 7/15/25 | | | 475 | | | | 505 | | |

WEA Finance LLC/Westfield UK & Europe

Finance PLC, | |

3.25%, 10/5/20 (b) | | | 450 | | | | 460 | | |

Wells Fargo & Co., | |

3.00%, 10/23/26 | | | 1,950 | | | | 1,909 | | |

5.61%, 1/15/44 | | | 250 | | | | 303 | | |

| | | | 49,268 | | |

Industrials (17.4%) | |

21st Century Fox America, Inc., | |

4.75%, 9/15/44 | | | 375 | | | | 402 | | |

Abbott Laboratories, | |

3.75%, 11/30/26 | | | 1,025 | | | | 1,054 | | |

Air Liquide Finance SA, | |

1.75%, 9/27/21 (b) | | | 450 | | | | 440 | | |

Akamai Technologies, Inc., | |

0.00%, 2/15/19 | | | 375 | | | | 365 | | |

Amazon.com, Inc., | |

2.80%, 8/22/24 (b) | | | 975 | | | | 980 | | |

3.80%, 12/5/24 | | | 600 | | | | 642 | | |

Amgen, Inc., | |

4.66%, 6/15/51 | | | 750 | | | | 826 | | |

Anadarko Petroleum Corp., | |

5.55%, 3/15/26 (e) | | | 600 | | | | 671 | | |

Anheuser-Busch InBev Finance, Inc., | |

3.70%, 2/1/24 | | | 575 | | | | 604 | | |

4.90%, 2/1/46 | | | 575 | | | | 652 | | |

Apple, Inc., | |

2.45%, 8/4/26 | | | 400 | | | | 386 | | |

4.45%, 5/6/44 | | | 750 | | | | 818 | | |

AT&T, Inc., | |

4.25%, 3/1/27 | | | 1,250 | | | | 1,289 | | |

4.50%, 3/9/48 | | | 900 | | | | 833 | | |

4.90%, 8/14/37 | | | 300 | | | | 304 | | |

Baidu, Inc., | |

2.75%, 6/9/19 | | | 650 | | | | 658 | | |

The accompanying notes are an integral part of the financial statements.

9

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Industrials (cont'd) | |

Becton Dickinson and Co., | |

2.89%, 6/6/22 | | $ | 600 | | | $ | 603 | | |

BHP Billiton Finance USA Ltd., | |

5.00%, 9/30/43 | | | 250 | | | | 296 | | |

BP Capital Markets PLC, | |

3.12%, 5/4/26 | | | 825 | | | | 826 | | |

3.25%, 5/6/22 | | | 625 | | | | 648 | | |

Charter Communications Operating LLC/

Charter Communications Operating Capital, | |

4.91%, 7/23/25 | | | 425 | | | | 455 | | |

6.48%, 10/23/45 | | | 450 | | | | 530 | | |

CNH Industrial Capital LLC, | |

4.38%, 11/6/20 | | | 625 | | | | 658 | | |

CNOOC Finance 2013 Ltd., | |

3.00%, 5/9/23 | | | 540 | | | | 542 | | |

Coca-Cola Co. (The), | |

3.20%, 11/1/23 | | | 375 | | | | 392 | | |

Comcast Corp., | |

4.60%, 8/15/45 | | | 380 | | | | 419 | | |

ConocoPhillips Co., | |

4.95%, 3/15/26 (e) | | | 600 | | | | 677 | | |

Daimler Finance North America LLC, | |

2.25%, 7/31/19 (b) | | | 700 | | | | 703 | | |

Darden Restaurants, Inc., | |

3.85%, 5/1/27 | | | 450 | | | | 458 | | |

DCP Midstream Operating LP, | |

5.35%, 3/15/20 (b) | | | 169 | | | | 177 | | |

Delta Air Lines, Inc., | |

2.88%, 3/13/20 | | | 475 | | | | 481 | | |

Deutsche Telekom International Finance BV, | |

3.60%, 1/19/27 (b)(e) | | | 750 | | | | 760 | | |

Discovery Communications LLC, | |

3.95%, 3/20/28 | | | 425 | | | | 423 | | |

Dollar General Corp., | |

1.88%, 4/15/18 | | | 550 | | | | 551 | | |

3.25%, 4/15/23 | | | 400 | | | | 409 | | |

Eldorado Gold Corp., | |

6.13%, 12/15/20 (b) | | | 380 | | | | 388 | | |

Enable Midstream Partners LP, | |

3.90%, 5/15/24 | | | 425 | | | | 428 | | |

Equifax, Inc., | |

3.30%, 12/15/22 | | | 300 | | | | 299 | | |

Express Scripts Holding Co., | |

4.50%, 2/25/26 (e) | | | 500 | | | | 536 | | |

4.80%, 7/15/46 (e) | | | 325 | | | | 345 | | |

Exxon Mobil Corp., | |

4.11%, 3/1/46 | | | 775 | | | | 839 | | |

Ford Motor Credit Co., LLC, | |

3.20%, 1/15/21 | | | 400 | | | | 408 | | |

General Motors Co., | |

6.60%, 4/1/36 | | | 200 | | | | 238 | | |

| | | Face

Amount

(000) | | Value

(000) | |

GlaxoSmithKline Capital, Inc., | |

6.38%, 5/15/38 | | $ | 175 | | | $ | 240 | | |

Goldcorp, Inc., | |

3.70%, 3/15/23 | | | 293 | | | | 305 | | |

HCA, Inc., | |

4.75%, 5/1/23 | | | 645 | | | | 682 | | |

Heathrow Funding Ltd., | |

4.88%, 7/15/21 (b) | | | 525 | | | | 564 | | |

Home Depot, Inc. (The), | |

5.88%, 12/16/36 | | | 625 | | | | 813 | | |

Illumina, Inc., | |

0.00%, 6/15/19 | | | 328 | | | | 348 | | |

International Paper Co., | |

3.00%, 2/15/27 | | | 925 | | | | 900 | | |

J Sainsbury PLC, | |

Series SBRY | |

1.25%, 11/21/19 | | GBP | 300 | | | | 408 | | |

Johnson Controls International PLC, | |

3.90%, 2/14/26 | | $ | 500 | | | | 527 | | |

Kinder Morgan Energy Partners LP, | |

3.95%, 9/1/22 | | | 1,175 | | | | 1,221 | | |

Kraft Heinz Foods Co., | |

4.38%, 6/1/46 | | | 675 | | | | 669 | | |

Lockheed Martin Corp., | |

3.10%, 1/15/23 | | | 725 | | | | 748 | | |

LVMH Moet Hennessy Louis Vuitton SE, | |

Series MCFP | |

0.00%, 2/16/21 | | | 150 | | | | 445 | | |

LyondellBasell Industries N.V., | |

4.63%, 2/26/55 | | | 450 | | | | 466 | | |

Macquarie Infrastructure Corp., | |

2.00%, 10/1/23 | | | 850 | | | | 828 | | |

MasTec, Inc., | |

4.88%, 3/15/23 | | | 540 | | | | 555 | | |

McDonald's Corp., | |

MTN | |

4.60%, 5/26/45 | | | 400 | | | | 438 | | |

Medtronic, Inc., | |

4.63%, 3/15/45 | | | 325 | | | | 371 | | |

Microsoft Corp., | |

3.13%, 11/3/25 | | | 325 | | | | 334 | | |

4.45%, 11/3/45 | | | 800 | | | | 903 | | |

| MPLX LP, | |

4.88%, 6/1/25 | | | 250 | | | | 268 | | |

5.20%, 3/1/47 | | | 350 | | | | 368 | | |

NBCUniversal Media LLC, | |

5.95%, 4/1/41 | | | 325 | | | | 421 | | |

Netflix, Inc., | |

4.38%, 11/15/26 (b)(e) | | | 325 | | | | 327 | | |

NOVA Chemicals Corp., | |

5.25%, 8/1/23 (b) | | | 463 | | | | 479 | | |

Novartis Capital Corp., | |

4.40%, 5/6/44 | | | 375 | | | | 425 | | |

The accompanying notes are an integral part of the financial statements.

10

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Industrials (cont'd) | |

Nuance Communications, Inc., | |

1.00%, 12/15/35 | | $ | 425 | | | $ | 400 | | |

ON Semiconductor Corp., | |

1.00%, 12/1/20 | | | 625 | | | | 749 | | |

Ooredoo International Finance Ltd., | |

3.25%, 2/21/23 (b) | | | 450 | | | | 451 | | |

Oracle Corp., | |

2.95%, 5/15/25 | | | 381 | | | | 385 | | |

PepsiCo, Inc., | |

3.60%, 3/1/24 | | | 625 | | | | 661 | | |

Philip Morris International, Inc., | |

2.50%, 8/22/22 | | | 270 | | | | 270 | | |

Phillips 66 Partners LP, | |

4.68%, 2/15/45 | | | 150 | | | | 146 | | |

Priceline Group, Inc. (The), | |

0.90%, 9/15/21 (e) | | | 275 | | | | 316 | | |

QUALCOMM, Inc., | |

2.10%, 5/20/20 | | | 575 | | | | 580 | | |

Shell International Finance BV, | |

3.25%, 5/11/25 | | | 400 | | | | 410 | | |

Siemens Financieringsmaatschappij N.V., | |

2.35%, 10/15/26 (b) | | | 800 | | | | 755 | | |

SK Telecom Co., Ltd., | |

2.13%, 5/1/18 (b) | | | 200 | | | | 200 | | |

Southern Copper Corp., | |

5.25%, 11/8/42 | | | 600 | | | | 639 | | |

Spectra Energy Capital LLC, | |

3.30%, 3/15/23 | | | 475 | | | | 477 | | |

Sprint Corp., | |

7.13%, 6/15/24 | | | 500 | | | | 564 | | |

Sprint Spectrum Co., LLC/Sprint Spectrum

Co., II LLC/Sprint Spectrum Co., III LLC, | |

3.36%, 3/20/23 (b) | | | 1,437 | | | | 1,462 | | |

Telefonica Emisiones SAU, | |

4.10%, 3/8/27 | | | 850 | | | | 881 | | |

Telenor East Holding II AS, | |

Series VIP | |

0.25%, 9/20/19 | | | 600 | | | | 669 | | |

Teva Pharmaceutical Finance Netherlands III BV, | |

3.15%, 10/1/26 (e) | | | 1,175 | | | | 1,085 | | |

Thermo Fisher Scientific, Inc., | |

2.95%, 9/19/26 | | | 900 | | | | 883 | | |

Time Warner, Inc., | |

3.80%, 2/15/27 | | | 400 | | | | 401 | | |

Total Capital International SA, | |

2.88%, 2/17/22 | | | 500 | | | | 511 | | |

Transurban Finance Co., Pty Ltd., | |

3.38%, 3/22/27 (b) | | | 550 | | | | 541 | | |

Tyson Foods, Inc., | |

4.88%, 8/15/34 | | | 375 | | | | 415 | | |

| | | Face

Amount

(000) | | Value

(000) | |

United Airlines Pass-Through Trust, | |

Series A | |

4.00%, 4/11/26 | | $ | 599 | | | $ | 636 | | |

United Technologies Corp., | |

4.50%, 6/1/42 | | | 165 | | | | 178 | | |

Verizon Communications, Inc., | |

4.67%, 3/15/55 | | | 575 | | | | 550 | | |

5.01%, 8/21/54 | | | 300 | | | | 303 | | |

Viavi Solutions, Inc., | |

0.63%, 8/15/33 | | | 375 | | | | 394 | | |

Visa, Inc., | |

3.15%, 12/14/25 | | | 1,125 | | | | 1,154 | | |

Volkswagen Group of America Finance LLC, | |

2.40%, 5/22/20 (b) | | | 800 | | | | 804 | | |

Wal-Mart Stores, Inc., | |

5.25%, 9/1/35 | | | 615 | | | | 757 | | |

Woodside Finance Ltd., | |

3.70%, 9/15/26 (b) | | | 675 | | | | 677 | | |

ZF North America Capital, Inc., | |

4.50%, 4/29/22 (b) | | | 250 | | | | 264 | | |

| | | | 58,034 | | |

Utilities (0.9%) | |

Duke Energy Corp., | |

2.65%, 9/1/26 | | | 760 | | | | 728 | | |

Enel Finance International N.V., | |

3.63%, 5/25/27 (b) | | | 350 | | | | 351 | | |

Entergy Louisiana LLC, | |

3.05%, 6/1/31 | | | 525 | | | | 509 | | |

Southern Power Co., | |

Series D | |

1.95%, 12/15/19 | | | 550 | | | | 549 | | |

Trans-Allegheny Interstate Line Co., | |

3.85%, 6/1/25 (b) | | | 775 | | | | 812 | | |

| | | | 2,949 | | |

| | | | 110,251 | | |

Mortgages — Other (5.2%) | |

Adjustable Rate Mortgage Trust, | |

3.57%, 6/25/35 (c) | | | 458 | | | | 453 | | |

Alternative Loan Trust, | |

1 Month USD LIBOR + 0.18%, 1.42%,

5/25/47 (c) | | | 166 | | | | 161 | | |

Banc of America Alternative Loan Trust, | |

1 Month USD LIBOR + 0.65%, 1.89%,

7/25/46 (c) | | | 262 | | | | 198 | | |

5.86%, 10/25/36 | | | 652 | | | | 406 | | |

6.00%, 4/25/36 | | | 116 | | | | 117 | | |

Banc of America Funding Trust, | |

5.25%, 7/25/37 | | | 360 | | | | 361 | | |

ChaseFlex Trust, | |

6.00%, 2/25/37 | | | 961 | | | | 758 | | |

The accompanying notes are an integral part of the financial statements.

11

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Mortgages (cont'd) | |

Eurosail PLC, | |

3 Month GBP LIBOR + 0.95%, 1.25%,

6/13/45 (c) | | GBP | 600 | | | $ | 781 | | |

Farringdon Mortgages No. 2 PLC, | |

3 Month GBP LIBOR + 1.50%, 1.79%,

7/15/47 (c) | | | 275 | | | | 358 | | |

Federal Home Loan Mortgage Corporation, | |

3.00%, 7/25/46 - 5/25/47 | | $ | 1,785 | | | | 1,773 | | |

3.50%, 5/25/45 - 5/25/47 | | | 3,317 | | | | 3,373 | | |

3.88%, 5/25/45 (b)(c) | | | 201 | | | | 200 | | |

4.00%, 5/25/45 | | | 102 | | | | 105 | | |

1 Month USD LIBOR + 3.30%, 4.54%,

10/25/27 (c) | | | 400 | | | | 444 | | |

1 Month USD LIBOR + 3.75%, 4.99%,

9/25/24 (c) | | | 602 | | | | 675 | | |

1 Month USD LIBOR + 4.00%, 5.24%,

8/25/24 (c) | | | 306 | | | | 326 | | |

1 Month USD LIBOR + 5.15%, 6.39%,

10/25/29 (c) | | | 300 | | | | 318 | | |

Grifonas Finance PLC, | |

6 Month EURIBOR + 0.28%, 0.01%,

8/28/39 (c) | | EUR | 493 | | | | 511 | | |

HarborView Mortgage Loan Trust, | |

1 Month USD LIBOR + 0.19%, 1.43%,

1/19/38 (c) | | $ | 463 | | | | 438 | | |

IM Pastor 3 FTH, | |

3 Month EURIBOR + 0.14%, 0.00%,

3/22/43 (c) | | EUR | 493 | | | | 481 | | |

Impac CMB Trust, | |

1 Month USD LIBOR + 0.74%, 1.97%, | |

4/25/35 (c) | | $ | 232 | | | | 208 | | |

JP Morgan Mortgage Trust, | |

3.57%, 6/25/37 (c) | | | 205 | | | | 194 | | |

6.00%, 6/25/37 | | | 210 | | | | 208 | | |

Lehman Mortgage Trust, | |

5.50%, 11/25/35 - 2/25/36 | | | 907 | | | | 918 | | |

6.50%, 9/25/37 | | | 1,048 | | | | 801 | | |

Paragon Mortgages No. 13 PLC, | |

3 Month GBP LIBOR + 0.40%, 0.69%,

1/15/39 (c) | | GBP | 300 | | | | 370 | | |

Paragon Mortgages No. 15 PLC, | |

3 Month EURIBOR + 0.54%, 0.21%,

12/15/39 (c) | | EUR | 800 | | | | 823 | | |

RALI Trust, | |

5.50%, 12/25/34 | | $ | 710 | | | | 697 | | |

6.00%, 11/25/36 | | | 271 | | | | 239 | | |

Seasoned Credit Risk Transfer Trust, | |

4.00%, 8/25/56 (b)(c) | | | 600 | | | | 526 | | |

| | | | 17,221 | | |

Municipal Bonds (0.7%) | |

Chicago O'Hare International Airport, IL,

O'Hare International Airport Revenue | |

6.40%, 1/1/40 | | | 255 | | | | 349 | | |

| | | Face

Amount

(000) | | Value

(000) | |

City of New York, NY,Series G-1 | |

5.97%, 3/1/36 | | $ | 270 | | | $ | 351 | | |

Illinois State Toll Highway Authority, IL, | |

Highway Revenue, Build America Bonds | |

6.18%, 1/1/34 | | | 477 | | | | 609 | | |

Municipal Electric Authority of Georgia, GA, | |

6.64%, 4/1/57 | | | 283 | | | | 358 | | |

6.66%, 4/1/57 | | | 320 | | | | 400 | | |

New York City Transitional Finance Authority

Future Tax Secured Revenue, NY, | |

Transitional Finance Authority Future Tax

Secured Revenue | |

5.27%, 5/1/27 | | | 320 | | | | 374 | | |

| | | | 2,441 | | |

Sovereign (5.6%) | |

Argentine Republic Government

International Bond, | |

7.50%, 4/22/26 (e) | | | 1,181 | | | | 1,330 | | |

Brazil Notas do Tesouro Nacional, Series F | |

10.00%, 1/1/23 | | BRL | 10,700 | | | | 3,488 | | |

Cyprus Government International Bond, | |

3.88%, 5/6/22 | | EUR | 1,525 | | | | 2,032 | | |

Indonesia Treasury Bond, | |

8.25%, 7/15/21 | | IDR | 29,773,000 | | | | 2,370 | | |

Mexican Bonos, | |

Series M | |

6.50%, 6/10/21 | | MXN | 74,900 | | | | 4,092 | | |

Mexico Government International Bond, | |

3.60%, 1/30/25 | | $ | 704 | | | | 723 | | |

Petroleos Mexicanos, | |

6.38%, 1/23/45 | | | 329 | | | | 336 | | |

6.88%, 8/4/26 | | | 150 | | | | 171 | | |

Portugal Obrigacoes do Tesouro OT, | |

5.65%, 2/15/24 (b) | | EUR | 1,951 | | | | 2,881 | | |

Ukraine Government International Bond, | |

7.75%, 9/1/26 | | $ | 1,261 | | | | 1,300 | | |

| | | | 18,723 | | |

U.S. Agency Security (0.6%) | |

Federal Home Loan Bank, | |

0.88%, 10/1/18 (e) | | | 2,070 | | | | 2,061 | | |

U.S. Treasury Securities (11.7%) | |

U.S. Treasury Bond, | |

3.75%, 11/15/43 | | | 5,825 | | | | 6,830 | | |

U.S. Treasury Note, | |

0.38%, 1/15/27 | | | 3,015 | | | | 2,981 | | |

1.13%, 2/28/21 | | | 15,400 | | | | 15,101 | | |

1.50%, 5/31/19 - 8/15/26 | | | 6,225 | | | | 5,968 | | |

1.75%, 9/30/19 - 11/30/21 | | | 7,300 | | | | 7,331 | | |

2.25%, 2/15/27 | | | 675 | | | | 671 | | |

| | | | 38,882 | | |

Total Fixed Income Securities (Cost $295,175) | | | 298,828 | | |

The accompanying notes are an integral part of the financial statements.

12

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Shares | | Value

(000) | |

Short-Term Investments (20.1%) | |

Securities held as Collateral on Loaned Securities (1.8%) | |

Investment Company (1.8%) | |

Morgan Stanley Institutional Liquidity

Funds — Government Portfolio —

Institutional Class (See Note G)

(Cost $6,005) | | | 6,005,305 | | | $ | 6,005 | | |

Investment Company (18.1%) | |

Morgan Stanley Institutional Liquidity

Funds — Government Portfolio —

Institutional Class (See Note G)

(Cost $60,265) | | | 60,265,417 | | | | 60,265 | | |

| | | Face

Amount

(000) | | Value

(000) | |

U.S. Treasury Securities (0.2%) | |

U.S. Treasury Bills, | |

1.17%, 4/26/18 (g)(h) | | $ | 115 | | | | 114 | | |

1.19%, 4/26/18 (g)(h) | | | 687 | | | | 683 | | |

Total U.S. Treasury Securities (Cost $797) | | | 797 | | |

Total Short-Term Investments (Cost $67,067) | | | 67,067 | | |

Total Investments (109.9%) (Cost $362,242)

Including $7,858 of Securities Loaned (i)(j) | | | 365,895 | | |

Liabilities in Excess of Other Assets (–9.9%) | | | (33,035 | ) | |

Net Assets (100.0%) | | $ | 332,860 | | |

(a) Security is subject to delayed delivery.

(b) 144A security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(c) Floating or Variable rate securities: The rates disclosed are as of September 30, 2017. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description in the Portfolio of Investments.

(d) Inverse Floating Rate Security — Interest rate fluctuates with an inverse relationship to an associated interest rate. Indicated rate is the effective rate at September 30, 2017.

(e) All or a portion of this security was on loan at September 30, 2017.

(f) Perpetual — One or more securities do not have a predetermined maturity date. Rates for these securities are fixed for a period of time, after which they revert to a floating rate. Interest rates in effect are as of September 30, 2017.

(g) Rate shown is the yield to maturity at September 30, 2017.

(h) All or a portion of the security was pledged to cover margin requirements for swap agreements.

(i) Securities are available for collateral in connection with securities purchased on a forward commitment basis, open foreign currency forward exchange contracts, futures contracts and swap agreements.

(j) At September 30, 2017, the aggregate cost for federal income tax purposes is approximately $361,587,000. The aggregate gross unrealized appreciation is approximately $7,641,000 and the aggregate gross unrealized depreciation is approximately $3,994,000, resulting in net unrealized appreciation of approximately $3,647,000.

@ Value is less than $500.

EURIBOR Euro Interbank Offered Rate.

IO Interest Only.

LIBOR London Interbank Offered Rate.

MTN Medium Term Note.

PAC Planned Amortization Class.

REMIC Real Estate Mortgage Investment Conduit.

STRIPS Separate Trading of Registered Interest and Principal of Securities.

TBA To Be Announced.

Foreign Currency Forward Exchange Contracts:

The Fund had the following foreign currency forward exchange contracts open at September 30, 2017:

Counterparty | | Contracts to

Deliver

(000) | | In Exchange

For

(000) | | Delivery

Date | | Unrealized

Appreciation

(Depreciation)

(000) | |

Australia and New Zealand Banking Group | | AUD | 2,760 | | | $ | 2,201 | | | 10/6/17 | | $ | 36 | | |

Australia and New Zealand Banking Group | | MXN | 4,814 | | | $ | 265 | | | 10/6/17 | | | — | @ | |

Australia and New Zealand Banking Group | | SEK | 12,295 | | | $ | 1,510 | | | 10/6/17 | | | (— | @) | |

Australia and New Zealand Banking Group | | $ | 1,645 | | | NOK | 12,991 | | | 10/6/17 | | | (13 | ) | |

Barclays Bank PLC | | MXN | 56,452 | | | $ | 3,147 | | | 10/6/17 | | | 48 | | |

Citibank NA | | BRL | 7,657 | | | $ | 2,438 | | | 10/6/17 | | | 21 | | |

Citibank NA | | EUR | 5,754 | | | $ | 6,874 | | | 10/6/17 | | | 73 | | |

Citibank NA | | IDR | 31,480,044 | | | $ | 2,360 | | | 10/6/17 | | | 23 | | |

Citibank NA | | $ | 1 | | | EUR | — | @ | | 10/6/17 | | | (— | @) | |

Citibank NA | | $ | 3 | | | GBP | 2 | | | 10/6/17 | | | — | @ | |

HSBC Bank PLC | | EUR | 701 | | | $ | 827 | | | 10/6/17 | | | (2 | ) | |

HSBC Bank PLC | | GBP | 1,374 | | | $ | 1,796 | | | 10/6/17 | | | (46 | ) | |

HSBC Bank PLC | | $ | 31 | | | EUR | 26 | | | 10/6/17 | | | (— | @) | |

HSBC Bank PLC | | $ | 1,437 | | | PLN | 5,113 | | | 10/6/17 | | | (36 | ) | |

JPMorgan Chase Bank NA | | JPY | 162,471 | | | $ | 1,494 | | | 10/6/17 | | | 50 | | |

JPMorgan Chase Bank NA | | $ | 19 | | | EUR | 16 | | | 10/6/17 | | | (— | @) | |

JPMorgan Chase Bank NA | | $ | 1,539 | | | SEK | 12,242 | | | 10/6/17 | | | (36 | ) | |

| | | | | | | | | $ | 118 | | |

The accompanying notes are an integral part of the financial statements.

13

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

Futures Contracts:

The Fund had the following futures contracts open at September 30, 2017:

| | | Number

of

Contracts | | Expiration

Date | | Notional

Amount

(000) | | Value

(000) | | Unrealized

Appreciation

(Depreciation)

(000) | |

Long: | |

U.S. Treasury 2 yr. Note | | | 171 | | | Dec-17 | | | 34,200 | | | $ | 36,885 | | | $ | (101 | ) | |

U.S. Treasury 30 yr. Bond | | | 22 | | | Dec-17 | | | 2,200 | | | | 3,362 | | | | (65 | ) | |

U.S. Treasury 5 yr. Note | | | 210 | | | Dec-17 | | | 21,000 | | | | 24,675 | | | | (181 | ) | |

U.S. Treasury Ultra Bond | | | 125 | | | Dec-17 | | | 12,500 | | | | 20,641 | | | | (403 | ) | |

Short: | |

German Euro Bund | | | 27 | | | Dec-17 | | | (2,700 | ) | | | (5,138 | ) | | | 55 | | |

U.S. Treasury 10 yr. Note | | | 95 | | | Dec-17 | | | (9,500 | ) | | | (11,905 | ) | | | 103 | | |

U.S. Treasury 10 yr. Ultra Long Bond | | | 25 | | | Dec-17 | | | (2,500 | ) | | | (3,358 | ) | | | 42 | | |

| | | | | | | | | | | $ | (550 | ) | |

Credit Default Swap Agreements:

The Fund had the following credit default swap agreements open at September 30, 2017:

Swap Counterparty and

Reference Obligation | | Credit

Rating of

Reference

Obligation†

(Unaudited) | | Buy/Sell

Protection | | Pay/Receive

Fixed Rate | | Payment

Frequency | | Maturity

Date | | Notional

Amount

(000) | | Value

(000) | | Upfront

Payment

Paid

(Received)

(000) | | Unrealized

Depreciation

(000) | |

Barclays Bank PLC

Quest Diagnostics, Inc. | | BBB+ | | Buy | | | 1.00 | % | | Quarterly | | 3/20/19 | | $ | 995 | | | $ | (14 | ) | | $ | 19 | | | $ | (33 | ) | |

Deutsche Bank AG

CMBX.NA.BB.60 | | NR | | Sell | | | 5.00 | | | Monthly | | 5/11/63 | | | 230 | | | | (56 | ) | | | 1 | | | | (57 | ) | |

Goldman Sachs International

CMBX.NA.BB.60 | | NR | | Sell | | | 5.00 | | | Monthly | | 5/11/63 | | | 286 | | | | (69 | ) | | | (41 | ) | | | (28 | ) | |

| | | | | | | | | | | | | $ | 1,511 | | | $ | (139 | ) | | $ | (21 | ) | | $ | (118 | ) | |

Interest Rate Swap Agreements:

The Fund had the following interest rate swap agreements open at September 30, 2017:

Swap Counterparty | | Floating

Rate Index | | Pay/Receive

Floating Rate | | Fixed Rate | | Payment

Frequency

Paid/

Received | | Maturity

Date | | Notional

Amount

(000) | | Value

(000) | | Upfront

Payment

Paid

(000) | | Unrealized

Appreciation

(Depreciation)

(000) | |

Morgan Stanley & 3 Month Semi-Annual/

Co., LLC* | | LIBOR | | Receive | | | 2.26 | % | | Quarterly | | 12/7/26 | | $ | 3,656 | | | $ | (19 | ) | | $ | — | | | $ | (19 | ) | |

Morgan Stanley & 3 Month Semi-Annual/

Co., LLC* | | LIBOR | | Receive | | | 2.48 | | | Quarterly | | 12/21/26 | | | 3,683 | | | | (89 | ) | | | — | | | | (89 | ) | |

Morgan Stanley & 3 Month Semi-Annual/

Co., LLC* | | LIBOR | | Receive | | | 2.48 | | | Quarterly | | 5/23/47 | | | 3,237 | | | | 41 | | | | — | | | | 41 | | |

| | | | | | | | | | | | | $ | 10,576 | | | $ | (67 | ) | | $ | — | | | $ | (67 | ) | |

@ Value is less than $500.

† Credit rating as issued by Standard & Poor's.

* Cleared swap agreement, the broker is Morgan Stanley & Co., LLC.

LIBOR London Interbank Offered Rate.

NR Not rated.

AUD — Australian Dollar

BRL — Brazilian Real

EUR — Euro

GBP — British Pound

IDR — Indonesian Rupiah

JPY — Japanese Yen

MXN — Mexican Peso

NOK — Norwegian Krone

PLN — Polish Zloty

SEK — Swedish Krona

The accompanying notes are an integral part of the financial statements.

14

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

Portfolio Composition**

| Classification | | Percentage of

Total Investments | |

Agency Fixed Rate Mortgages | | | 17.1 | % | |

Short-Term Investments | | | 17.0 | | |

Industrials | | | 16.1 | | |

Finance | | | 13.7 | | |

U.S. Treasury Securities | | | 10.8 | | |

Other*** | | | 8.1 | | |

Asset-Backed Securities | | | 6.2 | | |

Commercial Mortgage-Backed Securities | | | 5.8 | | |

Sovereign | | | 5.2 | | |

Total Investments | | | 100.0 | %**** | |

** Percentages indicated are based upon total investments (excluding Securities held as Collateral on Loaned Securities) as of September 30, 2017.

*** Industries and/or investment types representing less than 5% of total investments.

**** Does not include open long/short futures contracts with an underlying face amount of approximately $105,964,000 with net unrealized depreciation of approximately $550,000. Does not include open foreign currency forward exchange contracts with net unrealized appreciation of approximately $118,000 and does not include open swap agreements with net unrealized depreciation of approximately $185,000.

The accompanying notes are an integral part of the financial statements.

15

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Core Plus Fixed Income Portfolio

Statement of Assets and Liabilities | | September 30, 2017

(000) | |

Assets: | |

Investments in Securities of Unaffiliated Issuers, at Value(1) (Cost $295,972) | | $ | 299,625 | | |

Investment in Security of Affiliated Issuer, at Value (Cost $66,270) | | | 66,270 | | |

Total Investments in Securities, at Value (Cost $362,242) | | | 365,895 | | |

Receivable for Investments Sold | | | 16,465 | | |

Interest and Paydown Receivable | | | 1,971 | | |

Receivable for Variation Margin on Futures Contracts | | | 804 | | |

Unrealized Appreciation on Foreign Currency Forward Exchange Contracts | | | 251 | | |

Receivable for Fund Shares Sold | | | 223 | | |

Receivable from Affiliate | | | 46 | | |

Due from Adviser | | | 40 | | |

Tax Reclaim Receivable | | | 21 | | |

Premium Paid on Open Swap Agreements | | | 20 | | |

Receivable for Variation Margin on Swap Agreements | | | 1 | | |

Dividends Receivable | | | — | @ | |

Other Assets | | | 72 | | |

Total Assets | | | 385,809 | | |

Liabilities: | |

Payable for Investments Purchased | | | 46,203 | | |

Collateral on Securities Loaned, at Value | | | 6,005 | | |

Payable for Trustees' Fees and Expenses | | | 164 | | |

Unrealized Depreciation on Foreign Currency Forward Exchange Contracts | | | 133 | | |

Unrealized Depreciation on Swap Agreements | | | 118 | | |

Payable for Fund Shares Redeemed | | | 76 | | |

Payable for Sub Transfer Agency Fees — Class I | | | 36 | | |

Payable for Sub Transfer Agency Fees — Class A | | | 8 | | |

Payable for Sub Transfer Agency Fees — Class L | | | — | @ | |

Payable for Sub Transfer Agency Fees — Class C | | | — | @ | |

Premium Received on Open Swap Agreements | | | 41 | | |

Payable for Custodian Fees | | | 26 | | |

Payable for Professional Fees | | | 22 | | |

Payable for Administration Fees | | | 21 | | |

Payable for Shareholder Services Fees — Class A | | | 12 | | |

Payable for Distribution and Shareholder Services Fees — Class L | | | — | @ | |

Payable for Distribution and Shareholder Services Fees — Class C | | | 4 | | |

Deferred Capital Gain Country Tax | | | 10 | | |

Payable for Transfer Agency Fees — Class I | | | 2 | | |

Payable for Transfer Agency Fees — Class A | | | 1 | | |

Payable for Transfer Agency Fees — Class L | | | 1 | | |

Payable for Transfer Agency Fees — Class C | | | 1 | | |

Other Liabilities | | | 65 | | |

Total Liabilities | | | 52,949 | | |

Net Assets | | $ | 332,860 | | |

Net Assets Consist of: | |

Paid-in-Capital | | $ | 529,207 | | |

Accumulated Undistributed Net Investment Income | | | 1,537 | | |

Accumulated Net Realized Loss | | | (200,913 | ) | |

Unrealized Appreciation (Depreciation) on: | |

Investments (Net of $10 of Deferred Capital Gain Country Tax) | | | 3,643 | | |

Futures Contracts | | | (550 | ) | |

Swap Agreements | | | (185 | ) | |

Foreign Currency Forward Exchange Contracts | | | 118 | | |

Foreign Currency Translations | | | 3 | | |

Net Assets | | $ | 332,860 | | |

The accompanying notes are an integral part of the financial statements.

16

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Core Plus Fixed Income Portfolio

Statement of Assets and Liabilities (cont'd) | | September 30, 2017

(000) | |

CLASS I: | |

Net Assets | | $ | 265,958 | | |

| Shares Outstanding (unlimited number of shares authorized, no par value) (not in 000's) | | | 23,816,526 | | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 11.17 | | |

CLASS A: | |

Net Assets | | $ | 60,874 | | |

| Shares Outstanding (unlimited number of shares authorized, no par value) (not in 000's) | | | 5,444,707 | | |

Net Asset Value, Redemption Price Per Share | | $ | 11.18 | | |

Maximum Sales Load | | | 4.25 | % | |

Maximum Sales Charge | | $ | 0.50 | | |

Maximum Offering Price Per Share | | $ | 11.68 | | |

CLASS L: | |

Net Assets | | $ | 1,138 | | |

| Shares Outstanding (unlimited number of shares authorized, no par value) (not in 000's) | | | 101,889 | | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 11.17 | | |

CLASS C: | |

Net Assets | | $ | 4,890 | | |

| Shares Outstanding (unlimited number of shares authorized, no par value) (not in 000's) | | | 440,402 | | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 11.10 | | |

(1) Including: | |

Securities on Loan, at Value: | | $ | 7,858 | | |

@ Amount is less than $500.

The accompanying notes are an integral part of the financial statements.

17

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Core Plus Fixed Income Portfolio

Statement of Operations | | Year Ended

September 30, 2017

(000) | |

Investment Income: | |

Interest from Securities of Unaffiliated Issuers (Net of $10 of Foreign Taxes Withheld) | | $ | 9,131 | | |

Dividends from Security of Affiliated Issuer (Note G) | | | 232 | | |

Income from Securities Loaned — Net | | | 26 | | |

Total Investment Income | | | 9,389 | | |

Expenses: | |

Advisory Fees (Note B) | | | 1,055 | | |

Sub Transfer Agency Fees — Class I | | | 232 | | |

Sub Transfer Agency Fees — Class A | | | 58 | | |

Sub Transfer Agency Fees — Class L | | | — | @ | |

Sub Transfer Agency Fees — Class C | | | 2 | | |

Administration Fees (Note C) | | | 225 | | |

Shareholder Services Fees — Class A (Note D) | | | 110 | | |

Distribution and Shareholder Services Fees — Class L (Note D) | | | 5 | | |

Distribution and Shareholder Services Fees — Class C (Note D) | | | 42 | | |

Professional Fees | | | 154 | | |

Registration Fees | | | 77 | | |

Custodian Fees (Note F) | | | 67 | | |

Shareholder Reporting Fees | | | 55 | | |

Pricing Fees | | | 55 | | |

Transfer Agency Fees — Class I (Note E) | | | 6 | | |

Transfer Agency Fees — Class A (Note E) | | | 4 | | |

Transfer Agency Fees — Class L (Note E) | | | 2 | | |

Transfer Agency Fees — Class C (Note E) | | | 3 | | |

Trustees' Fees and Expenses | | | 10 | | |

Other Expenses | | | 59 | | |

Total Expenses | | | 2,221 | | |

Waiver of Advisory Fees (Note B) | | | (576 | ) | |

Reimbursement of Class Specific Expenses — Class I (Note B) | | | (239 | ) | |

Reimbursement of Class Specific Expenses — Class A (Note B) | | | (18 | ) | |

Reimbursement of Class Specific Expenses — Class L (Note B) | | | (1 | ) | |

Reimbursement of Class Specific Expenses — Class C (Note B) | | | (1 | ) | |

Rebate from Morgan Stanley Affiliate (Note G) | | | (60 | ) | |

Net Expenses | | | 1,326 | | |

Net Investment Income | | | 8,063 | | |

Realized Gain (Loss): | |

Investments Sold | | | (256 | ) | |

Foreign Currency Forward Exchange Contracts | | | (440 | ) | |

Foreign Currency Transactions | | | (78 | ) | |

Futures Contracts | | | 482 | | |

Swap Agreements | | | (174 | ) | |

Net Realized Loss | | | (466 | ) | |

Change in Unrealized Appreciation (Depreciation): | |

Investments (Net of Increase in Deferred Capital Gain Country Tax of $10) | | | (1 | ) | |

Foreign Currency Forward Exchange Contracts | | | 23 | | |

Foreign Currency Translations | | | 9 | | |

Futures Contracts | | | (347 | ) | |

Swap Agreements | | | (52 | ) | |

Net Change in Unrealized Appreciation (Depreciation) | | | (368 | ) | |

Net Realized Loss and Change in Unrealized Appreciation (Depreciation) | | | (834 | ) | |

Net Increase in Net Assets Resulting from Operations | | $ | 7,229 | | |

@ Amount is less than $500.

The accompanying notes are an integral part of the financial statements.

18

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Core Plus Fixed Income Portfolio

Statements of Changes in Net Assets | | Year Ended

September 30, 2017

(000) | | Year Ended

September 30, 2016

(000) | |

Increase (Decrease) in Net Assets: | |

Operations: | |

Net Investment Income | | $ | 8,063 | | | $ | 6,334 | | |

Net Realized Gain (Loss) | | | (466 | ) | | | 14,178 | | |

Net Change in Unrealized Appreciation (Depreciation) | | | (368 | ) | | | 5,082 | | |

Net Increase in Net Assets Resulting from Operations | | | 7,229 | | | | 25,594 | | |

Distributions from and/or in Excess of: | |

Class I: | |

Net Investment Income | | | (6,968 | ) | | | (7,381 | ) | |

Class A: | |

Net Investment Income | | | (1,021 | ) | | | (245 | ) | |

Class L: | |

Net Investment Income | | | (26 | ) | | | (12 | ) | |

Class C: | |

Net Investment Income | | | (89 | ) | | | (25 | ) | |

Total Distributions | | | (8,104 | ) | | | (7,663 | ) | |

Capital Share Transactions:(1) | |

Class I: | |

Subscribed | | | 145,610 | | | | 49,744 | | |

Distributions Reinvested | | | 6,832 | | | | 7,372 | | |

Redeemed | | | (79,520 | ) | | | (76,546 | ) | |

Class A: | |

Subscribed | | | 68,634 | | | | 26,992 | | |

Distributions Reinvested | | | 1,021 | | | | 245 | | |

Redeemed | | | (32,914 | ) | | | (8,071 | ) | |

Class L: | |

Exchanged | | | 329 | | | | 517 | | |

Distributions Reinvested | | | 26 | | | | 11 | | |

Redeemed | | | (62 | ) | | | (70 | ) | |

Class C: | |

Subscribed | | | 2,739 | | | | 3,299 | | |

Distributions Reinvested | | | 87 | | | | 24 | | |

Redeemed | | | (1,463 | ) | | | (24 | ) | |

Net Increase in Net Assets Resulting from Capital Share Transactions | | | 111,319 | | | | 3,493 | | |

Total Increase in Net Assets | | | 110,444 | | | | 21,424 | | |

Net Assets: | |

Beginning of Period | | | 222,416 | | | | 200,992 | | |

End of Period (Including Accumulated Undistributed Net Investment Income of $1,537 and $2,646) | | $ | 332,860 | | | $ | 222,416 | | |

(1) Capital Share Transactions: | |

Class I: | |

Shares Subscribed | | | 13,189 | | | | 4,712 | | |

Shares Issued on Distributions Reinvested | | | 627 | | | | 721 | | |

Shares Redeemed | | | (7,289 | ) | | | (7,510 | ) | |

Net Increase (Decrease) in Class I Shares Outstanding | | | 6,527 | | | | (2,077 | ) | |

Class A: | |

Shares Subscribed | | | 6,217 | | | | 2,520 | | |

Shares Issued on Distributions Reinvested | | | 94 | | | | 23 | | |

Shares Redeemed | | | (3,009 | ) | | | (749 | ) | |

Net Increase in Class A Shares Outstanding | | | 3,302 | | | | 1,794 | | |

Class L: | |

Shares Exchanged | | | 30 | | | | 48 | | |

Shares Issued on Distributions Reinvested | | | 2 | | | | 1 | | |

Shares Redeemed | | | (5 | ) | | | (7 | ) | |

Net Increase in Class L Shares Outstanding | | | 27 | | | | 42 | | |

Class C: | |

Shares Subscribed | | | 250 | | | | 311 | | |

Shares Issued on Distributions Reinvested | | | 8 | | | | 2 | | |

Shares Redeemed | | | (134 | ) | | | (2 | ) | |

Net Increase in Class C Shares Outstanding | | | 124 | | | | 311 | | |

The accompanying notes are an integral part of the financial statements.

19

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2017

Financial Highlights

Core Plus Fixed Income Portfolio

| | | Class I | |

| | | Year Ended September 30, | |

Selected Per Share Data and Ratios | | 2017 | | 2016(1) | | 2015 | | 2014 | | 2013 | |

Net Asset Value, Beginning of Period | | $ | 11.22 | | | $ | 10.18 | | | $ | 10.36 | | | $ | 9.91 | | | $ | 10.48 | | |

Income (Loss) from Investment Operations: | |

Net Investment Income(2) | | | 0.32 | | | | 0.34 | | | | 0.33 | | | | 0.31 | | | | 0.32 | | |

Net Realized and Unrealized Gain (Loss) | | | (0.02 | ) | | | 1.11 | | | | (0.20 | ) | | | 0.45 | | | | (0.36 | ) | |

Total from Investment Operations | | | 0.30 | | | | 1.45 | | | | 0.13 | | | | 0.76 | | | | (0.04 | ) | |

Distributions from and/or in Excess of: | |

Net Investment Income | | | (0.35 | ) | | | (0.41 | ) | | | (0.31 | ) | | | (0.31 | ) | | | (0.53 | ) | |

Net Asset Value, End of Period | | $ | 11.17 | | | $ | 11.22 | | | $ | 10.18 | | | $ | 10.36 | | | $ | 9.91 | | |

Total Return(3) | | | 2.79 | %(4) | | | 14.80 | %(5) | | | 1.15 | % | | | 7.82 | % | | | (0.42 | )% | |

Ratios and Supplemental Data: | |

Net Assets, End of Period (Thousands) | | $ | 265,958 | | | $ | 193,976 | | | $ | 197,057 | | | $ | 192,868 | | | $ | 187,014 | | |

Ratio of Expenses to Average Net Assets(10) | | | 0.40 | %(6) | | | 0.43 | %(6)(7) | | | 0.51 | %(6)(8) | | | 0.61 | %(6) | | | 0.71 | %(6)(9) | |

Ratio of Net Investment Income to Average Net Assets(10) | | | 2.94 | %(6) | | | 3.31 | %(6)(7) | | | 3.24 | %(6)(8) | | | 3.02 | %(6) | | | 3.14 | %(6)(9) | |

Ratio of Rebate from Morgan Stanley Affiliates to Average Net Assets | | | 0.02 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | |

Portfolio Turnover Rate | | | 350 | % | | | 262 | % | | | 348 | % | | | 296 | % | | | 226 | % | |

(10) Supplemental Information on the Ratios to Average Net Assets: | |

Ratios Before Expense Limitation: | |

Expenses to Average Net Assets | | | 0.73 | % | | | 0.74 | % | | | 0.73 | % | | | 0.81 | % | | | 0.73 | % | |

Net Investment Income to Average Net Assets | | | 2.61 | % | | | 3.00 | % | | | 3.02 | % | | | 2.82 | % | | | 3.12 | % | |

(1) Reflects prior period custodian out-of-pocket expenses that were reimbursed in September 2016. The amount of the reimbursement was immaterial on a per share basis and did not impact the total return of Class I shares. The Ratio of Expenses to Average Net Assets and the Ratio of Net Investment Income to Average Net Assets would be unchanged as the reimbursement of custodian fees was offset against expense waivers/reimbursements with no impact to net expenses or net investment income.

(2) Per share amount is based on average shares outstanding.

(3) Calculated based on the net asset value as of the last business day of the period.

(4) Performance was positively impacted by approximately 0.46% due to the receipt of proceeds from the settlement of class action suits involving the Fund's past holdings. These were one-time settlements, and as a result, the impact on the NAV and consequently the performance will not likely be repeated in the future. Had these settlements not occurred, the total return for Class I shares would have been approximately 2.33%.

(5) Performance was positively impacted by approximately 7.72% due to the receipt of proceeds from the settlement of class action suits involving the Fund's past holdings. These were one-time settlements, and as a result, the impact on the NAV and consequently the performance will not likely be repeated in the future. Had these settlements not occurred, the total return for Class I shares would have been approximately 7.08%.

(6) The Ratios of Expenses and Net Investment Income reflect the rebate of certain Fund expenses in connection with the investments in Morgan Stanley affiliates during the period. The effect of the rebate on the ratios is disclosed in the above table as "Ratio of Rebate from Morgan Stanley Affiliates to Average Net Assets."

(7) Effective January 4, 2016, the Adviser has agreed to limit the ratio of expenses to average net assets to the maximum ratio of 0.42% for Class I shares. Prior to January 4, 2016, the maximum ratio was 0.52% for Class I shares.

(8) Effective October 6, 2014, the Adviser has agreed to limit the ratio of expenses to average net assets to the maximum ratio of 0.52% for Class I shares. Prior to October 6, 2014, the maximum ratio was 0.62% for Class I shares.

(9) Effective September 16, 2013, the Adviser has agreed to limit the ratio of expenses to average net assets to the maximum ratio of 0.62% for Class I shares.