UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03980

Morgan Stanley Institutional Fund Trust

(Exact Name of Registrant as Specified in Charter)

1585 Broadway, New York, New York 10036

(Address of Principal Executive Offices)

John H. Gernon

1585 Broadway, New York, New York 10036

(Name and Address of Agent for Services)

(212) 762-1886

(Registrant’s Telephone Number)

September 30,

Date of Fiscal Year End

September 30, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

(a)

TABLE OF CONTENTS

0000741375morganstanley:BloombergUSUniversalIndexUSD21107BroadBasedIndexMember2024-07-310000741375morganstanley:MSCIAllCountryWorldIndexUSD21046BroadBasedIndexMember2021-11-30

Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $48 | 0.45% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg U.S. Corporate Index:

↑ The portfolio’s overall investment grade credit positioning, which benefited from spreads tightening to historical levels.

↑ Overweight to high yield corporate bonds benefited as spreads tightened, particularly the overweight to financial institutions and industrials.

↑ Overweight to investment grade financial institutions, specifically banking and insurance.

↑ Overweight to certain subsectors and security selection within investment grade industrials, specifically energy and consumer cyclical.

↑ Overweight to investment grade utilities, specifically the electric sector.

↑ The portfolio’s duration exposure contributed slightly as interest rates fell during the period despite the volatility.

↓ Underweight to investment grade communications, as spreads tightened.

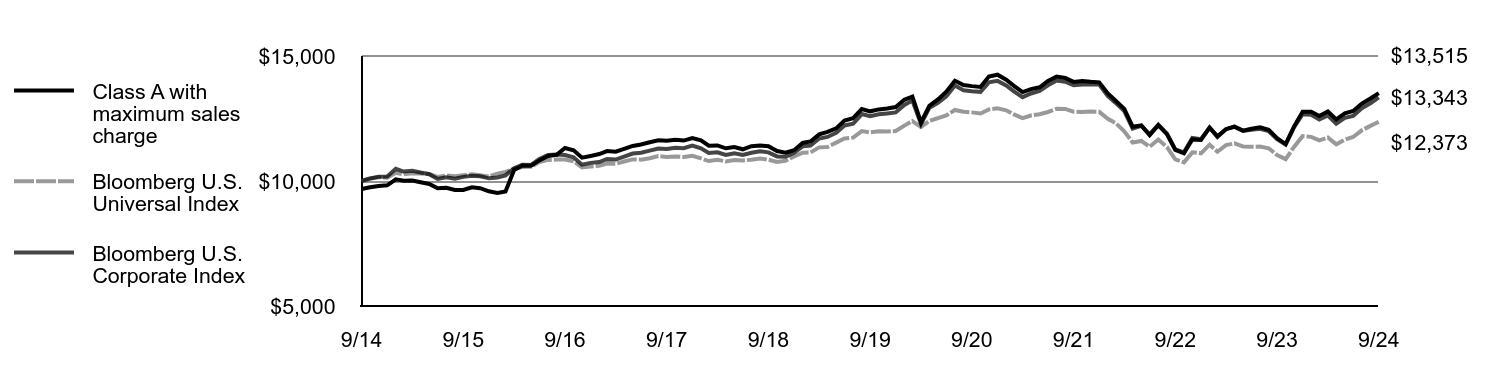

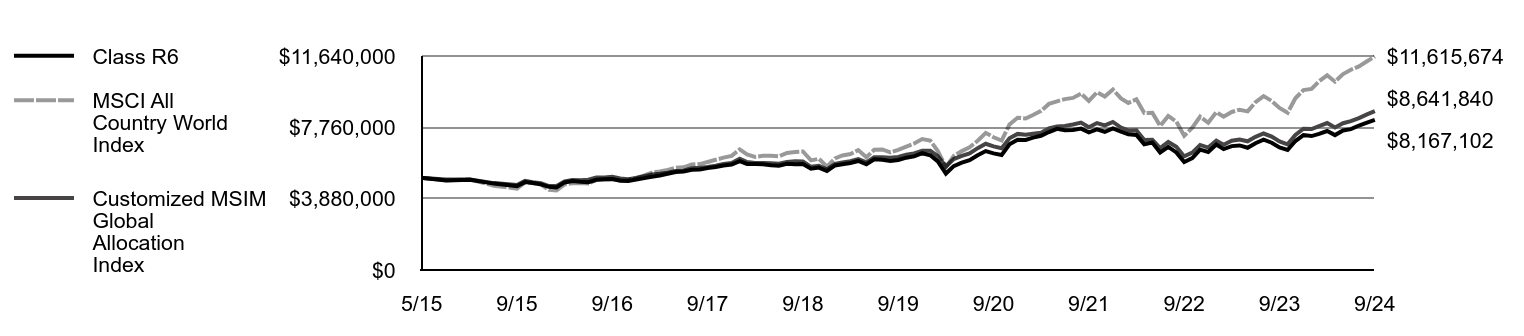

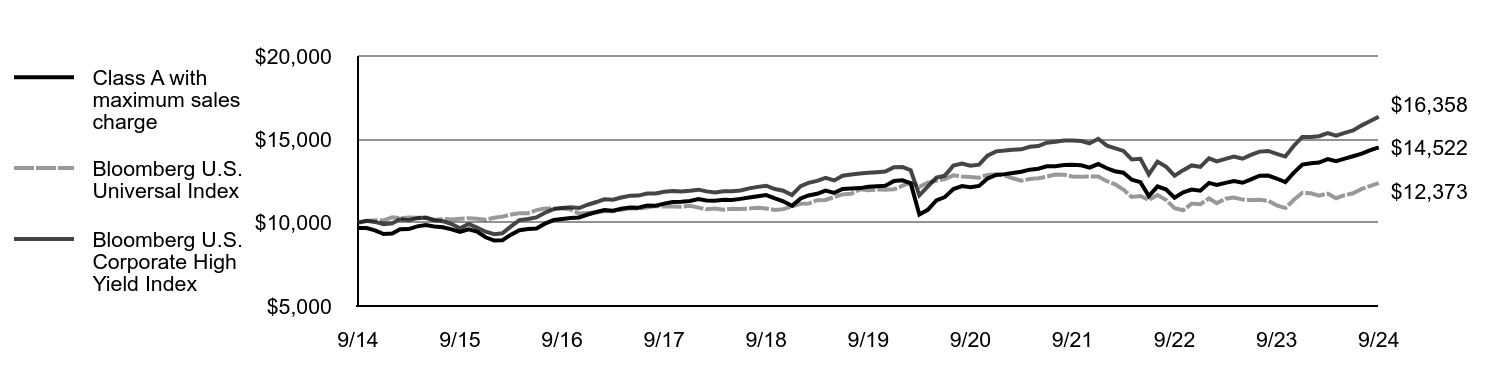

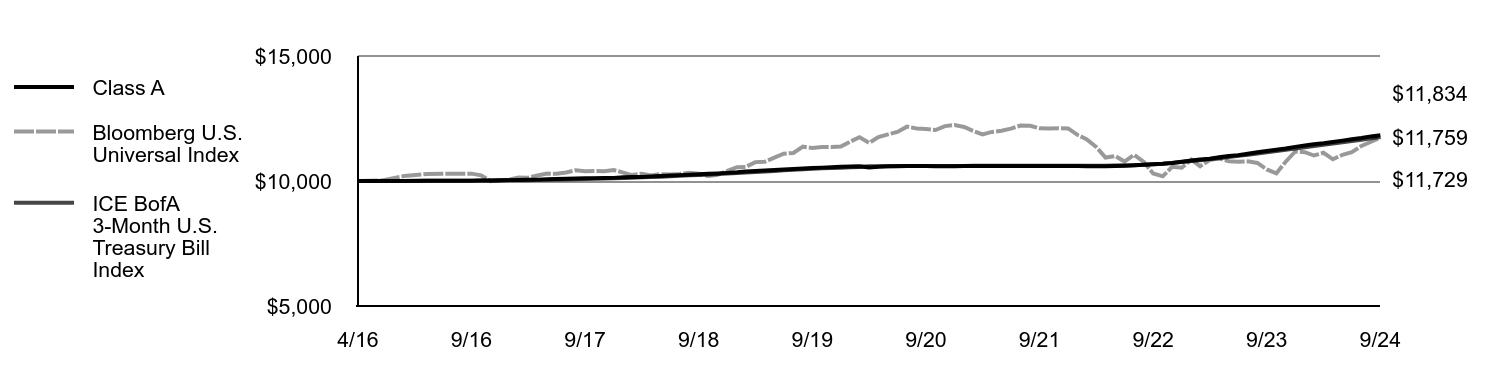

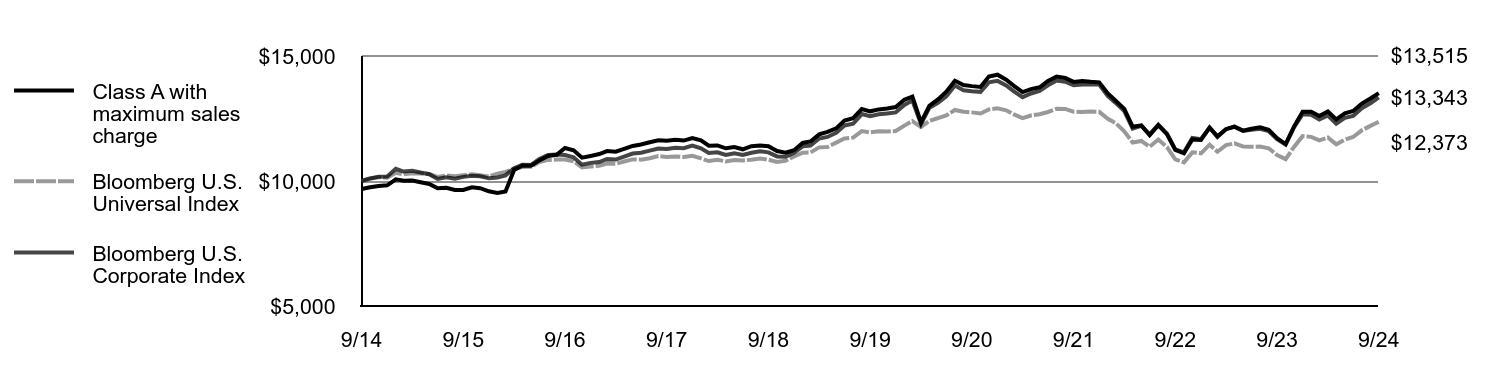

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with maximum sales charge | Bloomberg U.S. Universal Index | Bloomberg U.S. Corporate Index |

|---|

| 9/14 | $9,678 | $10,000 | $10,000 |

| 10/14 | $9,749 | $10,098 | $10,102 |

| 11/14 | $9,801 | $10,152 | $10,170 |

| 12/14 | $9,828 | $10,134 | $10,177 |

| 1/15 | $10,066 | $10,327 | $10,485 |

| 2/15 | $10,013 | $10,267 | $10,379 |

| 3/15 | $10,022 | $10,309 | $10,412 |

| 4/15 | $9,952 | $10,297 | $10,339 |

| 5/15 | $9,881 | $10,279 | $10,272 |

| 6/15 | $9,712 | $10,164 | $10,083 |

| 7/15 | $9,731 | $10,224 | $10,151 |

| 8/15 | $9,642 | $10,194 | $10,091 |

| 9/15 | $9,642 | $10,233 | $10,166 |

| 10/15 | $9,749 | $10,266 | $10,209 |

| 11/15 | $9,713 | $10,229 | $10,186 |

| 12/15 | $9,589 | $10,178 | $10,107 |

| 1/16 | $9,525 | $10,290 | $10,143 |

| 2/16 | $9,580 | $10,363 | $10,225 |

| 3/16 | $10,439 | $10,490 | $10,508 |

| 4/16 | $10,622 | $10,562 | $10,652 |

| 5/16 | $10,613 | $10,570 | $10,644 |

| 6/16 | $10,823 | $10,756 | $10,884 |

| 7/16 | $11,000 | $10,844 | $11,043 |

| 8/16 | $11,046 | $10,856 | $11,064 |

| 9/16 | $11,321 | $10,859 | $11,037 |

| 10/16 | $11,231 | $10,787 | $10,947 |

| 11/16 | $10,935 | $10,544 | $10,653 |

| 12/16 | $11,003 | $10,576 | $10,725 |

| 1/17 | $11,077 | $10,613 | $10,758 |

| 2/17 | $11,198 | $10,695 | $10,881 |

| 3/17 | $11,170 | $10,691 | $10,856 |

| 4/17 | $11,281 | $10,780 | $10,972 |

| 5/17 | $11,403 | $10,863 | $11,098 |

| 6/17 | $11,459 | $10,854 | $11,132 |

| 7/17 | $11,552 | $10,908 | $11,213 |

| 8/17 | $11,627 | $11,002 | $11,300 |

| 9/17 | $11,608 | $10,963 | $11,281 |

| 10/17 | $11,646 | $10,976 | $11,326 |

| 11/17 | $11,617 | $10,960 | $11,310 |

| 12/17 | $11,720 | $11,008 | $11,413 |

| 1/18 | $11,625 | $10,902 | $11,304 |

| 2/18 | $11,415 | $10,799 | $11,120 |

| 3/18 | $11,424 | $10,853 | $11,148 |

| 4/18 | $11,307 | $10,781 | $11,045 |

| 5/18 | $11,355 | $10,840 | $11,104 |

| 6/18 | $11,268 | $10,824 | $11,040 |

| 7/18 | $11,391 | $10,847 | $11,132 |

| 8/18 | $11,420 | $10,900 | $11,186 |

| 9/18 | $11,391 | $10,853 | $11,147 |

| 10/18 | $11,199 | $10,763 | $10,984 |

| 11/18 | $11,131 | $10,811 | $10,966 |

| 12/18 | $11,228 | $10,980 | $11,127 |

| 1/19 | $11,522 | $11,132 | $11,388 |

| 2/19 | $11,581 | $11,144 | $11,413 |

| 3/19 | $11,865 | $11,345 | $11,699 |

| 4/19 | $11,965 | $11,361 | $11,763 |

| 5/19 | $12,104 | $11,535 | $11,931 |

| 6/19 | $12,420 | $11,698 | $12,223 |

| 7/19 | $12,511 | $11,733 | $12,291 |

| 8/19 | $12,880 | $11,998 | $12,678 |

| 9/19 | $12,787 | $11,946 | $12,595 |

| 10/19 | $12,864 | $11,985 | $12,672 |

| 11/19 | $12,901 | $11,982 | $12,704 |

| 12/19 | $12,957 | $12,000 | $12,744 |

| 1/20 | $13,249 | $12,216 | $13,043 |

| 2/20 | $13,378 | $12,399 | $13,218 |

| 3/20 | $12,343 | $12,156 | $12,281 |

| 4/20 | $13,006 | $12,400 | $12,925 |

| 5/20 | $13,262 | $12,516 | $13,127 |

| 6/20 | $13,570 | $12,620 | $13,385 |

| 7/20 | $14,010 | $12,842 | $13,820 |

| 8/20 | $13,836 | $12,768 | $13,629 |

| 9/20 | $13,795 | $12,745 | $13,590 |

| 10/20 | $13,763 | $12,699 | $13,566 |

| 11/20 | $14,182 | $12,865 | $13,944 |

| 12/20 | $14,253 | $12,909 | $14,004 |

| 1/21 | $14,050 | $12,828 | $13,825 |

| 2/21 | $13,805 | $12,663 | $13,587 |

| 3/21 | $13,558 | $12,515 | $13,353 |

| 4/21 | $13,675 | $12,621 | $13,501 |

| 5/21 | $13,749 | $12,669 | $13,605 |

| 6/21 | $14,005 | $12,761 | $13,827 |

| 7/21 | $14,175 | $12,889 | $14,016 |

| 8/21 | $14,118 | $12,881 | $13,974 |

| 9/21 | $13,963 | $12,771 | $13,827 |

| 10/21 | $14,002 | $12,760 | $13,861 |

| 11/21 | $13,967 | $12,776 | $13,870 |

| 12/21 | $13,947 | $12,767 | $13,858 |

| 1/22 | $13,502 | $12,487 | $13,392 |

| 2/22 | $13,209 | $12,317 | $13,124 |

| 3/22 | $12,886 | $11,986 | $12,793 |

| 4/22 | $12,170 | $11,539 | $12,094 |

| 5/22 | $12,226 | $11,603 | $12,207 |

| 6/22 | $11,836 | $11,371 | $11,865 |

| 7/22 | $12,231 | $11,657 | $12,249 |

| 8/22 | $11,873 | $11,354 | $11,890 |

| 9/22 | $11,247 | $10,865 | $11,265 |

| 10/22 | $11,107 | $10,745 | $11,148 |

| 11/22 | $11,663 | $11,146 | $11,726 |

| 12/22 | $11,643 | $11,108 | $11,674 |

| 1/23 | $12,134 | $11,453 | $12,142 |

| 2/23 | $11,791 | $11,171 | $11,756 |

| 3/23 | $12,072 | $11,434 | $12,083 |

| 4/23 | $12,170 | $11,503 | $12,176 |

| 5/23 | $12,014 | $11,384 | $11,999 |

| 6/23 | $12,091 | $11,366 | $12,049 |

| 7/23 | $12,146 | $11,378 | $12,090 |

| 8/23 | $12,050 | $11,309 | $11,996 |

| 9/23 | $11,718 | $11,040 | $11,676 |

| 10/23 | $11,479 | $10,874 | $11,457 |

| 11/23 | $12,176 | $11,363 | $12,142 |

| 12/23 | $12,771 | $11,794 | $12,669 |

| 1/24 | $12,771 | $11,766 | $12,647 |

| 2/24 | $12,601 | $11,625 | $12,457 |

| 3/24 | $12,779 | $11,739 | $12,618 |

| 4/24 | $12,463 | $11,465 | $12,297 |

| 5/24 | $12,704 | $11,655 | $12,527 |

| 6/24 | $12,799 | $11,761 | $12,607 |

| 7/24 | $13,091 | $12,028 | $12,907 |

| 8/24 | $13,303 | $12,205 | $13,110 |

| 9/24 | $13,515 | $12,373 | $13,343 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 15.34% | 1.11% | 3.40% |

| Class A with maximum 3.25% sales charge | 11.54% | 0.45% | 3.06% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 12.08% | 0.70% | 2.15% |

| Bloomberg U.S. Corporate Index | 14.28% | 1.16% | 2.93% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $124,472,852 |

| # of Portfolio Holdings | 242 |

| Portfolio Turnover Rate | 183% |

| Total Advisory Fees Paid | $113,800 |

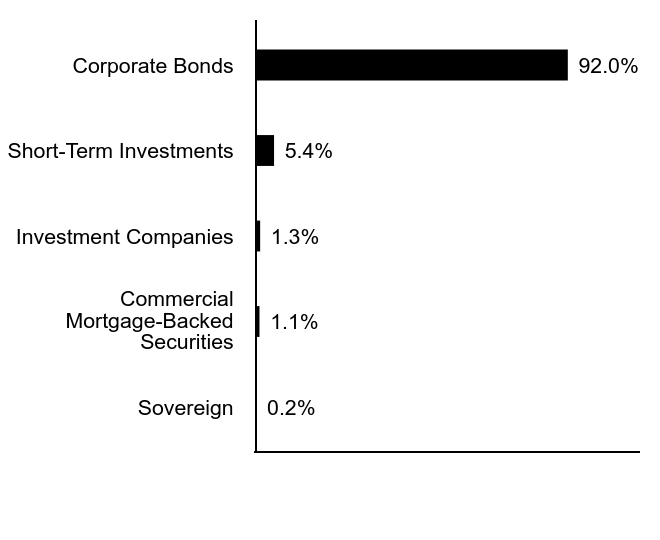

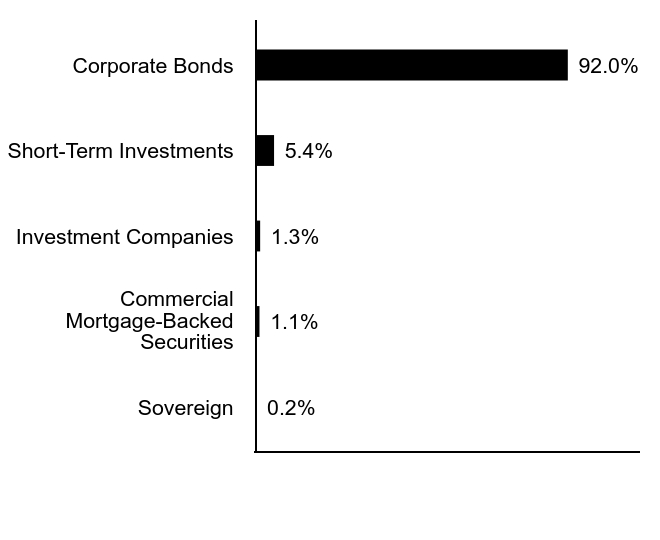

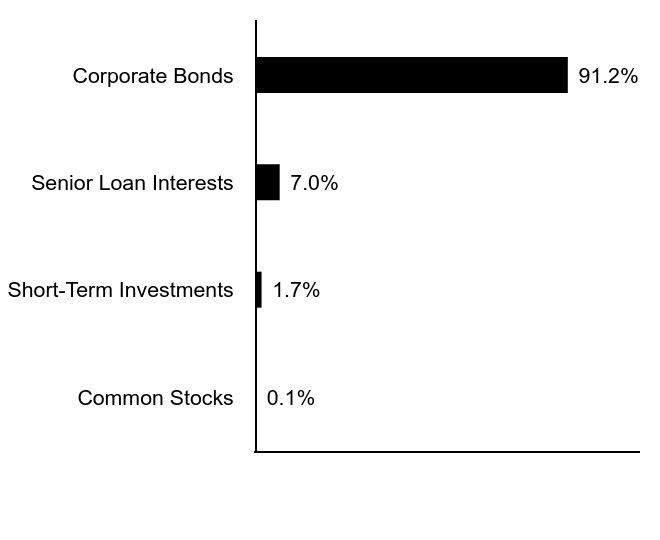

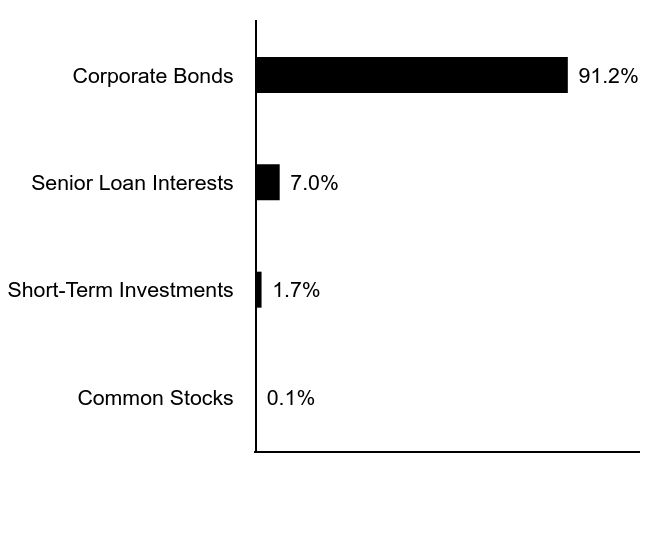

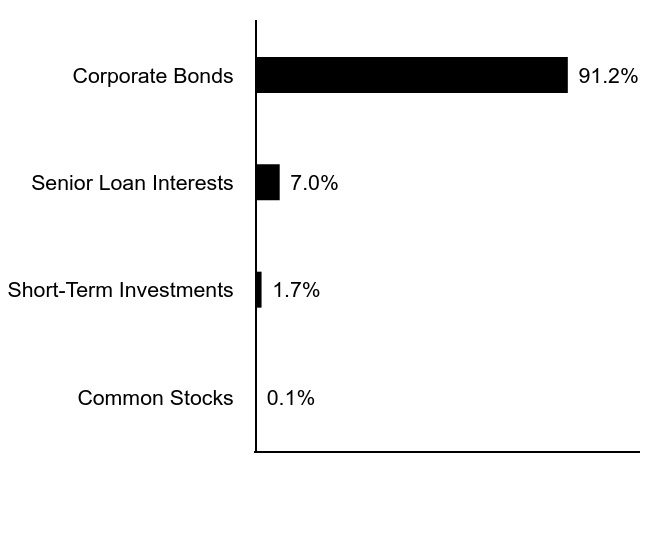

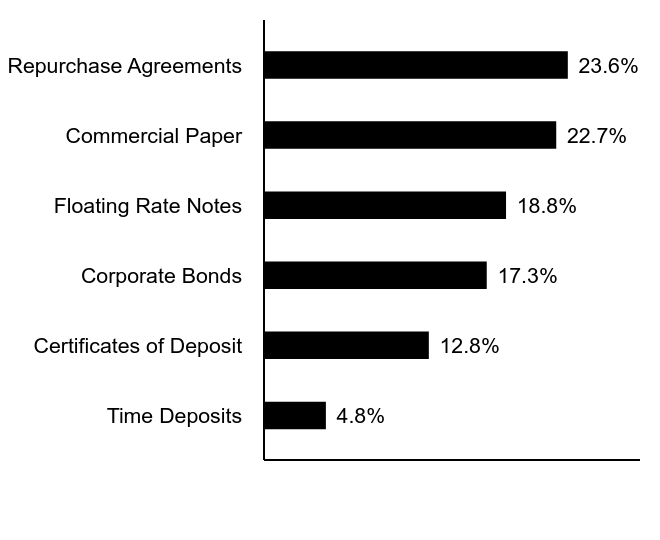

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Sovereign | 0.2% |

| Commercial Mortgage-Backed Securities | 1.1% |

| Investment Companies | 1.3% |

| Short-Term Investments | 5.4% |

| Corporate Bonds | 92.0% |

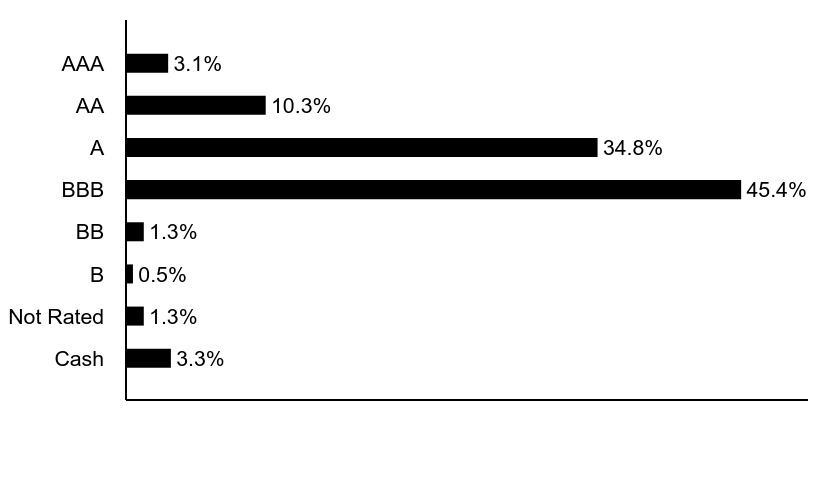

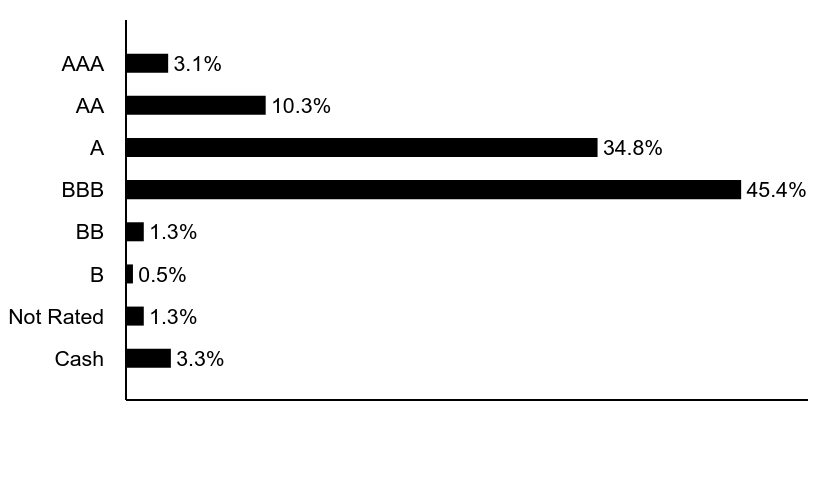

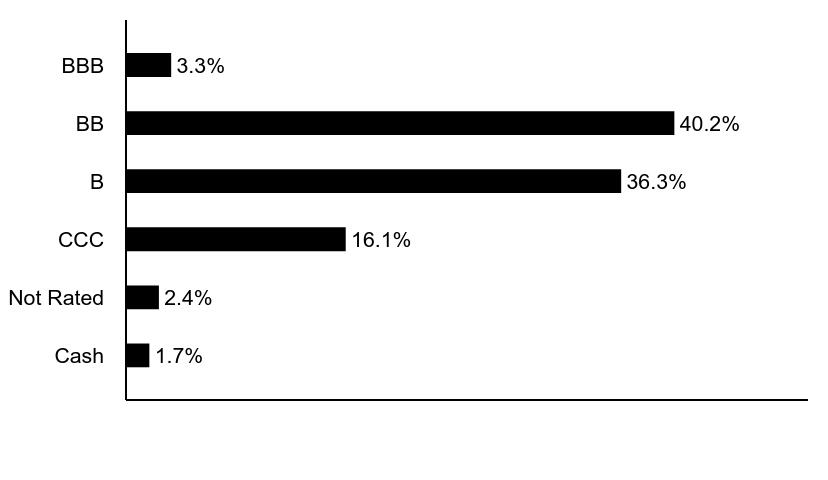

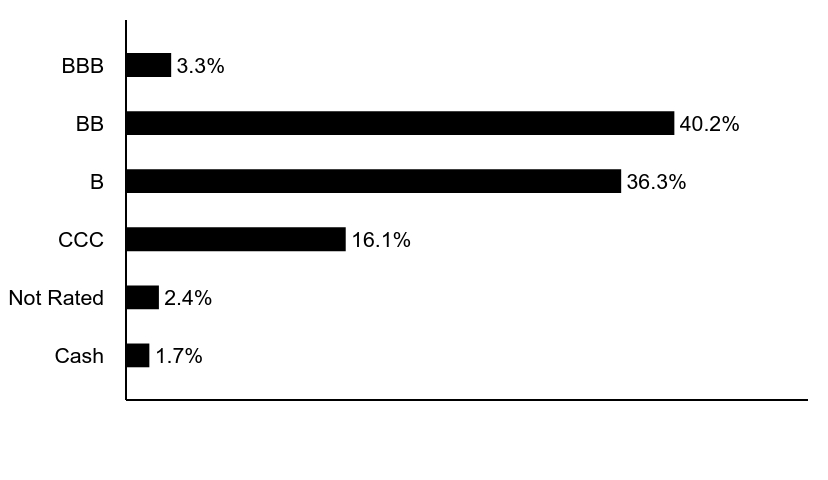

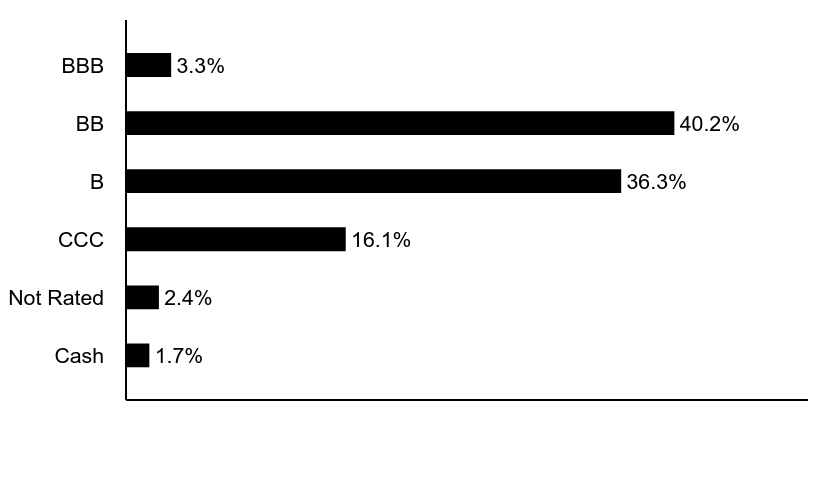

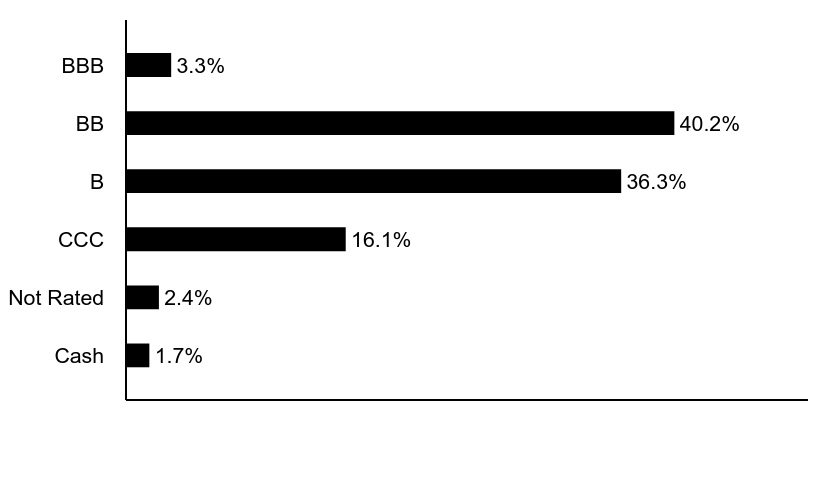

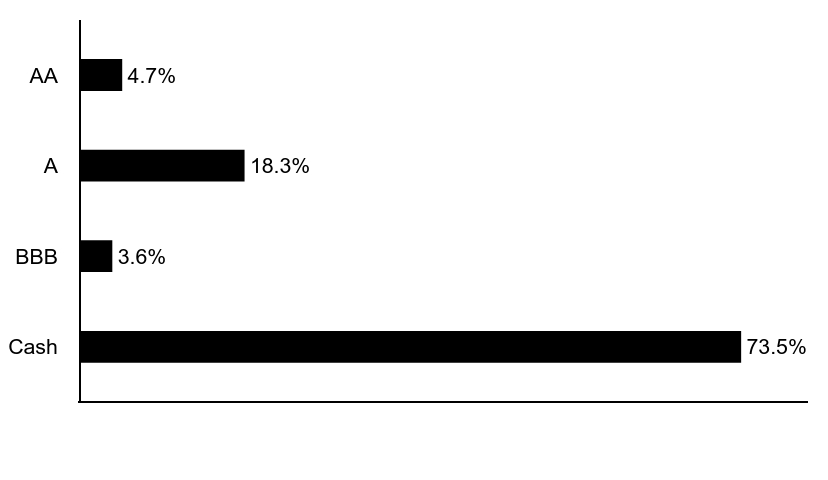

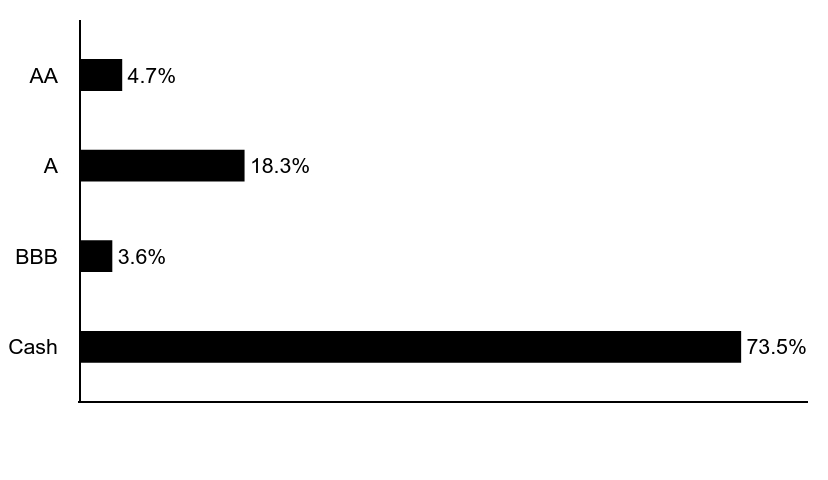

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash | 3.3% |

| Not Rated | 1.3% |

| B | 0.5% |

| BB | 1.3% |

| BBB | 45.4% |

| A | 34.8% |

| AA | 10.3% |

| AAA | 3.1% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $140 | 1.31% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg U.S. Corporate Index:

↑ The portfolio’s overall investment grade credit positioning, which benefited from spreads tightening to historical levels.

↑ Overweight to high yield corporate bonds benefited as spreads tightened, particularly the overweight to financial institutions and industrials.

↑ Overweight to investment grade financial institutions, specifically banking and insurance.

↑ Overweight to certain subsectors and security selection within investment grade industrials, specifically energy and consumer cyclical.

↑ Overweight to investment grade utilities, specifically the electric sector.

↑ The portfolio’s duration exposure contributed slightly as interest rates fell during the period despite the volatility.

↓ Underweight to investment grade communications, as spreads tightened.

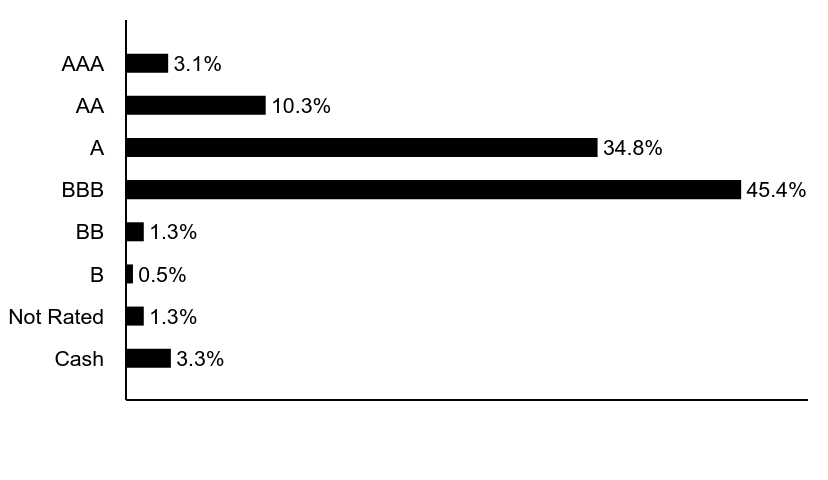

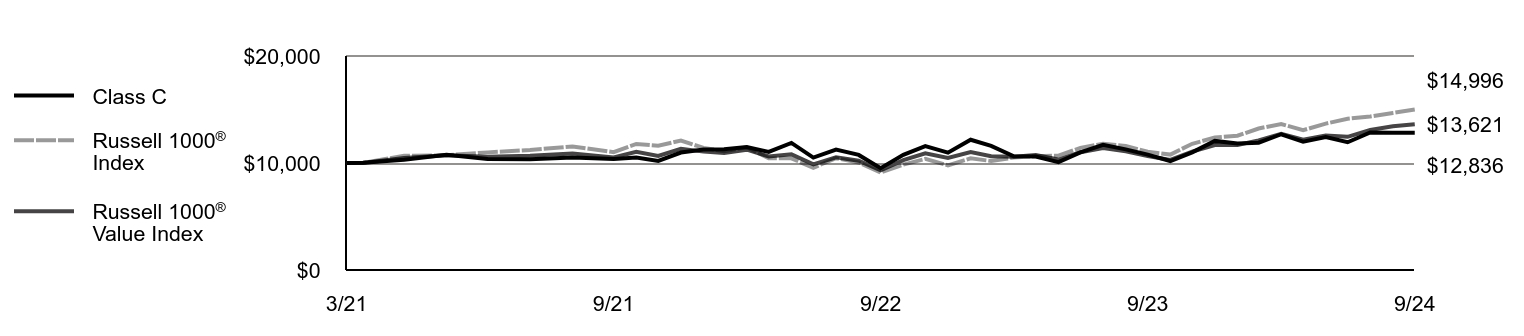

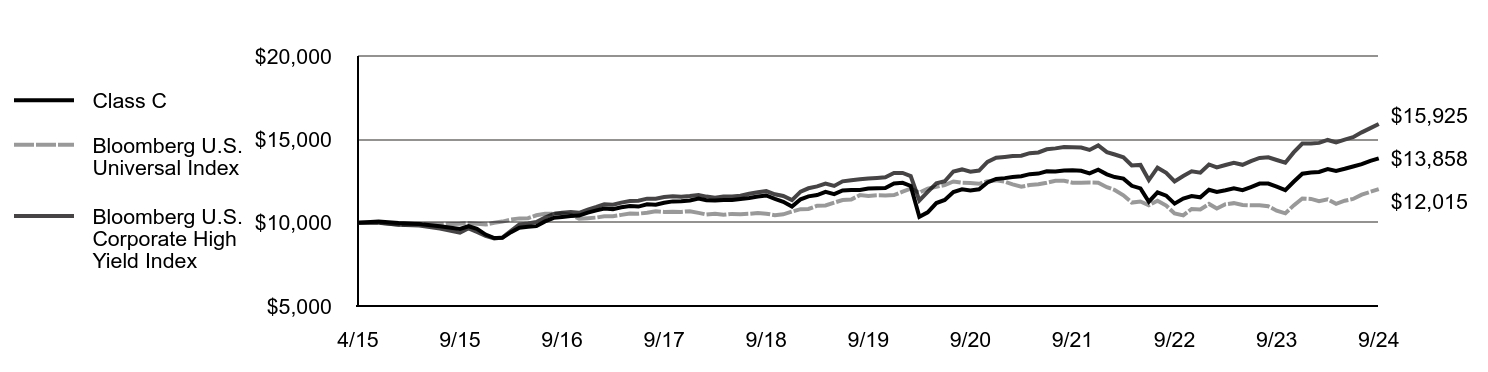

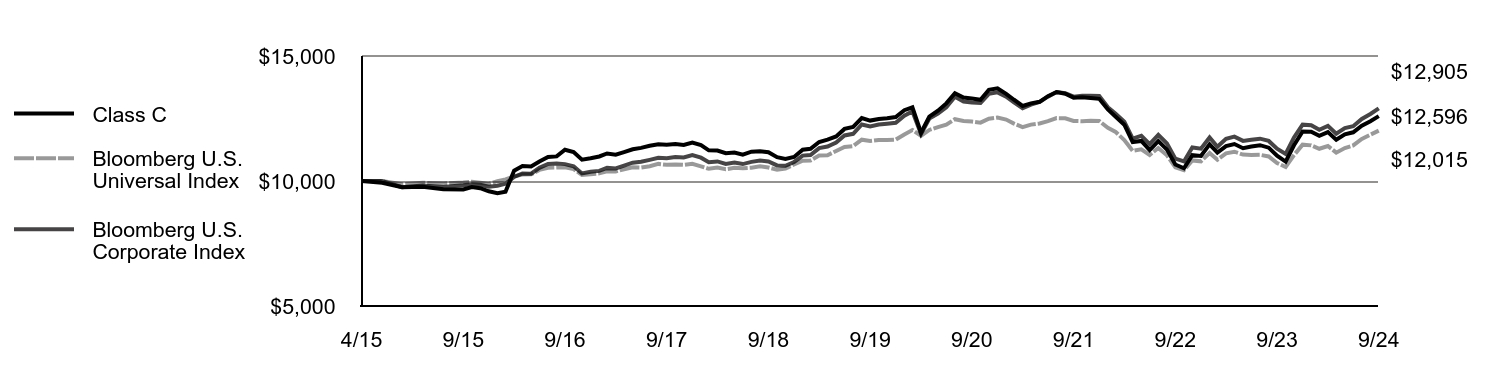

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | Bloomberg U.S. Universal Index | Bloomberg U.S. Corporate Index |

|---|

| 4/15 | $10,000 | $10,000 | $10,000 |

| 5/15 | $9,929 | $10,000 | $10,000 |

| 6/15 | $9,750 | $9,871 | $9,752 |

| 7/15 | $9,768 | $9,929 | $9,818 |

| 8/15 | $9,669 | $9,899 | $9,760 |

| 9/15 | $9,660 | $9,938 | $9,833 |

| 10/15 | $9,759 | $9,970 | $9,874 |

| 11/15 | $9,714 | $9,933 | $9,852 |

| 12/15 | $9,588 | $9,884 | $9,775 |

| 1/16 | $9,516 | $9,993 | $9,810 |

| 2/16 | $9,570 | $10,064 | $9,889 |

| 3/16 | $10,413 | $10,187 | $10,163 |

| 4/16 | $10,596 | $10,257 | $10,303 |

| 5/16 | $10,578 | $10,265 | $10,295 |

| 6/16 | $10,778 | $10,445 | $10,526 |

| 7/16 | $10,958 | $10,531 | $10,680 |

| 8/16 | $10,985 | $10,543 | $10,701 |

| 9/16 | $11,251 | $10,545 | $10,675 |

| 10/16 | $11,155 | $10,475 | $10,588 |

| 11/16 | $10,851 | $10,240 | $10,304 |

| 12/16 | $10,907 | $10,270 | $10,373 |

| 1/17 | $10,981 | $10,307 | $10,405 |

| 2/17 | $11,101 | $10,386 | $10,524 |

| 3/17 | $11,055 | $10,383 | $10,500 |

| 4/17 | $11,157 | $10,469 | $10,612 |

| 5/17 | $11,268 | $10,550 | $10,734 |

| 6/17 | $11,324 | $10,541 | $10,767 |

| 7/17 | $11,408 | $10,593 | $10,845 |

| 8/17 | $11,473 | $10,684 | $10,929 |

| 9/17 | $11,454 | $10,647 | $10,911 |

| 10/17 | $11,477 | $10,660 | $10,955 |

| 11/17 | $11,439 | $10,644 | $10,939 |

| 12/17 | $11,539 | $10,690 | $11,038 |

| 1/18 | $11,435 | $10,588 | $10,933 |

| 2/18 | $11,227 | $10,487 | $10,755 |

| 3/18 | $11,217 | $10,540 | $10,783 |

| 4/18 | $11,110 | $10,470 | $10,683 |

| 5/18 | $11,139 | $10,527 | $10,740 |

| 6/18 | $11,053 | $10,512 | $10,677 |

| 7/18 | $11,171 | $10,534 | $10,766 |

| 8/18 | $11,190 | $10,585 | $10,819 |

| 9/18 | $11,152 | $10,540 | $10,781 |

| 10/18 | $10,952 | $10,452 | $10,623 |

| 11/18 | $10,885 | $10,499 | $10,606 |

| 12/18 | $10,963 | $10,663 | $10,762 |

| 1/19 | $11,252 | $10,810 | $11,015 |

| 2/19 | $11,290 | $10,822 | $11,039 |

| 3/19 | $11,560 | $11,017 | $11,315 |

| 4/19 | $11,656 | $11,033 | $11,377 |

| 5/19 | $11,782 | $11,202 | $11,540 |

| 6/19 | $12,083 | $11,360 | $11,822 |

| 7/19 | $12,164 | $11,394 | $11,888 |

| 8/19 | $12,516 | $11,652 | $12,262 |

| 9/19 | $12,417 | $11,601 | $12,182 |

| 10/19 | $12,482 | $11,639 | $12,256 |

| 11/19 | $12,510 | $11,637 | $12,287 |

| 12/19 | $12,557 | $11,654 | $12,326 |

| 1/20 | $12,832 | $11,863 | $12,615 |

| 2/20 | $12,949 | $12,041 | $12,784 |

| 3/20 | $11,933 | $11,806 | $11,878 |

| 4/20 | $12,571 | $12,042 | $12,501 |

| 5/20 | $12,813 | $12,155 | $12,697 |

| 6/20 | $13,104 | $12,256 | $12,945 |

| 7/20 | $13,513 | $12,471 | $13,366 |

| 8/20 | $13,336 | $12,399 | $13,182 |

| 9/20 | $13,297 | $12,377 | $13,144 |

| 10/20 | $13,250 | $12,333 | $13,121 |

| 11/20 | $13,647 | $12,494 | $13,486 |

| 12/20 | $13,705 | $12,537 | $13,545 |

| 1/21 | $13,488 | $12,458 | $13,371 |

| 2/21 | $13,250 | $12,297 | $13,141 |

| 3/21 | $13,003 | $12,154 | $12,915 |

| 4/21 | $13,105 | $12,256 | $13,058 |

| 5/21 | $13,167 | $12,303 | $13,159 |

| 6/21 | $13,394 | $12,393 | $13,373 |

| 7/21 | $13,558 | $12,517 | $13,556 |

| 8/21 | $13,493 | $12,509 | $13,515 |

| 9/21 | $13,334 | $12,402 | $13,373 |

| 10/21 | $13,352 | $12,392 | $13,406 |

| 11/21 | $13,318 | $12,407 | $13,414 |

| 12/21 | $13,288 | $12,399 | $13,404 |

| 1/22 | $12,861 | $12,127 | $12,952 |

| 2/22 | $12,571 | $11,961 | $12,693 |

| 3/22 | $12,253 | $11,640 | $12,373 |

| 4/22 | $11,558 | $11,206 | $11,697 |

| 5/22 | $11,604 | $11,268 | $11,806 |

| 6/22 | $11,233 | $11,043 | $11,475 |

| 7/22 | $11,594 | $11,320 | $11,847 |

| 8/22 | $11,255 | $11,026 | $11,499 |

| 9/22 | $10,661 | $10,551 | $10,895 |

| 10/22 | $10,511 | $10,435 | $10,782 |

| 11/22 | $11,034 | $10,824 | $11,341 |

| 12/22 | $11,000 | $10,788 | $11,291 |

| 1/23 | $11,468 | $11,122 | $11,743 |

| 2/23 | $11,134 | $10,849 | $11,370 |

| 3/23 | $11,394 | $11,104 | $11,686 |

| 4/23 | $11,479 | $11,171 | $11,776 |

| 5/23 | $11,312 | $11,056 | $11,605 |

| 6/23 | $11,377 | $11,038 | $11,653 |

| 7/23 | $11,433 | $11,049 | $11,693 |

| 8/23 | $11,333 | $10,983 | $11,603 |

| 9/23 | $11,011 | $10,721 | $11,293 |

| 10/23 | $10,778 | $10,560 | $11,081 |

| 11/23 | $11,431 | $11,035 | $11,744 |

| 12/23 | $11,978 | $11,454 | $12,253 |

| 1/24 | $11,967 | $11,426 | $12,232 |

| 2/24 | $11,809 | $11,289 | $12,048 |

| 3/24 | $11,957 | $11,400 | $12,204 |

| 4/24 | $11,650 | $11,134 | $11,893 |

| 5/24 | $11,868 | $11,318 | $12,116 |

| 6/24 | $11,948 | $11,422 | $12,193 |

| 7/24 | $12,214 | $11,681 | $12,484 |

| 8/24 | $12,393 | $11,853 | $12,680 |

| 9/24 | $12,596 | $12,015 | $12,905 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since 4/30/15 (Inception) |

|---|

| Class C | 14.39% | 0.29% | 2.48% |

| Class C with maximum deferred sales charge | 13.39% | 0.29% | 2.48% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 12.08% | 0.70% | 2.75% |

| Bloomberg U.S. Corporate Index | 14.28% | 1.16% | 2.48% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $124,472,852 |

| # of Portfolio Holdings | 242 |

| Portfolio Turnover Rate | 183% |

| Total Advisory Fees Paid | $113,800 |

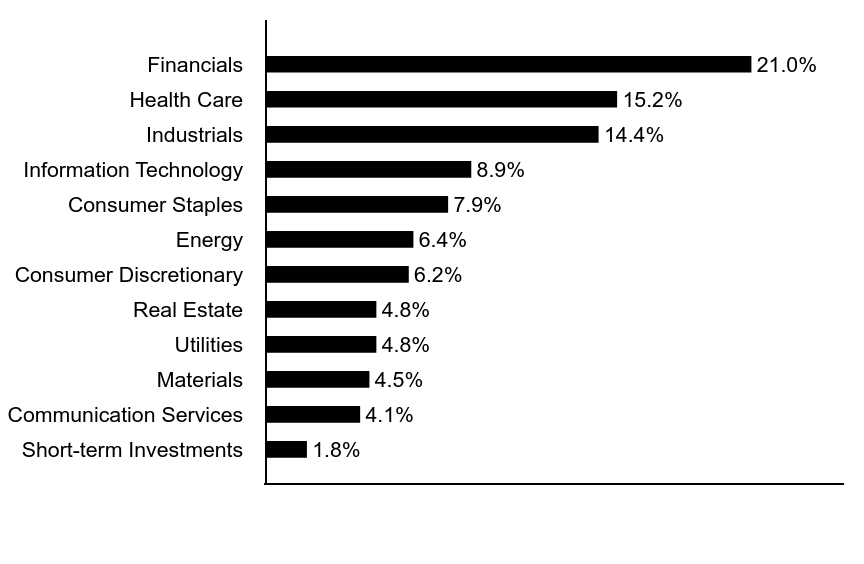

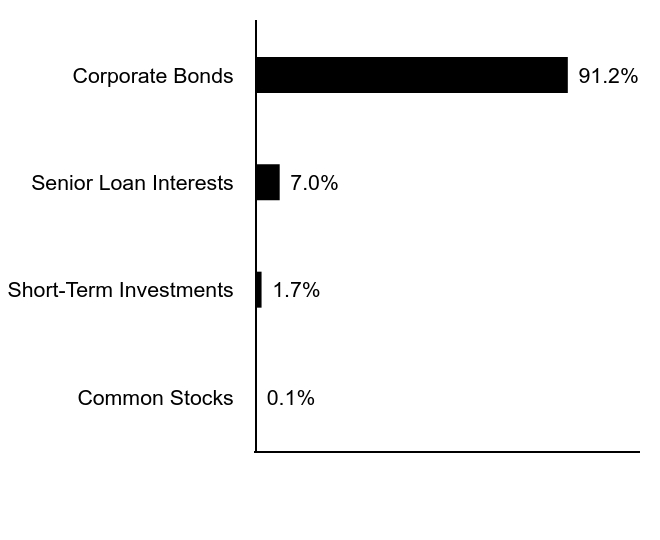

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Sovereign | 0.2% |

| Commercial Mortgage-Backed Securities | 1.1% |

| Investment Companies | 1.3% |

| Short-Term Investments | 5.4% |

| Corporate Bonds | 92.0% |

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash | 3.3% |

| Not Rated | 1.3% |

| B | 0.5% |

| BB | 1.3% |

| BBB | 45.4% |

| A | 34.8% |

| AA | 10.3% |

| AAA | 3.1% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $22 | 0.20% |

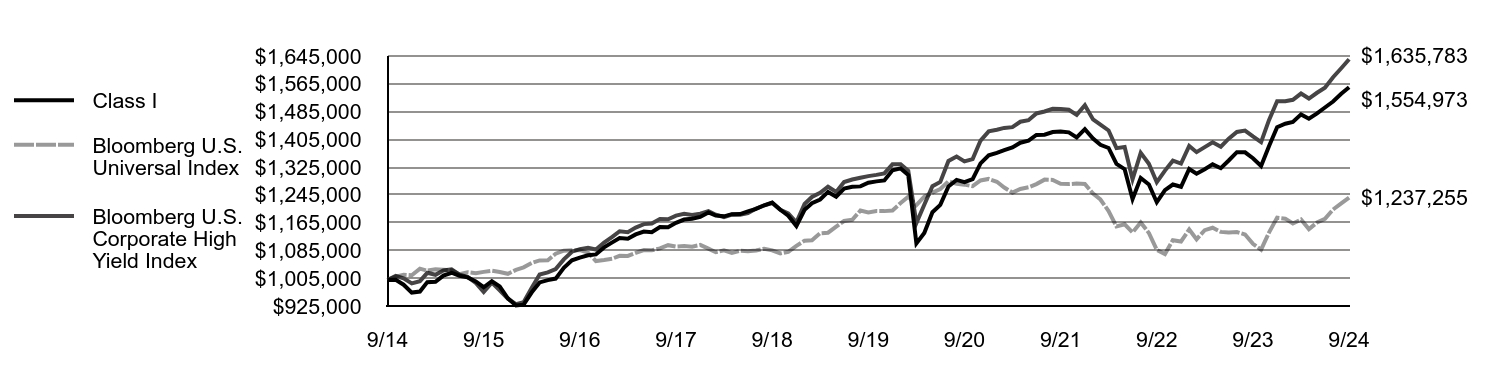

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg U.S. Corporate Index:

↑ The portfolio’s overall investment grade credit positioning, which benefited from spreads tightening to historical levels.

↑ Overweight to high yield corporate bonds benefited as spreads tightened, particularly the overweight to financial institutions and industrials.

↑ Overweight to investment grade financial institutions, specifically banking and insurance.

↑ Overweight to certain subsectors and security selection within investment grade industrials, specifically energy and consumer cyclical.

↑ Overweight to investment grade utilities, specifically the electric sector.

↑ The portfolio’s duration exposure contributed slightly as interest rates fell during the period despite the volatility.

↓ Underweight to investment grade communications, as spreads tightened.

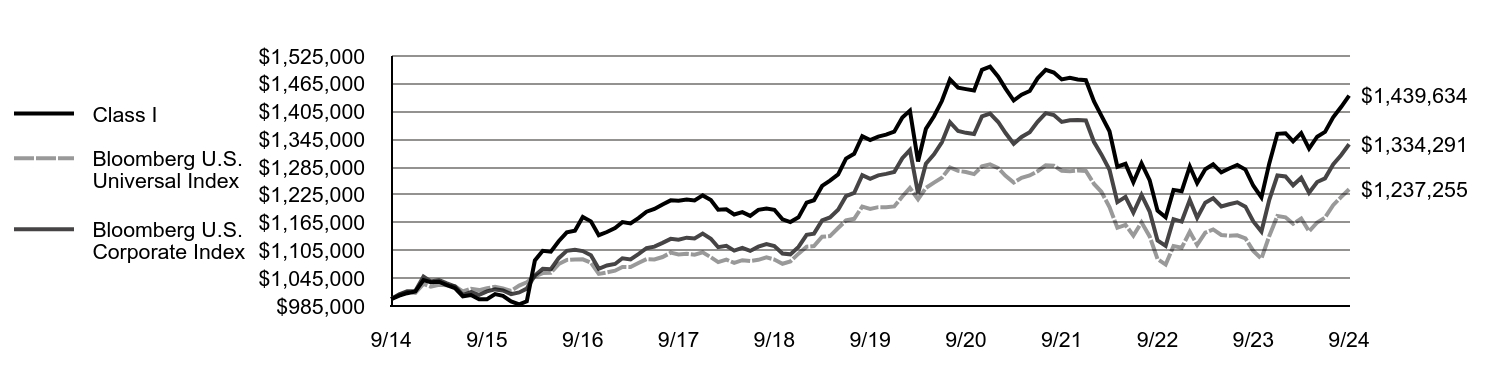

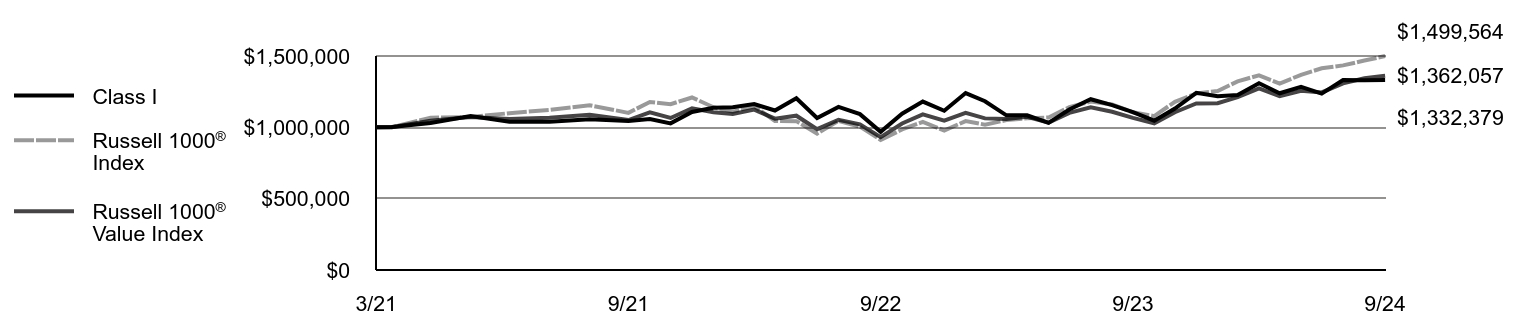

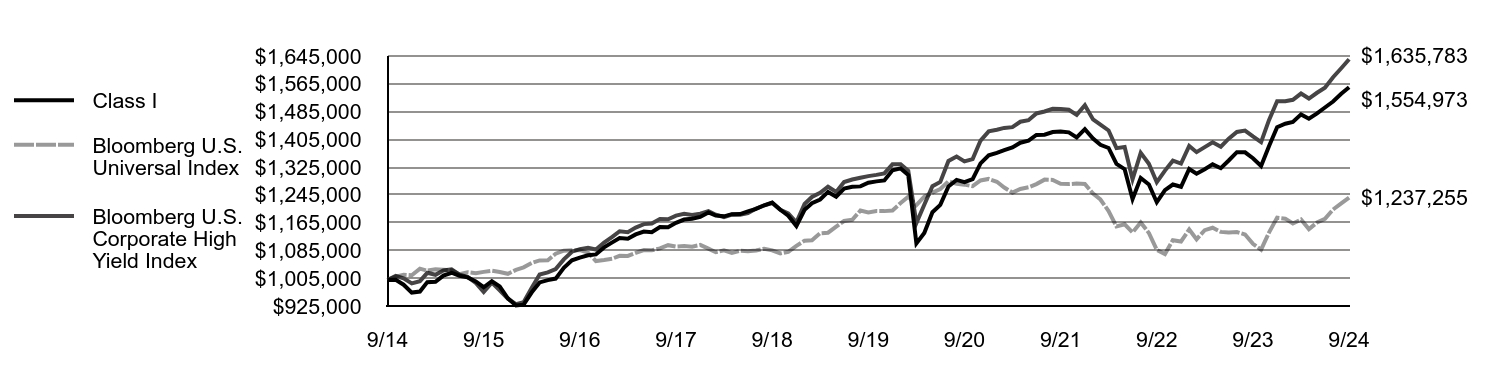

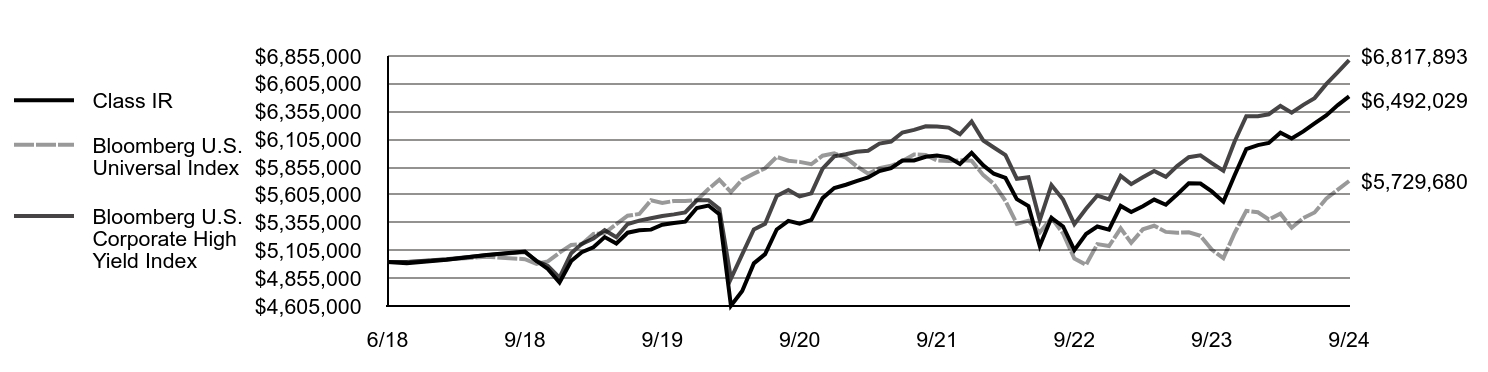

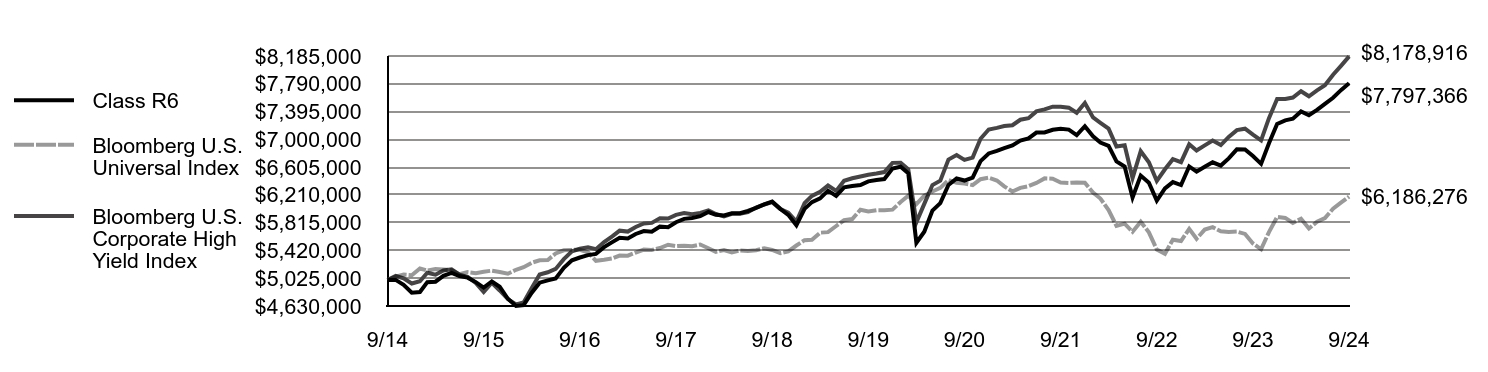

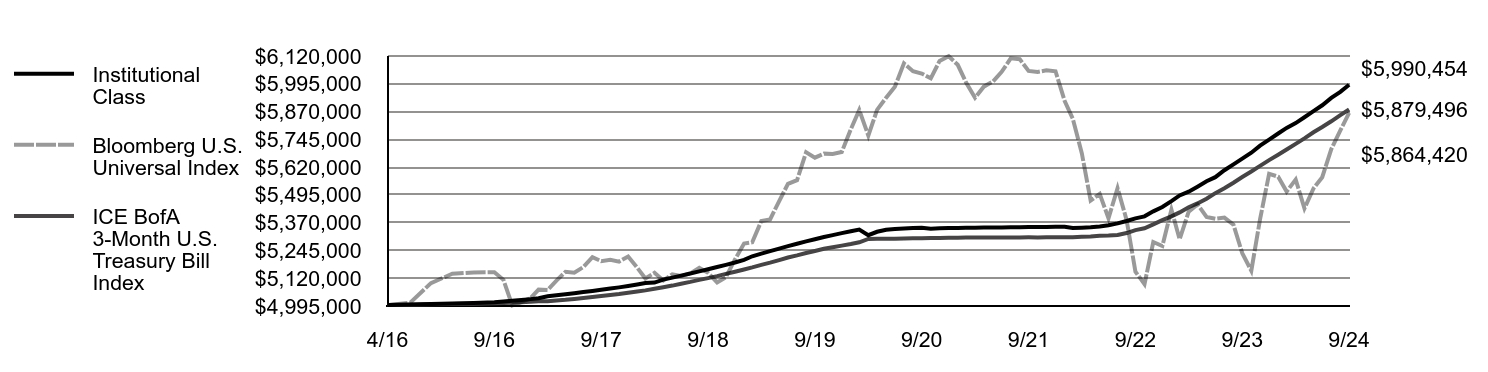

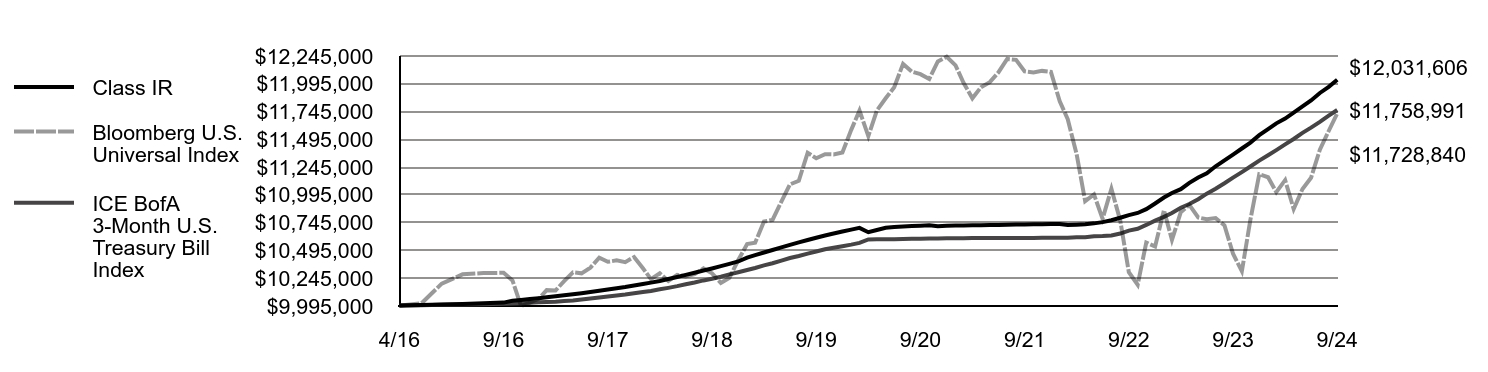

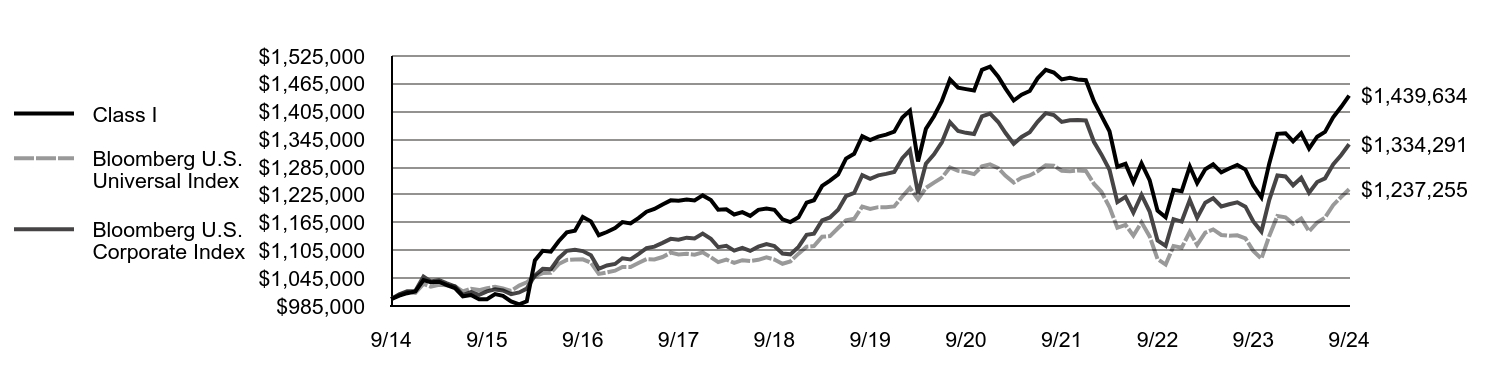

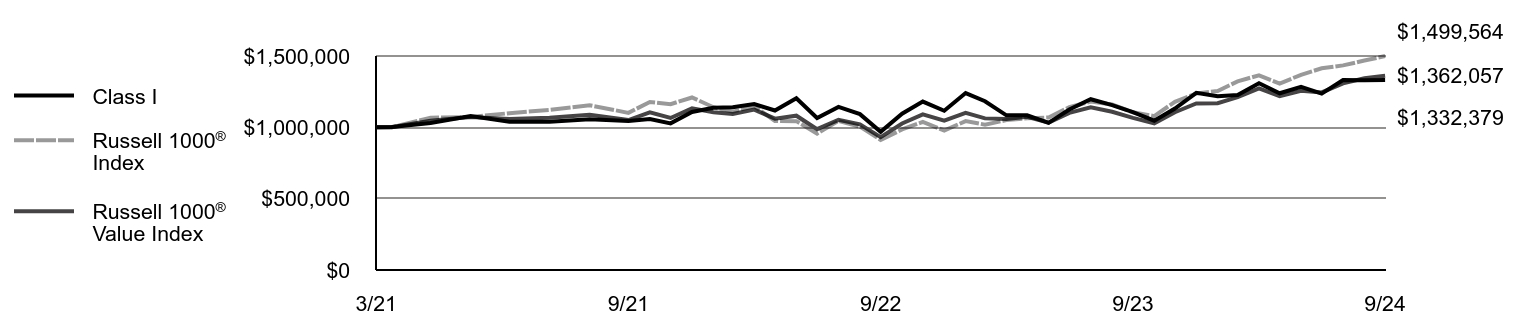

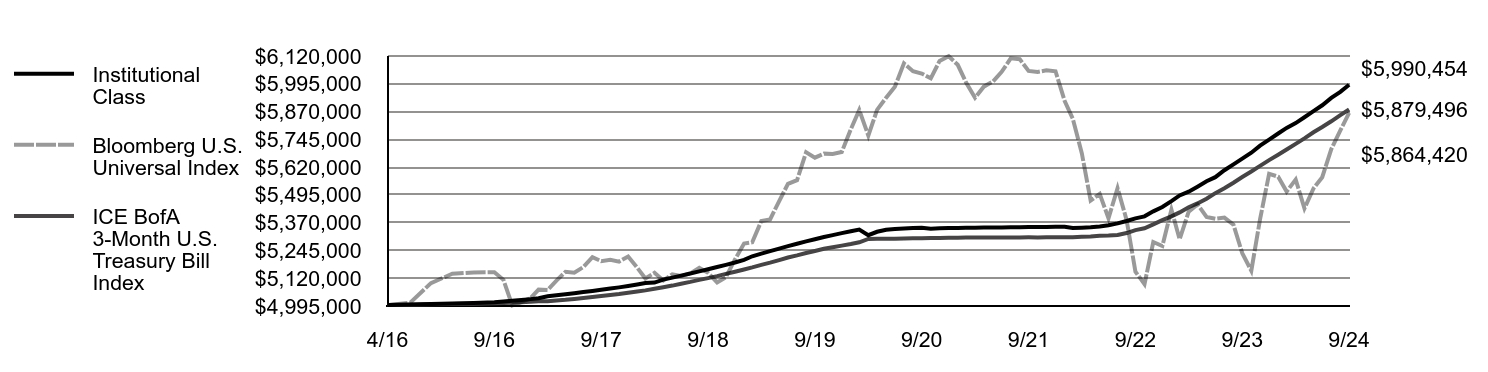

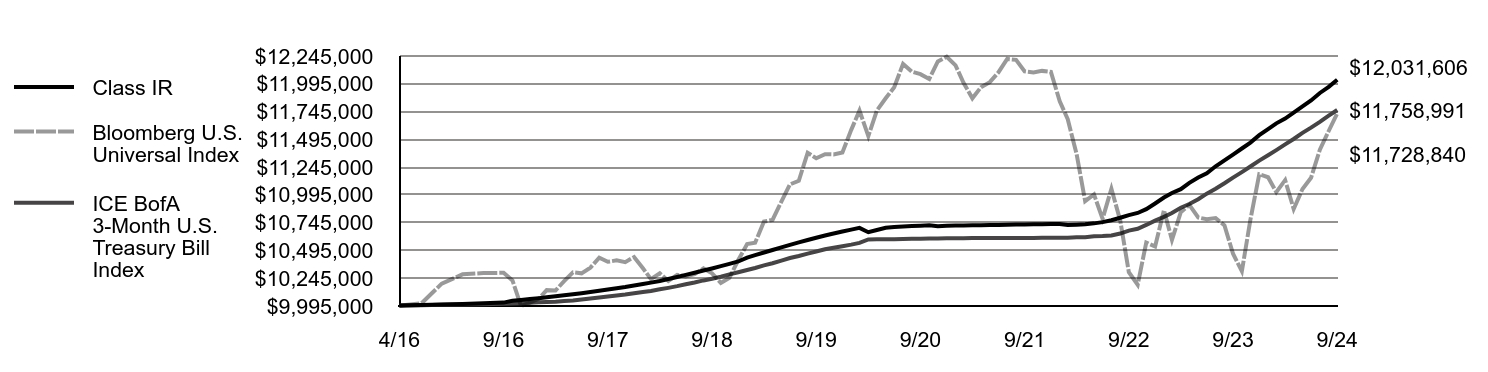

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Bloomberg U.S. Universal Index | Bloomberg U.S. Corporate Index |

|---|

| 9/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 10/14 | $1,007,220 | $1,009,792 | $1,010,237 |

| 11/14 | $1,012,655 | $1,015,242 | $1,017,043 |

| 12/14 | $1,016,317 | $1,013,408 | $1,017,662 |

| 1/15 | $1,040,950 | $1,032,698 | $1,048,535 |

| 2/15 | $1,036,388 | $1,026,679 | $1,037,910 |

| 3/15 | $1,037,300 | $1,030,917 | $1,041,222 |

| 4/15 | $1,029,937 | $1,029,721 | $1,033,931 |

| 5/15 | $1,023,506 | $1,027,919 | $1,027,182 |

| 6/15 | $1,006,049 | $1,016,447 | $1,008,303 |

| 7/15 | $1,008,840 | $1,022,366 | $1,015,109 |

| 8/15 | $999,584 | $1,019,354 | $1,009,101 |

| 9/15 | $999,584 | $1,023,344 | $1,016,622 |

| 10/15 | $1,010,760 | $1,026,615 | $1,020,872 |

| 11/15 | $1,007,030 | $1,022,871 | $1,018,639 |

| 12/15 | $994,908 | $1,017,761 | $1,010,697 |

| 1/16 | $988,326 | $1,028,996 | $1,014,281 |

| 2/16 | $994,908 | $1,036,306 | $1,022,471 |

| 3/16 | $1,083,303 | $1,049,006 | $1,050,834 |

| 4/16 | $1,104,131 | $1,056,153 | $1,065,222 |

| 5/16 | $1,102,236 | $1,056,978 | $1,064,398 |

| 6/16 | $1,124,982 | $1,075,586 | $1,088,358 |

| 7/16 | $1,143,994 | $1,084,449 | $1,104,261 |

| 8/16 | $1,147,814 | $1,085,619 | $1,106,423 |

| 9/16 | $1,177,416 | $1,085,877 | $1,103,682 |

| 10/16 | $1,167,825 | $1,078,673 | $1,094,703 |

| 11/16 | $1,138,004 | $1,054,427 | $1,065,336 |

| 12/16 | $1,144,841 | $1,057,560 | $1,072,465 |

| 1/17 | $1,153,566 | $1,061,291 | $1,075,769 |

| 2/17 | $1,166,168 | $1,069,479 | $1,088,108 |

| 3/17 | $1,163,260 | $1,069,121 | $1,085,577 |

| 4/17 | $1,174,958 | $1,077,992 | $1,097,178 |

| 5/17 | $1,188,632 | $1,086,309 | $1,109,793 |

| 6/17 | $1,194,492 | $1,085,388 | $1,113,186 |

| 7/17 | $1,204,331 | $1,090,794 | $1,121,326 |

| 8/17 | $1,213,187 | $1,100,205 | $1,130,033 |

| 9/17 | $1,212,203 | $1,096,333 | $1,128,073 |

| 10/17 | $1,215,162 | $1,097,650 | $1,132,627 |

| 11/17 | $1,213,179 | $1,095,989 | $1,130,977 |

| 12/17 | $1,223,877 | $1,100,820 | $1,141,296 |

| 1/18 | $1,213,894 | $1,090,227 | $1,130,383 |

| 2/18 | $1,192,931 | $1,079,889 | $1,112,034 |

| 3/18 | $1,193,929 | $1,085,336 | $1,114,850 |

| 4/18 | $1,182,639 | $1,078,094 | $1,104,507 |

| 5/18 | $1,187,668 | $1,083,973 | $1,110,424 |

| 6/18 | $1,179,622 | $1,082,401 | $1,103,972 |

| 7/18 | $1,192,753 | $1,084,667 | $1,113,151 |

| 8/18 | $1,195,785 | $1,090,010 | $1,118,648 |

| 9/18 | $1,192,753 | $1,085,340 | $1,114,658 |

| 10/18 | $1,172,355 | $1,076,261 | $1,098,382 |

| 11/18 | $1,166,239 | $1,081,101 | $1,096,552 |

| 12/18 | $1,176,478 | $1,098,015 | $1,112,679 |

| 1/19 | $1,208,358 | $1,113,155 | $1,138,850 |

| 2/19 | $1,213,500 | $1,114,368 | $1,141,319 |

| 3/19 | $1,244,351 | $1,134,491 | $1,169,909 |

| 4/19 | $1,255,784 | $1,136,079 | $1,176,259 |

| 5/19 | $1,269,265 | $1,153,482 | $1,193,115 |

| 6/19 | $1,303,485 | $1,169,797 | $1,222,295 |

| 7/19 | $1,313,905 | $1,173,279 | $1,229,132 |

| 8/19 | $1,351,871 | $1,199,827 | $1,267,786 |

| 9/19 | $1,343,461 | $1,194,629 | $1,259,540 |

| 10/19 | $1,350,826 | $1,198,489 | $1,267,184 |

| 11/19 | $1,355,059 | $1,198,249 | $1,270,375 |

| 12/19 | $1,361,394 | $1,200,035 | $1,274,439 |

| 1/20 | $1,392,142 | $1,221,573 | $1,304,324 |

| 2/20 | $1,407,035 | $1,239,864 | $1,321,775 |

| 3/20 | $1,297,307 | $1,215,645 | $1,228,122 |

| 4/20 | $1,367,499 | $1,239,996 | $1,292,515 |

| 5/20 | $1,394,896 | $1,251,577 | $1,312,733 |

| 6/20 | $1,427,688 | $1,262,020 | $1,338,468 |

| 7/20 | $1,474,383 | $1,284,189 | $1,381,978 |

| 8/20 | $1,456,411 | $1,276,784 | $1,362,922 |

| 9/20 | $1,453,481 | $1,274,483 | $1,359,022 |

| 10/20 | $1,450,568 | $1,269,928 | $1,356,576 |

| 11/20 | $1,494,995 | $1,286,499 | $1,394,370 |

| 12/20 | $1,501,780 | $1,290,942 | $1,400,442 |

| 1/21 | $1,480,439 | $1,282,828 | $1,382,473 |

| 2/21 | $1,454,677 | $1,266,275 | $1,358,655 |

| 3/21 | $1,428,877 | $1,251,539 | $1,335,342 |

| 4/21 | $1,441,394 | $1,262,063 | $1,350,134 |

| 5/21 | $1,449,416 | $1,266,877 | $1,360,507 |

| 6/21 | $1,476,704 | $1,276,113 | $1,382,701 |

| 7/21 | $1,494,961 | $1,288,927 | $1,401,627 |

| 8/21 | $1,489,276 | $1,288,066 | $1,397,386 |

| 9/21 | $1,474,479 | $1,277,067 | $1,382,677 |

| 10/21 | $1,477,892 | $1,276,023 | $1,386,105 |

| 11/21 | $1,474,469 | $1,277,564 | $1,386,959 |

| 12/21 | $1,472,808 | $1,276,703 | $1,385,848 |

| 1/22 | $1,426,930 | $1,248,712 | $1,339,198 |

| 2/22 | $1,396,288 | $1,231,687 | $1,312,412 |

| 3/22 | $1,362,372 | $1,198,643 | $1,279,318 |

| 4/22 | $1,285,782 | $1,153,936 | $1,209,366 |

| 5/22 | $1,292,015 | $1,160,286 | $1,220,656 |

| 6/22 | $1,252,219 | $1,137,100 | $1,186,479 |

| 7/22 | $1,293,280 | $1,165,689 | $1,224,887 |

| 8/22 | $1,256,889 | $1,135,386 | $1,188,969 |

| 9/22 | $1,190,952 | $1,086,469 | $1,126,482 |

| 10/22 | $1,176,489 | $1,074,548 | $1,114,833 |

| 11/22 | $1,235,800 | $1,114,614 | $1,172,562 |

| 12/22 | $1,233,002 | $1,110,828 | $1,167,417 |

| 1/23 | $1,286,347 | $1,145,286 | $1,214,193 |

| 2/23 | $1,250,302 | $1,117,145 | $1,175,570 |

| 3/23 | $1,280,427 | $1,143,352 | $1,208,301 |

| 4/23 | $1,291,107 | $1,150,337 | $1,217,552 |

| 5/23 | $1,273,603 | $1,138,410 | $1,199,919 |

| 6/23 | $1,282,056 | $1,136,641 | $1,204,856 |

| 7/23 | $1,289,513 | $1,137,771 | $1,209,012 |

| 8/23 | $1,279,622 | $1,130,920 | $1,199,619 |

| 9/23 | $1,244,719 | $1,103,953 | $1,167,596 |

| 10/23 | $1,219,735 | $1,087,351 | $1,145,732 |

| 11/23 | $1,292,972 | $1,136,287 | $1,214,225 |

| 12/23 | $1,356,973 | $1,179,403 | $1,266,867 |

| 1/24 | $1,358,242 | $1,176,580 | $1,264,712 |

| 2/24 | $1,340,411 | $1,162,474 | $1,245,701 |

| 3/24 | $1,358,333 | $1,173,887 | $1,261,807 |

| 4/24 | $1,324,917 | $1,146,456 | $1,229,697 |

| 5/24 | $1,350,744 | $1,165,459 | $1,252,731 |

| 6/24 | $1,361,076 | $1,176,114 | $1,260,698 |

| 7/24 | $1,392,438 | $1,202,809 | $1,290,748 |

| 8/24 | $1,415,319 | $1,220,515 | $1,311,047 |

| 9/24 | $1,439,634 | $1,237,255 | $1,334,291 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 15.66% | 1.39% | 3.71% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 12.08% | 0.70% | 2.15% |

| Bloomberg U.S. Corporate Index | 14.28% | 1.16% | 2.93% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $124,472,852 |

| # of Portfolio Holdings | 242 |

| Portfolio Turnover Rate | 183% |

| Total Advisory Fees Paid | $113,800 |

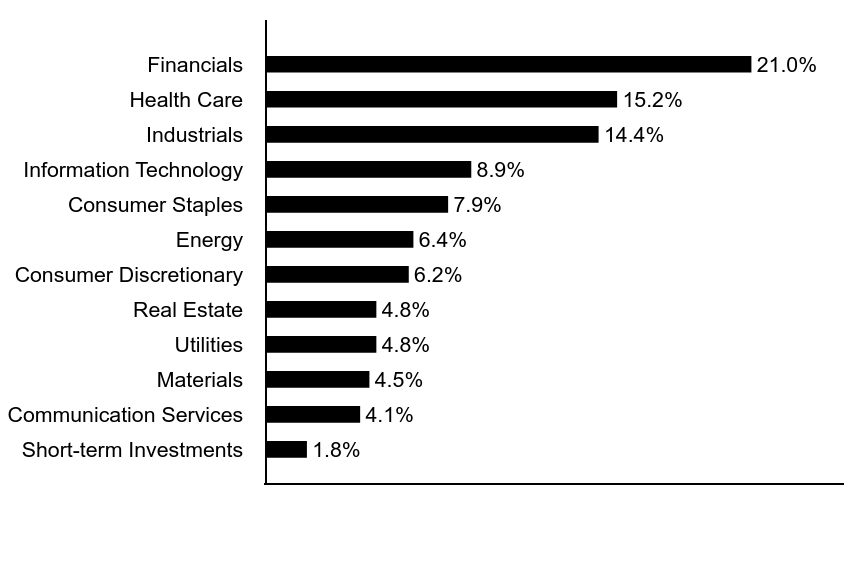

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Sovereign | 0.2% |

| Commercial Mortgage-Backed Securities | 1.1% |

| Investment Companies | 1.3% |

| Short-Term Investments | 5.4% |

| Corporate Bonds | 92.0% |

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash | 3.3% |

| Not Rated | 1.3% |

| B | 0.5% |

| BB | 1.3% |

| BBB | 45.4% |

| A | 34.8% |

| AA | 10.3% |

| AAA | 3.1% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Morgan Stanley Institutional Fund Trust - Corporate Bond Portfolio for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class L | $100 | 0.93% |

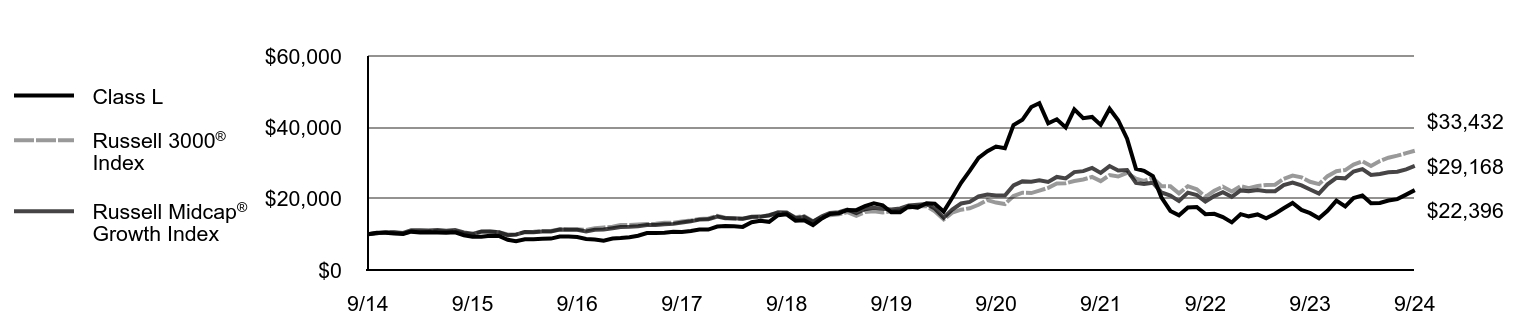

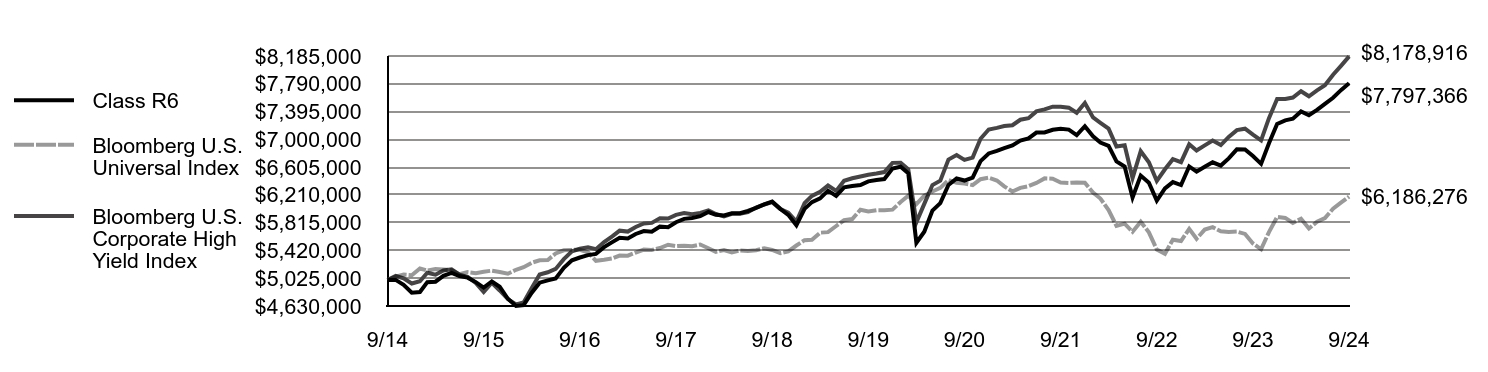

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg U.S. Corporate Index:

↑ The portfolio’s overall investment grade credit positioning, which benefited from spreads tightening to historical levels.

↑ Overweight to high yield corporate bonds benefited as spreads tightened, particularly the overweight to financial institutions and industrials.

↑ Overweight to investment grade financial institutions, specifically banking and insurance.

↑ Overweight to certain subsectors and security selection within investment grade industrials, specifically energy and consumer cyclical.

↑ Overweight to investment grade utilities, specifically the electric sector.

↑ The portfolio’s duration exposure contributed slightly as interest rates fell during the period despite the volatility.

↓ Underweight to investment grade communications, as spreads tightened.

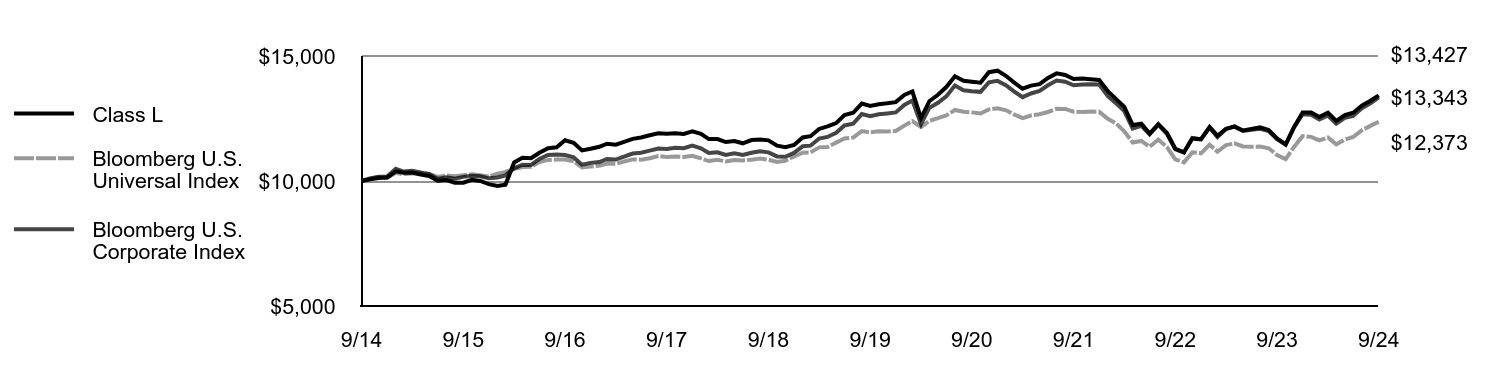

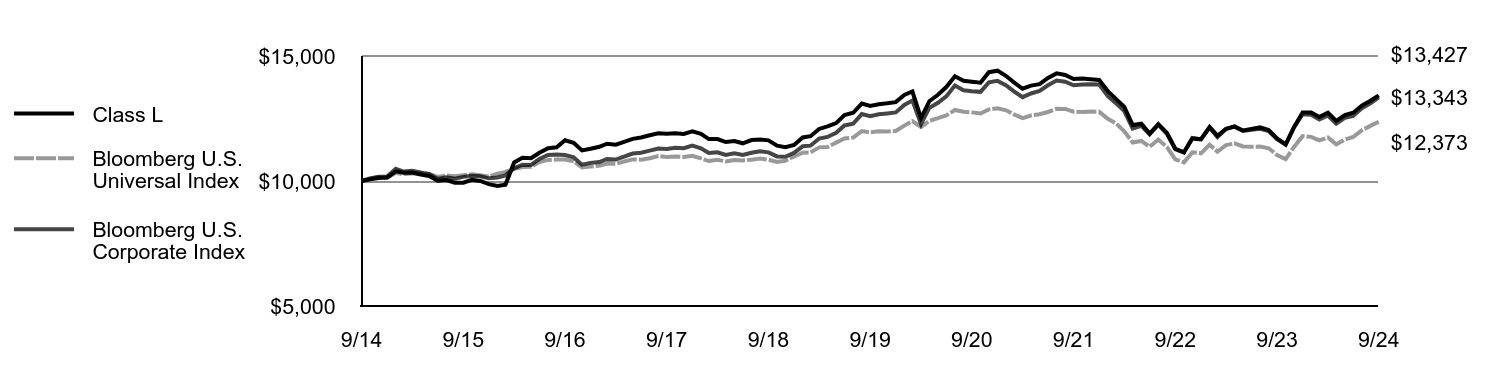

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class L | Bloomberg U.S. Universal Index | Bloomberg U.S. Corporate Index |

|---|

| 9/14 | $10,000 | $10,000 | $10,000 |

| 10/14 | $10,066 | $10,098 | $10,102 |

| 11/14 | $10,120 | $10,152 | $10,170 |

| 12/14 | $10,141 | $10,134 | $10,177 |

| 1/15 | $10,387 | $10,327 | $10,485 |

| 2/15 | $10,332 | $10,267 | $10,379 |

| 3/15 | $10,341 | $10,309 | $10,412 |

| 4/15 | $10,262 | $10,297 | $10,339 |

| 5/15 | $10,198 | $10,279 | $10,272 |

| 6/15 | $10,015 | $10,164 | $10,083 |

| 7/15 | $10,037 | $10,224 | $10,151 |

| 8/15 | $9,935 | $10,194 | $10,091 |

| 9/15 | $9,935 | $10,233 | $10,166 |

| 10/15 | $10,048 | $10,266 | $10,209 |

| 11/15 | $10,001 | $10,229 | $10,186 |

| 12/15 | $9,874 | $10,178 | $10,107 |

| 1/16 | $9,800 | $10,290 | $10,143 |

| 2/16 | $9,856 | $10,363 | $10,225 |

| 3/16 | $10,742 | $10,490 | $10,508 |

| 4/16 | $10,932 | $10,562 | $10,652 |

| 5/16 | $10,914 | $10,570 | $10,644 |

| 6/16 | $11,129 | $10,756 | $10,884 |

| 7/16 | $11,309 | $10,844 | $11,043 |

| 8/16 | $11,347 | $10,856 | $11,064 |

| 9/16 | $11,630 | $10,859 | $11,037 |

| 10/16 | $11,526 | $10,787 | $10,947 |

| 11/16 | $11,222 | $10,544 | $10,653 |

| 12/16 | $11,290 | $10,576 | $10,725 |

| 1/17 | $11,367 | $10,613 | $10,758 |

| 2/17 | $11,491 | $10,695 | $10,881 |

| 3/17 | $11,453 | $10,691 | $10,856 |

| 4/17 | $11,569 | $10,780 | $10,972 |

| 5/17 | $11,684 | $10,863 | $11,098 |

| 6/17 | $11,742 | $10,854 | $11,132 |

| 7/17 | $11,829 | $10,908 | $11,213 |

| 8/17 | $11,906 | $11,002 | $11,300 |

| 9/17 | $11,887 | $10,963 | $11,281 |

| 10/17 | $11,914 | $10,976 | $11,326 |

| 11/17 | $11,885 | $10,960 | $11,310 |

| 12/17 | $11,990 | $11,008 | $11,413 |

| 1/18 | $11,882 | $10,902 | $11,304 |

| 2/18 | $11,677 | $10,799 | $11,120 |

| 3/18 | $11,677 | $10,853 | $11,148 |

| 4/18 | $11,557 | $10,781 | $11,045 |

| 5/18 | $11,597 | $10,840 | $11,104 |

| 6/18 | $11,508 | $10,824 | $11,040 |

| 7/18 | $11,636 | $10,847 | $11,132 |

| 8/18 | $11,655 | $10,900 | $11,186 |

| 9/18 | $11,626 | $10,853 | $11,147 |

| 10/18 | $11,414 | $10,763 | $10,984 |

| 11/18 | $11,354 | $10,811 | $10,966 |

| 12/18 | $11,444 | $10,980 | $11,127 |

| 1/19 | $11,744 | $11,132 | $11,388 |

| 2/19 | $11,793 | $11,144 | $11,413 |

| 3/19 | $12,083 | $11,345 | $11,699 |

| 4/19 | $12,185 | $11,361 | $11,763 |

| 5/19 | $12,315 | $11,535 | $11,931 |

| 6/19 | $12,637 | $11,698 | $12,223 |

| 7/19 | $12,729 | $11,733 | $12,291 |

| 8/19 | $13,099 | $11,998 | $12,678 |

| 9/19 | $13,000 | $11,946 | $12,595 |

| 10/19 | $13,073 | $11,985 | $12,672 |

| 11/19 | $13,107 | $11,982 | $12,704 |

| 12/19 | $13,155 | $12,000 | $12,744 |

| 1/20 | $13,442 | $12,216 | $13,043 |

| 2/20 | $13,579 | $12,399 | $13,218 |

| 3/20 | $12,513 | $12,156 | $12,281 |

| 4/20 | $13,192 | $12,400 | $12,925 |

| 5/20 | $13,448 | $12,516 | $13,127 |

| 6/20 | $13,757 | $12,620 | $13,385 |

| 7/20 | $14,188 | $12,842 | $13,820 |

| 8/20 | $14,007 | $12,768 | $13,629 |

| 9/20 | $13,970 | $12,745 | $13,590 |

| 10/20 | $13,933 | $12,699 | $13,566 |

| 11/20 | $14,353 | $12,865 | $13,944 |

| 12/20 | $14,413 | $12,909 | $14,004 |

| 1/21 | $14,198 | $12,828 | $13,825 |

| 2/21 | $13,944 | $12,663 | $13,587 |

| 3/21 | $13,690 | $12,515 | $13,353 |

| 4/21 | $13,814 | $12,621 | $13,501 |

| 5/21 | $13,873 | $12,669 | $13,605 |

| 6/21 | $14,126 | $12,761 | $13,827 |

| 7/21 | $14,304 | $12,889 | $14,016 |

| 8/21 | $14,242 | $12,881 | $13,974 |

| 9/21 | $14,081 | $12,771 | $13,827 |

| 10/21 | $14,104 | $12,760 | $13,861 |

| 11/21 | $14,074 | $12,776 | $13,870 |

| 12/21 | $14,043 | $12,767 | $13,858 |

| 1/22 | $13,595 | $12,487 | $13,392 |

| 2/22 | $13,295 | $12,317 | $13,124 |

| 3/22 | $12,965 | $11,986 | $12,793 |

| 4/22 | $12,239 | $11,539 | $12,094 |

| 5/22 | $12,291 | $11,603 | $12,207 |

| 6/22 | $11,894 | $11,371 | $11,865 |

| 7/22 | $12,276 | $11,657 | $12,249 |

| 8/22 | $11,922 | $11,354 | $11,890 |

| 9/22 | $11,289 | $10,865 | $11,265 |

| 10/22 | $11,143 | $10,745 | $11,148 |

| 11/22 | $11,697 | $11,146 | $11,726 |

| 12/22 | $11,667 | $11,108 | $11,674 |

| 1/23 | $12,160 | $11,453 | $12,142 |

| 2/23 | $11,812 | $11,171 | $11,756 |

| 3/23 | $12,089 | $11,434 | $12,083 |

| 4/23 | $12,182 | $11,503 | $12,176 |

| 5/23 | $12,020 | $11,384 | $11,999 |

| 6/23 | $12,081 | $11,366 | $12,049 |

| 7/23 | $12,143 | $11,378 | $12,090 |

| 8/23 | $12,041 | $11,309 | $11,996 |

| 9/23 | $11,704 | $11,040 | $11,676 |

| 10/23 | $11,461 | $10,874 | $11,457 |

| 11/23 | $12,153 | $11,363 | $12,142 |

| 12/23 | $12,737 | $11,794 | $12,669 |

| 1/24 | $12,737 | $11,766 | $12,647 |

| 2/24 | $12,561 | $11,625 | $12,457 |

| 3/24 | $12,733 | $11,739 | $12,618 |

| 4/24 | $12,400 | $11,465 | $12,297 |

| 5/24 | $12,633 | $11,655 | $12,527 |

| 6/24 | $12,733 | $11,761 | $12,607 |

| 7/24 | $13,018 | $12,028 | $12,907 |

| 8/24 | $13,210 | $12,205 | $13,110 |

| 9/24 | $13,427 | $12,373 | $13,343 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class L | 14.71% | 0.65% | 2.99% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 12.08% | 0.70% | 2.15% |

| Bloomberg U.S. Corporate Index | 14.28% | 1.16% | 2.93% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $124,472,852 |

| # of Portfolio Holdings | 242 |

| Portfolio Turnover Rate | 183% |

| Total Advisory Fees Paid | $113,800 |

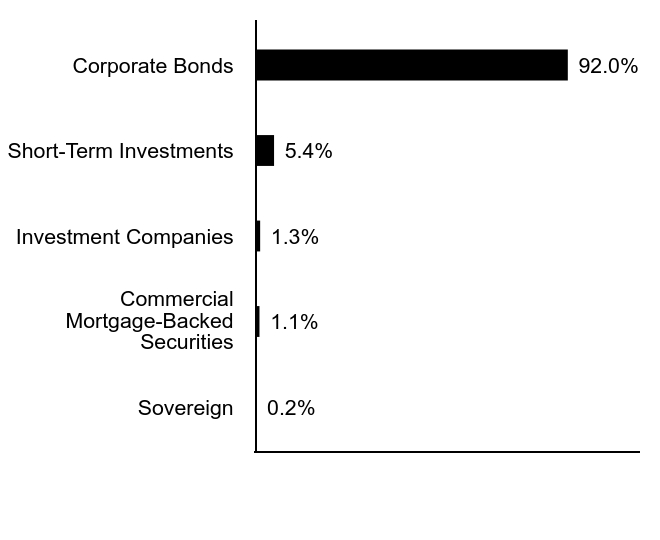

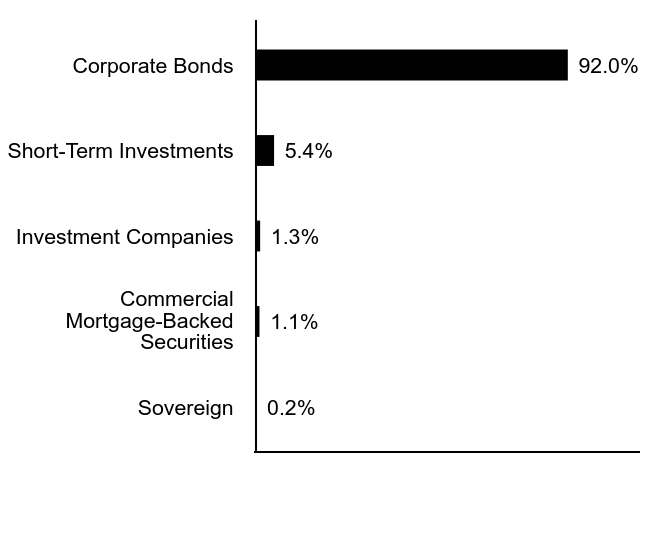

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Sovereign | 0.2% |

| Commercial Mortgage-Backed Securities | 1.1% |

| Investment Companies | 1.3% |

| Short-Term Investments | 5.4% |

| Corporate Bonds | 92.0% |

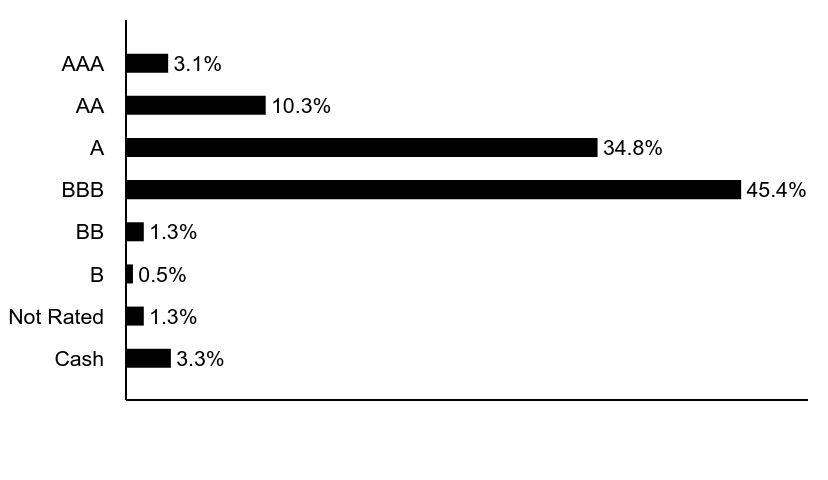

Credit Quality (% of net assets)Footnote Referencea

| Value | Value |

|---|

| Cash | 3.3% |

| Not Rated | 1.3% |

| B | 0.5% |

| BB | 1.3% |

| BBB | 45.4% |

| A | 34.8% |

| AA | 10.3% |

| AAA | 3.1% |

| Footnote | Description |

Footnotea | Security ratings disclosed with the exception for those labeled "Not Rated" is an aggregation of the highest security level rating amongst S&P Global Ratings, Moody's Investors Services, Inc., and Fitch Ratings, each a Nationally Recognized Statistical Ratings Organization. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

Morgan Stanley Institutional Fund Trust - Discovery Portfolio

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Morgan Stanley Institutional Fund Trust - Discovery Portfolio for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $118 | 0.98% |

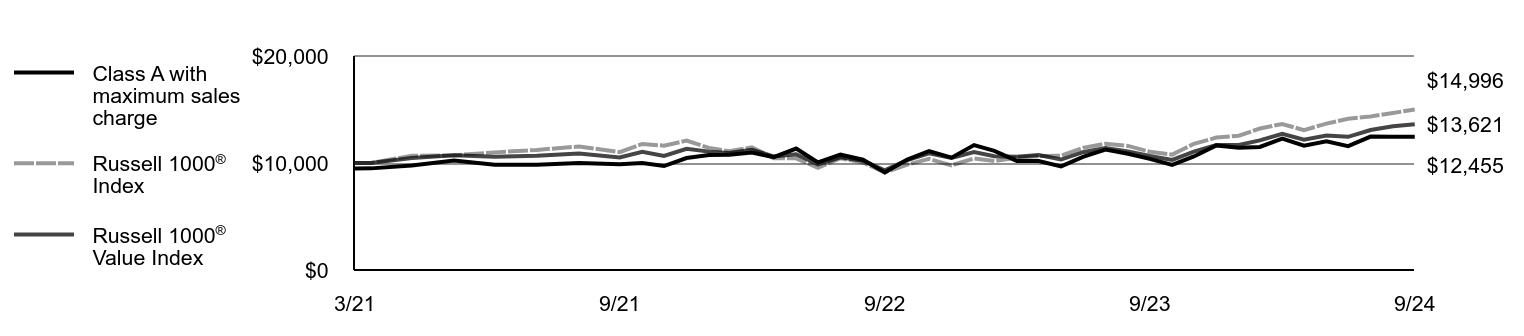

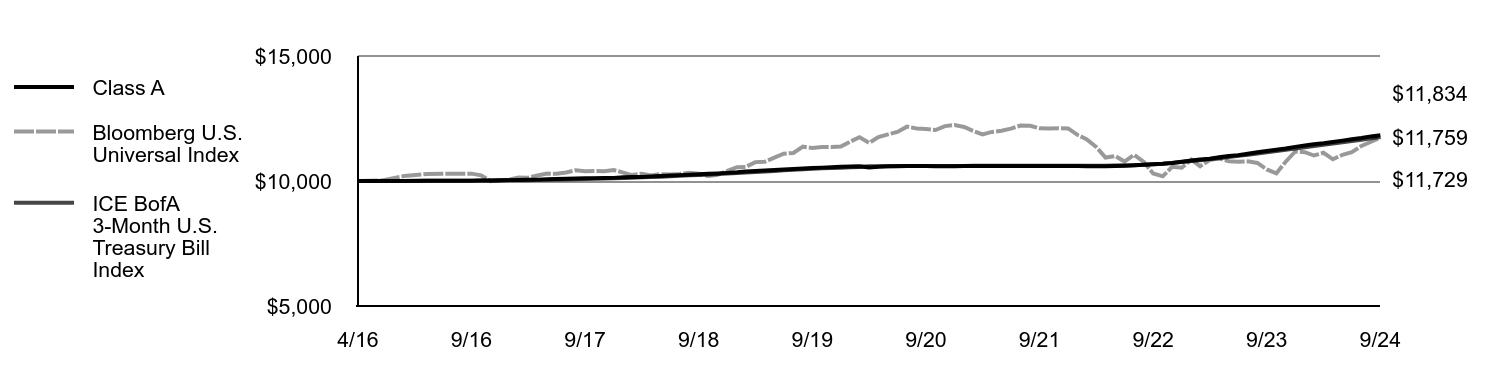

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Russell Midcap® Growth Index:

↑ Stock selection in consumer discretionary, led by a position in a leading seller of used cars online in the United States, which was the largest positive contributor in the portfolio.

↑ Stock selection in financials, led by a position in a payments technology services platform.

↑ Stock selection and an average overweight in communication services, led by a holding in a video game platform.

↓ Stock selection in health care, where a position in an underperforming health care services provider was the largest detractor across the portfolio.

↓ Stock selection and an average underweight in industrials, where exposure to the operator of a Southeast Asian super app (an integrated app platform combining multiple services) was the main detractor; the position was sold during the period.

↓ No exposure to utilities.

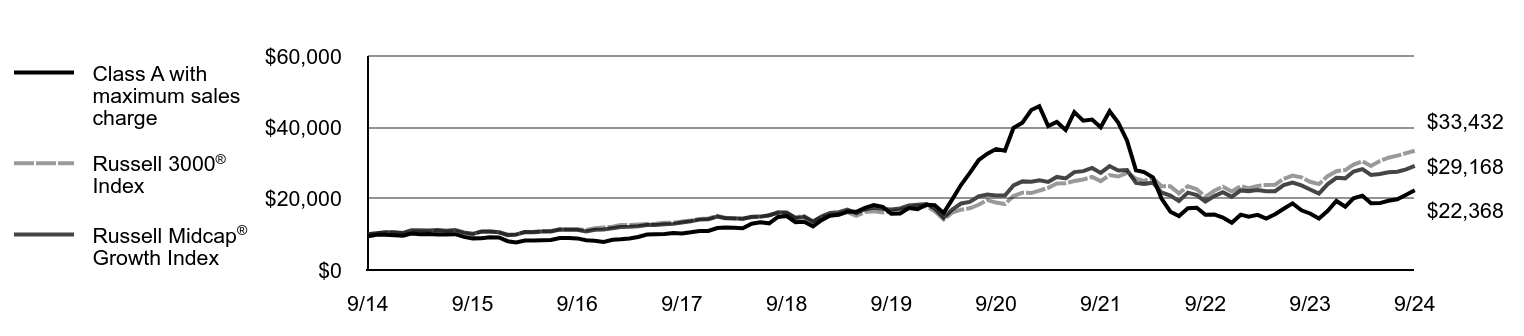

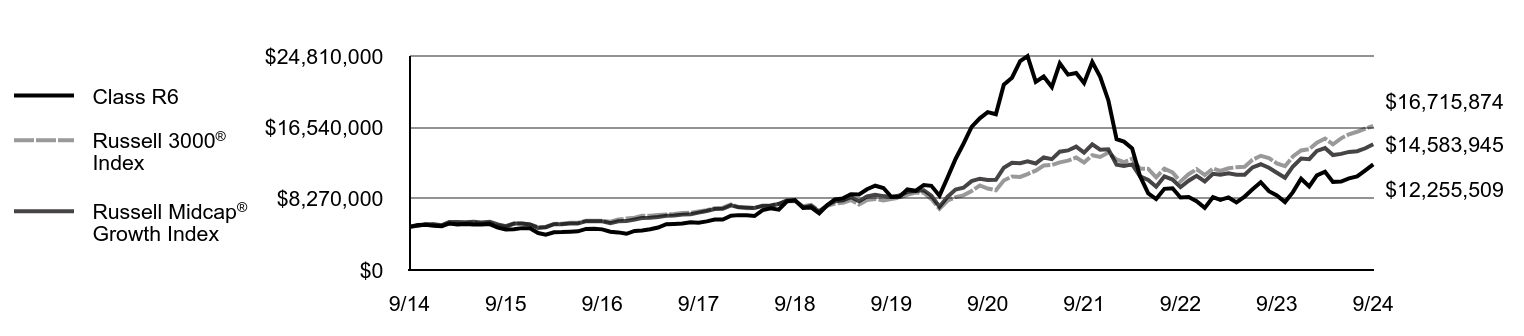

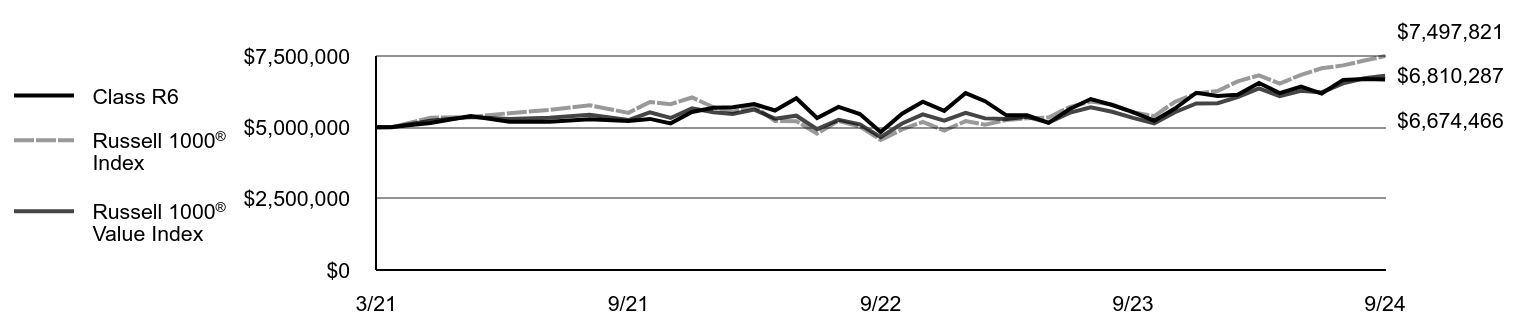

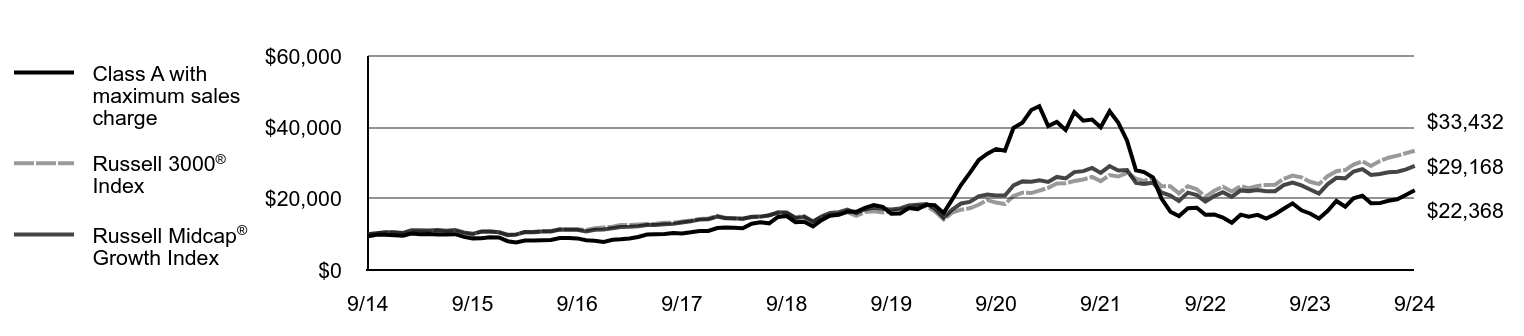

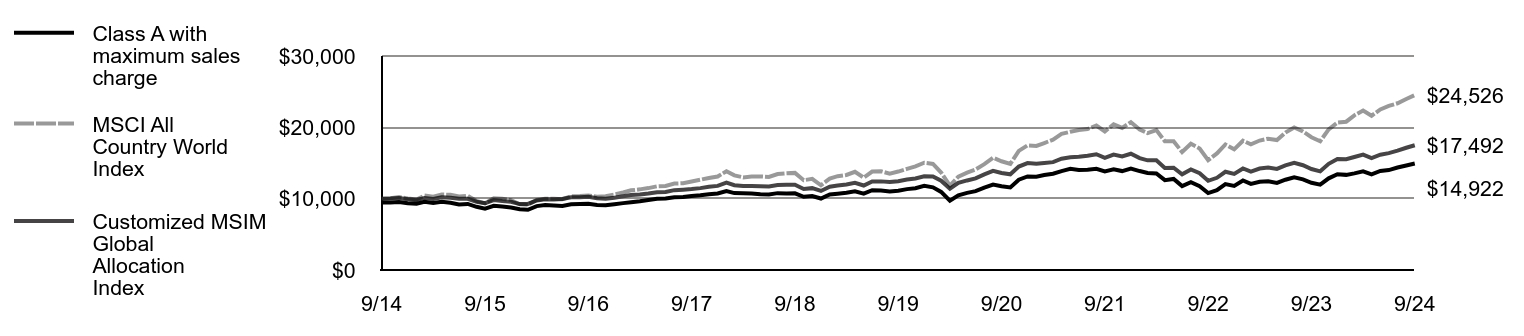

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with maximum sales charge | Russell 3000® Index | Russell Midcap® Growth Index |

|---|

| 9/14 | $9,474 | $10,000 | $10,000 |

| 10/14 | $9,871 | $10,275 | $10,276 |

| 11/14 | $9,909 | $10,524 | $10,614 |

| 12/14 | $9,721 | $10,524 | $10,584 |

| 1/15 | $9,612 | $10,231 | $10,405 |

| 2/15 | $10,213 | $10,824 | $11,122 |

| 3/15 | $10,003 | $10,713 | $11,153 |

| 4/15 | $10,065 | $10,762 | $11,075 |

| 5/15 | $9,979 | $10,911 | $11,206 |

| 6/15 | $9,945 | $10,728 | $11,026 |

| 7/15 | $10,052 | $10,908 | $11,204 |

| 8/15 | $9,281 | $10,249 | $10,553 |

| 9/15 | $8,867 | $9,951 | $10,145 |

| 10/15 | $8,904 | $10,736 | $10,783 |

| 11/15 | $9,154 | $10,796 | $10,807 |

| 12/15 | $9,126 | $10,574 | $10,563 |

| 1/16 | $8,079 | $9,978 | $9,763 |

| 2/16 | $7,729 | $9,975 | $9,916 |

| 3/16 | $8,248 | $10,677 | $10,624 |

| 4/16 | $8,272 | $10,743 | $10,617 |

| 5/16 | $8,346 | $10,935 | $10,791 |

| 6/16 | $8,429 | $10,958 | $10,790 |

| 7/16 | $8,963 | $11,393 | $11,324 |

| 8/16 | $8,966 | $11,422 | $11,291 |

| 9/16 | $8,856 | $11,440 | $11,285 |

| 10/16 | $8,328 | $11,192 | $10,827 |

| 11/16 | $8,189 | $11,693 | $11,297 |

| 12/16 | $7,881 | $11,921 | $11,337 |

| 1/17 | $8,499 | $12,145 | $11,715 |

| 2/17 | $8,612 | $12,597 | $12,052 |

| 3/17 | $8,859 | $12,606 | $12,118 |

| 4/17 | $9,246 | $12,739 | $12,298 |

| 5/17 | $9,962 | $12,870 | $12,592 |

| 6/17 | $10,023 | $12,986 | $12,629 |

| 7/17 | $10,096 | $13,231 | $12,840 |

| 8/17 | $10,363 | $13,256 | $12,931 |

| 9/17 | $10,260 | $13,579 | $13,296 |

| 10/17 | $10,564 | $13,876 | $13,668 |

| 11/17 | $10,940 | $14,297 | $14,125 |

| 12/17 | $10,946 | $14,440 | $14,201 |

| 1/18 | $11,760 | $15,201 | $15,005 |

| 2/18 | $11,905 | $14,641 | $14,534 |

| 3/18 | $11,852 | $14,347 | $14,510 |

| 4/18 | $11,698 | $14,402 | $14,373 |

| 5/18 | $12,979 | $14,808 | $14,911 |

| 6/18 | $13,378 | $14,905 | $14,968 |

| 7/18 | $13,079 | $15,400 | $15,289 |

| 8/18 | $14,889 | $15,940 | $16,171 |

| 9/18 | $15,119 | $15,967 | $16,102 |

| 10/18 | $13,417 | $14,791 | $14,507 |

| 11/18 | $13,547 | $15,087 | $14,877 |

| 12/18 | $12,238 | $13,683 | $13,527 |

| 1/19 | $14,031 | $14,858 | $15,081 |

| 2/19 | $15,236 | $15,380 | $15,965 |

| 3/19 | $15,471 | $15,605 | $16,181 |

| 4/19 | $16,373 | $16,228 | $16,908 |

| 5/19 | $16,324 | $15,178 | $15,936 |

| 6/19 | $17,441 | $16,244 | $17,055 |

| 7/19 | $18,185 | $16,485 | $17,453 |

| 8/19 | $17,695 | $16,149 | $17,135 |

| 9/19 | $15,785 | $16,433 | $16,940 |

| 10/19 | $15,814 | $16,786 | $17,254 |

| 11/19 | $17,392 | $17,424 | $18,112 |

| 12/19 | $17,072 | $17,928 | $18,324 |

| 1/20 | $18,296 | $17,908 | $18,496 |

| 2/20 | $18,138 | $16,442 | $17,220 |

| 3/20 | $16,006 | $14,181 | $14,652 |

| 4/20 | $19,815 | $16,059 | $16,947 |

| 5/20 | $23,885 | $16,918 | $18,649 |

| 6/20 | $27,161 | $17,304 | $19,086 |

| 7/20 | $30,766 | $18,287 | $20,611 |

| 8/20 | $32,614 | $19,612 | $21,172 |

| 9/20 | $33,917 | $18,898 | $20,875 |

| 10/20 | $33,464 | $18,490 | $20,901 |

| 11/20 | $39,823 | $20,739 | $23,708 |

| 12/20 | $41,290 | $21,672 | $24,845 |

| 1/21 | $44,842 | $21,576 | $24,763 |

| 2/21 | $45,901 | $22,250 | $25,185 |

| 3/21 | $40,367 | $23,048 | $24,705 |

| 4/21 | $41,501 | $24,236 | $26,093 |

| 5/21 | $39,246 | $24,346 | $25,694 |

| 6/21 | $44,293 | $24,947 | $27,440 |

| 7/21 | $41,863 | $25,369 | $27,723 |

| 8/21 | $42,199 | $26,092 | $28,618 |

| 9/21 | $40,031 | $24,921 | $27,232 |

| 10/21 | $44,517 | $26,607 | $29,141 |

| 11/21 | $41,352 | $26,202 | $27,910 |

| 12/21 | $36,256 | $27,234 | $28,008 |

| 1/22 | $27,965 | $25,631 | $24,394 |

| 2/22 | $27,437 | $24,986 | $24,097 |

| 3/22 | $25,967 | $25,796 | $24,484 |

| 4/22 | $20,031 | $23,481 | $21,727 |

| 5/22 | $16,357 | $23,450 | $20,886 |

| 6/22 | $15,132 | $21,488 | $19,325 |

| 7/22 | $17,318 | $23,504 | $21,690 |

| 8/22 | $17,450 | $22,627 | $20,980 |

| 9/22 | $15,471 | $20,528 | $19,199 |

| 10/22 | $15,584 | $22,212 | $20,708 |

| 11/22 | $14,679 | $23,371 | $21,834 |

| 12/22 | $13,228 | $22,003 | $20,524 |

| 1/23 | $15,509 | $23,518 | $22,315 |

| 2/23 | $14,924 | $22,968 | $22,095 |

| 3/23 | $15,452 | $23,583 | $22,399 |

| 4/23 | $14,397 | $23,834 | $22,074 |

| 5/23 | $15,622 | $23,927 | $22,088 |

| 6/23 | $17,167 | $25,560 | $23,795 |

| 7/23 | $18,674 | $26,477 | $24,515 |

| 8/23 | $16,752 | $25,966 | $23,707 |

| 9/23 | $15,848 | $24,729 | $22,552 |

| 10/23 | $14,435 | $24,073 | $21,401 |

| 11/23 | $16,526 | $26,318 | $24,012 |

| 12/23 | $19,353 | $27,714 | $25,833 |

| 1/24 | $17,732 | $28,021 | $25,694 |

| 2/24 | $20,088 | $29,538 | $27,625 |

| 3/24 | $20,841 | $30,491 | $28,286 |

| 4/24 | $18,693 | $29,149 | $26,643 |

| 5/24 | $18,750 | $30,526 | $26,927 |

| 6/24 | $19,428 | $31,471 | $27,377 |

| 7/24 | $19,843 | $32,056 | $27,543 |

| 8/24 | $21,124 | $32,754 | $28,227 |

| 9/24 | $22,368 | $33,432 | $29,168 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 41.14% | 7.22% | 8.97% |

| Class A with maximum 5.25% sales charge | 33.67% | 6.07% | 8.38% |

Russell 3000®IndexFootnote Reference1 | 35.19% | 15.26% | 12.83% |

Russell Midcap® Growth Index | 29.34% | 11.48% | 11.30% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $898,865,646 |

| # of Portfolio Holdings | 41 |

| Portfolio Turnover Rate | 46% |

| Total Advisory Fees Paid | $4,544,247 |

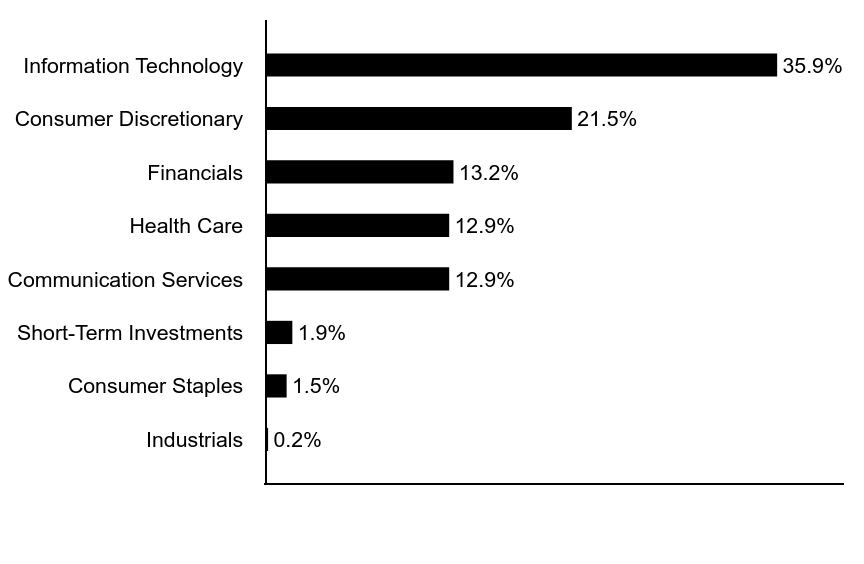

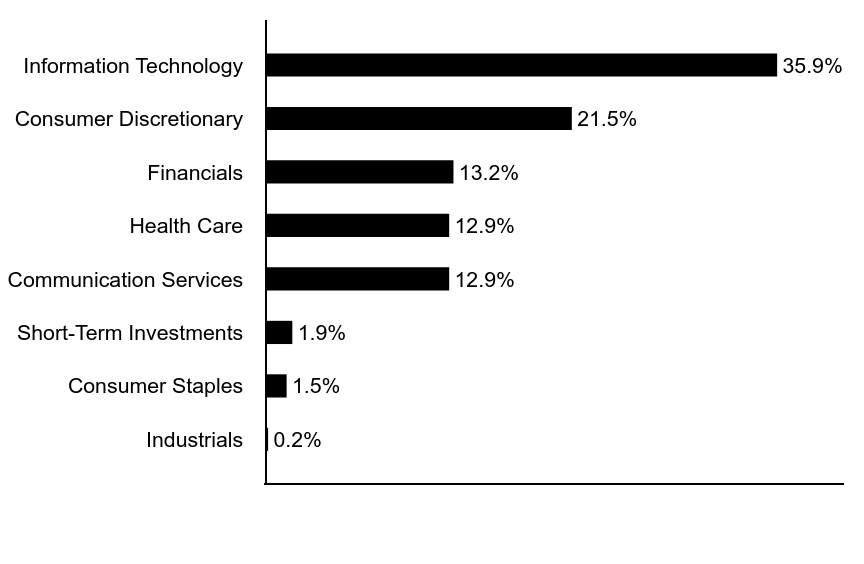

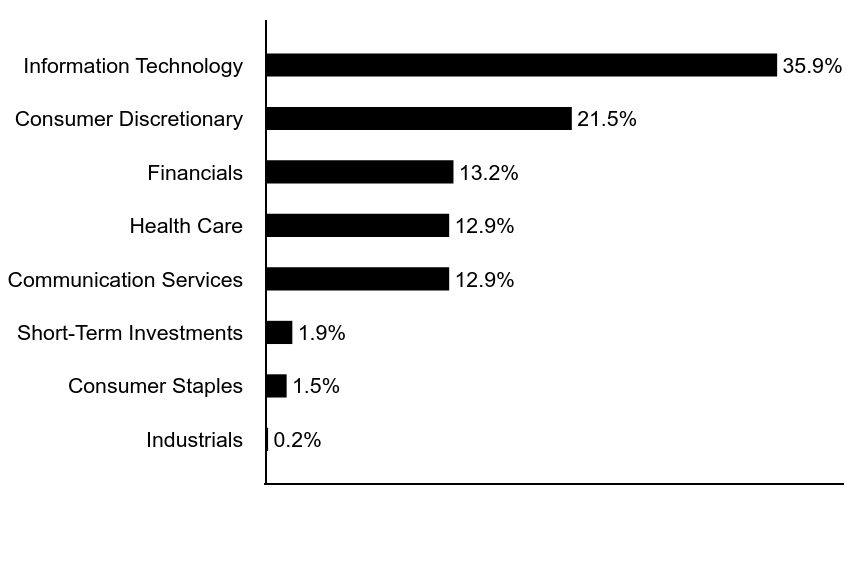

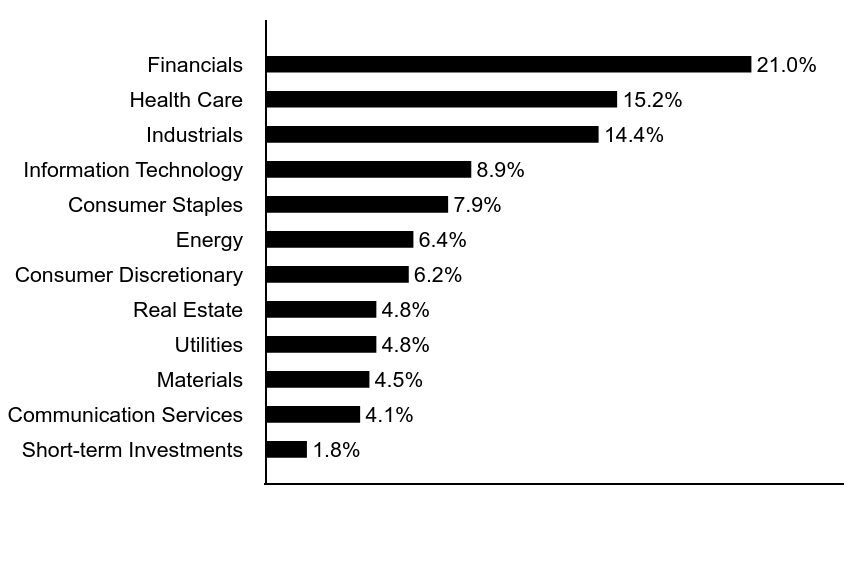

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Industrials | 0.2% |

| Consumer Staples | 1.5% |

| Short-Term Investments | 1.9% |

| Communication Services | 12.9% |

| Health Care | 12.9% |

| Financials | 13.2% |

| Consumer Discretionary | 21.5% |

| Information Technology | 35.9% |

Top Ten Holdings (% of total investments)Footnote Referencea

| DoorDash, Inc., Class A | 8.5% |

| Cloudflare, Inc., Class A | 7.5% |

| Trade Desk, Inc., Class A | 7.4% |

| Affirm Holdings, Inc. | 6.8% |

| Samsara, Inc., Class A | 6.8% |

| ROBLOX Corp., Class A | 5.5% |

| Global-e Online Ltd. | 5.3% |

| Carvana Co. | 4.9% |

| Royalty Pharma PLC, Class A | 4.5% |

| MicroStrategy, Inc., Class A | 4.3% |

| Total | 61.5% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

Morgan Stanley Institutional Fund Trust - Discovery Portfolio

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Morgan Stanley Institutional Fund Trust - Discovery Portfolio for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $211 | 1.76% |

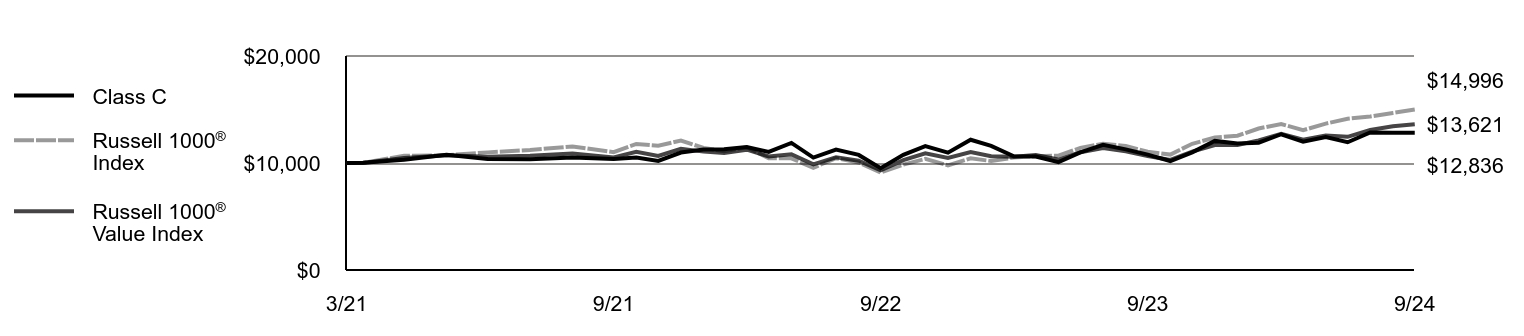

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Russell Midcap® Growth Index:

↑ Stock selection in consumer discretionary, led by a position in a leading seller of used cars online in the United States, which was the largest positive contributor in the portfolio.

↑ Stock selection in financials, led by a position in a payments technology services platform.

↑ Stock selection and an average overweight in communication services, led by a holding in a video game platform.

↓ Stock selection in health care, where a position in an underperforming health care services provider was the largest detractor across the portfolio.

↓ Stock selection and an average underweight in industrials, where exposure to the operator of a Southeast Asian super app (an integrated app platform combining multiple services) was the main detractor; the position was sold during the period.

↓ No exposure to utilities.

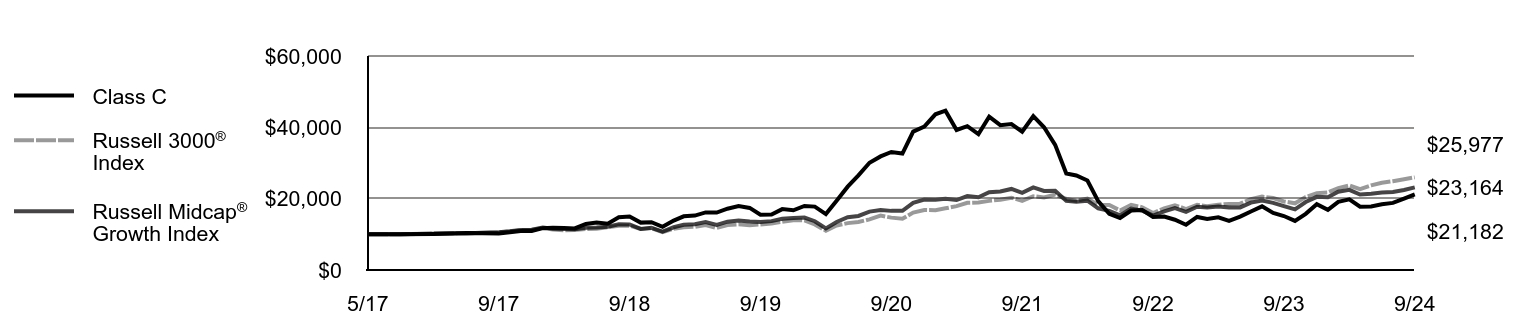

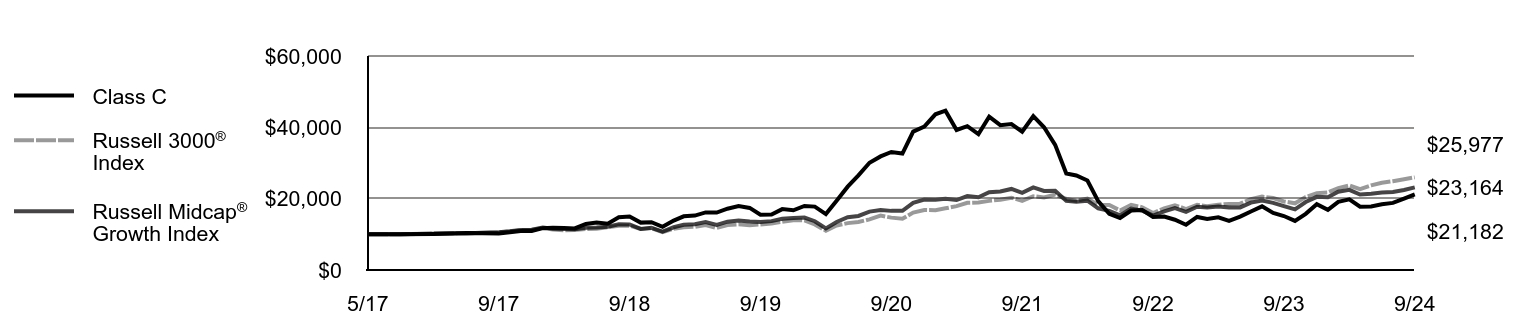

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | Russell 3000® Index | Russell Midcap® Growth Index |

|---|

| 5/17 | $10,000 | $10,000 | $10,000 |

| 6/17 | $10,052 | $10,000 | $10,000 |

| 7/17 | $10,114 | $10,280 | $10,197 |

| 8/17 | $10,377 | $10,300 | $10,269 |

| 9/17 | $10,264 | $10,552 | $10,560 |

| 10/17 | $10,558 | $10,782 | $10,855 |

| 11/17 | $10,931 | $11,109 | $11,218 |

| 12/17 | $10,924 | $11,220 | $11,278 |

| 1/18 | $11,727 | $11,812 | $11,916 |

| 2/18 | $11,858 | $11,376 | $11,542 |

| 3/18 | $11,804 | $11,148 | $11,523 |

| 4/18 | $11,642 | $11,190 | $11,415 |

| 5/18 | $12,908 | $11,506 | $11,842 |

| 6/18 | $13,287 | $11,581 | $11,887 |

| 7/18 | $12,986 | $11,966 | $12,142 |

| 8/18 | $14,769 | $12,386 | $12,842 |

| 9/18 | $14,993 | $12,406 | $12,788 |

| 10/18 | $13,287 | $11,493 | $11,521 |

| 11/18 | $13,410 | $11,723 | $11,815 |

| 12/18 | $12,107 | $10,632 | $10,742 |

| 1/19 | $13,870 | $11,545 | $11,977 |

| 2/19 | $15,049 | $11,951 | $12,679 |

| 3/19 | $15,267 | $12,125 | $12,850 |

| 4/19 | $16,149 | $12,609 | $13,428 |

| 5/19 | $16,090 | $11,793 | $12,656 |

| 6/19 | $17,179 | $12,622 | $13,544 |

| 7/19 | $17,903 | $12,809 | $13,861 |

| 8/19 | $17,407 | $12,548 | $13,608 |

| 9/19 | $15,525 | $12,768 | $13,453 |

| 10/19 | $15,535 | $13,043 | $13,703 |

| 11/19 | $17,070 | $13,539 | $14,384 |

| 12/19 | $16,746 | $13,930 | $14,553 |

| 1/20 | $17,944 | $13,915 | $14,689 |

| 2/20 | $17,771 | $12,776 | $13,676 |

| 3/20 | $15,675 | $11,019 | $11,636 |

| 4/20 | $19,395 | $12,478 | $13,459 |

| 5/20 | $23,368 | $13,145 | $14,811 |

| 6/20 | $26,547 | $13,446 | $15,158 |

| 7/20 | $30,060 | $14,209 | $16,369 |

| 8/20 | $31,845 | $15,239 | $16,814 |

| 9/20 | $33,100 | $14,684 | $16,578 |

| 10/20 | $32,639 | $14,367 | $16,599 |

| 11/20 | $38,813 | $16,115 | $18,828 |

| 12/20 | $40,220 | $16,840 | $19,732 |

| 1/21 | $43,653 | $16,765 | $19,666 |

| 2/21 | $44,658 | $17,289 | $20,002 |

| 3/21 | $39,254 | $17,908 | $19,620 |

| 4/21 | $40,335 | $18,832 | $20,722 |

| 5/21 | $38,122 | $18,918 | $20,406 |

| 6/21 | $42,992 | $19,384 | $21,792 |

| 7/21 | $40,614 | $19,712 | $22,017 |

| 8/21 | $40,920 | $20,274 | $22,728 |

| 9/21 | $38,796 | $19,364 | $21,627 |

| 10/21 | $43,119 | $20,674 | $23,143 |

| 11/21 | $40,029 | $20,359 | $22,165 |

| 12/21 | $35,085 | $21,161 | $22,243 |

| 1/22 | $27,036 | $19,916 | $19,373 |

| 2/22 | $26,521 | $19,414 | $19,138 |

| 3/22 | $25,078 | $20,044 | $19,445 |

| 4/22 | $19,322 | $18,245 | $17,255 |

| 5/22 | $15,782 | $18,221 | $16,587 |

| 6/22 | $14,576 | $16,696 | $15,347 |

| 7/22 | $16,672 | $18,263 | $17,226 |

| 8/22 | $16,791 | $17,581 | $16,661 |

| 9/22 | $14,873 | $15,951 | $15,247 |

| 10/22 | $14,971 | $17,259 | $16,446 |

| 11/22 | $14,101 | $18,160 | $17,340 |

| 12/22 | $12,697 | $17,097 | $16,300 |

| 1/23 | $14,873 | $18,274 | $17,722 |

| 2/23 | $14,299 | $17,847 | $17,547 |

| 3/23 | $14,793 | $18,324 | $17,789 |

| 4/23 | $13,785 | $18,519 | $17,531 |

| 5/23 | $14,952 | $18,591 | $17,542 |

| 6/23 | $16,415 | $19,861 | $18,898 |

| 7/23 | $17,839 | $20,573 | $19,469 |

| 8/23 | $15,980 | $20,176 | $18,828 |

| 9/23 | $15,130 | $19,215 | $17,910 |

| 10/23 | $13,765 | $18,705 | $16,996 |

| 11/23 | $15,743 | $20,450 | $19,070 |

| 12/23 | $18,432 | $21,534 | $20,516 |

| 1/24 | $16,870 | $21,773 | $20,405 |

| 2/24 | $19,105 | $22,952 | $21,939 |

| 3/24 | $19,797 | $23,692 | $22,464 |

| 4/24 | $17,740 | $22,649 | $21,159 |

| 5/24 | $17,800 | $23,720 | $21,385 |

| 6/24 | $18,432 | $24,454 | $21,742 |

| 7/24 | $18,808 | $24,908 | $21,874 |

| 8/24 | $20,015 | $25,451 | $22,417 |

| 9/24 | $21,182 | $25,977 | $23,164 |

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since 5/31/17 (Inception) |

|---|

| Class C | 40.00% | 6.41% | 10.78% |

| Class C with maximum deferred sales charge | 39.00% | 6.41% | 10.78% |

Russell 3000®IndexFootnote Reference1 | 35.19% | 15.26% | 13.90% |

Russell Midcap® Growth Index | 29.34% | 11.48% | 12.14% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $898,865,646 |

| # of Portfolio Holdings | 41 |

| Portfolio Turnover Rate | 46% |

| Total Advisory Fees Paid | $4,544,247 |

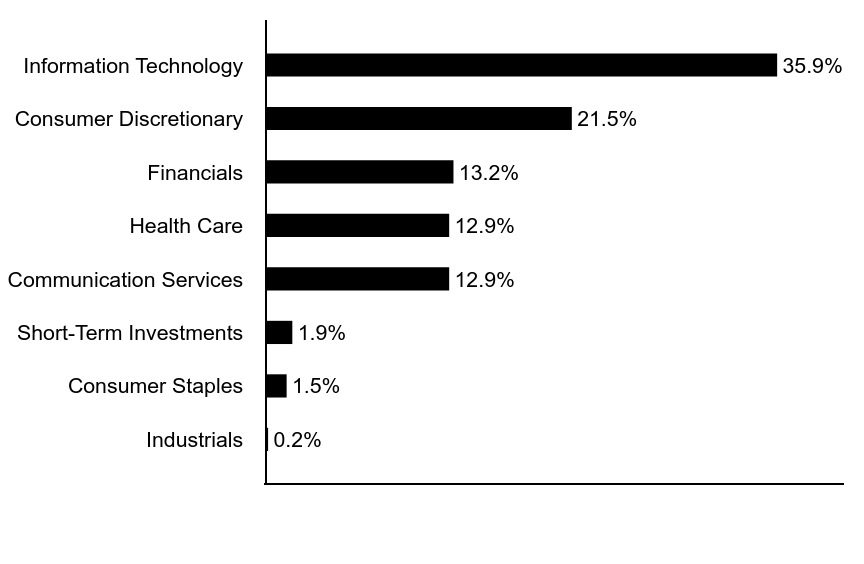

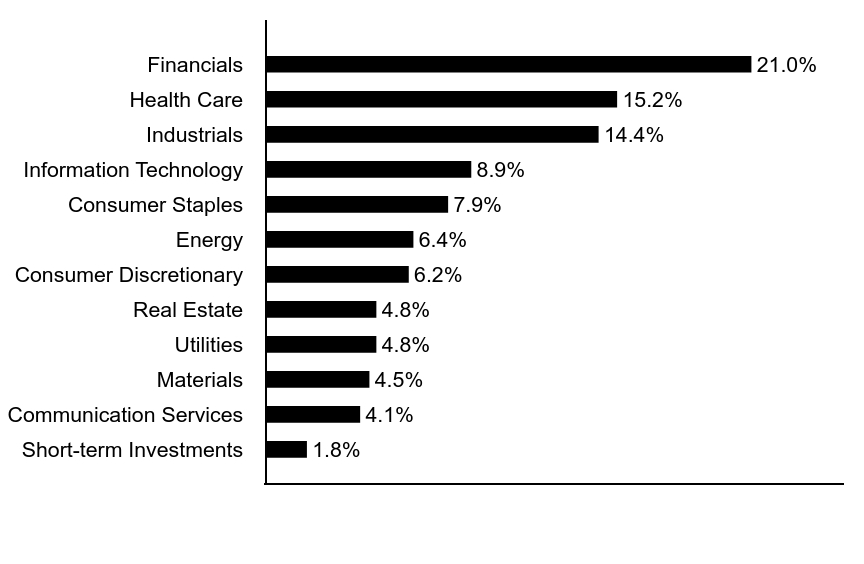

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Industrials | 0.2% |

| Consumer Staples | 1.5% |

| Short-Term Investments | 1.9% |

| Communication Services | 12.9% |

| Health Care | 12.9% |

| Financials | 13.2% |

| Consumer Discretionary | 21.5% |

| Information Technology | 35.9% |

Top Ten Holdings (% of total investments)Footnote Referencea

| DoorDash, Inc., Class A | 8.5% |

| Cloudflare, Inc., Class A | 7.5% |

| Trade Desk, Inc., Class A | 7.4% |

| Affirm Holdings, Inc. | 6.8% |

| Samsara, Inc., Class A | 6.8% |

| ROBLOX Corp., Class A | 5.5% |

| Global-e Online Ltd. | 5.3% |

| Carvana Co. | 4.9% |

| Royalty Pharma PLC, Class A | 4.5% |

| MicroStrategy, Inc., Class A | 4.3% |

| Total | 61.5% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

Morgan Stanley Institutional Fund Trust - Discovery Portfolio

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Morgan Stanley Institutional Fund Trust - Discovery Portfolio for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $87 | 0.72% |

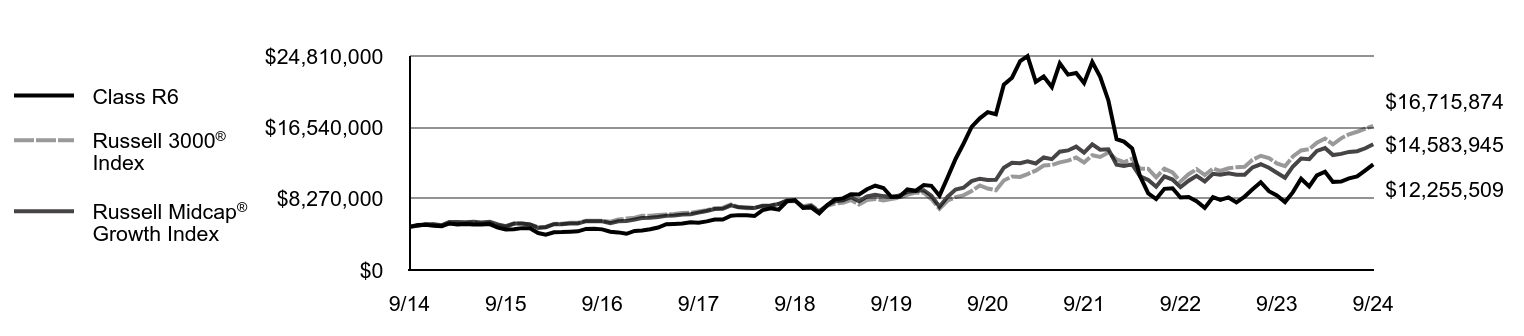

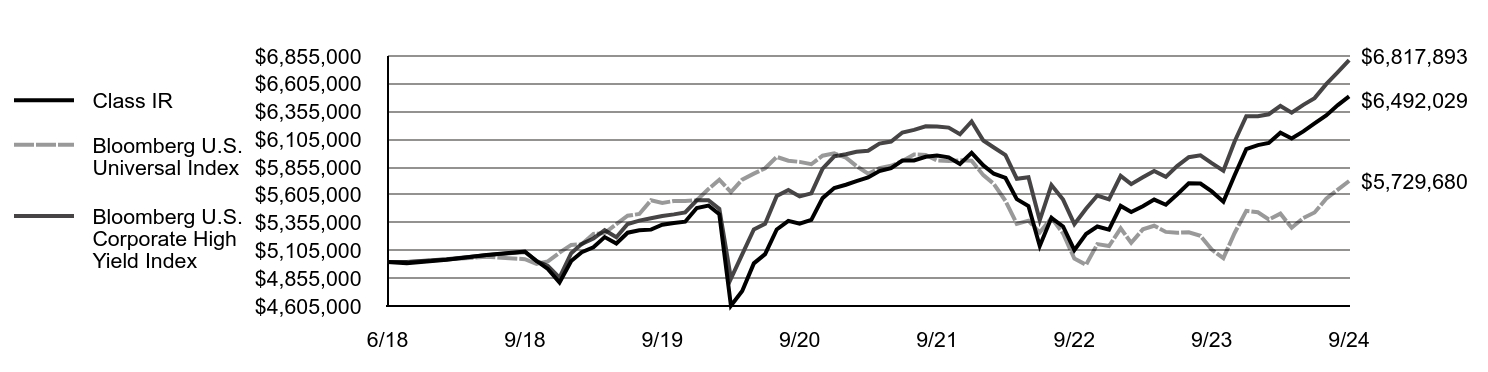

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Russell Midcap® Growth Index:

↑ Stock selection in consumer discretionary, led by a position in a leading seller of used cars online in the United States, which was the largest positive contributor in the portfolio.

↑ Stock selection in financials, led by a position in a payments technology services platform.

↑ Stock selection and an average overweight in communication services, led by a holding in a video game platform.

↓ Stock selection in health care, where a position in an underperforming health care services provider was the largest detractor across the portfolio.

↓ Stock selection and an average underweight in industrials, where exposure to the operator of a Southeast Asian super app (an integrated app platform combining multiple services) was the main detractor; the position was sold during the period.

↓ No exposure to utilities.

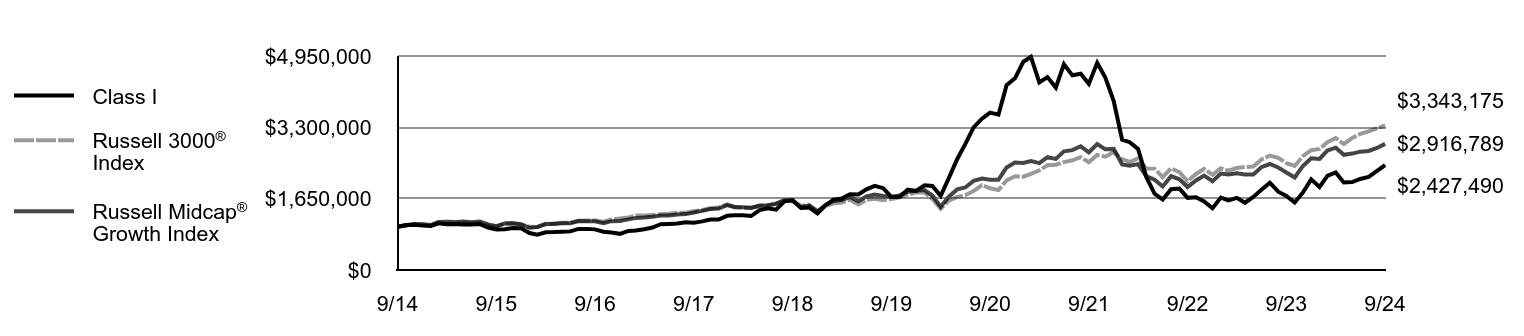

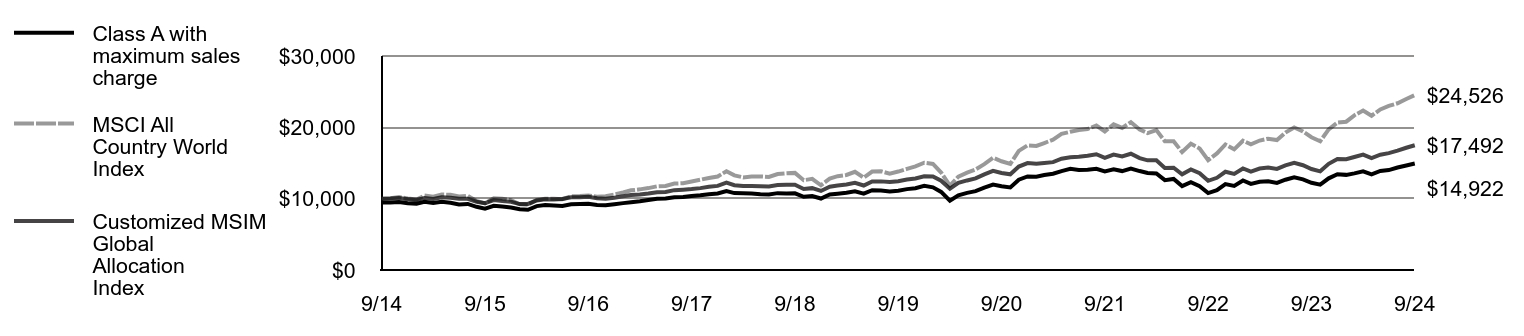

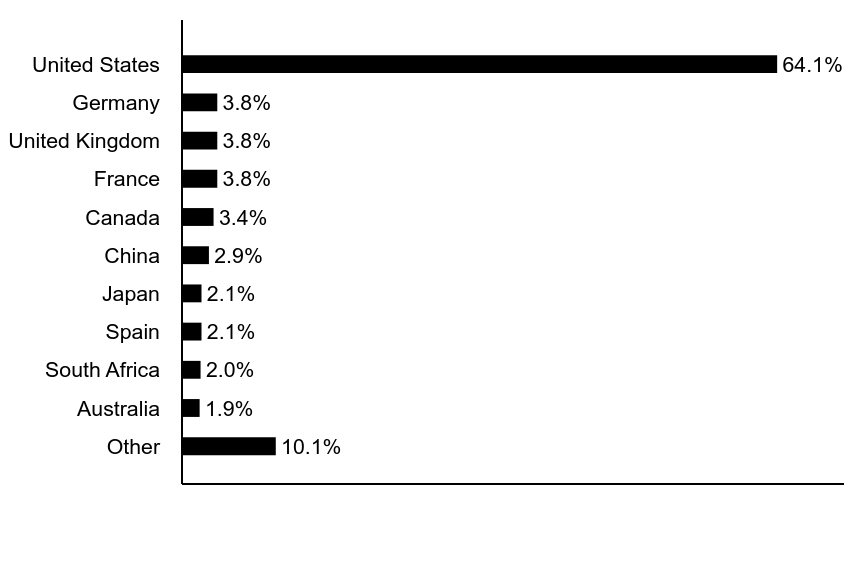

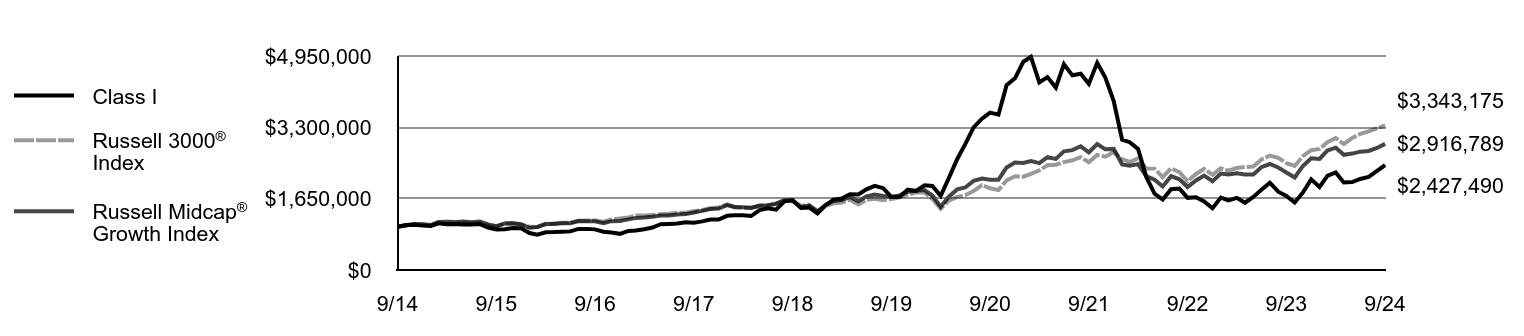

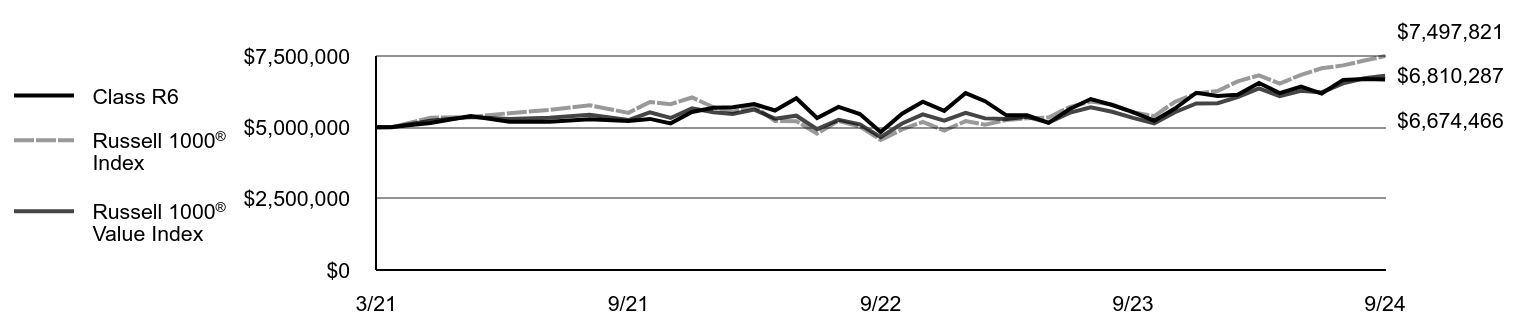

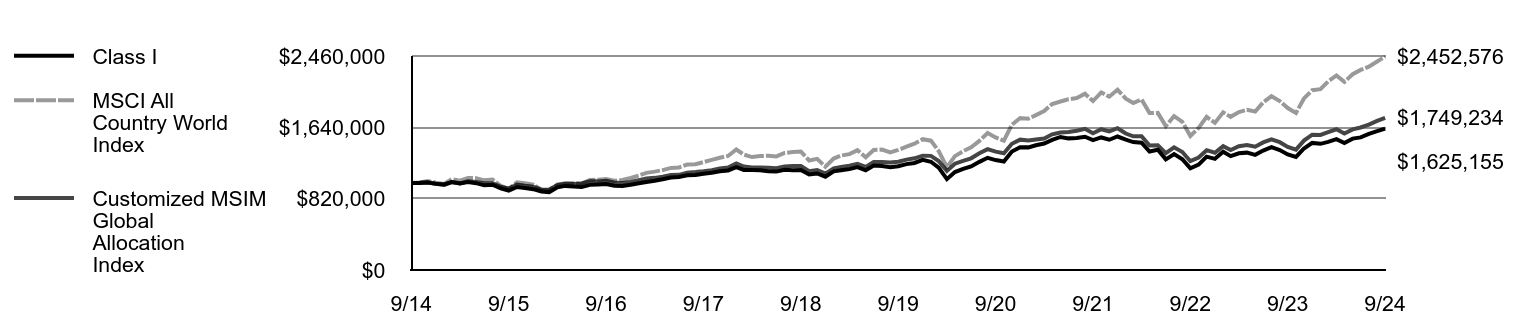

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Russell 3000® Index | Russell Midcap® Growth Index |

|---|

| 9/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 10/14 | $1,041,806 | $1,027,513 | $1,027,611 |

| 11/14 | $1,046,054 | $1,052,414 | $1,061,386 |

| 12/14 | $1,026,390 | $1,052,402 | $1,058,378 |

| 1/15 | $1,015,432 | $1,023,112 | $1,040,546 |

| 2/15 | $1,079,092 | $1,082,351 | $1,112,164 |

| 3/15 | $1,056,916 | $1,071,348 | $1,115,298 |

| 4/15 | $1,063,960 | $1,076,194 | $1,107,469 |

| 5/15 | $1,055,089 | $1,091,079 | $1,120,621 |

| 6/15 | $1,051,697 | $1,072,825 | $1,102,573 |

| 7/15 | $1,063,177 | $1,090,768 | $1,120,440 |

| 8/15 | $981,776 | $1,024,919 | $1,055,252 |

| 9/15 | $938,205 | $995,053 | $1,014,483 |

| 10/15 | $942,118 | $1,073,648 | $1,078,333 |

| 11/15 | $968,731 | $1,079,600 | $1,080,688 |

| 12/15 | $966,264 | $1,057,440 | $1,056,261 |

| 1/16 | $855,589 | $997,774 | $976,302 |

| 2/16 | $818,993 | $997,453 | $991,603 |

| 3/16 | $873,887 | $1,067,679 | $1,062,378 |

| 4/16 | $876,544 | $1,074,296 | $1,061,733 |

| 5/16 | $884,512 | $1,093,516 | $1,079,145 |

| 6/16 | $893,366 | $1,095,764 | $1,078,979 |

| 7/16 | $950,622 | $1,139,252 | $1,132,416 |

| 8/16 | $951,212 | $1,142,158 | $1,129,090 |

| 9/16 | $939,997 | $1,143,953 | $1,128,525 |

| 10/16 | $883,922 | $1,119,203 | $1,082,677 |

| 11/16 | $869,460 | $1,169,290 | $1,129,745 |

| 12/16 | $836,763 | $1,192,107 | $1,133,669 |

| 1/17 | $902,862 | $1,214,544 | $1,171,466 |

| 2/17 | $915,102 | $1,259,715 | $1,205,152 |

| 3/17 | $941,542 | $1,260,572 | $1,211,830 |

| 4/17 | $983,160 | $1,273,934 | $1,229,807 |

| 5/17 | $1,059,541 | $1,286,971 | $1,259,172 |

| 6/17 | $1,065,906 | $1,298,586 | $1,262,907 |

| 7/17 | $1,073,740 | $1,323,070 | $1,284,006 |

| 8/17 | $1,102,627 | $1,325,620 | $1,293,066 |

| 9/17 | $1,091,856 | $1,357,949 | $1,329,627 |

| 10/17 | $1,124,660 | $1,387,582 | $1,366,833 |

| 11/17 | $1,165,299 | $1,429,716 | $1,412,518 |

| 12/17 | $1,166,026 | $1,444,006 | $1,420,125 |

| 1/18 | $1,253,322 | $1,520,120 | $1,500,473 |

| 2/18 | $1,268,564 | $1,464,089 | $1,453,375 |

| 3/18 | $1,263,714 | $1,434,699 | $1,451,004 |

| 4/18 | $1,247,779 | $1,440,152 | $1,437,300 |

| 5/18 | $1,384,266 | $1,480,808 | $1,491,058 |

| 6/18 | $1,427,221 | $1,490,492 | $1,496,818 |

| 7/18 | $1,396,044 | $1,539,955 | $1,528,948 |

| 8/18 | $1,588,649 | $1,594,035 | $1,617,075 |

| 9/18 | $1,614,284 | $1,596,674 | $1,610,196 |

| 10/18 | $1,432,763 | $1,479,106 | $1,450,749 |

| 11/18 | $1,446,620 | $1,508,731 | $1,487,651 |

| 12/18 | $1,307,635 | $1,368,314 | $1,352,660 |

| 1/19 | $1,499,410 | $1,485,762 | $1,508,096 |

| 2/19 | $1,628,391 | $1,538,015 | $1,596,525 |

| 3/19 | $1,653,848 | $1,560,473 | $1,618,065 |

| 4/19 | $1,751,433 | $1,622,785 | $1,690,829 |

| 5/19 | $1,746,342 | $1,517,772 | $1,593,556 |

| 6/19 | $1,865,140 | $1,624,375 | $1,705,470 |

| 7/19 | $1,946,602 | $1,648,522 | $1,745,289 |

| 8/19 | $1,893,143 | $1,614,916 | $1,713,499 |

| 9/19 | $1,690,336 | $1,643,259 | $1,693,984 |

| 10/19 | $1,693,731 | $1,678,633 | $1,725,387 |

| 11/19 | $1,861,746 | $1,742,441 | $1,811,227 |

| 12/19 | $1,828,099 | $1,792,752 | $1,832,444 |

| 1/20 | $1,960,584 | $1,790,794 | $1,849,591 |

| 2/20 | $1,943,428 | $1,644,176 | $1,722,049 |

| 3/20 | $1,715,630 | $1,418,072 | $1,465,223 |

| 4/20 | $2,124,522 | $1,605,882 | $1,694,665 |

| 5/20 | $2,562,008 | $1,691,762 | $1,864,902 |

| 6/20 | $2,912,759 | $1,730,439 | $1,908,613 |

| 7/20 | $3,300,682 | $1,828,699 | $2,061,093 |

| 8/20 | $3,499,886 | $1,961,178 | $2,117,165 |

| 9/20 | $3,639,996 | $1,889,770 | $2,087,518 |

| 10/20 | $3,592,339 | $1,848,982 | $2,090,077 |

| 11/20 | $4,275,732 | $2,073,917 | $2,370,814 |

| 12/20 | $4,434,285 | $2,167,218 | $2,484,547 |

| 1/21 | $4,816,887 | $2,157,579 | $2,476,250 |

| 2/21 | $4,931,770 | $2,225,019 | $2,518,539 |

| 3/21 | $4,337,865 | $2,304,770 | $2,470,503 |

| 4/21 | $4,461,980 | $2,423,579 | $2,609,313 |

| 5/21 | $4,219,905 | $2,434,642 | $2,569,438 |

| 6/21 | $4,762,523 | $2,494,678 | $2,744,040 |

| 7/21 | $4,503,010 | $2,536,865 | $2,772,303 |

| 8/21 | $4,540,962 | $2,609,210 | $2,861,787 |

| 9/21 | $4,308,119 | $2,492,141 | $2,723,187 |

| 10/21 | $4,792,269 | $2,660,670 | $2,914,123 |

| 11/21 | $4,452,748 | $2,620,172 | $2,790,996 |

| 12/21 | $3,905,574 | $2,723,350 | $2,800,785 |

| 1/22 | $3,012,911 | $2,563,119 | $2,439,360 |

| 2/22 | $2,956,168 | $2,498,556 | $2,409,748 |

| 3/22 | $2,799,779 | $2,579,600 | $2,448,437 |

| 4/22 | $2,158,999 | $2,348,100 | $2,172,744 |

| 5/22 | $1,763,183 | $2,344,952 | $2,088,640 |

| 6/22 | $1,631,705 | $2,148,777 | $1,932,509 |

| 7/22 | $1,866,981 | $2,350,370 | $2,169,002 |

| 8/22 | $1,882,204 | $2,262,656 | $2,097,957 |

| 9/22 | $1,669,072 | $2,052,842 | $1,919,889 |

| 10/22 | $1,681,528 | $2,221,188 | $2,070,778 |

| 11/22 | $1,584,650 | $2,337,125 | $2,183,435 |

| 12/22 | $1,429,645 | $2,200,278 | $2,052,389 |

| 1/23 | $1,674,608 | $2,351,818 | $2,231,486 |

| 2/23 | $1,612,329 | $2,296,849 | $2,209,455 |

| 3/23 | $1,669,072 | $2,358,265 | $2,239,893 |

| 4/23 | $1,555,586 | $2,383,391 | $2,207,448 |

| 5/23 | $1,689,832 | $2,392,664 | $2,208,812 |

| 6/23 | $1,855,909 | $2,556,048 | $2,379,534 |

| 7/23 | $2,019,218 | $2,647,674 | $2,451,536 |

| 8/23 | $1,811,622 | $2,596,564 | $2,370,712 |

| 9/23 | $1,714,743 | $2,472,879 | $2,255,228 |

| 10/23 | $1,561,122 | $2,407,326 | $2,140,147 |

| 11/23 | $1,788,094 | $2,631,805 | $2,401,241 |

| 12/23 | $2,096,720 | $2,771,401 | $2,583,277 |

| 1/24 | $1,920,956 | $2,802,116 | $2,569,360 |

| 2/24 | $2,175,607 | $2,953,796 | $2,762,542 |

| 3/24 | $2,257,261 | $3,049,077 | $2,828,599 |

| 4/24 | $2,024,754 | $2,914,913 | $2,664,326 |

| 5/24 | $2,033,057 | $3,052,634 | $2,692,727 |

| 6/24 | $2,106,408 | $3,147,135 | $2,737,707 |

| 7/24 | $2,152,079 | $3,205,637 | $2,754,299 |

| 8/24 | $2,290,477 | $3,275,420 | $2,822,729 |

| 9/24 | $2,427,490 | $3,343,175 | $2,916,789 |

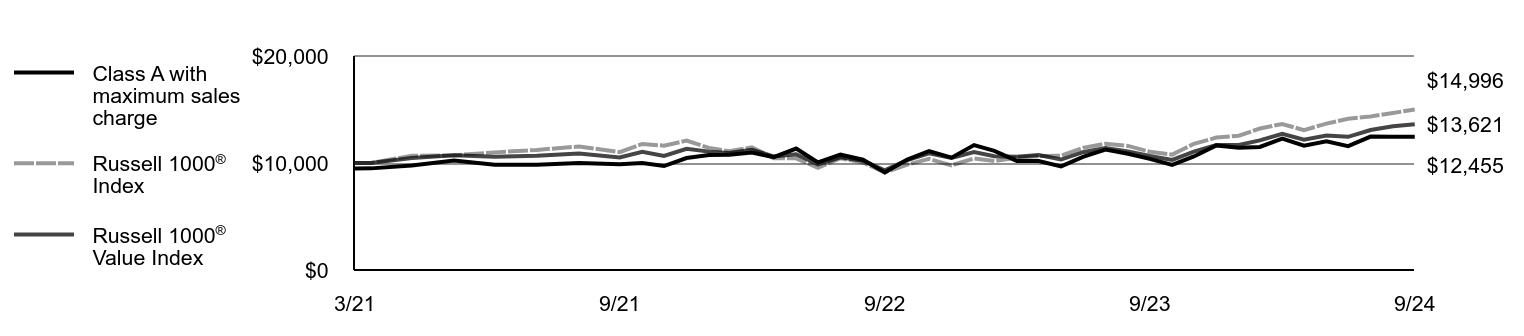

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 41.57% | 7.51% | 9.27% |

Russell 3000®IndexFootnote Reference1 | 35.19% | 15.26% | 12.83% |

Russell Midcap® Growth Index | 29.34% | 11.48% | 11.30% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.morganstanley.com/im/shareholderreports.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $898,865,646 |

| # of Portfolio Holdings | 41 |

| Portfolio Turnover Rate | 46% |

| Total Advisory Fees Paid | $4,544,247 |

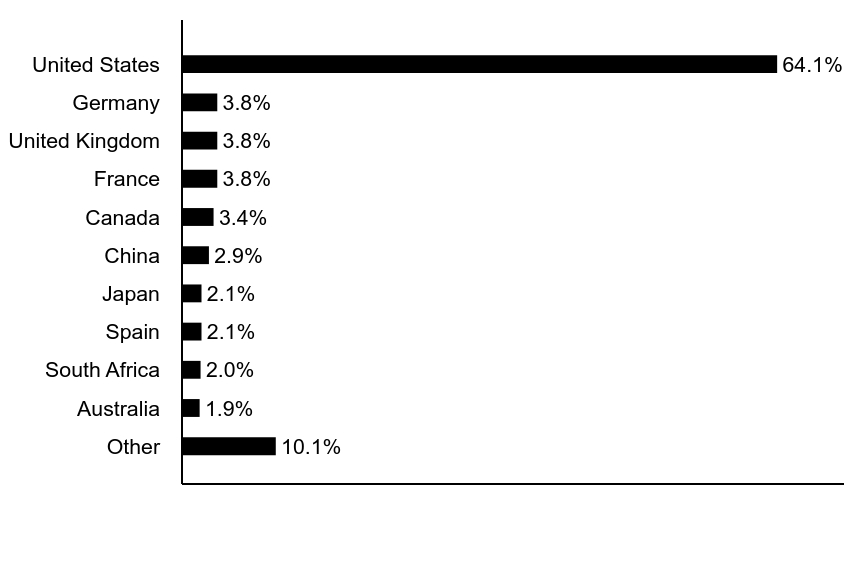

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Industrials | 0.2% |

| Consumer Staples | 1.5% |

| Short-Term Investments | 1.9% |

| Communication Services | 12.9% |

| Health Care | 12.9% |

| Financials | 13.2% |

| Consumer Discretionary | 21.5% |

| Information Technology | 35.9% |

Top Ten Holdings (% of total investments)Footnote Referencea

| DoorDash, Inc., Class A | 8.5% |

| Cloudflare, Inc., Class A | 7.5% |

| Trade Desk, Inc., Class A | 7.4% |

| Affirm Holdings, Inc. | 6.8% |

| Samsara, Inc., Class A | 6.8% |

| ROBLOX Corp., Class A | 5.5% |

| Global-e Online Ltd. | 5.3% |

| Carvana Co. | 4.9% |

| Royalty Pharma PLC, Class A | 4.5% |

| MicroStrategy, Inc., Class A | 4.3% |

| Total | 61.5% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

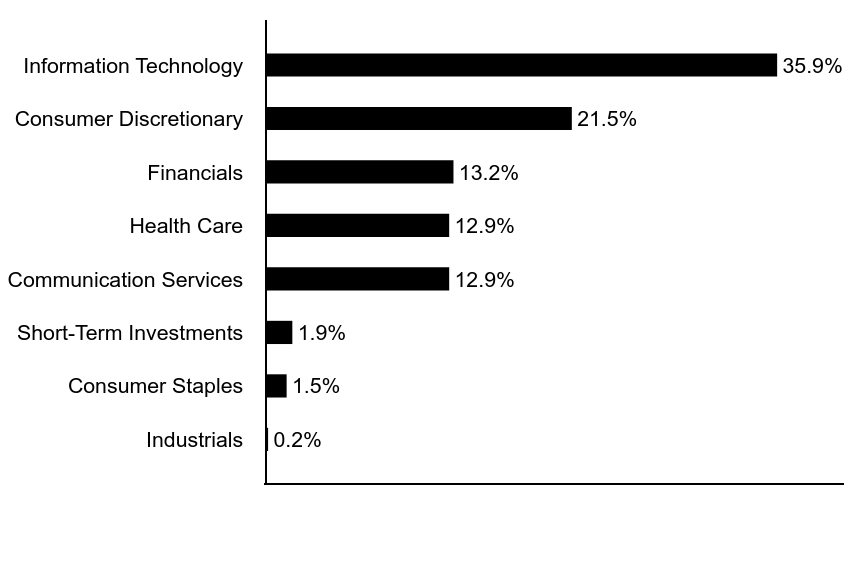

Morgan Stanley Institutional Fund Trust - Discovery Portfolio

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Morgan Stanley Institutional Fund Trust - Discovery Portfolio for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class L | $182 | 1.51% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Russell Midcap® Growth Index:

↑ Stock selection in consumer discretionary, led by a position in a leading seller of used cars online in the United States, which was the largest positive contributor in the portfolio.

↑ Stock selection in financials, led by a position in a payments technology services platform.

↑ Stock selection and an average overweight in communication services, led by a holding in a video game platform.

↓ Stock selection in health care, where a position in an underperforming health care services provider was the largest detractor across the portfolio.

↓ Stock selection and an average underweight in industrials, where exposure to the operator of a Southeast Asian super app (an integrated app platform combining multiple services) was the main detractor; the position was sold during the period.

↓ No exposure to utilities.

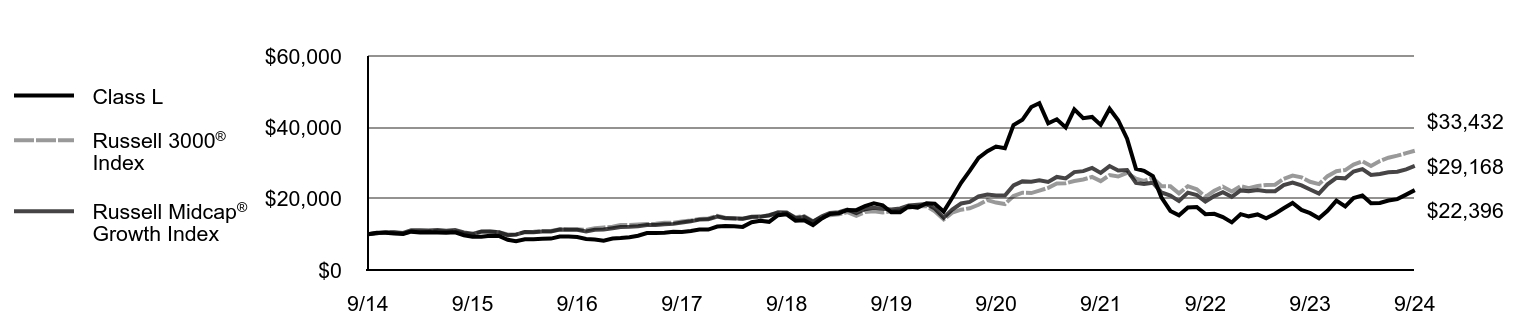

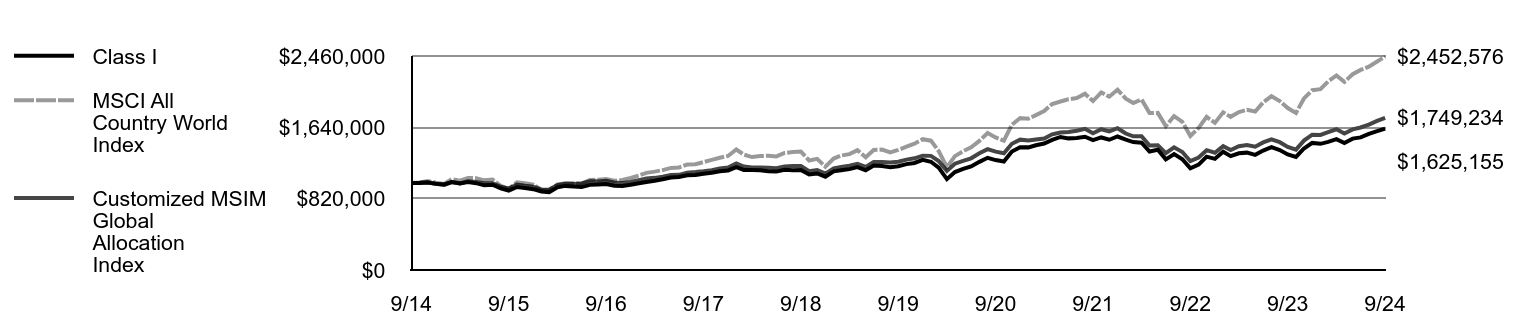

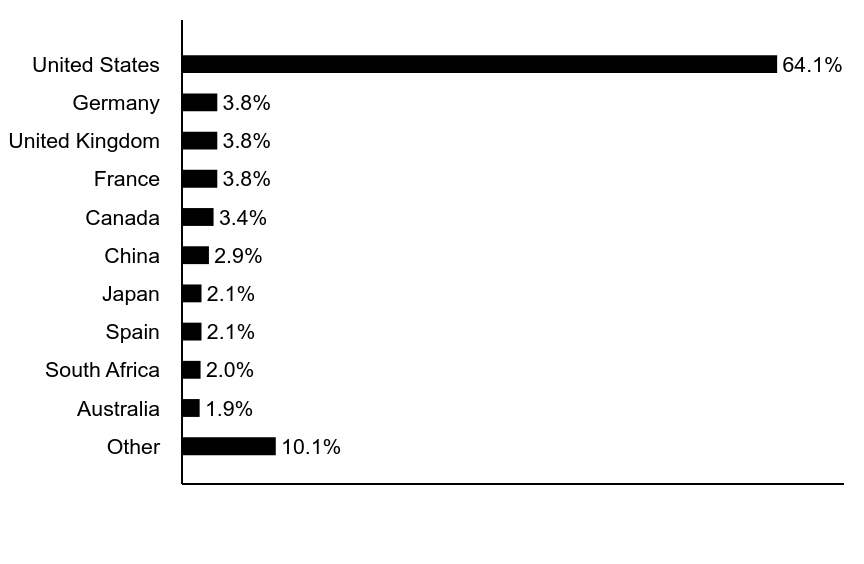

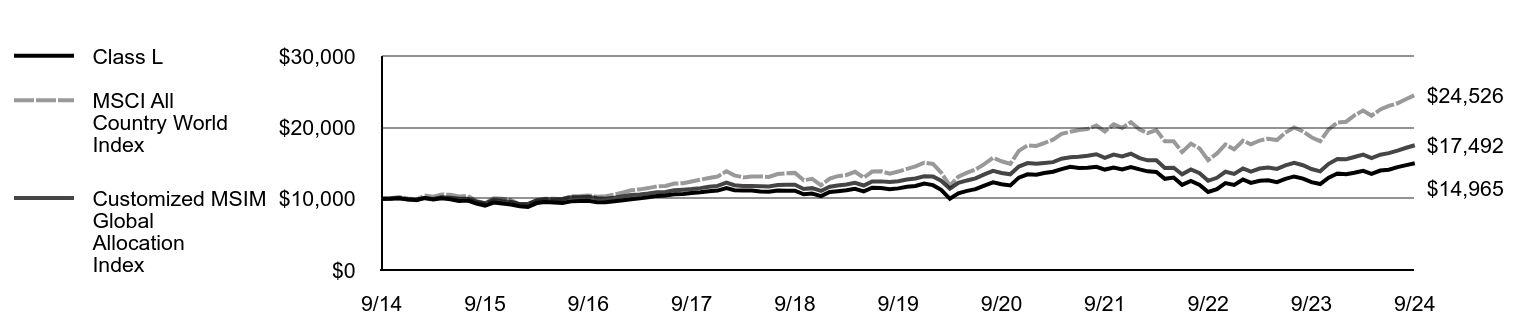

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class L | Russell 3000® Index | Russell Midcap® Growth Index |

|---|

| 9/14 | $10,000 | $10,000 | $10,000 |

| 10/14 | $10,412 | $10,275 | $10,276 |

| 11/14 | $10,445 | $10,524 | $10,614 |

| 12/14 | $10,245 | $10,524 | $10,584 |

| 1/15 | $10,125 | $10,231 | $10,405 |

| 2/15 | $10,755 | $10,824 | $11,122 |

| 3/15 | $10,526 | $10,713 | $11,153 |

| 4/15 | $10,590 | $10,762 | $11,075 |

| 5/15 | $10,493 | $10,911 | $11,206 |

| 6/15 | $10,454 | $10,728 | $11,026 |

| 7/15 | $10,563 | $10,908 | $11,204 |

| 8/15 | $9,746 | $10,249 | $10,553 |

| 9/15 | $9,306 | $9,951 | $10,145 |

| 10/15 | $9,342 | $10,736 | $10,783 |

| 11/15 | $9,598 | $10,796 | $10,807 |

| 12/15 | $9,566 | $10,574 | $10,563 |

| 1/16 | $8,464 | $9,978 | $9,763 |

| 2/16 | $8,098 | $9,975 | $9,916 |

| 3/16 | $8,636 | $10,677 | $10,624 |

| 4/16 | $8,655 | $10,743 | $10,617 |

| 5/16 | $8,728 | $10,935 | $10,791 |

| 6/16 | $8,808 | $10,958 | $10,790 |

| 7/16 | $9,362 | $11,393 | $11,324 |

| 8/16 | $9,359 | $11,422 | $11,291 |

| 9/16 | $9,238 | $11,440 | $11,285 |

| 10/16 | $8,684 | $11,192 | $10,827 |

| 11/16 | $8,534 | $11,693 | $11,297 |

| 12/16 | $8,209 | $11,921 | $11,337 |

| 1/17 | $8,848 | $12,145 | $11,715 |

| 2/17 | $8,961 | $12,597 | $12,052 |

| 3/17 | $9,210 | $12,606 | $12,118 |

| 4/17 | $9,612 | $12,739 | $12,298 |

| 5/17 | $10,353 | $12,870 | $12,592 |

| 6/17 | $10,404 | $12,986 | $12,629 |

| 7/17 | $10,472 | $13,231 | $12,840 |

| 8/17 | $10,749 | $13,256 | $12,931 |

| 9/17 | $10,630 | $13,579 | $13,296 |

| 10/17 | $10,941 | $13,876 | $13,668 |

| 11/17 | $11,332 | $14,297 | $14,125 |

| 12/17 | $11,324 | $14,440 | $14,201 |

| 1/18 | $12,167 | $15,201 | $15,005 |

| 2/18 | $12,306 | $14,641 | $14,534 |

| 3/18 | $12,254 | $14,347 | $14,510 |

| 4/18 | $12,089 | $14,402 | $14,373 |

| 5/18 | $13,409 | $14,808 | $14,911 |

| 6/18 | $13,808 | $14,905 | $14,968 |

| 7/18 | $13,504 | $15,400 | $15,289 |

| 8/18 | $15,354 | $15,940 | $16,171 |

| 9/18 | $15,597 | $15,967 | $16,102 |

| 10/18 | $13,825 | $14,791 | $14,507 |

| 11/18 | $13,956 | $15,087 | $14,877 |

| 12/18 | $12,613 | $13,683 | $13,527 |

| 1/19 | $14,449 | $14,858 | $15,081 |

| 2/19 | $15,681 | $15,380 | $15,965 |

| 3/19 | $15,920 | $15,605 | $16,181 |

| 4/19 | $16,844 | $16,228 | $16,908 |

| 5/19 | $16,775 | $15,178 | $15,936 |

| 6/19 | $17,916 | $16,244 | $17,055 |

| 7/19 | $18,680 | $16,485 | $17,453 |

| 8/19 | $18,155 | $16,149 | $17,135 |

| 9/19 | $16,205 | $16,433 | $16,940 |

| 10/19 | $16,217 | $16,786 | $17,254 |

| 11/19 | $17,824 | $17,424 | $18,112 |